2010 Annual Shareholders Meeting

February 23, 2010

Forward Looking Statements

This presentation contains statements about future events that constitute forward looking

statements within the meaning of the Section 27A of the Securities Act of 1933 and Section 21E of

the Securities Exchange Act of 1934. Such forward-looking statements may be identified by reference

to a future period or periods, or by the use of forward- looking terminology, such as “may,” “will,”

“believe,” “expect,” or similar terms or variations on those terms, or the negative of those terms.

Forward-looking statements are subject to numerous risks and uncertainties, including, but not

limited to, those risks previously disclosed in the Company’s filings with the SEC, general economic

conditions, changes in interest rates, regulatory considerations, competition, technological

developments, retention and recruitment of qualified personnel, and market acceptance of the

Company’s pricing, products and services, and with respect to the loans extended by the Bank and

real estate owned, the following: risks related to the economic environment in the market areas in

which the Bank operates, particularly with respect to the real estate market in New Jersey; the risk

that the value of the real estate securing these loans may decline in value; and the risk that

significant expense may be incurred by the Company in connection with the resolution of these

loans. The Company wishes to caution readers not to place undue reliance on any such forward-

looking statements, which speak only as of the date made. The Company does not undertake and

specifically declines any obligation to publicly release the result of any revisions that may be made to

any forward-looking statements to reflect events or circumstances after the date of such statements

or to reflect the occurrence of anticipated or unanticipated events.

Fiscal Year 2009 Highlights

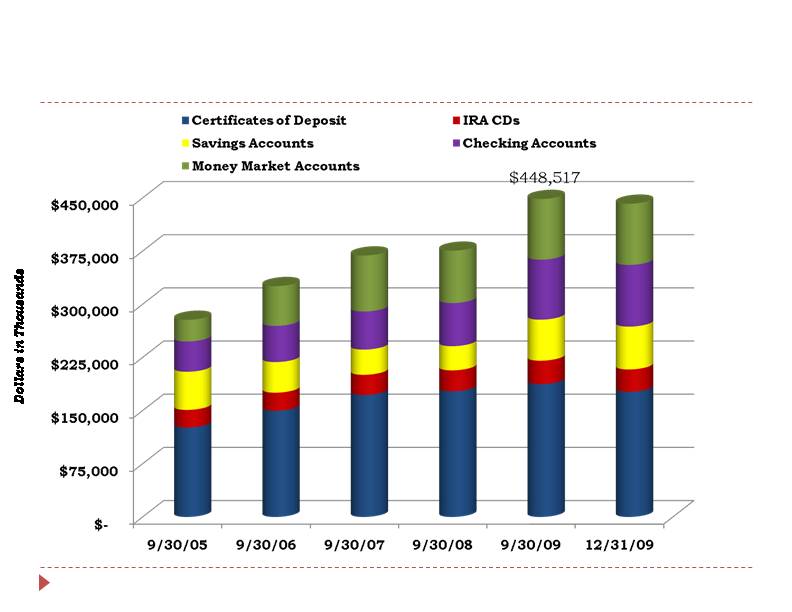

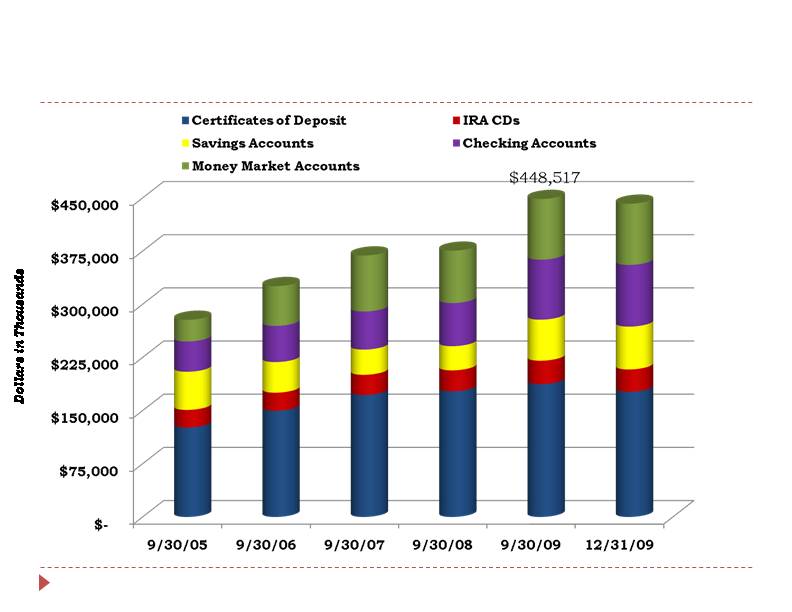

Deposit growth of 19.4%

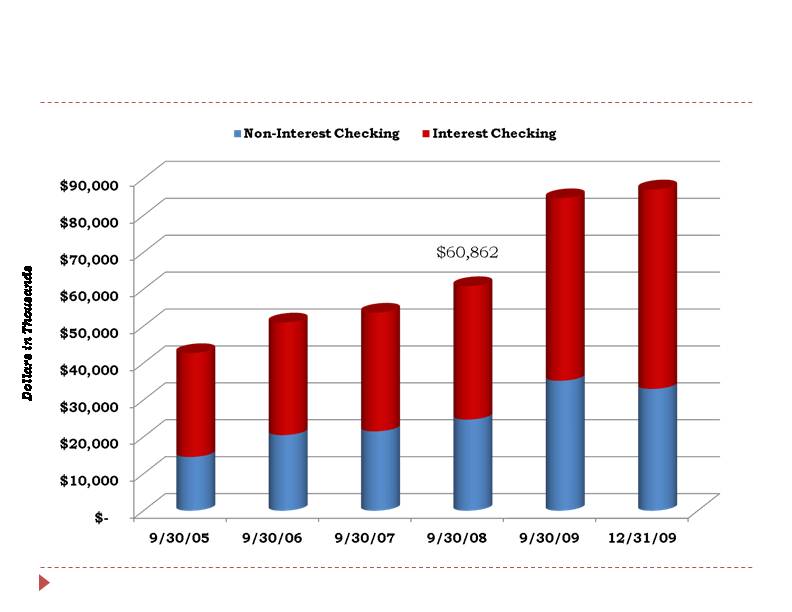

Checking deposits increased 39.1%

Reduced dependency on high cost CDs

Yield and margin expansion

Implemented expense controls and reduced non-

interest expenses as a percentage of average assets

Increased non-interest income as a percentage of

average assets

Remained Well Capitalized

Magyar Management Transition

Elizabeth E. Hance resigned as President and CEO

and Director of Magyar Bank and Magyar Bancorp,

December 23, 2009

John S. Fitzgerald named Acting President and Chief

Executive Officer on December 23, 2009

Previously served as Magyar Bank’s Executive Vice

President/Chief Operating Officer since 2007

Joined Magyar in 2001

Over 24 years experience in Banking Industry

Magyar General Information

Magyar Bank established in 1922

Magyar Bancorp completed its reorganization into

the Mutual Holding Company structure and public

offering in 2006

5 branches in Middlesex and Somerset Counties

Trades on NASDAQ under symbol MGYR

Main business lines/strategy:

Full-service Commercial Bank

Commercial/Residential lending & deposits

Community Banking is our business strategy

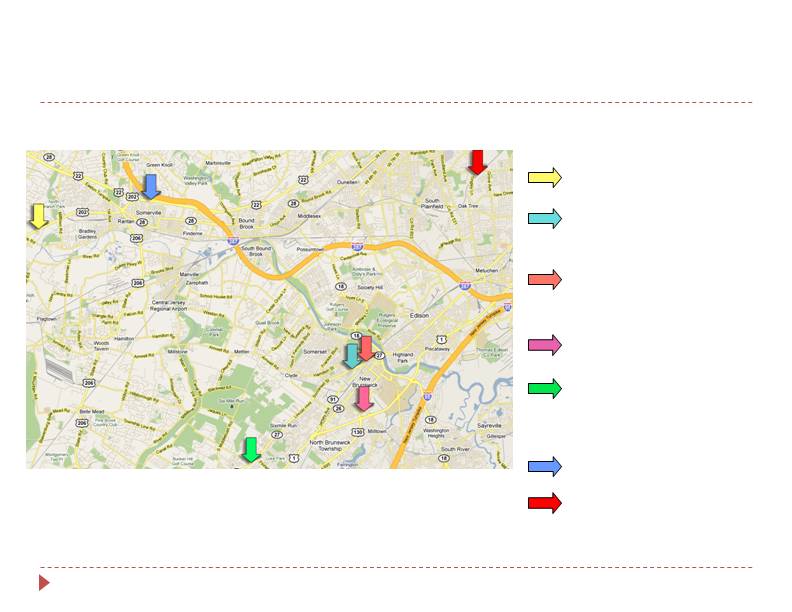

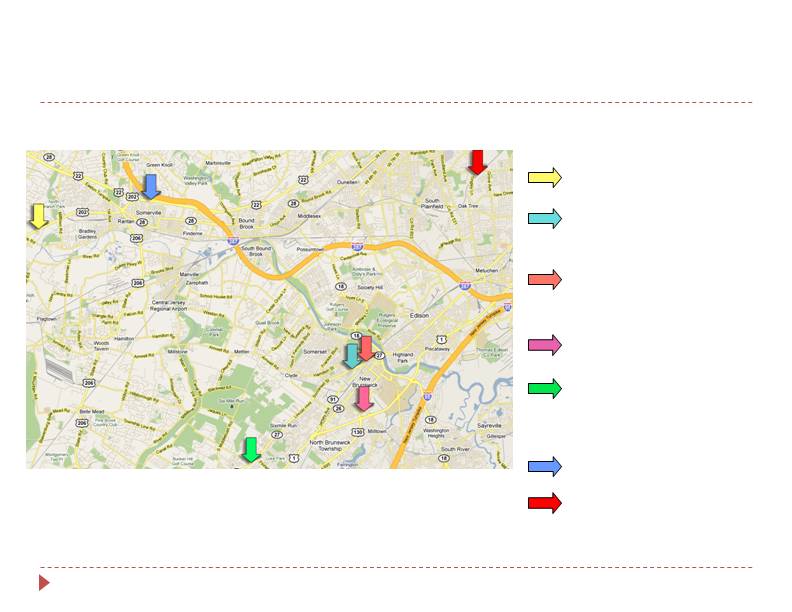

Magyar Bank Branch Locations

Branchburg

1000 Route 202 South

New Brunswick

(Corporate Headquarters )

400 Somerset Street

North Brunswick

582 Milltown Road

South Brunswick

3050 Highway 27

Existing Locations

New Brunswick

(Inside Child Health Institute)

93 French Street

Coming Soon…

Bridgewater

Edison

Fiscal Year 2009 Financial Summary

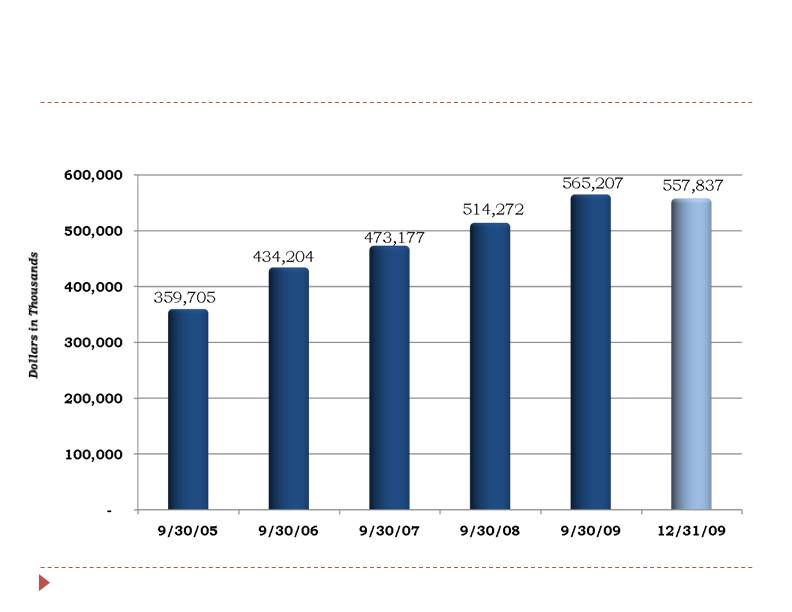

Total Assets Grew 9.9% in FY2009

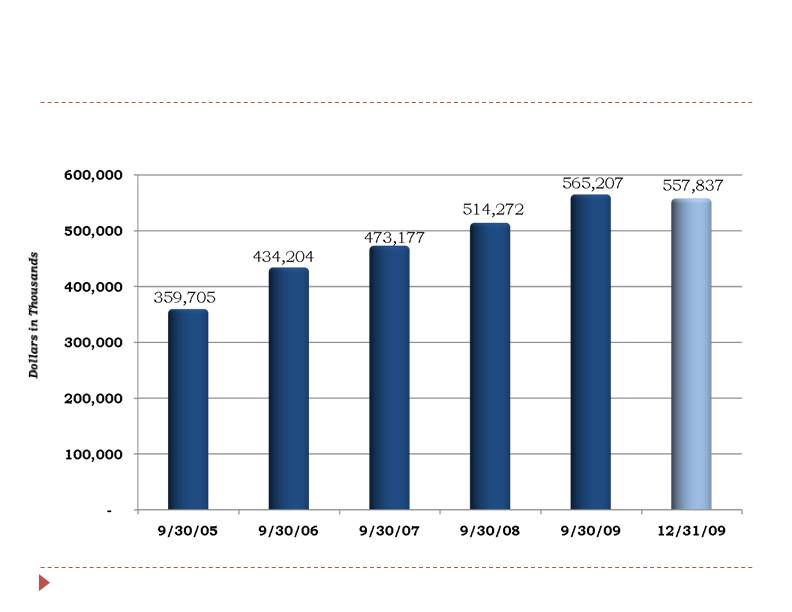

Deposits Grew 19.4% in FY2009

$278,090

$325,602

$368,777

$375,560

$441,888

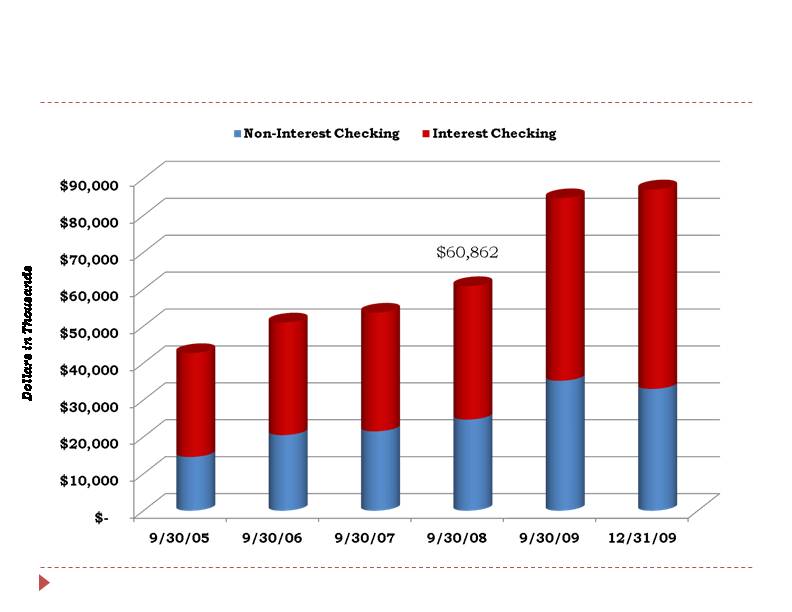

Checking Deposits grew 39.1% in FY2009

$42,715

$51,010

$53,672

$84,677

$87,064

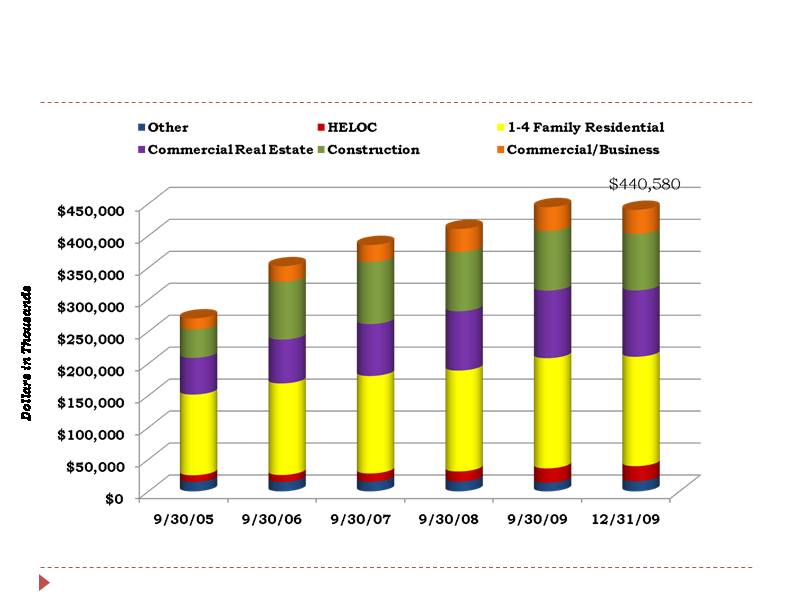

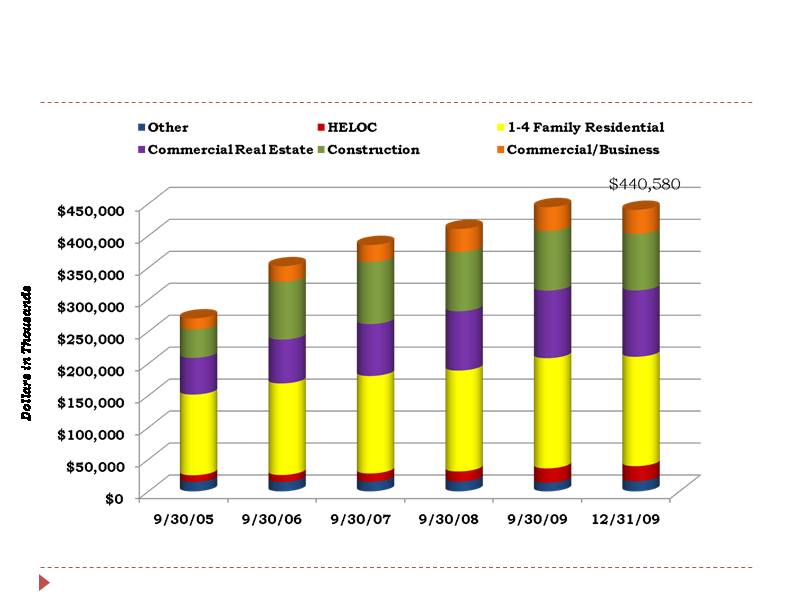

Loans Grew 8.3% in FY2009

$270,726

$352,353

$385,582

$410,728

$444,780

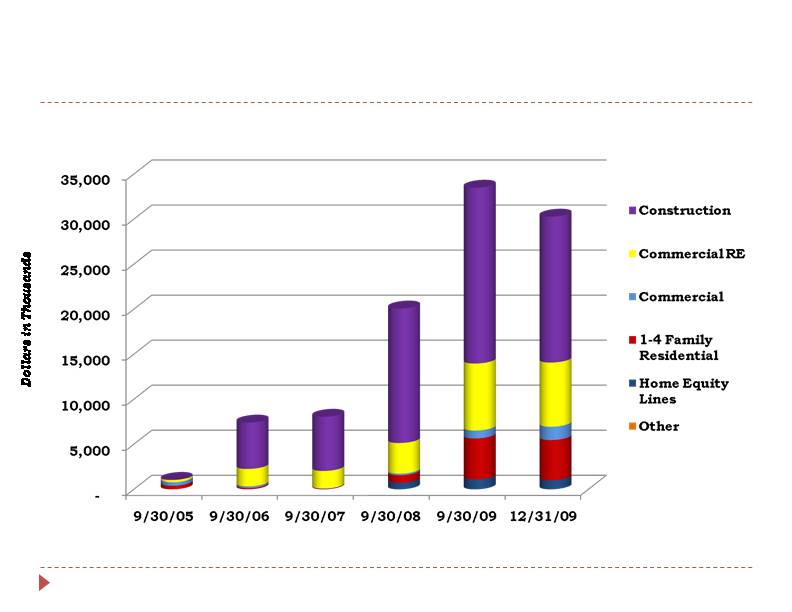

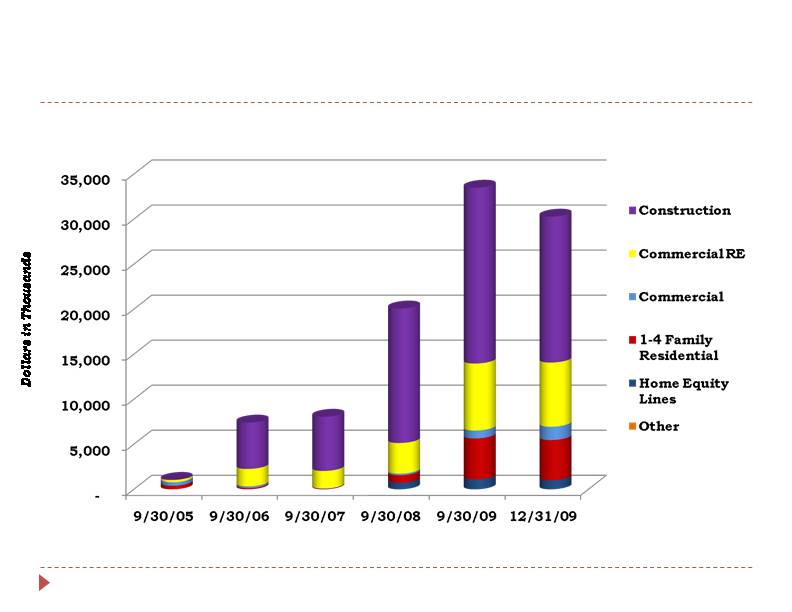

Non-Performing Loans

$1,040

$7,400

$8,048

$20,068

$33,484

$30,270

Other Real Estate Owned

$0

$0

$2,238

$4,666

$5,562

$8,976

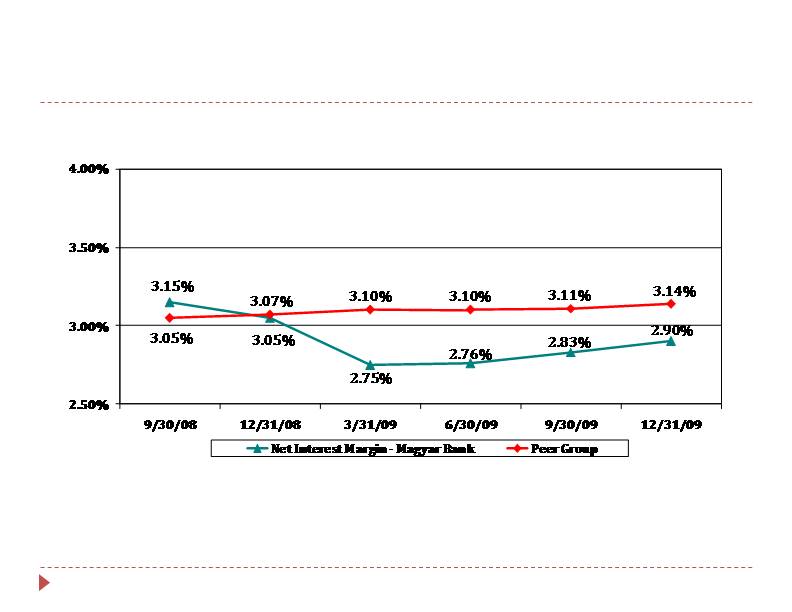

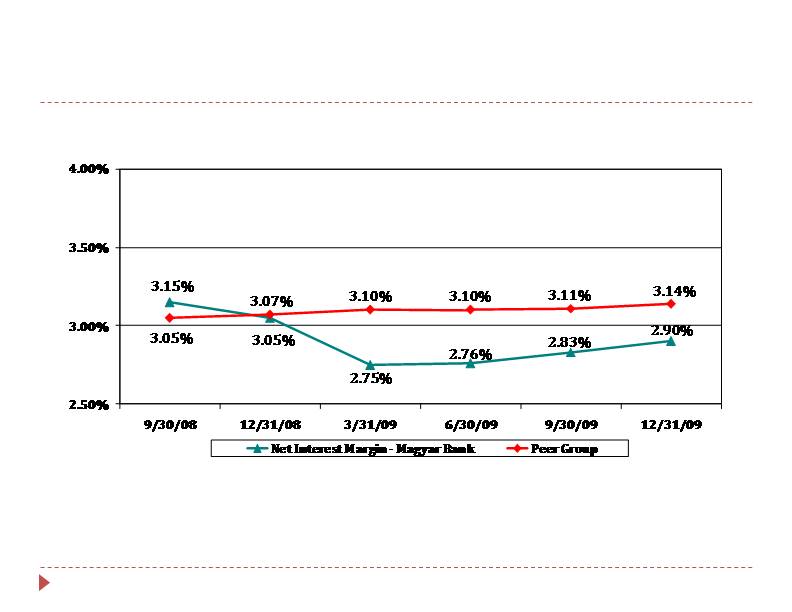

Net Interest Margin

Peer Group Source: FDIC UBPR data – Banks with total assets $300M - $1B

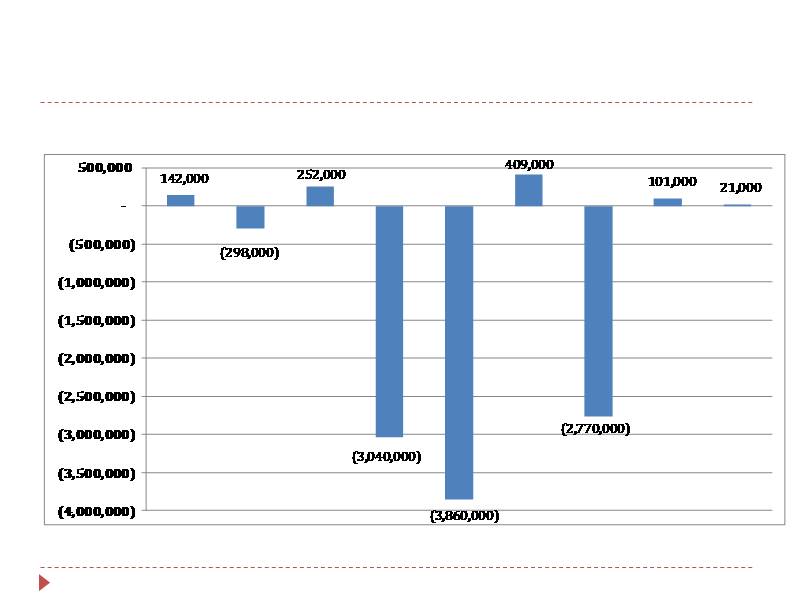

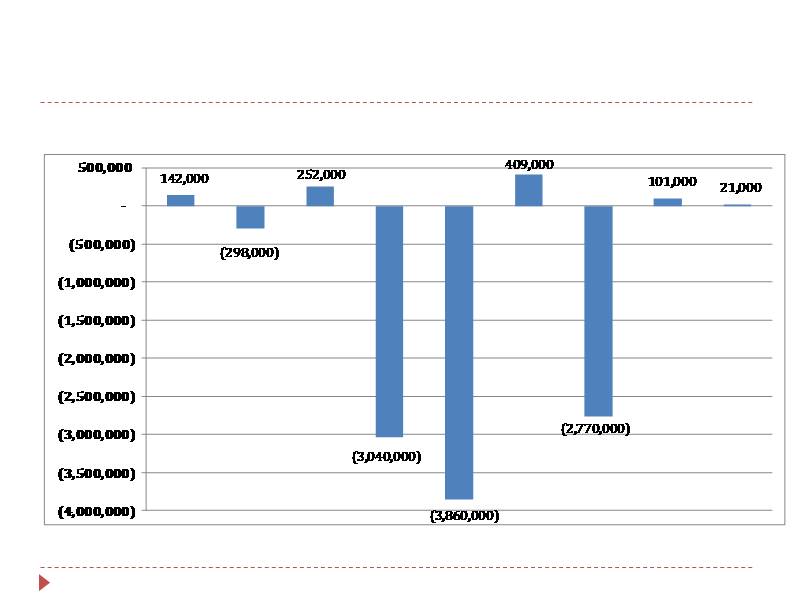

Quarterly Net Income (Loss)

12/31/07 3/31/08 6/30/08 9/30/08 12/31/08 3/31/09 6/30/09 9/30/09 12/31/09

$3.3 million

loan loss

provision

$4.0 million

loan loss

provision

$3.2 million

loan loss

provision

Net Income

$ 537,000

excluding

one-time

items

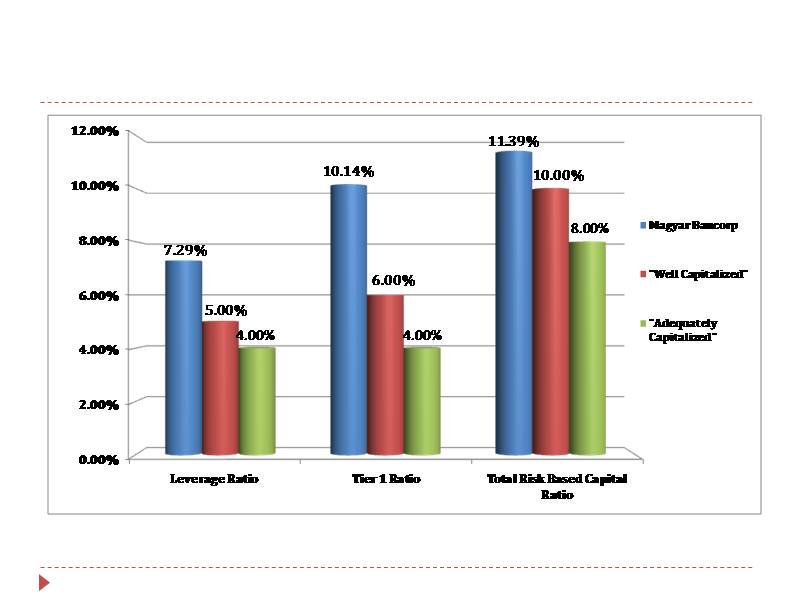

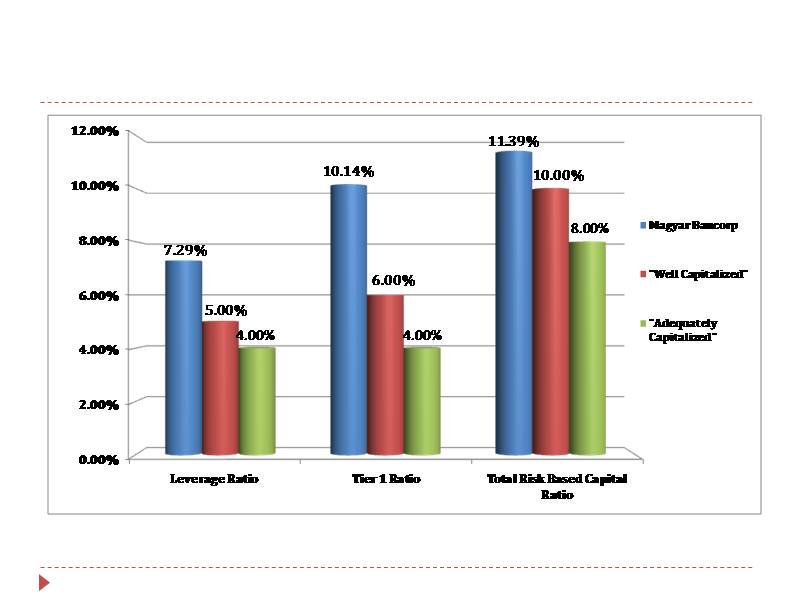

Magyar remains “Well-Capitalized”

As of December 31, 2009

Expense Reduction Program

Expense Reduction Program

Implemented March 2009 and included

10% staff reduction

Suspension of 401(k) match

Salary freeze

Expected to play a larger role in Fiscal Year 2010

with a full year’s impact

Net operating expense as a percentage of average

assets decreased from 2.63% at year-end 2008 to

2.42% at fiscal year-end 2009

Board Compensation Reduced

Retainer paid to Directors for Magyar Bancorp

suspended

Board size reduced to seven members

Combined, these actions are expected to reduce cash

compensation to Directors by 24% in Fiscal Year

2010

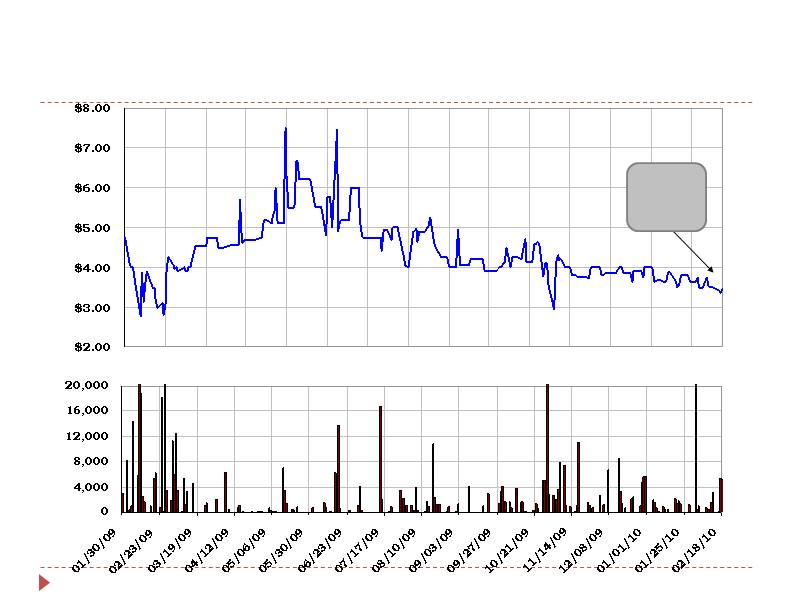

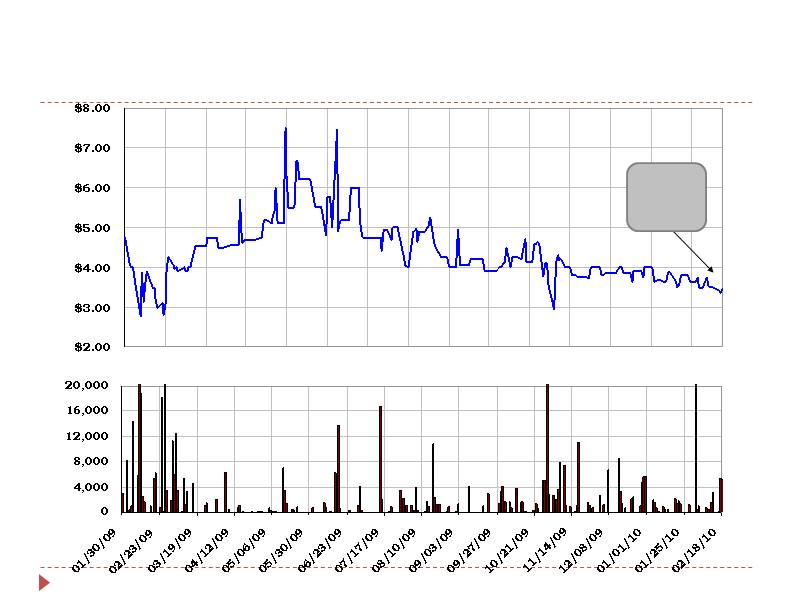

Stock Price Performance

MGYR Stock Price & Volume Chart

Price on

2/18/10

$3.45

Fiscal Year 2010 Strategic Initiatives

Fiscal Year 2010 Objectives

Focus on earnings

Reported Net Income of $21,000 in 1Q2010

Excluding one-time items, earnings were $537,000, $.09

EPS in 1Q2010

Reduce non-performing assets

Non-Performing Loans/Total Loans Receivable dropped to

6.87 % on 12/31/09 from 7.53% on 9/30/09

Focus on residential and commercial lending

opportunities

Fiscal Year 2010 Objectives

Continued growth in core deposits through

community involvement

Reduce Construction Loan portfolio

Continued improvement in Net Interest Margin

Magyar Bancorp Net Interest Margin increased to 3.11%

in 1Q10