Table of Contents

Exhibit 10.2

Execution Version

LETTER OF CREDIT AGREEMENT

Dated as of June 14, 2013 by and among

DELIA*S, INC.

(as the Lead Applicant),

THE OTHER APPLICANTS PARTY HERETO FROM TIME TO TIME,

and GENERAL ELECTRIC CAPITAL CORPORATION

****************************************

Table of Contents

ARTICLE I. THE CREDITS | 1 | |||||

1.1 The Letter of Credit Facility | 1 | |||||

1.2 Transaction Accounts | 3 | |||||

1.3 Fees and Interest | 5 | |||||

1.4 Payments by the Applicants | 6 | |||||

1.5 Lead Applicant | 7 | |||||

ARTICLE II. CONDITIONS PRECEDENT | 8 | |||||

2.1 Conditions of Initial Issuance | 8 | |||||

2.2 Conditions to the Issuance of each Letter of Credit | 9 | |||||

ARTICLE III. REPRESENTATIONS AND WARRANTIES | 9 | |||||

3.1 Corporate Existence and Power | 10 | |||||

3.2 Corporate Authorization; No Contravention | 10 | |||||

3.3 Governmental Authorization | 10 | |||||

3.4 Binding Effect | 11 | |||||

3.5 Litigation | 11 | |||||

3.6 No Default | 11 | |||||

3.7 Solvency | 12 | |||||

3.8 Ventures, Subsidiaries and Affiliates; Outstanding Stock | 12 | |||||

3.9 Jurisdiction of Organization; Chief Executive Office | 12 | |||||

3.10 Foreign Assets Control Regulations and Anti-Money Laundering | 12 | |||||

3.11 Patriot Act | 13 | |||||

3.12 ERISA Compliance | 13 | |||||

3.13 Margin Regulations | 13 | |||||

3.14 Taxes | 14 | |||||

3.15 Regulated Entities. | 14 | |||||

3.16 Brokers’ Fees; Transaction Fees | 14 | |||||

ARTICLE IV. AFFIRMATIVE COVENANTS | 14 | |||||

4.1 Financial Statements | 14 | |||||

4.2 Certificates; Other Information | 16 | |||||

4.3 Notices | 17 | |||||

4.4 Preservation of Corporate Existence, Etc. | 18 | |||||

4.5 Payment of Obligations | 18 | |||||

4.6 Compliance with Laws | 19 | |||||

4.7 Use of the L/C Facility | 19 | |||||

4.8 The Cash Collateral Account | 19 | |||||

4.9 Further Assurances | 20 | |||||

Table of Contents

ARTICLE V. NEGATIVE COVENANTS | 20 | |||||

5.1 Consolidations and Mergers | 20 | |||||

5.2 Change in Business | 21 | |||||

5.3 Change in Structure | 21 | |||||

5.4 Changes in Accounting, Name or Jurisdiction of Organization | 21 | |||||

5.5 OFAC; Patriot Act | 21 | |||||

5.6 Margin Stock; Use of Proceeds | 21 | |||||

5.7 Compliance with ERISA | 21 | |||||

ARTICLE VI. EVENTS OF DEFAULT | 22 | |||||

6.1 Events of Default | 22 | |||||

6.2 Remedies | 24 | |||||

6.3 Rights Not Exclusive | 24 | |||||

6.4 Cash Collateral Account | 24 | |||||

ARTICLE VII. MISCELLANEOUS | 25 | |||||

7.1 Amendments and Waivers | 25 | |||||

7.2 Notices | 25 | |||||

7.3 Electronic Transmissions | 26 | |||||

7.4 No Waiver; Cumulative Remedies | 27 | |||||

7.5 Costs and Expenses | 27 | |||||

7.6 Indemnity | 28 | |||||

7.7 Marshaling; Payments Set Aside | 28 | |||||

7.8 Successors and Assigns | 29 | |||||

7.9 Assignments and Participations; Binding Effect | 29 | |||||

7.10 Non-Public Information; Confidentiality | 30 | |||||

7.11 Set-off; Sharing of Payments | 31 | |||||

7.12 Counterparts; Facsimile Signature | 32 | |||||

7.13 Severability | 32 | |||||

7.14 Captions | 32 | |||||

7.15 Independence of Provisions | 32 | |||||

7.16 Interpretation | 32 | |||||

7.17 No Third Parties Benefited | 33 | |||||

7.18 Governing Law and Jurisdiction | 33 | |||||

7.19 Waiver of Jury Trial | 34 | |||||

7.20 Entire Agreement; Release; Survival | 34 | |||||

7.21 Patriot Act | 35 | |||||

7.22 Joint and Several | 35 | |||||

7.23 Creditor-Debtor Relationship | 35 | |||||

ARTICLE VIII. TAXES, YIELD PROTECTION AND ILLEGALITY | 36 | |||||

8.1 Taxes | 36 | |||||

8.2 Increased Costs and Reduction of Return | 39 | |||||

8.3 Certificates of Claimants | 40 | |||||

ii

Table of Contents

ARTICLE IX. DEFINITIONS | 40 | |||||

9.1 Defined Terms | 40 | |||||

9.2 Other Interpretive Provisions | 53 | |||||

9.3 Accounting Terms and Principles | 54 | |||||

9.4 Payments | 54 | |||||

iii

Table of Contents

SCHEDULES

Schedule A | Applicants | |

Schedule B | GECB Letters of Credit | |

Schedule C | Inactive Subsidiaries | |

Schedule D | Rollover Letters of Credit | |

Schedule 3.5 | Litigation | |

Schedule 3.8 | Ventures, Subsidiaries and Affiliates; Outstanding Stock | |

Schedule 3.9 | Jurisdiction of Organization; Chief Executive Office | |

Schedule 3.14 | Closing Date Tax Audits/Examinations |

EXHIBITS

Exhibit 1.1(a) | Form of L/C Request | |

Exhibit 2.1 | Closing Checklist | |

Exhibit 4.2(b) | Form of Compliance Certificate | |

Exhibit 9.1 | Form of Assignment |

iv

Table of Contents

LETTER OF CREDIT AGREEMENT

ThisLETTER OF CREDIT AGREEMENT (including all exhibits and schedules hereto, as the same may be amended, modified and/or restated from time to time, this “Agreement”) is entered into as of June 14, 2013, by and amongDELIA*S, INC., a Delaware corporation (the “Parent”), in its capacities as an Applicant and as the Lead Applicant, each of the other Persons identified onSchedule A as Applicants (together with the Parent, referred to herein collectively as the “Applicants” and each, individually, an “Applicant”), andGENERAL ELECTRIC CAPITAL CORPORATION, a Delaware corporation (“GE Capital”).

W I T N E S S E T H:

WHEREAS, the Applicants have requested, and the L/C Issuers have agreed to make available to the Applicants, Letters of Credit upon and subject to the terms and conditions set forth in this Agreement.

NOW,THEREFORE, in consideration of the mutual agreements, provisions and covenants contained herein, the parties hereto agree as follows:

ARTICLE I.

THE CREDITS

1.1The Letter of Credit Facility.

(a)Letters of Credit. Subject to the terms and conditions of this Agreement, GE Capital hereby establishes a letter of credit facility (the “L/C Facility”) in the Applicants’ favor pursuant to which GE Capital shall cause Letters of Credit for the account of one or more of the Applicants to be Issued as provided herein.

(i)Conditions. On the terms and subject to the conditions contained herein, the Lead Applicant may request that one or more L/C Issuers Issue, in accordance with such L/C Issuers’ usual and customary business practices and for the account of the Applicants and in accordance with this Agreement, Letters of Credit (denominated in Dollars) from time to time on any Business Day during the period from the Closing Date through the date that is seven (7) days prior to the Maturity Date;provided,however, that no L/C Issuer shall Issue any Letter of Credit upon the occurrence of any of the following or, if after giving effect to such Issuance:

(A)(i) the Letter of Credit Obligations for all Letters of Credit would exceed the Credit Limit or (ii) the aggregate funds on deposit in the Cash Collateral Account would be less than 105% of all Letter of Credit Obligations;

(B) the expiration date of such Letter of Credit (i) is not a Business Day, (ii) is more than one year after the date of Issuance thereof or (iii)

Table of Contents

is later than seven (7) days prior to the Maturity Date;provided,however, that any Letter of Credit with a term not exceeding one year may provide for its renewal for additional periods not exceeding one year as long as (x) each of the Applicants and the applicable L/C Issuer have the option to prevent such renewal before the expiration of such term or any such period and (y) neither such L/C Issuer nor any Applicant shall permit any such renewal to extend such expiration date beyond the date set forth inclause (iii) above; or

(C)(i) any fee due undersubsection 1.3(c) in connection with, and on or prior to, such Issuance has not been paid, (ii) such Letter of Credit is requested to be Issued in a form that is not acceptable to such L/C Issuer or (iii) such L/C Issuer shall not have received, each in form and substance reasonably acceptable to it and duly executed by the Applicants or the Lead Applicant on their behalf, the documents that such L/C Issuer generally uses in the Ordinary Course of Business for the Issuance of letters of credit of the type of such Letter of Credit (collectively, the “L/C Reimbursement Agreement”).

In the event that any term contained in the L/C Reimbursement Agreement shall be contrary to any term contained in this Agreement, this Agreement shall control and govern and such contrary provision shall be given no force or effect. Furthermore, GE Capital as an L/C Issuer may elect only to Issue Letters of Credit in its own name and may only Issue Letters of Credit to the extent permitted by Requirements of Law, and such Letters of Credit may not be accepted by certain beneficiaries such as insurance companies. For each Issuance, the applicable L/C Issuer may, but shall not be required to, determine that, or take notice whether, the conditions precedent set forth inSection 2.2 have been satisfied or waived in connection with the Issuance of any Letter of Credit.

(ii)Notice of Issuance. The Lead Applicant shall give the applicable L/C Issuer a notice of any requested Issuance of any Letter of Credit, which shall be effective only if received by such L/C Issuer not later than 2:00 p.m. (New York time) on the third Business Day prior to the date of such requested Issuance. Such notice shall be made in a writing or Electronic Transmission substantially in the form ofExhibit 1.1(a) duly completed or in a writing in any other form acceptable to such L/C Issuer (an “L/C Request”).

(iii)Reimbursement Obligations of the Applicants. Applicants jointly and severally agree to pay to the L/C Issuer of any Letter of Credit, or to GE Capital for the benefit of such L/C Issuer, upon demand the L/C Reimbursement Obligation owing with respect to such Letter of Credit in the event such L/C Issuer makes any payment to the beneficiary of such Letter of Credit. Upon the payment by the applicable L/C Issuer to the beneficiary of any Letter of Credit, such L/C Issuer shall notify the Lead Applicant that such payment has been made under such Letter of Credit and that the L/C Reimbursement Obligation owing with respect to such Letter of Credit is then due and owing;provided,however, that any failure to give or delay in giving such notice shall not relieve the Applicants of their L/C Reimbursement Obligation in respect of such Letter of Credit. The Applicants agree that at any time on or after the date upon

2

Table of Contents

which any L/C Reimbursement Obligation arises or any other Obligation becomes due and owing GE Capital shall have the right, without prior notice to or demand upon any of the Applicants, to withdraw funds or Cash Equivalents from the Cash Collateral Account in the amount of such L/C Reimbursement Obligation or other Obligation and apply such funds or Cash Equivalents to pay such L/C Reimbursement Obligation or other Obligation.

(iv)Obligations Absolute. The obligations of the Applicants pursuant toclause (iii) above shall be absolute, unconditional and irrevocable and performed strictly in accordance with the terms of this Agreement irrespective of (A) (i) the invalidity or unenforceability of any term or provision in any Letter of Credit, any document transferring or purporting to transfer a Letter of Credit, any Credit Document (including the sufficiency of any such instrument), or any modification to any provision of any of the foregoing, (ii) any document presented under a Letter of Credit being forged, fraudulent, invalid, insufficient or inaccurate in any respect or failing to comply with the terms of such Letter of Credit or (iii) any loss or delay, including in the transmission of any document, (B) the existence of any setoff, claim, abatement, recoupment, defense or other right that any Person (including any Applicant) may have against the beneficiary of any Letter of Credit or any other Person, whether in connection with any Credit Document or any other Contractual Obligation or transaction, or the existence of any other withholding, abatement or reduction, (C) in the case of the obligations of the L/C Issuer, (i) the failure of any condition precedent set forth inSection 2.2 to be satisfied or (ii) any adverse change in the condition (financial or otherwise) of any Applicant and (D) any other act or omission to act or delay of any kind of the L/C Issuer or any other Person or any other event or circumstance whatsoever, whether or not similar to any of the foregoing, that might, but for the provisions of thisclause (iv), constitute a legal or equitable discharge of any obligation of the Applicants or the L/C Issuer hereunder. No provision hereof shall be deemed to waive or limit the Applicants’ right to seek repayment of any payment of any L/C Reimbursement Obligations from the L/C Issuer under the terms of the applicable L/C Reimbursement Agreement or applicable law.

(v)Rollover Letters of Credit. Each of the Rollover Letters of Credit shall be deemed to have been Issued under this Agreement and shall be considered a Letter of Credit for all purposes under this Agreement and the other Credit Documents in accordance with the terms of the Transfer of Liability for Letters of Credit.

1.2Transaction Accounts.

(a) GE Capital shall record on its books and records the face amount of each Letter of Credit Issued hereunder, any unpaid L/C Reimbursement Obligation, all interest accrued and unpaid thereon and any fees, costs, expenses or other Obligations that have accrued and/or become payable pursuant to this Agreement. GE Capital shall deliver to the Lead Applicant on a monthly basis a statement setting forth such record for

3

Table of Contents

the immediately preceding calendar month. Such record shall, absent manifest error, be conclusive evidence of the amount of the L/C Reimbursement Obligations and other Obligations of the Applicants. Any failure to so record or any error in doing so, or any failure to deliver such statement shall not, however, limit or otherwise affect the L/C Reimbursement Obligations or the other Obligations of the Applicants or provide the basis for any claim against GE Capital.

(b) GE Capital, acting as a non-fiduciary agent of the Applicants solely for tax purposes and solely with respect to the actions described in thissubsection 1.2(b), shall establish and maintain at its address referred to inSection 7.2 (or at such other address as GE Capital may notify the Lead Applicant) (A) a record of ownership (the “Register”) in which GE Capital agrees to register by book entry the interests (including any rights to receive payment hereunder) of GE Capital and each L/C Issuer in the L/C Reimbursement Obligations and the Letter of Credit Obligations, each of their obligations under this Agreement to participate in each Letter of Credit, the Letter of Credit Obligations and the L/C Reimbursement Obligations, and any assignment of any such interest, obligation or right and (B) accounts in the Register in accordance with its usual practice in which it shall record (1) the name and address of each L/C Issuer (and each change thereto pursuant toSection 7.9), (2) the amount of the L/C Reimbursement Obligations due and payable or paid in respect of Letters of Credit and (3) any other payment received by GE Capital from an Applicant and its application to the Obligations.

(c) Notwithstanding anything to the contrary contained in this Agreement, the L/C Reimbursement Obligations are registered obligations, the right, title and interest of each L/C Issuer and its assignees in and to such L/C Reimbursement Obligations shall be transferable only upon notation of such transfer in the Register and no assignment thereof shall be effective until recorded therein and otherwise shall be in accordance with the terms of this Agreement. ThisSection 1.2 andSection 7.9 shall be construed so that the L/C Reimbursement Obligations are at all times maintained in “registered form” within the meaning of Sections 163(f), 871(h)(2) and 881(c)(2) of the Code.

(d) The Applicants, GE Capital, and the L/C Issuers shall treat each Person whose name is recorded in the Register as an L/C Issuer for all purposes of this Agreement. Information contained in the Register with respect to any L/C Issuer shall be available for access by the Applicants, the Lead Applicant, GE Capital and such L/C Issuer during normal business hours and from time to time upon at least one Business Day’s prior notice. No L/C Issuer shall, in such capacity, have access to or be otherwise permitted to review any information in the Register other than information with respect to such L/C Issuer unless otherwise agreed by GE Capital.

4

Table of Contents

1.3Fees and Interest.

(a)Fees. The Applicants shall pay to GE Capital, for its own account, fees in the amounts and at the times set forth in the Fee Letter.

(b)Unused L/C Facility Fee. The Applicants shall pay to GE Capital a fee (the “Unused L/C Facility Fee”) for the account of GE Capital in an amount equal to:

(i) The average daily amount of the Credit Limit during the preceding calendar month, less

(ii) the average daily aggregate outstanding amount of the Letter of Credit Obligations incurred by GE Capital during the preceding calendar month;provided, in no event shall the amount computed pursuant to clauses (i) and (ii) be less than zero,

(iii) multiplied by three-eighths of one percent (0.375%) per annum.

Such fee shall be payable monthly in arrears on the first day of the calendar month following the date hereof and the first day of each calendar month thereafter as well as on the Maturity Date. The Unused L/C Facility Fee provided in thissubsection 1.3(b) shall accrue at all times from and after the execution and delivery of this Agreement.

(c)Letter of Credit Fee. The Applicants agree to pay to GE Capital, as compensation to GE Capital for Letter of Credit Obligations incurred by GE Capital hereunder, (i) without duplication of costs and expenses otherwise payable to GE Capital hereunder or fees otherwise paid by the Applicants, all reasonable costs and expenses, excluding all Taxes and Excluded Taxes, incurred by GE Capital on account of such Letter of Credit Obligations, and (ii) for each calendar month during which any Letter of Credit Obligation shall remain outstanding, a fee (the “Letter of Credit Fee”) in an amount equal to the product of the average daily undrawn face amount of all Letters of Credit Issued, guaranteed or supported by risk participation agreements multiplied by a per annum rate equal to one and three-quarters of one percent (1.75%);provided,however, at GE Capital’s option, while an Event of Default exists (or automatically while an Event of Default undersubsection 7.1(a),7.1(f) or7.1(g) exists), such rate shall be increased by two percent (2.00%) per annum. Such fee shall be paid to GE Capital in arrears on the first day of each calendar month and on the date on which all L/C Reimbursement Obligations have been discharged. In addition, the Applicants shall pay to GE Capital or any other L/C Issuer, as appropriate, on demand, GE Capital’s or such other L/C Issuer’s customary fees at then prevailing rates, without duplication of fees otherwise payable hereunder (including all per annum fees), charges and expenses of GE Capital or such other L/C Issuer in respect of the application for, and the Issuance, negotiation, acceptance, amendment, transfer and payment of, each Letter of Credit or otherwise payable pursuant to the application and related documentation under which such Letter of Credit is Issued.

5

Table of Contents

(d)Interest. Notwithstanding anything to the contrary contained herein, in the event that any L/C Reimbursement Obligations or other Obligations are not paid when due, such L/C Reimbursement Obligations or other Obligations shall bear interest computed from the applicable due date until payment in full at a per annum interest rate equal to the Base Rate plus one and three-quarters of one percent (1.75%) per annum and such interest shall be payable by the Applicants to GE Capital upon demand.

(e)Maximum Lawful Rate. Anything herein to the contrary notwithstanding, the obligations of the Applicants hereunder shall be subject to the limitation that payments of interest shall not be required, for any period for which interest is computed hereunder, to the extent (but only to the extent) that contracting for or receiving such payment by GE Capital would be contrary to the provisions of any law applicable to GE Capital limiting the highest rate of interest which may be lawfully contracted for, charged or received by GE Capital, and in such event the Applicants shall pay GE Capital interest at the highest rate permitted by applicable law (“Maximum Lawful Rate”);provided,however, that if at any time thereafter the rate of interest payable hereunder is less than the Maximum Lawful Rate, the Applicants shall continue to pay interest hereunder at the Maximum Lawful Rate until such time as the total interest received by GE Capital is equal to the total interest that would have been received had the interest payable hereunder been (but for the operation of this paragraph) the interest rate payable since the Closing Date as otherwise provided in this Agreement.

1.4Payments by the Applicants.

(a) All payments to be made by the Applicants on account of any L/C Reimbursement Obligations or any interest, fees and other amounts required to be paid hereunder shall be made without set-off, recoupment, counterclaim or deduction of any kind, shall, except as otherwise expressly provided herein, be made to GE Capital (for the ratable account of the Persons entitled thereto) at the address for payment specified in the signature page hereof in relation to GE Capital (or such other address as GE Capital may from time to time specify in accordance withSection 7.2), including payments utilizing the ACH system, and shall be made in Dollars and by wire transfer or ACH transfer in immediately available funds (which shall be the exclusive means of payment hereunder), no later than 1:00 p.m. (New York time) on the date due. Any payment which is received by GE Capital later than 1:00 p.m. (New York time) may in GE Capital’s discretion be deemed to have been received on the immediately succeeding Business Day and any applicable interest or fee shall continue to accrue. Each Applicant hereby irrevocably waives the right to direct the application during the continuance of an Event of Default of any and all payments in respect of any Obligation and any proceeds of the Cash Collateral Account during such pendency.

6

Table of Contents

(b) If any payment hereunder shall be stated to be due on a day other than a Business Day, such payment shall be made on the next succeeding Business Day, and such extension of time shall in such case be included in the computation of interest or fees, as the case may be.

(c) During the continuance of an Event of Default, GE Capital may apply any and all payments received by it in respect of any Obligation in accordance with clauses first through sixth below. Notwithstanding any provision herein to the contrary, all payments made by the Applicants to GE Capital after any or all of the Obligations have been accelerated (so long as such acceleration has not been rescinded), including proceeds of the Cash Collateral Account, shall be applied as follows:

first, to payment of costs and expenses, including Attorney Costs, of GE Capital payable or reimbursable by the Applicants under the Credit Documents;

second, to payment of Attorney Costs of the L/C Issuers payable or reimbursable by the Applicants under this Agreement;

third, to payment of all accrued unpaid interest on the Obligations and fees owed to GE Capital and the L/C Issuers;

fourth, to payment of principal of the Obligations, including L/C Reimbursement Obligations then due and payable, and cash collateralization of unmatured L/C Reimbursement Obligations to the extent not then due and payable;

fifth, to payment of any other amounts owing constituting Obligations; and

sixth, unless otherwise required by law, be paid to the Applicants in account number XXXXX2090 maintained by the Lead Applicant with JPMorgan Chase, N.A.

In carrying out the foregoing, (i) amounts received shall be applied in the numerical order provided above until exhausted prior to the application to the next succeeding category and (ii) each of the L/C Issuers or other Persons entitled to payment shall receive an amount equal to its pro rata share of amounts available to be applied pursuant to clauses third, fourth and fifth above.

1.5Lead Applicant. Each Applicant hereby designates and appoints the Parent as its representative and agent on its behalf (the “Lead Applicant”) for the purposes of L/C Requests, delivering certificates, giving and receiving all other notices and consents hereunder or under any of the other Credit Documents and taking all other actions (including in respect of compliance with covenants) on behalf of any Applicant or the Applicants under the Credit Documents. The Lead Applicant hereby accepts such appointment. GE Capital

7

Table of Contents

and each other L/C Issuer may regard any notice or other communication pursuant to any Credit Document from the Lead Applicant as a notice or communication from all the Applicants. Each warranty, covenant, agreement and undertaking made on behalf of an Applicant by the Lead Applicant shall be deemed for all purposes to have been made by such Applicant and shall be binding upon and enforceable against such Applicant to the same extent as if the same had been made directly by such Applicant.

ARTICLE II.

CONDITIONS PRECEDENT

2.1Conditions of Initial Issuance. The obligation of GE Capital to cause any L/C Issuer to Issue the initial Letters of Credit hereunder (including the deemed Issuance of the Rollover Letters of Credit) is subject to satisfaction of the following conditions in a manner satisfactory to GE Capital:

(a)Credit Documents. GE Capital shall have received on or before the Closing Date all of the agreements, documents, instruments and other items set forth on the closing checklist attached hereto asExhibit 2.1, each in form and substance reasonably satisfactory to GE Capital;

(b)Repayment of Prior Lender Obligations; Satisfaction of Outstanding L/Cs. (i) GE Capital shall have received a fully executed pay-off letter reasonably satisfactory to GE Capital confirming that all Prior Indebtedness owing by any Applicant to the Prior Lender will be repaid in full on the Closing Date and that the Rollover Letters of Credit shall not be cancelled on the Closing Date but shall remain in full force and effect and shall be deemed to have been Issued under this Agreement in accordance with the terms of the Transfer of Liability for Letters of Credit; (ii) GECB Letters of Credit shall have been cash collateralized in accordance with the terms of such pay-off letter; and (iii) all commitments of the Prior Lender to extend credit under the Prior Credit Agreement shall have been terminated in accordance with the terms of such pay-off letter;

(c)Cash Collateral Account. The Applicants shall have deposited immediately available funds in the amount of $10,321,150.27 into the Cash Collateral Account;

(d)Approvals. GE Capital shall have received reasonably satisfactory evidence that the Applicants have obtained all consents and approvals of all Persons including all requisite Governmental Authorities, required to the execution, delivery and performance of this Agreement and the other Credit Documents;

(e)Due Diligence. GE Capital shall have completed its business and legal due diligence with respect to each Applicant (including satisfactory review of all material contracts and all pending or threatened litigation or proceedings in any court or before any arbitrator or Governmental Authority and background checks on the Applicants and each of their respective management, Subsidiaries and Affiliates) and the results thereof shall be acceptable to GE Capital in its reasonable discretion; and

8

Table of Contents

(f)Payment of Fees. The Applicants shall have paid the fees required to be paid on the Closing Date in the respective amounts specified inSection 1.3 (including the fees specified in the Fee Letter), and shall have reimbursed GE Capital for all fees, costs and expenses of closing presented as of the Closing Date to the extent required by this Agreement.

2.2Conditions to the Issuance of each Letter of Credit. Except as otherwise expressly provided herein, GE Capital shall not be obligated to Issue or cause the Issuance of any Letter of Credit if as of the date of such Issue or Issuance and after giving effect thereto:

(a) any representation or warranty by any Applicant contained herein or in any other Credit Document is untrue or incorrect in any material respect (without duplication of any materiality qualifier contained therein) as of such date, except to the extent that such representation or warranty expressly relates to an earlier date (in which event such representations and warranties were untrue or incorrect in any material respect (without duplication of any materiality qualifier contained therein) as of such earlier date), and GE Capital has determined not to Issue or cause the Issuance of such Letter of Credit as a result of the fact that such warranty or representation is untrue or incorrect as of such date;

(b) any Default or Event of Default has occurred and is continuing or would reasonably be expected to result after giving effect to the Issuance of such Letter of Credit, and GE Capital shall have determined not to Issue or cause the Issuance of such Letter of Credit as a result of that Default or Event of Default; or

(c) the Applicants have not deposited immediately available funds into the Cash Collateral Account in an amount equal to 105% of the face amount of such Letter of Credit.

The request by Lead Applicant and acceptance by the Applicants of the Issuance of any Letter of Credit shall be deemed to constitute, as of the date thereof, (i) a representation and warranty by the Applicants that the conditions in thisSection 2.2 have been satisfied and (ii) a reaffirmation by each Applicant of the granting and continuance of GE Capital’s Lien in the Cash Collateral.

ARTICLE III.

REPRESENTATIONS AND WARRANTIES

The Applicants, jointly and severally, represent and warrant to GE Capital and each L/C Issuer that the following are, as of the Closing Date, and after giving effect to the Issuance (or deemed Issuance) of each Letter of Credit will be, true, correct and complete:

9

Table of Contents

3.1Corporate Existence and Power. Each Applicant and each of their respective Subsidiaries:

(a) is a corporation or limited liability company, as applicable, duly organized, validly existing and in good standing under the laws of the jurisdiction of its incorporation, organization or formation, as applicable;

(b) has the power and authority and all governmental licenses, authorizations, permits, registrations, certificates, consents and approvals required to own its assets, carry on its business and execute, deliver, and perform its obligations under the Credit Documents;

(c) is duly qualified as a foreign corporation, limited liability company or limited partnership, as applicable, and licensed and in good standing, under the laws of each jurisdiction where its ownership, lease or operation of Property or the conduct of its business requires such qualification or license; and

(d) is in compliance with all Requirements of Law;

except, in each case referred to inclause (c) orclause (d), to the extent that the failure to do so would not reasonably be expected to have, either individually or in the aggregate, a Material Adverse Effect.

3.2Corporate Authorization; No Contravention. The execution, delivery and performance by each of the Applicants of this Agreement, and by each Applicant of any other Credit Document to which such Person is party, are within such Applicant’s corporate and similar powers and, at the time of execution thereof, have been duly authorized by all necessary action, and do not and will not:

(a) contravene the terms of any of that Person’s Organization Documents;

(b) conflict with or result in any material breach or contravention of any document evidencing any material Contractual Obligation to which such Person is a party or any order, injunction, writ or decree of any Governmental Authority to which such Person or its Property is subject; or

(c) violate any Requirement of Law in any material respect.

3.3Governmental Authorization. No approval, consent, exemption, authorization, or other action by, or notice to, or filing with, any Governmental Authority is necessary or required in connection with the execution, delivery or performance by, or enforcement against, any Applicant of this Agreement or any other Credit Document except for those obtained or made on or prior to the Closing Date.

10

Table of Contents

3.4Binding Effect. This Agreement and each other Credit Document to which any Applicant is a party constitute the legal, valid and binding obligations of each such Person which is a party thereto, enforceable against such Person in accordance with their respective terms, except as enforceability may be limited by applicable bankruptcy, insolvency, or similar laws affecting the enforcement of creditors’ rights generally or by equitable principles relating to enforceability.

3.5Litigation Except as specifically disclosed inSchedule 3.5, there are no actions, suits, proceedings, claims or disputes pending, or to the knowledge of each Applicant, threatened or contemplated, at law, in equity, in arbitration or before any Governmental Authority, against any Applicant, any Subsidiary of any Applicant or any of their respective Properties which:

(a) purport to affect or pertain to this Agreement, any other Credit Document, or any of the transactions contemplated hereby or thereby; or

(b) would reasonably be expected to result in equitable relief or monetary judgment(s), individually or in the aggregate, in excess of $500,000.

No injunction, writ, temporary restraining order or any order of any nature has been issued by any court or other Governmental Authority purporting to enjoin or restrain the execution, delivery or performance of this Agreement, any other Credit Document, or directing that the transactions provided for herein or therein not be consummated as herein or therein provided. As of the Closing Date, no Applicant or any Subsidiary of any Applicant is the subject of an audit or, to each Applicant’s knowledge, any review or investigation by any Governmental Authority (excluding the IRS and other taxing authorities) concerning the violation or possible violation of any Requirement of Law.

3.6No Default. No Default or Event of Default exists or would result from the Issuance (or deemed Issuance) of any Letter of Credit or incurring of any Obligations by any Applicant or the grant or perfection of GE Capital’s Liens on the Cash Collateral. No Applicant and no Subsidiary of any Applicant is in default under or with respect to any Contractual Obligation in any respect which, individually or together with all such defaults, would reasonably be expected to have a Material Adverse Effect.

11

Table of Contents

3.7Solvency.

Both before and after giving effect to (a) the Letters of Credit Issued (or deemed Issued) on or prior to the date this representation and warranty is made or remade and (b) the payment and accrual of all fees and other transaction costs in connection with the foregoing, all the Applicants taken as a whole and each Applicant individually are Solvent.

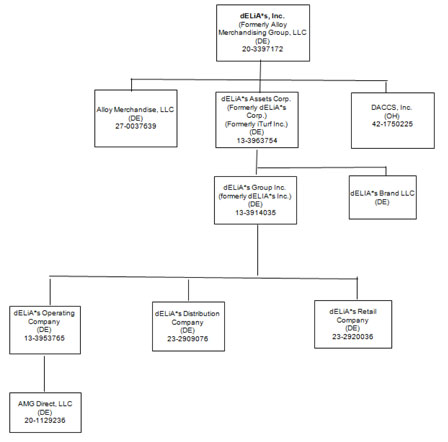

3.8Ventures, Subsidiaries and Affiliates; Outstanding Stock. Except as set forth inSchedule 3.8, as of the Closing Date, no Applicant and no Subsidiary of any Applicant has any Subsidiaries, is engaged in any joint venture or partnership with any other Person, or is an Affiliate of any other Person. All of the issued and outstanding Stock of each Applicant (other than Parent) and each Subsidiary of each Applicant is owned, as of the Closing Date, by each of the Persons and in the amounts set forth inSchedule 3.8. Except as set forth inSchedule 3.8, as of the Closing Date, there are no pre-emptive or other outstanding rights to purchase, options, warrants or similar rights or agreements pursuant to which any Applicant may be required to issue, sell, repurchase or redeem any of its Stock or Stock Equivalents or any Stock or Stock Equivalents of its Subsidiaries. Set forth inSchedule 3.8 is, as of the Closing Date, a true and complete organizational chart of Parent and its Subsidiaries.

3.9Jurisdiction of Organization; Chief Executive Office.Schedule 3.9 lists each Applicant’s jurisdiction of organization, legal name and organizational identification number, if any, and the location of such Applicant’s chief executive office or sole place of business, in each case as of the Closing Date, and suchSchedule 3.9 also lists all jurisdictions of organization and legal names of such Applicant for the five years preceding the Closing Date, which schedule shall be updated by the Applicants upon notice to GE Capital promptly following any change in any of the information set forth therein.

3.10Foreign Assets Control Regulations and Anti-Money Laundering. Each Applicant and each Subsidiary of each Applicant is and will remain in compliance in all material respects with all U.S. economic sanctions laws, Executive Orders and implementing regulations as promulgated by the U.S. Treasury Department’s Office of Foreign Assets Control (“OFAC”), and all applicable anti-money laundering and counter-terrorism financing provisions of the Bank Secrecy Act and all regulations issued pursuant to it. No Applicant and no Subsidiary or Affiliate of an Applicant (i) is a Person designated by the U.S. government on the list of the Specially Designated Nationals and Blocked Persons (the “SDN List”) with which a U.S. Person cannot deal with or otherwise engage in business transactions, (ii) is a Person who is otherwise the target of U.S. economic sanctions laws such that a U.S. Person cannot deal or otherwise engage in business transactions with such Person or (iii) is controlled by (including without limitation by virtue of such person being a director or owning voting shares or interests), or acts, directly or indirectly, for or on behalf of, any person or entity on the SDN List or a foreign government that is the target of U.S. economic sanctions prohibitions such that the entry into, or performance under, this Agreement or any other Credit Document would be prohibited under U.S. law.

12

Table of Contents

3.11Patriot Act. The Applicants, each of their Subsidiaries and each of their Affiliates are in compliance with (a) the Trading with the Enemy Act, and each of the foreign assets control regulations of the United States Treasury Department (31 C.F.R., Subtitle B Chapter V, as amended) and any other enabling legislation or executive order relating thereto, (b) the Patriot Act and (c) other federal or state laws relating to “know your customer” and anti-money laundering rules and regulations. No part of the proceeds of any Letter of Credit will be used directly or indirectly for any payments to any government official or employee, political party, official of a political party, candidate for political office, or anyone else acting in an official capacity, in order to obtain, retain or direct business or obtain any improper advantage, in violation of the United States Foreign Corrupt Practices Act of 1977.

3.12ERISA Compliance. Each Benefit Plan, and each trust thereunder, intended to qualify for tax exempt status under Section 401 or 501 of the Code or other Requirements of Law so qualifies (excluding, solely for this purpose, plan document or operational failures that (i) are eligible for correction under EPCRS, (ii) are promptly corrected under EPCRS and (iii) do not or are not reasonably expected to result in Liabilities in excess of $500,000) and has received a favorable opinion letter or determination letter from the IRS to the effect that the form of such Benefit Plan is qualified under Section 401(a) of the Code and the trust related thereto has been determined by the IRS to be exempt from federal income tax under Section 501(a) of the Code, or an application for such letter was filed by the end of such Benefit Plan’s applicable remedial amendment cycle under Revenue Procedure 2005-66 (or such successor promulgation), is currently being processed by the IRS or the deadline for filing such an application has not expired. Except for those that would not reasonably be expected to result in Liabilities in excess of $500,000 in the aggregate, (x) each Benefit Plan is in compliance with applicable provisions of ERISA, the Code and other Requirements of Law, (y) there are no existing or pending (or to the knowledge of any Applicant, threatened) claims (other than routine claims for benefits in the normal course), sanctions, actions, lawsuits or other proceedings or investigation involving any Benefit Plan to which any Applicant incurs or otherwise has or could have an obligation or any Liability and (z) no ERISA Event is reasonably expected to occur or has occurred in connection with which obligations and liabilities (contingent or otherwise) remain outstanding.

3.13Margin Regulations. No Applicant and no Subsidiary of any Applicant is engaged in the business of purchasing or selling Margin Stock or extending credit for the purpose of purchasing or carrying Margin Stock.

13

Table of Contents

3.14Taxes. All federal, state, local and foreign income and franchise and other material tax returns, reports and statements (collectively, the “Tax Returns”) required to be filed by any Tax Affiliate have been filed with the appropriate Governmental Authorities, all such Tax Returns are true and correct in all material respects, and all taxes, assessments and other governmental charges and impositions reflected therein or otherwise due and payable have been paid prior to the date on which any Liability may be added thereto for non-payment thereof except for those contested in good faith by appropriate proceedings diligently conducted and for which adequate reserves are maintained on the books of the appropriate Tax Affiliate in accordance with GAAP. As of the Closing Date, except as set forth on Schedule 3.14, no Tax Return is under audit or examination by any Governmental Authority, and no notice of any audit or examination or any assertion of any claim for Taxes has been given or made by any Governmental Authority. Proper and accurate amounts have been withheld by each Tax Affiliate from their respective employees for all periods in full and complete compliance with the tax, social security and unemployment withholding provisions of applicable Requirements of Law and such withholdings have been timely paid to the respective Governmental Authorities. No Tax Affiliate has participated in a “reportable transaction” within the meaning of Treasury Regulation Section 1.6011-4(b) or has been a member of an affiliated, combined or unitary group other than the group of which a Tax Affiliate is the common parent.

3.15Regulated Entities. None of any Applicant, any Person controlling any Applicant, or any Subsidiary of any Applicant, is (a) an “investment company” within the meaning of the Investment Company Act of 1940 or (b) subject to regulation under the Federal Power Act, the Interstate Commerce Act, any state public utilities code, or any other Federal or state statute, rule or regulation limiting its ability to incur Indebtedness, grant Liens on its assets or perform its Obligations under the Credit Documents.

3.16Brokers’ Fees; Transaction Fees. Except for fees payable to GE Capital and the L/C Issuers, none of the Applicants or any of their respective Subsidiaries has any obligation to any Person in respect of any finder’s, broker’s or investment banker’s fee in connection with the transactions contemplated hereby.

ARTICLE IV.

AFFIRMATIVE COVENANTS

Each Applicant covenants and agrees that, so long as GE Capital shall have an obligation hereunder to Issue or cause the Issuance of any Letters of Credit or any L/C Reimbursement Obligation or other Obligation (other than contingent indemnification Obligations to the extent no claim giving rise thereto has been asserted) shall remain unpaid or unsatisfied:

4.1Financial Statements. Each Applicant shall maintain, and shall cause each of its Subsidiaries to maintain, a system of accounting established and administered in accordance with sound business practices to permit the preparation of financial statements in conformity with GAAP (provided that monthly financial statements shall not be required to have footnote disclosures and are subject to normal year-end adjustments). The Applicants shall deliver to GE Capital by Electronic Transmission and in detail reasonably satisfactory to GE Capital:

14

Table of Contents

(a) as soon as available, but not later than ninety (90) days after the end of each Fiscal Year, a copy of the audited consolidated balance sheets of Parent and its Subsidiaries as at the end of such year and the related (i) consolidating statements of income or operations and (ii) consolidated statements of shareholders’ equity and cash flows for such Fiscal Year, setting forth in each case in comparative form the figures for the previous Fiscal Year, and accompanied by the report of any “Big Four” or other nationally-recognized independent public accounting firm reasonably acceptable to GE Capital (provided that GE Capital acknowledges that BDO USA, LLP is acceptable to GE Capital as of the Closing Date) which report shall (y) contain an unqualified opinion, stating that such consolidated financial statements present fairly in all material respects the financial position for the periods indicated in conformity with GAAP applied on a basis consistent with prior years and (z) not include any explanatory paragraph expressing substantial doubt as to going concern status;

(b) as soon as available, but not later than forty-five (45) days after the end of each Fiscal Quarter of each Fiscal Year, a copy of the unaudited consolidated balance sheets of Parent and its Subsidiaries, and the related (i) consolidating statements of income and (ii) consolidated statements of shareholders’ equity and cash flows as of the end of such Fiscal Quarter and for the portion of the Fiscal Year then ended, all certified on behalf of the Applicants by an appropriate Responsible Officer of the Lead Applicant as being complete and correct and fairly presenting, in all material respects, in accordance with GAAP, the financial position and the results of operations of Parent and its Subsidiaries, subject to normal year-end adjustments and absence of footnote disclosures; and

(c) as soon as available, but not later than thirty (30) days after the end of each of the first two fiscal months of each Fiscal Quarter, a copy of the unaudited consolidated balance sheets of Parent and its Subsidiaries, and the related (i) consolidating statements of income and (ii) consolidated statements of shareholders’ equity and cash flows as of the end of such fiscal month and for the portion of the Fiscal Year then ended, all certified on behalf of the Applicants by an appropriate Responsible Officer of the Lead Applicant as being complete and correct and fairly presenting, in all material respects, in accordance with GAAP, the financial position and the results of operations of Parent and its Subsidiaries, subject to normal year-end adjustments and absence of footnote disclosures.

15

Table of Contents

4.2Certificates; Other Information.

The Applicants shall furnish to GE Capital by Electronic Transmission, or shall permit and enable GE Capital to:

(a) together with each delivery of financial statements pursuant to (i) subsections 4.1(a) and4.1(b), a management discussion and analysis report, in reasonable detail, signed by the chief financial officer of the Lead Applicant, describing the operations and financial condition of the Applicants and their Subsidiaries for the Fiscal Quarter and the portion of the Fiscal Year then ended (or for the Fiscal Year then ended in the case of annual financial statements), and (ii) subsections 4.1(a),4.1(b) and4.1(c), a report setting forth in comparative form the corresponding figures for the corresponding periods of the previous Fiscal Year and the corresponding figures from the most recent projections for the current Fiscal Year delivered pursuant tosubsection 4.2(d) and discussing the reasons for any significant variations;

(b) concurrently with the delivery of the financial statements referred to insubsections 4.1(a),4.1(b) and4.1(c), a fully and properly completed Compliance Certificate in the form ofExhibit 4.2(b), certified on behalf of the Applicants by a Responsible Officer of the Lead Applicant;

(c) promptly after the same are sent, copies of all financial statements and reports which any Applicant sends to its shareholders or other equity holders, as applicable, generally and promptly after the same are filed, copies of all financial statements and regular, periodic or special reports which such Person may make to, or file with, the Securities and Exchange Commission or any successor or similar Governmental Authority;

(d) as soon as available and in any event no later than thirty (30) days after the last day of each Fiscal Year of the Applicants, projections of the Applicants (and their Subsidiaries’) consolidated and consolidating financial performance for the forthcoming three (3) Fiscal Years on a year by year basis, and for the forthcoming Fiscal Year on a month by month basis;

(e) promptly upon receipt thereof, copies of any reports submitted by the certified public accountants in connection with each annual, interim or special audit or review of any type of the financial statements or internal control systems of any Applicant made by such accountants, including any comment letters submitted by such accountants to management of any Applicant in connection with their services; and

(f) promptly, such additional business, financial, corporate affairs and other information as GE Capital may from time to time reasonably request.

16

Table of Contents

4.3Notices. The Applicants shall notify promptly GE Capital of the occurrence or existence of each of the following (and in no event later than five (5) Business Days after a Responsible Officer becoming aware thereof):

(a) any Default or Event of Default, or any event or circumstance that foreseeably will become a Default or Event of Default;

(b) any breach or non-performance of, or any default under, any Contractual Obligation of any Applicant or any Subsidiary of any Applicant, or any violation of, or non-compliance with, any Requirement of Law, which would reasonably be expected to result, either individually or in the aggregate, in a Material Adverse Effect, including a description of such breach, non-performance, default, violation or non-compliance and the steps, if any, such Person has taken, is taking or proposes to take in respect thereof;

(c) any dispute, litigation, investigation, proceeding or suspension which may exist at any time between any Applicant or any Subsidiary of any Applicant and any Governmental Authority which would reasonably be expected to result, either individually or in the aggregate, in Liabilities in excess of $500,000;

(d) the commencement of, or any material development in, any litigation or proceeding affecting any Applicant or any Subsidiary of any Applicant (i) in which the amount of damages claimed is $500,000 (or its equivalent in another currency or currencies) or more, (ii) in which injunctive or similar relief is sought and which, if adversely determined, would reasonably be expected to have a Material Adverse Effect, or (iii) in which the relief sought is an injunction or other stay of the performance of this Agreement or any other Credit Document;

(e) any Material Adverse Effect subsequent to the date of the most recent audited financial statements delivered to GE Capital pursuant to this Agreement;

(f) (i) on or prior to any filing by any ERISA Affiliate of any notice of any reportable event under Section 4043 of ERISA or intent to terminate any Title IV Plan, a copy of such notice (ii) promptly, and in any event within ten (10) days, after any officer of any ERISA Affiliate knows or has reason to know that a request for a minimum funding waiver under Section 412 of the Code has been filed with respect to any Title IV Plan or Multiemployer Plan, a notice describing such waiver request and any action that any ERISA Affiliate proposes to take with respect thereto, together with a copy of any notice filed with the PBGC or the IRS pertaining thereto, and (iii) promptly, and in any event within ten (10) days after any officer of any ERISA Affiliate knows or has reason to know that an ERISA Event will or has occurred, a notice describing such ERISA Event, and any action that any ERISA Affiliate proposes to take with respect thereto, together with a copy of any notices received from or filed with the PBGC, IRS, Multiemployer Plan or other Benefit Plan pertaining thereto;

17

Table of Contents

(g) any material change in accounting policies or financial reporting practices by any Applicant or any Subsidiary of any Applicant; and

(h) (i) the creation, or filing with the IRS or the State of New York, of any Contractual Obligation or other document extending, or having the effect of extending, the period for assessment or collection of any income or franchise or other material taxes with respect to any Tax Affiliate, (ii) the creation, or filing with any other Governmental Authority of any Contractual Obligation or other document extending, or having the effect of extending, the period for assessment or collection of any material income, franchise or other taxes with respect to any Tax Affiliate and (iii) the creation of any Contractual Obligation of any Tax Affiliate, or the receipt of any request directed to any Tax Affiliate, to make any material adjustment under Section 481(a) of the Code, by reason of a change in accounting method or otherwise.

Each notice pursuant to thisSection 4.3 shall be in electronic form accompanied by a statement by a Responsible Officer of the Lead Applicant, on behalf of the Applicants, setting forth details of the occurrence referred to therein, and stating what action the Applicants or other Person proposes to take with respect thereto and at what time. Each notice undersubsection 4.3(a) shall describe with particularity any and all clauses or provisions of this Agreement or other Credit Document that have been breached or violated.

4.4Preservation of Corporate Existence, Etc.

Each Applicant shall, and shall cause each of its Subsidiaries to:

(a) preserve and maintain in full force and effect its organizational existence and good standing under the laws of its jurisdiction of incorporation, organization or formation, as applicable, except in connection with transactions permitted bySection 5.1;

(b) preserve and maintain in full force and effect all rights, privileges, qualifications, permits, licenses and franchises necessary in the normal conduct of its business except in connection with transactions permitted bySection 5.1 and except as would not reasonably be expected to have, either individually or in the aggregate, a Material Adverse Effect; and

(c) use its commercially reasonable efforts, in the Ordinary Course of Business, to preserve its business organization and preserve the goodwill and business of the customers, suppliers and others having material business relations with it.

4.5Payment of Obligations. Each Applicant shall, and shall cause each of its Subsidiaries to, pay, discharge and perform as the same shall become due and payable or required to be performed, all their respective obligations and liabilities, except where the failure to perform would not reasonably be expected to have, either individually or in the aggregate, a Material Adverse Effect.

18

Table of Contents

4.6Compliance with Laws. Each Applicant shall, and shall cause each of its Subsidiaries to, comply with all Requirements of Law of any Governmental Authority having jurisdiction over it or its business, except where the failure to comply would not reasonably be expected to have, either individually or in the aggregate, a Material Adverse Effect.

4.7Use of the L/C Facility. The L/C Facility shall be used by the Applicants only in connection with the acquisition of inventory from suppliers, to provide standby letters of credit to various factors, landlords, insurance providers and other parties in the Ordinary Course of Business and for other general corporate purposes not in contravention of any Requirement of Law and not in contravention of this Agreement. The L/C Facility shall not be used to finance the purchase or carry of any Margin Stock.

4.8The Cash Collateral Account.

(a) The Applicants shall cause the Cash Collateral Account to at all times contain funds in an amount equal to not less than 105% of the Letter of Credit Obligations for all Letters of Credit then outstanding.

(b) The Cash Collateral Account shall be pledged by the Applicants to, and subject to the control of, GE Capital, for the benefit of itself and the other L/C Issuers, in a manner satisfactory to GE Capital. Each Applicant hereby grants to GE Capital, for the benefit of the L/C Issuers, a present and continuing security interest in the Cash Collateral Account, all funds and Cash Equivalents held in the Cash Collateral Account from time to time, and all proceeds of the foregoing (collectively, the “Cash Collateral”) as security for the payment of all L/C Reimbursement Obligations and the payment and performance of all other Obligations, whether or not then due.

(c) No Applicant nor any Person claiming on behalf of or through any Applicant shall have any right to withdraw any of the funds or Cash Equivalents held in the Cash Collateral Account, except that upon the termination of all Letter of Credit Obligations and the payment of all amounts payable by the Applicants to GE Capital, any funds or Cash Equivalents remaining in the Cash Collateral Account shall be applied to other Obligations then due and owing and upon payment in full of such Obligations, any remaining amount shall, unless otherwise required by law, be paid to the Applicants in account number XXXXX2090 maintained by the Lead Applicant with JPMorgan Chase, N.A. Interest earned on deposits in the Cash Collateral Account shall be for the account of GE Capital.

19

Table of Contents

(d) The Applicants shall not grant or create, or suffer to exist, any Lien on any of the Cash Collateral or any of the Applicants’ rights, titles or interests in, to or under any of the Cash Collateral except for the security interest therein granted to GE Capital under this Agreement.

(e) If at any time the Cash Collateral Account contains funds in an amount in excess of 105% of the Letter of Credit Obligations for all Letters of Credit then outstanding, GE Capital shall apply such excess funds to any Obligations then due and owing and upon payment in full of such Obligations, any remaining amount shall, unless otherwise required by law, be paid to the Applicants in account number XXXXX2090 maintained by the Lead Applicant with JPMorgan Chase, N.A.

4.9Further Assurances. Each Applicant shall ensure that all written information, exhibits and reports furnished to GE Capital do not and will not contain any untrue statement of a material fact and do not and will not omit to state any material fact or any fact necessary to make the statements contained therein not misleading in light of the circumstances in which made, and will promptly disclose to GE Capital and correct any defect or error that may be discovered therein or in any Credit Document or in the execution, acknowledgement or recordation thereof.

ARTICLE V.

NEGATIVE COVENANTS

Each Applicant covenants and agrees that, so long as GE Capital shall have an obligation hereunder to Issue or cause the Issuance of any Letters of Credit or any L/C Reimbursement Obligation or other Obligation (other than contingent indemnification Obligations to the extent no claim giving rise thereto has been asserted) shall remain unpaid or unsatisfied:

5.1Consolidations and Mergers. No Applicant shall, and no Applicant shall suffer or permit any of its Subsidiaries to merge, consolidate with or into, or convey, transfer, lease or otherwise dispose of (whether in one transaction or in a series of transactions) all or substantially all of its assets (whether now owned or hereafter acquired) to or in favor of any Person, except upon not less than five (5) Business Days prior written notice to GE Capital, (a) any Subsidiary of an Applicant may merge with, or dissolve or liquidate into, an Applicant or a Wholly-Owned Subsidiary of an Applicant which is a Domestic Subsidiary, provided that such Applicant or such Wholly-Owned Subsidiary which is a Domestic Subsidiary shall be the continuing or surviving entity and all actions required to maintain perfected Liens on the Cash Collateral Account in favor of GE Capital shall have been completed, (b) any Foreign Subsidiary may merge with or dissolve or liquidate into another Foreign Subsidiary and (c) any Inactive Subsidiary may liquidate or be dissolved provided that proceeds, if any, of any such liquidation or dissolution shall be paid to an Applicant.

20

Table of Contents

5.2Change in Business. No Applicant shall, and no Applicant shall permit any of its Subsidiaries to, engage in any line of business that is different from those lines of business carried on by it on the date hereof unless such new line of business is substantially similar or reasonably related thereto.

5.3Change in Structure. Except as otherwise permitted by this Agreement, no Applicant shall make any material changes in its equity capital structure or amend any of its Organization Documents, in each case, in any respect adverse to GE Capital or any L/C Issuer.

5.4Changes in Accounting, Name or Jurisdiction of Organization. No Applicant shall (i) make any significant change in accounting treatment or reporting practices, except as required by GAAP, (ii) change the Fiscal Year or method for determining Fiscal Quarters of any Applicant or of any consolidated Subsidiary of any Applicant, (iii) change its name as it appears in official filings in its jurisdiction of organization (provided,that Alloy Merchandise, LLC shall be permitted to change its name to A Merchandise LLC within 45 days following the Closing Date without any prior notice to GE Capital) or (iv) change its jurisdiction of organization, in the case of clauses (iii) and (iv), without at least ten (10) days’ prior written notice to GE Capital (or such shorter period as shall be acceptable to GE Capital).

5.5OFAC; Patriot Act. No Applicant shall, and no Applicant shall permit any of its Subsidiaries to fail to comply with the laws, regulations and executive orders referred to inSections 3.10 and3.11.

5.6Margin Stock; Use of Proceeds. No Applicant shall, and no Applicant shall suffer or permit any of its Subsidiaries to, use any portion of the proceeds of any Letter of Credit, directly or indirectly, to purchase or carry any Margin Stock or repay or otherwise refinance Indebtedness of any Applicant or others incurred to purchase or carry any Margin Stock, or otherwise in any manner which is in contravention of any Requirement of Law or in violation of this Agreement.

5.7Compliance with ERISA. No ERISA Affiliate shall cause or suffer to exist (a) any event that could result in the imposition of a Lien on any asset of an Applicant or a Subsidiary of an Applicant with respect to any Title IV Plan or Multiemployer Plan or (b) any other ERISA Event, that would, in the aggregate, result in Liabilities in excess of $500,000. No Applicant shall cause or suffer to exist any event that could result in the imposition of a Lien with respect to any Benefit Plan.

21

Table of Contents

ARTICLE VI.

EVENTS OF DEFAULT

6.1Events of Default. Any of the following shall constitute an “Event of Default”:

(a)Non-Payment. Any Applicant fails (i) to pay when and as required to be paid herein, any L/C Reimbursement Obligation or interest in respect thereof, or (ii) to pay within three (3) Business Days after the same shall become due, any fee or any other amount payable hereunder or pursuant to any other Credit Document;

(b)Representation or Warranty. Any representation, warranty or certification by or on behalf of any Applicant or any of its Subsidiaries made or deemed made herein, in any other Credit Document, or which is contained in any certificate, document or financial or other statement by any such Person, or their respective Responsible Officers, furnished at any time under this Agreement, or in or under any other Credit Document, shall prove to have been incorrect in any material respect (without duplication of other materiality qualifiers contained therein) on or as of the date made or deemed made;

(c)Specific Defaults. Any Applicant fails to perform or observe any term, covenant or agreement contained in any ofsubsection 4.2(a),4.2(b),4.2(d),4.3(a) or7.10(d),Section 4.1,4.7 or4.8, orArticle V or the Fee Letter;

(d)Other Defaults. Any Applicant or Subsidiary of any Applicant fails to perform or observe any other term, covenant or agreement contained in this Agreement or any other Credit Document, and such default shall continue unremedied for a period of fifteen (15) days after the earlier to occur of (i) the date upon which a Responsible Officer of any Applicant becomes aware of such default and (ii) the date upon which written notice thereof is given to the Lead Applicant by GE Capital;

(e)Cross-Default. Any Applicant or any Subsidiary of any Applicant (i) fails to make any payment in respect of any Indebtedness (other than the Obligations or any Indebtedness owing to another Applicant) or Contingent Obligation (other than the Obligations) having an aggregate principal amount (including undrawn committed or available amounts and including amounts owing to all creditors under any combined or syndicated credit arrangement) of more than $500,000 when due (whether by scheduled maturity, required prepayment, acceleration, demand, or otherwise) and such failure continues after the applicable grace or notice period, if any, specified in the document relating thereto on the date of such failure; or (ii) fails to perform or observe any other condition or covenant, or any other event shall occur or condition exist, under any agreement or instrument relating to any such Indebtedness or Contingent Obligation (other than Contingent Obligations owing by one Applicant with respect to the obligations of another Applicant), if the effect of such failure, event or condition is to cause, or to permit the holder or holders of such Indebtedness or beneficiary or

22

Table of Contents

beneficiaries of such Indebtedness (or a trustee or agent on behalf of such holder or holders or beneficiary or beneficiaries) to cause such Indebtedness to be declared to be due and payable prior to its stated maturity (without regard to any subordination terms with respect thereto), or such Contingent Obligation to become payable or cash collateral in respect thereof to be demanded;

(f)Insolvency; Voluntary Proceedings. An Applicant, individually, ceases or fails, or the Applicants and their Subsidiaries on a consolidated basis, cease or fail, to be Solvent, or any Applicant or any Subsidiary of any Applicant: (i) generally fails to pay, or admits in writing its inability to pay, its debts as they become due, subject to applicable grace periods, if any, whether at stated maturity or otherwise; (ii) voluntarily ceases to conduct its business in the ordinary course; (iii) commences any Insolvency Proceeding with respect to itself; or (iv) takes any action to effectuate or authorize any of the foregoing;

(g)Involuntary Proceedings. (i) Any involuntary Insolvency Proceeding is commenced or filed against any Applicant or any Subsidiary of any Applicant, or any writ, judgment, warrant of attachment, execution or similar process, is issued or levied against any such Person’s Properties with a value in excess of $500,000 individually or in the aggregate and any such proceeding or petition shall not be dismissed, or such writ, judgment, warrant of attachment, execution or similar process shall not be released, vacated or fully bonded within sixty (60) days after commencement, filing or levy; (ii) any Applicant or Subsidiary of any Applicant admits the material allegations of a petition against it in any Insolvency Proceeding, or an order for relief (or similar order under non-U.S. law) is ordered in any Insolvency Proceeding; (iii) any Applicant or any Subsidiary of any Applicant acquiesces in the appointment of a receiver, trustee, custodian, conservator, liquidator, mortgagee in possession (or agent therefor), or other similar Person for itself or a substantial portion of its Property or business; or (iv) any Applicant takes any action for the purpose of preparing for or effecting or authorizing any of the foregoing;

(h)Monetary Judgments. One or more judgments, non-interlocutory orders, decrees or arbitration awards shall be entered against any one or more of the Applicants or any of their respective Subsidiaries involving in the aggregate a liability of $500,000 or more (excluding amounts covered by insurance to the extent the relevant independent third party insurer has not denied coverage therefor), and the same shall remain unsatisfied, unvacated and unstayed pending appeal for a period of thirty (30) days after the entry thereof;

(i)Non-Monetary Judgments. One or more non-monetary judgments, orders or decrees shall be rendered against any one or more of the Applicants or any of their respective Subsidiaries which has or would reasonably be expected to have, either individually or in the aggregate, a Material Adverse Effect, and there shall be any period of ten (10) consecutive days during which a stay of enforcement of such judgment or order, by reason of a pending appeal or otherwise, shall not be in effect; or

23

Table of Contents

(j)Change of Control. There shall occur any Change of Control.

6.2Remedies. Upon the occurrence and during the continuance of any Event of Default, GE Capital may:

(a) declare its obligations hereunder to Issue or cause the Issuance of Letters of Credit to be suspended or terminated, whereupon such obligations shall forthwith be suspended or terminated;

(b) declare all or any portion of any unpaid Obligations, all interest accrued and unpaid thereon, and any fees, costs, expenses or other amounts owing or payable hereunder or under any other Credit Document to be immediately due and payable, in each case without presentment, demand, protest or other notice of any kind, all of which are hereby expressly waived by each Applicant; and/or

(c) exercise all rights and remedies available to it under the Credit Documents or applicable law;

provided,however, that upon the occurrence of any event specified insubsection 6.1(f) or6.1(g) above (in the case ofclause (i) ofsubsection 6.1(g) upon the expiration of the sixty (60) day period mentioned therein), the obligations of GE Capital to Issue or cause the Issuance of Letters of Credit shall automatically terminate and the unpaid Obligations and all interest, fees and other amounts as aforesaid shall automatically become due and payable without further act of GE Capital or any L/C Issuer.

6.3Rights Not Exclusive. The rights provided for in this Agreement and the other Credit Documents are cumulative and are not exclusive of any other rights, powers, privileges or remedies provided by law or in equity, or under any other instrument, document or agreement now existing or hereafter arising.

6.4Cash Collateral Account. If an Event of Default has occurred and is continuing, if this Agreement shall be terminated for any reason or if otherwise required by the terms hereof, the Applicants agree that GE Capital shall have the right to withdraw funds or Cash Equivalents from the Cash Collateral Account and apply such funds to pay any unpaid Obligations then due and owing. The remaining balance of the cash collateral will be returned to the Applicants when all Letters of Credit have been terminated or discharged, obligations of the L/C Issuers to Issue Letters of Credit have been terminated and all Obligations have been paid in full in cash or other satisfied.

24

Table of Contents

ARTICLE VII.

MISCELLANEOUS

7.1Amendments and Waivers. No amendment or waiver of any provision of this Agreement or any other Credit Document, and no consent with respect to any departure by any Applicant therefrom, shall be effective unless the same shall be in writing and signed by GE Capital and the Applicants, and then such waiver shall be effective only in the specific instance and for the specific purpose for which given.

7.2Notices.

(a)Addresses. All notices and other communications (“Communications”) required or expressly authorized to be made by this Agreement shall be given in writing, unless otherwise expressly specified herein, and shall be addressed to the address set forth on the applicable signature page hereto or such other address as shall be notified in writing to the other parties hereto. Transmissions made by electronic mail or E-Fax to GE Capital shall be effective only (x) for notices where such transmission is specifically authorized by this Agreement, (y) if such transmission is delivered in compliance with procedures of GE Capital applicable at the time and previously communicated to the Lead Applicant, and (z) if receipt of such transmission is acknowledged by GE Capital.

(b)Effectiveness. (i) All Communications described inclause (a) above and all other notices, demands, requests and other communications made in connection with this Agreement shall be effective and be deemed to have been received (A) if delivered by hand, upon personal delivery, (B) if delivered by overnight courier service, one (1) Business Day after delivery to such courier service, (C) if delivered by mail, three (3) Business Days after deposit in the mail and (D) if delivered by facsimile, upon sender’s receipt of confirmation of proper transmission;provided,however, that no communications to GE Capital pursuant toArticle I shall be effective until received by GE Capital.

(ii) The posting, completion and/or submission by Applicant of any communication pursuant to an E-System shall constitute a representation and warranty by the Applicants that any representation, warranty, certification or other similar statement required by the Credit Documents to be provided, given or made by an Applicant in connection with any such communication is true, correct and complete except as expressly noted in such communication or E-System.

25

Table of Contents

7.3Electronic Transmissions.

(a)Authorization. Subject to the provisions ofsubsection 7.2(a), GE Capital and each L/C Issuer, each Applicant and each of their Related Persons, is authorized (but not required) to transmit, post or otherwise make or communicate, in its sole discretion, Electronic Transmissions in connection with any Credit Document and the transactions contemplated therein. Each Applicant, each L/C Issuer and GE Capital acknowledge and agree that the use of Electronic Transmissions is not necessarily secure and that there are risks associated with such use, including risks of interception, disclosure and abuse and each indicates it assumes and accepts such risks by hereby authorizing the transmission of Electronic Transmissions.

(b)Signatures. Subject to the provisions ofsubsection 7.2(a), (i)(A) no posting to any E-System shall be denied legal effect merely because it is made electronically, (B) each E-Signature on any such posting shall be deemed sufficient to satisfy any requirement for a “signature” and (C) each such posting shall be deemed sufficient to satisfy any requirement for a “writing”, in each case including pursuant to any Credit Document, any applicable provision of any UCC, the federal Uniform Electronic Transactions Act, the Electronic Signatures in Global and National Commerce Act and any substantive or procedural Requirement of Law governing such subject matter, (ii) each such posting that is not readily capable of bearing either a signature or a reproduction of a signature may be signed, and shall be deemed signed, by attaching to, or logically associating with such posting, an E-Signature, upon which GE Capital, each L/C Issuer and each Applicant may rely and assume the authenticity thereof, (iii) each such posting containing a signature, a reproduction of a signature or an E-Signature shall, for all intents and purposes, have the same effect and weight as a signed paper original and (iv) each party hereto or beneficiary hereto agrees not to contest the validity or enforceability of any posting on any E-System or E-Signature on any such posting under the provisions of any applicable Requirement of Law requiring certain documents to be in writing or signed;provided,however, that nothing herein shall limit such party’s or beneficiary’s right to contest whether any posting to any E-System or E-Signature has been altered after transmission.

(c)Separate Agreements. All uses of an E-System shall be governed by and subject to, in addition toSection 7.2 and thisSection 7.3, the separate terms, conditions and privacy policy posted or referenced in such E-System (or such terms, conditions and privacy policy as may be updated from time to time, including on such E-System) and related Contractual Obligations executed by GE Capital and the Applicants in connection with the use of such E-System.