Exhibit 10.1

COLLEGE CROSSING BUSINESS PARK

BUILDING K

NET LEASE AGREEMENT

In consideration of the rents and covenants hereinafter set forth, Lessor Leases to Lessee and Lessee rents from Lessor the following described Premises upon the following terms and conditions:

1.LEASE PROVISIONS

1.1DATE: April 24, 2014

1.2PARTIES:

| Lessor: | College K, LLC | |

c/o Block Real Estate Services, LLC | ||

700 West 47th Street, Suite 200 | ||

Kansas City, Missouri 64112 | ||

Attn: Kenneth G. Block | ||

| Lessee: | First Biomedical, Inc. | |

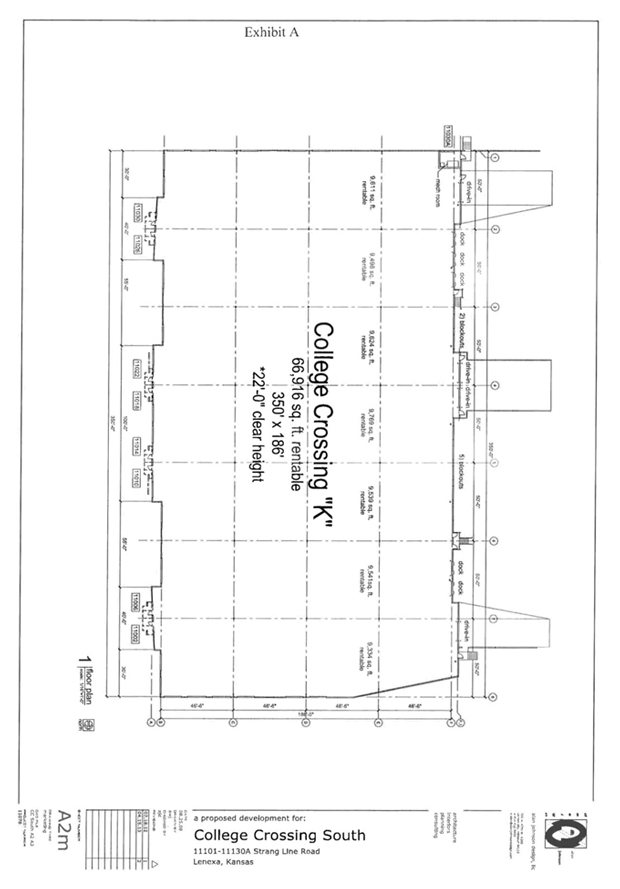

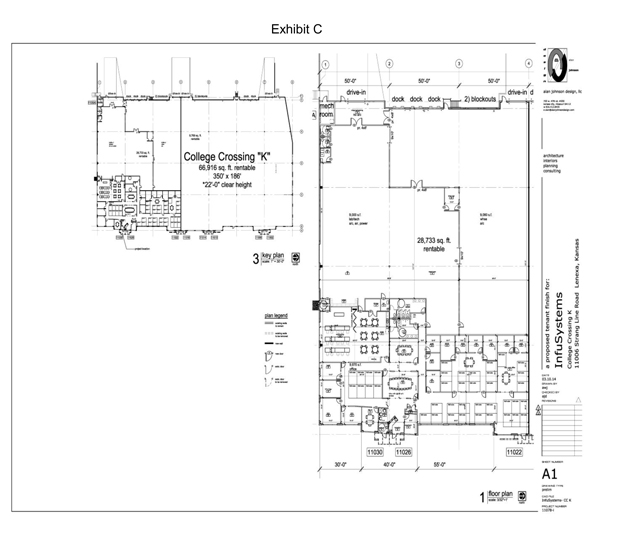

1.3PREMISES: Lessor Leases to Lessee and Lessee rents from Lessor a portion of the real property including the land and all improvements thereon, together with appurtenances, (herein called the “Premises”), situated in the City of Lenexa, County of Johnson, State of Kansas, which is within the College Crossing Business Park, and further described as a space within the South Building of the space within the south building which is commonly addressed as 11102 – 11134 Strang Line Road. The building plan attached hereto and made a part hereof and labeled Exhibit “A” indicates the Premises as being commonly addressed as 11030 Strang Line Road and containing approximately 28,733 rentable square feet of the total of 66,916 rentable square feet within College Crossing Building K.

1.4TERM: The term of this Lease shall be for a period of One Hundred Forty Seven (147) months to commence on July 1, 2014 and ending on September 30, 2026 unless earlier terminated as hereafter provided. In the event Lessor is unable to deliver possession of the Premises at the commencement of the term, Lessor shall not be liable for any damage caused thereby and the term hereof shall not be extended by such delay. However, if possession is not delivered by September 1, 2014, Lessee shall have the right to terminate this Lease by providing Lessor with written notice of such termination. In such event, Lessor shall immediately return all monies paid by Lessee to Lessor and Lessee shall have no further obligations hereunder. If Lessee, with Lessor’s consent, takes possession prior to the commencement of the term, Lessee shall do so subject to all of the covenants and conditions hereof and shall pay for the period from the date of taking possession until the commencement of the term at the same rent as that prescribed for an equal period during the term. Notwithstanding anything to the contrary herein, Lessee shall be permitted to install its fixtures and other equipment and such activities shall not be considered to be taking possession and Lessee shall not be required to pay rent until the commencement date. Prior to occupancy, Lessee shall submit to Lessor the required certificate of insurance as required under Section 4.l herein.

1.5BASE RENT AMOUNT AND PAYMENT: Lessee shall pay to Lessor as rent, in advance, without deduction, set-off, prior notice or demand, the following sums:

Dates | Rate PSF | Monthly Payment | ||||||

7/1/2014-9/30/2014* | $ | 0.00 | * | $ | 0.00 | * | ||

10/1/2014-9/30/2017 | $ | 5.75 | $ | 13,767.90 | ||||

10/1/2017-9/30/2021 | $ | 6.19 | $ | 14,821.44 | ||||

10/1/2021-9/30/2024 | $ | 6.66 | $ | 15,946.82 | ||||

10/1/2024-9/30/2026 | $ | 7.17 | $ | 17,167.97 | ||||

| * | base rent only, net charges due |

1 -

In lawful money of the United States. The base rent shall be paid at the address set out in Section l.2 or at such other place or places as Lessor may from time to time direct. Monthly base rental for any partial month shall be pro rated at the rate of 1/30th of monthly rental per day. All installments of rent not paid by the tenth (10th) day of the month in which they are due shall bear a late fee penalty of 2% of the current monthly Base Rent in addition to an interest carry charge at the then current Wall Street Journal prime rate plus two (2%) percent, effective from due date until paid in full, as set forth in Section 1.8 herein.

1.6SECURITY DEPOSIT: Intentionally Deleted

1.7ADDITIONAL CHARGES/ESCROW PAYMENTS: Lessee agrees to pay its proportionate share 42.94% (as further defined in Section 17.1) payable by Lessor pursuant to (i) Section 3.1 entitled “Real Estate Taxes and Assessments”, (ii) the cost of maintaining insurance pursuant to Section 4.2 entitled “Lessor’s Fire & Extended Risk Insurance” and (iii) the cost of any common area charges payable by Lessee in accordance with Section 17.1 entitled “Common area maintenance (CAM)”. During each month of the term of this Lease, on the same day that rent is due hereunder, Lessee shall escrow with Lessor an amount equal to one-twelfth (1/12) of the estimated annual cost of its proportionate share of such items. Lessee authorizes Lessor to use the funds deposited with Lessor under this Section 1.7 to pay such costs. The initial monthly escrow payments are based upon the estimated amount for the year in question, and shall be increased or decreased periodically to reflect the projected actual cost of all such items. Lessor makes no representation or warranty as to the accuracy of these estimates. They are estimates only and subject to adjustment as herein provided. If Lessee’s total escrow payments are less than Lessee’s actual proportionate share of all such items, Lessee shall pay the difference to Lessor within ten (10) days after demand. If the total escrow payments of Lessee are more than Lessee’s actual proportionate share of all such items, Lessor shall retain such excess and credit it against Lessee’s next escrow payment(s), or if the Lease has terminated, immediately refund such amounts to Lessee. The amount of the monthly rental and the initial monthly escrow payments for the first month beginning July 1, 2014 are as follows:

(1) | Base Rent Amount & Payment as set forth in Section 1.5* | $ | 0.00 | |||

(2) | Real Estate Taxes & Assessments-Escrow Payment as set forth in Section 3.1 | $ | 1,508.48 | |||

(3) | Lessor’s Fire & Extended Risk Insurance-Escrow Payment as set forth in Section 4.2 | $ | 215.50 | |||

(4) | Common area maintenance (CAM)-Escrow Payment as set forth in Section 17.1 | $ | 1,316.93 | |||

|

| |||||

| Monthly Payment Total: | $ | 3,040.91 |

The amount of the monthly rental and the initial monthly escrow payments for the month beginning October 1, 2014 are as follows:

(1) | Base Rent Amount & Payment as set forth in Section 1.5* | $ | 13,767.90 | |||

(2) | Real Estate Taxes & Assessments-Escrow Payment as set forth in Section 3.1 | $ | 1,508.48 | |||

(3) | Lessor’s Fire & Extended Risk Insurance-Escrow Payment as set forth in Section 4.2 | $ | 215.50 | |||

(4) | Common area maintenance (CAM)-Escrow Payment as set forth in Section 17.1 | $ | 1,316.93 | |||

|

| |||||

| Monthly Payment Total: | 16,808.81 |

| * | Payment will adjust as Base Rent Amount adjusts per Section 1.5 (item #1 above) and as reconciliations adjust each year (item #’s 2-4 above) |

In addition to the foregoing Base Rent, Lessee shall pay to Lessor as additional rent all charges required to be paid by Lessee under the provisions of this Lease, whether or not the same are designated as “Additional Rent”. If such charges are not paid at the time provided in this Lease, they shall be payable as additional rent upon demand or with the next installment of Base Rent thereafter falling due, whichever shall first occur, but nothing herein contained shall be deemed to suspend or authorize delay in the payment of any charge at the time the same becomes due and payable under this Lease.

2 -

1.8NET LEASE: Except for Lessor’s duties as outlined in Section 6.2 herein or elsewhere in this Lease, it is the purpose and intent of Lessor and Lessee that rent payable hereunder shall be net to Lessor so that this Lease shall yield to Lessor the net rent specified, in each year during the Term of this Lease, free to any charge, assessments, or impositions of any charged, assessed, or imposed on or against the Premises, and without abatement, deduction or set-off by Lessee, except as hereinafter specifically otherwise provided and Lessor shall not be expected or required to pay any such charge, assessment or imposition, or be under any obligation or liability hereunder, except as herein expressly set forth, and that all costs, expenses and obligations of any kind relating to the maintenance and operation of the Premises foreseen or unforeseen, including all alterations, repairs and replacements as hereinafter provided which may arise or become due during the Term of this Lease shall be paid by Lessee, and Lessor shall be indemnified and saved harmless by Lessee from and against such costs, expenses, and obligations.

1.9USE: Lessee shall use and occupy the Premises for offices, lab and tech servicing, and warehousing of medical devices, and related usages of medical devices and for no other purpose without the prior written consent of Lessor, which consent shall not be unreasonably delayed, withheld or conditioned. Lessee shall not use or permit the Premises or any part thereof to be used for any purpose other than the purpose expressly authorized herein. Notwithstanding anything in this Lease to the contrary, if Lessee is not otherwise in default under the Lease, and continues to make all payments of minimum Rent and other charges in accordance with the terms of the Lease including payment of utilities, Lessee shall not be deemed in breach because of its failure to operate business from the Premises.

2.UTILITIES

2.1LESSEE’S UTILITIES: Lessor shall provide mains and conduits to supply water, gas, electricity, and sanitary sewage to the Property. Lessor shall arrange to have all utilities separately metered, at Lessor’s expense. All utility leads and conduits have been installed at Lessor’s expense. Lessor agrees to pay all tap-in fees, impact fees and any other charges associated with the connection of all the utilities. Lessee shall pay, when due, all charges for garbage, disposal, refuse removal, electricity, gas, fuel oil, L.P. gas, telephone, janitorial, interior landscaping, internet access, and any other materials and utility services or energy source furnished in or about the Premises during the term of this Lease, and any renewal or extension thereof. If Lessor elects to furnish any of the foregoing utility services or other services furnished or caused to be furnished to Lessee, then the rate charged by Lessor shall not exceed the rate Lessee would be required to pay to a utility company or service company furnishing said utility(ies) or service(s).

3.REAL ESTATE TAXES, ASSESSMENTS, AND PERSONAL PROPERTY

3.1REAL ESTATE TAXES & ASSESSMENTS: Lessor shall pay all Real Estate Taxes and special assessments levied against the Premises throughout the term of this Lease. However, Lessee shall reimburse Lessor for its proportionate share of such real estate taxes pursuant to Section 1.7 herein. Additionally, Lessee shall reimburse Lessor for its proportionate share of such special assessments pursuant to Section 1.7 herein. In the event the Premises are not separately assessed Lessee’s share shall be an equitable proportion of the real property taxes or assessments for all of the land and improvements included within the tax parcel assessed, such proportion to be determined by Lessor from the respective valuations assigned in the Assessor’s worksheets or such other information as is reasonably available to the Lessor. In addition, any cost associated with a successful tax appeal resulting in a lower than assessed value for the property shall be paid by the Lessee on a pro-rata basis. Lessor’s determination thereof shall be conclusive. Real Estate Taxes shall exclude:

| a. | Franchise, gift, transfer, excise, capital stock, estate succession or inheritance taxes; |

| b. | Personal property taxes payable by Lessor on its property; |

| c. | Penalties or interest for late payment of Real Estate Taxes, whereas due to late payment by Lessee |

3 -

| d. | Income taxes relating to the income and gain of the Lessor which are not in the nature of ad valorem real estate taxes. |

Tenant shall be entitled to inspect and copy original bills for any costs which are imposed under this Section.

3.2PAYMENT: All such additional rentals shall be payable from Lessee to Lessor within fifteen (15) days after receipt of an invoice from Lessor advising Lessee of the increase in taxes to be paid by Lessee. Taxes for the last year of the term hereof shall be pro rated between Lessor and Lessee as of the expiration of the term. The Lessee’s share of such cost shall be determined on an annual basis for each calendar twelve month period ending on December 31st, prorating fractional years. The Lessee’s share of such annual cost shall be estimated as of the beginning of the term hereof and at the beginning of each calendar year thereafter and a monthly rate determined, and Lessee shall pay such estimated charge on the first day of each month in advance. If the monthly payment made by Lessee in such year results in a deficiency, said deficiency shall be paid by Lessee within fifteen (15) days after receipt of invoice from Lessor. If estimated payments result in excess payments by the Lessee, then said excess shall be applied toward subsequent monthly tax estimates for subsequent monthly payments, which shall be reduced accordingly until the excess is fully exhausted, or immediately paid to Lessee upon termination of this Lease. With respect to any assessments which may be levied against or upon the Premises, or which under the laws then in force may be evidenced by improvement or other bonds, or may be paid in annual installments, only the amount of such annual installment (with appropriate proration for any partial year) and interest due thereon shall be included within the computation of the annual real estate taxes and special assessments levied against the Premises. Notwithstanding anything herein to the contrary, in no event shall Lessee be liable for more than the reasonable portion of any assessment applicable to the Lease Term.

3.3PERSONAL PROPERTY: Lessee shall pay, prior to delinquency all taxes assessed against and levied upon any trade fixtures, furnishings, equipment and all other personal property of Lessee contained in the Premises or elsewhere and shall pay all taxes attributable to any Leasehold improvements which may be made to the Premises by Lessee. When possible, Lessee shall cause said trade fixtures, furnishings, equipment, personal property and Leasehold improvements to be separately assessed. If however, any or all of same shall be assessed and taxed with Lessor’s real property, Lessee shall pay to Lessor such taxes as are attributable to Lessee’s trade fixtures, furnishings, equipment, personal property and Leasehold improvements within fifteen (15) days after receipt of an invoice from Lessor advising Lessee of the taxes applicable to Lessee’s property.

4.INSURANCE

4.1LESSEE’S INSURANCE: Lessee, shall at all times during the term hereof, and at its own cost and expense, procure and continue in force bodily injury liability and property damage liability insurance, which policies shall name Lessor as an additional insured. Such insurance at all times shall be in an amount of not less than TWO MILLION DOLLARS ($2,000,000.00) aggregate limit coverage. The aforementioned minimum limits of policies shall not, however, limit the liability of Lessee hereunder. Lessee shall at all times during the term of this Lease keep and maintain in force and effect insurance coverage providing protection against loss, damage or injury by whatever means, with respect to all improvements, betterments, furniture, fixtures, machinery, equipment, stock in trade and all other items kept, used or maintained by Lessee in, on or about the Premises. Lessee shall also procure and continue in force throughout the term workmen’s compensation insurance. The aforementioned insurance shall be with companies having a rating of not less than Best’s AX rating. Certificates of such insurance shall be furnished to Lessor by the insurance companies, and no such policy shall be cancelable or subject to reduction of coverage or other modification except after TEN (10) days prior written notice to Lessor, unless such insurer refuses to provide such notice.

4.2LESSOR’S FIRE AND EXTENDED RISK INSURANCE: Lessor shall maintain in effect throughout the term of this Lease, a policy or policies of insurance providing special form fire and extended risk

4 -

coverage subject to standard exclusions, such insurance to be to an extent of at least ninety (90) percent of the full insurable replacement value of the building in which the Premises are located (exclusive of Lessee’s improvements and betterments, and furniture, trade fixtures, machinery, and equipment of Lessee), and insurance for Lessor’s loss of income, and general and umbrella liability insurance on the building and common areas.

4.3INCREASE IN FIRE AND EXTENDED COVERAGE INSURANCE PREMIUMS: Except in the ordinary course of Lessee’s business, provided however Lessee does hereby acknowledge that it does not use any items in its business which would increase Lessor’s property insurance premiums, Lessee agrees not to keep, use, sell or offer for sale in or upon the Premises any article or good which may be prohibited by the standard form of fire and extended coverage insurance policy. Lessee agrees to pay upon demand any increase in premium for fire and extended coverage and general and umbrella liability insurance on the building and common areas, that may be charged during the term of this Lease on the amount of such insurance which may be carried by Lessor on said Premises or the College Crossing Business Park, Building K, which is commonly addressed as 11102 - 11134 Strang Line Road of which the same are a part, resulting from the noncompliance of this Section 4.3 by Lessee, whether or not Lessor has consented to such use.

4.4WAIVER OF RIGHTS: Lessor and Lessee hereby waive any rights each may have against the other on account of any loss or damage occasioned to the Lessor or the Lessee, as the case may be, or to the Premises or its contents, and which may arise from any risk generally covered by fire and extended risk coverage insurance. The parties shall obtain from their respective insurance companies; if possible, insuring the property a waiver of any right of subrogation which said insurance company may have against the Lessor or the Lessee as the case may be. For purposes of this Section, the definition of the terms Lessor and Lessee as used herein shall include all agents, representatives, heirs, insurers, and assigns of either Lessee or Lessor. Lessee will indemnify and save harmless Lessor, its agents and servants, from and against any and all claims, actions, damages, suits judgments, decrees, orders, liability and expense in connection with loss of life, personal injury and/or damage to property arising from or out of any occurrence in, upon or about the Premises, or in the occupancy or use by Lessee of the Premises or any part thereof, or occasioned wholly or in part by any act or omission of Lessee, its agents, contractors, employees, servants, or sublessees, unless the same be caused by the willful or negligent act of Lessor.

5.DAMAGE OR DESTRUCTION

5.1DUTY TO REPAIR: If the Premises shall be partially or totally destroyed by fire or other casualty insurable under full standard fire and extended risk insurance, so as to become partially or totally untenantable, the same (unless Lessor shall elect not to rebuild as hereinafter provided) shall be repaired and restored by and at the cost of Lessor, and a just and proportionate part of the rent, as provided for hereinafter, shall be abated until the Premises are so restored. However, this duty to repair would not relieve Lessee from its obligations for Lessee’s insurance as set forth in Section 4.1, nor would it relieve Lessee from its obligations for repairs to glass or glazing from vandalism, malicious mischief, or other damages as set forth in Section 6.3 herein. Notwithstanding anything herein to the contrary, if the work of repairing or restoring Premises to pre-casualty condition is not completed within two hundred seventy (270) days after the date of said casualty, Lessee shall have the right to terminate this lease by providing written notice to Lessor.

5.2DAMAGE DURING LAST YEAR OF TERM: Notwithstanding anything to the contrary herein contained, if the Premises be damaged or destroyed during the last year of the term of this Lease to an extent greater than twenty-five (25) percent of the then replacement value of the improvements on the Premises, Lessor may elect not to restore, such election on the part of Lessor to be given by notice to Lessee within thirty (30) days after the date of damage or destruction. In the event Lessor so elects to terminate then this Lease shall be terminated as of the date of giving of such notice or the date Lessee completes its vacation from the Premises, whichever be the later. All proceeds of insurance covering Lessor’s interest in the Premises shall be payable to the Lessor.

5 -

6.MAINTENANCE AND REPAIRS

6.1CONDITION ON COMMENCEMENT: The acceptance of possession of the Premises by Lessee shall not constitute a waiver by Lessee of any warranted defects in the construction of the Premises or of any failure by Lessor to perform its agreements herein contained, and Lessee may, at any time thereafter, require Lessor to perform all of its agreements and repair any such defects, provided notice of any defects made in writing within ninety (90) days of occupancy.

6.2LESSOR’S DUTIES: Lessor at its sole cost and expense shall maintain in a good state of repair all structural portion of the roof, walls, floors and foundations, and exterior common areas except for any repairs caused by the wrongful or negligent act of Lessee and/or its agents. If Lessee is still occupying the Premises after the tenth (10th) year of the Lease, Lessee will not be obligated for any amortization of the replacement cost for HVAC that extends beyond the expiration of the Lease term.

6.3LESSEE’S DUTIES: Except as otherwise provided herein, Lessee, at its sole cost and expense but subject to any warranties provided in the Lease, shall maintain, in a clean and sanitary condition and a good state of repair, or replacement, if warranted all portions of the Premises herein that are not included in Section 6.2 entitled “Lessor’s Duties”. This shall include, but in no way be limited to, all plumbing, sewage, heating, air conditioning and ventilation, fans, wiring, windows and glazing, doors (metal and glass man-doors, drive-in and dock doors), floors, ceilings, interior walls and the interior surface of exterior walls, dock seals, plates, levelers and bumpers, drive-in ramps, and all fixtures and equipment, to the extent such items service only the Premises. In addition, Lessee shall maintain adequate heat in order to prevent freezing of plumbing and fire sprinkler systems. Lessor shall assign to Lessee any rights which it has under any manufacturer’s warranties concerning any building components including specifically the HVAC system, electrical system and plumbing, as it relates to Lessee’s space.

6.4PREVENTATIVE MAINTENANCE: HVAC: Lessee, at its sole cost and expense, shall have maintained, in a clean and sanitary condition, and in a good state of repair, all portions of heating, ventilating, and air conditioning equipment located in the Premises. Lessee shall submit to Lessor, a copy of a fully executed Preventative Maintenance Contract, on or before July 31, 2014 with a qualified (which includes insured) HVAC contractor the Preventative Maintenance Program as required herein. On behalf of Lessor, Block Real Estate Services, LLC shall provide Lessee with a list of qualified HVAC contractors from which Lessee may choose, or Lessee may choose to have Block Maintenance Solutions provide a bid and contract with Lessee for these services. Such Preventative Maintenance Contract inspections should be done to manufacturer’s specifications and shall have a minimum of four annual visits, including a springtime inspection with condenser cleaning and filter change; summer inspection and filter change; fall heating inspection and filter change; winter inspection and filter change; along with written reports from each visit, from the HVAC contractor, which Lessee shall submit to Lessor, within 30 days of each inspection Lessor, at its option, shall have the right, but not the obligation, to make periodic inspections of the premises and equipment and advise Lessee of any maintenance required, and Lessee shall promptly have performed such maintenance, at Lessee’s sole expense.

6.5FAILURE TO PERFORM: In the event Lessee fails to maintain the Premises pursuant to this Lease, Lessor shall give Lessee written notice and twenty (20) days to do such acts as are reasonably required to so maintain the Premises. In the event Lessee fails to promptly commence such work and diligently prosecute it to completion, then Lessor shall have the right to do such acts and expend such funds at the expense of Lessee as are reasonably required to perform such work. Any amount so expended by Lessor shall be paid by Lessee promptly after demand. Lessor shall have no liability to Lessee for any damage, inconvenience or interference with the use of the Premises by Lessee as a result of performing any such work.

6.6WAIVER BY LESSEE: Lessee waives all rights to make repairs at the expense of Lessor as provided for in any statute or law in effect at the time of execution of this Lease or any amendment thereof or any other statute or law which may be hereafter enacted during the term of this Lease.

6 -

6.7COMPLIANCE WITH LAWS: Lessor and Lessee, as to the portion of the Premises required to be maintained by them, each shall do all acts required to comply with all applicable laws, ordinances, regulations and rules on any public authority or organization relating to the maintenance of the Premises. Lessee represents and covenants that it shall conduct its occupancy and use the Premises (and if necessary place the Premises) in accordance and compliance with the AMERICANS WITH DISABILITIES ACT (ADA) including, but not limited to, modifying its policies, practices and procedures, and providing auxiliary aids and services to the disabled persons if required in order to so comply provided Lessee shall not be required to undertake any construction or structural improvements to the Premises. Furthermore, Lessee covenants and agrees that any and all alterations or improvements made by Lessee to the Premises shall comply with the ADA. Lessor covenants and agrees that when provided, the Premises, and any and all alterations or improvements made by Lessor to the Premises, shall comply with the ADA.

6.8CONDITION AT END OF TERM: Upon the termination of this Lease or upon the expiration of the term of this Lease, Lessee shall surrender the Premises in the same condition as received, ordinary and reasonable wear and tear and damage by fire, earthquake, act of God or the elements, alterations or additions permitted under this Lease and acts of abutting property owners and persons over whom Lessee has no control over excepted. Lessee shall leave the Premises broom clean.

7.ALTERATIONS

7.1LESSEE’S RIGHT TO MAKE: Lessee shall not make or permit to be made any alteration or changes in or additions to the Premises without the prior written consent of Lessor, which consent shall not be unreasonably withheld, delayed or conditioned. No work shall be commenced until Lessor shall have posted proper notices of non-responsibility. Notwithstanding anything herein to the contrary, Lessee shall not be required to obtain Lessor’s consent for any alteration, addition or improvement for which the total cost is $5,000 or less or which is non-structural in nature, but must provide notice to Landlord with plans prior to any work commencing.

7.2OWNERSHIP AND REMOVAL: All alterations, changes and additions made to or on the Premises shall be made at the sole cost and expense of Lessee and, upon completion, except trade fixtures, shall become part of the Premises, and the property of Lessor and upon termination of this Lease or upon expiration of the term shall be surrendered to the Lessor. Upon the termination of this Lease, or by notice delivered at least thirty (30) days prior to the expiration of the term, Lessor shall have the right to require Lessee at its sole expense, to remove from the Premises as of the end of the term all fixtures and equipment placed or installed on the Premises by Lessee with any damage caused to the Premises by such removal to be repaired by and at the expense of Lessee.

8.LIENS

8.1LESSEE’S OBLIGATION: Lessee shall keep the Premises and any building of which the Premises are a part, free and clear of any liens arising out of work performed or caused to be performed by Lessee and shall indemnify, hold harmless and defend Lessor from any liens and encumbrances arising out of any work performed or materials furnished by or at the direction of Lessee. In the event any lien is filed, Lessee shall do all acts necessary to discharge any lien within thirty (30) days of filing, or if Lessee desires to contest any lien, then Lessee shall deposit with Lessor such security as Lessor shall demand to insure the payment of the lien claim. In the event Lessee shall fail to pay any lien claim when due or shall fail to deposit the security with Lessor, then Lessor shall have the right to expend all sums necessary to discharge the lien claim, and Lessee shall pay promptly after demand all sums expended by Lessor in discharging any lien, including attorneys’ fees and costs.

7 -

9.ENTRY

9.1RIGHTS OF LESSOR: Upon prior notice, Lessor and its agents shall have the right at any reasonable time upon prior notice to Lessee to enter upon the Premises for the purpose of inspection, serving or posting notices, showing to a prospective purchaser or Lessee, or making any changes or alteration or repairs which Lessor shall deem necessary for the protection, improvement or preservation of the Premises or the building in which the Premises are a part or for any other lawful purpose.

10.INDEMNIFICATION

10.1LESSEE’S OBLIGATION: Lessee shall hold harmless, indemnify and defend Lessor and its employees against all claims, demands, and action for loss, liability, damage, cost and expense (including attorney fees) resulting from injury or death to any person and damage to property caused by the act or omission of any person, except Lessor and its employees, while in, or upon the Premises during the term of this Lease or any occupancy hereunder.

10.2LESSOR’S OBLIGATION: Lessor shall hold harmless, indemnify and defend Lessee and its employees against all claims, demands, and action for loss, liability, damage, cost and expense (including attorney fees) resulting from injury or death to any person and damage to property caused by the act or omission of any person, except Lessee and its employees, while in, or upon the Premises during the term of this Lease or any occupancy hereunder.

11.DEFAULT AND REMEDIES

11.1EVENTS: The occurrence of any of the following shall, at the option of Lessor, constitute a material default and breach of this Lease by Lessee: (i) Any failure by Lessee to pay the rental within five (5) (5) days of its due date or to make any other payment required to be made by Lessee hereunder. However, it shall not be considered a material default with respect to the first (1st) time in any twelve (12) month period during the Lease Term; (ii) The abandonment or vacation of the Premises by Lessee; (iii) A failure by Lessee to observe and perform any other provision of this Lease to be observed or performed by Lessee, where such failure continues for thirty (30) days after receipt of written notice thereof by Lessor to Lessee provided however, that if the nature of such default is such that the same cannot reasonably be cured within such thirty (30) day period Lessee shall not be deemed in default hereunder if Lessee commences such cure within said thirty (30) day period and thereafter diligently prosecutes the same to completion; (iv) The making by Lessee of any general assignment for the benefit of creditors; the filing by or against Lessee of a petition to have Lessee adjudged a bankrupt or of a petition for reorganization or arrangement under any law relating to bankruptcy (unless, in the case of a petition filed against Lessee, the same is dismissed within sixty (60) days); appointment of a trustee or receiver to take possession of substantially all of Lessee’s assets located at the Premises or of Lessee’s interest in this Lease, where possession is not restored to Lessee within thirty (30) days or the attachment, execution or other judicial seizure of Lessee’s interest in this Lease, where such seizure is not discharged within thirty (30) days.

11.2RIGHT OF RECOVERY: In the event of any such default by Lessee, after the expiration of any applicable cure period, then in addition to any other remedies available to Lessor at law or in equity, Lessor shall have the immediate option to terminate this Lease and all rights of Lessee hereunder by giving written notice of such intention to terminate. In the event that Lessor shall elect to terminate this Lease then Lessor may recover from Lessee: (i) The worth at the time of award of any unpaid rent which had been earned at the time of such termination plus; (ii) any other amount reasonably necessary to compensate Lessor for all the detriment proximately caused by Lessee’s failure to perform his obligations under this Lease or which in the ordinary course of events would be likely to result there from, and; (iii) at the Lessor’s election such other amounts in addition to or in lieu of the foregoing as may be permitted from time to time by applicable Kansas law. The term “rent” as used herein, shall be deemed to be and to mean the minimum annual rental and all other sums required to be paid by Lessee pursuant to the terms of this Lease. As used in (i) above, the “worth

8 -

at the time of award” is computed by allowing interest at the rate of ten (10%) percent per annum. All actual and reasonable costs incurred by Lessor in collecting any amounts and damages owing by Lessee pursuant to the provisions of this Lease or to enforce any provision of this Lease, including reasonable attorneys’ fees from the date any such matter is turned over to an attorney, provided Lessor prevails in court, will also be recoverable by Lessor from Lessee.

11.3RIGHT TO RE-ENTER: In the event of any such default by Lessee, Lessor shall also have the right, after receipt of a valid court order, with or without terminating this Lease, to re-enter the Premises and remove all persons and property from the Premises; such property may be removed and stored in a public warehouse or elsewhere at the cost of and for the account of Lessee.

11.4RIGHTS OF LESSOR: In the event that Lessor shall elect to re-enter as provided in Section 11.3 above or shall take possession of the Premises pursuant to legal proceeding or pursuant to any notice provided by law, then if Lessor does not elect to terminate this Lease, as provided in Section 11.2 above, then Lessor may from time to time, without terminating this Lease, either recover all rentals as they become due or relet the Premises or any part thereof for such term or terms and at such rental or rentals and upon such other terms and conditions as Lessor in its reasonable discretion may deem advisable with the right to make necessary repairs to the Premises. Lessor acknowledges it has a duty to mitigate its damages.

In the event that Lessor shall elect to so relet, then rentals received by Lessor from such reletting shall be applied: first, to the payment of any indebtedness other than rent due hereunder from Lessee to Lessor; second, to the payment of any cost of such reletting; third, to the payment of the cost of any alterations and repairs to the Premises; fourth, to the payment of rent due and unpaid hereunder; and the residue, if any, shall be held by Lessor and applied in payment of future rent as the same may become due and payable hereunder. Should that portion of such rentals received from such reletting during any month, which is applied by the payment of rent hereunder, be less than the rent payable during that month by Lessee hereunder, then Lessee shall pay such deficiency to Lessor immediately upon demand therefore by Lessor. Such deficiency shall be calculated and paid monthly. Lessee shall also pay to Lessor, as soon as ascertained, any costs and expenses incurred by Lessor in such reletting or in making such standard and reasonable alterations and repairs not covered by the rentals received from such reletting.

12.ASSIGNMENT AND SUBLETTING

12.1ASSIGNING AND SUBLETTING: Lessee shall not sublet the Premises or any part thereof and Lessee shall not assign, transfer, pledge, mortgage or otherwise encumber this Lease, or any portion of the term thereof, without the previous written consent in each instance of Lessor, and Lessee shall furnish to Lessor copy of such proposed instrument. The consent of the Lessor shall not be unreasonably withheld, conditioned or delayed. Permission is, however, granted Lessee to assign this Lease and also to sublet the Premises to any subsidiary corporation of Lessee, or parent or affiliated corporations of Lessee, upon giving Lessor written notice of intent to so do. In the event of any assignment or subletting, Lessee shall remain the principal obligor to the Lessor under all covenants of this Lease, and by accepting any assignment or subletting, an assignee or sublessee shall become bound by and shall perform and shall become entitled to the benefit of all of the terms, conditions and covenants by which the Lessee hereunder is bound. An assignment, forbidden within the meaning of this Section, shall be deemed to include a sale of all or substantially all of Lessee’s assets or one or more sales or transfers, by operation of law or otherwise, or creation of new stock, by which an aggregate of more than fifty percent (50%) of Lessee’s stock shall be vested in a party or parties who are non-stockholders as of the date hereof. The restriction as to stock sales shall not apply if Lessee’s stock is listed on a recognized security exchange. If Lessee wishes to list the

Premises with a real estate agent or broker for purposes of subletting or assigning its Leasehold interest in the Premises, Lessee agrees to use the real estate broker then representing Lessor at the College Crossing Business Park Building K, which is commonly addressed as 11102 - 11134 Strang Line Road, as Lessee’s exclusive agent for such purposes. Lessee further agrees to continue to use such broker as long as it is diligently seeking an assignee or sublessee.

9 -

In the event of a sale of all or substantially all of Lessee’s assets, the purchaser thereof shall be deemed to assume all of Lessee’s obligations under this Lease from and after the date of such acquisition, whether or not assumed in writing. In connection with such sale, Lessee shall cause the purchaser to execute an assumption agreement acceptable to Lessor.

Notwithstanding anything contained in this Section 12.1, Lessor shall not be required to consent to an assignment of this Lease or a sublease of all or part of the Premises by Lessee to any lessee who is currently occupying space in the Building or any building in the Great Kansas City Metropolitan area (or has occupied such space during the immediately preceding twelve (12) month period prior Lessee’s request for Lessor consent), which is owned or managed by Lessor o any affiliate of Lessor or at rental rates less than the current advertised market rental rate for the Building as established by Lessor.

Upon Lessor’s approval of any assignment or sublease, Lessee shall pay to Lessor a reasonable charge to cover Lessor’s administrative and out-of-pocket costs and expenses in connection with the approval, which amount shall not exceed Seven Hundred Fifty Dollars ($750.00). Lessee shall not advertise or allow the Premises to be advertised as being available for lease without the prior written approval by Lessor of the form and content of such advertisement.

Lessee shall pay to Lessor within five (5) days after receipt by Lessee 50% of the Excess Consideration from any approved assignment or any approved sublease. Excess Consideration is defined as the an amount of the monthly sublease rent received by Lessee less an amount equal to the sum of all Rent and Occupancy Cost payable by Lessee to Lessor under this Lease in respect of such Premises assignment of subleased after the date of such assignment or sublease

12.2VIOLATION: No consent to any assignment, voluntarily or by operation of law, of this Lease, or any subletting of the Premises shall be deemed to be a consent to any subsequent assignment or subletting except as to the specific instance covered thereby.

13.EXERCISE OF EMINENT DOMAIN

13.1PREMISES TAKEN: If the Premises or any portion thereof are taken under the power of eminent domain, or sold under the threat of the exercise of said power (all of which are herein called “condemnation”) this Lease shall terminate as to the part so taken as of the date the condemning authority takes title or possession, whichever first occurs. If more than ten (10) percent of the floor area of the Premises or more than twenty-five (25) percent of the land area of the Premises which is not occupied by any improvements, is taken by condemnation, Lessee or Lessor may at either’s option, to be exercised in writing only within ten (10) days after Lessor shall have given Lessee written notice of such condemnation (or in the absence of such notice, within ten (10) days after the condemning authority shall have taken possession) terminate this Lease as of the date the condemning authority takes such possession.

13.2PREMISES REMAINING: If Lessor or Lessee does not terminate this Lease in accordance with the foregoing, Lessor, at its expense, shall restore the improvements to an architectural whole, and this Lease shall remain in full force and effect as to the portion of the Premises remaining, except that the rent shall be reduced in the proportion that the floor area taken bears to the total floor area of the building situated on the Premises. Any award for the taking of all or any part of the Premises under the power shall be the property of Lessor, whether such award shall be made as compensation for diminution in value of the Leasehold or for the taking of the fee, or as severance damages; provided however, the Lessee shall be entitled to any award for loss or damage to Lessee’s trade fixtures and removable personal property

10 -

14.HOLDING OVER

14.1TERMS: Upon the expiration or other termination of the Term, Tenant shall quit and surrender the Leased Premises in good order and condition, ordinary wear and tear excepted, and shall remove all of its property therefrom, except as otherwise provided in this Lease. If Tenant retains possession of the Leased Premises or any part thereof after the termination of this Lease by lapse of time or otherwise without the written consent of Landlord, Tenant shall pay to Landlord the monthly installments of Base Rent and all additional rent and other charges hereunder payable, at one hundred thirty percent (130%) of the rate payable for the month immediately preceding said holding over, computed on a per month basis, for each month or part thereof (without reduction for any such partial month) that Tenant thus remains in possession. The provisions of this Paragraph 14.1 shall not be deemed to limit or exclude any of Landlord’s rights of re-entry or any other right granted to Landlord hereunder or under law.

15.SUBORDINATION

15.1SUBORDINATION: This Lease is and shall be subordinate to any, mortgages, deeds of trust, or any other instrument of security which have been or shall be placed on the land and College Crossing Business Park, Building K which is commonly described as 11102 - 11134 Strang Line Road of which the Premises form a part (as they may be extended, modified or amended from time to time) and such subordination is hereby made effective without any further act by Lessee, provided the holder of any such mortgage, deed of trust or other instrument of security agrees in writing to honor Lessee’s Lease, so long as Lessee is not in material default hereunder.

15.2ESTOPPEL CERTIFICATE: Lessee shall, without charge, at any time and from time to time, within twenty (20) business days after request by Lessor, deliver a written instrument to Lessor or any other person, firm or corporation specified by Lessor, duly executed and acknowledged, certifying that this Lease is unmodified and in full force and effect, or if there has been any modification, that the same is in full force and effect as so modified, and identifying any such modifications; whether or not there are then existing any set-offs or defenses in favor of Lessee against the enforcement of any of the terms covenants and conditions of this Lease by Lessor, and if so, specifying the same, and also whether or not Lessor has observed and performed all of the terms, covenants and conditions on the part of Lessor to be observed and performed, and if not, specifying the same; and the dates to which Rent and all other charges hereunder have been paid. Notwithstanding anything to the contrary herein, if Lessor requests Lessee to execute an estoppel letter, non-disturbance agreement, or similar certificate or agreement, Lessee shall not be obligated to execute and deliver such document(s) more than twice in any six (6) month period unless Lessor pays the attorney fees incurred by Lessee in responding to such request.

Lessor shall, with a charge of $500.00, at any time and from time to time, but no more than twice per year, within twenty (20) business days after request by Lessee, deliver a written instrument to Lessee or any other person, firm or corporation specified by Lessee, duly executed and acknowledged, certifying that this Lease is unmodified and in full force and effect, or if there has been any modification, that the same is in full force and effect as so modified, and identifying any such modifications; whether or not there are then existing any set-offs or defenses in favor of Lessor against the enforcement of any of the terms covenants and conditions of this Lease by Lessee, and if so, specifying the same, and also whether or not Lessee has observed and performed all of the terms, covenants and conditions on the part of Lessee to be observed and performed, and if not, specifying the same; and the dates to which Rent and all other charges hereunder have been paid. Notwithstanding anything to the contrary herein, if Lessee requests Lessor to execute an estoppel letter, non-disturbance agreement, or similar certificate or agreement, Lessor shall not be obligated to execute and deliver such document(s) more than twice in any six (6) month period unless Lessee pays the attorney fees incurred by Lessor in responding to such request.

15.3MORTGAGEE PROTECTION: Lessee agrees to give any Mortgagees and/or Trust Deed Holders, by registered mail, a copy of any Notice of Default served upon the Lessor, provided that prior to such notice Lessee has been notified, in writing (by way of Notice of Assignment of Rents and Leases, or otherwise), of the address of such Mortgagees and/or Trust Deed holders. Lessee further agrees that if Lessor

11 -

shall have failed to cure such default within the time provided for in this Lease, then the Mortgagees and/or Trust Deed Holders shall have an additional sixty (60) days within which to cure such default or if such default cannot be cured within that time, then such additional time as may be necessary if within such sixty (60) days, any Mortgagee and/or Trust Deed Holder has commenced and is diligently pursuing the remedies necessary to cure such default (including, but not limited to, commencement of foreclosure proceedings, if necessary to affect such cure), in which event this Lease shall not be terminated while such remedies are being so diligently pursued.

15.4ATTORNMENT: If this Lease is not extinguished by exercise of a power of sale, Lessee shall, in the event any proceedings are brought for the foreclosure of said Premises, or in the event of exercise of power of sale under any mortgage or deed of trust made by the Lessor covering the Premises (or by deed in lieu thereof), or in the event of a sale by Lessor of its fee or Leasehold interest in the property or its interest in this Lease attorn to the purchaser upon any such foreclosure or sale and recognize such purchaser as Lessor under this Lease, provided such purchaser agrees in writing to honor Lessee’s lease.

16.SIGNS

16.1RIGHT OF LESSOR: Lessor reserves the right to the use of the exterior walls and the roof of the Premises and of the building of which the Premises are a part.

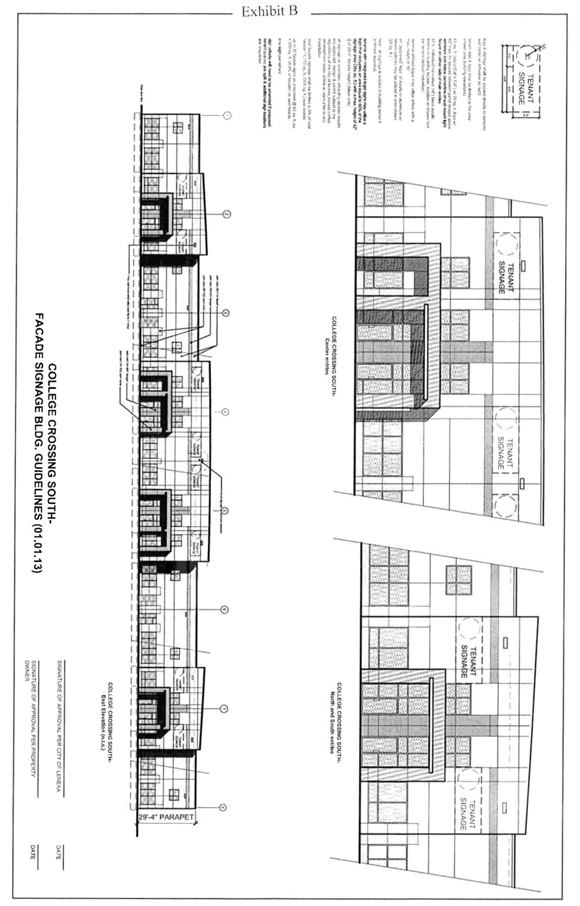

16.2RESTRICTIONS ON LESSEE: Lessee shall not inscribe, paint, affix or place any signs or advertisements on the exterior, interior or roof of the Premises without the prior written consent of Lessor, which consent shall not be unreasonably withheld, delayed or conditioned. Any signs to be placed by Lessee shall be removed by the Lessee upon demand by the Lessor following the expiration or termination of this Lease, and any damage caused by such removal shall be repaired at the expense of Lessee. Additionally, Lessee acknowledges that sign criteria are in full force and effect within College Crossing Business Park and further agrees that all signage shall conform with said criteria; said sign restrictions for the Premises attached hereto, made a part hereof, and labeled Exhibit “B”.

17.MAINTENANCE AND USE OF COMMON AREAS

17.1COMMON AREA MAINTENANCE (CAM): Lessor shall operate the College Crossing Business Park and the Premises at a first-class standard, consistent with other regional business parks in the area. Furthermore, Lessor shall not invoke its rights under this Lease in such a manner to adversely affect ingress, egress, visibility or parking to or for the Premises. Lessee shall pay its proportionate share of the costs incurred by Lessor in the operation, maintenance, and repair of the Property based on the percentage that the square-footage of the Premises bears to the total square-footage of the College Crossing Business Park, commonly described as Building K, which is commonly addressed as 11102 - 11134 Strang Line Road, which contains 66,916 rentable square feet. The Premises contain 28,733 rentable square feet, with said percentage therefore being 42.94% .Said expenses for costs shall include, where applicable, but not be limited to, repairs and maintenance for all common areas, such as, parking lot lights, and other exterior building lights, including related utility expenses, including any seasonal lights, dumpster corrals, fences, fire sprinklers, including monitoring and phone lines for same, alarm permits, and related inspections, gutters and downspouts, minor roof repairs and/or patching (where such repairs would not be capitalized), and annual roof inspections and preventative maintenance, lawn sprinkler lift station, parking lot repairs and maintenance, including, parking lot striping, sidewalk, loading areas, and curb repairs, common area building signs (not individual lessee signs), lawn and landscaping care and maintenance, including irrigation testing, start-up and shut-down of systems, maintenance and repair; exterior handrails, stair systems, canopies, if any, and exterior bollards; utilities serving parking lot lights and other exterior lighting, domestic water and sewer service, if not separately metered, water for law irrigation and fountains, lot cleaning service, tree service, patrol service, snow and ice removal, trash removal (when provided by the Lessor), window washing (when provided by the Lessor); management fees (not to exceed three and 75/100 (3.75%) percent of the gross rents of the project for the calendar year) common area plumbing, maintenance personnel salaries and

12 -

associated expenses, while conducting any maintenance and repairs included herein, costs associated with operating and maintaining the onsite post office/maintenance office, exterior painting, and the annual amortization over its useful life on a straight-line basis of the costs of any equipment or capital improvements made by Lessor to the common areas of the building, parking and loading areas or land in which the premises are a part of, and such other maintenance, repair, replacement, operation and management costs as Lessor determines relates to the common areas of the building, parking and loading areas or land in which the premises are a part.

During each calendar year and any portion thereof during the Lease term, Lessee will pay to Lessor, subject to limitations hereinafter set forth, a proportion of the common area operating costs as set forth above. The Lessee’s share of such cost shall be determined on an annual basis for each calendar twelve month period ending on December 31st, prorating fractional years. The Lessee’s share of such annual cost shall be estimated as of the beginning of the term hereof and at the beginning of each calendar year thereafter and a monthly rate determined, and Lessee shall pay such estimated charge on the first day of each month in advance; provided, however, that within sixty (60) days after the end of each calendar year the Lessor or his designated agent shall determine its net costs for such year and Lessee’s share thereof and furnish a copy of such computations in writing to Lessee. If the monthly payment made by Lessee in such year results in a deficiency, said deficiency shall be paid by Lessee within thirty (30) days of notice by Lessor. If estimated payments result in excess payments by the Lessee, then said excess shall be applied toward subsequent monthly common area maintenance estimates for subsequent monthly payments, which shall be reduced accordingly until the excess is fully exhausted, or paid to Lessee immediately upon termination of this Lease for any reason. The Lessor at the office of his designated agent shall make available during normal business hours for a period not to exceed ninety (90) days following the billing of said expenses, copies of all invoices and reasonably detailed accounting records for review by Lessee. In the event Lessee fails to notify Lessor within said ninety (90) day period, said billing will be deemed to be accurate and conclusive. In the event Lessee elects to audit Lessor’s common area maintenance and operating costs in accordance with this clause, such audit must be conducted by an independent nationally recognized accounting firm that is not being compensated on a contingency fee basis.

The estimated charge for the calendar year in which the Lease commences is $0.55 per square foot of gross rentable area, or One Thousand Three Hundred Sixteen & 93/100 Dollars ($1,316.93) per month.

17.2EMPLOYEE PARKING AREA: Lessee and its employees shall park their motor vehicles in such areas as Lessor shall from time to time designate as employee parking areas. Lessee agrees that all loading and unloading operations shall be conducted so as not to obstruct or hinder the operation of the businesses of the other Lessees in the said building(s), nor will Lessee unreasonably block or obstruct any street, sidewalk or right-of-way adjacent to or comprising part of said building(s). Lessor agrees to provide 72 parking spaces for Lessee’s employees at all times.

17.3CONTROL OF COMMON AREAS: All parking areas, driveways, entrances and exits thereto, pedestrian sidewalks and ramps, landscaped areas, exterior stairways and all other common areas and facilities provided by Lessor for the common use of Lessees of said building(s) and their officers, agents, employees and customers, shall at all times be subject to the exclusive control and management of Lessor, and Lessor shall have the right from time to time to establish, modify and enforce reasonable rules and regulations with respect to the use of all such common areas and facilities. Lessor shall have the right to operate and maintain the same in such manner as Lessor, in its sole discretion, shall determine from time to time, including without limitation, the right to employ all personnel and to make all rules and necessary for the proper operation and maintenance of said common areas and facilities. All such costs to be shared by Lessee as provided for in Section 17.1. Notwithstanding anything herein to the contrary Lessor shall not invoke its rights under this Section in such a manner as to adversely affect ingress, egress, visibility, or parking for or to the leased premises.

13 -

18.GENERAL PROVISIONS

18.1OBLIGATION OF LESSEE: Lessee agrees to conduct its business in a manner that will not be reasonably objectionable to other Lessees in the College Crossing Business Park, commonly described as Building K, which is commonly addressed as 11102 - 11134 Strang Line Road of which the Premises are a part, including noise, vibration, odor, or fumes. In the event Lessor receives complaints from other Lessees in the building and determine, in its reasonable judgment, that Lessee is conducting its operations in a manner so as to be reasonably objectionable to other Lessees, Lessee agrees, upon notice from Lessor thereof, to promptly modify the conduct of its operations to eliminate such objectionable operations. In such event that said conduct is not modified, Lessee shall be deemed in default of its obligations under this Lease.

According to the City of Lenexa, Kansas ordinance, smoking is prohibited within any enclosed facility of employment, which includes the building and the land, which it is constructed upon. Lessee may, at Lessee’s option, designate an area within the Premises for such purposes.

18.2QUIET ENJOYMENT: Provided Lessee performs all of its material covenants and obligations hereunder, Lessor covenants that Lessee shall have peaceful and quiet enjoyment of the Premises without hindrance on the part of Lessor and Lessor will warrant and defend Lessee in the peaceful and quiet enjoyment of the Premises against claims of all persons claiming through or under the Lessor.

18.3STATEMENT OF LEASE STATUS: Lessee shall, at any time during the term of this Lease, upon not less than twenty (20) days prior written notice from Lessor, execute and deliver to Lessor, a statement in writing certifying that this Lease is unmodified and in full force and effect (or, if modified, stating the nature of such modification) and the date to which the rent and other charges are paid in advance, if any, and acknowledging that there are not, to Lessee’s knowledge, any uncured defaults on the part of Lessor hereunder or specifying such defaults if they are claimed. Any such statement may be conclusively relied upon by any prospective purchaser or encumbrancer of the Premises. Lessee’s failure to deliver such statement within such time shall be conclusive upon the Lessee that (i) this Lease is in full force and effect without modification except as may be represented by Lessor; (ii) there are no uncured defaults in Lessor’s performance; (iii) not more than one month’s rent has been paid in advance. In addition, Lessee shall make such other certifications as are reasonably required by Lessor’s mortgagee. Notwithstanding anything to the contrary herein, if Lessor requests Lessee to execute any such statement, Lessee shall not be obligated to execute and deliver such document(s) more than once in any six (6) month period unless Lessor pays the attorney fees incurred by Lessee in responding to such request.

18.4TRANSFER OF LESSOR’S INTEREST IN PREMISES: In the event of any sale or exchange of the Premises by Lessor and assignment by Lessor of this Lease, the Lessor shall be entirely freed and relieved of its covenants and obligations contained in, or derived from the Lease arising out of any act, occurrence or omission relating to the Premises or this Lease occurring after the consummation of such sale or exchange and assignment, provided however, that the new owner shall assume and agree to perform all the covenants and obligations of Lessor contained herein. In the event of such sale or exchange, this Lease shall nevertheless remain unimpaired and in full force and effect and Lessee hereunder agrees to attorn to the then owner of the Premises, provided such owner agrees in writing to honor Lessee’s Lease.

18.5OBLIGATIONS OF SUCCESSORS: The parties hereto agree that all the provisions hereof are to be construed as covenants and agreements as though the words importing such covenants and agreements were used in each separate paragraph hereof, and that all of the provisions hereof shall bind and inure to the benefit of the parties hereto and their respective heirs, legal representatives, successors and assigns.

18.6CAPTIONS: The captions of the articles and paragraphs contained in this Lease are for convenience only and shall not be deemed to be relevant in resolving any questions of interpretation or construction of any article or paragraph of this Lease.

14 -

18.7NOTICES: Whenever under this Lease provision is made for any demand, notice or declaration of any kind, or where it is deemed desirable or necessary by either party to give or serve any such notice, demand or declaration to the other party, it shall be in writing and served either personally or sent by certified mail, postage prepaid, addressed at the addresses set forth below. Either party may, by like notice at any time and from time to time, designate a different address to which notices shall be sent. Notices shall be deemed given when received, but if delivery is not accepted, on the earlier of the date delivery is refused or the third business day after the same is deposited with the United States Postal Service. Any notices given by a party to this Agreement may be provided by that party’s attorney.

18.8APPLICABLE LAW: This Lease shall be governed and interpreted solely by the Laws of the State of Kansas then in force. Each number, singular or plural, as used in this Lease shall include all numbers, and each gender shall be deemed to include all genders.

18.9TIME AND JOINT AND SEVERAL LIABILITY: Time is of the essence of this Lease and each and every provision hereof, except as to the conditions relating to the delivery of possession of the Premises to Lessee. All the terms, covenants and conditions contained in this Lease to be performed by either party, if such party shall consist of more than one person or organization, shall be deemed to be joint and several, and all rights and remedies of the parties shall be cumulative and non-exclusive of any other remedy.

18.10LESSOR CONSENT TO LESSEE CREDIT FACILITY: In the event Lessee’s lender requests a consent and/or waiver, from Lessor, with respect to Lessee’s lender’s collateral, Lessee shall submit a proposed document to Lessor along with an administrative review fee of $500.00, per document submitted for Lessor’s counsel to complete review and approve such document(s) for Lessor’s signature. After receipt of the proposed document(s) and the administrative review fee, Lessor agrees to thereafter provide a consent and/or waiver to Lessee and its lender in such form and with such changes as are acceptable to Lessor in its reasonable discretion. Notwithstanding anything to the contrary herein, if Lessee requests Lessor to execute any such statement, Lessor shall not be obligated to execute and deliver such document(s) more than once in any six (6) month period unless Lessee pays the attorney fees incurred by Lessor in responding to such request.

19.LESSEE IMPROVEMENTS

19.1IMPROVEMENTS: The acceptance of possession of the Premises by Lessee shall not constitute a waiver by Lessee of any warranted defects in the construction of the Premises or of any failure by Lessor to perform its agreements herein contained, and Lessee may, at any time thereafter, require Lessor to perform all of its agreements and repair any such defects.

19.2WORKING DRAWINGS: As part of the Total Construction Costs, Lessor will have prepared the Working Drawings for the Premises. Lessee will review and approve the Working Drawings within five (5) business days following receipt thereof. As used herein, “Working Drawing(s)” shall mean the final working drawings approved by Lessor, as amended from time to time by any approved changes thereto, and “Work” shall mean all improvements to be constructed in accordance with and as indicated on the Working Drawings. Approval by Lessor or its Affiliate of the Working Drawings shall not be a representation or warranty of Lessor that such drawings are adequate for use, purpose, or condition, or that such drawings comply with any applicable laws and codes but shall merely be the consent of Lessor to the performance of the Work Lessee shall, at Lessor’s request, sign the Working Drawings to evidence its review and approval thereof. All changes in the Work must receive the prior written approval of Lessor, and in the event of any such approved change Lessee shall, upon completion of the Work, furnish Lessor with an accurate, reproducible “as-built” plan (e.g., sepia) of the improvements as constructed, which plan shall be incorporated into this Lease by this reference for all purposes.

15 -

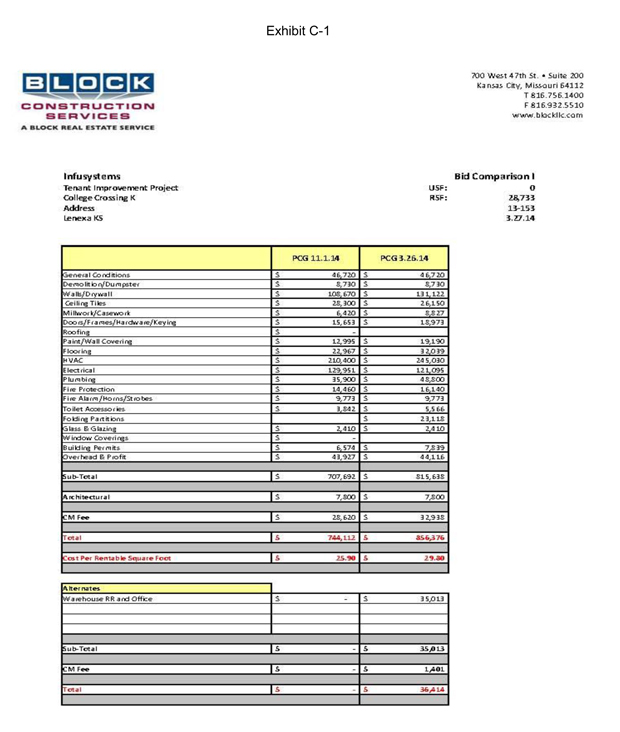

19.3CONSTRUCTION OF IMPROVEMENTS: As part of the Total Construction Costs, Lessor agrees to cause the construction work to be completed in accordance with the Working Drawings. Lessor shall not be obligated to construct or install any improvements or facilities of any kind other that those called for by the Working Drawings. “Building Grade” and/or “Building Standard” shall mean the type, brand, and/or quality of the materials Lessor designates from time to time to be the minimum quality to be used in the building commonly described as Building “K” or the exclusive type, grade or quality of material to be used in 11002 - 11134 Strang Line Rd., Lenexa, KS. The total cost of construction work (includes, without limitation, space planning and architectural, construction document fees, design of the work and preparation of the Working Drawings, including mechanical, electrical, and plumbing (MEP’s) plans, costs of construction supervision, provided by a third party construction manager, in the amount of four percent (4%) of the Construction Costs, labor and materials, all utility usage during construction, related taxes and other costs related directly to the improvement of the Premises, all of which costs are herein collectively called the “Total Construction Costs” as outlined in Exhibits “C” (“Bid Plan”) Exhibit “C-1” (Construction Bid/Cost”) hereof shall be borne by Lessee up to but not exceeding $856,376.00

Before construction of improvements shall begin, and upon Lease execution, Lessee agrees to pay to Lessor the amount of $263,864.00, which represents the overage on the above standard constructions costs. The remaining balance of the Construction Costs in the amount of $592,512.00 shall be paid by Lessee to Lessor as follows: $296,256.00, which represents fifty percent (50%) of the standard construction costs, within thirty (30) days after Lease Execution. Upon Lease Commencement, Lessee shall pay Lessor $237,004.80 plus 100% of the accumulated change order value, which shall be due and payable within ten (10) days of Lessee’s receipt of Lessor’s invoice. The remaining $59,251.20, representing ten percent (10%) holdback, shall be payable by Lessee to Lessor within thirty (30) days after occupancy and upon completion of all final punch list items.

Lessee further acknowledges and agrees that Lessor will hold back ten percent (10%) of the constructions costs paid by Lessee ($59,251.20). At such time as the Temporary Certificate of Occupancy is issued and all final punch list items are complete, Lessor will release the amount of $59,251.20 to the contractor.

“Total Construction Costs” shall be used exclusively for construction work and improvements to the building.

Lessor or its affiliate shall supervise the Work, make disbursements required to be made to the contractors, and act as a liaison between the contractors and Lessee and coordinate the relationship between the work, the building, and the building’s systems.

Lessor warrants that all of its work shall be done in accordance with all local laws and building codes; shall utilize new, good quality construction materials; shall be undertaken and completed in a good and workerlike manner. All components of the HVAC system shall be new. In addition, Lessor shall also assign to Lessee any rights which it has to any contractor’s or manufacturer’s warranties on building systems and components. Lessor agrees to complete its work in accordance with Exhibit “C”, prior to the commencement of the Lease. Substantial completion as used herein shall be the date that a temporary certificate of occupancy is issued by the City of Lenexa, Kansas.

Lessor will also require the contractor to name the Lessee as an additional insured on its insurance policies required under the construction contract, and Lessor shall collect and furnish copies of lien waivers from the contractor and its subcontractors.

19.4DELAY IN COMPLETION: If a delay in the performance of the Work occurs (a) because Lessee does not timely approve the Working Drawings; (b) because of any substantial change by Lessee to the Working Drawings, (c) because of any specification by Lessee of materials or installations in addition to or other than the agreed-upon materials, or (d) if Lessee, any contractor or subcontractor, or Lessee’s agents otherwise materially delay completion of the Work, and the obtaining of a temporary or final certificate of occupancy, then, notwithstanding any provision to the contrary in this Lease, Lessee’s obligation to pay rent and additional charges as set forth in the Lease shall commence on the Commencement Date of the Lease.

16 -

20.NO ORAL AGREEMENTS: It is agreed between the Lessor and Lessee that there are no oral agreements or representations between the parties hereto affecting this Lease and this Lease supersedes and cancels any and all previous negotiations, arrangements, brochures, agreements, representations and understanding, if any, between the parties hereto or between the parties hereto and any real estate broker who may represent either or both of said parties and none thereof shall be used to interpret or construe this Lease. Lessee agrees that in the event it employs a real estate broker to represent it in negotiating a renewal, extension, or a new lease elsewhere within the property, that it agrees to compensate said Broker directly for its services. There are no other representations and this Lease is based solely upon the representations and agreements contained in this Lease.

21.REAL ESTATE BROKER: Lessor acknowledges that Block Real Estate Services, LLC and Mohr Partners negotiated this Lease and further agrees to pay to said Realtor upon complete execution of this Lease, a leasing commission as set forth in a separate agreement. Lessor acknowledges that it shall be responsible to pay any and all brokers’ commissions and shall indemnify and hold Lessee harmless from same.

22.OWNERSHIP DISCLOSURE: Lessee acknowledges that Lessee has been informed that person(s) associated with Block Real Estate Services, LLC, may have or may acquire an ownership interest in the development or building of which the Premises is a part, and Lessee acknowledges that such ownership interest shall not affect the terms, conditions or validity of this Lease, and in no way affected the Lease negotiations.

23.HAZARDOUS MATERIALS: Lessee covenants and warrants to Lessor that Lessee shall not install, store, treat, transport, or dispose of, or permit the installation, storage, use, treatment, transportation or disposal of, any “Hazardous Materials” on, upon or beneath the Premises. In the event of any such installation, storage, use, treatment, transportation or disposal, Lessee shall remove any such Hazardous Material, or otherwise comply with all regulations or orders of any federal, state, county, regional, local or other governmental agency or authority (“Governmental Authority”), all at the expense of Lessee. Notwithstanding the foregoing, Lessee shall not be prohibited from using, storing, or disposing of any Hazardous Material that is not prohibited by any Governmental Authority and which is used, stored or disposed of by Lessee in the normal course of Lessee’s business and in quantities which are not in excess of quantities used, stored or disposed of by prudent individuals, firms or entities, conducting businesses of the same nature and purpose as the Lessee’s business and which use, storage and disposal of any Hazardous Material, including the quantities thereof, are all in accordance with the manufacturer’s recommendations and are in compliance with any and all laws, ordinances, rules, regulations or orders of any Governmental Authority. “Hazardous Materials” as used herein shall mean (a) asbestos in any form; (b) urea formaldehyde foam insulation; (c) transformers or other equipment which contain dye electric fluid containing a level of poly-chlorinated biphenyl in excess of 50 parts per million; (d) underground storage tanks; or (e) any other chemical, material, or substance which is regulated as toxic or hazardous or exposure to which is prohibited, limited or regulated by any Governmental Authority.

Lessee shall promptly notify Lessor in writing of any order or pending or threatened action by any regulator, agent or other Governmental Authority, or any claims made by any third party, relating to any Hazardous Materials on, or emanations from, the Premises, and shall promptly furnish Lessor with copies of any correspondence or legal pleadings in connection therewith.

Lessee hereby releases and agrees to indemnify and hold harmless Lessor and Lessor’s officers, directors, shareholders, employees, attorneys and agents (collectively the “Indemnitees”) from and against all loss, damage and expense (including, without limitation, attorneys’ fees and costs to the extent permitted by applicable law incurred in the investigation, defense and settlement of claims) that Indemnitees may incur as a result of or in connection with the assertion against Indemnitees of any claim relating directly or indirectly, in

17 -

whole or in part, to any activity on or off the Premises or any failure to act, if such activity or failure to act involves Hazardous Materials, in whole or in part, directly or indirectly, used, stored, installed, treated, transported or disposed of on, upon or beneath the Premises during the term of the Lease, or noncompliance with any federal, state, or local laws, ordinances, rules, regulations or orders relating thereto.

Lessor represents and warrants to Lessee that the College Crossing Business Park, commonly described as Building K, which is commonly addressed as 11102 - 11134 Strang Line Road in which the Premises are located and the land on which said building is located will comply with all environmental laws and regulations as of the date of Lessee’s occupancy of the Premises.

24.OPTION TO RENEW: In the event that this Lease shall be in full force and effect and Lessee, or its permittee assignee, shall be in full and complete possession of the Premises, and shall not be in material default, then in this event only, Lessee is hereby granted the sole and exclusive right to extend this Lease for two (2) additional terms of five (5) years each, with the first option commencing on 10/1/2026 and ending on 9/30/2031, and the second option commencing on 10/1/2031 and ending on 9/30/2036 at the annual rental calculated at fair market value which is defined as the market rent for like-kind space in Johnson County, Kansas. Notice of Lessee’s intent to so renew this Lease as is provided herein shall be furnished to Lessor in writing on or before 3/31/2026 for the first option and 3/31/2031 for the second option.

25.RIGHT OF FIRST REFUSAL: Lessee and Lessor acknowledge that Lessee will have a Right of First Refusal during the primary term to Lease any adjoining space in the College Crossing Business Park, building commonly described as Building K, which is commonly addressed as 11102 - 11134 Strang Line Road, subject to any existing right of First Refusal previously in effect under any other Lease with any existing Lessee. In such event that Lessor receives a bona fide offer to Lease, whether verbal and/or written, from a prospective client, Lessee will have seven (7) working days from the submission of the terms of said offer by Lessor to Lessee to exercise its Right of First Refusal. In such event that Lessee does not exercise its right to Lease the Premises on the proposed terms, then Lessor will have sixty (60) days thereafter to consummate a Lease with the prospective client on said terms and conditions. In such event that a Lease transaction is not consummated, thereafter Lessee’s Right of First Refusal will continue to be in full force and effect.

26.RIGHT OF CANCELLATION: Lessee and Lessor acknowledge that Lessee will have the one time right to cancel this Lease effective on September 30, 2021 by delivering written notice, at any time, on or before, April 30, 2021, of its intention to cancel. Lessee and Lessor acknowledge that Lessee’s penalty, for such early cancellation, shall be in the amount of $80,981.34, which shall be delivered, by check, along with said written notice.

27.CONFIDENTIALITY: Lessor agrees to keep all information and documentation submitted by Lessee under this Lease in strictest confidence. This information will only be shared with Lessor’s accountants, attorneys, and Lessor’s lender.

28.GUARANTY: Simultaneously with the execution of this Lease, Infusystem Holdings, Inc. (“Guarantor”) shall deliver to Lessor a guaranty agreement pursuant to which Guarantor guarantee the payment and performance of Lessee’s obligations hereunder, which guarantee agreement shall be in the form attached hereto as Exhibit “D”.

29.MEMORANDUM OF LEASE: Upon request of Lessor or Lessee, Lessor and Lessee shall, within 15 business days from the date of request, execute and deliver a memorandum of this Lease for recording purposes in mutually agreeable recordable form, which shall be recorded at the requesting party’s expense.

18 -

SIGNATURE PAGE TO FOLLOW

19 -

THE PARTIES HERETO affix their signatures as of the date shown below signatures.