2009 Annual Shareholders Meeting

February 11, 2009

Forward Looking Statements

This presentation contains statements about future events that constitute forward-

looking statements within the meaning of the Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934. Such forward-looking

statements may be identified by reference to a future period or periods, or by the use of

forward- looking terminology, such as “may,” “will,” “believe,” “expect,” or similar terms

or variations on those terms, or the negative of those terms. Forward-looking statements

are subject to numerous risks and uncertainties, including, but not limited to, those

risks previously disclosed in the Company’s filings with the SEC, general economic

conditions, changes in interest rates, regulatory considerations, competition,

technological developments, retention and recruitment of qualified personnel, and

market acceptance of the Company’s pricing, products and services, and with respect to

the loans extended by the Bank and real estate owned, the following: risks related to the

economic environment in the market areas in which the Bank operates, particularly with

respect to the real estate market in New Jersey; the risk that the value of the real estate

securing these loans may decline in value; and the risk that significant expense may be

incurred by the Company in connection with the resolution of these loans. The Company

wishes to caution readers not to place undue reliance on any such forward-looking

statements, which speak only as of the date made. The Company does not undertake

and specifically declines any obligation to publicly release the result of any revisions that

may be made to any forward-looking statements to reflect events or circumstances after

the date of such statements or to reflect the occurrence of anticipated or

unanticipated events.

2

Magyar Bancorp Overview

Founded in 1922

January 23, 2006 – Magyar Bancorp completed its

reorganization into the Mutual Holding Company form

On such date, Magyar Bancorp completed its Initial Public

Offering, raising $26.2 million. It currently has 45.7% of its

outstanding shares owned by public shareholders, including

MagyarBank Charitable Foundation. The remainder is owned

by Magyar Bancorp, MHC

Magyar operates five branch locations throughout Middlesex

and Somerset Counties in New Brunswick (2), North

Brunswick, South Brunswick and Branchburg

Magyar Bancorp trades on the NASDAQ Global Market under

the symbol MGYR

3

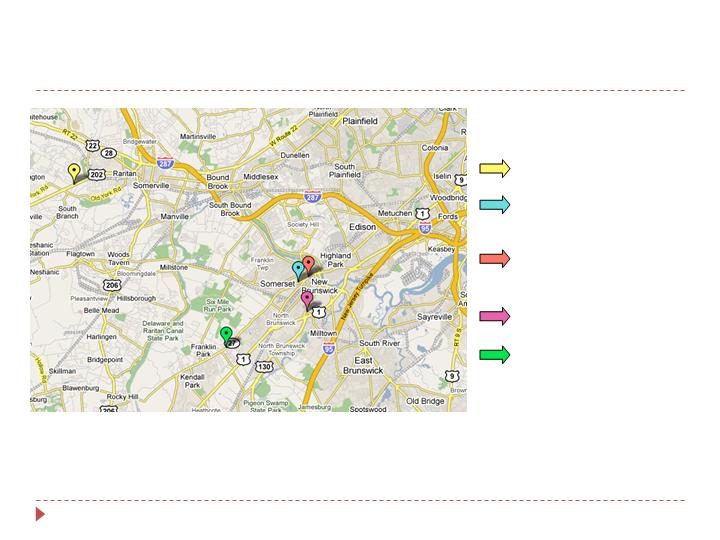

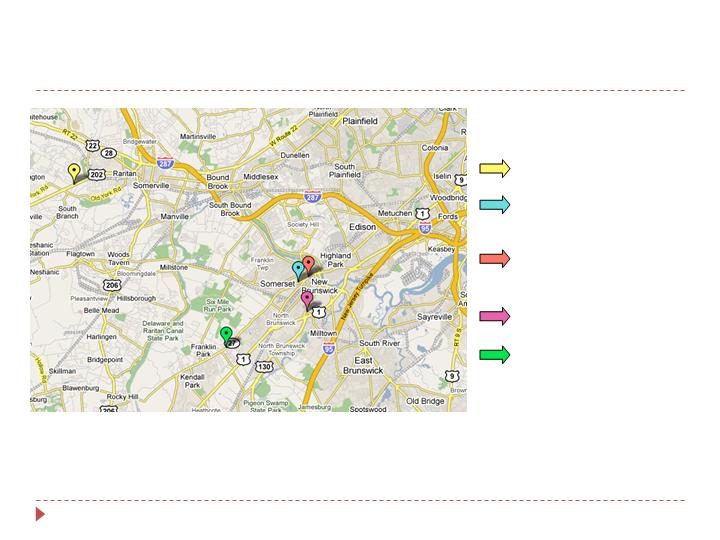

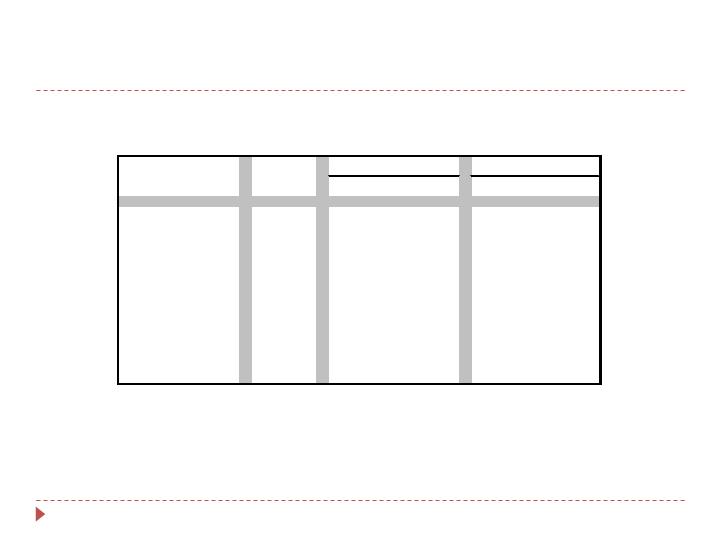

Magyar Bank Branch Locations

4

Branchburg

1000 Route 202 South

New Brunswick

(Corporate Headquarters)

400 Somerset Street

North Brunswick

582 Milltown Road

South Brunswick

3050 Highway 27

Existing Locations

New Brunswick

(Inside Child Health Institute)

93 French Street

2008 Year in Review

5

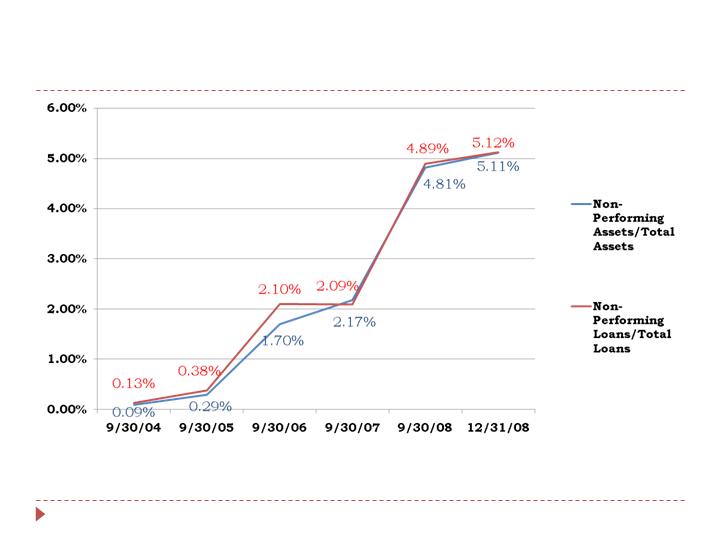

Impact of Economic Downturn on

Magyar Bancorp

Depreciation of collateral values securing

construction loans resulted in loan write downs

and additional loan loss provisions

Several large commercial and construction loans

moved into non-performing status

Increased loan loss provisions resulted in net loss

for Fiscal Year 2008 and Fiscal First Quarter 2009

6

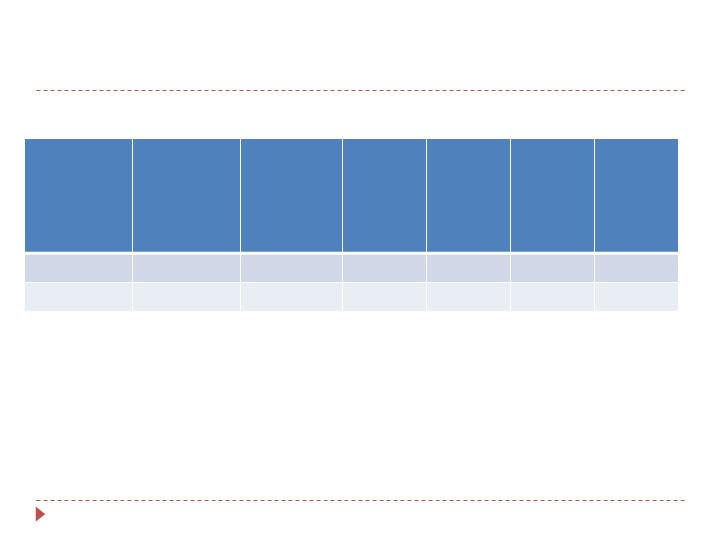

New Jersey Housing Market

7

County

3Q07

Median

Sales

Price

3Q08

Median

Sales

Price

%

Change

Homes

Sold

3Q07

Homes

Sold

3Q08

%

Change

Middlesex

$385,100

$375,600

-2.5%

1,499

1,203

-19.7%

Somerset

$508,400

$456,900

-10.1%

814

731

-10.2%

Source: New Jersey Association of Realtors

3rd Qtr. NJ Home Sales Report

Impact of Economic Downturn on

Magyar Bancorp

Residential mortgage portfolio – defined as 1-4

family closed end loans

90+ day delinquency rate as of 12/31/08: 0.91%

90+ day delinquency rate as of 12/31/07: 0.39%

8

2008 Financial Summary

9

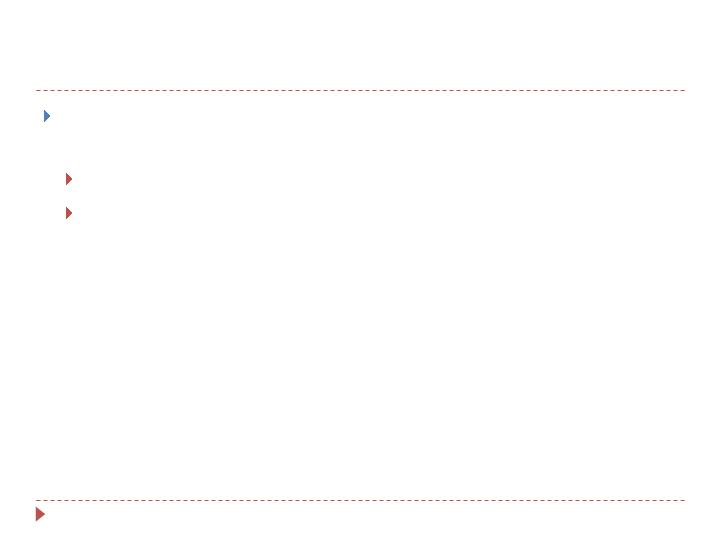

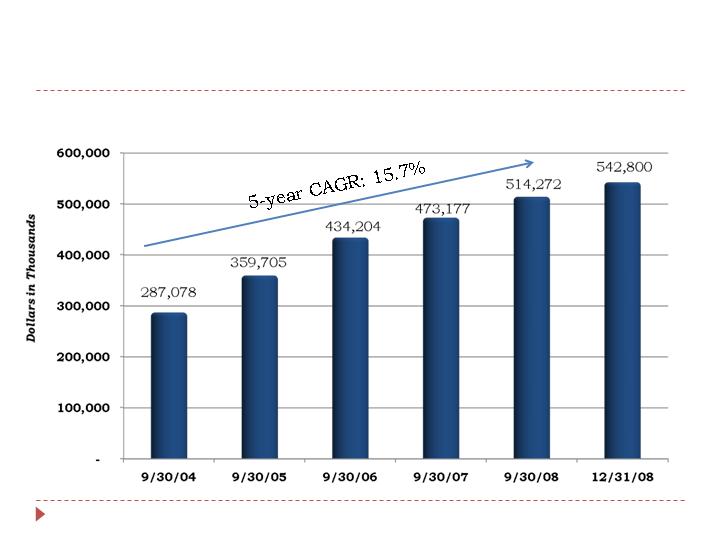

Asset Growth

10

Assets grew 8.7% in 2008

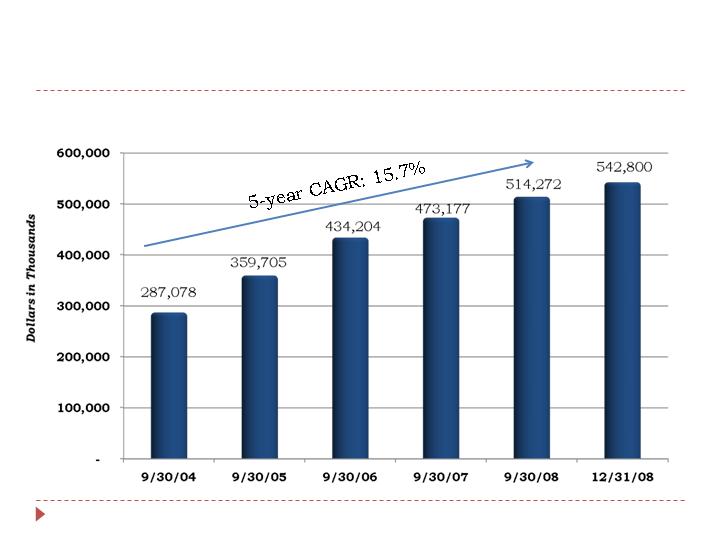

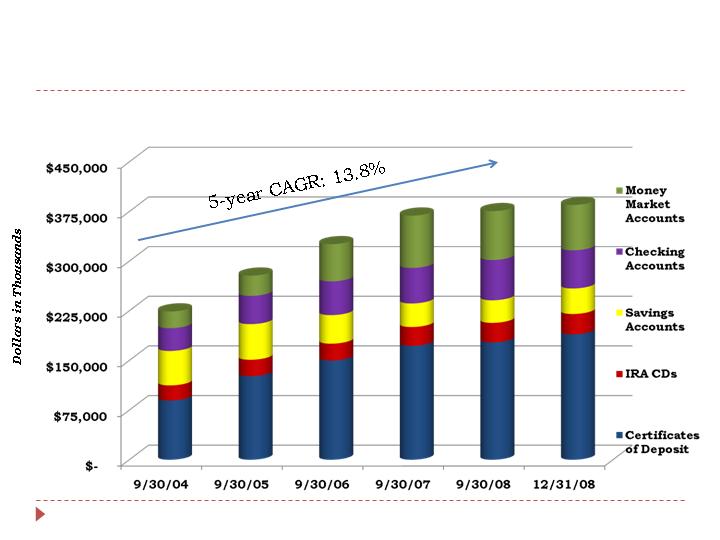

Deposit Growth

$223,974

$278,090

$325,602

$368,777

$375,560

11

$384,908

Deposits grew 1.8% in 2008

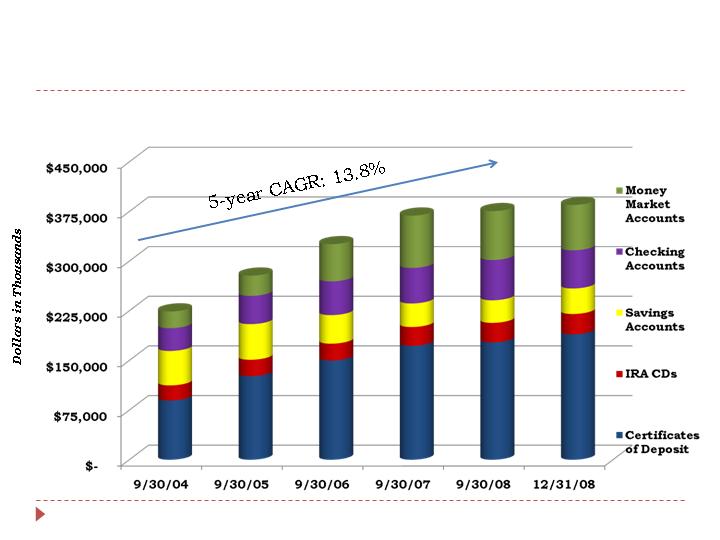

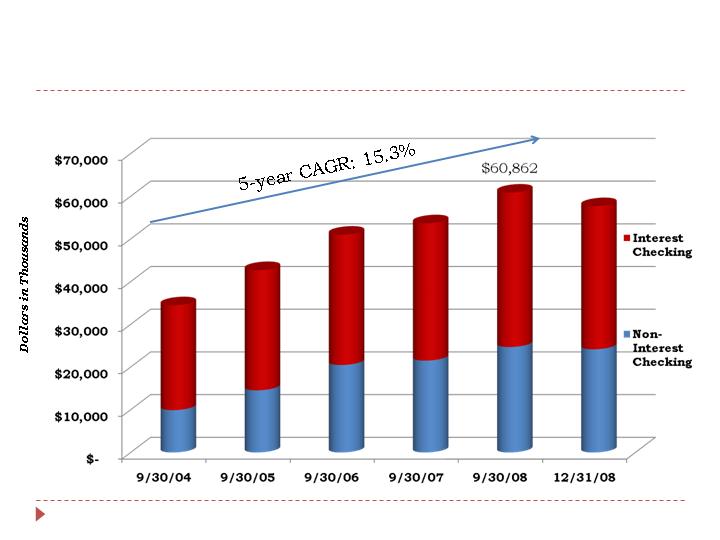

Growth in Non-Interest & Interest

Bearing Checking

12

$34,473

$42,715

$51,010

$53,672

$57,682

Non-Interest & Interest Bearing Checking grew 13.4% in 2008

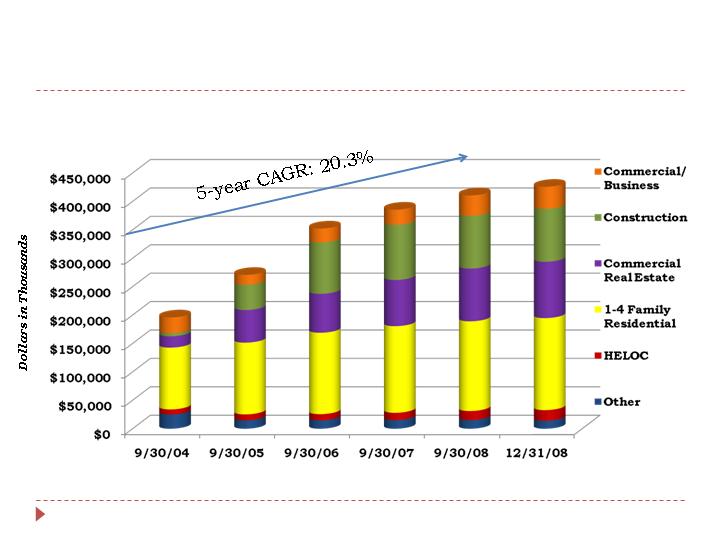

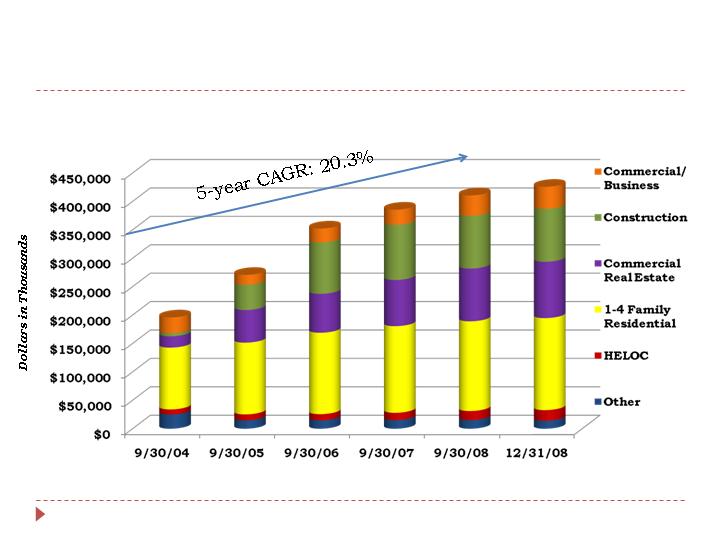

Loan Portfolio Growth

$195,910

$277,026

$352,353

$385,582

$410,651

13

$425,812

Loans grew 6.5% in 2008

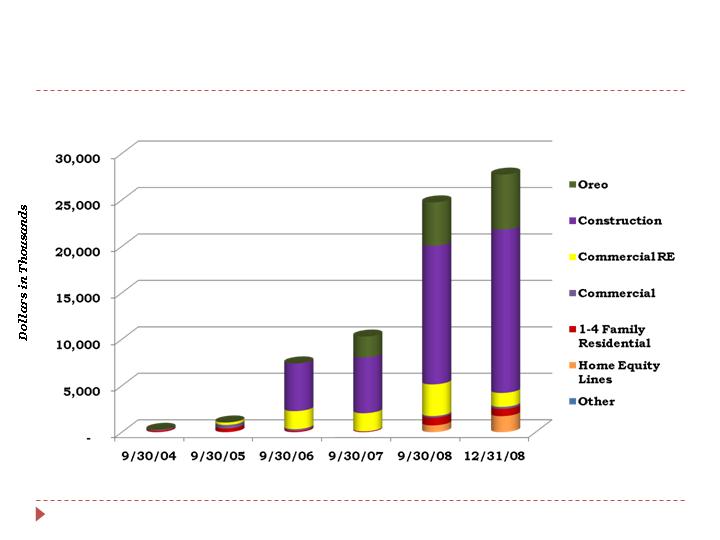

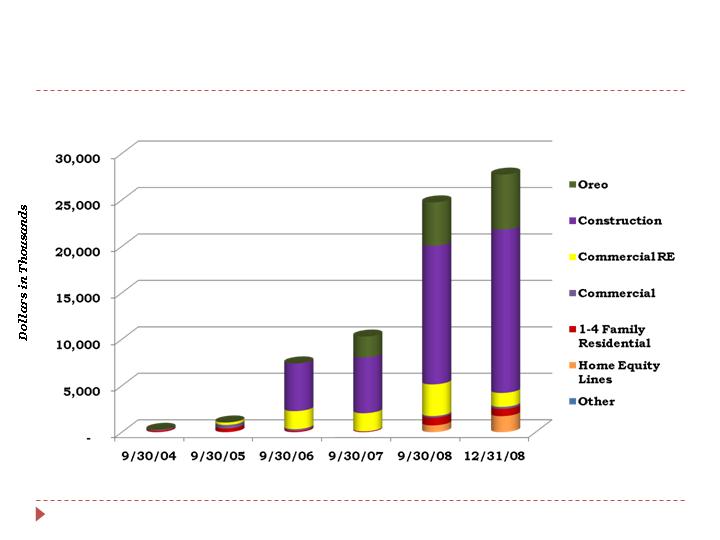

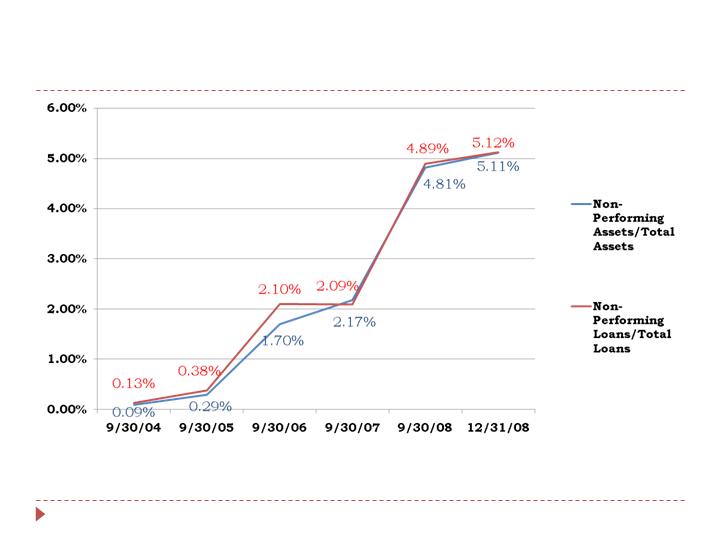

Non-Performing Assets

14

$247

$1,040

$7,400

$10,286

$24,734

$27,720

Asset Quality

15

16

Maintained Net Interest Margin in 2008

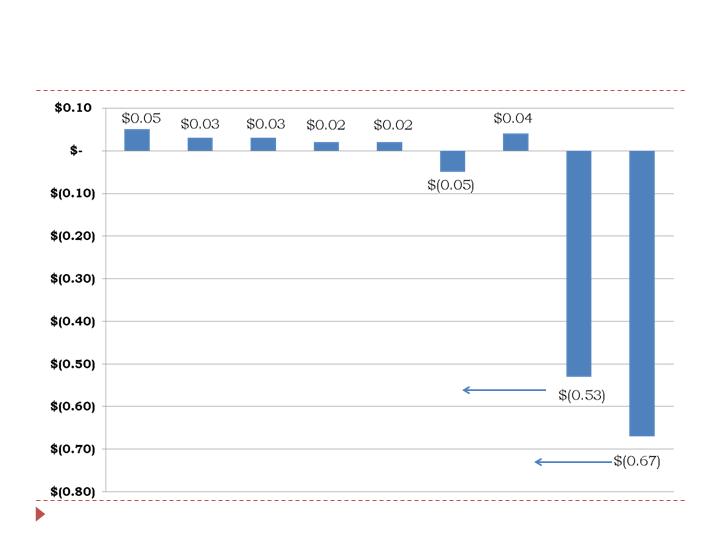

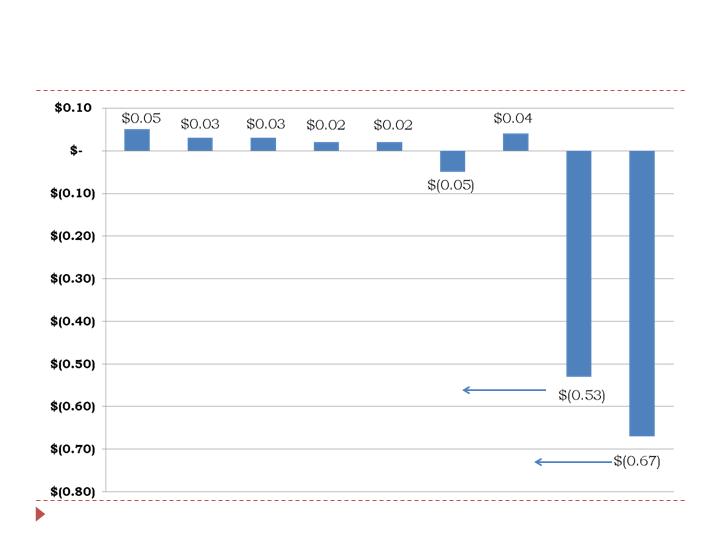

Quarterly Earnings Per Share

17

12/31/06 3/31/07 6/30/07 9/30/07 12/31/07 3/31/08 6/30/08 9/30/08 12/31/08

9/30/08 - $3.3 million loan loss provision

12/31/08 - $4.0 million loan loss provision

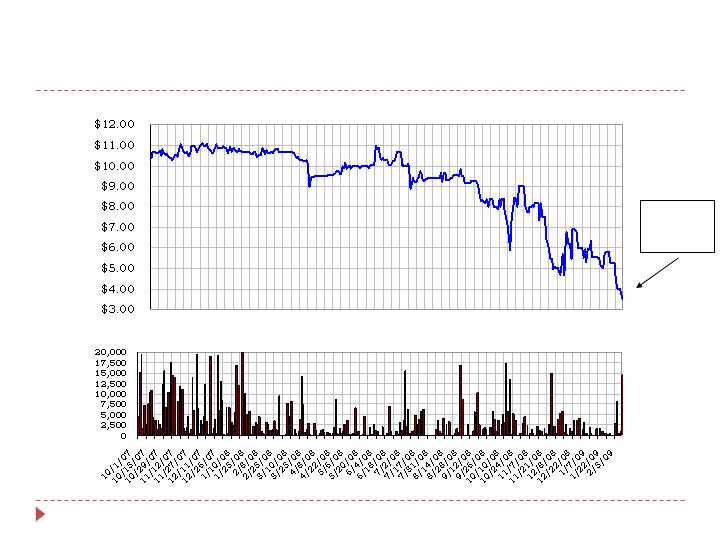

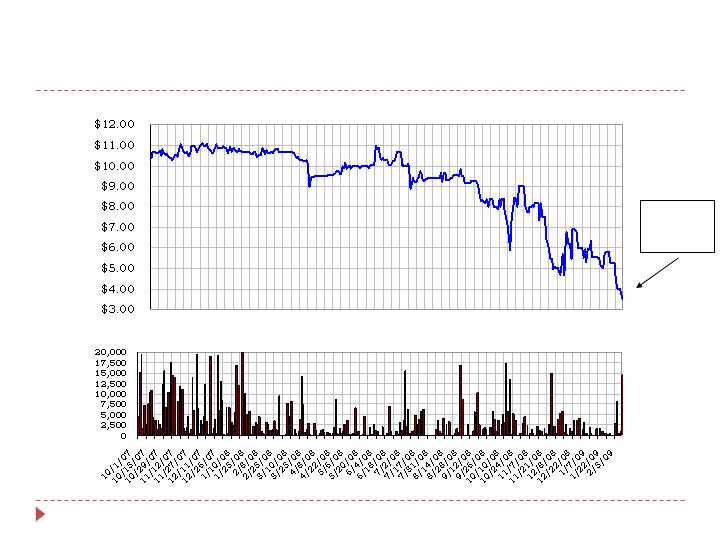

Stock Price Performance

18

19

MGYR Stock Price & Volume Chart

Price on

2/6/09

$3.50

20

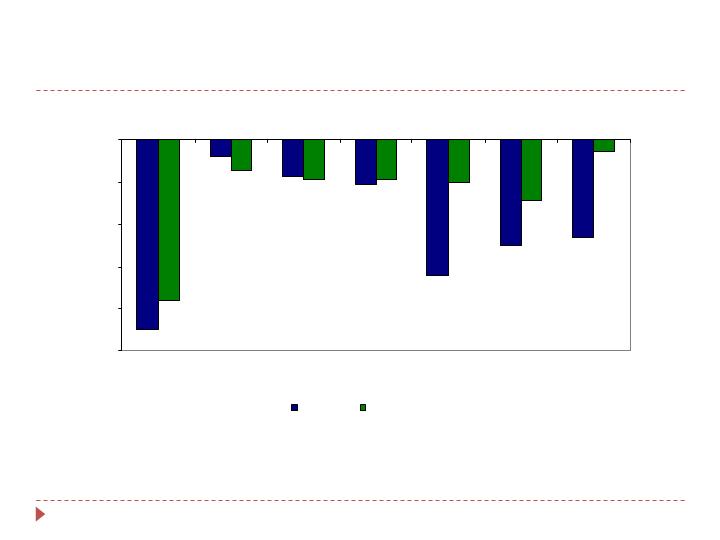

Market Trends

As of February 6, 2009

-67.50

-15.73

-37.34

-34.75

-48.07

-13.07

-5.79

-15.11

-4.01

-21.37

-14.13

-14.01

-10.98

-57.32

-75%

-60%

-45%

-30%

-15%

0%

MGYR

SNL Thrift

MHCs

NJ MHCs

Mid-Atlantic

MHCs

SNL Thrifts

Nasdaq Bank

S&P 500

Change LTM

Change Three Month

21

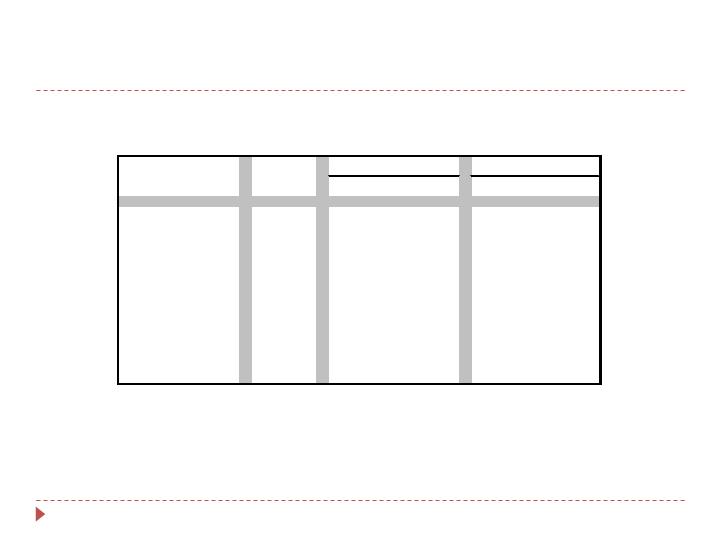

MGYR vs. MHCs

As of February 6, 2009

NM – Not Measureable

MGYR

Average

Median

Average

Median

Price

$3.50

Price/Earnings

NM

28.2x

24.5x

27.6x

27.7x

Price/LTM EPS

NM

31.7x

27.7x

33.5x

28.1x

Price/Book

47.0%

107.6%

98.6%

118.3%

121.8%

Price/Tang Book

47.0%

117.3%

104.8%

131.7%

134.2%

Nationwide MHCs

NJ MHCs

Stock Buyback Update

5% Buyback of 130,927 shares, announced

April 2007

Completed November 2007

Second 5% Buyback of 129,924 shares

announced November 2007

63,770 shares purchased through December 31,

2008

22

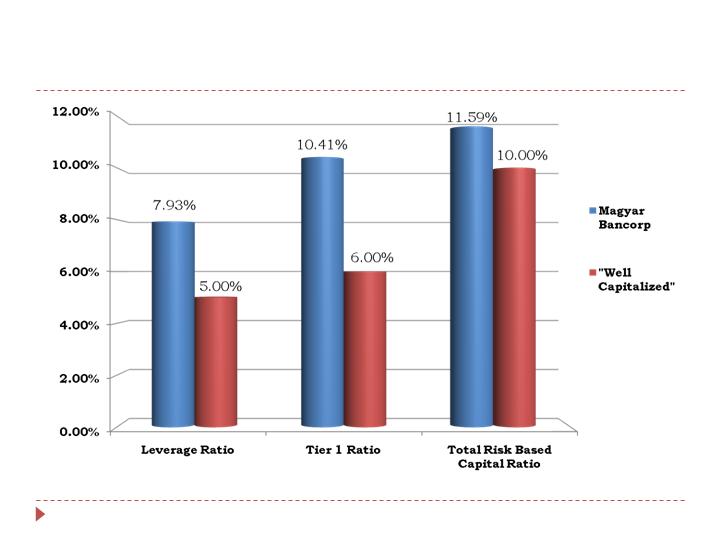

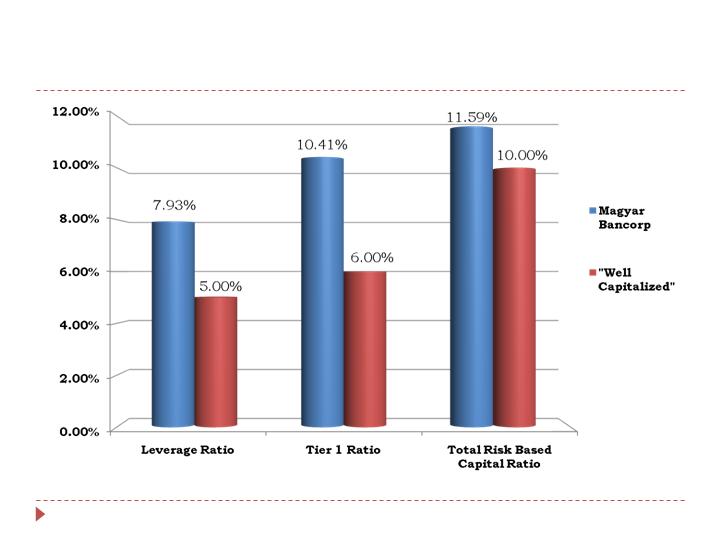

Capital Adequacy

23

As of December 31, 2008

Magyar Continues to be an Active

Leader in the Community

24

Community Involvement

25

HARP – Housing Assistance Recovery Program

Pilot program developed by Magyar Bank and First

Baptist Community Development Corporation (CDC),

Somerset, NJ

2008 Chris Kjeldsen Award

Presented by the Middlesex County Chamber of

Commerce

2008 Improving Financial Literacy Award

Presented by America’s Community Bankers

2008 Community Service Award

Presented by the NJ League of Community Bankers

MagyarBank Charitable Foundation made $92,000 of

grants in 2008

2009 Strategic Initiatives

26

Looking Ahead to 2009

Reduce non-performing assets

Reduce exposure to construction loans

Focus on residential and commercial lending

opportunities with a conservative underwriting approach

Gain deposit market share from dissatisfied customers

of national and regional banks and brokerage houses

Continue our commitment to support the local

community

27

Enhance shareholder value by positioning the Company

to take advantage of the eventual economic recovery

Any Questions?

28