UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

MOTRICITY, INC.

(Name of Registrant as Specified in its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

September , 2011

Dear Stockholders:

You are cordially invited to attend the 2011 Annual Meeting of Stockholders of Motricity, Inc. (the “Company”), to be held on Friday, October 28, 2011, beginning at 2:00 p.m. Eastern Daylight Time, at the offices of Brown Rudnick LLP, Seven Times Square, New York, NY 10036.

Information about the meeting and the various matters on which the stockholders will vote is included in the Notice of Meeting and Proxy Statement which follow. Also included is a proxy card and postage-paid return envelope. Please sign, date and mail the enclosed proxy card in the return envelope provided, as promptly as possible, whether or not you plan to attend the meeting.

Sincerely,

James R. Smith, Jr.

Interim Chief Executive Officer

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Friday, October 28, 2011

TO THE STOCKHOLDERS OF MOTRICITY, INC.:

Notice is hereby given that the Annual Meeting of Stockholders of Motricity, Inc. (the “Company”) will be held on Friday, October 28, 2011, beginning at 2:00 p.m. Eastern Daylight Time, at the offices of Brown Rudnick LLP, Seven Times Square, New York, NY 10036:

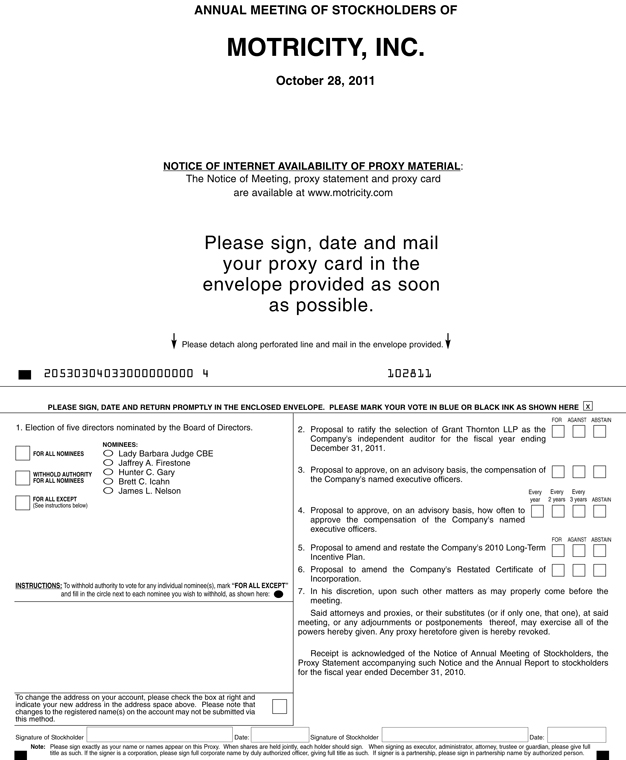

| 1. | To consider and act upon the election of five (5) directors to serve until the 2012 Annual Meeting of stockholders, or until their respective successors are elected and qualified or until his or her earlier death, resignation or removal; |

| 2. | To ratify the selection of Grant Thornton LLP (“Grant Thornton”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2011; |

| 3. | To consider and act upon an advisory vote to approve the compensation of the Company’s named executive officers as disclosed in this proxy statement under “Executive Compensation;” |

| 4. | To consider and act upon an advisory vote on how often to vote for approval of the compensation of the Company’s named executive officers; |

| 5. | To consider and act upon a proposal to amend and restate the Company’s 2010 Long-Term Incentive Plan; |

| 6. | To consider and act upon a proposal to amend the Company’s Restated Certificate of Incorporation; and |

| 7. | To transact such other business as may properly come before the meeting or any adjournments thereof. |

The Company’s Board of Directors recommends a FOR vote for each of proposals (1), (2), (3), (5) and (6) above and an EVERY YEAR vote for proposal (4) above.

Only holders of record of Common Stock as of the close of business on Tuesday, September 27, 2011 are entitled to notice of and to vote at the Annual Meeting and any adjournments thereof.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on October 28, 2011: The 2011 Proxy Statement and the Company’s Annual Report for the fiscal year ended December 31, 2010 are available atwww.motricity.com.

In accordance with Delaware law, a list of the holders of Common Stock entitled to vote at the Annual Meeting will be available for examination by any stockholder for any purpose germane to the Annual Meeting, during ordinary business hours, for at least 10 days prior to the Annual Meeting, at the offices of the Company, located at 601 108th Avenue Northeast, Suite 800, Bellevue, Washington 98004.

YOU ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE VOTE (I) BY TELEPHONE, (II) VIA THE INTERNET OR (III) BY COMPLETINGTHE ENCLOSED PROXY CARD AND RETURNING IT IN THE ENCLOSED ENVELOPE, WHICH NEEDS NO POSTAGE IF MAILED IN THE UNITED STATES. IF YOU LATER DESIRE TO REVOKE YOUR PROXY, YOU MAY DO SO AT ANY TIME BEFORE IT IS EXERCISED.

* * * *

By Order of the Board of Directors, |

Lady Barbara Judge CBE Chairman of the Board of Directors |

TABLE OF CONTENTS

i

Motricity, Inc.

601 108th Avenue Northeast, Suite 800

Bellevue, Washington 98004

425-957-6200

FOR

ANNUAL MEETING OF STOCKHOLDERS

To Be Held On October 28, 2011

We are sending you our proxy materials in connection with the solicitation of the enclosed proxy by the Board of Directors of Motricity, Inc. (the “Company”) for use at the Annual Meeting of Stockholders, and at any adjournments thereof.

Attending the Annual Meeting

The Annual Meeting will be held on Friday, October 28, 2011, at 2:00 p.m. Eastern Daylight Time, at the offices of Brown Rudnick LLP, Seven Times Square, New York, NY 10036, to consider the matters set forth in the Notice of Annual Meeting of Stockholders. This Proxy Statement and the form of proxy enclosed are being mailed to stockholders commencing on or about September , 2011.

Stockholders Entitled to Vote

Only stockholders of record of the Common Stock, par value $0.001 per share, of the Company (the “Common Stock”) at the close of business on September 27, 2011 will be entitled to vote at the Annual Meeting. As of that date, a total of shares of Common Stock were outstanding, each share being entitled to one vote. There is no cumulative voting.

Street Name Holders and Record Holders

If you own shares through a broker, the registered holder of those shares is the broker or its nominee. Such shares are often referred to as held in “street name,” and you, as the beneficial owner of those shares, do not appear in our share register. For street name shares, there is a two-step process for distributing our proxy materials and tabulating votes. Brokers inform us how many of their clients own shares in street name, and the broker forwards our proxy materials to those beneficial owners. If you receive our proxy materials, including a voting instruction card, from your broker, you should vote your shares by following the procedures specified on the voting instruction card. Shortly before the Annual Meeting, your broker will tabulate the votes it has received and submit a proxy card to us reflecting the aggregate votes of the street name holders. If you plan to attend the Annual Meeting and vote your street name shares in person, you should contact your broker to obtain a broker’s proxy card and bring it to the Annual Meeting.

If you are the registered holder of shares, you are the record holder of those shares, and you should vote your shares as described below under “How Record Holders Vote.”

1

How Record Holders Vote

You can vote at the Annual Meeting in person or by proxy. We recommend that you vote by proxy even if you plan to attend the Annual Meeting. You can always attend the Annual Meeting and revoke your proxy by voting in person.

There are three ways to vote by proxy:

| • | By telephone—You can vote by touch tone telephone by calling toll-free 1-800-PROXIES (1-800-776-9437) and following the instructions on our enclosed proxy card; |

| • | By Internet—You can vote by Internet by going to the website “www.voteproxy.com” and following the instructions on our enclosed proxy card; or |

| • | By mail—You can vote by mail by completing, signing, dating and mailing our enclosed proxy card to American Stock Transfer & Trust Company, LLC, 6201 15th Avenue, Brooklyn, NY 11219, at or before the taking of the vote at the Annual Meeting. |

By giving us your proxy, you are authorizing the individuals named on our proxy card, the proxies, to vote your shares in the manner you indicate. You may (i) vote for the election of all of our director nominees, (ii) withhold authority to vote for all of our director nominees, or (iii) vote for the election of one or more of our director nominees and withhold authority to vote for the other nominee(s), by so indicating on the proxy card. You may vote “FOR” or “AGAINST” or “ABSTAIN” from voting on (a) the ratification of the appointment of Grant Thornton as the Company’s independent auditor for fiscal year ending December 31, 2011, (b) the advisory vote to approve the compensation of the Company’s named executive officers as described in this proxy statement under “Executive Compensation,” (c) the amendment and restatement of the Company’s 2010 Long-Term Incentive Plan and (d) the amendment to the Company’s Restated Certificate of Incorporation. You may also vote to hold an advisory vote to approve the compensation of the Company’s named executive officers (i) every year, (ii) every two years, (iii) every three years or (iv) abstain from voting.

If you vote by proxy without indicating your instructions, your shares will be voted FOR:

| • | The election of our five (5) director nominees per the recommendation of our Board of Directors; |

| • | The ratification of the appointment of Grant Thornton as the Company’s independent auditor; |

| • | The advisory approval of the compensation of the Company’s named executive officers as described in this proxy statement under “Executive Compensation;” |

| • | The advisory vote to approve the compensation of the Company’s named executive officers every year; |

| • | The amendment and restatement of the Company’s 2010 Long-Term Incentive Plan; and |

| • | The amendment of the Company’s Restated Certificate of Incorporation. |

Revocation of Proxies

A stockholder may revoke a proxy at any time prior to its exercise (i) by giving to the Company’s Corporate Secretary a written notice of revocation of the proxy’s authority, (ii) by submitting a duly elected proxy bearing a later date or (iii) by attending the Annual Meeting and voting in person. Your attendance at the meeting alone will not revoke your proxy.

Quorum and Votes Necessary for Action to be Taken

The presence, at the commencement of the Annual Meeting, in person or by proxy of the holders of a majority of the issued and outstanding shares of Common Stock of the Company will constitute a quorum for the transaction of business at the Annual Meeting. If, however, a quorum is not present or represented at the Annual

2

Meeting, either the person presiding at the Annual Meeting or a majority of the stockholders entitled to vote thereat, present in person or by proxy, may adjourn the Annual Meeting, without notice other than announcement at the Annual Meeting, until a quorum shall be present or represented.

Election of directors and the advisory vote on the frequency of holding an advisory vote on executive compensation will be determined by a plurality of the votes cast by stockholders entitled to vote at the annual meeting. The proposal to amend the Company’s Restated Certificate of Incorporation requires the affirmative vote of at least a majority of the outstanding shares of the Company’s capital stock entitled to vote on the proposal. On all other matters being submitted to stockholders, the affirmative vote of a majority of shares present, in person or represented by proxy, and voting on each such matter at the annual meeting is required for approval.

Abstentions and broker “non-votes” are included in the number of shares present or represented for purposes of quorum, but are not considered as shares voting or as votes cast with respect to any matter presented at the annual meeting. As a result, abstentions and broker “non-votes” will not have any effect on the proposals to elect directors, to ratify the appointment of Grant Thornton as our auditor, to hold an advisory vote to approve executive compensation, to hold an advisory vote on the frequency of holding such an advisory vote, to amend and restate the Company’s 2010 Long-Term Incentive Plan and to adjourn the Annual Meeting, but will have the effect of a vote against the proposal to amend the Company’s Restated Certificate of Incorporation.

Other Matters

As of the date of this Proxy Statement, our Board of Directors does not know of any business that will be presented for consideration at the Annual Meeting other than the matters described in this Proxy Statement. If any other matters are properly brought before the Annual Meeting, the persons named in the enclosed form of proxy will vote the proxies in accordance with their best judgment.

Expenses of Proxy Solicitation

The Company is paying the costs for the solicitation of proxies, including the cost of preparing and mailing the Proxy Materials. Proxies are being solicited primarily by mail, but in addition, the solicitation by mail may be followed by solicitation in person, or by telephone or facsimile, by regular employees of the Company without additional compensation. Also, the Company has retained D.F. King & Co., Inc., to aid in the solicitation of proxies and to verify records relating to the solicitation. D.F. King & Co., Inc., will receive a fee of $10,000 as well as reimbursement for certain expenses, all of which will be paid for by the Company. The Company will also reimburse brokers, banks and other custodians and nominees for their reasonable out-of-pocket expenses incurred in sending proxy materials to the Company’s stockholders.

3

PROPOSAL 1—ELECTION OF DIRECTORS

The Board of Directors of the Company is currently composed of five members. There is no limit to the number of terms a director may serve and the term of office of each person elected as a director will continue until the next annual meeting of stockholders or until a successor has been elected and qualified. The Board of Directors has approved the nomination of Lady Judge and Messrs. Firestone, Gary, Icahn and Nelson for election and the five nominees have indicated a willingness to serve. A plurality of the shares of Common Stock present and voting at the Annual Meeting is necessary to elect the nominees for director.

The person named as proxy in the enclosed form of proxy will vote the proxies received by them for the election of Lady Judge and Messrs. Firestone, Gary, Icahn and Nelson unless otherwise directed. In the event that any of the nominees become unavailable for election at the Annual Meeting, the person named as proxy in the enclosed form of proxy may vote for a substitute nominee in their discretion as recommended by the Board of Directors.

Set forth below is certain biographical information regarding the nominees as of September 15, 2011:

Name | Age | Position | Director Since | |||||||

Lady Barbara Judge CBE(1)(2) | 64 | Chairman of the Board | 2010 | |||||||

Jaffrey A. Firestone(3) | 55 | Director | 2011 | |||||||

Hunter C. Gary(1)(2)(3) | 37 | Director | 2007 | |||||||

Brett C. Icahn(1)(3) | 32 | Director | 2010 | |||||||

James L. Nelson(2) | 62 | Director | 2011 | |||||||

| (1) | Member of our Nominating and Corporate Governance Committee |

| (2) | Member of our Compensation Committee |

| (3) | Member of our Audit Committee |

Jaffrey A. Firestonehas served as one of our directors since July 2011. Since 2006, Mr. Firestone has served as Chairman and Chief Executive Officer at Prodigy Pictures Inc., a leader in the production of quality film, television and cross-platform media. Previously, Mr. Firestone established Fireworks Entertainment in 1996 to produce, distribute and finance television programs and feature films. In 1998, Fireworks Entertainment was acquired by CanWest Global Communications Corporation and Mr. Firestone was named Chairman and Chief Executive Officer and oversaw the company’s Los Angeles and London based television operations as well as its Los Angeles feature film division, Fireworks Pictures. In addition, Mr. Firestone oversaw the company’s interest in New York based IDP Distribution, an independent distribution and marketing company formed by Fireworks in 2000 as a joint venture with Samuel Goldwyn Films and Stratosphere Entertainment. Mr. Firestone has served on the board of directors for the Academy of Canadian Cinema and Television and the Academy of Television Arts and Sciences International Council in Los Angeles. Mr. Firestone has led two successful initial public offerings and in 1998, was nominated for entrepreneur of the year. Mr. Firestone has extensive experience in dealing with financial reporting, which, in addition to his service on another board, enables him to advise our board on a range of matters including financial matters.

Hunter C. Gary has served as one of our directors since 2007. Since November 2010, Mr. Gary has served as the Senior Vice President of Icahn Enterprises, L.P., a diversified holding company engaged in the following continuing operating businesses: investment management, automotive, gaming, railcar, food packaging, metals, real estate and home fashion. Since June 2003, Mr. Gary has been employed by Icahn Associates Corp. in various roles, most recently as the Chief Operating Officer of Icahn Sourcing LLC. His specialty focuses on post-acquisition management of companies and hands-on involvement with, and support of, portfolio company management to reduce costs and enhance performance. From 1997 to 2002, Mr. Gary worked at Kaufhof Warenhaus AG, a subsidiary of the Metro Group, most recently as a Managing Director. Since September 2011, Mr. Gary has served as a director of XO Holdings, Inc., a telecommunications service provider. Since March 2010, Mr. Gary has served as a director of Tropicana Entertainment Inc., which owns and operates a diversified,

4

multi-jurisdictional collection of casino gaming properties. Since January 2008, Mr. Gary has served as a director of American Railcar Industries, Inc., a company that is primarily engaged in the business of manufacturing covered hopper and tank railcars. Since June 2007, Mr. Gary has served as a director of WestPoint International, Inc., a manufacturer of bed and bath home fashion products. With respect to each company mentioned above, Carl C. Icahn, directly or indirectly, either (i) controls such company or (ii) has an interest in such company through the ownership of securities. Mr. Gary has extensive experience in dealing with operations matters for a variety of companies which, in addition to his service on other boards, enables him to advise our board on a range of matters including operations and oversight.

Brett C. Icahn has served as one of our directors since January 2010. Mr. Icahn currently is responsible for co-executing a small/mid cap investment strategy across all industries as a Portfolio Manager of the Sargon Portfolio for Icahn Capital LP, an entity through which Carl C. Icahn manages investment funds, where Brett Icahn was an investment analyst from 2002 until April 2010. Since July 2010, Brett Icahn has served as a director of The Hain Celestial Group, Inc., a natural and organic food and personal care products company, and as a director of Cadus Corporation, a company engaged in the ownership and licensing of yeast-based drug discovery technologies. Since April 2010, Brett Icahn has served as a director of Take-Two Interactive Software, Inc., a developer, marketer, distributor and publisher of interactive entertainment software games. Since January 2007, Brett Icahn has served as a director of American Railcar Industries, Inc., a company that is primarily engaged in the business of manufacturing covered hopper and tank railcars. Prior to that Brett Icahn served on the board of directors of HowStuffWorks.com, an internet website acquired by Discovery Communication in 2007. With respect to each company mentioned above, Carl C. Icahn, directly or indirectly, either (i) controls such company or (ii) has an interest in such company through the ownership of securities. Brett Icahn has experience with technology companies, both as a board member and as a founder. In addition, his experience as a portfolio manager and an investment analyst provides him with strong skills in dealing with financial matters.

James L. Nelsonhas served as one of our directors since June 2011. Since April 2010, Mr. Nelson has served as a director of Take-Two Interactive Software, Inc., a publisher, developer, and distributor of video games and video game peripherals. Since March 2010, Mr. Nelson has served as a director of Tropicana Entertainment Inc. From May 2005 until November 2007, Mr. Nelson served as a director of Atlantic Coast Entertainment Holdings, Inc. Since December 2003, Mr. Nelson has served as a director of American Entertainment Properties Corp. From April 2003 through April 2010, Mr. Nelson served as a director of Viskase Companies, Inc., a producer of nonedible cellulose casings and nettings. Since June 2001, Mr. Nelson has also served as a director of Icahn Enterprises G.P. Inc., the general partner of Icahn Enterprises L.P. With respect to each company mentioned above, Carl C. Icahn, directly or indirectly, either (i) controls such company or (ii) has an interest in such company through the ownership of securities. From 1986 until 2009, Mr. Nelson was Chairman and Chief Executive Officer of Eaglescliff Corporation, a specialty investment banking, consulting and wealth management company. From March 1998 through 2003, Mr. Nelson was Chairman and Chief Executive Officer of Orbit Aviation, Inc., a company engaged in the acquisition and completion of Boeing Business Jets for private and corporate clients. From August 1995 until July 1999, Mr. Nelson was Chief Executive Officer and Co-Chairman of Orbitex Management, Inc., a financial services company in the mutual fund sector. From August 1995 until March 2001, he was on the board of Orbitex Financial Services Group, a provider of financial services. From January 2008 through June 2008, Mr. Nelson served as a director of Shuffle Master, Inc., a gaming manufacturing company. From March 2008 until March 2010, Mr. Nelson was a director of Pacific Energy Resources Ltd., an energy producer. Since April 2008, Mr. Nelson has served as a director of the board of directors of Cequel Communications, an owner and operator of a large cable television system. Because of Mr. Nelson’s experience as the chief executive officer of multiple companies, as well as his previous service as director of several other publicly reporting companies, he is able to provide the Board of Directors with the perspective of an experienced executive officer and is able to give insight related to the management and operations of a publicly traded company.

Lady Barbara Judge CBEhas served as one of our directors since January 2010 and chairman of the board since June 2010. Since 2011, Lady Judge has been chairman of the United Kingdom Pension Protection Fund and

5

from 2004 to 2010 she was chairman of the United Kingdom Atomic Energy Authority. From 2004 to 2007, Lady Judge was the deputy chairman of the United Kingdom Financial Reporting Council in London. From 2002 through 2004, she was a director of the Energy Group of the United Kingdom’s Department of Trade and Industry. Earlier in her career, Lady Judge served as a commissioner of the U.S. Securities and Exchange Commission, was a partner at the law firm Kaye, Scholer, Fierman, Hays & Handler and was an executive director at Samuel Montagu & Co. Ltd, a British merchant bank. Lady Judge serves as a director of Magna International Inc. and Statoil ASA. Lady Judge has 25 years of experience counseling boards and senior management regarding corporate governance, compliance, disclosure, international business conduct and other relevant issues. Lady Judge’s experience as a former commissioner of the U.S. Securities and Exchange Commission and broad legal and cross-border regulatory experience enables her to provide valuable insights and perspectives to our board.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF LADY JUDGE AND MESSRS. FIRESTONE, GARY, ICAHN AND NELSON.

6

PROPOSAL 2—RATIFICATION OF THE SELECTION OF INDEPENDENT AUDITOR

The Audit Committee of our Board of Directors has selected Grant Thornton as independent auditor for the fiscal year ending December 31, 2011 and has further directed that management submit the selection of the independent auditor for ratification by the stockholders at the Annual Meeting. A proposal to ratify the appointment of Grant Thornton will be presented at the Annual Meeting.

Our Audit Committee Charter requires stockholder ratification of the selection of Grant Thornton as our independent auditor for the fiscal year ending December 31, 2011. If the stockholders fail to ratify the selection, the Audit Committee will reconsider its selection of that firm.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting will be required to ratify the selection of Grant Thornton.

Change in Certifying Accountant

Previous Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP (“PricewaterhouseCoopers”) was the Company’s independent auditor during the fiscal year ended December 31, 2010. On September 20, 2011, PricewaterhouseCoopers informed the Board of Directors of the Company of its resignation effective as of that date.

PricewaterhouseCoopers’s reports on the Company’s financial statements for the fiscal years ended December 31, 2009 and December 31, 2010 did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the fiscal years ended December 31, 2009 and December 31, 2010 and through September 20, 2011, there were no disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K) with PricewaterhouseCoopers on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of PricewaterhouseCoopers, would have caused PricewaterhouseCoopers to make reference to the subject matter of such disagreements in connection with its reports on the financial statements for such years.

During the fiscal years ended December 31, 2009 and December 31, 2010 and through September 20, 2011, there have been no reportable events (as defined in Item 304(a)(1)(v) of Regulation S-K).

The Company provided PricewaterhouseCoopers with a copy of the above disclosure and requested that PricewaterhouseCoopers furnish the Company with a letter addressed to the U.S. Securities and Exchange Commission stating whether or not PricewaterhouseCoopers agrees with the statements contained above. PricewaterhouseCoopers has furnished the Company with a letter addressed to the U.S. Securities and Exchange Commission stating that it agrees with the above statements, a copy of which was filed as Exhibit 16.1 to the Company’s current report on Form 8-K on September 22, 2011.

New Independent Registered Public Accounting Firm

On September 21, 2011, the Audit Committee approved the appointment of Grant Thornton LLP (“Grant Thornton”) as the Company’s independent registered public accounting firm subject to clearance of Grant Thornton’s “Client Acceptance” process. The Company’s decision was influenced by, among other things, the desire to reduce the Company’s audit fees.

During the fiscal years ended December 31, 2009 and December 31, 2010 and through September 20, 2011, neither the Company nor anyone acting on behalf of the Company, consulted Grant Thornton with respect to (i) either the application of accounting principles to a specified transaction, completed or proposed; or the type of

7

audit opinion that might be rendered on the Company’s financial statements, and no written report or oral advice was provided to the Company by Grant Thornton reaching a decision as to the accounting, auditing, or financial reporting issue; or (ii) any matter that was the subject of either a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K) or a reportable event (as defined in Item 304(a)(1)(v) of Regulation S-K).

Audit Fees

During the years ended December 31, 2010 and 2009, we incurred fees and related expenses for professional services rendered by PricewaterhouseCoopers relating to the audit and review of the financial statements of the respective years totaling approximately $1.63 million and $182,000, respectively. “Audit Fees” included fees for professional services and expenses relating to the reviews of our quarterly financial statements for the quarters ended June 30, 2010 and September 30, 2010 on Form 10-Q and the audit of our annual financial statements and our Annual Report on Form 10-K for the fiscal year 2010. “Audit Fees” for the year ended December 31, 2010, also include fees relating to the procedures relating to our Form S-1 and Form S-8 filings with the U.S. Securities and Exchange Commission. For the year ended December 31, 2009, “Audit Fees” included fees for professional services and expenses relating to the audit of our annual financial statements for the fiscal year 2009.

Audit-Related Fees

We incurred fees to PricewaterhouseCoopers of approximately $4,000 during the year ended December 31, 2009 related to accounting research software.

Tax Fees

None.

All Other Fees

None.

Pre-Approval Policies and Procedures

The Audit Committee has adopted policies and procedures for the pre-approval of audit and non-audit services rendered by our independent auditor. The policy generally pre-approves specified services in the defined categories of audit services, audit-related services and tax services up to specified amounts. Pre-approval may also be given as part of our Audit Committee’s approval of the scope of the engagement of the independent auditor. All audit-related and tax services for fiscal years 2010 and 2009 by PricewaterhouseCoopers were pre-approved by the Audit Committee of the Company.

The Audit Committee has determined that the rendering of the services, other than the audit services, by PricewaterhouseCoopers, is compatible with maintaining the principal accountant’s independence.

Representatives of PricewaterhouseCoopers and Grant Thornton will be in attendance at the Annual Meeting by teleconference and in person, respectively, and will have an opportunity to make a statement if they so desire. The representatives will also be available to respond to appropriate questions.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” PROPOSAL 2.

8

PROPOSAL 3—ADVISORY VOTE TO APPROVE THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT UNDER “EXECUTIVE COMPENSATION”

As required by Section 14A of the Exchange Act, the Company is providing its shareholders with the opportunity to cast a non-binding advisory vote to approve the compensation of the Company’s named executive officers, as disclosed in the Compensation Discussion and Analysis (beginning on page 34), the compensation tables (beginning on page 48), and any related information contained in this proxy statement under “Executive Compensation.”

The Board of Directors believes that the Company’s compensation policies and procedures are centered on a pay-for-performance culture and are strongly aligned with the long-term interests of stockholders. You are urged to read the “Executive Compensation” section of this proxy statement for additional details on the Company’s executive compensation, including the Company’s philosophy and objectives and the 2010 compensation of the named executive officers.

Your vote is requested.The Company believes that the information regarding named executive officer compensation as disclosed within the “Executive Compensation” section of this proxy statement demonstrates that the Company’s executive compensation program was designed appropriately and structured to ensure a strong alignment with the long-term interests of the Company’s stockholders. This vote is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers, as described in this proxy statement. Accordingly, the Company will ask the Company’s shareholders to vote “FOR” the following resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers as disclosed under “Executive Compensation” pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative disclosure, is hereby APPROVED.”

This vote is advisory and therefore, it will not be binding on the Company, the Compensation Committee or the Company’s Board of Directors, nor will it overrule any prior decision or require the Board of Directors or the Compensation Committee to take any action. However, the Compensation Committee and the Company’s Board of Directors value the opinions of the Company’s stockholders and to the extent there is any significant vote against the named executive officer compensation as disclosed in this proxy statement, the Compensation Committee and the Company’s Board of Directors will consider stockholders’ concerns and the Compensation Committee will evaluate whether any actions are necessary to address those concerns.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” PROPOSAL 3.

9

PROPOSAL 4—ADVISORY VOTE TO APPROVE HOW OFTEN TO APPROVE ON COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT

Pursuant to SEC rules, the Company is providing its shareholders a separate vote to recommend whether an advisory vote to approve named executive officer compensation should occur once every one, two or three years.

After careful consideration of the frequency alternatives, the Company’s Board of Directors has determined that an advisory vote to approve named executive officer compensation that occurs every year is the most appropriate alternative for the Company at this time, and therefore the Company’s Board of Directors recommends a vote every year for the advisory vote to approve named executive officer compensation.

In formulating its recommendation, the Company’s Board of Directors considered that an annual advisory vote on executive compensation will allow our stockholders to provide us with their input on our compensation of named executive officers as disclosed in the proxy statement every year. We understand that our stockholders may have different views as to what is the best approach for the Company, and we look forward to hearing from our stockholders on this Proposal.

In the future, the Company may determine that a less frequent advisory vote is appropriate, either in response to the vote of the Company’s stockholders on this proposal or for other reasons.

Stockholders may cast their vote on the preferred voting frequency by choosing the option of one year, two years, or three years or abstain from voting when voting on this proposal. The option of one year, two years or three years that receives the highest number of votes cast by stockholders will be the frequency for the advisory vote to approve executive compensation that has been recommended by stockholders. However, because this vote is advisory and not binding on the Company’s Board of Directors or the Company in any way, the Company’s Board of Directors may decide that it is in the best interests of the Company’s stockholders and the Company to hold an advisory vote to approve executive compensation more or less frequently than the option approved by the Company’s stockholders.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE FOR THE OPTION OF “EVERY YEAR”

AS THE RECOMMENDED FREQUENCY VOTE

TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION ON PROPOSAL 4.

10

PROPOSAL 5—AMENDMENT AND RESTATEMENT OF 2010 LONG-TERM INCENTIVE PLAN

Effective April 23, 2010, the Company adopted the 2010 Long Term Incentive Plan (as amended, the “2010 LTIP”). On September 26, 2011, the Board of Directors, subject to shareholder approval, amended and restated the 2010 LTIP. The purposes of the proposed amendment and restatement are to (i) increase by 3,600,000 the maximum number of shares available for issuance under the 2010 LTIP from 2,765,621 to 6,365,621, provided that the maximum number of shares issued in any one year period for all types of awards does not exceed 4% of the Company’s issued and outstanding shares of Common Stock, (ii) expand the definition of “Cause,” which governs the consequences of certain separations of employment and the treatment of outstanding awards (See section “Forfeiture and Clawback” below), (iii) reduce the 10 year maximum term of option awards to 5 years, (iv) provide for ownership guidelines for the Company’s executive officers, (v) eliminate certain definitions and provisions, and (vi) require a 6-month holding period for recipients of restricted stock who are terminated from the Company for any reason.

The Board of Directors believes this increase is appropriate to allow the Company to continue to offer adequate numbers of equity-based and other incentive awards to its employees. As of September 12, 2011, there are only 454,664 shares of Common Stock available for issuance under the 2010 LTIP. If the amendment and restatement of the 2010 LTIP is not approved by the Company’s shareholders, the Company believes, based on current projections, that the pool of remaining shares currently available for issuance under the 2010 LTIP would likely be fully used in the next 6 months.

The 2010 LTIP is intended to benefit the Company by offering equity-based and other incentives to certain of the Company’s directors, executives and employees, thereby encouraging their continued involvement with the Company’s businesses. The following is a summary description of the 2010 LTIP and is qualified in its entirety by reference to the full text of the 2010 LTIP, which is set forth asAppendix A to this Proxy Statement.

Description of the Amended and Restated 2010 Long-Term Incentive Plan

Administration. The 2010 LTIP is administered by the Company’s Compensation Committee and all actions taken with respect to the 2010 LTIP will be made in accordance with the Compensation Committee’s Charter. For purposes of the 2010 LTIP, to the extent required by applicable law, it is intended that each member of the Compensation Committee qualify as (a) a “non-employee director” under Rule 16b-3, (b) an “outside director” under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), and (c) an “independent director” under the rules of the principal U.S. national securities exchange on which our shares are listed. The Compensation Committee has full authority to administer and interpret the 2010 LTIP. Among the Compensation Committee’s powers are to determine the form, amount and other terms and conditions of awards, clarify, construe or resolve any ambiguity in any provision of the 2010 LTIP or any award agreement, amend the terms of outstanding awards and adopt such rules, forms, instruments and guidelines for administering the 2010 LTIP as it deems necessary or proper. All actions, interpretations and determinations by the Compensation Committee or by our Board of Directors are final and binding.

Available Shares. The aggregate number of shares of Common Stock which may be issued or used for reference purposes under the 2010 LTIP or with respect to which awards may be granted may not exceed 6,365,621 shares, which may be either authorized and unissued shares of Common Stock or shares of Common Stock held in or acquired for our treasury. In general, if awards under the 2010 LTIP are for any reason cancelled, or expire or terminate unexercised, or are settled in cash, the shares covered by such awards will again be available for the grant of awards under the 2010 LTIP.

Following the Section 162(m) “transition period” (as described in “Federal Income Tax Consequences” below), the maximum number of shares subject to any award of stock options, or stock appreciation rights (which are referred to herein as “SARs”), or shares of restricted stock, or other stock-based awards subject to the attainment of specified performance goals which may be granted during any fiscal year to any participant will be 266,666 shares per type of award, provided that the maximum number of shares issued in any one year period for

11

all types of awards does not exceed 4% of the Company’s issued and outstanding shares of Common Stock. Except as otherwise required by the Code, there are no annual individual share limitations applicable to participants for restricted stock or other stock-based awards that are not subject to the attainment of specified performance goals. The maximum number of shares subject to any performance award during any fiscal year to any participant shall be 266,666 shares. The maximum value of a cash payment made under a performance award which may be granted with respect to any fiscal year to any participant shall be $5,440,000. The maximum value of cash payments made under performance awards granted with respect to any fiscal year to all participants shall be $14,104,670.

The foregoing share limitations imposed under the 2010 LTIP are subject to adjustment to the extent the Compensation Committee deems such adjustment appropriate and equitable to prevent dilution or enlargement of participants’ rights.

Eligibility for Participation.Members of our Board of Directors, as well as employees of, and consultants to, us or any of our subsidiaries and affiliates are eligible to receive awards under the 2010 LTIP. The selection of participants is within the sole discretion of the Compensation Committee.

Award Agreement. Awards granted under the 2010 LTIP shall be evidenced by award agreements (which need not be identical) that provide additional terms, conditions, restrictions and/or limitations covering the grant of the award, including, without limitation, additional terms providing for the acceleration of exercisability, or vesting of awards or conditions regarding the participant’s employment, as determined by the Compensation Committee in its sole discretion.

Awards Under the 2010 LTIP. The following types of awards are available under the 2010 LTIP:

Restricted Stock. The Compensation Committee may award shares of restricted stock. Except as otherwise provided by the Compensation Committee upon the award of restricted stock, the recipient generally has the rights of a stockholder with respect to the shares, including the right to receive dividends, the right to vote the shares of restricted stock and, conditioned upon full vesting of shares of restricted stock, the right to tender such shares, subject to the conditions and restrictions generally applicable to restricted stock or specifically set forth in the recipient’s restricted stock agreement. The Compensation Committee may determine at the time of award that the payment of dividends, if any, will be deferred until the expiration of the applicable restriction period.

Recipients of restricted stock are required to enter into a restricted stock agreement with us that states the restrictions to which the shares are subject, which may include satisfaction of pre-established performance goals, and the criteria or date or dates on which such restrictions will lapse.

If the grant of restricted stock or the lapse of the relevant restrictions is based on the attainment of performance goals, the Compensation Committee will establish for each recipient the applicable performance goals, formulae or standards and the applicable vesting percentages with reference to the attainment of such goals or satisfaction of such formulae or standards while the outcome of the performance goals are substantially uncertain. Such performance goals may incorporate provisions for disregarding (or adjusting for) changes in accounting methods, corporate transactions (including, without limitation, dispositions and acquisitions) and other similar events or circumstances. The performance goals for performance-based restricted stock will be based on one or more of the objective criteria set forth on Exhibit A to the 2010 LTIP and discussed in general below.

Stock Options. The Compensation Committee may grant nonqualified stock options and incentive stock options (only to eligible employees) to purchase shares of Common Stock. The Compensation Committee will determine the number of shares of Common Stock subject to each option, the term of each option (which may not exceed 5 years (or five years in the case of an incentive stock option granted to a 10% stockholder)), the exercise price, the vesting schedule (if any), and the other material terms of each option. No incentive stock option or nonqualified stock option may have an exercise price less than the fair market value of a share of Common Stock

12

at the time of grant (or, in the case of an incentive stock option granted to a 10% stockholder, 110% of such share’s fair market value). Options will be exercisable at such time or times and subject to such terms and conditions as determined by the Compensation Committee at grant and the exercisability of such options may be accelerated by the Compensation Committee in its sole discretion. The 2010 LTIP specifically provides that an outstanding option may not be modified to reduce the exercise price nor may a new option at a lower price be substituted for a surrendered option, unless such action is approved by the stockholders of the Company. The maximum number of shares of Common Stock with respect to which incentive stock options may be granted under the 2010 LTIP is 6,365,621 shares.

Stock Appreciation Rights. The Compensation Committee may grant SARs either with a stock option, which may be exercised only at such times and to the extent the related option is exercisable (which is referred to herein as a “Tandem SAR”), or independent of a stock option (which is referred to herein as a “Non-Tandem SAR”). A SAR is a right to receive a payment in shares of Common Stock or cash (as determined by the Compensation Committee) equal in value to the excess of the fair market value of one share of Common Stock on the date of exercise over the exercise price per share established in connection with the grant of the SAR. The term of each SAR may not exceed 10 years. The exercise price per share covered by a SAR will be the exercise price per share of the related option in the case of a Tandem SAR and will be the fair market value of Common Stock on the date of grant in the case of a Non-Tandem SAR. The Compensation Committee may also grant “limited SARs,” either as Tandem SARs or Non-Tandem SARs, which may become exercisable only upon the occurrence of an event as the Compensation Committee may, in its sole discretion, designate at the time of grant or thereafter.

Other Stock-Based Awards. The Compensation Committee may, subject to limitations under applicable law, make a grant of such other stock-based awards (including, without limitation, stock equivalent units or restricted stock units) under the 2010 LTIP that are payable in cash or denominated or payable in or valued by shares of Common Stock or factors that influence the value of such shares. The Compensation Committee shall determine the terms and conditions of any such other awards, which may include the achievement of certain minimum performance goals and/or a minimum vesting period. The performance goals for performance-based other stock- based awards will be based on one or more of the objective criteria set forth on Exhibit A to the 2010 LTIP and discussed in general below.

Other Cash-Based Awards. The Compensation Committee, in its discretion, may grant awards payable in cash. Cash-based awards shall be in such form, and dependent on such conditions, as the Compensation Committee shall determine, including, without limitation, being subject to the satisfaction of vesting conditions or awarded purely as a bonus and not subject to restrictions or conditions. If a cash-based award is subject to vesting conditions, the Compensation Committee may accelerate the vesting of such award in its discretion.

Performance Awards. The Compensation Committee may grant a performance award to a participant payable upon the attainment of specific performance goals. The Compensation Committee may grant performance awards that are intended to qualify as “performance-based compensation” under Section 162(m) of the Code, as well as performance awards that are not intended to qualify as “performance-based compensation” under Section 162(m) of the Code. If the performance award is payable in cash, it may be paid upon the attainment of the relevant performance goals either in cash or in shares of restricted stock (based on the then current fair market value of such shares), as determined by the Compensation Committee, in its sole discretion. Based on service, performance and/or such other factors or criteria, if any, as the Compensation Committee may determine, the Compensation Committee may, at or after grant, accelerate the vesting of all or any part of any performance award. The Compensation Committee has “negative discretion” to adjust bonus payments as permitted by Section 162(m) of the Code.

Performance Goals. The Compensation Committee may grant awards of restricted stock, performance awards, and other stock-based awards that are intended to qualify as “performance-based compensation” for purposes of Section 162(m) of the Code. These awards may be granted, vest and be paid based on attainment of specified performance goals established by the Compensation Committee. These performance goals will be based on the attainment of a certain target level of, or a specified increase or decrease in, one or more of the following

13

criteria selected by the Compensation Committee: (i) earnings per share; (ii) operating income; (iii) gross income; (iv) net income (before or after taxes); (v) cash flow; (vi) gross profit; (vii) gross profit return on investment; (viii) gross margin return on investment; (ix) gross margin; (x) operating margin; (xi) working capital; (xii) earnings before interest and taxes; (xiii) earnings before interest, tax, depreciation and amortization; (xiv) return on equity; (xv) return on assets; (xvi) return on capital; (xvii) return on invested capital; (xviii) net revenues; (xix) gross revenues; (xx) revenue growth; (xxi) annual recurring revenues; (xxii) recurring revenues; (xxiii) license revenues; (xxiv) sales or market share; (xxv) total shareholder return; (xxvi) economic value added; (xxvii) specified objectives with regard to limiting the level of increase in all or a portion of the Company’s bank debt or other long-term or short-term public or private debt or other similar financial obligations of the Company, which may be calculated net of cash balances and/or other offsets and adjustments as may be established by the Compensation Committee in its sole discretion; (xxviii) the fair market value of the a share of Common Stock; (xxix) the growth in the value of an investment in Common Stock assuming the reinvestment of dividends; or (xxx) reduction in operating expenses.

To the extent permitted by law, the Compensation Committee may also exclude the impact of an event or occurrence which the Compensation Committee determines should be appropriately excluded, including: (i) restructurings, discontinued operations, extraordinary items and other unusual or non-recurring charges; (ii) an event either not directly related to our operations or not within the reasonable control of management; or (iii) a change in accounting standards required by generally accepted accounting principles. Performance goals may also be based on an individual participant’s performance goals, as determined by the Compensation Committee, in its sole discretion.

In addition, all performance goals may be based upon the attainment of specified levels of our performance (or subsidiary, division or other operational unit) under one or more of the measures described above relative to the performance of other corporations. The Compensation Committee may designate additional business criteria on which the performance goals may be based or adjust, modify or amend those criteria.

Acquisition Event. In the event of a merger or consolidation in which the Company is not the surviving entity, a transaction that results in the acquisition of substantially all of the Company’s outstanding Common Stock, or the sale or transfer of all or substantially all of the Company’s assets (collectively, an “Acquisition Event”), then the Compensation Committee may terminate all outstanding and unexercised options, SARs, or any other stock-based award that provides for a participant elected exercise by cashing out such awards upon the date of consummation of the Acquisition Event or by delivering notice of termination to each participant at least 20 days prior to the date of consummation of the Acquisition Event, in which case during the period from the date on which such notice of termination is delivered to the consummation of the Acquisition Event, each such participant shall have the right to exercise in full all of his or her outstanding awards contingent on the occurrence of the Acquisition Event.

Stockholder Rights. Except as otherwise provided in the applicable award agreement, and with respect to an award of restricted stock, a participant has no rights as a stockholder with respect to shares of Common Stock covered by any award until the participant becomes the record holder of such shares.

Forfeiture and Clawback. Unless otherwise provided by the Compensation Committee in the governing award agreement, the 2010 LTIP provides that (a) in the event that the participant’s conduct meets the definition of “Cause” during the later of the 12-month period following exercise of an award or the 24-month period commencing on the date of vesting, distribution, or settlement of an award, the Company shall recover from the participant within the applicable period after such vesting, exercise, settlement, or distribution, an amount equal to any gain realized on such award, and (b) if the participant engages in conduct that meets the definition of “Cause” then all outstanding awards terminate and expire.

Unless otherwise provided by the Compensation Committee in the governing award agreement, the 2010 LTIP also provides that in the event of a restatement of the Company’s financial statements that reduces the amount of any previously awarded performance award, where the performance goals would not otherwise have

14

been met had the results been properly reported, the award will be cancelled and the participant will pay the Company an amount equal to any gain realized on such award within (a) 24 months preceding such financial restatement for any participant who has a position with the Company as a vice president, senior vice president, executive officer or named executive officer or (b) 12 months preceding such financial restatement for all other participants.

Ownership Guidelines and Holding Period. The 2010 LTIP includes ownership guidelines requiring (i) the Chief Executive Officer to own, within five years of the date of grant of an option or restricted stock, stock equal in value to at least six times of such executive’s annual base salary and (ii) the other executive officers to own, within five years of the date of grant of an option or restricted stock, stock equal in value to at least three times of each such executive’s annual base salary. In addition, the 2010 LTIP provides that if the participant has been granted restricted stock, such participant will continue to hold stock equal to 100% of the amount needed to meet the ownership guidelines discussed above for a period of at least 6 months following the termination of his or her employment with the Company for any reason.

Amendment and Termination. Notwithstanding any other provision of the 2010 LTIP, our Board of Directors may at any time amend any or all of the provisions of the 2010 LTIP, or suspend or terminate it entirely, retroactively or otherwise; provided, however, that, unless otherwise required by law or specifically provided in the 2010 LTIP, the rights of a participant with respect to awards granted prior to such amendment, suspension or termination may not be adversely affected without the consent of such participant.

Transferability.Awards granted under the 2010 LTIP are generally nontransferable (other than by will or the laws of descent and distribution), except that the Compensation Committee may provide for the transferability of nonqualified stock options in an award agreement at the time of grant or thereafter to certain family members.

Federal Income Tax Consequences

The following discussion of the Federal income tax consequences of the issuance of awards granted under the 2010 LTIP is based upon the provisions of the Code, as in effect on the date hereof, current regulations adopted and proposed thereunder, and existing administrative rulings and pronouncements of the Internal Revenue Service (the “IRS”). It is not intended to be a complete discussion of all of the Federal income tax consequences of the 2010 LTIP or of all of the requirements that must be met in order to qualify for the described tax treatment. The 2010 LTIP provides the Company with broad discretion to grant many different types of awards. The discussion below illustrates the Federal income tax consequences of only some of the types of awards the Company is permitted to make under the 2010 LTIP. Depending on the type of award granted under the 2010 LTIP, the Federal income tax consequences to the Company and recipients of awards could materially differ from the discussion below. In addition, because the tax consequences may vary, and certain exceptions to the general rules discussed herein may be applicable, depending upon the personal circumstances and the type of award granted, each recipient should consider his or her personal situation and consult with his or her tax advisor with respect to the specific tax consequences applicable to each recipient. No information is provided in the discussion below about foreign, state or local tax laws.

Restricted Stock.The recipient of restricted stock will generally not recognize income at the time that shares subject to such restrictions are issued, unless a Section 83(b) election (described below) is made. Absent a Section 83(b) election, recipients of restricted stock will recognize income at the time the restrictions are removed from the shares. In such event, recipients will recognize ordinary income on the date the restrictions are removed in an amount equal to the excess of the then fair market value of such shares over the purchase price (if any) paid for such shares. The tax basis in the shares with respect to which restrictions are removed will be equal to the sum of the amount paid for such shares plus the amount of ordinary income recognized by the recipient. The holding period for such shares for purposes of determining whether any capital gain or loss is short term or long term will begin just after the restrictions are removed (absent a Section 83(b) election).

15

Recipients will generally recognize capital gain or loss on a sale or exchange of the shares. The gain or loss will equal the difference between (i) the proceeds received on the sale or exchange and (ii) the adjusted tax basis in the shares. The gain or loss recognized on a sale or exchange of the shares will be long-term capital gain or loss if the shares are held for more than one year. The deductibility of capital losses is subject to limitation.

If a recipient makes a Section 83(b) election with respect to the shares, the recipient will recognize ordinary compensation income at the time the shares are issued and not when the restrictions are removed from such shares. In such event, the tax basis in the shares would equal their fair market value on the date issued, and the holding period for the shares would begin just after such date. However, if property for which a Section 83(b) election is in effect is forfeited while substantially non-vested, such forfeiture shall be treated as a sale or exchange upon which there is realized a loss equal to the excess (if any) of: (1) the amount paid (if any) for such property, over, (2) the amount realized (if any) upon such forfeiture. The advisability of making a Section 83(b) election will depend on various factors and each recipient’s individual circumstances. Recipients are urged to consult with his or her own tax advisors regarding whether, where and how to make a Section 83(b) election. Recipients who decide to do so must make a Section 83(b) election no later than the thirtieth day following the issuance of the restricted stock and, once made, such election generally would be irrevocable by a recipient.

Any distributions that the Company makes in respect of the vested shares (or shares subject to a valid Section 83(b) election) will be treated as dividends, taxable to recipients as ordinary income, to the extent paid out of the Company’s current or accumulated earnings and profits. If the distribution exceeds the Company’s current or accumulated earnings and profits, such excess will be treated first as a tax-free return of the recipient’s investment, up to the recipient’s basis in the shares. Any remaining excess will be treated as capital gain. Any distributions that the Company makes in respect of substantially non-vested shares (i.e., shares subject to a risk of forfeiture and on which no valid Section 83(b) election has been made) will be compensation income to the recipient and not a dividend.

The Company will generally be entitled to a compensation deduction for Federal income tax purposes in an amount equal to, and at the same time as, the ordinary income recognized by recipients. The Company will report the income on a Form W-2 or 1099, whichever is applicable, and will recognize a deduction in such amount.

Nonqualified Stock Options.An option holder will not recognize any taxable income upon the grant of a nonqualified option under the 2010 LTIP. Generally, an option holder recognizes ordinary taxable income at the time a nonqualified option is exercised in an amount equal to the excess of the fair market value of the shares received on the date of exercise over the exercise price.

However, if the Company imposes restrictions on the shares received upon exercise of the option that do not permit the recipient to transfer the shares to others and that require the recipient to return the shares to the Company at less than fair market value (a “risk of forfeiture”), the date on which taxable income (if any) is recognized will be the date on which such restricted shares become “freely transferable” or not subject to risk of forfeiture (the “Recognition Date”). In this circumstance, the option holder will generally recognize ordinary taxable income on the Recognition Date in an amount equal to the excess of the fair market value of the shares at that time over the exercise price.

Despite this general rule, in the case of a risk of forfeiture, the option holder may make an election pursuant to Section 83(b) of the Code. In this case, the option holder will recognize ordinary taxable income at the time the option is exercised and not on the later date. The option holder’s holding period for purposes of determining the appropriate capital gains rate applicable to a subsequent sale of the stock will also be impacted by a Section 83(b) election. In order to be effective, the Section 83(b) election must be filed with the Company and the Internal Revenue Service within thirty days of exercise.

The Company will generally be entitled to a deduction for Federal income tax purposes in an amount equal to the ordinary taxable income recognized by the option holder, provided the Company reports the income on a Form W-2 or 1099, whichever is applicable, that is timely provided to the option holder and filed with the IRS.

16

When an option holder subsequently disposes of the shares of Common Stock received upon exercise of a nonqualified option, he or she will recognize long-term or short-term capital gain or loss (depending upon the holding period), in an amount equal to the difference between (i) the sale price and (ii) the fair market value on the date on which the option holder recognized ordinary taxable income as a result of the exercise of the nonqualified option. The holding period for the shares generally would begin on the date the shares were acquired and would not include the period of time during which the option was held.

An option holder who pays the exercise price for a nonqualified option, in whole or in part, by delivering shares of Common Stock already owned by him or her will recognize no gain or loss for Federal income tax purposes on the shares surrendered, but otherwise will be taxed according to the rules described above.

Section 409A of the Code imposes certain rules applicable to “non-qualified deferred compensation plans,” which may include certain grants of nonqualified options. If a non-qualified deferred compensation plan subject to Section 409A fails to meet, or is not operated in accordance with, these requirements, then all compensation deferred under the plan is or becomes immediately taxable to the extent that it is not subject to a substantial risk of forfeiture and was not previously taxable. The tax imposed as a result of these rules would be increased by interest at a rate equal to the rate imposed upon tax underpayments plus one percentage point, and an additional tax equal to twenty percent of the compensation required to be included in income.

Any nonqualified options having an exercise price less than the fair market value of the Common Stock at the time such options are granted may be considered deferred compensation subject to Section 409A of the Code. The 2010 LTIP and any nonqualified options granted thereunder are intended to be exempt from, or comply with, the applicable requirements of Section 409A of the Code. This includes, but is not limited to, issuing nonqualified options with an exercise price equal to the fair market value of the Common Stock at the time such options are granted.

Incentive Stock Options.An option holder generally will not recognize taxable income upon either the grant or the exercise of an incentive stock option. However, under certain circumstances, there may be alternative minimum tax or other tax consequences, as discussed below.

An option holder will recognize taxable income upon the disposition of the shares received upon exercise of an incentive stock option. Any gain recognized upon a disposition that is not a “disqualifying disposition” will be taxable as long-term capital gain. A “disqualifying disposition” means any disposition of shares acquired on the exercise of an incentive stock option within two years of the date the option was granted or within one year of the date the shares were issued to the option holder. The use of shares acquired pursuant to the exercise of an incentive stock option to pay the option price under another stock option is treated as a disposition for this purpose. In general, if an option holder makes a disqualifying disposition, an amount equal to the excess of (a) the lesser of (i) the fair market value of the shares on the date of exercise or (ii) the amount actually realized on the disposition over (b) the option exercise price, will be taxable as ordinary income and the balance of the gain recognized, if any, will be taxable as either long-term or short-term capital gain, depending on the option holder’s holding period for the shares. The holding period for the shares generally would begin on the date the shares were acquired and would not include the period of time during which the option was held.

In addition to the tax consequences described above, the exercise of incentive stock options may result in an “alternative minimum tax” under the Code. The Code provides that an “alternative minimum tax” will be applied against a taxable base which is equal to “alternative minimum taxable income,” reduced by a statutory exemption. In general, the amount by which the value of the Common Stock received upon exercise of the incentive stock option exceeds the exercise price is included in the option holder’s alternative minimum taxable income. A taxpayer is required to pay the higher of his regular tax liability or the alternative minimum tax. A taxpayer who pays alternative minimum tax attributable to the exercise of an incentive stock option may be entitled to a tax credit against his or her regular tax liability in later years. Because of the many adjustments that

17

apply to the computation of the alternative minimum tax, it is not possible to predict the application of such tax to any particular option holder. An option holder may owe alternative minimum tax even though he or she has not disposed of the shares or otherwise received any cash with which to pay the tax.

The Company will not be entitled to any deduction with respect to the grant or exercise of an incentive stock option provided the holder does not make a disqualifying disposition. If the option holder does make a disqualifying disposition, the Company will generally be entitled to a deduction for Federal income tax purposes in an amount equal to the taxable ordinary income recognized by the holder, provided the Company reports the income on a Form W-2 or 1099 (whichever is applicable) that is timely provided to the option holder and filed with the IRS.

Under the applicable Treasury Regulations, incentive stock options do not provide for a deferral of compensation under Section 409A, and therefore are not subject to the imposition of the resulting taxes and interest charges.

Stock Appreciation Rights.A recipient of a SAR will not be considered to receive any income at the time a SAR is granted, nor will the Company be entitled to a deduction at that time. Upon the exercise of a SAR, the holder will have ordinary income equal to the cash received upon the exercise. At that time, the Company will be entitled to a tax deduction equal to the amount of ordinary income realized by the holder.

Under the applicable Treasury Regulations, a SAR does not provide for a deferral of compensation under Section 409A, and therefore is not subject to the imposition of the resulting taxes and interest charges, if (i) the compensation payable under the SAR cannot be greater than the difference between the stock’s fair market value on the date the SAR was granted and the stock’s fair market value on the date the SAR is exercised with respect to a number of shares that was fixed no later than the date of grant, (ii) the SAR exercise price can never be less than the stock’s fair market value on the date of grant, and (iii) the SAR does not include any feature for the deferral of compensation other than the deferral of the recognition of income until the date of exercise. In addition, a SAR with a fixed payment date generally complies with Section 409A. The 2010 LTIP and any SARs granted thereunder are intended to be exempt from, or comply with, the applicable requirements of Section 409A of the Code. This includes, but is not limited to, issuing SARs that meet the aforementioned requirements.

Unrestricted Common Stock.A person who receives an award of Common Stock generally will have taxable income at the time the shares are received (i) in an amount equal to the excess of the then fair market value of such shares over the purchase price (if any) paid for such shares, if the Common Stock is not subject to restrictions, or (ii) as described in theRestricted Stock discussion above, if the shares are subject to restrictions. The tax treatment of a stock award that consists of other rights will depend on the provisions of the award. It may be immediately taxable if there are no restrictions on the receipt of the cash or other property that the stock award represents, or the tax consequences may be deferred if the receipt of cash or other property for the stock award is restricted, or subject to vesting or performance goals. In those situations in which a participant receives property subject to restrictions, the participant may wish to make a Section 83(b) election, as described above. At the time that the holder of the stock award has ordinary income, the Company will generally be entitled to a tax deduction equal to the amount of ordinary income realized by the holder.

Deductibility of Awards. Section 162(m) of the Code places a $1 million annual limit on the compensation deductible by the Company paid to certain of its executives. The limit, however, does not apply to performance-based compensation. To qualify as performance-based compensation, the compensation must be payable solely on account of the satisfaction of pre-established performance goals which are set by an independent compensation committee and approved by the shareholders. Compensation will not be “performance-based” if it is payable, without regard to whether the performance goals are satisfied, on (i) involuntary termination or (ii) retirement.

A transition rule under Section 162(m) of the Code applies to compensation paid by the Company under an agreement or plan that was in effect at the time of the Company’s IPO; provided that the prospectus for the

18

offering disclosed the terms of the agreement or plan in accordance with the requirements of applicable securities law. The transition rule provides that compensation paid under such agreements before the end of a specified reliance period is not subject to the Section 162(m) deduction limit. Similarly, compensation paid pursuant to stock-based awards granted under a plan, like the 2010 LTIP, before the end of the specified reliance period is not subject to the Section 162(m) deduction limit. The reliance period for the Company under the transition rule will end on the earlier of (i) the expiration date of the 2010 LTIP, (ii) the date 2010 LTIP is materially modified, (iii) the date on which all of the Company shares authorized for issuance under the 2010 LTIP have been issued or (iv) the date of the first annual meeting of stockholders of the Company at which directors are to be elected that occurs after the close of the third calendar year following the calendar year in which the IPO occurred. It is expected that the current proposed amendment will qualify as a material modification under the Section 162(m) rules. Accordingly, it is likely that the transition rules will not apply to any grants that occur after the adoption of the proposed amendment.

The Company believes that awards under the 2010 LTIP subject to performance criteria will qualify for the performance-based compensation exception to the deductibility limit or, for pre-amendment stock-based grants, will otherwise be deductible under the transition rules discussed above.

Change of Control.To the extent payments that are contingent on a change in control are determined to exceed certain Code limitations, the recipients of such payments may be subject to a twenty percent nondeductible excise tax and the Company’s deduction with respect to the associated compensation expense may be disallowed in whole or in part.

Clawback.The clawback of compensation raises numerous federal income tax and employment tax considerations. If the Company previously deducted the compensation in an earlier tax year as a compensation expense, the Company will likely be required to include such forfeited compensation as taxable income in the later tax year that the compensation is forfeited and returned to the Company. Alternatively, if the service provider is required to return the compensation in a tax year subsequent to the tax year in which the compensation was received, the service provider may be entitled to a deduction or credit under Section 1341 of the Code. It is uncertain whether or not the service provider would be entitled to the benefits of Section 1341 of the Code. If Section 1341 is inapplicable, any deduction by the service provider may be limited by the rules applicable to miscellaneous itemized deductions (i.e., only deductible to the extent such expenses exceed two percent of the service provider’s adjusted gross income). Additionally, the Company may be required to reimburse the service provider for any employment taxes previously withheld in connection with the forfeited compensation. Thereafter, the Company would be entitled to claim a credit on a subsequent employment tax filing for both the Company’s and the employee’s overpayments of such employment tax.

New Plan Benefits

No grants have been issued with respect to the additional shares to be reserved for issuance under the 2010 LTIP. The number of shares that may be granted under the 2010 LTIP is not determinable at this time, as such grants are subject to the discretion of the Compensation Committee.