Exhibit 99.1

First Quarter Interim Statement

January – March 2021

| | | | |

| 2 | | Group Interim Statement | | |

Contents

MorphoSys Group:

First Quarter Interim Statement January – March 2021

| | | | |

| Group Interim Statement | |  | | 3 |

Summary of the First Quarter of 2021

OPERATING HIGHLIGHTS FOR THE FIRST QUARTER OF 2021

| · | | On January 5, 2021, MorphoSys and Incyte announced the acceptance of the Swiss Agency for Therapeutic Products (Swissmedic) of the marketing authorization application (MAA) for tafasitamab. |

| · | | On January 12, 2021, MorphoSys and Incyte announced the acceptance of Health Canada of the New Drug Submission (NDS) for tafasitamab. |

| · | | On January 25, 2021, MorphoSys and I-Mab announced the dosing in the United States of the first patient in a phase 1 dose-finding study of MOR210/TJ210 as monotherapy in patients with relapsed or refractory advanced solid tumors. |

| · | | On March 2, 2021, MorphoSys announced that its licensee GSK had published preliminary results from the OSCAR (Otilimab in Severe COVID-19 Related Disease) study of otilimab for the treatment of severe pulmonary COVID-19-related disease. |

FINANCIAL RESULTS FOR THE FIRST QUARTER OF 2021

| · | | Group revenue in the first quarter of 2021 reached € 47.2 million (3M 2020: € 251.2 million) and operating expenses amounted to € 71.7 million (3M 2020: € 44.4 million). |

| · | | Cash and investments totaled € 1,215.0 million as of March 31, 2021 (December 31, 2020: € 1,244.0 million). |

| · | | The Company confirmed its financial guidance for the 2021 financial year. |

CORPORATE DEVELOPMENTS

| · | | On January 6, 2021, MorphoSys announced the appointment of Mr. Sung Lee as the Company’s Chief Financial Officer (CFO), effective as of February 2, 2021. |

SIGNIFICANT EVENTS AFTER THE END OF THE FIRST QUARTER

| · | | On April 19, 2021, MorphoSys and Incyte announced that the first patient has been dosed in the Phase 3 inMIND study in patients with relapsed or refractory follicular lymphoma (FL) or marginal zone lymphoma (MZL). |

| | | | |

| 4 | | Group Interim Statement | | |

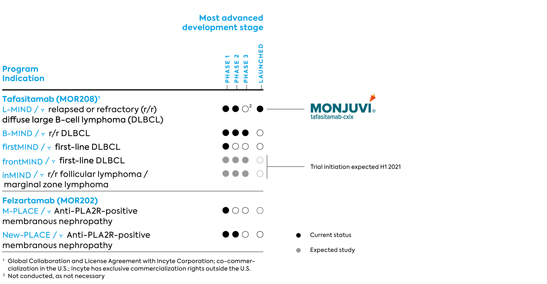

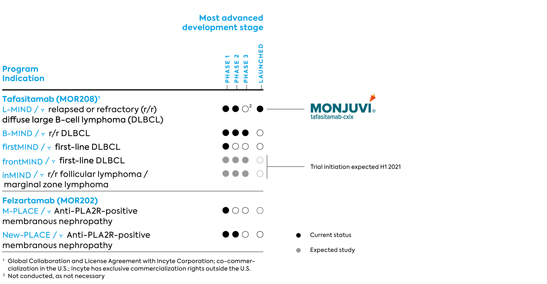

MORPHOSYS PRODUCT PIPELINE AS OF MARCH 31, 2021

OUR CLINICAL PIPELINE

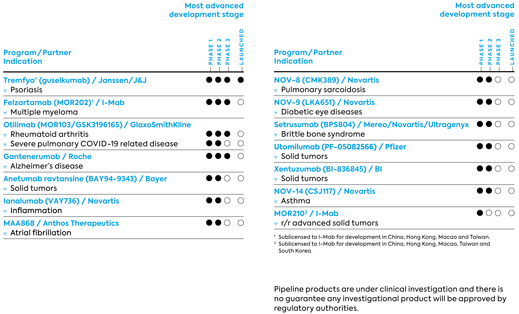

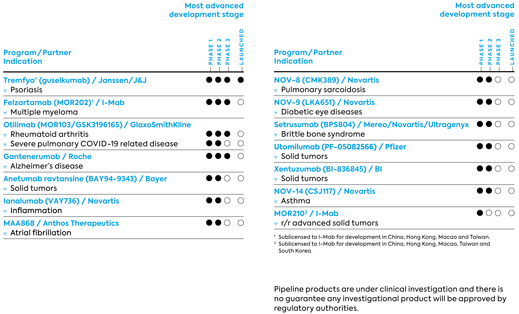

CLINICAL PROGRAMS DEVELOPED BY PARTNERS (SELECTION)

| | | | |

| Group Interim Statement | |  | | 5 |

Group Interim Statement:

January 1 – March 31, 2021

Operating Business Performance

MorphoSys’ commercial activities are currently focused on Monjuvi® (tafasitamab-cxix) in the U.S. On July 31, 2020, Monjuvi in combination with lenalidomide received FDA accelerated approval for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low-grade lymphoma, and who are not eligible for autologous stem cell transplantation (ASCT). We are co-promoting Monjuvi together with our partner Incyte in the United States.

MorphoSys’ development activities are currently focused on the following clinical candidates:

| · | | Tafasitamab – an antibody for the treatment of B-cell malignancies and the Company’s most advanced program. |

| · | | Felzartamab – currently being evaluated in autoimmune diseases by MorphoSys. In November 2017 MorphoSys entered into a regional license agreement with I-Mab for the development in China, Hong Kong, Macao and Taiwan. I-Mab is currently pursuing development in multiple myeloma. |

In addition to MorphoSys’s own pipeline, the following programs, among others, are being further developed by our partners:

| · | | Otilimab, an antibody that GlaxoSmithKline (GSK) is currently conducting clinical trials for the treatment of rheumatoid arthritis. The program originated as a proprietary MorphoSys program and was fully out-licensed to GSK in 2013. GSK is currently also evaluating the efficacy and safety of otilimab in patients with severe pulmonary disease associated with COVID-19 in a clinical trial (OSCAR). |

| · | | MOR210/TJ210 was out-licensed to I-Mab in November 2018 for China and certain other countries in Asia. On September 17, 2020, the FDA approved the IND application for MOR210/TJ210 for the treatment of patients with relapsed or refractory advanced solid tumors, and on January 25, 2021, we announced with I-Mab that the first patient was dosed in the U.S. |

Tafasitamab (MOR208, formerly XmAb5574) is a humanized monoclonal antibody directed against the CD19 antigen. CD19 is selectively expressed on the surface of B-cells, which belong to a group of white blood cells. CD19 enhances B-cell receptor signaling, which is an important factor in B-cell survival and growth, making CD19 a potential target structure for the treatment of B-cell malignancies.

OPERATIONAL DEVELOPMENT

On January 5, 2021, MorphoSys and Incyte announced that the Swiss Agency for Therapeutic Products (Swissmedic) had accepted the marketing authorization application (MAA) for tafasitamab and on January 12, 2021, MorphoSys and Incyte announced that Health Canada had accepted the New Drug Submission (NDS) for tafasitamab. Both applications are based on data from the L-MIND study of tafasitamab in combination with lenalidomide for the treatment of patients with relapsed or refractory DLBCL and data from the RE-MIND study, a retrospective observational study of relapsed or

| | | | |

| 6 | | Group Interim Statement | | |

refractory DLBCL. Both applications seek approval for tafasitamab, in combination with lenalidomide, followed by tafasitamab monotherapy, for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL), including DLBCL arising from low grade lymphoma, who are not eligible for, or refuse, autologous stem cell transplantation (ASCT). Incyte has exclusive marketing rights for tafasitamab outside the U.S. and if approved, Incyte will receive marketing approval in Switzerland and Canada.

On May 20, 2020, MorphoSys and Incyte announced the validation of the European Marketing Authorization Application (MAA) for tafasitamab in combination with lenalidomide for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low-grade lymphoma, and who are not eligible for autologous stem cell transplant (ASCT). As in the U.S., the marketing authorization application submitted by MorphoSys was based on data from the L-MIND study and supported by RE-MIND. Incyte has exclusive marketing rights for tafasitamab outside the U.S., and if approved, Incyte will receive the marketing authorization in Europe.

CLINICAL DEVELOPMENT

The focus of tafasitamab’s clinical development is on NHL. In DLBCL, MorphoSys intends to position tafasitamab as a backbone treatment for all patients suffering from DLBCL, irrespective of the line of treatment or a possible combination treatment. Both the L-MIND and B-MIND studies are focused on those patients with r/r DLBCL who are not candidates for high-dose chemotherapy (HDC) and ASCT. For this group of patients, the treatment options prior to the approval of tafasitamab in the U.S. were limited and not sufficiently effective. The firstMIND study includes patients with newly diagnosed DLBCL and is expected to pave the way for frontMIND, a pivotal phase 3 study in first-line patients that will begin in 2021.

In May 2020, MorphoSys and Incyte announced follow-up results from the ongoing phase 2 L-MIND study investigating the combination of tafasitamab and lenalidomide for the treatment of patients with r/r DLBCL. The data, based on a November 30, 2019 cut-off date, confirmed previously reported primary analysis data. In this long-term analysis of the L-MIND data, 80 patients were included in the efficacy analysis. After a minimum follow-up period of two years, the results were consistent with the primary analysis and confirmed the duration of response (DoR) and overall survival (OS). An assessment by an independent review committee (IRC) at data cut-off showed an objective response rate (ORR) of 58.8% and a complete response (CR) rate of 41.3%. Median duration of response (mDOR) was 34.6 months, with median overall survival (mOS) of 31.6 months and median progression-free survival (mPFS) of 16.2 months. The safety profile was consistent with that observed in the primary analysis.

The efficacy of the tafasitamab-lenalidomide combination therapy from the L-MIND study was compared to the efficacy results of lenalidomide monotherapy based on real-world data of patients (RE-MIND, retrospective observational study). The primary endpoint of RE-MIND was met, demonstrating a statistically significant superior best objective response rate (ORR) of the tafasitamab-lenalidomide combination compared to lenalidomide monotherapy. The ORR was 67.1% for the tafasitamab-lenalidomide combination compared to 34.2% for lenalidomide monotherapy. Superiority was consistently observed across all secondary endpoints, including complete response (CR) rate (39.5% for tafasitamab-lenalidomide combination versus 11.8% for lenalidomide monotherapy) and in pre-specified statistical sensitivity analyses. There was also a significant difference observed in median overall survival (mOS), which had not yet been reached in the tafasitamab-lenalidomide combination as compared to 9.3 months in the lenalidomide monotherapy (hazard ratio 0.47).

| | | | |

| Group Interim Statement | |  | | 7 |

Based on the data from the primary analysis of both studies and the results of the tafasitamab monotherapy study in NHL, MorphoSys submitted a Biologics License Application (BLA) to the FDA for tafasitamab in combination with lenalidomide for the treatment of r/r DLBCL in late December 2019. On July 31, 2020, the FDA approved Monjuvi in combination with lenalidomide in the U.S. for the treatment of adult patients suffering from relapsed or refractory diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low-grade lymphoma, who are not candidates for an autologous stem cell transplant (ASCT). The FDA’s approval was based primarily on data from the MorphoSys-sponsored phase 2 L-MIND study (primary analysis cut-off date: November 30, 2018). Clinical data in the FDA prescribing information showed an overall response rate (ORR) of 55% (primary endpoint) and a complete response (CR) rate of 37%. The median duration of response rate (mDOR) was 21.7 months (key secondary endpoint).

The phase 2/3 study, B-MIND, initiated in September 2016, is evaluating the safety and efficacy of administering tafasitamab in combination with the chemotherapeutic agent bendamustine in comparison to administering the anticancer drug rituximab plus bendamustine in patients with r/r DLBCL who are not candidates for high-dose chemotherapy and autologous stem cell transplantation. The study has been in the phase 3 part since mid-2017. MorphoSys expects top-line results from the study to be available in 2022.

In addition to the aforementioned clinical development in r/r DLBCL, MorphoSys initiated a randomized phase 1b clinical trial in first-line therapy in patients with DLBCL (firstMIND) at the end of 2019. The study completed enrollment earlier than anticipated and is evaluating the safety (primary endpoint) and preliminary efficacy of tafasitamab or tafasitamab plus lenalidomide in combination with R-CHOP (the current standard of care) in patients with newly diagnosed DLBCL. This study is expected to pave the way to frontMIND, a pivotal phase 3 trial of tafasitamab in first-line DLBCL that is expected to begin in 2021 and enroll up to 880 patients. Preliminary data from the firstMIND study were presented at the December 2020 ASH meeting and indicated that tafasitamab plus lenalidomide in combination with R-CHOP had an expected safety profile and that adding tafasitamab plus lenalidomide to R-CHOP did not impair the dosing of R-CHOP. An interim evaluation regarding response was performed in 45 patients after three cycles. In both study arms combined, 41 of 45 patients (91.1%) had an objective response according to the Lugano 2014 classification. MorphoSys and Incyte plan to initiate the phase 3 frontMIND study evaluating tafasitamab plus lenalidomide in combination with R-CHOP versus R-CHOP as first-line treatment for patients with newly diagnosed DLBCL.

In addition to these combination studies in DLBCL, MorphoSys has been investigating tafasitamab in a phase 2 combination study in the indications chronic lymphocytic leukemia (CLL) and small B-cell lymphoma (SLL) since December 2016. The COSMOS study is evaluating specifically the safety of tafasitamab in combination with the anticancer drugs idelalisib (cohort A) and venetoclax (cohort B). The study enrolled patients who either did not respond to or did not tolerate prior therapy with a Bruton tyrosine kinase inhibitor. Data from the primary analysis of both cohorts were presented at the ASH conference in Orlando in December 2019.

| | | | |

| 8 | | Group Interim Statement | | |

Incyte is responsible for initiating a combination study of its PI3K delta inhibitor parsaclisib with tafasitamab in relapsed or refractory B-cell malignancies, as well as initiating a pivotal phase 3 study (inMIND) in patients with relapsed or refractory follicular lymphoma (r/r FL) as well as in patients with relapsed or refractory marginal zone lymphoma (r/r MZL). The global randomized study, which started in April in 2021 and enrolls approximately 600 patients, will compare the safety and efficacy of tafasitamab in combination with rituximab and lenalidomide to the safety and efficacy of rituximab in combination with lenalidomide.

In November 2020, MorphoSys and Incyte announced a clinical collaboration agreement with Xencor to investigate the combination of tafasitamab, lenalidomide and plamotamab – a tumor-targeted bispecific antibody from Xencor with both a CD20-binding domain and a cytotoxic T-cell (CD3) binding domain – in patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL), first-line DLBCL and relapsed or refractory follicular lymphoma (FL). Under the agreement, the companies plan to initiate a phase 1/2 trial evaluating the combination of tafasitamab, plamotamab and lenalidomide in patients with relapsed or refractory DLBCL. The companies also plan to evaluate this combination in relapsed or refractory FL and first-line DLBCL patients in multiple phase 1b trials. MorphoSys and Incyte will provide tafasitamab for the studies, which will be sponsored and funded by Xencor and are planned to be conducted in North America, Europe and Asia-Pacific.

Felzartamab (MOR202/TJ202) is a recombinant human monoclonal HuCAL-IgG1-antibody directed against a unique epitope of the target molecule CD38. CD38 is a surface antigen broadly expressed on malignant myeloma cells as well as on antibody producing plasmablasts and plasma cells, the latter playing an important role in the pathogenesis of antibody-mediated autoimmune diseases.

ONGOING CLINICAL STUDIES

In October 2019, we initiated a phase 1/2 trial for the treatment of anti-PLA2R-positive membranous nephropathy, an autoimmune disease affecting the kidneys. This proof-of-concept trial called M-PLACE is an open-label, multi-center study and will primarily evaluate the safety and tolerability of felzartamab. Secondary endpoints are the effect of felzartamab on serum antibodies against PLA2R and the evaluation of the immunogenicity and pharmacokinetics of felzartamab; an exploratory goal is to determine clinical efficacy. Due to the COVID-19 pandemic, MorphoSys had temporarily paused the screening and enrollment of patients for the M-PLACE trial in the spring of 2020. MorphoSys has since resumed patient enrollment, and the first patient was dosed in the U.S. in late July 2020. In November 2020, the safety run-in phase of the study ended, and the further enrollment phase was opened. In February 2021, MorphoSys achieved the milestone First Patient Treated in the phase 2 New-PLACE study, which in coherence with M-PLACE is designed to identify the optimal felzartamab dosing schedule for the treatment of patients with anti-PLA2R-positive membranous nephropathy.

REGIONAL AGREEMENT WITH I-MAB BIOPHARMA

In November 2017, MorphoSys and I-Mab signed a regional license agreement for the development and commercialization of felzartamab in China, Hong Kong, Taiwan and Macao. Under this agreement, I-Mab was granted exclusive rights in the agreed regions.

On April 27, 2020, MorphoSys and I-Mab announced that the first patient had received treatment in a phase 3 clinical trial in mainland China to evaluate felzartamab in combination with lenalidomide plus dexamethasone in patients with r/r MM. This study (NCT03952091) is a randomized, open-label, parallel-controlled, multi-center study to evaluate the efficacy and safety of the combination of felzartamab, lenalidomide and dexamethasone versus the combination of lenalidomide and dexamethasone in patients with r/r MM who received at least one prior line of treatment. The multi-center study had been previously initiated in April 2019 at sites in Taiwan and has officially started in

| | | | |

| Group Interim Statement | |  | | 9 |

mainland China as part of a coordinated effort to accelerate the study. I-Mab is also evaluating felzartamab as a third-line therapy in patients with r/r MM in a phase 2 trial that started in March 2019. Both studies are considered pivotal in this region.

Otilimab (MOR103/GSK3196165), a fully human HuCAL-IgG1-antibody directed against GM-CSF, was fully out-licensed to GSK. In mid-2019, GSK announced the initiation of a phase 3 program in rheumatoid arthritis (RA) called ContRAst. This phase 3 program includes three pivotal studies as well as a long-term extension study, and is evaluating the antibody in patients with moderate to severe RA. In addition, GSK has initiated in 2020 a clinical trial (OSCAR) to evaluate the efficacy and safety of otilimab in patients with severe pulmonary disease associated with COVID-19. GSK reported in preliminary results of the OSCAR study in February 2021. Given these data suggest an important clinical benefit in a pre-defined sub-group of high-risk patients and the urgent public health need, GSK has amended the OSCAR study to expand this cohort to confirm these potentially significant findings. The dosing of the first patient in the expanded study triggered milestone payments of € 16 million to MorphoSys.

MOR210 is a human antibody directed against C5aR, derived from our HuCAL technology, and was brought into an exclusive strategic collaboration and regional license agreement with I-Mab in November 2018. Under this agreement, I-Mab receives exclusive rights to develop and commercialize MOR210/TJ210 in China, Hong Kong, Macao, Taiwan and South Korea, while MorphoSys retains rights in the rest of the world. With the support of MorphoSys, I-Mab will also fund and conduct all global development activities of MOR210/TJ210, including clinical trials in China and the U.S., for clinical proof-of-concept (PoC) in oncology.

On January 25, 2021, MorphoSys and I-Mab announced the dosing in the United States of the first patient in a phase 1 dose-finding study evaluating the safety, tolerability, pharmacokinetics (PK) and pharmacodynamics (PD) of MOR210/TJ210 as monotherapy in patients with relapsed or refractory advanced solid tumors. The phase 1 clinical trial is an open-label, multiple dose-group, dose-finding study in multiple centers across the United States to evaluate the safety, tolerability and PK/PD of MOR210/TJ210.

In addition to the programs listed above, MorphoSys and its partners are pursuing several programs in various phases of research and clinical development.

CORPORATE DEVELOPMENTS

On January 6, 2021, MorphoSys announced the appointment of Mr. Sung Lee as the Company’s Chief Financial Officer (CFO), effective as of February 2, 2021. Mr. Lee succeeds Jens Holstein, who left MorphoSys effective December 31, 2020. Mr. Lee has more than 20 years of financial leadership experience in biopharmaceutical and technology companies. As a member of the MorphoSys AG Management Board, Mr. Lee will be responsible for all financial areas of the Company and his place of employment will be Planegg, Germany.

MorphoSys continues to operate in accordance with its business continuity plans to minimize disruptions to ongoing operations caused by the COVID-19 pandemic and to establish the measures necessary to protect employees. MorphoSys is currently conducting a number of clinical trials with its investigational products and closely monitoring each program individually along with the overall situation. The Company is making adjustments where necessary to comply with regulatory, institutional and governmental requirements and guidelines related to COVID-19. The top priority is

| | | | |

| 10 | | Group Interim Statement | | |

to ensure the safety of all participants in the clinical programs and that the studies in which they participate are properly conducted, in accordance with the study protocol. In response to the COVID-19 pandemic, several of the clinics conducting the clinical trials had restricted visits to their premises and to patients to protect both staff and patients from potential COVID-19 exposure. MorphoSys therefore continuously monitored the situation and decided on the necessary procedures to ensure patient safety and adjust data collection on a case-by-case basis, depending on the study and country. Despite the rapidly changing conditions worldwide and the potential impact on clinical trials, MorphoSys continues to work diligently to maintain its drug development plans.

Human Resources

On March 31, 2021, the MorphoSys Group had 609 employees (December 31, 2020: 615). During the first quarter of 2021, the MorphoSys Group employed an average of 610 people (3M 2020: 439).

Financial Analysis

MorphoSys reports the key financial figures – revenues, operating expenses and percentage of research and development expenses included therein – relevant for internal management purposes in quarterly statements. Their presentation is supplemented accordingly if other areas of the statement of profit or loss or balance sheet are affected by material business transactions during the quarter.

As of the first quarter of 2021, MorphoSys will no longer present the segment information for the Proprietary Development and Partnered Discovery segments as part of the regular internal reporting to the Management Board as the Company’s chief operating decision maker. Internal reporting will focus exclusively on the key value drivers of future revenues from product sales, further market approvals for tafasitamab, and Group royalties. Segment reporting was published for the last time for external purposes as of December 31, 2020. Reporting now comprises only the consolidated statement of profit or loss and no longer includes separate segment reporting.

Revenues

Group revenues amounted to € 47.2 million (3M 2020: € 251.2 million). The decline in revenues was mainly attributable to the collaboration and license agreement with Incyte concluded in 2020. Group revenues included revenues of € 12.9 million (3M 2020: € 0 million) from the recognition of Monjuvi product sales in the USA.

Success-based payments including royalties accounted for 61% or € 28.9 million (3M 2020: 4% or € 10.3 million) of total revenues, with royalty revenues increasing by 25% year-on-year. On a regional basis, MorphoSys generated 60% or € 28.4 million of its commercial revenues in North America and 40% or € 18.8 million from customers primarily located in Europe and Asia. In the same period last year, these percentages were 99% and 1%, respectively. More than 66% of the Group’s revenues were generated with customers GSK, Janssen and Incyte (3M 2020: almost 100% with Incyte, Janssen and I-Mab).

| | | | |

| Group Interim Statement | |  | | 11 |

The following overview shows the timing of the fulfillment of the performance obligations.

| | | | | | | | | | | | |

| in 000’ € | | | | 2021 | | | | | 2020 | |

| | | | | | | | | | | | | |

| At a Point in Time thereof performance obligations fulfilled in previous periods: € 28.0 million in 2021, € 10.2 million in 2020 | | | | | 47,179 | | | | | | 251,139 | |

Over Time | | | | | 11 | | | | | | 84 | |

Total | | | | | 47,190 | | | | | | 251,223 | |

Cost of Sales

Cost of sales in the first quarter of 2021 amounted to € 5.0 million (3M 2020: € 3.3 million) and consisted primarily of expenses related to services provided for the transfer of projects to customers as well as acquisition and production costs of inventories recognized as an expense, mainly for Monjuvi.

Operating Expenses

RESEARCH AND DEVELOPMENT EXPENSES

Research and development expenses amounted to € 33.3 million in the first quarter of 2021 (3M 2020: € 21.5 million). Expenses in this area consisted primarily of expenses for external laboratory services of € 16.2 million (3M 2020: € 8.8 million) and personnel expenses of € 10.7 million (3M 2020: € 7.3 million). In the first quarter of 2021, research and development expenses accounted for 46% of total operating expenses (3M 2020: 48%).

SELLING EXPENSES

Selling expenses amounted to € 28.2 million in the first quarter of 2021 (3M 2020: € 12.8 million). This item consisted mainly of personnel expenses of € 15.5 million (3M 2020: € 7.2 million) and expenses for external services of € 10.6 million (3M 2020: € 4.7 million). Selling expenses also included all of the expenses for services provided by Incyte as part of the joint U.S. marketing activities for Monjuvi.

GENERAL AND ADMINISTRATIVE EXPENSES

In comparison to the same period of the previous year, general and administrative expenses remained almost unchanged at € 10.3 million (3M 2020: € 10.1 million). This line item mainly comprised personnel expenses amounting to € 6.4 million (3M 2020: € 6.2 million) and expenses for external services of € 1.7 million (3M 2020: € 2.2 million).

| | | | |

| 12 | | Group Interim Statement | | |

Other Income / Other Expenses / Finance Income / Finance Expenses

Other income amounted to € 1.2 million in the first quarter of 2021 (3M 2020: € 10.3 million) and stemmed primarily from foreign exchange gains from operations of € 1.1 million (3M 2020: € 10.2 million).

Finance income totaled € 13.9 million in the first quarter of 2021 (3M 2020: € 10.6 million) and resulted from the measurement of financial assets from collaborations in the amount of € 2.4 million (3M 2020: € 4.8 million). This included effects from currency translation and fair value measurement. Also included was finance income from cash and investments and corresponding foreign currency translation gains in the amount of € 11.5 million (3M 2020: € 5.4 million).

Finance expenses totaled € 39.7 million in the first quarter of 2021 (3M 2020: € 9.3 million) and stemmed mainly from the effects of financial liabilities from collaborations of € 34.9 million (3M 2020: € 1.7 million), specifically from the differences between planning assumptions and actual figures, the application of the effective interest method and foreign currency valuation. Also included are finance expenses from cash and investments and corresponding foreign currency translation losses in the amount of € 1.5 million (3M 2020: € 2.0 million). Furthermore, interest expenses on the convertible bond were included in the first three months of 2021 in the amount of € 2.9 million (3M 2020: € 0 million).

Income Taxes

In the first quarter of the 2021 reporting year, the Group recorded total tax benefits of € 14.5 million (3M 2020: expenses of € 18.9 million). This is primarily due to the capitalization of deferred taxes on temporary differences in the amount of € 11.2 million (3M 2020: € 0 million) and on compensable losses of the current period in the amount of € 3.3 million (3M 2020: € 0 million). Deferred taxes on temporary differences and tax loss carryforwards are capitalized in full due to the positive mid-term to long-term business expectations of MorphoSys AG and MorphoSys US Inc.

Cash and Investments

On March 31, 2021, the Group had cash and investments (previously referred to as liquidity) of € 1,215.0 million, compared to € 1,244.0 million on December 31, 2020.

Cash and investments are presented in the balance sheet items “Cash and Cash Equivalents”, “Financial Assets at Fair Value, with Changes Recognized in Profit or Loss”, and current and non-current “Other Financial Assets at Amortized Cost”.

The decrease in cash and investments resulted mainly from the use of cash for operating activities in the first quarter of 2021.

| | | | |

| Group Interim Statement | |  | | 13 |

Structural Changes to the Consolidated Statement of Profit or Loss

The change in the Company’s internal management and corresponding financial guidance for the 2021 financial year also prompted changes in the presentation of the consolidated statement of profit or loss. The following changes were implemented for the first time with the reporting on the first quarter of 2021:

| · | | Introduction of the item “Gross Profit” on the statement of profit or loss as the difference between revenues and cost of sales |

| · | | “Operating Expenses” include research and development, as well as selling, general and administrative expenses. In this context, total operating expenses for the first three months of 2020 decreased by € 3.3 million, because cost of sales are no longer included in this sum line item |

| · | | The item “Earnings before Interest and Taxes” (EBIT) on the statement of profit or loss has been discontinued |

| · | | Introduction of the item “Operating Profit / (Loss)” on the statement of profit or loss as the difference between the statement’s items “Gross Profit” and “Operating Expenses” |

The prior-year presentation of the figures has been adjusted accordingly in order to provide comparable information for the previous year.

Other Business Transactions Relevant for Financial Reporting

Starting with the first quarter of 2021, certain development costs related to tafasitamab and Monjuvi have been capitalized in the amount of € 0.4 million as internally generated intangible assets for the first time, as the recognition criteria as stated in MorphoSys’ Annual Report 2020 in Section 2.8.8 are met. This disclosure is shown as the balance sheet item “Internally Generated Intangible Assets”. The development of these assets is currently not yet completed and therefore they are not yet subject to amortization. Until the development activities are completed, the capitalized assets will undergo an annual impairment test.

Subsequent Events

On April 1, 2021, MorphoSys established a new Performance Share Unit Program (PSU-Program) for the Management Board and certain employees of the Company (beneficiaries). A new Restricted Stock Unit Plan (RSU-Plan 2019) was also established for certain employees of MorphoSys US Inc. (beneficiaries) on April 1, 2021.

| | | | |

| 14 | | Group Interim Statement | | |

April 1, 2021 marked the end of the four-year vesting period for the 2017 Long-Term Incentive Plan (LTI Plan 2017) and the 2017 stock option plan (SOP 2017). Under the LTI Plan 2017, the Management Board will receive 4,143 performance shares, the other members of the Executive Committee 2,030 performance shares and current and former employees of the Company 39,718 performance shares. For these performance shares, the option exists to receive those during the next six months. Under the SOP 2017, the Management Board received 8,197 stock options, the other members of the Executive Committee 4,018 stock options and current and former employees of the Company 60,435 stock options. For these allocated stock options, the exercise period is three years. In addition, on April 1, 2021, the second one-year performance period of the 2019 long-term incentive program of the MorphoSys US Inc. ended, whereby the beneficiaries now have an option to receive 2,369 shares within the next six months.

On April 19, 2021, MorphoSys and Incyte announced that the first patient has been dosed in the placebo-controlled Phase 3 inMIND study evaluating the efficacy and safety of tafasitamab or placebo in combination with lenalidomide and rituximab in patients with relapsed or refractory follicular lymphoma (FL) or marginal zone lymphoma (MZL).

No other reportable incidents occurred beyond those already described.

Financial Guidance

MorphoSys’ most recent financial guidance for the 2021 financial year was published on March 15, 2021 and remains unchanged. The Group expects Group revenues in the range of € 150 million to € 200 million for the 2021 financial year. This guidance includes milestone payments from GSK of € 16 million, realized in the first quarter of 2021, but excludes other potential significant milestones from development partners and/or licensing partnerships. The guidance is subject to a number of uncertainties, including potential fluctuations in the first full year of Monjuvi’s launch, the limited visibility MorphoSys has with respect to the Tremfya royalties, as well as the ongoing COVID-19 pandemic and the related impact on our business as well as that of our partners. Operating expenses are expected to range between € 355 million and € 385 million, with R&D expenses accounting for 45-50% of the total. R&D expenses represent our continued investment in the development of tafasitamab, felzartamab, early-stage development programs and in the continued advancement of our technologies.

The statements on the COVID-19 pandemic and its potential impact on MorphoSys’ business operations also remain unchanged.

| | | | |

| Group Interim Statement | |  | | 15 |

Consolidated Statement of Profit or Loss (IFRS) – (unaudited)

| | | | | | | | | | | | | | |

| in € | | | | 3M

2021 | | | | | | 3M

20201 | |

| | | | | | | | | | | | | | | |

| | | | | |

Revenues | | | | | 47,189,617 | | | | | | | | 251,222,691 | |

Cost of Sales | | | | | (5,047,981 | ) | | | | | | | (3,259,478 | ) |

Gross Profit | | | | | 42,141,636 | | | | | | | | 247,963,213 | |

Operating Expenses | | | | | | | | | | | | | | |

Research and Development | | | | | (33,317,104 | ) | | | | | | | (21,496,133 | ) |

Selling | | | | | (28,165,910 | ) | | | | | | | (12,827,589 | ) |

General and Administrative | | | | | (10,257,822 | ) | | | | | | | (10,123,622 | ) |

Total Operating Expenses | | | | | (71,740,836 | ) | | | | | | | (44,447,344 | ) |

Operating Profit / (Loss) | | | | | (29,599,200 | ) | | | | | | | 203,515,869 | |

Other Income | | | | | 1,175,078 | | | | | | | | 10,329,774 | |

Other Expenses | | | | | (1,972,045 | ) | | | | | | | (285,536 | ) |

Finance Income | | | | | 13,897,246 | | | | | | | | 10,600,670 | |

Finance Expenses | | | | | (39,690,005 | ) | | | | | | | (9,287,413 | ) |

Income from Reversals of Impairment Losses / (Impairment Losses) on Financial Assets | | | | | 89,000 | | | | | | | | (461,000 | ) |

Income Tax Benefit / (Expenses) | | | | | 14,491,693 | | | | | | | | (18,900,019 | ) |

Consolidated Net Profit / (Loss) | | | | | (41,608,233 | ) | | | | | | | 195,512,345 | |

Earnings per Share, Basic and Diluted | | | | | (1.27 | ) | | | | | | | - | |

Earnings per Share, Basic | | | | | - | | | | | | | | 6.12 | |

Earnings per Share, diluted | | | | | - | | | | | | | | 6.11 | |

Shares Used in Computing Earnings per Share, Basic and Diluted | | | | | 32,758,632 | | | | | | | | - | |

Shares Used in Computing Earnings per Share, Basic | | | | | - | | | | | | | | 31,959,151 | |

Shares Used in Computing Earnings per Share, Diluted | | | | | - | | | | | | | | 32,014,823 | |

1 The consolidated statement of profit or loss has been adjusted to present comparable information for the previous year. For details we refer to the section “Structural Changes to the Consolidated Statement of Profit or Loss”.

| | | | |

| 16 | | Group Interim Statement | | |

Consolidated Balance Sheet (IFRS) –

(unaudited)

| | | | | | | | | | | | | | |

| in € | | | | 03/31/2021 | | | | | | 12/31/2020 | |

| | | | | | | | | | | | | | |

| | | | | |

ASSETS | | | | | | | | | | | | | | |

Current Assets | | | | | | | | | | | | | | |

Cash and Cash Equivalents | | | | | 109,585,940 | | | | | | | | 109,794,680 | |

Financial Assets at Fair Value through Profit or Loss | | | | | 250,692,841 | | | | | | | | 287,937,972 | |

Other Financial Assets at Amortized Cost | | | | | 729,041,347 | | | | | | | | 649,713,342 | |

Accounts Receivable | | | | | 101,298,488 | | | | | | | | 83,354,276 | |

Financial Assets from Collaborations | | | | | 32,936,265 | | | | | | | | 42,870,499 | |

Income Tax Receivables | | | | | 465,641 | | | | | | | | 401,826 | |

Other Receivables | | | | | 2,409,222 | | | | | | | | 2,159,475 | |

Inventories, Net | | | | | 13,399,992 | | | | | | | | 9,962,657 | |

Prepaid Expenses and Other Current Assets | | | | | 17,546,475 | | | | | | | | 20,621,493 | |

Total Current Assets | | | | | 1,257,376,211 | | | | | | | | 1,206,816,220 | |

Non-current Assets | | | | | | | | | | | | | | |

Property, Plant and Equipment, Net | | | | | 6,161,828 | | | | | | | | 6,323,753 | |

Right-of-Use Assets, Net | | | | | 43,760,538 | | | | | | | | 44,417,767 | |

Patents, Net | | | | | 1,995,036 | | | | | | | | 1,937,856 | |

Licenses, Net | | | | | 11,589,042 | | | | | | | | 11,835,619 | |

Licenses for Marketed Products | | | | | 54,907,908 | | | | | | | | 55,485,886 | |

Internally Generated Intangible Assets | | | | | 432,670 | | | | | | | | 0 | |

Software, Net | | | | | 120,039 | | | | | | | | 115,788 | |

Goodwill | | | | | 1,619,233 | | | | | | | | 1,619,233 | |

Other Financial Assets at Amortized Cost, Net of Current Portion | | | | | 125,713,169 | | | | | | | | 196,587,542 | |

Deferred Tax Asset | | | | | 144,561,684 | | | | | | | | 132,806,097 | |

Prepaid Expenses and Other Assets, Net of Current Portion | | | | | 1,668,130 | | | | | | | | 1,567,259 | |

Total Non-current Assets | | | | | 392,529,277 | | | | | | | | 452,696,800 | |

Total Assets | | | | | 1,649,905,488 | | | | | | | | 1,659,513,020 | |

| | | | |

| Group Interim Statement | |  | | 17 |

| | | | | | | | | | | | | | | | |

| in € | | | | | 03/31/2021 | | | | | | 12/31/2020 | |

| | | | | | | | | | | | | | | | |

| | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | | | | | | | | | |

Current Liabilities | | | | | | | | | | | | | | | | |

Accounts Payable and Accruals | | | | | | | 124,296,820 | | | | | | | | 128,554,203 | |

Current Portion of Lease Liabilities | | | | | | | 3,105,143 | | | | | | | | 3,055,608 | |

Tax Liabilities | | | | | | | 65,310,985 | | | | | | | | 65,727,675 | |

Other Provisions | | | | | | | 183,500 | | | | | | | | 0 | |

Current Portion of Contract Liability | | | | | | | 4,547,077 | | | | | | | | 2,543,903 | |

Current Portion of Convertible Bond | | | | | | | 923,801 | | | | | | | | 422,945 | |

Current Portion of Financial Liabilities from Collaborations | | | | | | | 3,895,289 | | | | | | | | 154,895 | |

Total Current Liabilities | | | | | | | 202,262,615 | | | | | | | | 200,459,229 | |

Non-current Liabilities | | | | | | | | | | | | | | | | |

Lease Liabilities, Net of Current Portion | | | | | | | 41,436,855 | | | | | | | | 41,963,794 | |

Other Provisions, Net of Current Portion | | | | | | | 1,411,938 | | | | | | | | 1,527,756 | |

Contract Liability, Net of Current Portion | | | | | | | 61,055 | | | | | | | | 71,829 | |

Deferred Tax Liability | | | | | | | 2,328,209 | | | | | | | | 5,057,465 | |

Convertible Bond, Net of Current Portion | | | | | | | 275,192,962 | | | | | | | | 272,759,970 | |

Financial Liabilities from Collaborations, Net of Current Portion | | | | | | | 547,558,890 | | | | | | | | 516,350,960 | |

Total Non-current Liabilities | | | | | | | 867,989,909 | | | | | | | | 837,731,774 | |

Total Liabilities | | | | | | | 1,070,252,524 | | | | | | | | 1,038,191,003 | |

| | | | | | | | | | | | | | | | | |

Stockholders’ Equity | | | | | | | | | | | | | | | | |

Common Stock | | | | | | | 32,890,046 | | | | | | | | 32,890,046 | |

Ordinary Shares Issued (32,890,046 and 32,890,046 for 2021 and 2020, respectively) | | | | | | | | | | | | | | | | |

Ordinary Shares Outstanding (32,758,632 and 32,758,632 for 2021 and 2020, respectively) | | | | | | | | | | | | | | | | |

Treasury Stock (131,414 and 131,414 shares for 2021 and 2020, respectively), at Cost | | | | | | | (4,868,744 | ) | | | | | | | (4,868,744 | ) |

Additional Paid-in Capital | | | | | | | 749,845,501 | | | | | | | | 748,978,506 | |

Other Comprehensive Income Reserve | | | | | | | 1,283,604 | | | | | | | | 2,211,419 | |

Accumulated Deficit | | | | | | | (199,497,443 | ) | | | | | | | (157,889,210 | ) |

Total Stockholders’ Equity | | | | | | | 579,652,964 | | | | | | | | 621,322,017 | |

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | 1,649,905,488 | | | | | | | | 1,659,513,020 | |

| | | | |

| 18 | | Group Interim Statement | | |

Consolidated Statement of Changes in Stockholders’ Equity (IFRS) – (unaudited)

| | | | | | | | | | | | |

| | | | | Common Stock | |

| | | | | | | | | | | | |

| | | | | Shares | | | | | € | |

| | | | | | | | | | | | | |

| | | | |

Balance as of January 1, 2020 | | | | | 31,957,958 | | | | | | 31,957,958 | |

Capital Increase, Net of Issuance Cost of € 20,000 | | | | | 907,441 | | | | | | 907,441 | |

Compensation Related to the Grant of Stock Options and Performance Shares | | | | | 0 | | | | | | 0 | |

Exercise of Convertible Bonds Issued | | | | | 24,647 | | | | | | 24,647 | |

Reserves: | | | | | | | | | | | | |

Change in Fair Value of Shares through Other Comprehensive Income | | | | | 0 | | | | | | 0 | |

Foreign Currency Translation Differences from Consolidation | | | | | 0 | | | | | | 0 | |

Consolidated Net Profit | | | | | 0 | | | | | | 0 | |

Total Comprehensive Income | | | | | 0 | | | | | | 0 | |

Balance as of March 31, 2020 | | | | | 32,890,046 | | | | | | 32,890,046 | |

Stand am 1. Januar 2021 | | | | | 32,890,046 | | | | | | 32,890,046 | |

Compensation Related to the Grant of Stock Options and Performance Shares | | | | | 0 | | | | | | 0 | |

Reserves: | | | | | | | | | | | | |

Foreign Currency Translation Differences from Consolidation | | | | | 0 | | | | | | 0 | |

Consolidated Net Loss | | | | | 0 | | | | | | 0 | |

Total Comprehensive Income | | | | | 0 | | | | | | 0 | |

Balance as of March 31, 2021 | | | | | 32,890,046 | | | | | | 32,890,046 | |

| | | | |

| Group Interim Statement | |  | | 19 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Treasury Stock | | | | | Additional Paid-in

Capital | | | | | Other

Comprehensive

Income Reserve | | | | | Accumulated

Deficit | | | | | Total

Stockholders’

Equity | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | Shares | | | | | € | | | | | € | | | | | € | | | | | € | | | | | € | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | 225,800 | | | | | | (8,357,250 | ) | | | | | 628,176,568 | | | | | | (1,295,718 | ) | | | | | (255,779,786 | ) | | | | | 394,701,772 | |

| | | | | | 0 | | | | | | 0 | | | | | | 79,671,027 | | | | | | 0 | | | | | | 0 | | | | | | 80,578,468 | |

| | | | | | 0 | | | | | | 0 | | | | | | 1,128,208 | | | | | | 0 | | | | | | 0 | | | | | | 1,128,208 | |

| | | | | | 0 | | | | | | 0 | | | | | | 760,976 | | | | | | 0 | | | | | | 0 | | | | | | 785,623 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | (3,262,031 | ) | | | | | 0 | | | | | | (3,262,031 | ) |

| | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | (749,715 | ) | | | | | 0 | | | | | | (749,715 | ) |

| | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 195,512,345 | | | | | | 195,512,345 | |

| | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | (4,011,746 | ) | | | | | 195,512,345 | | | | | | 191,500,599 | |

| | | | | | 225,800 | | | | | | (8,357,250 | ) | | | | | 709,736,779 | | | | | | (5,307,464 | ) | | | | | (60,267,441 | ) | | | | | 668,694,670 | |

| | | | | | 131,414 | | | | | | (4,868,744 | ) | | | | | 748,978,506 | | | | | | 2,211,419 | | | | | | (157,889,210 | ) | | | | | 621,322,017 | |

| | | | | | 0 | | | | | | 0 | | | | | | 866,995 | | | | | | 0 | | | | | | 0 | | | | | | 866,995 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | (927,815 | ) | | | | | 0 | | | | | | (927,815 | ) |

| | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | (41,608,233 | ) | | | | | (41,608,233 | ) |

| | | | | | 0 | | | | | | 0 | | | | | | 0 | | | | | | (927,815 | ) | | | | | (41,608,233 | ) | | | | | (42,536,048 | ) |

| | | | | | 131,414 | | | | | | (4,868,744 | ) | | | | | 749,845,501 | | | | | | 1,283,604 | | | | | | (199,497,443 | ) | | | | | 579,652,964 | |

| | | | |

| 20 | | Group Interim Statement | | |

Consolidated Statement of Cash Flows (IFRS) – (unaudited)

| | | | | | | | | | | | | | | | |

| For the Period Ended March 31, (in €) | | | | | 2021 | | | | | | 2020 | |

| | | | | | | | | | | | | |

Operating Activities: | | | | | | | | | | | | | | | | |

Consolidated Net Profit / (Loss) | | | | | | | (41,608,233 | ) | | | | | | | 195,512,345 | |

Adjustments to Reconcile Consolidated Net Profit / (Loss) to Net Cash

Provided by / (Used in) Operating Activities: | | | | | | | | | | | | | | | | |

Impairments of Assets | | | | | | | 47,914 | | | | | | | | 179,917 | |

Depreciation and Amortization of Tangible and Intangible Assets and of Right-of-Use Assets | | | | | | | 2,316,258 | | | | | | | | 1,849,516 | |

Net (Gain) / Loss of Financial Assets at Fair Value through Profit or Loss | | | | | | | (2,259,561 | ) | | | | | | | (3,096,930 | ) |

Net (Gain) / Loss of Financial Assets at Amortized Cost | | | | | | | (2,671,070 | ) | | | | | | | (1,062,703 | ) |

(Income) from Reversals of Impairments / Impairments on Financial Assets | | | | | | | (89,000 | ) | | | | | | | 461,000 | |

Net (Gain) / Loss on Derivative Financial Instruments | | | | | | | 0 | | | | | | | | 4,896,252 | |

Non Cash Effective Net Change in Financial Assets / Liabilities from Collaborations | | | | | | | 32,531,336 | | | | | | | | (3,908,396 | ) |

Non Cash Effective Change of Financial Liabilities at Amortized Cost | | | | | | | 2,933,848 | | | | | | | | 0 | |

Recognition of Contract Liability | | | | | | | (507,600 | ) | | | | | | | (892,447 | ) |

Share-based Payment | | | | | | | 728,834 | | | | | | | | 1,128,208 | |

Income Tax (Benefit) / Expenses | | | | | | | (14,491,693 | ) | | | | | | | 18,900,019 | |

Changes in Operating Assets and Liabilities: | | | | | | | | | | | | | | | | |

Accounts Receivable | | | | | | | (16,904,156 | ) | | | | | | | (10,747,759 | ) |

Inventories, Prepaid Expenses and Other Assets, Tax Receivables and Other Receivables | | | | | | | (63,278 | ) | | | | | | | 3,219,609 | |

Accounts Payable and Accruals, Lease Liabilities, Tax Liabilities and Other Provisions | | | | | | | (4,604,354 | ) | | | | | | | (4,994,219 | ) |

Other Liabilities | | | | | | | 0 | | | | | | | | 524,863 | |

Contract Liability | | | | | | | 2,500,000 | | | | | | | | 8,005,700 | |

Income Taxes Paid | | | | | | | (79,920 | ) | | | | | | | (10,912 | ) |

Net Cash Provided by / (Used in) Operating Activities | | | | | | | (42,220,675 | ) | | | | | | | 209,964,063 | |

| | | | |

| Group Interim Statement | |  | | 21 |

| | | | | | | | | | | | | | | | |

| For the Period Ended March 31, (in €) | | | | | 2021 | | | | | | 2020 | |

| | | | | | | | | | | | | |

| | | | | |

Investing Activities: | | | | | | | | | | | | | | | | |

Cash Payments to Acquire Financial Assets at Fair Value through Profit or Loss | | | | | | | 0 | | | | | | | | (134,302,876 | ) |

Cash Receipts from Sales of Financial Assets at Fair Value through Profit or Loss | | | | | | | 40,000,000 | | | | | | | | 16,411,842 | |

Cash Payments to Acquire Other Financial Assets at Amortized Cost | | | | | | | (316,000,000 | ) | | | | | | | (111,177,837 | ) |

Cash Receipts from Sales of Other Financial Assets at Amortized Cost | | | | | | | 310,000,000 | | | | | | | | 35,000,000 | |

Cash Receipts from (+) / Cash Payments for (-) Derivative Financial Instruments | | | | | | | 0 | | | | | | | | (4,501,471 | ) |

Cash Payments to Acquire Property, Plant and Equipment | | | | | | | (259,069 | ) | | | | | | | (713,806 | ) |

Cash Payments to Acquire Intangible Assets and for Internally Generated Intangible Assets | | | | | | | (568,889 | ) | | | | | | | (11,489,099 | ) |

Interest Received | | | | | | | 20,379 | | | | | | | | 83,672 | |

Net Cash Provided by / (Used in) Investing Activities | | | | | | | 33,192,421 | | | | | | | | (210,689,575 | ) |

| | | | | | | | | | | | | | | | | |

Financing Activities: | | | | | | | | | | | | | | | | |

Cash Proceeds from Issuing Shares | | | | | | | 0 | | | | | | | | 80,598,468 | |

Cash Payments for Costs from Issuing Shares | | | | | | | 0 | | | | | | | | (20,000 | ) |

Cash Proceeds in Connection with Convertible Bonds | | | | | | | 0 | | | | | | | | 773,300 | |

Cash Receipts from Financing from Collaborations | | | | | | | 12,351,222 | | | | | | | | 497,509,604 | |

Cash Payments for Principal Elements of Lease Payments | | | | | | | (789,054 | ) | | | | | | | (608,695 | ) |

Interest Paid | | | | | | | (536,345 | ) | | | | | | | (301,481 | ) |

Net Cash Provided by / (Used in) Financing Activities | | | | | | | 11,025,823 | | | | | | | | 577,951,196 | |

Effect of Exchange Rate Differences on Cash | | | | | | | (2,206,309 | ) | | | | | | | (719,955 | ) |

Increase / (Decrease) in Cash and Cash Equivalents | | | | | | | (208,740 | ) | | | | | | | 576,505,729 | |

Cash and Cash Equivalents at the Beginning of the Period | | | | | | | 109,794,680 | | | | | | | | 44,314,050 | |

Cash and Cash Equivalents at the End of the Period | | | | | | | 109,585,940 | | | | | | | | 620,819,779 | |

| | | | |

| 22 | | Group Interim Statement | | |

Imprint

MorphoSys AG

Semmelweisstr. 7

82152 Planegg

Germany

| | |

Tel.: | | +49-89-89927-0 |

Fax: | | +49-89-89927-222 |

Email: | | info@morphosys.com |

Website: | | www.morphosys.com |

Investor Relations

| | |

Tel.: | | +49-89-89927-404 |

Fax: | | +49-89-89927-5404 |

Email: | | investors@morphosys.com |

Published on May 5, 2021

This quarterly interim statement is also available in German and can be downloaded as a PDF document from the Company’s website. For better readability, this report uses the masculine form only but refers equally to all genders.

Translation

Klusmann Communications, Niedernhausen

Produced in-house with firesys

HuCAL®, HuCAL GOLD®, HuCAL PLATINUM®, CysDisplay®, RapMAT®, arYla®, Ylanthia®, 100 billion high potentials®, Slonomics®, CyCAT®, OkapY™, MONJUVI® and ENFORCER® are trademarks of the MorphoSys Group. Tremfya® is a registered trademark of Janssen Biotech, Inc. XmAb® is a registered trademark of Xencor Inc.

Financial Calendar 2021

| | |

March 15, 2021 | | Publication of 2020 Year-End Results |

May 05, 2021 | | Publication of 2021 First Quarter Interim Statement |

May 19, 2021 | | 2021 Annual General Meeting |

July 28, 2021 | | Publication of 2021 Half-Year Report |

November 10, 2021 | | Publication of 2021 Third Quarter Interim Statement |

MorphoSys AG

Semmelweisstr. 7

82152 Planegg

Germany

Tel.: +498989927-0

Fax: +498989927-222

www.morphosys.com