Exhibit 99.1 AERIE An Em e r g i n g L e a d e r i n O p h t h a l m o l o g y Ja n u a ry 2 0 2 2 For Investor Use Only 1

Disclaimer The information in this presentation regarding Aerie Pharmaceuticals, Inc. (the “Company” or “Aerie”) does not contain all of the information that a potential investor should review before investing in Aerie shares. The descriptions of Aerie in this presentation are qualified in their entirety by reference to the Company’s reports filed with the Securities and Exchange Commission (SEC). Certain information in this presentation has been obtained from outside sources or is anecdotal in nature. While such information is believed to be reliable for the purposes used herein, no representations are made as to the accuracy or completeness thereof and we take no responsibility for such information. ® ® Any discussion of the potential use or expected success of Rhopressa (netarsudil ophthalmic solution) 0.02% or Rocklatan (netarsudil and latanoprost ophthalmic solution) 0.02%/0.005%, with respect to foreign approval or additional indications, and our current or any future product candidates, including AR-1105, AR-13503, AR-14034, AR-6121 and AR-15512, is subject to regulatory approval. ® ® ® ® In addition, any discussion of U.S. Food and Drug Administration (“FDA”) approval of Rhopressa or Rocklatan does not guarantee successful commercialization of Rhopressa or Rocklatan . For ® ® ® more information on Rhopressa , including prescribing information, refer to the full Rhopressa product label at www.rhopressa.com. For more information on Rocklatan , including prescribing ® information, refer to the full Rocklatan product label at www.rocklatan.com. The information in this presentation is current only as of its date and may have changed or may change in the future. We undertake no obligation to update this information in light of new information, future events or otherwise, except as otherwise required by law. We are not making any representation or warranty that the information in this presentation is accurate or complete. This presentation shall not constitute an offer to sell, nor a solicitation of an offer to buy, any of Aerie’s securities. Certain statements in this presentation, including any guidance or timelines presented herein, are “forward-looking statements” within the meaning of the federal securities laws. Words such as “may,” “will,” “should,” “would,” “could,” “believe,” “expects,” “anticipates,” “plans,” “intends,” “estimates,” “targets,” “projects,” “potential” or similar expressions are intended to identify these forward- looking statements. These statements are based on the Company’s current plans and expectations. Known and unknown risks, uncertainties and other factors could cause actual results to differ materially from those contemplated by the statements. In evaluating these statements, you should specifically consider various factors that may cause our actual results to differ materially from any forward-looking statements. For example, uncertainties around the impact of the COVID-19 pandemic, including its impact on our clinical and commercial operations and our global supply chain, could cause actual results to be materially different than those expressed in this presentation. In particular, these statements include any discussion of potential commercial sales, placement or ® ® ® ® utilization of Rocklatan or Rhopressa in the United States or any other market. Likewise, FDA approval of Rhopressa and Rocklatan does not constitute approval of any future product candidates. Any top line data presented herein is preliminary and based solely on information available to us as of the date of this presentation and additional information about the results may be disclosed at ® ® ® ® any time. FDA approval of Rhopressa and Rocklatan also does not constitute regulatory approval of Rhopressa or Rocklatan in jurisdictions outside the United States and there can be no ® ® assurance that we will receive regulatory approval for Rhopressa or Rocklatan in jurisdictions outside the United States. In addition, any discussion in this presentation about preclinical activities or opportunities associated with our products or discussions involving the potential for our dry eye or retinal product candidates are preliminary and the outcome of any studies may not be predictive of the outcome of later trials and ultimate regulatory approval. Any future clinical trial results may not demonstrate safety and efficacy sufficient to obtain regulatory approval related to the preclinical research findings discussed in this presentation. Any statements regarding Aerie’s future liquidity, cash balances or financing transactions also constitute forward-looking statements as are discussions of the possibility of, or possible results of, any commercial transactions or collaborations. These risks and uncertainties are described more fully in the quarterly and annual reports that we file with the SEC, particularly in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” 2 For Investor Use Only

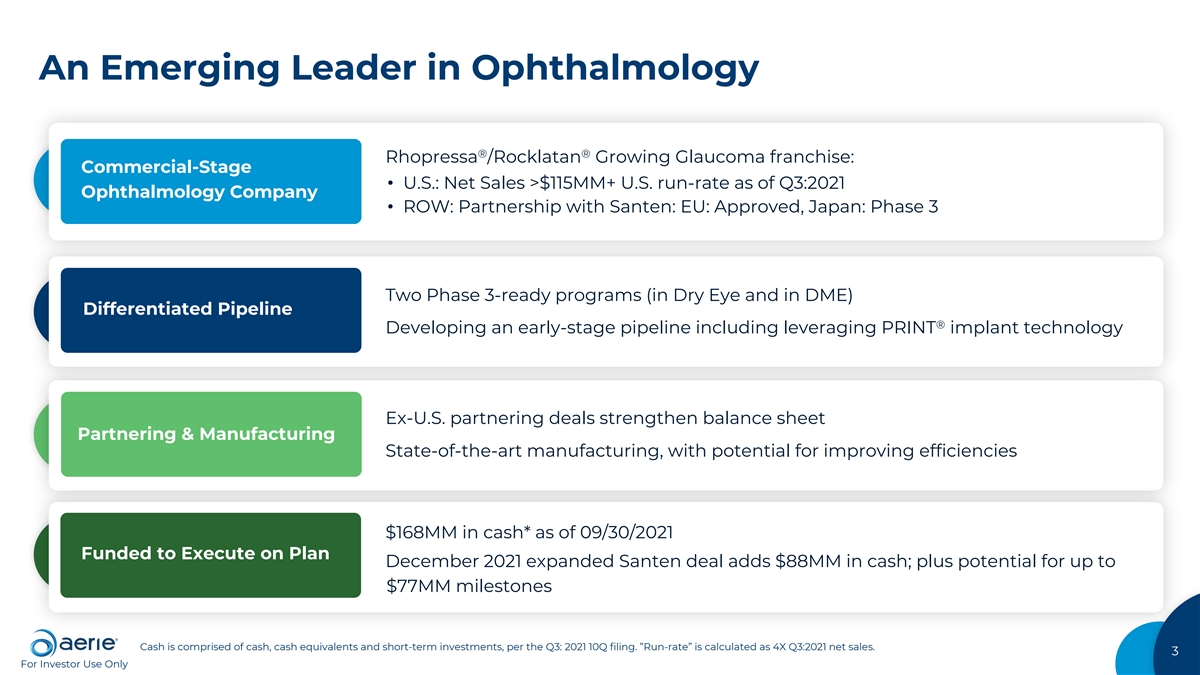

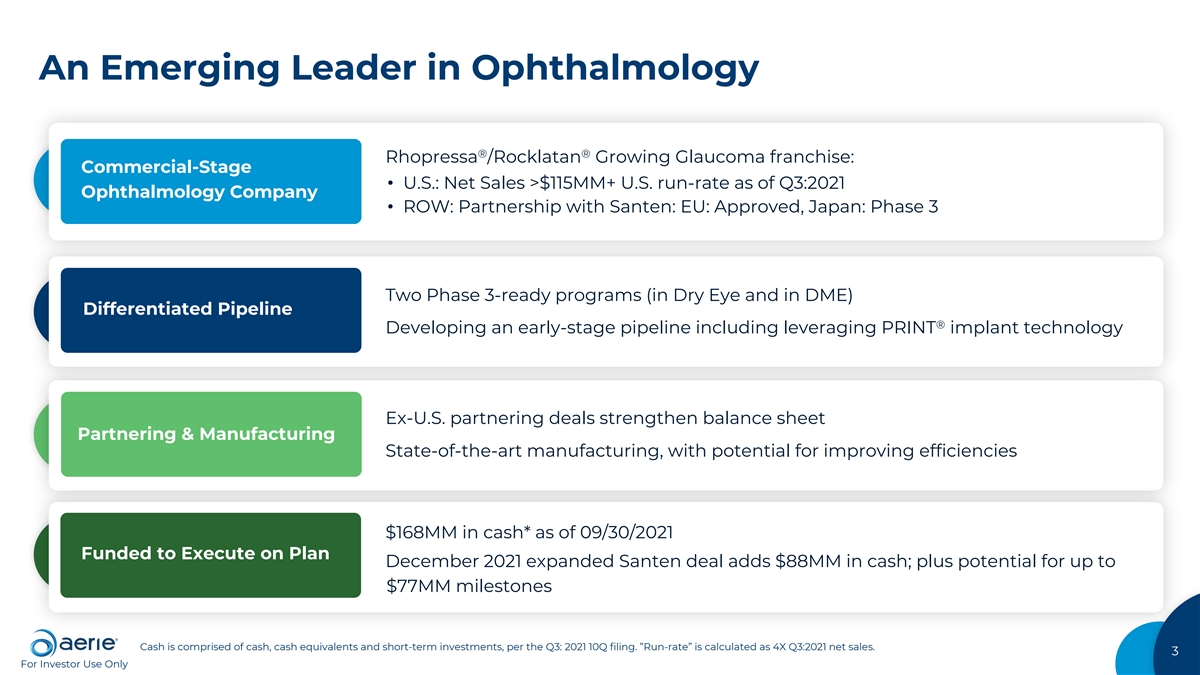

An Emerging Leader in Ophthalmology ® ® Rhopressa /Rocklatan Growing Glaucoma franchise: Commercial-Stage • U.S.: Net Sales >$115MM+ U.S. run-rate as of Q3:2021 Ophthalmology Company • ROW: Partnership with Santen: EU: Approved, Japan: Phase 3 Two Phase 3-ready programs (in Dry Eye and in DME) Differentiated Pipeline ® Developing an early-stage pipeline including leveraging PRINT implant technology Ex-U.S. partnering deals strengthen balance sheet Partnering & Manufacturing State-of-the-art manufacturing, with potential for improving efficiencies $168MM in cash* as of 09/30/2021 Funded to Execute on Plan December 2021 expanded Santen deal adds $88MM in cash; plus potential for up to $77MM milestones Cash is comprised of cash, cash equivalents and short-term investments, per the Q3: 2021 10Q filing. ”Run-rate” is calculated as 4X Q3:2021 net sales. 3 For Investor Use Only

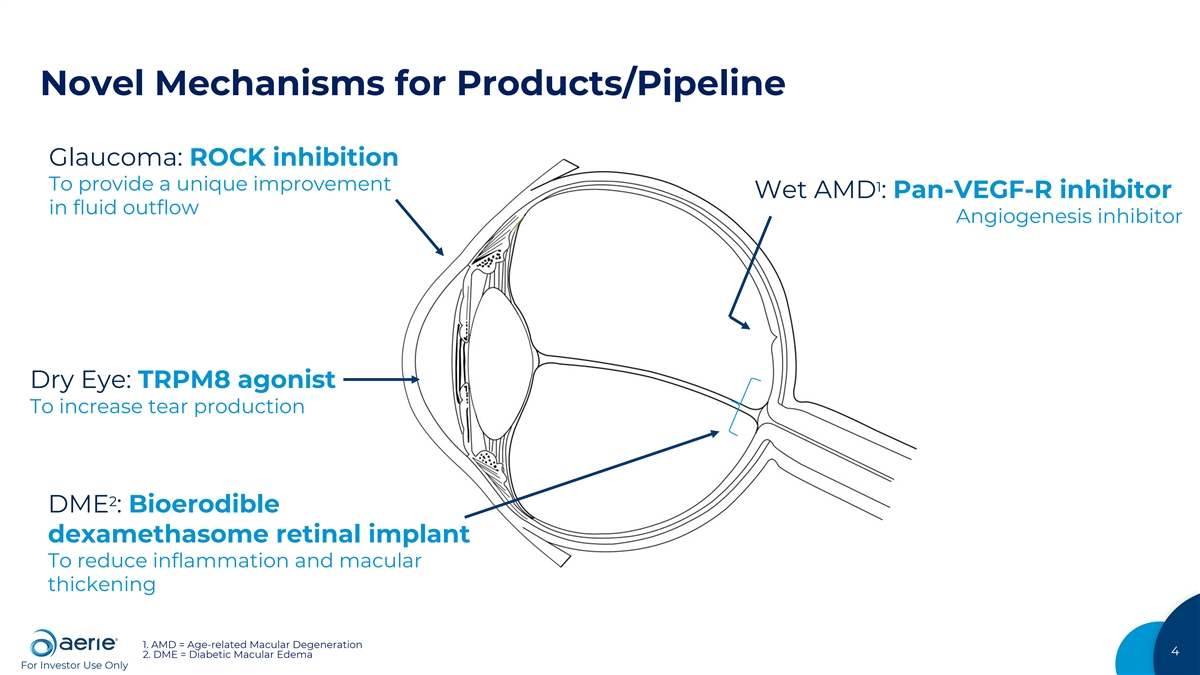

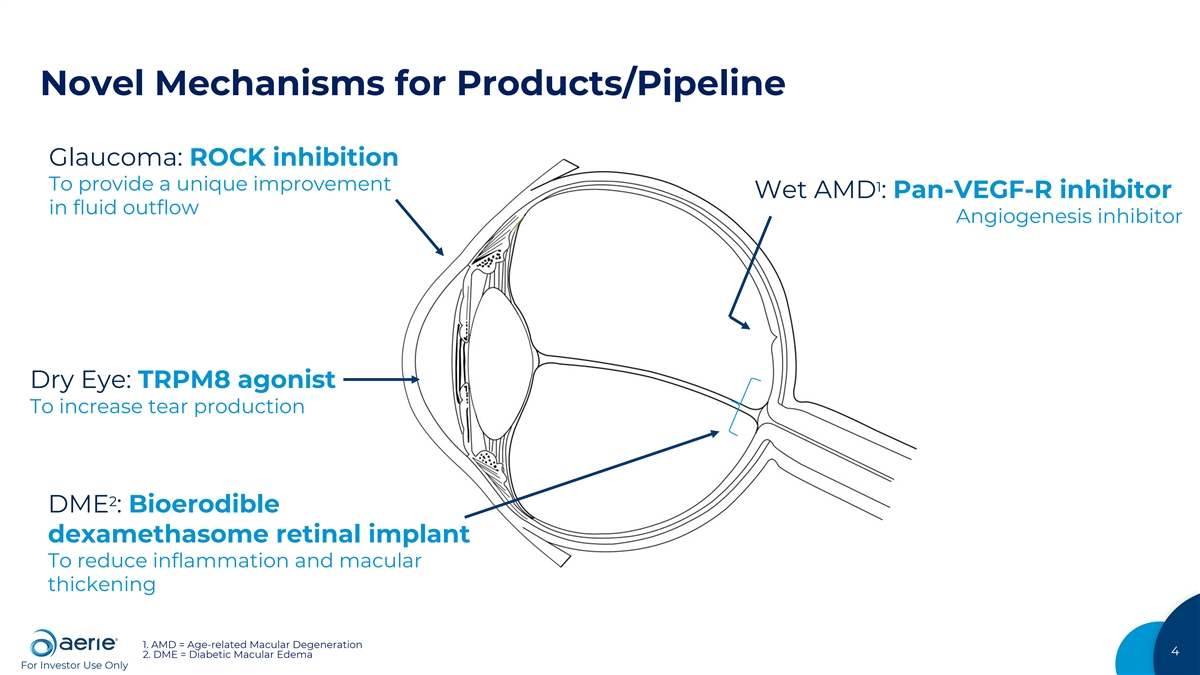

Novel Mechanisms for Products/Pipeline Glaucoma: ROCK inhibition To provide a unique improvement 1 Wet AMD : Pan-VEGF-R inhibitor in fluid outflow Angiogenesis inhibitor Dry Eye: TRPM8 agonist To increase tear production 2 DME : Bioerodible dexamethasome retinal implant To reduce inflammation and macular thickening 1. AMD = Age-related Macular Degeneration 4 2. DME = Diabetic Macular Edema For Investor Use Only

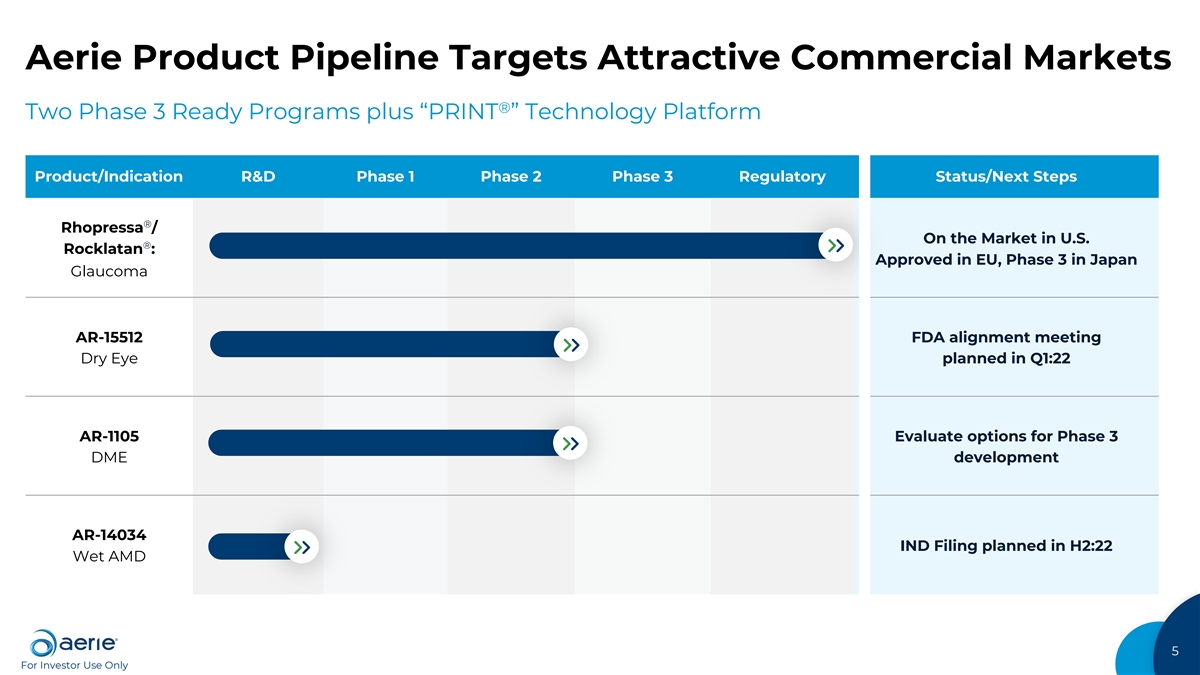

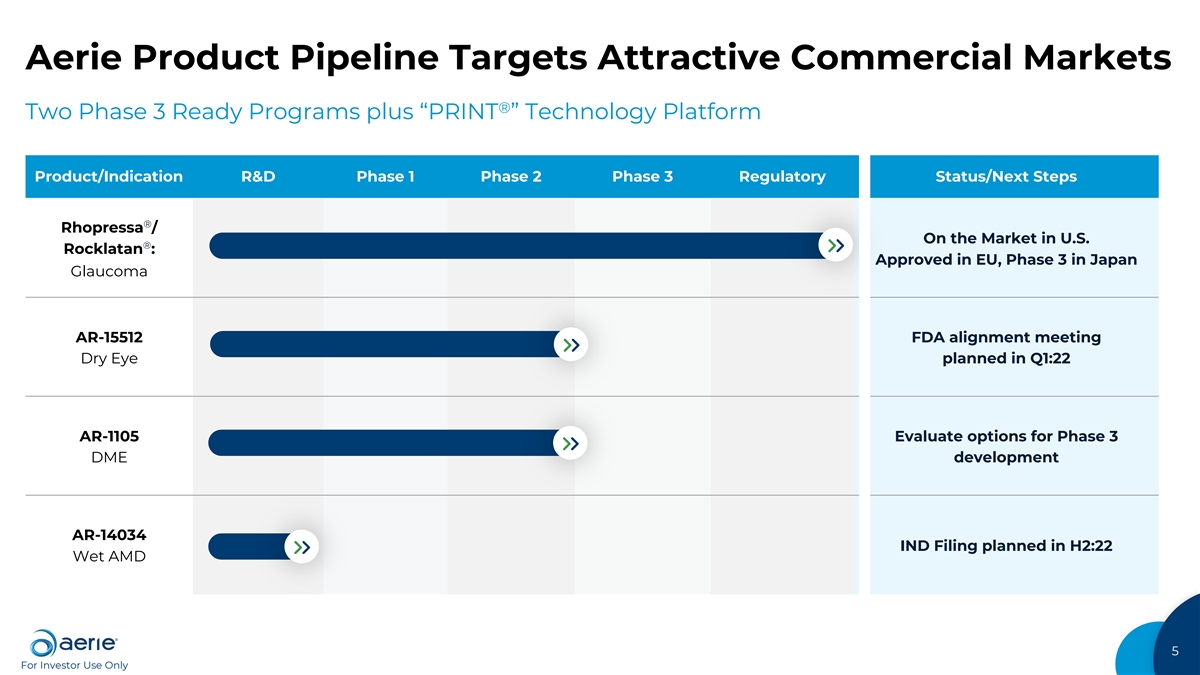

Aerie Product Pipeline Targets Attractive Commercial Markets ® Two Phase 3 Ready Programs plus “PRINT ” Technology Platform Product/Indication R&D Phase 1 Phase 2 Phase 3 Regulatory Status/Next Steps ® Rhopressa / On the Market in U.S. ® Rocklatan : Approved in EU, Phase 3 in Japan Glaucoma AR-15512 FDA alignment meeting Dry Eye planned in Q1:22 AR-1105 Evaluate options for Phase 3 DME development AR-14034 IND Filing planned in H2:22 Wet AMD 5 For Investor Use Only

1 Glaucoma: ~$3B U.S. Market Reduced THE PROBLEM fluid • Stiffening trabecular meshwork reduces normal drainage outflow • Increased intraocular Pressure (IOP) can damage the optic nerve Increased and lead to vision loss intra-ocular pressure THE OPPORTUNITY • 34MM prescriptions annually, 55MM bottles • 55% on monotherapy, 45% on 2-3X/day adjuncts ROCK inhibition leads to: CURRENT TREATMENT Relaxation of trabecular meshwork • Prostaglandin analogs are the most common first line therapy Dilation of episcleral veins Result: unique improvement in fluid outflow • Long term polypharmacy uses several other mechanisms 2 Two products with novel mechanism of action to treat glaucoma : ® • Rhopressa ® • Rocklatan 1. Market Scope 2021. 2. Also approved/launched for use in ocular hypertension. 6 For Investor Use Only

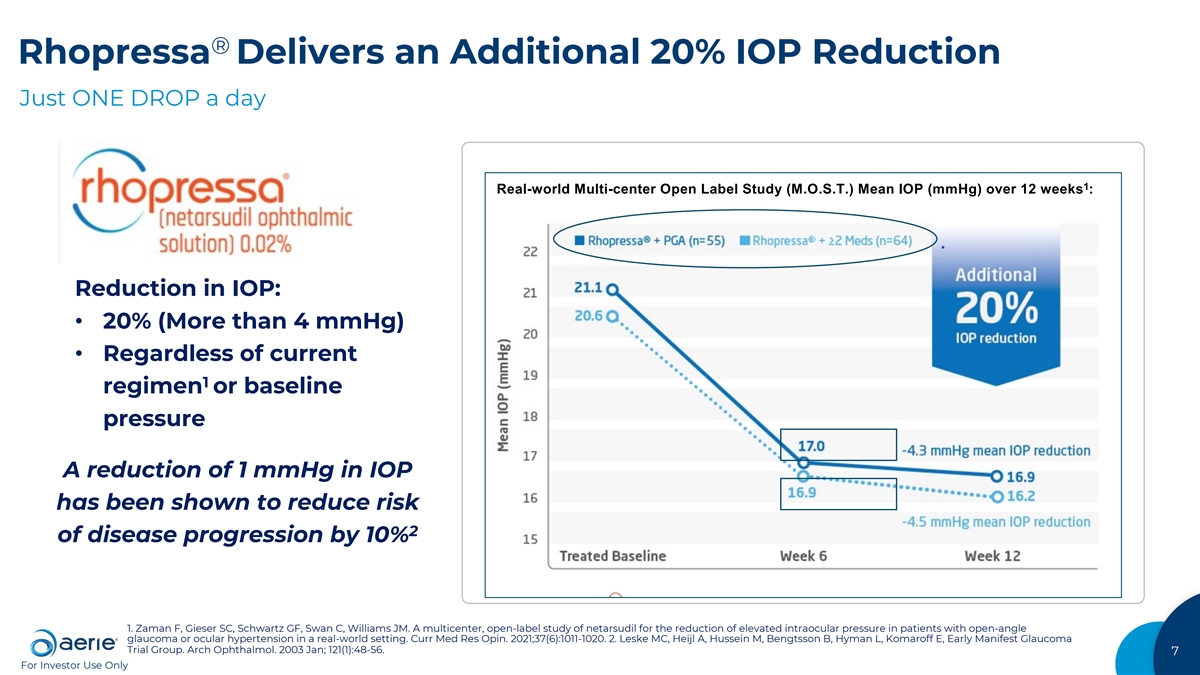

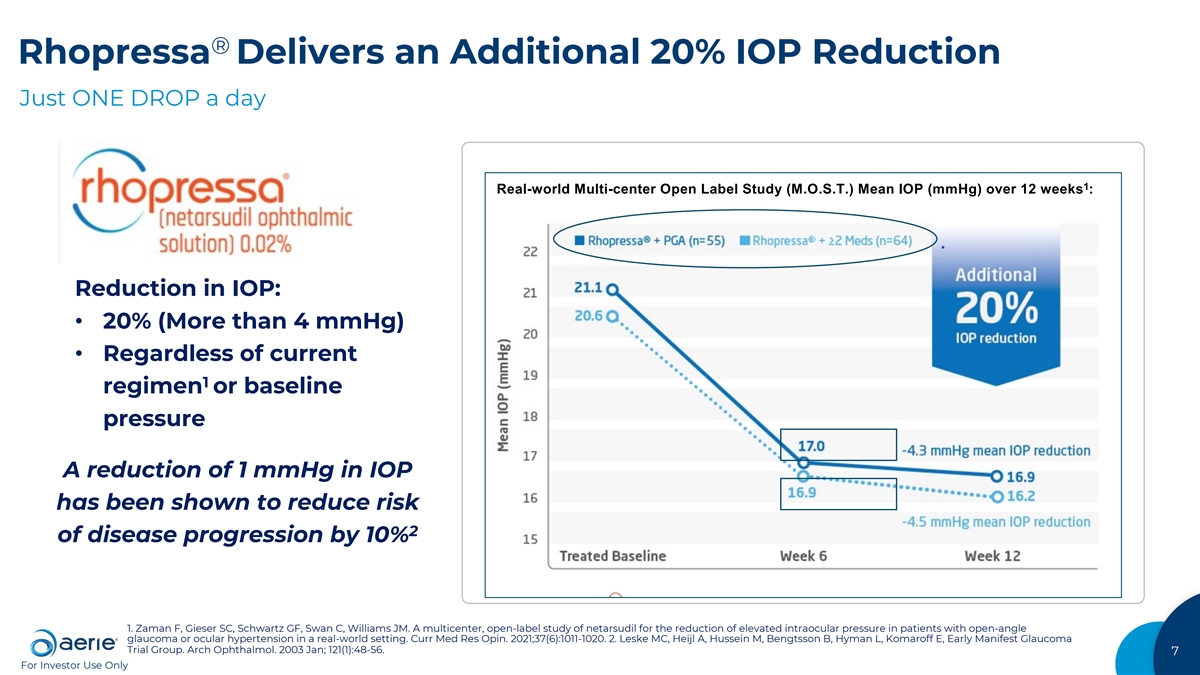

® Rhopressa Delivers an Additional 20% IOP Reduction Just ONE DROP a day 1 Real-world Multi-center Open Label Study (M.O.S.T.) Mean IOP (mmHg) over 12 weeks : Reduction in IOP: • 20% (More than 4 mmHg) • Regardless of current 1 regimen or baseline pressure A reduction of 1 mmHg in IOP has been shown to reduce risk 2 of disease progression by 10% 1. Zaman F, Gieser SC, Schwartz GF, Swan C, Williams JM. A multicenter, open-label study of netarsudil for the reduction of elevated intraocular pressure in patients with open-angle glaucoma or ocular hypertension in a real-world setting. Curr Med Res Opin. 2021;37(6):1011-1020. 2. Leske MC, Heijl A, Hussein M, Bengtsson B, Hyman L, Komaroff E, Early Manifest Glaucoma Trial Group. Arch Ophthalmol. 2003 Jan; 121(1):48-56. 7 For Investor Use Only

® Rocklatan Potential to be Best-in-Class for Glaucoma Care ® Rocklatan (netarsudil/latanoprost combo) is the only 1 once-daily, fixed-dose combination treatment in the U.S. 1,2 Achieves superior IOP reduction vs. latanoprost-- the 2 world’s most prescribed glaucoma treatment Effective, regardless of current regimen. No reported 3 systemic effects ® ® 4 Patent coverage (Rocklatan & Rhopressa ) through 2034 ® 1. Rocklatan (netarsudil and latanoprost ophthalmic solution) 0.02%/0.005% Prescribing Information, Aerie Pharmaceuticals, Inc., Irvine, Calif. 2020. 2. Asrani, S., Bacharach, J., Holland, E. et al. Fixed-Dose Combination of Netarsudil and Latanoprost in Ocular Hypertension and Open-Angle Glaucoma: Pooled Efficacy/Safety Analysis of Phase 3 MERCURY-1 and -2. Adv Ther 37, 8 1620–1631 (2020). For Investor Use Only

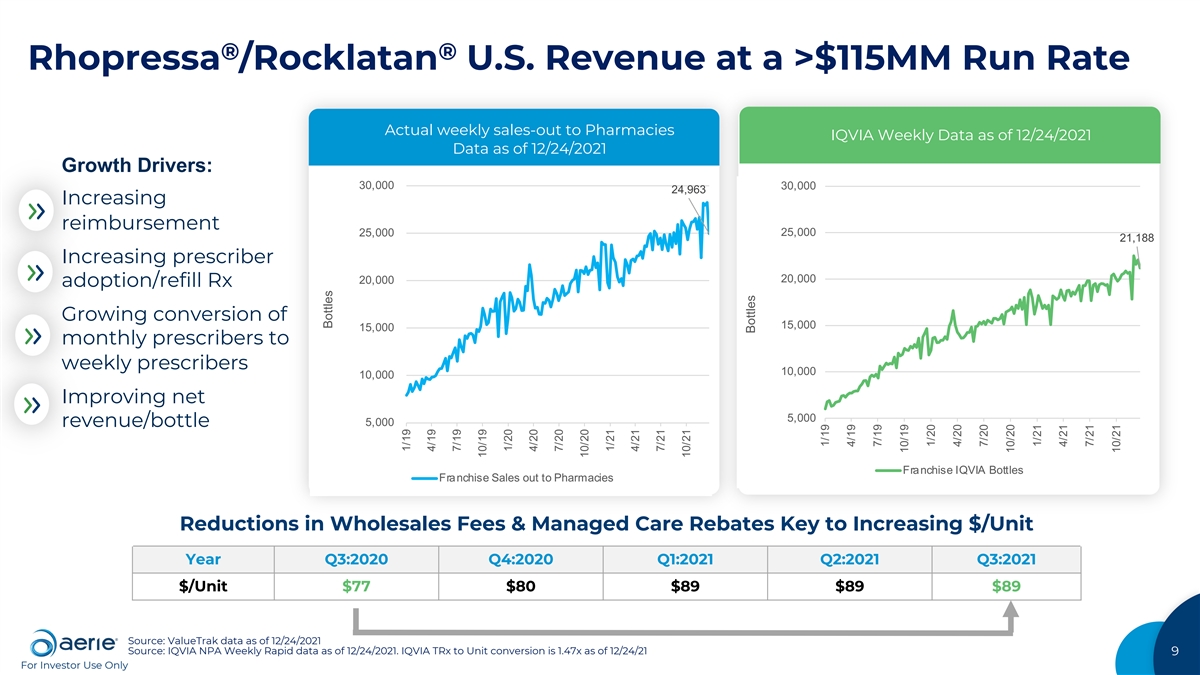

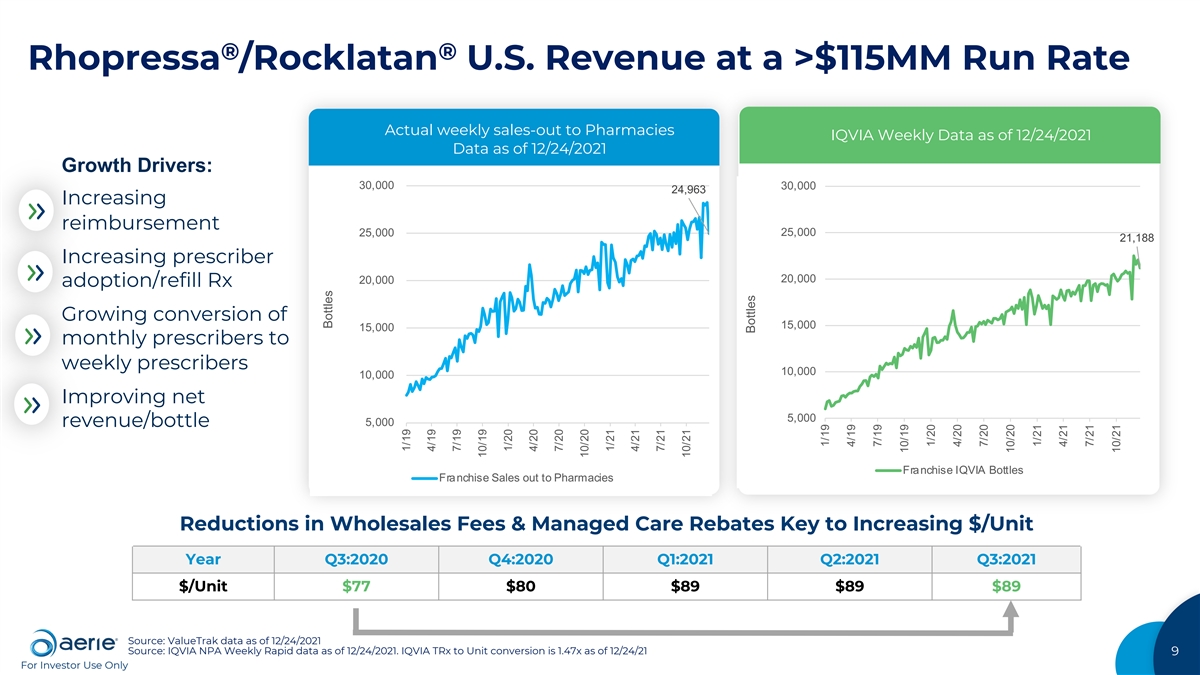

® ® Rhopressa /Rocklatan U.S. Revenue at a >$115MM Run Rate Actual weekly sales-out to Pharmacies IQVIA Weekly Data as of 12/24/2021 Data as of 12/24/2021 Growth Drivers: 30,000 30,000 24,963 Increasing reimbursement 25,000 25,000 21,188 Increasing prescriber 20,000 20,000 adoption/refill Rx Growing conversion of 15,000 15,000 monthly prescribers to weekly prescribers 10,000 10,000 Improving net 5,000 5,000 revenue/bottle Franchise IQVIA Bottles Franchise Sales out to Pharmacies Reductions in Wholesales Fees & Managed Care Rebates Key to Increasing $/Unit Year Q3:2020 Q4:2020 Q1:2021 Q2:2021 Q3:2021 $/Unit $77 $80 $89 $89 $89 Source: ValueTrak data as of 12/24/2021 Source: IQVIA NPA Weekly Rapid data as of 12/24/2021. IQVIA TRx to Unit conversion is 1.47x as of 12/24/21 9 For Investor Use Only Bottles 1/19 4/19 7/19 10/19 1/20 4/20 7/20 10/20 1/21 4/21 7/21 10/21 Bottles 1/19 4/19 7/19 10/19 1/20 4/20 7/20 10/20 1/21 4/21 7/21 10/21

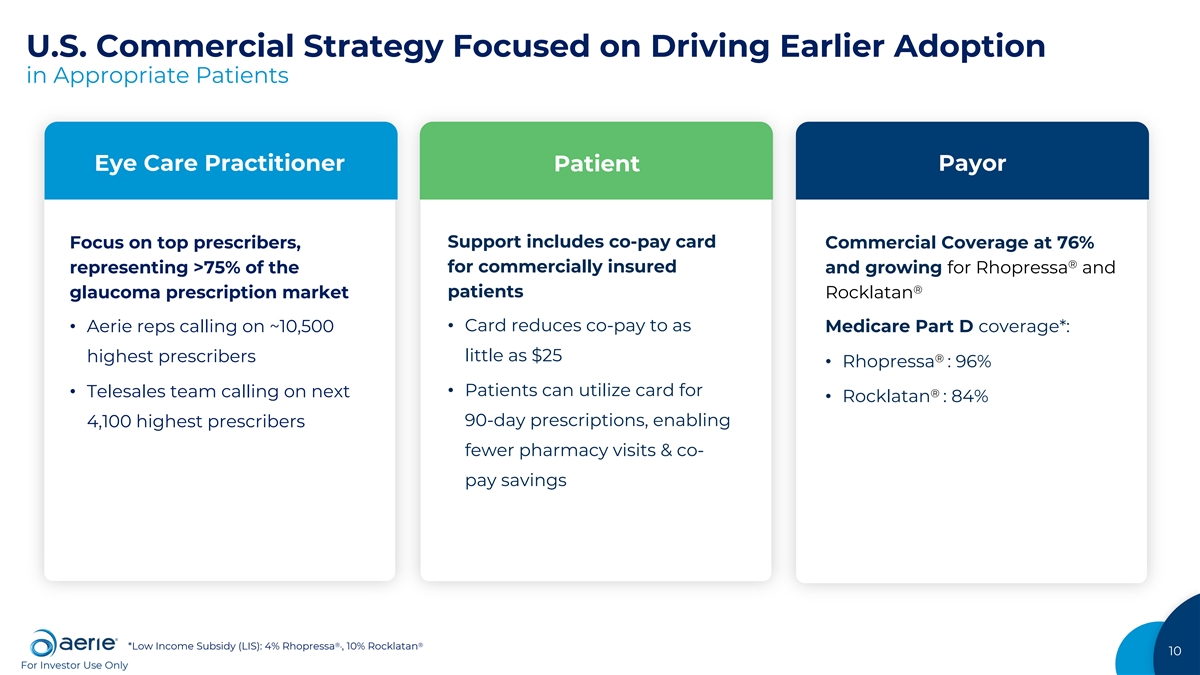

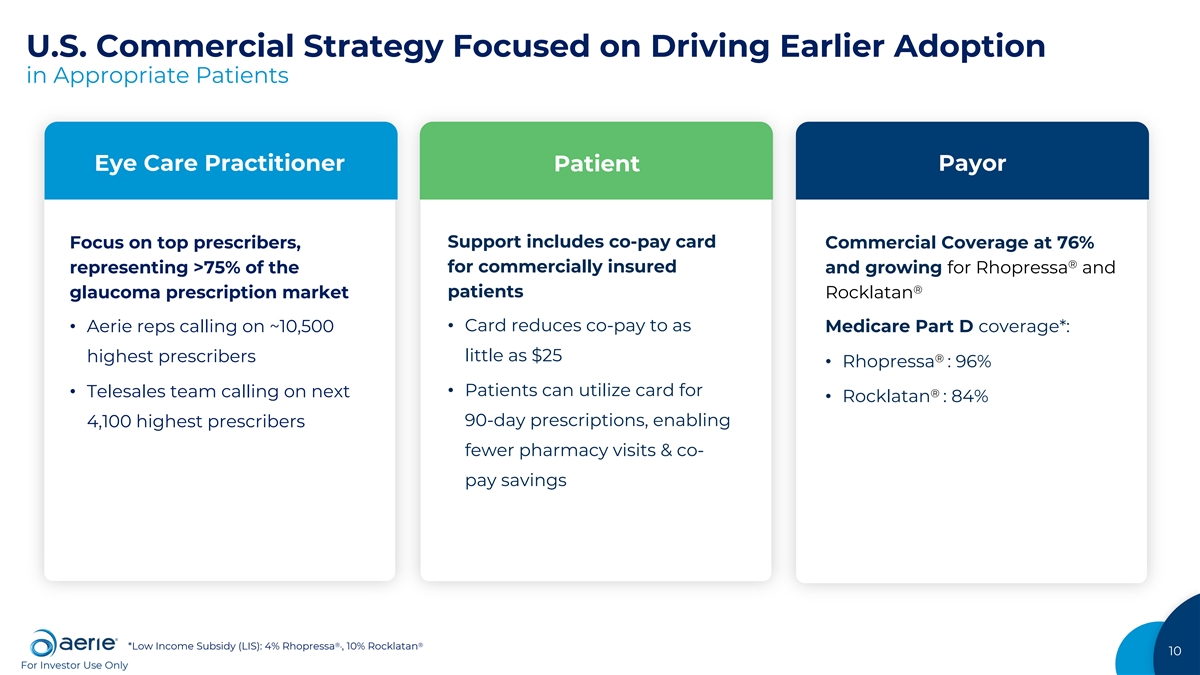

U.S. Commercial Strategy Focused on Driving Earlier Adoption in Appropriate Patients Eye Care Practitioner Patient Payor Support includes co-pay card Focus on top prescribers, Commercial Coverage at 76% ® for commercially insured representing >75% of the and growing for Rhopressa and ® patients glaucoma prescription market Rocklatan • Card reduces co-pay to as • Aerie reps calling on ~10,500 Medicare Part D coverage*: little as $25 highest prescribers ® • Rhopressa : 96% • Patients can utilize card for • Telesales team calling on next ® • Rocklatan : 84% 90-day prescriptions, enabling 4,100 highest prescribers fewer pharmacy visits & co- pay savings ®, ® *Low Income Subsidy (LIS): 4% Rhopressa , 10% Rocklatan 10 For Investor Use Only

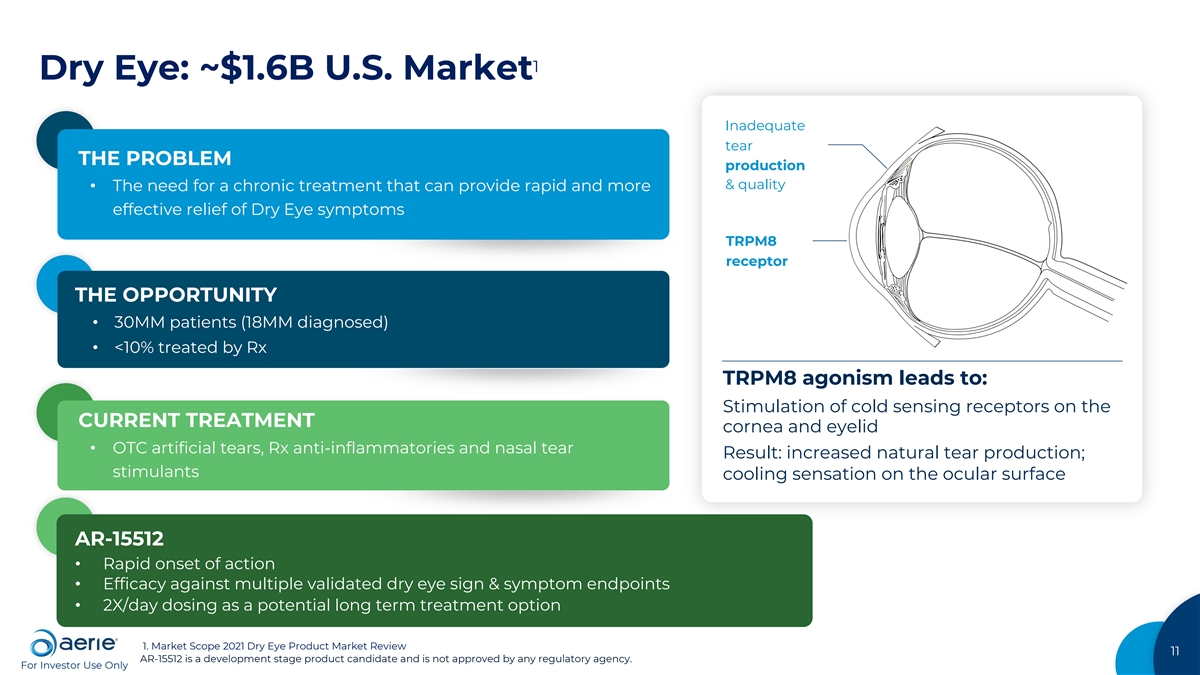

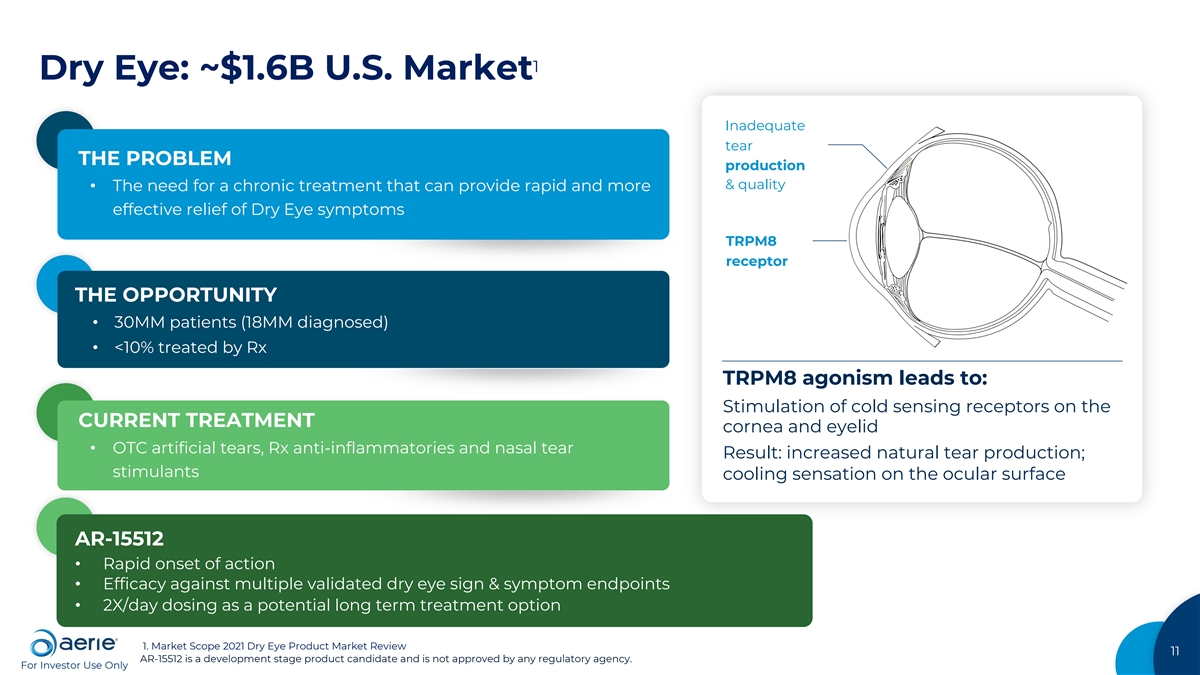

1 Dry Eye: ~$1.6B U.S. Market Inadequate tear THE PROBLEM production & quality • The need for a chronic treatment that can provide rapid and more effective relief of Dry Eye symptoms TRPM8 receptor THE OPPORTUNITY • 30MM patients (18MM diagnosed) • <10% treated by Rx TRPM8 agonism leads to: Stimulation of cold sensing receptors on the CURRENT TREATMENT cornea and eyelid • OTC artificial tears, Rx anti-inflammatories and nasal tear Result: increased natural tear production; stimulants cooling sensation on the ocular surface AR-15512 • Rapid onset of action • Efficacy against multiple validated dry eye sign & symptom endpoints • 2X/day dosing as a potential long term treatment option 1. Market Scope 2021 Dry Eye Product Market Review 11 AR-15512 is a development stage product candidate and is not approved by any regulatory agency. For Investor Use Only

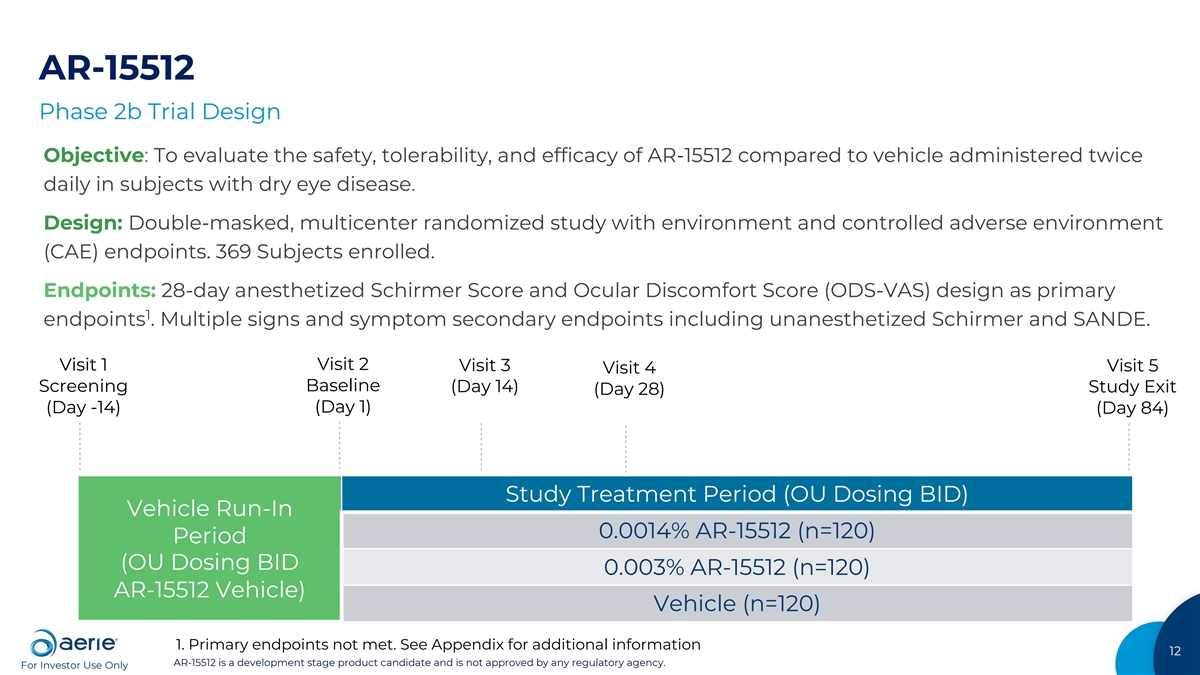

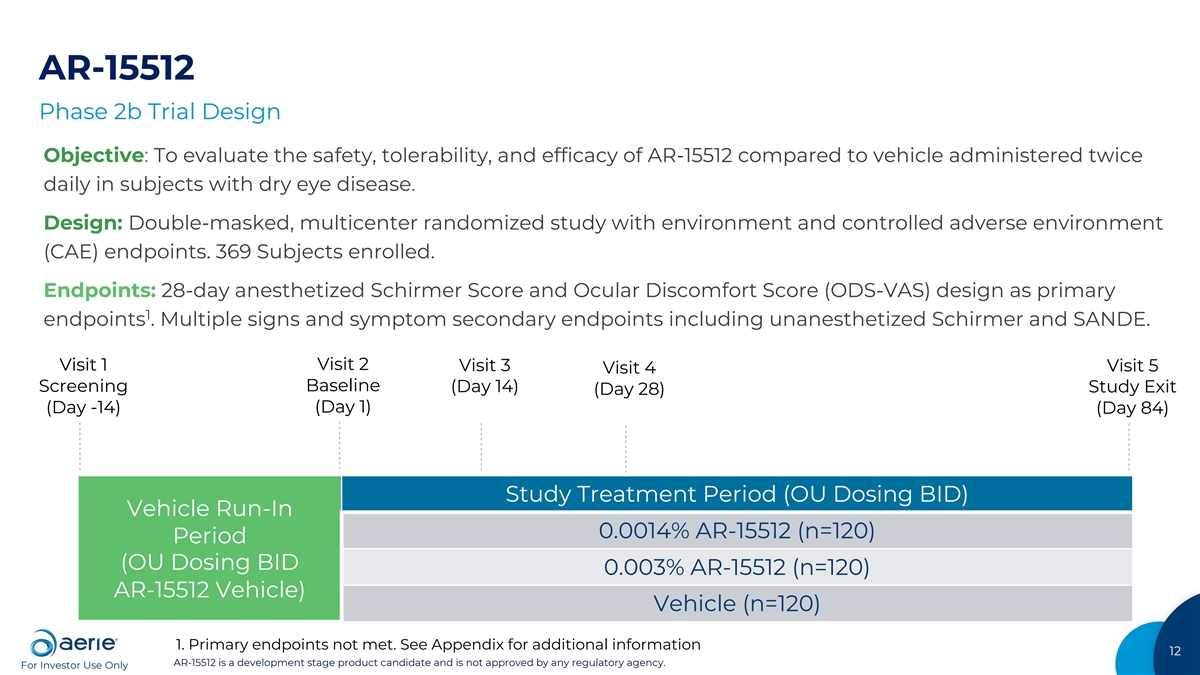

AR-15512 Phase 2b Trial Design Objective: To evaluate the safety, tolerability, and efficacy of AR-15512 compared to vehicle administered twice daily in subjects with dry eye disease. Design: Double-masked, multicenter randomized study with environment and controlled adverse environment (CAE) endpoints. 369 Subjects enrolled. Endpoints: 28-day anesthetized Schirmer Score and Ocular Discomfort Score (ODS-VAS) design as primary 1 endpoints . Multiple signs and symptom secondary endpoints including unanesthetized Schirmer and SANDE. Visit 2 Visit 1 Visit 3 Visit 5 Visit 4 Baseline Screening (Day 14) Study Exit (Day 28) (Day 1) (Day -14) (Day 84) Study Treatment Period (OU Dosing BID) Vehicle Run-In 0.0014% AR-15512 (n=120) Period (OU Dosing BID 0.003% AR-15512 (n=120) AR-15512 Vehicle) Vehicle (n=120) 1. Primary endpoints not met. See Appendix for additional information 12 AR-15512 is a development stage product candidate and is not approved by any regulatory agency. For Investor Use Only

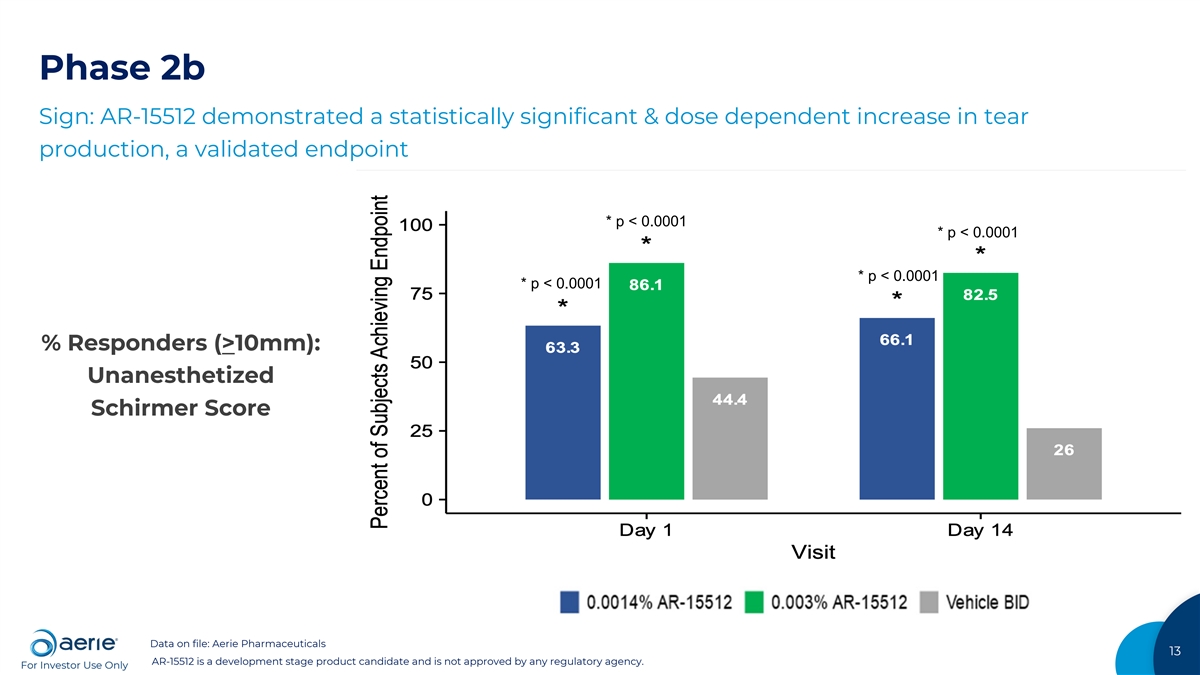

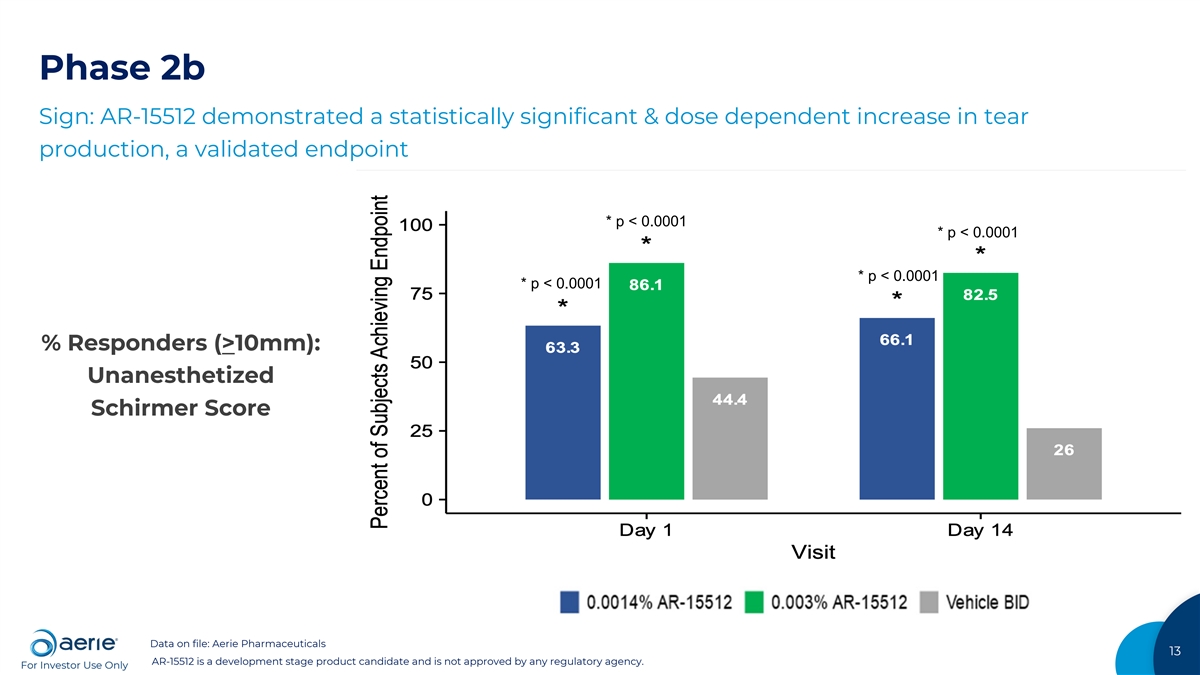

Phase 2b Sign: AR-15512 demonstrated a statistically significant & dose dependent increase in tear production, a validated endpoint * p < 0.0001 * p < 0.0001 * p < 0.0001 * p < 0.0001 % Responders (>10mm): Unanesthetized Schirmer Score Data on file: Aerie Pharmaceuticals 13 AR-15512 is a development stage product candidate and is not approved by any regulatory agency. For Investor Use Only

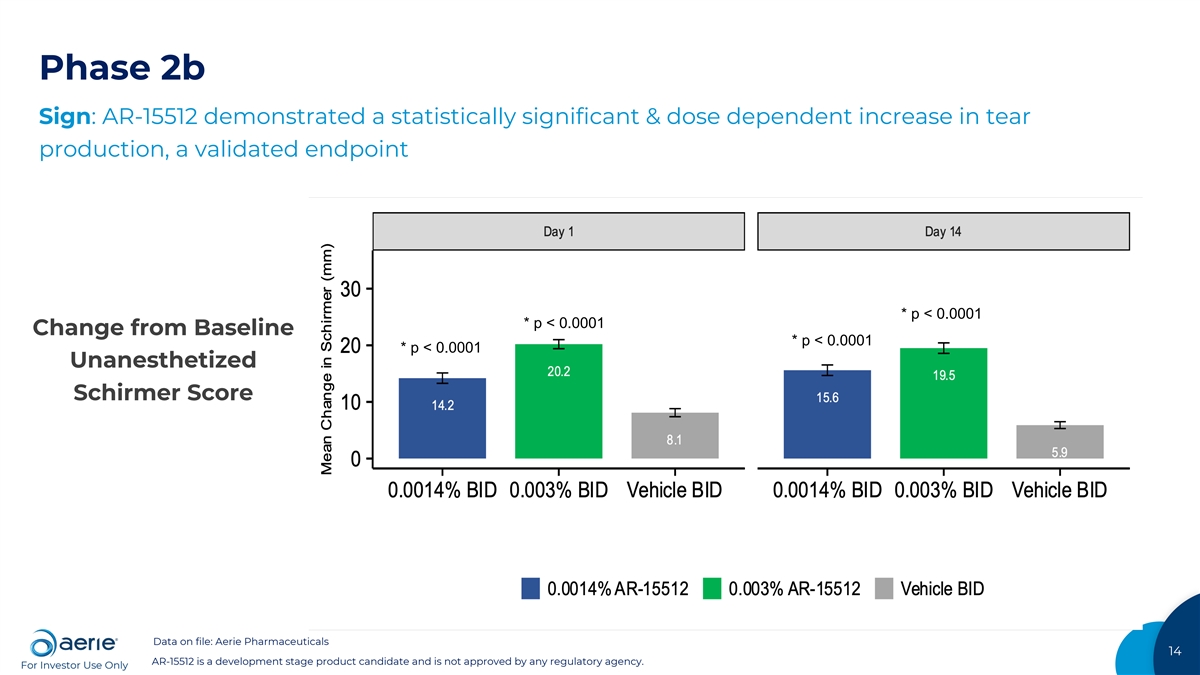

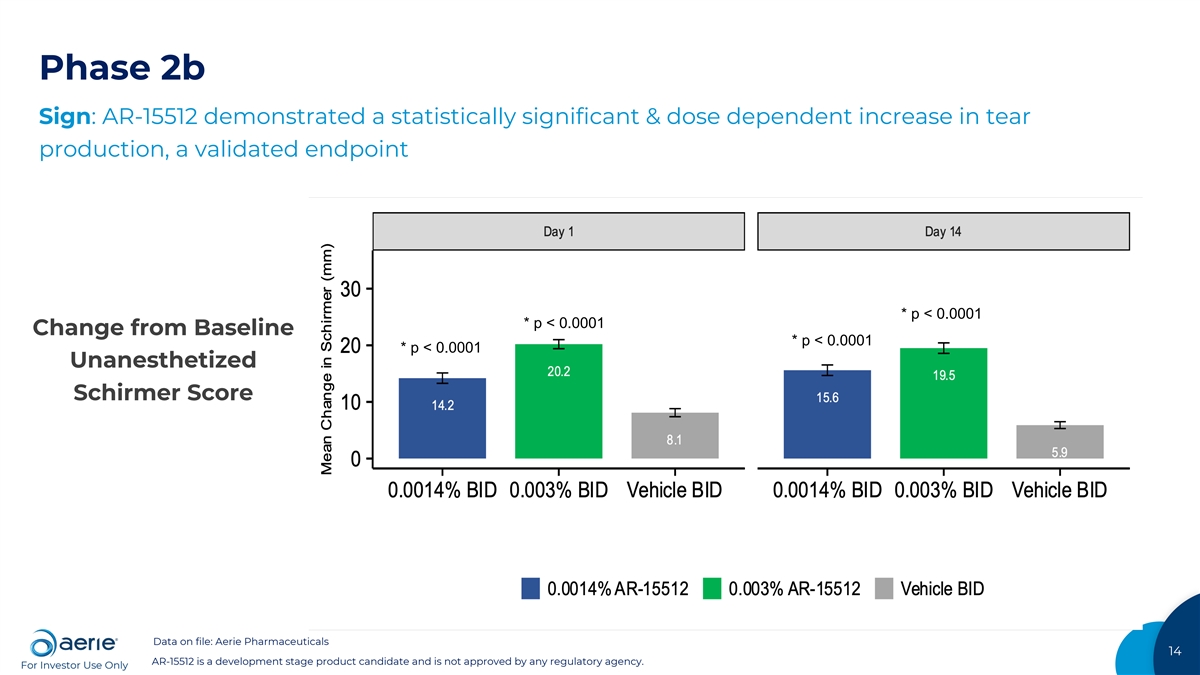

Phase 2b Sign: AR-15512 demonstrated a statistically significant & dose dependent increase in tear production, a validated endpoint * p < 0.0001 * p < 0.0001 Change from Baseline * p < 0.0001 * p < 0.0001 Unanesthetized Schirmer Score Data on file: Aerie Pharmaceuticals 14 AR-15512 is a development stage product candidate and is not approved by any regulatory agency. For Investor Use Only

Phase 2b Symptoms: AR-15512 demonstrated statistically significant improvement at Day 14; continued improvement over time vs. a validated endpoint Symptoms: SANDE score Data on file: Aerie Pharmaceuticals 15 AR-15512 is a development stage product candidate and is not approved by any regulatory agency.

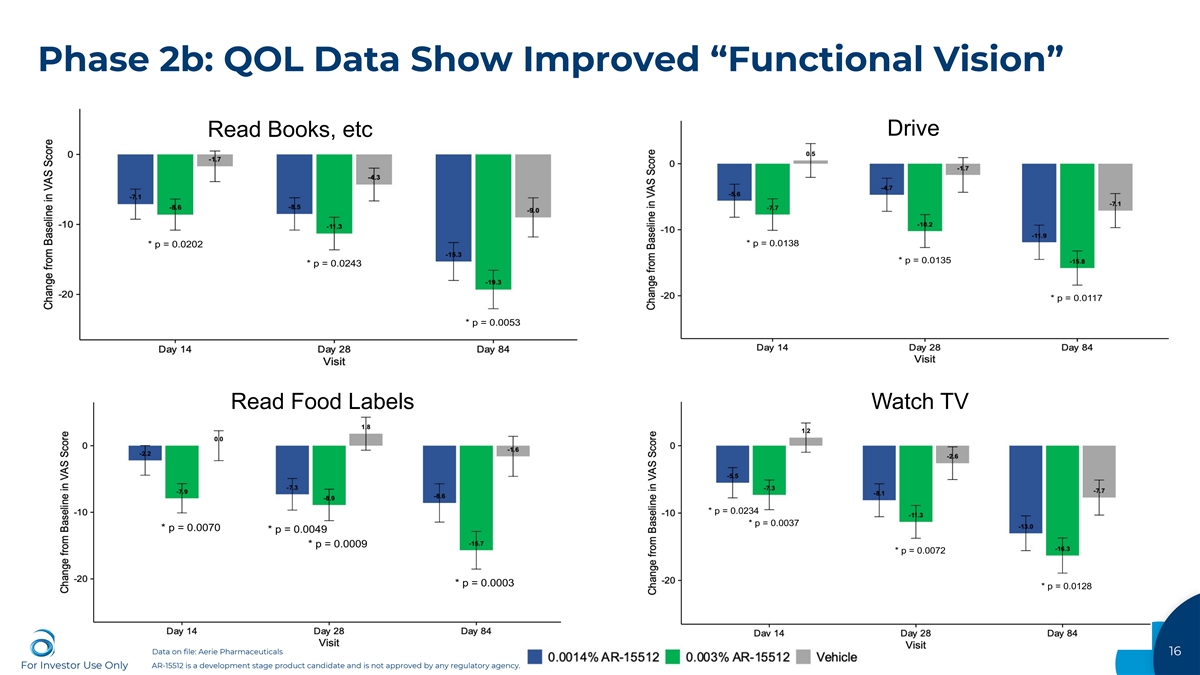

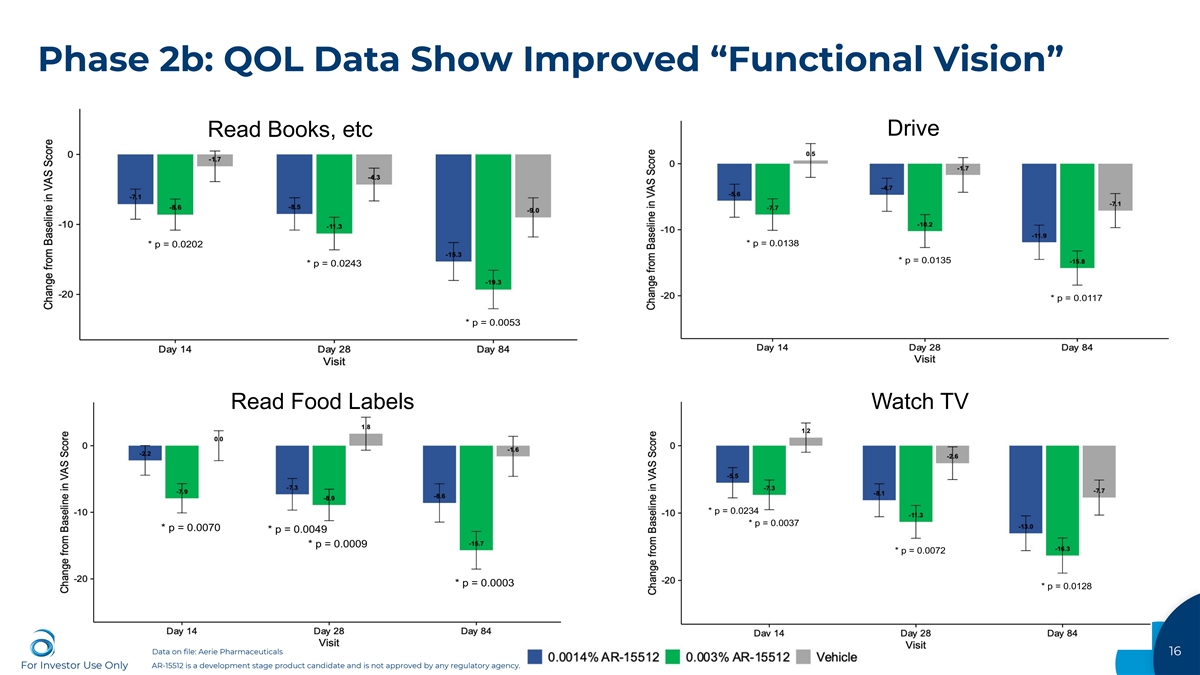

Phase 2b: QOL Data Show Improved “Functional Vision” Drive Read Books, etc * p = 0.0138 * p = 0.0202 * p = 0.0135 * p = 0.0243 * p = 0.0117 * p = 0.0053 Data on file Data on file Read Food Labels Watch TV AR-15512 is a development stage product candidate and is not approved by any regulatory agency. LS Mean ±SE, ITT, Available Data AR-15512 is a development stage product candidate and is not approved by any regulatory agency. LS Mean ±SE, ITT, Available Data * p = 0.0202 * p = 0.0243 * p = 0.0234 * p = 0.0037 * p = 0.0070 * p = 0.0049 * p = 0.0009 * p * = p 0. = 0. 0053 0072 * p = 0.0003 * p = 0.0128 Data on file: Aerie Pharmaceuticals 16 For Investor Use Only AR-15512 is a development stage product candidate and is not approved by any regulatory agency. Data on file Data on file Data on file AR-15512 is a development stage product candidate and is not approved by any regulatory agency. AR-15512 is a development stage product candidate and is not approved by any regulatory agency. LS Mean ±SE, ITT, Available Data LS Mean ±SE, ITT, Available Data AR-15512 is a development stage product candidate and is not approved by any regulatory agency. LS Mean ±SE, ITT, Available Data

Totality of AR-15512 Phase 2b Data Support Next Steps Primary endpoints not achieved. However, statistically significant, dose-dependent improvement observed across multiple time points and validated secondary endpoints Phase 2b Efficacy Data including Schirmer Score, SANDE, ocular discomfort, eye dryness, conjunctival redness, surface staining Good tolerability profile, low discontinuations (no difference across groups) Phase 2b Safety Data Brief, mild sensation immediately after dosing in ~40% of treated subjects No systemic or serious adverse events attributed to study medication Next Step Alignment meeting with the FDA on Phase 3 development options in Q1:22 17 AR-15512 is a development stage product candidate and is not approved by any regulatory agency. For Investor Use Only

1 DME: ~$2B U.S. Market THE PROBLEM • Inflammation and thickening of the macula (macular edema) Macular • Can lead to loss of vision edema CURRENT TREATMENT • Angiogenesis inhibitors & steroids. Patients & providers are dissatisfied with frequent high-cost intravitreal injections required to maintain vision gains AR-1105 • The only bioerodible dexamethasone retinal implant to demonstrate AR-1105 (dexamethasone) is the first 6 months of efficacy in treating macular edema product to use Aerie’s exclusive • Reduced injection frequency v. existing products ® PRINT delivery platform 1. 2021 Market Scope Retina Report. 18 AR-1105 is a development stage product candidate and is not approved by any regulatory agency. For Investor Use Only

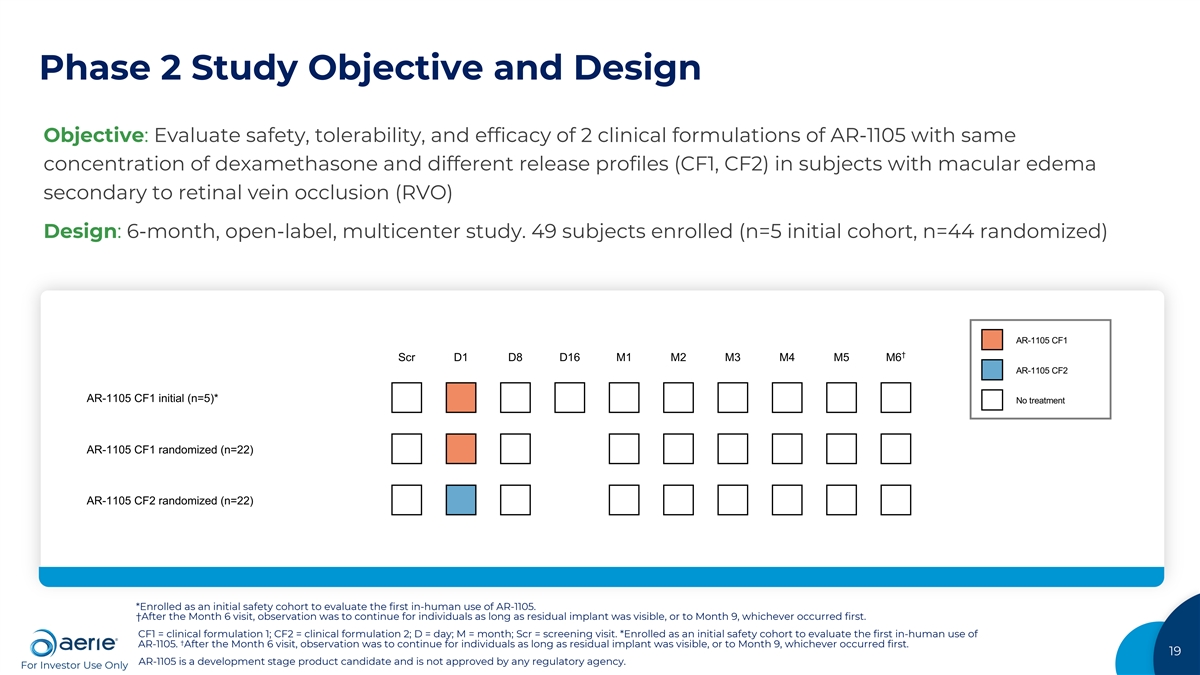

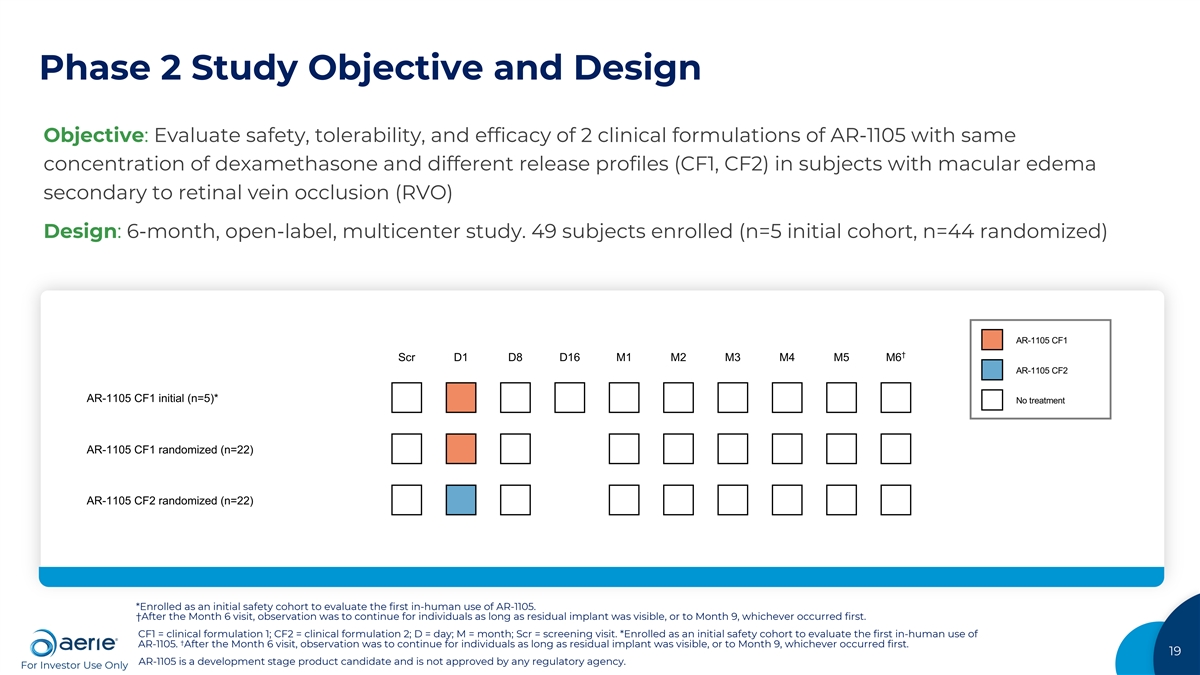

Phase 2 Study Objective and Design Objective: Evaluate safety, tolerability, and efficacy of 2 clinical formulations of AR-1105 with same concentration of dexamethasone and different release profiles (CF1, CF2) in subjects with macular edema secondary to retinal vein occlusion (RVO) Design: 6-month, open-label, multicenter study. 49 subjects enrolled (n=5 initial cohort, n=44 randomized) AR-1105 CF1 † Scr D1 D8 D16 M1 M2 M3 M4 M5 M6 AR-1105 CF2 AR-1105 CF1 initial (n=5)* No treatment AR-1105 CF1 randomized (n=22) AR-1105 CF2 randomized (n=22) *Enrolled as an initial safety cohort to evaluate the first in-human use of AR-1105. †After the Month 6 visit, observation was to continue for individuals as long as residual implant was visible, or to Month 9, whichever occurred first. CF1 = clinical formulation 1; CF2 = clinical formulation 2; D = day; M = month; Scr = screening visit. *Enrolled as an initial safety cohort to evaluate the first in-human use of † AR-1105. After the Month 6 visit, observation was to continue for individuals as long as residual implant was visible, or to Month 9, whichever occurred first. 19 AR-1105 is a development stage product candidate and is not approved by any regulatory agency. For Investor Use Only

Phase 2 AR-1105 CF2 demonstrated at least 6 months of efficacy on improving visual acuity 9 Mean Change in Visual 6 1 Acuity (ETDRS Letters) 3 0 Baseline Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 CF2 Randomized (n=22) Data on file: Aerie Pharmaceuticals. 1. Error bars are SEM 20 AR-1105 is a development stage product candidate and is not approved by any regulatory agency. For Investor Use Only Source: Table 14.2.1.2.1; error bars are SEM Mean Change from Baseline in BCVA (Letters)

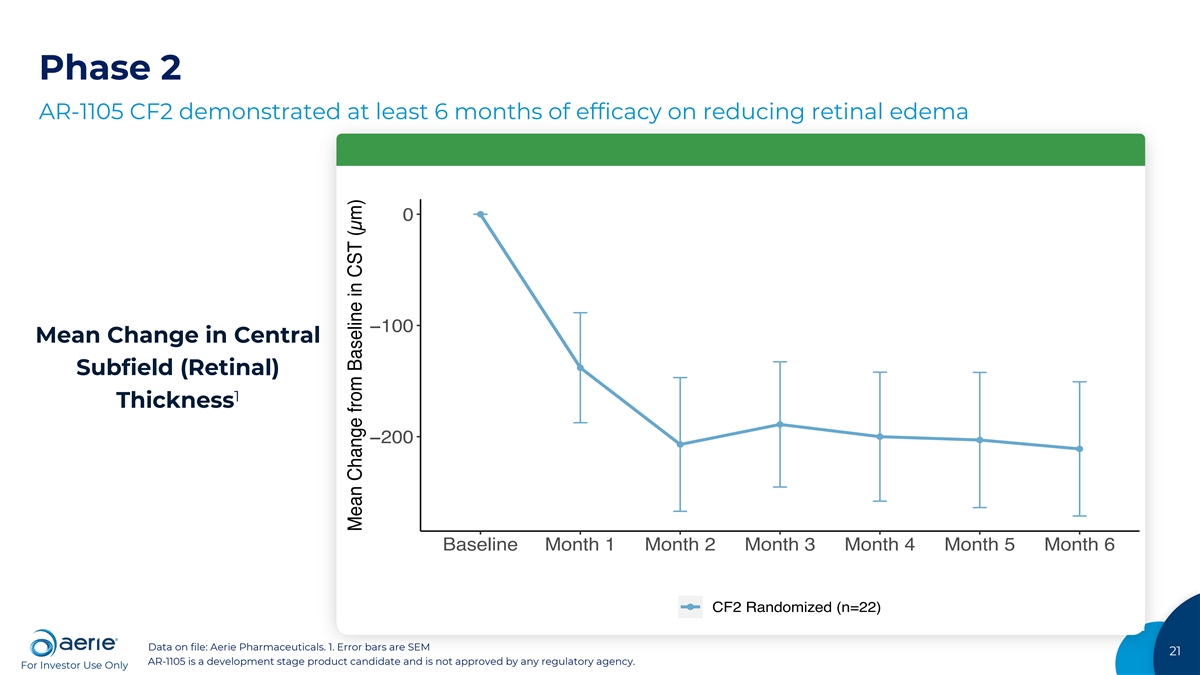

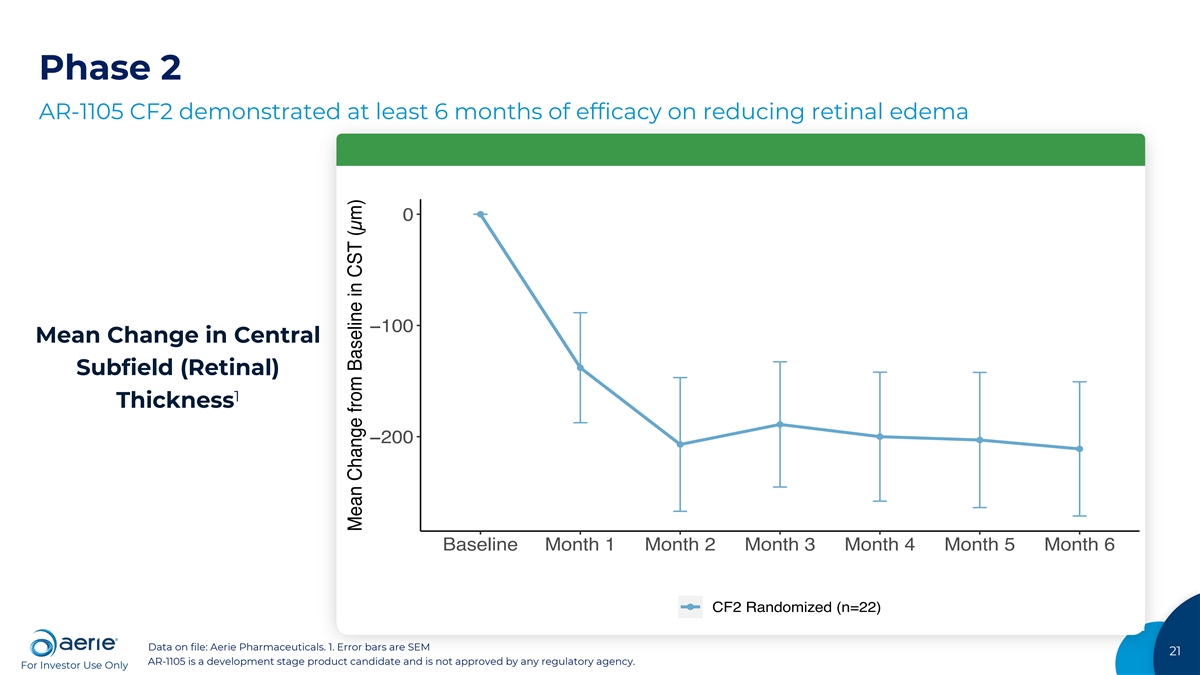

Phase 2 AR-1105 CF2 demonstrated at least 6 months of efficacy on reducing retinal edema 0 −100 Mean Change in Central Subfield (Retinal) 1 Thickness −200 Baseline Month 1 Month 2 Month 3 Month 4 Month 5 Month 6 CF2 Randomized (n=22) Data on file: Aerie Pharmaceuticals. 1. Error bars are SEM 21 AR-1105 is a development stage product candidate and is not approved by any regulatory agency. For Investor Use Only Source: 14.2.2.1.1 (21SEP2020); error bars are SEM Mean Change from Baseline in CST (µm)

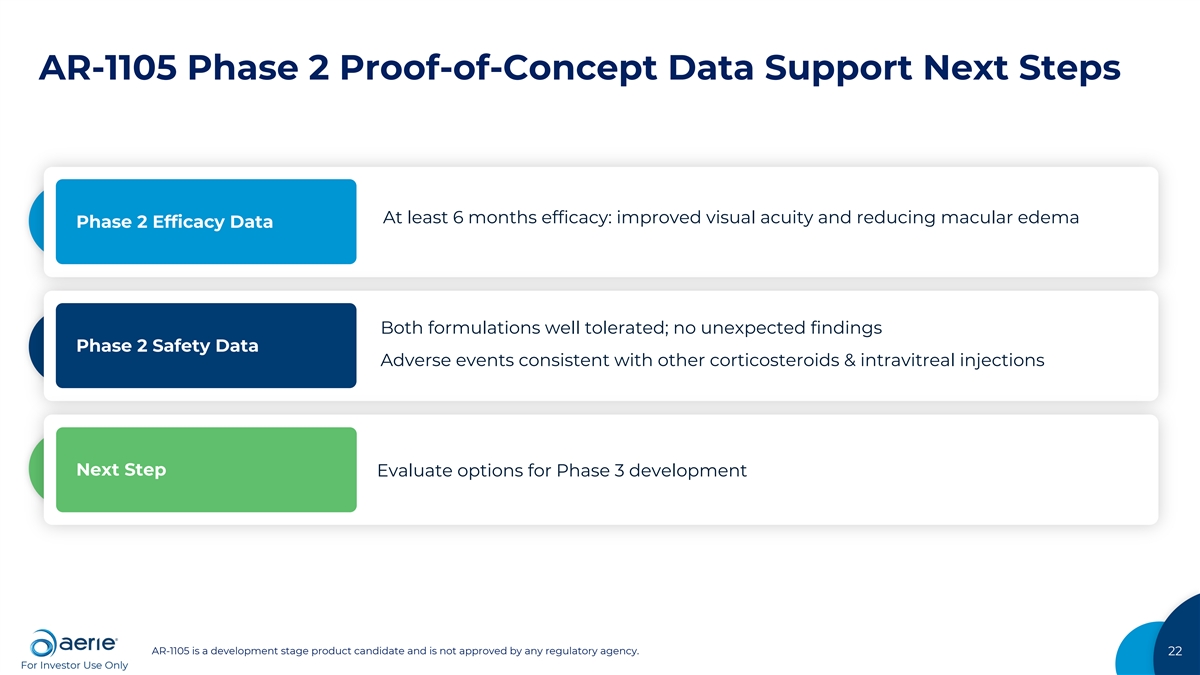

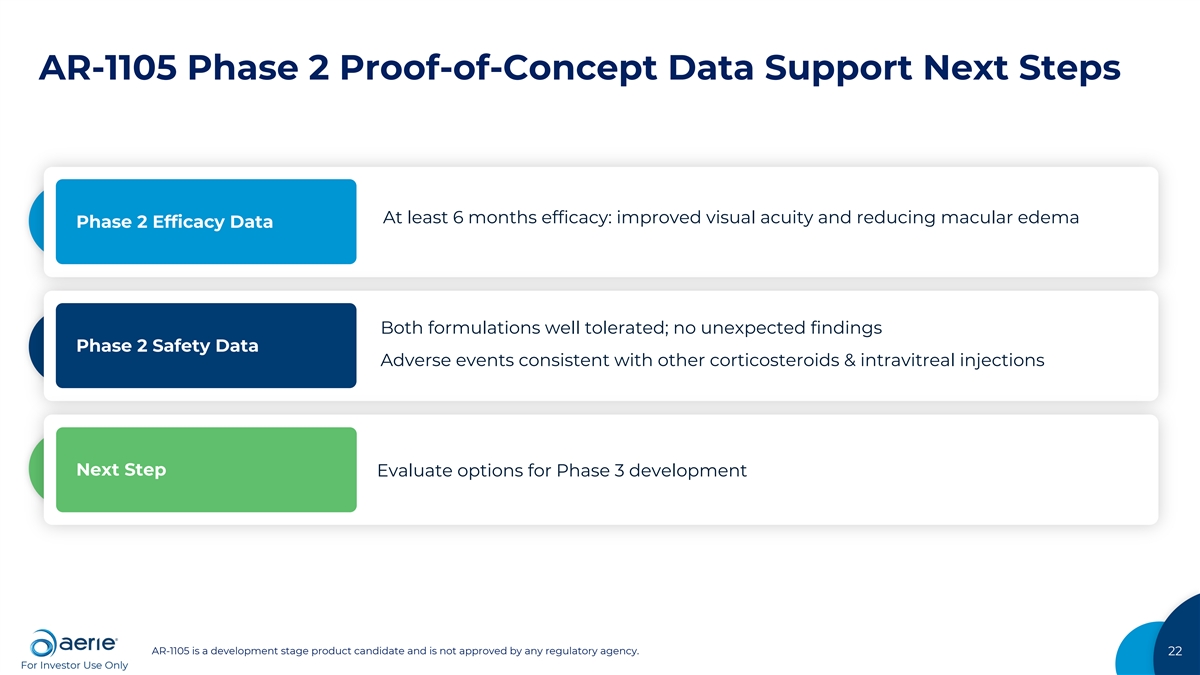

AR-1105 Phase 2 Proof-of-Concept Data Support Next Steps At least 6 months efficacy: improved visual acuity and reducing macular edema Phase 2 Efficacy Data Both formulations well tolerated; no unexpected findings Phase 2 Safety Data Adverse events consistent with other corticosteroids & intravitreal injections Next Step Evaluate options for Phase 3 development AR-1105 is a development stage product candidate and is not approved by any regulatory agency. 22 For Investor Use Only

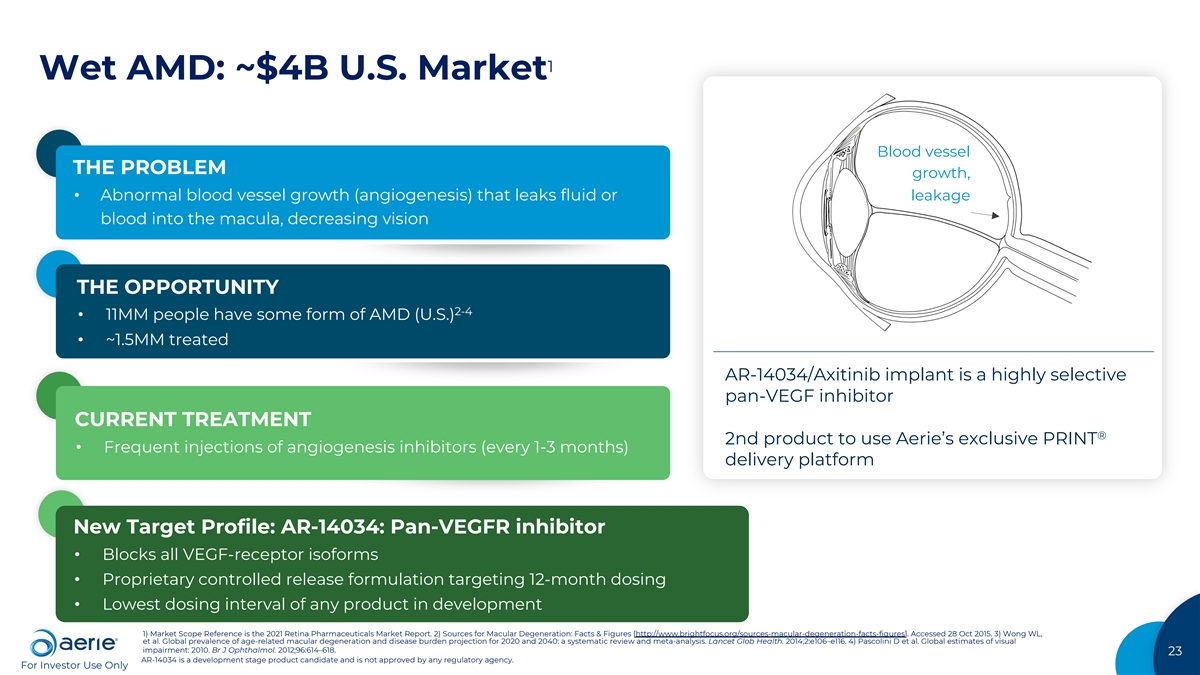

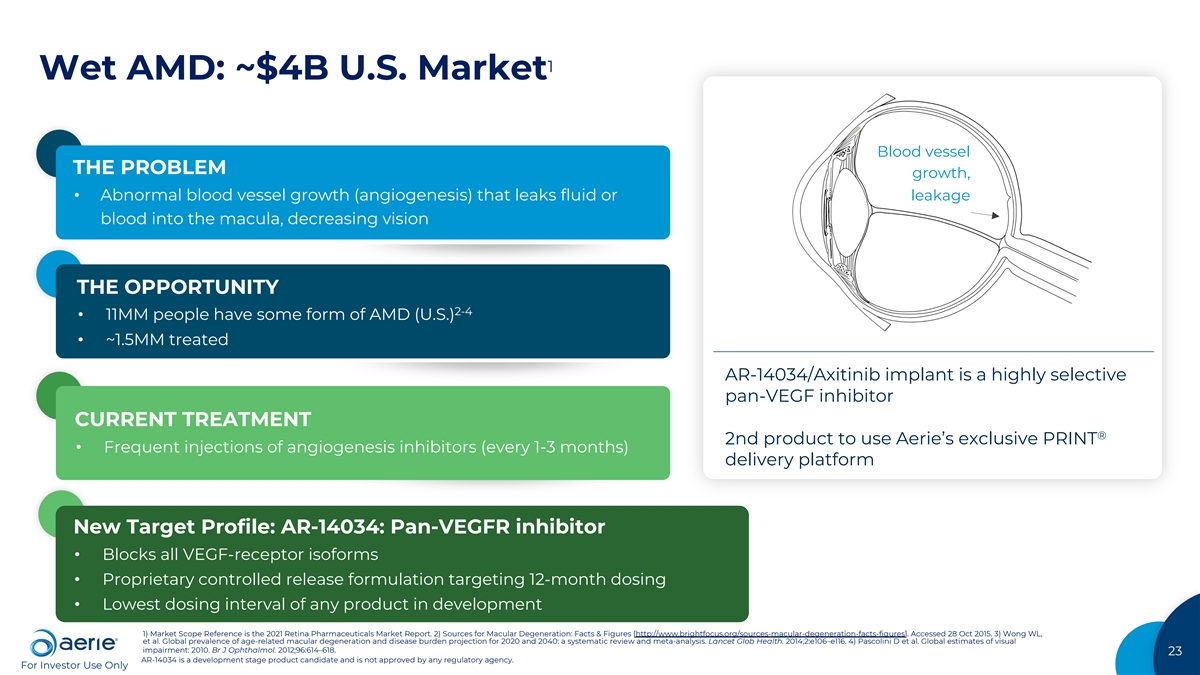

1 Wet AMD: ~$4B U.S. Market Blood vessel THE PROBLEM growth, • Abnormal blood vessel growth (angiogenesis) that leaks fluid or leakage blood into the macula, decreasing vision THE OPPORTUNITY 2-4 • 11MM people have some form of AMD (U.S.) • ~1.5MM treated AR-14034/Axitinib implant is a highly selective pan-VEGF inhibitor CURRENT TREATMENT ® 2nd product to use Aerie’s exclusive PRINT • Frequent injections of angiogenesis inhibitors (every 1-3 months) delivery platform New Target Profile: AR-14034: Pan-VEGFR inhibitor • Blocks all VEGF-receptor isoforms • Proprietary controlled release formulation targeting 12-month dosing • Lowest dosing interval of any product in development 1) Market Scope Reference is the 2021 Retina Pharmaceuticals Market Report. 2) Sources for Macular Degeneration: Facts & Figures [http://www.brightfocus.org/sources-macular-degeneration-facts-figures]. Accessed 28 Oct 2015. 3) Wong WL, et al. Global prevalence of age-related macular degeneration and disease burden projection for 2020 and 2040: a systematic review and meta-analysis. Lancet Glob Health. 2014;2:e106–e116. 4) Pascolini D et al. Global estimates of visual impairment: 2010. Br J Ophthalmol. 2012;96:614–618. 23 AR-14034 is a development stage product candidate and is not approved by any regulatory agency. For Investor Use Only

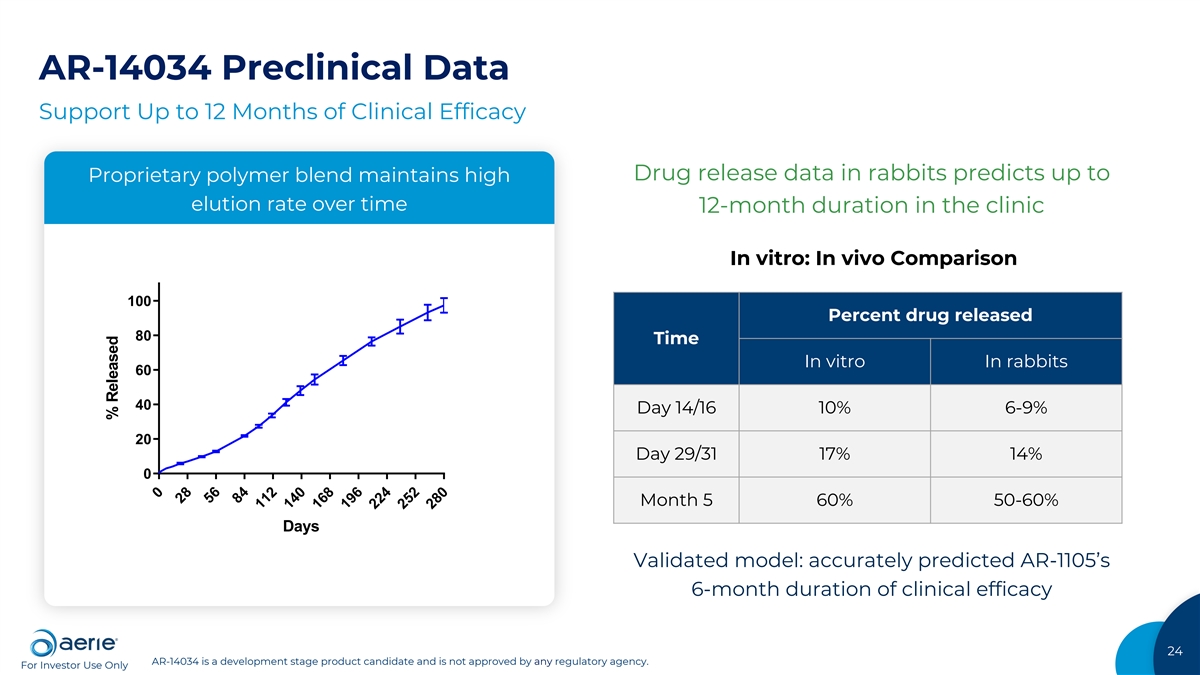

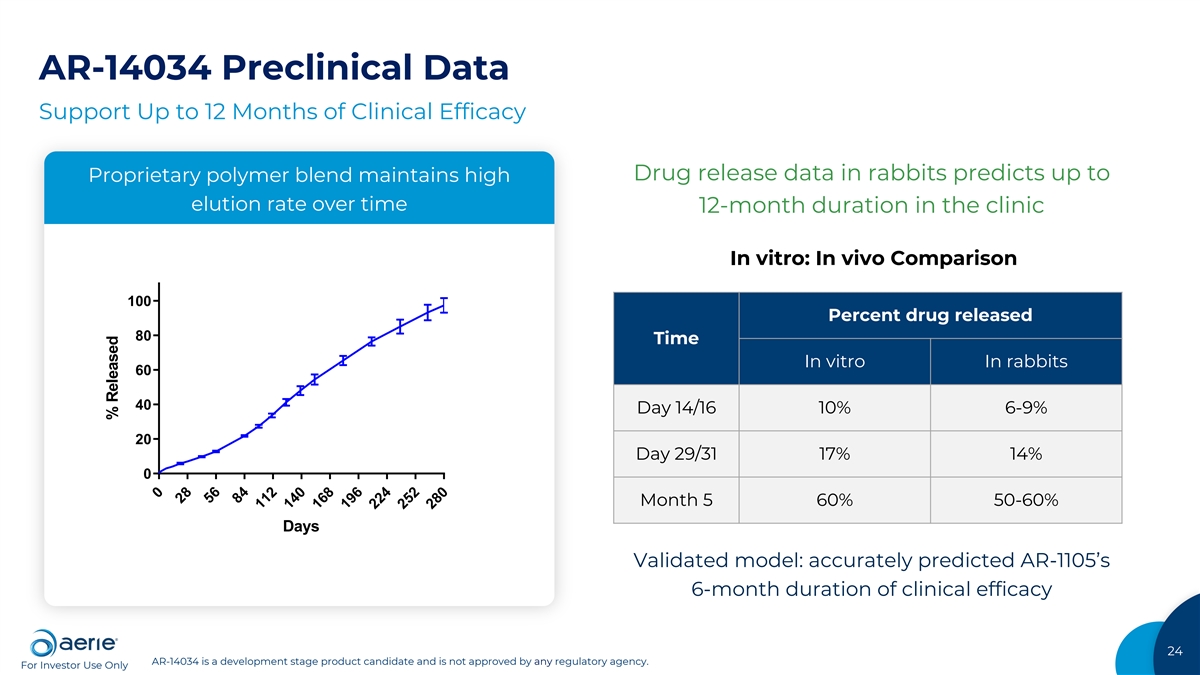

AR-14034 Preclinical Data Support Up to 12 Months of Clinical Efficacy Drug release data in rabbits predicts up to Proprietary polymer blend maintains high elution rate over time 12-month duration in the clinic Cumulative Release Rate in 1X PBS w/0.5% TWEEN 20 In vitro: In vivo Comparison 100 Percent drug released 80 Time In vitro In rabbits 60 40 Day 14/16 10% 6-9% 20 Day 29/31 17% 14% 0 Month 5 60% 50-60% Days Validated model: accurately predicted AR-1105’s 6-month duration of clinical efficacy 24 AR-14034 is a development stage product candidate and is not approved by any regulatory agency. For Investor Use Only 0 28 56 84 112 140 168 196 224 252 280 % Released

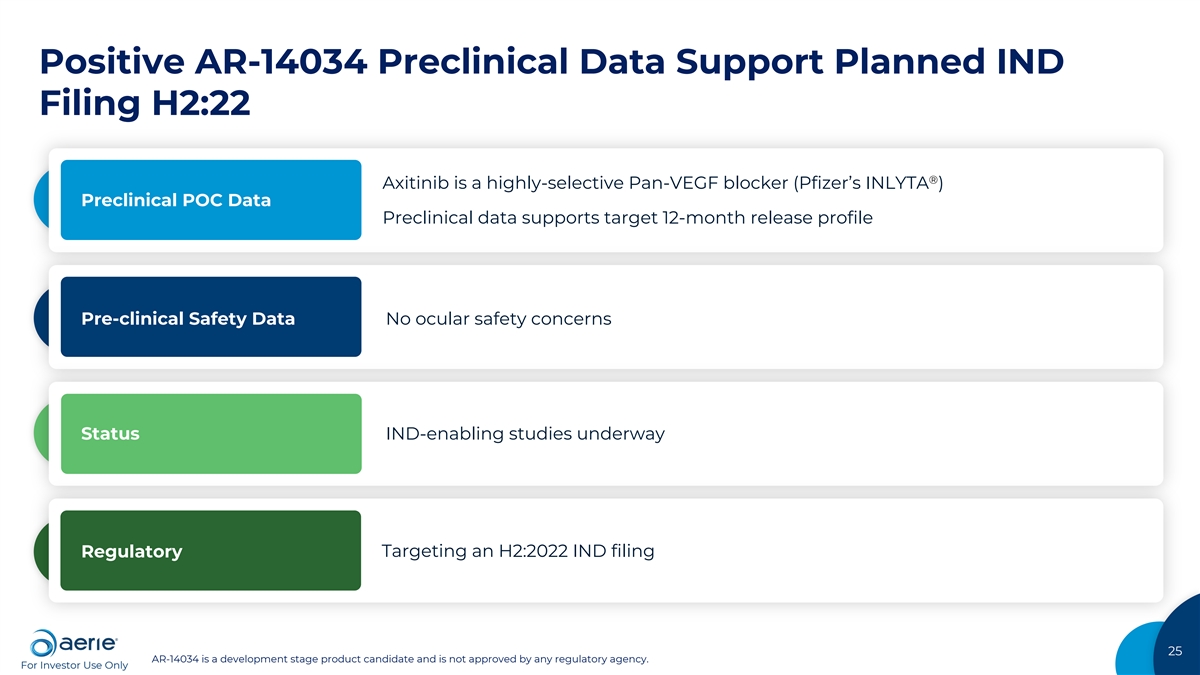

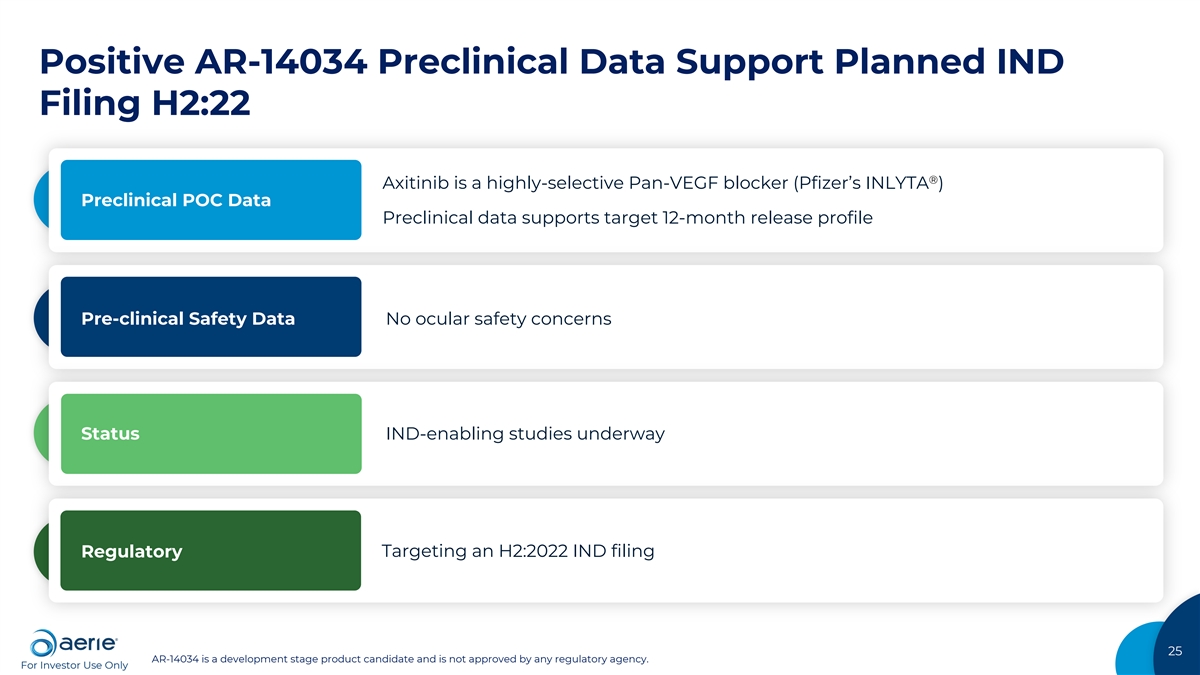

Positive AR-14034 Preclinical Data Support Planned IND Filing H2:22 ® Axitinib is a highly-selective Pan-VEGF blocker (Pfizer’s INLYTA ) Preclinical POC Data Preclinical data supports target 12-month release profile Pre-clinical Safety Data No ocular safety concerns Status IND-enabling studies underway Regulatory Targeting an H2:2022 IND filing 25 AR-14034 is a development stage product candidate and is not approved by any regulatory agency. For Investor Use Only

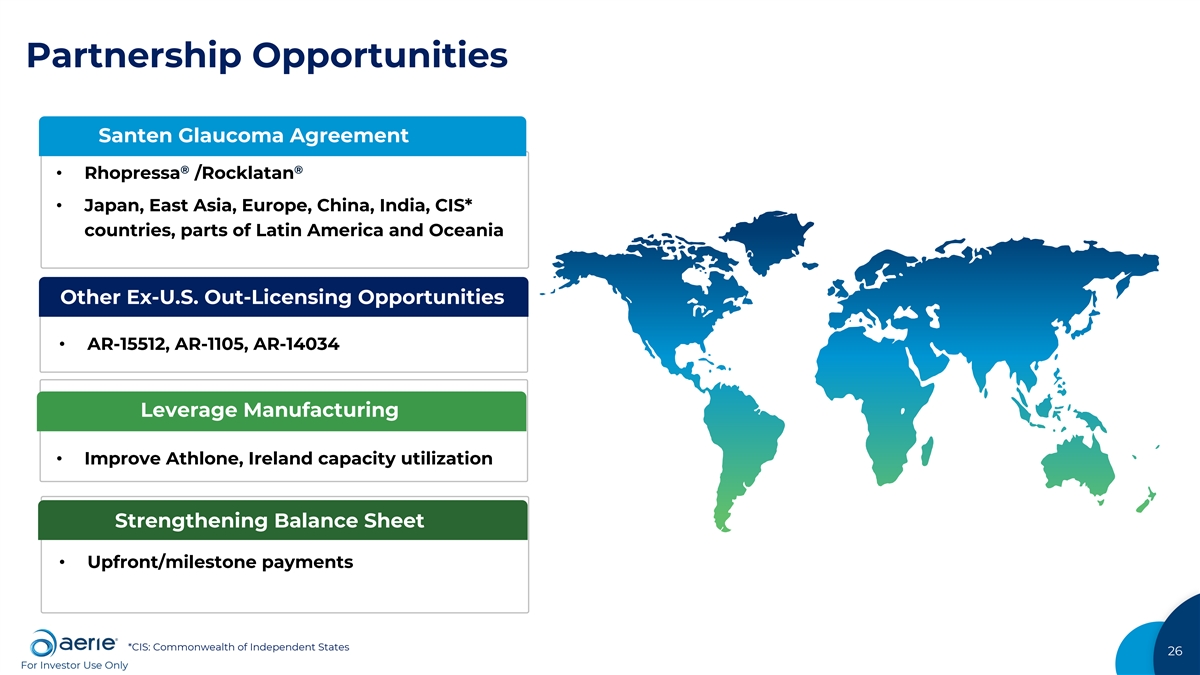

Partnership Opportunities Santen Glaucoma Agreement ® ® • Rhopressa /Rocklatan • Japan, East Asia, Europe, China, India, CIS* countries, parts of Latin America and Oceania Other Ex-U.S. Out-Licensing Opportunities • AR-15512, AR-1105, AR-14034 Leverage Manufacturing • Improve Athlone, Ireland capacity utilization Strengthening Balance Sheet • Upfront/milestone payments *CIS: Commonwealth of Independent States 26 For Investor Use Only

Key YE:2021-2022 Milestones ® ® Rocklatan /Rhopressa Glaucoma AR-15512 Dry Eye AR-14034 Wet AMD Increase adoption & grow sales End of Phase 2 FDA Meeting (Q1:22) File IND (H2:22) H1:2022 H2:2022 YE:2021 Evaluate Phase 3 options for development & commercialization AR-15512, AR-1105 AR-15512, AR-1105 and AR-14034 is a development stage product candidates and are not approved by any regulatory agency. 27 For Investor Use Only

An Emerging Leader in Ophthalmology ® ® Rhopressa /Rocklatan Growing Glaucoma franchise: Commercial-Stage • U.S.: Net Sales >$115MM+ U.S. run-rate as of Q3:2021 Ophthalmology Company • ROW: Partnership with Santen: EU: Approved, Japan: Phase 3 Two Phase 3-ready programs (in Dry Eye and in DME) Differentiated Pipeline ® Developing an early-stage pipeline including leveraging PRINT implant technology Ex-U.S. partnering deals strengthens balance sheet Partnering & Manufacturing State-of-the-art manufacturing, with potential for improving efficiencies $168MM in cash* as of 09/30/2021 Funded to Execute on Plan December 2021 expanded Santen deal adds $88MM in cash; plus potential for up to $77MM milestones Cash is comprised of cash, cash equivalents and short-term investments, per the Q3: 2021 10Q filing. ”Run-rate” is calculated as 4X Q3:2021 net sales. 28 For Investor Use Only

An Emerging Leader in Ophthalmology Carolyn McAuliffe Hans Vitzthum ir@aeriepharma.com www.aeriepharma.com For Investor Use Only

Appendix For Investor Use Only

AR-15512 Phase 2b Primary Endpoint Signs: Change from Baseline Anesthetized Schirmer (Primary Endpoint) p = 0.494 Data on file: Aerie Pharmaceuticals. LS Mean +/- SE 31 AR-15512 is a development stage product candidate and is not approved by any regulatory agency. For Investor Use Only

AR-15512 Phase 2b Primary Endpoint Symptom: Change from Baseline ODS VAS p = 0.23 (Primary Endpoint) * p = 0.028 Data on file: Aerie Pharmaceuticals. LS Mean +/- SE 32 AR-15512 is a development stage product candidate and is not approved by any regulatory agency. For Investor Use Only

An Emerging Leader in Ophthalmology Carolyn McAuliffe Hans Vitzthum ir@aeriepharma.com www.aeriepharma.com For Investor Use Only