Exhibit 99.1

Half-Year Report

January – June 2020

| | | | |

| 2 | | Group Interim Statement | | |

Contents

MorphoSys Group:

Half-Year Report January – June 2020

| | | | |

| Group Interim Statement | |  | | 3 |

Summary of the Second Quarter of 2020

STATEMENT ON THE IMPACT OF THE GLOBAL COVID-19 PANDEMIC

| · | | MorphoSys recognizes the impact of the global COVID-19 pandemic on healthcare systems and society worldwide, as well as the resulting potential impact on preclinical and clinical programs, especially clinical trials. In addition to the steps already communicated to mitigate the impact of the pandemic on MorphoSys’ employees, patients and the broader community, further measures may need to be implemented in the future. MorphoSys will take various factors into consideration, including potential adaptation of clinical trials due to restrictions on visits to healthcare facilities, increased demands on healthcare services and changes in the availability of study personnel. MorphoSys continuously monitors the situation and takes appropriate decisions on a case-by-case basis to ensure the safety of patients, study personnel and other stakeholders as well as to safeguard data integrity. |

| · | | Despite the uncertainty caused by the COVID-19 pandemic in the United States, all of the preparations for the market launch of tafasitamab continue, which includes the planned use of digital channels. MorphoSys and Incyte are preparing for the successful commercial launch of tafasitamab. |

| · | | Patient enrollment for all ongoing tafasitamab studies continues as planned. However, a delay cannot be excluded due to the factors mentioned above. |

| · | | Recruitment of patients for the M-PLACE study with MOR202 (which now has the International Nonproprietary Name (INN) felzartamab to which MorphoSys will refer to going forward), which has been temporarily paused due to the COVID-19 pandemic, has been resumed. The first patient was dosed on July 27, 2020. |

FINANCIAL RESULTS FOR THE FIRST HALF OF 2020

| · | | Group revenue in the first half of 2020 totaled € 269.7 million (H1 2019: € 48.2 million), and EBIT amounted to € 163.5 million (H1 2019: € -29.3 million). |

| · | | Liquidity equaled € 1,061.8 million on June 30, 2020 (December 31, 2019: € 357.4 million). |

| · | | 2020 financial guidance remains unchanged for revenue in the range of € 280 million to € 290 million, EBIT between € -15 million to € 5 million and R&D expenses within € 130 million to € 140 million. |

OPERATING HIGHLIGHTS FOR THE SECOND QUARTER OF 2020

PROPRIETARY DEVELOPMENT

| · | | On April 27, 2020, MorphoSys and I-Mab announced the dosing of the first patient in an ongoing phase 3 clinical study in mainland China to evaluate MorphoSys’ human CD38 antibody felzartamab (MOR202/TJ202) in combination with lenalidomide plus dexamethasone in patients with relapsed (recurrent) or refractory (treatment-resistant) multiple myeloma (r/r MM). Under a license agreement with MorphoSys, I-Mab has exclusive rights to develop and commercialize felzartamab (MOR202/TJ202) in China, Taiwan, Hong Kong and Macao. |

| | | | |

| 4 | | Group Interim Statement | | |

| · | | On May 14, 2020, MorphoSys and Incyte announced long-term follow-up results from the ongoing phase 2 L-MIND study investigating tafasitamab in combination with lenalidomide for the treatment of patients with relapsed/refractory diffuse large B cell lymphoma (r/r DLBCL). The data (based on a November 30, 2019 cut-off date) confirmed the previously reported results of the primary analysis. |

| · | | On May 20, 2020, MorphoSys and Incyte announced the validation of the European Marketing Authorization Application (MAA) for tafasitamab. The MAA seeks approval of tafasitamab in combination with lenalidomide, followed by tafasitamab monotherapy, for the treatment of adult patients with r/r DLBCL, including DLBCL arising from low-grade lymphoma, who are ineligible for autologous stem cell transplantation (ASCT). The validation of the Marketing Authorization Application by the European Medicines Agency (EMA) confirms that the formal review process can begin. Incyte has exclusive commercialization rights to tafasitamab outside of the U.S. |

| · | | Tafasitamab data were presented at the annual meetings of the American Society of Clinical Oncology (ASCO) and European Hematology Association (EHA), which were held as virtual conferences on May 29-31, 2020 and June 11-14, 2020, respectively. |

| · | | GSK started a clinical trial (OSCAR) to evaluate the efficacy and safety of otilimab in patients with severe pulmonary COVID 19-associated disease. |

PARTNERED DISCOVERY

| · | | In June 2020, the 15th antibody from the long-term collaboration between MorphoSys and Novartis entered clinical development. This triggered a milestone payment to MorphoSys. |

CORPORATE DEVELOPMENTS

| · | | On April 21, 2020, MorphoSys announced the appointment of Roland Wandeler, Ph.D., to the MorphoSys AG’s Management Board effective May 5, 2020. As today’s Chief Operating Officer, Mr. Wandeler leads the global commercial operations and oversees the Company’s U.S. operations. |

| · | | On May 27, 2020, the Annual General Meeting of MorphoSys AG re-elected Wendy Johnson, Dr. George Golumbeski and Michael Brosnan to the Company’s Supervisory Board. Due to the restrictions imposed by the COVID-19 pandemic, the 2020 Annual General Meeting was held as a virtual meeting without the physical presence of shareholders or their proxies and was broadcast live to registered shareholders over the Internet. |

| · | | At the end of the second quarter of 2020, MorphoSys’ pipeline comprised a total of 115 drug candidates, 27 of which were in clinical development. |

SIGNIFICANT EVENTS AFTER THE END OF THE SECOND QUARTER OF 2020

| · | | On July 14, 2020, MorphoSys announced that its licensee Janssen announced the FDA approval of Tremfya® (guselkumab) as a treatment for adult patients living with active psoriatic arthritis (PsA). |

| · | | On July 27, 2020, the first autoimmune membranous nephropathy (aMN) patient was dosed with felzartamab (MOR202) in the M-PLACE study. |

| · | | On August 1, 2020, MorphoSys and Incyte announced that the FDA has approved Monjuvi® (tafasitamab-cxix) in combination with lenalidomide for the treatment of adult patients with relapsed or refractory diffuse large |

| | | | |

| Group Interim Statement | |  | | 5 |

| | | B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low grade lymphoma, and who are not eligible for autologous stem cell transplant (ASCT). |

| | | | |

| 6 | | Group Interim Statement | | |

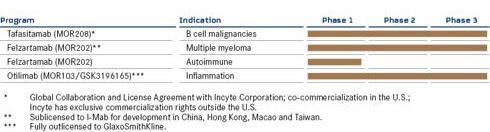

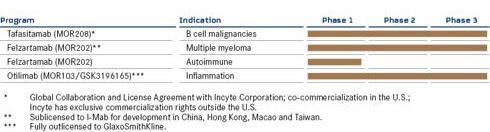

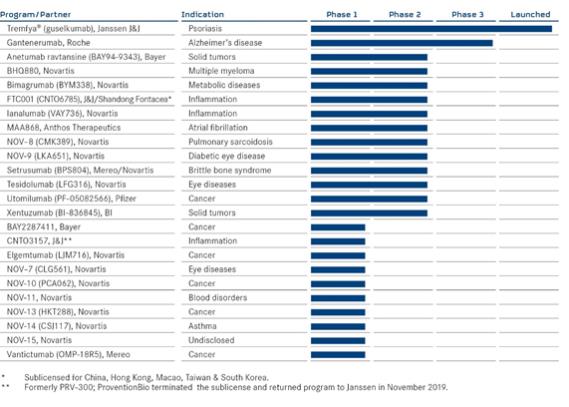

MORPHOSYS PRODUCT PIPELINE AS OF JUNE 30, 2020

CLINICAL PIPELINE – PROPRIETARY DEVELOPMENT PROGRAMS

Most advanced development stage

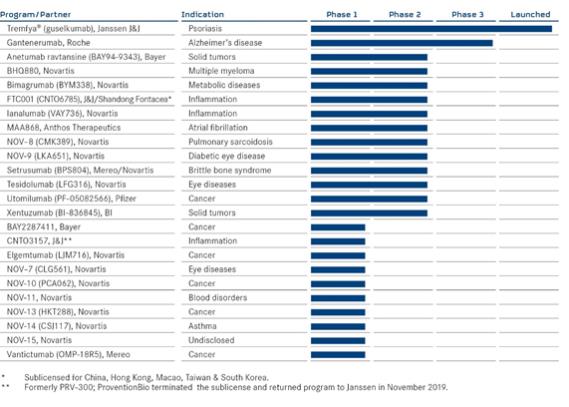

CLINICAL PIPELINE – PARTNERED DISCOVERY PROGRAMS

Most advanced development stage

| | | | |

| Group Interim Statement | |  | | 7 |

Interim Group Management Report: January 1 – June 30, 2020

Business Environment and Activities

ECONOMIC DEVELOPMENT

The International Monetary Fund (IMF) is anticipating a sharp decline in global economic development in 2020 as a result of the global COVID-19 pandemic. It is currently forecasting a contraction in global economic output of 4.9% in 2020. The economic recovery is likely to be slower than what estimates had indicated at the beginning of the pandemic. Economic output this year in Germany is forecast to decline by 7.8%, and in the Eurozone by even 10.2%. The United States are expected to see a decline in economic output of 8.0%.

The COVID-19 pandemic has also had a tremendous impact on stock markets worldwide. After an optimistic start to 2020, stock indices plunged in the second half of February and subsequently settled at a lower level. At the end of the first half-year, the German DAX index closed 7.1% lower, the MDAX index for medium-sized companies ended with a decline of 8.7% and the technology stocks index TecDAX had dropped 2.0%. Biotechnology stocks, on the other hand, benefited from the efforts to develop vaccines and drugs against the SARS-CoV-2 virus, as demonstrated by the performance of the Nasdaq Biotech Index, which closed the first half-year with an increase of 13.5%.

IMPLICATIONS FOR MORPHOSYS

Shares of MorphoSys AG could not avoid the impact of the economic developments described above. After starting the year in an uptrend, the shares reached an interim high of € 136.20 on January 10 followed by a low of € 70.20 several weeks later on March 18. The shares recovered quickly from this slump and, after some volatility, closed the first half of 2020 on June 30 at € 112.45.

SECTOR OVERVIEW

The first half of 2020 was marked by medical conferences featuring the presentation of research results by companies in the sector. Travel and meeting restrictions in the wake of the COVID-19 pandemic, however, meant that these conferences had to be held virtually. Among other events, the annual meeting of the American Society of Clinical Oncology (ASCO), which is the world’s largest oncology conference, was held as a virtual conference on May 29-31, 2020. On June 11-14, 2020, the 25th Annual Meeting of the European Hematology Association (EHA), the leading European conference in the field of hematology, was also held as a virtual conference. The Management presented the Company at several investor conferences which were also held as virtual events in June 2020. Clinical results of tafasitamab were presented at all conferences.

| | | | |

| 8 | | Group Interim Statement | | |

BUSINESS PERFORMANCE

MorphoSys is very satisfied with the Company’s business performance in the first half of 2020, both with respect to its research activities concerning the Company’s proprietary programs and partnered compounds, as well as with the Group’s development.

In the second quarter, MorphoSys and Incyte announced long-term follow-up results from the ongoing phase 2 L-MIND study evaluating tafasitamab in combination with lenalidomide for the treatment of patients with r/r DLBCL. New two-year follow-up data of the L-MIND study (November 30, 2019 cut-off date) confirmed earlier reported results from the primary analysis. The Biologics License Application (BLA) for tafasitamab submitted by MorphoSys to the U.S. Food and Drug Administration (FDA) in December 2019 was also accepted by the FDA for Priority Review. In addition, MorphoSys and I-Mab jointly announced that the first patient had been dosed in an ongoing phase 3 clinical trial in mainland China to evaluate MorphoSys’ human CD38 antibody felzartamab (MOR202/TJ202) in combination with lenalidomide plus dexamethasone in patients with r/r MM. After announcing the initiation of a phase 3 clinical development program for the antibody otilimab (formerly MOR103/GSK3196165) in rheumatoid arthritis in mid-2019, GSK has also started a clinical trial (OSCAR) to evaluate the efficacy and safety of otilimab in patients with severe pulmonary COVID-19-associated disease.

The ongoing collaborations in the Partnered Discovery segment continued successfully during the first half of 2020. With the start of clinical development of the 15th antibody from the long-term collaboration with Novartis, the number of clinical candidates increased during the reporting period.

At the end of the second quarter of 2020, MorphoSys’ product pipeline comprised 115 partnered and proprietary programs in research and development, of which 27 were clinical programs.

In the opinion of the Management Board, at the time of publishing this half-year report, MorphoSys was well on track to achieve its full-year business and financial targets.

STRATEGY AND GROUP MANAGEMENT

MorphoSys did not make any changes to its strategy or management of the Group during the first six months of 2020. A full description of the strategy and Group management can be found from page 47 ff. of the 2019 Annual Report.

Research and Development and Operating Business Performance

PROPRIETARY DEVELOPMENT

MorphoSys’ development activities in this segment are currently focused on the following clinical candidates:

| | | | |

| Group Interim Statement | |  | | 9 |

| · | | Tafasitamab – an antibody for the treatment of blood cancers and the most advanced proprietary product candidate in the Proprietary Development segment. |

| · | | Felzartamab (MOR202) – an antibody for which MorphoSys signed a regional license agreement with I-Mab Biopharma (I-Mab) in November 2017 for development in multiple myeloma in Greater China, and whose therapeutic potential in autoimmune diseases is currently being evaluated by MorphoSys. |

| · | | Otilimab – an antibody in which GlaxoSmithKline [GSK] is currently conducting clinical trials for the treatment of rheumatoid arthritis. This program was originally a MorphoSys proprietary program and was fully out-licensed to GSK in 2013. |

In addition to the programs listed above, several proprietary programs are in earlier-stage research and development, including MOR210, a preclinical antibody that was out-licensed to I-Mab in November 2018 for China and certain other territories in Asia. The lanthipeptide MOR107 (LP 2-3), which is in development at Dutch Lanthio Group, was subject to an event-related impairment test at the end of the second quarter. Since the program is not expected to progress towards clinical development, a full impairment was recognized and the development has been terminated.

Tafasitamab (MOR208) is a humanized monoclonal antibody directed against the CD19 antigen. CD19 is selectively expressed on the surface of B cells, which belong to a group of white blood cells. CD19 enhances B cell receptor signaling, which is an important factor in B cell survival and growth, making CD19 a potential target in the treatment of B cell malignancies.

On January 13, 2020, MorphoSys and Incyte announced the signing of a collaboration and license agreement for the further global development and commercialization of MorphoSys’ proprietary anti-CD19 antibody tafasitamab. Under this agreement, MorphoSys and Incyte will co-develop tafasitamab broadly in r/r DLBCL, first-line DLBCL and other indications beyond DLBCL, such as follicular lymphoma (FL), marginal zone lymphoma (MZL) and chronic lymphocytic leukemia (CLL). Incyte will be responsible for initiating a combination study of its PI3K delta inhibitor parsaclisib with tafasitamab in relapsed/refractory malignant B cell disease, in addition to leading any potential pivotal studies in CLL, and for a phase 3 trial in r/r FL/MZL. MorphoSys will continue to be responsible for its ongoing clinical studies with tafasitamab in non-Hodgkin’s lymphoma (NHL), CLL, r/r DLBCL and first-line DLBCL. MorphoSys and Incyte will share responsibility for initiating further global clinical trials. Incyte intends to pursue development in additional territories, including Japan and China.

The current focus of the clinical development of tafasitamab is DLBCL. Both the L-MIND and B-MIND studies target patients suffering from r/r DLBCL who are ineligible for high-dose chemotherapy (HDC) or ASCT. For this group of patients, the currently available treatment options are limited and not yet sufficiently effective, which is why MorphoSys and Incyte see a high unmet medical need for the development of alternative treatment options. The First-MIND study is being conducted in patients with newly diagnosed DLBCL and is expected to pave the way

| | | | |

| 10 | | Group Interim Statement | | |

for a pivotal phase 3 trial in first-line patients.

The phase 2 study L-MIND (Lenalidomide-MOR208 IN DLBCL), initiated in April 2016, was designed as a single-arm, open-label study with the primary endpoint of overall response rate (ORR) and several secondary endpoints including progression-free survival (PFS), overall survival (OS) and time to progression (TTP). In October 2017, based on the study’s interim data, the FDA granted Breakthrough Therapy Designation for tafasitamab in combination with lenalidomide. Patient recruitment was completed in November 2017.

On May 14, 2020, MorphoSys and Incyte announced updates on the ongoing phase 2 L-MIND study evaluating tafasitamab in combination with lenalidomide for the treatment of patients with r/r DLBCL. The data (November 30, 2019 data cut-off date) confirm the previously reported results of the primary analysis. In this long-term analysis of the L-MIND data, 80 study patients treated with tafasitamab plus lenalidomide were included in the efficacy analysis. After a minimum two-year follow-up, outcomes from the L-MIND study were consistent with the primary analysis and confirmed the duration of response (DoR) and overall survival (OS) after treatment with tafasitamab plus lenalidomide, followed by tafasitamab monotherapy in patients with r/r DLBCL who are ineligible for ASCT. At the data cut-off date, an assessment by an independent review committee (IRC) showed an objective response rate (ORR) of 58.8% (47 out of 80 patients) and a complete response rate (CR) of 41.3% (33 out of 80 patients). The median duration of response (mDOR) was 34.6 months, the median overall survival (mOS) was 31.6 months, and the median progression-free survival (mPFS) was 16.2 months. The safety profile was consistent with that observed in earlier reported studies with tafasitamab plus lenalidomide. The complete results were presented at the 25th EHA Annual Congress, which was held virtually on June 11-14, 2020.

At the annual meeting of the American Society of Clinical Oncology (ASCO), which was held as a virtual conference on May 29-31, 2020, detailed primary analysis data from the retrospective observational matched control cohort (Re-MIND) were presented. Topline data of the Re-MIND study were first published in October 2019. The efficacy of the lenalidomide monotherapy was compared to the efficacy data of tafasitamab combined with lenalidomide, as investigated in our L-MIND study, based on real-world patient data. For this purpose, Re-MIND collected real-world efficacy data from 490 patients with r/r DLBCL who were ineligible for HDC and ASCT and had already received lenalidomide monotherapy in the U.S. or EU. For the best possible comparison with the patients from the L-MIND study, qualification criteria for matching patients from both studies were pre-specified. As a result, 76 eligible Re-MIND patients were identified and matched one to one to 76 of the 80 L-MIND patients based on important baseline characteristics (matching). The objective response rates (ORR) were determined for both Re-MIND and L-MIND based on this subset of 76 patients.

The primary endpoint of Re-MIND was met and showed a statistically significant superior best objective response rate (ORR) of the tafasitamab/lenalidomide combination compared to lenalidomide monotherapy. The ORR was

| | | | |

| Group Interim Statement | |  | | 11 |

67.1% for the tafasitamab/lenalidomide combination compared to 34.2% for lenalidomide monotherapy. Superiority was consistently observed across all secondary endpoints, including complete response (CR) rate (tafasitamab/lenalidomide combination 39.5%; versus lenalidomide monotherapy at 11.8%, as well as in pre-specified statistical sensitivity analyses). In addition, there was a significant difference observed for median overall survival (OS), which had not yet been reached in the tafasitamab/lenalidomide combination as compared to 9.3 months in lenalidomide monotherapy (hazard ratio 0.47).

Based on the data from the primary analysis of both studies and the results of the tafasitamab monotherapy study in NHL, MorphoSys submitted a BLA to the FDA for tafasitamab in combination with lenalidomide for the treatment of r/r DLBCL in late December 2019. In early March 2020, MorphoSys announced that the FDA formally accepted the application and granted a Priority Review. The FDA has set August 30, 2020 as the target date for the decision on a potential approval under the PDUFA. On August 1, 2020, MorphoSys and Incyte announced that the FDA has approved Monjuvi® (tafasitamab-cxix) in combination with lenalidomide for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low grade lymphoma, and who are not eligible for autologous stem cell transplant (ASCT).

On May 20, 2020, MorphoSys and Incyte announced the validation of the European Marketing Authorization Application (MAA) for tafasitamab. The application seeks the approval of tafasitamab in combination with lenalidomide, followed by tafasitamab monotherapy, for the treatment of adult patients with r/r DLBCL, including DLBCL arising from low-grade lymphoma, who are ineligible for ASCT. The validation of the Marketing Authorization Application by the European Medicines Agency (EMA) confirms that the formal review process can begin. MorphoSys’ application for approval is based on data from the L-MIND study evaluating tafasitamab in combination with lenalidomide for the treatment of patients suffering from r/r DLBCL. The application is supported by the Re-MIND study, an observational retrospective study in r/r DLBCL. If approved, Incyte will hold the marketing authorization giving it exclusive commercialization rights for tafasitamab in Europe.

The phase 2/3 trial by the name of B-MIND (Bendamustine-MOR208 IN DLBCL), initiated in September 2016, is evaluating the safety and efficacy of the administration of tafasitamab in combination with the chemotherapeutic agent bendamustine in comparison to the administration of the cancer drug rituximab plus bendamustine in patients with r/r DLBCL who are ineligible for high-dose chemotherapy and autologous stem cell transplantation. The study has been in phase 3 since mid-2017. In 2019, in consultation with the FDA, MorphoSys expanded the study to include a biomarker-based co-primary endpoint. This biomarker is defined as a low baseline peripheral blood natural killer (NK low) cell count. In November 2019, the B-MIND study successfully passed the pre-planned, event-driven interim analysis for futility. Within the scope of this analysis, the data were reviewed by an

| | | | |

| 12 | | Group Interim Statement | | |

independent monitoring committee (IDMC) to determine the likelihood of a futile outcome of the study at the time of study completion. The IDMC evaluated efficacy data in the entire patient population, as well as in the biomarker-positive patient subpopulation, and recommended increasing the number of patients from 330 to 450. MorphoSys expects the study’s topline results to become available in 2022.

In addition to the aforementioned clinical development in r/r DLBCL, at the end of 2019, MorphoSys initiated a phase 1b clinical trial of tafasitamab as a first-line therapy in DLBCL (First-MIND). The study evaluates tafasitamab or tafasitamab plus lenalidomide in addition to R-CHOP (the current standard therapy) in patients with newly diagnosed DLBCL. The primary endpoint of the study is the incidence and severity of treatment-emergent adverse events (AEs). The secondary endpoints are the objective response rate (ORR) and complete response (CR) rate at the end of treatment, the incidence and severity of AEs in the 18-month follow-up period, the best ORR and CR by the end of the study (approximately 24 months), progression-free survival (PFS), event-free survival (ES) and overall survival (OS) at 12 and 24 months. This study is expected to pave the way for a pivotal phase 3 trial of tafasitamab as a first-line therapy in DLBCL.

In addition to these combination studies in DLBCL, MorphoSys has been evaluating tafasitamab in a phase 2 combination study in chronic lymphocytic leukemia (CLL) or small cell B cell lymphoma (SLL) since December 2016. The study named COSMOS (CLL patients assessed for ORR & Safety in MOR208 Study) is investigating the safety of tafasitamab in combination with the cancer drugs idelalisib (cohort A) or venetoclax (cohort B). The study will include patients for whom previous therapy with a Bruton tyrosine kinase inhibitor was either not tolerated or no longer effective. Data from the primary analysis of both cohorts were presented at the ASH conference in Orlando in December 2019. Cohort A included eleven patients receiving tafasitamab plus idelalisib. Patients were in the study for a median of 7.4 months. The overall response rate was 91%, and one patient achieved complete remission. Eight patients were tested for minimal residual disease (MRD), two of these eight patients achieved MRD negativity in blood, and one of three patients also achieved MRD negativity in bone marrow. A total of 13 patients were enrolled in cohort B and treated with tafasitamab plus venetoclax. The median time in the study was 15.6 months. In the intent-to-treat population, the best overall response was 76.9%; 46.2% of patients achieved complete remission. Seven patients were tested for the presence of minimal residual disease. Six of these seven patients achieved MRD negativity in blood, and two of four patients achieved MRD negativity in bone marrow. The COSMOS study showed that combinations of tafasitamab with idelalisib or venetoclax were generally well-tolerated.

R/r DLBCL and r/r CLL are life threatening diseases. Therefore, we currently continue the inclusion and treatment of patients in all ongoing studies with tafasitamab despite the COVID-19 pandemic.

| | | | |

| Group Interim Statement | |  | | 13 |

MorphoSys continues to work diligently on establishing its commercial presence in the U.S. in anticipation of tafasitamab’s approval by the FDA and in preparation for the successful market launch of tafasitamab with partner Incyte. A key position has been created with the appointment of Dr. Roland Wandeler to the Management Board. As today’s Chief Operating Officer, Mr. Wandeler is responsible for the global commercial operations and oversees the Company’s U.S. operations. The necessary commercial infrastructure has also been set up, and recruitment for important positions at the Company’s U.S. headquarters in Boston (Massachusetts) has been completed.

Felzartamab (MOR202) is directed against CD38, an antigen expressed on the surface of plasma cells.

In November 2017, MorphoSys and I-Mab signed a regional license agreement for felzartamab (MOR202) granting I-Mab Biopharma exclusive development and commercialization rights in China, Hong Kong, Taiwan and Macao.

On April 27, 2020, MorphoSys and I-Mab announced the dosing of the first patient in a phase 3 clinical study in mainland China to evaluate felzartamab (MOR202/TJ202) in combination with lenalidomide plus dexamethasone in patients with r/r MM. This clinical trial (NCT03952091) is a randomized, open-label, controlled, multi-center study to evaluate the efficacy and safety of the combination of felzartamab (MOR202/TJ202), lenalidomide and dexamethasone versus the combination of lenalidomide and dexamethasone in patients with r/r MM who received at least one prior line of treatment. This multi-center study had already started at locations in Taiwan in April 2019 and has now officially started in mainland China as part of a coordinated effort to accelerate the study. In addition, I-Mab is investigating felzartamab (MOR202/TJ202) in a phase 2 trial which started in March 2019 as a third-line treatment for r/r MM. Both studies are considered relevant for approval in the region.

In October 2019, MorphoSys initiated a phase 1/2 trial in anti-PLA2R-positive membranous nephropathy, an autoimmune disease affecting the kidneys. The proof-of-concept study, called M-PLACE, is an open-label, multi-center study and primarily evaluates the safety and tolerability of felzartamab (MOR202). Secondary endpoints are the effect of felzartamab (MOR202) on serum antibodies against PLA2R and the evaluation of the immunogenicity and pharmacokinetics of felzartamab (MOR202). An exploratory goal is to determine clinical efficacy.

In response to the COVID-19 pandemic, several hospitals conducting clinical trials have restricted visits to their premises and patients to protect both staff and patients from possible COVID-19 exposure. In order to ensure patient and physician safety and correct data collection, MorphoSys temporarily paused the patient screening and enrollment for the M-PLACE study of felzartamab (MOR202). Now, MorphoSys has resumed patient recruitment. The first patient was dosed in the U.S. end of July 2020.

| | | | |

| 14 | | Group Interim Statement | | |

MOR106, a human monoclonal antibody against IL-17, became part of an exclusive development and commercialization agreement with Novartis in July 2018. In October 2019, the three parties to this agreement – Galapagos, MorphoSys and Novartis – announced that the clinical development of MOR106 in atopic dermatitis (AtD) was terminated for all studies based on the results of interim analysis for futility. Novartis terminated the development and commercialization agreement within the notice period. All ongoing activities related to the terminated studies will be completed jointly by the three parties.

Otilimab (MOR103/GSK3196165), a fully human antibody directed against GM-CSF, was fully out-licensed to GSK in 2013. In mid-2019, GSK announced the start of a phase 3 program in rheumatoid arthritis (RA) called ContRAst. It comprises three pivotal studies and a long-term extension study and evaluates the antibody in patients with moderate to severe RA. GSK has also started a clinical trial (OSCAR) to evaluate the efficacy and safety of otilimab in patients with severe pulmonary COVID-19-associated disease. According to information on www.clinicaltrials.gov, up to 800 patients are expected to be enrolled in the study and data are expected in 1H 2021.

Other programs: In addition to the programs listed above, MorphoSys is pursuing several proprietary programs in earlier phases of research and development.

On June 30, 2020, the number of therapeutic programs in the Proprietary Development segment totaled 11, four of which were out-licensed (December 31, 2019: 12 programs, four of which were out-licensed). Three of these programs are in clinical development, one is in preclinical development, and six are in the discovery stage. The clinical development of MOR106 is currently stopped.

PARTNERED DISCOVERY

The Partnered Discovery segment comprises the activities and programs in which MorphoSys is contracted by its partners to use its proprietary technology to discover new antibodies. Partners are then responsible for the products’ clinical development and subsequent commercialization with MorphoSys participating in the later development and commercialization success according to predefined milestone payments and royalties.

In June 2020, the 15th antibody from the long-term collaboration (active from 2004 to 2017) between MorphoSys and Novartis entered clinical development. The antibody is being tested by Novartis in a phase 1 clinical trial. The start of clinical development triggered a milestone payment to MorphoSys.

During the first six months of 2020, the number of therapeutic programs in the Partnered Discovery segment remained stable at 104 (December 31, 2019: 104). As of June 30, 2020, 24 of these programs were in clinical development, 23 were in preclinical development, and 56 were in the discovery stage. Our Tremfya® Partnered Discovery program is already available on the market.

| | | | |

| Group Interim Statement | |  | | 15 |

CORPORATE DEVELOPMENTS

On April 6, 2020, MorphoSys provided an update on its operations and the measures it is taking to mitigate the impact of the rapidly evolving COVID-19 global pandemic on its employees, patients and the wider community.

MorphoSys is currently operating in accordance with its business continuity plan to minimize disruptions to operations and to implement the measures necessary to protect employees. MorphoSys is currently conducting a number of clinical trials of investigational drugs and closely monitoring each program individually in addition to the overall situation. MorphoSys is making adjustments, where necessary, to comply with regulatory, institutional and governmental requirements and guidelines related to COVID-19. The highest priority is to ensure the safety of all clinical program participants and the proper execution of the trials in which they are participating in accordance with the study protocols. In response to the COVID-19 pandemic, several clinics conducting clinical trials have restricted visits to their premises and patients to protect both staff and patients from possible COVID-19 exposure. As a result, MorphoSys monitored the situation and decided on the necessary procedures to ensure patient safety and correct data collection on a case-by-case basis, depending on the study and country. Despite the rapidly changing conditions worldwide and the potential impact on clinical trials, MorphoSys continues to work diligently to maintain its drug development plans.

Roland Wandeler, Ph.D., was appointed to the MorphoSys AG’s Management Board effective May 5, 2020. In his today’s position as Chief Operating Officer, Mr. Wandeler leads the global commercial operations and oversees the Company’s U.S. operations.

On May 27, 2020, the Annual General Meeting of MorphoSys AG re-elected Wendy Johnson, Dr. George Golumbeski and Michael Brosnan to the Company’s Supervisory Board. The shareholders also approved all items on the agenda, which were put to vote by the management. Due to the restrictions imposed by the COVID-19 pandemic, the 2020 Annual General Meeting was held as a virtual annual general meeting without the physical presence of shareholders or their proxies and was visually and was broadcast live to the Company’s registered shareholders via the Internet.

Intellectual Property

In the first six months of 2020, MorphoSys continued to consolidate and expand the patents protecting its development programs and growing technology portfolio, which represent the Company’s key value drivers.

Currently, the Company possesses more than 60 different proprietary patent families worldwide in addition to the numerous patent families it pursues in cooperation with its partners.

| | | | |

| 16 | | Group Interim Statement | | |

Human Resources

On June 30, 2020, the MorphoSys Group had 572 employees (December 31, 2019: 426). During the first six months of 2020, the number of employees at the MorphoSys Group averaged 518 (H1 2019: 353).

Financial Analysis

Due to the business model, the Covid-19 pandemic has had little impact on MorphoSys’ net assets, financial position and results of operations in the first six months of 2020. There were no significant asset impairments related to Covid-19.

Revenues

Group revenues in the first half of 2020 increased to € 269.7 million (H1 2019: € 48.2 million). This rise resulted primarily from the collaboration and license agreement with Incyte for the out-licensing of tafasitamab outside the United States.

Success-based payments, including royalties, comprised 9%, or € 23.1 million (H1 2019: 90% and € 43.4 million), of total revenues. From a geographical standpoint, MorphoSys generated 99%, or € 266.0 million, of its commercial revenues with biotechnology and pharmaceutical companies and non-profit organizations headquartered in North America and 1%, or € 3.7 million, with partners primarily located in Europe and Asia. In the comparable period of the previous year, these figures were 28% and 72%, respectively. 99% of the Group’s revenues were generated with partners Incyte, Janssen and I-Mab (H1 2019: 90% with GlaxoSmithKline, Janssen and I-Mab).

PROPRIETARY DEVELOPMENT SEGMENT

In the first half of 2020, the Proprietary Development segment generated revenue of € 245.4 million (H1 2019: € 31.7 million). These revenues do not contain milestone payments (H1 2019: € 29.1 million) but service fees of € 9.4 million (H1 2019: € 2.6 million).

PARTNERED DISCOVERY SEGMENT

The revenue from the Partnered Discovery segment included € 1.2 million in service and licensing fees (H1 2019: € 2.2 million) and € 23.1 million in milestone payments and royalties (H1 2019: € 14.3 million).

| | | | |

| Group Interim Statement | |  | | 17 |

Operating Expenses

COST OF SALES

Cost of sales in the first six months of 2020 amounted to € -4.0 million (H1 2019: € 9.9 million) and included expenses related to services provided in the transfer of projects to customers. Furthermore, the impairments to a net realizable value of zero recognized on the antibody material resulting from fermentation runs (tafasitamab) have been reversed due to the market approval of tafasitamab. This can now be used for commercialization purposes and therefore qualifies as inventory. This resulted in income in the amount of € 11.0 million, of which € 9.9 million have to be attributed to fiscal year 2019. This reversal of impairment was included in cost of sales and overcompensated expenses incurred in the first six months of fiscal year 2020. Therefore, the cost of sales line item in total presented an income.

RESEARCH AND DEVELOPMENT EXPENSES

In the first six months of 2020, research and development expenses amounted to € 52.4 million (H1 2019: € 49.3 million). Expenses in this area were largely driven by expenses for intangible assets of € 16.2 million (H1 2019: € 2.0 million), personnel expenses in the amount of € 14.4 million (H1 2019: € 13.8 million) as well as expenses for external laboratory services in the amount of € 13.1 million (H1 2019: € 25.0 million). Expenses for intangible assets were mainly influenced by impairment charges of € 13.7 million related to an impairment of the in-process-R&D program MOR107 as well as a license. Furthermore, the reversal of impairments of inventories on the pre-manufactured antibody material (tafasitamab), which is designated to further clinical trials, had a relieving effect of € 4.1 million. The reversal of impairments for previously devalued stock amounted to a total of € 3.3 million.

SELLING EXPENSES

Selling expenses in the first six months of 2020 amounted to € 42.1 million (H1 2019: € 4.9 million). This line item included mainly personnel expenses in the amount of € 20.6 million (H1 2019: € 2.3 million) and expenses for external services of € 19.8 million (H1 2019: € 2.1 million). It also comprised expenses for services rendered by Incyte in connection with the joint US activities.

GENERAL AND ADMINISTRATIVE EXPENSES

In comparison to the same period of the previous year, general and administrative expenses increased to € 23.9 million (H1 2019: € 13.4 million). This line item comprised mainly personnel expenses amounting to € 14.4 million (H1 2019: € 9.7 million) and expenses for external services of € 6.4 million (H1 2019: € 2.0 million).

| | | | |

| 18 | | Group Interim Statement | | |

Other Income / Finance Income / Finance Expenses

Other income amounted to € 10.0 million in the first six months of 2020 (H1 2019: € 0.3 million) and resulted primarily from currency gains from operating activities of € 9.7 million (H1 2019: € 0.1 million).

Finance income amounted to € 28.1 million (H1 2019: € 1.1 million) and resulted from effects from the financial assets and financial liabilities from collaborations of € 22.3 million (H1 2019: € 0), comprising currency translation effects, effects in changes in fair value and deviations in planning assumptions, as well as from investments of liquid funds and their foreign currency gains of € 5.8 million (H1 2019: € 0.6 million).

Finance expense increased to € 34.4 million (H1 2019; € 0.7 million) mainly driven by the effects from the financial assets and financial liabilities from collaborations of € 17.6 million (H1 2019: € 0), comprising effects from deviations in planning assumptions, application of the effective interest rate method and effects relating to foreign currency translation, from investments of liquid funds and their foreign currency losses of € 9.0 million (H1 2019: € 0.2 million) and from financial derivatives of € 7.0 million (H1 2019: gain of € 0.4 million).

Income Taxes

The Group recognized a total tax benefit of € 23.3 million in the first six months of 2020, which was primarily impacted by the tax assessment of the collaboration and license agreement with Incyte. This included current tax expenses of € 108.8 million and deferred tax expense from temporary differences of € 13.0 million, which were more than offset by deferred tax benefit from temporary differences of € 145.1 million.

Financial Position

LIQUIDITY

On June 30, 2020, the Group’s liquidity amounted to € 1,061.8 million, compared to € 357.4 million on December 31, 2019.

Liquidity is presented in the balance sheet items “cash and cash equivalents”, “financial assets at fair value through profit or loss” and current and non-current “other financial assets at amortized cost”.

The increase in liquidity resulted primarily from payments received upon signing the collaboration and license agreement with Incyte for the further development and commercialization of tafasitamab. This increase was offset by the use of cash for operating activities in the first six months of 2020.

| | | | |

| Group Interim Statement | |  | | 19 |

Balance Sheet

ASSETS

At € 1,424.1 million, total assets as of June 30, 2020 were € 927.7 million higher than their level on December 31, 2019 (€ 496.4 million). The rise in current assets primarily resulted from the increase of € 373.5 million in “Financial Assets at Fair Value through Profit or Loss” and € 179.7 million increase in “Other Financial Assets at Amortized Cost”, which stemmed mainly from the investment of funds received under the collaboration and license agreement with Incyte. In addition, the balance sheet item “Financial Assets from Collaborations”, which amounted to € 45.3 million as of June 30, 2020, was recognized for the first time in 2020 due to the collaboration and license agreement with Incyte. Furthermore, inventories increased by € 15.0 million, as the impairments to the net realizable value of zero of inventories had to be reversed due to the market approval of tafasitamab.

Non-current assets increased by € 303.4 million in comparison to December 31, 2019, to a total of € 496.2 million. This increase was primarily due to the increase in “Other Financial Assets at Amortized Cost, Net of Current Portion” by € 162.1 million resulting from the long-term investment of funds received from Incyte. Additionally, “Deferred Tax Assets” of € 145.1 million were recognized mainly due to the contract with Incyte. This increase was partly offset by a decline in „Shares at Fair Value through Other Comprehensive Income” in the amount of € 4.7 million.

LIABILITIES

Current liabilities increased from € 61.6 million as of December 31, 2019 to € 171.6 million as of June 30, 2020. This increase was primarily the result of an increase in the item “Tax Liabilities” of € 108.7 million and an increase in “Current Portion of Contract Liability” by 3.4 million. This increase was partly offset by a decline in „ Accounts Payable and Accruals” in the amount of € 2.9 million.

Non-current liabilities increased by € 555.8 million compared to their level on the December 31, 2019 reporting date. This increase was largely a result of the first-time recognition of the item “financial liabilities from collaborations” in 2020 resulting from the collaboration and licensing agreement with Incyte amounting to € 538.2 million as of June 30, 2020 and deferred tax liabilities of € 13.0 million resulting from this agreement.

STOCKHOLDERS´ EQUITY

On June 30, 2020, the Company’s common stock, including treasury shares totaled € 32,890,046 (December 31, 2019: € 31,957,958). Common stock was higher primarily as a result of the purchase of 3,692,754 American Depositary Shares (“ADS”), which is equivalent to 907,441 shares, by Incyte. These shares were issued through a capital increase from Authorized Capital 2017-I. Common stock also increased by € 24,647 due to the exercise of 24,647 convertible bonds granted to the Management Board and to former employees. The weighted-average exercise price of the convertible bonds was € 31.88.

| | | | |

| 20 | | Group Interim Statement | | |

The value of treasury shares declined from € 8,357,250 on December 31, 2019 to € 6,383,882 on June 30, 2020. The reason for this decline was the transfer of 52,322 treasury shares in the amount of € 1,933,821 from the performance-based 2016 Long-Term Incentive Plan (LTI Plan) to the Management Board and the Senior Management Group. The vesting period for this LTI program expired on April 1, 2020 and provided beneficiaries with a six-month option until October 20, 2020 to receive a total of 91,037 shares. In addition, 1,070 treasury shares valued at € 39,547 were transferred to selected employees of MorphoSys US Inc. from the Long-Term Incentive Plan (LTI Plan) 2019. As a result, as of June 30, 2020, the Company held 172,408 MorphoSys shares (December 31, 2019: 225,800 shares).

On June 30, 2020, additional paid-in capital amounted to € 710,306,493 (December 31, 2019: € 628,176,568). The increase of € 82,129,925 resulted mainly from the capital increase with Incyte in the amount of € 79,590,657 net of transaction costs of € 100,370, the allocation of personnel expenses from share-based payments in the amount of € 3,751,660 and the exercise of convertible bonds in the amount of € 760,976. Part of the increase was offset by a decline that resulted from the reclassification of treasury shares related to share allocations from the 2016 Long-Term Incentive Plan in the amount of €1,933,821 as well as from the allocation of treasury shares from the 2019 LTI Plan of MorphoSys US Inc. to selected employees of MorphoSys US Inc. in the amount of € 39,547.

Risk and Opportunity Report

The risks and opportunities and their assessment remain unchanged from the situation described on pages 81-88 in the 2019 Annual Report.

Outlook

FINANCIAL GUIDANCE

MorphoSys’ current financial guidance for the 2020 financial year was published on March 18, 2020 and remains unchanged. The Group expects to achieve revenues in the range of € 280 million to € 290 million in the 2020 financial year. R&D expenses are expected to be between € 130 million and € 140 million. The Group expects EBIT to be in the range of approximately € -15 million to € 5 million. This guidance is based on constant currency exchange rates and does not include any contributions from tafasitamab revenues. This guidance does not include any effects of potential in-licensing or co-development deals for the development of new candidates.

The guidance might potentially be impacted by the ongoing global COVID-19 crisis on MorphoSys’ business operations including but not limited to the Company’s supply chain, clinical trial conduct, as well as timelines for regulatory and commercial execution. While MorphoSys is maintaining its previously communicated guidance on its clinical trials, these could potentially be affected in terms of patient enrollment and data collection timelines, among other factors.

| | | | |

| Group Interim Statement | |  | | 21 |

The statements in the 2019 Annual Report on pages 77-80 concerning the strategic outlook, the expected business and human resources developments, future research and development and the dividend policy continue to apply.

| | | | |

| 22 | | Group Interim Statement | | |

Consolidated Statement of Profit or Loss (IFRS) – (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| in € | | | | Note | | | | | Q2 2020 | | | | | Q2 2019 | | | | | H1 2020 | | | | | H1 2019 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

Revenues | | | | | 2, 3 | | | | | | 18,434,036 | | | | | | 34,656,185 | | | | | | 269,656,727 | | | | | | 48,204,456 | |

Operating Expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cost of Sales | | | | | 16 | | | | | | 7,227,804 | | | | | | (4,921,410 | ) | | | | | 3,968,326 | | | | | | (9,891,210 | ) |

Research and Development | | | | | | | | | | | (30,932,839 | ) | | | | | (24,652,089 | ) | | | | | (52,428,972 | ) | | | | | (49,344,574 | ) |

Selling | | | | | | | | | | | (29,278,842 | ) | | | | | (3,225,981 | ) | | | | | (42,106,431 | ) | | | | | (4,900,824 | ) |

General and Administrative | | | | | | | | | | | (13,816,895 | ) | | | | | (7,458,856 | ) | | | | | (23,940,517 | ) | | | | | (13,377,392 | ) |

Total Operating Expenses | | | | | 2 | | | | | | (66,800,772 | ) | | | | | (40,258,336 | ) | | | | | (114,507,594 | ) | | | | | (77,514,000 | ) |

Other Income | | | | | | | | | | | (360,300 | ) | | | | | 165,897 | | | | | | 9,969,474 | | | | | | 320,310 | |

Other Expenses | | | | | | | | | | | (1,344,435 | ) | | | | | (295,790 | ) | | | | | (1,629,971 | ) | | | | | (330,527 | ) |

Earnings before Interest and Taxes (EBIT) | | | | | | | | | | | (50,071,471 | ) | | | | | (5,732,044 | ) | | | | | 163,488,636 | | | | | | (29,319,761 | ) |

Finance Income | | | | | | | | | | | 17,470,786 | | | | | | 113,260 | | | | | | 28,071,456 | | | | | | 1,055,110 | |

Finance Expenses | | | | | | | | | | | (25,076,101 | ) | | | | | (440,492 | ) | | | | | (34,363,514 | ) | | | | | (690,113 | ) |

Income from Reversals of Impairment Losses / (Impairment Losses) on Financial Assets | | | | | | | | | | | (311,000 | ) | | | | | 291,000 | | | | | | (772,000 | ) | | | | | 859,000 | |

Income Tax Benefit / (Expenses) 1 | | | | | 4 | | | | | | 4,899,051 | | | | | | (91,028 | ) | | | | | 23,336,280 | | | | | | (433,031 | ) |

Consolidated Net Profit / (Loss) | | | | | | | | | | | (53,088,735 | ) | | | | | (5,859,304 | ) | | | | | 179,760,858 | | | | | | (28,528,795 | ) |

Earnings per Share, basic and diluted | | | | | | | | | | | (1.62 | ) | | | | | (0.19 | ) | | | | | - | | | | | | (0.90 | ) |

Earnings per Share, basic | | | | | | | | | | | - | | | | | | - | | | | | | 5.56 | | | | | | - | |

Earnings per Share, diluted | | | | | | | | | | | - | | | | | | - | | | | | | 5.54 | | | | | | - | |

Shares Used in Computing Earnings per Share, basic and diluted | | | | | | | | | | | 32,696,980 | | | | | | 31,576,812 | | | | | | - | | | | | | 31,567,074 | |

Shares Used in Computing Earnings per Share, basic | | | | | | | | | | | - | | | | | | - | | | | | | 32,309,894 | | | | | | - | |

Shares Used in Computing Earnings per Share, diluted | | | | | | | | | | | - | | | | | | - | | | | | | 32,437,297 | | | | | | - | |

1 Of the € 23.3 million for the first six months of 2020, € 18.4 million are attributable to the first quarter of 2020.

| | | | |

| Group Interim Statement | |  | | 23 |

Consolidated Statement of Comprehensive Income (IFRS) – (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| in € | | | | Q2 2020 | | | | | Q2 2019 | | | | | H1 2020 | | | | | H1 2019 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Consolidated Net Profit / (Loss) | | | | | (53,088,735 | ) | | | | | (5,859,304 | ) | | | | | 179,760,858 | | | | | | (28,528,795 | ) |

Items that will not be reclassified to Profit or Loss | | | | | | | | | | | | | | | | | | | | | | | | |

Change in Fair Value of Shares through Other Comprehensive Income | | | | | (303,371 | ) | | | | | 106,000 | | | | | | (3,565,402 | ) | | | | | 106,000 | |

Items that may be reclassified to Profit or Loss | | | | | | | | | | | | | | | | | | | | | | | | |

Foreign Currency Translation Differences from Consolidation | | | | | 1,329,973 | | | | | | 45,835 | | | | | | 580,257 | | | | | | 31,574 | |

Other Comprehensive Income | | | | | 1,026,602 | | | | | | 151,835 | | | | | | (2,985,145 | ) | | | | | 137,574 | |

Total Comprehensive Income | | | | | (52,062,133 | ) | | | | | (5,707,469 | ) | | | | | 176,775,713 | | | | | | (28,391,221 | ) |

| | | | |

| 24 | | Group Interim Statement | | |

Consolidated Balance Sheet (IFRS)

| | | | | | | | | | | | | | | | | | |

| in € | | | | Note | | | | | 06/30/2020 | | | | | 12/31/2019 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | |

ASSETS | | | | | | | | | | | | | | | | | | |

Current Assets | | | | | | | | | | | | | | | | | | |

Cash and Cash Equivalents | | | | | 6 | | | | | | 33,404,351 | | | | | | 44,314,050 | |

Financial Assets at Fair Value through Profit or Loss | | | | | 6 | | | | | | 393,938,454 | | | | | | 20,454,949 | |

Other Financial Assets at Amortized Cost | | | | | 6 | | | | | | 387,451,191 | | | | | | 207,735,195 | |

Accounts Receivable and Contract Assets | | | | | 6 | | | | | | 33,103,019 | | | | | | 15,081,702 | |

Financial Assets from Collaborations | | | | | 3,6 | | | | | | 45,332,222 | | | | | | 0 | |

Income Tax Receivables | | | | | | | | | | | 166,071 | | | | | | 145,817 | |

Other Receivables | | | | | | | | | | | 3,389,076 | | | | | | 1,613,254 | |

Inventories, Net | | | | | 16 | | | | | | 15,330,267 | | | | | | 288,212 | |

Prepaid Expenses and Other Current Assets | | | | | | | | | | | 15,812,721 | | | | | | 14,059,627 | |

Total Current Assets | | | | | | | | | | | 927,927,372 | | | | | | 303,692,806 | |

Non-current Assets | | | | | | | | | | | | | | | | | | |

Property, Plant and Equipment, Net | | | | | | | | | | | 4,914,561 | | | | | | 4,652,838 | |

Right-of-Use Assets, Net | | | | | | | | | | | 46,654,982 | | | | | | 43,160,253 | |

Patents, Net | | | | | | | | | | | 2,489,305 | | | | | | 2,981,282 | |

Licenses, Net | | | | | | | | | | | 325,003 | | | | | | 2,350,002 | |

In-process R&D Programs | | | | | | | | | | | 35,348,576 | | | | | | 35,683,709 | |

Software, Net | | | | | | | | | | | 92,690 | | | | | | 107,137 | |

Goodwill | | | | | | | | | | | 3,676,233 | | | | | | 3,676,233 | |

Other Financial Assets at Amortized Cost, Net of Current Portion | | | | | 6 | | | | | | 247,052,089 | | | | | | 84,922,176 | |

Shares at Fair Value through Other Comprehensive Income | | | | | 6 | | | | | | 9,408,000 | | | | | | 14,076,836 | |

Deferred Tax Asset | | | | | 4 | | | | | | 145,109,528 | | | | | | 0 | |

Prepaid Expenses and Other Assets, Net of Current Portion | | | | | 6 | | | | | | 1,107,129 | | | | | | 1,136,030 | |

Total Non-current Assets | | | | | | | | | | | 496,178,096 | | | | | | 192,746,496 | |

Total Assets | | | | | | | | | | | 1,424,105,468 | | | | | | 496,439,302 | |

| | | | |

| Group Interim Statement | |  | | 25 |

| | | | | | | | | | | | | | | | | | |

| in € | | | | Note | | | | | 06/30/2020 | | | | | 12/31/2019 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | | | | | | | | | | | |

Current Liabilities | | | | | | | | | | | | | | | | | | |

Accounts Payable and Accruals | | | | | 6 | | | | | | 54,138,646 | | | | | | 57,041,902 | |

Current Portion of Lease Liabilities | | | | | 6 | | | | | | 3,119,799 | | | | | | 2,515,097 | |

Tax Liabilities | | | | | 4 | | | | | | 108,819,595 | | | | | | 94,732 | |

Other Provisions | | | | | | | | | | | 546,730 | | | | | | 323,000 | |

Current Portion of Contract Liability | | | | | | | | | | | 4,994,506 | | | | | | 1,570,801 | |

Convertible Bonds due to Related Parties | | | | | | | | | | | 0 | | | | | | 12,324 | |

Total Current Liabilities | | | | | | | | | | | 171,619,276 | | | | | | 61,557,856 | |

Non-current Liabilities | | | | | | | | | | | | | | | | | | |

Lease Liabilities, Net of Current Portion | | | | | 6 | | | | | | 43,991,310 | | | | | | 40,041,581 | |

Other Provisions, Net of Current Portion | | | | | | | | | | | 665,559 | | | | | | 23,166 | |

Contract Liability, Net of Current Portion | | | | | | | | | | | 93,378 | | | | | | 114,927 | |

Deferred Tax Liability | | | | | 4 | | | | | | 13,023,509 | | | | | | 0 | |

Financial Liabilities from Collaborations | | | | | 3, 6 | | | | | | 538,199,570 | | | | | | 0 | |

Total Non-current Liabilities | | | | | | | | | | | 595,973,326 | | | | | | 40,179,674 | |

Total Liabilities | | | | | | | | | | | 767,592,602 | | | | | | 101,737,530 | |

| | | | | | | | | | | | | | | | | | | |

Stockholders’ Equity | | | | | | | | | | | | | | | | | | |

Common Stock | | | | | 7 | | | | | | 32,890,046 | | | | | | 31,957,958 | |

Ordinary Shares Issued (32,890,046 and 31,957,958 for 2020 and 2019, respectively) | | | | | | | | | | | | | | | | | | |

Ordinary Shares Outstanding (32,717,638 and 31,732,158 for 2020 and 2019, respectively) | | | | | | | | | | | | | | | | | | |

Treasury Stock (172,408 and 225,800 shares for 2020 and 2019, respectively), at Cost | | | | | 7 | | | | | | (6,383,882 | ) | | | | | (8,357,250 | ) |

Additional Paid-in Capital | | | | | 7 | | | | | | 710,306,493 | | | | | | 628,176,568 | |

Other Comprehensive Income Reserve | | | | | 7 | | | | | | (4,280,863 | ) | | | | | (1,295,718 | ) |

Accumulated Deficit | | | | | | | | | | | (76,018,928 | ) | | | | | (255,779,786 | ) |

Total Stockholders’ Equity | | | | | | | | | | | 656,512,866 | | | | | | 394,701,772 | |

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | | | | 1,424,105,468 | | | | | | 496,439,302 | |

| | | | |

| 26 | | Group Interim Statement | | |

Consolidated Statement of Changes in Stockholders’ Equity (IFRS) – (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | Common Stock | | | | | | |

| | | | | Note | | | | | Shares | | | | | € | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Balance as of January 1, 2019 | | | | | | | | | | | 31,839,572 | | | | | | 31,839,572 | | | | | | | |

Compensation Related to the Grant of Stock Options and Performance Shares | | | | | | | | | | | 0 | | | | | | 0 | | | | | | | |

Transfer of Treasury Stock for Long-Term Incentive Programs | | | | | | | | | | | 0 | | | | | | 0 | | | | | | | |

Transfer of Treasury Stock to Related Parties | | | | | | | | | | | 0 | | | | | | 0 | | | | | | | |

Reserves: | | | | | | | | | | | | | | | | | | | | | | | | |

Change in Fair Value of Shares through Other Comprehensive Income | | | | | | | | | | | 0 | | | | | | 0 | | | | | | | |

Foreign Currency Translation Differences from Consolidation | | | | | | | | | | | 0 | | | | | | 0 | | | | | | | |

Consolidated Net Loss | | | | | | | | | | | 0 | | | | | | 0 | | | | | | | |

Total Comprehensive Income | | | | | | | | | | | 0 | | | | | | 0 | | | | | | | |

Balance as of June 30, 2019 | | | | | | | | | | | 31,839,572 | | | | | | 31,839,572 | | | | | | | |

Balance as of January 1, 2020 | | | | | | | | | | | 31,957,958 | | | | | | 31,957,958 | | | | | | | |

Capital Increase, Net of Issuance Cost of € 100,370 | | | | | 7 | | | | | | 907,441 | | | | | | 907,441 | | | | | | | |

Compensation Related to the Grant of Stock Options and Performance Shares | | | | | 7, 11 | | | | | | 0 | | | | | | 0 | | | | | | | |

Exercise of Convertible Bonds Issued | | | | | 7, 8 | | | | | | 24,647 | | | | | | 24,647 | | | | | | | |

Transfer of Treasury Stock for Long-Term Incentive Programs | | | | | 7, 8 | | | | | | 0 | | | | | | 0 | | | | | | | |

Reserves: | | | | | | | | | | | | | | | | | | | | | | | | |

Change in Fair Value of Shares through Other Comprehensive Income | | | | | | | | | | | 0 | | | | | | 0 | | | | | | | |

Foreign Currency Translation Differences from Consolidation | | | | | | | | | | | 0 | | | | | | 0 | | | | | | | |

Consolidated Net Profit | | | | | | | | | | | 0 | | | | | | 0 | | | | | | | |

Total Comprehensive Income | | | | | | | | | | | 0 | | | | | | 0 | | | | | | | |

Balance as of June 30, 2020 | | | | | | | | | | | 32,890,046 | | | | | | 32,890,046 | | | | | | | |

| | | | |

| Group Interim Statement | |  | | 27 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Treasury Stock | | | | | Additional Paid-in

Capital | | | | | Other

Comprehensive

Income Reserve | | | | | Accumulated

Deficit | | | | | Total

Stockholders’ Equity | |

| | | | | Shares | | | | | € | | | | | € | | | | | € | | | | | € | | | | | € | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | 281,036 | | | | | | (10,398,773 | ) | | | | | 619,908,453 | | | | | | (210,890 | ) | | | | | (152,765,728 | ) | | | | | 488,372,634 | |

| | | | | | 0 | | | | | | 0 | | | | | | 3,060,776 | | | | | | 0 | | | | | | 0 | | | | | | 3,060,776 | |

| | | | | | | | | | | | |

| | | | | | (23,738 | ) | | | | | 877,356 | | | | | | (877,356 | ) | | | | | 0 | | | | | | 0 | | | | | | 0 | |

| | | | | | (2,134 | ) | | | | | 78,873 | | | | | | (78,873 | ) | | | | | 0 | | | | | | 0 | | | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 106,000 | | | | | | 0 | | | | | | 106,000 | |

| | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 31,574 | | | | | | 0 | | | | | | 31,574 | |

| | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | (28,528,795 | ) | | | | | (28,528,795 | ) |

| | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 137,574 | | | | | | (28,528,795 | ) | | | | | (28,391,221 | ) |

| | | | | | 255,164 | | | | | | (9,442,544 | ) | | | | | 622,013,000 | | | | | | (73,316 | ) | | | | | (181,294,523 | ) | | | | | 463,042,189 | |

| | | | | | 225,800 | | | | | | (8,357,250 | ) | | | | | 628,176,568 | | | | | | (1,295,718 | ) | | | | | (255,779,786 | ) | | | | | 394,701,772 | |

| | | | | | 0 | | | | | | 0 | | | | | | 79,590,657 | | | | | | 0 | | | | | | 0 | | | | | | 80,498,098 | |

| | | | | | | | | | | | |

| | | | | | 0 | | | | | | 0 | | | | | | 3,751,660 | | | | | | 0 | | | | | | 0 | | | | | | 3,751,660 | |

| | | | | | 0 | | | | | | 0 | | | | | | 760,976 | | | | | | 0 | | | | | | 0 | | | | | | 785,623 | |

| | | | | | (53,392 | ) | | | | | 1,973,368 | | | | | | (1,973,368 | ) | | | | | 0 | | | | | | 0 | | | | | | 0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | (3,565,402 | ) | | | | | 0 | | | | | | (3,565,402 | ) |

| | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 580,257 | | | | | | 0 | | | | | | 580,257 | |

| | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 179,760,858 | | | | | | 179,760,858 | |

| | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | (2,985,145 | ) | | | | | 179,760,858 | | | | | | 176,775,713 | |

| | | | | | 172,408 | | | | | | (6,383,882 | ) | | | | | 710,306,493 | | | | | | (4,280,863 | ) | | | | | (76,018,928 | ) | | | | | 656,512,866 | |

| | | | |

| 28 | | Group Interim Statement | | |

Consolidated Statement of Cash Flows (IFRS) – (unaudited)

| | | | | | | | | | | | | | | | | | |

| H1 (in € ) | | | | Note | | | | | 2020 | | | | | 2019 | |

| | | | | | | | | | | | | | | | |

Operating Activities: | | | | | | | | | | | | | | | | | | |

Consolidated Net Profit / (Loss) | | | | | | | | | | | 179,760,858 | | | | | | (28,528,795 | ) |

Adjustments to Reconcile Consolidated Net Profit / (Loss) to Net Cash

Provided by / (Used in) Operating Activities: | | | | | | | | | | | | | | | | | | |

Impairments of Assets | | | | | | | | | | | 14,305,306 | | | | | | 0 | |

Depreciation and Amortization of Tangible and Intangible Assets and of Right-of-Use Assets | | | | | | | | | | | 3,696,928 | | | | | | 3,061,535 | |

Net (Gain) / Loss of Financial Assets at Fair Value through Profit or Loss | | | | | | | | | | | 1,226,920 | | | | | | (427,522 | ) |

Net (Gain) / Loss of Financial Assets at Amortized Cost | | | | | | | | | | | 2,751,558 | | | | | | 0 | |

(Income) from Reversals of Impairments / Impairments on Financial Assets | | | | | | | | | | | 772,000 | | | | | | (859,000 | ) |

Net (Gain) / Loss on Derivative Financial Instruments | | | | | | | | | | | 6,991,506 | | | | | | (440,866 | ) |

Non Cash Effective Net Change in Financial Assets / Liabilities from Collaborations | | | | | 3 | | | | | | (4,642,257 | ) | | | | | 0 | |

(Income) from Reversals of Impairments on Inventories | | | | | 16 | | | | | | (15,509,559 | ) | | | | | 0 | |

Net (Gain) / Loss on Sale of Property, Plant and Equipment | | | | | | | | | | | 0 | | | | | | 961 | |

Recognition of Contract Liability | | | | | | | | | | | (7,987,408 | ) | | | | | (2,234,458 | ) |

Share-based Payment | | | | | 11 | | | | | | 4,395,357 | | | | | | 3,060,776 | |

Income Tax (Benefit) / Expenses | | | | | 4 | | | | | | (23,336,280 | ) | | | | | 433,031 | |

Changes in Operating Assets and Liabilities: | | | | | | | | | | | | | | | | | | |

Accounts Receivable and Contract Assets | | | | | | | | | | | (18,021,317 | ) | | | | | (23,688,844 | ) |

Prepaid Expenses and Other Assets, Tax Receivables and Other Receivables | | | | | | | | | | | (3,980,369 | ) | | | | | (1,252,323 | ) |

Accounts Payable and Accruals, Lease Liabilities, Tax Provisions and Other Provisions | | | | | | | | | | | (2,124,194 | ) | | | | | 4,280,321 | |

Other Liabilities | | | | | | | | | | | 118,489 | | | | | | 230,098 | |

Contract Liability | | | | | | | | | | | 11,389,563 | | | | | | 2,112,976 | |

Income Taxes Paid | | | | | | | | | | | (45,156 | ) | | | | | (13,712 | ) |

Net Cash Provided by / (Used in) Operating Activities | | | | | | | | | | | 149,761,945 | | | | | | (44,265,822 | ) |

| | | | |

| Group Interim Statement | |  | | 29 |

| | | | | | | | | | | | | | | | | | |

| H1 (in €) | | | | Note | | | | | 2020 | | | | | 2019 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Investing Activities: | | | | | | | | | | | | | | | | | | |

Cash Payments to Acquire Financial Assets at Fair Value through Profit or Loss | | | | | | | | | | | (416,449,668 | ) | | | | | (13,326,710 | ) |

Cash Receipts from Sales of Financial Assets at Fair Value through Profit or Loss | | | | | | | | | | | 41,521,507 | | | | | | 7,356,761 | |

Cash Payments to Acquire Other Financial Assets at Amortized Cost | | | | | | | | | | | (476,140,326 | ) | | | | | (41,000,000 | ) |

Cash Receipts from Sales of Other Financial Assets at Amortized Cost | | | | | | | | | | | 131,190,000 | | | | | | 103,000,000 | |

Cash Receipts from (+) / Cash Payments for (-) Derivative Financial Instruments | | | | | | | | | | | (6,595,240 | ) | | | | | 294,877 | |

Cash Payments to Acquire Property, Plant and Equipment | | | | | | | | | | | (1,504,428 | ) | | | | | (1,123,055 | ) |

Cash Payments to Acquire Intangible Assets | | | | | | | | | | | (11,544,656 | ) | | | | | (211,988 | ) |

Cash Receipts from Sales of Shares at Fair Value through Other Comprehensive Income | | | | | | | | | | | 1,103,433 | | | | | | 0 | |

Interest Received | | | | | | | | | | | 166,591 | | | | | | 50,517 | |

Net Cash Provided by / (Used in) Investing Activities | | | | | | | | | | | (738,252,787 | ) | | | | | 55,040,402 | |

| | | | | | | | | | | | | | | | | | | |

Financing Activities: | | | | | | | | | | | | | | | | | | |

Cash Proceeds from Issuing Shares | | | | | 7 | | | | | | 80,598,468 | | | | | | 0 | |

Cash Payments for Costs from Issuing Shares | | | | | 7 | | | | | | (100,370 | ) | | | | | 0 | |

Cash Proceeds in Connection with Convertible Bonds Granted to Related Parties | | | | | 7 | | | | | | 773,300 | | | | | | 0 | |

Cash Receipts from Financing from Collaborations | | | | | 3 | | | | | | 497,509,605 | | | | | | 0 | |

Cash Payments for Principal Elements of Lease Payments | | | | | | | | | | | (1,233,706 | ) | | | | | (1,140,958 | ) |

Interest Paid | | | | | | | | | | | (683,835 | ) | | | | | (459,296 | ) |

Net Cash Provided by / (Used in) Financing Activities | | | | | | | | | | | 576,863,462 | | | | | | (1,600,254 | ) |

Effect of Exchange Rate Differences on Cash | | | | | | | | | | | 717,681 | | | | | | 70,487 | |

Increase / (Decrease) in Cash and Cash Equivalents | | | | | | | | | | | (10,909,699 | ) | | | | | 9,244,813 | |

Cash and Cash Equivalents at the Beginning of the Period | | | | | | | | | | | 44,314,050 | | | | | | 45,459,836 | |

Cash and Cash Equivalents at the End of the Period | | | | | | | | | | | 33,404,351 | | | | | | 54,704,649 | |

| | | | |

| 30 | | Group Interim Statement | | |

Notes (Unaudited)

MorphoSys AG (“the Company” or “MorphoSys”) develops and applies technologies for generating therapeutic antibodies. MorphoSys possesses a broad portfolio of proprietary compounds and an extensive pipeline of compounds jointly developed with partners from the pharmaceutical and biotechnology industry. MorphoSys was founded in July 1992 as a German limited liability company and became a German stock corporation in June 1998. In March 1999, the Company completed its initial public offering on Germany’s “Neuer Markt,” the former segment of the Deutsche Börse designated for high-growth companies. On January 15, 2003, MorphoSys AG was admitted to the Prime Standard segment of the Frankfurt Stock Exchange. On April 18, 2018, the Company completed its initial public listing on the Nasdaq Global Market with the placement of American Depositary Shares (ADS). Each ADS represents 1/4 of a MorphoSys ordinary share. MorphoSys AG’s registered head office is located in Planegg (district of Munich), and the registered business address is Semmelweisstraße 7, 82152 Planegg, Germany. The Company is registered in the Commercial Register of the District Court of Munich, Section B, under HRB 121023.

These interim consolidated financial statements were prepared in accordance with the International Financial Reporting Standards (IFRS) of the International Accounting Standards Board (IASB) taking into account the recommendations of the International Financial Reporting Standards Interpretations Committee (IFRS IC) as applicable in the European Union (EU). These interim consolidated financial statements comply with IAS 34 “Interim Financial Reporting.”

The condensed interim consolidated financial statements do not contain all of the information and disclosures required for the financial year-end consolidated financial statements and, therefore, should be read in conjunction with the consolidated financial statements dated December 31, 2019.

The condensed interim consolidated financial statements were approved for publication on August 5, 2020.

The consolidated financial statements as of June 30, 2020, include MorphoSys AG, MorphoSys US Inc. (Boston, Massachusetts, USA), Lanthio Pharma B.V. (Groningen, the Netherlands) and LanthioPep B.V. (Groningen, the Netherlands), which are collectively known as the “Group.”

| |  | Accounting Policies |

Except for the principles described below, the accounting and valuation principles applied to the consolidated financial statements for the financial year ending December 31, 2019, were the same as those applied to the first six months of 2020. The consolidated financial statements as of December 31, 2019 are available on the Company’s website at www.morphosys.com/financial-reports.

| | | | |

| Group Interim Statement | |  | | 31 |

Further details to newly adopted accounting policies for financial assets from collaborations and financial liabilities from collaborations can be found in Note 3.

A contract asset from milestone payments and corresponding revenues are recognized when it is highly probable that the milestone will be achieved. If it is achieved, the contract asset is reclassified to accounts receivable, as the right has become unconditional.

The effective tax rate for the six-month period as of June 30, 2020, was -14.9% (H1 2019: -1.5%). This reflected both the net income from the capitalization of deferred tax assets and liabilities in connection with the collaboration and license agreement with Incyte and the current tax expense, which affected the tax liability due to the use of tax loss carryforwards from previous years and the minimum taxation regulation.

NEW AND REVISED STANDARDS APPLIED FOR THE FIRST TIME IN THE FINANCIAL YEAR

| | | | | | | | | | | | | | | | | | | | | | |

Standard/Interpretation | | | | Mandatory

Application for

financial years

starting on | | | | | Adopted by the

European Union | | | | | Possible

Impact on

MorphoSys | |

| | | | | | | | | | | | | | | | | | | | | | | |

IFRS 3 (A) | | | | Business Combinations | | | | | 01/01/2020 | | | | | | yes | | | | | | none | |

IFRS 9, IAS 39 and IFRS 7 | | | | Interest Rate Benchmark Reform | | | | | 01/01/2020 | | | | | | yes | | | | | | none | |

IAS 1 and IAS 8 (A) | | | | Definition of Material | | | | | 01/01/2020 | | | | | | yes | | | | | | yes | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Amendments to References to the Conceptual Framework in IFRS Standards | | | | | 01/01/2020 | | | | | | yes | | | | | | none | |

| | | | | | | | | | | | | | | | | | | | | | | |

(A) Amendments | | | | | | | | | | | | | | | | | | | | | | |

The impact on the consolidated financial statements from the amendments to IAS 1 and IAS 8 is not considered to be material and are therefore not explained separately.

NEW AND REVISED STANDARDS NOT YET MANDATORY

The following new and revised standards that were not yet mandatory in the reporting period or not yet adopted by the European Union were not applied in advance. Standards with the remark “yes” are likely to have an impact on the consolidated financial statements and are currently being assessed by the Group. The following discussion focuses only on those changes that have a material impact. The impact on the consolidated financial statements from the amendments to IFRS 16 and IAS 1 are not

| | | | |

| 32 | | Group Interim Statement | | |

considered to be material and are therefore not explained separately. Standards with the remark “none” are not expected to have a material impact on the consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | |

Standard/Interpretation | | | | Mandatory

Application for

financial years

starting on | | | | | Adopted by the

European Union | | | | | Possible

Impact on

MorphoSys | |

| | | | | | | | | | | | | | | | | | | | | | | |

IFRS 3 (A) | | | | Reference to the Conceptual Framework (Amendments to IFRS 3) | | | | | 01/01/2022 | | | | | | no | | | | | | none | |

IFRS 4 (A) | | | | Extension of the Temporary Exemption from Applying IFRS 9 (Amendments to IFRS 4) | | | | | 01/01/2021 | | | | | | no | | | | | | none | |

IFRS 17 | | | | Insurance Contracts and Amendments to IFRS 17 | | | | | 01/01/2023 | | | | | | no | | | | | | none | |

IFRS 16 (A) | | | | Covid-19-Related Rent Concessions (Amendment to IFRS 16) | | | | | 01/06/2020 | | | | | | no | | | | | | yes | |

IAS 1 (A) | | | | Classification of Liabilities as Current or Non-current (Amendments to IAS 1) | | | | | 01/01/2023 | | | | | | no | | | | | | yes | |

IAS 16 (A) | | | | Property, Plant and Equipment — Proceeds before Intended Use (Amendments to IAS 16) | | | | | 01/01/2022 | | | | | | no | | | | | | none | |

IAS 37 (A) | | | | Amended by Onerous Contracts — Cost of Fulfilling a Contract (Amendments to IAS 37) | | | | | 01/01/2022 | | | | | | no | | | | | | none | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Annual Improvements to International Financial Reporting Standards, 2018 - 2020 | | | | | 01/01/2022 | | | | | | no | | | | | | none | |

(A) Amendments | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| |  | Segment Reporting |

The Group applies IFRS 8 “Segment Reporting”. An operating segment is defined as a unit of an entity whose business activities can generate revenues and expenses, whose operating results are regularly reviewed by the entity’s chief operating decision-maker (the Management Board), and for which discrete financial information is available.

Segment information is provided based on the Group’s business segments. The business segments are aligned to the Group’s management organization and the structure of its internal reporting. The segment results and segment assets contain components that are either directly attributable to the individual segments or can be reasonably allocated to the segments.

The Management Board assesses the economic success of the segments based on key indicators that are selected to reflect the recognition of all relevant income and expenses. EBIT, which the Company defines as operating income

| | | | |

| Group Interim Statement | |  | | 33 |

before finance income, finance expenses, income from reversals of impairment losses/expenses from impairment losses on financial assets and income taxes, is the central benchmark for assessing and evaluating operating income. Revenues, operating expenses, segment results and the liquidity position are also considered key performance indicators in internal reporting.

The Group consists of the operating segments described below.

PROPRIETARY DEVELOPMENT