Exhibit 99.2

1

2

Message to Shareholders

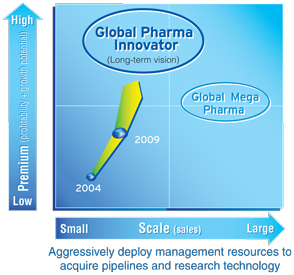

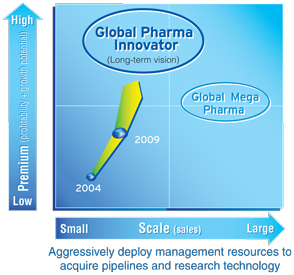

Our growth-related goals at DAIICHI SANKYO are not concerned merely with achieving greater scale in sales terms. We also aim to develop a continuous stream of innovative prescription drugs to forge a leading presence in key therapeutic areas so that we can take dramatic steps forward, evolving into a premier company that achieves high profits and strong growth.

With the establishment on September 28, 2005 of the joint holding company DAIICHI SANKYO COMPANY, LIMITED, we took a first step on the challenging road toward becoming a “Global Pharma Innovator Originating in Japan.”

Prior to the integration, both Daiichi and Sankyo ranked high in the Japanese pharmaceuticals industry as companies that had grown by virtue of their ability to develop innovative prescription drugs. Going forward, however, achieving an influential position in the global marketplace will require more advanced and innovative drug development, combined with highly efficient operations.

The decision to integrate our combined resources reflects a desire to achieve high earnings growth by creating a competitive advantage exceeding the value of our existing operations in Japan and overseas. In so doing, we aim to maximize our corporate value for the benefit of all our stakeholders (shareholders, customers, employees and society at large). Our integration schedule is on course, and we are making steady progress in the optimization of our systems and structures.

We continue to pursue business development goals from both micro and macro perspectives with the aim of creating innovative products and services that meet the needs of patients and medical professionals. We ask our shareholders for their continuing support and understanding.

3

Faster Development of Innovative Prescription Drugs by Maximizing Synergies to Become a “Global Pharma Innovator Originating in Japan”

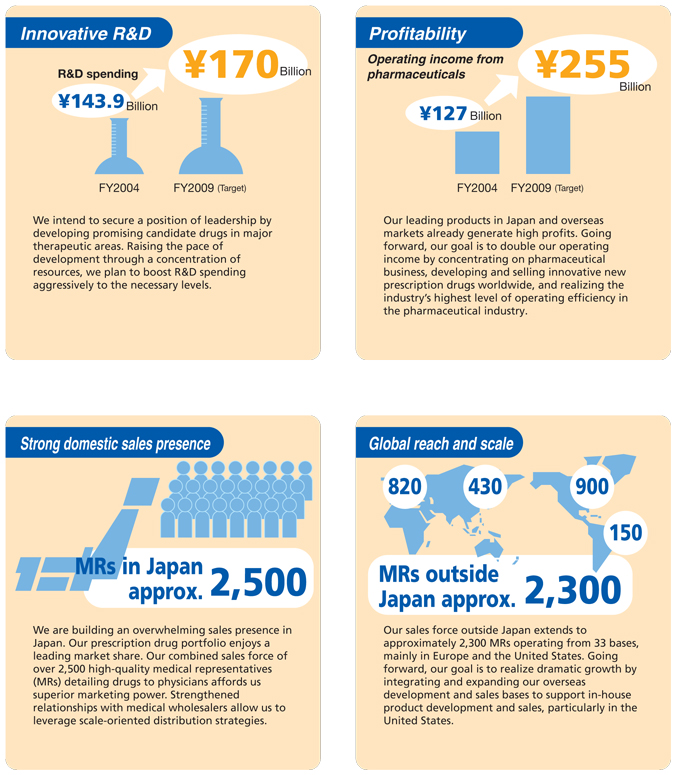

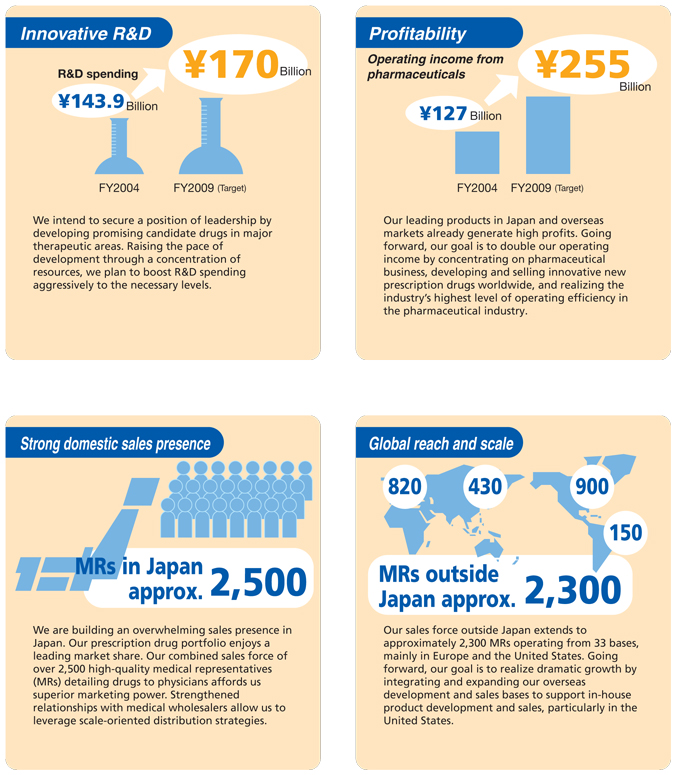

Enhanced R&D capabilities and faster processes

R&D spending rising to ¥170 billion (fiscal 2009 target) to fund expanded drug discovery capabilities

Synergies generated since September 2005, in just the first six months of the integration process, in terms of higher sales and lower costs are projected to boost our consolidated operating income from pharmaceuticals by ¥67 billion in fiscal 2007 and ¥93 billion in fiscal 2009. DAIICHI SANKYO plans to use these substantial synergy generated gains to raise investment in R&D in pursuit of the goal of becoming a “Global Pharma Innovator.” We anticipate a rise in R&D spending from ¥158.7 billion in the year ended March 2006 to ¥170 billion by fiscal 2009.

Selection of five top-priority drug R&D projects

The merger has created a rich drug development pipeline that is expected to yield a continuous stream of major product launches, notably in key therapeutic areas. The Global Executive Meeting of Research and Development (GEMRAD), a new in-house body responsible for global R&D decisions, conducted a priority evaluation of the drug pipeline, as a result of which work is now proceeding on five top-priority clinical development projects. In the cardiovascular therapeutic area, the compounds concerned include prasugrel (CS-747), an anti-platelet agent; DU-176b, a factor-Xa-inhibiting anticoagulant; CS-8663, a combination drug containing the antihypertensives olmesartan and amlodipine; and DZ-697b, an anti-platelet agent. The fifth priority project is DJ-927, a taxane derivative (anti-cancer agent). Going forward, the emphasis will remain on achieving effective use of our R&D resources by focusing smooth decision-making capabilities on project prioritization.

Prioritized Development Projects

| | | | |

Project name | | Drug type, planned

indication, etc. | | |

Prasugrel (CS-747) | | Anti-platelet agent | | A platelet aggregation inhibitor under co-development with Eli Lilly and Co., prasugrel exhibited strong inhibition of platelet aggregation in Phase I studies. It has also demonstrated stable clinical effects with fast onset. An NDA filing is planned for the second half of 2007. |

| | |

DU-176b | | Anticoagulant (factor Xa inhibitor) | | An anticoagulant that works by inhibiting factor Xa, DU-176b has demonstrated dose-dependent suppression of thrombin production in human volunteers with oral administration. A clinical data is consistent with preclinical data including toxicogenomics that suggests a low risk of hepatotoxity. Preparations for Phase IIb clinical studies are now under way. Planned indications are prevention of cardiogenic cerebral infarction associated with atrial fibrillation and prevention and treatment of venous thromboembolism. |

| | |

CS-8663 | | Combination drug con-taining olmesartan and amlodipine | | This is a combination drug combining olmesartan, an angiotensin II receptor inhibitor, with the calcium blocker amlodipine. Phase III clinical trials are under way to establish the efficacy of CS-8663 as a second-line treatment in patients with hypertension who are insufficiently responsive to monotherapy. |

| | |

DJ-927 | | Taxane derivative (anti- cancer agent) | | A next-generation taxane derivative, this anti-cancer agent has demonstrated superior efficacy against tumors with oral administration together with low rates of elimination, as well as activity against colon cancer and other refractory tumors showing resistance to multiple drugs. Evidence points to a reduced risk of peripheral neurotoxicity. |

| | |

DZ-697b | | Anti-platelet agent | | DZ-697b exhibits fast-onset and long-acting suppression of platelet aggregation stimulated by collagen, ristocetin or shear stress. It is not accompanied by any increase in bleeding time, even at high doses. The mechanism of platelet aggregation inhibition is novel. FDA consent has been obtained to conduct clinical trials for stroke and cardiovascular conditions. Possible major indications include stroke, acute coronary disorders and microcirculatory blockage. |

4

Building Global Competitiveness and Profitability Through a Strong Integrated DAIICHI SANKYO Presence

Global development strategy

Integration of sales and development bases to boost the global presence

Integration of the two companies’ business operations and drug development capabilities around the world is critical for boosting the presence of DAIICHI SANKYO in the global market. Integration of sales, marketing and development operations in the United States and Europe was completed in April 2006. In the United States, sales and marketing operations have been consolidated at the head office in Parsippany, New Jersey, while integrated development operations are now based in Edison, New Jersey. In Europe, development operations are based in London. We also have sales bases throughout the European market, with the sales and marketing headquarters located in Munich, Germany. Our global sales force outside Japan of approximately 2,300 highly qualified MRs is well placed to target customers in all our major markets with high-quality detailing activities.

Targeting significant gains in profitability overseas through in-house development and sales

Out-licensing, co-development and in-house development are all valid methods for developing prescription drug operations. The first two approaches rely on making use of other companies’ resources to develop and sell products. These methods are commonly used within the industry to secure early market share gains for a drug or to avoid development and sales risk. From the perspective of return on investment, however, the in-house route (developing and marketing the product using only internal resources) is the most effective for generating profits. Despite our development of industry-leading innovative drugs such as Mevalotin® and Cravit®, a lack of scale in terms of overseas operations has historically prevented us from choosing the potentially most profitable option of in-house development and sales. The integration will make the in-house route a viable option in overseas markets, opening the door to a global strategy that we expect to make a significant contribution to dramatically increased profitability.

5

Maximizing Sales Power in the Japanese Market

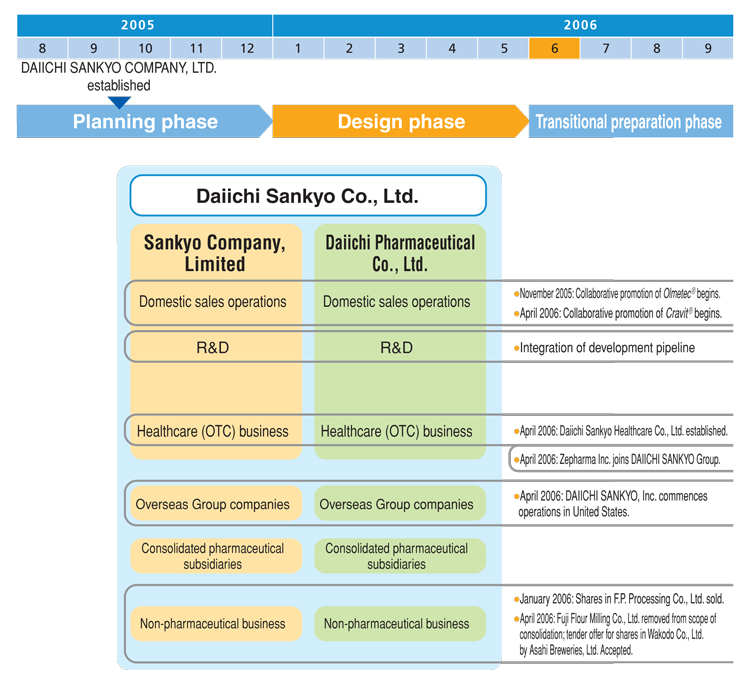

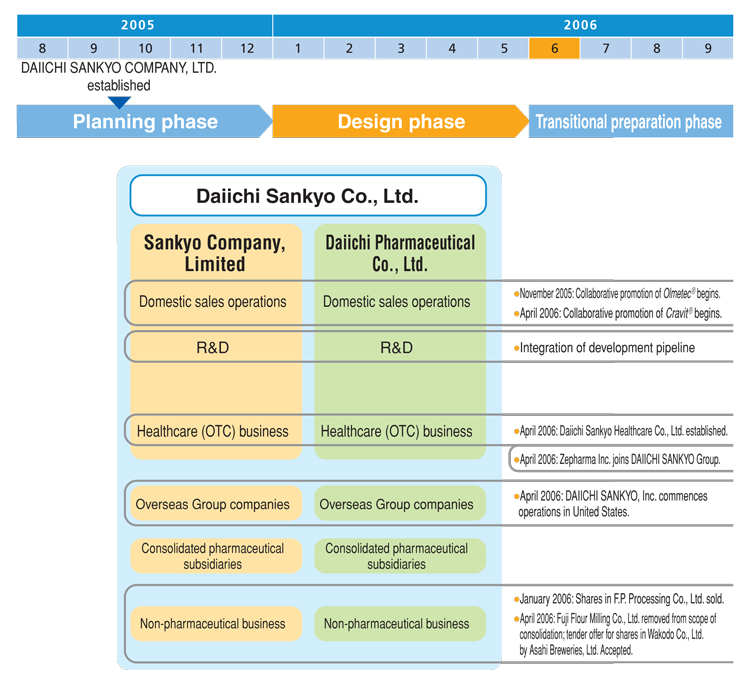

Domestic sales collaboration initiated with joint promotional activities for Olmetec® and Cravit®

We regard the establishment of effective systems for sales collaboration in the Japanese market as important to realizing synergies from the integration quickly. Sankyo and Daiichi Pharmaceutical initiated a system of full-scale sales cooperation in October 2005. In November 2005, Daiichi MRs began detailing one of Sankyo’s leading products, the antihypertensive agent Olmetec®. This arrangement focuses a total of 2,500 MRs from the DAIICHI SANKYO Group on promoting sales of this drug. Field reports suggest that these joint promotional activities are already generating many new prescriptions. Such results promise to translate into a steadily increasing sales presence within the Japanese market. Joint promotional activities for Cravit®, a broad-spectrum oral antibacterial agent that is one of Daiichi’s leading products, began in April 2006. Going forward, we plan to continue developing sales collaboration between the two companies to achieve further gains in performance.

Growth potential inherent in attaining top-class sales among major Japanese pharmaceutical makers

DAIICHI SANKYO has many top-selling prescription drugs in the Japanese market. Domestic sales in the year ended March 2005, including exports, were ¥143.2 billion for the antihyperlipidemic agent Mevalotin®, for example, and ¥97.6 billion for Cravit®. Sales of the x-ray contrast medium Omnipaque® totaled ¥34.7 billion. We expect to generate more growth in sales of such leading products as the integration process produces expanded and more effective sales capabilities in Japan. Our core focus is less on increasing overall sales volumes, however, than on boosting the profitability and growth potential of our operations from a long-term perspective. These goals lie at the heart of our drive to become a “Global Pharma Innovator.” Going forward, we plan to devote efforts to accelerating the gains in efficiency and market power we are deriving from the integration.

6

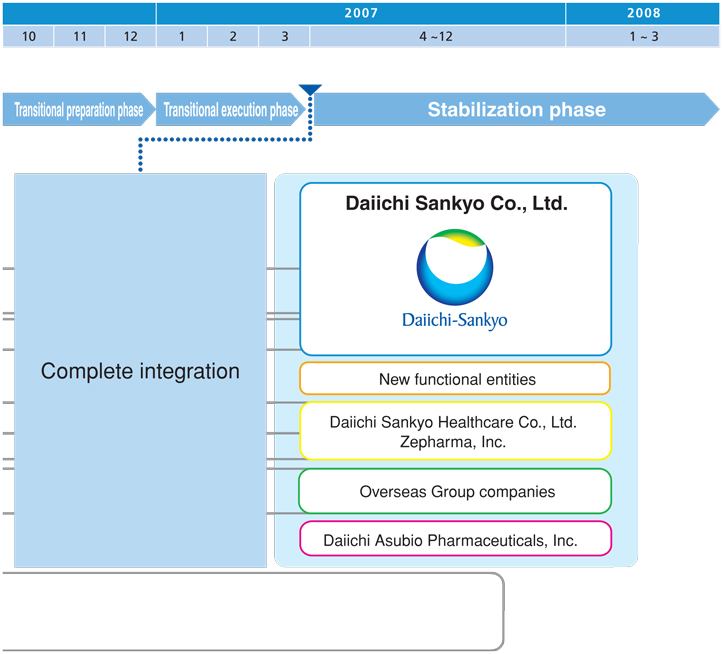

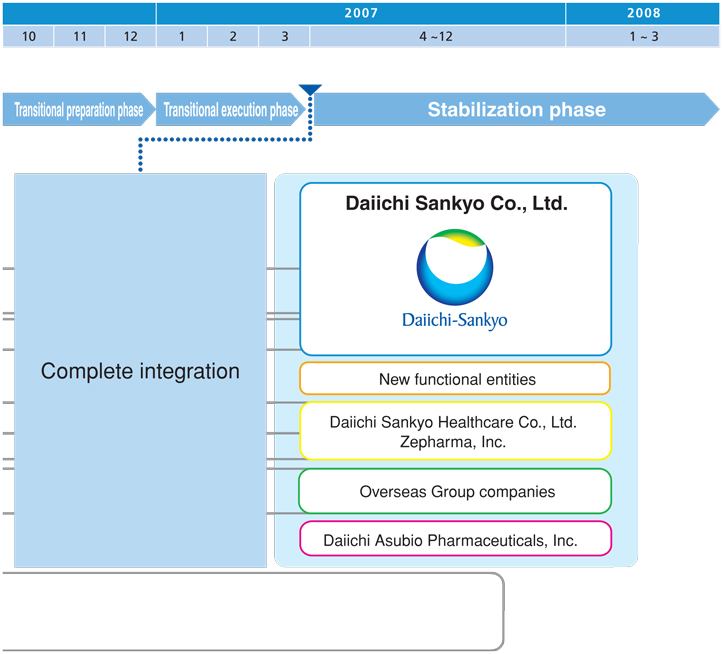

Integration Progress

We have pressed ahead with the most actionable integration issues, completing a number of moves (marked by circles in the chart below) by April 2006. Based on a process that is divided into a number of phases, full integration of operations remains on schedule to finish in March 2007.

7

8

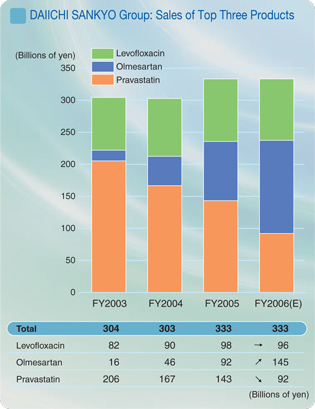

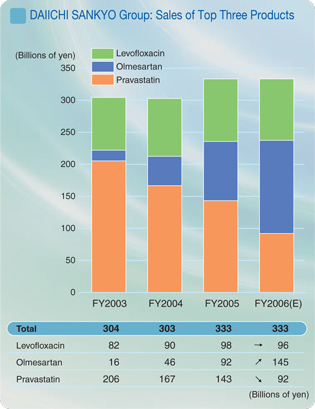

Trends in Major Products

Top Three Products

The DAIICHI SANKYO prescription drug portfolio ranks among the finest in the industry. Many products in the lineup are strong sellers and highly competitive. The drugs positioned as our top products are expected to play particularly important roles in our future strategic and business development. By solidifying our earnings base, these “core products” promise to provide a strong basis for future growth.

Cravit®

The broad-spectrum oral antibacterial Cravit® (generic name: levofloxacin) is an orally active antibiotic of the new quinolone type that is widely recognized as offering superior efficacy along with excellent safety characteristics. Since its launch in Japan in 1993, its powerful antibacterial action and broad range of indications have established it as an effective first-line choice for physicians in treating many infections. It is currently sold in 115 countries*1 worldwide. The cumulative number of patients treated with Cravit® now exceeds 400 million.

Cravit® is positioned particularly strongly as a respiratory quinolone*2. Its success in treating pulmonary infections has been extensively documented in the medical literature, which supports its widespread use in many medical settings. In terms of sales, Cravit® remains one of the leading new quinolones on the market.

| *1: | This figure includes countries in Western and other markets where alliance partners sell the drug under a different brand name. |

| *2: | A quinolone-type antibacterial that is highly effective against pulmonary infections such as pneumonia. |

9

Olmetec®

The antihypertensive agent Olmetec® (generic name: olmesartan), which is sold under this brand name in Japan and Europe and as Benicar® in North America, is an angiotensin II receptor inhibitor. Compared to other drugs in its class, it has a powerful ability to lower blood pressure and a superior organ-protective effect.

Angiotensin II receptor inhibitors are a relatively novel form of antihypertensive drug therapy. Global sales for this class of drug are growing rapidly due to the combination of a powerful reduction in blood pressure with superior safety.

Olmesartan was launched in the U.S. market in May 2002, and has since been launched in Germany (October 2002) and Japan (May 2004) as well. It is currently sold in 36 countries worldwide. Sales are handled by DAIICHI SANKYO, Inc. in the United States and by another subsidiary, Sankyo Pharma GmbH, in Europe. Global sales in the year ended March 2006 exceeded ¥90 billion. Our goal is to increase this figure to ¥200 billion as quickly as possible.

Mevalotin®

At its launch in 1989, the antihyperlipidemic agent Mevalotin® (generic name: pravastatin) was the first HMG-CoA reductase inhibitor in the world. It has since played a major role in treating people with high cholesterol levels, thus helping to prevent myocardial infarction. It is sold in approximately 100 countries worldwide. In November 2005, the results of a large-scale clinical trial (“MEGA Study”) involving Japanese patients were published, adding to the weight of evi-dence*3 of its benefits. This study provided further support for the high efficacy and excellent safety profile of Mevalotin®.

Our patents for Mevalotin® have now expired in major markets, however, including Japan, Europe and the United States (most recently, in April 2006). Going forward, as one of the leaders in the field of hyperlipi-demia, DAIICHI SANKYO plans to leverage its accumulated expertise and clinical trial data to continue to provide the market with high-quality information on the use of this drug, focusing primarily on Japan.

| *3: | There is extensive academic literature on this drug that has been presented in papers at scientific meetings or published in journals. |

10

The Present Status of Research and Development

Research & Development Pipeline (Development Stage)

The full integration of our development pipeline management promises to significantly boost the speed of decision-making, facilitating the setting of priorities for compounds in development. By maximizing our technical and cost-related synergies, moreover, we will continue to improve the efficiency of our R&D activities in the core therapeutic areas of cardiovascular diseases, glucose metabolic disorders, infectious diseases and cancer. This will, in turn, enable us to bring to market potential blockbuster drugs faster than our competitors.

| | |

| | *The table shows R&D pipeline after Phase II. |

| | ** means additional-indications, new formulations etc. |

| | | | | | | | |

Region | | Main Existing Product | | Phase II | | Phase III | | Application/Approval, Launch |

| Cardiovascular diseases |

| | | | |

EU/US | | Pravachol / Mevalotin Benicar / Olmetec WelChol | | HGF DNA therapy(Peripheral arterial diseases) DU-176b (Oral factor Xa inhibitor) SUN 4936h (Acute heart failure/licensed

-out to Astellas US) CS-9803 (Delta PKC inhibitor) | | CS-747 (Anti-platelet agent) * CS-8663 (Olmesartan/Amlodipine combination) | | |

| | | | |

Japan | | Mevalotin, Panaldine, Artist, Acecol, Sunrythm, Coversyl, Olmetec, Hanp, Calblock, Livalo, Captoril, Slonnon | | DU-176b (Oral factor Xa inhibitor) * CS-866RN (Olmesartan/chronic glomerulonephritis) * CS-866CMB (Olmesartan /Hydrochlorotiazide combination) * CS-866AZ (Olmesartan/Azelnidipine combination) | | HGF DNA therapy (Peripheral arterial diseases) * CS-866DM (Olmesartan/diabetic nephropathy) | | |

| | |

| Glucose metabolic disorders | | | | |

| | | | |

EU/US | | | | CS-011 (Antidiabetic/glitazone type) CS-917 (Gluconeogenesis inhibitor) | | * WelChol DM (Antidiabetic) | | |

| | | | |

| Japan | | Fastic | | | | | | |

| | |

| Infectious diseases | | | | |

| | | | |

EU/US | | Levaquin / Tavanic Froxin Otic Banan | | DU-6859a inj (New quinolone / US) CS-023 (Carbapenem-type antibiotic/licensed-out to Roche) | | | | SUN A0026 (Penem-type antibiotic /licensed-out to Replidyne /application) |

| | | | |

| Japan | | Cravit, Carbenin, Banan | | CS-023 (Carbapenem-type antibiotic) | | DU-6859a oral (New quinolone) | | DF-098 (Hib vaccine/application) |

| | | | |

| Reference | | Phase I | | Phase II | | Phase III | | Application |

| | | | |

| | Testing with a small number of healthy subjects to study such drug candidate characteristics as safety, absorption, diffusion, metabolism, and excretion. | | Testing a small number of patients to study usage methods, doses, and efficacy while continuing to give top priority to safety. | | Sometimes referred to as large-scale clinical testing, this involves testing with several hundred thousand patients to confirm efficacy and safety characteristics as well as usefulness (benefit/utility). | | Only candidates with confirmed usefulness are approved for manufacturing as new drug products. |

11

| | | | | | | | |

Region | | Main Existing Product | | Phase II | | Phase III | | Application/Approval, Launch |

| Cancer | | |

| | | | |

EU/US | | Camptoser | | DJ-927 (Anti-cancer/oral taxane deriv.) | | | | |

| | | | |

Japan | | Topotecin Krestin | | | | | | |

| |

| Immunological allergic diseases | | |

| | | | |

Japan | | Zyrtec | | CS-712 (Cedar pollen pollinosis) | | | | |

| | |

| Bone/Joint diseases etc. | | | | |

| | | | |

EU/US | | Venofer Evoxac | | CS-706 (COX-2 inhibitor) SUN 4057 (Acute ischemic stroke) CS-088 (Antiglaucoma/co -development with Santen) | | SUN0588r (Hyperphenylalaninemia /licensed-out to Biomarin) | | |

| | | | |

Japan | | Omnipaque, Loxonin, Kremezin, Zantac, Mobic, Omniscan, Feron, Kelnac, Neuer, Evoxac, Adenoscan, Miltax | | CS-088 (Antiglaucoma/co-development with Santen)SUN E3001 (anti osteoporosis/licensed-out to Chugai) | | * CS-600G (loxoprofen gel/PIII preparation) SUN Y7017 (mild to moderate and severe dementia of Alzheimer type) * DL-8234 (FERON add indic./hepatitis /with Ribavirin) * CS-1401E (pain relief during anesthesia) | | * LOXONIN PAP (loxoprofen patch/launch) Intrathecal Gabalon (anti-spastic/launch) URIEF (treatment of dysuria/launch) * FERON (liver cirrhosis/approval) DD-723 (ultrasound contrast media/application) |

| | | | |

China | | | | KMD-3213 (treatment of dysuria associated with benign prostatic hyperplasia) | | | | |

Number of projects at Phase I and preparation preclinical stage

Total:26[Cardiovascular diseases: 6, glucose metabolic disorders: 2, infectious diseases: 6, cancer: 3, immunological allergic diseases: 3, bone/joint diseases etc.: 6]

New Product Information

URIEF®

Developed jointly by Daiichi Pharmaceutical and Kissei Pharmaceutical Co., Ltd., URIEF® is a selective alpha 1A blocker for treatment of dysuria associated with benign prostatic hyperplasia (BPH). It was launched in Japan on May 11, 2006. URIEF® works by selectively blocking alpha 1A receptors, a subtype that is found mostly in the prostate gland. This relieves urinary stress by significantly lowering urethral resistance with a fast onset of action, thereby alleviating any BPH-associated symptoms of dysuria. URIEF® was awarded a premium for usefulness II on its NHI price listing, reflecting the anticipated benefits of the drug for patients in terms of enhanced quality of life (QOL).

LOXONIN®PAP

Developed jointly by Sankyo and Lead Chemical Co., Ltd., LOXONIN® PAP is a percutaneous absorption-type analgesic and anti-inflammatory preparation. It was launched in Japan on May 23, 2006. LOXONIN® PAP is a hydrophilic preparation containing the same constituents as LOXONIN® which is the leading brands among orally administered analgesic and anti-inflammatory drugs. As it is the first poultice for application once per day among poultice preparations containing nonsteroidal anti-inflammatory drugs (NSAIDs), we anticipate an improvement in user compliance.

12

Overview of Performance

Overall Performance

|

Net sales |

¥925.9 billion |

|

Operating income |

¥154.7 billion |

|

Ordinary income |

¥159.7 billion |

|

Net income |

¥87.6 billion |

| | |

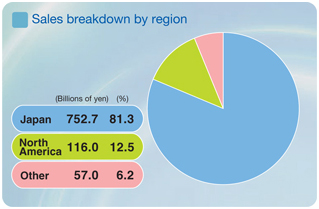

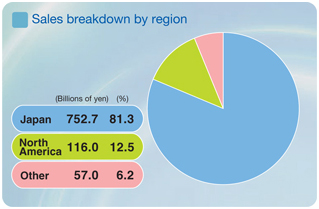

| Ratio of overseas sales | | 33.2% |

| (as percentage of net sales) | |

| |

| Ratio of R&D spending | | 17.1% |

| (as percentage of net sales) | |

The Company was established on September 28, 2005, as a joint holding company through the share transfer. Accordingly, as the current fiscal year is the Company’s first year of operation, year-by-year performance comparisons are not presented.

Performance figures for the fiscal year include the two subsidiaries’ consolidated results from April 1, 2005 through March 31, 2006, as well as the Company’s non-consolidated results from September 28, 2005 through March 31, 2006.

While, the global pharmaceutical market continues to realize a certain level of growth, led by the U.S. market, the global market is characterized by such trends as the progressive globalization and the increasing strictness of new drug development standards as well as the intense competition centered on global mega pharmaceutical companies in the areas of both R&D and marketing activities. In the Japanese market, measures to contain healthcare costs advanced further as national university hospitals were reorganized into independent medical corporations and an increasing number of medical institutions have been adopting a new comprehensive in-hospital treatment evaluation system. In addition, the competition among increasingly prominent foreign-owned pharmaceutical companies and other major companies has intensified, which resulted in our business environment being intensively harsh.

The DAIICHI SANKYO Group focused its marketing efforts on expanding markets for its products by promoting the proper use of drugs through the provision of accurate information related to the efficacy and safety of its products. As a result, the Company posted consolidated net sales of ¥925.9 billion in its first inaugural fiscal year. The Company’s top-selling products in Japan included the antihypertensive agentsOlmetec® andCalblock®, the broad-spectrum oral antibacterial agentCravit®, andArtist®, a treatment for high blood pressure, angina, and chronic cardiac insufficiency. In overseas markets, leading contributors to the net sales included bulk exports of the synthetic antibacterial levofloxacin and the antihypertensive agent olmesartan (sold asBenicar® in North America and asOlmetec® in Europe).

In terms of profitability, the Company invested in improving quality and technology levels while promoting cost-reduction measures. As a result, the total cost of sales amounted to ¥290.7 billion (cost-of-sales ratio: 31.4%); selling, general and administrative expenses totaled ¥480.4 billion, of which research and development expenses accounted for ¥158.7 billion. Operating income was ¥154.7 billion and ordinary income was ¥159.7 billion.

The Company took a charge of ¥9.8 billion related to the business integration and also posted an impairment loss of ¥5.2 billion for idle property, plant and equipment in the extraordinary losses. Net income for the year ended March 31, 2006 amounted to ¥87.6 billion.

13

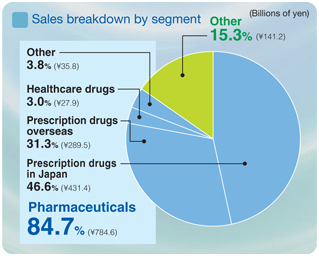

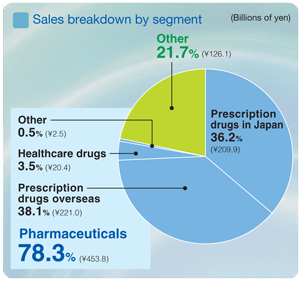

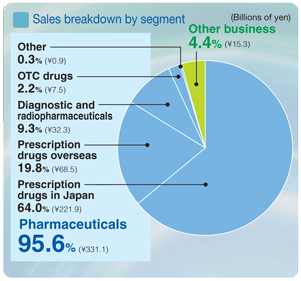

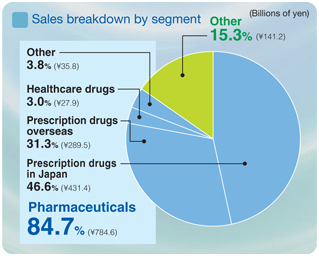

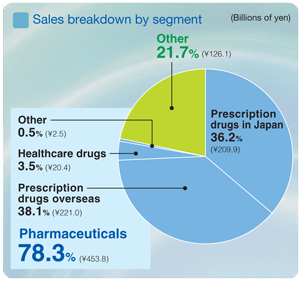

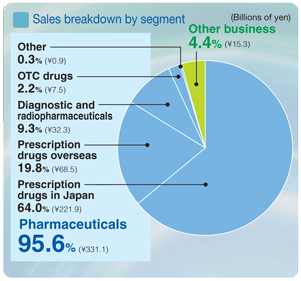

Segment Information

Pharmaceuticals

Net sales ¥784.6 billion

Operating income ¥148.1 billion

Uncertainty plagued the business environment in the Japanese prescription drug market with an ongoing impact of government initiatives to reduce healthcare spending, including more affirmative measures to promote the use of generic medicines, and a downward revision in the National Health Insurance (NHI) drug reimbursement tariff implemented in April 2006 by an average of 6.7%.

Under these harsh market conditions, sales of prescription drugs in the Japanese market totaled ¥431.4 billion. Although sales of the antihyperlipidemic agentMevalotin®declined, several leading products recorded higher sales, including the broad-spectrum oral antibacterial agentCravit®and the antihypertensive agentOlmetec®. Sales revenue was also increased by a receipt of the milestone payments related to the approval on manufacturing and marketing ofPlavix®. Sales of prescription drugs in overseas markets totaled ¥289.5 billion. Sales of bulk pravastatin, an antihyperlipidemic agent, declined due to its patent expiration in Europe and fierce competition in the United States. Sales of the antihypertensive agent olmesartan (marketed asBenicar®in North America and asOlmetec®in Europe) increased significantly, and bulk exports of the synthetic antibacterial levofloxacin also generated a steady growth. In addition, favorable currency translation arising from yen depreciation contributed to the higher sales amount.

Sales of healthcare drugs amounted to ¥27.9 billion. Depressed market conditions in Japan and the entry of rival products resulted in lower sales of leading products such as the hair growth agentsKaroyan Gush®andCystina C®, a vitamin complex. The decrease was offset by brisk sales ofLamisil AT®, the switch-OTC formulation of a prescription drug for treating athlete’s foot.

Other

Net sales ¥141.2 billion

Operating income ¥6.1 billion

The DAIICHI SANKYO Group plans to focus its resources on the pharmaceutical business. To this end, the Company plans to spin off the non-pharmaceutical businesses as independent enterprises, and thereby to realize greater operational efficiency.

Mevalotin®, an antihyperlipidemic agent

Olmetec®, an antihypertensive agent

Artist®, a treatment for high blood pressure, angina, and chronic cardiac insufficiency

Cravit®, a broad-spectrum oral antibacterial agent

Calblock®, an antihypertensive agent

Lamisil AT®, a drug for treating athlete’s foot

| * | Net sales of each operating segment include only sales to outside customers. |

14

Consolidated Results

Segment Information

Consolidated Balance Sheet (Summary) (Millions of yen)

| | | |

| | | March 31, 2006 | |

ASSETS | | | |

Current assets: | | 958,483 | |

Cash and time deposits | | 223,979 | |

Trade notes and accounts receivable | | 240,173 | |

Marketable securities | | 274,510 | |

Other current assets | | 220,419 | |

Allowance for doubtful accounts | | (599 | ) |

Non-current assets: | | 637,643 | |

Property, plant and equipment | | 289,712 | |

Intangible assets: | | 36,166 | |

Investments and other assets: | | 311,763 | |

Investment securities | | 256,338 | |

Other assets | | 55,955 | |

Allowance for doubtful accounts | | (529 | ) |

| | | |

Total assets | | 1,596,126 | |

| | | |

| |

LIABILITIES | | | |

Current liabilities: | | 236,833 | |

Trade notes and accounts payable | | 65,596 | |

Short-term bank loans | | 13,547 | |

Income taxes payable | | 26,169 | |

Other current liabilities | | 131,519 | |

Non-current liabilities: | | 110,154 | |

Long-term debt | | 3,374 | |

Deferred tax liabilities | | 23,926 | |

Accrued retirement and severance benefits | | 68,321 | |

Other non-current liabilities | | 14,531 | |

| | | |

Total liabilities | | 346,987 | |

| | | |

| |

MINORITY INTERESTS | | | |

Minority interests | | 11,609 | |

| |

SHAREHOLDERS’ EQUITY | | | |

Common stock | | 50,000 | |

Additional paid-in-capital | | 179,858 | |

Retained earnings | | 936,513 | |

Net unrealized gain on investment securities | | 80,254 | |

Foreign currency translation adjustments | | 735 | |

Treasury stock at cost | | (9,832 | ) |

| | | |

Total shareholders’ equity | | 1,237,529 | |

| | | |

Total liabilities, minority interests and shareholders’ equity | | 1,596,126 | |

| | | |

15

Consolidated Statement of Income (Summary) (Millions of yen)

| | | |

| | | Year Ended

March 31, 2006 | |

Net sales | | 925,918 | |

| | | |

Cost of sales | | 290,735 | |

Gross profit | | 635,182 | |

Selling, general and administrative expenses | | 480,454 | |

| | | |

Operating income | | 154,728 | |

| | | |

Non-operating income: | | 10,951 | |

Interest income | | 3,326 | |

Dividend income | | 1,995 | |

Other income | | 5,628 | |

Non-operating expenses: | | 5,964 | |

Interest expense | | 313 | |

Loss on disposal and write-down of inventories | | 1,587 | |

Other expenses | | 4,064 | |

| | | |

Ordinary income | | 159,714 | |

| | | |

Extraordinary gains | | 6,890 | |

Extraordinary losses | | 29,712 | |

| | | |

Net income before income taxes and minority interests | | 136,892 | |

| | | |

Income tax expense – current | | 54,207 | |

| | | |

Income tax benefit – deferred | | (5,011 | ) |

| | | |

Minority interests in net income of subsidiaries | | 3 | |

| | | |

Net income | | 87,692 | |

| | | |

Consolidated Statement of Retained Earnings (Summary) (Millions of yen)

| | |

| | | Year Ended

March 31, 2006 |

Additional paid-in capital | | |

Additional paid-in capital, beginning of year | | 180,027 |

Decrease in additional paid-in capital | | 169 |

| | |

Additional paid-in capital, end of year | | 179,858 |

| | |

Retained earnings | | |

Retained earnings, beginning of year | | 956,658 |

Increase in retained earnings: | | 87,692 |

Net income | | 87,692 |

Decrease in retained earnings | | 107,837 |

| | |

Retained earnings, end of year | | 936,513 |

| | |

Consolidated Statement of Cash Flows (Millions of yen)

| | | |

| | | Year Ended

March 31, 2006 | |

Net cash provided by operating activities | | 132,759 | |

Net cash used in investing activities | | (39,258 | ) |

Net cash used in financing activities | | (50,106 | ) |

Effect of exchange rate changes on cash and cash equivalents | | 3,793 | |

Net increase in cash and cash equivalents | | 47,188 | |

Cash and cash equivalents, beginning of year | | 354,102 | |

Decrease in cash and cash equivalents due to changes in scope of consolidation | | (322 | ) |

Cash and cash equivalents, end of year | | 400,967 | |

| * | Figures less than ¥1 million have been omitted. |

| • | Cash Flows from Operating Activities |

Net cash provided by operating activities amounted to ¥132.7 billion. The amount mainly consisted of ¥136.8 billion in income before income taxes and minority interests, ¥41.1 billion in depreciation expense, and ¥53 billion in payments of income taxes.

| • | Cash Flows from Investing Activities |

Net cash used in investing activities totaled ¥39.2 billion. The Company used ¥48.5 billion for the capital expenditures in property, plant and equipment and intangible assets, and ¥10.2 billion for the acquisition of investments in subsidiaries.

| • | Cash Flows from Financing Activities |

Cash used in financing activities amounted to ¥50.1 billion. A total of ¥16.6 billion was used to purchase treasury stock, ¥17.3 billion was paid as cash dividends, and ¥17.1 billion was paid as stock transfer payments.

16

(Reference) Overview of Sankyo Results

In the year ended March 31, 2006, the Sankyo Group posted consolidated net sales of ¥579,949 million (a decline by 1.3% compared with the previous year), operating income of ¥78,335 million (a decrease by 7.8%), ordinary income of ¥82,164 million (a decrease by 0.4%) and net income of ¥50,627 million (an increase by 4.9%). Robust growth in sales in Japan, Europe and the United States of the strategic global product olmesartan, an antihypertensive agent (sold in the United States asBenicar®and in Europe and Japan asOlmetec®), helped to offset a number of factors that depressed net sales, including lower sales of the flagship antihyperlipidemic agentMevalotin®; the termination of the co-promotion agreements forEspo®(renal anemia),Gran®(leukopenia) andAlesion®(allergic disorders); and the exclusion of certain non-pharmaceutical subsidiaries from the scope of consolidation. As a result, net sales declined only slightly.

Operating income decreased by 7.8% due to a rise in R&D expenditures and other factors. However, ordinary income was kept at virtually the same level as in the previous year owing to an improved non-operating income and expenses.

At the net income level, a lower tax rate at U.S.-based subsidiaries resulted in substantially higher after-tax income, despite the fact that net extraordinary losses increased due to a reduction in gain on sale of property, plant and equipment compared to the previous year and other factors, resulting in a 4.9% increase in net income compared with the previous year.

Balance Sheet Data (Millions of yen)

| | |

| | | March 31, 2006 |

Current assets | | 598,238 |

Non-current assets | | 366,150 |

Current liabilities | | 147,475 |

Non-current liabilities | | 79,326 |

Minority interests | | 23,870 |

Shareholders’ equity | | 713,715 |

Total assets | | 964,389 |

Earnings Data (Millions of yen)

| | |

| | | Year ended

March 31, 2006 |

Net sales | | 579,949 |

Cost of sales | | 198,263 |

Selling, general and administrative expenses | | 303,350 |

Operating income | | 78,335 |

Ordinary income | | 82,164 |

Net income before income taxes and minority interests | | 70,457 |

Net income | | 50,627 |

17

(Reference)Overview of Daiichi Pharmaceutical Results

The Daiichi Group focused its marketing efforts on expanding markets for its products by promoting the proper use of drugs through the provision of information related to the efficacy and safety of its products. Higher revenue from domestic sales of prescription drugs, an increase in bulk exports of the synthetic antibacterial levofloxacin, and a receipt of milestone payments related to the approval on manufacturing and marketing of an anti-platelet agentPlavix®contributed to an increase in net sales. Net sales totaled ¥346,447 million, an increase of 5.5% compared with the previous year. Regarding profitability, increased expenses related to the expansion of global R&D programs and the business integration with Sankyo Company, Limited were offset by higher revenues plus cost-of-sales reductions following the start of operations at Daiichi Pharmatech Co., Ltd. Operating income and ordinary income both increased significantly compared with the previous year. Operating income rose significantly by 35.7% to ¥76,087 million, while ordinary income increased by 36.0% to ¥77,929 million. As a result, net income was kept higher than the prior year level even after an extraordinary loss arising from the integration with Sankyo Company, Limited, rising by 0.6% to ¥37,409 million. The amounts of net sales, operating income, ordinary income and net income all marked the new record highs.

Balance Sheet Data (Millions of yen)

| | |

| | | March 31, 2006 |

Current assets | | 310,772 |

Non-current assets | | 286,929 |

Current liabilities | | 85,305 |

Non-current liabilities | | 30,827 |

Minority interests | | 385 |

Shareholders’ equity | | 481,181 |

Total assets | | 597,701 |

Earnings Data (Millions of yen)

| | |

| | | Year ended

March 31, 2006 |

Net sales | | 346,447 |

Cost of sales | | 92,190 |

Selling, general and administrative expenses | | 178,169 |

Operating income | | 76,087 |

Ordinary income | | 77,929 |

Net income before income taxes and minority interests | | 66,813 |

Net income | | 37,409 |

18

Forecast of Consolidated Results for Fiscal 2006 (April 1, 2006 – March 31, 2007)

| | | | | | |

Net sales | | Operating income | | Ordinary income | | Net income |

¥865billion | | ¥108billion | | ¥115billion | | ¥47billion |

The DAIICHI SANKYO Group expects the business environment in the year ending March 31, 2007 to remain challenging in Japan and in overseas markets. The Company plans to leverage its combined marketing forces to boost market presence and thereby strengthen the earnings base. At the same time, the Company will continue to focus on realizing increased efficiency.

On the sales front, the Company faces a particularly tough challenge due to a number of factors that will significantly depress revenues, including the effect of NHI price cuts in Japan; the expiration of the U.S. patent on pravastatin, an antihyperlipidemic agent; and the planned reorganization of the DAIICHI SANKYO Group’s non-pharmaceutical businesses. On the other hand, the Company will be able to reinforce sales and promotional efforts in prescription drug market in Japan by utilizing its superior sales force for core mainstay products such as the antihypertensiveOlmetec®, the antihyperlipidemic agentMevalotin®and the broad-spectrum oral antibacterial agentCravit®. Another key sales goal in Japan is a smooth market introduction forUrief®, an agent for relieving symptoms of dysuria associated with prostatic hypertrophy (launched in May 2006).

In overseas prescription drug markets, the two major sales-related objectives are the prioritized allocation of resources to expand sales of the antihypertensive agent olmesartan (marketed asBenicar®in North America and asOlmetec®in Europe) and a continued focus on building cooperative relationships with alliance partners to maximize sales of the bulk agents pravastatin and levofloxacin (a synthetic antibacterial), as well as other major products. In the healthcare drug business, by having divested and integrated the healthcare operations of Sankyo and Daiichi into one entity and having also acquired Zepharma Inc., the main focus will be on expanding and strengthening the business base. Taking into account all the above factors, the DAIICHI SANKYO Group projects a 6.6% decline in overall sales to ¥865.0 billion.

On the profit side, the Company plans to invest consistently in critical R&D areas, as well as investing in sales bases outside of Japan. The Company also expects business integration costs to be incurred to achieve the complete integration in April 2007. A variety of efforts are now underway across the entire DAI-ICHI SANKYO Group to maintain profitability and build operational efficiency by restructuring the infrastructures and business processes, and by reducing cost and containing expenses. The company will continue to work on making group companies in non-pharmaceutical business become completely independent companies outside of the Group by the end of March 2007. For the year ending March 31, 2007, the DAIICHI SANKYO Group projects a 30.2% decline in operating income to ¥108.0 billion and a 28.0% decrease in ordinary income to ¥115.0 billion, and a 46.4% decrease in net income to ¥47 billion.

Earnings at overseas subsidiaries are calculated using the foreign exchange rates of ¥115 = U.S.$1.00 and ¥135 = EUR 1.00.

Regarding dividend payment in fiscal 2006, although the Company forecasts its earnings to decline, it plans to pay cash dividend of 60 yen per share, up 10 yen compared to the current fiscal year, based on its policy to increase a level of cash dividends at a stable rate to the mid-term targeted ratio of 5% on a cash dividend on shareholders’ equity (DOE).

Notes Concerning Future Forecasts

Figures from future forecasts and the like in this document are judgments and hypotheses made by DAIICHI SANKYO based on information available to us as of this writing. These figures include elements of risk and uncertainty. Consequently, it is possible that actual performance and other figures will differ from these forecasts.

19

Corporate Information

Company Name

DAIICHI SANKYO COMPANY, LIMITED

Established

September 28, 2005

Business

Management and administration of wholly-ownedsubsidiaries and the Group, and related matters

Head Office

3-5-1, Nihombashi-honcho, Chuo-ku,

Tokyo 103-8426

Employees

76

Board of Directors (as of June 29, 2006)

| | | | |

Representative Director and Chairman | | Kiyoshi Morita | | |

Representative Director and President | | Takashi Shoda | | |

Executive Director | | Hiroyuki Nagasako | | |

Executive Director | | Yasuhiro Ikegami | | |

Executive Director | | Tsutomu Une | | |

Executive Director | | Yukio Sugimura | | |

Outside Director | | Kunio Nihira | | |

Outside Director | | Yoshifumi Nishikawa | | |

Outside Director | | Jotaro Yabe | | |

Outside Director | | Katsuyuki Sugita | | |

Auditor (Internal) | | Kozo Wada | | |

Auditor (Internal) | | Atsuo Inoue | | |

Auditor (External) | | Kaoru Shimada | | |

Auditor (External) | | Koukei Higuchi | | |

Business Establishment (Group)

| | | | | | |

R&D Base | | | | • Tokyo (Shinagawa-ku) • Tokyo (Edogawa-ku) • Daiichi Asubio Pharma Co., Ltd. (Mishima-gun, Osaka) | | |

Marketing Base | | | | • Nationwide • Nationwide | | |

Manufacturing Base | | • Onahama, Hiratsuka, Odawara, Osaka • Daiichi Pharmatech Co., Ltd. (Osaka, Shizuoka, Akita) | | |

Main Pharmaceuticals | | Cardiovascular | | • Mevalotin® (Antihyperlipidemic agent) • Olmetec® (Antihypertensive agent) • Livalo® (Antihyperlipidemic agent) • Acecol® (Antihypertensive agent) • Calblock® (Antihypertensive agent) | | • Panaldine® (Anti-platelet agent) • Artist® (Agent for treating high blood pressure, angina, and chronic cardiac insufficiency) • Coversyl® (Antihypertensive agent) • Sunrythm® (Antiarrhythmic) • Hanp® (Agent for treating acute cardiac insufficiency) |

| | | | | | |

| | Infection | | • Banan®(Antibiotic) • Carbenin® (Antibiotic) | | • Cravit® (Broad-spectrum oral antibacterial agent) |

| | Other | | • Kremezin® (Agent for chronic kidney failure) • Loxonin® (Pain relief, anti-inflammatory, antifebrile) • Fastic® (Hypoglycemic agent) | | • Zyrtec® (Anti-allergy agent) • Mobic® (Nonsteroidal anti-inflammatory agent) • Omnipaque® (X-ray contrast agent) |

| | | | • Sankyo Company, Limited | | • Daiichi Pharmaceutical Company, Limited |

20

Investor Information on DAIICHI SANKYO

Announcement schedule

First-quarter results (year ending March 2007)

Interim results (year ending March 2007)

Medium-term business plan

Third-quarter results (year ending March 2007)

Full-year results (year ending March 2007)

IR materials

Share-related information

Latest financial indicators

This report and other information for shareholders about DAIICHI SANKYO are available on our web site (URL http://www.daiichisankyo.co.jp/eng/). We aim to upgrade the content and presentation of this information on an ongoing basis.

English and Japanese versions of the Annual Report are due to be published on our web site in August 2006.

Disclosure Policy

| • | | As Japanese leading and real “Global Pharma Innovator”, aiming to gain trust in the society, DAIICHI SANKYO (the Company) will put thorough efforts into disclosing enough information for all the stakeholders including domestic and overseas shareholders/investors to gain accurate understanding of the Company’s group’s status and make accurate judgements. |

| • | | The Company works to provide information in a timely and proactive manner that, on the basis of the Company’s judgement, is thought to facilitate the understanding of the Company’s group by shareholders and investors based on the principles of transparency, fairness, and continuity, in addition to the disclosure of information pursuant to the Securities and Exchange Law and timely disclosure rules of stock exchanges. |

| • | | Exploiting various communication channels, the Company endeavor to disclose information in an easy to understand manner for investors. |

| • | | Always sharing the shareholders/investors’ standpoint, we aim to develop a corporate system to realize swift, accurate and fair disclosure. |

21

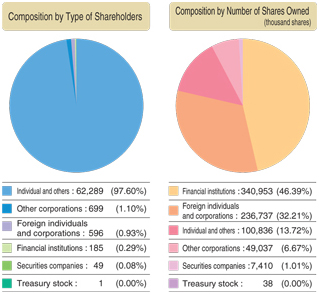

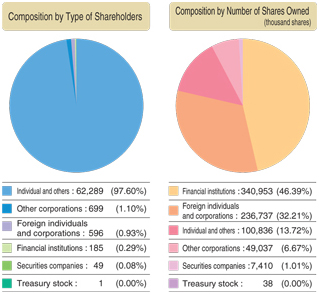

About Our Shares

Share Information (as of March 31, 2006)

| | |

Authorized capital | | 2,800,000,000 shares |

Issued shares | | 735,011,343 shares |

Number of shares constituting one unit | | 100 shares |

Number of shareholders | | 63,819 |

Major Shareholders

| | | | |

Shareholder’s name | | No. of

shares held | | Shareholding

ratio (%) |

| | |

The Master Trust of Japan, Ltd. (Trust Account) | | 55,883,800 | | 7.60 |

| | |

Japan Trustee Services Bank, Ltd. (Trustee Account) | | 48,316,400 | | 6.57 |

| | |

Nippon Life Insurance Company | | 41,839,182 | | 5.69 |

| | |

The Chase Manhattan Bank NA London SL Omnibus Account | | 15,945,752 | | 2.17 |

| | |

Sumitomo Mitsui Banking Corporation | | 13,413,368 | | 1.82 |

| | |

State Street Bank & Trust Company 505103 | | 12,833,867 | | 1.75 |

| | |

The Bank of Tokyo-Mitsubishi UFJ, Ltd. | | 9,468,983 | | 1.29 |

| | |

Tokio Marine & Nichido Fire Insurance Co., Ltd. | | 9,328,109 | | 1.27 |

| | |

Mizuho Corporate Bank, Ltd. | | 8,591,876 | | 1.17 |

| | |

Mizuho Pension Trust/Mizuho Corporate Bank Account Custodial Trustee Asset Management Service Trust | | 8,497,706 | | 1.16 |

| | | | | | |

| For inquiry | | Please contact the share registrar below for administrative share procedures. |

| | Tel (Toll-free number) | | 0120-232-711 | | |

| |

| | For administrative paperwork documents relating to stocks (changes to registered address/seal/name etc. or application forms for dividend payment, purchase request forms for fractional stocks, stock transfer request forms etc.), please contact Mitsubishi UFJ Trust and Banking Corporation which is available 24 hours a day, either by telephone or via the Internet. |

| | | |

| | Telephone (toll free number) | | 0120-244-479 | | (Corporate Agency Division, Head Office) |

| | | | 0120-684-479 | | (Corporate Agency Division, Osaka Branch) |

| | Web site address | | http://www.tr.mufg.jp/daikou/ |

| |

| | If you use the stock certificate depository and ownership transfer system, please contact the securities companies that have your transaction account. |

Shareholder Information

| | |

Business year | | from April 1 to March 31 of the following year |

| |

Record date for year-end dividend | | March 31 |

| |

Record date for interim dividend | | September 30 |

| |

| | *You can receive dividends either through a “Postal Transfer Payment” or by direct remittance to your bank or postal account. |

| |

Annual general meeting of shareholders | | June each year |

| |

Number of shares constituting one unit | | 100 shares |

| |

| | *Please contact the share registrar for procedure relating to fractional share purchase request and sale request. |

| |

| | (If you use the stock certificate depository and ownership transfer system, please contact the securities companies that have your transaction account.) |

| |

Web site for public notice | | http://www.daiichisankyo.co.jp/ |

| |

| | The Company makes public notices electronically. However, if the Company is unable to give an electronic public notice because of an accident or any other unavoidable reason, public notices may be given in the Nihon Keizai Shimbun. |

| |

Stock exchange listings | | First Section of Tokyo, Osaka and Nagoya |

| |

Share registrar | | Mitsubishi UFJ Trust and Banking Corporation |

| |

Mailing address | | Mitsubishi UFJ Trust and Banking Corporation, Corporate Agency Division 7-10-11, Higashisuna, Koto-ku, Tokyo 137-8081 Tel 0120-232-711 (Toll-free number) |

| |

Other points of contact | | All nationwide branches of Mitsubishi UFJ Trust and Banking Corporation Head office and all nationwide branches of Nomura Securities Co., Ltd. |

DAIICHI SANKYO CO., LTD.

DAIICHI SANKYO CO., LTD.

http://www.daiichisankyo.co.jp/

3-5-1, Nihombashi-honcho, Chuo-ku, Tokyo 103-8426, Japan

<Contact>

Corporate Communications Department

TEL. +81-3-6225-1126 FAX. +81-3-6225-1132

DAIICHI SANKYO CO., LTD.

DAIICHI SANKYO CO., LTD.