Registration No. 333-_______

As filed with the Securities and Exchange Commission on March __, 2008

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1/A

(Amendment No. 2 to Form SB-2)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ALTERNATIVE CONSTRUCTION TECHNOLOGIES, INC.

(f/k/a ALTERNATIVE CONSTRUCTION COMPANY, INC.)

(Name of small business issuer in its charter)

(Commission File No.

| | 3448 | |

| FLORIDA | | 20-1776133 |

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Number) | (IRS Employer Identification Number) |

2910 Bush Drive

Melbourne, FL 32935

(321) 421-6601

(Address and telephone of principal executive offices and

principal place of business)

Michael W. Hawkins

Chief Executive Officer

Alternative Construction Technologies, Inc.

2910 Bush Drive

Melbourne, FL 32935

(321) 421-6601

(Name, address and telephone number of agent for service)

Copies of all communication to be sent to:

Thomas G. Amon, Esq.

Law Offices of Thomas G. Amon

250 West 57th Street, Suite 1316

New York, NY 10107

Telephone: (212) 810-2430

Facsimile: (212) 810-2427

Approximate date of proposed sale to the public: AS SOON AS PRACTICABLE AFTER

THE EFFECTIVE DATE OF THIS REGISTRATION STATEMENT.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box: x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this form is a post-effective registration statement amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If delivery of the Prospectus is expected to be made pursuant to Rule 434, check the following box: o

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | | Number of Shares to be Registered (1) | | Proposed Maximum Offering Price per Share (2) | | Proposed Maximum Aggregate Offering Price | | Amount of Registration Fee | |

| | | | | | | | | | |

| Common Stock (3) | | | 543,478 | | $ | 4.00 | | $ | 2,173,911 | | $ | 232.61 | |

| Common Stock (3) | | | 407,609 | | $ | 4.00 | | $ | 1,630,435 | | $ | 174.46 | |

| Common Stock (3) | | | 135,870 | | $ | 4.00 | | $ | 543,480 | | $ | 58.15 | |

| Common Stock (4) | | | 61,142 | | $ | 4.00 | | $ | 244,568 | | $ | 26.17 | |

| Common Stock (4) | | | 91,712 | | $ | 4.00 | | $ | 366,848 | | $ | 39.25 | |

| Common Stock (4) | | | 91,711 | | $ | 4.00 | | $ | 366,844 | | $ | 39.25 | |

| Common Stock (4) | | | 815,217 | | $ | 4.00 | | $ | 3,260,868 | | $ | 348.91 | |

| Common Stock (4) | | | 611,413 | | $ | 4.00 | | $ | 2,445,652 | | $ | 261.68 | |

| Common Stock (4) | | | 203,804 | | $ | 4.00 | | $ | 815,216 | | $ | 87.23 | |

| Total | | | 2,961,956 | | | | | $ | 11,847,822 | | $ | 1,267.72 | |

(1) Pursuant to Rule 416, the Registration Statement also covers an indeterminate number of additional shares of common stock that may be issuable to prevent dilution resulting from stock splits, stock dividends, or similar events.

(2) The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(c). Our common stock is traded on the OTC Bulletin Board.

(3) Issuable on conversion of outstanding senior secured convertible debentures at conversion price of $4.00 per share.

(4) Issuable on exercise of outstanding common stock purchase warrants at exercise price of $4.00 per share.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(A) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(A), may determine.

PRELIMINARY PROSPECTUS

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

Subject to Completion Dated March __, 2008

2,961,956 SHARES OF COMMON STOCK

TO BE OFFERED BY CERTAIN HOLDERS OF SECURITIES OF

ALTERNATIVE CONSTRUCTION TECHNOLOGIES, INC.

This Prospectus relates to 2,961,956 shares of common stock of Alternative Construction Technologies, Inc. (“ACT” or the “Company”) which may be offered by the selling shareholders listed in this Prospectus for their own accounts. The shares offered include 1,086,957 shares of our common stock issuable upon conversion of outstanding senior secured convertible debentures of $4,347,826, and 1,874,999 shares of our common stock issued from exercise of outstanding common stock purchase warrants for an additional investment of $7,499,996.

On June 30, 2007, the Company sold $4,347,826 million aggregate principal amount of its Senior Secured Convertible Debentures due June 30, 2009 (the “Debentures”), pursuant to the terms of a Securities Purchase Agreement dated as of June 30, 2007, among ACT and the purchasers named therein (the “Purchasers”). The Debentures contain a clause that allows the note holders to invest an additional $4,347,826 prior to twelve months from the effective date of this registration statement.

In connection with the agreed issuance of Debentures, ACT also issued Common Stock Purchase Warrants (“Warrants”) also dated June 30, 2007 to the Purchasers. The Warrants allow the purchasers to acquire up to one hundred and fifty percent (150%) of the shares issuable upon conversion of the Debentures, at an exercise price of $4.00 per share, or up to $6,521,736 additional investment. Also as a part of the Debentures, 244,565 Warrants at an exercise price of $4.00 per share, or up to $978,260, also dated June 30, 2007, were issued to the agent responsible for facilitating the transaction between the Company and the Purchasers. ACT has agreed to file a registration statement with the Securities and Exchange Commission (“SEC”) covering resales of ACT common stock issuable upon conversion of the Debentures or exercise of the Warrants. Also in connection with the Purchase Agreements, the Company entered into Lock-Up Agreements with certain of its stockholders, dated as of June 30, 2007, pursuant to which such stockholders have agreed not to sell or dispose of Company securities owned by them until June 30, 2008. At that time, with the exception of Michael W. Hawkins, the stockholders can sell or dispose up to 20% of their total shares.

The Debentures will be convertible, at the option of the holder at any time on or prior to maturity, into shares of ACT common stock, at a conversion price of $4.00 per share, subject to adjustments. Interest on the Debentures is payable monthly, which began on July 30, 2007. The Debentures will mature on June 30, 2009.

The Debentures are secured by all of the assets of ACT and its subsidiaries and will have priority in right of payment with all of its existing unsecured and unsubordinated indebtedness.

The summary of the foregoing transaction is qualified in its entirety by reference to the text of the related agreements, which are included as exhibits hereto and are incorporated herein by reference.

We are not selling any shares of our common stock in this offering and therefore will not receive any proceeds from this offering. However, to the extent there are cash exercises of warrants, we will received proceeds from such warrant exercises. Instead, the shares may be offered and sold from time to time by the selling shareholders and/or their registered representatives at prevailing market prices or privately negotiated prices. As a result of such activities, the selling shareholders may be deemed underwriters as that term is defined in the federal securities laws.

The shares of common stock being offered pursuant to this Prospectus are "restricted securities" under the Securities Act of 1933, as amended (the Securities Act), before their sale under this Prospectus. This Prospectus has been prepared for the purpose of registering these shares of common stock under the Securities Act to allow for a sale by the selling shareholders to the public without restriction.

The selling shareholders may sell the shares of common stock covered by this Prospectus in a number of different ways and at varying prices. We provide more information about how the selling shareholders may sell their shares in a section entitled "Plan of Distribution" on page 35. You should read this Prospectus and any supplement carefully before you invest.

Our common stock is traded on the NASDAQ OTC Bulletin Board under the symbol “ACCY.OB”. On March 14, 2007, the closing price of the common stock was $5.00 per share.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is March __, 2008.

| | Page |

| PROSPECTUS SUMMARY | 6 |

| RISK FACTORS | 10 |

| FORWARD-LOOKING STATEMENTS | 15 |

| WHERE YOU CAN FIND MORE INFORMATION | 16 |

| USE OF PROCEEDS | 16 |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 16 |

| MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 23 |

| DESCRIPTION OF BUSINESS | 25 |

| LEGAL PROCEEDINGS | 37 |

| MANAGEMENT | 38 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 39 |

| EXECUTIVE COMPENSATION | 40 |

| ORGANIZATION WITHIN PAST FIVE YEARS | 41 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 41 |

| PLAN OF DISTRIBUTION | 45 |

| DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES | 46 |

| DESCRIPTION OF SECURITIES | 46 |

| EXPERTS | 48 |

| LEGAL OPINION | 48 |

| CONSOLIDATED FINANCIAL STATEMENTS | |

| December 31, 2007 and 2006 (restated): | |

| Report of Independent Registered Accounting Firm | F1 |

| Consolidated Balance Sheet | F2 |

| Consolidated Statement of Income | F4 |

| Consolidated Statement of Stockholders’ Equity | F5 |

| Consolidated Statement of Cash Flows | F6 |

| Notes to Consolidated Financial Statements | F8 |

| OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION | 51 |

| IDEMNIFICATION OF DIRECTORS AND OFFICERS | 51 |

| RECENT SALES OF UNREGISTERED SECURITIES | 51 |

| EXHIBITS | 53 |

| UNDERTAKINGS | 55 |

| SIGNATURES | 56 |

HAVE NOT AUTHORIZED ANY DEALER, SALESPERSON OR OTHER PERSON TO GIVE ANY INFORMATION OR REPRESENT ANYTHING NOT CONTAINED IN THIS PROSPECTUS. YOU SHOULD NOT RELY ON ANY UNAUTHORIZED INFORMATION. THIS PROSPECTUS IS NOT AN OFFER TO SELL OR BUY ANY SHARES IN ANY STATE OR OTHER JURISDICTION IN WHICH IT IS UNLAWFUL. THE INFORMATION IN THIS PROSPECTUS IS CURRENT AS OF THE DATE ON THE COVER. YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS PROSPECTUS.

PROSPECTUS SUMMARY

The following summary highlights selected information from this Prospectus and may not contain all the information that is important to you. To understand our business and this offering fully, you should read this entire Prospectus carefully, including the financial statements and the related notes beginning on page F-1. When we refer in this Prospectus to "ACT" or the "Company," "we," "us," and "our," we mean Alternative Construction Technologies, Inc. (formerly known as Alternative Construction Company, Inc.), a Florida corporation, together with its subsidiaries, Alternative Construction Manufacturing of Tennessee, Inc. (“ACMT”, formerly known as Alternative Construction Technologies Corporation), a Delaware corporation, Alternative Construction by ProSteel Builders, Inc. (“ACP”, formerly known as ProSteel Builders Corporation), a Florida Corporation, Alternative Construction Safe Rooms, Inc. (“ACSR”, formerly known as Universal Safe Structures, Inc.), a Florida corporation, Alternative Construction by Ionian, Inc. (“ACI”, formerly known as Ionian Construction, Inc.), a Tennessee corporation, Alternative Construction by Revels, Inc. (“ACR”), a Florida corporation, Alternative Construction Consulting Services, Inc. (“ACCS”), a Florida corporation, Alternative Construction Design, Inc. (“ACD”), a Florida corporation, Future of Building Institute, Inc. (“FBII”), a Florida non-profit corporation, Modular Rental and Leasing, Inc. (“MRL”), a Florida corporation, Alternative Construction Manufacturing of Florida, Inc. (“ACMF”), a Florida corporation, and Solar 18 ACTech Panel, Inc. (“Solar 18”), a Florida corporation. This Prospectus contains forward-looking statements and information relating to the Company.

The Company

We are Alternative Construction Technologies, Inc., a Florida corporation, which was formed in October 2004 and is a developer, manufacturer and wholesaler of proprietary structural insulated panels ("SIP"s) for the use in commercial, residential, and government construction including multi-story buildings. The ACT SIPs are marketed under the name ACTech® Panel. Our SIPs provide the end user with a quality product with extensive independent testing and certifications that is more efficient in building, energy efficient, resistant to mold, mildew, termites and other insects, and proven to withstand high winds and projectiles created by such winds from hurricanes and tornadoes. Other benefits include acoustical advantages and fire retardation. The SIPs can be installed by a seasoned construction professional or, with short training, unskilled labor, both resulting in a superior building structure. The purchasers of the ACTech® Panel are individuals, companies, school districts, government agencies and developers.

Our Predecessor, Alternative Construction Technologies Corporation, a Delaware corporation ("ACT-DE" or the "Predecessor"), was formed in 1997. It was acquired by ACT effective January 21, 2005 and renamed in August 2007 to Alternative Construction Manufacturing of Tennessee, Inc. In April 2005, we acquired 80% ownership of Universal Safe Structures, Inc., a Florida corporation formed in April 2005, which is now our operating subsidiary for the sale of the proprietary safe rooms. In August 2007, it was renamed Alternative Construction Safe Rooms, Inc. Also in April 2005, we acquired 80% ownership of ProSteel Builders Corporation, a Florida corporation formed in April 2005, which is now our operating subsidiary for commercial and residential development utilizing the ACTech® Panel in Georgia, Louisiana and Mississippi. In August 2007, it was renamed Alternative Construction by ProSteel Builders, Inc. In May 2007, we acquired 80% ownership of Ionian Construction, Inc., a Tennessee corporation formed in June 2004, which is now our operating subsidiary for commercial and residential development utilizing the ACTech® Panel in Tennessee. In August 2007, it was renamed Alternative Construction by Ionian, Inc. In August 2007, we acquired 100% ownership of Revels Construction, LLC, a Florida limited liability company, formed in May 2005, which is now our operating subsidiary for commercial and residential development utilizing the ACTech® Panel in Florida. In August 2007, it was renamed Alternative Construction by Revels, Inc. In August 2007, two new wholly-owned subsidiaries were formed; Alternative Construction Consulting Services, Inc. and Alternative Construction Design, Inc. In May 2007, we formed Future of Building Institute, Inc., a non-profit corporation. In November 2007, we acquired 100% ownership of Modular Rental and Leasing Corporation, a Florida corporation formed in April 2005, which is now our subsidiary providing leasing of structures using the ACTech® Panel. In January 2008, we formed Alternative Construction Manufacturing of Florida, Inc., a Florida corporation, and Solar 18 ACTech Panel, Inc., a Florida corporation for the joint venture between Atlan International Holdings, Inc. (“Atlan”), ACCS and ACT.

ACT-DE was primarily performing research and development on its patented ACTech® Panel and the patented safe room prior to the acquisition. During this time, ACT-DE sold its product primarily to builders for commercial buildings and had introduced the product to Nelson LC in designing the school modular classroom known as the “Hybrid Classroom” as designed and developed by Florida Architects, Inc. in the State of Florida.

In 2004, the majority of the Predecessor's revenues were derived from the sale of our ACTech® Panel primarily in the United States. The principal outlet for this product is commercial building developers.

During 2006, the Company diversified its sales, reducing its classroom / school market as an overall percentage of gross sales in order to better secure future growth. The Company believes the low income housing market and commercial application of the product will enhance overall future sales and growth.

During 2007, the Company has managed consecutive profitable quarters. In addition, the Company acquired 80% of Ionian Construction, Inc. and 100% of Revels Construction, LLC to manage business opportunities in Tennessee and Florida, respectively.

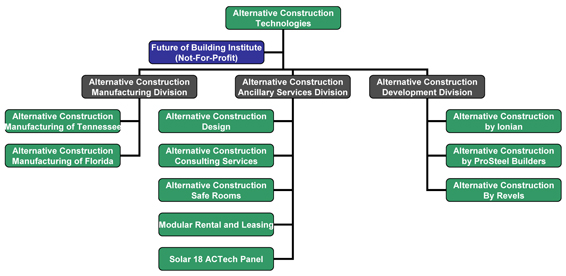

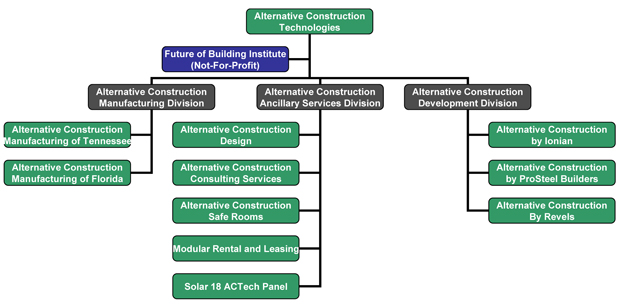

A chart of the Company’s subsidiaries is as follows:

| | | | Ownership | | Division | | Activity |

Wholly-Owned Operating Subsidiaries | | | | | | | |

| Alternative Construction Manufacturing of Tennessee, Inc. | | ACMT | 100% | | Manufacturing | | Manufacturer of the ACTech® Panel |

| (f/k/a Alternative Construction Technologies Corporation) | | | | | | | |

| Alternative Construction Design, Inc. | | ACD | 100% | | Ancillary | | Complementary services |

| Alternative Construction Consulting Services, Inc. | | ACCS | 100% | | Ancillary | | Complementary services |

| Alternative Construction by Revels, Inc. | | ACR | 100% | | Development | | Residential/commercial developer |

| Modular Rental and Leasing Corporation | | MRL | 100% | | Ancillary | | Leasing company |

| Alternative Construction Manufacturing of Florida, Inc. | | ACMF | 100% | | Manufacturing | | Florida manufacturing |

| | | | | | | | |

Majority-Owned Operating Subsidiaries | | | | | | | |

| Alternative Construction Safe Rooms, Inc. | | ACSR | 80% | | Ancillary | | Reseller of the Universal Safe Room™ |

| (f/k/a Universal Safe Structures, Inc.) | | | | | | | |

| Alternative Construction by ProSteel Builders, Inc. | | ACP | 80% | | Development | | Commercial developer |

| (f/k/a ProSteel Builders Corporation) | | | | | | | |

| Alternative Construction by Ionian, Inc. | | ACI | 80% | | Development | | Residential/commercial developer |

| (f/k/a Ionian Construction, Inc.) | | | | | | | |

| Solar 18 ACTech Panel, Inc. | | S18 | 80% | | Ancillary | | Joint venture |

| | | | | | | | |

Non-Profit Subsidiary | | | | | | | |

| Future of Building Institute, Inc. | | FBII | 100% | | n/a | | |

ACT operates under three divisions; a (i) Alternative Construction Manufacturing Division, (ii) Alternative Construction Development Division, and (iii) Alternative Construction Ancillary Services Division. The Manufacturing Division currently contains two subsidiaries, ACMT, which manufactures the ACTech® Panel System, and ACMF, which will provide manufacturing services in Florida. The Development Division contains three subsidiaries; Alternative Construction by ProSteel Builders, Inc., Alternative Construction by Ionian, Inc., and Alternative Construction by Revels, Inc. The Alternative Construction Ancillary Services Division contains five subsidiaries; Alternative Construction Design, Inc., Alternative Construction Consulting Services, Inc., Alternative Construction Safe Rooms, Inc., Modular Rental and Leasing Corporation, and Solar 18 ACTech Panel, Inc. Future of Building Institute, Inc., as a non-profit entity, functions separately.

Contact Information

Our principal operations and executive offices are located at 2910 Bush Drive, Melbourne, FL 32935 and our telephone number is (321) 421-6601. We also maintain a web site at http://www.actechpanel.com. The information on our web site is not, and should not be considered to be part of this Prospectus.

The Offering

| | Up to 2,961,956 shares |

| | | |

| Terms of the Offering: | | The selling shareholders will determine when and how they will sell the common stock offered by this Prospectus. See "Plan of Distribution." |

| | | |

| Use of proceeds: | | We will not receive any of the proceeds from the sale of common stock by the selling shareholders. However, to the extent there are cash exercises of warrants, we will receive proceeds from such warrant exercises. |

The following table provides selected consolidated financial and operating data for the years ended December 31, 2007 and 2006 and the period ended December 31, 2005 and has been derived from consolidated financial statements included elsewhere in this Prospectus.

STATEMENT OF OPERATIONS DATA

| | | For the Twelve Months Ended December 31, 2007 | | For the Twelve Months Ended December 31, 2006 | | For the Period January 21, 2005 through December 31, 2005 | |

| | | | | | | | |

| Revenue, net | | $ | 12,960,008 | | $ | 8,634,349 | | $ | 9,528,984 | |

| Gross profit | | $ | 4,374,698 | | $ | 1,303,540 | | $ | 2,056,722 | |

| | | | | | | | | | | |

| Income (loss) from operations | | $ | 2,199,575 | | $ | (1,725,618 | ) | $ | (72,593 | ) |

| Net income (loss) | | $ | 1,603,261 | | $ | (2,039,294 | ) | $ | (318,177 | ) |

| Net income (loss) per share: | | | | | | | | | | |

| Basic | | $ | 0.22 | | $ | (0.43 | ) | $ | (0.02 | ) |

| Diluted | | $ | 0.14 | | $ | (0.23 | ) | $ | (0.02 | ) |

BALANCE SHEET DATA

| | | December 31, | |

| | | 2007 | | 2006 | | 2005 | |

| Current assets | | $ | 4,652,835 | | $ | 1,112,363 | | $ | 2,688,363 | |

| Current liabilities | | $ | 2,503,260 | | $ | 1,790,284 | | $ | 4,235,450 | |

| Total assets | | $ | 11,638,863 | | $ | 4,226,052 | | $ | 5,826,017 | |

| Long-term debt | | $ | 5,169,495 | | $ | 1,021,289 | | $ | 3,132,920 | |

| Stockholders' equity | | $ | 4,588,119 | | $ | 1,960,066 | | $ | 1,091,047 | |

RISK FACTORS

Risks Related to our Business

If the Company is unable to raise equity capital or negotiate favorable terms with its current convertible debt holders it may be unable to achieve its 2008 objectives.

We incurred substantial growth for the year ended December 31, 2007 and have projected considerable growth in 2008. The Company has pledged all of its assets to the current convertible debt holders and because of this have subsequently restricted the Company’s ability to secure additional financing. Typical manufacturing companies rely heavily on debt to finance growth through inventory financing, purchase order financing, equipment financing, and factoring of receivables, which is currently unavailable to the Company. With the expected growth rate, the Company will require additional capital to meet its projections. In the event the Company is unable to successfully raise the necessary capital it may fail to reach targeted sales or overextend the Company’s obligations or ability to pay. There is no guarantee that we will succeed in obtaining additional financing, or if available, that it will be on terms favorable to us. The debentures are convertible into common stock, at a fixed price of $4.00 per share; however, until the debentures are paid in full or converted into common stock, all of the Company’s assets have been proffered as collateral. The maturity date of the debentures is June 30, 2009. The debentures bear an interest rate of 10% per year. If we become in default of the payment terms or other provisions of the debentures, there is no assurance that we will be able to successfully negotiate new terms favorable to us. In that event, the lenders may elect to accelerate the payment terms and may exercise their rights against the collateral.

If the price of raw materials increases or its availability decreases, it may create a reduction in our capability to produce our product, or increase in the retail panel price making us uncompetitive with conventional building.

The key components to our product are steel and foam. Steel is a commodity product; therefore the Company continues to seek various suppliers to provide sufficient source and pricing to meet our production schedule and pricing points. In the current market, steel and foam, the key ingredients in our product, rise and fall in cost, which could affect our abilities to procure enough raw materials based on cash and credit availability to produce enough products to meet demand and sell finished products at a profit. With an increase in raw material pricing, which often fluctuates because of availability, natural disasters, and force majeure, the Company may not maintain adequate cash to procure raw materials to meet current demand and expanded growth. As additional funding is required in the future, obtaining such financing is at the sole discretion of numerous third party financial institutions. Therefore, the Company cannot predict its ability to obtain future financing or the specific terms associated with such agreements. As such, the Company would be required to adjust production schedules based on cash availability and market pricing for its finished products which could therefore reduce production and limit its sales growth potential. In the event the Company elects to pass on these increases to its customers we may not be able to compete with conventional building. The Company experienced a 25% cost increase to spot-bid steel pricing in 2007 while maintaining a favorable profit ratio.

If we are unable to protect our intellectual property, while maintaining a “first to market” status, it will increase competition and competitive pricing that may have an impact on our future growth.

We rely significantly on the protections afforded by patent and trademark registrations that we routinely seek from the United States Patent and Trademark Office (USPTO) and from similar agencies in foreign countries. We cannot be certain that any patent or trademark application that is filed will be approved by the USPTO or other foreign agencies. In addition, we cannot be certain that we will be able to successfully defend any trademark, trade name or patent that we hold against claims from, or use by, competitors or other third parties. Our future success will depend on our ability to prevent others from infringing on our proprietary rights, as well as our ability to operate without infringing upon the proprietary rights of others. We may be required at times to take legal action to protect our proprietary rights and, despite our best efforts, we may be sued for infringing on the patent rights of others. Patent litigation is costly and, even if we prevail, the cost of such litigation could adversely affect our financial condition. If we do not prevail, in addition to any damages we might have to pay, we could be required to stop the infringing activity or obtain a license. We cannot be certain that any required license would be available on acceptable terms, or at all. If we fail to obtain a license, our business might be materially adversely affected. In addition to seeking patent protection, we rely upon a combination of non-disclosure agreements, other contractual restrictions and trade secrecy laws to protect proprietary information. There can be no assurance that these steps will be adequate to prevent misappropriation of our proprietary information or that our competitors will not independently develop technology or trade secrets that compete with our proprietary information.

With only one manufacturing facility and one production line, the Company could lose substantial revenue due to down time if the equipment is damaged and/or the plant suffers from a natural disaster.

The Company relies on one production line to manufacture its products. While a supply of most replacement parts is maintained and regularly scheduled maintenance conducted, the Company has the risk of shutting down if a key processing line component fails. In the third quarter of 2007, the facility was struck by lightning which caused a three week delay in production while waiting on a specific component to be manufactured in California. This delay adversely affected revenues for the third quarter of 2007. The component was a minor component, but the time to manufacture a new one was considerable. To replace the entire proprietary equipment line could take six to nine months, or longer, to design, assemble and have operational. The Company protects its patented process of continuous line manufacturing and as such will not allow a subcontractor to manufacture the ACTech® Panel unless it was in a plant designed and built by the Company.

Our facilities, manufacturing equipment and distribution systems may be subject to catastrophic loss due to fire, flood, hurricane, tornado, earthquake, terrorism or other natural or man-made disasters. Our corporate office in Florida is located in an area subject to hurricanes and other tropical storms. We believe our insurance policies are adequate with the appropriate limits and deductibles to mitigate the potential loss exposure of our business. We do not have financial reserves for policy deductibles and we do have exclusions under our insurance policies that are customary for our industry, including earthquakes, flood and terrorism. If any of our facilities or a significant amount of our manufacturing equipment were to experience a catastrophic loss, it could disrupt our operations, delay orders, shipments and revenue recognition and result in expenses to repair or replace the damaged manufacturing equipment and facilities not covered by insurance.

The Company has entered into indemnification agreements with the officers and directors and we may be required to indemnify our Directors and Officers, and if the claim is greater than $1,000,000, it may create significant losses for the Company.

We have authority under Section 607.0850 of the Florida Business Corporation Act to indemnify our directors and officers to the extent provided in that statute. Our Articles of Incorporation require the Company to indemnify each of our directors and officers against liabilities imposed upon them (including reasonable amounts paid in settlement) and expenses incurred by them in connection with any claim made against them or any action, suit or proceeding to which they may be a party by reason of their being or having been a director or officer of the company. We maintain officer's and director's liability insurance coverage with limits of liability of $1,000,000. Consequently, if such judgment exceeds the coverage under the policy, the Company may be forced to pay such difference. We have entered into indemnification agreements with each of our officers and directors containing provisions that may require us, among other things, to indemnify our officers and directors against certain liabilities that may arise by reason of their status or service as officers or directors (other than liabilities arising from willful misconduct of a culpable nature) and to advance their expenses incurred as a result of any proceeding against them as to which they could be indemnified. Management believes that such indemnification provisions and agreements are necessary to attract and retain qualified persons as directors and executive officers. We are subject to claims arising from disputes with employees, vendors and other third parties in the normal course of business. These risks may be difficult to assess or quantify and their existence and magnitude may remain unknown for substantial periods of time. If the plaintiffs in any suits against us were to successfully prosecute their claims, or if we were to settle such suits by making significant payments to the plaintiffs, our operating results and financial condition would be harmed. In addition, our organizational documents require us to indemnify our senior executives to the maximum extent permitted by Florida law. If our senior executives were named in any lawsuit, our indemnification obligations could magnify the costs of these suits.

We may acquire other businesses that have a strategic alliance with our goals and positioning which will create dilution to our shareholders and additional cash requirements we cannot meet.

The Company has acquired three businesses in 2007 and will continue to seek complementary businesses to acquire in 2008. Two of the businesses (ACI and ACR) acquired in 2007 created dilution of the company shareholders, but have brought considerable opportunities to the company business. With this additional business, the Company has struggled with meeting its cash flow requirements. The typical companies acquired are young companies with considerable contracts they are unable to fulfill or cash flow themselves. Coupled with our need for increased raw materials, to add on these contracts, and the cash flow needs of the acquired business, the Company will need to look to equity and debt resources to fulfill its obligations.

Future changes in financial accounting standards and other applicable regulations by various governmental regulatory agencies may cause lower than expected operating results and affect our reported results of operations.

Changes in accounting standards and their application may have a significant effect on our reported results on a going forward basis and may also affect the recording and disclosure of previously reported transactions. New standards have occurred and will continue to occur in the future. For example, in December 2004, the Financial Accounting Standards Board issued SFAS No. 123 (revised 2004), as amended, “Share Based Payment” (“SFAS No. 123R”), which requires us to expense stock options at fair value effective January 1, 2006. Under SFAS No. 123R, the recognition of compensation expense for the fair value of stock options reduces our reported net income and net income per share subsequent to implementation; however, this accounting change will not have any impact on the cash flows of our business. Under the prior rules, expensing of the fair value of the stock options was not required and therefore, no compensation expense for stock options was included in reported net income and net income per share in fiscal 2006. The Company issued 100,000 shares of stock options in fiscal 2007, recognizing $24,150 of compensation expense. Any future issuances of stock options, in addition to the fiscal 2006 issuances, will cause additional compensation expense to be recognized.

The Sarbanes-Oxley Act of 2002 and various new rules subsequently implemented by the Securities and Exchange Commission (“SEC”) and the NASDAQ National Market have imposed additional reporting and corporate governance practices on public companies. Since adoption of these regulations, our legal, accounting and financial compliance costs have increased and a significant portion of management’s time has been diverted to comply with these rules. We expect these additional costs and the diversion of management’s time to continue and to the extent additional rules and regulations are adopted, the diversion or addition of resources may potentially increase over time, with respect to these legal initiatives.

In addition, if we do not adequately continue to comply with the requirements of Section 404 of the Sarbanes-Oxley Act in the future, we may not be able to accurately report our financial results or prevent error or fraud, which may result in sanctions or investigation by regulatory authorities, such as the SEC. Any such action could harm our business, financial results or investors’ confidence in our company, and could cause our stock price to fall.

The nature of our businesses exposes us to the risk of litigation and liability under environmental, health and safety and product liability laws.

Certain aspects of our businesses involve risks of liability. In general, litigation in our industry, including class actions that seek substantial damages, arises with increasing frequency. Claims may be asserted under environmental, labor, health and safety or product liability laws. Litigation is invariably expensive, regardless of the merit of the plaintiffs’ claims. We may be named as a defendant in the future, and there can be no assurance that regardless of the merit of such claims, we will not be required to make substantial settlement payments in the future.

If we do not effectively manage our credit risk or collect on our accounts receivable, it could have a material adverse effect on our operating results.

We generally sell to qualified customers on a 30-day payment term; however, our average collection time is 49 days. We perform credit evaluation procedures on our customers on each transaction and require security deposits or other forms of security from our customers when a significant credit risk is identified. The Company expects to expand offering terms on purchases in an effort to increase sales. As the Company exposes itself to greater risks we will have to further evaluate accounts receivable and increase our reserves for bad debt, as applicable.

In 2006, the Company wrote off a substantial amount of aged accounts receivable. The Company has implemented a policy of filing Notice to Owners (“NTO”) on each property in which it produces product for to alleviate the inability to collect. However, if a customer fails to pay, there could be considerable time between the need to pay our vendors and the receipt of our final payment. ACP maintains more than $150,000 in immediate payables on a contract in which it is owed $254,000 and may be required to use legal remedies to collect. Failure to manage our credit risk and receive timely payments on our customer accounts receivable may result in the write-off of customer receivables. If we are not able to manage credit risk issues, or if a large number of customers should have financial difficulties at the same time, our credit losses would increase above historical levels. If this should occur, our results of operations may be materially and adversely affected.

Failure by third parties to supply our raw materials or deliver our product to our specifications or on a timely basis may harm our reputation and financial condition.

We are dependent on third parties to provide steel, foam, and other building materials even though we are able to purchase products from a variety of third-party suppliers. In the future, we may be limited as to the number of third-party suppliers for some of our products. Currently, we do not have any long-term purchase contracts with any third-party supplier. In the future, we may not be able to negotiate arrangements with these third parties on acceptable terms, if at all. If we cannot negotiate arrangements with these third parties to provide our raw materials to our specifications or in a timely manner, our reputation and financial condition could be harmed. In addition, specific requirements exist for delivery of raw materials that can cause significant damage and delays if not properly serviced during the transportation. While financial cost is insured by the carrier, lost time and reputation may suffer decreasing customer satisfaction and thwarting future sales.

If we are not able to anticipate and mitigate the risks associated with operating internationally, as planned, there could be a material adverse effect on our operating results.

Currently, we have no significant revenue derived from foreign interests. The Company is projecting significant international growth in 2008 in various construction segments including commercial, affordable housing, military, and education. The Company is currently negotiating in more than ten different countries and has made an impact in the international communities through its various United Nations invitations to present our products and solutions. Over time, we anticipate the amount of international business may increase significantly if our focus on international market opportunities continues. Doing business in foreign countries does subject the Company to additional risks, any of which may adversely impact our future operating results, including:

| | • | | international political, economic and legal conditions including tariffs and trade barriers; |

| | • | | our ability to comply with customs, import/export and other trade compliance regulations of the countries in which we do business, together with any unexpected changes in such regulations; |

| | • | | difficulties in attracting and retaining staff and business partners to operate internationally; |

| | • | | language and cultural barriers; |

| | • | | seasonal reductions in business activities in the countries where our international customers are; located; |

| | • | | integration of foreign operations; and |

| | • | | potential adverse tax consequences. |

| | • | | potential foreign currency fluctuations. |

SPECIFIC RISKS RELATED TO OUR MANUFACTURING OF STRUCTURAL INSULATED PANELS

Continued decline in school operations maintenance funding; and new facility funding in the state of Florida could cause the demand for our ACTech® Panel to decline, which could result in a reduction in our revenues and profitability.

For two consecutive years, sales of our SIPs to contractors building modular portable classrooms for the Florida public school districts for use as portable classrooms, restroom buildings, and administrative offices for kindergarten through grade twelve has declined. Funding for public school facilities is derived from a variety of sources including the passage of both statewide and local facility bond measures, developer fees and various taxes levied to support school operating budgets. Many of these funding sources are subject to financial and political considerations, which vary from district to district and are not tied to demand. Historically, we have benefited from the passage of facility bond measures and believe these are essential to our business. While all forecast reports believe 2008 to be a substantial year in the school facility market, there is no guarantee that this business sector will return to its historical 2005 levels.

To the extent public school districts’ funding is reduced for the rental and purchase of modular facilities, our business could be harmed and our results of operations negatively impacted. We believe that interruptions or delays in the passage of facility bond measures, changes in legislative or educational policies at either the state or local level including the contraction or elimination of class size reduction programs, a lack or insufficient amount of fiscal funding, a significant reduction of funding to public schools, or changes negatively impacting enrollment may reduce the rental and sale demand for our educational products and result in lower revenues and profitability.

A significant reduction of construction due to economic downturns, population growth variations and/or other definable effects on the construction industry could cause the demand for our construction solutions to decline, which could result in a reduction in our revenues and profitability.

The US Market has magnified the housing market crisis to disproportionate levels. As such, the housing market has created a negative spin on all construction and related product suppliers, even though the commercial market and “green” building market has witnessed considerable and consistent growth. While less than 25% of our Company’s SIP business is in the housing market, this negative spin has created indecisiveness within our customers which has hampered our growth.

The US Market is projecting a 60% growth in “green” building materials and the Structural Insulated Panel Association (SIPA) is projecting an increase from 1.5% to 5% of all housing to be built with SIPs within the next five years. To the contrary, the US Market is projecting a slowdown in commercial construction in 2008, but is expecting a massive influx of school related contracts, while the housing market continues to struggle. Each of these trends, forecasts, and potential markets will have a direct impact on our success and failures. The Company’s inability to recognize which information is correct, and utilize this information to develop a roadmap for future success could impede our ability to increase profits.

Public policies that create demand for our products and services may change, stall in Congress or State Legislation reducing leverage to enforce change thereby decreasing sales.

Florida has passed legislation to limit the number of students that may be grouped in a single classroom for certain grade levels. School districts with class sizes in excess of these limits have been and continue to be a significant source of demand for modular classrooms using the ACTech® Panel. The educational priorities and policies were stalled in 2007, therefore demand for our products and services declined. While legislation still dictates the need for additional modular classrooms, and with the ACTech® Panel System featured in more than 1,300 modular facilities within the state of Florida, we may not experience the historical growth levels of 2005; therefore, we may not grow as quickly as or reach the levels that we anticipate.

Similar to conventionally constructed buildings, the modular building industry, including the manufacturers and lessors of portable classrooms, are subject to evolving regulations by multiple governmental agencies at the federal, state and local level. This oversight includes but is not limited to governing code bodies, environmental, health, safety and transportation. Failure by our customers to comply with these laws or regulations could impact our business. Compliance with building codes and regulations have always entailed a certain amount of risk as municipalities do not necessarily interpret these building codes and regulations in a consistent manner, particularly where applicable regulations may be unclear and subject to interpretation. Many aspects of the construction and modular building industry have developed “best practices” which are constantly evolving.

The inability to get our product and services listed as a mandated “Green Product”, such as the State of Florida Climate Action Team Approved Green Building Product Listing, may limit opportunities for growth or restrict access to certain states.

With 22 states and Washington, D.C. currently enforcing “Green Laws”, laws that define the use of “green” building materials, and many other states considering the passage of “Green Laws”, our inability to get our product listed as an approved “Green Product” in each state may restrict growth for some government contracts. Three states (Connecticut, Wisconsin and Illinois) have set up commissions to draft “green” building legislation and regulations. Four states (Nevada, New Mexico, Virginia, and Maryland) and Washington, D.C. require state and/or state-funded buildings to be built to a “green” building standard and offer incentives for compliance. Eleven states (Washington, California, Arizona, Colorado, Maine, Massachusetts, Rhode Island, New Jersey, South Carolina, Michigan, and Florida) require state-funded public and educational building to be built to the “green” standard.

We face strong competition in our structural insulated panel markets on a region-by-region basis which may provide resistance to the Company’s ability to become a national leader in structural insulated panels manufacturing.

The structural insulated panel industry is fragmented and highly competitive in our states of operation and we project it to remain the same. We compete with three types of competitors; (i) conventional builders, (ii) wood-based SIP manufacturers, and (iii) other steel-skin SIP manufacturers. As the housing market has dwindled, many conventional builders are attempting to enter into the commercial marketplace; thus creating increased competition for use of our product. As more and more people decide to use alternative methods of construction, the SIP industry is poised to gain significant growth in this market. The boom has been projected for years by industry experts. As such, many wood-based SIP manufacturers have been gearing up for the growth opportunities creating an influx of potential candidates to compete with for new building styles. The competitive market in which we operate may prevent us from raising sales prices to pass any increased costs on to our customers. We compete on the basis of a number of factors, quality, price, service, reliability, appearance, functionality, and delivery times. We believe we may experience pricing pressures in our areas of operation in the future as some of our competitors seek to obtain market share by reducing prices.

In the event a defect were to arise from our manufacturing of the ACTech® Panel, our warranty costs would increase and could cause the Company to go into bankruptcy.

Sales of structural insulated panels are typically covered by warranties. We provide a one year warranty on the ACTech® Panel. Historically, our warranty costs have not been significant, and we monitor the quality of our products closely. If a defect were to arise in the manufacturing of our structural insulated panel at our facility, we may experience increased warranty claims. Such claims could disrupt our sales operations, damage our reputation and require costly repairs or other remedies, negatively impacting revenues, costs, and operating income, even to the point, if the defects were universal, a complete shutdown of the operation and a need to file for protection under bankruptcy laws.

SPECIFIC RISKS RELATED TO OUR DEVELOPMENT BUSINESS

Economics and cyclical downturns in the construction industry may result in periods of low demand for our services resulting in the reduction of our operating results and cash flows.

The Company currently owns three development division subsidiaries located in Newnan, Georgia, Cleveland, Tennessee, and Bradenton, Florida. The revenues are derived from providing construction solutions to a broad range of companies, developers and individuals. Historically, the construction industry has been cyclical and has experienced periodic downturns, which have a material adverse impact on the industry’s demand for construction. The Company is currently developing a 59 home subdivision in Cleveland, Tennessee. If the Company does not sell these homes as they are built, it will directly impact our cash flow and profitability.

In addition, the severity and length of any downturn on an industry may also affect overall access to capital, which could adversely affect our customers. During periods of reduced and declining demand for construction material and/or solutions, we are exposed to additional risk from reduced revenue and may need to rapidly align our cost structure with prevailing market conditions while at the same time motivating and retaining key employees. While the market demand for construction related products and/or solutions in a significant portion of the areas in our focus, especially with the devastation due to hurricanes in Florida and Louisiana in 2004 and 2005, respectively, no assurance can be given regarding the length or extent of the recovery, and no assurance can be given that our rates, operating results and cash flows will not be adversely impacted by the reversal of any current trends or any future downturns or slowdowns in the rate of capital investment in this industry.

Significant increases in construction supplies, subcontractors and labor costs could increase our cost of construction, which would increase our cost of goods sold and reduce our profitability.

We incur labor costs, purchase construction supplies, and employ subcontractors. Generally, increases in labor, construction supplies, and subcontractors will also increase the cost of our structure. During periods of rising prices for labor, construction supplies or subcontractor services, and in particular, when the prices increase rapidly or to levels significantly higher than normal, we may incur significant increases and incur higher cost of goods sold that we may not be able to recoup from our customers, which would reduce our profitability.

SPECIFIC RISKS RELATED TO OUR ANCILLARY SERVICES

Company management may choose to acquire strategic alliances and/or partners which may create long-term beneficial growth but would adversely affect short-term gains.

The Company projects new strategic alliances, joint ventures, and acquisition candidates in the “green” and “clean tech” industries. Through these alliances, the Company has the opportunity to provide various consulting services which promotes revenue and furthers the Company’s message of operating in the “green” world. Company management will determine at the appropriate times whether these alliances are beneficial to remain a third party or to be acquired, either wholly or partially.

The Company relies partially on outside consultants for architectural and engineering services that may put the Company at further risk and liability.

The Company requires its professional consultants to provide certification and license documentation to include named insurance from claims. As the Company is the contracted entity it faces additional liability that it may have to defend in the event of a faulty design.

The Company’s subsidiary, ACCS, has a significant receivable from Atlan.

The Company has a short-term receivable of $1,000,000 and a long-term receivable of $1,000,000 from Atlan. This constitutes 57.1% of the consolidated accounts receivable, net and 17.2% of the consolidated total assets. The Company would be negatively affected if Atlan were unable to pay the receivable timely and/or not pay at it in its entirety. The Company has strategically protected itself as it has three options in the case of non-payment. First, the Company could receive the Atlan stock which is collateral to the receivable. This would include Atlan’s ongoing contracts and assets. The other options include the Company assisting Atlan in obtaining additional financing to enable the payment to the Company and/or the Company has the option to lien the royalties of the joint venture payments to Atlan until the receivable is paid in full. In the case of non-payment, it could be costly to the Company to negotiate the settlement which would restrict the Company’s future cash flow.

We are subject to compliance with the reporting requirements of the Exchange Act of 1934 as well as the Sarbanes-Oxley Act of 2002. We expect to incur additional expenses and diversion of management's time as a result of the requirements imposed on small business issuers by the Sarbanes-Oxley Act. Moreover, we are a small company with limited resources that will make it difficult for us to timely comply with the requirements of the Exchange Act or the Sarbanes-Oxley Act. If we are not able to timely comply with the requirements of those Acts, we might be subject to sanctions or investigation by regulatory authorities. Any such action could materially and adversely affect our business and financial results as well as the market price of our stock.

FORWARD-LOOKING STATEMENTS

Such forward-looking statements include statements regarding, among other thins, (a) our projected sales, profitability, and cash flows, (b) our growth strategies, (c) anticipated trends in our industries, (d) our future financing plans and (e) our anticipated needs for working capital. Forward-looking statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words "may, "will, " "should, " "except, " "anticipate, " "estimate, " "believe, 'I "intend," or "project" or the negative of these words or other variations on these words or comparable terminology. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found under "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business," as well as in this Prospectus generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under "Risk Factors" and matters described in this Prospectus generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. In addition to the information expressly required to be included in this filing, we will provide such further material information, if any, as may be necessary to make the required statements in light of the circumstances under which they are made, not misleading.

The Private securities Litigation Reform Act of 1995, which provides a "safe harbor" for similar statements by existing public companies, does apply to this registration.

WHERE YOU CAN FIND MORE INFORMATION

In addition, we file annual, quarterly and current reports, proxy statements and other information with the SEC. We have filed with the SEC a registration statement on Form SB-2 under the Securities Act with respect to the securities offered by this Prospectus. These reports, proxy statements and other information may be inspected and copied at the public reference facilities maintained by the SEC at 450 Fifth Street, N.W., Washington, D.C. 20549. You can obtain copies of these materials from the Public Reference Section of the SEC upon payment of fees prescribed by the SEC. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC's web site, http://www.sec.gov, contains reports, proxy and information statements and other information regarding registrants that file electronically with the SEC, including us. Information contained on our website should not be considered part of this Prospectus. In addition, we file annual, quarterly and current reports, proxy statements and other information with the SEC. We have filed with the SEC a registration statement on Form S-1 (File No. 333-______) under the Securities Act with respect to the securities offered by this Prospectus.

You may also request a copy of our filings at no cost by writing or telephoning us at:

Alternative Construction Technologies, Inc.

2910 Bush Drive

Melbourne, FL 32935

Attention: John Wittler

USE OF PROCEEDS

This Prospectus relates to shares of common stock that may be offered and sold from time to time by the selling shareholders. There will be no proceeds to the Company from the sale of shares of common stock in this offering, except upon exercise of the warrants. There are no guarantees that these warrants will ever be exercised. We will bear all expenses incident to the registration of the shares of our common stock under federal and state securities laws other than expenses incident to the delivery of the shares to be sold by the selling shareholders. Any transfer taxes payable on these shares and any commissions and discounts payable to underwriters, agents, brokers or dealers will be paid by the selling shareholders.

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

CRITICAL ACCOUNTING POLICIES

The preparation of our financial statements in conformity with accounting principles generally accepted in the United States (“GAAP”) requires us to make estimates and judgments that affect our reported assets, liabilities, revenues, and expenses, and the disclosure of contingent assets and liabilities. We base our estimates and judgments on historical experience and on various other assumptions we believe to be reasonable under the circumstances. Future events, however, may differ markedly from our current expectations and assumptions. While there are a number of significant accounting policies affecting our consolidated financial statements; we believe the following critical accounting policies involve the most complex, difficult and subjective estimates and judgments:

| · | Product Warranty Reserve |

| · | Allowance for uncollectible accounts |

| · | Fair value of Stock-based compensation |

Revenue Recognition

The Company recognizes revenue when persuasive evidence of an arrangement exists, the price to the customer is fixed, collectibility is reasonably assured and title and risk of ownership is passed to the customer, which is usually upon delivery. However, in limited circumstances, certain customers traditionally have requested to take title and risk of ownership prior to shipment. Revenue for these transactions is recognized only when:

| · | Title and risk of ownership have passed to the customer; |

| · | The Company has obtained a written fixed purchase commitment; |

| · | The customer has requested in writing the transaction be on a bill and hold basis; |

| · | The customer has provided a delivery schedule; |

| · | All performance obligations related to the sale have been completed; |

| · | The modular unit has been processed to the customer’s specifications, accepted by the customer and made ready for shipment; and |

| · | The modular unit is segregated and is not available to fill other orders. |

The remittance terms for these “bill and hold” transactions are consistent with all other sales by the Company.

In the event that the Company’s arrangements with its customers include more than one product or service, the Company determines whether the individual revenue elements can be recognized separately in accordance with Financial Accounting Standards Board (FASB) Emerging Issues Task Force No. 00-21 (EITF 00-21), Revenue Arrangements with Multiple Deliverables, EITF 00-21 addresses the determination of whether an arrangement involving more than one deliverable contains more than one unit of accounting and how the arrangement consideration should be measured and allocated to the separate units of accounting.

The Company’s Development Division contracts to build commercial, residential, and other infrastructures to its customers, none of which are related to the Company. As such, they recognize their revenue under the percentage of completion method as work on a contract as progresses. Recognition of revenue and profits generally is related to costs incurred in providing the services required under the contract. Statement of Position 81-1 discusses accounting for performance of construction contracts. The use of the percentage of completion method depends on our ability to make reasonably dependable estimates. Additionally, contracts executed by the Company and its customers include provisions that clearly specify the enforceable rights of our services that are provided to and received by our customers. Our estimates assume that our customers will satisfy their obligations under the contract and our performance requirements will be completed.

Product Warranty Reserve

Currently, the Company has a standard one year warranty on manufacturing defects on the ACTech® Panel. The development projects carry a standard one year warranty period on construction defects. The cost of replacing defective products and product returns have been immaterial and within management’s expectations. In the future, when the company deems warranty reserves are appropriate that such costs will be accrued to reflect anticipated warranty costs.

The Company’s Development Division contracts to build commercial, residential, and other infrastructures to its customers, none of which are related to the Company. As such, they recognize their revenue under the percentage of completion method as work on a contract as progresses. Recognition of revenue and profits generally is related to costs incurred in providing the services required under the contract. Statement of Position 81-1 discusses accounting for performance of construction contracts. The use of the percentage of completion method depends on our ability to make reasonably dependable estimates. Additionally, contracts executed by the Company and its customers include provisions that clearly specify the enforceable rights of our services that are provided to and received by our customers. Our estimates assume that our customers will satisfy their obligations under the contract and our performance requirements will be completed.

Inventories

We value our inventories, which consists of raw materials, work in progress, and finished goods, at the lower of cost or market. Cost is determined on the first-in, first-out method (FIFO) and includes the cost of merchandise and freight for manufacturing inventories, and at the actual costs for development projects. A periodic review of inventory quantities on hand is performed in order to determine if inventory is properly positioned at the lower of cost or market. Factors related to current inventories such as future consumer demand and trends in the Company's core business, current aging, current and anticipated wholesale discounts, and class or type of inventory is analyzed to determine estimated net realizable values. A provision would be recorded to reduce the cost of inventories to the estimated net realizable values, if required. Any significant unanticipated changes in the factors noted above could have a significant impact on the value of our inventories and our reported operating results.

Allowance for Uncollectible Accounts

We are required to estimate the collectibility of our trade receivables. A considerable amount of judgment is required in assessing the realization of these receivables including the current creditworthiness of each customer and related aging of the past due balances. In order to assess the collectibility of these receivables, we perform ongoing credit evaluations of our customers' financial condition. Through these evaluations we may become aware of a situation where a customer may not be able to meet its financial obligations due to deterioration of its financial viability, credit ratings or bankruptcy. The reserve requirements are based on the best facts available to us and are reevaluated and adjusted as additional information is received. Our reserves are also based on amounts determined by using percentages applied to certain aged receivable categories. These percentages are determined by a variety of factors including, but are not limited to, current economic trends, historical payment and bad debt write-off experience. We are not able to predict changes in the financial condition of our customers and if circumstances related to our customers deteriorate, our estimates of the recoverability of our receivables could be materially affected and we may be required to record additional allowances. Alternatively, if we provided more allowances than are ultimately required, we may reverse a portion of such provisions in future periods based on our actual collection experience. As of December 31, 2007, we recorded an additional $10,850 reserve.

Goodwill Impairment

In accordance with Statement of Financial Accounting Standards No. 142, Goodwill and Other Intangible Assets, goodwill is evaluated for potential impairment annually, generally during the fourth quarter, by comparing the fair value of a reporting unit to its carrying value, including recorded goodwill. If the carrying value exceeds the fair value, impairment is measured by comparing the derived fair value of goodwill to its carrying value, and any impairment determined would be recorded in the current period. To date there has been no impairment of the Company’s recorded goodwill.

Fair Value of Stock-based Compensation

Under its Year 2004 Stock Option Plan (the “Plan”), the Company grants stock options for a fixed number of shares to employees and directors with an exercise price equal to the fair market value of the shares at the date of grant. The Company adopted SFAS 123(r), Share-Based Payments, in the first quarter of fiscal 2006. Prior to fiscal 2006, the Company had adopted the disclosure-only provision of SFAS 123, Accounting for Stock-Based Compensation, as amended by SFAS 148, Accounting for Stock-Based Compensation, Transition and Disclosure, which permitted the Company to account for stock option grants in accordance with APB Opinion No. 25, Accounting for Stock Issued to Employees. Under APB 25, compensation expense is recorded when the exercise price of the Company’s employee stock option is less than the market price of the underlying stock at the date of grant.

The provisions of SFAS 123(r) require the Company to estimate the fair value of each option grant and employee stock purchase plan. The Company uses the Black-Scholes option pricing model to estimate these fair values. The Black-Scholes option-pricing model was developed for use in estimating the value of traded options that have no vesting restrictions and are fully transferable, while the options issued by the Company are subject to both vesting and restrictions on transfer. In addition, option pricing models require input of highly subjective assumptions including expected stock price volatility. The Company uses projected data for expected volatility and estimates the life of its stock options by applying the simplified method set out in SEC Staff Accounting Bulletin No. 107 (SAB 107). The simplified method defines the expected term of an option as the average of the contractual term of the options and the weighted average vesting period for all option tranches.

RECENT ACCOUNTING PRONOUNCEMENTS

In April 2003, the Financial Accounting Standards Board (FASB) issued Statement of Financial Standards (SFAS) No. 149, "Amendment of Statement 133 on Derivative Instruments and Hedging Activities." The statement amends and clarifies accounting and reporting for derivative instruments, including certain derivative instruments embedded in other contracts, and hedging activities. This statement is designed to improve financial reporting such that contracts with comparable characteristics are accounted for similarly. The statement, which is generally effective for contracts entered into or modified after June 30, 2003, is not anticipated to have a significant effect on our financial position or results of operations.

In May 2003, the FASB issued SFAS No. 150, "Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity." This statement establishes standards for how an issuer classifies and measures certain financial instruments with characteristics of both liabilities and equity. This statement is effective for financial instruments entered into or modified after May 31, 2003, and is otherwise effective at the beginning of the first interim period beginning after June 15, 2003. The statement is not anticipated to have a significant effect on our financial position or results of operations.

In December 2003, the FASB issued FASB Interpretation No. 46 (Revised), "Consolidation of Variable Interest Entities". This interpretation clarifies rules relating to consolidation where entities are controlled by means other than a majority voting interest and instances in which equity investors do not bear the residual economic risks. We currently have no ownership in variable interest entities and therefore adoption of this standard currently has no financial reporting implications.

OFF BALANCE SHEET ARRANGEMENTS

We do not currently have any off-balance sheet arrangements that have or are reasonably likely to have a current or future affect on our financial condition, change in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our shareholders.

OVERVIEW

The Company is a manufacturing, development, and ancillary services company engaged in the research, development and marketing of proprietary products for the construction industry. We manufacture and distribute the ACTech® Panel, a structural insulated panel (SIP), throughout the United States. Our products, development expertise and ancillary services are marketed through our internal sales staff and by manufacturer representatives.

UMMARY FINANCIAL INFORMATION

STATEMENT OF OPERATIONS DATA

| | | For the Twelve Months Ended December 31, 2007 | | For the Twelve Months Ended December 31, 2006 | | For the Period January 21, 2005 through December 31, 2005 | |

| | | | | | | | |

| Revenue, net | | $ | 12,960,008 | | $ | 8,634,349 | | $ | 9,528,984 | |

| Gross profit | | $ | 4,374,698 | | $ | 1,303,540 | | $ | 2,056,722 | |

| Income (loss) from operations | | $ | 2,199,575 | | $ | (1,725,618 | ) | $ | (72,593 | ) |

| Net income (loss) | | $ | 1,603,261 | | $ | (2,039,294 | ) | $ | (318,177 | ) |

| Net income (loss) per share: | | | | | | | | | | |

| Basic | | $ | 0.22 | | $ | (0.43 | ) | $ | (0.02 | ) |

| Diluted | | $ | 0.14 | | $ | (0.23 | ) | $ | (0.02 | ) |

BALANCE SHEET DATA

| | | December 31, | |

| | | 2007 | | 2006 | | 2005 | |

| | | | | | | | |

| Current assets | | $ | 4,652,835 | | $ | 1,112,363 | | $ | 2,688,363 | |

| Current liabilities | | $ | 2,503,260 | | $ | 1,790,284 | | $ | 4,235,450 | |

| Total assets | | $ | 11,638,863 | | $ | 4,226,052 | | $ | 5,826,017 | |

| Long-term debt | | $ | 5,169,495 | | $ | 1,021,289 | | $ | 3,132,920 | |

| Stockholders' equity | | $ | 4,588,119 | | $ | 1,960,066 | | $ | 1,091,047 | |

YEAR ENDED DECEMBER 31, 2007 COMPARED TO YEAR ENDED DECEMBER 31, 2006

RESULTS OF OPERATIONS

Overview

Total revenues increased to $12,960,008 for the year ended December 31, 2007 from $8,634,349 for the year ended December 31, 2006. The increase of $4,325,659 or 50.1% is a direct result of the Company’s acquisition of ACI and ACR on May 16, 2007 and August 27, 2007, respectively and the revenues generated from its ancillary services offered under ACCS and ACD. The revenue growth is directly related to the Company’s diversification as a product supplier to a systems provider that incorporates all elements of construction to include complete shells, modular facilities, development, consulting, design, architecture and engineering.

Overall cost of sales was $8,585,310 and $7,330,809 for the years ended December 31, 2007 and 2006, respectively. As a percent of revenue, the cost of sales decreased from 84.9% to 66.2%, for the year ended December 31, 2006 as compared to the year ended December 31, 2007. The decrease is primarily due to the expansion of services offered by the Company to include design, consulting, and component sales. The revenue generated through ancillary services, which has a low cost of sales represented 15.4% of total revenue, therefore the impact was significant in the overall reduction of cost of sales. Extracting the impact of these new services, the cost of sales was 73.8% as a percent of total revenue, which represents a substantial 11.1% decrease from the year ended December 31, 2006, even though overall construction costs were on the rise.

The cost of sales and the percent of consolidated cost of sales for the year ended December 31, 2007, by segment, are as follows: Manufacturing Division, $2,830,339 (33.0%) which is attributed solely to ACMT, Ancillary Services Division $510,369 (6.0%) and Development Division $5,529,511 (64.4%) of which 19.8%, 40.9%, and 3.7% is attributed to cost of sales associated with ACP, ACI, and ACR, respectively. The difference between the reported cost of sales and the respective segments is the result of intercompany eliminations.

Gross profit was $4,374,699 and $1,303,540 for the years ended December 31, 2007 and 2006, respectively. As a percent of revenue, gross profit was 33.8% and 15.1% for the years ended December 31, 2007 and 2006, respectively.

Total operating expenses decreased to $2,175,123 for the year ended December 31, 2007 from $3,029,158 for the year ended December 31, 2006. This $854,035 or 28.2% decrease was primarily attributable to the reduction in accounts receivable factoring fees (from $307,156 to $100,714 for the year ended December 31, 2006 and 2007, respectively), insurance (from $243,123 to $139,447 for the year ended December 31, 2006 and 2007, respectively), professional fees (from $696,575 to $534,014 for the year ended December 31, 2006 and 2007, respectively), bad debt expense (from $424,157 to $35,000 for the year ended December 31, 2006 and 2007, respectively) offset with increases primarily in payroll and related expenses (from $534,624 to $776,590 for the year ended December 31, 2006 and 2007, respectively) and SEC related expenses (from $72,731 to $106,321 for the year ended December 31, 2006 and 2007, respectively).

The operating expenses and the percent of consolidated operating expenses for the year ended December 31, 2007, were contributed as follows: Manufacturing Division, $734,434 (33.8%) attributed solely to ACMT, Ancillary Services Division, $10,786 (0.5%), Construction Division, $661,172 (30.4%) with $535,302 (24.6%) attributed to ACP, and Corporate, $768,731 (35.3%).

Manufacturing Division