Exhibit 99.1

1

A New Global Pharma Innovator

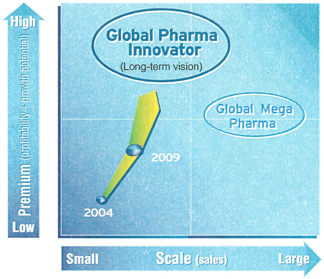

The two companies from which we were born, Sankyo Company, Limited and Daiichi Pharmaceutical Co., Ltd., have long histories of contributing to society as two of Japan’s top pharmaceutical firms, both experienced in developing innovative prescription drugs. Through the integration of their operations, the new firm, DAIICHI SANKYO COMPANY, LIMITED, will aim for dramatic improvement in corporate value driven by strong profitability and robust growth.

Aggressively deploy management resources to acquire pipelines and research technology

Brand Mark Development Concept

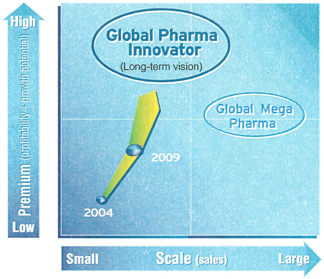

The company aims to leap forward and become a Japan-based Global Pharma Innovator.

The overall spherical shape represents the beauty of the Earth, which gives the viewer a sense of the splendor and mysteries of life. The gentle movement evoked in the upper part of the logo is meant to express supple intelligence and creativity, while the solid arc of the lower part represents reliability and a sense of mission, and the white space that appears as if it is being held within two hands stands for the vibrancy of life and, at the same time, the importance and dearness of life.

2

We want to share with our shareholders the benefits that will accrue from our tackling new challenges in the global market.

Everything is for the benefit of shareholders

| | | | |

| Kiyoshi Morita | | Takashi Shoda | | |

Representative Director and Chairman | | Representative Director, President and CEO | | |

DAIICHI SANKYO COMPANY, LIMITED took the first step toward challenging the world market by becoming a Global Pharma Innovator originating in Japan on September 28, 2005. We continue to provide innovative pharmaceuticals to meet the medical needs of people all over the globe. As a life sciences company we play an important role in the social welfare system. In that spirit we will maintain high ethical standards, transparent management and efficient use of limited resources.

What do we mean by the term Global Pharma Innovator originating in Japan? Our aspiration is to become a premier company with a significant presence in key therapeutic markets and the ability to originate innovative new drugs consistently. We aim for dramatic improvement in corporate value by strong profitability and growth. The pharmaceutical business is developing into a strategic core industry in Japan in the 21st century, and DAIICHI SANKYO aims to be one of the leaders. “Global” means being a company that develops and markets products not only in Japan, but also in the US, Europe, and other world markets; “Pharma” refers to concentrating management resources on developing innovative drugs, and “Innovator” expresses our commitment to world-class productivity in R&D and all other functions.

Our task now is to create a company that will make use of the drug development capabilities of the two merging companies, and their competitive force in the Japanese market, to grow on the world market. By sharing the corporate value that we derive in doing this, we hope to meet the expectations of all our shareholders. We believe this is our responsibility. We will do everything in our power to enhance our corporate and shareholder value, and continue to share our corporate philosophy and management vision with our shareholders. Thank you for your unwavering support.

3

Message to Our Shareholders

Business Targets after the integration

Dividend Rate on Shareholders’ Equity (DOE) of 5% in Fiscal 2009

Because the cost synergy of the operational integration of the two firms, and the sales synergy resulting from the sales collaboration beginning in October 2005 greatly exceed the potential risks, such as decreased sales and profits due to product cannibalization and the like, we are confident that our profit growth will surge.

Our goal is to achieve an operating profit of greater than ¥250 billion by fiscal 2009, while ensuring that we have the R&D funding required of a global pharma company through the integration of our facilities in Japan and overseas, and a focus on cost reduction. We are also committed to building a solid presence in the global market and maximizing our corporate value, while at the same time setting a target of a 5% dividend rate on shareholders’ equity (DOE) – the highest shareholder dividend in Japan.

Pharmaceuticals Business Targets

| | | | | | | | | |

(billions of yen)

| | Fiscal 2004

| | | Fiscal 2007

| | | Fiscal 2009

| |

Net sales | | 760 | | | 760 | | | 930 | |

Operating income | | 130 | | | 160 | | | 260 | |

Operating income to net sales | | 17 | % | | 21 | % | | 27 | % |

Note: Figures for fiscal 2007 and fiscal 2009 are targets; figures for fiscal 2004 are derived from simply combining the figures from Sankyo Company, Limited and Daiichi Pharmaceutical Co., Ltd.

4

DAIICHI SANKYO REPORT

-Nov. 2005-

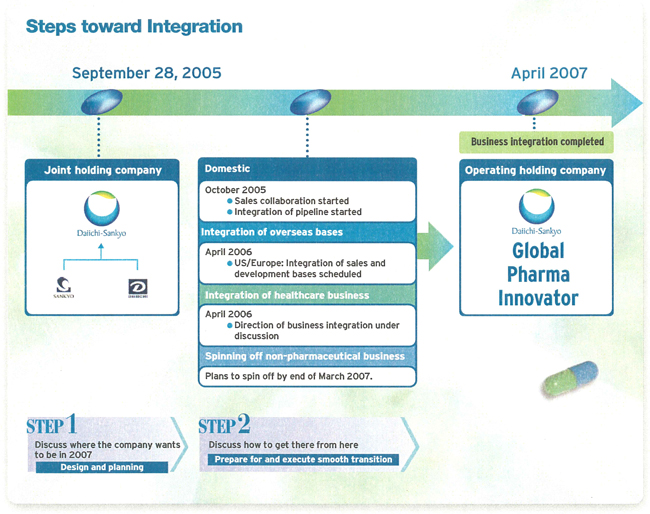

Progress with Management Challenges for April 2007

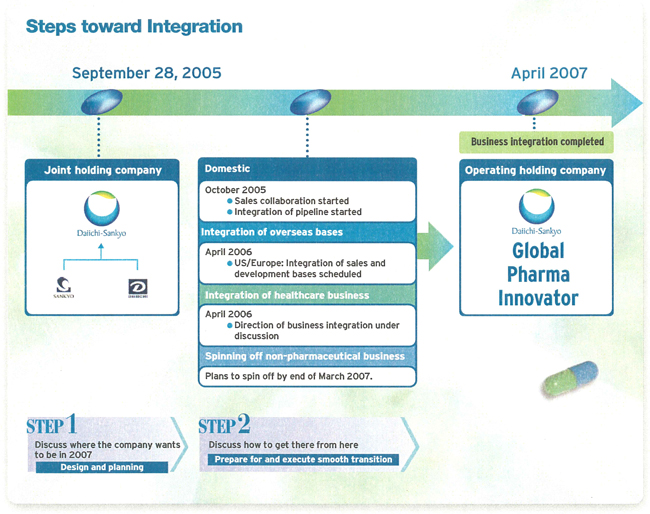

Over the medium- to long-term, the goal of our business integration is to make DAIICHI SANKYO a Global Pharma Innovator. We are aiming to achieve the highest level of management efficiency in the industry, while achieving true integration through unfailing, step-by-step efforts.

5

DAIICHI SANKYO REPORT

-Nov. 2005-

Centralizing pipelines

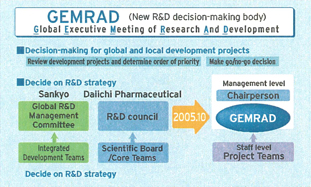

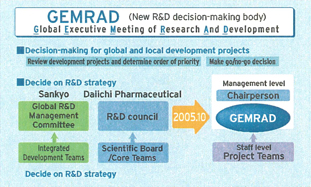

In October 2005, we started centralizing our R&D pipelines. We merged the two companies’ R&D planning and decision-making organizations to establish GEMRAD, the Global Executive Meeting of Research and Development. The primary task of this new decision-making body is to review development projects and determine their relative priority. GEMRAD has been reviewing several projects per month since October 2005, and we intend to announce DAIICHI SANKYO’s new R&D pipelines in the first half of 2006.

Note: See p. 9-10 for the status of our current pipeline by stage.

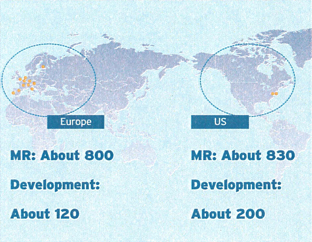

Integration of overseas bases

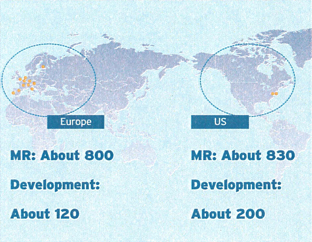

In order to increase our presence in the global market, it is vital that we integrate and enhance the sales and development capabilities of both companies, while making our businesses more efficient. To this end, we plan to integrate our sales and development facilities in the United States and Europe. In April 2006, we will integrate our US sales and development operations (Sankyo Pharma, Inc., Daiichi Pharmaceuticals Corporation, and Daiichi Medical Research) with a sales operation in Parsippany, New Jersey, and a development operation in Edison, New Jersey.

We will also integrate our European operations in April 2006, with development operations centered in London and sales operations in Munich.

Integration and spin-off other business

The healthcare businesses of both Sankyo and Daiichi Pharmaceutical will be integrated into a single business in April 2006, which should help to improve productivity at DAIICHI SANKYO. In addition, we are carefully examining our group companies with the aim of spinning off all non-pharmaceutical businesses by March 2007. This will increasingly focus management resources on our core mission: to create an ongoing line of revolutionary Pharmaceuticals.

6

Trends in Major Products and Future Strategies

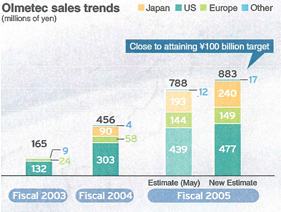

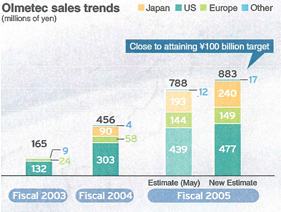

Sankyo and Daiichi began collaboration in their domestic businesses in October 2005, and on November 1, 2005, we began promoting one of Sankyo’s major products,Olmetec®(generic name: Olmesartan), via Daiichi’s MRs. DAIICHI SANKYO is now operating this business with a 2,500-strong organization. There have already been many reports of prescriptions that resulted from these joint sales promotions, and the enhancements we have made to our sales readiness in the Japanese market are steadily bearing fruit. In the future, we will strengthen our mutual collaborative framework with the aim of further improving performance.

On November 1, 2005, Daiichi Pharmaceutical began promotingOlmetec®as one concrete step to strengthen the new sales structure resulting from our operational integration.

Olmetec®

Due to the collaboration between Sankyo and Daiichi Pharmaceutical in Japan, and the strong performance of Sankyo Pharma Inc. in the United States, we expect our global net sales for fiscal 2005 to reach nearly ¥90 billion. We expect to meet our initial target of ¥100 billion for global net sales in fiscal 2006, and aim to double that to over ¥200 billion by fiscal 2009.

US

| | n | Strengthen sales capability by integrating sales organization |

| | n | Lifecycle management: Start development of CS-8663 (formulation with amlodipine) and commence Phase III trials |

Europe

| | n | Begin selling Olmetec Plus (formulation with diuretic) at earliest opportunity |

| | n | ROADMAP trials (prevention of urine albumin) |

Japan

| | n | DAIICHI SANKYO team of 2,500 MRs begins providing information |

| | n | Lifecycle management: CS-866AZ (formulation with CALBLOCK), CS-866CMB (formulation with diuretic) under development |

| | n | ORIENT study (additional indications, chronic glomerulonephritis) |

Other

| | n | Expand alliance partnerships (including with Pfizer, Schering-Plough, Daewoong Pharmaceutical) |

7

Trends in Major Products and Future Strategies

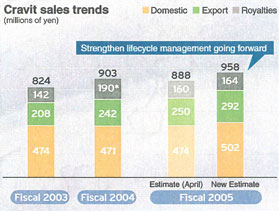

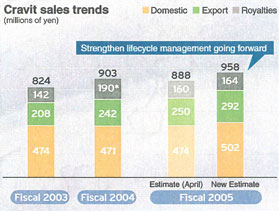

Cravit®

On the back of steady growth in bulk exports, sales ofCravit®are significantly above our target levels. Sales are also stable in the Japanese market, and we believe that sales will grow strongly in the future as well. We are taking steps to achieve even greater growth going forward.

US

| | n | Acute sinusitis indication added in August 2005 |

| | n | Short-term, high dosage therapy with 750mg formulation established for treating moderate pulmonary infections |

| | n | Promote use in treatment of urological disorders |

Europe

| | n | Established market evaluation for 500mg formulation as pulmonary infection treatment (double-digit YoY growth in Germany, France, Spain, etc.) |

| | n | Considering promotion of short-term, high dosage therapy based on 750mg formulation data in US |

Japan

| | n | Establish position as treatment of choice for pulmonary disorders by communicating combination of safety and efficacy |

| | n | Promote proper prescription based on evidence for high-risk and elderly patients |

Other

| | n | Promote lifecycle management projects |

| * | Due to a change in the accounting term for US patent royalties, in FY2004, this figure was calculated for 15 months. |

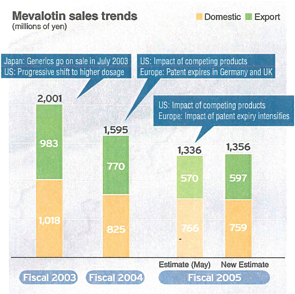

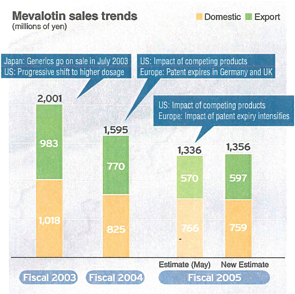

Mevalotin®

Following the expiration of patents worldwide, and the expiration of our US patent in April 2006, we expect sales from bulk exports to decline. In the domestic market, sales are declining as generic products entered the Japanese market in July 2003; competition is fierce, and drug prices were revised.

Amidst these circumstances, in November of 2005, the results of the largest-scale clinical trial “MEGA Study” were announced, establishing evidence unique to Japan. We are working to maintain domestic sales over the long-term by leveraging these results among other measures.

8

DAIICHI SANKYO Group Research & Development Pipeline

(Development Stage)

By integrating the two companies’ R&D pipelines, we were able to build a broad, seamless development pipeline that will continuously bring major new products to market, with a focus on cardiovascular diseases and glucose metabolic disorders, which were key domains of both companies. To begin, we are working to improve the efficiency of our R&D by quantifying each project in minute detail and assigning priorities to each product in the pipeline.

| | | | | | | | |

Region

| | Existing Product

| | Phase II

| | Phase III

| | Registration

|

Cardiovascular diseases |

| | | | |

EU/US | | Pravachol®/Mevalotin® Benicar®/Olmetec® WelChol® | | HGF DNA therapy (PAD: peripheral arterial diseases) DU-176b (oral factor Xa inhibitor) SUN 4936h (acute heart failure/licensed-out to Astellas Pharma US) | | CS-747 (anti-platelet agent) ¶CS-8663 (Olmesartan/Amlodipine combination) | | |

| | | | |

Japan | | Mevalotin®, Panaldine®, Artist®, Acecol®, Sunrythm®, Coversyl®, Olmetec®, Hanp®, Calblock®, Livalo®, Captoril®, Slonnon® | | ¶CS-866RN (Olmesartan/chronic glomerulonephritis) | | HGF DNA therapy (PAD: peripheral arterial diseases) ¶CS-866DM (Olmesartan/diabetic nephropathy) | | |

|

Glucose metabolic disorders |

| | | | |

EU/US | | | | CS-011 (antidiabetic/glitazone type)CS-917 (gluconeogenesis inhibitor) | | ¶WelChol (antidiabetic) SNK-860 (aldose reductase inhibitor/P3 preparation) | | |

| | | | |

Japan | | Fastic® | | | | | | |

|

Infectious diseases |

| | | | |

EU/US | | Levaquin®/Tavanic® Froxin Otic® Banan® | | DU-6859a (new quinolone/US) CS-023 (carbapenem antibiotic/licensed-out to Roche) | | | | SUN A0026 (penem-type antibiotic/registration preparation/licensed-out to Replidyne) |

| | | | |

Japan | | Cravit®, Carbenin®, Banan®, Tarivid® | | | | DU-6859a (new quinolone) | | DF-098 (Act-HIB/Hib vaccine) |

|

Cancer |

| | | | |

EU/US | | Camptoser® | | DJ-927 (anti-cancer/oral taxane deriv.) | | | | |

| | | | |

Japan | | Krestin® Topotecin® | | | | | | ¶CPT-11 (pancreatic cancer/Topotecin add indic.) |

|

Immunological allergic diseases |

| | | | |

Japan | | Zyrtec® | | CS-712 (cedar pollen pollinosis) | | IGE025 (anti-IgE antibody) | | |

| * | The table shows R&D pipeline after Phase II. |

| *¶ | means additional-indications, new formulations etc. |

| | |

Reference: |

| |

Phase I: | | Testing with a small number of healthy subjects to study such drug candidate characteristics as safety, absorption, diffusion, metabolism, and excretion. |

| |

Phase II: | | Testing a small number of patients to study usage methods, doses, and efficacy while continuing to give top priority to safety. |

| |

Phase III: | | Sometimes referred to as large-scale clinical testing, this involves testing with several hundred thousand patients to confirm efficacy and safety characteristics as well as usefulness (benefit/utility). Only candidates with confirmed usefulness are approved for manufacturing as new drug products. |

9

DAIICHI SANKYO Group Research & Development Pipeline

(Development Stage)

| | | | | | | | |

Region

| | Existing Product

| | Phase II

| | Phase III

| | Registration

|

| | | |

Bone/Joint diseases etc. | | | | | | |

| | | | |

EU/US | | Venofer® Evoxac® | | CS-706 (COX-2 inhibitor) SUN 4057 (acute ischemic stroke) CS-088 (antiglaucoma/licensed-out to Santen) | | SUN0588r (BH4-responsive hyperphenylalaninemia/ licensed-out to Biomarin) | | |

| | | | |

Japan | | Omnipaque®, Loxonin®, Kremezin®, Zantac®, Mobic®, Omniscan®, Feron®, Kelnac®, Neuer®, Evoxac®, Adenoscan® | | CS-088 (antiglaucoma/licensed-out to Santen) SUN E3001 (anti osteoporosis/licensed-out to Chugai) | | ¶CS-600G (loxoprofen gel/P3 preparation) SUN Y7017 (memantine/mild to moderate and severe dementia of Alzheimer’s type) CS-801 (pollakiuria and urinary incontinence) ¶DL-8234 (FERON add indic./hepatitis/with Ribavirin) ¶CS-1401E (pain relief during anesthesia) | | ¶LX-A (loxoprofen patch) Gabalon Intrathecal(approval) (ITB/lntrathecal Baclofen therapy) DD-723 (Sonazoid/ultrasound contrast media) KMD-3213 (silodosin/treatment of dysuria associated with benign prostatic hyperplasia) ¶DL-8234 (FERON add indic./liver cirrhosis) |

| | | | |

China | | | | KMD-3213 (silodosin/treatment of dysuria associated with benign prostatic hyperplasia) | | | | |

| |

| Number of projects at Phase I and preparation preclinical stage | | Total: 31 [Cardiovascular disease: 9, glucose metabolic disorders: 2, infectious diseases: 8, cancer: 3, immunological allergic diseases: 3, bone/joint diseases etc.: 6] |

Profile of Main Products under Development

| | | | | | | | | | | | | | | | |

Development Code Number

| | Generic Name

| | Dosage

Form/Route

| | Class/Indication

| | Origin

| | Region

| | Developer

| | Stage

| | Comments

|

| | | | | | | | |

| CS-747 | | Prasugrel®

| | Oral | | Ischemic disease

(Anti-platelet

agent) | | Sankyo,

Ube

Industries | | EU/US | | Sankyo,

Eli

Lilly | | P-III | | -In nonclinical trials, this antithrombotic drug exhibited stronger activity in inhibiting platelet aggregation and faster manifestation of activity compared to other drugs. -In clinical trials, it was confirmed that there were few differences among individuals in the inhibition of platelet aggregation. -Co-development with Eli Lilly in Europe and USA |

| �� | | | | | Japan | | Sankyo | | P-I | |

| |

| Point | | l In Phase III trialsl Covering 13,000 cases at 800 facilities in 25 countries |

| | | | | | | | |

| DU-176b | | — | | Oral | | Oral factor Xa

inhibitor | | Daiichi | | EU/US | | Daiichi | | P-II | | -An anticoagulant possessing anti-Xa activity, with confirmed high oral absorption within human trials. -Basic effectiveness and safety have been attained for prescribed dosage. |

| | | | | | | Japan | | Daiichi | | P-I | |

| |

| Point | | lInternational Society on Thrombosis and Haemostasis meeting (Sydney, August 2005)

l Efficacy and safety confirmed in a certain range of dose® Preparing for Phase IIb trials to determine optimum

dose, etc. |

| | | | | | | | |

| DJ-927 | | — | | Oral

Injection | | Cancer

chemotherapeutic

(Taxane deriv.) | | Daiichi | | EU/US | | Daiichi | | P-II | | -A taxane derivative anti-cancer agent available for oral administration. Shows a broader anti-tumor spectrum than the existing agents in the same class (docetaxcel, paclitaxcel), as well as reduced neurological toxicity in nonclinical trials. |

| | | | | | Japan | | Daiichi | | P-I | |

| |

| Point | | l Efficacy confirmed for colon, breast, and stomach cancers® Preparing for Phase IIb trials |

10

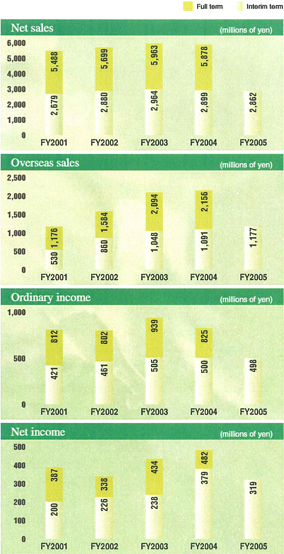

Results of Operation: Sankyo Company, Limited

Overview of Performance

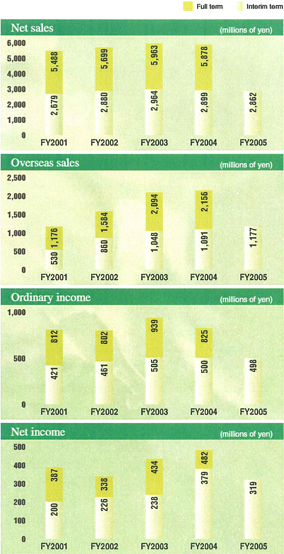

During the current interim period, the pharmaceutical industry remained marked by intense competition. Although the pharmaceutical market in the United States continues to expand, strengthening of measures to contain medical costs persists. In Japan, stricter steps to reduce medical expenditures are also being implemented to ensure the soundness of the national medical insurance system, resulting in tougher operating conditions for pharmaceutical companies despite its market’s status being as the second largest in the world. In addition, the effects of borderless markets and global competition, mainly amongst the mega-pharmaceutical companies in Europe and the United States, is becoming more prominent within the Japanese market, contributing to increasingly fierce competition amid a flat market growth.

Furthermore, sluggish market conditions and tougher competition in such related industries as health care, food products, and agrochemicals, are making the general operating environment extremely challenging in these segments.

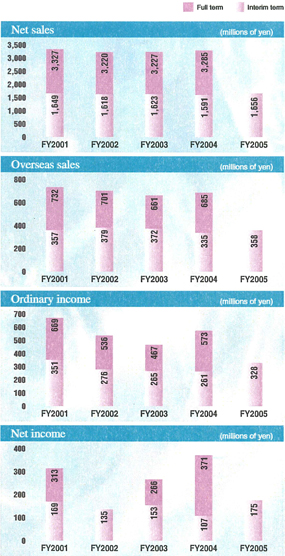

In the interim period, the Group’s sales declined by 1.3% as compared to the same period in the previous fiscal year, to ¥286.2 billion, operating income decreased by 2.2%, to ¥48.1 billion, ordinary income was down by 0.3%, to ¥49.8 billion, and net income was down by 15.8%, to ¥31.9 billion.

Robust growth in sales, in Japan, Europe and the United States, of our strategic global product, olmesartan, an antihypertensive agent, offered in the United States asBenicar®and in Europe and Japan asOlmetec®,partially offset lower sales of the flagship antihyperlipidemic agent,Mevalotin®;the transfer of sales ofEspo®,a drug for the treatment of renal anemia, andGran®,a drug for the treatment of leukopenia, to Kirin Brewery Co., Ltd.; and the exclusion of Nippon Daiya Valve Co., Ltd., and Sankyo Foods Co., Ltd., from the scope of consolidation. As a result, net sales declined only slightly.

Operating income and ordinary income decreased mainly due to lower sales, higher R&D expenses, and an increase in payments to our business partner as a result of the increased sales ofBenicar®.

Net income was down due to the aforementioned factors as well as an absence of ¥10.6 billion in extraordinary income from sale of land for the site of the Company’s former Tanashi Plant recorded in the same period in the previous fiscal year.

11

Results of Operation:

Sankyo Company, Limited

Segment Information

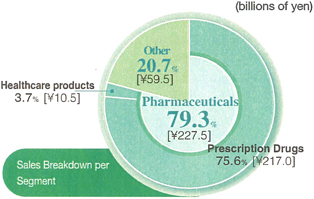

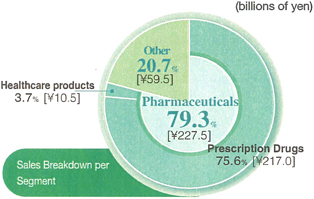

Net sales in the Pharmaceuticals segment totaled ¥227.5 billion, a 0.5% decline from the same period in the previous fiscal year, and operating income was ¥45.6 billion, down by 2.2%.

In Japan, sales of our top-priority strategic global product olmesartan – an antihypertensive agent sold asBenicar®in the United States and asOlmetec®in Europe and Japan – demonstrated solid growth, encouraged by the passage of a full year since the product’s May 2004 launch and the lifting of restrictions on long-term prescription. In addition, Sankyo Pharma Inc. continued to markedly expand sales of olmesartan in the United States under a co-promotion agreement with Forest Laboratories, Inc. In Europe, the Sankyo Pharma GmbH (SPG) Group also recorded higher sales of the agent, which it has been introducing sequentially in various European countries.

On the other hand, sales of the mainstay productMevalotin®,an antihyperlipidemic agent declined substantially, due to lower bulk exports of the product to Bristol-Myers Squibb Company, the expiration of the patent of the products for this agent in Europe, and intensifying competition in Japan and the United States. In addition, the transfer of sales ofEspo®,a drug for the treatment of renal anemia, andGran®,a drug for the treatment of leukopenia, to Kirin Brewery Co., Ltd. led to a slight decline in overall sales in the pharmaceutical segment.

Regarding healthcare products, sales reached ¥10.5 billion, a 6.1% YOY increase. This was largely due to the solid performance of our main product lines, includingLulu®andRegain®,and the success of our foot treatment drug,Lamisil AT®,which became the top brand in athlete’s foot treatment market.

Operating income declined, due mainly to higher R&D expenses, rising costs related to the business integration with Daiichi and an increased profit sharing with co-promotion partner Forest Laboratories as a result of expanded sales ofBenicar®.

Net sales in this segment dipped by 5.1% from the same period in the previous fiscal year, to ¥59.5 billion, and operating income rose by 2.6%, to ¥2.1 billion.

During the interim period, the Sankyo Group sold the stock of Nippon Daiya Valve and the business of Sankyo Foods as part of initiatives to increase its focus on the pharmaceutical business. As a result, these companies were excluded from the scope of consolidation, leading to a decline in sales.

Operating income rose as a result of ongoing efforts to improve operational efficiency through cost controls, review of unprofitable products, and other measures that offset an increase in the cost of raw materials for chemicals and other products due to skyrocketing oil prices.

| | |

| |  |

| Olmetec®, an antihypertensive agent | | Regain®, an energy drink |

12

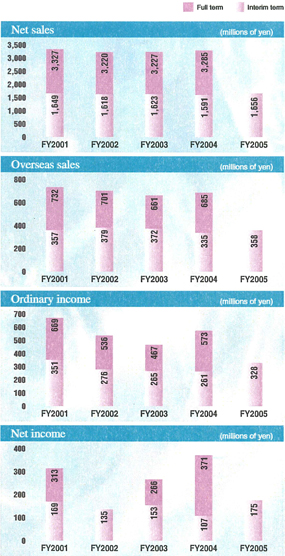

Results of Operation: Daiichi Pharmaceutical Co., Ltd.

Overview of Performance

During the current interim period, the world’s pharmaceutical markets were characterized by a further intensification of global competition amongst “global-mega” pharmaceutical companies in the areas of both new drug-related R&D and marketing activities. In Japan, the medical industry environment has continued to change, due to such factors as the reorganization of national university hospitals and other national hospitals into independent medical corporations. Under such environments, various measures intended to contain medical costs, including a growing application of the comprehensive hospital treatment evaluation system and an average 4.2% reduction in National Health Insurance (NHI) drug reimbursement prices implemented in April 2004, have caused the pharmaceutical market in Japan to remain depressed.

Despite such tough market conditions, the Daiichi Group has worked to expand the markets for its products while promoting appropriate drug use through a provision of information related to drug efficacy and safety. As a result, higher revenue from domestic sales of prescription drugs and an increase in bulk levofloxacin exports helped boost net sales to the interim record high level of ¥165.6 billion, up 4.1% from the interim period in the previous fiscal year. Regarding profitability, increased expenses related to the expansion of global R&D programs and preparations for business integration with Sankyo Company, Limited were offset by the increase in revenues and the reductions in cost of sales due to the start of operations of Daiichi Pharmatech Co., Ltd. As a result, double-digit increase was achieved in operating income and ordinary income. Operating income totaled ¥31.8 billion, up 27.1% from the previous interim period, and ordinary income amounted to ¥32.8 billion, up 25.4% from the previous interim period. Net income surged by 63.5% from the previous interim period to ¥17.5 billion, the record high level of net income for an interim six-month period.

The percentage of consolidated net sales derived from overseas operations was 21.7%.

13

Results of Operation:

Daiichi Pharmaceutical Co., Ltd.

Segment Information

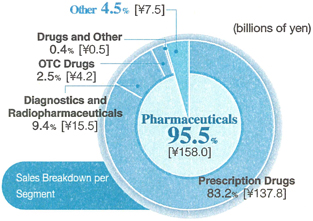

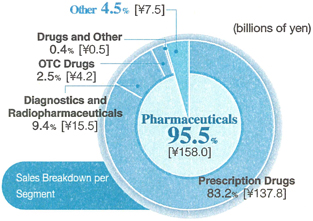

Prescription Drugs

The continuing impact of measures intended to reduce healthcare spending has caused tough conditions in the domestic prescription drug market to persist. However, an increase was recorded in sales of such products asCravit®,a mainstay broad-spectrum oral antibacterial agent;Artist®,a long-acting beta-blocker for treating high blood pressure, angina, and chronic cardiac insufficiency;Zyrtec®,an anti-allergy agent;Mobic®,a nonsteroidal anti-inflammatory agent;HANP®,an agent for treating acute cardiac insufficiency; andTopotecin®,an anticancer agent. As a result, total domestic prescription drug sales advanced by 6.2% from the previous interim period, to ¥104.8 billion. Moreover, in June 2005, the Company began marketingAdenoscan®,an adjunctive agent for myocardial scintigraphy imaging for which the government approval was obtained by Daiichi Suntory Pharma Co., Ltd.

Overseas prescription drug sales were positively affected by such factors as an increased bulk shipments of the antibacterial agent, levofloxacin, to the United States and Europe, a rise in patent licensing fees from principal licensees, and an increase in a U.S. subsidiary’s sales ofFLOXIN Otic®,an antibacterial quinolone solution for treating ear infections. Accordingly, overseas net sales of prescription drugs rose by 11.6% from the previous interim period to ¥33.0 billion.

Diagnostics and Radiopharmaceuticals

Although measures aimed at containing medical costs and intensifying competition have kept the market conditions challenging, the Company recorded increased domestic sales and exports of diagnostics products. However, a decrease in sales of radiopharmaceuticals products caused total net sales of diagnostics and radiopharmaceutical products to decline by 2.8% from the previous interim period to ¥15.5 billion.

OTC Drugs

Two new OTC drug products were launched in April 2005, but sales of two main OTC drug products – the hair-growth acceleratorKaroyan Gush®and the vitamin C productCystina C® – declined, due to such factors as the launch of new competing products by the competitors. Accordingly, OTC drug sales dropped by 24.7% from the previous interim period to ¥4.2 billion.

Although the profitability of fine chemicals operations was improved, a decrease in vitamin product sales primarily in North America and Europe and other factors caused net sales of fine chemical products to fall by 14.3% from the previous interim period to ¥5.6 billion. Total net sales in the other businesses segment, including fine chemicals, declined by 9.6% from the previous interim period, to ¥7.5 billion.

| | |

| |  |

| Cravit®, a broad-spectrum oral antibacterial agent | | Cystina C®, a vitamin C product |

14

Consolidated Financial Statements: DAIICHI SANKYO COMPANY, LIMITED

| | | |

Consolidated Balance Sheets | | (Millions of yen)

|

|

| | | September 30, 2005

| |

ASSETS | | | |

Current Assets | | 884,558 | |

| | |

|

|

Cash and time deposits | | 187,926 | |

Trade notes and accounts receivable | | 240,694 | |

Marketable securities | | 253,968 | |

Mortgage-backed securities | | 18,000 | |

Inventories | | 121,067 | |

Deferred tax assets | | 36,682 | |

Other current assets | | 27,085 | |

Allowance for doubtful accounts | | (866 | ) |

| | |

|

|

Non-current assets | | 634,134 | |

| | |

|

|

Property, plant and equipment | | 297,293 | |

Buildings and structures | | 165,823 | |

Machinery, equipment and vehicles | | 48,407 | |

Land | | 48,552 | |

Construction in progress | | 15,952 | |

Other | | 18,557 | |

Intangible assets | | 36,029 | |

Goodwill, net | | 10,964 | |

Other intangible assets, net | | 25,064 | |

Investments and other assets | | 300,811 | |

Investment securities | | 240,861 | |

Long-term loans | | 6,737 | |

Prepaid pension costs | | 15,028 | |

Deferred tax assets | | 14,795 | |

Other assets | | 24,022 | |

Allowance for doubtful accounts | | (635 | ) |

| | |

|

|

Total assets | | 1,518,692 | |

| | |

|

|

| | | | |

LIABILITIES | | | |

Current liabilities | | 233,271 | |

| | |

|

|

Trade notes and accounts payable | | 55,773 | |

Short-term bank loans | | 9,524 | |

Income taxes payable | | 27,103 | |

Deferred tax liabilities | | 321 | |

Allowance for sales returns | | 1,013 | |

Allowance for sales rebates | | 2,485 | |

Allowance for contingent losses | | 2,240 | |

Accrued expenses and other current liabilities | | 134,807 | |

| | |

|

|

Non-current liabilities | | 101,061 | |

| | |

|

|

Long-term debt | | 3,639 | |

Deferred tax liabilities | | 17,691 | |

Accrued retirement and severance benefits | | 70,225 | |

Accrued directors’ retirement and severance benefits | | 2,750 | |

Other non-current liabilities | | 6,754 | |

| | |

|

|

Total liabilities | | 334,333 | |

| | |

|

|

MINORITY INTERESTS | | | |

Minority interests | | 10,122 | |

| | |

|

|

SHAREHOLDERS’ EQUITY | | | |

Common stock | | 50,000 | |

Additional paid-in-capital | | 179,858 | |

Retained earnings | | 898,270 | |

Net unrealized gain on investment securities | | 61,612 | |

Foreign currency translation adjustments | | (5,755 | ) |

Treasury stock at cost | | (9,747 | ) |

| | |

|

|

Total shareholders’ equity | | 1,174,237 | |

| | |

|

|

Total liabilities, minority interests and shareholders’ equity | | 1,518,692 | |

| | |

|

|

Performance figures for the interim period include consolidated results of Sankyo and Daiichi from April 1 through September 30, 2005 as well as DAIICHI SANKYO’s non-consolidated results from September 28 through September 30, 2005.

15

Consolidated Financial Statements

DAIICHI SANKYO COMPANY, LIMITED

| | | |

Consolidated Statements of Income | | (Millions of yen)

|

|

| | | Six-months ended

September 30, 2005

| |

Net sales | | 451,808 | |

| | |

|

|

Cost of sales | | 141,296 | |

Gross profit | | 310,512 | |

Selling, general and administrative expenses | | 230,166 | |

| | |

|

|

Operating income | | 80,345 | |

| | |

|

|

Non-operating income | | 5,734 | |

Non-operating expenses | | 3,436 | |

| | |

|

|

Ordinary income | | 82,642 | |

| | |

|

|

Extraordinary gains | | 3,766 | |

Extraordinary losses | | 11,236 | |

Net income before income taxes and minority interests | | 75,172 | |

Income tax expense - current | | 27,439 | |

Income tax expense - deferred | | (1,516 | ) |

Minority interests in net losses of subsidiaries | | (201 | ) |

| | |

|

|

Net income | | 49,450 | |

| | |

|

|

| | | |

Consolidated Statements of Cash Flows | | (Millions of yen)

|

|

| | | Six-months ended

September 30, 2005

| |

Net cash provided by operating activities | | 66,237 | |

| | |

|

|

Net cash used in investing activities | | (24,596 | ) |

| | |

|

|

Net cash used in financing activities | | (37,253 | ) |

| | |

|

|

Effect of exchange rate changes on cash and cash equivalents | | 1,067 | |

Net increase in cash and cash equivalents | | 5,455 | |

Cash and cash equivalents, beginning of period | | 354,102 | |

Decrease in cash and cash equivalents due to changes in scope of consolidation | | (322 | ) |

| | |

|

|

Cash and cash equivalents, end of period | | 359,235 | |

| | |

|

|

As DAIICHI SANKYO was established on September 28, 2005, the Company is not able to provide an interim dividend in its first fiscal year. For this reason, on December 12, 2005 (Mon.), DAIICHI SANKYO will pay a transfer bonus of ¥25 per old share of Sankyo or Daiichi Pharmaceutical, to all Sankyo Company, Limited and Daiichi Pharmaceutical Co., Ltd. shareholders listed in the final register of shareholders on September 27, 2005, in lieu of an interim dividend. Please note that the Company plans to pay a fiscal year-end dividend of ¥25 per share to all those who are shareholders as of end-March 2006.

16

<For Reference>

Consolidated Financial Statements: Sankyo Company, Limited

| | | | | | |

| Consolidated Balance Sheets | | (Millions of yen)

| |

| | | September 30, 2005

| | | March 31, 2005

| |

ASSETS | | | | | | |

Current assets | | 595,699 | | | 606,067 | |

| | |

|

| |

|

|

Cash and time deposits | | 167,869 | | | 175,960 | |

Trade notes and accounts receivable | | 153,568 | | | 162,442 | |

Marketable securities | | 148,008 | | | 146,632 | |

Parent company stock | | 7,717 | | | — | |

Inventories | | 85,720 | | | 89,979 | |

Deferred tax assets | | 22,317 | | | 21,832 | |

Other current assets | | 11,320 | | | 9,704 | |

Allowance for doubtful accounts | | (823 | ) | | (483 | ) |

| | |

|

| |

|

|

Non-current assets | | 365,683 | | | 370,163 | |

| | |

|

| |

|

|

Property, plant and equipment | | 192,883 | | | 196,439 | |

Buildings and structures | | 111,104 | | | 111,966 | |

Machinery, equipment and vehicles | | 29,296 | | | 31,831 | |

Other | | 52,482 | | | 52,641 | |

Intangible assets | | 19,456 | | | 25,026 | |

Investments and other assets | | 153,344 | | | 148,696 | |

Investment securities | | 122,286 | | | 114,480 | |

Deferred tax assets | | 11,382 | | | 14,967 | |

Other assets | | 19,992 | | | 19,578 | |

Allowance for doubtful accounts | | (317 | ) | | (329 | ) |

| | |

|

| |

|

|

Total assets | | 961,383 | | | 976,230 | |

| | |

|

| |

|

|

| | |

LIABILITIES | | | | | | |

Current liabilities | | 144,140 | | | 173,712 | |

| | |

|

| |

|

|

Trade notes and accounts payable | | 40,334 | | | 54,435 | |

Short-term bank loans | | 9,515 | | | 16,699 | |

Income taxes payable | | 14,921 | | | 16,904 | |

Allowance | | 3,917 | | | 14,981 | |

Deferred tax liabilities | | 321 | | | 689 | |

Accrued expenses and other current liabilities | | 75,130 | | | 70,002 | |

| | |

|

| |

|

|

Non-current liabilities | | 75,306 | | | 76,495 | |

| | |

|

| |

|

|

Long-term debt | | 3,633 | | | 3,373 | |

Accrued retirement and severance benefits | | 65,405 | | | 66,843 | |

Deferred tax liabilities | | 1,047 | | | 441 | |

Other non-current liabilities | | 5,219 | | | 5,836 | |

| | |

|

| |

|

|

Total liabilities | | 219,447 | | | 250,208 | |

| | |

|

| |

|

|

MINORITY INTERESTS | | | | | | |

Minority interests | | 9,788 | | | 9,434 | |

| | |

|

| |

|

|

SHAREHOLDERS’ EQUITY | | | | | | |

Common stock | | 68,793 | | | 68,793 | |

Additional paid-in capital | | 66,862 | | | 66,862 | |

Retained earnings | | 565,267 | | | 580,514 | |

Net unrealized gain on investment securities | | 36,115 | | | 27,857 | |

Foreign currency translation adjustments | | (4,892 | ) | | (7,026 | ) |

Treasury stock at cost | | — | | | (20,412 | ) |

| | |

|

| |

|

|

Total shareholders’ equity | | 732,146 | | | 716,587 | |

| | |

|

| |

|

|

Total liabilities, minority interests and shareholders’ equity | | 961,383 | | | 976,230 | |

| | |

|

| |

|

|

| | | | | |

| Consolidated Statements of Income | | (Millions of yen)

|

| | | Six-months ended

September 30, 2005

| | | Six-months ended

September 30, 2004

|

Net sales | | 286,207 | | | 289,988 |

| | |

|

| |

|

Cost of sales | | 94,770 | | | 105,313 |

Gross profit | | 191,437 | | | 184,674 |

Selling, general and administrative expenses | | 143,336 | | | 135,515 |

| | |

|

| |

|

Operating income | | 48,101 | | | 49,159 |

| | |

|

| |

|

Non-operating income | | 4,260 | | | 3,464 |

Non-operating expenses | | 2,462 | | | 2,550 |

| | |

|

| |

|

Ordinary income | | 49,899 | | | 50,073 |

| | |

|

| |

|

Extraordinary gains | | 3,602 | | | 14,717 |

Extraordinary losses | | 8,486 | | | 3,855 |

Net income before taxes and minority interests | | 45,015 | | | 60,935 |

Income tax expense - current | | 15,321 | | | 20,885 |

Income tax expense - deferred | | (2,536 | ) | | 1,834 |

Minority interests in net income of subsidiaries | | 275 | | | 249 |

| | |

|

| |

|

Net income | | 31,953 | | | 37,965 |

| | |

|

| |

|

| | | | | | |

| Consolidated Statements of Cash Flows | | (Millions of yen)

| |

| | | Six-months ended

September 30, 2005

| | | Six-months ended

September 30, 2004

| |

Net cash provided by operating activities | | 36,993 | | | 57,817 | |

| | |

|

| |

|

|

Net cash (used in) provided by investing activities | | (10,283 | ) | | 2,466 | |

| | |

|

| |

|

|

Net cash used in financing activities | | (32,605 | ) | | (11,167 | ) |

| | |

|

| |

|

|

Effect of exchange rate changes on cash and cash equivalents | | 983 | | | 52 | |

Net (decrease) increase in cash and cash equivalents | | (4,911 | ) | | 49,169 | |

Cash and cash equivalents, beginning of period | | 262,530 | | | 194,789 | |

Decrease in cash and cash equivalents due to changes in scope of consolidation | | (314 | ) | | — | |

Increase in cash and cash equivalents due to merger with a non-consolidated subsidiary | | — | | | 144 | |

| | |

|

| |

|

|

Cash and cash equivalents, end of period | | 257,304 | | | 244,103 | |

| | |

|

| |

|

|

17

<For Reference>

Consolidated Financial Statements: Daiichi Pharmaceutical Co., Ltd.

| | | | | | |

| Consolidated Balance Sheets | | (Millions of yen)

| |

| | | September 30, 2005

| | | March 31, 2005

| |

ASSETS | | | | | | |

Current assets | | 300,819 | | | 299,836 | |

| | |

|

| |

|

|

Cash and time deposits | | 15,569 | | | 16,395 | |

Trade notes and accounts receivable | | 87,155 | | | 88,168 | |

Marketable securities | | 105,960 | | | 107,514 | |

Parent company stock | | 6,049 | | | — | |

Mortgage-backed securities | | 18,000 | | | 20,000 | |

Inventories | | 35,347 | | | 40,486 | |

Deferred tax assets | | 12,738 | | | 13,826 | |

Other current assets | | 20,041 | | | 13,496 | |

Allowance for doubtful accounts | | (43 | ) | | (50 | ) |

| | |

|

| |

|

|

Non-current assets | | 268,168 | | | 246,718 | |

| | |

|

| |

|

|

Property, plant and equipment | | 104,408 | | | 105,602 | |

Buildings and structures | | 54,718 | | | 55,969 | |

Machinery, equipment and vehicles | | 19,111 | | | 19,705 | |

Other | | 30,577 | | | 29,927 | |

Intangible assets | | 16,297 | | | 6,796 | |

Investments and other assets | | 147,463 | | | 134,319 | |

Investment securities | | 118,575 | | | 105,461 | |

Deferred tax assets | | 3,409 | | | 3,167 | |

Other assets | | 25,796 | | | 26,013 | |

Allowance for doubtful accounts | | (317 | ) | | (323 | ) |

| | |

|

| |

|

|

Total assets | | 568,987 | | | 546,555 | |

| | |

|

| |

|

|

| | |

LIABILITIES | | | | | | |

Current liabilities | | 71,536 | | | 74,339 | |

| | |

|

| |

|

|

Trade notes and accounts payable | | 15,438 | | | 17,182 | |

Short-term bank loans | | 9 | | | 18 | |

Income taxes payable | | 12,160 | | | 8,401 | |

Allowance | | 1,822 | | | 1,869 | |

Accrued expenses and other current liabilities | | 42,105 | | | 46,867 | |

| | |

|

| |

|

|

Non-current liabilities | | 25,754 | | | 22,070 | |

| | |

|

| |

|

|

Long-term debt | | 5 | | | 5 | |

Accrued retirement and severance benefits | | 4,819 | | | 4,754 | |

Deferred tax liabilities | | 16,644 | | | 9,791 | |

Other non-current liabilities | | 4,285 | | | 7,518 | |

| | |

|

| |

|

|

Total liabilities | | 97,291 | | | 96,409 | |

| | |

|

| |

|

|

MINORITY INTERESTS | | | | | | |

Minority Interests | | 333 | | | 1,582 | |

| | |

|

| |

|

|

SHAREHOLDERS’ EQUITY | | | | | | |

Common stock | | 45,246 | | | 45,246 | |

Additional paid-in-capital | | 48,961 | | | 49,130 | |

Retained earnings | | 350,131 | | | 376,144 | |

Net unrealized gain on investment securities | | 27,886 | | | 18,215 | |

Foreign currency translation adjustments | | (863 | ) | | (1,305 | ) |

Treasury stock at cost | | — | | | (38,867 | ) |

| | |

|

| |

|

|

Total shareholders’ equity | | 471,362 | | | 448,563 | |

| | |

|

| |

|

|

Total liabilities, minority interests and shareholders’ equity | | 568,987 | | | 546,555 | |

| | |

|

| |

|

|

| | | | | | |

| Consolidated Statements of Income | | (Millions of yen)

| |

| | | Six-months ended

September 30, 2005

| | | Six-months ended

September 30, 2004

| |

Net sales | | 165,667 | | | 159,139 | |

| | |

|

| |

|

|

Cost of sales | | 46,527 | | | 49,207 | |

Gross profit | | 119,139 | | | 109,931 | |

Selling, general and administrative expenses | | 87,330 | | | 84,911 | |

| | |

|

| |

|

|

Operating income | | 31,809 | | | 25,019 | |

| | |

|

| |

|

|

Non-operating income | | 1,622 | | | 1,570 | |

Non-operating expenses | | 613 | | | 414 | |

| | |

|

| |

|

|

Ordinary income | | 32,818 | | | 26,175 | |

| | |

|

| |

|

|

Extraordinary gains | | 163 | | | 1,124 | |

Extraordinary losses | | 2,749 | | | 8,142 | |

Net income before income taxes and minority interests | | 30,232 | | | 19,158 | |

Income tax expense - current | | 12,095 | | | 10,087 | |

Income tax expense - deferred | | 1,019 | | | (1,207 | ) |

Minority interests in net losses of subsidiaries | | (477 | ) | | (484 | ) |

| | |

|

| |

|

|

Net income | | 17,594 | | | 10,762 | |

| | |

|

| |

|

|

| | | | | | |

| Consolidated Statements of Cash Flows | | (Millions of yen)

| |

| | | Six-months ended

September 30, 2005

| | | Six-months ended

September 30, 2004

| |

Net cash provided by operating activities | | 24,893 | | | 17,363 | |

| | |

|

| |

|

|

Net cash used in investing activities | | (14,312 | ) | | (17,923 | ) |

| | |

|

| |

|

|

Net cash used in financing activities | | (4,784 | ) | | (8,294 | ) |

| | |

|

| |

|

|

Effect of exchange rate changes on cash and cash equivalents | | 84 | | | 147 | |

Net increase (decrease) in cash and cash equivalents | | 5,879 | | | (8,706 | ) |

Cash and cash equivalents, beginning of period | | 91,571 | | | 90,346 | |

Decrease in cash and cash equivalents due to changes in scope of consolidation | | (8 | ) | | — | |

| | |

|

| |

|

|

Cash and cash equivalents, end of period | | 97,443 | | | 81,640 | |

| | |

|

| |

|

|

18

DAIICHI SANKYO COMPANY, LIMITED:

Forecast of Consolidated Results for Fiscal 2005

| | | | |

| Net sales | | Ordinary income | | Net income |

| 900 billion yen | | 130 billion yen | | 71 billion yen |

DAIICHI SANKYO expects market conditions to remain challenging in Japan and overseas during the current fiscal year. Under such environment, the DAIICHI SANKYO Group will mobilize its marketing force to establish a solid market presence and strengthen its revenue base.

As for sales, in Japan, DAIICHI SANKYO will strive to expand revenues by leveraging its overwhelming marketing strength to reinforce efforts to promote such flagship products as the antihyperlipidemic agent,Mevalotin®,the broad-spectrum oral antibacterial agent,Cravit®,and the antihypertensive agent,Olmetec®as well as developing effective logistics strategies. In particular, the Company aims to achieve sales growth and greater market shares with respect toOlmetec®through the collaborative marketing activities of Sankyo and Daiichi, which have begun in October 2005.

Overseas, DAIICHI SANKYO will work closely with business partners, continuing to focus on such mainstay products as bulk pravastatin, an antihyperlipidemic agent, and bulk levofloxacin, an antibacterial agent, while concentrating resources on expanding sales of the antihypertensive agent,Benicar®(U.S.)/Olmetec® (Europe).

Regarding profitability, DAIICHI SANKYO will continue to make focused, ongoing investments in R&D and anticipates expenses related to the business integration to increase during the fiscal year. However, the DAIICHI SANKYO Group companies will continue to move forward with business reforms and make concerted efforts to reduce costs and curb operating expenses to establish solid profitability and enhance management efficiency.

Notes Concerning Future Forecasts

Figures from future forecasts and the like in this document are judgments and hypotheses made by DAIICHI SANKYO based on information available to us as of this writing. These figures include elements of risk and uncertainty. Consequently, it is possible that actual performance and other figures will differ from these forecasts.

19

Corporate Data(as of September 30, 2005)

Company Name

DAIICHI SANKYO COMPANY, LIMITED

Business

Management and administration of wholly-owned subsidiaries and the Group, and related matters

Head Office

3-5-1, Nihombashi-honcho, Chuo-ku, Tokyo 103-8426, Japan

Employees

67

| | |

Board of Directors (as of September 30, 2005) | | |

| |

Representative Director and Chairman | | Kiyoshi Morita |

Representative Director and President | | Takashi Shoda |

Executive Director | | Hiroyuki Nagasako |

Executive Director | | Hideho Kawamura |

Executive Director | | Yasuhiro Ikegami |

Executive Director | | Tsutomu Une |

Outside Director | | Kunio Nihira |

Outside Director | | Yoshifumi Nishikawa |

Outside Director | | Jotaro Yabe |

Outside Director | | Katsuyuki Sugita |

Auditor (Internal) | | Kozo Wada |

Auditor (Internal) | | Atsuo Inoue |

Auditor (External) | | Kaoru Shimada |

Auditor (External) | | Koukei Higuchi |

Outline of Subsidiaries

| | | | |

| | |  | |  |

Founded | | 1913 | | 1918 |

| | |

Head Office | | 3-5-1, Nihombashi-honcho, Chuo-ku, Tokyo 103-8426, Japan | | 3-14-10, Nihombashi, Chuo-ku, Tokyo 103-8234, Japan |

| | |

R&D Base | | Tokyo (Shinagawa-ku) and other locations | | Tokyo (Edogawa-ku), Daiichi Asubio Pharma Co., Ltd. (Mishima-gun, Osaka) |

| | |

Marketing Base | | Nationwide | | Nationwide |

| | |

Manufacturing Base | | Onahama, Hiratsuka, Odawara, Osaka | | Daiichi Pharmatech Co., Ltd. (Osaka, Shizuoka, Akita) |

| | |

Main Pharmaceuticals | | | | |

| | |

Cardiovascular | | Mevalotin® (Antihyperlipidemic Agent) Olmetec® (Antihypertensive Agent) Livalo® (Antihyperlipidemic Agent) Acecol® (Antihypertensive Agent) Calblock® (Antihypertensive Agent) | | Panaldine® (Anti-Platelet Agent) Artist® (Antihypertensive Agent) Coversyl® (Antihypertensive Agent) Sunrythm® (Antiarrhythmic) Hanp® (Agent For Treating Acute Cardiac Insufficiency) |

| | |

Infection | | Banan® (Antibiotic) Carbenin® (Antibiotic) | | Cravit® (Oral Antibacterial Agent) |

| | |

Other | | Kremezin® (Agent For Chronic Kidney Failure) Loxonin® (Pain Relief, Anti-Inflammatory, Antifebrile) Fastic® (Hypoglycemic Agent) | | Zyrtec® (Anti-Allergy Agent) Mobic® (A Nonsteroidal Anti-Inflammatory Agent) Omnipaque® (X-Ray Contrast Agent) |

20

About Our Shares

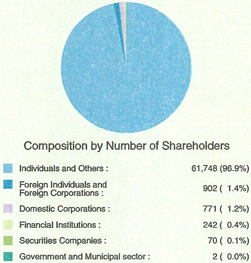

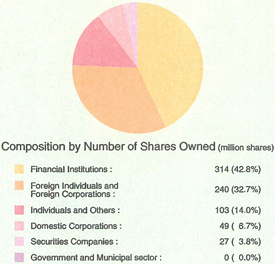

Share Information(as of September 27, 2005)

| | |

n Authorized Capital | | 2,800,000,000 shares |

| |

n Issued Shares | | 735,011,343 shares |

| |

n Number of Shares Constituting One Unit | | 100 shares |

| |

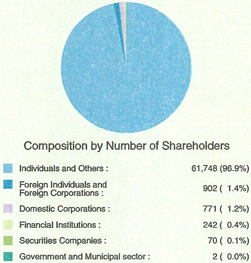

n Number of Shareholders | | 63,735 |

| |

(Simple total of Sankyo and Daiichi as of September 27, 2005) | | |

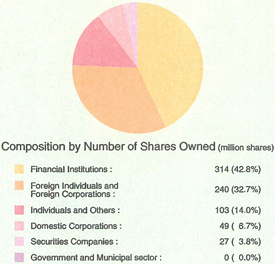

Ownership Profile

| Note: | The composition of shareholders and the list of major shareholders are prepared based on the register of shareholders of Sankyo Co., Ltd. and Daiichi Pharmaceutical Co., Ltd. as of September 27, 2005, reflecting their respective share transfer ratio. |

Major Shareholders

| | | | |

Shareholder’s Name

| | No. of Shares Held

| | Shareholding Ratio (%)

|

The Master Trust Bank of Japan, Ltd. (Trust Account) | | 43,241,457 | | 5.88 |

Japan Trustee Services Bank, Ltd. (Trustee Account) | | 42,909,743 | | 5.84 |

Nippon Life Insurance Company | | 41,839,182 | | 5.69 |

Sumitomo Mitsui Banking Corporation | | 13,413,368 | | 1.82 |

Nomura Securities Co., Ltd. | | 13,341,252 | | 1.82 |

The Chase Manhattan Bank NA London SL Omnibus Account | | 12,441,873 | | 1.69 |

Mellon Bank Treaty Clients Omnibus | | 9,957,748 | | 1.35 |

BNP Paribas Securities (Japan) Ltd. (BNP Paribas Securities Corp.) | | 9,585,139 | | 1.30 |

The Bank of Tokyo-Mitsubishi, Ltd. | | 9,468,983 | | 1.29 |

Tokio Marine & Nichido Fire Insurance Co., Ltd. | | 9,328,109 | | 1.27 |

21

Administrative Share Procedures

Our stock transfer agent is Mitsubishi UFJ Trust and Banking Corporation.

1. Issuance of New Share Certificates for DAIICHI SANKYO COMPANY, LIMITED

We sent a Notification of Stock Split Due to Share Transfer to persons submitting their share certificates by the submission deadline (Tuesday, September 27, 2005), to the addresses specified by them. If you have shares in a securities depository system, the allocated split shares are treated as if they were entrusted to the securities firm with which you do business as of the date of share transfer (Wednesday, September 28, 2005).

If you have shares that you were unable to submit by the deadline, Sankyo and Daiichi Pharmaceutical began procedures to exchange their share certificates for new ones on November 16, 2005 (Wed.). Please apply to exchange your certificates for new ones at the offices of the transfer agent listed below, or one of the listed stock exchanges.

2. Requests for Purchase of Fractional Stocks to Make up Whole Units

As of December 1, 2005 (Thu.), we began accepting requests by shareholders to purchase fractional stocks in order to make up whole units. Please note that if the requests we receive for such purchases on a given day exceed the volume of treasury stock we hold, we will be unable to handle the request. For this reason, please contact the transfer agent ahead of time if you wish to make such a purchase.

| | | | |

| Shareholder Information | | | | |

| |

Fiscal year-end date | | March 31 |

| |

Dates for dividend payment | | March 31 (Year-end) September 30 (Interim) |

| |

Annual General Meeting of Shareholders | | June each year |

| |

Number of shares constituting one unit | | 100 shares |

| |

Newspaper in which public announcements appear | | Nihon Keizai Shimbun (In lieu of advertising its results, the Company has posted its Balance Sheet and Statements of Income on its website at http://www.daiichisankyo.co.jp/) |

| |

Stock Exchange Listings | | First Section of Tokyo, Osaka and Nagoya |

| |

Stock Transfer Agent | | Mitsubishi UFJ Trust Banking Corporation |

| |

Transfer Handling Office | | Mitsubishi UFJ Trust Banking Corporation, Stock Transfer Agent Department |

| |

| | | 1-4-5, Marunouchi, Chiyoda-ku, Tokyo |

| |

Mailing Address | | Mitsubishi UFJ Trust Banking Corporation, Stock Transfer Agent Department |

| |

| | | 7-10-11, Higashisuna, Koto-ku, Tokyo 137-8081 |

| |

Other Points of Contact | | All branches of Mitsubishi UFJ Trust Banking Corporation nationwide |

| |

| | | Head office and all branches of Nomura Securities Co., Ltd. nationwide |

| * | You can receive dividends either through a “Postal Transfer Payment” or by direct remittance to your bank or postal savings account. |

22

|

|

| |

DAIICHI SANKYO CO., LTD. DAIICHI SANKYO CO., LTD. |

|

http://www.daiichisankyo.co.jp/ 3-5-1, Nihombashi-honcho, Chuo-ku, Tokyo 103-8426, Japan <Contact> Corporate Communications Department TEL. +81-3-6225-1126 FAX. +81-3-6225-1132 |

DAIICHI SANKYO CO., LTD.

DAIICHI SANKYO CO., LTD.