UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT UNDER SECTION 13 OR 15 (D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED JUNE 30, 2011

o TRANSITION REPORT PURSUANT TO SECTION 13 OF 15 (D) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM _____ TO _____

COMMISSION FILE NUMBER:

CHINA GINSENG HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 20-3348253 |

| (State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification or Organization No.) |

64 Jie Fang Da Road, Ji Yu Building A, Suite 1208

Changchun City, China, 130022

011-86-4318-5790-039

(Address and telephone number of principal executive offices

and principal place of business)

Securities registered under Section 12 (b) of the Exchange Act: NONE

Securities registered under Section 12 (g) of the Exchange Act:

COMMON STOCK WITH $.001 PAR VALUE

(Title of Class)

Indicate by check mark if the Registrant is a well known seasoned issuer as defined in Rule 405 of the securities Act. Yes o No x

Indicate by check mark if Registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act. Yes o No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated Filer o |

Non-accelerated filer o | Smaller reporting company x |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the Registrant as of December 31, 2010 (the last business day of the Registrant’s most recently completed second fiscal quarter) was approximately $10 million1.

As of October 13, 2011, the Registrant has 44,397,297 shares of common stock outstanding.

________________

1 The last time our stock traded in the public markets was on March 9, 2007. Therefore, we based our market value on the most recent price at which we sold our stock, which was $0.25 through a private placement as described below in this report, as well as 39,846,047 shares held by non-affiliates as of December 31, 2010.

CHINA GINSENG HOLDINGS, INC

FORM 10-K INDEX

| | PART I | |

| | | Page |

| | 1 |

| | | |

| | 22 |

| | | |

| | 23 |

| | | |

| | 23 |

| | | |

| | 23 |

| | | |

| | | |

| | | |

| Market for Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Security | 24 |

| | | |

| | 25 |

| | | |

| Management’s Discussion and Analysis of Financial Conditions and Results of Operations | 25 |

| | | |

| Quantitative and Qualitative Disclosure about Market Risk | 37 |

| | | |

| Financial Statements and Supplementary Data | F- |

| | | |

| Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 38 |

| | | |

| | 38 |

| | | |

| | 38 |

| | | |

| | | |

| | | |

| Directors, Executive Officers and Corporate Governance | 39 |

| | | |

| | 41 |

| | | |

| Security Ownership of Certain Beneficial Owners and Management And Related Stockholder Matters | 42 |

| | | |

| Certain Relationships and Related Transactions and Director Independence | 44 |

| | | |

| Principal Accountant Fees and Services | 46 |

| | | |

| | | |

| | | |

| Exhibits, Financial Statements Schedules and Reports | 47 |

| | | |

| | | 49 |

PART I

ITEM 1. DESCRIPTION OF BUSINESS

China Ginseng Holdings, Inc. (the “Company”, together with its subsidiaries, herein referred to as “we” “us” and “our”) was incorporated on June 24, 2004 in the State of Nevada. Since our inception in 2004, we have been engaged in the business of farming, processing, distribution and marketing of fresh ginseng. Starting August 2010, we have gradually shifted our business focus from farming and selling ginseng to producing and selling ginseng juice and wine with our crops as raw materials, although we still maintain our farming and selling ginseng business. Through leases, we control 3,705 acres of land approved by the Chinese government for ginseng planting and approximately 750 acres of grape vineyards which are harvested annually.

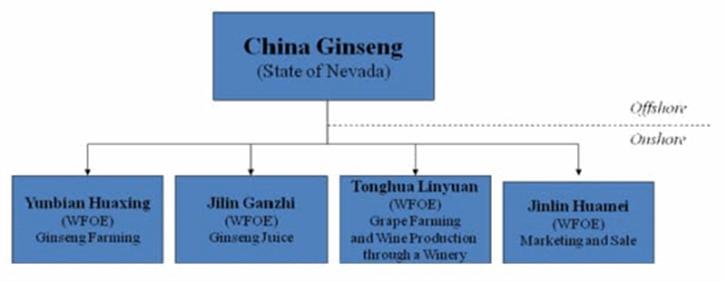

OUR ORGANIZATIONAL STRUCTURE

Below is a chart of our current organizational structure:

Note: All the four wholly foreign owned enterprises have duly obtained the approval from the relevant government. Pursuant to PRC laws, a wholly foreign owned enterprise needs to apply for and obtain an approval certificate from the competent approval government authorities (the Ministry of Commerce of PRC or its local branch) and then a business license from the competent registration authorities (the Administration for industry and commerce of the PRC or its local branches) before it legally starts its business operation. Each of the four foreign owned enterprises has not only obtained the approval certificate from the competent local approval government authorities but also the business license for the competent local registration authorities.

On August 8, 2006, six PRC regulatory agencies, including the Ministry of Commerce of the People’s Republic of China, the China Securities Regulatory Commission, the State-owned Assets Supervision and Administration Commission of the State Council, the State Administration of Taxation, the State Administration for Industry and Commerce, and the State Administration of Foreign Exchange, jointly amended and released the Merger & Acquisition Rules, which became effective on September 8, 2006 ( the “2006 M&A rules”). This regulation, among other things, includes provisions that purport to require that an offshore special purpose vehicle formed for purposes of overseas listing of equity interest in PRC companies and controlled directly or indirectly by PRC companies or individuals obtain the approval of the China Securities Regulatory Commission prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock exchange. However, the 2006 M&A rules do not apply to any foreign owned enterprise. Three of the four foreign owned enterprises (Jilin Ganzhi, Yanbian Huaxing and Jilin Huamei) became wholly foreign owned enterprises before September 8, 2006. Therefore, the 2006 M&A rules definitely are not applicable to Jilin Ganzhi, Yanbian Huaxing or Jilin Huamei. Tonghua Linyuan became a wholly foreign owned enterprise after September 8, 2006. According to the 2006 M&A rules, where a special purpose company is to be listed overseas for transaction, it shall be subject to the approval of the securities regulatory organization under the State Council of the PRC. Under the said rules, the “special purpose company” refers to an overseas company directly or indirectly controlled by a domestic company or Chinese person to realize the interests of a domestic company actually owned by the aforesaid domestic company or Chinese person by means of overseas listing. The current shareholders of Tonghua Linyuan are not the original shareholders of Tonghua Linyuan before Tonghua Linyuan became a wholly foreign owned enterprise on January 15, 2008. Thus the Company is not of the opinion that China Ginseng Holdings, Inc. is a “special purpose company” as defined in the 2006 M&A rules. Our structure shall not be subject to the 2006 M&A rules.

Yanbian Huaxing Ginseng Industry Co. Limited (“Yanbian Huaxing”) – Ginseng farming and sales

| | ¨ | On September 8, 2003, we and Jilin Dunhua Huaxing Ginseng Industry Co, Ltd. (“Dunghua Huaxing”, a PRC company) jointly and legally established Yanbian Huaxing as a joint venture company, in which we held 25% equity interest and Dunhua Huaxing held 75% equity interest. We received a certificate of approval issued by the competent local approval authority on September 8, 2003 and a business license issued by the competent local registration authority on September 16, 2003. On November 24, 2004, we and Dunhua Huaxing adjusted the registered capital of Yanbian Huaxing and our respective shareholding percentage in Yanbian Huaxing, and then we held 55% equity interest in Yanbian Huaxing. Subsequently in August, 2005, we acquired the remaining 45% equity interest from Dunhua Huaxing at a purchase of $164,000, and then we hold 100% equity interest in Yanbian Huaxing and changed Yanbian Huaxing from a joint venture into a wholly foreign owned enterprise (“WFOE”). The purchase prices were determined based upon the registered capital of Yanbian Huaxing of $364,000. In October 2005, we increased the registered capital of Yanbian Huaxing by putting in an additional $250,000 in order to meet the requirement for foreign owned enterprise requirement for tax purpose. Now the registered capital of Yanbian Huaxing is $614,000. We have applied with the relevant PRC approval and registration authorities for each of the aforesaid changes and have obtained all applicable approvals and registrations for such changes, including a certificate of approval issued by the local approval authority and a renewed business license issued by the local registration authority certifying Yanbian Huaxing as a WFOE lawfully owned by us. Yanbian Huaxing is operated to plant ginseng and our revenue in the past was mainly from the sales of ginseng produced and sold by Yanbian Huaxing. With the shift of business focus to canned ginseng juice, we anticipate a decrease of revenue of direct sales of ginseng while most of ginseng produced by Yanbian Huaxing has been and will continue to be used as raw material for canned ginseng juice. |

Jilin Ganzhi Ginseng Products Co. Ltd. (“Jilin Ganzhi”) - Producing Canned Ginseng Juice.

| | ¨ | On May 31, 2006, we acquired 100% equity interest in Jilin Ganzhi at a price of $95,691. We received a certificate of approval issued by the competent local approval authority on May 31, 2006 and a business license issued by the competent local registration authority on June 19, 2006. Subsequently on September 26, 2007 and August 31, 2008 we increased Jilin Ganzhi’s registered capital by $50,000 and $20,000 respectively. Now the registered capital of Jilin Ganzhi is $100,000. We have applied with the relevant PRC approval and registration authorities for each of the aforesaid capital increases and have obtained all applicable approvals and registrations for such changes, including a renewed certificate of approval issued by the local approval authority and a renewed business license issued by the local registration authority certifying Jilin Ganzhi as a WFOE lawfully owned by us. Jilin Ganzhi is operated to process ginseng and produce canned ginseng juice. Jilin Ganzhi started production of canned ginseng juice in the three months ended December 31, 2010. However, since the sales of canned ginseng juice is conducted through Jilin Huamei, Jilin Ganzhi has not and will not generate any revenue. |

Tonghua Linyuan Grape Planting Co. (“Tonghua Linyuan”) – Growing grapes and producing wine through a winery producer

| | ¨ | On January 15, 2008, we acquired 100% equity interest in Tonghua Linyuan from two PRC individual shareholders at a price of $1,000,000. The price was determined by arm’s-length negotiations based upon the appraised net asset value of Tonghua Linyuan at the time of acquisition which was approximately $1,332,248. We received a certificate of approval issued by the competent local approval authority on January 15, 2008 and a business license issued by the competent local registration authority on April 1, 2008 certifying Tonghua Linyuan as a WFOE lawfully owned by us. Now the registered capital of Tonghua Linyuan is RMB10,330,000. Tonghua Linyuan is operated to plant grapes and produce wine. Other than one sale of grapes made by Tonghua Linyuan in 2010, Tonghua Linyuan reserved all the grapes planted for wine production. In addition, Tonghua Linyuan has contracted for the production of wine with a winery producer whereby Tonghua Linyuan provides the producer with grape juice and supplies and producer charges processing fee per bottle. Tonghua Linyuan started wine production through a winery producer in March 2011 and the sales of wine is conducted through Jilin Huamei starting in April, 2011. |

When we acquired Tonghua Linyuan, it was in debt as a result of a loan of 2,000,000 RMB (about $309,043) to Ji’An Qingshi Credit Cooperatives (“Ji’An Qingshi”). Therefore, we are responsible for paying back the loan. The principal terms of the loan are as follows:

| | 1. | Type of Loan: Short Term Agriculture Loan |

| | 3. | Loan Amount: Principal of 2,000,000 RMB (about USD $309,043) with an annual interest of 6.325% |

| | 4. | Loan Period: From February 4, 2002 to February 4, 2003; Repayment due date was February 4, 2003 |

| | 5. | Security: The loan is secured by assets of Tonghua Linyuan including 14 carbon-steel storage cans; 16 high-speed steel storage cans and 150 tons of grape juice (the “Secured Assets”). |

Until now, we have not paid any principal or interest of the loan, however, Ji’An Qingshi verbally agreed in March 2008 not to call the loan. The material terms for the verbal agreement are: No principal or interest payments are required to be made until the Company is generating profits and interest continues to accrue until we repay the loan. We had a net loss of $1,108,333 for the year ended June 30, 2011. If we continue operation without generating net income, Ji’An Qingshi might revoke the oral agreement and call the loan. In the event Ji’An Qingshi revokes the oral agreement, Ji’An Qingshi has the right to sell, initiate an auction sale or take any other methods to liquidate the Secured Assets and receive payment of the outstanding principal and interests senior to any other party out of such liquidation.

Jinlin Huamei Beverage Co. Ltd (“Jilin Huamei”) - Marketing our canned ginseng juice and wine

| | ¨ | Jilin Huamei was incorporated by us on October 17, 2005 as a WFOE. We received a certificate of approval issued by the competent local approval authority on October 17, 2005 and a business license issued by the competent local registration authority on October 19, 2005 certifying Jilin Huamei as a WFOE lawfully owned by us. The registered capital of Jilin Huamei is $200,000. Jilin Huamei operates as a sales department for our canned ginseng juice and wine, which are produced by our other subsidiaries. We plan to recruit one general distributor for our canned ginseng juice and one general distributor for our wine in each big city in China through Jilin Huamei. As of the date of this filing, Jilin Huamei has signed 19 general distributors for our ginseng beverage and one general distributor for our wine, as well as established one sale branch office in Jiangsu Province (the agreement is filed as Exhibit 10.25 to this Form 10-K). We commenced sales of ginseng beverage in October 2010 and Jilin Huamei started generating revenue in November 2010. |

OVERALL OF OUR BUSINESS:

Our business in China is currently conducted through the above four wholly owned subsidiaries located in Northeast China, the current operational status of each of these businesses as of the date of this filing is as follows:

| | · | Yanbian Huaxing: In the past, our revenue was mainly from the sales of ginseng produced and sold by Yanbian Huaxing. In August 2010, we shifted our business focus to canned ginseng juice and wine and started to store fresh ginseng for producing canned ginseng juice. Most of the ginseng produced by Yanbian Huaxing has been and will continued to be used as raw material of canned ginseng juice and only those oxidized ginseng not qualified to be used for canned ginseng juice will be sold directly through Yanbian Huaxing. Therefore, the revenues attributable to the direct sales of ginseng produced by Yanbian Huaxing have already and will continue to decrease as the ginseng is utilized for the ginseng juice. Nevertheless, because of the excessive rain in the beginning of fiscal year 2011, we had 90% of ginseng oxidized, and because market prices of ginseng increased in the three months ended December 31, 2010 and we just started sales of canned ginseng juice in that period, the sales of ginseng by Yanbian Huaxing still accounted for the biggest part of our revenue for the year ended June 30, 2011. However, we decided to shift our business focus mainly to production and sale of ginseng juice because we believe that there is a significant opportunity for functional drinks in China and there are currently no leading brands in the market. With our unique production technology of ginseng beverage and our focus on high-end consumers, we anticipate that, in the next five years, around 70% of our revenue will come from sales of ginseng beverage. Nevertheless, there is no assurance that our sales of ginseng beverage will generate 70% of our revenues in the next five years. |

| | · | Jilin Ganzhi: Jilin Ganzhi has been processing fresh ginseng and started producing canned ginseng in the quarter ended December 31, 2010 and the revenue is reflected in the financial statements in this Form 10-K for the year ended June 30, 2011. |

| | · | Tonghua Linyuan: Tonghua Linyuan operates our vineyards to grow and crush the grapes and reserve grape juices for wine production. In addition, Tonghua Linyuan contracted with a winery whereby Tonghua Linyuan will provide the winery with grape juice and supplies and the winery will produce wine with certain processing charge per bottle. Tonghua Linyuan started wine production through the winery producer in March 2011 and sales in April 2011. In addition, we have been receiving positive feedback about our wine from the distributors of other cities with which we are negotiating. We estimate that 10% of our revenues will come from sales of wine in the next five years, however, there is no assurance that our sales of wine will generate 10% of revenues in the next five years. |

| | · | Jilin Huamei: Jilin Huamei operates as a sale department for canned ginseng juice and wine. Our market promotion and penetration of canned ginseng juice and wine is conducted by Jilin Huamei and all of our distribution agreements for sales of our canned ginseng juice and wine are signed through Jilin Huamei. |

As of the date of this filing, each of our four subsidiaries operates as an essential part of our integrated business and all of our businesses are operational.

OUR PRODUCTS:

Previously, through Yanbian Huaxing, we focused on the farming, processing, distribution and marketing of Asian and American Ginseng and related byproducts in the following varieties:

| | · | Fresh Ginseng: For pharmaceutical, health supplement, cosmetic industry and fresh consumption. |

| | · | Dry Ginseng: Dried form for pharmaceutical and health supplement consumption. |

| | · | Ginseng Seeds: Selling of ginseng seeds. |

| | · | Ginseng Seedling: Selling of ginseng seedling. |

We obtained 20 years land use rights to 3,705 acres of land approved by the local government for ginseng growing on June 12, 2005 and we have developed 3% of the land resources.

Since August 2010, we have gradually shifted our business focus from direct sales of ginseng and ginseng byproducts to production and sale of canned ginseng juice and wine. We have started reserving most of the ginseng produced by Yanbian Huaxing for use in the planned production of canned ginseng juice and grape juice produced by Tonghua Linyuan for use in the planned production of wine. Meanwhile, as there is higher standard for ginseng used in canned ginseng juice, we are able to sell some of the ginseng produced by Yanbian Huaxing which is not qualified for use in canned ginseng juice to the market through Yanbian Huaxing. Although we have shifted our business focus to production and sale of ginseng juice and wine, we still receive orders for ginseng and its byproducts because of our reputation in the industry for selling high-quality ginseng. We intend to maintain this part of our business even though it is no longer our business focus. In addition, if we receive large orders for ginseng and/or ginseng byproducts, we will directly purchase ginseng and/or ginseng byproducts from the market if we can get a lower price of the products. This part of sale of ginseng is generated on order-to-order basis and conditioned on whether we can get a lower price for such demanded products in the market.

Through Jilin Ganzhi, we are producing two types of canned ginseng juice.

| | · | Ganzhi Asian Ginseng Beverage |

| | · | Ganzhi American Ginseng Beverage |

In 2008, we started storing fresh ginseng as a raw material in a rented refrigerated warehouse. We entered into a 5 year lease agreement with Meat Union Refrigerated Warehouse for the rented refrigerated warehouse in 2008 for the rental of 160 cubic meters with a monthly rental of 57RMB (about USD $ 8.1) per cubic meter. In October 2010, we renewed the lease agreement with a rental of 4500 RMB (about USD $678.86, approximately $4.2 per cubic meter) per month. The principal terms of the lease agreement are as follows:

| | · | Parties: Meat Union Refrigerated Warehouse (“Meat Union”) and Jilin Ganzhi Ginseng Products Co Ltd. (“Jilin Ganzhi”); |

| | · | Meat Union leases out three refrigerated warehouses for Jilin Ganzhi to store ginseng. During the refrigerated period, Meat Union is required to keep the temperature at 12 – 15 degrees below zero, if there are any changes of the temperature Meat Union needs to notify Jilin Ganzhi immediately. If Meat Union fails to notify Jilin Ganzhi and consequently caused the molding or rotting of ginseng, Meat Union shall be responsible for all the losses. Jilin Ganzhi shall inspect warehouse temperature periodically. |

| | · | The contracts starts from October 15, 2010, monthly rent is 4500 RMB. When Jilin Ganzhi vacates a warehouse, both parties will renegotiate the rent for the refrigerated warehouse. |

We purchased a production factory of ginseng beverage for total consideration of 9,000,000 RMB under a written contract dated March 2, 2010. We paid 500,000 RMB (about USD $75,207) on June 24, 2010; obtained an 8 million RMB (about USD $1,203,312) bank loan from Meihekou City Rural Credit Union to pay the seller on September 10, 2010; and paid 100,000 RMB (about USD $15,041) in December, 2010. The remaining balance 400,000 RMB (about USD $60,167) was to be paid off by end of June 2010 pursuant to the written contract; however, on March 22, 2010, we have obtained oral consent from the seller to extend the due date to December 31, 2011. Nevertheless, if we are unable to pay off the remaining balance by December 31, 2011 and cannot obtain a further extension from the seller or the seller revokes its oral consent of extension, the seller has the right to repossess the production factory, confiscate the deposit paid to the seller and we will be liable to compensate the seller for an amount equivalent to 6 month’s rental expenses for using the production factory. The principal terms of the written contract are as follows:

| | · | Parties: Meihekou City Hengyide Warehouse Logistics Co., Ltd. (“Meihekou”) and Ganzhi Ginseng Products Co Ltd & China Ginseng Holdings, Inc. (collectively “Ginseng.”) |

| | · | Meihekou and Ginseng shall go to the PRC auction company Jilin Mingshi Auction Co. Ltd. together to apply for the change of the purchaser’s name from Meihekou to Ginseng. The application fee is borne by Ginseng. |

| | · | All details/content of the location, land area and facilities that to be acquired originally by Meihekou remain unchanged. The amount of the consideration of RMB 9,000,000 (about USD$1,353,726) and the agency commission that was to be originally paid by Meihekou shall remain unchanged and payment shall be made by Ginseng to Meihekou. |

| | · | Payment method: This agreement became effective upon date of signing, Ginseng shall pay Meihekou of RMB 500,000 (about USD $75,207) before March 20, 2010, the remaining balance shall be repaid in full by June 30, 2010. |

| | · | Meihekou shall waive the rental expenses incurred by Ginseng for using the premise for the period from January 2010 to Feburary 2010. |

| | · | If the remaining balance is not settled by June 2010, Meihekou has the right to repossess the premise and confiscate the deposit paid to Meihekou. And Ginseng is liable to compensate Meihekou for an amount equivalent to 6 month’s rental expenses for using the premise. |

Ginseng has not paid off the remaining balance of 400,000 RMB (about USD $60,167) until now; however, Meihekou has orally agreed to extend the due date of the payment to December 31, 2011, with all other terms and conditions remain the same.

The principal terms of the 8 million RMB bank loan agreement are as follows:

| | · | Parties: Jilin Ganzhi Ginseng Products Co., Ltd (“Jilin Ganzhi”) and Meihekou City Rural Credit Union (“Meihekou Credit Union”); |

| | · | Meihekou Credit Union granted a loan of 8 million RMB (about USD $ 1,236,170) to Jilin Ganzhi to be used to pay off its debt and the term of the loan is 23 months from September 12, 2010 to August 10, 2012. |

| | · | The loan carries an annual floating rate equals to 90% of the benchmark interest rate. The benchmark interest rate is the rate announced by the People’s Bank of China as an interest rate of same type and class of loans at the date of the loan and changes with the adjustment of national bank rate. Meihekou Credit Union calculates the interest on a monthly basis applying this annual floating rate which is payable on the 21st day of each month. The Company is current on the payment of the interest. The monthly interest rate of September 2011 is 10.1531 and we paid interest of 84,415.00 RMB (about USD $ 13,225.00) on September 21, 2011. |

| | · | The payment shall be made in the order of loan expense, interest and principal. Jilin Ganzhi shall pay 1,600,000 RMB (about USD $250,000) principal on August 10, 2011 and the rest of principal of 6,400,000 RMB (about USD $986,170) on August 10, 2012. Jilin Ganzhi was in default on paying the 1,600,000 RMB principal on August 10, 2011, and Meihekou Credit Union orally agreed to extend the due day of the 1,600,000 RMB principal to August 10, 2012. (Description of the oral amendment of loan agreement is filed herewith as Exhibit 10.26) |

In addition to canned ginseng juice, we have started to focus on wine production. We have already grown and crushed the grapes from our vineyards and have the juices reserved. We have contracted for the final production and bottling of the wine. According to the contract, we shall provide Jinyuanshan Winery with grape juice, bottling supplies and packaging supplies; pay Jinyuanshan Winery RMB 1 (about USD $0.15) per bottle for processing red wine and RMB 1.5 (about USD $0.22) per bottle for processing ice wine. We started wine production through Jinyuanshan Winery in March 2011 and sales in April 2011. All of our products will be sold through Jilin Huamei. For fiscal year ended June 30, 2011, we generated a small amount of revenue of $475 from wine sales.

We generated $4,157,418 and $736,651 in revenues for our fiscal years ended June 30, 2011 and 2010 respectively. For the year ended June 30, 2011, our sales and principal customers were as follows:

| | | Yanbian Huaxing | | | Jilin Huamei | | | | |

| Heilongjian YiKangYuan Trade company | | $ | 1,632,578.67 | | | | | | | | 44.52 | % |

| Yisheng Foreign Trade Company | | $ | 464,617.52 | | | | | | | | 12.67 | % |

| Anguo New Long Chinese Medicine Company | | $ | 326,002.35 | | | | | | | | 8.89 | % |

| Jilin Province Ganzhi Ginseng Products Co,Ltd | | $ | 255,961.35 | | | | | | | | 6.98 | % |

| Hebei Yuanfa Pharmaceutical Co, Ltd | | $ | 226,624.80 | | | | | | | | 6.18 | % |

| Tong Hua Nanheng Ginseng Co, Ltd | | $ | 196,188.14 | | | | | | | | 5.35 | % |

| Tongyong Meikang Pharmaceutical Co, Ltd | | $ | 179,319.63 | | | | | | | | 4.89 | % |

| Shao, Bingcheng | | $ | 174,185.73 | | | | | | | | 4.75 | % |

| Dandong dongYi Food Co, Ltd | | $ | 114,045.81 | | | | | | | | 3.11 | % |

| Others | | $ | 97,544 | | | | | | | | 2.66 | % |

| Total Ginseng Revenue | | $ | 3,667,068 | | | | | | | | 100 | % |

| Li, zhongfong | | | | | | $ | 102,114.33 | | | | 38.20 | % |

| Changchun Zhongsheng Beverage Co, Ltd | | | | | | $ | 34,884.61 | | | | 13.05 | % |

| Jiang, Linchun | | | | | | $ | 28,870.02 | | | | 10.80 | % |

| Wang, Jianjun | | | | | | $ | 10,719.33 | | | | 4.01 | % |

| Ma, Yan | | | | | | $ | 8,794.66 | | | | 3.29 | % |

| Liu, Jianxia | | | | | | $ | 8,794.66 | | | | 3.29 | % |

| Zhang, Jiajiang | | | | | | $ | 8,767.93 | | | | 3.28 | % |

| Zhang, Haibo | | | | | | $ | 7,912.52 | | | | 2.96 | % |

| Others | | | | | | $ | 56,456.93 | | | | 21.12 | % |

| Total Ginseng Beverage Revenue | | | | | | $ | 267,315 | | | | 100 | % |

| | | | | | | | | | | | | |

| Beijing Huayang Shengbang Trade Co, Ltd | | | | | | $ | 475 | | | | 100 | % |

| Total Wine Revenue | | | | | | $ | 475 | | | | 100 | % |

| | | | | | | | | | | | | |

Our ginseng sales revenue includes revenue from our ginseng production and revenue from resale of ginseng purchased from outside farmers. Our ginseng production is constituted of our own farmed ginseng production and ginseng purchased from the farmers who leased land from us. We sell ginseng directly to the market without distributors and to customers who purchase ginseng from us on order-to-order basis. Though purchases from a few customers aggregately accounted for more than 10% of our sales of ginseng, we do not have any written or oral agreement with those customers. We consider a purchase to be completed once cash is paid by a customer. For large orders, as is custom in the ginseng business, when ginseng is shipped to a customer, the customer pays approximately 20%-30% of the invoice and is entitled to an inspection process which could take up to 60 days. Upon completion of the inspection and approval process, the customer notifies us and sends us the balance of the invoice price, and a sale is recorded.

However, as we have recently begun to shift the focus of our business from sale of ginseng to canned ginseng juice and wine, which is currently in the initial stage, there is no assurance that there will be sufficient demand for our beverages and wine to allow us to operate profitably in the short term until our new products are more widely recognized and sold. Accordingly, past revenues and other financial results will not provide a meaningful basis for future performance given the material change in our business.

PRINCIPAL EXECUTIVE OFFICE:

Our principal executive offices are located at 64 Jie Fang Da Road, Ji Yu Building A, Suite 1208, Changchun City, China, Tel: (86) 43185790029. Our website is www.chinaginsengs.com.

OUR BUSINESS:

Ginseng Production

Sales of Ginseng

We sell ginseng directly to the market without distributors and to customers who purchase ginseng from us on order-to-order basis. Though purchases from a few customers aggregately accounted for more than 10% of our sales of ginseng respectively, we do not have any written or oral agreements with those customers. We consider a purchase is completed once cash is paid by a customer. For large orders, as is custom in ginseng business, when ginseng is shipped to a customer, the customer pays approximately 20%-30% of the invoice and is entitled to an inspection process which could take up to 60 days. Upon completion of the inspection and approval process, the customer pays the balance of the invoice and a sale is recorded.

During the fiscal year ended June 30, 2011, the following customers accounted for the following approximated percentages of sales of our ginseng:

| | | Yanbian Huaxing | | | | |

| Heilongjian YiKangYuan Trade company | | $ | 1,632,578.67 | | | | 44.52 | % |

| Yisheng Foreign Trade Company | | $ | 464,617.52 | | | | 12.67 | % |

| Anguo New Long Chinese Medicine Company | | $ | 326,002.35 | | | | 8.89 | % |

| Jilin Province Ganzhi Ginseng Products Co,Ltd | | $ | 255,961.35 | | | | 6.98 | % |

| Hebei Yuanfa Pharmaceutical Co, Ltd | | $ | 226,624.80 | | | | 6.18 | % |

| Tong Hua Nanheng Ginseng Co, Ltd | | $ | 196,188.14 | | | | 5.35 | % |

| Tongyong Meikang Pharmaceutical Co, Ltd | | $ | 179,319.63 | | | | 4.89 | % |

| Shao, Bingcheng | | $ | 174,185.73 | | | | 4.75 | % |

| Dandong dongYi Food Co, Ltd | | $ | 114,045.81 | | | | 3.11 | % |

| Others | | $ | 97,544 | | | | 2.66 | % |

During the fiscal year ended June 30, 2010, the following customers accounted for the following approximated percentages of sales of our product:

| · | Yisheng Foreign Trade Company | | | 23 | % |

| · | Wang Linqing | | | 8 | % |

| · | Heilongjiang Mulin Forestry Bureau | | | 8 | % |

| · | Heilongjian Yikang Yuan Trade Co. | | | 15 | % |

| · | Wang Chunjiang | | | 20 | % |

| · | Xu Hong Yi | | | 17 | % |

| · | Others | | | 9 | % |

Most of ginseng we sold was produced by us. In addition, as we have been engaged in the business of farming, processing and selling ginseng for more than seven years, we are very familiar with the local ginseng planting and have good connection with ginseng farmers. Therefore, sometimes we are able to purchase ginseng with good quality from the outside farmers at a price lower than market price and then directly sell those ginseng we purchased to the market. Starting in 2008, we began reserving fresh ginseng as raw material to produce canned ginseng juice. As of the date of this filing, we are no longer selling fresh ginseng or dry ginseng directly to the market except such portions of our product that are not qualified for use in our canned ginseng juice and the ginseng we purchased from outside farmers which is oxidized ginseng. Ginseng's growing season is from April to September. Normally we sow the seed in April and harvest in September. Excessive rain in June to August will cause oxidation on the ginseng because that is the grow season for ginseng. Our average yearly rain volume in the past ten years is approximately 500 Millimeter and we usually have around 30% of ginseng oxidized each year. However, we had 90% of ginseng oxidized in the beginning of fiscal year 2011 because there was 1400 millimeter rain from July to August which was unusual given the average annual rain volume in the past ten years. Once ginseng is oxidized, it is no longer qualified as raw material for ginseng beverage; however, we can still sell it to the market at a lower price compared to the price of non-oxidized ginseng.

After we shifted our business focus from direct sale of ginseng to ginseng beverage and wine, we have stored most fresh ginseng for the production of canned ginseng beverage. We are no longer selling fresh ginseng produced by Yanbian Huaxing except oxidized ginseng. The oxidized ginseng is not qualified for production of ginseng beverage and we usually have around 30% of ginseng oxidized each year. Therefore, the revenues attributable to the direct sales of ginseng produced by Yanbian Huaxing have already, and will continue to decrease as the ginseng is utilized for the ginseng juice. Nevertheless, because of the 90% oxidized ginseng in the beginning of fiscal year 2011 and the increase of market price of ginseng in the same year, the sales of ginseng by Yanbian Huaxing still counted for the biggest part of our revenue for the year ended June 30, 2011. We sold approximately 202,426 kg ginseng in the year ended June 30, 2011, 60.54% of which is the oxidized ginseng and 39.46 % of which is the ginseng we purchased from outside farmers. However, we shifted our business focus mainly to production and sale of ginseng beverage because we believe that there is a significant opportunity for functional drinks in China and there are currently no leading brands in the China market; with our unique production technology of ginseng beverage and our focus on high-end consumers, we expect, in the long run, a decrease of revenue from direct sales of ginseng and an increase of revenue from sales of canned ginseng juice. In addition, we have a signed production contract with a winery producer and a distribution agreement with a distributor. And we have been receiving positive feedback about our wine from the distributors we are negotiating with for other cities. We estimate to have 70% of our revenue from sales of canned ginseng juice, 20% of our revenue from sales of ginseng and 10% of our revenue from sales of our wine in next five years. However, there is no assurance that the sales of ginseng beverage and wine will generate 70% and 10% of our revenues respectively in the next five years.

Sources and Availability of Raw Materials

Ginseng can only be cultivated under severely limited conditions demanding an almost perfect combination of terrain, altitude, and temperature. The growth cycle requires 5-6 years and, once harvested, the land can not be used again for ginseng planting for at least 25-30 years. Because the suitable lands for ginseng farming are very limited, the key to success in this industry is to control suitable land, as well as to continually develop techniques to increase production per acre.

We have been granted land use rights to 1,500 hectares (about 3705 acres) of land resources for ginseng planting by the local government. Currently, we have developed about 3% of our land resources.

With regard to this 3% of our land resources we developed, we have hired our own employees to plant ginseng on part of the lands. Simultaneously, we have executed agreements with a number of local farmers to grow, cultivate and harvest Ginseng utilizing the remaining portion of the land resources. Approximately 32.76% of the ginseng we need is from the 3% of developed land. The farming contracts commenced in January 2008 and were renewed in April 2010. In connection with these agreements, we (1) lease sections of the ginseng land to the farmers at approximately $1.5 (10 RMB) per square meter yearly, (2) provide the seeds and fertilizer to the farmers and clear the land of large debris (these costs are capitalized by the Company and included in the Ginseng Crop inventory, and, (3) pay the farmers a management fee of approximately $0.50 (4.00 RMB) per square meter and the farmers are required to produce ginseng for each square meter that they manage. After harvest, we pay the farmers the market price, which is the price at which other non-affiliated purchasers purchase similar ginseng from other farmers, for their ginseng. If the harvest is below 2 kg per square meter, the difference will be deducted from the total payment for ginseng purchased. If the harvest produces more than 2 kg per square meter, we pay $3.00 for every extra kg. In fiscal year 2011, we purchased approximately 67.24% of the ginseng we needed from these local farmers.

The Company has recorded a receivable from the farmers for the rental income of the leased ginseng land grants of $449,334 and $157,665 at June 30, 2011 and 2010, respectively. The Company has also recorded a long-term payable-farmers for the management fee due to the farmers. The liability as of June 30, 2011 and 2010 was $803,214 and $420,440, respectively. The receivable and liability balances for the respective areas will be settled at harvest time when the Company purchases the harvest at the current market value for ginseng.

With our own land and these agreements with the farmers, we believe we have sufficient supply for anticipated future needs for ginseng products and canned ginseng juice. If we need additional supply in the future, we believe we can negotiate additional agreements with other farmers in the area.

Inventory

Almost all of our ginseng is currently reserved for use by us in the manufacture of ginseng juice. Fresh ginseng can be placed in refrigerated storage for two years and still be used in the production of ginseng beverages.

Seasonality

Sales of ginseng products are seasonal, with most customers placing orders in the first and fourth quarter in any year as our ginseng is harvested in autumn, after necessary processing procedures, it is be available for sale in winter. However, as we no longer sell these products to any significant extent, seasonality is no longer an issue.

Canned Ginseng Juice

We are selling the following two products:

| | · | Ganzhi Ginseng Beverage, Approval No. State Food & Drug Administration G20090249 |

| | · | Ganzhi American Ginseng Beverage, Approval No. State Food & Drug Administration G20090208 |

To produce canned ginseng juice, we take ginseng juice extracted from fresh ginseng as the main material plus natural extracts like xylitol, citric acid and steviosides as subsidiary ingredients. We have farming technicians periodically inspect farmers to ensure they follow our growing guidelines to control the quality of the fresh ginseng. We use low residue pesticide and biodegradable fertilizer for ginseng planting. And we use xylitol instead of sugar to lower calories. Further, products made with xylitol do not cause a sour taste.

Currently, there are about 10 kinds of ginseng drinks on the market; all of them are imported from Korea. The price range for those products is 4 –30 RMB per can (about USD $0.60-$ 4.51).

The most important component of ginseng is ginsenoside. Through reading our competitor’s labels, we found that nearly all of their ginseng drinks are produced by blending after extracting ginsenosides through chemical methods. The extraction for ginsenosides will cause damage to its nutritional components. Our technology is different from that traditional method. We squeeze out the natural juice from fresh ginseng so as to preserve freshness and nutrition for the final product.

The reason direct squeezing is not commonly used in canned ginseng juice is that it needs fresh ginseng as a raw material and preservation of fresh ginseng is very difficult. Fresh ginseng rots very fast. The harvest time concentrates in September and October, which is a fairly short period. After that, one can only buy dried ginseng from market such as sun-dried ginseng from which we cannot squeeze juice. However, our drink formula enables us to use refrigerated ginseng as a raw material to produce canned ginseng juice and still be able to maintain its freshness and nutrition in our final products. The drink formula for our ginseng beverages is a registered patent approved by the Chinese government, patent number ZL 03111397.6. This patent was issued on January 23, 2008 and expires 20 years after issuance.

This is why we store our fresh ginseng in refrigerated warehouse space. We are currently renting a refrigerated warehouse (-20 C degree) to store all fresh ginseng inventory necessary for production of the ginseng beverages. Monthly rent for refrigerated warehouse is RMB 4,500 (about USD $676.86). We commenced production in August 2010 and sales in October 2010 which was reflected in our financial statement for the three months ended December 31, 2010. We initiated our sales of canned ginseng juice in China and we plan to expand our business to overseas markets in 2012 or 2013. Our Ganzhi Ginseng beverage costs approximately $2.21 per 1600 ml bottle and our American ginseng beverage will cost approximately $2.66 per 1600 ml bottle. However, as we are in the initial stage of ginseng beverage business, we cannot assure the demands for our ginseng beverage will be profitable in the short term and there is no guarantee that we will be able to generate the revenue with ginseng beverage business.

We own the production plant. The plant is certified by the Chinese government as a Good Manufacturing Process facility, which is required for our production of these products. Good Manufacturing Process standards cover organization and personnel, building and facilities, equipment, materials, hygiene and sanitation, validation, documentation, production management, quality management, production distribution and recall, complaints and adverse reactions report, and self-inspections.

The estimated total costs associated with the production of our ginseng beverage is approximately 50 million RMB (about USD $7,549,791) including 2 million RMB for research and governmental approval, 6 million RMB for GMP adjustment construction, 8 million RMB for equipment, 11 million RMB for facility construction and upgrades, 20 million for working capital and 3 million RMB for other expenses.

We plan to fund these costs through a combination of short-term borrowings, bank loans, cash from operations and sales of our equity.

During the fiscal year ended June 30, 2011, the following customers accounted for the following approximated percentages of sales of our ginseng beverage:

| Li, Zhongfong | | $ | 102,114.33 | | | | 38.20 | % |

| Changchun Zhongsheng Beverage Co, Ltd | | $ | 34,884.61 | | | | 13.05 | % |

| Jiang, Linchun | | $ | 28,870.02 | | | | 10.80 | % |

| Wang, Jianjun | | $ | 10,719.33 | | | | 4.01 | % |

| Ma, Yan | | $ | 8,794.66 | | | | 3.29 | % |

| Liu, Jianxia | | $ | 8,794.66 | | | | 3.29 | % |

| Zhang, Jiajiang | | $ | 8,767.93 | | | | 3.28 | % |

| Zhang, Haibo | | $ | 7,912.52 | | | | 2.96 | % |

| Others | | $ | 56,456.93 | | | | 21.12 | % |

Distribution Methods

There are 667 cities in China. We plan to recruit one general distributor for canned ginseng juice in each city through Jilin Huamei. The general distributor can recruit the second level distributors. In addition to recruiting general distributors, in some major cities, Jilin Huamei will establish sale branch offices to facilitate the local sales. Our direct sale will target at customers of high end retailers such as supermarkets, pharmacies, hotels, gift shops, entertainment centers, tourists attractions, airport and high speed trains, etc.

We have started negotiating distribution and sales agreements with potential general distributors. We are using a form of distribution agreement for general distributors; however, specific terms might differ based on negotiations we have with each distributor. As of the date of this filing, we have signed 19 distributors through Jilin Huamei and established one sale branch office in Jiangsu Province. The form of the distribution agreement is incorporated herein by reference and is filed as Exhibit 10.14 to the Form 10-12G/A we filed on November 10, 2010.

| Name of Distributor | | Distribution Territory | | Term of Agreement | | Annual Minimum Purchase Requirements(1) | | | Down Payment(2) | | | Six Months Minimum Purchase Requirements(3) | |

| | | | | | | | | | | | | | |

| Ma Yan | | Baotou City, Inner Mongolia | | 09/10-09/11 | | $ | 299,850 | | | $ | 2,999 | | | $ | 44,978 | |

| Liu Jianxia | | Ordos City, Inner Mongolia | | 09/10-12/11 | | | 299.850 | | | | 29,985 | | | | 44,978 | |

| Gao Hong | | Huhehaote City, Inner Mongolia | | 09/10-09/11 | | | 449,775 | | | | 29,985 | | | | 149,925 | |

| Li Hua | | Autonomous Region, Inner Mongolia | | 09/10-09/12 | | | 119,940 | | | | 7,496 | | | | 29,985 | |

| Zhang Jiajiang | | Zhenzhou City, Henan Province | | 10/10-10/12 | | | 449,775 | | | | 7,496 | | | | 224,888 | |

| Li Zongfeng | | Guangzhou City, Guangdong Province | | 09/10-09/11 | | | 449,775 | | | | 29,985 | | | | 149,925 | |

| Wang, Guijie | | Liaoyuan City, Jilin Province | | 09/10-09/11 | | | 149,925 | | | | 4,498 | | | | 44,978 | |

| Jiang, Linchun | | Distributor of Shanxi Province | | 12/10-12/12 | | | 149,925 | | | | 2,549 | | | | 74,963 | |

| Wang, Jianjun | | Daqing City, Heilongjiang Province | | 01/11-01/13 | | | 299,850 | | | | 26,987 | | | | 74,963 | |

| Wang, Hongjuan | | Qin Huangdao city, Hebei Province | | 12/10-12/12 | | | 299,850 | | | | 29,985 | | | | 149,925 | |

| Renqiu City Zidong Department Store | | Changzhou City, Hebei Province | | 07/11-07/13 | | | 156,666 | | | | 23,500 | | | | 47,000 | |

| Ling, Kejin | | Yulin City, Guangxi Province | | 07/11-06/13 | | | 156,666 | | | | 23,500 | | | | 47,000 | |

| Liu, Zhonghui | | Chengdu City, Xichuan Province | | 01/11-01/13 | | | 313,332 | | | | 31,333 | | | | 156,666 | |

| Zhang, Haibo | | Hegang City, Heilongjiang Province | | 09/10/09/12 | | | 94,000 | | | | 15,667 | | | | 15,667 | |

| Zhuji City Fukai Trading Co., Ltd | | Zhejiang Province | | 06/11-06/16 | | | 313,332 | | | | 47,000 | | | | N/A | |

| Wang, Jianfu | | Haila’er City, Neimengu Province | | 12/10-12/12 | | | 78,333 | | | | 15,667 | | | | 15,667 | |

| Zhao, Junhui | | Changbai Mountain Tourism District | | 04/11-03/13 | | | 313,332 | | | | 15,667 | | | | 7,833 | |

| Changchun Ginseng Beverage Co., Ltd | | Changchun City, Jilin Province | | 03/11-03/16 | | | N/A | | | | 31,333 | | | | N/A | |

| Ma, Zhihuo | | Fujian Province | | 07/11-07/16 | | | 313,332 | | | | 94,000 | | | | 78,333 | |

(1) The number listed in this column represents the minimum amount of annual purchase payment the distributor shall make to purchase our ginseng beverage pursuant to the distribution agreement including the down payment and the follow-up payments. According to the distribution agreement, all distributors need to purchase our ginseng beverage at a wholesale price and give us a down payment, which payment amount is determined separately with each distributor. After that, the distributor will continuously place written orders with a full payment and we will ship the ordered ginseng beverage to the distributor. To further promote our products, we are currently executing a policy that will allow distributors to return any products they purchased and could not sell in the first 6 months of their distribution agreement, so long as the expiration date of the product has not been exceeded.

(2) The number listed in this column represents the first payment the distributor shall make to purchase the ginseng beverage from us pursuant to the distribution agreement. The Ganzhi ginseng beverage is sold at a wholesale price of 13.8RMB/ per can and the Ganzhi American ginseng beverage is sold at a wholesale price of 14.9 RMB/per can to all of our distributors.

(3) The number listed in this column represents the minimum amount of sales the distributor shall reach within 6 months of the date of the distribution agreement. We are entitled to cancel the distribution agreement if the distributor has not reached the minimum amount of sales within 6 months pursuant to the distribution agreement.

The agreements also provide:

| | · | Distributor is only authorized to sell in physical stores, and through the channels of promotion and group purchase. To guarantee the unified pricing system and fair competition among individual agents, Distributor is not allowed to sell goods by means of E-commerce (to sell on the internet). |

| | · | We guarantee the quality of the goods delivered complies with the relevant State standards for sanitary and health of food production and agrees to be responsible for Distributor’s loss caused by quality problems. |

| | · | We agree to support the publicity and marketing of the Products, provided that it will not affect the normal operation of our website. |

| | · | Distributor is obliged to supply copies of its business license, tax registration certificate and all other documents relevant to execution of agreements with us. Distributor is obliged to protect our enterprise image, goodwill and brand name. Distributor shall supply the monthly report of selling activities in writing to us which should describe the sales data, activities, sales analysis and plans in details. |

| | · | If any of products are not fit for distribution in selling regions within three months, Distributor has the right to exchange products in order to meet the market demand. |

| | · | We shall deliver goods within 7 working days from the date that received the order and payment was made in full. The long-distance freight of goods and related insurance cost to Distributor’s city of territory is to be borne by us, and local short-distance freight is to be borne by Distributor. |

| | · | We offer the following incentive awards: The principle of award shall be based on the accumulative purchase amount. If one distributor’s annual total purchase amount (from January 1 to December 31) reaches: |

| | · | Over 500 thousand—1 million RMB, Distributor will receive year-end rebate of one percent of the total purchase amount, in addition, take part in the overseas travel once for one person to Singapore, Malaysia and Thailand organized by Party A. |

| | · | Over 1 million—3 million RMB, rebate of 1.5 percent of the total purchase amount, in addition, take part in the travel once for two persons to Singapore, Malaysia and Thailand organized by Party A. |

| | · | Over 3 million RMB, rebate of 2 percent, and take part in the travel once for three persons to Singapore, Malaysia and Thailand organized by Party A. |

| | · | Other termination provisions include: |

| | · | If Distributor changes the products pricing system without our permission, or refuses to carry out our sales and promotion plans. |

| | · | If Distributor breaches or does not fulfill the provisions of this agreement, which creates adverse effects on us. |

| | · | If Distributor unilaterally decides to terminate the agreement without negotiating with us. |

| | · | Distributor is ordered to make a correction or its business license has been revoked by the government. |

| | · | In the event of a breach of any of the provisions of this Agreement by one party, and the other party does not get satisfactory reply after ten days of written notice, the non-breaching party has the right to terminate the Agreement unilaterally and hold the breaching party responsible for any direct and indirect loss and expenses (including, without limitation, attorney fee, arbitration or legal fee, auditor expenses, travel expenses and etc). |

Sources and Availability of Raw Materials

We will obtain the fresh ginseng for beverage production from two sources, self-planted ginseng and the ginseng sold to us by farmers in accordance with the contracts we entered into with them.

Ginseng's growing season is from April to September, six months a year. Normally we sow the seed in April and harvest in September and October. Ginseng seeds are obtained after the blossom in Autumn, the seed can be sowed in September or next Spring, it takes 10 days to germinate and 10 days for seeding. And the whole growing cycle for ginseng from seeding to harvest usually takes around 5-6 years to ensure the growth of ginseng and the nutrition it contains in the root. For ginseng, every hectare can harvest 18 to 20 kg ginseng. As of June 30, 2011, the planting area for ginseng is 443830 square meter.

Seasonality

There is no seasonality for sale of ginseng beverages.

Wine

We plan to sell two kinds of wine at the anticipated sale prices as follows:

| Bingqing ice wine | RMB 388 (about USD $ 58.36) /per bottle |

| Pearl in the Snow (Red) | RMB 88 (about USD$ 13.24 ) / per bottle |

The anticipated sale prices are based on management’s knowledge of the market price of similar quality wine from Changbai Mountain and costs of raw materials, processing, management, facilities and distributions available to us. However, we might adjust the sale prices after we start the production and sales to better respond to our production costs and the then current market, if needed.

Our grapes grow on 750 acres of land leased from a group of individual farmers, paying approximately $37.50 per acre a year for 15 years. This lease expires on December 31, 2014. We have adequate and suitable land for growing grapes. Our vineyard is located in Ji’An City, Jilin Province, North Latitude 41 degree with average temperature 7.5C, annual precipitation 800mm-1000mm, frost free period 150 days out of a year. Ji’An is the largest grape growing area in Asia. Our current estimated grape production is 565 tons annually.

We started production of wine in March 2011 and sales in April 2011. Through our subsidiary Tonghua Linyuan, we have a written production agreement with Tonghua Jinyuanshan Winery (“Jinyuanshan Winery”) to produce wine for us from May 20, 2009 to May 19, 2012. Under the terms of the agreement, we provide Jinyuanshan Winery with grape juice, bottling supplies and packaging supplies, and Jinyuanshan Winery produces and bottles the wine with a charge of approximately $0.15-0.22 per bottle (approximately $0.15 a bottle for processing red wine and approximately $0.22 per bottle for processing ice wine). Other principal terms of the agreement are as follows:

| | 1. | Product Names: Pearl in Snow Wine; Ice Wine. |

| | 2. | Prior to production, Tonghua Linyuan shall provide production guidelines and obtain approval from the city inspection department. |

| | 3. | Tonghua Linyuan shall notify the supervision department a week in advance for every batch of production. |

| | 4. | Products quality: Jinyuanshan Winery must meet the quality standard set by Tonghua Linyuan, in accordance with QB/1982-94 grape wine production standard requirement. |

| | 5. | Products Safekeeping: After final inspection of the products, products can be kept temporarily at Jinyuanshan Winery’s facility for up to one month. Tonghua Linyuan must ship out the products within one month. |

| | 6. | Product defect allowance: Jinyuanshan Winery is allowed to have 5% wine production defect rate; 0.3% on labeling and packaging; and 0.5% on bottles. If the bottle damage was caused by delivery, Jinyuanshan Winery will not be responsible for the damage. |

| | 7. | Duration of this Contract: This contract is valid from May 20, 2009 to May 19, 2012. If there is any dispute beyond negotiation, it will be mediated by the local arbitration authority. |

| | 8. | Tonghua Linyuan subcontracts Jinyuanshan Winery to produce under Jinyuanshan Winery’s National Industrial Production permit. Tonghua Linyuan shall name Jinyuanshan Winery on its labels (after city quality inspection’s approval). |

| | 9. | If there are any taxes incurred by Jinyuanshan Winery for processing Tonghua Linyuan’s wines, Tonghua Linyuan is liable for paying these taxes. |

The estimated total costs associated with our wine production is approximately 20 million RMB (about USD $3,019,916) including 10 million RMB for working capital, 10 million RMB for grape vineyard,, wine processing, storage, marketing and other expenses. We plan to be funded through a combination of short-term borrowings, bank loans, cash from operations and sales of our equity.

Production Methods

Wine is produced by fermenting crushed grapes using various types of yeast. Yeast consumes the sugars in the grapes and converts them into alcohol. As of June 30, 2010, Tonghua Linyuan has reserved 1,170 tons of grape juice for fermentation stored in 16 stainless holding tanks. As of June 30, 2011, we have 965 tons of fermented grape juice. The harvesting cycle of grapes take around 5 months, we plant in April and harvest in the middle of September. Last autumn we harvested 562.5 tons of grapes in average and produced 281 tons of juice. We let the juice ferment for 40 days and sealed it in barrels in December.

Sources and Availability of Raw Materials

The grape growing cycle is from April to September, six months a year. For grapes, every acre can produce 1500 kg grapes annually and we have planting area for grapes approximately 750 acres as of June 30, 2011.

Distribution Methods

There are 667 cities in China, we intend to recruit one general distributor for wine in every city. The city level distributor can recruit the second level distributors. In addition to recruiting general distributors, in some major cities, Jilin Huamei will establish sale branch offices to facilitate the local sales. Our direct sale will target at customers of high end retailers such as supermarkets, pharmacies, hotels, gift shops, entertainment centers, tourists attractions, airport and high speed trains, etc.

We have started negotiating distribution and sales agreements with potential general distributors. On November 16, 2010, we entered into a distribution and sales agreement with Beijing Huayang Shengbang Trading Ltd (“Beijing Huayang”) whereby Beijing Huayang shall act as our general distributor of our wine in the Beijng area from November 16, 2010 to November 15, 2013. According to the agreement, Beijing Huayang is authorized to sell to stores, as well as through the channels of promotion and group purchase and to enter into sub-distribution agreements with second level distributors in the Beijing area. However, in no circumstance, shall Beijing Huayang sell or distribute our wine at a price less than the price we offered. Beijing Huayang shall have minimum annual sales of RMB 3,000,000 (about USD $451,242) and shall receive a bonus at certain percentage of sales exceeding the minimum sales. We used the same form of distribution agreement we use for our beverage distributors when entering into agreement with Beijing Huayang, which was disclosed above in the Distribution Methods of Canned Ginseng Juice section. In addition, we intend to use the same form of distribution agreement when we recruit any general distributor for our wine, although some terms might differ based on the negotiation we have with each distributor. As of the date of this filing we have signed one wine distributor, Beijing Huayang, through Jilin Huamei. The distribution agreement was filed as Exhibit 10. 19 in Form 10-12G/A we filed on May 31, 2011.

| Name of Distributor | | Distribution Territory | | Term of Agreement | | Annual Minimum Purchase Requirements(1) | | Down Payment(2) | | Six Months Minimum Purchase Requirements(3) | |

| | | | | | | | | | | | |

| Beijing Huayang | | Beijing | | 11/2010-11/2013 | | 3,000,000 RMB | | 150,000RMB | | 800,000 RMB | |

(1) The minimum amount of annual purchase payment the distributor shall make to purchase our wine pursuant to the distribution agreement including the down payment and the follow-up payments. According to the distribution agreement, the distributor needs to purchase our wine at a wholesale price with an amount agreed in the distribution agreement as a down payment. After that, the distributor will continuously place written orders with full payments and we will ship the ordered wine to the distributor.

(2) The first payment the distributor shall make to purchase wine from us pursuant to the distribution agreement which we received on December 28, 2010. Our Bingqing ice wine is sold at a wholesale price of 128RMB/ per bottle and our Pearl in the Snow is sold at a wholesale price of 31 RMB/per bottle to our distributor.

(3) The minimum amount of sales the distributor shall reach within 6 months of the date of the distribution agreement. We are entitled to cancel the distribution agreement if the distributor has not reached the minimum amount of sales within 6 months pursuant to the distribution agreement.

Our distribution agreement with Beijing Huayang also provides:

| | · | Distributor is only authorized to sell in physical stores, and through the channels of promotion and group purchase. To guarantee the unified pricing system and fair competition among individual agents, Distributor is not allowed to sell goods by means of E-commerce (to sell on the internet). |

| | · | We guarantee the quality of the goods delivered complies with the relevant State standards for sanitary and health of food production and agrees to be responsible for Distributor’s loss caused by quality problems. |

| | · | We agree to support the publicity and marketing of the Products, provided that it will not affect the normal operation of our website. |

| | · | Distributor is obliged to supply copies of its business license, tax registration certificate and all other documents relevant to execution of agreements with us. Distributor is obliged to protect our enterprise image, goodwill and brand name. Distributor shall supply the monthly report of selling activities in writing to us which should describe the sales data, activities, sales analysis and plans in details. |

| | · | If any of products are not fit for distribution in selling regions within three months, Distributor has the right to exchange products in order to meet the market demand. |

| | · | We shall deliver goods within 7 working days from the date that received the order and payment was made in full. The long-distance freight of goods and related insurance cost to Distributor’s city of territory is to be borne by us, and local short-distance freight is to be borne by Distributor. |

| | · | We offer the following incentive awards: The principle of award shall be based on the accumulative purchase amount. If one distributor’s annual total purchase amount (from January 1 to December 31) reaches: |

| | · | Over 200,000 — 500,000 RMB, Distributor will receive year-end rebate of two percent of the total purchase amount; and take part in the travel once for one person to Singapore, Malaysia and Thailand organized by the Company. |

| | · | Over 500,000 — 1,000,000 RMB, Distributor will receive year-end rebate of four percent of the total purchase amount; and take part in the travel once for two persons to Singapore, Malaysia and Thailand. |

| | · | Over 1,000,000 RMB, Distributor will receive year-end rebate of six percent of the total purchase amount, and take part in the travel once for three persons to Singapore, Malaysia and Thailand. |

| | · | Over 3,000,000 RMB, Distributor will receive year-end rebate of six percent of the total purchase amount and take part in the travel once for three persons to Singapore, Malaysia and Thailand; in addition, a reward of a commercial-use van vehicle with a value of 40,000 RMB, subject to the condition that the exterior of the van must be used for advertising our wines. |

| | · | The distributor shall sell not less than 800,000 RMB within 6 months of the signing of the agreement, or we are entitled to cancel its distributor qualifications. |

| | · | Other termination provisions include: |

| | · | If Distributor changes the products pricing system without our permission, or refuses to carry out our sales and promotion plans. |

| | · | If Distributor breaches or does not fulfill the provisions of this agreement, which creates adverse effects on us. |

| | · | If Distributor unilaterally decides to terminate the agreement without negotiating with us. |

| | · | Distributor is ordered to make a correction or its business license has been revoked by the government.. |

| | · | In the event of a breach of any of the provisions of this Agreement by one party, and the other party does not get satisfactory reply after ten days of written notice, the non-breaching party has the right to terminate the Agreement unilaterally and hold the breaching party responsible for any direct and indirect loss and expenses (including, without limitation, attorney fee, arbitration or legal fee, auditor expenses, travel expenses and etc). |

Sources and Availability of Raw Materials

We anticipate that our production in the first year will be from our own grapes. Thereafter, depending upon demands, we may purchase grapes from other suppliers. Till now, we have no contracts, agreements or commitments with any third party suppliers for grapes.

Seasonality

Grapes are harvested in October, but wine has no seasonality.

MARKETING ACTIVITIES

All of our products will be sold by our subsidiary Jilin Huamei through distributors or Jilin Huamei’s sale branch offices in some major cities.

RESEARCH AND DEVELOPMENT

In July 2010, we conducted a market research program for ginseng beverages in China through a research institute, China Lantu Hongye Research Institute. Based on the report, management believes that there is not yet a leading brand of ginseng beverage in the China market and that the technology we use to produce our ginseng beverage will most likely provide a competitive advantage for our products in China over those currently in the Chinese market.

Other than as set forth above, we have had no research and development expenses in the past two years.

INTELLECTUAL PROPERTY

We rely primarily on a combination of patent, certificates and administrative protections to safeguard our intellectual property.

The drink formula for our ginseng beverages is a registered patent approved by the Chinese government, patent number ZL 03111397.6. This patent was issued on January 23, 2008 and expires 20 years after issuance.

Although our other products have no patent protection, our two types of ginseng beverages have been certified as PRC domestic healthcare food by SFDA (State Food and Drug Administration) and received approval certificates (“GMP Healthcare Food Certificate”) from the SFDA, each of which is valid for a term of 5 years and renewable at the expiration thereof. According to the Rules for Administration over Registration of Healthcare Food (Trial Implementation) issued by SFDA on April 30, 2005, the healthcare food applying for GMP Health Food Certificate refers to such food as claimed to have special health function or focuses on supplementing vitamins or minerals, that is, food which is suitable for special population, has function of regulating the institutions instead of treating diseases, and will not bring any acute, sub-acute or chronic damages to the body. The application for registration of healthcare food shall be subject to an examination and approval process in which the SDFA evaluates and examines systematically the safety, effectiveness, quality controllability as well as the specifications of the healthcare food being applied for registration and make a decision as approving the registration or not according to the application and based on the lawful procedures, conditions and requirements. The food for the application of GMP Healthcare Food Certificate shall be produced in the workshop conforming to the Good Manufacturing Practice on Healthcare Food (“GMP”), and the processing hereof shall satisfy the provisions of the GMP. GMP emphasizes the manufacturing quality standard and health/safety standard requirements. It presents mandatory standards used in pharmaceutical and food industries. It requires business entities to comply with the standards in all areas: raw materials, personnel, facility equipments, production lines, packaging, transportation, logistics, etc. The SFDA approval can be renewed every 5 years. As of the date of this filing, we have following GMP certificates and SFDA approval:

| | a. | GMP certificate for Jilin Ganzhi Beverage Company, Approval #077 issued on November 13, 2007 by Jilin Province Health Bureau. This certification is valid for four years. We cannot manufacture our products without this approval. |

| | b. | SFDA approval for Ganzhi Ginseng Beverage, No. SFDA G20090249 issued by the State Food & Drug Administration on 05/31/2009 |

| | c. | SFDA approval for Ganzhi American Ginseng Beverage, No. SFDA G20090208 issued by the State Food & Drug Administration on 5/27/2009 which is valid for five years. . |

REGULATORY ENVIRONMENT

China is transitioning from a planned economy to a market economy. While the Chinese government has pursued economic reforms since its adoption of the open-door policy in 1978, a large portion of the Chinese economy is still operating under five-year plans and annual state plans. Through these plans and other economic measures, such as control on foreign exchange, taxation and restrictions on foreign participation in the domestic market of various industries, the Chinese government exerts considerable direct and indirect influence on the economy. Many of the economic reforms carried out by the Chinese government are unprecedented or experimental, and are expected to be refined and improved. Other political, economic and social factors can also lead to further readjustment of such reforms. This refining and readjustment process may not necessarily have a positive effect on our operations or future business development. Our operating revenues may be reduced by changes in China's economic and social conditions as well as by changes in the policies of the Chinese government, such as changes in laws and regulations (or the official interpretation thereof), measures which may be introduced to control inflation, changes in the interest rate or method of taxation, and the imposition of additional restrictions on currency conversion.

China’s legal system is a civil law system. Unlike the common law system, the civil law system is based on written statutes in which decided legal cases have little value as precedents. In 1979, China began to promulgate a comprehensive system of laws and has since introduced many laws and regulations to provide general guidance on economic and business practices in China and to regulate foreign investment. Progress has been made in the promulgation of laws and regulations dealing with economic matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. The promulgation of new laws, changes of existing laws and the abrogation of local regulations by national laws could have a negative impact on our business and business prospects. In addition, as these laws, regulations and legal requirements are relatively recent, their interpretation and enforcement involve significant uncertainty.

We are subject to many general regulations governing business entities and their behavior in China and in any other jurisdiction in which we have operations. In particular, we are subject to laws and regulations covering food, dietary supplements and pharmaceutical products. Such regulations typically deal with licensing, approvals and permits. Specifically, these regulations concern Good Manufacturing Practices and SFDA approval as discussed above. Any change in product licensing may make our products more or less available on the market. Such changes may have a positive or negative impact on the sale of our products and may directly impact the associated costs in compliance and our operational and financial viability. Such regulatory environment also covers any existing or potential trade barriers in the form of import tariff and taxes that may make it difficult for us to export our products to certain countries and regions, such as Japan, South Korea and Hong Kong, which would limit our international expansion.

Because we are a wholly foreign owned enterprise, we are subject to the law on foreign investment enterprises in China, and the foreign company provisions of the Company Law of China, which governs the conduct of our wholly owned subsidiary and its officers and directors. Additionally, we are also subject to varying degrees of regulations and permit system by the Chinese government.

Foreign Investment in PRC Operating Companies

The Foreign Investment Industrial Catalogue jointly issued by the Ministry of Commerce for the People’s Republic of China and the National Development and Reform Commission in 2007 classified various industries/business into three different categories: (i) encouraged for foreign investment; (ii) restricted to foreign investment; and (iii) prohibited from foreign investment. For any industry/business not covered by any of these three categories, they will be deemed industries/business permitted to have foreign investment. Except for those expressly provided restrictions, encouraged and permitted industries/business are usually 100% open to foreign investment and ownership. With regard to those industries/business restricted to or prohibited from foreign investment, there is always a limitation on foreign investment and ownership. The PRC Subsidiary’s business does not fall under the industry categories that are restricted to, or prohibited from foreign investment and is not subject to limitation on foreign investment and ownership.

Regulation of Foreign Currency Exchange