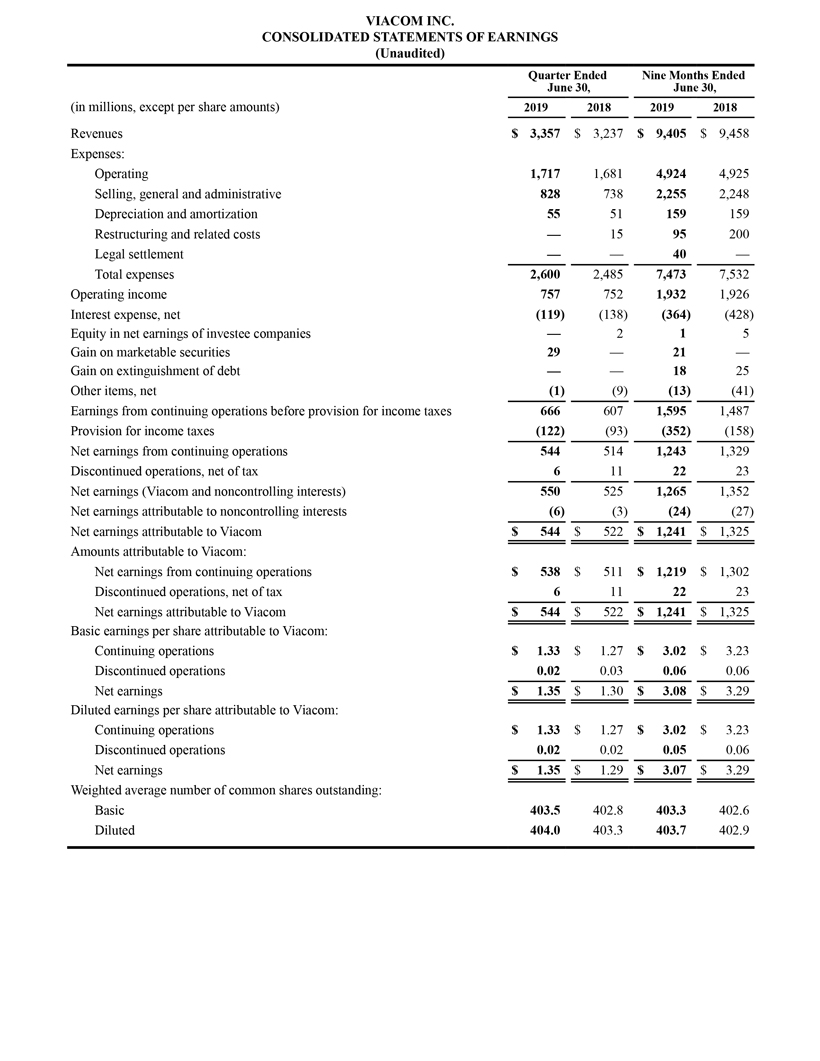

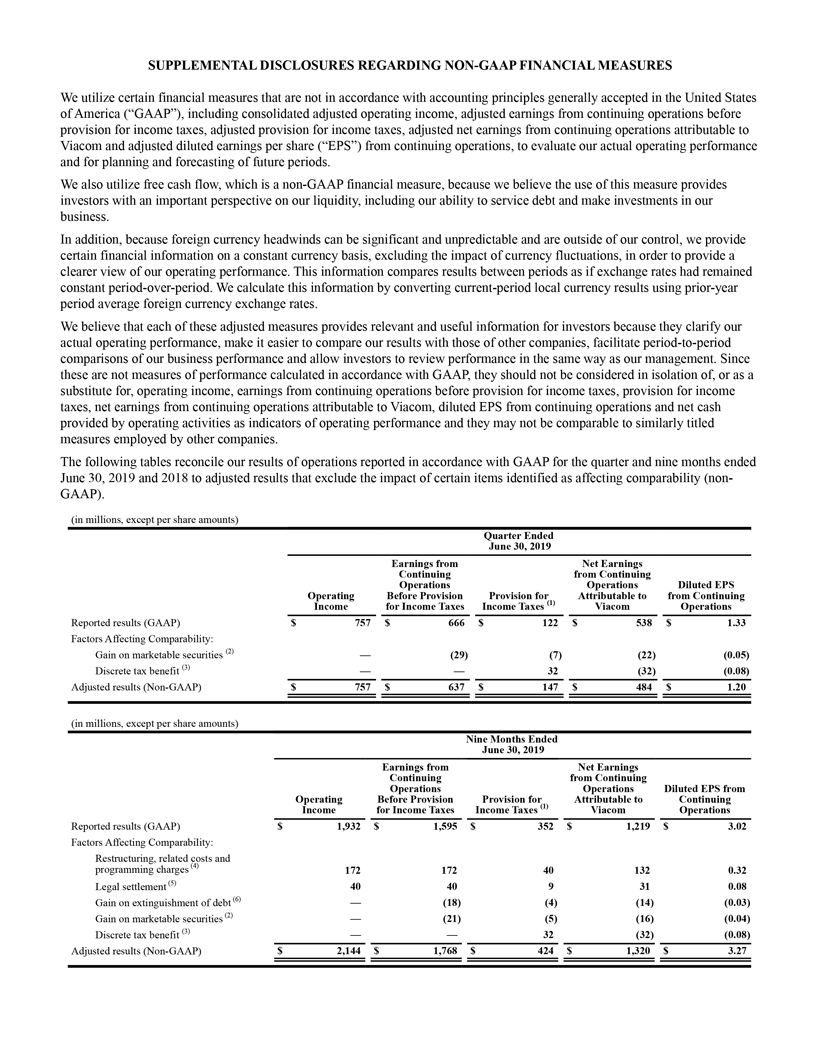

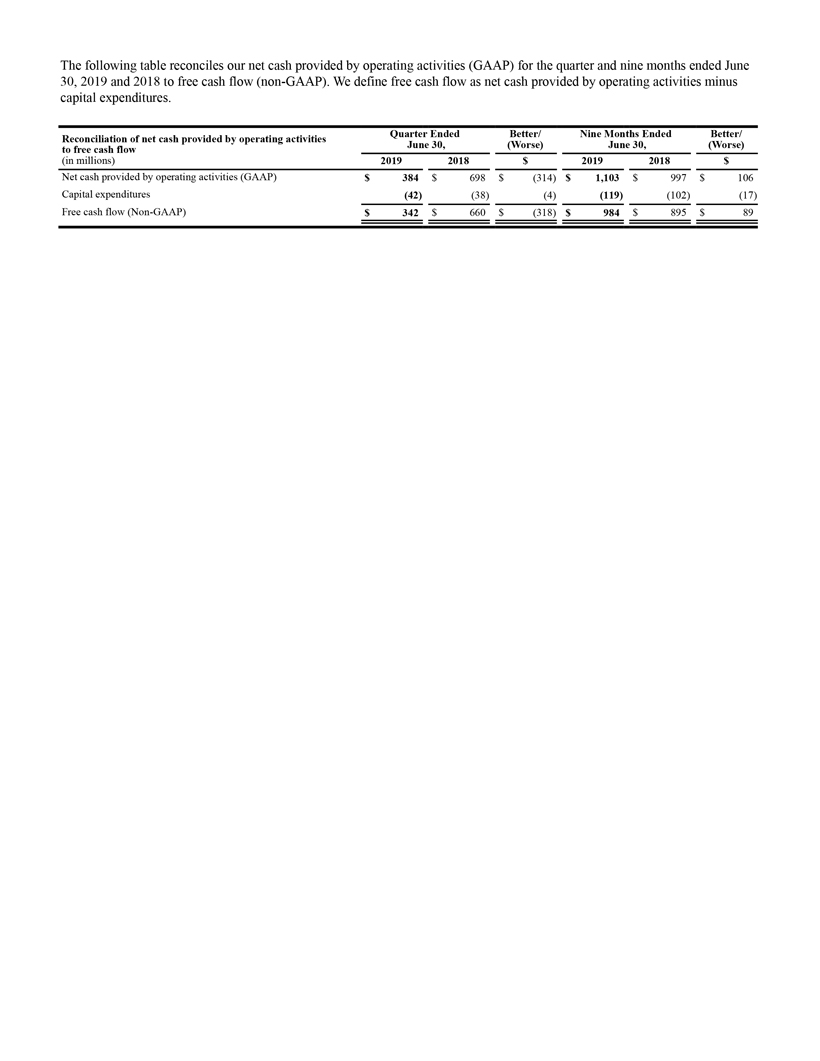

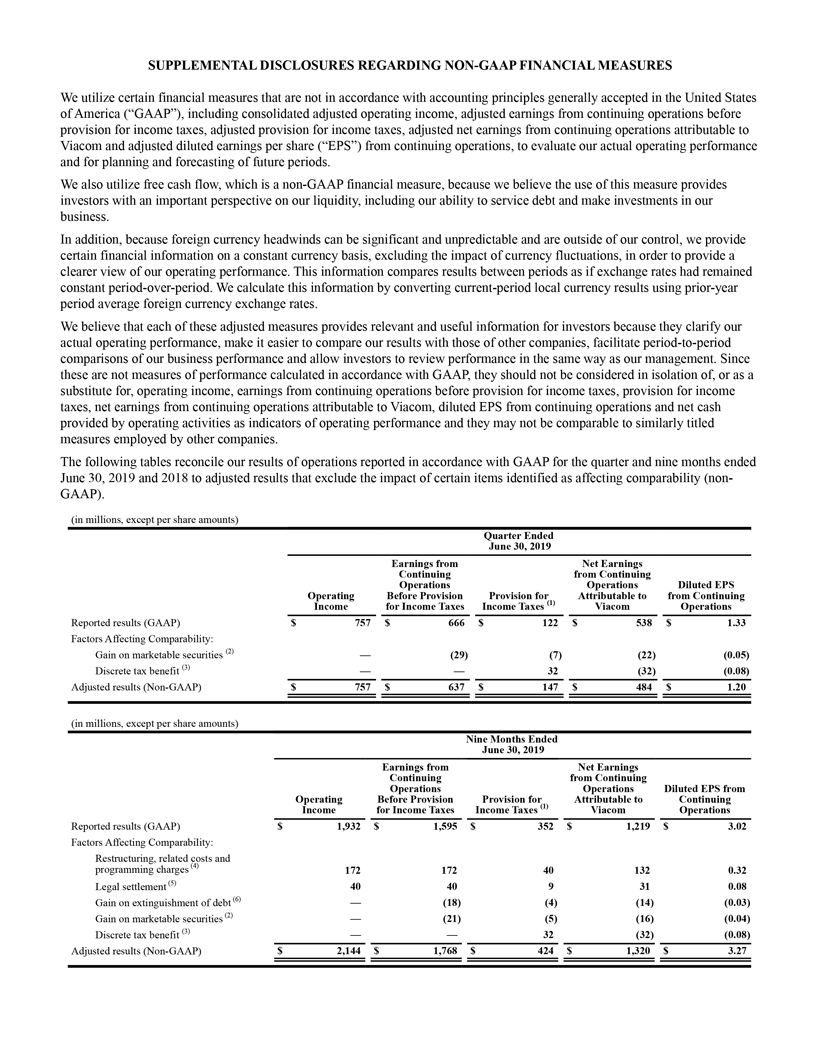

SUPPLEMENTAL DISCLOSURES REGARDINGNON-GAAP FINANCIAL MEASURES We utilize certain financial measures that are not in accordance with accounting principles generally accepted in the United States of America (“GAAP”), including consolidated adjusted operating income, adjusted earnings from continuing operations before provision for income taxes, adjusted provision for income taxes, adjusted net earnings from continuing operations attributable to Viacom and adjusted diluted earnings per share (“EPS”) from continuing operations, to evaluate our actual operating performance and for planning and forecasting of future periods. We also utilize free cash flow, which is anon-GAAP financial measure, because we believe the use of this measure provides investors with an important perspective on our liquidity, including our ability to service debt and make investments in our business. In addition, because foreign currency headwinds can be significant and unpredictable and are outside of our control, we provide certain financial information on a constant currency basis, excluding the impact of currency fluctuations, in order to provide a clearer view of our operating performance. This information compares results between periods as if exchange rates had remained constant period-over-period. We calculate this information by converting current-period local currency results using prior-year period average foreign currency exchange rates. We believe that each of these adjusted measures provides relevant and useful information for investors because they clarify our actual operating performance, make it easier to compare our results with those of other companies, facilitateperiod-to-period comparisons of our business performance and allow investors to review performance in the same way as our management. Since these are not measures of performance calculated in accordance with GAAP, they should not be considered in isolation of, or as a substitute for, operating income, earnings from continuing operations before provision for income taxes, provision for income taxes, net earnings from continuing operations attributable to Viacom, diluted EPS from continuing operations and net cash provided by operating activities as indicators of operating performance and they may not be comparable to similarly titled measures employed by other companies. The following tables reconcile our results of operations reported in accordance with GAAP for the quarter and nine months ended June 30, 2019 and 2018 to adjusted results that exclude the impact of certain items identified as affecting comparability(non-GAAP). (in millions, except per share amounts), , , , , Quarter Ended, , , June 30, 2019, , , , Earnings from, Net Earnings, , Continuing, , , from Continuing, , Operations, Operations, , Diluted EPS , , Operating, Before Provision, , Provision for, , Attributable to, from Continuing , , Income, for Income Taxes, Income Taxes (1), , Viacom, , Operations Reported results (GAAP), $, 757, $ 666, $, 122, $, 538, $, 1.33 Factors Affecting Comparability:, , , Gain on marketable securities (2), , —, (29), , (7), , (22), , (0.05) Discrete tax benefit (3), , —, —, , 32, , (32), , (0.08) Adjusted results(Non-GAAP), $, 757, $ 637, $, 147, $, 484, $, 1.20 (in millions, except per share amounts), , , Nine Months Ended, , June 30, 2019, , , , Earnings from, Net Earnings, , Continuing, , , from Continuing, , Operations, Operations, Diluted EPS from , Operating, Before Provision, Provision for, Attributable to, , Continuing , , Income, for Income Taxes, Income Taxes (1), , Viacom, , Operations Reported results (GAAP), $, 1,932, $ 1,595, $, 352, $, 1,219, $, 3.02 Factors Affecting Comparability:, , , Restructuring, related costs and, , , programming charges (4), , 172, 172, , 40, , 132, , 0.32 Legal settlement (5), , 40, 40, , 9, , 31, , 0.08 Gain on extinguishment of debt (6), , —, (18), , (4), , (14), , (0.03) Gain on marketable securities (2), , —, (21), , (5), , (16), , (0.04) Discrete tax benefit (3), , —, —, , 32, , (32), , (0.08) Adjusted results(Non-GAAP), $, 2,144, $ 1,768, $, 424, $, 1,320, $, 3.27