- CLMT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Calumet Specialty Products Partners (CLMT) 425Business combination disclosure

Filed: 29 Nov 23, 4:38pm

Filed by Calumet Specialty Products Partners, L.P.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Calumet Specialty Products Partners, L.P.

Commission File No.: 000-51734

Bank of America Leveraged Finance Conference November 2023

Cautionary Statements Calumet Specialty Products Partners, L.P. Forward-Looking Statements This Presentation has been prepared by Calumet Specialty Products Partners, L.P. (the “Company,” “Calumet,” “CLMT,” “we,” “our,” or like terms) and Montana Renewables LLC (“MRL”) as of November 29, 2023. The information in this Presentation includes cert ain “forward-looking statements.” These statements can be identified by the use of forward-looking terminology including “may,” “intend,” “believe,” “expect,” “anticipate,” “estimate,” “forecast,” “outlook,” “c ontinue” or other similar words. The statements discussed in this Presentation that are not purely historical data are forward-looking statements. These forward-looking statements discuss future expectations or state other “forward-looking” information and involve risks and uncertainties. W e caution that these statements, including prospects for MRL, our ability to execute on strategies and realize expected benefits therefrom, future actions, deleveraging and estimated mid-cycle Adjusted EBITDA are not guarantees of future performance or an indicator of future results, actual market value or future expected returns and you should not rely unduly on them, as they involve risks, uncertainties, and assumptions that we cannot predict. In addition, we have based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. W hile our management considers these assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predi ct and many of which are beyond our control, including risks related to available capital, actions by third parties (including customers, regulators and financing sources), construction, transportation and feedstock costs, and commodity prices. Accordingly, our actual results may differ materially from the expected future performance that we have expressed or estimated in our forward looking-statements. W hen considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements included in our most recent Annual Report on Form 10-K and other filings with the SEC. The risk factors and other factors noted in our most recent Annual Report on Form 10-K and other filings with the SEC could cause our actual results to differ materially from those contained in any forward- looking statement. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the foregoing. Existing and prospective investors are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date of this Presentation. W e undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise. Additional Information and Where to Find It Portions of this Presentation relate to the proposed corporate reorganization (the “Transaction”) between Calumet and a new Delaware corporation to be formed in connection with the Transaction (“New Calumet” or “New CLMT”). This Presentation may be deemed to be solicitation material in respect of the proposed Transaction. The proposed Transaction will be submitted to Calumet’s unitholders for their consideration. In connection with the proposed Transaction, New Calumet is expected to file with the SEC a registration statement on Form S-4 (the “Form S-4”) containing a proxy statement/prospectus (the “Proxy Statement/Prospectus”) to be distributed to Calumet’s unitholders in connection with Calumet’s solicitation of proxies for the vote of Calumet’s unitholders in connection with the proposed Transaction and other matters as described in such Proxy Statement/Prospectus. The Proxy Statement/Prospectus will also serve as the prospectus relating to the offer of the securities to be issued to Calumet’s equityholders in connection with the completion of the proposed Transaction. Calumet and New Calumet may file other relevant documents with the SEC regarding the proposed Transaction. The definitive Proxy Statement/Prospectus will be mailed to Calumet’s unitholders when available. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION W ITH RESPECT TO THE PROPOSED TRANSACTION, INVESTORS AND UNITHOLDERS AND OTHER INTERESTED PERSONS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND OTHER RELEVANT MATERIALS CAREFULLY AND IN THEIR ENTIRETY W HEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. This Presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. The Proxy Statement/Prospectus, any amendments or supplements thereto and other relevant materials, and any other documents filed by Calumet or New Calumet with the SEC, may be obtained once such documents are filed with the SEC free of charge at the SEC’s website at www.sec.gov or free of charge from Calumet at www.calumet.com or by directing a written request to Calumet at 2780 W aterfront Parkway East Drive, Indianapolis, Indiana 46214. Participants in the Solicitation Calumet, Calumet GP, LLC, the general partner of Calumet (the “General Partner”), and certain of the General Partner’s executive officers, directors, other members of management and employees may, under the rules of the SEC, be deemed to be “participants” in the solicitation of proxies in connection with the proposed Transaction. Information regarding the General Partner’s directors and executive officers is available in Calumet’s Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on March 15, 2023 (the “Annual Report”). To the extent that holdings of Calumet’s securities have changed from the amounts reported in the Annual Report, such changes have been or will be reflected on Statements of Changes in Beneficial Ownership on Form 4 filed with the SEC. These documents may be obtained free of charge from the sources indicated above. Information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Form S-4, the Proxy Statement/Prospectus and other relevant materials relating to the proposed Transaction to be filed with the SEC when they become available. Unitholders and other investors should read the Proxy Statement/Prospectus carefully when it becomes available before making any voting or investment decisions. Non-GAAP Financial Measures Adjusted EBITDA, Adjusted EBITDA margin, Adjusted gross profit (loss), and Adjusted gross profit (loss) per gallon are non-GAAP financial measures provided in this Presentation. Reconciliations to the most comparable GAAP financial measures are included in the Appendix to this Presentation. These non-GAAP financial measures are not defined by GAAP and should not be considered in isolation or as an alternative to net income (loss), net income margin, gross profit (loss), gross profit (loss) per gallon or other financial measures prepared in accordance with GAAP. Management is not able to reconcile estimated mid-cycle Adjusted EBITDA provided in this presentation to the most comparable GAAP financial measure without unreasonable effort. © 2023 Calumet Specialty Products Partners, L.P.

Tax Disclosures No Advice This Presentation has been prepared by Calumet as of November 29, 2023. This Presentation has been prepared for informational purposes only and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. Calumet unitholders should consult their own tax and other advisors before making any decisions regarding the proposed transaction Important Notice The information reflects the application of various assumptions and conventions, as disclosed by Calumet to you in various SEC filings and other offering documents. Calumet may provide disclosures of certain of these assumptions and conventions in the preparation of Calumet’s tax return as warranted to the Internal Revenue Service and/or other taxing authorities. We suggest that you refer to the appropriate federal and state income tax laws, instructions, SEC filings, and other offering documents, and that you consult with your personal tax advisor with any questions. You should discuss with your tax advisor whether the treatment of any items in this Presentation may subject you and/or your tax advisor to a penalty by a taxing authority and the need to adequately disclose any items in order to avoid such penalty. This Presentation is provided for your general guidance. The information herein is not intended to be, nor should it be construed as the basis of tax advice. The tax information discussed in this Presentation is based on existing federal and state laws and regulations as interpreted by Calumet. Before undertaking any tax filing, we strongly suggest that you refer to the appropriate federal and state income tax laws and consult with your personal tax advisor. Qualified Notice Notice Pursuant to Treasury Regulation Section 1.1446-4(b)(4) by Calumet. This statement is intended to serve as qualified notice to nominees under Treasury Regulation Section 1.1446-4(b). Brokers and nominees should treat 100% of Calumet’s distributions to foreign investors as being attributable to income that is effectively connected with a United States trade or business. Therefore, distributions to foreign investors are subject to federal income tax withholding at the highest applicable effective tax rate. Nominees, not Calumet, are treated as the withholding agents responsible for withholding on the distributions received by them on behalf of foreign investors. © 2023 Calumet Specialty Products Partners, L.P. 3

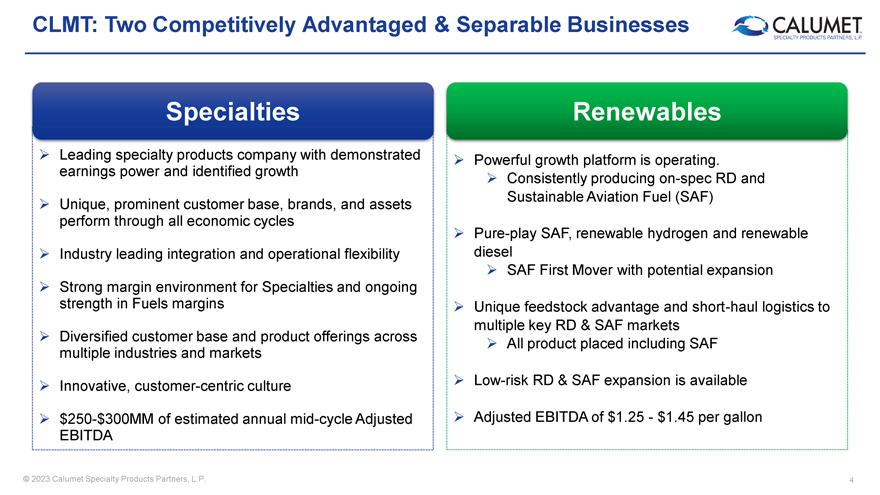

CLMT: Two Competitively Advantaged & Separable Businesses Specialties Renewables Leading specialty products company with demonstrated Powerful growth platform is operating. earnings power and identified growth Consistently producing on-spec RD and Sustainable Aviation Fuel (SAF) Unique, prominent customer base, brands, and assets perform through all economic cycles play SAF, renewable hydrogen and renewable Pure- Industry leading integration and operational flexibility diesel SAF First Mover with potential expansion Strong margin environment for Specialties and ongoing strength in Fuels margins Unique feedstock advantage and short-haul logistics to multiple key RD & SAF markets Diversified customer base and product offerings across All product placed including SAF multiple industries and markets Innovative, customer-centric culture Low-risk RD & SAF expansion is available $250-$300MM of estimated annual mid-cycle Adjusted Adjusted EBITDA of $1.25—$1.45 per gallon EBITDA © 2023 Calumet Specialty Products Partners, L.P. 4

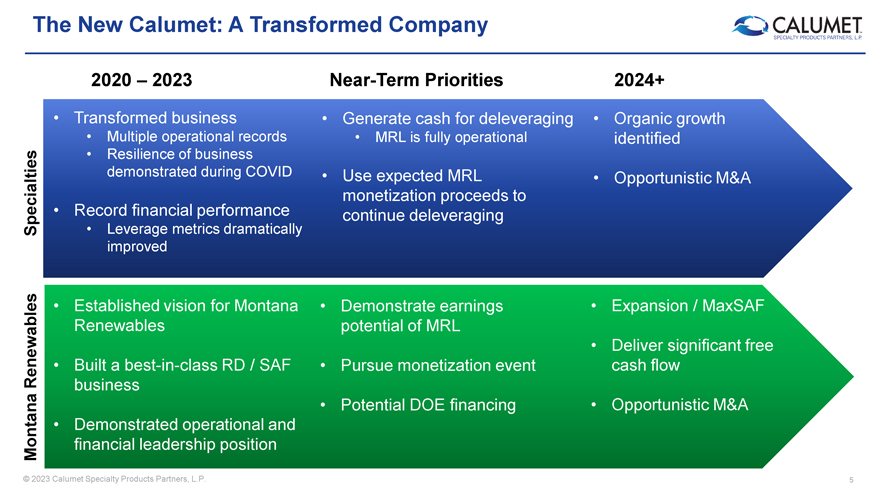

The New Calumet: A Transformed Company 2020 – 2023 Near-Term Priorities 2024+ • Transformed business • Generate cash for deleveraging • Organic growth • Multiple operational records • MRL is fully operational identified • Resilience of business demonstrated during COVID • Use expected MRL • Opportunistic M&A • Record financial performance monetization proceeds to Specialties • Leverage metrics dramatically continue deleveraging improved • Established vision for Montana • Demonstrate earnings • Expansion / MaxSAF Renewables potential of MRL ewables • Deliver significant free Ren • Built a best-in-class RD / SAF • Pursue monetization event cash flow business • Potential DOE financing • Opportunistic M&A • Demonstrated operational and Montana financial leadership position © 2023 Calumet Specialty Products Partners, L.P. 5

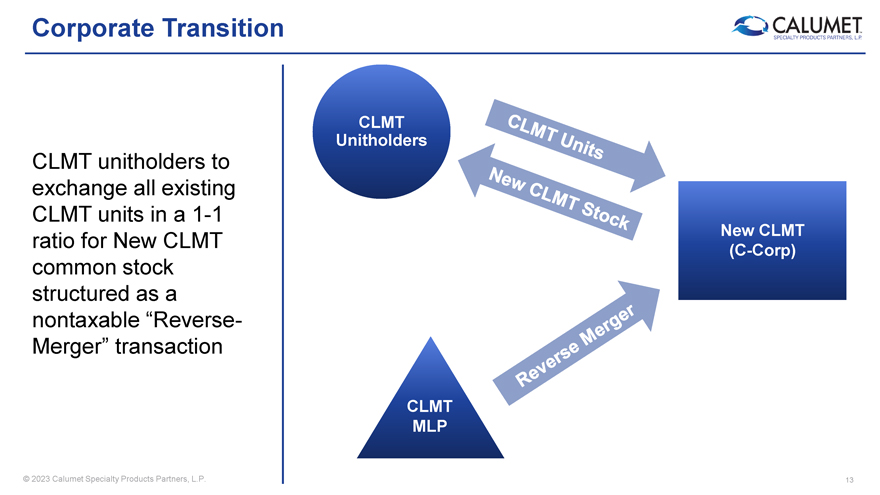

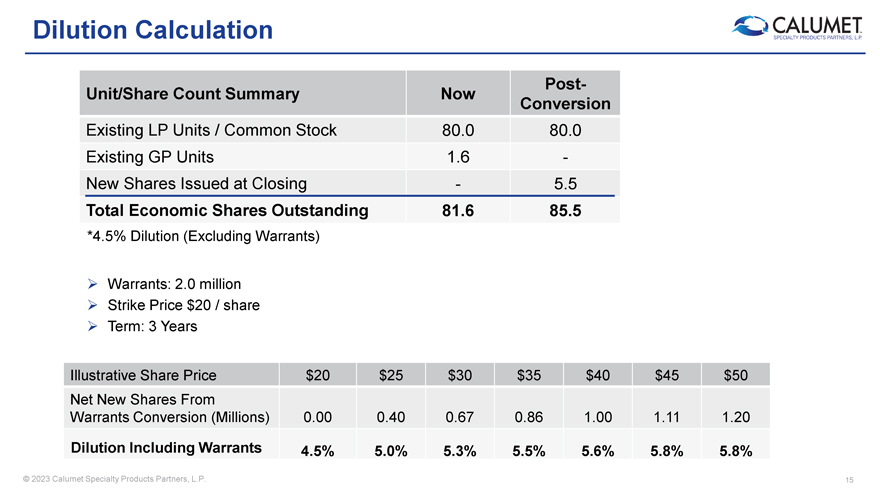

Transaction Overview: C-Corp Transition On November 9, 2023, Calumet announced plans to transition to a C-Corp to maximize future opportunities, access a broader base of investors and unlock shareholder value Transaction highlights: C-Corp transition will eliminate Incentive Distribution Rights (“IDRs”), align all shareholder interests, and is expected to substantially increase trading volume and institutional investment in the company Calumet expects to close C-Corp transition in mid-2024 and cancellation of IDRs will occur simultaneously with closing Upon closing, the C-Corp will acquire the General Partner (effectively constituting the indirect acquisition of the existing IDRs and 2% General Partner interest (~1.6 million GP units)) in exchange for 5.5 million shares of common stock and 2.0 million warrants Warrants will have a strike price of $20/share and will expire three years from the date of issuance 4.5% shareholder dilution (excluding warrants) at closing of transaction (see “Dilution Calculation” on slide 15) Governance: The board of directors will consist of 9 members who will serve staggered three-year terms; a majority of the directors will be independent For so long as The Heritage Group and its affiliates (“THG”) own at least 15% of the outstanding common stock, they will have the right to nominate three directors, which reduces to two directors so long as THG owns at least 10% and less than 15% of the outstanding common stock Until the earlier of THG no longer owning at least 5% of the outstanding common stock and the third anniversary of the closing date, THG will maintain certain consent rights, including with respect to: any amendment of the organizational documents, any increase or decrease in the size of the Board and any appointment or removal of the Chairman of the Board or Chief Executive Officer THG will receive customary registration rights covering its shares and warrants © 2023 Calumet Specialty Products Partners, L.P. 6

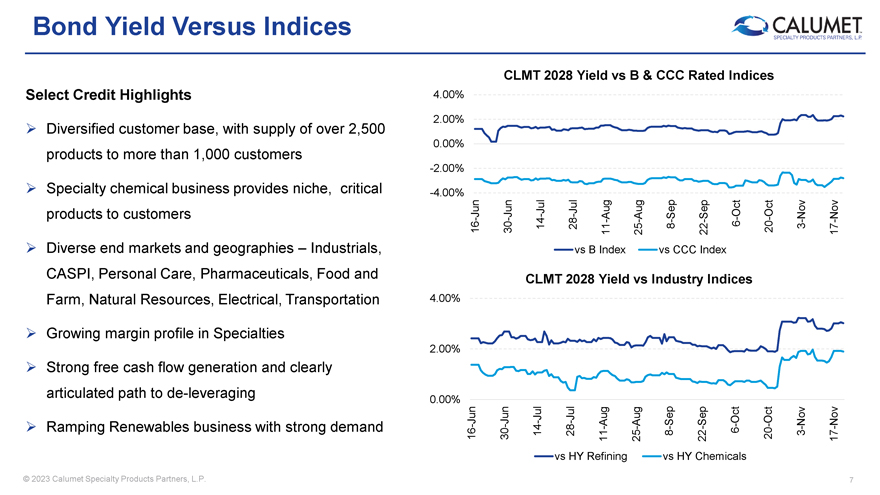

Bond Yield Versus Indices CLMT 2028 Yield vs B & CCC Rated Indices Select Credit Highlights 4.00% 2.00% Diversified customer base, with supply of over 2,500 0.00% products to more than 1,000 customers -2.00% Specialty chemical business provides niche, critical -4.00% products to customers Jun Jun—Jul Jul—Aug Aug Sep Sep Oct Oct Nov Nov — — 14 28 — 8 — 6 20—3—16 30 11 25 22 17 Diverse end markets and geographies – Industrials, vs B Index vs CCC Index CASPI, Personal Care, Pharmaceuticals, Food and CLMT 2028 Yield vs Industry Indices Farm, Natural Resources, Electrical, Transportation 4.00% Growing margin profile in Specialties 2.00% Strong free cash flow generation and clearly articulated path to de-leveraging 0.00% Jul Jul Oct Oct Jun Jun — Aug Aug Sep Sep Nov Nov — — Ramping Renewables business with strong demand 14 28 — 8 — 6 20—3—16 30 11 25 22 17 vs HY Refining vs HY Chemicals © 2023 Calumet Specialty Products Partners, L.P. 7

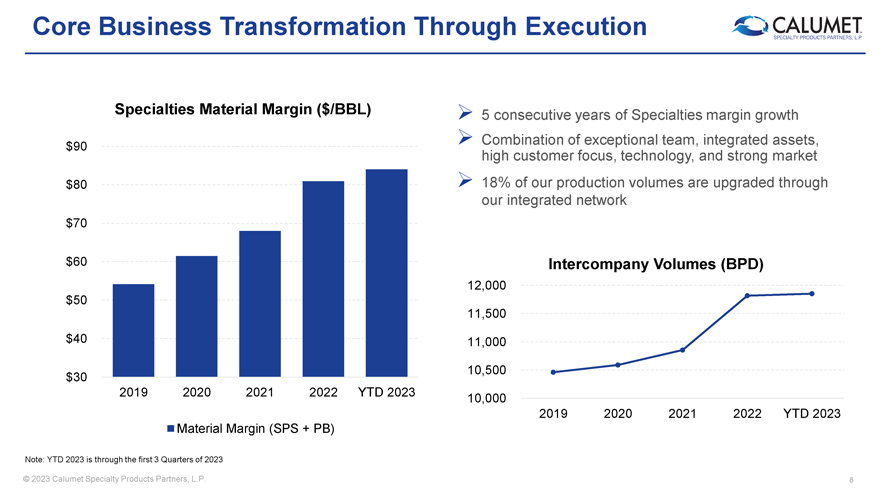

Core Business Transformation Through Execution Specialties Material Margin ($/BBL) 5 consecutive years of Specialties margin growth Combination of exceptional team, integrated assets, $90 high customer focus, technology, and strong market $80 18% of our production volumes are upgraded through our integrated network $70 $60 Intercompany Volumes (BPD) 12,000 $50 11,500 $40 11,000 10,500 $30 2019 2020 2021 2022 YTD 2023 10,000 2019 2020 2021 2022 YTD 2023 Material Margin (SPS + PB) Note: YTD 2023 is through the first 3 Quarters of 2023 © 2023 Calumet Specialty Products Partners, L.P. 8

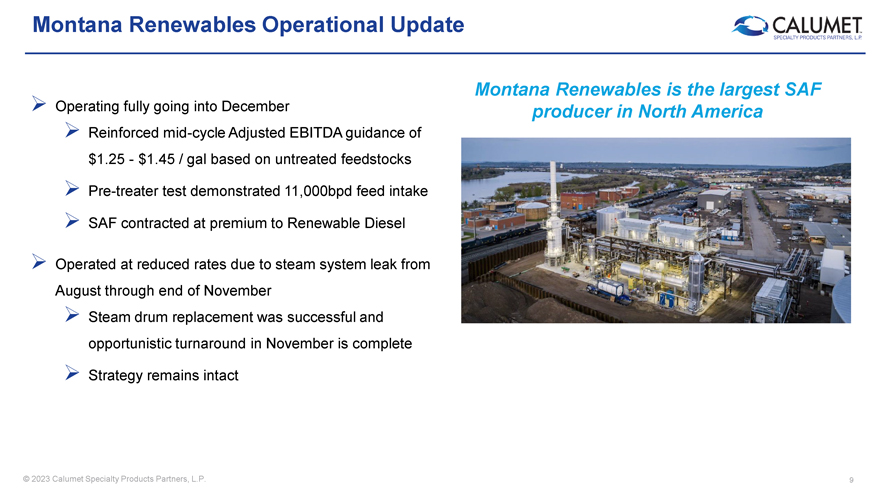

Montana Renewables Operational Update Montana Renewables is the largest SAF Operating fully going into December producer in North America Reinforced mid-cycle Adjusted EBITDA guidance of $1.25—$1.45 / gal based on untreated feedstocks Pre-treater test demonstrated 11,000bpd feed intake SAF contracted at premium to Renewable Diesel Operated at reduced rates due to steam system leak from August through end of November Steam drum replacement was successful and opportunistic turnaround in November is complete Strategy remains intact © 2023 Calumet Specialty Products Partners, L.P. 9

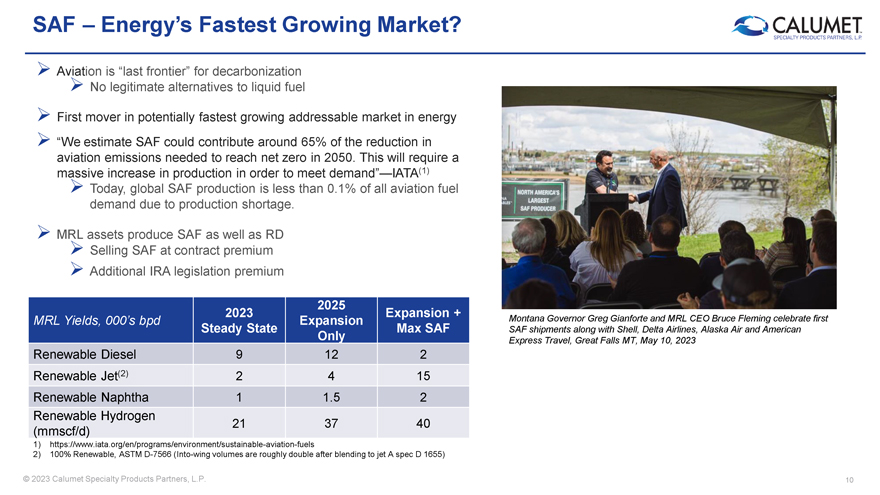

SAF – Energy’s Fastest Growing Market? Aviation is “last frontier” for decarbonization No legitimate alternatives to liquid fuel First mover in potentially fastest growing addressable market in energy “We estimate SAF could contribute around 65% of the reduction in aviation emissions needed to reach net zero in 2050. This will require a massive increase in production in order to meet demand”—IATA(1) Today, global SAF production is less than 0.1% of all aviation fuel demand due to production shortage. MRL assets produce SAF as well as RD Selling SAF at contract premium Additional IRA legislation premium 2025 2023 Expansion + MRL Yields, 000’s bpd Expansion SAF Montana Governor Greg Gianforte and MRL CEO Bruce Fleming celebrate first Steady State Max SAF shipments along with Shell, Delta Airlines, Alaska Air and American Only Express Travel, Great Falls MT, May 10, 2023 Renewable Diesel 9 12 2 Renewable Jet(2) 2 4 15 Renewable Naphtha 1 1.5 2 Renewable Hydrogen 21 37 40 (mmscf/d) 1) https://www.iata.org/en/programs/environment/sustainable-aviation-fuels 2) 100% Renewable, ASTM D-7566 (Into-wing volumes are roughly double after blending to jet A spec D 1655) © 2023 Calumet Specialty Products Partners, L.P. 10

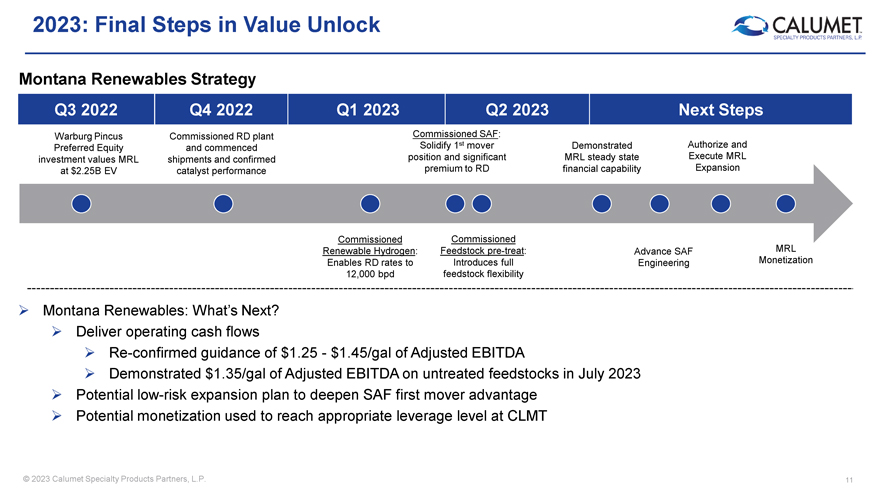

2023: Final Steps in Value Unlock Montana Renewables Strategy Q3 2022 Q4 2022 Q1 2023 Q2 2023 Next Steps Warburg Pincus Commissioned RD plant Commissioned SAF: Preferred Equity and commenced Solidify 1st mover Demonstrated Authorize and investment values MRL shipments and confirmed position and significant MRL steady state Execute MRL at $2.25B EV catalyst performance premium to RD financial capability Expansion Commissioned Commissioned Renewable Hydrogen: Feedstock pre-treat: Advance SAF MRL Enables RD rates to Introduces full Engineering Monetization 12,000 bpd feedstock flexibility Montana Renewables: What’s Next? Deliver operating cash flows Re-confirmed guidance of $1.25—$1.45/gal of Adjusted EBITDA Demonstrated $1.35/gal of Adjusted EBITDA on untreated feedstocks in July 2023 Potential low-risk expansion plan to deepen SAF first mover advantage Potential monetization used to reach appropriate leverage level at CLMT © 2023 Calumet Specialty Products Partners, L.P. 11

Appendix

Corporate Transition CLMT Unitholders CLMT unitholders to exchange all existing CLMT units in a 1-1 New CLMT ratio for New CLMT (C-Corp) common stock structured as a nontaxable “Reverse-Merger” transaction CLMT MLP © 2023 Calumet Specialty Products Partners, L.P. 13

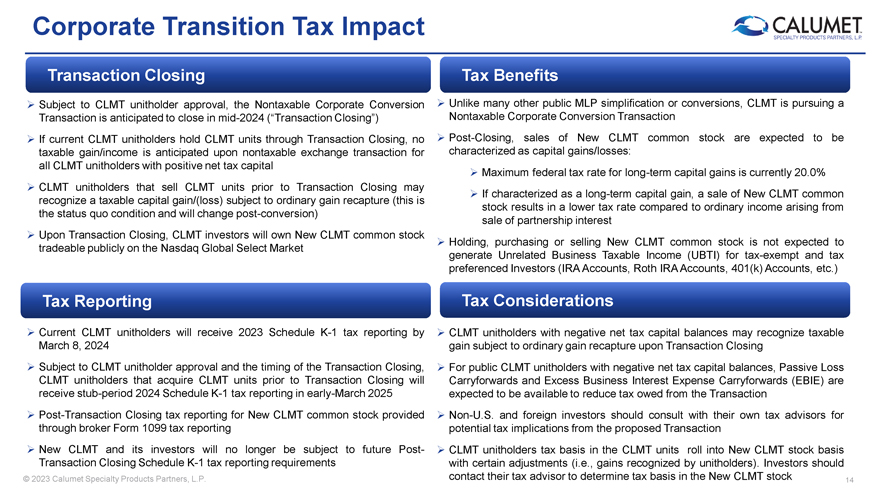

Corporate Transition Tax Impact Transaction Closing Tax Benefits Subject to CLMT unitholder approval, the Nontaxable Corporate Conversion Unlike many other public MLP simplification or conversions, CLMT is pursuing a Transaction is anticipated to close in mid-2024 (“Transaction Closing”) Nontaxable Corporate Conversion Transaction If current CLMT unitholders hold CLMT units through Transaction Closing, no Post-Closing, sales of New CLMT common stock are expected to be taxable gain/income is anticipated upon nontaxable exchange transaction for characterized as capital gains/losses: all CLMT unitholders with positive net tax capital Maximum federal tax rate for long-term capital gains is currently 20.0% CLMT unitholders that sell CLMT units prior to Transaction Closing may If characterized as a long-term capital gain, a sale of New CLMT common recognize a taxable capital gain/(loss) subject to ordinary gain recapture (this is stock results in a lower tax rate compared to ordinary income arising from the status quo condition and will change post-conversion) sale of partnership interest Upon Transaction Closing, CLMT investors will own New CLMT common stock Holding, purchasing or selling New CLMT common stock is not expected to tradeable publicly on the Nasdaq Global Select Market generate Unrelated Business Taxable Income (UBTI) for tax-exempt and tax preferenced Investors (IRA Accounts, Roth IRA Accounts, 401(k) Accounts, etc.) Tax Reporting Tax Considerations Current CLMT unitholders will receive 2023 Schedule K-1 tax reporting by CLMT unitholders with negative net tax capital balances may recognize taxable March 8, 2024 gain subject to ordinary gain recapture upon Transaction Closing Subject to CLMT unitholder approval and the timing of the Transaction Closing, For public CLMT unitholders with negative net tax capital balances, Passive Loss CLMT unitholders that acquire CLMT units prior to Transaction Closing will Carryforwards and Excess Business Interest Expense Carryforwards (EBIE) are receive stub-period 2024 Schedule K-1 tax reporting in early-March 2025 expected to be available to reduce tax owed from the Transaction Post-Transaction Closing tax reporting for New CLMT common stock provided Non-U.S. and foreign investors should consult with their own tax advisors for through broker Form 1099 tax reporting potential tax implications from the proposed Transaction New CLMT and its investors will no longer be subject to future Post- CLMT unitholders tax basis in the CLMT units roll into New CLMT stock basis Transaction Closing Schedule K-1 tax reporting requirements with certain adjustments (i.e., gains recognized by unitholders). Investors should © 2023 Calumet Specialty Products Partners, L.P. contact their tax advisor to determine tax basis in the New CLMT stock 14

Dilution Calculation Post-Unit/Share Count Summary Now Conversion Existing LP Units / Common Stock 80.0 80.0 Existing GP Units 1.6 -New Shares Issued at Closing—5.5 Total Economic Shares Outstanding 81.6 85.5 *4.5% Dilution (Excluding Warrants) Warrants: 2.0 million Strike Price $20 / share Term: 3 Years Illustrative Share Price $20 $25 $30 $35 $40 $45 $50 Net New Shares From Warrants Conversion (Millions) 0.00 0.40 0.67 0.86 1.00 1.11 1.20 Dilution Including Warrants 4.5% 5.0% 5.3% 5.5% 5.6% 5.8% 5.8% © 2023 Calumet Specialty Products Partners, L.P. 15

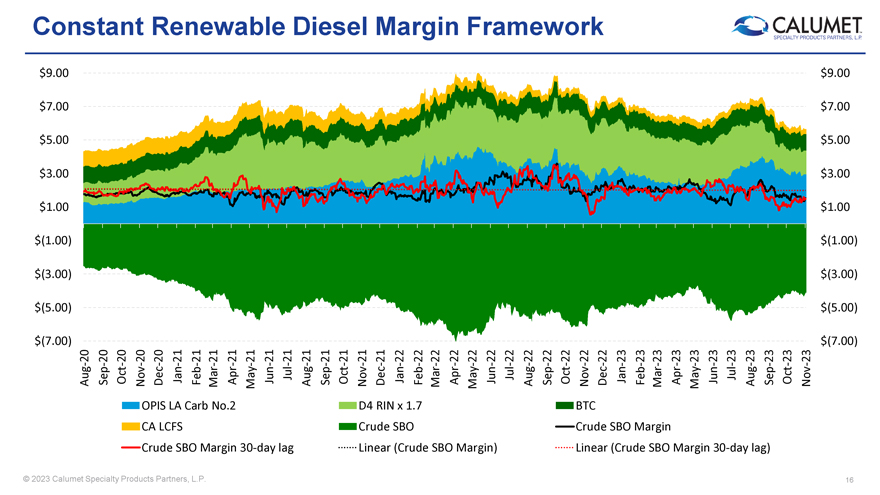

Constant Renewable Diesel Margin Framework $9.00 $9.00 $7.00 $7.00 $5.00 $5.00 $3.00 $3.00 $1.00 $1.00 $(1.00) $(1.00) $(3.00) $(3.00) $(5.00) $(5.00) $(7.00) $(7.00)—20 20—20—20—20 — 21 21—21—21—21—21 — 21 21—21—21—21 — 21 22—22 — 22 22 — 22 22 — 22 22—22 — 22—22—22—23—23 23 — 23—23 23—23—23 - 23 — 23—23 Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov OPIS LA Carb No.2 D4 RIN x 1.7 BTC CA LCFS Crude SBO Crude SBO Margin Crude SBO Margin 30-day lag Linear (Crude SBO Margin) Linear (Crude SBO Margin 30-day lag) © 2023 Calumet Specialty Products Partners, L.P. 16

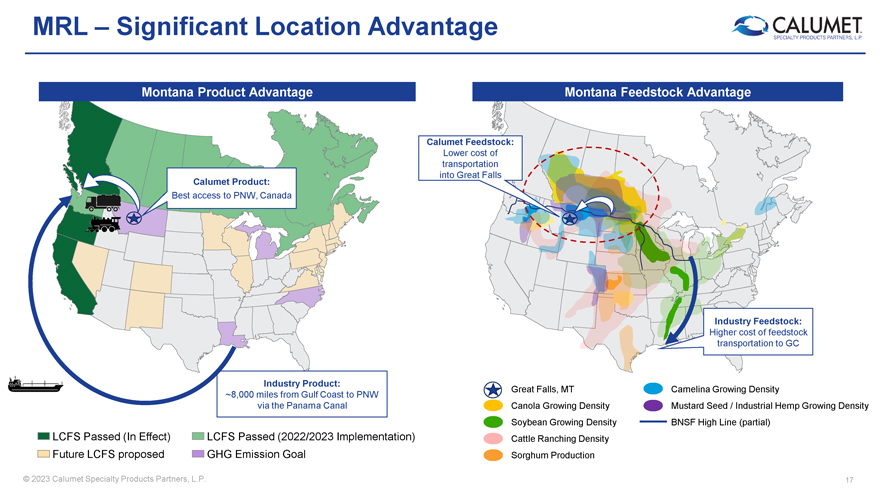

MRL – Significant Location Advantage Montana Product Advantage Montana Feedstock Advantage Calumet Feedstock: Lower cost of transportation into Great Falls Calumet Product: Best access to PNW, Canada Industry Feedstock: Higher cost of feedstock transportation to GC Industry Product: Great Falls, MT Camelina Growing Density ~8,000 miles from Gulf Coast to PNW via the Panama Canal Canola Growing Density Mustard Seed / Industrial Hemp Growing Density Soybean Growing Density BNSF High Line (partial) LCFS Passed (In Effect) LCFS Passed (2022/2023 Implementation) Cattle Ranching Density Future LCFS proposed GHG Emission Goal Sorghum Production © 2023 Calumet Specialty Products Partners, L.P. 17

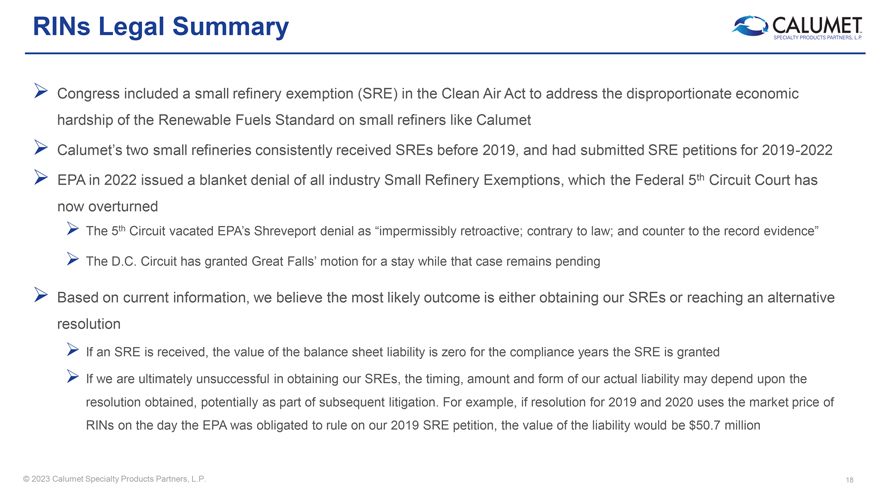

RINs Legal Summary CALUMET SPECIALTY PRODUCTS PARTNERS, L.P. Congress included a small refinery exemption (SRE) in the Clean Air Act to address the disproportionate economic hardship of the Renewable Fuels Standard on small refiners like Calumet Calumet’s two small refineries consistently received SREs before 2019, and had submitted SRE petitions for 2019-2022 EPA in 2022 issued a blanket denial of all industry Small Refinery Exemptions, which the Federal 5th Circuit Court has now overturned The 5th Circuit vacated EPA’s Shreveport denial as “impermissibly retroactive; contrary to law; and counter to the record evidence” The D.C. Circuit has granted Great Falls’ motion for a stay while that case remains pending Based on current information, we believe the most likely outcome is either obtaining our SREs or reaching an alternative resolution If an SRE is received, the value of the balance sheet liability is zero for the compliance years the SRE is granted If we are ultimately unsuccessful in obtaining our SREs, the timing, amount and form of our actual liability may depend upon the resolution obtained, potentially as part of subsequent litigation. For example, if resolution for 2019 and 2020 uses the market price of RINs on the day the EPA was obligated to rule on our 2019 SRE petition, the value of the liability would be $50.7 million © 2023 Calumet Specialty Products Partners, L.P.

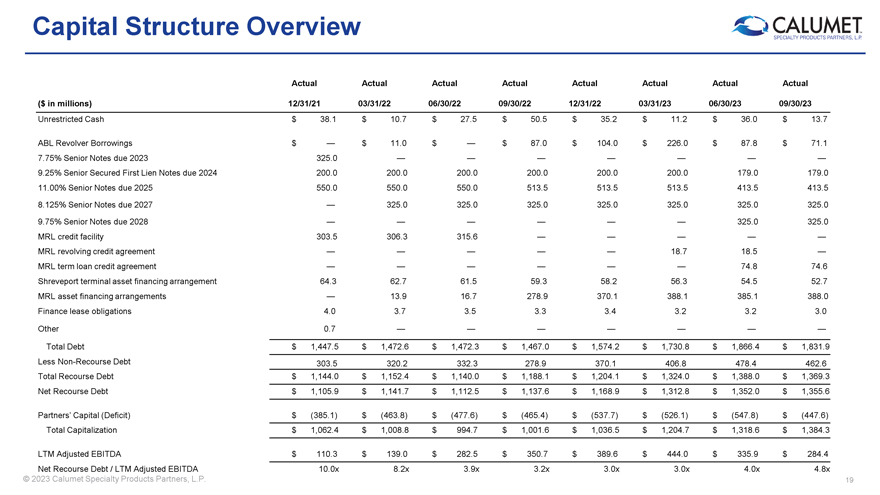

Capital Structure Overview Actual Actual Actual Actual Actual Actual Actual Actual ($ in millions) 12/31/21 03/31/22 06/30/22 09/30/22 12/31/22 03/31/23 06/30/23 09/30/23 Unrestricted Cash $ 38.1 $ 10.7 $ 27.5 $ 50.5 $ 35.2 $ 11.2 $ 36.0 $ 13.7 ABL Revolver Borrowings $ — $ 11.0 $ — $ 87.0 $ 104.0 $ 226.0 $ 87.8 $ 71.1 7.75% Senior Notes due 2023 325.0 — — — — — — — 9.25% Senior Secured First Lien Notes due 2024 200.0 200.0 200.0 200.0 200.0 200.0 179.0 179.0 11.00% Senior Notes due 2025 550.0 550.0 550.0 513.5 513.5 513.5 413.5 413.5 8.125% Senior Notes due 2027 — 325.0 325.0 325.0 325.0 325.0 325.0 325.0 9.75% Senior Notes due 2028 — — — — — — 325.0 325.0 MRL credit facility 303.5 306.3 315.6 — — — — — MRL revolving credit agreement — — — — — 18.7 18.5 — MRL term loan credit agreement — — — — — — 74.8 74.6 Shreveport terminal asset financing arrangement 64.3 62.7 61.5 59.3 58.2 56.3 54.5 52.7 MRL asset financing arrangements — 13.9 16.7 278.9 370.1 388.1 385.1 388.0 Finance lease obligations 4.0 3.7 3.5 3.3 3.4 3.2 3.2 3.0 Other 0.7 — — — — — — — Total Debt $ 1,447.5 $ 1,472.6 $ 1,472.3 $ 1,467.0 $ 1,574.2 $ 1,730.8 $ 1,866.4 $ 1,831.9 Less Non-Recourse Debt 303.5 320.2 332.3 278.9 370.1 406.8 478.4 462.6 Total Recourse Debt $ 1,144.0 $ 1,152.4 $ 1,140.0 $ 1,188.1 $ 1,204.1 $ 1,324.0 $ 1,388.0 $ 1,369.3 Net Recourse Debt $ 1,105.9 $ 1,141.7 $ 1,112.5 $ 1,137.6 $ 1,168.9 $ 1,312.8 $ 1,352.0 $ 1,355.6 Partners’ Capital (Deficit) $ (385.1) $ (463.8) $ (477.6) $ (465.4) $ (537.7) $ (526.1) $ (547.8) $ (447.6) Total Capitalization $ 1,062.4 $ 1,008.8 $ 994.7 $ 1,001.6 $ 1,036.5 $ 1,204.7 $ 1,318.6 $ 1,384.3 LTM Adjusted EBITDA $ 110.3 $ 139.0 $ 282.5 $ 350.7 $ 389.6 $ 444.0 $ 335.9 $ 284.4 Net Recourse Debt / LTM Adjusted EBITDA 10.0x 8.2x 3.9x 3.2x 3.0x 3.0x 4.0x 4.8x © 2023 Calumet Specialty Products Partners, L.P. 19

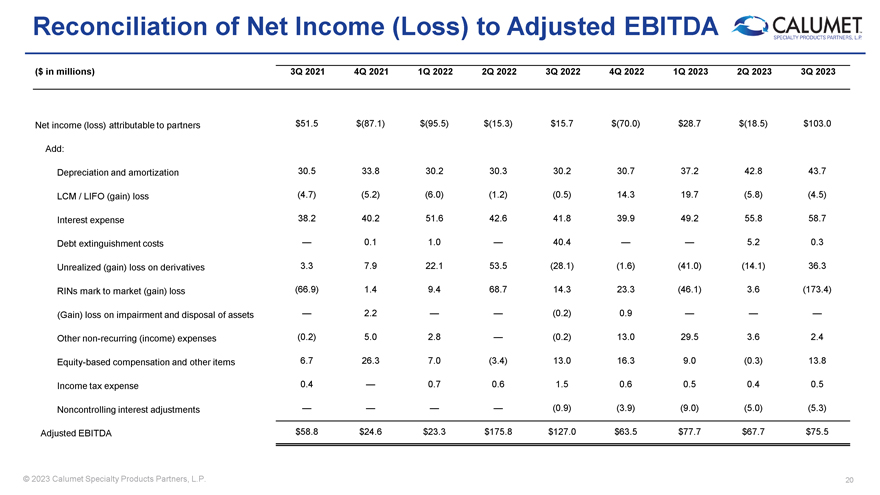

Reconciliation of Net Income (Loss) to Adjusted EBITDA ($ in millions) 3Q 2021 4Q 2021 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 2Q 2023 3Q 2023 Net income (loss) attributable to partners $51.5 $(87.1) $(95.5) $(15.3) $15.7 $(70.0) $28.7 $(18.5) $103.0 Add: Depreciation and amortization 30.5 33.8 30.2 30.3 30.2 30.7 37.2 42.8 43.7 LCM / LIFO (gain) loss (4.7) (5.2) (6.0) (1.2) (0.5) 14.3 19.7 (5.8) (4.5) Interest expense 38.2 40.2 51.6 42.6 41.8 39.9 49.2 55.8 58.7 Debt extinguishment costs — 0.1 1.0 — 40.4 — — 5.2 0.3 Unrealized (gain) loss on derivatives 3.3 7.9 22.1 53.5 (28.1) (1.6) (41.0) (14.1) 36.3 RINs mark to market (gain) loss (66.9) 1.4 9.4 68.7 14.3 23.3 (46.1) 3.6 (173.4) (Gain) loss on impairment and disposal of assets — 2.2 — — (0.2) 0.9 — — — Other non-recurring (income) expenses (0.2) 5.0 2.8 — (0.2) 13.0 29.5 3.6 2.4 Equity-based compensation and other items 6.7 26.3 7.0 (3.4) 13.0 16.3 9.0 (0.3) 13.8 Income tax expense 0.4 — 0.7 0.6 1.5 0.6 0.5 0.4 0.5 Noncontrolling interest adjustments — — — — (0.9) (3.9) (9.0) (5.0) (5.3) Adjusted EBITDA $58.8 $24.6 $23.3 $175.8 $127.0 $63.5 $77.7 $67.7 $75.5 © 2023 Calumet Specialty Products Partners, L.P. 20

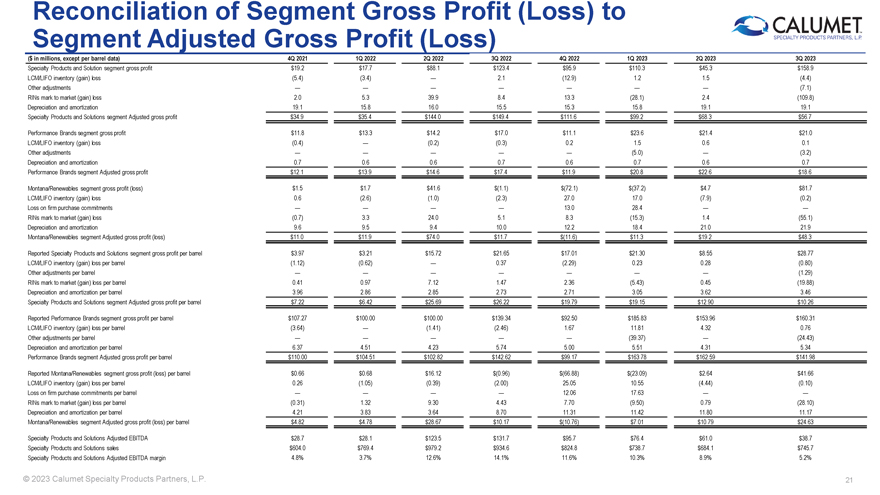

Reconciliation of Segment Gross Profit (Loss) to Segment Adjusted Gross Profit (Loss) ($ in millions, except per barrel data) 4Q 2021 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 2Q 2023 3Q 2023 Specialty Products and Solution segment gross profit $19.2 $17.7 $88.1 $123.4 $95.9 $110.3 $45.3 $158.9 LCM/LIFO inventory (gain) loss (5.4) (3.4) — 2.1 (12.9) 1.2 1.5 (4.4) Other adjustments — — — — — — — (7.1) RINs mark to market (gain) loss 2.0 5.3 39.9 8.4 13.3 (28.1) 2.4 (109.8) Depreciation and amortization 19.1 15.8 16.0 15.5 15.3 15.8 19.1 19.1 Specialty Products and Solutions segment Adjusted gross profit $34.9 $35.4 $144.0 $149.4 $111.6 $99.2 $68.3 $56.7 Performance Brands segment gross profit $11.8 $13.3 $14.2 $17.0 $11.1 $23.6 $21.4 $21.0 LCM/LIFO inventory (gain) loss (0.4) — (0.2) (0.3) 0.2 1.5 0.6 0.1 Other adjustments — — — — — (5.0) — (3.2) Depreciation and amortization 0.7 0.6 0.6 0.7 0.6 0.7 0.6 0.7 Performance Brands segment Adjusted gross profit $12.1 $13.9 $14.6 $17.4 $11.9 $20.8 $22.6 $18.6 Montana/Renewables segment gross profit (loss) $1.5 $1.7 $41.6 $(1.1) $(72.1) $(37.2) $4.7 $81.7 LCM/LIFO inventory (gain) loss 0.6 (2.6) (1.0) (2.3) 27.0 17.0 (7.9) (0.2) Loss on firm purchase commitments — — — — 13.0 28.4 — —RINs mark to market (gain) loss (0.7) 3.3 24.0 5.1 8.3 (15.3) 1.4 (55.1) Depreciation and amortization 9.6 9.5 9.4 10.0 12.2 18.4 21.0 21.9 Montana/Renewables segment Adjusted gross profit (loss) $11.0 $11.9 $74.0 $11.7 $(11.6) $11.3 $19.2 $48.3 Reported Specialty Products and Solutions segment gross profit per barrel $3.97 $3.21 $15.72 $21.65 $17.01 $21.30 $8.55 $28.77 LCM/LIFO inventory (gain) loss per barrel (1.12) (0.62) — 0.37 (2.29) 0.23 0.28 (0.80) Other adjustments per barrel — — — — — — — (1.29) RINs mark to market (gain) loss per barrel 0.41 0.97 7.12 1.47 2.36 (5.43) 0.45 (19.88) Depreciation and amortization per barrel 3.96 2.86 2.85 2.73 2.71 3.05 3.62 3.46 Specialty Products and Solutions segment Adjusted gross profit per barrel $7.22 $6.42 $25.69 $26.22 $19.79 $19.15 $12.90 $10.26 Reported Performance Brands segment gross profit per barrel $107.27 $100.00 $100.00 $139.34 $92.50 $185.83 $153.96 $160.31 LCM/LIFO inventory (gain) loss per barrel (3.64) — (1.41) (2.46) 1.67 11.81 4.32 0.76 Other adjustments per barrel — — — — — (39.37) — (24.43) Depreciation and amortization per barrel 6.37 4.51 4.23 5.74 5.00 5.51 4.31 5.34 Performance Brands segment Adjusted gross profit per barrel $110.00 $104.51 $102.82 $142.62 $99.17 $163.78 $162.59 $141.98 Reported Montana/Renewables segment gross profit (loss) per barrel $0.66 $0.68 $16.12 $(0.96) $(66.88) $(23.09) $2.64 $41.66 LCM/LIFO inventory (gain) loss per barrel 0.26 (1.05) (0.39) (2.00) 25.05 10.55 (4.44) (0.10) Loss on firm purchase commitments per barrel — — — — 12.06 17.63 — —RINs mark to market (gain) loss per barrel (0.31) 1.32 9.30 4.43 7.70 (9.50) 0.79 (28.10) Depreciation and amortization per barrel 4.21 3.83 3.64 8.70 11.31 11.42 11.80 11.17 Montana/Renewables segment Adjusted gross profit (loss) per barrel $4.82 $4.78 $28.67 $10.17 $(10.76) $7.01 $10.79 $24.63 Specialty Products and Solutions Adjusted EBITDA $28.7 $28.1 $123.5 $131.7 $95.7 $76.4 $61.0 $38.7 Specialty Products and Solutions sales $604.0 $769.4 $979.2 $934.6 $824.8 $738.7 $684.1 $745.7 Specialty Products and Solutions Adjusted EBITDA margin 4.8% 3.7% 12.6% 14.1% 11.6% 10.3% 8.9% 5.2% © 2023 Calumet Specialty Products Partners, L.P. 21