Exhibit 99.3

2020 First Quarter Results

Safe Harbor Statement 1 All per - share amounts in this presentation are reported on a diluted basis. The only common equity securities that are publicly traded are common shares of Eversource Energy. The earnings and EPS of each business do not represent a direct legal interest in the assets and liabilities allocat ed to such business, but rather represent a direct interest in Eversource Energy's assets and liabilities as a whole. EPS by business is a non - GAAP (not determined using generall y accepted accounting principles) measure that is calculated by dividing the net income or loss attributable to common shareholders of each business by the wei ght ed average diluted Eversource Energy common shares outstanding for the period. Earnings discussions also include non - GAAP financial measures referencing 2020 earnin gs and EPS excluding certain acquisition costs and Q2 2019 earnings and EPS excluding the Northern Pass Transmission (NPT) impairment charge. Eversource Ene rgy uses these non - GAAP financial measures to evaluate and provide details of earnings results by business and to more fully compare and explain 2020 an d 2019 results without including these items. Management believes the acquisition costs and the NPT impairment charge are not indicative of Eversource Energy’s ong oin g costs and performance. Due to the nature and significance of these items on net income attributable to common shareholders, management believes that the non - GAAP presentation is a more meaningful representation of Eversource Energy’s financial performance and provides additional and useful information to readers in anal yzi ng historical and future performance of the business. Non - GAAP financial measures should not be considered as alternatives to Eversource Energy’s consolidated net income a ttributable to common shareholders or EPS determined in accordance with GAAP as indicators of Eversource Energy’s operating performance. This document includes statements concerning Eversource Energy’s expectations, beliefs, plans, objectives, goals, strategies, as sumptions of future events, future financial performance or growth and other statements that are not historical facts. These statements are “forward - looking statem ents” within the meaning of the Private Securities Litigation Reform Act of 1995. Generally, readers can identify these forward - looking statements through the use of w ords or phrases such as “estimate,” “expect,” “anticipate,” “intend,” “plan,” “project,” “believe,” “forecast,” “should,” “could” and other similar expressions. Fo rward - looking statements involve risks and uncertainties that may cause actual results or outcomes to differ materially from those included in the forward - looking statemen ts. Factors that may cause actual results to differ materially from those included in the forward - looking statements include, but are not limited to: cyberattacks or breache s, including those resulting in the compromise of the confidentiality of our proprietary information and the personal information of our customers; disruptions in the capit al markets or other events that make our access to necessary capital more difficult or costly; the negative impacts of the novel coronavirus (COVID - 19) pandemic on our customers, vendors, employees, regulators, and operations; changes in economic conditions, including impact on interest rates, tax policies, and customer demand and payment ab ility; ability or inability to commence and complete our major strategic development projects and opportunities, acts of war or terrorism, physical attacks or grid distu rba nces that may damage and disrupt our electric transmission and electric, natural gas, and water distribution systems; actions or inaction of local, state and fede ral regulatory, public policy and taxing bodies, substandard performance of third - party suppliers and service providers; fluctuations in weather patterns, including extreme weat her due to climate change; changes in business conditions, which could include disruptive technology or development of alternative energy sources related to our cu rre nt or future business model; contamination of, or disruption in, our water supplies; changes in levels or timing of capital expenditures, including the Columbia Gas of Mas sachusetts asset acquisition; changes in laws, regulations or regulatory policy, including compliance with environmental laws and regulations; changes in accounting standar ds and financial reporting regulations; actions of rating agencies; and other presently unknown or unforeseen factors. Other risk factors are detailed in Eversource Energy’s reports filed with the Securities and Exchange Commission (SEC). They ar e updated as necessary and available on Eversource Energy’s website at www.eversource.com and on the SEC’s website at www.sec.gov. All such factors are difficult to pr edict and contain uncertainties that may materially affect Eversource Energy’s actual results, many of which are beyond our control. You should not place undue relia nce on the forward - looking statements, as each speaks only as of the date on which such statement is made, and, except as required by federal securities laws, Eversour ce Energy undertakes no obligation to update any forward - looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events.

Eversource Executing Its Business Plan and Serving 4 Million Customers During COVID - 19 Crisis ▪ Extensive efforts to protect employees, moving to remote working, hygienically cleaning facilities and fleet, promoting social distancing ▪ Essential field work continues with states exempting utility work from statewide business restrictions ▪ Since early March, approximately 4,000 employees normally working in ES facilities successfully redeployed to work remotely, including vast majority of customer service representatives ▪ Emergency response tested during March 23 - 24 snowstorm in New Hampshire that caused 56,000+ customer outages and intense nor’easter that battered our service territory on April 13 and caused 240,000 outages – Power back within 24 hours for vast majority ▪ Moratorium on customer shut - offs in all states, unless safety issue ▪ No significant supply issues ▪ Very positive feedback from customers and key policymakers 2

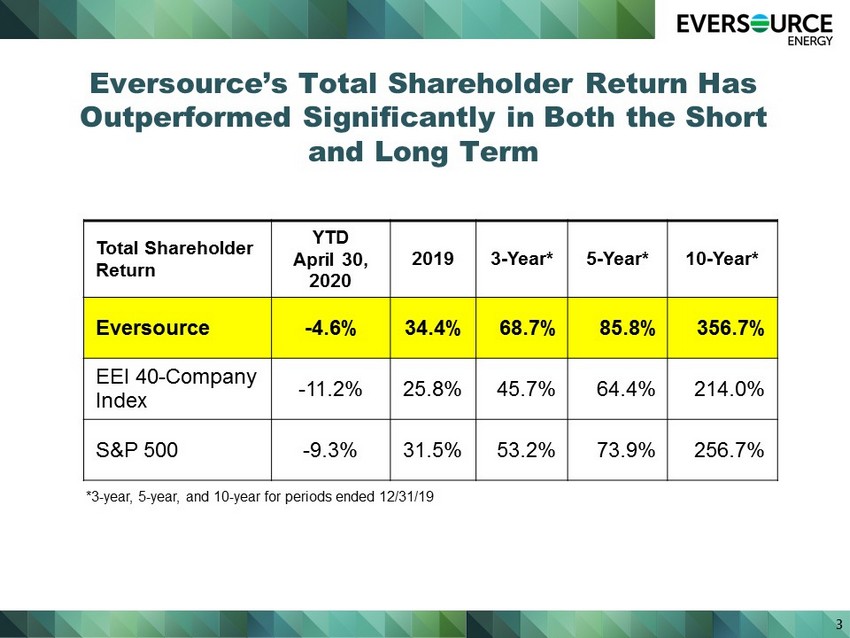

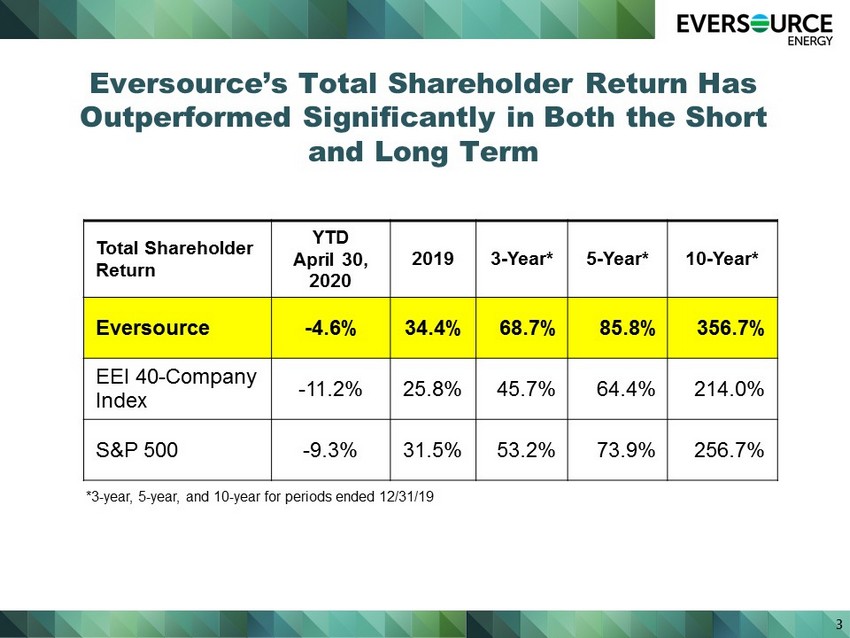

Eversource’s Total Shareholder Return Has Outperformed Significantly in Both the Short and Long Term 3 Total Shareholder Return YTD April 30, 2020 2019 3 - Year* 5 - Year* 10 - Year* Eversource - 4.6% 34.4% 68.7% 85.8% 356.7% EEI 40 - Company Index - 11.2% 25.8% 45.7% 64.4% 214.0% S&P 500 - 9.3% 31.5% 53.2% 73.9% 256.7% *3 - year, 5 - year, and 10 - year for periods ended 12/31/19

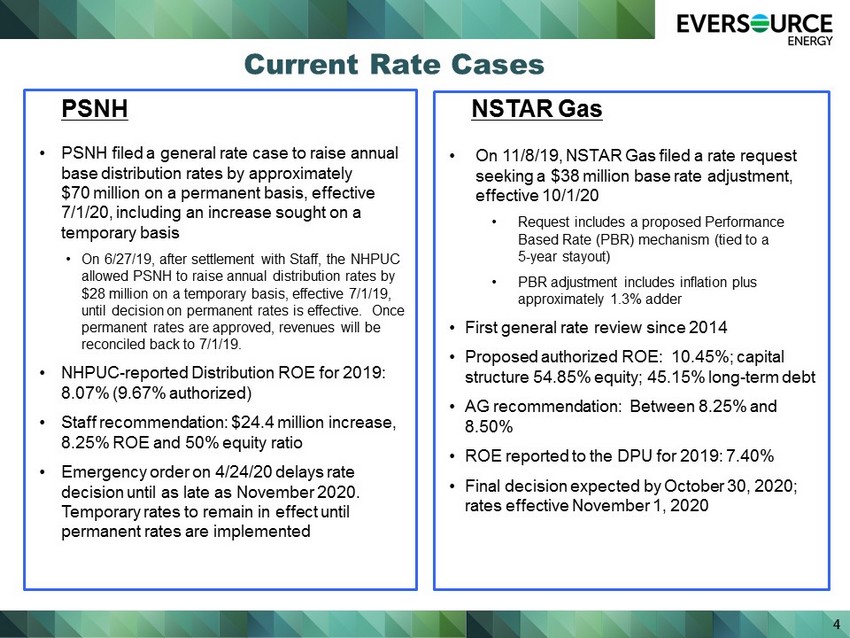

4 Current Rate Cases • PSNH filed a general rate case to raise annual base distribution rates by approximately $70 million on a permanent basis, effective 7/1/20, including an increase sought on a temporary basis • On 6/27/19, after settlement with Staff, the NHPUC allowed PSNH to raise annual distribution rates by $28 million on a temporary basis, effective 7/1/19, until decision on permanent rates is effective. Once permanent rates are approved, revenues will be reconciled back to 7/1/19. • NHPUC - reported Distribution ROE for 2019: 8.07% (9.67% authorized) • Staff recommendation: $24.4 million increase, 8.25% ROE and 50% equity ratio • Emergency order on 4/24/20 delays rate decision until as late as November 2020. Temporary rates to remain in effect until permanent rates are implemented PSNH • On 11/8/19, NSTAR Gas filed a rate request seeking a $38 million base rate adjustment, effective 10/1/20 • Request includes a proposed Performance Based Rate (PBR) mechanism (tied to a 5 - year stayout ) • PBR adjustment includes inflation plus approximately 1.3% adder • First general rate review since 2014 • Proposed authorized ROE: 10.45%; capital structure 54.85% equity; 45.15% long - term debt • AG recommendation: Between 8.25% and 8.50% • ROE reported to the DPU for 2019: 7.40% • Final decision expected by October 30, 2020; rates effective November 1, 2020 NSTAR Gas

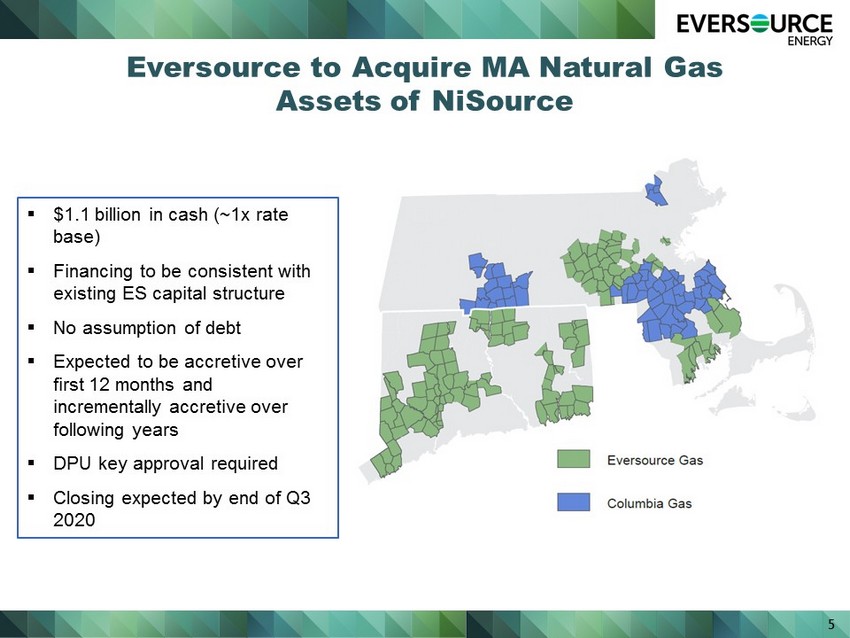

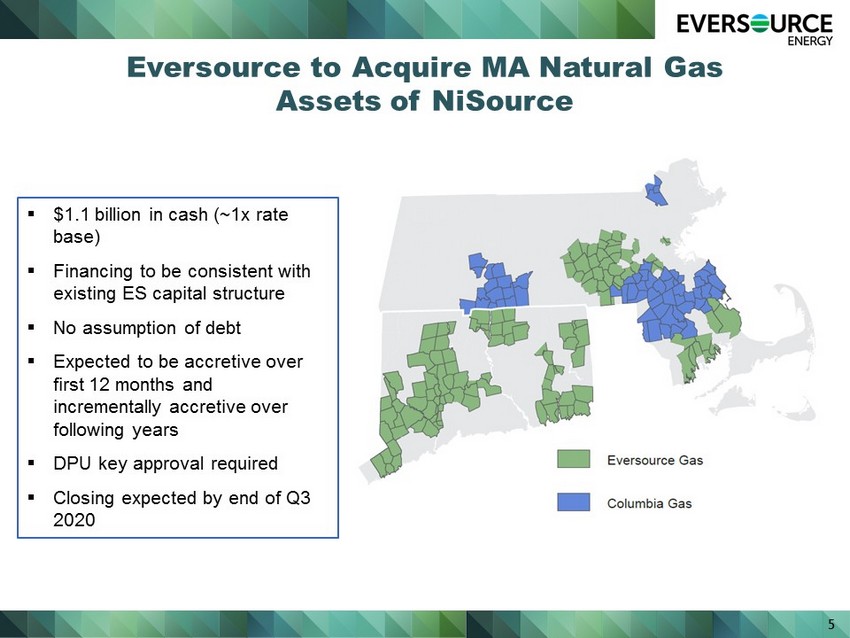

5 Eversource to Acquire MA Natural Gas Assets of NiSource ▪ $1.1 billion in cash (~1x rate base) ▪ Financing to be consistent with existing ES capital structure ▪ No assumption of debt ▪ Expected to be accretive over first 12 months and incrementally accretive over following years ▪ DPU key approval required ▪ Closing expected by end of Q3 2020

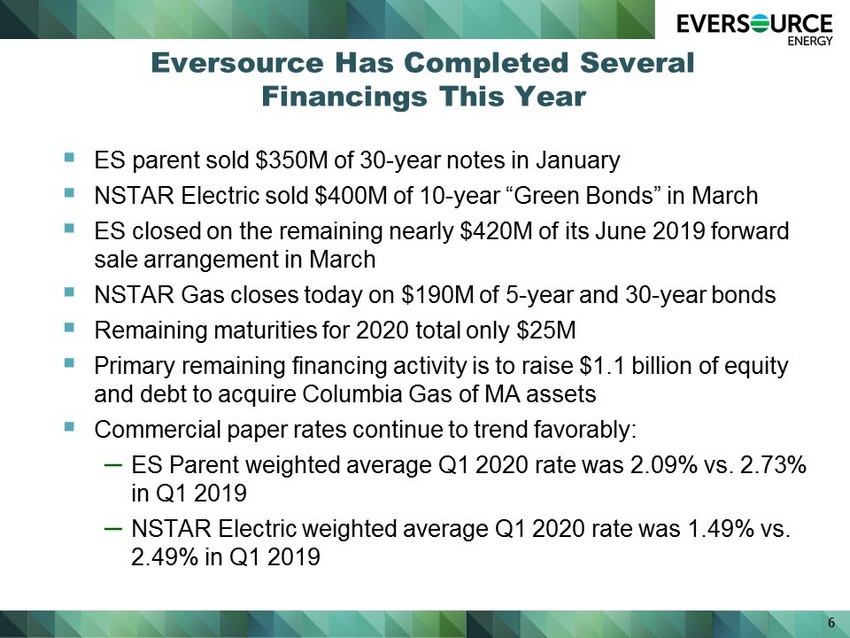

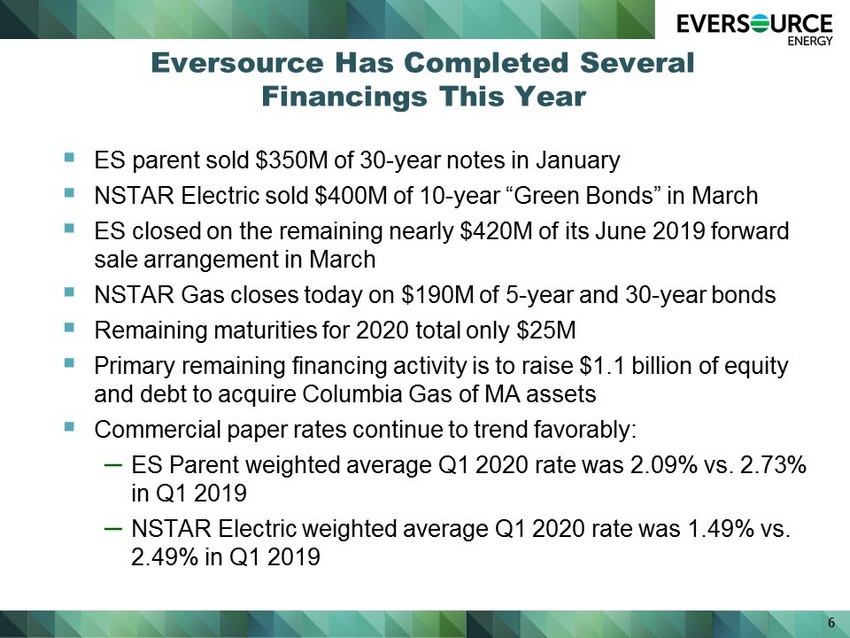

Eversource Has Completed Several Financings This Year ▪ ES parent sold $350M of 30 - year notes in January ▪ NSTAR Electric sold $400M of 10 - year “Green Bonds” in March ▪ ES closed on the remaining nearly $420M of its June 2019 forward sale arrangement in March ▪ NSTAR Gas closes today on $190M of 5 - year and 30 - year bonds ▪ Remaining maturities for 2020 total only $25M ▪ Primary remaining financing activity is to raise $1.1 billion of equity and debt to acquire Columbia Gas of MA assets ▪ Commercial paper rates continue to trend favorably: – ES Parent weighted average Q1 2020 rate was 2.09% vs. 2.73% in Q1 2019 – NSTAR Electric weighted average Q1 2020 rate was 1.49% vs. 2.49% in Q1 2019 6

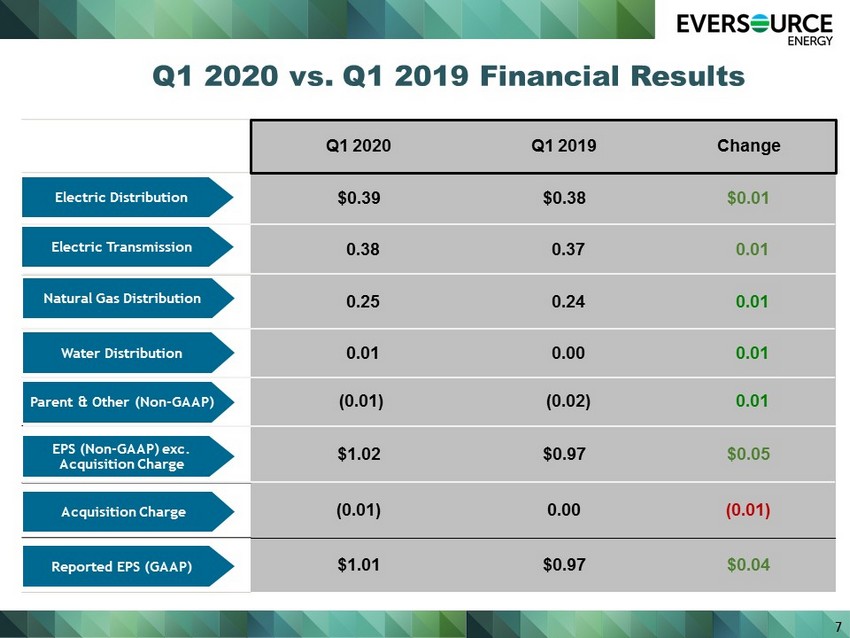

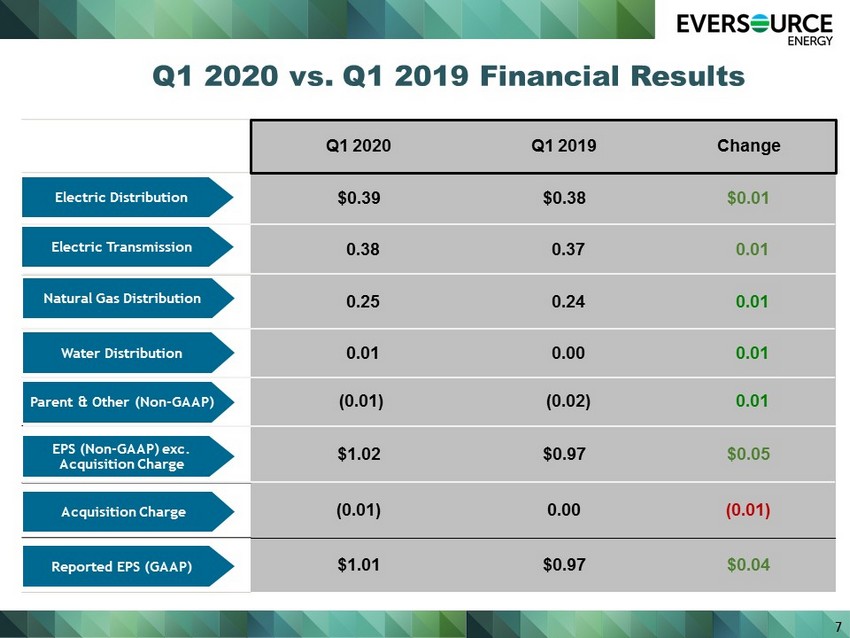

Q1 2020 Q1 2019 Change $0.39 $0.38 $0.01 0.38 0.37 0.01 0.25 0.24 0.01 0.01 0.00 0.01 (0.01) (0.02) 0.01 $1.02 $0.97 $0.05 (0.01) 0.00 (0.01) $1.01 $0.97 $0.04 Natural Gas Distribution Electric Transmission Electric Distribution Water Distribution Reported EPS (GAAP) 7 Q1 2020 vs. Q1 2019 Financial Results Parent & Other (Non - GAAP) EPS (Non - GAAP) exc. Acquisition Charge Acquisition Charge

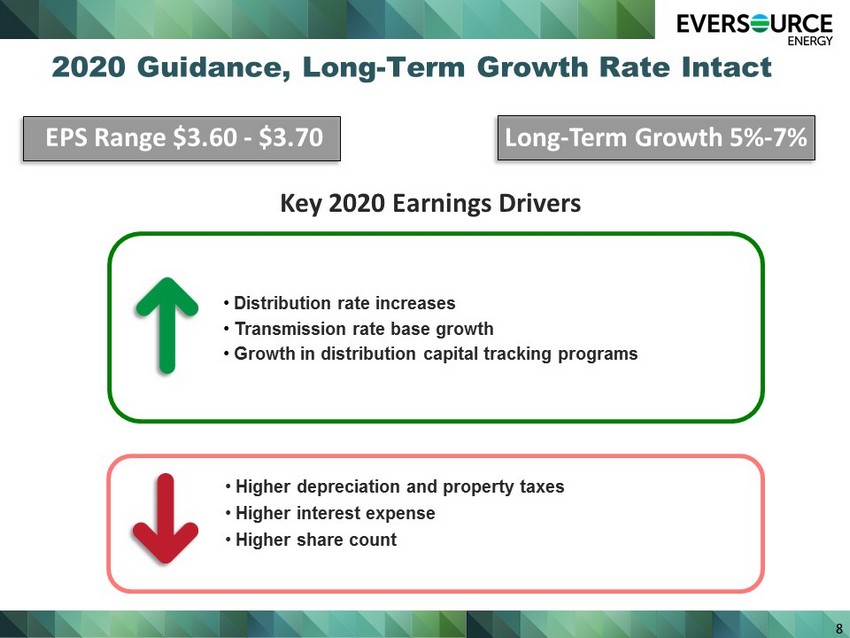

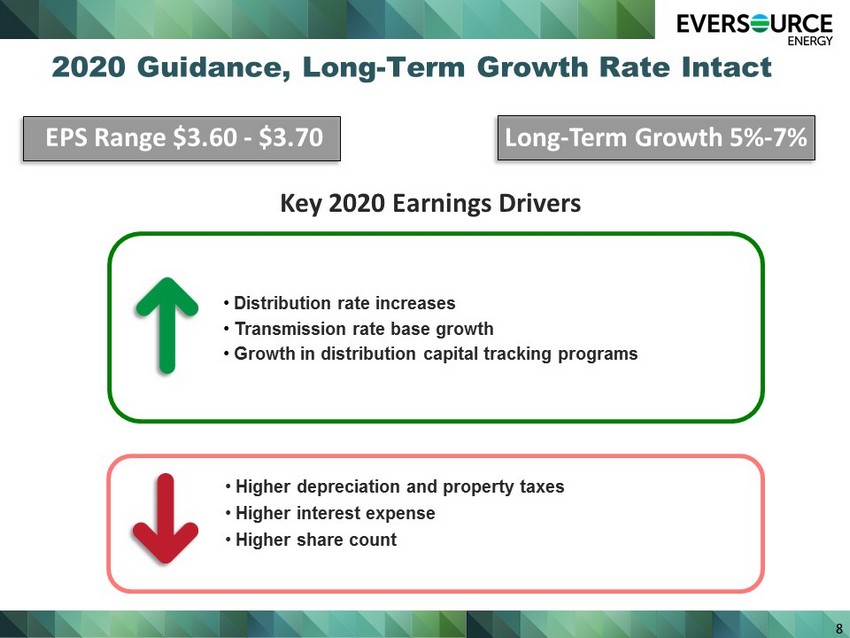

2020 Guidance, Long - Term Growth Rate Intact Key 2020 Earnings Drivers EPS Range $3.60 - $3.70 • Distribution rate increases • Transmission rate base growth • Growth in distribution capital tracking programs • Higher depreciation and property taxes • Higher interest expense • Higher share count 8 Long - Term Growth 5% - 7%

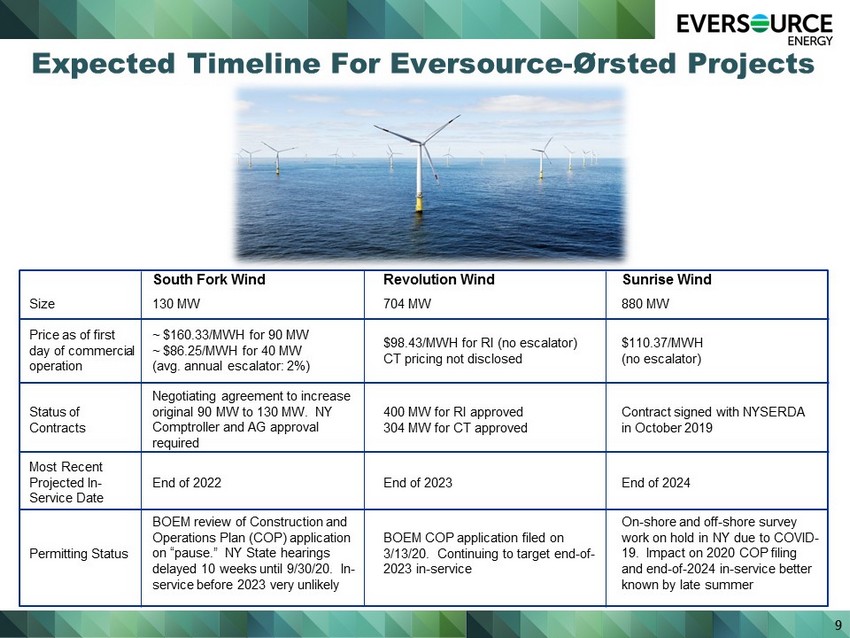

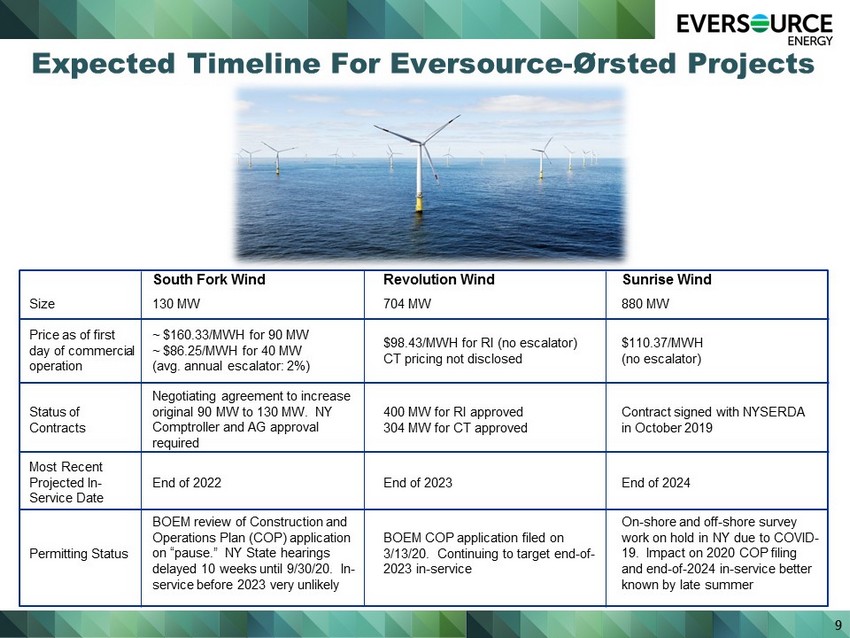

South Fork Wind Revolution Wind Sunrise Wind Size 130 MW 704 MW 880 MW Price as of first day of commercial operation ~ $160.33/MWH for 90 MW ~ $86.25/MWH for 40 MW (avg. annual escalator: 2%) $98.43/MWH for RI (no escalator) CT pricing not disclosed $110.37/MWH (no escalator) Status of Contracts Negotiating agreement to increase original 90 MW to 130 MW. NY Comptroller and AG approval required 400 MW for RI approved 304 MW for CT approved Contract signed with NYSERDA in October 2019 Most Recent Projected In - Service Date End of 2022 End of 2023 End of 2024 Permitting Status BOEM review of Construction and Operations Plan (COP) application on “pause.” NY State hearings delayed 10 weeks until 9/30/20. In - service before 2023 very unlikely BOEM COP application filed on 3/13/20. Continuing to target end - of - 2023 in - service On - shore and off - shore survey work on hold in NY due to COVID - 19. Impact on 2020 COP filing and end - of - 2024 in - service better known by late summer 9 Expected Timeline For Eversource - Ørsted Projects

10 APPENDIX

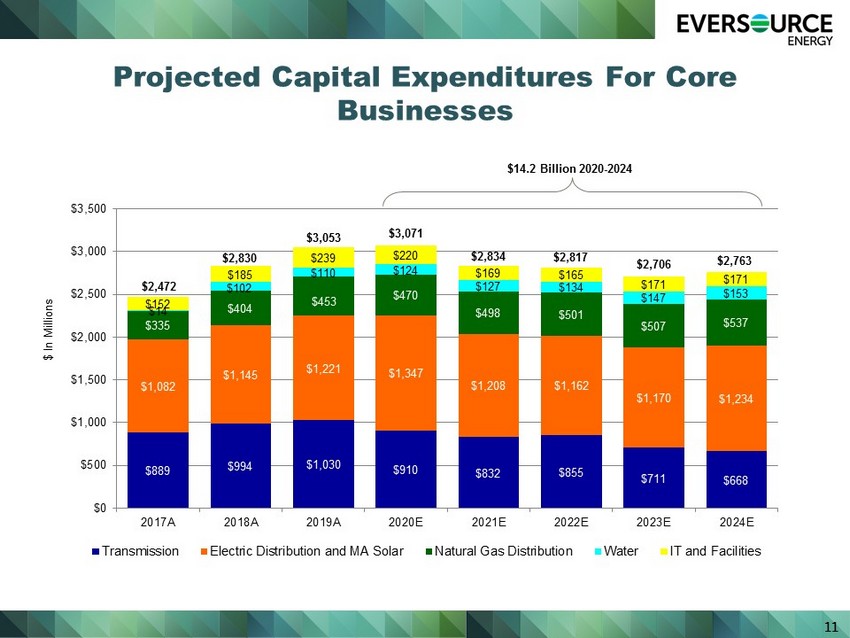

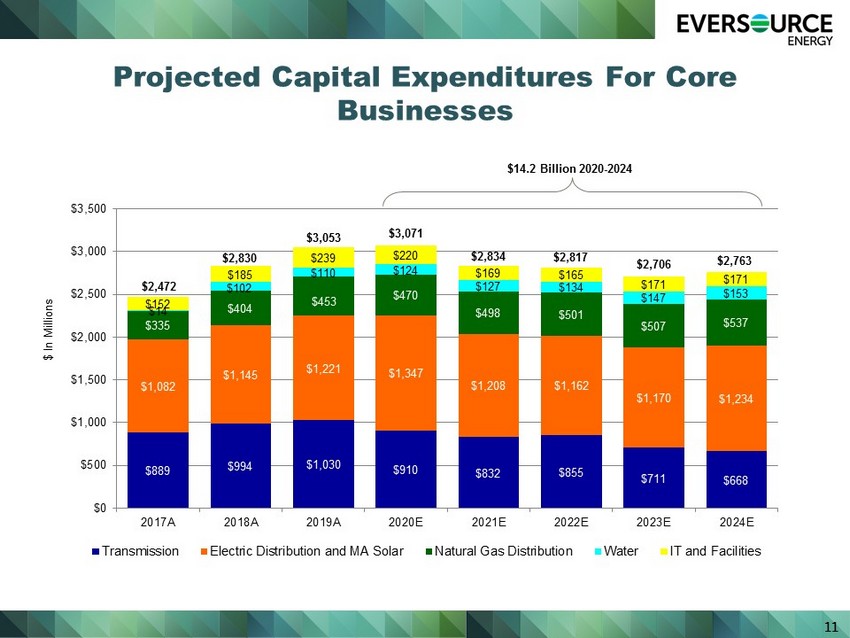

11 $889 $994 $1,030 $910 $832 $855 $711 $668 $1,082 $1,145 $1,221 $1,347 $1,208 $1,162 $1,170 $1,234 $335 $404 $453 $470 $498 $501 $507 $537 $14 $102 $110 $124 $127 $134 $147 $153 $152 $185 $239 $220 $169 $165 $171 $171 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 2017A 2018A 2019A 2020E 2021E 2022E 2023E 2024E Transmission Electric Distribution and MA Solar Natural Gas Distribution Water IT and Facilities $2,817 $2,834 $ In Millions Projected Capital Expenditures For Core Businesses $3,053 $2,830 $2,472 $14.2 Billion 2020 - 2024 $3,071 $2,706 $2,763

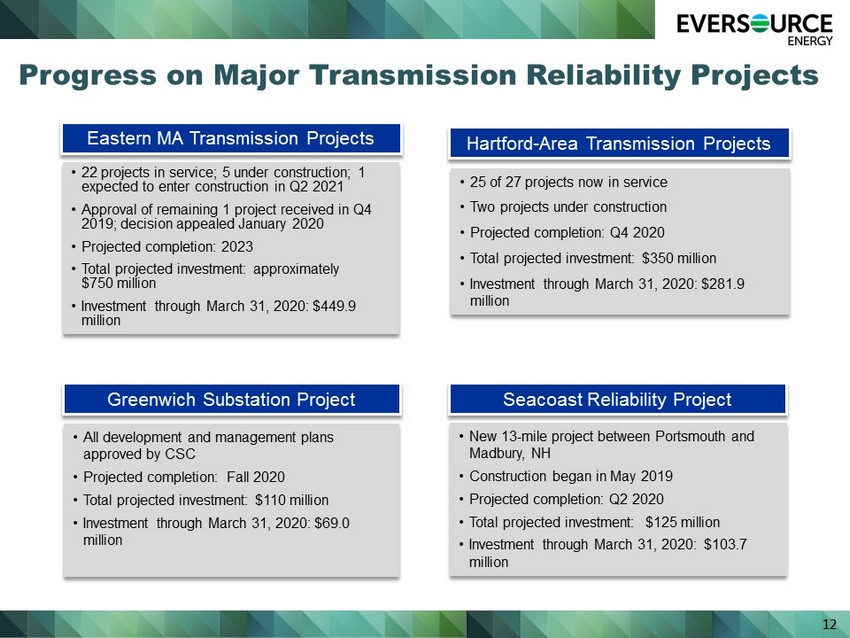

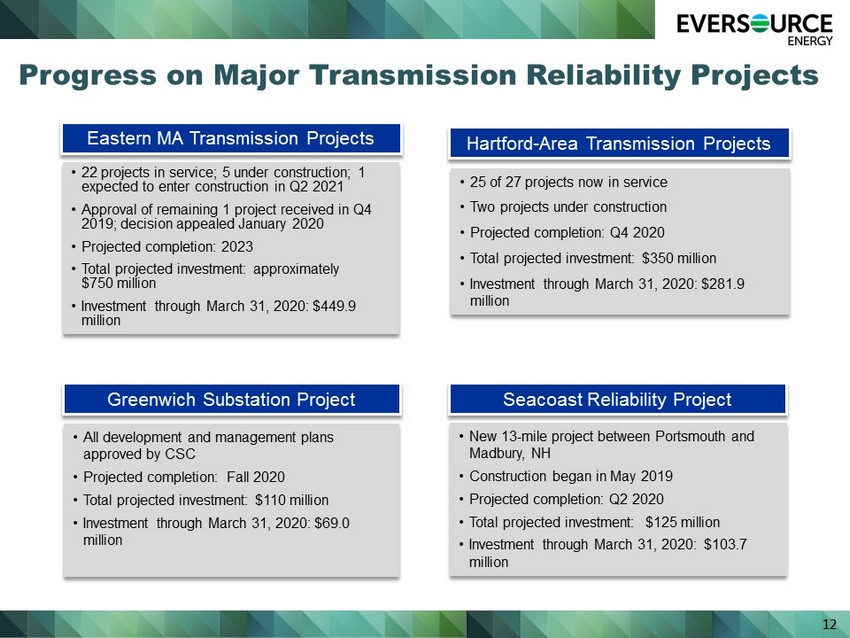

12 • New 13 - mile project between Portsmouth and Madbury , NH • Construction began in May 2019 • Projected completion: Q2 2020 • Total projected investment: $125 million • Investment through March 31, 2020: $103.7 million Seacoast Reliability Project • 25 of 27 projects now in service • Two projects under construction • Projected completion: Q4 2020 • Total projected investment: $350 million • Investment through March 31, 2020: $281.9 million Hartford - Area Transmission Projects Progress on Major Transmission Reliability Projects • All development and management plans approved by CSC • Projected completion: Fall 2020 • Total projected investment: $110 million • Investment through March 31, 2020: $69.0 million Greenwich Substation Project Eastern MA Transmission Projects • 22 projects in service; 5 under construction; 1 expected to enter construction in Q2 2021 • Approval of remaining 1 project received in Q4 2019; decision appealed January 2020 • Projected completion: 2023 • Total projected investment: approximately $750 million • Investment through March 31, 2020: $449.9 million

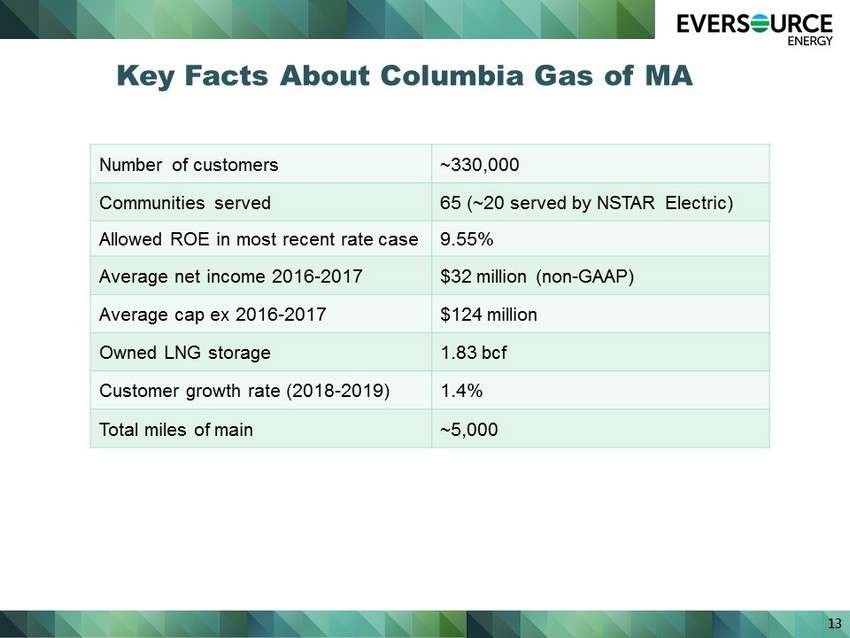

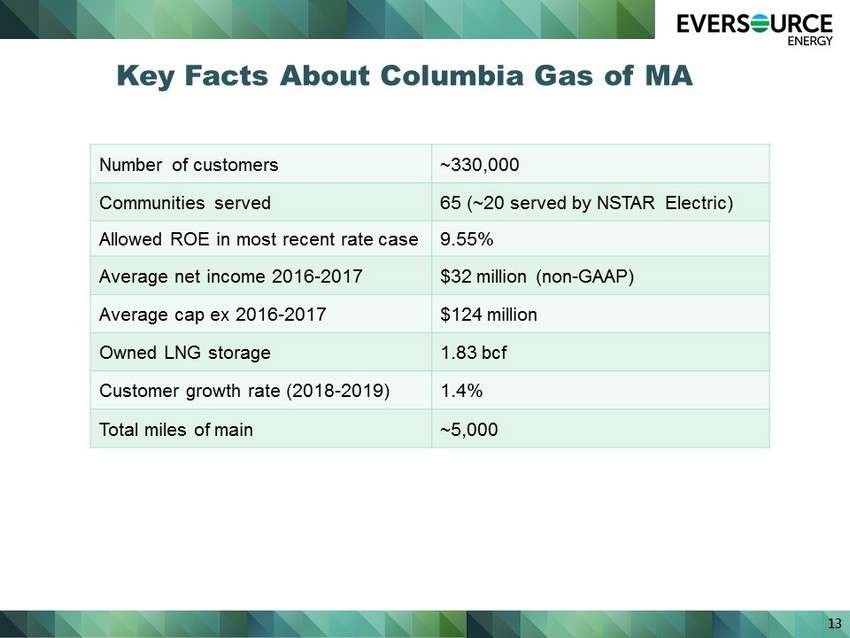

13 Key Facts About Columbia Gas of MA Number of customers ~330,000 Communities served 65 (~20 served by NSTAR Electric) Allowed ROE in most recent rate case 9.55% Average net income 2016 - 2017 $32 million (non - GAAP) Average cap ex 2016 - 2017 $124 million Owned LNG storage 1.83 bcf Customer growth rate (2018 - 2019) 1.4% Total miles of main ~5,000