Exhibit 10.12

Exhibit 10.12

FOURTH AMENDMENT TO CREDIT AGREEMENT

LASALLE RETAIL FINANCE

Date: June 20, 2008

THIS FOURTH AMENDMENT TO CREDIT AGREEMENT (this “Fourth Amendment”)

is made to the Credit Agreement (as amended, the “Credit Agreement”) dated as of July 2, 2007 by and among:

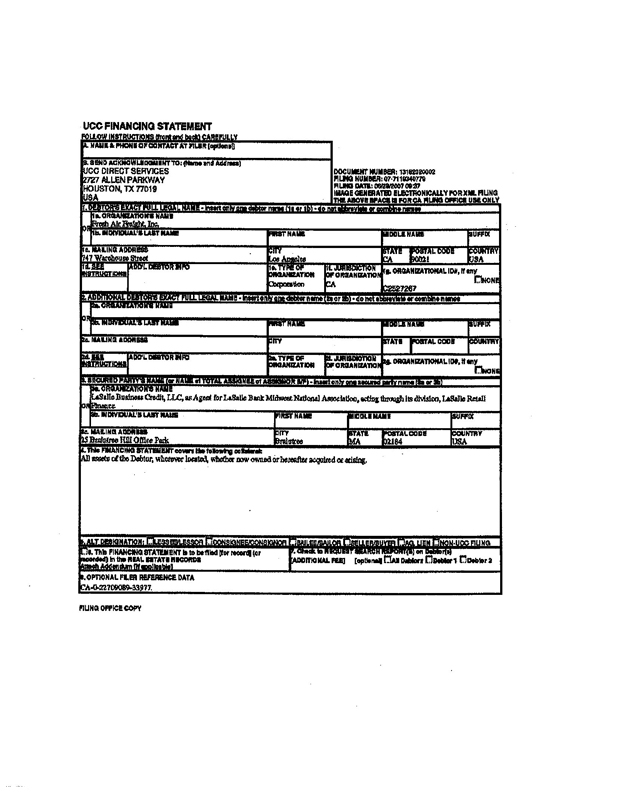

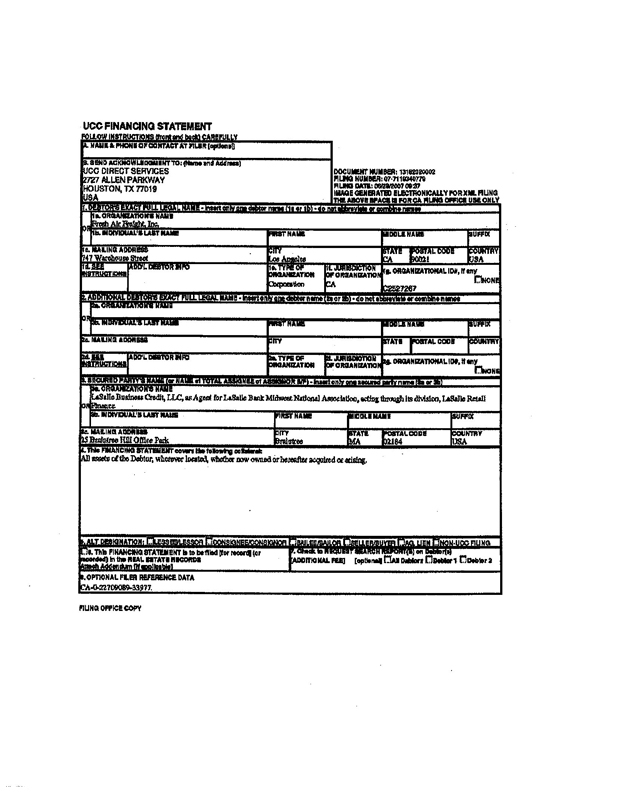

(a) American Apparel (USA), LLC (f/k/a AAI Acquisition LLC (successor-by-merger to American Apparel, Inc.)), a corporation organized under the laws of the State of California, with its principal executive offices at 747 Warehouse Street, Los Angeles, California 90021, for itself and as agent (in such capacity, the “Lead Borrower”) for the other Borrowers now or hereafter party to the Credit Agreement; and

(b) the BORROWERS now or hereafter party to the Credit Agreement; and

(c) the FACILITY GUARANTORS now or hereafter party to the Credit Agreement; and

(d) LASALLE BUSINESS CREDIT, LLC, AS AGENT FOR LASALLE BANK MIDWEST NATIONAL ASSOCIATION, ACTING THROUGH ITS DIVISION, LASALLE RETAIL FINANCE, with offices at 100 Federal Street, 9th Floor, Boston, Massachusetts 02110, as administrative agent (in such capacity, the “Administrative Agent”) for its own benefit and the benefit of the other Credit Parties; and

(e) LASALLE BUSINESS CREDIT, LLC, AS AGENT FOR LASALLE BANK MIDWEST NATIONAL ASSOCIATION, ACTING THROUGH ITS DIVISION, LASALLE RETAIL FINANCE, with offices at 100 Federal Street, 9th Floor, Boston, Massachusetts 02110, as collateral agent (in such capacity, the “Collateral Agent”, and together with the Administrative Agent, individually an “Agent” and collectively, the “Agents”) for its own benefit and the benefit of the other Credit Parties; and

(f) WELLS FARGO RETAIL FINANCE, LLC, with offices at One Boston Place, 19th Floor, Boston, Massachusetts 02108, as collateral monitoring agent (in such capacity, the “Collateral Monitoring Agent”) for its own benefit and the benefit of the other Credit Parties; and

(g) the LENDERS party to the Credit Agreement; and

- 1 - -

(h) LASALLE BANK NATIONAL ASSOCIATION, a national banking association with offices at 135 South LaSalle Street, Chicago, Illinois 60603, as Issuing Bank;

in consideration of the mutual covenants herein contained and benefits to be derived herefrom, the parties hereto agree as follows:

Background:

A. Amendment. The parties hereto entered into that certain First Amendment to Credit Agreement on October 11, 2007, that certain Second Amendment and Waiver to Credit Agreement on November 26, 2007, and that certain Third Amendment to Credit Agreement on December 12, 2007. The parties hereto desire to further amend the Credit Agreement on the terms and conditions set forth herein.

B. Waivers. On May 16, 2008, the parties hereto executed that certain Waiver and Consent to Credit Agreement, pursuant to which the Loan Parties agreed to enter into an amendment to the Credit Agreement and other related documents in order to effect (i) certain changes to the terms and provisions of the Credit Agreement, and (ii) a joinder by American Apparel, Inc. (f/k/a Endeavor Acquisition Corp.), a Delaware corporation with an address at 747 Warehouse Street, Los Angeles, California 90021 (the “Parent”), to the Credit Agreement and the other Loan Documents as a Facility Guarantor thereunder. On June 5, 2008, the parties hereto executed that certain Waiver to Credit Agreement (the “June Waiver”), pursuant to which the Loan Parties agreed to enter into the New Fourth Amendment Documents (as such term is defined in the June Waiver).

Accordingly, it is hereby agreed, as follows:

1. Amendment to Credit Agreement. Subject to satisfaction of each and all of the

Preconditions to Effectiveness set forth in Section 2 hereof, the Credit Agreement is amended as follows:

a. By deleting Exhibit K (Form of Compliance Certificate) to the Credit Agreement in its entirety and substituting the attached Exhibit K in its stead.

b. By deleting Exhibit M (Financial Performance Covenants) to the Credit Agreement in its entirety and substituting the attached Exhibit M in its stead.

c. By adding new Schedule 1.03, Schedule 1.04 and Schedule 1.05 to the Credit Agreement in the forms annexed hereto.

- 2 - -

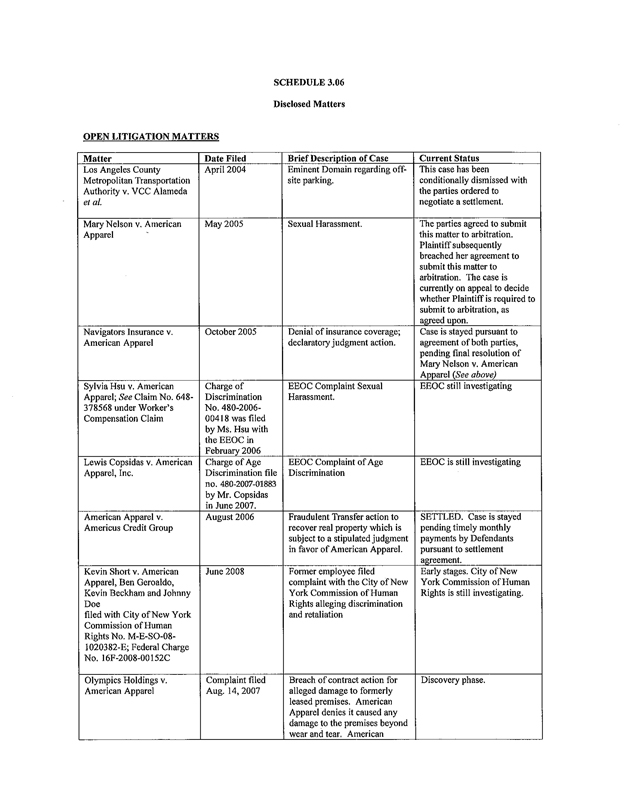

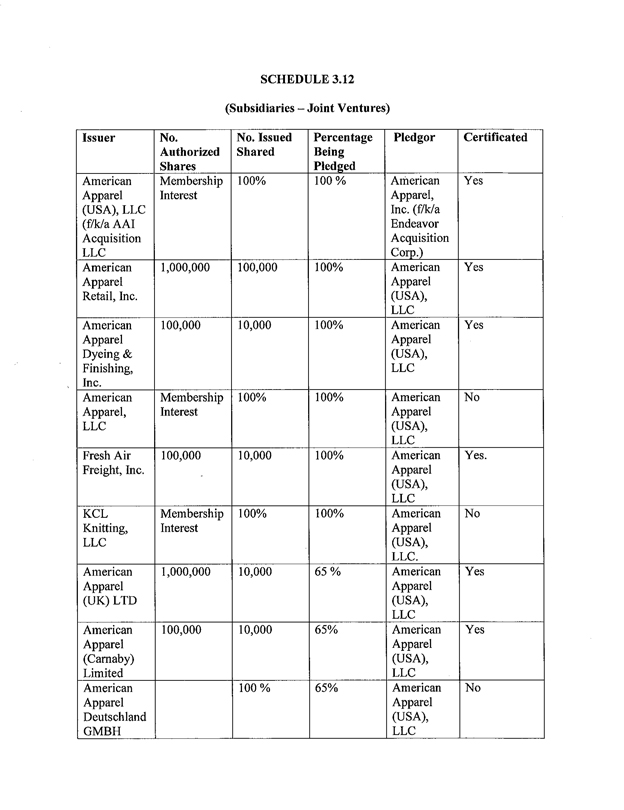

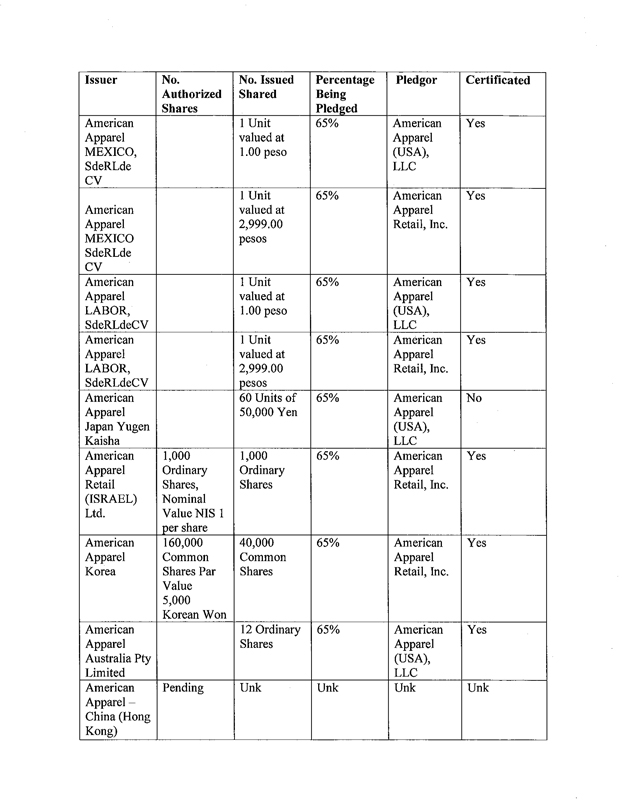

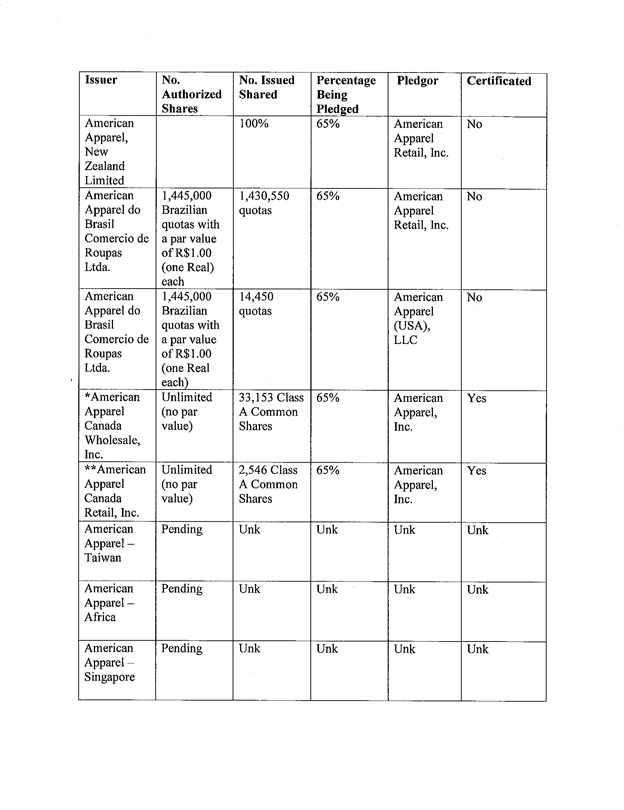

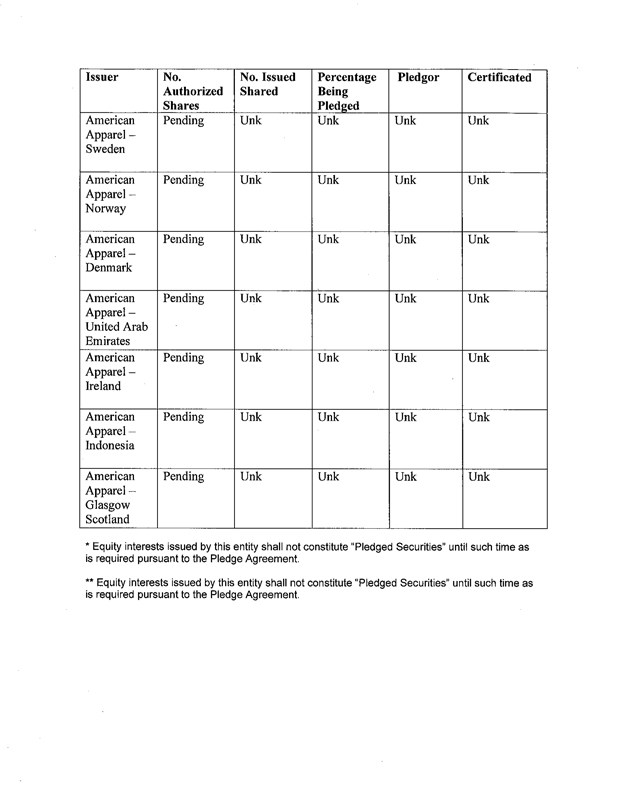

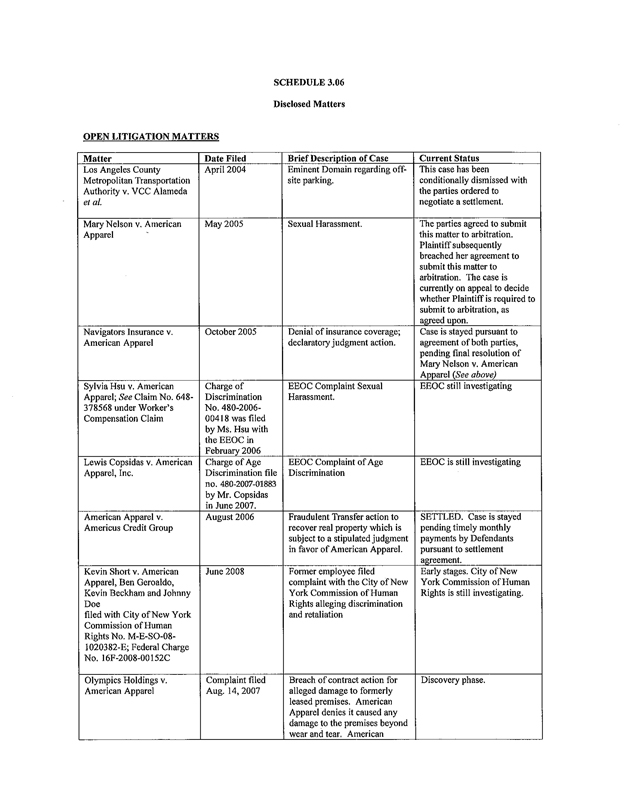

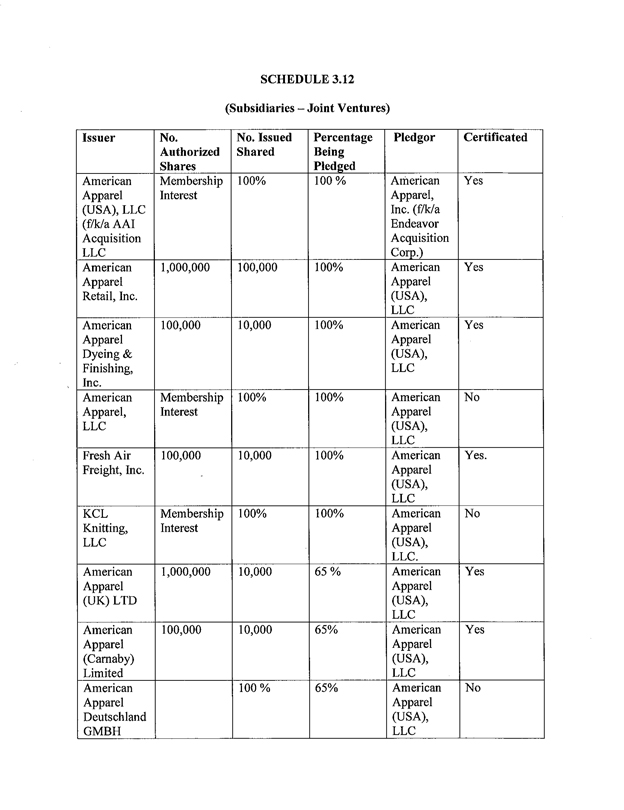

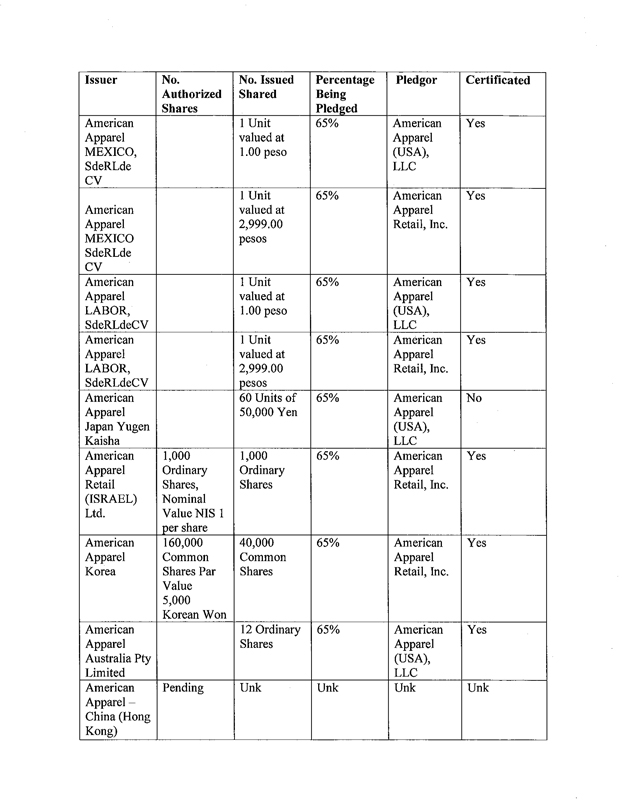

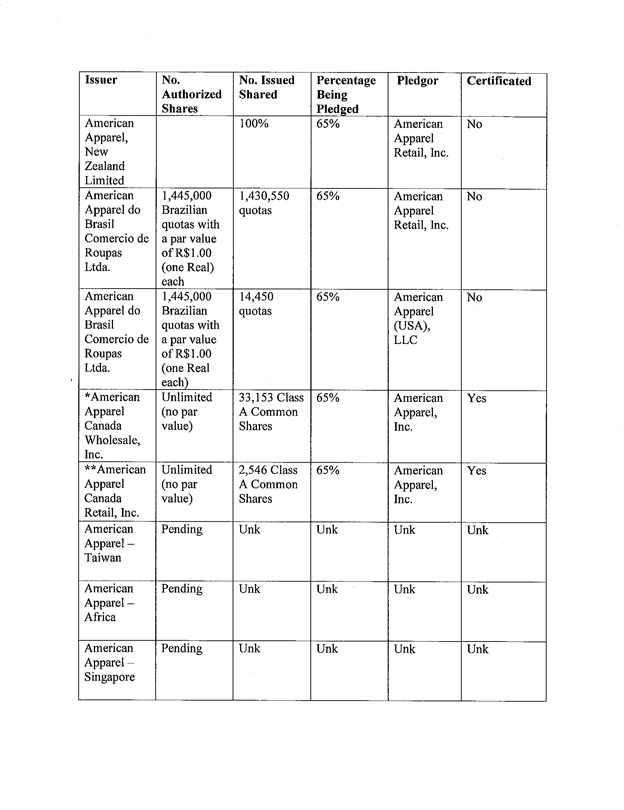

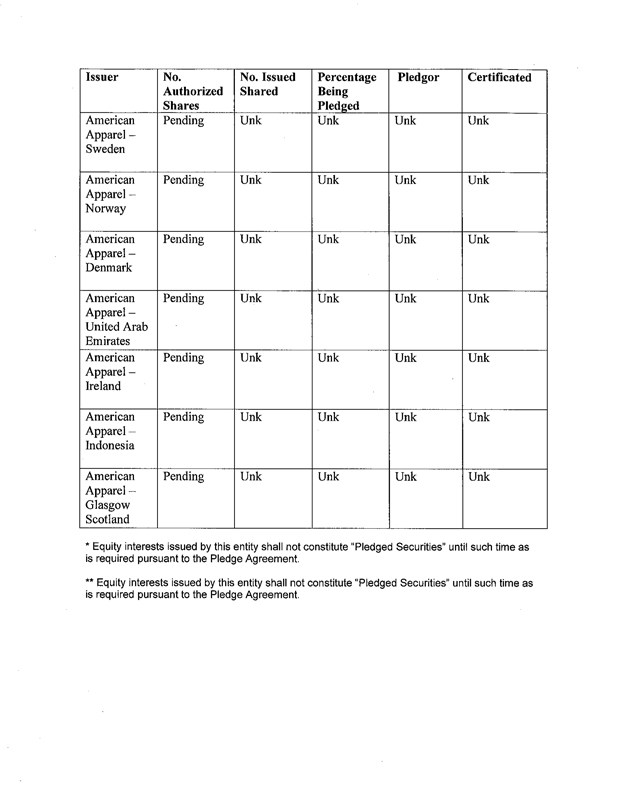

d. By deleting Schedules 2.18(a), 2.18(c)(iii). 2.18(h), 3.01, 3.05(a), 3.05(b). 3.05(c)(i), 3.05(c)(ii). 3.06. 3.12, 3.13, 3.14, and 6.01 to the Credit Agreement in their entirety and substituting the attached Schedules Schedules 2.18(a), 2.18(c)(iii), 2.18(h), 3.01, 3.05(a), 3.05(b), 3.05(c)(i). 3.05(c)(ii), 3.06, 3.12, 3.13, 3.14, and 6.01 in their stead.

e. By adding to Section 1.01 the following new definitions in appropriate alphabetical order:

“Canadian Lender” means The Toronto-Dominion Bank in its capacity as the lender pursuant to the Canadian Loan.

“Canadian Loan” means the loan or any refinancing made by the Canadian Lender to the Canadian Subsidiaries.

“Canadian Subsidiaries” means (i) each of American Apparel Canada Wholesale Inc. and American Apparel Canada Retail Inc., each a wholly-owned Subsidiary of the Parent, and (ii) all other wholly-owned Subsidiaries of the Parent organized under the laws of Canada or any political subdivision thereof. The term “Canadian Subsidiary” shall mean any one of the foregoing Persons.

“Fourth Amendment Effective Date” means the date on which all of the conditions precedent set forth in the Fourth Amendment and the other Loan Documents executed and delivered in connection therewith have been satisfied, as determined in the sole discretion of the Agents.

“Fourth Amendment Fee Letter” means the Fee Letter dated as of June 20, 2008 by and among the Lead Borrower and the Agents.

“Parent” means American Apparel, Inc. (f/k/a Endeavor Acquisition Corp.), a Delaware corporation.

“SPAC Blocked Accounts” means the deposit accounts numbered 48685387, 9939581478, and 000000002211351 of the Parent with Citi Private Bank subject to a Blocked Account Agreement among Citi Private Bank, the Parent and the Collateral Agent.

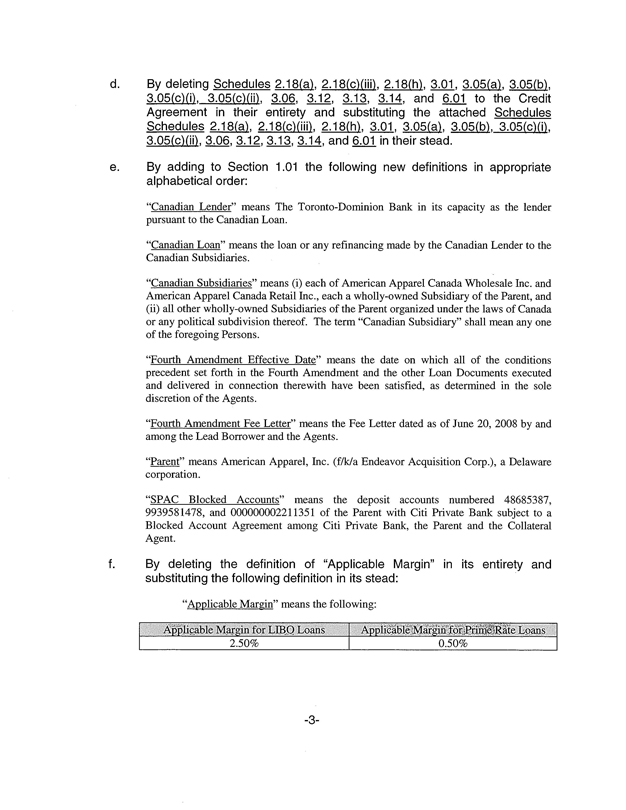

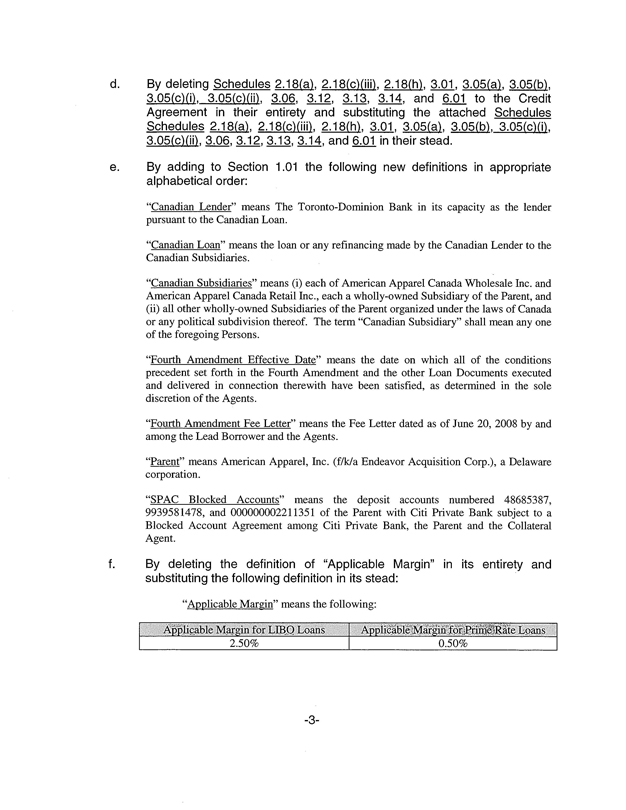

f. By deleting the definition of “Applicable Margin” in its entirety and substituting the following definition in its stead:

“Applicable Margin” means the following:

Applicable Margin for LIBO Loans 2.50%

Applicable Margin for Prime Rate Loans 0.50%

- 3 - -

g. By amending the definition of “Change in Control” by deleting the phrase “;or” at the end of clause (d) thereof and by deleting clause (e) thereof (regarding ownership by Dov Charney of certain Capital Stock) in its entirety.

h. By deleting the definition of “Facility Guarantors” in its entirety and substituting the following definition in its stead:

“Facility Guarantors” means (i) the Borrowers, (ii) each of the Subsidiaries of the Borrowers, whether now existing or hereafter created or acquired, other than any Foreign Subsidiaries, (iii) American Apparel, LLC, a California limited liability company, (iv) the Parent, and (v) any other Person required to become a Facility Guarantor hereunder.

i. By deleting the definition of “Letter of Credit” in its entirety and substituting the following definition in its stead:

“Letter of Credit” means a letter of credit or similar instrument (including, without limitation, a banker’s acceptance) that is (i) issued pursuant to this Agreement for the account of a Borrower, (ii) a Standby Letter of Credit or Commercial Letter of Credit, issued in connection with the purchase of Inventory by a Borrower and for other purposes for which such Borrower has historically obtained letters of credit, or for any other purpose that is reasonably acceptable to the Administrative Agent, and all deferred payment obligations arising with respect to any of the foregoing, and (iii) in form reasonably satisfactory to the Issuing Bank.

j. By deleting the definition of “Payment Conditions” in its entirety and substituting the following definition in its stead:

“Payment Conditions” means (i) no Default or Event of Default shall have occurred or be continuing nor shall result from the making of such Investment, distribution, dividend or payment, and (ii) at least five (5) days prior to the making of any such Investment, distribution, dividend or payment, the Lead Borrower shall have delivered to the Administrative Agent (A) a certificate from the chief financial officer of the Lead Borrower stating that at the time of, and after giving effect to such Investment, distribution, dividend or payment, Excess Availability was not less than twenty percent (20%) of the Borrowing Base for the thirty (30) consecutive days immediately prior, and shall be on a pro forma basis for the sixty (60) consecutive days immediately following, the making of such Investment, distribution or dividend, not less than twenty percent (20%) of the Borrowing Base, and (B) supporting documentation, in form and substance satisfactory to the Administrative Agent, demonstrating calculation of Excess Availability for such periods.

k. By amending the definition of “Permitted Acquisitions” by deleting “and” at the end of clause (g) thereof, by adding “; and” at the end of clause (h) thereof, by deleting the last sentence thereto, and by adding the following clause (i) at the end thereof:

- 4 - -

“(i) The Payment Conditions shall be satisfied; provided that the Loan Parties may make Acquisitions in an aggregate amount not to exceed $3,000,000 from the Fourth Amendment Effective Date until the Maturity Date without satisfying the Payment Conditions so long as the conditions set forth in clauses (a) through (h) above have been satisfied.”

I. By amending the definition of “Permitted Dividends” by deleting clauses (d), (e), and (f) thereof (regarding treatment of Loan Parties as “S” corporations and certain payments to Dov Charney and Sang H. Lim, respectively) in their entirety, adding the phrase “or to any Subsidiary” at the end of clause (c) thereof, and renumbering clause (g) thereof as clause (d).

m. By amending the definition of “Permitted Encumbrances” as follows:

i. By deleting clause (h) thereof in its entirety and substituting the following new clause (h) in its stead:

“(h) Liens on fixed or capital assets acquired by any Loan Party or any Subsidiary which are permitted under clause (e) of the definition of Permitted Indebtedness so long as (i) such Liens and the Indebtedness secured thereby are incurred prior to or within ninety (90) days after such acquisition or the completion of the construction or improvement thereof (other than refinancings thereof permitted hereunder), (ii) the Indebtedness secured thereby does not exceed 100% of the cost of acquisition of such fixed or capital assets, and (iii) such Liens shall not extend to any other property or assets of the Loan Parties;”

ii. By deleting the word “and” at the end of clause (m) thereof, re-lettering clause (n) thereof as clause (o), and inserting the following new clause (n):

“(n) Liens in favor of the Canadian Lender securing the obligations of American Apparel Canada Wholesale Inc. and American Apparel Canada Retail Inc. under the Canadian Loan;”

n. By amending the definition of “Permitted Indebtedness” as follows:

i. By deleting clause (d) thereof in its entirety and substituting the following new clause (d) in its stead:

“(d) (i) Guarantees by any Loan Party of Indebtedness of any other Loan Party, (ii) Guarantees by any Foreign Subsidiary of Indebtedness of another Foreign Subsidiary, and (iii) Guarantees by any Loan Party of Indebtedness in

-5-

respect of Leases of any Foreign Subsidiary existing as of the Fourth Amendment Effective Date and described on Schedule 1.03 annexed hereto;��

ii. By adding the phrase “or any Subsidiary” immediately after the phrase “of any Loan Party” in the first line thereof and by deleting the phrase “$15,000,000” in clause (e) thereof and substituting the phrase “$20,000,000” in its stead and;

iii. By deleting the word “and” at the end of clause (m) thereof, re-lettering clauses (m) and (n) thereof as clauses (q) and (r), respectively, and inserting the following new clauses (m), (n), (o) and (p):

“(m) Indebtedness due the Canadian Lender under the Canadian Loan;

(n) Indebtedness incurred by American Apparel Canada Wholesale, Inc. and due Dov Charney, as such Indebtedness is evidenced by that certain Promissory Note dated as of December 11, 2007 (as in effect on the date hereof, the “US Dov Promissory Note”) in the aggregate principal amount of $3,804,300.00;

(o) Indebtedness incurred by American Apparel Canada Wholesale, Inc. and due Dov Charney, as such Indebtedness is evidenced by that certain Promissory Note dated as of December 11, 2007 (as in effect on the date hereof, the “CN Dov Promissory Note”) in the aggregate principal amount of CAD$2,200,000.00;

(p) Indebtedness incurred by any Subsidiary to a Loan Party or any other Subsidiary to the extent that such Indebtedness is created by the acceptance of any Permitted Investment;”

o. By amending the definition of “Permitted Investments” as follows:

i. By deleting the phrase “means each of the following:” from the first line thereof and substituting the phrase “means, in each case to the extent made when no Event of Default then exists or would arise therefrom, each of the following:”

ii. By deleting the word “and” at the end of clause (i) thereof, deleting clause (j) thereto in its entirety and substituting the following new clause (j) in its stead, and inserting the following new clauses (k), (I) and (m):

“(j) the Investments by a Loan Party in a Foreign Subsidiary (other than a Canadian Subsidiary) described on Schedule 1.04 annexed hereto on the Fourth Amendment Effective Date and subsequently other Investments by a Loan Party in a Foreign Subsidiary (other than a Canadian Subsidiary) to the extent such other Investments do not exceed $10,000,000 in the aggregate, provided that any

-6-

initial Investment permitted pursuant to this clause (j) shall be included without duplication as to any subsequent reinvestment of the same funds by the recipient of such initial Investment in a Subsidiary of such Person;

(k) without duplication of Investments permitted by clause (j) above, other Investments by a Foreign Subsidiary in another Foreign Subsidiary;

(1) irrespective of whether the Payment Conditions have been met, other Investments not to exceed $2,000,000 in the aggregate outstanding at any time; and

(m) other Investments provided that the Payment Conditions have been met.”

iii. By deleting the proviso at the end thereof in its entirety and substituting the following new proviso in its stead:

“provided, however, that notwithstanding the foregoing, (i) no such Investments shall be permitted unless such Investments are, to the extent requested by the Agents, pledged to the Collateral Agent, as additional collateral for the Obligations, pursuant to such agreements as may be reasonably required by the Agents, and (ii) regardless of whether the Payment Conditions have been met, under no circumstances shall any Investment in any Canadian Subsidiary constitute a “Permitted Investment” hereunder, other than (x) any Investment in any Canadian Subsidiary in existence as of the Fourth Amendment Effective Date and described on Schedule 1.05 annexed hereto, or (y) any Investment permitted pursuant to clause (k) hereof. For purposes of clarity and avoidance of doubt, sales of Inventory by a Loan Party to a Foreign Subsidiary (including, without limitation, a Canadian Subsidiary) do not constitute Investments and therefore do not need to qualify as “Permitted Investments” hereunder.”

p. By deleting Section 2.16(d) thereto in its entirety and substituting the following new 2.16(d) in its stead:

“(d) (i) Each DDA Notification shall require the ACH or wire transfer not less frequently than twice weekly (and whether or not there is then an outstanding balance in the Loan Account) of all available cash receipts (the “Cash Receipts”) to the concentration account maintained by the Collateral Agent at LaSalle Bank (the “Concentration Account”) or to a Blocked Account (other than to a SPAC Blocked Account), and (ii) each Credit Card Agreement, Blocked Account Agreement (other than the Blocked Account Agreement with respect to the SPAC Blocked Accounts) and Lockbox Agreement shall require the ACH or wire transfer on each Business Day (and whether or not there is then an outstanding balance in the Loan Account) of all available Cash Receipts to the Concentration Account maintained, in each case, including, without limitation, those from:

(i) the sale of Inventory and other Collateral;

-7-

(ii) all proceeds of collections of Accounts;

(iii) all Net Proceeds, and all other cash payments received by a Borrower from any Person or from any source or on account of any Prepayment Event or other transaction or event;

(iv) the then contents of each DDA (net of any minimum balance, not to exceed $2,500.00, as may be required to be kept in the subject DDA by the bank at which such DDA is maintained); and

(v) the proceeds of all credit card charges.

Notwithstanding the foregoing or the provisions of clause (e) below, prior to the occurrence of an Event of Default, the Loan Parties shall be permitted to keep cash on hand (or cash equivalents) received by the Loan Parties in connection with the SPAC Transaction and existing on the Fourth Amendment Effective Date in an aggregate amount not to exceed $30,000,000 in the SPAC Blocked Account. The SPAC Blocked Account shall require, upon notice to the Blocked Account Bank from the Collateral Agent after an Event of Default, the ACH or wire transfer on each Business Day (and whether or not there is then an outstanding balance in the Loan Account) of all available amounts contained in the SPAC Blocked Account to the Concentration Account.

q. By deleting Section 5.12 thereto in its entirety and substituting the following new Section 5.12 in its stead:

“SECTION 5.12 Additional Subsidiaries.

If any Loan Party shall form or acquire a Subsidiary after the Closing Date, the Lead Borrower will notify the Agents thereof and (a) if such Subsidiary is not a Foreign Subsidiary, the Lead Borrower will cause such Subsidiary to become a Loan Party hereunder and under each applicable Security Document in the manner provided therein within ten (10) Business Days after such Subsidiary is formed or acquired and promptly take such actions to create and perfect Liens on such Subsidiary’s assets to secure the Obligations as the Administrative Agent or the Required Lenders shall request, (b) if any shares of Capital Stock or Indebtedness of such Subsidiary are owned by or on behalf of any Loan Party, the Lead Borrower will cause such shares and promissory notes evidencing such Indebtedness to be pledged to secure the Obligations within ten (10) Business Days after such Subsidiary is formed or acquired (except that (i) if such Subsidiary is a Foreign Subsidiary that is not a Canadian Subsidiary, shares of Capital Stock of such Subsidiary to be pledged may be limited to 65% of the outstanding shares of Capital Stock of such Subsidiary, and (ii) if such Subsidiary is a Canadian Subsidiary, the Lead Borrower shall not be obligated to cause such shares of Capital Stock of such Canadian Subsidiary to be pledged to secure the Obligations until such time as the Canadian Loan is refinanced in accordance with the terms of this Agreement with a lender other than the Canadian Lender).

-8-

r. By amending Section 6.07 (Restricted Payments; Certain Payments of Indebtedness) as follows:

i. By deleting clause (a) thereof in its entirety and substituting the following new clause (a) in its stead:

“(a) No Loan Party will, or will permit any Subsidiary to, declare or make, or agree to pay or make, directly or indirectly, any Restricted Payment other than (i) Permitted Dividends, (ii) so long as no Event of Default has occurred and is continuing, repurchases of the Loan Parties’ Capital Stock in an amount not to exceed $30,000,000 in the aggregate with the proceeds of the Loan Parties’ cash on hand (or cash equivalents) contained in the SPAC Blocked Account, without the prior consent of the Administrative Agent and the Required Lenders and (iii) other Restricted Payments so long as the Payment Conditions have been satisfied.”

ii. By deleting sub-clause (i) of clause (b) thereof in its entirety and substituting the following new sub-clause (i) in its stead:

“(i) as long as no Event of Default then exists or would arise therefrom, (x) mandatory payments of interest and principal as and when due, and (y) prepayments of principal not to exceed $1,000,000.00 in any twelve-month period, in each case in respect of any Permitted Indebtedness (other than Subordinated Indebtedness, the SOF Investments Loan and the Indebtedness described in clauses (n) and (o) of the definition of “Permitted Indebtedness”);”

iii. By deleting “and” at the end of sub-clause (iv) of clause (b) thereof, deleting sub-clause (v) of clause (b) thereof in its entirety and substituting the following new sub-clauses (v), (vi), (vii) and (viii) in its stead:

“(v) refinancing of any Permitted Indebtedness to the extent that (i) the principal amount of the Indebtedness being so refinanced is not increased by such refinancing except on account of fees and expenses required to be paid incidental to such refinancing, provided that in no event shall such increased principal amount exceed 102% of principal amount of the Indebtedness being so refinanced, (ii) such refinancing is on terms and conditions reasonably acceptable to the Administrative Agent, and (iii) the refinancing lender enters into an intercreditor agreement with the Administrative Agent on terms and conditions that the Agents, in their sole discretion exercised in good faith, deem necessary or desirable;

(vi) payments as and when due pursuant to the Canadian Loan, provided that (x) such payments shall be made only by a Canadian Subsidiary, and (y) no Loan Party may transfer proceeds of any Loan to any Canadian Subsidiary for purposes of making any such payments;

-9-

(vii) any prepayments of principal on the US Dov Promissory Note or the CN Dov Promissory Note to the extent such payments are permitted by the Canadian Lender, provided that (x) such prepayments shall be made only by a Canadian Subsidiary, and (y) no Loan party may transfer proceeds of any Loan to any Canadian Subsidiary for purposes of making any such prepayments; and

(vii) other payments on account of Permitted Indebtedness so long as the Payment Conditions have been satisfied.”

s. By amending Section 6.09 (Restrictive Agreements) by deleting the last sentence thereof in its entirety and substituting the following new sentence in its stead:

“Notwithstanding anything in this SECTION 6.09 to the contrary, neither (i) (a) the prohibition on the pledge of security interest in the Capital Stock of the Canadian Subsidiaries, nor (b) the prohibition on the granting of any guaranty or security interest by the Canadian Subsidiaries, in each case as set forth in the Canadian Loan, nor (ii) the prohibitions, restrictions and impositions of conditions expressly set forth in the Merger Agreement and Lim Option Agreement (to the extent such prohibitions, restrictions and impositions of conditions are in connection with the consummation of the merger or the transactions related thereto as expressly set forth in the Merger Agreement and would not result in a Material Adverse Effect) shall be prohibited by this SECTION 6.09.”

2. Preconditions to Effectiveness. This Fourth Amendment shall not take effect unless and until each and all of the following items has been satisfied or delivered, as the case may be, and in all events, to the satisfaction of the Agents, in their sole and exclusive discretion. The willingness of the Agents and the Lenders to enter into this Fourth Amendment is expressly conditioned upon the receipt by the Administrative Agent of the following items:

a. On or prior to the date hereof, the Lead Borrower, the Borrowers, and the Facility Guarantors shall have delivered to the Administrative Agent a duly executed copy of this Fourth Amendment, including all schedules and exhibits to be replaced in

accordance with the terms hereof, and evidence that the Borrowers have obtained all necessary consents and approvals to this Fourth Amendment.

b. The Administrative Agent, SOF Investments and the Loan Parties shall have executed and delivered to the Administrative Agent, in form and substance reasonably satisfactory to each of the Administrative Agent and SOF Investments, an agreement (the “Intercreditor Letter Agreement”) with respect to the amendments and other modifications to the Loan Documents contemplated hereby and by the Loan Documents described in Section 2(f)(iv) hereof, pursuant to which (i) SOF Investments shall have consented to such amendments and other modifications, and (ii) the

-10-

intercreditor agreement between the Administrative Agent and SOF Investments shall have been amended to, among other things, modify the definition of “Required Leverage Ratio” set forth therein.

c. The Loan Parties shall have delivered to the Administrative Agent a duly executed copy of the Amendment No. 7 to the SOF Investments Loan.

d. The Lead Borrower, the Borrowers, and the Facility Guarantors shall have delivered to the Administrative Agent such other and further documents as the Administrative Agent reasonably may require and shall have identified prior to the execution of this Fourth Amendment, in order to confirm and implement the terms and conditions of this Fourth Amendment.

e. On or prior to the date hereof, the Borrowers shall have paid to the Administrative Agent, for the ratable benefit of the Lenders, an amendment fee in the amount of $93,750.00. In this regard, the amendment fee shall be fully earned as of the date of execution of this Fourth Amendment, and the Administrative Agent is hereby authorized to make a Revolving Credit Loan under the Credit Agreement to pay the amendment fee.

f. On or prior to the date hereof, the Borrowers shall have paid the fees set forth in the Fourth Amendment Fee Letter.

g. The Parent (and each other Loan Party, to the extent requested by the Agents) shall each have delivered the following to the Agents, in form and substance reasonably satisfactory to the Agents:

i. A Certificate of Legal Existence and Good Standing issued by the Secretary of the State of its incorporation or organization, and Certificates of Foreign Qualification issued by the Secretary of State of any jurisdiction in which such Person is qualified to do business;

ii. A certificate of an authorized officer relating to the organization and existence of such party, the authorization of the transactions contemplated by the Loan Documents, and attesting to the true signatures of each Person authorized as a signatory to any of the Loan Documents, together with true and accurate copies of all Charter Documents;

iii. A Perfection Certificate;

iv. The following duly executed Loan Documents:

-11-

a) Joinder and First Amendment to Security Agreement;

b) Fourth Amendment Fee Letter;

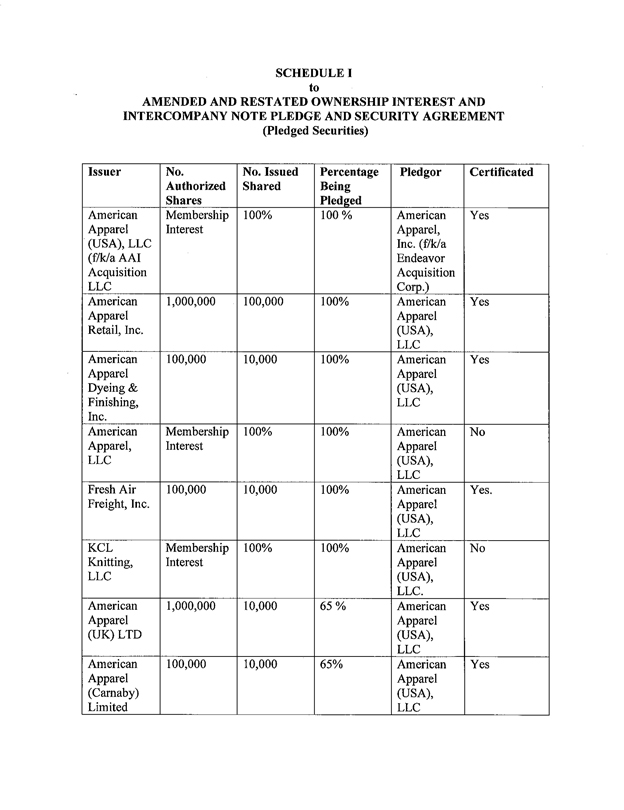

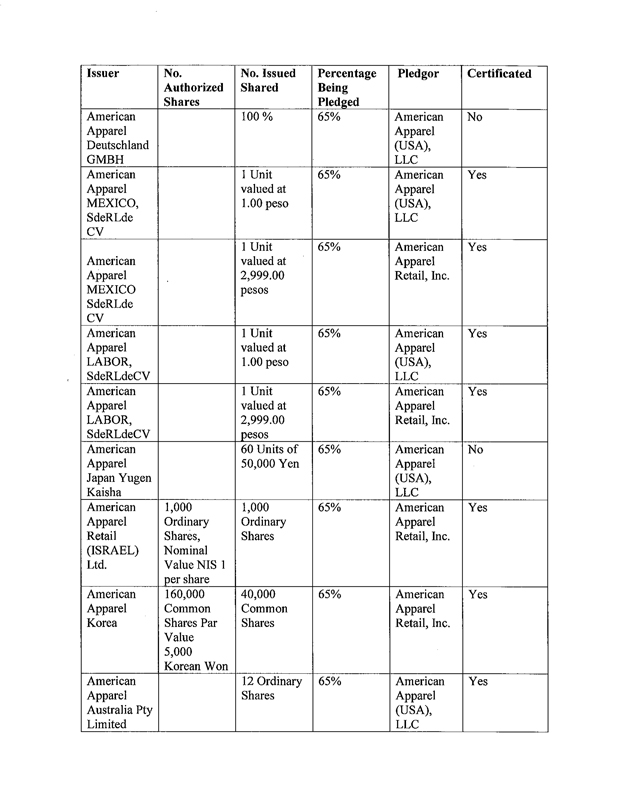

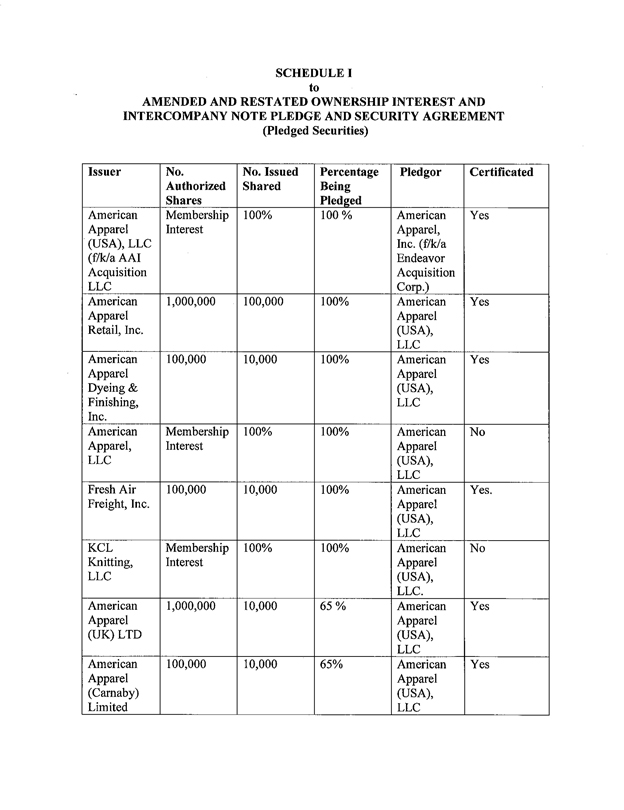

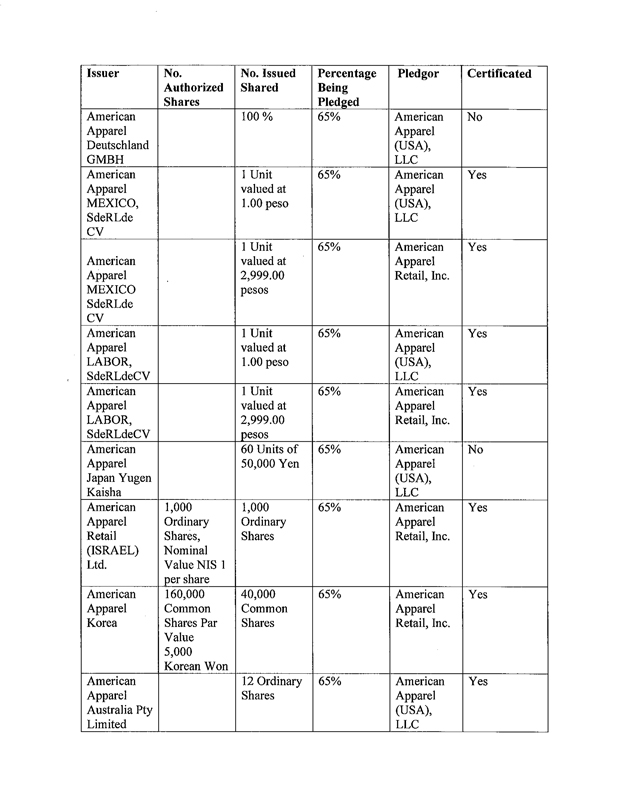

c) Amended and Restated Ownership Interest and Intercompany Note Pledge and Security Agreement;

d) Amended and Restated Guaranty; and

e) such other documents and agreements reasonably required by the Agents.

h. The Collateral Agent shall have received results of searches or other evidence reasonably satisfactory to the Collateral Agent (dated as of a date reasonably satisfactory to the Collateral Agent) indicating the absence of Liens on the assets of the Parent, except for Permitted Encumbrances and Liens for which termination statements and releases or subordination agreements are being tendered on the date hereof.

i. The Collateral Agent shall have received all documents and instruments, including financing statements, required by law or reasonably requested by the Collateral Agent to be filed, registered or recorded to create or perfect the first priority Liens intended to be created under the Loan Documents with respect to the Parent and all such documents and instruments shall have been so filed, registered or recorded to the satisfaction of the Agents.

j. The Agents shall have received an opinion of counsel to the Loan Parties, addressed to the Agents and each Lender, as to such matters concerning the Parent, the other Loan Parties and the Loan Documents as the Administrative Agent may reasonably request.

k. No Default or Event of Default shall exist.

l. No material misstatements in or omissions shall exist from the materials previously furnished to the Agents or any Lender for their review. The Agents shall be satisfied that any financial statements delivered to them fairly present the business and financial condition of the Loan Parties and their subsidiaries, and that there has been no material adverse change in the assets, business, financial condition, income or prospects of the Loan Parties since the date of the most recent financial information delivered to the Agents.

-12-

m. Except as set forth on Schedule 3.06 to the Credit Agreement, there shall not be pending any litigation or other proceeding, the result of which could reasonably be expected to have a Material Adverse Effect.

n. No default of any material contract or agreement of any Loan Party or any Subsidiary of any Loan Party shall exist.

3. Post-Closing Matters:

a. Within thirty (30) days following the Fourth Amendment Effective Date, the Loan Parties shall have delivered to the Collateral Agent, in form and substance reasonably satisfactory to the Collateral Agent, a duly executed Blocked Account Agreement with Citi Private Bank with respect to the SPAC Blocked Accounts.

b. The Loan Parties have advised the Administrative Agent that Fresh Air Freight, Inc., a California corporation (“Fresh Air”), is not in good standing in the State of California for failure to pay franchise taxes. The Loan Parties have further advised the Administrative Agent that such taxes were paid on or about June 5, 2008, and that the sole reason for failure of Fresh Air to be in good standing is the failure of the applicable Governmental Authority to process payment. Within sixty (60) days following the Fourth Amendment Effective Date, the Loan Parties shall have delivered to the Administrative Agent, in form and substance reasonably satisfactory to the Administrative Agent, certificates and other evidence that Fresh Air is in good standing in the State of California.

c. The Loan Parties have advised the Administrative Agent that American Apparel Retail, Inc., a California corporation (“AA Retail”), is not qualified to do business as a foreign corporation in the State of Tennessee for failure to pay franchise taxes. Within sixty (60) days following the Fourth Amendment Effective Date, the Loan Parties shall have delivered to the Administrative Agent, in form and substance reasonably satisfactory to the Administrative Agent, certificates and other evidence that AA Retail is qualified to do business as a foreign corporation in the State of Tennessee.

4. Ratification of Loan Documents. No Claims against any Lender:

a. Except as provided herein, all terms and conditions of the Credit Agreement and of each of the other Loan Documents remain in full force and effect. Each Loan Party hereby ratifies, confirms, and re-affirms all terms and provisions of the Loan Documents.

-13-

b. Each Loan Party hereby makes all representations, warranties, and covenants set forth in the Credit Agreement as of the date hereof (other than representations, warranties and covenants that relate solely to an earlier date. To the extent that any changes in any representations, warranties, and covenants require any amendments to the schedules to the Credit Agreement, such schedules are hereby updated, as evidenced by any supplemental schedules (if any) annexed to this Fourth Amendment.

c. Each Loan Party represents and warrants to the Administrative Agent and each Lender that as of the date of this Fourth Amendment, no Event of Default exists, or solely with the passage of time or notice, would exist under the Loan Documents.

d. Each Loan Party acknowledges and agrees that to its actual knowledge (i) there is no basis nor set of facts on which any amount (or any portion thereof) owed by any of the Loan Parties under any Loan Document could be reduced, offset, waived, or forgiven, by rescission or otherwise; (ii) nor is there any claim, counterclaim, off set, or defense (or other right, remedy, or basis having a similar effect) available to any of the Loan Parties with regard thereto; (iii) nor is there any basis on which the terms and conditions of any of the Obligations could be claimed to be other than as stated on the written instruments which evidence such Obligations.

e. Each of the Loan Parties hereby acknowledges and agrees that it has no offsets, defenses, claims, or counterclaims against the Agents, the Lenders, or their respective parents, affiliates, predecessors, successors, or assigns, or their officers, directors, employees, attorneys, or representatives, with respect to the Obligations, or otherwise, and that if any of the Loan Parties now has, or ever did have, any offsets, defenses, claims, or counterclaims against such Persons, whether known or unknown, at law or in equity, from the beginning of the world through this date and through the time of execution of this Fourth Amendment, all of them are hereby expressly WAIVED, and each of the Loan Parties hereby RELEASES such Persons from any liability therefor.

5. Miscellaneous:

a. Terms used in this Fourth Amendment which are defined in the Credit Agreement are used as so defined.

b. This Fourth Amendment may be executed in counterparts, each of which when so executed and delivered shall be an original, and all of which together shall constitute one agreement.

-14-

c. This Fourth Amendment expresses the entire understanding of the parties with respect to the transactions contemplated hereby. No prior negotiations or discussions shall limit, modify, or otherwise affect the provisions hereof.

d. Any determination that any provision of this Fourth Amendment or any application hereof is invalid, illegal, or unenforceable in any respect and in any instance shall not affect the validity, legality, or enforceability of such provision in any other instance, or the validity, legality, or enforceability of any other provisions of this Fourth Amendment.

e. The Borrowers shall pay on demand all reasonable costs and expenses of the Agents and the Lenders, including, without limitation, attorneys’ fees incurred by the Agents in connection with the preparation, negotiation, execution, and delivery of this Fourth Amendment. The Administrative Agent is hereby authorized by the Borrowers to make one or more Revolving Credit Loans to pay all such costs, expenses, and attorneys’ fees and expenses.

f. In connection with the interpretation of this Fourth Amendment and all other documents, instruments, and agreements incidental hereto:

i. All rights and obligations hereunder and thereunder, including matters of construction, validity, and performance, shall be governed by and construed in accordance with the law of The Commonwealth of Massachusetts and are intended to take effect as sealed instruments.

ii. The captions of this Fourth Amendment are for convenience purposes only, and shall not be used in construing the intent of the parties under this Fourth Amendment.

iii. In the event of any inconsistency between the provisions of this Fourth Amendment and any of the other Loan Documents, the provisions of this Fourth Amendment shall govern and control.

g. The Agents, the Lenders, the Borrowers, and the Facility Guarantors have prepared this Fourth Amendment and all documents, instruments, and agreements incidental hereto with the aid and assistance of their respective counsel. Accordingly, all of them shall be deemed to have been drafted by the Agents, the Lenders, the Borrowers, and the Facility Guarantors and shall not be construed against any party.

[Signatures Follow]

-15-

IN WITNESS WHEREOF, the undersigned have caused this Fourth Amendment to be duly executed under seal as of the date first set forth above.

AMERICAN APPAREL (USA), LLC (f/k/s AA)

Acquisition LLC (successor-by-merger to American Apparel, Inc.), as Lead Borrower and as a Borrower

By:

Name: Dov Charney

Title: CEO

AMERICAN APPAREL RETAIL, INC., as a Borrower

By:

Name: Dov Charney

Title: CEO

AMERICAN APPAREL DYEING & FINISHING, INC., as a Borrower

By:

Name: Dov Charney

Title: CEO

KCL KNITTING, LLC,

as a Borrower

By: American Apparel (USA), LLC, its sole member

By:

Name: Dov Charney

Title: CEO

Signature Page to Fourth Amendment to Credit Agreement

AMERICAN APPAREL, LLC, as a Facility Guarantor

By: American Apparel (USA), LLC, Its sole member

By:

Name: Dov Charney

Title: CEO

FRESH AIR FREIGHT, INC., as a Facility Guarantor

By:

Name: Dov Charney

Title: CEO

AMERICAN APPAREL, INC. (f/k/a Endeavor Acquisition Corp.), as a Facility Guarantor

By:

Name: Dov Charney

Title: CEO

Signature Page to Fourth Amendment to Credit Agreement

LASALLE BUSINESS CREDIT, LLC, AS AGENT FOR LASALLE BANK MIDWEST NATIONAL ASSOCIATION, ACTING THROUGH ITS DIVISION, LASALLE RETAIL FINANCE, as Administrative Agent, as Collateral Agent, as Swingline Lender and as Lender

By:

Name: Stephen J. Garvin

Title: Vice President

LASALLE BANK NATIONAL ASSOCIATION, as Issuing Bank

By:

Name: Stephen J. Garvin

Title: Vice President

Signature Page to Fourth Amendment to Credit Agreement

WELLS FARGO RETAIL FINANCE, LLC, as

Collateral Monitoring Agent and as a Lender

By:

Name: Emily Abrahamson

Title: Assistant Vice President/Account Executive

Signature Page to Fourth Amendment to Credit Agreement

NATIONAL CITY BUSINESS CREDIT, INC.,

as a Lender

By:

Name: Kathryn C. Ellero

Title: Vice President

Signature Page to Fourth Amendment to Credit Agreement

Exhibit K

FORM OF COMPLIANCE CERTIFICATE

[see attached]

Exhibit K to Credit Agreement

Page 1

Exhibit K

Form of Compliance Certificate

COMPLIANCE CERTIFICATE

Date of Certificate:

To: LaSalle Business Credit, LLC, as Agent

for LaSalle Bank Midwest National Association,

Acting through its Division, LaSalle Retail Finance

100 Federal Street, 9th Floor

Boston, Massachusetts 02110

Attention: Mr. Jeff Ryan

Re: Credit Agreement dated as of July 2, 2007 (as modified, amended, supplemented or restated and in effect from time to time, the “Credit Agreement”) by and between, among others, American Apparel (USA), LLC (f/k/a AAI Acquisition LLC (successor-by-merger to American Apparel, Inc.), for itself and as agent (in such capacity, the “Lead Borrower”) for the other Borrowers party thereto, and LaSalle Business Credit, LLC, as Agent for LaSalle Bank Midwest National Association, acting through its division, LaSalle Retail Finance, as administrative agent (the “Administrative Agent”) for its own benefit and the benefit of the other Credit Parties. Capitalized terms used but not defined herein shall have the meanings set forth in the Credit Agreement.

The undersigned, a duly authorized and acting Financial Officer of the Lead Borrower, hereby certifies on behalf of the Loan Parties as of the date hereof the following:

1. No Defaults or Events of Default.

(a) Since (the date of the last similar certification), and except as set forth in Appendix I, no Default or Event of Default has occurred.

(b) If a Default or Event of Default has occurred since (the date of the

last similar certification), the Borrowers have taken or propose to take those actions with respect to such Default or Event of Default as described on said Appendix I.

2. Financial Calculations. Attached hereto as Appendix II are reasonably detailed calculations with respect to Excess Availability for such period.

1

3. No Material Accounting Changes, Etc.

(a) The financial statements furnished to the Administrative Agent for the [Fiscal Year/Fiscal Month] ending were prepared in accordance with GAAP consistently applied and present fairly in all material respects the financial condition and results of operations of the Lead Borrower and its Subsidiaries on a Consolidated basis, as of the end of the period(s) covered, subject to (i) with respect to the monthly financial statements, normal year end audit adjustments and the absence of footnotes and (ii) any changes as disclosed on Appendix HI hereto.

(b) Except as set forth in Appendix in, there has been no change in GAAP which has been applied in the Lead Borrower’s most recent audited financial statements since (the date of the Lead Borrower’s most recent audited

financial statements), and if such a change has occurred, the effect of such change on the financial statements is detailed in Appendix III.

[signature pages follow]

2

IN WITNESS WHEREOF, the Lead Borrower, on behalf of itself and each of the other Loan Parties, has duly executed this Compliance Certificate as of , 20 .

LEAD BORROWER:

AMERICAN APPAREL (USA), LLC

By:

Name:

Title:

Signature Page to Compliance Certificate

APPENDIX I

Except as set forth below, no Default or Event of Default has occurred. [If a Default or Event of Default has occurred, the following describes the nature of the Default or Event of Default in reasonable detail and the steps, if any, being taken or contemplated by the Loan Parties to be taken on account thereof.]

Appendix I to Compliance Certificate

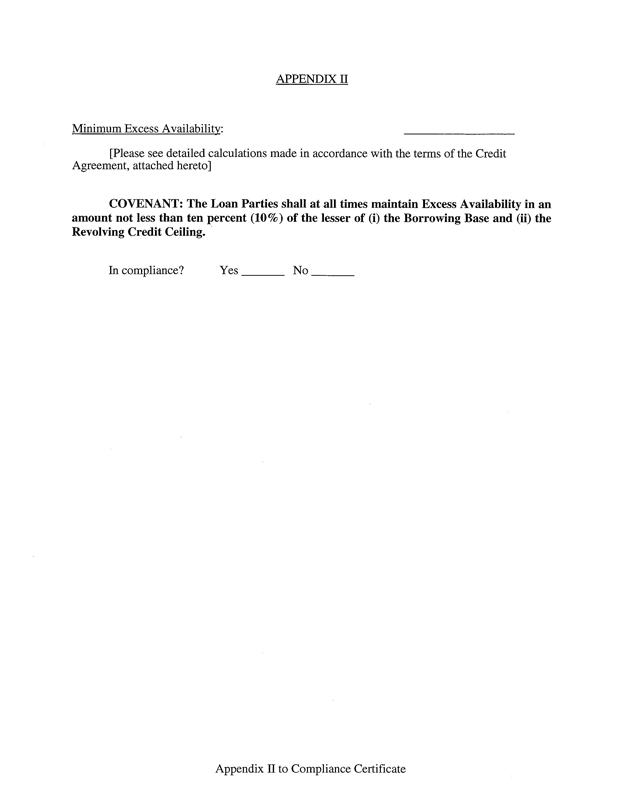

APPENDIX II

Minimum Excess Availability:

[Please see detailed calculations made in accordance with the terms of the Credit Agreement, attached hereto]

COVENANT: The Loan Parties shall at all times maintain Excess Availability in an amount not less than ten percent (10%) of the lesser of (i) the Borrowing Base and (ii) the Revolving Credit Ceiling.

In compliance? Yes No

Appendix II to Compliance Certificate

APPENDIX III

Except as set forth below, no change in GAAP which has been applied in the Lead Borrower’s most recent audited financial statements has occurred since (the date of the Lead Borrower’s most recent audited financial statements). [If any such change has occurred, the following describes the nature of the change in reasonable detail and the effect, if any, of each such change in GAAP or in application thereof on the financial statements delivered in accordance with the Credit Agreement].

1082989.2

Appendix III to Compliance Certificate

Exhibit M

FINANCIAL PERFORMANCE COVENANTS

1. Minimum Excess Availability. The Loan Parties shall at all times maintain Excess Availability in an amount not less than ten percent (10%) of the lesser of (i) the Borrowing Base and (ii) the Revolving Credit Ceiling.

Exhibit M to Credit Agreement

Page 1

Schedules to Credit Agreement [see attached]

1082444.11

Schedule to Credit Agreement

Page 1

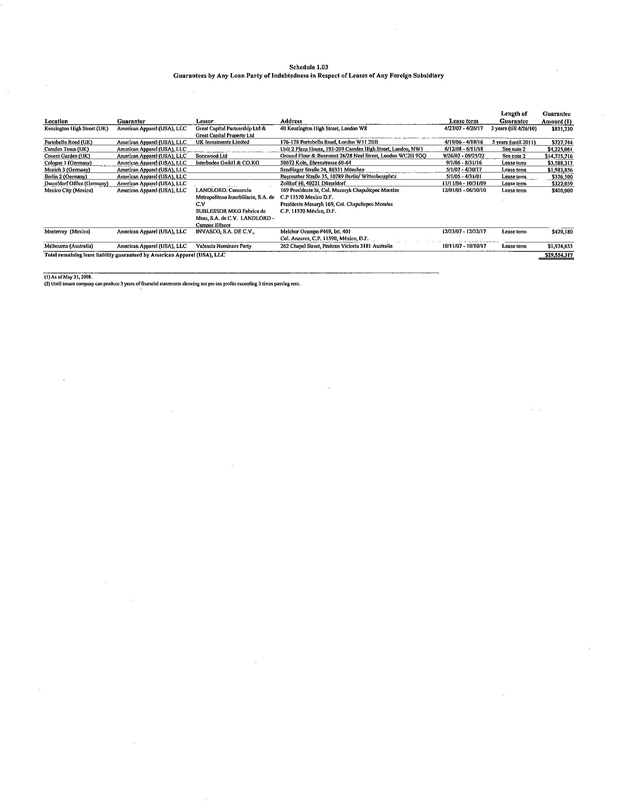

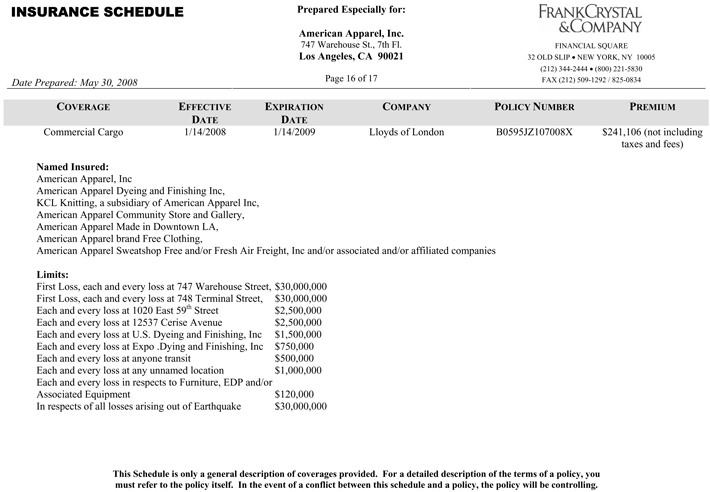

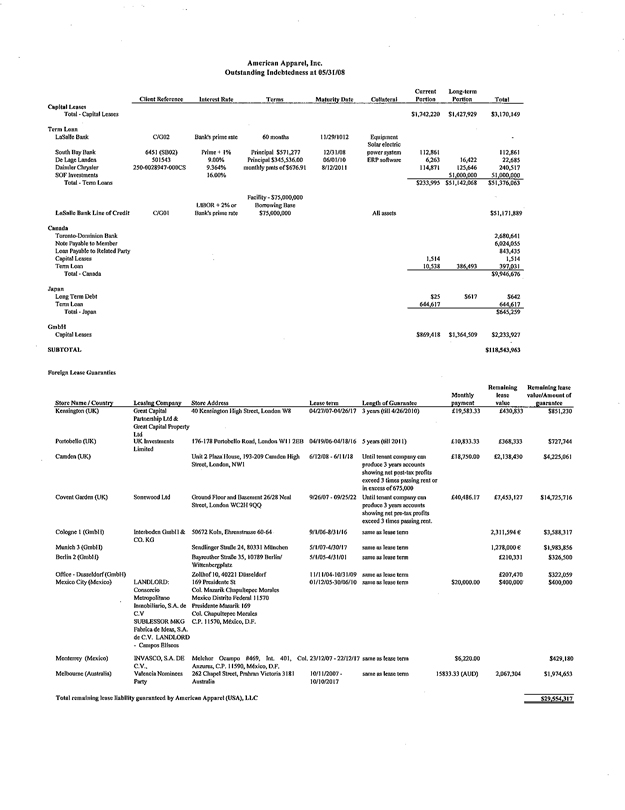

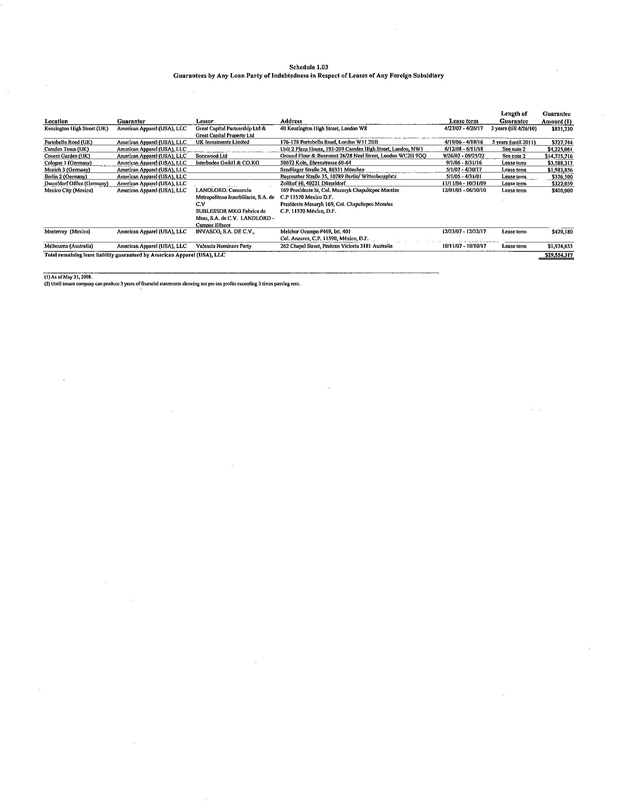

Schedule 1.03

Guarantees by Any Loan Party of Indebtedness in Respect of Leases of Any Foreign Subsidiary

Location Guarantor Lessor Address Lease term Length of Guarantee Guarantee Amount (1)

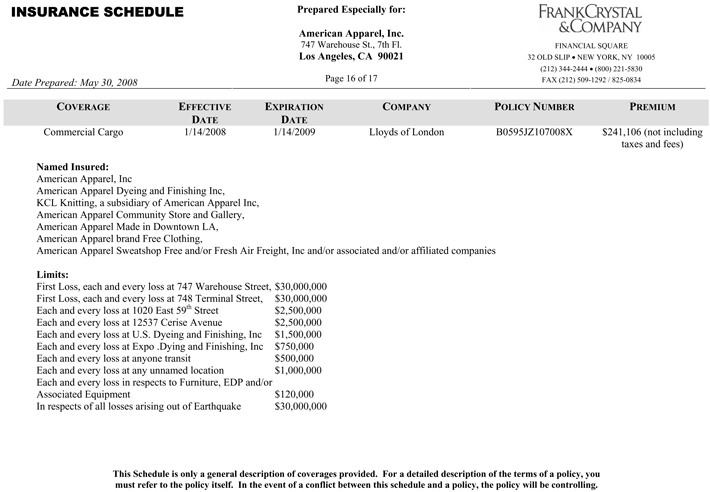

Kensington High Street (UK) American Apparel (USA), LLC Great Capital Partnership Ltd & Great Capital Property Ltd 40 Kensington High Street, London W8 4/27/07-4/26/17 3 years (till 4/26/10) $851,230

Portobello Road (UK) American Apparel (USA), LLC UK Investments Limited 176-178 Portobello Road, London W11 2EB 4/19/06-4/18/16 5 years (until 2011) $727,744

Camden Town (UK) American Apparel (USA), LLC Unit 2 Plaza House, 193-209 Camden High Street, London, NW1 6/12/08-6/11/18 See note 2 $4,225,061

Covent Garden (UK) American Apparel (USA), LLC Sonewood Ltd Ground Floor & Basement 26/28 Neal Street, London WC2H 9QQ 9/26/07 - 09/25/22 See note 2 $14,725,716

Cologne 1 (Germany) American Apparel (USA), LLC Inlerboden GmbH & CO.KG 50672 Koln, Ehrenstrasse 60-64 9/1/06-8/31/16 Lease term $3,588,317

Munich 3 (Germany) American Apparel (USA), LLC Sendlinger StraBe 24, 80331 München 5/1/07 - 4/30/17 Lease term $1,983,856

Berlin 2 (Germany) American Apparel (USA), LLC Bayreuther StraBe 35, 107S9 Berlin/ Wittenbergplafz 5/1/05-4/31/01 Lease term $326,500

Dusseldorf Office (Germany) American Apparel (USA), LLC Zollhof 10, 40221 Dosseldorf 11/11/04- 10/31/09 Lease term $322,059

Mexico City (Mexico) American Apparel (USA), LLC LANDLORD: Consorcio Metropolitano Inmobiliario, S.A. de C.V

SUBLESSOR MKG Fabrica de Ideas, SA.de C.V. LANDLORD -Campos Ellseos 169 Presidents St,

Col. Mazaryk

Chapultepec

Morales CP 11570 Mexico D.F.

Presidente Masaryk 169, Col. Chapultepec Morales CP. 11570 Mexico, D.F. 12/01/05-06730/10 Lease term $400,000

Monterrey (Mexico) American Apparel (USA), LLC INVASCO, S.A. DE C.V., Melchor Ocampo #469, Int. 401

Col, Anzures, C.P. 11590, Mexico, D.F. 12/23/07- 12/22/17 Lease term $429,180

Melbourne (Australia) American Apparel (USA), LLC Valencia Nominees Parly 262 Chapel Street, Prahran Victoria 3181 Australia 10/11/07-10/10/17 Lease term $1,974,653

Total remaining lease liability guaranteed by American Apparel (USA), LLC $29,554,317

(l) As of May 31, 2008.

(2) Until tenant company can produce 3 years of financial statements showing net pre-tax profits exceeding 3 times passing rent.

Schedule 1.04

Investments by a Loan Party in a Foreign Subsidiary (other than a Canadian Subsidiary)

Foreign Subsidiary Capital Contributions from AA (USA), LLC Capital Contributions from AAI Total

Brazil $600,000 $307,400 $907,400

Australia 1,116,319 0 1,116,319

Israel 248,331 0 248,331

Mexico 927,389 0 927,389

Japan 2,395,632 0 2,395,632

Korea 880,919 0 880,919

China 836,564 132,871 969,435

UK 1,258,233 0 1,258,233

GmbH 2,906,018 0 2,906,018

Total $11,169,404 $440,271 $11,609,675

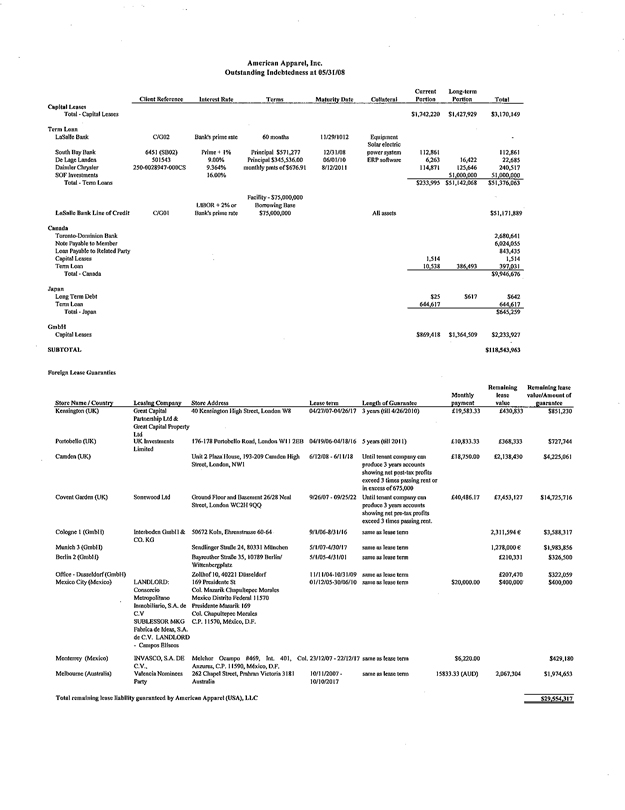

Schedule 1.05 Investments in Any Canadian Subsidiary

Capital Contributions Capital Contributions

Subsidiary from AA (USA), LLC from AAI Total Note

American Apparel $0 $1,957,181 $1,957,181 Loan from American Apparel, Inc. (f/k/a Endeavor Acquisition

Canda Wholesale Inc. Corp.) to Canadian Subsidiaries on 12/12/2007 pursuant to closing of transactions contemplated in Merger Agreement.

Total $0 $1,957,181 $1,957,181

LaSalle Fourth Amendment to Credit Agreement Schedule 3.01

ORGANIZATION INFORMATION

Name State of

Incorporation or Organization

Type of incorporation or organization

Corp. or Company ID No.

Federal EIN No.

American Apparel, Inc.,

Incorporated 7-22-2005 Delaware

Corporation

4004038

20-3200601

American Apparel (USA), LLC

Filed 10-16-2007

California Limited Liability Company

200729010015

26-2368940

American Apparel Retail, Inc.

Incorporated 2-11-2004 California

Corporation

C2605535 72-1577829

American Apparel Dyeing & Finishing, Inc.

Incorporated 9-14-2004 California

Corporation

C2687444

41-2150324

KCL Knitting, LLC

Filed 8-21-2000 California

Limited liability company

200023610152

95-4819518

American Apparel, LLC

Filed 6-30-1998 California

Limited liability company

101998181051

95-4695584

Fresh Air Freight, Inc.

Incorporated 10-23-2003 California

Corporation

C2527267

45-0533870

Schedule 3.05 (a) Title Exceptions

1.) Liens granted by the Loan Parties in favor of the Collateral Agent pursuant to the Loan Documents.

2.) Subject to the intercreditor agreement between the Agents and SOF Investments, Liens granted by the Loan Parties in favor of SOF Investments pursuant to the material agreements executed in connection with the SOF Investments Loan.

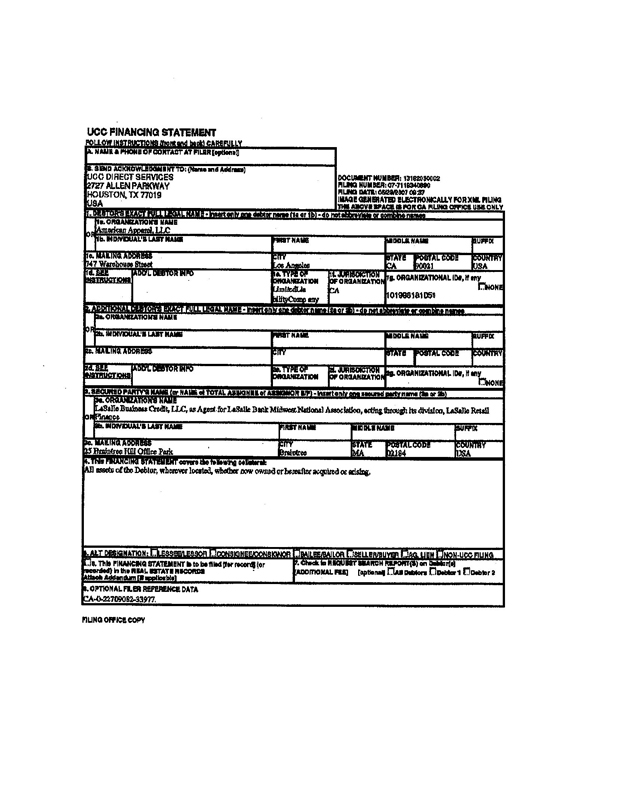

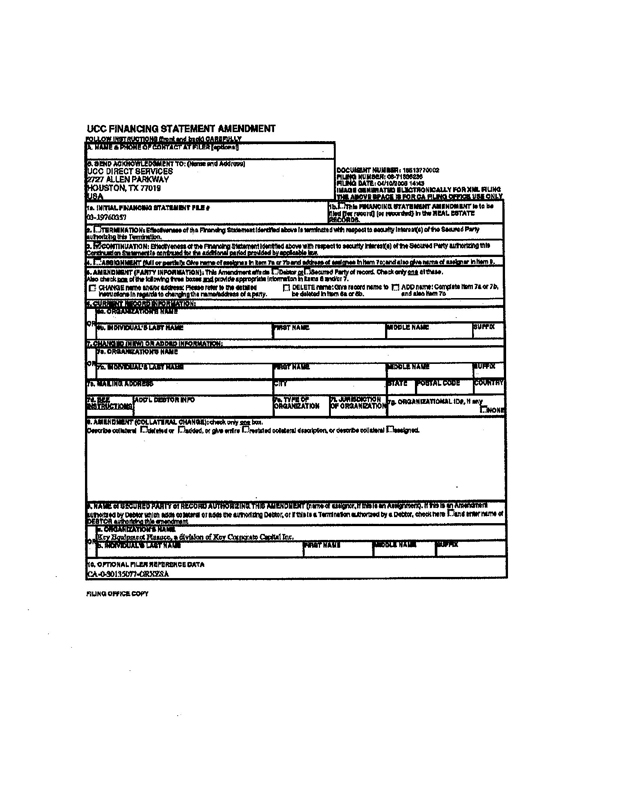

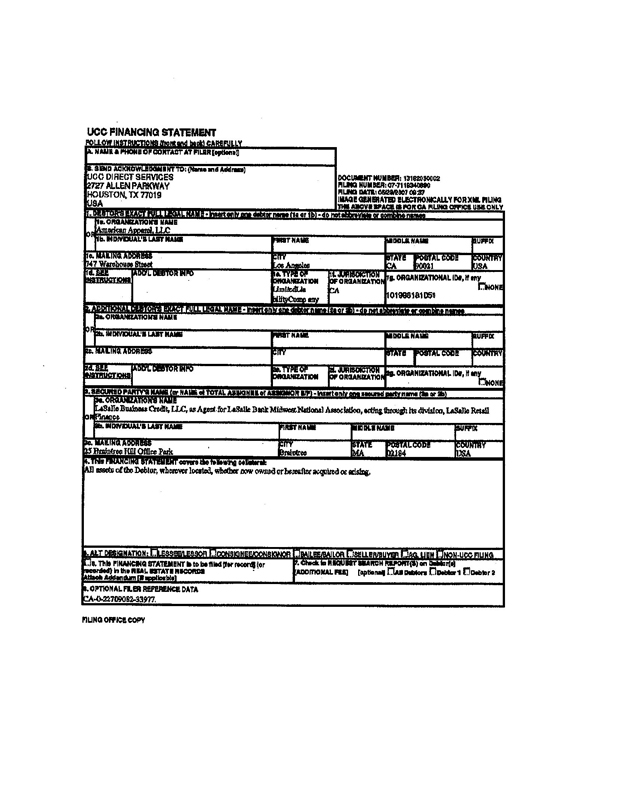

3.) Liens or encumbrances pursuant to the UCC Financing Statements listed and attached hereto in this “Schedule 3.05(a).”

4.) Permitted Encumbrances (as such term is defined in the Credit Agreement).

5.) Restrictions on transfer of real property leases pursuant to lease agreements.

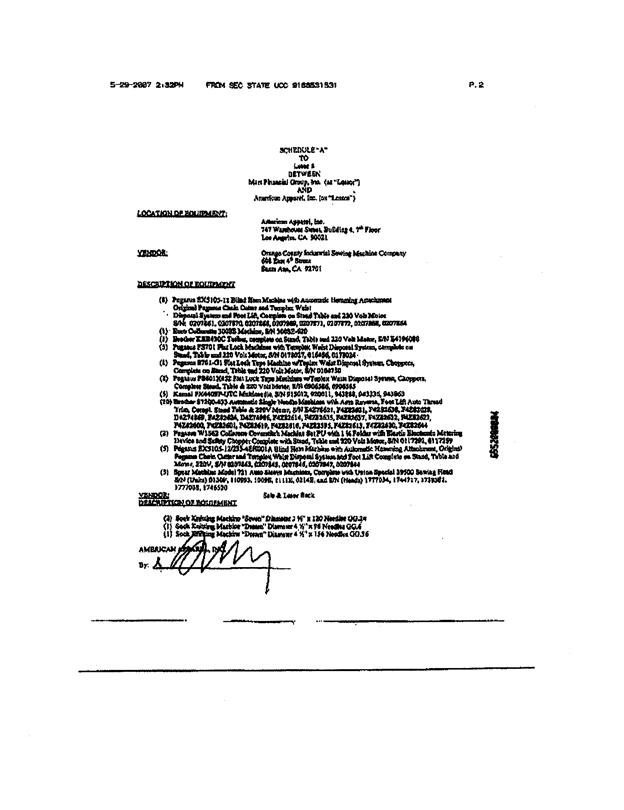

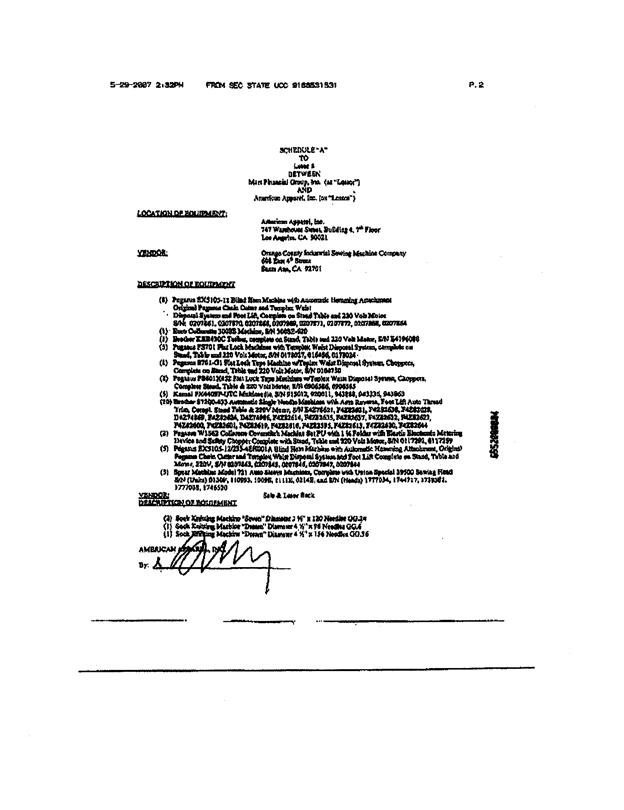

6.) Security interests granted pursuant to the equipment Lease Agreement (referenced therein as Lease Number 8324126001) by and amongst American Apparel, Inc. (“Lessee/Debtor”) and Ramsgate Leasing Systems, Inc., (“Lessor”) and General Electric Capital Corporation (“Lender”), dated May 17, 2007 and all commitments and obligations in connection therewith.

7.) Security interests granted pursuant to the Lease Agreement (referenced therein as Lease Number 106106 and hereinafter, “Equipment Lease”) by and amongst American Apparel, Inc. (“Lessee”), TCCG, LLC dba The Cambridge Capital Group (“Lessor”)and Quest CAD/CAM (“Supplier”) dated May 24, 2007 and all commitments and obligations in connection therewith.

8.) Any title exceptions in Schedule 3.05(b).

9.) Any materialmans’ liens or warehouseman’ liens that may arise by operation of law.

1

Schedule 3.05(a)

Attachment to Schedule 3.05a)

1. Incorporated by this reference are the attachments to Schedule 3.05(a) and the liens set forth therein as such schedule and attachments were delivered as of July 2, 2007.

2. The liens set forth on the attached list and UCC financing statements attached hereto.

Attachment to Schedule 3.05(a)

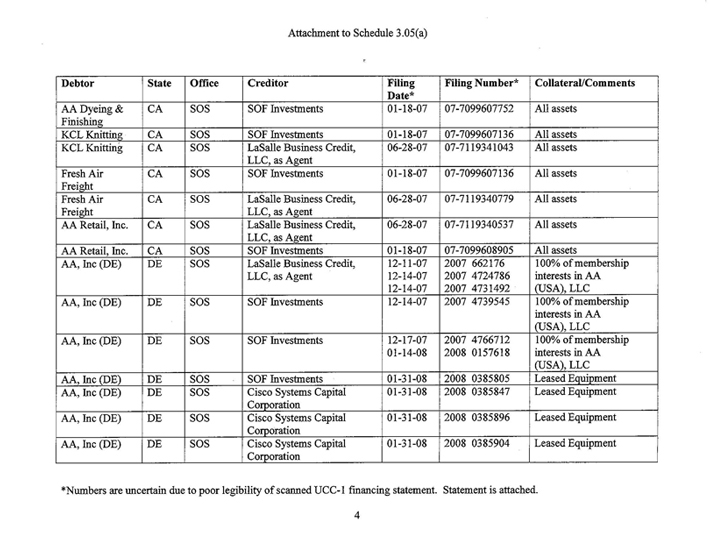

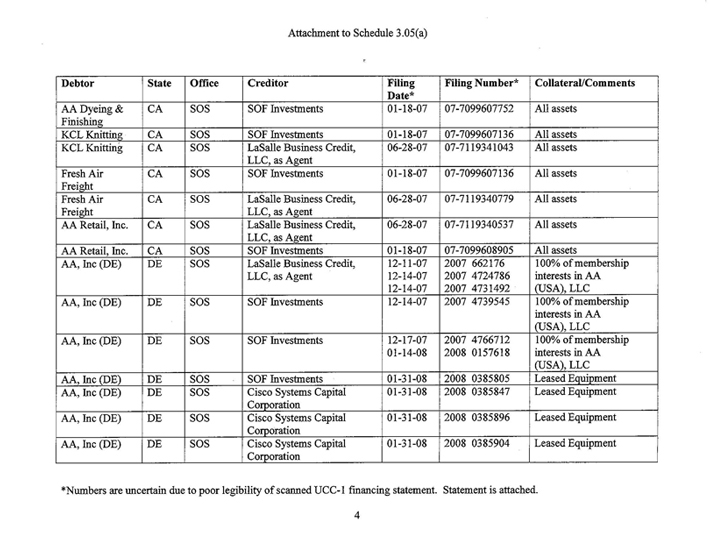

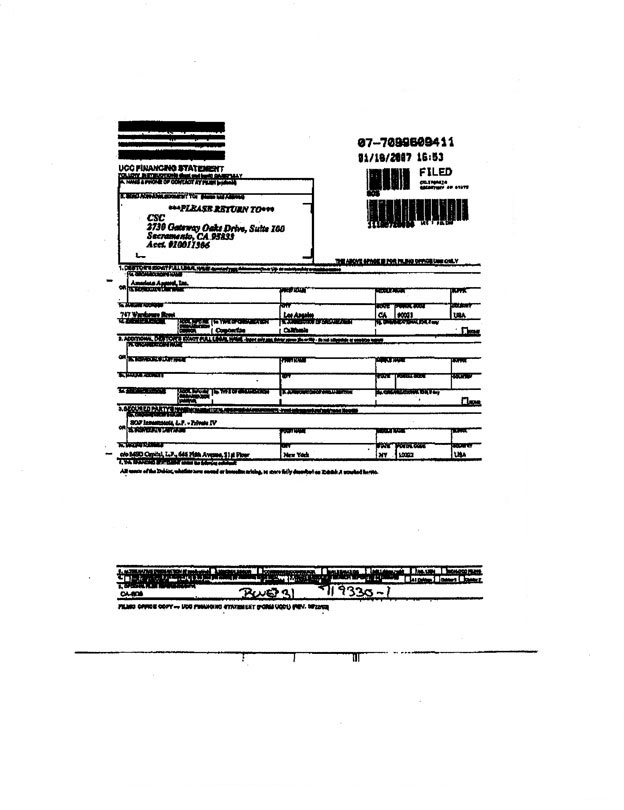

Debtor State Office Creditor Filing Date* Filing Number* Collateral/Comments

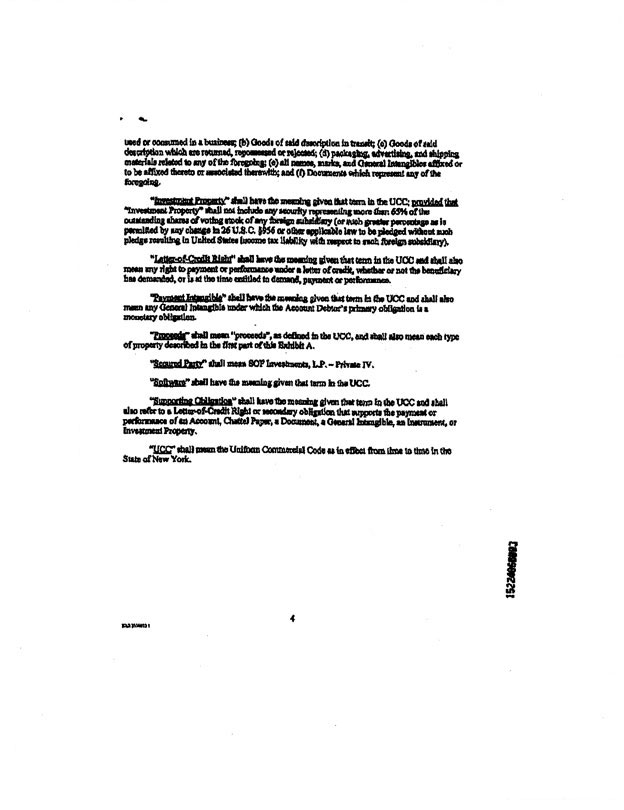

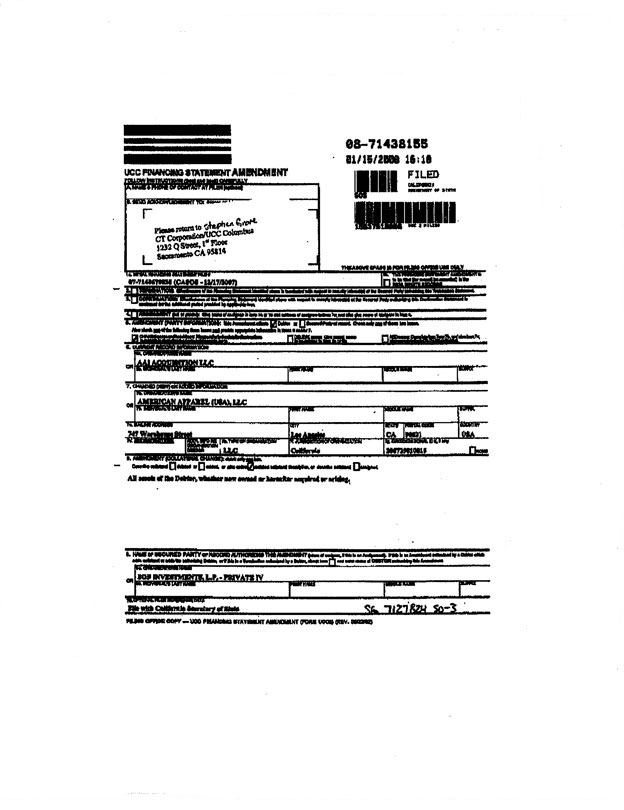

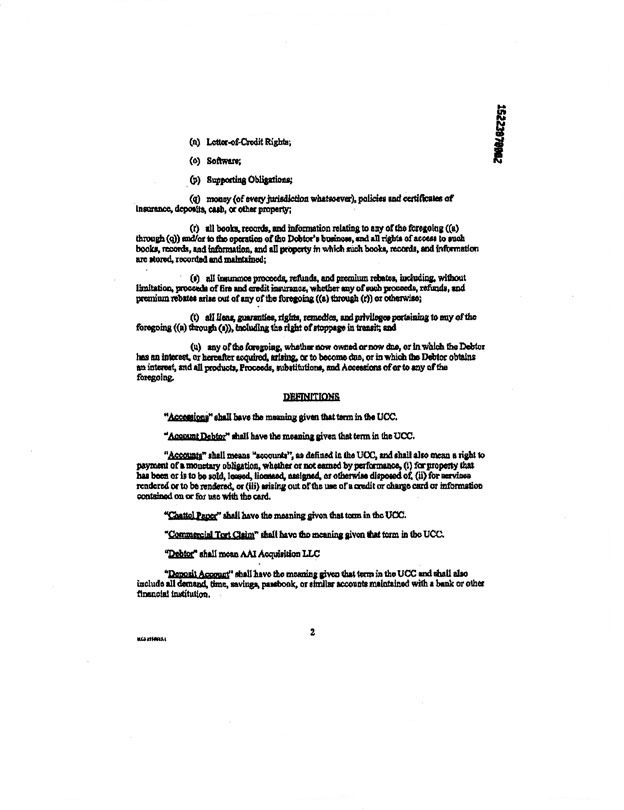

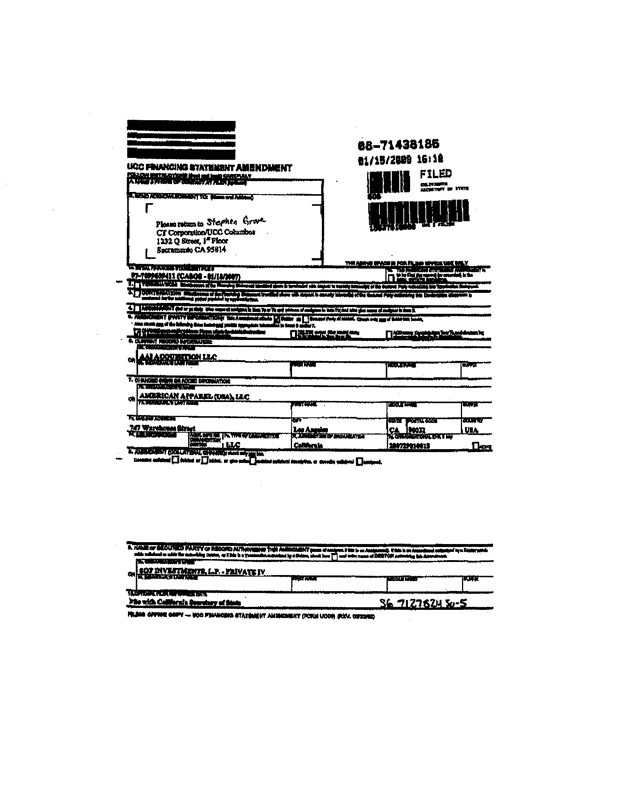

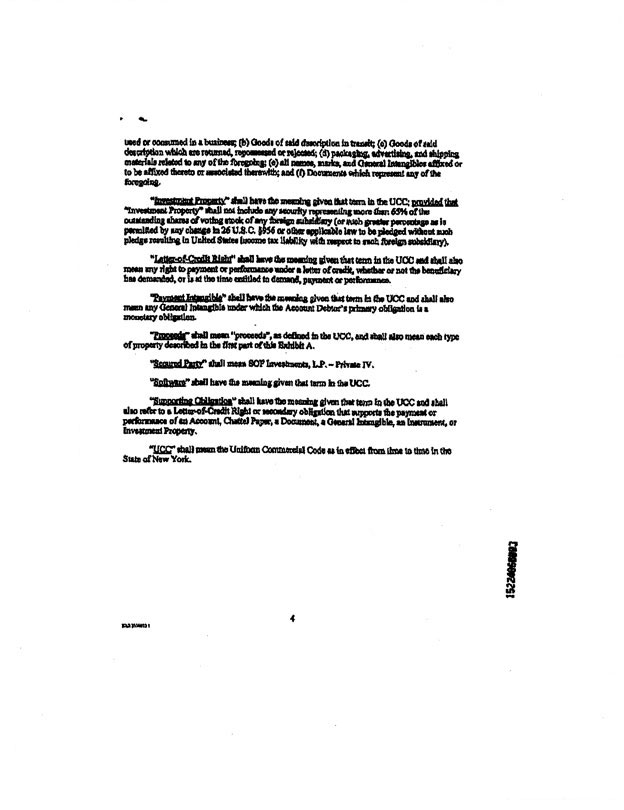

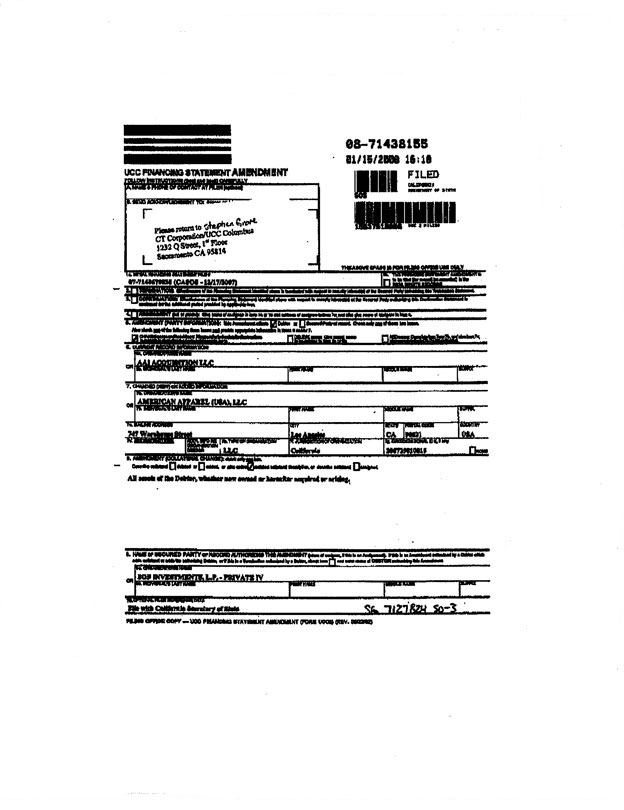

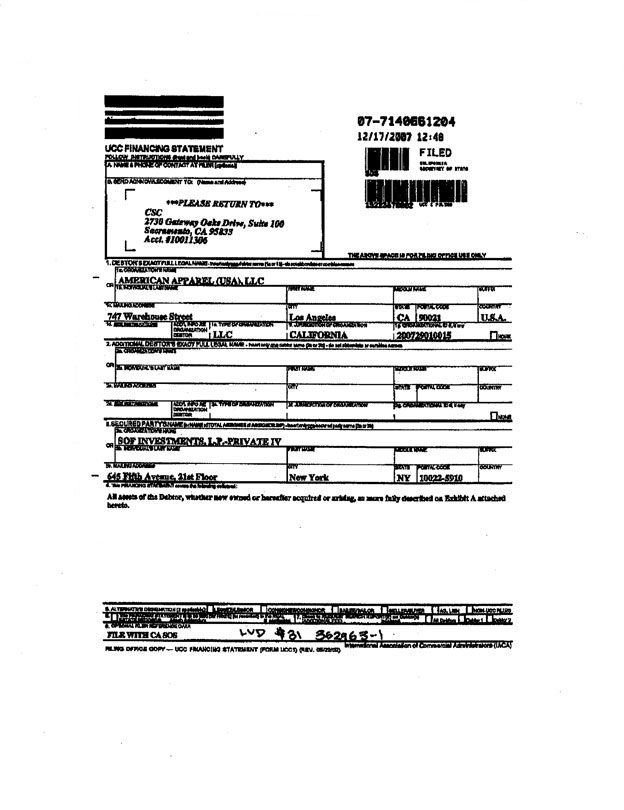

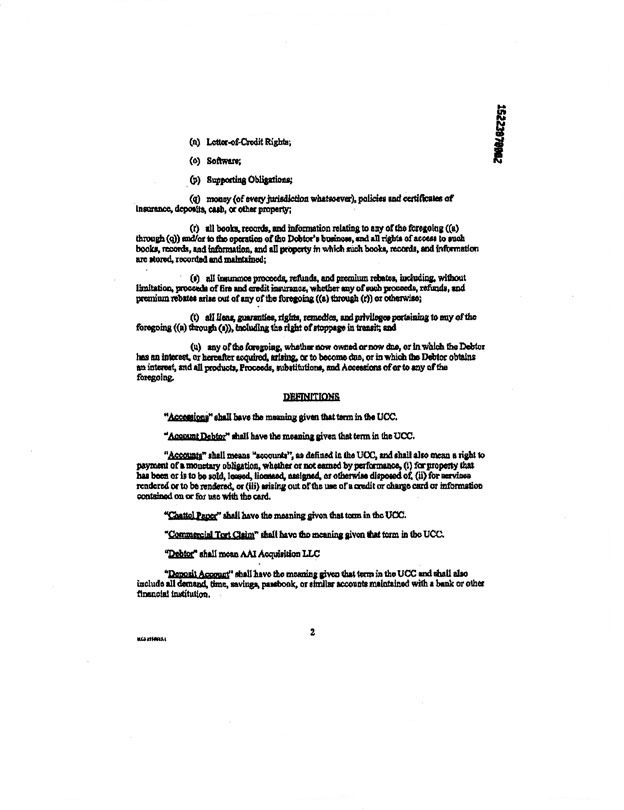

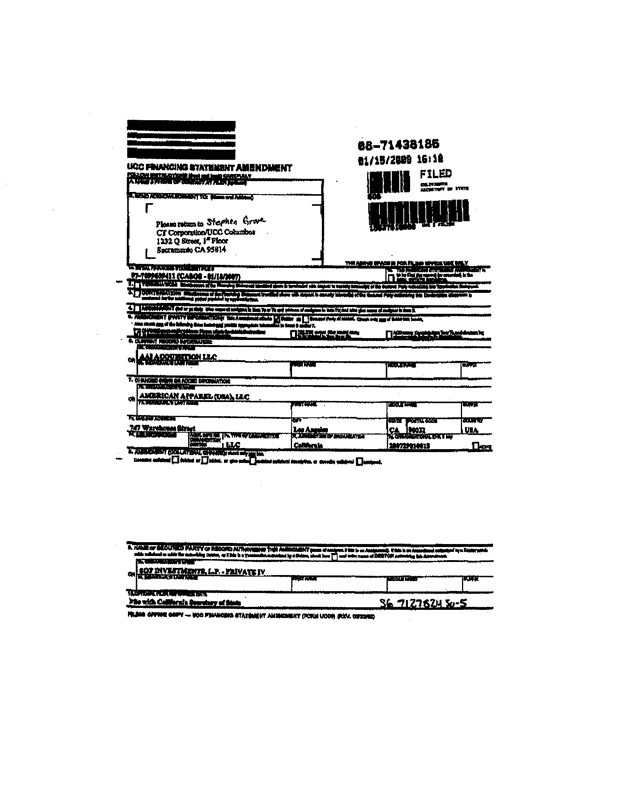

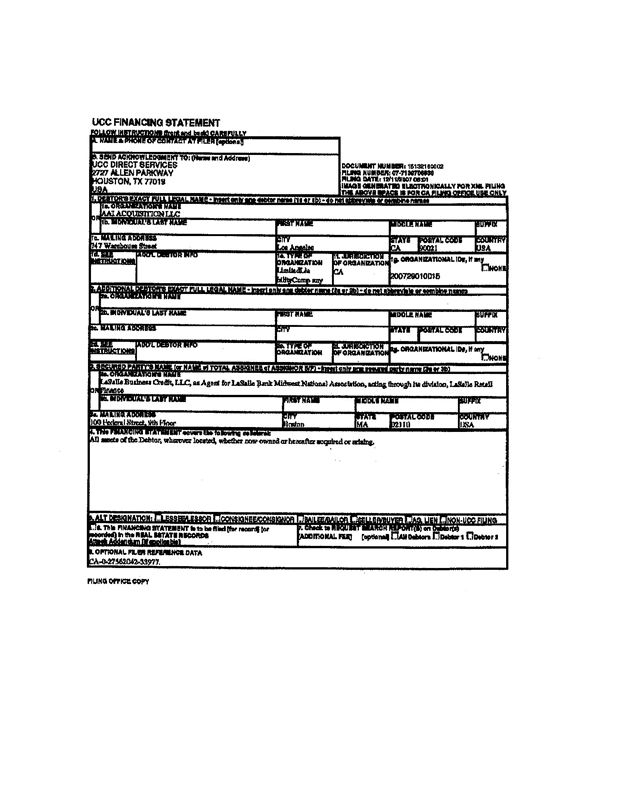

AA (USA), LLC CA SOS SOF Investments 12-17-07 12-24-07 07-7140670951 07-71413792 All assets

AA (USA), LLC CA SOS SOF Investments 12-17-07 01-15-08 07- 7140670830 08- 71438155 All assets

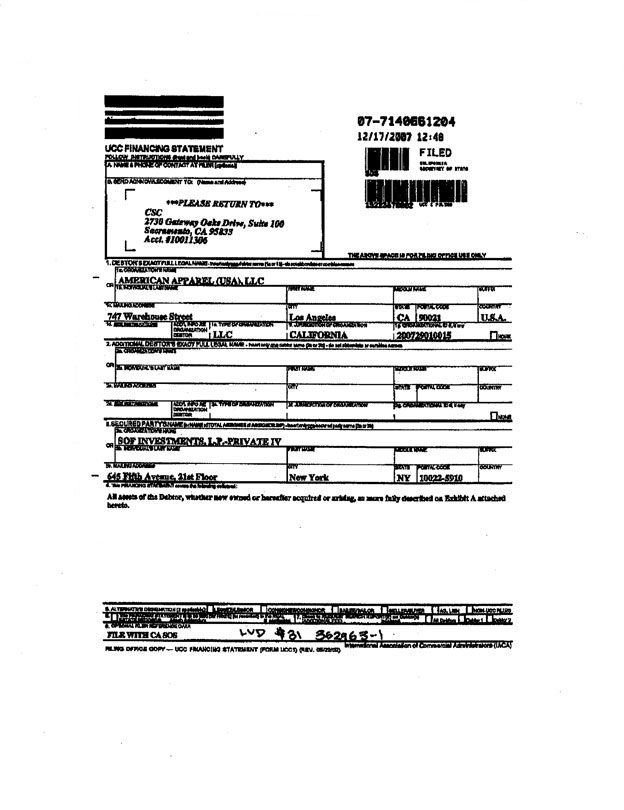

AA (USA), LLC CA SOS SOF Investments 12-17-07 07-7140661204 All assets

AA (USA), LLC CA SOS LaSalle Business Credit, LLC, as Agent 12-11.-07 12-14-07 07-7139706838 07-71402254 All assets

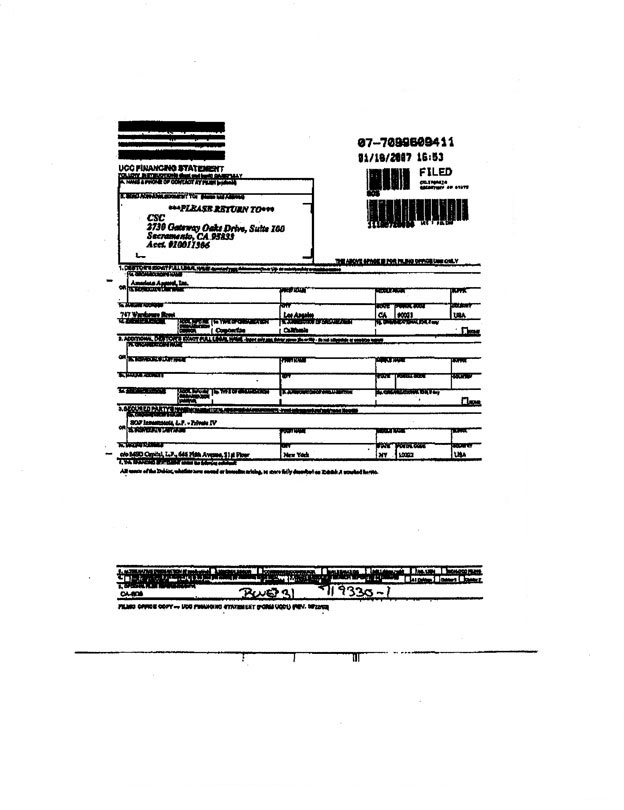

AA, Inc. (CA) CA SOS SOF Investments 01-18-07 12-20-07 01-15-08 07-7099609411 07- 71411371 08- 71438186 All assets

AA, Inc. (CA) CA SOS LEAF Funding, Inc. 01-10-07 07-7098153747 Equipment listed on attachment to UCC-1

AA, Inc. (CA) CA SOS SOF Investments 01-18-07 12-20-07 01-15-08 07-7099609411 07- 71411371 08- 71438185 All assets

AA, Inc (CA) CA SOS Marlin Leasing Corp 01-23-07 07-7099579458 Equipment listed on UCC-1

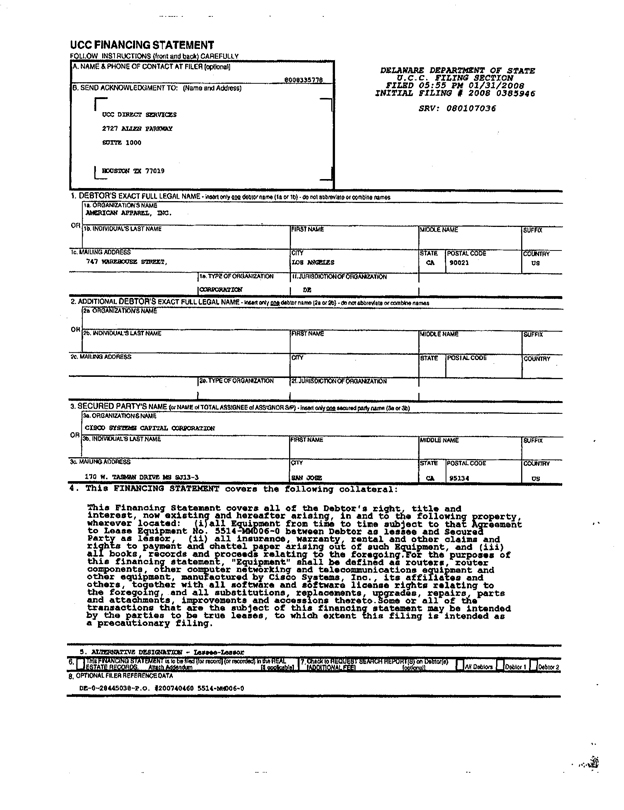

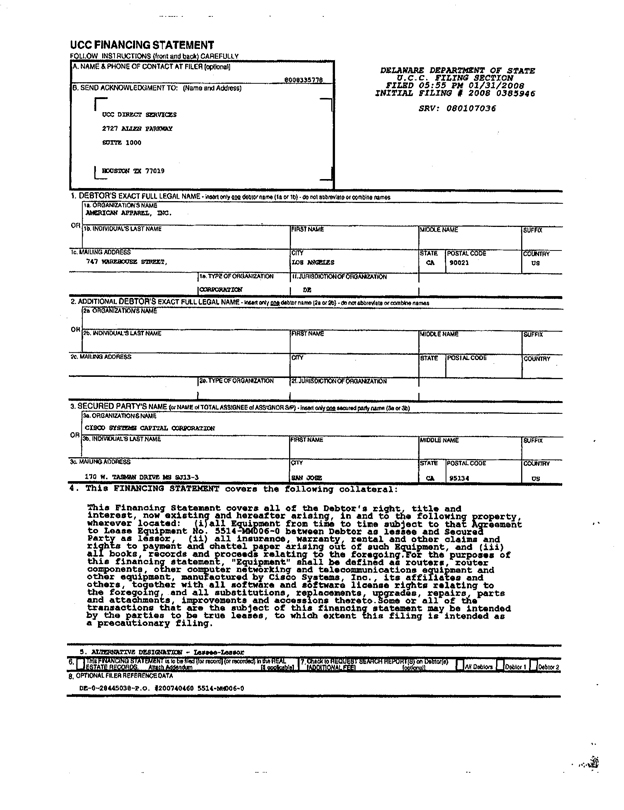

AA, Inc (CA) CA SOS Cisco Systems Capital Corporation 03-08-07 07-7105196723 Leased Equipment

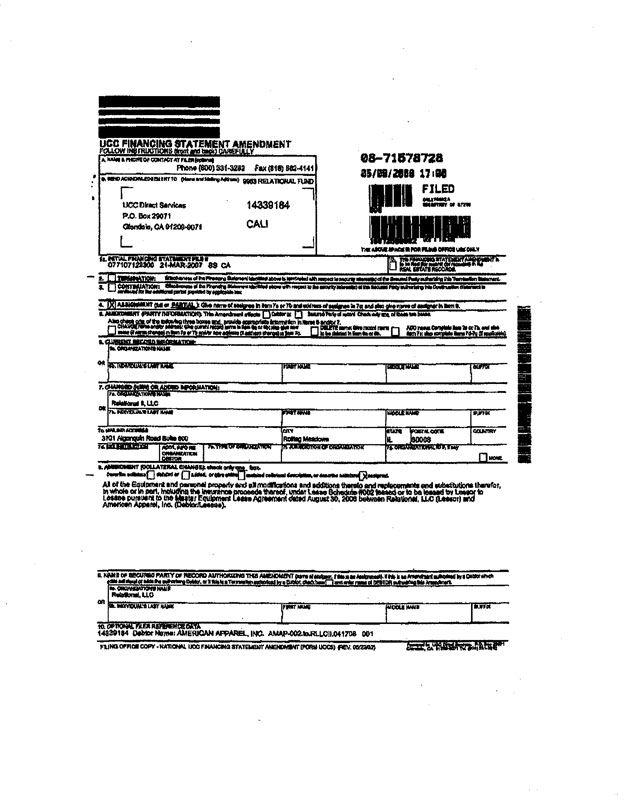

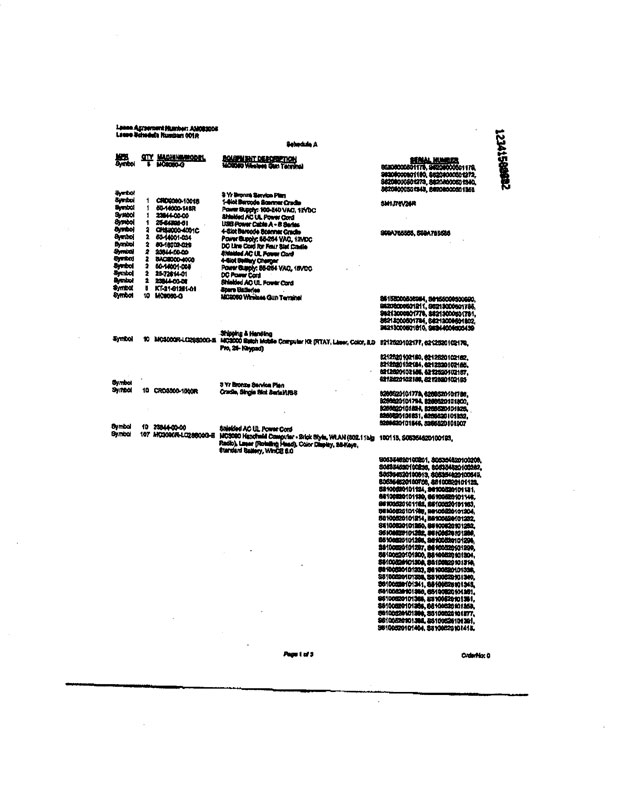

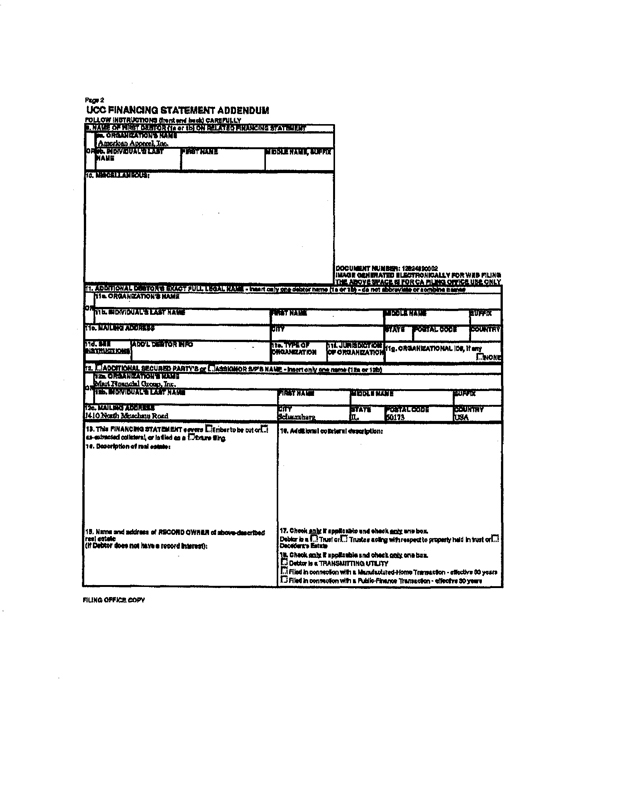

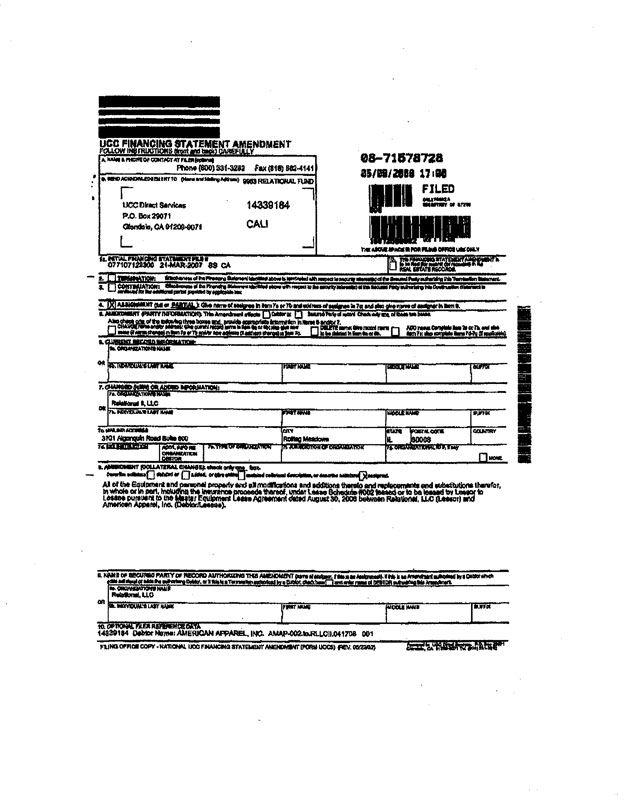

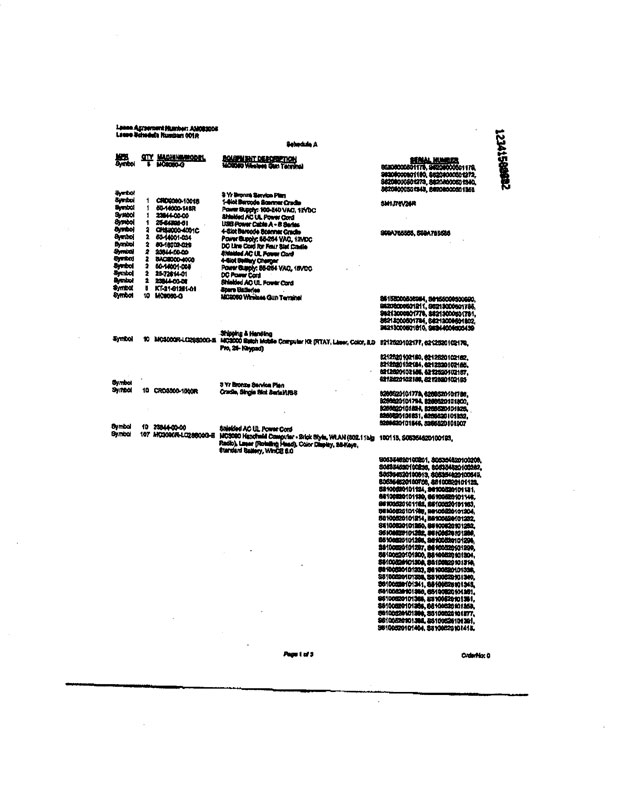

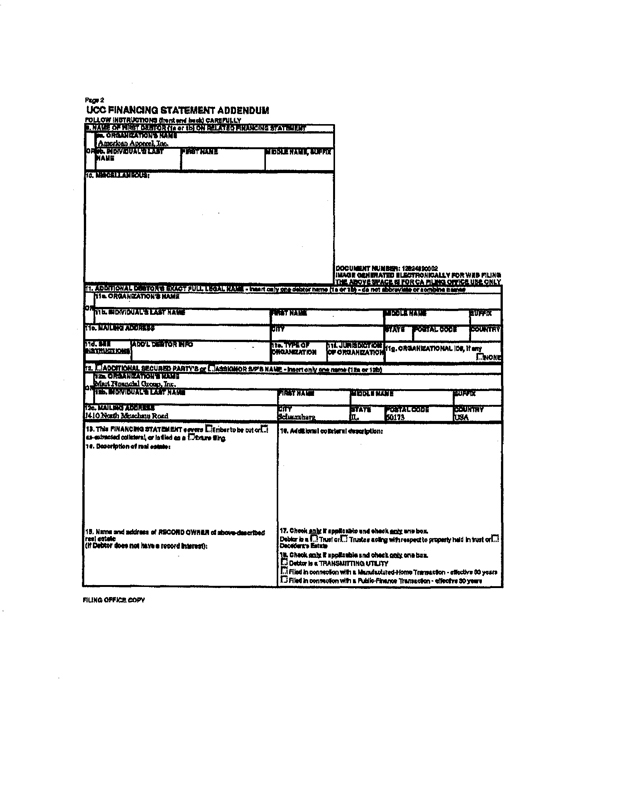

AA, Inc (CA) CA SOS Relational, LLC (Assigned in whole or part to Key Equipment Finance Inc.) (Assigned Relational, LLC in whole or part) 03-21-07 08-16-07 05-09-08 07-7107122300 07- 71255327 08- 71578728 Goods leased by Relationship LLC to AA, Inc.

AA, Inc (CA) CA SOS National City Commercial Capital Company, LLC 03-27-07 07-710770995 Equipment listed on UCC-1

AA, Inc (CA) CA SOS Winthrop Resources Corporation 04-17-07 07-7110642624 Equipment listed on UCC-1

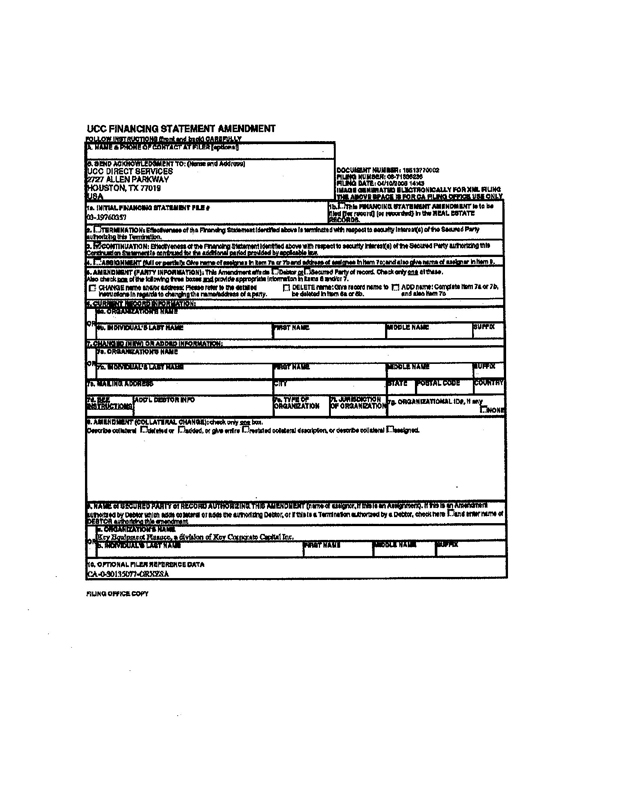

*Numbers are uncertain due to poor legibility of scanned UCC-6 financing statement. Statement is attached.

1

Attachment to Schedule 3.05(a)

Debtor State Office Creditor Filing Date* Filing Number* Collateral/Comments

AA, Inc (CA) CA SOS Libertyville Bank & Trust Company 05-30-07 07-7115825731 Equipment listed on UCC-1

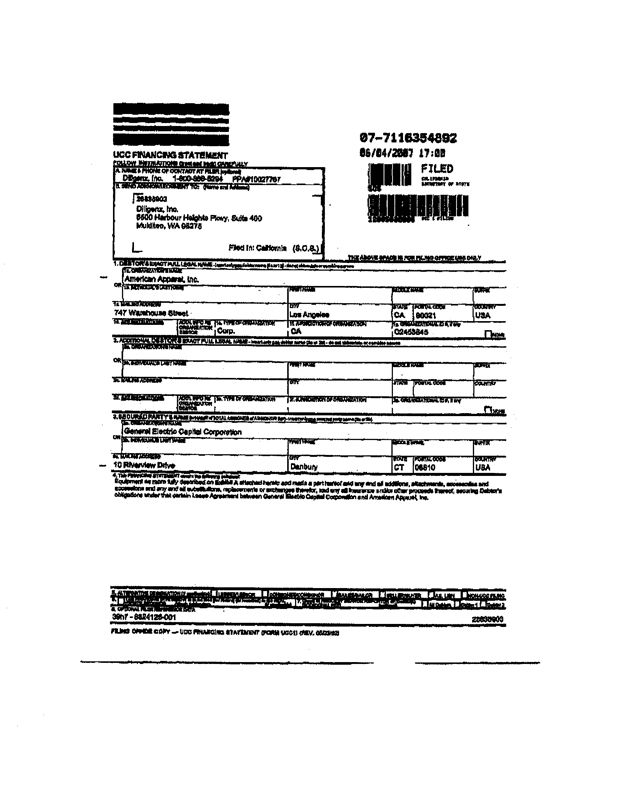

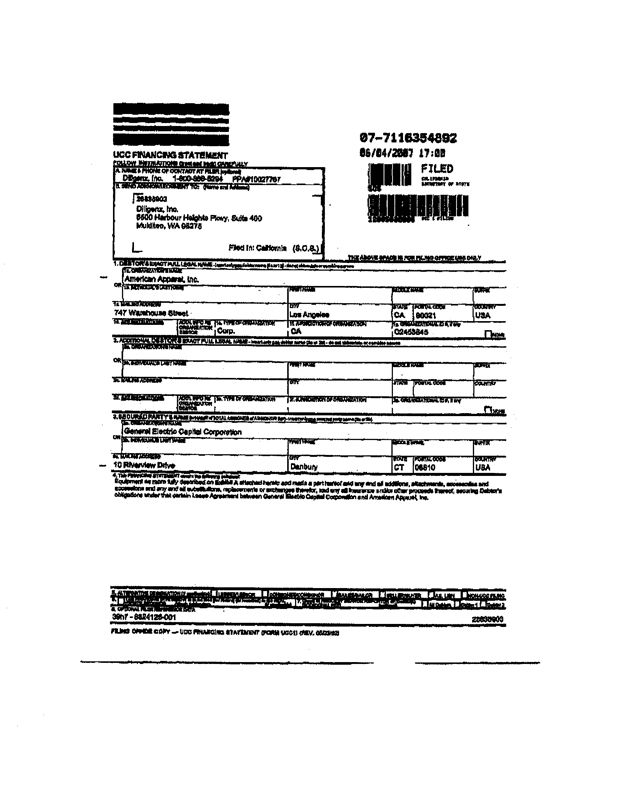

AA, Inc (CA) CA SOS General Electric Capital Corporation 06-04-07 07-7116354892 Equipment listed on UCC-1

AA, Inc (CA) CA SOS First Federal Leasing 06-22-07 07-7118590538 Equipment listed on UCC-1

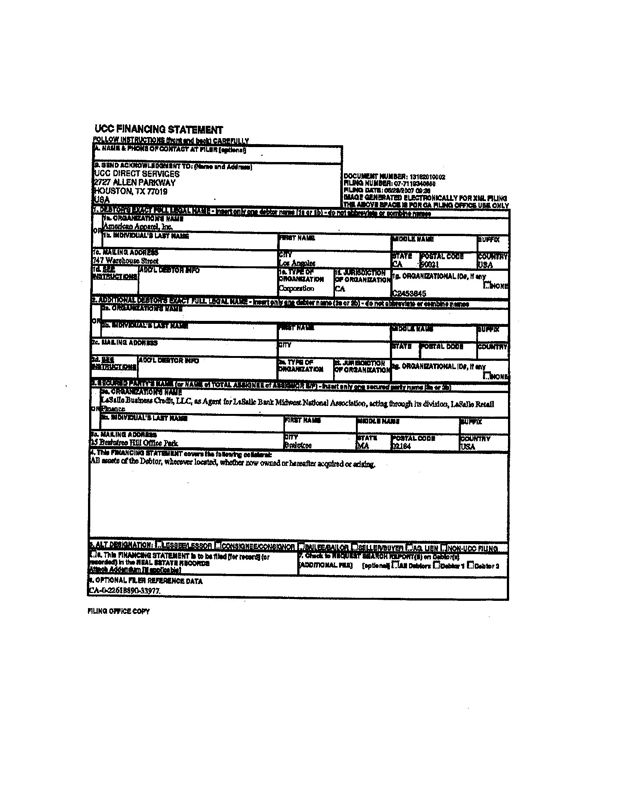

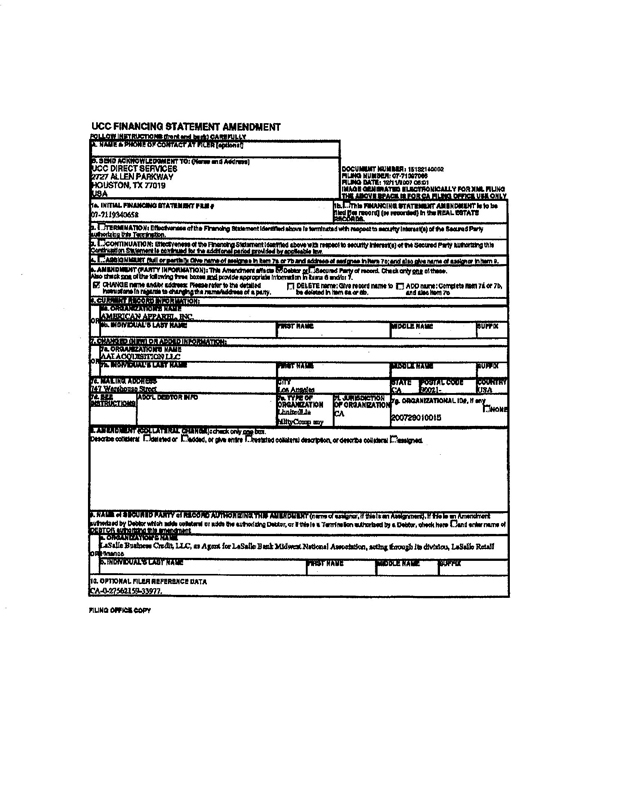

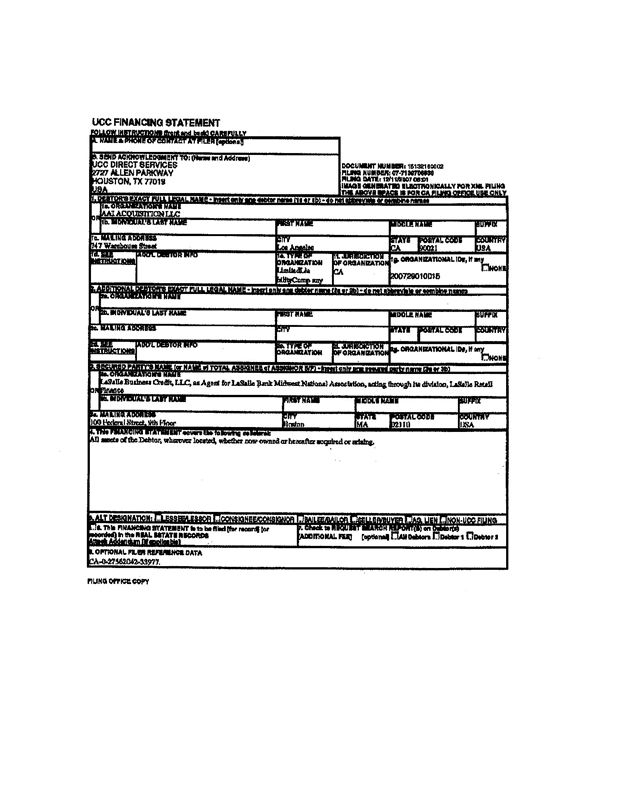

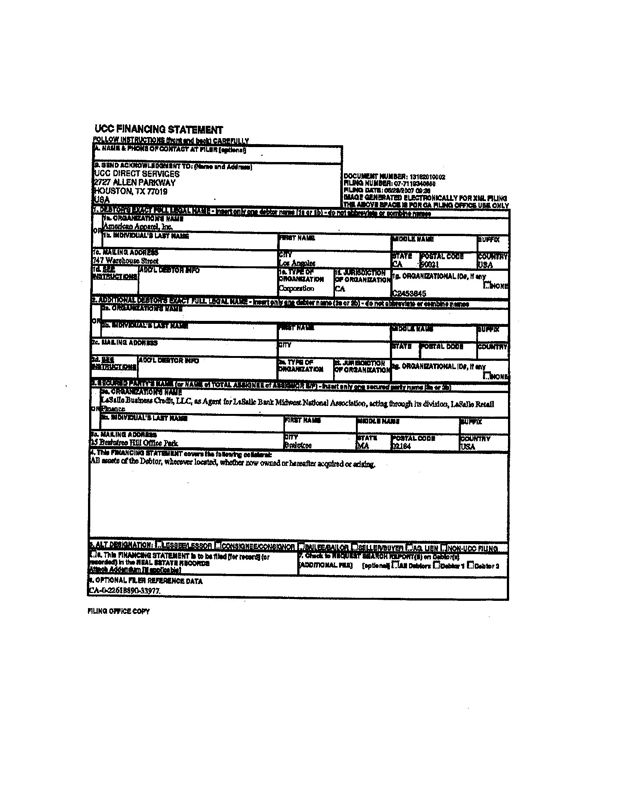

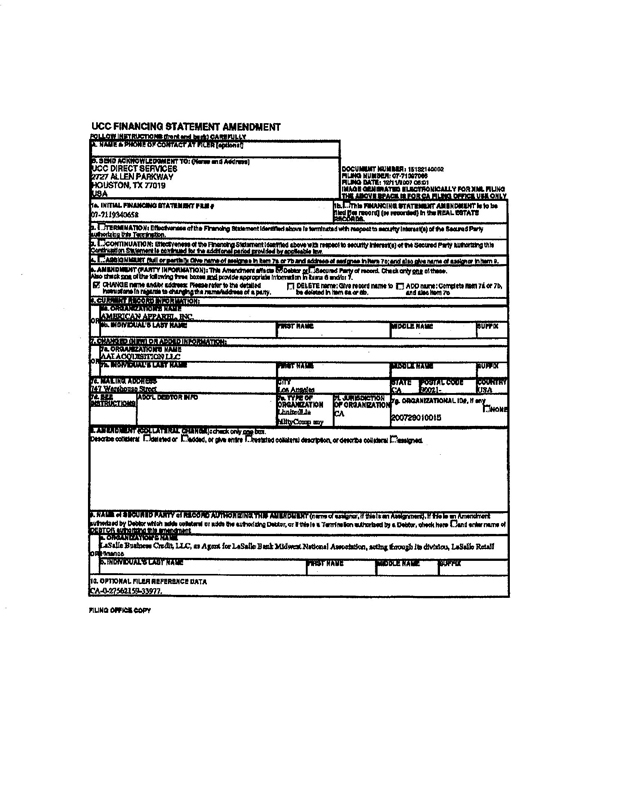

AA, Inc (CA) CA SOS LaSalle Business Credit, LLC, as Agent 06-28-07 12-11-07 12-14-07 07-7119340658 07-71397085 07-71402256 All assets

AA, Inc (CA) CA SOS BMT Leasing, Inc. 07-30-07 07-7123338105 Equipment listed on UCC-1

AA, Inc (CA) CA SOS Cisco Systems Capital Corporation 08-02-07 07-7124002790 Leased Equipment

AA, Inc (CA) CA SOS National City Commercial Capital Company, LLC 08-16-07 07-7125571175 Equipment listed on UCC-1

AA, Inc (CA) CA SOS Sterling National Bank 09-29-07 07-7127260637 Equipment listed on UCC-1

AA, Inc (CA) CA SOS The CIT Group/Commercial Services, Inc. 07-23-07 07-71224079 Continuation of initial filing 02-35360379. Lien shown on page 14 of 31 page list attached to Schedule 3.05(a) as delivered June 18,2007. American Apparel, LLC also shown as “Debtor” on that list.

*Numbers are uncertain due to poor legibility of scanned UCC-6 financing statement. Statement is attached.

2

Attachment to Schedule 3.05(a)

Debtor State Office Creditor Filing Date* Filing Number* Collateral/Comments

AA, Inc (CA) CA SOS Key Equipment Finance 04-10-08 08-71536296 Continuation of initial filing 03-19760357. Lien shown on page 15 of 31 page list attached to Schedule 3.05(a) as delivered June 18,2007. American Apparel, LLC also shown as “Debtor” on that list.

American Apparel, LLC. CA COS CCA Financial, LLC 1-21-08 08-41442737 Continuation of initial filing 03-20260423 for lease Lien shown on page 23 of 31 page list attached to Schedule 3.05(a) as delivered June 18, 2007. American Apparel, Inc also shown as “Debtor” on that list.

American Apparel, LLC CA SOS LaSalle Business Credit, LLC, as Agent 06-28-07 07-7119340890 All assets

American Apparel, LLC CA SOS SOF Investments 01-18-07 07-7099608147 All assets

AA Dyeing & Finishing CA SOS LaSalle Business Credit, LLC, as Agent 06-28-07 07-7119339515 All assets

AA Dyeing & Finishing CA SOS National City Commercial Capital Company, LLC 01-04-07 07-7097510985 Leased goods.

*Numbers are uncertain due to poor legibility of scanned UCC-6 financing statement. Statement is attached.

3

Attachment to Schedule 3.05(a)

Debtor State Office Creditor Filing Date* Filing Number* Collateral/Comments

AA Dyeing & Finishing CA SOS SOF Investments 01-18-07 07-7099607752 All assets

KCL Knitting CA SOS SOF Investments 01-18-07 07-7099607136 All assets

KCL Knitting CA SOS LaSalle Business Credit, LLC, as Agent 06-28-07 07-7119341043 All assets

Fresh Air Freight CA SOS SOF Investments 01-18-07 07-7099607136 All assets

Fresh Air Freight CA SOS LaSalle Business Credit, LLC, as Agent 06-28-07 07-7119340779 All assets

AA Retail, Inc. CA SOS LaSalle Business Credit, LLC, as Agent 06-28-07 07-7119340537 All assets

AA Retail, Inc. CA SOS SOF Investments 01-18-07 07-7099608905 All assets

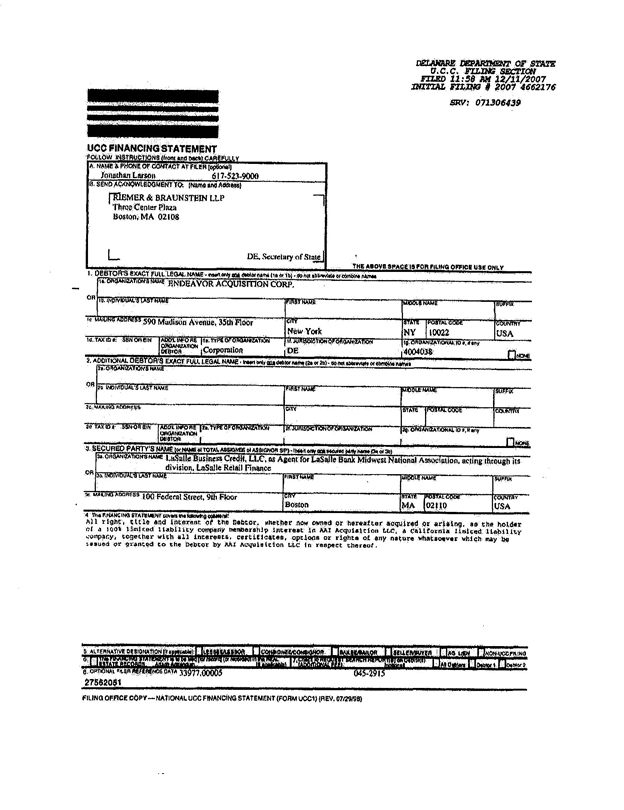

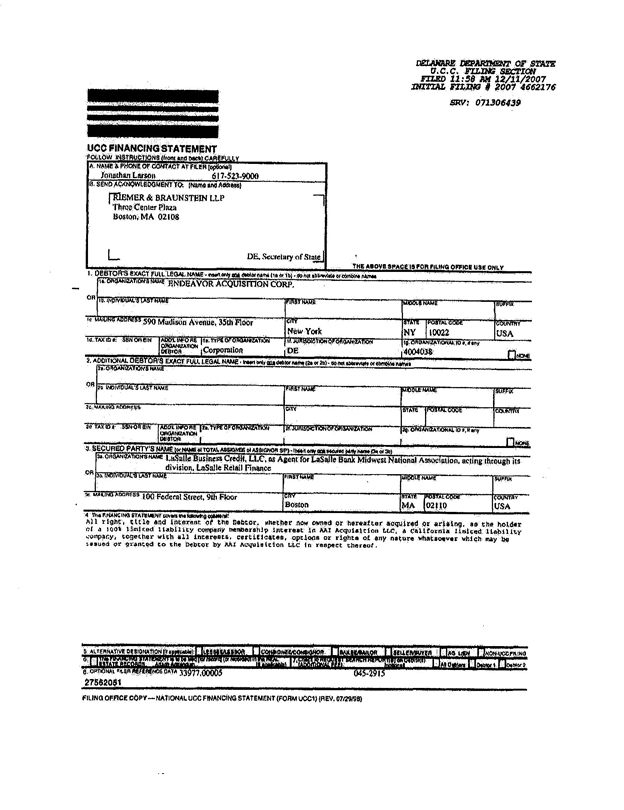

AA, Inc (DE) DE SOS LaSalle Business Credit, LLC, as Agent 12-11-07 12-14-07 12-14-07 2007 662176 2007 4724786 2007 4731492 100% of membership interests in AA (USA), LLC

AA, Inc (DE) DE SOS SOF Investments 12-14-07 2007 4739545 100% of membership interests in AA (USA), LLC

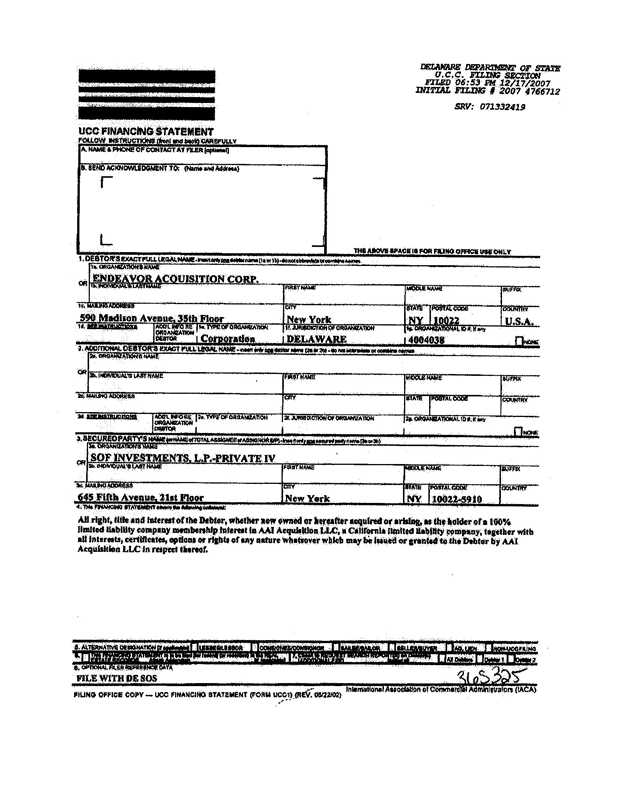

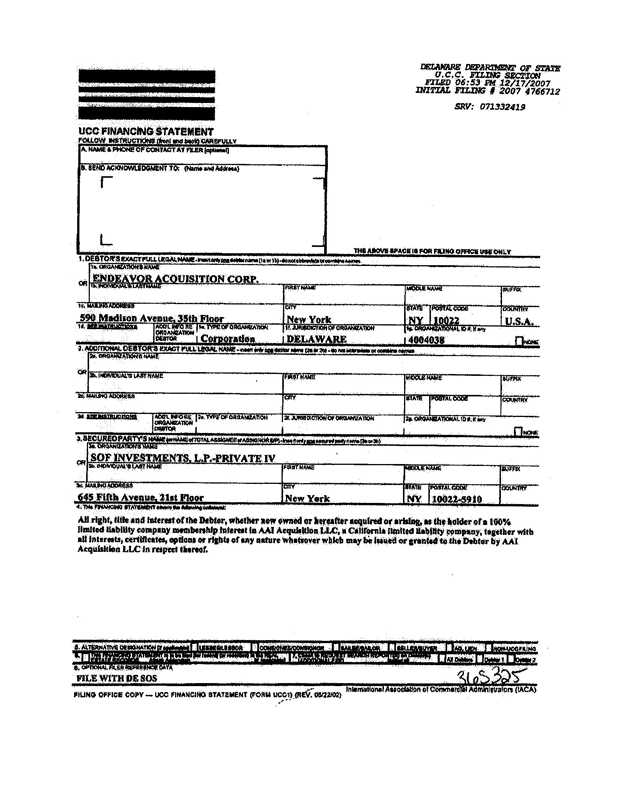

AA, Inc (DE) DE SOS SOF Investments 12-17-07 01-14-08 2007 4766712 2008 0157618 100% of membership interests in AA (USA), LLC

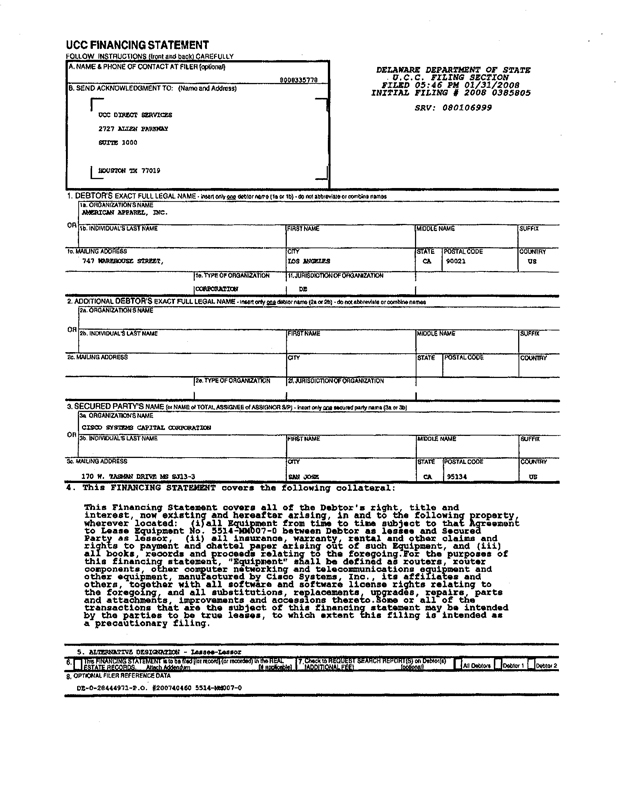

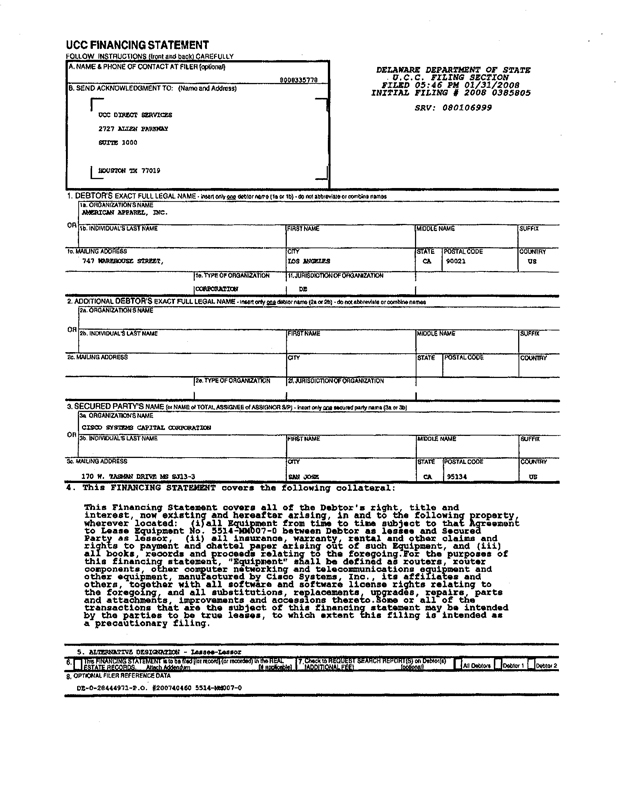

AA, Inc (DE) DE SOS SOF Investments 01-31-08 2008 0385805 Leased Equipment

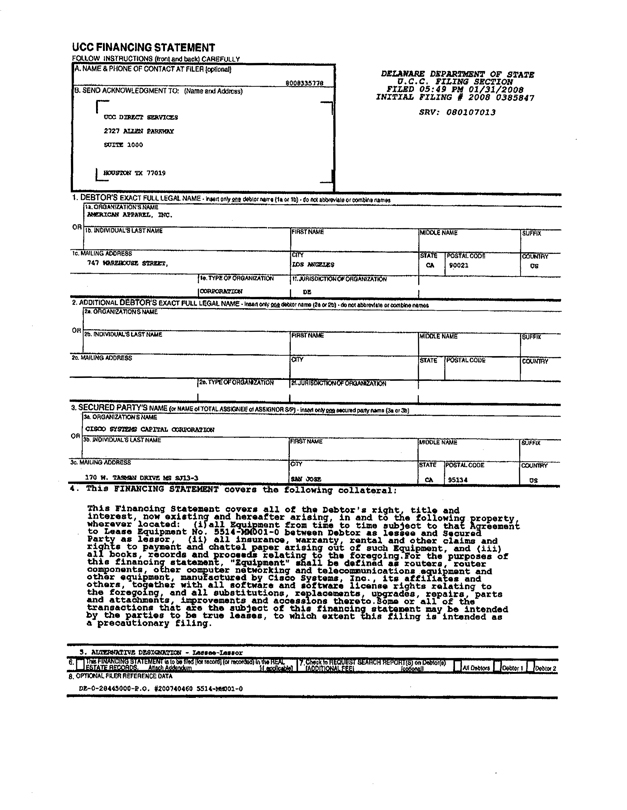

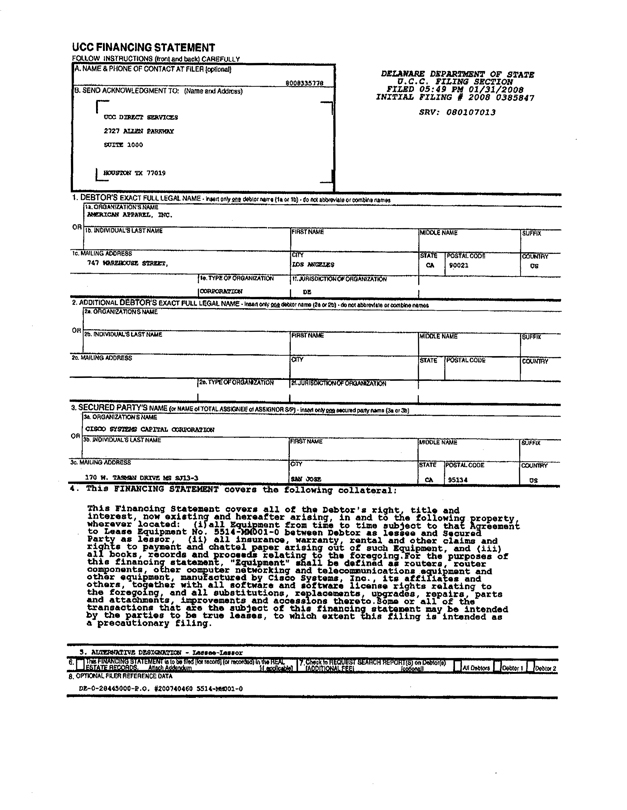

AA, Inc (DE) DE SOS Cisco Systems Capital Corporation 01-31-08 2008 0385847 Leased Equipment

AA, Inc (DE) DE SOS Cisco Systems Capital Corporation 01-31-08 2008 0385896 Leased Equipment

AA, Inc (DE) DE SOS Cisco Systems Capital Corporation 01-31-08 2008 0385904 Leased Equipment

*Numbers are uncertain due to poor legibility of scanned UCC-6 financing statement. Statement is attached.

4

Attachment to Schedule 3.05(a)

Debtor State Office Creditor Filing Date* Filing Number* Collateral/Comments

AA, Inc (DE) DE SOS Cisco Systems Capital Corporation 01-31-08 2008 0385920 Leased Equipment

AA, Inc (DE) DE SOS Cisco Systems Capital Corporation 01-31-08 2008 0385938 Leased Equipment

AA, Inc (DE) DE SOS Cisco Systems Capital Corporation 01-31-08 2008 0385946 Leased Equipment

*Numbers are uncertain due to poor legibility of scanned UCC-6 financing statement. Statement is attached.

5

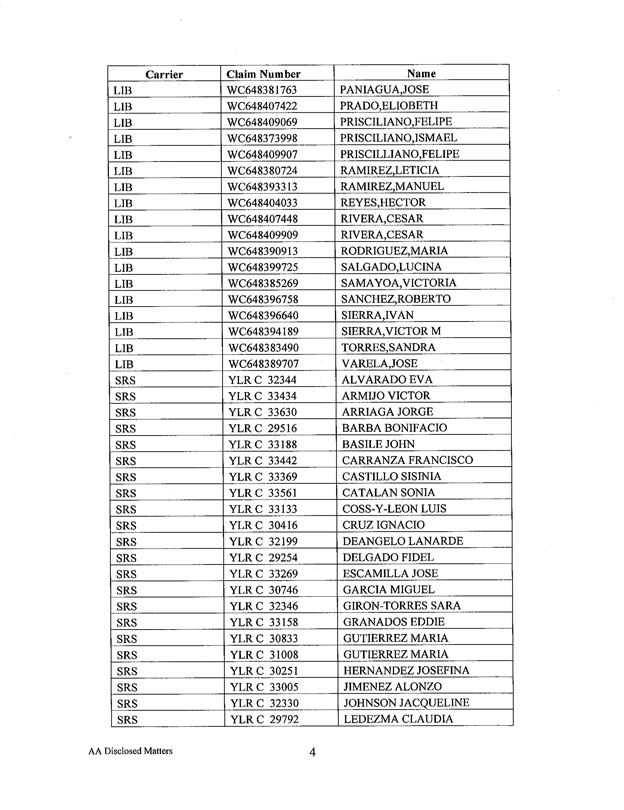

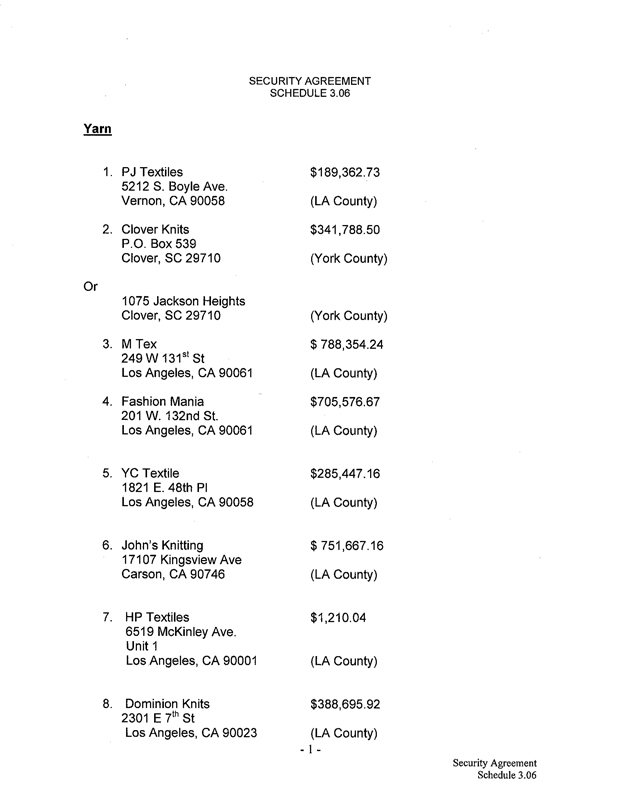

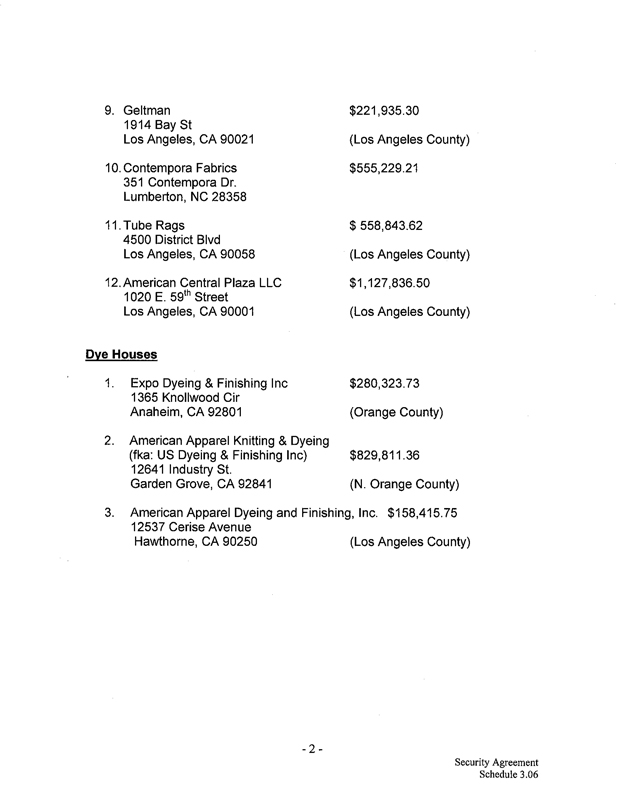

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

Fourth Amendment to Credit Agreement, dated June 20, 2008, amending the BofA Credit Agreement

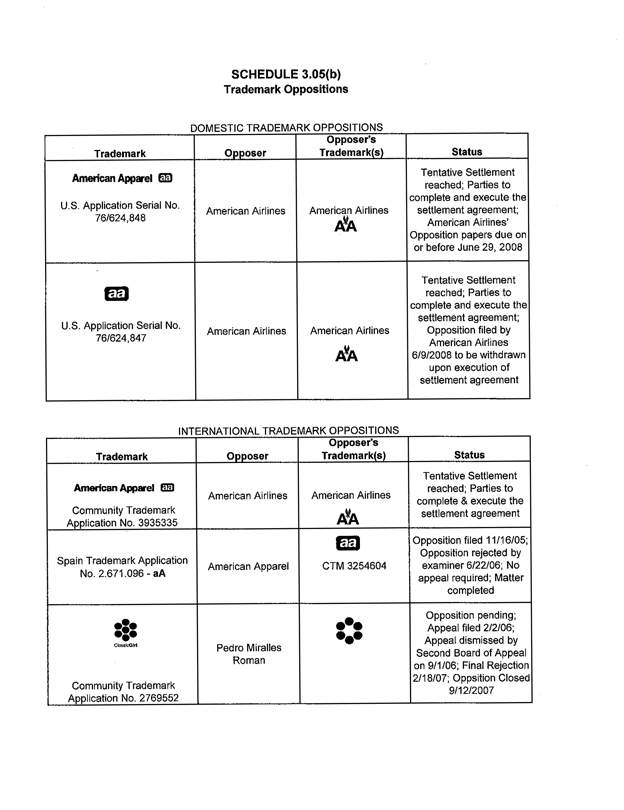

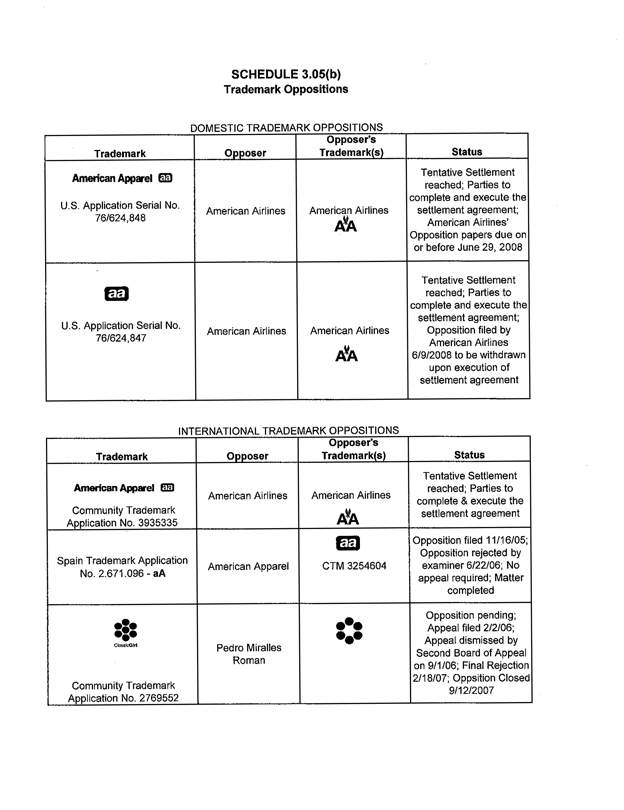

SCHEDULE 3.05(b)

Trademark Oppositions

DOMESTIC TRADEMARK OPPOSITIONS

Trademark Opposer Opposer’s Trademark(s) Status

American Apparel aa

U.S. Application Serial No. 76/624,848 American Airlines American Airlines AA Tentative Settlement reached; Parties to complete and execute the settlement agreement; American Airlines’ Opposition papers due on or before June 29, 2008

aa U.S. Application Serial No. 76/624,847 American Airlines American Airlines AA Tentative Settlement reached; Parties to complete and execute the settlement agreement; Opposition filed by American Airlines 6/9/2008 to be withdrawn upon execution of settlement agreement

INTERNATIONAL TRADEMARK OPPOSITIONS

Trademark Opposer Opposer’s Trademark(s) Status

American Apparel aa Community Trademark Application No. 3935335 American Airlines American Airlines AA Tentative Settlement reached; Parties to complete & execute the settlement agreement

Spain Trademark Application No. 2.671.096—aA American Apparel aa CTM 3254604 Opposition filed 11/16/05; Opposition rejected by examiner 6/22/06; No appeal required; Matter completed

Community Trademark Application No. 2769552 Pedro Miralles Roman Opposition pending; Appeal filed 2/2/06; Appeal dismissed by Second Board of Appeal on 9/1/06; Final Rejection 2/18/07; Oppsition Closed 9/12/2007

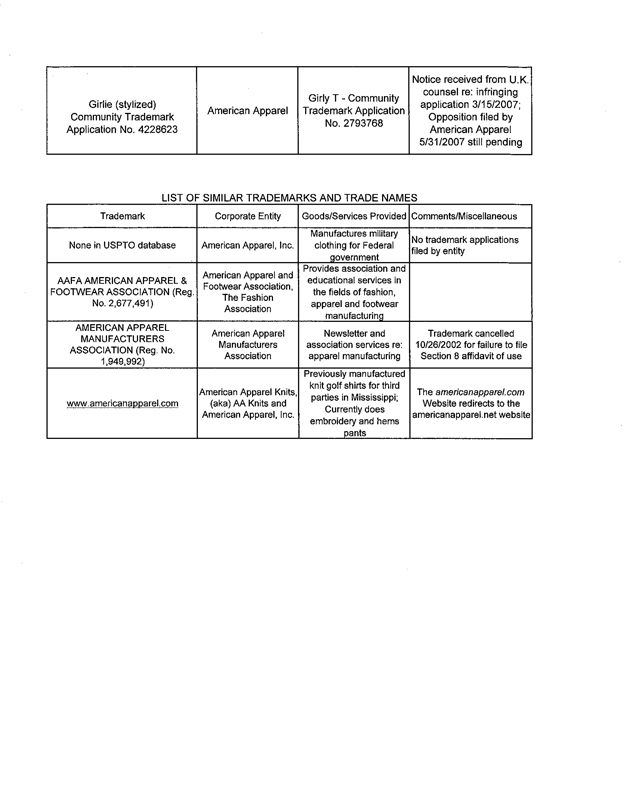

Girlie (stylized) Community Trademark Application No. 4228623 American Apparel Girly T—Community Trademark Application No. 2793768 Notice received from U.K. counsel re: infringing application 3/15/2007; Opposition filed by American Apparel 5/31/2007 still pending

LIST OF SIMILAR TRADEMARKS AND TRADE NAMES

Trademark Corporate Entity Goods/Services Provided Comments/Miscellaneous

None in USPTO database American Apparel, Inc. Manufactures military clothing for Federal government No trademark applications filed by entity

AAFA AMERICAN APPAREL & FOOTWEAR ASSOCIATION (Reg. No. 2,677,491) American Apparel and Footwear Association, The Fashion Association Provides association and educational services in the fields of fashion, apparel and footwear manufacturing

AMERICAN APPAREL MANUFACTURERS ASSOCIATION (Reg. No. 1,949,992) American Apparel Manufacturers Association Newsletter and association services re: apparel manufacturing Trademark cancelled 10/26/2002 for failure to file Section 8 affidavit of use

www.americanapparel.com American Apparel Knits, (aka) AA Knits and American Apparel, Inc. Previously manufactured knit golf shirts for third parties in Mississippi; Currently does embroidery and hems pants The americanapparel.com Website redirects to the americanapparel.net website

Schedule 3.05 (c) (i)

Owned Real Estate

None.

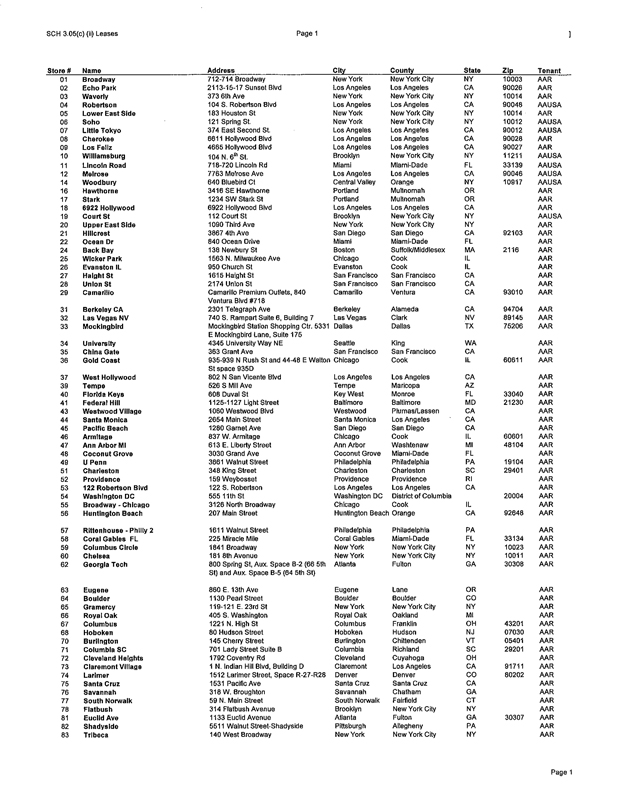

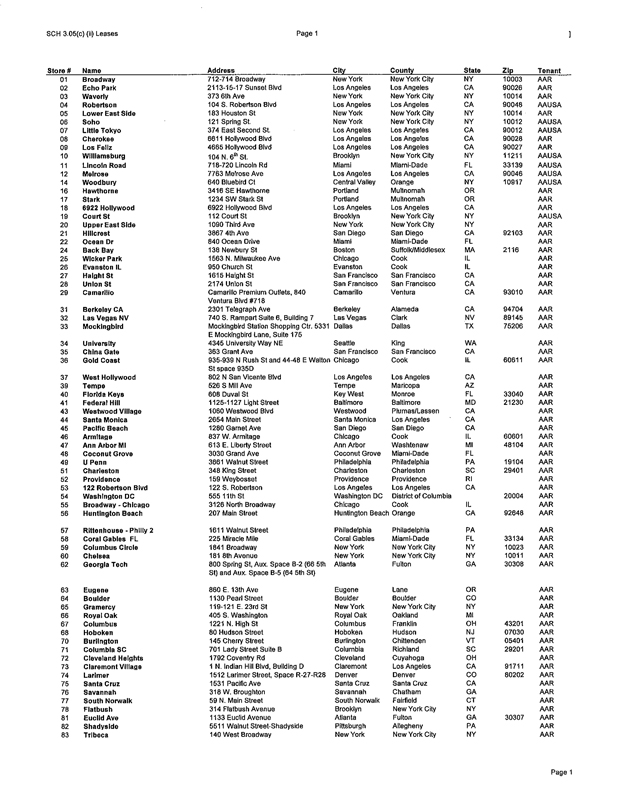

SCH 3.05(c) (ii) Leases Page 1

Store # Name Address City County State Zip Tenant

01 Broadway 712-714 Broadway New York New York City NY 10003 AAR

02 Echo Park 2113-16-17 Sunset Blvd Los Angeles Los Angeles CA 90026 AAR

03 Waverly 373 6th Ave New York New York City NY 10014 AAR

04 Robertson 104 S. Robertson Blvd Los Angeles Los Angeles CA 90048 AAUSA

05 Lower East Side 183 Houston St New York New York City NY 10014 AAR

06 Soho 121 Spring St. New York New York City NY 10012 AAUSA

07 Little Tokyo 374 East Second St. Los Angeles Los Angeles CA 90012 AAUSA

08 Cherokee 6611 Hollywood Blvd Los Angeles Los Angeles CA 90028 AAR

09 Los Fellz 4665 Hollywood Blvd Los Angeles Los Angeles CA 90027 AAR

10 Williamsburg 104 N. 6th St. Brooklyn New York City NY 11211 AAUSA

11 Lincoln Road 718-720 Lincoln Rd Miami Miami-Dade FL 33139 AAUSA

12 Melrose 7763 Melrose Ave Los Angeles Los Angeles CA 90046 AAUSA

14 Woodbury 640 Bluebird Ct Central Valley Orange NY 10917 AAUSA

16 Hawthorne 3416 SE Hawthorne Portland Multnomah OR AAR

17 Stark 1234 SW Stark St Portland Multnomah OR AAR

18 6922 Hollywood 6922 Hollywood Blvd Los Angeles Los Angeles CA AAR

19 Court St 112 Court St Brooklyn New York City NY AAUSA

20 Upper East Side 10S0 Third Ave New York New York City NY AAR

21 Hillcrest 3867 4th Ave San Diego San Diego CA 92103 AAR

22 Ocean Dr 840 Ocean Drive Miami Miami-Dade FL AAR

24 Back Bay 138 Newbury St Boston Suffolk/Middlesex MA 2116 AAR

25 Wicker Park 1563 N. Milwaukee Ave Chicago Cook IL AAR

26 Evanston IL 950 Church St Evanston Cook IL AAR

27 Haight St 1615 Haight St San Francisco San Francisco CA AAR

28 Union St 2174 Union St San Francisco San Francisco CA AAR

29 Camarlllo Camarillo Premium Outlets, 840 Camarillo Ventura CA 93010 AAR Ventura Blvd #718

31 Berkeley CA 2301 Telegraph Ave Berkeley Alameda CA 94704 AAR

32 Las Vegas NV 740 S. Rampart Suite 6, Building 7 Las Vegas Clark NV 89145 AAR

33 Mockingbird Mockingbird Station Shopping Ctr. 5331 Dallas Dallas TX 75206 AAR E Mockingbird Lane, Suite 175

34 University 4345 University Way NE Seattle King WA AAR

35 China Gate 363 Grant Ave San Francisco San Francisco CA AAR

36 Gold Coast 935-939 N Rush St and 44-46 E Walton Chicago Cook IL 60611 AAR St space 935D

37 West Hollywood 802 N San Vicente Blvd Los Angeles Los Angeles CA AAR

39 Tempo 526 S Mill Ave Tempe Maricopa AZ AAR

40 Florida Keys 608 Duval St Key West Monroe FL 33040 AAR

41 Federal Hill 1125-1127 Light Street Baltimore Baltimore MD 21230 AAR

43 Westwood Village 1060 Westwood Blvd Westwood Plumas/Lassen CA AAR

44 Santa Monica 2654 Main Street Santa Monica Los Angeles CA AAR

45 Pacific Beach 1280 GarnetAve San Diego San Diego CA AAR

46 Armitage 837 W. Armitage Chicago Cook IL 60601 AAR

47 Ann Arbor Ml 613 E. Liberty Street Ann Arbor Washtenaw Ml 48104 AAR

48 Coconut Grove 3030 Grand Ave Coconut Grove Miami-Dade FL AAR

49 U Penn 3661 Walnut Street Philadelphia Philadelphia PA 19104 AAR

51 Charleston 348 King Street Charleston Charleston SC 29401 AAR

52 Providence 159 Weybosset Providence Providence Rl AAR

53 122 Robertson Bivd 122 S. Robertson Los Angeles Los Angeles CA AAR

54 Washington DC 555 11th St Washington DC District of Columbia 20004 AAR

55 Broadway—Chicago 3126 North Broadway Chicago Cook IL AAR

56 Huntington Beach 207 Main Street Huntington Beach Orange CA 92648 AAR

57 Rlttenhouse-Philly 2 1611 Walnut Street Philadelphia Philadelphia PA AAR

58 Coral Gables FL 225 Miracle Mile Coral Gables Miami-Dade FL 33134 AAR

59 Columbus Circle 1841 Broadway New York New York City NY 10023 AAR

60 Chelsea 181 8th Avenue New York New York City NY 10011 AAR

62 Georgia Tech 800 Spring St, Aux. Space B-2 (66 5th Atlanta Fulton GA 30308 AAR St) and Aux. Space B-5 (64 5th St)

63 Eugene 860 E. 13th Ave Eugene Lane OR AAR

64 Boulder 1130 Peart Street Boulder Boulder CO AAR

65 Gramercy 119-121 E. 23rd St New York New York City NY AAR

66 Royal Oak 405 S. Washington Royal Oak Oakland Ml AAR

67 Columbus 1221 N. High St Columbus Franklin OH 43201 AAR

68 Hoboken 80 Hudson Street Hoboken Hudson NJ 07030 AAR

70 Burlington 145 Cherry Street Burlington Chittenden VT 05401 AAR

71 Columbia SC 701 Lady Street Suite B Columbia Richland SC 29201 AAR

72 Cleveland Heights 1792 Coventry Rd Cleveland Cuyahoga OH AAR

73 Claremont Village 1 N. Indian Hill Blvd, Building D Claremont Los Angeles CA 91711 AAR

74 Larimer 1512 Larimer Street, Space R-27-R28 Denver Denver CO 80202 AAR

75 Santa Cruz 1531 Pacific Ave Santa Cruz Santa Cruz CA AAR

76 Savannah 316 W. Broughton Savannah Chatham GA AAR

77 South Norwalk 59 N. Main Street South Norwalk Fairfield CT AAR

78 Flatbush 314 Flatbush Avenue Brooklyn New York City NY AAR

81 Euclid Ave 1133 Euclid Avenue Atlanta Fulton GA 30307 AAR

82 Shadyside 5511 Walnut Street-Shadyside Pittsburgh Allegheny PA AAR

83 Tribeca 140 West Broadway New York New York City NY AAR

Page 1

SCH 3.05(c) (ii) Leases Page 2

Store # Name Address City County State Zip Tenant

84 East Lansing 115 East Grand River Ave East Lansing Ingham Ml AAR

85 Charlotte 1510 Camden Road, Suite 300 Charlotte Mecklenburg NC 28203 AAR

86 Richmond 3140A West Cary Street Richmond City of Richmond VA 23221 AAR

88 Memphis 528 & 530 South Main Memphis Shelby TN 38103 AAR

89 Silver Springs 8701 Colesvllle Road Silver Spring Montgomery MD 20910 AAR

91 Cincinnati 243 W. McMillan Street Cincinnati Clermont/Hamilton OH AAR

92 Gainesville 15 SW 1st Ave Gainesville Alachua FL 32601 AAR

93 Smith St 237-239 Smith Street Brooklyn New York City NY AAR

94 Capitol Hill 200 Broadway Ave. E Seattle King WA 98102 AAR

95 Sunset - Miami FL 5855 Sunset Dr Miami Miami-Dade FL 33143 AAR

96 La Jolla 7925 Girard Ave La Jolla San Diego CA 92037 AAR

97 Houston, TX 1665 Westhelmer Houston Harris TX AAR

98 Nashville TN 320 Broadway Nashville Davidson TN AAR

99 Pittsburgh 2 3805 Forbes Ave, 4th Ward Pittsburgh Allegheny PA 15213 AAR

100 New Orleans 3310 Magazine St New Orleans Orleans Parish LA 70115 AAR

101 Factory People—Austin TX 1325 South Congress Ave Austin TX 78704 AAR

102 142 5th Ave 142 5th Ave New York New York City NY AAR

103 2831 Broadway 2831 Broadway New York New York City NY AAR

104 Santa Ana 200 N. Broadway Santa Ana Orange CA 92701 AAR

105 Santa Barbara 1019 State St Santa Barbara Santa Barbara CA 93101 AAR

106 Lennox—Atlanta GA 3400 Lenox Rd NE Atlanta Fulton GA 30326 AAR

107 Cambridge MA 47 Brattle St Cambridge Middlesex MA 02138 AAR

108 Downtown Seattle 1500 6th Ave Seattle King WA 98101 AAR

109 Tucson AZ 988 East University Blvd Tucson Pima AZ 85719 AAR

110 Downtown Houston 1111 Main St Houston Harris TX 77002 AAR

111 Palo Alto CA 170 University Ave Palo Alto Santa Clara CA 94301 AAR

112 Old Town Pasadena 46 West Colorado Blvd Pasadena Los Angeles CA 91105 AAR

113 Scottsdale AZ 4501 N Scottsdale Rd #102 Scottsdale Maricopa AZ 85251 AAR

114 Minneapolis, MN 1433 West Lake St Minneapolis Hennepin MN AAR

115 Kansas City MO 447-449 West 47th Street Kansas City Jackson MO 64112 AAR

116 King of Prussia, PA 160 North Gulph Road Store 2154B King of Prussia Montgomery PA 19406 AAR

117 Forum Shops—Las Vegas, NV 3500 Las Vegas Blvd S Las Vegas Clark NV 89109 AAR

118 Hawaii 2142 Kalakaua Ave Honolulu Honolulu HI 96815 AAR

119 Trolley Square—Salt Lake City, UT 5520 S 700 E Space D-109 Salt Lake City Salt Lake UT 84102 AAR

120 The Drag—Guadalupe—Austin, TX 2316 Guadalupe St Austin Travis/Williamson TX AAR

121 Outlet—Roundrock, TX 4401 N IH-35 Unit 131 Austin Travis/Williamson TX 78664 AAR

122 9th Ave -Hells Kitchen, NY 610 9th Ave New York New York NY AAR

123 Bridgeport, OR 7325 SW Bridgeport Rd Tigard Washington OR 97224 AAR

125 Georgetown 3025 M Street NW Georgetown DC 20007 AAR

126 Ventura Blvd—Studio City, CA 12202 Ventura Blvd Studio City Los Angeles CA 91604 AAR

127 Valencia St—San Francisco 988 Valencia St San Francisco San Francisco CA 94110 AAR

128 Little Tokyo 2-CA 375 E 2nd St Los Angeles Los Angeles CA 90012 AAR

129 Dallas—NorthPark Center 8687 N Central Expressway, Ste 2204 Dallas Dallas TX 75206 AAR

130 Berkeley 2 2315 Telegraph Rd Berkeley Alameda CA 94704 AAR

131 Garden State NJ 1 Garden State Plaza Store C5 Paramus Bergen NJ 07652 AAR

132 Annapolis MD 2002 Annapolis Mall Space 1335 Annapolis Anne Arundel MD 21401 AAR