File No. 333-_______

As filed with the SEC on August 15, 2011

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Pre-Effective Amendment No. __

Post-Effective Amendment No. __

(Check appropriate box or boxes)

FEDERATED ASSET ALLOCATION FUND

(Exact Name of Registrant as Specified in Charter)

1-800-341-7400

(Area Code and Telephone Number)

4000 Ericsson Drive

Warrendale, PA 15086-7561

(Address of Principal Executive Offices)

John W. McGonigle, Esquire

Federated Investors Tower

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

Copies to:

Jennifer Eck, Esquire

Dickstein Shapiro LLP

2101 L Street, NW

Washington, DC 20037-1526

(202) 828-2218

Acquisition of the assets of

FEDERATED BALANCED ALLOCATION FUND

a portfolio of Federated Managed Allocation Portfolios

By and in exchange for Class A Shares, Class B Shares and Class C Shares of

FEDERATED ASSET ALLOCATION FUND

a portfolio of Federated Asset Allocation fund

Approximate Date of Proposed Public Offering: As soon as

practicable after this Registration Statement becomes effective

under the Securities Act of 1933, as amended.

Title of Securities Being Registered: Class A Shares, Class B Shares and Class C Shares, without par value,

of Federated Asset Allocation Fund

It is proposed that this filing will become effective

on September 14, 2011 pursuant to Rule 488.

No filing fee is due because Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

Prospectus/Proxy Statement –

Please Vote Today!

Federated Balanced Allocation Fund

A Portfolio of Federated Managed Allocation Portfolios

Federated Balanced Allocation Fund will hold a special meeting of shareholders on November 8, 2011. Please refer to the enclosed Prospectus/Proxy Statement as well as the highlighted information below for details on the proposal to be considered at the special meeting.

It is important for you to vote and we encourage you to do so. We recommend that you read the Prospectus/Proxy Statement in its entirety to help you decide on your vote.

Why am I being asked to vote?

Mutual funds are required to obtain shareholders' votes for certain types of changes, like the one described here and in the accompanying Prospectus/Proxy Statement. As a shareholder, you have a right to vote on these changes and we urge you to do so. A prompt response will save the expense of additional follow-up mailings and solicitations.

What is the proposal?

The proposal is to reorganize Federated Balanced Allocation Fund into Federated Asset Allocation Fund (the “Reorganization”).

Why has the Board of Trustees recommended that I vote in favor of the proposal?

- The Board of Trustees recommends you vote in favor of the proposal because it believes that the Reorganization is in the best interest of Federated Balanced Allocation Fund and its shareholders and that the interests of existing shareholders will not be diluted as a result of the Reorganization.

- After the Reorganization, shareholders of Federated Balanced Allocation Fund will be invested in a more viable fund that has somewhat similar objectives and strategies.

Please see the section entitled “Summary — Reasons for the Proposed Reorganization” in the Prospectus/Proxy Statement for more information.

How will the Reorganization affect my investment?

- The value of your investment will not change. You will receive shares of Federated Asset Allocation Fund with a total dollar value equal to the total dollar value of the Federated Balanced Allocation Fund shares that you own at the time of the Reorganization.

| If you own shares In: | You will receive shares of: |

| Federated Balanced Allocation Fund | Federated Asset Allocation Fund |

| Class A Shares | Class A Shares |

| Class B Shares | Class B Shares |

| Class C Shares | Class C Shares |

- The Reorganization is expected to be a tax-free reorganization under the Internal Revenue Code of 1986, as amended.

- Federated Balanced Allocation Fund will distribute any undistributed income and realized capital gains accumulated prior to the Reorganization to its shareholders. These distributions, if any, will be taxable.

- If you hold Class B or C Shares, you will receive credit for the amount of time you held your shares for purposes of the contingent deferred sales charge holding period on the Class B or C Shares of Federated Asset Allocation Fund that you will receive.

- You will not incur a sales charge as a result of shares received in the Reorganization.

When will the Reorganization occur?

Assuming shareholder approval is obtained, the Reorganization is currently expected to occur after the close of business on or about November 18, 2011 ..

Will my current account options transfer over to my new account?Yes, these servicing features will transfer automatically to your Federated Asset Allocation Fund account. However, if you participate in a systematic investment program you will receive a communication requesting that you confirm your continued participation in such a plan.

What should I do in connection with the Reorganization?

Please vote your shares today. If the Reorganization is approved, your shares will automatically be exchanged for Federated Asset Allocation Fund shares. Please do not attempt to make the Reorganization exchange into Federated Asset Allocation Fund yourself.

How do I vote?

There are several ways in which you can cast your vote:

- You may vote in person at the November 8, 2011 meeting, or by completing and returning the proxy card enclosed with this statement.

- You may vote by telephone or through the internet. Please refer to your ballot for the appropriate toll-free telephone number and web address.

If you:

| 1. | Sign and return the proxy card without indicating a preference, your vote will be cast “for” the proposal. |

| 2. | Do not respond at all, we may contact you by telephone to request that you cast your vote. |

Whom do I call if I have questions about this Prospectus/Proxy Statement?

Please don't hesitate to contact your Investment Professional or call us toll-free at 1-800-341-7400.

Thank you in advance for your vote and your continued support of the Federated Funds.

After careful consideration, the Board of Trustees has unanimously approved this proposal.

The Board of Trustees recommends that you read the enclosed materials carefully and vote FOR the proposal.

1

FEDERATED BALANCED ALLOCATION FUND

A portfolio of Federated Managed Allocation Portfolios

4000 Ericsson Drive

Warrendale, PA 15086-7561

Telephone No: 1-800-341-7400

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD NOVEMBER 8, 2011

TO SHAREHOLDERS OF FEDERATED BALANCED ALLOCATION FUND:

A special meeting of shareholders of Federated Balanced Allocation Fund will be held at 4000 Ericsson Drive, Warrendale, Pennsylvania 15086-7561, at 10:00 a.m. (Eastern time), on November 8, 2011, for the following purposes:

| 1) | To approve or disapprove a proposed Agreement and Plan of Reorganization pursuant to which Federated Asset Allocation Fund would acquire all or substantially all of the assets of Federated Balanced Allocation Fund, a portfolio of Federated Managed Allocation Portfolios, in exchange for Class A Shares, Class B Shares and Class C Shares of Federated Asset Allocation Fund . The Shares of Federated Asset Allocation Fund held by Federated Balanced Allocation Fund would then be distributed to Federated Balanced Allocation Fund's Shareholders, pro rata, in complete liquidation and termination of Federated Balanced Allocation Fund. As a result of the reorganization, shareholders of Federated Balanced Allocation Fund will receive Shares of the corresponding share class of Federated Asset Allocation Fund; |

and

| (2) | To transact such other business as may properly come before the special meeting or any adjournment thereof. |

The Board of Trustees has fixed September 14, 2011, as the record date for determination of shareholders entitled to vote at the meeting.

By Order of the Board of Trustees,

John W. McGonigle

Secretary

September 29, 2011

PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD PROMPTLY.

YOU CAN HELP THE FUNDS AVOID THE NECESSITY AND EXPENSE OF SENDING

FOLLOW-UP LETTERS TO ENSURE A QUORUM BY PROMPTLY RETURNING THE ENCLOSED

PROXY CARD. IF YOU ARE UNABLE TO ATTEND THE MEETING, PLEASE MARK, SIGN,

DATE AND RETURN THE ENCLOSED PROXY CARD SO THAT THE NECESSARY QUORUM

MAY BE REPRESENTED AT THE MEETING. THE ENCLOSED ENVELOPE REQUIRES

NO POSTAGE IF MAILED IN THE UNITED STATES.

PROSPECTUS/PROXY STATEMENT

September 29, 2011

Acquisition of the assets of

FEDERATED BALANCED ALLOCATION FUND

a portfolio of Federated Managed Allocation Portfolios

Federated Investors Funds

4000 Ericsson Drive

Warrendale, PA 15086-7561

Telephone No: 1-800-341-7400

By and in exchange for Class A Shares, Class B Shares, and Class C Shares of

FEDERATED ASSET ALLOCATION FUND

(formerly, Federated Stock and Bond Fund)

Federated Investors Funds

4000 Ericsson Drive

Warrendale, PA 15086-7561

Telephone No: 1-800-341-7400

This Prospectus/Proxy Statement describes the proposal for the reorganization (the “Reorganization”) pursuant to the Agreement and Plan of Reorganization (the “Plan”), of Federated Balanced Allocation Fund (FBAF), a portfolio of Federated Managed Allocation Portfolios (the “Trust”), with and into Federated Asset Allocation Fund (FAAF). Under the Plan, FBAF would transfer all of it assets to FAAF, in exchange for Class A Shares, Class B Shares and Class C Shares of FAAF. FAAF is expected to be the accounting survivor in the Reorganization. Class A Shares, Class B Shares and Class C Shares of FAAF will be distributed pro rata by FBAF to its shareholders in complete liquidation and termination of FBAF. As a result of the Reorganization, each shareholder holding Class A Shares, Class B Shares and Class C Shares of FBAF will become the shareholder of Class A Shares, Class B Shares and Class C Shares, respectively, of FAAF, having a total net asset value (“NAV”) equal to the total NAV of the shareholder's holdings in FBAF on the date of the Reorganization (the “Closing Date”). For purposes of this Prospectus/Proxy Statement, FBAF and FAAF may be referred to individually, as applicable, as a “Fund” and, collectively, as the “Funds”.

The Board of Trustees (the “Board”) of the Trust has determined that the Reorganization is in the best interests of FBAF, and that interests of the existing shareholders of FBAF will not be diluted as a result of the Reorganization. Information on the rationale for the Reorganization is included in this Prospectus/Proxy Statement in the section entitled “Summary — Reasons for the Proposed Reorganization.”

The Reorganization is expected to be a tax-free reorganization for federal income tax purposes under the Internal Revenue Code of 1986, as amended (the ”Code”). For information on the tax consequences of the Reorganization, see the sections entitled “Summary — Tax Consequences” and “Information about the Reorganization — Federal Income Tax Consequences” in this Prospectus/Proxy Statement.

The investment objective of FBAF is to provide capital appreciation. The investment objective of FAAF is to provide relative safety of capital with the possibility of long-term growth of capital and income; consideration is also given to current income. For a comparison of the investment objectives, policies limitations and risks of FBAF with those of FAAF, see the section entitled “Summary — Comparison of Investment Objectives, Policies and Risks” in this Prospectus/Proxy Statement.

This Prospectus/Proxy Statement should be retained for future reference. It sets forth concisely the information about the Funds that a prospective investor should know before investing. This Prospectus/Proxy Statement is accompanied by the Prospectus for FAAF, dated January 31, 2011, which is incorporated herein by reference. The Statement of Additional Information dated September 29, 2011 relating to this Prospectus/Proxy Statement, contains additional information and has been filed by FAAF with the Securities and Exchange Commission (SEC) and is incorporated herein by reference. In addition each of the following documents is incorporated by reference (legally considered to be part of the Prospectus/Proxy Statement):

1. Statement of Additional Information for FAAF dated January 31, 2011 (File Nos. 2-10415 and 811-1);

2. Annual Report for FBAF dated November 30, 2010 (File Nos. 33-51247 and 811-7129);

3. Annual Report for FAAF dated November 30, 2010 (File Nos. 2-10415 and 811-1);

4. Semi-Annual Report for FBAF dated May 31, 2011 (File Nos. 33-51247 and 811-7129);

5. Semi-Annual Report for FAAF dated May 31, 2011 File Nos. 2-10415 and 811-1).

1

Copies of these materials and other information about FBAF and FAAF may be obtained without charge by writing or calling the Funds at the addresses and telephone numbers shown on the previous pages. You can copy and review information about the Funds at the SEC's Public Reference Room in Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling the SEC at (202)551-8090. Reports and other information about FBAF and FAAF are available on the EDGAR Database on the SEC's Internet site at http://www.sec.gov. You may obtain copies of this information, after paying a duplicating fee, by electronic request to the following e-mail address: publicinfo@sec.gov, or by writing the Commission's Public Reference Section, Washington, D.C. 20549-1520.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Shareholders to Be Held on November 8, 2011: This Proxy Statement is available on the Internet at the website listed on your proxy card(s). On this website, you also will be able to access the Notice of Special Meeting of Shareholders, the form of proxy cards and any amendments or supplements to the foregoing materials that are required to be furnished to shareholders.

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES, OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS/PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS OTHER THAN THOSE CONTAINED IN THIS PROSPECTUS/ PROXY STATEMENT AND IN THE MATERIALS EXPRESSLY INCORPORATED HEREIN BY REFERENCE AND, IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATIONS MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE FUNDS.

SHARES OF THE FUNDS ARE NOT DEPOSITS OR OBLIGATIONS OF, OR GUARANTEED OR ENDORSED BY, ANY BANK. SHARES OF THE FUNDS ARE NOT FEDERALLY INSURED BY, GUARANTEED BY, OBLIGATIONS OF OR OTHERWISE SUPPORTED BY THE U.S. GOVERNMENT, THE FEDERAL DEPOSIT INSURANCE CORPORATION, THE FEDERAL RESERVE BOARD OR ANY OTHER GOVERNMENTAL AGENCY. AN INVESTMENT IN THE FUNDS INVOLVES INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF PRINCIPAL AMOUNT INVESTED.

2

Contents

SUMMARY

This summary is qualified in its entirety by reference to the additional information contained elsewhere in this Prospectus/Proxy Statement, or incorporated by reference into this Prospectus/Proxy Statement. A form of the Agreement and Plan of Reorganization (the “Plan”) pursuant to which the reorganization (the “Reorganization”) will be conducted is attached to this Prospectus/Proxy Statement as Annex A. The prospectus of FAAF accompanies this Prospectus/Proxy Statement.

If the proposal is approved, under the Plan, FBAF will transfer substantially all of its assets (except for deferred or prepaid expenses to the extent that they don ot have a continuing value to FAAF, and which are not expected to be material in amount) to FAAF in exchange for Class A Shares, Class B Shares, and Class C Shares (as applicable) of FAAF. FBAF will be required to discharge all of its respective liabilities and obligations prior to consummation of the Reorganization. FAAF is expected to be the accounting survivor of the Reorganization. FAAF's Class A Shares, Class B Shares and Class C Shares (as applicable) will be distributed pro rata by FBAF to its respective shareholders in complete liquidation and dissolution/termination of FBAF. As a result of the Reorganization, each shareholder of FBAF's Class A Shares, Class B Shares and Class C Shares will become the shareholder of Class A Shares, Class B Shares and Class C Shares, respectively, of FAAF having a total NAV equal to the total NAV of the shareholder's holdings in FBAF on the date of the Reorganization.

REASONS FOR THE PROPOSED REORGANIZATION

FBAF's investment objective is to provide capital appreciation. Somewhat similarly, FAAF's investment objective is to provide relative safety of capital with the possibility of long-term growth of capital and income. Consideration is also given to current income.

FBAF was designed to provide investors with an equal allocation to four Federated Funds (Federated InterContinental Fund, Federated Capital Appreciation Fund, Federated Kaufmann Fund, and Federated Intermediate Corporate Bond Fund) within a single fund. The Reorganization was recommended to the Board because in the opinion of Federated Global Investment Management Corp. (the “Adviser”), FBAF has not grown to a viable asset size and the Adviser is unwilling to continue to voluntarily waive or reimburse certain fees and operating expenses after January 31, 2012, such that FBAF would operate at or near its stated gross expense ratios. FBAF's stated gross expenses are higher than the net and stated gross expense levels of FAAF. As of June 30, 2011 FAAF had $286,505,243 in assets — significantly more than FBAF's $57,616,365.

Given the asset levels of FAAF in comparison to FBAF, the stability of FAAF's net asset level, and the expected termination of fee waivers which would result in a significant increase in net expenses for FBAF, the Adviser believes that the proposed Reorganization will result in FBAF's shareholders receiving shares in a fund that: (i) is more viable, (ii) has somewhat similar objectives and strategies to FBAF and (iii) has a performance record that is generally competitive with that of FBAF over the long term.

In light of the above rationale and considerations, and the requirements of Rule 17a-8 under the Investment Company Act, in considering the proposed Reorganization, the Board took into account a number of factors, including:

- While the total net expenses of FAAF are currently slightly higher than those of FBAF, the Adviser and its affiliates have indicated that they intend to eliminate or substantially reduce the voluntary waivers on FBAF such that, after January 31, 2012, FBAF's shares would be operated at or near their stated gross expense ratios which are considerably higher than FAAF's stated gross and net expense ratios;

- FAAF has a larger asset base than FBAF and appeals to a broader distribution, giving it greater viability;

- Despite the trailing performance of FAAF for certain periods, the Adviser believes FAAF's performance is generally competitive with that of FBAF, and there is no anticipated decline in services to FBAF shareholders as a result of the Reorganization. The range and quality of the services that FBAF shareholders will receive as shareholders of FAAF will be comparable to the range and quality of services that they currently receive (note that the Funds are managed by the same Adviser);

- With respect to Reorganization-related expenses:

- FBAF will pay direct proxy expenses (e.g., mailing, processing, tabulation, printing and solicitation costs and expenses) associated with the Reorganization estimated at $38,000;

- FBAF will pay brokerage expenses related to repositioning FBAF's portfolio prior to the Reorganization (to better align the Funds' portfolios), estimated at $17,000; and

- The Adviser will pay the other direct and indirect expenses of the Reorganization (consisting primarily of legal and accounting fees).

- The effect on the net asset value of FBAF as a result of the payment of the direct proxy expenses and brokerage expenses would be approximately $0.0083 per share (before taking into account the impact of waivers). Given FBAF's large waiver positions and the fact that FBAF is being operated at its applicable voluntary expense caps, Federated will likely indirectly pay the expenses that FBAF is being asked to pay (except for brokerage and other transaction related expenses associated with the purchase of portfolio securities by FBAF prior to the Reorganization); and

- There will be no dilution to shareholders in the transaction, because each FBAF shareholder will become the owner of shares of FAAF having a total net asset value equal to the total net asset value of his or her holdings in FBAF on the date of the Reorganization.

In sum, FBAF shareholders will be receiving shares in a competitive, more viable fund with share class expense ratios ultimately below what the expense ratios of FBAF's share classes would be after the Adviser and its affiliates eliminate or substantially reduce the current voluntary waivers of FBAF share classes after January 31, 2012. FBAF shareholders also will be receiving shares of FAAF in a Reorganization transaction that is intended to be tax-free and therefore will experience a more preferable tax result as compared to a liquidation of FBAF.

Given the above factors, the Adviser believes that the bulk of the benefits of the Reorganization favor FBAF and its shareholders, as opposed to the Adviser and its affiliates, and that, in this instance, the proposed allocation of direct proxy expenses to FBAF is reasonable and appropriate, and will not result in unfair dilution or FBAF bearing the cost of a transaction where a greater benefit will accrue to another person (such as the Adviser and its affiliates).

The Board of the Trust, including a majority of the Trustees who are not “interested persons” within the meaning of Section 2(a)(19) of the Investment Company Act of 1940, as amended (“1940 Act”), has determined that participation in the Reorganization is in the best interests of FBAF and that the interests of the existing shareholders of FBAF will not be diluted as a result of the Reorganization. Therefore the Board has approved, and is recommending that FBAF shareholders approve, the Reorganization of FBAF into FAAF.

TAX CONSEQUENCES

As a condition to the Reorganization, each Fund will receive an opinion of counsel that the Reorganization will be considered a tax-free “reorganization” under applicable provisions of the Internal Revenue Code of 1986, as amended (the “Code”), so that no gain or loss will be recognized directly as a result of the Reorganization by either Fund or by FBAF's shareholders. The aggregate tax basis of the shares of FAAF received by the FBAF shareholders will be the same as the aggregate tax basis of their shares in FBAF. Prior to the Reorganization FBAF will distribute to shareholders any previously undistributed ordinary income and net capital gains (after reduction by any available capital loss carryover) accumulated prior to the Reorganization. Any such distributions will be taxable to FBAF shareholders. For further discussion, see “Information About the Reorganization — Federal Income Tax Consequences.

Distributions and the Treatment of Capital Loss Carryforwards and Realized Losses

As noted above, shareholders generally will not incur capital gains or losses on the exchange of shares of FBAF for shares of FAAF as a result of the Reorganization. However, shareholders will incur capital gains or losses if they sell their shares of FBAF before the Reorganization becomes effective or sell/exchange their shares of FAAF after the Reorganization becomes effective. Shareholders also will be responsible for tax obligations associated with monthly, periodic or other dividend or capital gains distributions that occur prior to and after the Reorganization.

For example, shareholders will be responsible for any taxes payable in connection with taxable distributions made, if any, by FBAF immediately before the Closing Date. These distributions may include capital gains realized on dispositions of portfolio securities in connection with the Reorganization. Prior to the Reorganization being consummated, the Adviser may sell securities from the portfolio of FBAF to better align the portfolios of FBAF and FAAF. It is anticipated that FBAF will dispose of a substantial portion or substantially all of its securities prior to the Reorganization in order to better align its portfolio with FAAF. This may cause FBAF to deviate from its stated investment objective and strategies. As of the Closing Date, if such dispositions of portfolio securities, together with any other dispositions of portfolio securities from the portfolio of FBAF, result in FBAF having a net capital gain, such capital gain will be distributed to shareholders as a taxable distribution prior to the Reorganization being consummated. Brokerage costs incurred in connection with the Reorganization and the repositioning of FBAF's portfolio are expected to be minimal. Assuming that all of FBAF's securities are sold, the estimated brokerage costs of FBAF would be $_____. FAAF will not incur any brokerage costs because it will not need to purchase securities with the assets received from FBAF.

As of their last fiscal year ends for which audited financial statements are available, FBAF had capital loss carryforwards of $6.4 million as of November 30, 2010 and FAAF had capital loss carryforwards of $20 million as of November 30, 2010. Capital loss carryforwards will reduce a Fund's taxable income arising from future net realized gains on investments, if any, to the extent permitted under the Code and, thus, will reduce the amount of distributions to shareholders that would otherwise be necessary to relieve a Fund of any liability for federal income tax. As of June 30, 2011, FBAF also had estimated year-to-date unrealized gains of $7 million and $436,000 in realized losses. In comparison, as of June 30, 2011 FAAF had estimated year-to-date unrealized gains of $21.8 million and $25.5 million in realized gains.The utilization of any capital loss carryforwards and realized losses of the Funds generated prior to the Reorganization may be subject to limitations under the Code, including limitations that may be imposed as a result of the Reorganization. While any limitations cannot be determined until the date on which the Reorganization is consummated, assuming the Reorganization occurred on June 30, 2011, the Adviser would not anticipate any permanent limitations on the use of these losses (other than the fact that these losses are subject to expiration in the future in accordance with the provisions of the Code). To the extent that FBAF would be in a net capital gain position or have undistributed ordinary income prior to the Reorganization, final capital gain and ordinary income distributions will be made to shareholders of FBAF.

Shareholders of FBAF should consult their tax advisors regarding the federal, state and local tax treatment and implications of the Reorganization in light of their individual circumstances.

THE BOARD OF TRUSTEES OF FBAF UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL OF THE REORGANIZATION.

COMPARISON OF INVESTMENT OBJECTIVES, POLICIES AND RISKS

This section will help you compare the investment objectives, policies and risks of the Funds. Following the Reorganization, FBAF will follow the investment objective, limitations, policies and risks of FAAF. The investment objectives, policies and risks of the Funds are somewhat similar. The differences in the Funds' investment limitations are also discussed below. Please be aware that the foregoing is only a summary, and this section is only a brief discussion. More complete information may be found in each Fund's prospectus.

INVESTMENT OBJECTIVES, POLICIES

FBAF

The investment objective of FBAF is to provide capital appreciation.

FBAF pursues its investment objective by investing, under normal market conditions, in a combination of the following Federated mutual funds (referred to herein collectively as the “Underlying Fund(s)” and individually as an “Underlying Fund”):

- Federated Kaufmann Fund

- Federated Capital Appreciation Fund

- Federated InterContinental Fund

- Federated Intermediate Corporate Bond Fund

The Underlying Funds will, in turn, invest in U.S. and foreign equity or fixed- income securities, depending upon the nature of each Underlying Fund's investment strategy. The Underlying Funds may invest in derivative contracts to implement their investment strategy. The strategies of the Underlying Funds are listed below. FBAF will endeavor to maintain a proportionate allocation (i.e., approximately 25% allocation to each Underlying Fund) among the Underlying Funds except to the extent FBAF maintains a cash position (e.g., in order to meet shareholder redemptions).

Federated Kaufmann Fund

Federated Kaufmann Fund seeks to provide capital appreciation by investing primarily in the common stocks of small and medium-sized companies that are traded on national security exchanges, the NASDAQ stock market and on the over-the-counter market. Up to 30% of the fund's net assets may be invested in foreign securities. When deciding which securities to buy the adviser considers: the growth prospects of existing products and new product development; the economic outlook of the industry; the price of the security and its estimated fundamental value; and relevant market, economic and political environments. The adviser uses a bottom-up approach to portfolio management. There is an emphasis on individual stock selection rather than trying to time the highs and lows of the market or concentrating in certain industries or sectors. This hands-on approach means that in addition to sophisticated computer analysis, the adviser may conduct in-depth meetings

with management, industry analysts and consultants. Through this interaction with companies, the adviser seeks to develop a thorough knowledge of the dynamics of the businesses in which the fund invests. The fund may also invest in fixed-income securities, exchange-traded funds, American Depositary Receipts (ADRs) and use derivative contracts and/or hybrid instruments to implement elements of its investment strategy. Federated Capital Appreciation Fund

Federated Capital Appreciation Fund seeks capital appreciation by investing primarily in common stock of domestic companies with large and medium market capitalizations that offer superior growth prospects or of companies whose stock is undervalued. In its stock selection process, the adviser uses fundamental and valuation analysis. The adviser evaluates a company's fundamentals and attempts to project long-term future earnings growth rates. In addition, the adviser employs valuation analysis as a framework for evaluating how the stock could be valued. The fund may also invest in common stocks of foreign issuers (including American Depositary Receipts (ADRs)), and may also invest in convertible securities and preferred stocks of these domestic and foreign companies. The fund may use derivative contracts and/or hybrid instruments to implement elements of its investment strategy.

Federated InterContinental Fund

Federated InterContinental Fund seeks long-term capital appreciation primarily through investing in equity securities of foreign companies. In selecting securities, the fund's investment adviser focuses first on country selection seeking to identify countries whose stock markets appear attractively valued relative to other countries, have better growth prospects, have attractive macroeconomic forces working in their favor and evidence other factors which the adviser has identified as being correlated with market outperformance. Once a country's stock market has been selected for investment, the adviser uses bottom up stock picking and optimization models to select a group of stocks which give broad exposure to the targeted market. The models' stock selection criteria includes among other things, growth indicators, valuation indicators and corporate quality indicators. The fund may also invest in derivative or hybrid contracts such as futures, options and swaps, as well as exchange-traded funds (ETFs) to implement its investment strategy.

Federated Intermediate Corporate Bond Fund

Federated Intermediate Corporate Bond Fund seeks to provide current income by investing in a diversified portfolio of investment-grade, fixed-income securities consisting primarily of corporate debt securities, U.S. government mortgage-backed securities, and U.S. Treasury and agency securities. The fund maintains, under normal market conditions, a dollar-weighted average portfolio duration of between three and seven years. Further, the dollar-weighted average portfolio maturity of the fund will normally be between three and ten years. Within the fund's three to seven-year portfolio duration range, the adviser may seek to change the fund's interest rate volatility exposure, by lengthening or shortening duration from time to time based on its interest rate outlook. In addition to managing the fund's portfolio duration, the adviser seeks to enhance the fund's current income by selecting securities, within the fund's credit-quality range, that the adviser expects will offer the best relative value. In other words, in selecting securities, the adviser assesses whether the fund will be adequately compensated for assuming the risks (such as credit risk) of a particular security by comparing the security to other securities without those risks. The adviser attempts to manage the fund's credit risk by selecting corporate debt securities that make default in the payment of principal and interest less likely. The adviser uses corporate earnings analysis to determine which business sectors and credit ratings are most advantageous for investment by the fund. In selecting individual corporate fixed-income securities, the adviser analyzes a company's business, competitive position, and financial condition to assess whether the security's credit risk is commensurate with its potential return. The fund may also invest in derivative contracts to implement its investment strategies.

FAAF

The investment objective of FAAF is to provide relative safety of capital with the possibility of long-term growth of capital and income. Consideration is also given to current income.

During normal market conditions, FAAF will invest between 20% and 80% of its assets in equity securities and between 20% and 80% of its assets in fixed-income securities. FAAF's asset mix will change based upon the Adviser's view of economic and market conditions.

With regard to the portion of FAAF allocated to equity securities, the Adviser may allocate relatively more of the Fund's assets, based upon its view of economic and market conditions, to securities with exposure to a particular sector, country or region, to securities chosen using a particular style of investing (e.g., growth or value) or to securities with a particular market capitalization (e.g., small, medium or large).

When selecting individual securities (whether foreign or domestic) in which to invest, FAAF focuses primarily on securities of companies that collectively provide the Adviser with the country, sector, style and size exposures it is targeting. In addition, the Adviser considers other security-specific factors that it expects to generate relatively better performance within the stock portfolio. Such factors include valuation, profitability, growth expectations, market sentiment and price behavior.The fixed-income asset classes in which FAAF may invest include domestic investment-grade debt securities, including corporate debt securities, U.S. government obligations and mortgage-backed securities. FAAF may also invest in noninvestment-grade, fixed-income securities, non-U.S. dollar and emerging market, fixed-income securities when the adviser considers the risk/return prospects of those sectors to be attractive. FAAF may buy or sell foreign currencies in lieu of or in addition to non-dollar denominated fixed-income securities in order to increase or decrease its exposure to foreign interest rate and/or currency markets.

FAAF may invest in government securities which are issued or guaranteed by a federal agency or instrumentality acting under federal authority, including government securities that are not backed by the full faith and credit of the U.S. government, such as those issued by the Federal Home Loan Mortgage Corporation, the Federal National Mortgage Association and the Federal Home Loan Bank System. These entities are, however, supported through federal subsidies, loans or other benefits. FAAF may also invest in government securities that are supported by the full faith and credit of the U.S. government, such as those issued by the Government National Mortgage Association.

FAAF may also invest in instruments, such as exchange-traded funds (ETFs) whose performance is determined by the price of an underlying commodity or commodity index. FAAF may also invest in ETFs, hybrid instruments, real estate investment trusts (REITs), derivative contracts and other investment companies in any manner consistent with its investment strategy. Lastly, FAAF may sell a security short in an effort to profit from a decline in the price of the security. FAAF's short exposure will not exceed 10% of FAAF's assets. Short exposure obtained through investments in derivative and/or hybrid instruments will be included in this limitation. Short exposures to foreign currencies held to offset underlying long exposures to foreign currency denominated assets (i.e., foreign currency hedges), or short positions used to adjust the duration of the fixed-income portion of FAAF, are not included in this 10% limitation.

Both FAAF and FBAF may use derivative contracts and/or hybrid instruments to implement elements of their respective investment strategies. For example, each Fund may use derivative contracts and/or hybrid instruments to increase or decrease each Fund's portfolio exposure to the investment(s) underlying the derivative or hybrid instrument in an attempt to benefit from changes in the value of the underlying investment(s). Additionally, by way of example, each Fund may use derivative contracts in an attempt to:

- Increase or decrease the effective duration of the Fund portfolio;

- Obtain premiums from sale of derivative contracts;

- Realize gains from trading a derivative contract; or

- Hedge against potential losses.

FAAF may also use derivative contracts in an attempt to seek to benefit from anticipated changes in the volatility of designated assets or instruments, such as indicies, currencies, and interest rates. (Volatility is a measure of the frequency and level changes in the value of an asset or instrument without regard to the direction of such changes.)

There can be no assurance that either Fund's use of derivative contracts or hybrid instruments will work as intended.

COMPARISON OF RISKS

Because each Fund has somewhat similar investment objectives and policies, their principal risks will be similar. All mutual funds take investment risks. Therefore, it is possible to lose money by investing in either Fund. FBAF is exposed to these risks through its investment in the Underlying Funds.

The following summarizes some of the more significant risk factors relating to both Funds.

- Stock Market Risks. The value of equity securities in the Fund's portfolio will fluctuate and, as a result, the Fund's Share price may decline suddenly or over a sustained period of time.

- Investment Style Risks. The Fund may employ a combination of styles that impact its risk characteristics, such as growth and value investing. Due to the Fund's style of investing, the Fund's Share price may lag that of other funds using a different investment style.

- Risks Related to Company Size. Because the smaller companies in which the Fund may invest may have unproven track records, a limited product or service base and limited access to capital, they may be more likely to fail than larger companies.

- Interest Rate Risks. Prices of fixed-income securities generally fall when interest rates rise. Interest rate changes have a greater effect on fixed-income securities with longer duration. Duration measures the price sensitivity of a fixed-income security to changes in interest rates.

- Prepayment Risks. When homeowners prepay their mortgages in response to lower interest rates, the Fund will be required to reinvest the proceeds at the lower interest rates available. Also, when interest rates fall, the price of mortgage-backed securities may not rise to as great an extent as that of other fixed-income securities.

- Credit Risks. There is a possibility that issuers of securities in which the Fund may invest may default in the payment of interest or principal on the securities when due, which would cause the Fund to lose money.

- Call Risks. The Fund's performance may be adversely affected by the possibility that an issuer of a security held by the Fund may redeem the security prior to maturity at a price below or above its current market value.

- Liquidity Risks. The equity and fixed-income securities in which the Fund invests may be less readily marketable and may be subject to greater fluctuation in price than other securities. Over-the-counter (OTC) derivative contracts generally carry greater liquidity risk than exchange-traded contracts.

- Sector Risks. Because the Fund may allocate relatively more assets to certain industry sectors than others, the Fund's performance may be more susceptible to any developments which affect those sectors emphasized by the Fund.

- Risks of Investing in Derivative Contracts and Hybrid Instruments. Derivative contracts and hybrid instruments involve risks different from, or possibly greater than, risks associated with investing directly in securities and other traditional investments. Specific risk issues related to the use of such contracts and instruments include valuation and tax issues, increased potential for losses and/or costs to the Fund and a potential reduction in gains to the Fund. Derivative contracts and hybrid instruments may also involve other risks such as stock market, interest rate, credit, currency, liquidity and leverage risks.

- Leverage Risks. Leverage risk is created when an investment (such as a derivative transaction) exposes the Fund to a level of risk that exceeds the amount invested. Changes in the value of such an investment magnify the Fund's risk of loss and potential for gain.

- Exchange-Traded Funds Risks. An investment in an ETF generally presents the same primary risks as an investment in a conventional fund (i.e., one that is not exchange traded) that has the same investment objectives, strategies and policies. The price of an ETF can fluctuate up or down, and the Fund could lose money investing in an ETF if the prices of the securities owned by the ETF go down.

- Risks of Foreign Investing. Because the Fund invests in securities issued by foreign companies, the Fund's Share price may be more affected by foreign economic and political conditions, taxation policies and accounting and auditing standards than could otherwise be the case.

- Risks of Investing in ADRs and Domestically Traded Securities of Foreign Issuers. Because the Fund may invest in American Depositary Receipts (ADRs) and other domestically traded securities of foreign companies, the Fund's Share price may be more affected by foreign economic and political conditions, taxation policies and accounting and auditing standards than would otherwise be the case.

- Currency Risks. Exchange rates for currencies fluctuate daily. Accordingly, the Fund may experience increased volatility with respect to the value of its Shares and its return as a result of its exposure to foreign currencies through direct holding of such currencies or holding of non-U.S. dollar denominated securities.

- Risks of Investing in Emerging Market Countries. Securities issued or traded in emerging markets generally entail greater risks than securities issued or traded in developed markets. For example, the prices of such securities may be significantly more volatile than prices of securities in developed countries. Emerging market economies may also experience more severe downturns (with corresponding currency devaluations) than developed economies.

FBAF is also subject to the following risks (to a greater extent than FAAF) due to its investments in the Underlying Funds:

- Medium Sized Company Risks. An Underlying Fund may invest in mid-size companies. Mid-capitalization companies often have narrower markets and limited managerial and financial resources compared to larger, more established companies.

- Risks Related to Investing for Growth. Due to their relatively high valuations, growth stocks are typically more volatile than value stocks. For instance, the price of a growth stock may experience a larger decline in a forecast of lower earnings, a negative fundamental development, or an adverse market development. Further, growth stocks may not pay dividends or may pay lower dividends than value stocks. This means they depend more on price changes for retruns and may be more adversely affected in a down market compared to value stocks that pay higher dividends.

- Risks Associated with Complex CMOs. An Underlying Fund may invest a portion of its assets in securities rated below investment grade which may be subject to greater interest rate, credit and liquidity risks than investment-grade securities.

- Custodial Services and Related Investment Costs Risks. Custodial services and other costs relating to investment in international securities markets generally are more expensive due to differing settlement and clearance procedures than those of the United States. The inability of an Underlying Fund to make intended securities purchases due to settlement problems could cause an Underlying Fund to miss attractive investment opportunities. In addition, security settlement and clearance procedures in some emerging market countries may not fully protect the Fund against the loss of its assets.

FAAF is also subject to the following risks to a greater extent than FBAF:

- Risks Associated with Noninvestment-Grade Securities. The Fund may invest a portion of its assets in securities rated below investment grade which may be subject to greater credit and liquidity risks than investment-grade securities.

- Risks Related to the Economy. Low-grade corporate bond returns are sensitive to changes in the economy. The value of the Fund's portfolio may decline in tandem with a drop in the overall value of the stock market based on negative developments in the U.S. and global economies.

- Risks of Investing in Commodities. Because the Fund may invest in investments or exchange-traded funds whose performance is linked to the price of an underlying commodity or commodity index, the Fund may be subject to the risks of investing in physical commodities. These types of risks including regulatory, economic and political developments, weather events and natural disasters, pestilence, market disruptions and the fact that commodity prices may have greater volatility than investments in traditional securities.

- Short Selling Risks. The Fund may enter into short sales which expose the Fund to the risks of short selling. Short sales involve borrowing a security from a lender which is then sold in the open market at a future date. The security is then repurchased by the Fund and returned to the lender. Short selling allows an investor to profit from declines in the prices of securities. Short selling a security involves the risk that the security sold short will appreciate in value at the time of repurchase therefore creating a loss for the Fund. The Fund may incur expenses in selling securities short and such expenses are investment expenses of the Fund.

COMPARISON OF INVESTMENT LIMITATIONS

Each Fund has fundamental investment limitations which cannot be changed without shareholder approval. Each Fund also has non-fundamental investment limitations which may be changed by the relevant Fund's board without shareholder approval.

With certain exceptions as noted below, the investment limitations of the Funds are generally similar. Nonetheless, there are differences in the limitations regarding investing in commodities, concentration of investments and underwriting. Additionally, FBAF has non-fundamental policies regarding pledging assets and investing in securities of other investment companies while FAAF has a non-fundamental policy regarding acquiring securities.

The following chart compares the fundamental and non-fundamental limitations of FBAF and FAAF.

| FBAF | FAAF |

Diversification (Fundamental)

With respect to securities comprising 75% of the value of its total assets, the Fund will not purchase the securities of any one issuer (other than cash; cash item; securities issued or guaranteed by the government of the United States or its agencies or instrumentalities and repurchase agreements collateralized by such U.S. government securities; and securities of other investment companies) if, as a result, more than 5% of the value of its total assets would be invested in the securities of that issuer, or if the Fund would own more than 10% of the outstanding voting securities of that issuer. | Diversification (Fundamental)

Same |

| FBAF | FAAF |

Borrowing Money (Fundamental)

The Fund may borrow money, directly or indirectly, and issue senior securities to the maximum extent permitted under the Investment Company Act of 1940, as amended (the “1940 Act”).* | Borrowing Money and Issuing Senior Securities (Fundamental)

Same |

Investing in Real Estate (Fundamental)

The Fund may not purchase or sell real estate, provided that this restriction does not prevent the Fund from investing in issuers which invest, deal, or otherwise engage in transactions in real estate or interests therein, or investing in securities that are secured by real estate or interests therein. The Fund may exercise its rights under agreements relating to such securities, including the right to enforce security interests and to hold real estate acquired by reason of such enforcement until that real estate can be liquidated in an orderly manner. | Investing in Real Estate (Fundamental)

Same |

Investing in Commodities (Fundamental)

The Fund may not purchase or sell physical commodities, provided that the Fund may purchase securities of companies that deal in commodities. | Investing in Commodities (Fundamental)

The Fund may invest in commodities to the maximum extent permitted under the 1940 Act. |

Underwriting (Fundamental)

The Fund may not underwrite the securities of other issuers, except that the Fund may engage in transactions involving the acquisition, disposition or resale of its portfolio securities, under circumstances where it may be considered to be an underwriter under the Securities Act of 1933. | Underwriting (Fundamental)

The Fund will not engage in underwriting or agency distribution of securities issued by others. |

Lending Cash or Securities (Fundamental)

The Fund may not make loans, provided that this restriction does not prevent the Fund from purchasing debt obligations, entering into repurchase agreements, lending its assets to broker/dealers or institutional investors and investing in loans, including assignments and participation interests. | Lending Cash or Securities (Fundamental)

The Fund will not lend any assets except portfolio securities. The purchase of corporate or government bonds, debentures, notes or other evidences of indebtedness shall not be considered a loan for purposes of this limitation. |

Concentration of Investments (Fundamental)

The Fund will not make investments that will result in the concentration of its investments in the securities of issuers primarily engaged in the same industry. Government securities, municipal securities and bank instruments will not be deemed to constitute an industry. | Concentration of Investments (Fundamental)

The Fund will not invest more than 25% of the value of its total assets in securities of companies in any one issuer. However, with respect to foreign government securities, the Fund reserves ther right to invest up to 25% of its total assets in fixed-income securities of foreign governmental units located within an individual foreign nation and to purchase or sell various currencies on either a spot or forward basis in connection with these investments. |

Investing in Illiquid Securities (Non-Fundamental)

The Fund will not purchase securities for which there is no readily available market, or enter into repurchase agreements or purchase time deposits that the Fund cannot dispose of within seven days, if immediately after and as a result, the value of such securities would exceed, in the aggregate, 15% of the Fund's assets. | Illiquid Securities (Non-Fundamental)

Same |

Pledging Assets (Non-Fundamental)

The Fund will not mortgage, pledge, or hypothecate any of its assets, provided that this shall not apply to the transfer of securities in connection with any permissible borrowing or to collateral arrangements in connection with permissible activities. | FAAF does not have a similar investment limitation. |

Buying on Margin (Non-Fundamental)

The Fund will not purchase securities on margin, provided that the Fund may obtain short-term credits necessary for the clearance of purchases and sales of securities, and further provided that the Fund may make margin deposits in connection with its use of financial options and futures, forward and spot currency contracts, swap transactions and other financial contracts or derivative instruments. | Purchases on Margin (Non-Fundamental)

Same |

Acquiring Securities (Non-Fundamental)

FBAF does not have a similar investment limitation. | Acquiring Securities (Non-Fundamental)

The Fund will not invest in securities of a company for the purpose of exercising control or management. |

Investing in Securities of other Investment Companies (Non-Fundamental)

The Fund may invest in securities of other investment companies pursuant to exemptive relief granted by the SEC. As a shareholder of an investment company, the Fund will indirectly bear investment management fees and other expenses that the Fund pays. This could cause the Fund's performance to be lower than if it were to invest directly in the securities owned by the underlying investment companies. | Investing in Securities of other Investment Companies (Non-Fundamental)

FAAF does not have a similar investment limitation. |

PROCEDURES FOR PURCHASING, REDEEMING AND EXCHANGING SHARES

The procedures for purchasing, redeeming and exchanging shares of FBAF are substantially similar to those for purchasing, redeeming and exchanging shares of FAAF. See the section entitled “Purchase, Redemption and Exchange Procedures” below for more information regarding these procedures.

COMPARATIVE FEE TABLES

Like all mutual funds, each Fund incurs certain expenses in its operations. These expenses include management fees, as well as the cost of maintaining accounts, administration, providing shareholder liaison and distribution services and other activities.

You will not pay any sales charges in connection with the Reorganization. Holders of FBAF's Class B and Class C Shares will receive credit for the amount of time that they have held their FBAF Class B and Class C Shares toward the CDSC holding period when such shareholders receive Class B and Class C Shares of FAAF in the Reorganization. See the section entitled “Procedures for Purchasing, Redeeming and Exchanging Shares” for further information regarding the front-end sales charges and CDSCs that may be payable with respect to the Class A Shares, Class B Shares and Class C Shares (as applicable) of the Funds.

Set forth in the tables below is information regarding the fees and expenses incurred by each class of shares of FAAF and each corresponding class of shares of FBAF, and the anticipated pro forma fees for the corresponding class of FAAF after giving effect to the Reorganization. It is anticipated that FAAF will be the accounting survivor after the Reorganization.

Federated Balanced Allocation Fund Class A Shares -

Federated Asset Allocation Fund Class a Shares

Fees and Expenses

This table describes (1) the actual fees and expenses for the Class A Shares of FBAF as of its semi-annual period ended May 31, 2011; (2) the actual fees and expenses for the Class A Shares of FAAF as of its semi-annual period ended May 31, 2011; and (3) the pro forma fees and expenses of the Class A Shares of FAAF on a combined basis after giving effect to the Reorganization.

| Shareholder Fees (fees paid directly from your investment) | FBAF

Class A | FAAF

Class A | FAAF

Class A

Proforma

Combined |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | 5.50% | 5.50% | 5.50% |

| Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, as applicable) | 0.00% | 0.00% | 0.00% |

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends (and other Distributions) (as a percentage of offering price) | None | None | None |

| Redemption Fee (as a percentage of amount redeemed, if applicable) | None | None | None |

| Exchange Fee | None | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of

your investment) | | | |

| Management Fee | None | 0.66% | 0.67% |

| Distribution (12b-1) Fee | 0.05% | None | None |

| Other Expenses | 1.22% | 0.71% | 0.65% |

| Acquired Fund Fees and Expenses | 1.14% | 0.19% | 0.19% |

| Total Annual Fund Operating Expenses | 2.41% | 1.56% | 1.51% |

| Fee Waivers and/or Expense Reimbursements | 1.00%1 | 0.12%2 | 0.07%2 |

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements | 1.41% | 1.44% | 1.44% |

| | | |

| 1 | The Adviser and its affiliates have voluntarily agreed to waive their fees and/or reimburse expenses so that the total annual fund operating expenses (excluding Acquired Fund Fees and Expenses) paid by the Fund's Class A Shares (after the voluntary waivers and/or reimbursements) will not exceed 0.27% (the “Fee Limit”) through the later of (the “Termination Date”): January 31, 2012; or (b) the date of the Fund's next effective Prospectus. While the Adviser and its affiliates currently do not anticipate terminating or increasing these arrangements prior to the Termination Date, these arrangements may only be terminated or the Fee Limit increased prior to the Termination Date with the agreement of the Fund's Board. |

| 2 | The Adviser and its affiliates have voluntarily agreed to waive their fees and/or reimburse expenses so that the total annual fund operating expenses (excluding Acquired Fund Fees and Expenses and Dividends and Expenses Related to Short Sales) paid by the Fund's Class A Shares (after the voluntary waivers and/or reimbursements) will not exceed 1.25% (the “Fee Limit”) through the later of (the “Termination Date”): May 31, 2012 or (b) the date of the Fund's next effective Prospectus. While the Adviser and its affiliates currently do not anticipate terminating or increasing these arrangements prior to the Termination Date, these arrangements may only be terminated or the Fee Limit increased prior to the Termination Date with the agreement of the Fund's Board of Trustees. If this Reorganization is approved, the Termination date will be extended to the later of (a) September 30, 2012 or (b) the date of the Fund's next effective Prospectus. |

Example

This Example is intended to help you compare the cost of investing in the indicated Fund's Class A Shares with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Funds' Shares for the time periods indicated and then redeem all of your Shares at the end of those periods. Expenses assuming no redemption are also shown. The Example also assumes that your investment has a 5% return each year and that the Funds' operating expenses are as shown in the table and remain the same. Although your actual costs and returns may be higher or lower, based on these assumptions your costs would be:

| Fund | 1 Year | 3 Years | 5 Years | 10 Years |

| FBAF Class A Shares: | | | | |

| Expenses assuming redemption | $781 | $1,260 | $1,765 | $3,145 |

| Expenses assuming no redemption | $781 | $1,260 | $1,765 | $3,145 |

| FAAF Class A Shares: | | | | |

| Expenses assuming redemption | $700 | $1,016 | $1,353 | $2,304 |

| Expenses assuming no redemption | $700 | $1,016 | $1,353 | $2,304 |

| FAAF Class A Shares Pro Forma Combined: | | | | |

| Expenses assuming redemption | $695 | $1,001 | $1,328 | $2,252 |

| Expenses assuming no redemption | $695 | $1,001 | $1,328 | $2,252 |

Federated Balanced Allocation Fund Class B Shares -

Federated Asset Allocation Fund Class B Shares

Fees and Expenses

This table describes (1) the actual fees and expenses for the Class B Shares of FBAF as of its semi-annual period ended May 31, 2011; (2) the actual fees and expenses for the Class B Shares of FAAF as of its semi- annual period ended May 31, 2011; and (3) the pro forma fees and expenses of the Class B Shares of FAAF on a combined basis after giving effect to the Reorganization.

| Shareholder Fees (fees paid directly from your investment) | FBAF

Class B | FAAF

Class B | FAAF

Class B

Proforma

Combined |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | None | None | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, as applicable) | 5.50% | 5.50% | 5.50% |

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends (and other Distributions) (as a percentage of offering price) | None | None | None |

| Redemption Fee (as a percentage of amount redeemed, if applicable) | None | None | None |

| Exchange Fee | None | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of

your investment) | | | |

| Management Fee | None | 0.66% | 0.67% |

| Distribution (12b-1) Fee | 0.75% | 0.75% | 0.75% |

| Other Expenses | 1.22% | 0.77% | 0.68% |

| Acquired Fund Fees and Expenses | 1.14% | 0.19% | 0.19% |

| Total Annual Fund Operating Expenses | 3.11% | 2.37% | 2.29% |

| Fee Waivers and/or Expense Reimbursements | 0.95%1 | 0.13%2 | 0.05%2 |

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements | 2.16% | 2.24% | 2.24% |

| | | |

| 1 | The Adviser and its affiliates have voluntarily agreed to waive their fees and/or reimburse expenses so that the total annual fund operating expenses (excluding Acquired Fund Fees and Expenses) paid by the Fund's Class B Shares (after the voluntary waivers and/or reimbursements) will not exceed 1.02% (the “Fee Limit”) through the later of (the “Termination Date”): January 31, 2012; or (b) the date of the Fund's next effective Prospectus. While the Adviser and its affiliates currently do not anticipate terminating or increasing these arrangements prior to the Termination Date, these arrangements may only be terminated or the Fee Limit increased prior to the Termination Date with the agreement of the Fund's Board. |

| 2 | The Adviser and its affiliates have voluntarily agreed to waive their fees and/or reimburse expenses so that the total annual fund operating expenses (excluding Acquired Fund Fees and Expenses and Dividends and Expenses Related to Short Sales) paid by the Fund's Class B Shares (after the voluntary waivers and/or reimbursements) will not exceed 2.05% (the “Fee Limit”) through the later of (the “Termination Date”): January 31, 2012 or (b) the date of the Fund's next effective Prospectus. While the Adviser and its affiliates currently do not anticipate terminating or increasing these arrangements prior to the Termination Date, these arrangements may only be terminated or the Fee Limit increased prior to the Termination Date with the agreement of the Fund's Board of Trustees. If this Reorganization is approved, the Termination Date will be extended to the later of (a) September 30, 2012 or (b) the date of the Fund's next effective Prospectus. |

Example

This Example is intended to help you compare the cost of investing in the indicated Funds Class B Shares with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Funds' Shares for the time periods indicated and then redeem all of your Shares at the end of those periods. Expenses assuming no redemption are also shown. The Example also assumes that your investment has a 5% return each year and that the Funds' operating expenses are as shown in the table and remain the same. Although your actual costs and returns may be higher or lower, based on these assumptions your costs would be:

| Fund | 1 Year | 3 Years | 5 Years | 10 Years |

| FBAF Class B Shares: | | | | |

| Expenses assuming redemption | $864 | $1,360 | $1,830 | $3,259 |

| Expenses assuming no redemption | $314 | $960 | $1,630 | $3,259 |

| FAAF Class B Shares: | | | | |

| Expenses assuming redemption | $790 | $1,139 | $1,465 | $2,505 |

| Expenses assuming no redemption | $240 | $739 | $1,265 | $2,505 |

| FAAF Class B Shares Pro Forma Combined: | | | | |

| Expenses assuming redemption | $782 | $1,115 | $1,425 | $2,430 |

| Expenses assuming no redemption | $232 | $715 | $1,225 | $2,430 |

Federated Balanced Allocation Fund Class C Shares -

Federated Asset Allocation Fund Class C Shares

This table describes (1) the actual fees and expenses for the Class C Shares of FBAF as of its semi-annual period ended May 31, 2011; (2) the actual fees and expenses for the Class C Shares of FAAF as of its semi-annual period ended May 31, 2011; and (3) the pro forma fees and expenses of the Class C Shares of FAAF on a combined basis after giving effect to the Reorganization.

| Shareholder Fees (fees paid directly from your investment) | FBAF

Class C | FAAF

Class C | FAAF

Class C

Proforma

Combined |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | None | None | None |

| Maximum Deferred Sales Charge (Load) (as a percentage of original purchase price or redemption proceeds, as applicable) | 1.00% | 1.00% | 1.00% |

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends (and other Distributions) (as a percentage of offering price) | None | None | None |

| Redemption Fee (as a percentage of amount redeemed, if applicable) | None | None | None |

| Exchange Fee | None | None | None |

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of

your investment) | | | |

| Management Fee | None | 0.66% | 0.67% |

| Distribution (12b-1) Fee | 0.75% | 0.75% | 0.75% |

| Other Expenses | 1.22% | 0.72% | 0.66% |

| Acquired Fund Fees and Expenses | 1.14% | 0.19% | 0.19% |

| Total Annual Fund Operating Expenses | 3.11% | 2.32% | 2.27% |

| Fee Waivers and/or Expense Reimbursements | 0.95%1 | 0.08%2 | 0.03%2 |

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements | 2.16% | 2.24% | 2.24% |

| | | |

| 1 | The Adviser and its affiliates have voluntarily agreed to waive their fees and/or reimburse expenses so that the total annual fund operating expenses (excluding Acquired Fund Fees and Expenses) paid by the Fund's Class C Shares (after the voluntary waivers and/or reimbursements) will not exceed 1.02% (the “Fee Limit”) through the later of (the “Termination Date”): January 31, 2012; or (b) the date of the Fund's next effective Prospectus. While the Adviser and its affiliates currently do not anticipate terminating or increasing these arrangements prior to the Termination Date, these arrangements may only be terminated or the Fee Limit increased prior to the Termination Date with the agreement of the Fund's Board. |

| 2 | The Adviser and its affiliates have voluntarily agreed to waive their fees and/or reimburse expenses so that the total annual fund operating expenses (excluding Acquired Fund Fees and Expenses and Dividends and Expenses Related to Short Sales) paid by the Fund's Class C Shares (after the voluntary waivers and/or reimbursements) will not exceed 2.05% (the “Fee Limit”) through the later of (the “Termination Date”): January 31, 2012 or (b) the date of the Fund's next effective Prospectus. While the Adviser and its affiliates currently do not anticipate terminating or increasing these arrangements prior to the Termination Date, these arrangements may only be terminated or the Fee Limit increased prior to the Termination Date with the agreement of the Fund's Board of Trustees. If this Reorganization is approved, the Termination Date will be extended to the later of (a) September 30, 2012 or (b) the date of the Fund's next effective Prospectus. . |

Example

This Example is intended to help you compare the cost of investing in the indicated Funds Class C Shares with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Funds' Shares for the time periods indicated and then redeem all of your Shares at the end of those periods. Expenses assuming no redemption are also shown. The Example also assumes that your investment has a 5% return each year and that the Funds' operating expenses are as shown in the table and remain the same. Although your actual costs and returns may be higher or lower, based on these assumptions your costs would be:

| Fund | 1 Year | 3 Years | 5 Years | 10 Years |

| FBAF Class C Shares: | | | | |

| Expenses assuming redemption | $414 | $960 | $1,630 | $3,420 |

| Expenses assuming no redemption | $314 | $960 | $1,630 | $3,420 |

| FAAF Class C Shares: | | | | |

| Expenses assuming redemption | $335 | $724 | $1,240 | $2,656 |

| Expenses assuming no redemption | $235 | $724 | $1,240 | $2,656 |

| FAAF Class C Shares Pro Forma Combined: | | | | |

| Expenses assuming redemption | $330 | $709 | $1,215 | $2,605 |

| Expenses assuming no redemption | $230 | $709 | $1,215 | $2,605 |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund Shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect each Fund's performance. During the most recent fiscal year, FAAF's portfolio turnover rate was 184% and FBAF's portfolio turnover rate was 9% of the average value of each Fund's respective portfolio.

COMPARISON OF POTENTIAL RISKS AND REWARDS: PERFORMANCE INFORMATION

The performance information shown below will help you analyze FBAF's and FAAF's investment risks in light of their historical returns. The bar charts compare the potential risks and rewards of investing in each Fund. The bar charts provide an indication of the risks of investing in each Fund by showing the variability of each Fund's performance on a calendar year-to-year basis.

The average annual total return tables show returns averaged over the stated periods, and include comparative performance information. The tables show how the Funds' average annual total returns for one year, five years and ten years (or start of performance if shorter) compare to the returns of a broad-based securities market index. The average annual total returns are reduced to reflect applicable sales charges. In addition to Return Before Taxes, Return After Taxes is shown to illustrate the effect of federal taxes on returns. Actual after tax returns depend upon each investor's personal tax situation, and are likely to differ from those shown. The tables also show returns for the applicable Fund's broad-based securities market index. Index returns do not reflect taxes, sales charges, expenses or other fees that the SEC requires to be reflected in a fund's performance. The indexes are unmanaged and, unlike the Funds, are not affected by cash flows. It is not possible to invest directly in the indexes.

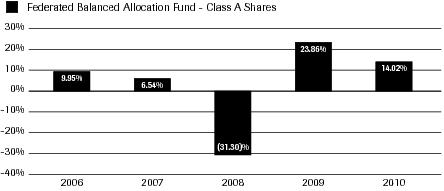

Federated Balanced Allocation Fund – Class A Shares, Class B Shares and Class C Shares Risk/Return Bar Chart and Table

FBAF commenced operations on December 23, 2005 and offers three classes of shares, Class A Shaares, Class B Shares and Class C Shares. The bar chart and performance table below reflect historical performance data for FBAF and are intended to help you analyze FBAF's investment risks in light of its historical returns. The bar chart shows the variability of FBAF's Class A Shares total returns on a calendar year-by-year basis. The Average Annual Total Return table shows returns averaged over the stated periods, and includes comparative performance information. FBAF 's performance will fluctuate, and past performance (before and after taxes) is not necessarily an indication of future results. Updated performance information for FBAF is available under the “Products” section at FederatedInvestors.com or by calling 1-800-341-7400.

| Federated Balanced Allocation Fund - | Class A Shares |

41 graphic description end -->

The total returns shown in the bar chart do not reflect the payment of any sales charges or recurring shareholder account fees. It these charges or fees had been included, the returns shown would have been lower.

Within the periods shown in the bar chart, the Fund's Class A Shares highest quarterly return was 14.44% (quarter ended June 30, 2009). Its lowest quarterly return was (15.99)% (quarter ended December 31, 2008).

Average Annual Total Return Table

In addition to Return Before Taxes, Return After Taxes is shown for FBAF's Class A Shares to illustrate the effect of federal taxes on Fund returns. After-tax returns are shown only for Class A Shares, and after-tax returns for Class B Shares and Class C Shares will differ from those for Class A Shares. Actual after-tax returns depend on each investor's personal tax situation, and are likely to differ from those shown. After-tax returns are calculated using a standard set of assumptions. The stated returns assume the highest historical federal income and capital gains tax rates. These after-tax returns do not reflect the effect of any applicable state and local taxes. After-tax returns are not relevant to investors holding Shares through tax-deferred programs, such as IRA or 401(k) plans.

(For the Period Ended December 31, 2010)

| 1 Year | 5 Years | Since Inception

(12/23/2005) |

| Class A Shares: | | | |

| Return Before Taxes | 7.70% | 1.44% | 1.43% |

| Return After Taxes on Distributions | 7.16% | 0.34% | 0.34% |

| Return After Taxes on Distributions and Sale of Fund Shares | 5.00% | 0.99% | 0.98% |

| Class B Shares: | | | |

| Return Before Taxes | 7.74% | 1.57% | 1.72% |

| Class C Shares: | | | |

| Return Before Taxes | 12.01% | 1.89% | 1.88% |

Barclays Capital U.S. Intermediate Credit Index1

(reflects no deduction for fees, expenses or taxes) | 7.76% | 6.03% | 6.00% |

Standard & Poor's 500 Index2

(reflects no deduction for fees, expenses or taxes) | 15.06% | 2.29% | 1.95% |

| 1 | Barclays Capital U.S. Intermediate Credit Index is an unmanaged index that consists of dollar-denominated, investment-grade, publicly-issued securities with a maturity of between one and ten years, a minimum amount outstanding of $250 million, and that are issued by both corporate issuers and non-corporate issuers (supranationals, sovereigns, foreign agencies and foreign local governments). |

| 2 | Standard and Poor's 500 Index is an unmanaged capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. |

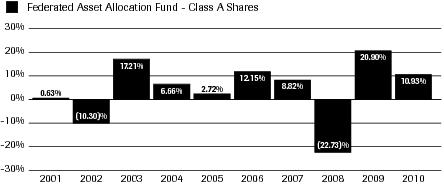

Federated Asset Allocation Fund – Class A Shares, Class B Shares and Class C Shares

Risk/Return Bar Chart and Table