UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| | [ ] | Preliminary Proxy Statement |

| | [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | [X] | Definitive Proxy Statement |

| | [ ] | Definitive Additional Materials |

| | [ ] | Soliciting Material Pursuant to § 240.14a-12 |

CHINA GENGSHENG MINERALS, INC.

(Name of Registrant as Specified In Its Charter)

_______________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| |

| [X] | No fee required. |

| | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | (5) | Total fee paid: |

| | | |

| [ ] | Fee paid previously with preliminary materials: |

| | |

| | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | (3) | Filing Party: |

| | | |

| | | |

| | (4) | Date Filed: |

| | | |

China GengSheng Minerals, Inc.

No.88 Gengsheng Road, Dayugou Town, Gongyi

Henan, People’s Republic of China 451271

November 22, 2013

Dear Stockholder:

On behalf of the Board of Directors, I cordially invite you to attend the 2013 Annual Meeting of Stockholders of China GengSheng Minerals, Inc., which will be held at No.88 Gengsheng Road, Dayugou Town, Gongyi, Henan, People’s Republic of China 451271, on Tuesday, December 31, 2013, commencing at 9:00 a.m., local time. The matters to be acted upon at the meeting are described in the attached Notice of Annual Meeting of Stockholders and Proxy Statement.

Your vote on the business to be considered at the meeting is important, regardless of the number of shares you own. Whether or not you plan to attend the meeting, we hope that you will vote as soon as possible so that your shares may be represented at the meeting. You may vote your shares via a toll-free telephone number or over the internet. If you received a proxy card or voting instruction card by mail, you may submit your proxy card or voting instruction card by completing, signing, dating and mailing your proxy card or voting instruction card in the envelope provided. Any stockholder attending the Annual Meeting may vote in person, even if you have already returned a proxy card or voting instruction card.

| | Sincerely yours, |

| | |

| | /s/Shunqing Zhang |

| | Shunqing Zhang |

| | Chief Executive Officer |

CHINA GENGSHENG MINERALS, INC.

No. 88 Gengsheng Road

Dayugou Town, Gongyi, Henan

People’s Republic of China 451271

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON TUESDAY, DECEMBER 31, 2013

Notice is hereby given that the Annual Meeting of Stockholders (“Annual Meeting”) of China GengSheng Minerals, Inc., a Nevada corporation (the “Company”) will be held on Tuesday, December 31, 2013, at 9:00 a.m., local time, at No.88 Gengsheng Road, Dayugou Town, Gongyi, Henan, People’s Republic of China 451271, for the following purposes:

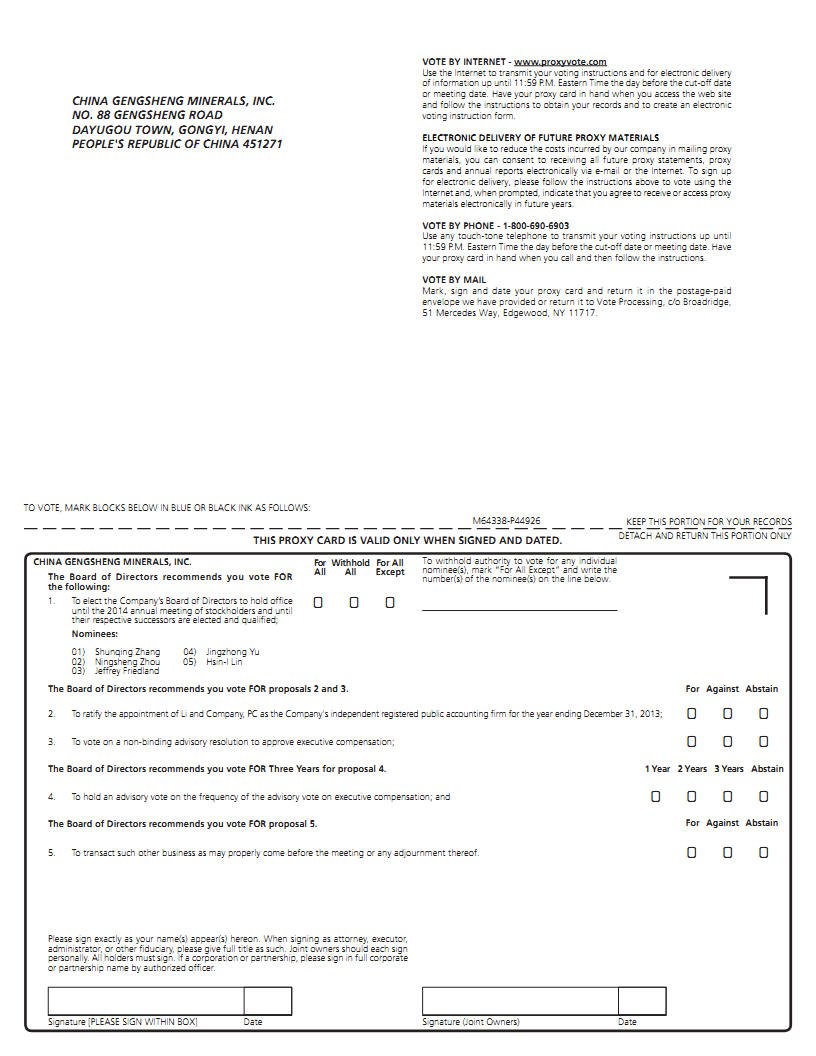

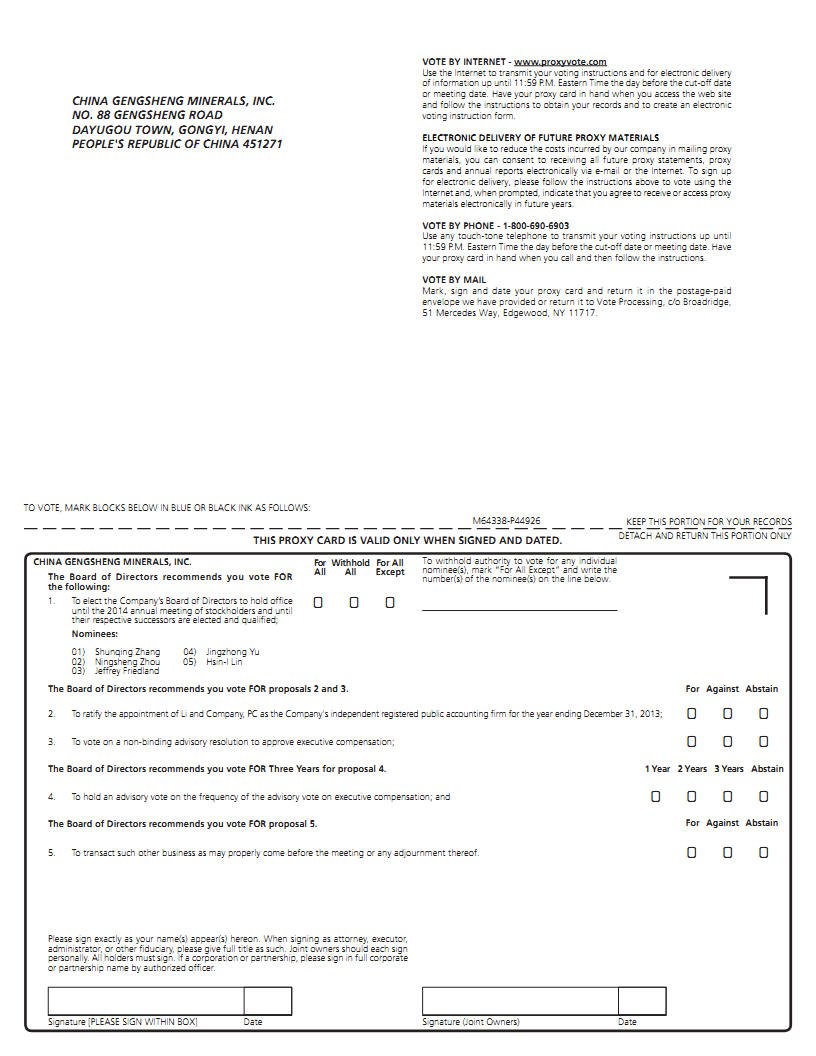

| | 1. | To elect the Company’s Board of Directors (the “Board”) to hold office until the 2014 annual meeting of stockholders and until their respective successors are elected and qualified; |

| | | |

| | 2. | To ratify the appointment of Li and Company, PC as the Company’s independent registered public accounting firm for the year ending December 31, 2013; |

| | | |

| | 3. | To vote on a non-binding advisory resolution to approve executive compensation; |

| | | |

| | 4. | To hold an advisory vote on the frequency of the advisory vote on executive compensation; and |

| | | |

| | 5. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Only stockholders of record as of the close of business on November 21, 2013(the “Record Date”) are entitled to receive notice of, to attend, and to vote at, the Annual Meeting.

The stockholders of the Company are cordially invited to attend the Annual Meeting in person. To ensure that your vote is counted at the Annual Meeting, however, please vote as promptly as possible.

| | By Order of the Board of Directors, |

| | |

| | /s/ Xiangyang Zhang |

| | Xiangyang Zhang |

| | Secretary |

| | |

| Henan, People’s Republic of China | |

| November 22, 2013 | |

IMPORTANT

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON DECEMBER 31, 2013: THE NOTICE OF ANNUAL MEETING, PROXY STATEMENT AND ANNUAL REPORT TO STOCKHOLDERS FOR THE YEAR ENDED DECEMBER 31, 2012 ARE AVAILABLE AT WWW.PROXYVOTE.COM.

CHINA GENGSHENG MINERALS, INC.

No. 88 Gengsheng Road

Dayugou Town, Gongyi, Henan

People’s Republic of China (86) 371-64059818

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON TUESDAY, DECEMBER 31, 2013

GENERAL INFORMATION

The Board is furnishing this proxy statement (the “Proxy Statement”) to the holders of the Company’s common stock, in connection with its solicitation of proxies for use at the Annual Meeting to be held at No.88 Gengsheng Road, Dayugou Town, Gongyi, Henan, People’s Republic of China 451271, at 9:00 a.m., local time, on Tuesday, December 31, 2013, and at any and all adjournments thereof. You may obtain directions to the location of the Annual Meeting by visiting www.proxyvote.com.

The Company’s principal executive offices are located at No.88 Gengsheng Road, Dayugou Town, Gongyi, Henan, People’s Republic of China 451271 and its telephone number is (86) 371-64059818.

Purpose of the Annual Meeting

At the Annual Meeting, the stockholders of the Company will be asked to consider and vote upon the following matters:

| | 1. | To elect the Company’s Board to hold office until the 2014 annual meeting of stockholders and until their respective successors are elected and qualified (Proposal 1); |

| | | |

| | 2. | To ratify the appointment of Li and Company, PC as the Company’s independent registered public accounting firm for the year ending December 31, 2013 (Proposal 2); |

| | | |

| | 3. | To vote on a non-binding advisory resolution to approve executive compensation (Proposal 3); |

| | | |

| | 4. | To hold an advisory vote on the frequency of the advisory vote on executive compensation (Proposal 4); and |

| | | |

| | 5. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The Company’s proxy materials in connection with the Annual Meeting, including the Notice of Annual Meeting, this Proxy Statement and the Annual Report on Form 10-K for the fiscal year ended December 31, 2012 (the “Annual Report”) will be first sent or made available to such stockholders on or about November 22, 2013.

Outstanding Shares, Voting Rights and Quorum

The Board has fixed the close of business on November 21, 2013 as the Record Date for determining the stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournments. A list of such stockholders will be available for inspection by any stockholder during ordinary business hours at our principal place of business at No. 88 Gengsheng Road, Dayugou Town, Gongyi, Henan, People’s Republic of China 451271, for the ten day period preceding the Annual Meeting. The stockholder list also will be available for inspection by any stockholder at the time and place of the Annual Meeting.

The Company’s common stock is the only class of securities entitled to vote at the Annual Meeting. As of the Record Date, the Company had outstanding 26,803,044 shares of common stock. Each outstanding share of common stock entitles the holder to one vote on all matters submitted to the stockholders. There is no cumulative voting.

For each proposal to be considered at the Annual Meeting, the holders of a majority of the shares of the Company’s common stock issued and outstanding and entitled to vote on such matter at the meeting, present in person or by proxy, will constitute a quorum. Both abstentions and “broker non-votes” will be treated as present for purposes of determining a quorum. A “broker non-vote,” however, does not count as a vote in favor of or against a particular proposal for which the broker has no discretionary voting authority. “Broker non-votes” are votes that brokers holding shares of record for their customers (i.e., in “street name”) are not permitted to cast under applicable stock market regulations because the brokers have not received instructions (or have received incomplete instructions) from their customers as to certain proposals, and, therefore, the brokers have advised us that they lack voting authority.

Revocation of Proxies

A proxy delivered pursuant to this solicitation is revocable at the option of the person giving it at any time before it is exercised. A proxy may be revoked by the stockholders, prior to its exercise, by executing and delivering a later dated proxy, by delivering written notice of the revocation of the proxy to the Secretary of China GengSheng Minerals, Inc. prior to the Annual Meeting or by attending and voting at the Annual Meeting. Attendance at the Annual Meeting, in and of itself, will not constitute a revocation of a proxy. Unless previously revoked, the shares represented by the enclosed proxy will be voted in accordance with the stockholder’s directions if the proxy card is duly executed and returned prior to the Annual Meeting. If no directions are specified, the shares will be voted pursuant to the recommendations of the Board and in accordance with the discretion of the named proxies on other matters brought before the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials

The proxy materials in connection with the Annual Meeting are available at www.proxyvote.com. This website address contains the following documents: the Notice of Annual Meeting, this Proxy Statement and the Annual Report. The stockholders are encouraged to access and review all of the important information contained in the proxy materials before voting.

Dissenters’ Right of Appraisal

The stockholders do not have appraisal rights under Nevada law or under the governing documents of the Company in connection with this solicitation.

Solicitation of Proxies

The expenses of solicitation of proxies will be paid by the Company. In addition to the use of the mails, proxies may be solicited by officers, directors and employees of the Company in person or by telephone, e-mail or facsimile transmission. The Company also will request brokerage firms, banks, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of the underlying shares as of the Record Date and will reimburse the cost of forwarding the proxy materials in accordance with customary practice. The stockholders’ cooperation in promptly completing, signing and returning the enclosed proxy card will help to avoid additional expense.

Required Votes for Each Proposal to Pass

Assuming the presence of a quorum at the Annual Meeting:

| | | Broker |

| | | Discretionary |

| Proposal | Vote Required | Vote Allowed |

Election of directors | Plurality of the votes cast (the five directors receiving the most “For” votes) | No |

| | |

Ratification of the appointment of Li and Company, PC as the Company’s independent registered public accounting firm | A majority of the votes cast | Yes |

| | |

An advisory vote on executive compensation | A majority of the votes cast | No |

| | |

An advisory vote on the frequency of the advisory vote on executive compensation | A majority of the votes cast | No |

Broker non-votes and abstentions are counted for purposes of determining whether a quorum is present. Only “FOR” and “AGAINST” votes are counted for purposes of determining the votes received in connection with each proposal, and therefore broker non-votes and abstentions have no effect on the proposal relating to the election of directors. In the case of each of the other proposals, broker non-votes and abstentions have no effect on determining whether the affirmative vote constitutes a majority of the shares present or represented by proxy and voting at the Annual Meeting. Approval of these other proposals also requires the affirmative vote of a majority of the shares necessary to constitute a quorum, however, and therefore broker non-votes and abstentions could prevent the approval of these other proposals because they do not count as affirmative votes. In order to minimize the number of broker non-votes, the Company encourages the stockholders to provide voting instructions to the organization that holds your shares by carefully following the instructions provided in the proxy card.

Voting Procedures

In voting by proxy with regard to the election of directors, you may vote in favor of all nominees, withhold your votes as to all nominees, or withhold your votes as to specific nominees. With regard to other proposals, you may vote in favor of each proposal or against each proposal, or in favor of some proposals and against others, or you may abstain from voting on any or all of the proposals. The stockholders should specify their respective choices on the proxy card.

Delivery of Proxy Materials to Households

Only one copy of the Notice of Annual Meeting, this Proxy Statement and the Annual Report will be delivered to an address where two or more stockholders reside with the same last name or whom otherwise reasonably appear to be members of the same family based on the stockholders’ prior express or implied consent.

We will deliver promptly upon written or oral request a separate copy of the Notice of Annual Meeting, this Proxy Statement and the Annual Report upon such request. If you share an address with at least one other stockholder, currently receive one copy of the Notice of Annual Meeting, the Proxy Statement and the Annual Report, and would like to receive a separate copy of the Notice of Annual Meeting, Proxy Statement and Annual Report for future stockholder meetings of the Company, please write or speak to the Company at the following address and phone number:

| | China GengSheng Minerals, Inc. |

| | No.88 Gengsheng Road, Dayugou Town |

| | Gongyi, Henan, People’s Republic of China 451271 |

| | Attention: Secretary |

| | Telephone: (86) 371-64059818 |

If you share an address with at least one other stockholder and currently receive multiple copies of the Notice of Annual Meeting, the Proxy Statement and the Annual Report, and you would like to receive a single copy of these materials, please write or speak to the Company at the address and phone number set forth above.

Interest of Officers and Directors in Matters to Be Acted Upon

Except for the election to the Board of the five nominees set forth herein, none of our officers or directors has any interest in any of the matters to be acted upon at the Annual Meeting.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding beneficial ownership of our common stock as of November 21, 2013 (i) by each person who is known by us to beneficially own more than 5% of our common stock; (ii) by each of our officers and directors; and (iii) by all of our officers and directors as a group.

Unless otherwise specified, the address of each of the persons set forth below is in care of China GengSheng Minerals, Inc., No. 88 Gengsheng Road, Dayugou Town, Gongyi, Henan, China 451271.

| | | | Amount & | |

| | Office, if Any | | Nature of | |

| Name & Address of | Officers and | | Beneficial | Percent of |

| Beneficial Owner | Directors | Title of Class | Ownership(1) | Class(2) |

| | | | | |

| Shunqing Zhang | Chief Executive

Officer,

Chairman of the Board

and President | Common Stock,

$0.001

par value | 15,231,748 | 56.83% |

| | | | | |

| Weina Zhang | Interim Chief

Financial Officer | Common Stock,

$0.001

par value | 0 | * |

| | | | | |

| Jeffrey Friedland | Independent Director | Common Stock,

$0.001

par value | 0 | * |

| | | | | |

| Jingzhong Yu | Independent Director | Common Stock,

$0.001

par value | 0 | * |

| | | | | |

Ningsheng Zhou

Hsin-I Lin | Director

Independent Director | Common Stock,

$0.001

par value

Common Stock,

$0.001

par value | 0

0 | *

* |

| | | | | |

All officers and

directors

as a group (six persons

named above) | | Common Stock,

$0.001

par value | 15,231,748 | 56.83% |

* Less than 1%

1Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Each of the beneficial owners listed above has direct ownership of and sole voting power and investment power with respect to the shares of our common stock.

2As of November 21, 2013, a total of 26,803,044 shares of the Company’s common stock are considered to be outstanding pursuant to SEC Rule 13d-3(d)(1). For each beneficial owner above, any options exercisable within 60 days have been included in the denominator.

Changes in Control

There are no arrangements known to us, including any pledge by any person of our securities, the operation of which may at a subsequent date result in a change in control of our Company.

PROPOSAL 1:

ELECTION OF DIRECTORS

Action will be taken at the Annual Meeting for the election of five directors. Each director elected at the Annual Meeting will serve until the 2014annual meeting of stockholders or until his successor is elected and qualified. Proxies can be voted for five nominees.

The Board has no reason to believe that any of the nominees for director will not be available to stand for election as director. However, if some unexpected occurrence should require the substitution by the Board of some other person or persons for any one or more of the nominees, the proxies may be voted in accordance with the discretion of the named proxies “FOR” such substitute nominees.

Nominees for Director

The name, age, principal occupation for the last five years, selected biographical information and period of service as a director of the Company of the nominees for election as directors are set forth below.

Shunqing Zhang,59, became Chief Executive Officerand President of China GengSheng Minerals, Inc. on April 25, 2007 and has served as Chairman of the Board since May 3, 2007. Mr. Zhang was elected Chairman of the Board and Chief Executive Officer of Henan Gengsheng in December, 2005. Prior to that, he served as President of Henan Gengsheng for June 2002 to December 2005, and served as Chairman of the Board and President of the Gengsheng Industry Group of Henan Province, from 1997 to 2002. Prior to that, Mr. Zhang served as Director of the Academy of the Ministry of Metallurgy Lofa Resistance Associated Experimental Plant in Gongyi City, a refractories manufacturer, from 1986 to 1997. Mr. Zhang holds an associate degree from China Central Radio and TV University. In December of 2008, Mr. Zhang was awarded the title of "Gongyi City's Most Influential Person in the 30 Years of Opening & Reform" by the City of Gongyi in Henan Province. In naming Mr. Zhang, the city cited his achievements in creating jobs in the local community, stimulating the rapid growth of Gongyi's economy and setting excellent examples of taking social responsibilities. As Chief Executive Officer of the Company, Mr. Zhang provides the Board with an intimate understanding of the Company’s operations and industry.

Jeffrey Friedland,62, Board member since July 2013, has been Managing Director of the corporate finance advisory firm, Friedland Global Capital Pte. Ltd. and its predecessor companies since 1979.Friedland Global Capital provides client companies with assistance in achieving their business planning and financing objectives. Mr. Friedland also has been the CEO of U.S. based Global Corporate Strategies LLC, since 2011, a firm that provides liaison services for non-U.S. companies in primarily the United States and Europe. Mr. Friedland has traveled globally with management of companies based in the United States and overseas, with the objective of assisting them in obtaining capital, expanding globally and entering into strategic alliances. Mr. Friedland has been featured or quoted in numerous publications including the Wall Street Journal, USA Today, The South China Morning Post (Hong Kong) and Forbes and on Bloomberg Radio, and Bloomberg Television. Mr. Friedland has been a frequent speaker at various tradeshows, conferences, conventions and meetings throughout North America, Europe and Asia, including as a panel participant at a Bloomberg Chinese equities conference in London. Mr. Friedland holds a BS in Business from University of Colorado. Among other qualifications, Mr. Friedland brings to the Board executive leadership experience, financial expertise, and a global business perspective.

Hsin-I Lin,60, Board member since October 2011, has been with Rim Asia Capital Partners since 2004, where he served as Partner. Prior to joining Rim Asia Capital Partners, he worked as a Partner at SVO, from 2002-2004. Mr. Lin has approximately twenty years of experience in business administration, direct investment, corporate finance, and investment banking in the United States and China. Mr. Lin received his B.A. from Tamkang University in Taiwan, his M.A. from Waseda University in Japan, his M.B.A from Oklahoma City University in the United States and his PhD in economics from Northwest University in China. Among other qualifications, Mr. Lin brings to the Board financial and business management expertise.

Jingzhong Yu, 48, Board member since November 2009, currently is an accounting professor at Zhongnan University of Economics and Law and has served in such position since 1985. Prof. Yu also served as an investment advisor from December 2003 to December 2007 to China Wanke Co., Ltd., which is a residential property developer, 999 Group, which is a pharmaceutical manufacturing company, Sanyi Group., Ltd., which is in the equipment and machinery manufacturing business, and China National Salt Industry Corporation, which is in the business of producing salt and salt chemicals. From December 2003 to June 2008, Prof. Yu served as an investment advisor to China Tobacco Group, which manufactures tobacco products. Prof. Yu serves as the chair of the Compensation Committee and is a member of the Audit Committee and Nominating and Corporate Governance Committee of the Board. Among other qualifications, Mr. Yu brings to the Board executive leadership experience.

Ningsheng Zhou, 54, Board member since July 2011, has been a professor and director of High Temperature Materials Institute of Henan University of Science and Technology since 2004. From 2000 to 2004, he was a Vice President of Luoyang Institute of Refractories Research in China. Mr. Zhou is an expert in refractories R&D and applications with 30 years of experiences in the refractory industry. Mr. Zhou received his Ph. D. degree from University of Montreal in Canada in 2000 and a Master of Science degree in Inorganic Non-Metallic Materials from LIRR in 1987. He received his Bachelor of Science degree in Refractories Technology from Wuhan University of Science and Technology in 1982 and also worked as a visiting scholar in Germany during 1991 and 1993.Among other qualifications, Mr. Zhou brings to the Board extensive experience in the refractory industry.

There are no family relationships among our directors or officers.

Director Independence

The Board is currently composed of five members, Mr. Shunqing Zhang, who is also our President and Chief Executive Officer, Mr. Ningsheng Zhou, Mr. Jeffrey Friedland, who is an independent director and Chairman of Audit Committee, Mr. Jingzhong Yu, who is an independent director and Chairman of Compensation Committee and Mr. Hsin-I Lin, who is an independent director and Chairman of Nominating Committee. Mr. Zhang and Mr. Zhou are not an “independent director” as defined by Section 303A.02 of the NYSE Listed Company Manual.

Involvement in Certain Legal Proceedings

To our knowledge, during the last ten years, none of our directors and executive officers (including those of our subsidiaries) has:

Had a bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at the time of the bankruptcy or within two years prior to that time.

Been convicted in a criminal proceeding or been subject to a pending criminal proceeding, excluding traffic violations and other minor offenses.

Been subject to any order, judgment or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities.

Been found by a court of competent jurisdiction (in a civil action), the SEC, or the Commodities Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

Been the subject to, or a party to, any sanction or order, not subsequently reverse, suspended or vacated, of any self-regulatory organization, any registered entity, or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

There are no material proceedings to which any director and executive officers of the Company is a party adverse to the Company or has a material interest adverse to the Company.

The Board recommends a vote “FOR ALL NOMINEES” listed in Proposal 1 for election to the Board.

EXECUTIVE OFFICERS

Our executive officers serve at the pleasure of the Board. The following sets forth certain information with respect to our executive officers. The biography of Mr. Shunqing Zhang is provided above under “Proposal 1: Election of Directors.”

| Name | Age | Date of Appointment | Position |

| Shunqing Zhang | 59 | April 25, 2007 | Chief Executive Officer, President and Chairman of the Board |

| Weina Zhang | 37 | September 16, 2013 | Interim Chief Financial Officer |

Weina Zhanghas been serving as the head of the Corporate Finance Department of Henan GengSheng High-Temperature Materials Co., Ltd., a subsidiary of the Company, since 2002. She worked as the head of the Audit Department of Henan GengSheng Refractories Co., Ltd., another subsidiary of the Company, from January 2000 to December 2001. Prior to that, Ms. Zhang was the secretary to the general manager of Henan GengSheng Refractories Co., Ltd. from August 1997 to December 1999. Ms. Zhang received a bachelor’s degree in accounting from Henan Industry University. Ms. Zhang is a qualified accountant in China and holds the certification of Registered Advanced Tax Planner.

CORPORATE GOVERNANCE

We have established corporate governance practices designed to serve the best interests of the Company and our stockholders. We are in compliance with the current corporate governance requirements imposed by the Sarbanes-Oxley Act of 2002, the rules and regulations of the SEC and the listing standards of The NYSE MKT. Our current Code of Business Conduct and Ethics and charters for certain committees of the Board are available on our corporate website atwww.gengsheng.comunder the heading “Investor Relations.”

Set forth below is information regarding the meetings of the Board during the fiscal year ended December 31, 2012, a description of the Board’s standing committees and additional highlights of our corporate governance policies and procedures.

Committees and Meetings of the Board of Directors

Board Composition.The Board of Directors presently consists of five members. The current members of the Board of Directors are Shunqing Zhang, Hsin-I Lin, Jeffrey Friedland, Jingzhong Yu and Ningsheng Zhou. The Board has determined that the following directors, who constitute a majority of the Board (three), are independent in accordance with the NYSE MKT and SEC rules governing director independence: Hsin-I Lin, Jeffrey Friedland and Jingzhong Yu.

Meetings of the Board of Directors.During the fiscal year ended December 31, 2012, the Board met six times. During that period, each of the incumbent directors attended 100% of the aggregate number of meetings held by the Board and by each of the committees on which such director served.

Board Committees.The Board currently has three standing committees: the Audit Committee, the Compensation Committee and the Nominating Committee. The principal functions and the names of the directors currently serving as members of each of those committees are set forth below. In accordance with applicable NYSE MKT and SEC requirements, the Board has determined that each director serving on the Audit, Compensation and Nominating Committees is an independent director.

Audit Committee. The Audit Committee assists the Board in fulfilling its oversight responsibilities with respect to our financial matters. The Audit Committee operates under a written charter, a copy of which is available on our website atwww.gengsheng.comunder the heading “Investor Relations.” Under the charter, the committee’s principal responsibilities include reviewing our financial statements, reports and releases; reviewing with the independent auditor all critical accounting policies and alternative treatments of financial information under generally accepted accounting principles; and appointing, compensating, retaining and overseeing the work of the independent auditor.

The Audit Committee met five times during the fiscal year ended December 31, 2012. The current members of the Audit Committee are Jeffrey Friedland (Chairman), Jingzhong Yu and Hsin-I Lin. The Board has determined that Mr. Firedland is an “audit committee financial expert,” as that term is defined in the listing rules of the NYSE MKT.

Compensation Committee. The Compensation Committee has the primary authority to determine our compensation philosophy and to establish compensation for our executive officers. The Compensation Committee operates under a written charter, a copy of which is available on our website atwww.gengsheng.comunder the heading “Investor Relations.” Under the charter, the committee’s principal responsibilities include making recommendations to the Board on the Company’s compensation policies, determining the compensation of senior management, making recommendations to the Board on the compensation of independent directors and approving performance-based compensation.

The Compensation Committee did not meet during the fiscal year ended December 31, 2012. The current members of the Compensation Committee are Jingzhong Yu (Chairman), Jeffrey Friedland and Hsin-I Lin.

Nominating Committee. The Nominating Committee provides for the nomination of persons to serve on our Board. The qualifications of recommended candidates also will be reviewed and approved by the full Board. The Committee considered the following factors when qualifying candidates: current composition of the Board and the characteristics of each candidate under consideration, including that candidate’s competencies, experience, reputation, integrity, independence, potential for conflicts of interest and other appropriate qualities. When considering a director standing for re-election, in addition to the factors described above, the Committee considers that individual’s past contribution and future commitment to the Company. The independent directors evaluate all candidates, regardless of the source from which the candidate was first identified, based upon the totality of the merits of each candidate and not based upon minimum qualifications or attributes. The Nominating Committee operates under a written charter, a copy of which is available on our website atwww.gengsheng.comunder the heading “Investor Relations.”

The Nominating Committee did not meet during the fiscal year ended December 31, 2012. The current members of the Nominating Committee are Hsin-I Lin (Chairman), Jeffrey Friedland and Jingzhong Yu.

Board Leadership Structure and Role in Risk Oversight

Mr. Shunqing Zhang is our chairman and chief executive officer. We have three independent directors. Our lead independent director was David Ming He (until April 23, 2013) and subsequently Mr. Jingzhong Yu. Our Board has three standing committees, each of which is comprised solely of independent directors with a committee chair. The Board believes that the Company’s chief executive officer is best situated to serve as Chairman of the Board because he is the director most familiar with our business and industry and the director most capable of identifying strategic priorities and executing our business strategy. In addition, having a single leader eliminates the potential for confusion and provides clear leadership for the Company. We believe that this leadership structure has served the Company well.

The directors have overall responsibility for risk oversight. The Board has delegated responsibility for the oversight of specific risks to Board committees as follows:

The Audit Committee oversees the Company’s risk policies and processes relating to the financial statements and financial reporting processes, as well as key credit risks, liquidity risks, market risks and compliance, and the guidelines, policies and processes for monitoring and mitigating those risks.

The Nominating Committee oversees risks related to the Company’s governance structure and processes.

The Board is responsible to approve all related party transactions. We have not adopted written policies and procedures specifically for related person transactions.

Material Changes to the Procedures by which Stockholders May Recommend Nominees to the Board

There have been no material changes to the procedures by which stockholders may recommend nominees to the Board.

Policy for Director Attendance at Annual Meetings

It is the policy of the Company and the Board all directors attend the annual meeting of stockholders and be available for questions from stockholders, except in the case of unavoidable conflicts. All members of the then incumbent Board attended our 2012 Annual Meeting of Stockholders.

Process for Stockholders to Send Communications to the Board

We encourage stockholder communication with the Board. Any security holder who wishes to communicate with the Board or with any particular director, including any independent director, may send a letter to the Secretary at our principal executive offices. Any communication should indicate that you are a stockholder of the Company and clearly specify whether it is intended to be made to the entire Board or to one or more particular director(s).

Code of Ethics

On April 25, 2007, our then sole director adopted a code of ethics pursuant to Section 406 of the Sarbanes-Oxley Act of 2002 that applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer, and principal accounting officer. The code of ethics is designed to deter wrongdoing and to promote:

Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships;

Full, fair, accurate, timely and understandable disclosure in reports and documents that we file with, or submit to, the SEC, and in other public communications that we made;

Compliance with applicable government laws, rules and regulations;

The prompt internal reporting of violations of the code to the appropriate person or persons; and

Accountability for adherence to the code.

The code requires the highest standard of ethical conduct and fair dealing of its senior financial officers, or SFO, defined as the Chief Executive Officer and Interim Chief Financial Officer. While this policy is intended to only cover the actions of the SFO, in accordance with Sarbanes-Oxley, we expect our other officers, directors and employees will also review our code and abide by its provisions. We believe that our reputation is a valuable asset and must continually be guarded by all associated with us so as to continue the trust, confidence and respect of our suppliers, customers and stockholders.

Our SFO are committed to conducting business in accordance with the highest ethical standards. The SFO must comply with all applicable laws, rules and regulations. Furthermore, SFO must not commit an illegal or unethical act, or instructor authorize others to do so.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act requires our directors and executive officers, and persons who beneficially own more than 10% of any class of our equity securities, who collectively we generally refer to as insiders, to file with the SEC initial reports of beneficial ownership and reports of changes in beneficial ownership of Common Stock and other equity securities of the Company. Our insiders are required by SEC regulation to furnish us with copies of all Section 16(a) reports they file. Based solely upon a review of the copies of the forms furnished to us, we believe that during the fiscal year ended December 31, 2012, our insiders complied with all applicable filing requirements.

REPORT OF AUDIT COMMITTEE

Notwithstanding anything to the contrary set forth in any of the Company’s filings under the Securities Act of 1933, as amended, or the Securities Act, that might incorporate by reference this Proxy Statement, in whole or in part, the following report shall not be incorporated by reference into any such filings.

The Audit Committee of the Board is composed of three directors and operates under a written charter adopted by the Board, a copy of which is available on our website atwww.gengsheng.comunder the heading “Investor Relations.” The members of the committee meet the independence requirements of SEC rules and NYSE MKT listing standards.

Management is responsible for the Company’s internal controls, financial reporting process and compliance with laws, regulations and ethical business standards. The independent auditors are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with the United States generally accepted auditing standards and issuing a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes and to report its findings to the Board. The Audit Committee members are not professional accountants or auditors, and their functions are not intended to duplicate or to certify the activities of management and the independent auditor, nor can the committee certify that the independent auditor is “independent” under applicable rules. The committee serves a board-level oversight role, in which it provides advice, counsel and direction to management and the auditors on the basis of the information it receives, discussions with management and the auditors and the experience of the committee’s members in business, financial and accounting matters.

In this context, the Audit Committee has met and held discussions with management and the independent auditors. Management represented to the Audit Committee that the Company’s audited consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent auditors. The Audit Committee also discussed with the independent auditors the matters required to be discussed under the standards of the Public Company Accounting Oversight Board (“PCAOB”), including those specified by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended (AICPA, Professional Standards, Vol. 1, AU section 380) as adopted by the PCAOB in Rule 3200T.

The Company’s independent auditors also provided to the Audit Committee the written disclosures and letter required by applicable requirements of the PCAOB, and the Audit Committee discussed with the independent auditors that firm’s independence.

Based upon the Audit Committee’s discussions with management and the independent auditors and the Audit Committee’s review of the representation of management and the report of the independent auditors to the Audit Committee, the Audit Committee recommended that the Board include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012, filed with the SEC.

| | Jeffrey Friedman, Chairman |

| | Hsin-I Lin |

| | Jingzhong Yu |

EXECUTIVE AND DIRECTOR COMPENSATION

Executive Compensation

The following table sets forth information concerning all cash and non-cash compensation awarded to, earned by or paid to the following persons for services rendered in all capacities during the noted periods: Shunqing Zhang, our President and Chief Executive Office, Ningfang Liang, our former Chief Financial Officer. Our interim Chief Financial Officer Shuxian Li was appointed on January 11, 2013 and thus we did not pay any compensation to her for her services as executive officer of the Company in the past two years.

No executive officer’s salary and bonus exceeded $100,000 in any of the applicable years. The following information includes the dollar value of base salaries, bonus awards, the number of stock options granted and certain other compensation, if any, whether paid or deferred.

SUMMARY COMPENSATION TABLE

Nameand

principalposition |

Year

| Salary

($) | Bonus

($) | Stock

awards

($) | Option

awards

($) | Nonequity

incentive plan

compensation

($) | Nonqualified

deferred

compensation

earnings

($) | All other

compensation

($) | Total

($) |

Shunqing Zhang,

Chairman,

CEO President | 2012 | 47,520 | - | - | - | - | - | - | 47,520(1) |

| 2011 | 77,450 | - | - | - | - | - | - | 77,450 |

Ningfang Liang,

former CFO(2) | 2012 | 63,000 | - | - | - | - | - | 27,000 | 90,000 |

| 2011 | 45,000 | - | - | - | - | - | - | 45,000 |

| (1) | Mr. Zhang took a voluntary pay cut in 2012. |

| (2) | Mr. Liang resigned as our CFO on January 8, 2013. |

Outstanding Equity Awards at Fiscal Year End

None.

Employment Agreement

As required by applicable PRC law, we have entered into employment agreements with most of our officers, managers and employees. Our subsidiary Henan Gengsheng has employment agreements with the following named executive officers:

Shunqing Zhang. Mr. Zhang’s preliminary employment agreement became effective as of January 1, 2007 and expired on December 31, 2009. We have renewed his employment agreement in January 2010 and 2012, which will expire on December 31, 2013 and continue on a year-to-year basis thereafter unless terminated by either party on not less than 30 days’ notice. Mr. Zhang is entitled to an annual salary of RMB 500,000 (approximately $77,450) under the agreement but voluntarily received a reduced salary of approximately $47,520 during the fiscal year of 2012.

Ningfang Liang.Pursuant to employment agreement that the Company and Mr. Liang entered into on June 30, 2011, Mr. Liang will be entitled to an annual salary of $90,000. The employment agreement has an initial term (the “Initial Term”) commencing as of June 27th, 2011 and expiring on June 26th, 2012, and continuing on a year-to-year basis thereafter unless terminated by either party on not less than thirty (30) days notice prior to the expiration of the Initial Term or any one-year extension. On January 8, 2013, Mr. Liang resigned as our Chief Financial Officer.

Shuxian Li.Ms. Li was appointed the interim Chief Financial Officer of the Company on January 11, 2013. Pursuant to the employment agreement dated January 11, 2013 between the Company and Ms. Li, Ms. Li will be entitled to an annual salary of Renminbi 180,000 (approximately $28,931) and will serve as the Company’s interim Chief Financial Officer until a suitable candidate for Chief Financial Officer has been qualified and selected by the Company.

Director Compensation

On November 18, 2009, we appointed Mr. Ming He and Mr. Jingzhong Yu as our independent directors, with engagement term to be one year, renewable for additional one year terms unless terminated by 30 days’ notice. On July 15, 2011, we appointed Mr. Ningsheng Zhou as our director for one year, renewable for additional one year terms unless terminated by 30 days’ notice. On October 5, 2011, we appointed Mr. Hsin-I Lin as our independent director, with engagement term to be one year, renewable for additional one year terms unless terminated by 30 days’ notice. Our board consists of five members, including the CEO, Mr. Shunqing Zhang, sits as the Chairman, Mr. Ningsheng Zhou, and along with the three independent directors. During the 2012 fiscal year, we did not pay Mr. Shunqing Zhang any compensation for his services as our director. For their function as directors, we paid Mr. Zhou, Mr. He, Mr. Yu and Mr. Lin in the amount of $19,008 (RMB 120,000), $25,000, $7,920 (RMB 50,000) and $25,000 respectively. We do reimburse our directors for reasonable travel expenses related to duties as a director.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee consists of Messrs. Yu, Lin and Friedland. None of the members of the Compensation Committee is a current or former officer or employee of the Company or any of our subsidiaries. There are no compensation committee interlocks or insider participation in compensation decisions that are required to be disclosed in this Proxy Statement.

RELATED PARTY TRANSACTIONS

During the fiscal year of 2012, Mr. Shunqing Zhang, our Chairman and Chief Executive Officer, loaned the Company an aggregate of $158,500. The loans are interest free and unsecured. The loans are still outstanding as of the date of this report. Additionally, Mr. Zhang also guaranteed a short term loan for the Company from a third party company of $3,170,000, with an interest of $24% per annum. The loan was fully settled on March 11, 2013.

During the fiscal year of 2011, Mr. Zhang provided guarantee for certain loans of the Company which have been fully settled.

Except described above, there were no other material transactions, or series of similar transactions, during our last two fiscal year, or any currently proposed transactions, or series of similar transactions, to which our Company or any of our subsidiaries was or is to be a party, in which the amount involved exceeded the lesser of $120,000 and in which any director, executive officer or any security holder who is known to us to own of record or beneficially more than five percent of any class of our common stock, or any member of the immediate family of any of the foregoing persons, had an interest.

Procedures for Approval of Related Party Transactions

The Board is charged with reviewing and approving all potential related party transactions. All such related party transactions must then be reported under applicable SEC rules. We have not adopted other procedures for review, or standards for approval, of such transactions, but instead review them on a case-by-case basis.

PROPOSAL 2:

RATIFICATION OF APPOINTMENT OF LI & COMPANY, PC

The Audit Committee of the Board appointed Li & Company, PC (“Li Co.”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013. The affirmative vote of a majority of the votes cast is necessary to ratify the appointment of Li Co. Representatives of Li Co.are not expected to be present at the Annual Meeting. If the appointment of Li Co. is not ratified by the stockholders, the Audit Committee may appoint another independent registered public accounting firm or may decide to maintain its appointment of Li Co.

Changes in Independent Registered Public Accounting Firm

On December 7, 2012, the Audit Committee received a resignation letter from PKF, Certified Public Accountants, Hong Kong, China, a member firm of International Limited network of legally independent firms (“PKF”), as the Company’s independent registered public accounting firm. On December 10, 2012, the Audit Committee approved the resignation of PKF.

The reports of PKF on the Company's consolidated financial statements for the fiscal years ended December 31, 2011 and 2010 did not contain adverse opinions or disclaimers of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles. For the years ended December 31, 2011 and 2010 and the subsequent periods through December 7, 2012, there were no disagreements between the Company and PKF on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to PKF’s satisfaction, would have caused them to make reference to the subject matter of the disagreements in connection with its reports. For the years ended December 31, 2011 and 2010 and the subsequent interim period through December 7, 2012, there were no "reportable events" as that term is described in Item 304(a)(1)(v) of Regulation S-K.

The Company has provided PKF with a copy of the above disclosure and the Company has requested that the PKF furnish a letter addressed to the Securities and Exchange Commission stating whether it agrees with the statements above. A copy of this letter dated December 11, 2012 is filed as an exhibit to the Company’s current report on Form 8-K on December 11, 2012.

On January 2, 2013, the Audit Committee and the Board appointed EFP Rotenberg, LLP (“EFP”) as the new independent registered public accounting firm for the Company, effective as of January 2, 2013. During the two most recent fiscal years and through the date of its engagement, the Company did not consult with EFP regarding either (1) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements, or (2) any matter that was either the subject of a disagreement (as defined in Regulation S-K Item 304(a)(1)(iv)) or a reportable event (as described in Regulation S-K Item 304(a)(1)(v)).

Prior to engaging EFP, EFP did not provide the Company with either written or oral advice that was an important factor considered by the Company in reaching a decision to change its independent registered public accounting firm from PKF to EFP.

On June 28, 2013, the Company received a letter from EFP informing the Company that EFP resigned as the Company’s independent registered public accounting firm, effective immediately.

The report of EFP on the Company’s financial statements for the year ended December 31, 2012 did not contain adverse opinions or disclaimers of opinion and was not qualified or modified as to uncertainty, audit scope, or accounting principles. EFP did not issue any report on the Company’s financial statements for the year ended December 31, 2011.

For the years ended December 31, 2011 and 2012 and the subsequent interim period through June 28, 2013, there were no disagreements between the Company and EFP on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to EFP’s satisfaction, would have caused them to make reference to the subject matter of the disagreements in connection with its report. For the years ended December 31, 2011 and 2012 and the subsequent interim period through June 28, 2013, there were no "reportable events" as that term is described in Item 304(a)(1)(v) of Regulation S-K.

The Company has provided EFP with a copy of the above disclosure and the Company has requested that the EFP furnish a letter addressed to the Securities and Exchange Commission stating whether it agrees with the statements above. A copy of this letter dated June 28, 2013 is filed as an exhibit to the Company’s current report on Form 8-K on July 1, 2013.

On July 19, 2013, the Audit Committee and the Board appointed Li Co. as the new independent registered public accounting firm for the Company, effective as of July 19, 2013. During the two most recent fiscal years and through the date of its engagement, the Company did not consult with Li Co. regarding (i) the application of accounting principles to a specific transaction, either completed or proposed; (ii) the type of audit opinion that might be rendered on the Company’s financial statements, and none of the following was provided to the Company (a) a written report, or (b) oral advice that Li Co. concluded was an important factor considered by the Company in reaching a decision as to an accounting, auditing, or financial reporting issue; or (iii) any matter that was subject of a disagreement, as that term is defined in Item 304(a)(1)(iv) of Regulation S-K, or a reportable event, as described in Item 304(a)(1)(v) of Regulation S-K.

AUDITOR FEES

Audit Fees. PKF was paid aggregate fees of approximately $45,144 for the reviews of the financial statements for the quarters ended March 31, 2012, June 30, 2012 and September 30, 2012 and approximately $143,485 for professional services rendered for the audit of our annual financial statements and for the reviews of the financial statements for the year ended December 31, 2011.

EFP was paid aggregate fee of approximately $140,000 for professional services rendered for the audit of our annual financial statements for the year ended December 31, 2012.

Audit Related Fees. We did not pay our auditors any fees for the fiscal years December 31, 2012 and December 31, 2011 for assurance and related services reasonably related to the performance of the audit or review of our financial statements.

Tax Fees. We did not pay any fees to our auditors for the fiscal years ended December 31, 2012 and December 31, 2011 for professional services rendered for tax compliance, tax advice and tax planning as none of these services were provided.

All Other Fees.We did not pay any other fees to our auditors for professional services during the fiscal years ended December 31, 2012 and December 31, 2011.

The Audit Committee and the Board reviewed and approved all audit services provided by our auditors and has determined that their provision of such services to us during the fiscal year ended December 31, 2012 is compatible with and did not impair their independence. It is the practice of our Audit Committee and Board to consider and approve in advance all auditing services provided to us by our independent auditors.

The Board recommends that the stockholders vote “FOR” the ratification of appointment of Li Co.

PROPOSAL 3:

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) requires the Company’s stockholders to have the opportunity to cast a non-binding advisory vote regarding the approval of the compensation disclosed in this Proxy Statement of the Company’s executive officers who are named above in the Summary Compensation Table (the “Named Executive Officers”). The Company has disclosed the compensation of the Named Executive Officers pursuant to rules adopted by the SEC.

We believe that our compensation policies for the Named Executive Officers are designed to attract, motivate and retain talented executive officers and are aligned with the long-term interests of the Company’s stockholders. This advisory stockholder vote, commonly referred to as a “say-on-pay vote,” gives you as a stockholder the opportunity to approve or not approve the compensation of the Named Executive Officers that is disclosed in this Proxy Statement by voting for or against the following resolution (or by abstaining with respect to the resolution):

RESOLVED, that the stockholders of China GengSheng Minerals, Inc. approve all of the compensation of the Company’s Named Executive Officers, as such compensation is disclosed in this Proxy Statement pursuant to disclosure rules of the Securities and Exchange Commission, which disclosure includes Summary Compensation Table and other executive compensation tables and related narrative disclosures.

Because your vote is advisory, it will not be binding on either the Board or the Company. However, the Company’s Compensation Committee will take into account the outcome of the stockholder vote on this proposal at the Annual Meeting when considering future executive compensation arrangements. In addition, your non-binding advisory votes described in this Proposal 3 and below in Proposal 4 will not be construed: (1) as overruling any decision by the Board, any Board committee or the Company relating to the compensation of the named executive officers, or (2) as creating or changing any fiduciary duties or other duties on the part of the Board, any Board committee or the Company.

The Board recommends that stockholders vote to approve the compensation of the Company’s Named Executive Officers.

PROPOSAL 4:

ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION

The Dodd-Frank Act requires the Company’s stockholders to have the opportunity to cast a non-binding advisory vote regarding how frequently the Company should seek from its stockholders a non-binding advisory vote (similar to Proposal 3 above) on the compensation of the Company’s Named Executive Officers disclosed in this Proxy Statement. By voting on this frequency proposal, stockholders may indicate whether they would prefer that the advisory vote on the compensation of the Company’s Named Executive Officers occur every one, two or three years. Stockholders may also abstain from voting on the proposal. Accordingly, the following resolution is submitted for an advisory stockholder vote at the Annual Meeting:

RESOLVED, that the highest number of votes cast by the stockholders of China GengSheng Minerals, Inc. for the option set forth below shall be the preferred frequency of the Company’s stockholders for holding an advisory vote on the compensation of the Company’s Named Executive Officers:

every year;

every two years; or

every three years.

The Board has determined that an advisory vote by the Company’s stockholders on executive compensation that occurs every three years is the most appropriate alternative for the Company. In formulating its conclusion, the Board considered that, because the Company’s compensation program for executive officers is not complex, a stockholder advisory vote every three years should be sufficient to permit our stockholders to express their views about our compensation program. Also, the Board believes that the success of the Company’s executive compensation program should be judged over a period of time that is longer than one year.

You may cast your vote on your preferred voting frequency by choosing the option of one year, two years or three years when you vote in response to this proposal, and you may also abstain from voting on the proposal. Your vote on this proposal is not a vote to approve or disapprove of the Board’s recommendation but rather is a vote to select one of the options described in the preceding sentence. The option of one year, two years or three years that receives the highest number of votes cast by stockholders will be the frequency of the advisory vote on executive compensation that has been recommended by the stockholders. However, because this vote is advisory and not binding on either the Board or the Company, the Board may subsequently decide that it is in the best interests of the Company and its stockholders to hold an advisory vote on executive compensation that differs in frequency from the option that received the highest number of votes from the Company’s stockholders at the Annual Meeting.

The Board recommends that stockholders vote to conduct an advisory stockholder vote every three years on the compensation of the Company’s Named Executive Officers.

STOCKHOLDER PROPOSALS

Requirements for Stockholder Proposals to Be Considered for Inclusion in the Company’s Proxy Materials

Stockholder proposals to be considered for inclusion in the proxy statement and form of proxy relating to the 2014 annual meeting of shareholders must be received no later than September 2, 2014. In addition, all proposals will need to comply with Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”), which lists the requirements for the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholder proposals must be delivered to the Company’s Secretary by mail at No. 88 Gengsheng Road, Dayugou Town, Gongyi, Henan, China 451271.

Requirements for Stockholder Proposals to Be Brought Before the 2014 Annual Meeting of Shareholders and Director Nominations

Notice of any proposal that a stockholder intends to present at the 2014 annual meeting of shareholders, but does not intend to have included in the proxy statement and form of proxy relating to the 2014 annual meeting of shareholders, as well as any director nominations, must be delivered to the Company’s Secretary by mail at No. 88 Gengsheng Road, Dayugou Town, Gongyi, Henan, China 451271, no later than the close of business on September 7, 2014.

OTHER MATTERS

The Company knows of no other matters to come before the Annual Meeting. However, should any other matters properly come before the meeting, the shares represented by the proxy solicited hereby will, on a poll, be voted on such matters in accordance with the best judgment of the persons voting the shares represented by the proxy.

APPROVAL AND CERTIFICATION

The contents of this Proxy Statement have been approved and this mailing has been authorized by the Board.

Where information contained in this Proxy Statement rests specifically within the knowledge of a person other than the Company, and that person has provided the information to the Company, the Company has relied upon information furnished by such person.

The foregoing contains no untrue statement of material fact and does not omit to state a material fact that is required to be stated or that is necessary to make a statement not misleading in the light of the circumstances in which it was made.

Dated this 22ndday of November, 2013

BY ORDER OF THE BOARD OF DIRECTORS

/s/ Shunqing Zhang

Shunqing Zhang

Chairman of the Board, Chief Executive Officer and President