Results Q1 2020 Jean-Paul Kress, M.D., CEO Jens Holstein, CFO Malte Peters, M.D., CR&DO May 7, 2020 Exhibit 99.2

© MorphoSys - Results Q1 2020 This communication contains certain forward-looking statements concerning the MorphoSys group of companies, including its financial guidance for 2020, the commencement, timing and results of clinical trials and release of clinical data both in respect of its proprietary product candidates and of product candidates of its collaborators, the development of commercial capabilities, interpretations by regulatory authorities of our clinical data and real-world data analyses, in particular with respect to tafasitamab (MOR208), and the transition of MorphoSys to a fully integrated biopharmaceutical company, the expected time of launch of tafasitamab (MOR208), interaction with regulators, including the potential approval of MorphoSys’s current or future drug candidates, including discussions with the FDA regarding the potential approval to market tafasitamab (MOR208), and expected royalty and milestone payments in connection with MorphoSys’s collaborations. The forward-looking statements contained herein represent the judgment of MorphoSys as of the date of this release and involve known and unknown risks and uncertainties, which might cause the actual results, financial condition and liquidity, performance or achievements of MorphoSys, or industry results, to be materially different from any historic or future results, financial conditions and liquidity, performance or achievements expressed or implied by such forward-looking statements. In addition, even if MorphoSys’s results, performance, financial condition and liquidity, and the development of the industry in which it operates are consistent with such forward-looking statements, they may not be predictive of results or developments in future periods. Among the factors that may result in differences are that MorphoSys’s expectations regarding its 2020 results of operations may be incorrect, MorphoSys’s expectations regarding its development programs may be incorrect, the inherent uncertainties associated with competitive developments, clinical trial and product development activities and regulatory approval requirements (including that MorphoSys may fail to obtain regulatory approval for tafasitamab (MOR208) and that data from MorphoSys’s ongoing clinical research programs may not support registration or further development of its product candidates due to safety, efficacy or other reasons), MorphoSys’s reliance on collaborations with third parties, estimating the commercial potential of its development programs and other risks indicated in the risk factors included in MorphoSys’s Annual Report on Form 20-F and other filings with the US Securities and Exchange Commission. Given these uncertainties, the reader is advised not to place any undue reliance on such forward-looking statements. These forward-looking statements speak only as of the date of publication of this document. MorphoSys expressly disclaims any obligation to update any such forward-looking statements in this document to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements, unless specifically required by law or regulation. The compounds discussed in this slide presentation are investigational products being developed by MorphoSys and its partners and are not currently approved by the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA) or any other regulatory authority (except for guselkumab/Tremfya®). There is no guarantee any investigational product will be approved. Forward-Looking Statements

Tafasitamab is an investigational product and has not been proven to be safe and effective. Agenda © MorphoSys - Results Q1 2020 Q1 2020 Earnings Call Moderation Julia Neugebauer, Ph.D., Director Investor Relations Review Q1 2020 & Tafasitamab Launch Preparation Update Jean-Paul Kress, M.D., CEO Financial Review Q1 2020 Jens Holstein, CFO Closing Remarks Jean-Paul Kress, M.D., CEO Q&A Jean-Paul Kress, Jens Holstein, Malte Peters

Review Q1 2020 & Launch Preparation Update Jean-Paul Kress, CEO © MorphoSys - Results Q1 2020

Strong Quarter of Execution © MorphoSys - Results Q1 2020 Q1 2020 Highlights Strong Momentum Heading into 2020 Global licensing agreement with Incyte Priority review for tafasitamab PDUFA date August 30, 2020 Expanded Access Program (EAP) in the U.S. Strengthening of the Team Appointment of Roland Wandeler, Ph.D., as our new Chief Commercial Officer

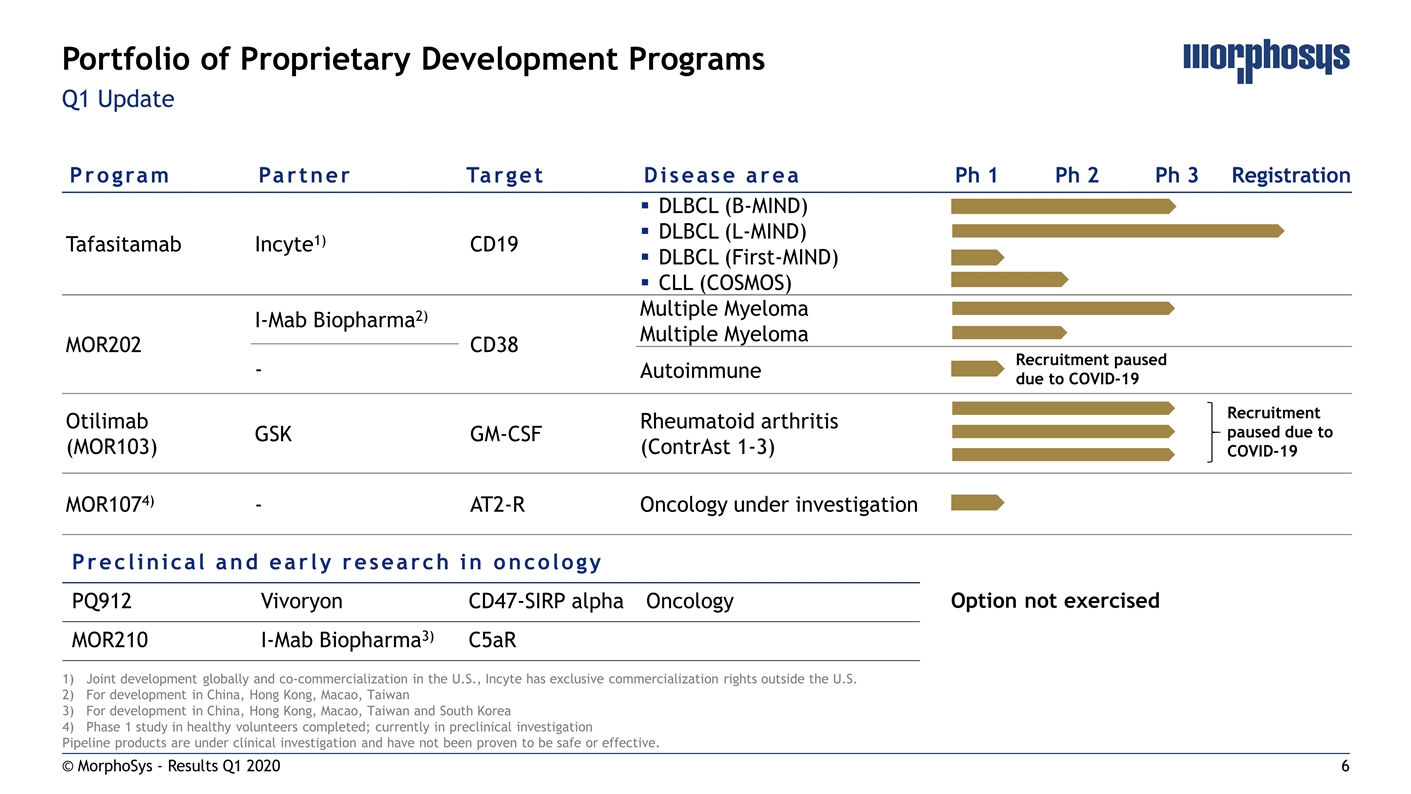

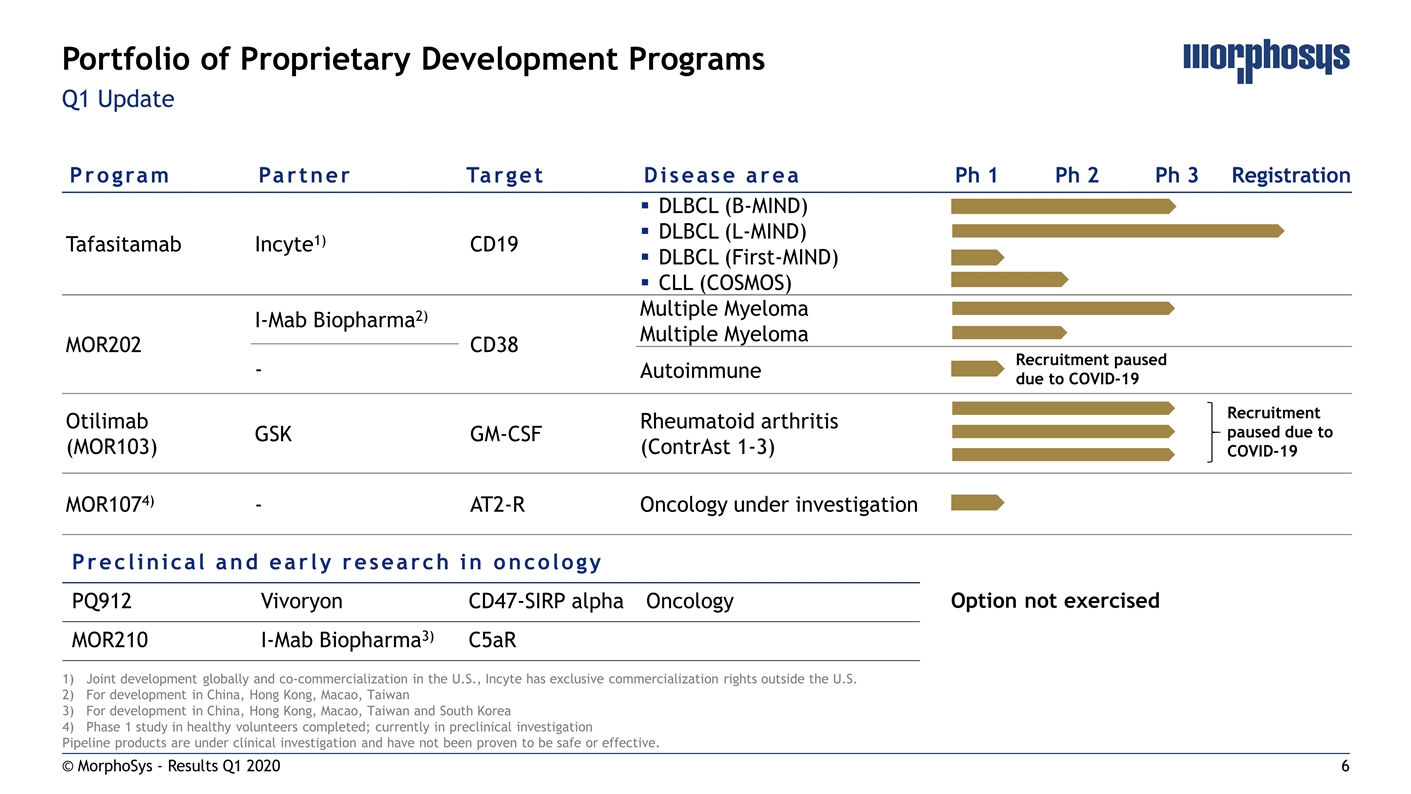

Q1 Update © MorphoSys - Results Q1 2020 Portfolio of Proprietary Development Programs Program Partner Target Disease area Ph 1 Ph 2 Ph 3 Registration Tafasitamab Incyte1) CD19 DLBCL (B-MIND) DLBCL (L-MIND) DLBCL (First-MIND) CLL (COSMOS) MOR202 I-Mab Biopharma2) CD38 Multiple Myeloma Multiple Myeloma - Autoimmune Otilimab (MOR103) GSK GM-CSF Rheumatoid arthritis (ContrAst 1-3) MOR1074) - AT2-R Oncology under investigation Joint development globally and co-commercialization in the U.S., Incyte has exclusive commercialization rights outside the U.S. For development in China, Hong Kong, Macao, Taiwan For development in China, Hong Kong, Macao, Taiwan and South Korea Phase 1 study in healthy volunteers completed; currently in preclinical investigation Pipeline products are under clinical investigation and have not been proven to be safe or effective. Preclinical and early research in oncology PQ912 Vivoryon CD47-SIRP alpha Oncology MOR210 I-Mab Biopharma3) C5aR Recruitment paused due to COVID-19 Option not exercised Recruitment paused due to COVID-19

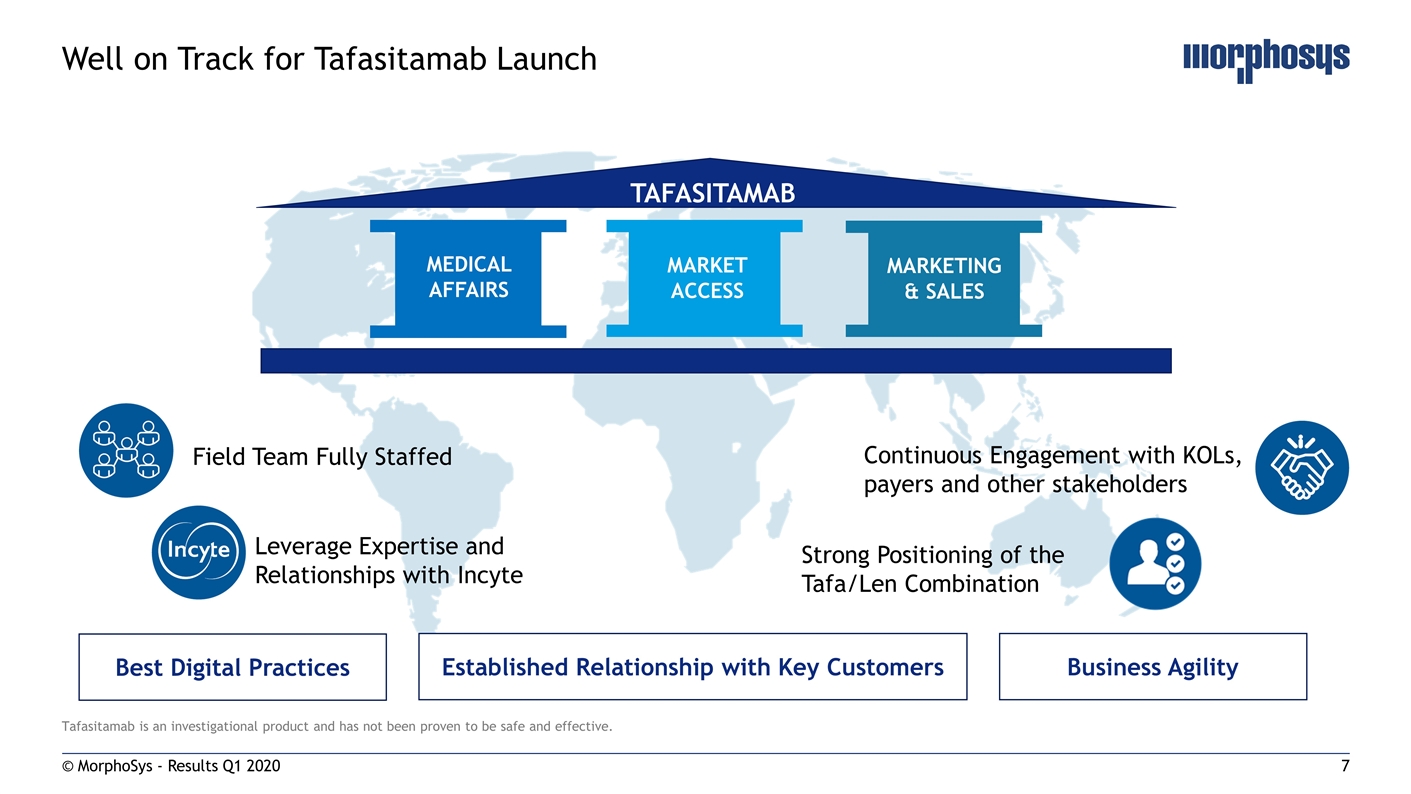

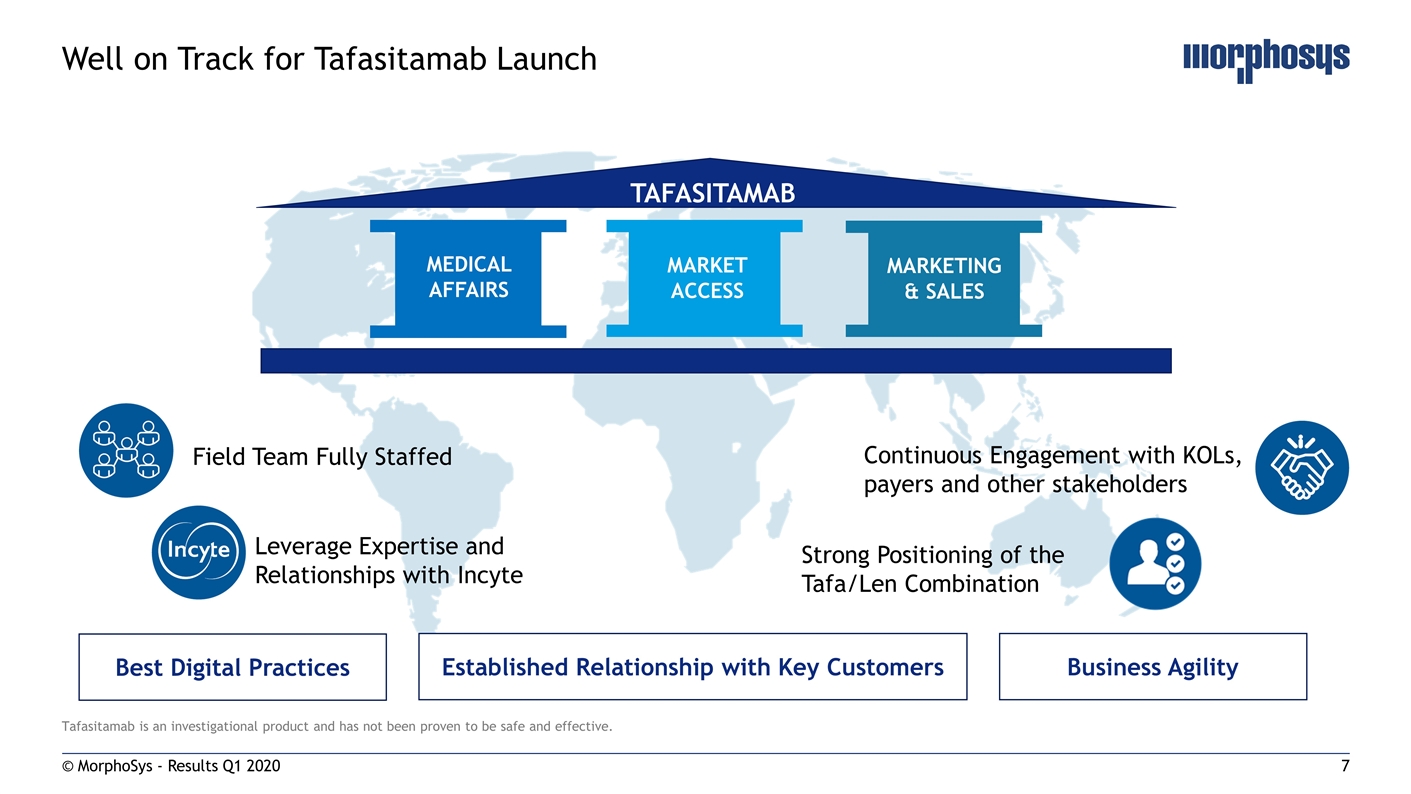

Tafasitamab is an investigational product and has not been proven to be safe and effective. © MorphoSys - Results Q1 2020 Well on Track for Tafasitamab Launch TAFASITAMAB MARKET ACCESS MEDICAL AFFAIRS MARKETING & SALES Established Relationship with Key Customers Business Agility Best Digital Practices Field Team Fully Staffed Leverage Expertise and Relationships with Incyte Strong Positioning of the Tafa/Len Combination Continuous Engagement with KOLs, payers and other stakeholders

Financial Review Q1 2020 Jens Holstein, CFO © MorphoSys - Results Q1 2020

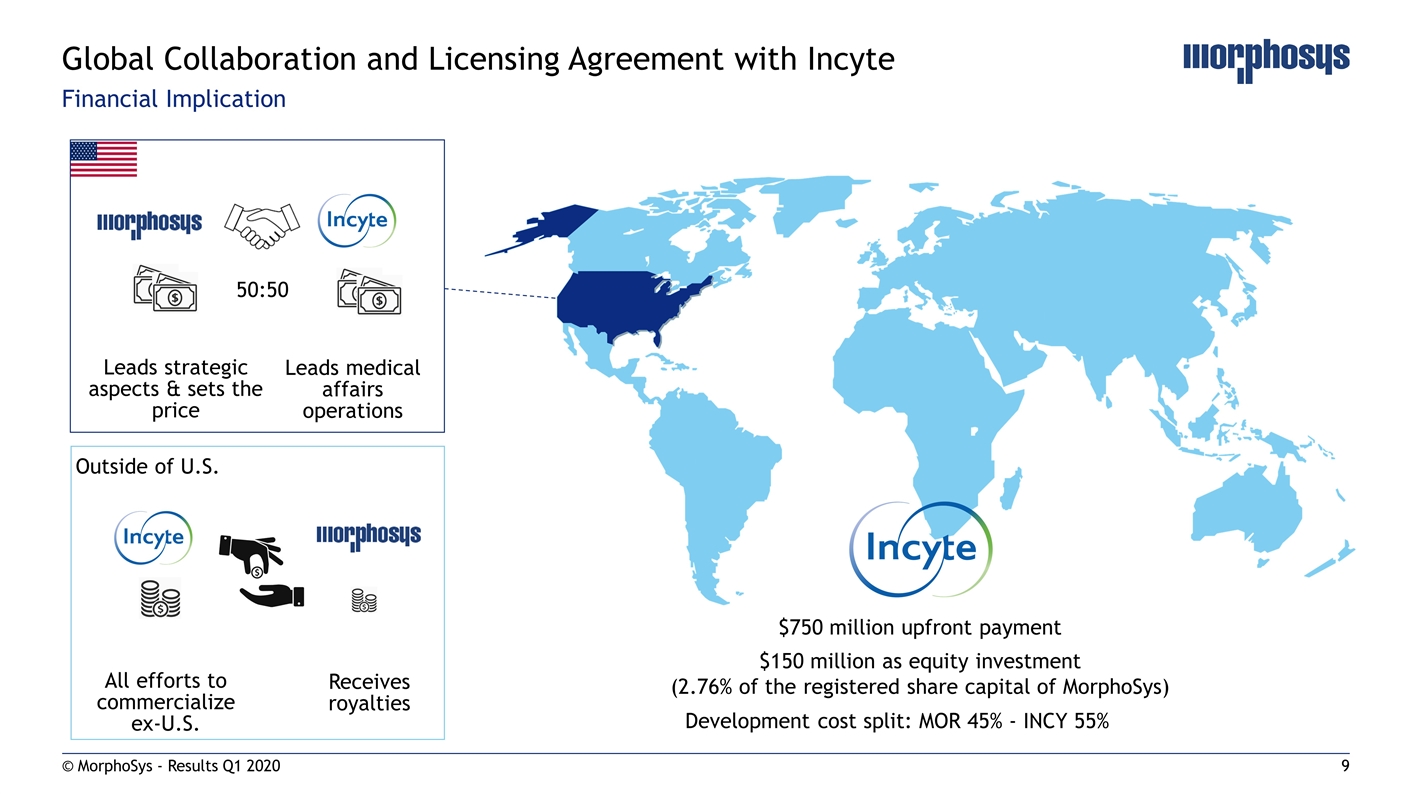

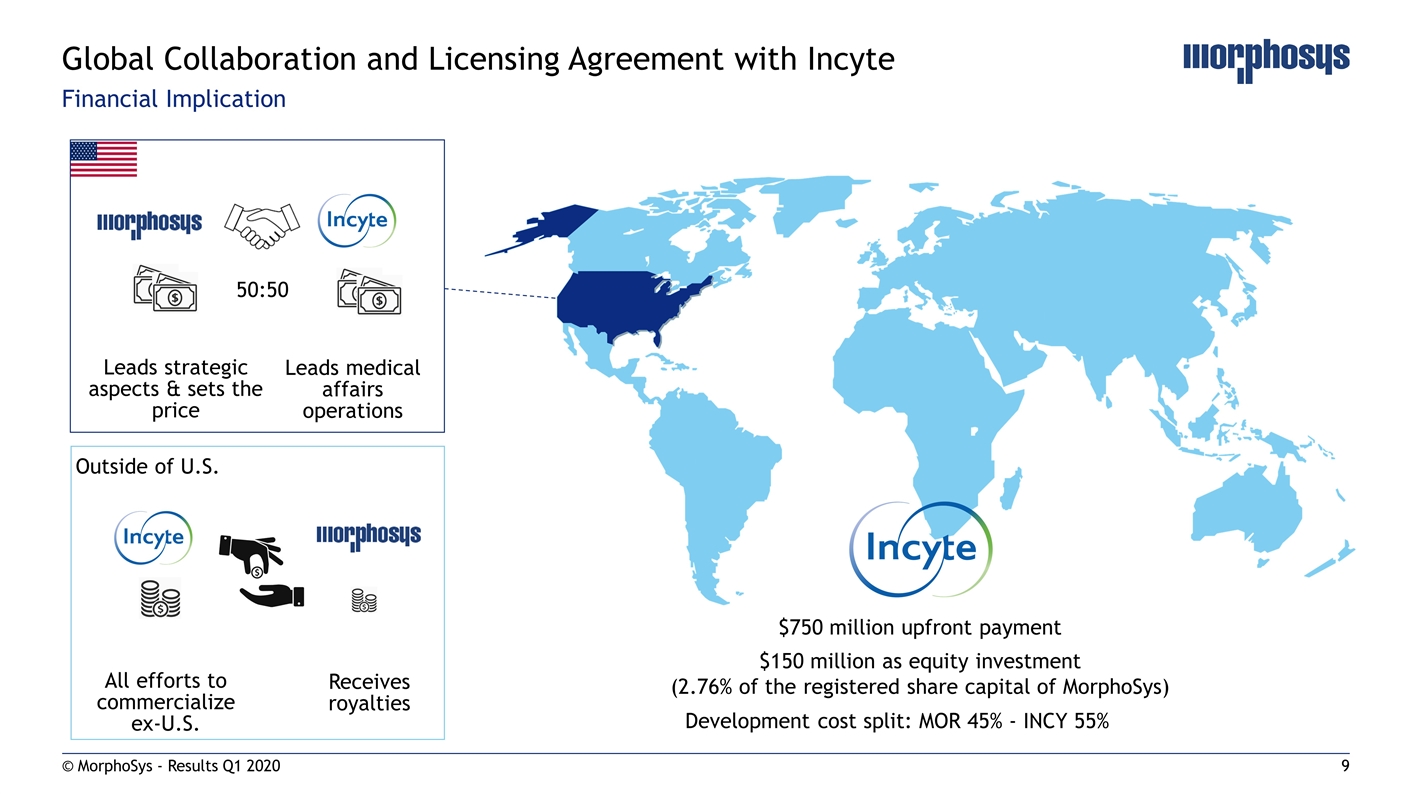

Financial Implication © MorphoSys - Results Q1 2020 Global Collaboration and Licensing Agreement with Incyte Outside of U.S. Receives royalties All efforts to commercialize ex-U.S. 50:50 Leads medical affairs operations Leads strategic aspects & sets the price Development cost split: MOR 45% - INCY 55% $750 million upfront payment $150 million as equity investment (2.76% of the registered share capital of MorphoSys)

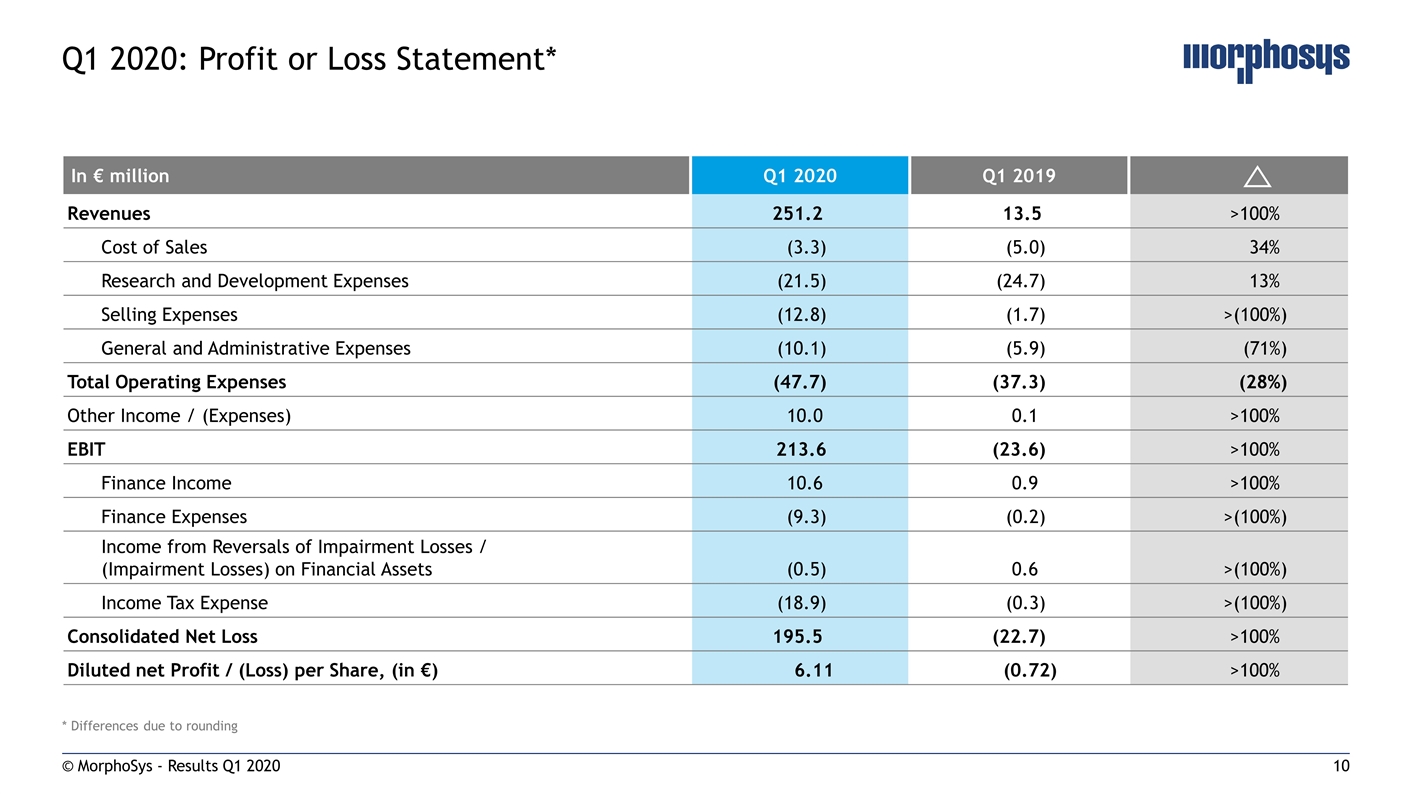

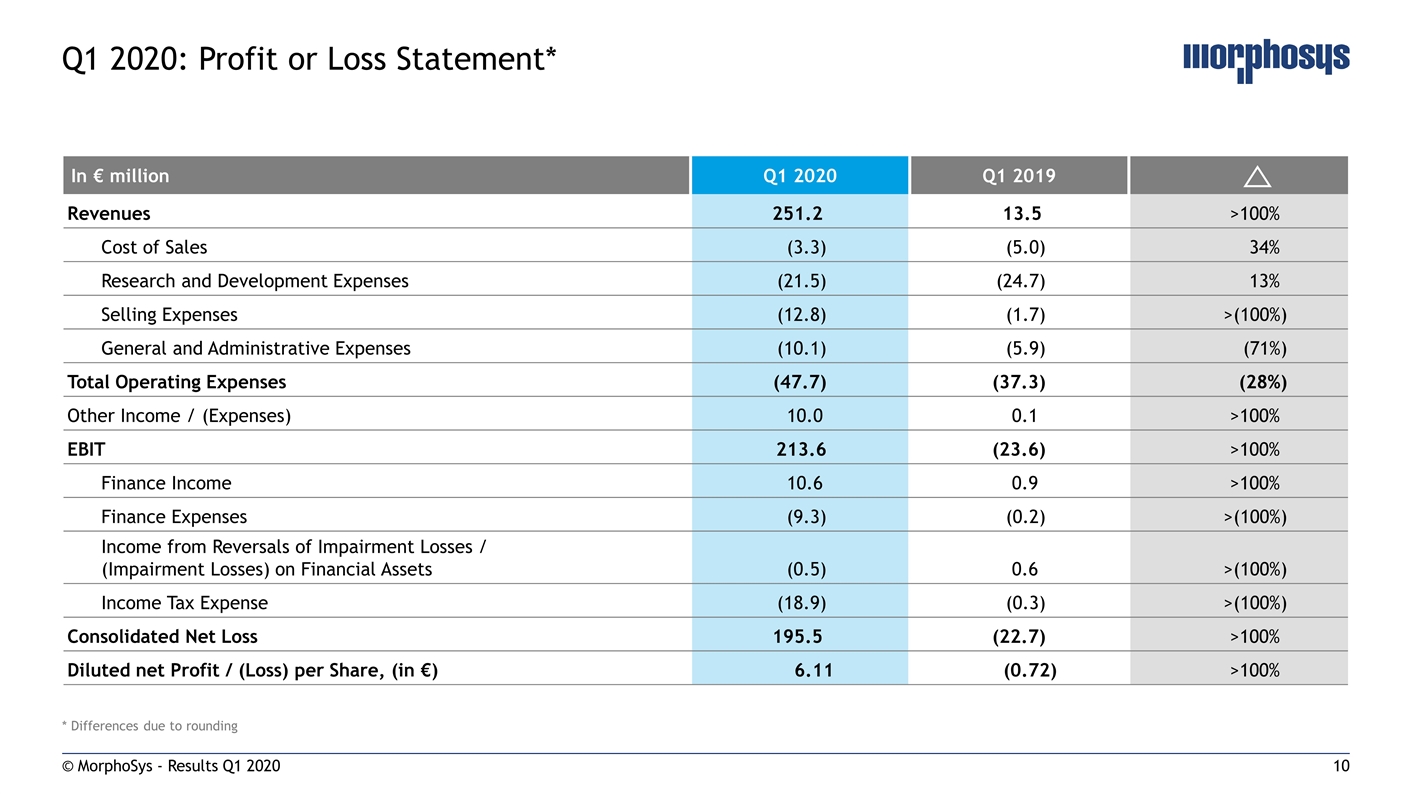

* Differences due to rounding © MorphoSys - Results Q1 2020 Q1 2020: Profit or Loss Statement* In € million Q1 2020 Q1 2019 Revenues 251.2 13.5 >100% Cost of Sales (3.3) (5.0) 34% Research and Development Expenses (21.5) (24.7) 13% Selling Expenses (12.8) (1.7) >(100%) General and Administrative Expenses (10.1) (5.9) (71%) Total Operating Expenses (47.7) (37.3) (28%) Other Income / (Expenses) 10.0 0.1 >100% EBIT 213.6 (23.6) >100% Finance Income 10.6 0.9 >100% Finance Expenses (9.3) (0.2) >(100%) Income from Reversals of Impairment Losses / (Impairment Losses) on Financial Assets (0.5) 0.6 >(100%) Income Tax Expense (18.9) (0.3) >(100%) Consolidated Net Loss 195.5 (22.7) >100% Diluted net Profit / (Loss) per Share, (in €) 6.11 (0.72) >100%

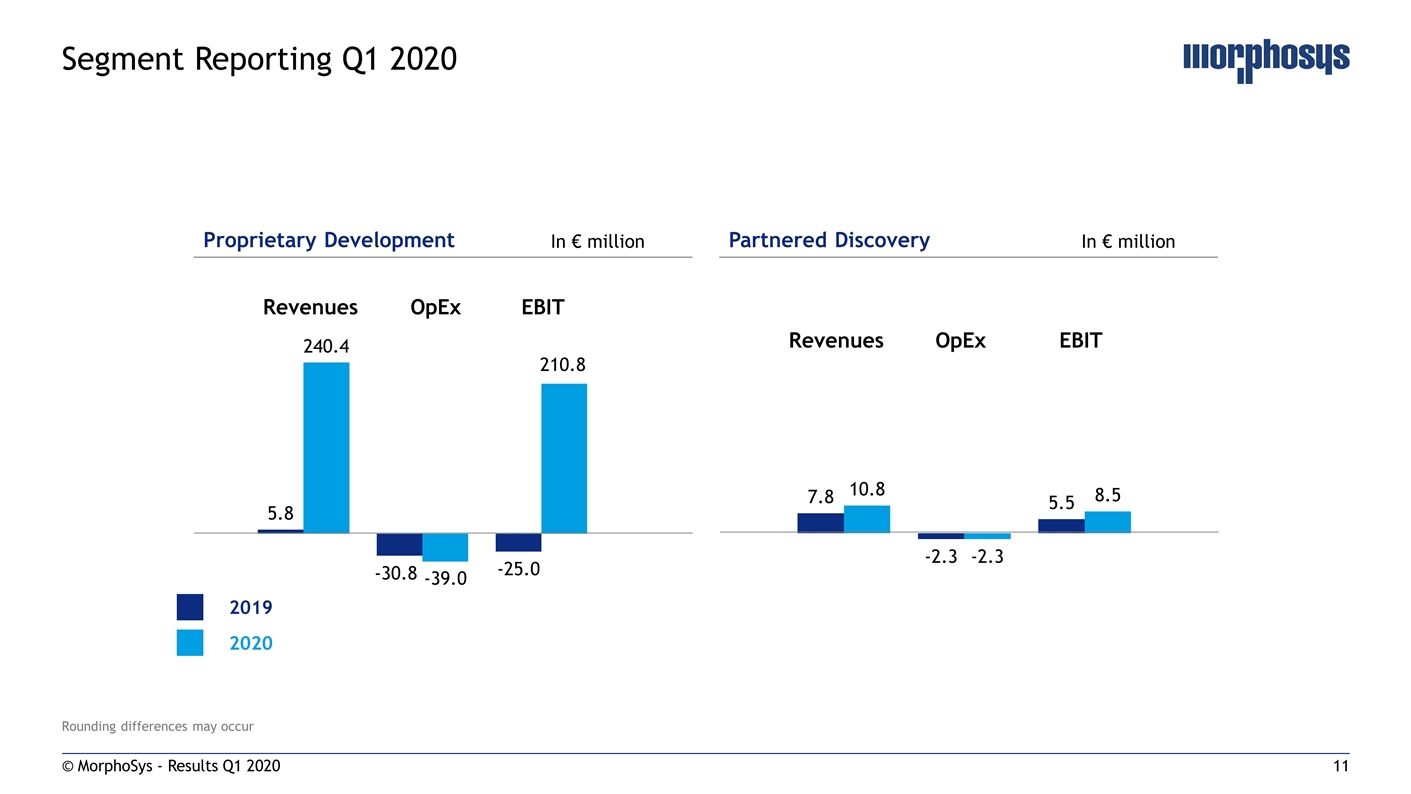

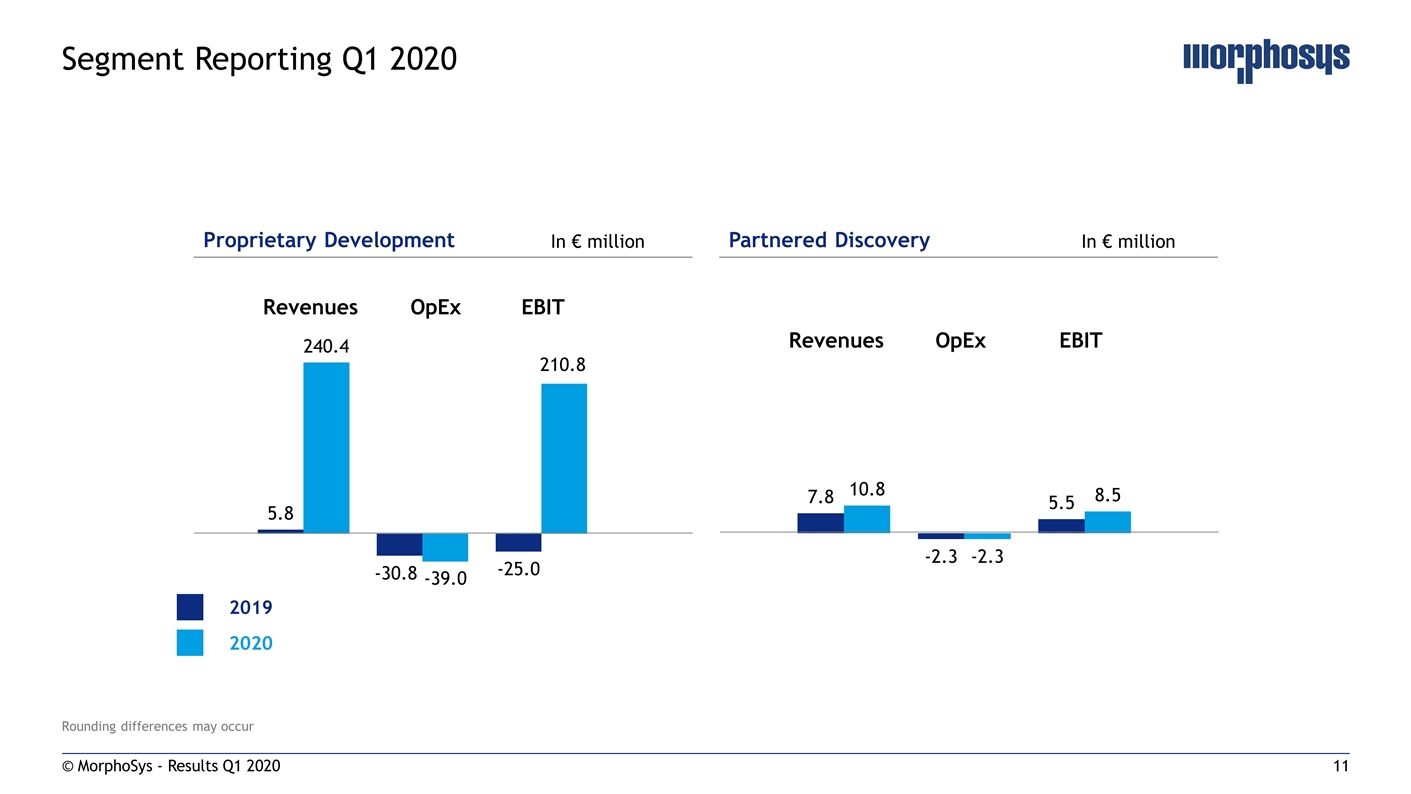

Rounding differences may occur © MorphoSys - Results Q1 2020 Segment Reporting Q1 2020 Proprietary Development Partnered Discovery In € million In € million Revenues OpEx EBIT Revenues OpEx EBIT 2019 2020

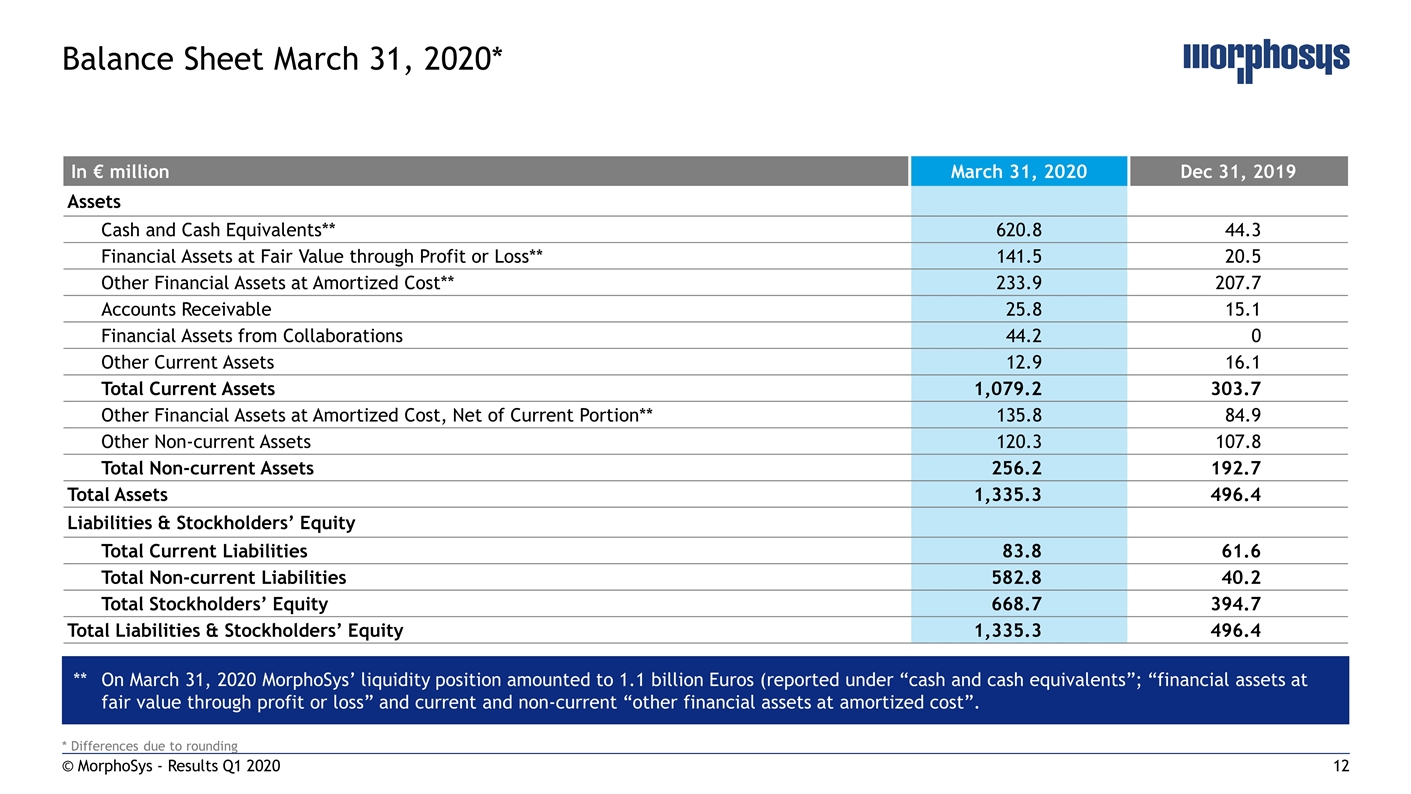

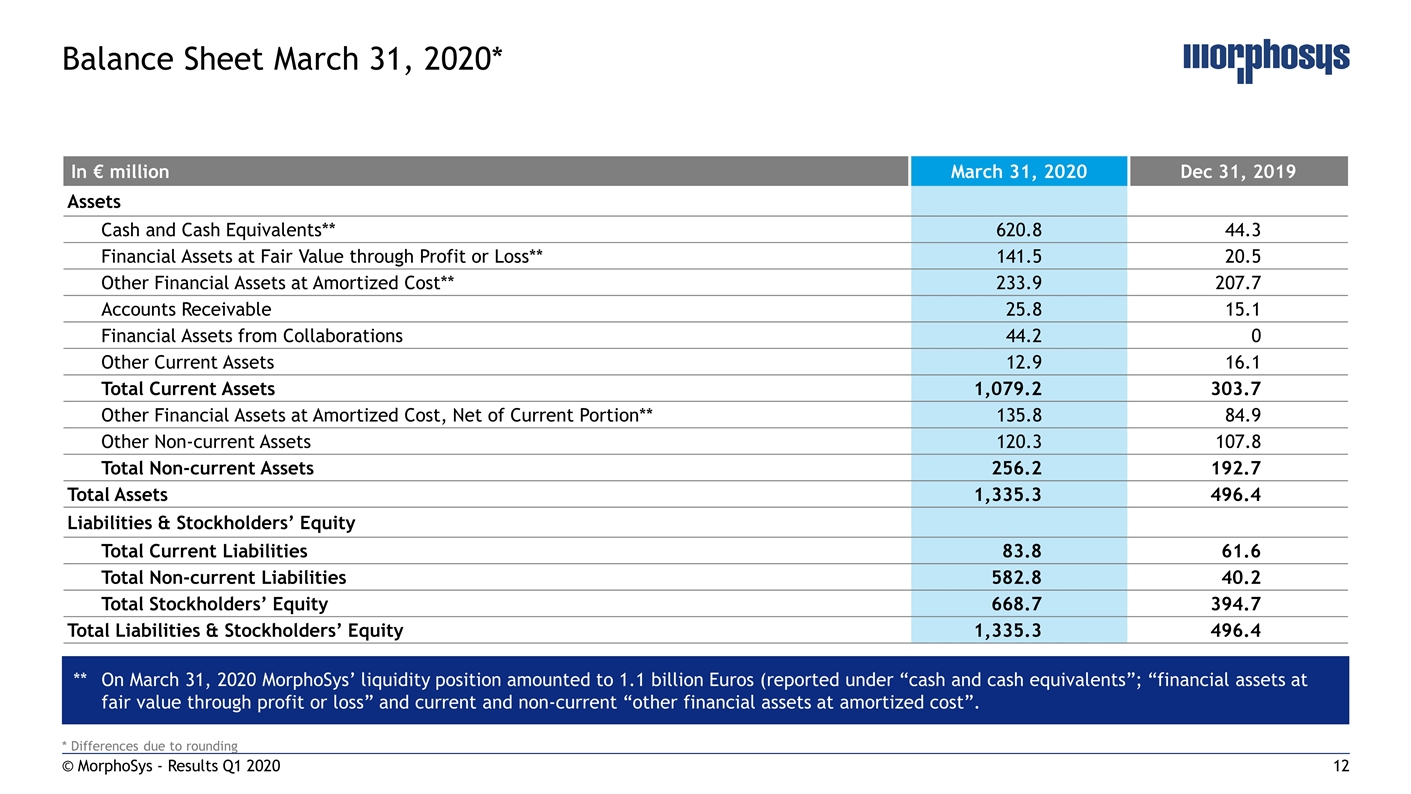

* Differences due to rounding © MorphoSys - Results Q1 2020 Balance Sheet March 31, 2020* In € million March 31, 2020 Dec 31, 2019 Assets Cash and Cash Equivalents** 620.8 44.3 Financial Assets at Fair Value through Profit or Loss** 141.5 20.5 Other Financial Assets at Amortized Cost** 233.9 207.7 Accounts Receivable 25.8 15.1 Financial Assets from Collaborations 44.2 0 Other Current Assets 12.9 16.1 Total Current Assets 1,079.2 303.7 Other Financial Assets at Amortized Cost, Net of Current Portion** 135.8 84.9 Other Non-current Assets 120.3 107.8 Total Non-current Assets 256.2 192.7 Total Assets 1,335.3 496.4 Liabilities & Stockholders’ Equity Total Current Liabilities 83.8 61.6 Total Non-current Liabilities 582.8 40.2 Total Stockholders’ Equity 668.7 394.7 Total Liabilities & Stockholders’ Equity 1,335.3 496.4 **On March 31, 2020 MorphoSys’ liquidity position amounted to 1.1 billion Euros (reported under “cash and cash equivalents”; “financial assets at fair value through profit or loss” and current and non-current “other financial assets at amortized cost”.

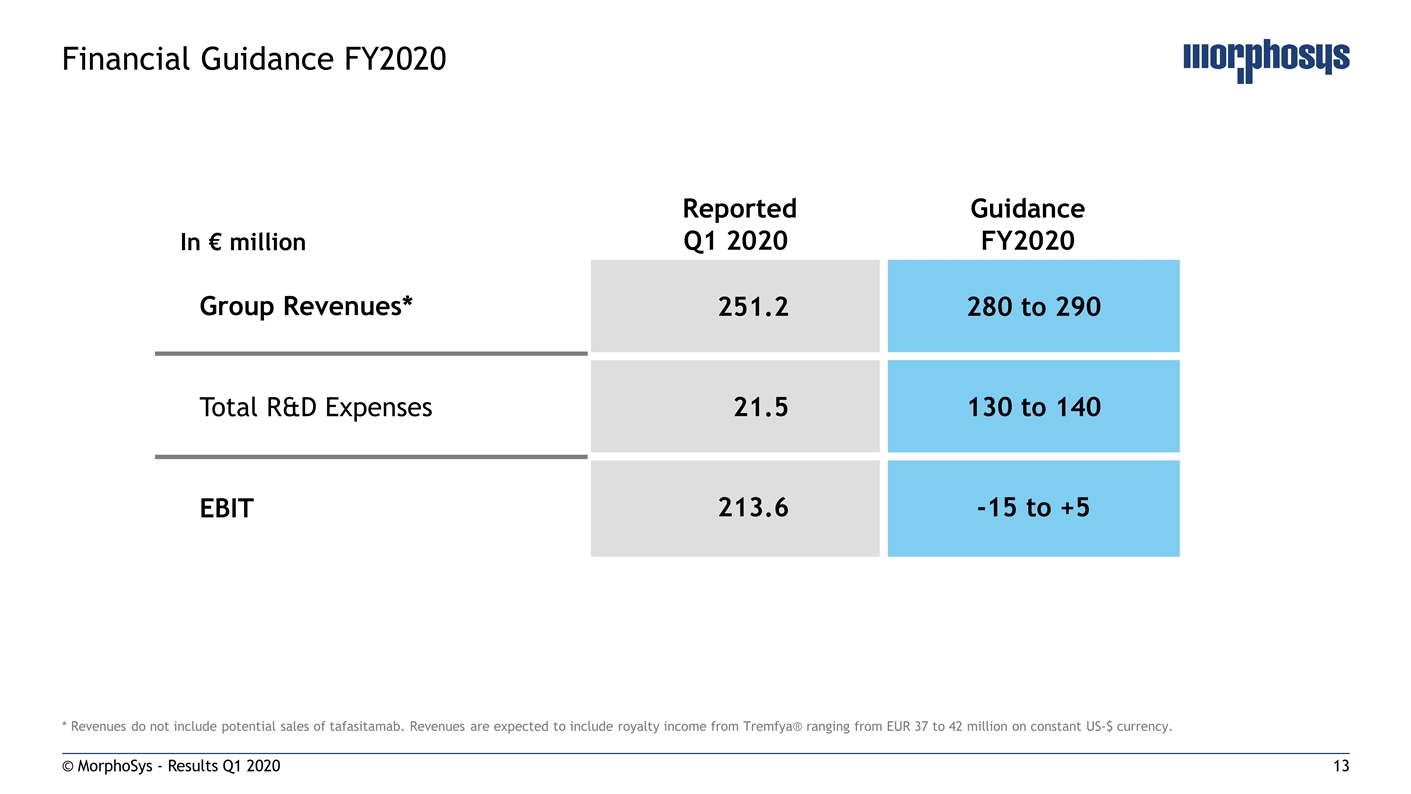

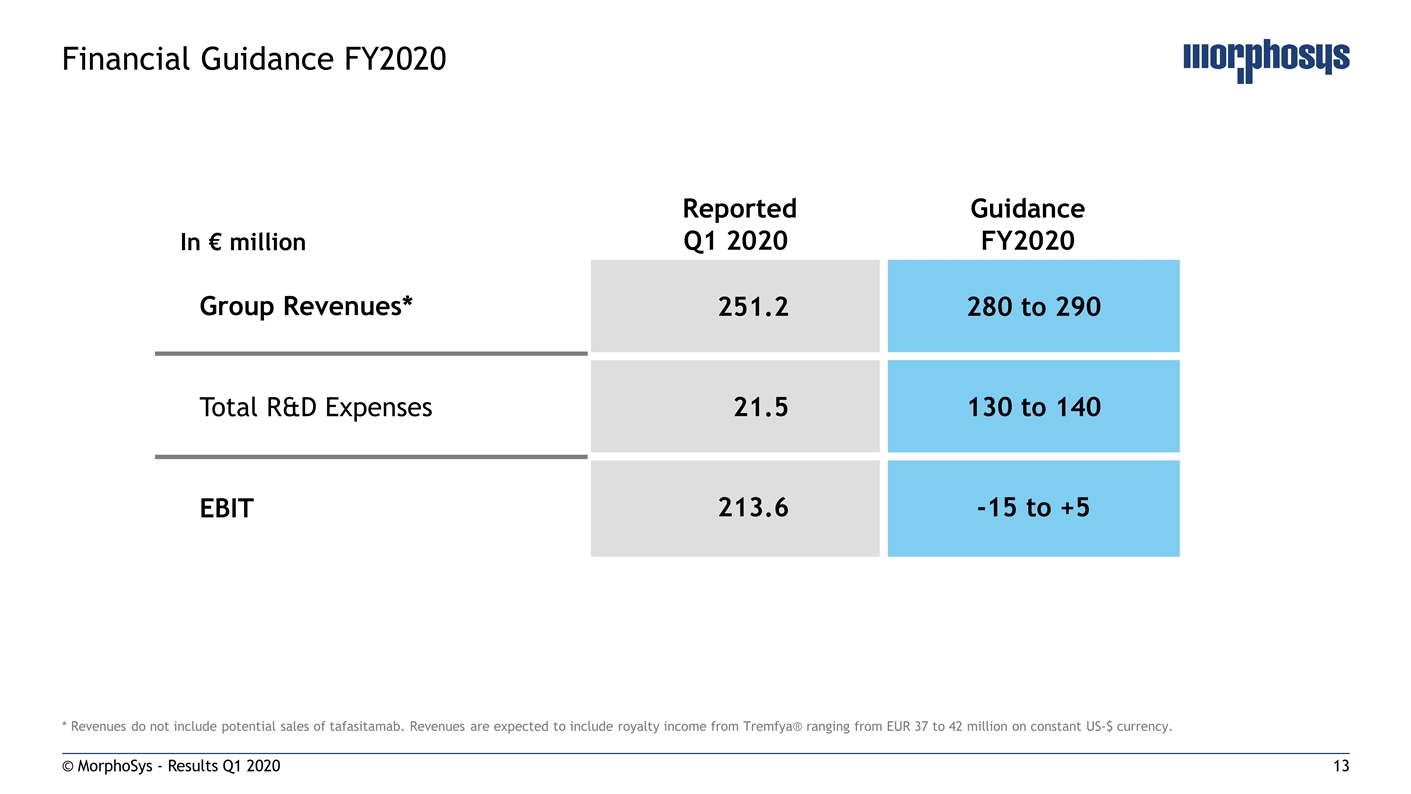

* Revenues do not include potential sales of tafasitamab. Revenues are expected to include royalty income from Tremfya® ranging from EUR 37 to 42 million on constant US-$ currency. © MorphoSys - Results Q1 2020 Financial Guidance FY2020 In € million Reported Q1 2020 Guidance FY2020 251.2 280 to 290 21.5 130 to 140 213.6 -15 to +5 Group Revenues* Total R&D Expenses EBIT

Closing Remarks Jean-Paul Kress, CEO © MorphoSys - Results Q1 2020

* pending FDA approval; tafasitamab is an investigational product and has not been proven to be safe and effective. Well Positioned for Success and Value Creation © MorphoSys - Results Q1 2020 Key Priorities for 2020 Flawless tafasitamab launch* in the U.S. and successful commercialization Unlock tafasitamab‘s full potential with Incyte Progress of our other proprietary programs

© MorphoSys - Results Q1 2020 Q & A