Exhibit 99.1

InfuSystem Holdings, Inc.

Post Shareholders Meeting

August 29, 2013

Eric K. Steen, CEO

Jonathan P. Foster, CFO

InfuSystem®

INFUSION MADE EASY SM

Safe Harbor Statement

Certain statements contained in this release are forward-looking statements and are based on future expectations, plans and prospects for InfuSystem Holdings, Inc.’s (“InfuSystem”, “INFU”, “the Company”, “We”) business and operations that involve a number of risks and uncertainties. InfuSystem’s outlook for 2013 and other forward-looking statements in this release are made as of August 29, 2013, and the Company disclaims any duty to supplement, update or revise such statements on a going-forward basis, whether as a result of subsequent developments, changed expectations or otherwise. In connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, the Company is identifying certain factors that could cause actual results to differ, perhaps materially, from those indicated by these forward-looking statements. Those factors, risks and uncertainties include, but are not limited to, potential changes in overall healthcare reimbursement - including CMS competitive bidding, sequestration, concentration of customers, increased focus on early detection of cancer, competitive treatments, dependency on Medicare Supplier Number, availability of chemotherapy drugs, global financial conditions, changes and enforcement of state and federal laws, natural forces, competition, dependency on suppliers, risks in acquisitions & joint ventures, US Healthcare Reform, relationships with healthcare professionals and organizations, technological changes related to infusion therapy, dependency on websites and intellectual property, the ability of the Company to successfully integrate acquired businesses, dependency on key personnel, dependency on banking relations and covenants, and other risks associated with our common stock, as well as any other litigation to which the Company may be subject from time to time; and other risk factors as discussed in the Company’s annual report on Form

10-K for the year ended December 31, 2012 and in other filings made by the Company from time to time with the Securities and Exchange Commission.

InfuSystem®

INFUSION MADE EASY SM

Positioned for Growth

InfuSystem®

INFUSION MADE EASY SM

Positioned For Growth

Market Trends

InfuSystem is uniquely positioned to take advantage of market trends

Strategy

Transformational strategy is developed and being implemented

Leadership

Leadership can now focus on running a business for first time in over a year

InfuSystem®

INFUSION MADE EASY SM

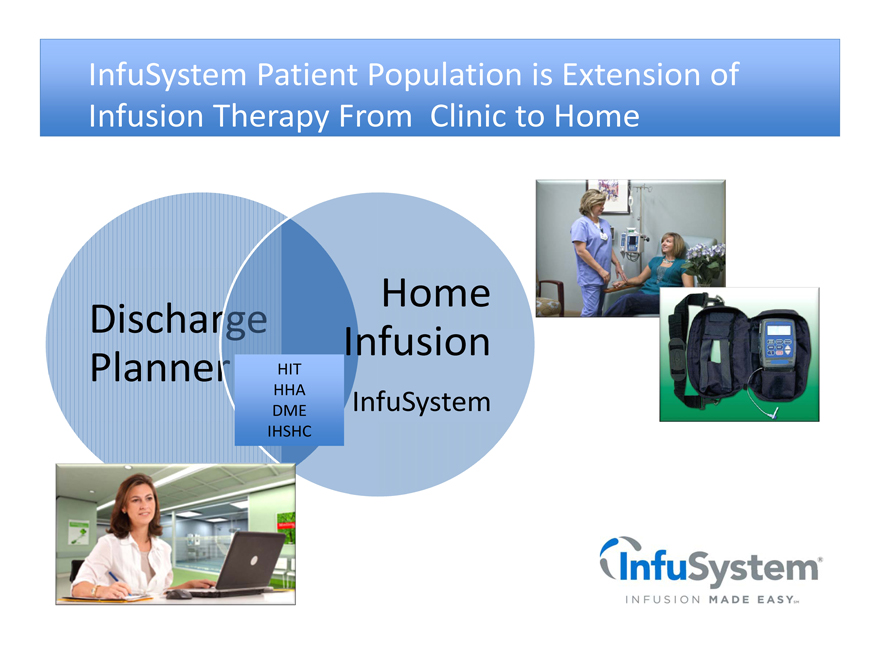

InfuSystem Patient Population is Extension of Infusion Therapy From Clinic to Home

Discharge Planner

HIT HHA DME IHSHC

Home Infusion

InfuSystem

InfuSystem®

INFUSION MADE EASY SM

Extension of Clinic to Home

Ambulatory Infusion

Some drugs more effective when infused continuously

Patient Satisfaction

Multiple Therapies - Oncology, Post Surgical Pain, Special Disease States

Payor Contracts

Over 250 Payor Contracts

Private Pay & Government

Commercial Payors reimburse more therapies than CMS

InfuSystem®

INFUSION MADE EASY SM

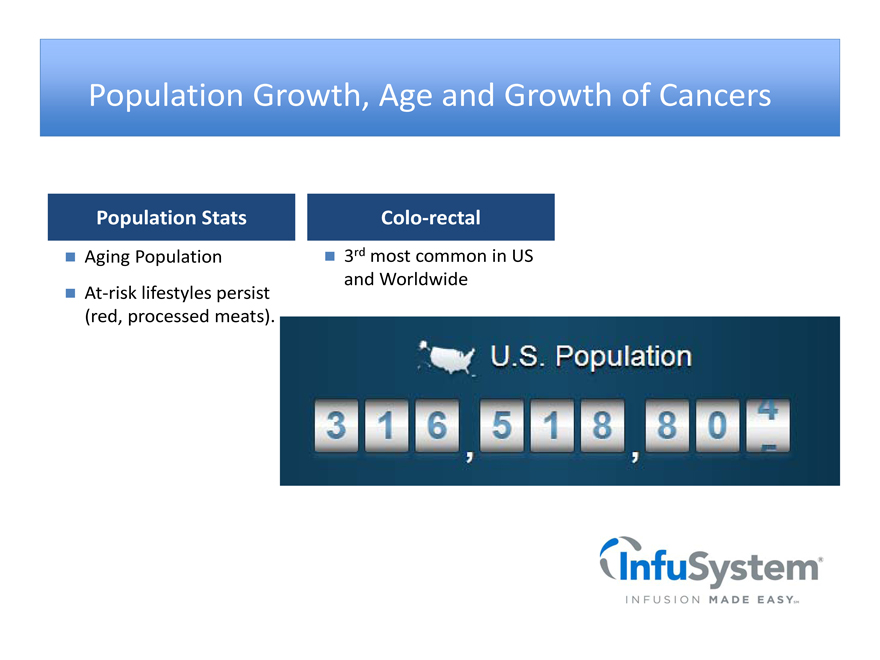

Population Growth, Age and Growth of Cancers

Population Stats

Aging Population

At-risk lifestyles persist (red, processed meats).

Colo-rectal

3rd most common in US and Worldwide

U.S. Population

316,518,80

InfuSystem®

INFUSION MADE EASY SM

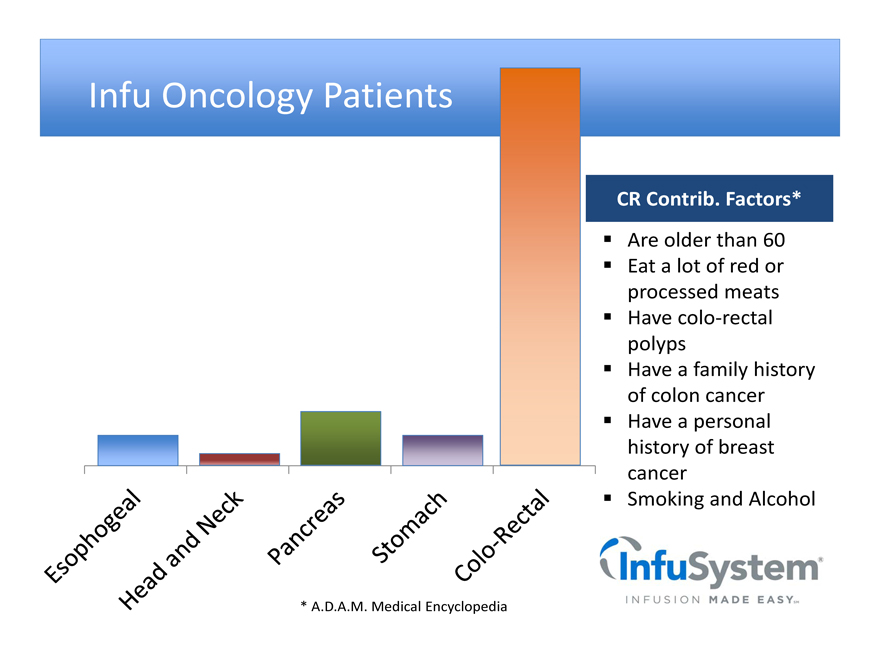

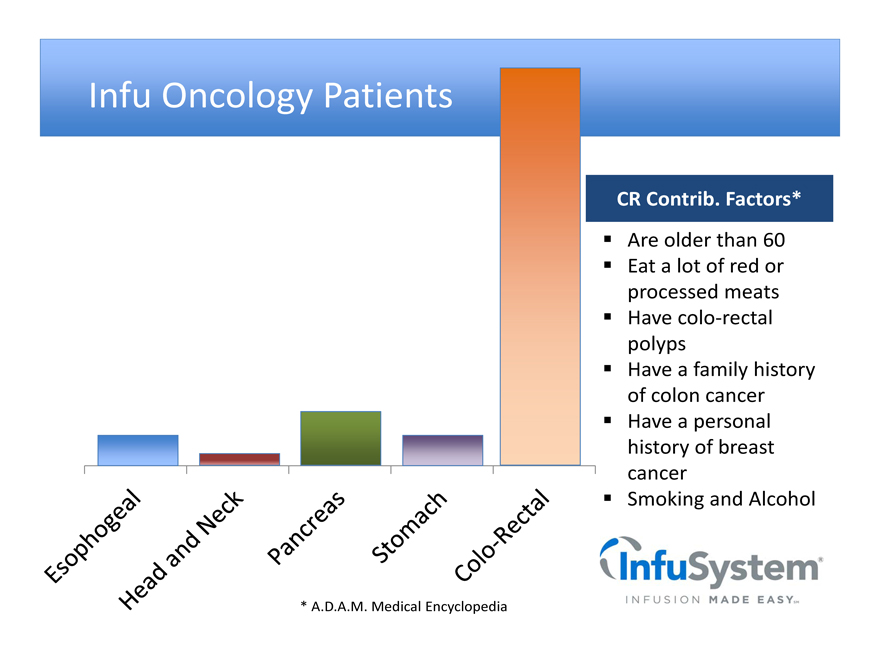

Infu Oncology Patients

Esophogeal

Head and Neck

Pancreas

Stomach

Colo-Rectal

* A.D.A.M. Medical Encyclopedia

CR Contrib. Factors*

Are older than 60

Eat a lot of red or processed meats

Have colo-rectal polyps

Have a family history of colon cancer

Have a personal history of breast cancer

Smoking and Alcohol

InfuSystem®

INFUSION MADE EASY SM

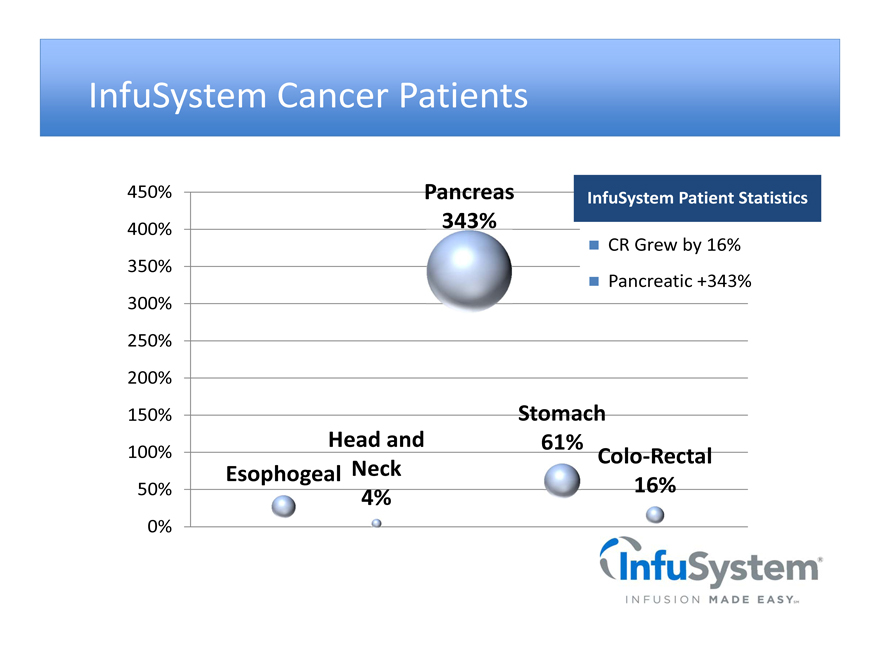

InfuSystem Cancer Patients

450%

400%

350%

300%

250%

200%

150%

100%

50%

0%

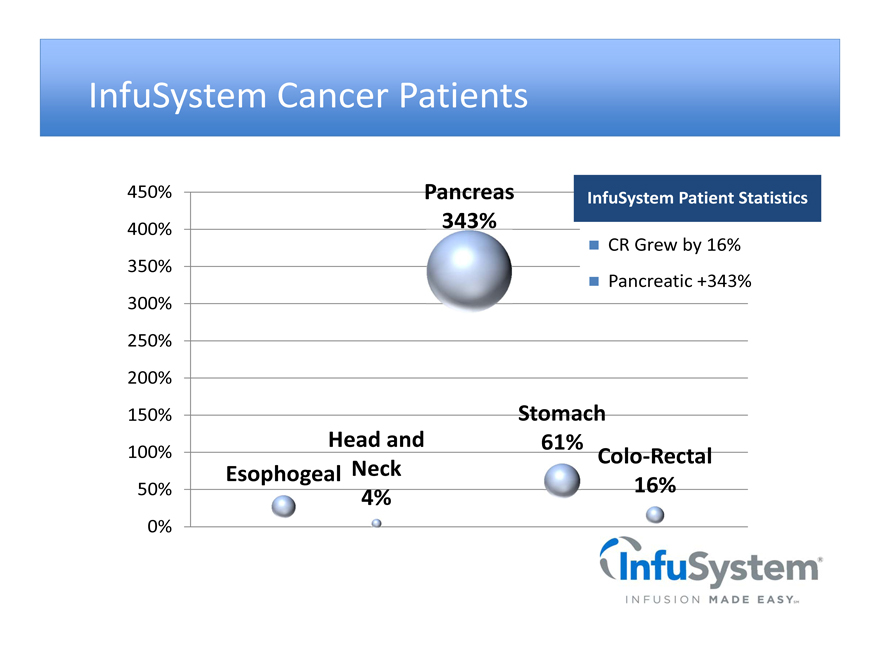

Pancreas 343%

Esophogeal

Head and Neck 4%

InfuSystem Patient Statistics

CR Grew by 16%

Pancreatic +343%

Stomach 61%

Colo-Rectal 16%

InfuSystem®

INFUSION MADE EASY SM

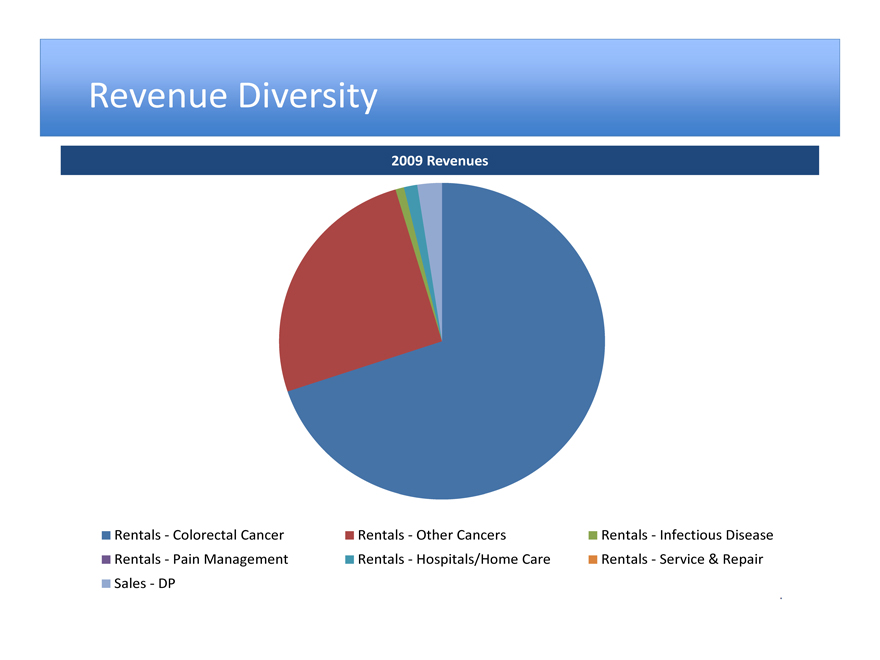

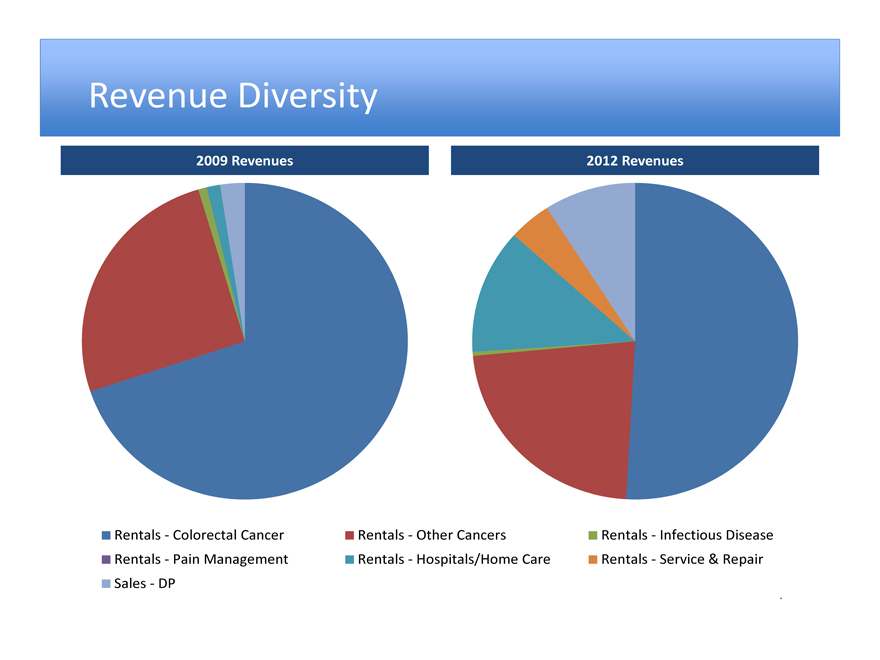

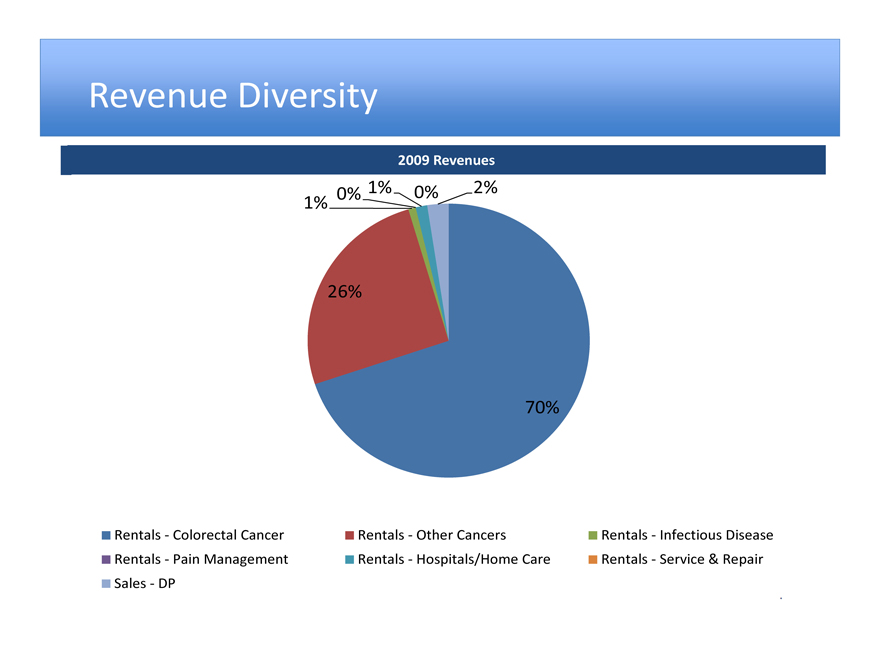

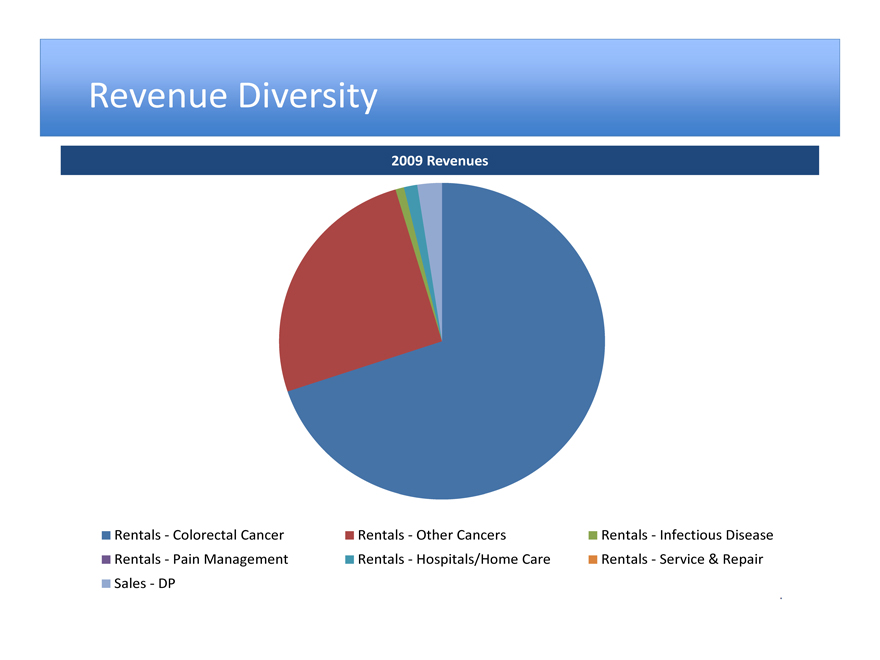

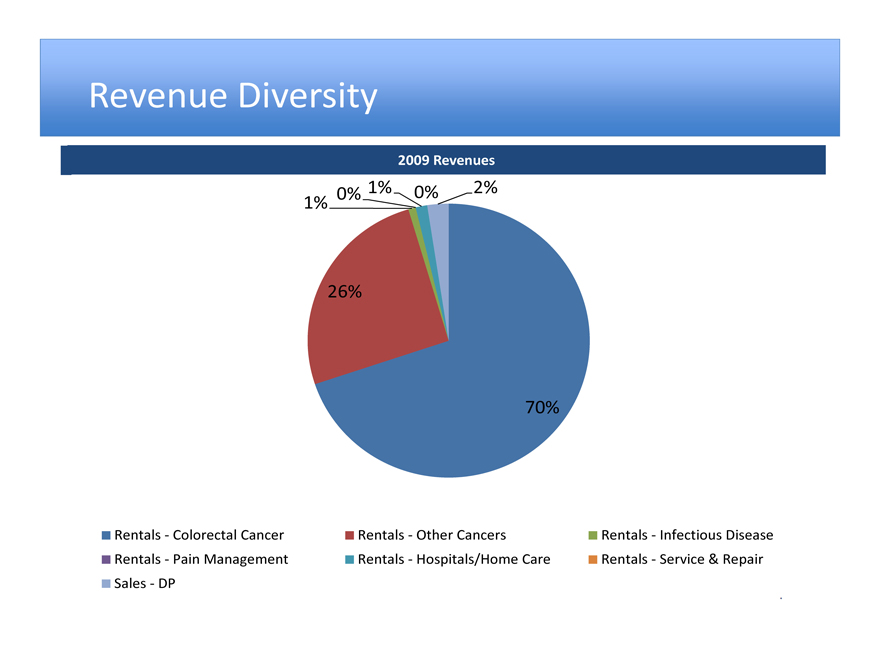

Revenue Diversity

2009 Revenues

Rentals - Colorectal Cancer Rentals - Pain Management Sales - DP

Rentals - Other Cancers Rentals - Hospitals/Home Care

Rentals - Infectious Disease Rentals - Service & Repair

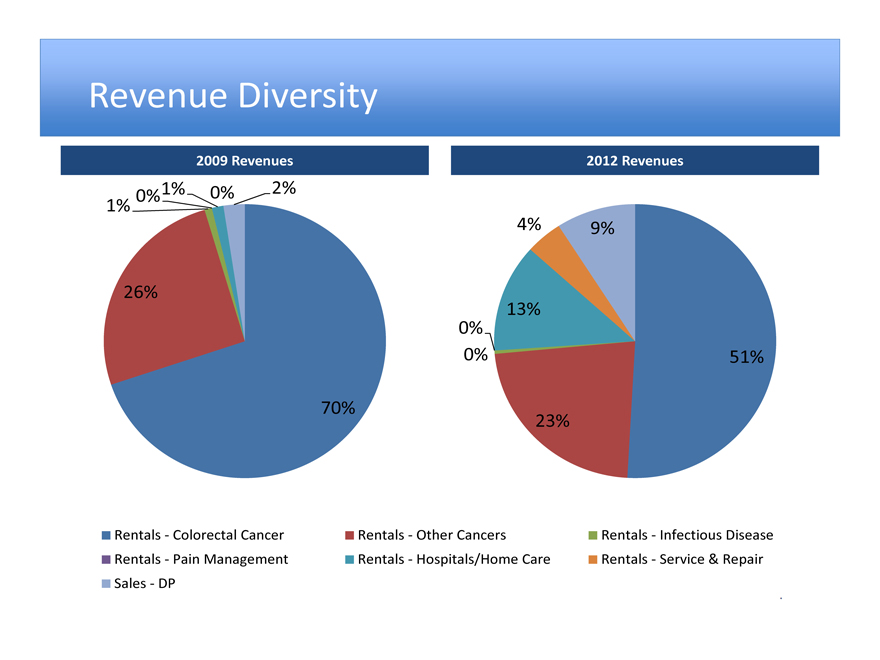

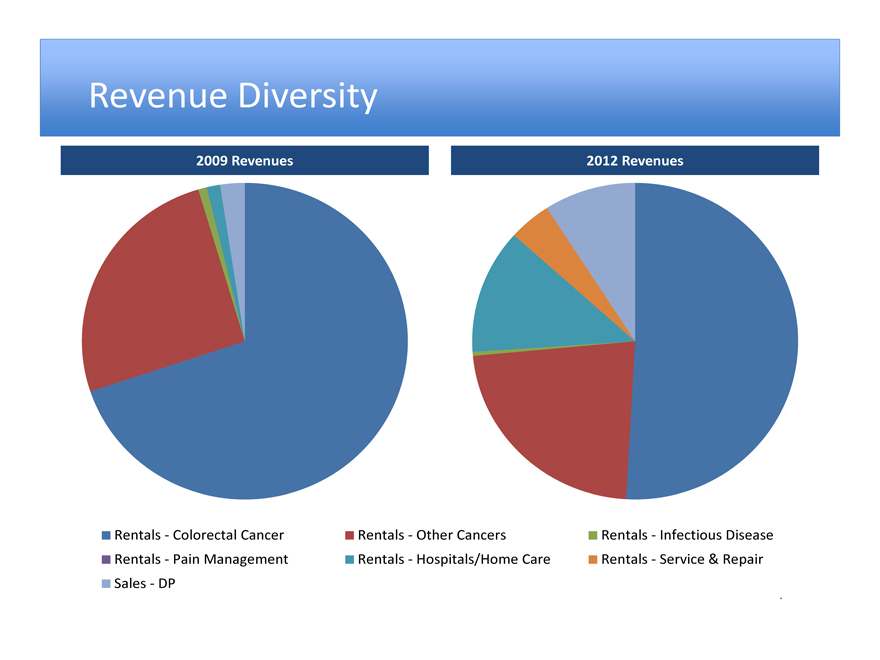

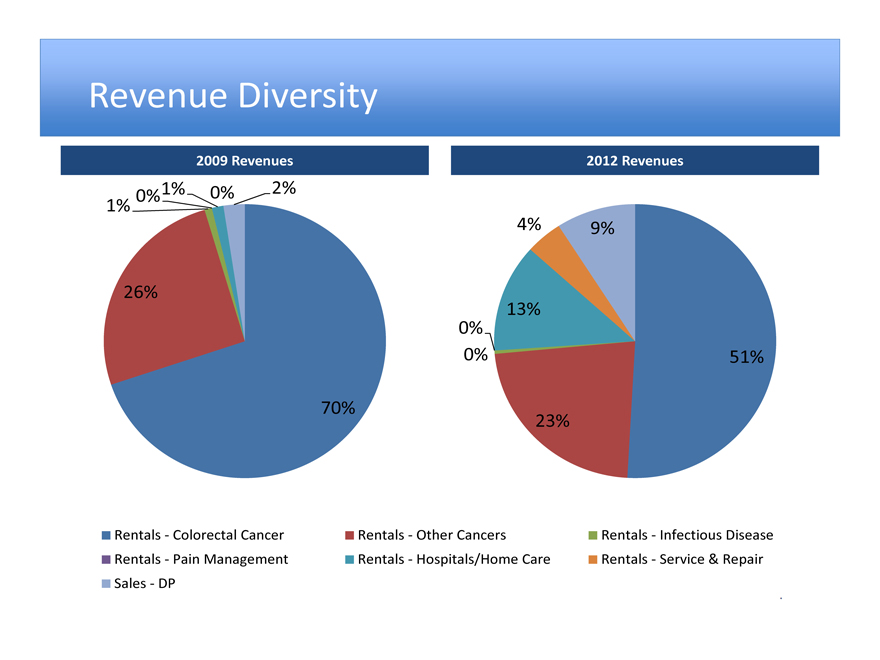

Revenue Diversity

2009 Revenues

2012 Revenues

Rentals - Colorectal Cancer Rentals - Pain Management Sales - DP

Rentals - Other Cancers Rentals - Hospitals/Home Care

Rentals - Infectious Disease Rentals - Service & Repair

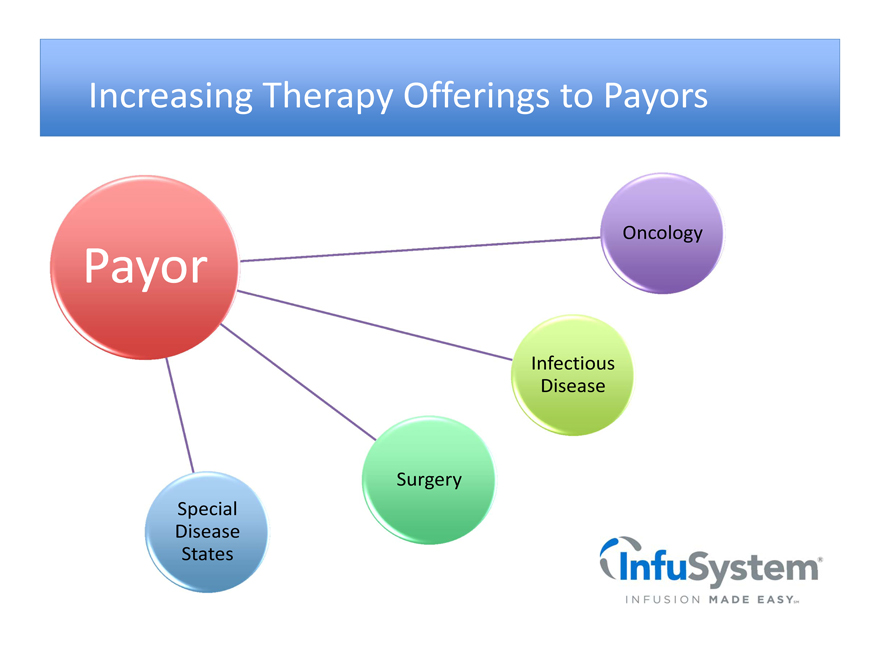

Increasing Therapy Offerings to Payors

Payor

Oncology

Infectious Disease

Surgery

Special Disease States

InfuSystem®

INFUSION MADE EASY SM

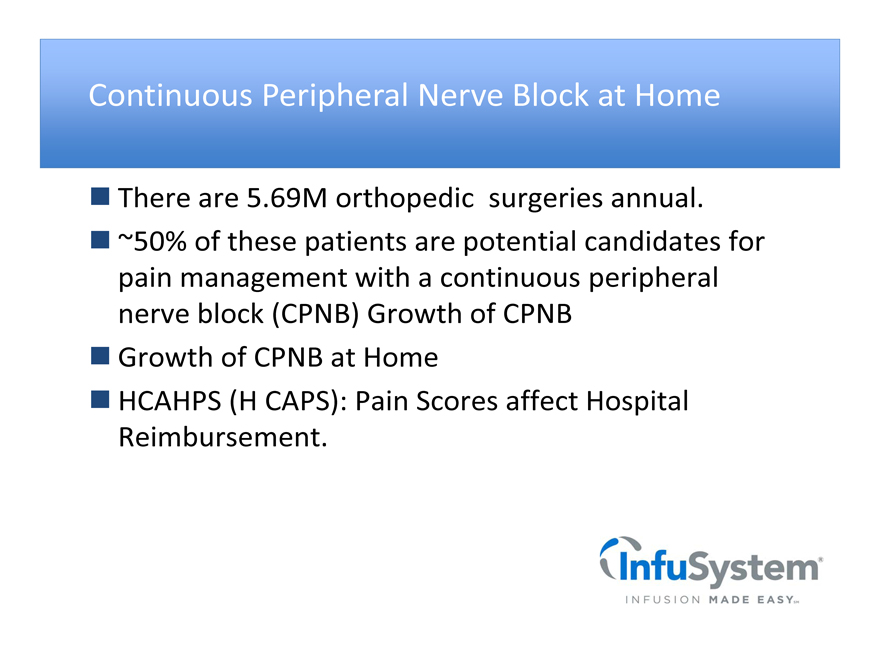

Continuous Peripheral Nerve Block at Home

There are 5.69M orthopedic surgeries annual.

~50% of these patients are potential candidates for pain management with a continuous peripheral nerve block (CPNB) Growth of CPNB

Growth of CPNB at Home

HCAHPS (H CAPS): Pain Scores affect Hospital Reimbursement.

InfuSystem®

INFUSION MADE EASY SM

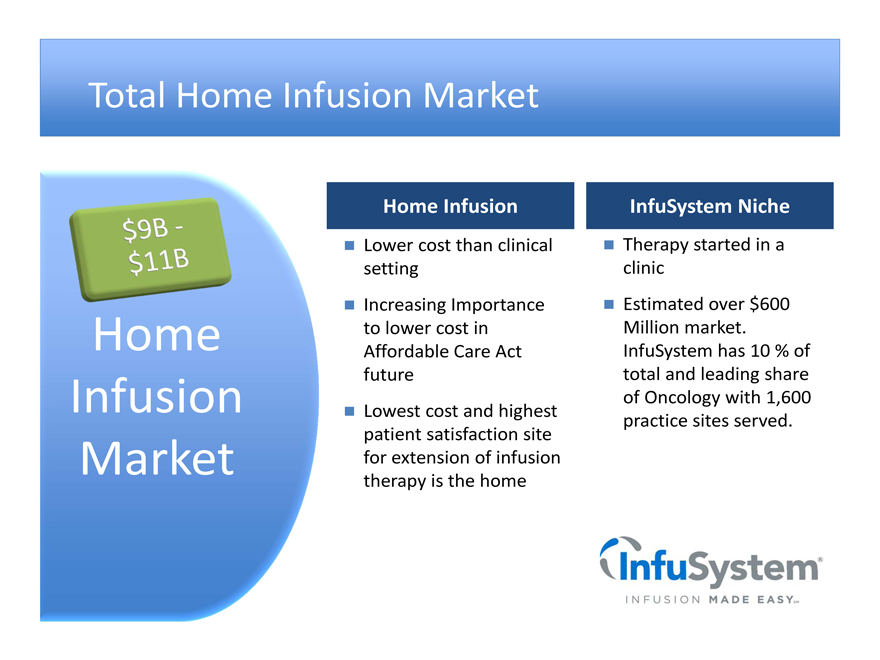

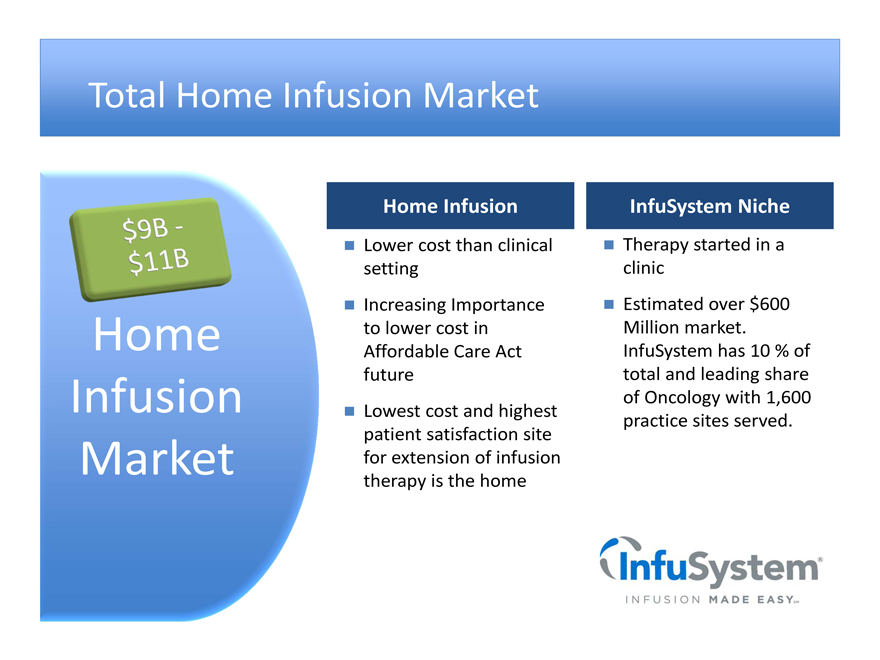

Total Home Infusion Market

$9B - $11B

Home Infusion Market

Home Infusion

Lower cost than clinical setting

Increasing Importance to lower cost in Affordable Care Act future

Lowest cost and highest patient satisfaction site for extension of infusion therapy is the home

InfuSystem Niche

Therapy started in a clinic

Estimated over $600 Million market.

InfuSystem has 10 % of total and leading share of Oncology with 1,600 practice sites served.

InfuSystem®

INFUSION MADE EASY SM

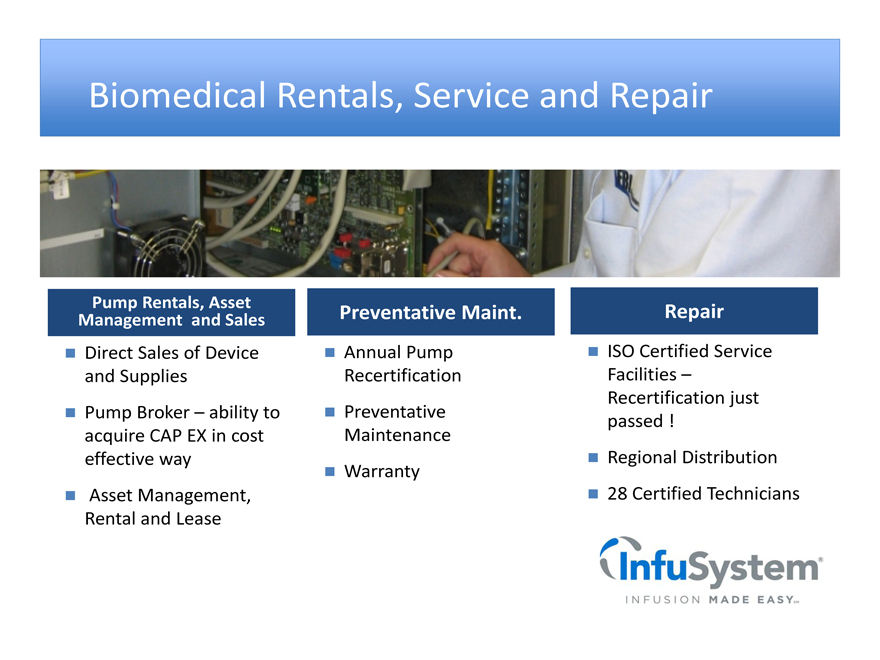

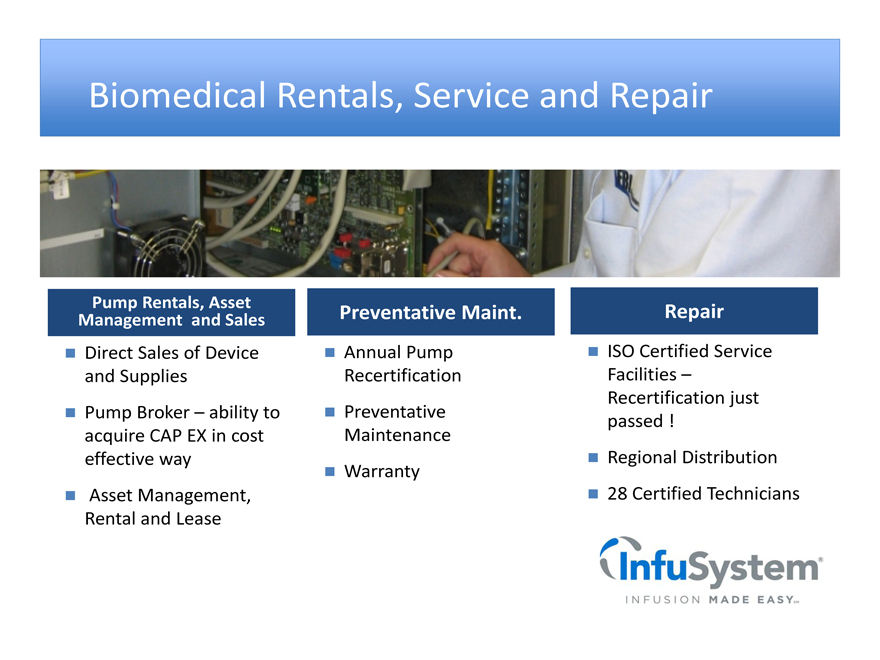

Biomedical Rentals, Service and Repair

Pump Rentals, Asset Management and Sales

Direct Sales of Device and Supplies

Pump Broker - ability to acquire CAP EX in cost effective way

Asset Management, Rental and Lease

Preventative Maint.

Annual Pump Recertification

Preventative Maintenance

Warranty

Repair

ISO Certified Service Facilities - Recertification just passed !

Regional Distribution

28 Certified Technicians

InfuSystem®

INFUSION MADE EASY SM

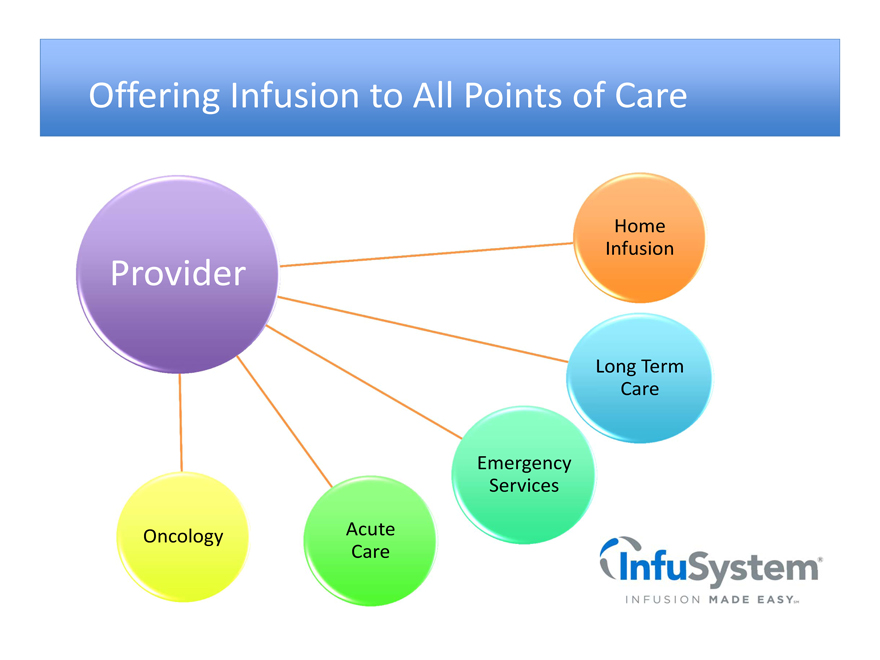

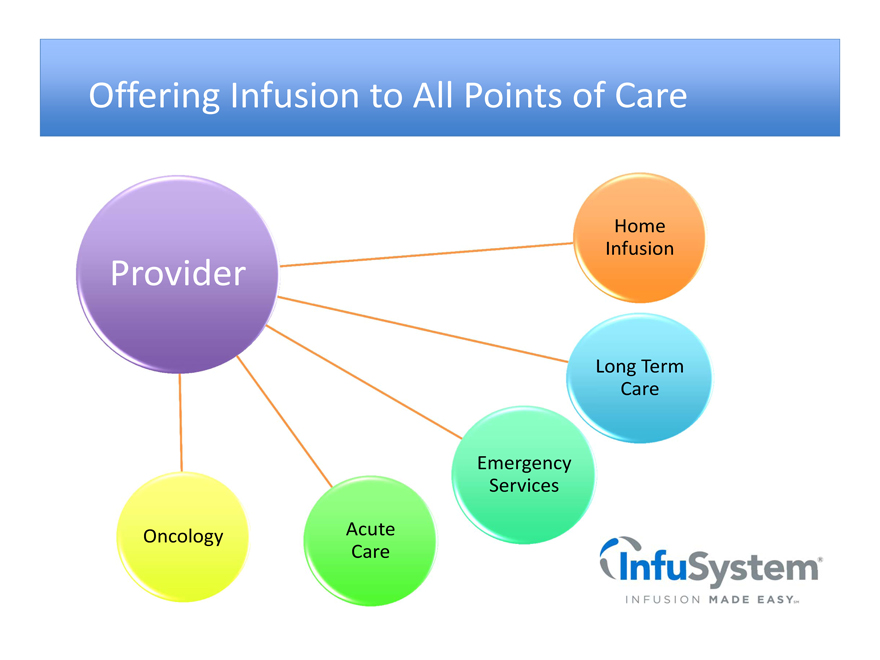

Offering Infusion to All Points of Care

Provider

Home Infusion

Long Term Care

Emergency Services

Acute Care

Oncology

InfuSystem®

INFUSION MADE EASY SM

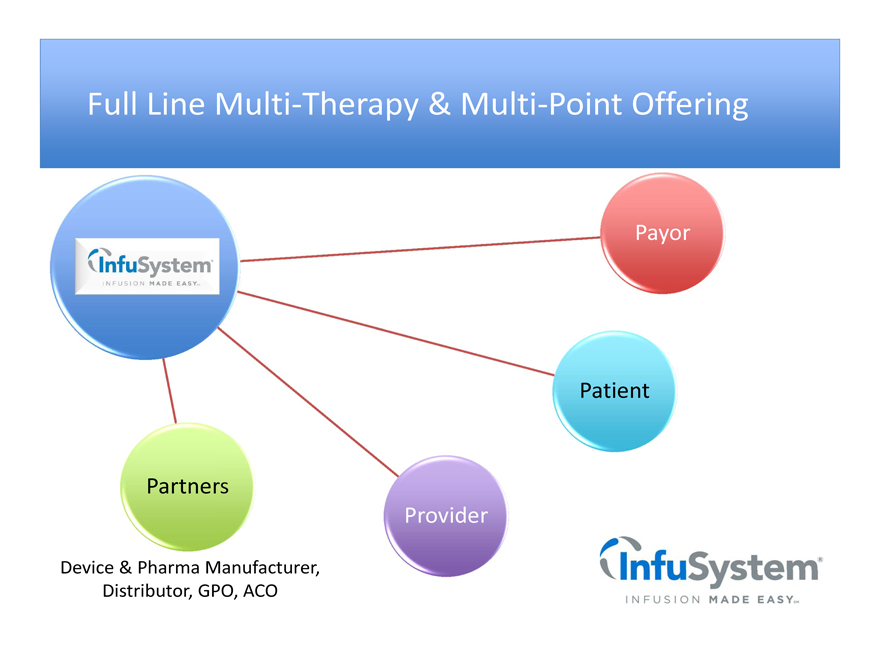

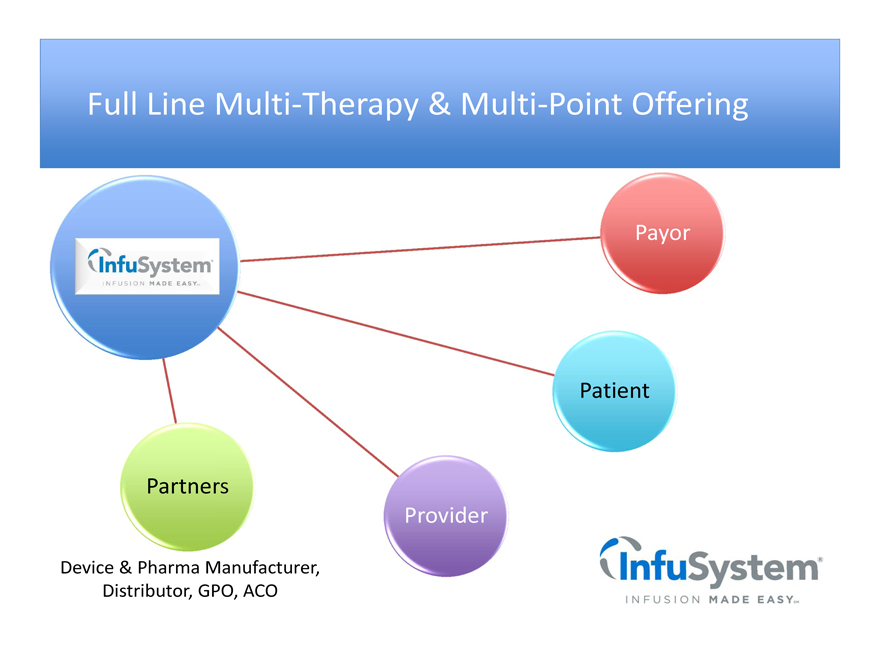

Full Line Multi-Therapy & Multi-Point Offering

InfuSystem®

INFUSION MADE EASY SM

Payor

Patient

Provider

Partners

Device & Pharma Manufacturer, Distributor, GPO, ACO

InfuSystem®

INFUSION MADE EASY SM

What a Difference a Year Makes

Financial Position

New Team in place

IT improvements begun

New Product launches - Kits, Smart Pumps, Post Surgical Pain

InfuSystem®

INFUSION MADE EASY SM

IT and Automation

Shift into High Gear

More insurance billings with existing staff

Greater revenue per employee

Road Map completed , New iPad features, Automation of initial internal processes

InfuSystem®

INFUSION MADE EASY SM

Connectivity through eMAR , Web Portal and System Interface

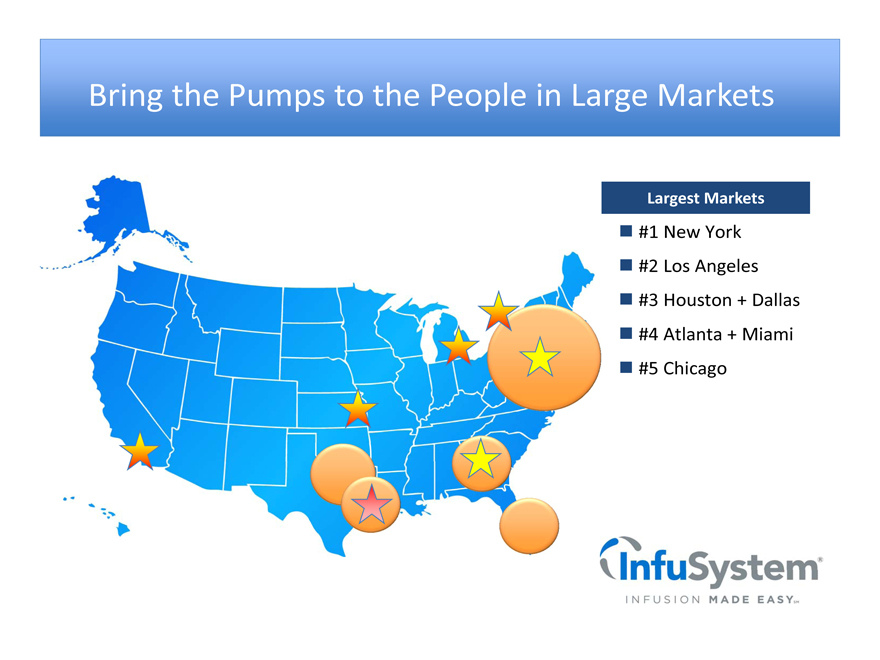

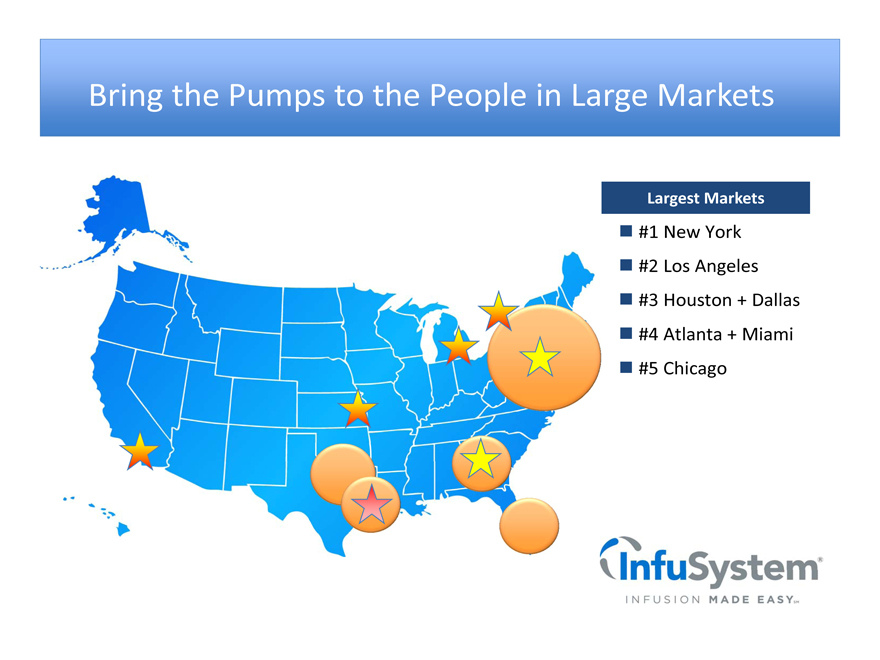

Bring the Pumps to the People in Large Markets

Largest Markets

#1 New York

#2 Los Angeles

#3 Houston + Dallas

#4 Atlanta + Miami

#5 Chicago

InfuSystem®

INFUSION MADE EASY SM

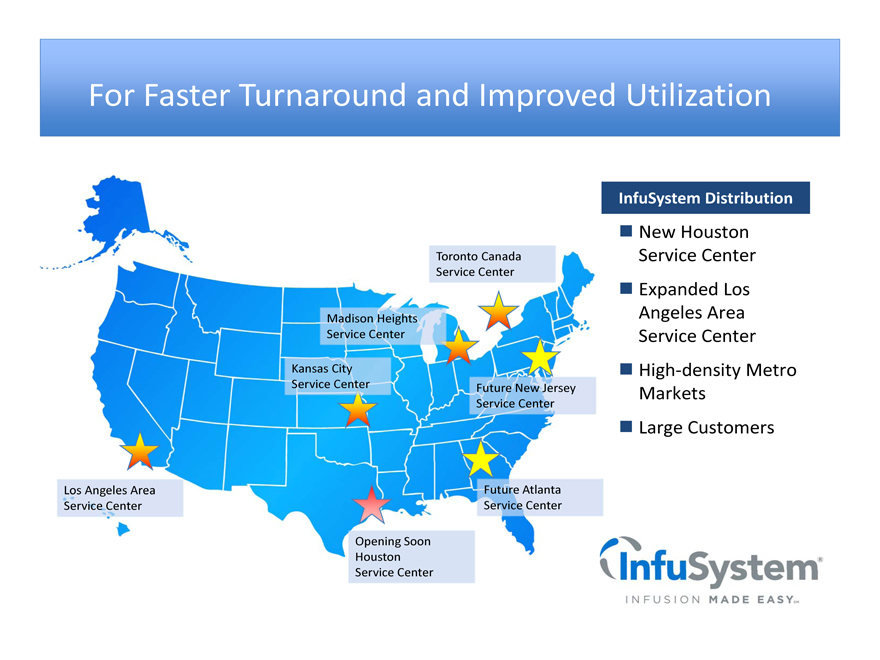

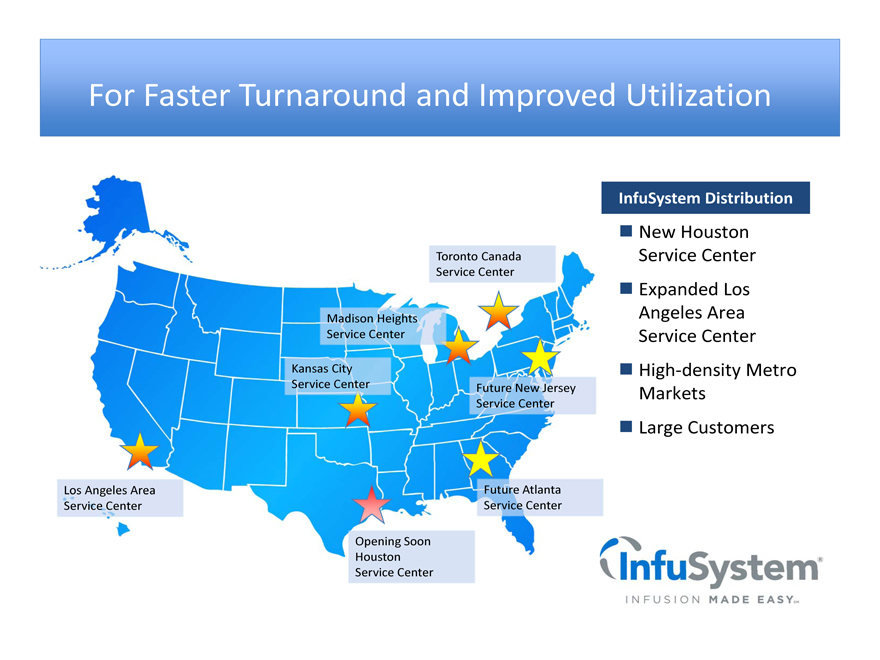

For Faster Turnaround and Improved Utilization

Los Angeles Area Service Center

Toronto Canada Service Center

Madison Heights Service Center

Kansas City Service Center

Future New Jersey Service Center

Future Atlanta Service Center

Opening Soon Houston Service Center

InfuSystem Distribution

New Houston Service Center

Expanded Los Angeles Area Service Center

High-density Metro Markets

Large Customers

InfuSystem®

INFUSION MADE EASY SM

Where Does This Get INFU in Three Years ?

Aging Population and Cancer growth

More Patients Home IV , commercial pay recognizing value, CMS competitive bidding

Peripheral Nerve Block and Smart Pump Growth

Revenue Growth in High Single Digits

InfuSystem®

INFUSION MADE EASY SM

Next Up - Action Items

IT Implementation - web portal, eMar, interfaces, automation of insurance processes

Product and service line expansion

Geographic Expansion

Productivity measures implemented

Evaluating depreciable life

Utilization metrics and improvement

InfuSystem®

INFUSION MADE EASY SM

Positioned For Growth

Market Trends

InfuSystem is uniquely positioned to take advantage of market trends

Strategy

Transformational strategy is developed and being implemented

Leadership

Leadership can now focus on running a business for first time in over a year

InfuSystem®

INFUSION MADE EASY SM

Financial Review

InfuSystem®

INFUSION MADE EASY SM

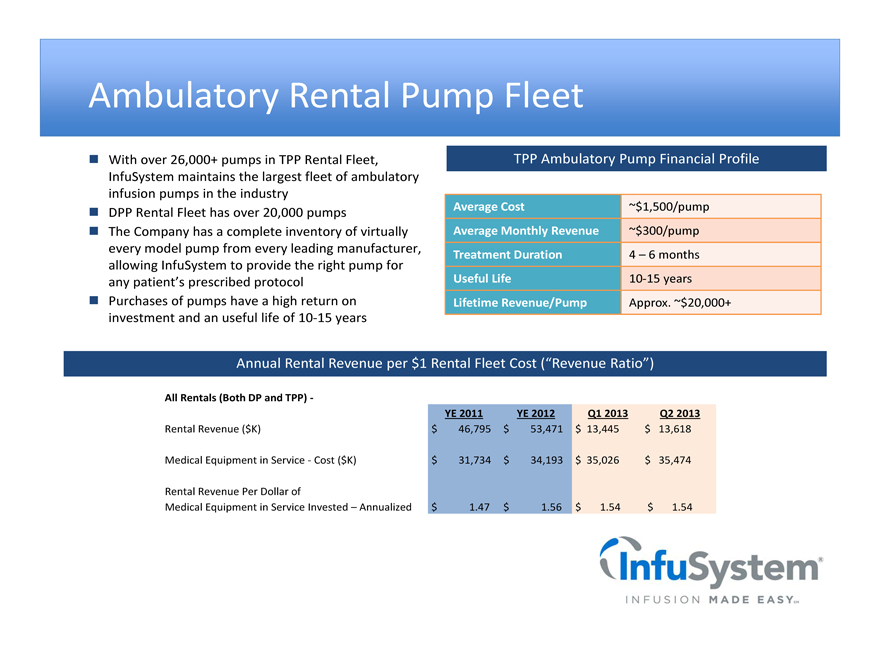

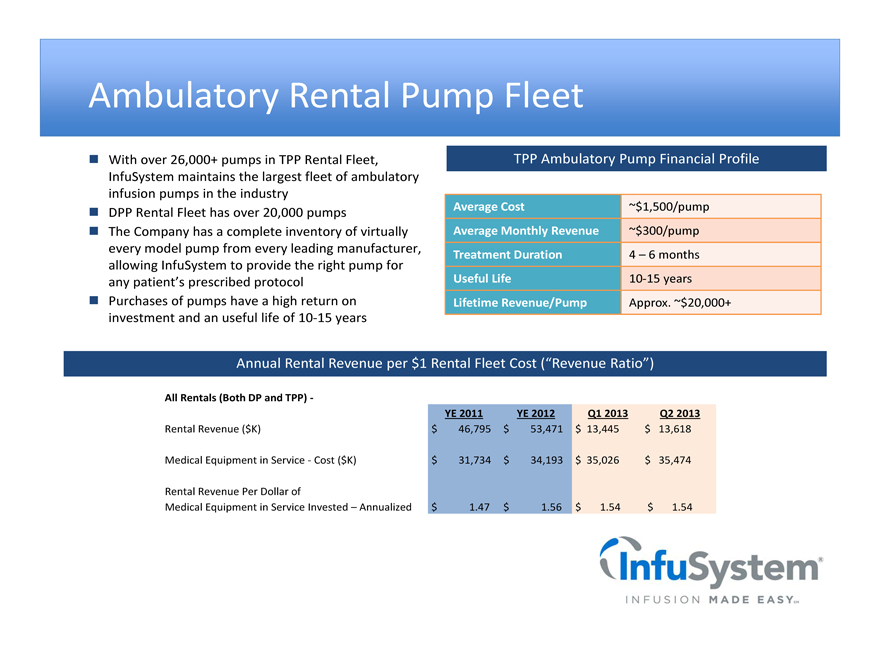

Ambulatory Rental Pump Fleet

n With over 26,000+ pumps in TPP Rental Fleet, InfuSystem maintains the largest fleet of ambulatory infusion pumps in the industry

n DPP Rental Fleet has over 20,000 pumps

n The Company has a complete inventory of virtually every model pump from every leading manufacturer, allowing InfuSystem to provide the right pump for any patient’s prescribed protocol

n Purchases of pumps have a high return on investment and an useful life of 10-15 years

TPP Ambulatory Pump Financial Profile

Average Cost

~$1,500/pump

Average Monthly Revenue

~$300/pump

Treatment Duration

4 - 6 months

Useful Life

10-15 years

Lifetime Revenue/Pump

Approx. ~$20,000+

Annual Rental Revenue per $1 Rental Fleet Cost (“Revenue Ratio”)

InfuSystem®

All Rentals (Both DP and TPP) -

YE 2011

YE 2012

Q1 2013

Q2 2013

Rental Revenue ($K)

$46,795

$53,471

$13,445

$13,618

Medical Equipment in Service - Cost ($K)

$31,734

$34,193

$35,026

$35,474

Rental Revenue Per Dollar of

Medical Equipment in Service Invested - Annualized

$1.47

$1.56

$1.54

$1.54

INFUSION MADE EASY SM

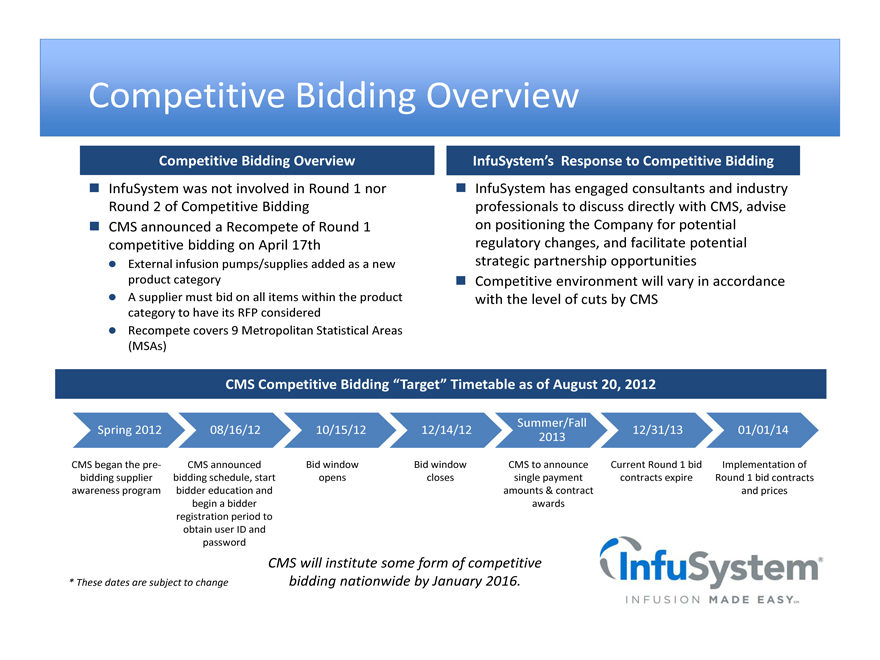

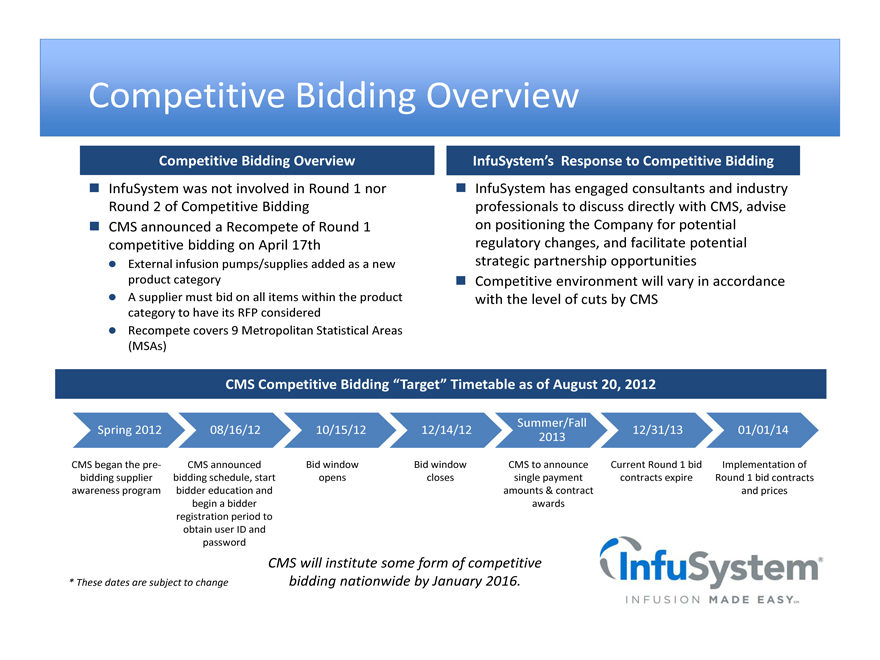

Competitive Bidding Overview

Competitive Bidding Overview

n InfuSystem was not involved in Round 1 nor Round 2 of Competitive Bidding

n CMS announced a Recompete of Round 1 competitive bidding on April 17th

Š External infusion pumps/supplies added as a new product category

Š A supplier must bid on all items within the product category to have its RFP considered

Š Recompete covers 9 Metropolitan Statistical Areas (MSAs)

InfuSystem’s Response to Competitive Bidding

n InfuSystem has engaged consultants and industry professionals to discuss directly with CMS, advise on positioning the Company for potential regulatory changes, and facilitate potential strategic partnership opportunities

n Competitive environment will vary in accordance with the level of cuts by CMS

CMS Competitive Bidding “Target” Timetable as of August 20, 2012

| | | | | | | | | | | | |

Spring 2012 | | 08/16/12 | | 10/15/12 | | 12/14/12 | | Summer/Fall 2013 | | 12/31/13 | | 01/01/14 |

CMS began the pre-bidding supplier awareness program | | CMS announced bidding schedule, start bidder education and begin a bidder registration period to obtain user ID and password | | Bid window opens | | Bid window closes | | CMS to announce single payment amounts & contract awards | | Current Round 1 bid contracts expire | | Implementation of Round 1 bid contracts and prices |

* These dates are subject to change

CMS will institute some form of competitive bidding nationwide by January 2016.

InfuSystem®

INFUSION MADE EASY SM

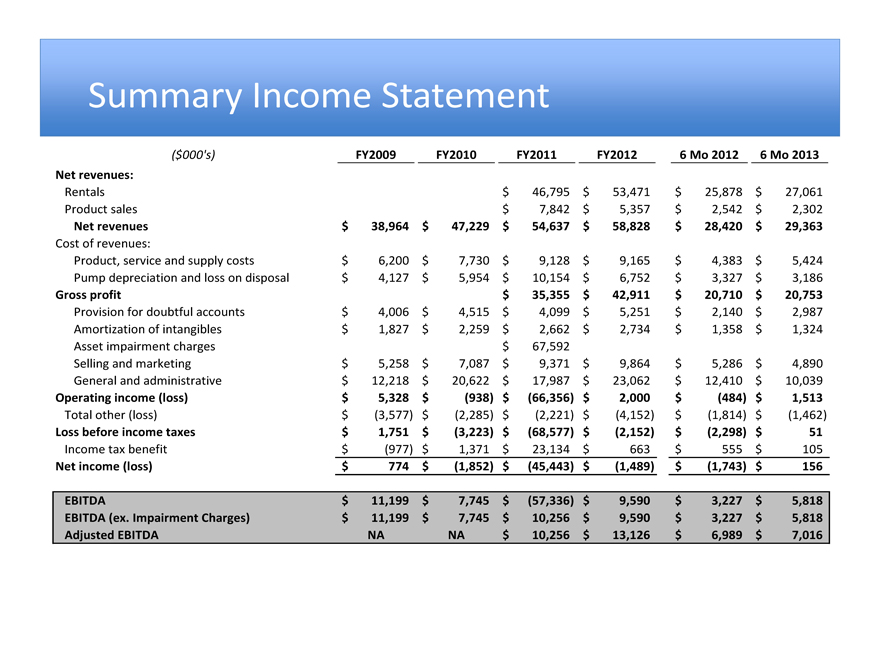

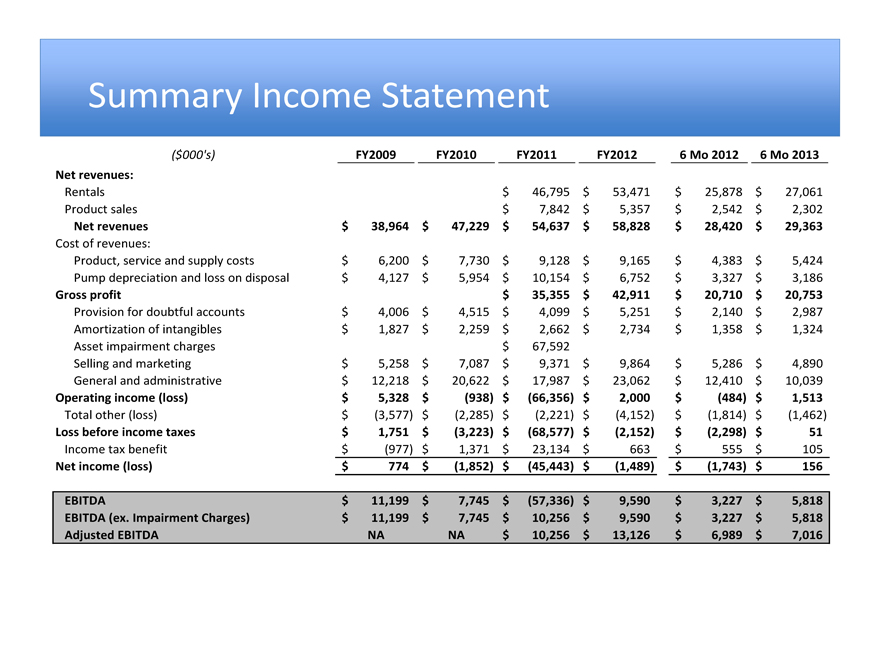

Summary Income Statement

($000’s)

FY2009

FY2010

FY2011

FY2012

6 Mo 2012

6 Mo 2013

Net revenues:

Rentals

$46,795

$53,471

$25,878

$27,061

Product sales

$7,842

$5,357

$2,542

$2,302

Net revenues

$38,964

$47,229

$54,637

$58,828

$28,420

$29,363

Cost of revenues:

Product, service and supply costs

$6,200

$7,730

$9,128

$9,165

$4,383

$5,424

Pump depreciation and loss on disposal

$4,127

$5,954

$10,154

$6,752

$3,327

$3,186

Gross profit

$35,355

$42,911

$20,710

$20,753

Provision for doubtful accounts

$4,006

$4,515

$4,099

$5,251

$2,140

$2,987

Amortization of intangibles

$1,827

$2,259

$2,662

$2,734

$1,358

$1,324

Asset impairment charges

$67,592

Selling and marketing

$5,258

$7,087

$9,371

$9,864

$5,286

$4,890

General and administrative

$12,218

$20,622

$17,987

$23,062

$12,410

$10,039

Operating income (loss)

$5,328

$(938)

$(66,356)

$2,000

$(484)

$1,513

Total other (loss)

$(3,577)

$(2,285)

$(2,221)

$(4,152)

$(1,814)

$(1,462)

Loss before income taxes

$1,751

$(3,223)

$(68,577)

$(2,152)

$(2,298)

$51

Income tax benefit

$(977)

$1,371

$23,134

$663

$555

$105

Net income (loss)

$774

$(1,852)

$(45,443)

$(1,489)

$(1,743)

$156

EBITDA

$11,199

$7,745

$(57,336)

$9,590

$3,227

$5,818

EBITDA (ex. Impairment Charges)

$11,199

$7,745

$10,256

$9,590

$3,227

$5,818

Adjusted EBITDA

NA

NA

$10,256

$13,126

$6,989

$7,016

Revenue Diversity

2009 Revenues

Rentals - Colorectal Cancer

Rentals - Other Cancers

Rentals - Infectious Disease

Rentals - Pain Management

Rentals - Hospitals/Home Care

Rentals - Service & Repair

Sales - DP

Revenue Diversity

2009 Revenues

0% 1% 0% 2% 1% 26% 70%

2012 Revenues

4% 9% 13% 0% 0% 51% 23%

Rentals - Colorectal Cancer

Rentals - Other Cancers

Rentals - Infectious Disease

Rentals - Pain Management

Rentals - Hospitals/Home Care

Rentals - Service & Repair

Sales - DP

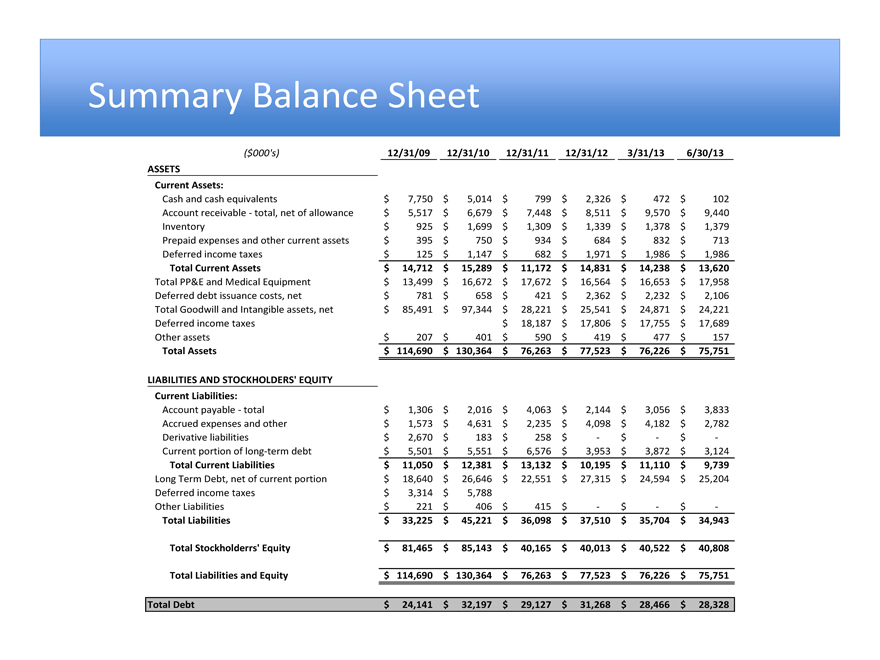

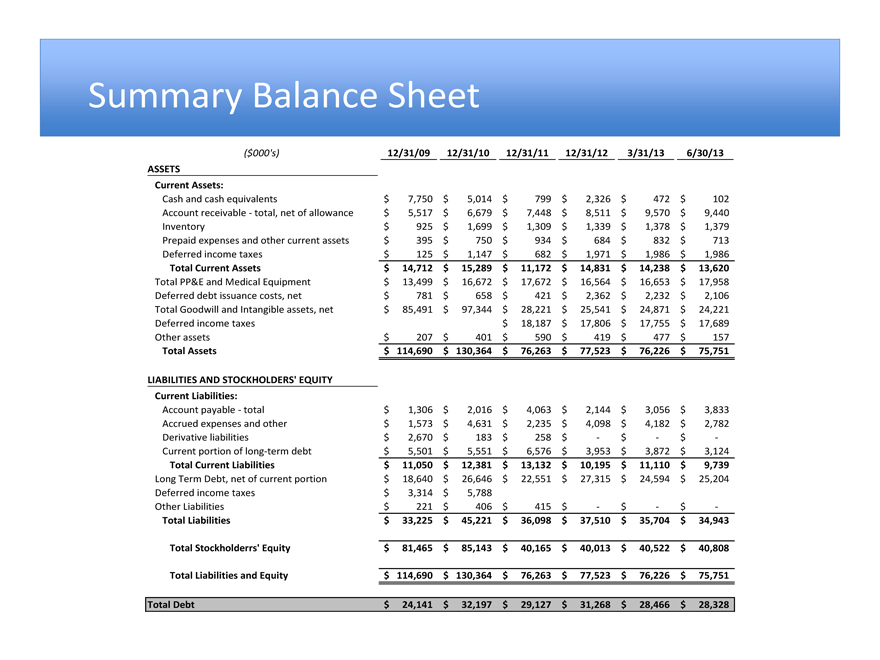

Summary Balance Sheet

($000’s) 12/31/09 12/31/10 12/31/11 12/31/12 3/31/13 6/30/13

ASSETS

Current Assets:

Cash and cash equivalents

$7,750 $5,014 $799 $2,326 $472 $102

Account receivable - total, net of allowance

$5,517 $6,679 $7,448 $8,511 $9,570 $9,440

Inventory

$925 $1,699 $1,309 $1,339 $1,378 $1,379

Prepaid expenses and other current assets

$395 $750 $934 $684 $832 $713

Deferred income taxes

$125 $1,147 $682 $1,971 $1,986 $1,986

Total Current Assets

$14,712 $15,289 $11,172

$14,831 $14,238 $13,620

Total PP&E and Medical Equipment

$13,499 $16,672 $17,672 $16,564 $16,653 $17,958

Deferred debt issuance costs, net

$781 $658 $421 $2,362 $2,232 $2,106

Total Goodwill and Intangible assets, net

$85,491 $97,344 $28,221 $25,541 $24,871 $24,221

Deferred income taxes

$18,187 $17,806 $17,755 $17,689

Other assets

$207 $401 $590 $419 $477 $157

Total Assets

$114,690 $130,364 $76,263 $77,523

$76,226 $75,751

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current Liabilities:

Account payable - total

$1,306 $2,016 $4,063 $2,144 $3,056 $3,833

Accrued expenses and other

$1,573 $4,631 $2,235 $4,098 $4,182 $2,782

Derivative liabilities

$2,670 $183 $258 $ - $ - $ -

Current portion of long-term debt

$5,501 $5,551 $6,576 $3,953 $3,872 $3,124

Total Current Liabilities

$11,050 $12,381 $13,132 $10,195 $11,110 $9,739

Long Term Debt, net of current portion

$18,640 $26,646 $22,551 $27,315 $24,594 $25,204

Deferred income taxes

$3,314 $5,788

Other Liabilities

$221 $406 $415 $ - $ - $ -

Total Liabilities

$33,225 $45,221 $36,098 $37,510 $35,704 $34,943

Total Stockholderrs’ Equity

$81,465 $85,143 $40,165 $40,013 $40,522 $40,808

Total Liabilities and Equity

$114,690 $130,364 $76,263 $77,523 $76,226 $75,751

Total Debt

$24,141 $32,197 $29,127 $31,268 $28,466 $28,328

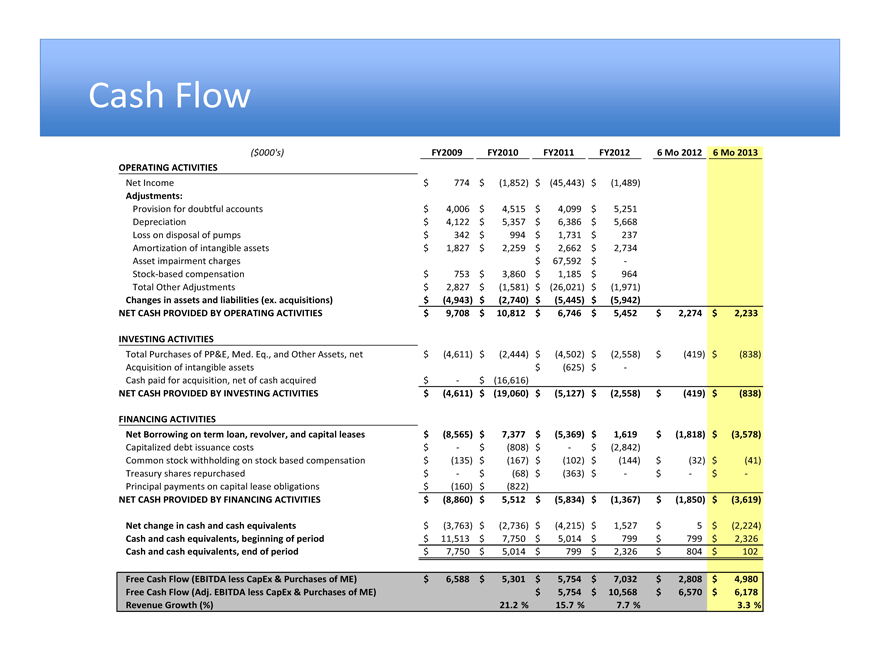

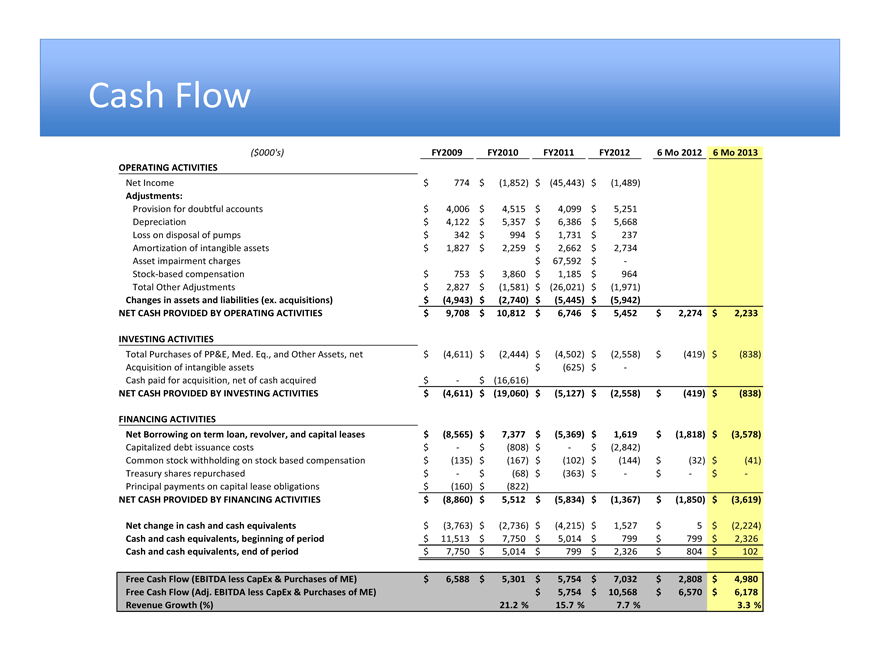

Cash Flow

($000’s) FY2009 FY2010 FY2011 FY2012 6 Mo 2012 6 Mo 2013

OPERATING ACTIVITIES

Net Income

$774 $(1,852) $(45,443) $(1,489)

Adjustments:

Provision for doubtful accounts

$4,006 $4,515 $4,099 $5,251

Depreciation

$4,122 $5,357 $6,386 $5,668

Loss on disposal of pumps

$342 $994 $1,731 $237

Amortization of intangible assets

$1,827 $2,259 $2,662 $2,734

Asset impairment charges

$67,592 $ -

Stock-based compensation

$753 $3,860 $1,185 $964

Total Other Adjustments

$2,827 $(1,581) $(26,021) $(1,971)

Changes in assets and liabilities (ex. acquisitions)

$(4,943) $(2,740) $(5,445) $(5,942)

NET CASH PROVIDED BY OPERATING ACTIVITIES

$9,708 $10,812 $6,746 $5,452 $2,274 $2,233

INVESTING ACTIVITIES

Total Purchases of PP&E, Med. Eq., and Other Assets, net

$(4,611) $(2,444) $(4,502) $(2,558) $(419) $(838)

Acquisition of intangible assets

$(625) $ -

Cash paid for acquisition, net of cash acquired

$ - $(16,616)

NET CASH PROVIDED BY INVESTING ACTIVITIES

$(4,611) $(19,060) $(5,127) $(2,558) $(419) $(838)

FINANCING ACTIVITIES

Net Borrowing on term loan, revolver, and capital leases

$(8,565) $7,377 $(5,369) $1,619 $(1,818) $(3,578)

Capitalized debt issuance costs

$ - $(808) $ - $(2,842)

Common stock withholding on stock based compensation

$(135) $(167) $(102) $(144) $(32) $(41)

Treasury shares repurchased

$ - $(68) $(363) $ - $ - $ -

Principal payments on capital lease obligations

$(160) $(822)

NET CASH PROVIDED BY FINANCING ACTIVITIES

$(8,860) $5,512 $(5,834) $(1,367) $(1,850) $(3,619)

Net change in cash and cash equivalents

$(3,763) $(2,736) $(4,215) $1,527 $5 $(2,224)

Cash and cash equivalents, beginning of period

$11,513 $7,750 $5,014 $799 $799 $2,326

Cash and cash equivalents, end of period

$7,750 $5,014 $799 $2,326 $804 $102

Free Cash Flow (EBITDA less CapEx & Purchases of ME)

$6,588 $5,301 $5,754 $7,032 $2,808 $4,980

Free Cash Flow (Adj. EBITDA less CapEx & Purchases of ME)

$5,754 $10,568 $6,570 $6,178

Revenue Growth (%)

21.2% 15.7% 7.7% 3.3%

Take Away

InfuSystem®

INFUSION MADE EASY SM

Positioned For Growth

Market Trends

InfuSystem is uniquely positioned to take advantage of market trends

Strategy

Transformational strategy is developed and being implemented

Leadership

Leadership can now focus on running a business for first time in over a year

InfuSystem®

INFUSION MADE EASY SM

Thank You for Your Interest!

IR Contact Info:

The Dilenschneider Group

212-922-0900

Rob Swadosh, rswadosh@dgi-nyc.com Patrick Malone, pmalone@dgi-nyc.com

InfuSystem®

INFUSION MADE EASY SM

Appendix: INFU Overview

InfuSystem®

INFUSION MADE EASY SM

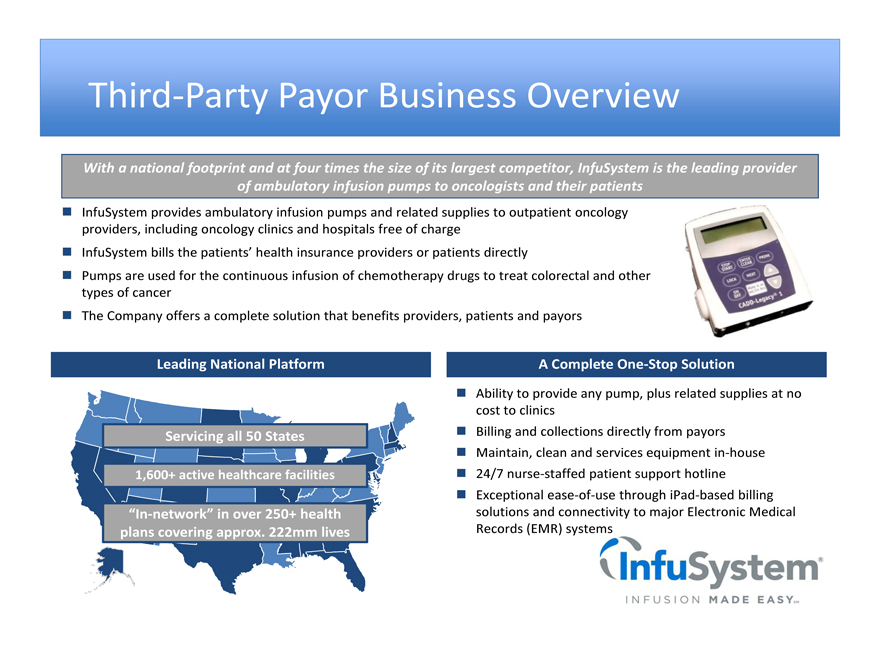

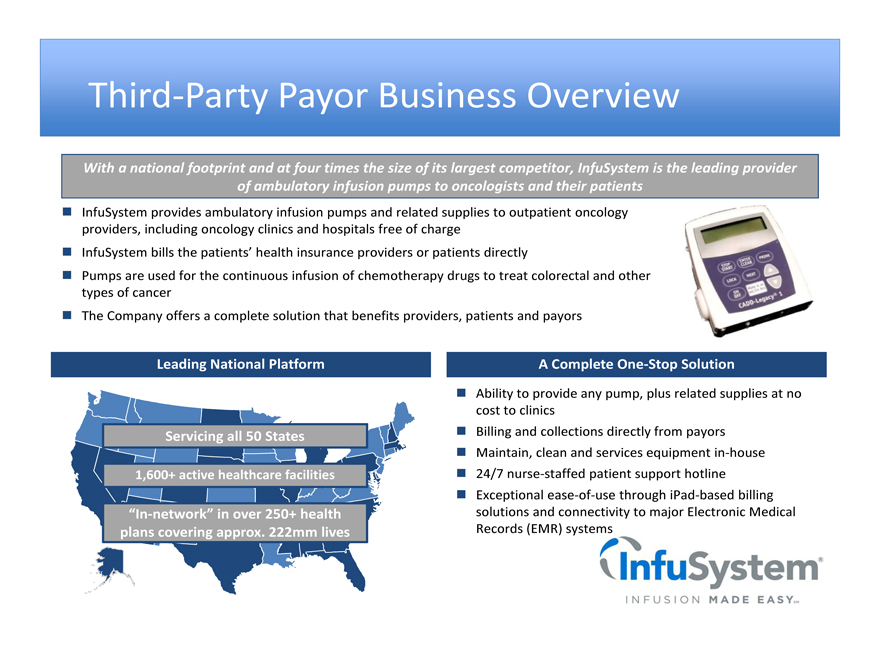

Third-Party Payor Business Overview

With a national footprint and at four times the size of its largest competitor, InfuSystem is the leading provider of ambulatory infusion pumps to oncologists and their patients

n InfuSystem provides ambulatory infusion pumps and related supplies to outpatient oncology providers, including oncology clinics and hospitals free of charge

n InfuSystem bills the patients’ health insurance providers or patients directly

n Pumps are used for the continuous infusion of chemotherapy drugs to treat colorectal and other types of cancer

n The Company offers a complete solution that benefits providers, patients and payors

Leading National Platform

Servicing all 50 States

1,600+ active healthcare facilities

“In-network” in over 250+ health plans covering approx. 222mm lives

A Complete One-Stop Solution

n Ability to provide any pump, plus related supplies at no cost to clinics

n Billing and collections directly from payors

n Maintain, clean and services equipment in-house

n 24/7 nurse-staffed patient support hotline

n Exceptional ease-of-use through iPad-based billing solutions and connectivity to major Electronic Medical Records (EMR) systems

InfuSystem®

INFUSION MADE EASY SM

Key Competitive Advantages

n “In-network” in over 250+ health plans covering approx. 222mm lives

n National footprint with over 1,600+ active healthcare facilities

n 20+ years in Durable Medical Equipment (“DME”) billing and licensing

n Full-service billing capabilities: paper, fax, electronic medical record, iPad

n Regulatory compliance in constantly changing landscape

n 24/7 support line staffed by certified oncology nurses

n Relationships with equipment manufacturers

n In-house refurbishment and repair capabilities

n Premier industry reputation for customer service

n Expansive and diverse fleet includes virtually all makes and models

InfuSystem®

INFUSION MADE EASY SM

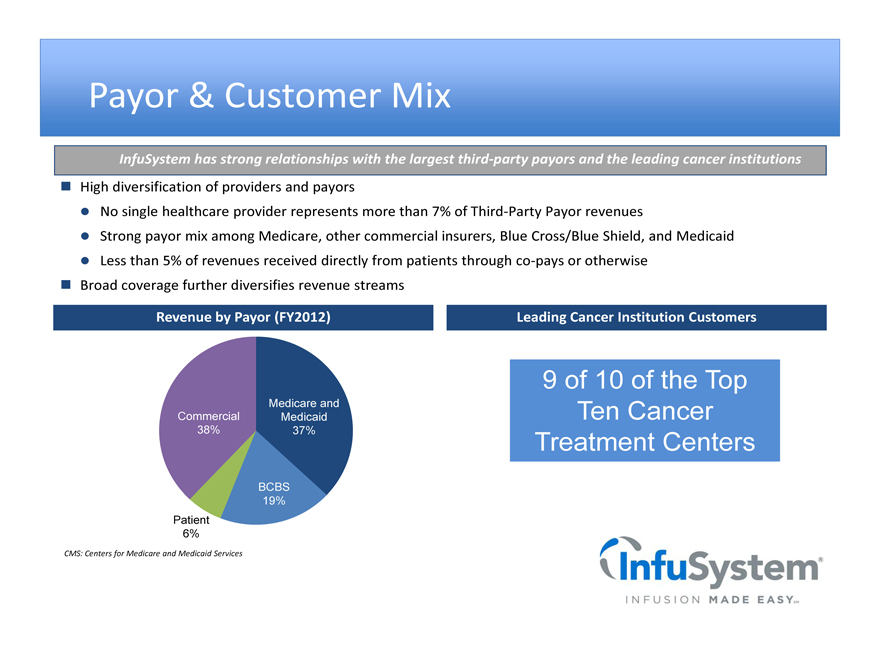

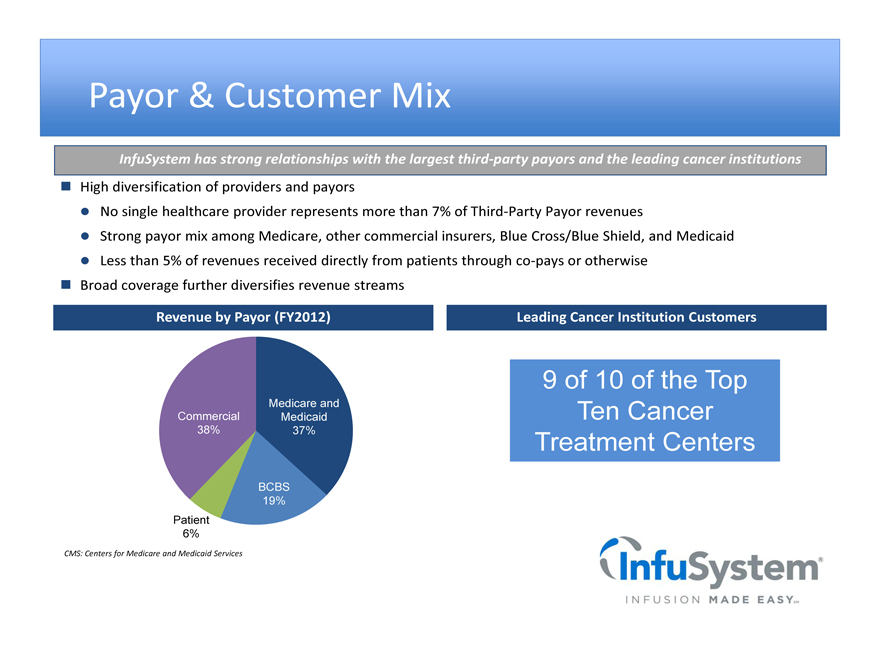

Payor & Customer Mix

InfuSystem has strong relationships with the largest third-party payors and the leading cancer institutions

n High diversification of providers and payors

Š No single healthcare provider represents more than 7% of Third-Party Payor revenues

Š Strong payor mix among Medicare, other commercial insurers, Blue Cross/Blue Shield, and Medicaid

Š Less than 5% of revenues received directly from patients through co-pays or otherwise

n Broad coverage further diversifies revenue streams

Revenue by Payor (FY2012)

| | |

Commercial | | Medicare and Medicaid |

38% | | 37% |

| | | BCBS |

| | | 19% |

Patient | | |

6% | | |

CMS: Centers for Medicare and Medicaid Services

Leading Cancer Institution Customers

9 of 10 of the Top Ten Cancer Treatment Centers

InfuSystem®

INFUSION MADE EASY SM

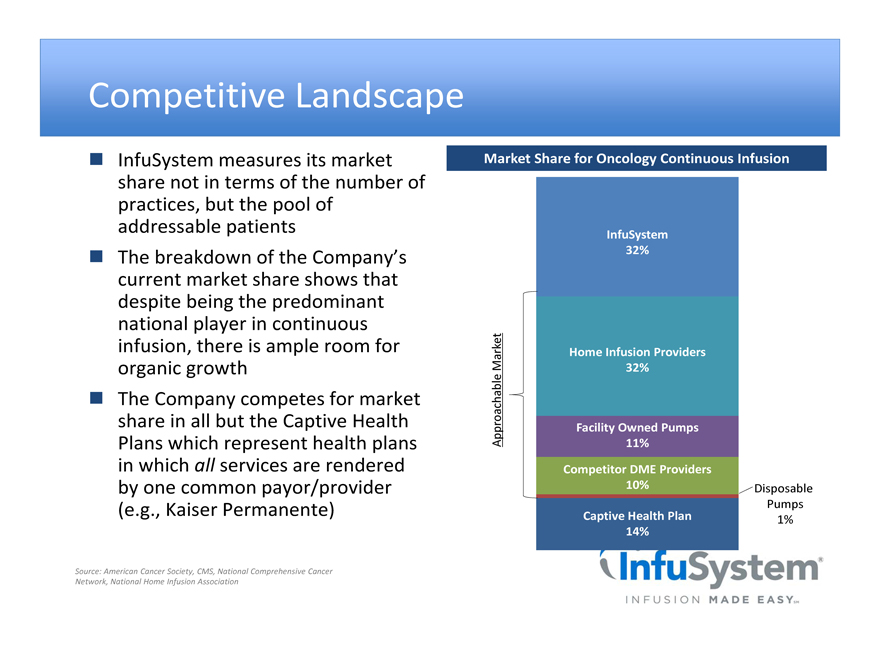

Competitive Landscape

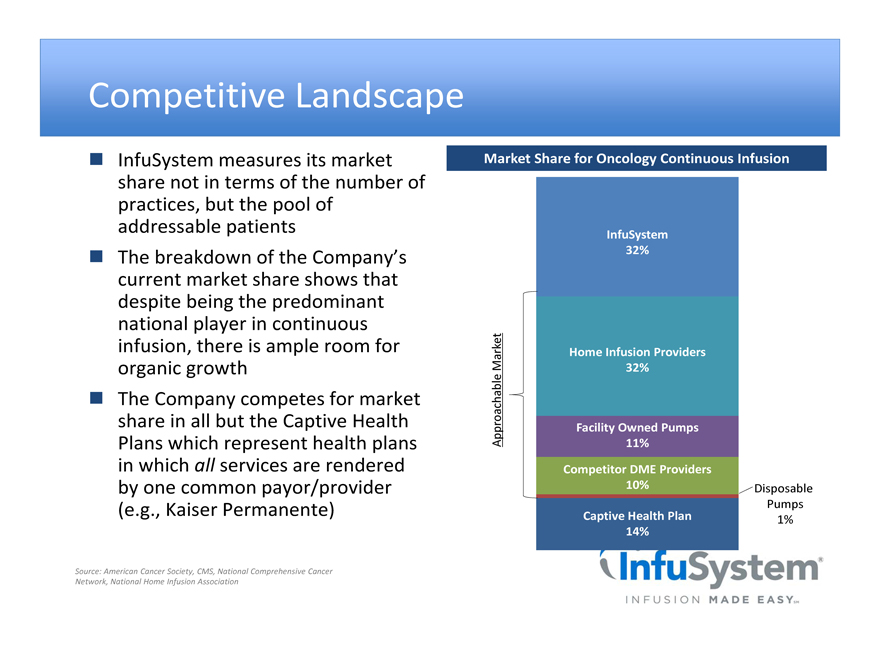

InfuSystem measures its market share not in terms of the number of practices, but the pool of addressable patients

The breakdown of the Company’s current market share shows that despite being the predominant national player in continuous infusion, there is ample room for organic growth

The Company competes for market share in all but the Captive Health Plans which represent health plans in which all services are rendered by one common payor/provider (e.g., Kaiser Permanente)

Source: American Cancer Society, CMS, National Comprehensive Cancer Network, National Home Infusion Association

Market Share for Oncology Continuous Infusion

InfuSystem 32%

Approachable Market

Home Infusion Providers

32%

Facility Owned Pumps

11%

Competitor DME Providers

10%

Disposable

Pumps 1%

Captive Health Plan

14%

InfuSystem®

INFUSION MADE EASY SM

Direct Payor Business Model InfuSystem’s Direct Payor business is focused primarily on the sale, rental, financing and accompanying service of movable medical equipment to hospitals and alternate care sites who pay InfuSystem directly - no third-party reimbursement

Founded in 1998 and headquartered in Olathe, KS with distribution/service centers in Santa Fe Springs, CA and Mississauga, Ontario

InfuSystem services - ISO 9001 - and repairs movable medical equipment

Leading provider to alternate site healthcare facilities and hospitals in the United States and Canada

Home infusion providers, long-term care, physician clinics, research facilities, etc.

Transacts directly with healthcare providers - no third-party reimbursement revenue

Products

InfuSystem sells, rents and finances a wide variety of new and used large volume and ambulatory pumps

Infusion pumps

Syringe pumps

Enteral pumps

Ambulatory pumps

Service & Repair

InfuSystem services and repairs both its own fleet of pumps and many types of other movable medical

Large volume pumps

Fluid collection

Ambulatory pumps

Medical equipment

InfuSystem®

INFUSION MADE EASY SM

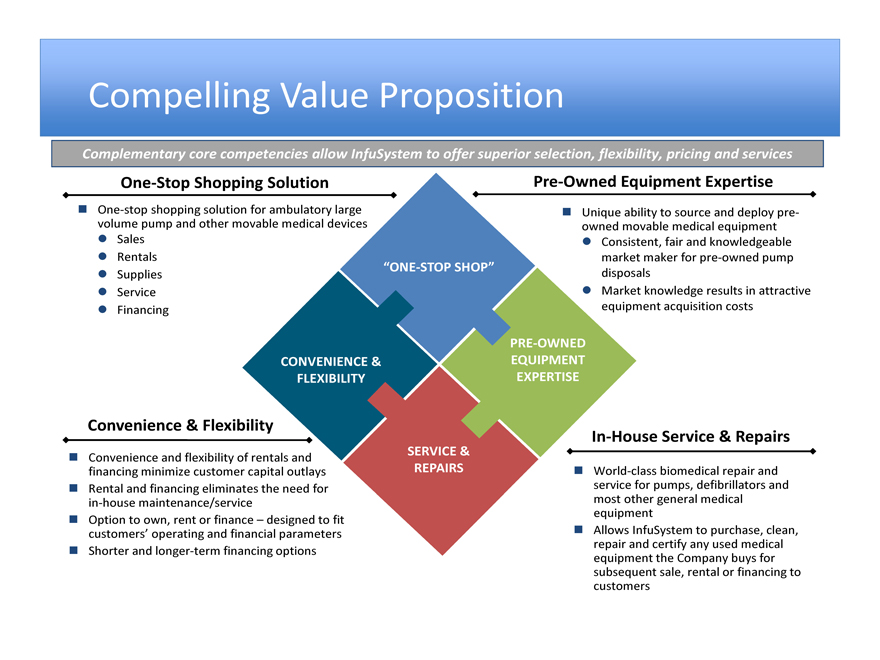

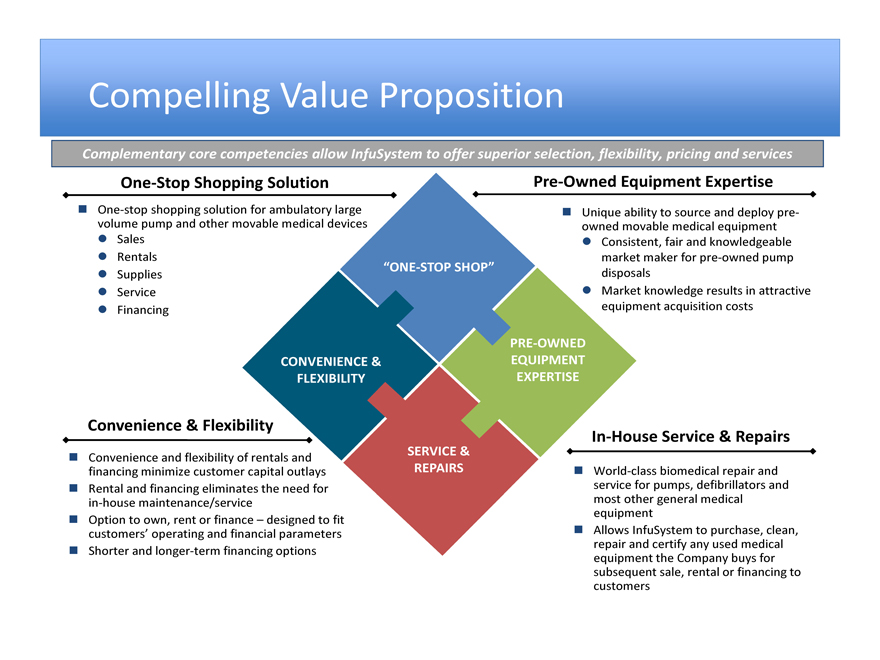

Compelling Value Proposition

Complementary core competencies allow InfuSystem to offer superior selection, flexibility, pricing and services

One-Stop Shopping Solution

One-stop shopping solution for ambulatory large volume pump and other movable medical devices

Sales

Rentals

Supplies

Service

Financing

Pre-Owned Equipment Expertise

Unique ability to source and deploy pre-owned movable medical equipment

Consistent, fair and knowledgeable market maker for pre-owned pump disposals

Market knowledge results in attractive equipment acquisition costs

“ONE-STOP SHOP”

CONVENIENCE & FLEXIBILITY

PRE-OWNED EQUIPMENT EXPERTISE

SERVICE & REPAIRS

Convenience & Flexibility

Convenience and flexibility of rentals and financing minimize customer capital outlays

Rental and financing eliminates the need for in-house maintenance/service

Option to own, rent or finance - designed to fit customers’ operating and financial parameters

Shorter and longer-term financing options

In-House Service & Repairs

World-class biomedical repair and service for pumps, defibrillators and most other general medical equipment

Allows InfuSystem to purchase, clean, repair and certify any used medical equipment the Company buys for subsequent sale, rental or financing to customers

Direct Payor Offerings

Leading Provider of New and Pre-Owned Pumps

InfuSystem offers new pumps from top brands

Broker-dealer trading desk

Web Portal

In addition, over 70 models and versions of pre-owned pumps are offered

Pre-owned pumps are re-built and certified by in-house biomedical technicians to be patient ready

Warranty offered on pre-owned pumps

A variety of financing options to fit customers’ operating, budgeting and financing parameters

Nationwide, industry-leading ISO 9001 service programs

Launching branch service center in Houston

Pre-Owned & New Pumps from Top Manufacturers

ALARIS TM MEDICAL SYSTEMS

CME Caesarea Medical Electronics

MC MarCal Medical, Inc.

sigma REDEFINING SMART

BBRAUN SHARING EXPERTISE

EXCELSIOR MEDICAL

Medis®

smiths medical

Baxter

Hospira

MOOG

CMO CRO

KENDALL HEALTHCARE PRODUCTS COMPANY

ROSS

ZEVEX®

Full Spectrum of Ownership Options for Customers

Rental

Renting new or pre-owned equipment

Rent pumps by the day, week or month to match swings in patient count

Free shipping on all rentals

Sales

Industry leader in sales of pre-owned

equipment, creating significant savings

Competitive pricing on new equipment

Option to sell back pre-owned pumps

Leasing plans offered

Asset Management

ISO 9001 Service offered

Service plans offered

Local service expansion

2 existing; 1 planned

Coordinate with TPP

Loaner pumps available

Medical Equipment Service & Repair

In addition to supporting and repairing

InfuSystem’s in-house fleet, the Company certifies, recalibrates, repairs and services a variety of infusion pumps

Pumps require scheduled maintenance and calibration in accordance with manufacturer’s specifications and regulatory guidelines

Service and repair capabilities on high demand services reaching end of life that are no longer supported by manufacturers

ISO certification and an established quality system strengthens relationships with major customers

Provides InfuSystem an opportunity to establish a business relationship with customers that acquired pumps through other sources

Continuing and increased need for compliance with current as well as anticipated regulations

28 highly qualified service technicians

5 major manufacturer relationships:

BBRAUN SHARING EXPERTISE

CMEAmerica

smiths medical

MOOG

Walkmed Infusion

3 service centers, located in California, Toronto and Kansas

InfuSystem®

INFUSION MADE EASY SM