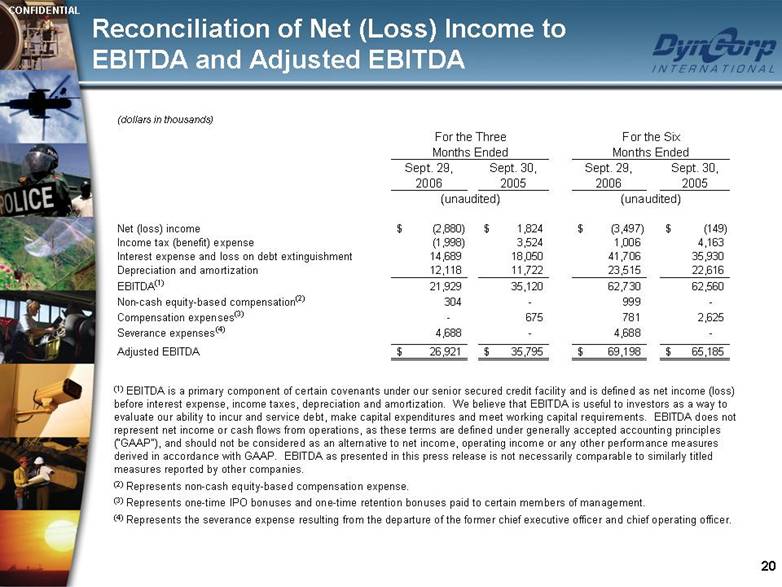

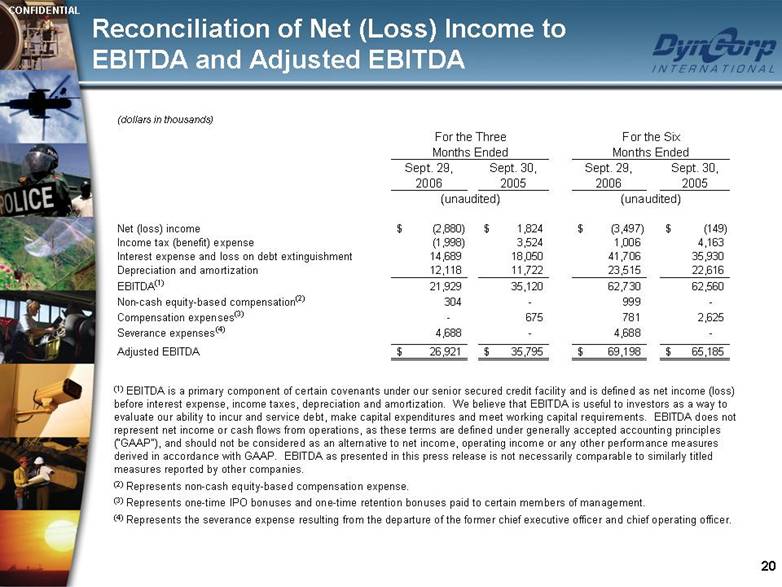

| Reconciliation of Net (Loss) Income to EBITDA and Adjusted EBITDA(1) EBITDA is a primary component of certain covenants under our senior secured credit facility and is defined as net income (loss) before interest expense, income taxes, depreciation and amortization. We believe that EBITDA is useful to investors as a way to evaluate our ability to incur and service debt, make capital expenditures and meet working capital requirements. EBITDA does not represent net income or cash flows from operations, as these terms are defined under generally accepted accounting principles (“GAAP”), and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP. EBITDA as presented in this press release is not necessarily comparable to similarly titled measures reported by other companies. (2) Represents non-cash equity-based compensation expense. (3) Represents one-time IPO bonuses and one-time retention bonuses paid to certain members of management. (4) Represents the severance expense resulting from the departure of the former chief executive officer and chief operating officer. (dollars in thousands)Sept. 29, 2006Sept. 30, 2005Sept. 29, 2006Sept. 30, 2005Net (loss) income(2,880)$ 1,824$ (3,497)$ (149)$ Income tax (benefit) expense(1,998)3,5241,0064,163Interest expense and loss on debt extinguishment14,68918,05041,70635,930Depreciation and amortization12,11811,72223,51522,616EBITDA(1)21,92935,12062,73062,560Non-cash equity-based compensation(2)304-999-Compensation expenses(3)-6757812,625Severance expenses(4)4,688-4,688-Adjusted EBITDA26,921$ 35,795$ 69,198$ 65,185$ For the Three Months EndedFor the Six Months Ended(unaudited)(unaudited) |