Chiasma Overview January 2021 | NASDAQ: CHMA Exhibit 99.2

These slides and the accompanying presentation contain forward-looking statements and information. The use of words such as “may,” “might,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “intend,” “future,” “potential,” or “continue,” and other similar expressions are intended to identify forward-looking statements. These statements include, without limitation, those statements regarding the company’s expectations relating to MYCAPSSA for the long-term maintenance treatment in patients with acromegaly who have responded to and tolerated treatment with octreotide or lanreotide, statements regarding the commercialization of MYCAPSSA, including its pricing, reimbursement, payer mix and market adoption, statements regarding the data from the open label extension of the CHIASMA OPTIMAL trial, statements regarding the size and composition of the U.S. market for MYCAPSSA, the commercial or therapeutic potential of MYCAPSSA, including its ability to become a standard of care, and anticipated market acceptance of and access to MYCAPSSA, statements regarding the expansion of its customer-facing team, statements regarding the success of commercial launch of MYCAPSSA in the United States, statements regarding the company’s expectations regarding formulary coverage for MYCAPSSA, statements regarding the data from the MPOWERED trial and whether the data will support the submission of a marketing authorization application (MAA) to the European Medicines Agency (EMA) for MYCAPSSA in the European Union and ultimately regulatory approval, statements regarding the timing of an MAA submission and regulatory review, statements regarding the company’s plans for the presentation of the full trial results, statements regarding the potential commercialization of MYCAPSSA in the European Union and in other jurisdictions, statements concerning the utilization of TPE platform to develop new therapeutic agents, and statements regarding Chiasma’s commercial organization and efforts and potential sales and revenue growth. All forward-looking statements are based on estimates and assumptions by Chiasma’s management that, although Chiasma believes them to be reasonable, are inherently uncertain. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that Chiasma expects. Management’s expectations and, therefore, any forward-looking statements in these slides and the accompanying presentation could be affected by risks and uncertainties relating to a number of factors, including the following: the content and timing of decisions made by the FDA, including with respect to the manufacturing supplements to the company’s approved new drug application, the results of any inspections of the company’s third-party manufacturers, the company’s reliance on third parties to manufacture active pharmaceutical ingredient and commercial octreotide capsules, the company’s ability to retain requisite regulatory approvals for the commercial sale of octreotide capsules in the United States, the content and timing of decisions made by the EMA, the sufficiency of the data collected from the company’s clinical trials to obtain regulatory approval in the European Union or elsewhere, and the timing and costs involved in commercializing MYCAPSSA, and the impact the ongoing COVID-19 pandemic may have on the company’s business, including its expected development, manufacturing, regulatory and commercialization timelines for MYCAPSSA. These and other potential risks, uncertainties and other important factors are described under the heading “Risk Factors” in our Form 10-Q for the quarter ended September 30, 2020 filed with the Securities and Exchange Commission, or SEC, as well as in Chiasma’s subsequent filings with the SEC. Undue reliance should not be placed on any forward-looking statement, which speak only as of the date on which it was made. Chiasma undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Unless otherwise noted, all references to acromegaly market sizes are Chiasma internal estimates. This presentation is intended only for communications with investors. MYCAPSSA has been approved by the FDA for the long-term maintenance treatment in patients with acromegaly who have responded to and tolerated treatment with octreotide or lanreotide, but remains an investigational drug outside the U.S. Forward-Looking Statements

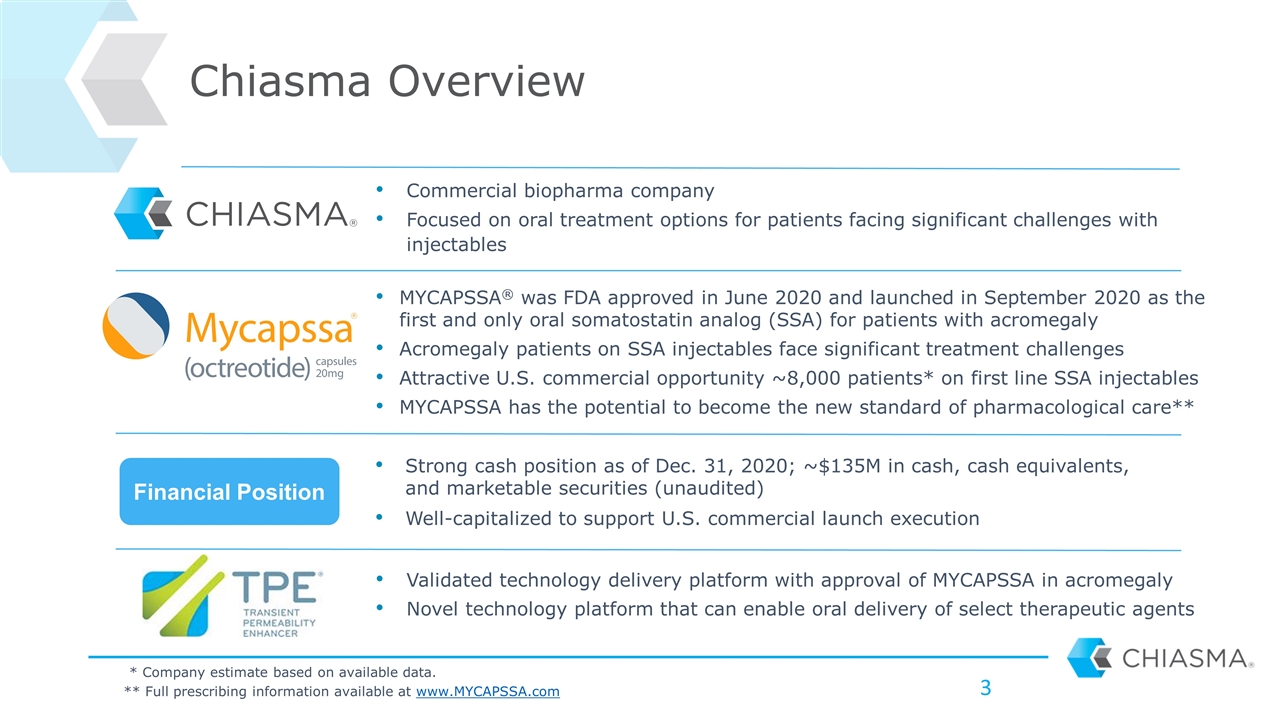

Chiasma Overview MYCAPSSA® was FDA approved in June 2020 and launched in September 2020 as the first and only oral somatostatin analog (SSA) for patients with acromegaly Acromegaly patients on SSA injectables face significant treatment challenges Attractive U.S. commercial opportunity ~8,000 patients* on first line SSA injectables MYCAPSSA has the potential to become the new standard of pharmacological care** Validated technology delivery platform with approval of MYCAPSSA in acromegaly Novel technology platform that can enable oral delivery of select therapeutic agents Commercial biopharma company Focused on oral treatment options for patients facing significant challenges with injectables Strong cash position as of Dec. 31, 2020; ~$135M in cash, cash equivalents, and marketable securities (unaudited) Well-capitalized to support U.S. commercial launch execution Financial Position * Company estimate based on available data. ** Full prescribing information available at www.MYCAPSSA.com

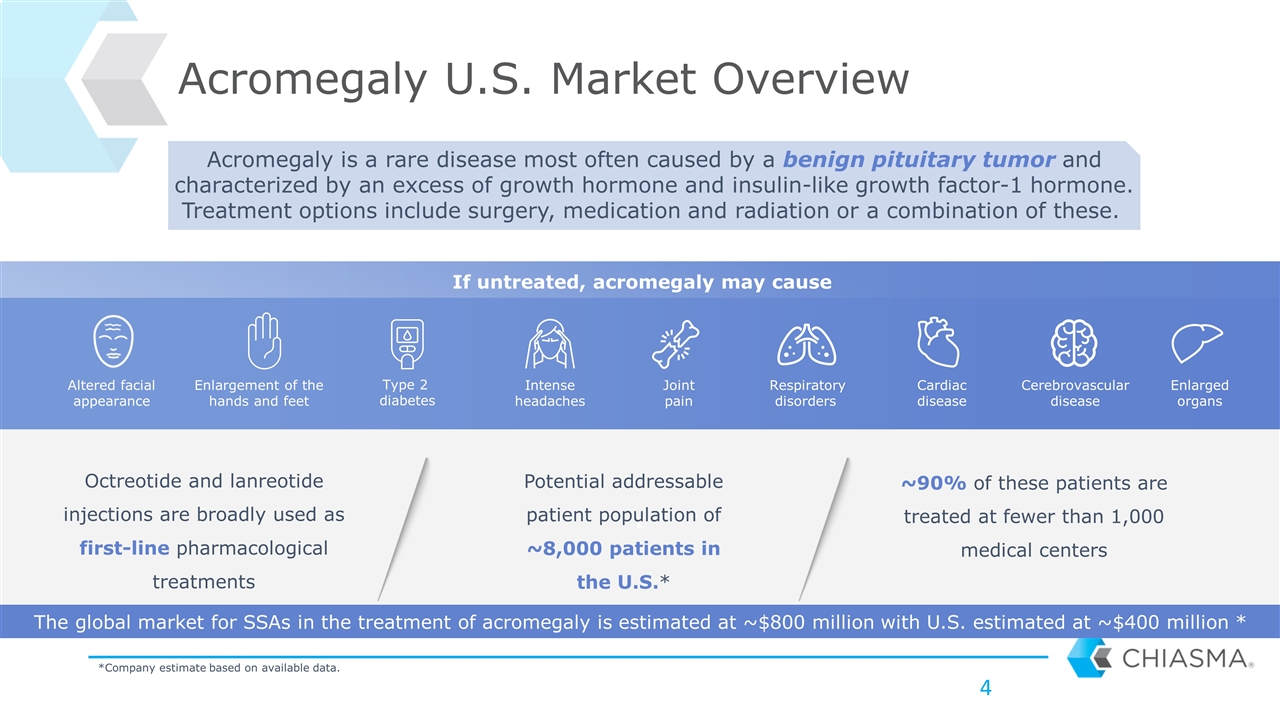

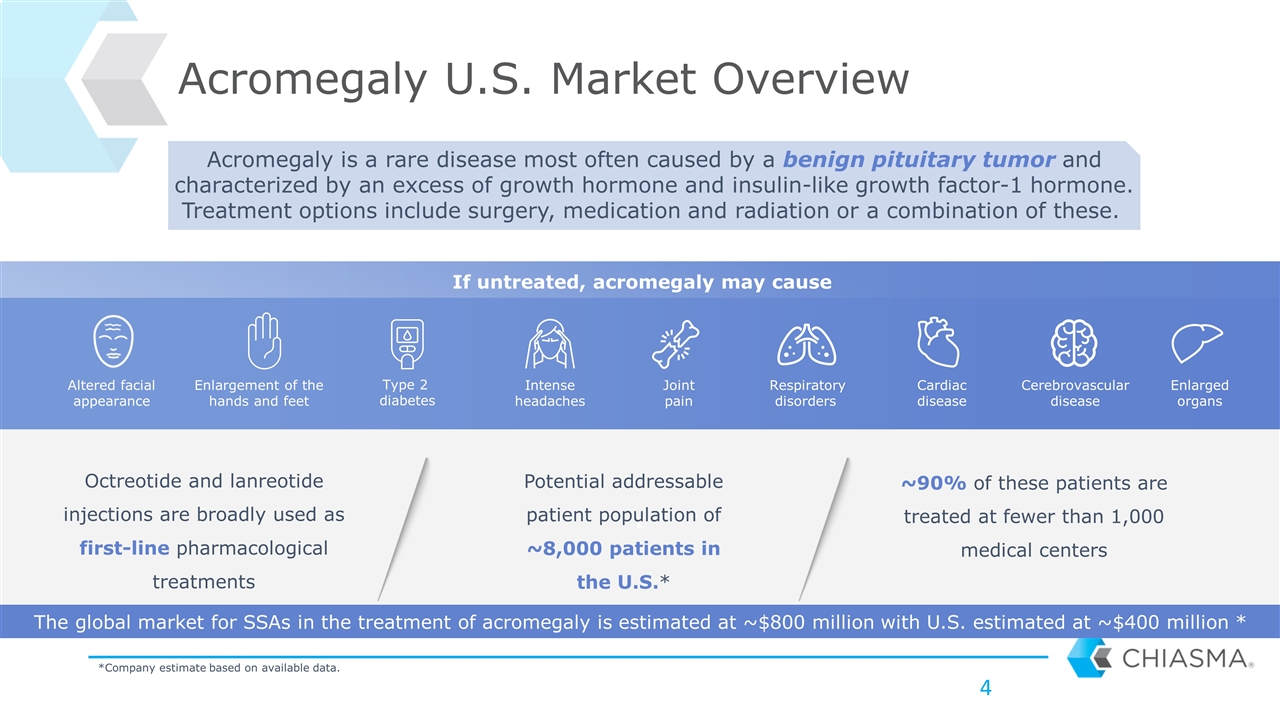

z Acromegaly U.S. Market Overview Octreotide and lanreotide injections are broadly used as first-line pharmacological treatments ~90% of these patients are treated at fewer than 1,000 medical centers Potential addressable patient population of ~8,000 patients in the U.S.* Acromegaly is a rare disease most often caused by a benign pituitary tumor and characterized by an excess of growth hormone and insulin-like growth factor-1 hormone. Treatment options include surgery, medication and radiation or a combination of these. If untreated, acromegaly may cause *Company estimate based on available data. Enlarged organs Intense headaches Altered facial appearance Enlargement of the hands and feet Type 2 diabetes Respiratory disorders Cardiac disease Joint pain Cerebrovascular disease The global market for SSAs in the treatment of acromegaly is estimated at ~$800 million with U.S. estimated at ~$400 million *

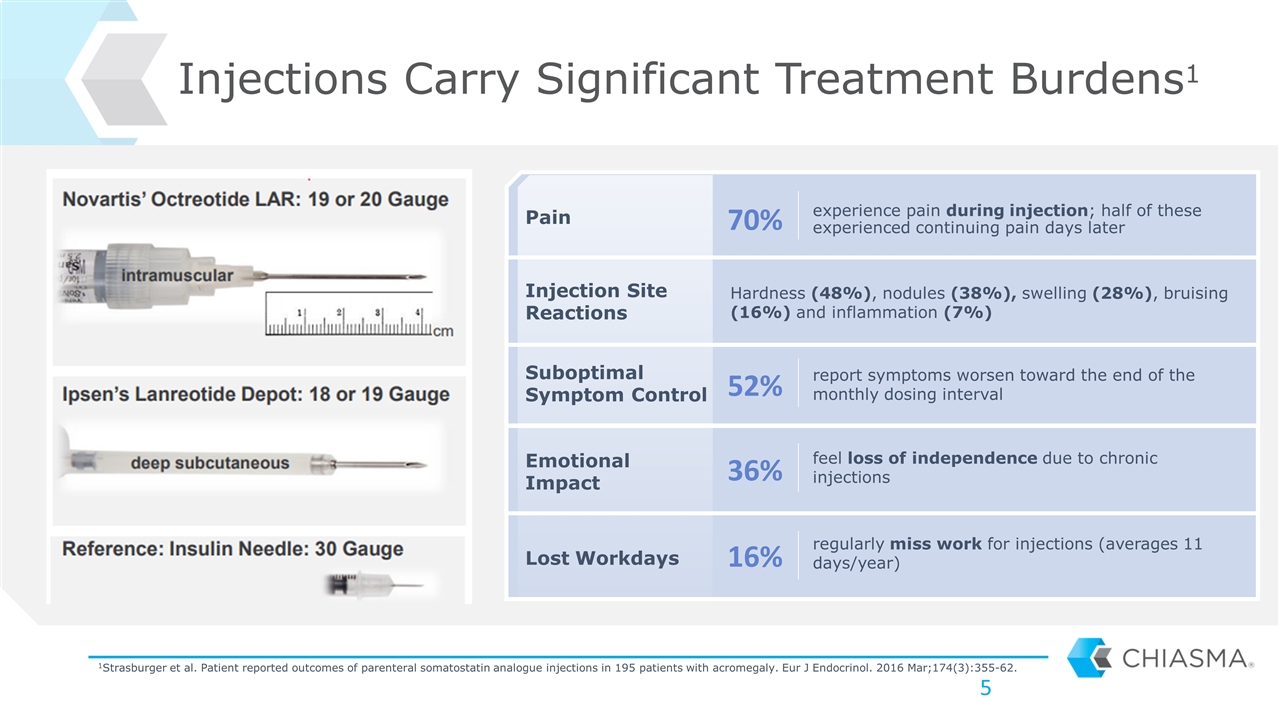

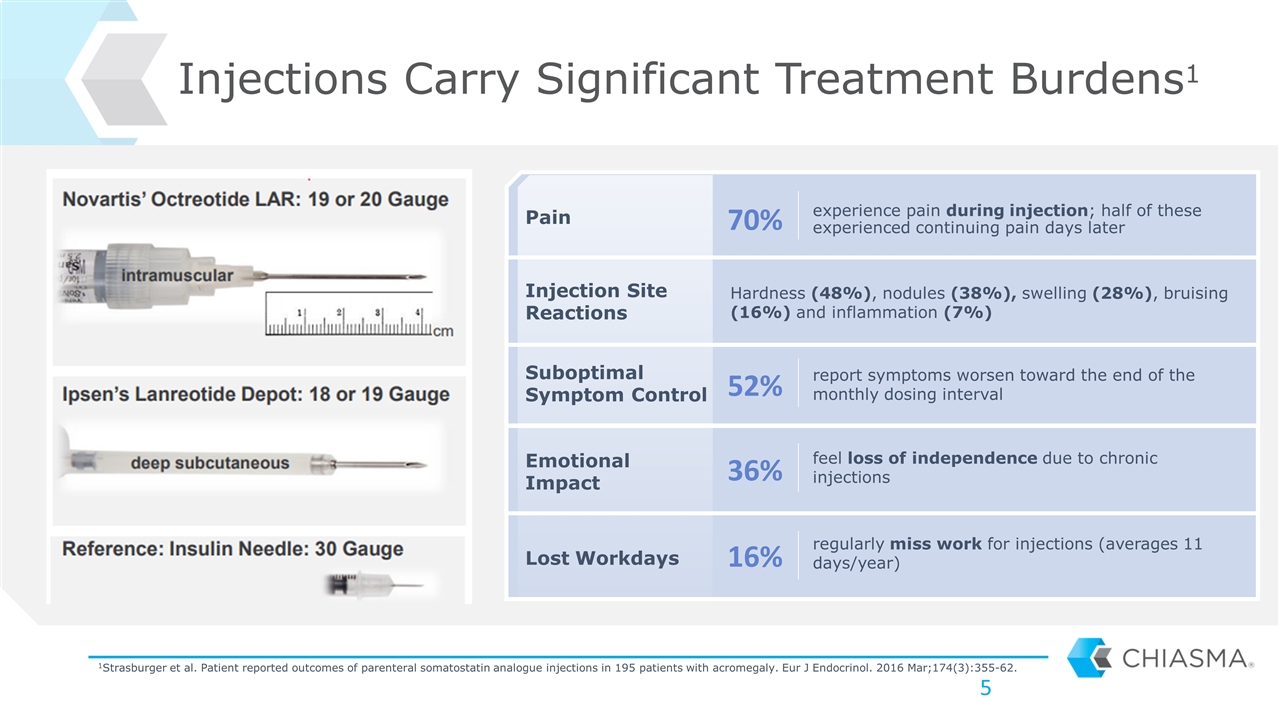

experience pain during injection; half of these experienced continuing pain days later Injections Carry Significant Treatment Burdens1 Pain Suboptimal Symptom Control Lost Workdays Emotional Impact Injection Site Reactions Hardness (48%), nodules (38%), swelling (28%), bruising (16%) and inflammation (7%) report symptoms worsen toward the end of the monthly dosing interval feel loss of independence due to chronic injections regularly miss work for injections (averages 11 days/year) 70% 52% 36% 16% 1Strasburger et al. Patient reported outcomes of parenteral somatostatin analogue injections in 195 patients with acromegaly. Eur J Endocrinol. 2016 Mar;174(3):355-62.

MYCAPSSA® First and only FDA-approved oral SSA for acromegaly; developed using TPE

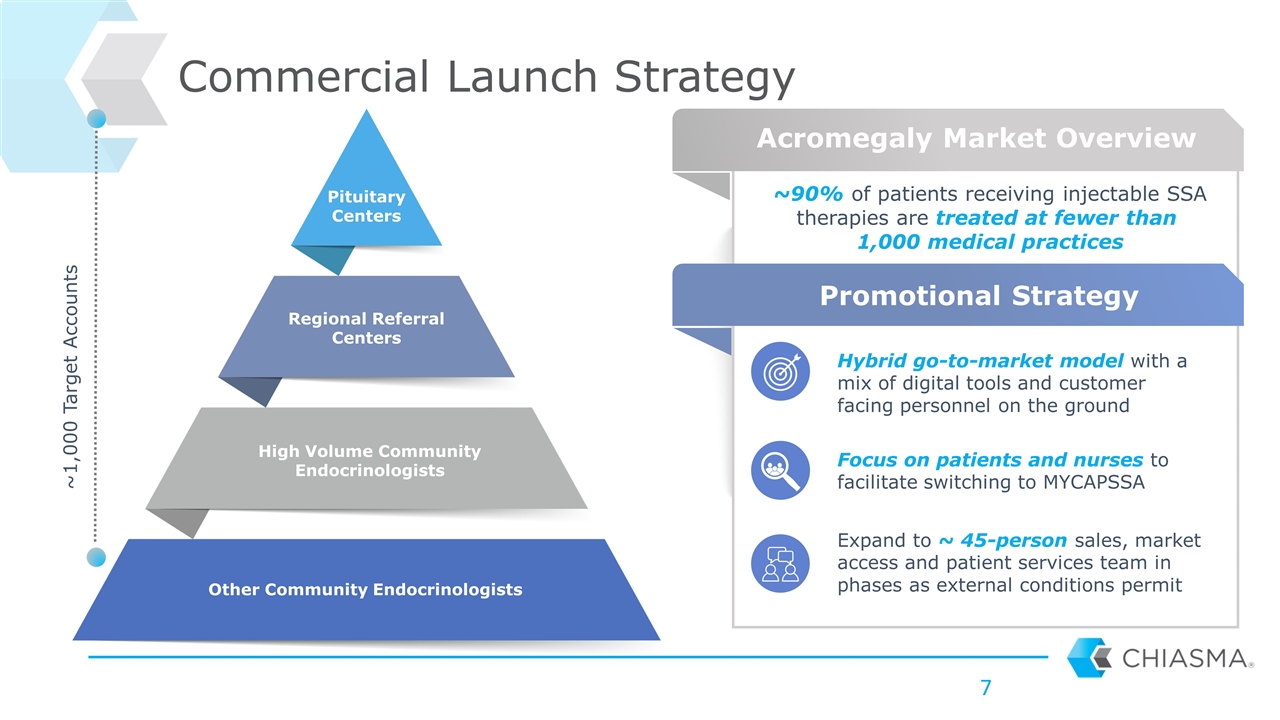

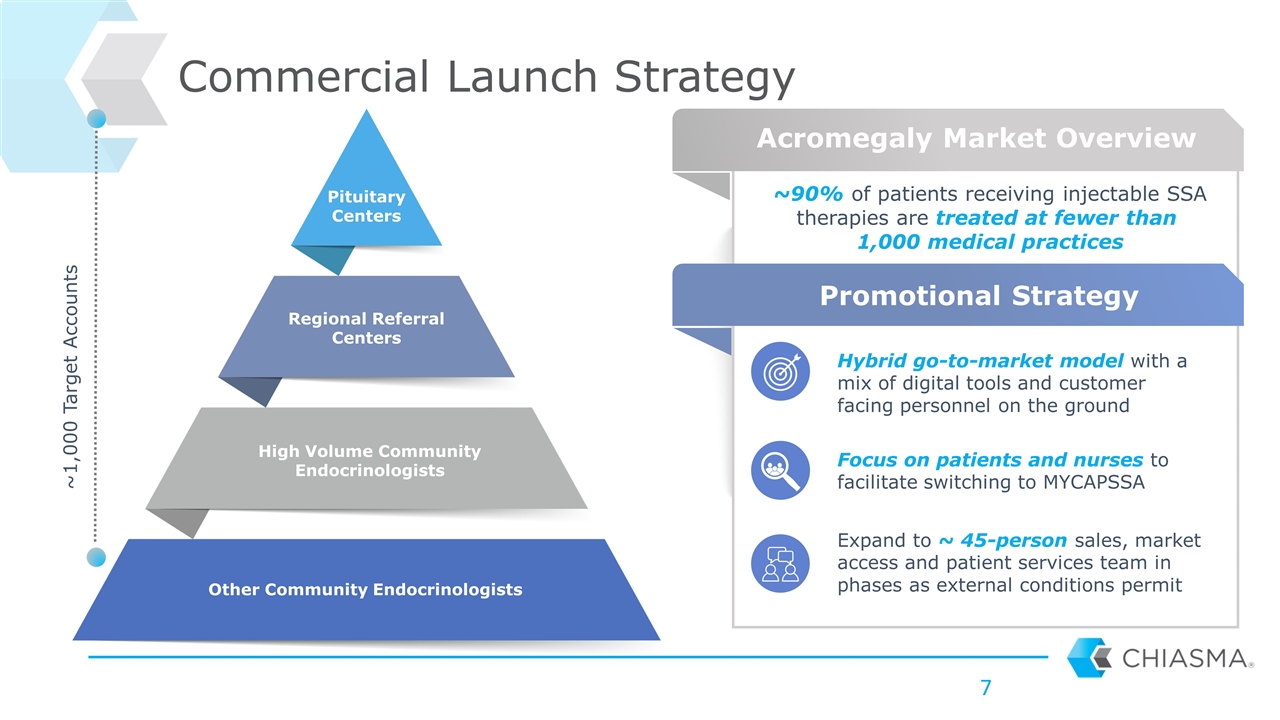

Commercial Launch Strategy Pituitary Centers Regional Referral Centers High Volume Community Endocrinologists Other Community Endocrinologists ~90% of patients receiving injectable SSA therapies are treated at fewer than 1,000 medical practices ~1,000 Target Accounts Acromegaly Market Overview Promotional Strategy Expand to ~ 45-person sales, market access and patient services team in phases as external conditions permit Focus on patients and nurses to facilitate switching to MYCAPSSA Hybrid go-to-market model with a mix of digital tools and customer facing personnel on the ground

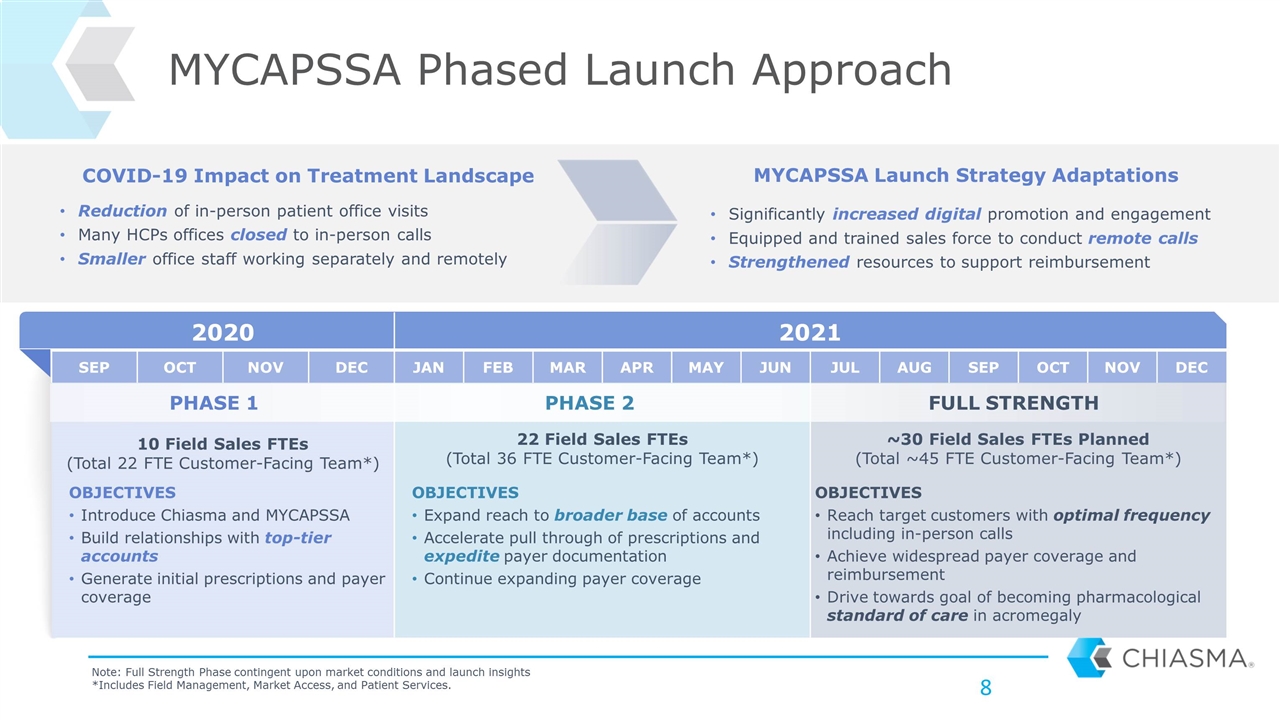

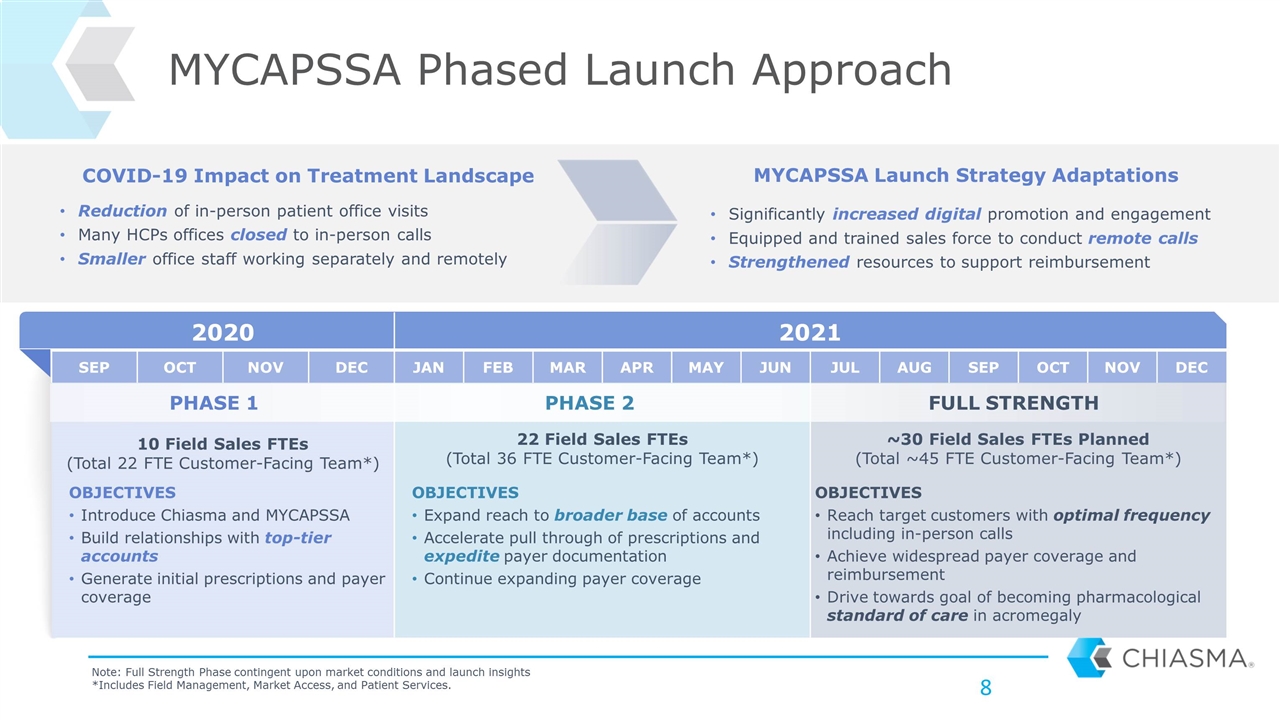

MYCAPSSA Phased Launch Approach 2020 2021 SEP OCT NOV DEC JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC 10 Field Sales FTEs (Total 22 FTE Customer-Facing Team*) 22 Field Sales FTEs (Total 36 FTE Customer-Facing Team*) ~30 Field Sales FTEs Planned (Total ~45 FTE Customer-Facing Team*) Reduction of in-person patient office visits Many HCPs offices closed to in-person calls Smaller office staff working separately and remotely Note: Full Strength Phase contingent upon market conditions and launch insights *Includes Field Management, Market Access, and Patient Services. Significantly increased digital promotion and engagement Equipped and trained sales force to conduct remote calls Strengthened resources to support reimbursement COVID-19 Impact on Treatment Landscape MYCAPSSA Launch Strategy Adaptations OBJECTIVES Introduce Chiasma and MYCAPSSA Build relationships with top-tier accounts Generate initial prescriptions and payer coverage OBJECTIVES Expand reach to broader base of accounts Accelerate pull through of prescriptions and expedite payer documentation Continue expanding payer coverage OBJECTIVES Reach target customers with optimal frequency including in-person calls Achieve widespread payer coverage and reimbursement Drive towards goal of becoming pharmacological standard of care in acromegaly FULL STRENGTH PHASE 1 PHASE 2

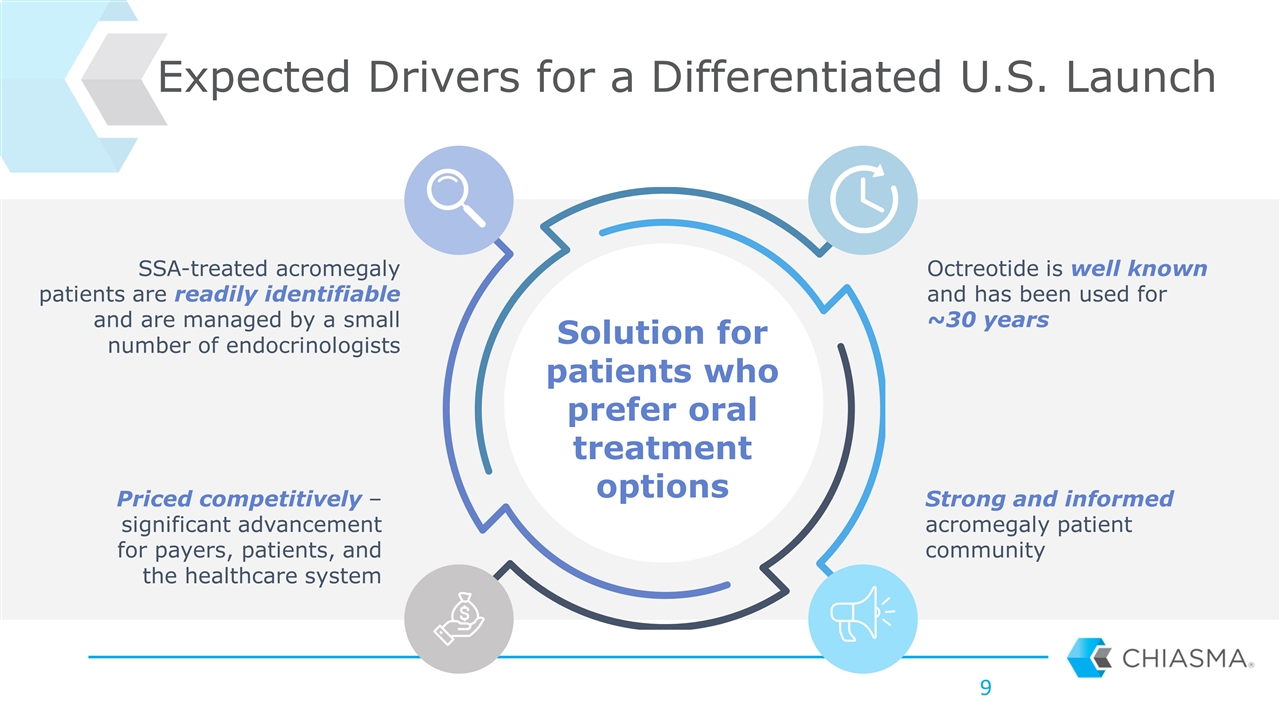

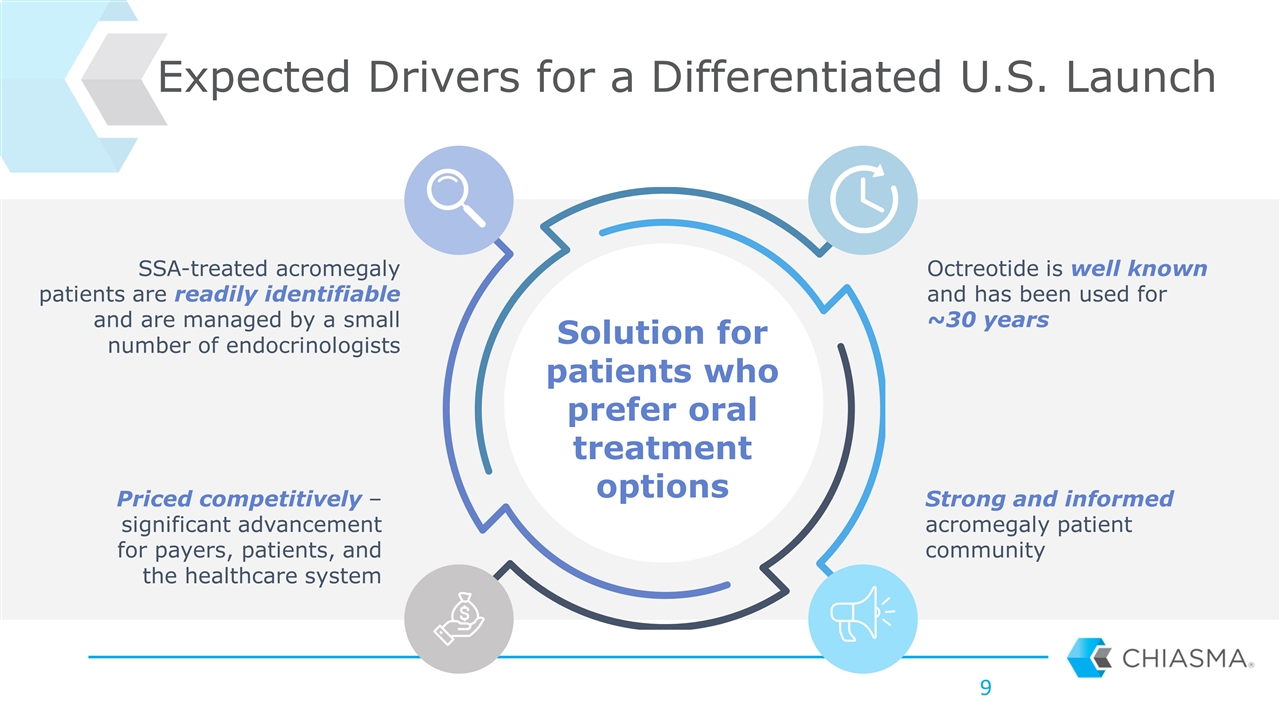

SSA-treated acromegaly patients are readily identifiable and are managed by a small number of endocrinologists Priced competitively – significant advancement for payers, patients, and the healthcare system Octreotide is well known and has been used for ~30 years Strong and informed acromegaly patient community Expected Drivers for a Differentiated U.S. Launch Solution for patients who prefer oral treatment options

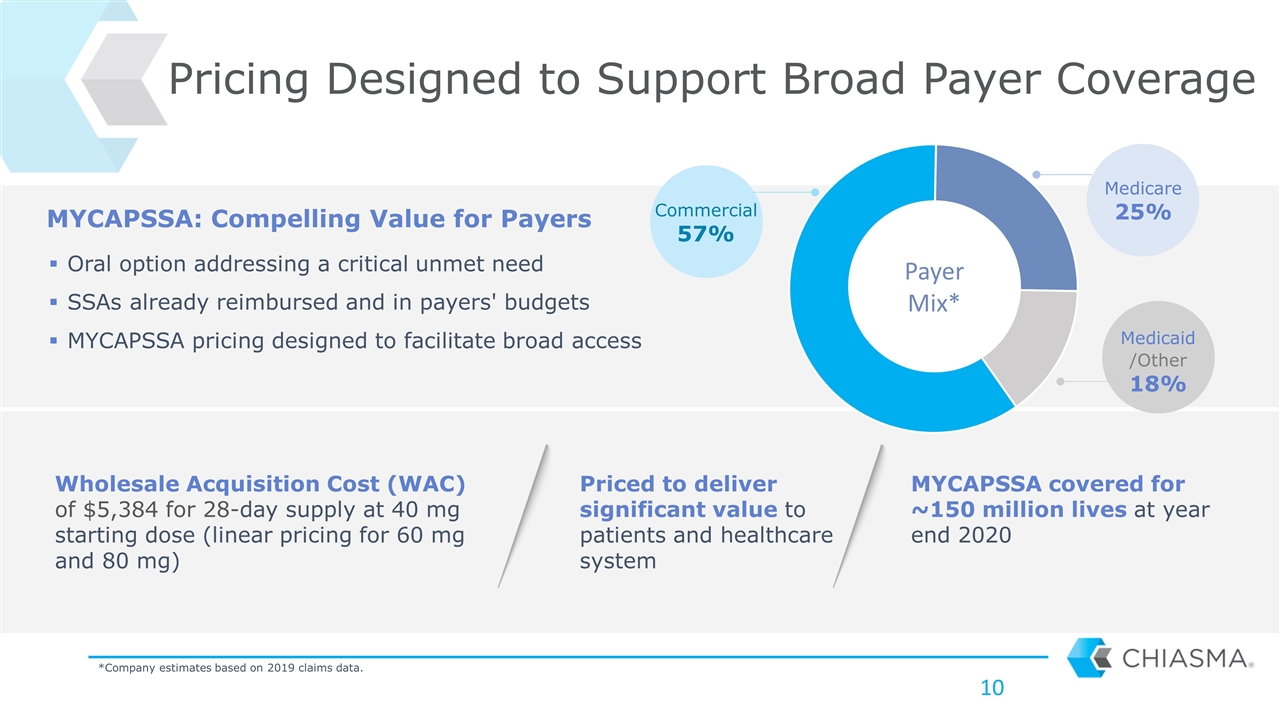

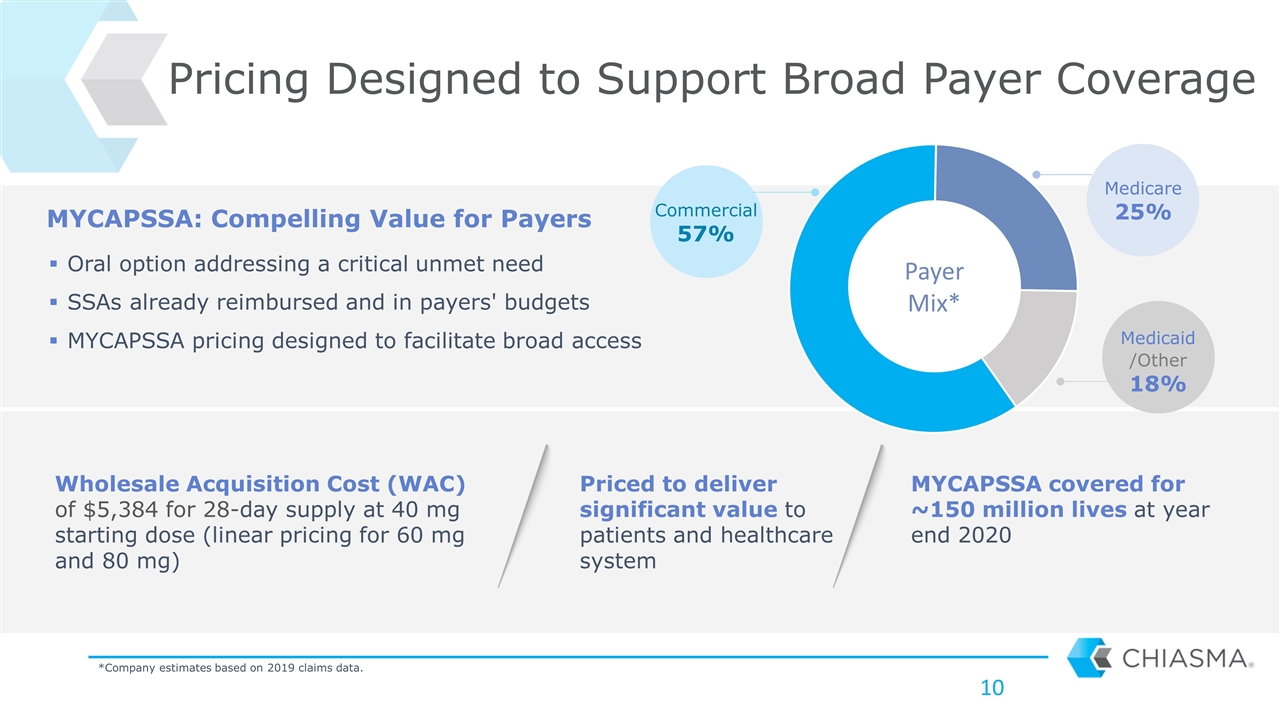

Pricing Designed to Support Broad Payer Coverage MYCAPSSA: Compelling Value for Payers Wholesale Acquisition Cost (WAC) of $5,384 for 28-day supply at 40 mg starting dose (linear pricing for 60 mg and 80 mg) Oral option addressing a critical unmet need SSAs already reimbursed and in payers' budgets MYCAPSSA pricing designed to facilitate broad access Payer Mix* Commercial 57% Medicaid / 18% *Company estimates based on 2019 claims data. Priced to deliver significant value to patients and healthcare system MYCAPSSA covered for ~150 million lives at year end 2020

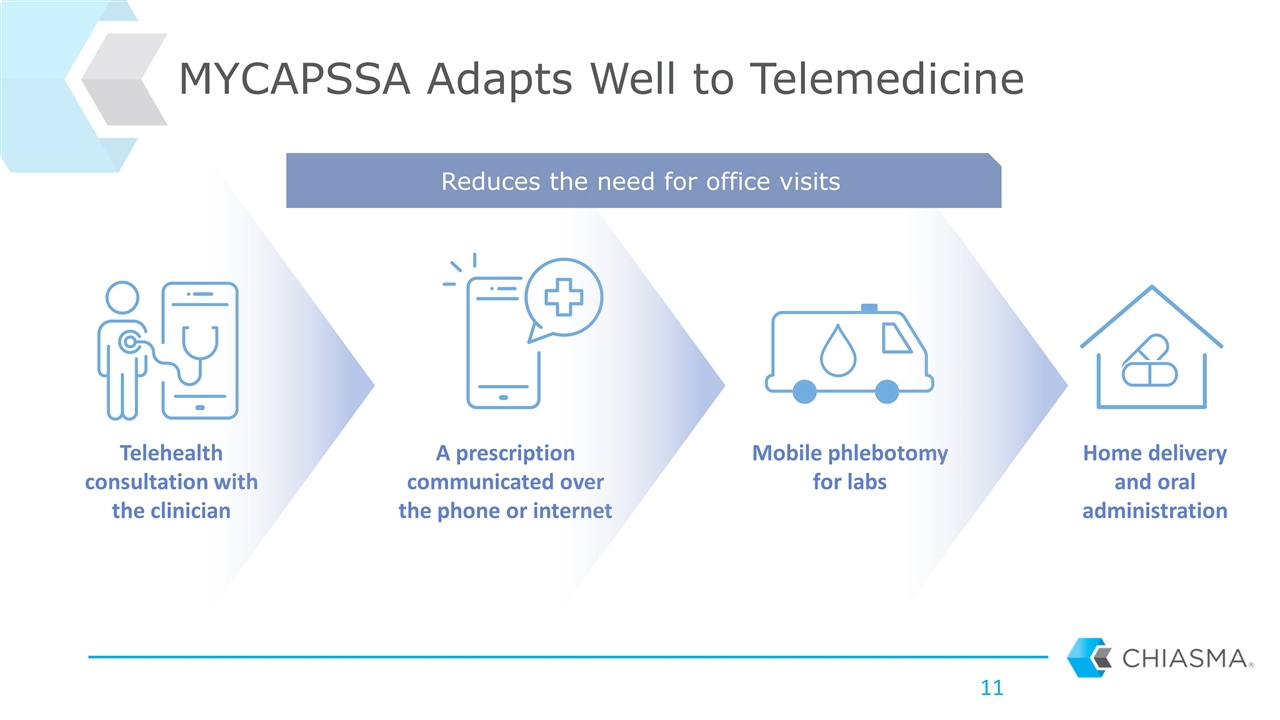

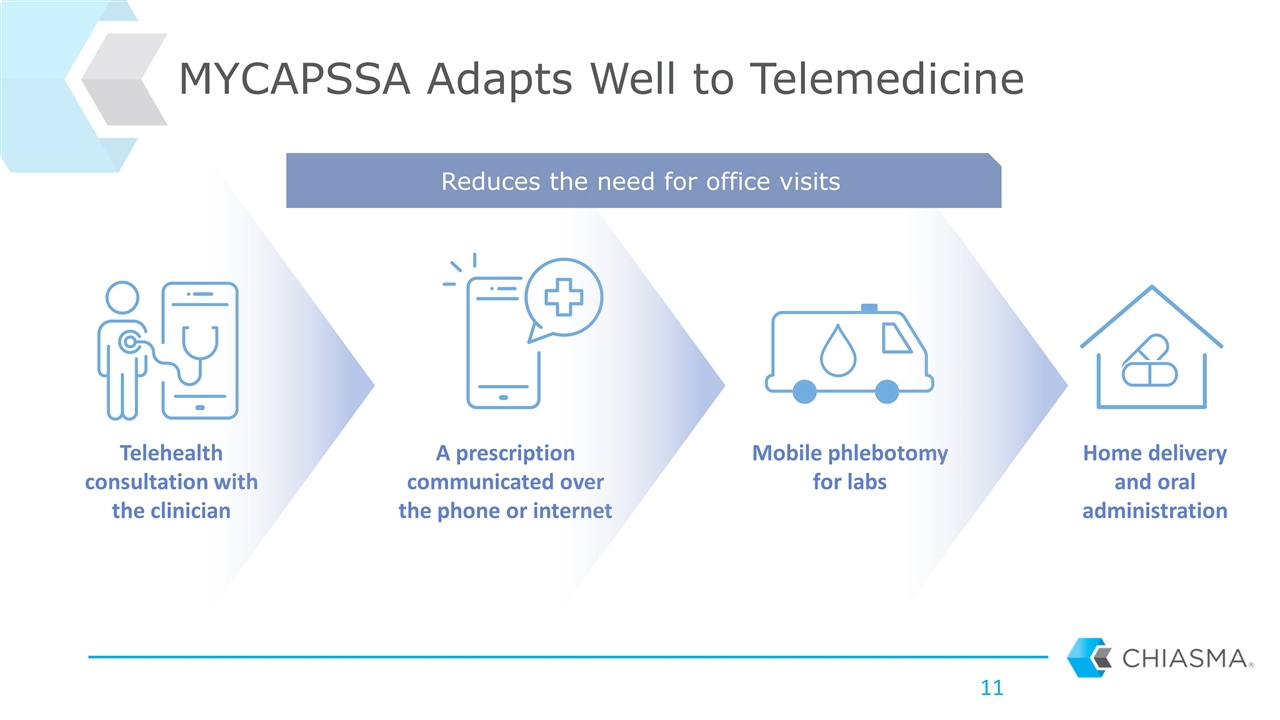

Telehealth consultation with the clinician A prescription communicated over the phone or internet Mobile phlebotomy for labs Home delivery and oral administration MYCAPSSA Adapts Well to Telemedicine Reduces the need for office visits

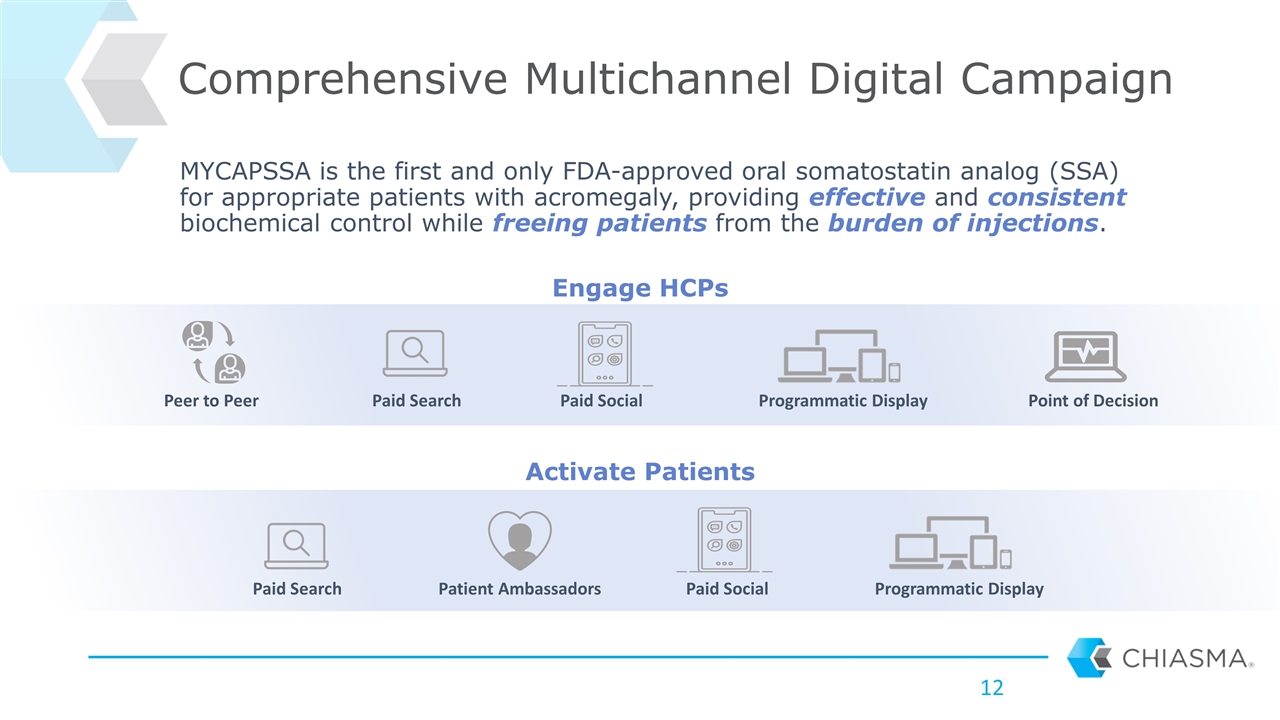

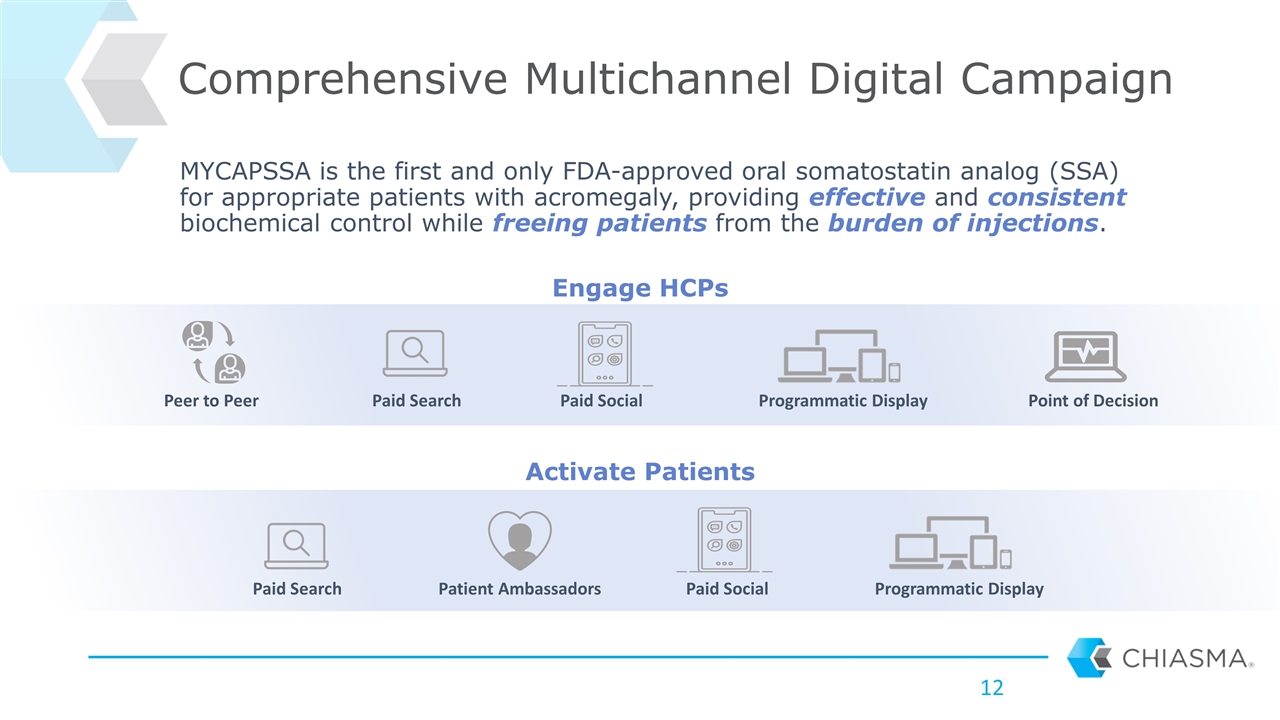

Comprehensive Multichannel Digital Campaign MYCAPSSA is the first and only FDA-approved oral somatostatin analog (SSA) for appropriate patients with acromegaly, providing effective and consistent biochemical control while freeing patients from the burden of injections. Activate Patients Paid Search Patient Ambassadors Paid Social Programmatic Display Peer to Peer Paid Search Paid Social Programmatic Display Point of Decision Engage HCPs

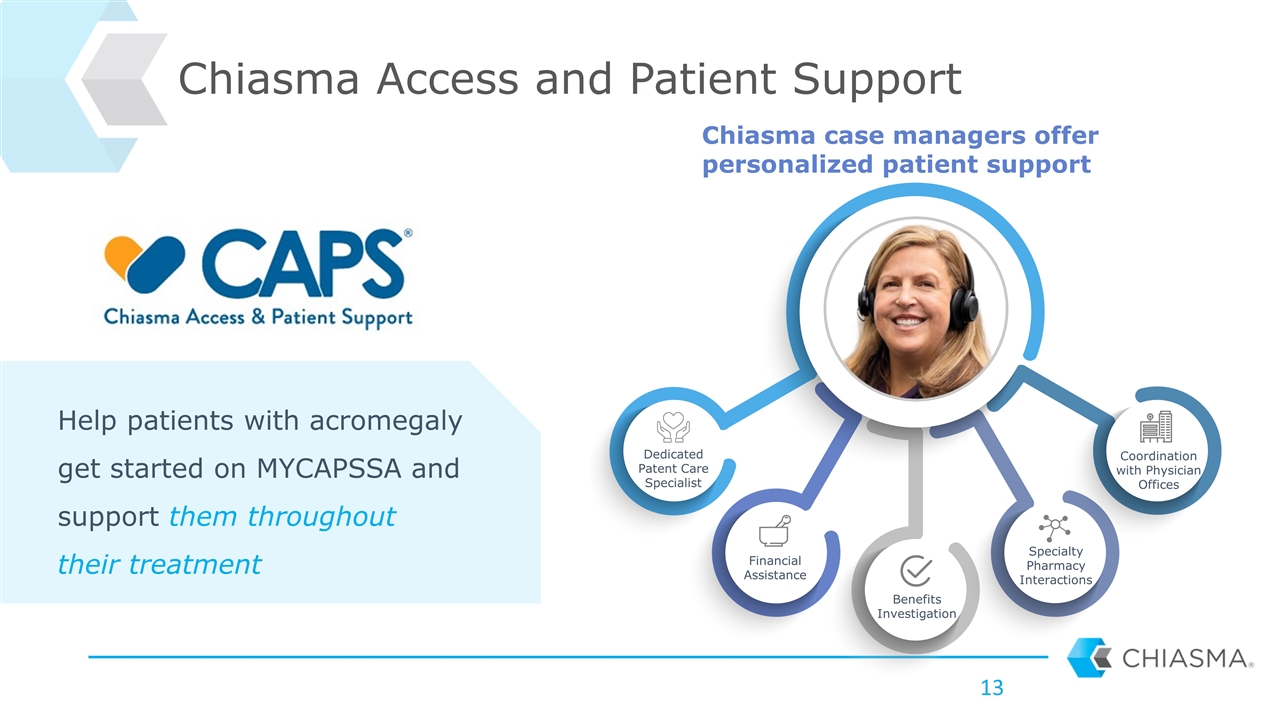

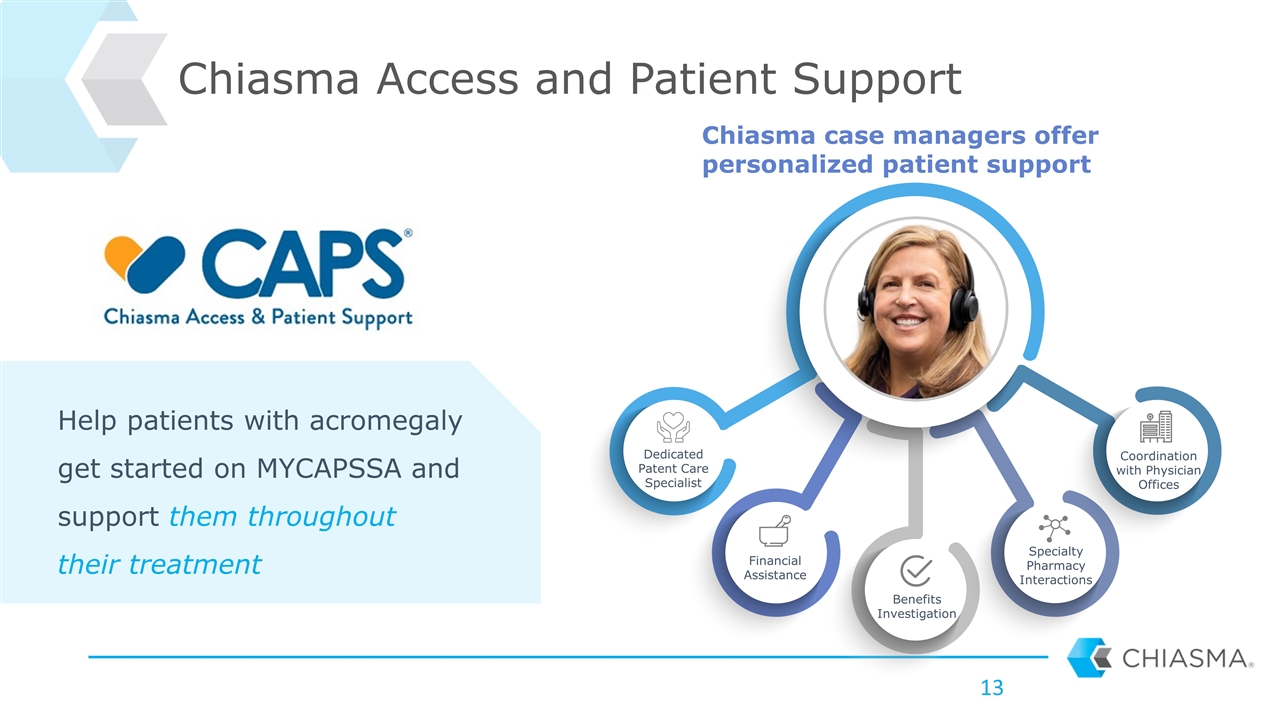

Chiasma Access and Patient Support Dedicated Patent Care Specialist Financial Assistance Benefits Investigation Specialty Pharmacy Interactions Coordination with Physician Offices Help patients with acromegaly get started on MYCAPSSA and support them throughout their treatment Chiasma case managers offer personalized patient support

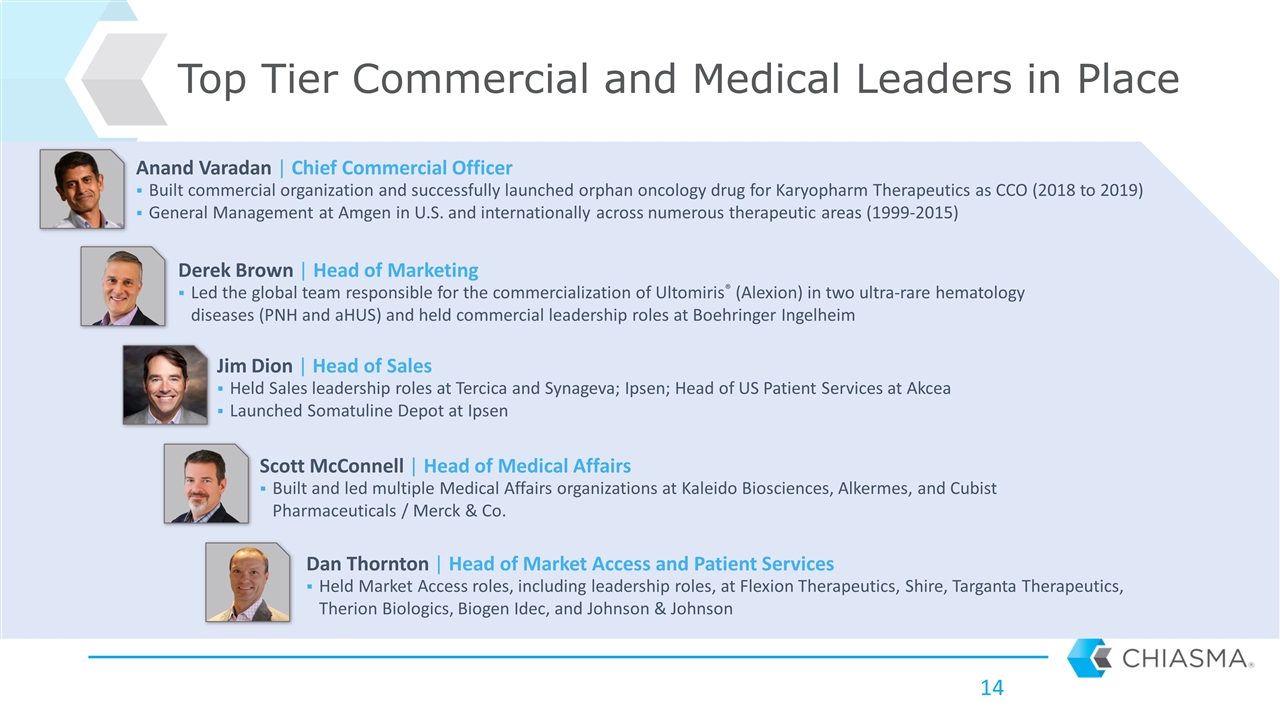

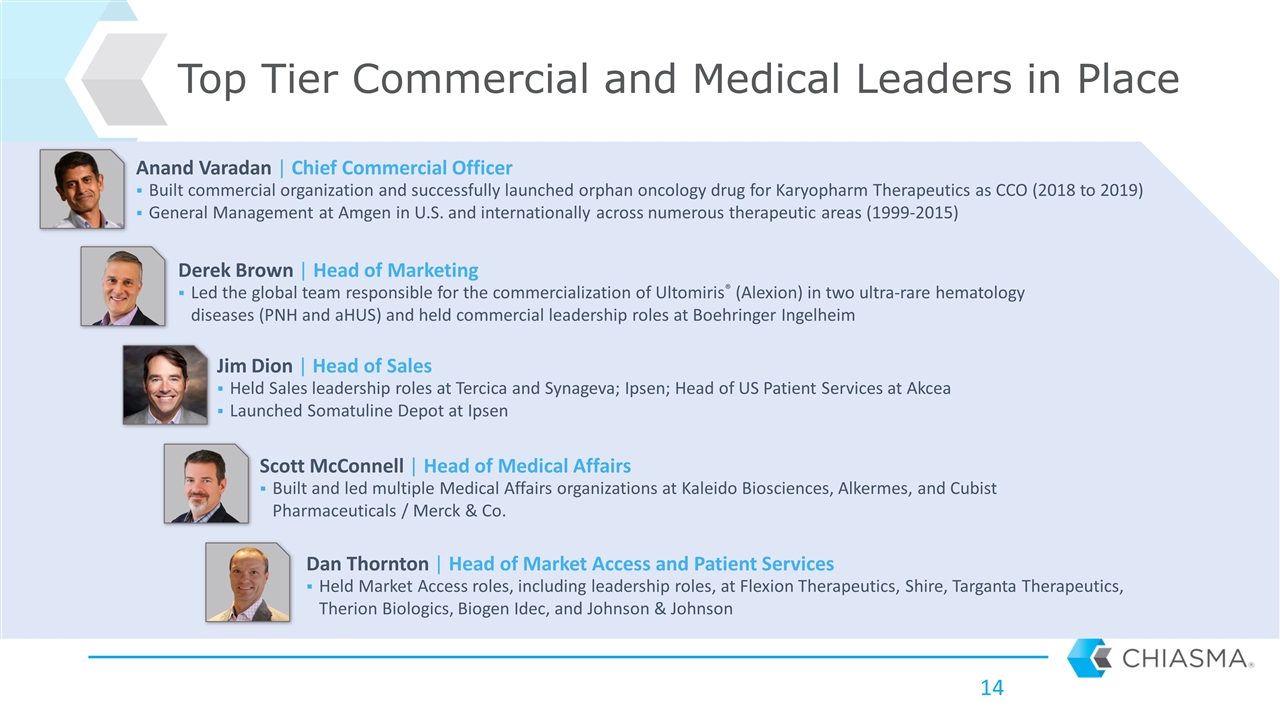

Top Tier Commercial and Medical Leaders in Place Scott McConnell | Head of Medical Affairs Built and led multiple Medical Affairs organizations at Kaleido Biosciences, Alkermes, and Cubist Pharmaceuticals / Merck & Co. Derek Brown | Head of Marketing Led the global team responsible for the commercialization of Ultomiris® (Alexion) in two ultra-rare hematology diseases (PNH and aHUS) and held commercial leadership roles at Boehringer Ingelheim Anand Varadan | Chief Commercial Officer Built commercial organization and successfully launched orphan oncology drug for Karyopharm Therapeutics as CCO (2018 to 2019) General Management at Amgen in U.S. and internationally across numerous therapeutic areas (1999-2015) Jim Dion | Head of Sales Held Sales leadership roles at Tercica and Synageva; Ipsen; Head of US Patient Services at Akcea Launched Somatuline Depot at Ipsen Dan Thornton | Head of Market Access and Patient Services Held Market Access roles, including leadership roles, at Flexion Therapeutics, Shire, Targanta Therapeutics, Therion Biologics, Biogen Idec, and Johnson & Johnson

OUR SCIENCE TPE technology and MYCAPSSA clinical trials

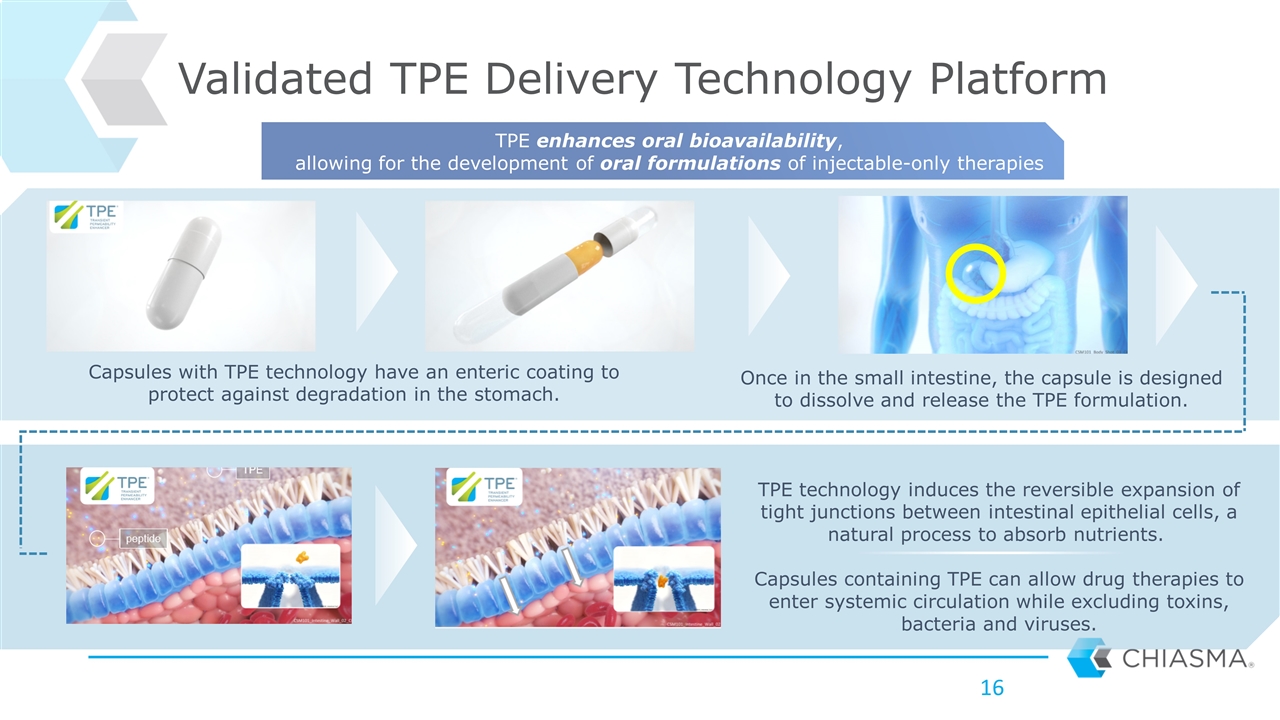

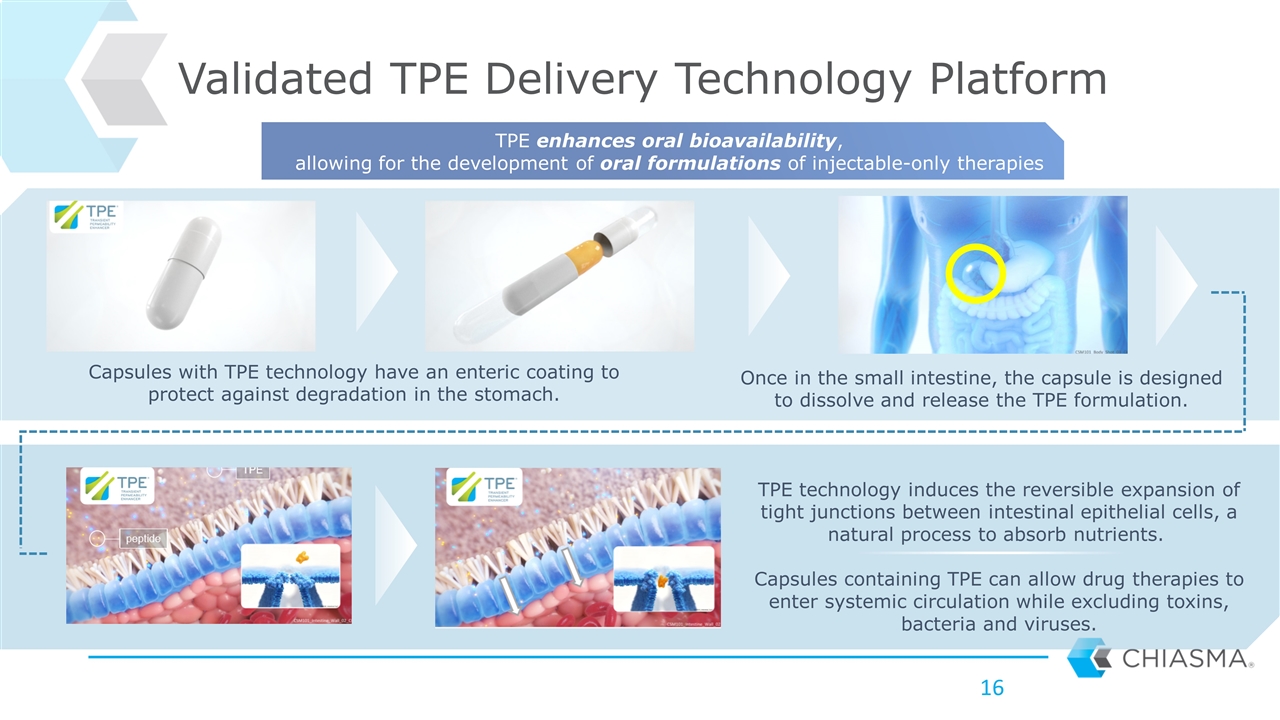

Capsules with TPE technology have an enteric coating to protect against degradation in the stomach. Once in the small intestine, the capsule is designed to dissolve and release the TPE formulation. TPE technology induces the reversible expansion of tight junctions between intestinal epithelial cells, a natural process to absorb nutrients. Capsules containing TPE can allow drug therapies to enter systemic circulation while excluding toxins, bacteria and viruses. Validated TPE Delivery Technology Platform TPE enhances oral bioavailability, allowing for the development of oral formulations of injectable-only therapies

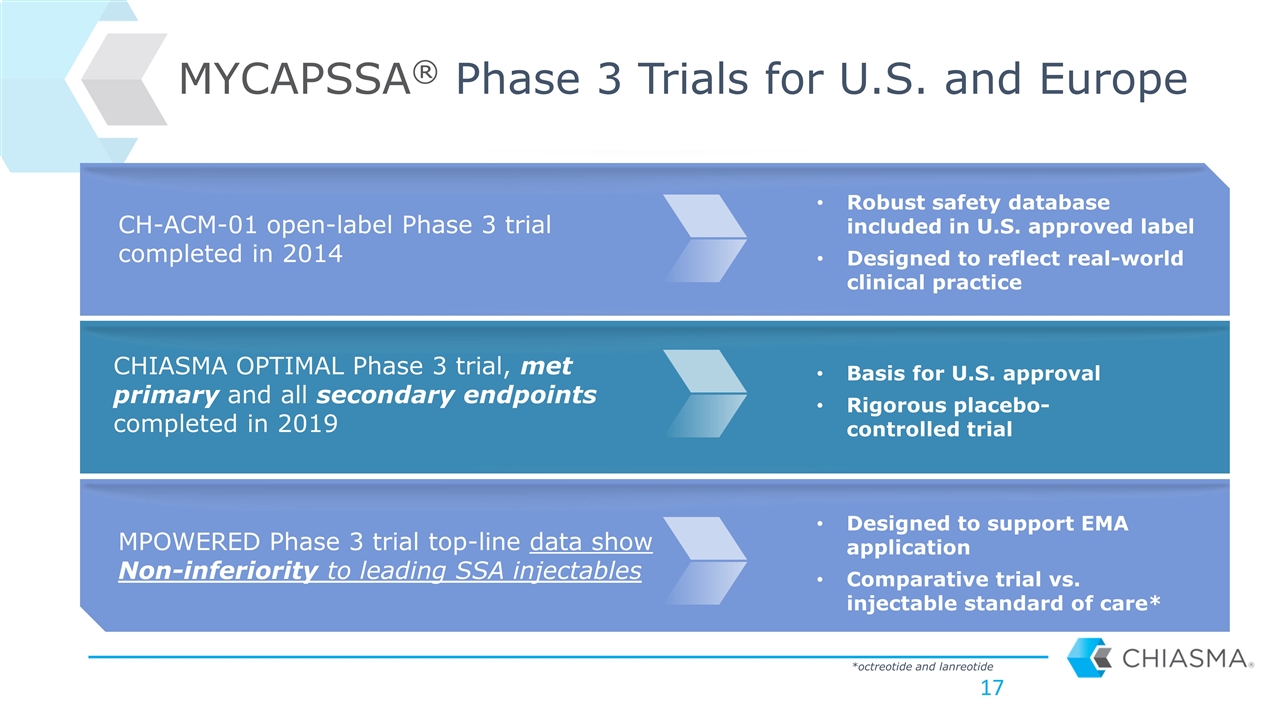

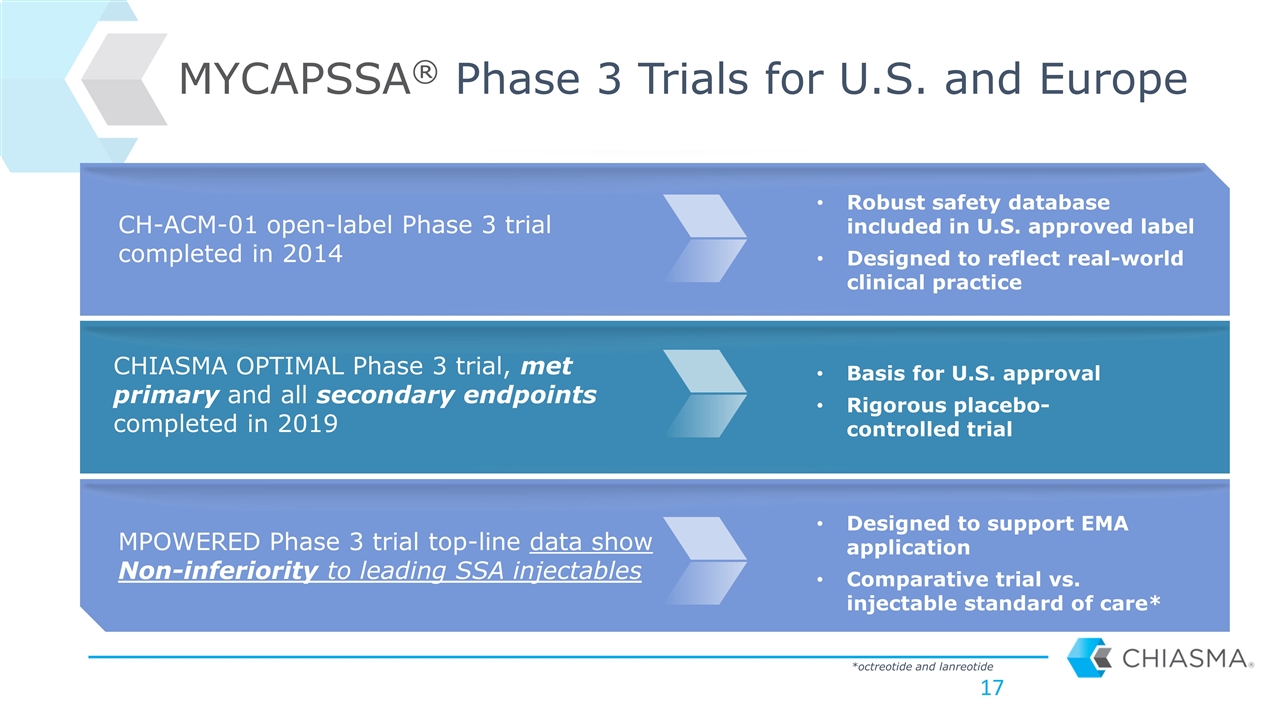

CHIASMA OPTIMAL Phase 3 trial, met primary and all secondary endpoints completed in 2019 MYCAPSSA® Phase 3 Trials for U.S. and Europe MPOWERED Phase 3 trial top-line data show Non-inferiority to leading SSA injectables Basis for U.S. approval Rigorous placebo-controlled trial Designed to support EMA application Comparative trial vs. injectable standard of care* CH-ACM-01 open-label Phase 3 trial completed in 2014 Robust safety database included in U.S. approved label Designed to reflect real-world clinical practice *octreotide and lanreotide

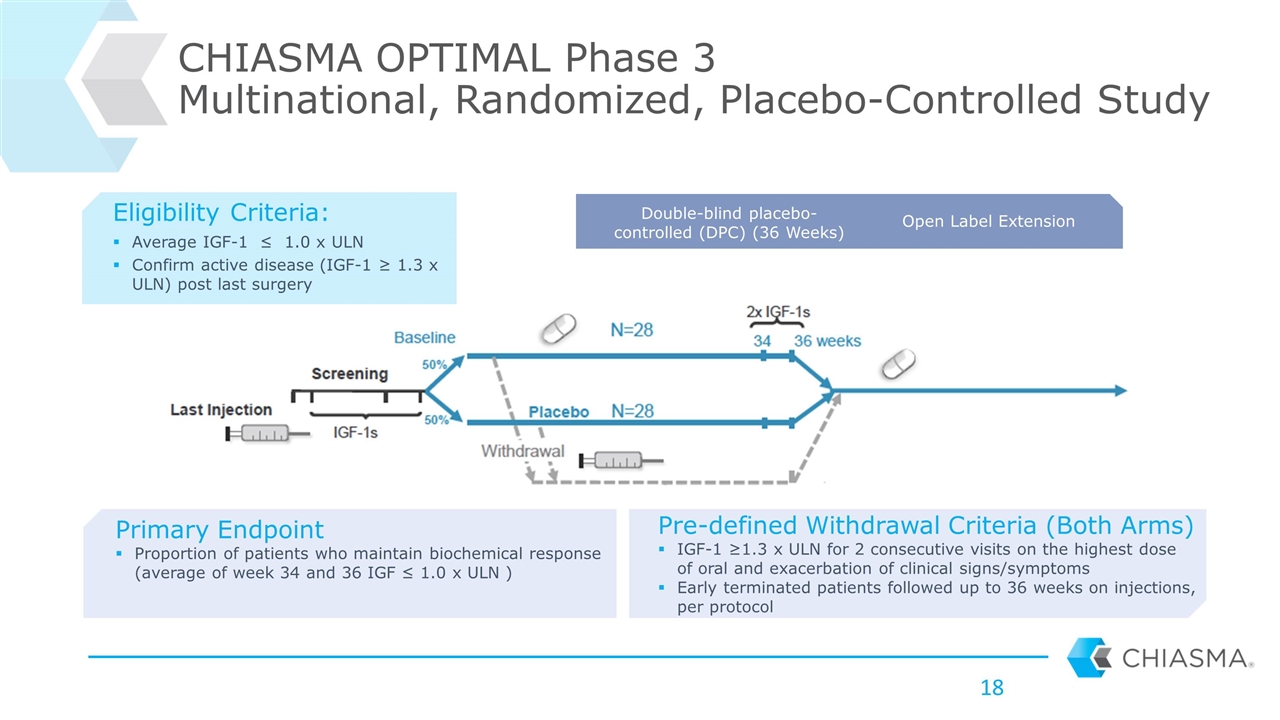

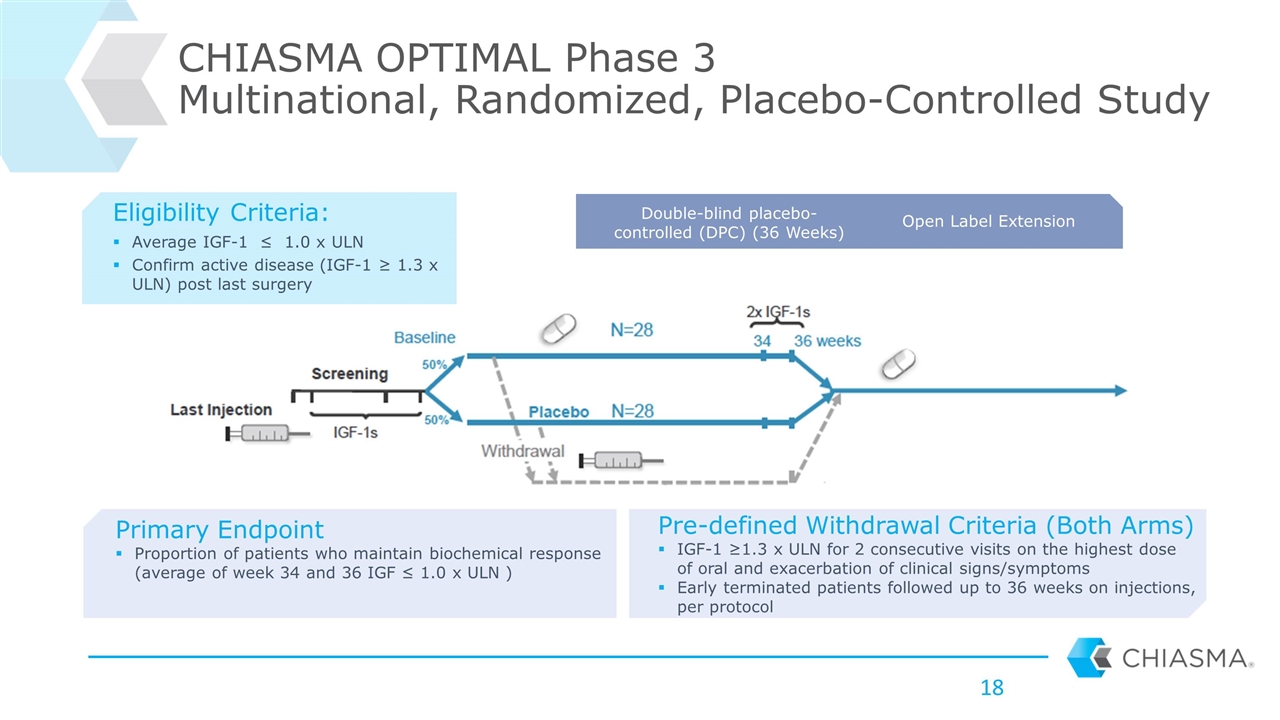

CHIASMA OPTIMAL Phase 3 Multinational, Randomized, Placebo-Controlled Study Double-blind placebo-controlled (DPC) (36 Weeks) Open Label Extension Primary Endpoint Proportion of patients who maintain biochemical response (average of week 34 and 36 IGF ≤ 1.0 x ULN ) Pre-defined Withdrawal Criteria (Both Arms) IGF-1 ≥1.3 x ULN for 2 consecutive visits on the highest dose of oral and exacerbation of clinical signs/symptoms Early terminated patients followed up to 36 weeks on injections, per protocol Eligibility Criteria: Average IGF-1 ≤ 1.0 x ULN Confirm active disease (IGF-1 ≥ 1.3 x ULN) post last surgery

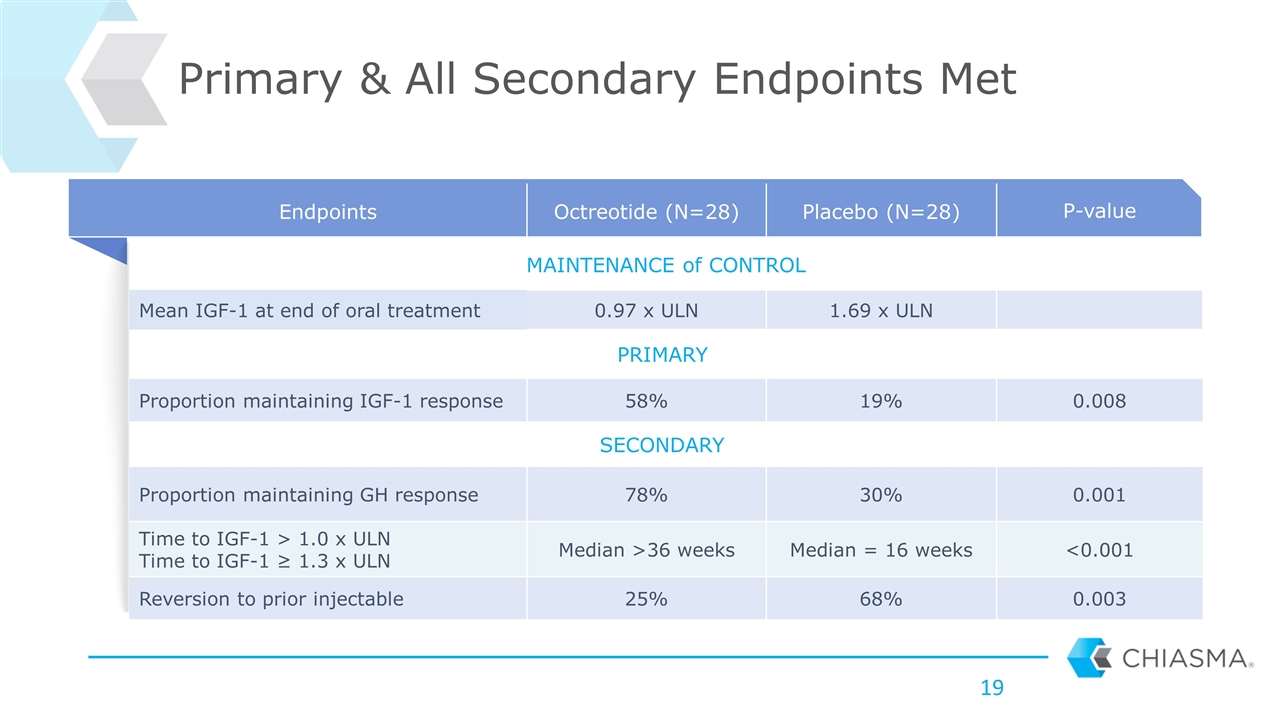

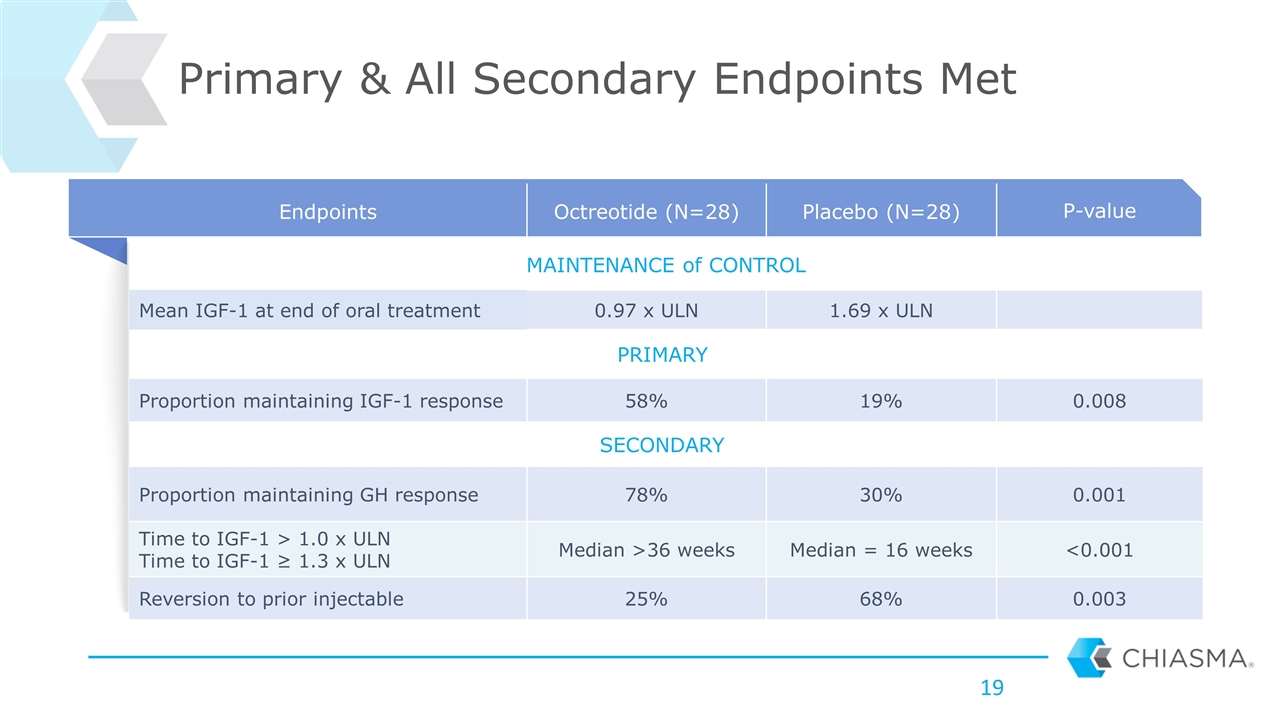

Endpoints Octreotide (N=28) Placebo (N=28) P-value MAINTENANCE of CONTROL Mean IGF-1 at end of oral treatment 0.97 x ULN 1.69 x ULN PRIMARY Proportion maintaining IGF-1 response 58% 19% 0.008 SECONDARY Proportion maintaining GH response 78% 30% 0.001 Time to IGF-1 > 1.0 x ULN Time to IGF-1 ≥ 1.3 x ULN Median >36 weeks Median = 16 weeks <0.001 Reversion to prior injectable 25% 68% 0.003 Primary & All Secondary Endpoints Met

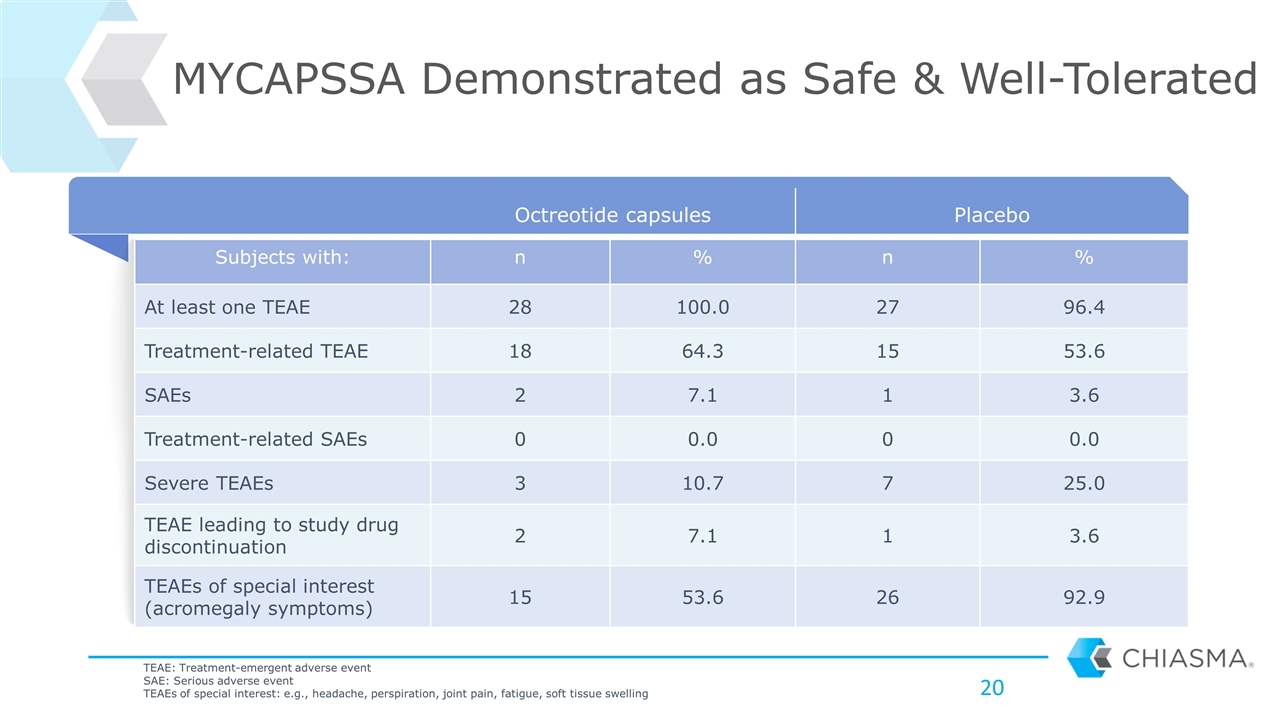

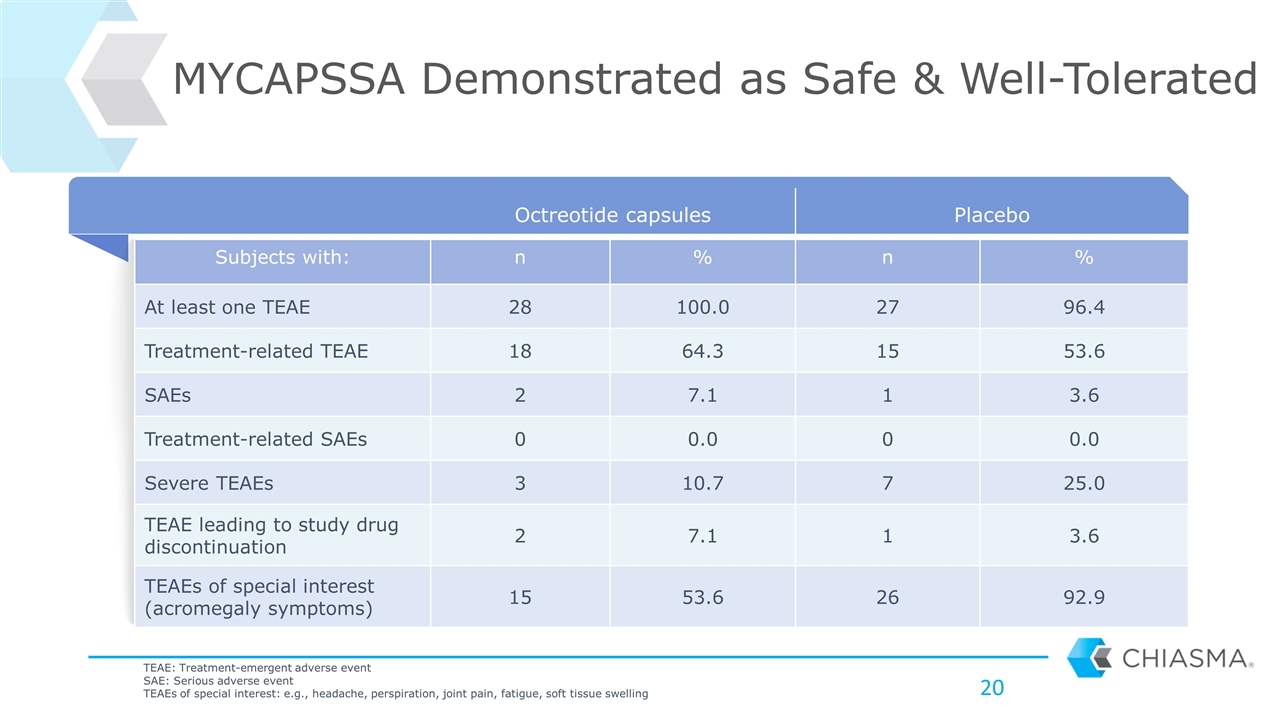

Octreotide capsules Placebo Subjects with: n % n % At least one TEAE 28 100.0 27 96.4 Treatment-related TEAE 18 64.3 15 53.6 SAEs 2 7.1 1 3.6 Treatment-related SAEs 0 0.0 0 0.0 Severe TEAEs 3 10.7 7 25.0 TEAE leading to study drug discontinuation 2 7.1 1 3.6 TEAEs of special interest (acromegaly symptoms) 15 53.6 26 92.9 MYCAPSSA Demonstrated as Safe & Well-Tolerated TEAE: Treatment-emergent adverse event SAE: Serious adverse event TEAEs of special interest: e.g., headache, perspiration, joint pain, fatigue, soft tissue swelling

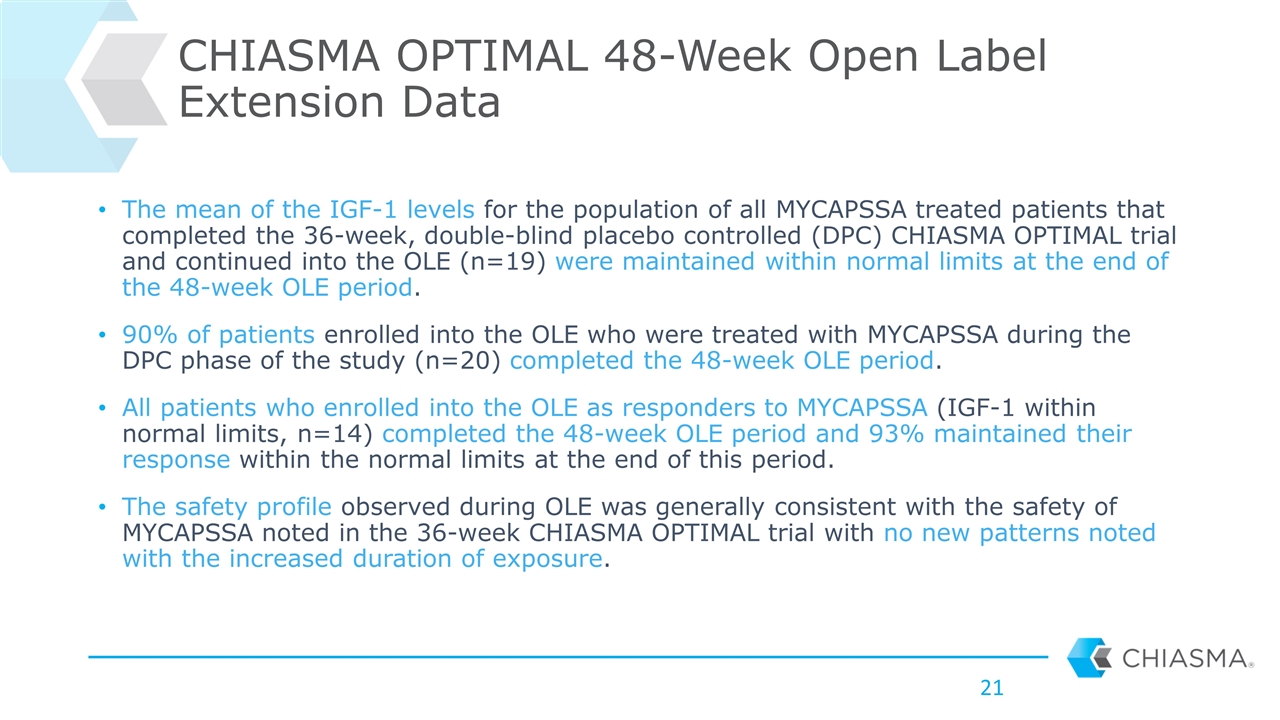

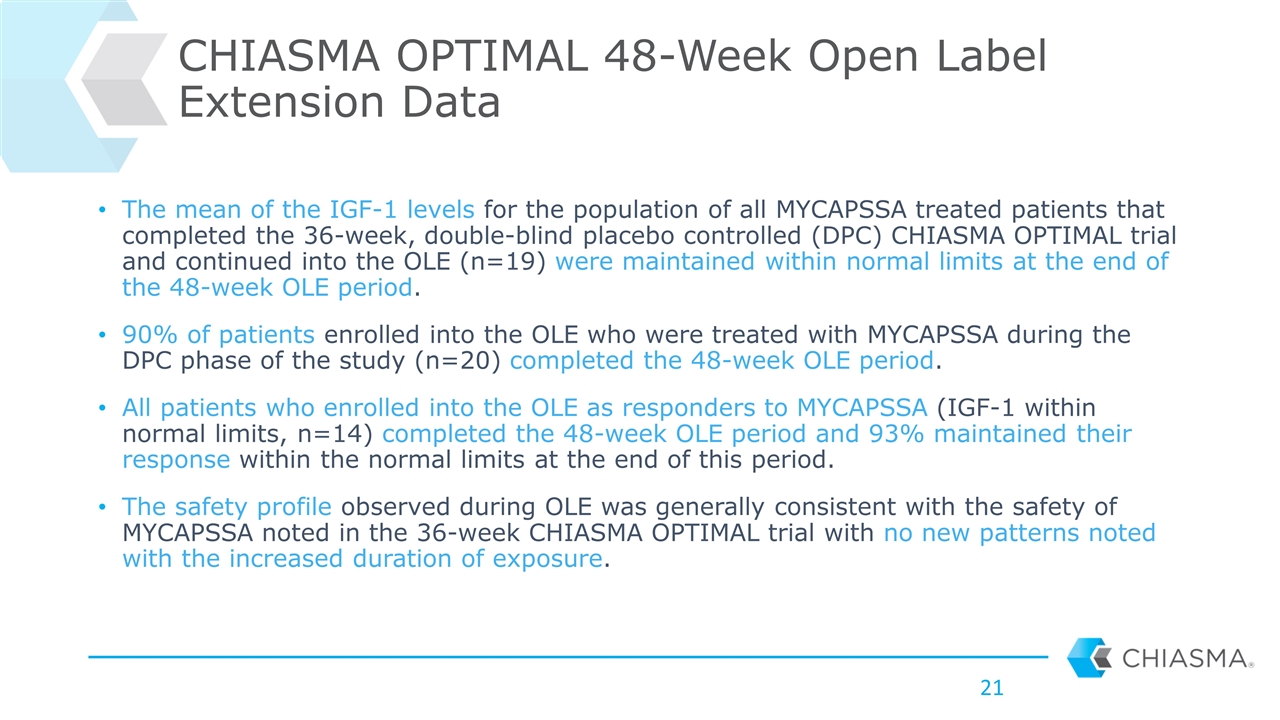

The mean of the IGF-1 levels for the population of all MYCAPSSA treated patients that completed the 36-week, double-blind placebo controlled (DPC) CHIASMA OPTIMAL trial and continued into the OLE (n=19) were maintained within normal limits at the end of the 48-week OLE period. 90% of patients enrolled into the OLE who were treated with MYCAPSSA during the DPC phase of the study (n=20) completed the 48-week OLE period. All patients who enrolled into the OLE as responders to MYCAPSSA (IGF-1 within normal limits, n=14) completed the 48-week OLE period and 93% maintained their response within the normal limits at the end of this period. The safety profile observed during OLE was generally consistent with the safety of MYCAPSSA noted in the 36-week CHIASMA OPTIMAL trial with no new patterns noted with the increased duration of exposure. CHIASMA OPTIMAL 48-Week Open Label Extension Data

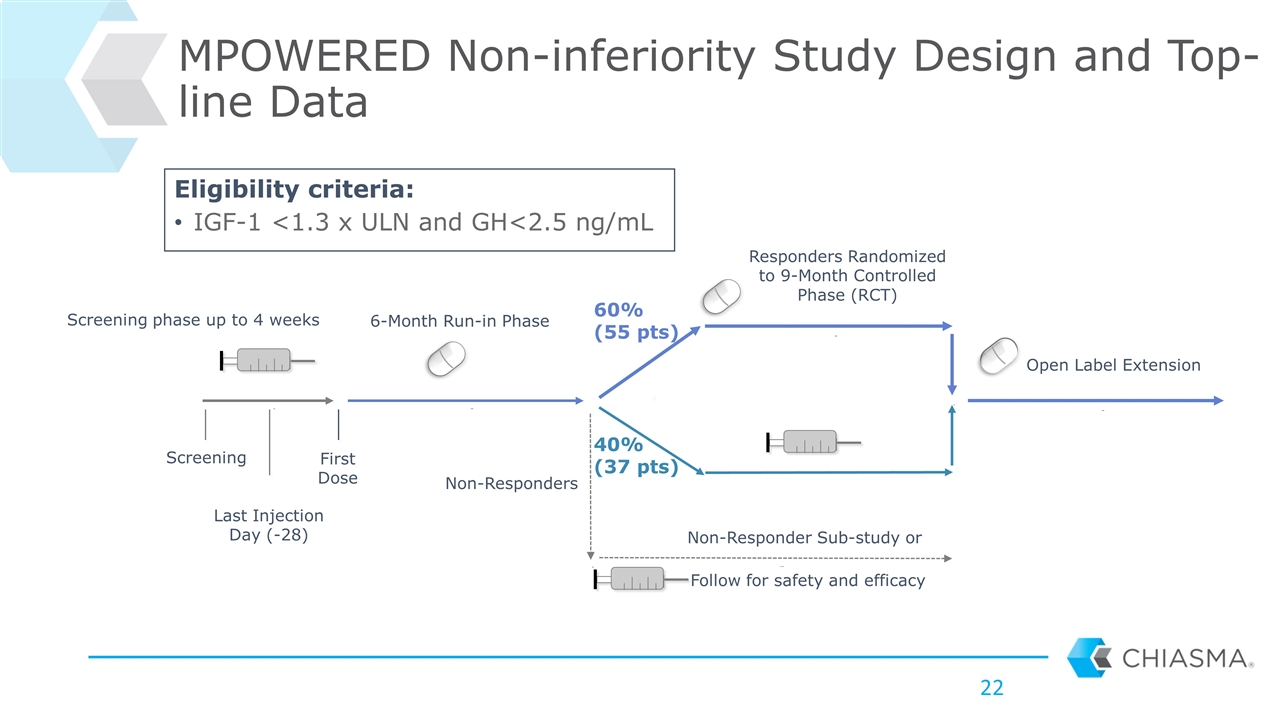

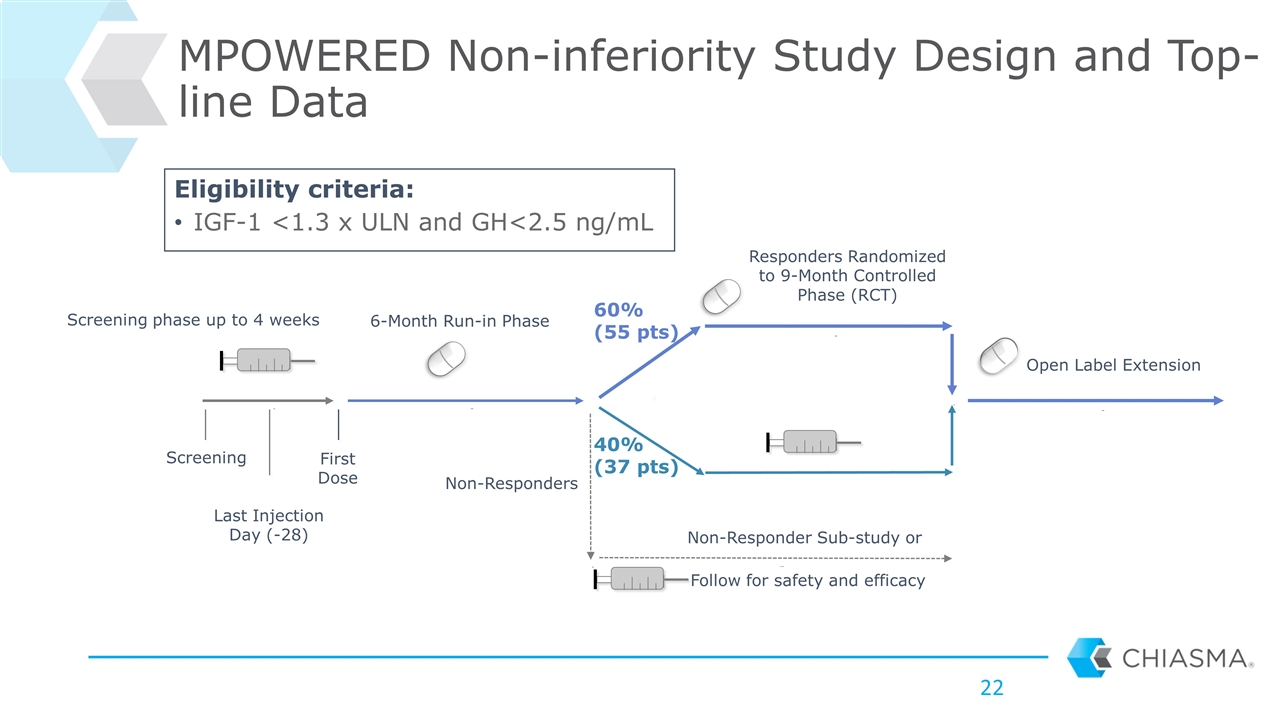

MPOWERED Non-inferiority Study Design and Top-line Data Last Injection Day (-28) Screening First Dose 6-Month Run-in Phase Responders Randomized to 9-Month Controlled Phase (RCT) Open Label Extension Follow for safety and efficacy 60% (55 pts) 40% (37 pts) Non-Responder Sub-study or Non-Responders Screening phase up to 4 weeks Eligibility criteria: IGF-1 <1.3 x ULN and GH<2.5 ng/mL

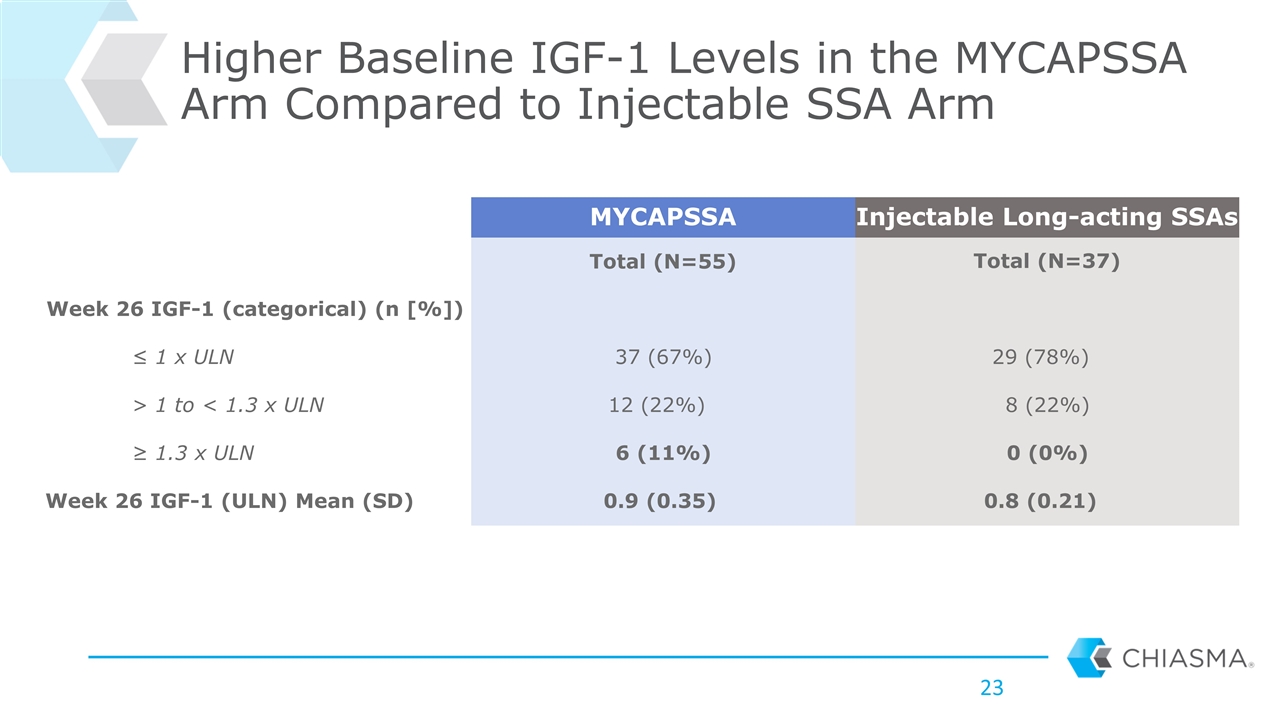

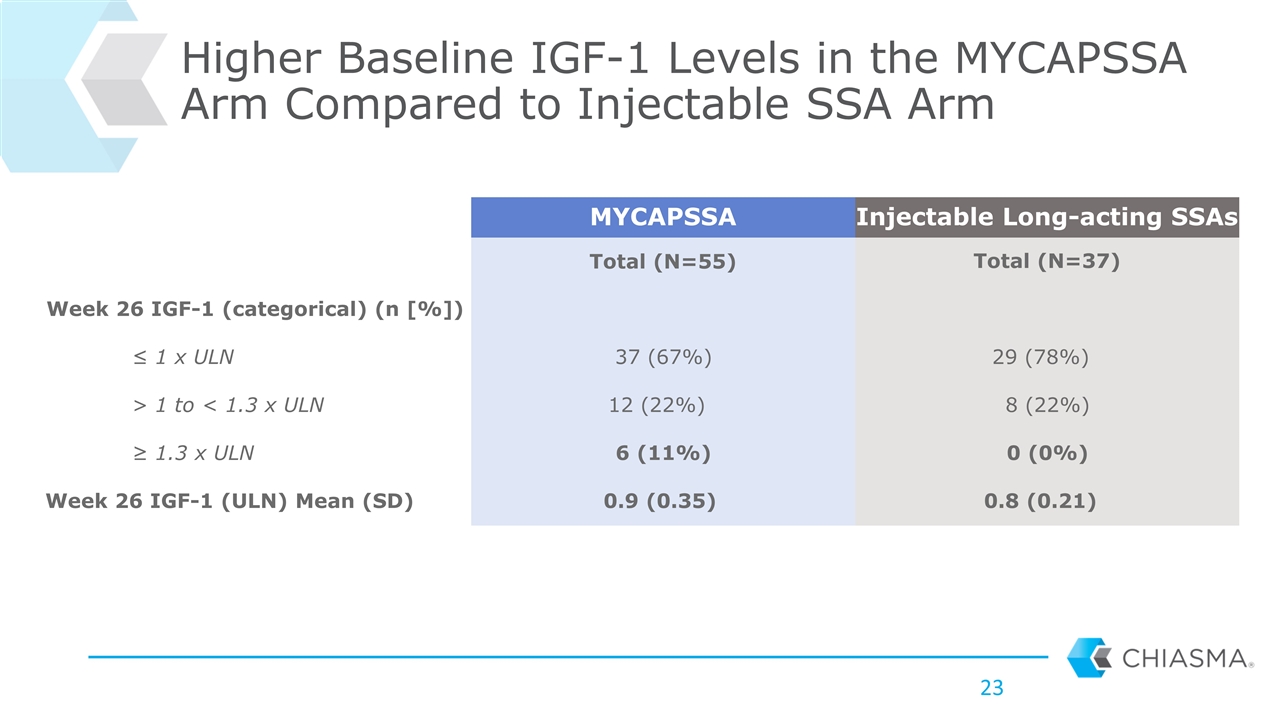

Higher Baseline IGF-1 Levels in the MYCAPSSA Arm Compared to Injectable SSA Arm MYCAPSSA Injectable Long-acting SSAs Total (N=55) Total (N=37) Week 26 IGF-1 (categorical) (n [%]) ≤ 1 x ULN 37 (67%) 29 (78%) > 1 to < 1.3 x ULN 12 (22%) 8 (22%) ≥ 1.3 x ULN 6 (11%) 0 (0%) Week 26 IGF-1 (ULN) Mean (SD) 0.9 (0.35) 0.8 (0.21)

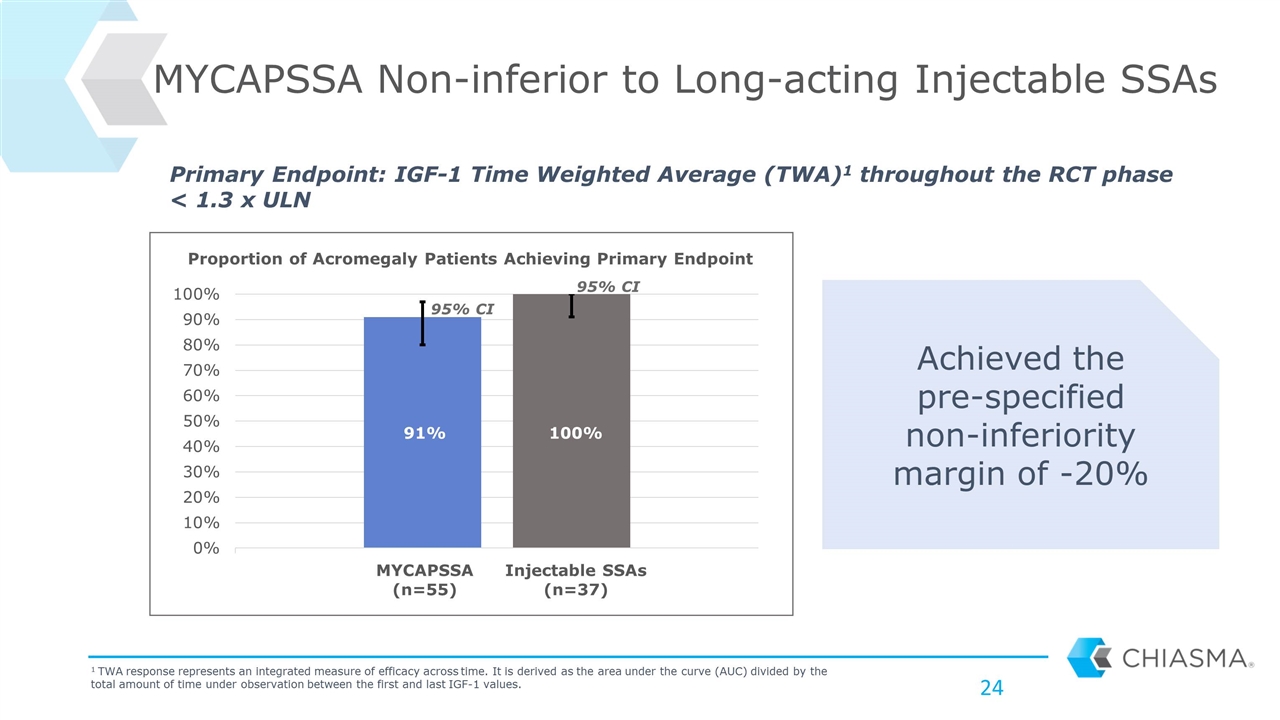

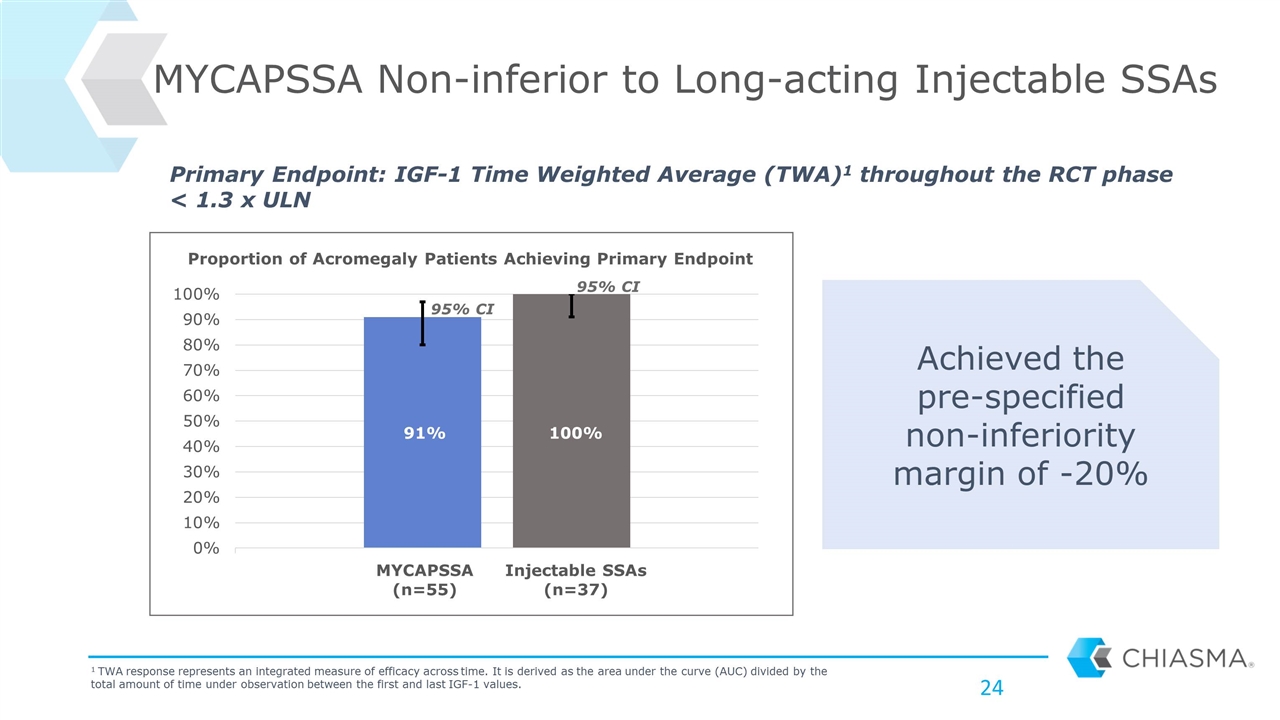

MYCAPSSA Non-inferior to Long-acting Injectable SSAs Achieved the pre-specified non-inferiority margin of -20% Primary Endpoint: IGF-1 Time Weighted Average (TWA)1 throughout the RCT phase < 1.3 x ULN 1 TWA response represents an integrated measure of efficacy across time. It is derived as the area under the curve (AUC) divided by the total amount of time under observation between the first and last IGF-1 values. MYCAPSSA (n=55) Injectable SSAs (n=37) 95% CI 95% CI Proportion of Acromegaly Patients Achieving Primary Endpoint 91% 100%

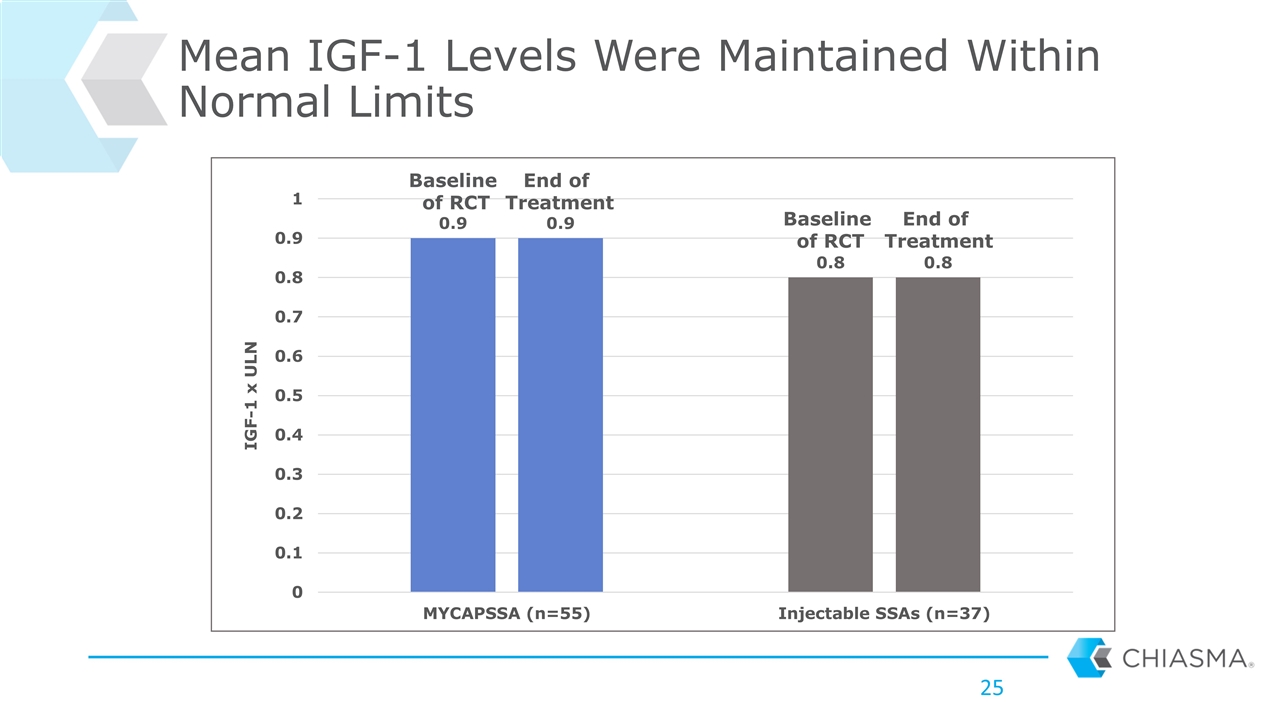

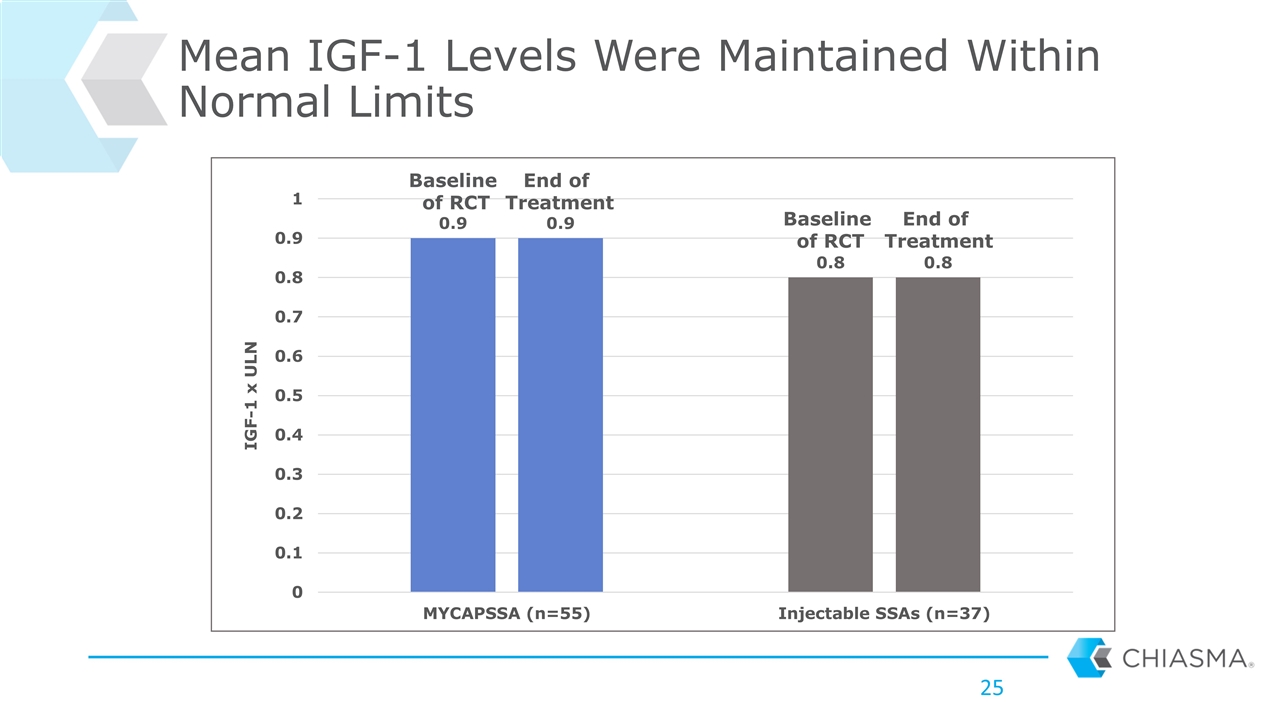

Mean IGF-1 Levels Were Maintained Within Normal Limits Baseline of RCT Baseline of RCT End of Treatment End of Treatment

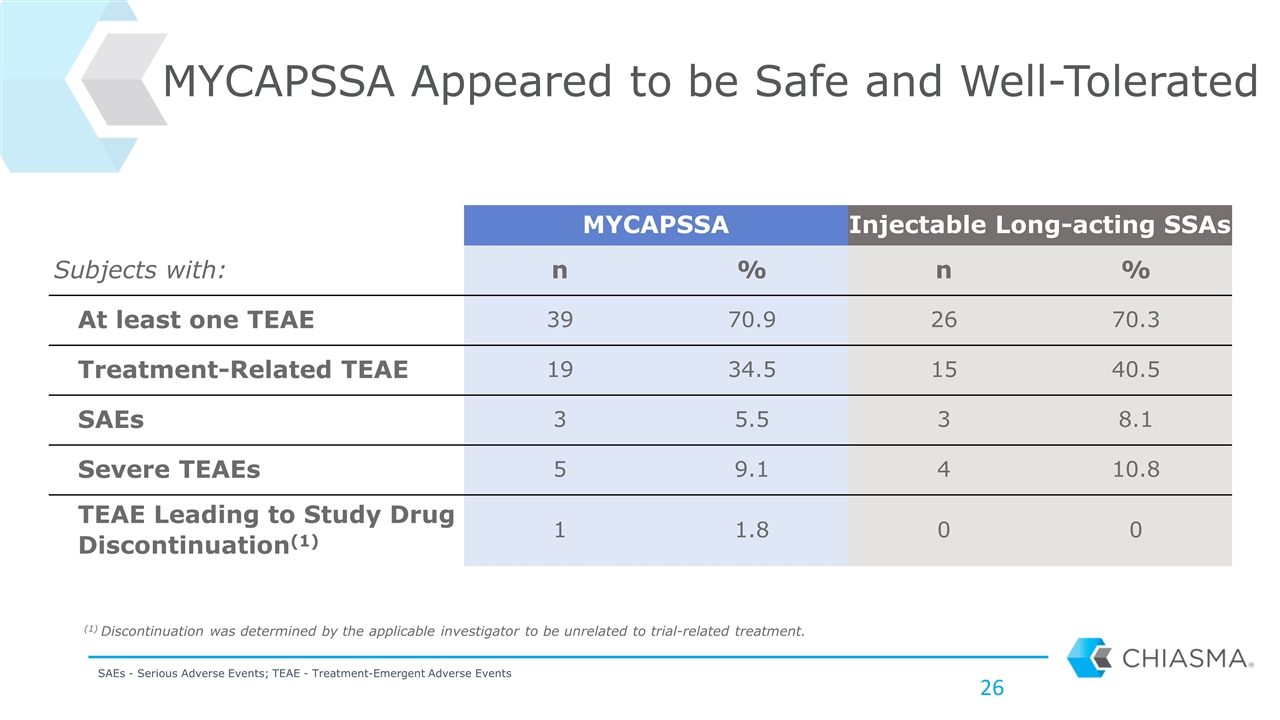

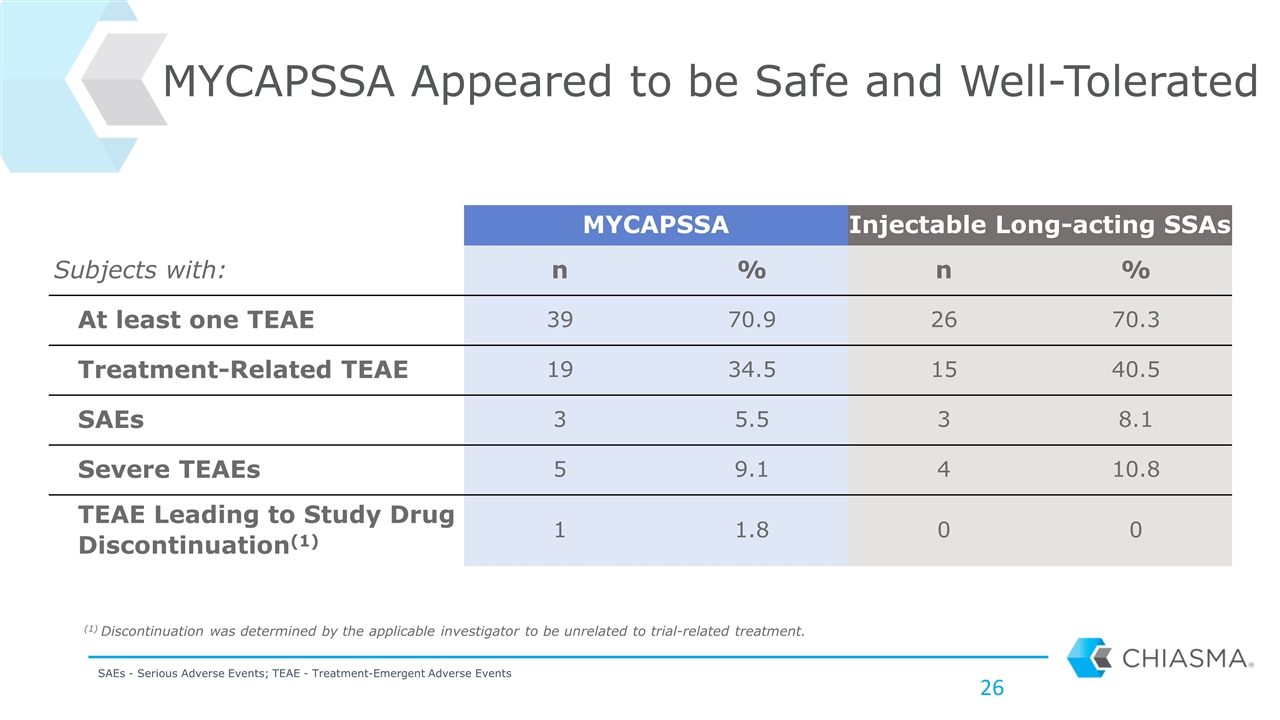

MYCAPSSA Appeared to be Safe and Well-Tolerated MYCAPSSA Injectable Long-acting SSAs Subjects with: n % n % At least one TEAE 39 70.9 26 70.3 Treatment-Related TEAE 19 34.5 15 40.5 SAEs 3 5.5 3 8.1 Severe TEAEs 5 9.1 4 10.8 TEAE Leading to Study Drug Discontinuation(1) 1 1.8 0 0 SAEs - Serious Adverse Events; TEAE - Treatment-Emergent Adverse Events (1) Discontinuation was determined by the applicable investigator to be unrelated to trial-related treatment.

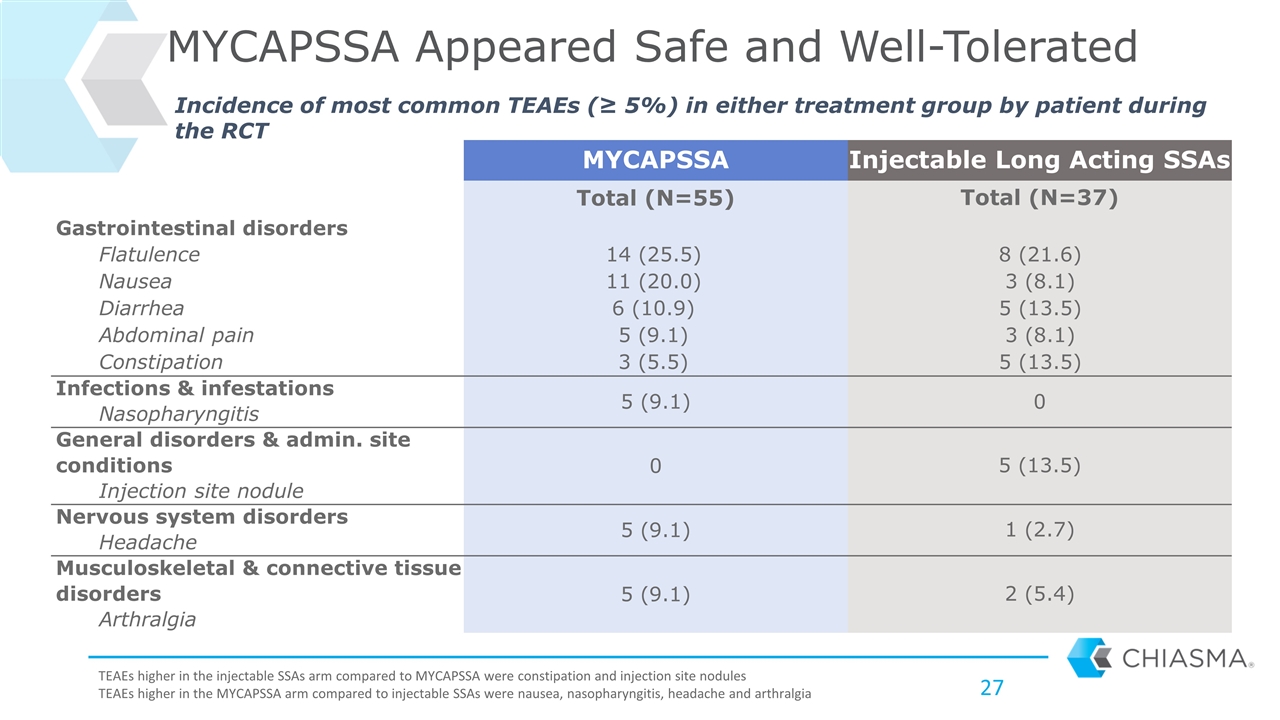

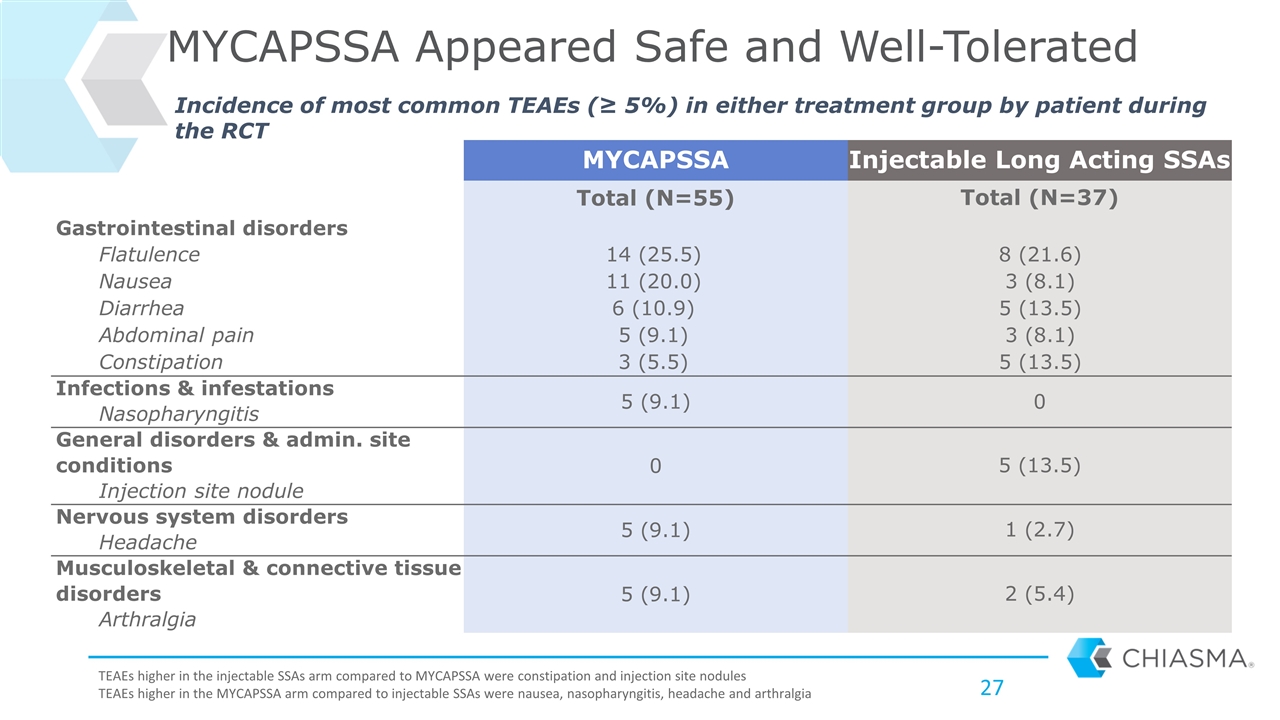

MYCAPSSA Injectable Long Acting SSAs Total (N=55) Total (N=37) Gastrointestinal disorders Flatulence 14 (25.5) 8 (21.6) Nausea 11 (20.0) 3 (8.1) Diarrhea 6 (10.9) 5 (13.5) Abdominal pain 5 (9.1) 3 (8.1) Constipation 3 (5.5) 5 (13.5) Infections & infestations 5 (9.1) 0 Nasopharyngitis General disorders & admin. site conditions 0 5 (13.5) Injection site nodule Nervous system disorders 5 (9.1) 1 (2.7) Headache Musculoskeletal & connective tissue disorders 5 (9.1) 2 (5.4) Arthralgia MYCAPSSA Appeared Safe and Well-Tolerated Incidence of most common TEAEs (≥ 5%) in either treatment group by patient during the RCT TEAEs higher in the injectable SSAs arm compared to MYCAPSSA were constipation and injection site nodules TEAEs higher in the MYCAPSSA arm compared to injectable SSAs were nausea, nasopharyngitis, headache and arthralgia

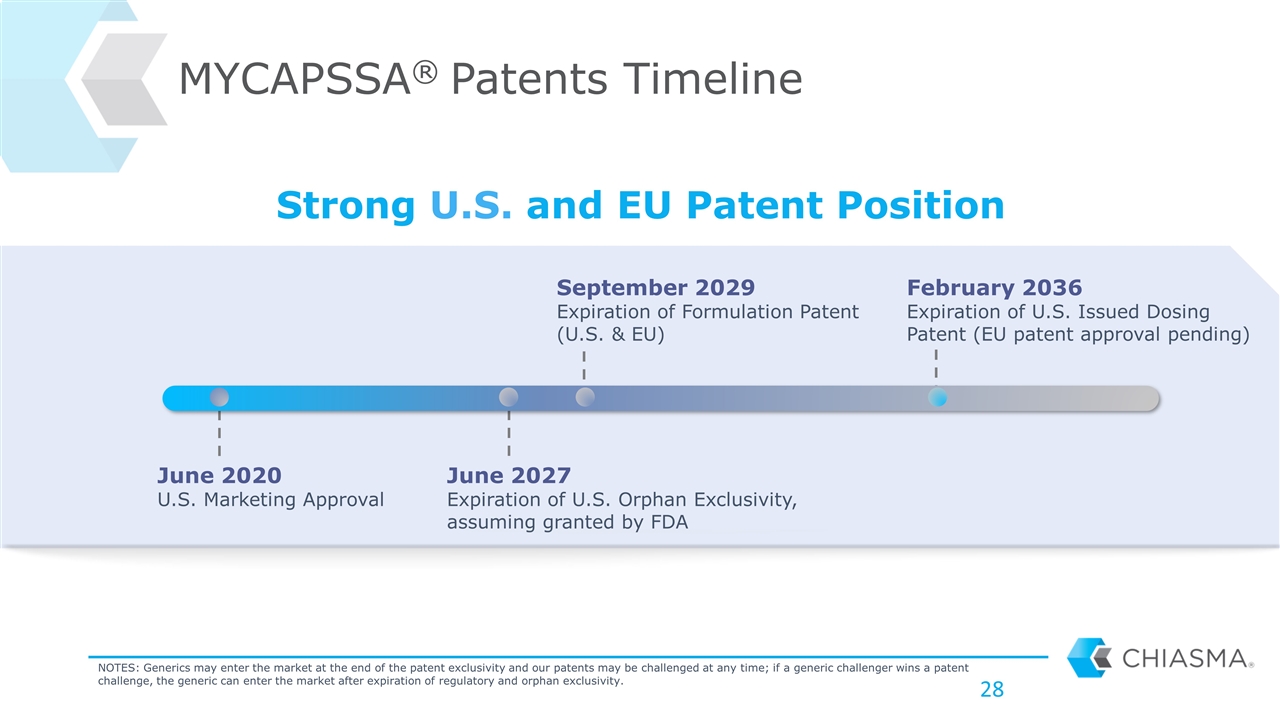

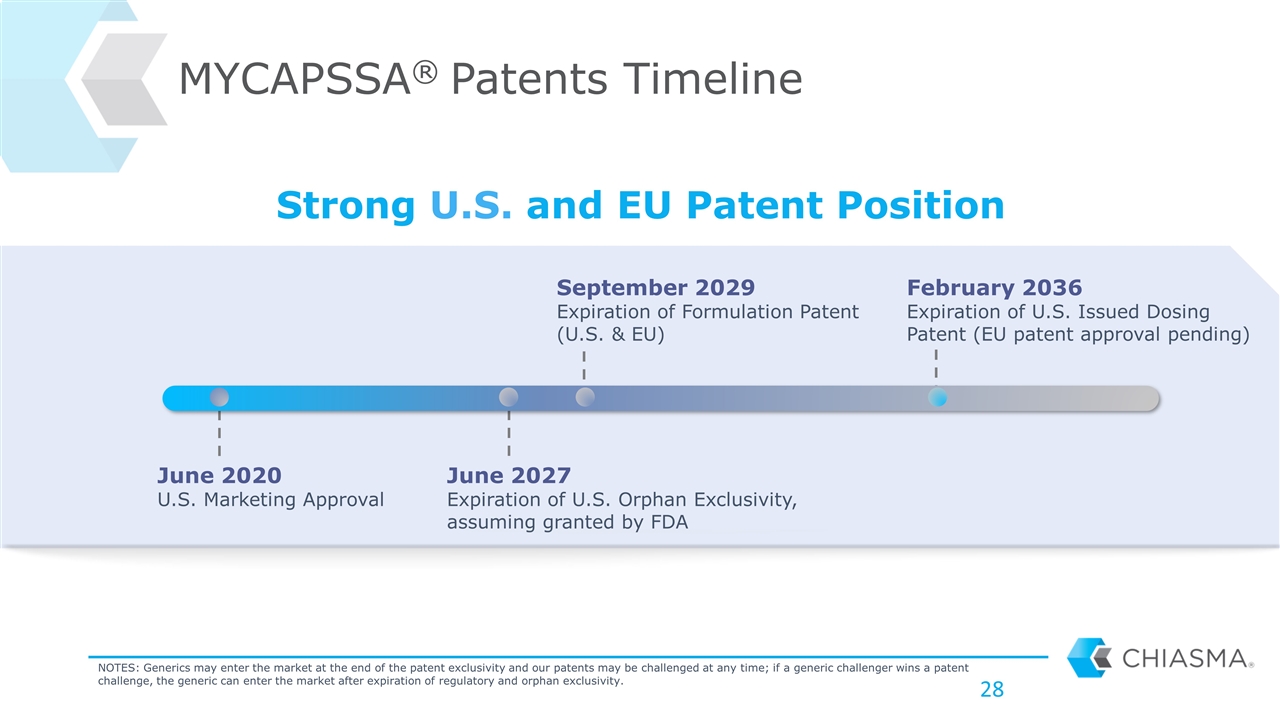

MYCAPSSA® Patents Timeline Strong U.S. and EU Patent Position June 2020 U.S. Marketing Approval June 2027 Expiration of U.S. Orphan Exclusivity, assuming granted by FDA September 2029 Expiration of Formulation Patent (U.S. & EU) February 2036 Expiration of U.S. Issued Dosing Patent (EU patent approval pending) NOTES: Generics may enter the market at the end of the patent exclusivity and our patents may be challenged at any time; if a generic challenger wins a patent challenge, the generic can enter the market after expiration of regulatory and orphan exclusivity.

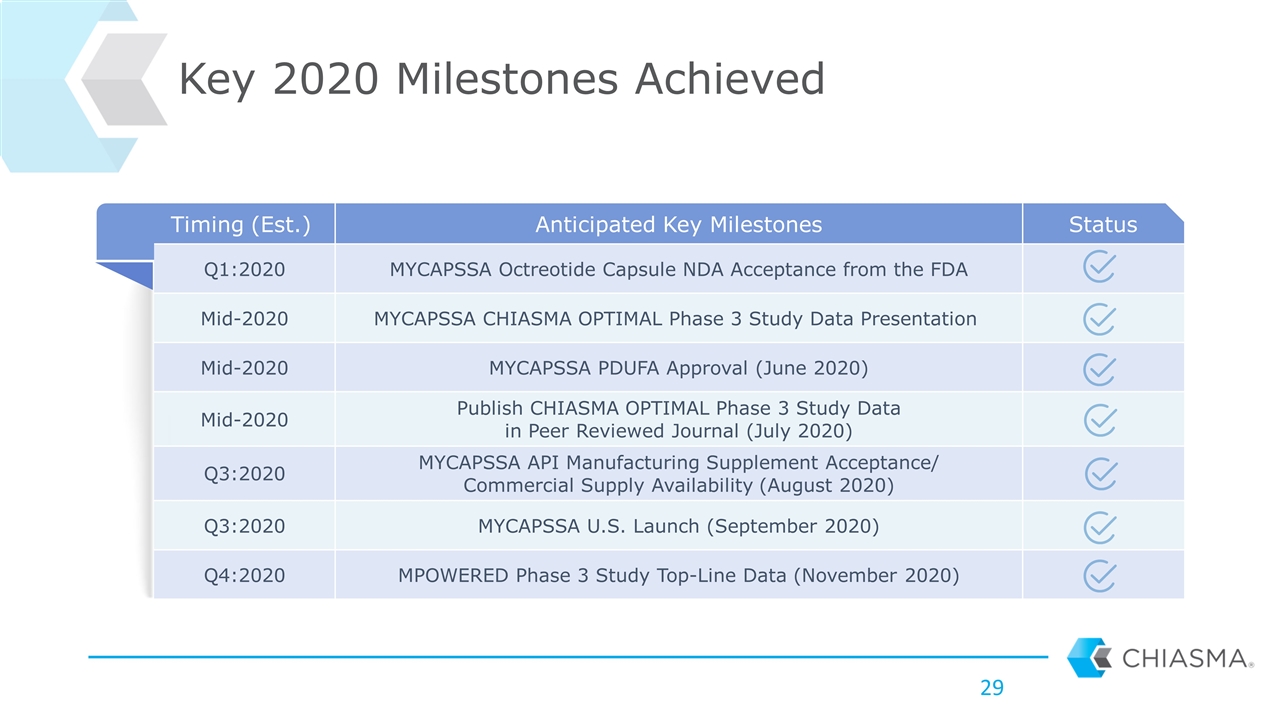

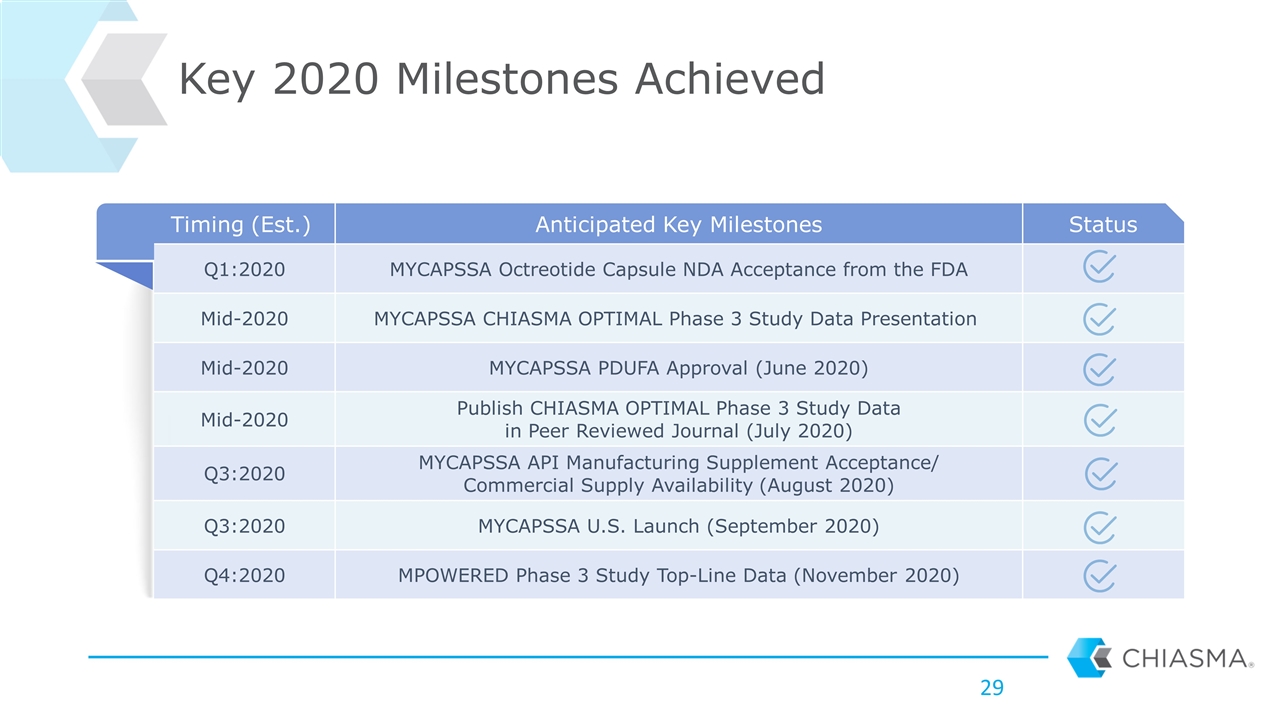

Timing (Est.) Anticipated Key Milestones Status Q1:2020 MYCAPSSA Octreotide Capsule NDA Acceptance from the FDA Mid-2020 MYCAPSSA CHIASMA OPTIMAL Phase 3 Study Data Presentation Mid-2020 MYCAPSSA PDUFA Approval (June 2020) Mid-2020 Publish CHIASMA OPTIMAL Phase 3 Study Data in Peer Reviewed Journal (July 2020) Q3:2020 MYCAPSSA API Manufacturing Supplement Acceptance/ Commercial Supply Availability (August 2020) Q3:2020 MYCAPSSA U.S. Launch (September 2020) Q4:2020 MPOWERED Phase 3 Study Top-Line Data (November 2020) Key 2020 Milestones Achieved

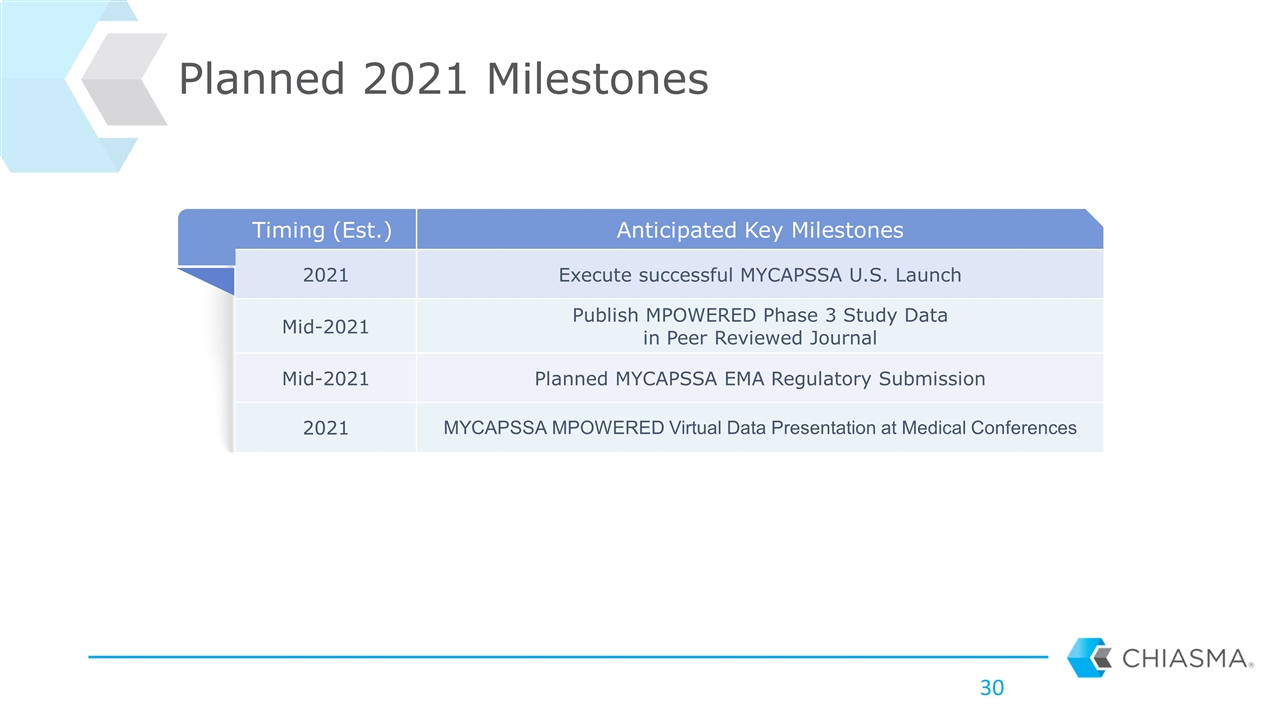

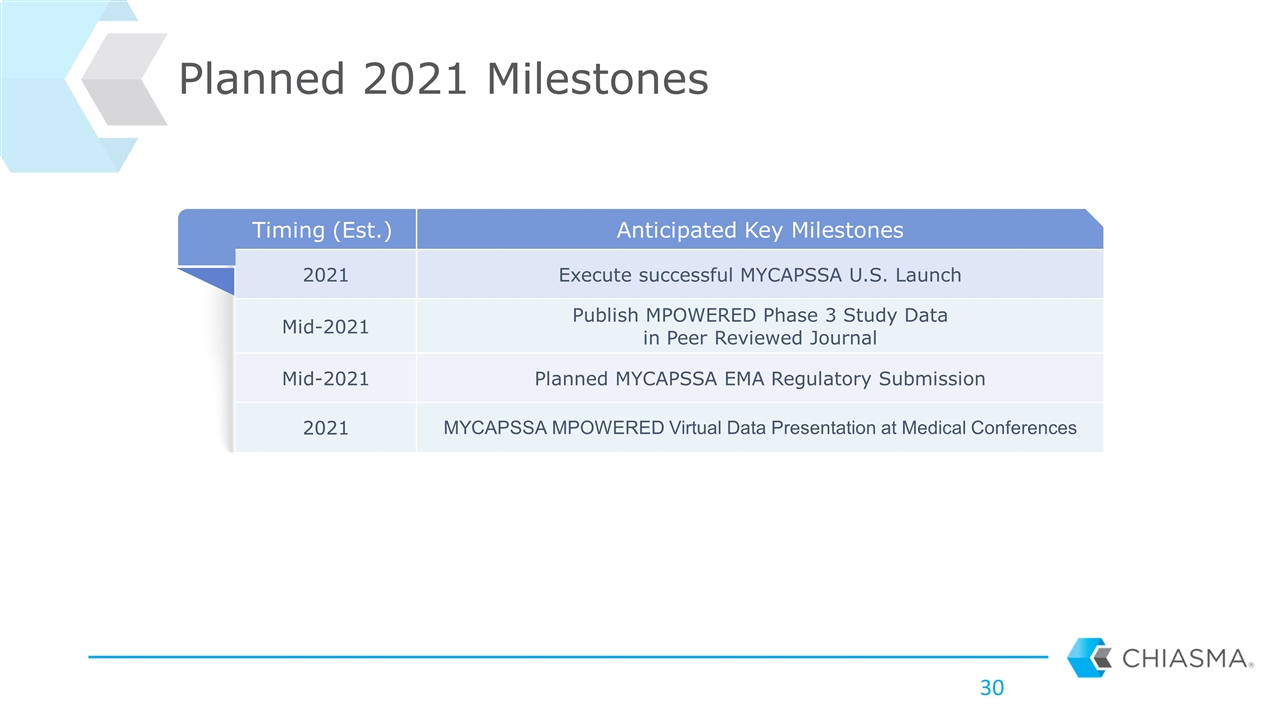

Timing (Est.) Anticipated Key Milestones 2021 Execute successful MYCAPSSA U.S. Launch Mid-2021 Publish MPOWERED Phase 3 Study Data in Peer Reviewed Journal Mid-2021 Planned MYCAPSSA EMA Regulatory Submission 2021 MYCAPSSA MPOWERED Virtual Data Presentation at Medical Conferences Planned 2021 Milestones

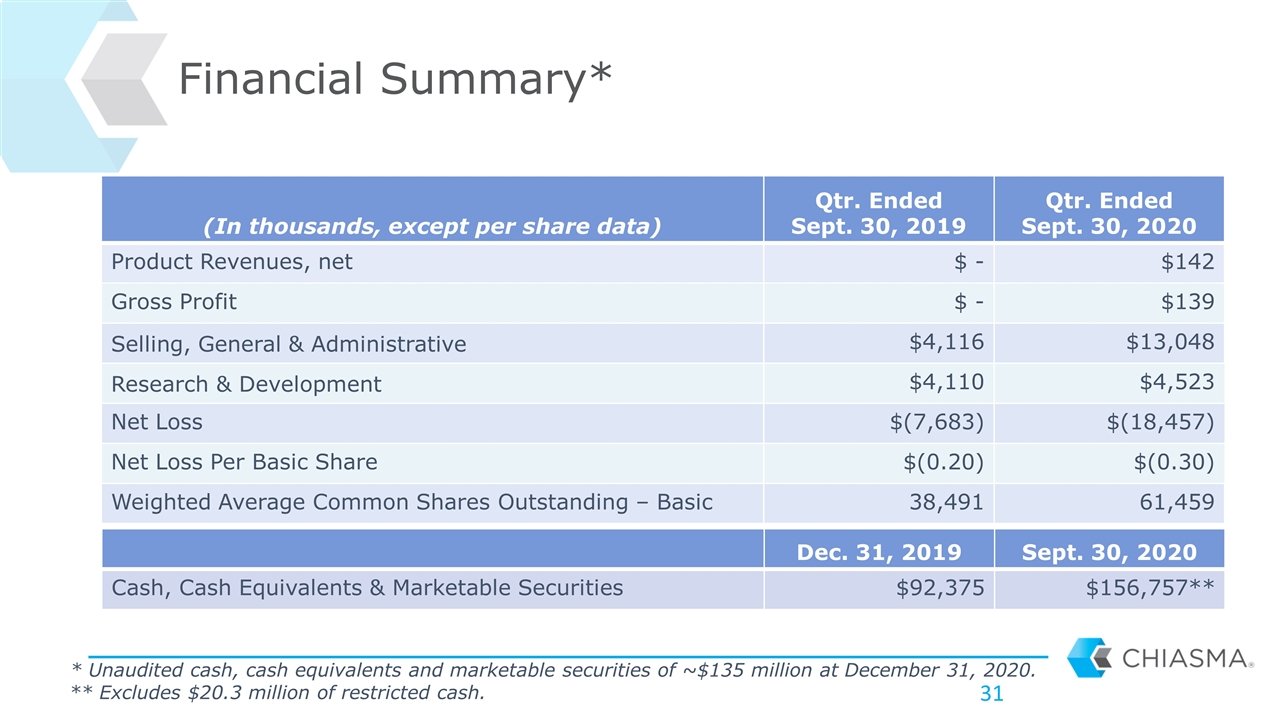

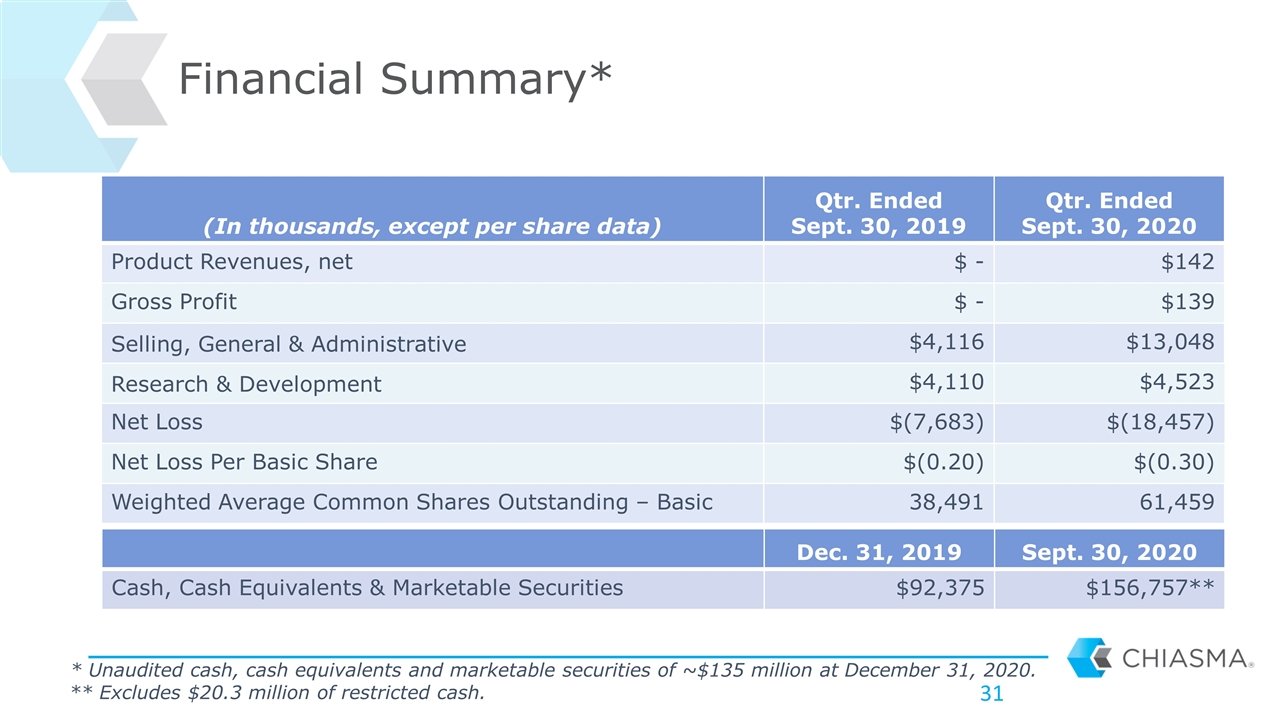

Financial Summary* * Unaudited cash, cash equivalents and marketable securities of ~$135 million at December 31, 2020. (In thousands, except per share data) Qtr. Ended Sept. 30, 2019 Qtr. Ended Sept. 30, 2020 Product Revenues, net $ - $142 Gross Profit $ - $139 Selling, General & Administrative $4,116 $13,048 Research & Development $4,110 $4,523 Net Loss $(7,683) $(18,457) Net Loss Per Basic Share $(0.20) $(0.30) Weighted Average Common Shares Outstanding – Basic 38,491 61,459 Dec. 31, 2019 Sept. 30, 2020 Cash, Cash Equivalents & Marketable Securities $92,375 $156,757** ** Excludes $20.3 million of restricted cash.

Raj Kannan Chief Executive Officer Management Team Mark J. Fitzpatrick President (Principal Financial Officer) William Ludlam, M.D., Ph.D. Clinical Development & Medical Affairs Anand Varadan Chief Commercial Officer Drew Enamait Finance & Administration Lee Giguere General Counsel Shoshie Katz VP, Regulatory & Quality; Israel Site Head Gary Patou, M.D. Strategic Clinical Advisor Roni Mamluk, Ph.D. Director Board of Directors Dave Stack Chairman of the Board Raj Kannan CEO & Director Todd Foley Director Bard Geesaman, M.D., Ph.D. Director John F. Thero Director Scott Minick Director John A. Scarlett, M.D. Director David Schubert SVP, Regulatory & Quality

Successful Launch with MYCAPSSA Enables a Bright Future Clinical Stage Company Commercial Stage Company with Validated TPE Platform Vision: Become a Successful Commercial Company with a Promising Pipeline

Thank You January 2021 | NASDAQ: CHMA