MANAGEMENT INFORMATION CIRCULAR

May 17, 2011

GENERAL PROXY INFORMATION

This Circular is furnished in connection with the solicitation of proxies by or on behalf of the management of the Company for use at the Meeting to be held on June 28, 2011 and at any adjournment(s) or postponement(s) thereof. Unless the context otherwise requires, references to the Company include the Company and its subsidiaries. The solicitation will be conducted primarily by mail and may be supplemented by telephone, electronic or other personal contact to be made without special compensation by directors, officers and employees of the Company. The costs of the solicitation will be borne by the Company.

The Meeting Materials (as defined below) are being sent to both registered Shareholders and Non-Registered Shareholders (as defined below). If you are a Non-Registered Shareholder, and the Company or Computershare Investor Services Inc. has sent the Meeting Materials directly to you, your name and address and information about your holdings of Shares, have been obtained in accordance with applicable securities regulatory requirements from the relevant Intermediary (as defined below). By choosing to send the Meeting Materials to you directly, the Company, or its agent (and not such Intermediary) has assumed responsibility for (i) delivering the Meeting Materials to you, and (ii) executing your proper voting instructions.

Appointment of Proxyholder

The purpose of a proxy is to designate persons who will vote the proxy on a Shareholder’s behalf in accordance with the instructions given by the Shareholder in the proxy. The persons whose names are printed in the enclosed form of proxy are officers or directors of the Company. (the “Management Proxyholders”).

A Shareholder has the right to appoint a person other than a Management Proxyholder to represent the Shareholder at the Meeting by inserting the name of that individual in the blank space provided in the form of proxy or by completing another acceptable form of proxy. A proxyholder need not be a Shareholder.

Voting by Proxy

Only registered Shareholders or duly appointed proxyholders are permitted to vote at the Meeting.Shares represented by properly executed and delivered proxies in the accompanying form will be voted or withheld from voting on each respective matter in accordance with the instructions of the Shareholder on any ballot that may be conducted.If there are no instructions provided in respect of any matters, the named individuals will vote FOR the proposed resolutions.

The enclosed form of proxy, when properly completed and signed, confers discretionary authority upon the proxyholder(s) named therein with respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting. At the date of this Circular, management of the Company knows of no such amendments, variations or other matters to come before the Meeting.

Page 1 of 18

Completion and Return of Proxy

Completed proxies must be deposited at the office of the Company’s registrar and transfer agent, Computershare Investor Services Inc. at Suite 200, 510 Burrard Street, Vancouver, British Columbia, V6C 3B9 or delivered by facsimile to 1-604-661-9401, not later than forty eight (48) hours, excluding Saturdays, Sundays and holidays, prior to the time of the Meeting, or any adjournment thereof.

Non-Registered Holders

Only persons whose name appear on the register of the Company at the close of business on May 17, 2011 as the holders of Shares or their duly appointed proxyholders are permitted to vote at the Meeting.In many cases, however, Shares beneficially owned by a holder (a “Non-Registered Shareholder”) are registered in the name of either: (i) an intermediary, among others, such as a brokerage firm, a bank or trust company; or (ii) a clearing agency (such as CDS Clearing and Depository Services Inc.) in which the relevant Intermediary is a participant. If you purchased your Shares through a broker, you are likely a Non-Registered Shareholder.

In accordance with the requirements of National Instrument 54-101 –Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”), the Company has distributed copies of meeting materials including Notice of Meeting and this Circular (collectively, the “Meeting Materials”), to the Intermediaries for distribution to Non-Registered Shareholders. The Company will reimburse brokers and other intermediaries for costs incurred by them in mailing Meeting Materials to Non-Registered Shareholders in accordance with the requirements of the Canadian Securities Administrators.

Intermediaries are required to forward the Meeting Materials to Non-Registered Shareholders in order to seek their voting instructions in advance of the Meeting. Shares held by Intermediaries can only be voted in accordance with the instructions of Non-Registered Shareholders. The Intermediaries often have their own voting instruction form and mailing instructions. Generally, Non-Registered Shareholders will either:

a) be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile stamped signature), which is restricted as to the number of shares beneficially owned by the Non-Registered Shareholder but which is otherwise not completed. Because the Intermediary has already signed the form of proxy, this form of proxy is not required to be signed by the Non-Registered Shareholder when submitting the proxy. In this case, the Non-Registered Shareholder who wishes to submit a proxy should otherwise properly complete the form of proxy and deliver it Computershare Investor Services Inc. as provided above; or

b) more typically, be given a voting instruction form which is not signed by the Intermediary, but which, when properly completed and signed by the Non-Registered Shareholder and returned to the Intermediary or its designated service company, will constitute voting instructions (often called a “proxy authorization form”) which the Intermediary must follow. Typically, the proxy authorization form will consist of a one page pre-printed form. Sometimes, instead of the one page pre-printed form, the proxy authorization form will consist of a regularly printed proxy form accompanied by a page of instructions which includes a removable label containing a bar code and other information. In this case, in order for the form of proxy to validly constitute a proxy authorization form, the Non-Registered Shareholder must remove the label from the page of instructions and affix it to the form of proxy, properly complete and sign the form of proxy and return it to the Intermediary or its service company in accordance with the instructions of the Intermediary or its service company.

In either case, the purpose of these procedures is to permit Non-Registered Shareholders to direct the voting of the Shares which they beneficially own. Should a Non-Registered Shareholder who receives one of the above forms wish to vote at the Meeting in person, the Non-Registered Shareholder should insert the Non-Registered Shareholder’s name in the appropriate blank space provided. In either case, Non-Registered Shareholders should carefully follow the instructions of their Intermediary or its service company, including those regarding when and where the proxy or proxy authorization form is to be delivered.

Page 2 of 18

Revocability of Proxies

A proxy given pursuant to this solicitation may be revoked at any time before the Meeting by executing a valid form of revocation and delivering it to the head office of the Company being Suite 1100, 1199 West Hastings Street, Vancouver, British Columbia V6E 3T5, at any time up 5:00 p.m. on the last business day preceding the date of the Meeting, or any adjournment or postponement thereof, or by delivering it to the chair of the Meeting prior to the commencement of the Meeting, or any adjournment(s) or postponement(s) thereof. If you attend the Meeting and vote on a ballot, you will automatically be revoking any valid proxy previously delivered by you. If you attend the Meeting in person you need not revoke your proxy and vote in person unless you wish to do so. A proxy may also be revoked in any other manner permitted by law.Only registered Shareholders have the right to revoke a proxy. Non-Registered Shareholders who wish to change their vote must arrange with adequate prior notice for their respective Intermediaries to revoke the proxy on their behalf.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

Except as otherwise disclosed, to the knowledge of the Company, no director or executive officer since the commencement of the Company’s last completed fiscal year, and no proposed nominee for election as a director, or any associate or affiliate of the foregoing persons, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any of the matters to be acted upon at the Meeting other than the election of directors.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

As at May 17, 2011, the record date for the Meeting, 142,120,540 shares were issued and outstanding. Holders of record of Shares at the close of business on May 17, 2011 are entitled to receive notice of and to vote at the Meeting. The holders of Shares entitled to one vote for each Share held. To the knowledge of the directors and executive officers of the Company, as at the record date, there are no persons who beneficially owned, directly or indirectly, or controlled or directed voting securities carrying 10% or more of the voting rights attached to all Shares.

A quorum of Shareholders will be present at the Meeting if not less than one Shareholder is present in person or represented by proxy or a duly authorized representative.

ELECTION OF DIRECTORS

The board of directors of the Company currently consists of seven directors and it is proposed to fix the number of directors at seven and to elect seven directors for the ensuing year.

The Company’s board of directors proposes to nominate the persons named in the table below for election as directors of the Company. Each director elected will hold office until the next annual general meeting of the Company or until his or her successor is duly elected or appointed, unless the office is earlier vacated in accordance with the Articles of the Company or theBusiness Corporations Act (British Columbia).

Page 3 of 18

The following table sets out the names of management’s nominees for election as directors, the place in which each is ordinarily resident, all offices of the Company now held by each of them, their principle occupations, the period of time during which each has been a director of the Company, and the number of common shares of the Company beneficially owned by each of them, directly or indirectly, or over which control or direction is exercised, as of the date of this information circular.

Name, Jurisdiction of

Residence and Position with the

Company | Principal Occupation,

Business or

Employment | Director Since | Number of Securities

Beneficially Owned,

Directly or Indirectly,

or Controlled or

Directed |

Thomas C. Patton

Washington, USA

President, CEO and Director | President of the Company | Since 1998 | 2,457,212 |

Eugene Spiering

British Columbia, Canada

Vice President, Exploration andDirector | Vice President, Exploration of the Company | Since 2006 | 165,790 |

Lawrence Page, Q.C.

British Columbia, Canada

Corporate Secretary andDirector | Lawyer | Since 1995 | 500 |

Robert Gayton(1)(2)

British Columbia, Canada

Director | Financial Consultant | Since 1997 | 140,023 |

Tracy Stevenson

Utah, USA

Chairman and Director | Retired Mining Executive | Since 2007 | 142,293 |

LeRoy Wilkes(1)(2)

Colorado, USA

Director | Retired Mining Executive | Since 2006 | 105,428 |

John Kerr(1)(2)

British Columbia, Canada

Director | Geological Engineer | Since 1993 | 21,667 |

| (1) | Member of the Audit Committee |

| (2) | Member of the Corporate Governance, Nomination Compensation Committee. |

Director biographies can be viewed on the Company’s website atwww.quaterra.com.

Unless otherwise instructed, the persons named in the accompanying form of proxy intend to vote FOR the election of the foregoing individuals as directors until the close of the next annual general meeting of the Shareholders or until their successors are otherwise elected or appointed.

Except as otherwise disclosed in this Circular, to the knowledge of the Company, no director:

a. is, as at the date of this Circular, or has been, within 10 years before the date of this Circular, a director, chief executive officer or chief financial officer of any company (including the Company) that,

i) was subject to an order that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or ii) was subject to an order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as a director, chief executive officer or chief financial officer, or

Page 4 of 18

b. is, as at the date of this Circular, or has been within 10 years before the date of this Circular, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or

c. has within 10 years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director.

For the purpose of the paragraphs above, “order” means: (i) a cease trade order; (ii) an order similar to a cease trade order; or (iii) an order that denied the relevant company access to any exemption under securities legislation that was in effect for a period of more than 30 consecutive days.

a. Southern Silver Exploration Corp.

Lawrence Page, Robert Gayton and Thomas Patton, who were directors and/or executive officers of Newcoast Silver Mines Ltd. (now Southern Silver Exploration Corp.) when a Cease Trade Order was issued by the British Columbia Securities Commission on September 30, 2003 and the Alberta Securities Commission on October 23, 2003, for failure to file certain financial information, which Cease Trade Orders were revoked by the British Columbia Securities Commission on October 31, 2003, and by the Alberta Securities Commission on March 25, 2004.

b. Saturna Beach Estates Ltd.

Lawrence Page, a director and President of Saturna Beach Estates Ltd., a private Company formed under the laws of British Columbia, Canada (“SBEL”) which conducts the business of a vineyard and winery. On August 17, 2004, SBEL obtained an Order from the Supreme Court of British Columbia under the provisions of the Companies’ Creditors Arrangement Act (Canada) that allowed SBEL to continue to run its daily business affairs without creditor action during financial reorganization. In June 2005, the financial reorganization was completed and the Order terminated.

c. Copper Mesa Mining Corporation

LeRoy E. Wilkes, was a director of Copper Mesa Mining Corporation which had a cease trading order issued against it on April 8, 2009 for failure to file its annual financial statements, accompanying management's discussion and analysis and annual information form (collectively, the "Annual Filings) for its financial year ended December 31, 2008. On June 3, 2009, the cease trade order was revoked as Copper Mesa Mining Corporation had filed its Annual Filings. Mr. Wilkes ceased to be a director on November 5, 2009.

APPOINTMENT OF AUDITORS

Smythe Ratcliffe, Chartered Accountants are the current auditors of the Company. At the Meeting, shareholders will be requested to re-appoint Smythe Ratcliffe, Chartered Accountants as auditors of the Company to hold office until the next annual meeting of shareholders or until a successor is appointed, and to authorize the Board of Directors to fix the auditors’ remuneration. Smythe Ratcliffe was first appointed auditors of the Company in 1993.

Page 5 of 18

The person(s) designated by management of the Company in the enclosed form of proxy intend to vote FOR the re-appointment of Smythe Ratcliffe, Chartered Accountants, as auditors of the Company to hold office until the next annual meeting of shareholders or until a successor is appointed and the authorization of the Board of Directors to fix the remuneration of the auditors.

STOCK OPTION PLAN

At the Meeting, the shareholders will be asked to approve the Company’s stock option plan (the “Plan”) and the number of common shares reserved for issuance under the Plan in accordance with and subject to the rules and policies of the TSX Venture Exchange (“TSX”).

The purpose of the Plan is to provide the directors, officers and key employees of, and certain other persons who provide services to the Company and its subsidiaries with an opportunity to purchase shares of the Company and benefit from any appreciation in the value of the Company’s shares. This will provide an increased incentive for these individuals to contribute to the future success and prosperity of the Company, thus enhancing the value of the Company’s shares for the benefit of all the shareholders and increasing the ability of the Company and its subsidiaries to attract and retain skilled and motivated individuals in the service of the Company.

The proposed Plan is a “rolling” plan that provides that the aggregate number of shares reserved for issuance under it, and all of the Company’s other previously established and outstanding stock option plans or grants, will not exceed 10% of the Company’s issued common shares at the time of the grant of a stock option under the proposed Plan.

Under the proposed Plan, the option exercise price must not be less than the closing price of the Company’s common shares on the TSX on the day immediately preceding the date of grant, less the applicable discount permitted by the policies of the TSX. An option granted under the Plan must be exercised within the term permitted by the policies of the TSX on the date of grant. The Board of Directors of the Company may determine the limitation period during which an option may be exercised and, notwithstanding that none may be required by the policies of the TSX whether a particular grant will have a minimum vesting period. As a “rolling” plan, any amendment to the proposed Plan will require the approval of the TSX and may require shareholder approval.

In accordance with the terms of the proposed Plan, it is subject to its acceptance for filing by the Exchange and the approval of the Company’s shareholders. Under the policies of the TSX, if

a. the grants of options under the proposed Plan to “insiders” of the Company, together with all of the Company’s outstanding stock options, could result at any time in:

i. the number of shares reserved for issuance pursuant to stock options granted to insiders of the Company exceeding 10% of the issued common shares of the Company; or

ii. the grant to insiders of the Company, within a 12-month period, of a number of options exceeding 10% of the issued common shares of the Company; or

b. the number of shares reserved for issuance pursuant to stock options granted to any one optionee, within a 12-month period, exceeding 5% of the issued common shares of the Company;

such shareholder approval must be “disinterested shareholder approval”, but as the proposed Plan is restrictive as to these results, disinterest shareholder approval of the proposed Plan is not required.

Page 6 of 18

The policies of the TSX and the terms of the proposed Plan also provide that “disinterested shareholder approval” will be required for any agreement to decrease the exercise price of options previously granted to insiders of the Company but no such agreements are being brought before the Meeting.

The term “disinterested shareholder approval” means approval by a majority of the votes cast at the Meeting other than votes attaching to shares of the Company beneficially owned by insiders of the Company to whom options may be granted under the proposed Plan and associates of such persons. The term “insiders” is defined in theSecurities Act (British Columbia) and generally includes directors and senior officers of the Company and its subsidiaries and holders of greater than 10% of the voting securities of the Company. The term “associates” is defined in theSecurities Act (British Columbia).

If shareholder approval of the proposed Plan or a modified version thereof is not obtained, the Company will not proceed to implement the proposed Plan nor grant options under it. Even if approved, the directors may determine not to proceed with the proposed Plan.

The proposed Plan will be available for inspection at the Meeting. The directors recommend that the shareholders approve the proposed Plan.

The person(s) designated by management of the Company in the enclosed form of Proxy intend to vote FOR the adoption of the Stock Option Plan Resolution.

EXECUTIVE COMPENSATION

Compensation Discussion & Analysis

Named Executive Officers

Applicable securities regulations require that the Company give details of the compensation paid to the Company’s “named executive officers” who are defined as follows:

| | (a) | the chief executive officer; |

| | (b) | the chief financial officer; |

| | (c) | each of the three most highly compensated executive officers, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed financial year whose compensation was, individually, greater than $150,000 for that financial year; and |

| | (d) | any individual who would be a named executive officer under paragraph (c) but for the fact that the individual was neither an executive officer of the Company, nor acting in a similar capacity, at the end of that financial year. |

As at December 31, 2010, the Company’s Named Executive Officers were: Thomas Patton (President and CEO), Scott Hean (CFO), Eugene Spiering (VP Exploration) Tracy Stevenson (Chairman) and Thomas Turner (Exploration Geologist).

Page 7 of 18

Corporate Governance, Nomination and Compensation Committee

The Company’s compensation policy is administered by the Corporate Governance Nomination and Compensation Committee (the “Compensation Committee”). The Compensation Committee has the responsibility for approving the compensation program for the Company’s Named Executive Officers, (“Named Executives”) including a review of any proposed stock options or any other equity plans. The Compensation Committee acts pursuant to the Governance Nomination Compensation Charter (the “Governance Charter”) that has been approved by the board of directors. The Governance Charter can be viewed on the Company’s website atwww.quaterra.com. The Compensation Committee reports to the Board of Directors which decides the bases of employment agreements and equity compensation. The Compensation Committee also seeks the views of the CEO when reviewing compensation for other executive officers because of his involvement with these officers.

The members of the Compensation Committee are LeRoy Wilkes (Chair), Robert Gayton and John Kerr, all of whom are independent directors, applying the definition set out in Section 1.4 of National Instrument 52-110

Objectives of the Compensation Program

The general objectives of the Company’s compensation strategy are to:

| | (a) | compensate management in a manner that encourages and rewards a high level of performance and outstanding results with a view to increasing long term shareholder value; |

| | | |

| | (b) | provide a compensation package that is commensurate with other comparable mineral exploration companies to enable the Company to attract and retain talent; and |

| | | |

| | (c) | ensure that the total compensation package is designed in a manner that takes into account the Company’s present stage of development and its available financial resources. The Company’s compensation packages have been designed to provide a blend of non-cash stock option component with a reasonable cash salary. |

Salaries for the Named Executives are determined by evaluating the responsibilities inherent in the position held, and the individuals experience and past performance, as well as by reference to the competitive marketplace for management talent at other mineral exploration companies. Following the annual general meeting of shareholders, the Compensation Committee reviews actual performance for the Company and the named executive officer for such year, including the quality and measured progress of the Company’s exploration projects, raising of capital and similar achievements.

Elements of Compensation

During 2010, the Company’s compensation program consisted of two elements (i) cash and (ii) incentive stock options administered under the Company’s stock option plan. The Company does not presently have a long-term incentive plan. There is no policy or target regarding allocation between cash and non-cash elements of the Company’s compensation program. The Board reviews annually the total compensation package of each of the Company’s Named Executives on an individual basis, against the backdrop of the compensation goals and objectives described above.

Salary - Base salary for Named Executives for any given year is fixed by the Compensation Committee at its meeting in June. Increases or decreases in salary on a year over year basis are dependent on the Compensation Committee’s assessment of the performance of the Company and the particular Named Executive. When considering the base salaries of the Company’s Named Executives, the Compensation Committee reviews the qualifications of the Named Executive, performance, and salaries paid to executives in the Company’s peer group. Recommendations for executive salaries are made by the Compensation Committee to the full Board of Directors in consultation with the CEO.

Page 8 of 18

Equity Compensation – The Compensation Committee believes that a portion of each Named Executive’s compensation should be in the form of equity awards. Equity awards are made to the Named Executive pursuant to the Company’s stock option plan. The stock option plan provides for awards in the form of stock options. The Committee has generally followed a practice of issuing stock options to its Named Executives on an annual basis in June of each year. The Committee retains the discretion to make additional awards to Named Executives at other times, in connection with the initial hiring of a new executive, for retention purposes or otherwise. In determining the amount of stock options to be issued, the Compensation Committee considers qualifications, performance, and similar option programs of competitor companies.

Perquisites and Other Personal Benefits –The Company’s Named Executives are not generally entitled to significant perquisites. The Company offers paid parking for several of its Named Executives as well has health care benefits, otherwise, there are no other perquisites which account for a material portion of the overall compensation paid to Named Executives.

Employment Agreements, Termination and Change of Control

The Company has employment agreements with three of its Named Executives namely Thomas Patton, Scott Hean and Eugene Spiering. The Compensation Committee believes that these agreements will help to secure the continued employment and dedication of the Company’s Named Executives.

Thomas Patton – In January 2010, Dr. Thomas Patton entered into an employment agreement with the Company and its subsidiary, Quaterra Alaska, Inc. for a period of five years which replaced a prior employment agreement dated January 1, 2009. Under the employment agreement, Dr. Patton is entitled to receive an annual base salary of $150,000. Upon the expiration of one year following the date of the employment agreement and each year thereafter, the Company will review Dr. Patton’s salary with a view to its increase, giving consideration to the Company’s financial position and the scope of its activities. Dr. Patton may be eligible to participate in future stock option grants. The Company may terminate the employment of Dr. Patton only for breach of the employment agreement or for cause. Dr. Patton is entitled to two months’ notice of such discharge. If Dr. Patton becomes disabled and unable to perform his regular duties, he shall be entitled to receive his full salary for two months. Upon a change of control, as defined in the employment agreement, Dr. Patton has the right to terminate the employment agreement and receive an amount of money equal to the Dr. Patton’s annual salary for two (2) years, that being $300,000.

Scott Hean - On January 1, 2010, Scott Hean entered into an employment agreement with the Company for a period of five years, which replaced a prior employment agreement dated December 1, 2008. Under the employment agreement, Mr. Hean is entitled to receive an annual salary of $175,000. Mr. Hean may be eligible to participate in future incentive stock options. The Company may terminate the employment of Mr. Hean only for breach of the employment agreement or for cause. Mr. Hean is entitled to two months notice of such discharge. Upon a change of control, as defined in the employment agreement, Mr. Hean has the right to terminate the employment agreement and receive an amount of money equal to the Mr. Hean’s annual salary for two (2) years, that being $350,000.

Page 9 of 18

Eugene Spiering - On January 1, 2010, Eugene Spiering entered into an employment agreement with the Company for a period of five years, which replaced prior employment agreements dated December 1, 2008. Under the employment agreement, Mr. Spiering is entitled to receive an annual base salary of $200,000. Upon the expiration of one year following the date of the employment agreement and each year thereafter, the Company will review Mr. Spiering’s salary with a view to its increase, giving consideration to the Company’s financial position and the scope of its activities. Mr. Spiering may be eligible to participate in future stock option grants. If Mr. Spiering becomes disabled and unable to perform his regular duties, he shall be entitled to receive his full salary for two months. Upon a change of control, as defined in the employment agreement, Dr. Patton has the right to terminate the employment agreement and receive an amount of money equal to the Dr. Patton’s annual salary for two (2) years, that being $400,000.

Page 10 of 18

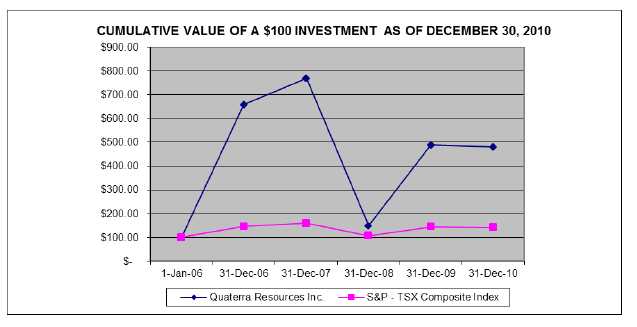

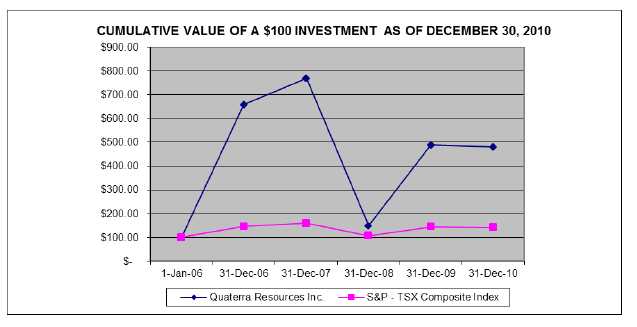

Performance Graph

The following graph compares the Company’s cumulative total shareholder return on its common shares with the cumulative total return of the TSX Composite Index over the period from January 1, 2006 to December 31, 2010. The graph illustrates the cumulative return on a $100 investment in common shares made on December 31, 2006 with the cumulative total return of the S&P/TSX Composite Index.

A number of factors and performance elements are taken into consideration when determining compensation for the Named Executives. The realities of the global recession in 2008 created adverse effects in the Canadian and U.S. economies including the mining industry. Under previous agreements which were replaced by the agreements discussed under Employment Agreements, Termination and Change of Control, three of the Company’s Named Executives adjusted their cash salaries to reflect the changes in the economy and overall performance of the Company’s shares. However, a direct correlation between total cumulative shareholder return over a given period and executive compensation cannot always be made.

Page 11 of 18

Summary Compensation Table – Named Executive Officers

The following table sets out information concerning the compensation earned from the Company and any of the Company’s subsidiaries during the financial year ended December 31, 2010, by the Company’s Named Executive Officers.

| | | | Option- | Non-equity incentive | | |

| | | based | | | | |

Name and Principal | | Salary | awards | Annual | Long-term | All other | Total |

Position | Year | ($) | ($) (1) | Incentive | Incentive | compensation | (Compensation$) |

| | | | Plans | Plans | | |

| Thomas Patton | 2010 | 154,500 | 117,000 | N/A | N/A | N/A | 271,500 |

| President & | 2009 | 3,125 | 441,000 | N/A | N/A | N/A | 444,125 |

| Chief Executive Officer | 2008 | 146,414 | 560,726 | N/A | N/A | N/A | 707,140 |

| | 2010 | 175,000 | 58,500 | N/A | N/A | N/A | 233,500 |

| Scott Hean | 2009 | 45,864 | 196,000 | N/A | N/A | N/A | 241,864 |

| Chief Financial Officer | 2008 | 69,958 | 186,909 | N/A | N/A | N/A | 256,867 |

| | 2010 | 200,000 | 58,500 | N/A | N/A | N/A | 258,500 |

| Eugene Spiering | 2009 | 100,000 | 294,000 | N/A | N/A | N/A | 394,000 |

| Vice President, Exploration | 2008 | 166,667 | 280,363 | N/A | N/A | N/A | 447,030 |

| | 2010 | N/A | 46,800 | N/A | N/A | 34,000(2) | 80,800 |

| Tracy Stevenson | 2009 | N/A | 318,500 | N/A | N/A | 26,000(2) | 344,500 |

| Chairman of the Board | 2008 | N/A | 447,155 | N/A | N/A | 21,750(2) | 461,780 |

| | 2010 | 126,270 | 58,500 | N/A | N/A | N/A | 184,770 |

| Thomas Turner | 2009 | 150,568 | 130,714 | N/A | N/A | N/A | 281,282 |

| Exploration Geologist | 2008 | 127,880 | 186,909 | N/A | N/A | N/A | 314,789 |

| (1) | The Company uses the Black-Scholes option pricing model to value stock options. |

| (2) | These fees were paid to Mr. Stevenson for his attendance and participation at Board meetings as Chairman and as an Independent Director. |

Incentive Awards

The following table sets out information respecting outstanding option-based awards for the financial year ended December 31, 2010, by the Company’s Named Executive Officers. The stock price at the close of business December 31, 2010 was $1.97 per share.

| | | | Value of |

| Number of | | | unexercised |

Named Executive | unexercised | Option exercise | Option expiration | in-the-money |

Officer | stock options | price ($) | date | options ($) |

| Thomas Patton | 150,000 | 1.29 | August 9, 2015 | 102,000 |

| | 450,000 | 1.02 | November 9, 2014 | 427,500 |

| | 300,000 | 3.30 | June 19, 2013 | -0- |

| | 150,000 | 3.33 | July 20, 2012 | -0- |

| | 150,000 | 1.55 | July 28, 2011 | 63,000 |

| Scott Hean | 75,000 | 1.29 | August 9, 2015 | 51,000 |

| | 200,000 | 1.02 | November 9, 2014 | 190,000 |

| | 100,000 | 3.30 | June 19, 2013 | -0- |

| | 100,000 | 3.33 | July 20, 2012 | -0- |

| | 100,000 | 1.55 | July 28, 2011 | 42,000 |

| Eugene Spiering | 75,000 | 1.29 | August 9, 2015 | 51,000 |

| | 300,000 | 1.02 | November 9, 2014 | 285,000 |

| | 150,000 | 3.30 | June 19, 2013 | -0- |

| | 150,000 | 3.33 | July 20, 2012 | -0- |

| | 150,000 | 1.55 | July 28, 2011 | 63,000 |

| Tracy Stevenson | 60,000 | 1.29 | August 9, 2015 | 40,800 |

| | 325,000 | 1.02 | November 9, 2014 | 308,750 |

| | 75,000 | 3.30 | June 19, 2013 | -0- |

| | 150,000 | 3.45 | March 13, 2013 | -0- |

| | 100,000 | 3.33 | July 20, 2012 | -0- |

| Thomas Turner | 75,000 | 1.29 | August 9, 2015 | 51,000 |

Page 12 of 18

Pension Plan Benefits

The Company does not provide retirement benefits for its directors or executive officers.

Director Compensation

The Company’s director compensation program is designed to enable the Company to attract and retain highly qualified individuals to serve as directors. In 2010, the directors’ compensation package allowed for non-employee directors to receive the following fees:

| a) | an annual retainer of $12,000; |

| b) | an annual retainer to the Chairman of the Board of $24,000; |

| c) | an annual retainer to the Chairman of the Audit Committee of $15,000 |

| d) | an annual retainer to the Chairman of the Governance Nomination Compensation Committee of $13,500 |

| e) | a $500 fee per meeting attending in person or by telephone |

| f) | a $500 travel fee per travel day; |

The following table summarizes the compensation earned by non-employee directors for the year ended December 31, 2010. Directors accepted their fees earned in cash for the 4th quarter 2009 to the end of 2010.

| | | | Non-equity | | |

| | | | Incentive | | |

| | | Option | Plan | All other | |

| Name | Fees Earned | Awards(1) | Compensation | compensation | Total |

| | $ | $ | $ | $ | $ |

| Lawrence Page(2) | 15,000 | 42,900 | - | 3,500 | 61,400 |

| LeRoy Wilkes | 16,875 | 42,900 | - | 10,000 | 69,775 |

| Robert Gayton | 18,750 | 42,900 | - | 9,000 | 70,650 |

| John Kerr | 15,000 | 42,900 | - | 9,000 | 66,900 |

| Tracy Stevenson(3) | | Refer to Summary Compensation Table | | |

| | | | | |

| (1) | The fair value of each option granted is estimated at the time of grant using the Black-Scholes option pricing model. |

| (2) | Lawrence Page is not an independent director and earned these fees in his capacity as Corporate Secretary. |

| (3) | Tracy Stevenson is an Independent Director and a Named Executive Officer – refer to the Summary Compensation Table. |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets forth information with respect to the Company’s compensation plans under which equity securities were authorized for issuance as at the end of its most recently completed financial year.

| Plan Category | Number of Securities

to be issued upon

exercise of outstandingoptions, warrants and

rights

(a) | Weighted-average exercise

price of outstanding options,warrants and rights

(b) | Number of Securities

remaining available for

future issuance under equitycompensation plans

(excluding securities

reflected in column (a))

(c) |

| Equity compensation plansapproved by security holders | 10,624,000 | $1.60 | 3,022,416 |

| Equity compensation plans notapproved by security holders | N/A | N/A | N/A |

| Total | 10,624,000 | | 3,022,416 |

Page 13 of 18

INDEBTEDNESS TO COMPANY OF DIRECTORS AND EXECUTIVE OFFICERS

No director or executive officer, or any proposed director or any associate of any of them, is or, since the beginning of the last completed financial year of the Company, was indebted to the Company, or has been the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Company.

INDEMNIFICATION OF DIRECTORS AND OFFICERS

As provided under the B. C. Corporations Act and the Company’s Articles, the Company indemnifies the directors and officers against certain losses arising from claims against them for their acts, errors or omissions as such. The Company maintains liability insurance for its directors and officers. The policy provides insurance for directors and officers of the Company in respect of certain losses arising from claims against them for their acts, errors or omissions in their capacity as directors or officers. The policy was renewed in March 2011 at an annual premium cost of $50,000 for coverage up to $10,000,000.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

No insider of the Company, no management proposed nominee for election as a director of the Company and no associate or affiliate of any of these persons, has any material interest, direct or indirect, in any transaction since the commencement of the Company's last financial year or in any proposed transaction, which, in either case, has materially affected or will materially affect the Company or any of its subsidiaries other than as disclosed under the headings "Executive Compensation" and "Particulars of Matters to be Acted Upon".

MANAGEMENT CONTRACTS

The Company entered into an agreement with related party Manex Resource Corp. (“Manex”) in June 2008 whereby Manex provides administrative, accounting, and secretarial services to the Company. Manex is a private company controlled by Lawrence Page, a director and officer of the Company. The basic fee for office space and office infrastructure is $14,000 per month and other services rendered are based on hourly rates specified in the agreement. The Company also reimburses Manex for office supplies including paper, courier, postage, parking, filing fees and other out-of-pocket expenses. During the year ended December 31, 2010 the Company paid $501,350 to Manex. Manex is located at the same address as the Company at suite 1100, 1199 West Hastings Street, Vancouver, British Columbia, V6E 3T5.

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

The Company’s corporate governance disclosure obligations are set out in National Instrument 58-101 –Disclosure of Corporate Governance Practices (the “National Instrument”), National Policy 58-201 –Corporate Governance Guidelines and National Instrument 52-110 –Audit Committees. These instruments set out a series of guidelines and requirements for effective corporate governance, collectively the “Guidelines”. The National Instrument requires the Company to disclose its approach to corporate governance with reference to Guidelines.

The Board of Directors

The National Instrument defines an “independent director” as a director who has no direct or indirect material relationship with the Company. A “material relationship” is in turn defined as a relationship which could, in the view of the Board of Directors, be reasonably expected to interfere with such member’s independent judgment. The Board of Directors considers the factual circumstances of each director in the context of Guidelines.

Page 14 of 18

The Board has a majority of independent directors who are Robert Gayton, John Kerr, Tracy Stevenson and LeRoy Wilkes.

The Board of Directors holds regularly scheduled meetings and from January 1, 2010 to December 31, 2010 the following meetings were held:

| For the year ended December 31, 2010 | | |

| Board of Directors | | 6 |

| Audit Committee | | 4 |

| Corporate Governance Nomination and Compensation Committee | | 5 |

| Total number of meetings held | | 15 |

| | Board | Committee |

| Summary of Director Attendance | Meetings | Meetings |

| | Attended | Attended |

| Thomas Patton | 6 | N/A |

| Tracy Stevenson | 6 | N/A |

| Eugene Spiering | 6 | N/A |

| Lawrence Page | 5 | N/A |

| LeRoy Wilkes | 5 | 9 |

| Robert Gayton | 5 | 9 |

| John Kerr | 5 | 8 |

Participation of Directors in Other Reporting Issuers

Certain of the Company’s directors are directors of other reporting issuers, as set out in the following table:

| Name of Director or Proposed | Directorship(s) held in other Reporting Issuers |

| Director | | |

| | | |

| | | |

| Lawrence Page | Duncastle Gold Corp. | Southern Silver Exploration Corp. |

| | Bravada Gold Corporation | Valterra Resource Corporation |

| | Bravo Gold Corp. | |

| | | |

| Robert Gayton | Amerigo Resources Ltd. | Silvercorp Metals Inc. |

| | Eastern Platinum Limited | B2 Gold Corp. |

| | Western Copper Corp. | Palo Duro Energy Inc. |

| | Nevsun Resources Ltd. | |

| | | |

| | | |

| | | |

| John Kerr | Pacific Coast Nickel Corp. | |

| | Bravada Gold Corporation | |

| | | |

| LeRoy Wilkes | Sabina Silver Corporation | |

| | | |

| Tracy Stevenson | Vista Gold Corp. | |

| | Ivanhoe Mines Ltd. | |

Page 15 of 18

Board Mandate

The Board of Directors of the Company explicitly acknowledges responsibility for the stewardship of the Company, including responsibility for:

| a) | to the extent feasible, satisfying itself as to the integrity of the Chief Executive Officer, ("CEO") and other executive officers and that the CEO and other executive officers create a culture of integrity throughout the organization; |

| | |

| b) | succession planning, including appointing, training, monitoring and, if deemed necessary, firing the CEO; |

| | |

| c) | adoption of a strategic planning process and approving on at least an annual basis, a strategic plan which takes into account, among other things, the opportunities and risks of the business; |

| | |

| d) | in cooperation with the senior management team, led by the CEO, identification of the principal risks of the Company's business and ensuring the implementation of appropriate systems to manage these risks; |

| | |

| e) | assisting the CEO in the appointment, training and monitoring of senior management of the Company; |

| | |

| f) | adopting a communication policy for the Company; |

| | |

| g) | the integrity of the Company's internal control and management information systems; |

| | |

| h) | developing the Company's approach to corporate governance, including developing a set of corporate governance principles and guidelines that are specifically applicable to the Company, including an annual review by way of a corporate governance checklist for the Board members to complete to assist them in understanding the steps and other actions that they may take to fulfill their respective duties and responsibilities. |

Orientation and Continuing Education

The Company does not provide formal continuing education to its Board members, but does encourage them to communicate with management, auditors and technical consultants. Board members have access to Company policies, corporate governance documents, technical data and financial information 24 hours a day through an internet-based software support system, essentially an electronic Boardroom.

Ethical Business Conduct

The Board has adopted a Code of Business Conduct and Ethics (the “Code”) that can be viewed atwww.quaterra.com. The Code addresses honesty and integrity, fair dealing, discrimination and harassment, safety and security, and honest and accurate record keeping. The Code also addresses Ethical Business Conduct for financial managers.

Audit Committee

The Audit Committee is responsible for assisting directors to meet their responsibilities; providing better communication between directors and external auditors; enhancing the independence of the external auditor; increasing the credibility and objectivity of financial reports; and strengthening the role of the directors facilitating in-depth discussions among directors, management and the external auditor. The Audit Committee is responsible for the appointment, compensation, retention and oversight of the external auditor, as well as the pre-approval of all non-audit services provided by the external auditor, and for directing the auditor’s examination into specific areas of the Company’s business. A full version of the Audit Committee Charter is available atwww.quaterra.com.

Page 16 of 18

Composition of the Audit Committee

The Audit Committee is comprised of three directors of the Company, Robert Gayton, (Chair), LeRoy Wilkes, and John Kerr, all of whom are independent and financially literate within the meaning of NI 52-110. To be considered to be independent, a member of the audit committee must not have any direct or indirect ‘material relationship’ with the Company. A material relationship is a relationship which could, in the view of the board of directors of the Company, reasonably interfere with the exercise of a member’s independent judgment.

To be considered financially literate, a member of the audit committee must have the ability to read and understand a set of financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected in the Company’s financial statements.

Dr. Gayton graduated from the University of British Columbia in 1962 with a Bachelor of Commerce degree and in 1964 earned a chartered accountant (C.A.) designation while at Peat Marwick Mitchel, Chartered Accountants. Dr. Gayton has directed the accounting and financial matters of public companies in the resource and non-resource fields since 1987.

Mr. Kerr graduated from the University of British Columbia in 1964 with a BASc degree in Geological Engineering. Mr. Kerr has sat on several public company Boards and in his positions, he would be responsible for receiving financial information relating to his Company and obtaining an understanding of the balance sheet, income statement and statement of cash flows and how these statements are integral in assessing the financial position of the Company and its operating results.

Mr. Wilkes recently retired as president of Washington Group International’s Mining Business Unit. As leader of this group, he participated in many developing mining projects throughout the world. Mr. Wilkes was also the Chief Operating Officer of Santa Fe Pacific Gold Corporation during the expansion of its Nevada operations, and held the position of Senior Vice President of Business Development for Anaconda Minerals.

Pre-approved Policies and Procedures

All non-audited services are pre-approved by the Committee. Before approval is given, the Committee examines the independence of the external auditors in relation to the services to be provided and assesses the reasonableness of the fees to be charged for such services.

External Auditor Service Fees

Financial Year

Ending | Audit Fees(1) | Audit Related

Fees(2) | Tax Fees | All other Fees | Total |

| December 31, 2010 | $123,500 | $4,000 | $2,800 | $NIL | $130,300 |

| December 31, 2009 | $80,000 | $5,000 | $2,800 | $NIL | $87,800 |

| December 31, 2008 | $97,586 | $600 | $2,800 | $NIL | $100,986 |

| (1) | The aggregate audit fees include the audit of the Company’s consolidated financial statements and the audit of ICFR. |

| (2) | The aggregate fees billed for audit related services that are reasonably related to the performance of the audit of the Company’s consolidated financial statements, which are not included under the heading “Audit Fees”. |

Page 17 of 18

Corporate Governance, Nomination and Compensation Committee

The Corporate Governance Nomination and Compensation Committee (“Governance Committee”) is appointed by and acts on behalf of the Board of Directors. The Governance Committee acts pursuant to the Corporate Governance Nomination Compensation Charter (the “Governance Charter”) that has been approved by the board of directors. The Governance Charter can be viewed on the Company’s website atwww.quaterra.com. The Governance Committee is responsible for:

| 1) | developing and recommending to the Board a set of corporate governance guidelines applicable to the Company and for periodically reviewing such guidelines; |

| | |

| 2) | identifying individuals qualified to become Board members; |

| | |

| 3) | recommending that the Board select the director nominees for the next annual meeting of shareholders; |

| | |

| 4) | overseeing the Board’s annual evaluation of its performance, and |

| | |

| 5) | reviewing, approving and reporting to the Board on major compensation plans, policies and programs of the Company. The Governance Committee approves the compensation of executive officers and certain senior management, takes specific actions with respect to such compensation and has oversight responsibility over the Company’s management development programs, performance assessment of senior executives and succession planning. |

The members of the Governance Committee are LeRoy Wilkes (Chair), Robert Gayton and John Kerr, all of whom are independent directors, applying the definition set out in Section 1.4 of National Instrument 52-110

MANAGEMENT IS NOT AWARE OF ANY OTHER MATTER TO COME BEFORE THE MEETING OTHER THAN AS SET FORTH IN THE NOTICE OF MEETING. IF ANY OTHER MATTER PROPERLY COMES BEFORE THE MEETING, IT IS THE INTENTION OF THE MANAGEMENT APPOINTEES TO VOTE THE SHARES REPRESENTED BY THE FORM OF PROXY ACCOMPANYING THIS INFORMATION CIRCULAR ON A POLL IN ACCORDANCE WITH THEIR BEST JUDGMENT ON SUCH MATTER. |

ADDITIONAL INFORMATION

Additional information relating to the Company including audited annual financial statements can be

found atwww.sedar.com or without charge, upon request to the Company at

Suite 1100 – 1199 West Hastings Street, Vancouver, B.C. V6E 3T5 T

elephone: (604) 681-9059 Fax: (604) 641-2740

BY ORDER OF THE BOARD

(signed) Thomas C. Patton

Thomas C. Patton, President and Chief Executive Officer

Page 18 of 18