United States Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-1

(Investment Company Act File Number)

Federated Hermes Global Allocation Fund

(Exact Name of Registrant as Specified in Charter)

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, PA 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant’s Telephone Number)

Peter J. Germain, Esquire

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 2024-11-30

Date of Reporting Period: Six months ended 2024-05-31

| Item 1. | Reports to Stockholders |

Federated Hermes Global Allocation Fund

Class R6 Shares FSBLX

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about the Federated Hermes Global Allocation Fund (the "Fund") for the period of December 1, 2023 to May 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Class R6 Shares | $43 | 0.83% |

Key Fund Statistics

| Net Assets | $281,378,320 |

| Number of Investments | 1,232 |

| Portfolio Turnover | 52% |

Fund Holdings

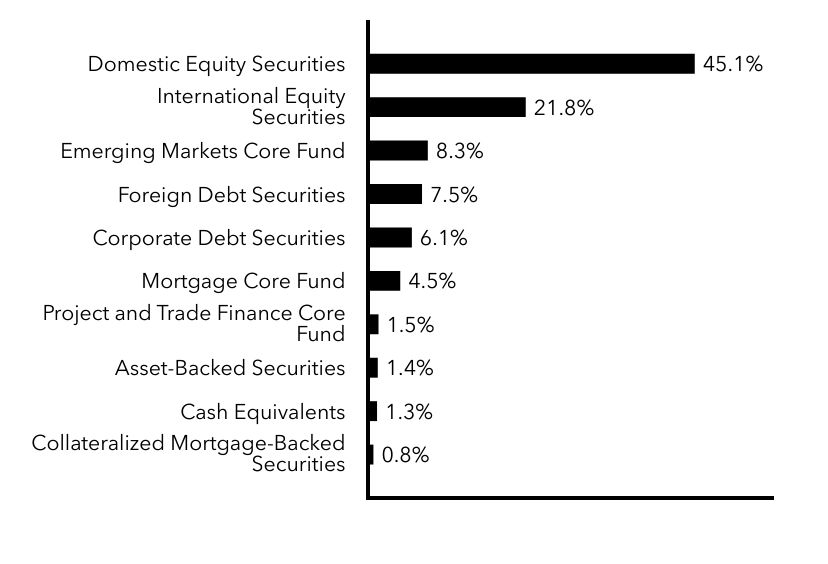

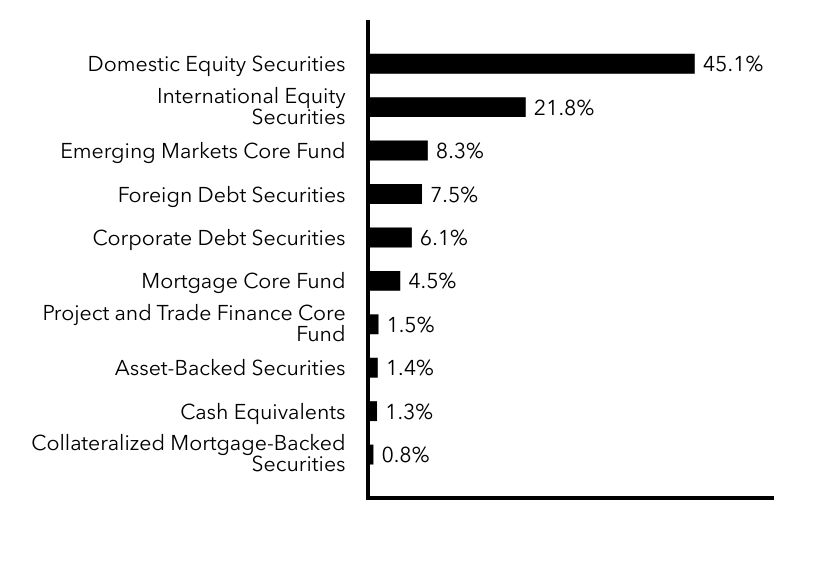

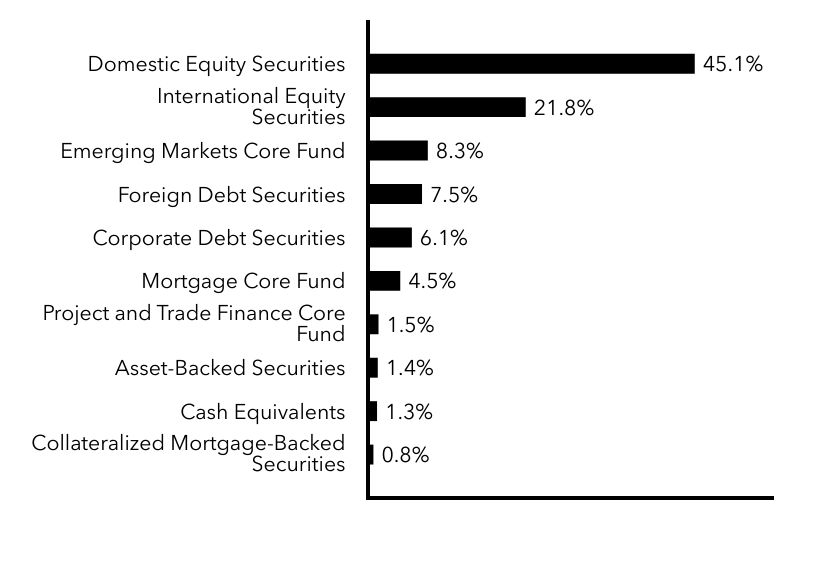

Top Security Types (% of Net Assets)

| Value | Value |

|---|---|

| Collateralized Mortgage-Backed Securities | 0.8% |

| Cash Equivalents | 1.3% |

| Asset-Backed Securities | 1.4% |

| Project and Trade Finance Core Fund | 1.5% |

| Mortgage Core Fund | 4.5% |

| Corporate Debt Securities | 6.1% |

| Foreign Debt Securities | 7.5% |

| Emerging Markets Core Fund | 8.3% |

| International Equity Securities | 21.8% |

| Domestic Equity Securities | 45.1% |

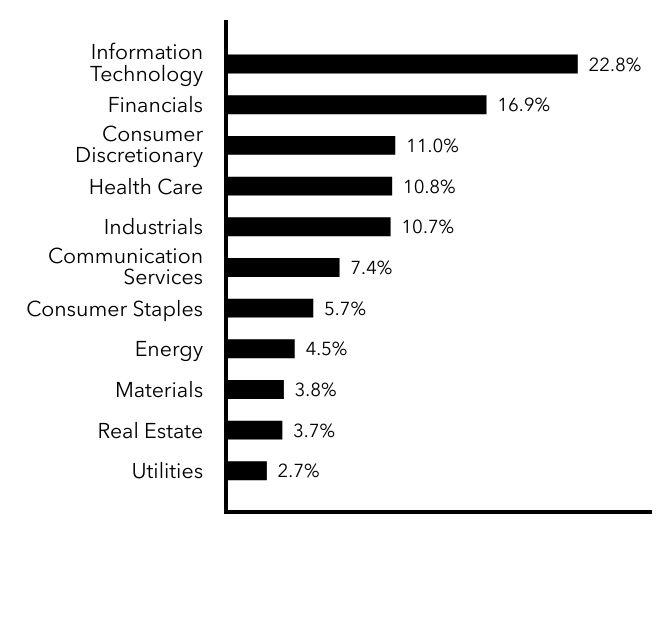

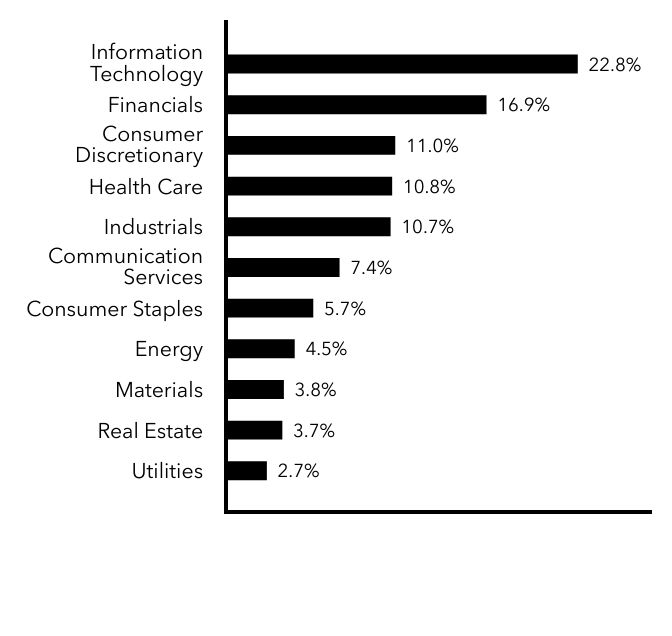

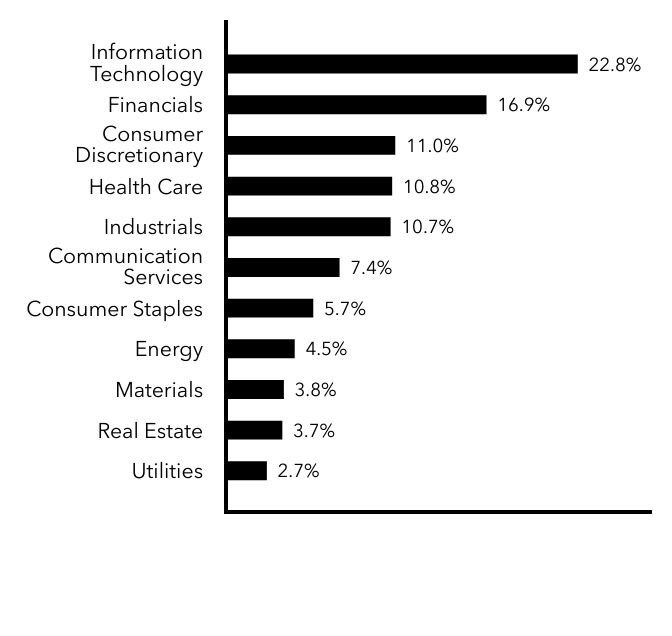

Top Sectors - Equity (% of Equity Securities)

| Value | Value |

|---|---|

| Utilities | 2.7% |

| Real Estate | 3.7% |

| Materials | 3.8% |

| Energy | 4.5% |

| Consumer Staples | 5.7% |

| Communication Services | 7.4% |

| Industrials | 10.7% |

| Health Care | 10.8% |

| Consumer Discretionary | 11.0% |

| Financials | 16.9% |

| Information Technology | 22.8% |

Semi-Annual Shareholder Report

Federated Hermes Global Allocation Fund

Additional Information about the Fund

Additional information is available on the Fund’s website at www.FederatedHermes.com/us/FundInformation, including its:

• prospectus • financial information • holdings • proxy voting information

CUSIP 314183609

8080105-E (07/24)

Federated Securities Corp., Distributor

www.federatedhermes.com/us

© 2024 Federated Hermes, Inc.

Federated Hermes Global Allocation Fund

Class A Shares FSTBX

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about the Federated Hermes Global Allocation Fund (the "Fund") for the period of December 1, 2023 to May 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Class A Shares | $60 | 1.14% |

Key Fund Statistics

| Net Assets | $281,378,320 |

| Number of Investments | 1,232 |

| Portfolio Turnover | 52% |

Fund Holdings

Top Security Types (% of Net Assets)

| Value | Value |

|---|---|

| Collateralized Mortgage-Backed Securities | 0.8% |

| Cash Equivalents | 1.3% |

| Asset-Backed Securities | 1.4% |

| Project and Trade Finance Core Fund | 1.5% |

| Mortgage Core Fund | 4.5% |

| Corporate Debt Securities | 6.1% |

| Foreign Debt Securities | 7.5% |

| Emerging Markets Core Fund | 8.3% |

| International Equity Securities | 21.8% |

| Domestic Equity Securities | 45.1% |

Top Sectors - Equity (% of Equity Securities)

| Value | Value |

|---|---|

| Utilities | 2.7% |

| Real Estate | 3.7% |

| Materials | 3.8% |

| Energy | 4.5% |

| Consumer Staples | 5.7% |

| Communication Services | 7.4% |

| Industrials | 10.7% |

| Health Care | 10.8% |

| Consumer Discretionary | 11.0% |

| Financials | 16.9% |

| Information Technology | 22.8% |

Semi-Annual Shareholder Report

Federated Hermes Global Allocation Fund

Additional Information about the Fund

Additional information is available on the Fund’s website at www.FederatedHermes.com/us/FundInformation, including its:

• prospectus • financial information • holdings • proxy voting information

CUSIP 314183104

8080105-A (07/24)

Federated Securities Corp., Distributor

www.federatedhermes.com/us

© 2024 Federated Hermes, Inc.

Federated Hermes Global Allocation Fund

Class C Shares FSBCX

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about the Federated Hermes Global Allocation Fund (the "Fund") for the period of December 1, 2023 to May 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Class C Shares | $101 | 1.93% |

Key Fund Statistics

| Net Assets | $281,378,320 |

| Number of Investments | 1,232 |

| Portfolio Turnover | 52% |

Fund Holdings

Top Security Types (% of Net Assets)

| Value | Value |

|---|---|

| Collateralized Mortgage-Backed Securities | 0.8% |

| Cash Equivalents | 1.3% |

| Asset-Backed Securities | 1.4% |

| Project and Trade Finance Core Fund | 1.5% |

| Mortgage Core Fund | 4.5% |

| Corporate Debt Securities | 6.1% |

| Foreign Debt Securities | 7.5% |

| Emerging Markets Core Fund | 8.3% |

| International Equity Securities | 21.8% |

| Domestic Equity Securities | 45.1% |

Top Sectors - Equity (% of Equity Securities)

| Value | Value |

|---|---|

| Utilities | 2.7% |

| Real Estate | 3.7% |

| Materials | 3.8% |

| Energy | 4.5% |

| Consumer Staples | 5.7% |

| Communication Services | 7.4% |

| Industrials | 10.7% |

| Health Care | 10.8% |

| Consumer Discretionary | 11.0% |

| Financials | 16.9% |

| Information Technology | 22.8% |

Semi-Annual Shareholder Report

Federated Hermes Global Allocation Fund

Additional Information about the Fund

Additional information is available on the Fund’s website at www.FederatedHermes.com/us/FundInformation, including its:

• prospectus • financial information • holdings • proxy voting information

CUSIP 314183302

8080105-B (07/24)

Federated Securities Corp., Distributor

www.federatedhermes.com/us

© 2024 Federated Hermes, Inc.

Federated Hermes Global Allocation Fund

Institutional Shares SBFIX

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about the Federated Hermes Global Allocation Fund (the "Fund") for the period of December 1, 2023 to May 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Institutional Shares | $45 | 0.85% |

Key Fund Statistics

| Net Assets | $281,378,320 |

| Number of Investments | 1,232 |

| Portfolio Turnover | 52% |

Fund Holdings

Top Security Types (% of Net Assets)

| Value | Value |

|---|---|

| Collateralized Mortgage-Backed Securities | 0.8% |

| Cash Equivalents | 1.3% |

| Asset-Backed Securities | 1.4% |

| Project and Trade Finance Core Fund | 1.5% |

| Mortgage Core Fund | 4.5% |

| Corporate Debt Securities | 6.1% |

| Foreign Debt Securities | 7.5% |

| Emerging Markets Core Fund | 8.3% |

| International Equity Securities | 21.8% |

| Domestic Equity Securities | 45.1% |

Top Sectors - Equity (% of Equity Securities)

| Value | Value |

|---|---|

| Utilities | 2.7% |

| Real Estate | 3.7% |

| Materials | 3.8% |

| Energy | 4.5% |

| Consumer Staples | 5.7% |

| Communication Services | 7.4% |

| Industrials | 10.7% |

| Health Care | 10.8% |

| Consumer Discretionary | 11.0% |

| Financials | 16.9% |

| Information Technology | 22.8% |

Semi-Annual Shareholder Report

Federated Hermes Global Allocation Fund

Additional Information about the Fund

Additional information is available on the Fund’s website at www.FederatedHermes.com/us/FundInformation, including its:

• prospectus • financial information • holdings • proxy voting information

CUSIP 314183500

8080105-D (07/24)

Federated Securities Corp., Distributor

www.federatedhermes.com/us

© 2024 Federated Hermes, Inc.

Federated Hermes Global Allocation Fund

Class R Shares FSBKX

Semi-Annual Shareholder Report - May 31, 2024

This semi-annual shareholder report contains important information about the Federated Hermes Global Allocation Fund (the "Fund") for the period of December 1, 2023 to May 31, 2024. You can find additional information at www.FederatedHermes.com/us/FundInformation. You can also request this information by contacting us at 1-800-341-7400, Option 4, or your financial advisor.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Cost of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

| Class R Shares | $82 | 1.57% |

Key Fund Statistics

| Net Assets | $281,378,320 |

| Number of Investments | 1,232 |

| Portfolio Turnover | 52% |

Fund Holdings

Top Security Types (% of Net Assets)

| Value | Value |

|---|---|

| Collateralized Mortgage-Backed Securities | 0.8% |

| Cash Equivalents | 1.3% |

| Asset-Backed Securities | 1.4% |

| Project and Trade Finance Core Fund | 1.5% |

| Mortgage Core Fund | 4.5% |

| Corporate Debt Securities | 6.1% |

| Foreign Debt Securities | 7.5% |

| Emerging Markets Core Fund | 8.3% |

| International Equity Securities | 21.8% |

| Domestic Equity Securities | 45.1% |

Top Sectors - Equity (% of Equity Securities)

| Value | Value |

|---|---|

| Utilities | 2.7% |

| Real Estate | 3.7% |

| Materials | 3.8% |

| Energy | 4.5% |

| Consumer Staples | 5.7% |

| Communication Services | 7.4% |

| Industrials | 10.7% |

| Health Care | 10.8% |

| Consumer Discretionary | 11.0% |

| Financials | 16.9% |

| Information Technology | 22.8% |

Semi-Annual Shareholder Report

Federated Hermes Global Allocation Fund

Additional Information about the Fund

Additional information is available on the Fund’s website at www.FederatedHermes.com/us/FundInformation, including its:

• prospectus • financial information • holdings • proxy voting information

CUSIP 314183401

8080105-C (07/24)

Federated Securities Corp., Distributor

www.federatedhermes.com/us

© 2024 Federated Hermes, Inc.

| Item 2. | Code of Ethics |

Not Applicable

| Item 3. | Audit Committee Financial Expert |

Not Applicable

| Item 4. | Principal Accountant Fees and Services |

Not Applicable

| Item 5. | Audit Committee of Listed Registrants |

Not Applicable

| Item 6. | Schedule of Investments |

(a) The registrant’s Schedule of Investments is included as part of the Financial Statements filed under Item 7 of this form.

(b) Not Applicable.

| Item 7. | Financial Statements and Financial Highlights for Open-End Management Companies |

and Additional Information

Share Class | Ticker | A | FSTBX | C | FSBCX | R | FSBKX |

Institutional | SBFIX | R6 | FSBLX |

Federated Hermes Global Allocation Fund

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—66.9% | |||

Communication Services—4.9% | |||

4 | 1 | Advantage Solutions, Inc. | $ 14 |

14,905 | 1 | Alphabet, Inc., Class A | 2,571,112 |

12,710 | 1 | Alphabet, Inc., Class C | 2,211,032 |

16,939 | AT&T, Inc. | 308,629 | |

59,000 | Axiata Group BHD | 35,187 | |

9,939 | Bharti Airtel Ltd. | 163,465 | |

107 | 1 | Cinemark Holdings, Inc. | 1,848 |

6,770 | Deutsche Telekom AG, Class REG | 164,090 | |

55,400 | Digi Swisscom Berhad | 44,856 | |

4,419 | Electronic Arts, Inc. | 587,197 | |

312 | Elisa Communications Oyj | 14,454 | |

3 | 1 | Eventbrite, Inc. | 15 |

72,300 | Focus Media Information Technology Co. Ltd. | 63,315 | |

572 | 1 | Frontier Communications Parent, Inc. | 15,250 |

2 | Gray Television, Inc. | 12 | |

421 | Hellenic Telecommunication Organization SA | 6,142 | |

189,000 | HKT Trust and HKT Ltd. | 220,173 | |

3,574 | Informa PLC | 38,955 | |

285 | 1 | Iridium Communications, Inc. | 8,581 |

2,300 | Konami Corp. | 161,015 | |

25,782 | Koninklijke KPN NV | 96,358 | |

2,424 | KT Corp. | 63,995 | |

34,800 | 1 | Kuaishou Technology | 248,312 |

6,556 | LG Uplus Corp. | 45,796 | |

4,693 | 1 | Liberty Latin America Ltd. | 42,565 |

43 | 1 | Liberty Media Corp. OLD | 1,575 |

2,221 | 1 | Lions Gate Entertainment Corp. | 17,146 |

3,270 | 1 | Live Nation Entertainment, Inc. | 306,530 |

300 | 1 | Madison Square Garden Spinco | 10,662 |

5,869 | 1 | Meta Platforms, Inc. | 2,739,825 |

8,578 | NetEase, Inc. | 152,185 | |

536 | 1 | Netflix, Inc. | 343,908 |

910 | PLDT, Inc. | 22,965 | |

1,323 | Publicis Groupe | 148,819 | |

3,693 | Quebecor, Inc., Class B | 77,900 | |

168 | Realestate.com.au Ltd. | 21,034 | |

1,011 | Shutterstock, Inc. | 41,077 | |

22,900 | SoftBank Corp. | 274,948 | |

2,900 | SoftBank Group Corp. | 167,860 | |

3,984 | Spark New Zealand Ltd. | 10,216 | |

1,026 | 1 | Spotify Technology S.A. | 304,496 |

21 | Swisscom AG | 11,603 | |

2,595 | Tegna, Inc. | 38,691 | |

1,382 | Telenor ASA | 16,157 | |

10,948 | Telstra Group LTD. | 25,403 | |

18,096 | Tencent Holdings Ltd. | 839,469 | |

14,327 | TIM S.A./Brazil | 43,274 | |

1,158 | 1 | T-Mobile USA, Inc. | 202,604 |

4,092 | 1 | Trade Desk, Inc./The | 379,656 |

9,962 | Verizon Communications, Inc. | 409,936 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Communication Services—continued | |||

3 | 1 | Vimeo Holdings, Inc. | $ 12 |

3 | 1 | Vivid Seats, Inc. | 15 |

2,447 | Vodafone Group PLC | 2,380 | |

11,395 | WPP PLC | 119,479 | |

2,724 | 1 | ZipRecruiter, Inc. | 27,540 |

TOTAL | 13,869,733 | ||

Consumer Discretionary—7.4% | |||

306 | 1 | Abercrombie & Fitch Co., Class A | 52,898 |

692 | Academy Sports and Outdoors, Inc. | 39,921 | |

766 | Acushnet Holdings Corp. | 50,479 | |

68,208 | 1 | Alibaba Group Holding Ltd. | 667,589 |

22,886 | 1 | Amazon.com, Inc. | 4,038,006 |

1,740 | American Eagle Outfitters, Inc. | 38,228 | |

640 | 1 | Aptiv PLC | 53,286 |

6,865 | Aristocrat Leisure Ltd. | 206,727 | |

75 | 1 | AutoZone, Inc. | 207,745 |

2,501 | Bayerische Motoren Werke AG | 253,092 | |

2,555 | Berkeley Group Holdings PLC | 172,244 | |

58 | 1 | Birkenstock Holding Ltd. | 3,306 |

292 | Bloomin Brands, Inc. | 6,366 | |

550 | BorgWarner, Inc. | 19,613 | |

5,800 | Bridgestone Corp. | 252,749 | |

4,790 | Burberry Group PLC | 63,430 | |

12,070 | BYD Co. Ltd. | 339,501 | |

2,800 | BYD Co. Ltd. | 88,731 | |

1,279 | Canadian Tire Corp. Ltd. | 127,661 | |

743 | 1 | Carvana Co. | 74,285 |

20,226 | Chongqing Changan Automobile Co. Ltd. | 38,524 | |

1,697 | 1 | Churchill Capital Corp. IV | 4,819 |

1,231 | Cie Financiere Richemont S.A. | 197,719 | |

859 | 1 | Dave & Buster’s Entertainment, Inc. | 43,886 |

47 | D’ieteren Group | 10,270 | |

17 | Dillards, Inc., Class A | 7,605 | |

615 | Dollarama, Inc. | 58,208 | |

1,418 | eBay, Inc. | 76,884 | |

3,000 | Eclat Textile Co. Ltd. | 44,987 | |

3,784 | 1 | Everi Holdings, Inc. | 27,358 |

2,076 | Evolution AB | 223,698 | |

4,362 | 1 | Expedia Group, Inc. | 492,295 |

753 | Ferrari NV | 309,630 | |

9,273 | Ford Motor Co. | 112,481 | |

211 | Ford Otomotiv Sanayi A.S. | 7,157 | |

7,600 | Fuyao Glass Industry Group Co. Ltd. | 43,071 | |

29,000 | Geely Automobile Holdings Ltd. | 35,246 | |

2,722 | General Motors Co. | 122,463 | |

550 | Gentex Corp. | 19,250 | |

836 | 1 | Green Brick Partners, Inc. | 45,646 |

9,000 | Haier Smart Home Co. Ltd. | 36,728 | |

444 | Hankook Tire Co. Ltd. | 14,055 | |

294 | Harley-Davidson, Inc. | 10,549 | |

116 | Hermes International | 274,914 | |

388 | 1 | Hilton Grand Vacations, Inc. | 16,036 |

2 | 1 | Holley, Inc. | 8 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Consumer Discretionary—continued | |||

3,454 | Home Depot, Inc. | $ 1,156,641 | |

1,800 | Huizhou Desay Sv Automotive Co. | 25,042 | |

1,100 | Hulic Co., Ltd. | 10,227 | |

335 | Hyundai Motor Co. | 61,696 | |

12,903 | Indian Hotels Co. Ltd. | 86,947 | |

5,876 | Industria de Diseno Textil S.A. | 279,923 | |

6 | Installed Building Products, Inc. | 1,271 | |

122 | InterContinental Hotels Group PLC | 12,377 | |

2,559 | International Game Technology PLC | 50,515 | |

97 | Jack in the Box, Inc. | 5,370 | |

15,031 | 1 | JD.com, Inc. | 221,550 |

259 | Jumbo S.A. | 7,441 | |

880 | KB HOME | 62,128 | |

1,227 | Kia Corp. | 104,840 | |

969 | La Francaise des Jeux SAEM | 34,858 | |

2 | La-Z-Boy, Inc. | 75 | |

137 | Lear Corp. | 17,173 | |

3,611 | Lennar Corp., Class A | 579,024 | |

2,699 | Lennar Corp., Class B | 394,756 | |

7,500 | 1 | Li Auto, Inc. | 76,439 |

796 | 1 | Light & Wonder, Inc. | 76,002 |

423 | 1 | Lululemon Athletica, Inc. | 131,972 |

373 | LVMH Moet Hennessy Louis Vuitton S.A. | 299,740 | |

1 | Magna International, Inc. | 45 | |

535 | Marriott International, Inc., Class A | 123,676 | |

5,401 | Marriott Vacations Worldwide Corp. | 487,548 | |

824 | Maruti Suzuki India Ltd. | 123,073 | |

17,814 | 1 | Meituan | 241,372 |

2,272 | Mercedes-Benz Group AG | 163,844 | |

14,467 | MGM Resorts International | 581,139 | |

6,712 | Michelin, Class B | 271,149 | |

8,600 | Midea Group Co., Ltd. | 76,893 | |

14,600 | 1 | MINISO Group Holding Ltd. | 82,926 |

1,629 | 1 | Mohawk Industries, Inc. | 198,624 |

2 | Naspers Ltd., Class N | 400 | |

979 | Next PLC | 117,263 | |

242 | 1 | ODP Corp./The | 9,477 |

414 | OPAP S.A. | 6,589 | |

264 | Oxford Industries, Inc. | 29,222 | |

1,945 | 1,2 | Ozon Holdings PLC, ADR | 0 |

25,400 | Panasonic Holdings Corp. | 223,954 | |

1,503 | Pandora A/S | 247,158 | |

466 | Patrick Industries, Inc. | 53,404 | |

3,945 | Pearson PLC | 48,007 | |

106 | 1 | Phinia, Inc. | 4,745 |

3,808 | 1 | Prosus NV | 139,600 |

408 | Pulte Group, Inc. | 47,867 | |

769 | 1 | QuantumScape Corp. | 4,545 |

1,580 | 1 | Rivian Automotive, Inc. | 17,254 |

22,052 | Samvardhana Motherson International Ltd. | 39,941 | |

14,600 | Sekisui Chemical Co. | 209,587 | |

3,300 | Sekisui House Ltd. | 74,254 | |

410 | Signet Jewelers Ltd. | 44,891 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Consumer Discretionary—continued | |||

425 | 1 | Six Flags Entertainment Corp. | $ 10,816 |

10,170 | Sona Blw Precision Forgings Ltd. | 79,432 | |

5,200 | Sony Group Corp. | 427,353 | |

2 | Starbucks Corp. | 160 | |

13,850 | Stellantis N.V. | 306,311 | |

4 | 1 | Super Group SGHC Ltd. | 14 |

10,167 | Tata Motors Ltd. | 112,427 | |

10,619 | Tata Motors Ltd. | 78,978 | |

933 | 1 | Taylor Morrison Home Corp. | 53,955 |

6,532 | 1 | Tesla, Inc. | 1,163,219 |

27,659 | The Wendy’s Co. | 482,650 | |

120 | Thor Industries, Inc. | 11,909 | |

2,526 | Titan Industries Ltd. | 98,443 | |

8,490 | TJX Cos., Inc. | 875,319 | |

14,700 | Toyota Motor Corp. | 319,171 | |

1,346 | Travel + Leisure Co. | 59,143 | |

430 | 1 | Tri Pointe Homes, Inc. | 16,654 |

947 | 1 | United Parks & Resorts, Inc. | 49,519 |

2 | 1 | Urban Outfitters, Inc. | 83 |

372 | 1 | Visteon Corp. | 41,430 |

270 | Winnebago Industries, Inc. | 16,753 | |

492 | Worthington Industries, Inc. | 28,059 | |

4,000 | Yamaha Corp. | 90,410 | |

491 | Yum China Holding, Inc. | 17,558 | |

1 | 1 | Zomato Ltd. | 2 |

TOTAL | 20,733,566 | ||

Consumer Staples—3.8% | |||

3,600 | Ajinomoto Co., Inc. | 128,644 | |

154,000 | 1 | Alibaba Health Information Technology Ltd. | 65,011 |

648 | Alimentation Couche-Tard, Inc. | 37,821 | |

16,667 | Altria Group, Inc. | 770,849 | |

38,397 | Ambev S.A. | 84,532 | |

1,903 | Anheuser-Busch InBev NV | 119,863 | |

7,619 | Arca Continental, S.A.B. de C.V. | 78,105 | |

10,553 | Archer-Daniels-Midland Co. | 658,929 | |

534 | 1 | Bellring Brands, Inc. | 31,063 |

3,964 | Bid Corp. Ltd. | 88,291 | |

4,716 | BIM Birlesik Magazalar AS | 70,387 | |

567 | Cal-Maine Foods, Inc. | 34,967 | |

1 | Carlsberg A/S, Class B | 135 | |

179 | Carrefour S.A. | 2,919 | |

118 | 1 | Chefs Warehouse, Inc. | 4,652 |

1 | Chocoladefabriken Lindt & Sprungli AG | 119,125 | |

56 | Coca-Cola Bottling Co. | 54,938 | |

336 | Coca-Cola Europacific Partners PLC | 24,767 | |

4,447 | Coca-Cola Femsa S.A.B. de C.V. | 41,531 | |

295 | Costco Wholesale Corp. | 238,918 | |

1,114 | Danone S.A. | 71,674 | |

8,817 | Diageo PLC | 297,372 | |

679 | Dollar General Corp. | 92,962 | |

12,000 | 1 | East Buy Holding Ltd. | 28,233 |

413 | 1 | elf Beauty, Inc. | 77,194 |

520 | Energizer Holdings, Inc. | 14,882 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Consumer Staples—continued | |||

9,078 | General Mills, Inc. | $ 624,113 | |

959 | Henkel AG & Co. KGAA | 76,749 | |

10,003 | Imperial Brands PLC | 248,301 | |

49 | Ingles Markets, Inc., Class A | 3,584 | |

21,598 | ITC Ltd. | 110,527 | |

23,000 | 1 | JD Health International, Inc. | 77,460 |

622 | Jeronimo Martins SGPS S.A. | 13,932 | |

1,400 | Kao Corp. | 61,389 | |

27,984 | 1 | Kenvue, Inc. | 540,091 |

346 | Kerry Group PLC | 29,206 | |

598 | Kesko | 10,911 | |

15,500 | Kirin Holdings Co., Ltd. | 214,466 | |

4,640 | Koninklijke Ahold NV | 144,007 | |

451 | Korea Tobacco & Ginseng Corp. | 27,249 | |

2,960 | Kroger Co. | 155,015 | |

1,604 | Loblaw Cos. Ltd. | 186,297 | |

721 | L’Oreal S.A. | 355,756 | |

1 | Lotus Bakeries | 10,634 | |

9,678 | Mondelez International, Inc. | 663,233 | |

1,026 | Mowi ASA | 18,424 | |

5,401 | Nestle S.A. | 571,859 | |

2,200 | Nongfu Spring Co. Ltd. | 11,731 | |

1,544 | Orkla ASA | 12,344 | |

164 | PepsiCo, Inc. | 28,356 | |

1 | 1 | Post Holdings, Inc. | 107 |

88 | PriceSmart, Inc. | 7,405 | |

2,281 | Primo Water Corp. | 51,459 | |

5,507 | Procter & Gamble Co. | 906,122 | |

145 | Salmar ASA | 8,881 | |

1,300 | Shanxi Xinghuacun Fen Wine Factory Co. Ltd. | 43,374 | |

6,944 | Shoprite Holdings Ltd. | 92,362 | |

119 | SpartanNash Co. | 2,338 | |

343 | 1 | Sprouts Farmers Market, Inc. | 27,090 |

3,528 | Sysco Corp. | 256,909 | |

4,474 | Target Corp. | 698,660 | |

69,844 | Tesco PLC | 278,212 | |

115 | The Anderson’s, Inc. | 6,019 | |

2,705 | The Coca-Cola Co. | 170,226 | |

1,606 | Unilever PLC | 87,996 | |

200 | 1 | United Natural Foods, Inc. | 2,402 |

361 | Vector Group Ltd. | 3,960 | |

208 | 1 | Vita Coco Co., Inc./The | 6,055 |

10,094 | WalMart, Inc. | 663,781 | |

57 | Weis Markets, Inc. | 3,736 | |

4,443 | Woolworth’s Ltd. | 93,651 | |

TOTAL | 10,844,143 | ||

Energy—3.0% | |||

700 | Aker BP ASA | 18,069 | |

3,139 | Ampol Ltd. | 72,549 | |

1,253 | Ardmore Shipping Corp. | 28,080 | |

12,527 | 1 | Bharat Petroleum Corp. Ltd. | 94,985 |

21,680 | BP PLC | 135,792 | |

97 | California Resources Corp. | 4,593 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Energy—continued | |||

3,304 | Canadian Natural Resources Ltd. | $ 253,809 | |

4,689 | Chevron Corp. | 761,025 | |

318 | Chord Energy Corp. | 58,960 | |

1 | Coal India Ltd. | 6 | |

558 | CONSOL Energy, Inc. | 57,848 | |

4,210 | DHT Maritime, Inc. | 50,941 | |

20,900 | ENEOS Holdings, Inc. | 108,027 | |

1,995 | Equinor ASA | 57,978 | |

14,075 | Exxon Mobil Corp. | 1,650,435 | |

1,026 | Galp Energia, SGPS S.A. | 21,621 | |

2 | 1 | Gulfport Energy Corp. | 324 |

1,429 | Helmerich & Payne, Inc. | 54,388 | |

270 | Hyundai Robotics Co. Ltd. | 13,385 | |

3,326 | Imperial Oil Ltd. | 235,000 | |

897 | International Seaways, Inc. | 57,785 | |

3 | 1 | Kosmos Energy Ltd. | 18 |

2,514 | Liberty Energy, Inc. | 62,071 | |

3,869 | Marathon Petroleum Corp. | 683,304 | |

1,003 | MOL Hungarian Oil & Gas PLC | 7,796 | |

149 | Motor Oil (Hellas) Corinth Refineries S.A. | 4,220 | |

1,285 | Murphy Oil Corp. | 54,985 | |

927 | Neste Oyj | 19,356 | |

9,850 | Nordic American Tankers Ltd. | 40,779 | |

1 | Oil & Natural Gas Corp. Ltd. | 3 | |

323 | OMV AG | 16,272 | |

3,546 | ORLEN S.A. | 57,275 | |

1,146 | PBF Energy, Inc. | 53,094 | |

2,016 | Peabody Energy Corp. | 49,956 | |

287,177 | PetroChina Co. Ltd. | 293,105 | |

58,100 | PetroChina Co. Ltd. | 81,752 | |

17,436 | Petroleo Brasileiro S.A. | 135,147 | |

4,846 | Phillips 66 | 688,665 | |

75,400 | PTT Public Co. Ltd. | 67,150 | |

4,585 | Reliance Industries Ltd. | 157,404 | |

1 | Repsol S.A. | 16 | |

113 | 1 | Sandridge Energy, Inc. | 1,577 |

6,169 | Santos Ltd. | 31,459 | |

758 | Scorpio Tankers, Inc. | 62,209 | |

4,906 | Select Energy Services, Inc. | 53,623 | |

2,100 | Shanxi Lu’an Environmental Energy Development Co. Ltd. | 6,577 | |

16,758 | Shell PLC | 604,644 | |

8,080 | Suncor Energy, Inc. | 329,614 | |

12,123 | 2 | Tatneft | 0 |

206 | 1 | Teekay Corp. | 2,017 |

137 | Teekay Tankers Ltd., Class A | 9,978 | |

5,070 | TotalEnergies SE | 370,172 | |

9,117 | Tupras Turkiye Petrol Rafinerileri A.S. | 50,020 | |

3,148 | Ultrapar Participacoes S.A. | 13,891 | |

4,165 | Valero Energy Corp. | 654,488 | |

188 | 1 | Vitesse Energy, Inc. | 4,798 |

TOTAL | 8,403,035 | ||

Financials—11.3% | |||

10,285 | ABSA Group Ltd. | 81,685 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Financials—continued | |||

2 | 1 | Acacia Research Corp. | $ 11 |

7,888 | Aflac, Inc. | 708,895 | |

350 | Ageas | 17,435 | |

3,000 | Agricultural Bank of China Ltd. | 1,818 | |

3,461 | AIB Group PLC | 19,748 | |

7,963 | Al Rajhi Bank | 161,780 | |

1 | Alinma Bank | 8 | |

1,070 | Allianz SE | 311,697 | |

4,979 | 1 | Alpha Bank AE | 8,428 |

1,824 | Amalgamated Financial Corp. | 46,111 | |

2,637 | 1 | Ambac Financial Group, Inc. | 46,728 |

3,701 | American Express Co. | 888,240 | |

2,156 | American International Group, Inc. | 169,936 | |

1,544 | Ameriprise Financial, Inc. | 674,126 | |

861 | ANZ Group Holdings Ltd. | 16,238 | |

14,665 | Arab National Bank | 77,176 | |

1,365 | 1 | AssetMark Financial Holdings, Inc. | 46,942 |

11,454 | Aviva PLC | 70,499 | |

6,274 | AXA S.A. | 226,352 | |

881 | Bajaj Holdings & Investment Ltd. | 95,942 | |

29,526 | Banco Bilbao Vizcaya Argentaria S.A. | 321,301 | |

3,679 | Banco BPM SpA | 26,556 | |

24,580 | Banco Bradesco S.A. | 53,599 | |

21,848 | Banco del Bajio S.A. | 75,653 | |

3,132 | Banco Do Brasil S.A. | 16,176 | |

1,568 | 1 | Bancorp, Inc., DE | 52,669 |

1 | Bank AlBilad | 9 | |

1 | Bank AlJazira | 4 | |

22,700 | Bank Hapoalim BM | 209,281 | |

7,417 | Bank Leumi Le-Israel | 61,877 | |

5,967 | Bank of America Corp. | 238,620 | |

1 | Bank of Baroda | 3 | |

595,388 | Bank of China Ltd. | 282,708 | |

77,456 | Bank of Communications Ltd. | 58,371 | |

2,328 | Bank of Ireland Group PLC | 26,841 | |

11,446 | Bank of New York Mellon Corp. | 682,296 | |

689 | Bank of Nova Scotia, Toronto | 32,616 | |

113,171 | Barclays PLC | 320,692 | |

14,111 | BB Seguridade Participacoes S.A. | 86,801 | |

6,040 | 1 | Berkshire Hathaway, Inc., Class B | 2,502,976 |

73,000 | BOC Hong Kong (Holdings) Ltd. | 229,108 | |

2,025 | Byline Bancorp, Inc. | 46,778 | |

27,143 | Caixa Seguridade Participacoes S/A | 76,866 | |

5,348 | 1 | Cantaloupe, Inc. | 38,292 |

3 | Capital Federal Financial | 16 | |

899 | Cathay Bancorp, Inc. | 33,119 | |

528,501 | China Construction Bank Corp. | 375,464 | |

1,045 | China Merchants Bank Co. Ltd. | 4,679 | |

19,400 | China Pacific Insurance Group Co. Ltd. | 50,885 | |

15,700 | China Pacific Insurance Group Co. Ltd. | 62,496 | |

32,300 | CIMB Group Holdings Berhad | 47,047 | |

3,964 | Citigroup, Inc. | 246,997 | |

22,113 | Citizens Financial Group, Inc. | 780,368 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Financials—continued | |||

8,602 | CNA Financial Corp. | $ 395,176 | |

656 | CNO Financial Group, Inc. | 18,821 | |

2,059 | Commonwealth Bank of Australia | 165,413 | |

3,469 | 1 | CrossFirst Bankshares, Inc. | 45,409 |

1,031 | 1 | Customers Bancorp, Inc. | 46,704 |

2,034 | DNB Bank ASA | 39,776 | |

7 | 1 | Donnelley Financial Solutions, Inc. | 427 |

7,647 | East West Bancorp, Inc. | 567,331 | |

1,543 | Enact Holdings, Inc. | 47,386 | |

2 | Enterprise Financial Services Corp. | 77 | |

15,561 | Equitable Holdings, Inc. | 645,626 | |

504 | Equity Bancshares, Inc. | 16,985 | |

757 | Erste Group Bank AG | 37,194 | |

312 | Essent Group Ltd. | 17,690 | |

5,800 | 1 | Eurobank Ergasias S.A. | 12,711 |

2,339 | Euronext NV | 230,593 | |

128 | 1 | F&G Annuities & Life, Inc. | 5,172 |

231 | Fairfax Financial Holdings Ltd. | 260,043 | |

269 | Federal Agricultural Mortgage Association, Class C | 46,986 | |

2,571 | 1 | Fidelis Insurance | 42,627 |

819 | Fifth Third Bancorp | 30,647 | |

365 | First BanCorp | 6,471 | |

467 | First Financial Corp. | 17,298 | |

19,768 | FirstRand Ltd. | 68,734 | |

438 | Gjensidige Forsikring ASA | 7,682 | |

189 | Goldman Sachs Group, Inc. | 86,282 | |

5,156 | Great-West Lifeco, Inc. | 154,648 | |

25 | Greene County Bancorp, Inc. | 786 | |

193 | Groupe Bruxelles Lambert S.A. | 14,811 | |

13,645 | Grupo Financiero Banorte S.A. de C.V. | 129,618 | |

57 | 1 | Hamilton Insurance Group, Ltd. | 983 |

1,318 | Hana Financial Holdings | 58,563 | |

1,243 | Hancock Whitney Corp. | 58,085 | |

2,335 | Hanmi Financial Corp. | 36,800 | |

6,322 | Hartford Financial Services Group, Inc. | 654,011 | |

11 | HCI Group, Inc. | 1,055 | |

1,984 | HDFC Bank Ltd. | 36,224 | |

4,800 | Hithink RoyalFlush Information Network Co. Ltd. | 77,622 | |

18,992 | HSBC Holdings PLC | 170,175 | |

3,081 | iA Financial Corp., Inc. | 200,600 | |

5,931 | ICICI Bank Ltd. | 80,129 | |

4,282 | ICICI Lombard General Insurance Co. Ltd. | 81,412 | |

327 | Independent Bank Corp.- Michigan | 8,195 | |

249,000 | Industrial & Commercial Bank of China | 141,057 | |

8,300 | Industrial & Commercial Bank of China | 6,221 | |

1 | Industrial Bank of Korea | 10 | |

18,855 | ING Groep N.V. | 337,961 | |

53,580 | Insurance Australia Group Ltd. | 221,743 | |

10,166 | Investor AB, Class B | 276,360 | |

2,366 | Israel Discount Bank | 12,212 | |

4,015 | JPMorgan Chase & Co. | 813,559 | |

2,297 | KB Financial Group, Inc. | 131,348 | |

548 | KBC Groupe | 40,040 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Financials—continued | |||

39,812 | KeyCorp | $ 572,098 | |

170 | Komercni Banka A.S. | 5,831 | |

4,600 | 1 | LendingClub Corp. | 41,032 |

450,543 | Lloyds Banking Group PLC | 321,175 | |

1,296 | M&T Bank Corp. | 196,474 | |

2,390 | Macquarie Group Ltd. | 305,908 | |

50,300 | Malayan Banking BHD | 106,122 | |

12,553 | Manulife Financial Corp. | 326,040 | |

2 | 1 | Marqeta, Inc. | 11 |

861 | Marsh & McLennan Cos., Inc. | 178,726 | |

3,132 | Mastercard, Inc. | 1,400,223 | |

1,233 | Mercantile Bank Corp. | 47,236 | |

422 | Merchants Bancorp, Inc. | 16,901 | |

937 | Meta Financial Group, Inc. | 49,951 | |

68,320 | Metro Bank and Trust Co. | 72,676 | |

225 | Midland States Bancorp, Inc. | 5,112 | |

44,600 | Mitsubishi UFJ Financial Group, Inc. | 471,305 | |

729 | Moneta Money Bank AS | 3,191 | |

8,696 | Morgan Stanley | 850,817 | |

715 | 1 | Mr. Cooper Group, Inc. | 59,631 |

724 | Muenchener Rueckversicherungs-Gesellschaft AG | 360,208 | |

1,741 | 1 | National Bank of Greece | 15,112 |

4,402 | Nedbank Group Ltd. | 53,541 | |

1,373 | 1 | NMI Holdings, Inc. | 45,556 |

6,957 | Nordea Bank Abp | 85,610 | |

1,326 | OFG Bancorp. | 49,274 | |

2 | Old National Bancorp | 34 | |

3,275 | Old Second Bancorp, Inc. | 47,357 | |

12,400 | ORIX Corp. | 273,147 | |

24 | 1 | Oscar Health, Inc. | 479 |

502 | OTP Bank RT | 24,270 | |

26,600 | Oversea-Chinese Banking Corp. Ltd. | 287,188 | |

68 | 1 | Palomar Holdings, Inc. | 5,769 |

191 | Partners Group Holding AG | 255,856 | |

9,280 | 1 | Payoneer Global, Inc. | 55,587 |

533 | 1 | PayPal Holdings, Inc. | 33,574 |

2 | Peoples Bancorp, Inc. | 58 | |

256,000 | People’s Insurance, Co. (Group) of China Ltd. | 89,163 | |

31,477 | Phoenix Group Holdings PLC | 200,417 | |

78,000 | PICC Property and Casualty Co., Ltd., Class H | 101,579 | |

2,000 | Ping An Insurance (Group) Co. of China Ltd. | 10,178 | |

7,000 | Ping An Insurance (Group) Co. of China Ltd. | 41,683 | |

2,369 | 1 | Piraeus Bank S.A. | 9,304 |

2,052 | PNC Financial Services Group, Inc. | 322,964 | |

78,000 | Postal Savings Bank of China Co. Ltd. | 44,093 | |

18,231 | Power Finance Corp. | 107,431 | |

7,218 | Powszechna Kasa Oszczednosci Bank Polski SA | 109,511 | |

613 | Preferred Bank Los Angeles, CA | 45,803 | |

3,732 | Prosperity Bancshares, Inc. | 232,504 | |

4,200 | PT Bank Central Asia | 2,389 | |

268,000 | PT Bank Mandiri Tbk | 97,242 | |

156,200 | PT Bank Negara Indonesia | 42,269 | |

361,500 | PT Bank Rakyat Indonesia Tbk | 96,480 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Financials—continued | |||

18,749 | QBE Insurance Group Ltd. | $ 222,536 | |

6,840 | Rand Merchant Investment Holdings Ltd. | 14,593 | |

2 | 1 | Remitly Global, Inc. | 26 |

1 | Riyad Bank | 7 | |

2,779 | Royal Bank of Canada | 303,764 | |

15,911 | Rural Electrification Corp. Ltd. | 103,145 | |

989 | Sampo Oyj, Class A | 42,474 | |

9,286 | Saudi British Bank/The | 95,870 | |

1,208 | 1 | Saudi Tadawul Group Holding Co. | 76,379 |

206 | 1 | Siriuspoint Ltd. | 2,709 |

787 | 1 | Skyward Specialty Insurance Group, Inc. | 29,371 |

34 | Sofina | 8,286 | |

1,013 | Southern Missouri Bancorp, Inc. | 42,657 | |

6,710 | Standard Bank Group Ltd. | 64,126 | |

21,961 | Standard Life PLC | 43,600 | |

3,806 | 1 | StoneCo Ltd. | 52,675 |

6,300 | Sumitomo Mitsui Financial Group, Inc. | 413,068 | |

4,100 | Sumitomo Mitsui Trust Holdings, Inc. | 95,919 | |

5,206 | Sun Life Financial Services of Canada | 260,921 | |

1,449 | Swiss Re AG | 184,619 | |

4,270 | Synchrony Financial | 187,026 | |

15,568 | Synovus Financial Corp. | 617,894 | |

886,100 | Thai Military Bank | 40,716 | |

2,676 | The National Commercial Bank | 24,380 | |

3,032 | The Travelers Cos., Inc. | 654,002 | |

929 | Tiptree, Inc. | 16,239 | |

616 | Toronto Dominion Bank | 34,439 | |

7,521 | UBS Group AG | 240,618 | |

6,372 | UniCredit SpA | 253,458 | |

45,813 | 1 | Union Bank of India Ltd. | 87,523 |

10,900 | United Overseas Bank Ltd. | 249,534 | |

210 | Virtus Investment Partners, Inc. | 48,004 | |

5,805 | Visa, Inc., Class A | 1,581,630 | |

2,652 | Wells Fargo & Co. | 158,908 | |

1,009 | WestAmerica Bancorp. | 49,259 | |

2,395 | Woori Financial Group, Inc. | 24,481 | |

9 | Zurich Insurance Group AG | 4,730 | |

TOTAL | 31,820,124 | ||

Health Care—7.3% | |||

9,240 | Abbott Laboratories | 944,236 | |

827 | AbbVie, Inc. | 133,346 | |

4,685 | 1 | ACELYRIN, Inc. | 19,302 |

10,327 | 1 | Adaptive Biotechnologies Corp. | 35,628 |

259 | 1 | Addus Homecare Corp. | 29,736 |

4,409 | Agilent Technologies, Inc. | 574,978 | |

5,656 | 1 | Alector, Inc. | 27,828 |

2 | 1 | Alignment Healthcare, Inc. | 16 |

15,311 | 1 | Allogene Therapeutics, Inc. | 38,278 |

2,761 | 1 | Alx Oncology Holdings, Inc. | 29,349 |

2,945 | Amgen, Inc. | 900,728 | |

634 | 1 | AMN Healthcare Services, Inc. | 35,466 |

1,829 | 1 | Annexon, Inc. | 8,834 |

16,196 | 1 | Arbutus Biopharma Corp. | 54,419 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Health Care—continued | |||

129 | 1 | Argenx SE | $ 47,833 |

3,900 | Astellas Pharma, Inc. | 38,433 | |

269 | 1 | Astrana Health, Inc. | 11,145 |

2,149 | AstraZeneca PLC | 334,172 | |

1,947 | 1,2 | AstraZeneca PLC, Rights | 604 |

2 | 1 | Aurinia Pharmaceuticals, Inc. | 11 |

69,200 | Bangkok Dusit Medical Services Public Co., Ltd. | 50,806 | |

396 | 1 | Biogen, Inc. | 89,076 |

419 | Bruker Corp. | 27,449 | |

3,792 | 1 | CareDx, Inc. | 49,334 |

1,449 | Carl Zeiss Meditec AG | 133,148 | |

1,198 | Cencora, Inc. | 271,431 | |

1 | 1 | Centene Corp. | 72 |

2,300 | Chongqing Zhifei Biological Products Co. Ltd. | 10,410 | |

3,765 | Cipla Ltd. | 65,419 | |

1,105 | Cochlear Ltd. | 238,742 | |

202 | 1 | Corvel Corp. | 48,450 |

2 | CSL Ltd. | 375 | |

114,000 | CSPC Pharmaceutical Group Ltd. | 97,018 | |

10,234 | CVS Health Corp. | 609,946 | |

6,302 | 1 | Cytek Biosciences, Inc. | 35,480 |

336 | Ebos Group Ltd. | 6,822 | |

2 | 1 | Editas Medicine, Inc. | 10 |

5,400 | Eisai Co. Ltd. | 231,870 | |

1,592 | Elevance Health, Inc. | 857,260 | |

2,701 | Eli Lilly & Co. | 2,215,738 | |

1,240 | Embecta Corp. | 15,339 | |

346 | Ensign Group, Inc. | 41,949 | |

1,284 | 1 | Entrada Therapeutics, Inc. | 19,863 |

9,002 | 1 | Fate Therapeutics, Inc. | 33,127 |

1,286 | Fisher & Paykel Healthcare Corp. Ltd. | 23,356 | |

605 | Fresenius SE & Co KGaA | 19,242 | |

311 | Gedeon Richter Rt | 7,890 | |

18,764 | GSK PLC | 420,941 | |

180 | Hanmi Pharmaceutical Co. Ltd. | 36,827 | |

2,628 | 1 | HilleVax, Inc. | 31,904 |

2,412 | 1 | Hims & Hers Health, Inc. | 46,841 |

1,800 | Hoya Corp. | 219,088 | |

279 | Humana, Inc. | 99,915 | |

444 | 1 | Inmode Ltd. | 8,494 |

2 | 1 | Innovage Holding Corp. | 9 |

2,781 | 1 | IQVIA Holdings, Inc. | 609,289 |

3,132 | 1 | iTeos Therapeutics, Inc. | 52,430 |

2,272 | Johnson & Johnson | 333,234 | |

1,000 | Koninklijke Philips NV | 27,323 | |

8,600 | Kyowa Hakko Kirin Co., Ltd. | 146,053 | |

851 | 1 | Lantheus Holdings, Inc. | 69,637 |

10 | LeMaitre Vascular, Inc. | 789 | |

4,451 | Lupin Ltd. | 85,842 | |

15,589 | 1 | Lyell Immunopharma, Inc. | 43,182 |

9,634 | 1 | MaxCyte, Inc. | 43,160 |

1,329 | McKesson Corp. | 756,985 | |

10,230 | Merck & Co., Inc. | 1,284,274 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Health Care—continued | |||

279 | Merck KGAA | $ 50,421 | |

272 | 1 | Merit Medical Systems, Inc. | 22,073 |

2,799 | 1 | Nkarta, Inc. | 19,005 |

6,164 | Novartis AG | 637,422 | |

8,745 | Novo Nordisk A/S | 1,182,490 | |

7,429 | 1 | Omniab, Inc. | 32,242 |

1,936 | 1 | Option Care Health, Inc. | 57,732 |

236 | Orion Oyj | 9,603 | |

2,117 | Owens & Minor, Inc. | 36,899 | |

4 | 1 | Pacific Biosciences of California, Inc. | 7 |

319 | 1 | PetIQ, Inc. | 6,622 |

5,005 | 1 | Prime Medicine, Inc. | 32,432 |

1,498 | 1 | Progyny, Inc. | 40,371 |

854 | 1 | Regeneron Pharmaceuticals, Inc. | 837,057 |

7,085 | 1 | Relay Therapeutics, Inc. | 45,415 |

6,926 | 1 | Replimune Group, Inc. | 36,500 |

707 | Roche Holding AG | 181,084 | |

3,489 | 1 | SAGE Therapeutics, Inc. | 38,763 |

101 | 1 | Samsung Biologics Co. Ltd. | 53,469 |

4,391 | Sanofi | 429,046 | |

1 | 1 | Scilex Holding Co. | 1 |

1,100 | Shenzhen Mindray Bio-Medical Electronics Co. Ltd. | 44,100 | |

106 | 1 | SK Bioscience Co. Ltd. | 3,985 |

829 | Sonova Holding AG | 262,245 | |

743 | Straumann Holding AG | 96,589 | |

2,584 | 1 | Summit Therapeutics, Inc. | 22,442 |

5 | 1 | Tenaya Therapeutics, Inc. | 21 |

2,467 | The Cigna Group | 850,178 | |

2 | 1 | Travere Thrapeutics, Inc. | 15 |

1,062 | 1 | Tyra Biosciences, Inc. | 17,226 |

277 | UCB S.A. | 38,829 | |

140 | 1 | UFP Technologies, Inc. | 36,450 |

2,424 | UnitedHealth Group, Inc. | 1,200,777 | |

1,144 | Universal Health Services, Inc., Class B | 217,131 | |

908 | 1 | Veracyte, Inc. | 18,841 |

1,829 | 1 | Vertex Pharmaceuticals, Inc. | 832,817 |

6,465 | 1 | Verve Therapeutics, Inc. | 33,553 |

2,238 | 1 | Vir Biotechnology, Inc. | 22,984 |

556 | 1 | Waters Corp. | 171,748 |

715 | 1 | Wave Life Sciences Ltd. | 4,419 |

3,400 | WuXi AppTec Co. Ltd. | 19,709 | |

TOTAL | 20,422,894 | ||

Industrials—7.1% | |||

7,591 | ABB Ltd. | 416,136 | |

393 | ABM Industries, Inc. | 18,577 | |

1,029 | 1 | AerCap Holdings NV | 95,399 |

85 | Airbus Group SE | 14,431 | |

1,895 | 1 | APi Group Corp. | 67,538 |

366 | Applied Industrial Technologies, Inc. | 70,638 | |

395 | 1 | Atkore, Inc. | 60,099 |

17,310 | Atlas Copco AB, Class A | 332,591 | |

16,726 | Atlas Copco AB, Class B | 277,431 | |

2,915 | Auckland International Airport Ltd. | 13,976 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Industrials—continued | |||

1,623 | Automatic Data Processing, Inc. | $ 397,505 | |

280 | AZZ, Inc. | 23,486 | |

310,800 | Bangkok Expressway and Metro PCL | 66,586 | |

49 | Barrett Business Services, Inc. | 6,485 | |

584 | 1 | Beacon Roofing Supply, Inc. | 56,683 |

17 | Bidvest Group Ltd. | 222 | |

188 | 1 | BlueLinx Holdings, Inc. | 19,343 |

465 | Boise Cascade Co. | 63,840 | |

15,815 | Brambles Ltd. | 150,310 | |

1 | Brenntag AG | 72 | |

1,953 | Brookfield Business Corp. | 40,134 | |

1,574 | Canadian National Railway Co. | 200,366 | |

1,315 | Carlisle Cos., Inc. | 550,051 | |

2,779 | Caterpillar, Inc. | 940,747 | |

750 | 1 | CBIZ, Inc. | 56,865 |

84,000 | China Communication Services Corp. Ltd. | 40,567 | |

1,032 | Cintas Corp. | 699,665 | |

2,000 | CK Hutchison Holdings Ltd. | 9,773 | |

2,663 | Compagnie de St. Gobain | 236,003 | |

1,366 | Costamare, Inc. | 21,870 | |

310 | CRA International, Inc. | 54,551 | |

19,271 | CSX Corp. | 650,396 | |

2,291 | Cummins India, Ltd. | 97,756 | |

2,251 | Cummins, Inc. | 634,174 | |

3,500 | Dai Nippon Printing Co. Ltd. | 108,930 | |

400 | Daikin Industries Ltd. | 58,213 | |

3,027 | 1 | Daimler Truck Holding AG | 129,125 |

552 | DasS.A.ult Aviation S.A. | 119,660 | |

1,919 | Deere & Co. | 719,164 | |

1 | Delta Air Lines, Inc. | 51 | |

529 | Doosan Bobcat, Inc. | 22,260 | |

794 | Emcor Group, Inc. | 308,596 | |

209 | Encore Wire Corp. | 60,345 | |

1,395 | Enerpac Tool Group Corp. | 54,851 | |

77,000 | EVA Airways Corp. | 84,962 | |

2,048 | 1 | Exlservice Holding, Inc. | 61,153 |

4,414 | Expeditors International Washington, Inc. | 533,653 | |

8,900 | Fanuc Ltd. | 248,876 | |

939 | FTAI Aviation Ltd. | 79,176 | |

1 | Genpact Ltd. | 33 | |

608 | 1 | GMS, Inc. | 57,128 |

137 | Griffon Corp. | 9,253 | |

2,520 | GS Holdings Corp. | 79,225 | |

845 | H&E Equipment Services, Inc. | 40,028 | |

3,477 | HEICO Corp., Class A | 610,770 | |

255 | Herc Holdings, Inc. | 36,993 | |

1,137 | 1 | Hub Group, Inc. | 49,062 |

498 | 1 | Huron Consulting Group, Inc. | 43,978 |

86 | Hyster-Yale Materials Handling, Inc. | 6,243 | |

3,619 | Hyundai Merchant Marine Co., Ltd. | 47,011 | |

2,848 | Illinois Tool Works, Inc. | 691,352 | |

282 | IMCD Group NV | 42,729 | |

2,800 | Itochu Corp. | 132,247 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Industrials—continued | |||

1,133 | Jacobs Solutions, Inc. | $ 157,872 | |

2,708 | 1 | JELD-WEN Holding, Inc. | 42,001 |

11,200 | Kawasaki Kisen Kaisha Ltd. | 166,182 | |

344 | Kingspan Group PLC | 33,227 | |

1,188 | Koc Holding A.S. | 8,776 | |

3,100 | Komatsu Ltd. | 91,277 | |

747 | Kone Corp. OYJ, Class B | 38,170 | |

194 | Kongsberg Gruppen ASA | 16,677 | |

2,654 | Korean Air Co. Ltd. | 40,105 | |

881 | Korn Ferry | 58,093 | |

5,218,113 | Latam Airlines Group S.A. | 70,199 | |

3,503 | Lifco AB | 93,072 | |

1,663 | Lockheed Martin Corp. | 782,175 | |

1,300 | Marubeni Corp. | 25,413 | |

196 | Maximus, Inc. | 16,876 | |

21,988 | Melrose Industries PLC | 174,364 | |

1,457 | Metso Corp. | 17,836 | |

16,400 | Mitsubishi Corp. | 345,453 | |

15,700 | Mitsubishi Electric Corp. | 272,801 | |

7,000 | Mitsui & Co. | 355,818 | |

560 | Mueller Industries, Inc. | 32,990 | |

39 | 1 | MYR Group, Inc. | 6,047 |

224 | Mytilineos Holdings S.A. | 8,932 | |

12,900 | Nari Technology Development Co., Ltd. | 40,106 | |

1,442 | Northrop Grumman Corp. | 650,010 | |

9,500 | Obayashi Corp. | 110,802 | |

3,465 | Old Dominion Freight Lines, Inc. | 607,241 | |

6,348 | PACCAR, Inc. | 682,410 | |

2 | 1 | Planet Labs PBC | 4 |

1,251 | Polycab India Ltd. | 100,942 | |

3 | Preformed Line Products Co. | 403 | |

796 | Primoris Services Corp. | 43,589 | |

910 | Prysmian SpA | 59,982 | |

619 | Reece Ltd. | 10,786 | |

8,967 | Relx PLC | 393,298 | |

1 | RTX Corp | 108 | |

15,829 | 1 | Rumo S.A. | 59,416 |

492 | Rush Enterprises, Inc., Class B | 20,797 | |

1,676 | Safran S.A. | 393,813 | |

322 | Schneider Electric S.A. | 80,604 | |

2,735 | Siemens AG | 523,852 | |

113 | Simpson Manufacturing Co., Inc. | 18,749 | |

21,000 | Sinotruk Hong Kong Ltd. | 48,841 | |

499 | SK Holdings Co. Ltd., Class A | 63,673 | |

5,238 | Smith (A.O.) Corp. | 438,106 | |

7,784 | Smiths Group PLC | 171,598 | |

18 | Standex International Corp. | 3,028 | |

39 | Stantec, Inc. | 3,148 | |

363 | 1 | Sterling Construction Co., Inc. | 44,602 |

349 | 1 | Sun Country Airlines Holdings | 3,696 |

907 | Terex Corp. | 54,121 | |

578 | TFI International, Inc. | 76,479 | |

1,674 | Thomson Reuters Corp. | 288,066 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Industrials—continued | |||

1,296 | 1 | Titan International, Inc. | $ 10,718 |

1,800 | Toppan Holdings, Inc. | 46,698 | |

389 | 1 | TriNet Group, Inc. | 40,444 |

604 | Union Pacific Corp. | 140,623 | |

984 | Universal Truckload Services, Inc. | 43,050 | |

1,586 | Verisk Analytics, Inc. | 400,909 | |

2,657 | Vinci S.A. | 332,892 | |

1,120 | Wabtec Corp. | 189,538 | |

1,037 | Wartsila OYJ, Class B | 21,915 | |

13,466 | Weg S.A. | 96,297 | |

2,000 | Weichai Power Co. Ltd. | 4,389 | |

42,000 | Weichai Power Co. Ltd., Class H | 75,518 | |

TOTAL | 20,068,950 | ||

Information Technology—15.2% | |||

4,000 | Accton Technology Corp. | 62,741 | |

9,000 | Acer Sertek, Inc. | 14,732 | |

1,710 | 1 | ACM Research, Inc. | 36,936 |

96 | 1 | Adobe, Inc. | 42,697 |

3,580 | 1 | Advanced Micro Devices, Inc. | 597,502 |

435 | 1 | Agilysys, Inc. | 41,529 |

771 | 1 | Alarm.com Holdings, Inc. | 50,431 |

952 | 1 | Alpha & Omega Semiconductor Ltd. | 27,903 |

1,730 | Amkor Technology, Inc. | 56,381 | |

252 | 1 | AppFolio, Inc. | 57,537 |

36,099 | Apple, Inc. | 6,940,033 | |

4,721 | Applied Materials, Inc. | 1,015,393 | |

69 | 1 | Arabian Internet & Communications Services Co | 4,842 |

17,000 | ASE Industrial Holding Co. Ltd. | 82,123 | |

1,025 | ASML Holding N.V. | 982,648 | |

7,000 | Asustek Computer, Inc. | 111,091 | |

2,706 | 1 | Atlassian Corp. PLC | 424,463 |

4 | 1 | Aurora Innovation, Inc. | 10 |

7,400 | Azbil Corp. | 204,514 | |

292 | Badger Meter, Inc. | 56,344 | |

402 | Bechtle AG | 19,476 | |

36 | Bel Fuse, Inc. | 2,455 | |

164 | Belden, Inc. | 15,693 | |

930 | 1 | Blackline, Inc. | 44,380 |

812 | Broadcom, Inc. | 1,078,783 | |

6,400 | Brother Industries Ltd. | 123,143 | |

23,000 | BYD Electronic International Co. Ltd. | 99,914 | |

238 | Capgemini SE | 48,226 | |

441 | CDW Corp. | 98,616 | |

1,995 | 1 | CGI, Inc., Class A | 197,004 |

19,800 | Cisco Systems, Inc. | 920,700 | |

1,054 | 1 | Clear Secure, Inc. | 17,802 |

10,000 | Compal Electronics, Inc. | 11,460 | |

6,500 | Delta Electronics (Thailand) PLC | 13,099 | |

12,000 | Delta Electronics, Inc. | 120,125 | |

759 | 1 | Diodes, Inc. | 56,265 |

10,106 | 1 | DocuSign, Inc. | 553,202 |

372 | Elm Co. | 79,088 | |

307 | 1 | Fabrinet | 73,536 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Information Technology—continued | |||

25,600 | Foxconn Industrial Internet Co., Ltd. | $ 80,849 | |

3,305 | 1 | Freshworks, Inc. | 42,568 |

16,900 | Fujitsu Ltd. | 243,809 | |

1,000 | Global Unichip Corp. | 45,087 | |

3,000 | Globalwafers Co. Ltd. | 48,866 | |

66 | Hanmi Semiconductor Co. Ltd. | 7,720 | |

4,766 | 1 | HashiCorp, Inc. | 160,042 |

6,423 | HCL Technologies Ltd. | 102,296 | |

12,000 | Hon Hai Precision Industry Co. Ltd. | 63,795 | |

54 | 1 | Ichor Holdings Ltd. | 2,051 |

7,388 | Infineon Technologies AG | 294,968 | |

10,491 | Infosys Ltd. | 176,676 | |

231 | 1 | Insight Enterprises, Inc. | 45,160 |

20,000 | Inventec Co. Ltd. | 33,130 | |

3,802 | Jabil, Inc. | 452,058 | |

839 | KLA Corp. | 637,246 | |

920 | Lam Research Corp. | 857,845 | |

36,000 | Lenovo Group Ltd. | 51,821 | |

23,000 | Lite-On Technology Corp. | 76,824 | |

980 | 1 | LiveRamp Holdings, Inc. | 30,664 |

732 | Logitech International S.A. | 73,418 | |

848 | 1 | Marathon Patent Group, Inc. | 16,553 |

3 | 1 | Matterport, Inc. | 13 |

6,000 | MediaTek, Inc. | 227,986 | |

16,919 | Microsoft Corp. | 7,023,584 | |

11 | 1 | MicroStrategy, Inc., Class A | 16,769 |

10,000 | Nan Ya Printed Circuit Board Corp. | 60,258 | |

11,683 | Nokia Oyj | 45,603 | |

3,100 | Nomura Research Institute Ltd. | 83,141 | |

5,000 | Novatek Microelectronics Corp. Ltd. | 91,343 | |

1 | 1 | Nutanix, Inc. | 55 |

5,940 | NVIDIA Corp. | 6,512,200 | |

6,222 | 1 | Okta, Inc. | 551,767 |

5 | 1 | Olo, Inc. | 23 |

2 | 1 | PDF Solutions, Inc. | 70 |

2 | 1 | Perficient, Inc. | 148 |

1,165 | Persistent Systems Ltd. | 47,475 | |

7,162 | 1 | Procore Technologies, Inc. | 480,785 |

624 | Progress Software Corp. | 31,606 | |

5,926 | Qualcomm, Inc. | 1,209,200 | |

373 | 1 | Qualys, Inc. | 52,451 |

16,000 | Quanta Computer, Inc. | 134,935 | |

891 | 1 | Rapid7, Inc. | 32,201 |

24,300 | Ricoh Co. Ltd. | 217,535 | |

1,315 | Roper Technologies, Inc. | 700,579 | |

5,073 | Sage Group PLC/The | 66,275 | |

446 | 1 | Salesforce, Inc. | 104,560 |

12,186 | Samsung Electronics Co. Ltd. | 652,781 | |

37 | Samsung SDI Co. Ltd. | 10,097 | |

445 | Samsung SDS Co. Ltd. | 49,561 | |

668 | 1 | Sanmina Corp. | 45,785 |

1,377 | SAP SE | 248,111 | |

12,800 | Seiko Epson Corp. | 204,997 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Information Technology—continued | |||

724 | 1 | ServiceNow, Inc. | $ 475,617 |

758 | 1 | Shenzhen Transsion Holdings Co. Ltd. | 13,714 |

2,508 | 1 | Shopify, Inc. | 148,425 |

1,575 | SK Hynix, Inc. | 215,808 | |

1,934 | 1 | SMART Global Holdings, Inc. | 39,802 |

8,100 | 1 | Smartsheet, Inc. | 299,700 |

3,498 | 1 | Sprinklr, Inc. | 39,213 |

365 | 1 | SPS Commerce, Inc. | 68,653 |

3,036 | STMicroelectronics N.V. | 126,639 | |

221 | 1 | Super Micro Computer, Inc. | 173,377 |

420 | Suzhou TFC Optical Communication Co. Ltd. | 5,121 | |

35,000 | Synnex Technology International Corp. | 91,218 | |

1,364 | 1 | Synopsys, Inc. | 764,931 |

53,122 | Taiwan Semiconductor Manufacturing Co. Ltd. | 1,340,773 | |

3,716 | Tata Consultancy Services Ltd. | 165,258 | |

2 | TD SYNNEX Corp. | 262 | |

600 | Tokyo Electron Ltd. | 129,401 | |

8,270 | 1 | Twilio, Inc. | 474,698 |

23,859 | 1 | UiPath, Inc. | 292,511 |

1,372 | 1 | Veeco Instruments, Inc. | 55,772 |

2,282 | Vishay Intertechnology, Inc. | 53,924 | |

28,000 | Wistron Corp. | 96,983 | |

28,000 | WPG Holdings Co., Ltd. | 74,404 | |

860 | 1 | Xero Ltd. | 78,090 |

77,000 | 1 | Xiaomi Corp. | 171,706 |

1,500 | Zhongji Innolight Co., Ltd. | 32,504 | |

9,529 | 1 | Zoom Video Communications, Inc. | 584,509 |

TOTAL | 42,841,170 | ||

Materials—2.6% | |||

129 | Air Liquide S.A. | 25,373 | |

860 | Akzo Nobel NV | 59,985 | |

129 | Alpha Metallurgical Resources, Inc. | 40,688 | |

44,236 | 2 | Alrosa AO | 0 |

2 | 1 | Arcadium Lithium PLC | 9 |

9,141 | ArcelorMittal S.A. | 242,930 | |

31,500 | Asahi Kasei Corp. | 206,413 | |

1,343 | Asian Paints (India) Ltd. | 46,315 | |

30,700 | Baoshan Iron & Steel Co. Ltd. | 29,261 | |

4,272 | Berger Paints India Ltd. | 23,157 | |

7,960 | 1 | Berry Global Group, Inc. | 476,645 |

11,163 | BHP Group Ltd. | 330,902 | |

3,401 | 2 | Cherepovets MK Severstal | 0 |

115,377 | China Hongqiao Group Ltd. | 190,827 | |

308 | 1 | Clearwater Paper Corp. | 16,367 |

25,219 | 1 | Cleveland-Cliffs, Inc. | 435,784 |

3,000 | CMOC Group Ltd. | 2,785 | |

14,700 | CMOC Group Ltd. | 17,020 | |

2,812 | Companhia Vale Do Rio Doce | 33,845 | |

1,246 | 1 | Constellium SE | 27,001 |

11,736 | Corteva, Inc. | 656,512 | |

4,125 | CRH PLC | 325,161 | |

11,106 | Dow, Inc. | 640,039 | |

2 | DuPont de Nemours, Inc. | 164 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Materials—continued | |||

5,107 | 1,2 | Ferroglobe Representation & Warranty Insurance Trust | $ 0 |

1,296 | Fortescue Metals Group Ltd. | 21,278 | |

8 | Givaudan S.A. | 37,609 | |

41,246 | Glencore PLC | 254,291 | |

686 | Greif, Inc. | 44,762 | |

2,121 | Heidelberg Materials AG | 220,604 | |

3,422 | Holcim Ltd. | 299,323 | |

1,191 | Hyundai Steel Co. | 25,692 | |

59 | Innospec, Inc. | 7,717 | |

6,776 | 1 | James Hardie Industries PLC, GDR | 213,450 |

33,768 | Kinross Gold Corp. | 274,267 | |

24 | L.G. Chemical Ltd. | 6,152 | |

2,039 | Luberef | 70,794 | |

691 | Minerals Technologies, Inc. | 59,944 | |

8,900 | Mitsubishi Chemical Holdings Corp. | 47,105 | |

36,200 | 2 | Norilsk Nickel | 0 |

2,934 | Norsk Hydro ASA | 19,857 | |

23,929 | 2 | Novolipetski Metallurgicheski Komb OAO | 0 |

3,411 | Nucor Corp. | 575,947 | |

4,119 | Nutrien Ltd. | 241,377 | |

1 | Olin Corp. | 54 | |

443 | Olympic Steel, Inc. | 23,098 | |

3,127 | Pactiv Evergreen, Inc. | 38,650 | |

1,493 | PI Industries Ltd. | 64,076 | |

4 | Polymetal International PLC | 0 | |

274 | 2 | Polyus PJSC | 0 |

262 | POSCO Holdings, Inc. | 70,458 | |

4,211 | 1 | PQ Group Holdings, Inc. | 39,162 |

4,315 | 1 | Queen’s Road Capital Investment Ltd. | 2,628 |

575 | 1,2,3 | Resolute Forest Products, Rights | 817 |

66,277 | 1,2 | Rusal | 0 |

1,098 | Ryerson Holding Corp. | 26,078 | |

1,900 | Shin-Etsu Chemical Co. Ltd. | 70,752 | |

572 | Smurfit Kappa Group PLC | 27,950 | |

1,282 | Stora Enso Oyj, Class R | 18,922 | |

4,396 | SunCoke Energy, Inc. | 46,378 | |

669 | Suzano Papel e Celulose S.A. | 6,205 | |

162 | 1 | Syensqo S.A. | 16,194 |

459 | Umicore S.A. | 9,104 | |

1,174 | UPM - Kymmene Oyj | 45,026 | |

255 | Va Stahl Ag | 7,489 | |

1 | Vedanta Ltd. | 5 | |

1 | West Fraser Timber Co. Ltd. | 80 | |

3,871 | WestRock Co. | 207,640 | |

1,387 | 1 | Worthington Steel, Inc. | 45,757 |

364 | Yara International ASA | 11,277 | |

24,300 | Zhejiang Juhua Co., Ltd. | 79,895 | |

50,000 | Zijin Mining Group Co. Ltd. | 105,318 | |

TOTAL | 7,210,365 | ||

Real Estate—2.5% | |||

10,452 | American Homes 4 Rent | 376,690 | |

2 | 1 | Anywhere Real Estate, Inc. | 8 |

2,026 | Avalonbay Communities, Inc. | 390,370 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Real Estate—continued | |||

2 | Broadstone Net Lease, Inc. | $ 31 | |

4,631 | Chatham Lodging Trust | 39,178 | |

130,000 | China Overseas Property Holdings Ltd. | 88,520 | |

50,000 | China Resources Mixc Lifestyle Services Ltd. | 174,068 | |

5 | 1 | Compass, Inc. | 19 |

5,320 | Cousins Properties, Inc. | 123,052 | |

3,757 | Crown Castle, Inc. | 385,092 | |

3,008 | Cubesmart | 127,268 | |

100 | Daito Trust Construction Co. Ltd. | 10,595 | |

902 | Digital Realty Trust, Inc. | 131,097 | |

3,172 | DigitalBridge Group, Inc. | 43,266 | |

4 | Diversified Healthcare Trust | 10 | |

2 | DLF Ltd. | 20 | |

1,309 | EastGroup Properties, Inc. | 216,221 | |

1,340 | Equinix, Inc. | 1,022,393 | |

483 | Essex Property Trust, Inc. | 125,479 | |

52,003 | Fibra Uno Administracion S.A. | 73,561 | |

34 | FirstService Corp. | 4,992 | |

33 | Gecina S.A. | 3,557 | |

904 | Global Medical REIT, Inc. | 8,398 | |

8,219 | Goodman Group | 185,296 | |

509 | Innovative Industrial Properties, Inc. | 54,860 | |

3,659 | Invitation Homes, Inc. | 127,297 | |

2,001 | Klepierre S.A. | 57,859 | |

2,742 | Land Securities Group PLC | 23,037 | |

909 | Macerich Co. (The) | 13,744 | |

5,801 | 1 | Macrotech Developers Ltd. | 97,587 |

13,400 | Mitsubishi Estate Co. Ltd. | 225,611 | |

11,707 | 1 | Opendoor Technologies, Inc. | 25,521 |

8,706 | ProLogis, Inc. | 961,926 | |

1,183 | Public Storage | 323,941 | |

619 | Ryman Hospitality Properties, Inc. | 65,038 | |

4,779 | Simon Property Group, Inc. | 723,110 | |

2,775 | SITE Centers Corp. | 40,015 | |

4,928 | Sunstone Hotel Investors, Inc. | 50,660 | |

1,896 | Tanger, Inc. | 52,614 | |

2,673 | UMH Properties, Inc. | 40,416 | |

4 | Uniti Group, Inc. | 13 | |

1,448 | Urban Edge Properties | 25,673 | |

1,395 | Vonovia SE | 43,654 | |

384 | Warehouses De Pauw SCA | 11,241 | |

3,663 | Welltower, Inc. | 379,743 | |

3,231 | Whitestone Project | 42,132 | |

TOTAL | 6,914,873 | ||

Utilities—1.8% | |||

32,024 | AES Corp. | 691,398 | |

448 | Allete, Inc. | 28,291 | |

4,503 | AltaGas Ltd. | 101,594 | |

944 | Black Hills Corp. | 53,289 | |

944 | Centrica PLC | 1,715 | |

359 | CEZ A.S. | 14,976 | |

800 | China Resources Logic Ltd. | 2,786 | |

50,000 | China Resources Power Holdings Co. Ltd. | 141,820 |

Shares, Principal Amount or Contracts | Value | ||

COMMON STOCKS—continued | |||

Utilities—continued | |||

1,999 | Clearway Energy, Inc. | $ 51,334 | |

29,000 | CLP Holdings Ltd. | 230,128 | |

1 | Duke Energy Corp. | 104 | |

9,821 | E.ON SE | 130,953 | |

673 | EDP Renovaveis S.A. | 10,792 | |

65 | Elia System Operator S.A./NV | 6,630 | |

12,497 | Enel SpA | 90,650 | |

6,873 | Energias de Portugal S.A. | 28,008 | |

5,681 | Engie | 96,370 | |

4,795 | Engie Brasil Energia S.A. | 39,577 | |

10,916 | Evergy, Inc. | 596,668 | |

12,238 | Exelon Corp. | 459,537 | |

10 | Fortis, Inc. / Canada | 400 | |

983 | Fortum Oyj | 15,021 | |

29,492 | Iberdrola S.A. | 388,992 | |

64 | Korea Electric Power Corp. | 904 | |

90,000 | Kunlun Energy Co. Ltd. | 93,662 | |

2,842 | Meridian Energy Ltd. | 11,794 | |

1,528 | Mighty River Power Ltd. | 6,270 | |

3,212 | 1 | National Grid PLC, Rights | 8,024 |

11,015 | National Grid-SP PLC | 125,594 | |

65 | New Jersey Resources Corp. | 2,825 | |

2,723 | NRG Energy, Inc. | 220,563 | |

149 | Oesterreichische Elektrizitaetswirtschafts AG | 12,295 | |

4,619 | OGE Energy Corp. | 167,670 | |

1,181,504 | 2 | OJSC Inter Rao Ues | 0 |

852 | ONE Gas, Inc. | 52,509 | |

9,400 | Origin Energy Ltd. | 63,981 | |

611 | Otter Tail Corp. | 55,277 | |

1,063 | Pinnacle West Capital Corp. | 83,828 | |

31,838 | Power Grid Corp. of India Ltd. | 118,332 | |

468 | 1 | Public Power Corp. | 5,714 |

9,065 | Public Service Enterprises Group, Inc. | 686,764 | |

2,258 | SSE PLC | 50,736 | |

3,500 | Tokyo Gas Co. Ltd. | 78,347 | |

869 | Unitil Corp. | 46,483 | |

17,400 | Zhejiang Zheneng Electric Power Co. Ltd. | 16,094 | |

TOTAL | 5,088,699 | ||

TOTAL COMMON STOCKS (IDENTIFIED COST $148,470,538) | 188,217,552 | ||

FOREIGN GOVERNMENTS/AGENCIES—7.5% | |||

Sovereign—7.5% | |||

AUD 350,000 | Australia, Government of, Sr. Unsecd. Note, Series 148, 2.750%, 11/21/2027 | 223,128 | |

400,000 | Australia, Government of, Sr. Unsecd. Note, Series 155, 2.500%, 5/21/2030 | 242,724 | |

EUR 180,000 | Belgium, Government of, Series 74, 0.800%, 6/22/2025 | 189,960 | |

600,000 | Belgium, Government of, Sr. Unsecd. Note, Series 86, 1.250%, 4/22/2033 | 560,706 | |

BRL 1,250,000 | Brazil, Government of, Unsecd. Note, Series NTNF, 10.000%, 1/1/2027 | 242,326 | |

EUR 350,000 | Buoni Poliennali del Tes, Sr. Unsecd. Note, 5.000%, 8/1/2039 | 412,462 | |

CAD 350,000 | Canada, Government of, 5.750%, 6/1/2033 | 298,127 | |

480,000 | Canada, Government of, Series WL43, 5.750%, 6/1/2029 | 386,881 | |

200,000 | Canada, Government of, Unsecd. Note, 1.250%, 3/1/2027 | 136,665 | |

460,000 | Canada, Government of, Unsecd. Note, 2.250%, 6/1/2025 | 330,200 | |

EUR 306,000 | France, Government of, 0.500%, 5/25/2025 | 322,596 |

Shares, Principal Amount or Contracts | Value | ||

FOREIGN GOVERNMENTS/AGENCIES—continued | |||

Sovereign—continued | |||

EUR 100,000 | France, Government of, 5.750%, 10/25/2032 | $ 129,577 | |

150,000 | France, Government of, Bond, 4.500%, 4/25/2041 | 185,918 | |

600,000 | France, Government of, O.A.T., 5.500%, 4/25/2029 | 723,890 | |

300,000 | France, Government of, Unsecd. Note, 1.000%, 5/25/2027 | 306,698 | |

450,000 | France, Government of, Unsecd. Note, 1.250%, 5/25/2036 | 393,049 | |

200,000 | France, Government of, Unsecd. Note, 1.750%, 5/25/2066 | 138,144 | |

300,000 | France, Government of, Unsecd. Note, 1.750%, 6/25/2039 | 265,464 | |

300,000 | France, Government of, Unsecd. Note, 2.500%, 5/25/2030 | 317,143 | |

840,000 | Germany, Government of, 0.250%, 2/15/2027 | 850,293 | |

250,000 | Germany, Government of, Bond, Series 03, 4.750%, 7/4/2034 | 320,667 | |

300,000 | Germany, Government of, Bond, Series 08, 4.750%, 7/4/2040 | 406,405 | |

500,000 | Germany, Government of, Unsecd. Note, 0.500%, 2/15/2025 | 531,470 | |

300,000 | Germany, Government of, Unsecd. Note, 2.100%, 11/15/2029 | 316,334 | |

480,000 | Italy, Government of, Sr. Unsecd. Note, 1.650%, 3/1/2032 | 450,302 | |

600,000 | Italy, Government of, Sr. Unsecd. Note, 4.750%, 9/1/2028 | 684,322 | |

825,000 | Italy, Government of, Unsecd. Note, 1.600%, 6/1/2026 | 863,692 | |

208,000 | Italy, Government of, Unsecd. Note, 3.250%, 9/1/2046 | 191,940 | |

JPY 80,000,000 | JAPAN (40 YEAR ISSUE), Sr. Unsecd. Note, Series 12, 0.500%, 3/20/2059 | 298,233 | |

72,000,000 | Japan, Government of, Sr. Unsecd. Note, Series 114, 2.100%, 12/20/2029 | 493,765 | |

70,000,000 | Japan, Government of, Sr. Unsecd. Note, Series 122, 1.800%, 9/20/2030 | 474,913 | |

215,000,000 | Japan, Government of, Sr. Unsecd. Note, Series 153, 1.300%, 6/20/2035 | 1,382,718 | |

60,000,000 | Japan, Government of, Sr. Unsecd. Note, Series 351, 0.100%, 6/20/2028 | 374,650 | |

90,000,000 | Japan, Government of, Sr. Unsecd. Note, Series 44, 1.700%, 9/20/2044 | 555,989 | |

90,000,000 | Japan, Government of, Sr. Unsecd. Note, Series 58, 0.800%, 3/20/2048 | 443,405 | |

90,000,000 | Japan, Government of, Sr. Unsecd. Note, Series 92, 2.100%, 12/20/2026 | 596,484 | |

$ 30,000 | Mexico, Government of, Series MTNA, 6.750%, 9/27/2034 | 31,482 | |

MXN 15,000,000 | Mexico, Government of, Sr. Unsecd. Note, Series M, 5.750%, 3/5/2026 | 816,506 | |

EUR 370,000 | Netherlands, Government of, Unsecd. Note, 2.500%, 1/15/2033 | 390,504 | |

60,000 | Netherlands, Government of, Unsecd. Note, 2.750%, 1/15/2047 | 62,745 | |

80,000 | Netherlands, Government of, Unsecd. Note, 3.750%, 1/15/2042 | 95,302 | |

250,000 | Spain, Government of, 4.200%, 1/31/2037 | 289,518 | |

600,000 | Spain, Government of, Sr. Unsecd. Note, 1.500%, 4/30/2027 | 621,603 | |

640,000 | Spain, Government of, Sr. Unsecd. Note, 1.950%, 7/30/2030 | 650,273 | |

430,000 | Spain, Government of, Sr. Unsecd. Note, 2.750%, 10/31/2024 | 464,873 | |

100,000 | Spain, Government of, Sr. Unsecd. Note, 2.900%, 10/31/2046 | 93,507 | |

GBP 400,000 | United Kingdom, Government of, 2.750%, 9/7/2024 | 506,782 | |

630,000 | United Kingdom, Government of, 3.250%, 1/22/2044 | 653,782 | |

270,000 | United Kingdom, Government of, Bond, 4.250%, 3/7/2036 | 339,025 | |

330,000 | United Kingdom, Government of, Unsecd. Deb., 1.625%, 10/22/2028 | 377,913 | |

600,000 | United Kingdom, Government of, Unsecd. Note, 1.500%, 7/22/2047 | 419,968 | |

220,000 | United Kingdom, Government of, Unsecd. Note, 4.250%, 6/7/2032 | 281,723 | |

TOTAL FOREIGN GOVERNMENTS/AGENCIES (IDENTIFIED COST $24,703,967) | 21,136,746 | ||

CORPORATE BONDS—6.1% | |||

Capital Goods - Aerospace & Defense—0.3% | |||

$ 145,000 | Huntington Ingalls Industries, Inc., Sr. Unsecd. Note, Series WI, 3.844%, 5/1/2025 | 142,610 | |

300,000 | Leidos, Inc., Sr. Unsecd. Note, Series WI, 2.300%, 2/15/2031 | 246,145 | |

215,000 | Leidos, Inc., Sr. Unsecd. Note, Series WI, 3.625%, 5/15/2025 | 211,067 | |

90,000 | Lockheed Martin Corp., Sr. Unsecd. Note, 3.550%, 1/15/2026 | 87,753 | |

90,000 | 3 | Textron Financial Corp., Jr. Sub. Note, 144A, 7.318% (CME Term SOFR 3 Month +1.996%), 2/15/2042 | 78,398 |

TOTAL | 765,973 | ||

Capital Goods - Building Materials—0.1% | |||

125,000 | Allegion PLC, Sr. Unsecd. Note, 3.500%, 10/1/2029 | 114,672 |

Shares, Principal Amount or Contracts | Value | ||

CORPORATE BONDS—continued | |||

Capital Goods - Building Materials—continued | |||

$ 85,000 | Carrier Global Corp., Sr. Unsecd. Note, 6.200%, 3/15/2054 | $ 91,240 | |

TOTAL | 205,912 | ||

Capital Goods - Construction Machinery—0.2% | |||

315,000 | Ashtead Capital, Inc., Sr. Unsecd. Note, 144A, 2.450%, 8/12/2031 | 253,628 | |

205,000 | Ashtead Capital, Inc., Sr. Unsecd. Note, 144A, 5.550%, 5/30/2033 | 199,912 | |

195,000 | Deere & Co., Sr. Unsecd. Note, 2.750%, 4/15/2025 | 190,742 | |

TOTAL | 644,282 | ||

Capital Goods - Diversified Manufacturing—0.0% | |||

75,000 | Lennox International, Inc., Sr. Unsecd. Note, 1.700%, 8/1/2027 | 67,108 | |

50,000 | Wabtec Corp., Sr. Unsecd. Note, 5.611%, 3/11/2034 | 50,185 | |

TOTAL | 117,293 | ||

Communications - Cable & Satellite—0.1% | |||

30,000 | Charter Communications Operating, LLC / Charter Communications Operating Capital Corp., 5.050%, 3/30/2029 | 28,758 | |

110,000 | Charter Communications Operating, LLC/Charter Communications Operating Capital Corp., Sec. Fac. Bond, 6.550%, 6/1/2034 | 110,264 | |

TOTAL | 139,022 | ||

Communications - Media & Entertainment—0.0% | |||

20,000 | Discovery Communications LLC, Sr. Unsecd. Note, 4.900%, 3/11/2026 | 19,744 | |

70,000 | Grupo Televisa S.A., Sr. Unsecd. Note, 6.125%, 1/31/2046 | 67,709 | |

TOTAL | 87,453 | ||

Communications - Telecom Wireless—0.2% | |||

100,000 | American Tower Corp., Sr. Unsecd. Note, 5.450%, 2/15/2034 | 98,806 | |

330,000 | Crown Castle, Inc., Sr. Unsecd. Note, 5.000%, 1/11/2028 | 324,851 | |

80,000 | T-Mobile USA, Inc., 2.250%, 11/15/2031 | 64,922 | |

300,000 | T-Mobile USA, Inc., Series WI, 3.400%, 10/15/2052 | 204,177 | |

TOTAL | 692,756 | ||

Communications - Telecom Wirelines—0.1% | |||

364,000 | AT&T, Inc., Sr. Unsecd. Note, 3.550%, 9/15/2055 | 244,607 | |

Consumer Cyclical - Automotive—0.3% | |||

200,000 | Ford Motor Credit Co. LLC, Sr. Unsecd. Note, 6.050%, 3/5/2031 | 199,245 | |

200,000 | Ford Motor Credit Co. LLC, Sr. Unsecd. Note, 6.125%, 3/8/2034 | 197,590 | |

70,000 | General Motors Co., Sr. Unsecd. Note, 4.200%, 10/1/2027 | 67,264 | |

235,000 | General Motors Financial Co., Inc., Sr. Unsecd. Note, 3.100%, 1/12/2032 | 196,906 | |

145,000 | General Motors Financial Co., Inc., Sr. Unsecd. Note, 5.750%, 2/8/2031 | 144,980 | |

TOTAL | 805,985 | ||

Consumer Cyclical - Retailers—0.3% | |||

600,000 | Advance Auto Parts, Inc., Sr. Unsecd. Note, Series WI, 3.900%, 4/15/2030 | 539,722 | |

225,000 | AutoNation, Inc., Sr. Unsecd. Note, 4.750%, 6/1/2030 | 214,300 | |

TOTAL | 754,022 | ||

Consumer Non-Cyclical - Health Care—0.3% | |||

35,689 | CVS Health Corp., Pass Thru Cert., 144A, 5.298%, 1/11/2027 | 35,253 | |

105,000 | GE Healthcare Holding LLC, Sr. Unsecd. Note, 6.377%, 11/22/2052 | 113,956 | |

250,000 | HCA, Inc., Sr. Unsecd. Note, 5.500%, 6/1/2033 | 247,326 | |

400,000 | PerkinElmer, Inc., Sr. Unsecd. Note, 3.300%, 9/15/2029 | 362,880 | |

TOTAL | 759,415 | ||

Consumer Non-Cyclical - Pharmaceuticals—0.0% | |||

90,000 | Gilead Sciences, Inc., Sr. Unsecd. Note, 3.650%, 3/1/2026 | 87,517 | |

Consumer Non-Cyclical - Tobacco—0.5% | |||

145,000 | BAT Capital Corp., Sr. Unsecd. Note, 6.000%, 2/20/2034 | 146,603 | |

EUR 520,000 | Philip Morris International, Inc., Sr. Unsecd. Note, 2.875%, 5/14/2029 | 540,557 | |

$ 450,000 | Philip Morris International, Inc., Sr. Unsecd. Note, 5.750%, 11/17/2032 | 459,497 | |

200,000 | Reynolds American, Inc., Sr. Unsecd. Note, 5.850%, 8/15/2045 | 186,351 | |

TOTAL | 1,333,008 |

Shares, Principal Amount or Contracts | Value | ||

CORPORATE BONDS—continued | |||

Energy - Independent—0.0% | |||

$ 85,000 | Ovintiv, Inc., Sr. Unsecd. Note, 7.100%, 7/15/2053 | $ 94,532 | |

Energy - Integrated—0.0% | |||

35,000 | Petro-Canada, Deb., 7.000%, 11/15/2028 | 37,233 | |

Energy - Midstream—0.4% | |||

130,000 | Boardwalk Pipeline Partners LP, Sr. Unsecd. Note, 3.600%, 9/1/2032 | 111,657 | |

325,000 | Energy Transfer LP, Sr. Unsecd. Note, 4.050%, 3/15/2025 | 320,541 | |

80,000 | MPLX LP, Sr. Unsecd. Note, 4.125%, 3/1/2027 | 77,529 | |

100,000 | MPLX LP, Sr. Unsecd. Note, 5.500%, 6/1/2034 | 97,847 | |

190,000 | ONEOK, Inc., Sr. Unsecd. Note, 6.100%, 11/15/2032 | 195,878 | |

70,000 | Targa Resources, Inc., Sr. Unsecd. Note, 4.200%, 2/1/2033 | 62,851 | |

250,000 | Targa Resources, Inc., Sr. Unsecd. Note, 6.250%, 7/1/2052 | 252,276 | |

TOTAL | 1,118,579 | ||

Financial Institution - Banking—1.1% | |||

500,000 | Bank of America Corp., Sr. Unsecd. Note, 2.687%, 4/22/2032 | 420,393 | |

100,000 | Bank of America Corp., Sr. Unsecd. Note, Series MTN, 4.875%, 4/1/2044 | 92,916 | |

300,000 | Bank of America Corp., Sub. Note, Series MTN, 4.000%, 1/22/2025 | 296,798 | |

115,000 | Citigroup, Inc., Sr. Unsecd. Note, 3.057%, 1/25/2033 | 97,134 | |

300,000 | Citigroup, Inc., Sr. Unsecd. Note, 3.785%, 3/17/2033 | 266,677 | |

250,000 | Citizens Bank N.A., Sr. Unsecd. Note, Series BKNT, 3.750%, 2/18/2026 | 240,990 | |

95,000 | 3 | Citizens Financial Group, Inc., Sr. Unsecd. Note, 6.645% (SOFR +2.325%), 4/25/2035 | 97,525 |

250,000 | Compass Bank, Birmingham, Sub. Note, Series BKNT, 3.875%, 4/10/2025 | 246,139 | |

250,000 | FNB Corp. (PA), Sr. Unsecd. Note, 5.150%, 8/25/2025 | 247,514 | |

100,000 | 3 | KeyCorp, Sr. Unsecd. Note, 6.401%, 3/6/2035 | 100,723 |

70,000 | Morgan Stanley, Sr. Unsecd. Note, Series MTN, 1.794%, 2/13/2032 | 55,757 | |

200,000 | PNC Financial Services Group, Inc., Sr. Unsecd. Note, 5.582%, 6/12/2029 | 201,374 | |

11,587 | 2 | Regional Diversified Funding, 144A, 9.250%, 3/15/2030 | 4,867 |

225,000 | Truist Financial Corp., Sr. Unsecd. Note, Series MTN, 5.867%, 6/8/2034 | 225,846 | |

250,000 | US Bancorp, Sr. Unsecd. Note, 5.836%, 6/12/2034 | 252,124 | |

300,000 | US Bancorp, Sr. Unsecd. Note, Series MTN, 1.375%, 7/22/2030 | 240,066 | |

TOTAL | 3,086,843 | ||

Financial Institution - Broker/Asset Mgr/Exchange—0.1% | |||

140,000 | Invesco Finance PLC, Sr. Unsecd. Note, 3.750%, 1/15/2026 | 136,178 | |

70,000 | TIAA Asset Management Finance Co. LLC, Sr. Unsecd. Note, 144A, 4.125%, 11/1/2024 | 69,496 | |

TOTAL | 205,674 | ||

Financial Institution - Finance Companies—0.1% | |||

220,000 | Air Lease Corp., Sr. Unsecd. Note, 5.850%, 12/15/2027 | 222,460 | |

Financial Institution - Insurance - Life—0.1% | |||

160,000 | AIA Group Ltd., Sr. Unsecd. Note, 144A, 4.950%, 4/4/2033 | 156,925 | |

10,000 | 3 | MetLife, Inc., Jr. Sub. Note, 10.750% (3-month USLIBOR +7.548%), 8/1/2039 | 13,324 |

TOTAL | 170,249 | ||

Financial Institution - Insurance - P&C—0.0% | |||

75,000 | Nationwide Mutual Insurance Co., Sub., 144A, 4.350%, 4/30/2050 | 57,152 | |

Financial Institution - REIT - Apartment—0.1% | |||

70,000 | Camden Property Trust, Sr. Unsecd. Note, 2.800%, 5/15/2030 | 61,396 | |