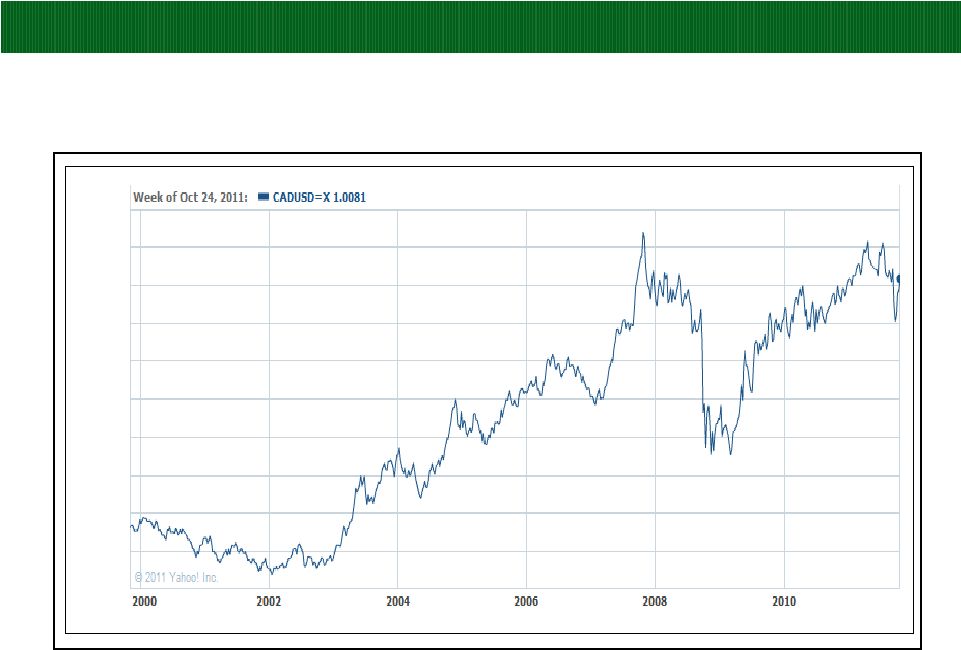

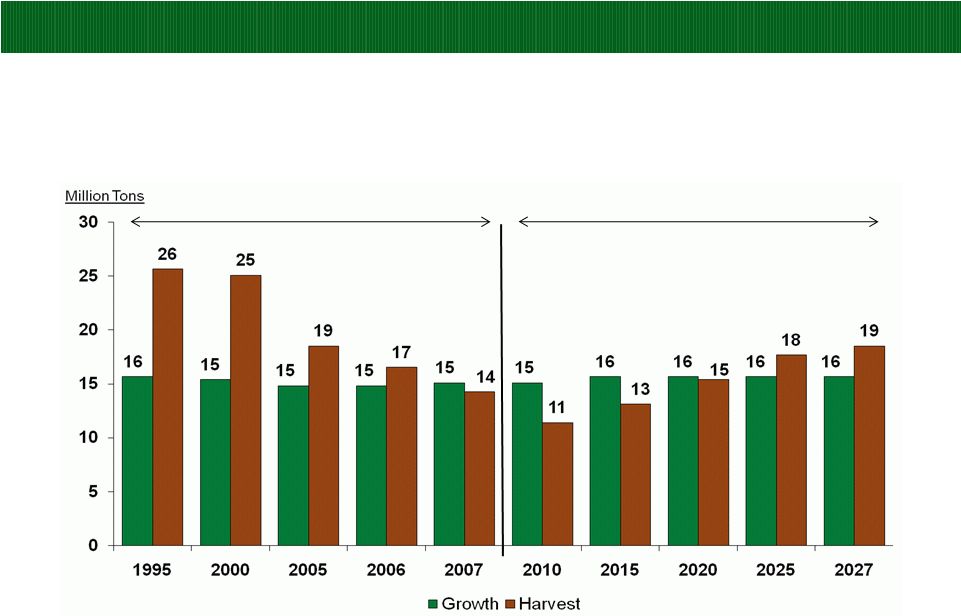

POTLATCH CORPORATION 2 Forward-Looking Statements This presentation contains certain forward-looking statements within the meaning of the Private Litigation Reform Act of 1995 as amended, including without limitation statements about future company performance, the company’s business model, strength of the company’s balance sheet and credit metrics, dividend levels and yields, direction of markets and the economy, management of timberlands to optimize values, projected inland private timber growth and harvest, future harvest levels and their relation to market trends, cash flow and dividend leverage to sawlog pricing, impact of the pine beetle on North American lumber supply, forecasts of North American exports of lumber to China, softwood stumpage price trends, forecast of U.S. housing starts, the company’s capital structure, weighted average cost of debt, cash flow generation, Canadian/U.S. dollar exchange rate, funds available for distribution, real estate business potential and land development potential, real estate value opportunities, biomass opportunities, forecasts of U.S. biomass consumed to produce electricity, management of the output of our Wood Products facilities, leverage and interest coverage ratios, debt repayment, net asset value, and dividend policy. These forward-looking statements are based on current expectations, estimates, assumptions and projections that are subject to change, and actual results may differ materially from the forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, changes in timberland values; changes in timber harvest levels on the company’s lands; changes in timber prices; changes in policy regarding governmental timber sales; changes in the United States and international economies; changes in the level of domestic construction activity; changes in international tariffs, quotas and trade agreements involving wood products; changes in domestic and international demand for wood products; changes in production and production capacity in the forest products industry; competitive pricing pressures for the company’s products; unanticipated manufacturing disruptions; changes in general and industry-specific environmental laws and regulations; unforeseen environmental liabilities or expenditures; weather conditions; changes in fuel and energy costs; changes in raw material and other costs; the ability to satisfy complex rules in order to remain qualified as a REIT; changes in tax laws that could reduce the benefits associated with REIT status; and other risks and uncertainties described from time to time in the company’s public filings with the Securities and Exchange Commission. All forward-looking statements are made as of the date of this presentation, and the company does not undertake to update any forward-looking statements. |