Company Overview Investor Presentation June 2017 Exhibit 99.1

Important Information Any discussion of the potential use or expected success of our product candidates is subject to our product candidates being approved by regulatory authorities. In addition, any discussion of clinical trial results for RhopressaTM (netarsudil ophthalmic solution) 0.02% relate to the results in its first Phase 3 registration trials named Rocket 1 and Rocket 2, or Rocket 4 which will be used primarily for European regulatory filing purposes, and for RoclatanTM (netarsudil/latanoprost ophthalmic solution) 0.02%/0.005% relate to the results in its Phase 3 registration trials. The information in this presentation is current only as of its date and may have changed or may change in the future. We undertake no obligation to update this information in light of new information, future events or otherwise. We are not making any representation or warranty that the information in this presentation is accurate or complete. Certain statements in this presentation, including the updated guidance presented herein, are “forward-looking statements” within the meaning of the federal securities laws. Words such as “may,” “will,” “should,” “would,” “could,” “believe,” “expects,” “anticipates,” “plans,” “intends,” “estimates,” “targets,” “projects,” “potential” or similar expressions are intended to identify these forward-looking statements. These statements are based on the Company’s current plans and expectations. Known and unknown risks, uncertainties and other factors could cause actual results to differ materially from those contemplated by the statements. In evaluating these statements, you should specifically consider various factors that may cause our actual results to differ materially from any forward-looking statements. Any top line data presented herein is preliminary and based solely on information available to us as of the date of this document and additional information about the results may be disclosed at any time. In addition, the preclinical research discussed in this presentation is preliminary and the outcome of such preclinical studies may not be predictive of the outcome of later trials. Any future clinical trial results may not demonstrate safety and efficacy sufficient to obtain regulatory approval related to the preclinical research findings discussed in this presentation. These risks and uncertainties are described more fully in the quarterly and annual reports that we file with the SEC, particularly in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Such forward-looking statements only speak as of the date they are made. We undertake no obligation to publicly update or revise any forward-looking statements, whether because of new information, future events or otherwise, except as otherwise required by law. For Investor Use

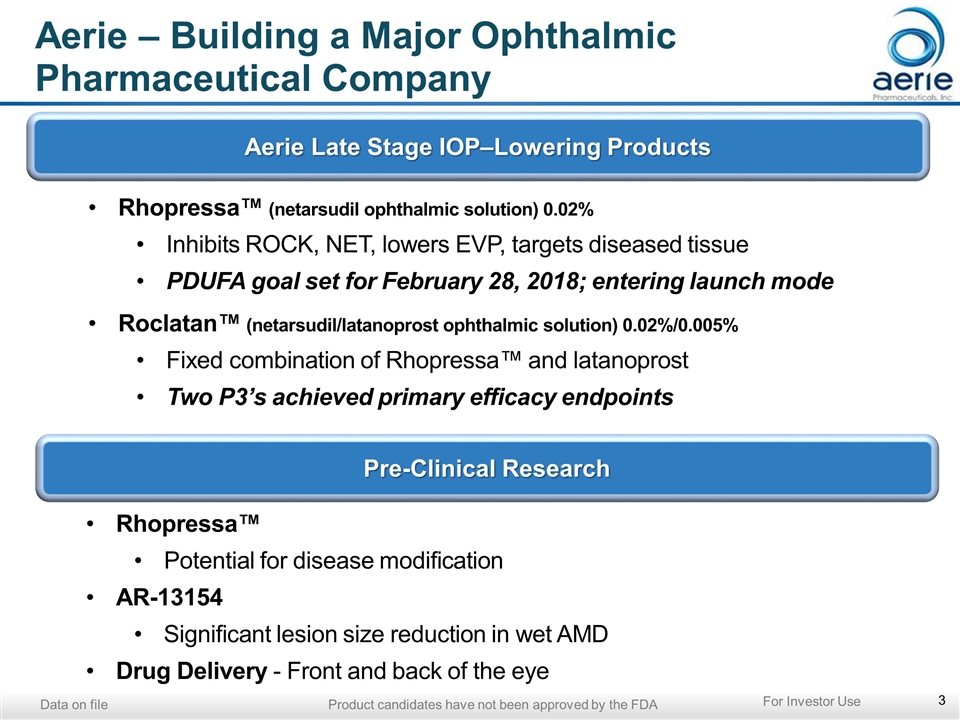

Aerie Late Stage IOP–Lowering Products Pre-Clinical Research Rhopressa™ Potential for disease modification AR-13154 Significant lesion size reduction in wet AMD Drug Delivery - Front and back of the eye Rhopressa™ (netarsudil ophthalmic solution) 0.02% Inhibits ROCK, NET, lowers EVP, targets diseased tissue PDUFA goal set for February 28, 2018; entering launch mode Roclatan™ (netarsudil/latanoprost ophthalmic solution) 0.02%/0.005% Fixed combination of Rhopressa™ and latanoprost Two P3’s achieved primary efficacy endpoints Aerie – Building a Major Ophthalmic Pharmaceutical Company Data on file Product candidates have not been approved by the FDA For Investor Use

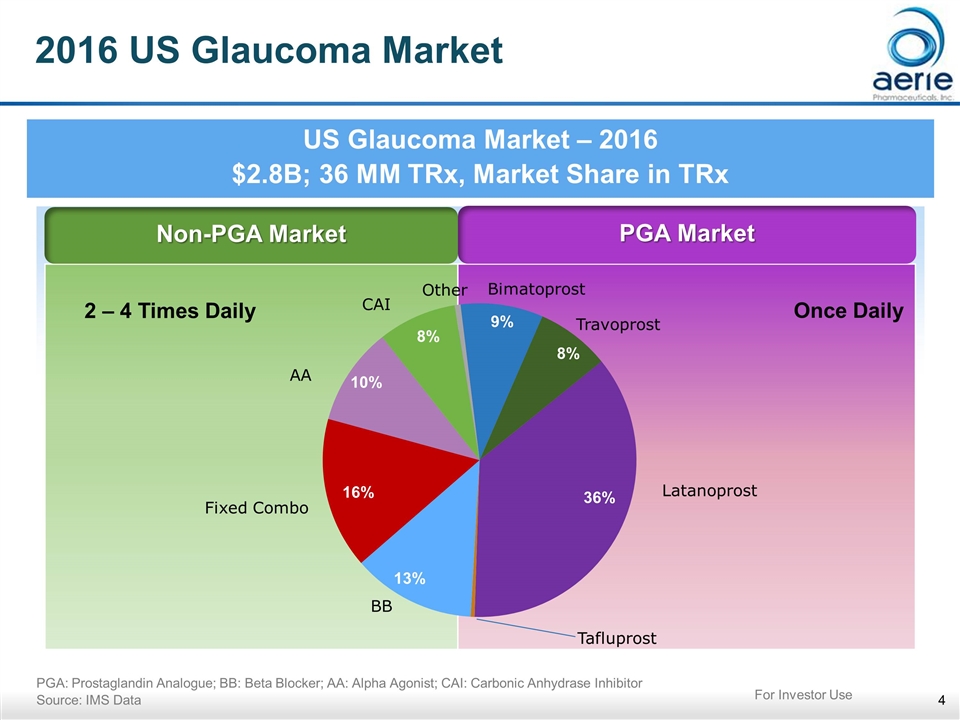

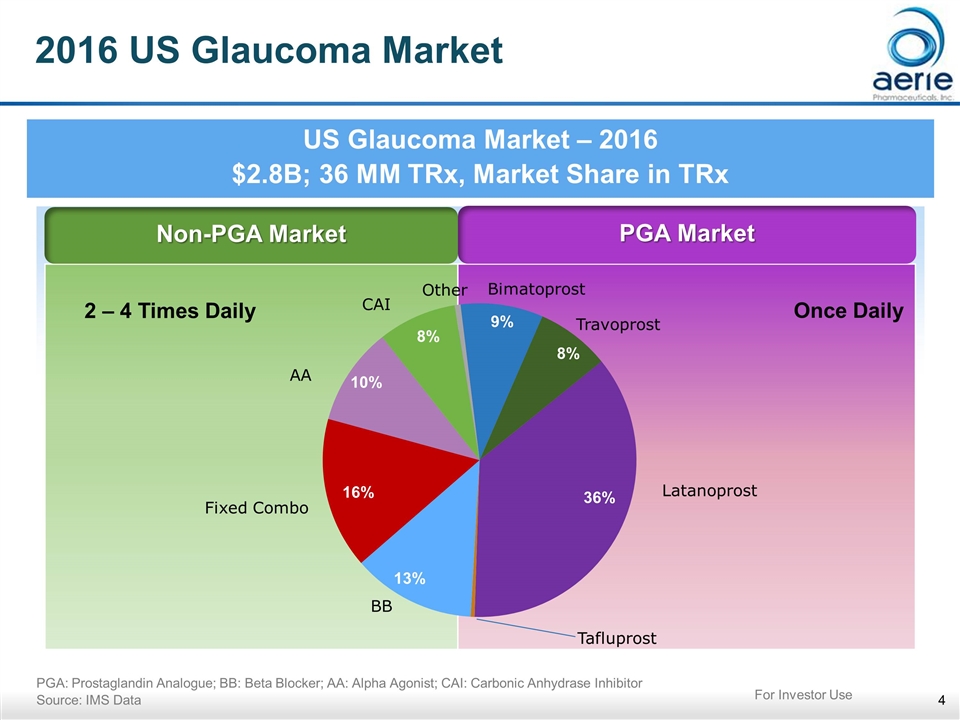

2016 US Glaucoma Market US Glaucoma Market – 2016 $2.8B; 36 MM TRx, Market Share in TRx PGA: Prostaglandin Analogue; BB: Beta Blocker; AA: Alpha Agonist; CAI: Carbonic Anhydrase Inhibitor Source: IMS Data Non-PGA Market PGA Market 16% 13% 10% 8% 36% 9% 8% 2 – 4 Times Daily Once Daily For Investor Use

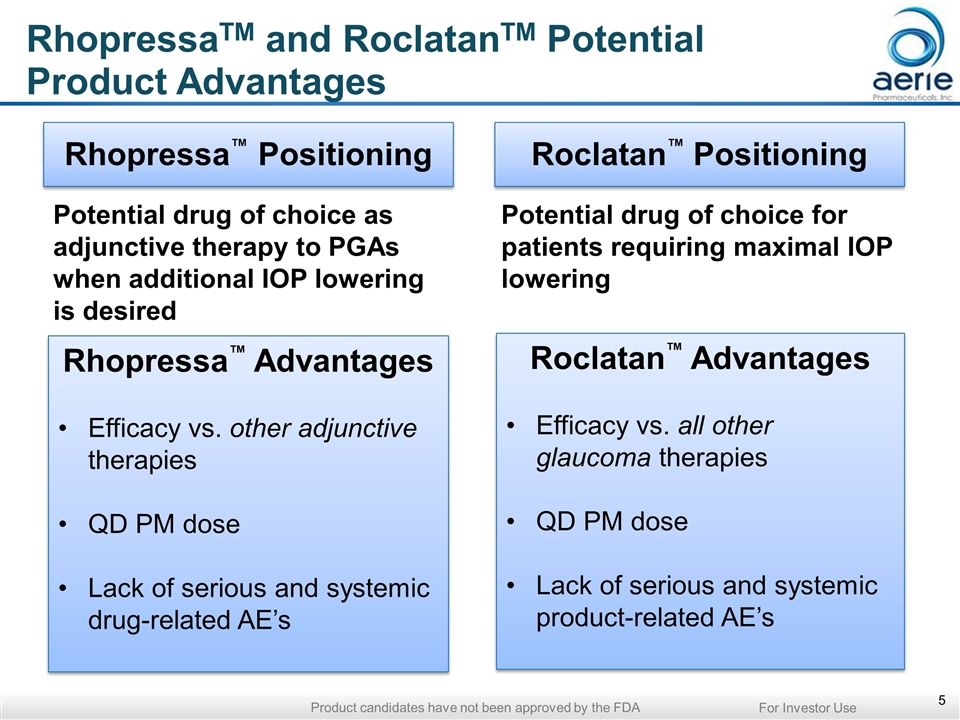

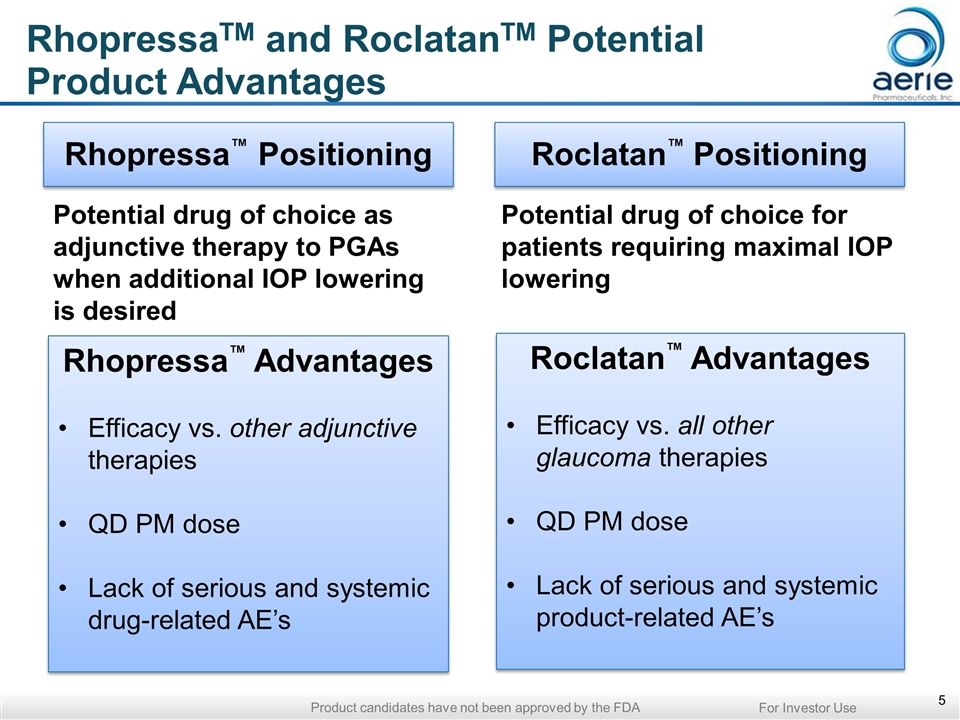

Potential drug of choice as adjunctive therapy to PGAs when additional IOP lowering is desired Potential drug of choice for patients requiring maximal IOP lowering Initial therapy for PGA non-responders and those with tolerability concerns Patients using two or more glaucoma therapies Normal-tension glaucoma Patients with high / very high IOP Patients at any IOP with significant disease progression Rhopressa™ Positioning Roclatan™ Positioning Rhopressa™ Advantages Efficacy vs. other adjunctive therapies QD PM dose Lack of serious and systemic drug-related AE’s Roclatan™ Advantages Efficacy vs. all other glaucoma therapies QD PM dose Lack of serious and systemic product-related AE’s RhopressaTM and RoclatanTM Potential Product Advantages For Investor Use Product candidates have not been approved by the FDA

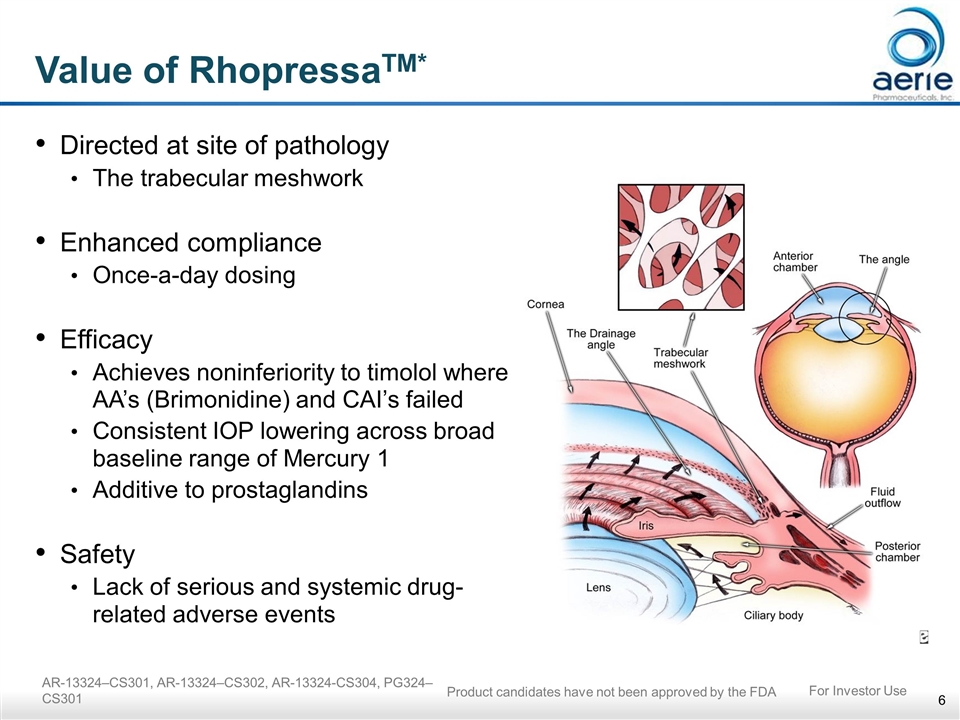

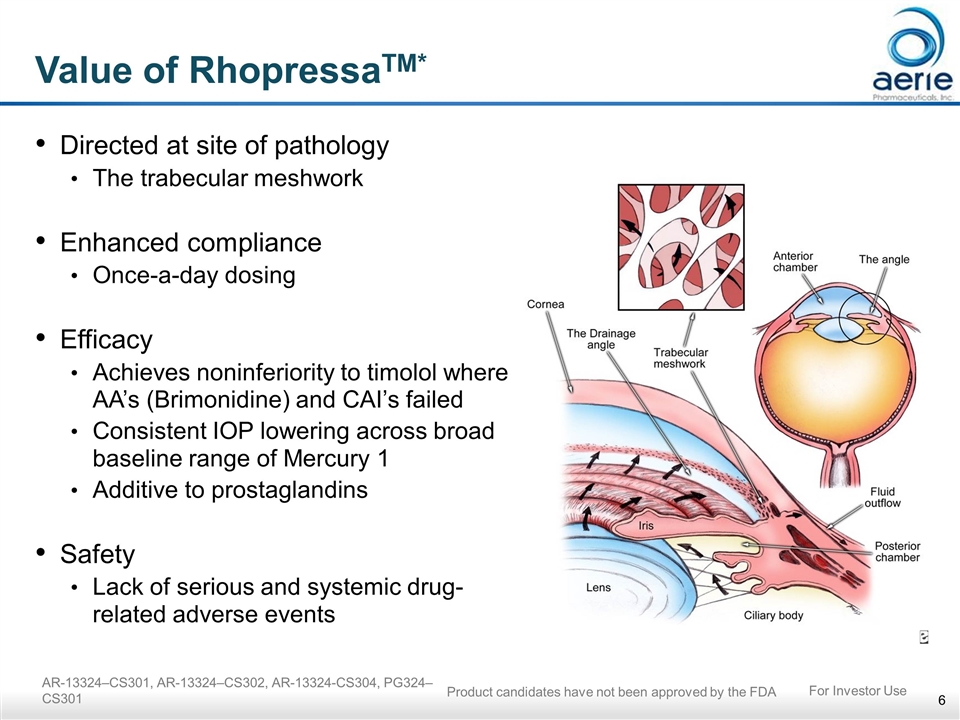

AR-13324–CS301, AR-13324–CS302, AR-13324-CS304, PG324–CS301 Value of RhopressaTM* Directed at site of pathology The trabecular meshwork Enhanced compliance Once-a-day dosing Efficacy Achieves noninferiority to timolol where AA’s (Brimonidine) and CAI’s failed Consistent IOP lowering across broad baseline range of Mercury 1 Additive to prostaglandins Safety Lack of serious and systemic drug-related adverse events For Investor Use Product candidates have not been approved by the FDA

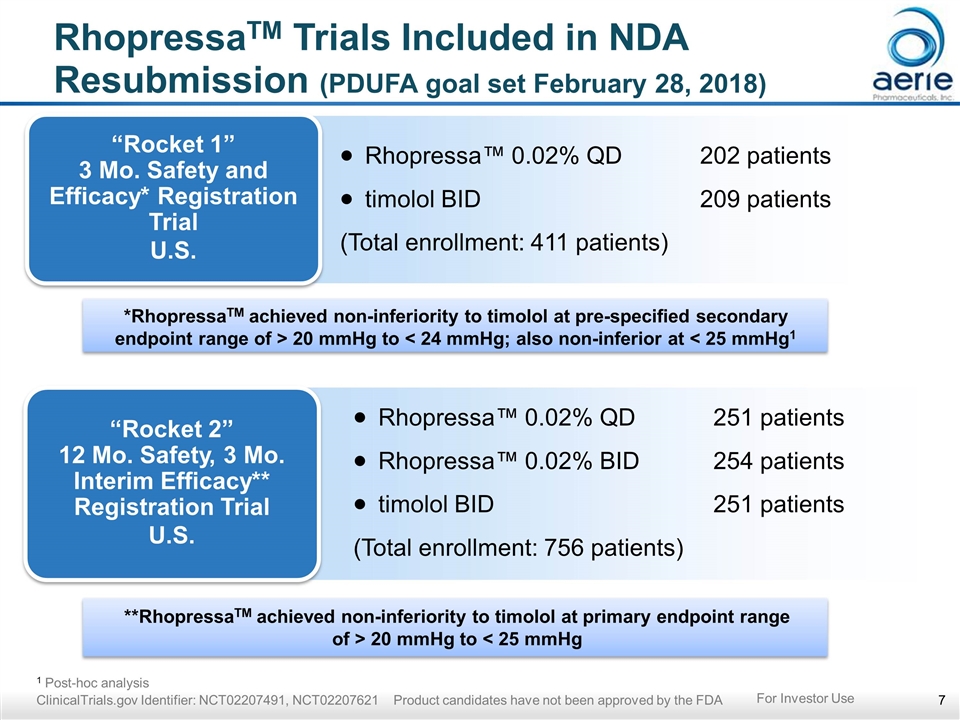

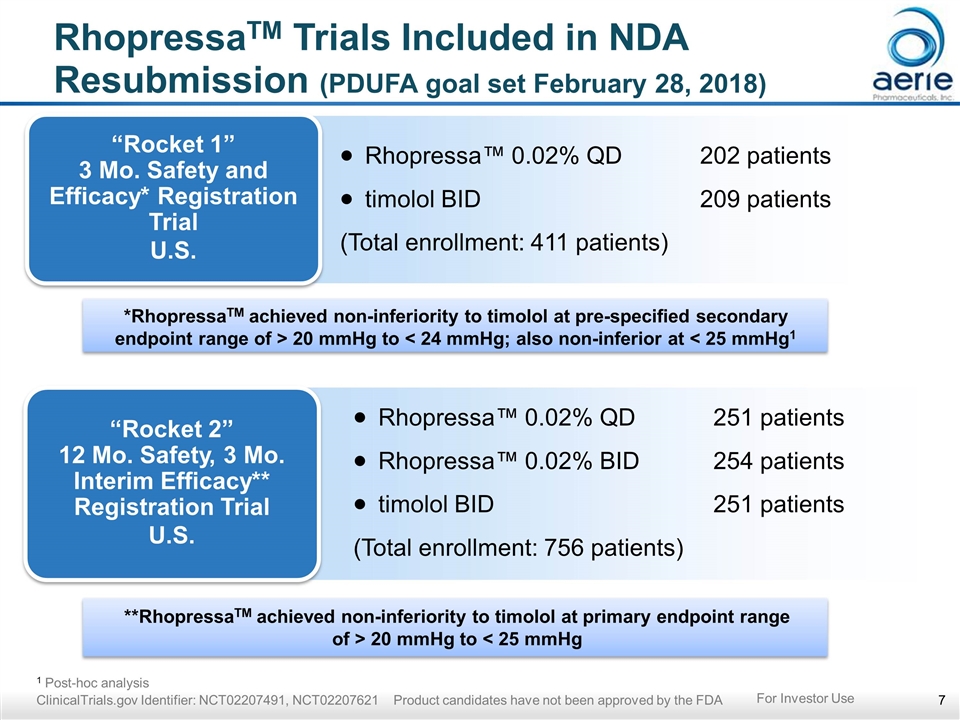

**RhopressaTM achieved non-inferiority to timolol at primary endpoint range of > 20 mmHg to < 25 mmHg *RhopressaTM achieved non-inferiority to timolol at pre-specified secondary endpoint range of > 20 mmHg to < 24 mmHg; also non-inferior at < 25 mmHg1 RhopressaTM Trials Included in NDA Resubmission (PDUFA goal set February 28, 2018) “Rocket 1” 3 Mo. Safety and Efficacy* Registration Trial U.S. Rhopressa™ 0.02% QD202 patients timolol BID209 patients (Total enrollment: 411 patients) “Rocket 2” 12 Mo. Safety, 3 Mo. Interim Efficacy** Registration Trial U.S. Rhopressa™ 0.02% QD251 patients Rhopressa™ 0.02% BID254 patients timolol BID251 patients (Total enrollment: 756 patients) 1 Post-hoc analysis ClinicalTrials.gov Identifier: NCT02207491, NCT02207621 Product candidates have not been approved by the FDA For Investor Use

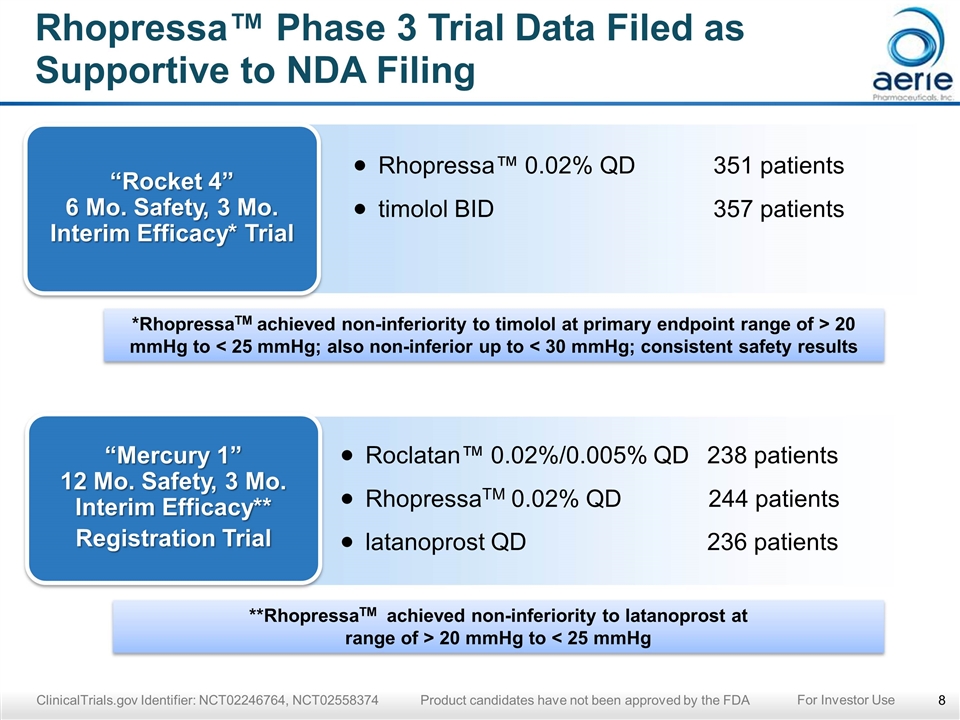

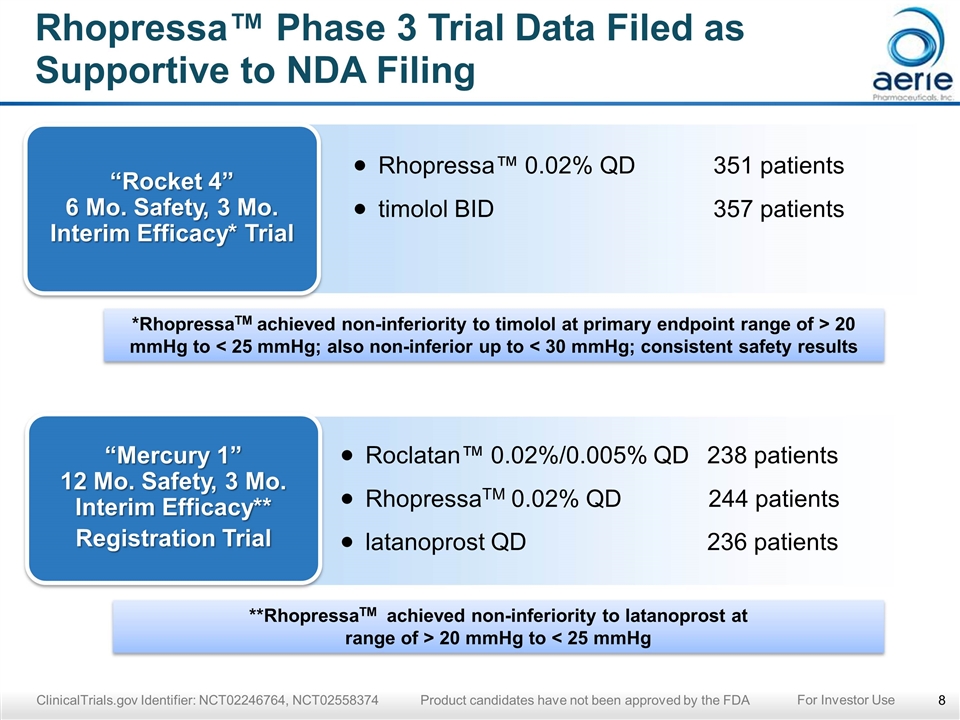

Rhopressa™ Phase 3 Trial Data Filed as Supportive to NDA Filing ClinicalTrials.gov Identifier: NCT02246764, NCT02558374 Product candidates have not been approved by the FDA “Rocket 4” 6 Mo. Safety, 3 Mo. Interim Efficacy* Trial Rhopressa™ 0.02% QD351 patients timolol BID357 patients *RhopressaTM achieved non-inferiority to timolol at primary endpoint range of > 20 mmHg to < 25 mmHg; also non-inferior up to < 30 mmHg; consistent safety results “Mercury 1” 12 Mo. Safety, 3 Mo. Interim Efficacy** Registration Trial Roclatan™ 0.02%/0.005% QD 238 patients RhopressaTM 0.02% QD 244 patients latanoprost QD 236 patients **RhopressaTM achieved non-inferiority to latanoprost at range of > 20 mmHg to < 25 mmHg For Investor Use

RhopressaTM: Consistent IOP Lowering (12 Month 8am IOP from Rocket 2) Rocket 2 Safety Population, Completed Patients (<27 mmHg) Day 90 Month 12 AR-13324 0.02% QD (n=118) BL W2 W6 M3 M6 M9 M12 Interim 12-month safety AR-13324–CS302 Product candidates have not been approved by the FDA For Investor Use Rocket 4 also demonstrated consistent RhopressaTM IOP lowering (6 months)

Rocket 2: Safety/Tolerability Overview of RhopressaTM QD (Interim 12-Month) Product candidates have not been approved by the FDA There were no drug-related systemic or serious adverse events No new adverse events introduced over the twelve-month period The most common adverse event was conjunctival hyperemia with ~50% incidence*, the majority mild Other ocular AEs AEs occurring in ~5-23% of patients included: conjunctival hemorrhage, corneal verticillata, blurry vision and reduced visual acuity *Incidence of conjunctival hyperemia ~50% including baseline at ~20% For Investor Use

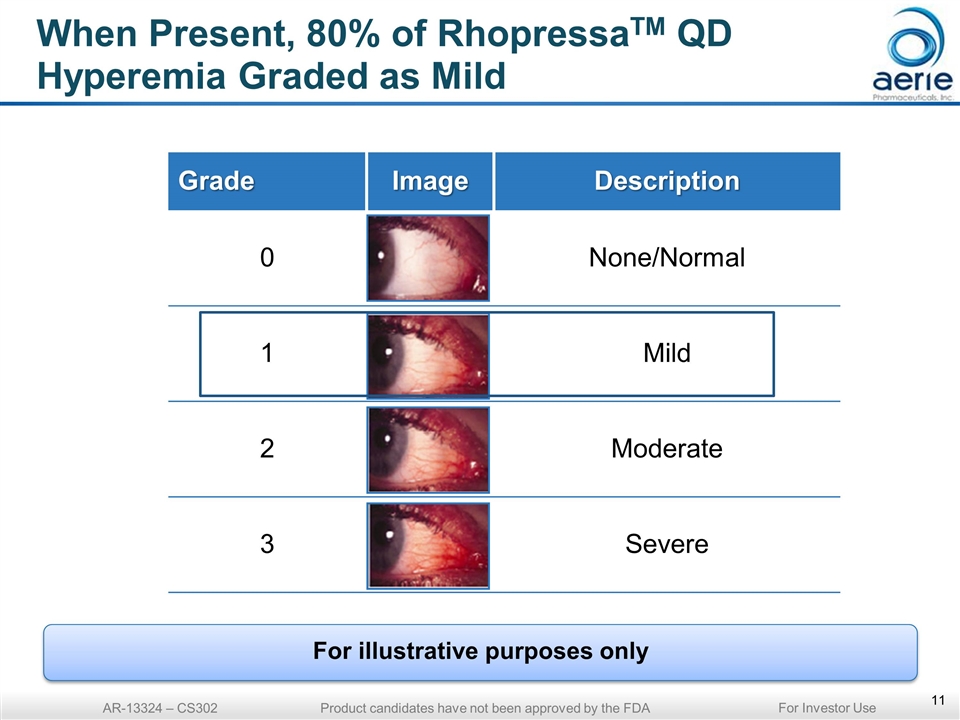

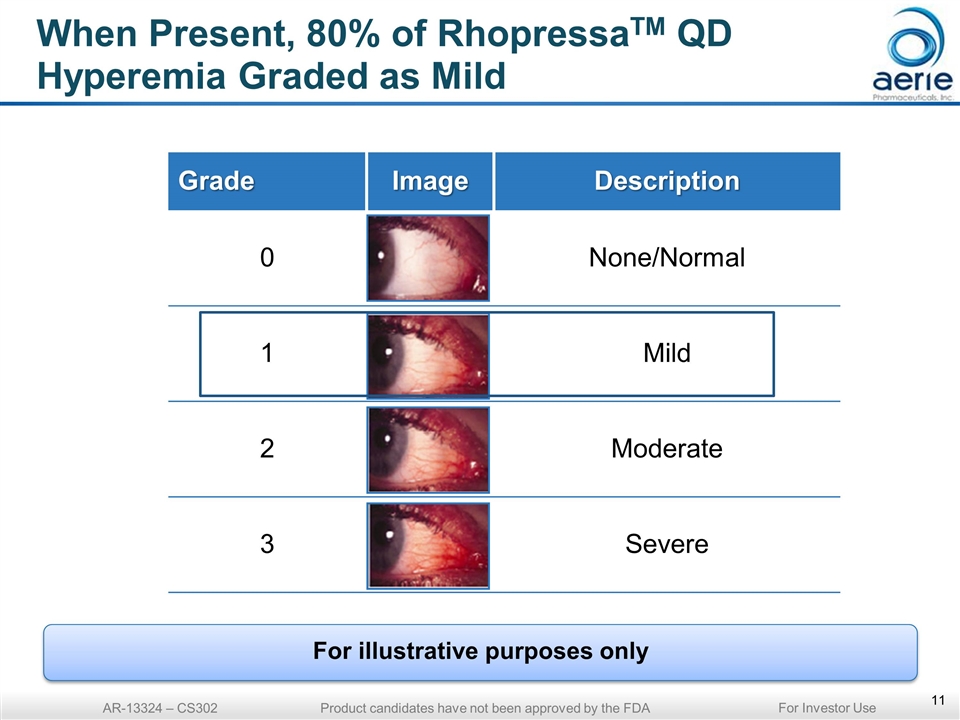

When Present, 80% of RhopressaTM QD Hyperemia Graded as Mild Grade Image Description 0 None/Normal 1 Mild 2 Moderate 3 Severe AR-13324 – CS302 Product candidates have not been approved by the FDA For illustrative purposes only For Investor Use

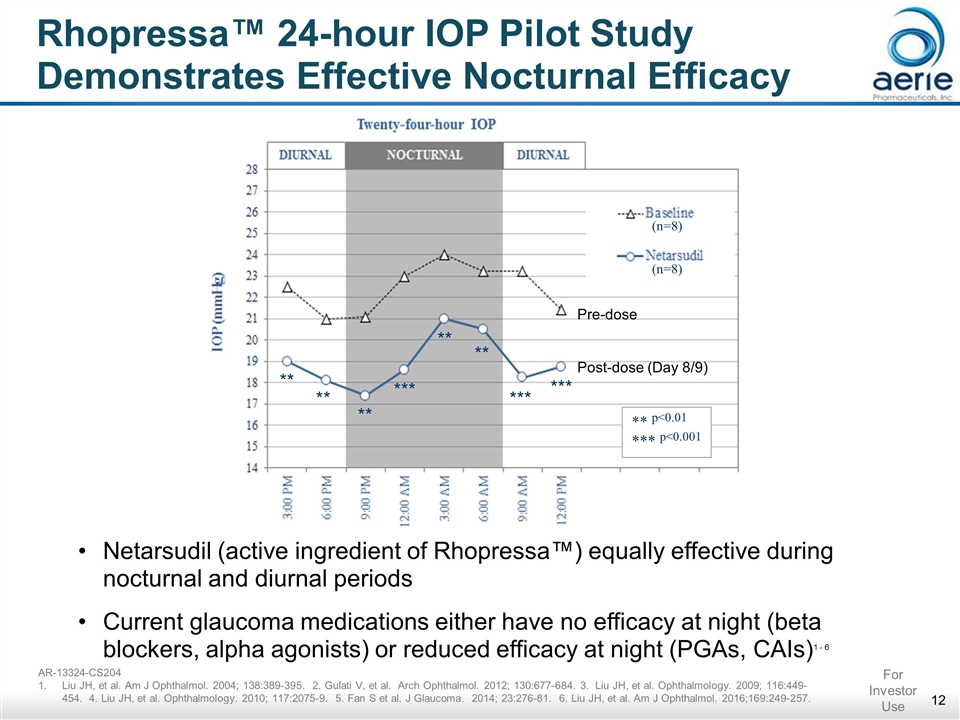

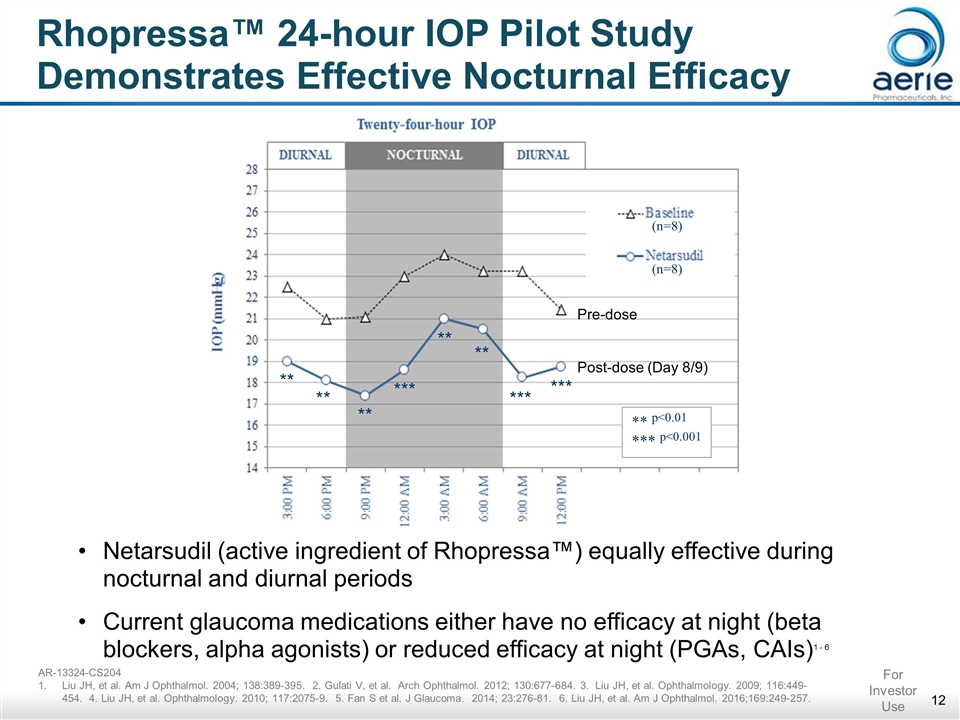

Rhopressa™ 24-hour IOP Pilot Study Demonstrates Effective Nocturnal Efficacy (n=8) (n=8) ** ** ** *** ** ** *** *** ** p<0.01 *** p<0.001 Netarsudil (active ingredient of Rhopressa™) equally effective during nocturnal and diurnal periods Current glaucoma medications either have no efficacy at night (beta blockers, alpha agonists) or reduced efficacy at night (PGAs, CAIs)1 - 6 AR-13324-CS204 Liu JH, et al. Am J Ophthalmol. 2004; 138:389-395. 2. Gulati V, et al. Arch Ophthalmol. 2012; 130:677-684. 3. Liu JH, et al. Ophthalmology. 2009; 116:449-454. 4. Liu JH, et al. Ophthalmology. 2010; 117:2075-9. 5. Fan S et al. J Glaucoma. 2014; 23:276-81. 6. Liu JH, et al. Am J Ophthalmol. 2016;169:249-257. For Investor Use Pre-dose Post-dose (Day 8/9)

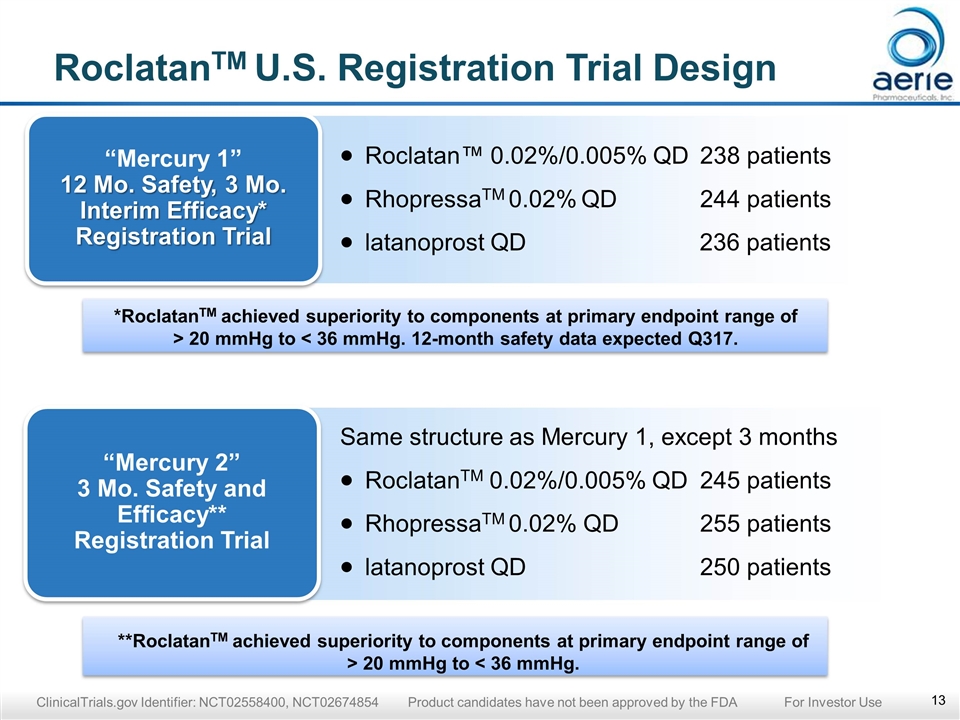

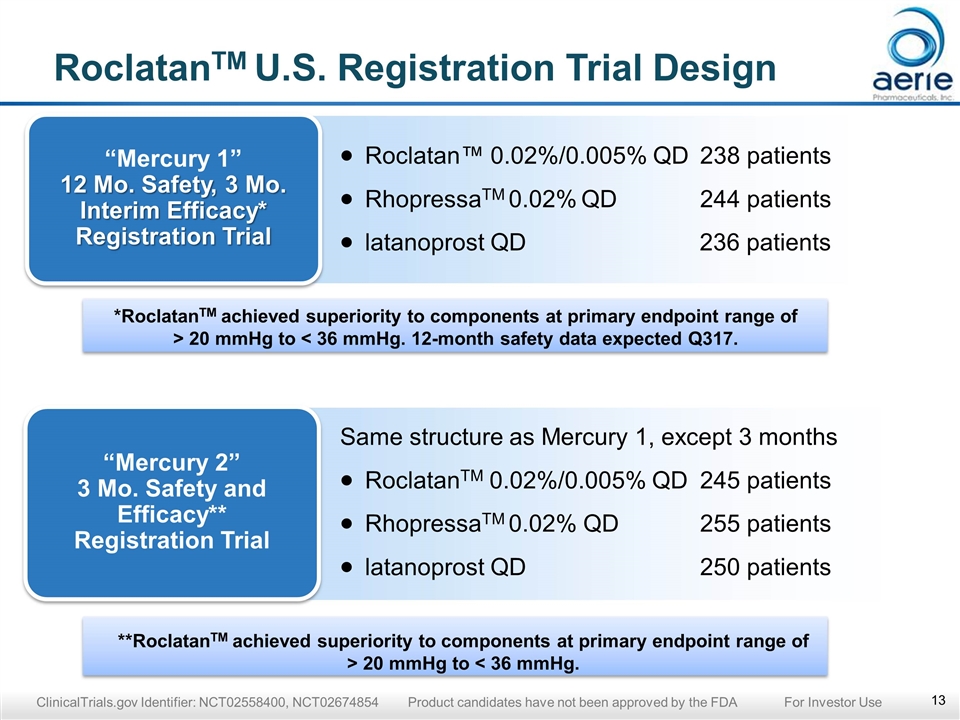

**RoclatanTM achieved superiority to components at primary endpoint range of > 20 mmHg to < 36 mmHg. *RoclatanTM achieved superiority to components at primary endpoint range of > 20 mmHg to < 36 mmHg. 12-month safety data expected Q317. RoclatanTM U.S. Registration Trial Design “Mercury 1” 12 Mo. Safety, 3 Mo. Interim Efficacy* Registration Trial Roclatan™ 0.02%/0.005% QD238 patients RhopressaTM 0.02% QD244 patients latanoprost QD 236 patients “Mercury 2” 3 Mo. Safety and Efficacy** Registration Trial Same structure as Mercury 1, except 3 months RoclatanTM 0.02%/0.005% QD245 patients RhopressaTM 0.02% QD 255 patients latanoprost QD250 patients ClinicalTrials.gov Identifier: NCT02558400, NCT02674854 Product candidates have not been approved by the FDA For Investor Use

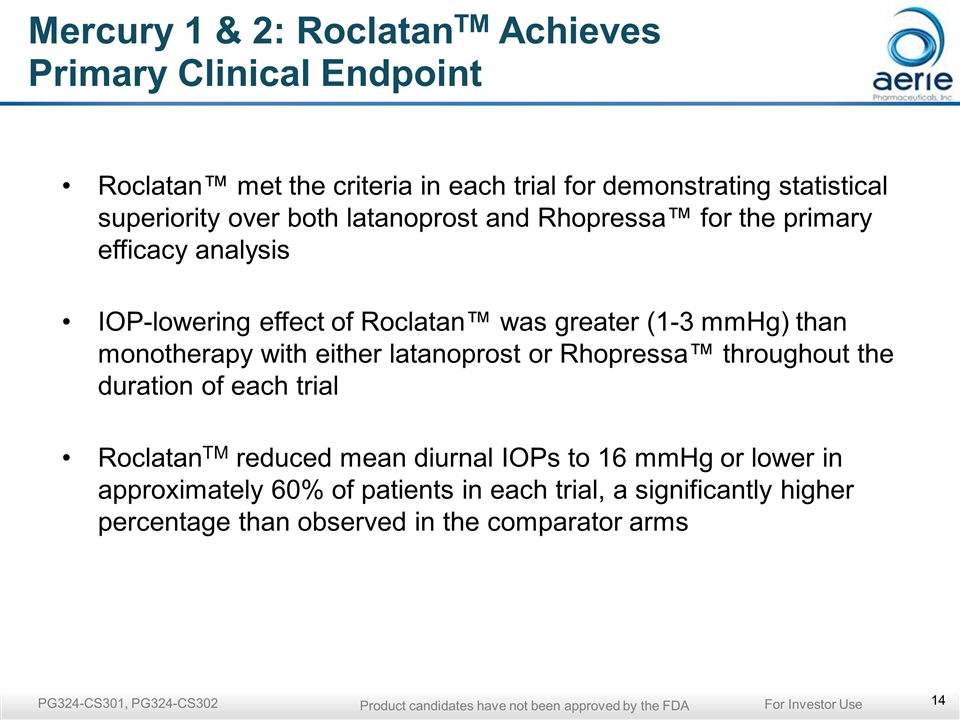

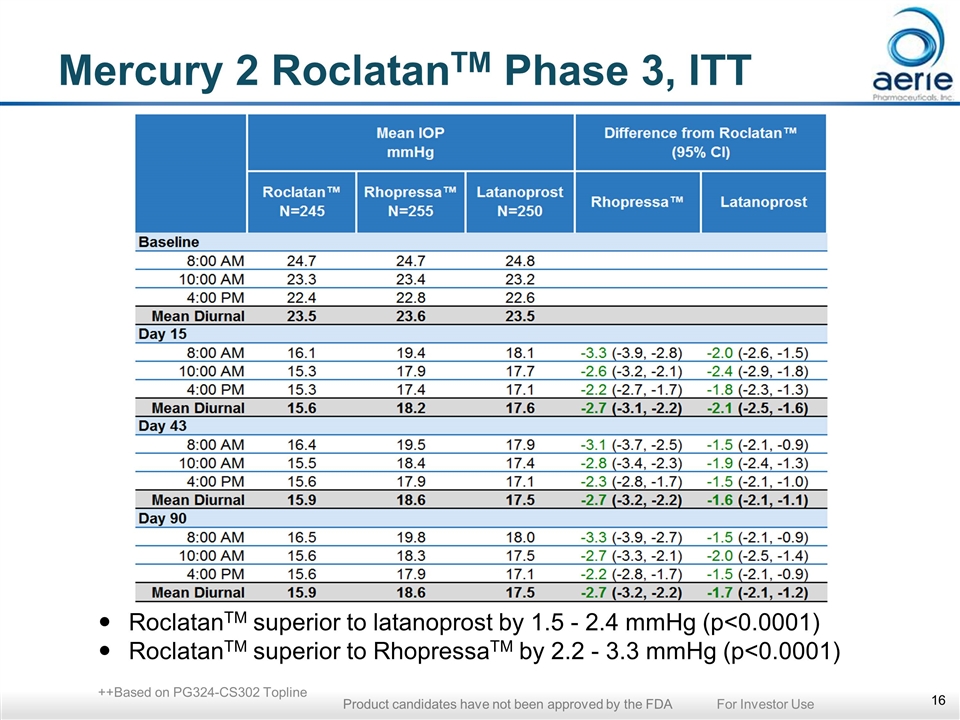

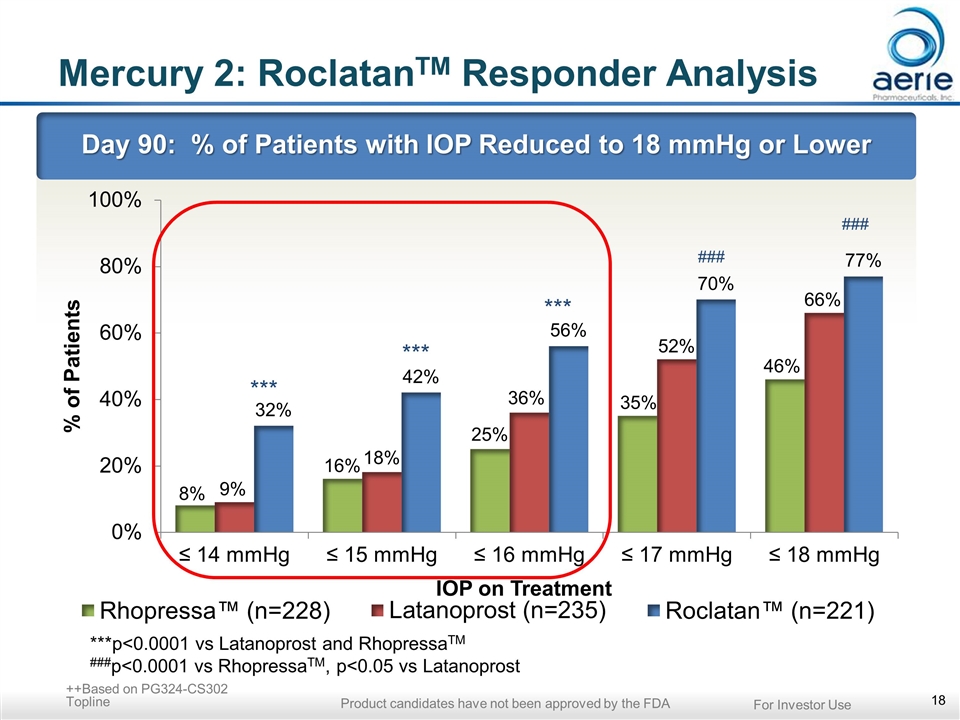

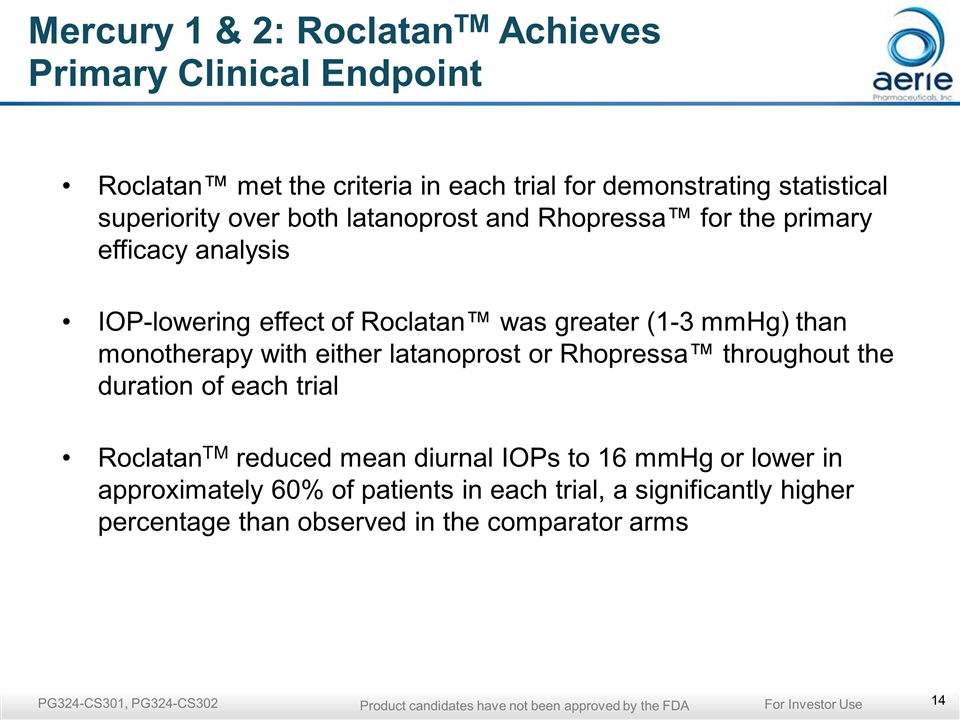

Roclatan™ met the criteria in each trial for demonstrating statistical superiority over both latanoprost and Rhopressa™ for the primary efficacy analysis IOP-lowering effect of Roclatan™ was greater (1-3 mmHg) than monotherapy with either latanoprost or Rhopressa™ throughout the duration of each trial RoclatanTM reduced mean diurnal IOPs to 16 mmHg or lower in approximately 60% of patients in each trial, a significantly higher percentage than observed in the comparator arms Mercury 1 & 2: RoclatanTM Achieves Primary Clinical Endpoint PG324-CS301, PG324-CS302 For Investor Use Product candidates have not been approved by the FDA

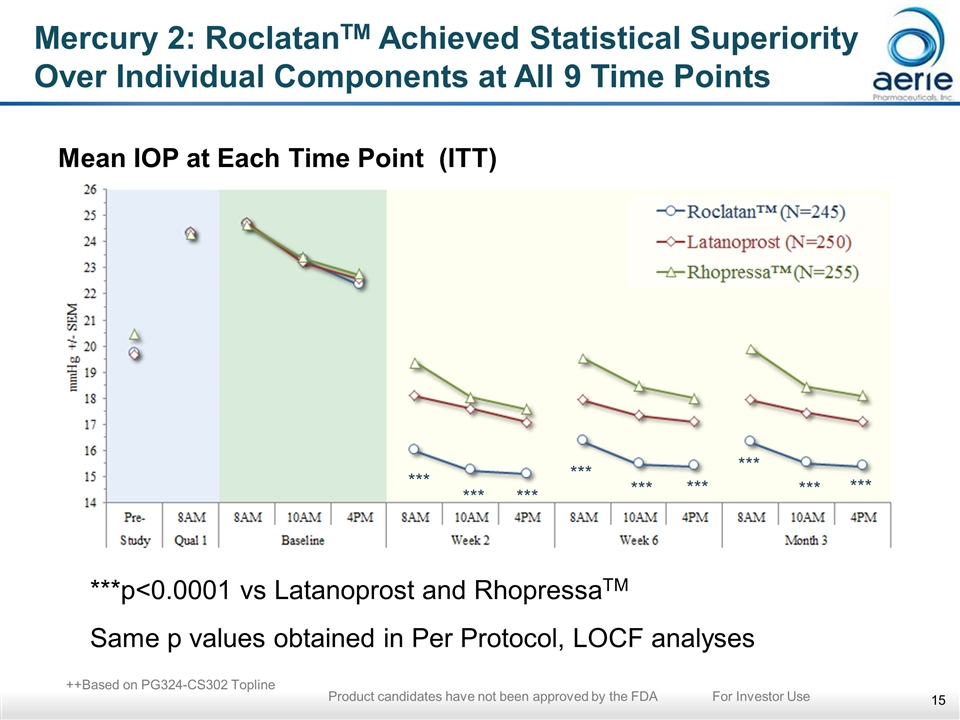

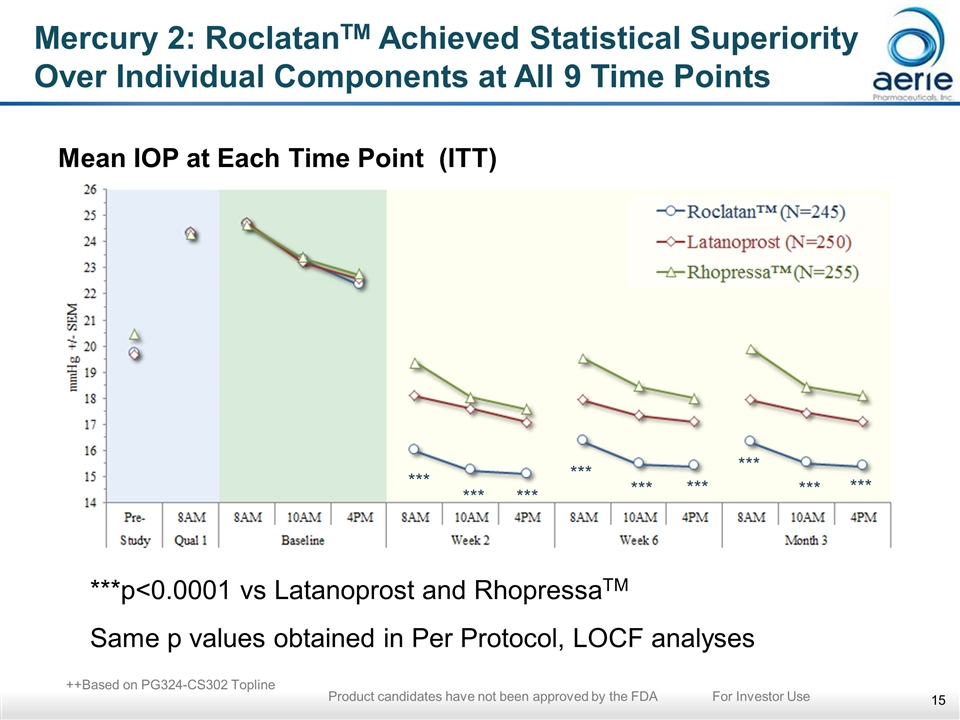

Mercury 2: RoclatanTM Achieved Statistical Superiority Over Individual Components at All 9 Time Points Mean IOP at Each Time Point (ITT) ***p<0.0001 vs Latanoprost and RhopressaTM Same p values obtained in Per Protocol, LOCF analyses *** *** *** *** *** *** *** *** *** ++Based on PG324-CS302 Topline Product candidates have not been approved by the FDA For Investor Use

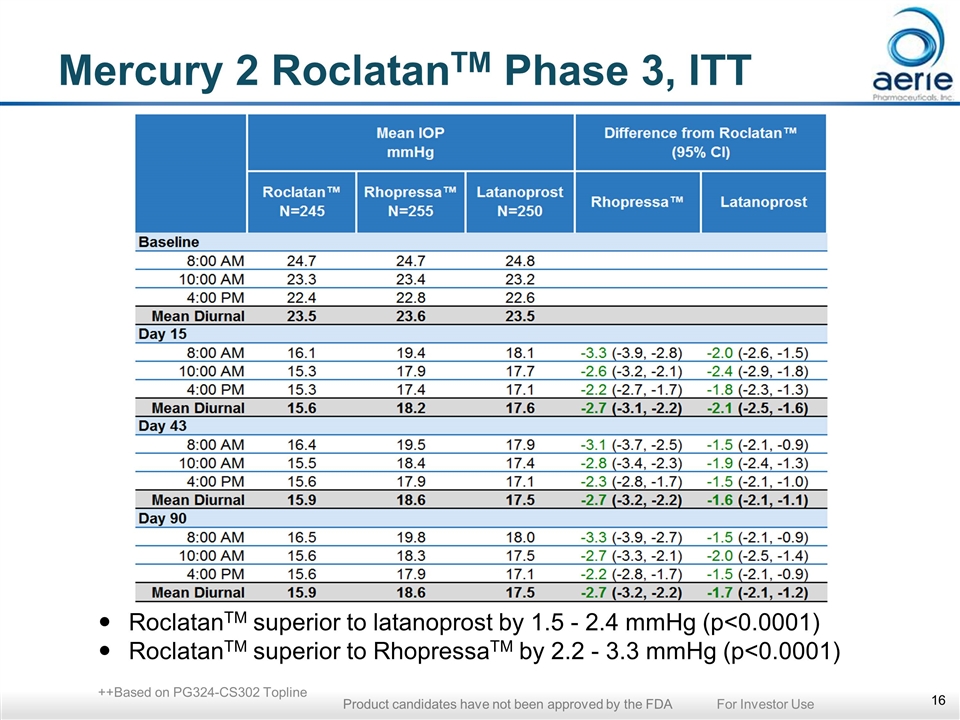

Mercury 2 RoclatanTM Phase 3, ITT RoclatanTM superior to latanoprost by 1.5 - 2.4 mmHg (p<0.0001) RoclatanTM superior to RhopressaTM by 2.2 - 3.3 mmHg (p<0.0001) ++Based on PG324-CS302 Topline Product candidates have not been approved by the FDA For Investor Use

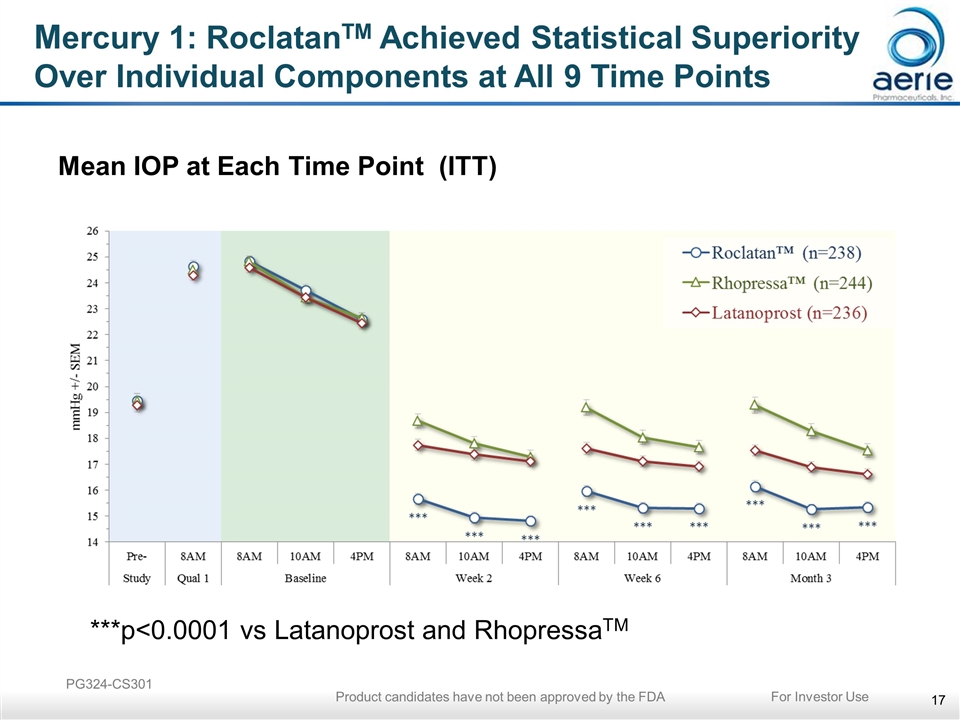

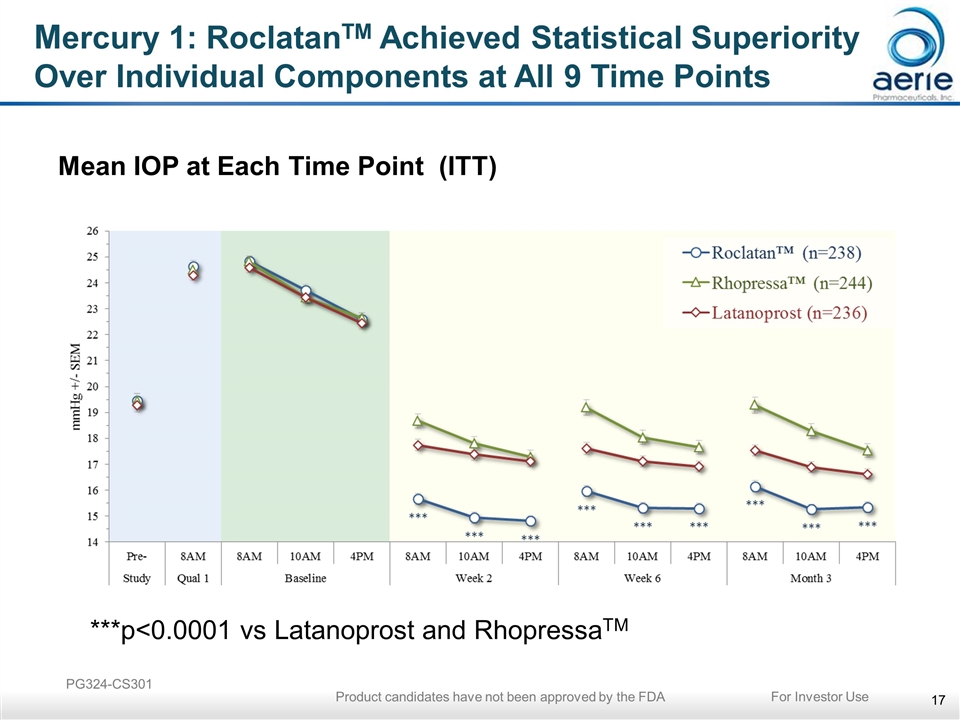

Mercury 1: RoclatanTM Achieved Statistical Superiority Over Individual Components at All 9 Time Points Mean IOP at Each Time Point (ITT) ***p<0.0001 vs Latanoprost and RhopressaTM PG324-CS301 For Investor Use Product candidates have not been approved by the FDA

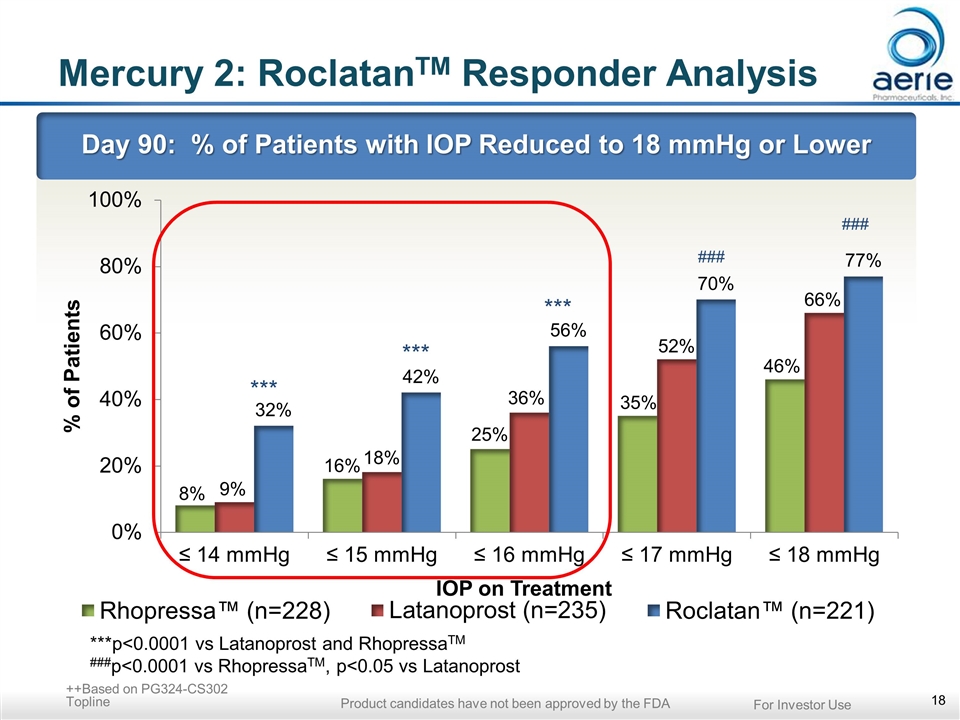

Mercury 2: RoclatanTM Responder Analysis Day 90: % of Patients with IOP Reduced to 18 mmHg or Lower *** *** *** ***p<0.0001 vs Latanoprost and RhopressaTM ###p<0.0001 vs RhopressaTM, p<0.05 vs Latanoprost ++Based on PG324-CS302 Topline For Investor Use Product candidates have not been approved by the FDA

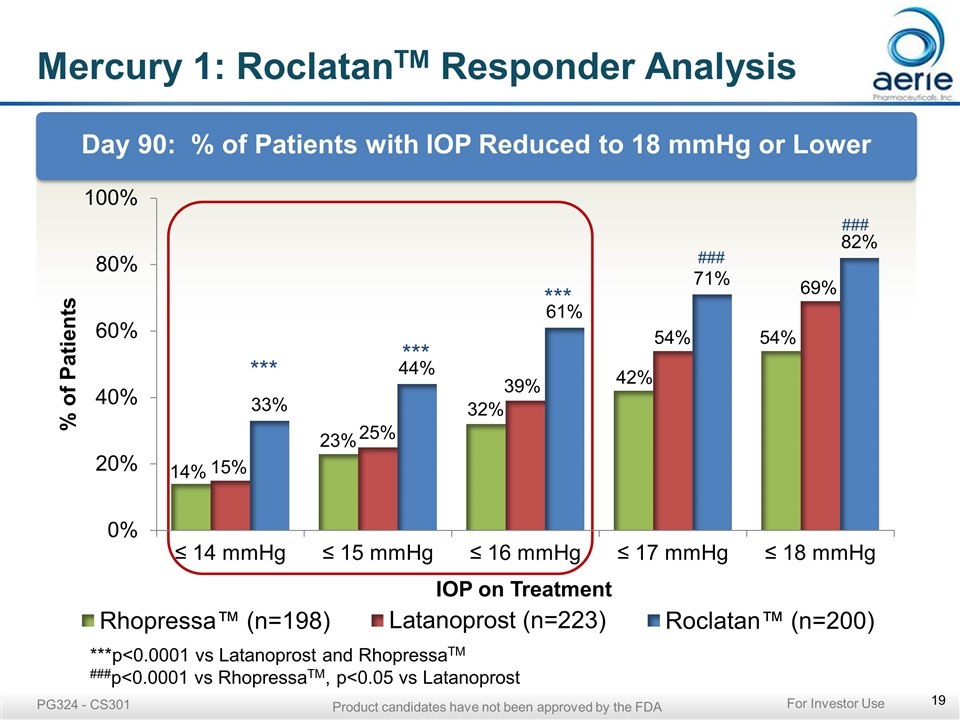

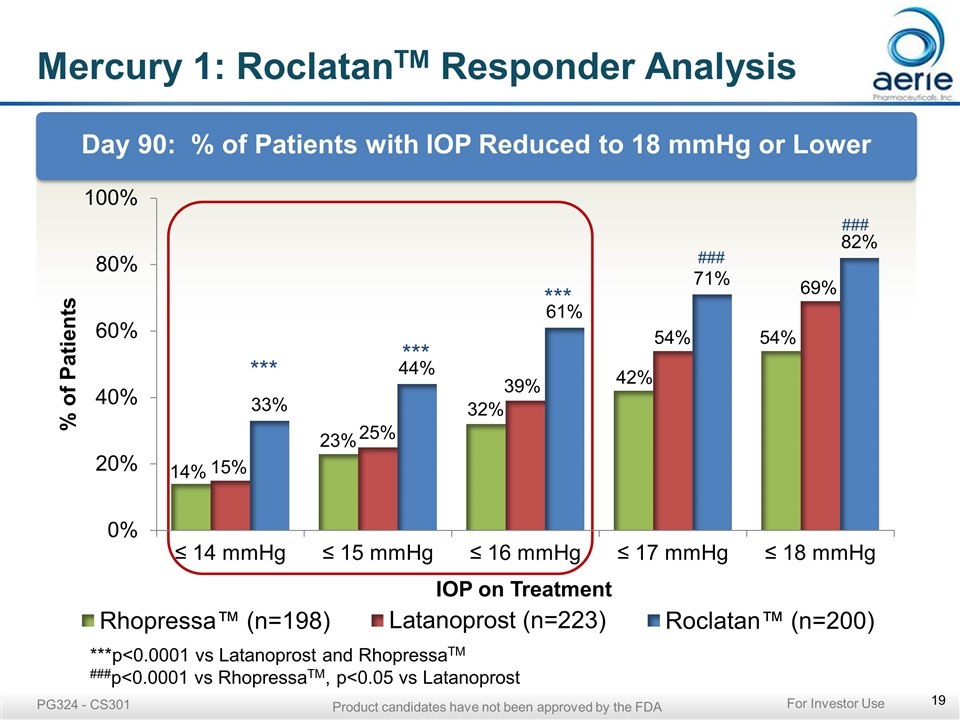

Mercury 1: RoclatanTM Responder Analysis Day 90: % of Patients with IOP Reduced to 18 mmHg or Lower *** *** *** ***p<0.0001 vs Latanoprost and RhopressaTM ###p<0.0001 vs RhopressaTM, p<0.05 vs Latanoprost PG324 - CS301 For Investor Use Product candidates have not been approved by the FDA

Mercury 2: RoclatanTM Safety Profile There were no drug-related serious adverse events (SAEs) There was no evidence of treatment-related systemic effects (e.g., clinical laboratory or haematology values, heart rate or blood pressure) The most common adverse event was conjunctival hyperemia in nearly 55% incidence, ~70% graded as mild on biomicroscopy Other ocular AEs AEs occurring in ~5-13% of subjects receiving RoclatanTM included: cornea verticillata, conjunctival hemorrhage (petechiae) and corneal disorder (asymptomatic change in appearance of corneal endothelial cells) ++Based on PG324-CS302 Topline Product candidates have not been approved by the FDA For Investor Use

Mercury 2: Corneal Endothelial Cell Evaluation FDA requires specular microscopy in at least 100 subjects to ensure no loss of corneal endothelial cell density over 3 months Conducted in Mercury 2 for Roclatan™ (Rocket 2 for Rhopressa™) Centralized reading center confirmed no cell loss for Roclatan™ and Rhopressa™ Slight increase in cell density observed for Roclatan™ or Rhopressa™ (also in Rocket 2 for Rhopressa™), slight decrease for latanoprost No significant changes in corneal endothelial cell hexagonality (shape) Corneal disorder AE noted upon specular microscopy by 2 of 35 sites Asymptomatic change in appearance of corneal endothelial cells noted by two investigators No change in endothelial cell count or corneal thickness, and no corneal edema Similar finding reported for ROCK inhibitor, ripasudil (marketed in Japan), which was identified as transient* ++ Based on AR-13324-CS302 12-month safety and Mercury 2 Topline *Okumura et al. Rho-Associated Kinase Inhibitor Eye Drop (Ripasudil) Transiently Alters the Morphology of Corneal Endothelial Cells. IOVS, November 2015. Vol. 56. No. 12; 7560-7567. Product candidates have not been approved by the FDA For Investor Use

Mercury 1: RoclatanTM Safety Profile There were no drug-related serious adverse events (SAEs) There was no evidence of treatment-related systemic effects The most common adverse event was conjunctival hyperemia with ~50% incidence*, ~80% mild on biomicroscopy Other ocular AEs AEs occurring in ~5-11% of subjects receiving RoclatanTM included: conjunctival hemorrhage, eye pruritus, lacrimation increased and cornea verticillata. * Incidence of conjunctival hyperemia ~50% including baseline at ~20% PG324 - CS301 For Investor Use Product candidates have not been approved by the FDA

Roclatan™ Next Steps Mercury 1 Topline 12-month safety results expected Q3 2017 RoclatanTM NDA filing expected 1H 2018 - Pre-NDA meeting expected 2H 2017 - Final stability data on critical path Aerie Ireland plant and 2 contract manufacturers are expected to support RoclatanTM US commercial activities Mercury 3 expected to commence in Europe mid-2017; regulatory submission expected in 2H 2019 Product candidates have not been approved by FDA For Investor Use

Expanding Aerie Franchise to Europe and Japan Europe Current clinical plan expected to satisfy EU regulatory requirements (including Rocket 4 for RhopressaTM and Mercury 3 for RoclatanTM) Mercury 3: 6-month efficacy and safety registration trial for Europe, comparing RoclatanTM for non-inferiority to a fixed-dose combo in Europe (Ganfort®) expected to start mid-2017. Approximately 230 patients per arm. Expect to file EU MAA for Rhopressa™ in 2018 Commenced construction of Ireland Plant to support worldwide commercial supply Japan Preparing to advance clinical development on our own Phases 1 and 2 to be conducted in U.S. on Japanese / Japanese Americans Phase 3 trials expected to be conducted in Japan commencing 2H18 For Investor Use

Advancing Earlier-Stage Pipeline Product candidates have not been approved by FDA Rhopressa™ Potential for disease modification AR-13154 Significant lesion size reduction in wet AMD Drug Delivery Rhopressa™: Front of the eye AR-13154: Back of the eye For Investor Use

Products in Development: Preclinical Netarsudil* sustained-release implant for Glaucoma Single injection to lower IOP for ~6 months Potential for increased efficacy, reduced ocular side effects, neuroprotection Addresses patient adherence for subset of population AR-13154 implant for AMD, DR/DME ROCK/PKC inhibitor Addresses multiple drivers of disease - fibrosis, inflammation, vessel leakage and neovascularization Efficacy demonstrated as monotherapy and as adjunct to anti-VEGF therapy (preclinical) Potential to improve long-term outcomes * Active ingredient of RhopressaTM Product candidates have not been approved by the FDA For Investor Use

Summary Key Clinical Priorities RhopressaTM: PDUFA goal date set for February 28, 2018 RoclatanTM: Mercury 1 12-month safety data expected Q3 2017 Mercury 3 expected to commence mid-2017 (EU) Research Initiatives Rhopressa™ disease modification, sustained release AR-13154 potential in wet AMD, etc. Evaluating Aerie’s 3,000+ proprietary molecules Business Development and Expansion Opportunities Drug delivery opportunities for front and back of the eye EU/JP clinical path and commercialization strategy Ireland Manufacturing Facility Well-Financed: ~$300M+ cash and investments estimated 6/30/17 For Investor Use

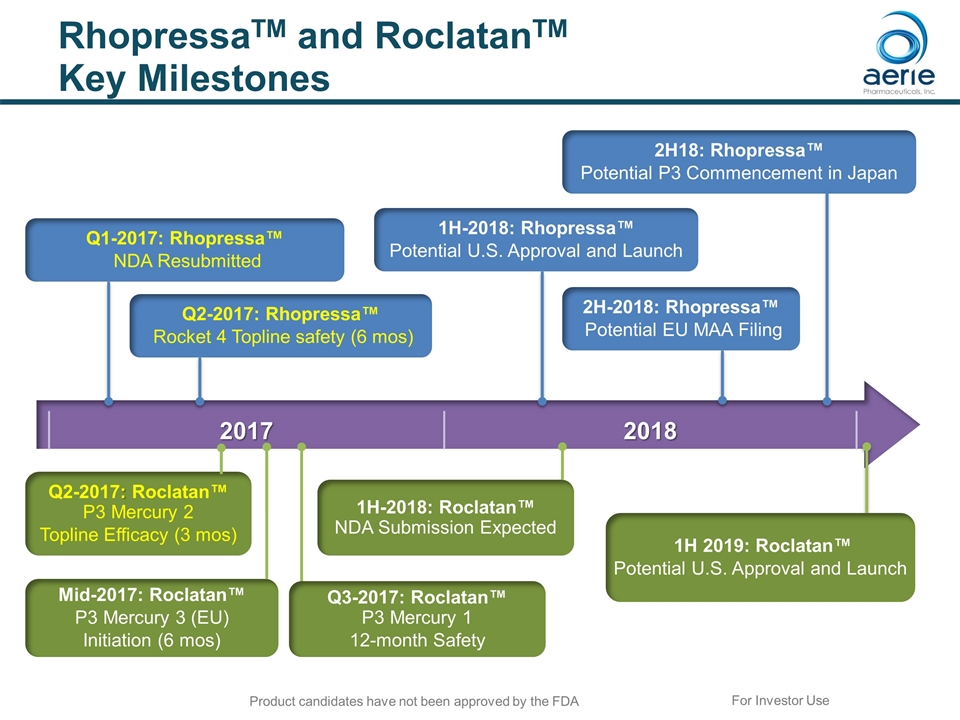

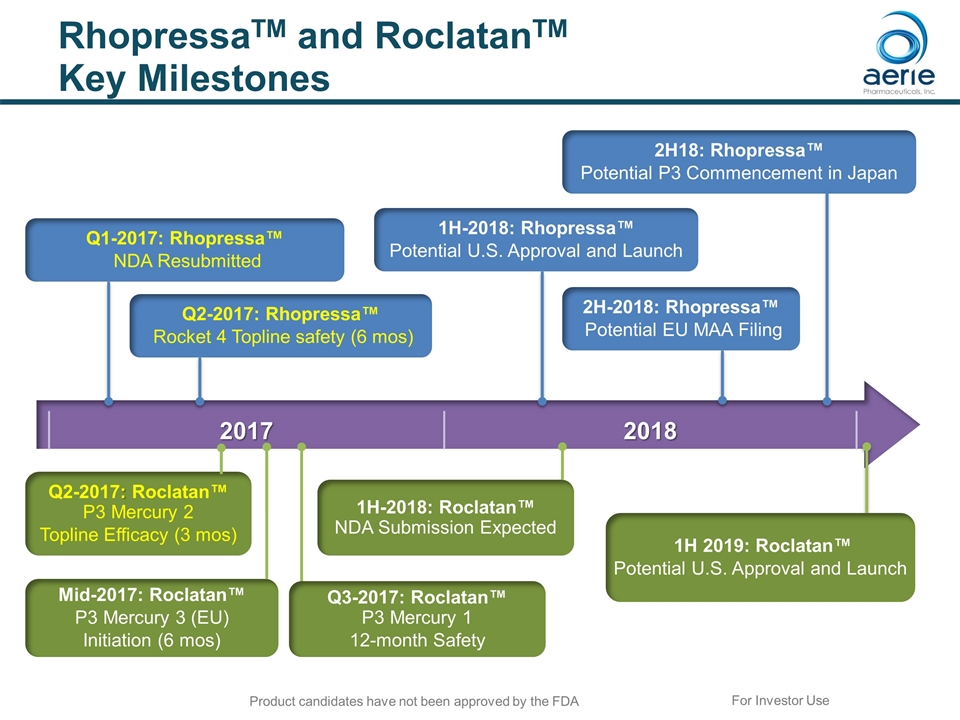

2017 2018 RhopressaTM and RoclatanTM Key Milestones 1H 2019: Roclatan™ Potential U.S. Approval and Launch 1H-2018: Roclatan™ NDA Submission Expected Q1-2017: Rhopressa™ NDA Resubmitted 1H-2018: Rhopressa™ Potential U.S. Approval and Launch Q2-2017: Rhopressa™ Rocket 4 Topline safety (6 mos) Mid-2017: Roclatan™ P3 Mercury 3 (EU) Initiation (6 mos) Q2-2017: Roclatan™ P3 Mercury 2 Topline Efficacy (3 mos) 2H-2018: Rhopressa™ Potential EU MAA Filing For Investor Use 2H18: Rhopressa™ Potential P3 Commencement in Japan Q3-2017: Roclatan™ P3 Mercury 1 12-month Safety Product candidates have not been approved by the FDA