Q2 2020 Results August 6, 2020 Exhibit 99.2

© MorphoSys - Results Q2 2020 This communication contains certain forward-looking statements concerning the MorphoSys group of companies, including its financial guidance for 2020, the commencement, timing and results of clinical trials and release of clinical data both in respect of its proprietary product candidates and of product candidates of its collaborators, the development of commercial capabilities, interpretations by regulatory authorities of our clinical data and real-world data analyses, in particular with respect to tafasitamab (MOR208), and the transition of MorphoSys to a fully integrated biopharmaceutical company, the expected time of launch of tafasitamab (MOR208), interaction with regulators, including the potential approval of MorphoSys’s current or future drug candidates, including discussions with the FDA regarding the potential approval to market tafasitamab (MOR208), and expected royalty and milestone payments in connection with MorphoSys’s collaborations. The forward-looking statements contained herein represent the judgment of MorphoSys as of the date of this release and involve known and unknown risks and uncertainties, which might cause the actual results, financial condition and liquidity, performance or achievements of MorphoSys, or industry results, to be materially different from any historic or future results, financial conditions and liquidity, performance or achievements expressed or implied by such forward-looking statements. In addition, even if MorphoSys’s results, performance, financial condition and liquidity, and the development of the industry in which it operates are consistent with such forward-looking statements, they may not be predictive of results or developments in future periods. Among the factors that may result in differences are that MorphoSys’s expectations regarding its 2020 results of operations may be incorrect, MorphoSys’s expectations regarding its development programs may be incorrect, the inherent uncertainties associated with competitive developments, clinical trial and product development activities and regulatory approval requirements (including that MorphoSys may fail to obtain regulatory approval for tafasitamab (MOR208) and that data from MorphoSys’s ongoing clinical research programs may not support registration or further development of its product candidates due to safety, efficacy or other reasons), MorphoSys’s reliance on collaborations with third parties, estimating the commercial potential of its development programs and other risks indicated in the risk factors included in MorphoSys’s Annual Report on Form 20-F and other filings with the US Securities and Exchange Commission. Given these uncertainties, the reader is advised not to place any undue reliance on such forward-looking statements. These forward-looking statements speak only as of the date of publication of this document. MorphoSys expressly disclaims any obligation to update any such forward-looking statements in this document to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements, unless specifically required by law or regulation. The compounds discussed in this slide presentation are investigational products being developed by MorphoSys and its partners and are not currently approved by the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA) or any other regulatory authority (except for tafasitamab/Monjuvi® and guselkumab/Tremfya®). There is no guarantee any investigational product will be approved. Forward-Looking Statements

Agenda © MorphoSys – Results Q2 2020 Q2 2020 Results Conference Call Introduction Anja Pomrehn, Ph.D., Head of Investor Relations Highlights Q2 2020 Jean-Paul Kress, M.D., CEO Financial Results Q2 / H1 2020 Jens Holstein, CFO Summary Jean-Paul Kress, M.D., CEO Q&A Jean-Paul Kress, Jens Holstein, Roland Wandeler, Malte Peters

Highlights Q2 2020 Jean-Paul Kress, M.D., CEO © MorphoSys - Results Q2 2020

© MorphoSys - Results Q2 2020 Monjuvi® (tafasitamab-cxix) approved in the U.S. 1) USPI = U.S. Prescribing Information; ORR: overall response rate; CR: complete response; mDoR: median duration of response; mOS: median overall survival Monjuvi® (tafasitamab-cxix) Approval of Monjuvi® in combination with lenalidomide in the U.S. First FDA approved second-line therapy in r/r DLBCL Durable clinical efficacy and sound safety and tolerability ORR 55%, CR 37%, mDoR 21.7 months1) Important milestone for patients battling this very aggressive disease

© MorphoSys - Results Q2 2020 Operational Highlights Tafasitamab Validation of MAA for tafasitamab by EMA L-MIND long term data presented at EHA is part of MAA Unprecedented durability: mDoR 34.6 months, mOS 31.6 months1) Pipeline progress Felzartamab (MOR202): first patient dosed in the M-PLACE study in autoimmune membranous nephropathy Otilimab: start of study (OSCAR) in patients with severe pulmonary COVID-19 related disease by GSK FDA approval of Tremfya® for PsA Salles et. al., EHA 2020; ORR: overall response rate; CR: complete response; mDoR: median duration of response; mOS: median overall survival Pipeline products are under clinical investigation and have not been proven to be safe or effective.

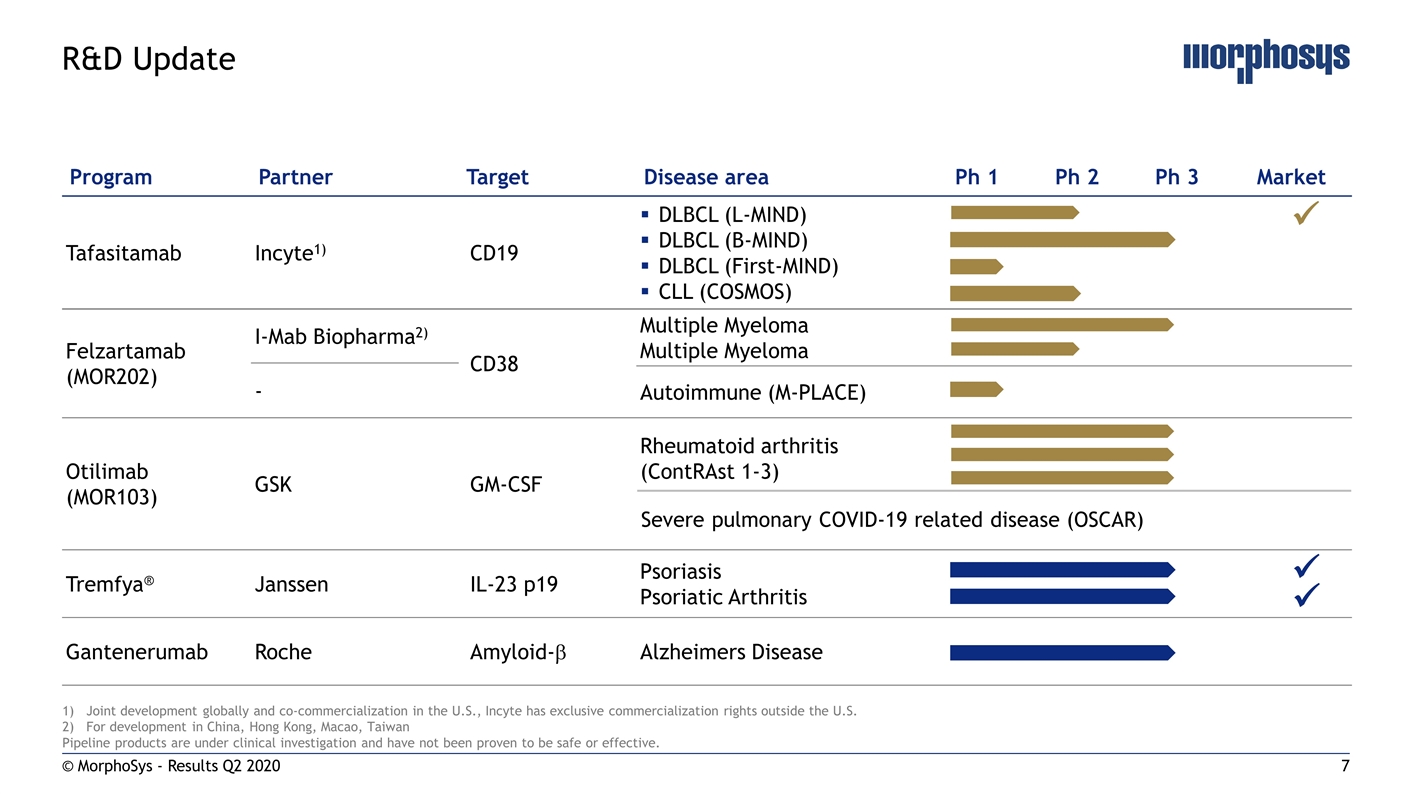

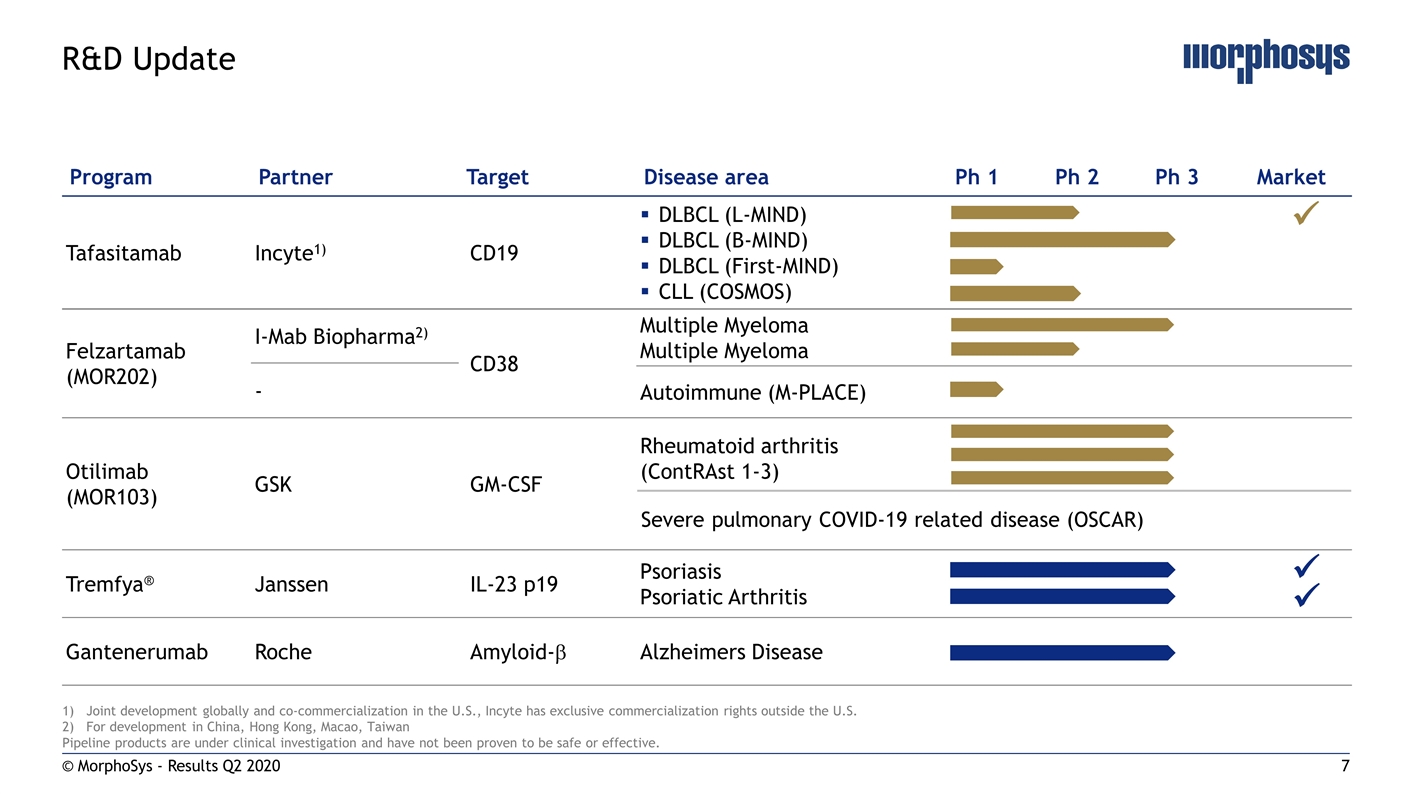

© MorphoSys - Results Q2 2020 R&D Update Program Partner Target Disease area Ph 1 Ph 2 Ph 3 Market Tafasitamab Incyte1) CD19 DLBCL (L-MIND) DLBCL (B-MIND) DLBCL (First-MIND) CLL (COSMOS) Felzartamab (MOR202) I-Mab Biopharma2) CD38 Multiple Myeloma Multiple Myeloma - Autoimmune (M-PLACE) Otilimab (MOR103) GSK GM-CSF Rheumatoid arthritis (ContRAst 1-3) Tremfya® Janssen IL-23 p19 Psoriasis Psoriatic Arthritis Gantenerumab Roche Amyloid-b Alzheimers Disease Joint development globally and co-commercialization in the U.S., Incyte has exclusive commercialization rights outside the U.S. For development in China, Hong Kong, Macao, Taiwan Pipeline products are under clinical investigation and have not been proven to be safe or effective. Severe pulmonary COVID-19 related disease (OSCAR) ü ü ü

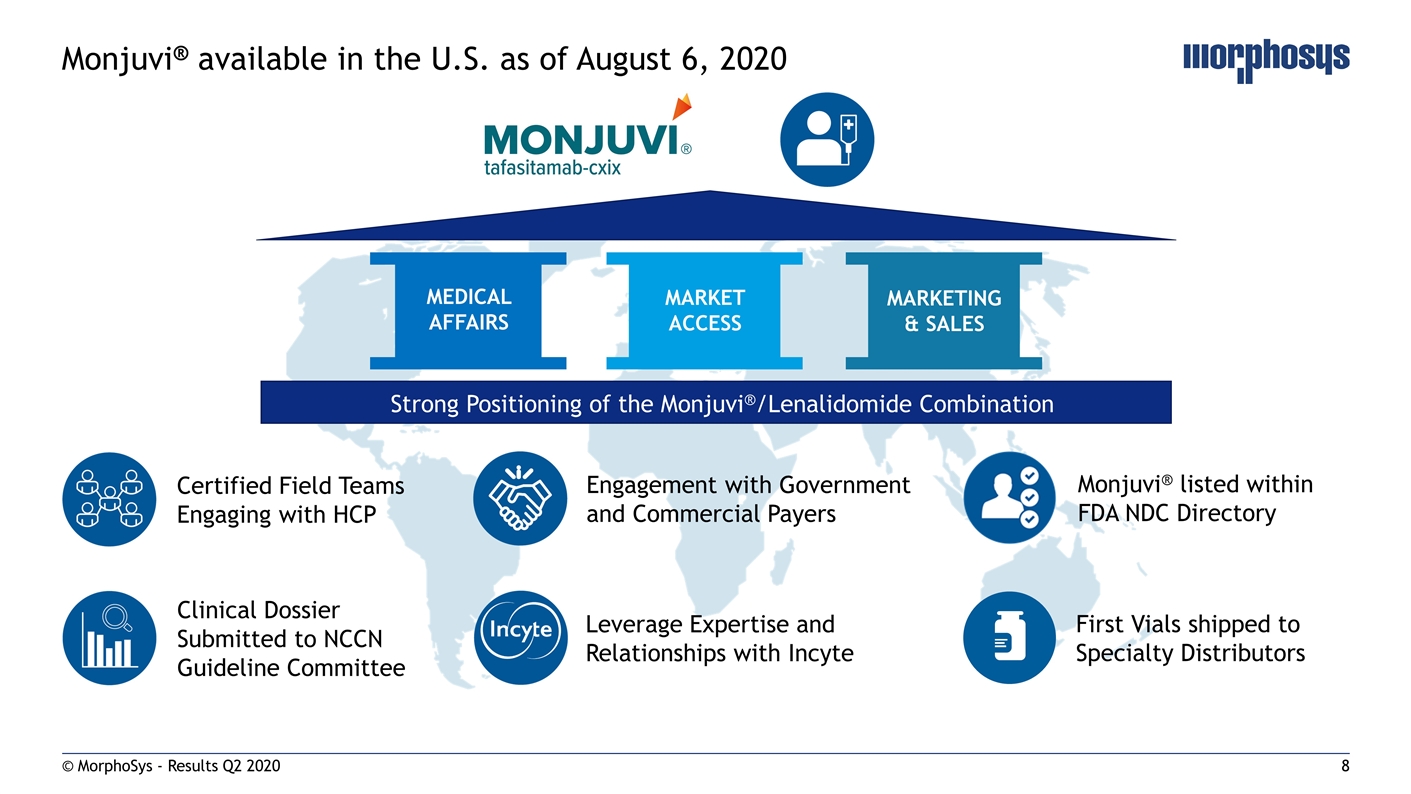

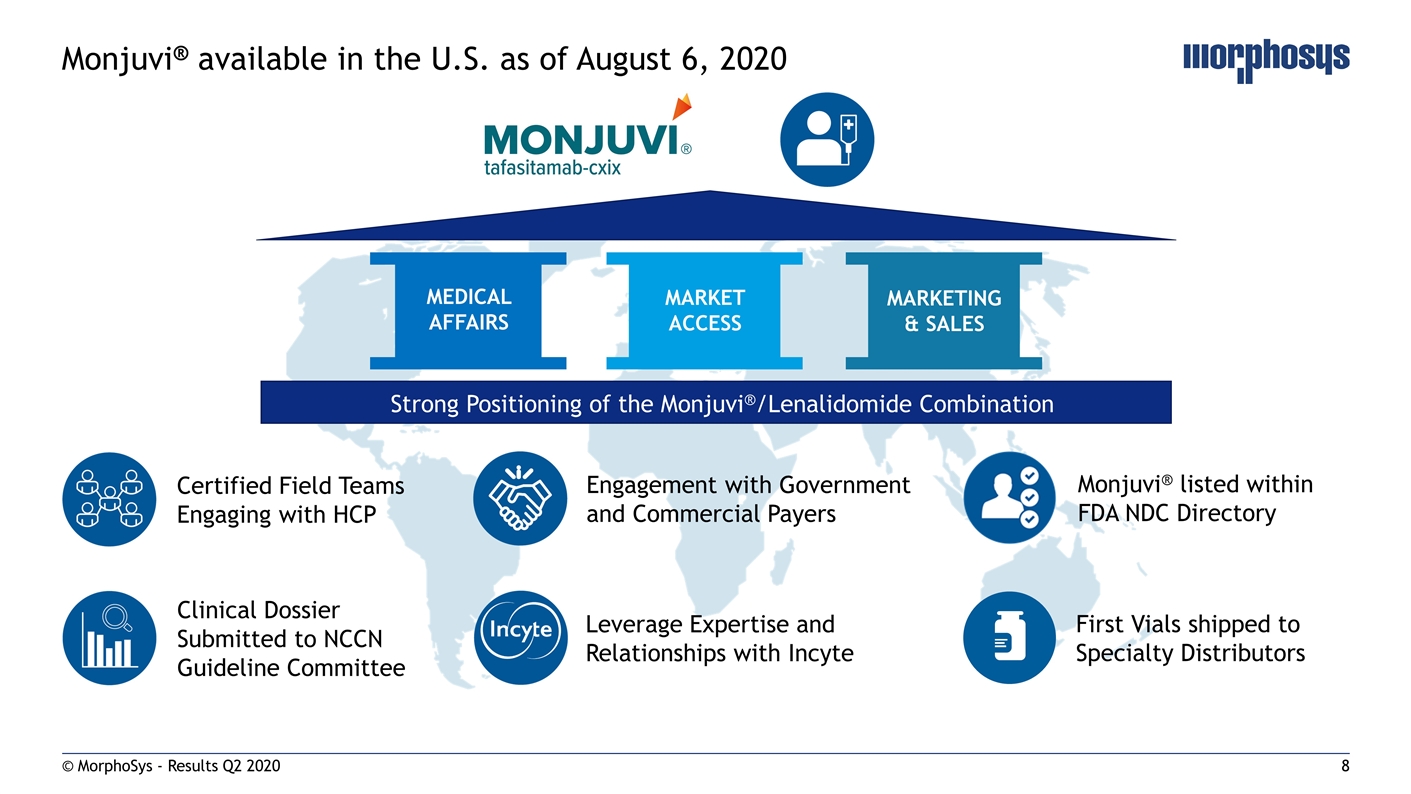

© MorphoSys - Results Q2 2020 Monjuvi® available in the U.S. as of August 6, 2020 MARKET ACCESS MEDICAL AFFAIRS MARKETING & SALES Certified Field Teams Engaging with HCP Leverage Expertise and Relationships with Incyte Engagement with Government and Commercial Payers Monjuvi® listed within FDA NDC Directory Clinical Dossier Submitted to NCCN Guideline Committee First Vials shipped to Specialty Distributors Strong Positioning of the Monjuvi®/Lenalidomide Combination

Financial Results Q2 and H1 2020 Jens Holstein, CFO © MorphoSys - Results Q2 2020

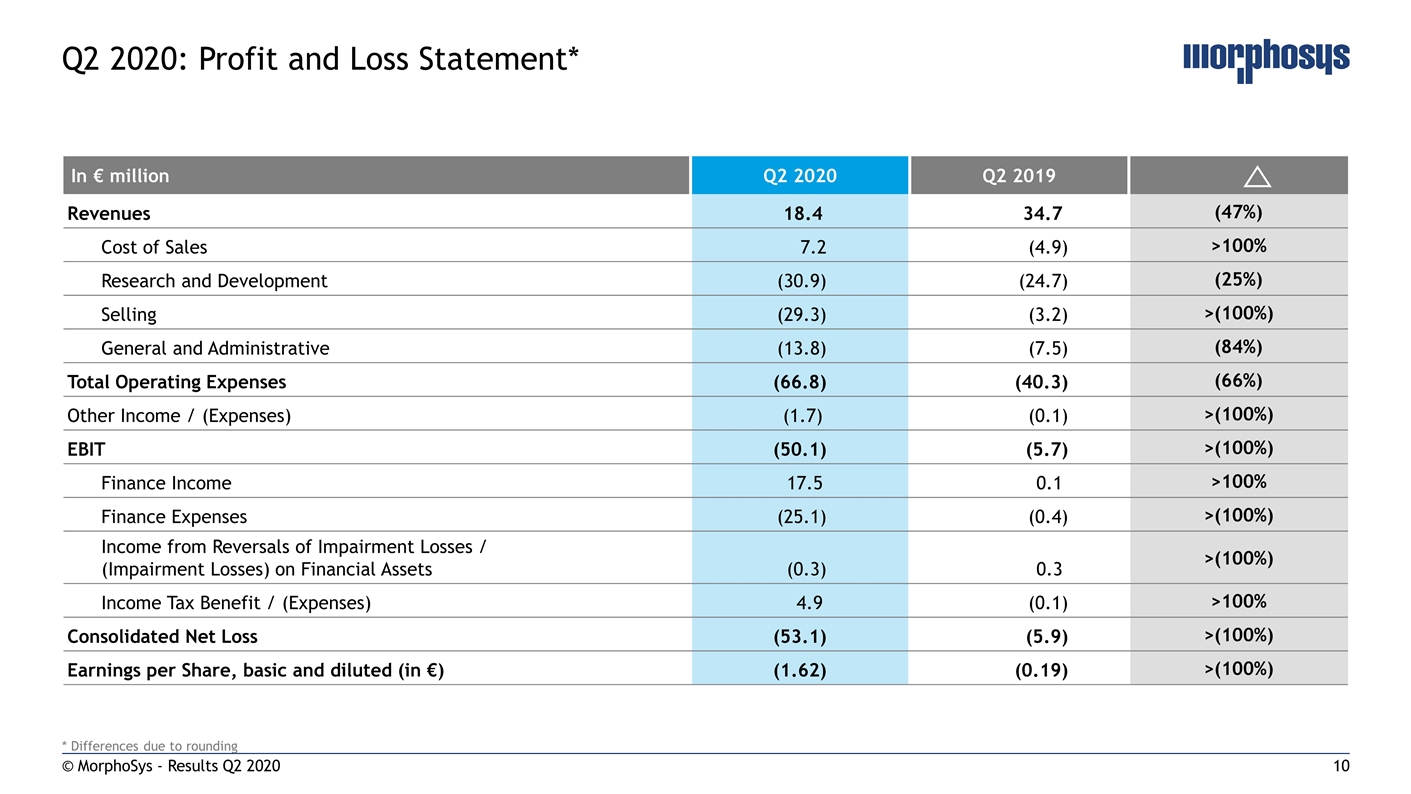

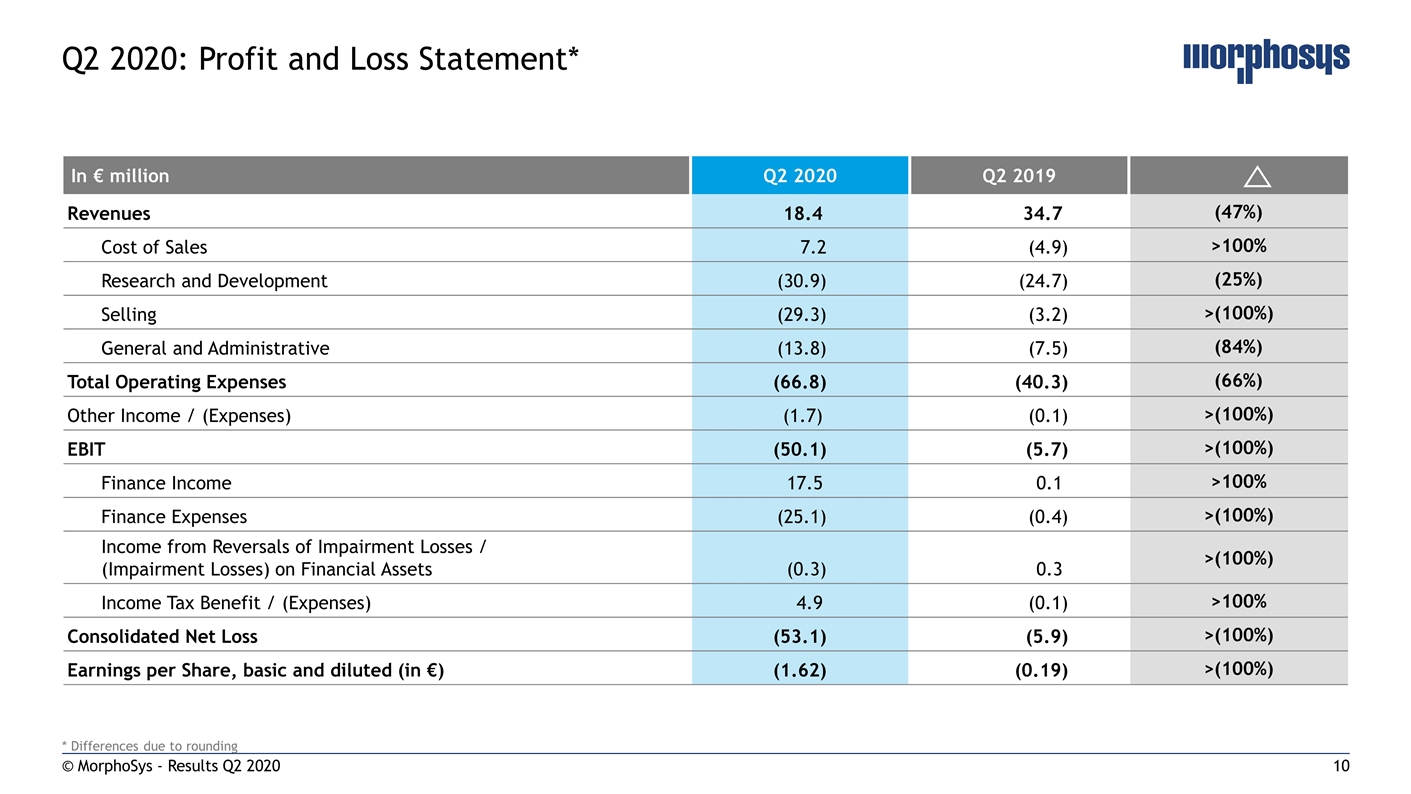

© MorphoSys - Results Q2 2020 Q2 2020: Profit and Loss Statement* In € million Q2 2020 Q2 2019 Revenues 18.4 34.7 (47%) Cost of Sales 7.2 (4.9) >100% Research and Development (30.9) (24.7) (25%) Selling (29.3) (3.2) >(100%) General and Administrative (13.8) (7.5) (84%) Total Operating Expenses (66.8) (40.3) (66%) Other Income / (Expenses) (1.7) (0.1) >(100%) EBIT (50.1) (5.7) >(100%) Finance Income 17.5 0.1 >100% Finance Expenses (25.1) (0.4) >(100%) Income from Reversals of Impairment Losses / (Impairment Losses) on Financial Assets (0.3) 0.3 >(100%) Income Tax Benefit / (Expenses) 4.9 (0.1) >100% Consolidated Net Loss (53.1) (5.9) >(100%) Earnings per Share, basic and diluted (in €) (1.62) (0.19) >(100%) * Differences due to rounding

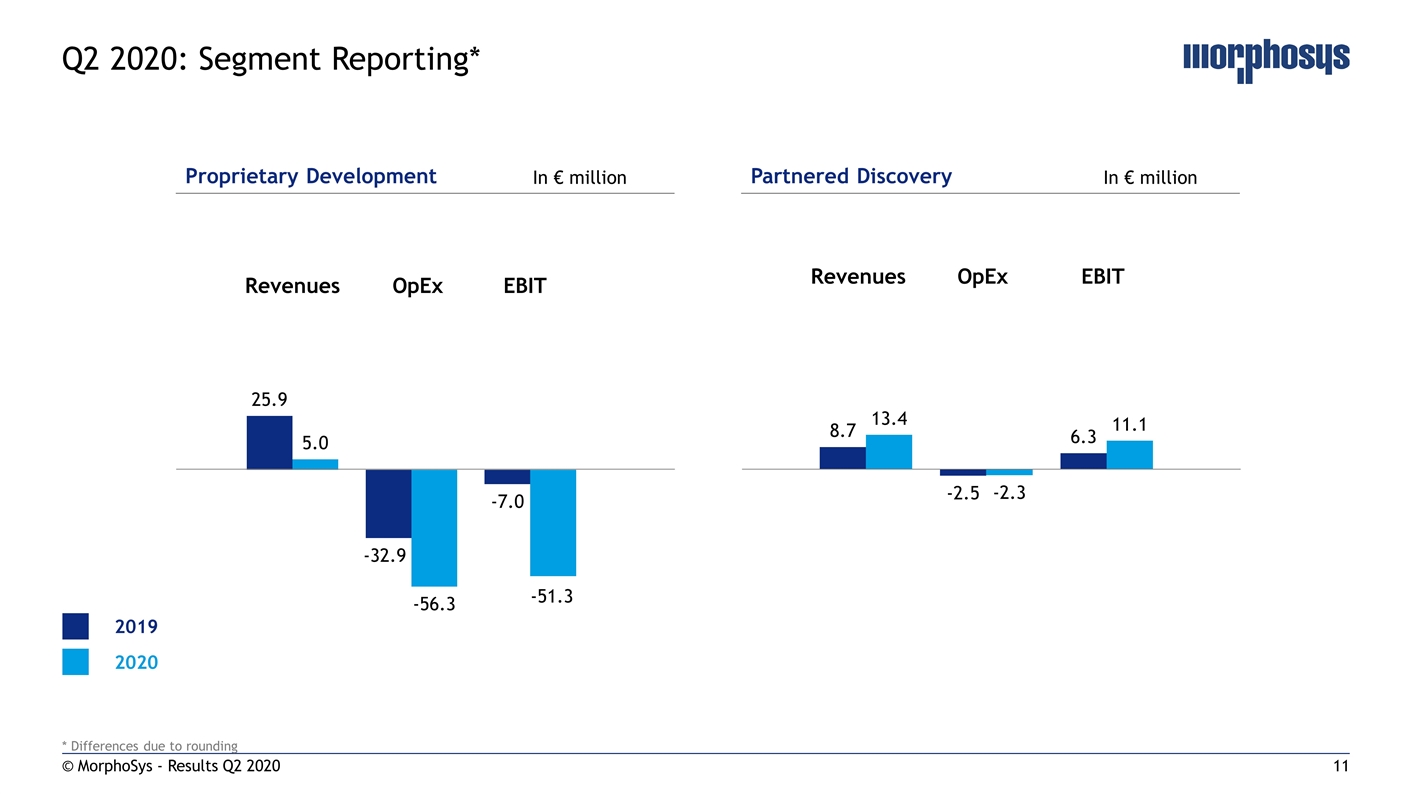

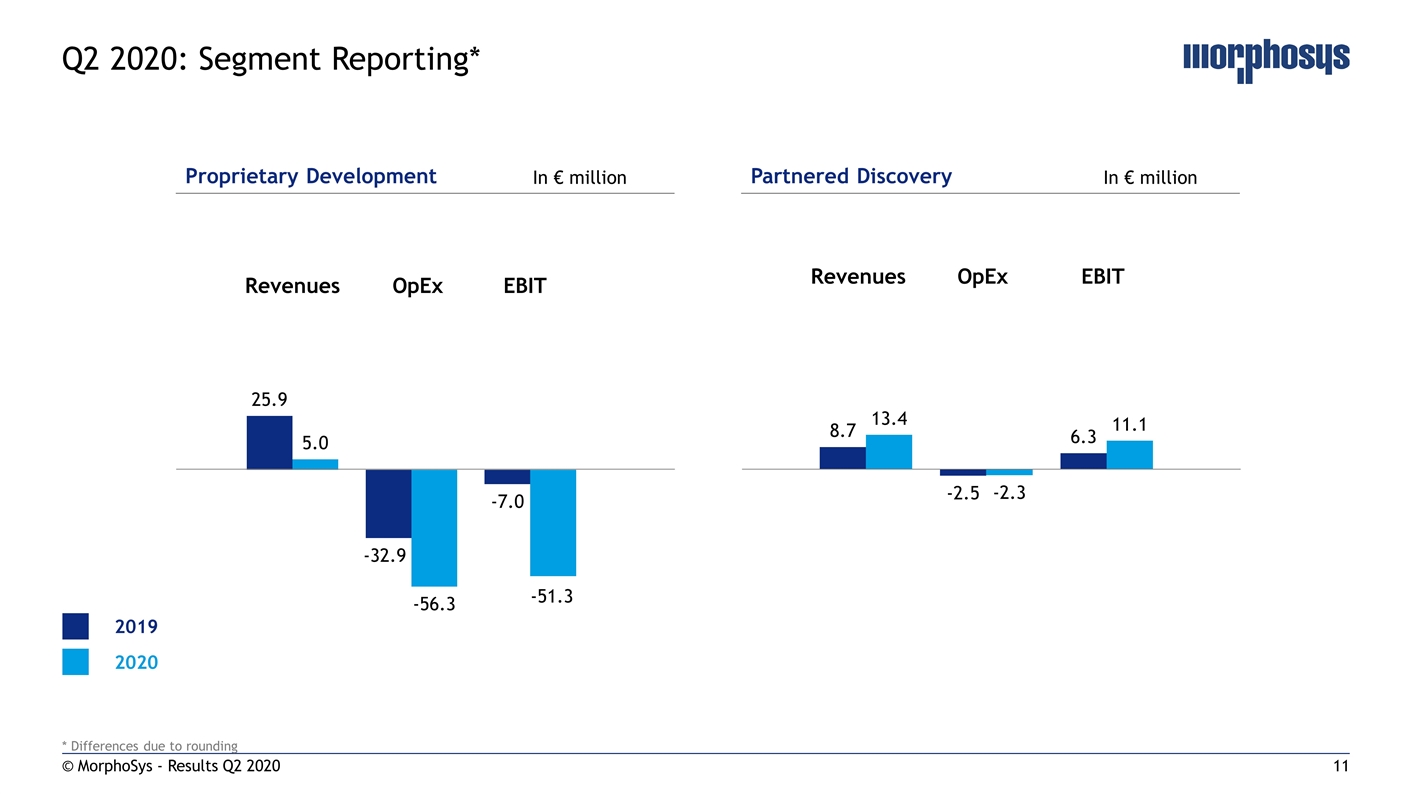

© MorphoSys - Results Q2 2020 Q2 2020: Segment Reporting* Proprietary Development Partnered Discovery In € million In € million Revenues OpEx EBIT Revenues OpEx EBIT 2019 2020 * Differences due to rounding

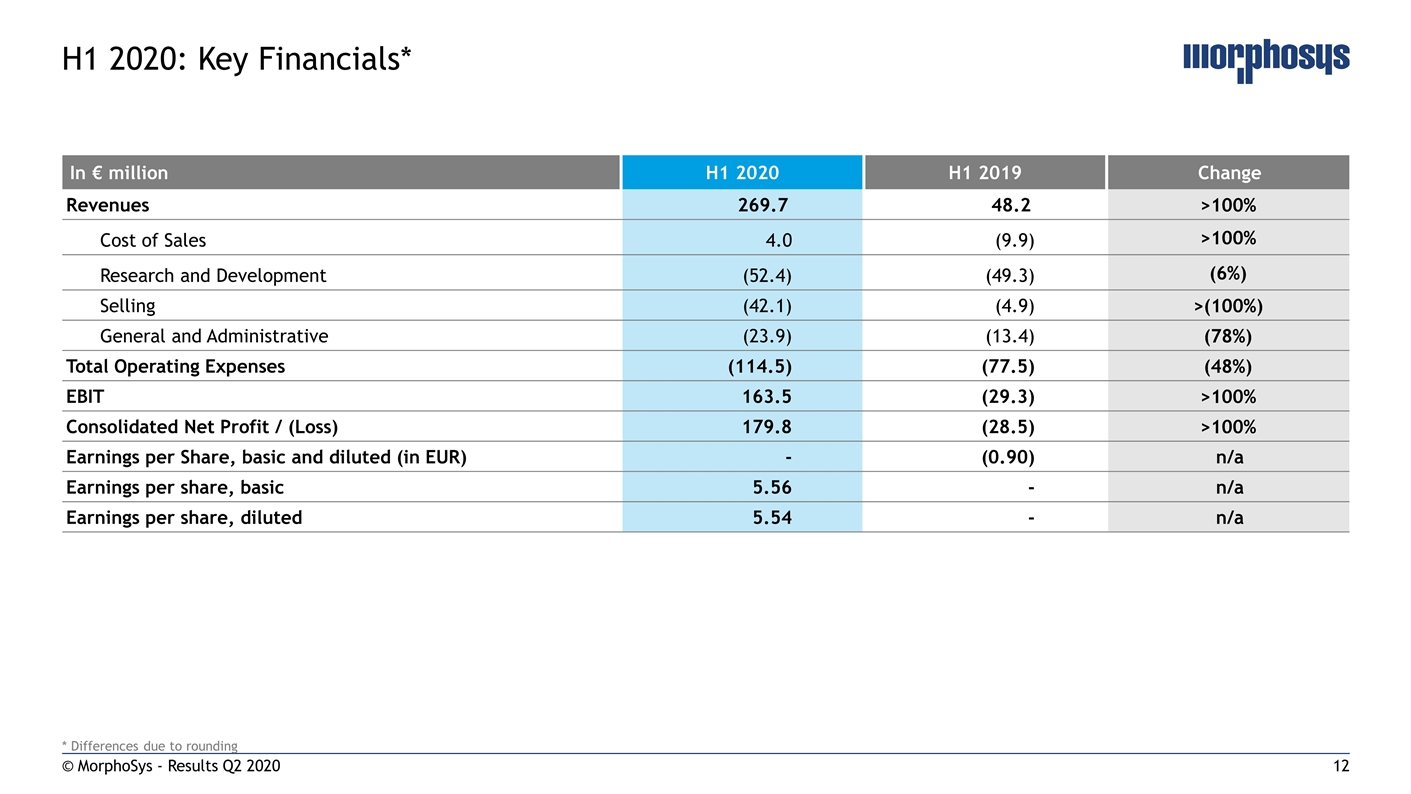

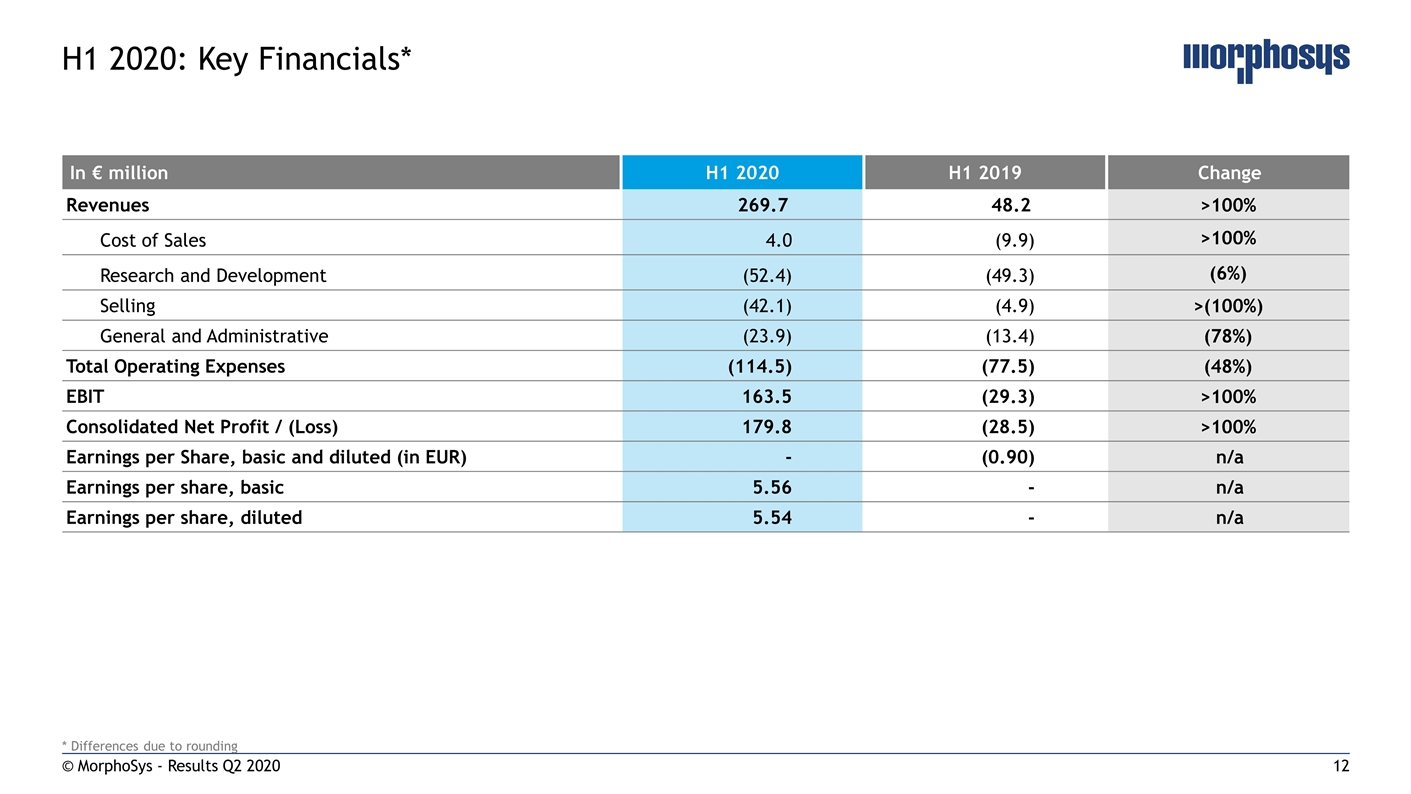

© MorphoSys - Results Q2 2020 H1 2020: Key Financials* In € million H1 2020 H1 2019 Change Revenues 269.7 48.2 >100% Cost of Sales 4.0 (9.9) >100% Research and Development (52.4) (49.3) (6%) Selling (42.1) (4.9) >(100%) General and Administrative (23.9) (13.4) (78%) Total Operating Expenses (114.5) (77.5) (48%) EBIT 163.5 (29.3) >100% Consolidated Net Profit / (Loss) 179.8 (28.5) >100% Earnings per Share, basic and diluted (in EUR) - (0.90) n/a Earnings per share, basic 5.56 - n/a Earnings per share, diluted 5.54 - n/a * Differences due to rounding

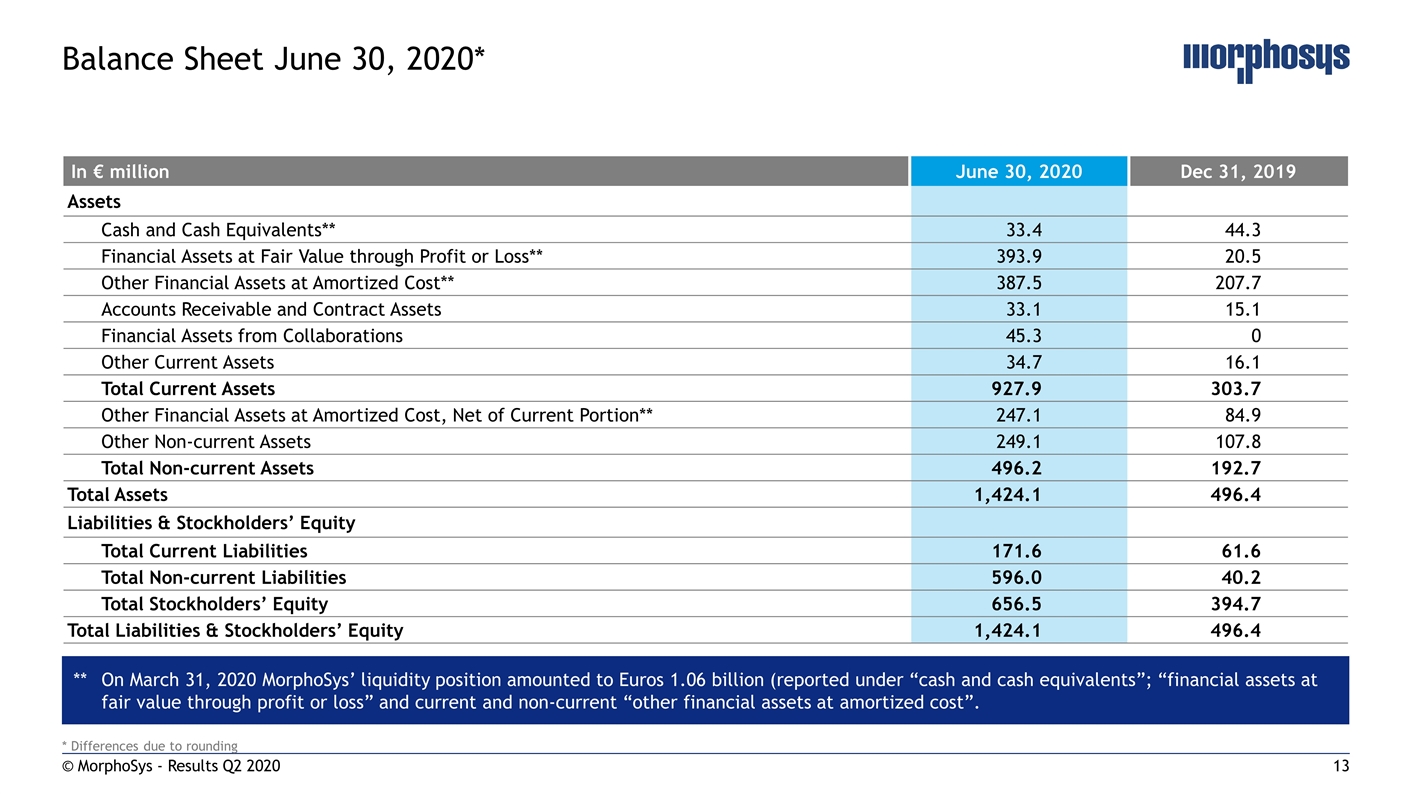

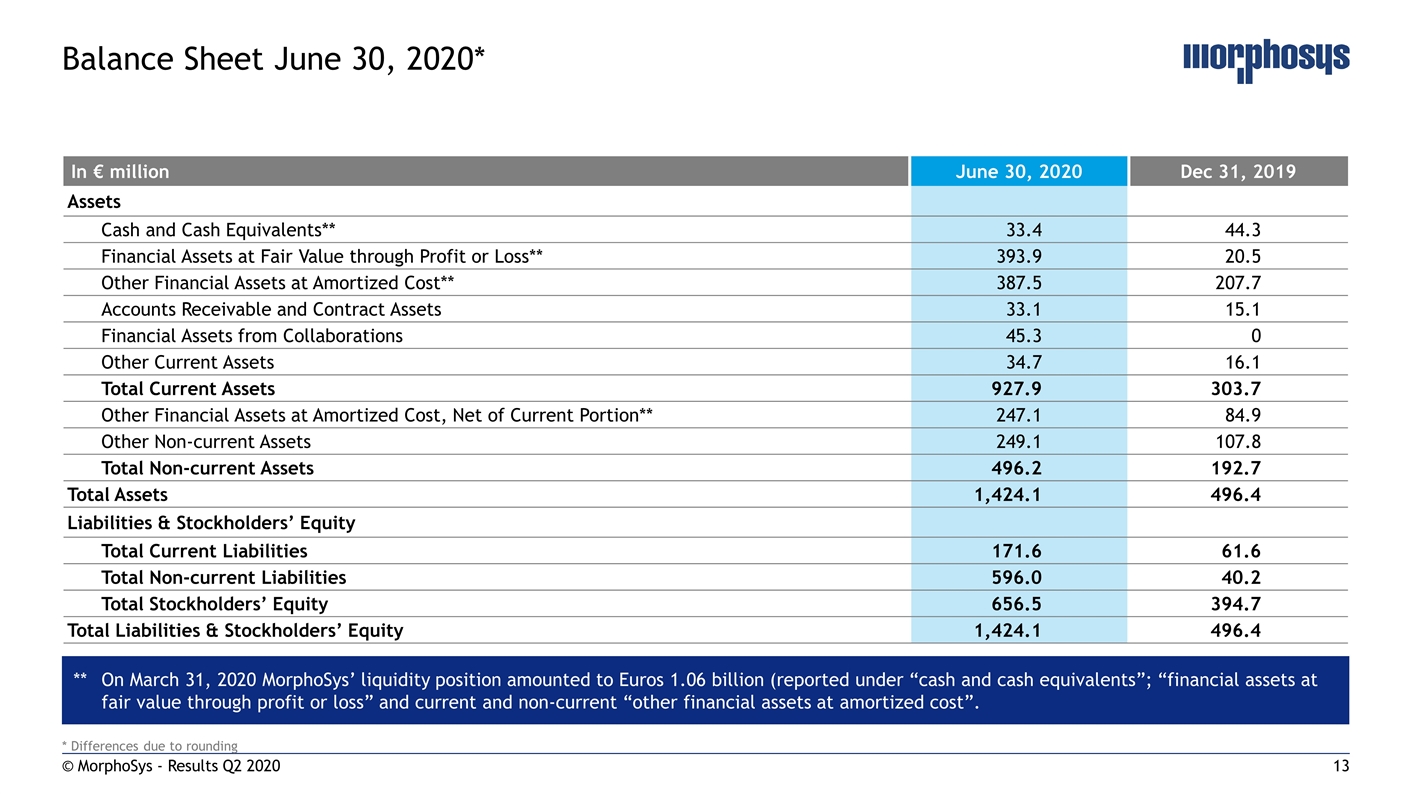

* Differences due to rounding © MorphoSys - Results Q2 2020 Balance Sheet June 30, 2020* In € million June 30, 2020 Dec 31, 2019 Assets Cash and Cash Equivalents** 33.4 44.3 Financial Assets at Fair Value through Profit or Loss** 393.9 20.5 Other Financial Assets at Amortized Cost** 387.5 207.7 Accounts Receivable and Contract Assets 33.1 15.1 Financial Assets from Collaborations 45.3 0 Other Current Assets 34.7 16.1 Total Current Assets 927.9 303.7 Other Financial Assets at Amortized Cost, Net of Current Portion** 247.1 84.9 Other Non-current Assets 249.1 107.8 Total Non-current Assets 496.2 192.7 Total Assets 1,424.1 496.4 Liabilities & Stockholders’ Equity Total Current Liabilities 171.6 61.6 Total Non-current Liabilities 596.0 40.2 Total Stockholders’ Equity 656.5 394.7 Total Liabilities & Stockholders’ Equity 1,424.1 496.4 **On March 31, 2020 MorphoSys’ liquidity position amounted to Euros 1.06 billion (reported under “cash and cash equivalents”; “financial assets at fair value through profit or loss” and current and non-current “other financial assets at amortized cost”.

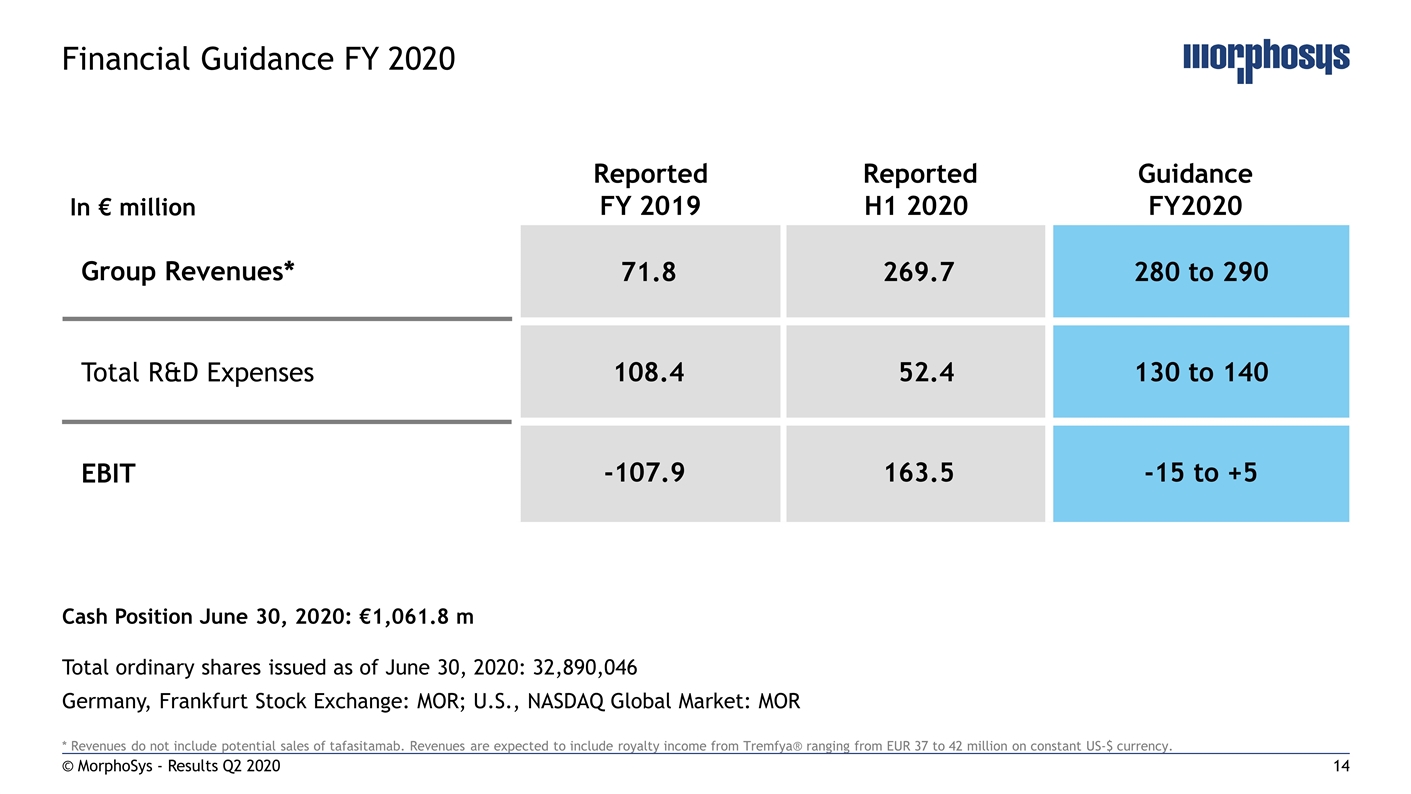

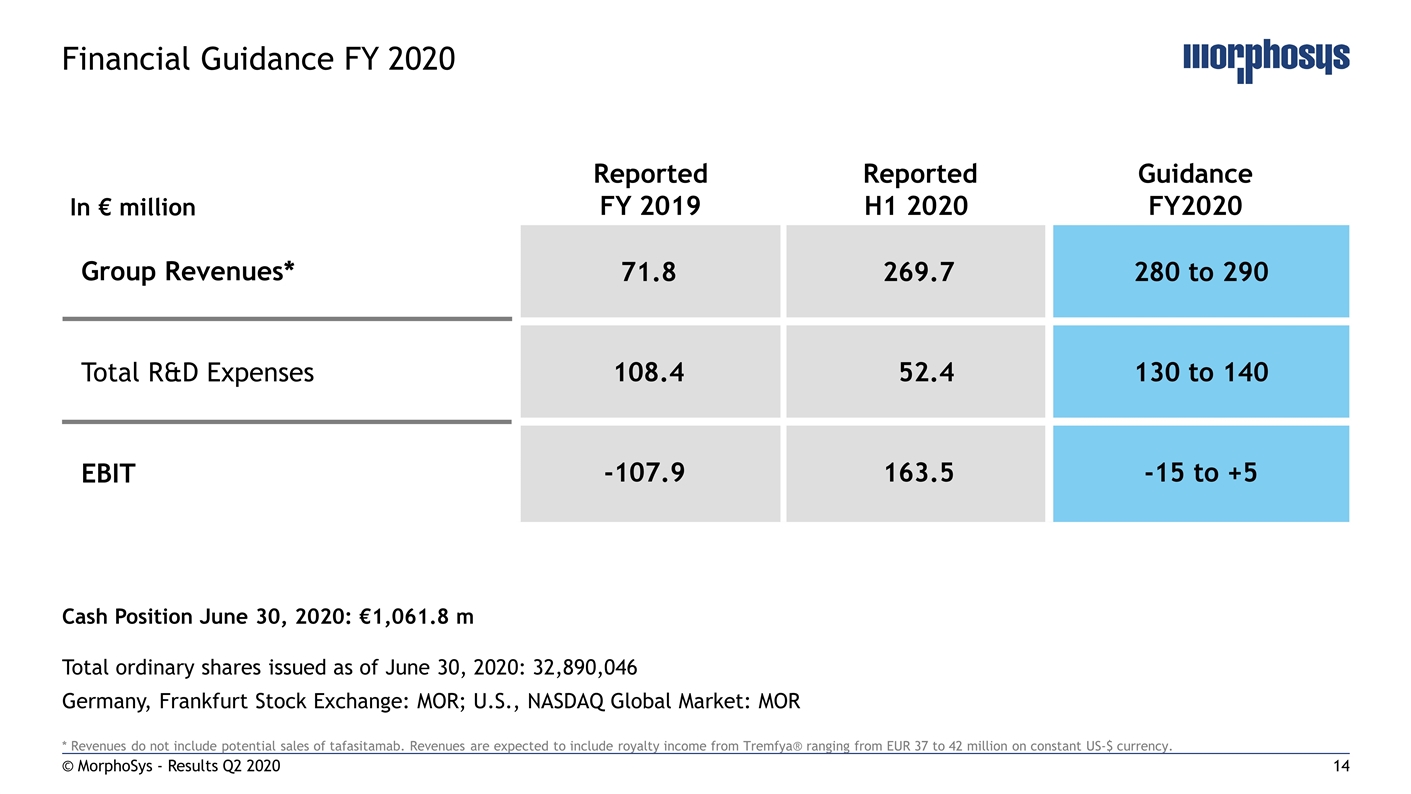

* Revenues do not include potential sales of tafasitamab. Revenues are expected to include royalty income from Tremfya® ranging from EUR 37 to 42 million on constant US-$ currency. © MorphoSys - Results Q2 2020 Financial Guidance FY 2020 In € million Reported FY 2019 Reported H1 2020 Guidance FY2020 71.8 269.7 280 to 290 108.4 52.4 130 to 140 -107.9 163.5 -15 to +5 Group Revenues* Total R&D Expenses EBIT Total ordinary shares issued as of June 30, 2020: 32,890,046 Germany, Frankfurt Stock Exchange: MOR; U.S., NASDAQ Global Market: MOR Cash Position June 30, 2020: €1,061.8 m

Summary Jean-Paul Kress, M.D., CEO © MorphoSys - Results Q2 2020

© MorphoSys - Results Q2 2020 Summary Major milestone achievement with FDA approval of Monjuvi® Monjuvi® already available in the U.S. as of today Unlock tafasitamab‘s full potential and focus on proprietary pipeline Well on track towards our FY 2020 guidance

© MorphoSys - Results Q2 2020 Q & A