Exhibit 99.1

Building a Major Ophthalmic Pharmaceutical Company

Aerie Pharmaceuticals, Inc.

Investor Day September 10, 2014

Important Information

aerie pharmaceuticals, inc.

Any discussion of the potential use or expected success of our product candidates is subject to our product candidates being approved by regulatory authorities. In addition, any discussion of clinical data results for our Rhopressa™ and Roclatan™ product candidates relate to the results in our Phase 2 clinical trials.

The information in this presentation is current only as of its date and may have changed or may change in the future. We undertake no obligation to update this information in light of new information, future events or otherwise. We are not making any representation or warranty that the information in this presentation is accurate or complete.

Certain statements in this presentation are “forward-looking statements” within the meaning of the federal securities laws, including beliefs, expectations, estimates, projections and statements relating to our business plans, prospects and objectives, and the assumptions upon which those statements are based. Words such as “may,” “will,” “should,” “would,” “could,” “believe,” “expects,” “anticipates,” “plans,” “intends,” “estimates,” “targets,” “projects” or similar expressions are intended to identify these forward-looking statements. These statements are based on the Company’s current plans and expectations. Known and unknown risks, uncertainties and other factors could cause actual results to differ materially from those contemplated by the statements. In evaluating these statements, you should specifically consider various factors that may cause our actual results to differ materially from any forward-looking statements. These risks and uncertainties are described more fully in the quarterly and annual reports that we file with the SEC, particularly in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation.” Such forward-looking statements only speak as of the date they are made. We undertake no obligation to publicly update or revise any forward-looking statements, whether because of new information, future events or otherwise, except as otherwise required by law.

2

Our Strategy

aerie pharmaceuticals, inc.

Advance the development of our product candidates to approval

Establish internal capabilities to commercialize our product candidates in North America (and potentially Europe)

Explore partnerships with leading pharmaceutical and biotechnology companies to maximize the value of our product candidates outside of North America

Continue to leverage and strengthen our intellectual property portfolio

Expand our product portfolio through internal discovery efforts and possible in-licensing or acquisitions of additional ophthalmic product candidates or products

3

Accomplishments Since October 2013

aerie pharmaceuticals, inc.

Completed IPO – raised $68M

EVP findings in 1Q 2014

Reported successful Roclatan™ Phase 2b results in June 2014

Initiated Rhopressa™ Phase 3 efficacy and safety studies in 3Q 2014

Added key senior executives in 2014 for Commercial, R&D, and Business Development

Recently announced additional $125M financing

4

Introductions

aerie pharmaceuticals, inc.

Vicente Anido, Jr., Ph.D., Chief Executive Officer

Thomas Mitro, Chief Operating Officer

Richard Parrish, M.D. – Professor Department of Ophthalmology, Bascom Palmer Eye Institute, University of Miami

Casey Kopczynski, Ph.D., Chief Scientific Officer

Brian Levy, O.D., M.Sc., Chief Medical Officer

Richard Rubino, Chief Financial Officer

Marvin Garrett, V.P. Regulatory Affairs

Craig Skenes, V.P. Business Development

Michael McCleerey, V.P. Marketing

5

Agenda

aerie pharmaceuticals, inc.

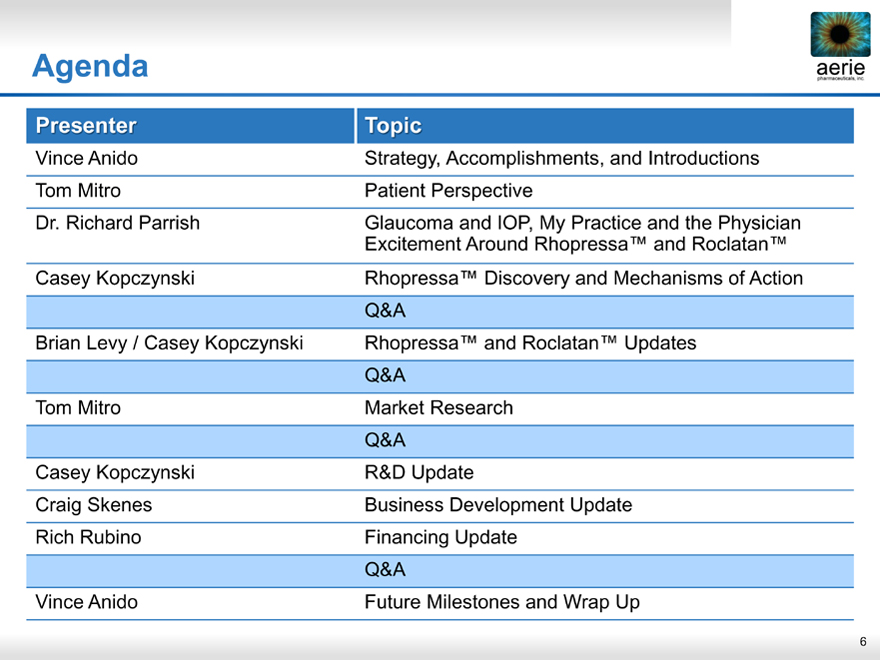

Presenter Topic

Vince Anido Strategy, Accomplishments, and Introductions

Tom Mitro Patient Perspective

Dr. Richard Parrish Glaucoma and IOP, My Practice and the Physician

Excitement Around Rhopressa™ and Roclatan™

Casey Kopczynski Rhopressa™ Discovery and Mechanisms of Action

Q&A

Brian Levy / Casey Kopczynski Rhopressa™ and Roclatan™ Updates

Q&A

Tom Mitro Market Research

Q&A

Casey Kopczynski R&D Update

Craig Skenes Business Development Update

Rich Rubino Financing Update

Q&A

Vince Anido Future Milestones and Wrap Up

6

A Patient’s Perspective

aerie pharmaceuticals, inc.

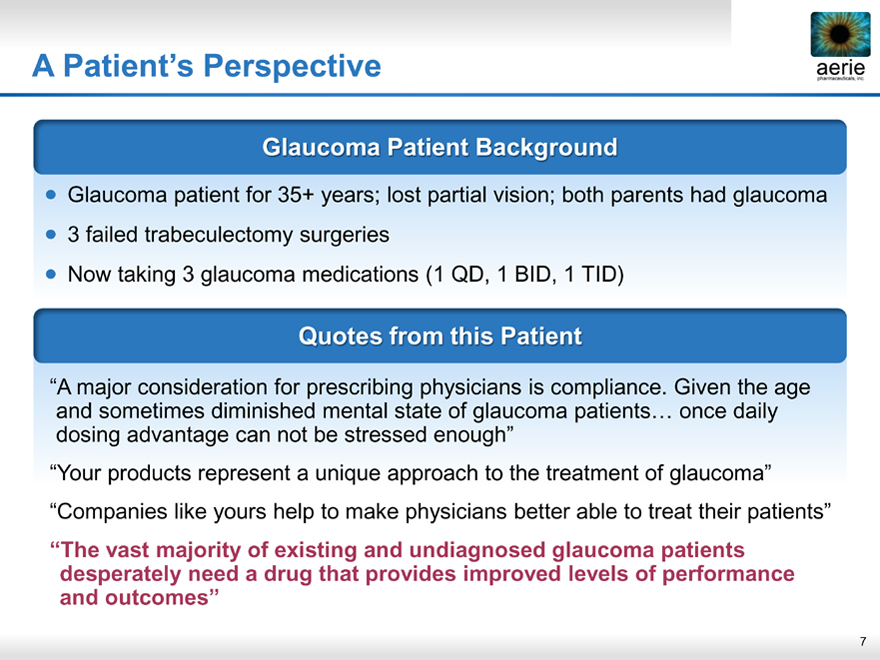

Glaucoma Patien Background

Glaucoma patient for 35+ years; lost partial vision; both parents had glaucoma

3 failed trabeculectomy surgeries

Now taking 3 glaucoma medications (1 QD, 1 BID, 1 TID)

Quotes from this Patient

“A major consideration for prescribing physicians is compliance. Given the age and sometimes diminished mental state of glaucoma patients… once daily dosing advantage can not be stressed enough” “Your products represent a unique approach to the treatment of glaucoma” “Companies like yours help to make physicians better able to treat their patients”

“The vast majority of existing and undiagnosed glaucoma patients desperately need a drug that provides improved levels of performance and outcomes”

7

Richard Parrish, M.D.:

aerie pharmaceuticals, inc.

Associate Dean for Graduate Medical Education, University of Miami School of Medicine Professor of Ophthalmology

Glaucoma and IOP

About my practice

Why my colleagues and I are excited about Rhopressa™ and Roclatan™

New MOAs

Trabecular Meshwork EVP

20 years

Low tension glaucoma

Where we will use these products

Hyperemia and glaucoma treatment

8

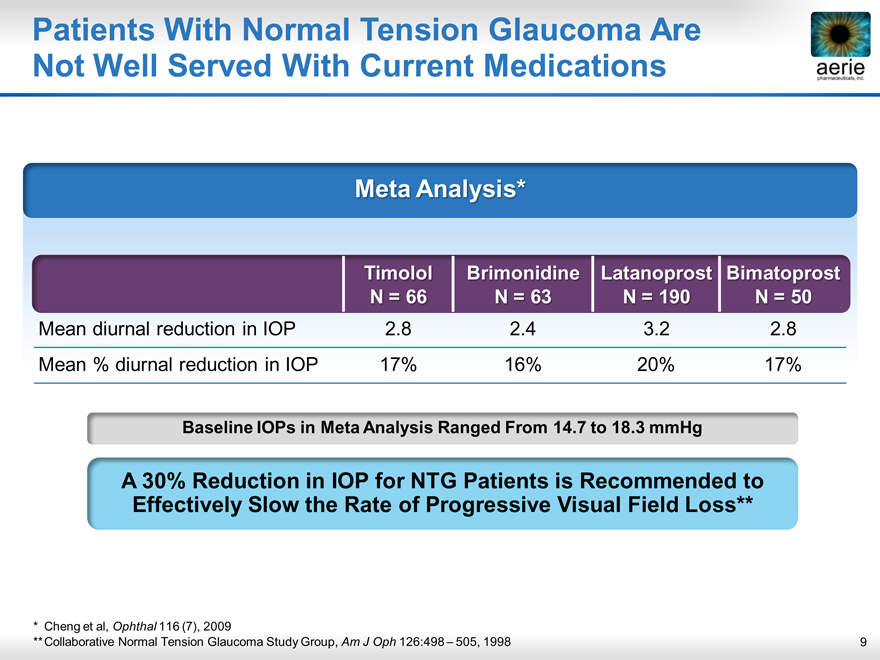

Patients With Normal Tension Glaucoma Are

aerie pharmaceuticals, inc.

Not Well Served With Current Medications

aerie

pharmaceuticals, inc.

Meta Analysis*

Timolol

N = 66 Brimonidine N = 63 Latanoprost N = 190 Bimatoprost

N = 50

Mean diurnal reduction in IOP 2.8 2.4 3.2 2.8

Mean % diurnal reduction in IOP 17% 16% 20% 17%

Baseline IOPs in Meta Analysis Ranged From 14.7 to 18.3 mmHg

A 30% Reduction in IOP for NTG Patients is Recommended to Effectively Slow the Rate of Progressive Visual Field Loss**

* Cheng et al, Ophthal 116 (7), 2009

** Collaborative Normal Tension Glaucoma Study Group, Am J Oph 126:498 – 505, 1998

9

Rhopressa™ Discovery and Mechanisms of Action

Casey Kopczynski

10

The Aerie Rho Kinase R&D Success Story

aerie pharmaceuticals, inc.

Ophthalmic Efficacy by Design

Optimal ocular delivery, formulation properties built into Aerie lead compounds

Rapid cycle time from medicinal chemistry to ophthalmic efficacy, tolerability testing

– >1,500 Rho kinase inhibitors designed, screened and characterized to date

Discovered new ROCK-selective inhibitors and the novel ROCK/NET inhibitor drug class

Large patent portfolio, key patents provide protection through 2030

ROCK/NET inhibitor Rhopressa™ advanced to Phase 3 trials

“Prodrug” design provides strong efficacy, good tolerability with once-daily dosing in clinic

Lowers IOP through 3 different mechanisms of action

Achieves consistent IOP lowering regardless of baseline IOP

11

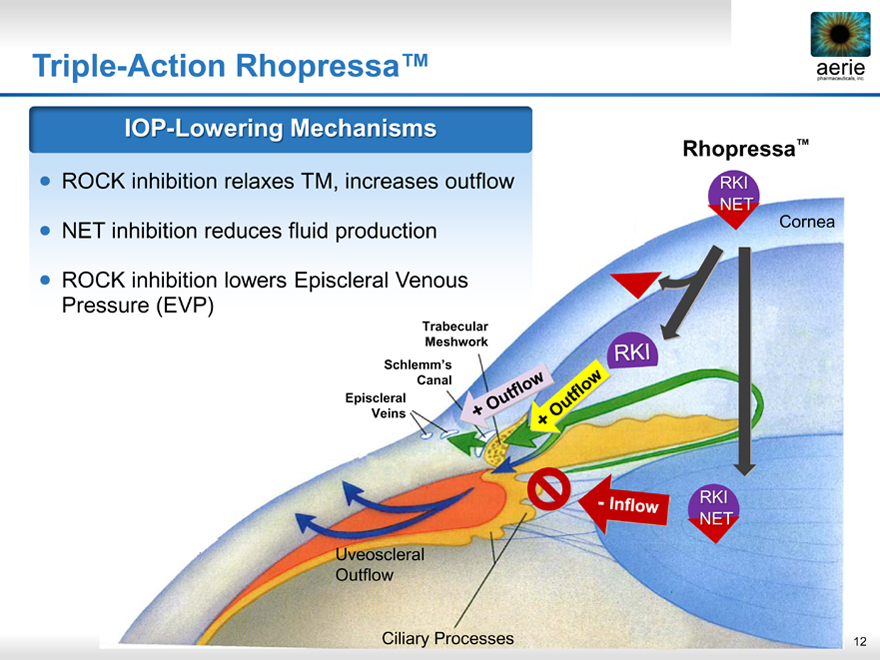

Triple-Action Rhopressa™

aerie pharmaceuticals, inc.

IOP-Lowering Mechanisms

ROCK inhibition relaxes TM, increases outflow

NET inhibition reduces fluid production

ROCK inhibition lowers Episcleral Venous Pressure (EVP)

Rhopressa™

RKI NET

Cornea

Trabecular Meshwork Schlemm’s Canal Episcleral Veins

RKI

Uveoscleral Outflow

Ciliary Processes 12

-Inflow

RKI NET

+ Outflow

+ Outflow

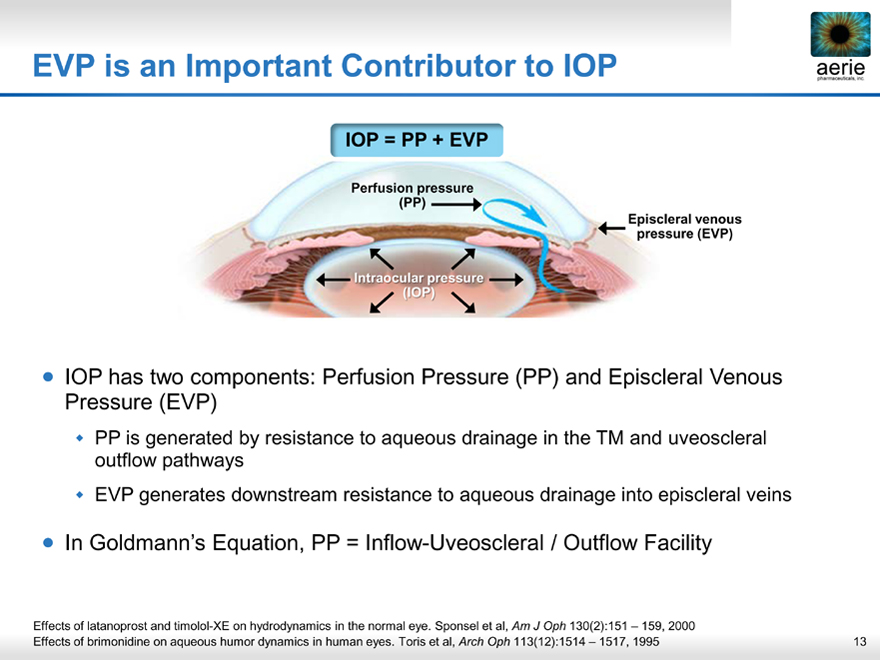

EVP is an Important Contributor to IOP

IOP = PP + EVP

Perfusion pressure (PP)

Episcleral venous pressure (EVP)

aerie pharmaceuticals, inc.

Intraocular pressure (IOP)

• |

| IOP has two components: Perfusion Pressure (PP) and Episcleral Venous Pressure (EVP) |

PP is generated by resistance to aqueous drainage in the TM and uveoscleral outflow pathways EVP generates downstream resistance to aqueous drainage into episcleral veins

• |

| In Goldmann’s Equation, PP = Inflow-Uveoscleral / Outflow Facility |

Effects of latanoprost and timolol-XE on hydrodynamics in the normal eye. Sponsel et al, Am J Oph 130(2):151 – 159, 2000

Effects of brimonidine on aqueous humor dynamics in human eyes. Toris et al, Arch Oph 113(12):1514 – 1517, 1995

13

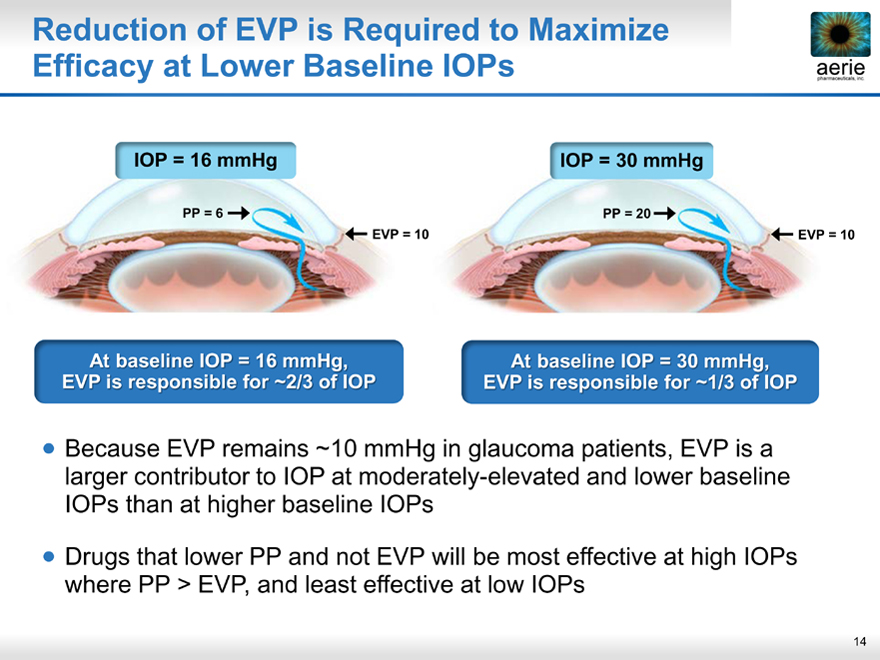

Reduction of EVP is Required to Maximize Efficacy at Lower Baseline IOPs

aerie pharmaceuticals, inc.

IOP = 16 mmHg IOP = 30 mmHg

PP = 6 PP = 20

EVP = 10 EVP = 10

At baseline IOP = 16 mmHg, EVP is responsible for ~2/3 of IOP

At baseline IOP = 30 mmHg, EVP is responsible for ~1/3 of IOP

Because EVP remains ~10 mmHg in glaucoma patients, EVP is a larger contributor to IOP at moderately-elevated and lower baseline IOPs than at higher baseline IOPs

Drugs that lower PP and not EVP will be most effective at high IOPs where PP > EVP, and least effective at low IOPs

14

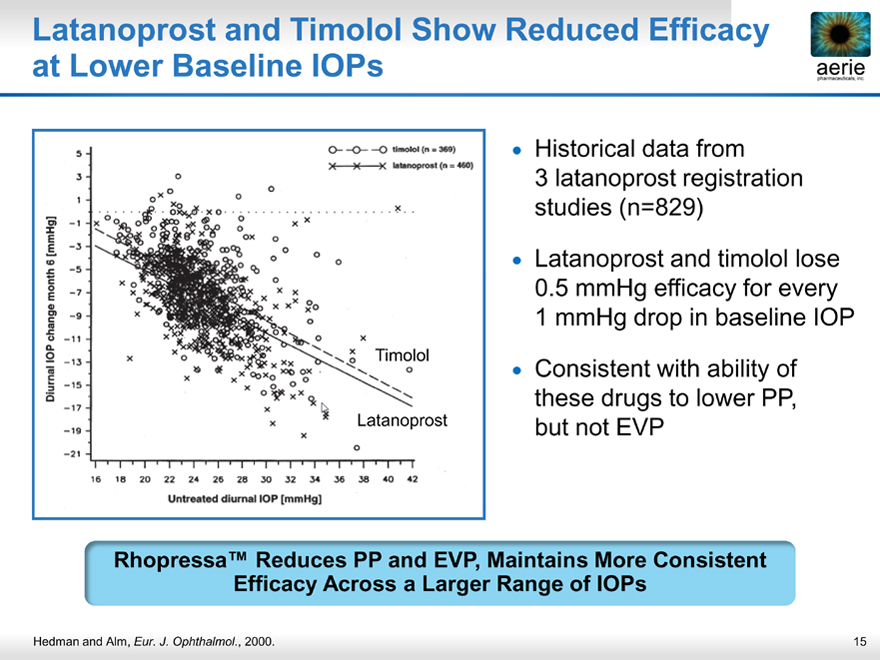

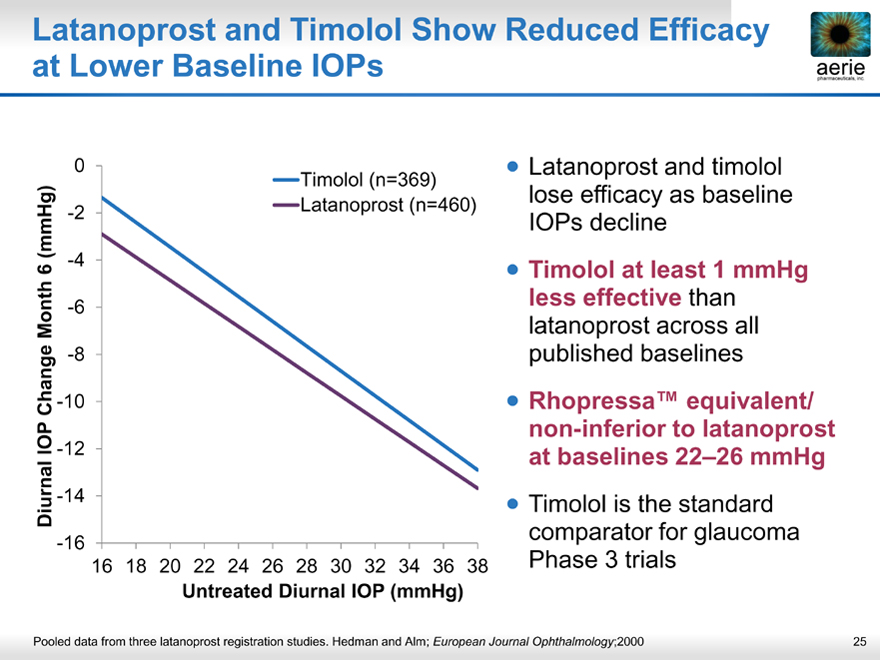

Latanoprost and Timolol Show Reduced Efficacy at Lower Baseline IOPs

aerie pharmaceuticals, inc.

Timolol

Diurnal IOP change month 6 [mmHg]

Untreated diurnal IOP [mmHg]

timolol (n = 369)

latanoprost (n = 460)

Latanoprost

Historical data from 3 latanoprost registration studies (n=829)

Latanoprost and timolol lose 0.5 mmHg efficacy for every 1 mmHg drop in baseline IOP

Consistent with ability of these drugs to lower PP, but not EVP

Rhopressa™ Reduces PP and EVP, Maintains More Consistent Efficacy Across a Larger Range of IOPs

Hedman and Alm, Eur. J. Ophthalmol., 2000.

15

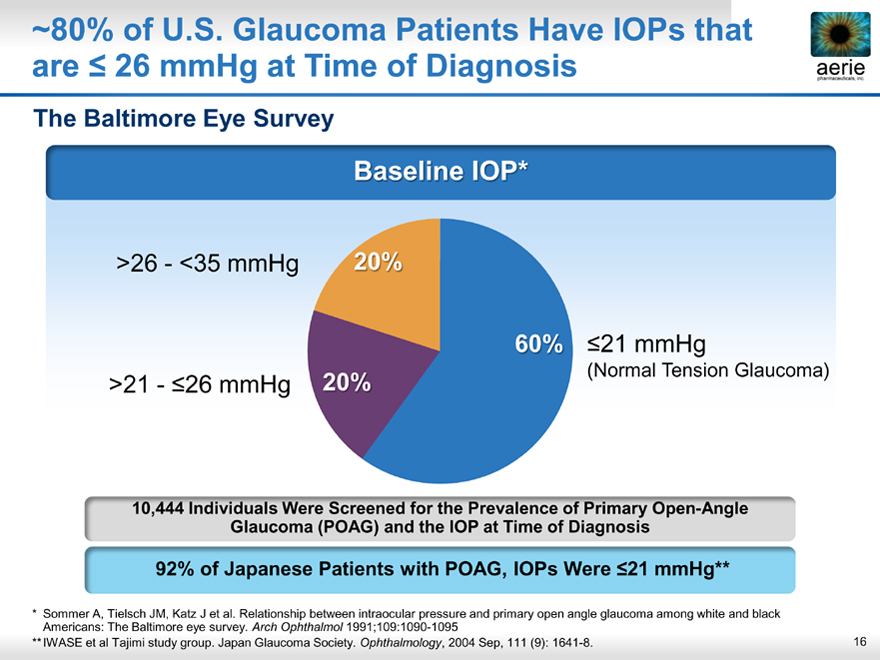

~80% of U.S. Glaucoma Patients Have IOPs that are <26 mmHg at Time of Diagnosis

The Baltimore Eye Survey

Baseline IOP*

>26 - <35 mmHg 20%

60%< 21 mmHg

20% (Normal Tension Glaucoma)

>21 - <26 mmHg

10,444 Individuals Were Screened for the Prevalence of Primary Open-Angle Glaucoma (POAG) and the IOP at Time of Diagnosis

92% of Japanese Patients with POAG, IOPs Were <21 mmHg**

* Sommer A, Tielsch JM, Katz J et al. Relationship between intraocular pressure and primary open angle glaucoma among white and black Americans: The Baltimore eye survey. Arch Ophthalmol 1991;109:1090-1095 **IWASE et al Tajimi study group. Japan Glaucoma Society. Ophthalmology, 2004 Sep, 111 (9): 1641-8.

16

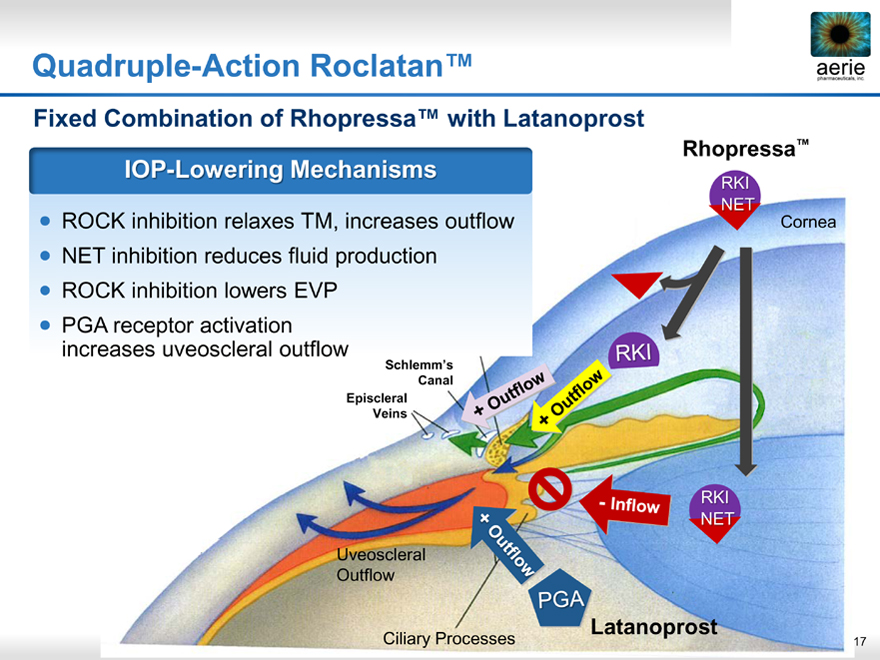

Quadruple-Action Roclatan™

aerie pharmaceuticals, inc.

Fixed Combination of Rhopressa™ with Latanoprost

IOP-Lowering Mechanisms

ROCK inhibition relaxes TM, increases outflow

NET inhibition reduces fluid production

ROCK inhibition lowers EVP

• PGA receptor activation increases uveoscleral outflow

Rhopressa™

RKI NET

Cornea

Trabecular Meshwork Schlemm’s Canal Episcleral Veins

RKI

Uveoscleral

Outflow

Latanoprost

Ciliary Processes 17

- Inflow

PGA

Q&A

18

Rhopressa™ / Roclatan™ Clinical Updates

Brian Levy

19

IOP Measurement Variability

aerie pharmaceuticals, inc.

Measuring Intraocular Pressure (IOP) – Goldmann Applanation Tonometry

Goldmann is standard against which others measured

Corneal Thickness affects measurement of IOP

Inter- and intra-observer variability (>30% varied by 2-3 mmHg)

• Protocol specified clinical technique results in ~0.5 mmHg variability in IOP measurements

20

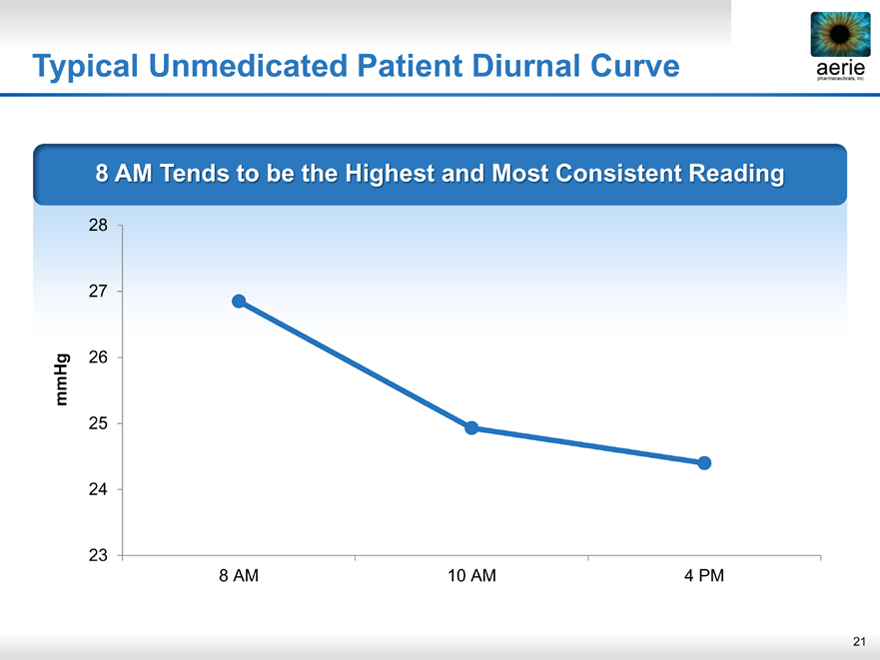

Typical Unmedicated Patient Diurnal Curve

8 AM Tends to be the Highest and Most Consistent Reading

28

27

mmHg 26 25

24

23

8 AM 10 AM 4 PM

21

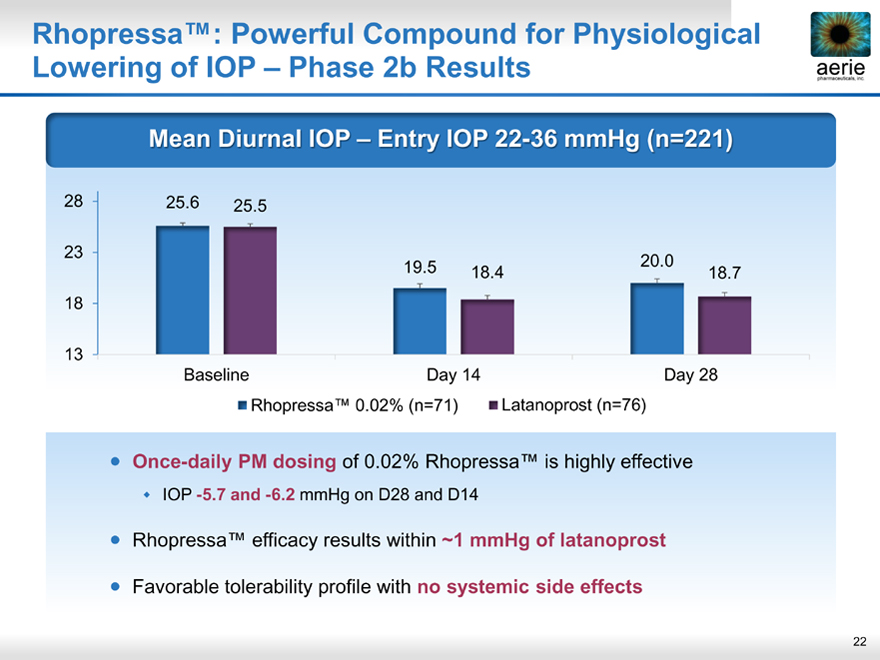

Rhopressa™: Powerful Compound for Physiological Lowering of IOP – Phase 2b Results

aerie pharmaceuticals, inc.

Mean Diurnal IOP – Entry IOP 22-36 mmHg (n=221)

28 25.6 25.5

23

19.5 20.0 18.4 18.7 18

13

Baseline Day 14 Day 28

• Rhopressa™ 0.02% (n=71) • Latanoprost (n=76)

• Once-daily PM dosing of 0.02% Rhopressa™ is highly effective

• IOP -5.7 and -6.2 mmHg on D28 and D14

• Rhopressa™ efficacy results within ~1 mmHg of latanoprost

• Favorable tolerability profile with no systemic side effects

22

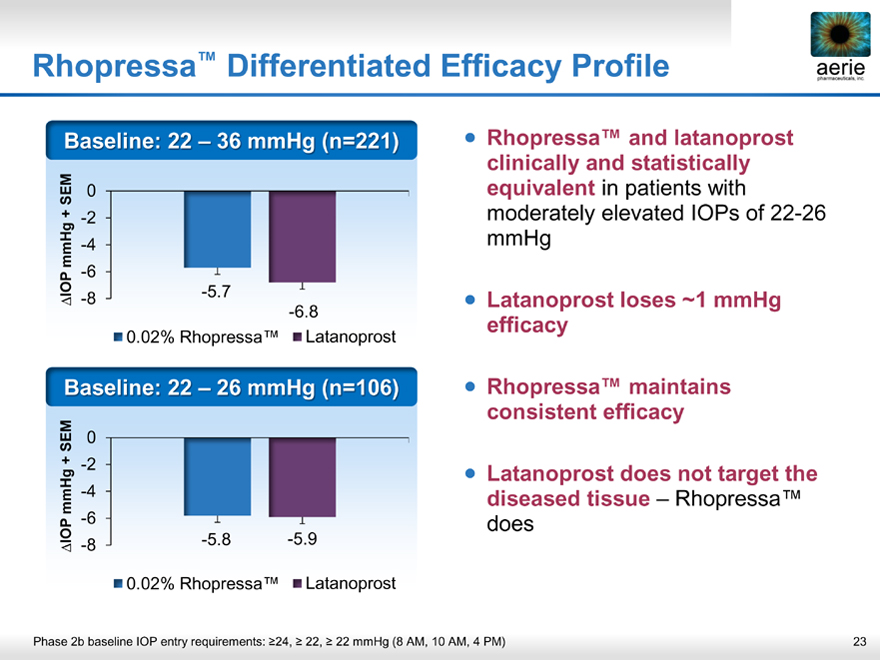

Rhopressa™ Differentiated Efficacy Profile

aerie pharmaceuticals, inc.

Baseline: 22 – 36 mmHg (n=221)

IOP mmHg + SEM

-8 -6 -4 -2 0

-5.7

-6.8

• 0.02% Rhopressa™ • Latanoprost

Baseline: 22 – 26 mmHg (n=106)

IOP mmHg + SEM

-8 -6 -4 -2 0

-5.8 -5.9

• 0.02% Rhopressa™ • Latanoprost

• Rhopressa™ and latanoprost clinically and statistically equivalent in patients with moderately elevated IOPs of 22-26 mmHg

• Latanoprost loses ~1 mmHg efficacy

• Rhopressa™ maintains consistent efficacy

• Latanoprost does not target the diseased tissue – Rhopressa™ does

Phase 2b baseline IOP entry requirements: >24, >22, >22 mmHg (8 AM, 10 AM, 4 PM)

23

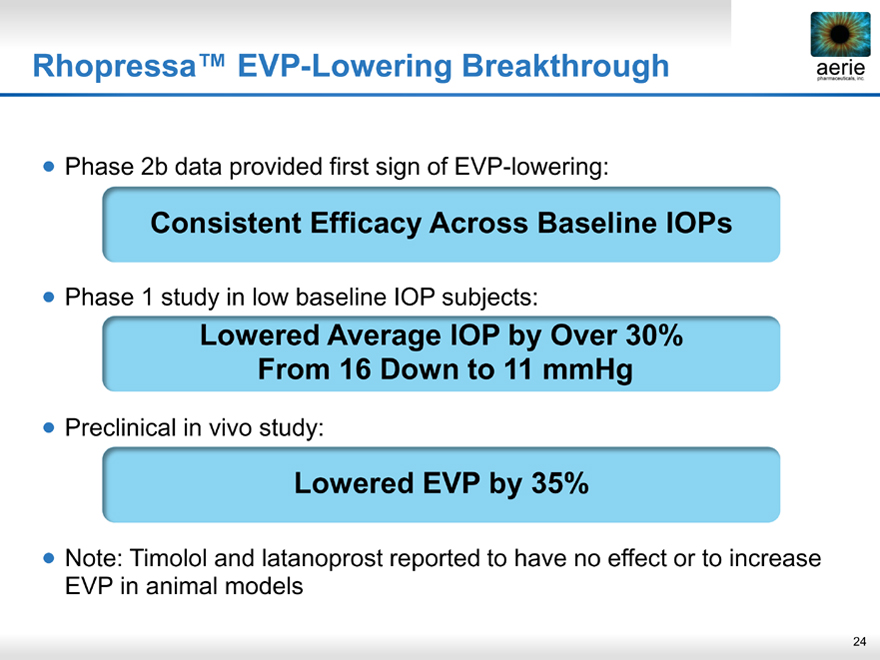

Rhopressa™ EVP-Lowering Breakthrough

aerie pharmaceuticals, inc.

• Phase 2b data provided first sign of EVP-lowering:

Consistent Efficacy Across Baseline IOPs

• Phase 1 study in low baseline IOP subjects:

Lowered Average IOP by Over 30% From 16 Down to 11 mmHg

• Preclinical in vivo study:

Lowered EVP by 35%

• Note: Timolol and latanoprost reported to have no effect or to increase EVP in animal models

24

Latanoprost and Timolol Show Reduced Efficacy at Lower Baseline IOPs

aerie pharmaceuticals, inc.

Diurnal IOP Change Month 6 (mmHg)

-16 -14 -12 -10 -8 -6 -4 -2 0

16 18 20 22 24 26 28 30 32 34 36 38

Untreated Diurnal IOP (mmHg)

Timolol (n=369) Latanoprost (n=460)

• Latanoprost and timolol lose efficacy as baseline IOPs decline

• Timolol at least 1 mmHg less effective than latanoprost across all published baselines

• Rhopressa™ equivalent/ non-inferior to latanoprost at baselines 22–26 mmHg

• Timolol is the standard comparator for glaucoma Phase 3 trials

Pooled data from three latanoprost registration studies. Hedman and Alm; European Journal Ophthalmology;2000

25

Rhopressa™ Phase 3 De-risking / Confidence Summary

aerie pharmaceuticals, inc.

• Rhopressa™ Phase 3 entry IOP is >20 mmHg and <27 mmHg

• Rhopressa™ QD non-inferior to latanoprost at entry IOPs of 22-26 mmHg

• Timolol is comparator for Phase 3 trials (standard comparator)

• Timolol BID at least 1 mmHg less effective than latanoprost across all published baselines • FDA agreed to these entry IOPs with no expected impact on label

• Rhopressa™ well-tolerated with hyperemia rates within range of current PGA drugs

• No drug-related systemic safety issues in Phase1/Phase 2 trials

• Approximately 250 patients exposed to 0.02% Rhopressa™ to date

26

Rhopressa™ Registration Trial Overview

aerie pharmaceuticals, inc.

Š Primary efficacy endpoint: IOP at nine time points through Day 90

Š Non-inferiority design vs. timolol

‰ 95% Cl within 1.5 mmHg at all time points, within 1.0 mmHg at a majority of time points

FDA discussions on Phase 3 design complete

‰ Combined trials to include approximately 1,300 total patients

‰ 100 patients with 12 months of safety data needed for NDA filing

Š Should meet efficacy requirements for EMA file

‰ 300 patients with 6 months safety data needed for EMA filing and 100 with 12 months

27

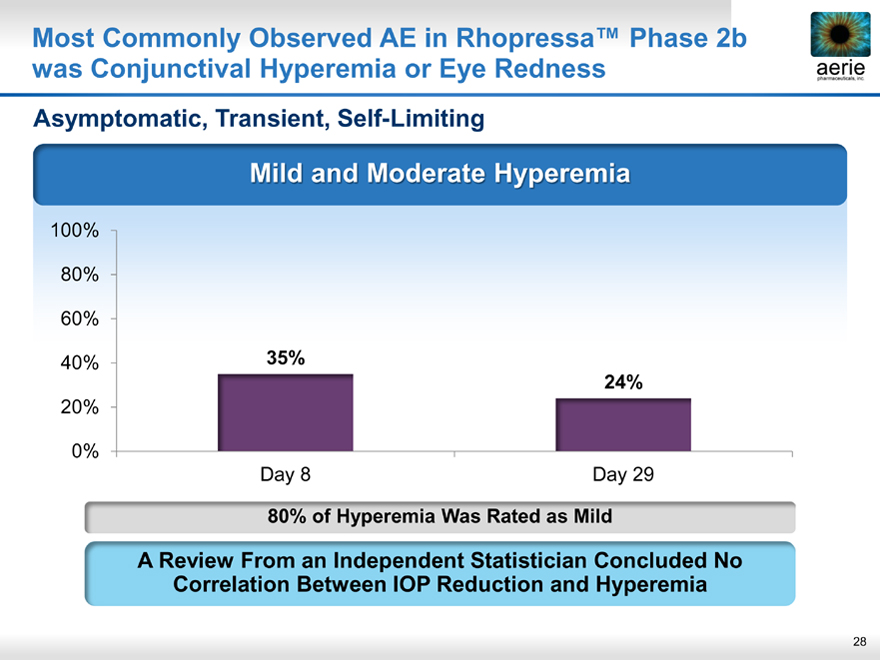

Most Commonly Observed AE in Rhopressa™ Phase 2b was Conjunctival Hyperemia or Eye Rednessaerie pharmaceuticals, inc.

Asymptomatic, Transient, Self-Limiting

Mild and Moderate Hyperemia

100%

80%

60%

40% 35%

24%

20%

0%

Day 8 Day 29

80% of Hyperemia Was Rated as Mild

A Review From an Independent Statistician Concluded No Correlation Between IOP Reduction and Hyperemia

28

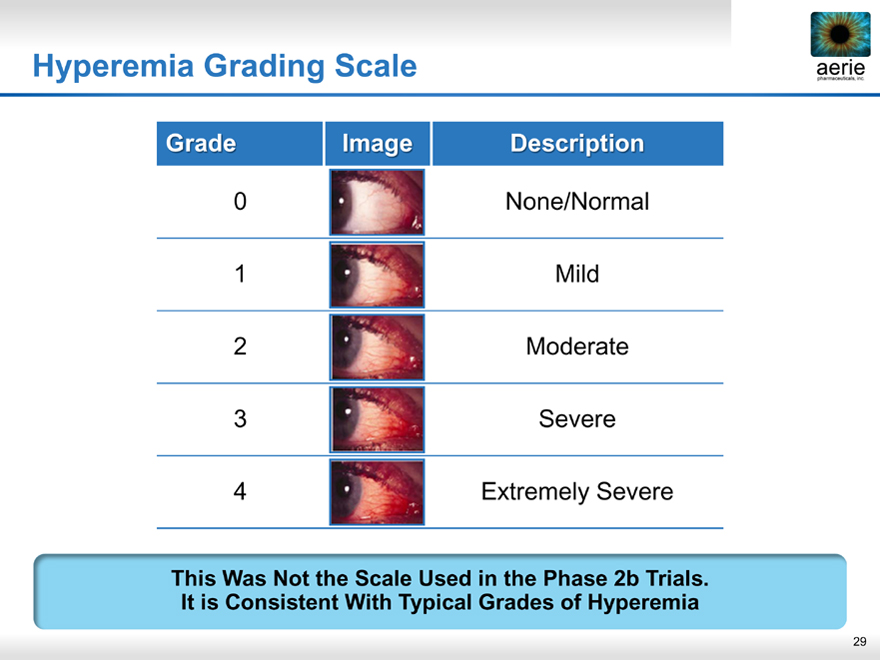

Hyperemia Grading Scale

aerie pharmaceuticals, inc.

Grade Image Description

0 None/Normal

1 Mild

2 Moderate

3 Severe

4 Extremely Severe

This Was Not the Scale Used in the Phase 2b Trials. It is Consistent With Typical Grades of Hyperemia

29

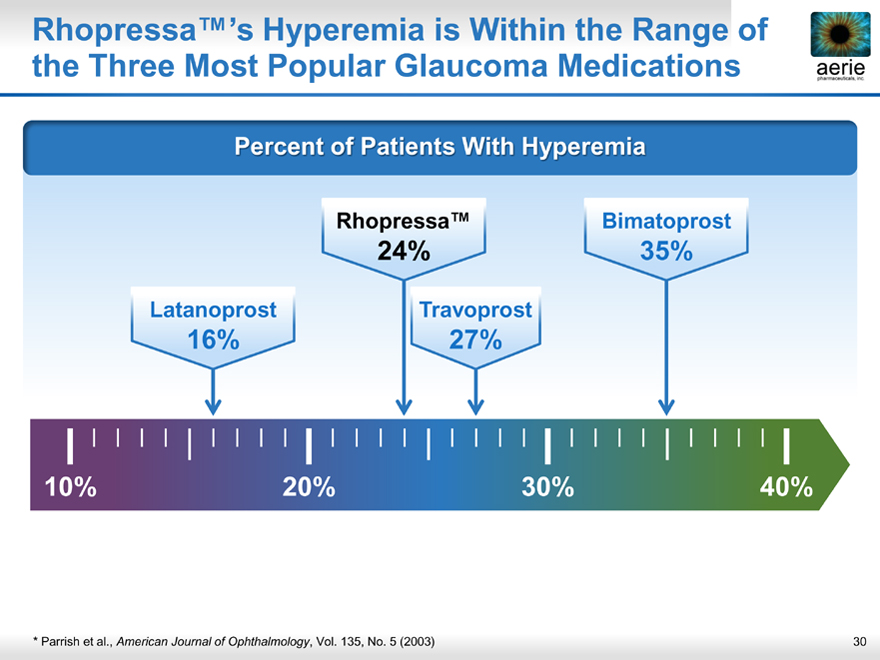

Rhopressa™’s Hyperemia is Within the Range of the Three Most Popular Glaucoma Medications

aerie pharmaceuticals, inc.

Percent of Patients With Hyperemia

Rhopressa™ Bimatoprost

24% 35%

Latanoprost Travoprost

16% 27%

10% 20% 30% 40%

* Parrish et al., American Journal of Ophthalmology, Vol. 135, No. 5 (2003)

30

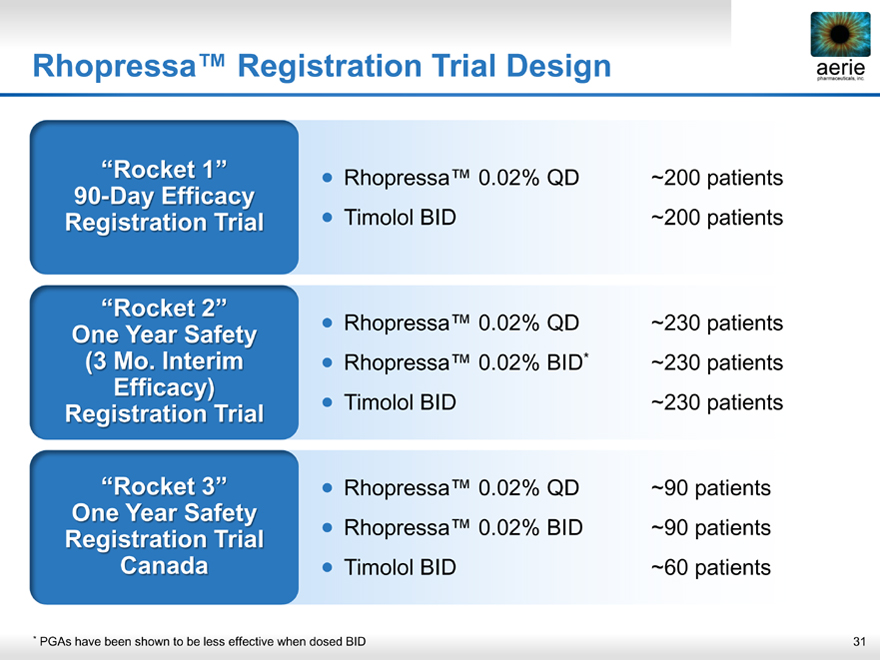

Rhopressa™ Registration Trial Design

aerie pharmaceuticals, inc.

“Rocket 1” • Rhopressa™ 0.02% QD

~200patients

90-Day Efficacy

Registration Trial • Timolol BID

~200 patients

“Rocket 2” • Rhopressa™ 0.02% QD

~230 patients

One Year Safety

(3 Mo Interim • Rhopressa™ 0.02% BID*

~230 patients

Efficacy)

Registration Trial • Timolol BID

~230 patients

“Rocket 3” • Rhopressa™ 0.02% QD

~90 patients

One Year Safety

Registration Trial • Rhopressa™ 0.02% BID

~90 patients

Canada • Timolol BID

~60 patients

* PGAs have been shown to be less effective when dosed BID

31

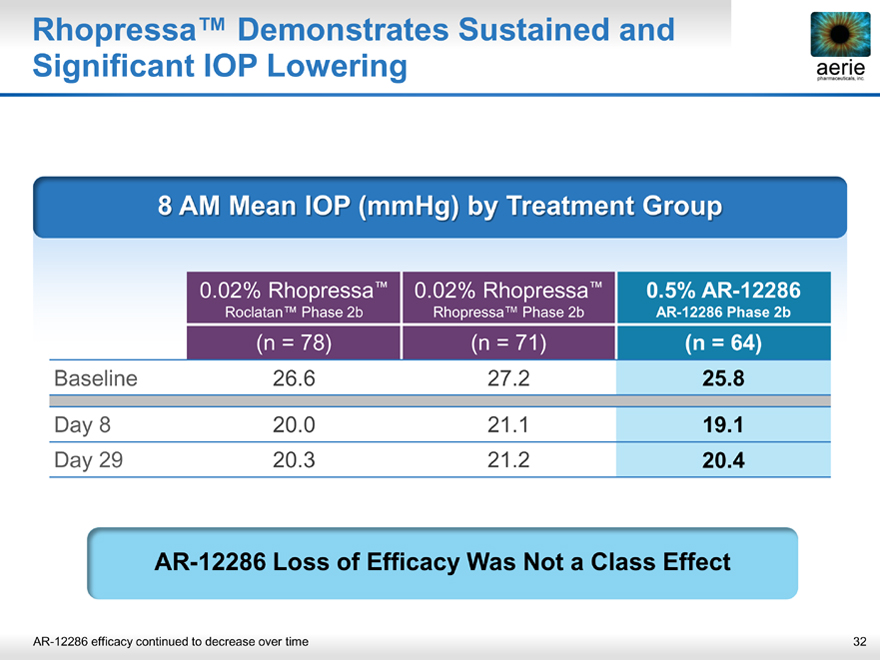

Rhopressa™ Demonstrates Sustained and Significant IOP Lowering aerie

aerie pharmaceuticals, inc.

8 AM Mean IOP (mmHg) by Treatment Group

0.02% Rhopressa™ 0.02% Rhopressa™ 0.5% AR-12286

Roclatan™ Phase 2b Rhopressa™ Phase 2b AR-12286 Phase 2b

(n = 78)(n = 71)(n = 64)

Baseline 26.6 27.2 25.8

Day 8 20.0 21.1 19.1

Day 29 20.3 21.2 20.4

AR-12286 Loss of Efficacy Was Not a Class Effect

AR-12286 efficacy continued to decrease over time

32

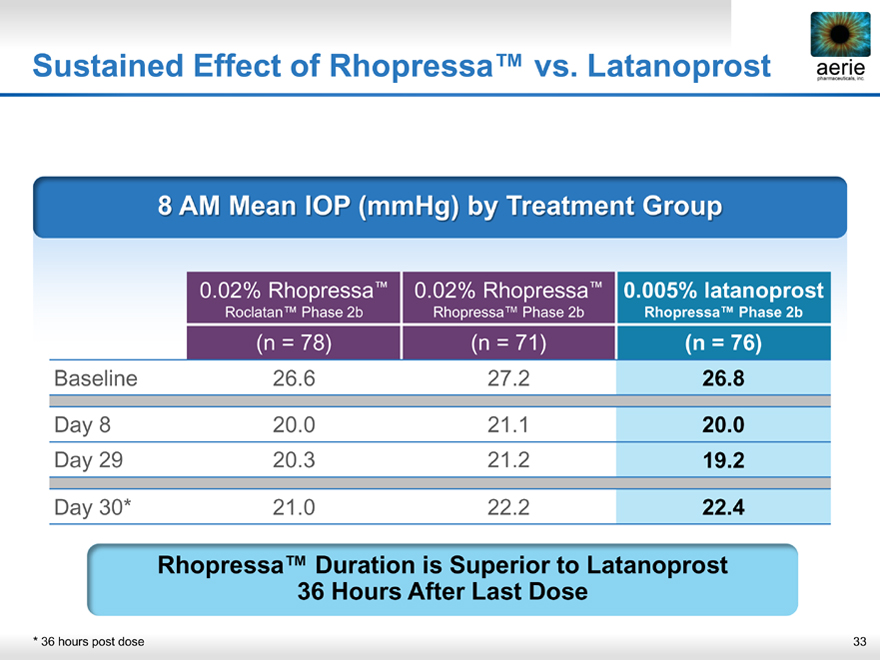

Sustained Effect of Rhopressa™ vs. Latanoprost

aerie pharmaceuticals, inc.

8 AM Mean IOP (mmHg) by Treatment Group

0.02% Rhopressa™ 0.02% Rhopressa™ 0.005% latanoprost

Roclatan™ Phase 2b Rhopressa™ Phase 2b Rhopressa™ Phase 2b

(n = 78) (n = 71) (n = 76)

Baseline 26.6 27.2 26.8

Day 8 20.0 21.1 20.0

Day 29 20.3 21.2 19.2

Day 30* 21.0 22.2 22.4

Rhopressa™ Duration is Superior to Latanoprost

36 Hours After Last Dose

* 36 hours post dose

33

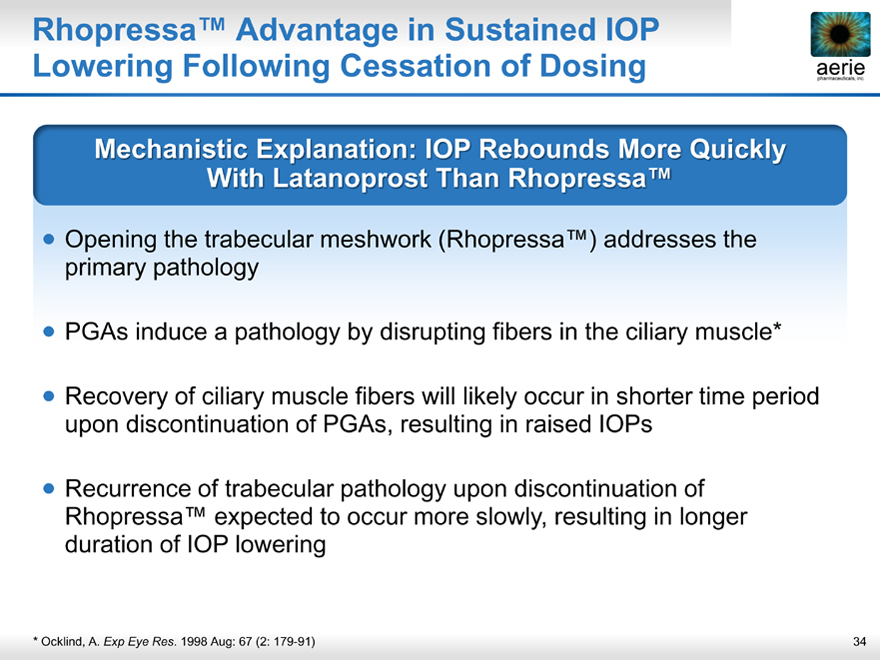

Rhopressa™ Advantage in Sustained IOP

aerie pharmaceuticals, inc. Lowering Following Cessation of Dosing aerie

Mechanistic Explanation: IOP Rebounds More Quickly With Latanoprost Than Rhopressa™

Opening the trabecular meshwork (Rhopressa™) addresses the primary pathology

PGAs induce a pathology by disrupting fibers in the ciliary muscle*

Recovery of ciliary muscle fibers will likely occur in shorter time period upon discontinuation of PGAs, resulting in raised IOPs

Recurrence of trabecular pathology upon discontinuation of Rhopressa™ expected to occur more slowly, resulting in longer duration of IOP lowering

* Ocklind, A. Exp Eye Res. 1998 Aug: 67 (2: 179-91)

34

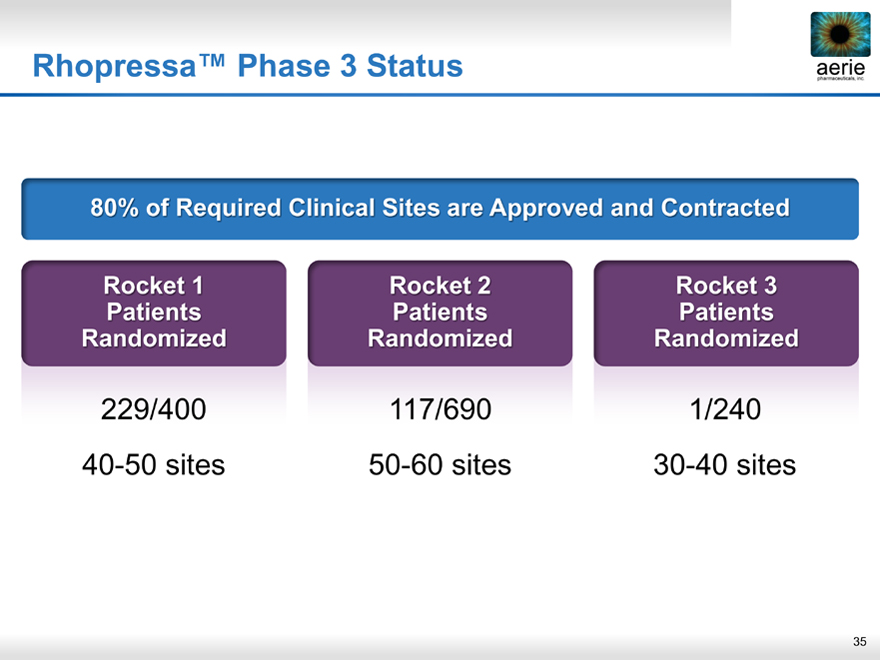

Rhopressa™ Phase 3 Status aerie

aerie pharmaceuticals, inc.

80% of Required Clinical Sites are Approved and Contracted

Rocket 1 Rocket 2 Rocket 3

Patients Patients Patients

Randomized Randomized Randomized

229/400 117/690 1/240

40-50 sites 50-60 sites 30-40 sites

35

Roclatan™ Discussion

36

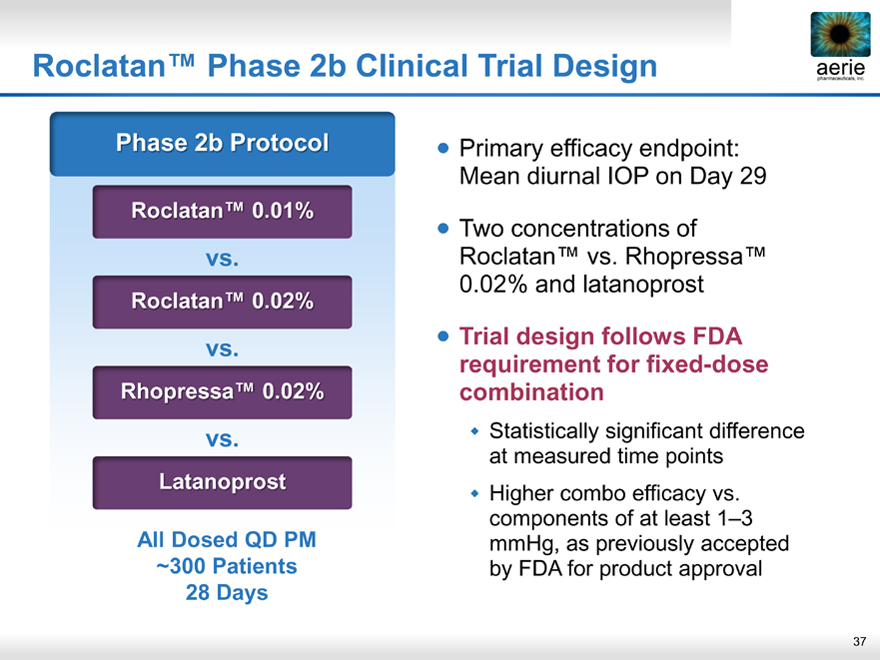

Roclatan™ Phase 2b Clinical Trial Design aerie

aerie pharmaceuticals, inc.

Phase 2b Protocol

Roclatan ™ 0.01%

vs.

Roclatan ™ 0.02%

vs.

Rhopressa™ 0.02%

vs.

Latanoprost

All Dosed QD PM ~300 Patients

28 Days

Primary efficacy endpoint: Mean diurnal IOP on Day 29

Two concentrations of Roclatan™ vs. Rhopressa™ 0.02% and latanoprost

Trial design follows FDA requirement for fixed-dose combination

Statistically significant difference at measured time points

Higher combo efficacy vs. components of at least 1–3 mmHg, as previously accepted by FDA for product approval

37

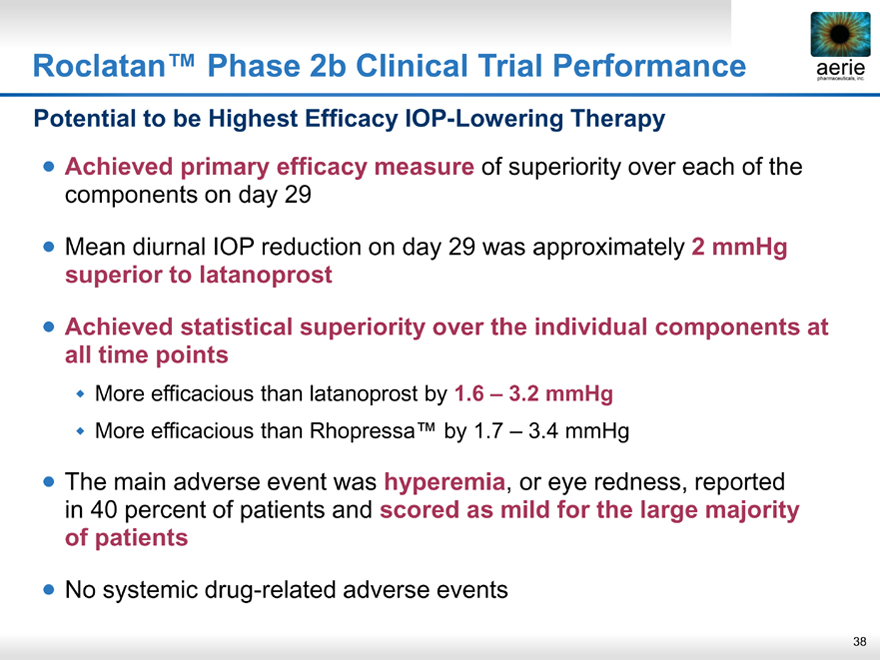

Roclatan™ Phase 2b Clinical Trial Performance aerie

aerie pharmaceuticals, inc.

Potential to be Highest Efficacy IOP-Lowering Therapy

Achieved primary efficacy measure of superiority over each of the components on day 29

• Mean diurnal IOP reduction on day 29 was approximately 2 mmHg superior to latanoprost

• Achieved statistical superiority over the individual components at all time points

More efficacious than latanoprost by 1.6 – 3.2 mmHg More efficacious than Rhopressa™ by 1.7 – 3.4 mmHg

• The main adverse event was hyperemia, or eye redness, reported in 40 percent of patients and scored as mild for the large majority of patients

No systemic drug-related adverse events

38

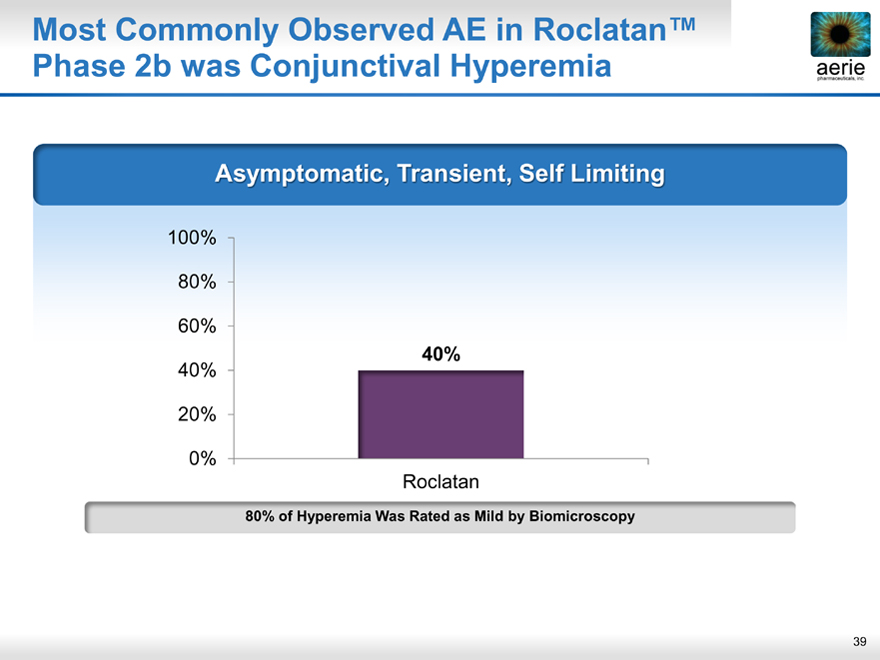

Most Commonly Observed AE in Roclatan™ Phase 2b was Conjunctival Hyperemia

aerie pharmaceuticals, inc.

Asymptomati , Transient, Self Limiting

100%

80%

60%

40%

40%

20%

0%

Roclatan

80% of Hyperemia Was Rated as Mild by Biomicroscopy

39

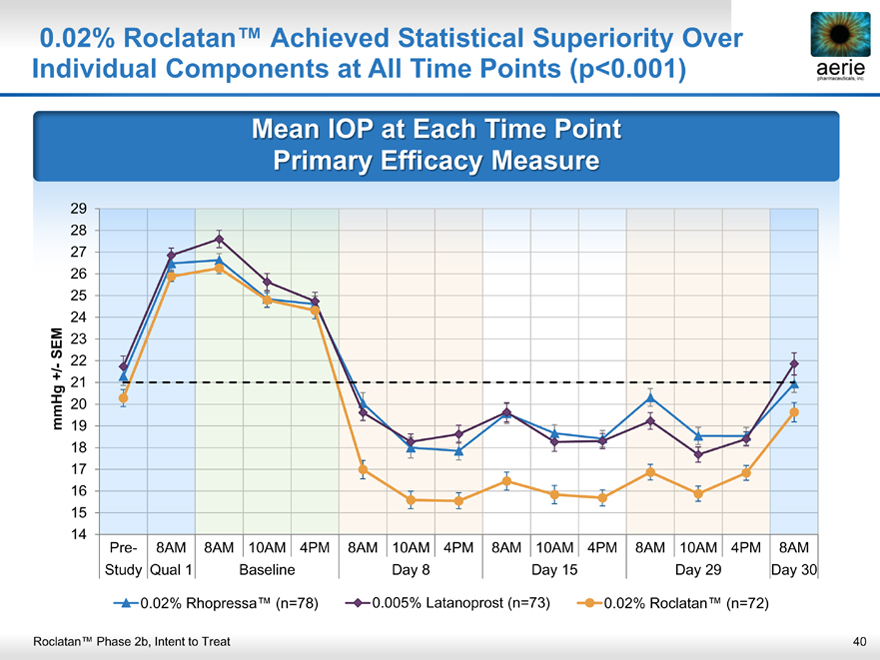

0.02% Roclatan™ Achieved Statistical Superiority Over Individual Components at All Time Points (p<0.001)

aerie pharmaceuticals, inc.

Mean IOP at Each Time Point Primary Efficacy Measure

29

28

27

26

25

24

SEM 23

- 22

+/ 21

mmHg 20

19

18

17

16

15

14

Pre- 8AM 8AM 10AM 4PM 8AM 10AM 4PM 8AM 10AM 4PM 8AM 10AM 4PM 8AM Study Qual 1 Baseline Day 8 Day 15 Day 29 Day 30

0.02% Rhopressa™ (n=78) 0.005% Latanoprost (n=73) 0.02% Roclatan™ (n=72)

Roclatan™ Phase 2b, Intent to Treat

40

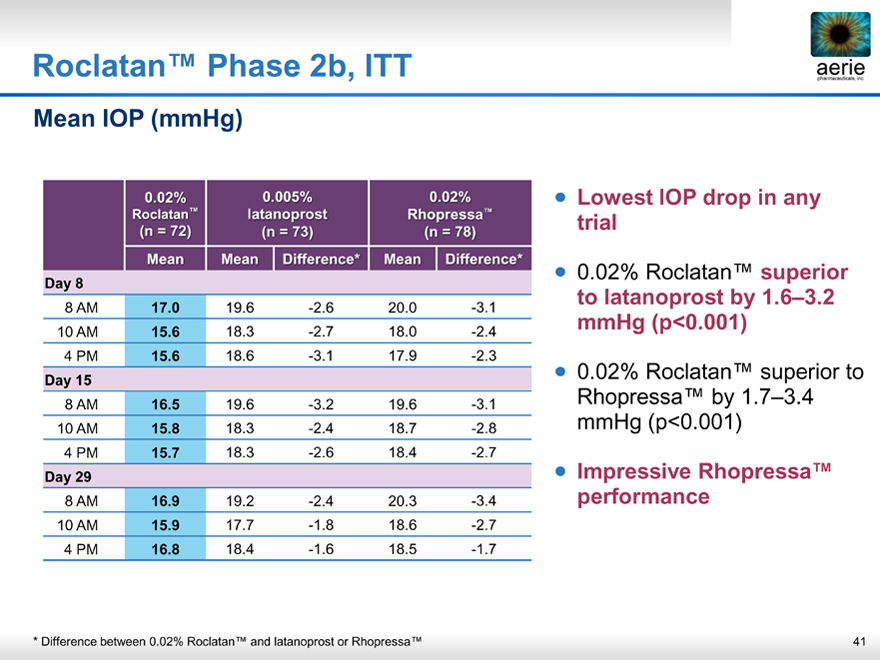

Roclatan™ Phase 2b, ITT

aeria pharmaceuticals, inc.

Mean IOP (mmHg)

0.02% 0.005% 0.02%

Roclatan™ latanoprost Rhopress ™

(n = 72)(n = 73)(n = 78)

Mean Mean Difference* Mean Difference*

Day 8

8 AM 17.0 19.6 -2.6 20.0 -3.1

10 AM 15.6 18.3 -2.7 18.0 -2.4

4 PM 15.6 18.6 -3.1 17.9 -2.3

Day 15

8 AM 16.5 19.6 -3.2 19.6 -3.1

10 AM 15.8 18.3 -2.4 18.7 -2.8

4 PM 15.7 18.3 -2.6 18.4 -2.7

Day 29

8 AM 16.9 19.2 -2.4 20.3 -3.4

10 AM 15.9 17.7 -1.8 18.6 -2.7

4 PM 16.8 18.4 -1.6 18.5 -1.7

Lowest IOP drop in any trial

0.02% Roclatan™ superior to latanoprost by 1.6–3.2 mmHg (p<0.001)

0.02% Roclatan™ superior to Rhopressa™ by 1.7–3.4 mmHg (p<0.001)

Impressive Rhopressa™ performance

* Difference between 0.02% Roclatan™ and latanoprost or Rhopressa™

41

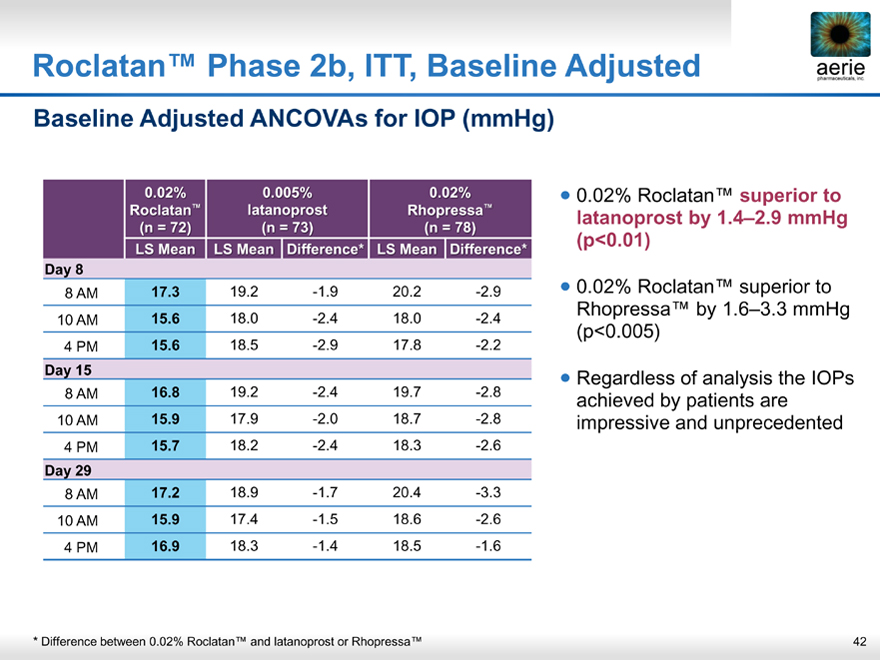

Roclatan™ Phase 2b, ITT, Baseline Adjusted

aeria pharmaceuticals, inc.

Baseline Adjusted ANCOVAs for IOP (mmHg)

0.02% 0.005% 0.02%

Roclatan™ latanoprost Rhopress ™

(n = 72)(n = 73)(n = 78)

LS Mean LS Mean Difference* LS Mean Difference*

Day 8

8 AM 17.3 19.2 -1.9 20.2 -2.9

10 AM 15.6 18.0 -2.4 18.0 -2.4

4 PM 15.6 18.5 -2.9 17.8 -2.2

Day 15

8 AM 16.8 19.2 -2.4 19.7 -2.8

10 AM 15.9 17.9 -2.0 18.7 -2.8

4 PM 15.7 18.2 -2.4 18.3 -2.6

Day 29

8 AM 17.2 18.9 -1.7 20.4 -3.3

10 AM 15.9 17.4 -1.5 18.6 -2.6

4 PM 16.9 18.3 -1.4 18.5 -1.6

0.02% Roclatan™ superior to latanoprost by 1.4–2.9 mmHg (p<0.01)

0.02% Roclatan™ superior to Rhopressa™ by 1.6–3.3 mmHg (p<0.005)

Regardless of analysis the IOPs achieved by patients are impressive and unprecedented

* Difference between 0.02% Roclatan™ and latanoprost or Rhopressa™

42

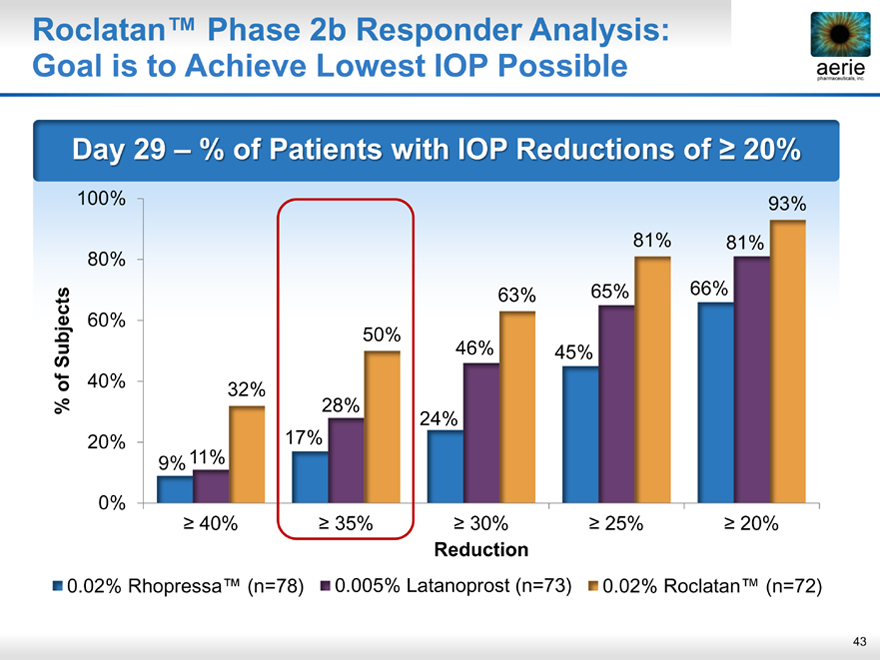

Roclatan™ Phase 2b Responder Analysis: Goal is to Achieve Lowest IOP Possible

aeria pharmaceuticals, inc.

Day 29 % of Patients with IOP Reductions of > 20%

100%

80%

Subjects 60% of 40% %

20%

0%

93% 81% 81% 63% 65% 66% 50% 46% 45% 32% 28% 24% 11% 17% 9%

> 40% > 35% > 30% > 25% > 20%

Reduction

0.02% Rhopressa™ (n=78) 0.005% Latanoprost (n=73) 0.02% Roclatan™ (n=72)

43

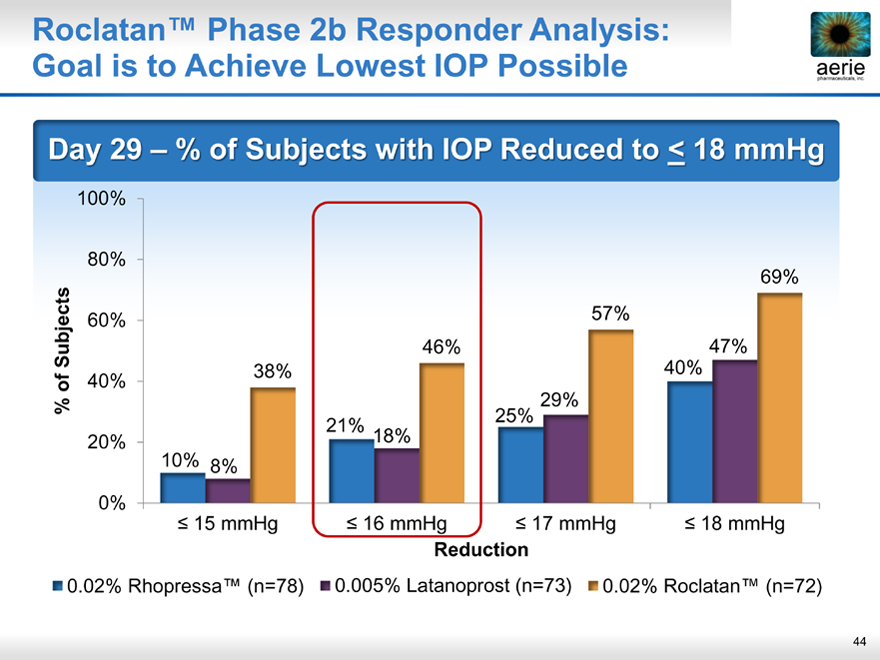

Roclatan™ Phase 2b Responder Analysis: Goal is to Achieve Lowest IOP Possible

aeria pharmaceuticals, inc.

Day 29 % of Subjects with IOP Reduced to < 18 mmHg

100%

80%

Subjects 60% of 40% %

20%

0%

69%

57%

46% 47%

38% 40%

29%

21% 18% 25%

10% 8%

< 15 mmHg < 16 mmHg < 17 mmHg < 18 mmHg

Reduction

0.02% Rhopressa™ (n=78) 0.005% Latanoprost (n=73) 0.02% Roclatan™ (n=72)

44

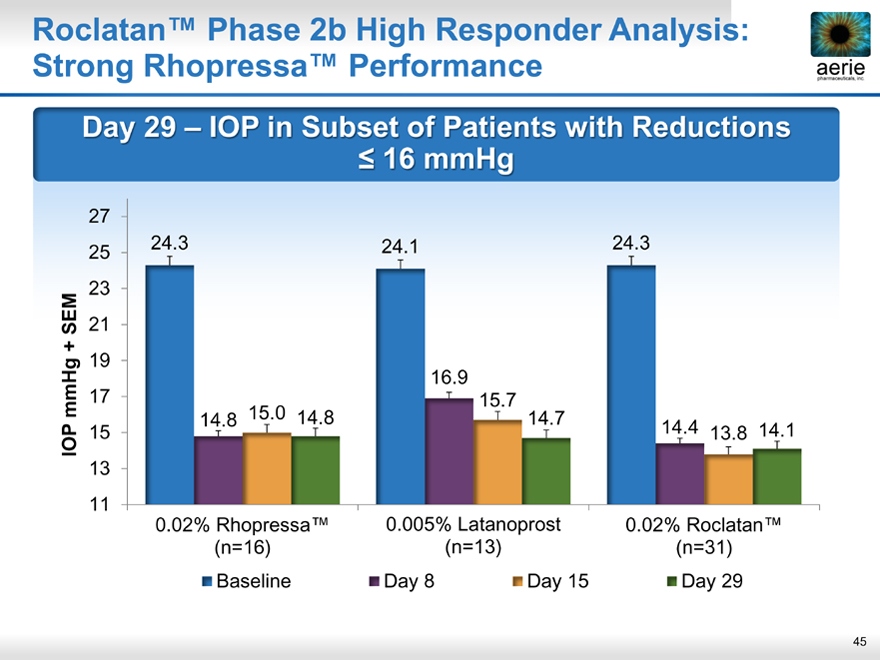

aeria pharmaceuticals, inc.

Roclatan™ Phase 2b High Responder Analysis: Strong Rhopressa™ Performance

Day 29 – IOP in Subset of Patients with Reductions

< 16 mmHg

27

25 24.3 24.1 24.3 23

SEM 21 + 19

16.9 mmHg 17 15.7 15.0

IOP 15 14.8 14.8 14.7 14.4 13.8 14.1 13 11

0.02% Rhopressa™ 0.005% Latanoprost 0.02% Roclatan™ (n=16) (n=13) (n=31)

Baseline Day 8 Day 15 Day 29

45

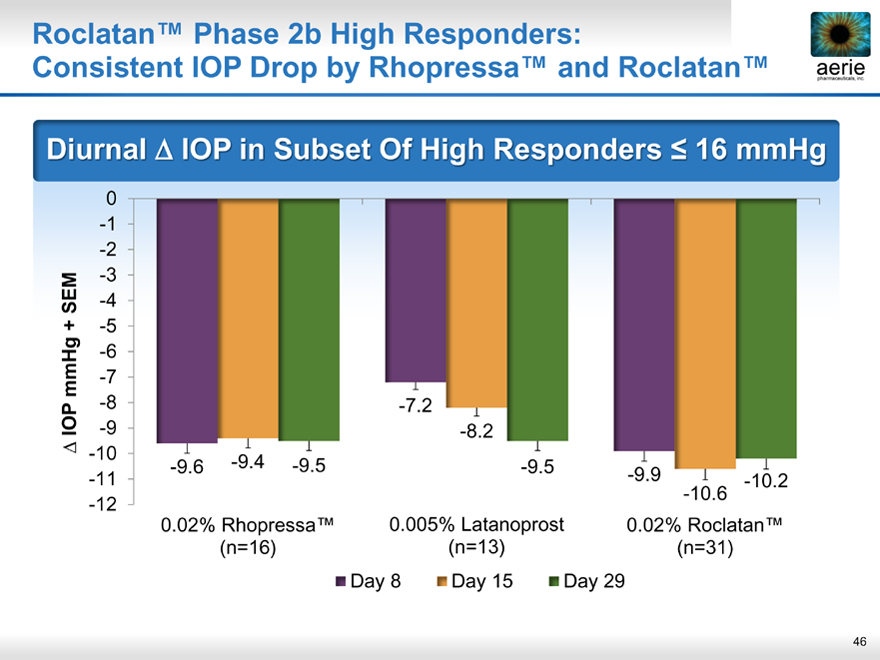

Roclatan™ Phase 2b High Responders:

aeria pharmaceuticals, inc.

Consistent IOP Drop by Rhopressa™ and Roclatan™

Diurnal IOP in Subset Of High Responders < 16 mmHg

0 -1 -2 -3

SEM -4

+ -5 -6 mmHg -7

-8

IOP -9

-10 -11 -12

-7.2 -8.2

-9.6 -9.4 -9.5 -9.5

-9.9 -10.6 -10.2

0.02% Rhopressa™ 0.005% Latanoprost 0.02% Roclatan™

(n=16) (n=13) (n=31)

• Day 8 • Day 15 • Day 29

46

Roclatan™ Expected Registration Trial Design

aeria pharmaceuticals, inc.

Two Trials Required by both FDA and EMA

• First Trial – 3 month efficacy/safety vs individual components required by FDA

• Second Trial – Further discussion with FDA regarding the nature of the incremental safety trial

• EU Regulators require comparison to an approved combination (FDA open to such a design)

• May conduct one of the trials in Europe

• Strategy will facilitate submission to both jurisdictions

• Patient numbers 1200-1500

47

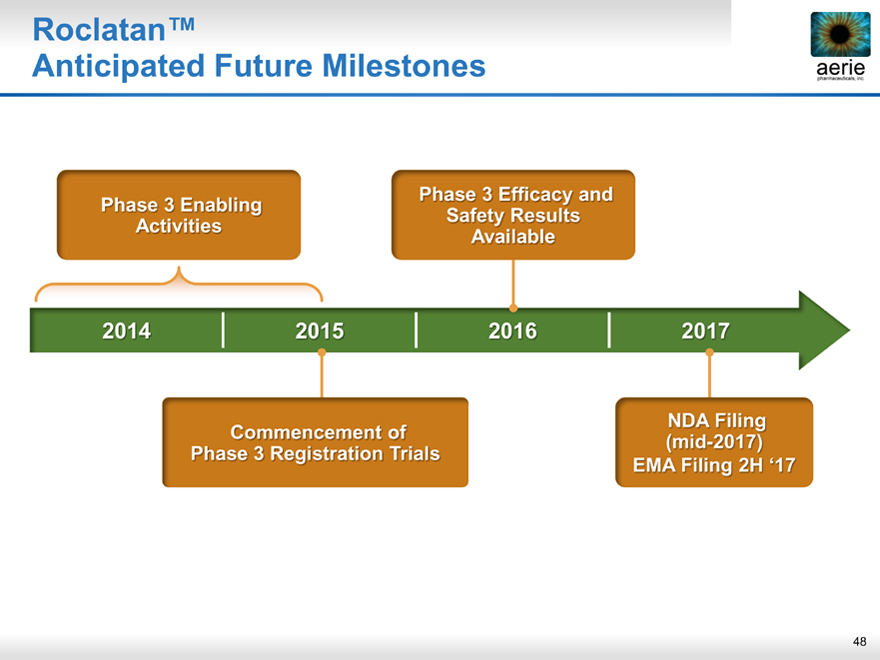

Roclatan™

aeria pharmaceuticals, inc.

Anticipated Future Milestones

Phase 3 Enabling Activities Phase 3 Efficacy and Safety Results Available

2014 2015 2016 2017

Commencement of Phase 3 Registration Trials NDA Filing (mid-2017) EMA Filing 2H ‘17

48

Roclatan™ Phase 3 Preparations

aeria pharmaceuticals, inc.

Preclinical Toxicology

• Discussed with FDA at Type C meeting

• One 3-month ocular tox study – underway

• One ocular PK study: Roclatan™ vs. each component

CMC

• API will be supplied from Rhopressa™ Registration Stability Batch

• Manufacture of Phase 3 DP scheduled 1Q2015

• Clinical supplies packaged, labeled, released mid-2015

49

Q&A

50

Marketing Research

Thomas Mitro

51

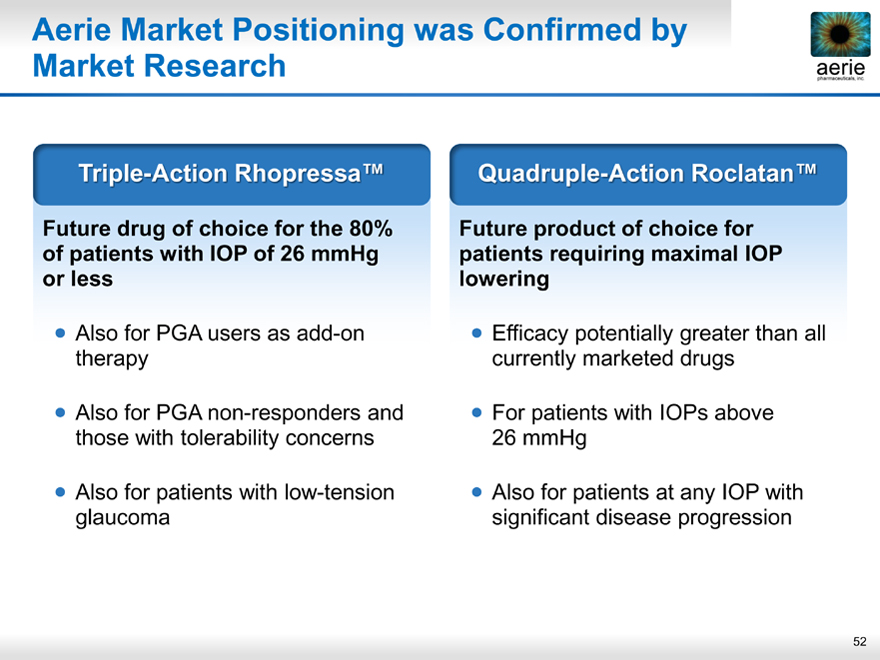

Aerie Market Positioning was Confirmed by Market Research

aeria pharmaceuticals, inc.

Triple-Action Rhopressa™

Future drug of choice for the 80% of patients with IOP of 26 mmHg or less

Also for PGA users as add-on therapy

Also for PGA non-responders and those with tolerability concerns

Also for patients with low-tension glaucoma

Quadruple-Action Roclatan™

Future product of choice for patients requiring maximal IOP lowering

Efficacy potentially greater than all currently marketed drugs

For patients with IOPs above 26 mmHg

Also for patients at any IOP with significant disease progression

52

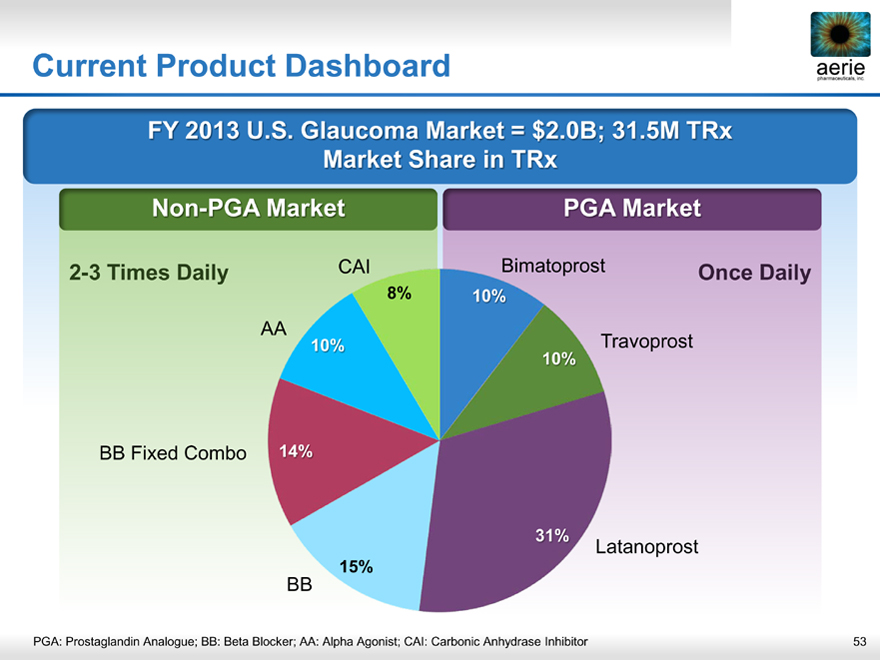

Current Product Dashboard

aeria pharmaceuticals, inc.

FY 2013 U.S. Glaucoma Market = $2.0B; 31.5M TRx Market Share in TRx

Non- PGA Market PGA Market

2-3 Times Daily CAI Bimatoprost Once Daily

8% 10%

AA

10% 10% Travoprost

BB Fixed Combo 14%

31%

Latanoprost

15%

BB

PGA: Prostaglandin Analogue; BB: Beta Blocker; AA: Alpha Agonist; CAI: Carbonic Anhydrase Inhibitor 53

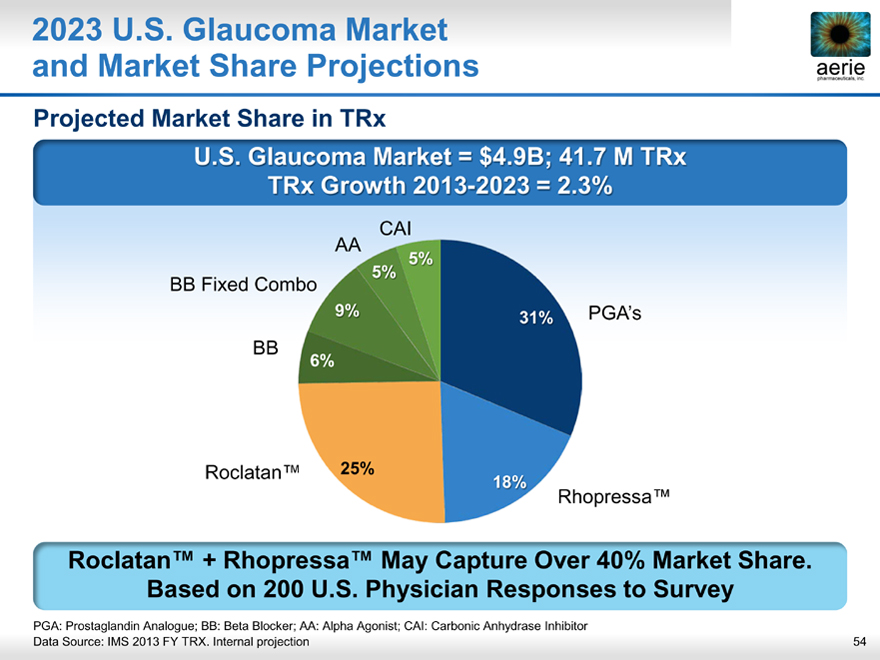

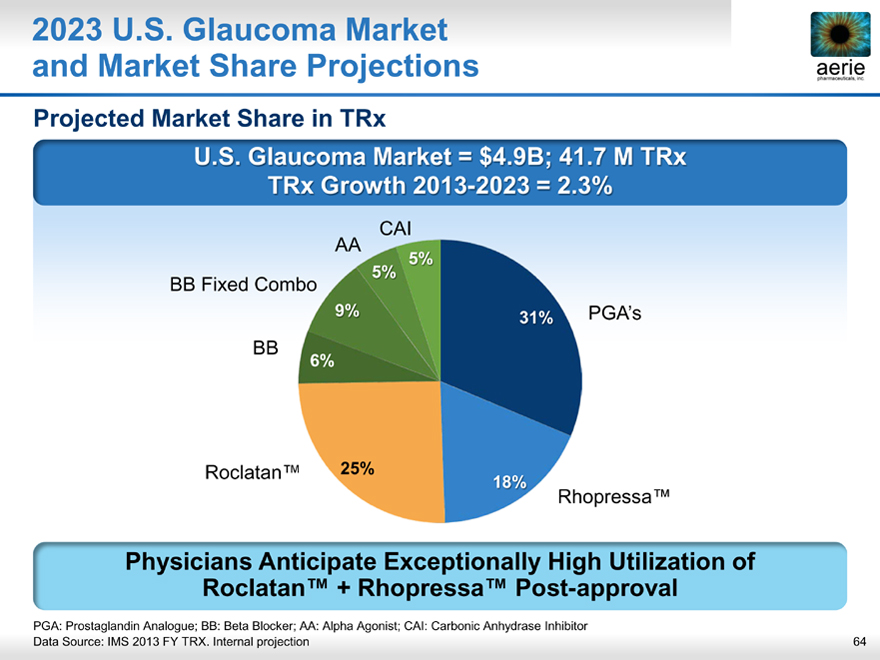

2023 U.S. Glaucoma Market and Market Share Projections

aeria pharmaceuticals, inc.

Projected Market Share in TRx

U.S. Glaucoma Market = $4.9B; 41.7 M TRx TRx Growth 2013- 2023 = 2.3%

CAI AA

5% 5%

BB Fixed Combo

9% 31% PGA’s BB

6%

Roclatan™ 25%

18%

Rhopressa™

Roclatan™ + Rhopressa™ May Capture Over 40% Market Share. Based on 200 U.S. Physician Responses to Survey

PGA: Prostaglandin Analogue; BB: Beta Blocker; AA: Alpha Agonist; CAI: Carbonic Anhydrase Inhibitor

Data Source: IMS 2013 FY TRX. Internal projection

54

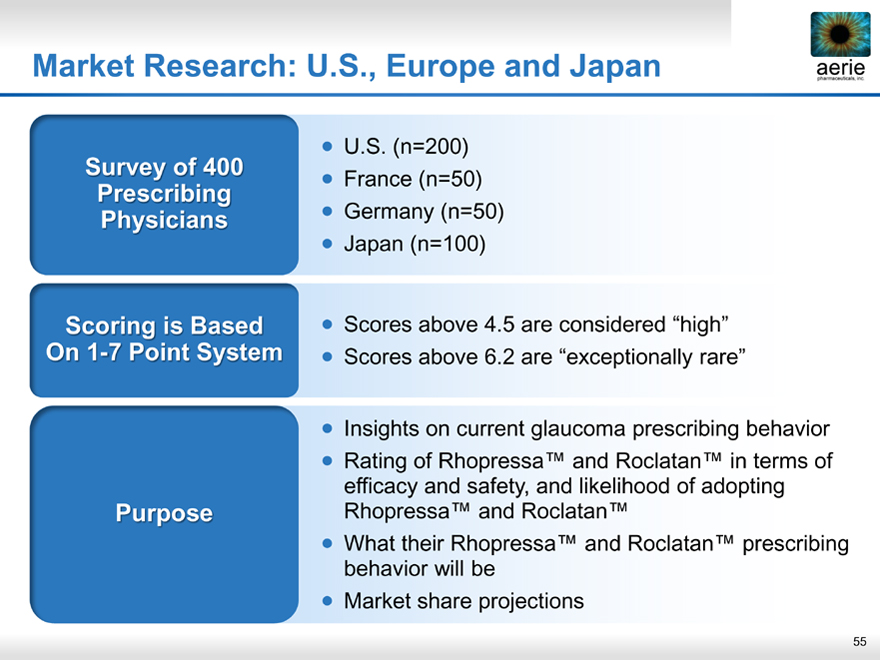

Market Research: U.S., Europe and Japan aerie

aeria pharmaceuticals, inc.

Survey of 400 Prescribing Physicians

Scoring is Based On1- 7 Point System

Purpose

U.S. (n=200)

France (n=50)

Germany (n=50)

Japan (n=100)

Scores above 4.5 are considered “high”

Scores above 6.2 are “exceptionally rare”

Insights on current glaucoma prescribing behavior

Rating of Rhopressa™ and Roclatan™ in terms of efficacy and safety, and likelihood of adopting Rhopressa™ and Roclatan™

What their Rhopressa™ and Roclatan™ prescribing behavior will be

Market share projections

55

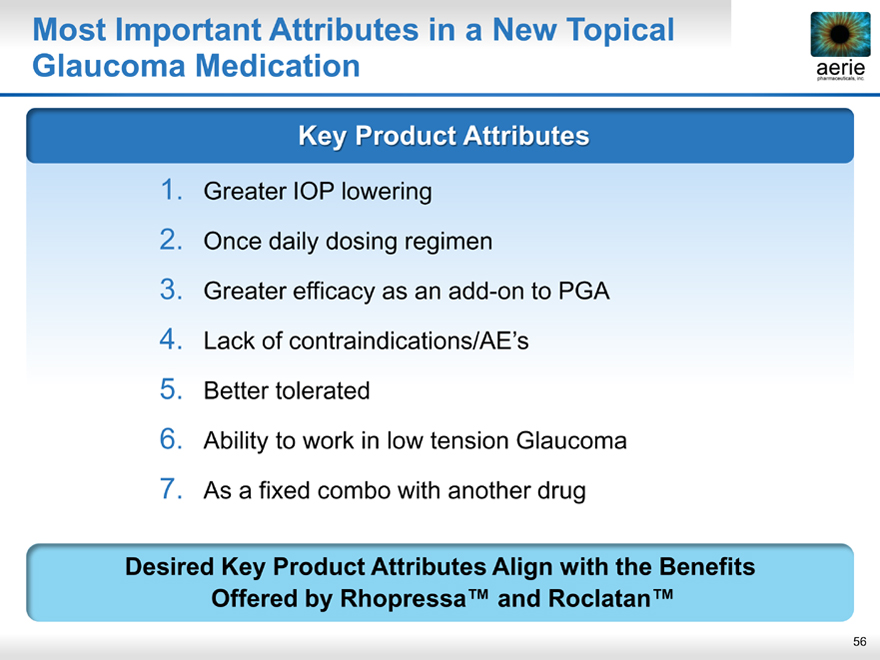

Most Important Attributes in a New Topical Glaucoma Medication

aeria pharmaceuticals, inc.

Key Product Attributes

1. Greater IOP lowering

2. Once daily dosing regimen

3. Greater efficacy as an add-on to PGA

4. Lack of contraindications/AE’s

5. Better tolerated

6. Ability to work in low tension Glaucoma

7. As a fixed combo with another drug

Desired Key Product Attributes Align with the Benefits Offered by Rhopressa™ and Roclatan™

56

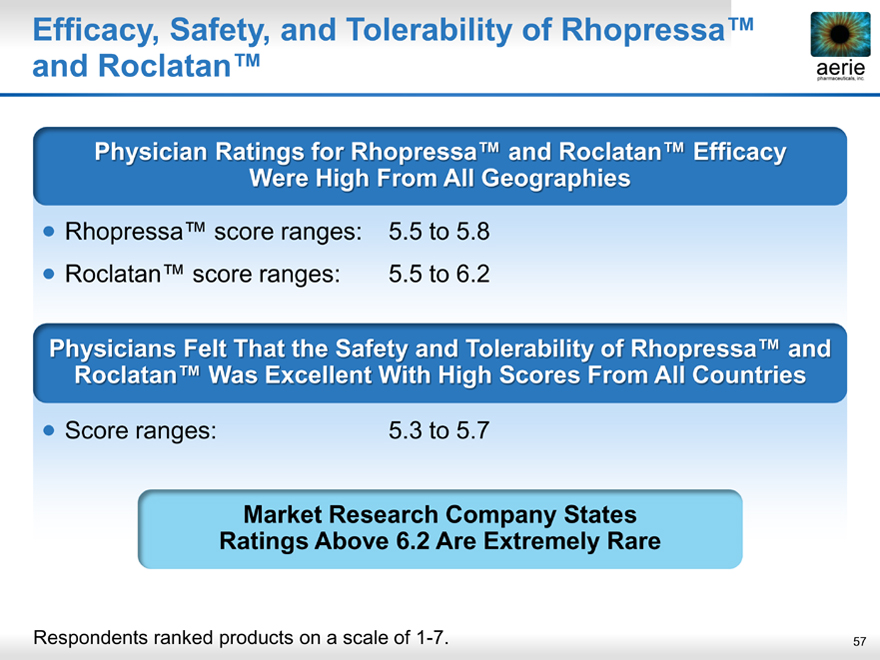

Efficacy, Safety, and Tolerability of Rhopressa™ and Roclatan™

aeria pharmaceuticals, inc.

Physician Ratings for Rhopressa™ and Roclatan™ Efficacy Were High From All Geographies

Rhopressa™ score ranges: 5.5 to 5.8

Roclatan™ score ranges: 5.5 to 6.2

Physicians Felt That the Safety and Tolerability of Rhopressa™ and Roclatan™ Was Excellent With High Scores From All Countries

Score ranges: 5.3 to 5.7

Market Research Company States Ratings Above 6.2 Are Extremely Rare

Respondents ranked products on a scale of 1-7.

57

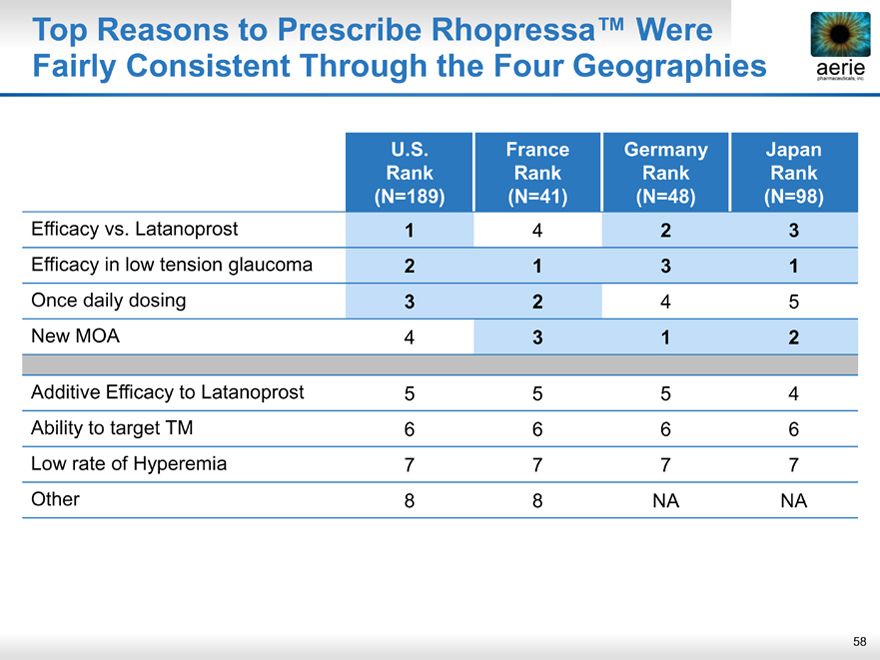

Top Reasons to Prescribe Rhopressa™ Were Fairly Consistent Through the Four Geographies

aeria pharmaceuticals, inc.

U.S. France Germany Japan

Rank Rank Rank Rank

(N=189)(N=41)(N=48)(N=98)

Efficacy vs. Latanoprost 1 4 2 3

Efficacy in low tension glaucoma 2 1 3 1

Once daily dosing 3 2 4 5

New MOA 4 3 1 2

Additive Efficacy to Latanoprost 5 5 5 4

Ability to target TM 6 6 6 6

Low rate of Hyperemia 7 7 7 7

Other 8 8 NA NA

58

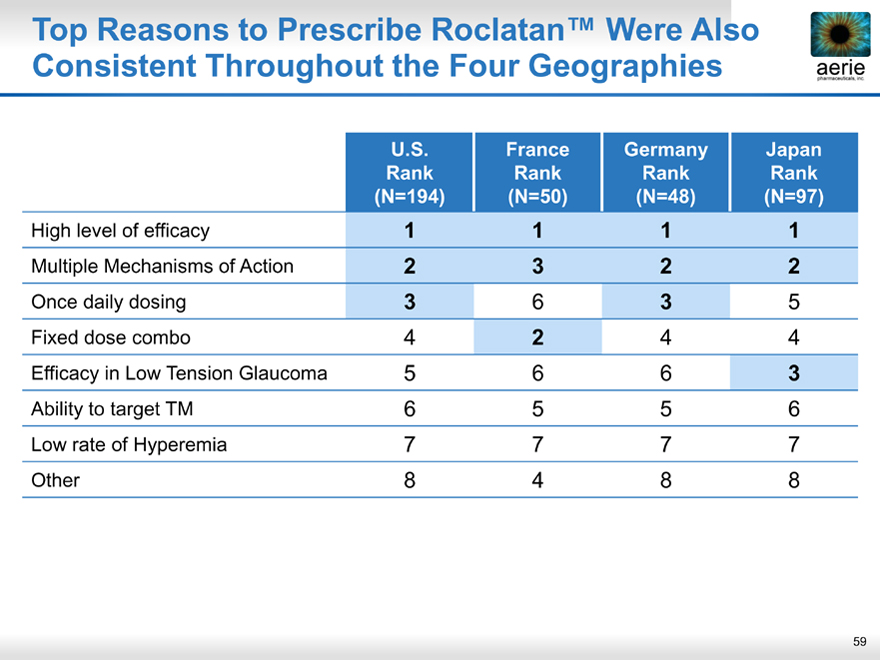

Top Reasons to Prescribe Roclatan™ Were Also Consistent Throughout the Four Geographies

aeria pharmaceuticals, inc.

U.S. France Germany Japan

Rank Rank Rank Rank

(N=194)(N=50)(N=48)(N=97)

High level of efficacy 1 1 1 1

Multiple Mechanisms of Action 2 3 2 2

Once daily dosing 3 6 3 5

Fixed dose combo 4 2 4 4

Efficacy in Low Tension Glaucoma 5 6 6 3

Ability to target TM 6 5 5 6

Low rate of Hyperemia 7 7 7 7

Other 8 4 8 8

59

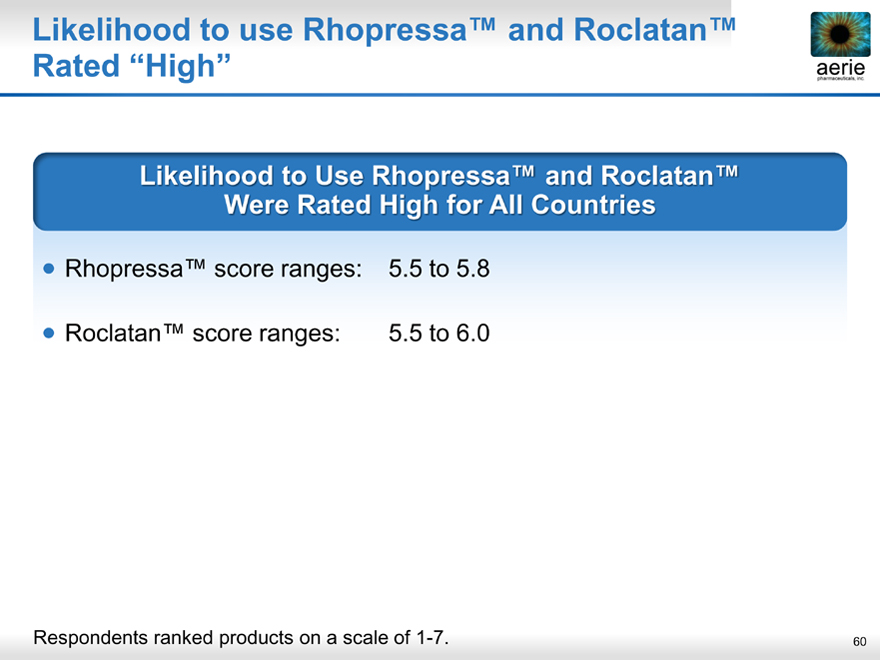

Likelihood to use Rhopressa™ and Roclatan™ Rated “High”

aeria pharmaceuticals, inc.

Likelihood to Use Rhopressa™ and Roclatan™ Were Rated High for All Countries

Rhopressa™ score ranges: 5.5 to 5.8

Roclatan™ score ranges: 5.5 to 6.0

Respondents ranked products on a scale of 1-7.

60

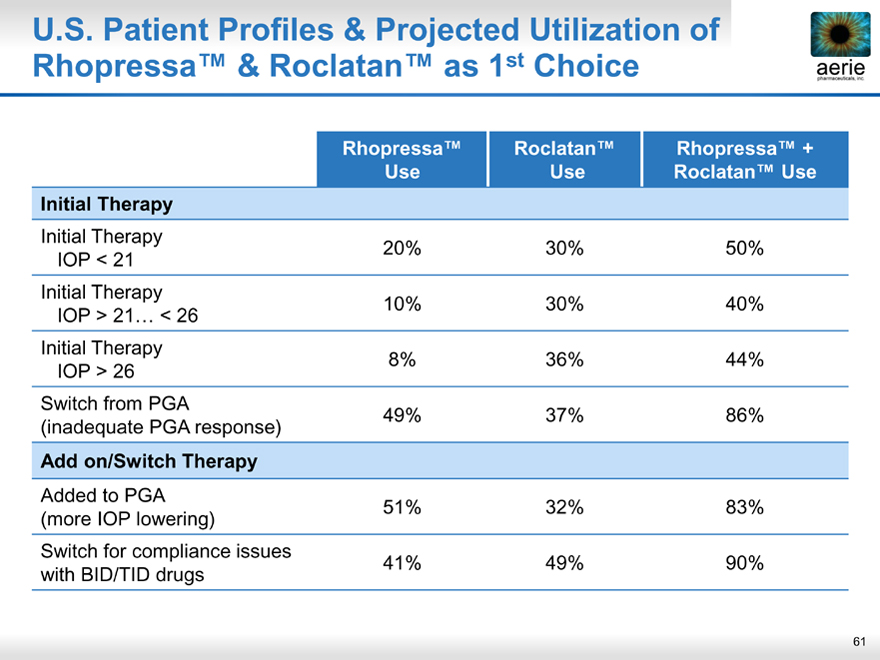

U.S. Patient Profiles & Projected Utilization of Rhopressa™ & Roclatan™ as 1st Choice

aeria pharmaceuticals, inc.

Rhopressa™ Roclatan™ Rhopressa™ +

Use Use Roclatan™ Use

Initial Therapy

Initial Therapy 20% 30% 50%

IOP < 21

Initial Therapy 10% 30% 40%

IOP > 21… < 26

Initial Therapy 8% 36% 44%

IOP > 26

Switch from PGA 49% 37% 86%

(inadequate PGA response)

Add on/Switch Therapy

Added to PGA 51% 32% 83%

(more IOP lowering)

Switch for compliance issues 41% 49% 90%

with BID/TID drugs

61

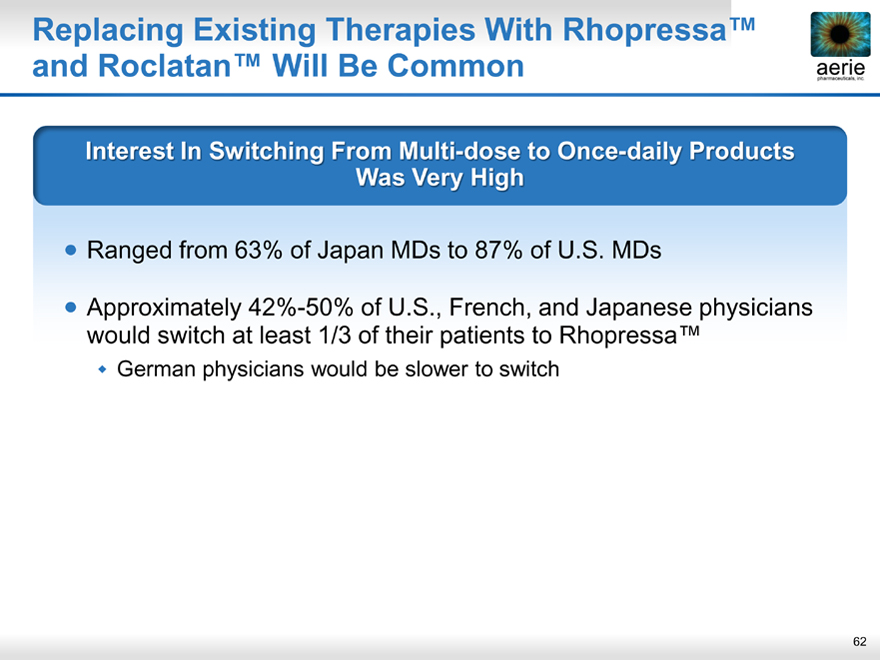

Replacing Existing Therapies With Rhopressa™ and Roclatan™ Will Be Common

aeria pharmaceuticals, inc.

Interest In Switching From Multi-dose to Once-daily Products Was Very High

Ranged from 63% of Japan MDs to 87% of U.S. MDs

Approximately 42%-50% of U.S., French, and Japanese physicians would switch at least 1/3 of their patients to Rhopressa™

German physicians would be slower to switch

62

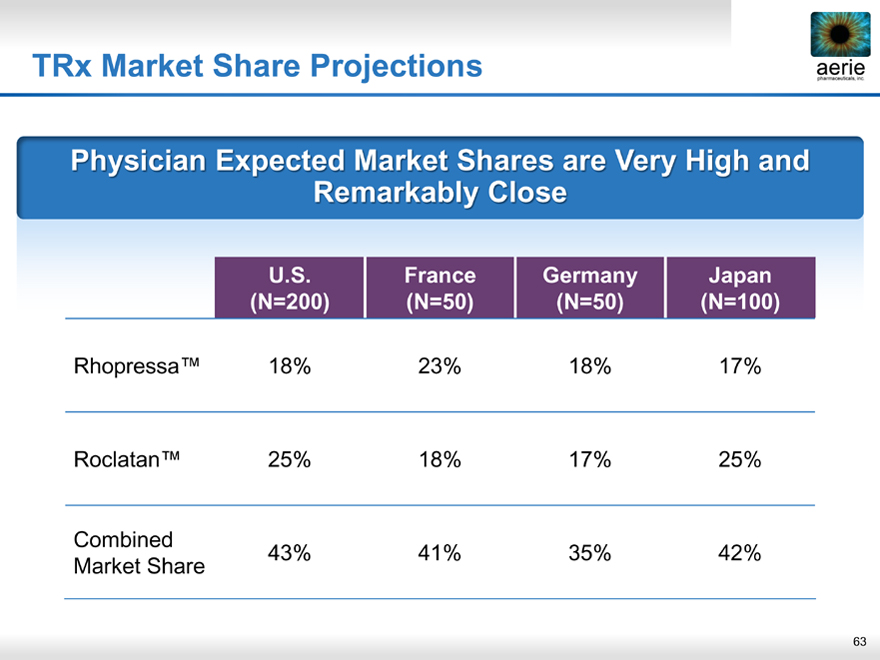

TRx Market Share Projections

aeria pharmaceuticals, inc.

Physician Expected Market Shares are Very High and Remarkably Close

U.S. France Germany Japan

(N=200)(N=50)(N=50)(N=100)

Rhopressa™ 18% 23% 18% 17%

Roclatan™ 25% 18% 17% 25%

Combined 43% 41% 35% 42%

Market Share

63

2023 U.S. Glaucoma Market and Market Share Projections

aeria pharmaceuticals, inc.

Projected Market Share in TRx

U.S. Glaucoma Market = $4.9B; 41.7 M TRx TRx Growth 2013-2023 = 2.3%

CAI

AA

5%

5%

BB Fixed Combo

9% 31% PGA’s

BB

6%

Roclatan™ 25%

18%

Rhopressa™

Physicians Anticipate Exceptionally High Utilization of Roclatan™ + Rhopressa™ Post-approval

PGA: Prostaglandin Analogue; BB: Beta Blocker; AA: Alpha Agonist; CAI: Carbonic Anhydrase Inhibitor

Data Source: IMS 2013 FY TRX. Internal projection

64

Q&A

65

R&D Update

Casey Kopczynski

66

Maximizing Value of R&D Assets

aerie pharmaceuticals, inc.

Rhopressa™ / Roclatan™

Exploring the longer-term impact on the diseased trabecular meshwork

ROCKi Library

New uses beyond glaucoma

• AMD

• DME

67

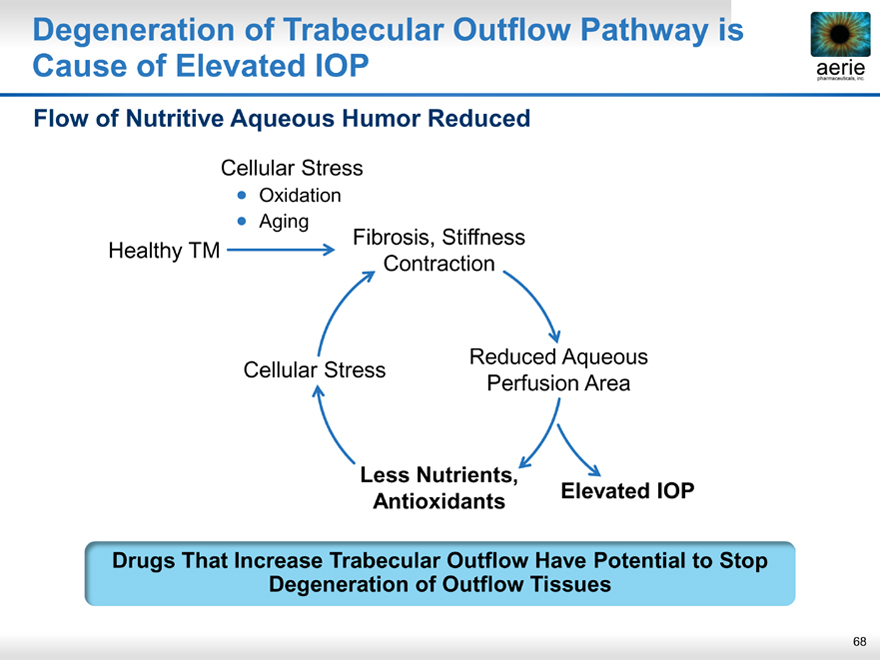

Degeneration of Trabecular Outflow Pathway is Cause of Elevated IOP

aeria pharmaceuticals, inc.

Flow of Nutritive Aqueous Humor Reduced

Cellular Stress

• Oxidation

• Aging

Fibrosis, Stiffness Healthy TM

Contraction

Reduced Aqueous Cellular Stress Perfusion Area

Less Nutrients,

Antioxidants Elevated IOP

Drugs That Increase Trabecular Outflow Have Potential to Stop Degeneration of Outflow Tissues

68

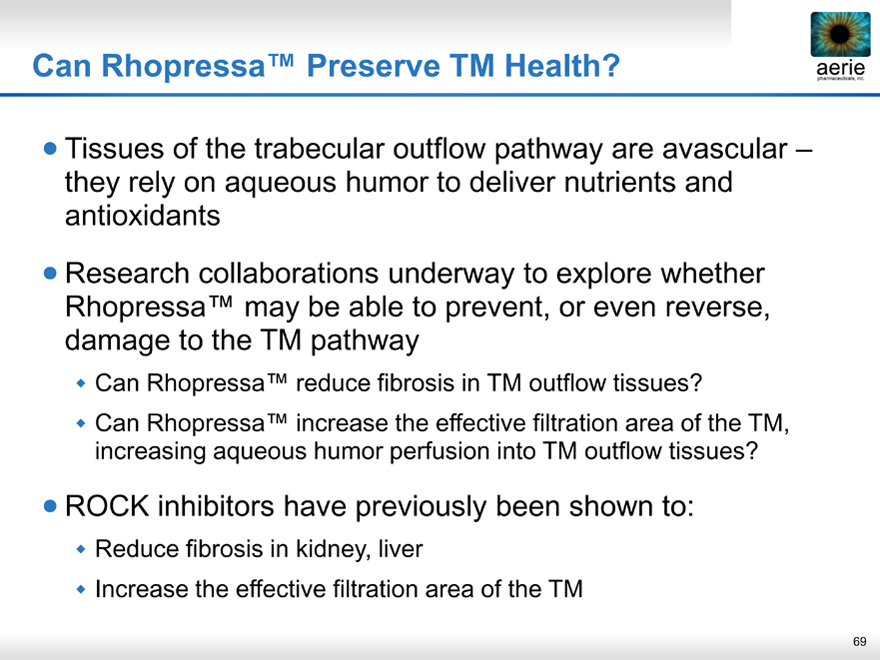

Can Rhopressa™ Preserve TM Health?

aeria pharmaceuticals, inc.

Tissues of the trabecular outflow pathway are avascular – they rely on aqueous humor to deliver nutrients and antioxidants

Research collaborations underway to explore whether Rhopressa™ may be able to prevent, or even reverse, damage to the TM pathway

Can Rhopressa™ reduce fibrosis in TM outflow tissues?

Can Rhopressa™ increase the effective filtration area of the TM, increasing aqueous humor perfusion into TM outflow tissues?

ROCK inhibitors have previously been shown to:

Reduce fibrosis in kidney, liver

Increase the effective filtration area of the TM

69

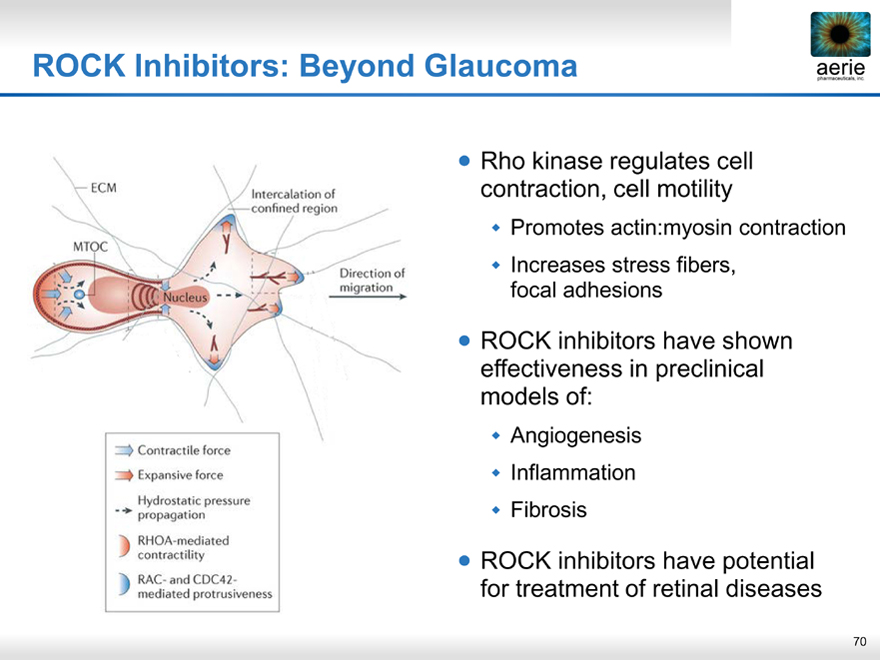

ROCK Inhibitors: Beyond Glaucoma

aeria pharmaceuticals, inc.

ECM

MTOC

Intercalation of confined region

Direction of migration

Contractile force

Expansive force

Hydrostatic pressure propagation

RHOA-mediated contractility

RAC- and CDC42- mediated protrusiveness

Rho kinase regulates cell contraction, cell motility

Promotes actin:myosin contraction

Increases stress fibers, focal adhesions

ROCK inhibitors have shown effectiveness in preclinical models of:

Angiogenesis

Inflammation

Fibrosis

ROCK inhibitors have potential for treatment of retinal diseases

70

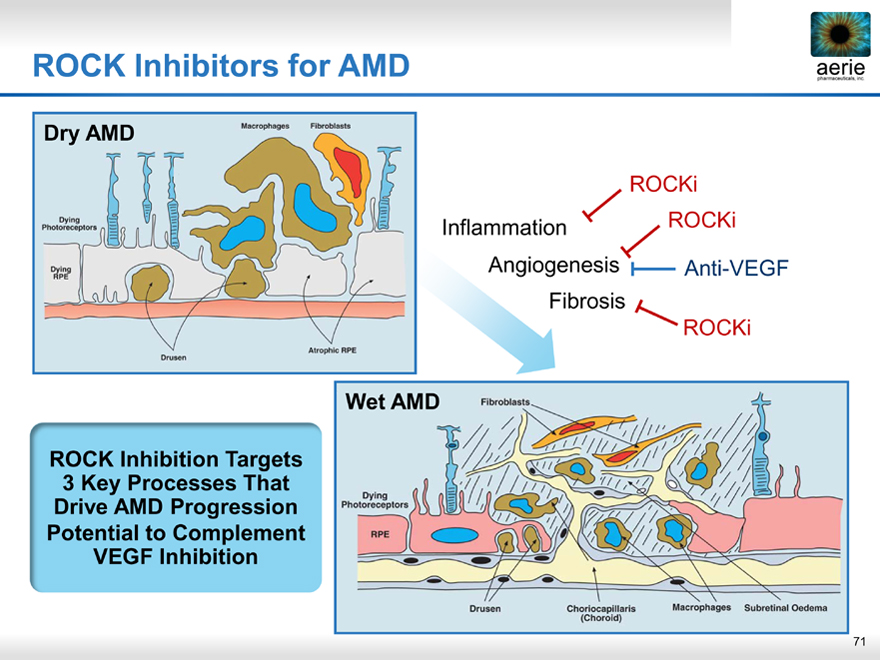

ROCK Inhibitors for AMD

aeria pharmaceuticals, inc.

Dry AMD

Macrophages

Fibroblasts

Dying

Photoreceptors

Dying RPE

Drusen

Atophic RPE

ROCKi Inflammation ROCKi Angiogenesis Anti-VEGF

Fibrosis

ROCKi

ROCK Inhibition Targets

3 Key Processes That Drive AMD Progression Potential to Complement VEGF Inhibition

Wet AMD

Fibroblasts

Dying Photoreceptors

Drusen

Choriocapillaris

(Choroid)

Macrophages

Subretinal Oedema

71

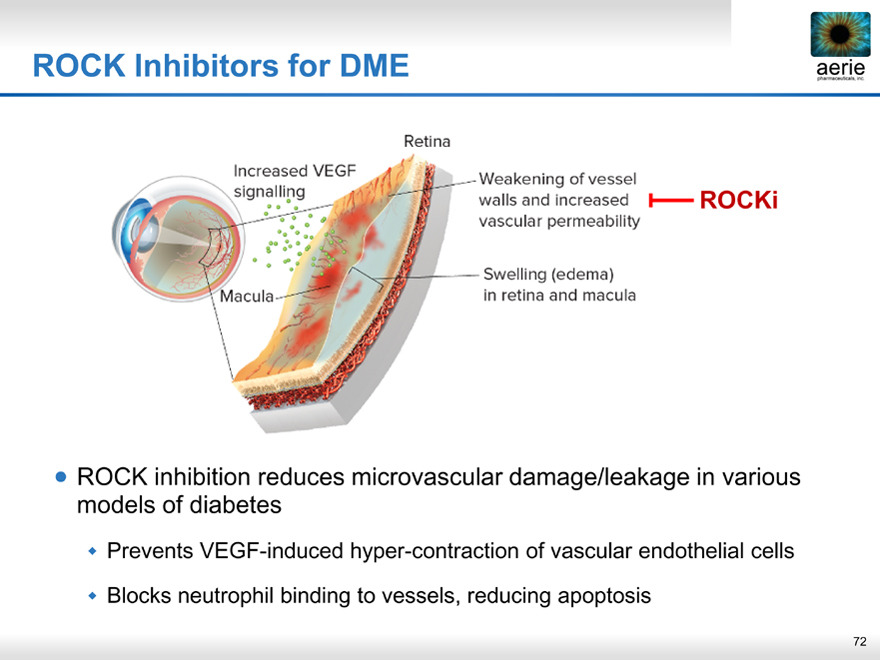

ROCK Inhibitors for DME aerie pharmaceuticals, inc.

aeria pharmaceuticals, inc.

Retina

Increased VEGF signalling

Macula

Weakening of vessel walls and increased vascular permeability

ROCKi

Swelling (edema) in retina and macula

ROCK inhibition reduces microvascular damage/leakage in various models of diabetes

Prevents VEGF-induced hyper-contraction of vascular endothelial cells

Blocks neutrophil binding to vessels, reducing apoptosis

72

ROCKi Proof of Concept for AMD, DME aerie pharmaceuticals, inc.

aeria pharmaceuticals, inc.

Preclinical

Fasudil (intravitreal)

Reduces retinal vessel damage/leakage in rat (Arita 2009)

Y27632 (intravitreal)

Reduces retinal neovascularization in mouse (Fang 2011)

AMA0428 (intravitreal)

Reduces CNV and vessel leakage in mouse (ARVO 2014)

K-115 (topical)

Reduces retinal neovascularization in mouse (ARVO 2014)

Clinical

Fasudil (intravitreal)

Open label pilot study, 15 DME patients refractory to anti-VEGF

Single Fasudil+bevacizumab injection improved BCVA by 42% (p = 0.003), reduced CMT by 22% (p=0.001)

73

Aerie R&D – Back of the Eye Explorations

aeria pharmaceuticals, inc.

Leverage large collection of proprietary ROCK inhibitors

Diverse physicochemical properties

Wide range of kinase inhibition profiles (e.g., ROCK+PKC)

Test select compounds in laser-induced CNV model

Widely accepted model for neovascular AMD

Compare compounds with different kinase selectivity profiles

Test intravitreal injection, topical delivery

Test as adjunct to anti-VEGF treatment

• Repeat above for established models of DME

74

Business Development

Craig Skenes

75

Rhopressa™ / Roclatan™ Partnering Strategy

aeria pharmaceuticals, inc.

Advance development of Rhopressa™ and Roclatan™ to approval in North America and potentially Europe

Establish our own commercial infrastructure in North America

Exploring Aerie’s more direct involvement of development and commercial objectives for Europe

Seeking collaboration for territories outside North America with focus on Japan and Europe

Japan prioritized over Europe at this point

Importance of finding partner with interest in developing and commercializing both products

– Ensure global development is aligned between parties

76

Partnering Update

aeria pharmaceuticals, inc.

Initiated outreach in Q3 upon conclusion of Roclatan™ Phase 2b study

Connected with broad spectrum of partnering candidates

Experiencing significant global interest

Discussions are in progress with approximately 20 companies

Range of regional to global players, inside and outside ophthalmology

Prospective partners are progressing in their evaluations

Dataroom is available and dialogue is ongoing

No requirement or timeline for completing a transaction

Ensure that value and structures are aligned with our strategy and recognize the extent we have de-risked these assets

77

Building the Enterprise

aeria pharmaceuticals, inc.

We have demonstrated capabilities in drug discovery, research, development and commercialization

Initiating process of evaluating opportunities for in-licensing or acquisition within ophthalmology

Seek opportunities with market potential consistent with Aerie’s other portfolio products

Focus on remaining unmet needs in ophthalmology

First-in-class or differentiable to existing therapeutics

Spin-outs, divestitures or discontinued programs from other ophthalmic players

We Are Driving to Make Aerie a Major Ophthalmic Pharmaceutical Company

78

Financing Update

Richard Rubino

79

New Deerfield Financing

aeria pharmaceuticals, inc.

$125 Million Senior Secured Convertible Debt Facility

Proceeds expected to fully finance Aerie through product commercialization

Facility also provides further operational and strategic flexibility

Summary of Key Terms

Interest: 1.75% annual coupon paid quarterly

Term: 7 year maturity

Conversion: Convertible into Aerie common stock at 30% premium to Aerie closing price on September 8, 2014, resulting in a conversion price of $24.80 per share.

80

Q&A

81

Our Strategy

aeria pharmaceuticals, inc.

Advance the development of our product candidates to approval

Establish internal capabilities to commercialize our product candidates in North America (and potentially Europe)

Explore partnerships with leading pharmaceutical and biotechnology companies to maximize the value of our product candidates outside of North America

Continue to leverage and strengthen our intellectual property portfolio

Expand our product portfolio through internal discovery efforts and possible in-licensing or acquisitions of additional ophthalmic product candidates or products

82

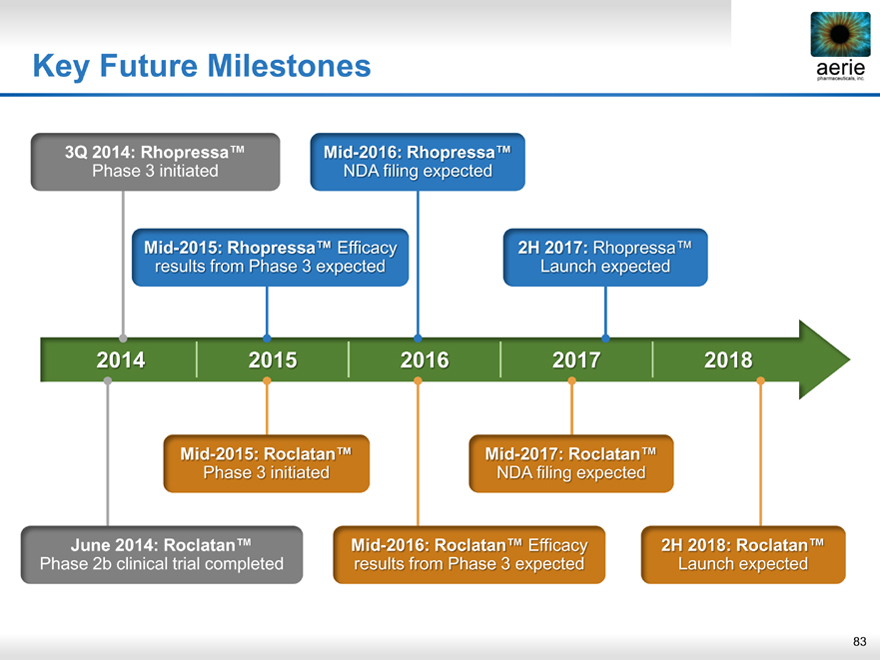

Key Future Milestones

aeria pharmaceuticals, inc.

3Q 2014: Rhopressa™

Phase 3 initiated

Mid-2016: Rhopressa™

NDA filing expected

Mid-2015: Rhopressa™ Efficacy results from Phase 3 expected

2H 2017: Rhopressa™ Launch expected

2014 2015 2016 2017 2018

Mid-2015: Roclatan™

Phase 3 initiated

Mid-2017: Roclatan™

NDA filing expected

June 2014: Roclatan™

Phase 2b clinical trial completed

Mid-2016: Roclatan™ Efficacy results from Phase 3 expected

2H 2018: Roclatan™

Launch expected

83

Building a Major Ophthalmic Pharmaceutical Company

Aerie Pharmaceuticals, Inc.

Investor Day September 10, 2014