Why Invest in PotlatchDeltic

Forward-Looking Statements & Non-GAAP Measures

Company and Industry Overview

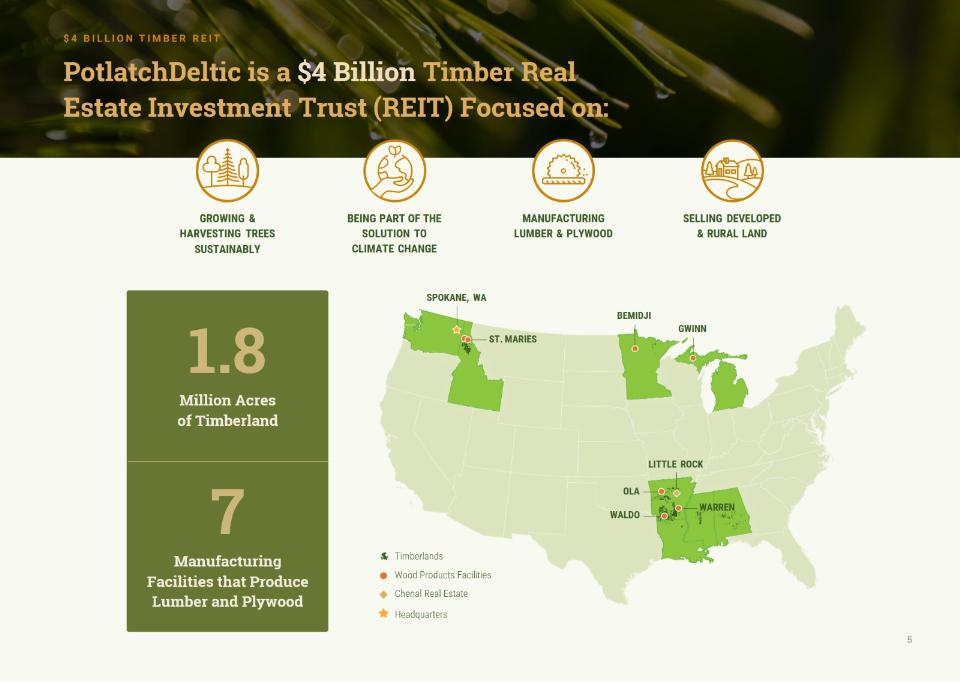

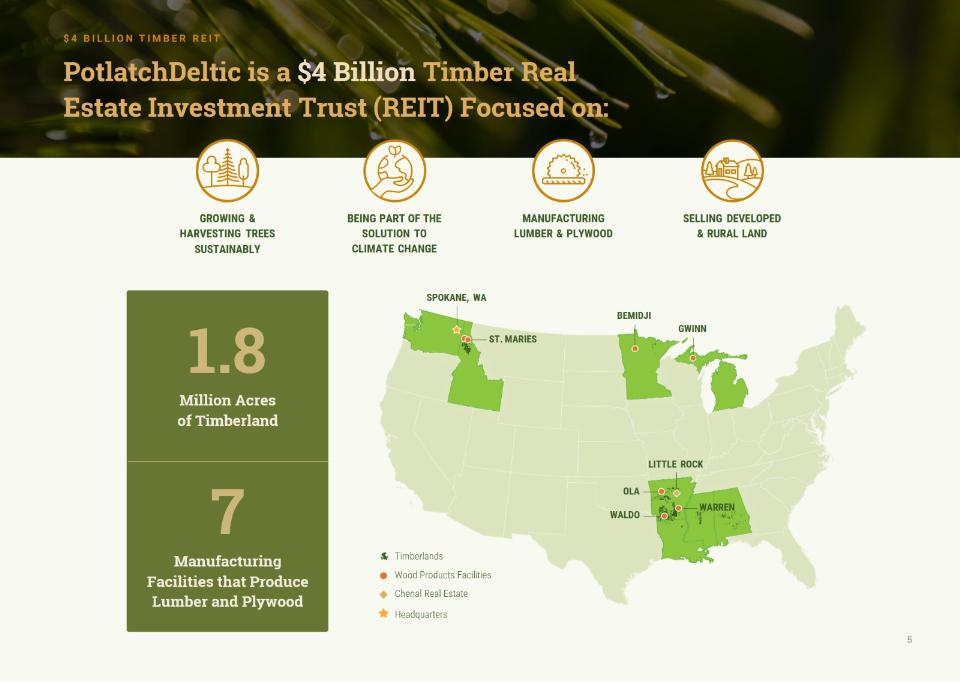

PotlatchDeltic is a $4 Billion Timber Real Estate Investment Trust (REIT) Focused on:

We Operate Three Business Segments

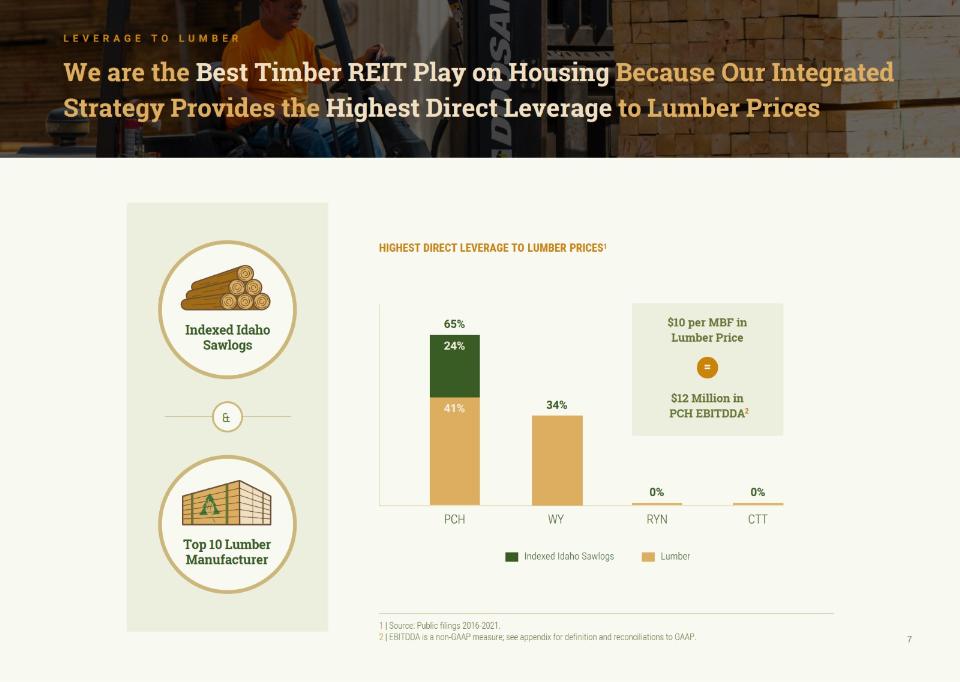

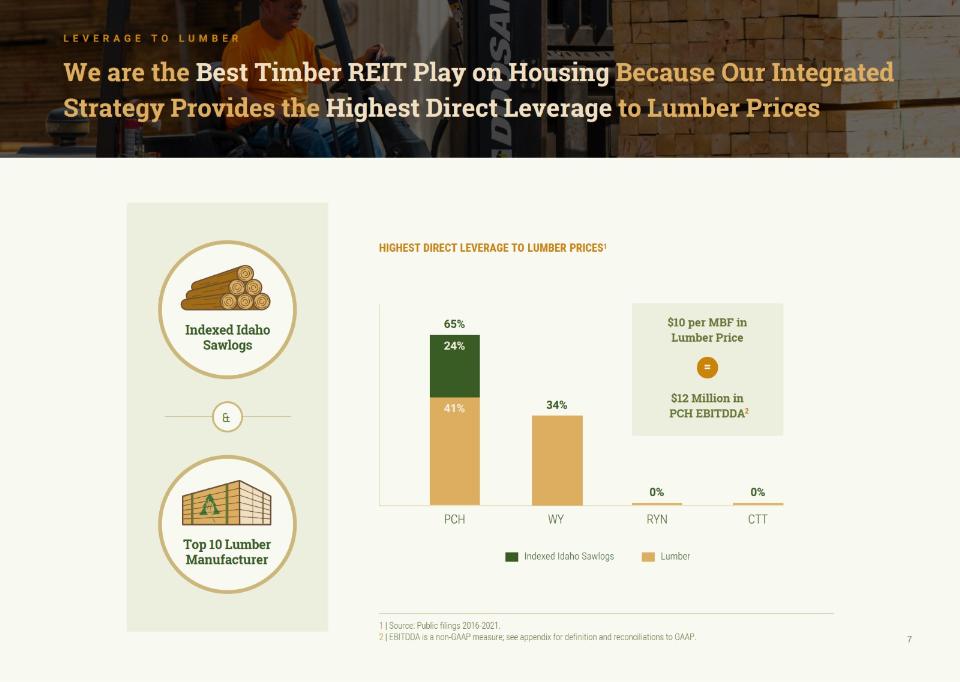

We are the Best Timber REIT Play on Housing Because Our Integrated Strategy Provides the Highest Direct Leverage to Lumber Prices

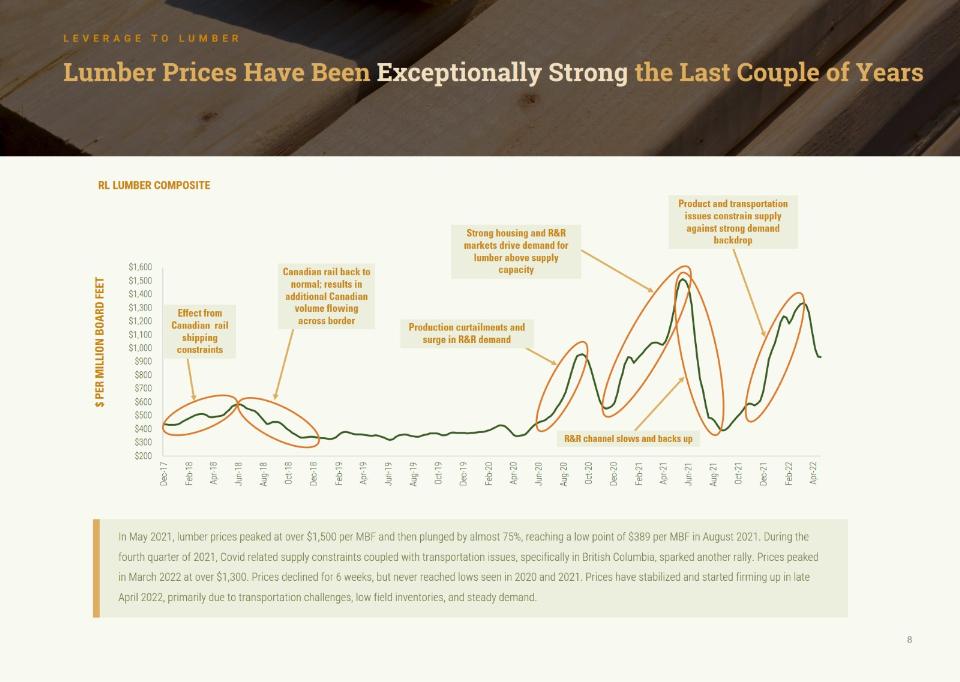

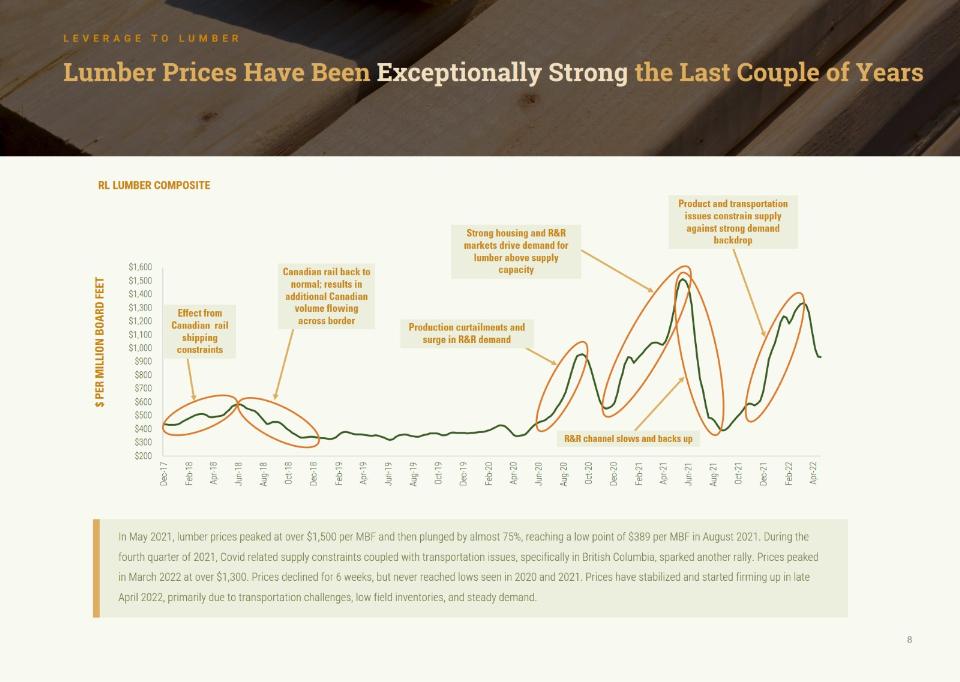

Lumber Prices Have Been Exceptionally Strong the Last Couple of Years

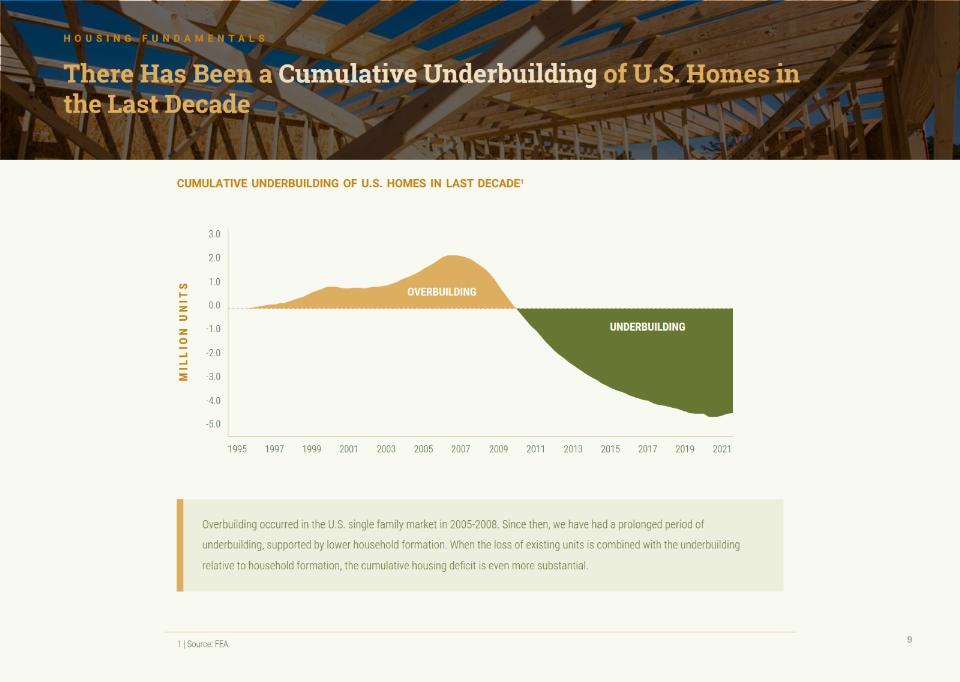

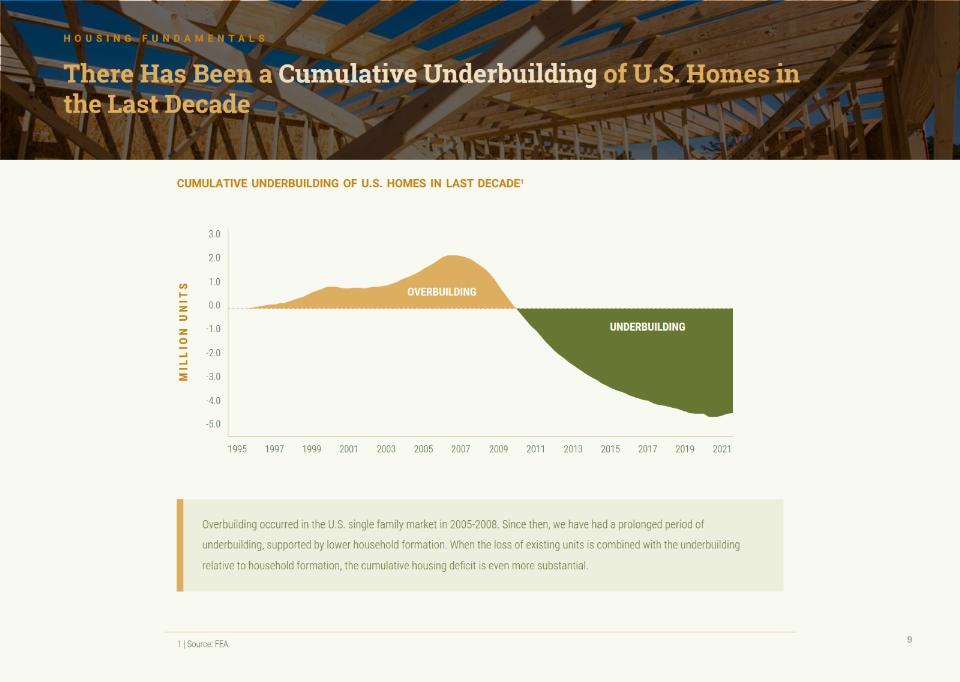

There Has Been a Cumulative Underbuilding of U.S. Homes in the Last Decade

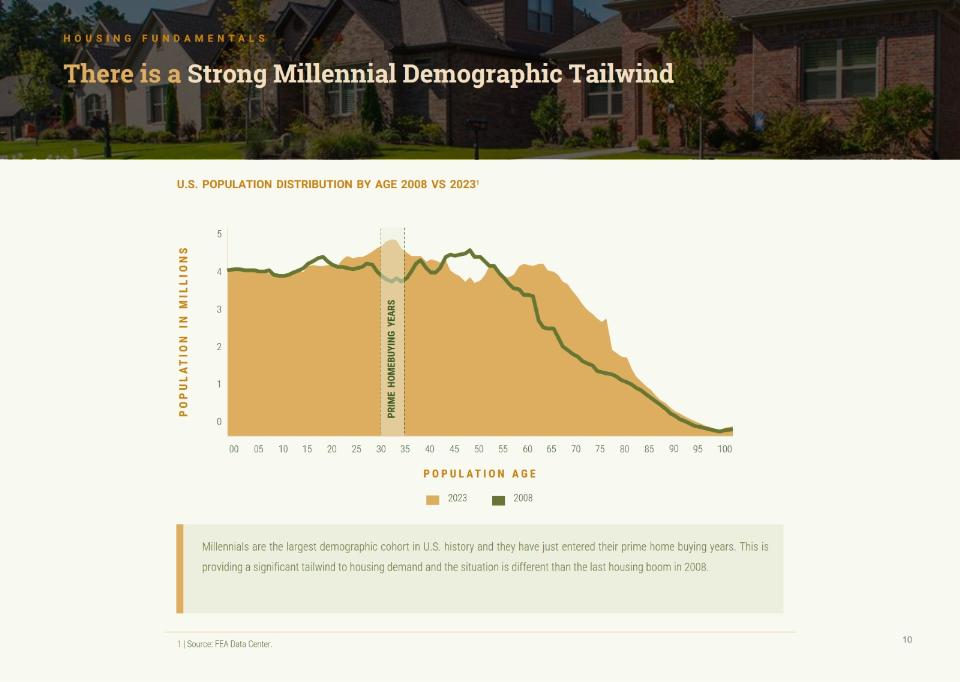

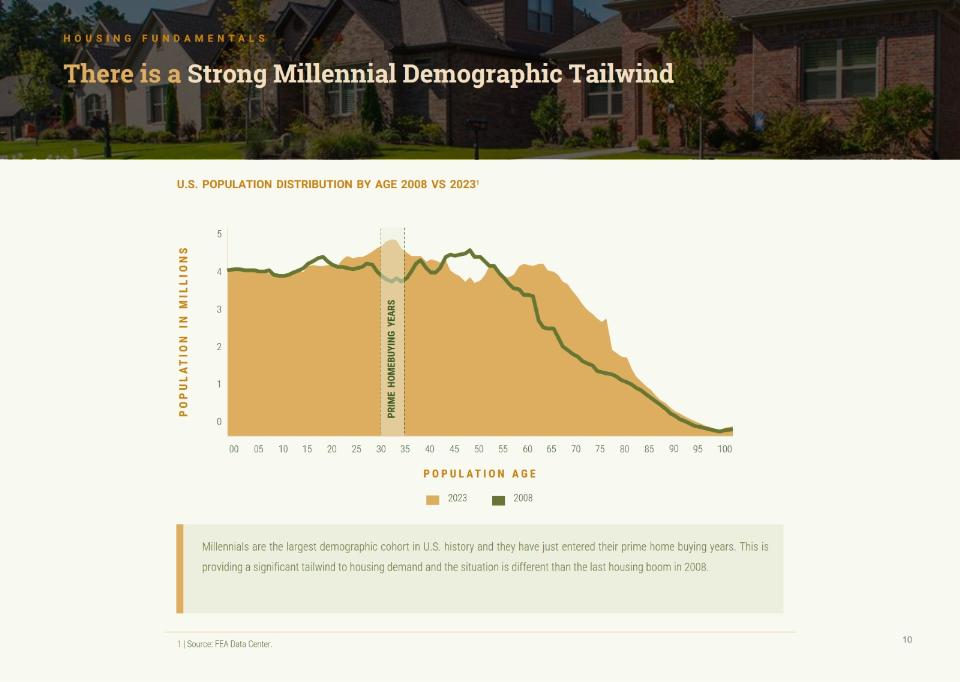

There is a Strong Millennial Demographic Tailwind

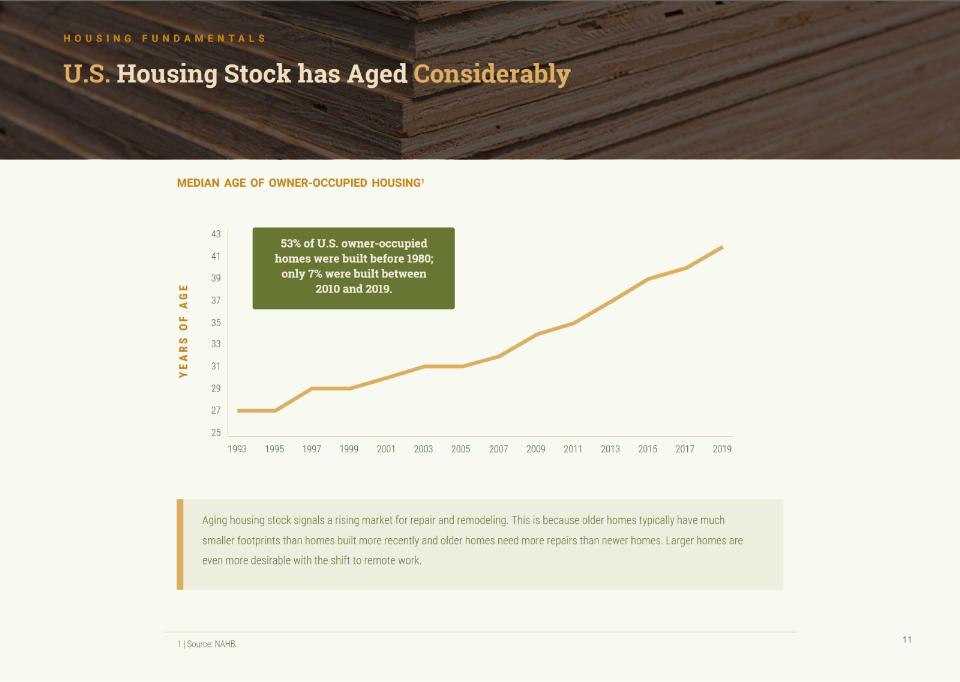

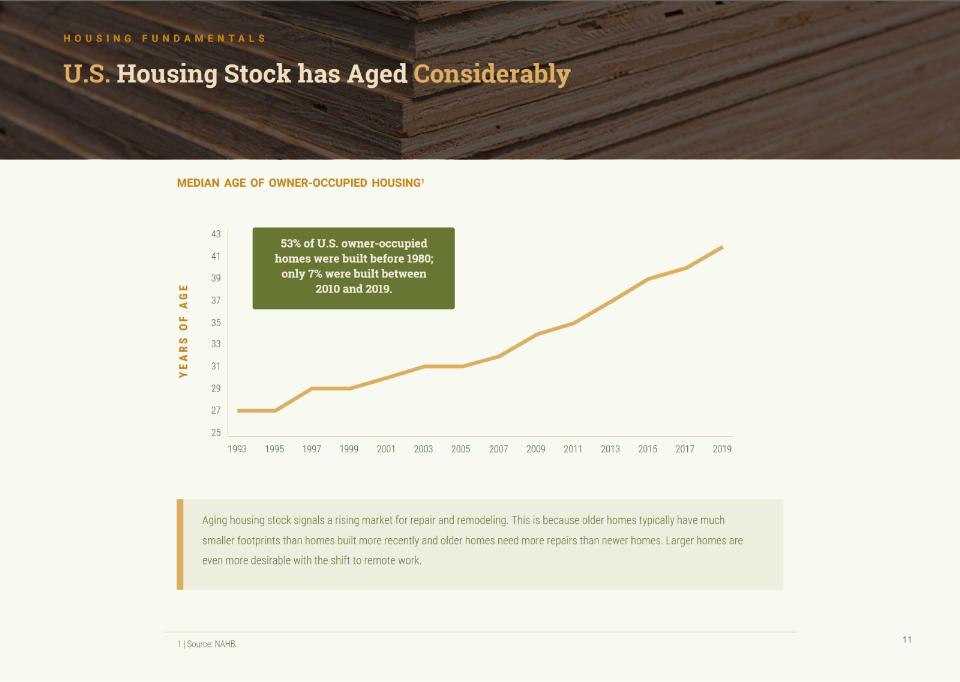

U.S. Housing Stock has Aged Considerably

Growing Residential Improvement Spending Supports Lumber Demand

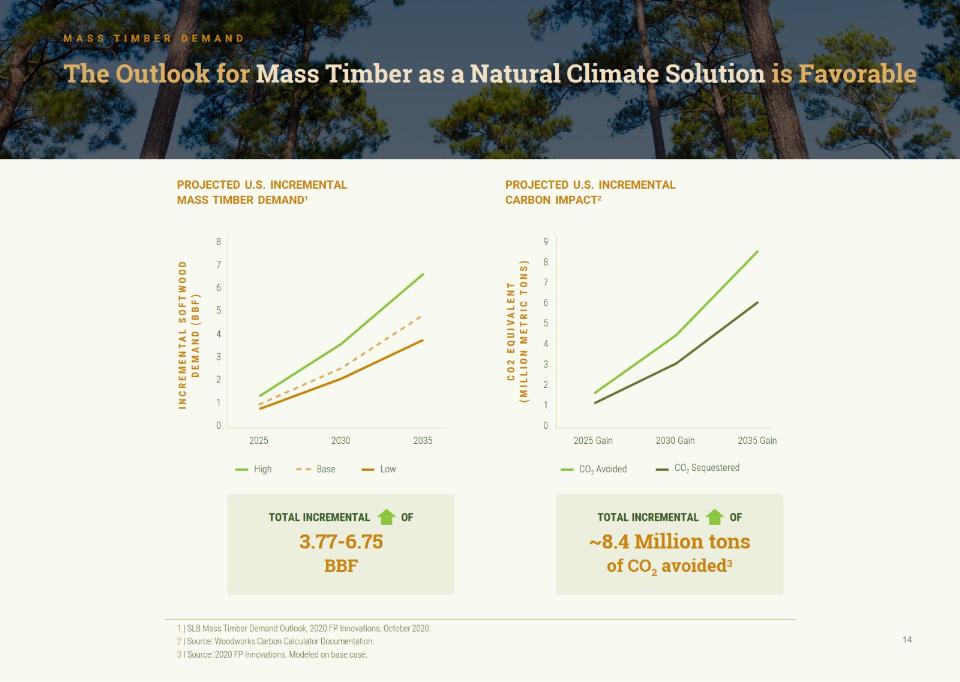

Demand for Lumber Used in Nonresidential Construction is Also Poised for Growth as Environmentally Beneficial Tall Wood Buildings Take Market Share from Steel and Concrete

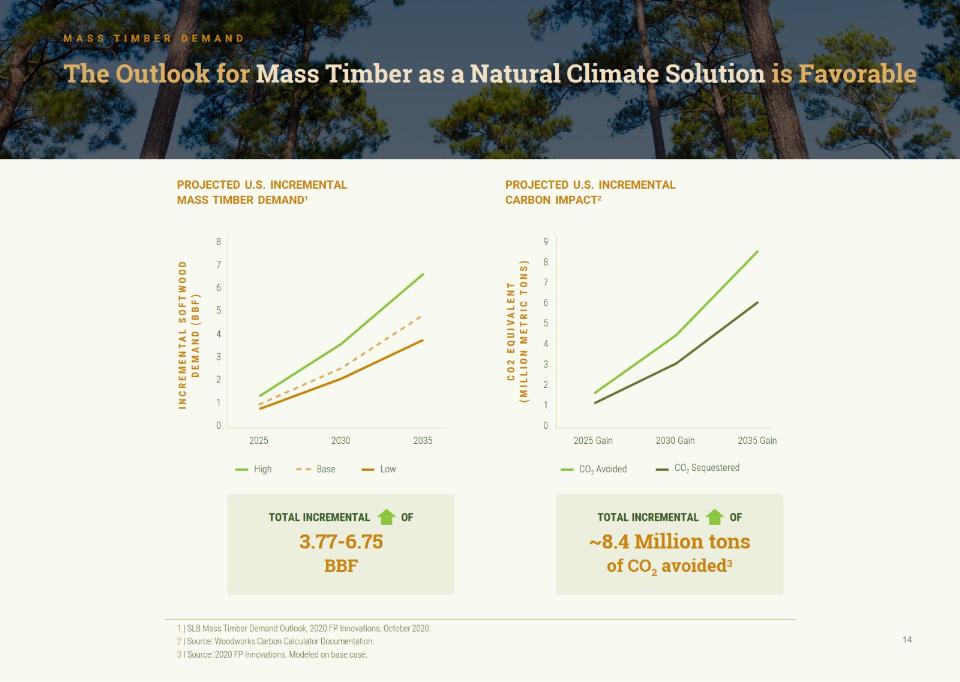

The Outlook for Mass Timber as a Natural Climate Solution is Favorable

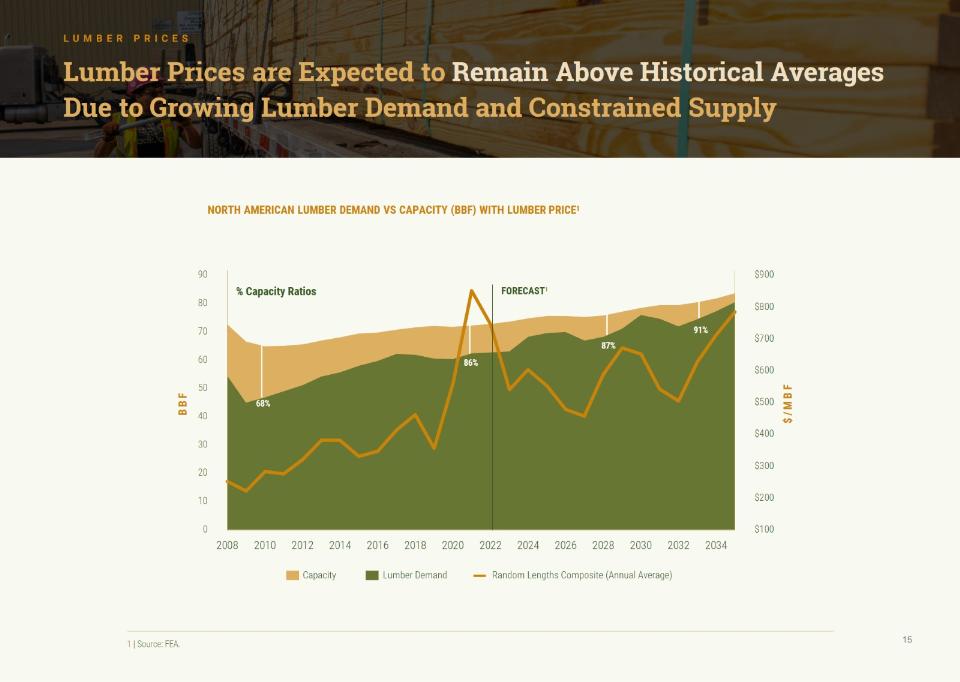

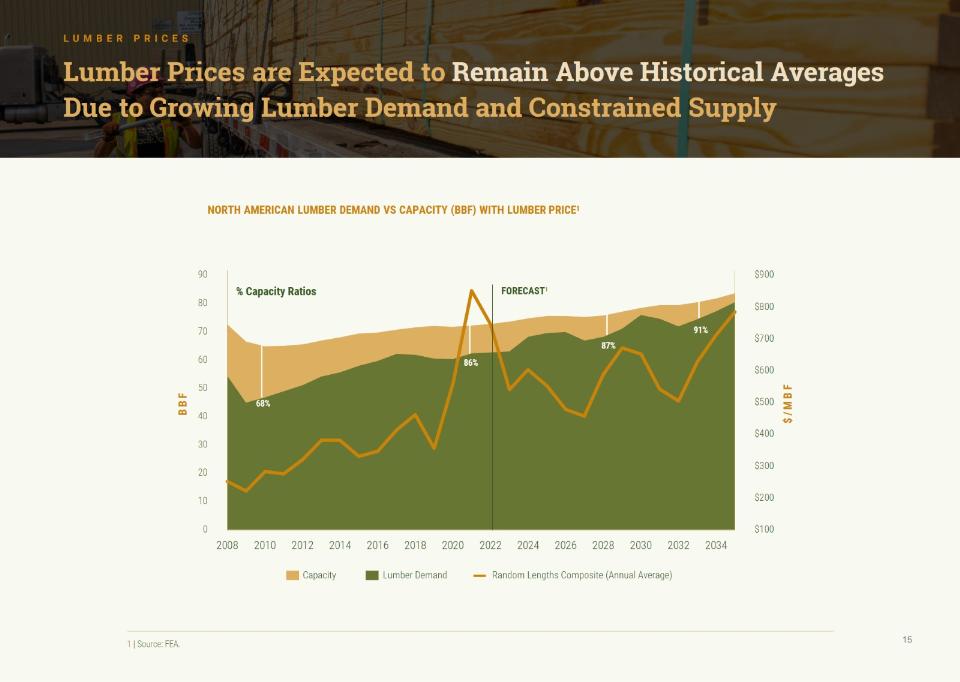

Lumber Prices are Expected to Remain Above Historical Averages Due to Growing Lumber Demand and Constrained Supply

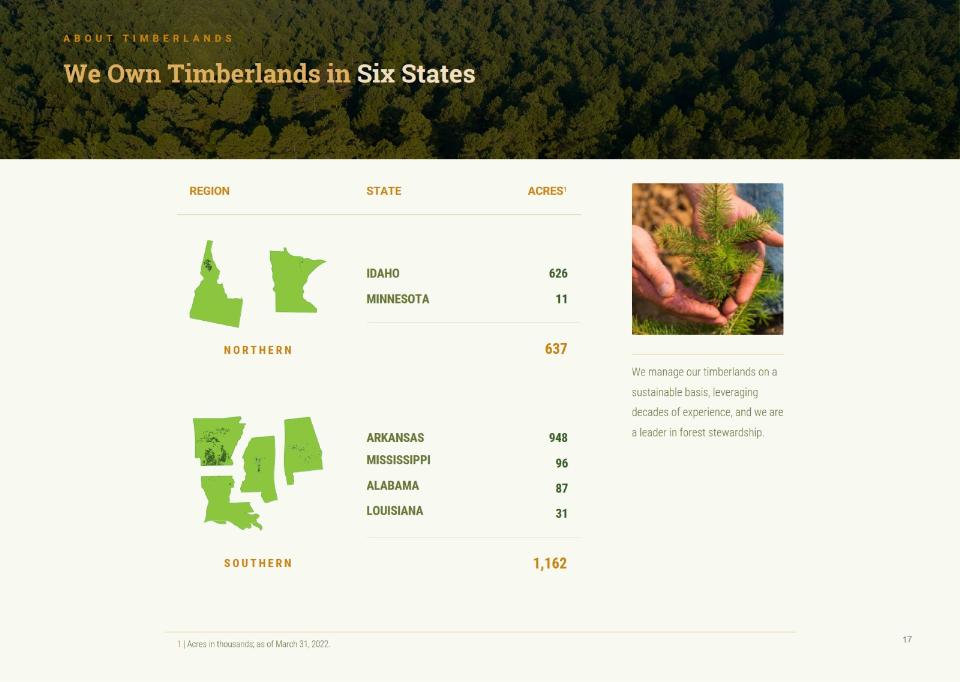

Timberlands Segment

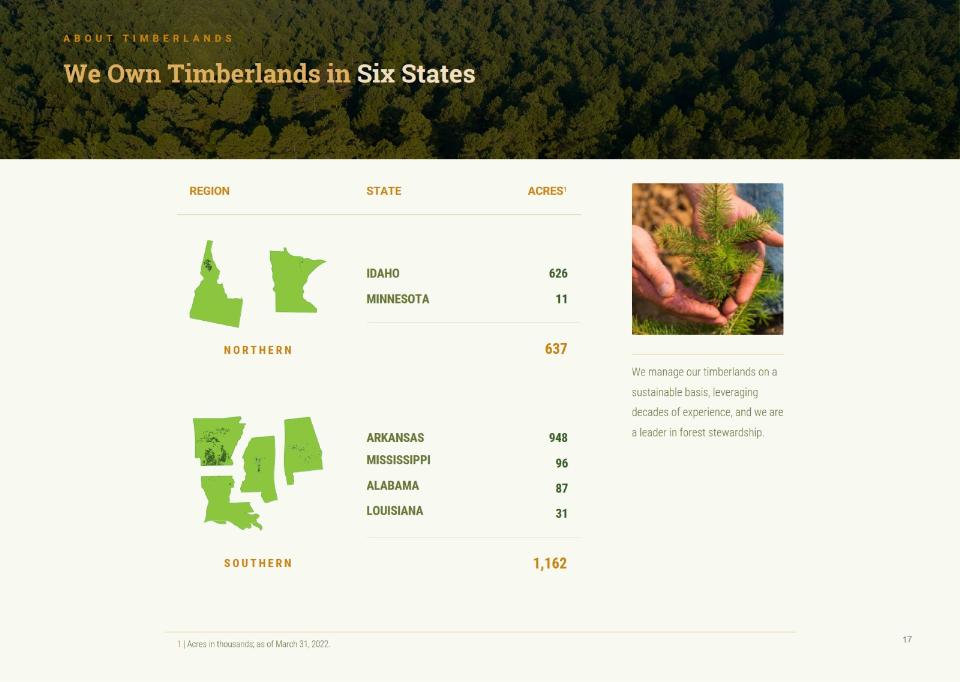

We Own Timberlands in Six States

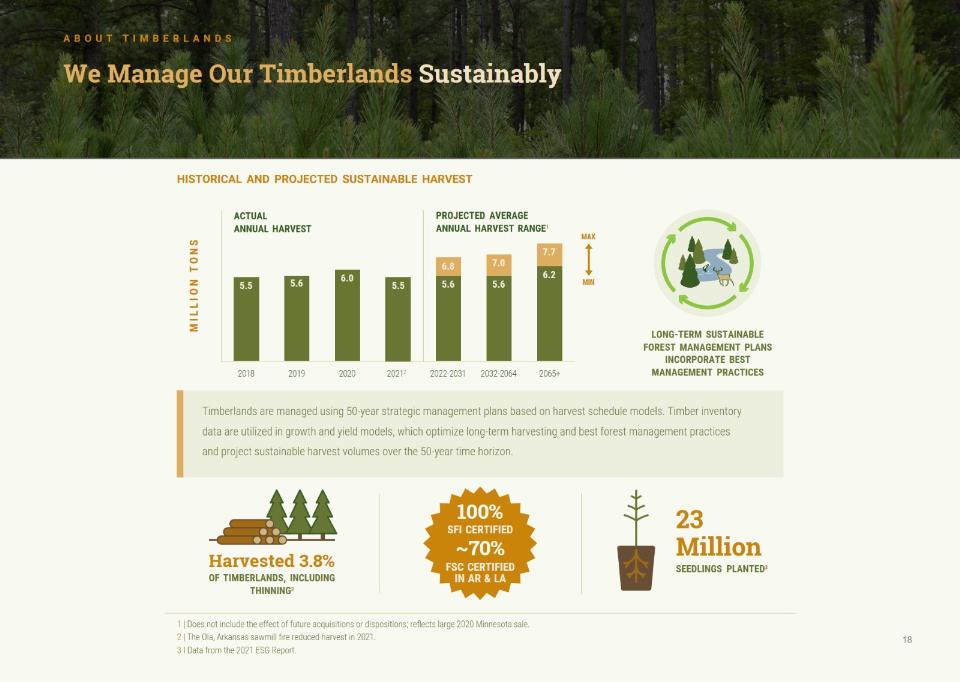

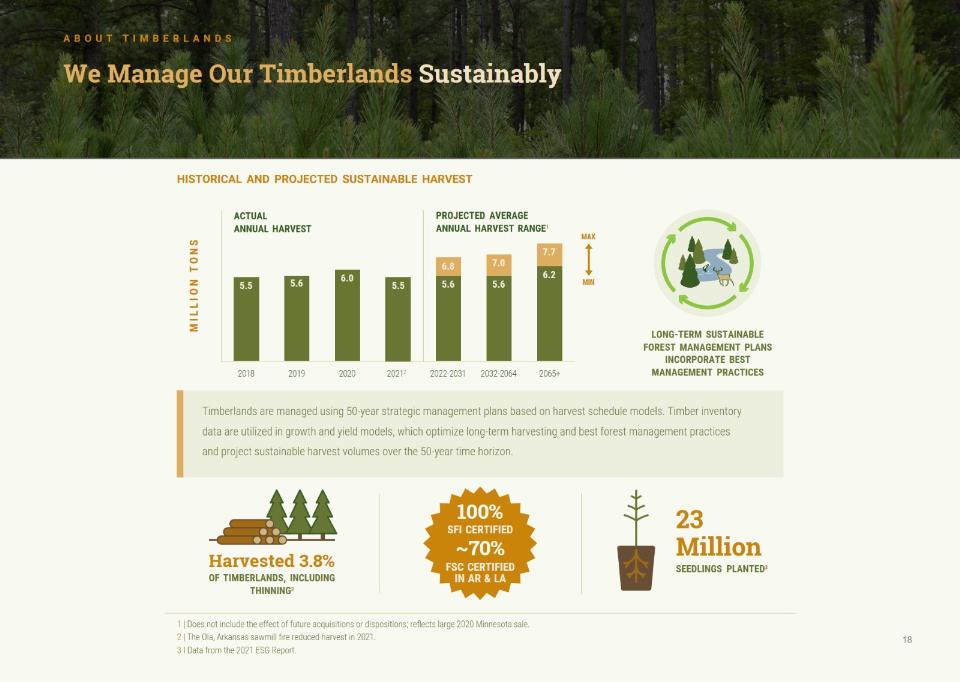

We Manage Our Timberlands Sustainably

A Significant Portion of Our Idaho Sawlogs are Indexed to Lumber

Our Idaho Timberlands are Highly Profitable and Productive

We are Naturally Hedged in the U.S. South

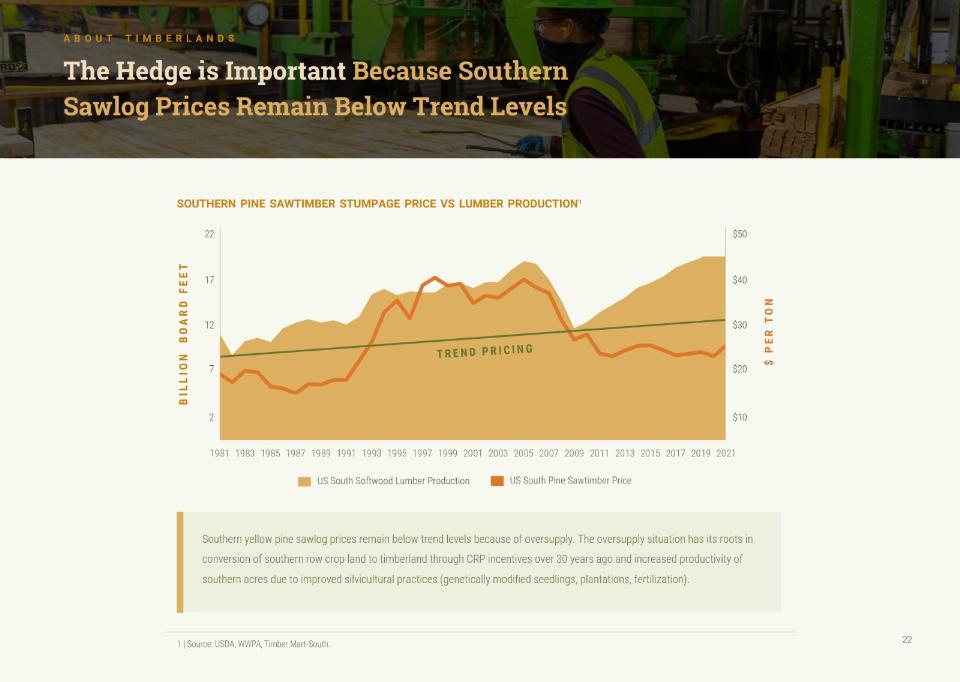

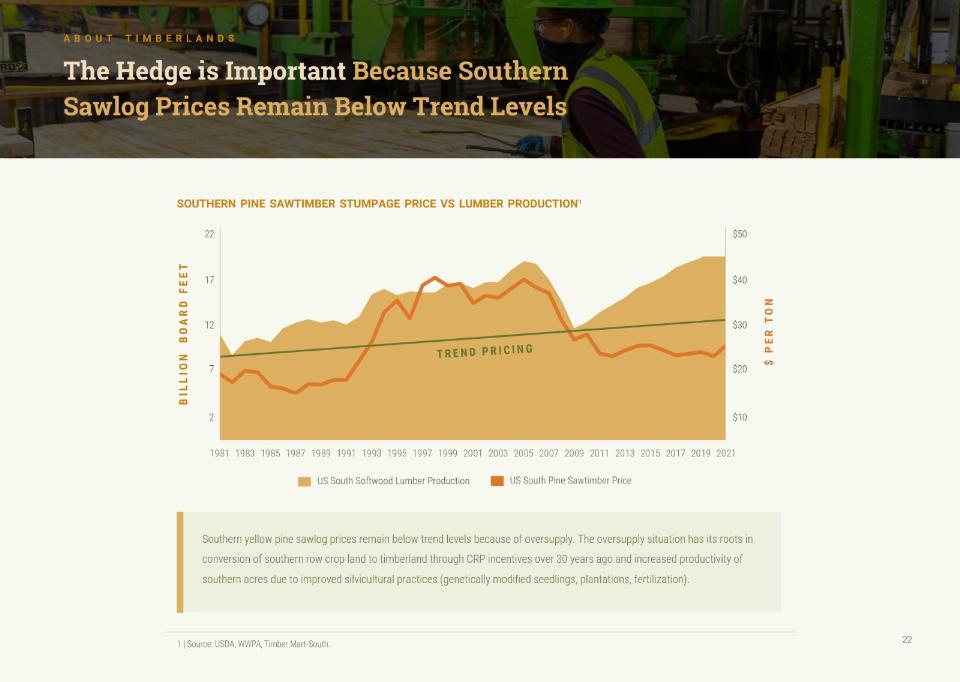

The Hedge is Important Because Southern Sawlog Prices Remain Below Trend Levels

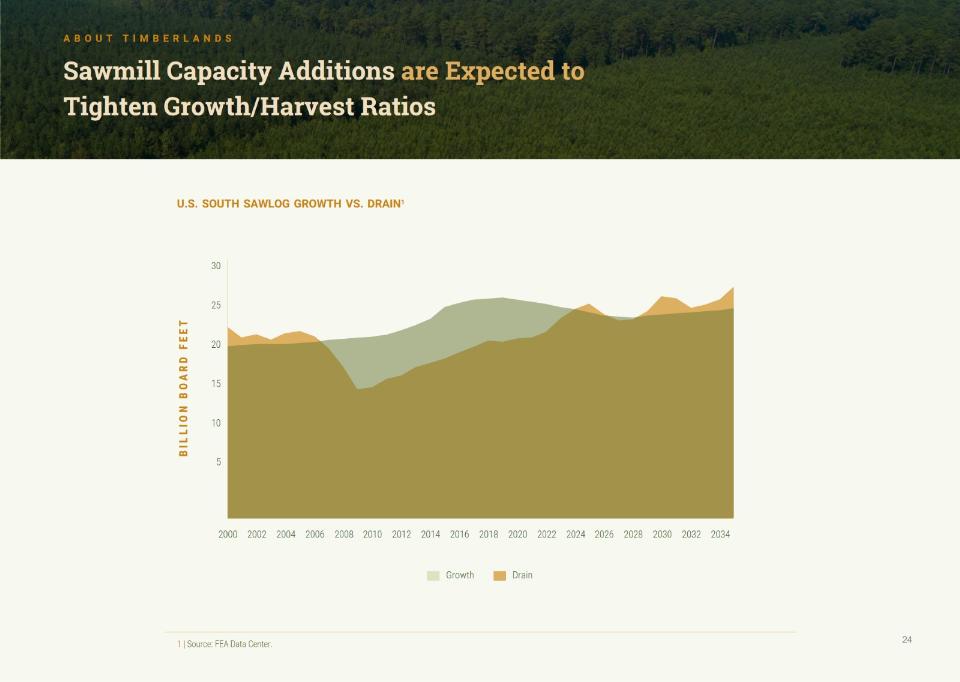

Sawmill Capacity Additions Should Continue to Tighten Log Markets

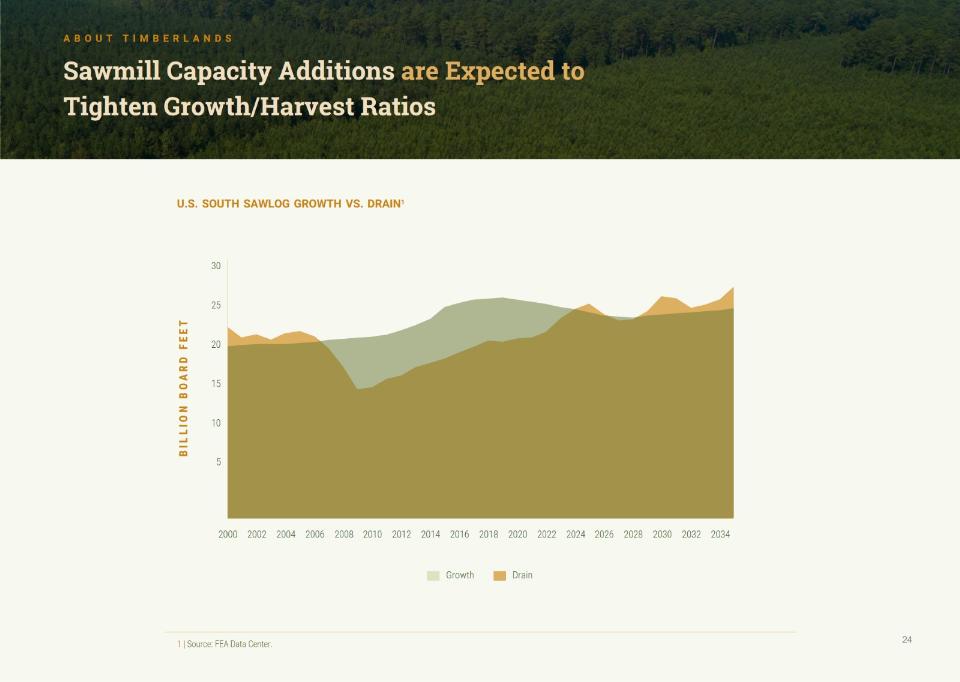

Sawmill Capacity Additions are Expected to Tighten Growth/Harvest Ratios

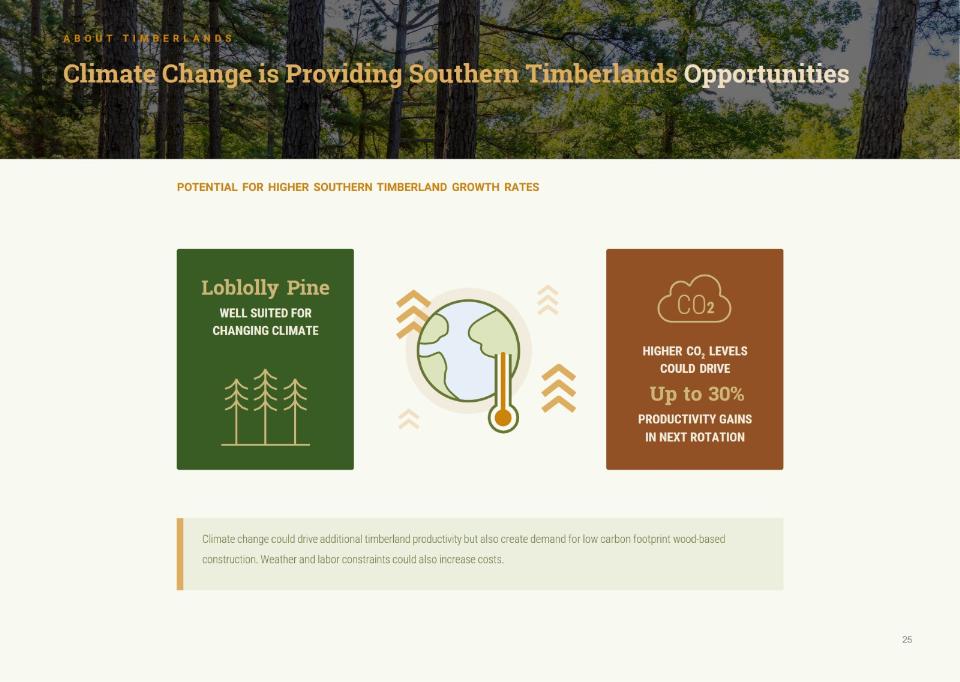

Climate Change is Providing Southern Timberlands Opportunities

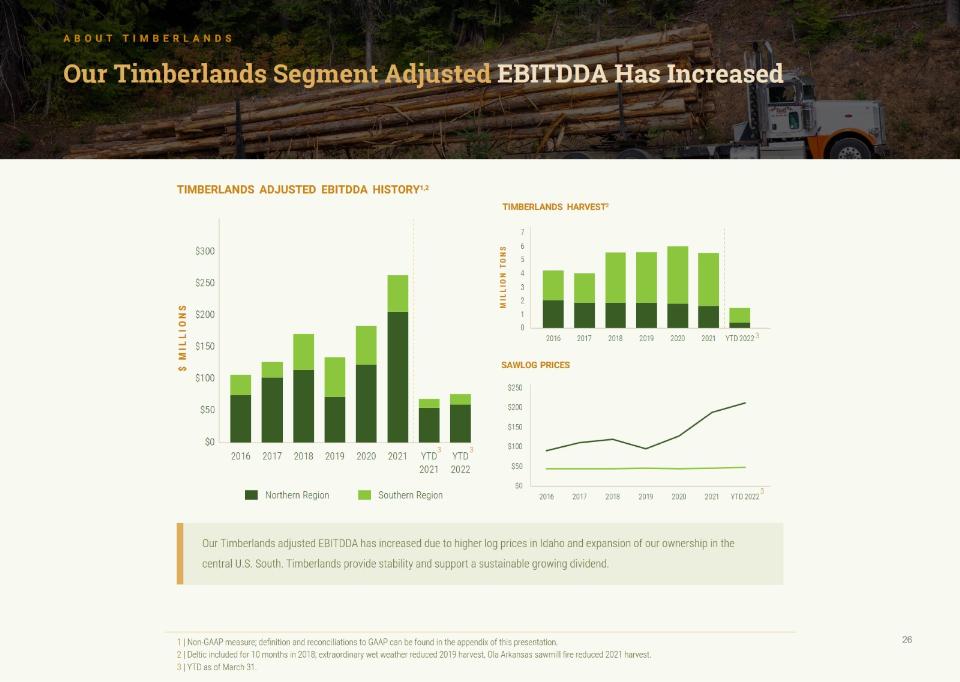

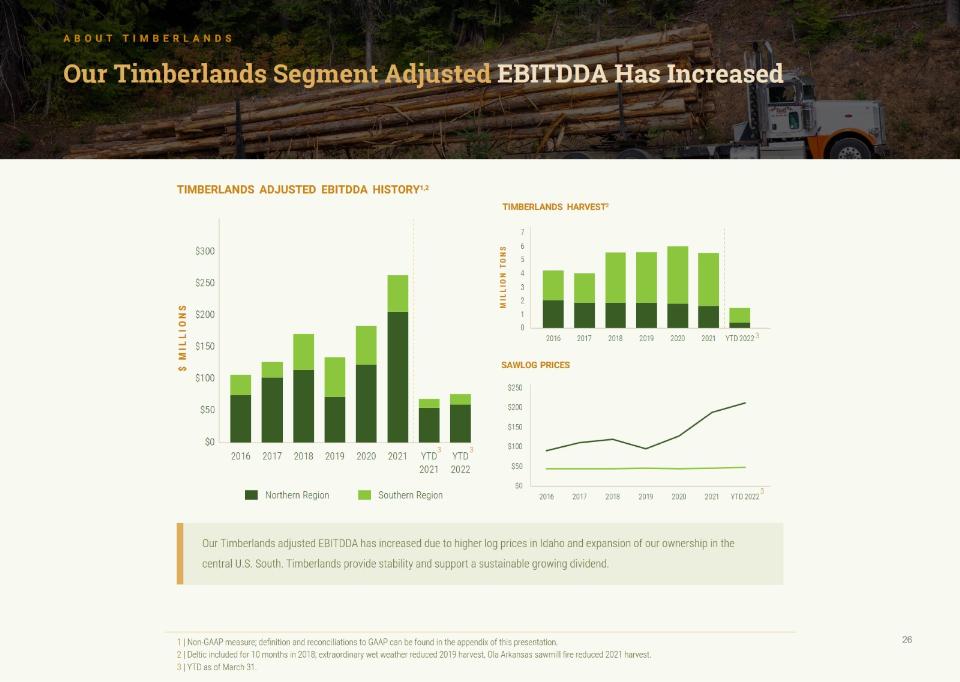

Our Timberlands Segment Adjusted EBITDDA Has Increased

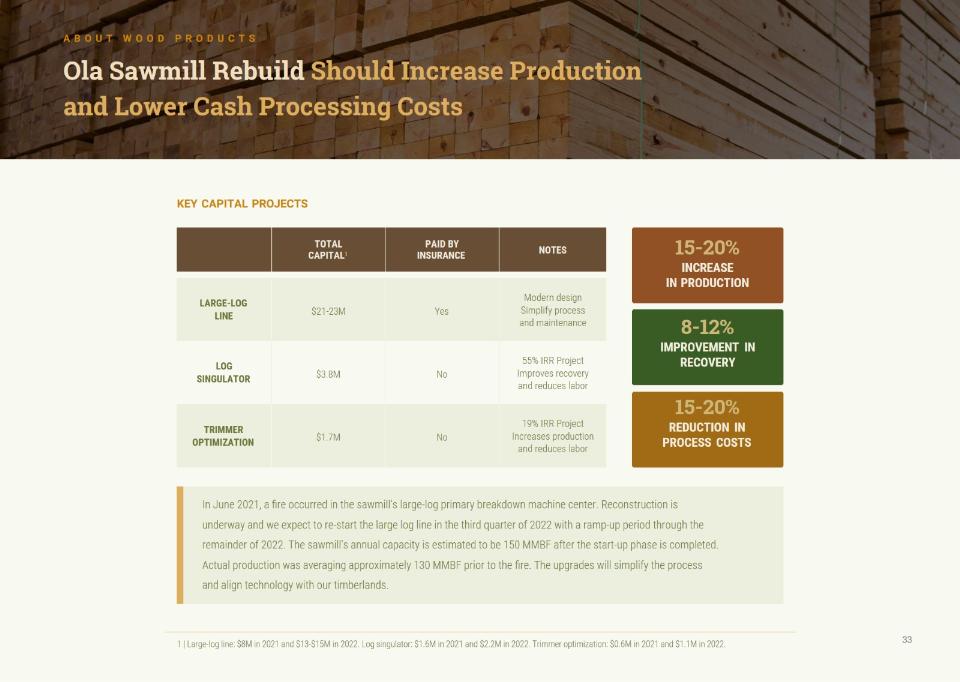

Wood Products Segment

Our Wood Products Facilities are Located Close to Major End Markets

Our Capacity is Growing With Acquisitions and Productivity Improvements

North American Lumber Supply

Lumber Production Shifting to the U.S. South

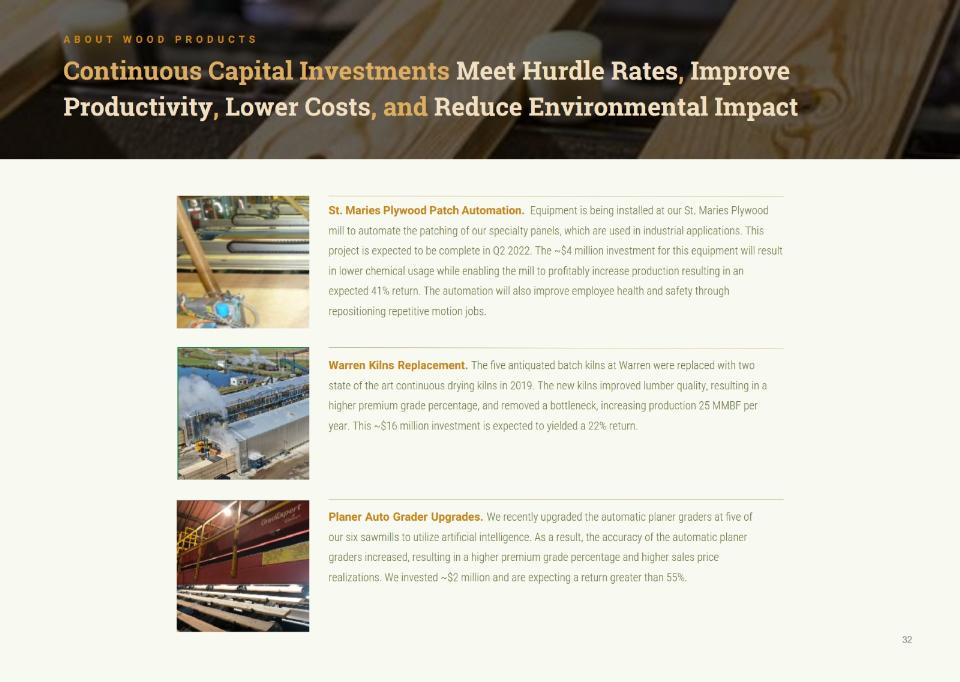

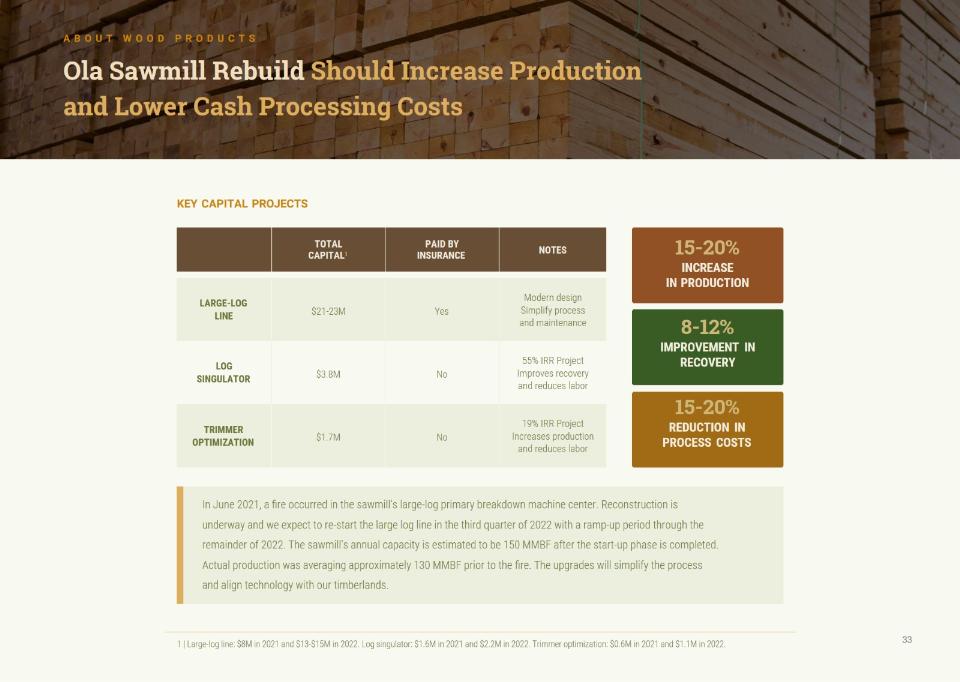

Continuous Capital Investments Meet Hurdle Rates, Improve Productivity, Lower Costs, and Reduce Environmental Impact

We are Relentlessly Focused on Continuously Improving our Environmental Performance

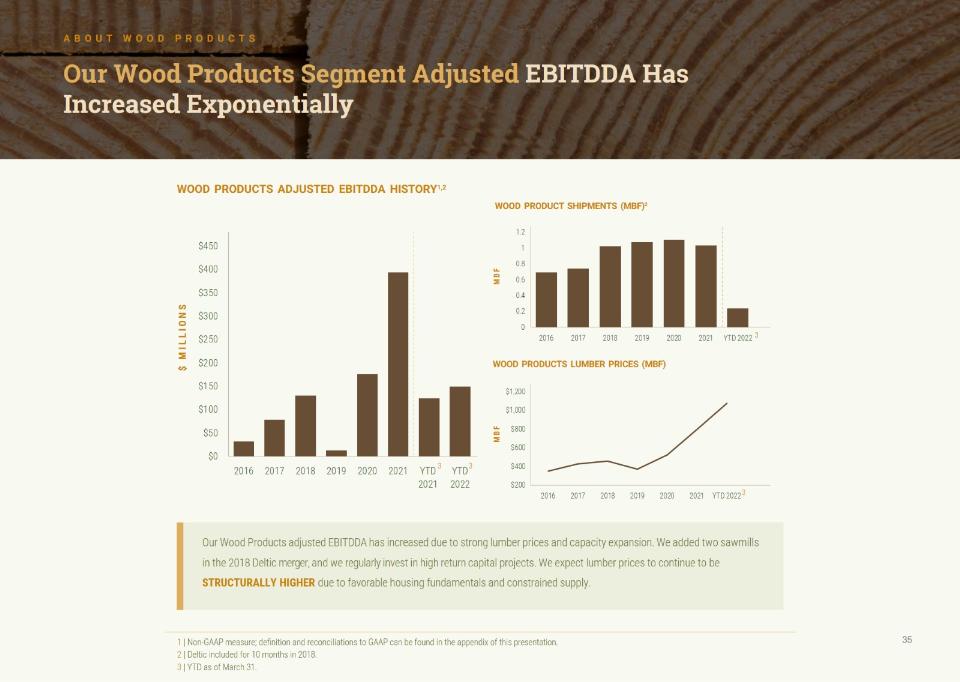

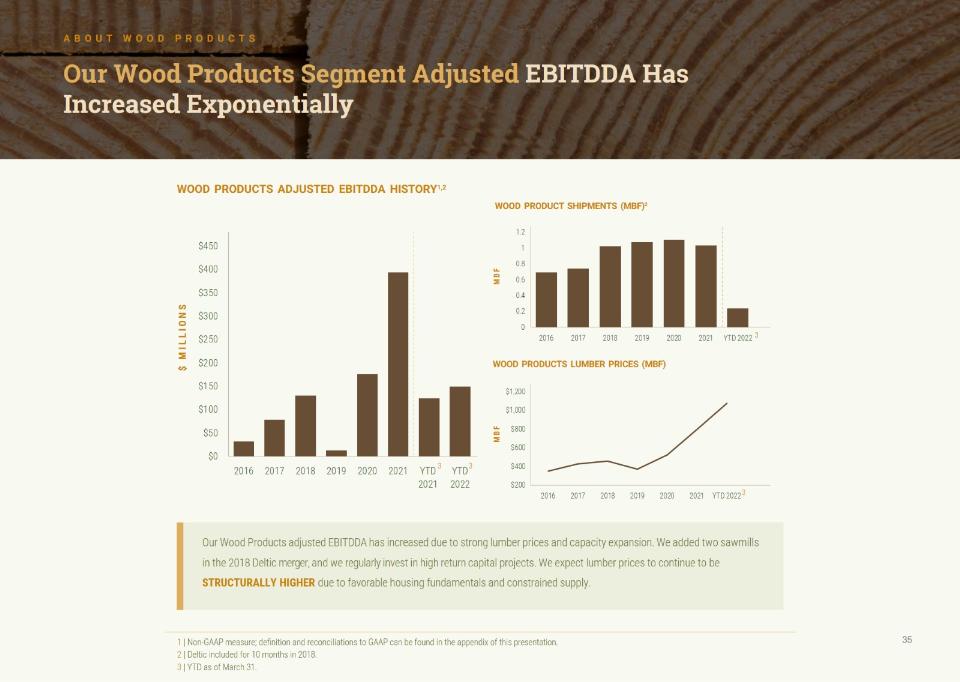

Our Wood Products Segment Adjusted EBITDDA Has Increased Exponentially

Real Estate Segment

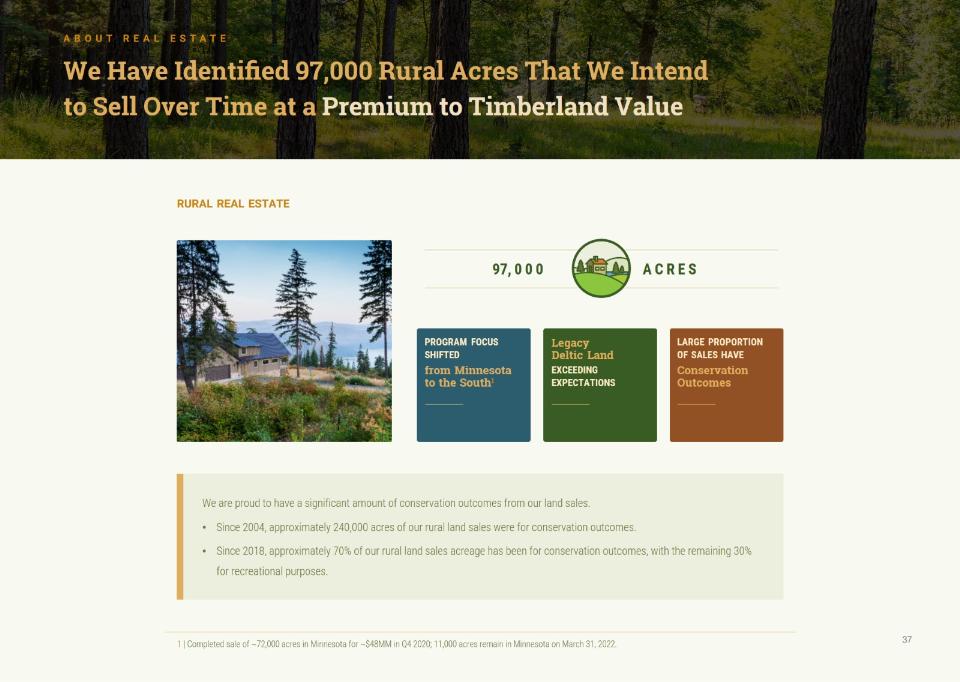

We Have Identified 97,000 Rural Acres That We Intend to Sell Over Time at a Premium to Timberland Value

We Create Significant Conservation Outcomes Through Rural Land Transactions

We Create Significant Conservation Outcomes Through Rural Land Transactions

Interest in Solar Opportunities on Our Timberlands Has Increased

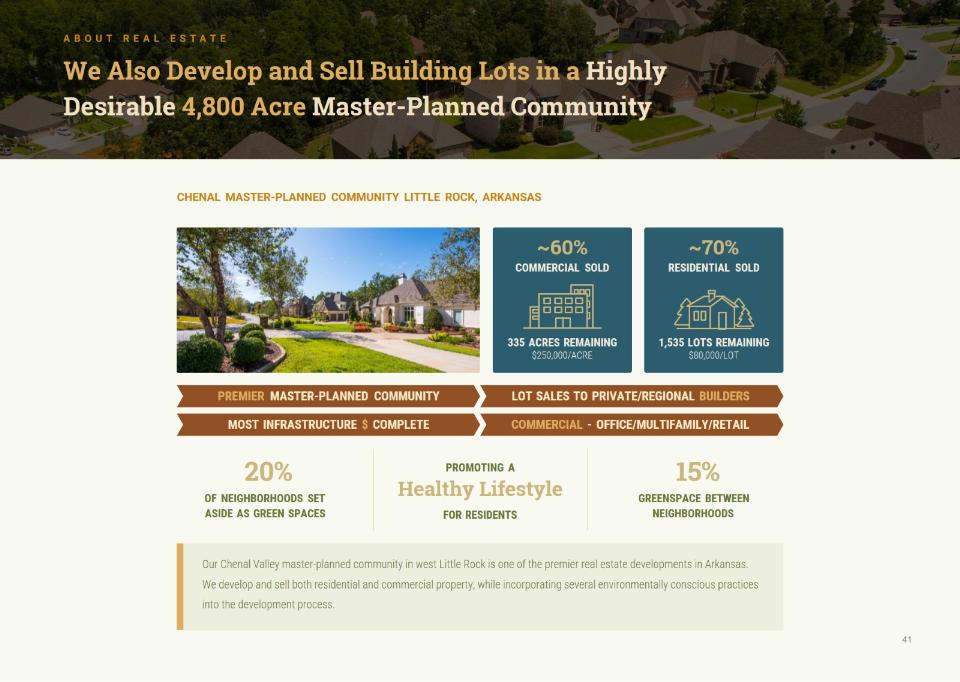

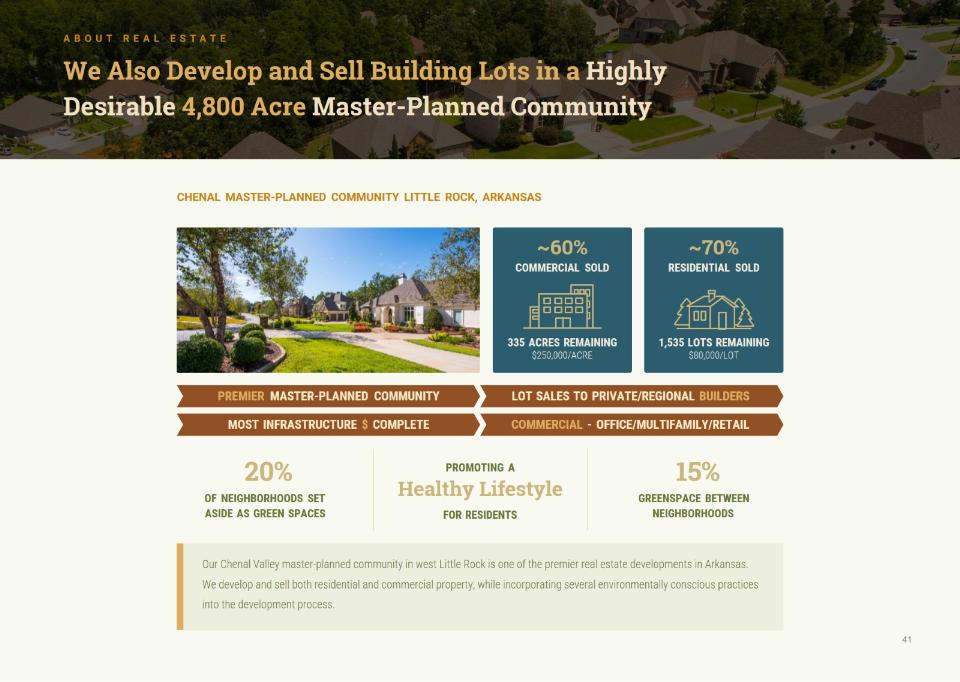

We Also Develop and Sell Building Lots in a Highly Desirable 4,800 Acre Master-Planned Community

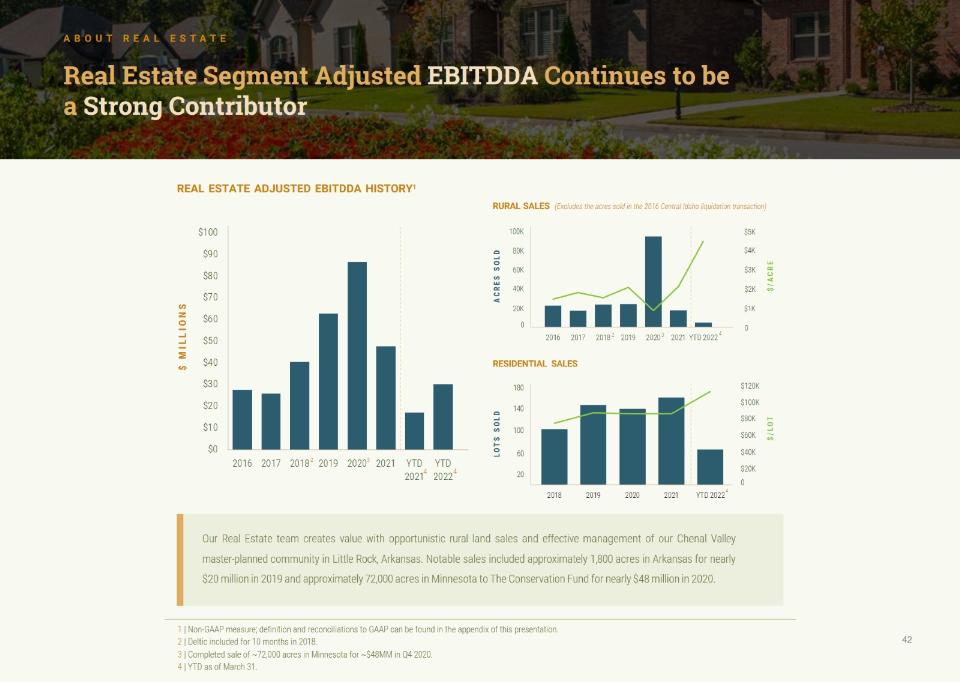

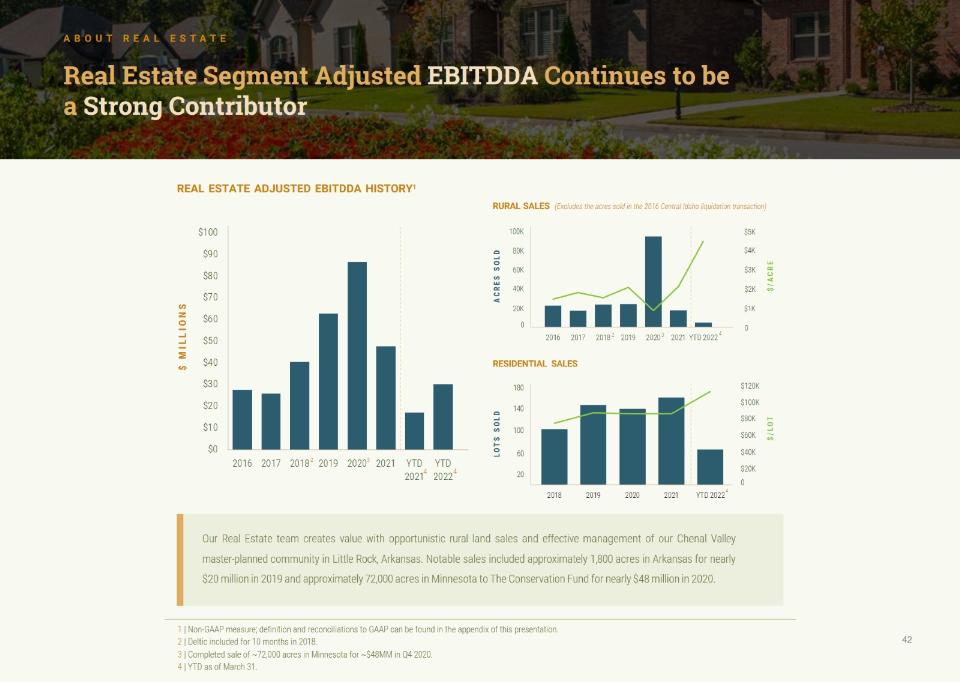

Real Estate Segment Adjusted EBITDDA Continues to be a Strong Contributor

Capital Allocation and Balance Sheet

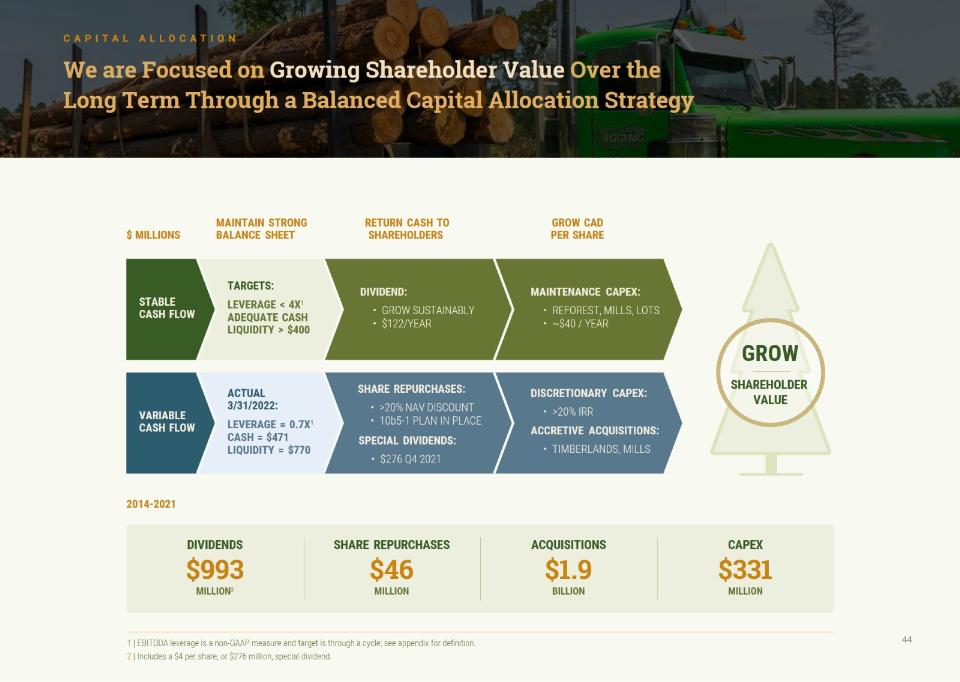

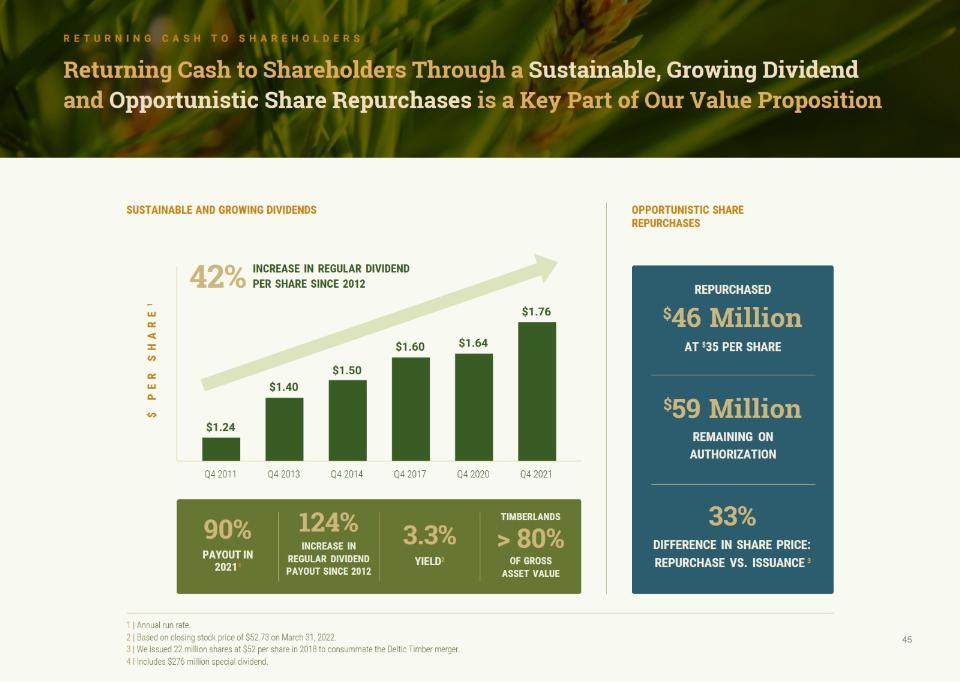

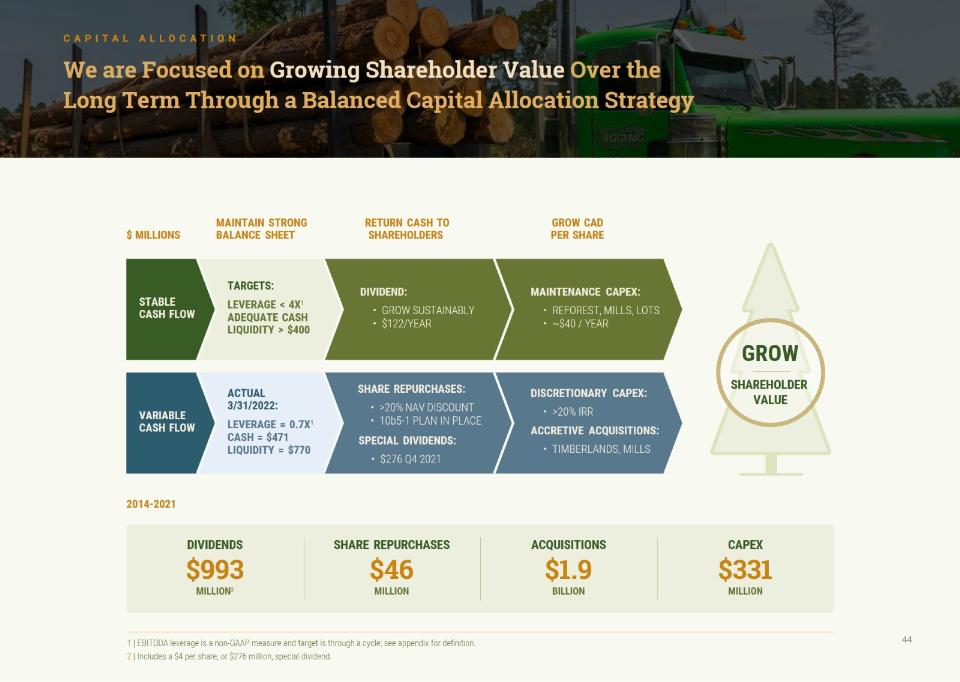

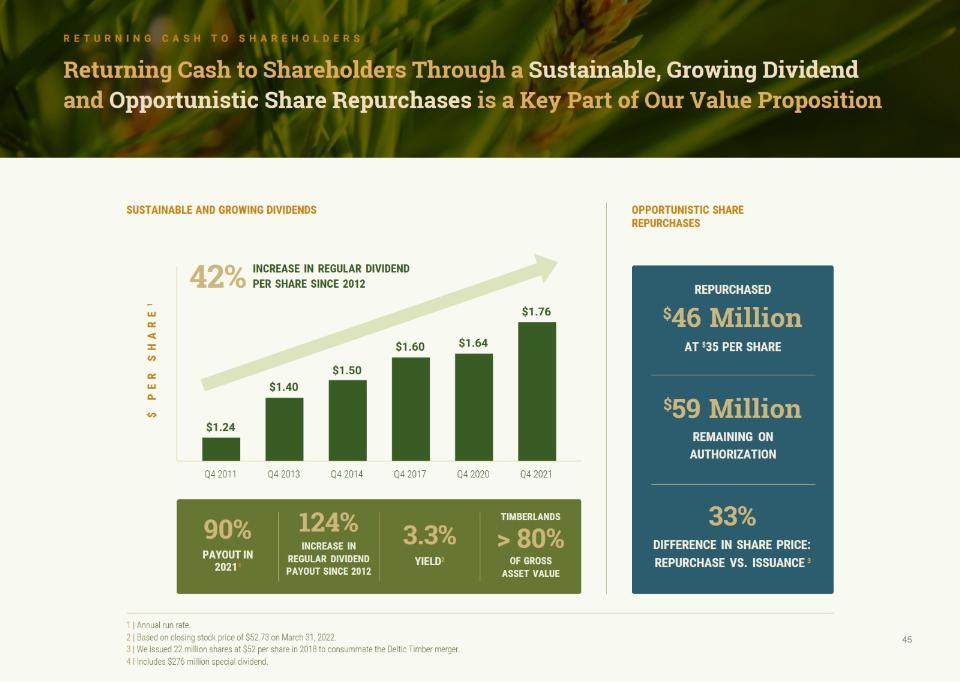

We are Focused on Growing Shareholder Value Over the Long Term Through a Balanced Capital Allocation Strategy

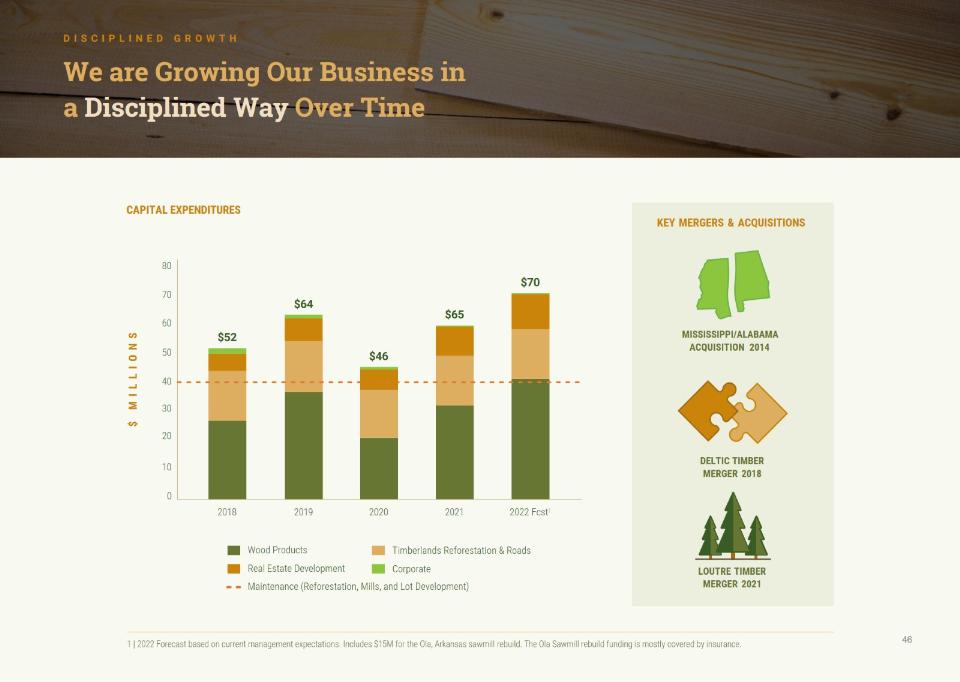

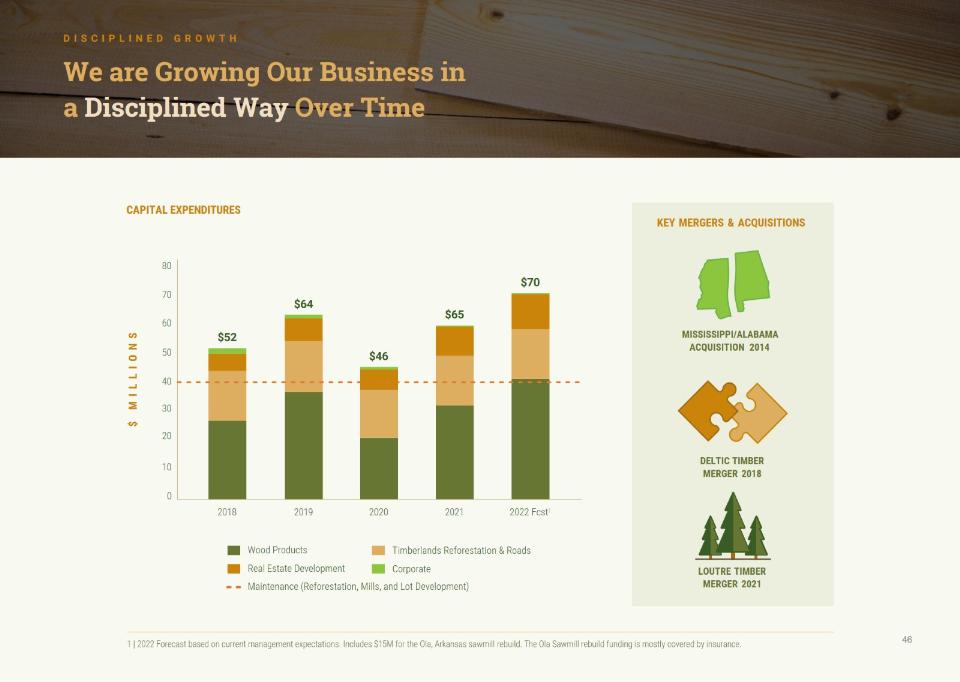

We are Growing Our Business in a Disciplined Way Over Time

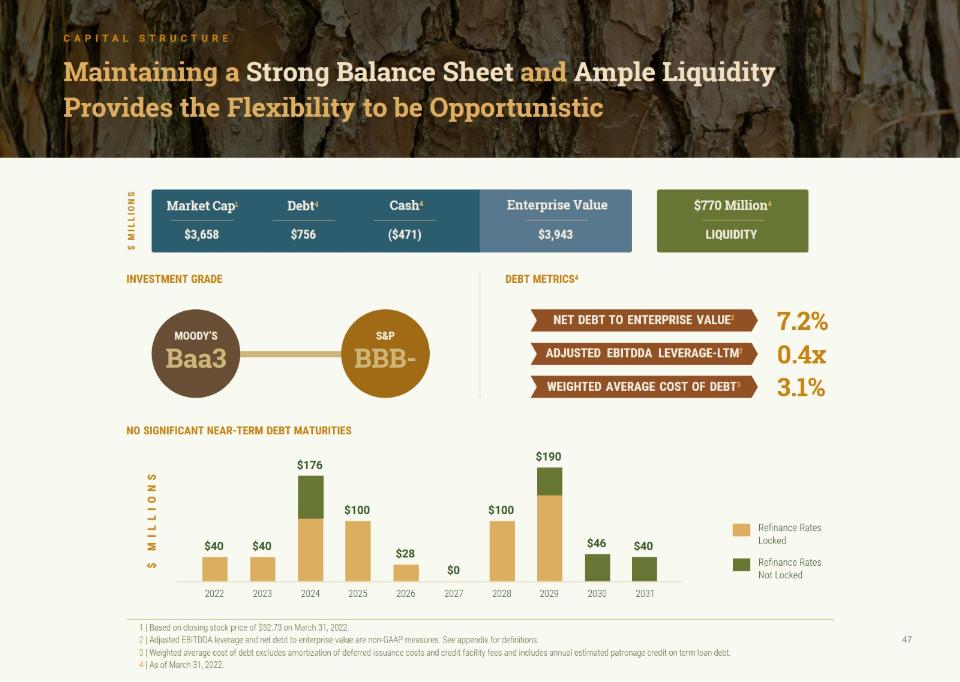

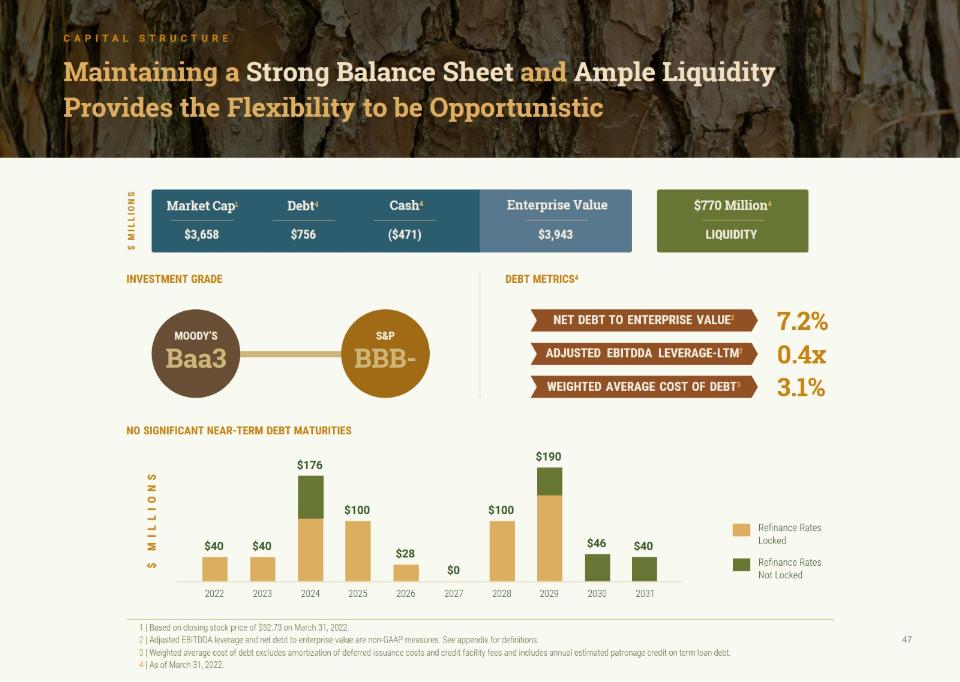

Maintaining a Strong Balance Sheet and Ample Liquidity Provides the Flexibility to be Opportunistic

The Power of Our Strategy is Evidenced by Our Strong Financial Performance

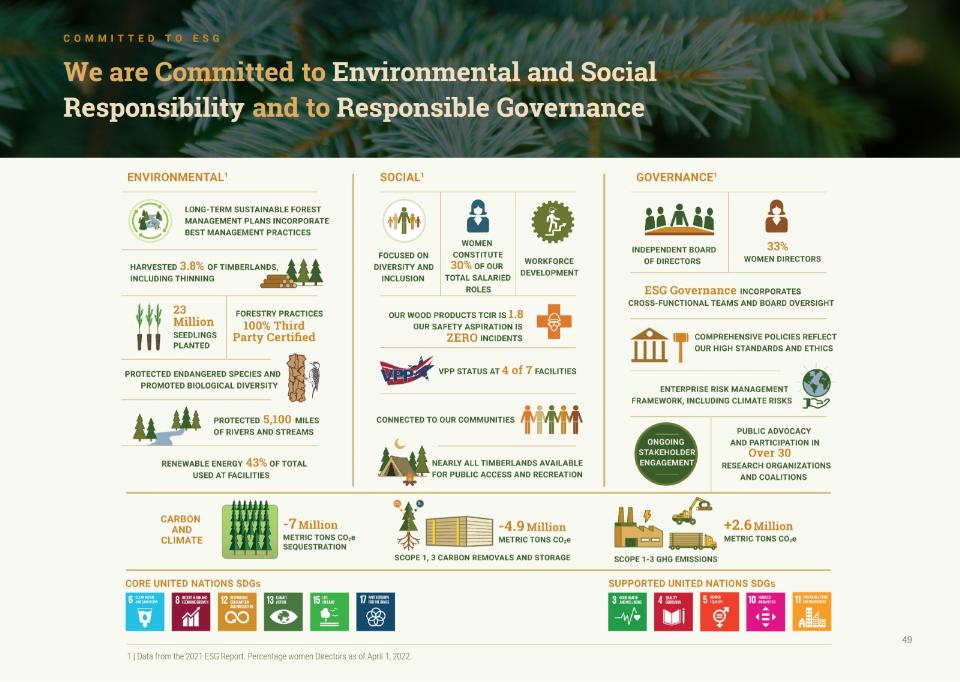

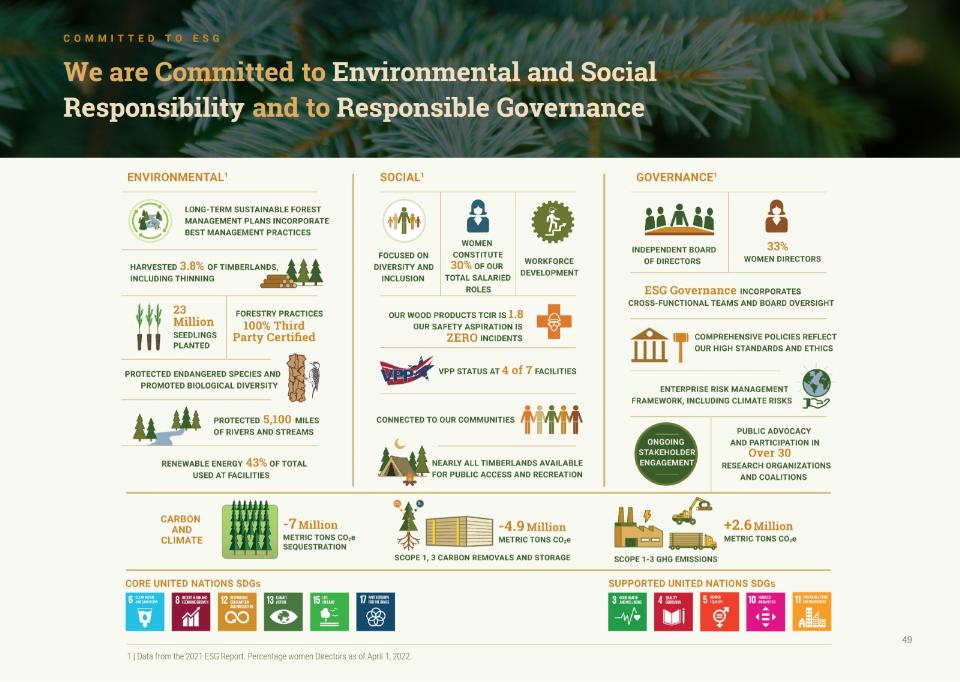

We are Committed to Environmental and Social Responsibility and to Responsible Governance

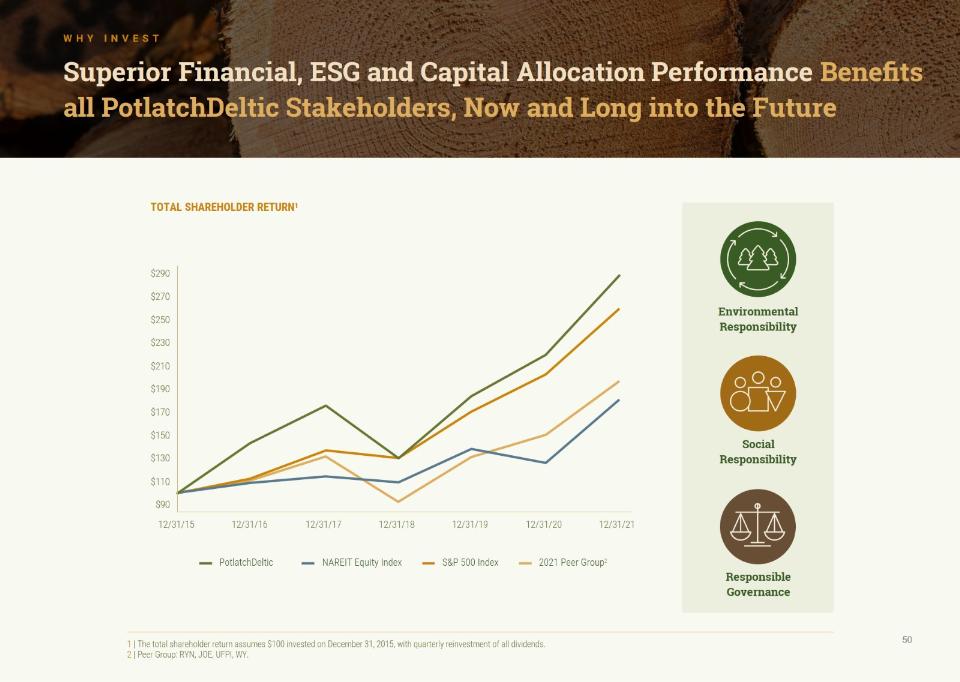

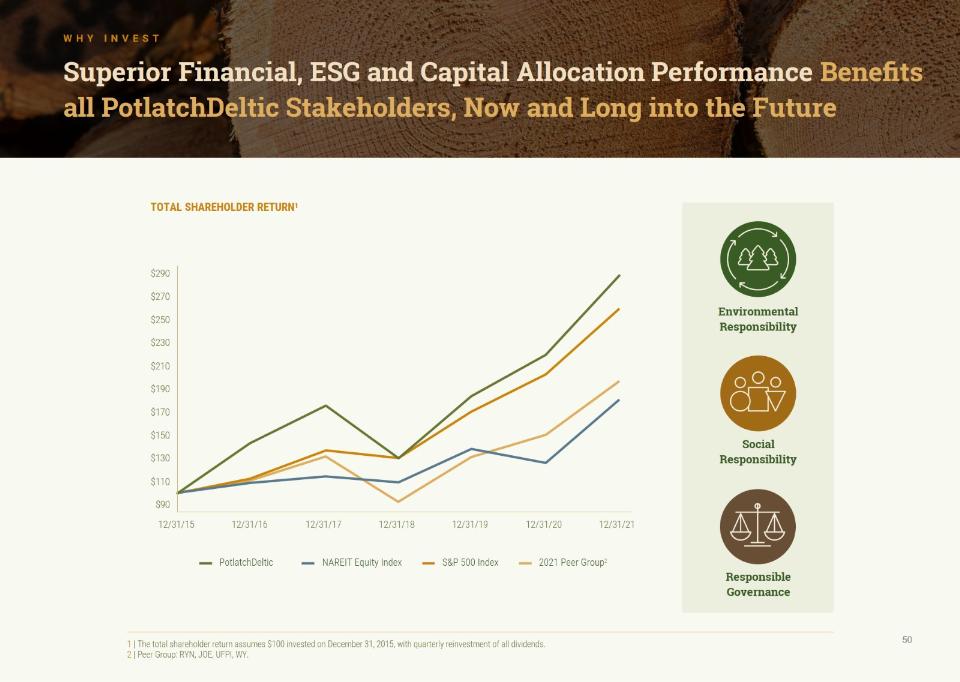

Superior Financial, ESG and Capital Allocation Performance Benefits all PotlatchDeltic Stakeholders, Now and Long into the Future

Appendix

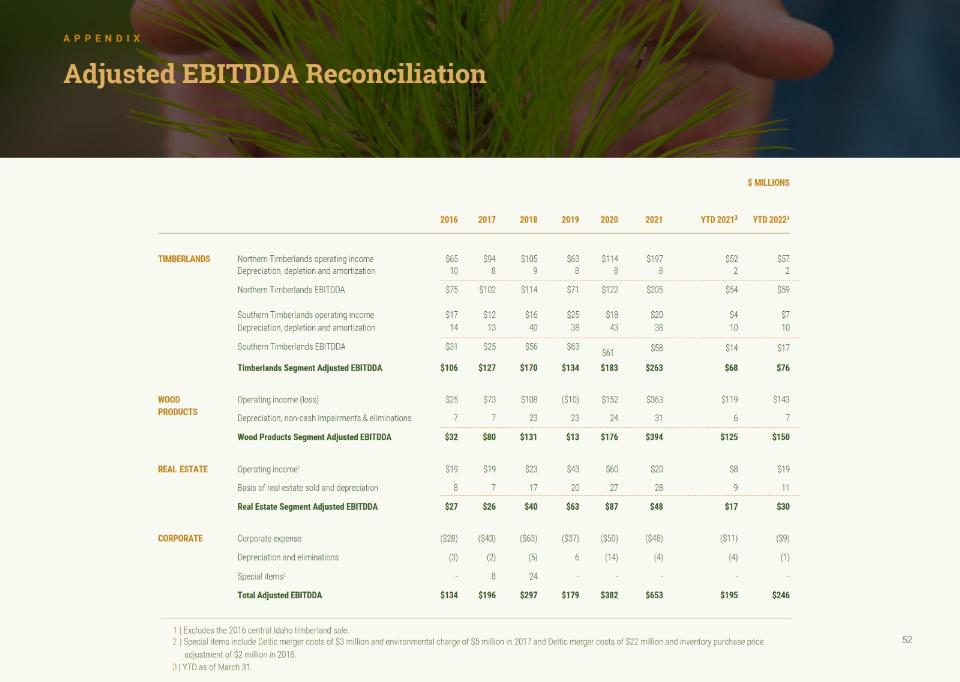

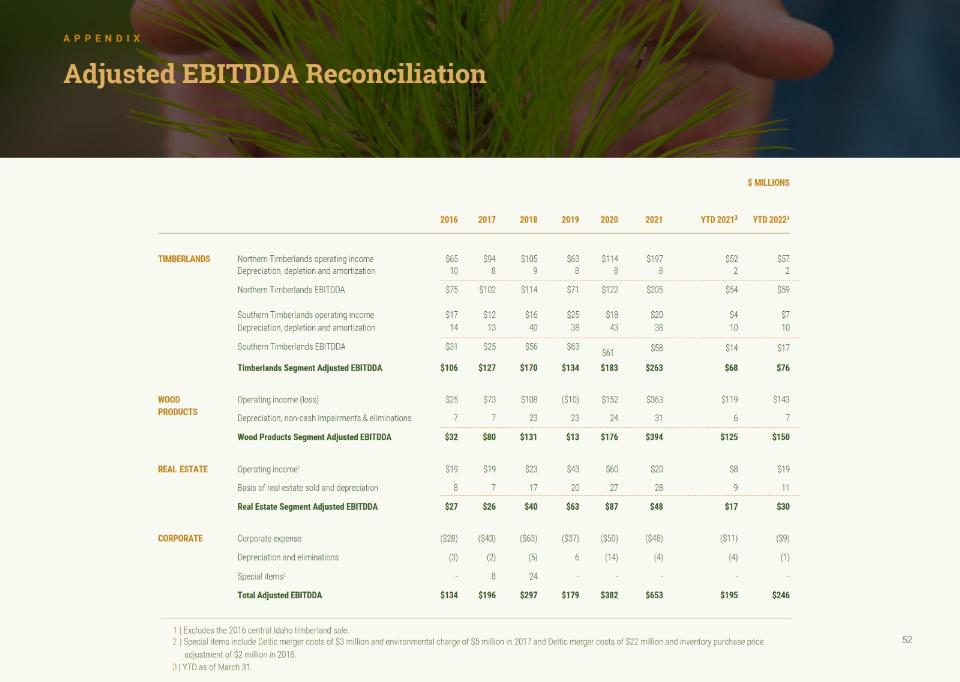

Adjusted EBITDDA Reconciliation

Definitions