- CLMT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Calumet Specialty Products Partners (CLMT) DEF 14ADefinitive proxy

Filed: 23 Dec 21, 4:10pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

CALUMET SPECIALTY PRODUCTS PARTNERS, L.P.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

December 23, 2021

To our unitholders:

You are cordially invited to attend a special meeting of the unitholders of Calumet Specialty Products Partners, L.P. (“Calumet”) to be held at Courtyard by Marriott Indianapolis West-Speedway, 6315 Crawfordsville Road, Indianapolis, IN 46224, on February 16, 2022 at 2:00 p.m., local time.

Details regarding the business to be conducted at the special meeting are described in the accompanying notice of the special meeting and proxy statement. We encourage you to carefully review these materials.

Your vote is very important. Even if you plan to attend the special meeting, we urge you to cast your vote promptly. You may vote your units in advance of the special meeting via the Internet, by telephone or by mail.

On behalf of the board of directors of our general partner, Calumet GP, LLC, I would like to express our appreciation for your continued support. We look forward to seeing you at the special meeting.

| /s/ Fred M. Fehsenfeld, Jr. | |

| Chairman of the Board of Directors | |

| Calumet GP, LLC |

This proxy statement is dated December 23, 2021 and is first being sent or made available to Calumet unitholders on or about December 23, 2021.

NOTICE OF SPECIAL

MEETING OF UNITHOLDERS OF

CALUMET SPECIALTY PRODUCTS PARTNERS, L.P.

TO BE HELD ON FEBRUARY 16, 2022

To our unitholders:

A special meeting of the unitholders of Calumet Specialty Products Partners, L.P. (“Calumet” or the “Partnership”) will be held on February 16, 2022 at 2:00 p.m., local time, at Courtyard by Marriott Indianapolis West-Speedway, 6315 Crawfordsville Road, Indianapolis, IN 46224, for the following purposes:

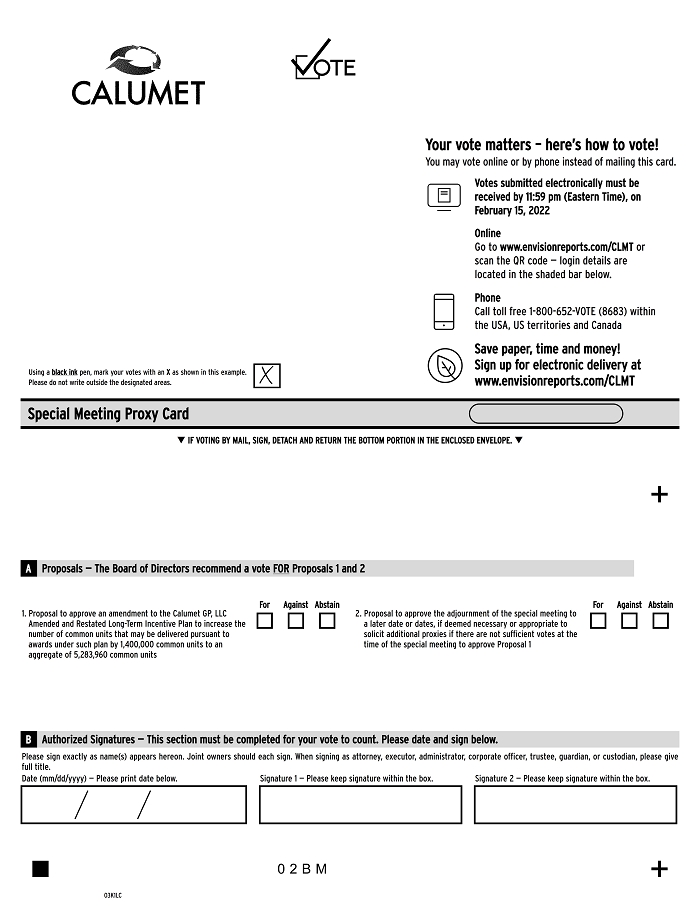

| 1. | to consider and vote upon a proposal, which we refer to as the “LTIP Proposal,” to approve an amendment to the Calumet GP, LLC Amended and Restated Long-Term Incentive Plan to increase the number of common units that may be delivered pursuant to awards under such plan by 1,400,000 common units to an aggregate of 5,283,960 common units; and |

| 2. | to consider and vote upon a proposal, which we refer to as the “Adjournment Proposal,” to approve the adjournment of the special meeting to a later date or dates, if deemed necessary or appropriate by our general partner, to solicit additional proxies if there are not sufficient votes at the time of the special meeting to approve the LTIP Proposal. |

Our board of directors has unanimously approved the LTIP Proposal and determined that it is in the best interests of us and our unitholders.

Accordingly, our board of directors unanimously recommends that you vote “FOR” the LTIP Proposal and “FOR” the Adjournment Proposal.

In order to constitute a quorum to conduct the proposed business at the special meeting, holders of a majority of our outstanding common units representing limited partner interests (including outstanding units deemed owned by our general partner) must be present in person or by proxy.

We have set the close of business on December 20, 2021 as the record date for determining which unitholders are entitled to receive notice of, and to vote at, the special meeting and any adjournments thereof. A list of unitholders of record will be available for inspection by any unitholder during the meeting.

Your vote is very important. Even if you plan to attend the special meeting, we urge you to cast your vote promptly. You may vote your units in advance of the special meeting via the Internet, by telephone or by mail.

As permitted by the Securities and Exchange Commission (the “SEC”), we are providing access to our proxy materials online under the SEC’s “notice and access” rules. As a result, unless you previously requested electronic or paper delivery on an ongoing basis, we are mailing to our unitholders a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of a paper copy of the proxy statement and a form of proxy card (together, the “proxy materials”). This distribution process is more resource- and cost-efficient. The Notice contains instructions on how to access the proxy materials online. The Notice also contains instructions on how unitholders can receive a paper copy of our proxy materials. If you elect to receive a paper copy, our proxy materials will be mailed to you.

We are actively monitoring the public health and travel safety concerns relating to the COVID-19 pandemic and the advisories or mandates that federal, state, and local governments, and related agencies, have issued and may issue. In the event it is not possible or advisable to hold our special meeting as currently planned, we will announce any additional or alternative arrangements for the meeting, which may include a change in venue or holding the meeting solely by means of remote communication. Please monitor our press releases and our filings with the SEC for updated information. Furthermore, we may impose additional procedures or limitations on meeting attendance based on applicable governmental requirements or recommendations or facility requirements. Such additional procedures or limitations may include, but are not limited to, thorough screenings of attendees (including temperature checks), limits on the number of attendees to promote social distancing and requiring the use of face masks.

By Order of the Board of Directors of Calumet GP, LLC, the general partner of Calumet.

| /s/ Stephen P. Mawer | |

| Chief Executive Officer |

December 23, 2021

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting to be Held on February 16, 2022: The Proxy Statement is available at www.envisionreports.com/CLMT.

i

TABLE OF CONTENTS (continued)

| Page | |

| OTHER MATTERS FOR ACTION AT THE SPECIAL MEETING | 24 |

| WHERE YOU CAN FIND MORE INFORMATION ABOUT US | 25 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS | 26 |

This brief summary highlights selected information from this proxy statement. It does not contain all of the information that may be important to you. To understand the LTIP Proposal fully and for a complete description of related transactions and related matters, you should read carefully this proxy statement and the full text of the annexes to this proxy statement.

We manufacture, formulate, and market a diversified slate of specialty branded products to customers in various consumer-facing and industrial markets. Calumet is headquartered in Indianapolis, Indiana and operates twelve facilities throughout North America.

Calumet Specialty Products Partners, L.P. is a Delaware limited partnership formed on September 27, 2005. Our general partner is Calumet GP, LLC, a Delaware limited liability company. Our general partner owns 2% of Calumet Specialty Products, L.P. and all incentive distribution rights and has sole responsibility for conducting our business and managing our operations. Our common units, which represent our limited partnership interests, are listed on Nasdaq under the symbol “CLMT”.

Proposal One: The LTIP Proposal

Our board of directors has approved an amendment (the “First Amendment”) to the Calumet GP, LLC Amended and Restated Long-Term Incentive Plan (the “LTIP” and, as amended by the First Amendment, the “Amended LTIP”), subject to the approval of our unitholders. A summary description of the Amended LTIP is set forth under “Proposal One: The LTIP Proposal” and the Amended LTIP is attached as Annex A to this proxy statement.

The LTIP is integral to our compensation strategy and, although cognizant of the potential dilutive effect of compensatory unit awards, our board of directors believes that increasing the aggregate number of common units that may be delivered with respect to awards under the LTIP will provide the flexibility required to align employee and unitholder incentives as the Partnership recruits, motivates and retains high caliber leadership. Accordingly, the First Amendment increases the number of common units available for delivery with respect to awards under the LTIP so that, as of the effective date of the First Amendment, the total number of common units available for delivery with respect to awards under the Amended LTIP will be increased by 1,400,000 common units to an aggregate of 5,283,960 common units.

We are asking for approval of the LTIP Proposal to comply with Nasdaq’s listing rules requiring unitholder approval of material amendments to an equity compensation plan, pursuant to which common units may be acquired by officers, directors, employees, or consultants. The LTIP Proposal requires the approval of a majority of our outstanding common units entitled to vote at the special meeting and represented either in person or by proxy at the special meeting.

Recommendation of our Board of Directors Regarding the LTIP Proposal

Our board of directors has determined that the LTIP Proposal is in the best interests of our partnership and recommended our unitholders vote to approve the LTIP Proposal.

Therefore, our board of directors recommends that our unitholders vote to approve the LTIP Proposal.

Proposal Two: The Adjournment Proposal

We are also asking our unitholders to approve the Adjournment Proposal to adjourn the special meeting to a later date or dates, if deemed necessary or appropriate by our general partner, to solicit additional proxies if there are insufficient votes at the time of the special meeting to approve the LTIP Proposal.

1

Recommendation of our Board of Directors Regarding the Adjournment Proposal

Our board of directors has recommended our unitholders vote to approve the Adjournment Proposal.

Therefore, our board of directors recommends that our unitholders vote to approve the Adjournment Proposal.

Information About the Special Meeting and Voting

Time, Date and Place

The special meeting will be held on February 16, 2022 at 2:00 p.m., local time, at Courtyard by Marriott Indianapolis West-Speedway, 6315 Crawfordsville Road, Indianapolis, IN 46224.

Purpose

Our unitholders are being asked to consider the LTIP Proposal and the Adjournment Proposal. The persons named in the accompanying proxy card will have discretionary authority to vote on other business, if any, that properly comes before the special meeting and any adjournment or postponement thereof.

Unitholders Entitled to Vote

Holders of our common units at the close of business on December 20, 2021, the record date for the special meeting, will be entitled to vote at the special meeting. Each unitholder may cast one vote at the special meeting for each common unit owned at the close of business on the record date. On the record date, there were 78,676,262 common units outstanding and entitled to be voted at the special meeting.

Required Unitholder Votes

Each of the LTIP Proposal and Adjournment Proposal requires the approval of a majority of our outstanding common units entitled to vote at the special meeting and represented either in person or by proxy at the special meeting.

Interests of Certain Persons in the Proposals

In considering the recommendations of our board of directors relating to the LTIP Proposal, you should be aware that employees, consultants and the members of our board of directors hold outstanding awards under the LTIP and will continue to be eligible to receive awards under the Amended LTIP if it is approved. Accordingly, the members of our board of directors and the executive officers of our general partner have a substantial interest in the approval of the LTIP Proposal.

Material Federal Income Tax Consequences of the LTIP Proposal

Please read “Proposal One: The LTIP Proposal—Material Federal Income Tax Consequences of the LTIP Proposal” for discussion of the federal income tax consequences of the LTIP Proposal.

2

PROPOSAL ONE: THE LTIP PROPOSAL

Our board of directors has approved an amendment (the “First Amendment”) to the Calumet GP, LLC Amended and Restated Long-Term Incentive Plan (the “LTIP” and, as amended by the First Amendment, the “Amended LTIP”), subject to the approval of our unitholders. The LTIP is integral to our compensation strategy and, although cognizant of the potential dilutive effect of compensatory unit awards, our board of directors believes that increasing the aggregate number of common units that may be delivered with respect to awards under the LTIP will provide the flexibility required to align employee and unitholder incentives as the Partnership recruits, motivates and retains high caliber leadership. Accordingly, the First Amendment increases the number of common units available for delivery with respect to awards under the LTIP so that, as of the effective date of the First Amended, the total number of common units available for delivery with respect to awards under the Amended LTIP will be increased by 1,400,000 common units to an aggregate of 5,283,960 common units. If the First Amendment is approved by our unitholders, the effective date of the First Amendment will be December 9, 2021.

As of December 22, 2021, a total of 78,676,262 common units were issued and outstanding, there were 6,288,131 common units underlying outstanding phantom units under the LTIP (assuming target performance levels are achieved), and there were no common units underlying outstanding restricted units or unit options. As of this same date, only 461,335 common units remained available for delivery to participants under the LTIP. To the extent that no common units remain available for delivery to participants, all phantom units that remain outstanding would be settled in cash. As a result, if the LTIP proposal is not approved, an additional 1,400,000 outstanding phantom units would be settled in cash and the LTIP would terminate once the units remaining available for delivery are exhausted. It is expected that the additional 1,400,000 common units requested under the First Amendment will provide sufficient common units to settle outstanding phantom unit awards that are expected to vest over approximately the next 24 months.

Consequences of Failing to Approve the Proposal

The Amended LTIP will not be implemented unless the First Amendment is approved by unitholders. If the proposed First Amendment is not approved by our unitholders, the LTIP will continue in effect in its present form and we will continue to grant equity awards under the terms of the LTIP until the units remaining available for delivery are exhausted. As noted above, we will also need to use cash to satisfy certain awards under the LTIP. Failure of our unitholders to approve the First Amendment also will not affect the rights of existing award holders under the LTIP or under any previously granted awards under the LTIP.

Description of the Amended LTIP

The description of the Amended LTIP set forth below is a summary of the material features of the Amended LTIP. This summary, however, does not purport to be a complete description of all the provisions of the Amended LTIP. The summary is qualified in its entirety by reference to the Amended LTIP, a copy of which is attached hereto as Annex A and incorporated herein by reference.

The purpose of the Amended LTIP is to promote our interests by providing incentive compensation awards that encourage superior performance and unitholder return. The Amended LTIP is also intended to enhance the ability of our general partner to attract and retain the services of individuals who are essential for our growth and profitability and to encourage those individuals to devote their best efforts to advancing our business. The Amended LTIP provides for the grant of unit options, restricted units, phantom units, substitute awards and tandem distribution equivalent rights (“DERs”).

Common Units Subject to the Amended LTIP

If the First Amendment is approved by our unitholders, the maximum number of common units that may be delivered with respect to awards under the Amended LTIP will be increased by 1,400,000 common units to an aggregate of 5,283,960 common units, which would be subject to the same adjustment provisions currently provided in the LTIP. If the First Amendment is approved by our unitholders, we intend to file a Form S-8 to register the additional common units reserved for issuance under the Amended LTIP.

The common units to be delivered under the Amended LTIP may be units otherwise issuable by the Partnership or units acquired in the open market and/or from any person. To the extent that an award terminates or

3

is cancelled prior to and without the delivery of common units (or if an award is forfeited), the units subject to the award may be used again with respect to new awards granted under the Amended LTIP.

Administration

The Amended LTIP will continue to be administered by the Compensation Committee of our general partner’s board of directors (the “Committee”). The Committee has the full authority, subject to the terms of the Amended LTIP, to establish, amend, suspend or waive such rules and regulations and appoint such agents as it shall deem appropriate for the proper administration of the Amended LTIP, to designate participants under the Amended LTIP, to determine the number of units to be covered by awards, to determine the type or types of awards to be granted to a participant and to determine the terms and conditions of any award.

Eligibility

All employees, consultants and directors of the general partner and its affiliates that perform services for us are eligible to be selected to participate in the Amended LTIP. The selection of which eligible individuals will receive awards is within the sole discretion of the Committee. As of December 22, 2021, approximately 61 individuals, including 5 executive officers, 8 non-employee directors, and 48 other employees, were eligible to receive awards under the LTIP.

Term of the Amended LTIP

The term of the Amended LTIP will expire on the earlier of (1) the date it is terminated by our board of directors or the Committee, (2) the date common units are no longer available under the Amended LTIP for delivery pursuant to awards and (3) December 10, 2025. However, any awards granted prior to such date under the LTIP may remain outstanding beyond such termination date.

Awards under the Amended LTIP

Unit Options

Unit options represent the right to purchase a number of common units at a specified exercise price. Unit options may be granted to such eligible individuals and with such terms as the Committee may determine, consistent with the Amended LTIP; however, unit options must generally have exercise prices that are no less than the fair market value of their underlying common units as of the date of grant. Vesting provisions applicable to unit options will be determined at the Committee’s discretion and set forth in an applicable award agreement. The term of any unit option will be no greater than ten years.

A unit option may be granted with a tandem DER grant. At the Committee’s discretion, a tandem DER grant may be paid directly to the participant, credited to a bookkeeping account subject to the same vesting restrictions as the underlying unit option, or be subject to such other provisions as the Committee deems appropriate.

Restricted Units and Phantom Units

A restricted unit is a common unit that is subject to forfeiture. Upon vesting, the forfeiture restrictions lapse and the participant holds a common unit that is not subject to forfeiture. A phantom unit is a notional unit that entitles the participant to receive a common unit (or the cash equivalent of the fair market value of a common unit) upon the vesting of the phantom unit or on a deferred basis upon specified future dates or events, which may be linked to service, performance criteria and/or other specified criteria. Restricted units and phantom units that vest and/or become payable may be based on the achievement of performance conditions specified by the Committee. Other time-based vesting provisions may be determined at the Committee’s discretion and set forth in an applicable award agreement. Unless otherwise provided in the applicable award agreement, outstanding restricted units and phantom units will be forfeited in the event that a participant ceases providing employment, consulting or director services, as applicable.

Distributions made by us with respect to awards of restricted units may, at the discretion of the Committee, be subject to the same vesting requirements as the restricted units. The Committee, at its discretion, may also grant tandem DERs with respect to phantom units that may be paid directly to the participant, credited to a bookkeeping

4

account subject to the same vesting restrictions as the underlying phantom unit, or be subject to such other provisions as the Committee deems appropriate. The Committee may also allow eligible participants to defer phantom unit awards in accordance with the terms of the Calumet Specialty Products Partners, L.P. Executive Deferred Compensation Plan.

Substitute Awards

Substitute awards may be granted under the Amended LTIP in substitution for similar awards held by individuals who become employees, consultants or directors of the Partnership or one of its affiliates as a result of a merger, consolidation or acquisition by us or an affiliate of another entity or the assets of another entity.

Adjustments

Upon certain transactions involving the Partnership, the number of units available for delivery under the Amended LTIP, the number and kind of units or property subject to awards and the exercise or other unit price will be adjusted as determined by the Committee.

Upon a change of control (as defined in the Amended LTIP) of the general partner or the Partnership, the Committee may, in its sole discretion, provide for the cash-out of awards, replacement of awards, assumption of awards, adjustment of awards as described above and/or accelerated vesting of awards. Currently, all outstanding awards under the Amended LTIP will automatically become fully vested and payable upon a change of control.

No Repricing

Repricing of unit options, directly or indirectly, is prohibited under the Amended LTIP without approval of our unitholders, except in the case of adjustments implemented to reflect certain Partnership transactions or if such a repricing would increase the exercise price of an outstanding unit option.

Transferability

Awards generally may not be assigned, alienated, pledged, attached, sole or otherwise transferred or encumbered, except by will or the laws of descent and distribution. If the Committee permits, unit options may be transferred by a participant without consideration to immediate family members or related family trusts, limited partnerships or similar entities or on such terms and conditions as the Committee may from time to time establish.

Amendment and Termination

Our board of directors or the Committee may amend or modify the Amended LTIP at any time; provided, however, that unitholder approval will be obtained for any amendment to the Amended LTIP to the extent necessary to comply with any applicable law, regulation or securities exchange rule. The Committee may also amend any outstanding award made under the Amended LTIP, provided that no change in any outstanding award may be made that would materially reduce the rights or benefits of the participant without the consent of the affected participant.

Clawback

The Amended LTIP contains a clawback provision that provides that awards under the Amended LTIP will be subject to any applicable clawback policy adopted by us, which may require the forfeiture, repurchase or recoupment of awards and amounts paid or payable in connection with awards, including with retroactive effect.

Interests of Directors and Executive Officers in the Amended LTIP

The officers and employees of our general partner, its affiliates and our subsidiaries and the members of our board of directors hold outstanding awards under and will be eligible to receive additional awards under the Amended LTIP if it is approved. In addition, the Amended LTIP provides for indemnification of the Committee to the fullest extent permitted by law, with respect to determinations made in connection with the Amended LTIP. Accordingly, the members of our board of directors and the executive officers of our general partner have a substantial interest in the approval of the LTIP Proposal.

5

U.S. Federal Income Tax Consequences of the Amended LTIP

The following discussion is for general information purposes only and is intended to summarize briefly the U.S. federal income tax consequences to participants arising from participation in the Amended LTIP. This description is based on current law, which is subject to change (possibly retroactively). The tax treatment of participants in the Amended LTIP may vary depending on their particular circumstances and, therefore, may be subject to special rules not discussed below. No attempt has been made to discuss any potential foreign, state or local tax consequences. In addition, unit options that provide for a “deferral of compensation” within the meaning of Section 409A of the Internal Revenue Code (“Section 409A”), phantom units, and certain other awards that may be granted pursuant to the Amended LTIP could be subject to additional taxes unless they are designed to comply with certain restrictions set forth in Section 409A and the guidance promulgated thereunder.

Unit Options

Participants will not realize taxable income upon the grant of a unit option. Upon the exercise or, if later, the settlement of a unit option, the participant will recognize ordinary compensation income in an amount equal to the excess of (i) the fair market value of the common units received over (ii) the exercise price (if any) paid therefor. A participant will generally have a tax basis in any common units received pursuant to the exercise of a unit option, that equals the fair market value of the common units on the date of exercise. Subject to the discussion under “—Tax Code Limitations on Deductibility” below, we will be entitled to a deduction for federal income tax purposes that corresponds as to timing and amount with the compensation income recognized by a participant under the foregoing rules.

When a participant sells the common units acquired as a result of the exercise of a unit option, any appreciation (or depreciation) in the value of the common units after the exercise date is treated as long- or short-term capital gain (or loss) for federal income tax purposes, depending on the holding period. The common units must be held for more than 12 months in order to qualify for long-term capital gain treatment.

Phantom Units, Restricted Units and Other Awards

A participant will not have taxable income at the time of a grant of an award in the form of a phantom unit award, but rather, will generally recognize ordinary compensation income at the time he receives common units or cash in settlement of the phantom unit award in an amount equal to the fair market value of the common units or the amount of cash.

Tax Code Limitations on Deductibility

In order for the amounts described above to be deductible as a compensation expense, the amounts must constitute reasonable compensation for services rendered or to be rendered and must be ordinary and necessary business expenses.

Limited Partnership Interest

We are not a taxable entity, and as such, we do not incur any federal income tax liability. Instead, each holder of our common units is required to report on his income tax return his share of our income, gains, losses and deductions in computing his federal income tax liability, regardless of whether cash distributions are made to him by us. Distributions by us to a holder of common units are generally not taxable unless the amount of cash distributed is in excess of the holder’s adjusted basis in his interest. Usually during the first quarter of each year, we will mail to each partner a Schedule K-1 showing the amounts of income, gains, losses, and deductions that the partner is required to reflect on his federal income tax return as a limited partner for the preceding year. A limited partner will not qualify for using Form 1040EZ or 1040A, and may not file his federal income tax return until he has received his Schedule K-1 and reflected the relevant information contained therein in his tax return.

The following table sets forth information with respect to outstanding phantom units that have been granted to the named executive officers, certain current executive officers and the specified groups set forth below under the LTIP as of December 22, 2021.

6

We have not granted any other award types under the LTIP as of such date. On December 22, 2021, the closing price of a common unit was $13.10.

Name and Principal Position | Phantom Units (1) |

Stephen P. Mawer Chief Executive Officer | 121,986 |

Timothy Go Former Chief Executive Officer | 781,096 |

D. West Griffin Former Executive Vice President - Chief Financial Officer | 316,851 |

Bruce A. Fleming Executive Vice President - Montana Renewables & Corporate Strategy | 672,404 |

Scott Obermeier Executive Vice President - Specialty Products & Solutions | 302,119 |

| L. Todd Borgmann Executive Vice President and Chief Financial Officer | 274,138 |

| Marc Lawn Executive Vice President - Performance Brands | 56,390 |

| All current executive officers as a group | 1,443,435 |

| All current directors who are not executive officers as a group | 776,707 |

| Each associate of the above-mentioned directors or executive officers | 0 |

| Each other person who received or is to receive 5% of such phantom units | 0 |

| All employees (other than executive officers) as a group | 4,067,989 |

| ____________ |

| (1) | Please see the “Executive and Director Compensation” section of this proxy statement for additional details on the phantom units granted to the named executive officers and the directors. |

New Plan Benefits Under the Amended LTIP

The awards, if any, that will be made to eligible persons under the Amended LTIP are subject to the discretion of the Compensation Committee or other designated plan administrator, and thus we cannot currently determine the benefits or number of common units subject to awards that may be granted in the future to our executive officers, employees and consultants or to members of our board of directors under the Amended LTIP.

If the Amended LTIP is approved, we anticipate continuing to make annual equity grants to our executive officers, certain employees, and board members under the Amended LTIP, but any amount of such grant is not determinable at this time. Such awards generally will be subject to a vesting schedule that will be specified in the applicable award agreement, and the number of common units subject to such awards will be determined at the date of grant of such awards.

Equity Compensation Plan Information (as of December 31, 2020)

| (a) | (b) | (c) | |

Number of securities | Weighted-average | Number of securities | |

| Equity compensation plans approved by security holders (1) | 1,063,941 | — | 0 |

| Equity compensation plans not approved by security holders | N/A | N/A | N/A |

| Total | 1,063,941 | — | 0 |

| ____________ |

| (1) | Represents securities under the LTIP. |

| (2) | The LTIP contemplates the issuance or delivery of up to 3,883,960 common units to satisfy awards under the plan. The number of units presented in column (a) represents the maximum number of common units that may be delivered pursuant to outstanding awards under the plan as of December 31, 2020. If such maximum number of common units are delivered pursuant to outstanding awards, no common units remained available for future delivery under column (c) as of December 31, 2020. |

7

The LTIP Proposal requires the approval of a majority of our outstanding common units entitled to vote at the special meeting and represented either in person or by proxy at the special meeting. Abstentions have the effect of a vote against the LTIP Proposal. Broker non-votes (as described below), if any, will have no effect on the outcome of the LTIP Proposal.

Our board of directors has determined that the LTIP Proposal is in the best interests of our partnership and recommended our unitholders vote to approve the LTIP Proposal.

Therefore, our board of directors recommends that our unitholders vote to approve the LTIP Proposal.

8

EXECUTIVE AND DIRECTOR COMPENSATION

We are currently considered a smaller reporting company for purposes of the SEC’s executive compensation disclosure rules. In accordance with such rules, we are required to provide a Summary Compensation Table and an Outstanding Equity Awards at Fiscal Year-End Table as well as limited narrative disclosures. Further, our reporting obligations extend only to the individuals serving as our chief executive officer and our two other most highly compensated executive officers during the 2020 fiscal year (or individuals that would have been our most highly compensated executive officers had they been providing services at the end of the year). For purposes of this executive compensation discussion, the names and positions of our named executive officers for the 2020 fiscal year were:

| · | Stephen P. Mawer — Chief Executive Officer |

| · | Timothy Go — Former Chief Executive Officer |

| · | D. West Griffin — Former Executive Vice President — Chief Financial Officer |

| · | Bruce A. Fleming — Executive Vice President — Montana Renewables & Corporate Strategy |

| · | Scott Obermeier — Executive Vice President - Specialty Products & Solutions |

Effective June 1, 2020, Mr. Go was no longer employed by Calumet. Because he served as the Chief Executive Officer during the 2020 fiscal year, he is deemed to be a “named executive officer” for the 2020 year for purposes of the compensation disclosures that follow. Mr. Mawer’s appointment as Chief Executive Officer was effective April 3, 2020.

Effective January 2, 2020, Mr. Griffin was no longer employed by Calumet; however, he continued to serve in a consulting role until the close of the financial process for the 2019 year. Because he served as an executive officer during the 2020 fiscal year and would have been one of the highly compensated executive officers during the 2020 fiscal year, he is also deemed to be a “named executive officer” for the purposes of the compensation disclosures that follow.

The compensation committee of the board of directors of our general partner oversees our compensation programs. Our general partner maintains compensation and benefits programs designed to allow us to attract, motivate and retain the best possible employees to manage us, including executive compensation programs designed to reward the achievement of both short-term and long-term goals necessary to promote growth and generate positive unitholder returns. Our general partner’s executive compensation programs are based on a pay-for-performance philosophy, including measurement of our performance against the specified financial target of Adjusted EBITDA (as defined below). Our executive compensation programs include both long-term and short-term compensation elements which, together with base salary and employee benefits, constitute a total compensation package intended to be competitive with similar companies.

Under their collective authority, the compensation committee and the board of directors maintain the right to develop and modify compensation programs and policies as they deem appropriate. Factors they may consider in making decisions to materially increase or decrease compensation include our overall financial performance, our growth over time, our changes in complexity as well as individual executive job scope, complexity and performance, and changes in competitive compensation practices in our defined labor markets. In determining any forms of compensation other than the base salary for the senior executives, or in the case of the chief executive officer, the recommendation to the board of directors of the forms of compensation for the chief executive officer, the compensation committee considers our financial performance and relative unitholder return, the value of similar incentive awards to senior executives at comparable companies and the awards given to senior executives in past years.

9

The following table sets forth certain compensation information of our named executive officers for the years ended December 31, 2020, 2019 and 2018:

| Summary Compensation Table for 2020 | ||||||||||||||||||||||||||||||||

| Name and Principal Position | Year | Salary | Bonus | Unit Awards (1)(2) | Non-Equity Incentive Plan Compensation (3) | Change in Non-Qualified Deferred Compensation Earnings | All Other Compensation (4) | Total | ||||||||||||||||||||||||

| Stephen P. Mawer Chief Executive Officer | 2020 | $ | 543,750 | $ | — | $ | 61,270 | $ | — | $ | — | $ | 70,019 | $ | 675,039 | |||||||||||||||||

| 2020 | $ | 304,830 | $ | — | $ | — | $ | — | $ | — | $ | 79,405 | $ | 384,235 | ||||||||||||||||||

| Timothy Go | 2019 | $ | 600,000 | $ | — | $ | 435,000 | $ | 435,000 | $ | — | $ | 16,139 | $ | 1,486,139 | |||||||||||||||||

| Former Chief Executive Officer | 2018 | $ | 537,450 | $ | — | $ | 375,000 | $ | 237,300 | $ | — | $ | 55,770 | $ | 1,205,520 | |||||||||||||||||

| D. West Griffin Former Executive Vice | 2020 | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 1,067,315 | $ | 1,067,315 | |||||||||||||||||

| President - Chief Financial | 2019 | $ | 424,368 | $ | — | $ | — | $ | — | $ | — | $ | 187,386 | $ | 611,754 | |||||||||||||||||

| Officer | 2018 | $ | 412,088 | $ | — | $ | 309,006 | $ | 232,785 | $ | — | $ | 178,441 | $ | 1,132,320 | |||||||||||||||||

| Bruce A. Fleming Executive Vice President - | 2020 | $ | 422,742 | $ | — | $ | — | $ | — | $ | — | $ | 19,553 | $ | 442,295 | |||||||||||||||||

| Montana Renewables & | 2019 | $ | 410,429 | $ | — | $ | 794,435 | $ | — | $ | — | $ | 18,299 | $ | 1,223,163 | |||||||||||||||||

| Corporate Strategy | 2018 | $ | 398,475 | $ | — | $ | 298,856 | $ | 225,000 | $ | — | $ | 14,635 | $ | 936,966 | |||||||||||||||||

| Scott Obermeier Executive Vice President - Specialty Products & Solutions | 2020 | $ | 333,000 | $ | 100,000 | $ | 1,120,126 | $ | — | $ | — | $ | 11,980 | $ | 1,565,106 | |||||||||||||||||

| ____________ |

| (1) | The amounts for 2020 would have included the aggregate grant date fair value of phantom unit awards made in connection with the applicable named executive officer’s requirement to defer 50% of their cash incentive award under the Cash Incentive Plan into our Deferred Compensation Plan, or phantom unit awards granted directly pursuant to our Long-Term Incentive Plan, but we did not grant such awards in the ordinary course in 2020. With respect to Mr. Mawer, the amount in this column reflects the phantom unit award granted to him in connection with his services on our board of directors for the 2020 year, rather than in his executive officer capacity. With respect to Mr. Obermeier, amounts include the aggregate grant date fair value of (i) 223,713 phantom unit awards granted to Mr. Obermeier during the 2020 fiscal year, and (ii) 100,000 performance based phantom unit awards granted to Mr. Obermeier during the 2020 fiscal year, which are based on certain market and company performance criteria. Mr. Obermeier’s 2020 performance based phantom unit awards were reflected at probable grant date fair values, which was the target amount on the grant date. The value for Mr. Obermeier’s 2020 performance based phantom unit awards would have been $367,000 assuming maximum performance. The amounts reflect the aggregate grant date fair value computed in accordance with FASB ASC Topic 718, disregarding the estimate of forfeitures. Please read Note 14 to our consolidated financial statements for the fiscal year ending December 31, 2020 in our Annual Report on Form 10-K for the year ended December 31, 2020 for a discussion of the assumptions used to determine the FASB ASC Topic 718 value of the awards. |

| (2) | We have determined that the annual phantom units should be reported in the year to which the performance relates, as all decisions that needed to be made to determine the grant values were determined in the performance year, therefore the amounts reflected in the 2018 row have been modified from the original disclosures for the 2018 year to include the 2018 phantom units earned in the 2018 year but awarded in 2019. The annual phantom units reported in the 2019 row reflect the phantom units earned in the 2019 year but awarded in 2020. |

| (3) | Represents amounts earned under our Cash Incentive Plan and not deferred into the Deferred Compensation Plan. |

| (4) | The following table provides the aggregate “All Other Compensation” information for each of the named executive officers for the 2020 year: |

| Stephen P. Mawer | Timothy Go | D. West Griffin | Bruce A. Fleming | Scott Obermeier | ||||||||||||||||

| 401(k) Plan Matching Contributions | $ | 21,771 | $ | 21,855 | $ | 82 | $ | 14,727 | $ | 11,750 | ||||||||||

| Relocation Expenses | 28,189 | — | — | — | — | |||||||||||||||

| HSA Plan Matching Contributions | — | 1,000 | — | — | — | |||||||||||||||

| Commuting and Living Expenses (1) | 20,059 | — | — | — | — | |||||||||||||||

| Long-Term Disability Insurance | — | 780 | — | 1,872 | (281 | ) | ||||||||||||||

| Term Life Insurance | — | — | — | 2,954 | 511 | |||||||||||||||

| Severance | — | 55,770 | 1,067,233 | — | — | |||||||||||||||

| Equity Purchase Repayment | — | — | — | — | — | |||||||||||||||

| Total | $ | 70,019 | $ | 79,405 | $ | 1,067,315 | $ | 19,553 | $ | 11,980 | ||||||||||

10

Outstanding Equity Awards at Fiscal Year-End

Our named executive officers had the following outstanding equity awards at December 31, 2020:

| Outstanding Unit Awards | ||||||||||||||||

| Name | Number of Units That | Market Value of Units | Equity Incentive Plan | Equity Incentive Plan | ||||||||||||

| Stephen P. Mawer | 17,197 | $ | 53,827 | — | $ | — | ||||||||||

| Timothy Go | — | $ | — | — | $ | — | ||||||||||

| D. West Griffin | — | $ | — | — | $ | — | ||||||||||

| Bruce A. Fleming | 60,692 | $ | 189,966 | — | $ | — | ||||||||||

| Scott Obermeier | 277,019 | $ | 867,069 | — | $ | — | ||||||||||

| ____________ |

| (1) | The phantom units in this column reflect time-based phantom units held by the named executive officers as of December 31, 2020. Each of the phantom units either has vested or will vest in accordance with the following schedules or dates: |

| Vesting Date | Stephen P. Mawer | Timothy Go | D. West Griffin | Bruce A. Fleming | Scott Obermeier | |||||||||||||||

| July 1, 2021 | 2,910 | — | — | 15,173 | — | |||||||||||||||

| December 31, 2021 | 7,103 | — | — | — | 27,027 | |||||||||||||||

| July 1, 2022 | 2,910 | — | — | 15,173 | — | |||||||||||||||

| December 31, 2022 | — | — | — | — | 249,992 | |||||||||||||||

| July 1, 2023 | 2,910 | — | — | 15,173 | — | |||||||||||||||

| July 1, 2024 | 1,364 | — | — | 15,173 | — | |||||||||||||||

| 17,197 | — | — | 60,692 | 277,019 | ||||||||||||||||

| (2) | Market value of phantom units reported in these columns is calculated by multiplying the closing market price of $3.13 of our common units at December 31, 2020 by the number of units outstanding. |

Narrative Disclosure to Summary Compensation Table and Outstanding Unit Awards Table

Elements of Executive Compensation

The compensation committee believes the total compensation and benefits program for our named executive officers should consist of the following:

| · | base salary; |

| · | annual incentive plan which includes short-term cash awards and also includes an optional deferred compensation element; |

| · | long-term incentive compensation, including unit-based awards; |

| · | retirement, health and welfare benefits; and |

| · | perquisites. |

These elements are designed to constitute an integrated executive compensation structure meant to incentivize a high level of individual executive officer performance in line with our financial and operating goals.

Base Salary

Design. Salaries provide executives with a base level of semi-monthly income as consideration for fulfillment of certain roles and responsibilities. The salary program assists us in achieving our objective of attracting and retaining the services of quality individuals who are essential for the growth and profitability of Calumet. Generally, changes in the base salary levels for our named executive officers are reviewed on an annual basis by the compensation committee of the board of directors and are effective at the beginning of the following fiscal year.

11

Short-Term Cash Bonus Awards

Under the Annual Bonus Program Cash Incentive Compensation Plan (the “Cash Incentive Plan”), short-term cash bonus awards are designed to aid us in retaining and motivating executives to assist us in meeting our financial performance objectives on an annual basis. Short-term cash awards are generally granted to named executive officers based on Adjusted EBITDA performance targets. We chose a performance metric that was applicable to all named executive officers. We believe this goal establishes a direct link between executive compensation and our financial performance.

The compensation committee established a minimum, target and stretch incentive opportunities for each executive officer and other key employees expressed as a percentage of base salary. For the 2020 award, the amount that could have been paid out was designed to be based on our achievement of a minimum, target, or stretch level of Adjusted EBITDA during the entire fiscal year. At the recommendation of the compensation committee, the board of directors approved Adjusted EBITDA targets for the performance period based on budgets prepared by management. When making the annual determination of the minimum goal, target goal and stretch goal levels of Adjusted EBITDA, the compensation committee and the board of directors considered the specific circumstances facing us during the year.

Generally, no awards are paid under the Cash Incentive Plan unless we achieve at least the minimum performance goal, as applicable. If the minimum, target or stretch level Adjusted EBITDA goal was achieved for 2020, participants in the plan could have received their minimum, target or stretch cash award opportunity, respectively. For fiscal year 2020, the minimum Adjusted EBITDA goal was set at $200.0 million. We did not meet the minimum Adjusted EBITDA goal for 2020, as defined in the Cash Incentive Plan, therefore no awards were deemed to be earned for the 2020 year.

For Messrs. Mawer, Fleming, and Obermeier, any awards that would have been earned were designed to be paid 50% in cash and 50% in fully vested phantom unit awards that would have been deferred into our Deferred Compensation Plan. All phantom units granted will be granted with distribution equivalent rights (“DERs”).

Executive Deferred Compensation Plan

Design. The compensation committee allows for the participation of the executive officers in the Calumet Specialty Products Partners, L.P. Executive Deferred Compensation Plan (the “Deferred Compensation Plan”) to encourage the officers to save for retirement and to assist us in retaining our officers. Pursuant to the Deferred Compensation Plan, a select group of management, including the named executive officers, and all of the non-employee directors are eligible to participate by making an annual irrevocable election to defer, in the case of management, all or a portion of their annual cash incentive award under the Cash Incentive Plan, and, in the case of non-management directors, all or none of their annual cash retainer. With respect to the 2020 year, all of our actively employed named executive officers as of December 31, 2020, would have been required to defer 50% of any Cash Incentive Plan award into deferred phantom units within the Deferred Compensation Plan. This required deferral has been in place for certain named executive officers in past years, as reflected within the Summary Compensation Table above.

The deferred amounts are credited to participants’ accounts in the form of phantom units, with each such phantom unit representing a notional unit that entitles the holder to receive either an actual common unit or the cash value of a common unit (determined by using the fair market value of a common unit at the time a determination is needed). The phantom units credited to each participant’s account also receive distribution equivalent rights, which are credited to the participant’s account in the form of additional phantom units. In our sole discretion, we may make matching contributions of phantom units or purely discretionary contributions of phantom units, in amounts and at times as the compensation committee recommends and the board of directors approves.

Participants will at all times be 100% vested in amounts they have deferred; however, amounts we have contributed may be subject to a vesting schedule, as determined appropriate by the compensation committee. The participants’ accounts are adjusted at least quarterly to determine the fair market value of our phantom units, as well as any DERs that may have been credited in that time period. Distributions from the Deferred Compensation Plan are payable on the earlier of the date specified by each participant and the participant’s termination of employment. Death, disability, normal retirement or a change in control (as such terms are defined within the Long-Term

12

Incentive Plan) require automatic distribution of the Deferred Compensation Plan benefits, and will also accelerate at that time the vesting of any portion of a participant’s account that has not already become vested. Benefits will be distributed to participants in the form of our common units, cash or a combination of common units and cash at the election of the compensation committee. In the event that accounts are paid in common units, such units will be distributed pursuant to the Long-Term Incentive Plan. Unvested portions of a participant’s account will be forfeited in the event that a distribution was due to a participant’s voluntary resignation or a termination for cause. To ensure compliance with Section 409A of the Code, distributions to participants that are considered “key employees” (as defined in Code Section 409A of the Code) may be delayed for a period of six months following such key employees’ termination of employment with us.

Results. We did not make any discretionary matching contributions of phantom units to the accounts of those participants in the Deferred Compensation Plan during 2020.

Long-Term Unit-Based Awards

Design. Long-term unit-based awards may consist of any type of award allowed pursuant to our Long-Term Incentive Plan, including phantom units, restricted units, unit options, substitution awards and DERs. In recent years we have granted phantom units to our named executive officers, both time-based and performance-based.

Results. There were no equity-based awards under the Long-Term Incentive Plan provided to Messrs. Mawer, Go, Griffin, or Fleming in 2020. The equity-based awards granted to Mr. Obermeier in 2020 were awarded under the Long-Term Incentive Plan at the discretion of the compensation committee as part of his promotion to the position he currently holds with the Company. Under the Long-Term Incentive Plan, phantom units are generally granted upon our achievement of specified levels of Adjusted EBITDA, with adjustments for individual performance, as discretionary awards, or as part of a sign on award. When granted, phantom units are subject to further time-based vesting criteria specified in the grant. Upon satisfaction of the time-based vesting criteria specified in the grant, phantom units convert into common units (or cash equivalent). Accordingly, these awards established a direct link between executive compensation and our financial performance. This component of executive compensation, when coupled with an extended cliff vesting period as compared to cash awards, further aligns the interests of applicable executives with our unitholders in the longer-term and reinforces unit ownership levels among executives.

Health and Welfare Benefits

We offer a variety of health and welfare benefits to all eligible employees of our general partner. These benefits are consistent with the types of benefits provided by our peer group and provided so as to ensure that we are able to maintain a competitive position in terms of attracting and retaining executive officers and other employees. In addition, the health and welfare programs are intended to protect employees against catastrophic loss and encourage a healthy lifestyle. The named executive officers generally are eligible for the same benefit programs on the same basis as the rest of our employees. Our health and welfare programs include medical, pharmacy, dental, life and accidental death and dismemberment insurance coverages. In addition, all employees working over 30 hours per week are eligible for long-term disability coverage. Long-term disability coverage benefits specific to the named executive officers provide for a compensation allowance, which is grossed up for the payment of taxes, to allow them to purchase long-term disability coverage on an after-tax basis at no net cost to them. As structured, these long-term disability benefits will pay 60% of monthly earnings, as defined by the policy, up to a maximum of $15,000 per month during a period of continuing disability up to normal retirement age, as defined by the policy. Executive officers and other key employees are also eligible to obtain annual executive physical examinations which are paid for by us. Decisions made with respect to this compensation element do not significantly factor into or affect decisions made with respect to other compensation elements.

Retirement Benefits

We provide the Calumet GP, LLC Retirement Savings Plan (the “401(k) Plan”) to assist our eligible officers and employees in providing for their retirement. Named executive officers participate in the same retirement savings plan as other eligible employees subject to ERISA limits. We match 100% of each 1% of eligible compensation contribution by the participant up to 4% and 50% of each additional 1% of eligible compensation

13

contribution up to 6%, for a maximum contribution by us of 5% of eligible compensation contributions per participant. These contributions are provided as a reward for prior contributions and future efforts toward our success and growth.

Perquisites

We provide executive officers with perquisites and other personal benefits that we believe are reasonable and consistent with our overall compensation programs and philosophy. These benefits are provided in order to enable us to attract and retain these executives. Decisions made with respect to this compensation element do not significantly factor into or affect decisions made with respect to other compensation elements.

All named executive officers are provided with all, or certain of, the following benefits as a supplement to their other compensation:

| · | Executive Physical Program: Generally, on an annual basis, we pay for a complete and professional personal physical exam for each named executive officer appropriate for their age to improve their health and productivity. |

| · | Spousal and Family Travel: On an occasional basis, we pay expenses related to travel of the spouses or certain family members of our named executive officers in order to accompany the named executive officer to business-related events. |

| · | Long-Term Disability Insurance: We provide compensation to allow each named executive officer to purchase long-term disability insurance on an after-tax basis at no net cost to them. |

| · | Use of Company Aircraft: On an occasional basis, our named executive officers may be eligible to use a leased aircraft for personal use and the incremental cost to us is treated as and reflected in the tables below as compensation to the applicable officer for purposes of these disclosures. The items that we use to determine the incremental cost to us of these flights include the variable costs for personal use of aircraft that were charged to us by the vendor that operates the leased aircraft for contracted hourly costs, fuel charges, and taxes. |

| · | Commuting and Living Expenses: In order for us to attract top executive talent, we must not be limited to those individuals residing in the Indianapolis metropolitan area and in some cases must be willing to offer payment or reimbursement for an agreed upon amount of relocation, commuting, temporary housing and other related costs. |

The compensation committee periodically reviews the perquisite program to determine if adjustments are appropriate and noted the addition of payment of legal expenses was appropriate.

Employment Agreements

As of December 31, 2020, there were no active employment agreements between our general partner and a named executive officer. We provide offer letters to newly hired or promoted employees that set forth the general terms of their employment with us as of the offer letter date, but those letters do not provide for severance, change in control or other post-termination benefits.

Transition and Separation Agreement

We entered into a Transition and Separation Agreement with Mr. Go on March 11, 2020 (the “Separation Agreement”), which governed certain aspects of his employment with us until June 1, 2020 (the “Separation Date”), as well as the separation payments and benefits that he was entitled to receive in connection with his separation from service with us. For more details regarding the Separation Agreement, please see the section below titled “Potential Payments Upon Termination or Change in Control.”

14

We entered into a Transitional Severance Agreement and General Release with Mr. Griffin on October 27, 2019 (the “Severance Agreement”), which governed certain aspects of his employment with us for the remainder of the 2019 year and until January 2, 2020 (the “Separation Date”), as well as the severance benefits that he was entitled to receive in connection with his separation from service with us. For more details regarding the Severance Agreement, please see the section below titled “Potential Payments Upon Termination or Change in Control.”

Potential Payments Upon Termination or Change in Control

We provide certain of our named executive officers with certain severance and change in control benefits in order to provide them with assurances against certain types of terminations without cause or resulting from change in control transactions where the terminations were not based upon cause. This type of protection is intended to provide the executive with a basis for keeping focus and functioning in the unitholders’ interests at all times.

Change of Control and Certain Terminations Pursuant to Long-Term Incentive Plan

Upon a Change of Control, all outstanding awards granted pursuant to the Long-Term Incentive Plan shall automatically vest and be payable at their maximum target level or become exercisable in full, as the case may be, or any restricted periods connected to the award shall terminate and all performance criteria, if any, shall be deemed to have been achieved at the maximum level. We provided these “single-trigger” change of control benefits because we believed such benefits were important retention tools for us, as providing for accelerated vesting of awards under the Long-Term Incentive Plan upon a Change of Control enables employees, including the named executive officers, to realize value from these awards in the event that we go through a change of control transaction. In addition, we believed that it was important to provide the named executive officers with a sense of stability, both in the middle of transactions that may create uncertainty regarding their future employment and post-termination as they seek future employment. Whether or not a change of control results in a termination of our officers’ employment with us or a successor entity, we wanted to provide our officers with certain guarantees regarding the importance of equity incentive compensation awards they were granted prior to that change of control. Further, we believe that change of control protection allows management to focus their attention and energy on the business transaction at hand without any distractions regarding the effects of a change of control. Also, we believe that such protection maximizes unitholder value by encouraging the named executive officers to review objectively any proposed transaction in determining whether such proposed transaction is in the best interest of our unitholders, whether or not the executive will continue to be employed.

For purposes of the Long-Term Incentive Plan, a Change of Control shall be deemed to have occurred upon one or more of the following events: (i) any person or group, other than a person or group who is our affiliate, becomes the beneficial owner, by way of merger, consolidation, recapitalization, reorganization or otherwise, of fifty percent (50%) or more of the voting power of our outstanding equity interests; (ii) a person or group, other than our general partner or one of our general partner’s affiliates, becomes our general partner; or (iii) the sale or other disposition, including by liquidation or dissolution, of all or substantially all of our assets or the assets of our general partner in one or more transactions to any person or group other than an a person or group who is our affiliate. However, in the event that an award is subject to Code Section 409A, a Change of Control shall have the same meaning as such term in the regulations or other guidance issued with respect to Code Section 409A for that particular award.

Under the Long-Term Incentive Plan, awards that were outstanding as of December 31, 2020, will also accelerate upon a termination due to death, disability or a normal retirement upon or after reaching the age of 66. The board of directors has the final authority to determine if a disability is permanent or of a long-term duration resulting in termination from us. A “disability” per the terms of the Long-Term Incentive Plan grant means (i) a participant’s inability to engage in any substantial gainful activity by reason of a physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of 12 months, or (ii) the participant is, by reason of a physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of 12 months, receiving income replacement benefits for a period of not less than 3 months under one of our accident and health plans. We have determined that providing acceleration of the Long-Term Incentive Plan awards upon a death or disability is appropriate because the termination of a participant’s employment with us due to such an occurrence is often an unexpected event, and it is our belief that providing an

15

immediate value to the participant or his family, as appropriate, in such a situation is a competitive retention tool. We also believe that providing for acceleration upon a normal retirement is appropriate due to the fact that the definition of a normal retirement requires an executive to remain employed with us until late in his career, and the acceleration of their equity awards upon such an event provides the executives with a reassurance that they will receive value for their awards at the end of their career. We have determined that it is in the unitholders’ best interest to provide such retention tools with respect to our equity compensation awards due to the fact that we strive to retain a high level of executive talent while competing in a very aggressive industry.

Transition and Separation Agreement with Mr. Go

We entered into a Transition and Separation Agreement with Mr. Go on March 11, 2020 (the “Separation Agreement”), which governed certain aspects of his employment with us until June 1, 2020 (the “Separation Date”), as well as the separation payments and benefits that he was entitled to receive in connection with his separation from service with us. We have provided all payments and benefits to Mr. Go that we believe he is entitled to receive pursuant to the Separation Agreement.

As part of the Separation Agreement, Mr. Go was entitled to receive the following benefits, as long as he remained continually employed by the Company and compliant with the other terms of the Agreement:

| · | A prorated 2020 annual bonus award, either based on actual achievement during the 2020 year as if Mr. Go had remained employed with the Company for 2020 or, in the event that the Company places Mr. Go on Reassignment (as defined in the Separation Agreement), at the target bonus amount of 150% of Mr. Go’s base salary, in each case prorated to reflect the number of days during the 2020 bonus year that Mr. Go was employed by the Company and paid at the same time that annual bonuses are paid to active employees of the Company. Notwithstanding the foregoing, in lieu of providing such prorated 2020 bonus award, the parties may mutually agree to alternatively provide Mr. Go with a prorated 2020 bonus payment based on the expected performance achievement during the remainder of the 2020 year, to be paid to Mr. Go within thirty (30) days following the Separation Date. The Company did not pay a prorated bonus, or any otherwise determined bonus amount, to Mr. Go with respect to the 2020 year. |

| · | A cash bonus payment of up to $1,000,000 if (i) an agreement is executed regarding the sale of the Partnership’s refinery located in Great Falls, Montana (the “Potential Transaction”) by December 31, 2020 and (ii) the Company successfully completes the Potential Transaction. The Company did not issue a cash bonus payment to Mr. Go with respect to the sale and completion of the Potential Transaction by December 31, 2020. |

| · | The Company waived certain non-competition restrictions currently applicable to Mr. Go (contained within Section 11(b)(i) through 11(b)(iv) of the Employment, Confidentiality, and Non-Compete Agreement previously entered into between Mr. Go and the Company effective as of September 14, 2015 (“Employment Agreement”)). |

| · | All unvested equity-based awards held by Mr. Go on the Separation Date were forfeited without any consideration, but any vested equity-based awards held by Mr. Go on the Separation Date continue to be governed by the terms of the applicable equity compensation plan agreements. |

Severance Arrangement with Mr. Griffin

We entered into a Transitional Severance Agreement and General Release with Mr. Griffin on October 27, 2019 (the “Severance Agreement”), which governed certain aspects of his employment with us until January 2, 2020 (the “Separation Date”), as well as the severance benefits that he was entitled to receive upon his separation from service with us.

The Severance Agreement provided Mr. Griffin with cash payments totaling $1,065,000, which were paid in three separate installments through July 2020, the amount of which was equal to 12 months of his 2019 base salary plus his 2019 target bonus amount. All outstanding phantom unit awards that Mr. Griffin held at the time of

16

his separation from service were treated in accordance with the terms of our Long-Term Incentive Plan and the grant agreements governing those awards.

The Severance Agreement requires Mr. Griffin to comply with standard confidentiality and non-disparagement provisions. The Severance Agreement has no impact on any restrictive covenants that were contained within any agreement previously entered into between the parties (including any employment agreements).

Change of Control with Respect to Deferred Compensation Plan Participants

The Deferred Compensation Plan provides the executives with the opportunity to defer all or a portion of their eligible compensation each year. At the time of their deferral election, the executive may choose a day in the future in which a payout from the plan will occur with regard to their vested account balance, or, if earlier, the payout of vested accounts will occur upon the executive’s termination from service for any reason. Despite the executive’s payout election date, however, the Deferred Compensation Plan accounts will also receive accelerated vesting and a pay out in the event of the executive’s termination from service due to death, disability or normal retirement, or upon the occurrence of a Change of Control.

A “disability” under the Deferred Compensation Plan means (i) a participant’s inability to engage in any substantial gainful activity by reason of a physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of 12 months, or (ii) the participant is, by reason of a physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of 12 months, receiving income replacement benefits for a period of not less than 3 months under one of our accident and health plans. A “normal retirement” means a participant’s termination of employment on or after the date that he or she reaches the age of 66.

There are various connections between the Deferred Compensation Plan and the Long-Term Incentive Plan. A “Change of Control” for the Deferred Compensation Plan has the same definition as that term within the Long-Term Incentive Plan noted above. Our compensation committee also has the discretion to pay Deferred Compensation Plan accounts in either cash or our common units. In the event that a Deferred Compensation Plan account is settled in our common units, those units will be issued pursuant to the Long-Term Incentive Plan. Please note that the compensation committee’s decision regarding such a settlement cannot be determined with any certainty until such an event actually occurred.

Officers or employees of our general partner who also serve as directors do not receive additional compensation for their service as a director of our general partner. Each director who is not an officer or employee of our general partner receives an annual fee as well as compensation for attending meetings of the board of directors and board committee meetings. Non-employee directors were entitled to fees and equity awards for 2020 that consisted of the following:

| · | an annual fee of $70,000; |

| · | an annual equity award in the form of restricted or phantom units, valued at approximately $100,000; |

| · | an audit and finance committee chair annual fee of $20,000; |

| · | a non-chair audit and finance committee member annual fee of $10,000; |

| · | a strategy and growth committee chair annual fee of $10,000; |

| · | a non-chair strategy and growth committee annual fee of $5,000; |

| · | a conflicts committee and compensation committee chair annual fee of $8,000; |

17

| · | a non-chair conflicts committee and compensation committee annual fee of $4,000; |

| · | all other committee chair annual fee of $5,000; and |

| · | all other committee member annual fee of $2,500. |

In addition, we reimburse each non-employee director for his or her out-of-pocket expenses incurred in connection with attending meetings of the board of directors or board committees. Under certain circumstances, we will also indemnify each director for his or her actions associated with being a director to the fullest extent permitted under Delaware law.

As a named executive officer, compensation that Mr. Mawer received with respect to his director services prior to his appointment as our Chief Executive Officer are reported above within the Summary Compensation Table. The following table sets forth certain compensation information of our non-employee directors for the year ended December 31, 2020:

| Director Compensation Table for 2020 | ||||||||||||

| Name | Fees Earned or Paid in Cash | Unit Awards (1) | Total | |||||||||

| Fred M. Fehsenfeld, Jr. | $ | — | $ | 203,349 | $ | 203,349 | ||||||

| James S. Carter | $ | — | $ | 222,975 | $ | 222,975 | ||||||

| Robert E. Funk | $ | 47,752 | $ | 162,469 | $ | 210,221 | ||||||

| Daniel J. Sajkowski | $ | 58,125 | $ | 123,886 | $ | 182,011 | ||||||

| Amy M. Schumacher | $ | — | $ | 203,349 | $ | 203,349 | ||||||

| Daniel L. Sheets | $ | — | $ | 207,928 | $ | 207,928 | ||||||

| Paul C. Raymond III (2) | $ | — | $ | 24,997 | $ | 24,997 | ||||||

| ____________ |

| (1) | The amounts in this column are calculated based on the aggregate grant date fair value of (i) annual phantom unit awards issued to non-employee directors serving on the board on the date the awards were granted, (ii) cash fees paid in the form of phantom unit awards (“Director Fee” awards) and (iii) matching phantom unit awards granted to those non-employee directors who deferred all, or a portion of, the fees they earned in 2020 pursuant to the Deferred Compensation Plan (“Matching Units”). The amounts reflect the aggregate grant date fair value computed in accordance with FASB ASC Topic 718, disregarding the estimate of forfeitures. Please read Note 14 to our consolidated financial statements for the fiscal year ending December 31, 2020 in our Annual Report on Form 10-K for the year ended December 31, 2020 for a discussion of the assumptions used to determine the FASB ASC Topic 718 value of the awards. As of December 31, 2020, the following directors each held outstanding phantom units as follows: Mr. Fehsenfeld, 188,750; Mr. Carter, 217,243; Mr. Funk, 173,802; Mr. Sajkowski, 144,603; Ms. Schumacher, 178,576; Mr. Sheets, 73,935; and Mr. Raymond, 6,963. |

| (2) | Mr. Raymond was appointed to the board of directors on November 3, 2020. |

Deferred Compensation Plan

Our directors were eligible to defer their fees earned into the Deferred Compensation Plan. When directors elect to defer any portion of their compensation into the plan, these deferred amounts are credited to the participant in the form of phantom units, and will receive DERs to be credited to the participant’s account in the form of additional phantom units on the corresponding dates of our distributions to our unitholders. The compensation committee may recommend a matching contribution for the deferred fees at its discretion. Phantom units credited to a participant’s account pursuant to matching contributions also carry DERs to be credited to the participant’s account in the form of additional phantom units.

18

PROPOSAL TWO: THE ADJOURNMENT PROPOSAL

We are also asking our unitholders to vote on a proposal (the “Adjournment Proposal”) to adjourn the special meeting to a later date or dates, if deemed necessary or appropriate by our general partner, to solicit additional proxies if there are insufficient votes at the time of the special meeting to approve the LTIP Proposal. We currently do not intend to propose adjournment at the special meeting if there are sufficient votes to approve the LTIP Proposal. If our unitholders approve the Adjournment Proposal, we may adjourn the special meeting and use the additional time to solicit additional proxies, including proxies from our unitholders who have previously voted against approval of the LTIP Proposal.

19

INFORMATION ABOUT THE SPECIAL MEETING AND VOTING

The special meeting will be held on February 16, 2022 at 2:00 p.m., local time, at Courtyard by Marriott Indianapolis West-Speedway, 6315 Crawfordsville Road, Indianapolis, IN 46224.

At the special meeting, our unitholders will act upon the LTIP Proposal and the Adjournment Proposal.