POTLATCH CORPORATION AUGUST 2011 POTLATCH CORPORATION Eric J. Cremers Vice President, Finance and Chief Financial Officer Deutsche Bank Conference – Boston Exhibit 99.1 |

POTLATCH CORPORATION 2 Forward-Looking Statements This presentation contains certain forward-looking statements within the meaning of the Private Litigation Reform Act of 1995 as amended, including without limitation statements about future company performance, the company’s business model, strength of the company’s balance sheet and credit metrics, dividend levels and yields, direction of markets and the economy, management of timberlands to optimize values, projected inland private timber growth and harvest, future harvest levels and their relation to market trends, impact of the pine beetle on North American lumber supply, forecasts of North American exports of lumber to China, softwood stumpage price trends, forecast of U.S. housing starts, the company’s capital structure, weighted average cost of debt, cash flow generation, Canadian/U.S. dollar exchange rate, “organic” and “inorganic” funds available for distribution, funds available for distribution, real estate business potential and land development potential, real estate value opportunities, biomass opportunities, forecasts of U.S. biomass consumed to produce electricity, management of the output of our Wood Products facilities, asset coverage, debt repayment, and dividend policy. These forward-looking statements are based on current expectations, estimates, assumptions and projections that are subject to change, and actual results may differ materially from the forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, changes in timberland values; changes in timber harvest levels on the company’s lands; changes in timber prices; changes in policy regarding governmental timber sales; changes in the United States and international economies; changes in the level of domestic construction activity; changes in international tariffs, quotas and trade agreements involving wood products; changes in domestic and international demand for wood products; changes in production and production capacity in the forest products industry; competitive pricing pressures for the company’s products; unanticipated manufacturing disruptions; changes in general and industry-specific environmental laws and regulations; unforeseen environmental liabilities or expenditures; weather conditions; changes in fuel and energy costs; changes in raw material and other costs; the ability to satisfy complex rules in order to remain qualified as a REIT; changes in tax laws that could reduce the benefits associated with REIT status; and other risks and uncertainties described from time to time in the company’s public filings with the Securities and Exchange Commission. All forward-looking statements are made as of the date of this presentation, and the company does not undertake to update any forward-looking statements. |

POTLATCH CORPORATION 3 Converted to tax efficient REIT in 2006 Single level of taxation Lower cost of capital Fourth largest US Timber REIT 1.5 million acres of owned timberland Growing real estate business Five wood products manufacturing facilities Enterprise value of $1.7 billion (1) Market cap of ~$1.4 billion Net debt (2) of ~$300 million Attractive dividend at $2.04 per share, yielding 5.6% (1) Strong balance sheet with solid credit metrics Company Overview Potlatch Corporation (REIT) Resource (Timberlands) Taxable REIT Subsidiaries North South Real Estate Wood Products (1) Based on July 12, 2011, closing stock price of $36.32 a share. (2) We define net debt as the total of short-term and long-term debt less cash and short-term investments, see reconciliation on page 31. |

POTLATCH CORPORATION 4 Wood Products Manufacturing Facilities Idaho: 818,000 acres Arkansas: 408,000 acres Minnesota: 228,000 acres Total: 1,454,000 acres Timberlands (1) (1) As of June 30, 2011. Potlatch owns approximately 1.5 million acres of FSC-certified timberland in Arkansas, Idaho and Minnesota and five wood products manufacturing facilities Potlatch Business Overview [818,000 acres] [818,000 acres] [228,000 acres] [228,000 acres] [408,000 acres] [408,000 acres] 408,000 acres] |

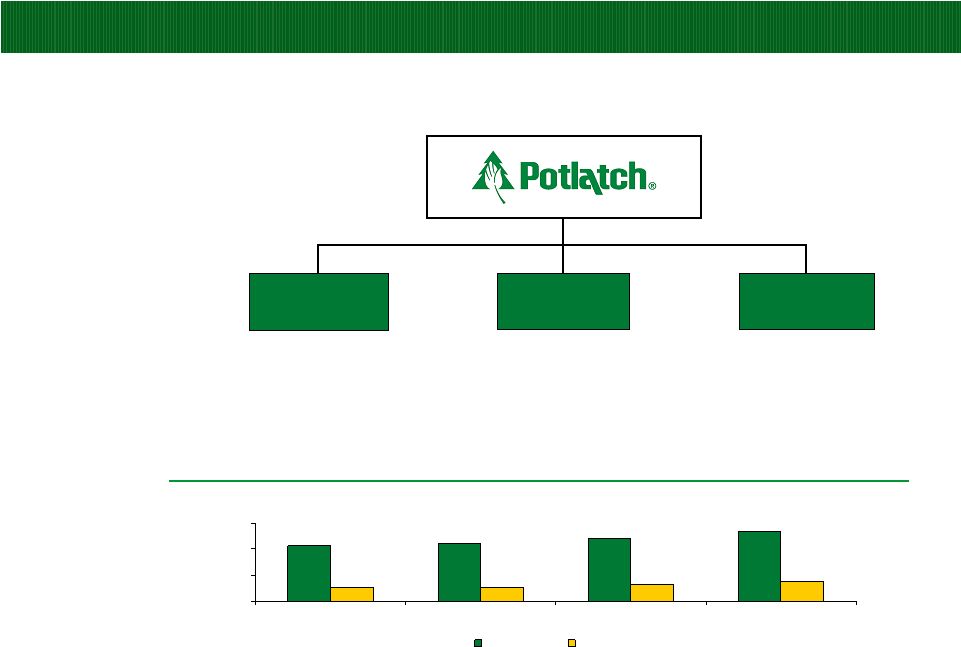

POTLATCH CORPORATION 5 Potlatch Financial Overview ($ in millions) 2010 Segment Revenues (1) 2010 Segment EBITDDA (2) Segment EBITDDA Margin (3) Resource $226 $83 36.7% Real Estate $85 $79 92.9% Wood Products $274 $15 5.5% Historical Consolidated Revenue and EBITDDA $423 $440 $476 $539 $102 $107 $131 $151 $0 $200 $400 $600 2007 2008 2009 2010 Revenue EBITDDA (2) (1) Segment revenues and EBITDDA presented prior to intersegment eliminations. (2) See page 36 of this presentation for definitions of EBITDDA and segment EBITDDA, and page 30 for reconciliations to most comparable GAAP measures. (3) Segment EBITDDA Margin is defined as Segment EBITDDA divided by Segment Revenues. |

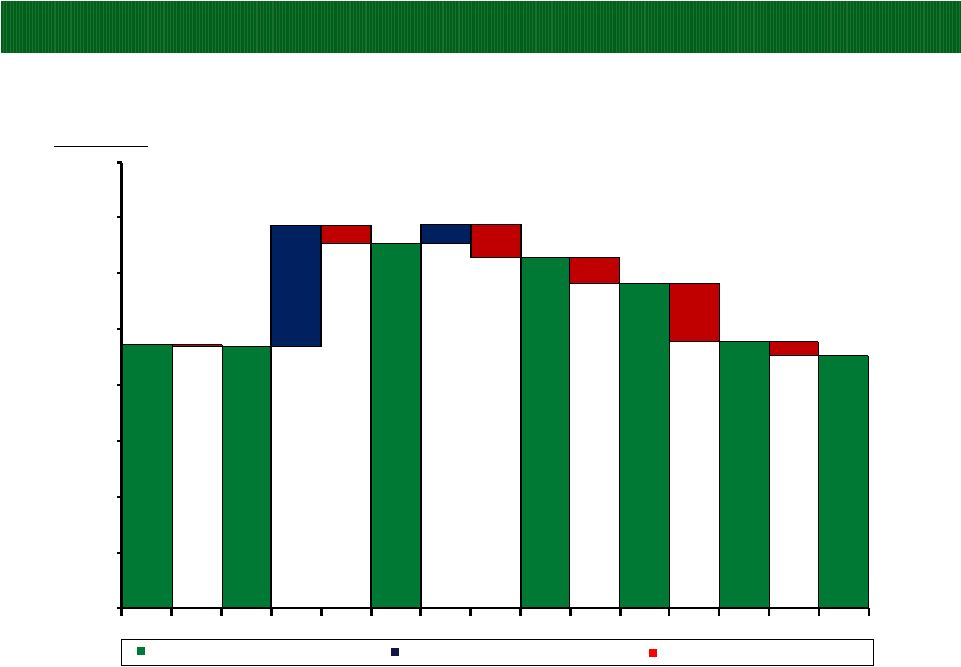

POTLATCH CORPORATION 0.0 1.0 2.0 3.0 4.0 5.0 2004 2005 2006 2007 2008 2009 2010 2011F ~ 2 to 3 Years Forward Sawlogs Pulpwood $72 $80 $70 $53 $60 $59 $27 $34 $36 $33 $34 $32 $0 $25 $50 $75 $100 2006 2007 2008 2009 2010 Q2 2011 YTD Sawlogs ($/ton) Pulpwood ($/ton) 6 Attractive Timber Inventory & Harvest Profile Allows active management of harvest volumes to correspond with the strength or weakness in timber prices Attractive distribution of timber across age-classes Flexibility to monetize sawlog or pulpwood harvests Overall, harvest volume increasing over time 4.2 million tons estimated in 2011 4.6 - 4.8 million tons expected in 2 - 3 years Highly leveraged to sawlog pricing $7/ton price increase in 2010 produced incremental EBITDDA of $21 million Fee Harvest Log Volume Timber Prices 3.0 3.3 3.3 3.9 4.4 3.8 ~4.6 $/Ton Tons in millions 4.2 4.2 |

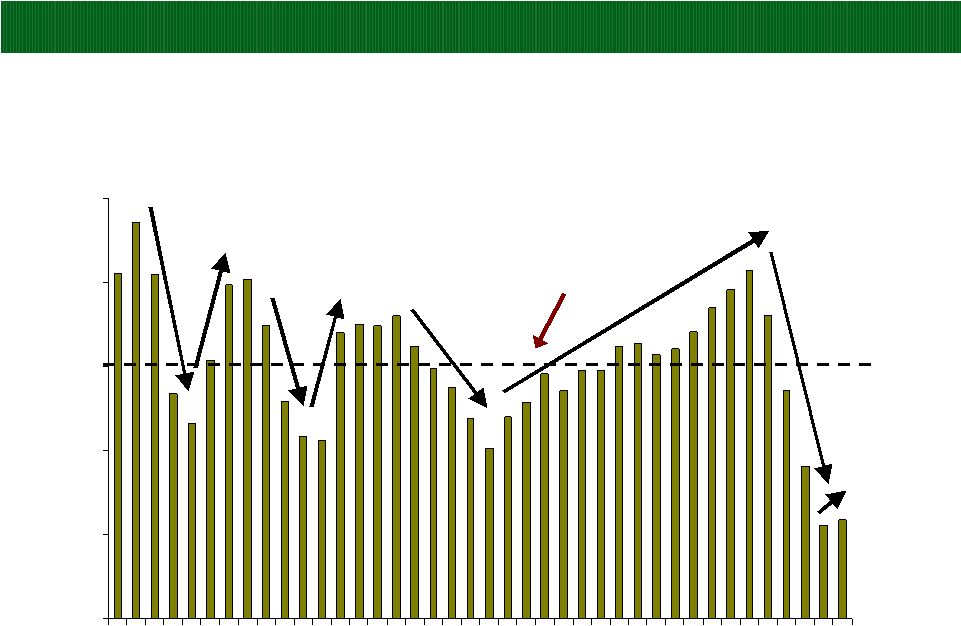

POTLATCH CORPORATION 7 Total Housing Starts Housing starts are presently far below the long-term average (in thousands) Source: U.S. Census Bureau 0 500 1,000 1,500 2,000 2,500 71 73 75 77 79 81 83 85 87 89 91 93 95 97 99 01 03 05 07 09 Year Average Starts Since 1971: 1.5 million |

POTLATCH CORPORATION Million U.S. Starts 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 U.S. Housing Starts Forecast Single Family & Multifamily Only Source: APA: Housing Starts: June 2011 (1) RBC: Royal Bank of Canada (2) FEA: Forest Economic Advisors (3) NAR: National Association of Realtors Actual Forecast 8 Forecasts (000) 2011 2012 RBC (1) -July 15 600 799 Wells Fargo-June 29 590 760 NAHB-June 29 589 775 FEA (2) -June 30 587 726 NAR (3) -July 6 584 768 RISI-June 30 580 630 Mesirow Financial-July 11 570 710 APA-June 15 545 630 Average 581 725 *FEA: Forest Economic Advisors. *NAR: National Assoc. of Realtors. *RBC: Royal Bank of Canada |

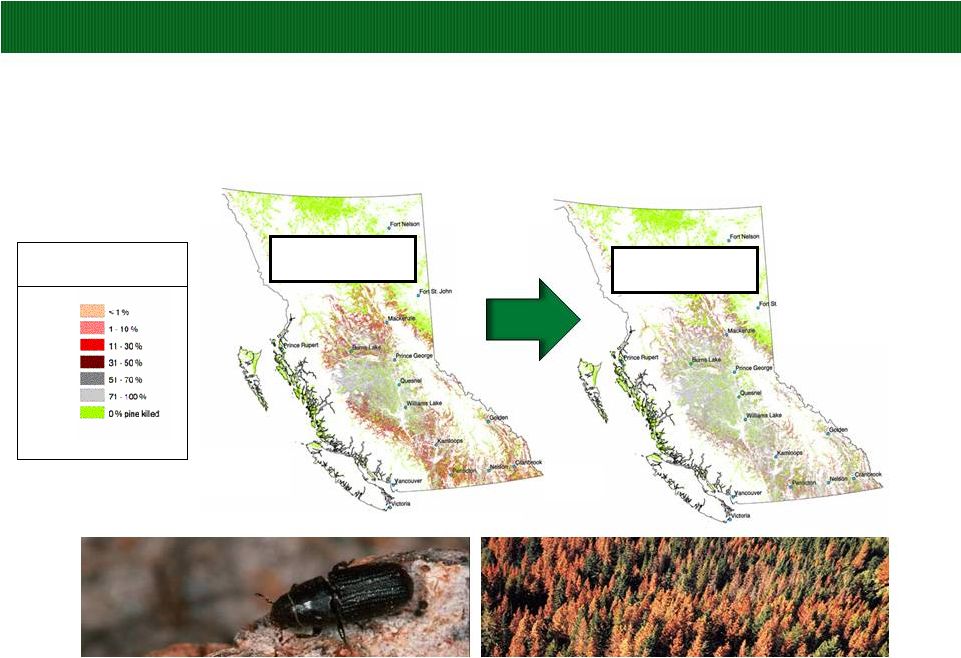

POTLATCH CORPORATION Impact of the Pine Beetle on North American Lumber Supply Source: British Columbia Ministry of Forest and Range 9 Combined with Eastern Canadian harvest reductions of 20%, the pine beetle in British Columbia is projected to lower North American lumber supply up to 15% over the next few years, depending on lumber price levels. Cumulative Percentage of Pine Killed British Columbia 2013 British Columbia 2009 |

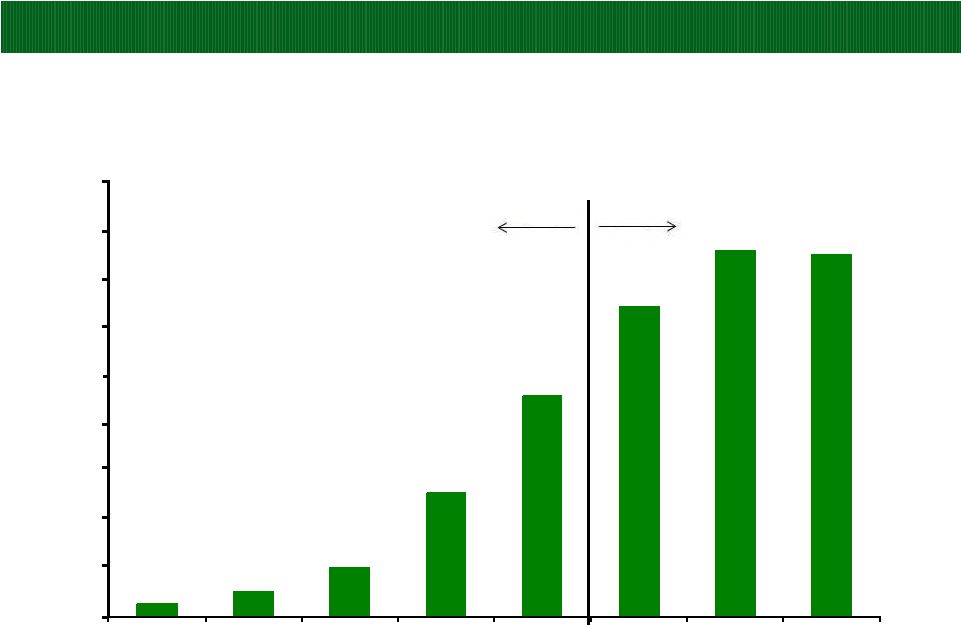

POTLATCH CORPORATION 10 North American Exports of Lumber to China as a % of North American Production Actual 0.2% 0.5% 1.0% 2.6% 4.6% 6.4% 7.6% 7.5% 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 2006 2007 2008 2009 2010 2011 2012 2013 Forecast Source: RISI North American Lumber Forecast, May 2011 & Potlatch Internal Forecast. |

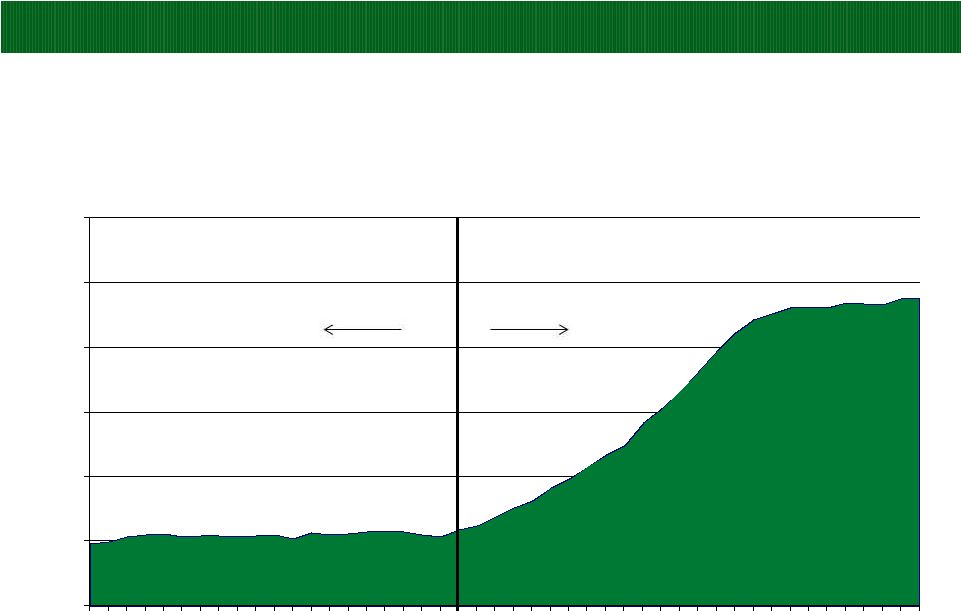

POTLATCH CORPORATION 0 50 100 150 200 250 300 1990 1994 1998 2002 2006 2010 2014 2018 2022 2026 2030 2034 U.S. Biomass Consumed to Produce Electricity (1) (Millions Green Tons) 11 Actual Forecast (1) EIA Annual Energy Outlook 2011 & Potlatch Estimates. |

POTLATCH CORPORATION Random Lengths Pricing for KD SYP (West) #2 2x6 ($/MBF) 12 $150 $200 $250 $300 $350 $400 $450 2007 2008 2009 2010 2006 2005 2011 (1) (1) Pricing through July 2011. |

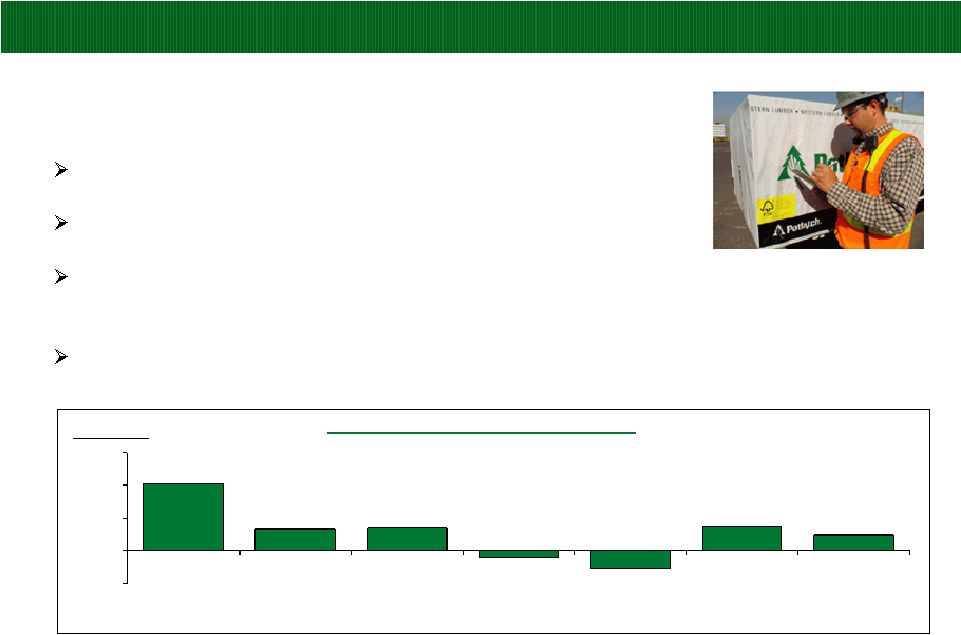

POTLATCH CORPORATION Wood Products Segment $41 $13 $14 ($4) ($11) $15 $10 -$20 $0 $20 $40 $60 2005 2006 2007 2008 2009 2010 LTM Q2 2011 13 Five manufacturing facilities, lumber and plywood Sell to wholesalers for use in homebuilding and construction Potlatch operates four sawmills in Idaho, Arkansas, Minnesota and Michigan as well as one industrial-grade plywood mill in Idaho Actively manage output of facilities to match supply and demand $ in millions (1) (2) Note: See page 36 of this presentation for the definition of segment EBITDDA, and page 30 for reconciliation to most comparable GAAP measure. (1) Wood Products EBITDDA excludes $31 million for Canadian lumber settlement. (2) Wood Products EBITDDA includes asset impairment charge of $3 million. Wood Products Segment EBITDDA |

POTLATCH CORPORATION 14 Rural Real Estate ~95,000 acres Frequently assess acreage to maximize value through sale of non-core timberland real estate More than 3,000 miles of desirable water frontage More than 9 million people live within three states of ownership Potlatch Timberlands (1) Core Timberland ~1.2 million acres Non-Strategic Timberland ~15,000 acres HBU/Development ~125,000 acres Land Portfolio Idaho: 818,000 acres Arkansas: 408,000 acres Minnesota: 228,000 acres (1) As of June 30, 2011. Real Estate Overview Coeur d’Alene Boise Sun Valley McCall Little Rock Hot Springs Brainerd Minneapolis St. Paul |

POTLATCH CORPORATION 15 Value Opportunities Are Unique to Each Category CONSERVATION EASEMENT NON-STRATEGIC TIMBERLAND RURAL REAL ESTATE HIGHER-BETTER-USE DEVELOPMENT $400 to $1,000 per acre $500 to $1,500 per acre $1,000 to $1,500 per acre $2,000 to $7,000 per acre 120,000 Opportunity dependent 10,000 to 20,000 acres 90,000 to 100,000 acres 120,000 to 130,000 acres Characteristics: - Habitat related - Appropriate payment for opportunity sold - Selective core lands Characteristics: - Fringe of ownership - Location disadvantage - Higher operation cost - Capital allocation focus Characteristics: - Fringe of ownership - Opportunity varies by geographic market - Location disadvantage - Higher operation cost - Capital allocation focus Characteristics: - Market position properties - Investor interest - Explore proper land use and entitlements - Emerging development focus LOWER VALUE OPPORTUNITIES HIGHER VALUE OPPORTUNITIES |

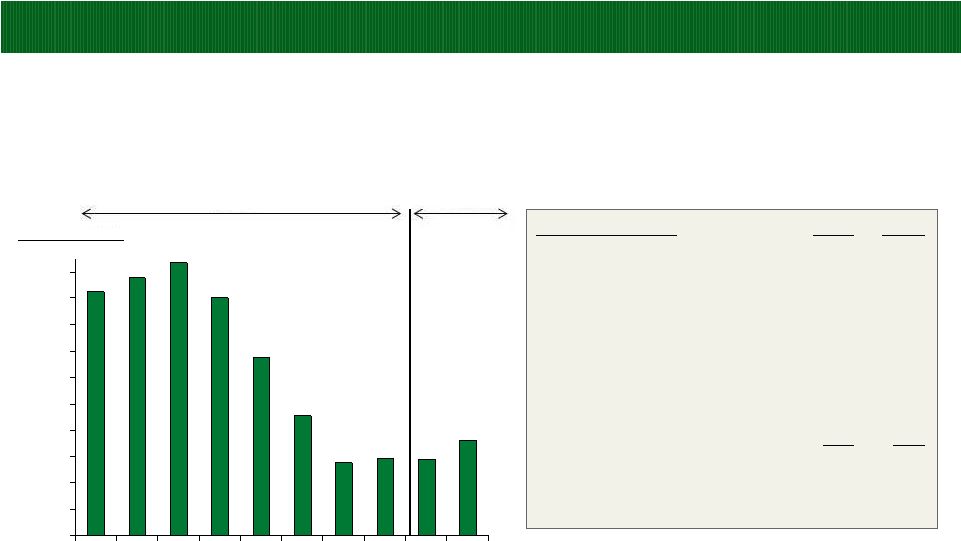

POTLATCH CORPORATION 16 Significant Real Estate Portfolio Realization of Non-Core Timberland Asset Value $24.1 $46.1 $65.4 16,175 60,669 44,786 (1) Segment Revenue in 2008 excludes sale of building. (2) Excludes the sale of the Boardman, Oregon tree farm of 17,000 acres. $ in millions $85.2 104,737 (2) $103.3 117,482 16.3 46.1 70.1 90.8 16.2 20.5 12.5 9.2 8.4 7.9 9.3 5.6 5.9 4.1 1.2 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 $110 2007 2008 2009 2010 LTM Q2 2011 Segment Revenue Conservation Easement HBU/Development Rural Real Estate Non-Strategic Timberland $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 2007 2008 2009 2010 LTM Q2 2011 $/Acre Price Per Acre 42,841 30,168 93,974 108,721 13,166 14,266 11,234 7,796 6,698 3,009 3,562 2,430 2,967 2,063 954 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 2007 2008 2009 2010 LTM Q2 2011 Acres Acres Sold (1) |

POTLATCH CORPORATION Potlatch Timberland Holdings 17 1,000 1,100 1,200 1,300 1,400 1,500 1,600 1,700 1,800 2005 2006 2007 2008 2009 1,471 (3) 1,468 218 1,653 36 (61) 1,628 (45) 1,583 (105) 1,478 Acres (000’s) PCH Owned Acreage at End of Period PCH Acquired Acreage During the Year PCH Sold Acreage During the Year 2010 (33) (1) (1) Includes the sale of the Boardman, Oregon tree farm of 17,000 acres. (2) Acreage through June 30, 2011. (24) 2011 1,454 (2) |

POTLATCH CORPORATION 18 Balance Sheet Review ASSETS Cash and short-term investments 75 $ Other current assets 64 Long-term assets 602 Total assets 741 $ LIABILITIES & EQUITY Current liabilities 81 $ Long-term debt 343 Other liabilities 134 Total liabilities 558 Equity 183 Total liabilities & equity 741 $ June 30, 2011 ($ in millions) Strong credit metrics $150 million revolver expiring December 2013 (1) $68 million of fixed rate debt swapped to floating as of June 30, 2010 $63 million of floating rate debt outstanding Maturities in 2012 - 2018 6.8% weighted average cost of debt (including interest rate swaps) 8.9 weighted average years to maturity 7.1% weighted average cost of debt (all at fixed rate) (1) Per an amendment to our credit agreement, the revolver decreased to $150 million from $250 million, effective February 4, 2011. |

POTLATCH CORPORATION 19 Conservative Leverage and Interest Coverage Ratios (1) as of June 30, 2011 Financial Actual Covenant 6/30/2011 Requirements 55.4% 70.0% 16.9% N/A 5.58x 2.75x (2) 3.27x (3) 3.00x Debt to Total Capitalization (1) Net Debt to Enterprise Value LTM EBITDDA to Interest Expense Collateral Coverage (1) Calculated per our bank credit agreement, using an accumulated other comprehensive loss “AOCL” exclusion. Per an amendment to the credit agreement, the Minimum Collateral Coverage ratio increased to 3.00 and the Maximum Funded Indebtedness to Capitalization ratio increased to 70.0% effective as of February 4, 2011. (2) This requirement will increase to 3.00 on October 1, 2011. (3) Updated for new appraisal dated June 15, 2011. Note: We define net debt as the total of short-term and long-term debt less cash and short-term investments, see page 31 for reconciliation. See page 36 of this presentation for the definition of EBITDDA and page 30 for reconciliation to most comparable GAAP measure. |

POTLATCH CORPORATION 20 Strong Asset Coverage Arkansas Timberland 408,000 Acres Secured Idaho Timberland 352,000 Acres Unsecured Idaho Timberland 466,000 Acres Wisconsin Timberland 1,000 Acres Minnesota Timberland 228,000 Acres Total = Approx. 1.5 Million Acres Represents 24% of our acres, but the appraisal represents approximately 41% of our enterprise value (1) Updated for new appraisal dated June 15, 2011. The appraisal uses comparable transactions and discounted cash flow analyses for purposes of the valuation. There is no assurance that sales could be effected at the appraised values or as to the timing of sales. The calculation of discounted cash flows involves projection of future market conditions, harvest levels and other factors, all of which could vary materially from those projected. There is no implication that the company’s other timberlands would have a similar value per acre. (2) Enterprise value is defined as market capitalization value plus net debt as of June 30, 2011. $150 million revolver requires collateral Another $66 million of debt is secured pari-passu along with the revolver The $216 million of debt is secured with 352,000 acres of ‘core’ Idaho Timberland Appraisal on this 352,000 acres = $707 million (1) Compares to entire Potlatch enterprise value of $1.7 billion (2) |

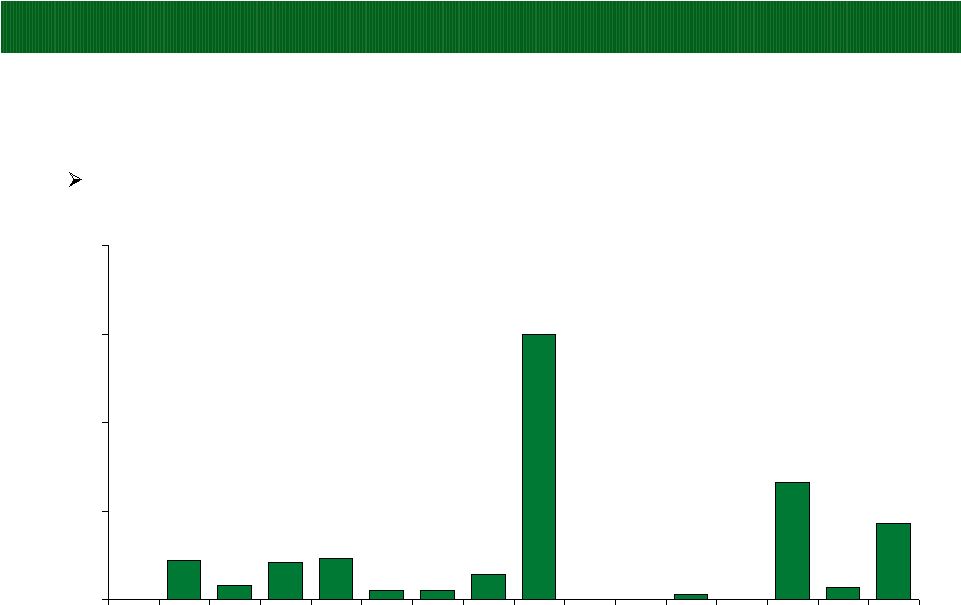

POTLATCH CORPORATION Conservative Capital Structure – Long Term Debt Maturity Profile ($ in millions) 21 Mandatory principal repayments of only $79 million through 2016 (1) $5 million maturity paid in January, 2011 with cash on hand. (1) $0 $22 $8 $21 $23 $5 $5 $14 $150 $0 $0 $3 $0 $66 $7 $43 $0 $50 $100 $150 $200 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 |

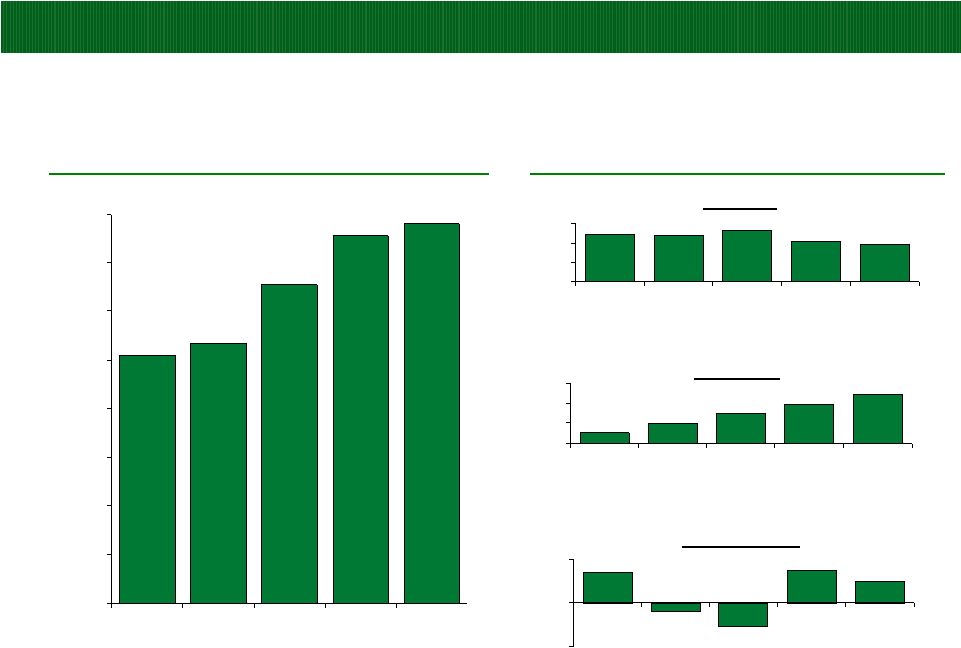

POTLATCH CORPORATION Strong Cash Flow Generation ($ in millions) $102 $107 $131 $151 $156 $0 $20 $40 $60 $80 $100 $120 $140 $160 2007 2008 2009 2010 LTM Q2 2011 22 Total EBITDDA $97 $95 $105 $83 $78 $0 $40 $80 $120 2007 2008 2009 2010 LTM Q2 2011 Resource $21 $41 $60 $79 $97 $0 $40 $80 $120 2007 2008 2009 2010 LTM Q2 2011 Real Estate $14 ($4) ($11) $15 $10 -$20 $0 $20 2007 2008 2009 2010 LTM Q2 2011 Wood Products Segment EBITDDA (1) See page 36 of this presentation for the definition of EBITDDA and Segment EBITDDA, and page 30 for a reconciliation to most comparable GAAP measures. (2) Consolidated and Wood Products EBITDDA includes a $3 million asset impairment charge taken in 2009. (2) (2) (1) (1) |

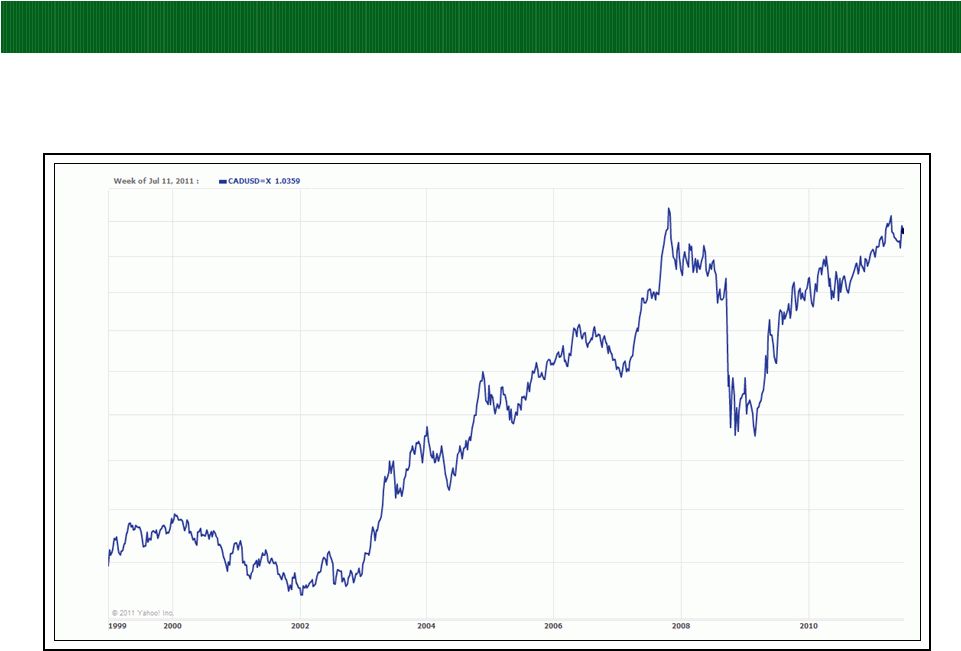

POTLATCH CORPORATION Exchange Rate Canadian Dollar to U.S. Dollar 23 $1.05 $1.00 $0.95 $0.90 $0.85 $0.80 $0.75 $0.70 $0.65 |

POTLATCH CORPORATION Funds Available for Distribution (FAD) ($ in millions) $85 $92 $111 $105 $112 $77 $81 $81 $82 $82 $0 $20 $40 $60 $80 $100 $120 2007 2008 2009 2010 LTM Q2 2011 FAD Dividend Distribution 24 Note: See page 36 of this presentation for the definition of FAD, and see page 32 for a reconciliation to most comparable GAAP measure. Excludes dividend distribution of Clearwater Paper stock in 2008. |

POTLATCH CORPORATION Organically Earning Our Dividend is Within Reach 25 $0 $20 $40 $60 $80 $100 $120 Dividend "Organic" FAD "Inorganic "FAD 2007 2008 2009 2010 ~2-3 Years Forward Baseline: 2010 “Organic” FAD Impact of a 10% increase in sawlog prices from 2010 Impact of an increase in the harvest level to 4.6 million tons AR and WI Non-Strategic Timberland Sale Timber Deed & AR Non-Strategic Timberland Sale MN Non-Strategic Timberland Sale ($ in millions) Note: See page 36 of this presentation for the definition of inorganic and organic FAD, and see page 32 for a calculation organic/inorganic FAD. |

POTLATCH CORPORATION 26 Attractive Dividend Potlatch's dividend policy has been driven primarily by the performance of its timber and real estate businesses We continue to pay our quarterly dividend at $0.51/share since we increased it from $0.49/share in Q3 2007 Our peers (2) have significantly lower dividend yield (avg. = 3.7%) At current dividend levels, a 3.7% yield for Potlatch equates to $55 stock price Source: Factset. Market data as of July 12, 2011. (1) Dividend yield calculated as annualized last quarter dividend divided by the closing stock price. (2) Plum Creek and Rayonier. Potlatch Dividend Yield (1) 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% Jan-2008 Sep-2008 May-2009 Jan-2010 Sep-2010 May-2011 Avg. 6.4% 5.6% |

POTLATCH CORPORATION 27 Stock Price Performance Comparison of Five-Year Total Returns (1) Potlatch Corporation NAREIT Equity Index S&P 500 Composite 2010 Peer Group (2) (1) Assumes $100 was invested on December 31, 2005. Total return assumes quarterly reinvestment of dividends. (2) Our Peer Group companies are Deltic Timber Corp.; Plum Creek Timber Co., Inc.; Rayonier Inc.; St. Joe Co.; Universal Forest Products Inc.; and Weyerhaeuser Co. $50 $75 $100 $125 $150 12/31/05 12/31/06 12/31/07 12/31/08 12/31/09 12/31/10 |

POTLATCH CORPORATION 28 Conclusion Potlatch maintains a very attractive asset base of 1.5 million acres of timberland We have the ability to meaningfully expand high margin sawlog harvest levels Wood Products business stabilized and generating solid cash flow Real Estate segment low risk, high margin Attractive dividend with improving coverage Strong balance sheet with attractive debt cost and maturity profile Industry trends beginning to turn positive Housing starts beginning to grow, albeit slowly Exports to China from North America continue to expand Pine beetle to impact supply from Canada Biomass continues to hold promise |

Appendix POTLATCH CORPORATION AUGUST 2011 |

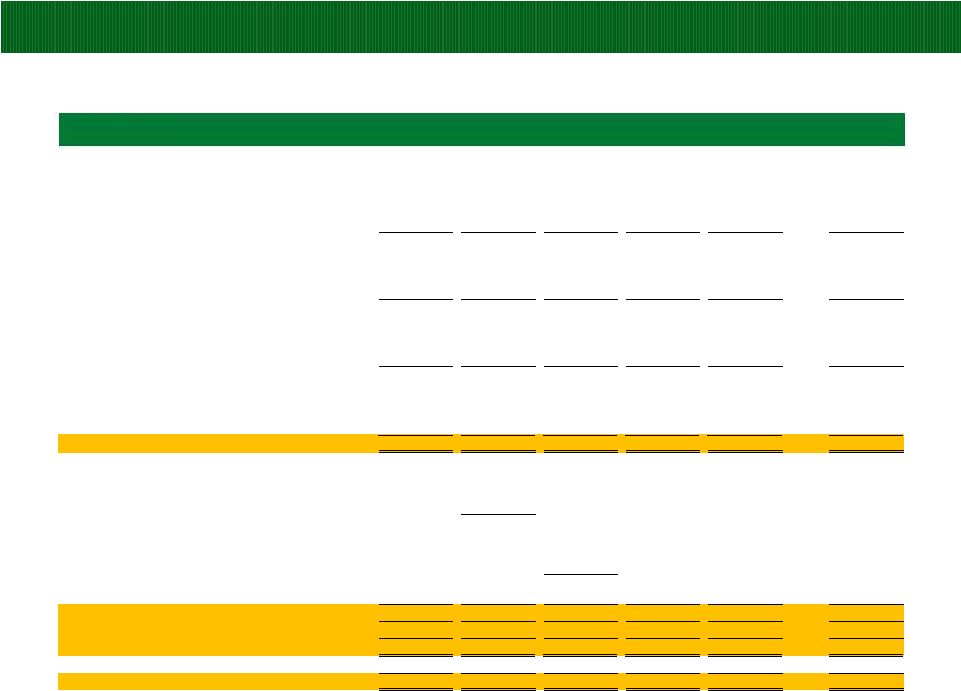

POTLATCH CORPORATION 30 EBITDDA and Segment EBITDDA Reconciliation ($ in millions) (1) Wood Products EBITDDA excludes $31 million for Canadian lumber settlement. (2) Consolidated and Wood Products EBITDDA includes a $3 million asset impairment charge taken in 2009. 2005 2006 (1) 2007 2008 2009 (2) 2010 LTM Q2 2011 Consolidated Earnings from continuing operations 74 $ 73 $ 81 $ 40 $ 43 $ Less: Income tax benefit (provision) 17 25 16 (5) (2) Add: Net cash interest expense 15 20 20 26 25 Depreciation, depletion, and amortization 26 30 35 31 31 Basis of real estate sold 4 9 11 49 55 Consolidated EBITDDA 102 $ 107 $ 131 $ 151 $ 156 $ Resource Operating income 82 $ 76 $ 82 $ 62 $ 59 $ Depreciation, depletion, and amortization 15 19 23 21 19 Resource Segment EBITDDA 97 $ 95 $ 105 $ 83 $ 78 $ Real Estate Operating income 17 $ 32 $ 49 $ 30 $ 43 $ Basis of real estate sold 4 9 11 49 54 Real Estate Segment EBITDDA 21 $ 41 $ 60 $ 79 $ 97 $ Wood Products Operating income (loss) 29 $ 2 $ 4 $ (14) $ (21) $ 7 $ 2 $ Depreciation 12 11 10 10 10 8 8 Wood Products Segment EBITDDA 41 $ 13 $ 14 $ (4) $ (11) $ 15 $ 10 $ Fiscal Year |

POTLATCH CORPORATION 31 Potlatch Net Debt Reconciliation ($ in millions) June 30 2007 2008 2009 2010 2011 Long-term debt 321 $ 221 $ 368 $ 363 $ 343 $ Current installments on long-term debt - 101 - 5 21 Current notes payable 110 129 - - - Cash (9) (1) (2) (6) (7) Short-term investments (22) (3) (53) (85) (68) Net Debt 400 $ 447 $ 313 $ 277 $ 289 $ At December 31 |

POTLATCH CORPORATION 32 Organic/Inorganic FAD Calculation ($ in millions) (1) Excludes distribution of Clearwater Paper stock in 2008. 2007 2008 2009 2010 LTM Q2 2011 Operating income (loss): Resource Baseline Income 82 $ 76 $ 82 $ 62 $ 59 $ 62 $ Increase to 4.6 million tons - - - - - 11 10% increase in sawlog prices from 2010 - - - - - 21 Resource 82 76 82 62 59 - 94 Real Estate 17 32 49 30 43 17 Wood Products 4 (14) (21) 7 2 19 Eliminations and adjustments 1 (1) 8 2 2 - 104 93 118 101 106 130 Corporate administration (32) (25) (33) (30) (34) (32) Net cash interest expense (15) (20) (20) (26) (25) (25) Income tax benefit (provision) 17 25 16 (5) (4) (5) Earnings from continuing operations 74 73 81 40 43 68 Depreciation, depletion and amortization 26 30 35 31 31 29 Basis of real estate sold 4 9 11 49 55 3 Capital expenditures (19) (20) (16) (15) (17) (18) Funds Available for Distribution 85 $ 92 $ 111 $ 105 $ 112 $ 82 $ Inorganic FAD: Minnesota non-strategic sale (after tax income) 14 $ Basis of real estate sold 2 Arkansas non-strategic sale (after tax income) 24 $ Basis of real estate sold 2 Timber deed (after tax income) 42 Depletion 7 Arkansas/Wisconsin non-strategic sale (after tax income) 11 $ 11 $ Basis of real estate sold 43 43 Total inorganic FAD - $ 16 $ 75 $ 54 $ 54 $ - $ Organic FAD 85 $ 76 $ 36 $ 51 $ 58 $ 82 $ Total FAD 85 $ 92 $ 111 $ 105 $ 112 $ 82 $ Distributions to Common Stockholders (1) 77 $ 81 $ 81 $ 82 $ 82 $ 82 $ ~2-3 Years Forward |

POTLATCH CORPORATION 33 Softwood Stumpage Price Trends Southwide Average Nominal Prices Source: Timber Mart-South, updated through June 30, 2011. $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 $50 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 $/Ton Years Pine Sawtimber Pine Pulpwood 2010 |

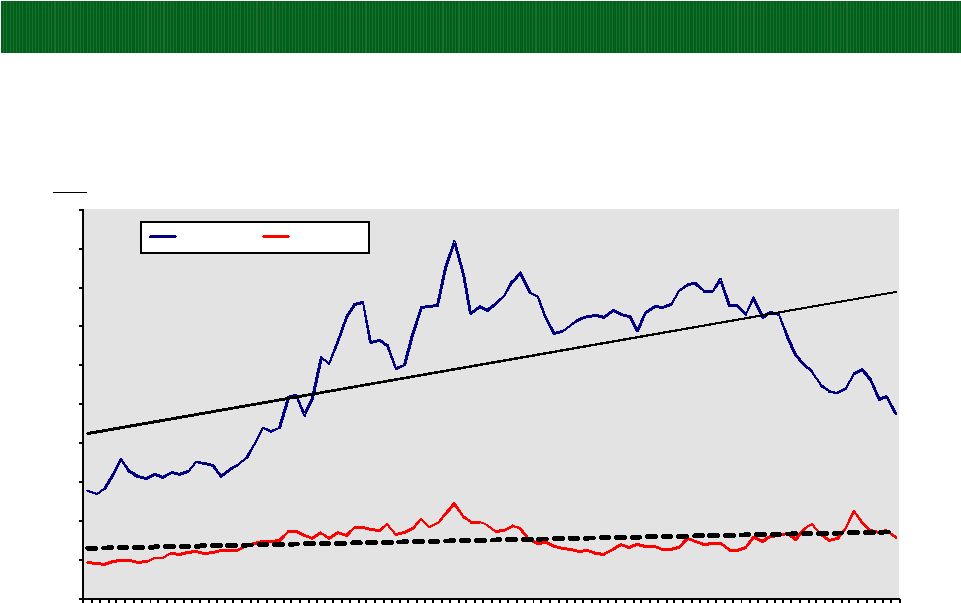

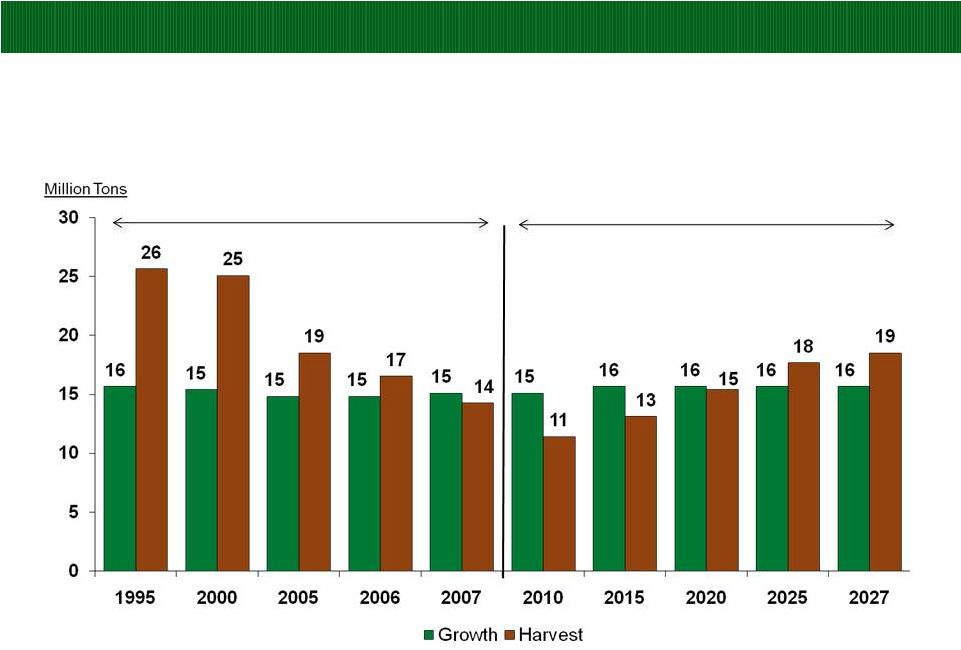

POTLATCH CORPORATION Projected Inland Private Timber Growth and Harvest (1995-2027) 34 Source: F2M and Potlatch Corporation Actual Forecast |

POTLATCH CORPORATION Inland Private Sawtimber Inventory – Private Lands (1995-2007) Inland West (Idaho, Eastern Washington, and Western Montana) 510 486 462 459 462 430 440 450 460 470 480 490 500 510 520 1995 2000 2005 2006 2007 Million Tons 35 Source: F2M and Potlatch Corporation |

POTLATCH CORPORATION , , , 36 Definitions of Non-GAAP Measures EBITDDA is a non-GAAP measure that management uses to evaluate the cash generating capacity of the company. The most directly comparable GAAP measure is net earnings. EBITDDA, as we define it, is net earnings from continuing operations adjusted for net cash interest expense, provision/benefit for income taxes, depreciation, depletion and amortization and the basis of real estate sold from continuing operations. It should not be considered as an alternative to net earnings computed under GAAP. Funds Available for Distribution (FAD) is a non-GAAP measure. FAD, as defined in the indenture governing our senior notes, is earnings from continuing operations, plus depreciation, depletion and amortization, plus basis of real estate sold, and minus capital expenditures. For purposes of this definition, capital expenditures exclude all expenditures relating to direct or indirect timberland purchases in excess of $5 million. We do not use FAD as, nor should it be considered to be, an alternative to net cash provided by operating activities computed under GAAP as an indicator of our operating performance, or as an indicator of our ability to fund our cash needs. FAD, as defined in the indenture governing our senior notes may not be comparable with measures of similar titles reported by other companies. Inorganic FAD as used in this presentation is FAD from certain large transactions. Inorganic FAD equals transaction income less income tax, if any, plus depletion or basis of real estate sold. Organic FAD as used in this presentation is calculated by subtracting inorganic FAD from Funds Available for Distribution (FAD), as defined above. Segment EBITDDA from continuing operations as we define it, is segment operating income (loss) adjusted for depreciation, depletion, amortization and the basis of real estate sold. |