Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

dELiA*s, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

Table of Contents

May 1, 2009

Dear Stockholder,

It is my pleasure to invite you to dELiA*s’ 2009 Annual Meeting of Stockholders.

We will hold the Annual Meeting at 9:00 a.m., local time, on Tuesday, June 9, 2009, at the offices of Troutman Sanders LLP, The Chrysler Building, 405 Lexington Avenue, New York, New York 10174. In addition to the formal items of business, we will review the major developments of the past year and answer your questions.

This booklet includes our Notice of Annual Meeting and Proxy Statement (containing important information about the matters to be acted upon at the Annual Meeting), and is accompanied by our Annual Report for the fiscal year ended January 31, 2009 and proxy card. The Proxy Statement describes the business that we will conduct at the Annual Meeting and provides information about dELiA*s that you should consider when you vote your shares.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please complete, date, sign and return the enclosed proxy card promptly in accordance with the instructions set forth on the card. This will ensure your proper representation at the Annual Meeting. If you attend the Annual Meeting and prefer to vote in person, you may do so.

We look forward to seeing you at the Annual Meeting.

Sincerely,

Robert E. Bernard

Chief Executive Officer

YOUR VOTE IS IMPORTANT.

PLEASE RETURN YOUR PROXY PROMPTLY.

Table of Contents

NOTICE OF 2009 ANNUAL MEETING OF STOCKHOLDERS

Date: | Tuesday, June 9, 2009 | |

Time: | 9:00 a.m., local time | |

Place: | Troutman Sanders LLP The Chrysler Building 405 Lexington Avenue New York, New York 10174 |

Dear Stockholder:

At our Annual Meeting, we will ask you to:

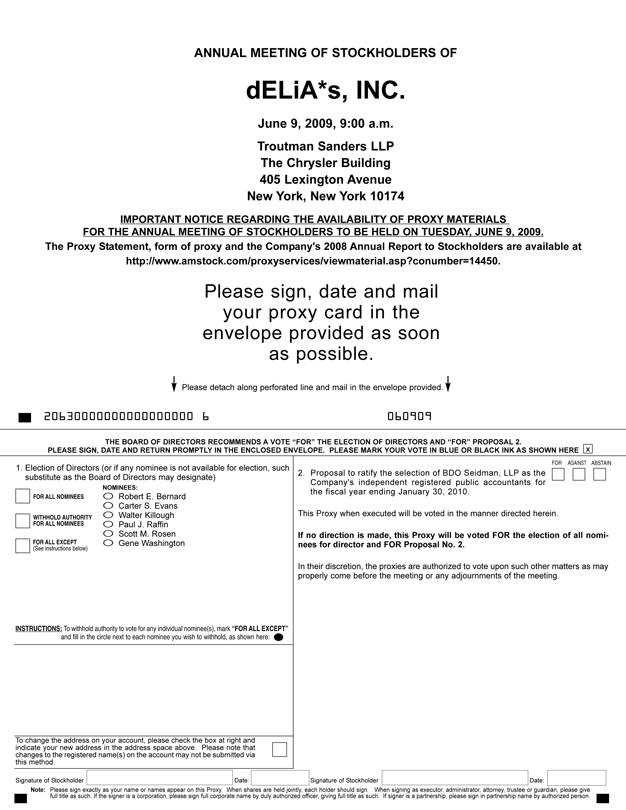

| • | Elect six members to our Board of Directors as named in the attached proxy statement to serve for a term ending in 2010 and until their successors are duly elected and qualified; |

| • | Ratify the appointment of BDO Seidman, LLP as our independent registered public accountants for the fiscal year ending January 30, 2010; |

| • | Transact any other business that may properly be presented by the Board of Directors at the Annual Meeting and any adjournments thereof. |

Stockholders of record at the close of business on April 22, 2009 will be entitled to vote at the Annual Meeting. The Proxy Statement, the accompanying form of proxy card and our Annual Report for the fiscal year ended January 31, 2009 will be mailed to all stockholders of record on or about May 1, 2009.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON JUNE 9, 2009.

THE PROXY STATEMENT AND OUR 2008 ANNUAL REPORT ARE AVAILABLE AT

HTTP://WWW.AMSTOCK.COM/PROXYSERVICES/VIEWMATERIAL.ASP?CONUMBER=14450

| BY ORDER OF THE BOARD OF DIRECTORS |

|

| Marc G. Schuback |

| Vice President, General Counsel and Secretary |

May 1, 2009

Table of Contents

| Page | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 2 | ||

How Does the Board of Directors Recommend That I Vote on the Proposals? | 2 | |

| 2 | ||

| 2 | ||

| 3 | ||

| 3 | ||

| 3 | ||

| 4 | ||

| 4 | ||

| 4 | ||

| 4 | ||

| 5 | ||

| 7 | ||

| 7 | ||

| 8 | ||

| 10 | ||

| 10 | ||

| 10 | ||

| 12 | ||

| 13 | ||

| 13 | ||

| 16 | ||

| 17 | ||

Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table | 17 | |

| 22 | ||

| 23 | ||

| 24 | ||

| 25 | ||

DISCUSSION OF PROPOSALS RECOMMENDED BY THE BOARD OF DIRECTORS | 27 | |

| 27 | ||

| 27 | ||

| 28 | ||

| 28 | ||

| 28 | ||

| 29 | ||

| 29 | ||

| 29 |

i

Table of Contents

PROXY STATEMENT FOR THE dELiA*s, INC.

2009 ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why Did You Send Me This Proxy Statement?

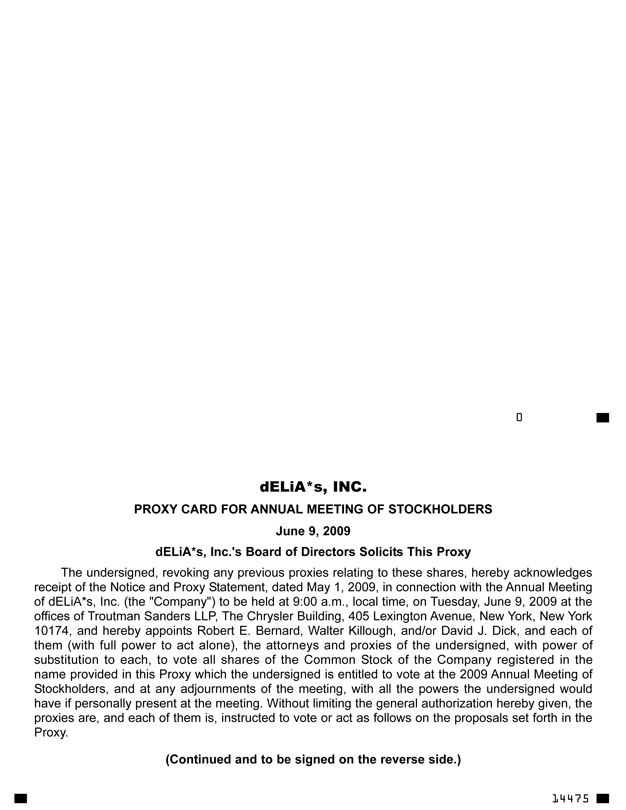

We sent you this Proxy Statement and the enclosed proxy card because the Board of Directors of dELiA*s, Inc. (“dELiA*s”, the “Company”, “us”, “our” or “we”) is soliciting your proxy to vote at our 2009 Annual Meeting of Stockholders and any adjournments of the Annual Meeting (the “Annual Meeting”). This Proxy Statement along with the accompanying Notice of Annual Meeting of Stockholders summarizes the purposes of the meeting and the information you need to know to vote at the Annual Meeting. You do not need to attend the Annual Meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card in accordance with the instructions set forth on the proxy card or, if you own shares in “street name”, you will need to instruct your bank, broker or other nominee to vote your shares, as described below.

On or about May 1, 2009, we will begin sending this Proxy Statement, the attached Notice of Annual Meeting and the enclosed proxy card to all stockholders of record as of the close of business on April, 22, 2009. Although not part of this Proxy Statement, we also will send our Annual Report for the fiscal year ended January 31, 2009 (the “2008 Annual Report”), which includes our audited financial statements.

Only stockholders of record of dELiA*s common stock, $.001 par value per share (“Common Stock”), at the close of business on April 22, 2009, or the “record date”, are entitled to vote at the Annual Meeting. The Common Stock is our only authorized class of voting stock. As of April 22, 2009, we had 31,199,889 shares of Common Stock outstanding.

Stockholder of Record: Shares Registered in Your Name

If on April 22, 2009 your shares were registered directly in your name with the Company’s transfer agent, American Stock Transfer & Trust Co, then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to complete, sign and date the enclosed proxy card and to return it promptly in the envelope provided.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on April 22, 2009 your shares were registered in the name of your broker, bank, or other nominee, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank, or other nominee on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your bank, broker or other nominee or you bring a letter from the bank, broker or nominee indicating that you were the beneficial owner of the shares on April 22, 2009, the record date for voting.

Each share of Common Stock that you own entitles you to one vote.

1

Table of Contents

Stockholder of Record: Shares Registered in Your Name

Whether or not you plan to attend the Annual Meeting, we urge you to complete, sign and date the enclosed proxy card and to return it promptly in the envelope provided. Returning the proxy card will not affect your right to attend the Annual Meeting and vote. If your shares are registered directly in your name through our stock transfer agent, American Stock Transfer & Trust Co., or if you have stock certificates, you may vote by completing, signing and mailing the enclosed proxy card in the envelope provided. Your proxy will be voted in accordance with your instructions. If you sign the proxy card, but do not specify how you want your shares voted, they will be voted as recommended by our Board of Directors. If you attend the Annual Meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which will be available at the meeting.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other nominee, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from us. Simply complete, sign and date the enclosed proxy card and return it promptly in accordance with the instructions of your broker, bank or other nominee.

How Does the Board of Directors Recommend That I Vote on the Proposals?

If we receive a properly completed proxy card in time to vote your “proxies”, Robert E. Bernard, our Chief Executive Officer, Walter Killough, our Chief Operating Officer, and/or David J. Dick, our Chief Financial Officer and Treasurer, will vote the shares as you or your bank, broker or other nominee have directed. If we receive a properly completed proxy card but no specific choices are made, your proxies will vote those shares as recommended by the Board of Directors as follows:

| • | “FOR” the election of the six nominees for director; |

| • | “FOR” ratification of the appointment of BDO Seidman, LLP as our independent registered public accountants for the fiscal year ending January 30, 2010; and |

If any other matter is presented at the Annual Meeting, your proxies will vote in accordance with their best judgment. As of the date of this Proxy Statement, we knew of no matters to be acted on at the Annual Meeting other than those discussed in this Proxy Statement.

If you are a record holder and you give us your proxy, you may revoke it at any time before it is exercised. You may revoke your proxy in any one of the following three ways:

| • | You may send in another proxy with a later date; |

| • | You may notify our Secretary in writing before the Annual Meeting that you have revoked your proxy; or |

| • | You may vote in person at the Annual Meeting. Attending the Annual Meeting in person will not in and of itself revoke a previously submitted proxy unless you specifically request it. |

As noted above, if your shares are held in street name, you must follow the instructions provided by your bank, broker, or other nominee in order to revoke your proxy.

What If I Receive More than One Proxy Card?

If you hold shares of our Common Stock in more than one account, whether as a record holder or in street name, you may receive more than one proxy card, or voting instruction form. If you choose to vote by proxy,

2

Table of Contents

which we recommend, please vote in the manner described under “How Do I Vote By Proxy?” for each account to ensure that all of your shares are voted.

If you hold shares in your own name (rather than in street name) and you plan to attend the Annual Meeting and vote in person, we will give you a ballot when you arrive. However, if your shares are held in the name of your broker, bank or other nominee, you are not the stockholder of record and you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your bank, broker or other nominee or you bring a letter from the bank, broker or nominee indicating that you were the beneficial owner of the shares on April 22, 2009, the record date for voting.

What Is The Effect Of Broker Non-Votes?

If your broker holds your shares in its name, the broker will be entitled to vote your shares on Proposals 1 and 2, even if it does not receive instructions from you. A bank or other nominee holding shares in your name may also have the ability to vote your shares, and we suggest that you contact them to determine whether they may do so. We encourage you to provide voting instructions to ensure your shares will be voted at the Annual Meeting in the manner you desire. If your bank, broker or other nominee does not receive instructions from you and it chooses not to vote on a matter for which it has discretionary voting authority, this is referred to as a “broker non-vote”. Broker non-votes are not counted in determining the shares that are entitled to vote on any matter that may be presented at the Annual Meeting. Accordingly, as to Proposals 1 and 2, broker non-votes will have no effect on the outcome of the vote.

What Vote Is Required To Approve Each Proposal?

Proposal 1: Elect Six Directors.

The six nominees for director who receive the most votes (also known as a “plurality” of the votes) will be elected. You may vote either FOR all of the nominees, WITHHOLD your vote from all of the nominees or WITHHOLD your vote from any one or more of the nominees. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name for the election of directors. If a broker does not exercise this authority, the resulting broker non-votes will not be considered as entitled to be voted for the election of directors and will have no effect on the results of this vote.

Proposal 2: Ratify Selection of Independent Registered Public Accountants.

The affirmative vote of a majority of the shares of Common Stock present, in person or by proxy at the Annual Meeting, and entitled to vote is required to ratify the selection of our independent registered public accountants. You may vote either FOR or AGAINST ratification, or you may ABSTAIN. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, the resulting broker non-votes will not be considered as entitled to be voted on this matter and will have no effect on the results of this vote. However, since a majority of shares of Common Stock present, in person or by proxy at the Annual Meeting, and entitled to vote is required to ratify the selection of our independent registered public accountants, shares that are voted to abstain will have the effect of a vote against ratification.

We are not required to obtain the approval of our stockholders to select our independent registered public accountants. However, if our stockholders do not ratify the selection of BDO Seidman, LLP as our independent registered public accountants for the fiscal year ending January 30, 2010, our Audit Committee will reconsider its selection.

3

Table of Contents

We will keep all the proxies, ballots and voting tabulations private. We let only our Inspector of Election (a representative of American Stock Transfer & Trust Company, our transfer agent) examine these documents.We will, however, forward to management any written comments you make on the proxy card or elsewhere.

Who Pays The Costs Of Soliciting These Proxies?

We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will reimburse them for their expenses.

What Constitutes a Quorum for the Meeting?

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of our Common Stock as of the record date is necessary to constitute a quorum at the Annual Meeting. Votes of stockholders of record who are present at the Annual Meeting in person or by proxy, abstentions and broker non-votes will be counted for purposes of determining whether a quorum exists.

On the record date, there were 31,199,889 shares of our Common Stock outstanding and entitled to vote. Thus, 15,599,945 shares of our Common Stock must be represented by proxy or by stockholders present at the Annual Meeting to have a quorum. If there is no quorum, the chairman of the Annual Meeting or holders of a majority of the votes present at the Annual Meeting may adjourn the Annual Meeting to another time or date.

How Do I Obtain An Annual Report On Form 10-K?

If you would like a copy of our 2008 Annual Report on Form 10-K, which we filed with the Securities and Exchange Commission (the “SEC”) on April 16, 2009 we will send you one without charge. Please write to:

Investor Relations

dELiA*s, Inc.

50 West 23rd Street

New York, NY 10010

Our Annual Report on Form 10-K also is available through the Investor Relations section of our website atwww.deliasinc.com. In addition, you can also find a copy of our 2008 Annual Report on Form 10-K on the Internet through the SEC’s electronic data system atwww.sec.gov.

4

Table of Contents

INFORMATION ABOUT dELiA*s SECURITY OWNERSHIP

The following table sets forth certain information with respect to the beneficial ownership of our Common Stock as of April 22, 2009 (other than as noted below) for (a) each of our named executive officers, as defined in the Summary Compensation Table below, (b) each of our directors, (c) all of our current directors and executive officers as a group and (d) each stockholder known by us to own beneficially more than 5% of our Common Stock. The information with respect to the former named executive officer in the table below is as of the last day of employment with the Company.Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Except where indicated in the footnotes below, the address for each director and executive officer listed is: c/o dELiA*s, Inc., 50 West 23rd Street, New York, New York 10010. We deem shares of Common Stock that may be acquired by an individual or group within 60 days of April 22, 2009, pursuant to the exercise of options or warrants or conversion of convertible securities, to be outstanding for the purpose of computing the percentage ownership of such individual or group, but these shares are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table. Except as indicated in the footnotes to this table, we believe that the stockholders named in this table have sole voting and investment power with respect to all shares of Common Stock shown to be beneficially owned by them based on information provided to us by such stockholders or on information contained in filings by them with the SEC. Percentage of ownership is based on 31,199,889 shares of Common Stock outstanding on April 22, 2009.

| Common Shares Beneficially Owned | ||||||

Name of Beneficial Owner | Number | Percentage (%) | ||||

Executive Officers and Directors: | ||||||

Robert E. Bernard | 1,584,940 | (1) | 5.1 | % | ||

Carter S. Evans | 57,796 | (2) | * | |||

Walter Killough | 547,218 | (3) | 1.8 | % | ||

Paul J. Raffin | 42,427 | (4) | * | |||

Scott M. Rosen | 50,796 | (5) | * | |||

Gene Washington | 50,046 | (6) | * | |||

Michele Donnan Martin | 93,750 | (7) | * | |||

Marc G. Schuback | 6,250 | (8) | * | |||

All current directors and executive officers as a group (9 persons) | 2,438,223 | (9) | 7.8 | |||

Former Executive Officer: | ||||||

Stephen A. Feldman | 30,000 | (10) | ||||

Five Percent Stockholders: | ||||||

T2 Partners Management LP | 2,862,997 | (11) | 9.2 | % | ||

Royce & Associates, LLC | 2,569,685 | (12) | 8.2 | % | ||

Wells Fargo & Company | 2,512,567 | (13) | 8.1 | % | ||

Robert G. Moses and RGM Capital, LLC | 2,295,925 | (14) | 7.4 | % | ||

| * | Less than 1%. |

| (1) | Includes 1,379,255 shares obtainable upon the exercise of options that are currently exercisable or would become exercisable within 60 days. Also includes 1,625 shares held by Mr. Bernard’s wife and 32,270 shares held in trust for the benefit of Mr. Bernard’s children, as to which shares Mr. Bernard disclaims beneficial ownership. |

| (2) | Includes 47,046 shares of restricted stock and 3,750 shares obtainable upon the exercise of options that are currently exercisable or would become exercisable within 60 days. |

| (3) | Includes 530,322 shares obtainable upon the exercise of options that are currently exercisable or would become exercisable within 60 days. |

| (4) | Includes 41,177 shares of restricted stock and 1,250 shares obtainable upon the exercise of options that are currently exercisable or would become exercisable within 60 days. |

| (5) | Includes 47,046 shares of restricted stock and 3,750 shares obtainable upon the exercise of options that are currently exercisable or would become exercisable within 60 days. |

5

Table of Contents

| (6) | Includes 47,046 shares of restricted stock and 2,500 shares obtainable upon the exercise of options that are currently exercisable or would become exercisable within 60 days. |

| (7) | Includes 25,000 shares of restricted stock and 68,750 shares obtainable upon the exercise of options that are currently exercisable or would become exercisable within 60 days. |

| (8) | Shares obtainable upon the exercise of options that are currently exercisable or would become exercisable within 60 days. |

| (9) | This amount includes 5,000 shares obtainable upon the exercise of options that are currently exercisable or would become exercisable within 60 days held by David J. Dick, the Company’s current Chief Financial Officer and Treasurer. |

| (10) | This amount is as of Mr. Feldman’s last day of employment with the Company in January 2009. Includes 25,000 shares obtainable upon the exercise of options that were currently exercisable on that date. |

| (11) | Based on Form 13G filed with the SEC on February 17, 2009. According to this Form 13G, T2 Partners Management, LP has shared voting and dispositive power with respect to such shares, and that T2 Partners Management, LP is the investment manager of T2 Qualified Plan, LP, a Delaware limited partnership, T2 Accredited Fund, LP, a Delaware limited partnership, Tilson Offshore Fund, Ltd., a Cayman Islands limited company and Tilson Focus Fund, a registered investment company. T2 Partners Management, LLC is the General Partner for T2 Accredited Fund, LP and T2 Qualified Fund, LP. T2 Partners Group, LLC controls T2 Partners Management, LP. Whitney R. Tilson and Glenn H. Tongue control T2 Partners Management, LP, T2 Partners Management, LLC and T2 Partners Group, LLC. |

| (12) | Based on a Form 13G filed with the SEC on January 23, 2009. According to this Form 13G, Royce & Associates LLC, an investment adviser registered under the Investment Company Act of 1940, has sole voting and dispositive power with respect to such shares, and the interest of one account, Royce Opportunity Fund, an investment company registered under the Investment Company Act of 1940, which is managed by Royce & Associates LLC, amounted to 1,842,450 shares of Common Stock. |

| (13) | Based on a Form 13G filed with the SEC on March 17, 2009 by Wells Fargo & Company on behalf of itself and on behalf of the following subsidiaries: Wells Capital Management Incorporated, Wells Fargo Funds Management, LLC, Wells Fargo Bank, National Association and Wachovia Securities, LLC. According to this Form 13G, Wells Fargo & Company has sole voting power with respect to 2,448,607 of such shares, sole dispositive power with respect to 2,511,637 of such shares and shared dispositive power with respect to 930 of such shares, and Wells Capital Management Incorporated has sole voting power with respect to 1,983,598 of such shares and sole dispositive power with respect to 2,402,224 of such shares. |

| (14) | Based on a Form 13G filed with the SEC on February 13, 2009. According to this Form 13G, Robert Moses and RGM Capital, LLC each has shared voting and investment power with respect to such shares, and that Robert G. Moses is the managing member of RGM Capital, LLC, a Delaware limited liability company that serves as the general partner of and exercises investment discretion over the accounts of a number of investment vehicles. This Form 13G indicates that none of those investment vehicles has beneficial ownership of 5% or more of our Common Stock. |

6

Table of Contents

INFORMATION ABOUT DIRECTORS AND EXECUTIVE OFFICERS

Our Restated Certificate of Incorporation and By-Laws provide that our business is to be managed by or under the direction of our Board of Directors. Each member of our Board of Directors is elected at each annual meeting of stockholders to serve until the Company’s next annual meeting and until their respective successors have been duly elected and qualified. Our Board of Directors currently consists of six members: Carter S. Evans, Robert E. Bernard, Walter Killough, Paul J. Raffin, Scott M. Rosen and Gene Washington.

Based upon a review by the Board of Directors of all relevant information, the Board of Directors has determined that Messrs. Evans, Rosen, Raffin and Washington are not officers or employees of dELiA*s, none of such persons has a relationship which, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, and that each of them is an “independent director” as that term is defined under Rule 4200(a)(15) of the NASDAQ Marketplace Rules, and is “independent” as that term is defined in the applicable rules and regulations promulgated by the SEC.

Based upon the recommendation of the Corporate Governance and Nominating Committee of our Board of Directors, the Board approved the nomination of each of Messrs. Evans, Bernard, Killough, Raffin, Rosen and Washington for election at the Annual Meeting until the Company’s 2010 Annual Meeting and until their respective successors have been duly elected and qualified.

The names of our current directors and director nominees and certain information about them, including their positions on standing committees of the Board of Directors, are set forth below:

Name | Age | Position | ||

Carter S. Evans (1) | 59 | Chairman and Director | ||

Robert E. Bernard | 58 | Chief Executive Officer and Director | ||

Walter Killough | 54 | Chief Operating Officer and Director | ||

Paul J. Raffin (2) | 55 | Director | ||

Scott M. Rosen (3) | 50 | Director | ||

Gene Washington (4) | 62 | Director |

| (1) | Member of the Compensation Committee, Corporate Governance and Nominating Committee and Chairman of the Audit Committee. |

| (2) | Member of the Corporate Governance and Nominating Committee. |

| (3) | Member of the Audit Committee, Compensation Committee and Chairman of the Corporate Governance and Nominating Committee. |

| (4) | Member of the Audit Committee and Chairman of the Compensation Committee. |

The following is a brief summary of the background of each of our current directors and director nominees:

Carter S. Evans has been a director since February 2006 and was appointed our Chairman of the Board in July 2008. He is currently a Managing Director with Alvarez & Marsal, LLC, a New York-based provider of specialized debtor management and advisory services, a position he has held since January 1995. Prior to joining Alvarez & Marsal, Mr. Evans had over 20 years experience in workouts and turnarounds serving in various capacities at Chemical Bank and later Lehman Brothers. He commenced his career at Price Waterhouse & Co. He has previously served on the boards of Timex Group B.V., Pratt-Read Corp. and the successor to US Financial. During his career, Mr. Evans has served as President of the Arrow Shirt Company and Arrow International (both part of Cluett American Group). He was also actively involved in the restructurings of Chrysler, International Harvester, Federated Department Stores, Allied Stores and General Homes.

Robert E. Bernard has served as our Chief Executive Officer and a director since December 2005. Mr. Bernard joined Alloy, Inc., a media and marketing services company and our former parent company

7

Table of Contents

(“Alloy”), in October 2003 and served as Chief Executive Officer of its Retail and Direct Consumer Division until the our spinoff from Alloy, Inc. in December 2005 (“the Spinoff”). From 1996 through 2002, Mr. Bernard served as the President and Chief Executive Officer of the Limited Stores Division of Limited Brands, Inc., a mall-based specialty store retailer, and from 1994 through 1996 he served as the President and Chief Operating Officer of J.Crew Group, Inc. (“J.Crew”), a multi-channel specialty retailer.

Walter Killough has served as our Chief Operating Officer and a director since December 2005. Mr. Killough joined Alloy, Inc. in March 2003 as a consultant, and served as the Chief Operating Officer of its Retail and Direct Consumer Division from October 2003 until December 2005. Prior to joining Alloy, Mr. Killough was at J.Crew for 14 years. He was appointed its Chief Operating Officer in 2001, and prior to that served as an executive vice president. As its Chief Operating Officer, he was responsible for all sourcing, catalog circulation and production, warehouse and distribution, retail and direct planning and logistics.

Paul J. Raffinhas served as a director since November 2007. Currently, Mr. Raffin is the Global Group Chief Executive Officer of Frette Inc., a provider of luxury linens, a position he has held since January 2008. From February 2007 to January 2008, Mr. Raffin served as Chief Executive Officer of Frette North America. From December 1997 to January 2007 he served in various positions at Limited Brands, Inc., most recently as President of the Express, Inc. division. Prior thereto, he was President, Mail Order of J.Crew; President of Gant, a division of Crystal Brands; and President of the Colours and Coloursport Division of Colours by Alexander Julian. Mr. Raffin has previously served as a director of The Bombay Company, Inc., previously a retailer of home furnishings.

Scott M. Rosen has been a director since December 2005. Mr. Rosen has served as Chief Operating Officer of Equinox Holdings, Inc., a New York-based operator of upscale fitness clubs, since January 2005. Before that, Mr. Rosen was Executive Vice President and Chief Financial Officer of Equinox Holdings, Inc., which he joined in September 2003. Prior to joining Equinox, Mr. Rosen was most recently Executive Vice President/Chief Financial Officer of J.Crew where he worked from 1994 to September 2003. Prior to joining J. Crew, Mr. Rosen was Vice President and Divisional Controller for the Women’s Sportswear Group division of Liz Claiborne, Inc. Mr. Rosen is a non-practicing certified public accountant.

Gene Washingtonhas served as a director since September 2006. Mr. Washington is currently the Principal of the Gene Washington Consulting Group. From June 1994 until his retirement in March 2009, Mr. Washington served as the Director of Football Operations with the National Football League in New York. He previously served as a professional sportscaster and as Assistant Athletic Director for Stanford University prior to assuming his position with the NFL in 1994. Mr. Washington has served as a director of Goodrich Petroleum Corporation, a NYSE-listed oil and gas company, since 2003; has served as a director of GP Strategies Corporation, a NYSE listed company, since 2007 and also served as a director of the former New York Bancorp, Inc.

Committees of the Board of Directors and Meetings

Meeting Attendance. During the fiscal year ended January 31, 2009, there were ten meetings of our Board of Directors. The Board of Directors also acted by unanimous written consent, pursuant to Delaware law, on two occasions during this period. Each director was in attendance, either in person or via telephone, at 75% or more of the total number of meetings of the Board and of committees of the Board on which he served during the fiscal year ended January 31, 2009. The Board has adopted a policy under which each member of the Board is strongly encouraged to attend each annual meeting of our stockholders. All of the members of our Board of Directors standing for re-election attended our 2008 annual meeting of stockholders.

Audit Committee. Our Audit Committee met ten times during the fiscal year ended January 31, 2009. This committee currently has three members, Carter S. Evans (Chairman), Scott M. Rosen and Gene Washington. Our Audit Committee reviews, acts on and reports to the Board of Directors with respect to various auditing and accounting matters, including the selection of our independent auditors, the scope of the annual audits, fees to be

8

Table of Contents

paid to the auditors, the performance of our independent auditors and our accounting practices. The AuditCommittee operates pursuant to a written charter, which was adopted December 5, 2005. The Audit Committeecharter is publicly available on our website atwww.deliasinc.com in the corporate governance section of our investor relations pages.

All of the current members of the Audit Committee are non-employee directors who meet the criteria for independence set forth in Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Rule 4200 of the NASDAQ Marketplace Rules. In addition, our Board of Directors has determined that Scott M. Rosen qualifies as an “audit committee financial expert” as that term is defined in the rules and regulations of the SEC.

Compensation Committee. Our Compensation Committee met ten times and also acted by unanimous written consent on one occasion during the fiscal year ended January 31, 2009. This committee currently has three members, Gene Washington (Chairman), Carter S. Evans and Scott M. Rosen. Our Compensation Committee is authorized to annually review and make recommendations to the Board of Directors with respect to the compensation of directors, executive officers and other key employees and approve and administer our cash incentive, employee benefit and stock incentive plans, including the dELiA*s, Inc. Amended and Restated 2005 Stock Incentive Plan (the “2005 Plan”). Please see also the Compensation Discussion and Analysis set forth elsewhere in this Proxy Statement. The Compensation Committee may designate one or more subcommittees, consisting of one or more members of the Compensation Committee, to exercise the powers and authority of the Compensation Committee. The Board of Directors adopted a Compensation Committee charter on December 5, 2005. The Compensation Committee charter is publicly available on our website atwww.deliasinc.com in the corporate governance section of our investor relations pages.

Corporate Governance and Nominating Committee. Our Corporate Governance and Nominating Committee held five meetings during the fiscal year ended January 31, 2009. Our Corporate Governance and Nominating Committee is currently comprised of Scott M. Rosen (Chairman), Carter S. Evans and Paul J. Raffin. The Corporate Governance and Nominating Committee operates pursuant to a written charter adopted on December 5, 2005. The Corporate Governance and Nominating Committee charter is publicly available on our website atwww.deliasinc.com in the corporate governance section of our investor relations pages.

The Corporate Governance and Nominating Committee is responsible for, among other things, (1) reviewing the appropriate size, function and needs of the Board of Directors, (2) developing the Board’s policy regarding tenure and retirement of directors, (3) establishing criteria for evaluating and selecting new members of the Board, subject to Board approval thereof, (4) identifying and recommending to the Board for approval individuals qualified to become members of the Board of Directors, consistent with criteria established by the Committee and the Board, (5) overseeing the evaluation of management and the Board, and (6) monitoring and making recommendations to the Board on matters relating to corporate governance.

For all potential candidates, the Corporate Governance and Nominating Committee may consider all factors it deems relevant, such as a candidate’s integrity and judgment, business and professional skills and experience, independence, knowledge of the industry in which we operate, possible conflicts of interest, diversity, the extent to which the candidate would fill a present need on the Board, and concern for the long-term interests of stockholders. If a stockholder wishes to nominate a candidate to be considered for election as a director at the 2010 Annual Meeting of Stockholders using the procedures set forth in our By-Laws, it must follow the procedures described in “Certain Matters Pertaining to Stockholder Business and Nominations.” To be timely, a stockholder’s notice nominating a candidate for election to the Board of Directors at an annual meeting must be delivered to the Company’s Secretary at our principal executive offices not later than the close of business on the 45th day nor earlier than the close of business on the 75th day prior to the first anniversary of the preceding year’s mailing date for stockholder proxy materials. In the event that the date of the annual meeting is more than 30 days before or more than 60 days after the date of the annual meeting in the preceding year, or if an annual meeting was not held in the preceding year, notice by the stockholder to be timely must be delivered by the later

9

Table of Contents

of (a) the close of business on the 90th day prior to the date of such stockholders’ meeting or (b) the close of business on the 10th day following the day on which public announcement of the date of such meeting is first made by us. A stockholder’s notice must contain the information set forth in the By-Laws under “Certain Matters Pertaining to Stockholder Business and Nominations.”

In general, the Corporate Governance and Nominating Committee will consider all recommendations submitted by stockholders in the same manner and under the same process as any other recommendations submitted from other sources, including current directors, Company officers and employees, following which it will select candidates to be recommended for nomination to the Board according to the requirements and qualification criteria established by the Corporate Governance and Nominating Committee. However, the Corporate Governance and Nominating Committee is under no obligation to recommend any candidate for nomination.

Codes of Business Conduct and Ethics

We have adopted a Code of Business Conduct, applicable to all employees, as well as a Code of Ethics for Principal Executive Officers and Senior Financial Officers within the meaning of Item 406(b) of Regulation S-K. This Code of Ethics applies to our principal executive officer, principal financial officer, principal accounting officer and others performing similar functions. The Code of Business Conduct and the Code of Ethics each are publicly available on our website atwww.deliasinc.com in the corporate governance section of our investor relations pages.

Communicating with Our Directors

We have adopted a policy regarding stockholder communications with directors. Pursuant to that policy, stockholders who wish to communicate with the Board of Directors as a whole, with any committee of the Board of Directors, with the non-management members of the Board of Directors as a group or with specified non-management directors should do so by sending any communication to dELiA*s, Inc. Board of Directors, c/o Corporate Secretary, 50 West 23rd Street, New York, NY 10010, or by sending an email to legal@deliasinc.com.

Any such communication should state the name and address of, and the number of shares beneficially owned by, the stockholder making the communication. Such communication will be forwarded to the full Board of Directors, a Board committee, the non-management directors or to any individual non-management director or directors, in each case to whom the communication is directed, unless the communication is unduly hostile, threatening, illegal or similarly inappropriate, or is not related to the duties and responsibilities of the Board of Directors, in which case the communication may be discarded or appropriate legal action may be taken regarding the communication.

Director compensation consists principally of cash, an award of options to purchase shares of our Common Stock and awards of shares of restricted stock. The Company’s non-employee directors received the following amounts of compensation for our fiscal year ended January 31, 2009:

Name | Fees Earned or Paid in Cash ($) | Stock Awards ($)(1)(2) | Option Awards ($)(1)(3) | Total ($) | ||||

Carter S. Evans | 64,000 | 47,616 | 659 | 112,275 | ||||

Paul J. Raffin | 42,000 | 30,031 | 2,306 | 74,337 | ||||

Scott M. Rosen | 64,500 | 47,616 | 582 | 112,698 | ||||

Gene Washington | 56,000 | 47,616 | 1,182 | 104,798 | ||||

Former Director | ||||||||

Matthew L. Feshbach | 18,000 | 73,212 | 582 | 91,794 |

10

Table of Contents

| (1) | The amount shown in this column represents the compensation costs for financial statement reporting purposes recognized for fiscal 2008 with respect to stock and option awards, as determined pursuant to SFAS No. 123(R). A discussion of the assumptions used in calculating these values may be found in footnote 10 to our audited financial statements beginning on page F-21 of our Annual Report on Form 10-K for the fiscal year ended January 31, 2009. |

| (2) | Each of Messrs. Evans, Raffin, Rosen and Washington were awarded 22,727 shares of restricted stock in January 2009. The restrictions on these shares lapse equally on each of the first three anniversaries of the grant date. After Mr. Feshbach ceased to be a member of our Board of Directors, the Board of Directors authorized the lapse of restrictions (and the Company’s right of repurchase) on the 22,364 restricted shares then held by Mr. Feshbach. |

| (3) | Each of the named directors was granted options to purchase 5,000 shares of Common Stock upon commencement of service on the Board of Directors. The options vest in equal annual installments on each of the first four anniversaries of the date of grant and expire on the tenth anniversary of the date of grant. As of January 31, 2009, options to purchase 2,500 shares of Common Stock were vested with respect to each of Messrs. Evans and Washington, options to purchase 3,750 shares of Common Stock were vested with respect to Mr. Rosen and options to purchase 1,250 shares of Common Stock were vested with respect to Mr. Raffin. After Mr. Feshbach ceased to be a member of our Board of Directors, his 2,500 unvested options to purchase the Company’s Common Stock were forfeited and cancelled and his 2,500 vested options to purchase the Company’s Common Stock expired without being exercised. |

Equity Compensation

Upon their commencement of service, non-employee directors each receive a grant of options to purchase 5,000 shares of our Common Stock under the 2005 Plan. These options vest equally on each of the first four anniversaries of the grant date, provided that the optionee is still a non-employee director at the opening of business on each such date. Options granted to these directors entitle them to purchase shares of our Common Stock at an exercise price equal to the fair market value of such shares on the date of grant.

For each subsequent year of service, each non-employee director will receive, without cost to such director, the number of shares of our Common Stock that could be purchased for $50,000 at the closing price of such Common Stock on the trading date immediately preceding the award of such shares. These restricted stock shares will be issued pursuant to one or more of our existing stock incentive plans, as such plans may be amended from time to time. These shares will be subject to lapsing rights of repurchase on our part under the applicable plan documents, which repurchase right will entitle us to repurchase the shares for $0.001 per share and which rights will lapse equally on each of the first three anniversaries of the grant date. Such shares will also be subject to the terms and conditions of the plan under which they are awarded and the execution and delivery of restricted stock agreements relating to such shares. The grant date for these restricted stock awards is the first business day of each calendar year. Accordingly, in fiscal 2008, each of Messrs. Evans, Raffin, Rosen and Washington received an award of 22,727 restricted shares on January 2, 2009.

Cash Compensation

Each non-employee director receives an annual retainer of $24,000, payable in equal quarterly installments, and a fee of $1,000 for each meeting of the Board of Directors he or she attends in person or by telephone. Each non-employee director also receives an annual retainer of $8,000, payable in equal quarterly installments, for each committee on which such director serves, and an additional $6,000 annual retainer, payable in equal quarterly installments, for each committee of which such director is the chairman.

Directors who are also our employees do not receive any fees or other compensation for service on our Board of Directors or its committees. We reimburse all directors for reasonable out-of-pocket expenses incurred in attending board or committee meetings.

11

Table of Contents

The following table sets forth certain information regarding our executive officers who are not also directors. All of these executive officers other than Ms. Martin are at-will employees.

Name | Age | Position | ||

Michele Donnan Martin | 45 | President, dELiA*s Brand | ||

David J. Dick | 42 | Chief Financial Officer and Treasurer | ||

Marc G. Schuback | 47 | Vice President, General Counsel and Secretary |

Michele Donnan Martinhas served as President, dELiA*s Brand since January 2008. Prior to that, Ms. Martin served as Chief Design Officer Women’s for Martin + OSA, a retail brand that is part of American Eagle Outfitters, Inc., from January 2005 to June 2007. From 2003 to 2004, she was Vice President and General Manager of C+M Martin, Inc., an apparel design firm which was a joint venture with Brandix Apparel of Sri Lanka. From 2001 to 2002, Ms. Martin served as Senior Vice President and General Manager of Hold Everything, a retail division of Williams-Sonoma, Inc. which offered storage solutions for the home. From 1992 to 1999, Ms. Martin served as Vice President and General Merchandise Manager, Women’s and Girls’ of Abercrombie & Fitch Co., a mall-based specialty apparel retailer.

David J. Dickhas served as our Chief Financial Officer and Treasurer since February 2, 2009 and had served as the Company’s Vice President, Controller and Chief Accounting Officer since April 2008. Prior to that, Mr. Dick served as Chief Financial Officer of Charlie Brown’s Acquisition Corp., a multi-concept casual dining restaurant operator, from 2006 to 2007, and from 1993 to 2006, he worked for Linens ‘n Things, Inc., a specialty retailer of home furnishings, where he held a number of positions including Vice President, Controller and Treasurer. From 1987 to 1992, Mr. Dick worked for Ernst & Young LLP. He is a certified public accountant.

Marc G. Schuback has served as our Vice President, General Counsel and Secretary since August 2007. Prior to that, Mr. Schuback served as Vice President, Assistant General Counsel and Assistant Corporate Secretary of Footstar, Inc., a nationwide footwear retailer, from July 1996 to August 2007.

12

Table of Contents

Compensation Discussion and Analysis

Compensation Objectives

The Company’s compensation policy for executive officers is designed to achieve the following objectives:

| • | to reward executives consistent with the Company’s annual and long-term performance goals; |

| • | to recognize individual initiative, leadership and achievement; and |

| • | to provide competitive compensation that will attract and retain qualified executives, all with a view to enhancing the profitability of the Company and increasing stockholder value. |

To achieve these objectives, the Company’s overall compensation program aims to pay its executive officers competitively, consistent with the Company’s growth and their contribution to that growth. Accordingly, the Company relies on programs that provide compensation in the form of both cash and equity. Although the Compensation Committee has not adopted any formal guidelines for allocating total compensation between cash and equity or long-term and current compensation, the Compensation Committee takes into account the overall compensation packages provided by comparable companies, while also considering the balance between providing short-term incentives and long-term parallel investment with stockholders to align the interests of management with stockholders.

Executive Officer Compensation Program

The Compensation Committee has the primary authority to determine and recommend to the Board of Directors the compensation awards available to the Company’s executive officers. The Compensation Committee performs annual reviews of executive compensation to confirm the competitiveness of the overall executive compensation packages as compared with companies which are similarly situated to the Company in terms of industry, size and stage of development and which compete with the Company for prospective employees. To aid the Compensation Committee in making its determination, the Chief Executive Officer provides recommendations to the Compensation Committee regarding the compensation of all executive officers, excluding himself.

The compensation program for executive officers currently consists of three elements: (1) base salary, which, if not set by the terms of employment agreements between us and our executive officers, is set on an annual basis; (2) annual incentive compensation, in the form of cash bonuses, which is based primarily on achievement of predetermined financial and operational objectives as set forth in the Company’s management incentive plan; and (3) long-term incentive compensation, in the form of stock options granted when the executive officer joins the Company and stock options and/or restricted stock granted periodically thereafter with the objective of aligning the executive officers’ long-term interests with those of the stockholders and encouraging the achievement of superior results over an extended period. The Compensation Committee reviews at least annually the elements of compensation for its executive officers. The amount of each compensation element selected for the executive officers is developed on an individual, case-by-case basis utilizing a number of factors, including publicly available data for comparable companies and the Company’s performance and objectives, as well as the compensation committee’s determination with respect to each executive’s individual contributions to the Company’s performance and objectives.

Elements of Compensation

Base Salary. Base salaries for executive officers are targeted at competitive market levels for their respective positions, levels of responsibility and experience utilizing relevant market data. In addition to external market data, the Compensation Committee also reviews dELiA*s’ financial performance and individual performance when considering the adjustment of base salaries annually. For fiscal 2008, the Compensation

13

Table of Contents

Committee did not grant any discretionary increases in the base salary for our named executive officers. Any salary increases for the named executive officers resulted from contractually specified increases.

Bonus Compensation. Bonus compensation is primarily based on the Company’s achievement of predetermined financial, operational and strategic performance objectives. Giving greatest weight to the attainment of financial targets, the Compensation Committee may also award bonuses based on various operational and strategic objectives, such as management efficiency, and the ability to motivate others and build a strong management team, develop and maintain the skills necessary to work in a high-growth company, recognize and pursue new business opportunities and initiate and implement programs to enhance the Company’s growth and successes. The Compensation Committee considers the award of bonuses on an annual basis. The Compensation Committee believes that the payment of annual bonuses in cash provides incentives that are important to retain executive officers and reward them for short-term Company performance.

Generally, the Compensation Committee approves the Company’s Management Incentive Plan (the “MIP”), which establishes a bonus pool for the payment of cash bonus awards, based upon the Company’s achievement of specified EBIT or EBITDA levels, as defined in the MIP, for each fiscal year to specified employees of the Company, including the named executive officers. Set forth below are the percentages of base salary each of our current executive officers is entitled to receive, pursuant to the terms of their respective employment agreements and offer letters with us, under any approved MIP in the event that the Company achieved the approved target EBIT or EBITDA level:

Name | Target EBIT/EBITDA | ||

Robert E. Bernard | 90 | % | |

Walter Killough | 60 | % | |

Michele Donnan Martin | 60 | % | |

David J. Dick | 30 | % | |

Marc G. Schuback | 30 | % |

As the Company’s structure was uncertain in fiscal 2008 as a result of the evaluation of and closing in the fourth quarter of fiscal 2008 of the CCS transaction, the Compensation Committee did not approve a MIP for fiscal 2008. However, Ms. Martin did receive incentive compensation in fiscal 2008 as specified in her employment agreement and as indicated in the Summary Compensation Table below. In addition, the Compensation Committee approved special bonuses to Messrs. Bernard, Killough and Schuback of $216,625, $216,625 and $42,750, respectively in consideration of their performance in connection with the successful completion of the CCS transaction.

Long–Term Incentive Compensation. The Compensation Committee administers the 2005 Plan, which provides for the grant of both restricted stock and options, on a tax–deferred basis. The 2005 Plan provides that (1) the exercise price of options granted under the 2005 Plan must equal at least 100% of the fair market value of the Common Stock at the time of grant, and (2) the exercise price of awards granted under the 2005 Plan may not be lowered without the approval of the Company’s stockholders.

Long-term incentive compensation, in the form of stock options and restricted stock grants, allows the executive officers to share in the appreciation in the value of the Company’s Common Stock. The Board of Directors believes that the issuance of stock options and restricted stock aligns executive officers’ interests with those of the stockholders and provides incentives to those executive officers to maximize stockholder value. In addition, the Board of Directors believes that equity ownership by executive officers helps to balance the short-term focus of annual incentive compensation with a longer term view and may help to retain key executive officers.

When establishing grant levels, the Compensation Committee considers general corporate performance, the level of seniority, experience and responsibilities, existing levels of stock ownership, previous grants, vesting schedules of outstanding options and restricted stock and the current stock price.

14

Table of Contents

It is the standard policy of the Company to make an initial stock option grant to all executive officers at the time they commence employment with the Company, consistent with the number of options granted to executive officers in similarly situated companies at similar levels of seniority. In addition, the Compensation Committee may also make performance–based grants of options and/or restricted stock throughout the year. In making such performance–based grants, individual contributions to the Company’s financial, operational and strategic objectives are considered.

Other Compensation. The Company’s executive officers are entitled to the various benefits offered by the Company from time to time to its employees, including medical, dental, life, accidental death and dismemberment, and disability insurance, and to participate in the Company’s 401(k) plan for its full-time employees. In addition, under the terms of his employment agreement, Mr. Bernard receives $20,000 per annum for application to a term life insurance policy for the benefit of a beneficiary to be designated by Mr. Bernard.

Certain Accounting and Tax Considerations.The Compensation Committee is aware that base salary, bonuses, stock-based awards, and other elements of the Company’s compensation programs for executive officers generate charges to earnings under generally accepted accounting principles (including as provided in SFAS 123R). The Compensation Committee generally does not adjust compensation components based on accounting factors. With respect to the tax treatment of compensation, the Compensation Committee will consider the tax effect of types of compensation, including whether it should structure incentive compensation to secure the deduction for performance-based compensation under Section 162(m) of the Internal Revenue Code of 1986, as amended. Section 162(m) denies a deduction for compensation paid to an executive officer in a taxable year if that compensation is in excess of $1,000,000, unless the excess amount meets the definition of “performance-based compensation.” It is the Compensation Committee’s present intention that, as long as consistent with its overall compensation objectives, substantially all executive compensation will be deductible for federal income tax purposes. It is possible, however, that portions of any future grants or awards may not qualify as performance-based compensation and, when combined with other compensation to an executive officer, may exceed this limitation in any particular year.

Compensation Committee Report

The Compensation Committee of our Board of Directors has reviewed and discussed the Compensation Discussion and Analysis with management. Based on this review and discussions, the Compensation Committee recommended to our Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement.

The Compensation Committee

Gene Washington

Carter S. Evans

Scott M. Rosen

15

Table of Contents

The information under this heading summarizes the compensation awarded, paid to or earned during our last fiscal year by our Chief Executive Officer, Chief Financial Officer, and certain other of our executive officers, whom we collectively refer to as our “named executive officers,” for services rendered to the Company during the fiscal years ended January 31, 2009, February 2, 2008 and February 3, 2007.

Name and Principal Position | Year | Salary ($) | Bonus ($) | Option and Stock Awards ($)(1) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($) | Total ($) | |||||||||||

Robert E. Bernard | 2008 | 607,500 | 216,625 | (2) | 75,229 | 27,000 | (3) | 926,354 | ||||||||||

Chief Executive Officer | 2007 | 600,000 | 130,286 | — | 28,673 | (3) | 758,959 | |||||||||||

| 2006 | 600,000 | 381,663 | 270,000 | (4) | 20,000 | (3) | 1,271,663 | |||||||||||

Walter Killough | 2008 | 378,796 | 216,625 | (2) | 36,689 | 6,491 | (5) | 638,601 | ||||||||||

Chief Operating Officer | 2007 | 375,000 | 54,921 | — | — | 429,921 | ||||||||||||

| 2006 | 375,000 | 147,672 | 112,500 | (4) | — | 635,172 | ||||||||||||

Michele Donnan Martin (7) | 2008 | 500,000 | 117,592 | (8) | 120,000 | (6) | — | 737,592 | ||||||||||

President, dELiA*s Brand | 2007 | 9,615 | 1,986 | (8) | — | — | 11,601 | |||||||||||

| 2006 | — | — | — | — | — | |||||||||||||

Stephen A. Feldman (7) | 2008 | 350,000 | 57,984 | — | 39,028 | (9) | 447,012 | |||||||||||

Chief Financial Officer and | 2007 | 323,077 | 136,951 | — | 25,224 | (9) | 485,252 | |||||||||||

Treasurer | 2006 | — | — | — | — | — | ||||||||||||

Marc G. Schuback (7) | 2008 | 284,808 | 42,750 | (2) | 9,072 | 7,452 | (10) | 344,082 | ||||||||||

Vice President, General | 2007 | 124,808 | 4,564 | — | 529 | (10) | 129,901 | |||||||||||

Counsel and Secretary | 2006 | — | — | — | — | — |

| (1) | The amount shown in this column represents compensation costs for financial statement reporting purposes recognized in fiscal 2008 with respect to option awards and restricted stock awards (to Ms. Martin only), as determined pursuant to SFAS No. 123(R). A discussion of the assumptions used in calculating these values may be found in footnote 10 to our audited consolidated financial statements beginning on page F-21 of our Annual Report on Form 10-K for the fiscal year ended January 31, 2009. |

| (2) | Represents special bonus awarded in consideration of performance in connection with the sale of the Company’s former CCS business. |

| (3) | For 2008, represents $20,000 paid to Mr. Bernard to be applied to a term life insurance policy for the benefit of a beneficiary to be designated by Mr. Bernard and $7,000 representing the amount of the Company match pursuant to the Company’s 401(K) plan. For 2007, represents $20,000 paid to Mr. Bernard to be applied to a term life insurance policy for the benefit of a beneficiary to be designated by Mr. Bernard and $8,673 representing the amount of the Company match pursuant to the Company’s 401(K) plan. For 2006, represents $20,000 paid to Mr. Bernard to be applied to a term life insurance policy for the benefit of a beneficiary to be designated by Mr. Bernard. |

| (4) | Represents bonuses awarded pursuant to the Company’s 2006 Management Incentive Plan described in the Company’s 2006 proxy statement, which bonuses were earned in 2006 and paid in full in cash in April 2007. |

| (5) | Represents the amount of the Company match pursuant to the Company’s 401(K) plan. |

| (6) | Represents the portion of Ms. Martin’s annual incentive award payable in 2008 as specified in her employment agreement. |

| (7) | Ms. Martin’s employment with the Company commenced January 28, 2008. Mr. Feldman’s employment with the Company commenced February 26, 2007 and ended January 30, 2009. Mr. Schuback’s employment with the Company commenced August 15, 2007. |

| (8) | Ms. Martin was granted options to purchase 275,000 shares of our Common Stock at an exercise price of $1.96 per share and was granted 25,000 shares of restricted stock upon the commencement of her employment with the Company on January 28, 2008. For 2007, $1,467 of this amount relates to options granted and $519 of this amount relates to restricted stock granted. For 2008, $88,804 of this amount relates to options granted and $28,788 of this amount relates to restricted stock granted. |

16

Table of Contents

| (9) | For 2008, represents $39,028 paid to Mr. Feldman for relocation expenses and $7,867 representing the amount of the Company match pursuant to the Company’s 401(K) plan. For 2007, represents $17,484 paid to Mr. Feldman for relocation expenses and $7,740 representing the amount of the Company match pursuant to the Company’s 401(K) plan. |

| (10) | Represents the amount of the Company match pursuant to the Company’s 401(K) plan. |

The following tables set forth information concerning grants of plan-based awards made by the Company during the fiscal year ended January 31, 2009 to the named executive officers.

Name | Grant Date | All Other Option Awards: Number of Securities Underlying Options (#) | Exercise or Base Price of Option Awards ($/sh) | Grant Date Fair Value of Option Awards ($)(1) | ||||||

Robert E. Bernard | 12/02/2008 | 304,000 | $ | 2.13 | $ | 300,710 | ||||

Walter Killough | 12/02/2008 | 182,500 | $ | 2.13 | $ | 180,526 | ||||

Marc G. Schuback | 03/17/2008 | 10,000 | $ | 1.59 | $ | 8,308 | ||||

| (1) | The amount shown in this column represents the full grant date fair value of the awards, as determined pursuant to SFAS No. 123(R). The grant date fair value was based on the closing price of our Common Stock on the date of grant. A discussion of the assumptions used in calculating these values may be found in footnote 10 to our audited consolidated financial statements beginning on page F-21 of our Annual Report on Form 10-K for the fiscal year ended January 31, 2009. |

Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table

Employment Agreements

During our fiscal year ended January 31, 2009, we were a party with Robert Bernard, our Chief Executive Officer, to an employment agreement, as amended, which first became effective on December 19, 2005 and had a termination date of December 18, 2008 (the “Original Bernard Employment Agreement”). The Original Bernard Employment Agreement provided for Mr. Bernard’s employment as our Chief Executive Officer and for his nomination as a director of the Company during this agreement’s term. The Original Bernard Employment Agreement provided for an initial base salary of $600,000 per annum, plus a potential annual bonus of up to 60% of his base salary for financial targets achieved and an additional annual bonus of up to 20% of his base salary at the discretion of our Board of Directors, unless otherwise provided in any other bonus plan adopted by the Company. Mr. Bernard was also entitled to receive the various benefits offered by us from time to time to our employees. We also agreed to pay an annual premium of no more than $20,000 for a term life insurance policy for the benefit of a beneficiary designated by Mr. Bernard.

On December 2, 2008, the Company entered into a new employment agreement (the “CEO Agreement”) with Mr. Bernard which replaced the Original Bernard Employment Agreement. The CEO Agreement is for a four-year term (subject to earlier termination as provided in the CEO Agreement), renewing automatically for successive one-year terms unless terminated by either party. Mr. Bernard is entitled to receive a base salary of not less than $650,000, subject to annual review by the Compensation Committee of the Board of Directors. Mr. Bernard also is entitled to participate in the Company’s Management Incentive Plan each year during the term of his employment, subject to the terms and conditions of that plan governing eligibility and participation, with a target annual incentive award opportunity of not less than 90% of his base salary. In addition, Mr. Bernard is eligible to receive stock incentive awards under the 2005 Plan and other benefits as are made available to the Company’s employees generally. Pursuant to the terms of the CEO Agreement, on December 2, 2008, Mr. Bernard received an initial grant of options to purchase 304,000 shares of Common Stock. These options have an exercise price per share of $2.13 and vest in four equal annual installments commencing on the first

17

Table of Contents

anniversary of the CEO Agreement and continuing thereafter on the next three succeeding anniversary dates of the CEO Agreement. During the term of the CEO Agreement, the Company will nominate Mr. Bernard to serve as a member of the Board at each annual meeting of stockholders. Upon the termination of Mr. Bernard’s employment, he will be deemed to have resigned from the Board and the board of any subsidiary of the Company if he is then currently serving on the Board or the board of any subsidiary.

If the CEO Agreement is terminated for Cause (as defined in the CEO Agreement), Mr. Bernard will be entitled to receive (i) his base salary through the date of termination; (ii) the right to exercise all outstanding vested stock options that are vested as of the date of termination during the 30-day period following such date, and all unvested stock options will be forfeited and cancelled; and (iii) additional benefits to the extent then due or earned. If the CEO Agreement is terminated without Cause or is constructively terminated without cause (as defined in the CEO Agreement), Mr. Bernard will be entitled to receive (a) his base salary through the date of termination; (b) his base salary for a period of 12 months following the date of termination; (c) a lump sum payment equal to one times target bonus under the Company’s Management Incentive Plan within 30 days of the date of termination; (d) the vesting of all unvested options as of the date of termination and the right to exercise all outstanding stock options that are vested as of the date of termination during the one-year period following such date, or for the remainder of the exercise period, if less; (e) continued participation in the Company’s medical and dental benefit plans during the 12-month period following the date of termination; and (f) additional benefits to the extent then due or earned. If the CEO Agreement is terminated without Cause or is constructively terminated without cause within one year following a Change of Control (as defined in the CEO Agreement), Mr. Bernard will be entitled to receive (1) his base salary through the date of termination; (2) his base salary for a period of 18 months following the date of termination; (3) a lump sum payment equal to one times target bonus under the Company’s Management Incentive Plan within 30 days of the date of termination; (4) the vesting of all unvested options as of the date of termination and the right to exercise all outstanding stock options that are vested as of the date of termination during the one-year period following such date, or for the remainder of the exercise period, if less; (5) continued participation in the Company’s medical and dental benefit plans during the 18-month period following the date of termination; and (6) additional benefits to the extent then due or earned.

The CEO Agreement also contains customary confidentiality provisions, as well as non-competition and non-solicitation provisions that extend for a minimum of one-year following termination of Mr. Bernard’s employment with the Company.

During our fiscal year ended January 31, 2009, we were also a party with Walter Killough, our Chief Operating Officer, to an employment agreement, as amended, which first became effective on December 19, 2005 and had a termination date of December 19, 2008 (the “Original Killough Employment Agreement”). The Original Killough Employment Agreement provided for Mr. Killough’s employment as our Chief Operating Officer and for his nomination as a director of the Company during this agreement’s term. The Original Killough Employment Agreement provided for an initial base salary of $375,000 per annum, plus a potential annual cash bonus up to 25% of his base salary, unless otherwise provided in any other bonus plan adopted by the Company. Mr. Killough was also entitled to receive the various benefits offered by us from time to time to our employees.

On December 2, 2008, the Company entered into a new employment agreement (the “COO Agreement”) with Mr. Killough which replaced the Original Killough Employment Agreement. The COO Agreement is for a four-year term (subject to earlier termination as provided in the COO Agreement), renewing automatically for successive one-year terms unless terminated by either party. Mr. Killough will receive a base salary of not less than $400,000, subject to annual review by the Compensation Committee of the Board of Directors. Mr. Killough is entitled to participate in the Company’s Management Incentive Plan each year during the term of his employment, subject to the terms and conditions of that plan governing eligibility and participation, with a target annual incentive award opportunity of not less than 60% of his base salary, subject to annual review. Mr. Killough is eligible to receive stock incentive awards under the 2005 Plan and other benefits as are made available to the Company’s employees generally. Pursuant to the terms of the COO Agreement, on December 2, 2008, Mr. Killough received an initial grant of options to purchase 182,500 shares of Common Stock. These options have an exercise price per share of

18

Table of Contents

$2.13 and vest in four equal annual installments commencing on the first anniversary of the date of the COO Agreement and continuing thereafter on the next three succeeding anniversary dates of the COO Agreement.

During the term of the COO Agreement, the Company will nominate Mr. Killough to serve as a member of the Board at each annual meeting of stockholders. Upon the termination of Mr. Killough’s employment, he will be deemed to have resigned from the Board and the board of any subsidiary of the Company if he is then currently is serving on the Board or the board of any subsidiary.

If the COO Agreement is terminated for Cause (as defined in the COO Agreement), Mr. Killough will be entitled to receive (i) his base salary through the date of termination; (ii) the right to exercise all outstanding vested stock options that are vested as of the date of termination during the 30-day period following such date and all unvested stock options will be forfeited and cancelled; and (iii) additional benefits to the extent then due or earned. If the COO Agreement is terminated without Cause or is constructively terminated (as defined in the COO Agreement), Mr. Killough will be entitled to receive (a) his base salary through the date of termination; (b) his base salary for a period of 12 months following the date of termination; (c) a lump sum payment equal to one times target bonus under the Company’s Management Incentive Plan within 30 days of the date of termination; (d) the vesting of all unvested options as of the date of termination and the right to exercise all outstanding stock options that are vested as of the date of termination during the one-year period following such date, or for the remainder of the exercise period, if less; (e) continued participation in the Company’s medical and dental benefit plans during the 12-month period following the date of termination; and (f) additional benefits to the extent then due or earned. If the event the COO Agreement is terminated without Cause or is constructively terminated within one-year following a Change of Control (as defined in the COO Agreement), Mr. Killough will be entitled to receive (1) his base salary through the date of termination; (2) his base salary for a period of 18 months following the date of termination; (3) a lump sum payment equal to one times target bonus within 30 days of the date of termination; (4) the vesting of all unvested options as of the date of termination and the right to exercise all outstanding stock options that are vested as of the date of termination during the one-year period following such date, or for the remainder of the exercise period, if less; (5) continued participation in the Company’s medical and dental benefit plans during the 18-month period following the date of termination; and (6) additional benefits to the extent then due or earned.

The COO Agreement also contains customary confidentiality provisions, as well as non-competition and non-solicitation provisions that extend for a minimum of one-year following termination of Mr. Killough’s employment with the Company.