Exhibit 4.3

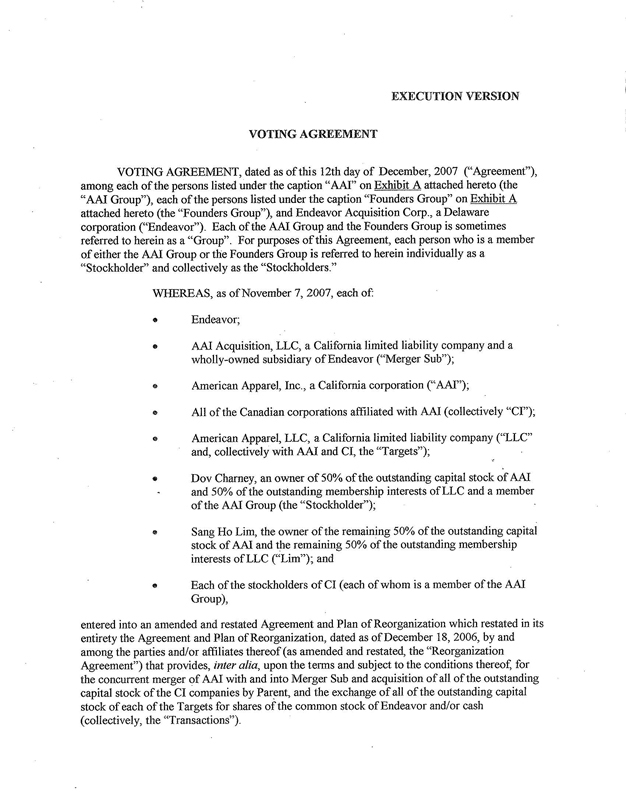

EXECUTION VERSION

VOTING AGREEMENT

VOTING AGREEMENT, dated as of this 12th day of December, 2007 (“Agreement”), among each of the persons listed under the caption “AAI” on Exhibit A attached hereto (the “AAI Group”), each of the persons listed under the caption “Founders Group” on Exhibit A attached hereto (the “Founders Group”), and Endeavor Acquisition Corp., a Delaware corporation (“Endeavor”). Each of the AAI Group and the Founders Group is sometimes referred to herein as a “Group”. For purposes of this Agreement, each person who is a member of either the AAI Group or the Founders Group is referred to herein individually as a “Stockholder” and collectively as the “Stockholders.”

WHEREAS, as of November 7, 2007, each of:

Endeavor;

AAI Acquisition, LLC, a California limited liability company and a wholly-owned subsidiary of Endeavor (“Merger Sub”);

American Apparel, Inc., a California corporation (“AAI”);

All of the Canadian corporations affiliated with AAI (collectively “CI”);

American Apparel, LLC, a California limited liability company (“LLC” and, collectively with AAI and CI, the “Targets”);

Dov Charney, an owner of 50% of the outstanding capital stock of AAI and 50% of the outstanding membership interests of LLC and a member of the AAI Group (the “Stockholder”);

Sang Ho Lim, the owner of the remaining 50% of the outstanding capital stock of AAI and the remaining 50% of the outstanding membership interests of LLC (“Lim”); and

Each of the stockholders of CI (each of whom is a member of the AAI Group),

entered into an amended and restated Agreement and Plan of Reorganization which restated in its entirety the Agreement and Plan of Reorganization, dated as of December 18, 2006, by and among the parties and/or affiliates thereof (as amended and restated, the “Reorganization Agreement”) that provides, inter alia, upon the terms and subject to the conditions thereof, for the concurrent merger of AAI with and into Merger Sub and acquisition of all of the outstanding capital stock of the CI companies by Parent, and the exchange of all of the outstanding capital stock of each of the Targets for shares of the common stock of Endeavor and/or cash (collectively, the “Transactions”).

WHEREAS, as of the date hereof, each Stockholder who is a member of the Founders Group owns beneficially and of record shares of common stock of Endeavor, par value $0.0001 per share (“Endeavor Common Stock”), as set forth opposite such stockholder’s name on Exhibit A hereto (all such shares and any shares of which ownership of record or the power to vote with respect to the Endeavor Common Stock is hereafter acquired by any of the Stockholders, whether by purchase, conversion or exercise, prior to the termination of this Agreement being referred to herein as the “Shares”);

WHEREAS, at the Effective Time, all common shares of each of the Targets (“Company Common Stock”) beneficially owned by each Stockholder who is a member of the AAI Group shall be converted into the right to receive and shall be exchanged for his, her or its pro rata portion of the shares of Endeavor Common Stock to be issued to the Company’s security holders as consideration in the Transactions;

WHEREAS, as a condition to the consummation of the Merger Agreement, the Stockholders have agreed, severally, to enter into this Agreement; and

WHEREAS, capitalized terms used but not defined in this Agreement shall have the meanings ascribed to them in the Merger Agreement.

NOW, THEREFORE, in consideration of the premises and of the mutual agreements and covenants set forth herein and in the Merger Agreement, and intending to be legally bound hereby, the parties hereto hereby agree as follows:

ARTICLE I

VOTING OF SHARES FOR DIRECTORS

SECTION 1.01 Vote in Favor of the Directors. During the term of this Agreement, each Stockholder agrees to vote the shares of Endeavor Common Stock he, she or it now owns, or will hereafter acquire prior to the termination of this Agreement, for the election and re-election of the following persons as directors of Endeavor (“Director Designees”):

(a) Four (4) persons, each of whom shall be designees of the AAI Group; with two (2) of such designees to stand for election in 2008 (“Class A Director”), who shall initially be Robert Greene and Allan Mayer; one of such designees to stand for election in 2009 (“Class B Director”), who shall initially be Adrian Kowalewski; and one of such designees to stand for election in 2010 (“Class C Directors”), who shall initially be Dov Charney (collectively, the “AAI Directors”), with two of such designees qualifying as “independent” directors within the meaning of the American Stock Exchange rules;

(b) Four (4) persons, each of whom shall be designees of the Founders Group; two (2) of such designees being a Class B Director, who shall initially be Mark Klein and Mortimer Singer; and two (2) of such designees being Class C Directors, who shall initially be Mark Sanson and Mark Thornton (collectively, the “Endeavor Directors”), with two of such designees qualifying as “independent” directors within the meaning of the American Stock Exchange rules;

2

(c) One (1) person, who shall be mutually designated by the AAI Group and Founders Group, who shall, at all times, be an “independent director” within the meaning of the American Stock Exchange Rules, with such designee being a Class A Director. The initial mutual designee shall be Keith Miller.

Neither the Stockholders, nor any of the officers, directors, stockholders, members, managers, partners, employees or agents of any Stockholder, makes any representation or warranty as to the fitness or competence of any Director Designee to serve on the Board of Directors by virtue of such party’s execution of this Agreement or by the act of such party in designating or voting for such Director Designee pursuant to this Agreement.

Any Director Designee may be removed from the Board of Directors in the manner allowed by law and Endeavor’s governing documents except that, subject to Section 1.04, below, each Stockholder agrees that he, she or it will not, as a stockholder, vote for the removal of any director who is a member of the Group of which such Stockholder is not a member. If a director is removed or resigns from office, the remaining directors of the Group of which the vacating director is a member shall be entitled to appoint the successor.

All committees of the Board shall be formed in accordance with, and its members shall be qualified under, the applicable rules and regulations of the United States securities laws and the American Stock Exchange or such other principal trading market on which Endeavor’s securities trade. All of the members of any committee (including, but not limited to, any audit, nominating, compensation or executive governance committee) shall be comprised of the mutually appointed director and an equal number of independent directors that were appointed by each of the AAI Group and the Founders Group.

SECTION 1.02 Obligations of Endeavor. Endeavor shall take all necessary and desirable actions within its control during the term of this Agreement to provide for the Endeavor Board of Directors to be comprised of nine (9) members and to enable the election to the Board of Directors of the Director Designees.

SECTION 1.03 Term of Agreement. The obligations of the Stockholders pursuant to this Agreement shall terminate immediately following the election or re-election of directors at the annual meeting of Endeavor that will be held in 2010.

SECTION 1.04 Obligations as Director and/or Officer. Nothing in this Agreement shall be deemed to limit or restrict any director or officer of Endeavor from acting in his or her capacity as such director or officer or from exercising his or her fiduciary duties and responsibilities, it being agreed and understood that this Agreement shall apply to each Stockholder solely in his, her or its capacity as a stockholder of Endeavor and shall not apply to his, her or its actions, judgments or decisions as a director or officer of Endeavor if he or she is such a director or officer.

SECTION 1.05 Transfer of Shares. If a member of the AAI Group desires to transfer his, her or its Shares to a permitted transferee pursuant to the Lock-Up Agreement of even date herewith, executed by such member, or if a member of the Founders Group desires to transfer his or its shares to a permitted transferee pursuant to the Escrow Agreement dated as of

3

December 15, 2005, it shall be a condition to such transfer that the transferee agree to be bound by the provisions of this Agreement. This Agreement shall in no way restrict the transfer on the public market of Shares that are not subject to the Lock-Up Agreement or the Escrow Agreement, and any such transfers on the public market of Shares not subject to the provisions of the Lock-Up Agreement or the Escrow Agreement, as applicable, shall be free and clear of the restrictions in this Agreement.

ARTICLE II

REPRESENTATIONS AND WARRANTIES: COVENANTS OF THE STOCKHOLDERS

Each Stockholder hereby severally represents warrants and covenants as follows:

SECTION 2.01 Authorization. Such Stockholder has full legal capacity and authority to enter into this Agreement and to carry out such Stockholder’s obligations hereunder. This Agreement has been duly executed and delivered by such Stockholder, and (assuming due authorization, execution and delivery by Endeavor and the other Stockholders) this Agreement constitutes a legal, valid and binding obligation of such Stockholder, enforceable against such Stockholder in accordance with its terms.

SECTION 2.02 No Conflict: Required Filings and Consents.

(a) The execution and delivery of this Agreement by such Stockholder does not, and the performance of this Agreement by such Stockholder will not, (i) conflict with or violate any Legal Requirement applicable to such Stockholder or by which any property or asset of such Stockholder is bound or affected, or (ii) result in any breach of or constitute a default (or an event which with notice or lapse of time or both would become a default) under, or give to others any right of termination, amendment, acceleration or cancellation of, or result in the creation of any encumbrance on any property or asset of such Stockholder, including, without limitation, the Shares, pursuant to, any note, bond, mortgage, indenture, contract, agreement, lease, license, permit, franchise or other instrument or obligation.

(b) The execution and delivery of this Agreement by such Stockholder does not, and the performance of this Agreement by such Stockholder will not, require any consent, approval, authorization or permit of, or filing with or notification to, any governmental or regulatory authority, domestic or foreign, except (i) for applicable requirements, if any, of the Exchange Act, and (ii) where the failure to obtain such consents, approvals, authorizations or permits, or to make such filings or notifications, would not prevent or materially delay the performance by such Stockholder of such Stockholder’s obligations under this Agreement,

SECTION 2.03 Title to Shares. Such Stockholder is the legal and beneficial owner of its Shares, or will be the legal beneficial owner of the Shares that such Stockholder will receive as a result of the Transactions, free and clear of all liens and other encumbrances except certain restrictions upon the transfer of such Shares.

4

ARTICLE III

GENERAL PROVISIONS

SECTION 3.01 Notices. All notices and other communications given or made pursuant hereto shall be in writing and shall be given (and shall be deemed to have been duly given upon receipt) by delivery in person, by overnight courier service, by telecopy, or by registered or certified mail (postage prepaid, return receipt requested) to the respective parties at the following addresses (or at such other addresses as shall be specified by notice given in accordance with this Section 3.01):

(a) If to Endeavor:

Endeavor Acquisition Corp.

970 West Broadway

PMB 402

Jackson, WY 83001

Attention: Chairman of the Board

Telephone No.: 212-683-5350

Facsimile No.: 212-521-4389

with a mandatory copy to

American Apparel, Inc.

747 Warehouse Street

Los Angeles, California 90021

Attention: Dov Charney

Telephone No.: 213-488-0226

Facsimile No.: 213-488-0334

with a mandatory copy to

Graubard Miller

405 Lexington Avenue

New York, NY 10174-1901

Attention: David Alan Miller, Esq.

Telephone No. : 212-818-8800

Facsimile No.: 212-818-8881

with a mandatory copy to

Buchanan Ingersoll & Rooney PC

One Chase Manhattan Plaza

35th Floor

New York, New York 10005-1417

Attention: Brian North, Esq.

Telephone No.: 212-440-4400

Facsimile No.: 212-440-4401

5

(b) If to any Stockholder, to the address set forth opposite his, her or its name on Exhibit A.

SECTION 3.02 Headings. The headings contained in this Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement.

SECTION 3.03 Severability. If any term or other provision of this Agreement is invalid, illegal or incapable of being enforced by any rule of law or public policy, all other conditions and provisions of this Agreement shall nevertheless remain in full force and effect so long as the economic or legal substance of the transactions contemplated hereby is not affected in any manner materially adverse to any party. Upon such determination that any term or other provision is invalid, illegal or incapable of being enforced, the parties hereto shall negotiate in good faith to modify this Agreement so as to effect the original intent of the parties as closely as possible to the fullest extent permitted by applicable law in an acceptable manner to the end that the transactions contemplated hereby are fulfilled to the extent possible.

SECTION 3.04 Entire Agreement. This Agreement, collectively with the Lock-Up Agreements and the Merger Agreement, constitutes the entire agreement of the parties with respect to the subject matter contained herein and supersedes all prior agreements and undertakings, both written and oral, between the parties, or any of them, with respect to the subject matter hereof. This Agreement may not be amended or modified except in an instrument in writing signed by, or on behalf of, the parties hereto.

SECTION 3.05 Specific Performance. The parties hereto agree that irreparable damage would occur in the event that any provision of this Agreement was not performed in accordance with the terms hereof and that the parties shall be entitled to specific performance of the terms hereof, in addition to any other remedy at law or in equity.

SECTION 3.06 Governing Law. This Agreement shall be governed by, and construed in accordance with, the law of the State of Delaware applicable to contracts executed in and to be performed in that State.

SECTION 3.07 Disputes. All actions and proceedings arising out of or relating to this Agreement shall be heard and determined exclusively in any state or federal court in Delaware.

SECTION 3.08 No Waiver. No failure or delay by any party in exercising any right, power or privilege hereunder shall operate as a waiver thereof nor shall any single or partial exercise thereof preclude any other or further exercise thereof or the exercise of any other right, power or privilege. The rights and remedies herein provided shall be cumulative and not exclusive of any rights or remedies provided by law.

SECTION 3.09 Counterparts. This Agreement may be executed in one or more counterparts, and by the different parties hereto in separate counterparts, each of which when executed shall be deemed to be an original but all of which taken together shall constitute one and the same agreement.

6

SECTION 3.10 Waiver of Jury Trial. Each of the parties hereto irrevocably and unconditionally waives all right to trial by jury in any action, proceeding or counterclaim (whether based in contract, tort or otherwise) arising out of or relating to this Agreement or the Actions of the parties hereto in the negotiation, administration, performance and enforcement thereof.

SECTION 3.11 Merger Agreement. All references to the Merger Agreement herein shall be to such agreement as may be amended by the parties thereto from time to time.

7

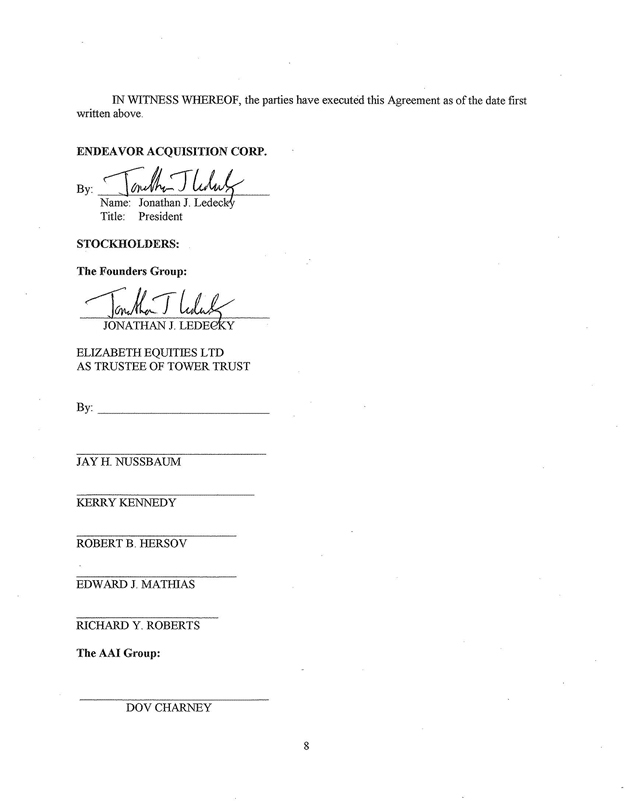

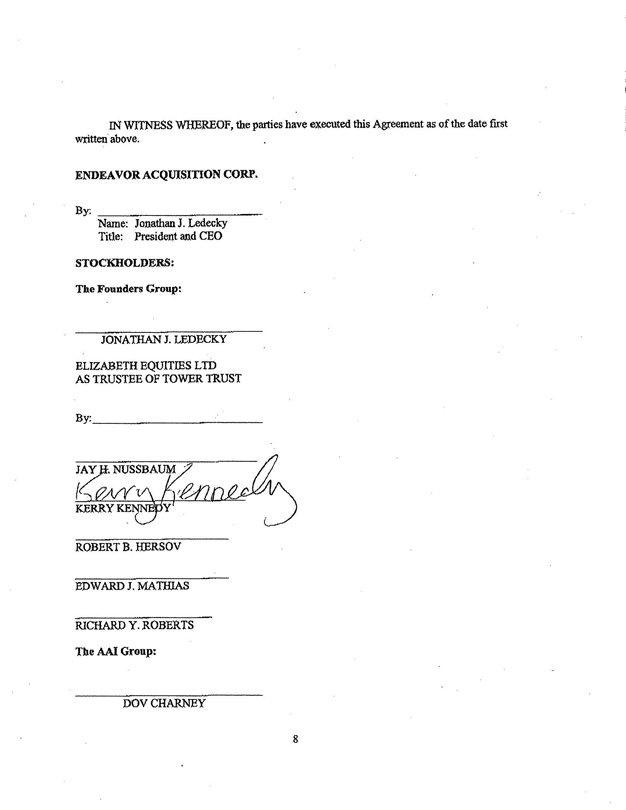

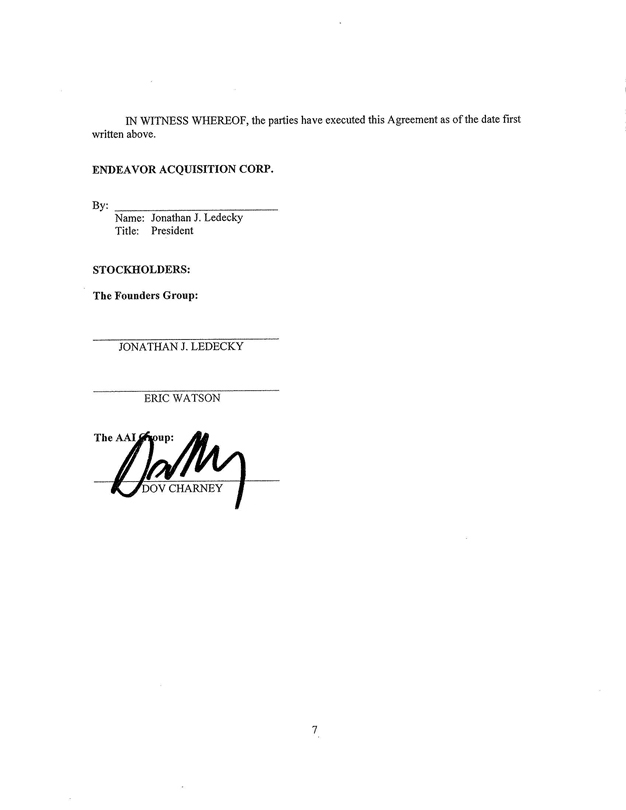

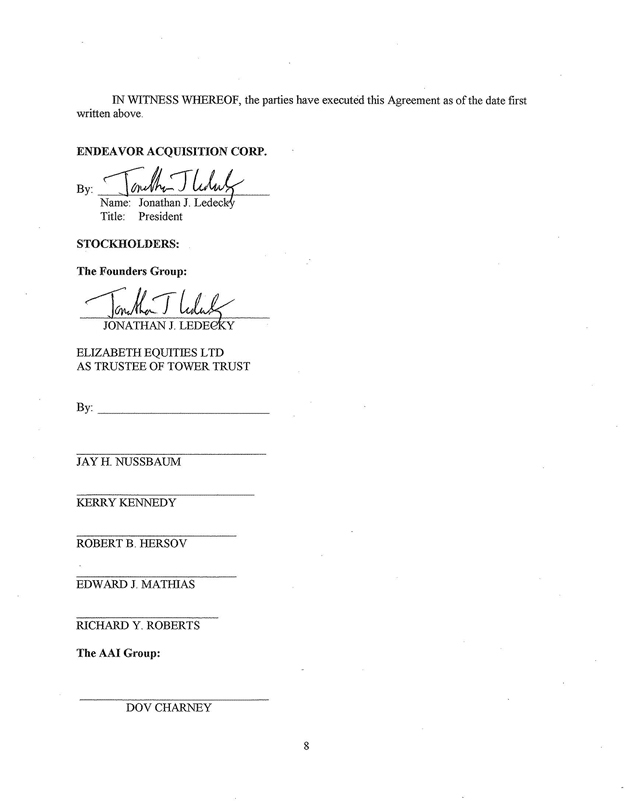

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

ENDEAVOR ACQUISITION CORP.

By:

Name: Jonathan J. Ledecky

Title: President

STOCKHOLDERS:

The Founders Group:

JONATHAN J. LEDECKY

ELIZABETH EQUITIES LTD

AS TRUSTEE OF TOWER TRUST

By:

JAY H. NUSSBAUM

KERRY KENNEDY

ROBERT B. HERSOV

EDWARD J. MATHIAS

RICHARD Y. ROBERTS

The AAI Group:

DOV CHARNEY

8

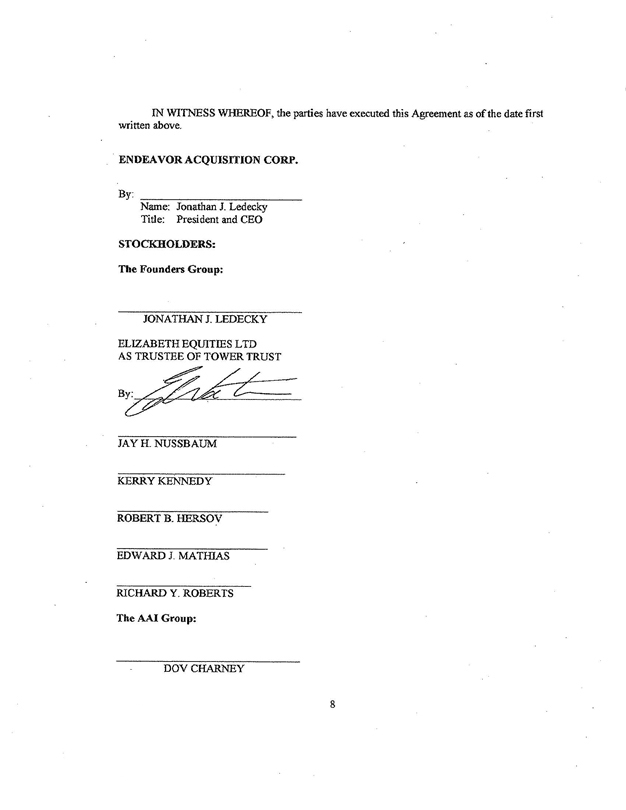

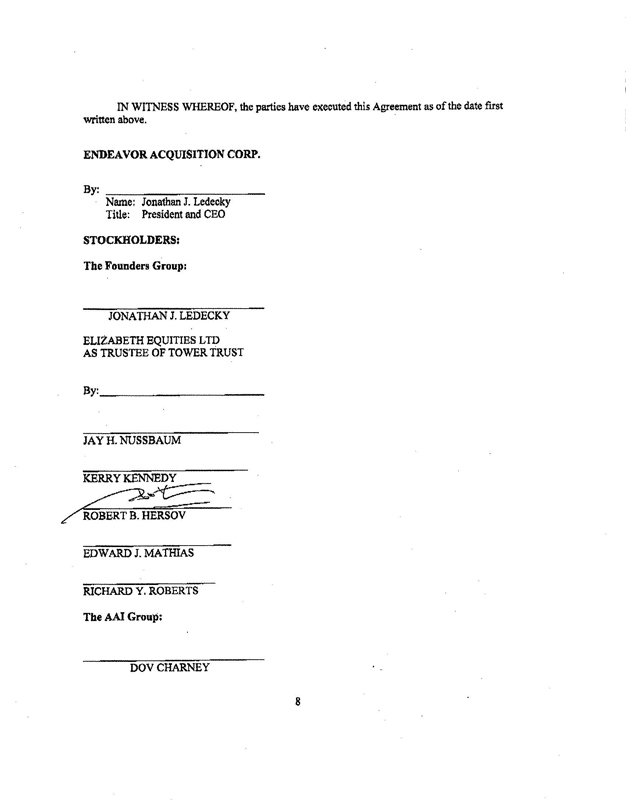

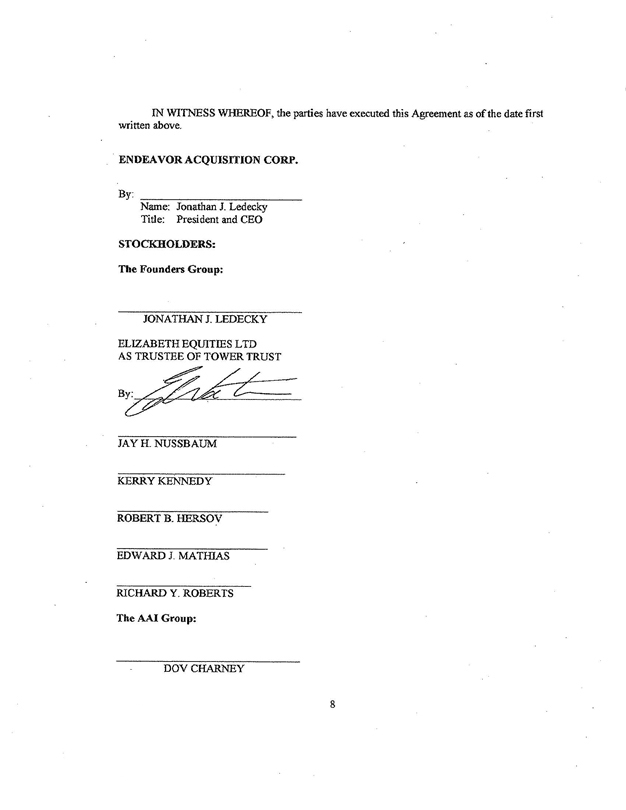

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

ENDEAVOR ACQUISITION CORP.

By:

Name: Jonathan J. Ledecky

Title: President and CEO

STOCKHOLDERS:

The Founders Group:

JONATHAN J. LEDECKY

ELIZABETH EQUITIES LTD

AS TRUSTEE OF TOWER TRUST

By:

JAY H. NUSSBAUM

KERRY KENNEDY

ROBERT B. HERSOV

EDWARD J. MATHIAS

RICHARD Y. ROBERTS

The AAI Group:

DOV CHARNEY

8

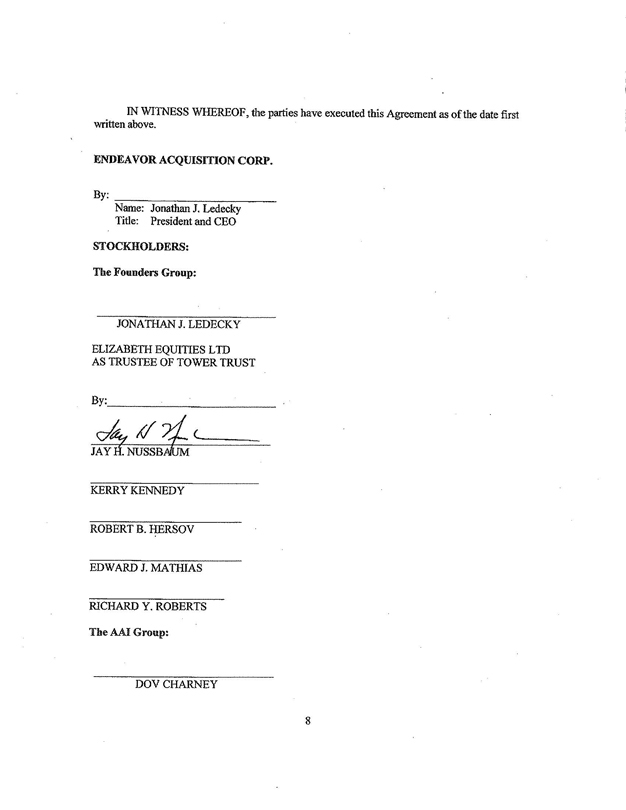

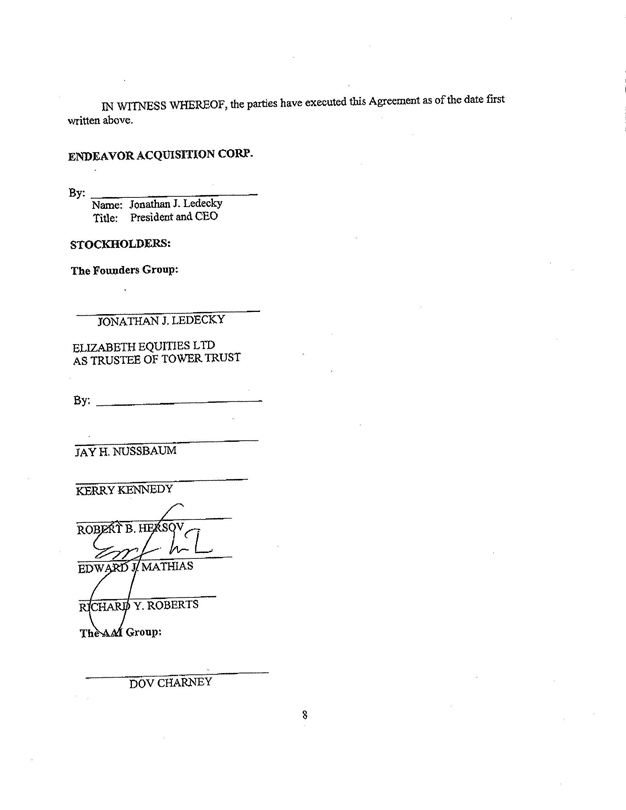

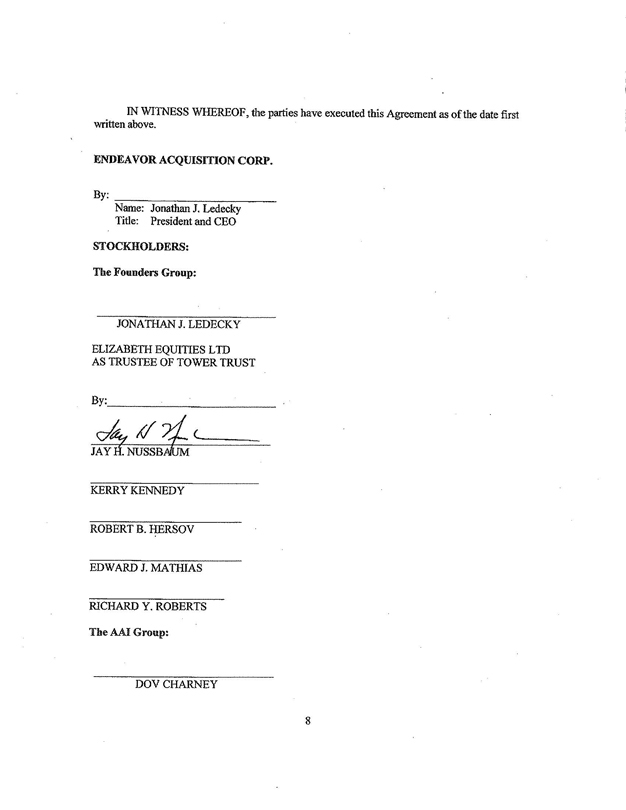

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

ENDEAVOR ACQUISITION CORP.

By:

Name: Jonathan J. Ledecky

Title: President and CEO

STOCKHOLDERS:

The Founders Group:

JONATHAN J. LEDECKY

ELIZABETH EQUITIES LTD

AS TRUSTEE OF TOWER TRUST

By:

JAY H. NUSSBAUM

KERRY KENNEDY

ROBERT B. HERSOV

EDWARD J. MATHIAS

RICHARD Y. ROBERTS

The AAI Group:

DOV CHARNEY

8

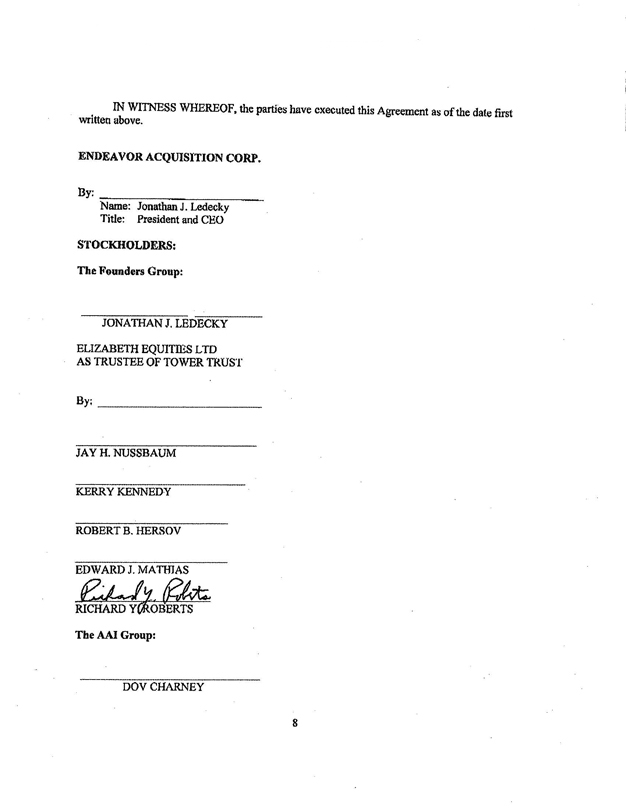

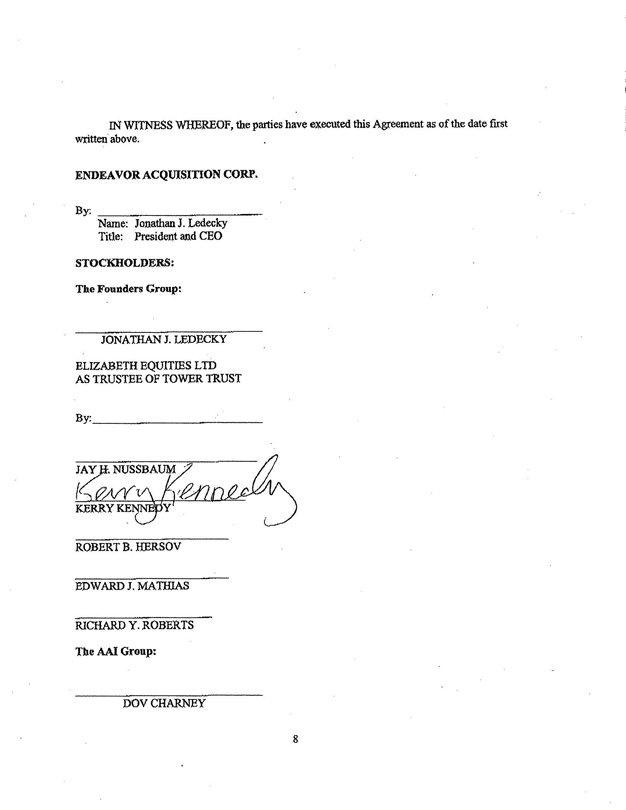

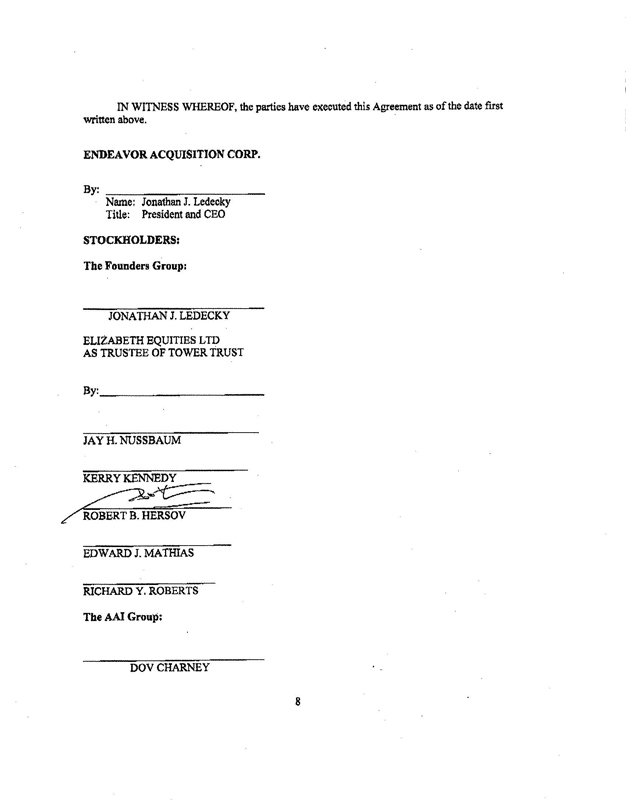

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

ENDEAVOR ACQUISITION CORP.

By:

Name: Jonathan J. Ledecky

Title: President and CEO

STOCKHOLDERS:

The Founders Group:

JONATHAN J. LEDECKY

ELIZABETH EQUITIES LTD

AS TRUSTEE OF TOWER TRUST

By:

JAY H. NUSSBAUM

KERRY KENNEDY

ROBERT B. HERSOV

EDWARD J. MATHIAS

RICHARD Y. ROBERTS

The AAI Group:

DOV CHARNEY

8

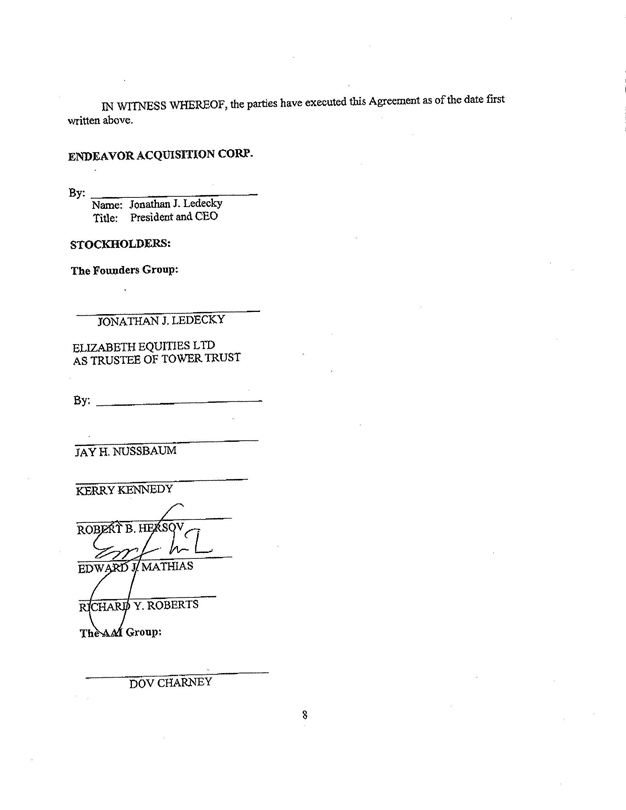

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

ENDEAVOR ACQUISITION CORP.

By:

Name: Jonathan J. Ledecky

Title: President and CEO

STOCKHOLDERS:

The Founders Group:

JONATHAN J. LEDECKY

ELIZABETH EQUITIES LTD

AS TRUSTEE OF TOWER TRUST

By:

JAY H. NUSSBAUM

KERRY KENNEDY

ROBERT B. HERSOV

EDWARD J. MATHIAS

RICHARD Y. ROBERTS

The AAI Group:

DOV CHARNEY

8

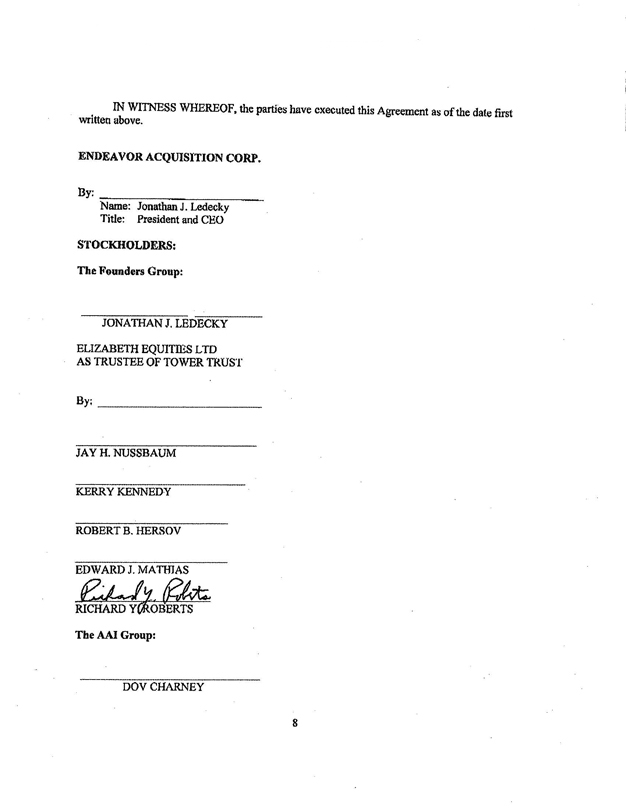

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

ENDEAVOR ACQUISITION CORP.

By:

Name: Jonathan J. Ledecky

Title: President and CEO

STOCKHOLDERS:

The Founders Group:

JONATHAN J. LEDECKY

ELIZABETH EQUITIES LTD

AS TRUSTEE OF TOWER TRUST

By:

JAY H. NUSSBAUM

KERRY KENNEDY

ROBERT B. HERSOV

EDWARD J. MATHIAS

RICHARD Y. ROBERTS

The AAI Group:

DOV CHARNEY

8

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

ENDEAVOR ACQUISITION CORP.

By:

Name: Jonathan J. Ledecky

Title: President and CEO

STOCKHOLDERS:

The Founders Group:

JONATHAN J. LEDECKY

ELIZABETH EQUITIES LTD

AS TRUSTEE OF TOWER TRUST

By:

JAY H. NUSSBAUM

KERRY KENNEDY

ROBERT B. HERSOV

EDWARD J. MATHIAS

RICHARD Y. ROBERTS

The AAI Group:

DOV CHARNEY

8

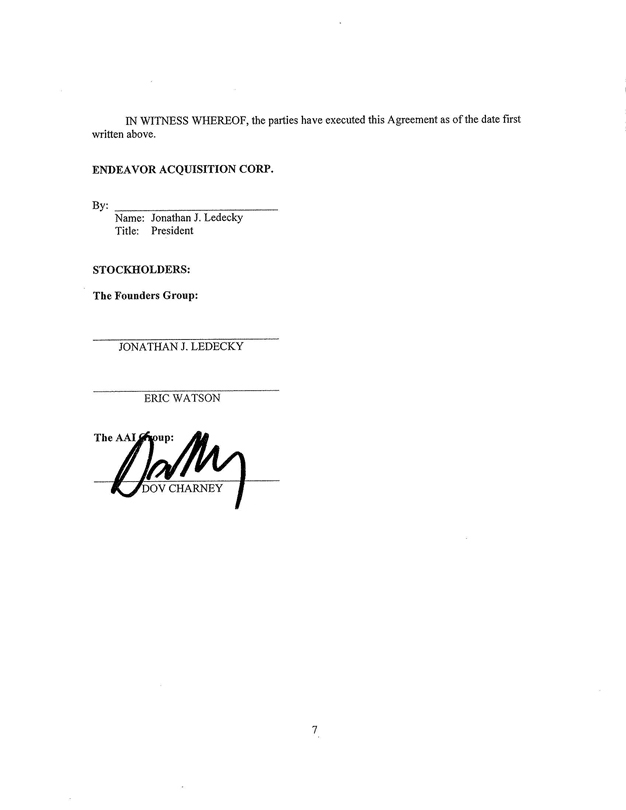

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first written above.

ENDEAVOR ACQUISITION CORP.

By:

Name: Jonathan J. Ledecky

Title: President

STOCKHOLDERS:

The Founders Group:

JONATHAN J. LEDECKY

ERIC WATSON

The AAI Group:

DOV CHARNEY

7

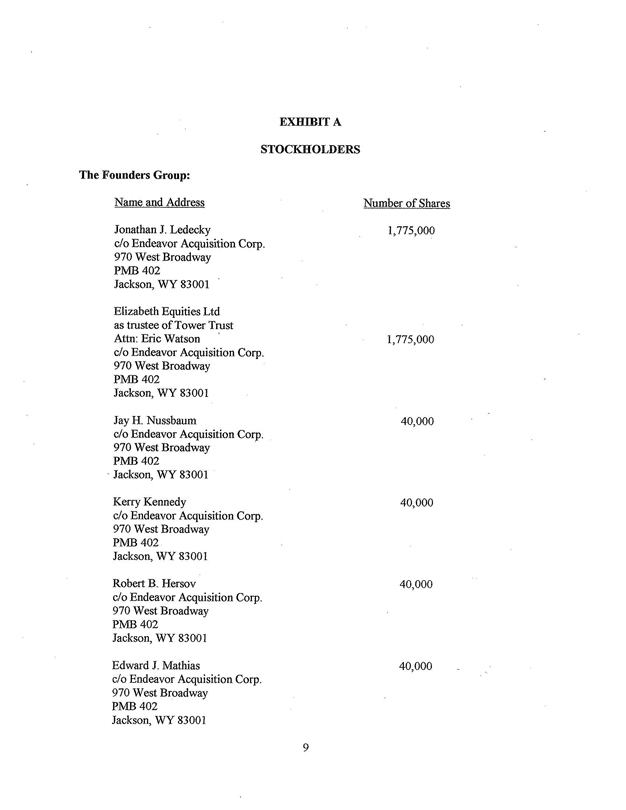

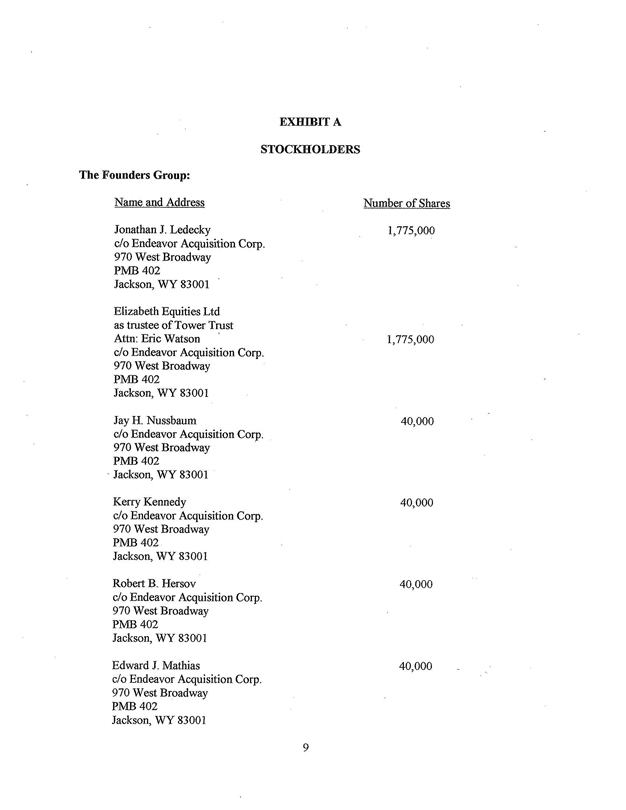

EXHIBIT A

STOCKHOLDERS

The Founders Group:

Name and Address Number of Shares

Jonathan J. Ledecky 1,775,000

c/o Endeavor Acquisition Corp.

970 West Broadway

PMB 402

Jackson, WY 83001

Elizabeth Equities Ltd as trustee of Tower Trust

Attn: Eric Watson 1,775,000

c/o Endeavor Acquisition Corp. 970

West Broadway PMB 402

Jackson, WY 83001

Jay H. Nussbaum 40,000

c/o Endeavor Acquisition Corp.

970 West Broadway

PMB 402

Jackson, WY 83001

Kerry Kennedy 40,000

c/o Endeavor Acquisition Corp.

970 West Broadway

PMB 402

Jackson, WY 83001

Robert B. Hersov 40,000

c/o Endeavor Acquisition Corp.

970 West Broadway

PMB 402

Jackson, WY 83001

Edward J. Mathias 40,000

c/o Endeavor Acquisition Corp.

970 West Broadway

PMB 402

Jackson, WY 83001

9

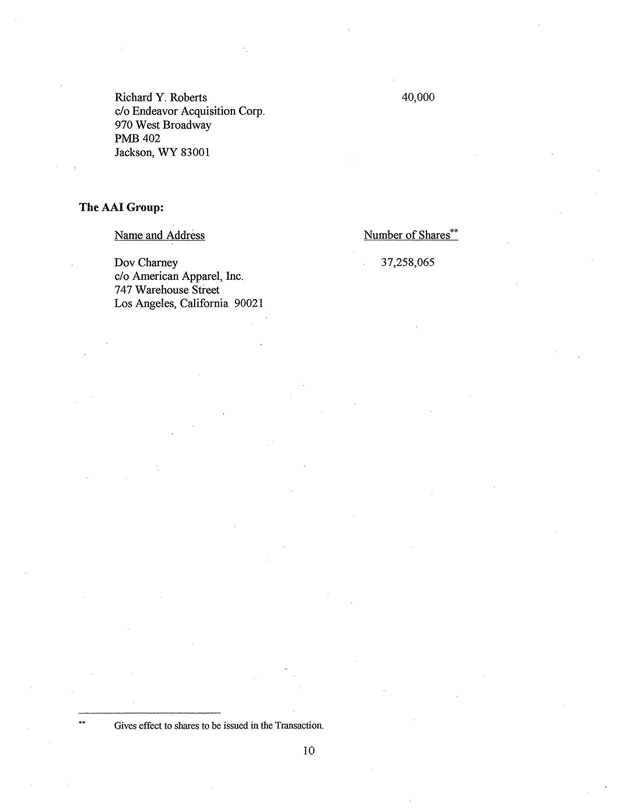

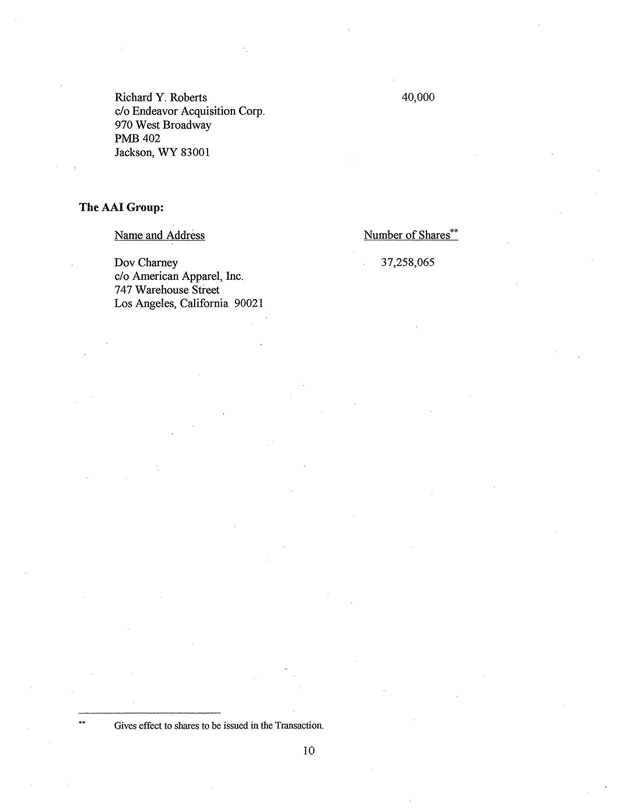

Richard Y. Roberts 40,000

c/o Endeavor Acquisition Corp.

970 West Broadway

PMB 402

Jackson, WY 83001

The AAI Group:

Name and Address Number of Shares**

Dov Charney 37,258,065

c/o American Apparel, Inc.

747 Warehouse Street

Los Angeles, California 90021

** Gives effect to shares to be issued in the Transaction.

10