|

Exhibit 99.1

|

ENERGY TRANSFER PARTNERS, L.P.

REGENCY ENERGY PARTNERS LP

ETP’s Merger with Regency

January 30, 2015

LEGAL DISCLAIMER

Additional Information and Where to Find It

SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND THE REGISTRATION STATEMENT REGARDING THE

TRANSACTION (THE “TRANSACTION”) INVOLVING THE MERGER OF ENERGY TRANSFER PARTNERS, L.P. (“ETP”) AND REGENCY ENERGY PARTNERS LP (“RGP” AND/OR “REGENCY”) CAREFULLY WHEN IT BECOMES AVAILABLE. These documents (when they become available), and any other doc uments filed by ETP or Regency with the U.S. Securities and Exchange Commission (“SEC”), may be obtained free of charge at the SEC’s website, at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the registration statement and the proxy statement/prosp ectus by phone, e-mail or written request by contacting the investor relations department of ETP or Regency at the following:

Energy Transfer Partners, L.P. Regency Energy Partners LP

3738 Oak Lawn Ave. 2001 Bryan Street, Suite 3700

Dallas, TX 75219 Dallas, TX 75201

Attention: Investor Relations Attention: Investor Relations

Phone: 214-981-0700 Phone: 214-840-5477

Participants in the Solicitation

ETP, Regency and their respective directors and executive officers may be deemed to be participants in the solicitation of pr oxies in connection with the proposed merger. Information regarding the directors and executive officers of ETP is contained in ETP’s Form 10 -K for the year ended December 31, 2013, which was filed with the SEC on February 27, 2014. Information regarding the directors and executive officers of Regency is contained in Regency’s Form 10-K for the year ended

December 31, 2013, which was filed with the SEC on February 27, 2014. Additional information regarding the interests of parti cipants in the solicitation of proxies in connection with the proposed merger will be included in the proxy statement/prospectus.

Cautionary Statement Regarding Forward-Looking Statements

This presentation includes “forward-looking” statements. Forward-looking statements are identified as any statement that does not relate strictly to historical or current facts. Statements using words such as “anticipate,” “believe,” “intend,” “project,” “plan,” “expect,” “continue,” “estimate,” “goal,” “forecast,” “may” or similar expressions help identify forward-looking statements. ETP and Regency cannot give any assurance that expectations and projections about futu re events will prove to be correct. Forward-looking statements are subject to a variety of risks, uncertainties and assumptions. These risks and uncertainties inclu de the risks that the proposed transaction may not be consummated or the benefits contemplated therefrom may not be realized. Additional risks include: the ability to obtain requisite regulatory and unitholder approval and the satisfaction of the other conditions to the consummation of the proposed transaction, the ability of ETP to successfully integrate Regency’s operations and employees and realize anticipated synergies and cost savings, the potential impact of the announcement or cons ummation of the proposed transaction on relationships, including with employees, suppliers, customers, competitors and credit rating agencies, the ability to achi eve revenue, DCF and EBITDA growth, and volatility in the price of oil, natural gas, and natural gas liquids. Actual results and outcomes may differ materially from those expressed in such forward-looking statements. These and other risks and uncertainties are discussed in more detail in filings made by ETP and Regency with the Securities and Exchange Commission

(the “SEC”), which are available to the public. ETP and Regency undertake no obligation to update publicly or to revise any f orward-looking statements, whether as a result of new information, future events or otherwise.

KEY MERGER HIGHLIGHTS

Energy Transfer Partners, L.P. (“ETP”) has executed a definitive agreement to merge with Regency Energy Partners LP (“Regency”) in an all unit transaction

– 0.4066 ETP common units plus a one-time cash payment of $0.32 for each Regency LP unit implying an all-in price of $26.89 per unit based on ETP’s closing price on January 23, 2015

– Implied premium:

13% to Regency’s closing price on January 23, 2015

15% to Regency’s 3-day VWAP ending January 23, 2015

ETP will assume Regency’s outstanding debt and will refinance Regency’s outstanding revolver borrowings

– $6.4 billion of debt at September 30, 2014

– Regency’s revolver to be terminated at closing

– No change of control triggered in Regency existing notes except for two series of notes assumed by Regency in the PVR merger

The assumed PVR senior notes consist of $400 million of 6.5% notes due 2021 and $473 million of 8.375% notes due 2020

Regency will be required to make a change of control offer at 101% of par for these notes

These notes have recently traded at or above 101% of par

All three rating agencies have affirmed ETP’s credit ratings and put Regency on review for upgrade

Breakeven to distributable cash flow per unit for ETP in 2015 and accretive in 2016 and beyond

ETE will provide to ETP $320mm of total IDR subsidies over 5 years

– $80mm IDR subsidy for the first full year after closing and $60mm per year for the following 4 years

ETE and ETP have also agreed to vote their 94.8mm Regency units in support of the merger

Merger subject to customary approvals

– HSR clearance

– Expect transaction to close in Q2 2015

MERGER TAKES ETP TO THE NEXT LEVEL AND CREATES LONG TERM VALUE FOR ALL UNITHOLDERS

(1) | | Based on market data as of 1/23/15 |

STRATEGIC CONSIDERATIONS

LEADING POSITIONS Strong positions in Permian, Eagle Ford, Marcellus and Utica basins

IN THE MOST – Active in 9 of the top 10 basins by active rig count (1)

ATTRACTIVE – Top 3 regions by oil production and top 3 regions by gas production (2)

BASINS IN THE U.S. Adds diversity and leadership positions in substantially all major basins/plays

WORLD CLASS Combines strong Permian Basin / Eagle Ford positions to create the premier franchise

MIDSTREAM Provides additional customer relationships with some of the most active operators in each basin

FOOTPRINT Current combined gathering and processing throughput of 8.7 Bcf/d

COMPLEMENTARY Significant organic growth project opportunities

ASSETS WITH – 2015 pro forma growth capex of ~$4.9 billion

SIGNIFICANT Additional NGL production and volumes to further support Lone Star’s(3) leading NGL position in Mont

GROWTH Belvieu

OPPORTUNITIES Incremental natural gas volumes for ETP’s intrastate natural gas system

SIGNIFICANT LONG- Substantial cost savings and efficiencies

TERM VALUE Higher long-term distribution growth profile than ETP stand-alone

CREATION Provides immediate and long-term value to Regency unitholders

A “WIN–WIN” FOR ALL STAKEHOLDERS

(1) | | Source: Baker Hughes 4 (2) Source: EIA |

(3) | | Lone Star is owned 70% by ETP and 30% by Regency |

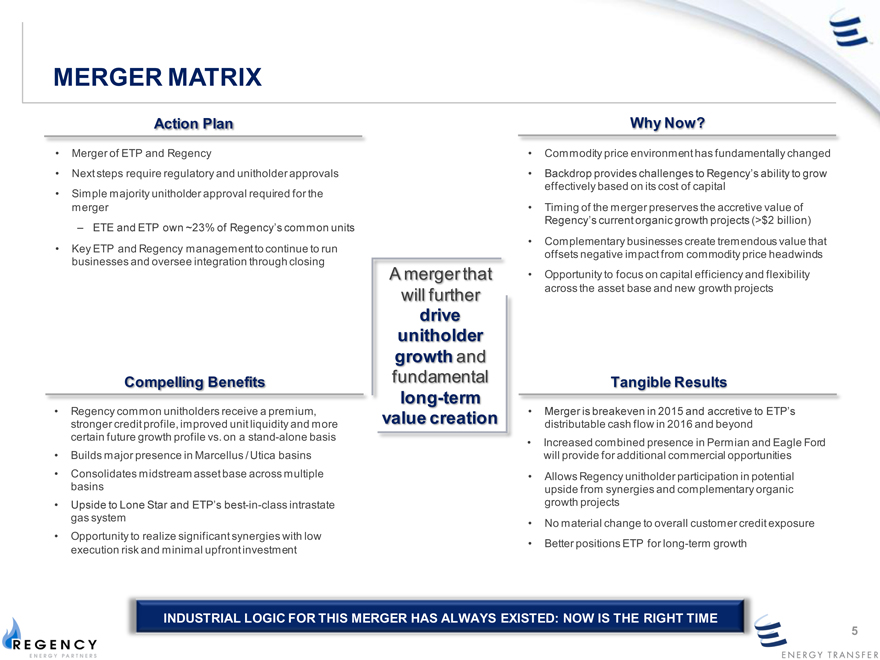

MERGER MATRIX

Action Plan Why Now?

Merger of ETP and Regency Commodity price environment has fundamentally changed

Next steps require regulatory and unitholder approvals Backdrop provides challenges to Regency’s ability to grow

effectively based on its cost of capital

Simple majority unitholder approval required for the

merger Timing of the merger preserves the accretive value of

Regency’s current organic growth projects (>$2 billion)

– ETE and ETP own ~23% of Regency’s common units

Complementary businesses create tremendous value that

Key ETP and Regency management to continue to run offsets negative impact from commodity price headwinds

businesses and oversee integration through closing

A merger that Opportunity to focus on capital efficiency and flexibility

will further across the asset base and new growth projects

drive

unitholder

growth and

Compelling Benefits fundamental Tangible Results

long-term

Regency common unitholders receive a premium, value creation Merger is breakeven in 2015 and accretive to ETP’s

stronger credit profile, improved unit liquidity and more distributable cash flow in 2016 and beyond

certain future growth profile vs. on a stand-alone basis Increased combined presence in Permian and Eagle Ford

Builds major presence in Marcellus / Utica basins will provide for additional commercial opportunities

Consolidates midstream asset base across multiple Allows Regency unitholder participation in potential

basins upside from synergies and complementary organic

Upside to Lone Star and ETP’s best-in-class intrastate growth projects

gas system No material change to overall customer credit exposure

Opportunity to realize significant synergies with low

execution risk and minimal upfront investment Better positions ETP for long-term growth

INDUSTRIAL LOGIC FOR THIS MERGER HAS ALWAYS EXISTED: NOW IS THE RIGHT TIME

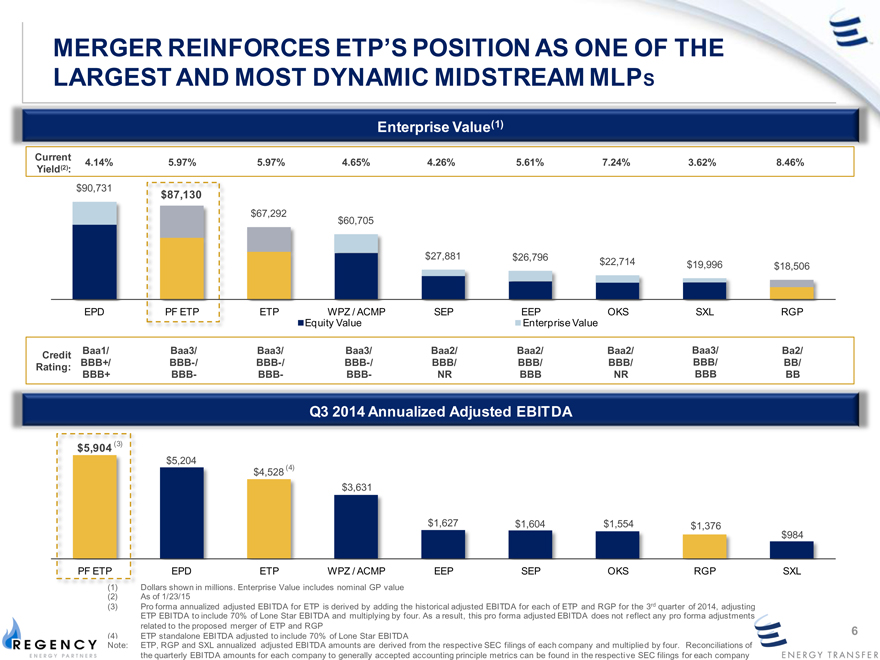

MERGER REINFORCES ETP’S POSITION AS ONE OF THE

LARGEST AND MOST DYNAMIC MIDSTREAM MLPS

Enterprise Value(1)

Current 4.14% 5.97% 5.97% 4.65% 4.26% 5.61% 7.24% 3.62% 8.46%

Yield(2):

$90,731 $87,130

$67,292

$60,705

$27,881 $26,796 $22,714 $19,996 $18,506

EPD PF ETP ETP WPZ / ACMP SEP EEP OKS SXL RGP

Equity Value Enterprise Value

Credit Baa1/ Baa3/ Baa3/ Baa3/ Baa2/ Baa2/ Baa2/ Baa3/ Ba2/

Rating: BBB+/ BBB-/ BBB-/ BBB-/ BBB/ BBB/ BBB/ BBB/ BB/

BBB+ BBB- BBB- BBB- NR BBB NR BBB BB

Q3 2014 Annualized Adjusted EBITDA

$5,204

$4,528 (4)

$3,631

$1,627 $1,604 $1,554 $1,376

$984

EPD ETP WPZ / ACMP EEP SEP OKS RGP SXL

(1) | | Dollars shown in millions. Enterprise Value includes nominal GP value |

(3) Pro forma annualized adjusted EBITDA for ETP is derived by adding the historical adjusted EBITDA for each of ETP and RGP for the 3rd quarter of 2014, adjusting

ETP EBITDA to include 70% of Lone Star EBITDA and multiplying by four. As a result, this pro forma adjusted EBITDA does not reflect any pro forma adjustments

related to the proposed merger of ETP and RGP (4) ETP standalone EBITDA adjusted to include 70% of Lone Star EBITDA

Note:(5) ETP, RGP and SXL annualized adjusted EBITDA amounts are derived from the respective SEC filings of each company and multiplied by four. Reconciliations of

the quarterly EBITDA amounts for each company to generally accepted accounting principle metrics can be found in the respective SEC filings for each company

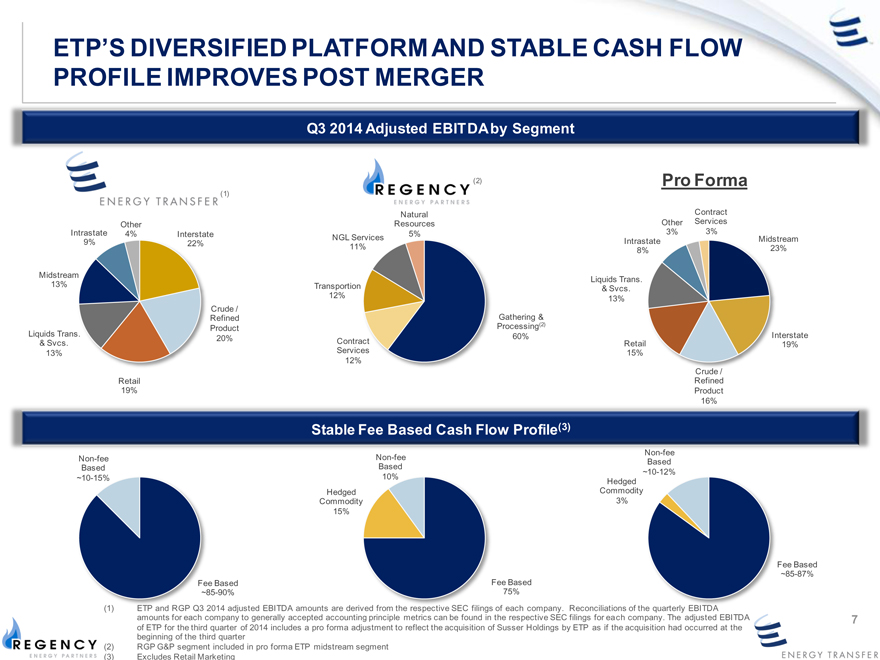

ETP’S DIVERSIFIED PLATFORM AND STABLE CASH FLOW

PROFILE IMPROVES POST MERGER

Q3 2014 Adjusted EBITDA by Segment

Natural Contract

Other Resources Other Services

Intrastate 4% Interstate 5% 3% 3%

9% 22% NGL Services Intrastate Midstream

11% 8% 23%

Midstream Liquids Trans.

13% Transportion & Svcs.

12% 13%

Crude /

Refined Gathering &

Product Processing(2)

Liquids Trans. 20% 60% Interstate

& Svcs. Contract Retail 19%

13% Services 15%

12%

Crude /

Retail Refined

19% Product

16%

Stable Fee Based Cash Flow Profile(3)

Non-fee Non-fee Based

Based Based ~10-12%

~10-15% 10% Hedged

Hedged Commodity

Commodity 3%

15%

Fee Based

~85-87%

Fee Based Fee Based

~85-90% 75%

(1) ETP and RGP Q3 2014 adjusted EBITDA amounts are derived from the respective SEC filings of each company. Reconciliations of the quarterly EBITDA

amounts for each company to generally accepted accounting principle metrics can be found in the respective SEC filings for each company. The adjusted EBITDA

of ETP for the third quarter of 2014 includes a pro forma adjustment to reflect the acquisition of Susser Holdings by ETP as if the acquisition had occurred at the

beginning of the third quarter

(2) | | RGP G&P segment included in pro forma ETP midstream segment |

(3) | | Excludes Retail Marketing |

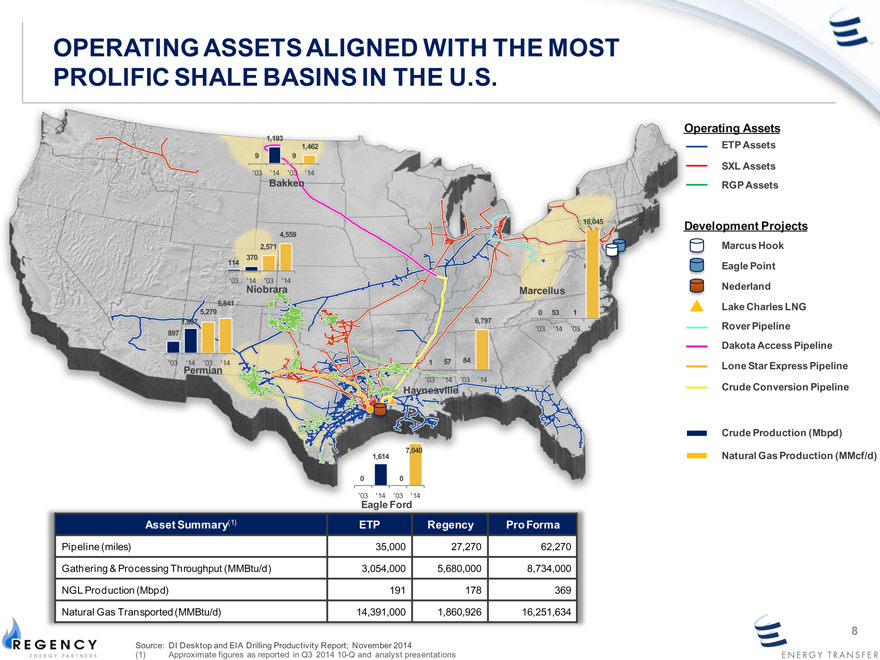

OPERATING ASSETS ALIGNED WITH THE MOST PROLIFIC SHALE BASINS , IN THE U.S.

,

,

, Operating Assets

1,193 , ETP Assets

1,462

9 9 ,

, SXL Assets

‘03 ‘14 ‘03 ‘14

Bakken , RGP Assets

,

, ,

,

,

, 16,045 Development Projects

,

4,559,

,

2,571 , Marcus Hook

, 370 ,

114 Eagle Point

, ,

‘03 ‘14 ‘03 ‘14

Niobrara Marcellus Nederland

5,841 Lake Charles LNG

5,279 0 53 1 1,807 6,797

Rover Pipeline

‘03 ‘14 ‘03 ‘14

897

Dakota Access Pipeline

‘03 ‘14 ‘03 ‘14 1 57 84

Lone Star Express Pipeline Permian

‘03 ‘14 ‘03 ‘14

Haynesville Crude Conversion Pipeline

Crude Production (Mbpd)

1,614 7,040

Natural Gas Production (MMcf/d)

0 0

‘03 ‘14 ‘03 ‘14

Eagle Ford

Asset Summary(1) ETP Regency Pro Forma

Pipeline (miles) 35,000 27,270 62,270

Gathering & Processing Throughput (MMBtu/d) 3,054,000 5,680,000 8,734,000

NGL Production (Mbpd) 191 178 369

Natural Gas Transported (MMBtu/d) 14,391,000 1,860,926 16,251,634

Source: DI Desktop and EIA Drilling Productivity Report; November 2014

(1) | | Approximate figures as reported in Q3 2014 10-Q and analyst presentations |

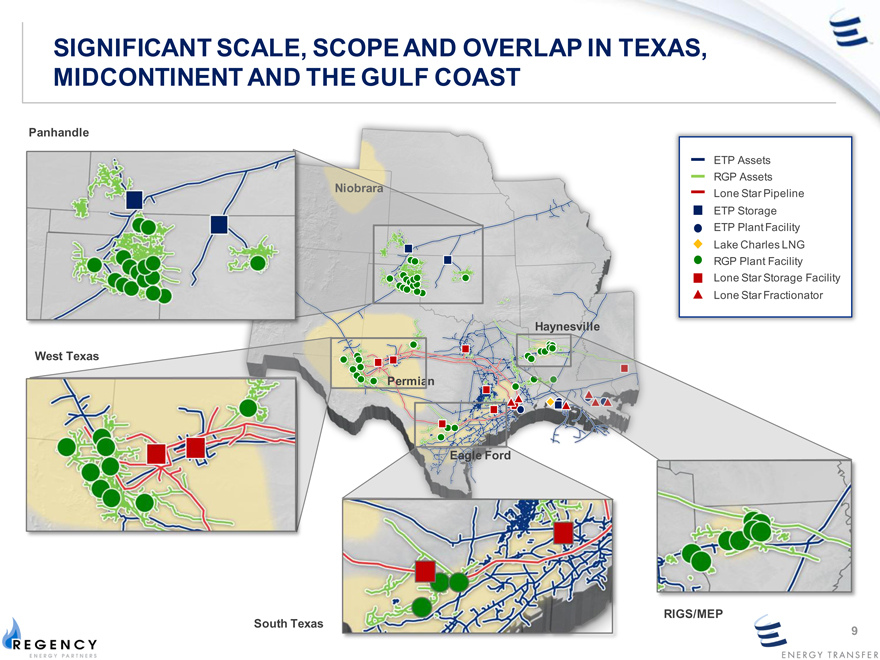

SIGNIFICANT SCALE, SCOPE AND OVERLAP IN TEXAS, MIDCONTINENT AND THE GULF COAST

Panhandle

ETP Assets RGP Assets

Niobrara

Lone Star Pipeline ETP Storage ETP Plant Facility Lake Charles LNG RGP Plant Facility

Lone Star Storage Facility Lone Star Fractionator

Haynesville West Texas Permian

Eagle Ford

RIGS/MEP South Texas

9

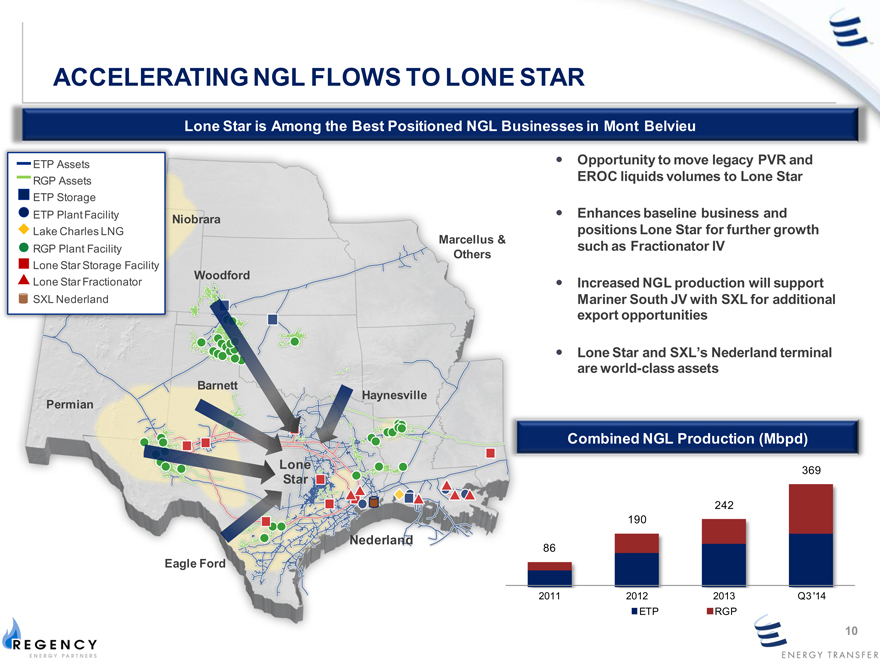

ACCELERATING NGL FLOWS TO LONE STAR

Lone Star is Among the Best Positioned NGL Businesses in Mont Belvieu

ETP Assets Opportunity to move legacy PVR and RGP Assets EROC liquids volumes to Lone Star

ETP Storage

ETP Plant Facility Enhances baseline business and

Niobrara

Lake Charles LNG positions Lone Star for further growth

Marcellus &

RGP Plant Facility such as Fractionator IV

Others

Lone Star Storage Facility Woodford

Lone Star Fractionator Increased NGL production will support SXL Nederland Mariner South JV with SXL for additional export opportunities

Lone Star and SXL’s Nederland terminal are world-class assets

Barnett

Haynesville Permian

Combined NGL Production (Mbpd)

Lone

369

Star

242 190

Nederland

86

Eagle Ford

2011 2012 2013 Q3 ‘14

ETP RGP

10

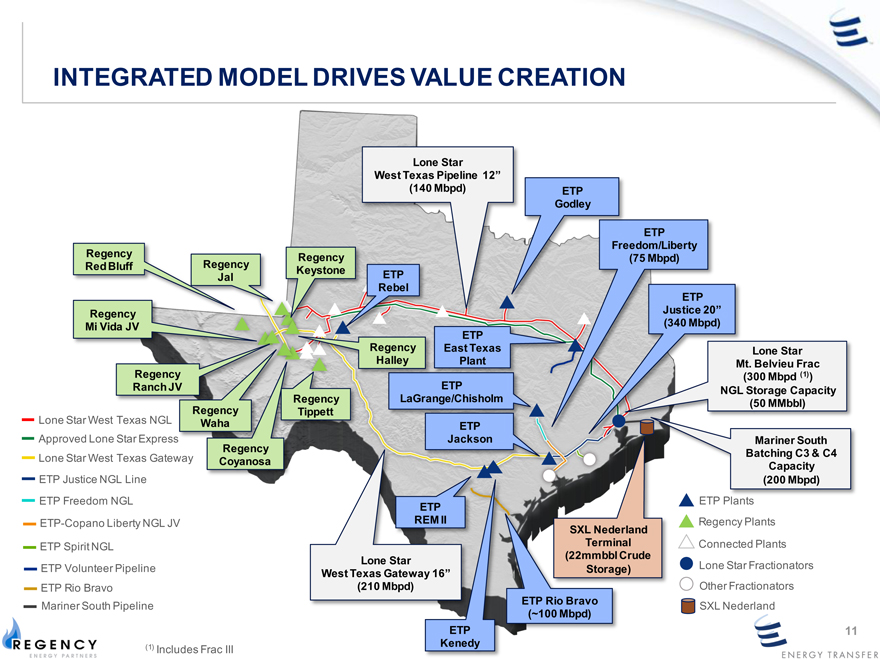

INTEGRATED MODEL DRIVES VALUE CREATION

Lone Star

West Texas Pipeline 12”

(140 Mbpd) ETP Godley

ETP edom/Liberty Regency Regency (75 Mbpd) Red Bluff y Keyston ETP

Rebel ETP

Justice 20”

Mi Vida JV (340 Mbpd) ETP

Regency East Texas Lone Star Halley Plant Mt. Belvieu Frac Regency (300 Mbpd (1)) Ranch JV ETP NGL Storage Capacity Regency LaGrange/Chisholm (50 MMbbl)

Lone Star West Texas NGL Regency Tippett

Waha ETP

Approved Lone Star Express Regency Jackson Mariner South

Batching C3 & C4

Lone Star West Texas Gateway Coyanosa

Capacity

ETP Justice NGL Line (200 Mbpd) ETP Freedom NGL ETP Plants ETP-Copano Liberty NGL JV R rland Regency Plants ETP Spirit NGL al Connected Plants

Crude

Lone Star Lone Star Fractionators ETP Volunteer Pipeline e)

West Texas Gatewa

ETP Rio Bravo (210 Mbpd) Other Fractionators

ETP Rio Bravo

Mariner South Pipeline SXL Nederland

(~100 Mbpd)

ETP 11 (1) Kenedy

Includes Frac III

11

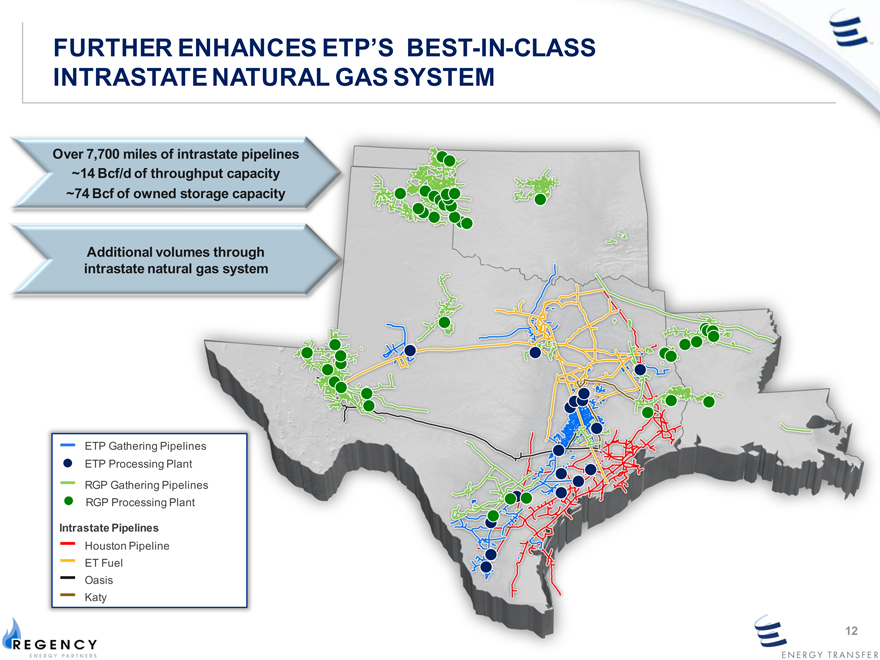

FURTHER ENHANCES ETP’S BEST-IN-CLASS INTRASTATE Interstate Pipeline NATURAL Assets GAS SYSTEM

Over 7,700 miles of intrastate pipelines ~14 Bcf/d of throughput capacity ~74 Bcf of owned storage capacity

Additional volumes through intrastate natural gas system

ETP Gathering Pipelines ETP Processing Plant RGP Gathering Pipelines RGP Processing Plant

Intrastate Pipelines

Houston Pipeline ET Fuel Oasis Katy

12

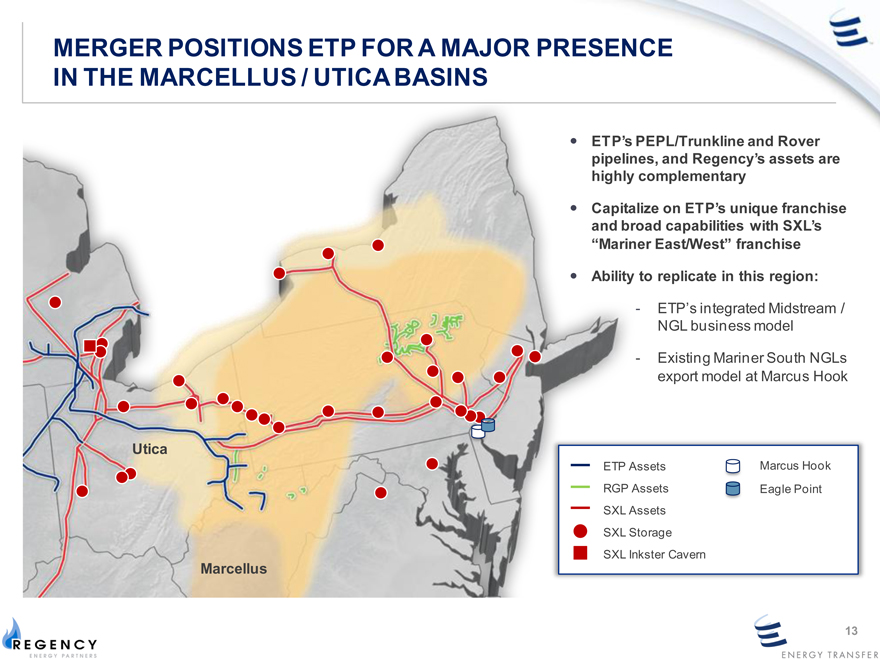

MERGER POSITIONS ETP FOR A MAJOR PRESENCE IN THE MARCELLUS / UTICA BASINS

ETP’s PEPL/Trunkline and Rover pipelines, and Regency’s assets are highly complementary

Capitalize on ETP’s unique franchise and broad capabilities with SXL’s “Mariner East/West” franchise

Ability to replicate in this region:

- ETP’s integrated Midstream /

NGL business model

- Existing Mariner South NGLs export model at Marcus Hook

Utica

ETP Assets Marcus Hook RGP Assets Eagle Point SXL Assets SXL Storage SXL Inkster Cavern

Marcellus

13

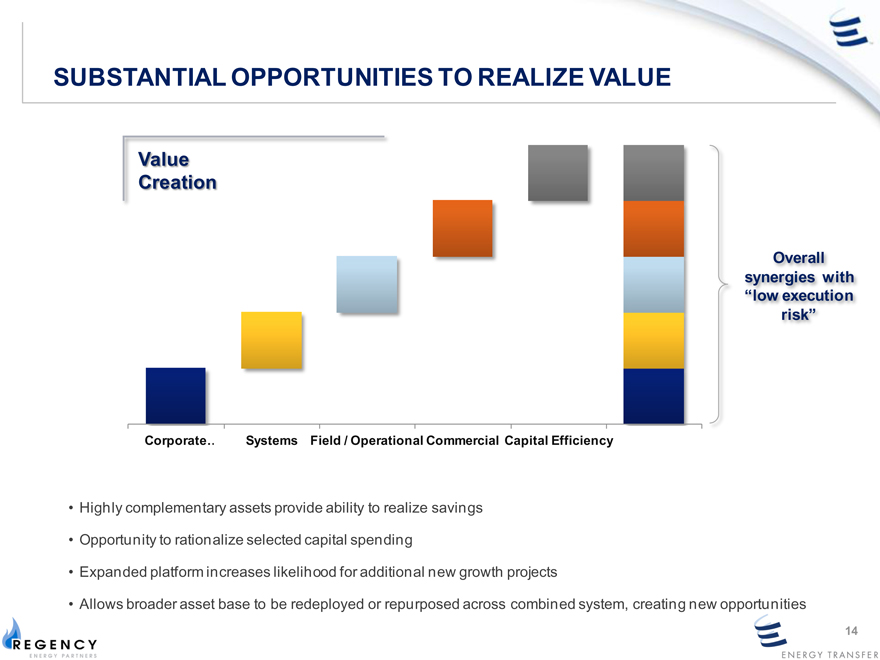

SUBSTANTIAL OPPORTUNITIES TO REALIZE VALUE

Value

Creation

Overall

synergies with

“low execution

risk”

Corporate… Systems Field / Operational Commercial Capital Efficiency

Highly complementary assets provide ability to realize savings

Opportunity to rationalize selected capital spending

Expanded platform increases likelihood for additional new growth projects

Allows broader asset base to be redeployed or repurposed across combined system, creating new opportunities

14

PROVEN TRACK RECORDS OF SUCCESSFUL INTEGRATION

Energy Transfer and Regency management teams have proven track records of successfully integrating acquisitions:

2011 2012 2012 2013 2014 2014 2014

Knowledge of respective assets and businesses will facilitate a smooth integration of:

– Operations

– Commercial

– Risk Management

– Finance / Accounting

– Information Technology

Integration plan expected to be substantially complete by the time of merger closing 15

15

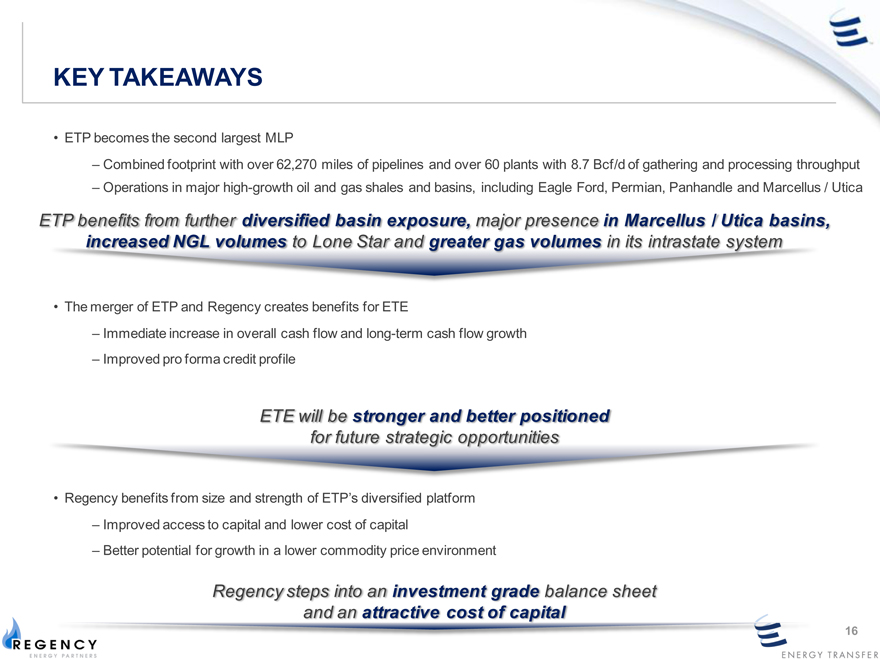

KEY TAKEAWAYS

ETP becomes the second largest MLP

– Combined footprint with over 62,270 miles of pipelines and over 60 plants with 8.7 Bcf/d of gathering and processing throughput

– Operations in major high-growth oil and gas shales and basins, including Eagle Ford, Permian, Panhandle and Marcellus / Utica

ETP benefits from further diversified basin exposure, major presence in Marcellus / Utica basins, increased NGL volumes to Lone Star and greater gas volumes in its intrastate system

The merger of ETP and Regency creates benefits for ETE

– Immediate increase in overall cash flow and long-term cash flow growth

– Improved pro forma credit profile

ETE will be stronger and better positioned for future strategic opportunities

Regency benefits from size and strength of ETP’s diversified platform

– Improved access to capital and lower cost of capital

– Better potential for growth in a lower commodity price environment

Regency steps into an investment grade balance sheet and an attractive cost of capital

16

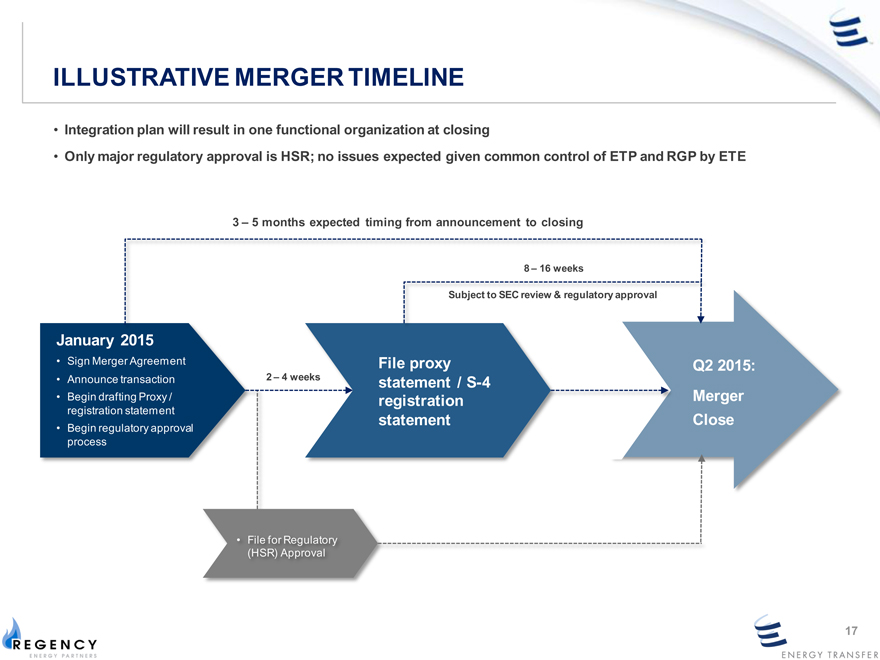

ILLUSTRATIVE MERGER TIMELINE

Integration plan will result in one functional organization at closing

Only major regulatory approval is HSR; no issues expected given common control of ETP and RGP by ETE

3 | | – 5 months expected timing from announcement to closing |

Subject to SEC review & regulatory approval

January 2015

Sign Merger Agreement File proxy Q2 2015:

Announce transaction 2 – 4 weeks statement / S-4

Begin drafting Proxy / registration Merger

registration statement

Begin regulatory approval statement Close

process

File for Regulatory

(HSR) Approval

APPENDIX

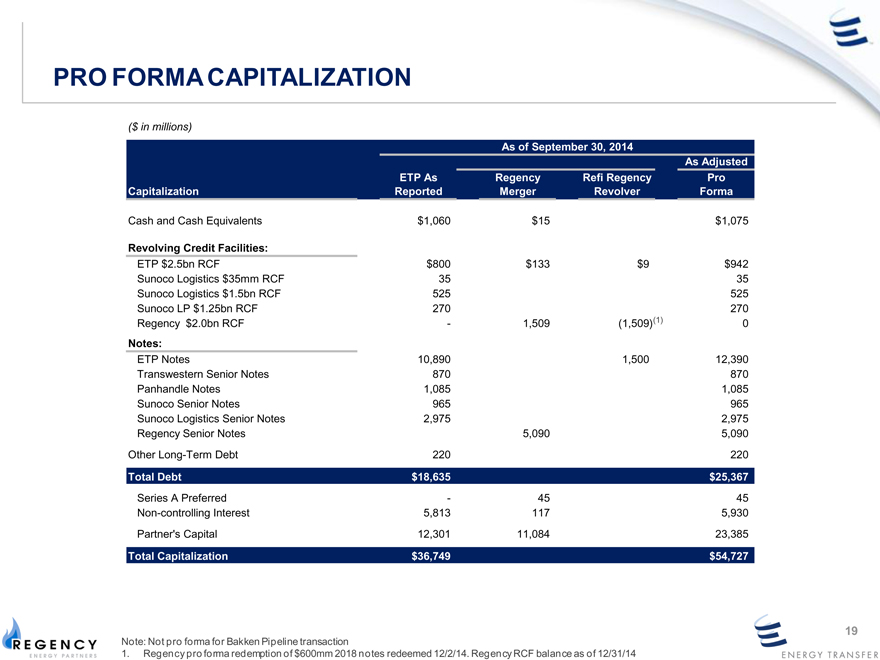

PRO FORMA CAPITALIZATION

($ in millions)

As of September 30, 2014

As Adjusted

ETP As Regency Refi Regency Pro

Capitalization Reported Merger Revolver Forma

Cash and Cash Equivalents $1,060 $15 $1,075

Revolving Credit Facilities:

ETP $2.5bn RCF $800 $133 $9 $942

Sunoco Logistics $35mm RCF 35 35

Sunoco Logistics $1.5bn RCF 525 525

Sunoco LP $1.25bn RCF 270 270

Regency $2.0bn RCF—1,509(1,509)(1) 0

Notes:

ETP Notes 10,890 1,500 12,390

Transwestern Senior Notes 870 870

Panhandle Notes 1,085 1,085

Sunoco Senior Notes 965 965

Sunoco Logistics Senior Notes 2,975 2,975

Regency Senior Notes 5,090 5,090

Other Long-Term Debt 220 220

Total Debt $18,635 $25,367

Series A Preferred—45 45

Non-controlling Interest 5,813 117 5,930

Partner’s Capital 12,301 11,084 23,385

Total Capitalization $36,749 $54,727

Note: Not pro forma for Bakken Pipeline transaction

1. | | Regency pro forma redemption of $600mm 2018 notes redeemed 12/2/14. Regency RCF balance as of 12/31/14 |