Investor Presentation December 2006

American Apparel

Endeavor Acquisition Corp.

This slide show presentation has been was filed with the Securities and Exchange Commission on December 19, 2006 as part of a Form 8-K by Endeavor Acquisition Corp. (“Endeavor”) with the Securities and Exchange Commission (“SEC”). Endeavor is holding presentations for certain of its stockholders, as well as other persons who might be interested in purchasing Endeavor’s securities, regarding its acquisition of American Apparel, Inc. and its affiliated subsidiaries (collectively referred to as “American Apparel” or the “Company”), as described in the Form 8-K.

The slide show presentation is being distributed to attendees of these presentations. Stockholders of Endeavor and other interested persons are advised to read Endeavor’s preliminary proxy statement, and the amendments thereto, and, when available, its definitive proxy statement in connection with Endeavor’s solicitation of proxies for the special meeting because these proxy statements will contain important information. Such persons can also read Endeavor’s final prospectus, dated December 15, 2005, for a description of the security holdings of the Endeavor officers and directors and their respective interests in the successful consummation of this business combination. The definitive proxy statement will be mailed to stockholders as of a record date to be established for voting on the merger. Stockholders will also be able to obtain a copy of the definitive proxy statement, without charge, by directing a request to: Endeavor Acquisition Corp., 7 Times Square, 17th Floor, New York, New York 10036. The proxy statement and definitive proxy statement, once available, and the final prospectus can also be obtained, without charge, at the SEC’s Internet site (http://www.sec.gov).

Safe Harbor Statement

This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about Endeavor, the Company and their combined business after completion of the proposed acquisition. Forward-looking statements are statements that are not historical facts. Such forward-looking statements, based upon the current beliefs and expectations of Endeavor’s and the Company’s management, are subject to risks and uncertainties, which could cause actual results to differ from the forward-looking statements. The following factors, among others, could cause actual results to differ from those set forth in the forward-looking statements: business conditions; the Company’s relationships with its financial lenders and its ability to adhere to the terms of its existing credit facilities; changing interpretations of generally accepted accounting principles; changes in the overall level of consumer spending or preferences in apparel; the performance of the Company’s products within the prevailing retail environment; paper and printing costs; availability of store locations at appropriate terms; inquiries and investigations and related litigation; continued compliance with U.S. and foreign government regulations; legislation or regulatory environments; requirements or changes adversely affecting the businesses in which the Company is engaged; fluctuations in customer demand; management of rapid growth; intensity of competition from other apparel providers; general economic conditions; geopolitical events and regulatory changes; as well as other relevant risks detailed in Endeavor’s filings with the Securities and Exchange Commission, including its reports on Form10-Q. The Company’s financial information and data contained herein is unaudited and prepared by the Company as a private company and will not conform to SEC Regulation S-X. Accordingly, such information and data will be adjusted and presented differently in Endeavor’s proxy statement to solicit stockholder approval of the acquisition. This presentation includes certain financial information (EBITDA) not derived in accordance with generally accepted accounting principles (“GAAP”). Endeavor believes that the presentation of this non-GAAP measure provides information that is useful to investors as it indicates more clearly the ability of the Company to meet capital expenditures and working capital requirements and otherwise meet its obligations as they become due. The Company’s EBITDA was derived by taking earnings before interest, taxes, depreciation and amortization as adjusted for certain one-time non-recurring items and exclusions. Accordingly, such information may be adjusted and presented differently in Endeavor’s proxy statement to solicit stockholder approval of the merger. Neither Endeavor nor the Company assumes any obligation to update the information contained in this presentation.

Endeavor Acquisition Corp.

Endeavor Overview

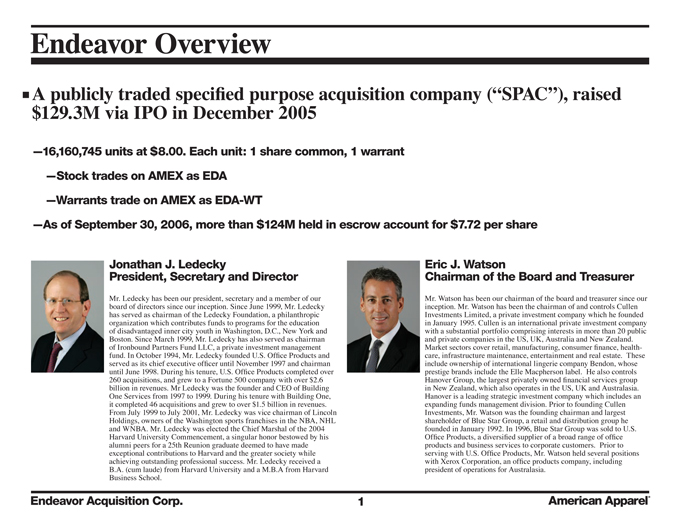

A publicly traded specified purpose acquisition company (“SPAC”), raised $129.3M via IPO in December 2005

—16,160,745 units at $8.00. Each unit: 1 share common, 1 warrant

—Stock trades on AMEX as EDA

—Warrants trade on AMEX as EDA-WT

—As of September 30, 2006, more than $124M held in escrow account for $7.72 per share

Jonathan J. Ledecky

President, Secretary and Director

Mr. Ledecky has been our president, secretary and a member of our board of directors since our inception. Since June 1999, Mr. Ledecky has served as chairman of the Ledecky Foundation, a philanthropic organization which contributes funds to programs for the education of disadvantaged inner city youth in Washington, D.C., New York and Boston. Since March 1999, Mr. Ledecky has also served as chairman of Ironbound Partners Fund LLC, a private investment management fund. In October 1994, Mr. Ledecky founded U.S Office Products and served as its chief executive officer until November 1997 and chairman until June 1998. During his tenure, U.S. Office Products completed over 260 acquisitions, and grew to a Fortune 500 company with over $2.6 billion in revenues. Mr Ledecky was the founder and CEO of Building One Services from 1997 to 1999. During his tenure with Building One, it completed 46 acquisitions and grew to over $1.5 billion in revenues. From July 1999 to July 2001, Mr. Ledecky was vice chairman of Lincoln Holdings, owners of the Washington sports franchises in the NBA, NHL and WNBA. Mr. Ledecky was elected the Chief Marshal of the 2004 Harvard University Commencement, a singular honor bestowed by his alumni peers for a 25th Reunion graduate deemed to have made exceptional contributions to Harvard and the greater society while achieving outstanding professional success. Mr. Ledecky received a B.A. (cum laude) from Harvard University and a M.B.A from Harvard Business School.

Eric J. Watson

Chairman of the Board and Treasurer

Mr. Watson has been our chairman of the board and treasurer since our inception. Mr. Watson has been the chairman of and controls Cullen Investments Limited, a private investment company which he founded in January 1995. Cullen is an international private investment company with a substantial portfolio comprising interests in more than 20 public and private companies in the US, UK, Australia and New Zealand. Market sectors cover retail, manufacturing, consumer finance, health-care, infrastructure maintenance, entertainment and real estate. These include ownership of international lingerie company Bendon, whose prestige brands include the Elle Macpherson label. He also controls Hanover Group, the largest privately owned financial services group in New Zealand, which also operates in the US, UK and Australasia. Hanover is a leading strategic investment company which includes an expanding funds management division. Prior to founding Cullen Investments, Mr. Watson was the founding chairman and largest shareholder of Blue Star Group, a retail and distribution group he founded in January 1992. In 1996, Blue Star Group was sold to U.S. Office Products, a diversified supplier of a broad range of office products and business services to corporate customers. Prior to serving with U.S. Office Products, Mr. Watson held several positions with Xerox Corporation, an office products company, including president of operations for Australasia.

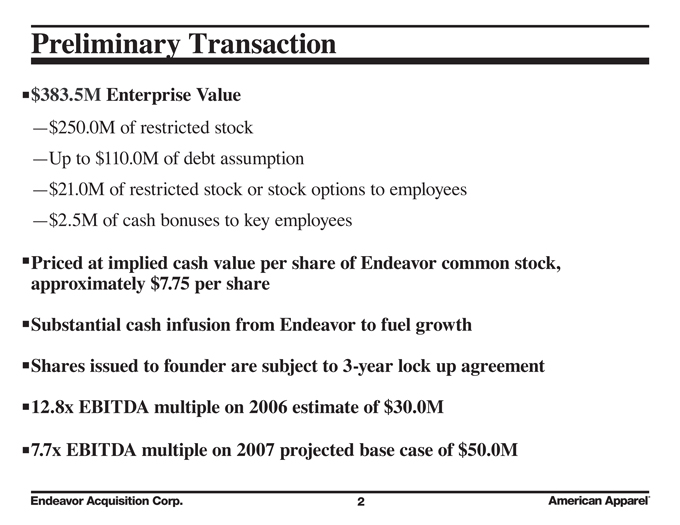

Preliminary Transaction

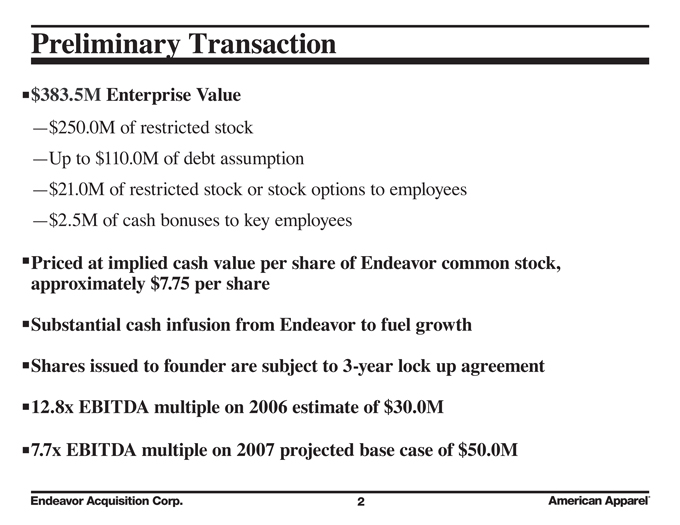

$383.5M Enterprise Value

—$250.0M of restricted stock

—Up to $110.0M of debt assumption

—$ 21.0M of restricted stock or stock options to employees

—$ 2.5M of cash bonuses to key employees

Priced at implied cash value per share of Endeavor common stock, approximately $7.75 per share

Substantial cash infusion from Endeavor to fuel growth

Shares issued to founder are subject to 3-year lock up agreement

12.8x EBITDA multiple on 2006 estimate of $30.0M

7.7x EBITDA multiple on 2007 projected base case of $50.0M

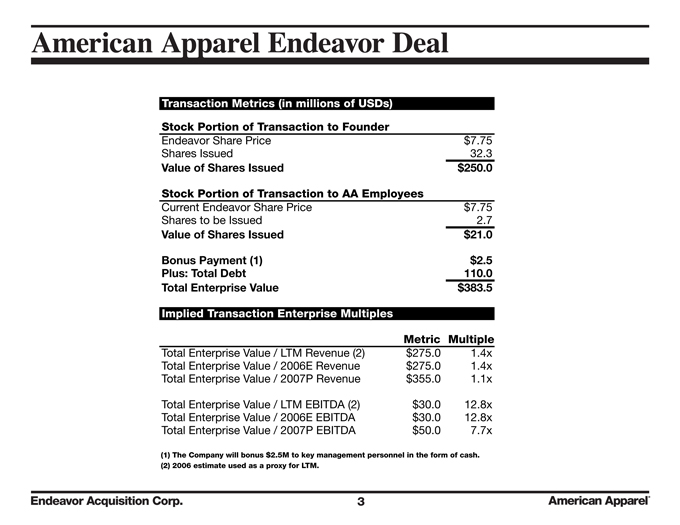

American Apparel Endeavor Deal

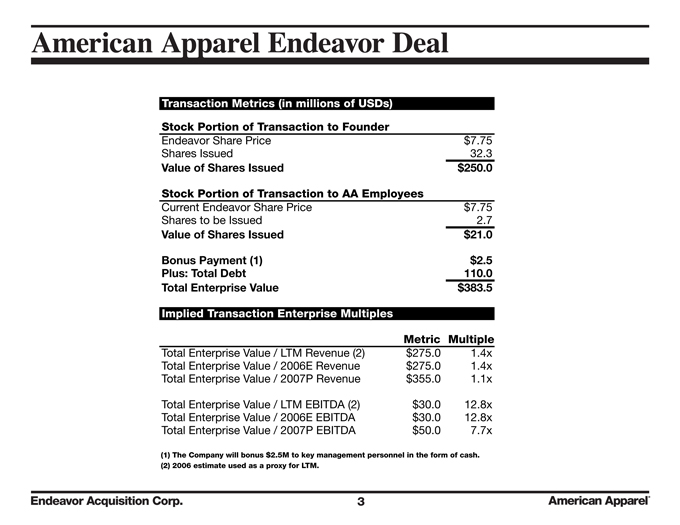

| | | |

Transaction Metrics (in millions of USDs) | | | |

Stock Portion of Transaction to Founder | | | |

Endeavor Share Price | | $ | 7.75 |

Shares Issued | | | 32.3 |

Value of Shares Issued | | $ | 250.0 |

Stock Portion of Transaction to AA Employees | | | |

Current Endeavor Share Price | | $ | 7.75 |

Shares to be Issued | | | 2.7 |

Value of Shares Issued | | $ | 21.0 |

Bonus Payment (1) | | $ | 2.5 |

Plus: Total Debt | | | 110.0 |

Total Enterprise Value | | $ | 383.5 |

| | | | | |

Implied Transaction Enterprise Multiples | | | | | |

| | | Metric | | Multiple |

Total Enterprise Value / LTM Revenue (2) | | $ | 275.0 | | 1.4x |

Total Enterprise Value / 2006E Revenue | | $ | 275.0 | | 1.4x |

Total Enterprise Value / 2007P Revenue | | $ | 355.0 | | 1.1x |

Total Enterprise Value / LTM EBITDA (2) | | $ | 30.0 | | 12.8x |

Total Enterprise Value / 2006E EBITDA | | $ | 30.0 | | 12.8x |

Total Enterprise Value / 2007P EBITDA | | $ | 50.0 | | 7.7x |

(1) | | The Company will bonus $2.5M to key management personnel in the form of cash. |

(2) | | 2006 estimate used as a proxy for LTM. |

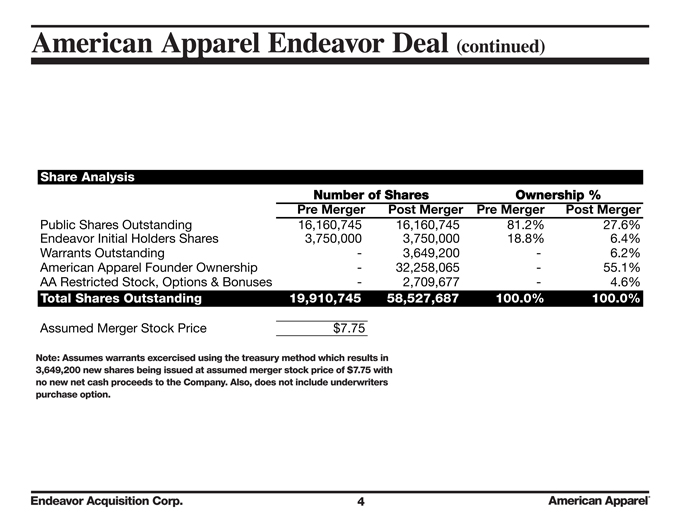

American Apparel Endeavor Deal(continued)

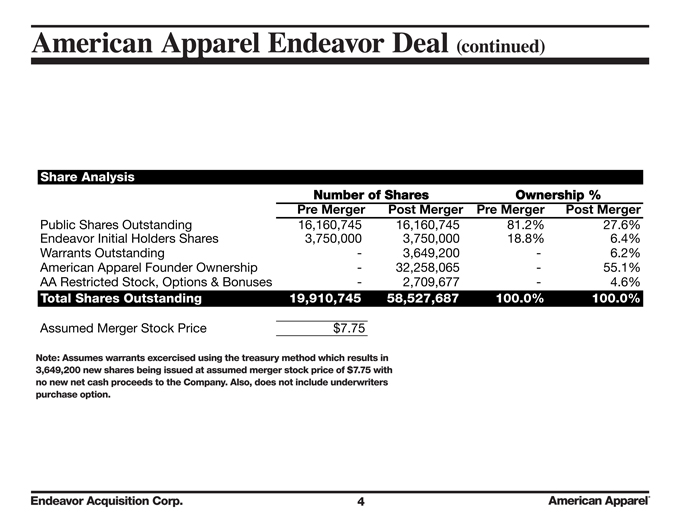

Share Analysis

| | | | | | | | | | | |

| | | | Number of Shares | | Ownership % | |

| | | | Pre Merger | | Post

Merger | | Pre

Merger |

| | Post

Merger |

|

Public Shares Outstanding | | | 16,160,745 | | 16,160,745 | | 81.2 | % | | 27.6 | % |

Endeavor Initial Holders Shares | | | 3,750,000 | | 3,750,000 | | 18.8 | % | | 6.4 | % |

Warrants Outstanding | | | — | | 3,649,200 | | — | | | 6.2 | % |

American Apparel Founder Ownership | | | — | | 32,258,065 | | — | | | 55.1 | % |

AA Restricted Stock, Options & Bonuses | | | — | | 2,709,677 | | — | | | 4.6 | % |

Total Shares Outstanding | | | 19,910,745 | | 58,527,687 | | 100.0 | % | | 100.0 | % |

Assumed Merger Stock Price | | $ | 7.75 | | | | | | | | |

Note: Assumes warrants excercised using the treasury method which results in

3,649,200 new shares being issued at assumed merger stock price of $7.75 with

no new net cash proceeds to the Company. Also, does not include underwriters

purchase option.

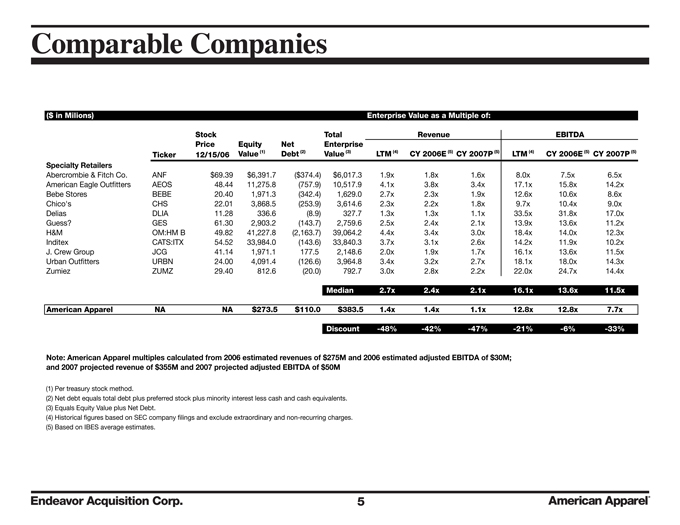

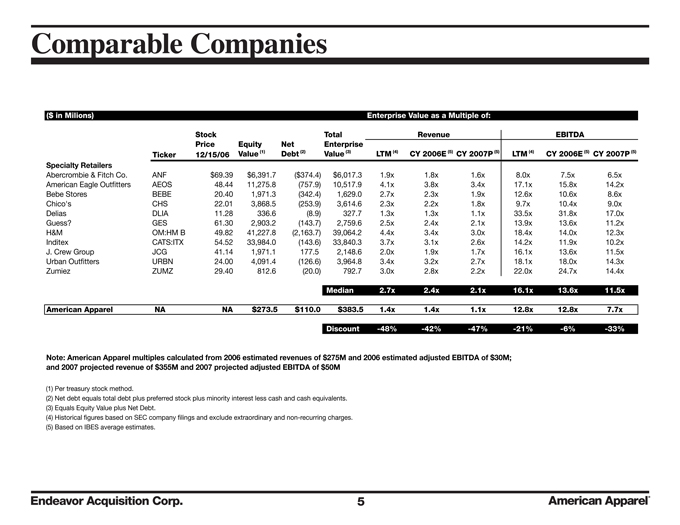

Comparable Companies

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

($ in Milions) | | | | | | | | | | | | | | | | | Enterprise Value as a Multiple of: |

| | | | | | | | | | | | | | | | | | Revenue | | EBITDA |

Ticker | | | |

| Stock

Price

12/15/06 | |

| Equity

Value (1) | | | Net Debt(2) | | |

| Total

Enterprise

Value(3) | | LTM(4) | | CY

2006E(5) | | CY

2007P(5) | | LTM(4) | | CY

2006E(5) | | CY

2007P(5) |

Specialty Retailers | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Abercrombie & Fitch Co. | | ANF | | $ | 69.39 | | $ | 6,391.7 | | ($ | 374.4 | ) | | $ | 6,017.3 | | 1.9x | | 1.8x | | 1.6x | | 8.0x | | 7.5x | | 6.5x |

American Eagle Outfitters | | AEOS | | | 48.44 | | | 11,275.8 | | | (757.9 | ) | | | 10,517.9 | | 4.1x | | 3.8x | | 3.4x | | 17.1x | | 15.8x | | 14.2x |

Bebe Stores | | BEBE | | | 20.40 | | | 1,971.3 | | | (342.4 | ) | | | 1,629.0 | | 2.7x | | 2.3x | | 1.9x | | 12.6x | | 10.6x | | 8.6x |

Chico’s | | CHS | | | 22.01 | | | 3,868.5 | | | (253.9 | ) | | | 3,614.6 | | 2.3x | | 2.2x | | 1.8x | | 9.7x | | 10.4x | | 9.0x |

Delias | | DLIA | | | 11.28 | | | 336.6 | | | (8.9 | ) | | | 327.7 | | 1.3x | | 1.3x | | 1.1x | | 33.5x | | 31.8x | | 17.0x |

Guess? | | GES | | | 61.30 | | | 2,903.2 | | | (143.7 | ) | | | 2,759.6 | | 2.5x | | 2.4x | | 2.1x | | 13.9x | | 13.6x | | 11.2x |

H&M | | OM:HM B | | | 49.82 | | | 41,227.8 | | | (2,163.7 | ) | | | 39,064.2 | | 4.4x | | 3.4x | | 3.0x | | 18.4x | | 14.0x | | 12.3x |

Inditex | | CATS:ITX | | | 54.52 | | | 33,984.0 | | | (143.6 | ) | | | 33,840.3 | | 3.7x | | 3.1x | | 2.6x | | 14.2x | | 11.9x | | 10.2x |

J. Crew Group | | JCG | | | 41.14 | | | 1,971.1 | | | 177.5 | | | | 2,148.6 | | 2.0x | | 1.9x | | 1.7x | | 16.1x | | 13.6x | | 11.5x |

Urban Outfitters | | URBN | | | 24.00 | | | 4,091.4 | | | (126.6 | ) | | | 3,964.8 | | 3.4x | | 3.2x | | 2.7x | | 18.1x | | 18.0x | | 14.3x |

Zumiez | | ZUMZ | | | 29.40 | | | 812.6 | | | (20.0 | ) | | | 792.7 | | 3.0x | | 2.8x | | 2.2x | | 22.0x | | 24.7x | | 14.4x |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | Median | | 2.7x | | | 2.4x | | | 2.1x | | | 16.1x | | | 13.6x | | | 11.5x | |

American Apparel | | NA | | NA | | $

|

273.5 | | $

|

110.0 | | $ | 383.5 | | 1.4x | | | 1.4x | | | 1.1x | | | 12.8x | | | 12.8x | | | 7.7x | |

| | | | | | | | | | | | | | Discount | | -48 | % | | -42 | % | | -47 | % | | -21 | % | | -6 | % | | -33 | % |

Note: American Apparel multiples calculated from 2006 estimated revenues of $275M and 2006 estimated adjusted EBITDA of $30M;

and 2007 projected revenue of $355M and 2007 projected adjusted EBITDA of $50M

(1) | | Per treasury stock method. |

(2) | | Net debt equals total debt plus preferred stock plus minority interest less cash and cash equivalents. |

(3) | | Equals Equity Value plus Net Debt. |

(4) | | Historical figures based on SEC company filings and exclude extraordinary and non-recurring charges. |

(5) | | Based on IBES average estimates. |

Company Overview

American Apparel Highlights

A leading basics brand for young adults, the largest emerging market demographic(1)

Strong growth of wholesale and retail divisions, including international retail expansion

—Revenue CAGR of 62% for 2002-2006 period, well above sector average

—EBITDA growth towards top of the sector with 69% CAGRfor 2002-2006 period

Successful strategy with significant expansion potential

—Retail Expansion: Continued organic growth in core US, UK, European and Asian markets (Currently 143 stores worldwide) —Other Distribution: Continued development of wholesale and online businesses

Category Extension: Ongoing categories

(1) | | As reported by Steve Kroft for 60 Minutes, September 2005 |

Highlights (continued)

Cutting-edge advertising, product branding, and “Made in Downtown LA” operations have created significant brand awareness and “cult” status worldwide

A “Vertically Integrated” business model (based on speed-to-market) and merchandise focus on year-round styles, minimizes risk and provides for consistent operating results

Opportunities to improve sales productivity and profitability with stronger capital structure

American Apparel Facts

Now the largest single garment factory(1) in the United States, employing over 5,000 people worldwide

“Vertically Integrated” – has eliminated the use of sewing sub-contractors and offshore labor

Knits, dyes, cuts, sews, photographs, markets, distributes, and designs garments in Los Angeles

Capacity to produce over 1 million T-shirts per week with significant potential to expand

Recognized in INC. Magazine’s “Top 500” issue for two years in a row as one of the fastest-growing private companies

Operates full distribution facilities in Montreal, Canada and Frankfurt, Germany

Has opened 143 retail locations in 11 countries: United States, Canada, France, England, Germany, Mexico, Japan, Korea, Israel, Switzerland and the Netherlands

Dov Charney awarded the prestigious “Entrepreneur of the Year” award by Ernst & Young (2004)

Dov Charney was included in Los Angeles Times Magazine’s list of the “100 Most Powerful People in Southern California” (2006)

Dov Charney was included in Details Magazine, “50 Most Powerful People” (2006)

Dov Charney was honored in the GQ “Men of the Year” issue (2003)

Media Magazine recognized American Apparel in its “Top 10 Socially Responsible Companies” (2006)

Experienced sewers can earn between $10-$12 per hour or more

(1) | | As reported in Los Angeles Times, West Magazine, August 2006 |

Selected American Apparel Items

| | |

Selected Press | | |

“...it’s also, slowly and surely, changing the way some people dress.” | | “The beauty of this system is that, at AA, it is in every worker’s interest to spot what ‘constraints’ hold back production and to identify solutions, thereby achieving ever-higher efficiencies.” |

Nylon Magazine “Jersey City” | |

October 2006 | | |

| | | The London Times “Too Sexy for His Shirt” February 2005 |

“Charney’s downtown L.A. factory is the largest single apparel plant in the nation ” | | |

Los Angeles Times—West Magazine | | “Patriotism, social value, and an environmentally friendly spirit, plus value for the pocketbook, and they make a damn good product.” |

“The Power Issue” | |

August 2006 | |

| | | New York Times |

| | | “Building a Brand By Not Being a Brand” |

“They are on everybody’s radar.” | | November 2004 |

Newsweek | | |

“California Hustlin’” | | |

June 2006 | | “Innovation and social responsibility are the new American Dream.” |

| | | The Counselor |

“[the factory] turns out more than 9,000 separate items ” | | “Dov Charney: Rebel With a Cause” |

| | August 2004 |

New York Times Magazine | | |

“And You Thought Abercrombie & Fitch Was Pushing It?” | | “...people overlooked what kind of savings could be made on doing things closer to home.” |

April 2006 | |

| | | The Sunday Times of London |

“Sales have doubled or nearly doubled every year ” | | “Fashion Rebel” |

| | | April 2004 |

Inc. Magazine | | |

“Dov Charney, Like It Or Not” | | |

September 2005 | | |

Selected Press (continued)

“In fact, just about the only print ads I’ve consistently engaged with lately are for American Apparel. His ads are not only hot (they show his sexy employees modeling the merch) and briskly reinforce the brand message (which is about no-frills, sweatshop-free clothing), but are refreshingly not celebrity-obsessed.”

AdAge

“Media Guy Slips Into Coma:

Are Print Ads to Blame?”

August 29, 2005

Selected Television Coverage, USA

| | | | | | |

Charlie Rose | | Lou

Dobbs

Tonight | | Today

Show | | 20/20 |

| | | | | | |

Today Show | | KRON-4 | | ABC | | CNN |

July 2006 | | Rob Black & Your | | World News Tonight | | Maverick of |

| | | Money | | June 2005 | | the Morning |

PBS | | March 2006 | | | | May 2003 |

Charlie Rose | | | | Telemundo | | |

July 2006 | | ABC | | Nightly News | | PBS |

| | | 20/20 “The New Rich: | | March 2005 | | News Hour |

NBC | | Secrets, Strategies and | | | | with Jim Leheher |

Dateline | | What You Can Learn” | | Oxygen Network | | August 2002 |

July 2006 | | December 2005 | | Life & Style | | |

| | | | | January 2005 | | PBS |

ABC | | Forbes | | | | Realidades |

ABC News—Nightline | | Morning Update: | | CNN | | April 2002 |

May 2006 | | Business View Report | | Lou Dobbs Tonight | | |

| | | September 2005 | | February 2004 | | |

The American Apparel Experience

The Company’s products, store environment and employees help create a unique shopping experience.

—Large selection of logo-free, knit fabric basics in wide variety of colors

—Bright, contemporary store design

—In-store visuals with free-spirited imagery appealto core demographic

—Welcoming and engaging store environment

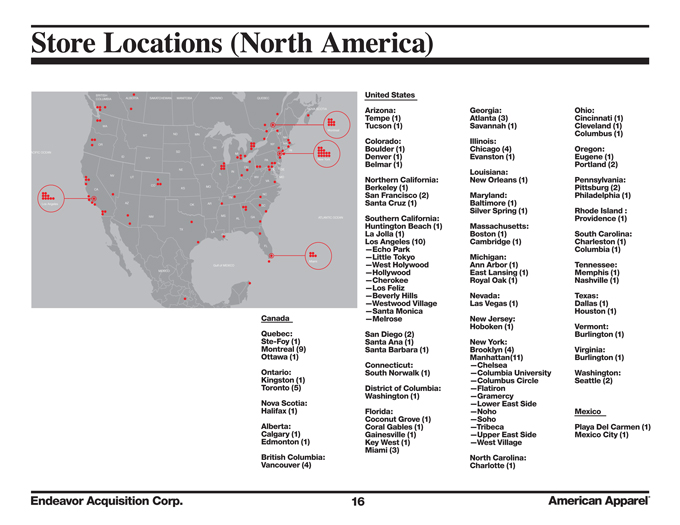

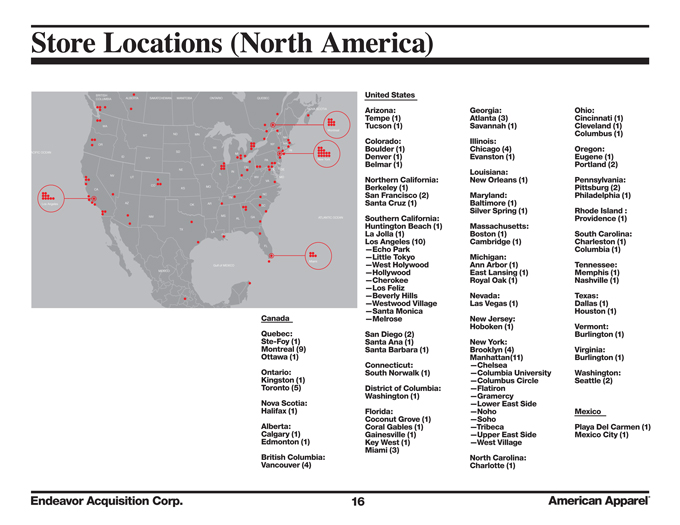

Store Locations (North America)

Canada

Quebec: Ste-Foy (1) Montreal (9) Ottawa (1) Ontario: Kingston (1) Toronto (5) Nova Scotia: Halifax (1) Alberta: Calgary (1) Edmonton (1) British Columbia: Vancouver (4)

United States

Arizona:

Georgia:

Ohio:

Tempe (1)

Atlanta (3)

Cincinnati (1)

Tucson (1)

Savannah (1)

Cleveland (1)

Columbus (1)

Colorado:

Illinois:

Boulder (1)

Chicago (4)

Oregon:

Denver (1)

Evanston (1)

Eugene (1)

Belmar (1)

Portland (2)

Louisiana:

Northern California:

New Orleans (1)

Pennsylvania:

Berkeley (1)

Pittsburg (2)

San Francisco (2)

Maryland:

Philadelphia (1)

Santa Cruz (1)

Baltimore (1)

Silver Spring (1)

Rhode Island :

Southern California:

Providence (1)

Huntington Beach (1)

Massachusetts:

La Jolla (1)

Boston (1)

South Carolina:

Los Angeles (10)

Cambridge (1)

Charleston (1)

—Echo Park

Columbia (1)

—Little Tokyo

Michigan:

—West Holywood

Ann Arbor (1)

Tennessee:

—Hollywood

East Lansing (1)

Memphis (1)

—Cherokee

Royal Oak (1)

Nashville (1)

—Los Feliz

—Beverly Hills

Nevada:

Texas:

—Westwood Village

Las Vegas (1)

Dallas (1)

—Santa Monica

Houston (1)

—Melrose

New Jersey:

Hoboken (1)

Vermont:

San Diego (2)

Burlington (1)

Santa Ana (1)

New York:

Santa Barbara (1)

Brooklyn (4)

Virginia:

Manhattan(11)

Burlington (1)

Connecticut:

—Chelsea

South Norwalk (1)

—Columbia University

Washington:

—Columbus Circle

Seattle (2)

District of Columbia:

—Flatiron

Washington (1)

—Gramercy

—Lower East Side

Florida:

—Noho

Mexico

Coconut Grove (1)

—Soho

Coral Gables (1)

—Tribeca

Playa Del Carmen (1)

Gainesville (1)

—Upper East Side

Mexico City (1)

Key West (1)

—West Village

Miami (3)

North Carolina:

Charlotte (1)

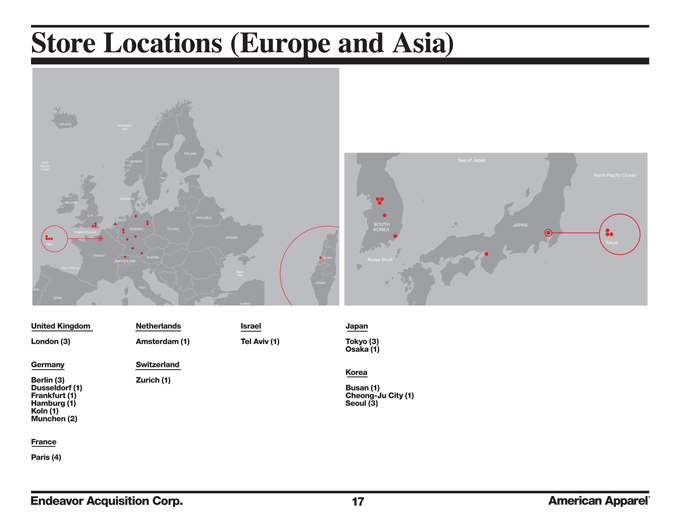

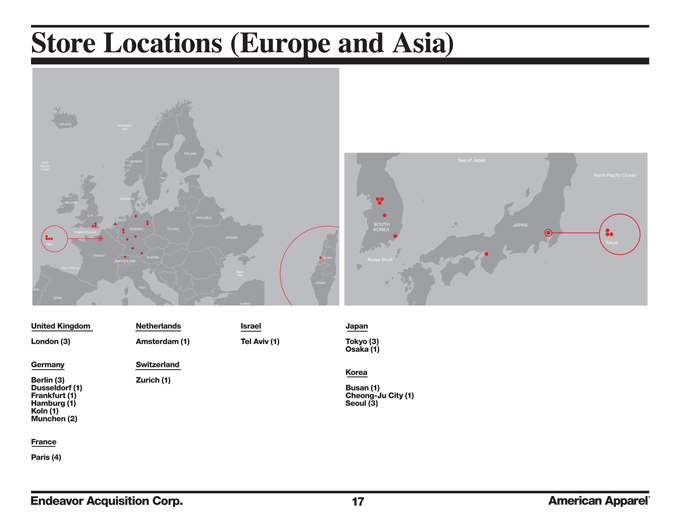

Store Locations (Europe and Asia)

| | | | | | |

United Kingdom | | Netherlands | | Israel | | Japan |

London (3) | | Amsterdam (1) | | Tel Aviv (1) | | Tokyo (3) |

| | | | | | | Osaka (1) |

Germany | | Switzerland | | | | |

| | | | | | | Korea |

Berlin (3) | | Zurich (1) | | | | |

Dusseldorf (1) | | | | | | Busan (1) |

Frankfurt (1) | | | | | | Cheong-Ju City (1) |

Hamburg (1) | | | | | | Seoul (3) |

Koln (1) | | | | | | |

Munchen (2) | | | | | | |

France | | | | | | |

Paris (4) | | | | | | |

Culture Drives Execution

American Apparel provides a unique culture where employees execute at high levels while expressing their passion for the brand

“Not to suggest that we are more ethical than the next business. We’re just out to try something different, to make a buck, to bring people the clothes they love, to be human, and have a good time in the process. So far, so good!”

—Dov Charney

American Apparel Management

Dov Charney

Founder and Chief Executive Officer

American Apparel owner Dov Charney has been a passionate producer of T-shirts and related apparel for over 10 years (an obsession that can be traced back to his teens in Montreal). Charney, an early pioneer of the woman’s tee, went on to build American Apparel, a vertically integrated, made-in-the-USA, sweatshop-free enterprise. Under his leadership, the downtown Los Angeles operation has grown into the single largest domestic clothing manufacturer. For both his business acumen and his commitment to his workers, Charney was named Entrepreneur of the Year by Ernst & Young as well as “Man of the Year” separately by Apparel Magazine, The Fashion Industry Guild and the Ad Specialty Industry. In 2006, The Los Angeles Times Magazine included Charney in the “100 Most Powerful People of Southern California” and, the same year, Details Magazine named him in their “Power 50” list. With American Apparel, Charney has created job opportunities for over 4,000 people and offers his garment workers unprecedented wages and benefits.

Ken Cieply, CA Chief Financial Officer

Ken Cieply joined American Apparel in June 2006 and brings over 25 years of experience in multinational private and public companies. As a Chartered Accountant, Cieply started his professional career at KPMG in Montreal, Canada and then went on to industry and built a successful career as a CFO. Cieply managed the complex needs of high growth companies and led the successful IPO on the Canadian and US stock exchanges for Gildan Activewear. As a consultant, Cieply advised companies on strategic, financial, and management issues. Cieply earned his Bachelor of Commerce degree from McGill University in Montreal, Canada, and is a member of the Canadian Institute of Chartered Accountants and the Order of Chartered Accountants of Canada.

Some members of the creative team.

Marty Bailey

President of Manufacturing

Having been at the helm of major growth and change in the apparel industry for over 20 years, Marty Bailey brings a wealth of experience to American Apparel. Having successfully managed manufacturing services and operations for companies such as Fruit of the Loom, Alstyle Apparel, Volunteer Knit Apparel and Beltex Underwear, Bailey has earned a reputation in the apparel industry as a T-shirt genius. Since his arrival at American Apparel in 2002, as one of his many new constructive programs, Bailey quickly bolstered the company’s production, integrating a new system and advancing apparel technology into the 21st century. Bailey’s brilliant manufacturing modification has resulted in record-breaking sales and increased wages for skilled workers.

Adrian Kowalewski

Director of Corporate Finance & Development

As Director of Corporate Finance & Development, Adrian is involved in the capital raising function and in helping set corporate strategy. He comes to American Apparel from a career in investment banking. Adrian began his career in the Mergers & Acquisitions Group at CIBC World Markets in their New York and London offices. Following CIBC, he was in the Chicago office of Houlihan Lokey Howard & Zukin, where he worked on financial restructurings, mergers and acquisitions, and private placements. He was also a summer associate at Lazard Freres & Co., a preeminent advisory investment bank. Adrian holds an MBA with concentrations in Finance and Strategic Management from the University of Chicago Graduate School of Business, and an AB with honors in Economics from Harvard College.

From let to right: Marsha Brady, Alexandra Spunt, Benno Russell, Iris Alonzo, Raz Schionning, Tory Lowitz

Perhaps one of the most critical aspects of American Apparel’s success is the behind-the-scenes, in-house creative team that has carefully crafted the Company’s product line and brand image. Many of them have worked with American Apparel for over 5 years and plan to stay on now that a proper financial structure is in place. This group, and all of its other valuable members, will help the Company fulfill long-held visions for its growth and expansion.

Growth Opportunities

Growth Opportunities

Infusion of substantial capital to strengthen business structure and fuel growth

Significant store expansion potential

—Potential for 800 stores worldwide in current format

—Potential for new concepts that leverage unique infrastructure

Continue to strategically expand the wholesale business

Leverage American Apparel brand equity and vertical manufacturing expertise

Improve productivity of current operations

Platform in place; concepts proven; growth now funded

Endeavor Acquisition Corp.

American Apparel

Put A Stronger Capital Structure & Working Capital To Use

Key new hires will be added in top management positions

—New COO, CFO and CIO per Acquisition Agreement

Upgrades to operating systems: Enterprise Resource Planning (ERP) Adoption

—Allocation systems

—Inventory management systems

Enhancements to operating procedures

Category expansions:

—Denim

—Sweaters

—Accessories

Accelerate store openings

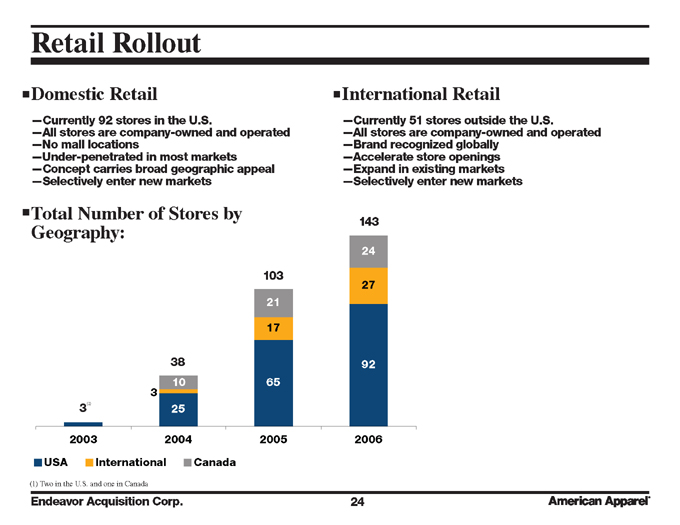

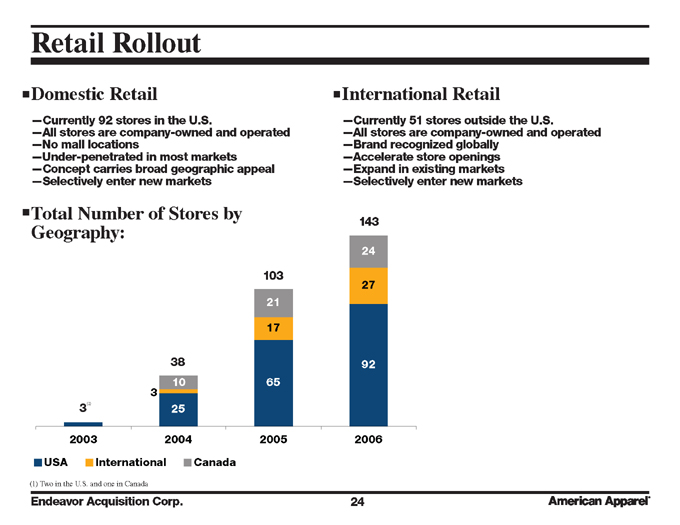

Retail Rollout

Domestic Retail

—Currently 92 stores in the U.S.

—No mall locations

—Under-penetrated in most markets

—Concept carries broad geographic appeal

—Selectively enter new markets

Total Number of Stores by Geography:

International Retail

—Currently 51 stores outside the U.S.

—All stores are company-owned and operated

—Brand recognized globally

—Re-accelerate store openings

—Aggressively expand in existing markets

—Selectively enter new markets

USA International Canada

(1) | | Two in the U.S. and one in Canada |

|

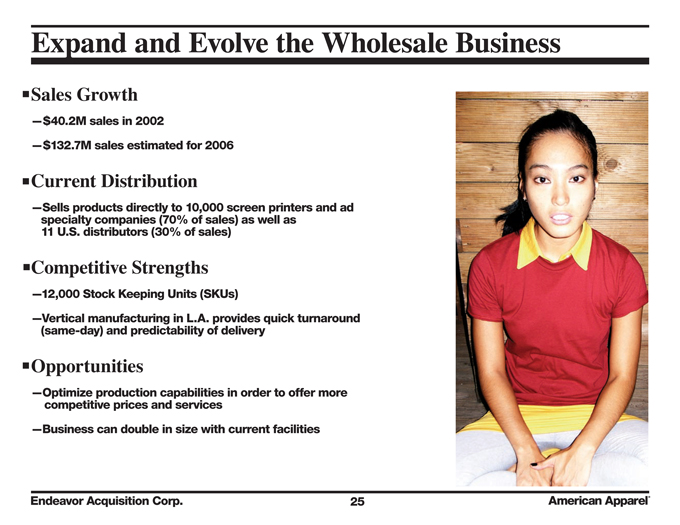

Expand and Evolve the Wholesale Business |

|

Sales Growth |

| |

|

—$40.2M sales in 2002 |

| |

|

—$132.7M sales estimated for 2006 |

| |

|

Current Distribution |

| |

|

—Sells products directly to 10,000 screen printers and ad specialty companies (70% of sales) as well as |

|

11 U.S. distributors (30% of sales) |

|

Competitive Strengths |

|

—12,000 Stock Keeping Units (SKUs) |

|

—Vertical manufacturing in L.A. provides quick turnaround |

| |

|

(same-day) and predictability of delivery |

| |

|

Opportunities |

| |

|

—Optimize production capabilities in order to offer more competitive prices and services |

| |

|

—Business can double in size with current facilities |

| |

Leverage Brand, Improve Productivity

Leverage Brand

—Introduce complementary products consistent with the brand —Explore other channels of distribution, including maximizing online business

Continue to grow average unit economics of

American Apparel retail stores

—Implement planning and allocation systems

—Enhance training of store employees

—Add complimentary products to existing assortments

—Improve merchandise flows

Capitalize on scale

—Inventory buys and flows

—Add or enhance information systems

—Leverage infrastructure over continued growth

Financial Summary

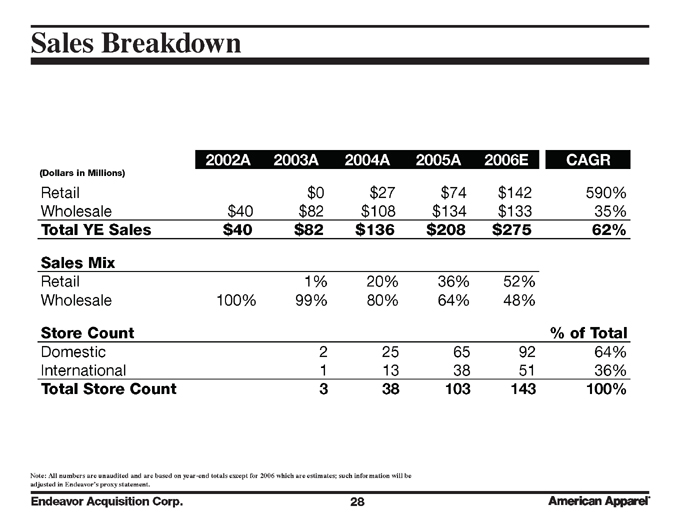

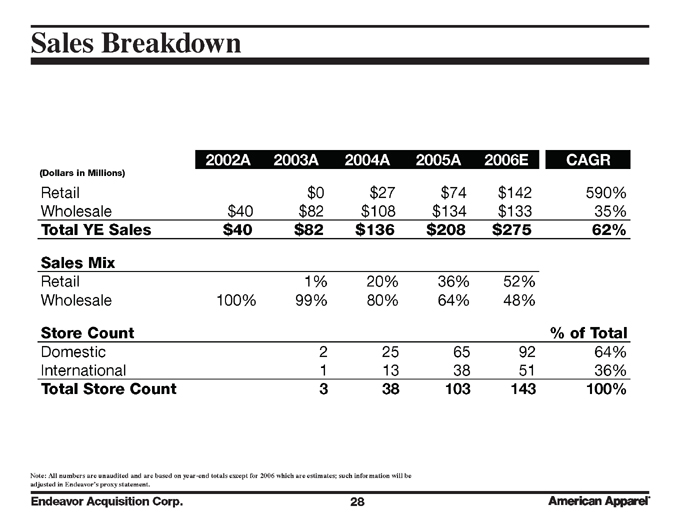

Sales Breakdown

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | 2002A | | | | 2003A | | | | 2004A | | | | 2005A | | | | 2006E | | | CAGR | |

(Dollars in Millions) | | | | | | | | | | | | | | | | | | | | | | | |

Retail | | | | | | $ | 0 | | | $ | 27 | | | $ | 74 | | | $ | 142 | | | 590 | % |

Wholesale | | $ | 40 | | | $ | 82 | | | $ | 108 | | | $ | 134 | | | $ | 133 | | | 35 | % |

Total YE Sales | | $ | 40 | | | $ | 82 | | | $ | 136 | | | $ | 208 | | | $ | 275 | | | 62 | % |

Sales Mix | | | | | | | | | | | | | | | | | | | | | | | |

Retail | | | | | | | 1 | % | | | 20 | % | | | 36 | % | | | 52 | % | | | |

Wholesale | | | 100 | % | | | 99 | % | | | 80 | % | | | 64 | % | | | 48 | % | | | |

Store Count | | | | | | | | | | | | | | | | | | | | | | % of

Total |

|

Domestic | | | | | | | 2 | | | | 25 | | | | 65 | | | | 92 | | | 64 | % |

International | | | | | | | 1 | | | | 13 | | | | 38 | | | | 51 | | | 36 | % |

Total Store Count | | | | | | | 3 | | | | 38 | | | | 103 | | | | 143 | | | 100 | % |

Note: All numbers are unaudited and are based on year-end adjusted in Endeavor’s proxy statement.

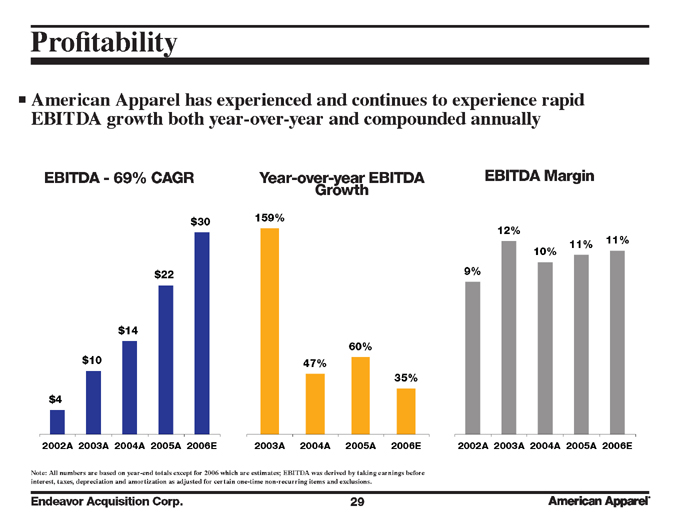

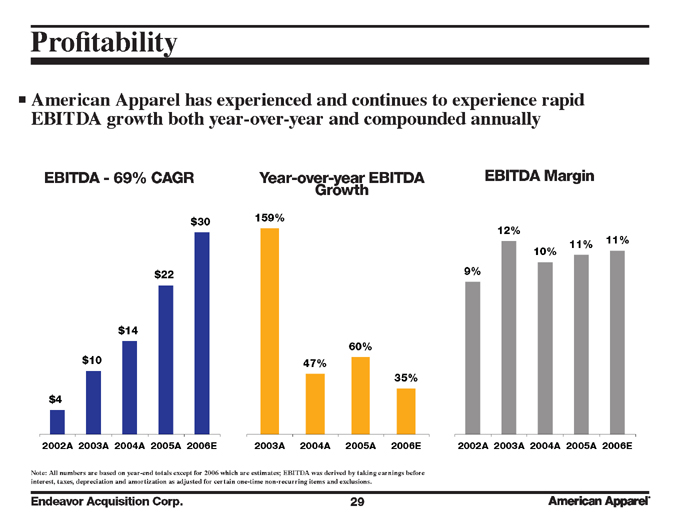

Profitability

American Apparel has experienced and continues to experience rapid EBITDA growth both year-over-year and compounded annually

EBITDA - 69% CAGR EBITDA Margin Year-over-year EBITDA Growth

Note: All numbers are based on year-end totals except for 2006 which are estimates.

Note: All numbers are based on year-end totals except for 2006 which are estimates; EBITDA was derived by taking earnings before

interest, taxes, depreciation and amortization as adjusted for certain one-time non-recurring items and exclusions.

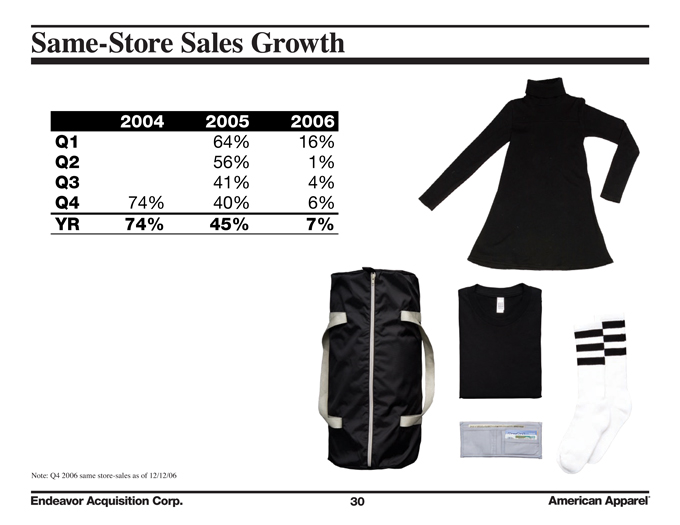

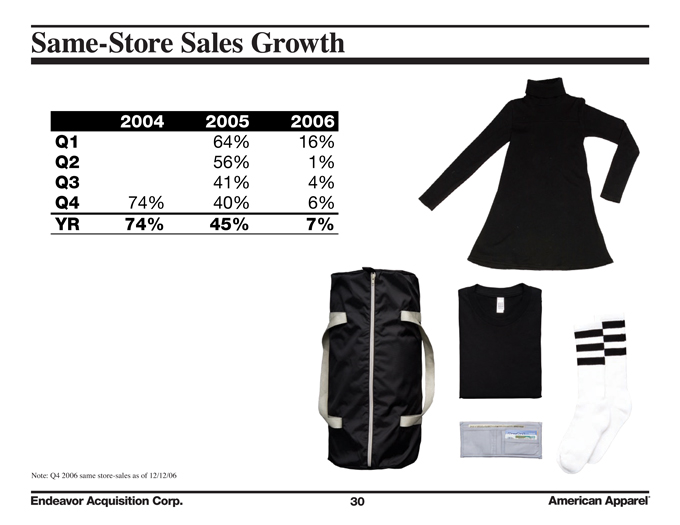

Same-Store Sales Growth

| | | | | | | | | |

| | | 2004 | | | 2005 | | | 2006 | |

Q1 | | | | | 64 | % | | 16 | % |

Q2 | | | | | 56 | % | | 1 | % |

Q3 | | | | | 41 | % | | 4 | % |

Q4 | | 74 | % | | 40 | % | | 6 | % |

YR | | 74 | % | | 45 | % | | 7 | % |

Note: Q4 2006 same store-sales as of 12/12/06

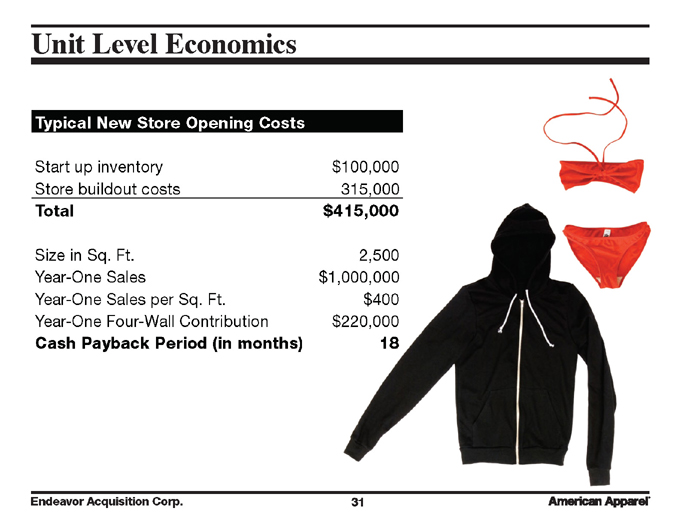

Unit Level Economics

| | | |

Typical New Store Opening Costs | | | |

Start up inventory | | $ | 100,000 |

Store buildout costs | | | 315,000 |

Total | | $ | 415,000 |

Size in Sq. Ft. | | | 2,500 |

Year-One Sales | | $ | 1,000,000 |

Year-One Sales per Sq. Ft. | | $ | 400 |

Year-One Four-Wall Contribution | | $ | 220,000 |

Cash Payback Period (in months) | | | 18 |

Summary

An exciting new brand, with an international following

Versatile basics made in a vertically integrated, domestic factory, capable of rapid-fire response to demand

A core demographic of yound adults, emerging as the largest market in 5 decades

Sales and EBITDA profits have grown nearly eight-fold in 4 years

143 stores in 11 countries, with potential to expand to 800 locations worldwide