- FEMY Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1 Filing

Femasys (FEMY) S-1IPO registration

Filed: 14 May 21, 4:55pm

Delaware | | | 3841 | | | 11-3713499 |

(State or other jurisdiction of incorporation or organization) | | | (Primary Standard Industrial Classification Code Number) | | | (I.R.S. Employer Identification No.) |

David S. Rosenthal, Esq. Dechert LLP 1095 Avenue of Americas New York, New York 10036 (212) 698-3616 | | | Kristopher D. Brown, Esq. Thomas S. Levato, Esq. Goodwin Procter LLP 620 Eighth Avenue New York, New York 10018 (212) 813-8800 |

Large accelerated filer ☐ | | | Accelerated filer ☐ | | | Non-accelerated filer ☒ | | | Smaller reporting company ☒ |

| | | | | | | Emerging growth company ☒ |

Title of Each Class of Securities To Be Registered | | | Proposed Maximum Aggregate Offering Price | | | Amount of Registration Fee(1)(2) |

Common Stock, $0.001 par value per share | | | $40,250,000 | | | $4,391.28 |

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes the offering price of shares that the underwriters have an option to purchase. |

| | | Per Share | | | Total | |

Public offering price | | | $ | | | $ |

Underwriting discount(1) | | | $ | | | $ |

Proceeds, before expenses, to us | | | $ | | | $ |

| (1) | See “Underwriting” for additional information regarding underwriting discounts and commissions and estimated offering expenses |

Chardan | | | | | JonesTrading |

| | | Page | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| • | Address unmet clinical needs in multiple large markets for women. |

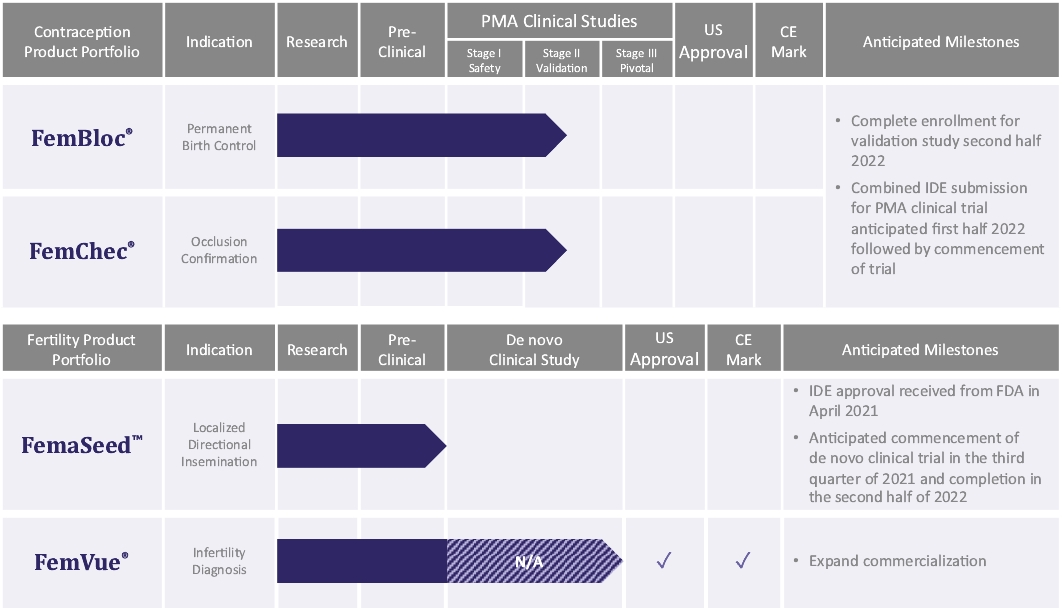

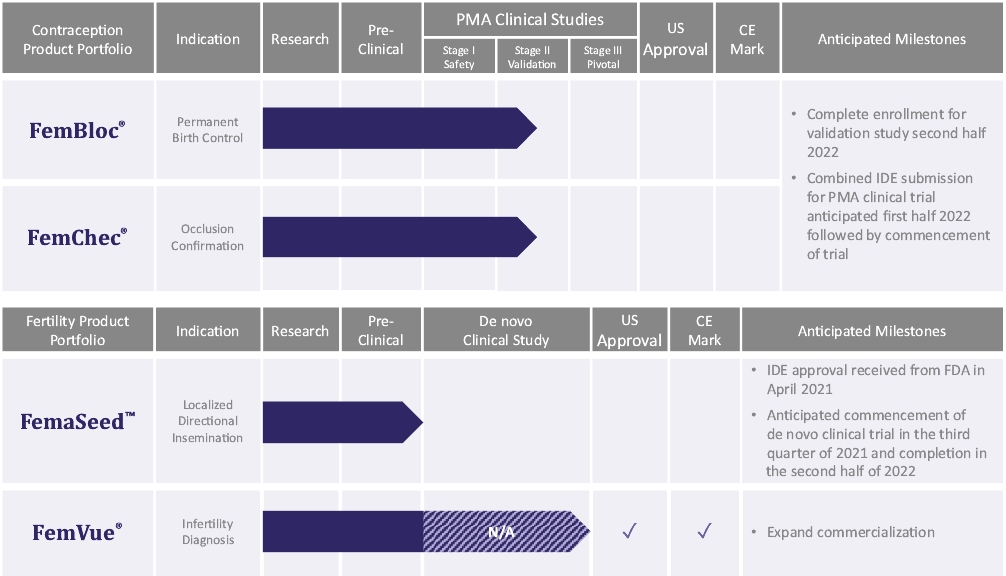

| • | Execute on our clinical program to achieve FDA approval to advance our FemBloc system for use together with our FemChec occlusion confirmation device as the preferred option for permanent birth control for women. |

| • | Execute on our clinical program to achieve FDA grant of a de novo classification request to advance our FemaSeed system for use together with our FemVue saline-air device as the preferred option for artificial insemination. |

| • | Continuously innovate to introduce additional product offerings for women. |

| • | Penetrate the addressable markets by promoting patient and practice awareness. |

| • | Build a commercialization infrastructure with a specialized direct sales and marketing team. |

| • | Expand gynecologists’ practice capabilities by diversifying products and services to include artificial insemination with FemaSeed. |

| • | We have incurred significant operating losses since inception, we expect to incur operating losses in the future and we may not be able to achieve or sustain profitability. We have limited history operating as a commercial company. |

| • | The FDA may not allow us to continue the pivotal trial for FemBloc due to safety concerns. |

| • | Our current product candidates are in various stages of development. Our product candidates may fail in development or suffer delays that adversely affect their commercial viability. If we fail to obtain or maintain U.S. Food and Drug Administration approval to market and sell our FemBloc or a granted de novo classification of FemaSeed, or if such approval or de novo classification is delayed, our business will be materially harmed. |

| • | The process to conduct clinical trials that may be necessary to obtain regulatory approval, grant of a de novo classification, or 510(k) clearance is lengthy and expensive with uncertain outcomes, and our data developed in those clinical trials is subject to interpretation by FDA and foreign regulatory authorities. If clinical trials of our current FemBloc system, FemaSeed system and future products do not produce results necessary to support regulatory approval, de novo classification, or clearance in the United States or, with respect to our current or future products, elsewhere, we will be unable to commercialize these products and may incur additional costs or experience delays in completing, or ultimately be unable to complete, the commercialization of those products. |

| • | We will require substantial additional capital to finance our planned operations, which may not be available to us on acceptable terms or at all. As a result, we may not be able to implement our planned sales and marketing program to commercialize our products. |

| • | We have derived minimal revenue from our operations and incurred significant operating losses since inception, we expect to incur operating losses in the future, and we may not be able to achieve or sustain profitability. |

| • | There is a substantial doubt about our ability to continue as a going concern. |

| • | We have limited experience marketing and selling our devices, and if we are unable to establish, manage and maintain sales and marketing capabilities, we will be unable to successfully commercialize our FemBloc system or our FemaSeed system, or generate product revenue. |

| • | We will need to grow the size of our organization, and we may experience difficulties in managing this growth. |

| • | We face risks related to health epidemics and outbreaks, including the COVID-19 pandemic which has impacted our ability to enroll trial patients and conduct our clinical trials, and therefore our receipt of necessary regulatory approvals, clearances or grants could be delayed or prevented. |

| • | Our products and operations are subject to extensive government regulation and oversight both in the United States and internationally, and our failure to comply with applicable requirements could harm our business. |

| • | If we are unable to achieve and maintain adequate levels of coverage or reimbursement for our FemBloc system, or any current or future products we seek to commercialize, our commercial success may be severely hindered. |

| • | If we are unable to maintain, obtain or adequately protect our intellectual property rights, we may not be able to compete effectively in our market or we could be required to incur significant expenses to enforce or defend our rights or attempt to do the same. |

| • | Our operating results may fluctuate significantly, which makes our future operating results difficult to predict and could cause our operating results to fall below expectations or our guidance. |

| • | being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations in this prospectus; |

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended; |

| • | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| • | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

| • | 6,663,750 shares of our common stock issuable upon the exercise of options outstanding as of March 31, 2021, at a weighted-average exercise price of $0.39 per share; |

| • | 10,000,000 shares of our common stock that are available for future issuance under our 2021 Equity Incentive Plan, or our 2021 Plan, which will become effective on the day immediately prior to the date the registration statement of which this prospectus forms a part is declared effective, as well as any shares of our common stock that become available pursuant to provisions in the 2021 Plan pursuant to which additional shares may become available for issuance under the 2021 Plan; |

| • | 2,201,116 shares of our common stock issuable upon the exercise of warrants to purchase shares of our convertible preferred stock outstanding as of March 31, 2021, which will convert into warrants to purchase shares of our common stock immediately prior to the closing of this offering, at a weighted average exercise price of $1.41 per share; and |

| • | 1,500,000 shares of our common stock reserved for future issuance under our 2021 Employee Stock Purchase Plan, or ESPP, which will become effective on the day immediately prior to the date the registration statement of which this prospectus forms a part is declared effective, as well as shares of our common stock that become available pursuant to provisions in our ESPP that automatically increase the common stock reserve under the ESPP. |

| • | assumes a for - reverse stock split effected on ; |

| • | assumes no exercise by the underwriters of their option to purchase up to an additional shares of our common stock; |

| • | gives effect to the automatic conversion upon the completion of this offering of all of our warrants to purchase convertible preferred stock into warrants to purchase shares of common stock; |

| • | gives effect to the automatic conversion upon the completion of this offering of all of our convertible preferred stock into an aggregate of 73,046,442 shares of common stock; and |

| • | gives effect to the filing and effectiveness of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws immediately prior to the completion of this offering. |

| | | Years Ended December 31 | | | Three Months Ended March 31 | |||||||

| | | 2020 | | | 2019 | | | 2021 | | | 2020 | |

| | | | | | | (unaudited) | ||||||

Statement of Comprehensive Loss Data: | | | | | | | | | ||||

Sales | | | $1,037,918 | | | $929,064 | | | $329,775 | | | $260,512 |

Cost of sales | | | 306,533 | | | 223,678 | | | 93,042 | | | 73,188 |

Gross margin | | | 731,385 | | | 705,386 | | | 236,733 | | | 187,324 |

Operating expenses: | | | | | | | | | ||||

Research and development | | | 4,130,613 | | | 6,914,179 | | | 995,022 | | | 1,350,701 |

Sales and marketing | | | 310,219 | | | 1,503,784 | | | 22,819 | | | 237,189 |

General and administrative | | | 2,544,043 | | | 3,298,829 | | | 891,987 | | | 650,192 |

Depreciation and amortization | | | 679,653 | | | 625,778 | | | 153,453 | | | 169.410 |

Total operating expenses | | | 7,664,528 | | | 12,342,570 | | | 2,063,281 | | | 2,407,492 |

Loss from operations | | | (6,933,143) | | | (11,637,184) | | | (1,826,548) | | | (2,220,168) |

Other income (expense): | | | | | | | | | ||||

Interest income, net | | | 22,504 | | | 287,537 | | | 164 | | | 20,336 |

Other income | | | 10,000 | | | 93,000 | | | — | | | — |

Other expense | | | — | | | (2,323) | | | — | | | — |

Interest expense | | | (12,553) | | | (9,972) | | | (3,848) | | | (1,895) |

Total other income (expense) | | | 19,951 | | | 368,242 | | | (3,684) | | | 18,441 |

Loss before income taxes | | | (6,913,192) | | | (11,268,942) | | | (1,830,232) | | | (2,201,727) |

Income tax expense | | | 1,800 | | | 3,006 | | | — | | | — |

Net loss | | | $(6,914,992) | | | $(11,271,948) | | | $(1,830,232) | | | $(2,201,727) |

Comprehensive loss: | | | | | | | | | ||||

Net loss | | | $(6,914,992) | | | $(11,271,948) | | | $(1,830,232) | | | $(2,201,727) |

Change in fair value of available for sale investments | | | (20) | | | 4,783 | | | — | | | (20) |

Total comprehensive loss | | | $(6,915,012) | | | $(11,267,165) | | | $(1,830,232) | | | $(2,201,747) |

Net loss attributable to common stockholders, basic and diluted | | | $(6,914,992) | | | $(11,271,948) | | | $(1,830,232) | | | $(2,201,727) |

Net loss per share attributable to common stockholders, basic and diluted | | | $(0.80) | | | $(1.33) | | | $(0.20) | | | $(0.26) |

Weighted-average shares used in computing net loss per share attributable to common stockholders, basic and diluted | | | 8,638,755 | | | 8,459,588 | | | 8,956,255 | | | 8,597,505 |

| | | | | | | | | |||||

| | | Years Ended December 31 | | | Three Months Ended March 31 | |||||||

| | | 2020 | | | 2019 | | | 2021 | | | 2020 | |

| | | | | | | (unaudited) | ||||||

Pro forma net loss per share, basic and diluted (unaudited)(1) | | | $ | | | $ | | | $ | | | $ |

Weighted average shares of common stock outstanding used to compute pro forma net loss per share, basic and diluted (unaudited)(1) | | | | | | |||||||

| (1) | See note 12 to our audited financial statements included elsewhere in this prospectus for an explanation of the method used to calculate our historical basic and diluted net loss per share. |

| | | As of March 31, 2021 (unaudited) | |||||||

| | | Actual | | | Pro Forma(1) | | | Pro Forma As Adjusted(2) | |

Balance Sheet Data: | | | | | | | |||

Cash and cash equivalents | | | $2,016,553 | | | $2,016,553 | | | |

Working capital(3) | | | (1,409,730) | | | (1,409,730) | | | |

Total assets | | | 6,686,186 | | | 6,686,186 | | | |

Total liabilities | | | 4,905,920 | | | 4,905,920 | | | |

Total redeemable convertible preferred stock | | | 55,343,686 | | | — | | | |

Total stockholders' deficit | | | (53,563,420) | | | 1,780,226 | | | |

| (1) | Pro forma amounts reflect the automatic conversion of all outstanding convertible preferred stock into 73,046,442 shares of our common stock immediately prior to the closing of this offering. |

| (2) | The pro forma as adjusted amounts give effect to (i) the pro forma adjustments set forth in footnote (1) and (ii) the issuance and sale by us of shares of our common stock in this offering at an initial public offering price of $ per share, after deducting the underwriting discounts and commissions and estimated expenses payable by us. |

| (3) | We define working capital as current assets less current liabilities. See our financial statements and the related notes included elsewhere in this prospectus for further details regarding our current assets and current liabilities. |

| • | the initiation, scope, rate of enrollment, progress, success and cost of our current or future clinical trials; |

| • | the cost of our research and development activities; |

| • | the acceptance of our clinical trial data by the FDA or foreign regulatory authorities; |

| • | patient, physician and market acceptance of our permanent birth control system, intrauterine insemination system and women-specific medical products; |

| • | the cost of filing and prosecuting patent applications and defending and enforcing our patent or other intellectual property rights; |

| • | the cost of defending, in litigation or otherwise, any claims that we infringe third-party patents or other intellectual property rights; |

| • | the cost and timing of additional regulatory clearances, de novo grants or approvals; |

| • | the cost and timing of establishing additional sales and marketing capabilities; |

| • | costs associated with any product recall that may occur; |

| • | the effect of competing technological and market developments; |

| • | the extent to which we acquire or invest in products, technologies and businesses, although we currently have no commitments or agreements relating to any of these types of transactions; and |

| • | the costs of operating as a public company. |

| • | patient and physician adoption of our FemBloc system, if approved to market; |

| • | patient and physician adoption of our FemaSeed system, if granted de novo classification; |

| • | changes in coverage policies by third-party payors that affect the reimbursement of procedures using our products; |

| • | unanticipated pricing pressure; |

| • | the hiring, retention and continued productivity of our sales representatives; |

| • | our ability to expand the geographic reach of our sales and marketing efforts; |

| • | our ability to obtain regulatory clearance or approval for any products in development or for our current products for additional indications or in additional countries outside the United States; |

| • | results of clinical research and trials on our existing products and products in development; |

| • | delays in receipt of anticipated purchase orders; |

| • | delays in, or failure of, component and raw material deliveries by our suppliers; and |

| • | positive or negative coverage in the media or clinical publications of our products or products of our competitors or our industry. |

| • | we may not be able to demonstrate to the FDA's satisfaction that our product is safe and effective for its intended use; |

| • | the FDA may disagree that our clinical data supports the label and use that we are seeking; |

| • | the FDA may disagree that the data from our preclinical studies and clinical trials is sufficient to support marketing authorization; and |

| • | the manufacturing process and facilities we use may not meet applicable requirements. |

| • | we are required to submit an IDE application to FDA, which must become effective prior to commencing human clinical trials, and FDA may reject our IDE application and notify us that we may not begin investigational trials; |

| • | regulators and other comparable foreign regulatory authorities may disagree as to the design or implementation of our clinical trials; |

| • | regulators and/or IRBs or other reviewing bodies may not authorize us or our investigators to commence a clinical trial, or to conduct or continue a clinical trial at a prospective or specific trial site; |

| • | we may not reach agreement on acceptable terms with prospective contract research organizations, or CROs, and clinical trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites; |

| • | clinical trials may produce negative or inconclusive results, or we may not agree with regulatory authorities on the interpretation of our clinical trial results, and we may decide, or regulators may require us, to conduct additional clinical trials or abandon product development programs; |

| • | the number of subjects or patients required for clinical trials may be larger than we anticipate, enrollment in these clinical trials may be insufficient or slower than we anticipate, and the number of clinical trials being conducted at any given time may be high and result in fewer available patients for any given clinical trial, or patients may drop out of these clinical trials at a higher rate than we anticipate; |

| • | our third-party contractors, may fail to comply with regulatory requirements or meet their contractual obligations to us in a timely manner, or at all; |

| • | we might have to suspend or terminate clinical trials for various reasons, including a finding that the subjects are being exposed to unacceptable health risks; |

| • | we may have to amend clinical trial protocols or conduct additional studies to reflect changes in regulatory requirements or guidance, which we may be required to submit to an IRB and/or regulatory authorities for re-examination; |

| • | regulators, IRBs, or other parties may require or recommend that we or our investigators suspend or terminate clinical research for various reasons, including safety signals or noncompliance with regulatory requirements; |

| • | the cost of clinical trials may be greater than we anticipate; |

| • | clinical sites may not adhere to the clinical protocol or may drop out of a clinical trial; |

| • | we may be unable to recruit a sufficient number of clinical trial sites or trial subjects; |

| • | regulators, IRBs, or other reviewing bodies may fail to approve or subsequently find fault with our manufacturing processes for clinical and commercial supplies, the supply of devices or other materials necessary to conduct clinical trials may be insufficient, inadequate or not available at an acceptable cost, or we may experience interruptions in supply; |

| • | approval policies or regulations of FDA or applicable foreign regulatory authorities may change in a manner rendering our clinical data insufficient for approval; and |

| • | our current or future products may have undesirable side effects or other unexpected characteristics. |

| • | lack of availability of adequate third-party payor coverage or reimbursement; |

| • | lack of experience with our products and with permanent birth control and sonography as treatment alternatives; |

| • | our inability to convince key opinion leaders to provide recommendations regarding our permanent birth control solution, or to convince physicians, patients and healthcare payors that our permanent birth control solution is an attractive alternative to surgical tubal ligation or other contraception options; |

| • | perceived inadequacy of evidence supporting clinical benefits, safety or cost-effectiveness of our permanent birth control solution over existing alternatives; |

| • | liability risks generally associated with the use of new products and procedures; and |

| • | the training required to use new products. |

| • | we may not be able to demonstrate to the FDA's satisfaction that general controls, or general and special controls, are sufficient to provide reasonable assurance of safety and effectiveness of our product for its intended use; |

| • | the FDA may disagree that the probable benefits of the device outweigh the probable risks; and |

| • | the FDA may disagree that the data from our manufacturing activities, preclinical studies and clinical trial are sufficient to support de novo classification. |

| • | lack of experience with our products and with intrauterine insemination and sonography as treatment alternatives; |

| • | our inability to convince key opinion leaders to provide recommendations regarding our artificial insemination solution, or to convince physicians and patients that our localized intrauterine insemination product is an attractive alternative to other intrauterine insemination options; |

| • | perceived inadequacy of evidence supporting clinical benefits, safety or cost effectiveness of our intrauterine insemination product over existing alternatives; |

| • | liability risks generally associated with the use of new products and procedures; and |

| • | the training required to use new products. |

| • | greater company, product and brand recognition; |

| • | superior product safety, reliability and durability; |

| • | better quality and larger volume of clinical data; |

| • | more effective marketing to and education of patients and physicians; |

| • | more sales force experience and greater market access; |

| • | better product support and service; |

| • | more advanced technological innovation, product enhancements and speed of innovation; |

| • | more effective pricing and revenue strategies; |

| • | lower procedure costs to patients; |

| • | more effective reimbursement teams and strategies; |

| • | dedicated practice development; and |

| • | more effective clinical training teams. |

| • | properly identify and anticipate physician and patient needs; |

| • | develop and introduce new products and product enhancements in a timely manner; |

| • | avoid infringing upon the intellectual property rights of third-parties; |

| • | demonstrate, if required, the safety and effectiveness of new products with data from preclinical studies and clinical trials; |

| • | obtain the necessary regulatory clearances, grants or approvals for expanded indications, new products or product modifications; |

| • | be fully FDA-compliant with marketing of new products or modified products; |

| • | provide adequate training to potential users of our products; |

| • | receive adequate coverage and reimbursement for procedures performed with our products; and |

| • | develop an effective and dedicated sales and marketing team. |

| • | difficulties in securing distribution partnerships and managing our international relationships; |

| • | increased competition as a result of more products and procedures receiving regulatory approval or otherwise free to market in international markets; |

| • | longer accounts receivable payment cycles and difficulties in collecting accounts receivable; |

| • | reduced or varied protection for intellectual property rights in some countries; |

| • | export restrictions, trade regulations, and foreign tax laws; |

| • | fluctuations in currency exchange rates; |

| • | foreign certification and regulatory clearance or approval requirements; |

| • | customs clearance and shipping delays; |

| • | political, social, and economic instability abroad, terrorist attacks, and security concerns in general; |

| • | preference for locally produced products; |

| • | potentially adverse tax consequences, including the complexities of foreign value-added tax systems; |

| • | the burdens of complying with a wide variety of foreign laws and different legal standards; and |

| • | increased financial accounting and reporting burdens and complexities. |

| • | costs of litigation; |

| • | distraction of management's attention from our primary business; |

| • | the inability to commercialize our current and future products; |

| • | decreased demand for our current and future products; |

| • | damage to our business reputation; |

| • | product recalls or withdrawals from the market; |

| • | withdrawal of clinical trial participants; |

| • | substantial monetary awards to patients or other claimants; or |

| • | loss of sales. |

| • | identifying, recruiting, integrating, maintaining and motivating additional employees; |

| • | managing our internal development efforts effectively, including the clinical and FDA application preparation for our product candidates, while complying with our contractual obligations to contractors and other third parties; and |

| • | improving our operational, financial and management controls, reporting systems and procedures. |

| • | our inability to demonstrate to the satisfaction of the FDA or the applicable regulatory entity or notified body that our products are safe or effective for their intended uses or, for a 510(k) device, that they are substantially equivalent to the predicate; |

| • | the disagreement of the FDA or the applicable foreign regulatory body with the design or implementation of our clinical trials or the interpretation of data from preclinical studies or clinical trials; |

| • | serious and unexpected adverse device effects experienced by participants in our clinical trials; |

| • | the data from our preclinical studies and clinical trials may be insufficient to support approval, de novo classification or clearance where required; |

| • | our inability to demonstrate that the clinical and other benefits of the device outweigh the risks; |

| • | the manufacturing process or facilities we use may not meet applicable requirements; and |

| • | the potential for approval policies or regulations of the FDA or applicable foreign regulatory bodies to change significantly in a manner rendering our clinical data or regulatory filings insufficient for approval, de novo classification or clearance. |

| • | untitled letters or warning letters; |

| • | fines, injunctions, consent decrees and civil penalties; |

| • | recalls, termination of distribution, administrative detention, or seizure of our products; |

| • | customer notifications or repair, replacement or refunds; |

| • | operating restrictions or partial suspension or total shutdown of production; |

| • | delays in or refusal to grant our requests for future PMA approvals or foreign regulatory approvals of new products, new intended uses, or modifications to existing products; |

| • | withdrawals or suspensions of our current PMA or foreign regulatory approvals, resulting in prohibitions on sales of our products; |

| • | FDA refusal to issue certificates to foreign governments needed to export products for sale in other countries; and |

| • | criminal prosecution. |

| • | strengthen the rules on placing devices on the market and reinforce surveillance once they are available; |

| • | establish explicit provisions on manufacturers' responsibilities for the follow-up of the quality, performance and safety of devices placed on the market; |

| • | improve the traceability of medical devices throughout the supply chain to the end-user or patient through a unique identification number; |

| • | set up a central database to provide patients, healthcare professionals and the public with comprehensive information on products available in the EU; |

| • | strengthen rules for the assessment of certain high-risk devices, such as implants, which may have to undergo an additional check by experts before they are placed on the market. |

| • | the federal Anti-Kickback Statute, which prohibits, among other things, persons and entities from knowingly and willfully soliciting, offering, receiving or providing remuneration, directly or indirectly, in cash or in kind, to induce either the referral of an individual or furnishing or arranging for a good or service, for which payment may be made, in whole or in part, under federal healthcare programs, such as Medicare and Medicaid. A person or entity does not need to have actual knowledge of the statute or specific intent to violate it to have committed a violation. The U.S. government has interpreted this law broadly to apply to the marketing and sales activities of manufacturers. Moreover, the government may assert that a claim including items or services resulting from a violation of the federal Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the federal civil False Claims Act. Violations of the federal Anti-Kickback Statute may result in civil monetary penalties. Civil penalties |

| • | the federal civil and criminal false claims laws and civil monetary penalties laws, including the federal civil False Claims Act, which prohibit, among other things, individuals or entities from knowingly presenting, or causing to be presented, claims for payment from Medicare, Medicaid or other federal healthcare programs that are false or fraudulent. These laws can apply to manufacturers who provide information on coverage, coding, and reimbursement of their products to persons who bill third-party payers. Private individuals can bring False Claims Act “qui tam” actions, on behalf of the government and such individuals, commonly known as “whistleblowers,” may share in amounts paid by the entity to the government in fines or settlement. When an entity is determined to have violated the federal civil False Claims Act, the government may impose civil fines and penalties, and exclude the entity from participation in Medicare, Medicaid and other federal healthcare programs; |

| • | the federal Civil Monetary Penalties Law, which prohibits, among other things, offering or transferring remuneration to a federal healthcare beneficiary that a person knows or should know is likely to influence the beneficiary's decision to order or receive items or services reimbursable by the government from a particular provider or supplier; |

| • | the Health Insurance Portability and Accountability Act of 1996, or HIPAA, which created additional federal criminal statutes that prohibit, among other things, executing a scheme to defraud any healthcare benefit program and making false statements relating to healthcare matters. Similar to the federal Anti-Kickback Statute, a person or entity does not need to have actual knowledge of the statute or specific intent to violate it to have committed a violation; |

| • | the federal Physician Sunshine Act under the ACA, which require certain applicable manufacturers of drugs, devices, biologics and medical supplies for which payment is available under Medicare, Medicaid or the Children's Health Insurance Program, or CHIP, to report annually to the DHHS Centers for Medicare and Medicaid Services, or CMS, information related to payments and other transfers of value to physicians, which is defined broadly to include other healthcare providers and teaching hospitals, and applicable manufacturers and group purchasing organizations, to report annually ownership and investment interests held by physicians and their immediate family members. Applicable manufacturers are required to submit annual reports to CMS. Failure to submit required information may result in civil monetary penalties for all payments, transfers of value or ownership or investment interests that are not timely, accurately, and completely reported in an annual submission, and may result in liability under other federal laws or regulations. We have not, to date, submitted reports under the Physician Sunshine Act under the ACA; |

| • | HIPAA, as amended by the HITECH Act, and their respective implementing regulations, which impose requirements on certain covered healthcare providers, health plans and healthcare clearinghouses as well as their business associates that perform services for them that involve individually identifiable health information, relating to the privacy, security and transmission of individually identifiable health information without appropriate authorization, including mandatory contractual terms as well as directly applicable privacy and security standards and requirements. Failure to comply with the HIPAA privacy and security standards can result in civil monetary penalties, and, in certain circumstances, criminal penalties. State attorneys general can also bring a civil action to enjoin a HIPAA violation or to obtain statutory damages on behalf of residents of his or her state; |

| • | analogous state and foreign law equivalents of each of the above federal laws, such as anti-kickback and false claims laws which may apply to items or services reimbursed by any third-party payor, including commercial insurers or patients; state laws that require device companies to comply with the industry's voluntary compliance guidelines and the applicable compliance guidance promulgated by the |

| • | California recently enacted the California Consumer Privacy Act, or CCPA, which creates new individual privacy rights for California consumers (as defined in the law) and places increased privacy and security obligations on entities handling personal data of consumers or households. The CCPA will require covered companies to provide certain disclosures to consumers about its data collection, use and sharing practices, and to provide affected California residents with ways to opt-out of certain sales or transfers of personal information. The CCPA went into effect on January 1, 2020, and the California State Attorney General submitted final regulations for review on June 2, 2020, which were finalized and are now effective. The California State Attorney General has commenced enforcement actions against violators as of July 1, 2020. Further, a new California privacy law, the California Privacy Rights Act, or CPRA, was passed by California voters on November 3, 2020. The CPRA will create additional obligations with respect to processing and storing personal information that are scheduled to take effect on January 1, 2023 (with certain provisions having retroactive effect to January 1, 2022). We will continue to monitor developments related to the CPRA and anticipate additional costs and expenses associated with CPRA compliance. Other U.S. states also are considering omnibus privacy legislation and industry organizations regularly adopt and advocate for new standards in these areas. While the CCPA and CPRA contain an exception for certain activities involving PHI under HIPAA, we cannot yet determine the impact the CCPA, CPRA or other such future laws, regulations and standards may have on our business. |

| • | imposed an annual excise tax of 2.3% on any entity that manufactures or imports medical devices offered for sale in the United States, with limited exceptions (described in more detail below), although the effective rate paid may be lower. Through a series of legislative amendments, the tax was suspended for 2016 through 2019. Absent further legislative action, the device excise tax was to be reinstated on medical device sales starting January 1, 2020. The Further Consolidated Appropriations Act, 2020 H.R. 1865 (Pub.L.116-94), signed into law on December 20, 2019, has repealed the medical device excise tax previously imposed by Internal Revenue Code section 4191. Prior to the repeal, the |

| • | established a new Patient-Centered Outcomes Research Institute to oversee and identify priorities in comparative clinical efficacy research in an effort to coordinate and develop such research; |

| • | implemented payment system reforms including a national pilot program on payment bundling to encourage hospitals, physicians and other providers to improve the coordination, quality and efficiency of certain healthcare services through bundled payment models; and |

| • | expanded the eligibility criteria for Medicaid programs. |

| • | any of our patents, or any of our pending patent applications, if issued, will include claims having a scope sufficient to protect our FemBloc system and FemaSeed system; |

| • | any of our pending patent applications will issue as patents; |

| • | we will be able to successfully commercialize our products on a substantial scale, if approved, before our relevant patents we may have expire; |

| • | we were the first to make the inventions covered by each of our patents and pending patent applications; |

| • | we were the first to file patent applications for these inventions; |

| • | others will not develop similar or alternative technologies that do not infringe our patents; any of our patents will be found to ultimately be valid and enforceable; |

| • | any patents issued to us will provide a basis for an exclusive market for our commercially viable products, will provide us with any competitive advantages or will not be challenged by third parties; |

| • | we will develop additional proprietary technologies or products that are separately patentable; or |

| • | our commercial activities or products will not infringe upon the patents of others. |

| • | stop making, selling or using products or technologies that allegedly infringe the asserted intellectual property; |

| • | lose the opportunity to license our technology to others or to collect royalty payments based upon successful protection and assertion of our intellectual property rights against others; incur significant legal expenses; |

| • | pay substantial damages or royalties to the party whose intellectual property rights we may be found to be infringing; |

| • | pay the attorney's fees and costs of litigation to the party whose intellectual property rights we may be found to be infringing; |

| • | redesign those products that contain the allegedly infringing intellectual property, which could be costly, disruptive and infeasible; and |

| • | attempt to obtain a license to the relevant intellectual property from third parties, which may not be available on reasonable terms or at all, or from third parties who may attempt to license rights that they do not have. |

| • | being permitted to present only two years of audited financial statements and only two years of related Management’s discussion and analysis of financial condition and results of operations in this prospectus; |

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act; |

| • | an exemption from compliance with any new requirements adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotations; |

| • | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| • | exemptions from the requirement to hold a nonbinding advisory vote on executive compensation and to obtain stockholder approval of any golden parachute payments not previously approved. |

| • | a prohibition on actions by our stockholders by written consent; |

| • | advance notice requirements for election to our board of directors and for proposing matters that can be acted upon at stockholder meetings; |

| • | a requirement that directors may only be removed “for cause”; |

| • | a requirement that only the board of directors may change the number of directors and fill vacancies on the board; |

| • | division of our board of directors into three classes, serving staggered terms of three years each; and |

| • | the authority of the board of directors to issue preferred stock with such terms as the board of directors may determine. |

| • | announcements of regulatory approval or disapproval of our FemBloc system or the FDA’s decision to grant or decline the de novo request for our FemaSeed system and any future approvals or clearances for enhancements to our products; |

| • | adverse results from or delays in clinical trials of our FemBloc system and/ or FemaSeed system; |

| • | unanticipated safety concerns related to the use of our FemBloc system and/ or FemaSeed system; |

| • | FDA or other U.S. or foreign regulatory or legal actions or changes affecting us or our industry; |

| • | our ability to develop, obtain regulatory clearance or approval for, and market new and enhanced medical products on a timely basis; |

| • | any voluntary or mandated product recalls; |

| • | adverse developments concerning our suppliers or any future strategic partnerships; |

| • | the volume and timing of sales of our products; |

| • | the introduction of new products or product enhancements by us or others in our industry; |

| • | disputes or other developments with respect to our or others' intellectual property rights; |

| • | product liability claims or other litigation; |

| • | quarterly variations in our results of operations or those of others in our industry; |

| • | media exposure of our products or of those of others in our industry; |

| • | changes in governmental regulations or in reimbursement; |

| • | changes in earnings estimates or recommendations by securities analysts; |

| • | changes in financial estimates or guidance, including our ability to meet our future revenue and operating profit or loss estimates or guidance; |

| • | the public’s reaction to our earnings releases, other public announcements and filings with the SEC; |

| • | sales of substantial amounts of our stock by directors, officers or significant stockholders, or the expectation that such sales might occur; |

| • | operating and stock performance of other companies that investors deem comparable to us and overall performance of the equity markets; |

| • | additions or departures of key personnel; |

| • | changes in our capital structure, such as future issuances of securities and the incurrence of debt; |

| • | general market conditions and other factors, including factors unrelated to our operating performance or the operating performance of our competitors; and |

| • | other factors described in this “Risk Factors” section. |

| • | our ability to develop and advance our current product candidates and programs into, and successfully initiate and complete, clinical trials; |

| • | the ability of our clinical trials to demonstrate safety and effectiveness of our product candidates and other positive results; |

| • | estimates regarding the total addressable market for our product candidates; |

| • | competitive companies and technologies in our industry; |

| • | our ability to obtain FDA approval for our permanent birth control system, ability to gain FDA grant of a de novo classification request for our intrauterine insemination system, expand sales of our women-specific medical products and develop and commercialize additional products; |

| • | our ability to commercialize or obtain regulatory approvals, grants of de novo classification requests or 510(k) clearance for our product candidates, or the effect of delays in commercializing or obtaining regulatory authorizations; |

| • | our business model and strategic plans for our products, technologies and business, including our implementation thereof; |

| • | commercial success and market acceptance of our product candidates; |

| • | our ability to achieve and maintain adequate levels of coverage or reimbursement for our FemBloc system or any future products we may seek to commercialize; |

| • | our ability to manufacture our products and product candidates in compliance with applicable laws, regulations and requirements and to oversee third-party suppliers, service providers and vendors in the performance of any contracted activities in accordance with applicable laws, regulations and requirements; |

| • | the impact of the COVID-19 pandemic on our business, financial condition, results of operations, and prospects; |

| • | our ability to accurately forecast customer demand for our product candidates, and manage our inventory; |

| • | our ability to build, manage and maintain our direct sales and marketing organization, and to market and sell our permanent birth control system, artificial insemination system and women-specific medical products in markets in and outside of the United States; |

| • | our ability to hire and retain our senior management and other highly qualified personnel; |

| • | our ability to obtain additional financing in this or future offerings; |

| • | FDA or other U.S. or foreign regulatory actions affecting us or the healthcare industry generally, including healthcare reform measures in the United States and international markets; |

| • | the timing or likelihood of regulatory filings and approvals or clearances; |

| • | our ability to establish and maintain intellectual property protection for our product candidates and our ability to avoid claims of infringement; |

| • | the volatility of the trading price of our common stock; |

| • | our expectations regarding the use of proceeds from this offering; and |

| • | our expectations about market trends. |

| • | approximately $ million to fund the clinical development program for the FemBloc system through the stage of development; |

| • | approximately $ million to fund the clinical development program for the FemaSeed system through the stage of development; |

| • | approximately $ million to fund product development and research and development activities; |

| • | approximately $ million to hire additional personnel; and |

| • | the remainder for working capital and general corporate purposes. |

| • | on an actual basis; |

| • | on a pro forma basis to give effect to: (i) the automatic conversion of all outstanding shares of our convertible preferred stock into 73,046,442 shares of our common stock immediately prior to the closing of this offering and (ii) the effectiveness of our amended and restated certificate of incorporation; and |

| • | on a pro forma as adjusted basis to give further effect to our issuance and sale of shares of common stock in this offering at an assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| | | As of March 31, 2021 (unaudited) | |||||||

| | | Actual | | | Pro Forma(1) | | | Pro Forma As Adjusted(2) | |

Cash and cash equivalents | | | $2,016,553 | | | $2,016,553 | | | $ |

Notes payable(3) | | | $853,699 | | | $853,699 | | | $ |

Redeemable convertible preferred stock, Series B, par value $0.001 per share; 13,344,349 shares authorized, issued and outstanding, actual; no shares authorized, issued or outstanding, pro forma and pro forma as adjusted | | | 10,748,873 | | | — | | | |

Redeemable convertible preferred stock, Series C, par value $0.001 per share; 42,491,484 shares authorized, issued and outstanding, actual; no shares authorized, issued or outstanding, pro forma and pro forma as adjusted | | | 44,594,813 | | | — | | | |

Stockholders' equity: | | | | | | | |||

Common stock, par value $0.001 per share; 95,853,558 shares authorized, 10,011,255 shares issued and 8,956,255 shares outstanding, actual; 95,853,558 shares authorized, 83,057,697 shares issued and 82,002,697 shares outstanding, pro forma; shares authorized, shares issued and outstanding, pro forma as adjusted | | | 10,012 | | | 83,058 | | | |

Treasury stock, 1,055,000 shares | | | (60,000) | | | (60,000) | | | |

Preferred stock, Series A, par value $0.001 per share; 17,310,609 shares authorized, and 17,210,609 shares issued and outstanding, actual; no shares authorized, issued and outstanding, pro forma and pro forma as adjusted | | | 17,211 | | | — | | | |

Warrants | | | 702,492 | | | 702,492 | | | |

Additional paid-in capital | | | 22,799,587 | | | 78,087,438 | | | |

Accumulated deficit | | | (77,032,722) | | | (77,032,722) | | | |

Total stockholders' (deficit) equity | | | (53,563,420) | | | 1,780,266 | | | |

Total capitalization | | | $2,633,965 | | | $ 2,633,965 | | | $ |

| (1) | Does not reflect the issuance of warrants to purchase shares of our convertible preferred stock, which will convert into warrants to purchase 2,201,116 shares of our common stock immediately prior to the closing of this offering at a weighted average exercise price of $1.41 per share, on March 31, 2021. |

| (2) | Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, would increase (decrease) the pro forma as adjusted amount of each of cash and cash equivalents, additional paid-in capital, total stockholders' equity and total capitalization by approximately $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase (decrease) of 1.0 million shares in the number of shares offered by us at the assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, would increase (decrease) the pro forma as adjusted amount of each of cash, cash equivalents and short-term investments, additional paid-in capital, total stockholders' equity and total capitalization by approximately $ million, assuming the shares of our common stock offered by this prospectus are sold at the assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover page of this prospectus, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| (3) | Includes Paycheck Protection Program loan payable of $812,500. See “Management's Discussion and Analysis of Financial Conditions and Results of Operations—Liquidity and Capital Resources—Indebtedness.” |

| • | 6,663,750 shares of our common stock issuable upon the exercise of options outstanding as of March 31, 2021, at a weighted-average exercise price of $0.39 per share; |

| • | 10,000,000 shares of our common stock that are available for future issuance under our 2021 Plan, which will become effective on the day immediately prior to the date the registration statement of which this prospectus forms a part is declared effective, as well as any shares of our common stock that become available pursuant to provisions in the 2021 Plan pursuant to which additional shares may become available for issuance under the 2021 Plan; |

| • | 2,201,116 shares of our common stock issuable upon the exercise of warrants to purchase shares of our convertible preferred stock outstanding as of March 31, 2021, which will convert into warrants to purchase shares of our common stock immediately prior to the closing of this offering, at a weighted average exercise price of $1.41 per share; and |

| • | 1,500,000 shares of our common stock reserved for future issuance under our ESPP, which will become effective on the day immediately prior to the date the registration statement of which this prospectus forms a part is declared effective, as well as shares of our common stock that become available pursuant to provisions in our ESPP that automatically increase the common stock reserve under the ESPP. |

Assumed initial public offering price per share | | | | | $ | |

Historical net tangible book value per share as of March 31, 2021 | | | $ | | | |

Decrease in pro forma net tangible book value per share | | | | | ||

Pro forma net tangible book value per share as of March 31, 2021 | | | | | ||

Increase in pro forma net tangible book value per share attributable to new investors participating in this offering | | | | | ||

Pro forma as adjusted net tangible book value per share after this offering | | | | | $ | |

Dilution per share to new investors in this offering | | | | | $ |

| | | Shares Purchased | | | Total Consideration | | | Average Price | |||||||

| | | Number | | | Percent | | | Amount | | | Percent | | | Per Share | |

Existing stockholders | | | | | % | | | $ | | | % | | | $ | |

New investors | | | | | | | | | | | |||||

| | | | | | | | | | | ||||||

Total | | | | | % | | | $ | | | % | | | ||

| • | 6,663,750 shares of our common stock issuable upon exercise of options outstanding as of March 31, 2021, at a weighted-average exercise price of $0.39 per share; |

| • | 10,000,000 shares of our common stock that are available for future issuance under our 2021 Plan, which will become effective on the day immediately prior to the date the registration statement of which this prospectus forms a part is declared effective, as well as any shares of our common stock that become available pursuant to provisions in the 2021 Plan pursuant to which additional shares may become available for issuance under the 2021 Plan; |

| • | 2,201,116 shares of our common stock issuable upon the exercise of warrants to purchase shares of our convertible preferred stock outstanding as of March 31, 2021, which will convert into warrants to purchase shares of our common stock immediately prior to the closing of this offering, at a weighted average exercise price of $1.41 per share; and |

| • | 1,500,000 shares of our common stock reserved for future issuance under our ESPP, which will become effective on the day immediately prior to the date the registration statement of which this prospectus forms a part is declared effective, as well as shares of our common stock that become available pursuant to provisions in our ESPP that automatically increase the common stock reserve under the ESPP. |

| • | Commencement and conduct of clinical trials for our product candidates. We must successfully obtain timely IDE approval to be able to commence clinical trials for FemBloc, as well as our future products. We must successfully recruit and enroll clinical trial participants in our clinical trials for FemBloc and FemaSeed, which is further complicated by the restrictions and public health concerns of the COVID-19 pandemic, in order to have the requisite data for regulatory submissions, both to the FDA and to international regulatory bodies, for marketing authorization. |

| • | Regulatory approval of our product candidates. We must successfully obtain timely approvals, de novo classifications or clearances for our product candidates. For our sales to grow, we will need to receive FDA approval for the FemBloc system for permanent birth control and FDA grant of a de novo classification request for the FemaSeed system for artificial insemination in the United States, and will need to obtain regulatory approval, grant, clearance or marketing authorization of our other pipeline products in the United States and in international markets. |

| • | Clinical results. Publications of clinical results by us, our competitors and other third parties can have a significant influence on whether, and the degree to which, our products are used by physicians and the procedures and treatments those physicians choose to provide. |

| • | Market acceptance. The success of our business will ultimately depend on our ability to gain broad acceptance of our products, which will require an extensive education process for both physicians and patients of the benefits of our products. |

| • | Competition. Our industry has a number of large, well-capitalized companies. We must continue to successfully compete in light of our competitors’ existing and future products and related pricing and their resources to successfully market to the physicians who use our products. |

| • | cost of clinical trials to support our product candidates and product enhancements, including expenses for activities conducted by third-party services providers, primarily clinical research organizations, or CROs, and site payments; |

| • | certain personnel-related expenses, including salaries, benefits and stock-based compensation; |

| • | materials and supplies used for internal R&D and clinical activities; |

| • | allocated overhead information technology expenses; and |

| • | cost of outside consultants, who assist with technology development, regulatory affairs, clinical affairs and quality assurance, and testing fees. |

| | | Year Ended December 31, | | |||||||||

| | | 2020 | | | 2019 | | | Change $ | | | Change % | |

Sales | | | $1,037,918 | | | $929,064 | | | $108,854 | | | 11.7 |

Cost of sales | | | 306,533 | | | 223,678 | | | 82,855 | | | 37.0 |

Gross margin | | | 731,385 | | | 705,386 | | | 25,999 | | | 3.7 |

Operating expenses: | | | | |||||||||

Research and development | | | 4,130,613 | | | 6,914,179 | | | (2,783,566) | | | (40.3) |

Sales and marketing | | | 310,219 | | | 1,503,784 | | | (1,193,565) | | | (79.4) |

General and administrative | | | 2,544,043 | | | 3,298,829 | | | (754,786) | | | (22.9) |

Depreciation and amortization | | | 679,653 | | | 625,778 | | | 53,875 | | | 8.6 |

Total operating expenses | | | 7,664,528 | | | 12,342,570 | | | (4,678,042) | | | (37.9) |

Loss from operations | | | (6,933,143) | | | (11,637,184) | | | 4,704,041 | | | (40.4) |

Other income (expense): | | | | | | | | | ||||

Interest income, net | | | 22,504 | | | 287,537 | | | (265,033) | | | (92.2) |

Other income | | | 10,000 | | | 93,000 | | | (83,000) | | | (89.2) |

Other expense | | | — | | | (2,323) | | | 2,323 | | | (100.0) |

Interest expense | | | (12,553) | | | (9,972) | | | (2,581) | | | 25.9 |

Total other income | | | 19,951 | | | 368,242 | | | (348,291) | | | (94.6) |

Loss before income taxes | | | (6,913,192) | | | (11,268,942) | | | 4,355,750 | | | (38.7) |

Income tax expense | | | 1,800 | | | 3,006 | | | (1,206) | | | (40.1) |

Net loss | | | $(6,914,992) | | | $(11,271,948) | | | $4,356,956 | | | (38.7) |

| | | Year Ended December 31, | ||||

| | | 2020 | | | 2019 | |

| | | | | |||

Compensation and related personnel costs | | | $2,610,615 | | | $4,164,394 |

Clinical-related costs | | | 966,026 | | | 1,420,430 |

Materials and development costs | | | 426,986 | | | 890,564 |

Professional and outside consultant costs | | | 86,779 | | | 321,955 |

Other costs | | | 40,207 | | | 116,836 |

Total research and development expenses | | | $4,130,613 | | | $6,914,179 |

| | | Three Months Ended March 31, | | | | | ||||||

| | | 2021 | | | 2020 | | | Change $ | | | Change% | |

Sales | | | $329,775 | | | $260,512 | | | $69,263 | | | 26.6 |

Cost of sales | | | 93,042 | | | 73,188 | | | 19,854 | | | 27.1 |

Gross margin | | | 236,733 | | | 187,324 | | | 49,409 | | | 26.4 |

Operating expenses: | | | | | | | | | ||||

Research and development | | | 995,022 | | | 1,350,701 | | | (355,679) | | | (26.3) |

Sales and marketing | | | 22,819 | | | 237,189 | | | (214,370) | | | (90.4) |

General and administrative | | | 891,987 | | | 650,192 | | | 241,795 | | | 37.2 |

Depreciation and amortization | | | 153,453 | | | 169,410 | | | (15,957) | | | (9.4) |

Total operating expenses | | | 2,063,281 | | | 2,407,492 | | | (344,211 ) | | | (14.3) |

Loss from operations | | | (1,826,548) | | | (2,220,168) | | | 393,620 | | | (17.7) |

Other income (expense): | | | | | | | | | ||||

Interest income, net | | | 164 | | | 20,336 | | | (20,172) | | | (99.2) |

Other income | | | — | | | — | | | — | | | — |

Other expense | | | — | | | — | | | — | | | — |

Interest expense | | | (3,848) | | | (1,895) | | | (1,953) | | | 103.1 |

Total other (expense) income | | | (3,684) | | | 18,441 | | | (22,125) | | | (120.0) |

Loss before income taxes | | | (1,830,232) | | | (2,201,727) | | | 371,495 | | | (16.9) |

Income tax expense | | | — | | | — | | | — | | | — |

Net loss | | | $ (1,830,232) | | | $ (2,201,727) | | | $371,495 | | | (16.9) |

| | | Three Months Ended March 31, | ||||

| | | 2021 | | | 2020 | |

Compensation and related personnel costs | | | $676,547 | | | $876,135 |

Clinical-related costs | | | 173,473 | | | 247,887 |

Materials and development costs | | | 114,118 | | | 208,338 |

Professional and outside consultant costs | | | 17,957 | | | 17,128 |

Other costs | | | 12,927 | | | 1,213 |

Total research and development expenses | | | $995,022 | | | $1,350,701 |

| • | the cost, timing and results of our clinical trials and regulatory reviews; |

| • | the cost and timing of establishing sales, marketing and distribution capabilities; |

| • | the timing, receipt and amount of sales from our current and potential products; |

| • | our ability to continue manufacturing our products and product candidates and to secure the components, services and supplies needed in their production; |

| • | the degree of success we experience in commercializing our products; |

| • | the emergence of competing or complementary technologies; |

| • | the cost of preparing, filing, prosecuting, maintaining, defending and enforcing any patent claims and other intellectual property rights; and |

| • | the extent to which we acquire or invest in businesses, products or technologies, although we currently have no commitments or agreements relating to any of these types of transactions. |

| | | Year Ended December 31, | ||||

| | | 2020 | | | 2019 | |

Net cash used in operating activities | | | $(4,933,015) | | | $(11,005,996) |

Net cash provided by investing activities | | | 968,319 | | | 12,317,506 |

Net cash provided by (used in) financing activities | | | 871,648 | | | (127,782) |

Net change in cash and cash equivalents | | | $(3,093,048) | | | $1,183,728 |

| | | Three Months Ended March 31, | ||||

| | | 2021 | | | 2020 | |

Net cash used in operating activities | | | $(1,160,682) | | | $(1,803,116) |

Net cash provided by investing activities | | | — | | | 984,039 |

Net cash (used in) provided by financing activities | | | (144,991) | | | 48,376 |

Net change in cash and cash equivalents | | | $(1,305,673) | | | $(770,701) |

| | | Payments Due by Period | |||||||||||||

| | | Total | | | Less than 1 Year | | | 1-3 Years | | | 3-5 Years | | | More than 5 Years | |

Operating lease obligations | | | $1,673,575 | | | $527,739 | | | $1,098,807 | | | $47,029 | | | $— |

Debt, principal and interest(1) | | | 823,306 | | | 640,436 | | | 182,870 | | | — | | | — |

Total | | | $ 2,496,881 | | | $ 1,168,175 | | | $ 1,281,677 | | | $47,029 | | | $— |

| (1) | In addition, we enter into agreements in the normal course of business with contract research organizations for clinical trials and with vendors for preclinical studies and other services and products for operating purposes which are cancelable at any time by us, generally upon 30 days prior written notice. These payments are not included in this table of contractual obligations. |

| • | Expected Term—The expected term represents the period that stock-based awards are expected to be outstanding. Our historical share option exercise information is limited due to a lack of sufficient data points and does not provide a reasonable basis upon which to estimate an expected term. The expected term for option grants is therefore determined using the simplified method. The simplified method deems the expected term to be the midpoint between the vesting date and the contractual life of the stock-based awards. |

| • | Expected Volatility—The expected volatility was derived from the historical stock volatilities of comparable peer public companies within our industry that are considered to be comparable to our business over a period equivalent to the expected term of the stock-based awards, since there has been no trading history of our common stock. |

| • | Risk-Free Interest Rate—The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the date of grant for zero-coupon U.S. Treasury notes with maturities approximately equal to the stock-based awards’ expected term. |

| • | Expected Dividend Yield—The expected dividend yield is zero as we have not paid nor do we anticipate paying any dividends on our common stock in the foreseeable future. |

| • | Address unmet clinical needs in multiple large markets for women. We believe we are the non-surgical biomedical option in development for reproductive women. Our initial focus is on critical areas of unmet need in reproductive health, which is a growing challenge for women that is not optimally addressed with existing therapies. Two ends of the spectrum (permanent birth control and infertility with artificial insemination) represent large, growing total addressable market opportunities. Patients who wish to control their risk of pregnancy are often utilizing temporary or reversible options or are choosing the only permanent option that bears surgical risk and expense. We expect our FemBloc system has the potential to offer the first non-surgical, non-implant option performed |

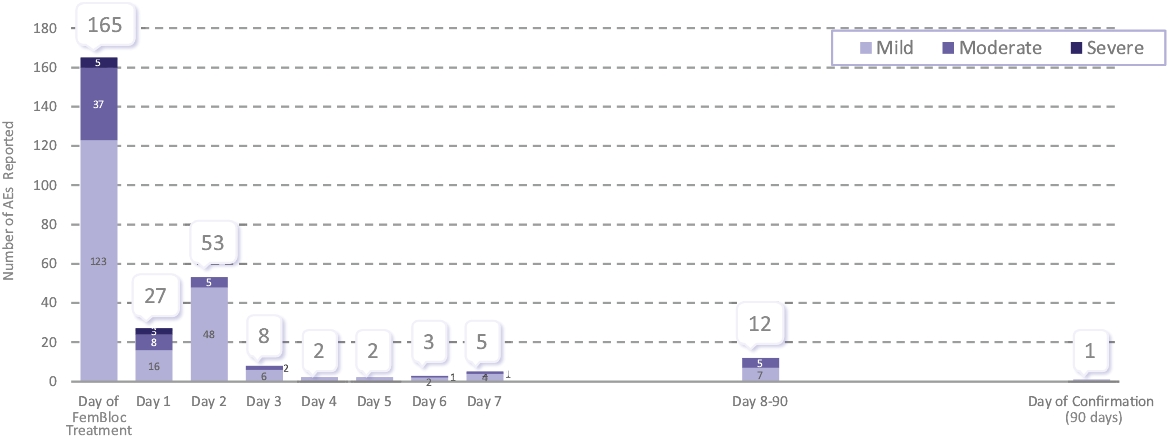

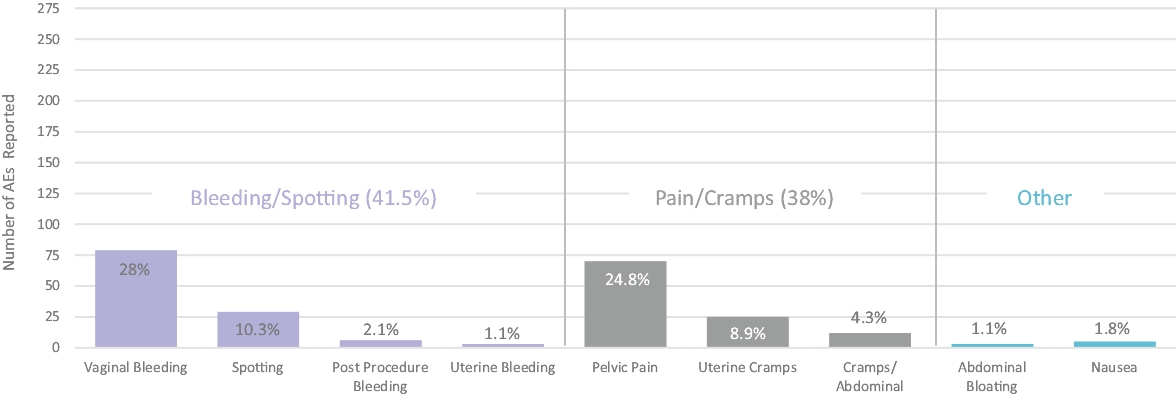

| • | Execute on our clinical program to achieve FDA approval to advance our FemBloc system for use together with our FemChec occlusion confirmation device as the preferred option for permanent birth control for women. We have studied FemBloc in two clinical trials pursuant to an FDA-approved IDE evaluating safety in 183 patients. We plan to continue safety follow-up for the 183 patients that were studied in two clinical trials pursuant to an FDA-approved IDE. We plan to complete the on-going small IDE study, which began In June 2020, and submit the results of the trial to demonstrate adequacy of proposed mitigations to reduce the risk of pregnancy and improve reliance rate, and to support selection of the final confirmation test. Along with the trial results, we plan to submit the study design that we expect to serve as the clinical support for a future PMA approval for FemBloc and FemChec to the FDA in the first half of 2022. If FDA approves the IDE for the pivotal trial, we will initiate a new pivotal trial. |

| • | Execute on our clinical program to achieve FDA grant of a de novo classification request to advance our FemaSeed system for use together with our FemVue saline-air device as the preferred option for artificial insemination. The safety profile of FemaSeed is supported by data from our FemBloc clinical trials and a post-market study of an identical single intrauterine directional delivery device design, which received FDA clearance for another indication. In April 2021 we received an IDE approval from FDA that allows us to initiate a pivotal study for the FemaSeed device. We plan on submitting the results from the trial in support of a future de novo classification request for FemaSeed. We anticipate initiating the clinical trial in the third quarter of 2021. |

| • | Continuously innovate to introduce additional product offerings for women. We intend to continue to invest in research and development activities focused on additional women-specific medical products and improvements and enhancements to our FemBloc system and FemaSeed system. In addition, we are building on our FDA-cleared sterile, single-use endocervical tissue sampling product, FemCerv, to develop FemEMB, a product candidate for endometrial sampling in support of uterine cancer detection testing. We have designed and developed proprietary methods utilized in our women’s health solutions and have protected these internally conceived advancements by patents, know-how, and trade secrets. Our team has demonstrated the ability to achieve marketing authorizations and clearances in the U.S., Europe, Canada, and Japan and to manufacture in accordance with U.S. Food and Drug Administration (FDA) and other international governing bodies. Availability of the additional product offerings will expand our suite of solutions for reproductive health and women’s health in general over time. |

| • | Penetrate the addressable markets by promoting patient and practice awareness. Currently it is estimated in the U.S. alone, annually, approximately 800,000 women elect surgical tubal ligation and 500,000 men elect vasectomy for permanent birth control. There are another 12 million women who utilize a non-permanent birth control option, many of whom we believe may prefer a permanent option if it were non-surgical. We believe the major factor that influences this light penetration of the market is the limitations of the existing technology despite the likely familiarity of tubal ligation as an option. In addition, with respect to the problem of infertility, it is currently estimated that in the United States alone, over nine million women are infertile and only a little over half proceed with some form of intervention, and only a very small proportion undergo more advanced technologies. We believe the major factor that influences this light penetration of the market is the cost and burden of the existing technologies despite the familiarity of intrauterine insemination as a first-line option. We intend to increase physician awareness through engagement and continued publication of scientific data in peer reviewed journals. Further, we intend to engage women who are candidates for permanent birth control or who suffer from infertility through direct patient outreach. |

| • | Build a commercialization infrastructure with a specialized direct sales and marketing team. From the outset, we spent significant time understanding the unmet needs of patients and physicians through |

| • | Expand gynecologists’ practice capabilities by diversifying products and services to include artificial insemination with FemaSeed. There are a limited number of gynecologists performing infertility services and treatment today, but we believe this has the potential to grow over time, in particular with the introduction of FemaSeed. FemaSeed is designed to be an in-office infertility procedure that can be done by a gynecologist using his or her existing skillset, expanding the number of gynecologists that can offer effective fertility services to their patients without needing to refer them to an infertility specialist. We plan to use our gynecologic sales force for FemBloc, if approved, to introduce those doctors to FemaSeed and broaden our sales force reach for our infertility treatment beyond our initial focus on reproductive endocrinologists. |

| • | establishment registration and device listing; |

| • | the Quality System Regulation, or QSR, which requires manufacturers, including third-party contract manufacturers, to follow stringent design, testing, control, documentation and other quality assurance procedures during all aspects of the manufacturing process; |

| • | labeling regulations and the FDA prohibitions against the promotion of products for uncleared or unapproved uses ( “off-label” uses) and other requirements related to promotional activities, including the advertising of restricted devices; |

| • | medical device reporting regulations, which require that manufacturers report to the FDA if their device may have caused or contributed to a death or serious injury, or if their device malfunctioned and the device or a similar device marketed by the manufacturer would be likely to cause or contribute to a death or serious injury if the malfunction were to recur; |

| • | corrections and removal reporting regulations, which require that manufacturers report to the FDA field corrections or removals if undertaken to reduce a risk to health posed by a device or to remedy a violation of the FDCA that may present a risk to health; and |

| • | post market surveillance regulations, which apply to certain Class II or III devices when necessary to protect the public health or to provide additional safety and efficacy data for the device. |

| • | warning or untitled letters, fines, injunctions, consent decrees and civil penalties; |

| • | customer notifications, voluntary or mandatory recall or seizure of our products; |

| • | operating restrictions, partial suspension or total shutdown of production; |

| • | delay in processing submissions or applications for new products or modifications to existing products; |

| • | withdrawing PMA approvals that have already been granted; and |

| • | criminal prosecution. |

Name | | | Age | | | Position |

Executive Officers | | | | | ||

Kathy Lee-Sepsick | | | 54 | | | Chairman, Chief Executive Officer and President |

Daniel Currie | | | 57 | | | Senior Vice President, Operations |

Lexy Kelley, MD | | | 49 | | | Vice President, Clinical & Medical Affairs |

Gary Thompson | | | 64 | | | Vice President, Finance & Administration |

| | | | | |||

Non-Employee Directors | | | | | ||

John Adams(2) | | | 59 | | | Director |

John Dyett(1)(2)(3) | | | 51 | | | Director |

Charles Larsen(1)(3) | | | 69 | | | Director |

Anne Morrissey(1) | | | 55 | | | Director |

Edward Uzialko(2) | | | 70 | | | Director |

William Witte(3) | | | 58 | | | Director |

| (1) | Member of the audit committee. |

| (2) | Member of the compensation committee. |

| (3) | Member of the nominating and corporate governance committee. |

| • | appointing, compensating, retaining and overseeing the work of our independent auditor and any other registered public accounting firm engaged for the purpose of preparing or issuing an audit report or related work or performing other audit, review or attest services for us; |

| • | discussing with our independent auditor any audit problems or difficulties and management's response; |

| • | pre-approving all audit and non-audit services provided to us by our independent auditor (other than those provided pursuant to appropriate preapproval policies established by the committee or exempt from such requirement under SEC rules); |

| • | reviewing and discussing our annual and quarterly financial statements with management and our independent auditor; |

| • | discussing and overseeing our policies with respect to risk assessment and risk management; and |

| • | establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters, and for the confidential and anonymous submission by our employees of concerns regarding questionable accounting or auditing matters. |

| • | reviewing and approving corporate goals and objectives with respect to the compensation of our Chief Executive Officer, evaluating our Chief Executive Officer's performance in light of these goals and objectives and setting compensation; |

| • | reviewing and setting or making recommendations to our board of directors regarding the compensation of our other executive officers; |

| • | reviewing and making recommendations to our board of directors regarding director compensation; |

| • | reviewing and approving or making recommendations to our board of directors regarding our incentive compensation and equity-based plans and arrangements; and |

| • | appointing and overseeing any compensation consultants. |

| • | identifying individuals qualified to become members of our board of directors, consistent with criteria approved by our board of directors; |

| • | recommending to our board of directors the nominees for election to our board of directors at annual meetings of our stockholders; |

| • | overseeing the annual self-evaluations of our board of directors and management; and |

| • | developing and recommending to our board of directors a set of corporate governance guidelines and principles. |

| • | Ms. Lee-Sepsick is intimately involved our day-to-day operations and is best positioned to elevate the most critical business issues for consideration by the board of directors. |

| • | The board of directors believes that having Ms. Lee-Sepsick serve in both capacities allows her to more effectively execute our strategic initiatives and business plans and confront its challenges. A combined chairman and chief executive officer structure provides us with decisive and effective leadership with clearer accountability to our shareholders. |

| • | Kathy Lee-Sepsick, President and Chief Executive Officer; |

| • | Daniel Currie, Senior Vice President of Operations; and |