UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2005

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-51544

A-Max Technology Limited

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Bermuda

(Jurisdiction of incorporation or organization)

10/F, A-MAX Technology Tower

12-16 Fui Yiu Kok Street, Tsuen Wan

New Territories, Hong Kong

(852) 2798-6699

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act

American Depositary Shares, each representing 25 ordinary shares, par value $0.00002 per share

Securities registered or to be registered pursuant to Section 12(g) of the Act

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. 749,900,000 ordinary shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

¨ Large accelerated filer ¨ Accelerated filer x Non-accelerated filer

Indicate by check mark which financial statement item the registrant has elected to follow: ¨ Item 17 x Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) ¨ Yes x No

TABLE OF CONTENTS

INTRODUCTION

- 3 -

INTRODUCTION

Unless otherwise indicated, references in this annual report on Form 20-F to:

| | • | | ““we,” “us,” “our company,” “our” and “A-Max” refer to A-Max Technology Limited and its subsidiaries; |

| | • | | “A-Max China” refers to Shenzhen Zhongyuyuanyi Digital Science and Technology Company Limited; |

| | • | | “China” and the “PRC” are to the People’s Republic of China, excluding, for the purposes of this annual report on Form 20-F only, Taiwan and the special administrative regions of Hong Kong and Macao; |

| | • | | “Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China; |

| | • | | “Macao” refers to the Macao Special Administrative Region of the People’s Republic of China; |

| | • | | “HK$” and “HK dollars” are to the legal currency of Hong Kong; |

| | • | | “RMB” and “Renminbi” are to the legal currency of China; |

| | • | | “$” and, “US$” and “U.S. dollars” are to the legal currency of the United States; and |

| | • | | “shares” or “ordinary shares” refers to our ordinary shares, “Series A Preferred Shares” refers to our Series A convertible preferred shares, “ADSs” refers to our American depositary shares, each of which represents 25 ordinary shares, and “ADRs” refers to the American depositary receipts that evidence our ADSs. |

This annual report on Form 20-F includes our audited consolidated financial statements for the years ended December 31, 2003, 2004 and 2005 and as of December 31, 2004 and 2005.

Currently, no public market exists for our shares or ADSs.

PART I

ITEM 1 IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2 OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3 KEY INFORMATION

| A. | Selected Financial Data |

- 4 -

SELECTED CONSOLIDATED FINANCIAL DATA

The following selected consolidated financial data as of and for the years ended December 31, 2003, 2004 and 2005 are derived from our audited consolidated financial statements included elsewhere in this annual report and should be read in conjunction with, and are qualified in their entirety by reference to those consolidated financial statements and related notes. Our consolidated financial statements have been audited by Deloitte Touche Tohmatsu and were prepared in accordance with U.S. GAAP. The following selected consolidated financial data as of and for the year ended December 31, 2002 are derived from our audited consolidated financial statements not included in this annual report and were prepared in accordance with U.S. GAAP. The following selected consolidated financial data as of and for the year ended December 31, 2001 are derived from our unaudited consolidated financial statements not included in this annual report and were prepared in accordance with U.S. GAAP. We have prepared the unaudited information on the same basis as the audited consolidated financial statements, and have included, in our opinion, all adjustments, consisting only of normal and recurring adjustments that we consider necessary for a fair presentation of the financial information set forth in those statements. The following selected consolidated financial data should be read in conjunction with our “Item 5. Operating and Financial Review and Prospects” included elsewhere in this annual report.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2001 | | | 2002 | | | 2003 | | | 2004 | | | 2005 | |

| | | (in thousands, except per share data) | |

Consolidated Statement of Operations Data | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 40,129 | | | $ | 41,921 | | | $ | 39,388 | | | $ | 141,384 | | | $ | 328,321 | |

Cost of sales | | | (36,775 | ) | | | (37,454 | ) | | | (33,232 | ) | | | (118,206 | ) | | | (288,057 | ) |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | $ | 3,354 | | | $ | 4,467 | | | $ | 6,156 | | | $ | 23,178 | | | $ | 40,264 | |

Selling expenses | | | (1,808 | ) | | | (1,507 | ) | | | (1,722 | ) | | | (2,926 | ) | | | (5,748 | ) |

General and administrative expenses | | | (3,063 | ) | | | (2,990 | ) | | | (3,878 | ) | | | (3,882 | ) | | | (8,893 | ) |

Research and development expenses | | | (254 | ) | | | (369 | ) | | | (153 | ) | | | (359 | ) | | | (1,652 | ) |

Impairment on long-lived assets | | | — | | | | (424 | ) | | | — | | | | — | | | | — | |

Gain on disposal of variable interest entity | | | — | | | | — | | | | — | | | | — | | | | 433 | |

Gain on disposal of subsidiaries and tradename | | | — | | | | — | | | | 827 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | $ | (1,771 | ) | | $ | (823 | ) | | $ | 1,230 | | | $ | 16,011 | | | $ | 24,404 | |

Other income | | | 343 | | | | 249 | | | | 466 | | | | 120 | | | | 649 | |

Net unrealized (loss) gain on investment securities | | | — | | | | — | | | | — | | | | (19 | ) | | | 1 | |

Impairment on investments | | | — | | | | — | | | | — | | | | (179 | ) | | | — | |

Initial Public Offering expenses | | | — | | | | — | | | | — | | | | — | | | | (3,080 | ) |

Interest income | | | 55 | | | | 3 | | | | 4 | | | | 15 | | | | 873 | |

Interest expense | | | (513 | ) | | | (545 | ) | | | (401 | ) | | | (649 | ) | | | (1,026 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | $ | (1,886 | ) | | $ | (1,116 | ) | | $ | 1,299 | | | $ | 15,299 | | | $ | 21,821 | |

Provision for income taxes | | | (1 | ) | | | (93 | ) | | | (165 | ) | | | (2,568 | ) | | | (4,400 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (1,887 | ) | | $ | (1,209 | ) | | $ | 1,134 | | | $ | 12,731 | | | $ | 17,421 | |

| | | | | |

Dividends on Series A Preferred Shares | | | — | | | | — | | | | — | | | | (36 | ) | | | (3,238 | ) |

Beneficial Conversion Amount | | | — | | | | — | | | | — | | | | — | | | | (27,619 | ) |

Income attributable to Series A preferred shareholders | | | — | | | | — | | | | — | | | | — | | | | (1,500 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) available to ordinary shareholders | | | (1,887 | ) | | | (1,209 | ) | | | 1,134 | | | | 12,695 | | | | (14,936 | ) |

| | | | | | | | | | | | | | | | | | | | |

Basic earnings (loss) per share | | $ | (0.003 | ) | | $ | (0.002 | ) | | $ | 0.002 | | | $ | 0.021 | | | $ | (0.020 | ) |

| | | | | | | | | | | | | | | | | | | | |

Diluted earnings (loss) per share | | | N/A | | | | N/A | | | | N/A | | | | 0.018 | | | | (0.020 | ) |

| | | | | | | | | | | | | | | | | | | | |

Shares used in computing basic earnings (loss) per share | | | 600,000 | | | | 600,000 | | | | 600,000 | | | | 613,150 | | | | 749,900 | |

Shares used in computing diluted earnings (loss) per share | | | N/A | | | | N/A | | | | N/A | | | | 712,550 | | | | 749,900 | |

- 5 -

| | | | | | | | | | | | | | | | |

| | | As of December 31, |

| | | 2001 | | 2002 | | | 2003 | | 2004 | | 2005 |

| | | (in thousands, except per share data) |

Consolidated Balance Sheet Data | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 1,112 | | $ | 409 | | | $ | 1,710 | | $ | 7,081 | | $ | 49,106 |

Accounts receivable, net | | | 3,940 | | | 6,412 | | | | 8,394 | | | 43,262 | | | 73,256 |

Inventories | | | 6,706 | | | 6,056 | | | | 7,131 | | | 25,604 | | | 43,426 |

Total assets | | | 18,713 | | | 19,855 | | | | 23,430 | | | 85,162 | | | 189,215 |

Borrowings | | | 8,515 | | | 8,491 | | | | 13,429 | | | 32,819 | | | 30,955 |

Accounts payable | | | 4,068 | | | 5,891 | | | | 4,985 | | | 30,025 | | | 49,168 |

Total current liabilities | | | 17,261 | | | 19,998 | | | | 22,469 | | | 70,387 | | | 94,495 |

Total shareholders’ equity (deficit) | | | 1,223 | | | (170 | ) | | | 502 | | | 14,636 | | | 29,339 |

Total liabilities and shareholders’ equity | | | 18,713 | | | 19,855 | | | | 23,430 | | | 85,162 | | | 189,215 |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

Risks Related to Our Business

We depend heavily on sales of flash-based players and if those players do not remain popular with consumers, our business and prospects could be materially and adversely affected.

We depend heavily on sales of flash-based players, which accounted for 91.4% and 92.1% of our net sales in 2004 and 2005, respectively. As a result, our business depends on the continued viability and growth of the market for these products. The continued popularity of stand-alone flash-based players will be affected significantly by factors that include:

| | • | | the prices of flash-based players and competing products such as HDD-based players or other portable devices; |

| | • | | consumer demands and preferences as to desired performance and features; |

| | • | | the availability of compressed digital audio content; |

| | • | | the increased market adoption of other portable digital audio and multimedia devices, such as HDD-based players, portable multimedia players, or PMPs, digital audio broadcast players, or DAB players, and converged devices such as mobile phones and personal digital assistants, or PDAs, with digital audio player capabilities; and |

| | • | | general economic and other conditions that affect consumers’ discretionary spending. |

In addition, changes in technology, consumer preferences or other factors may cause flash-based players to become uncompetitive with HDD-based players, PMPs, DAB players or other devices. Consumers may want HDD-based players and PMPs that offer a greater capacity to store a very large number of songs, photos or memory-intensive content, such as digital video. If even more compact and energy-efficient hard disk drives are introduced to the market or the price of HDD-based players decreases at a significantly faster rate than that of flash-based players, consumers may decide to purchase, or switch to, HDD-based players. In addition, consumers may demand converged devices, or “do-everything devices,” such as certain high-end multimedia mobile phones that incorporate a digital audio playback function. If we are unsuccessful in broadening our product mix and leveraging our experience and reputation in the flash-based player market to gain new customers in other markets, our business and prospects could be materially and adversely affected.

- 6 -

Our limited operating history in the portable player industry makes it difficult to evaluate our business and prospects.

We began producing portable players in 2000 and did not launch our first flash-based player product until 2002. In addition, with the emergence and rapid growth of the portable player market, and in particular, the flash-based player market, we have experienced a high rate of growth since 2003. As such, our historical operating results may not provide a meaningful basis for evaluating our business and prospects. We do not expect to achieve a similar growth rate in future periods. Accordingly, you should not rely on our results of operations for any prior period as an indication of our future performance.

We have incurred losses in prior periods and may incur losses in the future.

We incurred net losses in 2002 and in prior years, and we may incur losses in the future. We expect our operating expenses to increase as we expand our operations. Our ability to maintain profitability depends on the rate of growth of our target markets, the continued market acceptance and competitiveness of our products and our ability to provide new products and product enhancements to meet our customers’ demands. Even though we have achieved profitability in recent periods, we may not be able to sustain or increase profitability on a quarterly or an annual basis.

Because our business depends on an adequate and timely supply of components and we rely on a limited number of suppliers for the flash memory and chipsets used in our products, any shortages, interruptions in supply or substantial price increases by our key suppliers would cause a material adverse effect on our business, financial results and relationships with our customers.

Our business depends on our ability to obtain adequate supplies of components on a timely and cost-competitive basis. We purchase our components from various third-party vendors that meet our quality standards and volume requirements. In 2004 and 2005, we purchased a majority of our flash memory and chipsets from Samsung Electronics Co., Ltd., or Samsung, and SigmaTel, Inc., or SigmaTel, respectively. We do not have long-term agreements with our suppliers of key components. Some of our suppliers are one of only several sources for these components and hold dominant market shares in their respective markets. Reliance on a small number of key suppliers involves risks that could adversely affect our operations or financial condition, including shortages of components, an increase in component costs and our lack of control over component delivery schedules.

Certain components critical to our products have been subject to periodic shortages of supply in the past. For example, there have been industry-wide shortages of flash memory and hard disk drives due to increased demand across the entire consumer electronics industry. We cannot assure you that shortages of these kinds will not recur in the future. Any shortages, interruptions in supply or substantial price increases by our key suppliers would cause a material adverse effect on our business, financial results and relationships with our customers.

- 7 -

If our brand owner customers discontinue or reduce the use of independent end-to-end solutions providers such as ourselves, our business would be materially and adversely affected.

The growth of our business depends substantially on the extent to which brand owners rely on independent end-to-end solutions providers such as ourselves to provide comprehensive solutions for the design and manufacture of portable players, as opposed to producing portable players in-house or through a combination of other third parties such as design houses and electronic manufacturing service, or EMS, providers. If the leading brand owners in the flash-based player market manufacture their products in-house or discontinue or reduce the use of independent end-to-end solutions providers such as ourselves, our business would be materially and adversely affected.

If we fail to acquire new large retail chain customers or increase sales from our existing large retail chain customers, our business may be materially and adversely affected.

The growth of our business will depend in part on the extent to which we obtain the business of new large retail chain customers and increase the business of our existing large retail chain customers. An increasing number of large retail chains have begun to sell portable players under their own house brands, and these and other large retail chains are expected to increase their market share in the future. These large retail chains do not typically have in-house technical expertise, manufacturing capabilities or experience in the market and rely on independent providers to design and produce portable players for them. As the large retail chains’ products do not have the advantage of well-known consumer electronics brand names, there is even greater pressure on them to keep the retail price of their products low by using cost-efficient providers. If we are not successful in acquiring additional large retail customers and increased sales from our existing large retail customers, the growth of our business may be materially and adversely affected.

The average retail selling prices of consumer electronics products typically decrease significantly over a product’s life and will likely continue to do so in the future, which could adversely affect our revenue and profitability.

The average retail selling prices, or ASPs, of consumer electronics products, including portable players, typically decline significantly over a product’s life as new models are introduced, due to improvements in technology that permit enhanced performance and features at the same or lower prices. If ASPs for portable players continue to decline, we will be required to either reduce our costs and unit selling prices for comparable products over time or enhance the performance and features of our products in a cost-efficient manner in order to maintain our average unit selling prices. Our financial results will suffer if we are unable to increase our sales volumes, reduce our costs or introduce new or enhanced features for existing products or new products that can attain higher unit selling prices.

- 8 -

If we cannot provide new product models and enhancements in a timely and cost-efficient manner to meet our customers’ demands, the growth and success of our business will be materially and adversely affected.

The portable player industry is characterized by changing consumer preferences, demand for new and advanced features and greater storage capacities, rapid product obsolescence, declines in unit selling prices, intense competition, evolving industry standards, seasonality and fluctuations in product and component supply and demand. These factors result in the frequent introduction of new products, short product life cycles and significant price competition. Our ability and our customers’ ability to accurately forecast quarterly and annual sales is limited.

In order to be competitive, we must, among other things:

| | • | | be responsive to consumers’ demands for new features and functions in portable player products; |

| | • | | quickly incorporate those features and functions into new products and product enhancements; |

| | • | | timely deliver new products and enhanced products to our customers with high quality and in large volumes; |

| | • | | closely manage our key supplier relationships and the availability and pricing of adequate quantities of the main components of our products; |

| | • | | price our products and product enhancements competitively; and |

| | • | | manage product transitions smoothly and cost-effectively. |

If we are unable to cost-efficiently identify, develop, manufacture and sell new products or product enhancements, or if we are unable to manage product transitions smoothly and efficiently, the growth and success of our business will be materially and adversely affected.

Our business will suffer if we cannot meet increases in demand due to seasonality.

Sales of our portable players, as with many consumer electronic products, are subject to significant seasonality, with higher revenues typically in the fourth quarter of each year, when customers place orders to meet year-end holiday demand, and lower revenues in the first and second quarters of each year. However, our limited operating history in the portable player industry and recent market growth make it difficult for us to accurately assess the impact of seasonal factors on our business. We failed to ramp up production to meet increased customer orders in the third quarter and early part of the fourth quarter of 2004 prior to relocating to our current manufacturing facilities in November 2004, and we had to turn down some increased customer orders in advance of the winter holiday season due to our insufficient production capacity. If we are unable to ramp up production of new or existing products to meet any increases in demand due to seasonality or other factors, our sales and operating results could suffer materially.

Because of the length of the sales cycles for new products designed by us, we may make substantial expenditures before we earn revenues and may not ultimately achieve our forecasted sales.

For new products that we design based on our customers’ specifications, our sales cycle from design to manufacture and delivery is typically three to six months. The length of this sales cycle is due to a number of reasons, including the following:

| | • | | our customers usually complete in-depth technical evaluations of our designs and manufacturing plans and processes before they place purchase orders; |

- 9 -

| | • | | the volume production of our portable players may be limited during our customers’ initial release of these portable players to evaluate performance and consumer demand; |

| | • | | new product introductions often center around key trade shows and selling seasons and the failure to launch a new product at such times may result in a delay in the introduction of the new product; and |

| | • | | the development and commercial introduction of products incorporating complex technology are often delayed or canceled. |

We may make substantial expenditures before we earn revenues because we must order components and build inventory in advance of customer orders for products. In addition, we may make substantial expenditures to develop new products that may ultimately be unsuccessful in the market. For example, we have recently incurred expenditures to develop PMPs and electronic photo frames and have commenced the design of DAB players. We cannot be certain, however, that any of such products will be successful in the market. Because demand for our products is affected by a number of factors, including market acceptance of our products, competition and general economic conditions, there is a risk that we may forecast demand incorrectly and produce or order from component suppliers excess or insufficient inventories of particular products or components. Further, particularly during times of potential component shortages, we have purchased, and may continue to purchase, component parts in the expectation of receiving purchase orders. In the event we forecast demand incorrectly, we may experience product shortages or increased inventory levels and possible write-downs of inventory that could materially and adversely affect our business and operating results.

Our recent expansion has strained our management, personnel, systems and resources, and the continued success of our business depends on our ability to successfully manage our growth.

Our business operations have expanded significantly since 2003 due to the rapid growth of our sales of flash-based players, and we expect to further expand our operations to take advantage of the potential growth in our customer base and the portable player market. This expansion has placed, and our intended expansion will continue to place, a strain on our management, personnel, systems and resources. If we are unable to manage our growth effectively, we may not be able to take advantage of market opportunities, develop new products, enhance our design and manufacturing capabilities, satisfy customer requirements, execute our business plan or respond to competitive pressures. Further, as we become a public company, we will need to augment our support infrastructure because our information and control systems must enable us to prepare accurate and timely financial information and other required disclosures. To successfully manage our growth, we believe we must:

| | • | | recruit and retain skilled employees necessary to support our expanded operations; |

| | • | | continue to maintain adequate control of our costs and expenses; |

| | • | | continue to maintain strong relationships with our key suppliers, customers and other third parties; and |

| | • | | enhance our design, manufacturing, packaging and logistics services and after-sales support. |

- 10 -

All of these measures will require substantial management efforts and resources. We cannot assure you that we will be able to implement the measures successfully or to effectively manage our growth; any failure to do so may adversely and materially affect our business.

If we are unable to manage the expansion and relocation of our production facilities effectively, our financial results may be adversely affected.

We must expand our production facilities to meet growing customer orders and maintain growth. In the third quarter and early part of the fourth quarter of 2004 prior to relocating to our current production facilities in November 2004, we had to turn down some increased customer orders due to our insufficient production capacity. We must constantly evaluate our facilities to make sure that we have sufficient production capacity to meet growing customer orders and fulfill orders by new portable player brand owners and retail chain customers. If we are unable to expand our production facilities to meet growing customer orders, our existing and prospective customers may seek other companies to meet their demand.

In order to expand our production capacity, we relocated our production facilities to Shenzhen in November 2004. The new facilities have monthly production capacity of approximately 1.0 to 1.2 million units per month, depending on the models being produced. We have doubled our monthly production capacity to approximately 2.0 to 2.4 million units through the completion of Phase II of the expansion of our Shenzhen manufacturing facilities. In addition, we intend to acquire land in Shenzhen for the future relocation of our manufacturing facilities and purchase additional machinery and equipment to enhance our manufacturing efficiency. There are a number of events that could delay these expansion projects or increase the costs associated with our expansion. Such potential events include:

| | • | | shortages and late delivery of building materials and equipment; |

| | • | | delays in the delivery, installation, commissioning and qualification of our manufacturing equipment; |

| | • | | design or construction changes with respect to building spaces or equipment layout; |

| | • | | delays in securing the necessary governmental approvals; |

| | • | | technological, capacity and other changes to our plans necessitated by changes in market conditions; |

| | • | | failure to timely train new and existing employees to use the new production facilities. |

Expansion and modification of our production facilities will increase our costs. We will need to purchase additional equipment, train employees to operate the new equipment and hire additional employees. In addition, we have already committed substantial expenditures and resources towards certain of these expansion projects. We will need to increase our net sales accordingly to offset these higher costs. However, demand for our products may not be as high as we expect, and we cannot guarantee that we will be able to fully utilize additional capacity. If that happens, we may fail to realize the expected benefit from our investment in our new and expanded facilities and our financial results will be adversely affected.

- 11 -

Because the markets in which we operate are competitive and many of our competitors have greater resources than we do, we may not be able to compete successfully and we may lose or be unable to gain market share.

We face current and potential future competition from brand owners, original design manufacturers, or ODMs, and EMS providers. Many of our current and potential competitors have significantly greater financial, technical, marketing, sales and other resources than we do. In addition, some of these competitors may be closer in geographic proximity, and have greater cultural and language connections, to the leading brand owners and large retail chains which sell portable players. We cannot assure you that we will be able to compete successfully against our current or future competitors in our market.

If our customers are not successful in selling our products under their brands, our sales growth and financial results will be adversely affected.

As our products are sold to end users by our customers under their own brands, our success depends on our customers’ success in their portable player sales. Our customers face intense competition from other major consumer electronics brand owners and large retail chains that may have greater brand recognition and financial, marketing, distribution and other resources. We are not able to control our customers’ product and design choices, marketing and pricing strategies and other critical factors in the success and competitiveness of their sales of portable players. Accordingly, we cannot assure you that our customers will be successful in their sales of our products under their brands or that their purchases of our portable players will continue or grow with future orders. If our customers are not successful in selling our products under their brand names, our sales growth and financial results will be adversely affected. For example, some leading consumer electronics brand owners that have recently entered the flash-based player market design and manufacture their products entirely in-house or outsource the design and manufacturing of their products to other companies. Apple Computer, Inc., which already has a commanding market share of the HDD-based player market, entered the flash-based player market in January 2005, and has captured a substantial portion of that market. If leading brand names take market share from our existing customers and do not outsource the design and manufacturing of their products to us, our business will be adversely affected.

We rely on a limited number of customers for a significant portion of our net sales, and if a large customer fails to place additional orders with us, or if we fail to develop additional major customers, our operating results and financial condition could be materially and adversely affected.

We have been dependent on a small number of customers to generate a significant portion of our net sales. In 2004 and 2005, our top five customers collectively accounted for approximately 65.2% and 50.5%, respectively, of our net sales. Each of Medion, NEC Computers International BV, or NEC and a leading China-based consumer electronics company contributed over 10% of our net sales for 2004, and each of DSG Retail, Maxfield GmbH, or Maxfield and NEC contributed over 10% of our net sales for 2005. Sales to our largest customers have varied from period to period due primarily to our changing product mix and our relatively short history of sales of portable players, particularly flash-based players, as well as the continued expansion of our customer base and the impact of seasonality on customers’ purchasing decisions. Our largest customers may continue to vary in the future as we aim to attract more brand owners and large retail chains and our sales to different customers may vary from period to period.

- 12 -

We expect that we will continue to rely on a small number of customers for a significant portion of our revenues in the foreseeable future. Our ability to maintain close relationships with these customers is essential to the growth and profitability of our business. If a large customer fails to place additional orders with us, or if we fail to develop additional major customers, our revenues could decline, and our results of operations and financial condition could be materially and adversely affected.

The technologies and industry standards on which our products are based are continually evolving, and our success depends on our ability to adapt our products to incorporate and support these changing technologies and industry standards.

The continuing emergence of new technologies and industry standards, such as the introduction of new compression algorithms for digital audio and multimedia content, could render our products uncompetitive or obsolete. As a result, we may be required to invest significant time, effort and expense to enhance or redesign our products to incorporate new features, functions and technologies and ensure compliance with relevant standards. If our products do not comply with prevailing industry standards and technologies or we or our suppliers are unable to obtain the rights for us to incorporate new standards and technologies into our products, we may fail to attract new customers or lose existing customers and our business and financial results could be materially and adversely affected.

Our business depends largely on the continuing services of our senior executives, and our business may be severely disrupted if we lose their services.

Our future success depends largely upon the continued services of our senior executives, especially our Chairman and Chief Executive Officer, Victor Chan, our Chief Operating Officer, Yu Xiao Dong, and our Chief Financial Officer, Diana Chan. We rely on their experience in the consumer electronics industry, in finance and in business operations and on their relationships with our shareholders, suppliers, technology partners and customers. We do not maintain key-man life insurance for any of our key executives. If one or more of our key executives are unable or unwilling to continue in their present positions, we may not be able to replace them easily or at all. Therefore, our business may be severely disrupted, and we may incur additional expenses to recruit and retain new officers.

The demand for portable players depends on the availability of compressed digital audio content and may be adversely impacted by intellectual property protection measures, including litigation, against music providers and consumers of compressed digital audio content.

Demand for portable players may be adversely affected by the enforcement of limits on file sharing and downloadable music or other copy protection techniques and intellectual property protection measures. Among other intellectual property protection and enforcement measures undertaken by music industry participants and groups, the Recording Industry Association of America, a recording industry trade group, has sued numerous individuals who are alleged to have illegally distributed copyrighted music over the Internet. In the United States, the legal standards for determining indirect liability for copyright infringement have recently been tightened by the United States Supreme Court in the decisionMetro Goldwyn-Mayer Studios Inc. v. Grokster, Ltd., et al., 125 S.Ct. 2764, orGrokster. The implications of theGrokster decision for providers of compressed digital audio content inside and outside the United States are uncertain and may increase the risk of legal liability for those providers, which may in turn result in decreased availability of compressed digital audio content on the Internet. Although we work closely with industry participants to incorporate digital rights management technology and other copyright protection measures in our portable players, if music industry participants or other parties are successful in limiting the ability of consumers to obtain free or inexpensive music on the Internet, the demand for compressed digital audio players may decline.

- 13 -

The emergence of alternative models for downloading digital music content may impact our business in ways we cannot anticipate.

Currently, most compressed digital audio content is available through a pay-per-download model in which consumers purchase and own the audio file that they can transfer to and play on their portable players. Several companies, including Microsoft Corporation, or Microsoft, have recently launched digital rights management software that is expected to provide consumers access to music content on a subscription basis, through which they pay a subscription fee to rent, rather than own, the audio file for a limited period of time. If this technology is successful, it could compete with existing pay-per-download music services. These services may require us to incur additional expenses, including additional license fees, to incorporate these technologies into our products. We cannot predict the impact on our business if this or other similar technology or other content distribution models become widely adopted.

Our products incorporate third-party technologies and if we are unable to continue to use these technologies, our business could suffer.

Our products use third-party chipsets with built-in support for third-party technologies, such as the MP3 and WMA codecs, which either we obtain the right to include through sub-license rights provided by the chipset providers who embed these codecs into their chipsets or pursuant to license agreements with codec owners. If these sub-license rights or license agreements are terminated by the third parties or we otherwise lose the rights to use these technologies, we may not be able to find suitable alternate sources and our business may be materially and adversely affected.

We and our suppliers and technology providers may face intellectual property infringement claims that could be time consuming and costly to defend, may result in our loss of the right to use certain third-party technologies, or may result in shortages or interruptions in supply or substantial price increases by our key suppliers.

We and our suppliers and technology providers may be subject to intellectual property infringement and other claims. Litigation is expensive and time consuming and could divert management’s attention from our business. If there is a successful claim of infringement, we and our suppliers and technology providers may be required to pay substantial damages to the party claiming infringement, develop non-infringing technology or enter into royalty or license agreements that may not be available to us on acceptable terms, if at all. In addition, many of our key suppliers and technology providers are in industries that have had significant intellectual property infringement litigation in recent years. Any significant litigation against any of them could result in our loss of the right to use certain third party technologies, shortages or interruptions in supply or substantial price increases by our key suppliers.

Defects in our products could damage our reputation as well as result in product liability claims against us.

Because we cannot test our products for all possible scenarios, our products may contain defects that are not discovered until after they are shipped to consumers. If our products are frequently found to contain defects, our reputation may be damaged, which could harm our ability to retain existing customers and/or attract new customers. Product defects may also result in product liability claims against us, which may negatively affect our results of operations.

- 14 -

The product warranties we provide to our customers expose us to risks from warranty claims.

We provide our customers with limited product warranties. Under this limited product warranty, if a customer claims that our products are defective, we will, upon receiving the pre-approved return of the defective products, either repair or replace the products, or, at our discretion, refund to the customer all or a portion of the purchase price of the defective products. We cannot assure you that costs associated with product warranties will not be material in the future. If we are exposed to warranty claims, or if limitations on our warranty provisions are unenforceable in a particular jurisdiction, a successful claim could require us to incur substantial expense.

If we are unable to attract, train and retain skilled personnel, our business may be materially and adversely affected.

Our future success depends on our ability to attract, train and retain additional skilled personnel. Our industry is characterized by high demand and intense competition for talent. We cannot assure you that we will be able to attract and retain new and existing skilled personnel whom we will need to achieve our strategic objectives. In addition, as our business has grown rapidly, our ability to train and integrate new employees into our operations may not meet the growing demands of our business.

Our operating results could be harmed if we have to comply with new environmental regulations.

Our operations create some environmentally sensitive materials that may increase in the future depending on the nature of our manufacturing operations. The disposal of hazardous waste has received increasing attention from Chinese national and local governments and has been subject to stricter regulation. Currently, relevant Chinese environmental protection laws and regulations impose fines on the discharge of waste materials and empower certain environmental authorities to close any facility which causes serious environmental problems. Although Chinese government officials have not alleged that we have violated any current environmental regulations, we cannot assure you that we will not be liable for violations of these regulations or that the Chinese government will not further tighten its current environmental protection laws and regulations. Our business and operating results could be adversely affected if we were to increase expenditures to comply with new environmental regulations.

Our insurance coverage may not be sufficient to cover the risks related to our operations and losses.

We have not experienced any major accidents in the course of our operations that have caused significant property damage or personal injuries. However, there is no assurance that we will not experience major accidents in the future. Although we have purchased certain insurance, including policies covering loss or damage in respect of buildings, machinery, equipment and inventories, the occurrence of certain incidents such as earthquakes, fires, floods and wars, and the consequences resulting therefrom, may not be covered adequately, or at all, by such insurance. We also face exposure to product liability claims in the event that any of our products are alleged to have resulted in property damage, bodily injury or other adverse effects. Losses incurred or payments we may be required to make may have a material adverse effect on our results of operations if such losses or payments are not fully insured.

- 15 -

We depend on shipping companies to deliver our products and any interruptions to shipping could materially and adversely affect our business and operating results.

We rely on shipping companies, primarily air carriers, to transport our products through world ports to our customers. A work stoppage, disease outbreak, strike or shutdown of one or more major ports or airports could result in shipping delays, which could have a material adverse effect on our business and operating results. For example, in the first half of 2003, the outbreak of SARS in Hong Kong and other parts of Asia caused interruptions in the delivery of our products as shipping companies were required to undergo greater and more time-consuming inspections prior to the shipment of products. An outbreak of avian flu or other illnesses may result in similar delays. Additionally, an increase in surcharges due to rising fuel costs or general price increases could materially and adversely affect our business and operating results.

We have substantial international activities, which expose us to additional business risks including increased logistical complexity and political instability.

We currently conduct sales activities in Europe, the United States and Asia. We also acquire some key components from international suppliers. We plan to further expand our international sales activities and expect to continue to rely on certain international suppliers. Our international operations are subject to a number of risks, including:

| | • | | fluctuations in the U.S. dollar, the principal currency we use to transact business; |

| | • | | increased complexity and costs of managing international operations; |

| | • | | protectionist laws and business practices that favor local competition in some countries; |

| | • | | multiple, conflicting and changing laws, regulations and tax schemes in different jurisdictions; |

| | • | | greater difficulty in accounts receivable collection and longer collection periods; |

| | • | | shipping delays resulting from disruptions to our supply chain caused by labor disputes, war or other events beyond our control; |

| | • | | political and economic instability; and |

| | • | | other factors beyond our control, including major health concerns such as an outbreak of SARS or avian flu, terrorist attacks and rising fuel costs. |

Any acquisition activity could disrupt our ongoing business and may present risks not contemplated at the time of the transaction.

We may acquire companies that have products, services, personnel and technologies that complement our strategic objectives and product roadmap. These acquisitions may involve significant risks and uncertainties, including difficulties in incorporating the operations and technologies of the acquired businesses, distraction of management’s attention away from normal business operations, insufficient revenue generation to offset liabilities assumed and expenses associated with the acquisition, and unidentified issues not discovered in our due diligence process, including product liability issues and legal contingencies. Acquisitions are inherently risky, and no assurance can be given that any acquisitions will be successful and will not materially adversely affect our business, operating results or financial condition. In addition, if we issue our ordinary shares or other equity-related purchase rights as consideration for an acquisition, our current shareholders’ percentage ownership and earnings per share may become diluted.

- 16 -

Failure to achieve and maintain effective internal controls may have a material adverse effect on our business and results of operations.

We are subject to the reporting obligations under the U.S. securities laws. The Securities and Exchange Commission, or the SEC, as required by Section 404 of the Sarbanes-Oxley Act of 2002, has adopted rules requiring public companies to include a report of management on such companies’ internal control over financial reporting in its annual report, that contains an assessment by management of the effectiveness of such company’s internal control over financial reporting. This requirement will first apply to our annual report on Form 20-F for our fiscal year ending on December 31, 2006. We have only recently begun to evaluate our internal control over financial reporting. Given the status of our efforts, coupled with the fact that guidance from regulatory authorities in the area of internal control continues to evolve, substantial uncertainty exists regarding our ability to comply by the deadline. If we are unable to conclude that we have effective internal control over financial reporting, or if our independent auditors are unable to provide us with an unqualified report as to the effectiveness of our internal control over financial reporting as of December 31, 2007 and future year ends, as required by Section 404 of the Sarbanes-Oxley Act, we could experience delays or inaccuracies in our reporting of financial information, or non-compliance with SEC reporting and other regulatory requirements. This could subject us to regulatory scrutiny and may result in us incurring additional costs or require the allocation of more management resources in an effort comply with the regulatory requirements, which may adversely affect our business or results of operations.

Risks Related to Doing Business in China and Hong Kong

Adverse changes in economic and political policies of the PRC government could have a material adverse effect on the overall economic growth of China, which could adversely affect our business.

We conduct substantial business operations in China, including all of our manufacturing operations. Accordingly, our results of operations, financial condition and prospects are subject to a significant degree to economic, political and legal developments in China. The PRC economy differs from the economies of many developed countries in various respects, including with respect to the amount of government involvement, level of development, growth rate, control of foreign exchange and allocation of resources. Although the PRC economy has experienced significant growth in the past 20 years, growth has been uneven across different regions and among various economic sectors in China. The PRC government may implement various measures to encourage economic development and guide the allocation of resources that may also have a negative effect on us. For example, our financial condition and results of operations may be adversely affected by government control over capital investments, access to foreign currency or changes in tax regulations that are applicable to us.

- 17 -

Uncertainties with respect to the Chinese legal system could adversely affect us.

We conduct our business in China primarily through A-Max China and we may in the future expand our business through other subsidiaries or other ventures established in the PRC. Our operations in China are governed by PRC laws and regulations. A-Max China is subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to wholly foreign owned enterprises. The PRC legal system is based on written statutes. Prior court decisions may be cited for reference but have little precedential value.

Since 1979, PRC legislation and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, China has not developed a fully integrated legal system and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities in China. In particular, because these laws and regulations are relatively new, and because of the limited volume of published decisions and their nonbinding nature, the interpretation and enforcement of these laws and regulations involve uncertainties. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

Certain preferential tax treatment benefiting A-Max China will expire in future years, which will result in a higher enterprise income tax rate for A-Max China and may adversely affect our results of operations.

Under current PRC laws and regulations, a foreign investment enterprise, or FIE, in China, such as A-Max China, is typically subject to enterprise income tax, or EIT, at the rate of 30% on taxable income and local income tax at the rate of 3% on taxable income. Because A-Max China is located in Shenzhen, it qualifies for a special reduced EIT rate of 15%. Furthermore, since A-Max China is an enterprise engaged in manufacturing with foreign investment and its term of operation is more than ten years, it is entitled to a two-year EIT exemption beginning from its first profitable year, followed by a 50% reduction of the EIT rate for three years. A-Max China became profitable in 2004. As a result, A-Max China is exempt from EIT in 2004 and 2005 and will be subject to a 7.5% EIT rate from 2006 to 2008.

However, if the PRC government phases out preferential tax treatment for enterprises like A-Max China, the application or interpretation of such preferential tax treatment changes to our disadvantage or A-Max China becomes subject to different taxation law, rules, policies, rates or methods of taxation in the PRC, A-Max China’s effective EIT rate may increase to the standard statutory rate.

Certain tax exemptions which may be available to A-Max Macao may change in future years, which could result in a higher tax rate for A-Max Macao and may adversely affect our results of operations.

Under relevant Macao laws and regulations, an offshore institution in Macao conducting certain activities may, subject to review and approval of the Macao government, be exempted from income tax, industrial tax and stamp duties. Because of the structure of our operations in 2005, we did not account for the profits generated by A-Max Macao using this exemption. The laws governing these tax exemptions have been revised in the past, including, most recently in 2005, and if the relevant laws and regulations are changed, or if interpretation of such tax exemption are changed to our disadvantage, the tax exemptions available to A-Max Macao may decrease for future periods, which may adversely affect our results of operations to the extent we would have been able to take advantage of such tax exemptions prior to any such change.

- 18 -

Any fluctuation in the value of the RMB or the H.K. dollar may adversely affect our expenses and profitability.

We use U.S. dollars as our reporting currency for our consolidated financial statements, although a portion of our expenses are denominated in currencies other than U.S. dollars, such as RMB and H.K. dollars, and to a lesser extent, Euro. The value of the RMB and the H.K. dollar against the U.S. dollar may fluctuate and may be affected by, among other things, changes in political and economic conditions. Although the exchange rate between the H.K. dollar to the U.S. dollar has been pegged since 1983, we cannot assure you that the H.K. dollar will remain pegged to the U.S. dollar. The conversion of the RMB into foreign currencies, including the U.S. dollar and the Euro, is based on rates set by the People’s Bank of China. On July 21, 2005, the PRC government changed its policy of pegging the value of the RMB to the U.S. dollar. Under the new policy, the RMB will be permitted to fluctuate within a band against a basket of certain foreign currencies. This change in policy resulted initially in an approximately 2.5% appreciation in the value of the RMB against the U.S. dollar as of December 31, 2005. There remains significant international pressure on the PRC government to adopt a substantial liberalization of its currency policy, which could result in a further and more significant appreciation in the value of the RMB against the U.S. dollar.

Although substantially all of our net sales and most of our costs and expenses are denominated in U.S. dollars, the remainder of our net sales and costs and expenses are denominated primarily in RMB or H.K. dollars. In addition, as we may in the future rely in part on dividends paid to us by our subsidiaries in China and Hong Kong, any significant revaluation of the RMB or the H.K. dollar may have a material adverse effect on our revenues and financial condition, and the value of, and any dividends payable on, our ADSs in foreign currencies. For example, if we decide to convert our RMB into U.S. dollars for the purpose of making payments for dividends on our ordinary shares or ADSs or for other business purposes, depreciation in the value of the RMB against the U.S. dollar would have a negative effect on the U.S. dollar amount available to us. We have not used any forward contracts, futures, swaps or currency borrowings to hedge our exposure to foreign currency risk. As a result, any material increase in the value of the RMB or the H.K. dollar may affect our expenses and profitability.

Governmental control of currency conversion may affect the value of your investment.

The PRC government imposes controls on the convertibility of RMB into foreign currencies and, in certain cases, the remittance of currency out of China. Shortages in the availability of foreign currencies may restrict the ability of A-Max China or any of our subsidiaries or invested ventures that may be established in the PRC in the future to remit sufficient foreign currency to make profit distributions or other payments to us, or otherwise satisfy their foreign currency denominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including dividends, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from the PRC State Administration of Foreign Exchange by complying with certain procedural requirements. However, conversion of RMB for most capital account items, including direct investments, is subject to government approval in China. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. If the PRC foreign exchange control system prevents A-Max China or any of our subsidiaries or other ventures that may be established in the PRC from paying dividends in foreign currencies to us, we may in turn be unable to pay dividends to our shareholders, including holders of our ADSs.

- 19 -

Recent PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may limit our ability to inject capital into A-Max China, limit A-Max China’s ability to distribute profits to us, or otherwise adversely affect us.

The PRC State Administration of Foreign Exchange, or SAFE, issued a public notice in October 2005 requiring PRC residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of capital financing, referred to in the notice as a “special purpose offshore company.” PRC residents that are shareholders of special purpose offshore companies established before November 1, 2005 were required to register with the local SAFE branch before March 31, 2006. We have notified a beneficial owner of our company who is a PRC resident to register with the local SAFE branch as required under the SAFE notice. The failure or inability of such beneficial owner to comply with the registration procedures set forth therein may subject him to fines and legal sanctions and may also limit our ability to contribute additional capital into A-Max China, limit A-Max China’s ability to distribute profits to us or otherwise adversely affect our business.

Hong Kong’s relationship with the rest of the PRC is unpredictable and could disrupt our business.

Hong Kong is a special administrative region of the PRC with its own government. Hong Kong enjoys a high degree of autonomy from the PRC under the principle of “one country, two systems.” However, there can be no assurance that our financial condition and results of operations will not be adversely affected as a consequence of the exercise of PRC sovereignty over Hong Kong.

A significant portion of our net sales is derived from operations conducted through our Hong Kong subsidiary. As a result, our financial condition and results of operations may be influenced by the political situation in Hong Kong and by the general state of the Hong Kong economy and the PRC economy.

ITEM 4 INFORMATION ON THE COMPANY

| A. | History and Development of the Company |

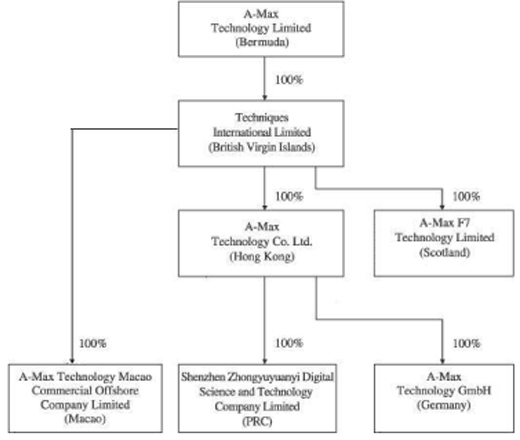

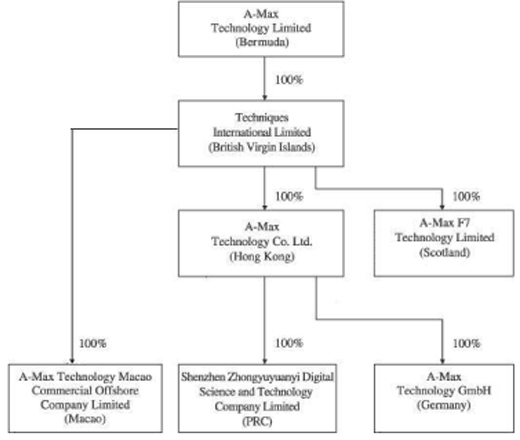

We commenced operations in 1996 through A-Max Technology Co., Ltd., or A-Max (HK), a company incorporated in Hong Kong, which currently conducts our logistics, finance and administrative activities. We conduct our manufacturing activities primarily in Shenzhen, China through A-Max China, which we established in March 2003 as a wholly-owned subsidiary of A-Max (HK). In March 2004, we established our holding company, A-Max Technology Limited, or A-Max, in Bermuda. In June 2005, we established A-Max Technology Macao Commercial Offshore Company Limited, or A-Max (Macao), in Macao, and subsequently transferred our sales and support activities to that company. In addition to A-Max (HK), A-Max China and A-Max (Macao), we also have the following subsidiaries:

| | • | | Techniques International Limited, or Techniques International, which was incorporated in the British Virgin Islands; |

- 20 -

| | • | | A-Max Technology GmbH, or A-Max (Europe), which was incorporated in Germany; and |

| | • | | A-Max F7 Technology Limited, or A-Max F7, which was incorporated in Scotland. |

On June 17, 2005, we effected a 1:50,000 share split and, unless otherwise indicated, all share numbers in this annual report reflect the share split.

Our principal executive offices are located at 10/F, A-Max Technology Tower, 12-16 Fui Yiu Kok Street, Tsuen Wan, New Territories, Hong Kong. Our telephone number at this address is (852) 2798-6699. Our registered office in Bermuda is located at Clarendon House, 2 Church Street, Hamilton HM11, Bermuda. Our telephone number at this address is (441) 295-1422.

Overview

We are a leading independent total solutions provider in the global portable player market. As an independent provider, we serve a wide group of customers, in each case on a non-exclusive basis. We provide flash-based players to leading international brand owners and large international retail chains that sell flash-based players under their own house brands.

We manufacture all of our products in China using components sourced from third-party suppliers and provide our customers with complete, “one-stop” services, including new product definition and introduction, product design and related electrical and mechanical engineering, embedded and application software development, manufacturing, packaging, logistics arrangements and after-sales support. In 2005, our net sales increased to $328.3 million from $141.4 million in 2004 and our net income increased to $17.4 million from $12.7 million in 2004.

Our portable players use third-party chipsets with built-in support for codecs, which are computer programs that encode and compress and decode and decompress digital audio data according to a given audio file format. The data compression offered by audio codecs allows a portable player to store significantly more audio content and facilitates faster downloads and transfers of digital audio data. To meet our customers’ demands, our portable players use third-party chipsets that support the widely-used MP3 and WMA codecs.

Since we began selling portable players in 2000, we have produced over 280 models for customers in Europe, the United States and Asia. In 2005, we generated net sales of $328.3 million, of which 92.1% was derived from flash-based players.

Products and Services

Flash-based Players. We depend heavily on sales of flash-based players, which accounted for 91.4% and 92.1% of our net sales in 2004 and 2005, respectively. We currently provide over 140 models of flash-based players with memory capacities of 128MB, 256MB, 512MB, 1GB, and 2GB. Our flash-based players consist of a wide variety of styles and form factors and all are highly portable and consume low amounts of power. Our flash-based players run on standard AAA alkaline batteries, providing between eight to eighteen hours of playback time. Our flash-based players are compatible with mainstream operating systems, including Windows and Macintosh, and use chipsets with built-in support for the MP3 and WMA codecs and Microsoft’s DRM platform.

- 21 -

We believe we were one of the first companies to launch 1GB flash-based players, which we introduced in September 2004, and 2GB flash-based players, which we introduced in June 2005. We were also one of the first companies to develop and ship a flash-based player using SigmaTel’s USB 2.0 chipset, which enables consumers to transfer digital audio content from personal computers to flash-based players at significantly faster transfer speeds and with greater convenience than USB 1.1 chipsets. All of our flash-based players can also be used as standard plug-and-play USB storage devices for documents and other types of data.

Our flash-based players include some or all of the following features, depending on the demands of the customer:

| | • | | USB 2.0 for data storage and high-speed transfer capabilities; |

| | • | | LCD, OLED, TFT, STN and CSTN screens and customizable displays and user menus; |

| | • | | Built-in voice recording and playback; |

| | • | | FM radio functionality and FM recording; |

| | • | | Equalizer with six defined presets; |

| | • | | SRS signal processing to improve audio sound; |

| | • | | Bluetooth version 1.2 module support; |

| | • | | Lyrics display synchronized with music; and |

| | • | | DRM 9 and DRM 10 support. |

Other Products. Our other products currently include MP3 CD players and computer peripherals. From time to time we also sell components for supply chain management purposes. We began to sell a small number of 1-inch HDD-based players in October 2004 but do not currently offer any HDD-based players due to lack of strong consumer demand. We have also recently developed PMPs and have commenced the design of DAB players, as well as electronic photo frames. PMPs enable users to capture, store and play digital media including compressed audio, photos and video. DAB players are devices that can be used to listen to DAB radio broadcasts using digital signals instead of traditional analog radio. An electronic photo frame allows users to insert a memory card into the photo frame and view pictures saved in the card sequentially.

Design, Manufacturing and Logistics

We offer complete end-to-end solutions to customers, including design, manufacturing and logistics services, with a goal of delivering complete, packaged products to customers.

Design. Our value-added design services consist of the following:

Industrial Design. With respect to a particular product that a customer requests us to design, our industrial design team is responsible for preliminary product exploration, market research, 2-D and 3-D sketch level drawings, 3-D mock-ups and proofs and hard models. In addition, in anticipation of future market demand and consumer preferences, our industrial design team also designs innovative products that we expect to become popular and attractive to consumers based on the latest market developments, customers’ suggestions and our design team’s creative ideas.

- 22 -

Mechanical Engineering Design. Our mechanical engineering design team designs the mechanical systems used in our portable players. It also prepares 2D and 3D designs to ensure that the mechanical parts and tools used in the portable player conform to the exterior design. In addition, our mechanical engineering team creates the bill of materials, or BOM, required for volume production of the portable player.

Tooling Design. Our tooling design team designs and develops prototypes and production tooling equipment for manufacturing our products. The goals of tooling design are to improve manufacturing efficiency, make use of new materials and techniques and improve the quality of portable players.

Electrical Engineering Design. Our electrical engineering design team develops electrical systems for our products, taking into consideration the need for cost-effective mass production. The electrical engineering design team is also responsible for schematic design, electrical layout, embedded system and digital signal processing design, high-speed digital interfaces, analog circuit design, power management solutions, wired and wireless communication protocols, display and storage solutions, imaging and audio/video applications and RF system and antenna design.

Software Design. Our software design team designs and develops software and applications for product and systems design, testing, maintenance and end-user interface, as well as product applications such as device drivers, embedded applications, communications protocols, digital signal processing algorithms and web applications.

Design Testing. Our design testing team is responsible for product testing, engineering testing and material testing. Our product testing involves product reliability tests, including accelerated life tests, climatic stress tests and mechanical endurance tests. Our engineering testing involves tests of product functions. Our material testing involves design-in tests to examine the quality and suitability of materials and components to be used in our products.

Manufacturing. Our customers seek a variety of high-quality and competitively priced products with extensive functionality and small form factors that are produced with fast time-to-market. This in turn requires more sophisticated yet highly efficient manufacturing technologies and processes. Our investment in advanced manufacturing equipment and our experience and expertise in manufacturing technologies enable us to offer a variety of manufacturing solutions to meet our customers’ demands. We currently have twenty surface mount technology lines, sixteen printed circuit board assembly lines, twenty assembly lines and twenty packaging lines. In addition, our easily-reset production lines allow us to quickly ramp up production for new designs as necessary. We are in compliance with applicable environmental regulations in China in all material respects.

We have implemented an enterprise resource planning, or ERP, system for our entire manufacturing process. We benefit from the ERP system in many aspects of our operations, including BOM system management, volume procurement, supplier qualification, inventory management and finance. The ERP system allows us to use sophisticated planning systems and enhanced electronic data interchange capabilities to ensure manufacturing efficiency, inventory control and optimization. We also fully leverage China’s competitive labor costs by utilizing labor in our manufacturing process where it proves to be more efficient and cost effective than equipment.

- 23 -

Logistics. We provide logistics services to our customers in Europe, the United States and Asia. We have established long-term, trusting relationships with major logistics companies serving us and these relationships are instrumental to the timely and cost-effective delivery of our products to customers. We offer our customers flexible delivery arrangements that allow us to coordinate product shipments with our customers’ inventory requirements. Increasingly, we ship products directly into our customers’ distribution channels or to their large retail chain customers. Combining our logistics services with our design and manufacturing operations and supply chain management, we are able to reduce costs and create integrated processes.

Quality Control

We maintain strict quality control programs for our products using quality management systems and advanced testing and calibration equipment. Our quality control personnel are divided into four major teams: incoming quality control, in-process quality control, output quality control and testing. The incoming quality control team inspects incoming materials and components to ensure they meet our quality standards. The in-process quality control team frequently examines our manufacturing process with a view to maintaining and improving the quality of our manufacturing process. The output quality control team inspects finished products to ensure they meet our customers’ specifications. The testing team conducts reliability tests for all product models, including accelerated life tests, climatic stress tests and mechanical endurance tests.

We work closely with our customers and provide support for them to monitor our production and test finished products on site at our manufacturing facilities. In addition, our research and development team is closely involved in the manufacturing process for new products designed by us for quality assurance purposes. Our manufacturing system for digital multimedia players and flash memory devices are certified under the ISO 9001:2000 quality system.

Suppliers

We purchase our components from third-party suppliers. The most costly components are flash memory for our flash-based players, and chipsets and display components such as LCDs. Due to the dominant market shares of several of our key suppliers, we rely on only a limited number of suppliers for certain key components.

In 2005, we purchased a majority of our flash memory from Samsung, a worldwide leader in providing flash-based memory. In February 2005, we received a “Most Valued Partner” award from Samsung. We also purchased a majority of our chipsets from SigmaTel in 2005. In March 2005, we announced a strategic relationship with SigmaTel for the development, design and manufacture of portable players.

Certain critical components for our players have been subject to periodic shortages of supply. For example, there have been industry-wide shortages of flash memory due to increased demand across the entire consumer electronics industry. Since the dramatic growth of portable players beginning in 2003, the demand for flash memory has often outpaced supply. We believe our strong relationships with key component suppliers and leading portable player brand owners have allowed us to secure the adequate and timely supply of components and timely deliver our players to customers even during periods of supply shortages in the market. In addition, some of our leading brand owner customers have access to memory and other key components for portable players and have helped us secure the supply of certain key components when there has been a shortage of supply. We intend to maintain and enhance our strong relationships with existing key suppliers and brand owner customers and develop relationships with new suppliers to ensure sufficient and timely supply of key components on favorable terms.

- 24 -

Customers

We provide portable players to leading brand owners and large international retail chains that sell portable players under their own house brands. We sell our products primarily through direct sales and, to a lesser extent, through distributors.

Leading brand owners. Portable player brand owners historically designed, manufactured, marketed and distributed their own products entirely in-house. In response to factors affecting the portable player market — including shortened development cycles, increasing demand for personalized features, increasing competition, higher cost structure and greater margin pressure — portable player brand owners have increasingly outsourced the design and manufacturing of their branded portable players in order to reduce development and production costs and risks, and to introduce new products with a faster time-to-market. We have benefited from this outsourcing trend and have acquired many leading brand owners as our customers, including the following current customers: Medion Aktiengesellschaft, which owns the Medion brand, Maxfield, which owns the Maxfield brand, and NEC Computers International, which owns the Packard Bell brand.

Large retail chains. Attempting to capitalize on the growth of the market, large retail chains have begun to sell portable players under house brands. Because they do not have well-known consumer electronics brand names for their products, it is particularly important for these large retail chains to provide quality products and keep the retail prices of their products relatively low. These large retail chains also typically do not have technical expertise or experience in designing and manufacturing portable players using in-house resources. As a result, these large retail chains use third parties to design and manufacture portable players. As portable players have grown into high volume consumer products, we believe large retail chains, which have substantial distribution power to reach a large number of consumers, are well positioned to capture a large share of this market. We have designed and manufactured portable players for a number of leading international retail chains in Europe and the U.S., including DSG Retail Ltd., which owns the Dixons retail chain.