1 2022 Annual Shareholders Meeting February 16, 2022

Forward Looking Statements This presentation contains statements about future events that constitute forward - looking statements within the meaning of the Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward - looking statements may be identified by reference to a future period or periods, or by the use of forward - looking terminology, such as “may,” “will,” “believe,” “expect,” or similar terms or variations on those terms, or the negative of those terms. Forward - looking statements are subject to numerous risks and uncertainties, including those risk - factors previously disclosed in the Company’s filings with the SEC, and the following: general economic conditions, changes in interest rates, regulatory considerations, competition, technological developments, retention and recruitment of qualified personnel, and market acceptance of the Company’s pricing, products and services, and risks related to the economic environment in the market areas in which the Bank operates, particularly with respect to the real estate market in New Jersey. In addition, the COVID - 19 pandemic has had and continues to have an adverse impact on the economy locally and nationally and may continue to adversely affect the Company’s business. The Company wishes to caution readers not to place undue reliance on any such forward - looking statements, which speak only as of the date made. The Company does not undertake and specifically declines any obligation to publicly release the result of any revisions that may be made to any forward - looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. 2

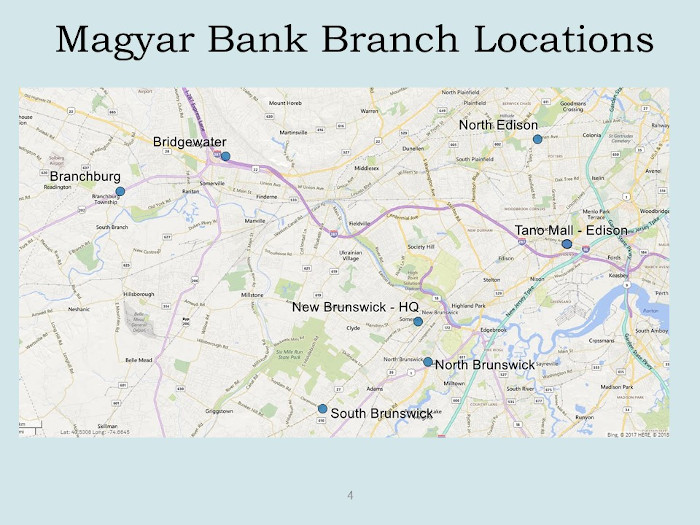

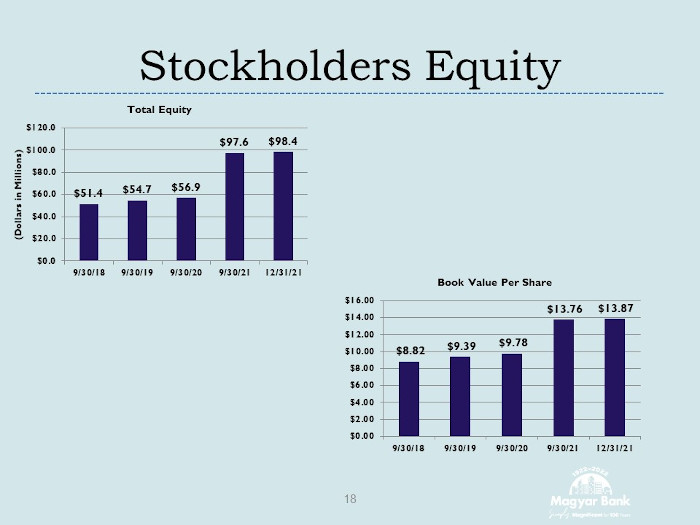

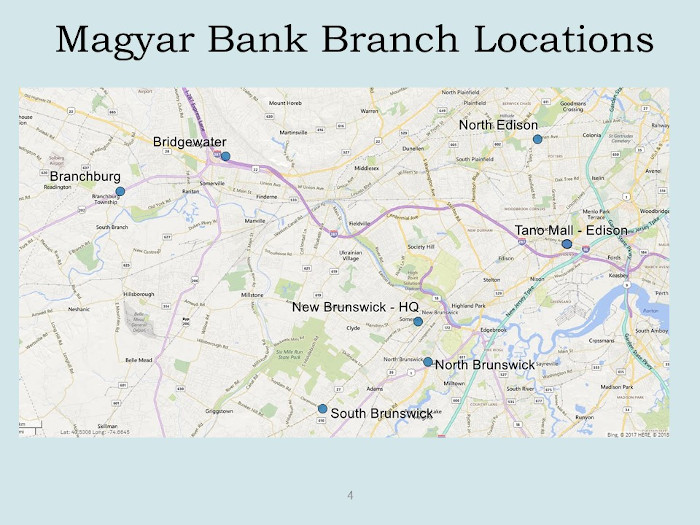

Magyar Bancorp, Inc. Overview ▪ Magyar Bank, a New Jersey chartered savings bank originally founded in 1922, is the wholly owned subsidiary of Magyar Bancorp, Inc. ▪ Magyar Bancorp, Inc., trades on NASDAQ under the symbol MGYR. ▪ As of December 31, 2021, we had $780 million in total assets, $583 million in net loans, $647 million in deposits and $98 million in stockholders’ equity. ▪ Magyar Bank conducts its business from its main office in New Brunswick and six additional branch offices located in North Brunswick, South Brunswick, Branchburg, Bridgewater, and two in Edison, New Jersey. ▪ Magyar Bank celebrates 100 years of service in 2022. Our website has an overview of our history and other information on special events taking place throughout the year, www.magbank.com . 3

4 Magyar Bank Branch Locations

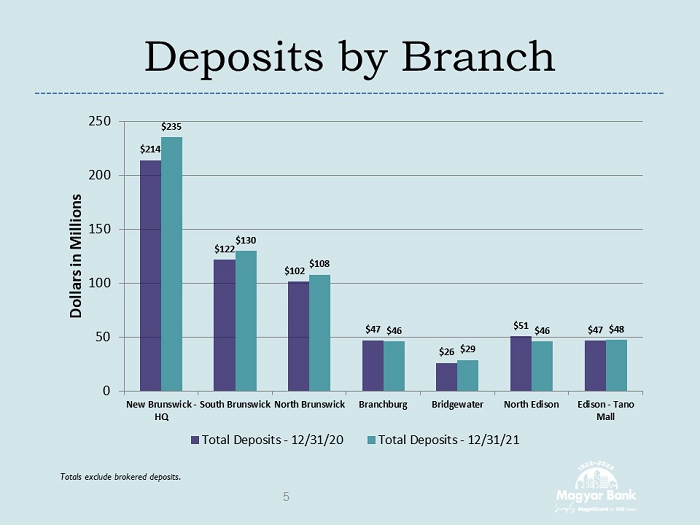

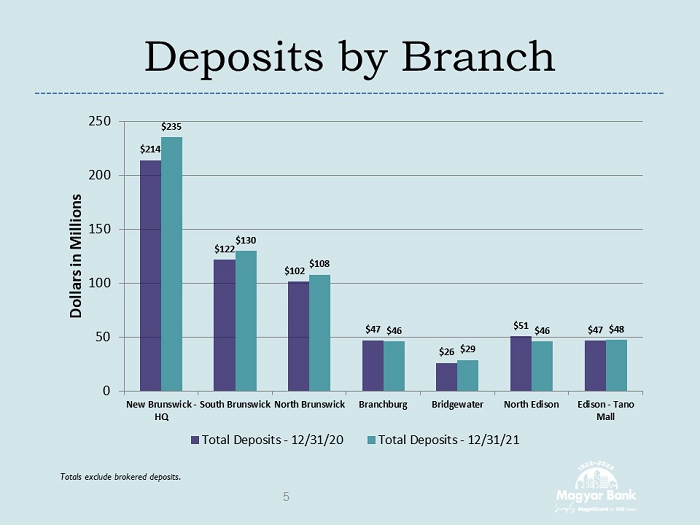

Deposits by Branch $214 $122 $102 $47 $26 $51 $47 $250 $130 $108 $46 $29 $46 $48 0 50 100 150 200 250 300 New Brunswick - HQ South Brunswick North Brunswick Branchburg Bridgewater North Edison Edison - Tano Mall Dollars in Millions Total Deposits - 12/31/20 Total Deposits - 12/31/21 5 Totals exclude brokered deposits .

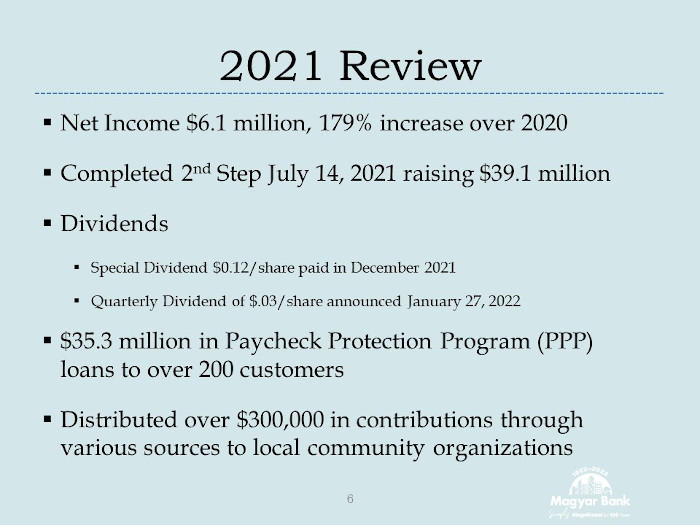

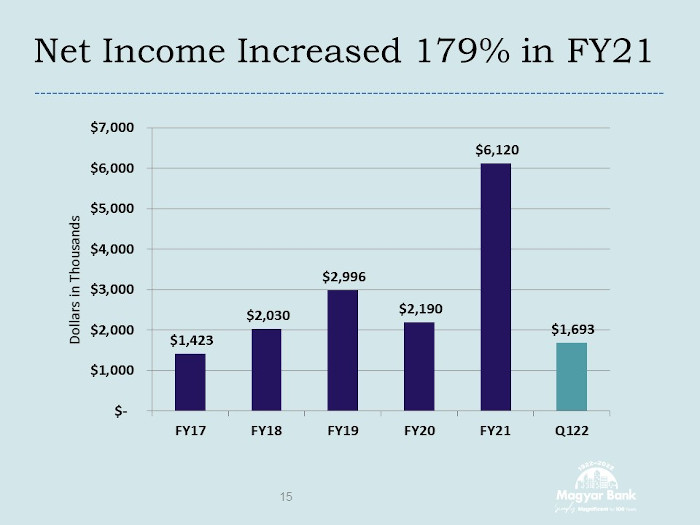

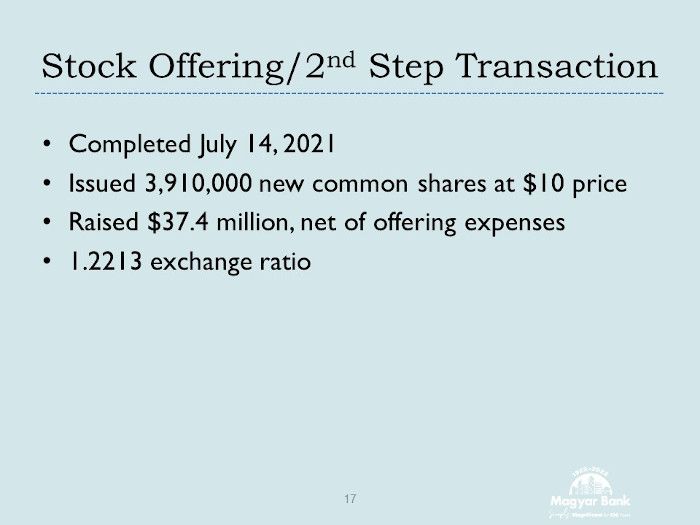

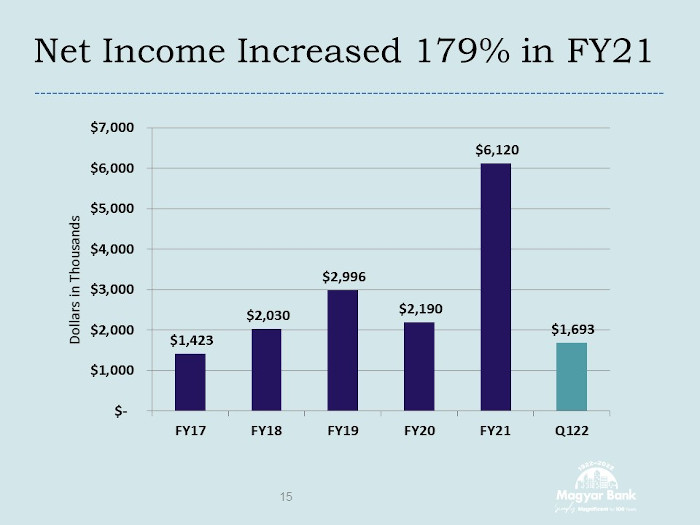

2021 Review ▪ Net Income $6.1 million, 179% increase over 2020 ▪ Completed 2 nd Step July 14, 2021 raising $39.1 million ▪ Dividends ▪ Special Dividend $0.12/share paid in December 2021 ▪ Quarterly Dividend of $.03/share announced January 27, 2022 ▪ $35.3 million in Paycheck Protection Program (PPP) loans to over 200 customers ▪ Distributed over $300,000 in contributions through various sources to local community organizations 6

Financial Highlights 7

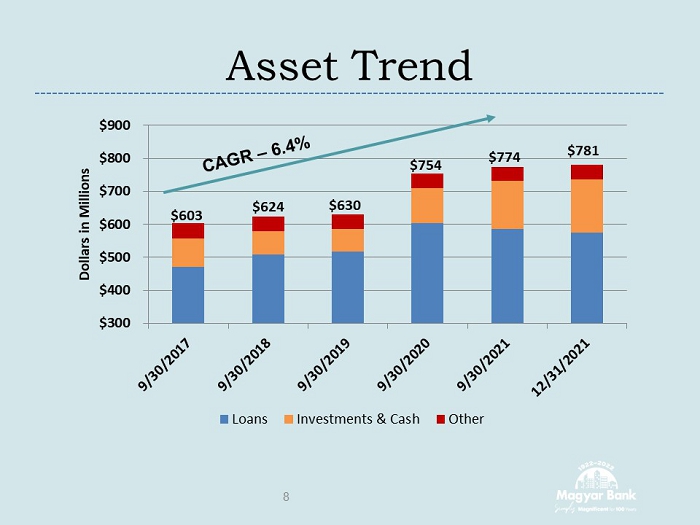

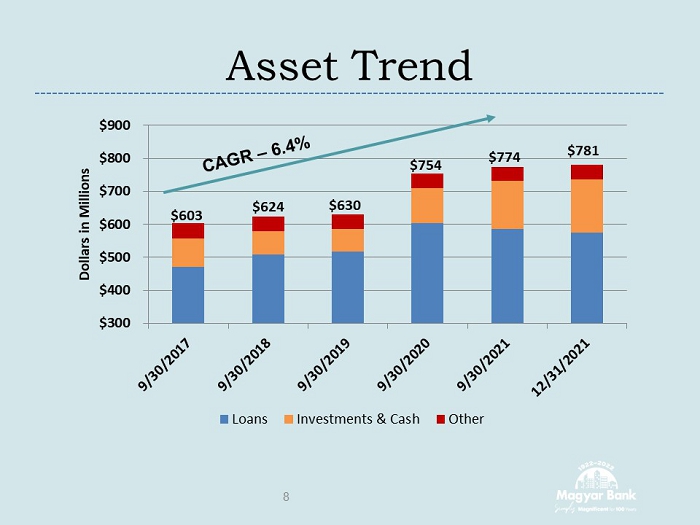

Asset Trend $300 $400 $500 $600 $700 $800 $900 Dollars in Millions Loans Investments & Cash Other $630 $774 $780 $624 $603 $754 8

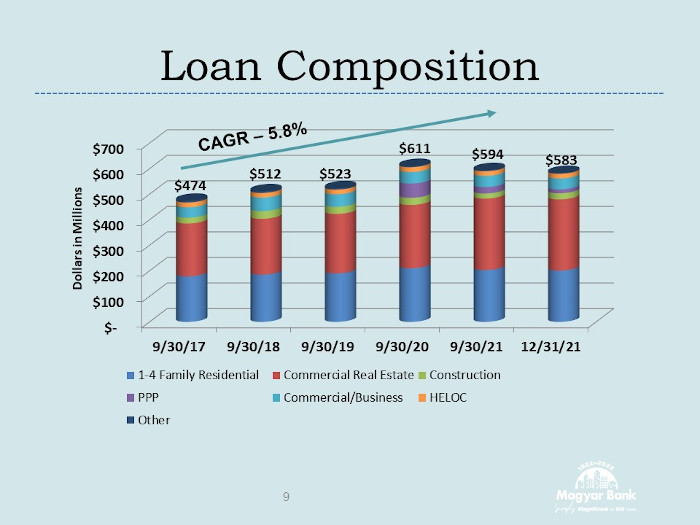

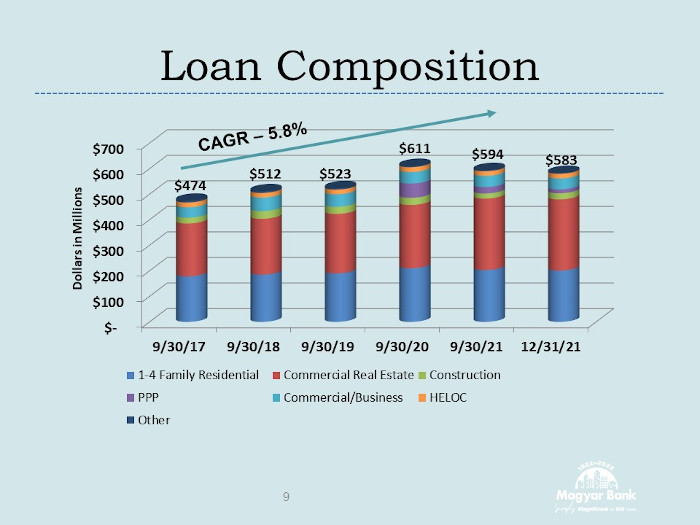

Loan Composition $- $100 $200 $300 $400 $500 $600 $700 9/30/17 9/30/18 9/30/19 9/30/20 9/30/21 12/31/21 Dollars in Millions 1-4 Family Residential Commercial Real Estate Construction PPP Commercial/Business HELOC Other 9 $523 $ 474 $512 $594 $611 $583

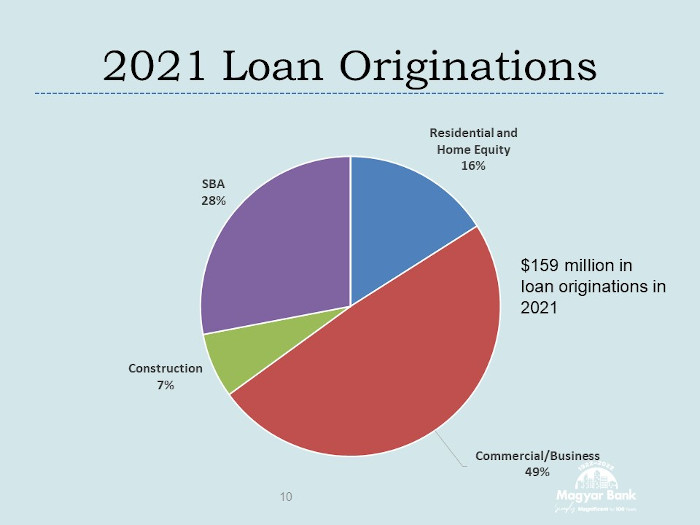

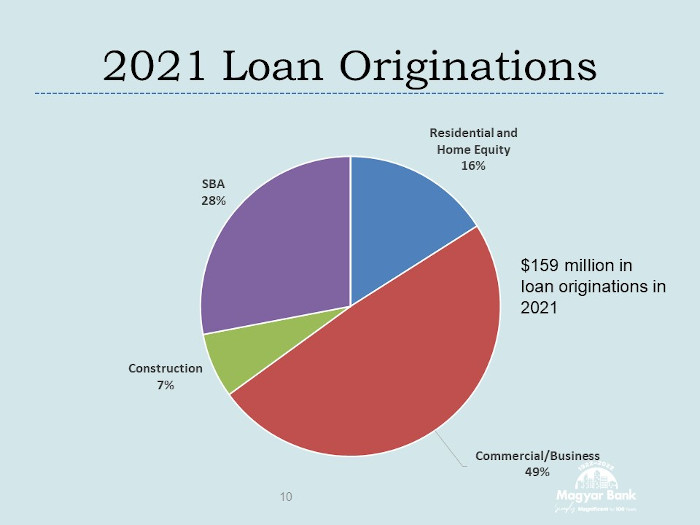

2021 Loan Originations Residential and Home Equity 16% Commercial/Business 49% Construction 7% SBA 28% 10 $159 million in loan originations in 2021

Non - Performing Assets/Assets 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 9/30/17 9/30/18 9/30/19 9/30/20 9/30/21 12/31/21 Non-Performing Loans OREO 1.63% 11 2.29% 0.88% 1.52% 2.22% 1.14%

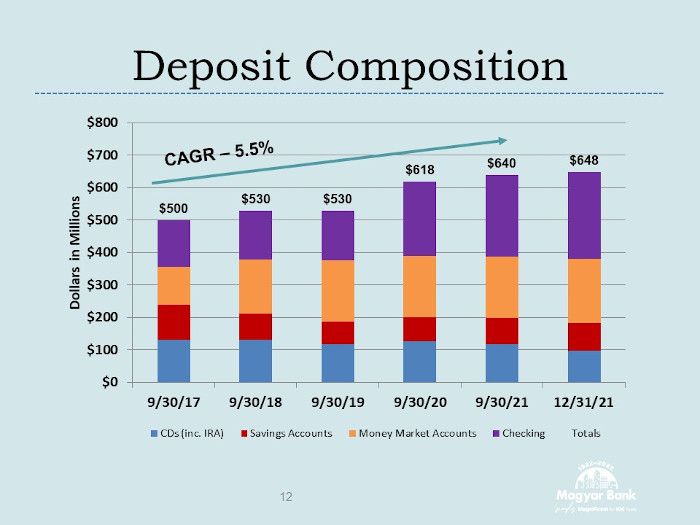

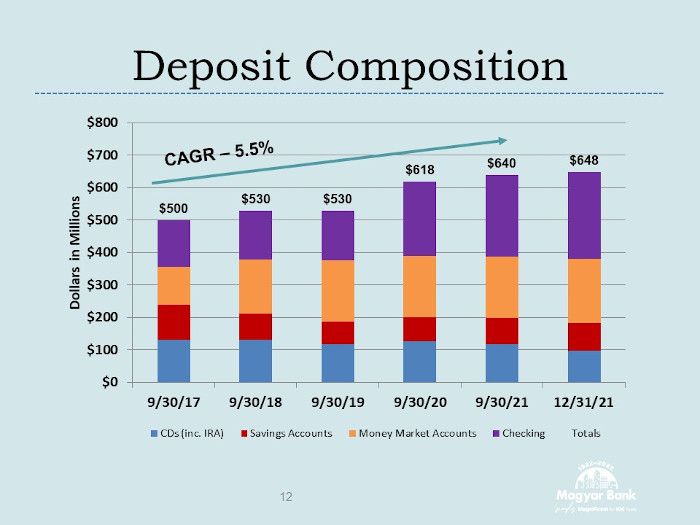

Deposit Composition $500 $530 $530 $618 $640 $648 $0 $100 $200 $300 $400 $500 $600 $700 $800 9/30/17 9/30/18 9/30/19 9/30/20 9/30/21 12/31/21 Dollars in Millions CDs (inc. IRA) Savings Accounts Money Market Accounts Checking Totals 12

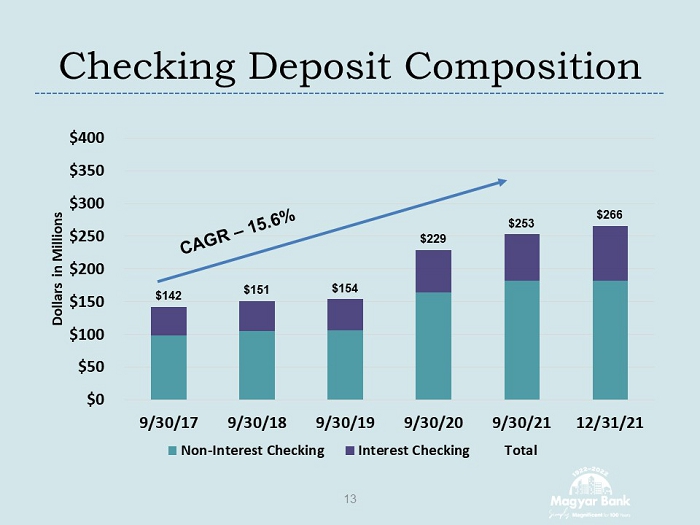

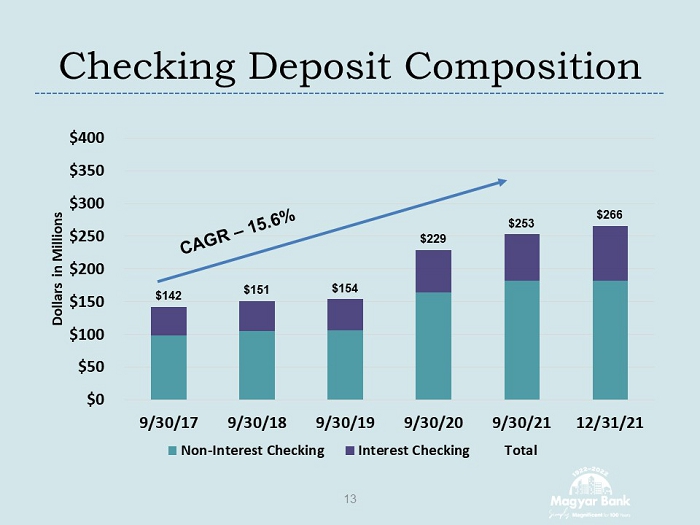

Checking Deposit Composition $142 $151 $154 $229 $253 $266 $0 $50 $100 $150 $200 $250 $300 $350 $400 9/30/17 9/30/18 9/30/19 9/30/20 9/30/21 12/31/21 Dollars in Millions Non-Interest Checking Interest Checking Total 13

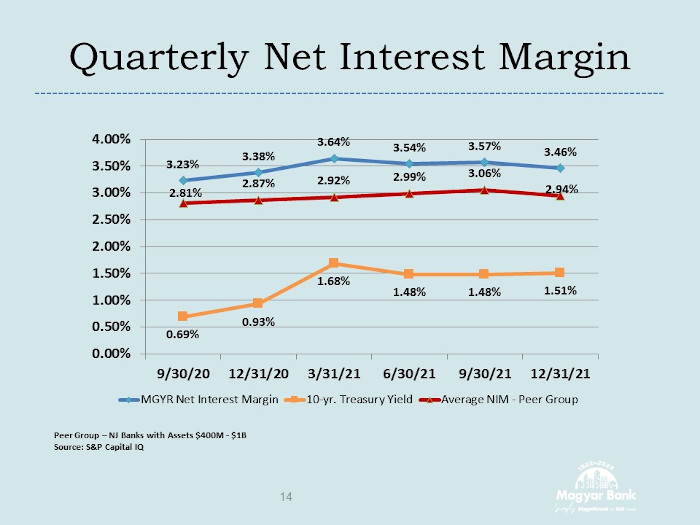

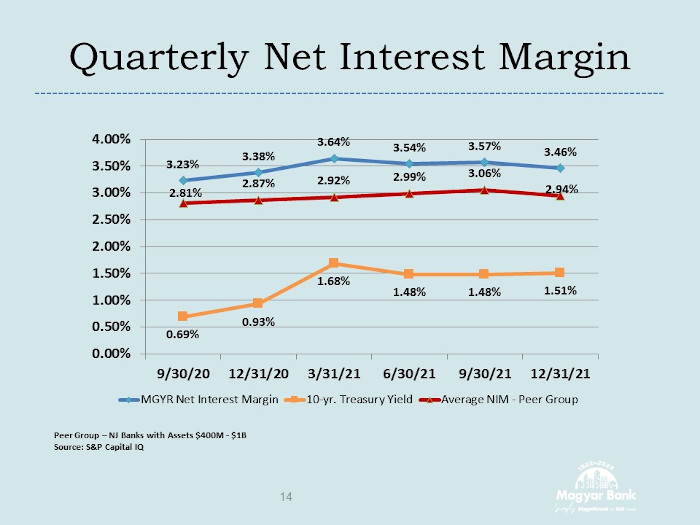

Quarterly Net Interest Margin 3.23% 3.38% 3.64% 3.54% 3.57% 3.46% 0.69% 0.93% 1.68% 1.48% 1.48% 1.51% 2.81% 2.87% 2.92% 2.99% 3.06% 2.94% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 9/30/20 12/31/20 3/31/21 6/30/21 9/30/21 12/31/21 MGYR Net Interest Margin 10-yr. Treasury Yield Average NIM - Peer Group 14 Peer Group – NJ Banks with Assets $400M - $1B Source: S&P Capital IQ

Net Income Increased 179% in FY21 $1,423 $2,030 $2,996 $2,190 $6,120 $1,693 $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 FY17 FY18 FY19 FY20 FY21 Q122 Dollars in Thousands 15

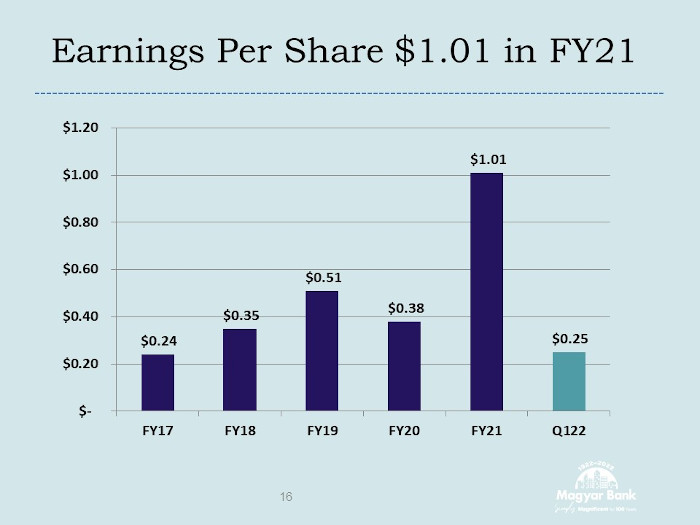

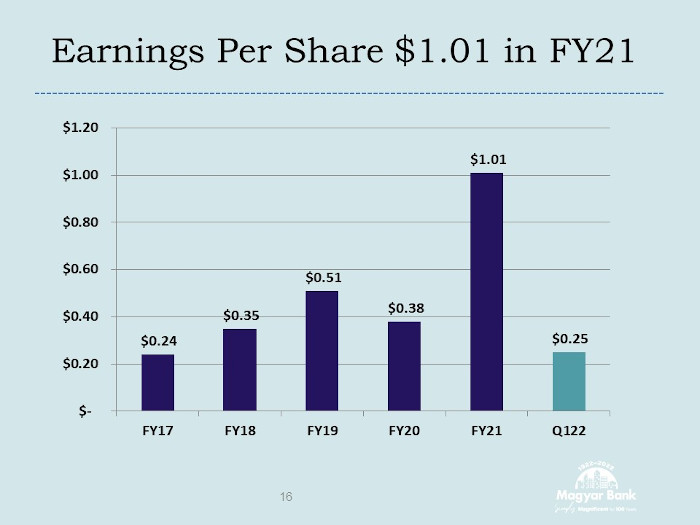

Earnings Per Share $1.01 in FY21 $0.24 $0.35 $0.51 $0.38 $1.01 $0.25 $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 FY17 FY18 FY19 FY20 FY21 Q122 16

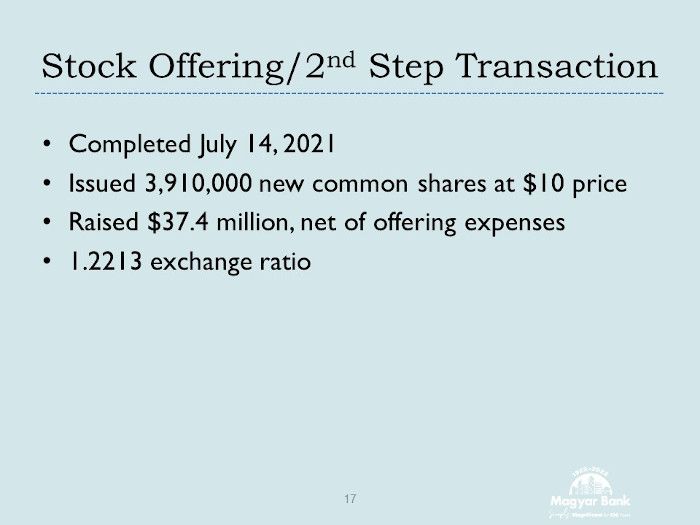

Stock Offering/2 nd Step Transaction • Completed July 14, 2021 • Issued 3,910,000 new common shares at $10 price • Raised $37.4 million, net of offering expenses • 1.2213 exchange ratio 17

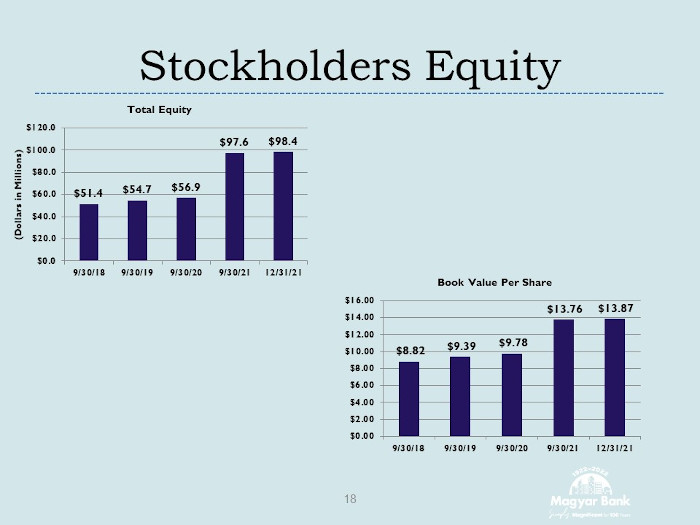

Stockholders Equity 18 $51.4 $54.7 $56.9 $97.6 $98.4 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 9/30/18 9/30/19 9/30/20 9/30/21 12/31/21 (Dollars in Millions) Total Equity $8.82 $9.39 $9.78 $13.76 $13.87 $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 9/30/18 9/30/19 9/30/20 9/30/21 12/31/21 Book Value Per Share

Stock Price Performance 19

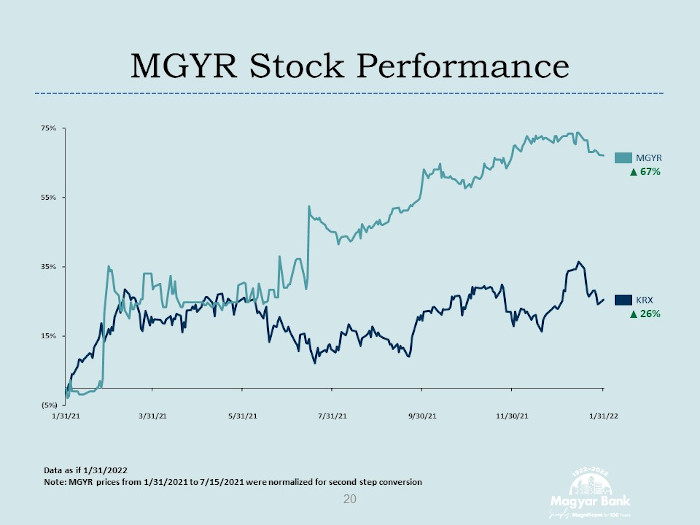

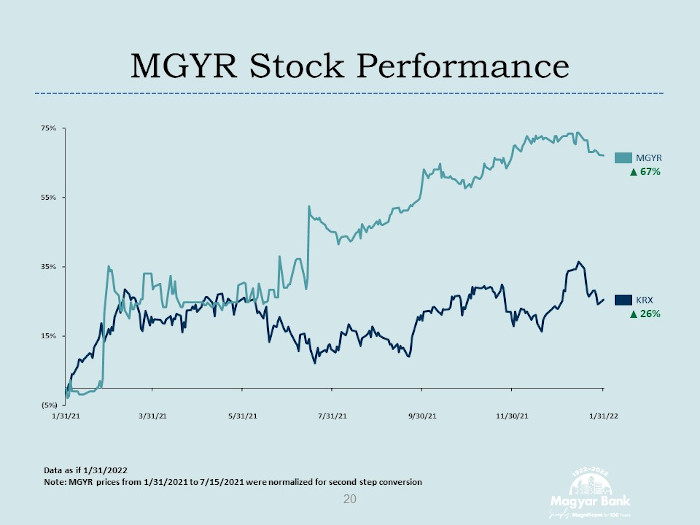

(5%) 15% 35% 55% 75% 1/31/21 3/31/21 5/31/21 7/31/21 9/30/21 11/30/21 1/31/22 MGYR Stock Performance 20 KRX 26 % MGYR 67 % Data as if 1/31/2022 Note: MGYR prices from 1/31/2021 to 7/15/2021 were normalized for second step conversion

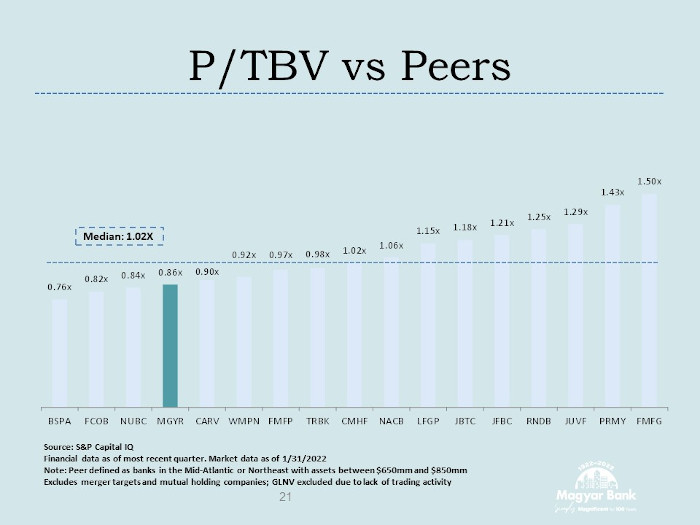

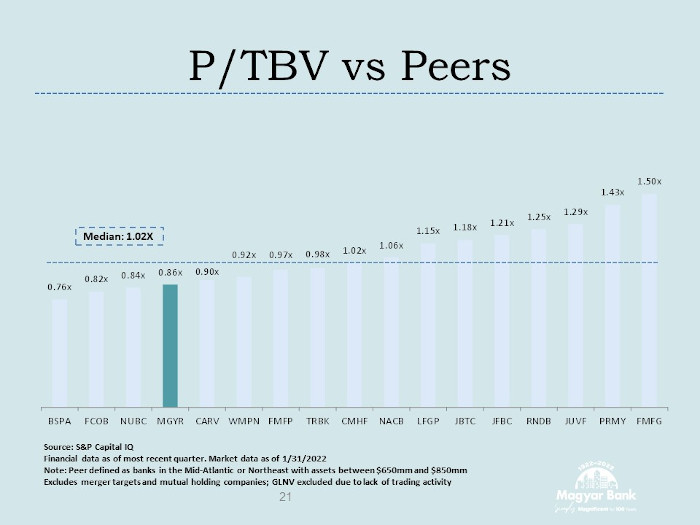

Median: 1.02X 0.76x 0.82x 0.84x 0.86x 0.90x 0.92x 0.97x 0.98x 1.02x 1.06x 1.15x 1.18x 1.21x 1.25x 1.29x 1.43x 1.50x BSPA FCOB NUBC MGYR CARV WMPN FMFP TRBK CMHF NACB LFGP JBTC JFBC RNDB JUVF PRMY FMFG P/TBV vs Peers 21 Source : S&P Capital IQ Financial data as of most recent quarter. Market data as of 1/31/2022 Note: Peer defined as banks in the Mid - Atlantic or Northeast with assets between $650mm and $850mm Excludes merger targets and mutual h olding companies; GLNV excluded due to lack of trading activity

Fiscal Year 2022 Outlook 22

Fiscal Year 2022 Outlook • Enhance shareholder value – Quarterly dividend – Evaluate stock buyback • Continued emphasis on community banking strategy to grow the business – Identify quality residential and commercial lending opportunities – Continued deployment of excess liquidity 23

Fiscal Year 2022 Outlook • Manage interest rate risk in a rising interest rate environment • IT Cybersecurity • Online deposit account opening product launch Q2 2022 • Continued focus on non - interest expenses 24

Questions? 25