Exhibit (c)(iii)

November 12, 2009 Draft Presentation to the

Special Committee of the Board of Directors of

The Orchard Enterprises, Inc.

| DRAFT |

| FOR DISCUSSION PURPOSES ONLY |

| SUBJECT TO REVISION |

The Orchard Enterprises, Inc.

Indications of Value Summary

As of September 30, 2009

(000’s Except per Share Value)

| Method | | Indicated Value | | | Weight Applied | | | Weighted Value | |

| | | | | | | | | | |

| Discounted Cash Flow Method | | $ | 30,344 | | | | 40 | % | | $ | 12,138 | |

| Guideline Market Transaction Method | | $ | 37,037 | | | | 40 | % | | $ | 14,815 | |

| Guideline Public Company Method | | $ | 46,764 | | | | 20 | % | | $ | 9,353 | |

| Indication of Controlling, Marketable Equity Value | | | | | | | | | | | 36,306 | |

| Less: Series A Preferred Stock Liquidation Preference | | | | | | | | | | | (24,993 | ) |

| Residual Value Available for Common Shareholders | | | | | | | | | | | 11,313 | |

| Divided by Common Shares Outstanding | | | | | | | | | | | 6,396 | |

| Common Stock on a Per Share Value | | | | | | | | | | $ | 1.77 | |

Note: Some amounts may not foot due to rounding

| DRAFT |

| FOR DISCUSSION PURPOSES ONLY |

| SUBJECT TO REVISION |

The Orchard Enterprises, Inc.

Business Enterprise Value - Without eMusic Synergies and Private Company Cost Savings

Discounted Cash Flow Method

September 30, 2009

(000’s)

| Aggressive Case | | Q4 2009 | | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | Residual | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Debt Free Cash Flow (Net Cash Flow to Invested Capital) | | $ | (53 | ) | | $ | 4,645 | | | $ | 6,054 | | | $ | 6,227 | | | $ | 6,291 | | | $ | 6,896 | | | $ | 7,172 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Capitalized Residual Value | | | | | | | | | | | | | | | | | | | | | | | | | | | 44,824 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Present Value Mid-Year Discount Factor @ 20% | | | 0.97747 | | | | 0.87220 | | | | 0.72683 | | | | 0.60569 | | | | 0.50474 | | | | 0.42062 | | | | 0.42062 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Present Value of Cash Flow | | | (52 | ) | | | 4,051 | | | | 4,400 | | | | 3,772 | | | | 3,175 | | | | 2,901 | | | | 18,854 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Indicated Enterprise Value (Market Value of Invested Capital) | | | | | | | | | | | | | | | | | | | | | | | | | | | 37,101 | |

| Less: Interest Bearing Debt | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | |

| Plus- present value of NOL carryforward tax benefit after 2014 | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | |

| Less: Series A Preferred Stock Liquidation Preference | | | | | | | | | | | | | | | | | | | | | | | | | | | (24,993 | ) |

| Indication of Controlling, Marketable Equity Value - Common Stock | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 12,108 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Neutral Case | | | Q4 2009 | | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | Residual | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Debt Free Cash Flow (Net Cash Flow to Invested Capital) | | $ | (53 | ) | | $ | 3,445 | | | $ | 4,719 | | | $ | 6,426 | | | $ | 5,378 | | | $ | 5,908 | | | $ | 6,144 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Capitalized Residual Value | | | | | | | | | | | | | | | | | | | | | | | | | | | 38,402 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Present Value Mid-Year Discount Factor @ 20% | | | 0.97747 | | | | 0.87220 | | | | 0.72683 | | | | 0.60569 | | | | 0.50474 | | | | 0.42062 | | | | 0.42062 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Present Value of Cash Flow | | | (52 | ) | | | 3,005 | | | | 3,430 | | | | 3,892 | | | | 2,715 | | | | 2,485 | | | | 16,153 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Indicated Enterprise Value (Market Value of Invested Capital) | | | | | | | | | | | | | | | | | | | | | | | | | | | 31,627 | |

| Less: Interest Bearing Debt | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | |

| Plus- present value of NOL carryforward tax benefit after 2014 | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | |

| Less: Series A Preferred Stock Liquidation Preference | | | | | | | | | | | | | | | | | | | | | | | | | | | (24,993 | ) |

| Indication of Controlling, Marketable Equity Value - Common Stock | | | | | | | | | | | | | | | | | | | | | | | | | | $ | 6,634 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Worst Case | | | Q4 2009 | | | 2010 | | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | Residual | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Debt Free Cash Flow (Net Cash Flow to Invested Capital) | | $ | (53 | ) | | $ | 513 | | | $ | 1,421 | | | $ | 2,848 | | | $ | 3,803 | | | $ | 4,418 | | | $ | 4,595 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Capitalized Residual Value | | | | | | | | | | | | | | | | | | | | | | | | | | | 28,717 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Present Value Mid-Year Discount Factor @ 20% | | | 0.97747 | | | | 0.87220 | | | | 0.72683 | | | | 0.60569 | | | | 0.50474 | | | | 0.42062 | | | | 0.42062 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Present Value of Cash Flow | | | (52 | ) | | | 447 | | | | 1,033 | | | | 1,725 | | | | 1,920 | | | 1,858 | | | | 12,079 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Indicated Enterprise Value (Market Value of Invested Capital) | | | | | | | | | | | | | | | | | | | | | | | | | | | 19,010 | |

| Less: Interest Bearing Debt | | | | | | | | | | | | | | | | | | | | | | | | | | | 0 | |

| Plus- present value of NOL carryforward tax benefit after 2014 | | | | | | | | | | | | | | | | | | | | | | | | | | | 727 | |

| Less: Series A Preferred Stock Liquidation Preference | | | | | | | | | | | | | | | | | | | | | | | | | | | (24,993 | ) |

| Indication of Controlling, Marketable Equity Value - Common Stock | | | | | | | | | | | | | | | | | | | | | | | | | | $ | (5,256 | ) |

| | | Enterprise Value | | | Common Stock | |

| | | Indicated Enterprise Value | | | Probability | | | Probability Adjusted Value | | | Indicated Common Value | | | Probability | | | Probability Adjusted Value | | | Common Shares o/s | | | Common Share Price | |

| Aggressive Case | | $ | 37,101 | | | | 20 | % | | $ | 7,420 | | | $ | 12,108 | | | | 20 | % | | $ | 2,422 | | | | 6,396,115 | | | $ | 1.89 | |

| Neutral Case | | | 31,627 | | | | 60 | % | | | 18,976 | | | | 6,634 | | | | 60 | % | | | 3,980 | | | 6,396,115 | | | $ | 1.04 | |

| Worst Case | | | 19,737 | | | | 20 | % | | | 3,947 | | | | 0 | | | | 20 | % | | | 0 | | | | 6,396,115 | | | $ | 0.00 | |

| Probability Adjusted | | | | | | | | | | $ | 30,344 | | | | | | | | | | | $ | 6,402 | | | | 6,396,115 | | | $ | 1.00 | |

PV of NOL CF Tax Savings | |

Per Client | | NOL | | | Tax Rate | | | Tax Savings | | | PV Factor | | | PV of Tax Svgs | |

| | | | | | | | | | | | | | | | | | | | | |

| 2015 | | | 3,135 | | | | 40 | % | | | 1,254 | | | | 0.35052 | | | | 440 | |

| 2016 | | | 2,462 | | | | 40 | % | | | 985 | | | | 0.29210 | | | | 288 | |

| | | | | | | | | | | | | | | | | | | | 727 | |

| DRAFT |

| FOR DISCUSSION PURPOSES ONLY |

| SUBJECT TO REVISION |

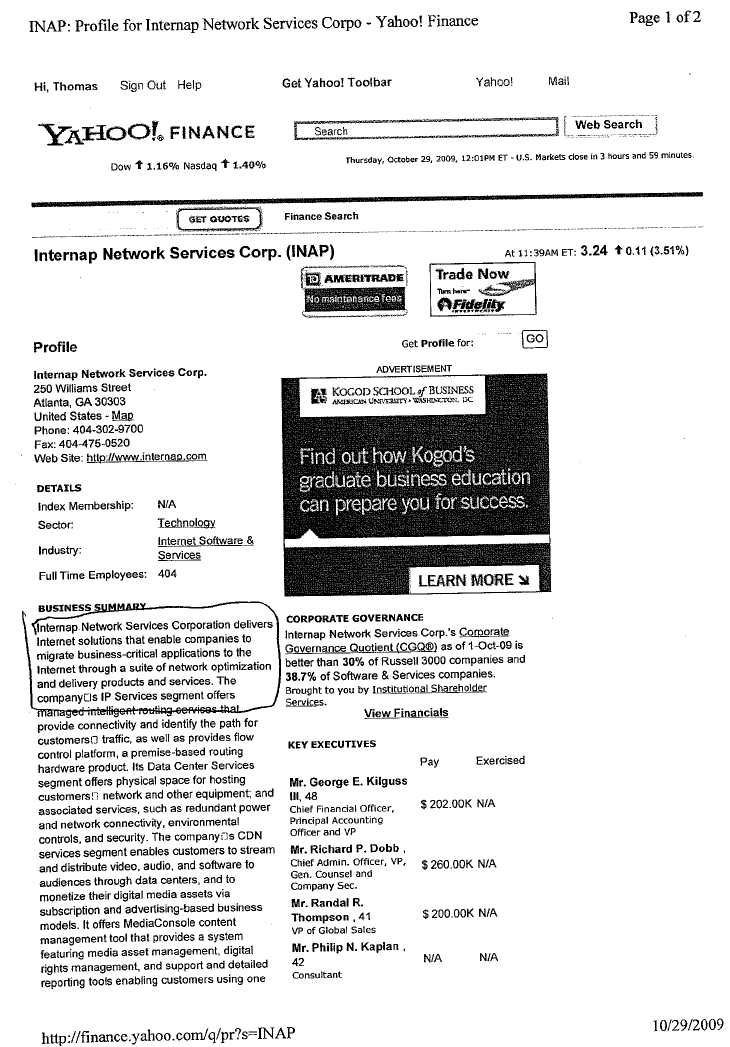

The Orchard Enterprises, Inc.

Guideline Company Transaction Method

September 30, 2009

(000’s)

Enterprise Value Approach:

| | | as of 9/30/09 | | | | | | | | | | | | | | | | | | Indicated | |

| Selected Pricing | | Normalized | | | Industry Multiples | | | Value | |

| Multiple | | (000’s) | | | Low | | | High | | | Mean | | | Median | | | Selected | | | (000’s) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| MVIC/Revenues | | $ | 61,729 | | | | 0.24 | | | | 3.54 | | | | 1.44 | | | | 1.12 | | | | 0.60 | | | $ | 37,037 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | Indication of Market Value of Invested Capital | | | | 37,037 | |

| | | | | | | Less: Interest Bearing Debt | | | | - | |

| | | | | | | Indication of Controlling, Marketable Equity Value | | | $ | 37,037 | |

Note: Some amounts may not foot due to rounding

Multiple selected is lower than the median primarily due to: decline in economic conditions (DOW is off 30% from high) and several of the selected guideline transactions have positive EBITDA.

| DRAFT |

| FOR DISCUSSION PURPOSES ONLY |

| SUBJECT TO REVISION |

The Orchard Enterprises, Inc.

Guideline Company Transaction Detail

September 30, 2009

(000’s)

| | | | | | | Sale | | Latest Fiscal Year | | | | | | MVIC/ | | | MVIC/ | |

Business Description | | Target Company Name | | Acquiring Company Name | | Date | | Revenues | | | EBITDA | | | MVIC | | | Revenues | | | EBITDA | |

| | | | | | | | | | | | | | | | | | | | | | |

| Digital media and IPTV solutions provider | | Visual Connection | | KIT Digital,Inc | | 10/5/2008 | | | 10,356 | | | | N/M | | | | 4,344 | | | | 0.42 | | | | N/M | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Provides Audio services for content download and playback on personal computers | | Audible, Inc. | | Amazon.com Inc. | | 3/19/2008 | | | 101,979 | | | | 2,326 | | | | 277,377 | | | | 2.72 | | | | 119.25 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Provider of video and audio content distribution to advertisers | | Vyvz Ads Business | | DG FastChannel, Inc. | | 6/5/2008 | | | 36,411 | | | | 10,516 | | | | 129,000 | | | | 3.54 | | | | 12.27 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Distribution of program and advertising content to television and radio stations | | Applied Graphics Technologies, Inc. | | Digital Generation Systems, Inc. | | 6/10/2004 | | | 21,546 | | | | 274 | | | | 14,100 | | | | 0.65 | | | | 51.46 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Distribution of entertainment programming and home video products | | GoodTimes Entertainment | | Gaiam Inc | | 9/13/2005 | | | 141,954 | | | | N/M | | | | 34,405 | | | | 0.24 | | | | N/M | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Digital distribution of motion pictures over the internet | | Movielink | | Blockbuster | | 8/8/2007 | | | 4,053 | | | | N/M | | | | 7,000 | | | | 1.73 | | | | N/M | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Markets and distributes digital images and provides visual content | | Creatas LLC | | Jupitermedia Corp | | 3/7/2005 | | | 43,073 | | | | 2,949 | | | | 60,400 | | | | 1.40 | | | | 20.48 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Provides digital background music and messaging services via the internet | | Trusonic Inc. | | Fluide Media Networks, Inc. | | 10/17/2007 | | | 2,838 | | | | N/M | | | | 6,000 | | | | 2.11 | | | | N/M | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Provides downloadable mobile content including ringtones and background wallpaper and text alerts | | Ringtone.com LLC | | New Motion, Inc. | | 6/30/2008 | | | 10,226 | | | | N/M | | | | 8,653 | | | | 0.85 | | | | N/M | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Direct to consumer mobile internet content and services | | AMV Holding Limited | | Mandalay Media, Inc. | | 10/23/2008 | | | 29,497 | | | | 4,244 | | | | 22,522 | | | | 0.76 | | | | 5.31 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Note: Some amounts may not foot due to rounding | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Low | | | | | | | | | | | | | | | | | | | | | 0.24 | | | | 5.31 | |

| High | | | | | | | | | | | | | | | | | | | | | 3.54 | | | | 119.25 | |

| Mean | | | | | | | | | | | | | | | | | | | | | 1.44 | | | | 41.75 | |

| Median | | | | | | | | | | | | | | | | | | | | | 1.12 | | | | 20.48 | |

| Standard Deviation | | | | | | | | | | | | | | | | | | | | | 1.08 | | | | 46.77 | |

| Coefficient of Variation (Standard Deviation\Mean) | | | | | | | | | | | | | | | | | | | | | 0.75 | | | | 1.12 | |

SOURCE: Pratt's Stats, Public Stats and Mergerstat

N/M = Not Meaningful

MVIC = Market Value of Invested Capital

| DRAFT |

| FOR DISCUSSION PURPOSES ONLY |

| SUBJECT TO REVISION |

The Orchard Enterprises, Inc.

Conclusion of Value - Guideline Public Company Method

September 30, 2009

(000’s)

| | | Normalized | | | | | | | | | | | | | | | | | | Indicated | |

| Selected Pricing | | as of September 30, 2009 | | | Industry Multiples | | | Value | |

| Multiple | | (000’s) | | | Low | | | High | | | Mean | | | Median | | | Selected | | | (000’s) | |

| | | | | | | | | | | | | | | | | | | | | | |

| MVIC/Revenues | | $ | 61,729 | | | | 0.21 | | | | 15.36 | | | | 2.18 | | | | 0.53 | | | | 0.53 | | | $ | 32,716 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Indication of Minority, Market Value of Invested Capital | | | | 32,716 | |

| | | | | | | Less: Interest Bearing Debt | | | | - | |

| | | | | | | Add: Cash and Marketable Securities | | | | 4,695 | |

| | | | | | | Indication of Minority, Marketable Equity Value | | | | 37,411 | |

| | | | | | | Add: 25% Control Premium | | | | 9,353 | |

| | | | | | | Indication of Controlling, Marketable Equity Value | | | $ | 46,764 | |

Note: Some amounts may not foot due to rounding

| DRAFT |

| FOR DISCUSSION PURPOSES ONLY |

| SUBJECT TO REVISION |

The Orchard Enterprises, Inc.

Guideline Public Company Method

As of September 30, 2009

(000’s)

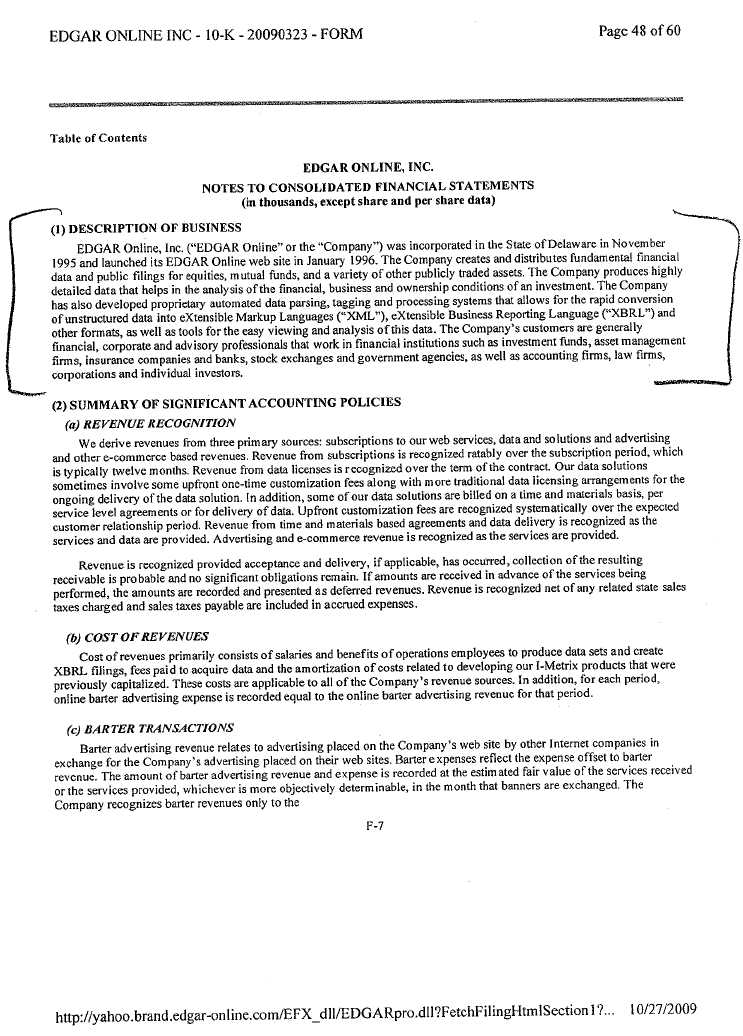

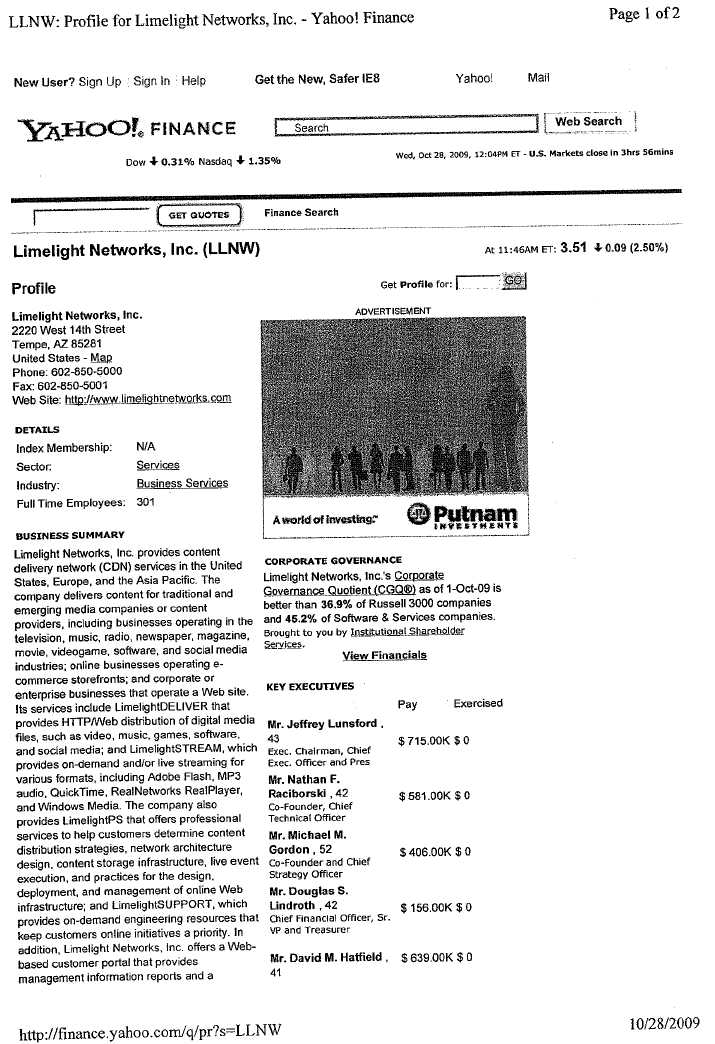

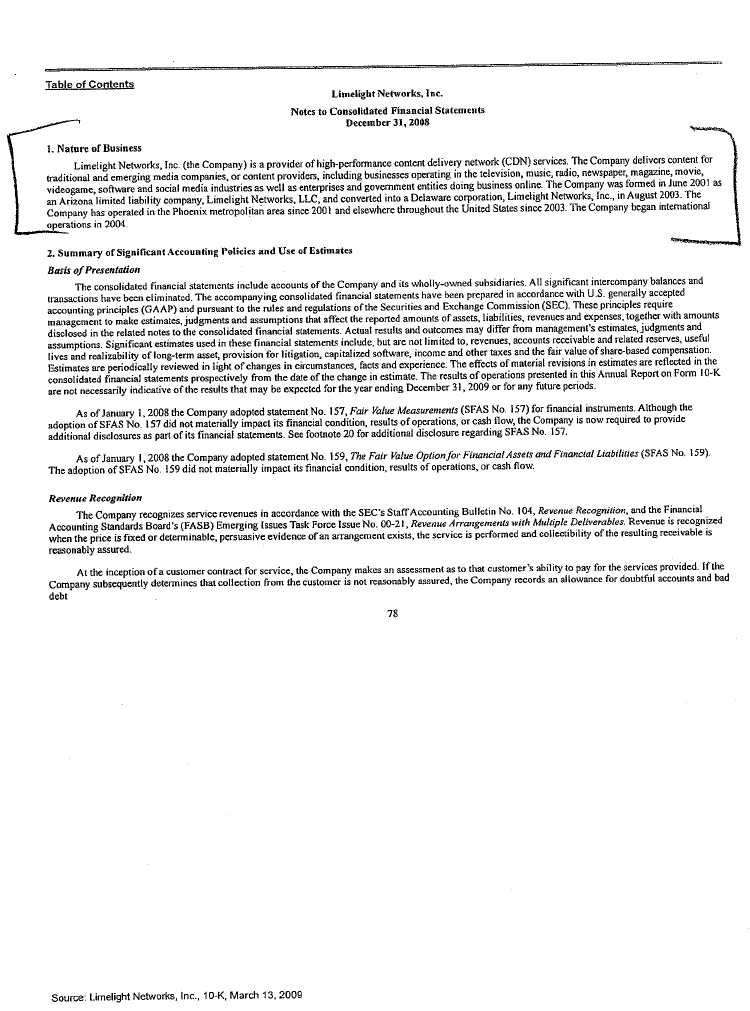

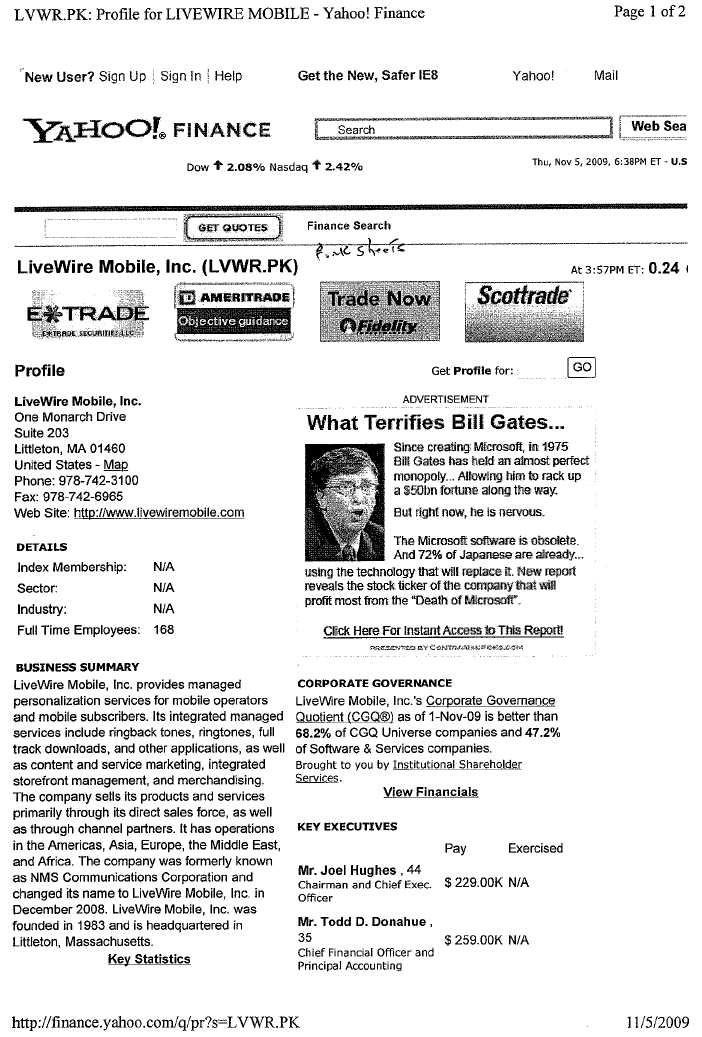

| | | | | | | | | | | | Limelight | | | Salary.Com, Inc. | | | | | | Image | | | | | | Internap | | | Fluid Music | | | LiveWire | |

| | Orchard | | | Glu Mobile, Inc. | | | EDGAR Online, Inc. | | | Networks, Inc. | | | and Subsidiaries | | | WebMediaBrands Inc. | | | Entertainment, Inc. | | | RealNetworks, Inc. | | | Network Services | | | Canada, Inc. | | | Mobile, Inc. | |

| | NASDAQ: ORCD | | | NASDAQ: GLUU | | | NASDAQ: EDGR | | | NASDAQ: LLNW | | | NASDAQ: SLRY | | | NASDAQ: WEBM | | | NASDAQ: DISK | | | NASDAQ: RNWK | | | NASDAQ: INAP | | | Toronto; FMN - T | | | NASDAQ; INAP.PK | |

| (LTM) Ending | | September 30, 2009 | | | June 30, 2009 | | | June 30, 2009 | | | June 30, 2009 | | | June 30, 2009 | | | June 30, 2009 | | | June 30, 2009 | | | June 30, 2009 | | | June 30, 2009 | | | June 30, 2009 | | | June 30, 2009 | |

| Stock Price as of 10/27/09 | | $ | 1.27 | | | $ | 1.07 | | | $ | 1.58 | | | $ | 3.60 | | | $ | 2.97 | | | $ | 0.65 | | | $ | 0.80 | | | $ | 4.03 | | | $ | 3.15 | | | $ | 1.80 | | | $ | 0.33 | |

| Shares Out (000) | | | 6,396 | | | | 29,663 | | | | 26,734 | | | | 84,457 | | | | 16,146 | | | | 36,732 | | | | 21,856 | | | | 134,784 | | | | 50,725 | | | | 52,522 | | | | 46,010 | |

| Minority Value Indication | | | 8,123 | | | | 31,739 | | | | 42,240 | | | | 304,045 | | | | 47,954 | | | | 23,876 | | | | 17,485 | | | | 543,180 | | | | 159,784 | | | | 94,540 | | | | 15,183 | |

| Preferred Stock | | | 7,017 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| M.V. of Total Equity | | | 15,140 | | | | 31,739 | | | | 42,240 | | | | 304,405 | | | | 47,954 | | | | 23,876 | | | | 17,485 | | | | 543,180 | | | | 159,784 | | | | 94,540 | | | | 15,183 | |

| Add: Short and Long Term Interest Bearing Debt | | | - | | | | 21,100 | | | | 2,147 | | | | - | | | | - | | | | 7,197 | | | | 26,408 | | | | - | | | | 20,000 | | | | 1,000 | | | | 533 | |

| Less: Cash and Marketable Securities | | | 4,695 | | | | 12,811 | | | | 1,431 | | | | 164,303 | | | | 17,018 | | | | 5,520 | | | | 241 | | | | 362,000 | | | | 54,514 | | | | 13,884 | | | | 7,325 | |

| Market Value of Invested Capital (Minority Value) | | | 10,444 | | | | 40,028 | | | | 42,956 | | | | 139,742 | | | | 30,936 | | | | 25,553 | | | | 43,652 | | | | 181,180 | | | | 125,270 | | | | 81,656 | | | | 8,391 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Comparative Balance Sheets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Current Assets | | | 19,368 | | | | 45,291 | | | | 4,131 | | | | 198,449 | | | | 26,971 | | | | 12,153 | | | | 802,000 | | | | 470,000 | | | | 88,395 | | | | 15,775 | | | | 14,539 | |

| Net Plant and Equipment | | | 2,451 | | | | 4,014 | | | | 2,343 | | | | 35,169 | | | | 2,697 | | | | 2,199 | | | | 174,000 | | | | 60,000 | | | | 94,301 | | | | 509 | | | | 1,522 | |

| Other Assets | | | 34,607 | | | | 26,174 | | | | 5,345 | | | | 6,003 | | | | 35,597 | | | | 34,401 | | | | 1,012,000 | | | | 72,000 | | | | 80,094 | | | | 2,751 | | | | 544 | |

| Total Assets | | | 56,426 | | | | 75,479 | | | | 11,819 | | | | 239,621 | | | | 65,265 | | | | 48,753 | | | | 1,988,000 | | | | 602,000 | | | | 262,790 | | | | 19,035 | | | | 16,605 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Current Liabilities Including Short Term Debt | | | 22,533 | | | | 38,336 | | | | 6,942 | | | | 25,742 | | | | 44,245 | | | | 7,915 | | | | 90,000 | | | | 203,000 | | | | 29,435 | | | | 4,644 | | | | 7,826 | |

| Long Term Debt | | | - | | | | 6,125 | | | | 1,647 | | | | - | | | | - | | | | 7,197 | | | | 200,000 | | | | - | | | | 20,000 | | | | - | | | | 257 | |

| Other Long Term Liabilities | | | - | | | | 10,498 | | | | 206 | | | | 4,640 | | | | 3,734 | | | | 1,772 | | | | 17,000 | | | | 20,000 | | | | 28,907 | | | | 711 | | | | 1,984 | |

| Stockholder's Equity | | | 33,893 | | | | 20,520 | | | | 3,024 | | | | 209,239 | | | | 17,286 | | | | 31,869 | | | | 1,681,000 | | | | 379,000 | | | | 184,448 | | | | 13,680 | | | | 6,538 | |

| Total Liabilities and Equity | | | 56,426 | | | | 75,479 | | | | 11,819 | | | | 239,621 | | | | 65,265 | | | | 48,753 | | | | 1,988,000 | | | | 602,000 | | | | 262,790 | | | | 19,035 | | | | 16,605 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Comparative Income Statements: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues | | | 61,729 | | | | 86,118 | | | | 18,353 | | | | 134,522 | | | | 44,198 | | | | 122,683 | | | | 121,798 | | | | 581,097 | | | | 257,907 | | | | 5,317 | | | | 14,647 | |

| Cost of Revenues | | | 44,233 | | | | 40,548 | | | | 3,893 | | | | 85,987 | | | | 13,550 | | | | 85,078 | | | | - | | | | 253,507 | | | | 207,916 | | | | 3,597 | | | | 8,679 | |

| Gross Margin | | | 17,496 | | | | 45,570 | | | | 14,460 | | | | 48,535 | | | | 30,648 | | | | 37,605 | | | | 121,798 | | | | 327,590 | | | | 49,991 | | | | 1,720 | | | | 5,968 | |

| Operating Expenses | | | 21,741 | | | | 74,800 | | | | 16,776 | | | | 91,985 | | | | 52,775 | | | | 46,643 | | | | 128,984 | | | | 426,971 | | | | 62,699 | | | | 8,955 | | | | 22,339 | |

| Income (Loss) from Operations | | | (4,245 | ) | | | (29,230 | ) | | | (2,316 | ) | | | (43,450 | ) | | | (22,127 | ) | | | (9,038 | ) | | | (7,186 | ) | | | (99,381 | ) | | | (12,708 | ) | | | (7,235 | ) | | | (16,371 | ) |

| Other Income (Expense) | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Interest Income | | | 14 | | | | 281 | | | | 37 | | | | 2,592 | | | | 294 | | | | 483 | | | | - | | | | 7,057 | | | | (1,884 | ) | | | 344 | | | | 223 | |

| Interest Expense | | | (48 | ) | | | (786 | ) | | | (468 | ) | | | (44 | ) | | | - | | | | (5,071 | ) | | | (3,074 | ) | | | - | | | | 1,251 | | | | (107 | ) | | | (374 | ) |

| Earnings Before Tax (EBT) | | | (4,279 | ) | | | (29,735 | ) | | | (2,747 | ) | | | (40,902 | ) | | | (21,833 | ) | | | (13,626 | ) | | | (10,260 | ) | | | (92,324 | ) | | | (13,341 | ) | | | (6,998 | ) | | | (16,522 | ) |

| Tax Expense (Benefit) | | | - | | | | 3,341 | | | | - | | | | 716 | | | | 148 | | | | 16,116 | | | | 46 | | | | 20,879 | | | | 359 | | | | (3 | ) | | | 491 | |

| Net Income (Loss) From Continuing Operations | | | (4,279 | ) | | | (33,076 | ) | | | (2,747 | ) | | | (41,618 | ) | | | (21,981 | ) | | | (29,742 | ) | | | (10,306 | ) | | | (113,203 | ) | | | (13,700 | ) | | | (6,995 | ) | | | (17,013 | ) |

| Depreciation and Amortization | | | 1,822 | | | | 13,453 | | | | 1,685 | | | | 28,022 | | | | 5,635 | | | | 20,114 | | | | (7,385 | ) | | | 35,789 | | | | 30,964 | | | | 1,437 | | | | 4,161 | |

| Stock Based Compensation | | | | | | | 1,194 | | | | 1,403 | | | | 18,581 | | | | 9,260 | | | | 3,956 | ) | | | 75 | | | | 22,829 | | | | 6,413 | | | | 1,028 | | | | 1,385 | |

| Gross Cash Flow (Net Income + Depreciation and Amortization) | | | (2,457 | ) | | | (19,623 | ) | | | (1,062 | ) | | | (13,596 | ) | | | (16,346 | ) | | | (9,628 | ) | | | (2,921 | ) | | | (77,414 | ) | | | 17,264 | | | | (5,558 | ) | | | (12,852 | ) |

| Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) | | | (2,423 | ) | | | (15,777 | ) | | | (631 | ) | | | (15,428 | ) | | | (16,492 | ) | | | 11,076 | | | | 199 | | | | (63,592 | ) | | | 18,256 | | | | (5,798 | ) | | | (12,210 | ) |

| EBITDA + Stock Based Compensation | | | (2,423 | ) | | | (14,583 | ) | | | 772 | | | | 3,153 | | | | (7,232 | ) | | | 15,032 | | | | 274 | | | | (40,763 | ) | | | 24,669 | | | | (4,770 | ) | | | (10,825 | ) |

| Earnings Before Interest and Taxes (EBIT) | | | (4,245 | ) | | | (29,230 | ) | | | (2,316 | ) | | | (43,450 | ) | | | (22,127 | ) | | | (9,038 | ) | | | (7,186 | ) | | | (99,381 | ) | | | (12,708 | ) | | | (7,.235 | ) | | | (16,371 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Earnings Per Share | | $ | -0.67 | | | $ | -1.12 | | | $ | -0.10 | | | $ | -0.49 | | | $ | -1.36 | | | $ | -0.81 | | | $ | -0.47 | | | $ | -0.84 | | | $ | -0.27 | | | $ | -0.13 | | | $ | -0.37 | |

| Gross Margin/Revenues | | | 28.3 | % | | | 52.9 | % | | | 78.8 | % | | | 36.1 | % | | | 69.3 | % | | | 30.7 | % | | | 100.0 | % | | | 56.4 | % | | | 19.4 | % | | | 32.3 | % | | | 40.7 | % |

| Operating Expenses/Revenues | | | 35.2 | % | | | 86.9 | % | | | 91.4 | % | | | 68.4 | % | | | 119.4 | % | | | 38.0 | % | | | 105.9 | % | | | 73.5 | % | | | 24.3 | % | | | 168.40 | % | | | 152.5 | % |

| EBITDA/Revenues | | | -3.9 | % | | | -18.3 | % | | | -3.4 | % | | | -11.5 | % | | | -37.3 | % | | | 9.0 | % | | | 0.2 | % | | | -10.9 | % | | | 7.1 | % | | | -109.0 | % | | | -83.4 | % |

| EBITDA + Stock Based Compensation/Revenues | | | -3.9 | % | | | -16.9 | % | | | 4.2 | % | | | 2.3 | % | | | -16.4 | % | | | 12.3 | % | | | 0.0 | % | | | -7.0 | % | | | 9.6 | % | | | -89.7 | % | | | -73.9 | % |

| EBITDA/Revenues | | | -6.9 | % | | | -33.9 | % | | | -12.6 | % | | | -32.3 | % | | | -50.1 | % | | | -7.4 | % | | | -5.9 | % | | | -17.1 | % | | | -4.9 | % | | | -136.1 | % | | | -111.8 | % |

| Depr. & Amort./Revenues | | | 3.0 | % | | | 15.6 | % | | | 9.2 | % | | | 20.8 | % | | | 12.7 | % | | | 16.4 | % | | | 6.1 | % | | | 6.2 | % | | | 12.0 | % | | | 27.0 | % | | | 28.4 | % |

| Depr. & Amort./Total Assets | | | 3.2 | % | | | 17.8 | % | | | 14.3 | % | | | 11.7 | % | | | 8.6 | % | | | 41.3 | % | | | 0.4 | % | | | 5.9 | % | | | 11.8 | % | | | 7.5 | % | | | 25.1 | % |

| Net Income/Revenues | | | -6.9 | % | | | -38.4 | % | | | -15.0 | % | | | -30.9 | % | | | -49.7 | % | | | -24.2 | % | | | -8.5 | % | | | -19.5 | % | | | -5.3 | % | | | -131.6 | % | | | -116.2 | % |

| Net Income/Equity | | | -12.6 | % | | | -161.2 | % | | | -90.8 | % | | | -19.9 | % | | | -127.2 | % | | | -93.3 | % | | | -0.6 | % | | | -29.9 | % | | | -7.4 | % | | | -51.1 | % | | | -260.2 | % |

| Gross Cash Flow/Revenues | | | -4.0 | % | | | -22.8 | % | | | -5.8 | % | | | -10.1 | % | | | -37.0 | % | | | -7.8 | % | | | -2.4 | % | | | -13.3 | % | | | 6.7 | % | | | -104.5 | % | | | -87.7 | % |

| Long Term Debt/Equity | | | 0.0 | % | | | 0.3 | | | | 0.5 | | | | 0.0 | | | | 0.0 | | | | 0.2 | | | | 0.1 | | | | 0.0 | | | | 0.1 | | | | 0.0 | | | 0.0 | |

| Working Capital | | | -3.165 | | | | 6.955 | | | | -2.811 | | | | 172,707 | | | | -17,274 | | | | 4.238 | | | | 712,000 | | | | 267,000 | | | | 58,960 | | | | 11,131 | | | | 6,713 | |

| Working Cap/Revenues | | | -5.1 | % | | | 8.1 | % | | | -15.3 | % | | | 128.4 | % | | | -39.1 | % | | | 3.5 | % | | | 584.6 | % | | | 45.9 | % | | | 22.9 | % | | | 209.3 | % | | | 45.8 | % |

| Current Ratio | | | 0.9 | | | | 1.2 | | | | 0.6 | | | | 7.7 | | | | 0.6 | | | | 1.5 | | | | 8.9 | | | | 2.3 | | | | 3.0 | | | | 3.4 | | | | 1.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Market Value of Invested Capital to: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues | | | 0.17 | | | | 0.46 | | | | 2.34 | | | | 1.04 | | | | 0.70 | | | | 0.21 | | | | 0.36 | | | | 0.31 | | | | 0.49 | | | | 15.36 | | | | 0.57 | |

| EBITDA | | NM | | | NM | | | NM | | | NM | | | NM | | | | 2.31 | | | | 219.36 | | | | NM | | | 6.86 | | | NM | | | NM | |

| EBITDA + Stock Based Competition | | NM | | | NM | | | | 55.64 | | | | 44.32 | | | NM | | | | 1.70 | | | | 159.31 | | | | NM | | | 5.08 | | | NM | | | NM | |

| EBIT | | NM | | | NM | | | NM | | | NM | | | NM | | | NM | | | NM | | | NM | | | NM | | | NM | | | NM | |