RBC Capital Markets

MLP Conference

November 15-16, 2007

© DCP Midstream Partners, LP 2007

2

Forward Looking Statements

Under the Private Securities Litigation Reform Act of 1995

This document may contain or incorporate by reference forward-looking statements as defined under the federal securities laws

regarding DCP Midstream Partners, LP, including projections, estimates, forecasts, plans and objectives. Although management

believes that expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such

expectations will prove to be correct. In addition, these statements are subject to certain risks, uncertainties and other

assumptions that are difficult to predict and may be beyond our control. If one or more of these risks or uncertainties materialize,

or if underlying assumptions prove incorrect, the Partnership’s actual results may vary materially from what management

anticipated, estimated, projected or expected. Among the key risk factors that may have a direct bearing on the Partnership’s

results of operations and financial condition are:

the level and success of natural gas drilling around our assets and our ability to connect supplies to our

gathering and processing systems in light of competition;

our ability to grow through acquisitions, asset contributions from our parents, or organic growth projects,

and the successful integration and future performance of such assets;

our ability to access the debt and equity markets;

fluctuations in oil, natural gas, propane and other NGL prices;

our ability to purchase propane from our principal suppliers for our wholesale propane logistics business; and

the credit worthiness of counterparties to our transactions.

Investors are encouraged to closely consider the disclosures and risk factors contained in the Partnership’s annual and quarterly

reports filed from time to time with the Securities and Exchange Commission. The Partnership undertakes no obligation to

publicly update or revise any forward-looking statements, whether as a result of new information, future events or

otherwise. Information contained in this document is unaudited, and is subject to change.

3

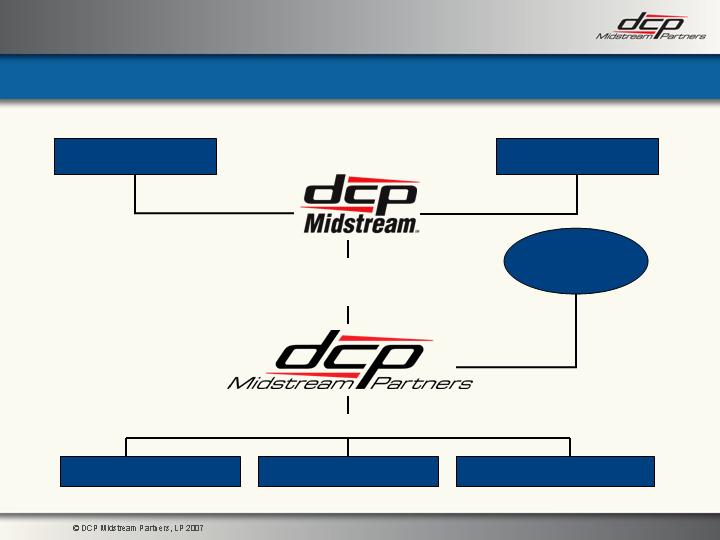

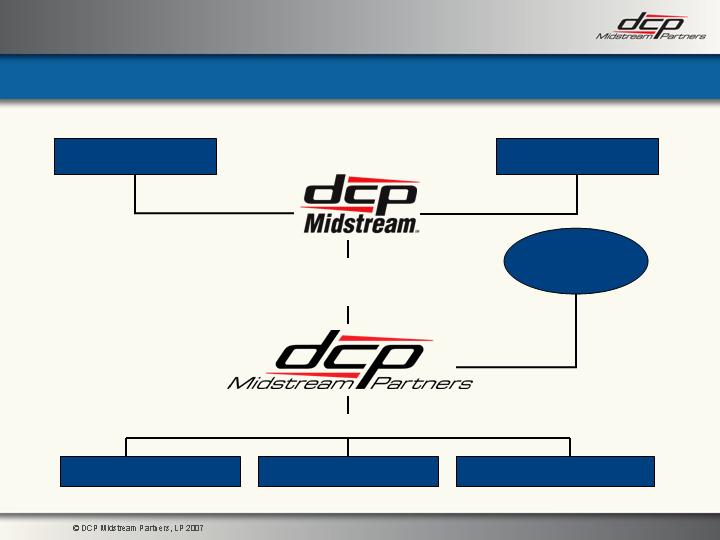

64.6% Common

LP Interest

(15.7MM units)

33.9% Subordinated and Common LP Interests

(8.2MM units)

1.5% GP Interest

NYSE: DPM

50%

50%

Spectra Energy

ConocoPhillips

Public

Unitholders

Natural Gas Services

NGL Logistics

Wholesale Propane Logistics

Our Partnership and Our Sponsors

One of the nation’s largest

natural gas gatherers and

producers & marketers of

NGLs

54 owned or operated plants,

10 fractionators and 58,000

miles of pipe

2006 net income in excess

of $1.1 billion

Industry leading midstream business

4

Our General Partner: DCP Midstream, LLC

5

Well positioned to execute growth strategy

Ability to capitalize on strong sponsorship

Assets with strong market positions

Stable cash flows from fee and substantially hedged commodity positions

Experienced management team with a demonstrated track record of

growing midstream and MLP businesses

Organic growth potential

Low cost of capital to facilitate growth strategy

Key Investment Highlights

2007 Operating Highlights

Expanded operations provide platform for future growth

Closed $625 million of growth acquisitions

Diversified operating footprint into new basins

Completed temporary Collbran plant expansion in Piceance Basin;

permanent expansion to be completed 1Q 2008

Expanded wholesale propane logistics footprint with completion of Midland

terminal

6

© DCP Midstream Partners, LP 2007

7

Growth Drives Impressive Total Return

Quarterly Distributions

Comparative Total Returns

$0.405

$0.430

$0.465

$0.530

$0.380

$0.350

116%

25%

42%

$0.550

8

Overview of Business Strategies

and Recent Transactions

© DCP Midstream Partners, LP 2007

Our primary business objective: increase our cash distribution per unit

9

Business Strategies

Pursue strategic and accretive acquisitions

Consolidate with and expand existing infrastructure

Pursue new lines of business and geographic areas

Potential to acquire assets from Sponsors

Capitalize on organic expansion opportunities

Expand existing infrastructure

Develop projects in new areas

Maximize profitability of existing assets

Increase capacity utilization

Expand market access

Enhance operating efficiencies

Leverage ability to provide integrated services

BUILD:

ACQUIRE:

OPTIMIZE:

Transactions/projects completed since IPO

Steady operating results support healthy distributable

cash flow and distribution increase

Distributions now 57.1% over MQD

Provided total unitholder return of 116% through

11/06/07

10

Successful Execution of Business Strategies

3rd Party Acquisitions Transaction Value ($MM)

New geographic areasAnadarko $181

Expand existing footprint Laser 10

Dropdown Transactions

New lines of business Wholesale Propane 83

New assets in new geographic areas Discovery & East Texas 270

Transactions in Conjunction with Sponsor

New assets in new geographic areas Momentum 165

Build New Assets Wilbreeze 12

Total $721

2006 / YTD 2007 Financial Highlights

Gulf Coast focus

11

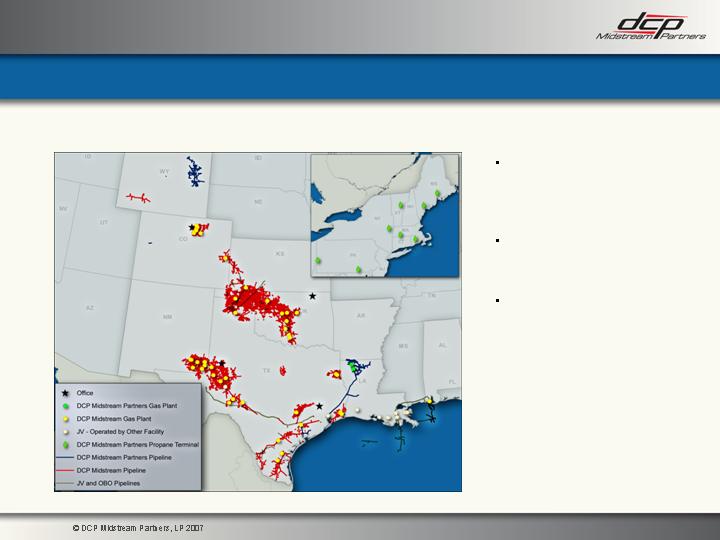

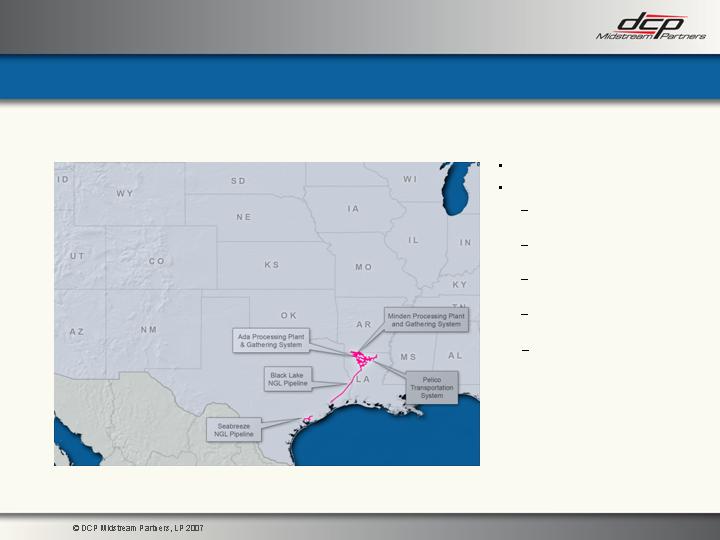

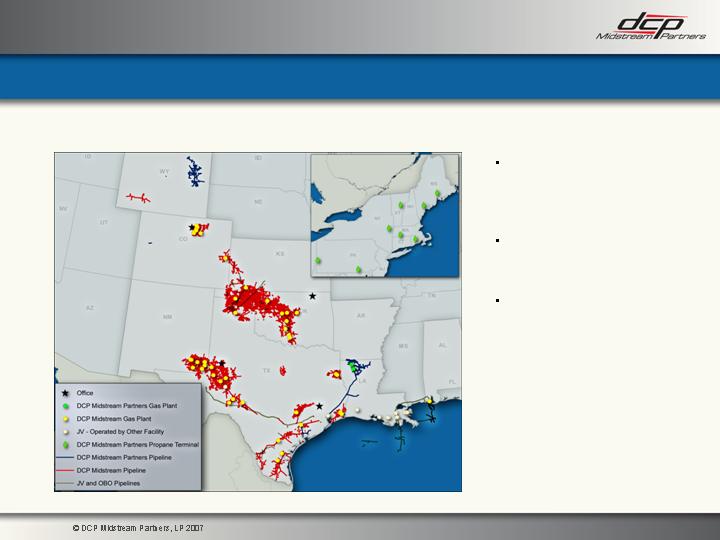

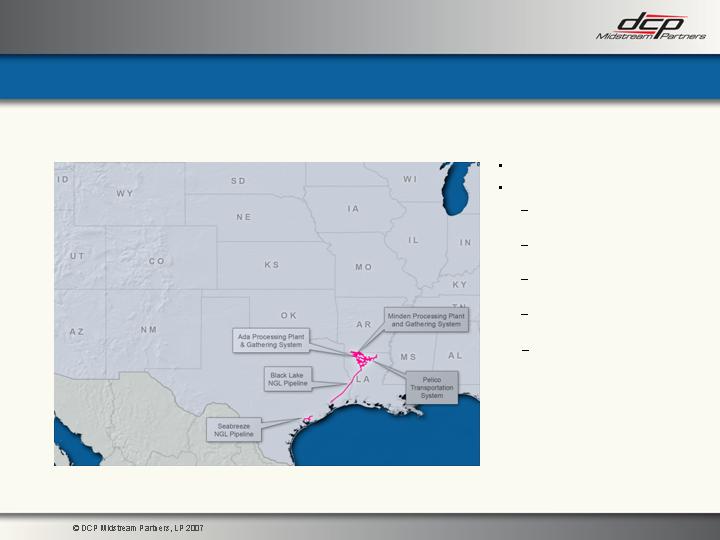

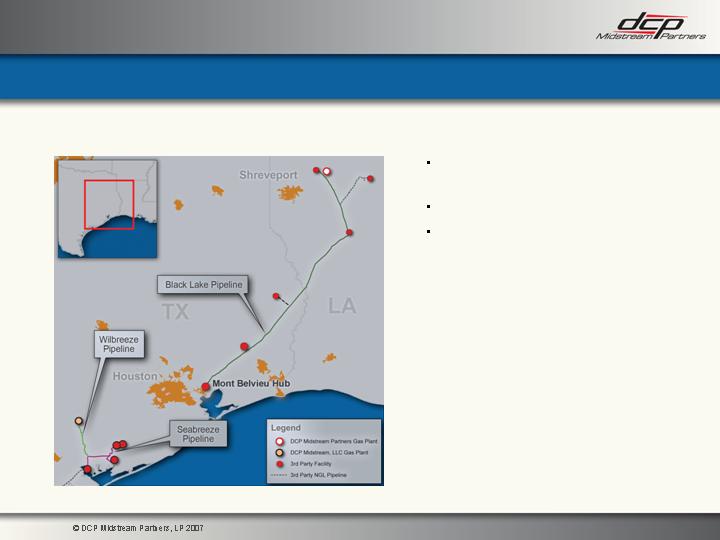

System Map - At Time of IPO

Two business segments

Five assets:

Minden Processing Plant

and Gathering System

Pelico Transportation

System

Ada Processing Plant and

Gathering System

Black Lake NGL Pipeline

(45%)

Seabreeze NGL Pipeline

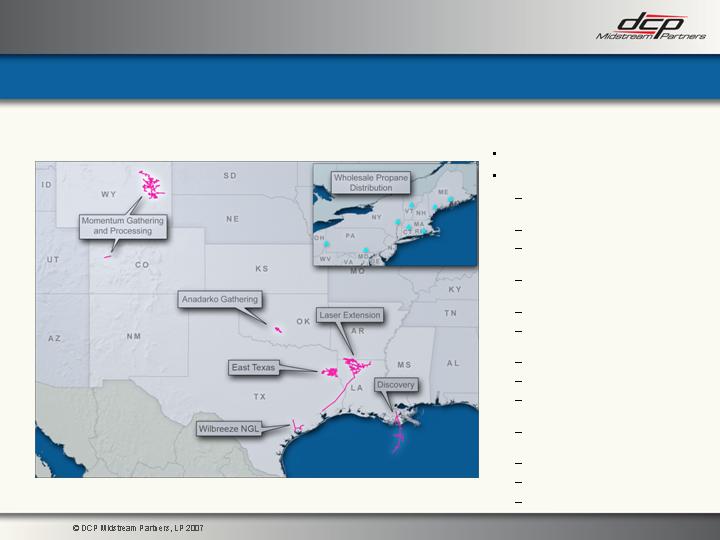

Acquisitions and construction diversify cash flow and grow asset footprint

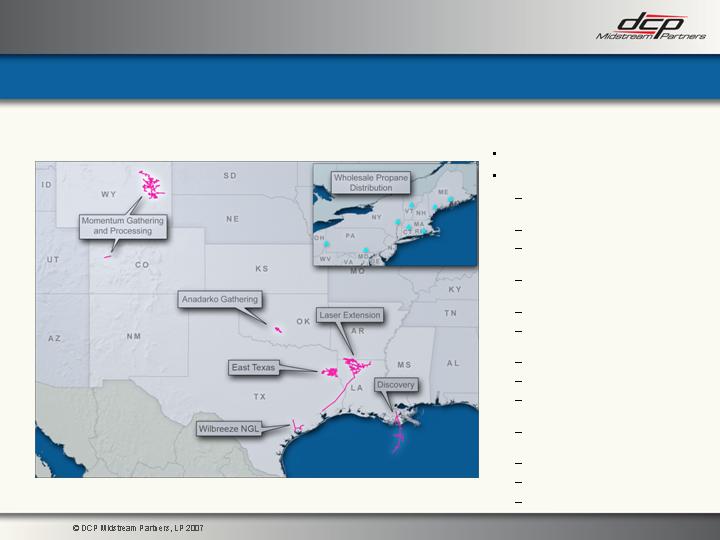

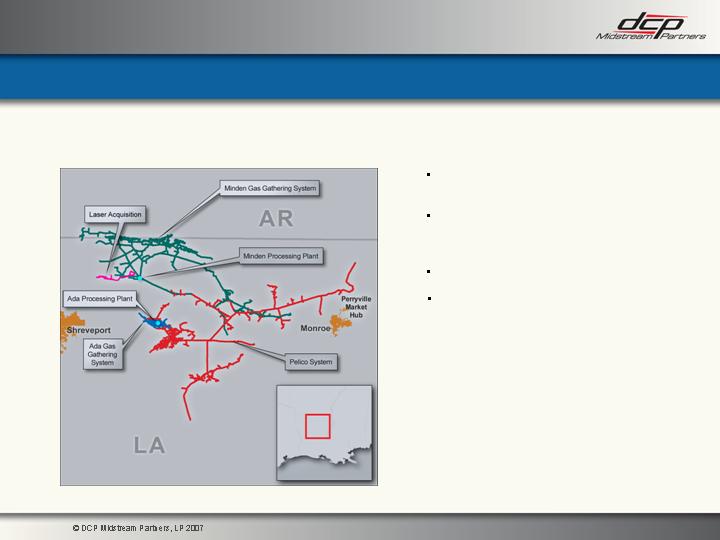

Three business segments

13 assets:

Minden Processing Plant and

Gathering System

Pelico Transportation System

Ada Processing Plant and

Gathering System

Black Lake NGL Pipeline

(45%)

Seabreeze NGL Pipeline

Wholesale Propane

Distribution (GSR)

Discovery (40%)

East Texas (25%)

Momentum Powder River

Basin

Momentum Piceance Basin

(70%)

Lindsay Gathering

Wilbreeze NGL Pipeline

Laser Extension

12

System Map - Current

13

Business Segment Overview

© DCP Midstream Partners, LP 2007

Integrated business with strong market position

Recent acquisitions add

scale and diversity

Assets well positioned to

capture processing,

marketing and

transportation upside

Commodity exposure

substantially hedged

through 2012

14

Natural Gas Services Segment

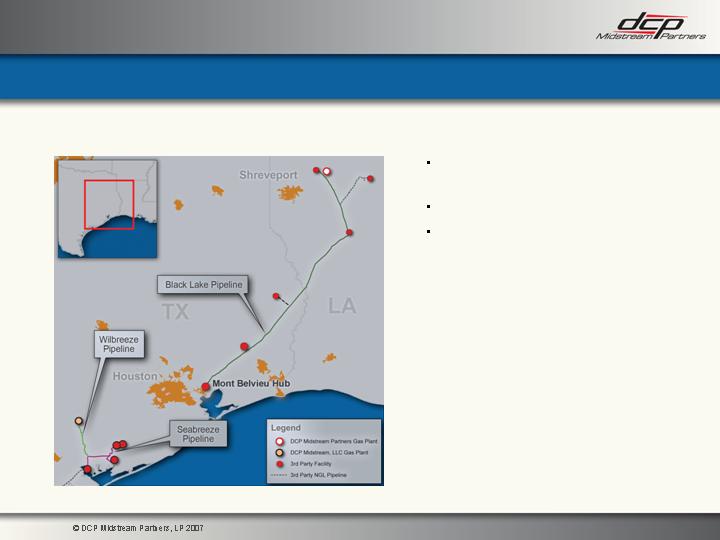

Access to key markets / fee-based cash flows

Wilbreeze pipeline delivers

DCP Midstream volumes

Black Lake volumes increasing

Fee-based revenue

15

NGL Logistics Segment

Largest wholesale propane

supplier in the Northeast

Generates fee-like earnings

Diversity of supply sources

Integrated and strategically

located business

Integrated business with strong market position

Six owned rail terminals and one owned pipeline terminal

Leased marine terminal

475,000 barrels storage

Marketing at several open access pipeline terminals

16

Wholesale Propane Logistics Segment

17

Acquired Businesses

And Constructed Assets

© DCP Midstream Partners, LP 2007

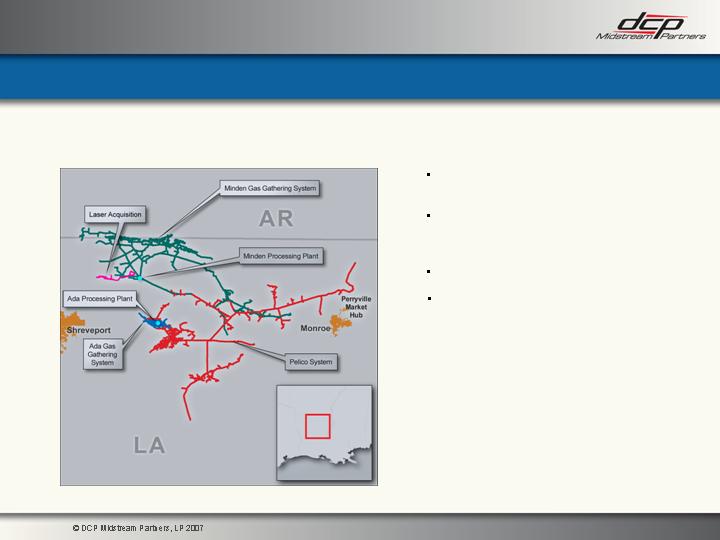

Natural extension of existing

Minden gathering system

Key producers include

Chesapeake, Devon, ConocoPhillips,

Anadarko, Headington

$10 million purchase price

Closed April 2, 2007

Adds 7 MMcf/d to Minden gathered volumes

18

Laser Transaction - Extends N. LA Footprint

Acquired natural gas gathering

assets from Anadarko for $181 million

Expands footprint into Mid-Continent

Provides operational synergies with

assets currently owned and operated

by DCP Midstream, LLC

Gathers approximately 20 mmcf/d of production

in Grady, Garvin and McClain counties

Gathering system consists of over

225 miles of pipeline and 9,500 hp

of compression

Closed May 9, 2007

Compliments Sponsor’s position in Mid-Continent

19

Lindsay Transaction - Synergies with Sponsor

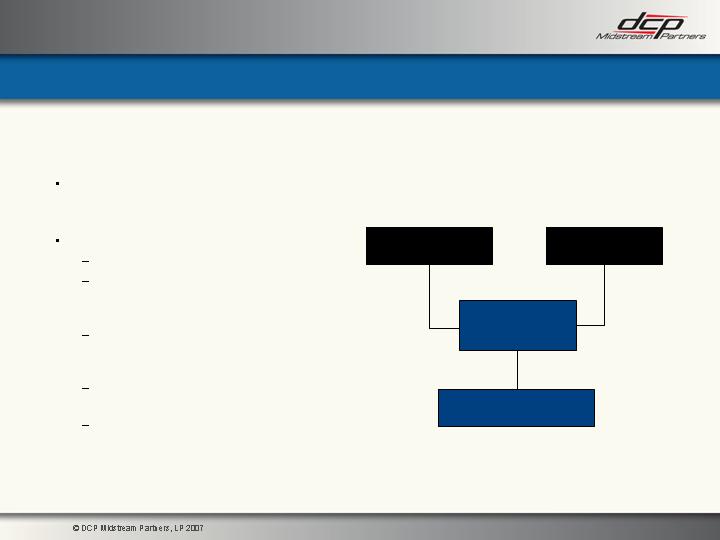

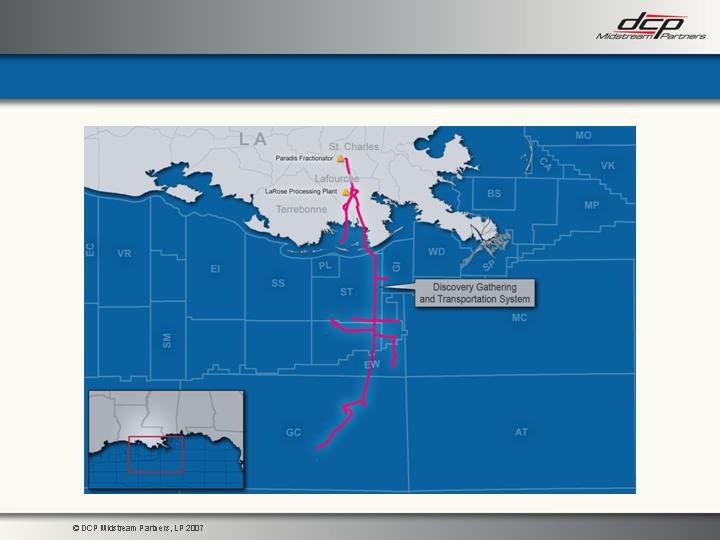

40% non-operated interest in partnership owning 270 mile

deepwater GOM gathering & transmission system

600 MMcf/d processing plant and 32 MBbls/d fractionator

located in Louisiana

25% interest in a 900 mile gathering system, 780 MMcf/d

processing plant and Carthage Hub located mainly in

Panola County, Texas

Discovery

East Texas

Purchase of $270 million of equity interests in assets from DCP

Midstream

Closed July 1, 2007

20

$270 MM “Dropdown” Transaction

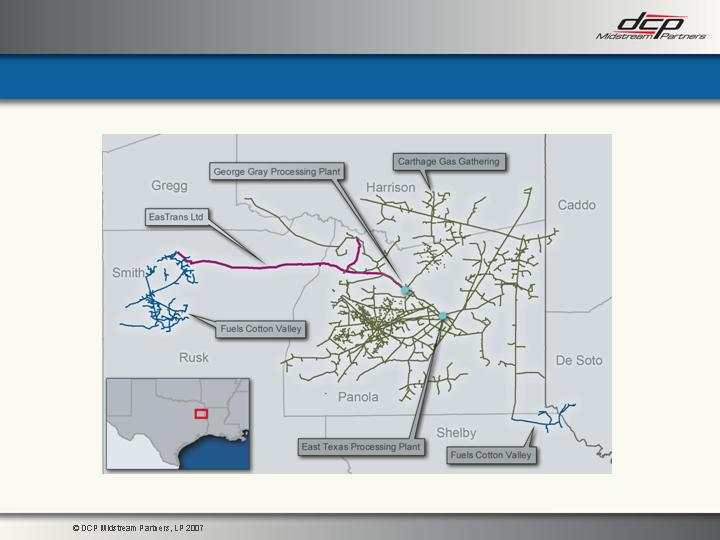

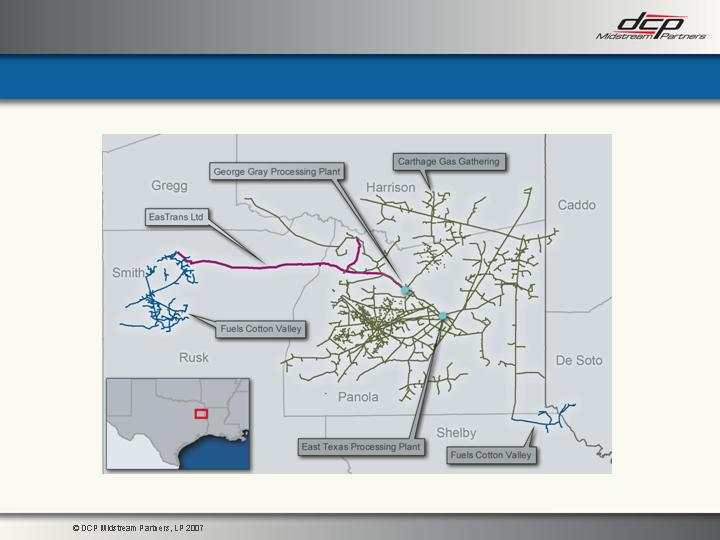

Located in Panola, Harrison, Shelby and Rusk Counties, TX with some smaller

lines in DeSoto and Caddo Parishes, LA. Assets include 4 primary parts:

East Texas Gathering System – Over 500 miles of gathering system and

over 25,000 HP

Carthage/East Texas Plant - individual gas processing plants with a total

capacity of 780 MMcf/d

EasTrans - pipeline and residue gas header system (“Carthage Hub”) at the

tailgate of the plant which provides access to 10 different residue pipeline outlets

Fuels Cotton Valley Gathering System - utility gathering system for 15 MMcf/d

primarily from Anadarko, and re-delivers to Houston Pipeline without being

processed at the Carthage plant

System includes 1,545 meter locations which includes wellhead and central delivery

point (“CDP”) locations

Integrated gas gathering and processing complex

21

East Texas Complex Overview

22

East Texas Asset Map

60%

100%

40%

DCP Midstream

Partners

Discovery

Producer

Services LLC

Discovery Gas

Transmission LLC

Williams Partners

L.P.

Discovery Ownership

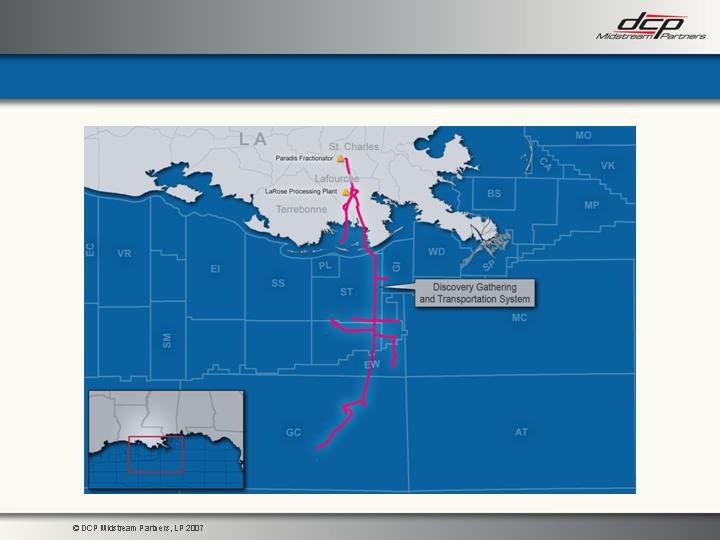

Located in the eastern Gulf of Mexico and

in Lafourche Parish, Louisiana

Principal assets include:

Gathering laterals – Approx. 100 miles

Discovery Gas Transmission (DGT)

– 105 mile mainline plus ~60 miles

of laterals under FERC jurisdiction

Larose Gas Processing Plant –

600 MMcf/d plant with high

recoveries and flexibility

Paradis Fractionator – working

capacity of 32,000 bpd

Tahiti Expansion – delayed pending

Chevron metallurgical work

Full range of “wellhead-to-market” services for offshore gas producers

23

Discovery Overview

24

Discovery Asset Map

$635 million acquisition of Momentum Energy Group by DCP Midstream

Allows DCP Midstream and DPM to collectively establish a strong presence in

three prominent producing basins

Fort Worth, Piceance and Powder River Basins

DPM acquired Piceance and PRB portions of asset base from DCP Midstream

Assets with existing cash flow

$165 million transaction

Transaction financed via issuance of $100 million of equity to sellers, $12 million

equity from DCP Midstream, debt and cash on hand

Number of sellers chose to roll a portion of their equity in Momentum into

DPM units

Closed August 29, 2007

Third-party acquisition made in conjunction with general partner

25

Momentum Transaction - Brings New Basins

1,324 miles of pipeline with footprint

covering more than 4,000 square miles

High pressure pipeline through the

heart of the Powder River Basin

Multiple operating modes

Low pressure casing head

Medium pressure CBM

High pressure transportation

Extensive Powder River Basin system

26

Douglas Gathering System

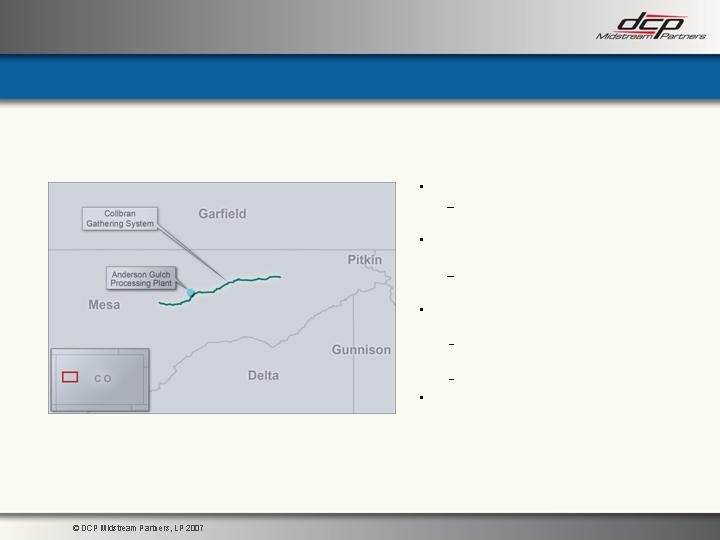

High organic growth potential

Evaluating significant future expansion

plans with JV partners

100 MMcf/d Anderson Gulch processing

facility

Processing capacity will expand to 120

MMcf/d in 1Q 2008

Key producers are Plains Exploration and

Delta Petroleum

24,200 acres – 10-year dedication with 67

Bcf volumetric guarantee

95% fee-based contracts

Purchased 70% of system (Plains Exploration

owns 25%, Delta owns 5%)

31 mile gathering system in Southern Piceance Basin in W. Colorado

27

Collbran Gathering & Processing System

28

Financial Overview

© DCP Midstream Partners, LP 2007

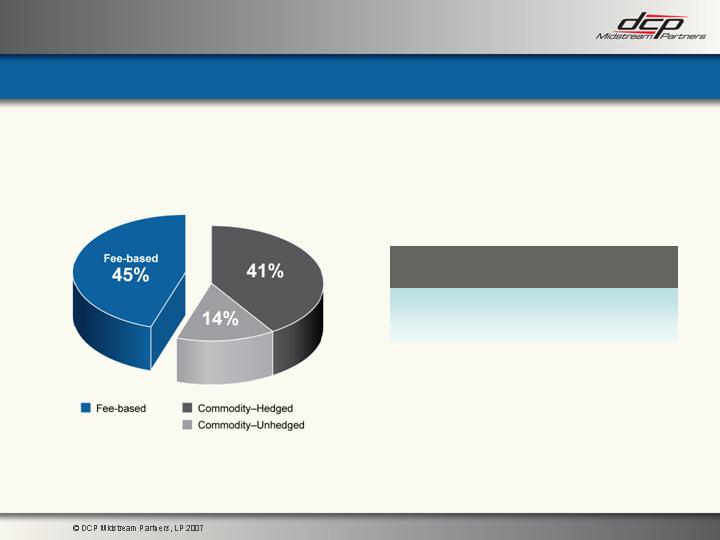

29

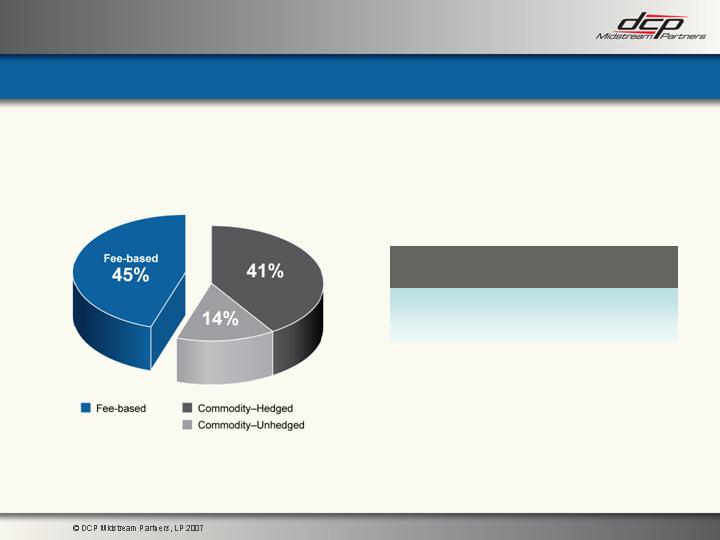

Contract Mix

2008 Estimated Gross Margin

by Contract Type

Estimated Commodity Sensitivity

Commodity

Natural Gas

NGL’s

Crude Oil

Amount of

Change

$1.00 / MMBtu

$0.10 / Gallon

$5.00 / Bbl

Impact on Cash

Flow ($Millions) *

$0.7

$3.0

$0.2

* Does not include potential non-cash mark-

to-market earnings impact from changes in

the fair value of commodity derivatives

2007 Financial Highlights

Strong cash flows and financing flexibility support growth

Distributable cash flow increased 22% 3Q07 YTD vs. 3Q06 YTD

Sixth consecutive quarterly distribution increase

Total unitholder return since IPO through 11-6-07 of 116%

Expanded credit facility to $850 million

Financed growth through timely and cost effective issuance of equity and

debt

30

31

Key Investment Highlights

Ability to capitalize on strong sponsorship

Assets with strong market positions

Stable cash flows from fee and substantially hedged commodity positions

Experienced management team with a demonstrated track record of

growing midstream and MLP businesses

Organic growth potential

Low cost of capital to facilitate growth strategy

Well positioned to execute growth strategy