UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811-21809 |

Nuveen S&P 500 Dynamic Overwrite Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Mark L. Winget

Nuveen Investments

333 West Wacker Drive, Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: December 31

Date of reporting period: June 30, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policy making roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss.3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Closed-End Funds

30 June

2022

Nuveen

Closed-End Funds

| | |

| BXMX | | Nuveen S&P 500 Buy-Write Income Fund |

| DIAX | | Nuveen Dow 30SM Dynamic Overwrite Fund |

| SPXX | | Nuveen S&P 500 Dynamic Overwrite Fund |

| QQQX | | Nuveen Nasdaq 100 Dynamic Overwrite Fund |

| JCE | | Nuveen Core Equity Alpha Fund |

Semiannual Report

IMPORTANT DISTRIBUTION NOTICE

for Shareholders of the Nuveen S&P 500 Buy-Write Income Fund (BXMX) Nuveen Dow 30SM Dynamic Overwrite Fund (DIAX)

Nuveen S&P 500 Dynamic Overwrite Fund (SPXX)

Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX)

Nuveen Core Equity Alpha Fund (JCE)

Semiannual Shareholder Report for the period ending June 30, 2022

The Nuveen S&P 500 Buy-Write Income Fund (BXMX), Nuveen Dow 30SM Dynamic Overwrite Fund (DIAX), Nuveen S&P 500 Dynamic Overwrite Fund (SPXX), Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX) and Nuveen Core Equity Alpha Fund (JCE) seek to offer attractive cash flow to their shareholders, by converting the expected long-term total return potential of the Funds’ portfolio of investments into regular quarterly distributions. Following is a discussion of the Managed Distribution Policy the Funds use to achieve this.

Each Fund pays quarterly common share distributions that seek to convert the Fund’s expected long-term total return potential into regular cash flow. As a result, the Funds’ regular common share distributions (presently $0.2365, $0.2867, $0.2940, $0.4934 and $0.3952 per share, respectively) may be derived from a variety of sources, including:

| | • | | net investment income consisting of regular interest and dividends, |

| | • | | realized capital gains or, |

| | • | | possibly, returns of capital representing in certain cases unrealized capital appreciation. |

Such distributions are sometimes referred to as “managed distributions.” Each Fund seeks to establish a distribution rate that roughly corresponds to the Adviser’s projections of the total return that could reasonably be expected to be generated by each Fund over an extended period of time. The Adviser may consider many factors when making such projections, including, but not limited to, long-term historical returns for the asset classes in which each Fund invests. As portfolio and market conditions change, the distribution amount and distribution rate on the Common Shares under the Funds’ Managed Distribution Policy could change.

When it pays a distribution, each Fund provides holders of its Common Shares a notice of the estimated sources of the Fund’s distributions (i.e., what percentage of the distributions is estimated to constitute ordinary income, short-term capital gains, long-term capital gains, and/or a non-taxable return of capital) on a year-to-date basis. It does this by posting the notice on its website (www.nuveen.com/cef), and by sending it in written form.

You should not draw any conclusions about the Funds’ investment performance from the amount of this distribution or from the terms of the Funds’ Managed Distribution Policy. The Funds’ actual financial performance will likely vary from month-to-month and from year-to-year, and there may be extended periods when the distribution rate will exceed the Funds’ actual total returns. The Managed Distribution Policy provides that the Board may amend or terminate the Policy at any time without prior notice to Fund shareholders. There are presently no reasonably foreseeable circumstances that might cause each Fund to terminate its Managed Distribution Policy.

Table of Contents

3

Chair’s Letter to Shareholders

Dear Shareholders,

The first half of 2022 was challenging for financial markets. While global economic activity began to slow from post-pandemic peaks as pent-up demand waned and crisis-era monetary and fiscal support programs were phased out, persistently high inflation and central banks’ response have contributed to heightened uncertainty about financial and economic conditions.

Inflation has surged partially due to supply chain bottlenecks and exacerbated by Russia’s war in Ukraine and recent lockdowns across China to contain a large-scale COVID-19 outbreak. This has necessitated more forceful responses from the U.S. Federal Reserve (Fed) and other central banks, who now face an even more difficult task of slowing inflation without pulling their respective economies into recession. As anticipated, the Fed began the rate hiking cycle in March 2022, raising its short-term rate by 0.25% from near zero for the first time since the pandemic was declared two years ago. Larger increases of 0.50% in May and 0.75% in both June and July 2022 followed, bringing the target fed funds rate to a range of 2.25% to 2.50%. Additional rate hikes are expected in the remainder of this year, although Fed officials will closely monitor inflation data along with other economic measures and modify their rate setting policy based upon these factors. U.S. gross domestic product growth has now contracted for two consecutive quarters, according to preliminary government estimates, as consumer and business activity has slowed in part due to higher prices and borrowing costs. However, the still strong labor market suggests not all areas of the economy are weakening.

In the meantime, while markets will likely continue fluctuating with the daily headlines, we encourage investors to keep a long-term perspective. To learn more about how well your portfolio is aligned to your time horizon, risk tolerance and investment goals, consider reviewing it with your financial professional.

On behalf of the other members of the Nuveen Fund Board, I look forward to continuing to earn your trust in the months and years ahead.

Terence J. Toth

Chair of the Board

August 22, 2022

4

Important Notices

Nuveen S&P 500 Buy-Write Income Fund (BXMX)

Nuveen Dow 30SM Dynamic Overwrite Fund (DIAX)

Nuveen S&P 500 Dynamic Overwrite Fund (SPXX)

Nuveen Nasdaq 100 Dynamic Overwrite Fund (QQQX)

Nuveen Core Equity Alpha Fund (JCE)

Portfolio Manager Commentaries in Semiannual Shareholder Reports

The Funds include portfolio manager commentary in their annual shareholder reports. For the Fund’s most recent annual portfolio manager discussion, please refer to the Portfolio Managers’ Comments section of the Fund’s December 31, 2021 annual shareholder report.

For current information on your Fund’s investment objectives, portfolio management team and average annual total returns please refer to the Fund’s website at www.nuveen.com.

For changes that occurred to your Fund both during and subsequent to this reporting period, please refer to the Notes to Financial Statements section of this report.

For average annual total returns as of the end of this reporting period, please refer to the Performance Overview and Holding Summaries section within this report.

5

Common Share Information

DISTRIBUTION INFORMATION

The following 19(a) Notice presents the Funds’ most current distribution information as of May 31, 2022 as required by certain exempted regulatory relief the Funds have received.

Because the ultimate tax character of your distributions depends on the Funds’ performance for its entire fiscal year (which is the calendar year for the Funds) as well as certain fiscal year-end (FYE) tax adjustments, estimated distribution source information you receive with each distribution may differ from the tax information reported to you on your Funds’ IRS Form 1099 statement.

DISTRIBUTION INFORMATION – AS OF MAY 31, 2022

This notice provides shareholders with information regarding fund distributions, as required by current securities laws. You should not draw any conclusions about the Funds’ investment performance from the amount of this distribution or from the terms of the Funds’ Managed Distribution Policy.

The amounts and sources of distributions set forth below are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Funds’ investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. Each Fund will send you a Form 1099-DIV for the calendar year that will tell you how to report these distributions for federal income tax purposes. More details about the Funds’ distributions and the basis for these estimates are available on www.nuveen.com/cef.

The following table provides estimates of the Funds’ distribution sources, reflecting year-to-date cumulative experience through the month-end prior to the latest distribution. The Funds attribute these estimates equally to each regular distribution throughout the year. Consequently, the estimated information as of the specified month-end shown below is for the current distribution, and also represents an updated estimate for all prior months in the year.

6

Data as of May 31, 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Estimated Per Share Sources of Distribution1 | | | Estimated Percentage of the Distribution1 | |

| Fund | | Inception

Date | | | Per Share

Distribution | | | Net

Investment

Income | | | Long-Term

Gains | | | Short-Term

Gains | | | Return of

Capital | | | Net

Investment

Income | | | Long-Term

Gains | | | Short-Term

Gains | | | Return of

Capital | |

BXMX (FYE 12/31) | | | Oct-2004 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Current Quarter | | | | | | $ | 0.2365 | | | $ | 0.0186 | | | $ | 0.0000 | | | $ | 0.2179 | | | $ | 0.0000 | | | | 7.90 | % | | | 0.00 | % | | | 92.10 | % | | | 0.00 | % |

Fiscal YTD | | | | | | $ | 0.4730 | | | $ | 0.0371 | | | $ | 0.0000 | | | $ | 0.4359 | | | $ | 0.0000 | | | | 7.90 | % | | | 0.00 | % | | | 92.10 | % | | | 0.00 | % |

DIAX (FYE 12/31) | | | Apr-2005 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Current Quarter | | | | | | $ | 0.2867 | | | $ | 0.0480 | | | $ | 0.0000 | | | $ | 0.2387 | | | $ | 0.0000 | | | | 16.80 | % | | | 0.00 | % | | | 83.20 | % | | | 0.00 | % |

Fiscal YTD | | | | | | $ | 0.5734 | | | $ | 0.0961 | | | $ | 0.0000 | | | $ | 0.4773 | | | $ | 0.0000 | | | | 16.80 | % | | | 0.00 | % | | | 83.20 | % | | | 0.00 | % |

SPXX (FYE 12/31) | | | Nov-2005 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Current Quarter | | | | | | $ | 0.2940 | | | $ | 0.0270 | | | $ | 0.0000 | | | $ | 0.2670 | | | $ | 0.0000 | | | | 9.20 | % | | | 0.00 | % | | | 90.80 | % | | | 0.00 | % |

Fiscal YTD | | | | | | $ | 0.5880 | | | $ | 0.0540 | | | $ | 0.0000 | | | $ | 0.5340 | | | $ | 0.0000 | | | | 9.20 | % | | | 0.00 | % | | | 90.80 | % | | | 0.00 | % |

QQQX (FYE 12/31) | | | Jan-2007 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Current Quarter | | | | | | $ | 0.4934 | | | $ | 0.0000 | | | $ | 0.0000 | | | $ | 0.4934 | | | $ | 0.0000 | | | | 0.00 | % | | | 0.00 | % | | | 100.00 | % | | | 0.00 | % |

Fiscal YTD | | | | | | $ | 0.9868 | | | $ | 0.0000 | | | $ | 0.0000 | | | $ | 0.9868 | | | $ | 0.0000 | | | | 0.00 | % | | | 0.00 | % | | | 100.00 | % | | | 0.00 | % |

JCE (FYE 12/31) | | | Mar-2007 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Current Quarter | | | | | | $ | 0.3952 | | | $ | 0.3952 | | | $ | 0.0000 | | | $ | 0.0000 | | | $ | 0.0000 | | | | 100.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

Fiscal YTD | | | | | | $ | 0.7904 | | | $ | 0.7904 | | | $ | 0.0000 | | | $ | 0.0000 | | | $ | 0.0000 | | | | 100.00 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

| 1 | Net investment income (NII) is a projection through the end of the current calendar quarter using actual data through the stated month-end date above. Capital gain amounts are as of the stated date above. The estimated per share sources above include an allocation of the NII based on prior year attributions which can be expected to differ from the actual final attributions for the current year. |

The following table provides information regarding the Funds’ distributions and total return performance over various time periods. This information is intended to help you better understand whether returns for the specified time periods were sufficient to meet distributions.

Data as of May 31, 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | Annualized | | | Cumulative | |

| Fund | | Inception

Date | | | Quarterly

Distribution | | | Fiscal YTD

Distribution | | | Net Asset

Value (NAV) | | | 5-Year

Return on NAV | | | Fiscal YTD

Dist Rate on NAV1 | | | Fiscal YTD

Return on NAV | | | Fiscal YTD

Dist Rate on NAV1 | |

BXMX | | | Oct-2004 | | | $ | 0.2365 | | | $ | 0.4730 | | | $ | 13.69 | | | | 6.31 | % | | | 6.91% | | | | (9.01 | )% | | | 3.46% | |

DIAX | | | Apr-2005 | | | $ | 0.2867 | | | $ | 0.5734 | | | $ | 16.79 | | | | 6.17 | % | | | 6.83% | | | | (5.68 | )% | | | 3.42% | |

SPXX | | | Nov-2005 | | | $ | 0.2940 | | | $ | 0.5880 | | | $ | 16.55 | | | | 7.68 | % | | | 7.11% | | | | (10.06 | )% | | | 3.55% | |

QQQX | | | Jan-2007 | | | $ | 0.4934 | | | $ | 0.9868 | | | $ | 23.96 | | | | 9.10 | % | | | 8.24% | | | | (17.69 | )% | | | 4.12% | |

JCE | | | Mar-2007 | | | $ | 0.3952 | | | $ | 0.7904 | | | $ | 15.07 | | | | 9.56 | % | | | 10.49% | | | | (10.94 | )% | | | 5.24% | |

| 1 | As a percentage of 5/31/22 NAV. |

NUVEEN CLOSED-END FUND DISTRIBUTION AMOUNTS

The Nuveen Closed-End Funds’ monthly and quarterly periodic distributions to shareholders are posted on www.nuveen.com and can be found on Nuveen’s enhanced closed-end fund resource page, which is at https://www.nuveen.com/resource-center-closed-end-funds, along with other Nuveen closed-end fund product updates. To ensure timely access to the latest information, shareholders may use a subscribe function, which can be activated at this web page (https://www.nuveen.com/subscriptions).

7

Common Share Information (continued)

COMMON SHARE EQUITY SHELF PROGRAMS

During the current reporting period, SPXX and QQQX were authorized by the Securities and Exchange Commission to issue additional common shares through an equity shelf program (Shelf Offering). Under these programs, the Funds, subject to market conditions, may raise additional capital from time to time in varying amounts and offering methods at a net price at or above each Fund’s NAV per common share. The maximum aggregate offering under these Shelf Offerings are as shown in the accompanying table.

| | | | | | | | |

| | | SPXX | | | QQQX | |

Maximum aggregate offering | | | 4,993,317 | | | | Unlimited | |

During the current reporting period, SPXX and QQQX sold common shares through their Shelf Offerings at a weighted average premium to their NAV per common share as shown in the accompanying table.

| | | | | | | | |

| | | SPXX | | | QQQX | |

Common shares sold through shelf offering | | | 218,784 | | | | 1,929,483 | |

Weighted average premium to NAV per common share sold | | | 1.31 | % | | | 2.13 | % |

Refer to Notes to Financial Statements, Note 5 – Fund Shares for further details of Shelf Offerings and each Fund’s respective transactions.

COMMON SHARE REPURCHASES

During August 2022 (subsequent to close of the reporting period), the Funds’ Board of Trustees reauthorized an open-market share repurchase program, allowing each Fund to repurchase an aggregate of up to approximately 10% of its outstanding common shares.

During the current reporting period, the Funds did not repurchase any of their outstanding common shares. As of June 30, 2022, and since the inception of the Funds’ repurchase programs, the Funds have cumulatively repurchased and retired their outstanding common shares as shown in the accompanying table.

| | | | | | | | | | | | | | | | | | | | |

| | | BXMX | | | DIAX | | | SPXX | | | QQQX | | | JCE | |

Common shares cumulatively repurchased and retired | | | 460,238 | | | | 0 | | | | 383,763 | | | | 0 | | | | 449,800 | |

Common shares authorized for repurchase | | | 10,405,000 | | | | 3,635,000 | | | | 1,720,000 | | | | 4,355,000 | | | | 1,600,000 | |

OTHER COMMON SHARE INFORMATION

As of June 30, 2022 the Funds’ common share prices were trading at a premium/(discount) to their common share NAVs and trading at an average premium/(discount) to NAV during the current reporting period, as follows:

| | | | | | | | | | | | | | | | | | | | |

| | | BXMX | | | DIAX | | | SPXX | | | QQQX | | | JCE | |

Common share NAV | | $ | 12.73 | | | $ | 15.83 | | | $ | 15.34 | | | $ | 22.02 | | | $ | 13.51 | |

Common share price | | $ | 12.37 | | | $ | 15.28 | | | $ | 15.66 | | | $ | 21.84 | | | $ | 13.35 | |

Premium/(Discount) to NAV | | | (2.83) | % | | | (3.47) | % | | | 2.09 | % | | | (0.82) | % | | | (1.18) | % |

Average premium/(discount) to NAV | | | (2.56) | % | | | (4.71) | % | | | (1.48) | % | | | 0.13 | % | | | (0.91) | % |

8

Shareholder

Meeting Report

The annual meeting of shareholders was held on April 8, 2022 for BXMX, DIAX, SPXX, QQQX and JCE. The meeting was held virtually due to public health concerns regarding the ongoing COVID-19 pandemic; at this meeting the shareholders were asked to elect Board members.

| | | | | | | | | | | | | | | | | | | | |

| | | BXMX | | | DIAX | | | SPXX | | | QQQX | | | JCE | |

| | | Common

Shares | | | Common

Shares | | | Common

Shares | | | Common

Shares | | | Common

Shares | |

Approval of the Board Members was reached as follows: | | | | | | | | | | | | | | | | | | | | |

William C. Hunter | | | | | | | | | | | | | | | | | | | | |

For | | | 86,857,786 | | | | 29,372,785 | | | | 13,532,642 | | | | 33,818,900 | | | | 13,276,806 | |

Withhold | | | 2,255,295 | | | | 573,310 | | | | 146,169 | | | | 548,513 | | | | 556,829 | |

Total | | | 89,113,081 | | | | 29,946,095 | | | | 13,678,811 | | | | 34,367,413 | | | | 13,833,635 | |

Judith M. Stockdale | | | | | | | | | | | | | | | | | | | | |

For | | | 87,404,832 | | | | 29,407,649 | | | | 13,514,800 | | | | 33,875,576 | | | | 13,271,604 | |

Withhold | | | 1,708,249 | | | | 538,446 | | | | 164,011 | | | | 491,837 | | | | 562,031 | |

Total | | | 89,113,081 | | | | 29,946,095 | | | | 13,678,811 | | | | 34,367,413 | | | | 13,833,635 | |

Carole E. Stone | | | | | | | | | | | | | | | | | | | | |

For | | | 87,379,934 | | | | 29,429,356 | | | | 13,522,661 | | | | 33,886,861 | | | | 13,294,191 | |

Withhold | | | 1,733,147 | | | | 516,739 | | | | 156,150 | | | | 480,552 | | | | 539,444 | |

Total | | | 89,113,081 | | | | 29,946,095 | | | | 13,678,811 | | | | 34,367,413 | | | | 13,833,635 | |

Margaret L. Wolff | | | | | | | | | | | | | | | | | | | | |

For | | | 87,490,144 | | | | 29,452,972 | | | | 13,537,129 | | | | 33,918,120 | | | | 13,306,961 | |

Withhold | | | 1,622,937 | | | | 493,123 | | | | 141,682 | | | | 449,293 | | | | 526,674 | |

Total | | | 89,113,081 | | | | 29,946,095 | | | | 13,678,811 | | | | 34,367,413 | | | | 13,833,635 | |

9

THIS PAGE INTENTIONALLY LEFT BLANK

10

| | |

| BXMX | | Nuveen S&P 500 Buy-Write Income Fund Performance Overview and Holding Summaries as of June 30, 2022 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of June 30, 2022*

| | | | | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 6-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

| BXMX at Common Share NAV | | | (13.82)% | | | | (8.52)% | | | | 5.03% | | | | 6.88% | |

| BXMX at Common Share Price | | | (12.53)% | | | | (8.21)% | | | | 4.80% | | | | 7.87% | |

| Cboe S&P 500® BuyWrite Index (BXMSM) | | | (10.19)% | | | | (2.62)% | | | | 4.09% | | | | 5.89% | |

| * | For purposes of Fund performance, relative results are measured against the Cboe S&P 500® BuyWrite Index (BXMSM). |

Performance data shown represents past performance and does not predict or guarantee future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

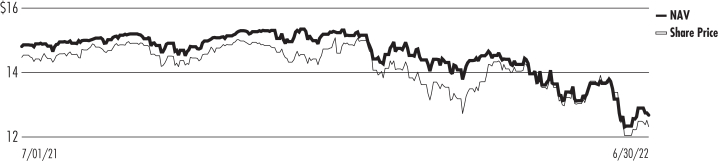

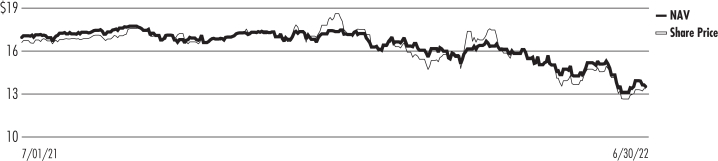

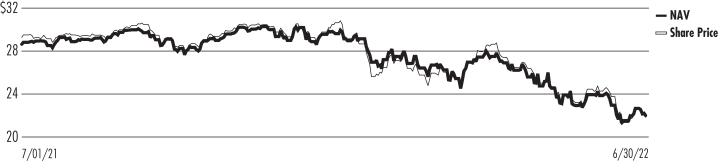

Daily Common Share NAV and Share Price

11

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Fund Allocation

(% of net assets)

| | | | |

| Common Stocks | | | 99.3% | |

| Repurchase Agreements | | | 3.8% | |

| Other Assets Less Liabilities | | | (3.1)% | |

Net Assets | | | 100% | |

Top Five Holdings

(% of total long-term investments)

| | | | |

| Apple Inc | | | 6.7% | |

| Microsoft Corp | | | 6.1% | |

| Amazon.com Inc | | | 3.0% | |

| Alphabet Inc, Class A | | | 2.4% | |

| Tesla Inc | | | 1.8% | |

Portfolio Composition1

(% of total investments)

| | | | |

| Software | | | 8.8% | |

| Technology Hardware, Storage & Peripherals | | | 6.6% | |

| Interactive Media & Services | | | 5.2% | |

| Semiconductors & Semiconductor Equipment | | | 5.0% | |

| Pharmaceuticals | | | 4.7% | |

| IT Services | | | 4.4% | |

| Oil, Gas & Consumable Fuels | | | 3.8% | |

| Banks | | | 3.7% | |

| Health Care Providers & Services | | | 3.4% | |

| Internet & Direct Marketing Retail | | | 2.9% | |

| Equity Real Estate Investment Trust | | | 2.7% | |

| Capital Markets | | | 2.4% | |

| Health Care Equipment & Supplies | | | 2.3% | |

| Insurance | | | 2.3% | |

| Biotechnology | | | 2.2% | |

| Automobiles | | | 2.0% | |

| Specialty Retail | | | 1.9% | |

| Hotels, Restaurants & Leisure | | | 1.9% | |

| Life Sciences Tools & Services | | | 1.8% | |

| Beverages | | | 1.8% | |

| Aerospace & Defense | | | 1.7% | |

| Diversified Financial Services | | | 1.7% | |

| Multi-Utilities | | | 1.7% | |

| Chemicals | | | 1.6% | |

| Household Products | | | 1.6% | |

| Machinery | | | 1.6% | |

| Food & Staples Retailing | | | 1.5% | |

| Other | | | 15.0% | |

| Repurchase Agreements | | | 3.8% | |

Total | | | 100% | |

| 1 | See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the Portfolio Composition above. |

12

| | |

| DIAX | | Nuveen Dow 30SM Dynamic Overwrite Fund Performance Overview and Holding Summaries as of June 30, 2022 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of June 30, 2022*

| | | | | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual |

| | | 6-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

| DIAX at Common Share NAV | | | (9.46)% | | | | (5.94)% | | | | 4.96% | | | | 7.78% | |

| DIAX at Common Share Price | | | (10.90)% | | | | (4.01)% | | | | 5.53% | | | | 8.59% | |

| Dow Jones Industrial Average Index (DJIA) | | | (14.44)% | | | | (9.05)% | | | | 9.98% | | | | 11.70% | |

| DIAX Blended Benchmark | | | (9.67)% | | | | (3.26)% | | | | 7.70% | | | | 8.33% | |

| * | For purposes of Fund performance, relative results are measured against the DIAX Blended Benchmark. The Fund’s Blended Benchmark consists of: 1) 55% Chicago Board Options Exchange (Cboe) DJIA BuyWrite Index (BXDSM) and 2) 45% Dow Jones Industrial Average Index (DJIA). |

Performance data shown represents past performance and does not predict or guarantee future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

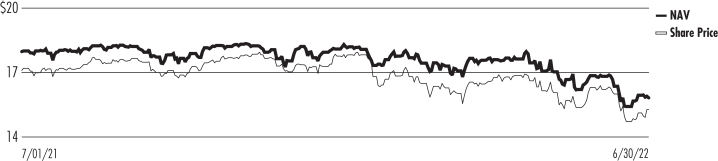

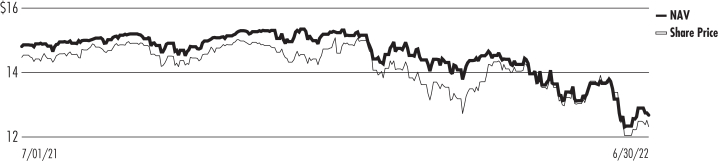

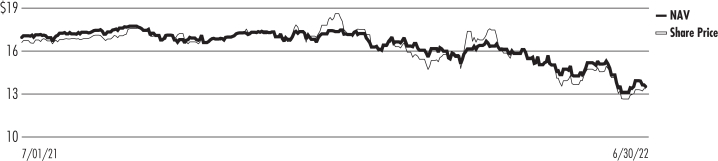

Daily Common Share NAV and Share Price

13

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Fund Allocation

(% of net assets)

| | | | |

| Common Stocks | | | 99.3% | |

| Exchange-Traded Funds | | | 3.1% | |

| Repurchase Agreements | | | 1.9% | |

| Other Assets Less Liabilities | | | (4.3)% | |

Net Assets | | | 100% | |

Top Five Holdings

(% of total long-term investments)

| | | | |

| UnitedHealth Group Inc | | | 10.7% | |

| Goldman Sachs Group Inc | | | 6.2% | |

| Home Depot Inc | | | 5.7% | |

| Microsoft Corp | | | 5.3% | |

| McDonald’s Corp | | | 5.1% | |

Portfolio Composition1

(% of total investments)

| | | | |

| Health Care Providers & Services | | | 10.5% | |

| Software | | | 8.5% | |

| IT Services | | | 6.9% | |

| Industrial Conglomerates | | | 6.2% | |

| Capital Markets | | | 6.1% | |

| Specialty Retail | | | 5.6% | |

| Pharmaceuticals | | | 5.5% | |

| Hotels, Restaurants & Leisure | | | 5.0% | |

| Biotechnology | | | 5.0% | |

| Machinery | | | 3.6% | |

| Insurance | | | 3.4% | |

| Food & Staples Retailing | | | 3.2% | |

| Oil, Gas & Consumable Fuels | | | 3.0% | |

| Household Products | | | 2.9% | |

| Consumer Finance | | | 2.8% | |

| Aerospace & Defense | | | 2.8% | |

| Technology Hardware, Storage & Peripherals | | | 2.8% | |

| Other | | | 11.3% | |

| Exchange-Traded Funds | | | 3.0% | |

| Repurchase Agreements | | | 1.9% | |

Total | | | 100% | |

| 1 | See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the Portfolio Composition above. |

14

| | |

| SPXX | | Nuveen S&P 500 Dynamic Overwrite Fund Performance Overview and Holding Summaries as of June 30, 2022 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of June 30, 2022*

| | | | | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 6-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

| SPXX at Common Share NAV | | | (15.04)% | | | | (7.96)% | | | | 6.28% | | | | 7.67% | |

| SPXX at Common Share Price | | | (12.83)% | | | | (7.98)% | | | | 7.35% | | | | 9.53% | |

| S&P 500® Index | | | (19.96)% | | | | (10.62)% | | | | 11.31% | | | | 12.96% | |

| SPXX Blended Benchmark | | | (14.66)% | | | | (6.21)% | | | | 7.38% | | | | 9.09% | |

| * | For purposes of Fund performance, relative results are measured against the SPXX Blended Benchmark. The Fund’s Blended Benchmark consists of: 1) 55% Chicago Board Options Exchange (Cboe) S&P 500® BuyWrite Index (BXMSM) and 2) 45% S&P 500® Index |

Performance prior to December 22, 2014, reflects the Fund’s performance under the management of a sub-adviser using an investment strategy that differed from those currently in place.

Performance data shown represents past performance and does not predict or guarantee future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

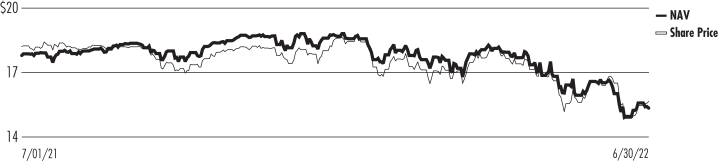

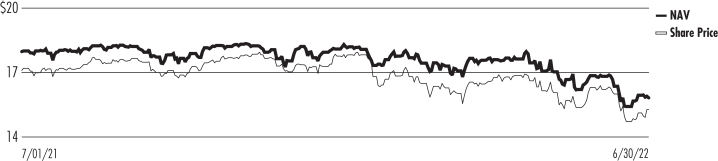

Daily Common Share NAV and Share Price

15

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Fund Allocation

(% of net assets)

| | | | |

| Common Stocks | | | 98.8% | |

| Exchange-Traded Funds | | | 3.0% | |

| Investments Purchased with Collateral from Securities Lending | | | 0.2% | |

| Repurchase Agreements | | | 2.1% | |

| Other Assets Less Liabilities | | | (4.1)% | |

Net Asset | | | 100% | |

Top Five Holdings

(% of total long-term investments)

| | | | |

| Apple Inc | | | 6.7% | |

| Microsoft Corp | | | 6.2% | |

| Amazon.com Inc | | | 3.0% | |

| Vanguard Total Stock Market ETF | | | 3.0% | |

| Alphabet Inc, Class C | | | 2.1% | |

Portfolio Composition

(% of total investments)1

| | | | |

| Software | | | 8.8% | |

| Technology Hardware, Storage & Peripherals | | | 6.6% | |

| Interactive Media & Services | | | 5.4% | |

| Pharmaceuticals | | | 4.5% | |

| Banks | | | 4.5% | |

| Semiconductors & Semiconductor Equipment | | | 4.2% | |

| Health Care Providers & Services | | | 4.0% | |

| IT Services | | | 3.8% | |

| Internet & Direct Marketing Retail | | | 3.1% | |

Equity Real Estate Investment Trust | | | 2.9% | |

| Oil, Gas & Consumable Fuels | | | 2.9% | |

| Beverages | | | 2.3% | |

| Machinery | | | 2.3% | |

| Capital Markets | | | 2.3% | |

| | | | |

| Health Care Equipment & Supplies | | | 2.2% | |

| Specialty Retail | | | 2.2% | |

| Biotechnology | | | 2.1% | |

| Household Products | | | 2.1% | |

| Hotels, Restaurants & Leisure | | | 1.9% | |

| Insurance | | | 1.9% | |

| Automobiles | | | 1.8% | |

| Diversified Financial Services | | | 1.8% | |

| Chemicals | | | 1.8% | |

| Aerospace & Defense | | | 1.7% | |

| Other | | | 17.8% | |

| Exchange-Traded Funds | | | 2.9% | |

| Investments Purchased with Collateral from Securities Lending | | | 0.2% | |

| Repurchase Agreements | | | 2.0% | |

Total | | | 100% | |

| 1 | See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the Portfolio Composition above. |

16

| | |

| QQQX | | Nuveen Nasdaq 100 Dynamic Overwrite Fund Performance Overview and Holding Summaries as of June 30, 2022 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of June 30, 2022*

| | | | | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 6-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

| QQQX at Common Share NAV | | | (22.72)% | | | | (17.26)% | | | | 8.02% | | | | 11.15% | |

| QQQX at Common Share Price | | | (25.83)% | | | | (20.20)% | | | | 7.26% | | | | 11.27% | |

| Nasdaq 100® Index | | | (29.22)% | | | | (20.38)% | | | | 16.37% | | | | 17.27% | |

| QQQX Blended Benchmark | | | (21.82)% | | | | (15.15)% | | | | 10.09% | | | | 11.23% | |

| * | For purposes of Fund performance, relative results are measured against the QQQX Blended Benchmark. The Fund’s Blended Benchmark consists of: 1) 55% Chicago Board Options Exchange (Cboe) Nasdaq 100 BuyWrite Index (BXNSM) and 2) 45% Nasdaq 100® Index. |

Performance data shown represents past performance and does not predict or guarantee future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

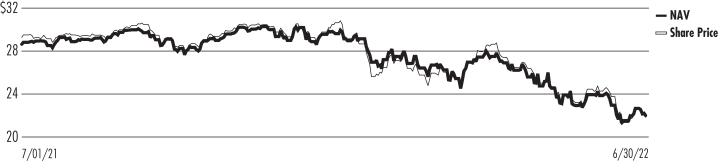

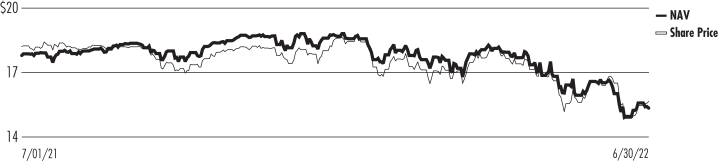

Daily Common Share NAV and Share Price

17

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Fund Allocation

(% of net assets)

| | | | |

| Common Stocks | | | 99.3% | |

| Exchange-Traded Funds | | | 3.1% | |

| Investments Purchased with Collateral from Securities Lending | | | 0.4% | |

| Repurchase Agreements | | | 2.2% | |

| Other Assets Less Liabilities | | | (5.0)% | |

Net Assets | | | 100% | |

Top Five Holdings

(% of total long-term investments)

| | | | |

| Microsoft Corp | | | 12.8% | |

| Apple Inc | | | 12.6% | |

| Amazon.com Inc | | | 6.5% | |

| Alphabet Inc, Class A | | | 5.3% | |

| Tesla Inc | | | 3.9% | |

Portfolio Composition1

(% of total investments)

| | | | |

| Software | | | 17.5% | |

| Semiconductors & Semiconductor Equipment | | | 13.3% | |

| Technology Hardware, Storage & Peripherals | | | 12.3% | |

| Interactive Media & Services | | | 12.1% | |

| Internet & Direct Marketing Retail | | | 8.2% | |

| Biotechnology | | | 4.7% | |

| Automobiles | | | 4.1% | |

| Media | | | 3.2% | |

| Communications Equipment | | | 2.5% | |

| Beverages | | | 2.0% | |

| IT Services | | | 1.8% | |

| Health Care Equipment & Supplies | | | 1.5% | |

| Hotels, Restaurants & Leisure | | | 1.4% | |

| Food & Staples Retailing | | | 1.2% | |

| Food Products | | | 1.2% | |

| Other | | | 7.6% | |

| Exchange-Traded Funds | | | 2.9% | |

| Investments Purchased with Collateral from Securities Lending | | | 0.4% | |

| Repurchase Agreements | | | 2.1% | |

Total | | | 100% | |

| 1 | See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the Portfolio Composition above. |

18

| | |

| JCE | | Nuveen Core Equity Alpha Fund Performance Overview and Holding Summaries as of June 30, 2022 |

Refer to Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of June 30, 2022*

| | | | | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | |

| | | 6-Month | | | 1-Year | | | 5-Year | | | 10-Year | |

| JCE at Common Share NAV | | | (17.82)% | | | | (9.34)% | | | | 7.80% | | | | 10.36% | |

| JCE at Common Share Price | | | (24.26)% | | | | (8.11)% | | | | 8.73% | | | | 11.55% | |

| S&P 500® Index | | | (19.96)% | | | | (10.62)% | | | | 11.31% | | | | 12.96% | |

| JCE Blended Benchmark | | | (15.15)% | | | | (6.61)% | | | | 7.74% | | | | 9.44% | |

| * | For purposes of Fund performance, relative results are measured against the JCE Blended Benchmark. The Fund’s Blended Benchmark consists of: 1) 50% S&P 500® Index and 2) 50% Chicago Board Options Exchange (Cboe) S&P 500® BuyWrite Index (BXMSM). |

Performance data shown represents past performance and does not predict or guarantee future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Daily Common Share NAV and Share Price

19

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

Fund Allocation

(% of net assets)

| | | | |

| Common Stocks | | | 99.5% | |

| Exchange-Traded Funds | | | 0.5% | |

| Investments Purchased with Collateral from Securities Lending | | | 0.1% | |

| Repurchase Agreements | | | 3.0% | |

| Other Assets Less Liabilities | | | (3.1)% | |

Net Asset | | | 100% | |

Top Five Holdings

(% of total long-term investments)

| | | | |

| Apple Inc | | | 7.2% | |

| Microsoft Corp | | | 6.5% | |

| Amazon.com Inc | | | 2.5% | |

| UnitedHealth Group Inc | | | 2.2% | |

| Alphabet Inc, Class C | | | 2.2% | |

Portfolio Composition

(% of total investments)1

| | | | |

| Software | | | 10.6% | |

| Technology Hardware, Storage & Peripherals | | | 7.0% | |

| Interactive Media & Services | | | 5.5% | |

| Pharmaceuticals | | | 5.0% | |

| Oil, Gas & Consumable Fuels | | | 4.2% | |

| IT Services | | | 4.2% | |

| Semiconductors & Semiconductor Equipment | | | 3.9% | |

| Life Sciences Tools & Services | | | 3.8% | |

| Specialty Retail | | | 3.4% | |

| Health Care Providers & Services | | | 3.0% | |

| Health Care Equipment & Supplies | | | 2.8% | |

| Hotels, Restaurants & Leisure | | | 2.4% | |

| | | | |

| Internet & Direct Marketing Retail | | | 2.4% | |

| Banks | | | 2.3% | |

| Diversified Financial Services | | | 2.3% | |

| Household Products | | | 2.1% | |

| Multiline Retail | | | 2.0% | |

| Food & Staples Retailing | | | 1.9% | |

| Diversified Telecommunication Services | | | 1.8% | |

| Electrical Equipment | | | 1.7% | |

| Commercial Services & Supplies | | | 1.6% | |

| Building Products | | | 1.6% | |

| Industrial Conglomerates | | | 1.6% | |

| Road & Rail | | | 1.6% | |

| Other | | | 17.9% | |

| Exchange-Traded Funds | | | 0.4% | |

| Investments Purchased with Collateral from Securities Lending | | | 0.1% | |

| Repurchase Agreements | | | 2.9% | |

Total | | | 100% | |

| 1 | See the Portfolio of Investments for the remaining industries/sectors comprising “Other” and not listed in the Portfolio Composition above. |

20

| | |

| BXMX | | Nuveen S&P 500 Buy-Write

Income Fund Portfolio of Investments June 30, 2022 |

| | | (Unaudited) |

| | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | |

| | | | LONG-TERM INVESTMENTS – 99.3% | | | | | | | | | | | | |

| | | | |

| | | | COMMON STOCKS – 99.3% (2) | | | | | | | | | | | | |

| | | | |

| | | | Aerospace & Defense – 1.8% | | | | | | | | | |

| | | | |

| | 28,960 | | | Boeing Co (3) | | | | | | | | | | $ | 3,959,411 | |

| | 9,566 | | | HEICO Corp | | | | | | | | | | | 1,254,294 | |

| | 62,456 | | | Howmet Aerospace Inc | | | | | | | | | | | 1,964,241 | |

| | 13,748 | | | Northrop Grumman Corp | | | | | | | | | | | 6,579,380 | |

| | 99,428 | | | Raytheon Technologies Corp | | | | | | | | | | | 9,556,025 | |

| | 4,597 | | | Woodward Inc | | | | | | | | | | | 425,177 | |

| | | | Total Aerospace & Defense | | | | | | | | | | | 23,738,528 | |

| | | | |

| | | | Air Freight & Logistics – 0.6% | | | | | | | | | |

| | | | |

| | 40,842 | | | United Parcel Service Inc, Class B | | | | | | | | | | | 7,455,299 | |

| | | | |

| | | | Airlines – 0.1% | | | | | | | | | |

| | | | |

| | 47,025 | | | United Airlines Holdings Inc (3) | | | | | | | | | | | 1,665,625 | |

| | | | |

| | | | Auto Components – 0.1% | | | | | | | | | |

| | | | |

| | 50,606 | | | Gentex Corp | | | | | | | | | | | 1,415,450 | |

| | 9,851 | | | Goodyear Tire & Rubber Co (3) | | | | | | | | | | | 105,504 | |

| | | | Total Auto Components | | | | | | | | | | | 1,520,954 | |

| | | | |

| | | | Automobiles – 2.0% | | | | | | | | | |

| | | | |

| | 252,900 | | | Ford Motor Co | | | | | | | | | | | 2,814,777 | |

| | 16,446 | | | Harley-Davidson Inc | | | | | | | | | | | 520,680 | |

| | 35,247 | | | Tesla Inc (3) | | | | | | | | | | | 23,736,035 | |

| | | | Total Automobiles | | | | | | | | | | | 27,071,492 | |

| | | | |

| | | | Banks – 3.8% | | | | | | | | | |

| | | | |

| | 81,507 | | | Citigroup Inc | | | | | | | | | | | 3,748,507 | |

| | 26,341 | | | Comerica Inc | | | | | | | | | | | 1,932,902 | |

| | 162,841 | | | Fifth Third Bancorp | | | | | | | | | | | 5,471,457 | |

| | 101,208 | | | First Horizon Corp | | | | | | | | | | | 2,212,407 | |

| | 132,821 | | | JPMorgan Chase & Co | | | | | | | | | | | 14,956,973 | |

| | 165,652 | | | KeyCorp | | | | | | | | | | | 2,854,184 | |

| | 14,051 | | | M&T Bank Corp | | | | | | | | | | | 2,239,589 | |

| | 41,891 | | | PNC Financial Services Group Inc | | | | | | | | | | | 6,609,143 | |

| | 195,504 | | | Wells Fargo & Co | | | | | | | | | | | 7,657,892 | |

| | 55,583 | | | Zions Bancorp NA | | | | | | | | | | | 2,829,175 | |

| | | | Total Banks | | | | | | | | | | | 50,512,229 | |

| | | | |

| | | | Beverages – 1.9% | | | | | | | | | |

| | | | |

| | 247,954 | | | Coca-Cola Co | | | | | | | | | | | 15,598,786 | |

| | 104,662 | | | Keurig Dr Pepper Inc | | | | | | | | | | | 3,703,988 | |

| | 56,712 | | | Monster Beverage Corp (3) | | | | | | | | | | | 5,257,203 | |

| | | | Total Beverages | | | | | | | | | | | 24,559,977 | |

| | | | |

| | | | Biotechnology – 2.3% | | | | | | | | | |

| | | | |

| | 83,076 | | | AbbVie Inc | | | | | | | | | | | 12,723,920 | |

| | 3,766 | | | Alnylam Pharmaceuticals Inc (3) | | | | | | | | | | | 549,271 | |

| | 28,089 | | | Amgen Inc | | | | | | | | | | | 6,834,054 | |

| | 9,647 | | | Biogen Inc (3) | | | | | | | | | | | 1,967,409 | |

| | 9,243 | | | BioMarin Pharmaceutical Inc (3) | | | | | | | | | | | 765,968 | |

| | 2,000 | | | Exact Sciences Corp (3) | | | | | | | | | | | 78,780 | |

| | 67,257 | | | Gilead Sciences Inc | | | | | | | | | | | 4,157,155 | |

| | 15,810 | | | Moderna Inc (3) | | | | | | | | | | | 2,258,459 | |

21

| | |

| |

| BXMX | | Nuveen S&P 500 Buy-Write Income Fund (continued) |

| | Portfolio of Investments June 30, 2022 |

| | (Unaudited) |

| | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | |

| | | | Biotechnology (continued) | | | | | | | | | |

| | | | |

| | 4,961 | | | Seagen Inc (3) | | | | | | | | | | $ | 877,799 | |

| | | | Total Biotechnology | | | | | | | | | | | 30,212,815 | |

| | | | |

| | | | Building Products – 0.4% | | | | | | | | | |

| | | | |

| | 15,381 | | | Allegion plc | | | | | | | | | | | 1,505,800 | |

| | 23,666 | | | Fortune Brands Home & Security Inc | | | | | | | | | | | 1,417,120 | |

| | 43,726 | | | Masco Corp | | | | | | | | | | | 2,212,536 | |

| | | | Total Building Products | | | | | | | | | | | 5,135,456 | |

| | | | |

| | | | Capital Markets – 2.4% | | | | | | | | | |

| | | | |

| | 83,608 | | | Charles Schwab Corp | | | | | | | | | | | 5,282,353 | |

| | 23,102 | | | CME Group Inc | | | | | | | | | | | 4,728,979 | |

| | 44,488 | | | Intercontinental Exchange Inc | | | | | | | | | | | 4,183,651 | |

| | 53,398 | | | Jefferies Financial Group Inc | | | | | | | | | | | 1,474,853 | |

| | 86,746 | | | Morgan Stanley | | | | | | | | | | | 6,597,901 | |

| | 8,344 | | | MSCI Inc | | | | | | | | | | | 3,438,980 | |

| | 19,659 | | | S&P Global Inc | | | | | | | | | | | 6,626,263 | |

| | | | Total Capital Markets | | | | | | | | | | | 32,332,980 | |

| | | | |

| | | | Chemicals – 1.7% | | | | | | | | | |

| | | | |

| | 16,669 | | | Chemours Co | | | | | | | | | | | 533,741 | |

| | 52,881 | | | Corteva Inc | | | | | | | | | | | 2,862,977 | |

| | 53,214 | | | Dow Inc | | | | | | | | | | | 2,746,375 | |

| | 42,507 | | | DuPont de Nemours Inc | | | | | | | | | | | 2,362,539 | |

| | 34,775 | | | Eastman Chemical Co | | | | | | | | | | | 3,121,752 | |

| | 30,588 | | | Linde PLC | | | | | | | | | | | 8,794,968 | |

| | 20,651 | | | Olin Corp | | | | | | | | | | | 955,728 | |

| | 14,399 | | | RPM International Inc | | | | | | | | | | | 1,133,489 | |

| | | | Total Chemicals | | | | | | | | | | | 22,511,569 | |

| | | | |

| | | | Commercial Services & Supplies – 0.7% | | | | | | | | | |

| | | | |

| | 14,179 | | | Waste Connections Inc | | | | | | | | | | | 1,757,629 | |

| | 47,435 | | | Waste Management Inc | | | | | | | | | | | 7,256,606 | |

| | | | Total Commercial Services & Supplies | | | | | | | | | | | 9,014,235 | |

| | | | |

| | | | Communications Equipment – 0.9% | | | | | | | | | |

| | | | |

| | 13,699 | | | Ciena Corp (3) | | | | | | | | | | | 626,044 | |

| | 220,344 | | | Cisco Systems Inc | | | | | | | | | | | 9,395,468 | |

| | 5,140 | | | Lumentum Holdings Inc (3) | | | | | | | | | | | 408,219 | |

| | 74,070 | | | Viavi Solutions Inc (3) | | | | | | | | | | | 979,946 | |

| | | | Total Communications Equipment | | | | | | | | | | | 11,409,677 | |

| | | | |

| | | | Consumer Finance – 0.4% | | | | | | | | | |

| | | | |

| | 42,085 | | | Discover Financial Services | | | | | | | | | | | 3,980,399 | |

| | 89,957 | | | SLM Corp | | | | | | | | | | | 1,433,915 | |

| | | | Total Consumer Finance | | | | | | | | | | | 5,414,314 | |

| | | | |

| | | | Containers & Packaging – 0.5% | | | | | | | | | |

| | | | |

| | 13,574 | | | Avery Dennison Corp | | | | | | | | | | | 2,197,223 | |

| | 20,677 | | | Crown Holdings Inc | | | | | | | | | | | 1,905,799 | |

| | 15,364 | | | Packaging Corp of America | | | | | | | | | | | 2,112,550 | |

| | 18,945 | | | Sonoco Products Co | | | | | | | | | | | 1,080,623 | |

| | | | Total Containers & Packaging | | | | | | | | | | | 7,296,195 | |

| | | | |

| | | | Distributors – 0.2% | | | | | | | | | |

| | | | |

| | 51,888 | | | LKQ Corp | | | | | | | | | | | 2,547,182 | |

| | | | |

| | | | Diversified Financial Services – 1.8% | | | | | | | | | |

| | | | |

| | 86,707 | | | Berkshire Hathaway Inc, Class B (3) | | | | | | | | | | | 23,672,745 | |

22

| | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | |

| | | | Diversified Telecommunication Services – 1.4% | | | | | | | | | |

| | | | |

| | 379,832 | | | AT&T Inc | | | | | | | | | | $ | 7,961,279 | |

| | 207,579 | | | Verizon Communications Inc | | | | | | | | | | | 10,534,634 | |

| | | | Total Diversified Telecommunication Services | | | | | | | | | | | 18,495,913 | |

| | | | |

| | | | Electric Utilities – 1.0% | | | | | | | | | |

| | | | |

| | 90,850 | | | Alliant Energy Corp | | | | | | | | | | | 5,324,718 | |

| | 58,152 | | | Evergy Inc | | | | | | | | | | | 3,794,418 | |

| | 52,512 | | | OGE Energy Corp | | | | | | | | | | | 2,024,863 | |

| | 29,198 | | | Pinnacle West Capital Corp | | | | | | | | | | | 2,134,958 | |

| | | | Total Electric Utilities | | | | | | | | | | | 13,278,957 | |

| | | | |

| | | | Electrical Equipment – 0.6% | | | | | | | | | |

| | | | |

| | 54,146 | | | Emerson Electric Co | | | | | | | | | | | 4,306,773 | |

| | 8,860 | | | Hubbell Inc | | | | | | | | | | | 1,582,219 | |

| | 13,511 | | | Rockwell Automation Inc | | | | | | | | | | | 2,692,877 | |

| | | | Total Electrical Equipment | | | | | | | | | | | 8,581,869 | |

| | | | |

| | | | Electronic Equipment, Instruments & Components – 0.4% | | | | | | | | | |

| | | | |

| | 20,728 | | | CDW Corp/DE | | | | | | | | | | | 3,265,904 | |

| | 86,143 | | | Corning Inc | | | | | | | | | | | 2,714,366 | |

| | | | Total Electronic Equipment, Instruments & Components | | | | | | | | | | | 5,980,270 | |

| | | | |

| | | | Energy Equipment & Services – 0.4% | | | | | | | | | |

| | | | |

| | 72,910 | | | Halliburton Co | | | | | | | | | | | 2,286,458 | |

| | 77,600 | | | Schlumberger NV | | | | | | | | | | | 2,774,976 | |

| | | | Total Energy Equipment & Services | | | | | | | | | | | 5,061,434 | |

| | | | |

| | | | Entertainment – 1.1% | | | | | | | | | |

| | | | |

| | 22,085 | | | Netflix Inc (3) | | | | | | | | | | | 3,862,004 | |

| | 1,091 | | | Roku Inc (3) | | | | | | | | | | | 89,615 | |

| | 85,224 | | | Walt Disney Co (3) | | | | | | | | | | | 8,045,146 | |

| | 146,699 | | | Warner Bros Discovery Inc (3) | | | | | | | | | | | 1,968,700 | |

| | | | Total Entertainment | | | | | | | | | | | 13,965,465 | |

| | | | |

| | | | Equity Real Estate Investment Trust – 2.8% | | | | | | | | | |

| | | | |

| | 97,035 | | | American Homes 4 Rent, Class A | | | | | | | | | | | 3,438,920 | |

| | 33,023 | | | American Tower Corp | | | | | | | | | | | 8,440,349 | |

| | 17,121 | | | Apartment Income REIT Corp | | | | | | | | | | | 712,234 | |

| | 73,114 | | | Apartment Investment and Management Co, Class A (3) | | | | | | | | | | | 467,930 | |

| | 123,846 | | | Brandywine Realty Trust | | | | | | | | | | | 1,193,875 | |

| | 75,722 | | | CubeSmart | | | | | | | | | | | 3,234,844 | |

| | 51,595 | | | Equity Commonwealth (3) | | | | | | | | | | | 1,420,410 | |

| | 84,268 | | | Healthcare Realty Trust Inc | | | | | | | | | | | 2,292,090 | |

| | 159,619 | | | Invitation Homes Inc | | | | | | | | | | | 5,679,244 | |

| | 19,823 | | | LXP Industrial Trust | | | | | | | | | | | 212,899 | |

| | 51,162 | | | Sabra Health Care REIT Inc | | | | | | | | | | | 714,733 | |

| | 15,931 | | | Sun Communities Inc | | | | | | | | | | | 2,538,764 | |

| | 42,955 | | | Welltower Inc | | | | | | | | | | | 3,537,344 | |

| | 94,015 | | | Weyerhaeuser Co | | | | | | | | | | | 3,113,777 | |

| | | | Total Equity Real Estate Investment Trust | | | | | | | | | | | 36,997,413 | |

| | | | |

| | | | Food & Staples Retailing – 1.5% | | | | | | | | | |

| | | | |

| | 3,640 | | | Casey’s General Stores Inc | | | | | | | | | | | 673,327 | |

| | 26,650 | | | Costco Wholesale Corp | | | | | | | | | | | 12,772,812 | |

| | 73,551 | | | Kroger Co | | | | | | | | | | | 3,481,169 | |

| | 34,540 | | | Sysco Corp | | | | | | | | | | | 2,925,883 | |

| | 15,913 | | | US Foods Holding Corp (3) | | | | | | | | | | | 488,211 | |

| | | | Total Food & Staples Retailing | | | | | | | | | | | 20,341,402 | |

| | | | |

| | | | Food Products – 1.0% | | | | | | | | | |

| | | | |

| | 71,353 | | | Hormel Foods Corp | | | | | | | | | | | 3,379,278 | |

23

| | |

| |

| BXMX | | Nuveen S&P 500 Buy-Write Income Fund (continued) |

| | Portfolio of Investments June 30, 2022 |

| | (Unaudited) |

| | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | |

| | | | Food Products (continued) | | | | | | | | | |

| | | | |

| | 133,397 | | | Mondelez International Inc, Class A | | | | | | | | | | $ | 8,282,620 | |

| | 12,100 | | | Post Holdings Inc (3) | | | | | | | | | | | 996,435 | |

| | | | Total Food Products | | | | | | | | | | | 12,658,333 | |

| | | | |

| | | | Gas Utilities – 0.1% | | | | | | | | | |

| | | | |

| | 12,873 | | | Atmos Energy Corp | | | | | | | | | | | 1,443,063 | |

| | 2,933 | | | National Fuel Gas Co | | | | | | | | | | | 193,725 | |

| | | | Total Gas Utilities | | | | | | | | | | | 1,636,788 | |

| | | | |

| | | | Health Care Equipment & Supplies – 2.4% | | | | | | | | | |

| | | | |

| | 98,976 | | | Abbott Laboratories | | | | | | | | | | | 10,753,742 | |

| | 19,319 | | | Alcon Inc | | | | | | | | | | | 1,350,205 | |

| | 7,646 | | | Avanos Medical Inc (3) | | | | | | | | | | | 209,042 | |

| | 49,755 | | | Baxter International Inc | | | | | | | | | | | 3,195,764 | |

| | 130,178 | | | Boston Scientific Corp (3) | | | | | | | | | | | 4,851,734 | |

| | 8,009 | | | IDEXX Laboratories Inc (3) | | | | | | | | | | | 2,808,997 | |

| | 89,338 | | | Medtronic PLC | | | | | | | | | | | 8,018,085 | |

| | | | Total Health Care Equipment & Supplies | | | | | | | | | | | 31,187,569 | |

| | | | |

| | | | Health Care Providers & Services – 3.5% | | | | | | | | | |

| | | | |

| | 20,430 | | | Cigna Corp | | | | | | | | | | | 5,383,714 | |

| | 8,265 | | | Covetrus Inc (3) | | | | | | | | | | | 171,499 | |

| | 69,178 | | | CVS Health Corp | | | | | | | | | | | 6,410,033 | |

| | 15,832 | | | Elevance Health Inc | | | | | | | | | | | 7,640,206 | |

| | 20,595 | | | HCA Healthcare Inc | | | | | | | | | | | 3,461,196 | |

| | 45,020 | | | UnitedHealth Group Inc | | | | | | | | | | | 23,123,623 | |

| | | | Total Health Care Providers & Services | | | | | | | | | | | 46,190,271 | |

| | | | |

| | | | Health Care Technology – 0.1% | | | | | | | | | |

| | | | |

| | 6,414 | | | Veeva Systems Inc, Class A (3) | | | | | | | | | | | 1,270,229 | |

| | | | |

| | | | Hotels, Restaurants & Leisure – 1.9% | | | | | | | | | |

| | | | |

| | 2,484 | | | Booking Holdings Inc (3) | | | | | | | | | | | 4,344,491 | |

| | 31,485 | | | Marriott International Inc/MD, Class A | | | | | | | | | | | 4,282,275 | |

| | 41,884 | | | McDonald’s Corp | | | | | | | | | | | 10,340,322 | |

| | 16,077 | | | Restaurant Brands International Inc | | | | | | | | | | | 806,261 | |

| | 74,292 | | | Starbucks Corp | | | | | | | | | | | 5,675,166 | |

| | | | Total Hotels, Restaurants & Leisure | | | | | | | | | | | 25,448,515 | |

| | | | |

| | | | Household Durables – 0.3% | | | | | | | | | |

| | | | |

| | 16,552 | | | Garmin Ltd | | | | | | | | | | | 1,626,234 | |

| | 32,919 | | | KB Home | | | | | | | | | | | 936,875 | |

| | 6,575 | | | TopBuild Corp (3) | | | | | | | | | | | 1,099,077 | |

| | | | Total Household Durables | | | | | | | | | | | 3,662,186 | |

| | | | |

| | | | Household Products – 1.6% | | | | | | | | | |

| | | | |

| | 144,112 | | | Procter & Gamble Co | | | | | | | | | | | 20,721,864 | |

| | 13,445 | | | Spectrum Brands Holdings Inc | | | | | | | | | | | 1,102,759 | |

| | | | Total Household Products | | | | | | | | | | | 21,824,623 | |

| | | | |

| | | | Industrial Conglomerates – 1.2% | | | | | | | | | |

| | | | |

| | 38,682 | | | 3M Co | | | | | | | | | | | 5,005,837 | |

| | 50,397 | | | General Electric Co | | | | | | | | | | | 3,208,777 | |

| | 40,807 | | | Honeywell International Inc | | | | | | | | | | | 7,092,665 | |

| | | | Total Industrial Conglomerates | | | | | | | | | | | 15,307,279 | |

| | | | |

| | | | Insurance – 2.3% | | | | | | | | | |

| | | | |

| | 2,535 | | | Alleghany Corp (3) | | | | | | | | | | | 2,111,908 | |

| | 28,004 | | | Allstate Corp | | | | | | | | | | | 3,548,947 | |

| | 47,396 | | | Arthur J Gallagher & Co | | | | | | | | | | | 7,727,444 | |

| | 37,130 | | | CNO Financial Group Inc | | | | | | | | | | | 671,682 | |

| | 23,577 | | | Fidelity National Financial Inc | | | | | | | | | | | 871,406 | |

24

| | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | |

| | | | Insurance (continued) | | | | | | | | | |

| | | | |

| | 16,078 | | | Genworth Financial Inc, Class A (3) | | | | | | | | | | $ | 56,755 | |

| | 38,545 | | | Hartford Financial Services Group Inc | | | | | | | | | | | 2,521,999 | |

| | 4,703 | | | Kemper Corp | | | | | | | | | | | 225,274 | |

| | 33,540 | | | Lincoln National Corp | | | | | | | | | | | 1,568,666 | |

| | 7,573 | | | RenaissanceRe Holdings Ltd | | | | | | | | | | | 1,184,190 | |

| | 32,951 | | | Travelers Cos Inc | | | | | | | | | | | 5,573,003 | |

| | 71,665 | | | W R Berkley Corp | | | | | | | | | | | 4,891,853 | |

| | | | Total Insurance | | | | | | | | | | | 30,953,127 | |

| | | | |

| | | | Interactive Media & Services – 5.3% | | | | | | | | | |

| | | | |

| | 14,278 | | | Alphabet Inc, Class A (3) | | | | | | | | | | | 31,115,474 | |

| | 9,974 | | | Alphabet Inc, Class C (3) | | | | | | | | | | | 21,817,626 | |

| | 99,036 | | | Meta Platforms Inc, Class (3) | | | | | | | | | | | 15,969,555 | |

| | 42,710 | | | Twitter Inc (3) | | | | | | | | | | | 1,596,927 | |

| | | | Total Interactive Media & Services | | | | | | | | | | | 70,499,582 | |

| | | | |

| | | | Internet & Direct Marketing Retail – 3.0% | | | | | | | | | |

| | | | |

| | 370,359 | | | Amazon.com Inc (3) | | | | | | | | | | | 39,335,829 | |

| | 5,685 | | | JD.com Inc, ADR | | | | | | | | | | | 365,091 | |

| | | | Total Internet & Direct Marketing Retail | | | | | | | | | | | 39,700,920 | |

| | | | |

| | | | IT Services – 4.6% | | | | | | | | | |

| | | | |

| | 30,096 | | | Accenture PLC, Class A | | | | | | | | | | | 8,356,155 | |

| | 20,604 | | | Akamai Technologies Inc (3) | | | | | | | | | | | 1,881,763 | |

| | 34,973 | | | Automatic Data Processing Inc | | | | | | | | | | | 7,345,729 | |

| | 15,971 | | | Broadridge Financial Solutions Inc | | | | | | | | | | | 2,276,666 | |

| | 39,198 | | | Fidelity National Information Services Inc | | | | | | | | | | | 3,593,281 | |

| | 41,235 | | | Mastercard Inc, Class A | | | | | | | | | | | 13,008,818 | |

| | 60,946 | | | PayPal Holdings Inc (3) | | | | | | | | | | | 4,256,468 | |

| | 9,442 | | | Twilio Inc, Class A (3) | | | | | | | | | | | 791,334 | |

| | 17,828 | | | VeriSign Inc (3) | | | | | | | | | | | 2,983,159 | |

| | 79,964 | | | Visa Inc, Class A | | | | | | | | | | | 15,744,112 | |

| | | | Total IT Services | | | | | | | | | | | 60,237,485 | |

| | | | |

| | | | Leisure Products – 0.1% | | | | | | | | | |

| | | | |

| | 25,861 | | | Mattel Inc (3) | | | | | | | | | | | 577,476 | |

| | 6,048 | | | Polaris Inc | | | | | | | | | | | 600,446 | |

| | | | Total Leisure Products | | | | | | | | | | | 1,177,922 | |

| | | | |

| | | | Life Sciences Tools & Services – 1.9% | | | | | | | | | |

| | | | |

| | 36,475 | | | Danaher Corp | | | | | | | | | | | 9,247,142 | |

| | 10,529 | | | Illumina Inc (3) | | | | | | | | | | | 1,941,126 | |

| | 21,185 | | | Thermo Fisher Scientific Inc | | | | | | | | | | | 11,509,387 | |

| | 7,519 | | | Waters Corp (3) | | | | | | | | | | | 2,488,639 | |

| | | | Total Life Sciences Tools & Services | | | | | | | | | | | 25,186,294 | |

| | | | |

| | | | Machinery – 1.6% | | | | | | | | | |

| | | | |

| | 32,898 | | | Caterpillar Inc | | | | | | | | | | | 5,880,847 | |

| | 15,389 | | | Deere & Co | | | | | | | | | | | 4,608,544 | |

| | 31,851 | | | Graco Inc | | | | | | | | | | | 1,892,268 | |

| | 39,784 | | | Otis Worldwide Corp | | | | | | | | | | | 2,811,535 | |

| | 15,767 | | | Parker-Hannifin Corp | | | | | | | | | | | 3,879,470 | |

| | 16,044 | | | Stanley Black & Decker Inc | | | | | | | | | | | 1,682,374 | |

| | 10,383 | | | Timken Co | | | | | | | | | | | 550,818 | |

| | | | Total Machinery | | | | | | | | | | | 21,305,856 | |

| | | | |

| | | | Media – 0.8% | | | | | | | | | |

| | | | |

| | 216,324 | | | Comcast Corp, Class A | | | | | | | | | | | 8,488,554 | |

| | 17,899 | | | New York Times Co, Class A | | | | | | | | | | | 499,382 | |

| | 78,489 | | | News Corp, Class A | | | | | | | | | | | 1,222,858 | |

| | | | Total Media | | | | | | | | | | | 10,210,794 | |

25

| | |

| |

| BXMX | | Nuveen S&P 500 Buy-Write Income Fund (continued) |

| | Portfolio of Investments June 30, 2022 |

| | (Unaudited) |

| | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | |

| | | | Metals & Mining – 0.4% | | | | | | | | | |

| | | | |

| | 15,262 | | | Arconic Corp (3) | | | | | | | | | | $ | 428,099 | |

| | 42,845 | | | Newmont Corp | | | | | | | | | | | 2,556,561 | |

| | 20,588 | | | Nucor Corp | | | | | | | | | | | 2,149,593 | |

| | | | Total Metals & Mining | | | | | | | | | | | 5,134,253 | |

| | | | |

| | | | Mortgage Real Estate Investment Trust – 0.0% | | | | | | | | | |

| | | | |

| | 26,802 | | | Annaly Capital Management Inc | | | | | | | | | | | 158,400 | |

| | | | |

| | | | Multiline Retail – 0.4% | | | | | | | | | |

| | | | |

| | 25,320 | | | Macy’s Inc | | | | | | | | | | | 463,862 | |

| | 16,563 | | | Nordstrom Inc | | | | | | | | | | | 349,976 | |

| | 31,203 | | | Target Corp | | | | | | | | | | | 4,406,800 | |

| | | | Total Multiline Retail | | | | | | | | | | | 5,220,638 | |

| | | | |

| | | | Multi-Utilities – 1.7% | | | | | | | | | |

| | | | |

| | 80,101 | | | Ameren Corp | | | | | | | | | | | 7,237,926 | |

| | 17,519 | | | NorthWestern Corp | | | | | | | | | | | 1,032,395 | |

| | 105,501 | | | Public Service Enterprise Group Inc | | | | | | | | | | | 6,676,103 | |

| | 81,221 | | | WEC Energy Group Inc | | | | | | | | | | | 8,174,082 | |

| | | | Total Multi-Utilities | | | | | | | | | | | 23,120,506 | |

| | | | |

| | | | Oil, Gas & Consumable Fuels – 3.9% | | | | | | | | | |

| | | | |

| | 44,283 | | | Cenovus Energy Inc | | | | | | | | | | | 841,820 | |

| | 12,521 | | | Cheniere Energy Inc | | | | | | | | | | | 1,665,669 | |

| | 84,740 | | | Chevron Corp | | | | | | | | | | | 12,268,657 | |

| | 9,675 | | | CNX Resources Corp (3) | | | | | | | | | | | 159,251 | |

| | 81,811 | | | ConocoPhillips | | | | | | | | | | | 7,347,446 | |

| | 15,719 | | | Continental Resources Inc | | | | | | | | | | | 1,027,237 | |

| | 183,113 | | | Exxon Mobil Corp | | | | | | | | | | | 15,681,797 | |

| | 29,828 | | | Hess Corp | | | | | | | | | | | 3,159,978 | |

| | 42,055 | | | Marathon Petroleum Corp | | | | | | | | | | | 3,457,342 | |

| | 17,934 | | | Ovintiv Inc | | | | | | | | | | | 792,503 | |

| | 26,554 | | | Phillips 66 | | | | | | | | | | | 2,177,162 | |

| | 26,407 | | | Suncor Energy Inc | | | | | | | | | | | 926,093 | |

| | 25,961 | | | Valero Energy Corp | | | | | | | | | | | 2,759,135 | |

| | | | Total Oil, Gas & Consumable Fuels | | | | | | | | | | | 52,264,090 | |

| | | | |

| | | | Personal Products – 0.0% | | | | | | | | | |

| | | | |

| | 15,340 | | | BellRing Brands Inc (3) | | | | | | | | | | | 381,813 | |

| | | | |

| | | | Pharmaceuticals – 4.9% | | | | | | | | | |

| | | | |

| | 123,308 | | | Bristol-Myers Squibb Co | | | | | | | | | | | 9,494,716 | |

| | 36,480 | | | Eli Lilly & Co | | | | | | | | | | | 11,827,910 | |

| | 115,829 | | | Johnson & Johnson | | | | | | | | | | | 20,560,806 | |

| | 112,570 | | | Merck & Co Inc | | | | | | | | | | | 10,263,007 | |

| | 241,787 | | | Pfizer Inc | | | | | | | | | | | 12,676,892 | |

| | | | Total Pharmaceuticals | | | | | | | | | | | 64,823,331 | |

| | | | |

| | | | Professional Services – 0.3% | | | | | | | | | |

| | | | |

| | 21,760 | | | CoStar Group Inc (3) | | | | | | | | | | | 1,314,522 | |

| | 9,803 | | | ManpowerGroup Inc | | | | | | | | | | | 749,047 | |

| | 23,554 | | | TransUnion | | | | | | | | | | | 1,884,084 | |

| | | | Total Professional Services | | | | | | | | | | | 3,947,653 | |

| | | | |

| | | | Road & Rail – 0.9% | | | | | | | | | |

| | | | |

| | 30,324 | | | Canadian Pacific Railway Ltd | | | | | | | | | | | 2,117,828 | |

| | 4,425 | | | Lyft Inc, Class A (3) | | | | | | | | | | | 58,764 | |

| | 24,761 | | | Norfolk Southern Corp | | | | | | | | | | | 5,627,928 | |

| | 15,787 | | | Old Dominion Freight Line Inc | | | | | | | | | | | 4,045,892 | |

| | 31,571 | | | Uber Technologies Inc (3) | | | | | | | | | | | 645,943 | |

| | | | Total Road & Rail | | | | | | | | | | | 12,496,355 | |

26

| | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | |

| | | | Semiconductors & Semiconductor Equipment – 5.2% | | | | | | | | | |

| | | | |

| | 76,680 | | | Advanced Micro Devices Inc (3) | | | | | | | | | | $ | 5,863,720 | |

| | 56,923 | | | Applied Materials Inc | | | | | | | | | | | 5,178,854 | |

| | 21,360 | | | Broadcom Inc | | | | | | | | | | | 10,376,902 | |

| | 7,284 | | | Enphase Energy Inc (3) | | | | | | | | | | | 1,422,128 | |

| | 203,100 | | | Intel Corp | | | | | | | | | | | 7,597,971 | |

| | 10,447 | | | Lam Research Corp | | | | | | | | | | | 4,451,989 | |

| | 32,109 | | | Marvell Technology Inc | | | | | | | | | | | 1,397,705 | |

| | 62,434 | | | Micron Technology Inc | | | | | | | | | | | 3,451,351 | |

| | 111,295 | | | NVIDIA Corp | | | | | | | | | | | 16,871,209 | |

| | 19,772 | | | NXP Semiconductors NV | | | | | | | | | | | 2,926,849 | |

| | 32,082 | | | ON Semiconductor Corp (3) | | | | | | | | | | | 1,614,045 | |

| | 56,144 | | | QUALCOMM Inc | | | | | | | | | | | 7,171,835 | |

| | | | Total Semiconductors & Semiconductor Equipment | | | | | | | | | | | 68,324,558 | |

| | | | |

| | | | Software – 9.1% | | | | | | | | | |

| | | | |

| | 25,704 | | | Adobe Inc (3) | | | | | | | | | | | 9,409,206 | |

| | 17,788 | | | Autodesk Inc (3) | | | | | | | | | | | 3,058,825 | |

| | 16,990 | | | Black Knight Inc (3) | | | | | | | | | | | 1,110,976 | |

| | 552 | | | CDK Global Inc | | | | | | | | | | | 30,233 | |

| | 10,744 | | | Check Point Software Technologies Ltd (3) | | | | | | | | | | | 1,308,404 | |

| | 48,865 | | | Fortinet Inc (3) | | | | | | | | | | | 2,764,782 | |

| | 314,362 | | | Microsoft Corp | | | | | | | | | | | 80,737,592 | |

| | 81,715 | | | Oracle Corp | | | | | | | | | | | 5,709,427 | |

| | 3,109 | | | Palo Alto Networks Inc (3) | | | | | | | | | | | 1,535,659 | |

| | 47,152 | | | Salesforce Inc (3) | | | | | | | | | | | 7,781,966 | |

| | 12,353 | | | ServiceNow Inc (3) | | | | | | | | | | | 5,874,099 | |

| | 6,422 | | | VMware Inc, Class A | | | | | | | | | | | 731,980 | |

| | | | Total Software | | | | | | | | | | | 120,053,149 | |

| | | | |

| | | | Specialty Retail – 2.0% | | | | | | | | | |

| | | | |

| | 8,358 | | | American Eagle Outfitters Inc | | | | | | | | | | | 93,442 | |

| | 24,636 | | | Best Buy Co Inc | | | | | | | | | | | 1,606,021 | |

| | 4,047 | | | Burlington Stores Inc (3) | | | | | | | | | | | 551,323 | |

| | 14,810 | | | CarMax Inc (3) | | | | | | | | | | | 1,340,009 | |

| | 4,361 | | | Five Below Inc (3) | | | | | | | | | | | 494,668 | |

| | 50,051 | | | Home Depot Inc | | | | | | | | | | | 13,727,488 | |

| | 38,481 | | | Lowe’s Cos Inc | | | | | | | | | | | 6,721,476 | |

| | 4,641 | | | Ulta Beauty Inc (3) | | | | | | | | | | | 1,789,013 | |

| | | | Total Specialty Retail | | | | | | | | | | | 26,323,440 | |

| | | | |

| | | | Technology Hardware, Storage & Peripherals – 6.8% | | | | | | | | | |

| | | | |

| | 645,863 | | | Apple Inc | | | | | | | | | | | 88,302,390 | |

| | 48,016 | | | Dell Technologies Inc, Class C | | | | | | | | | | | 2,218,819 | |

| | | | Total Technology Hardware, Storage & Peripherals | | | | | | | | | | | 90,521,209 | |

| | | | |

| | | | Textiles, Apparel & Luxury Goods – 0.6% | | | | | | | | | |

| | | | |

| | 6,689 | | | Kontoor Brands Inc | | | | | | | | | | | 223,212 | |

| | 3,315 | | | Lululemon Athletica Inc (3) | | | | | | | | | | | 903,702 | |

| | 63,640 | | | NIKE Inc, Class B | | | | | | | | | | | 6,504,008 | |

| | | | Total Textiles, Apparel & Luxury Goods | | | | | | | | | | | 7,630,922 | |

| | | | |

| | | | Thrifts & Mortgage Finance – 0.0% | | | | | | | | | |

| | | | |

| | 48,313 | | | MGIC Investment Corp | | | | | | | | | | | 608,744 | |

| | | | |

| | | | Tobacco – 0.6% | | | | | | | | | |

| | | | |

| | 175,892 | | | Altria Group Inc | | | | | | | | | | | 7,347,009 | |

| | | | Total Long-Term Investments (cost $584,362,523) | | | | | | | | | | | 1,315,587,838 | |

27

| | |

| |

| BXMX | | Nuveen S&P 500 Buy-Write Income Fund (continued) |

| | Portfolio of Investments June 30, 2022 |

| |

| | (Unaudited) |

| | | | | | | | | | | | | | | | |

Principal

Amount (000) | | | Description (1) | | Coupon | | | Maturity | | | Value | |

| | | | |

| | | | SHORT-TERM INVESTMENTS – 3.8% | | | | | | | | | | | | |

| | | | |

| | | | REPURCHASE AGREEMENTS – 3.8% | | | | | | | | | | | | |

| | | | |

| $ | 49,982 | | | Repurchase Agreement with Fixed Income Clearing Corporation,

dated 6/30/22, repurchase price $49,982,419,

collateralized by $43,831,600, U.S. Treasury Inflation Index Note,

0.500%, due 1/15/28, value $50,982,147 | | | 0.240% | | | | 7/01/22 | | | $ | 49,982,419 | |

| | | | Total Short-Term Investments (cost $49,982,419) | | | | | | | | | | | 49,982,419 | |

| | | | Total Investments (cost $634,344,942) – 103.1% | | | | | | | | | | | 1,365,570,257 | |

| | | | Other Assets Less Liabilities – (3.1)% (4) | | | | | | | | | | | (40,355,592 | ) |

| | | | Net Assets – 100% | | | | | | | | | | $ | 1,325,214,665 | |

Investments in Derivatives

Options Written

| | | | | | | | | | | | | | | | | | | | | | | | |

| Description (5) | | Type | | | Number of

Contracts | | | Notional

Amount (6) | | | Exercise

Price | | | Expiration

Date | | | Value | |

S&P 500® Index | | | Call | | | | (382 | ) | | $ | (146,115,000 | ) | | $ | 3,825 | | | | 7/15/22 | | | $ | (2,227,060 | ) |

S&P 500® Index | | | Call | | | | (382 | ) | | | (147,070,000 | ) | | | 3,850 | | | | 7/15/22 | | | | (1,808,770 | ) |

S&P 500® Index | | | Call | | | | (381 | ) | | | (148,590,000 | ) | | | 3,900 | | | | 7/15/22 | | | | (1,133,475 | ) |

S&P 500® Index | | | Call | | | | (382 | ) | | | (151,845,000 | ) | | | 3,975 | | | | 7/15/22 | | | | (490,870 | ) |

S&P 500® Index | | | Call | | | | (382 | ) | | | (156,620,000 | ) | | | 4,100 | | | | 7/15/22 | | | | (115,555 | ) |

S&P 500® Index | | | Call | | | | (383 | ) | | | (160,860,000 | ) | | | 4,200 | | | | 7/15/22 | | | | (35,428 | ) |

S&P 500® Index | | | Call | | | | (382 | ) | | | (142,295,000 | ) | | | 3,725 | | | | 7/29/22 | | | | (5,730,000 | ) |

S&P 500® Index | | | Call | | | | (383 | ) | | | (147,455,000 | ) | | | 3,850 | | | | 7/29/22 | | | | (3,102,300 | ) |

S&P 500® Index | | | Call | | | | (382 | ) | | | (152,800,000 | ) | | | 4,000 | | | | 8/19/22 | | | | (1,831,690 | ) |

Total Options Written (premiums received $35,322,334) | | | | (3,439 | ) | | $ | (1,353,650,000 | ) | | | | | | | | | | $ | (16,475,148 | ) |

For Fund portfolio compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications into sectors for reporting ease.

| (1) | All percentages shown in the Portfolio of Investments are based on net assets applicable to common shares unless otherwise noted. |

| (2) | The Fund may designate up to 100% of its common stock investments to cover outstanding options written. |

| (3) | Non-income producing; issuer has not declared an ex-dividend date within the past twelve months. |

| (4) | Other assets less liabilities includes the unrealized appreciation (depreciation) of certain over-the-counter (“OTC”) derivatives as presented on the Statement of Assets and Liabilities, when applicable. The unrealized appreciation (depreciation) of OTC cleared and exchange-traded derivatives is recognized as part of the cash collateral at brokers and/or the receivable or payable for variation margin as presented on the Statement of Assets and Liabilities, when applicable. Other assets less liabilities also includes the value of options as presented on the Statement of Assets and Liabilities. |

| (5) | Exchange-traded, unless otherwise noted. |

| (6) | For disclosure purposes, Notional Amount is calculated by multiplying the Number of Contracts by the Exercise Price by 100. |

| ADR | American Depositary Receipt |

| REIT | Real Estate Investment Trust |

See accompanying notes to financial statements.

28

| | |

| DIAX | | Nuveen Dow 30SM Dynamic

Overwrite Fund Portfolio of Investments June 30, 2022 |

| | | (Unaudited) |

| | | | | | | | | | | | | | | | |

| Shares | | | Description (1) | | | | | | | | Value | |

| | | | |

| | | | LONG-TERM INVESTMENTS – 102.4% | | | | | | | | | | | | |

| | | | |

| | | | COMMON STOCKS – 99.3% | | | | | | | | | | | | |

| | | | |

| | | | Aerospace & Defense – 2.9% | | | | | | | | | |

| | | | |

| | 122,356 | | | Boeing Co (2) | | | | | | | | | | $ | 16,728,512 | |

| | | | |

| | | | Banks – 2.4% | | | | | | | | | |

| | | | |

| | 122,356 | | | JPMorgan Chase & Co | | | | | | | | | | | 13,778,509 | |

| | | | |

| | | | Beverages – 1.3% | | | | | | | | | |

| | | | |

| | 122,356 | | | Coca-Cola Co | | | | | | | | | | | 7,697,416 | |

| | | | |

| | | | Biotechnology – 5.2% | | | | | | | | | |

| | | | |

| | 122,356 | | | Amgen Inc (3) | | | | | | | | | | | 29,769,215 | |

| | | | |

| | | | Capital Markets – 6.3% | | | | | | | | | |

| | | | |

| | 122,356 | | | Goldman Sachs Group Inc (3) | | | | | | | | | | | 36,342,179 | |

| | | | |

| | | | Chemicals – 1.1% | | | | | | | | | |

| | | | |

| | 122,356 | | | Dow Inc | | | | | | | | | | | 6,314,793 | |

| | | | |

| | | | Communications Equipment – 0.9% | | | | | | | | | |

| | | | |

| | 122,356 | | | Cisco Systems Inc | | | | | | | | | | | 5,217,260 | |

| | | | |

| | | | Consumer Finance – 2.9% | | | | | | | | | |

| | | | |

| | 122,356 | | | American Express Co | | | | | | | | | | | 16,960,989 | |

| | | | |

| | | | Diversified Telecommunication Services – 1.1% | | | | | | | | | |

| | | | |

| | 122,356 | | | Verizon Communications Inc | | | | | | | | | | | 6,209,567 | |

| | | | |

| | | | Entertainment – 2.0% | | | | | | | | | |

| | | | |

| | 122,356 | | | Walt Disney Co (2) | | | | | | | | | | | 11,550,407 | |

| | | | |

| | | | Food & Staples Retailing – 3.4% | | | | | | | | | |

| | | | |

| | 122,356 | | | Walgreens Boots Alliance Inc | | | | | | | | | | | 4,637,292 | |

| | 122,356 | | | Walmart Inc | | | | | | | | | | | 14,876,043 | |

| | | | Total Food & Staples Retailing | | | | | | | | | | | 19,513,335 | |

| | | | |

| | | | Health Care Providers & Services – 10.9% | | | | | | | | | |

| | | | |