Exhibit 99.1

Item 1. Business

OVERVIEW

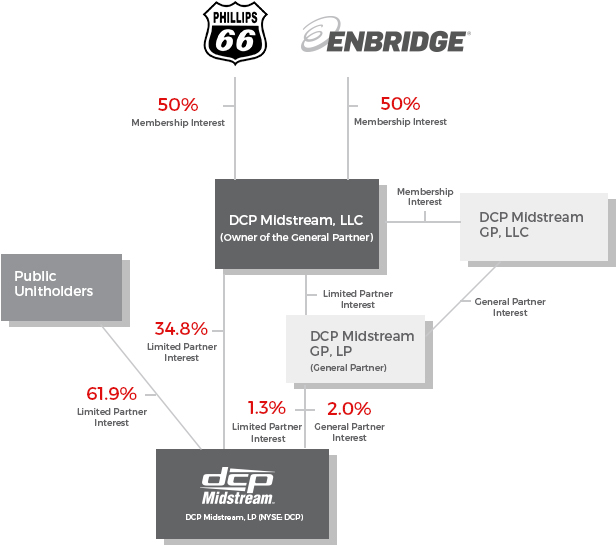

DCP Midstream, LP (together with its consolidated subsidiaries, “we”, “our”, “us”, the “registrant”, or the “Partnership”) is a Delaware limited Partnership formed in 2005 by DCP Midstream, LLC to own, operate, acquire and develop a diversified portfolio of complementary midstream energy assets. DCP Midstream, LLC and its subsidiaries and affiliates, collectively referred to as DCP Midstream, LLC is owned 50% by Phillips 66 and 50% by Enbridge, Inc. and its affiliates, or Enbridge.

The diagram below depicts our organizational structure as of May 24, 2017.

On January 1, 2017, DCP Midstream, LLC contributed to us: (i) its ownership interests in all of its subsidiaries owning operating assets, and (ii) $424 million of cash (together the “Contributions”). In consideration of the Partnership’s receipt of the Contributions, (i) the Partnership issued 28,552,480 common units to DCP Midstream, LLC and 2,550,644 general partner units to DCP Midstream GP, LP, the General Partner in a private placement and (ii) DCP Midstream Operating, LP ("the Operating Partnership") assumed $3,150 million of DCP Midstream, LLC’s debt. The transactions and documents contemplated by the Contribution Agreement are collectively referred to as the Transaction.

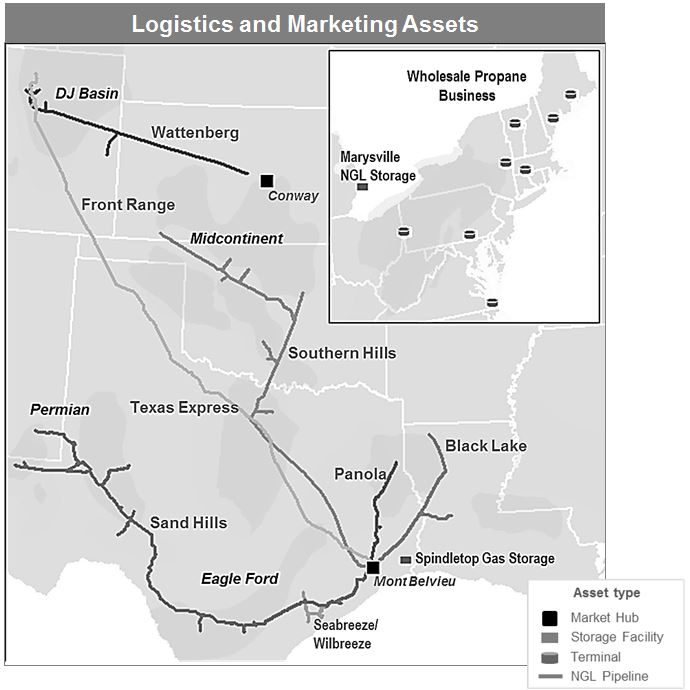

Concurrent with the completion of the Transaction in the first quarter of 2017, management reevaluated our reportable segments and determined that our operations are now organized into two reportable segments: (i) Gathering and Processing and (ii) Logistics and Marketing. Segment information for earlier periods has been retrospectively adjusted to reflect these reportable segments. Our Gathering and Processing segment includes operating segments that have been aggregated based on the nature of the products and services provided. Our Gathering and Processing segment consists of gathering, compressing, treating, and processing natural gas, producing and fractionating NGLs, and recovering and selling condensate. Our Logistics and Marketing segment includes transporting, trading, marketing, and storing natural gas and NGLs, fractionating NGLs, and wholesale propane logistics. The remainder of our business operations are presented as “Other,” and consist of unallocated corporate costs.

OUR BUSINESS STRATEGY

Our primary business objectives are to achieve sustained company profitability, a strong balance sheet and profitable growth, thereby sustaining our cash distribution per unit. We intend to accomplish these objectives by prudently executing the following business strategies:

Operational Performance. We believe our operating efficiency and reliability enhance our ability to attract new natural gas supplies by enabling us to offer more competitive terms, services and service flexibility to producers. Our gathering and processing systems and logistics assets consist of high-quality, well-maintained facilities, resulting in low-cost, efficient operations. Our goal is to establish a reputation in the midstream industry as a reliable, safe and low cost supplier of services to our customers. We will continue to pursue new contracts, cost efficiencies and operating improvements of our assets. We seek to increase the utilization of our existing facilities by providing additional services to our existing customers and by establishing relationships with new customers. In addition, we maximize efficiency by coordinating the completion of new facilities in a manner that is consistent with the expected production that supports them.

Organic Growth. We intend to use our strategic asset base in the United States and our position as the largest gatherer of natural gas, and as one of the largest producers and marketers of NGLs in the United States, as a platform for future growth. We plan to grow our business by constructing new gathering lines, processing facilities and NGL pipeline infrastructure, and expanding existing infrastructure.

Strategic Acquisitions and Partnerships. We intend to pursue economically attractive and strategic acquisition and partnership opportunities within the midstream energy industry, both in new and existing lines of business, and areas of operation.

OUR COMPETITIVE STRENGTHS

We are the largest gatherer of natural gas, based on wellhead volumes, in the United States, and one of the largest producers and marketers of NGLs in the United States. In 2016, our total wellhead volume was approximately 5.1 Bcf/d of natural gas and we produced an average of approximately 393 MBbls/d of NGLs. We provide an integrated package of logistics and marketing services to producers. We believe our ability to provide all of these services gives us an advantage in competing for new supplies of natural gas because we can provide substantially all services to move natural gas and NGLs from wellhead to market and creates value for our customers. We believe that we are well positioned to execute our business strategies and achieve one of our primary business objectives of sustaining our cash distribution per unit because of the following competitive strengths:

Strategically Located Gas Gathering and Processing Operations. Our assets are strategically located in areas with the potential for increasing our wellhead volumes and cash flow generation. We have operations in some of the largest producing regions in the United States: Permian Basin, Denver-Julesburg Basin (“DJ Basin”), Midcontinent, and Eagle Ford. In addition, we operate one of the largest portfolios of natural gas processing plants in the United States. Our gathering systems and processing plants are connected to numerous key natural gas pipeline systems that provide producers with access to a variety of natural gas market hubs.

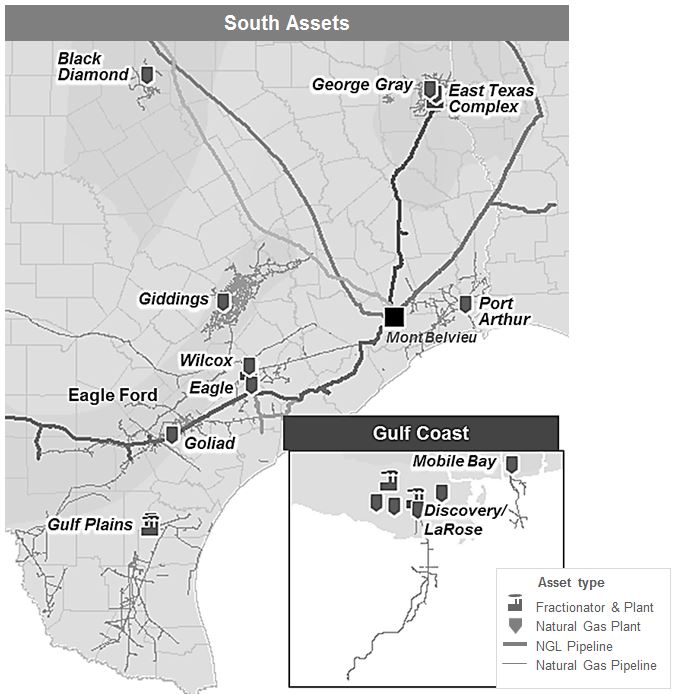

Integrated Logistics and Marketing Operations. We have connected our gathering and processing operations to key markets with NGL pipelines that offer our customers a competitive, integrated midstream service. We have strategically located NGL transportation pipelines in the Midcontinent, DJ Basin, East Texas, Gulf Coast, South Texas, Central Texas, and Permian Basin which are major NGL producing regions, NGL fractionation facilities in the Gulf Coast and an NGL storage facility in Michigan. Our NGL pipelines connect to various natural gas processing plants and transport the NGLs to large fractionation facilities, a petrochemical plant, a third party underground NGL storage facility and other markets along the Gulf Coast. Our NGL storage facility in Michigan is strategically adjacent to the Sarnia, Canada refinery and petrochemical corridor. We also have residue gas storage capacity at our Spindletop natural gas storage facility. We believe the strategic location of our assets coupled with their geographic diversity and our reputation for running our business reliably and effectively, presents us with continuing opportunities to provide competitive services to our customers and attract new natural gas production.

Stable Cash Flows. Our operations consist of a mix of fee-based and commodity-based services, which together with our commodity hedging program, are intended to generate relatively stable cash flows. Growth in our fee-based earnings will reduce the impact of unhedged margins. Additionally, while certain of our gathering and processing contracts subject us to commodity price risk, we have mitigated a portion of our currently anticipated commodity price risk associated with the equity volumes from our gathering and processing operations with fixed price commodity swaps, settling through the first quarter of 2018.

Established Relationships with Oil, Natural Gas and Petrochemical Companies. We have long-term relationships with many of our suppliers and customers, and we expect that we will continue to benefit from these relationships.

Experienced Management Team. Our senior management team and board of directors have extensive experience in the midstream industry. We believe our management team has a proven track record of enhancing value through organic growth and the acquisition, optimization and integration of midstream assets.

Affiliation with DCP Midstream, LLC and its owners. Our relationship with DCP Midstream, LLC and its owners, Phillips 66 and Enbridge, should continue to provide us with significant business opportunities. Through our relationship with DCP Midstream, LLC and its owners, we believe our strong commercial relationships throughout the energy industry, including with major producers of natural gas and NGLs in the United States, will help facilitate the implementation of our strategies.

DCP Midstream, LLC has a significant interest in us through its ownership of an approximately 2% general partner interest, a 36% limited partner interest and all of our incentive distribution rights.

OUR OPERATING SEGMENTS

Gathering and Processing Segment

General

Our Gathering and Processing segment consists of a geographically diverse complement of assets and ownership interests that provide a varied array of wellhead to market services for our producer customers in Alabama, Colorado, Kansas, Louisiana, Michigan, New Mexico, Oklahoma, Texas and Wyoming. These services include gathering, compressing, treating, and processing natural gas, producing and fractionating NGLs, and recovering and selling condensate. Our Gathering and Processing segment’s operations are organized into four regions: North, Permian, Midcontinent and South. Our geographic diversity helps to mitigate our natural gas supply risk in that we are not tied to one natural gas resource type or producing area. We believe our current geographic mix of assets is an important factor for maintaining and growing overall volumes and cash flow for this segment. Our assets are positioned in certain areas with active drilling programs and opportunities for organic growth.

We provide our producer customers with gathering and processing services that allow them to move their raw (unprocessed) natural gas to market. Raw natural gas is gathered, compressed and transported through pipelines to our processing facilities. In order for the raw natural gas to be accepted by the downstream market, we remove water, nitrogen and carbon dioxide and separate NGLs for further processing. Processed natural gas, usually referred to as residue natural gas, is then recompressed and delivered to natural gas pipelines and end users. The separated NGLs are in a mixed, unfractionated form and are sold and delivered through natural gas liquids pipelines to fractionation facilities for further separation.

We own or operate 61 natural gas processing plants and an interest in one additional plant through our 40% equity interest in Discovery Producer Services, LLC, or Discovery. At some of these facilities, we fractionate NGLs into individual components (ethane, propane, butane and natural gasoline).

We receive natural gas from a diverse group of producers under contracts with varying durations, and we receive fees or commodities from the producers to transport the natural gas from the wellhead to the processing plant. We receive fees or commodities as payment for our natural gas processing services, depending on the types of contracts we enter into with each supplier. We purchase or take custody of substantially all of our natural gas from producers, principally under fee-based or percent-of-proceeds/index processing contracts.

We actively seek new producing customers of natural gas on all of our systems to increase throughput volume and to offset natural declines in the production from connected wells. We obtain new natural gas supplies in our operating areas by contracting for production from new wells, by connecting new wells drilled on dedicated acreage and by obtaining natural gas that has been directly received or released from other gathering systems.

Our contracts with our producing customers in our Gathering and Processing segment are a mix of non-commodity sensitive fee-based contracts and commodity sensitive percent-of-proceeds and percent-of-liquids contracts. Percent-of-proceeds contracts are directly related to the price of natural gas, NGLs and condensate and percent-of-liquids contracts are directly related to the price of NGLs and condensate. Additionally, these contracts may include fee-based components. Generally, the initial term of these purchase agreements is three to five years and in some cases, the life of the lease. As we negotiate new agreements and renegotiate existing agreements, this may result in a change in contract mix period over period.

We enter into derivative financial instruments to mitigate a portion of the risk of weakening natural gas, NGL and condensate prices associated with our gathering, processing and sales activities, thereby stabilizing our cash flows. Our commodity derivative instruments used for our hedging program are a combination of direct NGL product, crude oil, and natural gas hedges. Due to the limited liquidity and tenor of the NGL derivative market, we have used crude oil swaps to mitigate a portion of our commodity price exposure to NGLs.

During 2016, total wellhead volume on our assets was approximately 5.1 Bcf/d, originating from a diversified mix of customers. Our systems each have significant customer acreage dedications that will continue to provide opportunities for growth as those customers execute their drilling plans over time. Our gathering systems also attract new natural gas volumes through numerous smaller acreage dedications and also by contracting with undedicated producers who are operating in or around our gathering footprint. During 2016, the combined NGL production from our processing facilities was approximately 393 MBbls/d and was delivered and sold into various NGL takeaway pipelines.

The following is operating data for our Gathering and Processing segment by region:

|

| | | | | | | | | | | | | | | |

| Operating Data |

| | | Year Ended December 31, 2016 |

| Regions | | Plants | | Approximate

Gathering

and Transmission

Systems (Miles) | | Approximate

Net Nameplate Plant

Capacity

(MMcf/d) (a) | | Natural Gas

Wellhead Volume

(MMcf/d) (a) | | NGL

Production

(MBbls/d) (a) |

| North | | 13 |

| | 5,445 |

| | 1,255 |

| | 1,126 |

| | 82 |

|

| Permian | | 16 |

| | 16,300 |

| | 1,460 |

| | 1,041 |

| | 107 |

|

| Midcontinent | | 12 |

| | 29,420 |

| | 1,765 |

| | 1,269 |

| | 94 |

|

| South | | 20 |

| | 7,415 |

| | 3,295 |

| | 1,688 |

| | 110 |

|

| Total | | 61 |

| | 58,580 |

| | 7,775 |

| | 5,124 |

| | 393 |

|

(a) Represents total capacity or total volumes allocated to our proportionate ownership share.

North Region

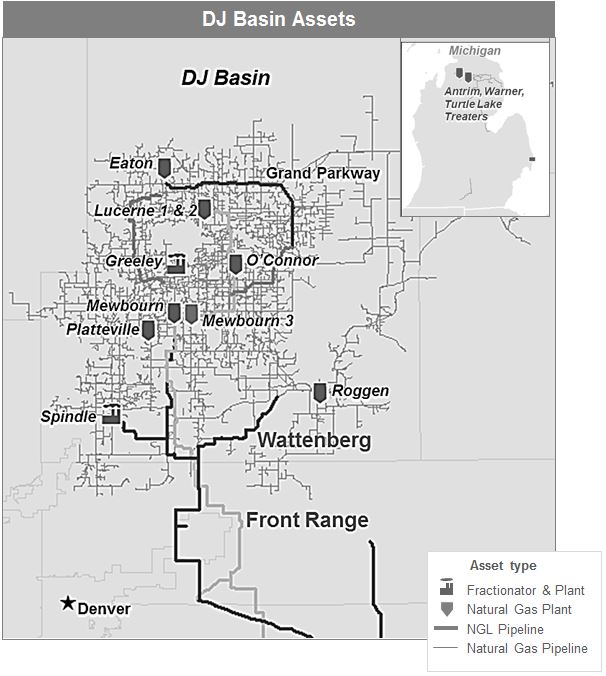

Our North region primarily consists of our DJ Basin system. We have a broad network of gathering and processing facilities in Weld County, Colorado that provide significant optionality and flexibility.

We are constructing a new 200 MMcf/d cryogenic natural gas processing plant, Mewbourn 3, which is expected to be placed in service in the fourth quarter of 2018. Our Mewbourn 3 plant will increase capacity to support the growing processing needs of producers in the DJ Basin.

Our DJ Basin system delivers to the Mont Belvieu hub in Mont Belvieu, Texas via the Front Range and Texas Express pipelines, owned 33.33% and 10% by us, respectively, and to the Conway hub in Bushton, Kansas via our Wattenberg pipeline in our Logistics and Marketing segment.

Permian Region

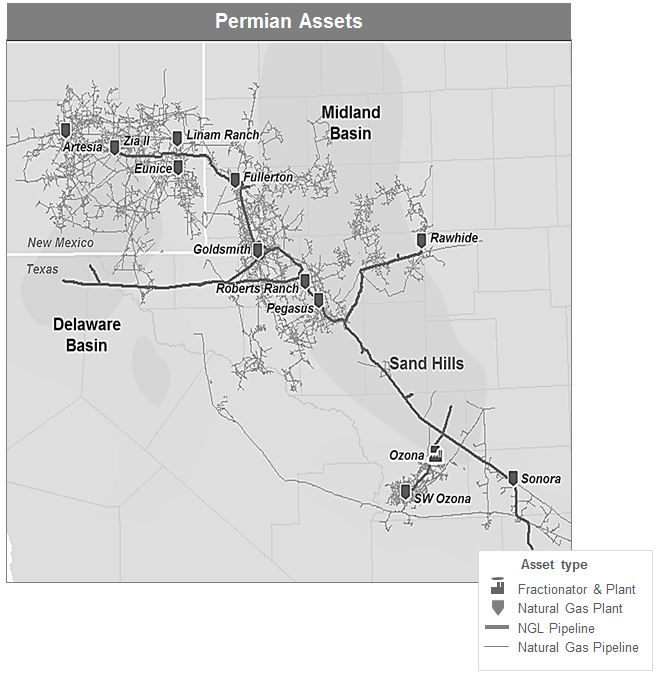

Our Permian region primarily includes our West Texas system in the Midland Basin and our Southeast New Mexico system in the Delaware Basin. Producers continue to focus drilling activity on the most attractive acreage in the Midland and Delaware Basins. Our gathering and processing assets in the Permian region provide NGL takeaway service via our Sand Hills pipeline, which is owned 66.67% by us and 33.33% by Phillips 66, to fractionation facilities along the Gulf Coast and to Mont Belvieu hub.

Midcontinent Region

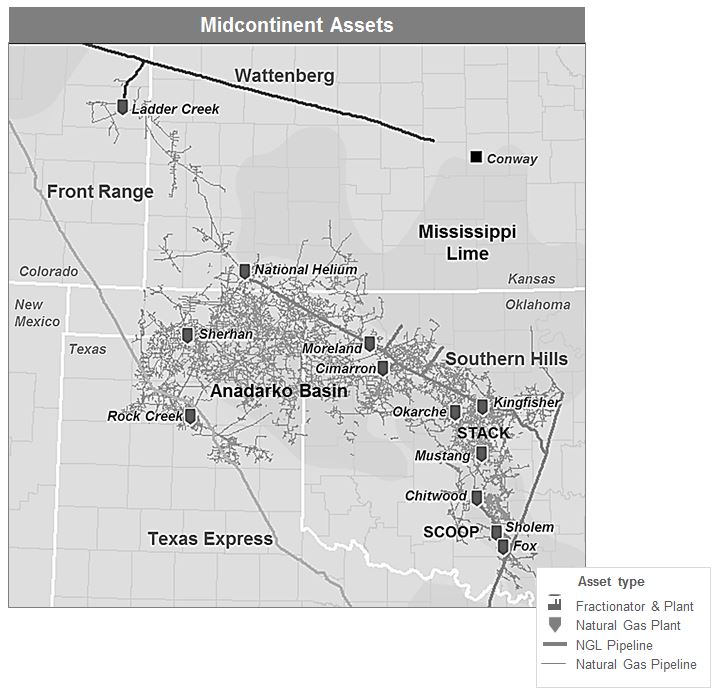

Our Midcontinent region primarily includes our Liberal system, Panhandle system, and our Central Oklahoma system. We gather and process raw natural gas primarily from the Ardmore and Anadarko Basins, including the prolific South Central Oklahoma Oil Province (“SCOOP”) play and the Sooner Trend Anadarko Basin Canadian and Kingfisher (“STACK”) play.

Existing production in the western Midcontinent region, which includes our Liberal and Panhandle systems, is typically from mature fields with shallow decline profiles that will provide our plants with a dependable source of raw natural gas over a long term. Our gathering system footprint in the eastern Midcontinent region, which includes our Central Oklahoma system, serves the SCOOP and STACK plays. We believe the infrastructure of our plants and gathering facilities is uniquely positioned to pursue our consolidation strategy in this region.

Our gathering and processing assets in the Midcontinent region deliver NGLs to the Gulf Coast and Mont Belvieu via our Southern Hills pipeline, owned 66.67% by us and 33.33% by Phillips 66.

South Region

Our South region primarily includes our Eagle Ford system, East Texas system, and 40% interest in the Discovery system. The South region also included our Northern Louisiana system which was sold on July 1, 2016, and is included in the 2016 operating data through the period of ownership. We are pursuing cost efficiencies and increasing the utilization of our existing assets as overall drilling and production has declined in certain areas of the region.

Our Eagle Ford system delivers NGLs to the Gulf Coast petrochemical markets and to Mont Belvieu through our Sand Hills pipeline and other third party NGL pipelines. Our East Texas system provides NGL takeaway service through the Panola pipeline, owned 15% by us, and delivers gas primarily through its Carthage Hub which delivers residue gas to multiple interstate and intrastate pipelines.

The Discovery system is operated by Williams Partners L.P., who owns a 60% interest, and offers a full range of wellhead-to-market services to both onshore and offshore natural gas producers. The assets are primarily located in the eastern Gulf of Mexico and Louisiana, and have access to downstream pipelines and markets.

Competition

We face strong competition in acquiring raw natural gas supplies. Our competitors in obtaining additional gas supplies and in gathering and processing raw natural gas includes major integrated oil and gas companies, interstate and intrastate pipelines, and companies that gather, compress, treat, process, transport, store and/or market natural gas. Competition is often the greatest in geographic areas experiencing robust drilling by producers and during periods of high commodity prices for crude oil, natural gas and/or NGLs. Competition is also increased in those geographic areas where our commercial contracts with our customers are shorter term and therefore must be renegotiated on a more frequent basis.

Logistics and Marketing Segment

General

We market our NGLs and residue gas and provide logistics and marketing services to third-party NGL producers and sales customers in significant NGL production and market centers in the United States. This includes purchasing NGLs on behalf of third-party NGL producers for shipment on our NGL pipelines and resale in key markets.

Our NGL services include plant tailgate purchases, transportation, fractionation, flexible pricing options, price risk management and product-in-kind agreements. Our primary NGL operations are located in close proximity to our Gathering and Processing assets in each of the operating regions.

Our NGL pipelines transport NGLs from natural gas processing plants to fractionation facilities, a petrochemical plant and a third party underground NGL storage facility. Our pipelines provide transportation services to customers primarily on a fee basis. Therefore, the results of operations for this business are generally dependent upon the volume of product transported and the level of fees charged to customers. The volumes of NGLs transported on our pipelines are dependent on the level of production of NGLs from processing plants connected to our NGL pipelines. When natural gas prices are high relative to NGL prices, it is less profitable to recover NGLs from natural gas because of the higher value of natural gas compared to the value of NGLs. As a result, we have experienced periods, and will likely experience periods in the future, when higher relative natural gas prices reduce the volume of NGLs produced at plants connected to our NGL pipelines.

Our natural gas systems have the ability to deliver gas into numerous downstream transportation pipelines and markets. We sell residue gas on behalf of our producer customers and residue gas which we earn under our gas supply agreements, supplying the residue gas demands of end-use customers physically attached to our pipeline systems and managing excess capacity of our owned storage and transportation assets. End-users include large industrial companies, natural gas distribution companies and electric utilities. We are focused on extracting the highest possible value for the residue gas that results from our processing and transportation operations. We sell the residue gas at market-based prices.

Our ownership in various intrastate natural gas pipelines give us access to market centers/hubs such as Waha, Texas; Katy, Texas and the Houston Ship Channel and are used in our natural gas asset based trading activities.

The following is operating data for our Logistics and Marketing segment:

|

| | | | | | | | | | | | | | | | | | | | | |

| Operating Data |

| | | | | | | | | | | | | Year Ended December 31, 2016 |

| System | | Approximate

System Length (Miles) | | Fractionators | | Approximate

Throughput Capacity

(MBbls/d) (a) | | Approximate NGL Storage Capacity (MMBbls) | | Approximate Natural Gas Storage Capacity (Bcf) | | Pipeline Throughput

(MBbls/d) (a) | | Fractionator Throughput

(MBbls/d) (a) |

| Sand Hills pipeline | | 1,325 |

| | — |

| | 186 |

| | — |

| | — |

| | 158 |

| | — |

|

| Southern Hills pipeline | | 940 |

| | — |

| | 117 |

| | — |

| | — |

| | 65 |

| | — |

|

| Front Range pipeline | | 450 |

| | — |

| | 50 |

| | — |

| | — |

| | 34 |

| | — |

|

| Texas Express pipeline | | 595 |

| | — |

| | 28 |

| | — |

| | — |

| | 15 |

| | — |

|

| Other pipelines | | 2,480 |

| | — |

| | 172 |

| | — |

| | — |

| | 148 |

| | — |

|

| Mont Belvieu fractionators | | — |

| | 2 |

| | 60 |

| | — |

| | — |

| | — |

| | 50 |

|

| Storage facilities | | — |

| | — |

| | — |

| | 8 |

| | 12 |

| | — |

| | — |

|

| Total | | 5,790 |

| | 2 |

| | 613 |

| | 8 |

| | 12 |

| | 420 |

| | 50 |

|

| |

| (a) | Represents total NGL capacity or throughput allocated to our proportionate ownership share for 2016 divided by 365 days. |

NGL Pipelines

DCP Sand Hills Pipeline, LLC, or the Sand Hills pipeline, an interstate NGL pipeline in which we own a 66.67% interest, is a common carrier pipeline which provides takeaway service from plants in the Permian and the Eagle Ford basins to fractionation facilities along the Texas Gulf Coast and at the Mont Belvieu, Texas market hub. We are currently further expanding the Sand Hills pipeline to 365 MBbls/d expected to be in service in the fourth quarter of 2017, and have multiple additional Sand Hills lateral connections in flight throughout 2017.

DCP Southern Hills Pipeline, LLC, or the Southern Hills pipeline, an interstate NGL pipeline in which we own a 66.67% interest, provides takeaway service from the Midcontinent to fractionation facilities at the Mont Belvieu, Texas market hub.

Front Range Pipeline LLC, or the Front Range pipeline, an interstate NGL pipeline in which we own a 33.33% interest, originates in the DJ Basin and extends to Skellytown, Texas. The Front Range pipeline connects to our O'Connor, Lucerne 1, Lucerne 2, and Mewbourn plants as well as third party plants in the DJ Basin. Enterprise Products Partners L.P., or Enterprise, is the operator of the pipeline.

Texas Express Pipeline LLC, or the Texas Express pipeline, an intrastate NGL pipeline in which we own a 10% interest, originates near Skellytown in Carson County, Texas, and extends to Enterprise's natural gas liquids fractionation and storage complex at Mont Belvieu, Texas. The pipeline also provides access to other third party facilities in the area. Enterprise is the operator of the pipeline.

The Southern Hills, Sand Hills, Texas Express, and Front Range pipelines have in place long-term, fee-based transportation agreements, a portion of which are ship-or-pay, with us as well as third party shippers. These NGL pipelines collect fee-based transportation revenue under regulated tariffs.

NGL Fractionation Facilities

We own a 12.5% interest in the Enterprise fractionator operated by Enterprise and a 20% interest in the Mont Belvieu 1 fractionator operated by ONEOK Partners, both located in Mont Belvieu, Texas. The fractionation facilities separate NGLs received from processing plants into their individual components. These fractionation services are provided on a fee basis. The results of operations for this business are generally dependent upon the volume of NGLs fractionated and the level of fees charged to customers.

Storage Facilities

Our NGL storage facility, which stores ethane, propane and butane, is located in Marysville, Michigan and has strategic access to the Marcellus, Utica and Canadian NGLs. Our facility includes 11 underground salt caverns with approximately 8 MMBbls of storage capacity. Our facility serves regional refining and petrochemical demand, and helps to balance the seasonality of propane distribution in the Midwestern and Northeastern United States and in Sarnia, Canada. We provide services to customers primarily on a fee basis under multi-year storage agreements. The results of operations for this business are generally dependent upon the volume stored and the level of fees charged to customers.

Our Spindletop natural gas storage facility is located in Texas and plays an important role in our ability to act as a full-service natural gas marketer. The facility has capacity for residue gas of approximately 12 Bcf. We may lease a portion of the facility’s capacity to third-party customers, and use the balance to manage relatively constant natural gas supply volumes with uneven demand levels, provide “backup” service to our customers and support our asset based trading activities. Our asset based trading activities are designed to realize margins related to fluctuations in commodity prices, time spreads and basis differentials and to maximize the value of our storage facility.

Wholesale Propane

We operate a wholesale propane logistics business in the mid-Atlantic, upper Midwest and Northeastern United States. We purchase large volumes of propane supply from fractionation facilities and crude oil refineries, primarily located in the Texas and Louisiana Gulf Coast area, Canada and other international sources, and transport these volumes of propane supply by pipeline, rail or ship to our terminals and storage facilities. We primarily sell propane on a wholesale basis to propane distributors under annual sales agreements who in turn resell propane to their customers. Our operations include one owned marine terminal, one owned propane pipeline terminal and six owned propane rail terminals, with a combined capacity of approximately 550 MBbls, and access to several open access pipeline terminals.

The wholesale propane marketing business is significantly impacted by seasonal and weather-driven demand, particularly in the winter, which can impact the price and volume of propane sold in the markets we serve.

Trading and Marketing

Our energy trading operations are exposed to market variables and commodity price risk. We manage commodity price risk related to our natural gas storage and pipeline assets by engaging in natural gas asset based trading and marketing. We may enter into physical contracts and financial instruments with the objective of realizing a positive margin from the purchase and sale of commodity-based instruments.

Our NGL proprietary trading activity includes trading energy related products and services. We undertake these activities through the use of fixed forward sales and purchases, basis and spread trades, storage opportunities, put/call options, term contracts and spot market trading. These energy trading operations are exposed to market variables and commodity price risk with respect to these products and services, and these operations may enter into physical contracts and financial instruments with the objective of realizing a positive margin from the purchase and sale of commodity-based instruments. These physical and financial instruments are not designated as hedging instruments and are recorded at fair value with changes in fair value recorded in the current period consolidated statements of operations.

We may execute a time spread transaction when the difference between the current price of natural gas (cash or futures) and the futures market price for natural gas exceeds our cost of storing physical gas in our owned and/or leased storage facilities. The time spread transaction allows us to lock in a margin when this market condition exists. A time spread transaction is executed by establishing a long gas position at one point in time and establishing an equal short gas position at a different point in time. We typically use swaps to execute these transactions, which are not designated as hedging instruments and are recorded at fair value with changes in fair value recorded in the current period consolidated statements of operations. While gas held in our storage locations is recorded at the lower of average cost or market, the derivative instruments that are used to manage our storage facilities are recorded at fair value and any changes in fair value are currently recorded in our consolidated statements of operations. Even though we may have economically hedged our exposure and locked in a future margin, the use of lower-of-cost-or-market accounting for our physical inventory and the use of mark-to-market accounting for our derivative instruments may subject our earnings to market volatility.

We may execute basis spread transactions when the market price differential between locations on a pipeline asset exceeds our cost of transporting physical gas through our owned and/or leased pipeline asset. When this market condition exists, we may execute derivative instruments around this differential at the market price. This basis spread transaction allows us to lock in a margin on our physical purchases and sales of gas. We typically use swaps to execute these transactions, which are not designated as hedging instruments and are recorded at fair value with changes in fair value recorded in the current period consolidated statements of operations. As discussed above, the accounting for physical gas purchases and sales and the accounting for the derivative instruments used to manage such purchases and sales differ, and may subject our earnings to market volatility, even though the transaction represents an economic hedge in which we have locked in a future margin.

Customers and Contracts

We sell NGLs to a variety of customers ranging from large, multi-national petrochemical and refining companies to small regional retail propane distributors. Substantially all of our NGL sales are made at market-based prices, including approximately 27% of our NGL production which was committed to Phillips 66 and Chevron Phillips Chemical, or CPChem as of December 31, 2016. The primary production commitment on certain contracts began a ratable wind down period in December 2014 and expires in January 2019. We anticipate continuing to purchase and sell commodities with Phillips 66 and CPChem in the ordinary course of business.

Competition

The Logistics and Marketing business is highly competitive in our markets and includes interstate and intrastate pipelines, integrated oil and gas companies that produce, fractionate, transport, store and sell natural gas and NGLs, and underground storage facilities. Competition is often the greatest in geographic areas experiencing robust drilling by producers and strong petrochemical demand and during periods of high NGL prices relative to natural gas. Competition is also increased in those geographic areas where our contracts with our customers are shorter term and therefore must be renegotiated on a more frequent basis.

Competition in the NGLs marketing area comes from other midstream NGL marketing companies, international producers/traders, chemical companies, refineries and other asset owners. Along with numerous marketing competitors, we offer price risk management and other services. We believe it is important that we tailor our services to the end-use customer to remain competitive.

Other Segment Information

For additional information on our segments, please see Exhibit 99.3 “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and Note 21 of the Notes to Consolidated Financial Statements in Exhibit 99.4 “Financial Statements and Supplementary Data" in this Form 8-K.

We have no revenue attributable to international activities.

REGULATORY AND ENVIRONMENTAL MATTERS

Safety and Maintenance Regulation

We are subject to regulation by the United States Department of Transportation, or DOT, under the Hazardous Liquids Pipeline Safety Act of 1979, as amended, or HLPSA, and comparable state statutes with respect to design, installation, testing, construction, operation, replacement and management of pipeline facilities. HLPSA applies to interstate and intrastate pipeline facilities and the pipeline transportation of liquid petroleum and petroleum products, including NGLs and condensate, and requires any entity that owns or operates pipeline facilities to comply with such regulations, to permit access to and copying of records and to file certain reports and provide information as required by the United States Secretary of Transportation. These regulations include potential fines and penalties for violations. We believe that we are in compliance in all material respects with these HLPSA regulations.

We are also subject to the Natural Gas Pipeline Safety Act of 1968, as amended, or NGPSA, and the Pipeline Safety Improvement Act of 2002. The NGPSA regulates safety requirements in the design, construction, operation and maintenance of gas pipeline facilities while the Pipeline Safety Improvement Act establishes mandatory inspections for all United States oil and natural gas transportation pipelines in high-consequence areas within 10 years. DOT, through the Pipeline and Hazardous Materials Safety Administration (PHMSA), has developed regulations implementing the Pipeline Safety Improvement Act that requires pipeline operators to implement integrity management programs, including more frequent inspections and other safety protections in areas where the consequences of potential pipeline accidents pose the greatest risk to people and their property.

Pipeline safety legislation enacted in 2012, the Pipeline Safety, Regulatory Certainty, and Job Creation Act of 2011, (the Pipeline Safety and Job Creations Act) reauthorizes funding for federal pipeline safety programs through 2015, increases penalties for safety violations, establishes additional safety requirements for newly constructed pipelines, and requires studies of certain safety issues that could result in the adoption of new regulatory requirements for existing pipelines, including the expansion of integrity management, use of automatic and remote-controlled shut-off valves, leak detection systems, sufficiency of existing regulation of gathering pipelines, use of excess flow valves, verification of maximum allowable operating pressure, incident notification, and other pipeline-safety related requirements. New rules proposed by DOT’s PHMSA address many areas of this legislation. Extending the integrity management requirements to our gathering lines would impose additional obligations on us and could add material cost to our operations.

The Pipeline Safety and Job Creation Act requires more stringent oversight of pipelines and increased civil penalties for violations of pipeline safety rules. The legislation gives PHMSA civil penalty authority up to $200,000 per day per violation, with a maximum of $2 million for any related series of violations. Any material penalties or fines under these or other statutes, rules, regulations or orders could have a material adverse impact on our business, financial condition, results of operation and cash flows.

We currently estimate we will incur between $16 million and $20 million between 2017 and 2021 to implement integrity management program testing along certain segments of our natural gas transmission and NGL pipelines. We believe that we are in compliance in all material respects with the NGPSA and the Pipeline Safety Improvement Act of 2002 and the Pipeline Safety and Job Creation Act.

States are largely preempted by federal law from regulating pipeline safety but may assume responsibility for enforcing intrastate pipeline regulations at least as stringent as the federal standards. In practice, states vary considerably in their authority and capacity to address pipeline safety. We do not anticipate any significant problems in complying with applicable state laws and regulations in those states in which we or the entities in which we own an interest operate. Our natural gas transmission and regulated gathering pipelines have ongoing inspection and compliance programs designed to keep the facilities in compliance with pipeline safety and pollution control requirements.

In addition, we are subject to the requirements of the federal Occupational Safety and Health Act, or OSHA, and comparable state statutes, whose purpose is to protect the health and safety of workers, both generally and within the pipeline industry. In addition, the OSHA hazard communication standard, the Environmental Protection Agency, or EPA, community right-to-know regulations under Title III of the federal Superfund Amendment and Reauthorization Act and comparable state statutes require that information be maintained concerning hazardous materials used or produced in our operations and that this information be provided to employees, state and local government authorities and citizens. We and the entities in which we own an interest are also subject to OSHA Process Safety Management and EPA Risk Management Program regulations, which are designed to prevent or minimize the consequences of catastrophic releases of toxic, reactive, flammable or explosive chemicals. The OSHA regulations apply to any process which involves a chemical at or above specified thresholds, or any process which involves flammable liquid or gas, pressurized tanks, caverns and wells holding or handling these materials in quantities in excess of 10,000 pounds at various locations. Flammable liquids stored in atmospheric tanks below their normal boiling point without the benefit of chilling or refrigeration are exempt from these standards. The EPA regulations have similar applicability thresholds. We have an internal program of inspection designed to monitor and enforce compliance with worker safety requirements. We believe that we are in compliance in all material respects with all applicable laws and regulations relating to worker health and safety.

Propane Regulation

National Fire Protection Association Codes No. 54 and No. 58, which establish rules and procedures governing the safe handling of propane, or comparable regulations, have been adopted as the industry standard in all of the states in which we operate. In some states these laws are administered by state agencies, and in others they are administered on a municipal level. With respect to the transportation of propane by truck, we are subject to regulations promulgated under the Federal Motor Carrier Safety Act. These regulations cover the transportation of hazardous materials and are administered by the DOT. The transportation of propane by rail is regulated by the Federal Railroad Administration. We conduct ongoing training programs to help ensure that our operations are in compliance with applicable regulations. We maintain various permits that are necessary to operate our facilities, some of which may be material to our propane operations. We believe that the procedures currently in effect at all of our facilities for the handling, storage and distribution of propane are consistent with industry standards and are in compliance in all material respects with applicable laws and regulations.

FERC and State Regulation of Operations

FERC regulation of interstate natural gas pipelines, the marketing and sale of natural gas in interstate commerce and the transportation of NGLs in interstate commerce may affect certain aspects of our business and the market for our products and services. Regulation of gathering systems and intrastate transportation of natural gas and NGLs by state agencies may also affect our business.

Interstate Natural Gas Pipeline Regulation

Our Cimarron River, Discovery, and Dauphin Island Gathering Partners systems, or portions thereof, are some of our natural gas pipeline assets that are subject to regulation by FERC, under the Natural Gas Act of 1938, as amended, or NGA. Natural gas companies subject to the NGA may only charge rates that have been determined to be just and reasonable. In addition, FERC authority over natural gas companies that provide natural gas pipeline transportation services in interstate commerce includes:

| |

| • | certification and construction of new facilities; |

| |

| • | abandonment of services and facilities; |

| |

| • | maintenance of accounts and records; |

| |

| • | acquisition and disposition of facilities; |

| |

| • | initiation and discontinuation of transportation services; |

| |

| • | terms and conditions of transportation services and service contracts with customers; |

| |

| • | depreciation and amortization policies; |

| |

| • | conduct and relationship with certain affiliates; and |

Generally, the maximum filed recourse rates for an interstate natural gas pipeline's transportation services are based on the pipeline's cost of service including recovery of and a return on the pipeline’s actual prudent investment cost. Key determinants in the ratemaking process are costs of providing service, including an income tax allowance, allowed rate of return and volume throughput and contractual capacity commitment assumptions. The allocation of costs to various pipeline services and the manner in which rates are designed also can impact a pipeline's profitability. The maximum applicable recourse rates and terms and conditions for service are set forth in each pipeline’s FERC-approved gas tariff. FERC-regulated natural gas pipelines are permitted to discount their firm and interruptible rates without further FERC authorization down to the minimum rate or variable cost of performing service, provided they do not “unduly discriminate.”

Tariff changes can only be implemented upon approval by FERC. Two primary methods are available for changing the rates, terms and conditions of service of an interstate natural gas pipeline. Under the first method, the pipeline voluntarily seeks a tariff change by making a tariff filing with FERC justifying the proposed tariff change and providing notice, generally 30 days, to the appropriate parties. If FERC determines, as required by the NGA, that a proposed change is just and reasonable, FERC will accept the proposed change and the pipeline will implement such change in its tariff. However, if FERC determines that a proposed change may not be just and reasonable as required by NGA, then FERC may suspend such change for up to five months beyond the date on which the change would otherwise go into effect and set the matter for an administrative hearing. Subsequent to any suspension period ordered by FERC, the proposed change may be placed into effect by the company, pending final FERC approval. In most cases, a proposed rate increase is placed into effect before a final FERC determination on such rate increase, and the proposed increase is collected subject to refund (plus interest). Under the second method, FERC may, on its own motion or based on a complaint, initiate a proceeding to compel the company to change or justify its rates, terms and/or conditions of service. If FERC determines that the existing rates, terms and/or conditions of service are unjust, unreasonable, unduly discriminatory or preferential, then any rate reduction or change that it orders generally will be effective prospectively from the date of the FERC order requiring this change.

The natural gas industry historically has been heavily regulated; therefore, there is no assurance that a more stringent regulatory approach will not be pursued by FERC and Congress, especially in light of potential market power abuse by marketing companies engaged in interstate commerce. In the Energy Policy Act of 2005, or EPACT 2005, Congress amended the NGA and Federal Power Act to add anti-fraud and anti-manipulation requirements. EPACT 2005 prohibits the use of any “manipulative or deceptive device or contrivance” in connection with the purchase or sale of natural gas, electric energy or transportation subject to FERC jurisdiction. FERC adopted market manipulation and market behavior rules to implement the authority granted under EPACT 2005. These rules, which prohibit fraud and manipulation in wholesale energy markets, are subject to broad interpretation. Given FERC's broad mandate granted in EPACT 2005, if energy prices are high, or exhibit what FERC deems to be "unusual" trading patterns, FERC may investigate energy markets to determine if behavior unduly impacted or "manipulated" energy prices.

In addition, EPACT 2005 gave FERC increased penalty authority for violations of the NGA and FERC's rules and regulations thereunder. FERC may issue civil penalties of up to $1 million per day per violation, and violators may be subject to criminal penalties of up to $1 million per violation and five years in prison. FERC may also order disgorgement of profits obtained in violation of FERC rules. FERC relies on its enforcement authority in issuing a number of natural gas enforcement actions. Failure to comply with the NGA and FERC's rules and regulations thereunder could result in the imposition of civil penalties and disgorgement of profits.

Intrastate Natural Gas Pipeline Regulation

Intrastate natural gas pipeline operations are not generally subject to rate regulation by FERC, but they are subject to regulation by various agencies in the respective states where they are located. While the regulatory regime varies from state to state, state agencies typically require intrastate gas pipelines to provide service that is not unduly discriminatory and to file and/or seek approval of their rates with the agencies and permit shippers to challenge existing rates or proposed rate increases. For example, our Guadalupe system is an intrastate pipeline regulated as a gas utility by the Railroad Commission of Texas. To the extent that an intrastate pipeline system transports natural gas in interstate commerce, the rates and terms and conditions of such interstate transportation service are subject to FERC rules and regulations under Section 311 of the Natural Gas Policy Act, or NGPA. Certain of our systems are subject to FERC jurisdiction under Section 311 of the NGPA for their interstate transportation services. Section 311 regulates, among other things, the provision of transportation services by an intrastate natural gas pipeline on behalf of a local distribution company or an interstate natural gas pipeline. Under Section 311, rates charged for transportation must be fair and equitable, and amounts collected in excess of fair and equitable rates are subject to refund with interest. Rates for service pursuant to Section 311 of the NGPA are generally subject to review and approval by FERC at least once every five years. Additionally, the terms and conditions of service set forth in the intrastate pipeline’s Statement of Operating Conditions are subject to FERC approval. Non-compliance with FERC's rules and regulations established under Section 311 of the NGPA, including failure to observe the service limitations applicable to transportation services provided under Section 311, failure to comply with the rates approved by FERC for Section 311 service, and failure to comply with the terms and conditions of service established in the pipeline’s FERC-approved Statement of Operating Conditions could result in the imposition of civil and criminal penalties. Among other matters, EPACT 2005 also amended the NGPA to give FERC authority to impose civil penalties for violations of the NGPA up to $1 million for any one violation and violators may be subject to criminal penalties of up to $1 million per violation and five years in prison.

Gathering Pipeline Regulation

Section 1(b) of the NGA exempts natural gas gathering facilities from the jurisdiction of FERC under the NGA. We believe that our natural gas gathering facilities meet the traditional tests FERC has used to establish a pipeline’s status as a gatherer not subject to FERC jurisdiction. However, the distinction between FERC-regulated transmission services and federally unregulated gathering services continues to be a current issue in various FERC proceedings with respect to facilities that interconnect gathering and processing plants with nearby interstate pipelines, so the classification and regulation of our gathering facilities may be subject to change based on future determinations by FERC and the courts. State regulation of gathering facilities generally includes various safety, environmental, and, in many circumstances, nondiscriminatory take requirements and complaint-based rate regulation.

Our purchasing, gathering and intrastate transportation operations are subject to ratable take and common purchaser statutes in the states in which they operate. The ratable take statutes generally require gatherers to take, without undue discrimination, natural gas production that may be tendered to the gatherer for handling. Similarly, common purchaser statutes generally require gatherers to purchase without undue discrimination as to source of supply or producer. These statutes are designed to prohibit discrimination in favor of one producer over another producer or one source of supply over another source of supply. These statutes have the effect of restricting our right as an owner of gathering facilities to decide with whom we contract to purchase or transport natural gas.

Natural gas gathering may receive greater regulatory scrutiny at both the state and federal levels where FERC has recognized a jurisdictional exemption for the gathering activities of interstate pipeline transmission companies and a number of such companies have transferred gathering facilities to unregulated affiliates. Many of the producing states have adopted some form of complaint-based regulation that generally allows natural gas producers and shippers to file complaints with state regulators in an effort to resolve grievances relating to natural gas gathering access and rate discrimination. Our gathering operations could be adversely affected should they be subject in the future to the application of state or federal regulation of rates and services. Additional rules and legislation pertaining to these matters are considered or adopted from time to time. We cannot predict what effect, if any, such changes might have on our operations, but the industry could be required to incur additional capital expenditures and increased costs depending on future legislative and regulatory changes.

Sales of Natural Gas

The price at which we buy and sell natural gas currently is not subject to federal regulation and, for the most part, is not subject to state regulation. However, with regard to our interstate purchases and sales of natural gas, and any related hedging activities that we undertake, we are required to observe anti-market manipulation laws and related regulations enforced by FERC and/or the Commodity Futures Trading Commission, or CFTC. Should we violate the anti-market manipulation laws and regulations, in additional to civil and criminal penalties, we could be subject to related third party damage claims by, among others, market participants, sellers, royalty owners and taxing authorities.

Our sales of natural gas are affected by the availability, terms and cost of pipeline transportation. As noted above, the price and terms of access to pipeline transportation are subject to extensive federal and state regulation. FERC is continually proposing and implementing new rules and regulations affecting those segments of the natural gas industry, most notably interstate natural gas transmission companies that remain subject to FERC jurisdiction. These initiatives also may affect the intrastate transportation of natural gas under certain circumstances. The stated purpose of many of these regulatory changes is to promote competition among the various sectors of the natural gas industry. We cannot predict the ultimate impact of these regulatory changes to our natural gas marketing operations.

Interstate NGL Pipeline Regulation

Certain of our pipelines, including Sand Hills and Southern Hills, are common carriers that provide interstate NGL transportation services subject to FERC regulation. FERC regulates interstate common carriers under its Oil Pipeline Regulations, the Interstate Commerce Act of 1887, as amended, or ICA, and the Elkins Act of 1903, as amended. FERC requires that common carriers file tariffs containing all the rates, charges and other terms for services provided by such pipelines. The ICA requires that tariffs apply to the interstate movement of NGLs, as is the case with the Sand Hills, Southern Hills, Black Lake, Wattenberg and Front Range pipelines. Pursuant to the ICA, rates must be just, reasonable, and nondiscriminatory, and can be challenged at FERC either by protest when they are initially filed or increased or by complaint at any time they remain on file with FERC.

In October 1992, Congress passed EPACT, which among other things, required FERC to issue rules establishing a simplified and generally applicable ratemaking methodology for pipelines regulated by FERC pursuant to the ICA. FERC responded to this mandate by issuing several orders, including Order No. 561 that enables petroleum pipelines to charge rates up to their ceiling levels, which are adjusted annually based on an inflation index. Specifically, the indexing methodology requires a pipeline to adjust the ceiling level for its rates annually by the inflation index established by the FERC. FERC reviews the indexing methodology every five years, and in 2015, the indexing methodology for the five years beginning July 1, 2016 was changed to be the Producer Price Index for Finished Goods plus 1.23 percent. The previous five-year period utilized the Producer Price Index for Finished Goods plus 2.65 percent. Pipelines may charge up to the calculated ceiling level for their transportation rates, and typically adjust their rates July 1 annually, when the new inflation index and ceiling levels are calculated. Rate increases made pursuant to the indexing methodology are subject to protest, but such protests must show that the portion of the rate increase resulting from application of the index is substantially in excess of the pipeline’s increase in costs from the previous year. If the indexing methodology results in a reduced ceiling level that is lower than a pipeline’s filed rate, the pipeline is required to reduce its rate to comply with the lower ceiling unless doing so would reduce a rate “grandfathered” under EPACT (see below) below the grandfathered level. A pipeline must, as a general rule, utilize the indexing methodology to change its rates. FERC, however, retained cost-of-service ratemaking, market-based rates, and settlement as alternatives to the indexing approach, which alternatives may be used in certain specified circumstances. Because of the change in indexing methodology effective July 1, 2016 and the trends in the producer price index, the ceiling levels calculated for our interstate NGL pipelines may be subject to decrease, which occurred in 2016 and resulted in the decrease in the tariff rates for many such pipelines.

EPACT deemed petroleum pipeline rates in effect for the 365-day period ending on the date of enactment of EPACT that had not been subject to complaint, protest or investigation during that 365-day period to be just and reasonable under the ICA. Generally, complaints against such “grandfathered” rates may only be pursued if the complainant can show that a substantial change has occurred since the enactment of EPACT in either the economic circumstances of the petroleum pipeline, or in the nature of the services provided, that were a basis for the rate. EPACT places no such limit on challenges to a provision of a petroleum pipeline tariff as unduly discriminatory or preferential.

On October 20, 2016, FERC issued an Advance Notice of Proposed Rulemaking, which presented significant changes to the indexing mechanism and reporting requirements of common carriers subject to FERC’s jurisdiction under the ICA. The proposed changes to the indexing methodology, would prohibit an increase in a common carrier’s ceiling level and rates if a complaint was filed and the return as reported by the common carrier in two previous annual reports exceeded a predetermined threshold. Additionally, the FERC proposed multiple changes to its annual reporting requirements. We cannot predict the outcome of the proceeding, but the proposal, if implemented, could adversely impact future rate increases of our common carriers and place additional administration and reporting burdens on our business.

Intrastate NGL Pipeline Regulation

NGL and other common carrier petroleum pipelines that provide intrastate transportation services are subject to regulation by various agencies in the respective states where they are located. While the regulatory regime varies from state to state, state agencies typically require intrastate petroleum pipelines to file tariffs and their rates with the agencies and permit shippers to challenge existing rates or proposed rate increases. For example, certain of our pipelines have tariffs filed with the Railroad Commission of Texas for their intrastate NGL transportation services.

Environmental Matters

General

Our operation of pipelines, plants and other facilities for gathering, compressing, treating, processing, transporting, fractionating, storing or selling natural gas, NGLs and other products is subject to stringent and complex federal, state and local laws and regulations governing the emission or discharge of materials into the environment or otherwise relating to the protection of the environment.

As an owner or operator of these facilities, we must comply with these laws and regulations at the federal, state and local levels. These laws and regulations can restrict or impact our business activities in many ways, such as:

| |

| • | requiring the acquisition of permits or authorizations to conduct regulated activities and imposing obligations in those permits, potentially including capital expenditures or operational requirements, that reduce or limit impacts to the environment; |

| |

| • | restricting the ways that we can handle or dispose of our wastes; |

| |

| • | limiting or prohibiting construction or operational activities in sensitive areas such as wetlands, coastal regions or areas inhabited by threatened and endangered species; |

| |

| • | requiring remedial action to mitigate pollution conditions caused by our operations or attributable to former operations; and |

| |

| • | enjoining, or compelling changes to, the operations of facilities deemed not to be in compliance with permits issued pursuant to such environmental laws and regulations. |

Failure to comply with these laws and regulations may trigger a variety of administrative, civil, or potentially criminal enforcement measures, including the assessment of monetary penalties, the imposition of remedial requirements, potential citizen lawsuits, and the issuance of orders enjoining or affecting future operations. Certain environmental statutes impose strict liability or joint and several liability for costs required to clean up and restore sites where hazardous substances, or in some cases hydrocarbons, have been disposed or otherwise released. Moreover, it is not uncommon for neighboring landowners and other third parties to file claims for property damage or personal injury allegedly caused by the release of substances or other waste products into the environment.

The overall trend in federal and state environmental programs is to expand regulatory requirements, placing more restrictions and limitations on activities that may affect the environment. Thus, there can be no assurance as to the amount or timing of future expenditures for environmental compliance or remediation, and actual future expenditures may be different from the amounts we currently anticipate. We try to anticipate future regulatory requirements that might be imposed and plan accordingly to remain in compliance with changing environmental laws and regulations, participate as applicable in the public process to ensure such new requirements are well founded and reasonable or to revise them if they are not, and to manage the costs of such compliance. We also actively participate in industry groups that help formulate recommendations for addressing existing or future regulations.

We do not believe that compliance with federal, state or local environmental laws and regulations will have a material adverse effect on our business, financial position or results of operations. Below is a discussion of the more significant environmental laws and regulations that relate to our business.

Impact of Air Quality Standards and Climate Change

A number of states have adopted or considered programs to reduce “greenhouse gases,” or GHGs, which can include methane, and, depending on the particular program or jurisdiction, we could be required to purchase and surrender allowances, either for GHG emissions resulting from our operations (e.g., compressor units) or from downstream combustion of fuels (e.g., oil or natural gas) that we process, or we may otherwise be required by regulation to take steps to reduce emissions of GHGs. Also, the EPA has declared that GHGs “endanger” public health and welfare, and is regulating GHG emissions from mobile sources such as cars and trucks. The EPA's 2010 action on the GHG vehicle emission rule triggered regulation of carbon dioxide and other GHG emissions from stationary sources under certain Clean Air Act programs at both the federal and state levels, particularly the Prevention of Significant Deterioration program and Title V permitting. These requirements for stationary sources took effect on January 2, 2011; however, in June 2014 the U.S. Supreme Court reversed a D.C. Circuit Court of Appeals decision upholding these rules and struck down the EPA’s greenhouse gas permitting rules to the extent they impose a requirement to obtain a federal air permit based solely on emissions of greenhouse gases, but major sources of other air pollutants, such as volatile organic compounds or nitrogen oxides, could still be required to implement process or technology controls and obtain permits regarding emissions of greenhouse gases. The EPA proposed a rule in 2016 to comply with the U.S. Supreme Court’s ruling by limiting the requirement to obtain permits addressing emissions of greenhouse gases to large sources of other air pollutants, such as volatile organic compounds or nitrogen oxides, which also emit 100,000 tons per year or more of CO2 equivalent (or modifications of these sources that result in an emissions increase of 75,000 tons per year or more of CO2). The EPA has also published various rules relating to the mandatory reporting of GHG emissions, including mandatory reporting requirements of GHGs from petroleum and natural gas systems. In October 2015, the EPA amended and expanded greenhouse gas reporting requirements to all segments of the oil and gas sector starting with the 2016 reporting year. In June 2016, the EPA published final new source performance standards for methane (a greenhouse gas) from new and modified oil and gas sector sources. These regulations expand upon the 2012 EPA rulemaking for oil and gas equipment-specific emissions controls, for example, regulating well head production emissions with leak detection and repair requirements, pneumatic controllers and pumps requirements, compressor requirements, and instituting leak detection and repair requirements for natural gas compressor and booster stations for the first time. In October 2015, the EPA finalized a reduction of the ambient ozone standard from 75 parts per billion to 70 parts per billion under the Clean Air Act. The EPA also finalized in October 2016 Control Techniques Guidelines for emissions of volatile organic compounds from oil and gas sector sources to be implemented or utilized by states in ozone nonattainment areas, with an expected co-benefit of reduced methane emissions. The permitting, regulatory compliance and reporting programs, taken as a whole, increase the costs and complexity of oil and gas operations with potential to adversely affect the cost of doing business for our customers resulting in reduced demand for our gas processing and transportation services, and which may also require us to incur certain capital and operating expenditures in the future to meet regulatory requirements or for air pollution control equipment, for example, in connection with obtaining and maintaining operating permits and approvals for air emissions associated with our facilities and operations.

Hazardous Substances and Waste

Our operations are subject to environmental laws and regulations relating to the management and release of hazardous substances, or solid or hazardous wastes, including petroleum hydrocarbons. These laws generally regulate the generation, storage, treatment, transportation and disposal of solid and hazardous waste, and may impose strict liability or joint and several liability for the investigation and remediation of areas at a facility where hazardous substances, or in some cases hydrocarbons, may have been released or disposed. For instance, the Comprehensive Environmental Response, Compensation, and Liability Act, as amended, or CERCLA, also known as the Superfund law, and comparable state laws impose liability, without regard to fault or the legality of the original conduct, on certain classes of persons that contributed to the release of a hazardous substance into the environment. These persons include current and prior owners or operators of the site where the release occurred and companies that disposed or arranged for the disposal of the hazardous substances found at the site. Under CERCLA, these persons may be subject to joint and several liability for the costs of cleaning up the hazardous substances that have been released into the environment, for damages to natural resources and for the costs of certain health studies. CERCLA also authorizes the EPA and, in some instances, third parties to act in response to threats to the public health or the environment and to seek to recover from the responsible parties the costs that the agency incurs. Despite the “petroleum exclusion” of CERCLA Section 101(14), which encompasses natural gas, we may nonetheless handle hazardous substances within the meaning of CERCLA, or similar state statutes, in the course of our ordinary operations and, as a result, may be jointly and severally liable under CERCLA for all or part of the costs required to clean up sites at which these hazardous substances have been released into the environment.

We also generate solid wastes, including hazardous wastes that are subject to the requirements of the Resource Conservation and Recovery Act, as amended, or RCRA, and comparable state statutes. While RCRA regulates both solid and hazardous wastes, it imposes strict requirements on the generation, storage, treatment, transportation and disposal of hazardous wastes. Certain petroleum and natural gas production wastes are excluded from RCRA’s hazardous waste regulations. However, it is possible that these wastes, which could include wastes currently generated during our operations, may in the future be designated by the EPA as hazardous wastes and therefore be subject to more rigorous and costly disposal requirements. Any such changes in the laws and regulations could have a material adverse effect on our maintenance capital expenditures and operating expenses.

We currently own or lease properties where petroleum hydrocarbons are being or have been handled for many years. Although we have utilized operating and disposal practices that were standard in the industry at the time, petroleum hydrocarbons or other wastes may have been disposed of or released on or under the properties owned or leased by us, or on or under the other locations where these petroleum hydrocarbons and wastes have been taken for treatment or disposal. In addition, certain of these properties may have been operated by third parties whose treatment and disposal or release of petroleum hydrocarbons or other wastes was not under our control. These properties and wastes disposed or released thereon may be subject to CERCLA, RCRA and analogous state laws, or separate state laws that address hydrocarbon releases. Under these laws, we could be required to remove or remediate releases of hydrocarbon materials, or previously disposed wastes (including wastes disposed of or released by prior owners or operators), or to clean up contaminated property (including contaminated groundwater) or to perform remedial operations to prevent future contamination. We are not currently aware of any facts, events or conditions relating to the application of such requirements that could reasonably have a material impact on our operations or financial condition.

Water

The Federal Water Pollution Control Act of 1972, as amended, also referred to as the Clean Water Act, or CWA, and analogous state laws impose restrictions and strict controls regarding the discharge of pollutants into navigable waters. Pursuant to the CWA and analogous state laws, permits must be obtained to discharge pollutants into state and federal waters. The CWA also requires implementation of spill prevention, control and countermeasure plans, also referred to as "SPCC plans," in connection with on-site storage of threshold quantities of oil or certain other materials. The CWA imposes substantial potential civil and criminal penalties for non-compliance. State laws for the control of water pollution also provide varying civil and criminal penalties and liabilities. In addition, some states maintain groundwater protection programs that require permits for discharges or operations that may impact groundwater. The EPA has also promulgated regulations that require us to have permits in order to discharge certain storm water. The EPA has entered into agreements with certain states in which we operate whereby the permits are issued and administered by the respective states. These permits may require us to monitor and sample the storm water discharges. We believe that compliance with existing permits and compliance with foreseeable new permit requirements will not have a material adverse effect on our financial condition or results of operations.

The Oil Pollution Act of 1990, or OPA, which is part of the Clean Water Act, addresses prevention, containment and cleanup, and liability associated with oil pollution. OPA applies to vessels, offshore platforms, and onshore facilities, including natural gas gathering and processing facilities, terminals, pipelines, and transfer facilities. OPA subjects owners of such facilities to strict liability for containment and removal costs, natural resource damages, and certain other consequences of oil spills into jurisdictional waters. Any unpermitted release of petroleum or other pollutants from our operations could result in government penalties and civil liability. We are not currently aware of any facts, events or conditions relating to the application of such requirements that could reasonably have a material impact on our operations or financial condition.

Anti-Terrorism Measures

The federal Department of Homeland Security regulates the security of chemical and industrial facilities pursuant to regulations known as the Chemical Facility Anti-Terrorism Standards. These regulations apply to oil and gas facilities, among others, that are deemed to present “high levels of security risk.” Pursuant to these regulations, certain of our facilities are required to comply with certain regulatory provisions, including requirements regarding inspections, audits, recordkeeping, and protection of chemical-terrorism vulnerability information.

Employees

We do not have any employees. Our operations and activities are managed by our general partner, DCP Midstream GP, LP, which is managed by its general partner, DCP Midstream GP, LLC, or the General Partner, which is 100% owned by DCP Midstream, LLC. Approximately 2,650 employees of DCP Services, LLC, a wholly-owned subsidiary of DCP Midstream, LLC, provided support for our operations pursuant to the Services and Employee Secondment Agreement between DCP Services, LLC and us. For additional information, refer to “Item 10. Directors, Executive Officers and Corporate Governance” in our Annual Report on Form 10-K filed with the SEC on February 15, 2017 (the "2016 Form 10-K) and Exhibit 99.5 “Certain Relationships and Related Transactions, and Director Independence - Services Agreement” in this Form 8-K.

General

We make certain filings with the Securities and Exchange Commission, or SEC, including our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments and exhibits to those reports, which are available free of charge through our website, www.dcpmidstream.com, as soon as reasonably practicable after they are filed with the SEC. Our website and the information contained on that site, or connected to that site, are not incorporated by reference into this report. The filings are also available through the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 or by calling 1-800-SEC-0330. Also, these filings are available on the internet at www.sec.gov. Our annual reports to unitholders, press releases and recent analyst presentations are also available on our website. We have also posted our code of business ethics on our website.