- CHMA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Chiasma (CHMA) 425Business combination disclosure

Filed: 5 May 21, 5:11pm

All Company Employee Meeting May 5, 2021 Filed by: Chiasma, Inc. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Chiasma, Inc. Commission File No: 001-37500

Agenda Welcome, Setting the Scene for TodayRaj Kannan Who am I? Who is Amryt?Dr Joe Wiley Next Steps & CloseJoe

This communication relates to a proposed business combination transaction between Amryt Pharma plc (“Amryt”) and Chiasma, Inc. (“Chiasma”). This communication includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements relate to future events and anticipated results of operations, business strategies, the anticipated benefits of the proposed transaction, the anticipated impact of the proposed transaction on the combined company’s business and future financial and operating results, the expected amount and timing of synergies from the proposed transaction, the anticipated closing date for the proposed transaction and other aspects of our operations or operating results. These forward-looking statements generally can be identified by phrases such as “will,” “expects,” “anticipates,” “foresees,” “forecasts,” “estimates” or other words or phrases of similar import. It is uncertain whether any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what impact they will have on the results of operations and financial condition of the combined companies or the price of Amryt or Chiasma stock. These forward-looking statements involve certain risks and uncertainties, many of which are beyond the parties’ control, that could cause actual results to differ materially from those indicated in such forward-looking statements, including but not limited to: the impact of public health crises, such as pandemics (including coronavirus (COVID-19)) and epidemics and any related company or government policies and actions to protect the health and safety of individuals or government policies or actions to maintain the functioning of national or global economies and markets; the effect of the announcement of the merger on the ability of Amryt or Chiasma to retain and hire key personnel and maintain relationships with customers, suppliers and others with whom Amryt or Chiasma do business, or on Amryt’s or Chiasma’s operating results and business generally; risks that the merger disrupts current plans and operations and the potential difficulties in employee retention as a result of the merger; the outcome of any legal proceedings related to the merger; the ability of the parties to consummate the proposed transaction on a timely basis or at all; the satisfaction of the conditions precedent to consummation of the proposed transaction, including the ability to secure regulatory approvals on the terms expected, at all or in a timely manner; the ability of Amryt to successfully integrate Chiasma’s operations; the ability of Amryt to implement its plans, forecasts and other expectations with respect to Amryt’s business after the completion of the transaction and realize expected synergies; and business disruption following the merger. These risks, as well as other risks related to the proposed transaction, will be included in the registration statement on Form F-4, and if necessary, the registration on Form F-6, and proxy statement/prospectus that will be filed with the Securities and Exchange Commission (“SEC”) in connection with the proposed transaction. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form F-4, and if necessary, the registration on Form F-6, are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. For additional information about other factors that could cause actual results to differ materially from those described in the forward-looking statements, see the section entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Amryt’s Registration Statement on Form F-1 filed with the SEC on June 23, 2020, as amended, and Chiasma’s most recent Quarterly Reports on Form 10-Q and Annual Report on Form 10-K. The forward-looking statements included in this communication are made only as of the date hereof. Neither Amryt nor Chiasma undertakes any obligation to update any forward-looking statements to reflect subsequent events or circumstances, except as required by law. Forward-Looking Statements

No Offer or Solicitation This communication is not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. Additional Information about the Merger and Where to Find It In connection with the proposed transaction, Amryt intends to file with the SEC a registration statement on Form F-4 that will include a proxy statement of Chiasma and that also constitutes a prospectus of Amryt, and each of Chiasma and Amryt may file with the SEC other documents regarding the proposed transaction. This communication is not a substitute for the proxy statement/prospectus or registration statement or any other document that Amryt or Chiasma may file with the SEC. The definitive proxy statement/prospectus (if and when available) will be mailed to stockholders of Amryt and Chiasma. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM F-4 AND THE PROXY STATEMENT/PROSPECTUS, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION, IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT AMRYT, CHIASMA AND THE PROPOSED TRANSACTION. Investors and security holders may obtain copies of these documents, once such documents are filed with the SEC, free of charge through the website maintained by the SEC at www.sec.gov or from Amryt at its website, https://amrytpharma.com, or from Chiasma at its website, https://chiasma.com. Documents filed with the SEC by Amryt will be available free of charge by accessing Amryt’s website under the heading Investors, or, alternatively, by contacting Amryt’s Investor Relations department at ir@amrytpharma.com, and documents filed with the SEC by Chiasma will be available free of charge by accessing Chiasma’s website at https://chiasma.com under the heading News and Investors or, alternatively, by contacting Chiasma’s Investor Relations department at investor.relations@chiasmapharma.com. Participants in the Solicitation Amryt and Chiasma and certain of their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders of Chiasma in respect of the proposed transaction under the rules of the SEC. Information about Chiasma’s directors and executive officers is available in Chiasma’s definitive proxy statement dated April 26, 2021 for its 2021 Annual Meeting of Stockholders. Information about Amryt’s directors and executive officers is available in Amryt’s Registration Statement on Form F-1 filed with the SEC on June 23, 2020, as amended. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Chiasma or Amryt using the sources indicated above. Regulation M-A Legend

Q&A: What was announced today? What was announced today? Prior to the opening of the markets today, Chiasma announced that it has entered into a definitive merger agreement pursuant to which Chiasma will be acquired by Amryt Pharma Plc in an all-stock transaction. If this transaction closes, Chiasma will become a wholly-owned subsidiary of Amryt and Chiasma’s equity holders will receive Amryt American Depositary Shares (or ADSs) in exchange for their currently-held Chiasma equity securities. Each Amryt ADS represents five common shares of Amryt. What is the value of the transaction? Upon closing of the announced transaction, all shares of Chiasma common stock will be exchanged for Amryt ADSs at a fixed exchange ratio of [0.395] Amryt ADS for each share of Chiasma stock. (See below for more information on the treatment of stock options and restricted stock units.) At closing, all existing Chiasma shares will be exchanged for Amryt ADSs according to the fixed exchange ratio set forth in the merger agreement. The precise value of this transaction will depend on the relative values of Chiasma’s common stock and securities and Amryt’s ADSs at that time.

Q&A: Deal rationale and timing What is the rationale for Chiasma to merge with AMRYT? What is the timing of the proposed transaction? The transaction agreement was signed on May 4, 2021, and the closing is expected to occur during the third quarter of 2021. The transaction is subject to the approval of Chiasma’s stockholders, Amryt’s stockholders and other customary closing conditions. Efficiently commercialize MYCAPSSA in the US and importantly in ex-US markets Fund our planned NET program Plan for new development opportunities leveraging our TPE Build a critical mass in becoming a significant part of a combined entity boasting a diversified portfolio of marketed products and a potentially promising pipeline

Q&A: Deal overview and activities What is the difference between deal signing and deal closing? Deal signing means that both parties, Chiasma and Amryt, have signed a definitive merger agreement that reflects the terms of the proposed transaction, the arrangements between the parties for the period between signing and closing, and the requirements for the transaction to close. Deal closing is when the proposed transaction is executed, i.e., Chiasma’s stockholders will receive Amryt ADSs per the deal terms and Chiasma will become a wholly-owned subsidiary of Amryt. What activities must occur between deal signing and deal close? Between signing and closing, Amryt and Chiasma will continue to operate as separate companies, subject to the interim operating covenants set forth in the definitive merger agreement. Following the announcement of this transaction, the parties will work together to file a registration and proxy statement that will describe the material terms of the transaction and solicit a vote from stockholders. Once this document is finalized with the U.S. Securities and Exchange Commission, Chiasma will call a stockholder meeting to approve the proposed transaction. In order for the transaction to close, Amryt and Chiasma’s stockholders must approve this transaction at a stockholder meeting.

Q&A: Organization and site What will happen to Chiasma? Upon closing of the transaction, Chiasma will become a subsidiary of Amryt and its business and operations will be integrated into those of Amryt. Amryt’s strong global commercial and medical infrastructure will be further enhanced by Chiasma’s U.S. commercial and medical platforms. Who will manage integration planning? Chiasma’s management team will work collaboratively with Amryt during the pre-closing integration planning period to ensure a smooth transition. Amryt has a successful track record with integration processes. We will provide more information in the coming weeks.

Q&A: Programs and Platforms What will happen to Chiasma’s commercial organization and launch? This is a critical time for Chiasma and we must maintain momentum for patients and for each other. We are committed to operating in the ordinary course during this time. The transaction is intended to leverage Amryt’s proven commercial execution ability expertise, global infrastructure and integration capabilities to accelerate MYCAPSSA launch in the US and, subject to approvals, in international markets We believe that the people and assets we have developed in our commercial organization will enhance Amryt’s existing commercial platform. What will happen to our development efforts for MYCAPSSA and TPE? Following closing, the combined organization is expected to have the financial strength to develop the potential for MYCAPSSA in patients with carcinoid symptoms stemming from NET and pursue other new development opportunities with our TPE technology platform. TPE and MYCAPSSA opportunities will supplement Amryt’s existing development pipeline.

Q&A: Employee Impact (1 of 2) What is Amryt’s culture like? Will Chiasma’s culture change? Like Chiasma, AMRYT shares common core beliefs – unwavering commitment to their patients and their employees, passionate about delivering innovative treatments to patients in need, ingenuity in execution, and a sense of urgency While of course there will be changes, we believe that there will be more common ground than not, and we look forward to the integration of the two companies. What should I be doing between now and deal close? As a general statement, it is business as usual through the closing. Everyone at Chiasma should continue working towards the corporate and individual goals we have set for 2021. At times, home office employees in the U.S. and Israel may need to participate in certain aspects of integration planning. In certain instances, Chiasma’s activities may require review with Amryt, and the Finance and Legal teams will coordinate that review.

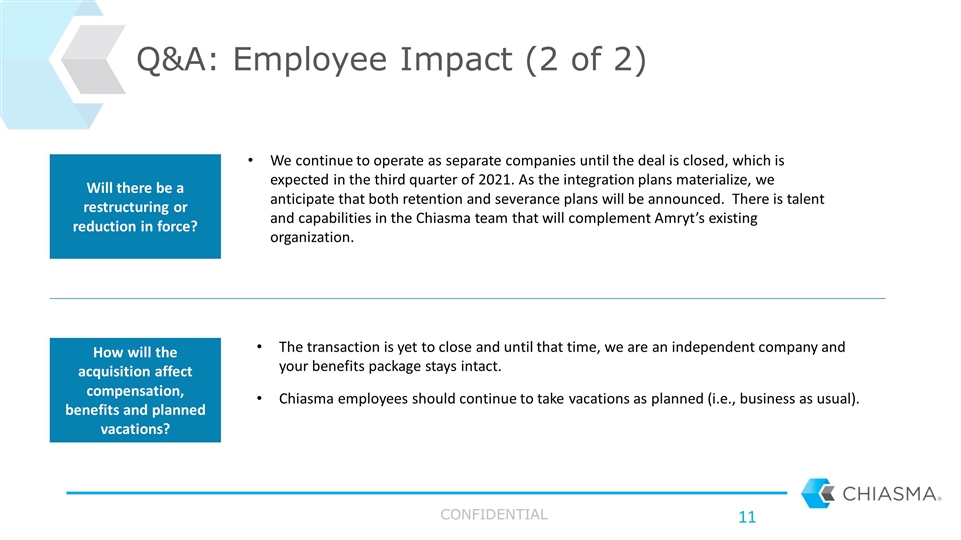

Q&A: Employee Impact (2 of 2) Will there be a restructuring or reduction in force? We continue to operate as separate companies until the deal is closed, which is expected in the third quarter of 2021. As the integration plans materialize, we anticipate that both retention and severance plans will be announced. There is talent and capabilities in the Chiasma team that will complement Amryt’s existing organization. How will the acquisition affect compensation, benefits and planned vacations? The transaction is yet to close and until that time, we are an independent company and your benefits package stays intact. Chiasma employees should continue to take vacations as planned (i.e., business as usual).

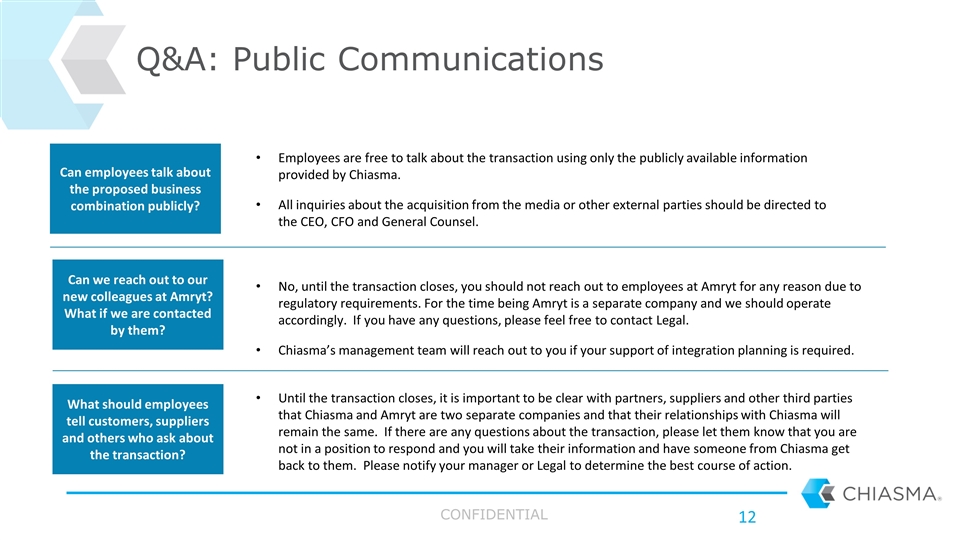

Q&A: Public Communications Can employees talk about the proposed business combination publicly? Employees are free to talk about the transaction using only the publicly available information provided by Chiasma. All inquiries about the acquisition from the media or other external parties should be directed to the CEO, CFO and General Counsel. Until the transaction closes, it is important to be clear with partners, suppliers and other third parties that Chiasma and Amryt are two separate companies and that their relationships with Chiasma will remain the same. If there are any questions about the transaction, please let them know that you are not in a position to respond and you will take their information and have someone from Chiasma get back to them. Please notify your manager or Legal to determine the best course of action. Can we reach out to our new colleagues at Amryt? What if we are contacted by them? What should employees tell customers, suppliers and others who ask about the transaction? No, until the transaction closes, you should not reach out to employees at Amryt for any reason due to regulatory requirements. For the time being Amryt is a separate company and we should operate accordingly. If you have any questions, please feel free to contact Legal. Chiasma’s management team will reach out to you if your support of integration planning is required.

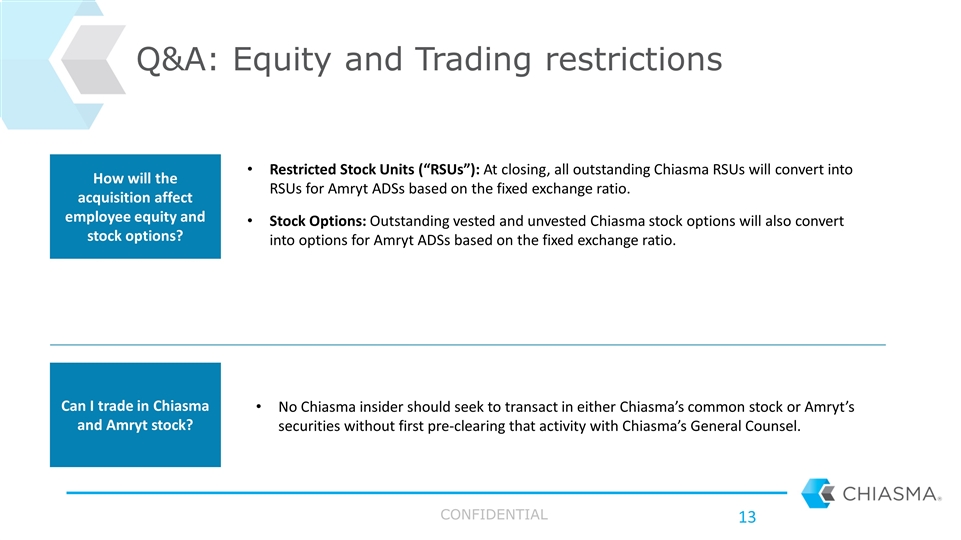

Q&A: Equity and Trading restrictions How will the acquisition affect employee equity and stock options? Restricted Stock Units (“RSUs”): At closing, all outstanding Chiasma RSUs will convert into RSUs for Amryt ADSs based on the fixed exchange ratio. Stock Options: Outstanding vested and unvested Chiasma stock options will also convert into options for Amryt ADSs based on the fixed exchange ratio. Can I trade in Chiasma and Amryt stock? No Chiasma insider should seek to transact in either Chiasma’s common stock or Amryt’s securities without first pre-clearing that activity with Chiasma’s General Counsel.

Welcome to AMRYT Joe Wiley, CEO

Disclaimer This presentation has been prepared by the Company. “Presentation” means this document, any oral presentation, any question and answer session and any written or oral material discussed or distributed during the meeting. By receiving this presentation and/or attending the meeting where this presentation is made, or by reading the presentation slides, you agree to be bound by the following limitations. This presentation is being made only to, and is directed only at, (i) persons having professional experience in matters relating to investments who fall within the definition of "investment professionals" in Article 19(5) of the United Kingdom Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended from time to time) (the “Order”); (ii) high net worth bodies corporate, unincorporated associations, partnerships and trustees of high value trusts as described in Article 49(2)(a)-(d) of the Order; (iii) “overseas recipients” as defined in Article 12 of the Order; (iv) persons in member states of the European Economic Area (the “EEA”) who are qualified investors, as defined in the Prospectus Regulation (Regulation (EU) 2017/1129) (as amended); (v) qualified institutional buyers in the United States as defined in Rule 144A of the United States Securities Act of 1933 as amended (the “Securities Act”); or (vi) persons to whom it would otherwise be lawful to distribute it (all such persons being “Relevant Persons”). Persons who receive this communication (other than Relevant Persons) should not rely on or act upon the contents of this presentation and should return this document immediately. This presentation is being directed only at Relevant Persons and any investment or investment activity to which this presentation relates will be engaged in only with Relevant Persons. This presentation does not constitute or form part of any offer to sell or issue, or invitation to purchase or subscribe for, or any solicitation of any offer to purchase or subscribe for, any securities of the Company or any of its subsidiaries (together the “Group”) or in any other entity, nor shall this presentation or any part of it, or the fact of its presentation, form the basis of, or be relied on in connection with, any contract or investment activity (including within the meaning specified in section 21 of the United Kingdom Financial Services and Markets Act 2000), nor does it constitute a recommendation regarding the securities of the Group. Securities of the abovementioned persons or any of their respective affiliates have not been registered under United States securities laws and may not be offered or sold in the United States absent registration under such laws absent registration or an applicable exemption from registration requirements. Past performance, including the price at which the Company’s securities have been bought or sold in the past and the past yield on the Company’s securities, cannot be relied on as a guide to future performance. Nothing herein should be construed as financial, legal, tax, accounting, actuarial or other specialist advice and persons needing advice should consult an independent financial adviser or independent legal counsel. Neither this presentation nor any information contained in this presentation should be transmitted into, distributed in or otherwise made available in whole or in part by the recipients of the presentation to any other person in the United States, Canada, Australia, Japan or any other jurisdiction which prohibits or restricts the same except in compliance with or as permitted by law or regulation. Recipients of this presentation are required to inform themselves of and comply with all restrictions or prohibitions in such jurisdictions. Accordingly, by requesting to receive and reviewing this document you represent that you are able to receive this document without contravention of any legal or regulatory restrictions applicable to you. No responsibility is accepted by and, to the fullest extent permitted by law, the Company, the Group, their affiliates and advisers and their respective directors, officers, partners, representatives, employees and agents expressly disclaim any and all liability, whether direct or indirect, express or implied, contractual, tortious, statutory or otherwise, as to the accuracy, fairness, reliability or completeness of the information contained herein or discussed verbally or as to the reasonableness of any assumptions on which any of the same is based or the use of any of the same or for any errors, omissions or misstatements in or from this presentation. No representations or warranties, express or implied, are given by the Company, the Group, their affiliates and advisers and their respective directors, officers, partners, representatives, employees and agents as to the accuracy, reliability or completeness of this presentation or any other written or oral information which has been or may be made available. Accordingly, no such person will be liable for any direct, indirect or consequential loss or damage suffered by any person resulting from the use of the information contained herein, or for any opinions expressed by any such person, or any errors, omissions or misstatements made by any of them. No duty of care is owed or will be deemed to be owed to any person in relation to the presentation. No reliance whatsoever may be placed on the presentation for any purpose. The Company’s shares are currently admitted to trading on public exchanges and, therefore, certain of the information in this presentation could constitute inside information and/or price sensitive information. By accepting this presentation, you agree to use and maintain any such information in accordance with your contractual obligations and applicable laws, including all applicable securities laws. The information contained in this presentation has not been independently verified. The Amryt logo, Myalept®, Myalepta®, Juxtapid®, Lojuxta®, Filsuvez® and other trademarks or service marks of Amryt appearing in this presentation are the property of Amryt and MYCAPSSA®, NET® and other trademarks or service marks of Chiasma appearing in this presentation are the property of Chiasma. This presentation includes trademarks, tradenames and service marks, certain of which belong to us and others that are the property of other organizations. Solely for convenience, trademarks, tradenames and service marks referred to in this presentation appear without the ®, TM and SM symbols, but the absence of those symbols is not intended to indicate, in any way, that we will not assert our rights or that the applicable owner will not assert its rights to these trademarks, tradenames and service marks to the fullest extent under applicable law. We do not intend our use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties. Filsuvez® (Oleogel-S10/birch triterpenes/formerly known as AP101) is currently an investigational product and has not received regulatory approval by the FDA or EMA. Elements of this presentation only apply in the event that Filsuvez® is approved by the appropriate regulatory authorities. MYCAPSSA has been approved by the FDA for the long-term maintenance treatment in patients with acromegaly who have responded to and tolerated treatment with octreotide or lanreotide but remains an investigational drug outside the U.S. and for other indications. This presentation is intended only for communications with investors. Confidential

Who am I? Confidential

my p’s and Q

Watching my p’s PERFORMANCE PURPOSE PATIENTS PEOPLE Confidential

OUR VISION, OUR FUTURE – Amryt 2025 To become a leading global rare disease company by acquiring, developing and commercializing medicines that transform the lives of patients & their families around the world Confidential

OUR PURPOSE – WHAT WE DO EVERY DAY “We transform the lives of people affected by rare, debilitating conditions by providing innovative medicines that bring hope to those in greatest need” Confidential

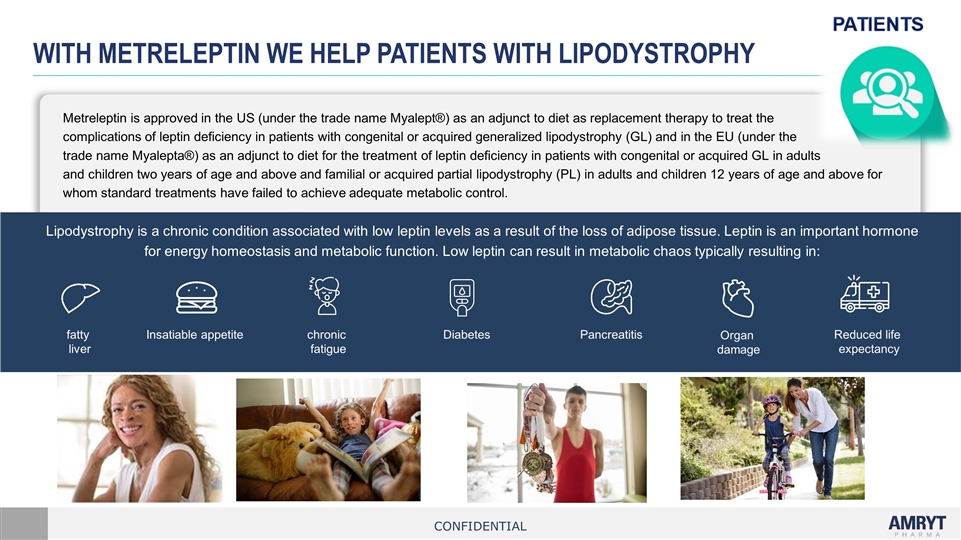

With Metreleptin we help patients with LIPODYSTROPHY fatty liver Insatiable appetite chronic fatigue Diabetes Pancreatitis Organ damage Reduced life expectancy Lipodystrophy is a chronic condition associated with low leptin levels as a result of the loss of adipose tissue. Leptin is an important hormone for energy homeostasis and metabolic function. Low leptin can result in metabolic chaos typically resulting in: Metreleptin is approved in the US (under the trade name Myalept®) as an adjunct to diet as replacement therapy to treat the complications of leptin deficiency in patients with congenital or acquired generalized lipodystrophy (GL) and in the EU (under the trade name Myalepta®) as an adjunct to diet for the treatment of leptin deficiency in patients with congenital or acquired GL in adults and children two years of age and above and familial or acquired partial lipodystrophy (PL) in adults and children 12 years of age and above for whom standard treatments have failed to achieve adequate metabolic control. Confidential

With LOMITAPIDE we help patients with HoFH Lomitapide is approved as an adjunct to a low-fat diet and other lipid-lowering medicinal treatments for adults with the rare cholesterol disorder, Homozygous Familial Hypercholesterolaemia ("HoFH") in the US, Canada, Columbia, Argentina and Japan (under the trade name Juxtapid®) and in the EU, Israel and Brazil (under the trade name Lojuxta®). HoFH is a potentially life-threatening disorder that impairs the body’s ability to remove LDL “bad” cholesterol from the blood. Typically results in extremely high blood LDL cholesterol levels leading to aggressive and premature blocking of arterial blood vessels. HoFH patients are at a high risk of experiencing life-threatening cardiovascular events and have a substantially reduced life expectancy.* *The effect of lomitapide on cardiovascular morbidity and mortality has not been determined. Confidential

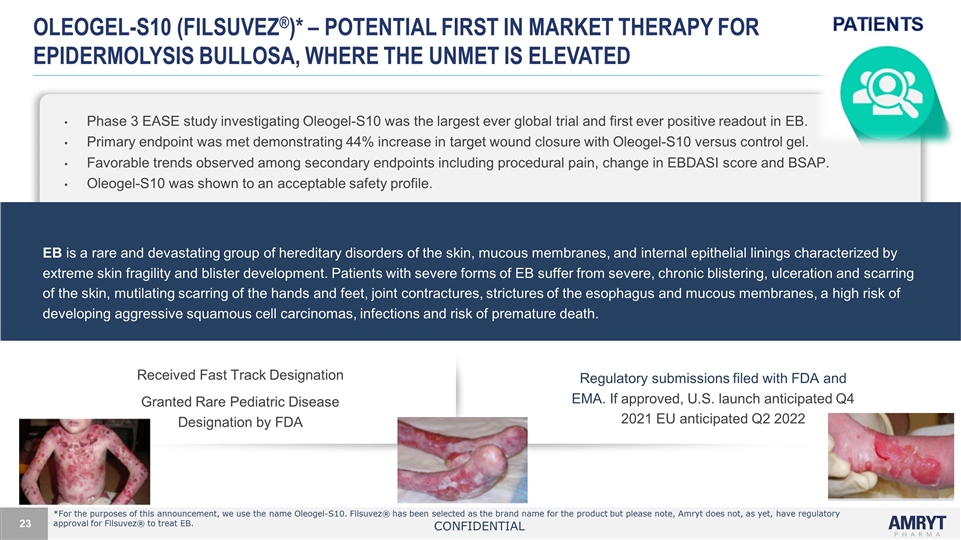

Oleogel-s10 (Filsuvez®)* – Potential first in market therapy for epidermolysis bullosa, where the unmet is elevated Regulatory submissions filed with FDA and EMA. If approved, U.S. launch anticipated Q4 2021 EU anticipated Q2 2022 Received Fast Track Designation Granted Rare Pediatric Disease Designation by FDA The global market is estimated to be in excess $1 billion fatty liver Insatiable appetite chronic fatigue Diabetes Pancreatitis Organ damage Reduced life expectancy EB is a rare and devastating group of hereditary disorders of the skin, mucous membranes, and internal epithelial linings characterized by extreme skin fragility and blister development. Patients with severe forms of EB suffer from severe, chronic blistering, ulceration and scarring of the skin, mutilating scarring of the hands and feet, joint contractures, strictures of the esophagus and mucous membranes, a high risk of developing aggressive squamous cell carcinomas, infections and risk of premature death. Phase 3 EASE study investigating Oleogel-S10 was the largest ever global trial and first ever positive readout in EB. Primary endpoint was met demonstrating 44% increase in target wound closure with Oleogel-S10 versus control gel. Favorable trends observed among secondary endpoints including procedural pain, change in EBDASI score and BSAP. Oleogel-S10 was shown to an acceptable safety profile. *For the purposes of this announcement, we use the name Oleogel-S10. Filsuvez® has been selected as the brand name for the product but please note, Amryt does not, as yet, have regulatory approval for Filsuvez® to treat EB. Confidential

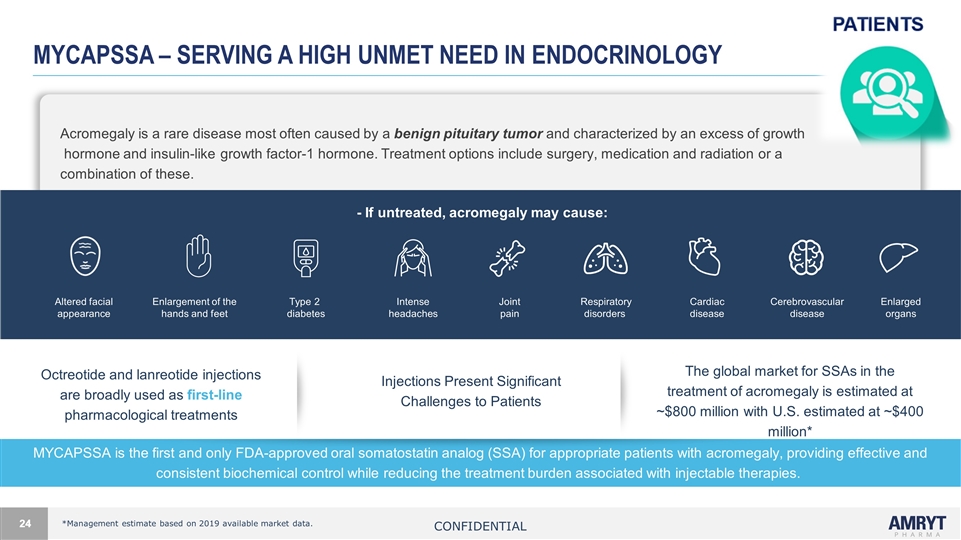

Mycapssa – serving a high unmet need in endocrinology Octreotide and lanreotide injections are broadly used as first-line pharmacological treatments Injections Present Significant Challenges to Patients The global market for SSAs in the treatment of acromegaly is estimated at ~$800 million with U.S. estimated at ~$400 million* Acromegaly is a rare disease most often caused by a benign pituitary tumor and characterized by an excess of growth hormone and insulin-like growth factor-1 hormone. Treatment options include surgery, medication and radiation or a combination of these. - If untreated, acromegaly may cause: *Management estimate based on 2019 available market data. Enlarged organs Intense headaches Altered facial appearance Enlargement of the hands and feet Type 2 diabetes Respiratory disorders Cardiac disease Joint pain Cerebrovascular disease MYCAPSSA is the first and only FDA-approved oral somatostatin analog (SSA) for appropriate patients with acromegaly, providing effective and consistent biochemical control while reducing the treatment burden associated with injectable therapies. Confidential

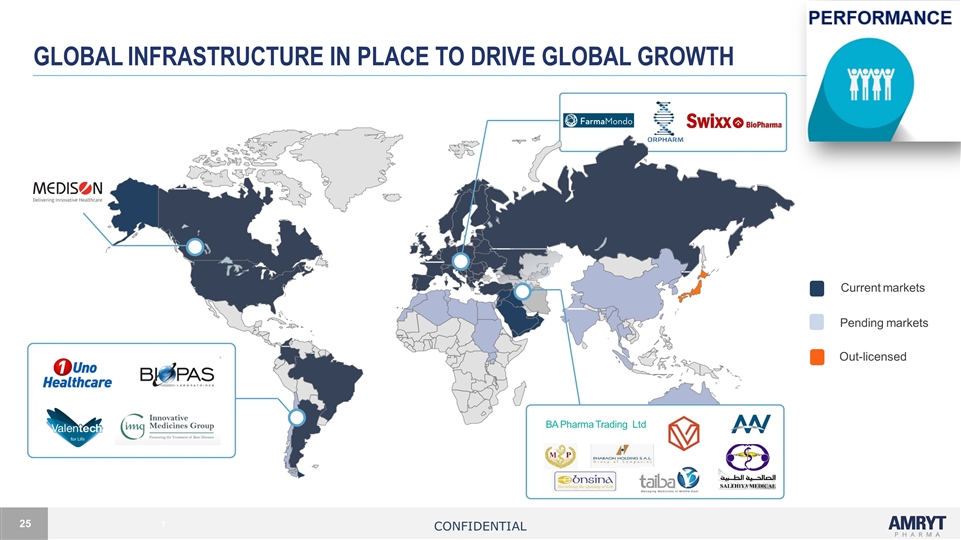

GLOBAL INFRASTRUCTURE in place to drive global growth 7 Current markets Pending markets Out-licensed BA Pharma Trading Ltd Confidential

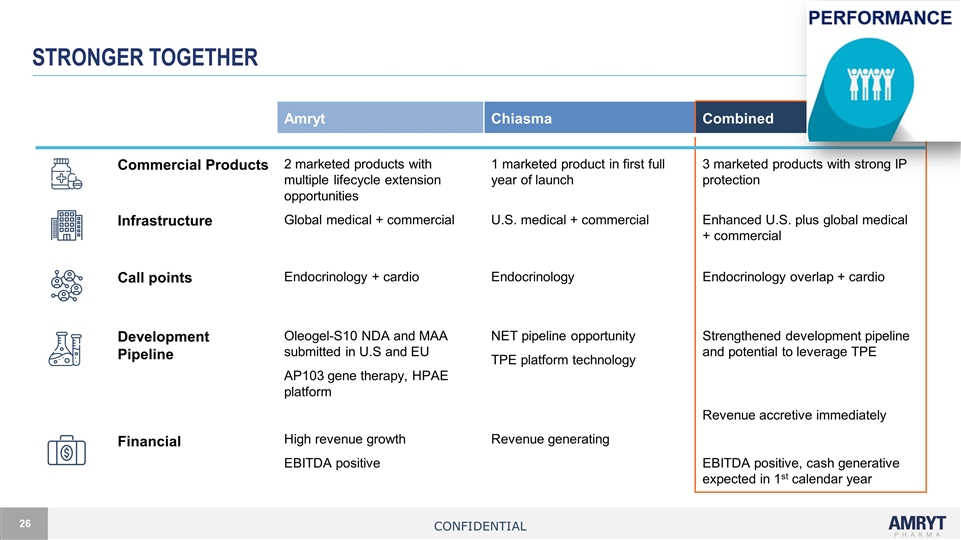

Stronger together Amryt Chiasma Amryt Chiasma Combined Commercial Products 2 marketed products with multiple lifecycle extension opportunities 1 marketed product in first full year of launch 3 marketed products with strong IP protection Infrastructure Global medical + commercial U.S. medical + commercial Enhanced U.S. plus global medical + commercial Call points Endocrinology + cardio Endocrinology Endocrinology overlap + cardio Development Pipeline Oleogel-S10 NDA and MAA submitted in U.S and EU AP103 gene therapy, HPAE platform NET pipeline opportunity TPE platform technology Strengthened development pipeline and potential to leverage TPE Financial High revenue growth EBITDA positive Revenue generating Revenue accretive immediately EBITDA positive, cash generative expected in 1st calendar year Confidential

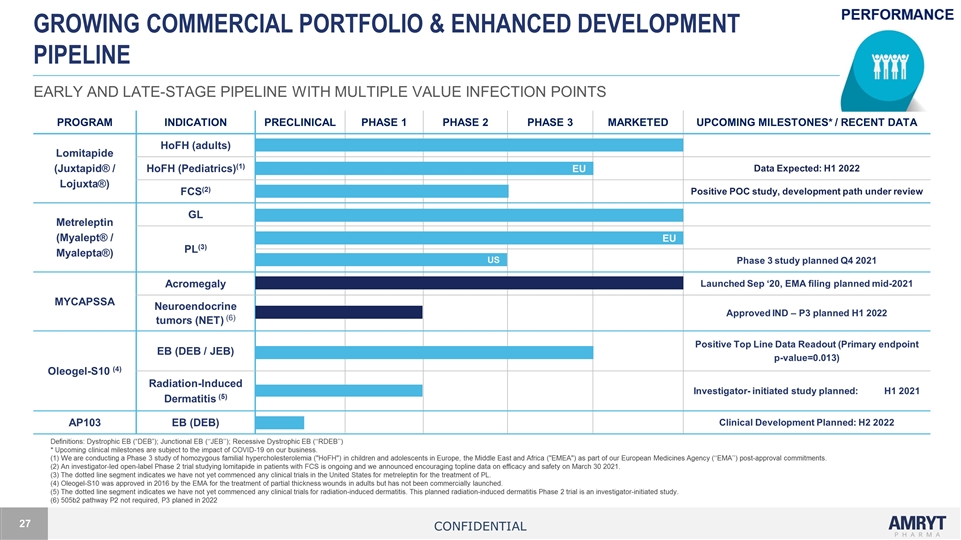

GROWING COMMERCIAL PORTFOLIO & ENHANCED Development Pipeline EARLY AND LATE-STAGE PIPELINE WITH MULTIPLE VALUE INFECTION POINTS Definitions: Dystrophic EB (“DEB”); Junctional EB (‘‘JEB’’); Recessive Dystrophic EB (‘‘RDEB’’) * Upcoming clinical milestones are subject to the impact of COVID-19 on our business. (1) We are conducting a Phase 3 study of homozygous familial hypercholesterolemia ("HoFH") in children and adolescents in Europe, the Middle East and Africa ("EMEA") as part of our European Medicines Agency (‘‘EMA’’) post-approval commitments. (2) An investigator-led open-label Phase 2 trial studying lomitapide in patients with FCS is ongoing and we announced encouraging topline data on efficacy and safety on March 30 2021. (3) The dotted line segment indicates we have not yet commenced any clinical trials in the United States for metreleptin for the treatment of PL. (4) Oleogel-S10 was approved in 2016 by the EMA for the treatment of partial thickness wounds in adults but has not been commercially launched. (5) The dotted line segment indicates we have not yet commenced any clinical trials for radiation-induced dermatitis. This planned radiation-induced dermatitis Phase 2 trial is an investigator-initiated study. (6) 505b2 pathway P2 not required, P3 planed in 2022 PROGRAM INDICATION PRECLINICAL PHASE 1 PHASE 2 PHASE 3 MARKETED UPCOMING MILESTONES* / RECENT DATA Lomitapide (Juxtapid® / Lojuxta®) HoFH (adults) HoFH (Pediatrics)(1) Data Expected: H1 2022 FCS(2) Positive POC study, development path under review Metreleptin (Myalept® / Myalepta®) GL PL(3) Phase 3 study planned Q4 2021 MYCAPSSA Acromegaly Launched Sep ‘20, EMA filing planned mid-2021 Neuroendocrine tumors (NET) (6) Approved IND – P3 planned H1 2022 Oleogel-S10 (4) EB (DEB / JEB) Positive Top Line Data Readout (Primary endpoint p-value=0.013) Radiation-Induced Dermatitis (5) Investigator- initiated study planned: H1 2021 AP103 EB (DEB) Clinical Development Planned: H2 2022 EU EU US Confidential

OUR PURPOSE – WHAT WE DO EVERY DAY “We transform the lives of people affected by rare, debilitating conditions by providing innovative medicines that bring hope to those in greatest need” MISSION: Replace painful injectable therapies with oral formulations so people can live better lives Confidential

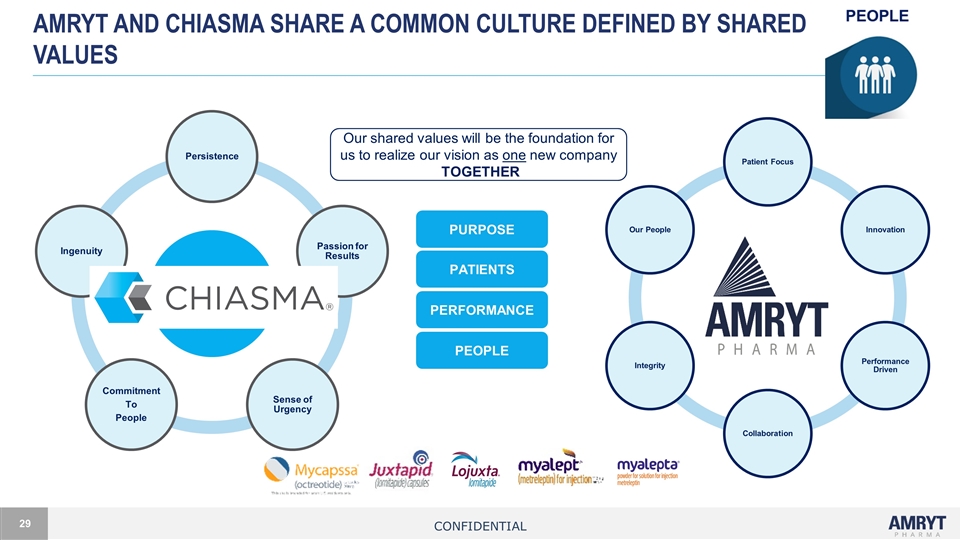

Amryt and chiasma share a common culture defined by shared values Our shared values will be the foundation for us to realize our vision as one new company TOGETHER PURPOSE PATIENTS PERFORMANCE PEOPLE Confidential Chiasma Values Persistence Passion for Results Sense of Urgency Commitment To People Ingenuity Amryt Values Patient Focus Innovation Performance Driven Collaboration Our People Integrity

And the Q? What does this mean for me? Confidential

Next steps – We want to hear your voice On Tuesday May 11 we will meet again to provide an opportunity have conversations in smaller groups You will get an opportunity to meet and get to know key leaders from Amryt Confidential

We are stronger & better, together as one Confidential