UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

|

SOMAXON PHARMACEUTICALS, INC. |

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

TABLE OF CONTENTS

SOMAXON PHARMACEUTICALS, INC.

10935 Vista Sorrento Parkway, Suite 250

San Diego, California 92130

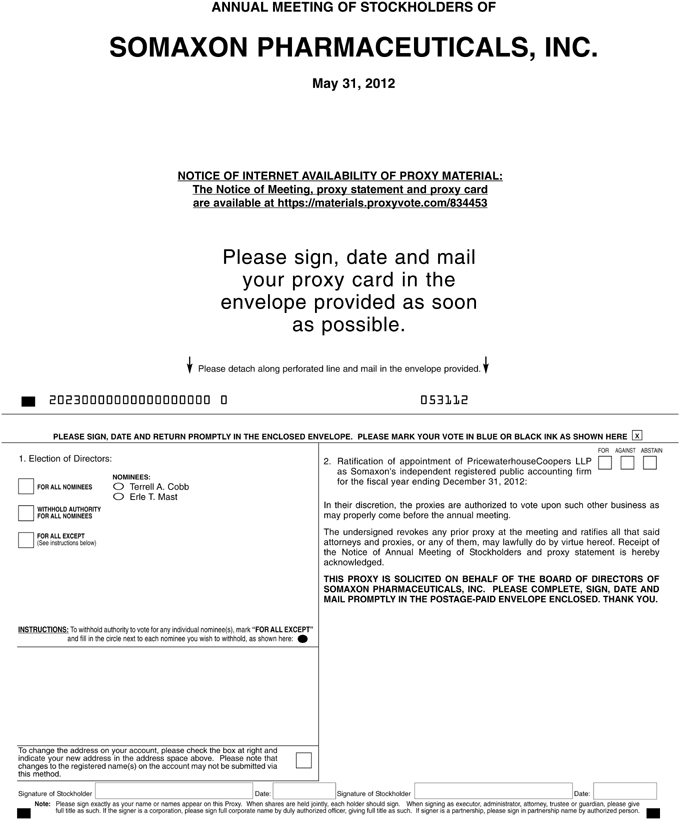

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

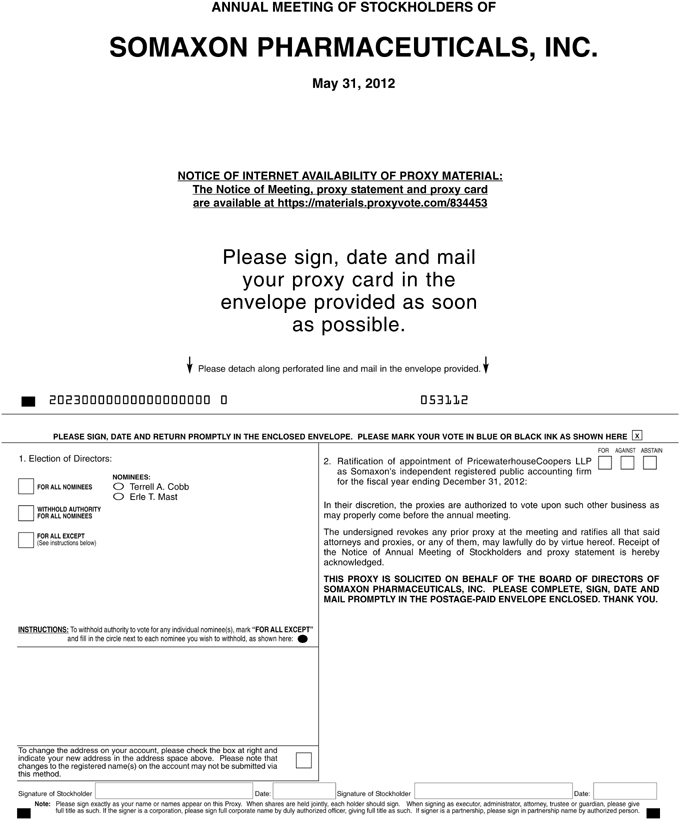

The Annual Meeting of the Stockholders of Somaxon Pharmaceuticals, Inc. will be held on May 31, 2012 at 9:00 a.m. Pacific time at the offices of Latham & Watkins LLP, 12636 High Bluff Drive, Suite 400, San Diego, CA 92130, for the following purposes:

| | 1. | To elect two directors for a three-year term to expire at the 2015 Annual Meeting of Stockholders; |

| | 2. | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2012; and |

| | 3. | To transact such other business as may be properly brought before the meeting or any adjournment thereof. |

Stockholders of record at the close of business on April 9, 2012 are entitled to notice of and to vote at our Annual Meeting and at any adjournment or postponement thereof.

Accompanying this notice is a proxy card.Whether or not you expect to attend our Annual Meeting, please complete, sign and date the enclosed proxy card and return it promptly, or complete and submit your proxy via phone or the internet in accordance with the instructions provided on the enclosed proxy card.If you plan to attend our Annual Meeting and wish to vote your shares personally, you may do so at any time before the proxy is voted.

All stockholders are cordially invited to attend the meeting.

| | |

| By Order of the Board of Directors, |

|

|

|

Richard W. Pascoe |

| President, Chief Executive Officer and Director |

San Diego, California

April 23, 2012

i

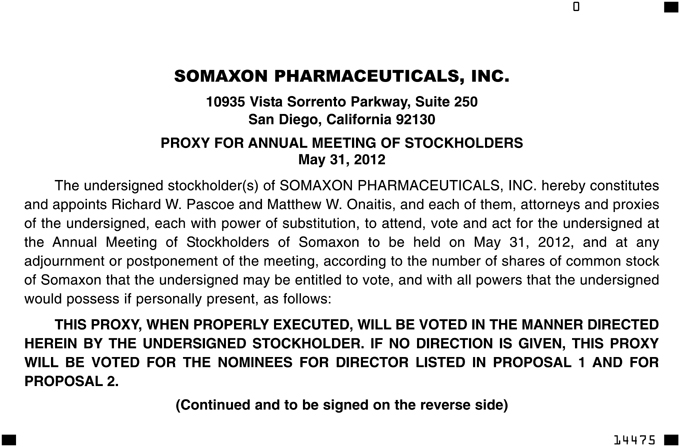

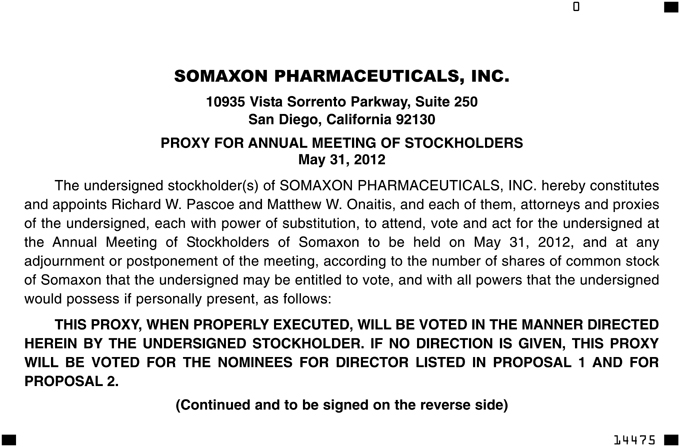

SOMAXON PHARMACEUTICALS, INC.

PROXY STATEMENT

The board of directors of Somaxon Pharmaceuticals, Inc., a Delaware corporation (“Somaxon,” the “company,” “we” or “us”), is soliciting the enclosed proxy for use at our Annual Meeting of Stockholders to be held on May 31, 2012 at 9:00 a.m. Pacific time at the offices of Latham & Watkins LLP, 12636 High Bluff Drive, Suite 400, San Diego, CA 92130, and at any adjournments or postponements thereof. If you need directions to the location of the annual meeting, please contact us at (858) 876-6500. This Proxy Statement will be first sent to stockholders on or about April 23, 2012.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on May 31, 2012:This proxy statement and our annual report are available electronically athttps://materials.proxyvote.com/834453.

All stockholders who find it convenient to do so are cordially invited to attend the meeting in person. In any event, please complete, sign, date and return the proxy card in the enclosed envelope, or complete and submit your proxy via phone or the internet in accordance with the instructions provided on the proxy card.

A proxy may be revoked by written notice to our corporate secretary at any time prior to the voting of the proxy, or by executing a later proxy or by attending the meeting and voting in person. Shares represented by proxies that reflect abstentions or “broker non-votes” (i.e., shares held by a broker or nominee which are represented at the Annual Meeting, but not empowered to vote on a particular proposal) will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum.

Directors will be elected by a favorable vote of a plurality of the aggregate votes present, in person or by proxy, at the Annual Meeting. Accordingly, abstentions will not affect the outcome of the election of candidates for director. Absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on certain non-routine items, such as the election of directors. Thus, if the beneficial owner does not give a broker specific instructions, the beneficially owned shares may not be voted on the election of directors and will not be counted in determining the number of shares necessary for approval, although they will count for purposes of determining whether a quorum exists. Stockholders are not permitted to cumulate their shares for the purpose of electing directors or otherwise.

The proposal to ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2011 requires the affirmative vote of a majority of the aggregate votes present, in person or by proxy, and entitled to vote at the Annual Meeting. Abstentions will have the same effect as a vote against this proposal. However, ratification of the selection of PricewaterhouseCoopers LLP is considered a routine matter on which a broker or other nominee is empowered to vote. Accordingly, no broker non-votes will result from this proposal.

Stockholders of record at the close of business on April 9, 2012 (the “record date”) will be entitled to vote at the meeting or vote by proxy. As of that date, 48,108,251 shares of our common stock, par value $0.0001 per share, were outstanding. Each share of our common stock is entitled to one vote. A majority of the outstanding shares of our common stock entitled to vote, represented in person or by proxy at our Annual Meeting, constitutes a quorum.

The cost of preparing, assembling and mailing the Notice of Annual Meeting, proxy statement and proxy card will be borne by us. In addition to soliciting proxies by mail, our officers, directors and other regular employees, without additional compensation, may solicit proxies personally or by other appropriate means. It is anticipated that banks, brokers, fiduciaries, other custodians and nominees will forward proxy soliciting materials to their principals, and that we will reimburse such persons’ out-of-pocket expenses.

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements. This means that only one copy of the proxy statement may have been sent to multiple stockholders who share an address. We will promptly deliver a separate copy to any stockholder upon written or oral request. Requests may be made by mail to: Corporate Secretary, Somaxon Pharmaceuticals, Inc., 10935 Vista Sorrento Parkway, Suite 250, San Diego, CA 92130, by email to: investors@somaxon.com, or by telephone to: (858) 876-6500. Any stockholder who would like to receive separate copies of the proxy statement in the future, or any stockholder who is receiving multiple copies and would like to receive only one copy per household, should contact the stockholder’s bank, broker, or other nominee record holder, or the stockholder may so designate on their proxy card at the time of voting. The stockholder can also contact us directly at (858) 876-6500.

1

PROPOSAL 1

ELECTION OF DIRECTORS

Our board of directors currently consists of eight members. Thomas G. Wiggans, a member of our board of directors and the chairman of the compensation committee of our board of directors, has notified us that he will not stand for re-election to the board at the 2012 annual meeting of stockholders. As such, Mr. Wiggans’ tenure on our board of directors will come to an end as of such meeting. Our board of directors, upon the recommendation of the nominating/corporate governance committee of our board of directors, has determined that effective as of the 2012 annual meeting of stockholders, the size of the board of directors will be reduced from eight to seven members. Our Amended and Restated Certificate of Incorporation provides for the classification of our board of directors into three classes, as nearly equal in number as possible and with staggered terms of office, and provides that upon the expiration of the term of office for a class of directors, nominees for such class shall be elected for a term of three years or until their successors are duly elected and qualified. At this meeting, two nominees for director are to be elected as Class I directors for a three-year term expiring at our 2015 Annual Meeting of Stockholders. The nominees are Terrell A. Cobb and Erle T. Mast. The Class II and Class III directors have one year and two years, respectively, remaining on their terms of office.

A plurality of the votes of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors is required to elect directors. If no contrary indication is made, proxies in the accompanying form are to be voted for our board of directors’ nominees or, in the event any such nominee is not a candidate or is unable to serve as a director at the time of the election (which is not currently expected), for any nominee who shall be designated by our board of directors to fill such vacancy.

Information Regarding Directors

The information set forth below as to the directors and nominees for director has been furnished to us by the directors and nominees for director:

Nominees for Election for a Three-Year Term Expiring at the

2015 Annual Meeting of Stockholders (Class I)

| | | | | | |

Name | | Age | | | Present Position with the Company |

Terrell A. Cobb | | | 62 | | | Director |

Erle T. Mast | | | 49 | | | Director, Chairman of Audit Committee |

Terrell A. Cobbhas served as a member of our board of directors since August 2003. Mr. Cobb is the founder and currently serves as President of ProCom One, a drug development company, a position he has held since 1998. We license Silenor from ProCom One, Inc. From 1995 to the present, Mr. Cobb has served as a consultant focusing on business development activities in the pharmaceutical industry. Mr. Cobb previously spent 15 years in various positions at Johnson and Johnson. Mr. Cobb has founded four specialty pharmaceutical companies, has held senior management positions in several start-up organizations, including Pharmaco and Scandipharm, and has acted as an advisor and consultant to other drug development companies. He received a B.A. degree from Mercer University in Chemistry and Psychology. Mr. Cobb’s depth and diversity of experience on boards of directors and in senior management of public and private specialty pharmaceutical companies, as well as his personal and professional integrity, ethics and values, led the board of directors to conclude that Mr. Cobb should serve as a director of the company. In addition, ProCom One has the right to designate one member of our board of directors, and ProCom One has designated Mr. Cobb to serve in such role.

Erle T. Masthas served on our board of directors since June 2008. Mr. Mast currently serves as Executive Vice President and Chief Financial Officer and is a co-founder of Clovis Oncology, Inc., a biopharmaceutical company. Previously, Mr. Mast was Chief Financial Officer of Pharmion Corporation from 2002 until its acquisition by Celgene Corporation in March 2008. Mr. Mast was also an Executive Vice President of Pharmion from February 2007 until the acquisition. He was Vice President of Finance for Dura Pharmaceuticals, Inc. from 1997 until its acquisition by Elan Corporation, plc in 2000, and thereafter he was Chief Financial Officer of Elan’s Global Biopharmaceuticals business until 2002. Prior to that, Mr. Mast was a partner with Deloitte & Touche, LLP. Mr. Mast has been a director of Zogenix, Inc. since 2008 and was a director of Verus Pharmaceuticals, Inc. from 2007 to 2009. Mr. Mast graduated from California State University, Bakersfield with a degree in business administration. Mr. Mast’s depth and diversity of experience on boards of directors and in senior management of public and private specialty pharmaceutical companies, including his specific experience and skills that qualify Mr. Mast to be our “audit committee financial expert” as that term is defined in the rules and regulations established by the SEC, as well as his personal and professional integrity, ethics and values, led the board of directors to conclude that Mr. Mast should serve as a director of the company.

2

Thomas G. Wiggansis also currently a member of Class I of our board of directors, but Mr. Wiggans has notified us that he will not stand for re-election to the board at the 2012 annual meeting of stockholders. As such, Mr. Wiggans’ tenure on our board of directors will come to an end as of such meeting. Our board of directors, upon the recommendation of the nominating/corporate governance committee of our board of directors, has determined that effective as of the 2012 annual meeting of stockholders, the size of the board of directors will be reduced from eight to seven members, and that the size of Class I of the board of directors will be reduced from three to two members.Mr. Wiggans has served on our board of directors since June 2008. Mr. Wiggans serves as Chief Executive Officer of Dermira, a company he co-founded in 2010. Mr. Wiggans served as Chief Executive Officer of Peplin, Inc. from August 2008 until Peplin’s acquisition by LEO Pharma A/S in November 2009, and as Chairman of Peplin’s Board of Directors from October 2007 until such acquisition. Mr. Wiggans served as Chief Executive Officer of Connetics Corporation from 1994 until December 2006 when Connetics was acquired by Stiefel Laboratories, Inc. Mr. Wiggans was also Chairman of the Board of Connetics from January 2006 until the acquisition. From 1992 to 1994, Mr. Wiggans served as President and Chief Operating Officer of CytoTherapeutics Inc. He served in various positions at Ares-Serono Group from 1980 to 1992, including President of its U.S. pharmaceutical operations and Managing Director of its U.K. pharmaceutical operations. Mr. Wiggans currently serves on the boards of directors of Sangamo Biosciences, Inc., Onyx Pharmaceuticals, Inc. and Lithera Inc. He is also on the Board of Trustees of the University of Kansas Endowment Association. In addition, Mr. Wiggans is Chairman of the Biotechnology Institute, a non-profit educational organization. Mr. Wiggans holds a B.S. in Pharmacy from the University of Kansas and an M.B.A. from Southern Methodist University. Mr. Wiggans’ depth and diversity of experience on boards of directors and in senior management of public and private specialty pharmaceutical companies, as well as his personal and professional integrity, ethics and values, led the board of directors to conclude that Mr. Wiggans should serve as a director of the company.

Members of the Board of Directors Continuing in Office

Term Expiring at the

2013 Annual Meeting of Stockholders (Class II)

| | | | |

Name | | Age | | Present Position with the Company |

Richard W. Pascoe | | 48 | | President, Chief Executive Officer and Director |

Kurt von Emster | | 44 | | Director, Chairman of the Nominating/Corporate Governance Committee |

Faheem Hasnain | | 53 | | Director |

Richard W. Pascoejoined as our President and Chief Executive Officer in August 2008. Before joining us, Mr. Pascoe was the Chief Operating Officer at ARIAD Pharmaceuticals, an emerging oncology company, where he led commercial operations, manufacturing, information services, program and alliance management and business development. Mr. Pascoe held a series of senior management roles at King Pharmaceuticals, Inc., including senior vice president of neuroscience marketing and sales and vice president positions in both international sales and marketing and hospital sales. He also held positions in the commercial groups at Medco Research, Inc. (which was acquired by King), COR Therapeutics, Inc. (where he helped lead the successful launch of eptifibatide [Integrilin®]), B. Braun Interventional and the BOC Group. Mr. Pascoe served as a commissioned officer in the United States Army following his graduation from the United States Military Academy at West Point where he received a B.S degree in Leadership. Mr. Pascoe’s appointment as our President and Chief Executive Officer and the board’s belief that the company’s chief executive officer should serve on the board, as well as Mr. Pascoe’s depth and diversity of experience in senior management of public specialty pharmaceutical companies and his personal and professional integrity, ethics and values, led the board of directors to conclude that Mr. Pascoe should serve as a director of the company.

Kurt von Emster, CFAhas served as a member of our board of directors since August 2005. Mr. von Emster is currently Managing Director of venBio LLC. From November 2000 through February 2009, Mr. von Emster was a General Partner and Portfolio Manager for the MPM BioEquities Fund. Prior to joining MPM, Mr. von Emster spent 11 years with Franklin Templeton Group as a Vice President and Portfolio Manager where he managed over $2 billion in health and biotech funds. In his tenure at Franklin, Mr. von Emster was responsible for building the healthcare group and was responsible for conceiving and developing seven different life science investment products for Franklin. Mr. von Emster holds the Chartered Financial Analyst designation (CFA), is a member of the Association for Investment Management and Research and is a member of the Security Analysts of San Francisco. Mr. von Emster currently serves on the board of directors of Metabolex, a private drug development company. Mr. von Emster is a past director of Facet Biotech Corporation, a public biotech company sold to Abbott Labs in 2010 and past Board Observer at Acceleron Pharmaceuticals, a private biotechnology company. He has a degree from the University of California at Santa Barbara in Business and Economics and in 2010, completed the Director College Executive Education Program at the Rock Center for Corporate Governance at Stanford University. Mr. von Emster’s depth and diversity of experience on boards of directors of public and private biotechnology companies and in evaluating and investing in biotech companies, as well as his personal and professional integrity, ethics and values, led the board of directors to conclude that Mr. von Emster should serve as a director of the company.

3

Faheem Hasnainhas served on our board of directors since September 2010. Mr. Hasnain is currently president, chief executive officer and a director of Receptos, Inc., a position he has held since December 2010. Previously, Mr. Hasnain was president, chief executive officer and a director of Facet Biotech Corporation from December 2008 until its acquisition by Abbott Laboratories in April 2010. Mr. Hasnain was president, chief executive officer and a director of PDL BioPharma, Inc. from October 2008 until Facet Biotech was spun off from PDL BioPharma in December 2008. From October 2004 to September 2008, Mr. Hasnain served at Biogen Idec Inc., most recently as executive vice president in charge of the oncology/rheumatology strategic business unit. Prior to Biogen Idec, Mr. Hasnain was president of Oncology Therapeutics Network, a subsidiary of Bristol-Myers Squibb Company, from March 2002 to September 2004. From 2000 to 2002, Mr. Hasnain served as vice president, global eBusiness, at GlaxoSmithKline and, from 1988 to 2000, he served in key commercial and entrepreneurial roles within GlaxoSmithKline and its predecessor organizations, spanning global eBusiness, international commercial operations, sales and marketing. Mr. Hasnain has been chairman of the board of Ambit Biosciences Corporation since November 2010. Mr. Hasnain received a B.H.K. and B.Ed. from the University of Windsor Ontario in Canada. Mr. Hasnain’s depth and diversity of experience on boards of directors and in senior management of public and private specialty and non-specialty pharmaceutical companies, as well as his personal and professional integrity, ethics and values, led the board of directors to conclude that Mr. Hasnain should serve as a director of the company.

Term Expiring at the

2014 Annual Meeting of Stockholders (Class II)

| | | | | | |

Name | | Age | | | Present Position with the Company |

David F. Hale | | | 63 | | | Chairman of the Board |

Michael L. Eagle | | | 64 | | | Director |

David F. Haleis one of our co-founders and has served as Chairman of the Board of Directors since our founding in August 2003. He also served as our interim Chief Executive Officer from January 2008 until August 2008. Mr. Hale has served as Executive Chairman of Biocept, Inc., a laboratory services company, since March 2011. He has served as Chairman and Chief Executive Officer of Hale BioPharma Ventures since May 2006. Mr. Hale served as President and Chief Executive Officer of CancerVax Corporation, a biotechnology company, from October 2000 until it merged with Micromet AG in 2006. He served as a director of CancerVax from December 2000 until the merger with Micromet Inc., and he served as Chairman of Micromet’s board of directors until Micromet’s acquisition by Amgen in March 2012. Prior to joining CancerVax, he was President and Chief Executive Officer of Women First HealthCare, Inc., a specialty pharmaceutical company, from January 1998 to May 2000. Mr. Hale served as President, Chief Executive Officer and Chairman of Gensia Inc., a pharmaceutical company which became Gensia Sicor, from May 1987 to November 1997. Prior to joining Gensia, Mr. Hale was President, Chief Operating Officer and Chief Executive Officer of Hybritech Inc. Mr. Hale serves as Chairman of the Board of Santarus, Inc. and the privately held companies SkinMedica, Inc., Neurelis, Inc., Ridge Diagnostics, Automedics, Inc., Advantar Laboratories, Crisi Medical Systems and Intrepid Theurapeutics, Inc. He also was a co-founder and serves as a member of the Board of Directors of Conatus Pharmaceuticals, Inc., and served on the Board of Directors of Verus Pharmaceuticals, Inc. Mr. Hale was formerly a director of Metabasis Therapeutics, Inc. from 1998 through January 2010, including its Chairman of the Board from 2006 through January 2010.

Mr. Hale is a member of the boards of directors of industry organizations including BIOCOM/San Diego and the Biotechnology Industry Organization (BIO), is a member of the board of directors of Rady Children’s Hospital and Health Center and was Chairman of CONNECT from July 2004 to January 2011. Mr. Hale received a B.A. degree in Biology and Chemistry from Jacksonville State University. Mr. Hale’s depth and diversity of experience on boards of directors and in senior management of public and private specialty pharmaceutical companies, as well as his personal and professional integrity, ethics and values, led the board of directors to conclude that Mr. Hale should serve as a director of the company and as its non-executive chairman of the board.

Michael L. Eaglehas served on our board of directors since May 2007. Mr. Eagle served as Vice President of Manufacturing for Eli Lilly and Company from 1994 through 2001 and held a number of executive management positions with Eli Lilly and its subsidiaries throughout his career there. Since retiring from Eli Lilly, he has served as a founding member of Barnard Life Sciences, LLC. Mr. Eagle earned his B. S. degree in mechanical engineering from Kettering University and an M.B.A. from the Krannert School of Management at Purdue University. He serves on the board of directors of Cadence Pharmaceuticals and Hansen Medical, Inc., and on the Board of Trustees of the La Jolla Playhouse and Futures for Children. Mr. Eagle’s depth and diversity of experience on boards of directors and in senior management of public and private pharmaceutical and medical device companies, as well as his personal and professional integrity, ethics and values, led the board of directors to conclude that Mr. Eagle should serve as a director of the company.

4

Board Meetings

Our board of directors held fourteen meetings during 2011. Our audit committee held four meetings during 2011. Our compensation committee held five meetings and acted by unanimous written consent without a meeting once during 2011. Our nominating/corporate governance committee held one meeting during 2011. Each of our directors who served during the past year attended at least 75% of the aggregate of the total number of meetings of our board of directors and the total number of meetings of committees of our board of directors on which he served.

Committees of the Board

Audit Committee.Our audit committee currently consists of Messrs. Mast (chair), Eagle and von Emster, each of whom our board of directors has determined is independent within the meaning of the independent director standards of the SEC and the Nasdaq Stock Market, Inc. Our board of directors has determined that Mr. Mast qualifies as an “audit committee financial expert” as that term is defined in the rules and regulations established by the SEC. The audit committee is governed by a written charter approved by our board of directors, a copy of which is available via the “About Us” page of our website atwww.somaxon.com. The committee annually reviews and assesses its charter. The committee’s main function is to oversee our accounting and financial reporting processes, internal systems of control, independent registered public accounting firm relationships and the audits of our financial statements. The committee’s responsibilities include:

| | • | selecting and hiring our independent registered public accounting firm; |

| | • | evaluating the qualifications, independence and performance of our independent registered public accounting firm; |

| | • | approving the audit and non-audit services to be performed by our independent registered public accounting firm; |

| | • | reviewing the design, implementation, adequacy and effectiveness of our internal controls and our critical accounting policies; |

| | • | overseeing and monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters; |

| | • | reviewing with management and our auditors any earnings announcements and other public announcements regarding our results of operations; |

| | • | preparing the report that the SEC requires in our annual proxy statement; |

| | • | reviewing and approving any related party transactions; and |

| | • | reviewing and monitoring compliance with our code of conduct and ethics and investigating complaints received through our ethics helpline. |

Both our independent registered public accounting firm and internal financial personnel regularly meet privately with our audit committee and have unrestricted access to this committee.

Compensation Committee.Our compensation committee currently consists of Messrs. Wiggans (chair), Eagle and Hasnain, each of whom our board of directors has determined is independent within the meaning of the independent director standards of the SEC and the Nasdaq Stock Market, Inc. Mr. von Emster was a member of the compensation committee until March 22, 2011, at which time he was replaced by Mr. Hasnain. From and after the 2012 annual meeting of stockholders, our compensation committee will consist of Messrs. Eagle (chair) and Hasnain, each of whom our board of directors has determined is independent within the meaning of the independent director standards of the SEC and the Nasdaq Stock Market, Inc., and Mr. Hale, who our board of directors has determined will be independent within the meaning of the independent director standards of the SEC and the Nasdaq Stock Market, Inc. as of June 9, 2012. The compensation committee is governed by a written charter approved by our board of directors, a copy of which is available via the “About Us” page of our website atwww.somaxon.com. The committee annually reviews and assesses its charter. The committee’s purpose is to assist our board of directors in determining the development plans and compensation for our senior management and directors and where applicable to recommend these plans to our board of directors. The committee’s responsibilities include:

| | • | reviewing and recommending compensation and benefit plans for our executive officers and compensation policies for members of our board of directors and board committees; |

5

| | • | reviewing the terms of offer letters and employment agreements and arrangements with our officers; |

| | • | setting performance goals for our company and reviewing performance against these goals; |

| | • | evaluating the competitiveness of our executive compensation plans and periodically reviewing executive succession plans; and |

| | • | preparing the report that the SEC requires in our annual proxy statement. |

Nominating/Corporate Governance Committee.Our nominating/corporate governance committee currently consists of Messrs. von Emster (chair), Mast and Wiggans, each of whom our board of directors has determined is independent within the meaning of the independent director standards of the SEC and the Nasdaq Stock Market, Inc. From and after the 2012 annual meeting of stockholders, our nominating/corporate governance committee will consist of Messrs. von Emster (chair) and Mast, each of whom our board of directors has determined is independent within the meaning of the independent director standards of the SEC and the Nasdaq Stock Market, Inc., and Mr. Hale, who our board of directors has determined will be independent within the meaning of the independent director standards of the SEC and the Nasdaq Stock Market, Inc. as of June 9, 2012. The nominating/corporate governance committee is governed by a written charter approved by our board of directors, a copy of which is available via the “About Us” page of our website atwww.somaxon.com. The committee annually reviews and assesses its charter. The committee’s purpose is to assist our board of directors by identifying individuals qualified to become members of our board of directors, consistent with criteria set by our board of directors, and to develop our corporate governance principles. The committee’s responsibilities include:

| | • | evaluating the composition, size and governance of our board of directors and its committees and making recommendations regarding future planning and the appointment of directors to our committees; |

| | • | developing and administering procedures for considering stockholder nominees for election to our board of directors; |

| | • | evaluating and recommending candidates for election to our board of directors; |

| | • | overseeing our board of directors’ performance and self-evaluation process; and |

| | • | reviewing our corporate governance principles and providing recommendations to the board of directors regarding possible changes. |

Director Nomination Process and Other Corporate Governance Matters

Director Qualifications

In evaluating director nominees, the nominating/corporate governance committee considers the following factors:

| | • | personal and professional integrity, ethics and values; |

| | • | experience in corporate management, such as serving as an officer or former officer of a publicly held company; |

| | • | experience in our industry and with relevant social policy concerns; |

| | • | experience as a board member of another publicly held company; |

| | • | diversity of expertise and experience in substantive matters pertaining to our business relative to other board members; and |

| | • | practical and mature business judgment. |

The nominating/corporate governance committee’s goal is to assemble a board of directors that brings to our company a variety of perspectives and skills derived from high quality business and professional experience.

6

Other than the foregoing, there are no stated minimum criteria for director nominees, although the nominating/corporate governance committee may also consider such other factors as it may deem to be in the best interests of our company and our stockholders. The nominating/corporate governance committee does, however, believe it appropriate for at least one, and preferably, several, members of our board of directors to meet the criteria for an “audit committee financial expert” as defined by SEC rules, and that a majority of the members of our board of directors meet the definition of “independent director” under the Nasdaq Stock Market qualification standards. The nominating/corporate governance committee also believes it appropriate for our President and Chief Executive Officer to serve as a member of our board of directors.

Identification and Evaluation of Nominees for Directors

The nominating/corporate governance committee identifies nominees for director by first evaluating the current members of our board of directors willing to continue in service. Current members with qualifications and skills that are consistent with the nominating/corporate governance committee’s criteria for board service and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of our board of directors with that of obtaining a new perspective.

If any member of our board of directors does not wish to continue in service or if our board of directors decides not to re-nominate a member for re-election, the nominating/corporate governance committee identifies the desired skills and experience of a new nominee in light of the criteria above. The nominating/corporate governance committee generally polls our board of directors and members of management for their recommendations. The nominating/corporate governance committee may also review the composition and qualification of the boards of directors of our competitors, and may seek input from industry experts or analysts. The nominating/corporate governance committee reviews the qualifications, experience and background of the candidates. In making its determinations, the nominating/corporate governance committee evaluates each individual in the context of our board of directors as a whole, with the objective of assembling a group that can best perpetuate the success of our company and represent stockholder interests through the exercise of sound business judgment. After review and deliberation of all feedback and data, the nominating/corporate governance committee makes its recommendation to our board of directors. Historically, the nominating/corporate governance committee has not relied on third-party search firms to identify director candidates. The nominating/corporate governance committee may in the future choose to do so in those situations where particular qualifications are required or where existing contacts are not sufficient to identify an appropriate candidate.

We have not received director candidate recommendations from our stockholders, and we do not have a formal policy regarding consideration of such recommendations. However, any recommendations received from stockholders will be evaluated in the same manner that potential nominees suggested by board members, management or other parties are evaluated.

Board Leadership and Risk Oversight

We believe it is the chief executive officer’s responsibility to manage the company and the chairman’s responsibility to lead the board. As directors continue to have more oversight responsibilities than ever before, we believe it is beneficial to have an independent chairman whose sole job with respect to us is leading the board. By having another director serve as chairman of the board, Mr. Pascoe is able to focus his entire energy on managing the company.

We believe our chief executive officer and our chairman have an excellent working relationship. By clearly delineating the role of the chairman position in our corporate governance guidelines, we ensure there is no duplication of effort between the chief executive officer and the chairman. We believe this provides strong leadership for our board, while also positioning Mr. Pascoe as the leader of the company in the eyes of our collaborators, vendors, employees and other stakeholders.

Our board has five independent members and three non-independent members. Mr. Wiggans has notified us that he will not stand for re-election to the board at the 2012 annual meeting of stockholders. As such, Mr. Wiggans’ tenure on our board of directors will come to an end as of the date of such meeting. Our board of directors, upon the recommendation of the nominating/corporate governance committee of our board of directors, has determined that effective as of the 2012 annual meeting of stockholders, the size of the board of directors will be reduced from eight to seven members. In addition, as of June 9, 2012, Mr. Hale will meet the independent director standards of the SEC and the Nasdaq Stock Market, Inc., and at that point our board will consist of five independent members and two non-independent members. A number of our independent board members are currently serving or have served as members of senior management of other public companies and have served as directors of other public companies. We have three board committees comprised solely of independent directors, each with a different independent director serving as chair of the committee. We believe that the number of independent, experienced directors that make up our board, along with the independent oversight of the board by the non-executive chairman, benefits our company and our stockholders.

7

Our audit committee is primarily responsible for overseeing the company’s risk management processes on behalf of the full board. The audit committee receives reports from management at least quarterly regarding the company’s assessment of risks. In addition, the audit committee reports regularly to the full board of directors, which also considers the company’s risk profile. The audit committee and the full board of directors focus on the most significant risks facing the company’s business and the company’s general risk management strategy, and also ensure that risks undertaken by the company are consistent with the board’s appetite for risk. While the board oversees the company’s risk management, company management is responsible for day-to-day risk management processes. We believe this division of responsibilities is the most effective approach for addressing the risks facing our company and that our board leadership structure supports this approach.

Pursuant to our bylaws and our corporate governance guidelines, our board determines the best board leadership structure for our company from time to time. As part of our annual board self-evaluation process, we evaluate our leadership structure to ensure that the board continues to believe that it provides the optimal structure for our company and stockholders. We recognize that different board leadership structures may be appropriate for companies in different situations. We believe our current leadership structure, with Mr. Pascoe serving as chief executive officer and Mr. Hale serving as chairman of the board, is the optimal structure for our company at this time.

Communications with our Board of Directors

Our stockholders may contact our board of directors or a specified individual director by writing to our corporate secretary at Somaxon Pharmaceuticals, Inc., 10935 Vista Sorrento Parkway, Suite 250, San Diego, California 92130. Our corporate secretary will relay all such communications to our board of directors, or individual members, as appropriate.

Code of Ethics

Our company has established a Code of Business Conduct and Ethics that applies to our officers, directors and employees which is available on our internet website atwww.somaxon.com. The Code of Ethics contains general guidelines for conducting the business of our company consistent with the highest standards of business ethics, and is intended to qualify as a “code of ethics” within the meaning of Section 406 of the Sarbanes-Oxley Act of 2002 and Item 406 of Regulation S-K.

Corporate Governance Documents

Our company’s Code of Business Conduct and Ethics, Corporate Governance Guidelines and the charters for each of our audit committee, compensation committee and nominating/corporate governance committee are available, free of charge, on our website atwww.somaxon.com. Please note, however, that the information contained on the website is not incorporated by reference in, or considered part of, this proxy statement. We will also provide copies of these documents, free of charge, to any stockholder upon written request to Investor Relations, Somaxon Pharmaceuticals, Inc., 10935 Vista Sorrento Parkway, Suite 250, San Diego, California 92130.

Report of the Audit Committee

The audit committee oversees our financial reporting process on behalf of our board of directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the audit committee reviewed the audited financial statements in our annual report with management, including a discussion of any significant changes in the selection or application of accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements and the effect of any new accounting initiatives.

The audit committee reviewed with PricewaterhouseCoopers LLP, who are responsible for expressing an opinion on the conformity of these audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of our accounting principles and such other matters as are required to be discussed with the audit committee under generally accepted auditing standards, including Statement on Auditing Standards No. 114,The Auditor’s Communication with Those Charged with Governance. In addition, the audit committee has discussed with PricewaterhouseCoopers LLP their independence from management and our company, has received from PricewaterhouseCoopers LLP the written disclosures and the letter required by the Public Company Accounting Oversight Board, Rule 3526Communication with Audit Committees Concerning Independence, and has considered the compatibility of non-audit services with the independence of our registered public accounting firm.

8

The audit committee met with PricewaterhouseCoopers LLP to discuss the overall scope of their audit. The meetings with PricewaterhouseCoopers LLP were held, with and without management present, to discuss the results of their examination, their comments on our internal controls and the overall quality of our financial reporting.

Based on the reviews and discussions referred to above, the audit committee recommended to our board of directors that the audited financial statements be included in our annual report for the year ended December 31, 2011.

This Audit Committee Report is furnished solely with this report, and is not filed with this report, and shall not be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Securities Act, or the Securities Exchange Act of 1934, as amended, or the Exchange Act, whether made by us before or after the date hereof, regardless of any general incorporation language in any such filing, except to the extent we specifically incorporate this material by reference into any such filing.

The foregoing report has been furnished by the audit committee.

Erle T. Mast, Chairman

Michael L. Eagle

Kurt von Emster.

Compensation of our Board of Directors

We compensate non-employee directors for their service on our board of directors under our Director Compensation Policy.

Under the current Director Compensation Policy, each non-employee director other than our non-Executive Chairman of the Board is eligible to receive a quarterly retainer of $6,250, or $25,000 annually, for service on our board of directors. Our non-Executive Chairman of the Board is eligible to receive a quarterly retainer of $28,000, or $112,000 annually, for his service in such role.

Our non-employee directors also receive retainers for their service on board committees. The chairman of the audit committee of the board of directors receives a quarterly retainer of $2,500, or $10,000 per year. Each other member of our audit committee receives a quarterly retainer of $1,250, or $5,000 per year. Each member of the compensation committee of our board of directors receives a quarterly retainer of $625, or $2,500 per year, and each member of the nominating/corporate governance committee of our board of directors receives a quarterly retainer of $625, or $2,500 per year.

Each non-employee director is also eligible to receive an incremental stipend of $2,000 for each board meeting attended in person, or $1,000 for each board meeting attended by telephone, and $1,000 for each committee meeting attended in person, or $500 for each committee meeting attended by telephone. We reimburse our non-employee directors for their reasonable expenses incurred in attending meetings of our board of directors and committees of the board of directors.

In March 2012 our board of directors, upon the recommendation of the compensation committee, amended our Director Compensation Policy, retroactively to October 1, 2011, to provide that non-employee directors will receive their quarterly retainers for service on the board of directors or committees of the board and their fees for attending meetings of the board and committees of the board in restricted stock units, or RSUs, under our 2005 Equity Incentive Award Plan. After each calendar quarter, each director will receive a number of RSUs calculated by dividing the total amount of such retainers and fees due to such director relating to such quarter, or the previous two quarters with respect to the grant of RSUs on March 31, 2012, by the closing price of our common stock on the Nasdaq Capital Market on the last trading day of such quarter, and multiplying the result by 1.2. All of these RSUs will vest upon the first date included within an open trading window under our Insider Trading Policy following December 31, 2012, subject to the director’s continued service to us on such date. In the event of a change of control transaction involving us or our stock prior to the vesting of the RSUs, 100% of the unvested RSUs would vest upon the consummation of the change of control.

9

Our directors may participate in our stock incentive plans and employee-directors may participate in our employee stock purchase plan. Any non-employee director who is elected to our board of directors is granted an option to purchase 35,000 shares of our common stock on the date of his or her initial election to our board of directors. In addition, on the date of each annual meeting of our stockholders, (1) each continuing non-employee director will be eligible to receive an option to purchase 15,000 shares of common stock, (2) the non-Executive Chairman of the Board will be eligible to receive an additional annual option to purchase 25,000 shares of common stock (for a total of 40,000 shares), (3) the chairman of our audit committee will be eligible to receive an additional annual option to purchase 5,000 shares of common stock (for a total of 20,000 shares) and (4) the chairmen of our nominating/corporate governance committee and our compensation committee will be eligible to receive an additional annual option to purchase 2,500 shares of common stock (for a total of 17,500 shares each). Such options will have an exercise price per share equal to the fair market value of our common stock on such date. The initial options granted to non-employee directors described above will vest over three years in 36 equal monthly installments on each monthly anniversary of the date of grant, subject to the director’s continuing service on our board of directors on those dates. The annual options granted to non-employee directors described above will vest in 12 equal monthly installments on each monthly anniversary of the date of grant, subject to the director’s continuing service on our board of directors (and, with respect to grants to a Chairman of the Board or board committee, service as Chairman of the Board or a committee) on those dates. The term of each option granted to a non-employee director shall be ten years.

Director Compensation Table

The following table summarizes our director compensation for each of our directors except Mr. Pascoe for the year ended December 31, 2011. Please see the tables relating to our Named Executive Officers under “Executive Compensation” below for information relating to Mr. Pascoe.

| | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Fees Earned

or Paid in

Cash ($) | | | Stock Awards

($) | | | Option Awards

($) (1) | | | All Other

Compensation

($) | | | Total ($) | |

David F. Hale, Chairman of the Board | | $ | 129,000 | | | $ | — | | | $ | 57,909 | | | $ | — | | �� | $ | 186,909 | |

Erle T. Mast, Director, Chairman of the Audit Committee | | $ | 54,908 | | | $ | — | | | $ | 28,955 | | | $ | — | | | $ | 83,863 | |

Kurt von Emster, Director, Chairman of the Nominating / Corporate Governance Committee | | $ | 53,272 | | | $ | — | | | $ | 25,335 | | | $ | — | | | $ | 78,607 | |

Terrell A. Cobb, Director | | $ | 42,000 | | | $ | — | | | $ | 21,716 | | | $ | — | | | $ | 63,716 | |

Michael L. Eagle, Director | | $ | 52,544 | | | $ | — | | | $ | 21,716 | | | $ | — | | | $ | 74,260 | |

Faheem Hasnain, Director | | $ | 44,431 | | | $ | — | | | $ | 21,716 | | | $ | — | | | $ | 66,147 | |

Thomas G. Wiggans, Director, Chairman of the Compensation Committee | | $ | 47,658 | | | $ | — | | | $ | 25,335 | | | $ | — | | | $ | 72,993 | |

| (1) | The “Option Awards” column is the grant date fair value of option awards issued to our non-employee directors during 2011, calculated in accordance with the provisions of FASB ASC Topic 718. See the assumptions used in the Black-Scholes model in the notes to our audited financial statements included in our annual report on Form 10-K for the year ended December 31, 2011. During 2011, our non-employee directors were granted stock options to purchase the following numbers of shares of our common stock: Mr. Hale, 40,000 shares; Mr. Mast, 20,000 shares; Mr. von Emster, 17,500 shares; Mr. Cobb, 15,000 shares; Mr. Eagle, 15,000 shares; Mr. Wiggans, 17,500 shares; and Mr. Hasnain, 15,000 shares. At December 31, 2011, our non-employee directors held options to purchase the following number of shares of our common stock: Mr. Hale, 452,219 shares; Mr. Mast, 86,666 shares; Mr. von Emster, 110,831 shares; Mr. Cobb, 126,387 shares; Mr. Eagle, 78,333 shares; Mr. Wiggans, 73,333 shares; and Mr. Hasnain, 50,000 shares. |

Director Independence

Our board of directors has determined that five of our eight directors are independent under the Nasdaq Stock Market qualification standards, including Messrs. Eagle, Hasnain, Mast, von Emster and Wiggans. Mr. Wiggans has notified us that he will not stand for re-election to the board at the 2012 annual meeting of stockholders. As such, Mr. Wiggans’ tenure on our board of directors will come to an end as the date of such meeting. Our board of directors, upon the recommendation of the nominating/corporate governance committee of our board of directors, has determined that effective as of the 2012 annual meeting of stockholders, the size of the board of directors will be reduced from eight to seven members. In addition, as of June 9, 2012, Mr. Hale will meet the independent director standards of the SEC and the Nasdaq Stock Market, and at that point our board will consist of five independent members and two non-independent members.

Director Attendance at Annual Meetings

Although our company does not have a formal policy regarding attendance by members of our board of directors at our Annual Meeting, we encourage all of our directors to attend. Messrs. Hale and Pascoe attended last year’s annual meeting.

Our board of directors unanimously recommends a vote “FOR” each nominee listed above. Proxies solicited by our board of directors will be so voted unless stockholders specify otherwise on the accompanying proxy.

10

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information regarding the beneficial ownership of our common stock as of April 9, 2012 for:

| | • | | each of our Named Executive Officers as defined in “Executive Compensation” of this report; |

| | • | | each person known by us to beneficially own more than 5% of our common stock; and |

| | • | | all of our Named Executive Officers and directors as a group. |

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and includes voting and investment power with respect to the securities. Except as indicated by footnote, and subject to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. The number of shares of common stock used to calculate the percentage ownership of each listed person includes the shares of common stock underlying options held by such persons that are exercisable as of June 8, 2012, which is 60 days after April 9, 2012.

Percentage of beneficial ownership is based on 48,108,251 shares of common stock outstanding as of April 9, 2012. Unless otherwise indicated, the address for the following stockholders is c/o Somaxon Pharmaceuticals, Inc., 10935 Vista Sorrento Parkway, Suite 250, San Diego, CA 92130.

| | | | | | | | |

Name and Address of Beneficial Owner | | Shares

Beneficially

Owned | | | Percent

Beneficially

Owned | |

5% Stockholders: | | | | | | | | |

Ingalls & Snyder LLC (1) 61 Broadway New York, NY 10006 | | | 5,957,000 | | | | 12.4 | % |

Funds affiliated with MPM Capital, L.P. (2) 601 Gateway Boulevard, Suite 350 South San Francisco, CA 94080 | | | 5,909,155 | | | | 12.0 | % |

Scale Venture Management I, LLC, (formerly BAVP, L.P.) (3) 950 Tower Lane, Suite 700 Foster City, CA 94404 | | | 3,002,858 | | | | 6.2 | % |

| | |

Directors and Named Executive Officers: | | | | | | | | |

David F. Hale (4) | | | 756,339 | | | | 1.6 | % |

Erle T. Mast (5) | | | 108,296 | | | | * | |

Faheem Hasnain (6) | | | 35,416 | | | | * | |

Kurt von Emster (7) | | | 180,463 | | | | * | |

Terrell A. Cobb (8) | | | 158,409 | | | | * | |

Michael L. Eagle (9) | | | 115,646 | | | | * | |

Thomas G. Wiggans (10) | | | 99,859 | | | | * | |

Richard W. Pascoe (11) | | | 652,182 | | | | 1.3 | % |

Tran B. Nguyen (12) | | | 162,147 | | | | * | |

Matthew W. Onaitis (13) | | | 325,797 | | | | * | |

Brian T. Dorsey (14) | | | 294,575 | | | | * | |

Jeffrey W. Raser (15) | | | 539,414 | | | | 1.1 | % |

Named Executive Officers and directors as a group (12 persons) (16) | | | 3,428,543 | | | | 6.7 | % |

| * | Indicates beneficial ownership of less than 1% of the total outstanding common stock. |

| (1) | The voting and disposition of the shares held by Ingalls & Snyder was obtained from the Schedule 13-G/A filed by Ingalls & Snyder on February 7, 2012. |

11

| (2) | Funds affiliated with MPM Capital L.P. include the following holdings: |

| | | | | | | | |

Shareholder Name | | Number

of Shares | | | Number of Warrants

Exercisable within 60

days of April 9, 2012 | |

MPM Asset Management Investors 2006 BVIII LLC | | | 68,399 | | | | 18,848 | |

MPM BioVentures III GmbH & Co. Beteiligungs KG | | | 326,317 | | | | 89,923 | |

MPM BioVentures III Parallel Fund, L.P. | | | 116,646 | | | | 32,144 | |

MPM BioVentures III, L.P. | | | 259,654 | | | | 71,553 | |

MPM BioVentures III-QP, L.P. | | | 3,861,546 | | | | 1,064,125 | |

| | | | | | | | |

Total | | | 4,632,562 | | | | 1,276,593 | |

| | | | | | | | |

MPM BioVentures III GP, L.P. and MPM BioVentures III LLC are the direct and indirect general partners of MPM BioVentures III-QP, L.P., MPM BioVentures III GmbH & Co. Beteiligungs KG, MPM BioVentures III, L.P. and MPM BioVentures III Parallel Fund, L.P. The members of MPM BioVentures III LLC and MPM Asset Management Investors 2006 BVIII LLC are Luke Evnin, Ansbert Gadicke, Nicholas Galakatos, Dennis Henner, Nicholas Simon III, Michael Steinmetz and Kurt Wheeler, who disclaim beneficial ownership of these shares except to the extent of their pecuniary interest therein.

| (3) | Shares held by Scale Venture Management I, LLC include warrants to purchase 510,638 shares of our common stock within 60 days of April 9, 2012. The voting and disposition of the shares held by Scale Venture Management I, LLC was obtained from the Schedule 13-G/A filed by BAVP, L.P. on July 13, 2009. |

| (4) | Shares held by David F. Hale include 435,552 shares of common stock subject to outstanding options which are exercisable within 60 days of April 9, 2012. |

| (5) | Shares held by Erle T. Mast include 86,666 shares of common stock subject to outstanding options which are exercisable within 60 days of April 9, 2012. |

| (6) | Shares held by Faheem Hasnain include 35,416 shares of common stock subject to outstanding options which are exercisable within 60 days of April 9, 2012. |

| (7) | Shares held by Kurt von Emster include 110,831 shares of common stock subject to outstanding options which are exercisable within 60 days of April 9, 2012 and warrants to purchase 42,553 shares of our common stock within 60 days of April 9, 2012. |

| (8) | Shares held by Terrell A. Cobb include 126,387 shares of common stock subject to outstanding options which are exercisable within 60 days of April 9, 2012. |

| (9) | Shares held by Michael L. Eagle include 78,333 shares of common stock subject to outstanding options which are exercisable within 60 days of April 9, 2012. |

| (10) | Shares held by Thomas G. Wiggans include 73,333 shares of common stock subject to outstanding options which are exercisable within 60 days of April 9, 2012. |

| (11) | Shares held by Richard W. Pascoe include 579,790 shares of common stock subject to outstanding options which are exercisable within 60 days of April 9, 2012. |

| (12) | Shares held by Tran B. Nguyen include 139,581 shares of common stock subject to outstanding options which are exercisable within 60 days of April 9, 2012. |

| (13) | Shares held by Matthew W. Onaitis include 270,760 shares of common stock subject to outstanding options which are exercisable within 60 days of April 9, 2012. |

| (14) | Shares held by Brian T. Dorsey include 260,123 shares of common stock subject to outstanding options which are exercisable within 60 days of April 9, 2012. |

| (15) | Shares held by Jeffrey W. Raser include 516,081 shares of common stock subject to outstanding options which are exercisable within 60 days of April 9, 2012. |

| (16) | Includes 2,712,853 shares of common stock subject to outstanding options and 42,553 warrants which are exercisable within 60 days of April 9, 2012. |

12

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Our Executive Officers

At April 9, 2012, our executive officers consisted of the following:

| | | | | | |

Name | | Age | | | Position with the Company |

Richard W. Pascoe | | | 48 | | | President and Chief Executive Officer |

Tran B. Nguyen | | | 38 | | | Senior Vice President and Chief Financial Officer |

Brian T. Dorsey | | | 43 | | | Senior Vice President, Technical Operations |

Matthew W. Onaitis | | | 41 | | | Senior Vice President, General Counsel and Secretary |

See “Information Regarding Directors” for the biography of Mr. Pascoe.

Tran B. Nguyenhas served as our Vice President and Chief Financial Officer since April 2010 and as our Senior Vice President and Chief Financial Officer since February 2011. Mr. Nguyen brings to the Company more than 10 years of finance experience primarily focused in the life science industry. Previously, Mr. Nguyen was Vice President and Chief Financial Officer at Metabasis Therapeutics, Inc., a biopharmaceutical company, where he was responsible for managing all finance and accounting activities, and played a significant role in strategic and operating decisions from March 2009 until the company was sold to Ligand Pharmaceuticals Incorporated in January 2010. Prior to joining Metabasis, Mr. Nguyen was a Vice President in the Healthcare Investment Banking group at Citi Global Markets, Inc. from May 2007 until January 2009, where he was responsible for senior and junior relationship management of small-to-large-cap biotechnology and specialty pharma companies on the West Coast. Mr. Nguyen served in the Healthcare Investment Banking group at Lehman Brothers, Inc. as a Vice President from January 2006 until April 2007, and as an associate from July 2004 until December 2005 where he was responsible for executing various transactions including equity, equity-linked, debt, and mergers and acquisitions for small-to-large-cap biotechnology and specialty pharma companies. Mr. Nguyen received a B.A. in Economics and Psychology from Claremont McKenna College, and an M.B.A. from the Anderson School of Management at U.C.L.A.

Brian T. Dorseyjoined us as Executive Director, Manufacturing and Program Management in March 2005. He was later promoted to Vice President, Manufacturing and Program Management in November 2006, named Vice President, Product Development in January 2007 and named Senior Vice President, Technical Operations in April 2010. From April 2002 to March 2005, Mr. Dorsey served as Head of Project Management, Medical Writing and Library Services at Maxim Pharmaceuticals Inc., a biopharmaceutical company. From May 2001 to April 2002, Mr. Dorsey served as Director, Head of Biopharmaceutical Project Management at Baxter Bioscience, a division of Baxter Healthcare Corporation. Previously, Mr. Dorsey served as a Global Project Leader / Project Director at Pfizer Global Research and Development (Agouron). Mr. Dorsey received his B.S. in chemistry and his Masters degree in executive leadership, both from the University of San Diego.

Matthew W. Onaitisjoined us as Vice President, Legal Affairs and Secretary in May 2006. He was later promoted to Vice President, General Counsel and Secretary in January 2007 and named Senior Vice President, General Counsel and Secretary in April 2010. From January 2006 to May 2006, Mr. Onaitis served as Associate General Counsel at Biogen Idec Inc., a biopharmaceutical company. From June 2004 to December 2005, Mr. Onaitis was Director, Legal Affairs at Elan Corporation plc, a biopharmaceutical company. Mr. Onaitis practiced corporate and commercial law in private practice from 1998 to June 2004, which included a secondment to Elan from October 2003 to June 2004. Mr. Onaitis holds a J.D. from Stanford Law School and a B.S. in mechanical engineering from Carnegie Mellon University.

Executive Compensation

Compensation Discussion and Analysis

Executive Summary

This Compensation Discussion and Analysis describes our overall compensation policies and practices and specifically analyzes the total compensation for the following executive officers, also referred to herein as our Named Executive Officers:

| | • | | Richard W. Pascoe, President, Chief Executive Officer and Director, |

13

| | • | | Tran B. Nguyen, Senior Vice President and Chief Financial Officer, |

| | • | | Brian T. Dorsey, Senior Vice President, Technical Operations, |

| | • | | Matthew W. Onaitis, Senior Vice President and General Counsel, and |

| | • | | Jeffrey W. Raser, our former Senior Vice President and Chief Commercial Officer. |

All of our compensation programs are designed to attract and retain key employees and to motivate them to achieve key strategic performance measures to create long-term shareholder value. With respect to the compensation of our Named Executive Officers, we believe that their compensation should largely reflect their success as a management team in meeting key corporate objectives, rather than as individual contributors. As a result, we believe that the performance of the executives in managing our company, considered in light of general economic and specific company, industry and competitive conditions, should be the main basis for determining their overall compensation.

Overview of Total Compensation and Process

Elements of total compensation for our Named Executive Officers include:

| | • | | base salary, which is initially negotiated with the executive when the executive is hired and is reviewed by the compensation committee annually, |

| | • | | annual cash bonus awards, which reward annual company performance based on pre-determined objectives, |

| | • | | performance-based equity awards, which reward company performance based on pre-determined criteria for key corporate objectives, |

| | • | | time based equity awards, which reward company performance as reflected in its stock price over time, and |

| | • | | other benefits, such as health insurance benefits. |

Each of these is described in more detail below.

The compensation committee has the primary authority to determine our company’s compensation philosophy and to establish compensation for our Named Executive Officers. Each year, generally in the first quarter, the compensation committee, which consists entirely of independent members of our board of directors, reviews the performance of each of our Named Executive Officers during the previous year. In connection with this review, the compensation committee typically reviews and resets base salaries for our Named Executive Officers, determines their annual cash bonuses relating to prior year performance, approves elements of the incentive bonus plan for the current year, including target bonuses and corporate objectives, and grants equity awards to our Named Executive Officers and certain other eligible employees. The compensation committee also has the discretion to make adjustments to executive compensation at other times during the year.

In making these compensation decisions, it has been the practice of our compensation committee to review the historical levels of each element of each Named Executive Officer’s total compensation (salary, bonus, equity awards and other benefits) and to compare each element with that of the executive officers in an appropriate group of comparable specialty pharmaceutical companies.

With respect to the compensation committee’s executive compensation review in early 2011, the committee authorized management to engage Barney & Barney Compensation Consulting, or Barney & Barney, to perform an assessment of our group of comparable specialty pharmaceutical companies. Our management reviewed with Barney & Barney the comparison group that we used in 2010, and this review resulted in a new comparison group for 2011 that possessed the following characteristics at the time of selection:

| | • | | market capitalizations between $100 and $500 million, |

| | • | | most advanced product in a pivotal clinical trial, NDA filed, FDA approved but awaiting launch, or marketed, |

| | • | | less than 250 employees, and |

| | • | | a reasonable expectation that we could compete with these companies to fill senior management positions. |

14

The compensation committee then approved the companies comprising the comparison group. The companies in the group were:

| | |

| |

• Affymax Inc. | | • Ligand Pharmaceuticals, Inc. |

| |

• Allos Therapeutics, Inc. | | • MAP Pharmaceuticas, Inc. |

| |

• Arena Pharmaceuticals, Inc. | | • Neurocrine Biosciences, Inc. |

| |

• Avanir Pharmaceuticals, Inc. | | • Neurogesx Inc. |

| |

• Biocryst Pharmaceuticals, Inc. | | • Optimer Pharmaceuticals, Inc. |

| |

• Cadence Pharmaceuticals Inc. | | • Orexigen Therapeutics, Inc. |

| |

• Columbia Laboratories Inc. | | • Pain Therapeutics, Inc. |

| |

• Cornerstone Therapeutics, Inc. | | • Santarus, Inc. |

| |

• Dyax Corp. | | • Spectrum Pharmaceuticals, Inc. |

| |

• Dynavax Technologies Corp. | | • Sunesis Pharmaceuticals, Inc. |

| |

• GTX Inc. | | • Transcept Pharmaceuticals, Inc. |

| |

• Idenix Pharmaceuticals, Inc. | | • Vanda Pharmaceuticals, Inc. |

The changes made to the selection criteria for the 2011 comparison group reflected a desire on the part of the compensation committee to include additional companies having commercial operations as a result of the launch of Silenor in September 2010. The compensation committee intends to review compensation information relating to this sub-group both separately and as part of the entire comparison group, in each case in light of the company’s status with respect to commercialization efforts, in considering future compensation determinations.

Barney & Barney compiled competitive executive compensation information from each of the companies in this comparison group for the compensation committee to review and analyze in making executive compensation decisions during 2011.

With respect to Named Executive Officers for which the publicly available competitive information from the comparison group was not sufficient to provide meaningful analysis in 2011, Barney & Barney provided the compensation committee with competitive information relating to such officers’ positions from one or more executive compensation surveys. The surveys were national surveys of executive compensation in the life sciences industries that were selected to provide the most comparable, comprehensive comparative compensation information for our executives.

With respect to survey data not relating to our comparison groups that was reviewed by the compensation committee in 2011, the identities of the individual companies included in the surveys were not provided to the compensation committee, and the compensation committee did not refer to individual compensation information for such companies. Instead, the compensation committee only referred to statistical summaries of such surveys.

While we believe that comparisons to market data are a useful tool, we do not believe that it is appropriate to establish executive compensation levels based solely on a comparison to competitive data. While compensation paid by other companies is a factor that the compensation committee considers in assessing the reasonableness of compensation, the compensation committee does not rely entirely on that data to determine executive officer compensation. Instead, the compensation committee incorporates flexibility into our compensation programs and in the assessment process to respond to and adjust for the evolving business environment and specific circumstances relating to our company. As a result of this approach, there are no comparative guidelines, such as percentiles, used by our compensation committee in making compensation determinations relative to the compensation data from our comparison group. In addition, the compensation committee has discretion to make stock awards to executive officers that are outside of the ranges in previously-approved stock option grant guidelines. Our compensation committee relies upon the judgment of its members in making executive compensation decisions, after reviewing the following factors:

| | • | | our performance against corporate objectives for the previous year, |

| | • | | difficulty in achieving desired results in the previous year and the current year, |

15

| | • | | the value of the executive’s unique leadership and other skills and capabilities to support our long-term performance, |

| | • | | historical compensation versus performance, |

| | • | | status relative to similarly-situated executives from our comparison group or from compensation surveys, |

| | • | | the executive’s performance generally, including against individual objectives, if any, for the previous year, and |

| | • | | the impact that any compensation awards that are payable in cash would have on our cash position. |

With respect to the compensation committee’s executive compensation review in early 2012, because the committee did not intend to increase the base salaries of our executive officers, pay cash bonuses to our executive officers or make equity awards to our executive officers, in each case due to the company’s 2011 performance and/or our cash position, the committee instructed management not to update our comparison group at that time.

Historically, the data regarding the compensation history and the relevant comparison group for each Named Executive Officer are provided to our Chief Executive Officer, the Chairman of the Board and the compensation committee. Our Chief Executive Officer then makes compensation recommendations to the compensation committee with respect to the executive officers who report to him. Our Chairman of the Board makes compensation recommendations to the compensation committee with respect to the Chief Executive Officer. The compensation committee considers, but is not bound to accept, these recommendations with respect to executive officer compensation. No executive officer is present at the time that his or her compensation is being discussed or determined.

Our policy for allocating between long-term and currently paid compensation is to ensure adequate base compensation to attract and retain personnel, while providing incentives to maximize long-term value for our company and our stockholders. A significant percentage of total compensation is allocated to incentive compensation as a result of this philosophy. We have no pre-established policy or target for the allocation between either cash and non-cash or short-term and long-term incentive compensation. Rather, the compensation committee reviews historical and competitive information and applies its judgment in light of the company’s then-current circumstances regarding current and long-term goals to determine the appropriate level and mix of incentive compensation.

Elements of Executive Compensation

Summary Compensation Table

The following “Summary Compensation Table” summarizes the compensation received by the Named Executive Officers in the fiscal years ended December 31, 2011, 2010 and 2009. This table provides an all-inclusive presentation of the various cash and non-cash elements that comprise total compensation for each of the Named Executive Officers. Except as set forth below, no Named Executive Officer earned any pension or other nonqualified deferred compensation, or perquisites exceeding $10,000 during 2011, 2010 or 2009.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | | Salary

($) | | | Bonus

($) (1) | | | Stock

Awards ($) (2) | | | Option

Awards($) (3) | | | Non-Equity

Incentive Plan

Compensation ($) (4) | | | All Other

Compensation ($) | | | Total ($) | |

Richard W. Pascoe, | | | 2011 | | | $ | 482,551 | | | $ | — | | | $ | 219,750 | | | $ | 508,276 | | | $ | — | | | $ | — | | | $ | 1,210,577 | |

President, Chief Executive Officer and | | | 2010 | | | $ | 456,250 | | | $ | 112,050 | | | $ | 429,500 | | | $ | 1,283,536 | | | $ | 209,875 | | | $ | — | | | $ | 2,491,211 | |

Director (5) | | | 2009 | | | $ | 415,000 | | | $ | — | | | $ | — | | | $ | 1,461,045 | | | $ | — | | | $ | — | | | $ | 1,876,045 | |

| | | | | | | | |

Tran B. Nguyen, | | | 2011 | | | $ | 301,779 | | | $ | — | | | $ | 87,900 | | | $ | 203,310 | | | $ | — | | | $ | 22,998 | | | $ | 615,987 | |

Senior Vice President and Chief Financial Officer (6) | | | 2010 | | | $ | 206,193 | | | $ | — | | | $ | 206,500 | | | $ | 1,234,226 | | | $ | 66,394 | | | $ | 42,163 | | | $ | 1,755,476 | |

| | | | | | | | |

Brian T. Dorsey, | | | 2011 | | | $ | 302,878 | | | $ | — | | | $ | 87,900 | | | $ | 203,310 | | | $ | — | | | $ | — | | | $ | 594,088 | |

Senior Vice President, | | | 2010 | | | $ | 284,500 | | | $ | 53,130 | | | $ | 257,700 | | | $ | 641,768 | | | $ | 91,609 | | | $ | — | | | $ | 1,328,707 | |