POTLATCH CORPORATION

MARCH 2010

POTLATCH CORPORATION

Eric J. Cremers Vice President, Finance and Chief Financial Officer

Goldman Sachs 2010 Montreal Paper and Forest Products Investor Conference

Potlatch®

WWW.POTLATCHCORP.COM

POTLATCH CORPORATION

Forward-Looking Statements

This presentation contains certain forward-looking statements within the meaning of the Private Litigation Reform Act of 1995 as amended, including without limitation statements about future company performance, the company’s business model, strength of the company’s balance sheet and credit metrics, dividend levels and yields, direction of markets and the economy, management of timberlands to optimize values, pursuit of creative transaction structures, acquisition strategy, timber inventory and growth, future harvest levels and their relation to market trends, stumpage and log pricing, wood fiber demand forecasts, forecast of housing starts, timberland values, the company’s capital structure, cash flow generation, revenue from non-timber related activities, real estate business potential and land development potential, biomass opportunities, management of the output of our Wood Products facilities, and dividend policy. These forward-looking statements are based on current expectations, estimates, assumptions and projections that are subject to change, and actual results may differ materially from the forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, changes in timberland values; changes in timber harvest levels on the company’s lands; changes in timber prices; changes in policy regarding governmental timber sales; changes in the United States and international economies; changes in the level of construction activity; changes in tariffs, quotas and trade agreements involving wood products; changes in demand for Potlatch’s products; changes in production and production capacity in the forest products industry; competitive pricing pressures for the company’s products; unanticipated manufacturing disruptions; changes in general and industry-specific environmental laws and regulations; unforeseen environmental liabilities or expenditures; weather conditions; changes in raw material and other costs; the ability to satisfy complex rules in order to remain qualified as a REIT; changes in tax laws that could reduce the benefits associated with REIT status; and other risks and uncertainties described from time to time in the company’s public filings with the Securities and Exchange Commission. All forward-looking statements are made as of the date of this presentation, and the company does not undertake to update any forward-looking statements.

2

POTLATCH CORPORATION

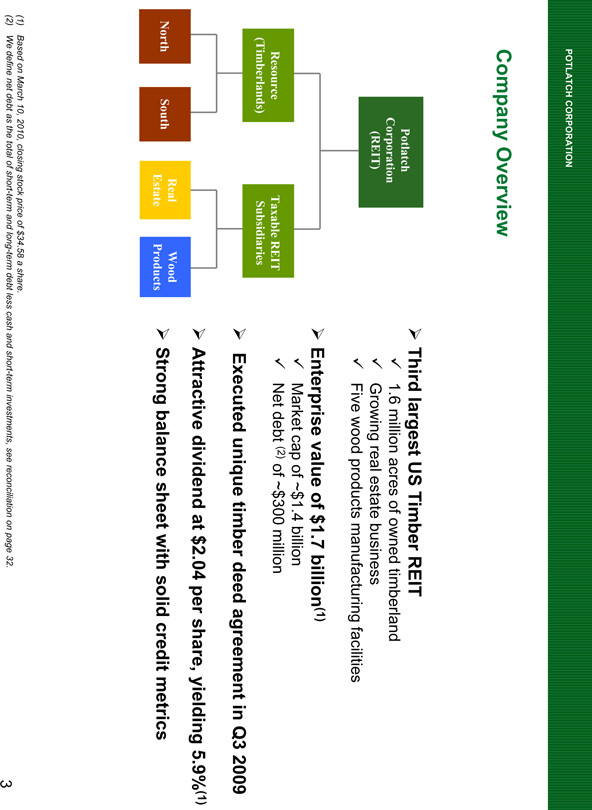

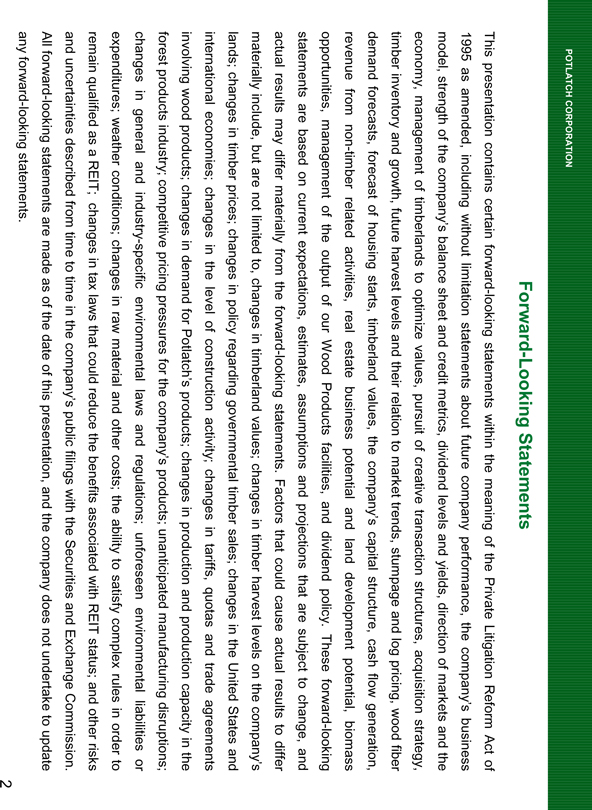

Company Overview

Potlatch Corporation (REIT)

Resource (Timberlands)

Taxable REIT Subsidiaries

North

South

Wood Products

Third largest US Timber REIT

1.6 million acres of owned timberland

Growing real estate business

Five wood products manufacturing facilities

Enterprise value of $1.7 billion(1)

Market cap of ~$1.4 billion

Net debt (2) of ~$300 million

Executed unique timber deed agreement in Q3 2009

Attractive dividend at $2.04 per share, yielding 5.9%(1)

Strong balance sheet with solid credit metrics

(1) Based on March 10, 2010, closing stock price of $34.58 a share.

(2) We define net debt as the total of short-term and long-term debt less cash and short-term investments, see reconciliation on page 32.

3

POTLATCH CORPORATION

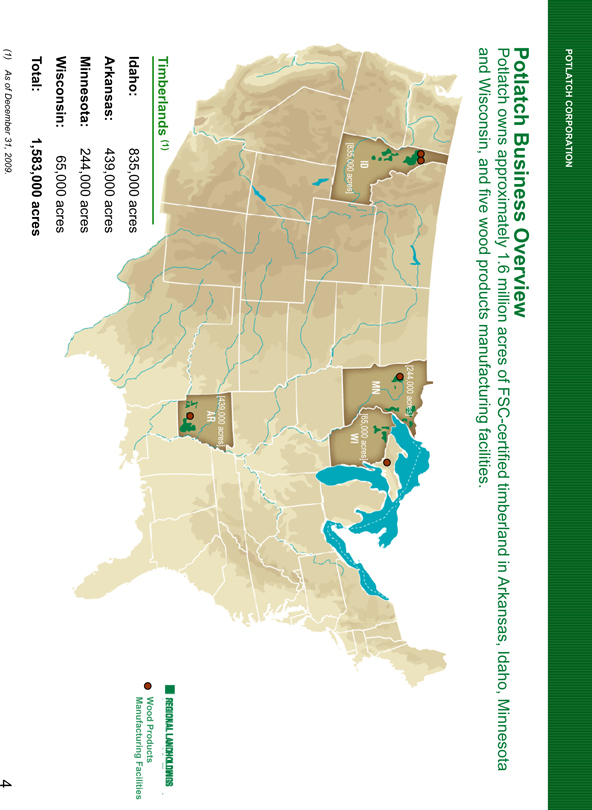

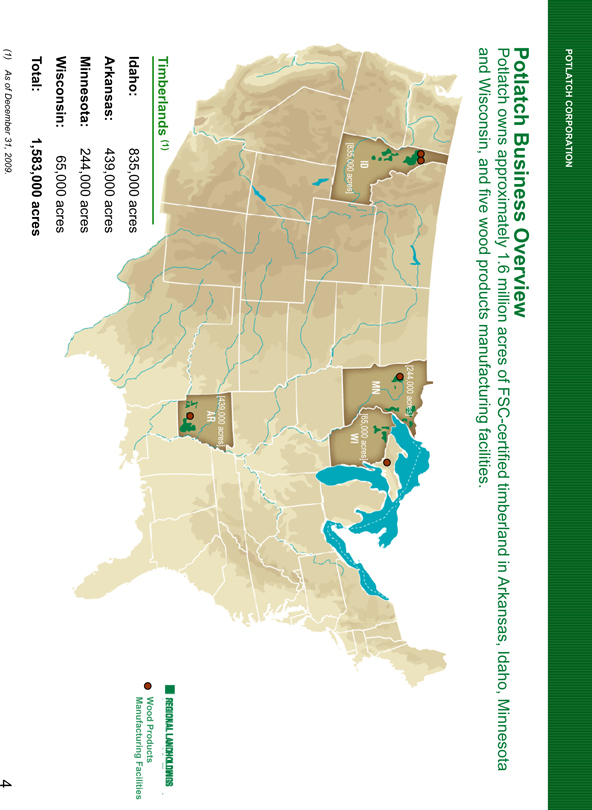

Potlatch Business Overview

Potlatch owns approximately 1.6 million acres of FSC-certified timberland in Arkansas, Idaho, Minnesota and Wisconsin, and five wood products manufacturing facilities.

ID

[835,000 acres]

[244,000 acres]

MN

[65,000 acres]

WI

[439,000 acres]

AR

Timberlands (1)

Idaho: 835,000 acres

Arkansas: 439,000 acres

Minnesota: 244,000 acres

Wisconsin: 65,000 acres

Total: 1,583,000 acres

REGIONAL LANDHOLDINGS

Wood Products

Manufacturing Facilities

(1) As of December 31, 2009.

4

POTLATCH CORPORATION

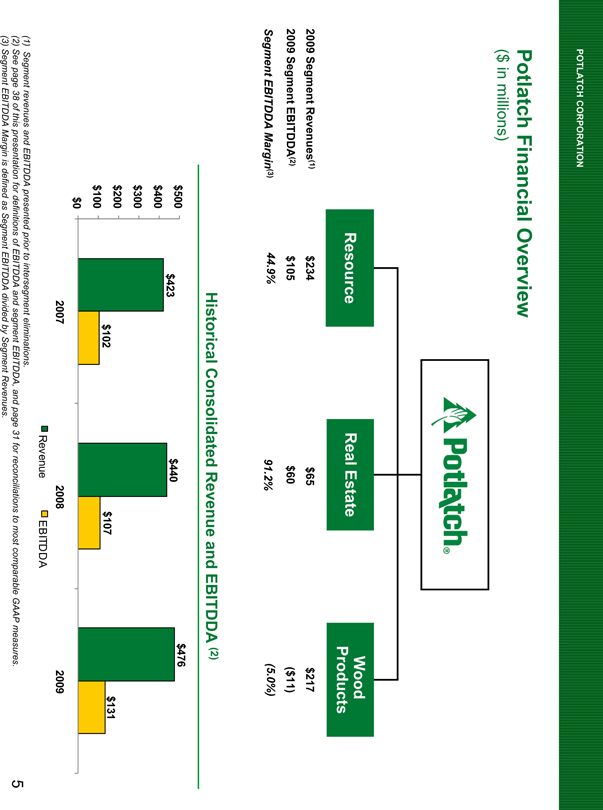

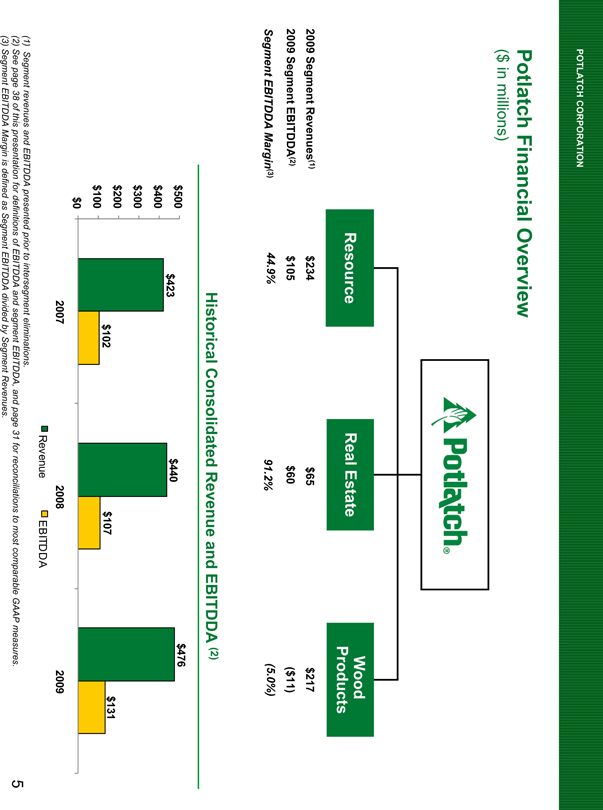

Potlatch Financial Overview

($ in millions)

Potlatch®

Resource Real Estate Wood Products

2009 Segment Revenues(1) $234 $65 $217

2009 Segment EBITDDA(2) $105 $60 ($11)

Segment EBITDDA Margin(3) 44.9% 91.2% (5.0%)

Historical Consolidated Revenue and EBITDDA (2)

$500

$400

$300

$200

$100

$0

$423

$102

2007

$440

$107

2008

$476

$131

2009

Revenue EBITDDA

(1) Segment revenues and EBITDDA presented prior to intersegment eliminations.

(2) See page 38 of this presentation for definitions of EBITDDA and segment EBITDDA, and page 31 for reconciliations to most comparable GAAP measures.

(3) Segment EBITDDA Margin is defined as Segment EBITDDA divided by Segment Revenues.

5

POTLATCH CORPORATION

Resource Segment

Manage timberlands to optimize value of all possible revenue producing opportunities

Increase harvest levels and reduce rotation ages to maximize NPV in strong markets

Defer timber harvest in weak markets

Pursue creative transaction structures designed to unlock maximum value from timberland properties

Arkansas timber deed transaction

Selectively seek acquisitions

Complement the existing land base

Immediately cash flow accretive

Have a blend of timber and real estate values

Maintain highest stewardship standards in the industry

100% of lands are certified by the Forest Stewardship Council (“FSC”)

©

FSC

6

POTLATCH CORPORATION

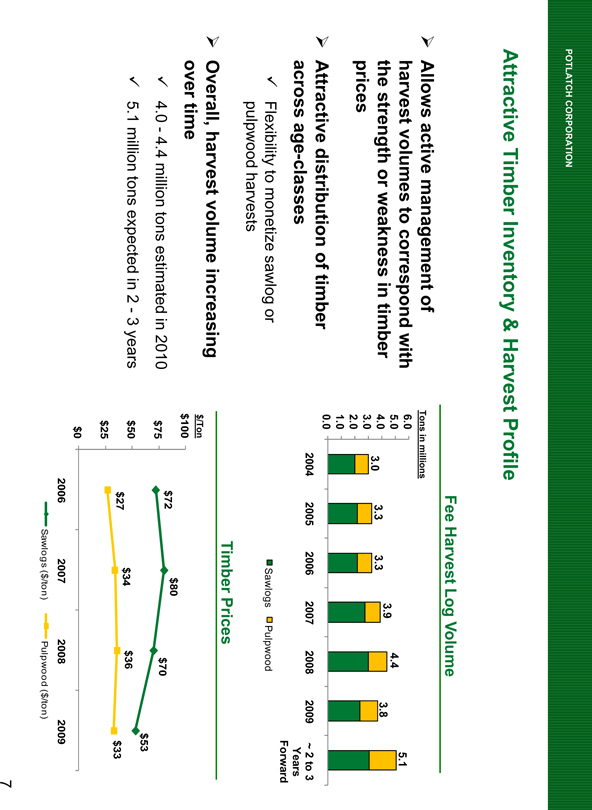

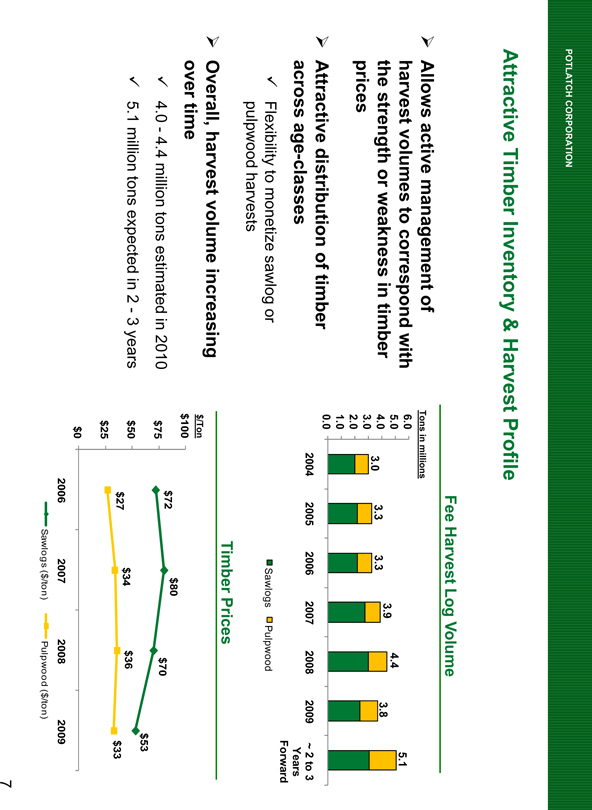

Attractive Timber Inventory & Harvest Profile

Allows active management of harvest volumes to correspond with the strength or weakness in timber prices

Attractive distribution of timber across age-classes

Flexibility to monetize sawlog or pulpwood harvests

Overall, harvest volume increasing over time

4.0 - 4.4 million tons estimated in 2010

5.1 million tons expected in 2 - 3 years

Fee Harvest Log Volume

Tons in millions

6.0

5.0

4.0

3.0

2.0

1.0

0.0

3.0

3.3

3.3

3.9

4.4

3.8

5.1

2004 2005 2006 2007 2008 2009 ~ 2 to 3 Years Forward

Sawlogs Pulpwood

Timber Prices

$/Ton

$100

$75

$50

$25

$0

$72

$80

$70

$53

$27

$34

$36

$33

2006

2007

2008

2009

Sawlogs ($/ton) Pulpwood ($/ton)

7

POTLATCH CORPORATION

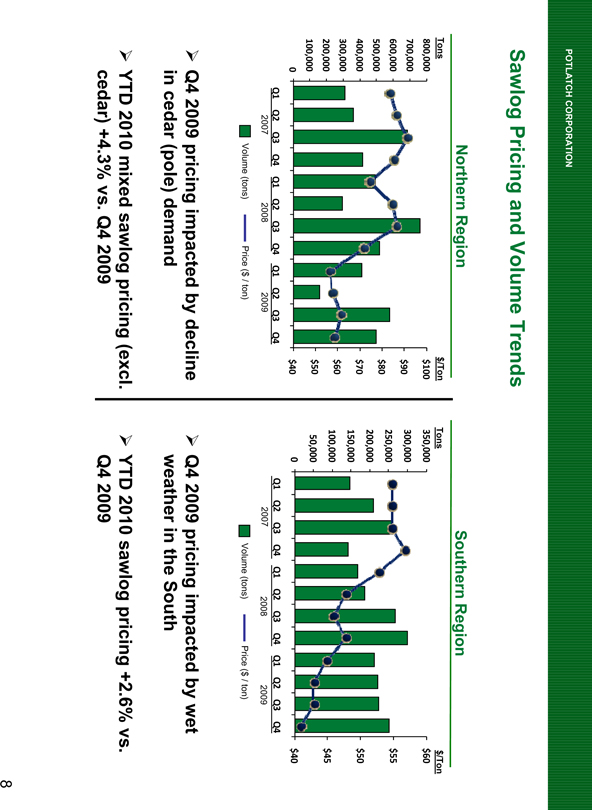

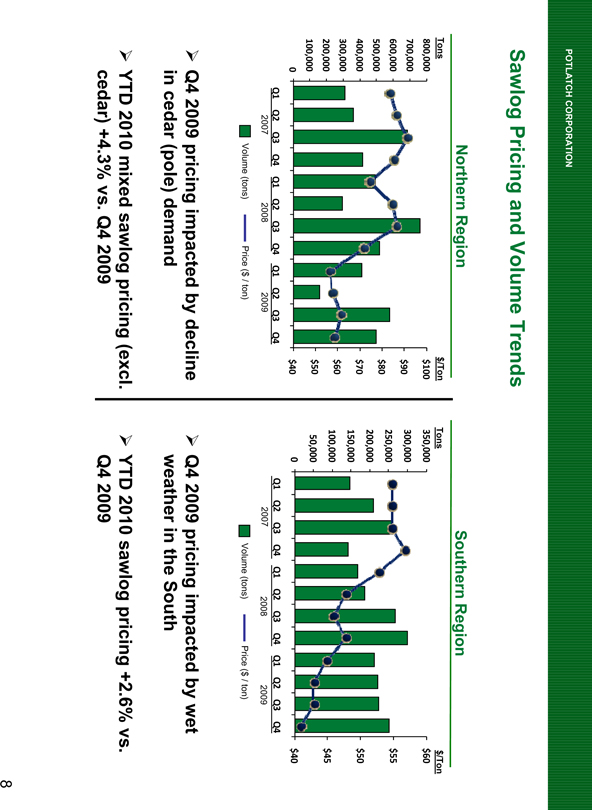

Sawlog Pricing and Volume Trends

Northern Region

Tons

800,000

700,000

600,000

500,000

400,000

300,000

200,000

100,000

0

$/Ton

$100

$90

$80

$70

$60

$50

$40

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

2007 2008 2009

Volume (tons) Price ($ / ton)

Q4 2009 pricing impacted by decline in cedar (pole) demand

YTD 2010 mixed sawlog pricing (excl. cedar) +4.3% vs. Q4 2009

Southern Region

Tons

350,000

300,000

250,000

200,000

150,000

100,000

50,000

0

$/Ton

$60

$55

$50

$45

$40

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

2007 2008 2009

Volume (tons) Price ($ / ton)

Q4 2009 pricing impacted by wet weather in the South

YTD 2010 sawlog pricing +2.6% vs. Q4 2009

8

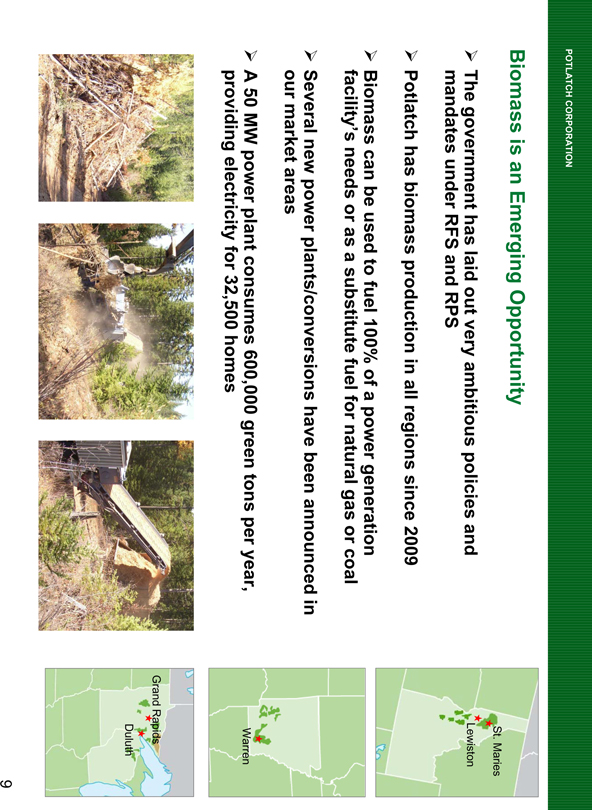

POTLATCH CORPORATION

Biomass is an Emerging Opportunity

The government has laid out very ambitious policies and mandates under RFS and RPS

Potlatch has biomass production in all regions since 2009

Biomass can be used to fuel 100% of a power generation facility’s needs or as a substitute fuel for natural gas or coal

Several new power plants/conversions have been announced in our market areas

A 50 MW power plant consumes 600,000 green tons per year, providing electricity for 32,500 homes

St. Maries

Lewiston

Warren

Grand Rapids

Duluth

9

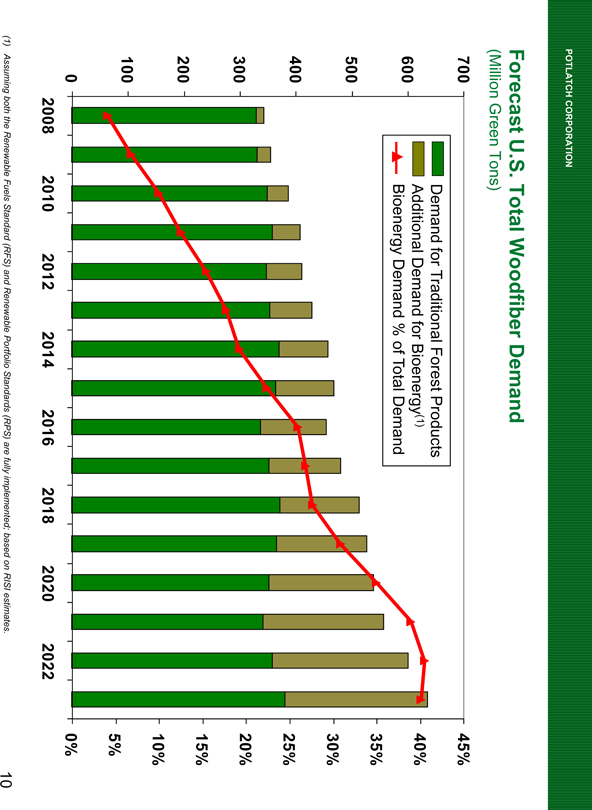

POTLATCH CORPORATION

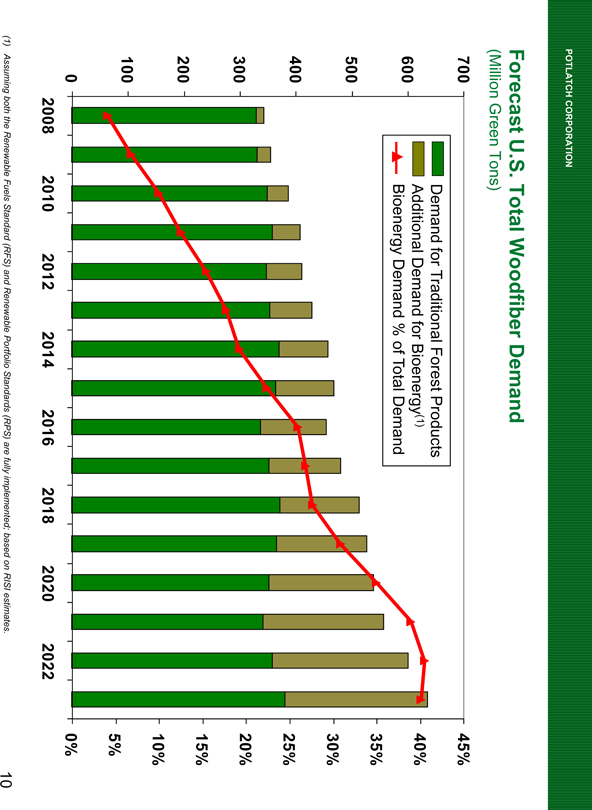

Forecast U.S. Total Woodfiber Demand

(Million Green Tons)

700

600

500

400

300

200

100

0

Demand for Traditional Forest Products

Additional Demand for Bioenergy(1)

Bioenergy Demand % of Total Demand

45%

40%

35%

30%

25%

20%

15%

10%

5%

0%

2008 2010 2012 2014 2016 2018 2020 2022

(1) Assuming both the Renewable Fuels Standard (RFS) and Renewable Portfolio Standards (RPS) are fully implemented; based on RISI estimates.

10

POTLATCH CORPORATION

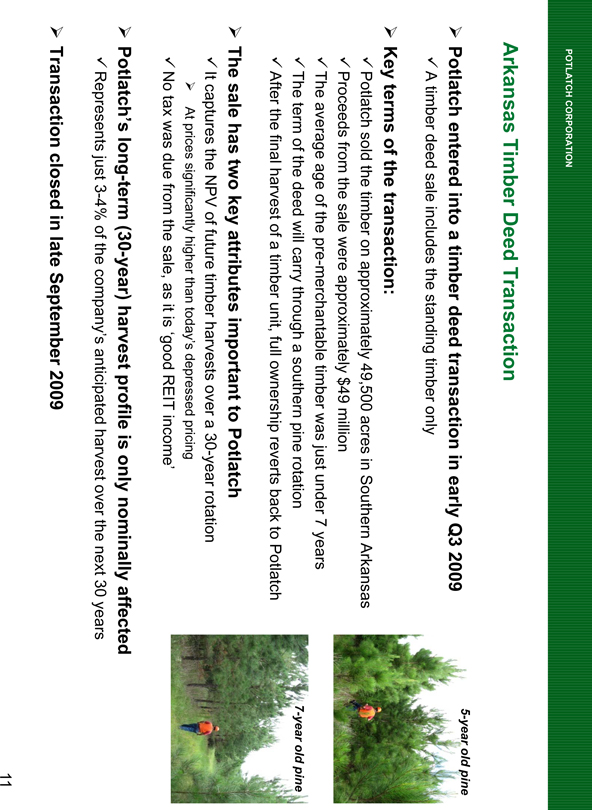

Arkansas Timber Deed Transaction

Potlatch entered into a timber deed transaction in early Q3 2009

A timber deed sale includes the standing timber only

Key terms of the transaction:

Potlatch sold the timber on approximately 49,500 acres in Southern Arkansas

Proceeds from the sale were approximately $49 million

The average age of the pre-merchantable timber was just under 7 years

The term of the deed will carry through a southern pine rotation

After the final harvest of a timber unit, full ownership reverts back to Potlatch

The sale has two key attributes important to Potlatch

It captures the NPV of future timber harvests over a 30-year rotation

At prices significantly higher than today’s depressed pricing

No tax was due from the sale, as it is ‘good REIT income’

Potlatch’s long-term (30-year) harvest profile is only nominally affected

Represents just 3-4% of the company’s anticipated harvest over the next 30 years

Transaction closed in late September 2009

5-year old pine

7-year old pine

11

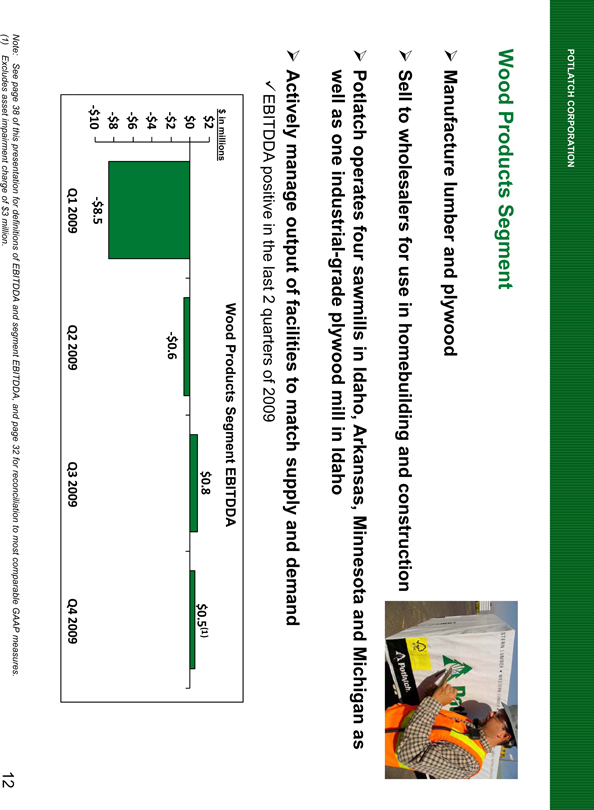

POTLATCH CORPORATION

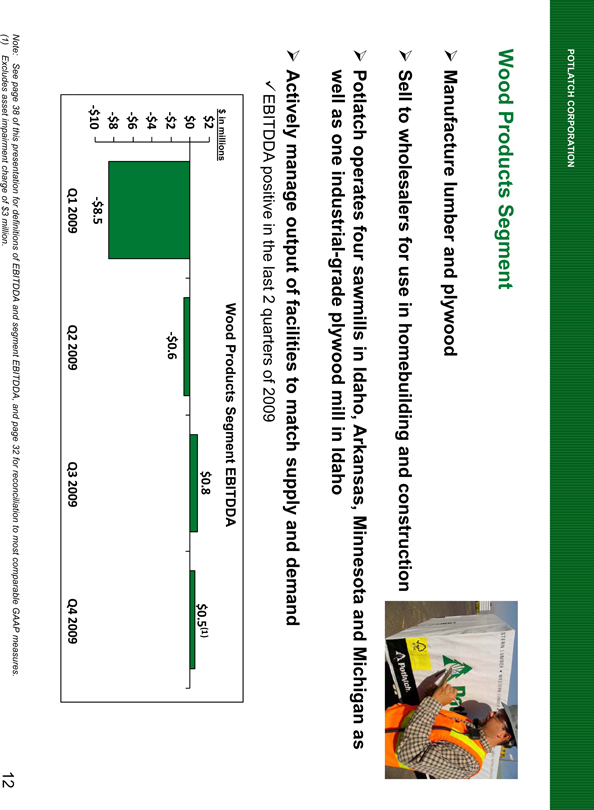

Wood Products Segment

Manufacture lumber and plywood

Sell to wholesalers for use in homebuilding and construction

Potlatch operates four sawmills in Idaho, Arkansas, Minnesota and Michigan as well as one industrial-grade plywood mill in Idaho

Actively manage output of facilities to match supply and demand

EBITDDA positive in the last 2 quarters of 2009

Wood Products Segment EBITDDA

$ in millions

$2

$0

-$2

-$4

-$6

-$8

-$10

-$8.5

-$0.6

$0.8

$0.5(1)

Q1 2009 Q2 2009 Q3 2009 Q4 2009

Note: See page 38 of this presentation for definitions of EBITDDA and segment EBITDDA, and page 32 for reconciliation to most comparable GAAP measures.

(1) Excludes asset impairment charge of $3 million.

12

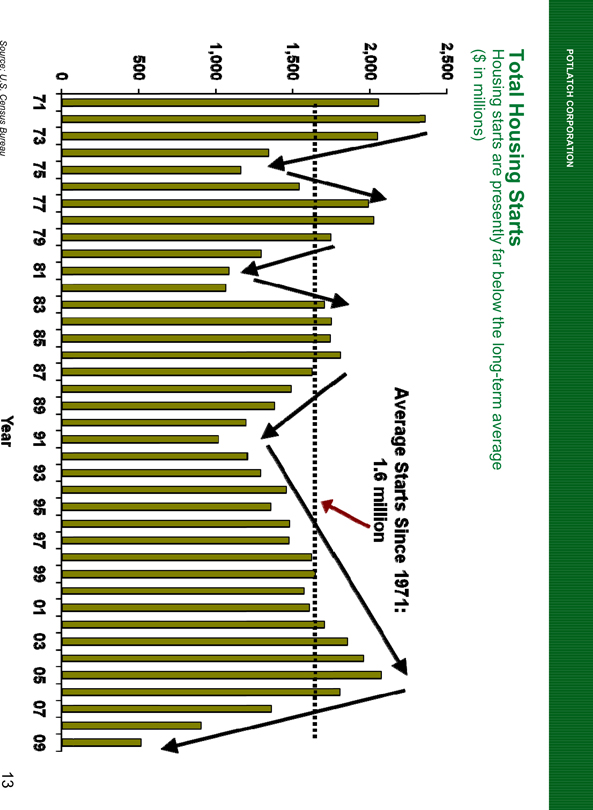

POTLATCH CORPORATION

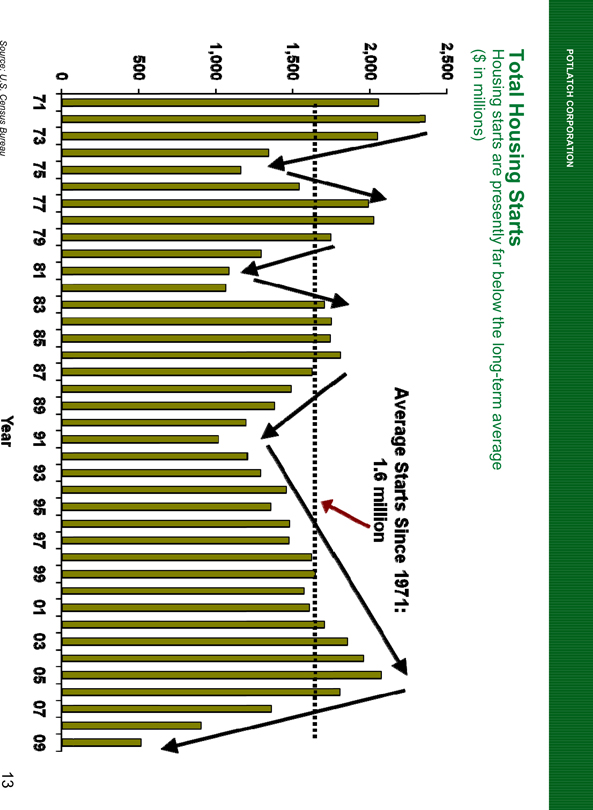

Total Housing Starts

Housing starts are presently far below the long-term average

($ in millions)

2,500

2,000

1,500

1,000

500

0

Average Starts Since 1971:

1.6 million

71 73 75 77 79 81 83 85 87 89 91 93 95 97 99 01 03 05 07 09

Year

Source: U.S. Census Bureau

13

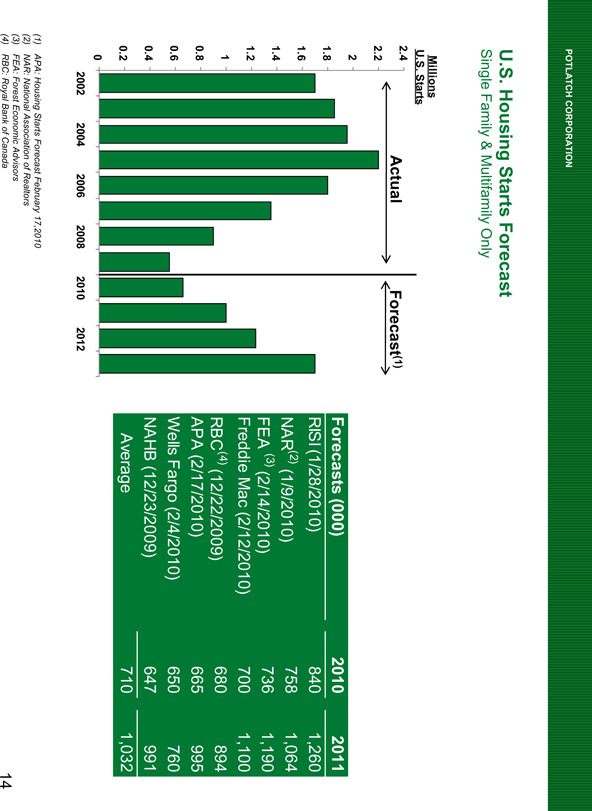

POTLATCH CORPORATION

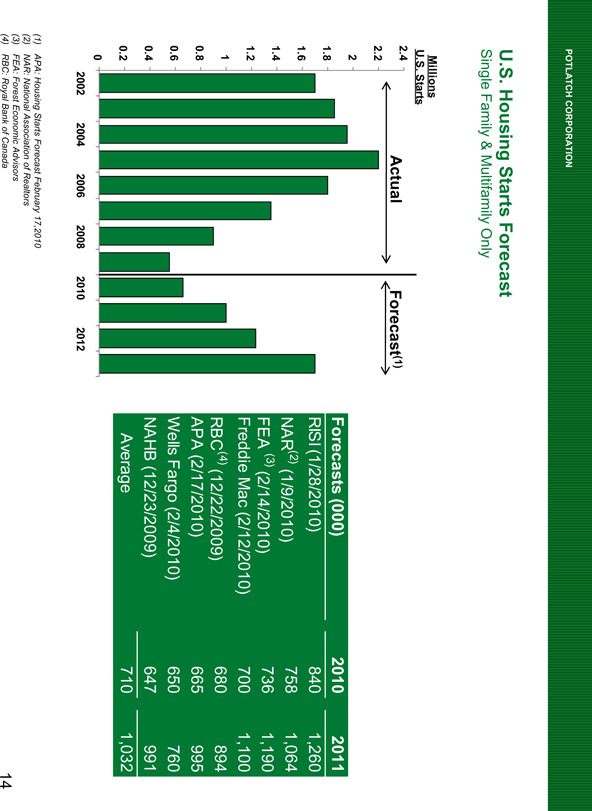

U.S. Housing Starts Forecast

Single Family & Multifamily Only

Millions

U.S. Starts

2.4

2.2

2

1.8

1.6

1.4

1.2

1

0.8

0.6

0.4

0.2

0

Actual Forecast(1)

2002 2004 2006 2008 2010 2012

Forecasts (000)

RISI (1/28/2010)

NAR(2) (1/9/2010)

FEA (3) (2/14/2010)

Freddie Mac (2/12/2010)

RBC(4) (12/22/2009)

APA (2/17/2010)

Wells Fargo (2/4/2010)

NAHB (12/23/2009)

Average

2010

840

758

736

700

680

665

650

647

710

2011

1,260

1,064

1,190

1,100

894

995

760

991

1,032

(1) APA: Housing Starts Forecast February 17,2010

(2) NAR: National Association of Realtors

(3) FEA: Forest Economic Advisors

(4) RBC: Royal Bank of Canada

14

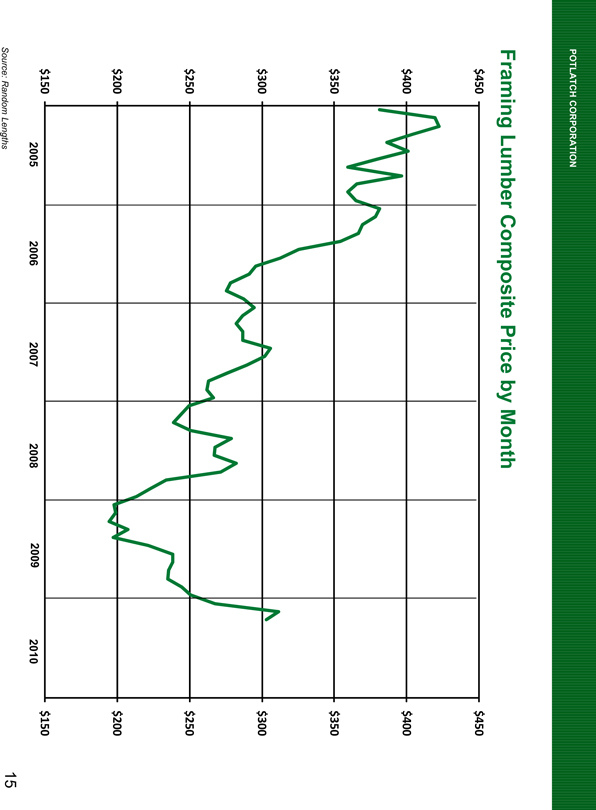

POTLATCH CORPORATION

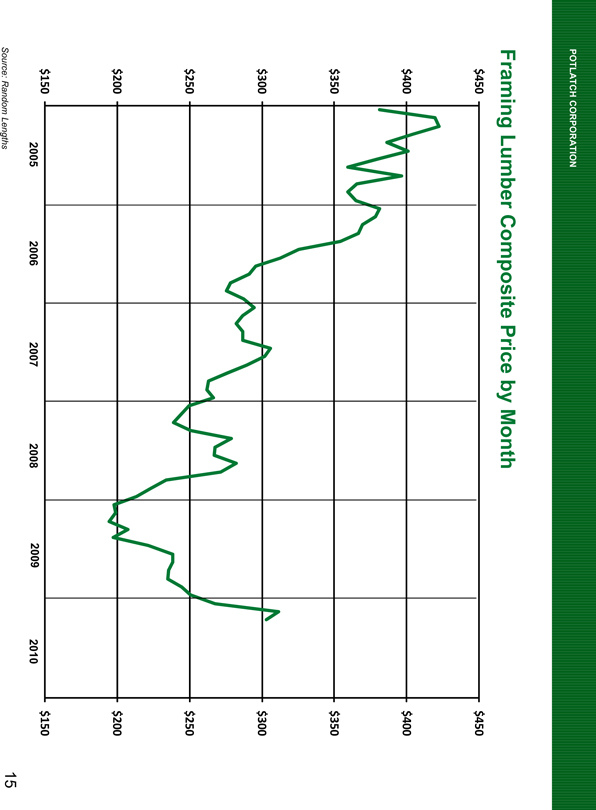

Framing Lumber Composite Price by Month

$450

$400

$350

$300

$250

$200

$150

$450

$400

$350

$300

$250

$200

$150

2005 2006 2007 2008 2009 2010

Source: Random Lengths

15

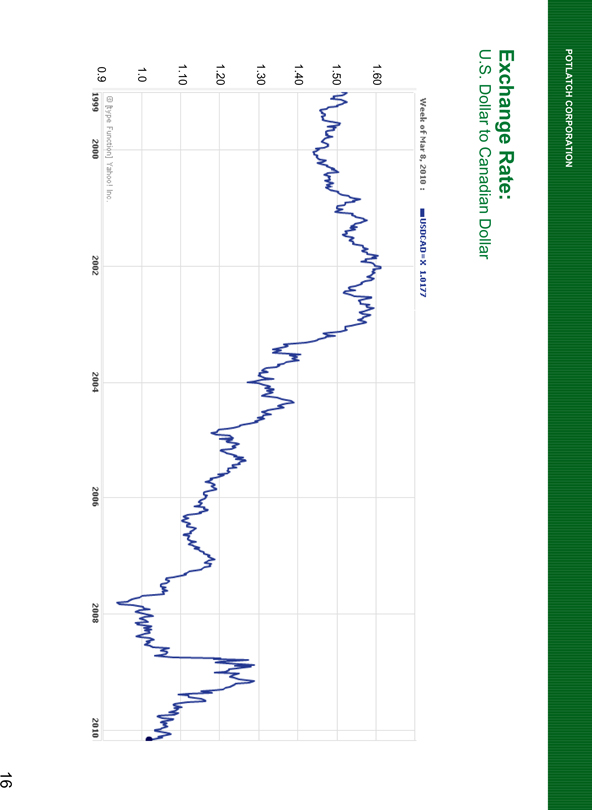

POTLATCH CORPORATION

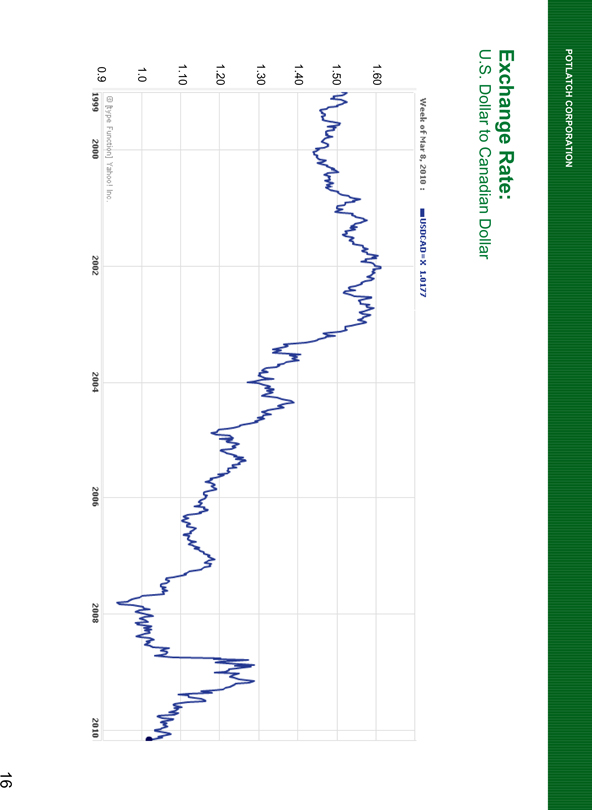

Exchange Rate:

U.S. Dollar to Canadian Dollar

Week of Mar 8, 2010 : USDCAD=X 1.0177

1.60

1.50

1.40

1.30

1.20

1.10

1.0

0.9

1999 2000 2002 2004 2006 2008 2010

16

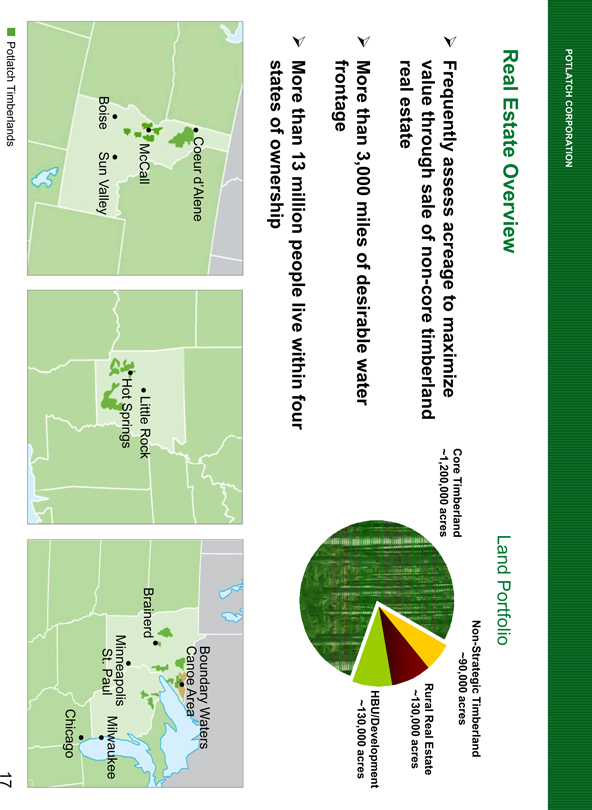

POTLATCH CORPORATION

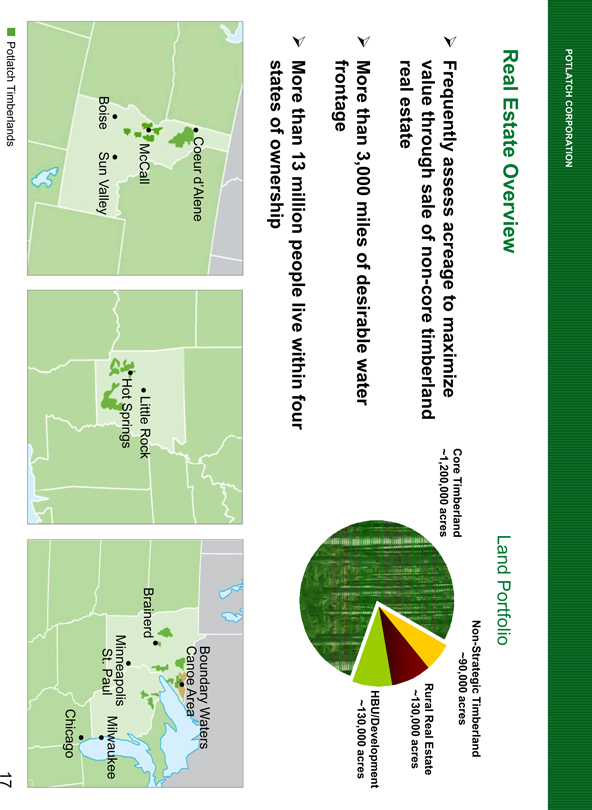

Real Estate Overview

Frequently assess acreage to maximize value through sale of non-core timberland real estate

More than 3,000 miles of desirable water frontage

More than 13 million people live within four states of ownership

Land Portfolio

Core Timberland

~1,200,000 acres

Non-Strategic Timberland

~90,000 acres

Rural Real Estate

~130,000 acres

HBU/Development

~130,000 acres

Coeur d’Alene

McCall

Boise

Sun Valley

Little Rock

Hot Springs

Boundary Waters

Canoe Area

Brainerd

Minneapolis

St. Paul

Milwaukee

Chicago

Potlatch Timberlands

17

POTLATCH CORPORATION

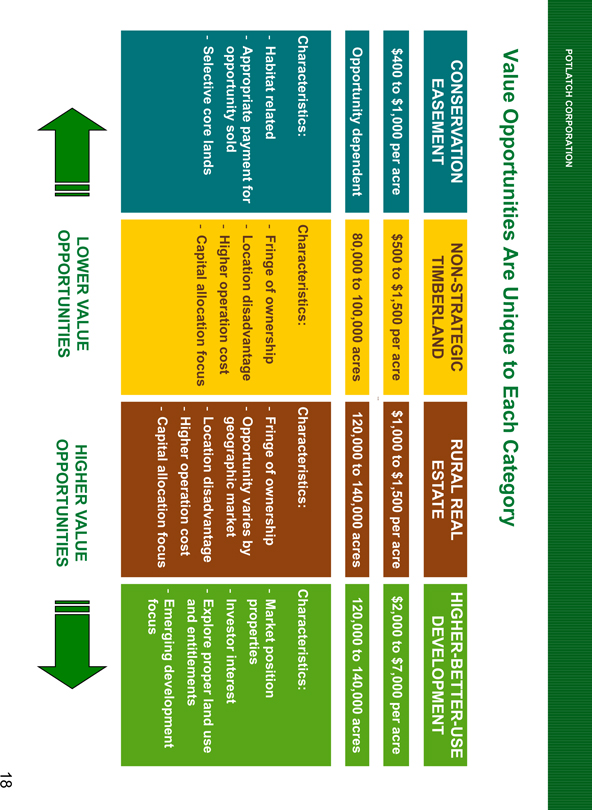

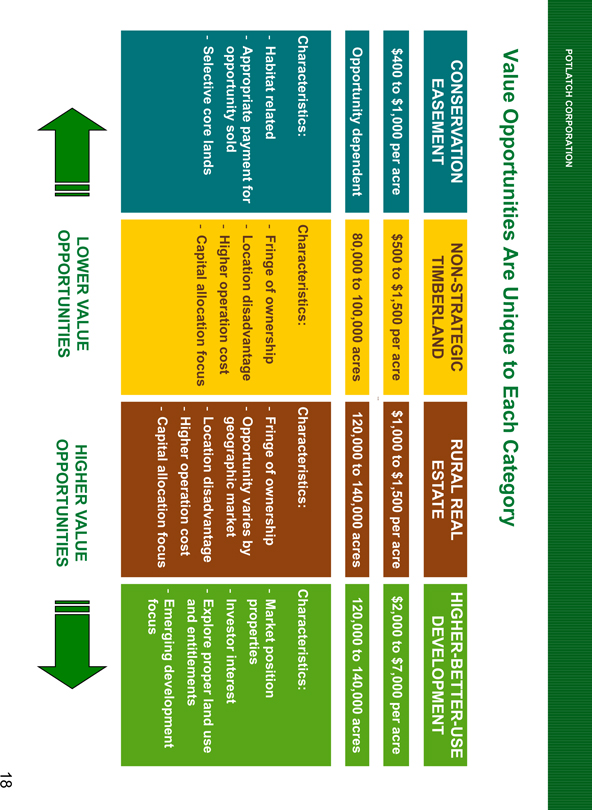

Value Opportunities Are Unique to Each Category

CONSERVATION EASEMENT

$400 to $1,000 per acre

Opportunity dependent

Characteristics:

- Habitat related

- Appropriate payment for opportunity sold

- Selective core lands

NON-STRATEGIC TIMBERLAND

$500 to $1,500 per acre

80,000 to 100,000 acres

Characteristics:

- Fringe of ownership

- Location disadvantage

- Higher operation cost

- Capital allocation focus

RURAL REAL ESTATE

$1,000 to $1,500 per acre

120,000 to 140,000 acres

Characteristics:

- Fringe of ownership

- Opportunity varies by geographic market

- Location disadvantage

- Higher operation cost

- Capital allocation focus

HIGHER-BETTER-USE DEVELOPMENT

$2,000 to $7,000 per acre

120,000 to 140,000 acres

Characteristics:

- Market position properties

- Investor interest

- Explore proper land use and entitlements

- Emerging development focus

LOWER VALUE OPPORTUNITIES

HIGHER VALUE OPPORTUNITIES

18

POTLATCH CORPORATION

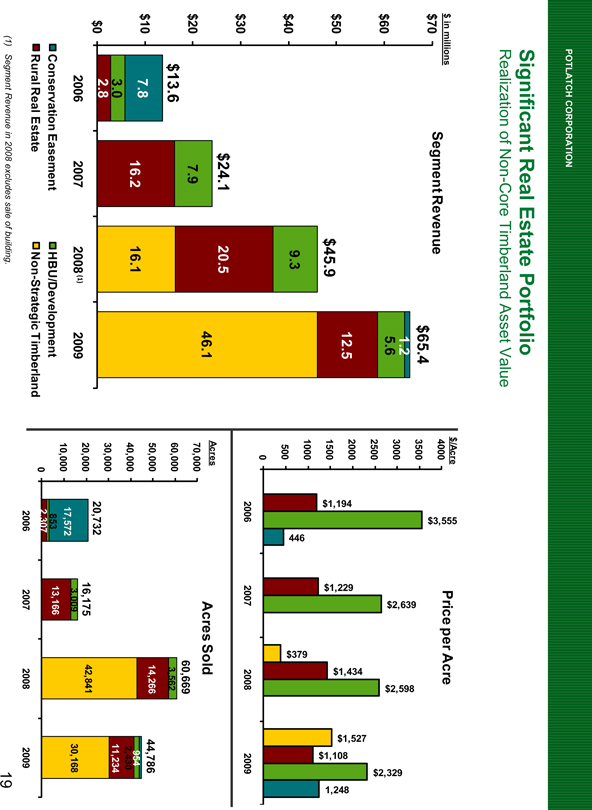

Significant Real Estate Portfolio

Realization of Non-Core Timberland Asset Value

$ in millions

$70

$60

$50

$40

$30

$20

$10

$0

Segment Revenue

$13.6

7.8

3.0

2.8

$24.1

7.9

16.2

$45.9

9.3

20.5

16.1

$65.4

1.2

5.6

12.5

46.1

2006

2007

2008(1)

2009

Conservation Easement

Rural Real Estate

HBU/Development

Non-Strategic Timberland

$/Acre

4000

3500

3000

2500

2000

1500

1000

500

0

Price per Acre

$1,194

$3,555

446

$1,229

$2,639

$379

$1,434

$2,598

$1,527

$1,108

$2,329

1,248

2006 2007 2008 2009

Acres

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

Acres Sold

20,732

17,572

853

2,307

16,175

3,009

13,166

60,669

3,562

14,266

42,841

44,786

954

2,430

11,234

30,168

2006 2007 2008 2009

(1) Segment Revenue in 2008 excludes sale of building.

19

POTLATCH CORPORATION

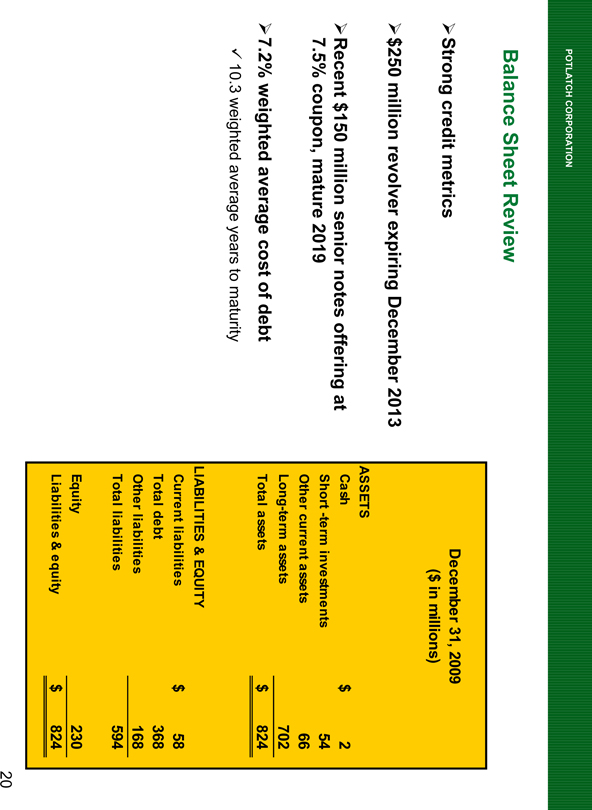

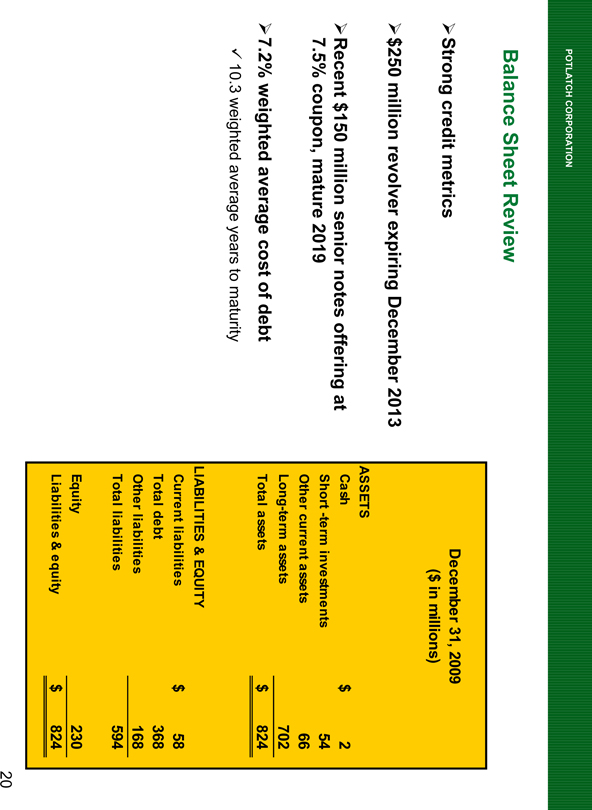

Balance Sheet Review

Strong credit metrics

$250 million revolver expiring December 2013

Recent $150 million senior notes offering at 7.5% coupon, mature 2019

7.2% weighted average cost of debt

10.3 weighted average years to maturity

December 31, 2009

($ in millions)

ASSETS

Cash $ 2

Short-term investments 54

Other current assets 66

Long-term assets 702

Total assets $ 824

LIABILITIES & EQUITY

Current liabilities $ 58

Total debt 368

Other liabilities 168

Total liabilities 594

Equity 230

Liabilities & equity $ 824

20

POTLATCH CORPORATION

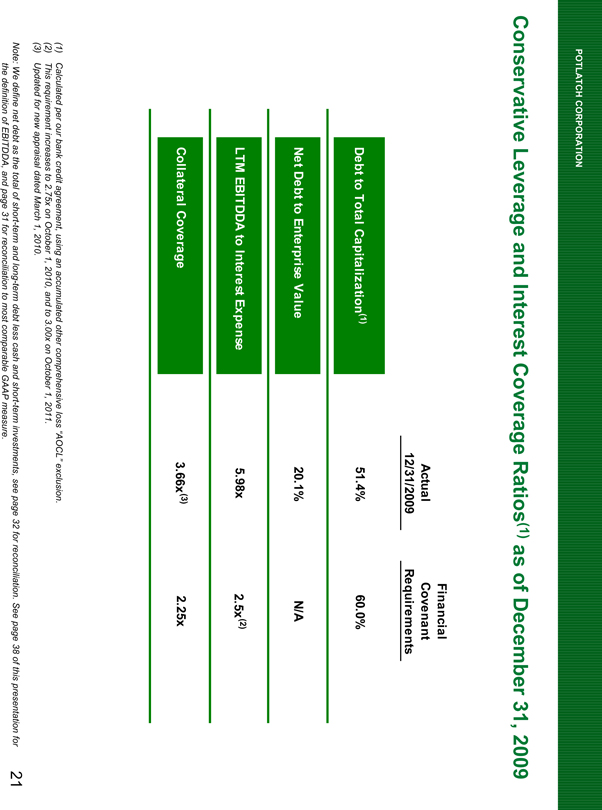

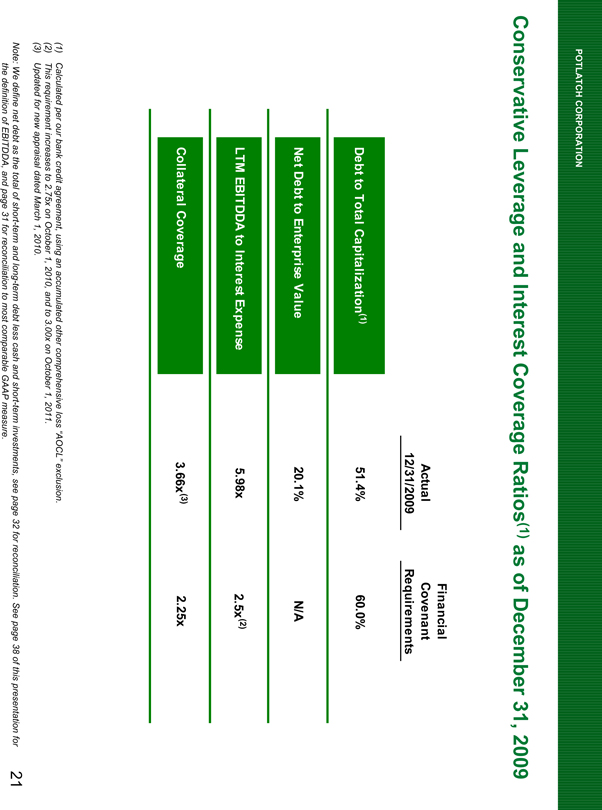

Conservative Leverage and Interest Coverage Ratios(1) as of December 31, 2009

Actual 12/31/2009

Financial Covenant Requirements

Debt to Total Capitalization(1) 51.4% 60.0%

Net Debt to Enterprise Value 20.1% N/A

LTM EBITDDA to Interest Expense 5.98x 2.5x(2)

Collateral Coverage 3.66x(3) 2.25x

(1) Calculated per our bank credit agreement, using an accumulated other comprehensive loss “AOCL” exclusion.

(2) This requirement increases to 2.75x on October 1, 2010, and to 3.00x on October 1, 2011.

(3) Updated for new appraisal dated March 1, 2010.

Note: We define net debt as the total of short-term and long-term debt less cash and short-term investments, see page 32 for reconciliation. See page 38 of this presentation for the definition of EBITDDA, and page 31 for reconciliation to most comparable GAAP measure.

21

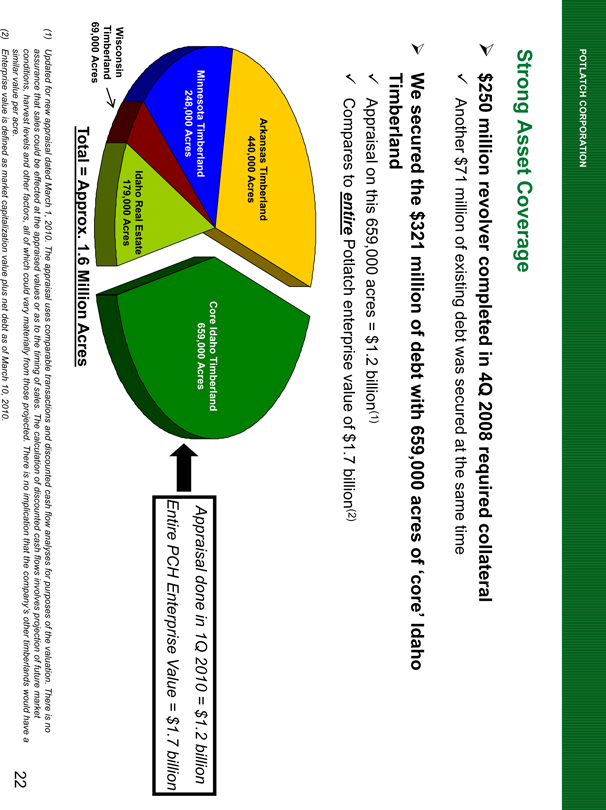

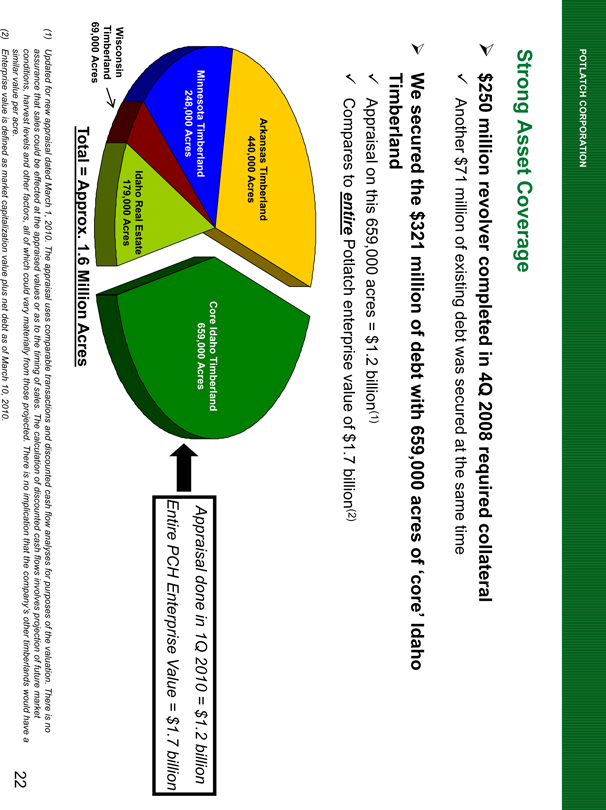

POTLATCH CORPORATION

Strong Asset Coverage

$250 million revolver completed in 4Q 2008 required collateral

Another $71 million of existing debt was secured at the same time

We secured the $321 million of debt with 659,000 acres of ‘core’ Idaho Timberland

Appraisal on this 659,000 acres = $1.2 billion(1)

Compares to entire Potlatch enterprise value of $1.7 billion(2)

Arkansas Timberland

440,000 Acres

Minnesota Timberland

248,000 Acres

Core Idaho Timberland

659,000 Acres

Idaho Real Estate

179,000 Acres

Wisconsin

Timberland

69,000 Acres

Total = Approx. 1.6 Million Acres

Appraisal done in 1Q 2010 = $1.2 billion

Entire PCH Enterprise Value = $1.7 billion

(1) Updated for new appraisal dated March 1, 2010. The appraisal uses comparable transactions and discounted cash flow analyses for purposes of the valuation. There is no assurance that sales could be effected at the appraised values or as to the timing of sales. The calculation of discounted cash flows involves projection of future market conditions, harvest levels and other factors, all of which could vary materially from those projected. There is no implication that the company’s other timberlands would have a 22

similar value per acre.

(2) Enterprise value is defined as market capitalization value plus net debt as of March 10, 2010.

22

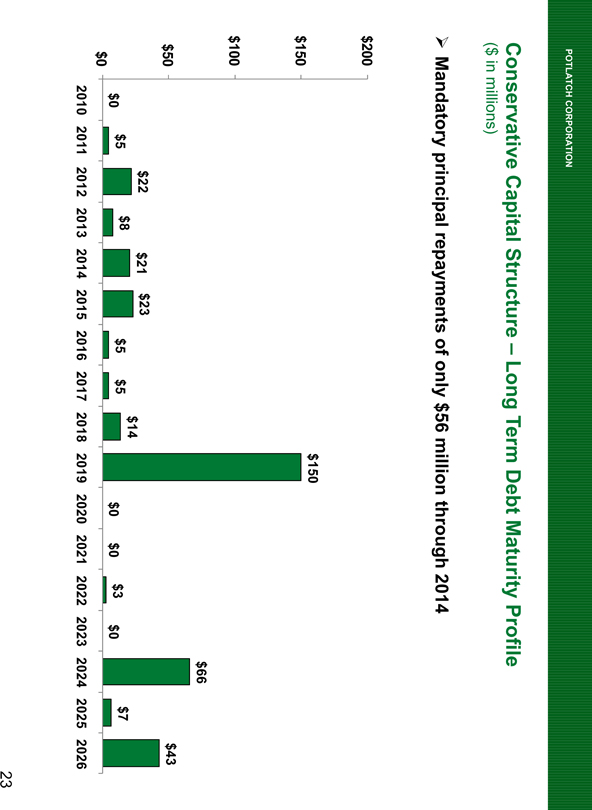

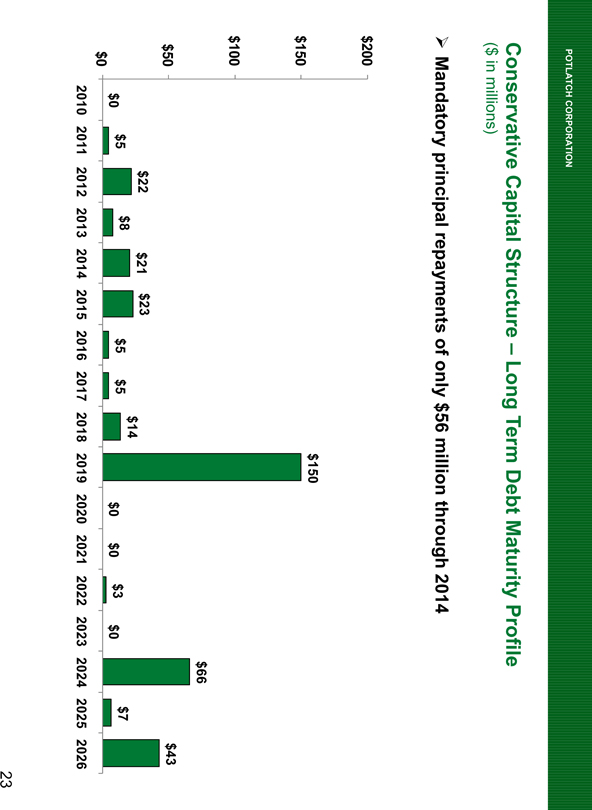

POTLATCH CORPORATION

Conservative Capital Structure – Long Term Debt Maturity Profile

($ in millions)

Mandatory principal repayments of only $56 million through 2014

$200

$150

$100

$50

$0

$0

$5

$22

$8

$21

$23

$5

$5

$14

$150

$0

$0

$3

$0

$66

$7

$43

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

23

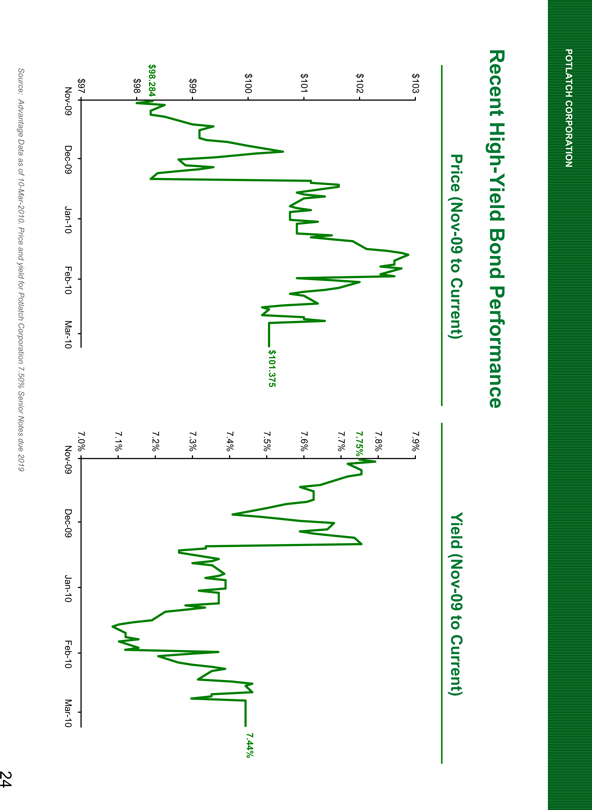

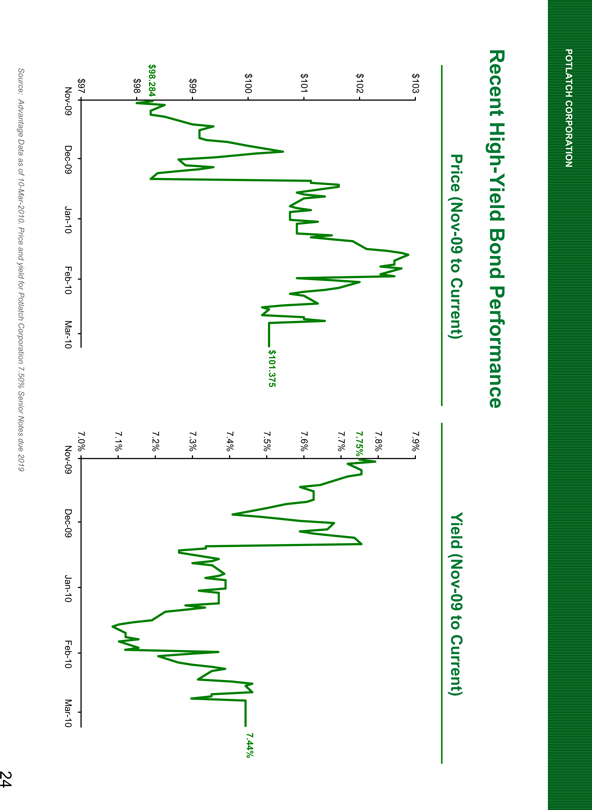

POTLATCH CORPORATION

Recent High-Yield Bond Performance

Price (Nov-09 to Current)

$103

$102

$101

$100

$99

$98.284

$98

$97

$101.375

Nov-09 Dec-09 Jan-10 Feb-10 Mar-10

Yield (Nov-09 to Current)

7.9%

7.8%

7.75%

7.7%

7.6%

7.5%

7.4%

7.3%

7.2%

7.1%

7.0%

7.44%

Nov-09 Dec-09 Jan-10 Feb-10 Mar-10

Source: Advantage Data as of 10-Mar-2010. Price and yield for Potlatch Corporation 7.50% Senior Notes due 2019

24

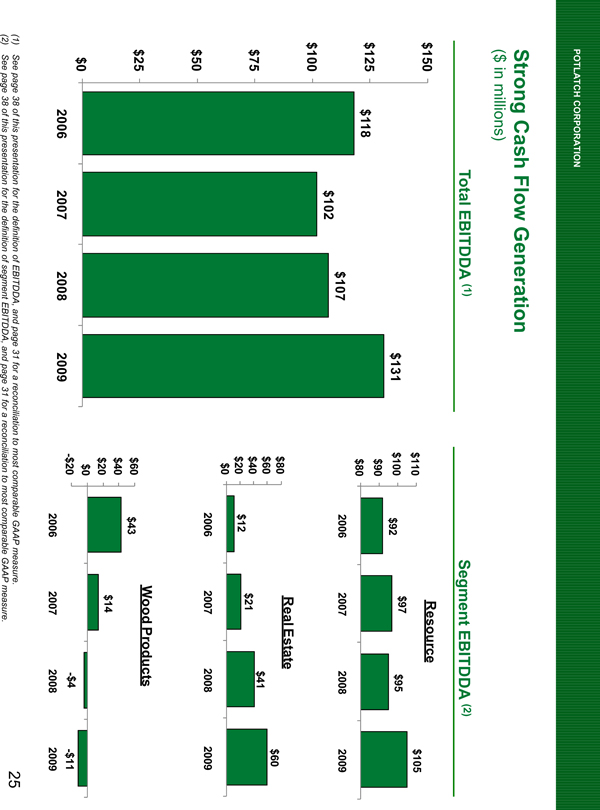

POTLATCH CORPORATION

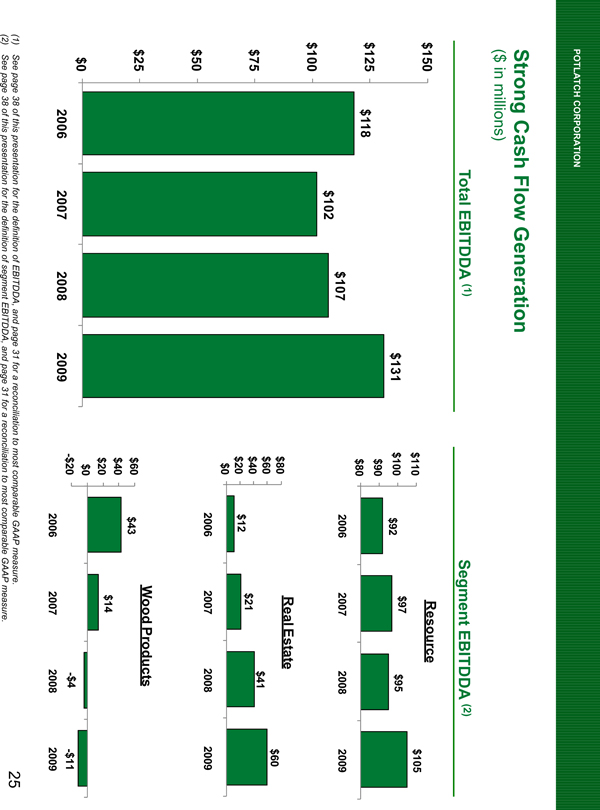

Strong Cash Flow Generation

($ in millions)

Total EBITDDA (1)

$150

$125

$100

$75

$50

$25

$0

$118 $102 $107 $131

2006 2007 2008 2009

Segment EBITDDA (2)

Resource

$110

$100

$90

$80

$92 $97 $95 $105

2006 2007 2008 2009

Real Estate

$80

$60

$40

$20

$0

$12 $21 $41 $60

2006 2007 2008 2009

Wood Products

$60

$40

$20

$0

-$20

$43 $14 -$4 -$11

2006 2007 2008 2009

(1) See page 38 of this presentation for the definition of EBITDDA, and page 31 for a reconciliation to most comparable GAAP measure.

(2) See page 38 of this presentation for the definition of segment EBITDDA, and page 31 for a reconciliation to most comparable GAAP measure.

25

POTLATCH CORPORATION

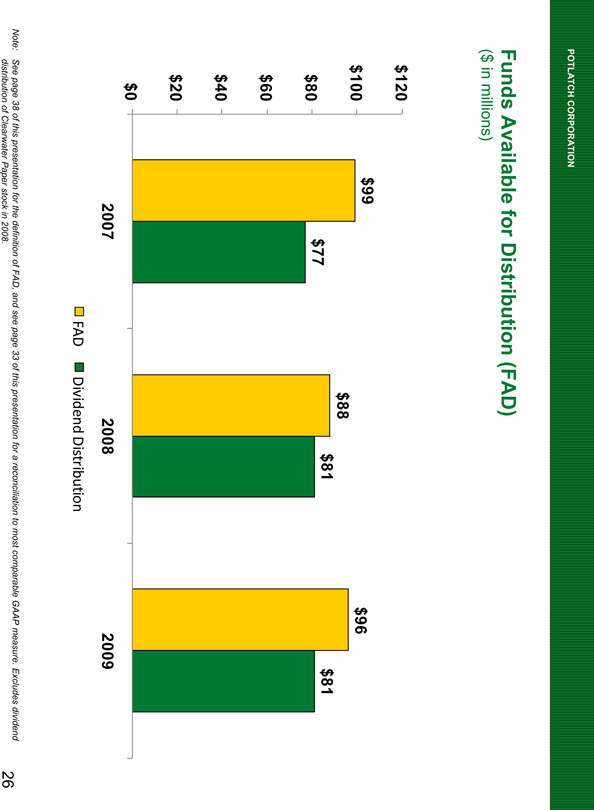

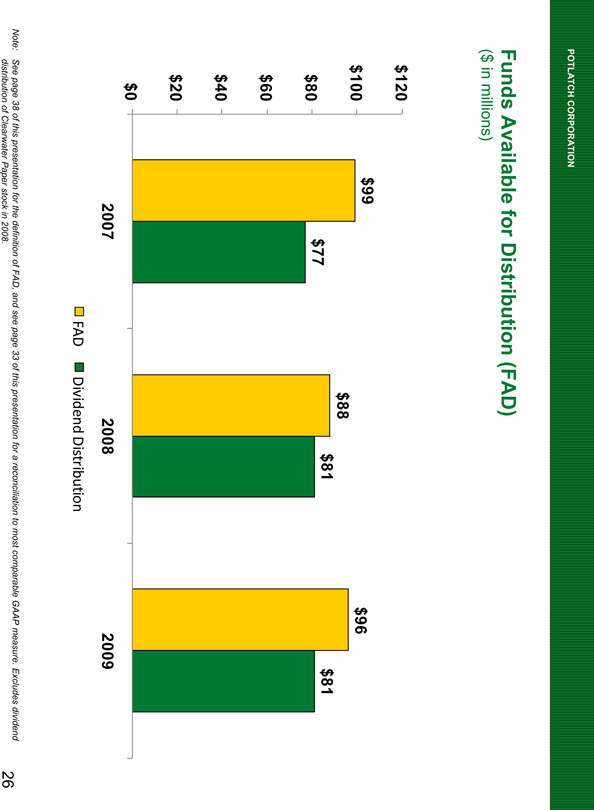

Funds Available for Distribution (FAD)

($ in millions)

$120

$100

$80

$60

$40

$20

$0

$99 $77 $88 $81 $96 $81

2007 2008 2009

FAD Dividend Distribution

Note: See page 38 of this presentation for the definition of FAD, and see page 33 of this presentation for a reconciliation to most comparable GAAP measure. Excludes dividend distribution of Clearwater Paper stock in 2008.

26

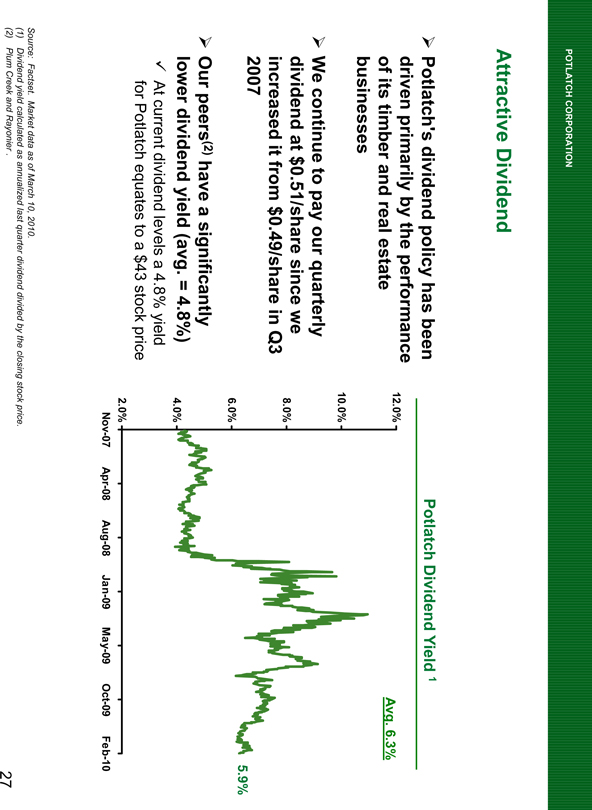

POTLATCH CORPORATION

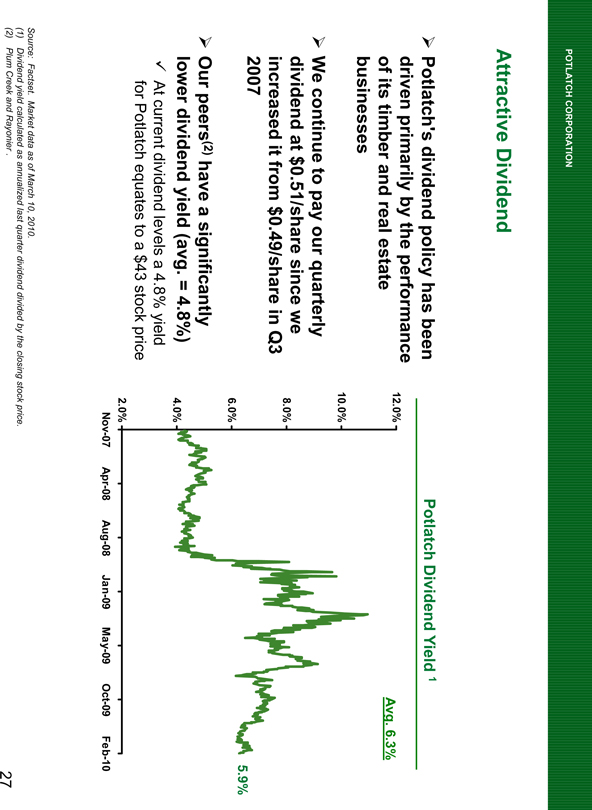

Attractive Dividend

Potlatch’s dividend policy has been driven primarily by the performance of its timber and real estate businesses

We continue to pay our quarterly dividend at $0.51/share since we increased it from $0.49/share in Q3 2007

Our peers(2) have a significantly lower dividend yield (avg. = 4.8%)

At current dividend levels a 4.8% yield for Potlatch equates to a $43 stock price

Potlatch Dividend Yield 1

12.0%

10.0%

8.0%

6.0%

4.0%

2.0%

Avg. 6.3%

5.9%

Nov-07 Apr-08 Aug-08 Jan-09 May-09 Oct-09 Feb-10

Source: Factset. Market data as of March 10, 2010.

(1) Dividend yield calculated as annualized last quarter dividend divided by the closing stock price.

(2) Plum Creek and Rayonier.

27

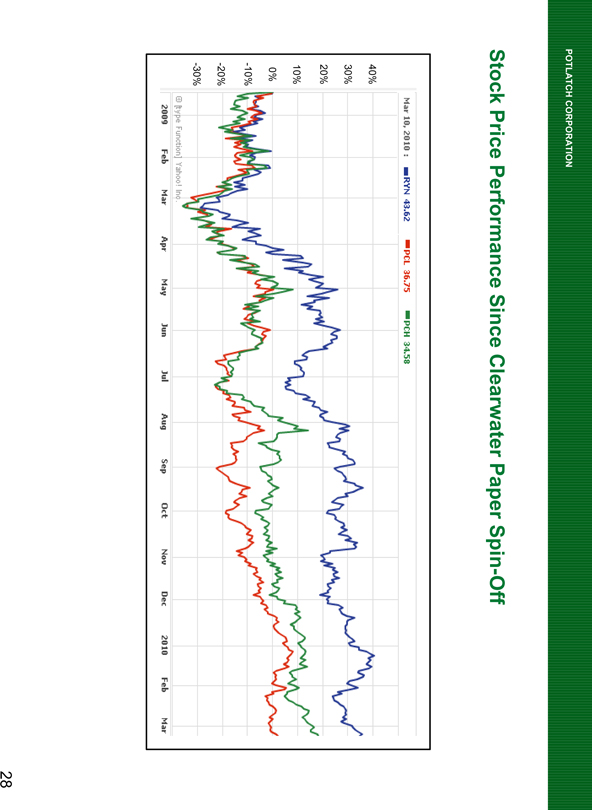

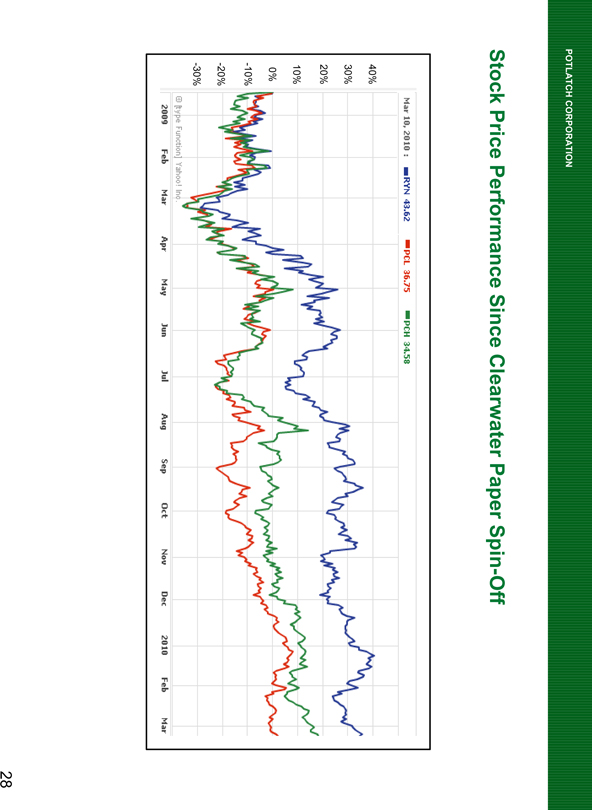

POTLATCH CORPORATION

Stock Price Performance Since Clearwater Paper Spin-Off

Mar 10, 2010 : RYN 43.62 PCL 36.75 PCH 34.58

40%

30%

20%

10%

0%

-10%

-20%

-30%

© [type Function] Yahoo! Inc.

2009 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2010 Feb Mar

28

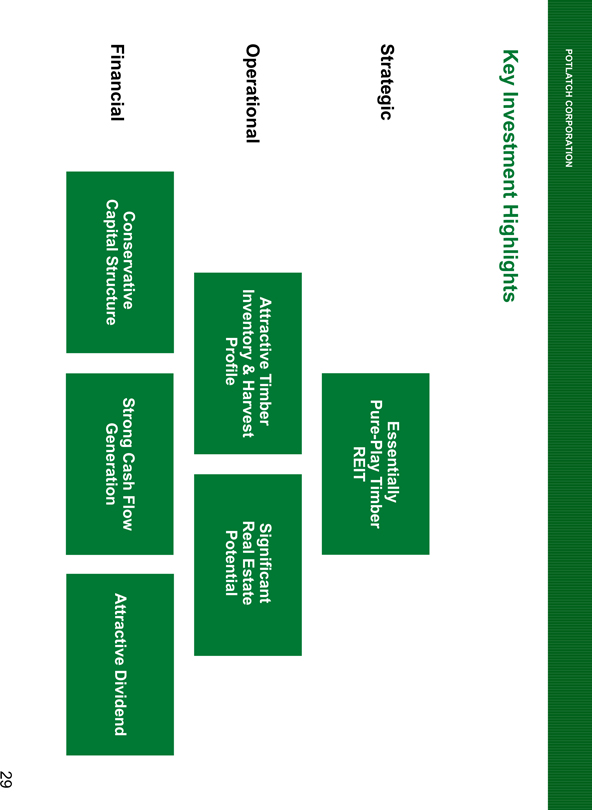

POTLATCH CORPORATION

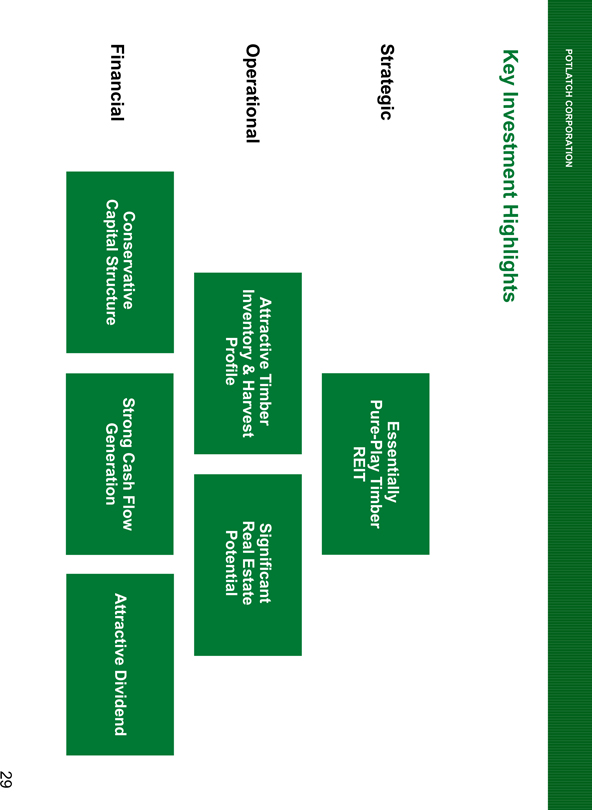

Key Investment Highlights

Strategic

Operational

Financial

Essentially Pure-Play Timber REIT

Attractive Timber Inventory & Harvest Profile

Significant Real Estate Potential

Conservative Capital Structure

Strong Cash Flow Generation

Attractive Dividend

29

POTLATCH CORPORATION

MARCH 2010

Appendix

Potlatch®

WWW.POTLATCHCORP.COM

POTLATCH CORPORATION

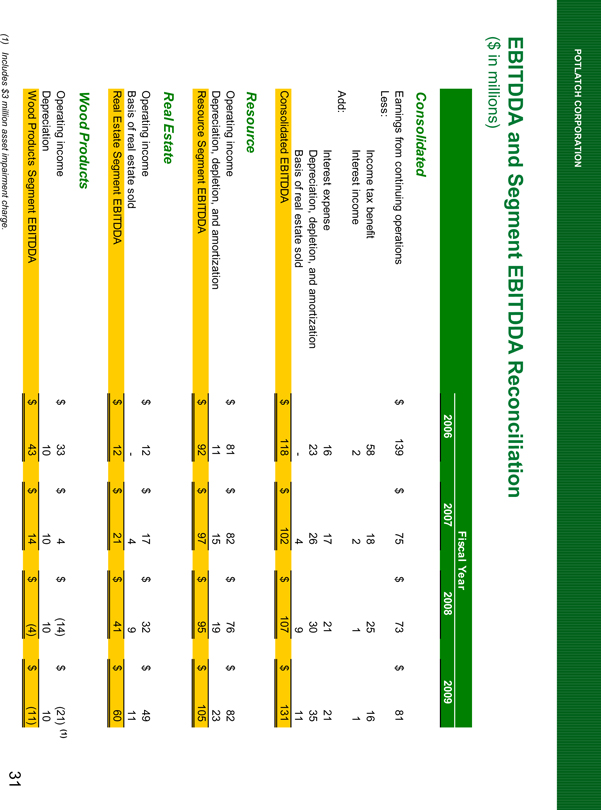

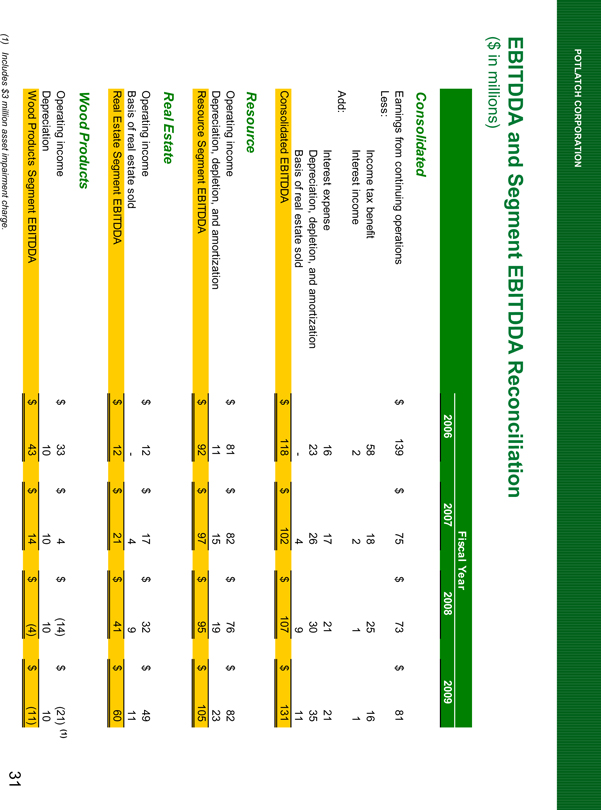

EBITDDA and Segment EBITDDA Reconciliation

($ in millions)

Fiscal Year

2006 2007 2008 2009

Consolidated

Earnings from continuing operations $ 139 $ 75 $ 73 $ 81

Less:

Income tax benefit 58 18 25 16

Interest income 2 2 1 1

Add:

Interest expense 16 17 21 21

Depreciation, depletion, and amortization 23 26 30 35

Basis of real estate sold - 4 9 11

Consolidated EBITDDA $ 118 $ 102 $ 107 $ 131

Resource

Operating income $ 81 $ 82 $ 76 $ 82

Depreciation, depletion, and amortization 11 15 19 23

Resource Segment EBITDDA $ 92 $ 97 $ 95 $ 105

Real Estate

Operating income $ 12 $ 17 $ 32 $ 49

Basis of real estate sold - 4 9 11

Real Estate Segment EBITDDA $ 12 $ 21 $ 41 $ 60

Wood Products

Operating income $ 33 $ 4 $ (14) $ (21) (1)

Depreciation 10 10 10 10

Wood Products Segment EBITDDA $ 43 $ 14 $ (4) $ (11)

(1) Includes $3 million asset impairment charge.

31

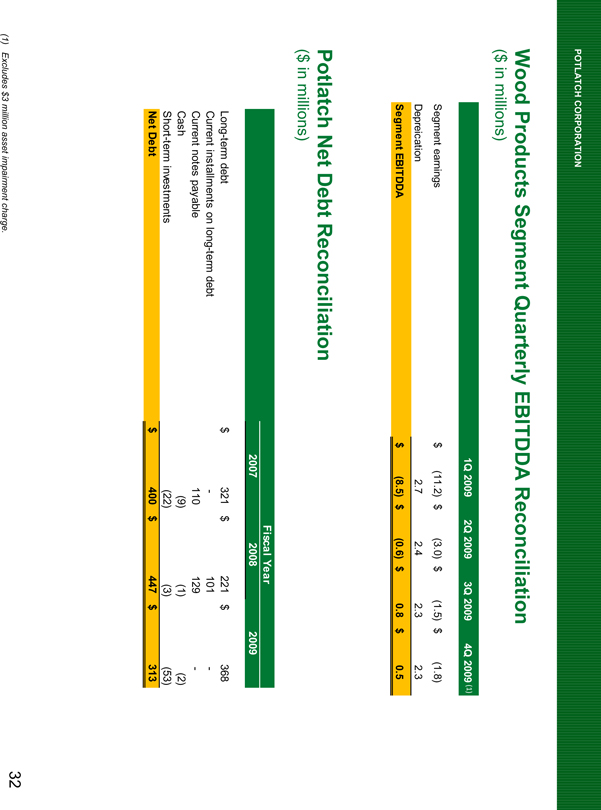

POTLATCH CORPORATION

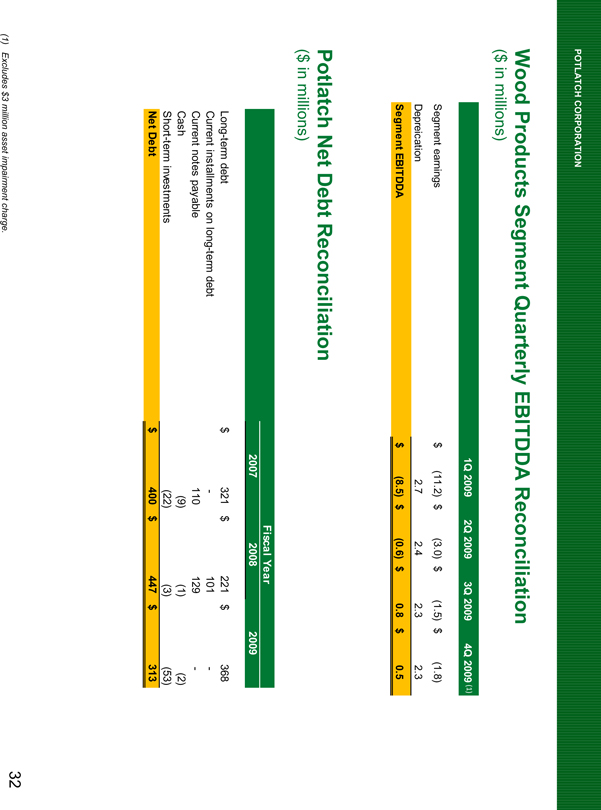

Wood Products Segment Quarterly EBITDDA Reconciliation

($ in millions)

1Q 2009 2Q 2009 3Q 2009 4Q 2009 (1)

Segment earnings $ (11.2) $ (3.0) $ (1.5) $ (1.8)

Depreciation 2.7 2.4 2.3 2.3

Segment EBITDDA $ (8.5) $ (0.6) $ 0.8 $ 0.5

Potlatch Net Debt Reconciliation

($ in millions)

Fiscal Year

2007 2008 2009

Long-term debt $ 321 $ 221 $ 368

Current installments on long-term debt - 101 -

Current notes payable 110 129 -

Cash (9) (1) (2)

Short-term investments (22) (3) (53)

Net Debt $ 400 $ 447 $ 313

(1) Excludes $3 million asset impairment charge.

32

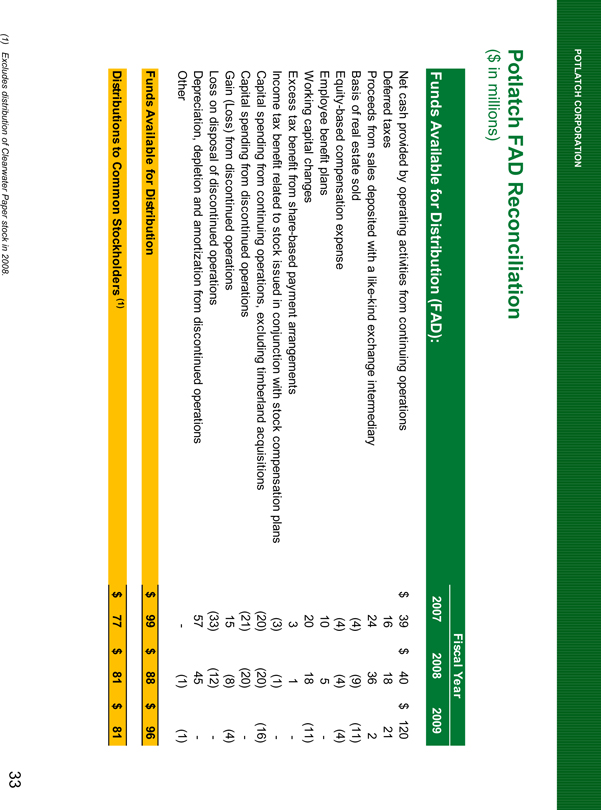

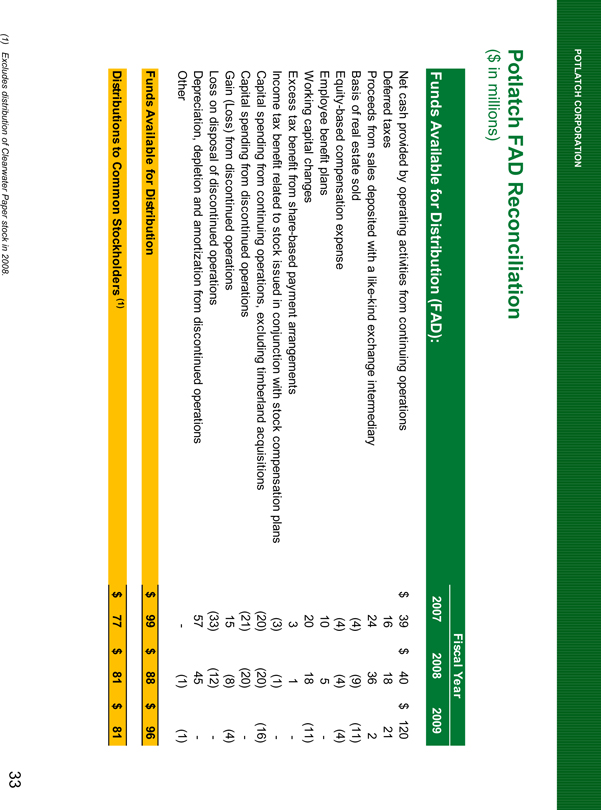

POTLATCH CORPORATION

Potlatch FAD Reconciliation

($ in millions)

Fiscal Year

Funds Available for Distribution (FAD): 2007 2008 2009

Net cash provided by operating activities from continuing operations $ 39 $ 40 $ 120

Deferred taxes 16 18 21

Proceeds from sales deposited with a like-kind exchange intermediary 24 36 2

Basis of real estate sold (4) (9) (11)

Equity-based compensation expense (4) (4) (4)

Employee benefit plans 10 5 -

Working capital changes 20 18 (11)

Excess tax benefit from share-based payment arrangements 3 1 -

Income tax benefit related to stock issued in conjunction with stock compensation plans (3) (1) -

Capital spending from continuing operations, excluding timberland acquisitions (20) (20) (16)

Capital spending from discontinued operations (21) (20) -

Gain (Loss) from discontinued operations 15 (8) (4)

Loss on disposal of discontinued operations (33) (12) -

Depreciation, depletion and amortization from discontinued operations 57 45 -

Other - (1) (1)

Funds Available for Distribution $ 99 $ 88 $ 96

Distributions to Common Stockholders (1) $ 77 $ 81 $ 81

(1) Excludes distribution of Clearwater Paper stock in 2008.

33

POTLATCH CORPORATION

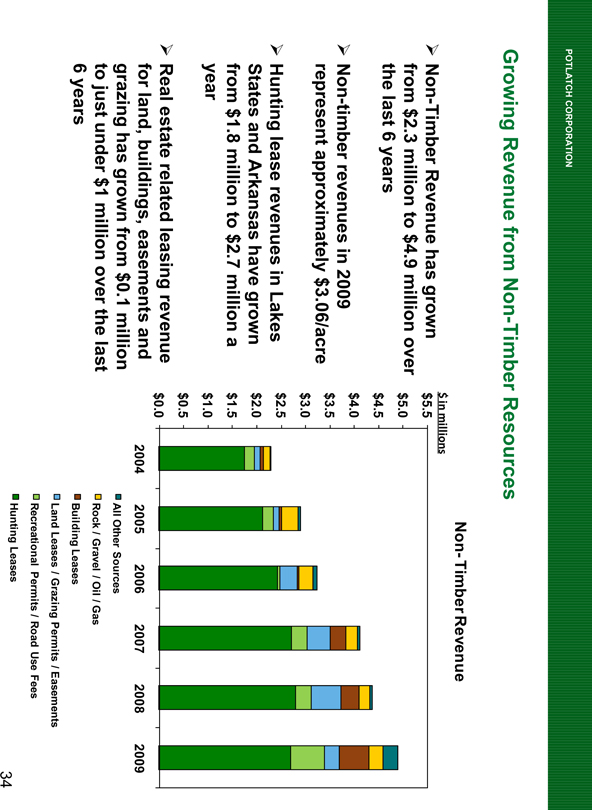

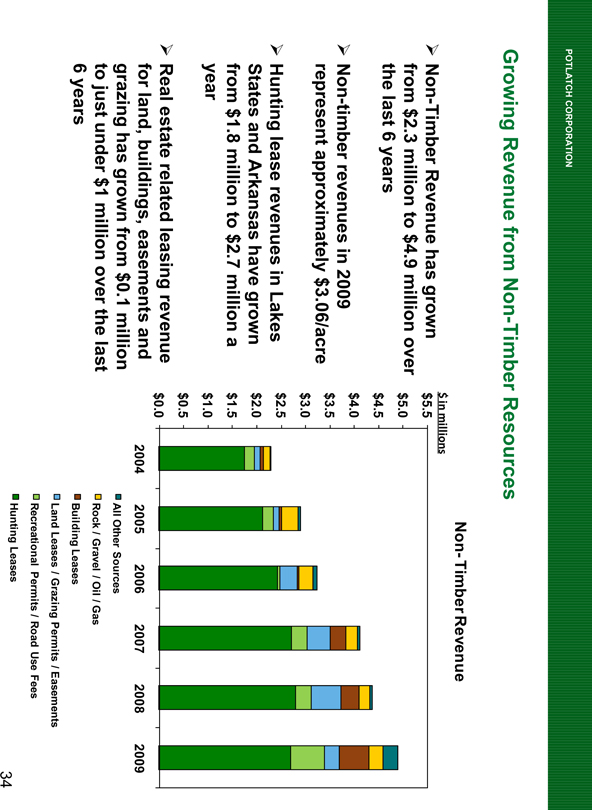

Growing Revenue from Non-Timber Resources

Non-Timber Revenue has grown from $2.3 million to $4.9 million over the last 6 years

Non-timber revenues in 2009 represent approximately $3.06/acre

Hunting lease revenues in Lakes States and Arkansas have grown from $1.8 million to $2.7 million a year

Real estate related leasing revenue for land, buildings, easements and grazing has grown from $0.1 million to just under $1 million over the last 6 years

Non-Timber Revenue

$ in millions

$5.5

$5.0

$4.5

$4.0

$3.5

$3.0

$2.5

$2.0

$1.5

$1.0

$0.5

$0.0

2004 2005 2006 2007 2008 2009

All Other Sources

Rock / Gravel / Oil / Gas

Building Leases

Land Leases / Grazing Permits / Easements

Recreational Permits / Road Use Fees

Hunting Leases

34

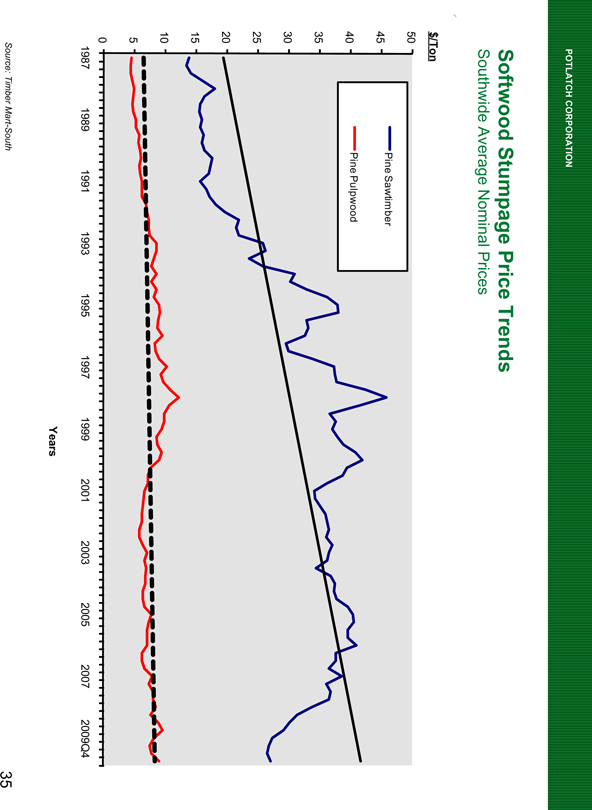

POTLATCH CORPORATION

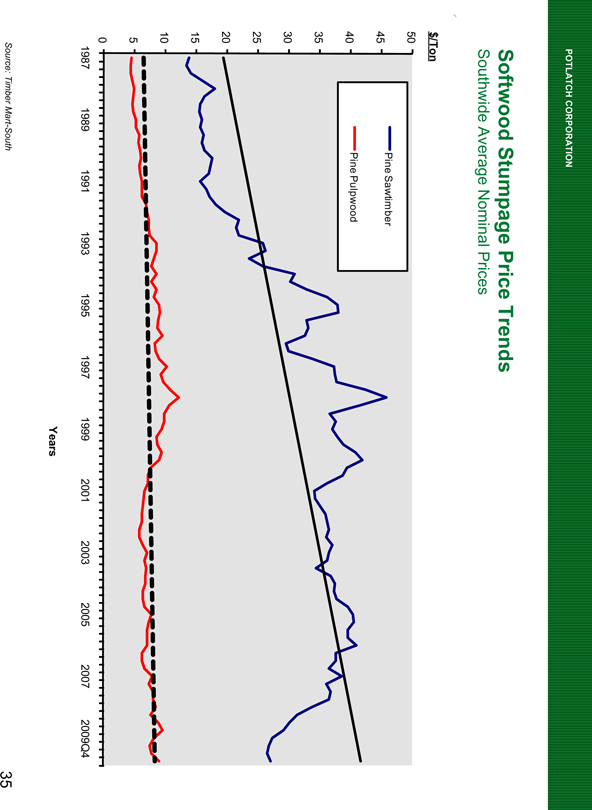

Softwood Stumpage Price Trends

Southwide Average Nominal Prices

$/Ton

50

45

40

35

30

25

20

15

10

5

0

Pine Sawtimber

Pine Pulpwood

1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009Q4

Years

Source: Timber Mart-South

35

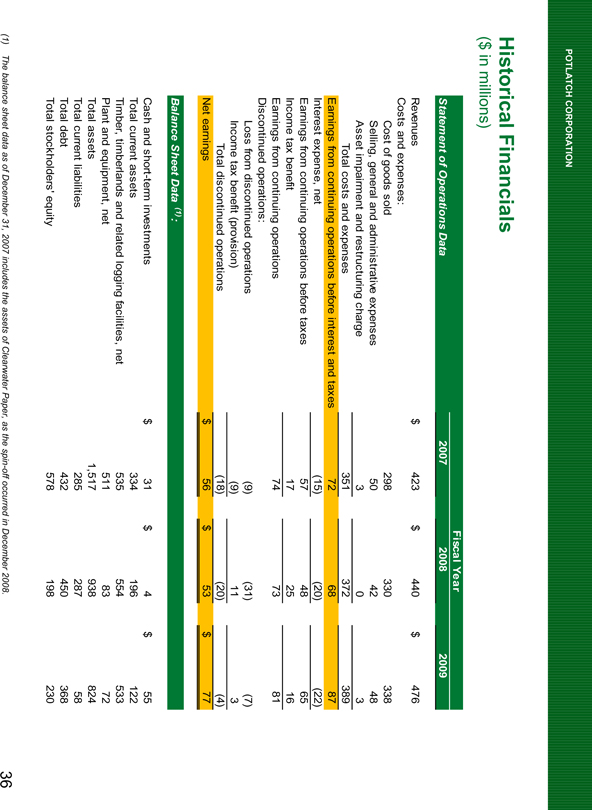

POTLATCH CORPORATION

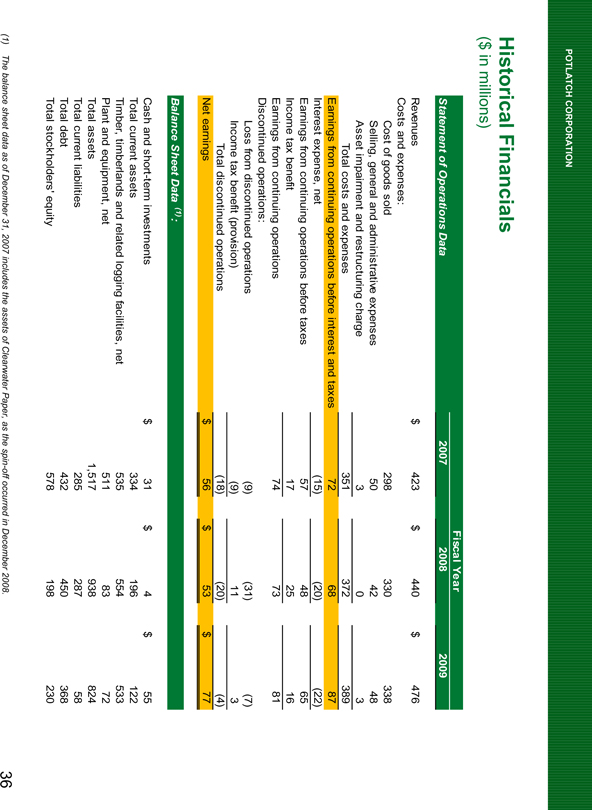

Historical Financials

($ in millions)

Fiscal Year

Statement of Operations Data 2007 2008 2009

Revenues $ 423 $ 440 $ 476

Costs and expenses:

Cost of goods sold 298 330 338

Selling, general and administrative expenses 50 42 48

Asset impairment and restructuring charge 3 0 3

Total costs and expenses 351 372 389

Earnings from continuing operations before interest and taxes 72 68 87

Interest expense, net (15) (20) (22)

Earnings from continuing operations before taxes 57 48 65

Income tax benefit 17 25 16

Earnings from continuing operations 74 73 81

Discontinued operations:

Loss from discontinued operations (9) (31) (7)

Income tax benefit (provision) (9) 11 3

Total discontinued operations (18) (20) (4)

Net earnings $ 56 $ 53 $ 77

Balance Sheet Data (1):

Cash and short-term investments $ 31 $ 4 $ 55

Total current assets 334 196 122

Timber, timberlands and related logging facilities, net 535 554 533

Plant and equipment, net 511 83 72

Total assets 1,517 938 824

Total current liabilities 285 287 58

Total debt 432 450 368

Total stockholders’ equity 578 198 230

(1) The balance sheet data as of December 31, 2007 includes the assets of Clearwater Paper, as the spin-off occurred in December 2008.

36

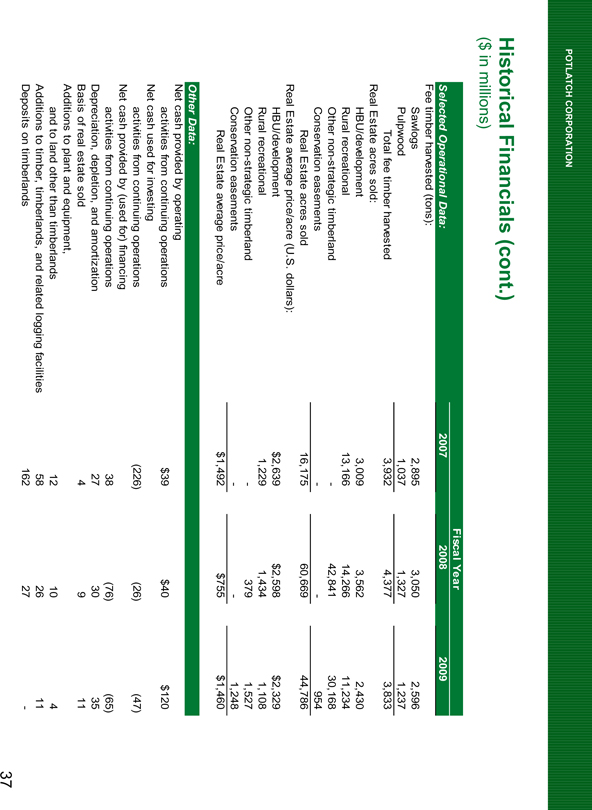

POTLATCH CORPORATION

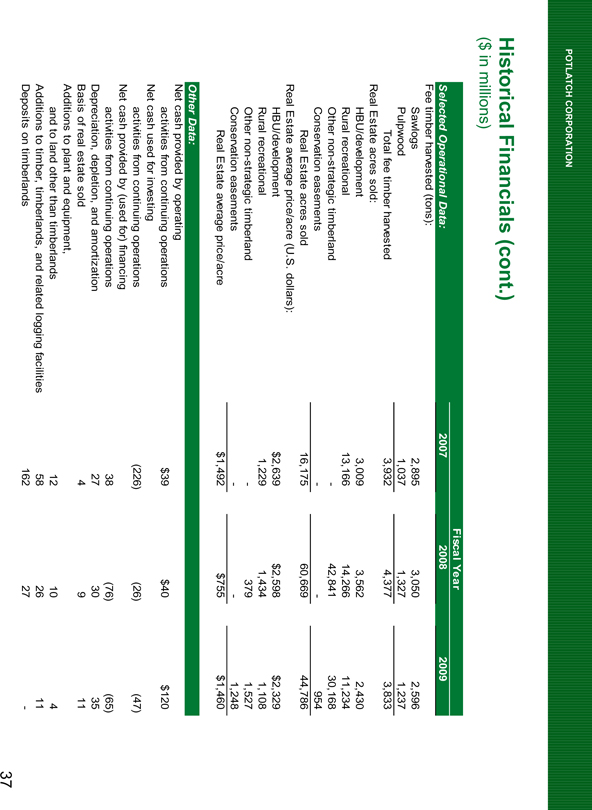

Historical Financials (cont.)

($ in millions)

Fiscal Year

Selected Operational Data: 2007 2008 2009

Fee timber harvested (tons):

Sawlogs 2,895 3,050 2,596

Pulpwood 1,037 1,327 1,237

Total fee timber harvested 3,932 4,377 3,833

Real Estate acres sold:

HBU/development 3,009 3,562 2,430

Rural recreational 13,166 14,266 11,234

Other non-strategic timberland - 42,841 30,168

Conservation easements - - 954

Real Estate acres sold 16,175 60,669 44,786

Real Estate average price/acre (U.S. dollars):

HBU/development $2,639 $2,598 $2,329

Rural recreational 1,229 1,434 1,108

Other non-strategic timberland - 379 1,527

Conservation easements - - 1,248

Real Estate average price/acre $1,492 $755 $1,460

Other Data:

Net cash provided by operating

activities from continuing operations $39 $40 $120

Net cash used for investing

activities from continuing operations (226) (26) (47)

Net cash provided by (used for) financing

activities from continuing operations 38 (76) (65)

Depreciation, depletion, and amortization 27 30 35

Basis of real estate sold 4 9 11

Additions to plant and equipment,

and to land other than timberlands 12 10 4

Additions to timber, timberlands, and related logging facilities 58 26 11

Deposits on timberlands 162 27 -

37

POTLATCH CORPORATION

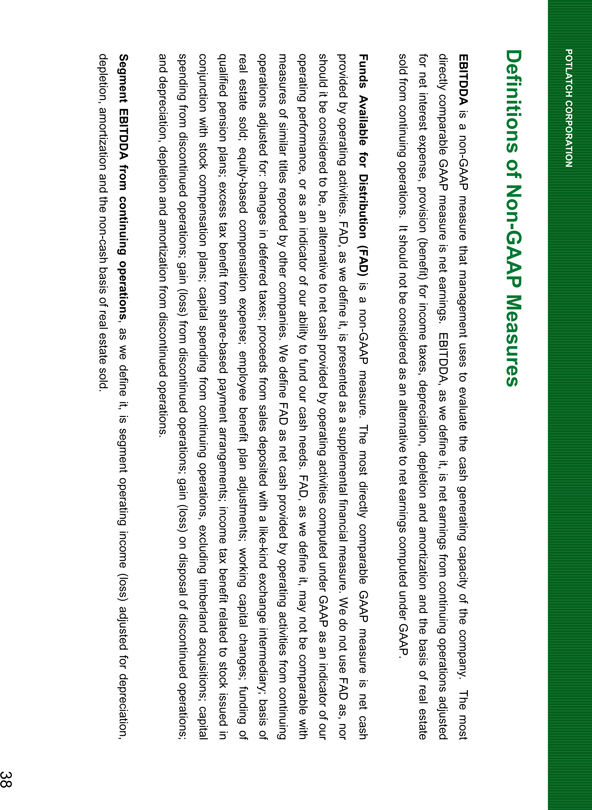

Definitions of Non-GAAP Measures

EBITDDA is a non-GAAP measure that management uses to evaluate the cash generating capacity of the company. The most directly comparable GAAP measure is net earnings. EBITDDA, as we define it, is net earnings from continuing operations adjusted for net interest expense, provision (benefit) for income taxes, depreciation, depletion and amortization and the basis of real estate sold from continuing operations. It should not be considered as an alternative to net earnings computed under GAAP.

Funds Available for Distribution (FAD) is a non-GAAP measure. The most directly comparable GAAP measure is net cash provided by operating activities. FAD, as we define it, is presented as a supplemental financial measure. We do not use FAD as, nor should it be considered to be, an alternative to net cash provided by operating activities computed under GAAP as an indicator of our operating performance, or as an indicator of our ability to fund our cash needs. FAD, as we define it, may not be comparable with measures of similar titles reported by other companies. We define FAD as net cash provided by operating activities from continuing operations adjusted for: changes in deferred taxes; proceeds from sales deposited with a like-kind exchange intermediary; basis of real estate sold; equity-based compensation expense; employee benefit plan adjustments; working capital changes; funding of qualified pension plans; excess tax benefit from share-based payment arrangements; income tax benefit related to stock issued in conjunction with stock compensation plans; capital spending from continuing operations, excluding timberland acquisitions; capital spending from discontinued operations; gain (loss) from discontinued operations; gain (loss) on disposal of discontinued operations; and depreciation depletion and amortization from discontinued operations.

Segment EBITDDA from continuing operations, as we define it, is segment operating income (loss) adjusted for depreciation, depletion, amortization and the non-cash basis of real estate sold.

38

POTLATCH CORPORATION

Potlatch®

WWW.POTLATCHCORP.COM