Exhibit 99.2 March 16, 2021 Q4 / FY 2020 ResultsExhibit 99.2 March 16, 2021 Q4 / FY 2020 Results

Forward-Looking Statements This communication contains certain forward-looking statements concerning the MorphoSys group of companies, including the expectations regarding Monjuvi's ability to treat patients with relapsed or refractory diffuse large B-cell lymphoma, the further clinical development of tafasitamab, including ongoing confirmatory trials, additional interactions with regulatory authorities and expectations regarding future regulatory filings and possible additional approvals for tafasitamab as well as the commercial performance of Monjuvi. The words anticipate, believe, estimate, expect, intend, may, plan, predict, project, would, could, potential, possible, hope and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The forward-looking statements contained herein represent the judgment of MorphoSys as of the date of this release and involve known and unknown risks and uncertainties, which might cause the actual results, financial condition and liquidity, performance or achievements of MorphoSys, or industry results, to be materially different from any historic or future results, financial conditions and liquidity, performance or achievements expressed or implied by such forward-looking statements. In addition, even if MorphoSys' results, performance, financial condition and liquidity, and the development of the industry in which it operates are consistent with such forward-looking statements, they may not be predictive of results or developments in future periods. Among the factors that may result in differences are MorphoSys' expectations regarding risks and uncertainties related to the impact of the COVID-19 pandemic to MorphoSys' business, operations, strategy, goals and anticipated milestones, including its ongoing and planned research activities, ability to conduct ongoing and planned clinical trials, clinical supply of current or future drug candidates, commercial supply of current or future approved products, and launching, marketing and selling current or future approved products, the global collaboration and license agreement for tafasitamab, the further clinical development of tafasitamab, including ongoing confirmatory trials, and MorphoSys' ability to obtain and maintain requisite regulatory approvals and to enroll patients in its planned clinical trials, additional interactions with regulatory authorities and expectations regarding future regulatory filings and possible additional approvals for tafasitamab as well as the commercial performance of Monjuvi, MorphoSys' reliance on collaborations with third parties, estimating the commercial potential of its development programs and other risks indicated in the risk factors included in MorphoSys' Annual Report on Form 20-F and other filings with the U.S. Securities and Exchange Commission. Given these uncertainties, the reader is advised not to place any undue reliance on such forward-looking statements. These forward-looking statements speak only as of the date of publication of this document. MorphoSys expressly disclaims any obligation to update any such forward-looking statements in this document to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements, unless specifically required by law or regulation. The compounds discussed in this slide presentation are investigational products being developed by MorphoSys and its partners and are not currently approved by the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA) or any other regulatory authority (except for tafasitamab/Monjuvi® and guselkumab/Tremfya®). There is no guarantee any investigational product will be approved. © MorphoSys - Q4 / FY 2020 results 2Forward-Looking Statements This communication contains certain forward-looking statements concerning the MorphoSys group of companies, including the expectations regarding Monjuvi's ability to treat patients with relapsed or refractory diffuse large B-cell lymphoma, the further clinical development of tafasitamab, including ongoing confirmatory trials, additional interactions with regulatory authorities and expectations regarding future regulatory filings and possible additional approvals for tafasitamab as well as the commercial performance of Monjuvi. The words anticipate, believe, estimate, expect, intend, may, plan, predict, project, would, could, potential, possible, hope and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The forward-looking statements contained herein represent the judgment of MorphoSys as of the date of this release and involve known and unknown risks and uncertainties, which might cause the actual results, financial condition and liquidity, performance or achievements of MorphoSys, or industry results, to be materially different from any historic or future results, financial conditions and liquidity, performance or achievements expressed or implied by such forward-looking statements. In addition, even if MorphoSys' results, performance, financial condition and liquidity, and the development of the industry in which it operates are consistent with such forward-looking statements, they may not be predictive of results or developments in future periods. Among the factors that may result in differences are MorphoSys' expectations regarding risks and uncertainties related to the impact of the COVID-19 pandemic to MorphoSys' business, operations, strategy, goals and anticipated milestones, including its ongoing and planned research activities, ability to conduct ongoing and planned clinical trials, clinical supply of current or future drug candidates, commercial supply of current or future approved products, and launching, marketing and selling current or future approved products, the global collaboration and license agreement for tafasitamab, the further clinical development of tafasitamab, including ongoing confirmatory trials, and MorphoSys' ability to obtain and maintain requisite regulatory approvals and to enroll patients in its planned clinical trials, additional interactions with regulatory authorities and expectations regarding future regulatory filings and possible additional approvals for tafasitamab as well as the commercial performance of Monjuvi, MorphoSys' reliance on collaborations with third parties, estimating the commercial potential of its development programs and other risks indicated in the risk factors included in MorphoSys' Annual Report on Form 20-F and other filings with the U.S. Securities and Exchange Commission. Given these uncertainties, the reader is advised not to place any undue reliance on such forward-looking statements. These forward-looking statements speak only as of the date of publication of this document. MorphoSys expressly disclaims any obligation to update any such forward-looking statements in this document to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements, unless specifically required by law or regulation. The compounds discussed in this slide presentation are investigational products being developed by MorphoSys and its partners and are not currently approved by the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA) or any other regulatory authority (except for tafasitamab/Monjuvi® and guselkumab/Tremfya®). There is no guarantee any investigational product will be approved. © MorphoSys - Q4 / FY 2020 results 2

Q4 2020 Results Conference Call Agenda Highlights FY 2020 / 2021 Outlook Jean-Paul Kress, M.D., CEO Commercial Update Roland Wandeler, Ph.D., COO R&D Update and Outlook Malte Peters, M.D., CR&DO Financial Results Q4 / FY 2020 Sung Lee, CFO Closing Remarks Jean-Paul Kress, M.D., CEO Jean-Paul Kress, Sung Lee, Roland Wandeler, Q&A Malte Peters © MorphoSys - Q4 / FY 2020 results 3Q4 2020 Results Conference Call Agenda Highlights FY 2020 / 2021 Outlook Jean-Paul Kress, M.D., CEO Commercial Update Roland Wandeler, Ph.D., COO R&D Update and Outlook Malte Peters, M.D., CR&DO Financial Results Q4 / FY 2020 Sung Lee, CFO Closing Remarks Jean-Paul Kress, M.D., CEO Jean-Paul Kress, Sung Lee, Roland Wandeler, Q&A Malte Peters © MorphoSys - Q4 / FY 2020 results 3

Highlights FY 2020 / Outlook 2021 Jean-Paul Kress, M.D., CEO © MorphoSys - Q4 / FY 2020 results 4Highlights FY 2020 / Outlook 2021 Jean-Paul Kress, M.D., CEO © MorphoSys - Q4 / FY 2020 results 4

2020 was a Transformational Year for MorphoSys Integrated biopharmaceutical company ® n MONJUVI (tafasitamab-cxix) approved in the U.S. in July 2020 § First and only FDA-approved 2nd line therapy in r/r DLBCL n Global commercial and development collaboration with Incyte for ® tafasitamab (Monjuvi ) n Phase 1b data for tafasitamab in 1L DLBCL pave the way for a pivotal trial in 2021 n Combination trials with plamotamab (CD20xCD3) sponsored by Xencor to start in 2021 n Monjuvi revenues in 2020 of USD 22 million (€ 18.5 million) since August launch n Significantly strengthened balance sheet with a liquidity position of € ~1.2 bn © MorphoSys - Q4 / FY 2020 results 52020 was a Transformational Year for MorphoSys Integrated biopharmaceutical company ® n MONJUVI (tafasitamab-cxix) approved in the U.S. in July 2020 § First and only FDA-approved 2nd line therapy in r/r DLBCL n Global commercial and development collaboration with Incyte for ® tafasitamab (Monjuvi ) n Phase 1b data for tafasitamab in 1L DLBCL pave the way for a pivotal trial in 2021 n Combination trials with plamotamab (CD20xCD3) sponsored by Xencor to start in 2021 n Monjuvi revenues in 2020 of USD 22 million (€ 18.5 million) since August launch n Significantly strengthened balance sheet with a liquidity position of € ~1.2 bn © MorphoSys - Q4 / FY 2020 results 5

Products, Partnerships and Research Drive Stakeholder Value Three drivers of value creation PRODUCT REVENUE ROYALTY REVENUE RESEARCH PLATFORMS from MorphoSys from partners create opportunities to drive commercialization long-term growth First marketed product Blockbuster medicine Cutting-edge research platforms and programs: § Antibodies, T-cell engagers, bispecifics Felzartamab in clinical Several additional § Focus on oncology and development for autoimmune programs in mid and late- autoimmune diseases disease stage development © MorphoSys - Q4 / FY 2020 results 6Products, Partnerships and Research Drive Stakeholder Value Three drivers of value creation PRODUCT REVENUE ROYALTY REVENUE RESEARCH PLATFORMS from MorphoSys from partners create opportunities to drive commercialization long-term growth First marketed product Blockbuster medicine Cutting-edge research platforms and programs: § Antibodies, T-cell engagers, bispecifics Felzartamab in clinical Several additional § Focus on oncology and development for autoimmune programs in mid and late- autoimmune diseases disease stage development © MorphoSys - Q4 / FY 2020 results 6

2021 – Building Momentum for Monjuvi and Expanding Pipeline Commercial Continued execution of the Monjuvi launch Build on established foundation for Monjuvi’s long-term growth trajectory Pipeline Development Expand tafasitamab opportunity by initiating pivotal studies in 1st line DLBCL and r/r indolent lymphomas (FL/MZL) Progress the development of felzartamab in autoimmune diseases © MorphoSys - Q4 / FY 2020 results 72021 – Building Momentum for Monjuvi and Expanding Pipeline Commercial Continued execution of the Monjuvi launch Build on established foundation for Monjuvi’s long-term growth trajectory Pipeline Development Expand tafasitamab opportunity by initiating pivotal studies in 1st line DLBCL and r/r indolent lymphomas (FL/MZL) Progress the development of felzartamab in autoimmune diseases © MorphoSys - Q4 / FY 2020 results 7

Commercial Update Roland Wandeler, Ph.D., COO © MorphoSys - Q4 / FY 2020 results 8Commercial Update Roland Wandeler, Ph.D., COO © MorphoSys - Q4 / FY 2020 results 8

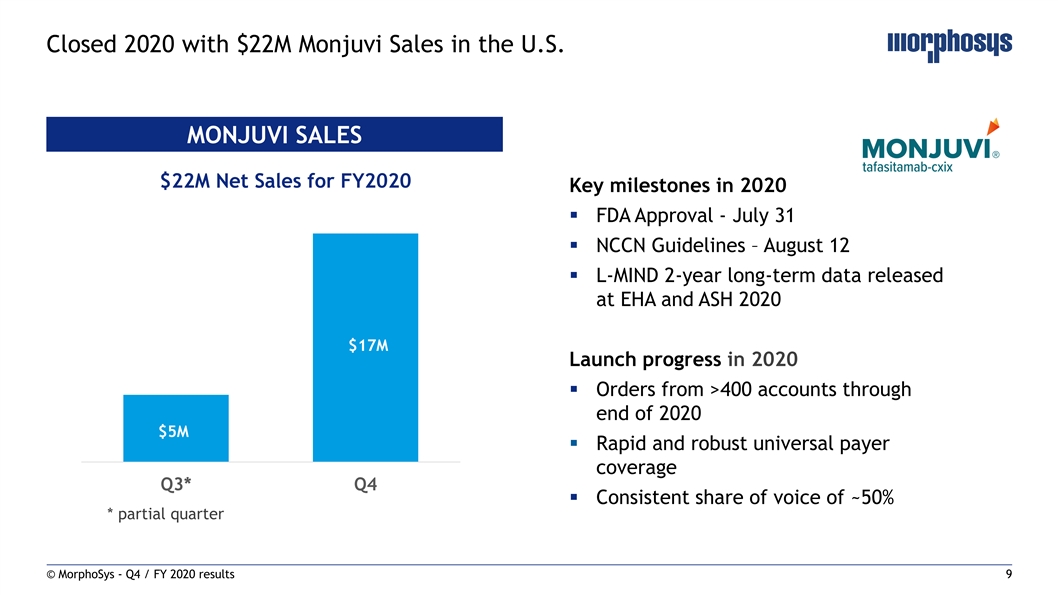

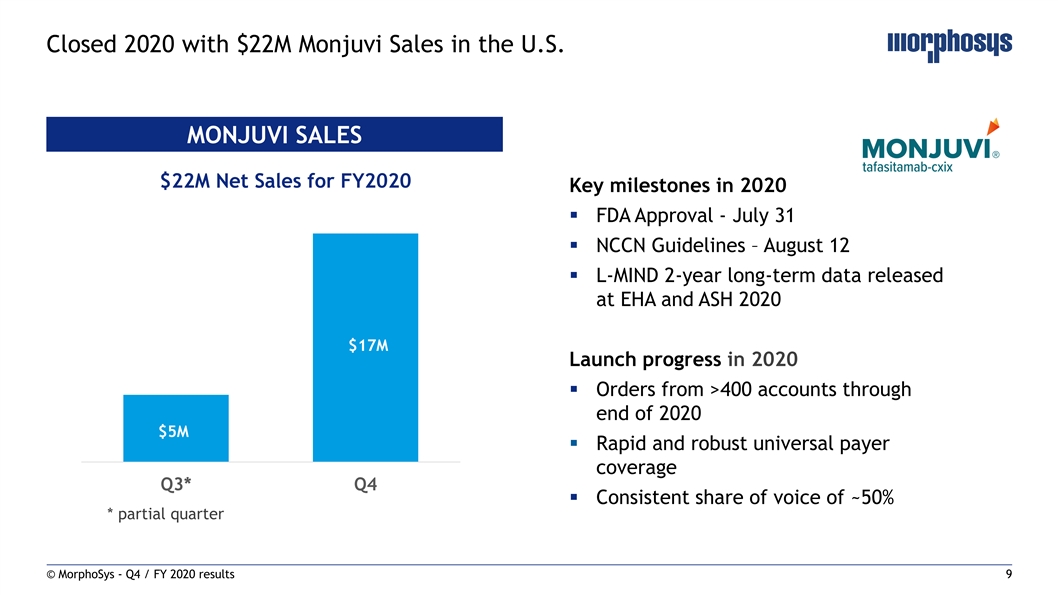

Closed 2020 with $22M Monjuvi Sales in the U.S. MONJUVI SALES $22M Net Sales for FY2020 Key milestones in 2020 § FDA Approval - July 31 § NCCN Guidelines – August 12 § L-MIND 2-year long-term data released at EHA and ASH 2020 $17M Launch progress in 2020 § Orders from >400 accounts through end of 2020 $5M § Rapid and robust universal payer coverage Q3* Q4 § Consistent share of voice of ~50% * partial quarter © MorphoSys - Q4 / FY 2020 results 9Closed 2020 with $22M Monjuvi Sales in the U.S. MONJUVI SALES $22M Net Sales for FY2020 Key milestones in 2020 § FDA Approval - July 31 § NCCN Guidelines – August 12 § L-MIND 2-year long-term data released at EHA and ASH 2020 $17M Launch progress in 2020 § Orders from >400 accounts through end of 2020 $5M § Rapid and robust universal payer coverage Q3* Q4 § Consistent share of voice of ~50% * partial quarter © MorphoSys - Q4 / FY 2020 results 9

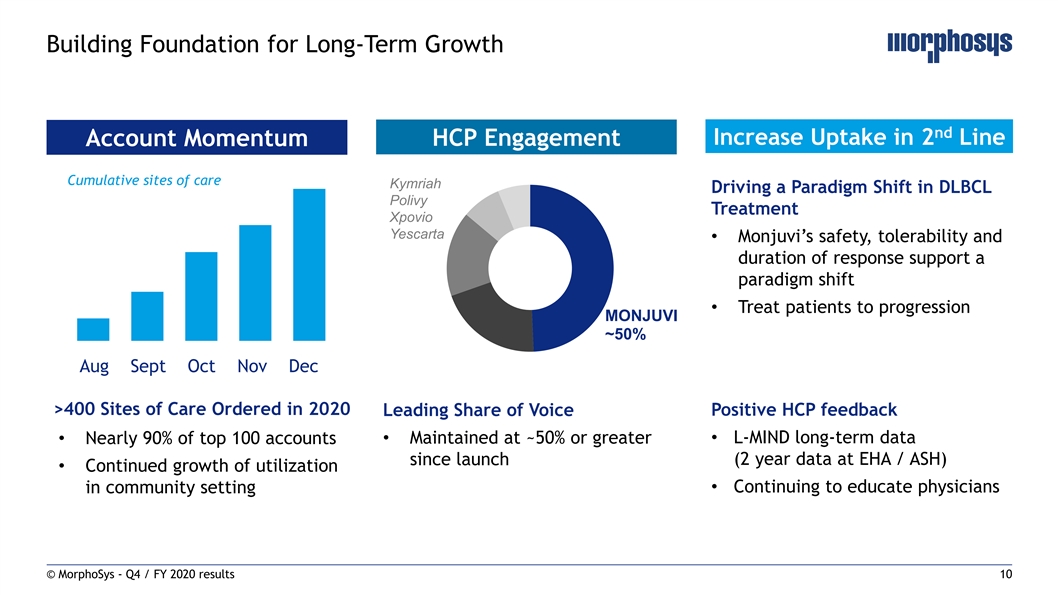

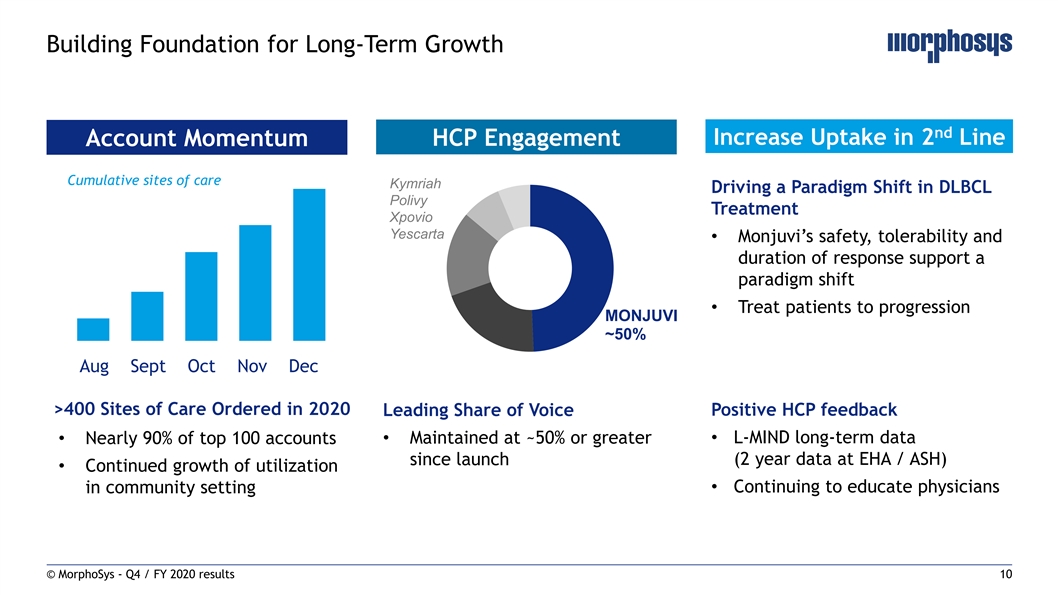

Building Foundation for Long-Term Growth nd Increase Uptake in 2 Line Account Momentum HCP Engagement Cumulative sites of care Kymriah Driving a Paradigm Shift in DLBCL Polivy Treatment Xpovio Yescarta • Monjuvi’s safety, tolerability and duration of response support a paradigm shift • Treat patients to progression MONJUVI ~50% Aug Sept Oct Nov Dec >400 Sites of Care Ordered in 2020 Leading Share of Voice Positive HCP feedback • L-MIND long-term data • Nearly 90% of top 100 accounts• Maintained at ~50% or greater since launch (2 year data at EHA / ASH) • Continued growth of utilization in community setting• Continuing to educate physicians © MorphoSys - Q4 / FY 2020 results 10Building Foundation for Long-Term Growth nd Increase Uptake in 2 Line Account Momentum HCP Engagement Cumulative sites of care Kymriah Driving a Paradigm Shift in DLBCL Polivy Treatment Xpovio Yescarta • Monjuvi’s safety, tolerability and duration of response support a paradigm shift • Treat patients to progression MONJUVI ~50% Aug Sept Oct Nov Dec >400 Sites of Care Ordered in 2020 Leading Share of Voice Positive HCP feedback • L-MIND long-term data • Nearly 90% of top 100 accounts• Maintained at ~50% or greater since launch (2 year data at EHA / ASH) • Continued growth of utilization in community setting• Continuing to educate physicians © MorphoSys - Q4 / FY 2020 results 10

R&D Update and Outlook Malte Peters, M.D., CR&DO © MorphoSys - Q4 / FY 2020 results 11R&D Update and Outlook Malte Peters, M.D., CR&DO © MorphoSys - Q4 / FY 2020 results 11

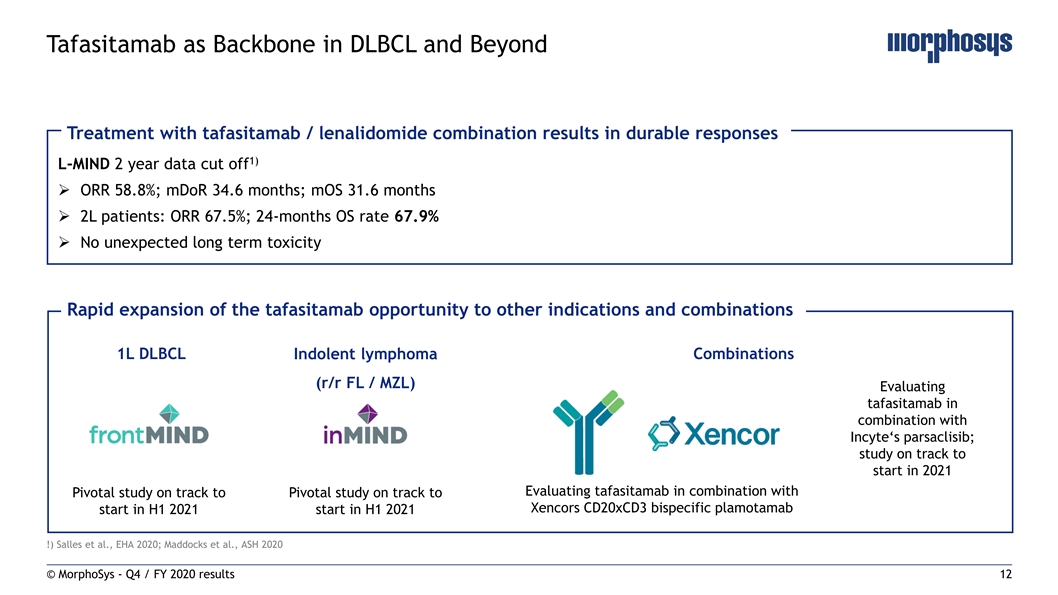

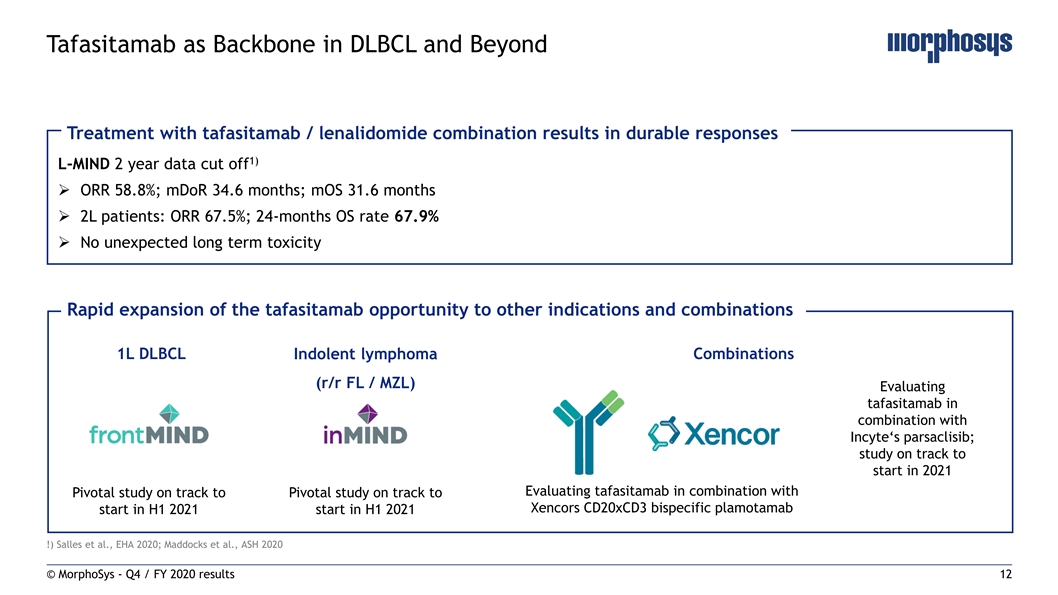

Tafasitamab as Backbone in DLBCL and Beyond Treatment with tafasitamab / lenalidomide combination results in durable responses 1) L-MIND 2 year data cut off Ø ORR 58.8%; mDoR 34.6 months; mOS 31.6 months Ø 2L patients: ORR 67.5%; 24-months OS rate 67.9% Ø No unexpected long term toxicity Rapid expansion of the tafasitamab opportunity to other indications and combinations 1L DLBCL Indolent lymphoma Combinations (r/r FL / MZL) Evaluating tafasitamab in combination with Incyte‘s parsaclisib; study on track to start in 2021 Evaluating tafasitamab in combination with Pivotal study on track to Pivotal study on track to Xencors CD20xCD3 bispecific plamotamab start in H1 2021 start in H1 2021 !) Salles et al., EHA 2020; Maddocks et al., ASH 2020 © MorphoSys - Q4 / FY 2020 results 12Tafasitamab as Backbone in DLBCL and Beyond Treatment with tafasitamab / lenalidomide combination results in durable responses 1) L-MIND 2 year data cut off Ø ORR 58.8%; mDoR 34.6 months; mOS 31.6 months Ø 2L patients: ORR 67.5%; 24-months OS rate 67.9% Ø No unexpected long term toxicity Rapid expansion of the tafasitamab opportunity to other indications and combinations 1L DLBCL Indolent lymphoma Combinations (r/r FL / MZL) Evaluating tafasitamab in combination with Incyte‘s parsaclisib; study on track to start in 2021 Evaluating tafasitamab in combination with Pivotal study on track to Pivotal study on track to Xencors CD20xCD3 bispecific plamotamab start in H1 2021 start in H1 2021 !) Salles et al., EHA 2020; Maddocks et al., ASH 2020 © MorphoSys - Q4 / FY 2020 results 12

Exploring Felzartamab (MOR202) in Autoimmune Diseases First PoC data in membranous nephropathy anticipated in H1 2021 Different B-cell stages produce autoantibodies which CD38 antibody in clinical development damage organ tissue in autoimmune diseases Specific targeting of autoantibody producing plasma cells First indication in development: aMN - membranous nephropathy – 10,000 eligible patients in the U.S. per year – High unmet need, 30%–40% of patients progress to Plasma-blast Activated Earlier 1) Short/ Long- end-stage renal disease (ESRD) within 5–15 years B cell B-cell lived Plasma cell stages Anti-CD38 (Felza) Anti-CD20,-CD19,-CD40 (L),-BAFF Clinical development plan: - PoC data from M-PLACE phase 1b/2a study anticipated in H1 2021 - Ready to broaden clinical development 1) Chen et al. 2014 © MorphoSys - Q4 / FY 2020 results 13Exploring Felzartamab (MOR202) in Autoimmune Diseases First PoC data in membranous nephropathy anticipated in H1 2021 Different B-cell stages produce autoantibodies which CD38 antibody in clinical development damage organ tissue in autoimmune diseases Specific targeting of autoantibody producing plasma cells First indication in development: aMN - membranous nephropathy – 10,000 eligible patients in the U.S. per year – High unmet need, 30%–40% of patients progress to Plasma-blast Activated Earlier 1) Short/ Long- end-stage renal disease (ESRD) within 5–15 years B cell B-cell lived Plasma cell stages Anti-CD38 (Felza) Anti-CD20,-CD19,-CD40 (L),-BAFF Clinical development plan: - PoC data from M-PLACE phase 1b/2a study anticipated in H1 2021 - Ready to broaden clinical development 1) Chen et al. 2014 © MorphoSys - Q4 / FY 2020 results 13

Financial Results Q4 / FY 2020 Sung Lee, CFO © MorphoSys - Q4 / FY 2020 results 14Financial Results Q4 / FY 2020 Sung Lee, CFO © MorphoSys - Q4 / FY 2020 results 14

Q4 / FY2020: Profit or Loss Statement* In € million FY 2020 FY 2019 Q4 2020 Q4 2019 327.7 71.8 36.0 11.1 >100% Revenues >100% (9.2) (12.1) (9.4) (1.2) >(100%) Cost of Sales 24% 318.5 59.7 26.6 9.9 >100% Gross Profit >100% (141.4) (108.4) (54.8) (33.2) (65%) R&D Expenses (30%) (159.1) (59.4) (47.0) (27.6) (70%) SG&A Expenses >(100%) (309.7) (179.9) (111.2) (62.0) (79%) Total Operating Expenses (72%) 0.7 (0.6) >100% 9.4 0.2 Other Income / (Expenses) >100% 27.4 (107.9) (74.5) (51.6) (44%) EBIT >100% 97.9 (103.0) (16.5) (50.3) 67% Consolidated Net Profit / (Net Loss) >100% - (3.26) (0.5) (1.59) >100% Earnings per Share, basic and diluted (in €) - 3.01 Earnings per Share, basic (in €) - 2.97 Earnings per Share, diluted (in €) - On December 31, 2020 MorphoSys’ liquidity position amounted to Euros 1,244.0 million * Differences due to rounding © MorphoSys - Q4 / FY 2020 results 15Q4 / FY2020: Profit or Loss Statement* In € million FY 2020 FY 2019 Q4 2020 Q4 2019 327.7 71.8 36.0 11.1 >100% Revenues >100% (9.2) (12.1) (9.4) (1.2) >(100%) Cost of Sales 24% 318.5 59.7 26.6 9.9 >100% Gross Profit >100% (141.4) (108.4) (54.8) (33.2) (65%) R&D Expenses (30%) (159.1) (59.4) (47.0) (27.6) (70%) SG&A Expenses >(100%) (309.7) (179.9) (111.2) (62.0) (79%) Total Operating Expenses (72%) 0.7 (0.6) >100% 9.4 0.2 Other Income / (Expenses) >100% 27.4 (107.9) (74.5) (51.6) (44%) EBIT >100% 97.9 (103.0) (16.5) (50.3) 67% Consolidated Net Profit / (Net Loss) >100% - (3.26) (0.5) (1.59) >100% Earnings per Share, basic and diluted (in €) - 3.01 Earnings per Share, basic (in €) - 2.97 Earnings per Share, diluted (in €) - On December 31, 2020 MorphoSys’ liquidity position amounted to Euros 1,244.0 million * Differences due to rounding © MorphoSys - Q4 / FY 2020 results 15

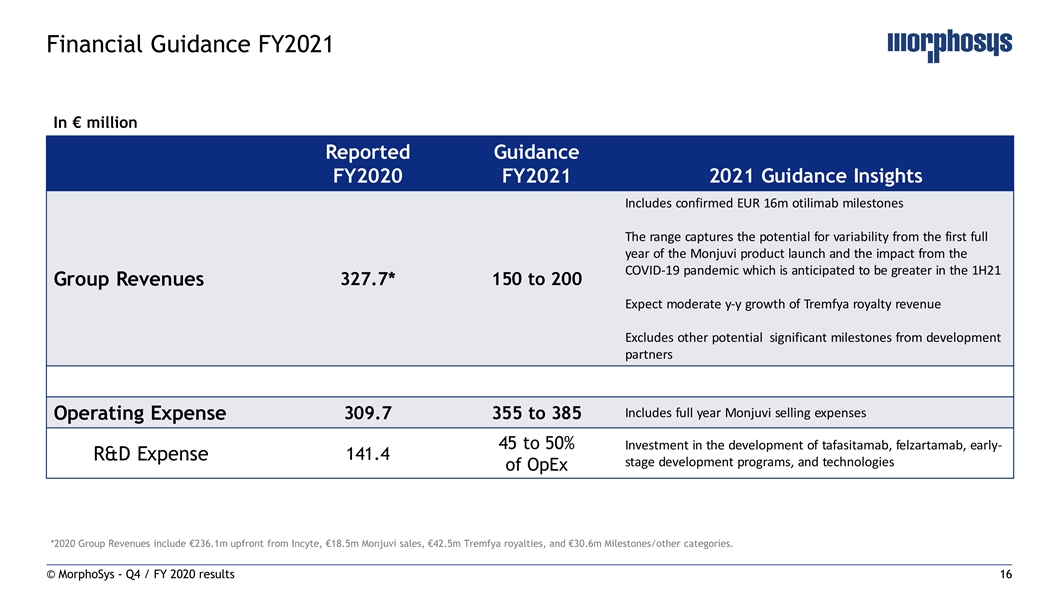

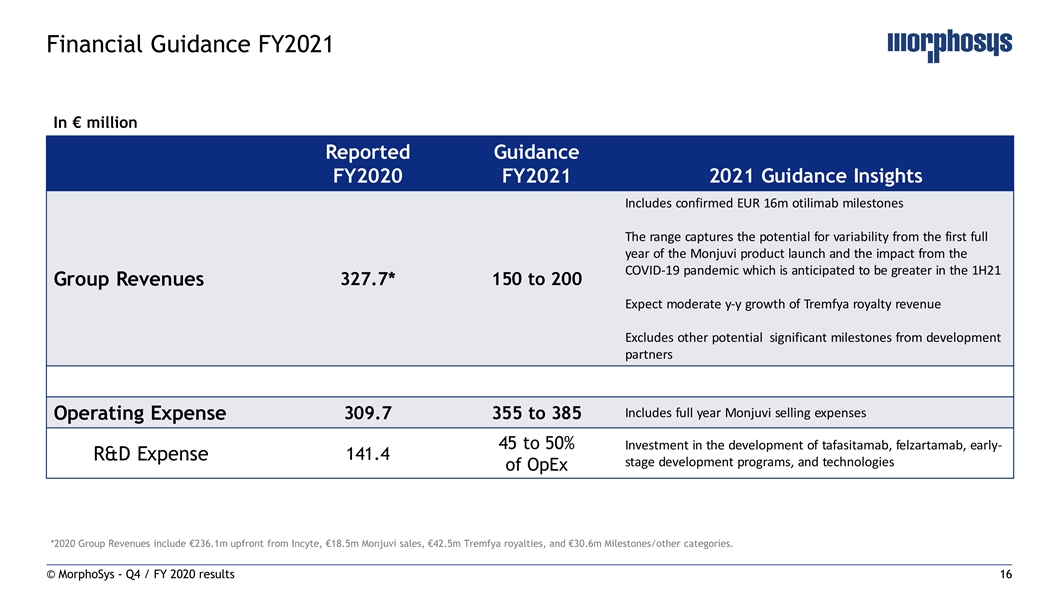

Financial Guidance FY2021 In € million Reported Guidance FY2020 FY2021 2021 Guidance Insights Includes confirmed EUR 16m otilimab milestones The range captures the potential for variability from the first full year of the Monjuvi product launch and the impact from the COVID-19 pandemic which is anticipated to be greater in the 1H21 327.7* 150 to 200 Group Revenues Expect moderate y-y growth of Tremfya royalty revenue Excludes other potential significant milestones from development partners Includes full year Monjuvi selling expenses 309.7 355 to 385 Operating Expense 45 to 50% In vestment in the development of tafasitamab, felzartamab, early- R&D Expense 141.4 stage development programs, and technologies of OpEx *2020 Group Revenues include €236.1m upfront from Incyte, €18.5m Monjuvi sales, €42.5m Tremfya royalties, and €30.6m Milestones/other categories. © MorphoSys - Q4 / FY 2020 results 16Financial Guidance FY2021 In € million Reported Guidance FY2020 FY2021 2021 Guidance Insights Includes confirmed EUR 16m otilimab milestones The range captures the potential for variability from the first full year of the Monjuvi product launch and the impact from the COVID-19 pandemic which is anticipated to be greater in the 1H21 327.7* 150 to 200 Group Revenues Expect moderate y-y growth of Tremfya royalty revenue Excludes other potential significant milestones from development partners Includes full year Monjuvi selling expenses 309.7 355 to 385 Operating Expense 45 to 50% In vestment in the development of tafasitamab, felzartamab, early- R&D Expense 141.4 stage development programs, and technologies of OpEx *2020 Group Revenues include €236.1m upfront from Incyte, €18.5m Monjuvi sales, €42.5m Tremfya royalties, and €30.6m Milestones/other categories. © MorphoSys - Q4 / FY 2020 results 16

Closing Remarks Jean-Paul Kress, M.D., CEO © MorphoSys - Q4 / FY 2020 results 17Closing Remarks Jean-Paul Kress, M.D., CEO © MorphoSys - Q4 / FY 2020 results 17

Q & A © MorphoSys - Q4 / FY 2020 results 18Q & A © MorphoSys - Q4 / FY 2020 results 18

Thank You www.morphosys.com The compounds discussed in this slide presentation are investigational products being developed by MorphoSys and its partners and are not currently approved by the U.S. Food and Drug Administration (FDA), European Medicine Agency (EMA) or any other regulatory authority (except for tafasitamab/Monjuvi® and guselkumab/Tremfya®). HuCAL®, HuCAL GOLD®, HuCAL PLATINUM®, CysDisplay®, RapMAT®, arYla®, Ylanthia®, 100 billion high potentials®, Slonomics®, ENFORCER® and Monjuvi® are trademarks of the MorphoSys Group. Tremfya® is a trademark of Janssen Biotech, Inc. XmAb® is a trademark of Xencor, Inc.Thank You www.morphosys.com The compounds discussed in this slide presentation are investigational products being developed by MorphoSys and its partners and are not currently approved by the U.S. Food and Drug Administration (FDA), European Medicine Agency (EMA) or any other regulatory authority (except for tafasitamab/Monjuvi® and guselkumab/Tremfya®). HuCAL®, HuCAL GOLD®, HuCAL PLATINUM®, CysDisplay®, RapMAT®, arYla®, Ylanthia®, 100 billion high potentials®, Slonomics®, ENFORCER® and Monjuvi® are trademarks of the MorphoSys Group. Tremfya® is a trademark of Janssen Biotech, Inc. XmAb® is a trademark of Xencor, Inc.

Overview of Accounting for Co-Commercialization of Monjuvi in the U.S. 100% Monjuvi Net Product Sales MorphoSys Income Statement 100% Monjuvi Cost of Sales 100% of Profit/Loss from Monjuvi Selling Expenses Monjuvi Selling Expenses Monjuvi co- incurred by MorphoSys incurred by Incyte commercialization is reflected on MorphoSys’ Income Statement MorphoSys credits MorphoSys debits Cash and debits Cash and credits If result is a Loss: If result is a Profit: Financial Liability Financial Asset Incyte refunds MorphoSys MorphoSys refunds Incyte 50% of Loss 50% of Profit © MorphoSys - Q4 / FY 2020 results 20 Balance Sheet Income StatementOverview of Accounting for Co-Commercialization of Monjuvi in the U.S. 100% Monjuvi Net Product Sales MorphoSys Income Statement 100% Monjuvi Cost of Sales 100% of Profit/Loss from Monjuvi Selling Expenses Monjuvi Selling Expenses Monjuvi co- incurred by MorphoSys incurred by Incyte commercialization is reflected on MorphoSys’ Income Statement MorphoSys credits MorphoSys debits Cash and debits Cash and credits If result is a Loss: If result is a Profit: Financial Liability Financial Asset Incyte refunds MorphoSys MorphoSys refunds Incyte 50% of Loss 50% of Profit © MorphoSys - Q4 / FY 2020 results 20 Balance Sheet Income Statement