QUATERRA RESOURCES INC.

1100 – 1199 West Hastings Street, Vancouver, B.C. V6E 3T5

Telephone: (604) 681-9059 Fax: (604) 641-2740

www.quaterra.com

INFORMATION CIRCULAR

AS AT AND DATED MAY 8, 2013

(Unless otherwise noted)

This Information Circular accompanies the Notice of the 2013 Annual General Meeting (“Notice of Meeting”) of holders of common shares (“shareholders”) ofQuaterra Resources Inc. (the “Company”) scheduled to be held on Wednesday,June 12, 2013 (the “Meeting”), and is furnished in connection with a solicitation of proxies for use at that Meeting and at any adjournment or postponement thereof.

PERSONS OR COMPANIES MAKING THE SOLICITATION

THE FORM OF PROXY ACCOMPANYING THIS INFORMATION CIRCULAR

IS BEING SOLICITED BY MANAGEMENT OF THE COMPANY

Solicitations will be made by mail and possibly supplemented by telephone, electronic means or other personal contact to be made without special compensation by directors, officers and employees of the Company. The Company may reimburse shareholders’ nominees or agents for the cost incurred in obtaining from their principals authorization to execute forms of proxy. It is not anticipated that any solicitation will be made by specially engaged employees or soliciting agents. The cost of solicitation will be borne by the Company.

No person has been authorized to give any information or to make any representation other than as contained in this Information Circular in connection with the solicitation of proxies. If given or made, such information or representations must not be relied upon as having been authorized by the Company. The delivery of this Information Circular shall not create, under any circumstances, any implication that there has been no change in the Information set forth herein since the date of this Information Circular. This Information Circular does not constitute the solicitation of a proxy by anyone in any jurisdiction in which such solicitation is not authorized, or in which the person making such solicitation is not qualified to do so, or to anyone to whom it is unlawful to make such an offer of solicitation.

APPOINTMENT OF PROXYHOLDER

Only registered shareholders or duly appointed proxyholders are permitted to vote at the Meeting. Those shareholders so desiring may be represented by proxy at the Meeting. The persons named in the form of proxy accompanying this Information Circular are directors and/or officers of the Company (“Management Appointees”).A shareholder has the right to appoint a person or company (who need not be a shareholder) to attend and act on the shareholder’s behalf at the Meeting other than the Management Appointees. To exercise this right, the shareholder must either insert the name of the desired person in the blank space provided in the form of proxy accompanying this Information Circular and strike out the names of the Management Appointees or submit another proper form of proxy.

NON-REGISTERED SHAREHOLDERS

Only shareholders whose names appear on the records of the Company (“registered shareholders”) or duly appointed proxyholders are permitted to vote at the Meeting. Most shareholders of the Company are not registered shareholders because the shares they own are not registered in their names. More particularly, a person is not a registered shareholder in respect of shares which are held on behalf of that person (the “Non-Registered Holder”) but which are registered either (a) in the name of an intermediary (an “Intermediary”) that the Non-Registered Holder deals with in respect of the shares including, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSP’s, RRIF’s, RESP’s and similar plans; or (b) in the name of a clearing agency such as The Canadian Depository for Securities Limited (“CDS”) of which the Intermediary is a participant. In accordance with securities regulatory policy, the Company has distributed copies of the Notice of Meeting, this Information Circular and the form of proxy accompanying this Information Circular (collectively, the “Meeting Materials”) to the clearing agencies and Intermediaries.

1 of 26

Intermediaries are required to forward the Meeting Materials to, and to seek voting instructions from, Non-Registered Holders unless a Non-Registered Holder has waived the right to receive them. Intermediaries will often use service companies to forward the Meeting Materials to Non-Registered Holders. Generally, Non-Registered Holders who have not waived the right to receive Meeting Materials will either:

| | (a) | Be given a form of proxywhich has already been signed by the Intermediary(typically by a facsimile, stamped signature), which is restricted as to the number of shares beneficially owned by the Non-Registered holder but which is otherwise not completed. Because the Intermediary has already signed the form of proxy, this form of proxy is not required to be signed by the Non- Registered Holder when submitting the proxy. In this case, the Non-Registered Holder who wishes to submit a proxy should otherwise properly complete this form of proxy andsubmit it to the Company, c/o Computershare Investor Services Inc., 9thFloor, 100 University Avenue, Toronto, Ontario M5J 2Y1, fax number 416-263-9261; or |

| | | |

| | (b) | more typically, be given a voting instruction or proxy authorization formwhich is not signed by the Intermediary,and which, when properly completed and signed by the Non-Registered Holder andreturned to the Intermediary or its service company, will constitute voting instructions (often called a “proxy authorization form”) which the Intermediary must follow. Typically, the proxy authorization form will consist of a one page pre- printed form. Sometimes, instead of the one page pre-printed form, the proxy authorization form will consist of a regular printed proxy form accompanied by a page of instructions which contains a removable label containing a bar-code and other information. In order for this proxy form to validly constitute a proxy authorization form, the Non-Registered Holder must remove the label from the instructions and affix it to the proxy form, properly complete and sign the proxy form and return it to the Intermediary or its service company in accordance with the instructions of the Intermediary or its service company.A Non-Registered Holder cannot use a proxy authorization form to vote shares directly at the Meeting. |

In either case, the purpose of this procedure is to permit Non-Registered Holders to direct the voting of shares which they beneficially own.

The Meeting Materials are being sent to both registered and non-registered owners of shares. If you are a Non-Registered Holder and the Company or its agent has sent the Meeting Materials directly to you, your name and address and information about your holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the Intermediary holding shares on your behalf. By choosing to send the Meeting Materials to you directly, the Company (and not the Intermediary holding shares on your behalf) has assumed responsibility for (i) delivering the Meeting Materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the request for voting instructions.

Non-Registered Holders cannot be recognized at the Meeting for purposes of voting their shares in person or by way of depositing a form of proxy.If you are a Non-Registered Holder and wish to vote in person at the Meeting, please see the voting instructions you received or contact your Intermediary well in advance of the Meeting to determine how you can do so.

Non-Registered Holders should carefully follow the voting instructions they receive, including those on how and when voting instructions are to be provided, in order to have their shares voted at the Meeting.

VOTING BY PROXY

To be effective, the instrument of proxy must be dated and signed and, together with the power of attorney or other authority, if any, under which it is signed or notarial certified copy thereof, deposited either at the office of Computershare Investor Services Inc., 9th Floor, 100 University Avenue, Toronto, Ontario M5J 2Y1, or at the office of the Company at Suite 1100 – 1199 West Hastings Street, Vancouver, BC V6E 3T5, not less than 48 hours, excluding Saturdays, Sundays, and holidays, prior to the time of the holding of the Meeting or any adjournment thereof.

2 of 26

The shares represented by a properly executed and deposited proxy will be voted or withheld from voting on each matter referred to in the Notice of Meeting in accordance with the instructions given (provided such instructions are certain) on any ballot that may be called for and, if a choice is specified with respect to any matter to be acted upon at the Meeting, the shares shall be voted or withheld from voting accordingly.Where no choice is specified in respect of any matter to be acted upon other than the appointment of an auditor or the election of directors and one of the management appointees is named in the form of proxy to act as the shareholder’s proxyholder, the shares represented by the proxy will be voted in favour of all such matters on any ballot that may be called for. The form of proxy accompanying this information circular gives the person or company named as proxyholder discretionary authority regarding amendments or variations to matters identified in the Notice of Meeting and other matters that may properly come before the Meeting. In the event that amendments or variations to matters identified in the Notice of Meeting are properly brought before the Meeting or any other business is properly brought before the Meeting, it is the intention of the management appointees to vote in accordance with their best judgment on such matters or business on any ballot that may be called for. At the time of printing this information circular, management knows of no such amendments, variations or other matters which may be brought before the Meeting.

REVOCABILITY OF PROXY

In addition to revocation in any other manner permitted by law, a proxy may be revoked by instrument in writing executed by the registered shareholder or his attorney authorized in writing, or if the registered shareholder or his attorney authorized in writing, or if the registered shareholder is a corporation, by a duly authorized officer or attorney thereof, and deposited either at the registered office of the Company at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, or, as to any matter in respect of which a vote shall not already have been cast pursuant to such proxy, with the Chairman of the Meeting on the day of the Meeting, or any adjournment thereof, and upon either of such deposits the proxy revoked.

Only registered shareholders have the right to revoke a proxy. A Non-Registered Holder may revoke a proxy authorization form or a waiver of the right to receive Meeting material and to vote given to an Intermediary at any time by written notice to the Intermediary, except that an Intermediary is not required to act on a revocation of proxy authorization for or of a waiver of the right to receive Meeting Materials and to vote that is not received by the Intermediary at least 7 days prior to the Meeting.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

Except as otherwise disclosed, to the knowledge of the Company, no director or executive officer since the commencement of the Company’s last completed fiscal year, and no proposed nominee for election as a director, or any associate or affiliate of the foregoing persons, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any of the matters to be acted upon at the Meeting other than the election of directors.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

As at May 8, 2013 there were 162,990,836 common shares issued and outstanding without par value that are entitled to be voted at the Meeting. Shareholders of record as of May 8, 2013 will be entitled to receive notice of and to vote at the meeting.

At a General Meeting of the Company, on a show of hands, every registered shareholder present in person and entitled to vote and every proxyholder duly appointed by a registered shareholder who would have been entitled to vote shall have one vote and, on a poll, every registered shareholder present in person or represented by proxy or other proper authority and entitled to vote shall have one vote for each share of which such shareholder is the registered holder. Shares represented by proxy will only be voted if a ballot is called for. A ballot may be requested by a registered shareholder or proxyholder present at the Meeting and entitled to vote or required because the number of votes attached to shares represented by proxies that are to be voted against a matter is greater than 5% of the votes that could be cast at the Meeting.

A quorum of Shareholders will be present at the Meeting if not less than one Shareholder is present in person or represented by proxy or a duly authorized representative.

3 of 26

To the knowledge of the directors and senior officers of the Company, no person or company beneficially owns, directly or indirectly, or exercises control or direction over, voting securities carrying more than 10% of the outstanding voting rights of the Company.

ELECTION OF DIRECTORS

Each director of the Company is elected annually and holds office until the next Annual General Meeting of the shareholders unless that person ceases to be a director before then.Unless such authority is withheld, Management Appointees intend to vote the shares represented by proxy on any ballot that may be called for.

MANAGEMENT DOES NOT CONTEMPLATE THAT ANY OF THE NOMINEES WILL BE UNABLE TO SERVE AS A DIRECTOR. IN THE EVENT THAT PRIOR TO THE MEETING ANY VACANCIES OCCUR IN THE SLATE OF NOMINEES HEREIN LISTED, IT IS INTENDED THAT DISCRETIONARY AUTHORITY SHALL BE EXERCISED BY THE MANAGEMENT APPOINTEES, IF NAMED IN THE PROXY, TO VOTE THE SHARES REPRESENTED BY PROXY FOR THE ELECTION OF ANY OTHER PERSON OR PERSONS AS DIRECTORS ON ANY BALLOT THAT MAY BE CALLED FOR UNLESS THE SHAREHOLDER HAS SPECIFIED THAT THE SHARES REPRESENTED BY PROXY ARE TO BE WITHHELD FROM VOTING IN THE ELECTION OF DIRECTORS.

Voting Results

Following the meeting, a report on the Voting Results will be available on the Company’s website atwww.quaterra.comThe Voting Results will also be filed with securities regulators on Sedar.com. The Company will also issue a news release disclosing these results.

Management proposes that the number of directors for the Company be determined at seven (7) for the ensuing year, subject to such increases as may be permitted by the Articles of the Company, and that each of the following persons be nominated for election as a director of the Company for the ensuing year. Information concerning these persons, as furnished by the individual nominees, is as follows:

Name, Jurisdiction of Residence and

Position with the Company

| Principal Occupation,

Business or

Employment | Director Since

| Number of Securities Beneficially

Owned, Directly or Indirectly, or

Controlled or Directed |

Thomas C. Patton(3)

Washington, USA

President, CEO and Director | President of the

Company

| Since 1998

| 3,374,762

|

Lawrence Page, Q.C.(3)

British Columbia, Canada

Corporate Secretary and Director | Lawyer

| Since 1995

| 25,500

|

Tracy Stevenson

Utah, USA

Chairman of the Board | Retired Mining

Executive

| Since 2007

| 250,626

|

John Kerr(1)(3)

British Columbia, Canada

Director | Geological Engineer

| Since 1993

| 63,334

|

LeRoy Wilkes(2)

Colorado, USA

Director | Retired Mining

Executive

| Since 2006

| 105,428

|

Anthony Walsh(1)(2)

British Columbia, Canada

Director | Retired Mining

Executive

| Since 2012

| NIL

|

4 of 26

Todd Hilditch(1)(2)

British Columbia, Canada

Director

| President and CEO of

Terraco Gold Corp;

President and CEO of

Salares Lithium Inc.,

Talison Lithiuim

President and Owner of

Rock Management

Consulting Ltd. | Since 2012

| 85,000(4)

|

| (1) | Member of the Audit Committee |

| (2) | Member of the Corporate Governance, Nomination and Compensation Committee |

| (3) | Member of the Safety, Health, Security and Environment Committee |

| (4) | 10,000 of the common shares are held by Rock Management Consulting Ltd., a company wholly owned by Todd Hilditch. |

Dr. Robert Gayton resigned from the Board of Directors, Chairman of the Audit Committee and member of the Corporate Governance and Nomination Committee on September 30, 2012.

Mr. Walsh was appointed the Chairman of the Audit Committee to fill the vacancy created by the resignation of Dr. Gayton.

Mr. Hilditch was appointed as a member of the Audit Committee on October 1, 2012 and a member of the Corporate Governance and Nomination Committee on November 13, 2012 to fill the vacancy created by the resignation of Dr. Gayton.

Minimum Share Ownership

The Company has established share ownership guidelines which require each director to own shares, directly or indirectly, of the Company to a minimum of 25,000 shares of the Company (excluding stock option grants). New directors have one year from the date of their appointment to the Board to meet the ownership requirement.

The Company’s directors, as a group, beneficially own, directly or indirectly or exercise control or direction over a total of 3,899,650 common shares with a total value of approximately CAD$779,930. Six out of seven directors’ share ownership meets the minimum requirement, while the directors who do not meet the minimum share ownership requirement have one year from the date of their appointment to meet the requirement. The table below outlines share ownership as at the May 8, 2013 for the Company’s directors.

| Name | Ownership |

| Thomas Patton | 3,374,762 |

| Tracy Stevenson | 250,626 |

| Lawrence Page | 25,500 |

| LeRoy Wilkes | 105,428 |

| John Kerr | 63,334 |

| Anthony Walsh | NIL |

| Todd Hilditch | 80,000(1) |

| | (1) | 10,000 of the common shares are held by Rock Management Consulting Ltd., a company wholly owned by Todd Hilditch. |

Unless otherwise instructed, the persons named in the accompanying form of proxy intend to vote FOR the election of the foregoing individuals as directors until the close of the next annual general meeting of the Shareholders or until their successors are otherwise elected or appointed.

Director biographies can be viewed on the Company’s website atwww.quaterra.com.

5 of 26

Director Skills

Director/

Nominee

| Mining

Industry

Expertise

| Capital

Markets

| Strategy

| Accounting

and

Finance

| Legal

| Safety, Health,

Security

and

Environment |

| Thomas Patton | x | x | x | | | x |

| Lawrence Page | x | x | x | | x | x |

| Tracy Stevenson | x | | x | x | | x |

| LeRoy Wilkes | x | | x | | | x |

| John Kerr | x | | x | | | x |

| Anthony Walsh | x | x | x | x | | x |

| Todd Hilditch | x | x | x | | | x |

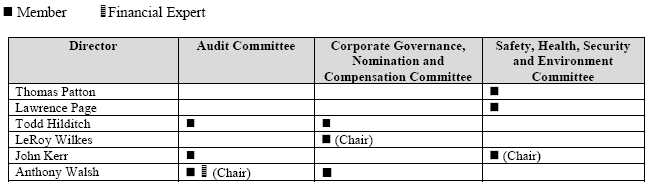

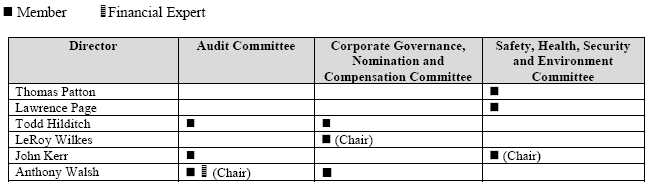

Committees of the Board

The following chart sets out current committee members:

Audit Committee Composition:

The Committee shall be composed of three or more members of the Board, all of whom are independent and financially literate within the meaning of NI 52-110. The members of the Committee shall appoint from among themselves a Chair of the Committee. The Chair shall have responsibility for ensuring that the Committee fulfills its principal duties and responsibilities effectively. |

Corporate Governance, Nomination, and Compensation Composition:

The Committee will be composed of at least three directors of the Company, all of whom shall be independent directors as required by National Instrument 58-101. The members of the Committee shall meet the independence requirements of the NYSE MKT. The members of the Committee and the Committee Chair will be appointed by the Board and will serve until they resign, are removed by a majority vote of the independent directors of the Board, or their successors are appointed by the Board. The Board may at any time change the composition of the Committee by adding or removing members. Where a Committee Member ceases to be a Committee member (as a result of resignation, removal or for any other reason), the Board may fill the resulting casual vacancy. A member of the Committee who ceases to be a director shall also cease to be a member of the Committee. |

Safety, Health, Security and Environment Committee Composition:

The Committee shall consist of not less than three nor more than six members to be elected by the Board of Directors. The Board of Directors shall designate a Committee Chair, who shall be a Director of the Board. Each Member of the Committee shall be elected annually from among the members of the Board of Directors and the Executive Management of the Company. Considering the high degree of management accountability for leading the Company’s Safety, Health, Security and Environment programs, it is deemed appropriate to have a member of Executive Management on the Committee. |

6 of 26

Majority Voting

The Company has adopted a Majority Voting Policy in its Corporate Governance Principles. Pursuant to this Policy, any nominee proposed for election as a director in an uncontested election who receives, from the shares voted at the meeting in person or by proxy, a greater number of shareswithheld than shares votedin favour of his or her election, must promptly tender his or her resignation to the Chairman of the Board. Any such resignation shall take effect upon acceptance by the Board. The Compensation and Nomination Committee will expeditiously consider the director’s offer to resign and, unless there are extraordinary circumstances, will recommend to the Board to accept such resignation. The Board will have 90 days to make a final decision and announce such decision, including any reasons for not accepting a resignation, by way of a press release. The applicable director will not participate in any Committee or Board deliberations after the resignation offer. The Corporate Governance Committee charter is available on the Company’s website atwww.quaterra.com.

Cease Trade Orders – Bankruptcies

Except as otherwise disclosed in this Circular, to the knowledge of the Company, no director:

a. is, as at the date of this Circular, or has been, within 10 years before the date of this Circular, a director, chief executive officer or chief financial officer of any company (including the Company) that,

i) was subject to an order that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer.

ii) was subject to an order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as a director, chief executive officer or chief financial officer, or

b. is, as at the date of this Circular, or has been within 10 years before the date of this Circular, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or

c. has within 10 years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director.

For the purpose of the paragraphs above, “order” means: (i) a cease trade order; (ii) an order similar to a cease trade order; or (iii) an order that denied the relevant company access to any exemption under securities legislation that was in effect for a period of more than 30 consecutive days.

Lawrence Page was a director and officer of Valterra Resource Corporation (formerly Valterra Wines Ltd.) (“Valterra”) when Valterra was subject to cease trade orders issued by the British Columbia Securities Commission on June 3, 2003 and by the Alberta Securities Commission on July 18, 2003 for failure to file financial statements. The British Columbia Securities Commission granted a partial revocation of the cease trade order on November 7, 2006 and the Alberta Securities Commission granted the same on December 14, 2006. Both the British Columbia Securities Commission and the Alberta Securities Commission granted full revocation of the cease trade orders on August 3, 2007;

Lawrence Page who is a director and executive officer of Newcoast Silver Mines Ltd. (now Southern Silver Exploration Corp.) when a Cease Trade Order was issued by the British Columbia Securities Commission on September 30, 2003 and the Alberta Securities Commission on October 23, 2003, for failure to file certain financial information, which Cease Trade Orders were revoked by the British Columbia Securities Commission on October 31, 2003, and by the Alberta Securities Commission on March 25, 2004;

7 of 26

Southern Silver Exploration Corp.

Lawrence Page, Robert Gayton and Thomas Patton, who were directors and/or executive officers of Newcoast Silver Mines Ltd. (now Southern Silver Exploration Corp.) when a Cease Trade Order was issued by the British Columbia Securities Commission on September 30, 2003 and the Alberta Securities Commission on October 23, 2003, for failure to file certain financial information, which Cease Trade Orders were revoked by the British Columbia Securities Commission on October 31, 2003, and by the Alberta Securities Commission on March 25, 2004.

Saturna Beach Estates Ltd.

Lawrence Page, a director and President of Saturna Beach Estates Ltd., a private Company formed under the laws of British Columbia, Canada (“SBEL”) which conducts the business of a vineyard and winery. On August 17, 2004, SBEL obtained an Order from the Supreme Court of British Columbia under the provisions of the Companies’ Creditors Arrangement Act (Canada) that allowed SBEL to continue to run its daily business affairs without creditor action during financial reorganization. In June 2005, the financial reorganization was completed and the Order terminated.

Copper Mesa Mining Corporation

LeRoy E. Wilkes, was a director of Copper Mesa Mining Corporation which had a cease trading order issued against it on April 8, 2009 for failure to file its annual financial statements, accompanying management's discussion and analysis and annual information form (collectively, the "Annual Filings) for its financial year ended December 31, 2008. On June 3, 2009, the cease trade order was revoked as Copper Mesa Mining Corporation had filed its Annual Filings. Mr. Wilkes ceased to be a director on November 5, 2009

APPOINTMENT OF AUDITORS

Smythe Ratcliffe, Chartered Accountants are the current auditors of the Company. At the Meeting, shareholders will be requested to re-appoint Smythe Ratcliffe, Chartered Accountants as auditors of the Company to hold office until the next annual meeting of shareholders or until a successor is appointed, and to authorize the Board of Directors to fix the auditors’ remuneration. Smythe Ratcliffe was first appointed auditors of the Company in 1993.

The person(s) designated by management of the Company in the enclosed form of proxy intend to vote FOR the reappointment of Smythe Ratcliffe, Chartered Accountants, as auditors of the Company to hold office until the next annual meeting of shareholders or until a successor is appointed and the authorization of the Board of Directors to fix the remuneration of the auditors.

STOCK OPTION PLAN

At the Meeting, the shareholders will be asked to approve the Company’s stock option plan (the “Plan”) and the number of common shares reserved for issuance under the Plan in accordance with and subject to the rules and policies of the TSX Venture Exchange (“TSX”).

The purpose of the Plan is to provide the directors, officers and key employees of, and certain other persons who provide services to the Company and its subsidiaries with an opportunity to purchase shares of the Company and benefit from any appreciation in the value of the Company’s shares. This will provide an increased incentive for these individuals to contribute to the future success and prosperity of the Company, thus enhancing the value of the Company’s shares for the benefit of all the shareholders and increasing the ability of the Company and its subsidiaries to attract and retain skilled and motivated individuals in the service of the Company.

The proposed Plan is a “rolling” plan that provides that the aggregate number of shares reserved for issuance under it, and all of the Company’s other previously established and outstanding stock option plans or grants, will not exceed 10% of the Company’s issued common shares at the time of the grant of a stock option under the proposed Plan.

8 of 26

Under the proposed Plan, the option exercise price must not be less than the closing price of the Company’s common shares on the TSX on the day immediately preceding the date of grant, less the applicable discount permitted by the policies of the TSX. An option granted under the Plan must be exercised within the term permitted by the policies of the TSX on the date of grant. The Board of Directors of the Company may determine the limitation period during which an option may be exercised and, notwithstanding that none may be required by the policies of the TSX whether a particular grant will have a minimum vesting period. As a “rolling” plan, any amendment to the proposed Plan will require the approval of the TSX and may require shareholder approval.

In accordance with the terms of the proposed Plan, it is subject to its acceptance for filing by the Exchange and the approval of the Company’s shareholders. Under the policies of the TSX, if

a. the grants of options under the proposed Plan to “insiders” of the Company, together with all of the Company’s outstanding stock options, could result at any time in:

i. the number of shares reserved for issuance pursuant to stock options granted to insiders of the Company exceeding 10% of the issued common shares of the Company; or

ii. the grant to insiders of the Company, within a 12-month period, of a number of options exceeding 10% of the issued common shares of the Company; or

b. the number of shares reserved for issuance pursuant to stock options granted to any one optionee, within a 12-month period, exceeding 5% of the issued common shares of the Company;

such shareholder approval must be “disinterested shareholder approval”, but as the proposed Plan is restrictive as to these results, disinterest shareholder approval of the proposed Plan is not required.

The policies of the TSX and the terms of the proposed Plan also provide that “disinterested shareholder approval” will be required for any agreement to decrease the exercise price of options previously granted to insiders of the Company but no such agreements are being brought before the Meeting.

The term “disinterested shareholder approval” means approval by a majority of the votes cast at the Meeting other than votes attaching to shares of the Company beneficially owned by insiders of the Company to whom options may be granted under the proposed Plan and associates of such persons. The term “insiders” is defined in theSecurities Act (British Columbia) and generally includes directors and senior officers of the Company and its subsidiaries and holders of greater than 10% of the voting securities of the Company. The term “associates” is defined in theSecurities Act (British Columbia).

If shareholder approval of the proposed Plan or a modified version thereof is not obtained, the Company will not proceed to implement the proposed Plan nor grant options under it. Even if approved, the directors may determine not to proceed with the proposed Plan.

The proposed Plan will be available for inspection at the Meeting. The directors recommend that the shareholders approve the proposed Plan.

The person(s) designated by management of the Company in the enclosed form of Proxy intend to vote FOR the adoption of the Stock Option Plan Resolution.

STATEMENT OF EXECUTIVE COMPENSATION

Compensation Discussion & Analysis

Named Executive Officers

“CEO”means an individual who acted as chief executive officer of the Company, or acted in a similar capacity, for any part of the most recently completed financial year;

9 of 26

“CFO” means an individual who acted as chief financial officer of the company, or acted in a similar capacity, for any part of the most recently completed financial year;

“NEO” ornamed executive officer means each of the following individuals:

| | (a) | a CEO; |

| | (b) | a CFO; |

| | (c) | each of the three most highly compensated executive officers, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000; and |

| | (d) | each individual who would be an NEO under paragraph (c) but for the fact that the individual was neither an executive officer of the Company, nor acting in a similar capacity, at the end of that financial year. |

As at December 31, 2012, the Company’s Named Executive Officers were: Thomas Patton (President and CEO), Scott Hean (CFO), Eugene Spiering (VP Exploration), Steven Dischler (VP and General Manager- Yerington District) and J.L. Christman, (Country Manager, Mexico).

Corporate Governance, Nomination and Compensation Committee

The Corporate Governance, Nomination and Compensation Committee (the “Governance Committee”) of the Board was established to assist the Board in fulfilling its responsibilities relating to compensation matters, including the evaluation and approval of the Company’s compensation plans, policies and programs.

One of the key roles of the Governance Committee is to assist the directors of the Company in attracting, evaluating and retaining key senior executive personnel through compensation and other appropriate performance incentives. It is the Governance Committee’s responsibility to ensure that the Company develops a compensation plan for its executive officers that is fair and competitive and consistent with the best interests of the Company. The role of management is to provide the Governance Committee with perspectives on the business strategy and individual performance of senior executive personnel in order to assist the Governance Committee in making recommendations regarding compensation.

The Governance Committee reviews the performance of the Company’s NEOs against established performance goals and criteria and makes recommendations to the Board of the Company on appropriate compensation. Other than with respect to the CEO, the Governance Committee also considers the evaluations and recommendations of the CEO.

The Governance Committee has the responsibility for reviewing compensation policies, programs and procedures for the Company’s NEOs, including a review of any proposed awards of stock options or any other equity plans and recommending same for approval by the full Board. The Governance Committee acts pursuant to the Governance, Nomination and Compensation Committee Charter (the “Governance Charter”) that has been approved by the Board of Directors.

The Governance Committee is composed of three directors, all of whom are independent within the meaning of National Instrument 58-101. They are, LeRoy Wilkes (Chair), Anthony Walsh and Todd Hilditch. None of the members of the Governance Committee is an officer, employee or former officer of the Company. All of the members are experienced in matters of executive compensation and the Board believes that the Committee collectively has the knowledge, experience and background required to fulfill its mandate.

The Governance Committee Charter can be viewed on the Company’s website atwww.quaterra.com. The Governance Committee reports to the Board of Directors which has final accountability for the Company’s compensation policies and programs. The Governance Committee also seeks the views of the CEO when reviewing compensation for other executive officers because of his involvement with these officers.

Dr. Gayton resigned as a Member of the Governance Committee on September 30, 2012. Mr. Hilditch was appointed as a Member of the Governance Committee to fill the vacancy created by the resignation of Dr. Gayton.

10 of 26

Role of the Chief Executive Officer

The Chief Executive Officer (“CEO”) completes a review of each NEO’s performance. The CEO makes a recommendation to the Governance Committee on compensation for each NEO which is taken into consideration by the Governance Committee in completing its review and ultimate recommendations to the Board.

Role of Consultants and Benchmarking

The Governance Committee has periodically engaged a third party consultant to conduct a review of compensation of executive officers and directors at peer companies to assist in setting the compensation program for executive directors and officers. The Governance Committee plans to continue to periodically engage third party consultants to conduct a benchmark analysis to assist in the setting of compensation for its executive officers and directors.

Objectives of the Compensation Program

The general objectives of the Company’s compensation strategy are to:

| | (a) | compensate management in a manner that encourages and rewards a high level of performance and outstanding results with a view to increasing long term shareholder value; |

| | | |

| | (b) | provide a compensation package that is competitive with other comparable mineral exploration companies to enable the Company to attract and retain talent; and |

| | | |

| | (c) | ensure that the total compensation package is designed in a manner that takes into account the Company’s present stage of development and its available financial resources. The Company’s compensation packages have been designed to provide a non-cash stock option component in conjunction with a reasonable cash salary. |

Salaries for the NEOs are determined by evaluating the responsibilities inherent in the position held, and the individuals experience and past performance, as well as by reference to the competitive marketplace for management talent at other mineral exploration companies. Following the annual general meeting of shareholders, the Governance Committee reviews actual performance for the Company and the each of the NEOs for such year, including the quality and measured progress of the Company’s exploration projects, raising of capital and similar achievements.

Elements of Compensation

During 2012, the Company’s compensation program consisted of two elements (i) cash and (ii) incentive stock options administered under the Company’s stock option plan. The Company does not presently have a long-term incentive plan. There is no policy or target regarding allocation between cash and non-cash elements of the Company’s compensation program. The Board reviews annually the total compensation package of each of the Company’s NEOs on an individual basis, against the backdrop of the competitive landscape and the compensation goals and objectives described above.

Salary - Base salaries for the NEOs for any given year are reviewed by the Governance Committee at its meeting in June. Increases or decreases in salary on a year over year basis are dependent on the Governance Committee’s assessment of the performance of the Company and the particular NEO. When considering the base salaries of each of the Company’s NEOs, the Governance Committee reviews the qualifications and performance of, and salaries paid to executives of similar companies engaged in mining exploration and development. Recommendations for executive salaries are made by the Governance Committee to the full Board of Directors in consultation with the CEO.

Incentive Awards – The Governance Committee believes that a significant portion of each NEO’s compensation should be in the form of equity awards. Equity awards are made to the NEOs pursuant to the Company’s stock option plan. The stock option plan provides for awards in the form of stock options. The Committee has generally followed a practice of issuing stock options to its NEOS on an annual basis in June of each year. The Committee retains the discretion to make additional awards to NEOS at other times, in connection with the initial hiring of a new executive, for retention purposes or otherwise. In determining the amount of stock options to be issued, the Governance Committee considers qualifications, performance, and option programs of similar companies.

11 of 26

Perquisites and Other Personal Benefits –The Company’s NEOs are not generally entitled to significant perquisites. The Company offers health care benefits, but there are no other perquisites which account for a material portion of the overall compensation paid to any NEO.

Employment Agreements, Termination and Change of Control

The Company has employment agreements with five of its NEOs, namely Thomas Patton, Scott Hean, Steven Dischler, J.L. Christman and Eugene Spiering. The Governance Committee believes that these agreements will help to secure the continued employment and dedication of the Company’s NEOs.

Thomas Patton – In January 2010, Dr. Thomas Patton entered into an employment agreement with the Company and its subsidiary, Quaterra Alaska, Inc. for a period of five years which replaced a prior employment agreement dated January 1, 2009. Under the employment agreement, Dr. Patton is entitled to receive an annual base salary of $150,000. Upon the expiration of one year following the date of the employment agreement and each year thereafter, the Company will review Dr. Patton’s salary with a view to its increase, giving consideration to the Company’s financial position and the scope of its activities. Dr. Patton may be eligible to participate in future stock option grants. The Company may terminate the employment of Dr. Patton only for breach of the employment agreement or for cause. Dr. Patton is entitled to two months’ notice of such discharge. If Dr. Patton becomes disabled and unable to perform his regular duties, he shall be entitled to receive his full salary for two months. Upon a change of control, as defined in the employment agreement, Dr. Patton has the right to terminate the employment agreement and receive an amount of money equal to his annual salary for two (2) years, that amount being $300,000.

Scott Hean – On January 1, 2010, Atherton Enterprises Ltd. (“AEL”), a company controlled by Scott Hean, Scott Hean (“Hean”) and the Company entered into a Services Agreement whereby the Company engaged AEL to provide the services of Hean to act in the capacity of Chief Financial Officer. This agreement replaces a prior services agreement dated December 1, 2008. The term of the Agreement is for a period of five years. Under the agreement, AEL is entitled to receive an annual salary of $175,000. Hean may be eligible to participate in future incentive stock options. The Company may terminate the employment of AEL and Hean only for breach of the agreement or for cause. AEL and Hean are entitled to two months’ notice of such discharge. Upon a change of control, as defined in the agreement, AEL and Hean has the right to terminate the agreement and receive an amount of money equal to his annual salary for two (2) years, that amount being $350,000.

Eugene Spiering - On January 1, 2010, Eugene Spiering entered into an employment agreement with the Company for a period of five years, which replaced prior employment agreements dated December 1, 2008. Under the employment agreement, Mr. Spiering is entitled to receive an annual base salary of $200,000. Upon the expiration of one year following the date of the employment agreement and each year thereafter, the Company will review Mr. Spiering’s salary with a view to its increase, giving consideration to the Company’s financial position and the scope of its activities. Mr. Spiering may be eligible to participate in future stock option grants. If Mr. Spiering becomes disabled and unable to perform his regular duties, he shall be entitled to receive his full salary for two months. Upon a change of control, as defined in the employment agreement, Mr. Spiering has the right to terminate the employment agreement and receive an amount of money equal to his annual salary for two (2) years, that amount being $400,000.

Steven Dischler:On October 24, 2011, Steven Dischler entered into an employment agreement with the Company for a period of five years. Under the employment agreement, Mr. Dischler is entitled to receive an annual base salary of US$250,000. Upon the expiration of one year following the date of the employment agreement and each year thereafter, the Company will review Mr. Dischler’s salary with a view to its increase, giving consideration to the Company’s financial position and the scope of its activities. Mr. Dischler may be eligible to participate in future stock option grants. If Mr. Dischler becomes disabled and unable to perform his regular duties, he shall be entitled to receive his full salary for two months. Upon a change of control, as defined in the employment agreement, Mr. Dischler has the right to terminate the employment agreement and receive an amount of money equal to his annual salary for two (2) years, that amount being US$500,000.

12 of 26

J.L. Christman– On January 6, 2011, J.L. Christman entered into an employment agreement with the Company’s subsidiary, Quaterra Alaska, Inc. Under the employment agreement, Mr. Christman is entitled to receive an annual base salary of US$130,000. Upon the expiration of three months following the date of the employment agreement and each year thereafter, the Company will review Mr. Christman’s salary and conduct a general performance assessment of employment.

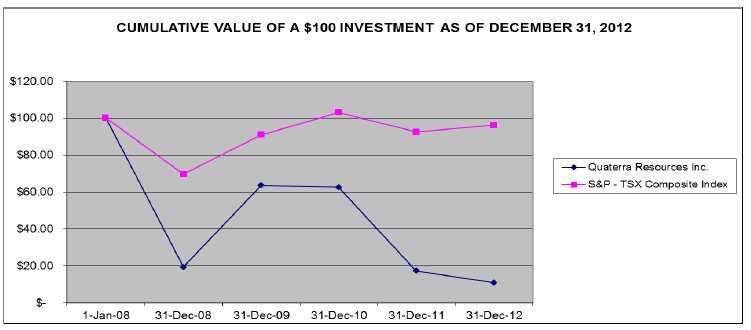

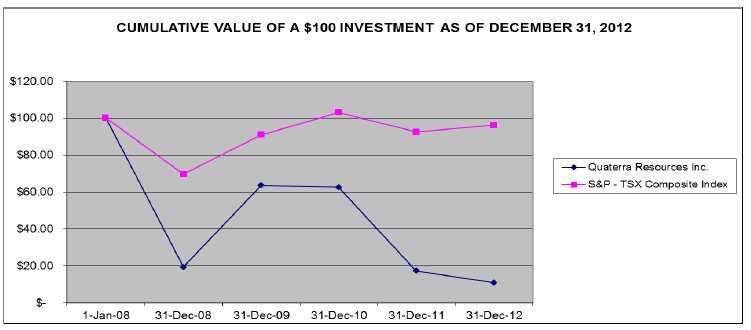

Performance Graph

The following graph compares the Company’s cumulative total shareholder return on its common shares with the cumulative total return of the TSX Composite Index over the period from January 2, 2008 to December 31, 2012. The graph illustrates the cumulative return on a $100 investment in common shares made on January 2, 2008 with the cumulative total return of the S&P/TSX Composite Index.

A number of factors and performance elements are taken into consideration when determining compensation for the NEOs. The realities of the global recession in 2008 created adverse effects in the Canadian and U.S. economies including the mining industry. Under previous agreements operative in the 2008 to 2010 time frame three of the Company’s NEOs adjusted downward their cash salaries to reflect the changes in the economy and overall performance of the Company’s shares. These agreements were replaced in 2010 by the agreements discussed under Employment Agreements, Termination and Change of Control. A direct correlation between total cumulative shareholder return over a given period and executive compensation cannot always be made. General market conditions for junior mining exploration companies worsened in 2011 continuing into 2012.

Summary Compensation Table – Named Executive Officers

The following table sets out information concerning the compensation earned from the Company and any of the Company’s subsidiaries during the financial year ended December 31, 2012, by the Company’s NEOs:

13 of 26

Name and

principal position

| Year

| Salary

($)

| Share-

based

awards

($)

| Option-

based

awards

($)

| Non-equity incentive

plan compensation

($)

| Pension

value

($)

| All other

compensation

($)

| Total

compensation

($)

|

Annual

incentive

plans

| Long-

term

incentive

plans |

Thomas Patton

President & Chief

Executive Officer

| 2012

2011

2010

| 137,500

151,003

154,500

| N/A

N/A

N/A

| 44,800

158,000

117,000

| N/A

N/A

N/A

| N/A

N/A

N/A

| N/A

N/A

N/A

| N/A

N/A

N/A

| 182,300

309,003

271,500

|

Scott Hean

Chief Financial

Officer

| 2012

2011

2010

| N/A

N/A

N/A

| N/A

N/A

N/A

| 44,800

98,750

58,500

| N/A

N/A

N/A

| N/A

N/A

N/A

| N/A

N/A

N/A

| 157,880(2)

175,000(2)

175,000(2)

| 202,680

273,750

233,500

|

Eugene Spiering

Vice President,

Exploration

| 2012

2011

2010

| 200,000

200,000

200,000

| N/A

N/A

N/A

| 44,800

98,750

58,500

| N/A

N/A

N/A

| N/A

N/A

N/A

| N/A

N/A

N/A

| N/A

N/A

N/A

| 244,800

298,750

258,500

|

Steven Dischler(3)

VP and GM

Yerington District | 2012

2011

| 249,850

109,935

| N/A

N/A

| 44,800

85,500

| N/A

N/A

| N/A

N/A

| N/A

N/A

| N/A

N/A

| 294,650

195,435

|

J.L. Christman

Country Manager,

Mexico | 2012

2011

| 129,948(4)

114,984(4)

| N/A

N/A

| 44,800

229,000

| N/A

N/A

| N/A

N/A

| N/A

N/A

| N/A

N/A

| 174,748

151,984

|

Thomas Turner

Exploration

Geologist | 2010

| 126,270

| N/A

| 58,500

| N/A

| N/A

| N/A

| N/A

| 184,770

|

| (1) | The Company uses the Black-Scholes option pricing model to value stock options. |

| | |

| (2) | This represents payments to Atherton Enterprises Ltd. pursuant to a Services Agreement between Atherton Enterprises Ltd., a company controlled by Scott Hean and the Company for services as CFO provided to the Company. Please see “Employment Agreements, Termination and Change of Control” for more information on this arrangement. |

| | |

| (3) | Steven Dischler was appointed VP and GM, Yerington District in June, 2011. |

| | |

| (4) | J.L.Christman’s salary is paid in U.S. Dollars. |

Incentive Awards

The following table sets out information in respect of outstanding option-based awards* for the financial year ended December 31, 2012, for the Company’s NEOs.

| | Option-based Awards | Share-based Awards |

Name

| Number of

securities

underlying

unexercised

options

(#)

| Option

exercise

price

($)

| Option expiration date

| Value of

unexercis

ed

in-the -

money

options

($)(1) | Number

of shares

or units

of shares

that have

not

vested

(#) | Market or

payout

value of

share-based

awards that

have not

vested

($) | Market or payout

value of vested share-

based awards not paid

out or distributed

($)

|

Thomas Patton

| 300,000

450,000

150,000

200,000

160,000 | 3.30

1.02

1.29

1.25

0.45 | June 19, 2013

November 9, 2014

August 9, 2015

August 9, 2016

June 28, 2017 | -0-

-0-

-0-

-0-

-0- | N/A

N/A

N/A

N/A

N/A | N/A

N/A

N/A

N/A

N/A | N/A

N/A

N/A

N/A

N/A |

14 of 26

Scott Hean

| 100,000

200,000

75,000

125,000

160,000 | 3.30

1.02

1.29

1.25

0.45 | June 19, 2013

November 9, 2014

August 9, 2015

August 9, 2016

June 28, 2017 | -0-

-0-

-0-

-0-

-0- | N/A

N/A

N/A

N/A

N/A | N/A

N/A

N/A

N/A

N/A | N/A

N/A

N/A

N/A

N/A |

Eugene Spiering

| 150,000

300,000

75,000

125,000

160,000 | 3.30

1.02

1.29

1.25

0.45 | June 19, 2013

November 9, 2014

August 9, 2015

August 9, 2016

June 28, 2017 | -0-

-0-

-0-

-0-

-0- | N/A

N/A

N/A

N/A

N/A | N/A

N/A

N/A

N/A

N/A | N/A

N/A

N/A

N/A

N/A |

Steven Dischler

| 300,000

160,000 | 0.90

0.45 | October 24, 2016

June 28, 2017 | -0-

-0- | N/A

N/A | N/A

N/A | N/A

N/A |

J.L. Christman

| 200,000

50,000

160,000 | 1.60

1.25

0.45 | March 24, 2016

August 9, 2016

June 28, 2017 | -0-

-0-

-0- | N/A

N/A

N/A | N/A

N/A

N/A | N/A

N/A

N/A |

| (1) | “In-the -money options” means the excess of the market value of the Company’s shares at the Company’s most recently completed financial year on December 31, 2012 over the exercise price of the options. The last trading price of the Company’s shares on the TSX Venture Exchange on December 30, 2012 was $0.34. |

| * | Until a stock option has been exercised and the stock sold, the NEO does not receive any cash proceeds from the option and, accordingly, the amount shown is only the deemed “paper gain” of the option. |

Incentive plan awards – value vested or earned during the year

The following table summarizes the value of each incentive plan award vested or earned by each NEO during the Company’s most recently completed financial year.

Name

| Option-based awards –

Value vested during the

year(1)

($)

|

Share-based awards –

Value vested during the

year(1)

($) | Non-equity incentive plan

compensation – Value earned

during the year

($)

|

| Thomas Patton | 44,800 | NIL | NIL |

| Scott Hean | 44,800 | NIL | NIL |

| Eugene Spiering | 44,800 | NIL | NIL |

| Steven Dischler | 44,800 | NIL | NIL |

| J L Christman | 44,800 | NIL | NIL |

| (1) | “Value vested during the year” means the aggregate dollar value that would have been realized if the options under the option-based award had been exercised on the vesting date. This amount is calculated by determining the difference between the market price of underlying securities at exercise and the exercise or base price of the options under the option-based award on the vesting date. |

Pension Plan Benefits

The Company does not provide retirement benefits for its directors or executive officers.

Director Compensation

The Company’s director’s compensation program revolves around three key areas:

- Recruiting and retaining qualified individuals to serve as members of our board of directors and contribute to our overall success;

- Aligning the interests of the board members with those of our shareholders by requiring directors to hold a minimum number of shares and to compensation in the form of option based awards and cash; and

- Offering competitive compensation by positioning director compensation in relation to companies that are comparable in size and in a similar business.

15 of 26

In 2012, the directors’ compensation package allowed for non-employee directors to receive the following fees:

| Annual Retainer | ($) |

| Non-Executive Chairman of the Board | 24,000 |

| Committee members (excluding Chairman) | 12,000 |

| Audit Committee Chair | 15,000 |

| Other Committee Chairs | 13,500 |

Other:

Meeting Attendance – per meeting

Travel Fee – per day |

$500

$500 |

Below is a summary of Directors’ Retainers and Fees for the year ended December 31, 2012 by element:

Name

| Directors’

Fees

($) | Corporate

Governance

Committee ($) | Audit

Committee

($) | Board

Meetings

($) | Other

Committee

($) | Travel

($) | Total

($) |

| Robert Gayton | 11,250 | 1,500 | 1,500 | 2,500 | Nil | Nil | 16,750 |

| Anthony Walsh | 9,750 | 1,500 | 1,500 | 2,500 | Nil | Nil | 15,250 |

| John Kerr | 13,500 | 500 | 2,000 | 3,500 | 2,000 | Nil | 21,500 |

| LeRoy Wilkes | 13,500 | 2,000 | 500 | 3,500 | Nil | 5,000 | 24,500 |

| Tracy Stevenson | 24,000 | Nil | Nil | 3,500 | Nil | 4,000 | 31,500 |

| Todd Hilditch | 6,000 | 500 | 500 | 1,500 | Nil | 1,000 | 9,500 |

Dr. Gayton resigned from the Board of Directors on September 30, 2012.

Mr. Hilditch was appointed a Director of the Company on June 28, 2012.

Below is a summary of total compensation paid to the Directors (excluding NEOs) during 2012:

Name

|

Fees

Earned

($) |

Share-

based

awards

($) |

Option-

based

awards(1)

($) | Non-equity

incentive plan

compensation

($) |

Pension

Value

($) |

All other

Compensation

($) |

Total

($) |

| Lawrence Page(2) | 50,000 | N/A | 22,400 | N/A | N/A | N/A | 72,400 |

| Robert Gayton(3) | 16,750 | N/A | 22,400 | N/A | N/A | N/A | 39,150 |

| John Kerr | 21,500 | N/A | 22,400 | N/A | N/A | N/A | 43,900 |

| LeRoy Wilkes | 24,500 | N/A | 22,400 | N/A | N/A | N/A | 46,900 |

| Tracy Stevenson | 31,500 | N/A | 28,000 | N/A | N/A | N/A | 59,500 |

| Todd Hilditch | 9,500 | N/A | 28,000 | N/A | N/A | N/A | 37,500 |

| Anthony Walsh | 15,250 | N/A | 51,400 | N/A | N/A | N/A | 66,650 |

| (1) | The fair value of each option granted is estimated at the time of grant using the Black-Scholes option pricing model. |

| (2) | Lawrence Page is not an independent director and earned these fees in his capacity as Corporate Secretary. |

| (3) | Dr. Gayton resigned from the Board of Directors on September 30, 2012. |

Outstanding share-based awards and option-based awards

The following table summarizes the outstanding share-based awards and option-based awards to the Non-Named Executive Directors as at the Company’s most recently completed financial year.

16 of 26

| Option- based Awards | Share- based Awards |

Name

|

Number of

securities

underlying

unexercised

options

(#)

|

Option

exercise

price

($)

|

Option expiration date

|

Value of

unexercised

in-the-

money

options(1)

($)

|

Number

of shares

or units

of shares

that

have not

vested

(#) |

Market or

payout value

of share-

based awards

that have not

vested

($)

|

Lawrence Page, Q.C.

| 60,000

55,000

105,000

80,000 | $3.30

$1.29

$1.25

$0.45 | June 19, 2013

August 9, 2015

August 9, 2016

June 28, 2017 | Nil

Nil

Nil

Nil | N/A

N/A

N/A

N/A | N/A

N/A

N/A

N/A |

Robert Gayton(2)

| 60,000

110,000

55,000

105,000

80,000 | $3.30

$1.02

$1.29

$1.25

$0.45 | June 19, 2013

November 9, 2015

August 9, 2015

August 9, 2016

June 28, 2017 | Nil

Nil

Nil

Nil

Nil | N/A

N/A

N/A

N/A

N/A | N/A

N/A

N/A

N/A

N/A |

John Kerr

| 60,000

110,000

50,000

105,000

80,000 | $3.30

$1.02

$1.29

$1.25

$0.45 | June 19, 2013

November 9, 2015

August 9, 2015

August 9, 2016

June 28, 2017 | Nil

Nil

Nil

Nil

Nil | N/A

N/A

N/A

N/A

N/A | N/A

N/A

N/A

N/A

N/A |

Tracy Stevenson

| 75,000

325,000

60,000

110,000

100,000 | $3.30

$1.02

$1.29

$1.25

$0.45 | June 19, 2013

November 9, 2015

August 9, 2015

August 9, 2016

June 28, 2017 | Nil

Nil

Nil

Nil

Nil | N/A

N/A

N/A

N/A

N/A | N/A

N/A

N/A

N/A

N/A |

Anthony Walsh

| 100,000

80,000 | $0.50

$0.45 | March 27, 2017

June 28, 2017 | Nil

Nil | N/A

N/A | N/A

N/A |

LeRoy Wilkes

| 60,000

110,000

55,000

105,000

80,000 | $3.30

$1.02

$1.29

$1.25

$0.45 | June 19, 2013

November 9, 2015

August 9, 2015

August 9, 2016

June 28, 2017 | Nil

Nil

Nil

Nil

Nil | N/A

N/A

N/A

N/A

N/A | N/A

N/A

N/A

N/A

N/A |

| (1) | “In-the-money options” means the excess of the market value of the Company’s shares at the Company’s most recently completed financial year on December 31, 2012 over the exercise price of the options. The last trading price of the Company’s shares on the TSX Venture Exchange on December 31, 2012 was $0.34. |

| (2) | Dr. Gayton resigned from the Board of Directors on September 30, 2012. |

Incentive plan awards – value vested or earned during the year

The following table summarizes the value of each incentive plan award vested or earned by each Non-Named Executive Director during the Company’s most recently completed financial year.

17 of 26

Name

| Option-based awards –

Value vested during the

year(1)

($) | Share-based awards –

Value vested during the

year(1)

($) | Non-equity incentive plan

compensation – Value earned during

the year

($) |

| Lawrence Page, Q.C. | 22,400 | N/A | N/A |

| Robert Gayton(2) | 22,400 | N/A | N/A |

| John Kerr | 22,400 | N/A | N/A |

| Tracy Stevenson | 28,000 | N/A | N/A |

| Anthony Walsh | 51,400 | N/A | N/A |

| LeRoy Wilkes | 22,400 | N/A | N/A |

| Todd Hilditch | 28,000 | N/A | N/A |

| (1) | “Value vested during the year” means the aggregate dollar value that would have been realized if the options under the option-based award had been exercised on the vesting date. This amount is calculated by determining the difference between the market price of underlying securities at exercise and the exercise or base price of the options under the option-based award on the vesting date. |

| (2) | Dr. Gayton resigned from the Board of Directors on September 30, 2012. |

Securities Authorized for Issuance under Equity Plans

The following table sets out the number of the Company’s shares to be issued and remaining available for future issuance under the Company’s Incentive Stock Option Plan at the end of the Company’s most recently completed financial year:

Plan Category

|

Number of Securities to

be issued upon exercise

of outstanding options

(a) |

Weighted-average

exercise price of

outstanding options

(b) | Number of securities remaining available

for future issuance under incentive stock

option plans (excluding securities

reflected in column (a))

(c)

|

| Stock Option Plan approved by securityholders | 14,010,000 | $1.16 | 2,289,084 |

| Equity compensation plans not approved by securityholders | N/A | N/A | N/A |

| Total | 14,010,000 | | 2,289,084 |

INDEBTEDNESS TO COMPANY OF DIRECTORS AND EXECUTIVE OFFICERS

No director or executive officer, or any proposed director or any associate of any of them, is or, since the beginning of the last completed financial year of the Company, was indebted to the Company, or has been the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Company.

INDEMNIFICATION OF DIRECTORS AND OFFICERS

As provided under the B. C. Corporations Act and the Company’s Articles, the Company indemnifies the directors and officers against certain losses arising from claims against them for their acts, errors or omissions as such. The Company maintains liability insurance for its directors and officers. The policy provides insurance for directors and officers of the Company in respect of certain losses arising from claims against them for their acts, errors or omissions in their capacity as directors or officers. The policy was extended to May 15, 2013 at an annual premium cost of $50,000 for coverage up to $10,000,000.

18 of 26

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

No insider of the Company, no management proposed nominee for election as a director of the Company and no associate or affiliate of any of these persons, has any material interest, direct or indirect, in any transaction since the commencement of the Company's last financial year or in any proposed transaction, which, in either case, has materially affected or will materially affect the Company or any of its subsidiaries other than as disclosed under the headings "Executive Compensation" and "Particulars of Matters to be Acted Upon".

MANAGEMENT CONTRACTS

The Company entered into a service agreement with related party Manex Resource Corp. (“Manex”) on February 2, 2012 which replaces a prior service agreement dated June, 2008, whereby Manex provides administrative, accounting, and secretarial services to the Company. Manex is a private company controlled by Lawrence Page, a director and officer of the Company. The basic fee for office space and office infrastructure is $14,000 per month and other services rendered are based on hourly rates specified in the agreement. The Company also reimburses Manex for office supplies including paper, courier, postage, parking, filing fees and other out-of-pocket expenses. During the year ended December 31, 2012 the Company paid $535,349 to Manex. Manex is located at the same address as the Company at suite 1100, 1199 West Hastings Street, Vancouver, British Columbia, V6E 3T5.

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

The Company’s corporate governance disclosure obligations are set out in National Instrument 58-101 –Disclosure of Corporate Governance Practices (the “National Instrument”), National Policy 58-201 –Corporate Governance Guidelines and National Instrument 52-110 –Audit Committees.These instruments set out a series of guidelines and requirements for effective corporate governance, collectively the “Guidelines”. The National Instrument requires the Company to disclose its approach to corporate governance with reference to Guidelines.

Composition of the Board

The Board consists of seven directors. The National Instrument defines an “independent director” as a director who has no direct or indirect material relationship with the Company. A “material relationship” is in turn defined as a relationship which could, in the view of the Board of Directors, is reasonably expected to interfere with such member’s independent judgment. The Board of Directors considers the factual circumstances of each director in the context of Guidelines.

The Board has determined that five (5) directors are independent for purposes of the Board members as provided in National Instrument 58-101. There are two (2) who are not independent for purposes of the Board members as provided in National Instrument 58-101.The Board has concluded that Mr. Tracy Stevenson, Chairman of the Board, is an “independent” director. See Composition of the Board below.

| Director Nominees | Independent | Non-Independent | Reason for Non Independence |

| Thomas Patton | | x | President and CEO of the Company |

| Lawrence Page, Q.C. | | x | President of a company providing administrative services and office accommodation to the Company |

| Tracy Stevenson | x | | |

| LeRoy Wilkes | x | | |

| John Kerr | x | | |

| Anthony Walsh | x | | |

| Todd Hilditch | x | | |

The Board of Directors holds regularly scheduled meetings. From January 1, 2012 to December 31, 2012 the following meetings were held:

19 of 26

| Board of Directors | 6 |

| Audit Committee | 4 |

| Corporate Governance, Nomination and Compensation Committee | 4 |

| Safety, Health, Security and Environment Committee | 2 |

| Total number of meetings held…… | 16 |

| | Number and % of Meetings Attended |

Director |

Board | Corporate

Governance,

Nomination

and

Compensation

Committee |

Audit

Committee

|

Safety,

Health,

Security and

Environment |

Committees

(Total) |

Overall

Attendance |

Thomas Patton

| 6/6

100% |

|

| 2/2

100% | 2/2

100% | 8/8

100% |

Tracy Stevenson

| 6/6

100% |

|

|

|

| 6/6

100% |

Lawrence Page

| 4/6

68% |

|

| 2/2

100% | 2/2

100% | 6/8

75% |

LeRoy Wilkes

| 6/6

100% | 4/4

100% | 1/1

100% |

| 5/5

100% | 11/11

100% |

Robert Gayton

| 4/5

85% | 3/3

100% | 3/3

100% |

| 6/6

100% | 10/11

91% |

John Kerr

| 6/6

100% | 1/1

100% | 4/4

100% | 2/2

100% | 7/7

100% | 13/13

100% |

Anthony Walsh

| 6/6

100% | 3/3

100% | 3/3

100% |

| 6/6

100% | 12/12

100% |

Todd Hilditch

| 4/4

100% | 1/1

100% | 1/1

100% |

| 2/2

100% | 6/6

100% |

Mr. Wilkes resigned from the Audit Committee on April 2, 2012.

Mr. Kerr resigned from the Corporate Governance and Nomination Committee on April 2, 2012.

Dr. Robert Gayton resigned from the Board of Directors, Chairman of the Audit Committee and member of the Corporate Governance and Nomination Committee on September 30, 2012.

Mr. Walsh was appointed the Chairman of the Audit Committee to fill the vacancy created by the resignation of Dr. Gayton.

Mr. Hilditch was appointed as a member of the Audit Committee on October 1, 2012 and a member of the Corporate Governance and Nomination Committee on November 13, 2012 to fill the vacancy created by the resignation of Dr. Gayton.

Independent Directors Meetings

The independent directors hold in camera sessions, at which non-independent directors and members of management are not in attendance. These meetings are held at all quarterly board meetings and otherwise as deemed necessary. During the financial year ended December 31, 2012, the independent directors held six (6) such meetings.

Participation of Directors in Other Reporting Issuers

Certain of the Company’s directors are directors of other reporting issuers, as set out in the following table:

| Director or Proposed Director | Reporting Issuer |

| Lawrence Page | Duncastle Gold Corp. | Southern Silver Exploration Corp. |

| | Bravada Gold Corporation | Valterra Resource Corporation |

| | Homestake Resource Corporation | |

| John Kerr | Pacific Coast Nickel Corp. | Bravada Gold Corporation |

| LeRoy Wilkes | Sabina Gold and Silver Corp. | Athena Silver Corporation |

20 of 26

| Tracy Stevenson | Vista Gold Corp. | |

| Anthony Walsh | Dundee Precious Metals Ltd. | Sabina Gold and Silver Corp. |

| | NovaGold Ltd | TMX Group Ltd. |

| | Avala Resources Ltd. | |

| Todd Hilditch | Terraco Gold Corp. | Sama Resources Inc. |

| | Bryant Resources Inc. | International Enexco Ltd. |

Board Mandate

The Board has a written mandate that was implemented in March, 2011 that can be viewed atwww.quaterra.com. The roles and responsibilities of the Board include the following:

selecting and monitoring senior management;

strategic planning;

appointing appropriate committees of the Board and delegating responsibilities for specific functions to such committees

with the assistance of the Company’s Audit Committee, selecting an auditor for appointment at the Company’s annual meeting;

regulatory compliance; and

board assessment

Position Descriptions

The Board has developed written position descriptions for the Chairman of the Board and the Chair of each Board Committee. The Board and the CEO have also developed a written position description for the CEO. All of these written position descriptions were adopted by the Company in March, 2011.

Orientation and Continuing Education

Board members are provided with a policy and procedure manual and have access to technical data and financial information 24 hours a day through an internet-based software support system, essentially an electronic Boardroom. The Company does not provide formal continuing education to its Board members, but does encourage them to communicate with management, auditors and technical consultants. Board members are also encouraged to participate in industry related conferences, meetings and educational events.

Ethical Business Conduct

The Board has adopted a Code of Business Conduct and Ethics (the “Code”) that can be viewed atwww.quaterra.com.The Code addresses honesty and integrity, fair dealing, discrimination and harassment, safety and security, and honest and accurate record keeping. The Code also addresses Ethical Business Conduct for financial managers.

Audit Committee

The Audit Committee is responsible for assisting directors to meet their responsibilities; providing better communication between directors and external auditors; enhancing the independence of the external auditor; increasing the credibility and objectivity of financial reports; and strengthening the role of the directors facilitating in-depth discussions among directors, management and the external auditor. The Audit Committee is responsible for the appointment, compensation, retention and oversight of the external auditor, as well as the pre-approval of all non-audit services provided by the external auditor, and for directing the auditor’s examination into specific areas of the Company’s business. A full version of the Audit Committee Charter is available atwww.quaterra.com.

21 of 26

Composition of the Audit Committee

The Audit Committee is comprised of three directors of the Company, Anthony Walsh (Chair), Todd Hilditch, and John Kerr, all of whom are independent and financially literate within the meaning of NI 52-110. Dr. Gayton resigned as a Director and Chair of the Audit Committee on September 30, 2012. Mr. Hilditch was appointed as a Member of the Audit Committee to fill the vacancy created by the resignation of Dr. Gayton and Mr. Walsh was appointed as the Chair of the Audit Committee.

To be considered to be independent, a member of the audit committee must not have any direct or indirect ‘material relationship’ with the Company. A material relationship is a relationship which could, in the view of the board of directors of the Company, reasonably interfere with the exercise of a member’s independent judgment.

To be considered financially literate, a member of the audit committee must have the ability to read and understand a set of financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected in the Company’s financial statements.

Mr. Walshgraduated from Queen’s University (Canada) in 1973 and became a member of The Canadian Institute of Chartered Accountants in 1976. Mr. Walsh has over 20 years’ experience in the field of exploration, mining and development. Mr. Walsh has sat on several public company Boards and in his positions, he was responsible for receiving financial information relating to his Company and obtaining an understanding of the balance sheet, income statement and statement of cash flows and how these statements are integral in assessing the financial position of the Company and its operating results.

Mr. Kerr graduated from the University of British Columbia in 1964 with a BASc degree in Geological Engineering. Mr. Kerr has sat on several public company Boards and in his positions, he would be responsible for receiving financial information relating to his Company and obtaining an understanding of the balance sheet, income statement and statement of cash flows and how these statements are integral in assessing the financial position of the Company and its operating results.

Mr. Hilditch graduated from Rensselaer Polytechnic Institute in Troy, New York with a Bachelor of Science degree in Management, majoring in finance. Mr. Hilditch has over 15 years’ experience in the natural resource sector and has held the position of President, CEO and Director of numerous TSX Venture listed companies and in his positions, he would be responsible for receiving financial information relating to his Company and obtaining an understanding of the balance sheet, income statement and statement of cash flows and how these statements are integral in assessing the financial position of the Company and its operating results.

Pre-approved Policies and Procedures