2021 Annual Report A nn ua l R ep or t 20 21

Our Clinical Pipeline Clinical Programs Developed by Partners (Selection) Most advanced development stage Program / Partner Indication Gantenerumab / Roche Alzheimer’s disease Otilimab (MOR103/GSK3196165) / GlaxoSmithKline Rheumatoid arthritis Severe pulmonary COVID-19 related disease Felzartamab1 / I-Mab Multiple myeloma Abelacimab (MAA868) / Anthos Therapeutics Atrial fibrillation Setrusumab (BPS804) / Mereo/Novartis/Ultragenyx Brittle bone syndrome NOV-8 (CMK389) / Novartis Pulmonary sarcoidosis NOV-9 (LKA651) / Novartis Diabetic eye diseases Most advanced development stage Program Indication Tafasitamab1 L-MIND / Relapsed or refractory (r/r) diffuse large B-cell lymphoma (DLBCL) B-MIND / r/r DLBCL firstMIND / First-line DLBCL frontMIND / First-line DLBCL inMIND / r/r follicular lymphoma / marginal zone lymphoma Pelabresib MANIFEST-2 / Myelofibrosis MANIFEST / Myelofibrosis Most advanced development stage Program Indication Felzartamab IGNAZ / Immunoglobulin A nephropathy M-PLACE / Anti-PLA2R-positive membranous nephropathy New-PLACE / Anti-PLA2R-positive membranous nephropathy CPI-0209 Advanced solid tumors / Hematologic malignancies Most advanced development stage Program / Partner Indication Ianalumab (VAY736) / Novartis Inflammation Bimagrumab / Novartis / Versanis Bio Type 2 diabetes Utomilumab (PF-05082566) / Pfizer Cancer (multiple indications) NOV-14 (CSJ117) / Novartis Asthma MOR2102 / I-Mab r/r advanced solid tumors © MorphoSys, March 2022 P H A S E 1 P H A S E 2 P H A S E 3 L A U N C H E D P H A S E 1 P H A S E 2 P H A S E 3 L A U N C H E D P H A S E 1 P H A S E 2 P H A S E 3 L A U N C H E D P H A S E 1 P H A S E 2 P H A S E 3 L A U N C H E D 1 Global Collaboration and License Agreement with Incyte Corporation; co-commer- cialization in the U.S.; Incyte has exclusive commercialization rights outside the U.S. 2 Not conducted, as not necessary. Pipeline products are under clinical investigation and there is no guarantee any investigational product will be approved by regulatory authorities. 1 Sublicensed to I-Mab for development in China, Hong Kong, Macao and Taiwan. 2 Sublicensed to I-Mab for development in China, Hong Kong, Macao, Taiwan and South Korea. 2

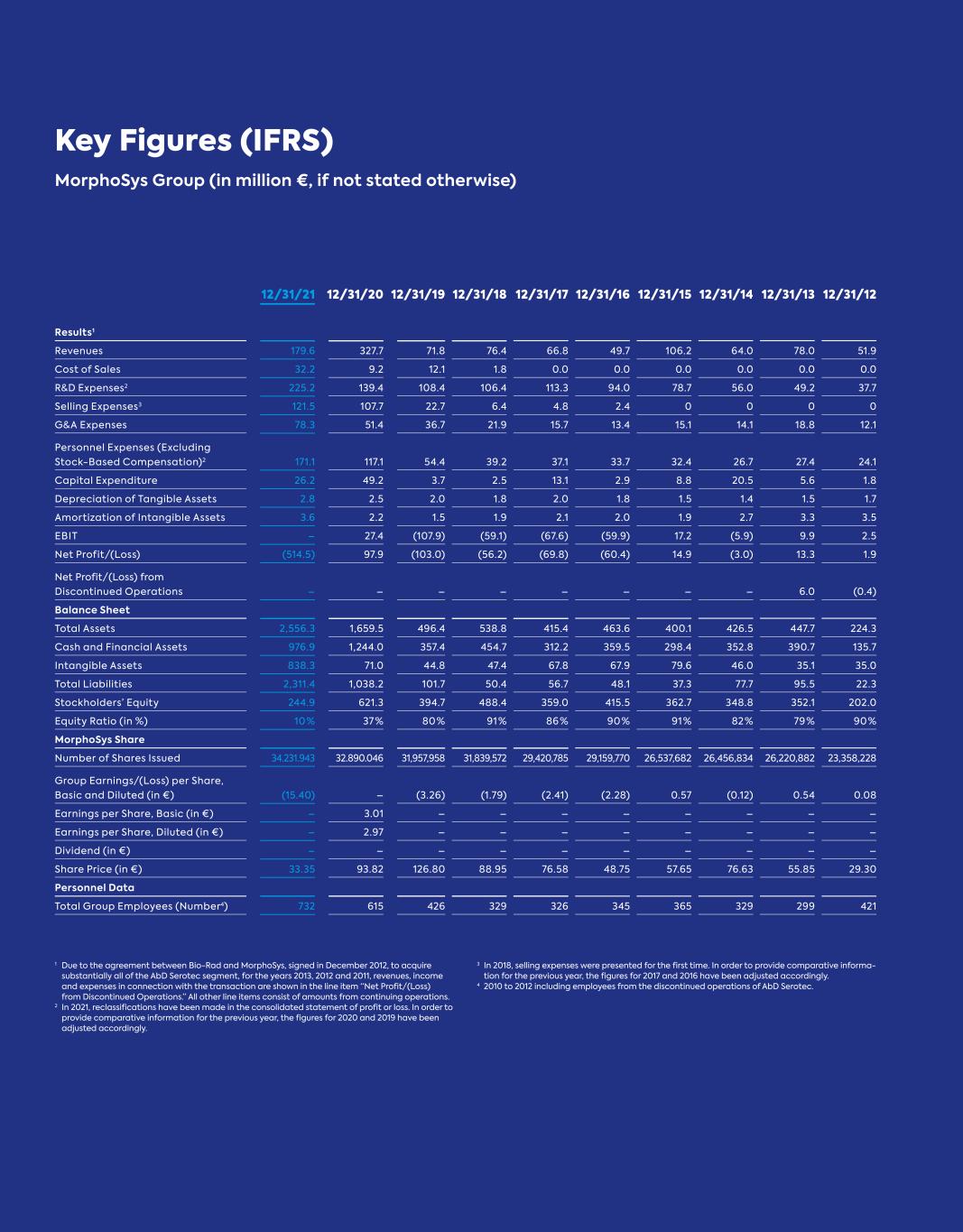

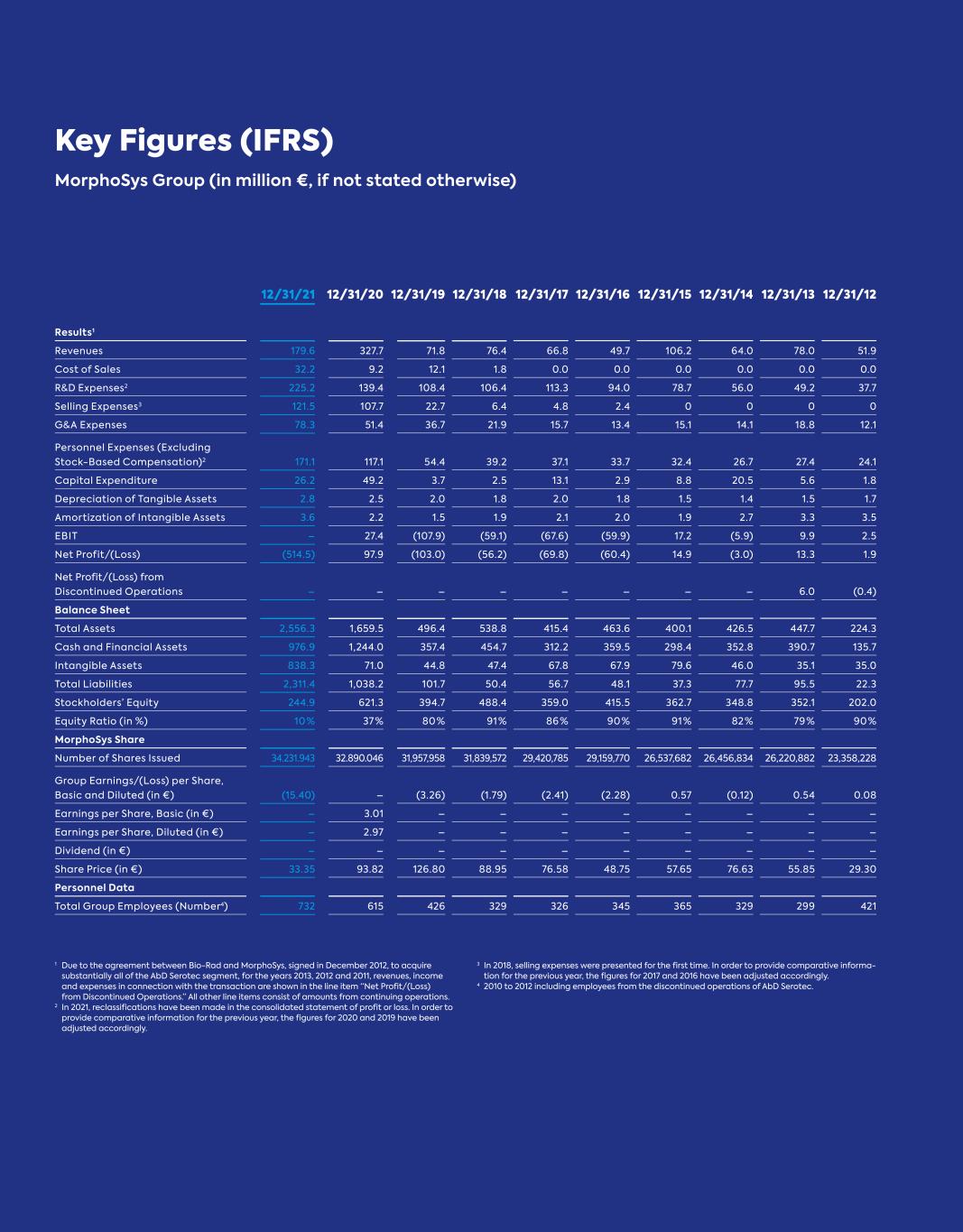

Key Figures (IFRS) MorphoSys Group (in million €, if not stated otherwise) 1 Due to the agreement between Bio-Rad and MorphoSys, signed in December 2012, to acquire substantially all of the AbD Serotec segment, for the years 2013, 2012 and 2011, revenues, income and expenses in connection with the transaction are shown in the line item “Net Profit/(Loss) from Discontinued Operations.” All other line items consist of amounts from continuing operations. 2 In 2021, reclassifications have been made in the consolidated statement of profit or loss. In order to provide comparative information for the previous year, the figures for 2020 and 2019 have been adjusted accordingly. 3 In 2018, selling expenses were presented for the first time. In order to provide comparative informa- tion for the previous year, the figures for 2017 and 2016 have been adjusted accordingly. 4 2010 to 2012 including employees from the discontinued operations of AbD Serotec. 12/31/21 12/31/20 12/31/19 12/31/18 12/31/17 12/31/16 12/31/15 12/31/14 12/31/13 12/31/12 Results1 Revenues 179.6 327.7 71.8 76.4 66.8 49.7 106.2 64.0 78.0 51.9 Cost of Sales 32.2 9.2 12.1 1.8 0.0 0.0 0.0 0.0 0.0 0.0 R&D Expenses2 225.2 139.4 108.4 106.4 113.3 94.0 78.7 56.0 49.2 37.7 Selling Expenses3 121.5 107.7 22.7 6.4 4.8 2.4 0 0 0 0 G&A Expenses 78.3 51.4 36.7 21.9 15.7 13.4 15.1 14.1 18.8 12.1 Personnel Expenses (Excluding Stock-Based Compensation)2 171.1 117.1 54.4 39.2 37.1 33.7 32.4 26.7 27.4 24.1 Capital Expenditure 26.2 49.2 3.7 2.5 13.1 2.9 8.8 20.5 5.6 1.8 Depreciation of Tangible Assets 2.8 2.5 2.0 1.8 2.0 1.8 1.5 1.4 1.5 1.7 Amortization of Intangible Assets 3.6 2.2 1.5 1.9 2.1 2.0 1.9 2.7 3.3 3.5 EBIT – 27.4 (107.9) (59.1) (67.6) (59.9) 17.2 (5.9) 9.9 2.5 Net Profit/(Loss) (514.5) 97.9 (103.0) (56.2) (69.8) (60.4) 14.9 (3.0) 13.3 1.9 Net Profit/(Loss) from Discontinued Operations – – – – – – – – 6.0 (0.4) Balance Sheet Total Assets 2,556.3 1,659.5 496.4 538.8 415.4 463.6 400.1 426.5 447.7 224.3 Cash and Financial Assets 976.9 1,244.0 357.4 454.7 312.2 359.5 298.4 352.8 390.7 135.7 Intangible Assets 838.3 71.0 44.8 47.4 67.8 67.9 79.6 46.0 35.1 35.0 Total Liabilities 2,311.4 1,038.2 101.7 50.4 56.7 48.1 37.3 77.7 95.5 22.3 Stockholders’ Equity 244.9 621.3 394.7 488.4 359.0 415.5 362.7 348.8 352.1 202.0 Equity Ratio (in %) 10 % 37 % 80 % 91 % 86 % 90 % 91 % 82 % 79 % 90 % MorphoSys Share Number of Shares Issued 34.231.943 32.890.046 31,957,958 31,839,572 29,420,785 29,159,770 26,537,682 26,456,834 26,220,882 23,358,228 Group Earnings/(Loss) per Share, Basic and Diluted (in €) (15.40) – (3.26) (1.79) (2.41) (2.28) 0.57 (0.12) 0.54 0.08 Earnings per Share, Basic (in €) – 3.01 – – – – – – – – Earnings per Share, Diluted (in €) – 2.97 – – – – – – – – Dividend (in €) – – – – – – – – – – Share Price (in €) 33.35 93.82 126.80 88.95 76.58 48.75 57.65 76.63 55.85 29.30 Personnel Data Total Group Employees (Number4) 732 615 426 329 326 345 365 329 299 421

Annual Report https://reports.morphosys.com/2021 Non-Financial Report https://csr.morphosys.com/2021 2021 2021 See our latest reports online You can also find our Group’s current annual and non-financial reports in both English and German online. Simply go to our website. We look forward to your visit. Annual Report Non-Financial Report

Th e C o m p a ny C o nt en ts At MorphoSys, our ambition is to redefine how cancer is treated. As a commercial-stage biopharmaceutical company, we are driven by the urgency to deliver groundbreaking medicines. Guided by our mission: more life for people with cancer.

We are an emerging leader in hematology/oncology and are committed to making a profound im- pact in the lives of patients - with the ongoing commercialization of Monjuvi® and the clinical development of pelabresib in myelofibrosis.

Th e C o m p a ny C o nt en ts

Th e C o m p a ny C o nt en ts Monjuvi Since launch, approximately 2,000 patients have been treated with our cancer immuno- therapy in the U.S. Monjuvi, in combination with lenalidomide, provides a paradigm shift in treating adult patients with relapsed or refrac- tory diffuse large B-cell lymphoma (DLBCL) who are not eligible for autologous stem cell transplant. Beyond the current indication, approved under accelerated approval, we are developing Monjuvi in additional hemato- logical indications.

Pelabresib Our aspiration for our most exciting new pipe- line asset is to potentially change the standard of care in myelofibrosis, a bone marrow cancer for which only limited treatment options are available. Pelabresib is currently being explored in a phase 3 trial, and we expect the data in the first half of 2024.

Th e C o m p a ny C o nt en ts

Contents 01 02 The Company Letter to the Shareholders 14 Report of the Supervisory Board 18 Supervisory Board of MorphoSys AG 22 MorphoSys on the Capital Market 25 Non-Financial Group Report 28 Fundamentals of the MorphoSys Group 34 Macroeconomic and Sector-Specific Conditions 51 Analysis of Net Assets, Financial Position and Results of Operations 52 Outlook and Forecast 69 Risk and Opportunity Report 73 Subsequent Events 84 Statement on Corporate Governance, Group Statement on Corporate Governance and Report on Corporate Governance 85 Group Management Report 8 Contents

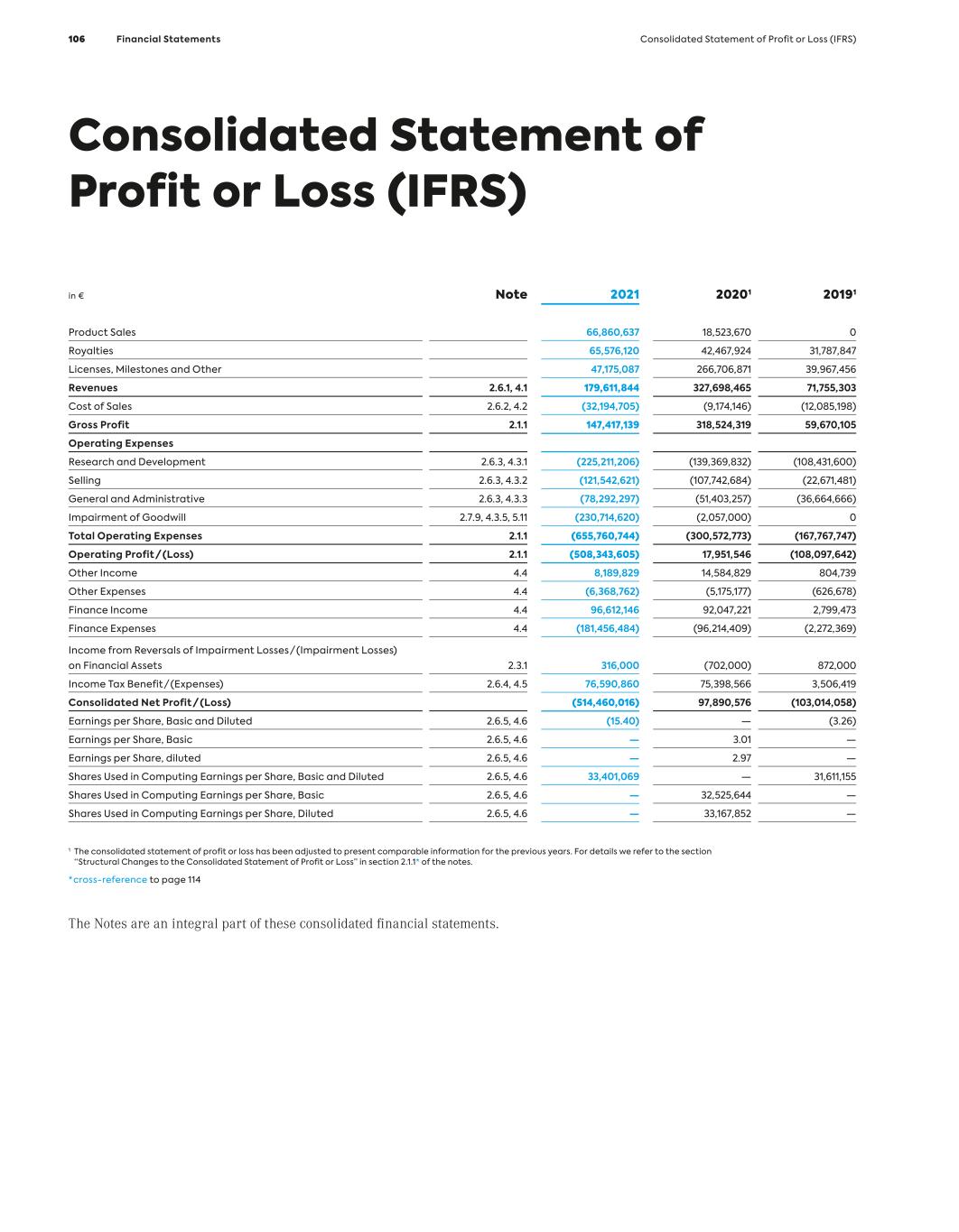

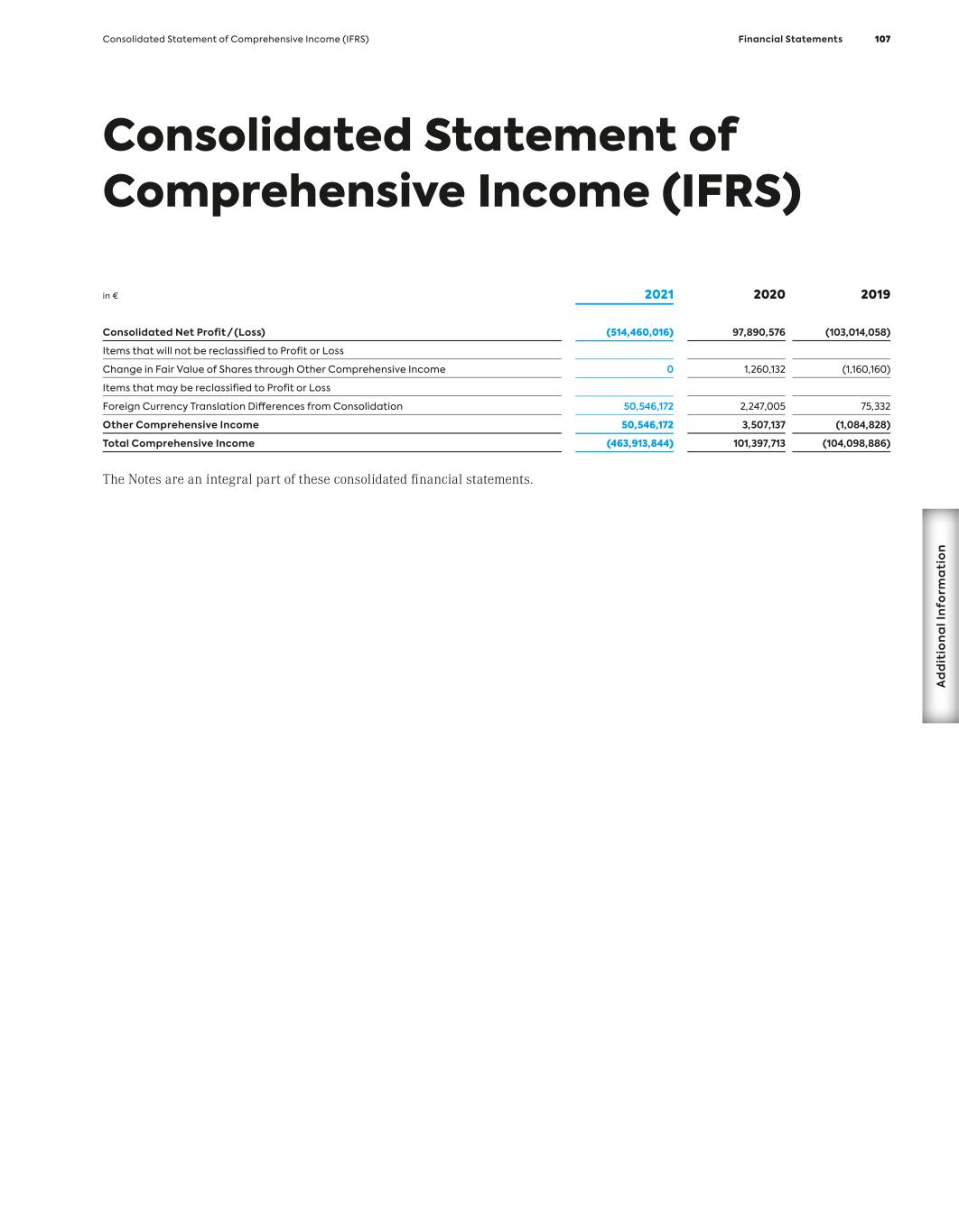

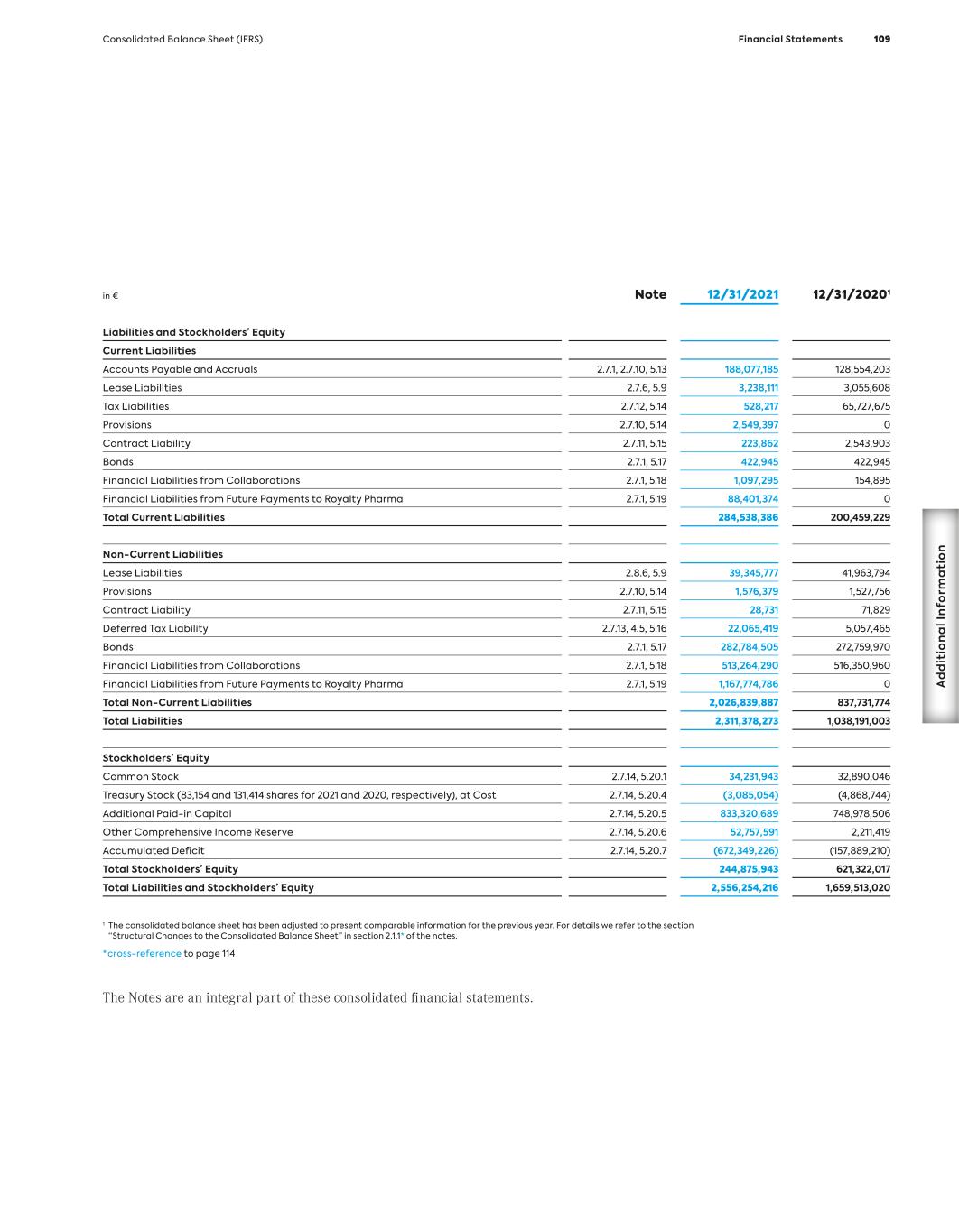

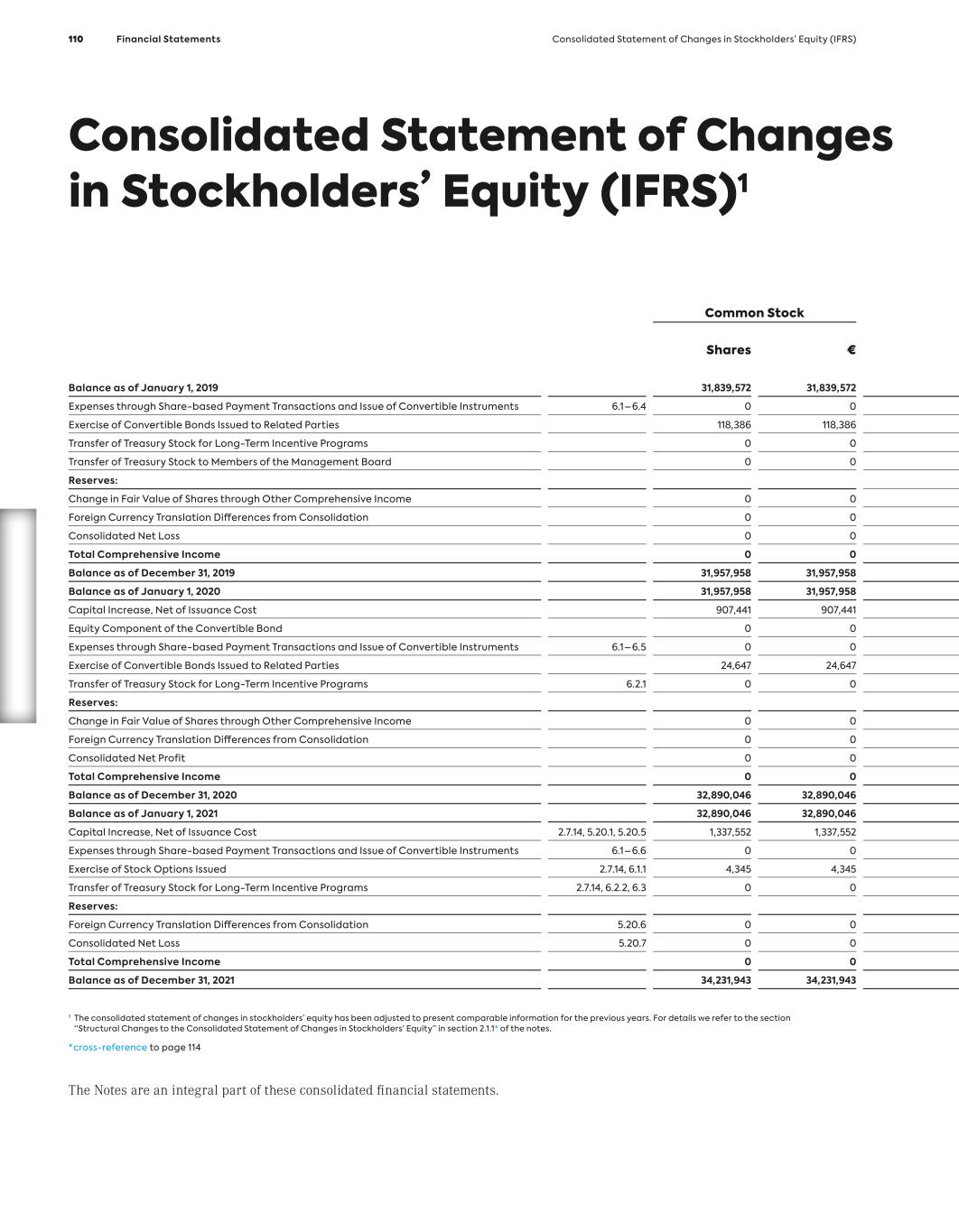

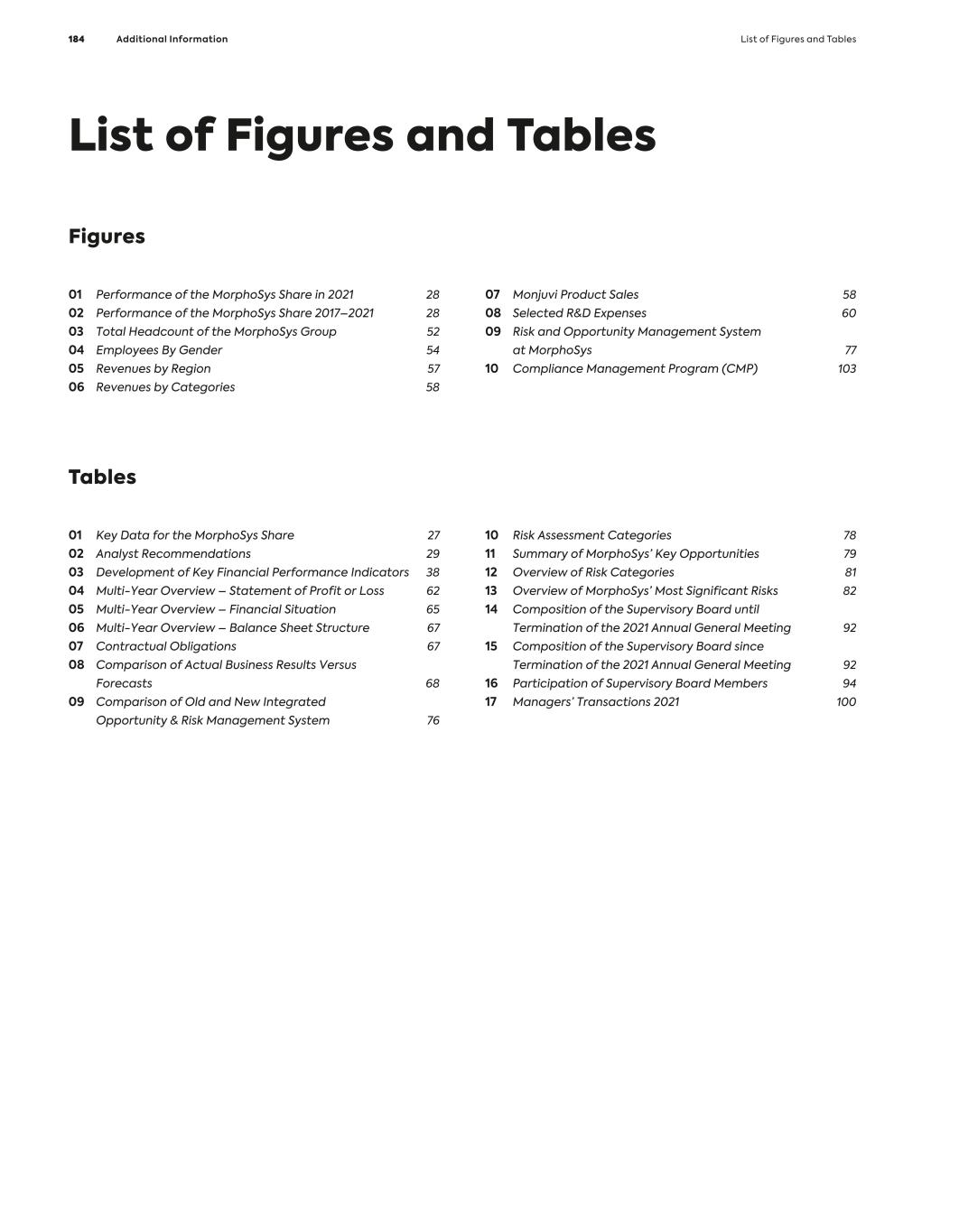

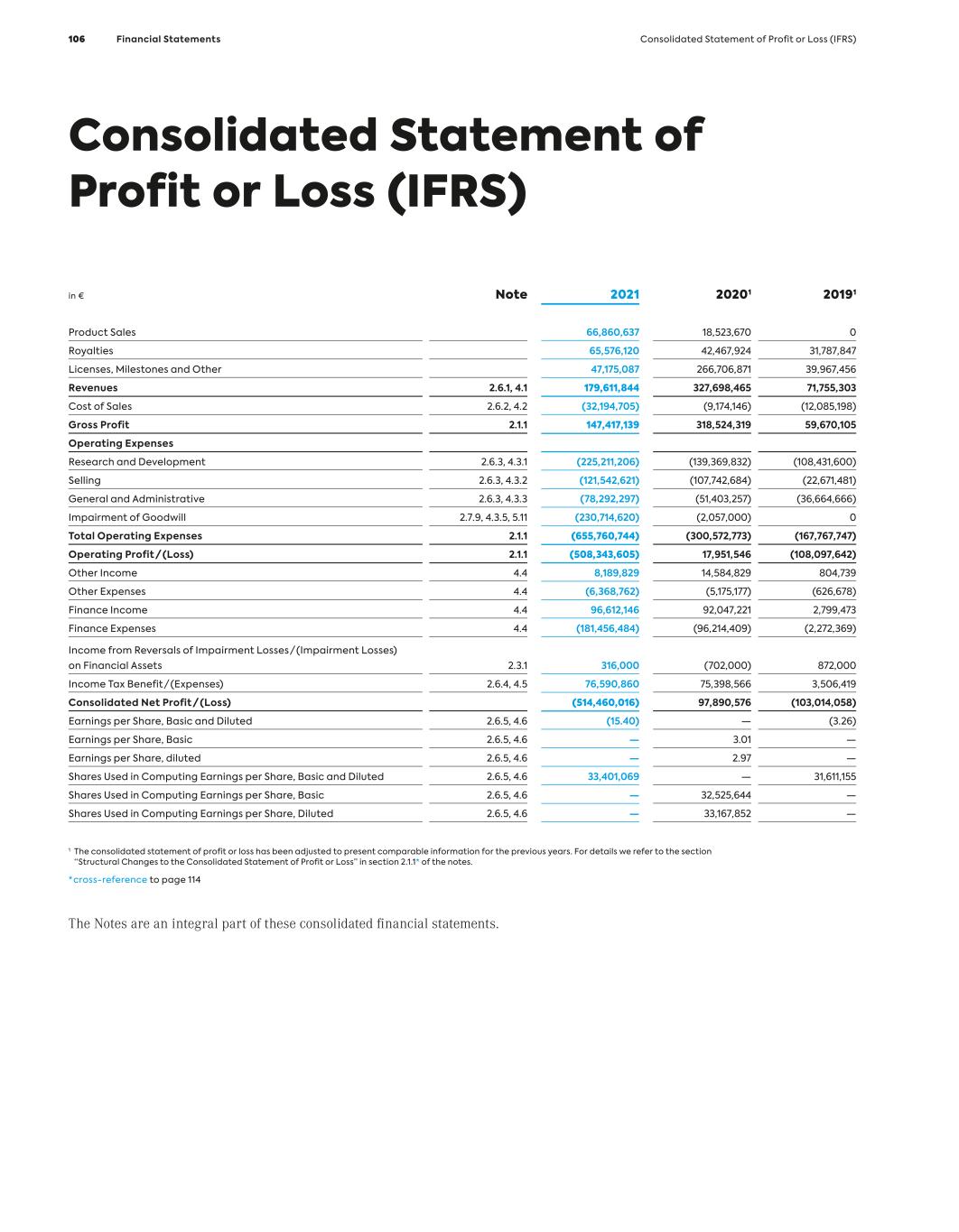

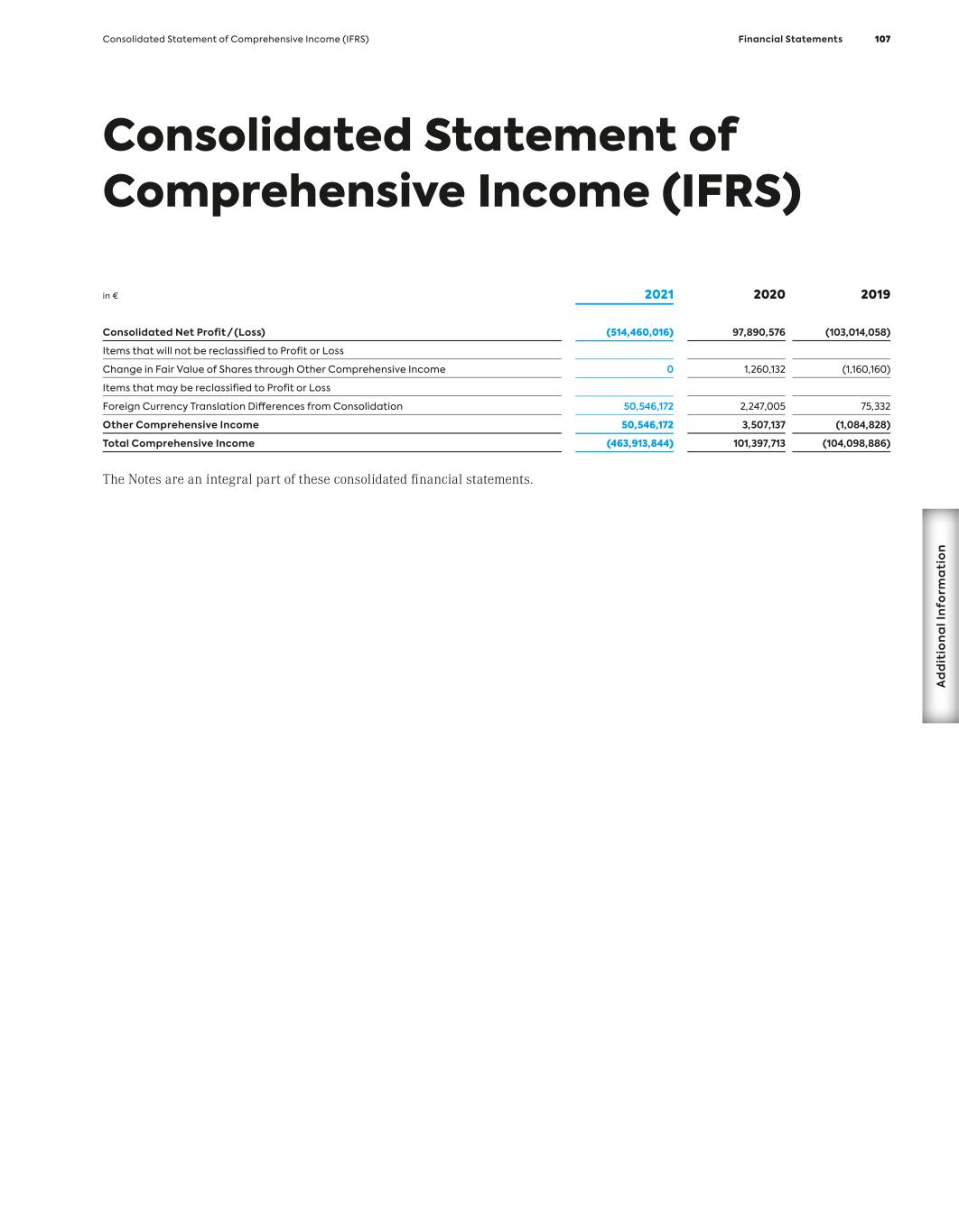

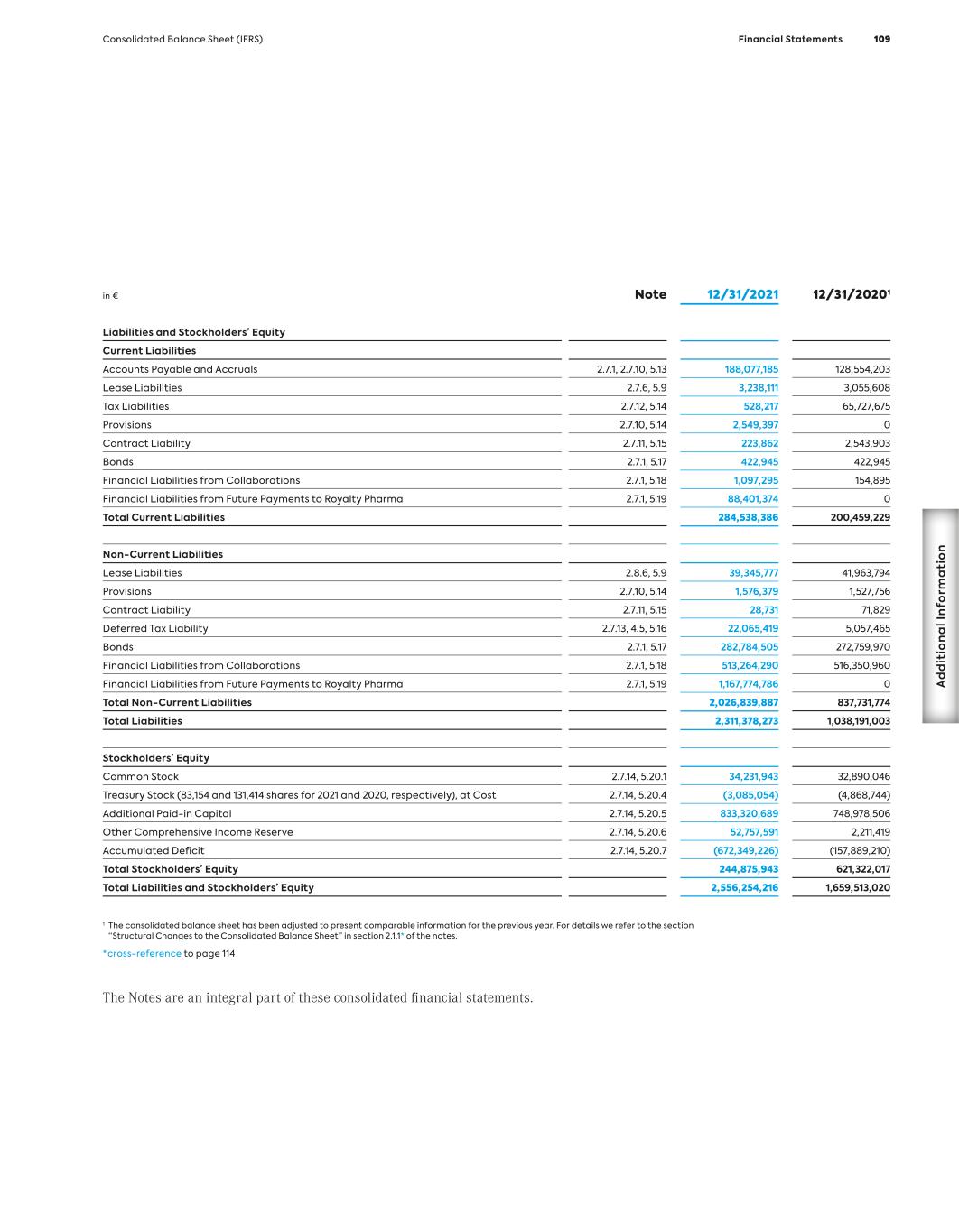

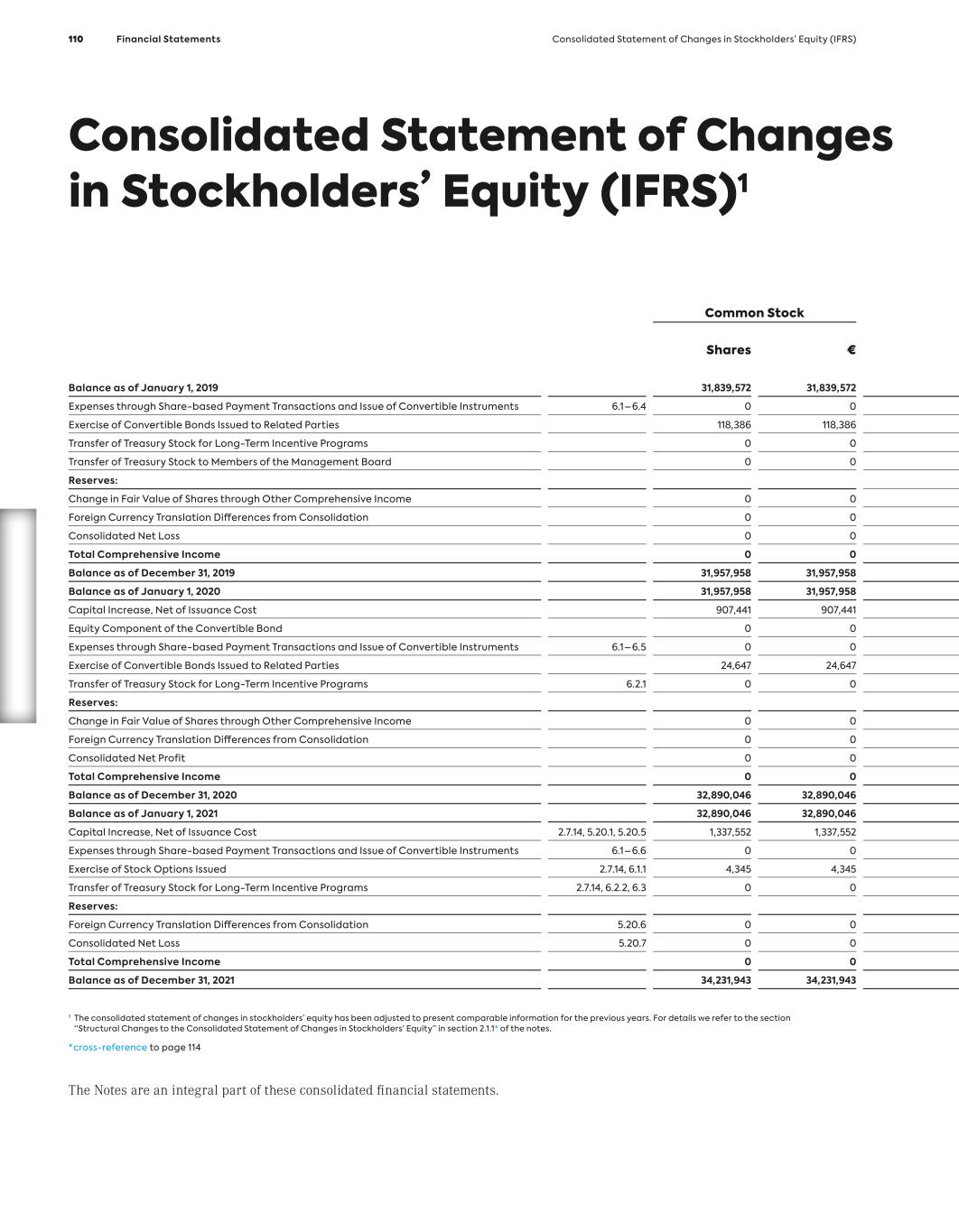

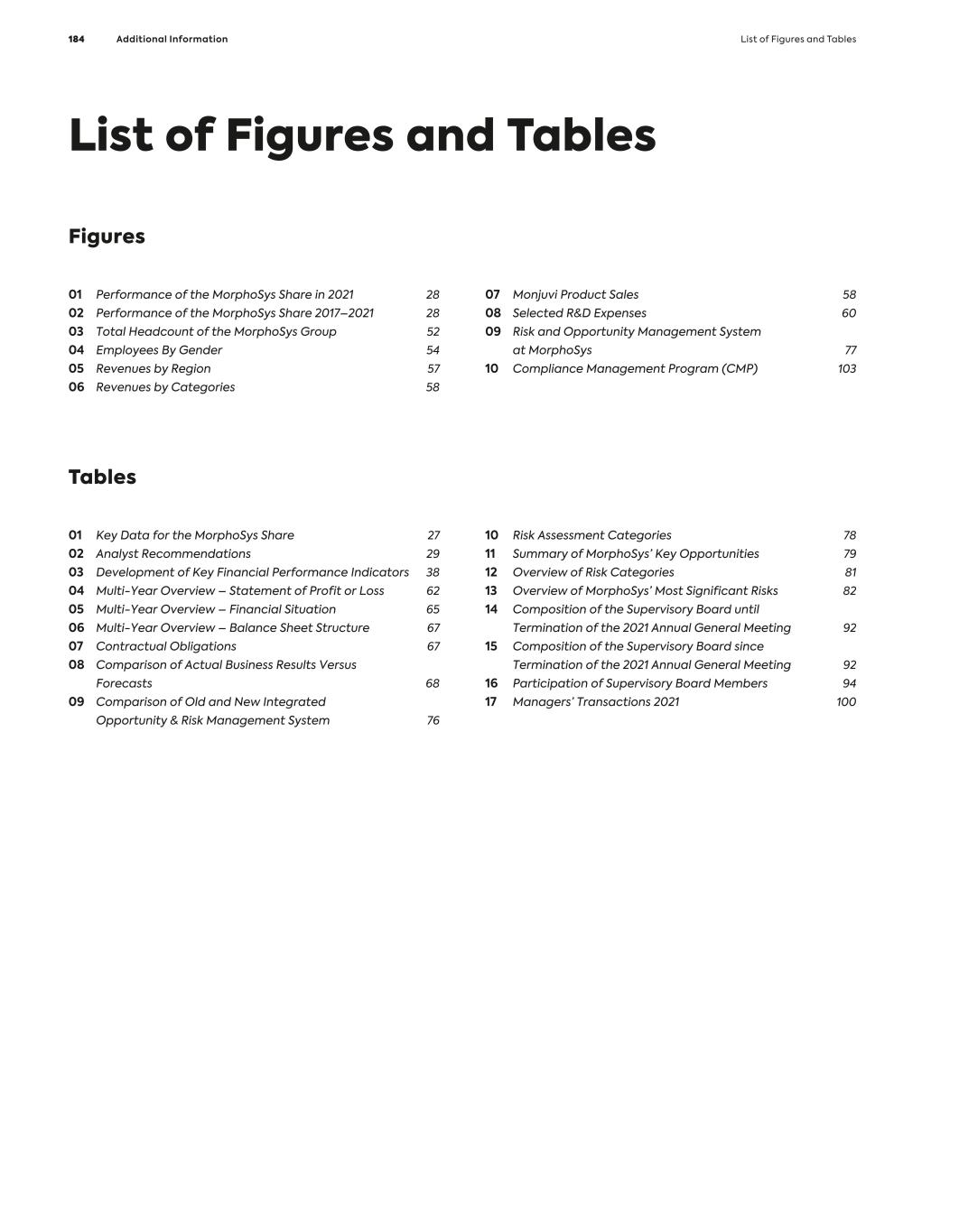

Th e C o m p a ny03 Consolidated Statement of Profit or Loss (IFRS) 106 Consolidated Statement of Comprehensive Income (IFRS) 107 Consolidated Balance Sheet (IFRS) 108 Consolidated Statement of Changes in Stockholders’ Equity (IFRS) 110 Consolidated Statement of Cash Flows (IFRS) 112 Notes 114 Responsibility Statement 172 Independent Auditor’s Report 173 Executive Committee of MorphoSys AG 180 Glossary 182 List of Figures and Tables 184 Financial Statements Additional Information C o nt en ts 9Contents

See our latest reports online You can also find our Group’s current annual and non-financial reports in both English and German online. Simply go to our website. We look forward to your visit. Annual Report https://reports.morphosys.com/2021 Non-Financial Report https://csr.morphosys.com/2021 10 The Company Contents

01Contents Th e C o m p a nyThe Company Letter to the Shareholders 14 Report of the Supervisory Board 18 Supervisory Board of MorphoSys AG 22 MorphoSys on the Capital Market 25 Non-Financial Group Report 28 Contents The Company 11

With the acquisition of Constellation Pharmaceuticals, we accelerated our transformation into a global biopharmaceutical company and strengthened our late-stage pipeline. 12 The Company

G ro up M a na g em en t R ep o rt The Management Board Malte Peters, M.D. Chief Research and Development Officer Jean-Paul Kress, M.D. Chief Executive Officer Sung Lee Chief Financial Officer from left to right: The Management Board The Company 13

Letter to the Shareholders Dear Ladies and Gentlemen, Dear Shareholders, In 2020, with the accelerated U.S. approval and launch of Monjuvi® (tafasitamab-cxix), we became an integrated commercial biopharma- ceutical company. Building on this achievement, in 2021 we made significant steps towards our ambition of becoming a leader in the hematology/oncology space. We continue to make progress with the Monjuvi launch, and 2021 has been the first full year as a commer- cial enterprise. We have seen encouraging sales growth over the past quarters and approximately 2,000 patients with relapsed or refractory (r/r) diffuse large B-cell lymphoma (DLBCL) have been treated with our immunotherapy in the U.S. since the approval in 2020. In 2021 we made an important strategic move with the acquisition of Constellation Pharmaceuticals which added pelabresib to our late stage pipeline. Pelabresib, like tafasitamab, has the potential to change how cancer patients are treated. 2021 also reflected the ongoing challenges we faced with the COVID-19 pandemic. Despite the incredible achievements in medicine, the dis- ease continues to affect us all on both a personal and business level. We are just at the beginning of the opportunity with Monjuvi® Monjuvi received accelerated approval in July 2020 in the U.S. for adult patients with r/r DLBCL and who are not eligible for autologous stem cell transplant. DLBCL is an aggressive disease and the most common type of non-Hodgkin’s lymphoma (NHL) worldwide. Monjuvi is the first and only FDA-approved second-line treatment for non-transplant eligible patients, and we believe this cancer immunotherapy has the potential to transform the standard of care in DLBCL. The adoption of new treatment regimens, especially in DLBCL, can take time. While the pandemic restricted our ability to meet with doctors in Letter to the Shareholders 14 The Company Letter to the Shareholders

G ro up M a na g em en t R ep o rt person for the majority of the first half of 2021, the gradual opening up of facilities and continued education about the benefits of Monjuvi in the second half led to a broadening of the prescriber base and in- creased treatments of second-line patients. During the year, we presented compelling new data for Monjuvi: The three-year long-term data from the L-MIND study not only showed a durable response and consistent safety profile, but also suggested that the combination with lenalidomide could potentially lead to durable remission. We also presented real-world evidence at a medi- cal conference comparing the tafasitamab-lenalidomide combi- nation with other treatments currently used for relapsed or refrac- tory DLBCL. The tafasitamab opportunity has broad potential applicability in NHL. Looking beyond the U.S. market, we were delighted to announce with our partner, Incyte, conditional approvals in 2021 in the European Union and Canada. Incyte has exclusive commercialization rights to tafasitamab outside the United States. We also made important progress in potentially broadening the indi- cations for tafasitamab. In the spring, we initiated a pivotal phase 3 trial, called frontMIND, in first-line DLBCL. We started this trial based on encouraging early-stage data in DLBCL patients previously un- treated for their disease, and the trial is already enrolling with signifi- cant interest from the medical community. With our partner Incyte, we initiated a phase 3 trial in other types of NHL: In April, we dosed the first patient in the inMIND study, evaluating tafasitamab in combina- tion with lenalidomide and rituximab in patients with r/r follicular lym- phoma (FL) or marginal zone lymphoma (MZL). Acquisition of Constellation Pharmaceuticals represents transforma- tional growth opportunity An important part of our growth strategy has been to expand our late-stage clinical pipeline, especially in our focus area of hematology/ oncology. The Constellation acquisition bolstered our position in he- matology/oncology, supporting our aspiration to become a leader in this space. It added another phase 3 product candidate, pelabresib, to our pipeline that is currently being evaluated in combination with ruxolitinib, the current standard of care, in patients with myelofibrosis. Our vision here is to change the standard of care. With the acquisition also came a promising mid-stage oncology clinical program, CPI-0209, an EZH2 inhibitor. Letter to the Shareholders The Company 15

To fund this acquisition, we entered into a funding agreement with Royalty Pharma that could potentially provide more than US$ 2 billion of capital. We understand there are questions about the rationale of monetizing royalty streams in order to finance the development of clinical programs. We did this because of the high conviction we have in pelabresib, the lead product candidate of Constellation. Moreover, we fundamentally believe we can create greater long-term share- holder value by focusing on our proprietary drug development and commercialization. Our vision for pelabresib is to change the treatment paradigm for myelofibrosis A major growth driver over the intermediate and long-term is pelabresib which we believe could have the potential to change the standard of care in myelofibrosis. It is currently being evaluated in a pivotal phase 3 clinical trial (MANIFEST-2) to treat myelofibrosis – a type of bone marrow cancer for which there is no cure and treatment options are limited. The latest interim data from the MANIFEST phase 2 trial were presented in late 2021 at the American Society of Hematology Annual Meeting. These data underpin our strong conviction in pelabresib and in the ongoing phase 3 trial where we have applied our clinical development expertise to optimize the trial design. We expect the data to readout in the first half of 2024 and we are continuing our efforts to ensure operational excellence. “In 2021 we took bold moves towards realizing our long- term goal of becoming not just a player but a leader in the hema tology/oncology space.” Jean-Paul Kress, M.D., Chief Executive Officer 16 The Company Letter to the Shareholders

G ro up M a na g em en t R ep o rt Growing the clinical pipeline behind our lead programs Beyond tafasitamab and pelabresib, we are building an attractive and robust pipeline. We acquired CPI-0209 through the acquisition of Constellation. CPI-0209 is a small molecule designed to promote anti- tumor activity by specifically inhibiting EZH2. We believe that targeting EZH2 has the potential for a broad therapeutic application in a variety of tumor types. CPI-0209 is currently being assessed in a phase 2 study, and we expect to report proof-of-concept data in 2022. Felzartamab is a CD38 targeting antibody that has the potential to deplete CD38 positive plasma cells. The clinical development of felz- artamab in two autoimmune diseases affecting the kidneys – membra- nous nephropathy and immunoglobulin A nephropathy is progressing. The enrollment for the studies in membranous nephropathy has been completed and topline data are expected in the second half of 2022. We thank you for helping MorphoSys to achieve our ambitious goals and build a bright future MorphoSys is entering an exciting, new era. We took bold steps this year to strengthen our position for future success. We are very well positioned to develop and deliver innovative cancer medicines that could have a profound impact on the lives of cancer patients and drive growth in the years ahead. We are proud of our accomplishments this year and remain highly focused on successfully delivering and executing our strategy. I am truly excited about what lies ahead for our Company. I would like to thank everyone who has played an important role in help- ing us bring life-saving therapies to patients. Thank you to our employees for their hard work, dedication and flexibility during a time of uncer- tainty and change. Thank you to the clinicians, patients and their loved ones who participate in our clinical trials. And thank you to our share- holders who believe in our Company and our ability to achieve our goals. We look forward to continuing to make progress in the year ahead and making a difference for people with cancer. Sincerely, Jean-Paul Kress, M.D. Chief Executive Officer Letter to the Shareholders The Company 17

Report of the Supervisory Board Cooperation of the Management Board and Supervisory Board During the 2021 financial year, the Supervisory Board compre- hensively performed the duties assigned to it by law, the Articles of Association, Rules of Procedure and the recommendations of the German Corporate Governance Code in its version dated De- cember 16, 2019 (hereinafter referred to as the “Code”) with two justified exceptions. We regularly advised and continually over- saw the Management Board in its management of the Company and dealt extensively with the operational and strategic develop- ment of the Group. The Management Board fulfilled its duty to inform and furnish us with periodic written and verbal reports containing timely and detailed information on all business trans- actions and events of significant relevance to the Company. The Management Board prepared these reports in collaboration with the respective departments. In our Committee meetings and ple- nary sessions, we had the opportunity to discuss the Manage- ment Board’s reports and the proposed resolutions in full. The Management Board answered our questions on strategic topics affecting the Company with a great level of detail and submitted the relevant documents in a timely manner. Any deviations from the business plan were thoroughly explained to us and we were directly involved at an early stage in all decisions relevant to the Company. An appropriate resolution was passed when the Supervisory Board’s approval for individual actions was required by law, the Articles of Association or the Rules of Procedure. The Supervisory Board members approved all actions by the Management Board requiring Supervisory Board approval based on the documenta- tion provided in advance by the Management Board. When neces- sary, the Supervisory Board received the support of the relevant Committees and, together with the Management Board, discussed any projects requiring decision. All matters requiring approval were submitted for review by the Management Board to the Super- visory Board on a timely basis. Outside of the meetings of the Supervisory Board plenum and the Committees, the chairman of the Supervisory Board regularly exchanged information and ideas with the Management Board and especially the Chief Executive Officer, Dr. Jean-Paul Kress. The Supervisory Board chairman was always kept promptly in- formed of the current business situation and any significant busi- ness transactions. The Chairs of the Committees have also had regular contact with the Management Board members in their respective areas of responsibility and individual Management Board members on demand. Supervisory Board Meetings in the 2021 Financial Year and Key Items of Discussion A total of 11 Supervisory Board meetings were held in the 2021 financial year. The Supervisory Board regularly held closed ses- sions without participation of the Management Board as part of their Supervisory Board meetings. All Supervisory Board mem- bers were present at all Supervisory Board meetings. A detailed overview of the participation of all Supervisory Board members in the respective Supervisory Board and Committee meetings can be found in the “Statement on Corporate Governance,” which is available on the Company’s website under the heading “Inves- tors > Corporate Governance > Statement on Corporate Gover- nance,” and in the Annual Report on pages 90 to 91. In urgent cases occurring outside of meetings, the Supervisory Board passed resolutions by written procedure. In addition to the above, a one-day strategy meeting took place in November 2021 that primarily addressed: • the Company’s corporate strategy & financial outlook; • the development strategy for the clinical and pre-clinical assets of the MorphoSys Group; • review of the research portfolio and strategy for the research assets of the MorphoSys Group; and • organizational effectiveness. During the 2021 financial year, the Supervisory Board paid par- ticular attention to the following topics and passed resolutions on these topics after a thorough review and discussion: • acquisition of Constellation Pharmaceuticals Inc.; • entering into the strategic funding partnership with Royalty Pharma Inc. including capital increase to allow for agreed upon equity investment by Royalty Pharma; • approval of various study and supply-related contracts exceed- ing EUR 10 Mio.; • evaluation of the achievement of the Company goals 2020 and setting the Company goals for 2021 and 2022; • approval of the terms and conditions of the Performance Share Unit Program 2021 as well as an amendment to the terms and conditions of the Performance Share Unit Program 2020 and defi- nition of the number of performance share units to be granted to the members of the Management Board under these plans; • approval of the terms and conditions of the Restricted Stock Units Program 2021 and the Stock Option Program 2021 for US beneficiaries; • agenda and proposed resolutions for the 2021 Annual General Meeting; Report of the Supervisory Board 18 The Company Report of the Supervisory Board

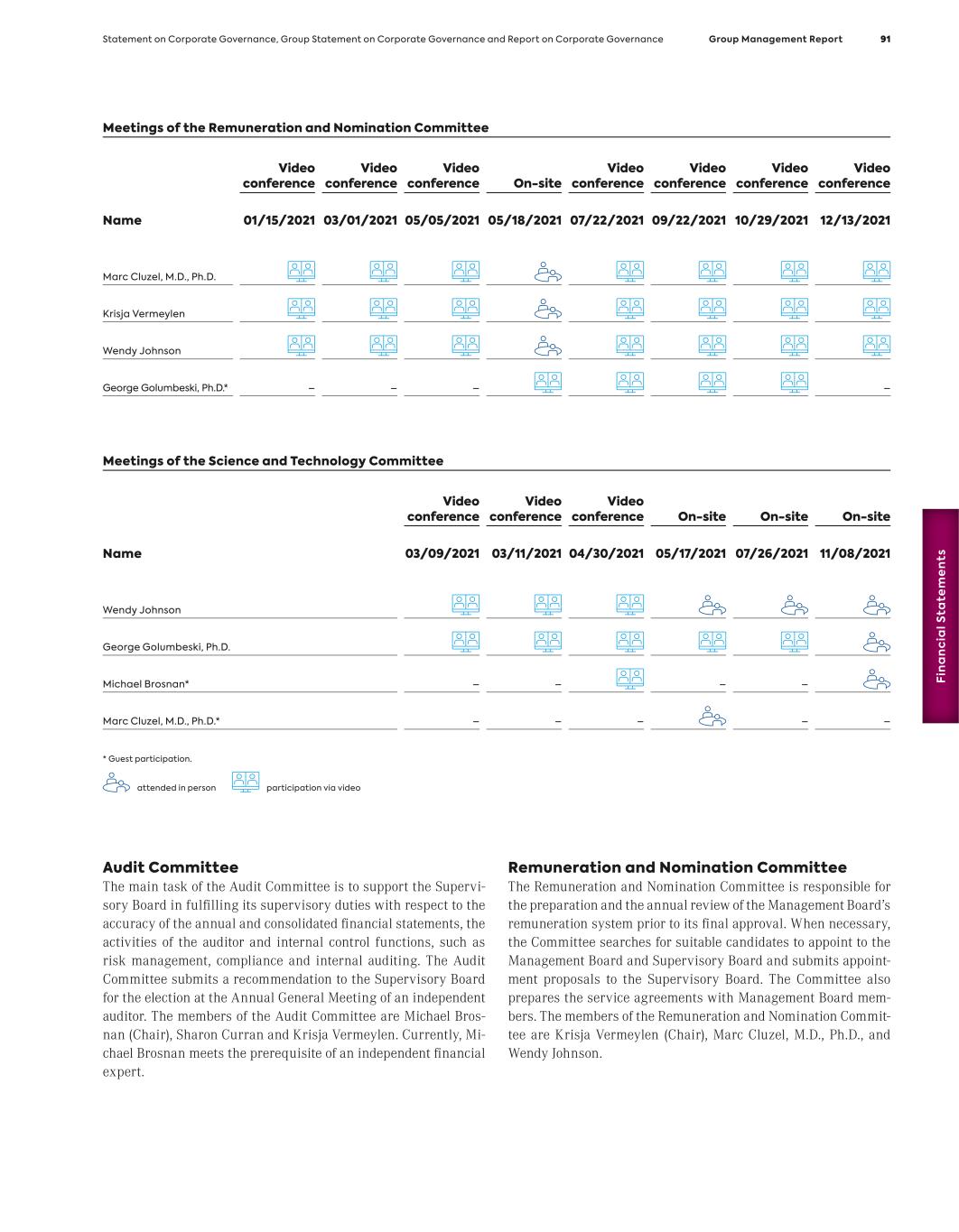

G ro up M a na g em en t R ep o rt • confirmation of Dr. Marc Cluzel as chair of the Supervisory Board and re-establishment and re-staffing of the Committees in the Board’s constituent meeting following the 2021 Annual General Meeting; • appointment of the new Chief Financial Officer, Sung Lee, and conclusion of a corresponding service agreement; • re-appointment of Dr. Jean-Paul Kress as Chief Executive Officer and Dr. Malte Peters as Chief Research & Development Officer and conclusion of corresponding service agreements; • revision of the rules of procedure of the Management Board in- cluding schedules of responsibilities; • resolution upon a remuneration system for the Management Board and for the Supervisory Board as well as development of a new remuneration system 2022 and the remuneration report 2021; • conclusion of a release agreement with the former Chief Operat- ing Officer, Dr. Roland Wandeler, in the course of his stepping down as of December 31, 2021; • update of the declaration of conformity 2020 and new declara- tion of conformity 2021; and • budget for the 2022 financial year. We commissioned an independent remuneration consultant to confirm the appropriateness of the Management Board’s compen- sation and its comparison to the remuneration of various levels of employees. We discussed and agreed on the key performance indicators for the long-term incentive plans for the Management Board and other employees in key positions. Further, we approved the new remuneration system for the members of the Manage- ment Board, which is in line with the new provisions of the Ger- man Stock Corporation Act (AktG) and the Code, and which was submitted for approval to the 2021 Annual General Meeting. In addition, we developed a new remuneration system which shall be submitted for approval to the 2022 Annual General Meeting. Furthermore, we approved the financial statements for the finan- cial year 2020, acknowledged the half-year results for 2021 and the first and third quarter reports as well as dealt with the State- ment on Corporate Governance and the Corporate Governance Report. Our regular discussions in the Supervisory Board’s plenary meet- ings were focused on MorphoSys’ long-term strategy, Monjuvi® sales performance, revenue and cash development as well as the regular financial reports including the communication to the in- vestor community and share price development. Further focal points of discussion were results and progress of the Company’s clinical programs for the development of proprietary drugs and research activities as well as the acquisition and subsequent inte- gration of Constellation Pharmaceuticals, which included a review of the combined research and development portfolio and future organizational R&D set-up. Furthermore, we reviewed the finan- cial outlook for the 2023/2024 financial years and deliberated on MorphoSys’ associated future potential financing needs. In addition, we carried out an evaluation on how effective the Super- visory Board and its committees fulfill their tasks, which was performed via a questionnaire that included a joint self-evaluation of the Supervisory Board, its Committees and also the Manage- ment Board. Furthermore, we kept ourselves regularly informed with respect to the Company’s risk management system, internal audit results as well as the internal control and compliance man- agement system. Conflicts of Interest within the Supervisory Board No conflicts of interest arose within the Supervisory Board in the 2021 financial year. Activities and Meetings of Supervisory Board Committees To ensure that its duties are performed efficiently, the Supervisory Board has established three permanent committees – the Audit Committee, the Remuneration and Nomination Committee and the Science and Technology Committee – to prepare the issues that fall within the Supervisory Board’s respective areas of responsi- bility for the Supervisory Board plenum. In each Supervisory Board meeting, the chairs of the Committees report to the Super- visory Board on the Committees’ work. The minutes of the Com- mittee meetings are made available to all Supervisory Board members. The composition of these committees can be found in the “Statement on Corporate Governance,” which is available on the Company’s website under the heading “Investors > Corporate Governance > Statement on Corporate Governance,” and in the Annual Report on pages 87 to 92. The Audit Committee met on 5 occasions in the 2021 financial year. All Committee members were present at all Audit Committee meetings. The Committee dealt mainly with accounting issues, quarterly reports, annual financial statements and consolidated financial statements. The Committee discussed these topics with the Management Board and recommended the approval of the financial statements to the Supervisory Board. The auditor took part in four Audit Committee meetings and informed its members of the audit results. Based on the Auditors Reform Act and the requirements for the external and internal rotation of the auditor, the Audit Committee had carried out in 2020 a public tender for the 2021 annual audit and half-year review. As a result, the Audit Committee made a recommendation to the Supervisory Board with respect to the Supervisory Board’s proposal at the Annual Gen- eral Meeting for the election of the independent auditor for the 2021 financial year. In addition, the Audit Committee dealt with the annual update of a list of permitted and pre-approved non-audit services of the auditor. The Committee also discussed the risk management system, the compliance management system and the results of the internal audit conducted in the 2021 financial year, as well as specific accounting issues under International Report of the Supervisory Board The Company 19

Financial Reporting Standards (IFRS) relevant to the Company. Furthermore, the Committee regularly discussed the Company’s asset management policy and the investment recommendations made by the Management Board. The Committee also discussed in depth the 2022 budget and the financial outlook for the 2023/2024 financial years. Furthermore, the Committee moni- tored the further development and adaptation to new processes and transactions of the system of Internal Control over Financial Reporting (ICoFR) to ensure continuous SOX compliance by end of 2021. To increase efficiency, there is a joint Remuneration and Nomina- tion Committee, which deliberates on matters relating to remu- neration and nomination. The Committee met on 8 occasions in the 2021 financial year. All Committee members participated at all Committee meetings. In its function as a remuneration com- mittee, the Committee mainly dealt with the Management Board’s remuneration system and level of compensation. In particular, the Committee dealt with the implementation of a new remuneration system 2021 for the members of the Management Board, which was submitted to the 2021 Annual General Meeting for approval. In addition, the Committee developed a new remuneration system 2022 for the members of the Management Board, which shall be submitted to the 2022 Annual General Meeting for approval, and dealt with the preparation of the 2021 remuneration report. Fur- ther, the Committee also commissioned an independent remuner- ation expert to verify the (horizontal and vertical) appropriateness of the Management Board’s remuneration. Based on this report, the Committee prepared a recommendation on the Management Board’s compensation and submitted this to the Supervisory Board for approval. In addition, the Committee gave careful con- sideration to the Company goals as a basis for the Management Board’s short-term variable remuneration and offered appropriate recommendations to the Supervisory Board for resolution. The Committee discussed the key performance indicators of the long- term incentive plans for the Management Board and other em- ployees in key positions. Further, this Committee prepared the release agreement with the Chief Operating Officer, Dr. Roland Wandeler. In addition, this Committee dealt with succession plan- ning within the Company, in particular as regards the succession of the departed Management Board member Jens Holstein. In this context, the Committee recommended the appointment and pre- pared the respective Management Board contract of Sung Lee as the new Chief Financial Officer, who has been appointed as mem- ber of the Management Board by the Supervisory Board. The Science and Technology Committee was held on 6 occasions during the 2021 financial year. All Committee members partici- pated in all Committee meetings. The Committee dealt mainly with the Company’s research activities as well as overall strategy to expand the proprietary drug pipeline, the development of novel technologies, the Company’s drug development plans and future development strategy, progress in the clinical trials as well as required budget resources. One major focus was the acquisi- tion and integration of Constellation Pharmaceuticals, including the overall strategy and opportunity related to the expansion of the research pipeline and the development in myelofibrosis, the development of the BET Inhibitor pelabresib, as well as the second generation EZH2 Inhibitor (CPI-0209). The Committee further deliberated about the future research organizational set-up. Moreover, the development of tafasitamab with its expansion into other indications and lines of therapy, in combination with estab- lished or novel anti-cancer agents, was examined. The Committee also evaluated the execution of the frontMIND and firstMIND studies to complement the forementioned development. Addition- ally, the Committee also addressed and reviewed the further de- velopment of felzartamab in autoimmune diseases. The members of the Science and Technology Committee also serve as members of the ad-hoc deal committee, which meets in this function when necessary and which dealt with the acquisi- tion of Constellation Pharmaceuticals Inc. during the financial year 2021. Corporate Governance The Supervisory Board devoted its attention to the further devel- opment of MorphoSys’ corporate governance, taking into consid- eration the Code. The Corporate Governance Statement according to Section 289f HGB (German Commercial Code), including the detailed Corporate Governance Report, and the Group Statement on Corporate Governance according to Section 315d HGB, can be found on the Company’s website under the heading “Investors > Corporate Governance > Corporate Governance Report” and in the Annual Report on pages 85 to 104. We also discussed with the Management Board the Company’s compliance with the Code’s recommendations and in two justified cases approved an exception to the recommendations of the Code. Based on this consultation, the Management Board and the Super- visory Board submitted the annual Declaration of Conformity on November 29, 2021. The current version of the Declaration of Conformity can be found in this Annual Report and is perma- nently available on the Company’s website under the heading “Investors > Corporate Governance > Declaration of Conformity.” Changes in the Composition of the Management Board and Supervisory Board By decision of the Supervisory Board on January 18, 2021, Sung Lee was appointed as Chief Financial Officer for a term of three years from February 2, 2021, until January 31, 2024. Further, the Chief Operating Officer, Dr. Roland Wandeler, resigned as mem- ber of the Management Board and COO in November 2021 with effect as of December 31, 2021. No further changes in the compo- sition of the Management Board took place during the 2021 finan- cial year. No changes in the composition of the Supervisory Board took place during the 2021 financial year. 20 The Company Report of the Supervisory Board

G ro up M a na g em en t R ep o rt Audit of the Annual Financial Statements and Consolidated Financial Statements For the 2021 financial year, the Company commissioned Pricewater- houseCoopers GmbH Wirtschaftsprüfungsgesellschaft, Munich (“PwC”) as its auditor. The audit contract was awarded by the Supervisory Board in accordance with the resolution of the Annual General Meeting on May 19, 2021. The Supervisory Board ob- tained a declaration of independence from the auditor in advance. The consolidated financial statements and the annual financial statements of MorphoSys AG, as well as the Group Management Report and the Management Report for the 2021 financial year, were properly audited by PwC and issued with an unqualified audit opinion. The key topics of the audit for the consolidated and annual financial statements for the 2021 financial year were man- agement override of controls and fraud in revenue recognition, the risk of fraud in revenue recognition due to potential fictitious manual adjustments to revenue, the gross-to net accounting re- lated to Monjuvi®, sales, the subsequent valuation of the financial liability from collaborations, the valuation of the financial liabili- ties arising from the agreements with Royalty Pharma, the tax treatment of the Royalty Pharma agreements, the purchase price allocation for the business combination with Constellation Pharma- ceuticals, the goodwill impairment test related to Constellation Pharmaceuticals and for statutory purposes the valuation of the investment in MorphoSys US Inc., as well as the assessment of the design and effectiveness of internal controls in accordance with SOX404. In addition, the auditor confirmed that the Manage- ment Board had established an appropriate early risk detection system. The audit reports and documents relating to the consolidated financial statements and the annual financial statements were provided on a timely basis to all Supervisory Board members for review. The audit report, the consolidated financial statements, the Group Management Report of the MorphoSys Group and the audit report, the annual financial statements and the Manage- ment Report of MorphoSys AG were discussed in detail at the Audit Committee meeting on March 14, 2022, and the meeting of the Supervisory Board on March 15, 2022. The auditor attended all meetings concerning the consolidated and annual financial state- ments, the half-year report and quarterly interim statements and reported on the key results of his audit and review, respectively. The auditor also explained the scope and focus of the audit and review and was available to the Audit Committee and the Super- visory Board to answer questions and provide further information. The Audit Committee discussed the audit results in detail and recommended to the Supervisory Board that it approves the consolidated and annual financial statements prepared by the Management Board. The Supervisory Board also took note of the audit results and, in turn, reviewed the consolidated and annual financial statements and Management Reports in accordance with the statutory provisions. Following its own examination, the Supervisory Board also determined that it sees no cause for objec- tion. The consolidated and annual financial statements as well as the Group Management Report and the Management Report as prepared by the Management Board and audited by the auditor, were subsequently approved by the Supervisory Board. Thus, the annual financial statements were adopted. The Company has to prepare a remuneration report in accordance with Sec. 162 of the German Stock Corporation Act (AktG) and a separate non-financial report for the fiscal year 2021. The Super- visory Board has commissioned PwC with a voluntary material review of the remuneration report and to review the separate non-financial report by way of a review with limited assurance. All members of the Supervisory Board received the remuneration report and the separate non-financial report and the independent auditor’s report on the audit in a timely manner. PwC’s report and the audit opinion were discussed at the Supervisory Board’s ple- nary meeting on March 15, 2022. PwC’s auditor participated in this discussion and presented the audit results. The Supervisory Board took note of the results of the audit with approval. Recognition for Dedicated Service On behalf of the entire Supervisory Board, I would like to thank the members of the Management Board and the employees of MorphoSys for their achievements, their dedicated service and the inspirational work environment witnessed during this past financial year. Through their efforts, MorphoSys’ portfolio has continued to mature and expand, and important milestones have been achieved. The Supervisory Board would also like to thank the departed Management Board member Dr. Roland Wandeler for his contri- butions to the Executive Committee, the launch of Monjuvi® and the establishment of our commercial operations. Planegg, March 15, 2022 Dr. Marc Cluzel Chairman of the Supervisory Board Report of the Supervisory Board The Company 21

Supervisory Board of MorphoSys AG Supervisory Board of MorphoSys AG Marc Cluzel, M.D., Ph.D. Chairman, Montpellier, France Member of the Supervisory Board of: Griffon Pharmaceuticals Inc., Canada (Member of the Board of Directors) Moleac Pte. Ltd., Singapore (Member of the Board of Directors) George Golumbeski, Ph.D. Deputy Chairman, Far Hills, NJ, USA Member of the Supervisory Board of: Ananke Therapeutics, Inc., Boston, MA, USA (Chairman of the Board of Directors) Carrick Therapeutics Ltd., Dublin, Ireland (Chairman of the Board of Directors) Sage Therapeutics, Inc., Cambridge, MA, USA (Member of the Board of Directors) Shattuck Labs, Inc., Austin, TX, USA (Chairman of the Board of Directors) Krisja Vermeylen Board Member, Herentals, Belgium Member of the Supervisory Board of: Diaverum AB, Lund, Sweden (Member of the Board of Directors) 22 The Company Supervisory Board of MorphoSys AG

G ro up M a na g em en t R ep o rt The CVs of our Supervisory Board Members can be found on the Company’s website under the heading “About us > Leadership.” Sharon Curran Board Member, Dublin, Ireland Member of the Supervisory Board of: CAT Capital Topco Ltd., Saint Peter Port, Guernsey (Member of the Board of Directors) CAT Capital Bidco Ltd., Dublin, Ireland (Member of the Board of Directors) Clinigen Group plc., Burton upon Trent, United Kingdom (Member of the Board of Directors) Circassia Pharmaceuticals plc., Oxford, United Kingdom (Member of the Board of Directors) Wendy Johnson Board Member, San Diego, CA, USA Member of the Supervisory Board of: Exagen, Inc., Vista, CA, USA (Member of the Board of Directors) Michael Brosnan Board Member, Osterville, MA, USA Member of the Supervisory Board of: Daimler Truck AG, Stuttgart, Germany (Member of the Board of Directors) Daimler Truck Holding AG, Stuttgart, Germany (Member of the Board of Directors) Supervisory Board of MorphoSys AG The Company 23

2021 Non-Financial Report Sustainability at MorphoSys We are aware of our responsibility to current and future generations and believe that sustainable action is a prerequisite for long-term business success. Read more on this topic in our Group’s 2021 Non-Financial Report. You can find our 2021 Non-Financial Report online at: https://csr.morphosys.com/2021 24 The Company Sustainability at MorphoSys

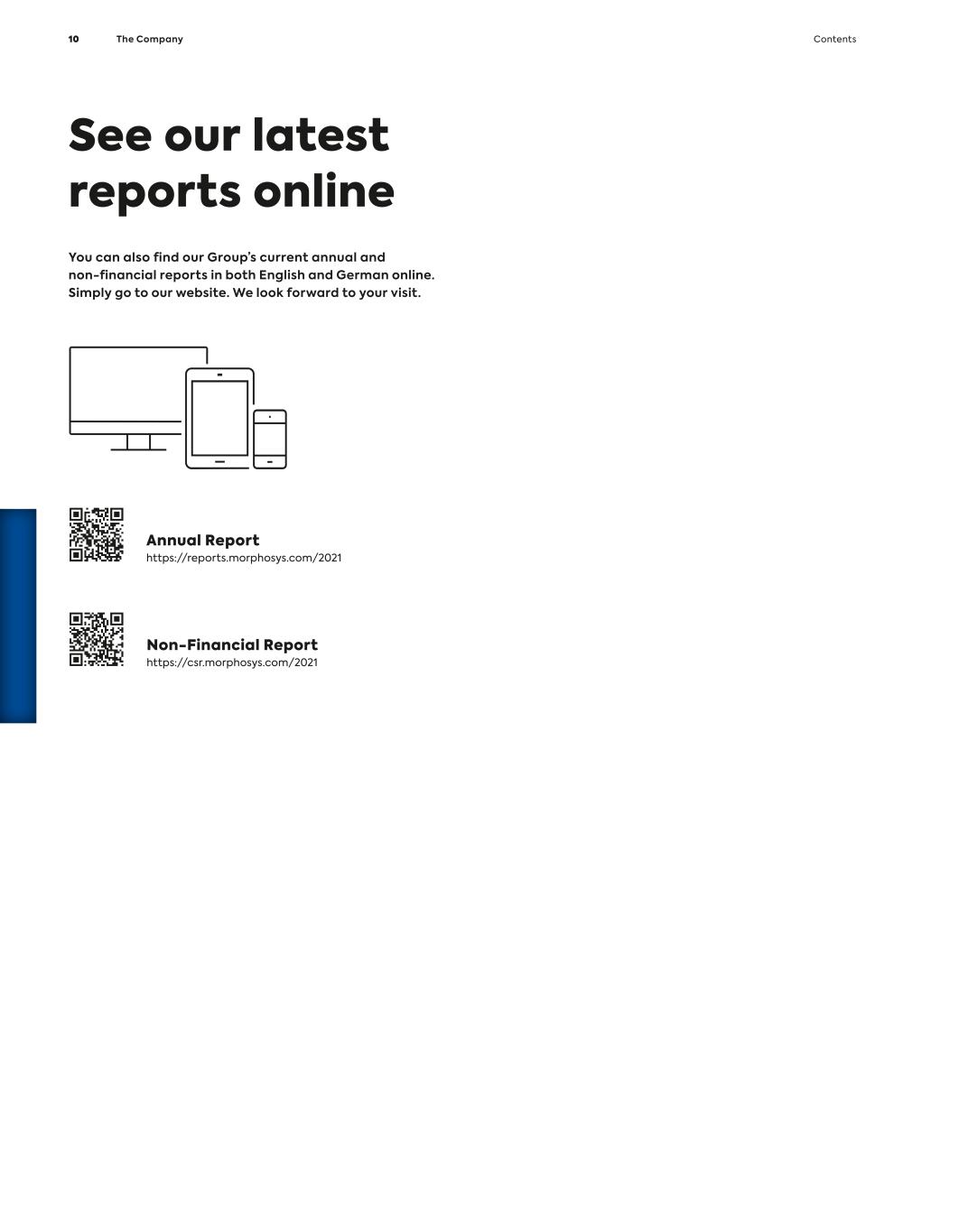

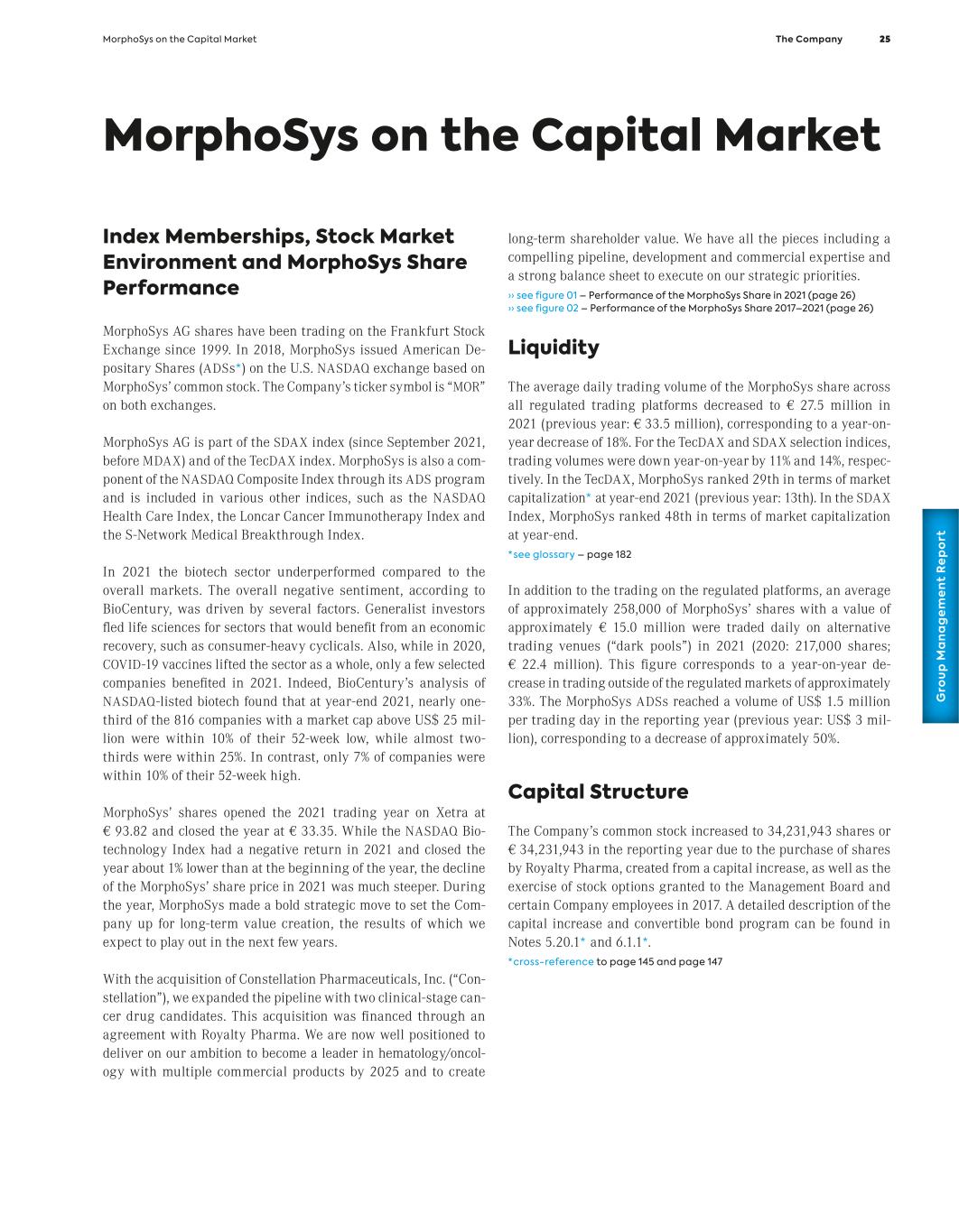

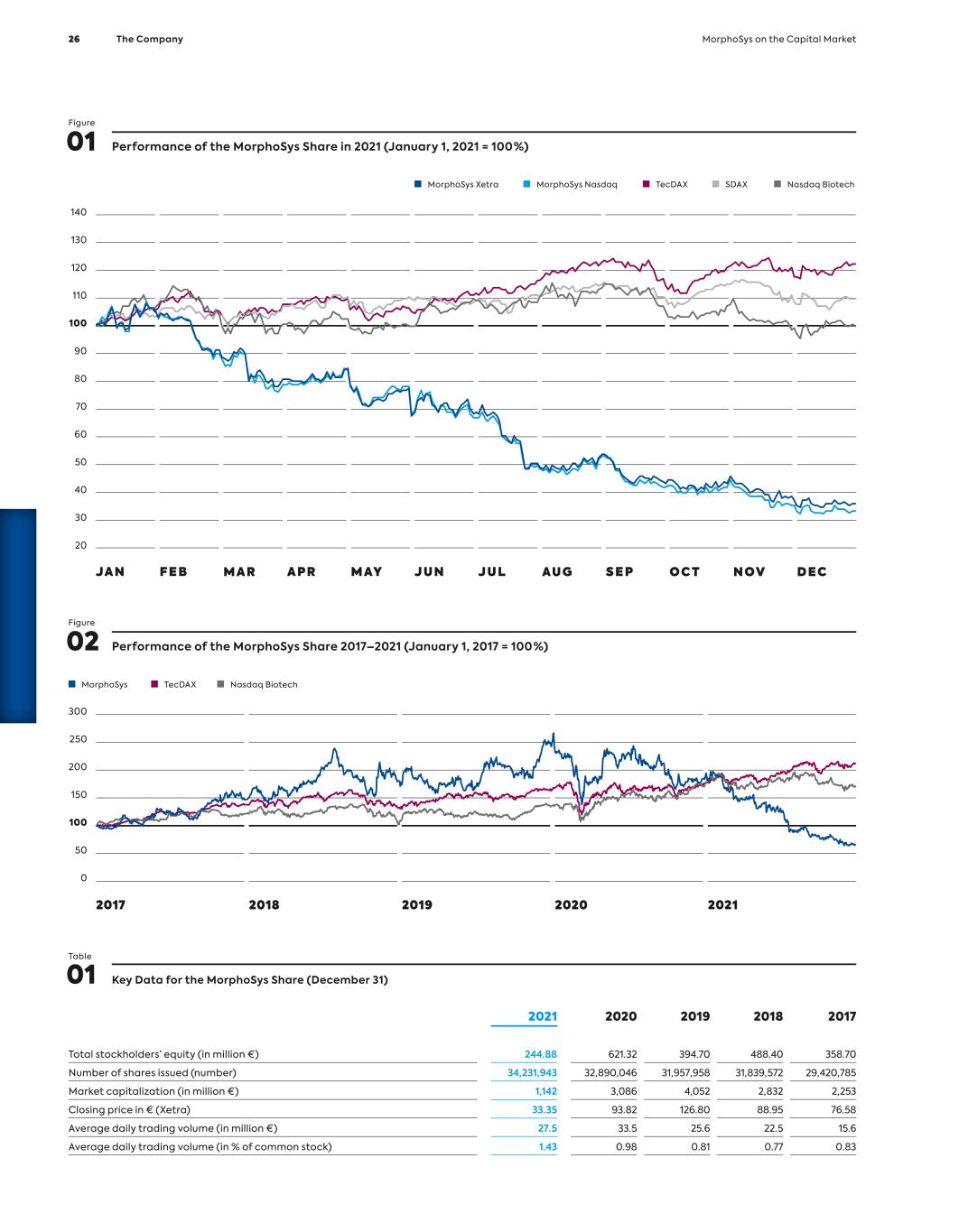

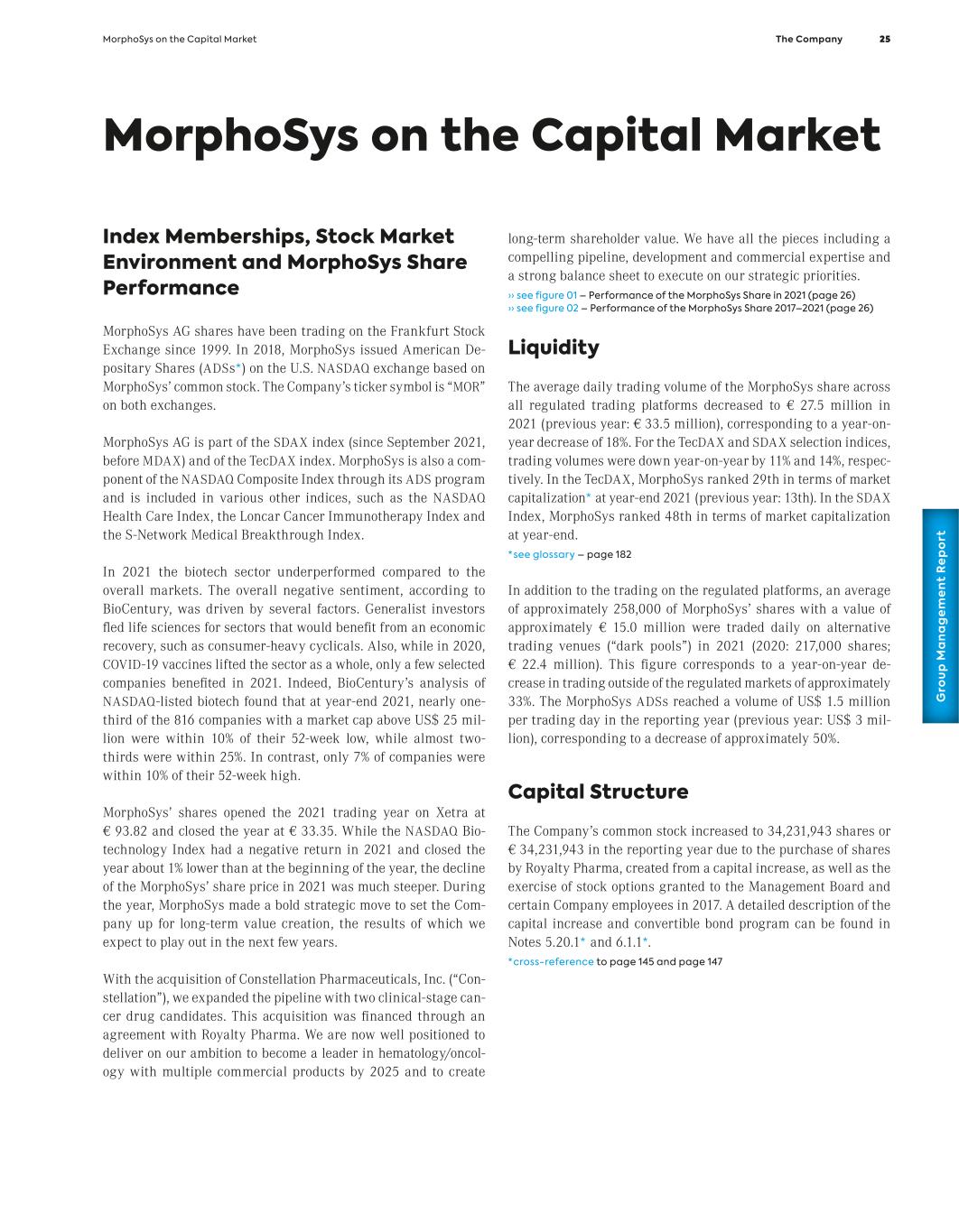

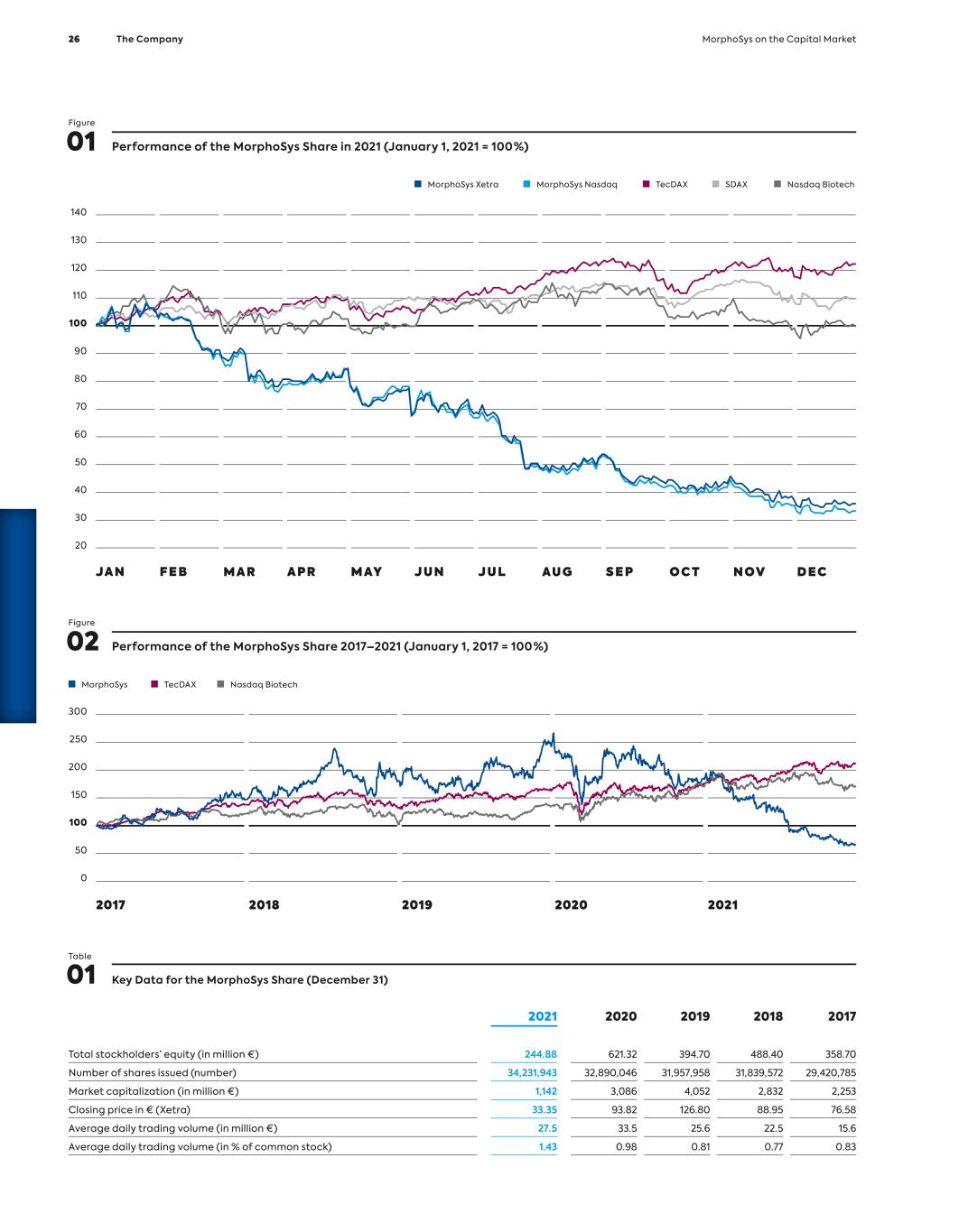

G ro up M a na g em en t R ep o rt MorphoSys on the Capital Market Index Memberships, Stock Market Environment and MorphoSys Share Performance MorphoSys AG shares have been trading on the Frankfurt Stock Exchange since 1999. In 2018, MorphoSys issued American De- positary Shares (ADSs*) on the U.S. NASDAQ exchange based on MorphoSys’ common stock. The Company’s ticker symbol is “MOR” on both exchanges. MorphoSys AG is part of the SDAX index (since September 2021, before MDAX) and of the TecDAX index. MorphoSys is also a com- ponent of the NASDAQ Composite Index through its ADS program and is included in various other indices, such as the NASDAQ Health Care Index, the Loncar Cancer Immunotherapy Index and the S-Network Medical Breakthrough Index. In 2021 the biotech sector underperformed compared to the overall markets. The overall negative sentiment, according to BioCentury, was driven by several factors. Generalist investors fled life sciences for sectors that would benefit from an economic recovery, such as consumer-heavy cyclicals. Also, while in 2020, COVID-19 vaccines lifted the sector as a whole, only a few selected companies benefited in 2021. Indeed, BioCentury’s analysis of NASDAQ-listed biotech found that at year-end 2021, nearly one- third of the 816 companies with a market cap above US$ 25 mil- lion were within 10% of their 52-week low, while almost two- thirds were within 25%. In contrast, only 7% of companies were within 10% of their 52-week high. MorphoSys’ shares opened the 2021 trading year on Xetra at € 93.82 and closed the year at € 33.35. While the NASDAQ Bio- technology Index had a negative return in 2021 and closed the year about 1% lower than at the beginning of the year, the decline of the MorphoSys’ share price in 2021 was much steeper. During the year, MorphoSys made a bold strategic move to set the Com- pany up for long-term value creation, the results of which we expect to play out in the next few years. With the acquisition of Constellation Pharmaceuticals, Inc. (“Con- stellation”), we expanded the pipeline with two clinical-stage can- cer drug candidates. This acquisition was financed through an agreement with Royalty Pharma. We are now well positioned to deliver on our ambition to become a leader in hematology/oncol- ogy with multiple commercial products by 2025 and to create long-term shareholder value. We have all the pieces including a compelling pipeline, development and commercial expertise and a strong balance sheet to execute on our strategic priorities. ›› see figure 01 – Performance of the MorphoSys Share in 2021 (page 26) ›› see figure 02 – Performance of the MorphoSys Share 2017–2021 (page 26) Liquidity The average daily trading volume of the MorphoSys share across all regulated trading platforms decreased to € 27.5 million in 2021 (previous year: € 33.5 million), corresponding to a year-on- year decrease of 18%. For the TecDAX and SDAX selection indices, trading volumes were down year-on-year by 11% and 14%, respec- tively. In the TecDAX, MorphoSys ranked 29th in terms of market capitalization* at year-end 2021 (previous year: 13th). In the SDAX Index, MorphoSys ranked 48th in terms of market capitalization at year-end. * see glossary – page 182 In addition to the trading on the regulated platforms, an average of approximately 258,000 of MorphoSys’ shares with a value of approximately € 15.0 million were traded daily on alternative trading venues (“dark pools”) in 2021 (2020: 217,000 shares; € 22.4 million). This figure corresponds to a year-on-year de- crease in trading outside of the regulated markets of approximately 33%. The MorphoSys ADSs reached a volume of US$ 1.5 million per trading day in the reporting year (previous year: US$ 3 mil- lion), corresponding to a decrease of approximately 50%. Capital Structure The Company’s common stock increased to 34,231,943 shares or € 34,231,943 in the reporting year due to the purchase of shares by Royalty Pharma, created from a capital increase, as well as the exercise of stock options granted to the Management Board and certain Company employees in 2017. A detailed description of the capital increase and convertible bond program can be found in Notes 5.20.1* and 6.1.1*. * cross-reference to page 145 and page 147 MorphoSys on the Capital Market MorphoSys on the Capital Market MorphoSys on the Capital Market The Company 25

JAN FE B MAR APR MAY JUN JUL AUG SE P OC T NOV DEC TecDAX MorphoSys Nasdaq MorphoSys Xetra SDAX Nasdaq Biotech TecDAX MorphoSys Nasdaq Biotech 140 130 120 110 100 90 80 70 60 50 40 30 20 300 250 200 150 100 50 0 2017 2018 2019 2020 2021 Figure 01 Performance of the MorphoSys Share in 2021 (January 1, 2021 = 100 %) Figure 02 Performance of the MorphoSys Share 2017–2021 (January 1, 2017 = 100 %) Table 01 Key Data for the MorphoSys Share (December 31) 2021 2020 2019 2018 2017 Total stockholders’ equity (in million €) 244.88 621.32 394.70 488.40 358.70 Number of shares issued (number) 34,231,943 32,890,046 31,957,958 31,839,572 29,420,785 Market capitalization (in million €) 1,142 3,086 4,052 2,832 2,253 Closing price in € (Xetra) 33.35 93.82 126.80 88.95 76.58 Average daily trading volume (in million €) 27.5 33.5 25.6 22.5 15.6 Average daily trading volume (in % of common stock) 1.43 0.98 0.81 0.77 0.83 26 The Company MorphoSys on the Capital Market

G ro up M a na g em en t R ep o rt Various voting rights notifications were made pursuant to Section 33 (1) of the German Securities Trading Act (WpHG) during the reporting year. The notifications were published on the MorphoSys website under Investors – Stock Information – Voting Rights. At the end of the reporting year, the free float in MorphoSys AG shares, as per the definition of Deutsche Börse, was 99.76%. Dividend Policy We have not distributed dividends since our inception, and we do not expect to set or distribute any cash dividends in the foresee- able future. It is our intention to invest any future profits in the growth and development of our business. Unless otherwise re- quired by law, the future determination of any cash dividends will be at the sole discretion of the Management Board and Super- visory Board and will depend on our net assets, financial position, results of operations, capital requirements and other factors that the Management Board and Supervisory Board deem relevant. Investor Relations Activities Since March 2020, with the onset of the COVID-19 pandemic, interactions with shareholders, investors and analysts have been taking place digitally to a much greater extent than before. The impact of this has been particularly evident on investor confer- ences, whose added value has always been the direct personal exchange with a broad spectrum of market participants and resulting networking. While the pandemic revealed that increas- ing digitalization saves travel time and costs, it also showed that established processes and contacts needed to adapt even better to the changed digital environment. During the reporting year, MorphoSys participated in 20 international investor conferences and investment banking events. The year 2021 began with the J.P. Morgan Healthcare Conference, where the medical and com- mercial potential of tafasitamab were presented together with an outlook for the rest of the pipeline. The vast majority of investor conferences in 2021 were held using various virtual formats. MorphoSys held conference calls in the reporting year with the publication of its annual, half-year and quarterly reports. These calls could be followed over the Internet. During these calls, the Management Board reported on business developments and an- swered questions from participants. At the analyst and investor meetings, the main topics addressed were the advances made in Monjuvi®’s commercialization, the further progress of tafasitamab’s clinical development, the acqui- sition of Constellation and, its lead product pelabresib, and cash runway. On June 2, 2021, MorphoSys hosted a conference call and webcast on the acquisition of Constellation. During the call, management presented the clinical development candidates pelabresib and CPI-0209 and explained their medical and commercial potential in a number of oncology indications. At the end of 2021, 18 analysts were monitoring and evaluating the performance of MorphoSys shares (previous year: 20). These analysts had the following recommendations at the end of 2021: Table 02 Analyst Recommendations (December 31, 2021) Buy/Overweight/Market Outperform Hold/Neutral Reduce/Underperform 9 9 0 Buy/Overweight/Market Outperform = buy/positive; Hold/Neutral = neutral; Reduce/Underperform = sell/negative. Further detailed information on MorphoSys’ shares, key financial figures, events and conferences, can be found on the Company’s website under Investors. MorphoSys on the Capital Market The Company 27

Non-Financial Group Report https://csr.morphosys.com/2021 Non-Financial Group Report We are conscious of the responsibility we share for present and future generations and see sustainable action as a prerequisite for long-term business success. MorphoSys is dedicated to the discovery, development and commercialization of outstanding, innovative therapies for patients, with a focus on cancer and auto- immune diseases. To ensure sustainable business success, we incorporate Environmental, Social and Governance (ESG) into our daily business and base our business model on sustainable growth that is aligned with the interests of stakeholders. We are focused on creating long-term value and weigh our actions in terms of their impact on the environment, society, patients and employees. A detailed explanation of our view of sustainable corporate gover- nance and the specific measures we have taken during the re- porting year can be found in the separate “Non-Financial Group Report,” available on our website under https://csr.morphosys. com/2021. Non-Financial Group Report 28 The Company Non-Financial Group Report

02Contents Group Management Report Fundamentals of the MorphoSys Group 34 Macroeconomic and Sector-Specific Conditions 51 Analysis of Net Assets, Financial Position and Results of Operations 52 Outlook and Forecast 69 Risk and Opportunity Report 73 Subsequent Events 84 Statement on Corporate Governance, Group Statement on Corporate Governance and Report on Corporate Governance 85 G ro up M a na g em en t R ep o rt Group Management Report 29

Summary In 2021, MorphoSys continued its work to discover, develop and commercialize, innovative therapies for patients, with a focus on cancer and autoimmune diseases. In July 2021, we completed the acquisition of Constellation Pharmaceuticals Inc. (“Constel- lation”). The addition of Constellation offers a transformational growth opportunity for MorphoSys, expanding our pipeline in a meaningful way with two clinical-stage cancer drug candidates. In addition to this major corporate event, we continued to make progress with our existing programs. At the time of the Constella- tion acquisition, we also entered into a funding agreement with Royalty Pharma plc. Our lead program, tafasitamab, is already on the market in the U.S. under the brand name Monjuvi (tafasitamab-cxix). Monjuvi (tafasitamab-cxix) has been approved under accelerated approval by the U.S. FDA in July 2020. Together with Incyte, we are co-promoting Monjuvi in the U.S. Incyte holds exclusive rights for development and commercialization outside the U.S. In August 2021, the European Commission (EC) granted condi- tional marketing authorization for Minjuvi® (tafasitamab) in Europe in combination with lenalidomide, followed by Minjuvi monotherapy, for the treatment of adult patients with relapsed or refractory (r/r) diffuse large B-cell lymphoma (DLBCL) who are not eligible for autologous stem cell transplant (ASCT). Also in August 2021, Health Canada granted Incyte a Notice of Com- pliance with conditions for Minjuvi (tafasitamab) in combination with lenalidomide for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low- grade lymphoma, who are not eligible for ASCT. In January 2021, a marketing authorization application for tafasitamab was accepted for review by regulatory authorities in Switzerland. 30 Group Management Report

Fi na nc ia l S ta te m en ts To further broaden the tafasitamab opportunity, during 2021, MorphoSys initiated the frontMIND study, a pivotal phase 3 trial in patients with first-line DLBCL. Also, MorphoSys and Incyte announced the first patient dosed in inMIND, a phase 3 study in patients with r/r follicular lymphoma or r/r marginal zone lym- phoma (MZL). In June 2021, MorphoSys and Incyte announced new three-year follow-up data from the phase 2 L-MIND study of tafasitamab in combination with lenalidomide in adult pa- tients with r/r DLBCL. The new results built on previous findings showing durable responses and a consistent safety profile of ta- fasitamab in combination with lenalidomide followed by tafasi- tamab monotherapy. In December 2021, additional results from the RE-MIND2 dataset comparing tafasitamab and lenalido- mide outcomes to those observed in matched cohorts of 1) po- latuzumab vedotin plus bendamustine and rituximab (pola-BR), 2) rituximab plus lenalidomide (R2); and 3) CAR-T therapies were presented. The findings suggested that tafasitamab plus lena- lidomide may improve health outcomes compared to pola-BR and R2, with a prolonged survival benefit for r/r DLBCL patients. Comparable overall survival (OS) between tafasitamab and lenalidomide and CAR-T therapies was observed. Pelabresib is a late-stage proprietary program that MorphoSys acquired through the Constellation acquisition. We are currently conducting two clinical trials of pelabresib for the treatment of myelofibrosis (MF): MANIFEST, our ongoing, open-label phase 2 clinical trial evaluating pelabresib both as a monotherapy and in combination with ruxolitinib, and MANIFEST-2, our global, dou- ble-blinded, randomized pivotal phase 3 study evaluating pela- bresib in combination with ruxolitinib versus placebo in JAK-in- hibitor-naïve MF patients. Exploratory data from the MANIFEST trial were presented at the European Hematology Association (EHA) Annual Meeting in June 2021. Translational data across all Summary Group Management Report 31

three arms of the study illustrated the effect of pelabresib on key cytokines associated with MF and its impact on bone mar- row fibrosis. Taken together, these data support our hypothesis that pelabresib may have a potential disease-modifying activ- ity in MF. At the American Society of Hematology (ASH) Annual Meeting in December 2021, we presented updated interim clini- cal and translational data from the ongoing MANIFEST trial, which included 54 more patients and longer-term follow-up than previously reported data. We believe that the latest interim data from MANIFEST underscore the potential of pelabresib in the treatment of MF. With respect to MANIFEST-2, MorphoSys has optimized the study design and implemented measures to accelerate patient recruitment since the acquisition of Constel- lation. Progress was also made with programs in earlier stages of clinical development. Interim data from the phase 1/2 proof- of-concept M-PLACE trial that evaluates felzartamab in an- ti-PLA2R antibody positive membranous nephropathy (MN) were presented in November 2021. Early efficacy data were pre- sented: of the 27 treated patients with evaluable results, 24 showed an initial rapid reduction of anti-PLA2R antibody levels one week after the first treatment. The safety profile was shown to be consistent with the proposed mechanism of action of felz- artamab. The trial was fully enrolled in November 2021. Two ad- ditional trials with felzartamab were initiated during 2021 – New-PLACE, a phase 2 study evaluating different treatment schedules to identify the regimen for a pivotal study in patients with anit-PLA2R-antibody positive MN, and the phase 2 IGNAZ trial evaluating felzartamab in patients with immunoglobulin A nephropathy (IgAN). 32 Group Management Report Summary

Fi na nc ia l S ta te m en ts CPI-0209 is another product candidate acquired through Con- stellation. CPI-0209 is a small molecule designed to promote anti-tumor activity by specifically inhibiting the enzymatic function of enhancer of zeste homolog 2 (EZH2) protein. We are currently conducting a phase 1/2 clinical trial of CPI-0209 in pa- tients with solid tumors and hematological malignancies. Our partners responsible for clinical development of licensed programs also continued their activities during 2021. For exam- ple, in June I-Mab announced that the Center for Drug Evalua- tion (CDE) of the China National Medical Products Administra- tion (NMPA) had approved the Investigational New Drug (IND) application to initiate a phase 1b study with felzartamab in pa- tients with systemic lupus erythematosus (SLE), the most com- mon form of lupus. In October, licensing partner Roche received Breakthrough Therapy Designation from the U.S. Food and Drug Administration (FDA) for gantenerumab for the treatment of people living with Alzheimer’s disease. Also in October 2021, li- censing partner GSK announced that it had made the decision not to further explore otilimab as a potential treatment for se- vere pulmonary COVID-19- related disease in patients aged of 70 years and older. Clinical development of otilimab in rheuma- toid arthritis remains ongoing. In 2021, MorphoSys continued to transform the Company with activities focused on advancing and positioning the Company for long-term success. We grew sales of Monjuvi, while also broadening our pipeline through a transformative acquisition. Summary Group Management Report 33

Fundamentals of the MorphoSys Group Organizational Structure and Business Model MorphoSys AG, as the ultimate parent company, is located in Planegg, near Munich. MorphoSys AG has one wholly owned sub- sidiary, MorphoSys US Inc. (Boston, Massachusetts, USA). MorphoSys US Inc. in turn has a wholly owned subsidiary - Con- stellation Pharmaceuticals, Inc. (Cambridge, Massachusetts, USA). Constellation Pharmaceuticals, Inc. also has a wholly owned subsidiary, Constellation Securities Corp. (Cambridge, Massachusetts, USA). Constellation Pharmaceuticals, Inc. and Constellation Securities Corp. are collectively referred to as “Con- stellation”, and all entities constitute the “MorphoSys Group” or “Group”. Following the acquisition on July 15, 2021, Constellation Pharma- ceuticals Inc. was merged into MorphoSys Development Inc., which was incorporated as a wholly owned subsidiary of MorphoSys US Inc. on May 28, 2021, in accordance with the merger agreement. From this upward merger, Constellation Phar- maceuticals Inc. remained as a wholly owned subsidiary of MorphoSys US Inc. The Planegg site MorphoSys AG houses the central corporate functions such as accounting, controlling, human resources, le- gal, patents, purchasing, corporate communications and investor relations, as well as the scientific research departments and labo- ratories. MorphoSys US Inc. is responsible for advancing tafasi- tamab’s* commercialization. Constellation focuses its activities on the clinical development of drug candidates and the related administrative departments. Further information on the Group’s overall structure can be found in Note 2.2.1*. * cross-reference to page 117 Legal Structure of the Morphosys Group: Group Management and Supervision The parent company of the MorphoSys Group is MorphoSys AG, a German stock corporation listed in the Prime Standard segment of the Frankfurt Stock Exchange and on the NASDAQ Global Mar- ket. In accordance with the German Stock Corporation Act, the Company has a dual management structure with the Manage- ment Board as the governing body. The four members of the Man- agement Board are appointed and supervised by the Supervisory Board. Following the departure of Roland Wandeler, Ph.D., Chief Operating Officer, effective December 31, 2021, the Management Board consists of only three members. The Supervisory Board of MorphoSys AG is elected by the Annual General Meeting and cur- rently consists of six members. Detailed information on the Group’s management and supervision and its corporate gover- nance principles can be found in the Corporate Governance Re- port. Targets and Strategy MorphoSys mission is to discover, develop and commercialize in- novative therapies for patients. MorphoSys is a fully integrated commercial biopharmaceutical company. Its activities in 2021 focused on hematology/oncology and autoimmune diseases. The Company aims to realize intermediate- and long-term growth through its focus on proprietary drug development and commer- cialization. Through the acquisition of Constellation, the Com- pany has rapidly expanded its pipeline in the hematology/oncol- ogy area. Our priority is on the Company’s lead development candidates pelabresib and tafasitamab; continuing to make progress with the commercialization of Monjuvi and obtaining approvals in addi- tional indications; bringing pelabresib to the market as well as continuing to develop other clinical candidates. Fundamentals of the MorphoSys Group 34 Group Management Report Fundamentals of the MorphoSys Group

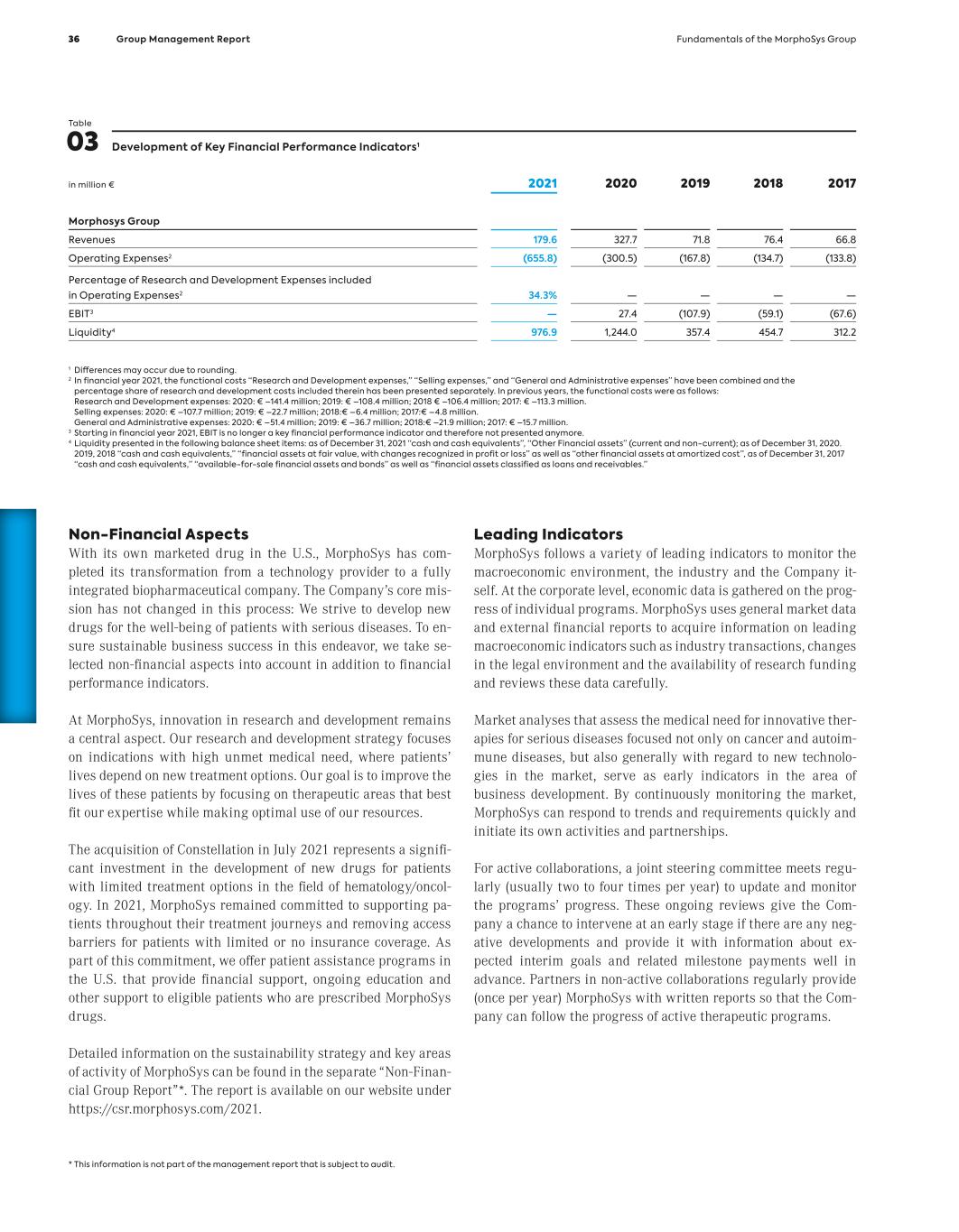

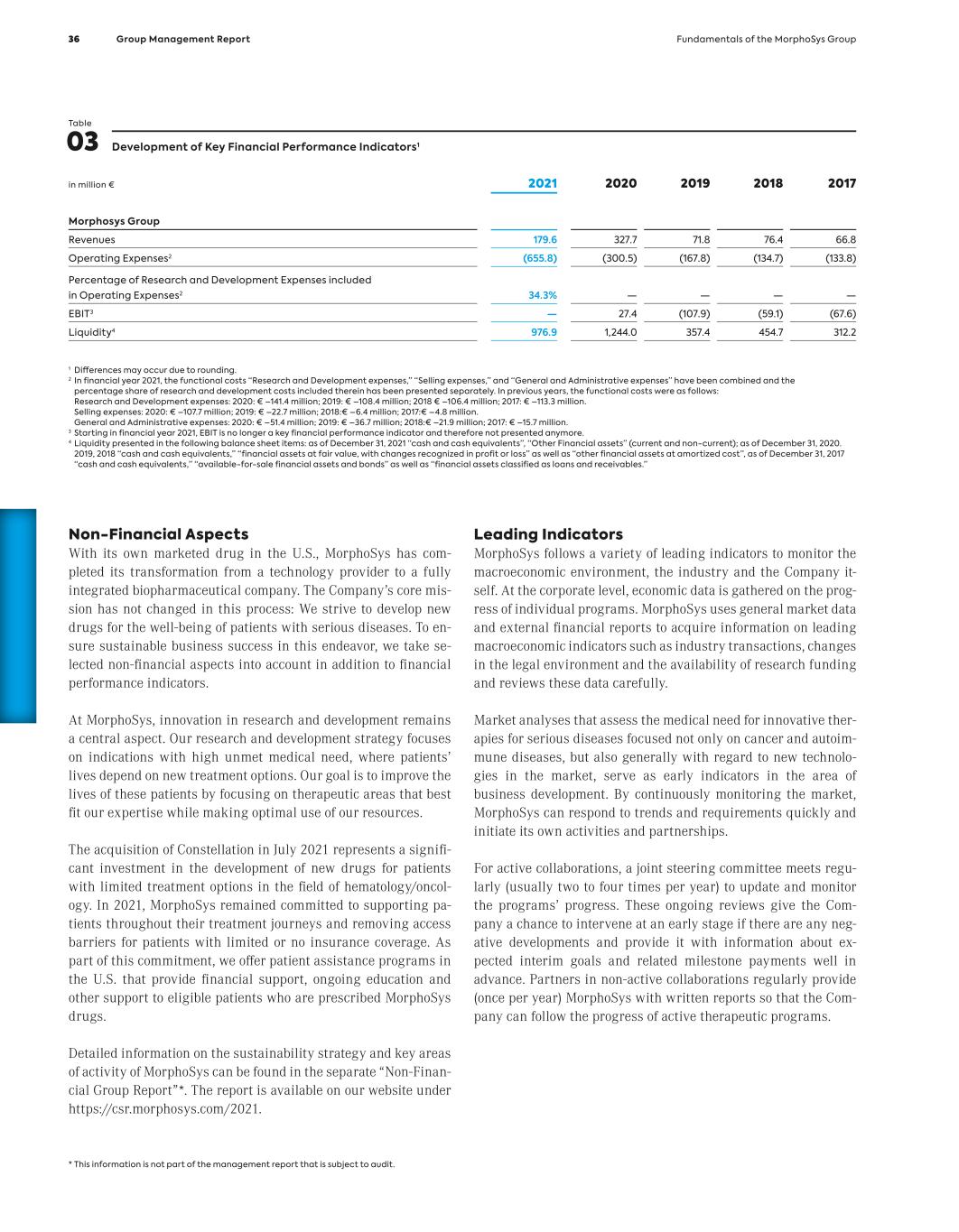

Fi na nc ia l S ta te m en ts MorphoSys is now primarily advancing the clinical development of its own compounds, with further antibody candidates being clinically developed by partners. During the clinical phases, deci- sions are made on a case-by-case basis as to whether and at what point a partnership for further development and commercializa- tion should be pursued. Drug candidates can be either fully out-li- censed, developed on a proprietary basis or with a partner (co-de- velopment). The development of drug candidates on behalf of other companies is no longer a focus of MorphoSys’ business activities. As such, the previous segment reporting for the Proprietary Development and Partnered Discovery segments was discontinued as of the first quarter of 2021. The development of drug candidates is broadly based on MorphoSys’ innovative technologies. These include our estab- lished antibody and technology platforms HuCAL®*, Ylanthia®* and Slonomics®*, as well as the bispecific technology CyCAT®. Under the agreement signed with Cherry Biolabs in November 2020, MorphoSys was granted exclusive access to the Hemibody technology* for several targets*, which will be used to develop a novel multispecific antibody technology for effector cell recruit- ment (T-cell* engager). We continue to leverage our resources and know-how to expand and develop these technologies. This may include the expansions of our portfolio not only through our own proprietary research and development activities but also through in-licensing and acquisitions. * see glossary – page 182 Group Management and Performance Indicators MorphoSys uses financial indicators to steer the Group. These in- dicators help to monitor the success of strategic decisions and give the Group the opportunity to take quick corrective action when necessary. The Company’s management also monitors and evaluates selected early indicators so that it can thoroughly as- sess a project’s progress and promptly take the appropriate ac- tions should a problem occur. No most important non-financial performance indicators are used for steering the Company. Mate- rial non-financial aspects are taken into account in a separate “Non-Financial Group Report”, which is available on our website. Financial Performance Indicators The development of the significant financial performance indica- tors in the reporting year is described in detail in the chapter “Analysis of Net Assets, Financial Position and Results of Opera- tions”. The key financial indicators used to measure the Compa- ny’s operating performance are revenues, operating expenses and percentage of research and development expenses included therein. Starting 2022, Monjuvi U.S. net product sales, the gross margin of Monjuvi U.S. net product sales, Research and Development ex- penses, as well as total combined expenses for Selling and Gen- eral & Administrative will be used as key financial performance indicators, since these indicators are the most significant for steering MorphoSys Group. These indicators are routinely ana- lyzed and evaluated. As an additional factor, the liquidity position (presented in the following balance sheet items: “Cash and cash equivalents” as well as “Other financial assets (current and non-current)” is also regularly analyzed and evaluated. Liquidity position is not con- sidered to be part of the key financial performance indicators. The budget for the respective financial year is approved by the Management Board and Supervisory Board. Subsequent to the approval of the budget, a forecast is made two times within the year to assess if the Company is on track to achieve its financial goals and progress towards financial guidance. The forecast in- forms decision-making and enables management to take actions to achieve its goals. Fundamentals of the MorphoSys Group Group Management Report 35

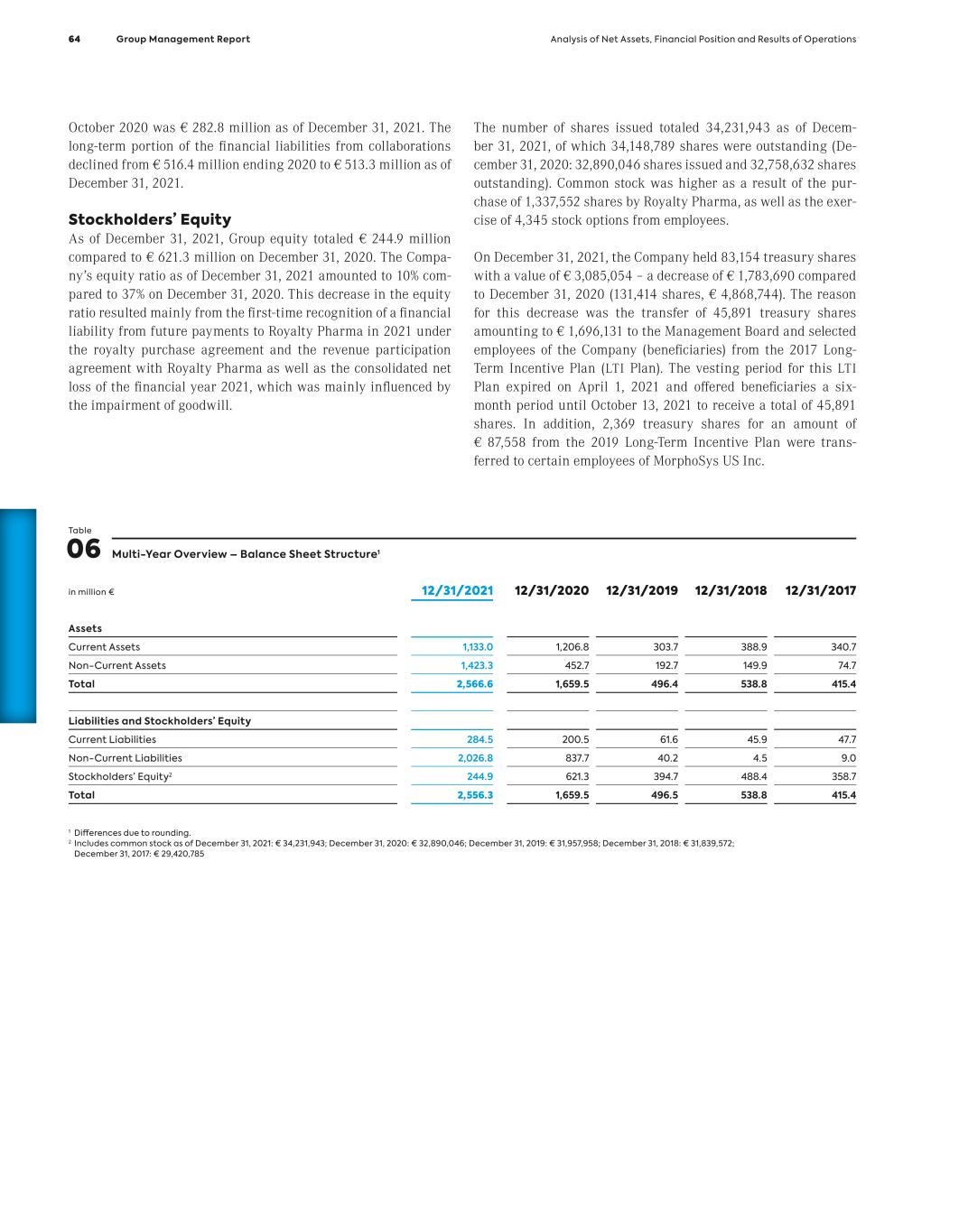

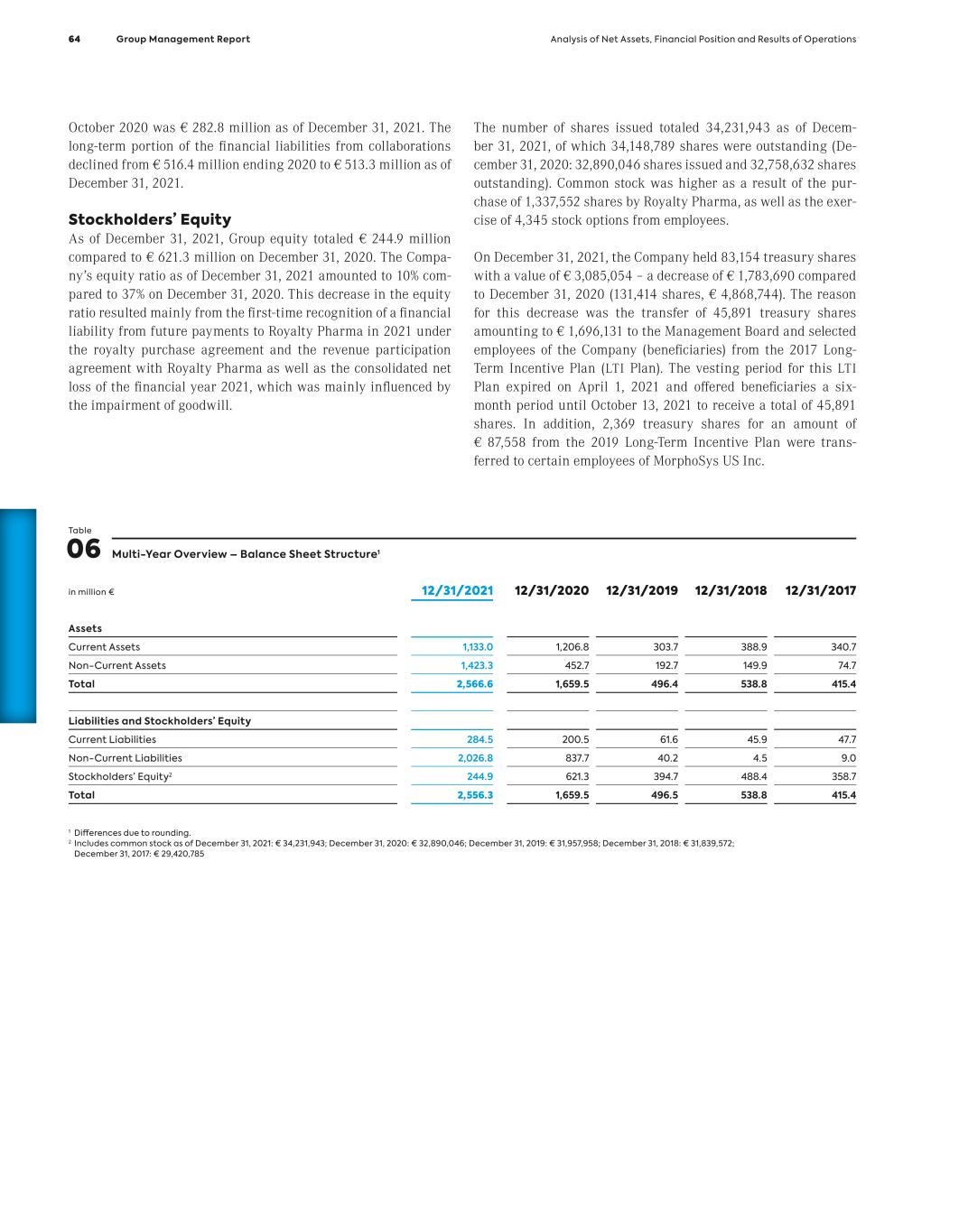

Table 03 Development of Key Financial Performance Indicators1 in million € 2021 2020 2019 2018 2017 Morphosys Group Revenues 179.6 327.7 71.8 76.4 66.8 Operating Expenses2 (655.8) (300.5) (167.8) (134.7) (133.8) Percentage of Research and Development Expenses included in Operating Expenses2 34.3% — — — — EBIT3 — 27.4 (107.9) (59.1) (67.6) Liquidity4 976.9 1,244.0 357.4 454.7 312.2 1 Differences may occur due to rounding. 2 In financial year 2021, the functional costs “Research and Development expenses,” “Selling expenses,” and “General and Administrative expenses” have been combined and the percentage share of research and development costs included therein has been presented separately. In previous years, the functional costs were as follows: Research and Development expenses: 2020: € –141.4 million; 2019: € –108.4 million; 2018 € –106.4 million; 2017: € –113.3 million. Selling expenses: 2020: € –107.7 million; 2019: € –22.7 million; 2018:€ –6.4 million; 2017:€ –4.8 million. General and Administrative expenses: 2020: € –51.4 million; 2019: € –36.7 million; 2018:€ –21.9 million; 2017: € –15.7 million. 3 Starting in financial year 2021, EBIT is no longer a key financial performance indicator and therefore not presented anymore. 4 Liquidity presented in the following balance sheet items: as of December 31, 2021 “cash and cash equivalents”, “Other Financial assets” (current and non-current); as of December 31, 2020. 2019, 2018 “cash and cash equivalents,” “financial assets at fair value, with changes recognized in profit or loss” as well as “other financial assets at amortized cost”, as of December 31, 2017 “cash and cash equivalents,” “available-for-sale financial assets and bonds” as well as “financial assets classified as loans and receivables.” Non-Financial Aspects With its own marketed drug in the U.S., MorphoSys has com- pleted its transformation from a technology provider to a fully integrated biopharmaceutical company. The Company’s core mis- sion has not changed in this process: We strive to develop new drugs for the well-being of patients with serious diseases. To en- sure sustainable business success in this endeavor, we take se- lected non-financial aspects into account in addition to financial performance indicators. At MorphoSys, innovation in research and development remains a central aspect. Our research and development strategy focuses on indications with high unmet medical need, where patients’ lives depend on new treatment options. Our goal is to improve the lives of these patients by focusing on therapeutic areas that best fit our expertise while making optimal use of our resources. The acquisition of Constellation in July 2021 represents a signifi- cant investment in the development of new drugs for patients with limited treatment options in the field of hematology/oncol- ogy. In 2021, MorphoSys remained committed to supporting pa- tients throughout their treatment journeys and removing access barriers for patients with limited or no insurance coverage. As part of this commitment, we offer patient assistance programs in the U.S. that provide financial support, ongoing education and other support to eligible patients who are prescribed MorphoSys drugs. Detailed information on the sustainability strategy and key areas of activity of MorphoSys can be found in the separate “Non-Finan- cial Group Report”*. The report is available on our website under https://csr.morphosys.com/2021. Leading Indicators MorphoSys follows a variety of leading indicators to monitor the macroeconomic environment, the industry and the Company it- self. At the corporate level, economic data is gathered on the prog- ress of individual programs. MorphoSys uses general market data and external financial reports to acquire information on leading macroeconomic indicators such as industry transactions, changes in the legal environment and the availability of research funding and reviews these data carefully. Market analyses that assess the medical need for innovative ther- apies for serious diseases focused not only on cancer and autoim- mune diseases, but also generally with regard to new technolo- gies in the market, serve as early indicators in the area of business development. By continuously monitoring the market, MorphoSys can respond to trends and requirements quickly and initiate its own activities and partnerships. For active collaborations, a joint steering committee meets regu- larly (usually two to four times per year) to update and monitor the programs’ progress. These ongoing reviews give the Com- pany a chance to intervene at an early stage if there are any neg- ative developments and provide it with information about ex- pected interim goals and related milestone payments well in advance. Partners in non-active collaborations regularly provide (once per year) MorphoSys with written reports so that the Com- pany can follow the progress of active therapeutic programs. * This information is not part of the management report that is subject to audit. 36 Group Management Report Fundamentals of the MorphoSys Group

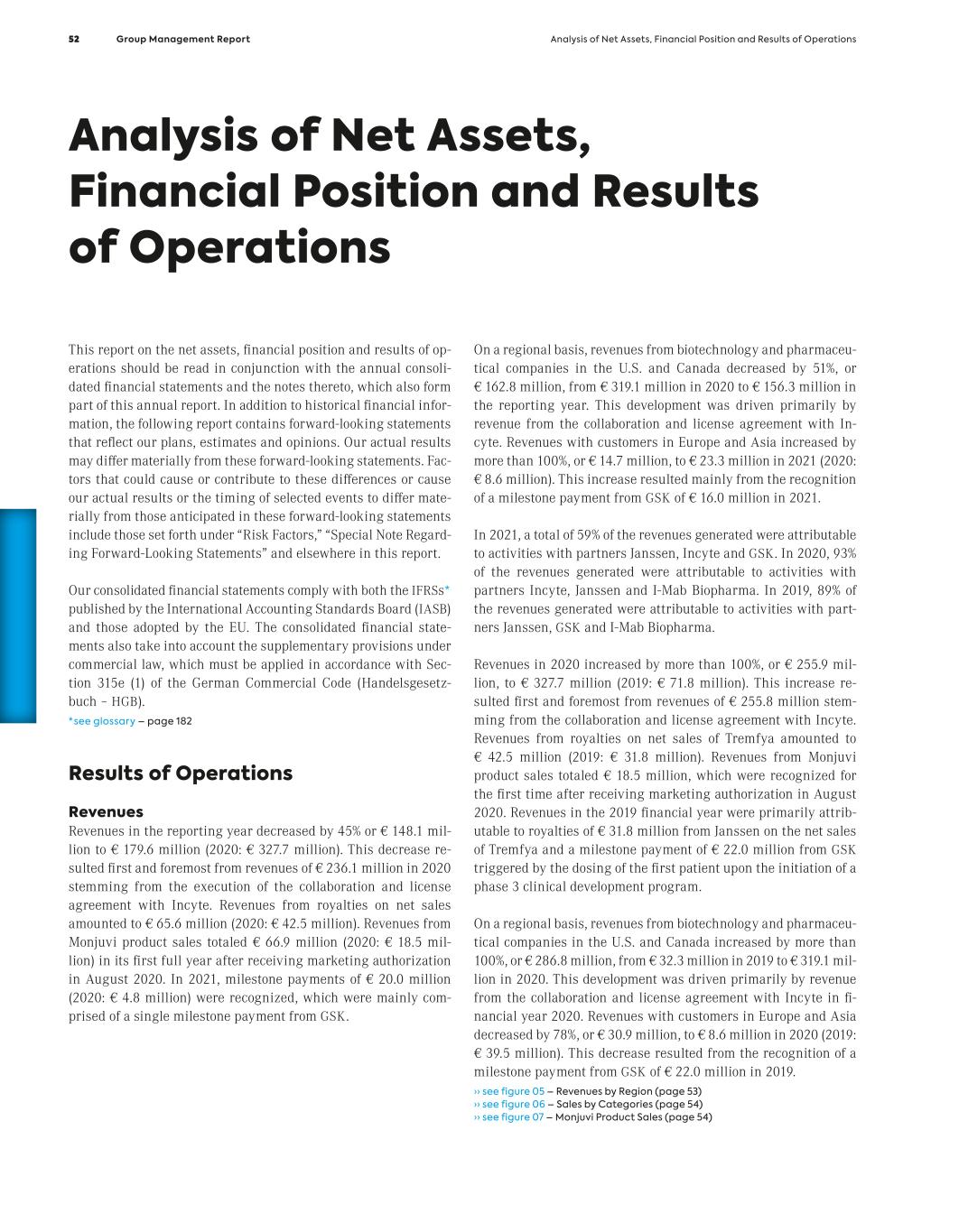

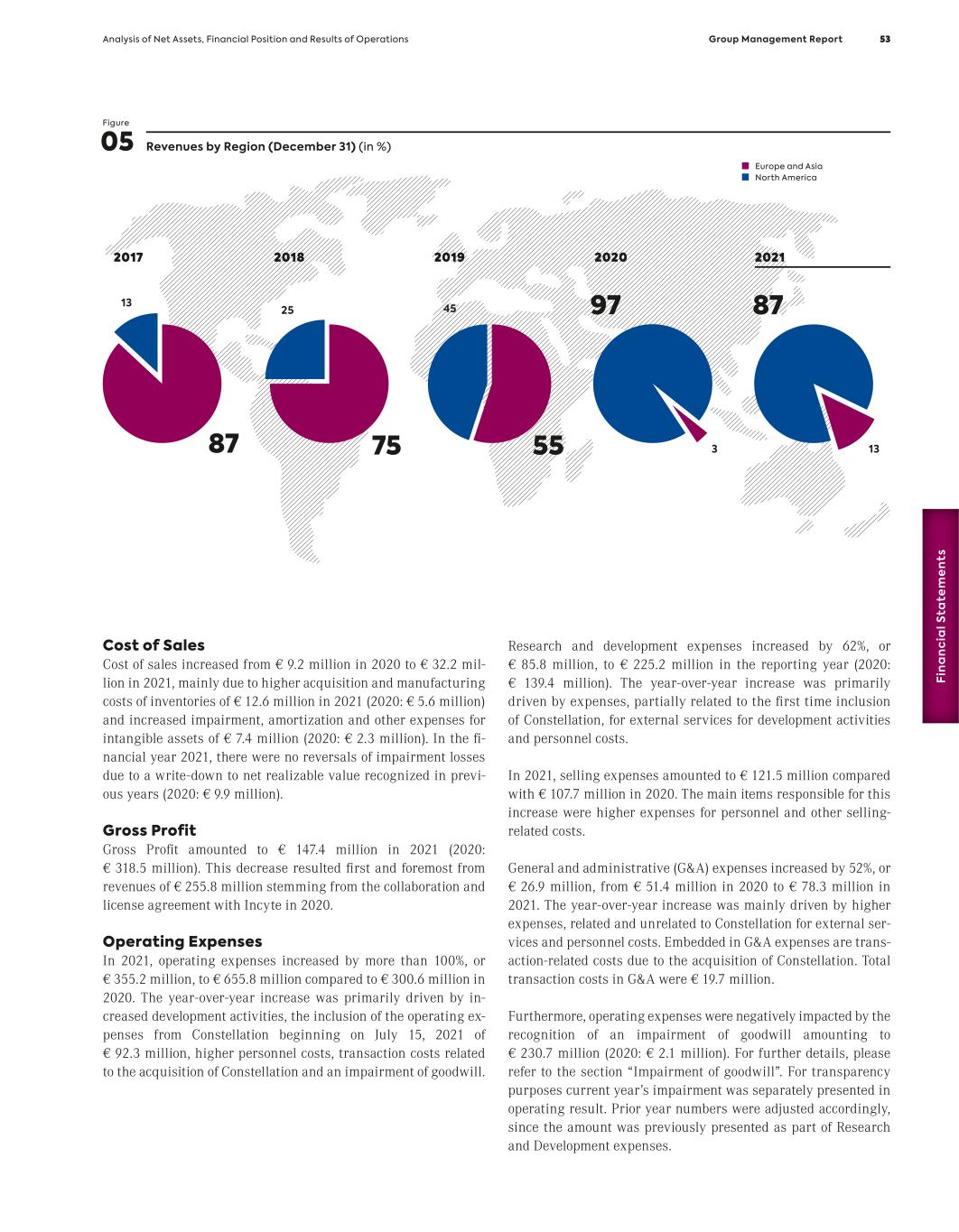

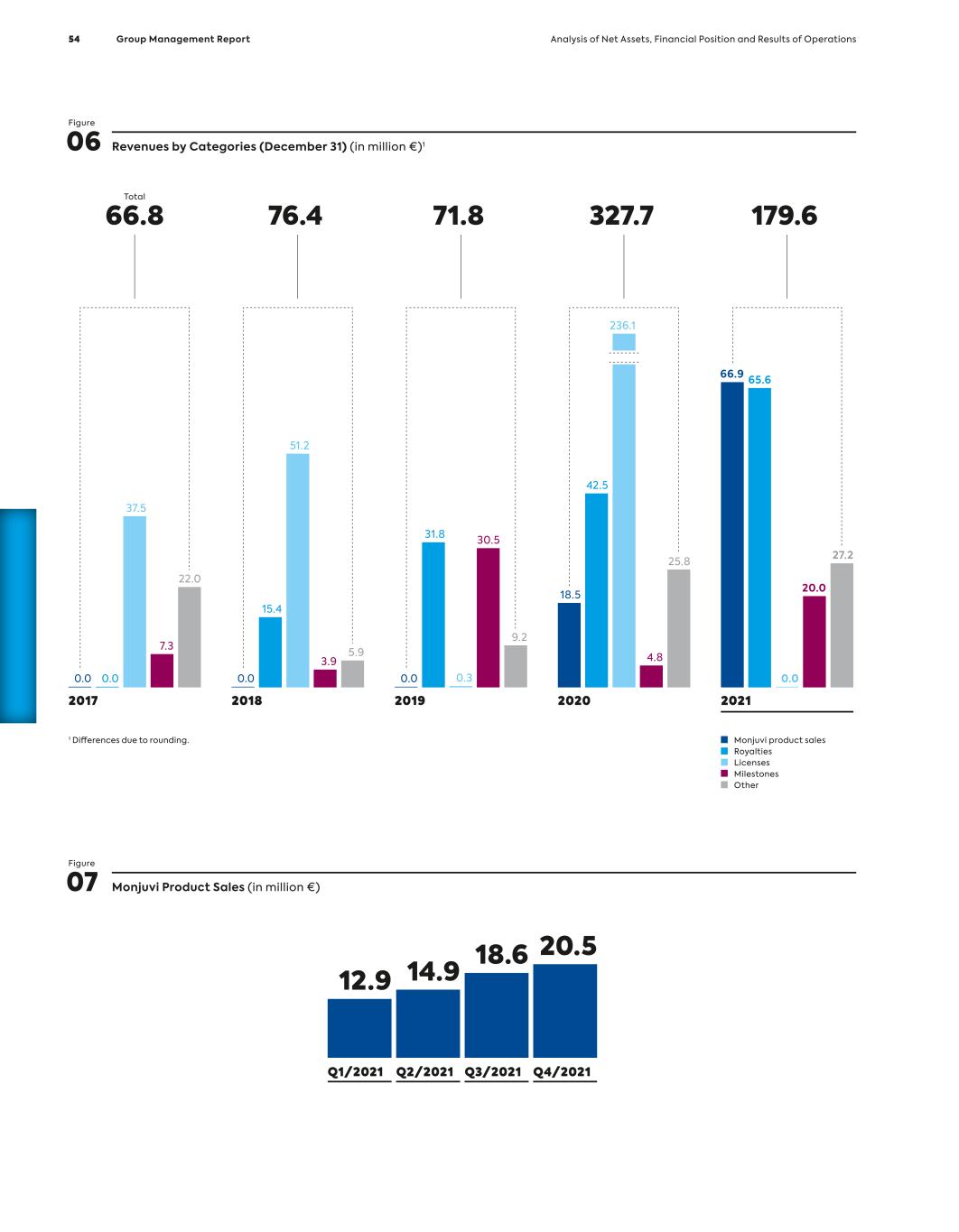

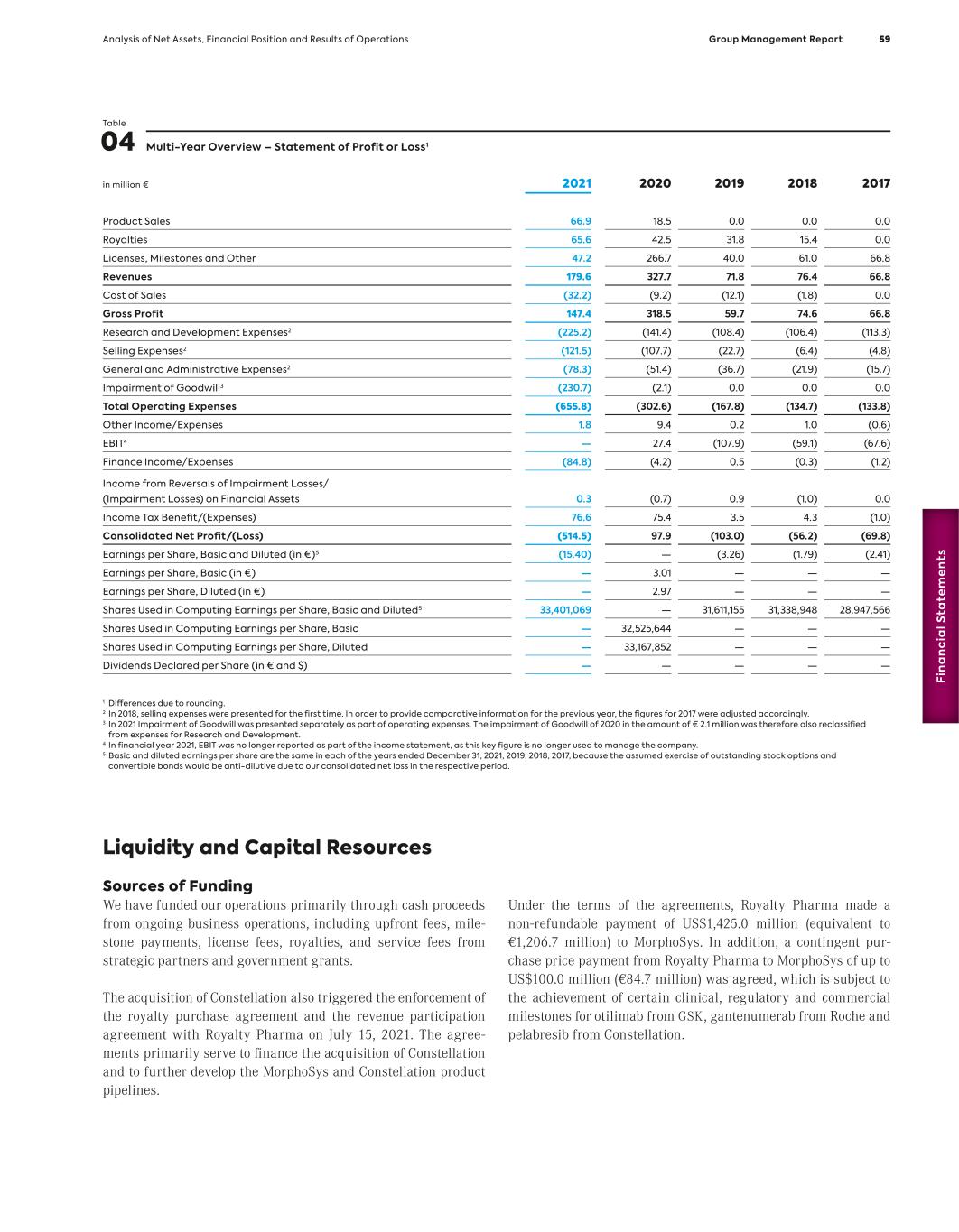

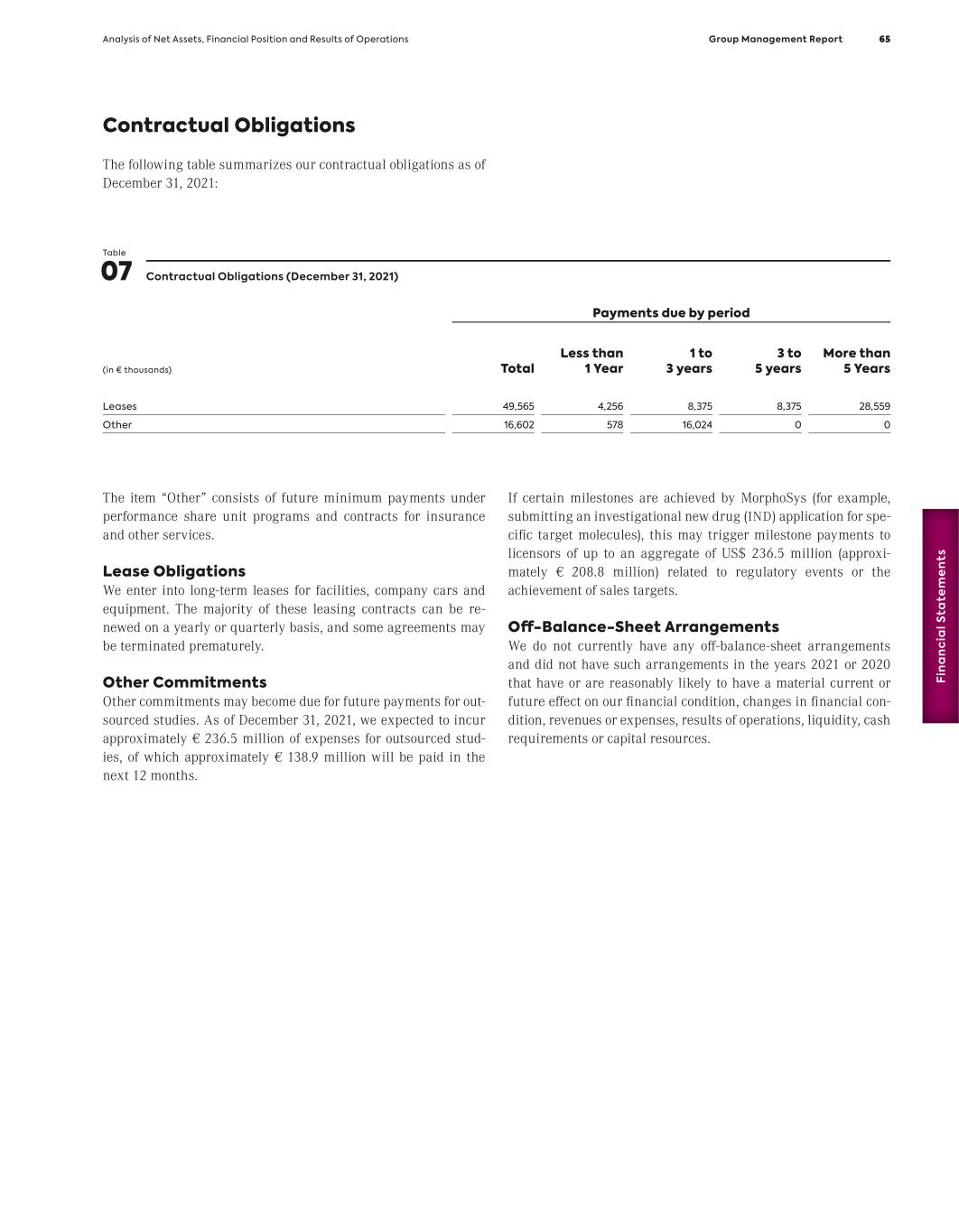

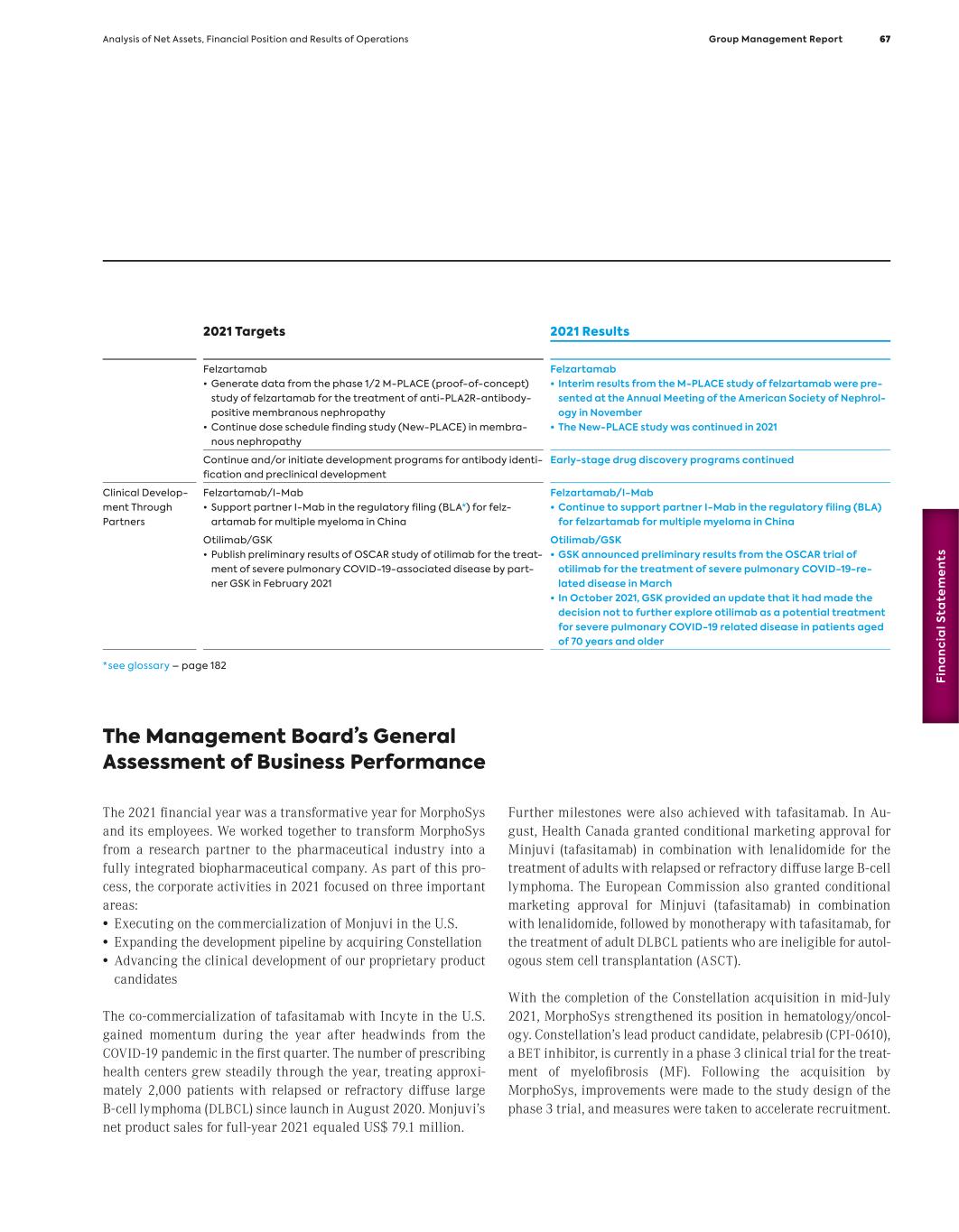

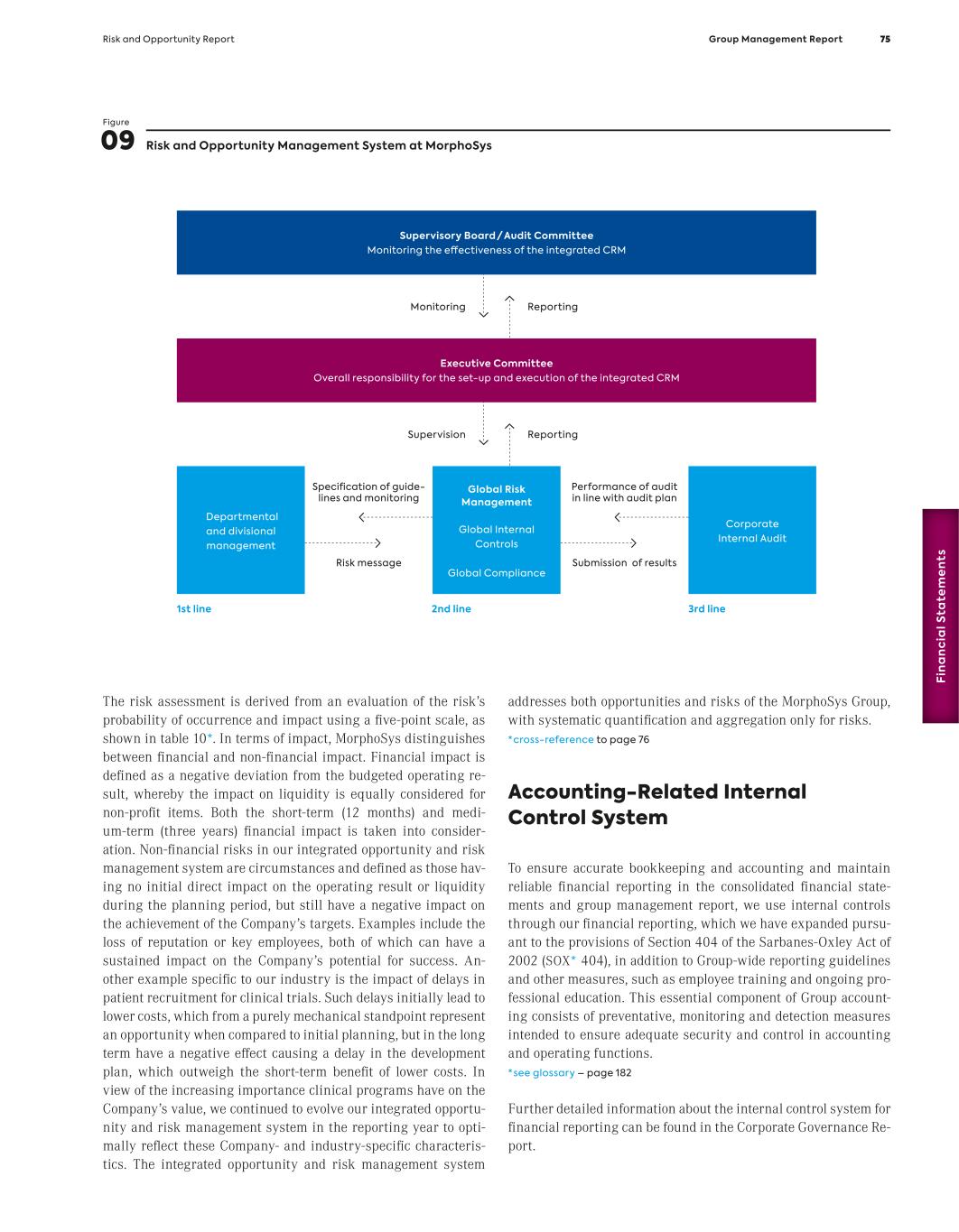

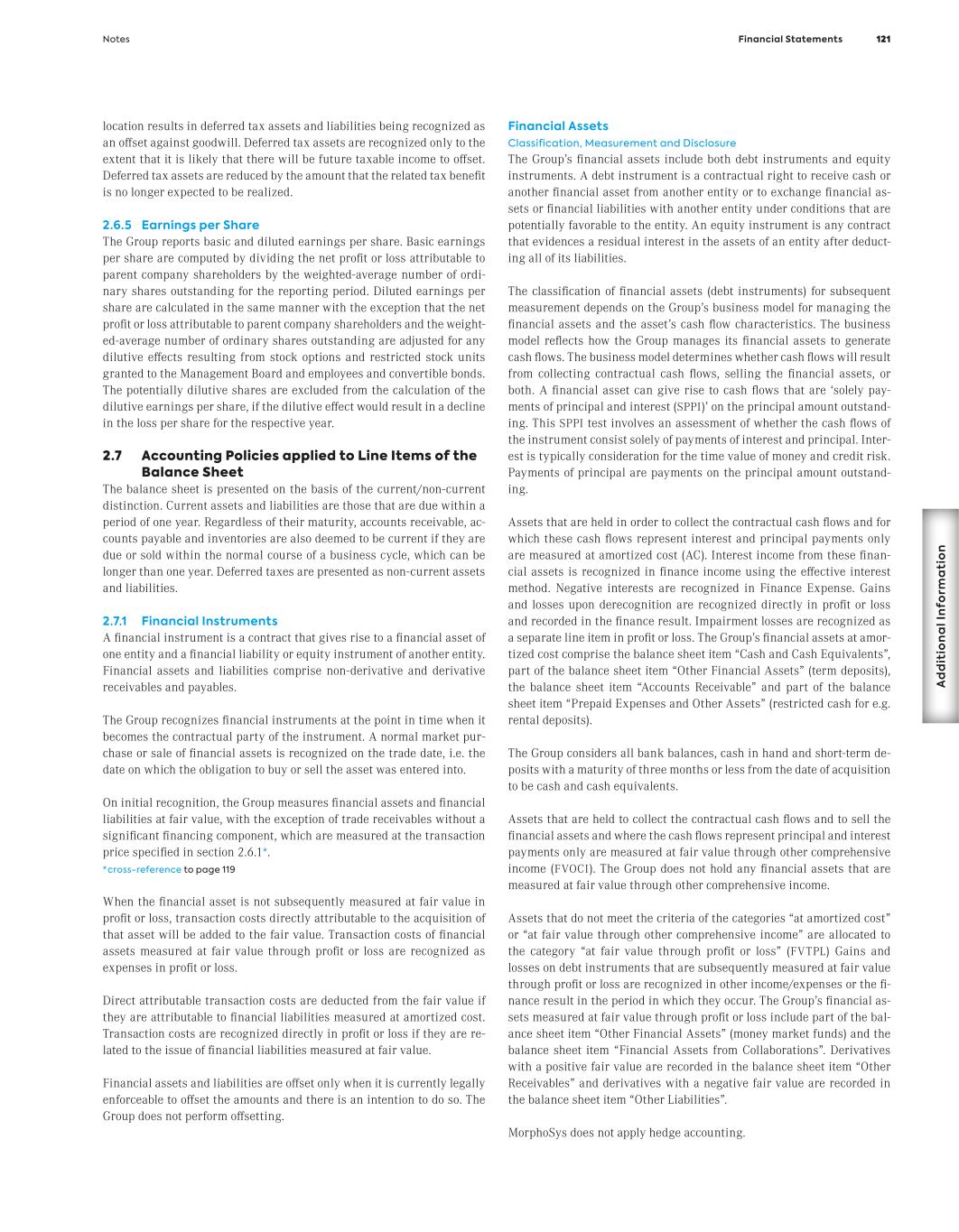

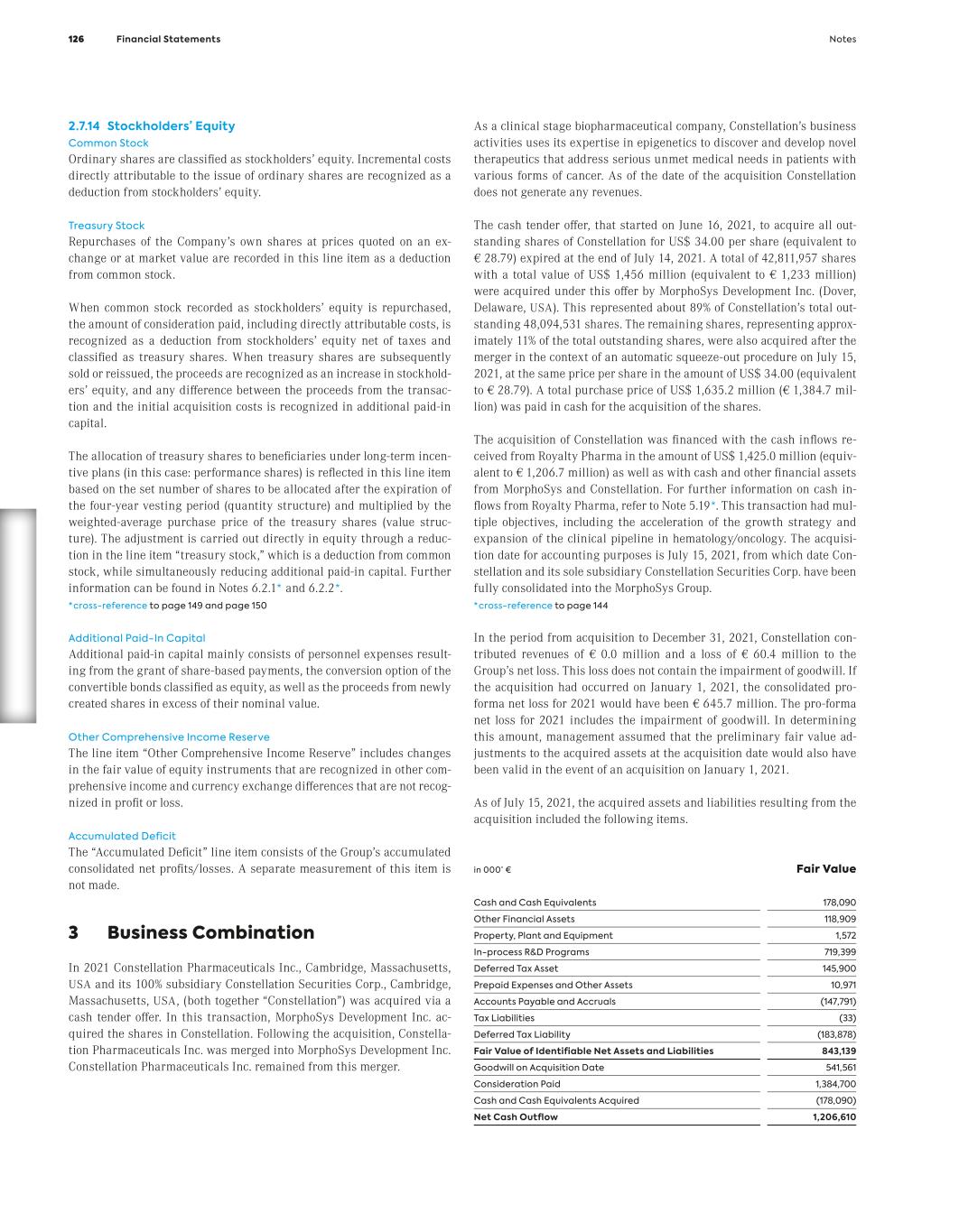

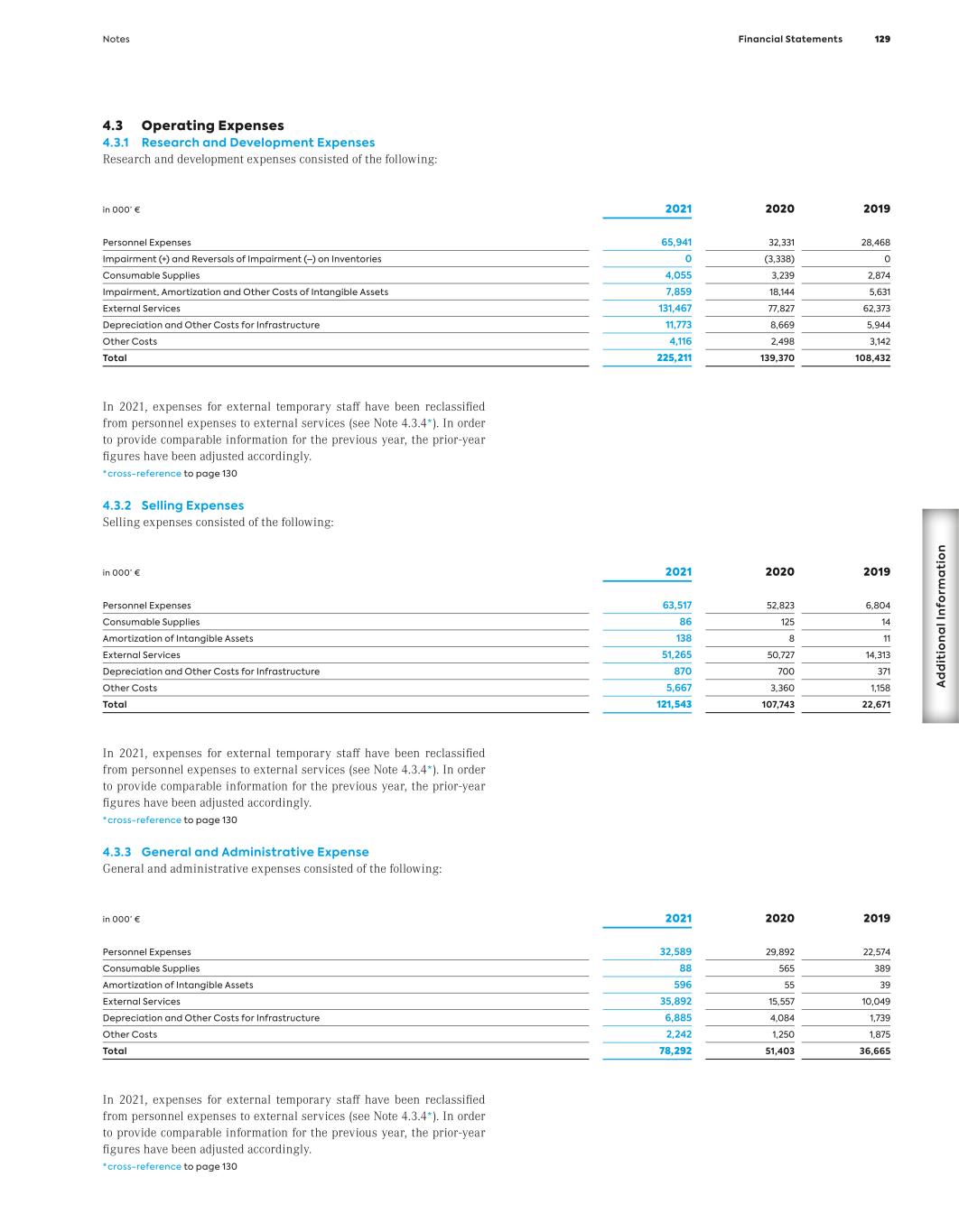

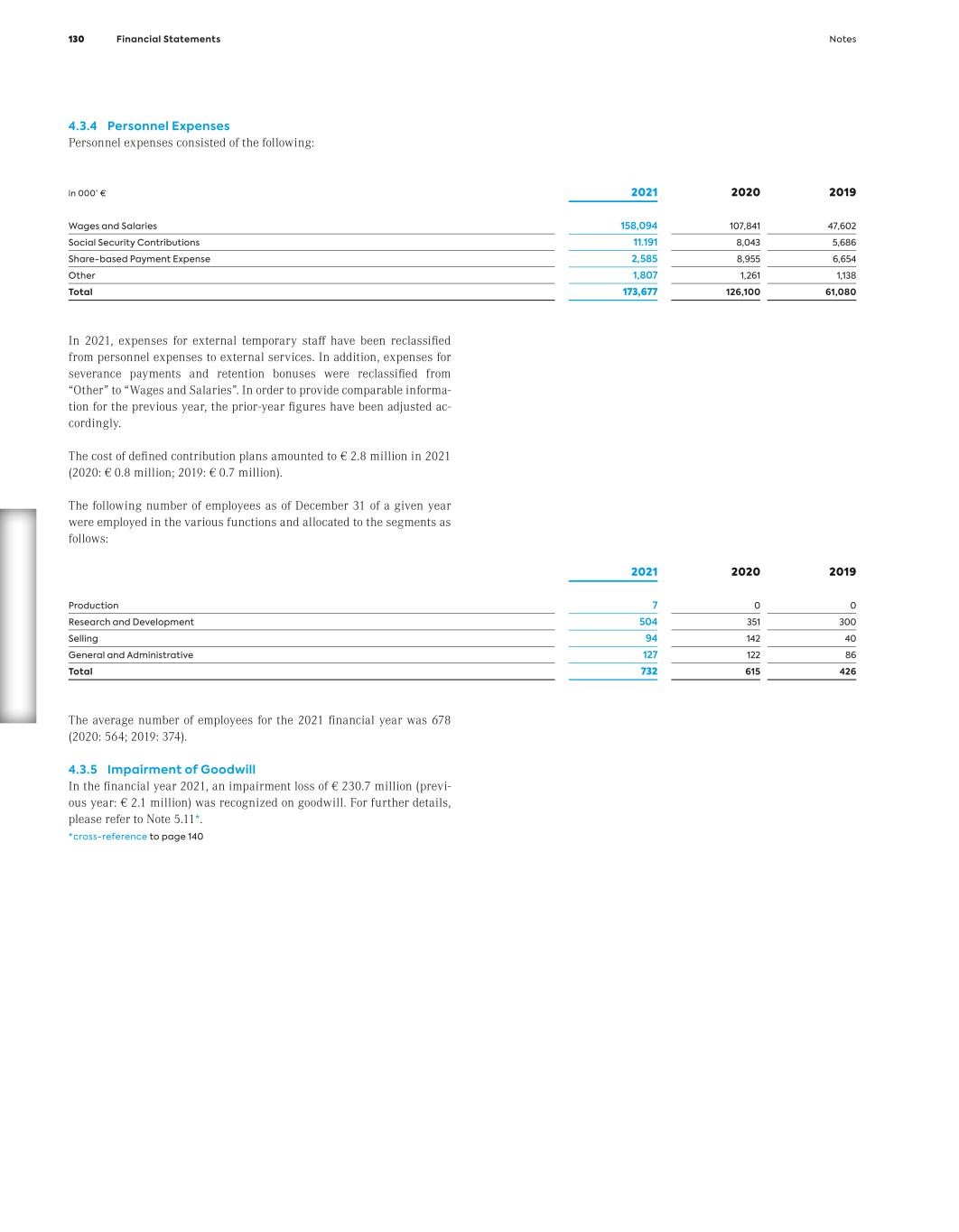

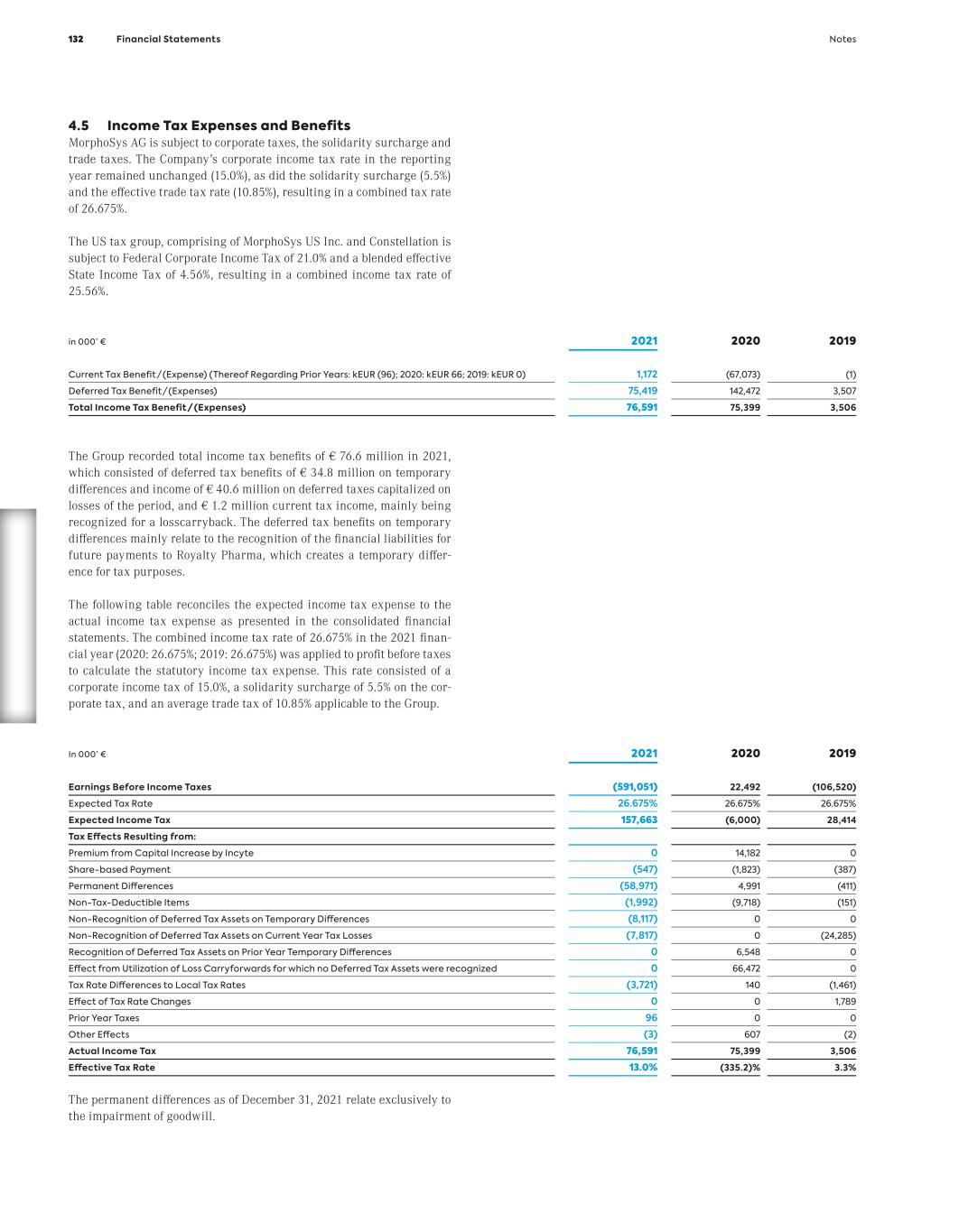

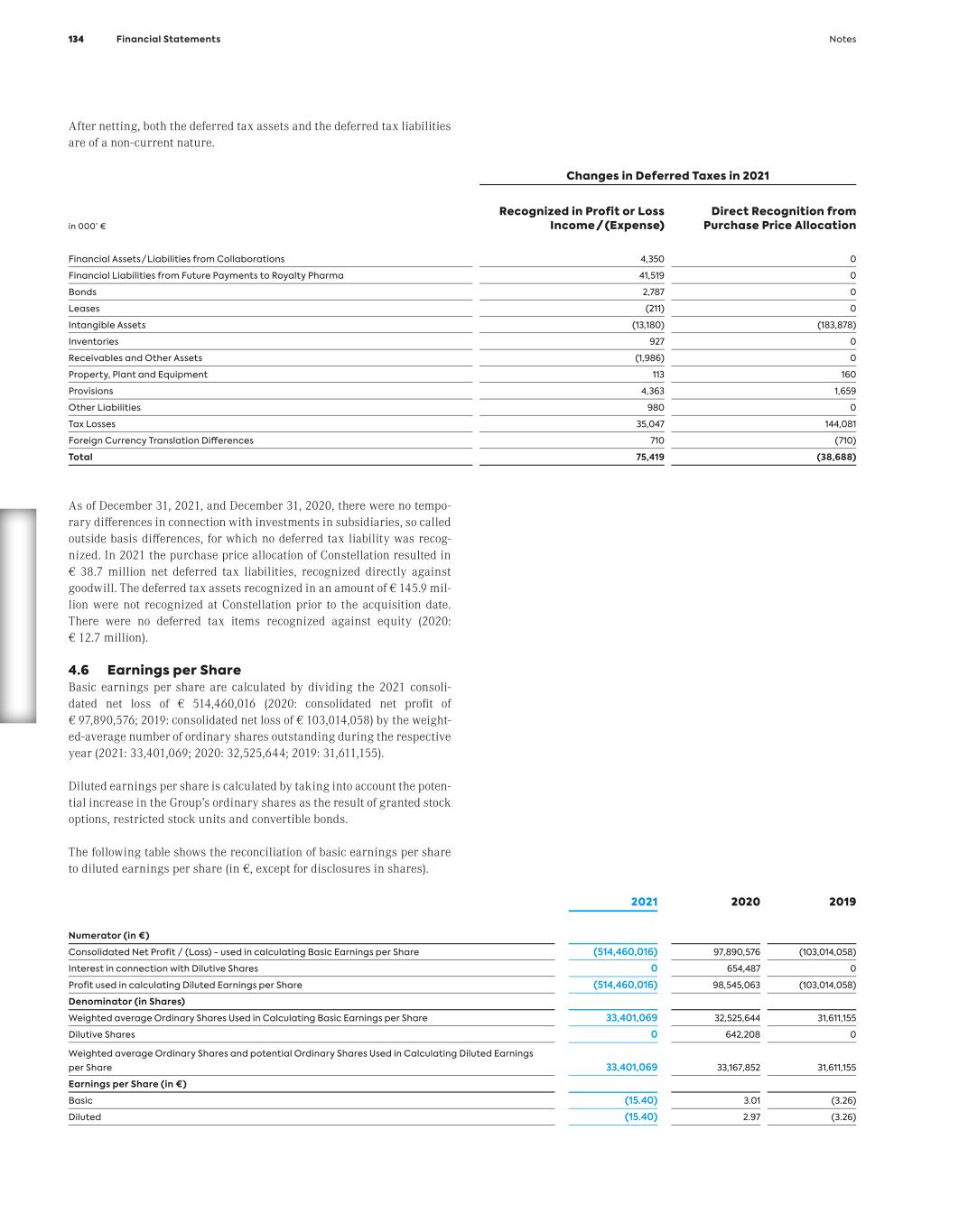

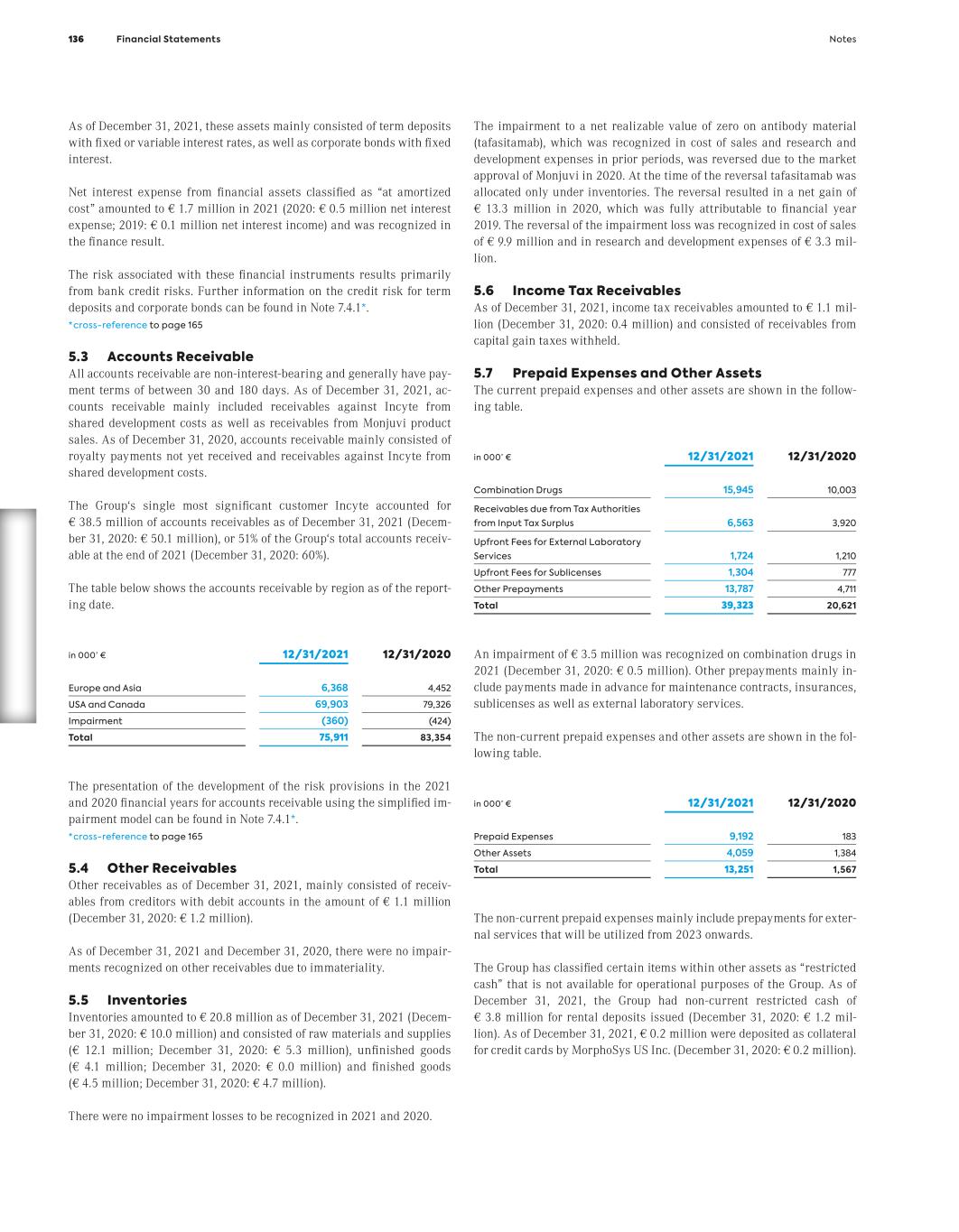

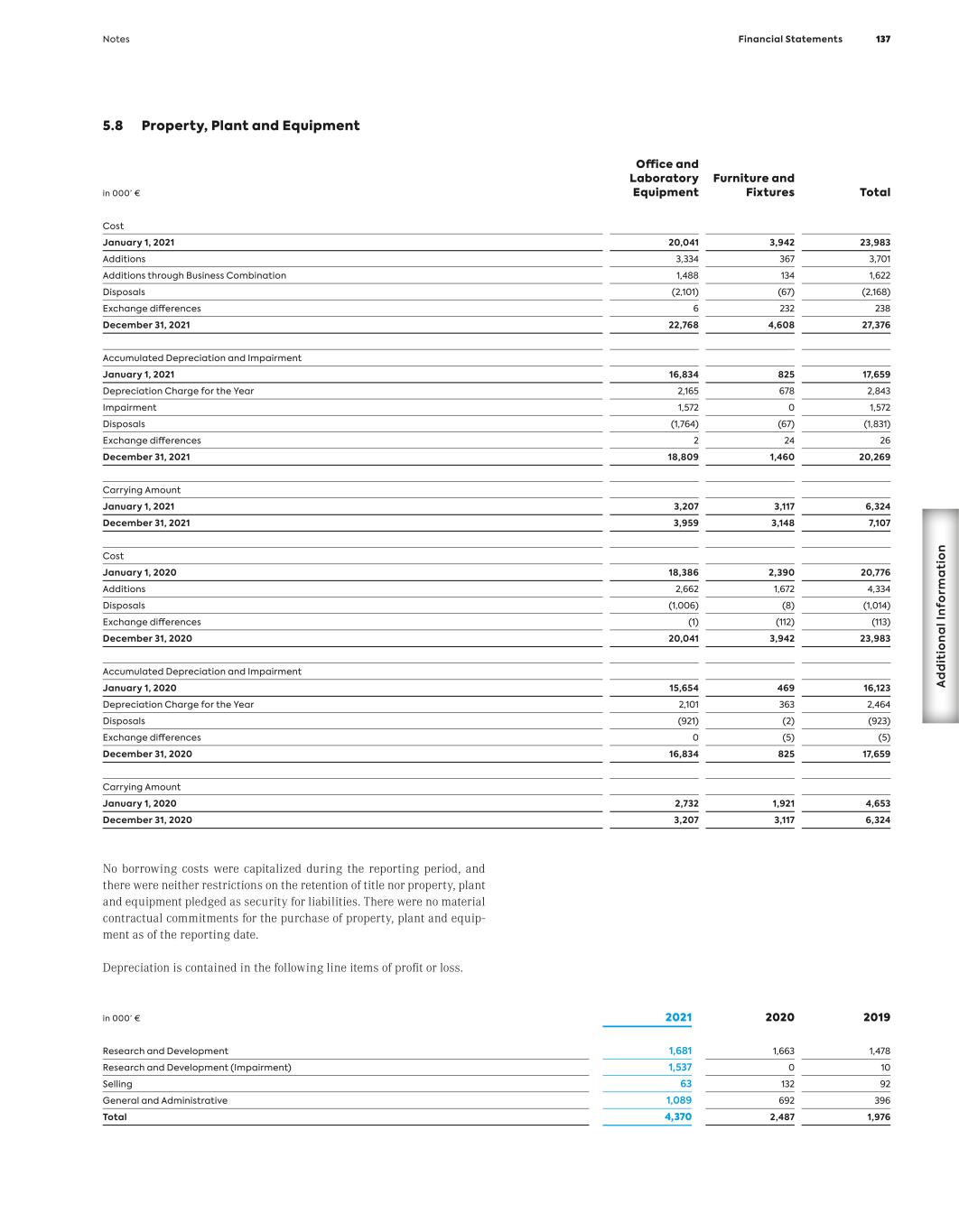

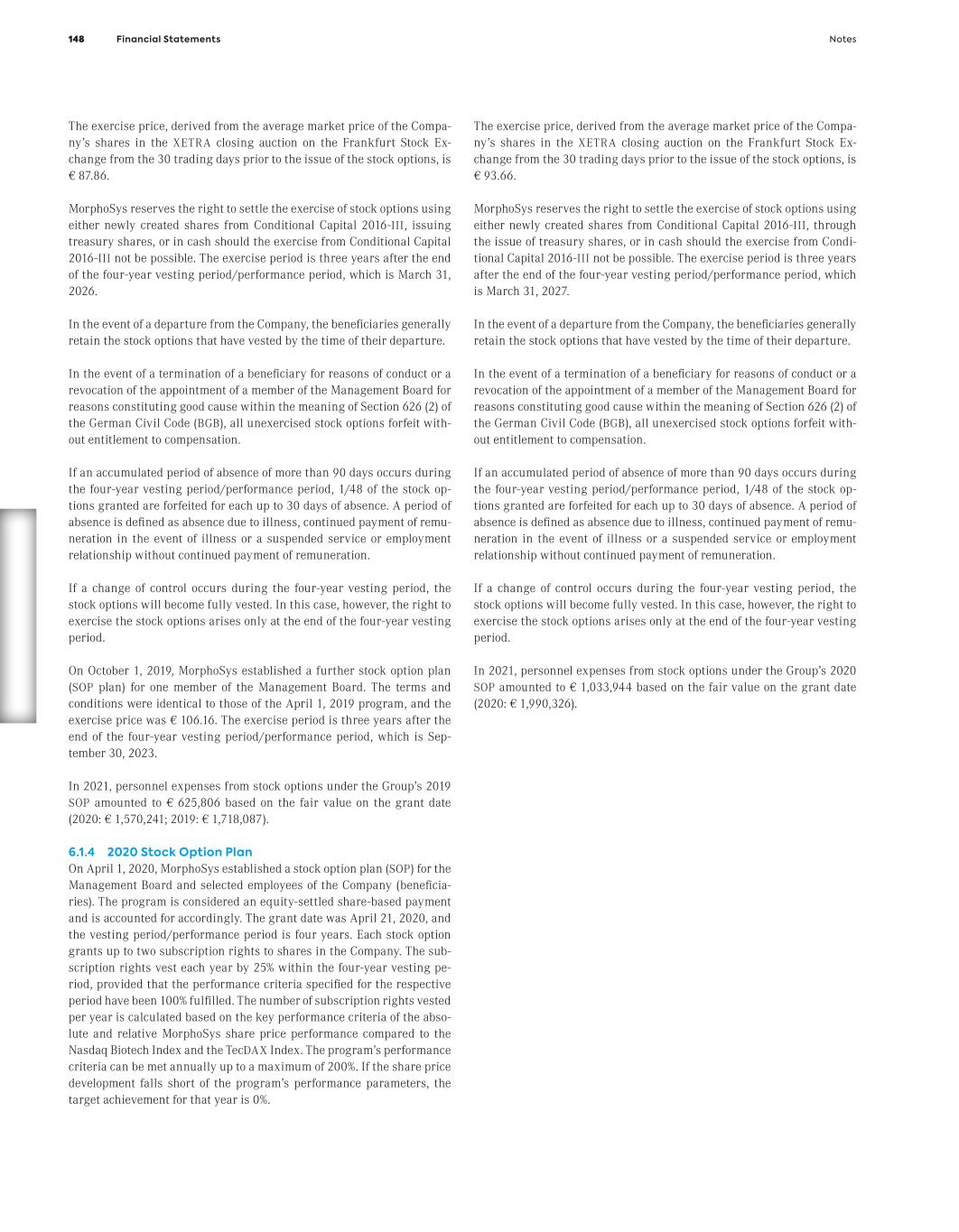

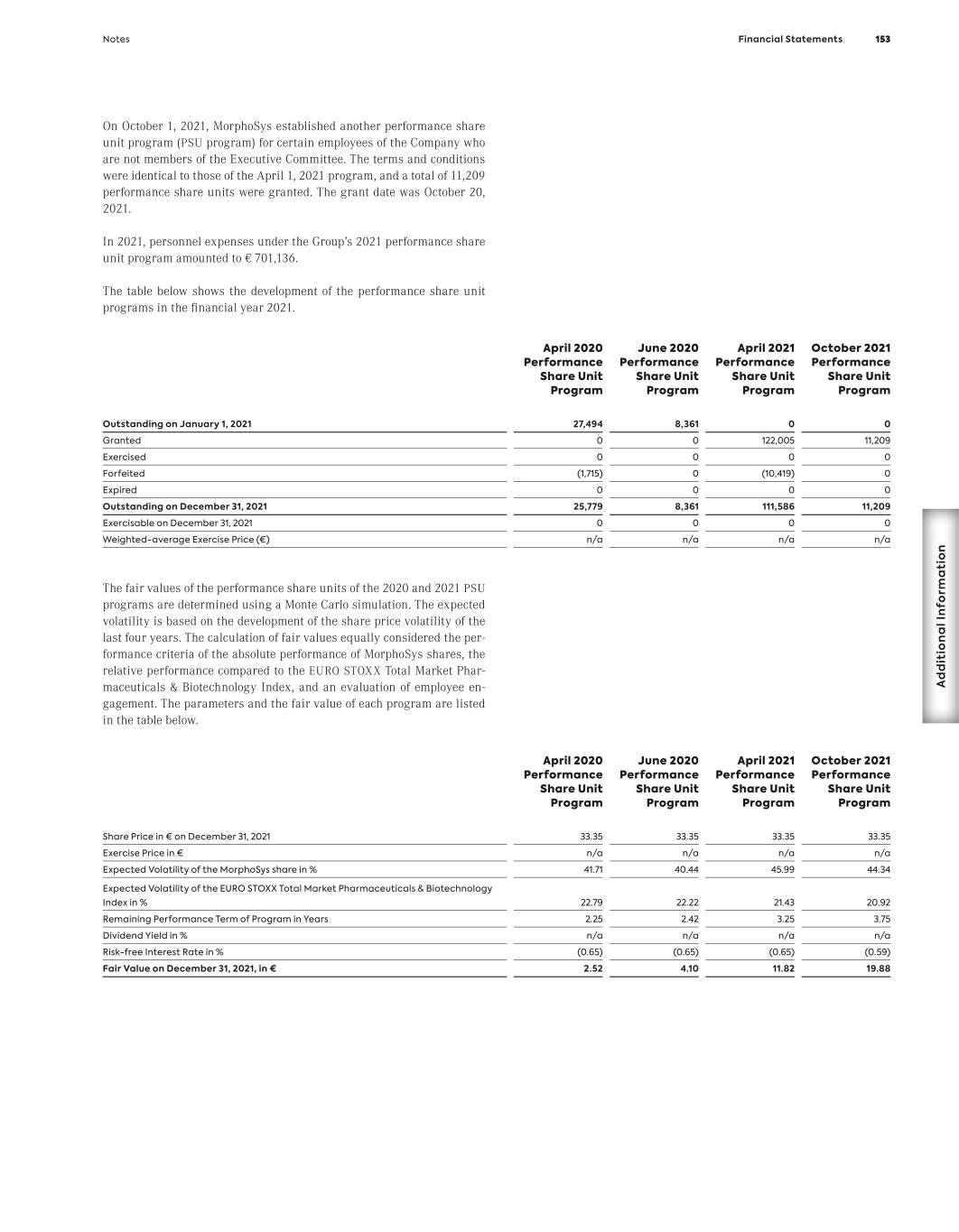

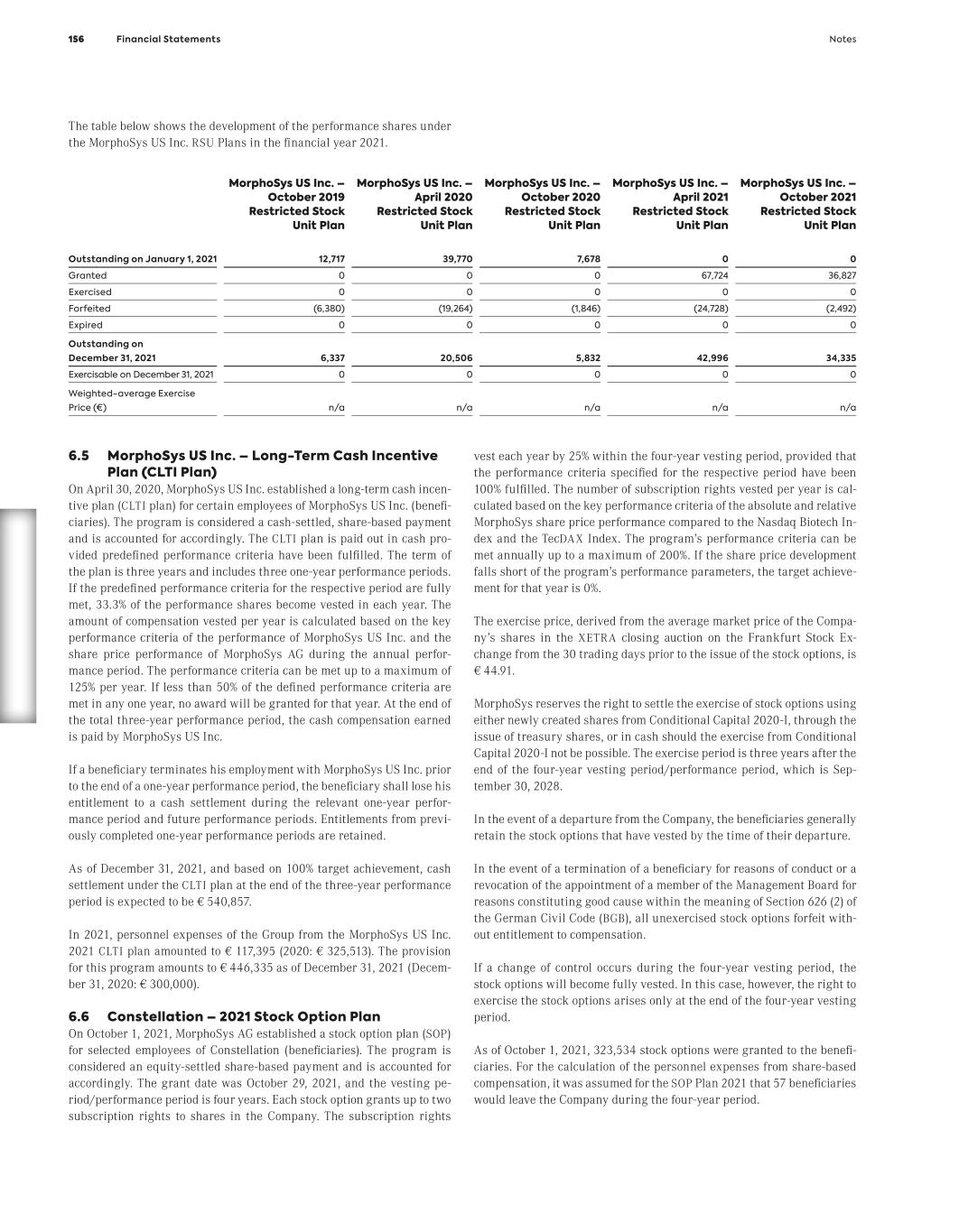

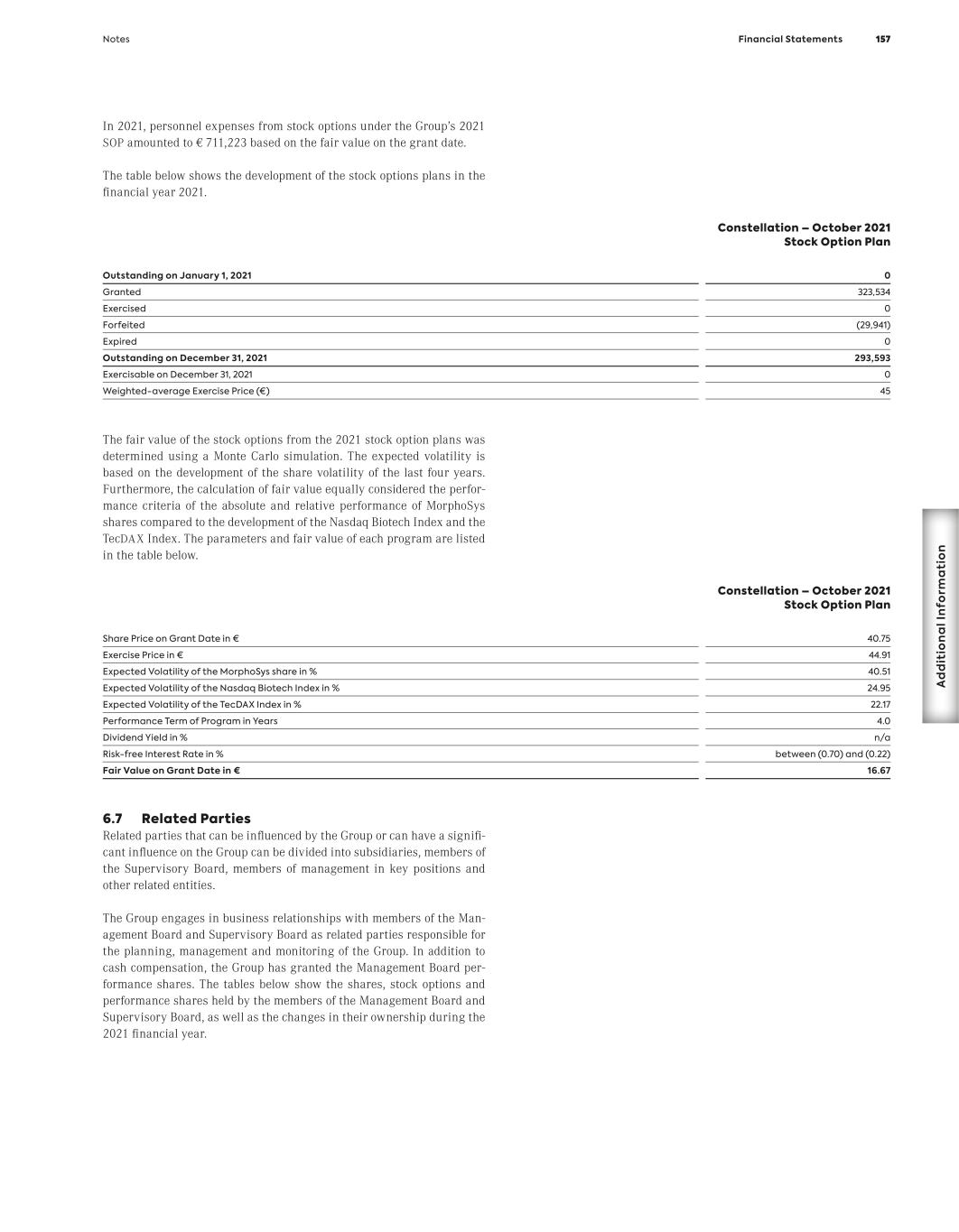

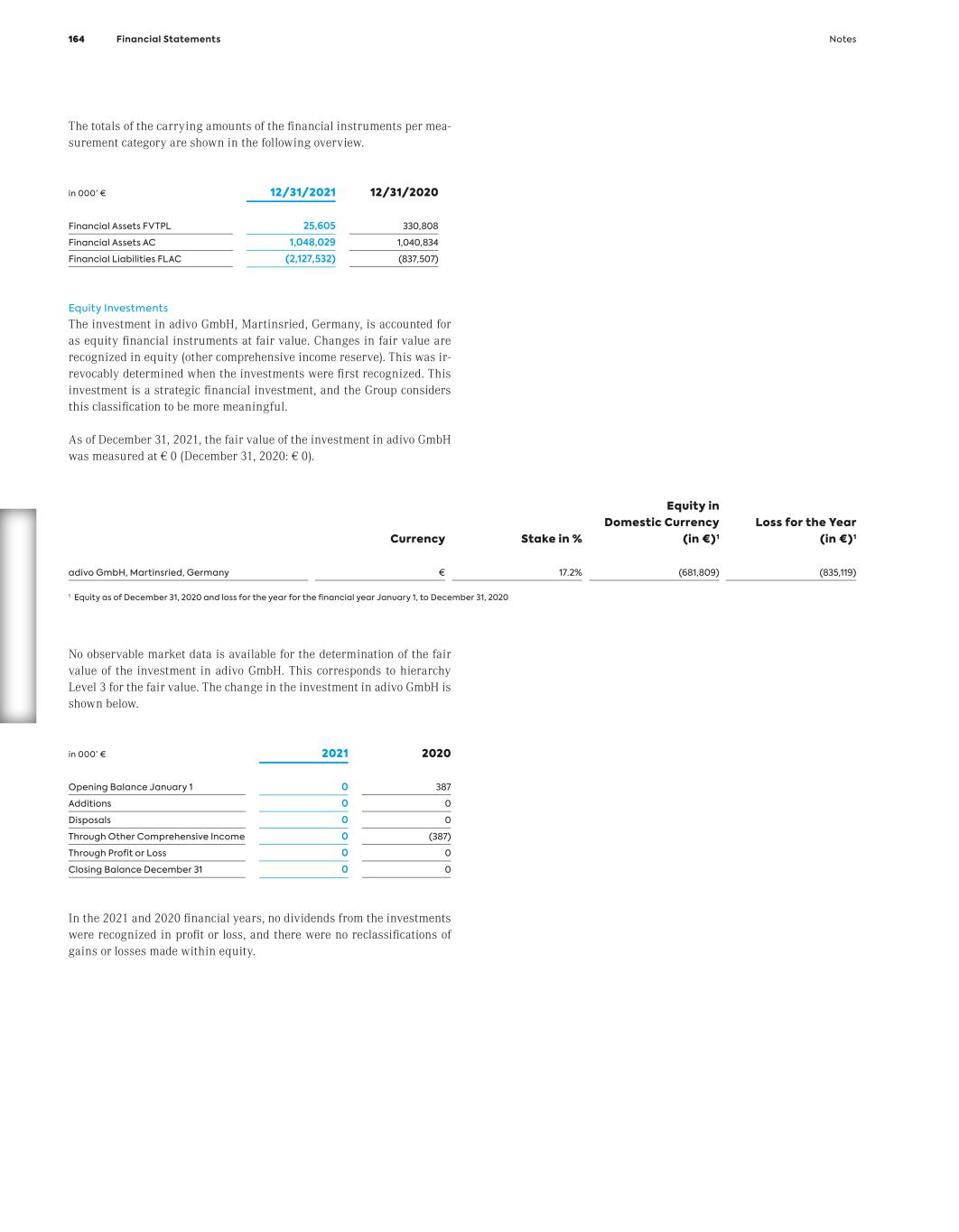

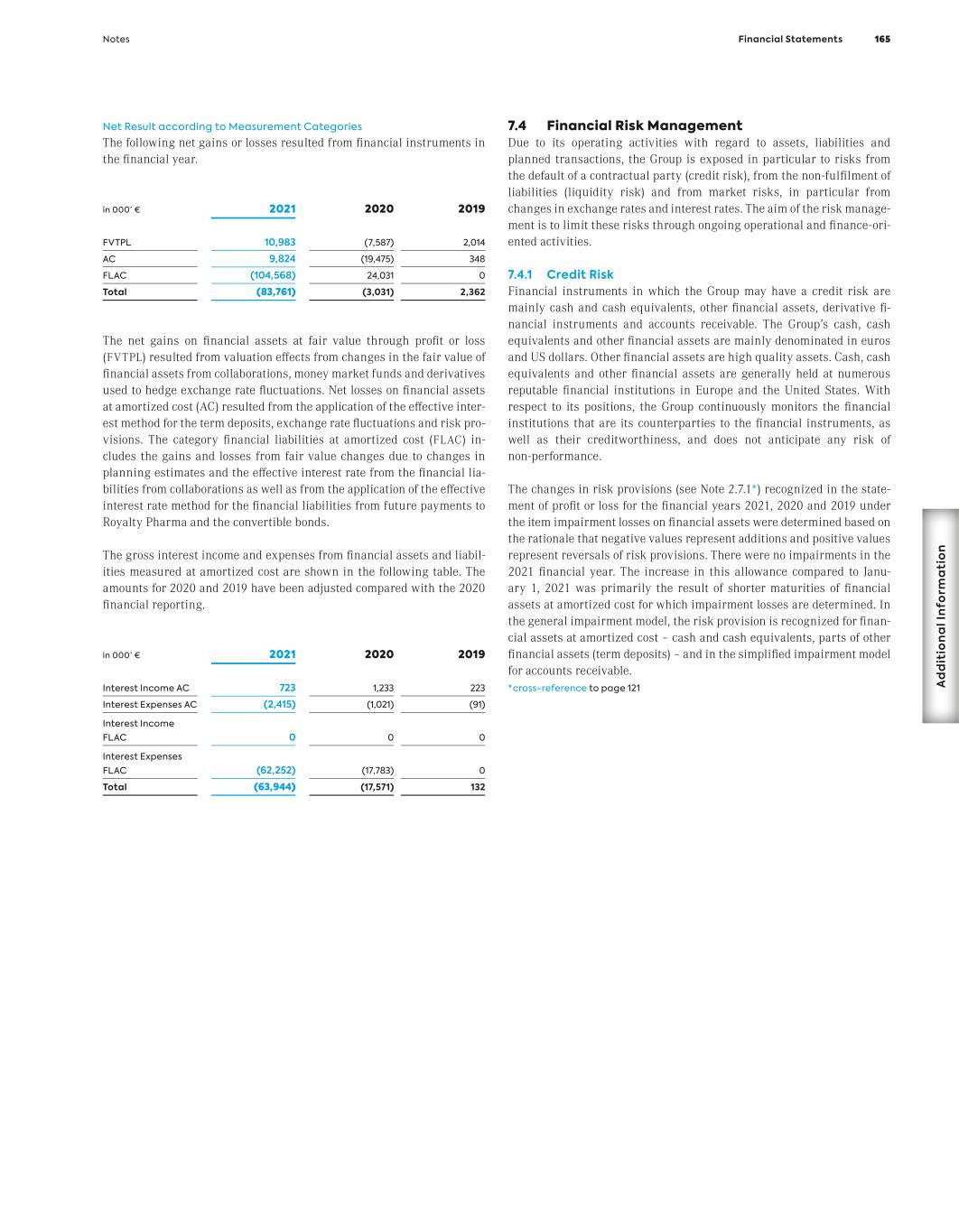

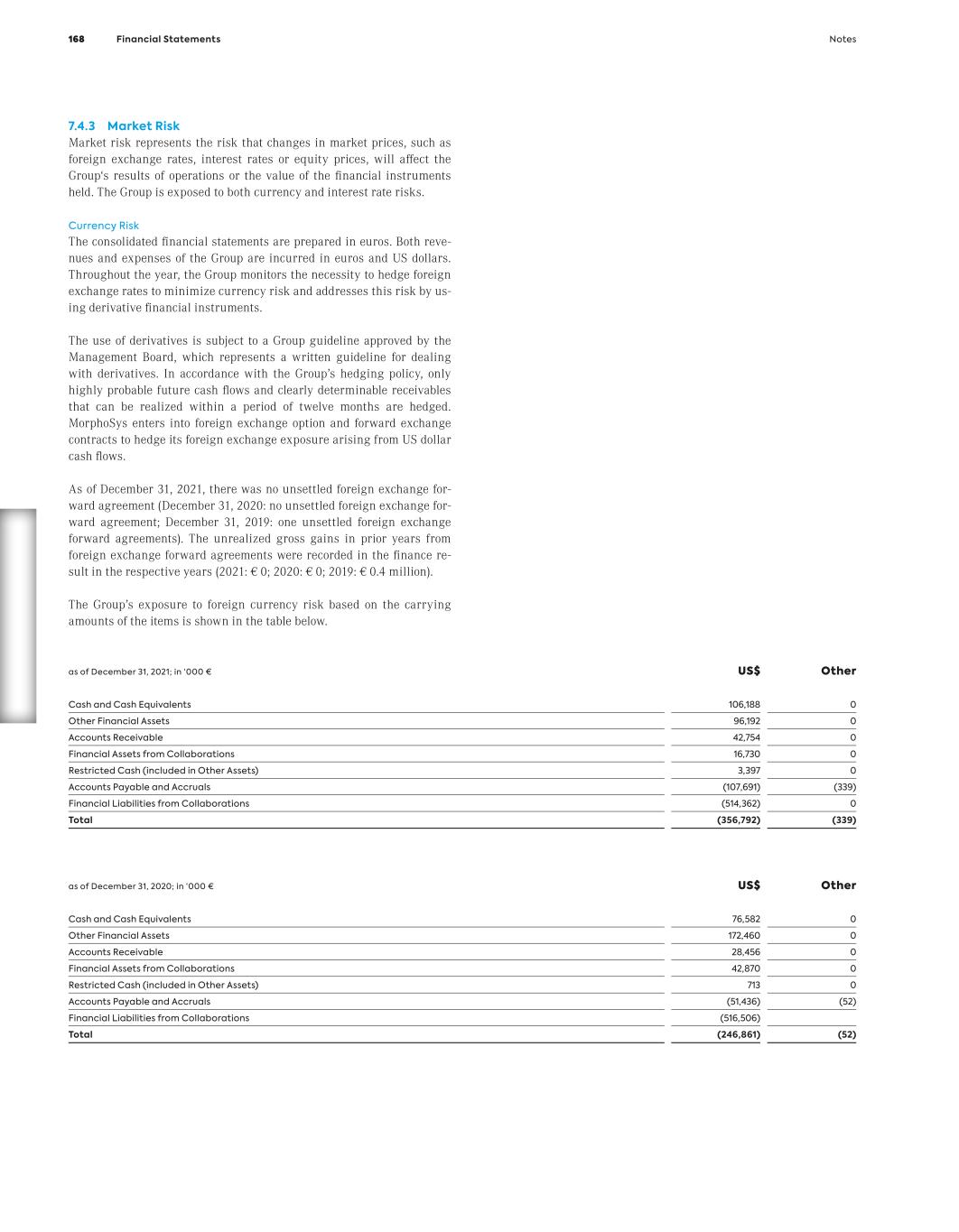

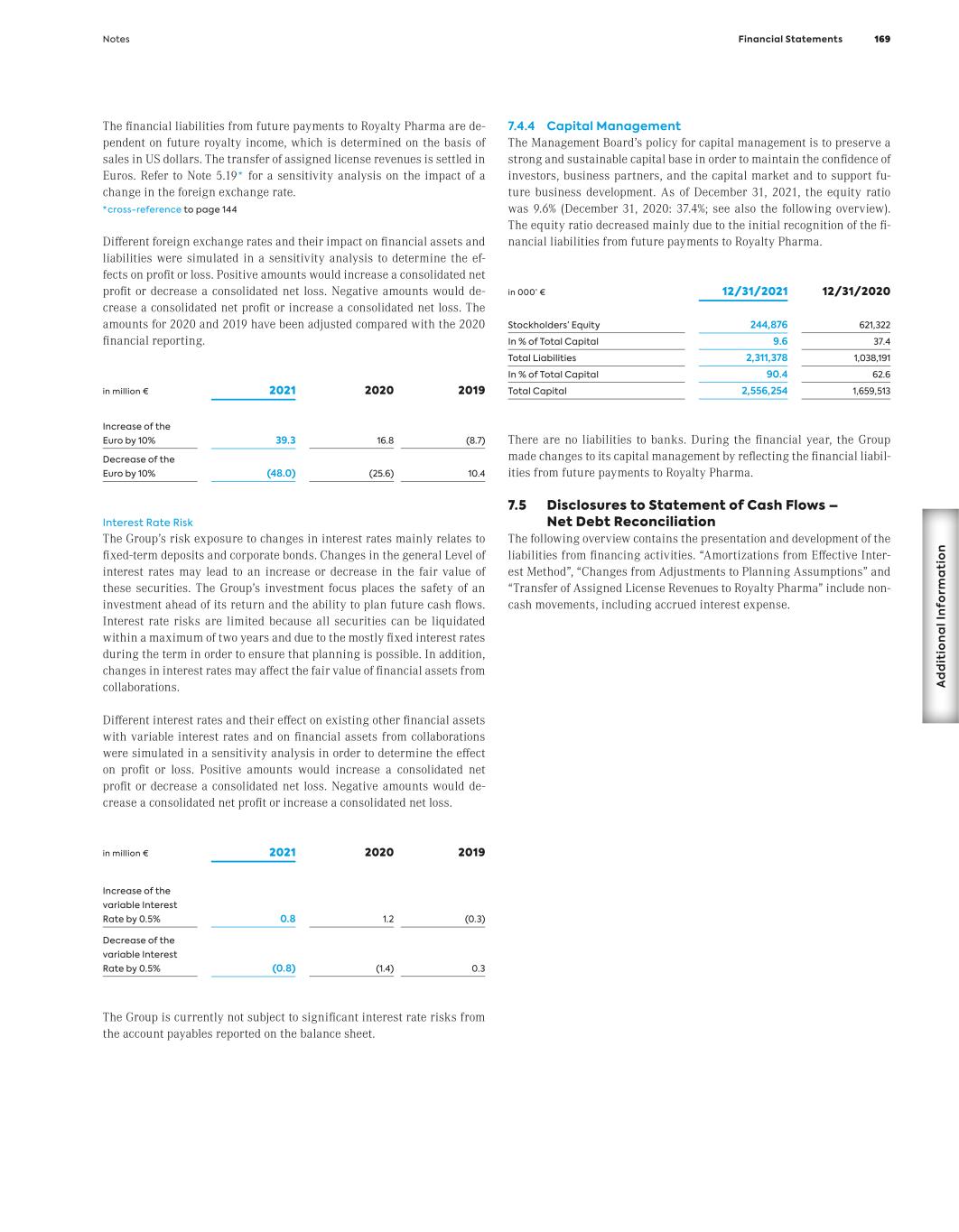

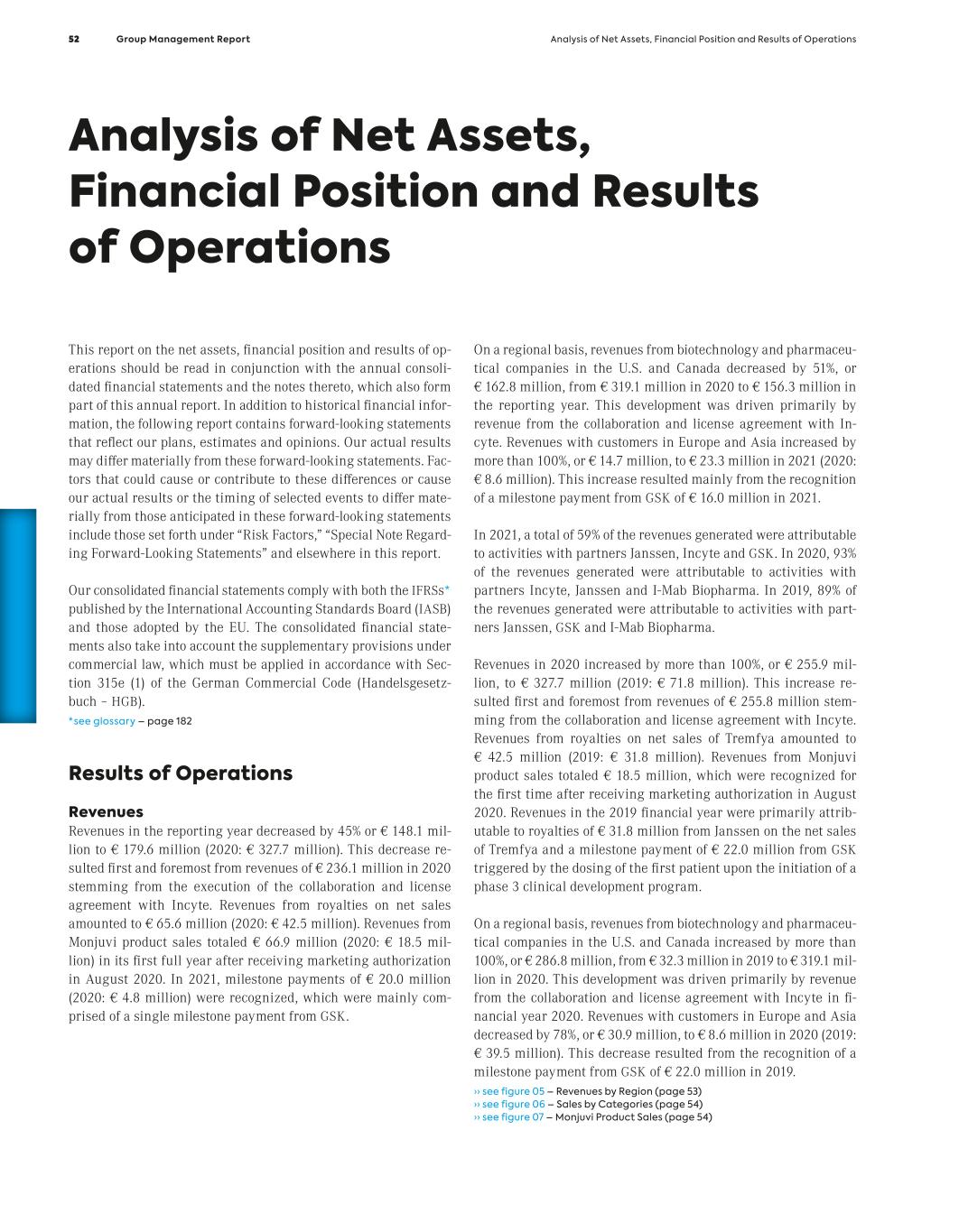

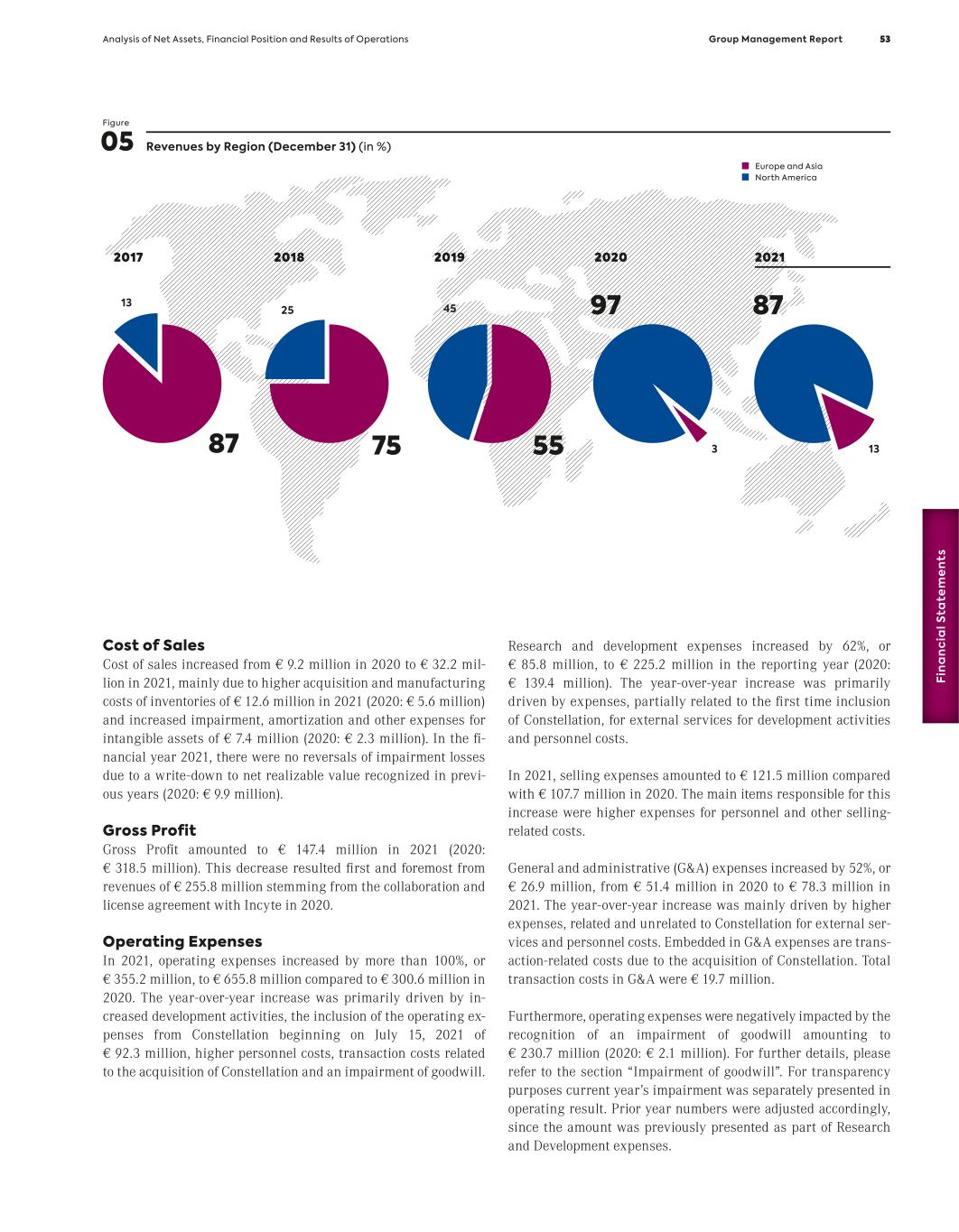

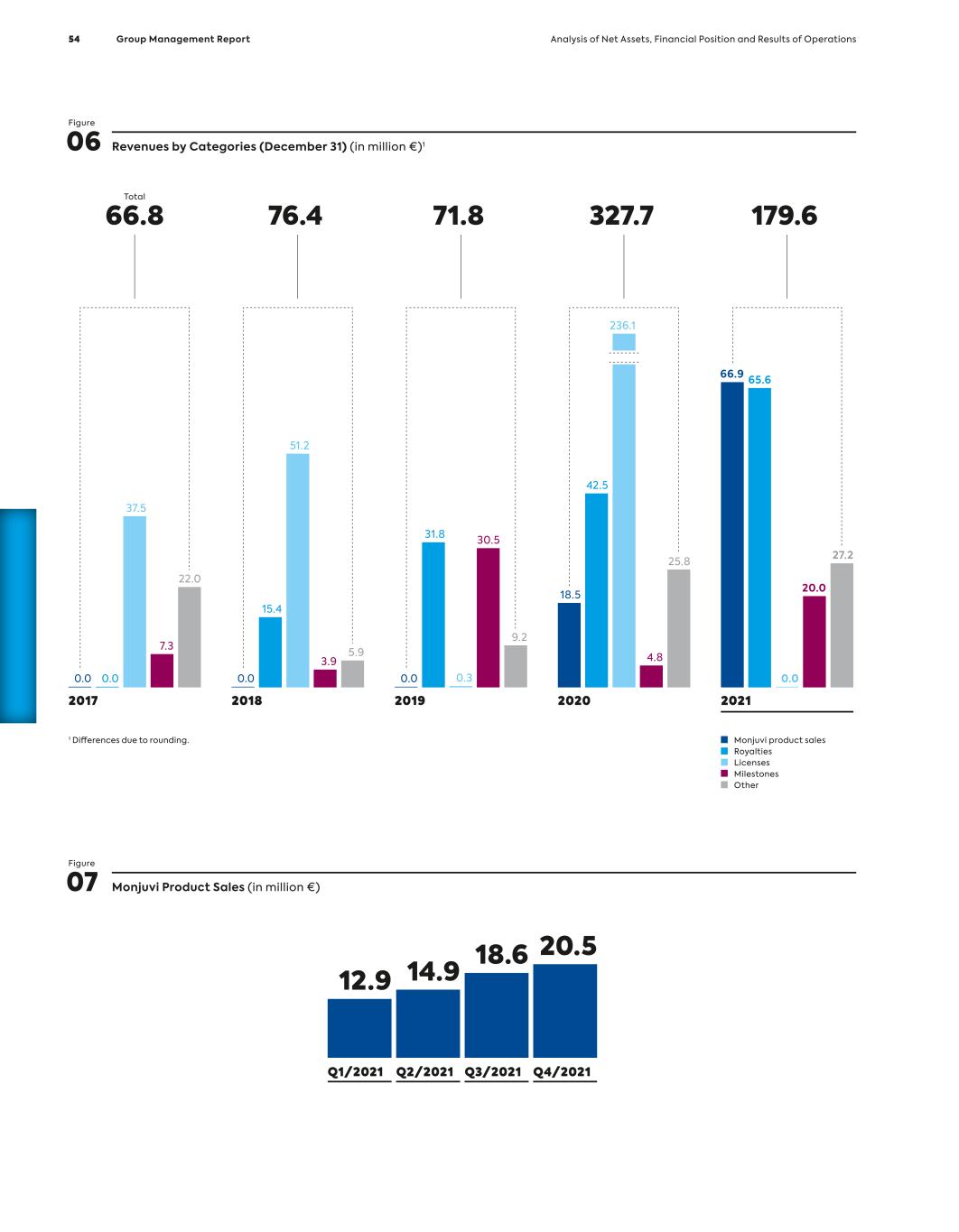

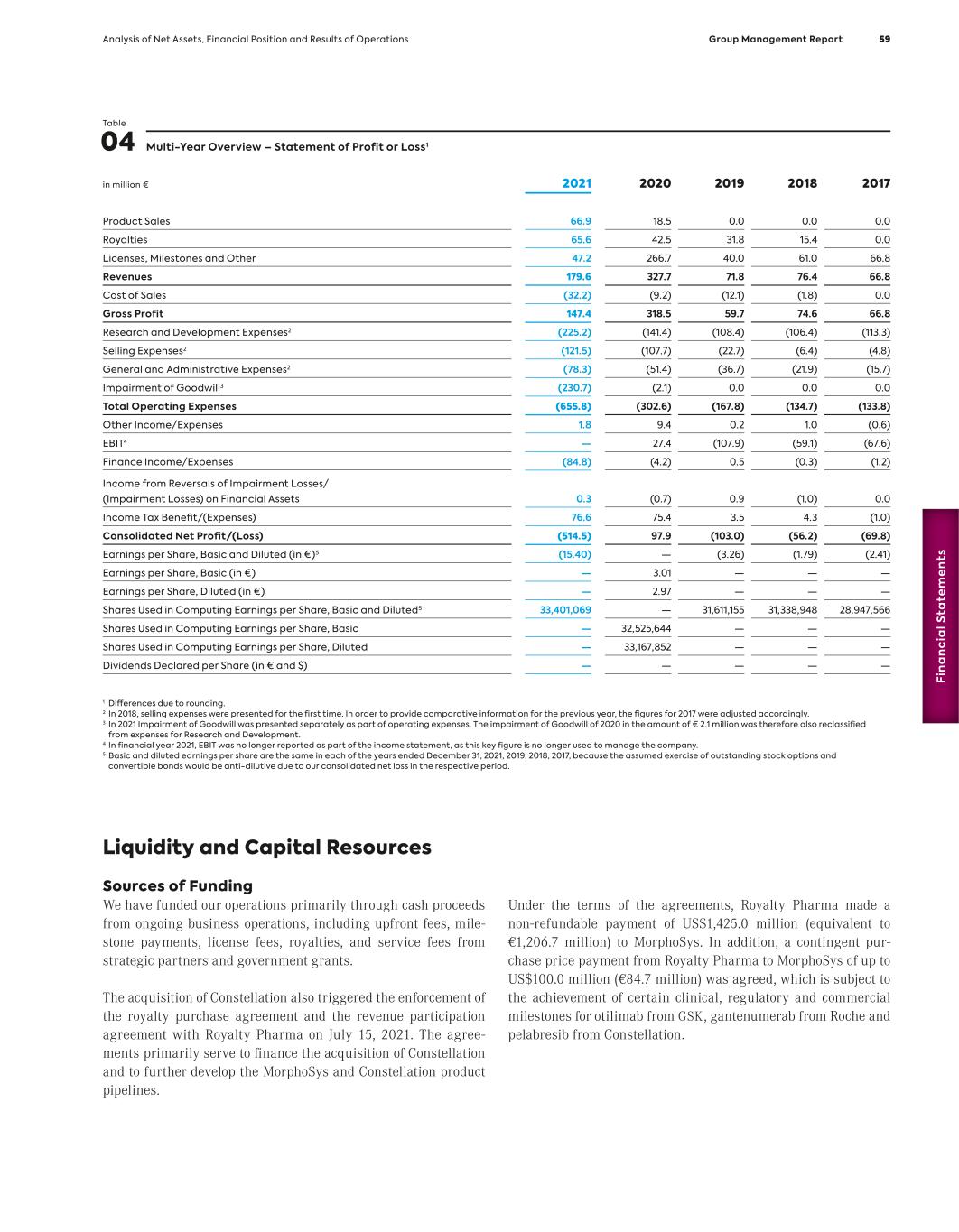

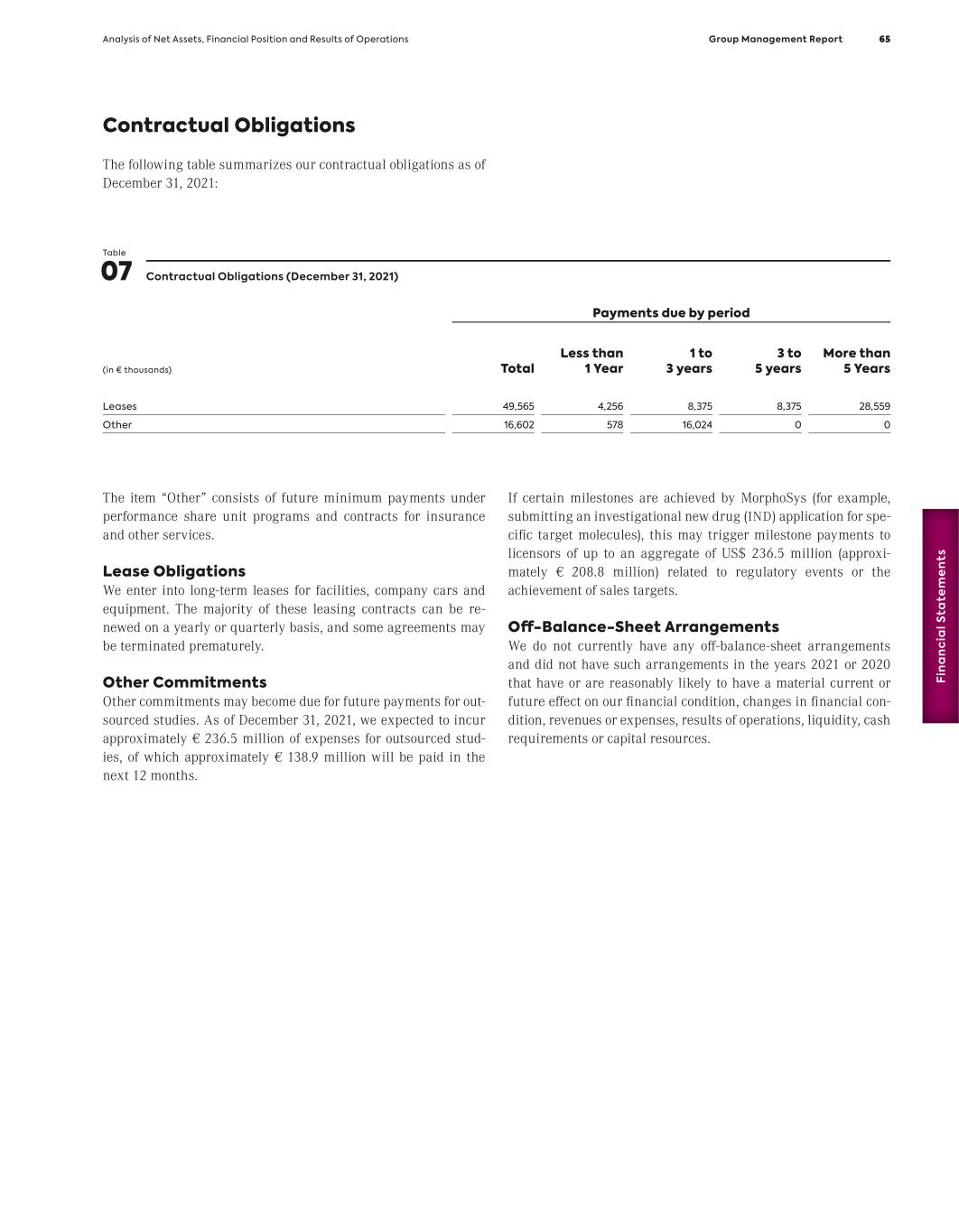

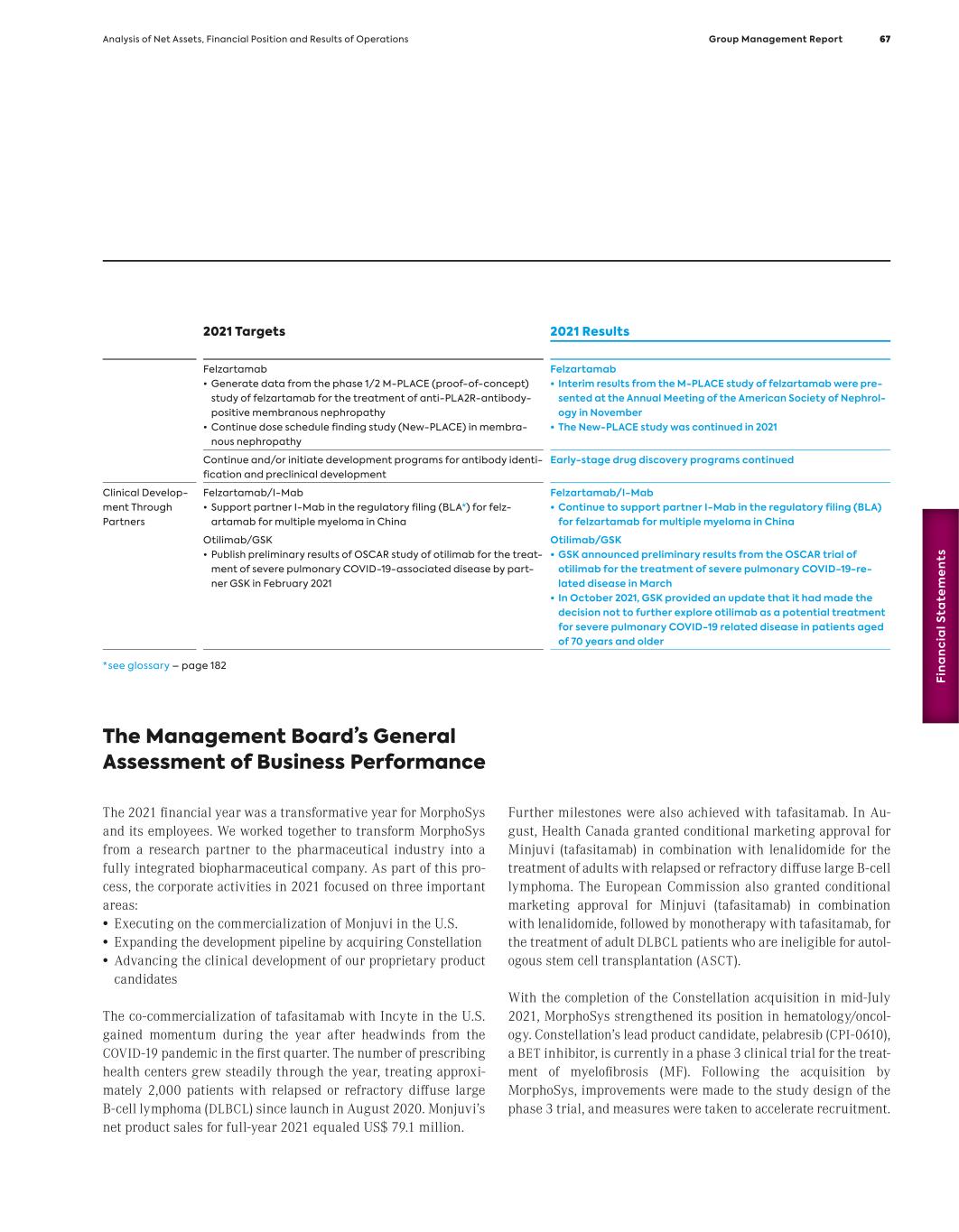

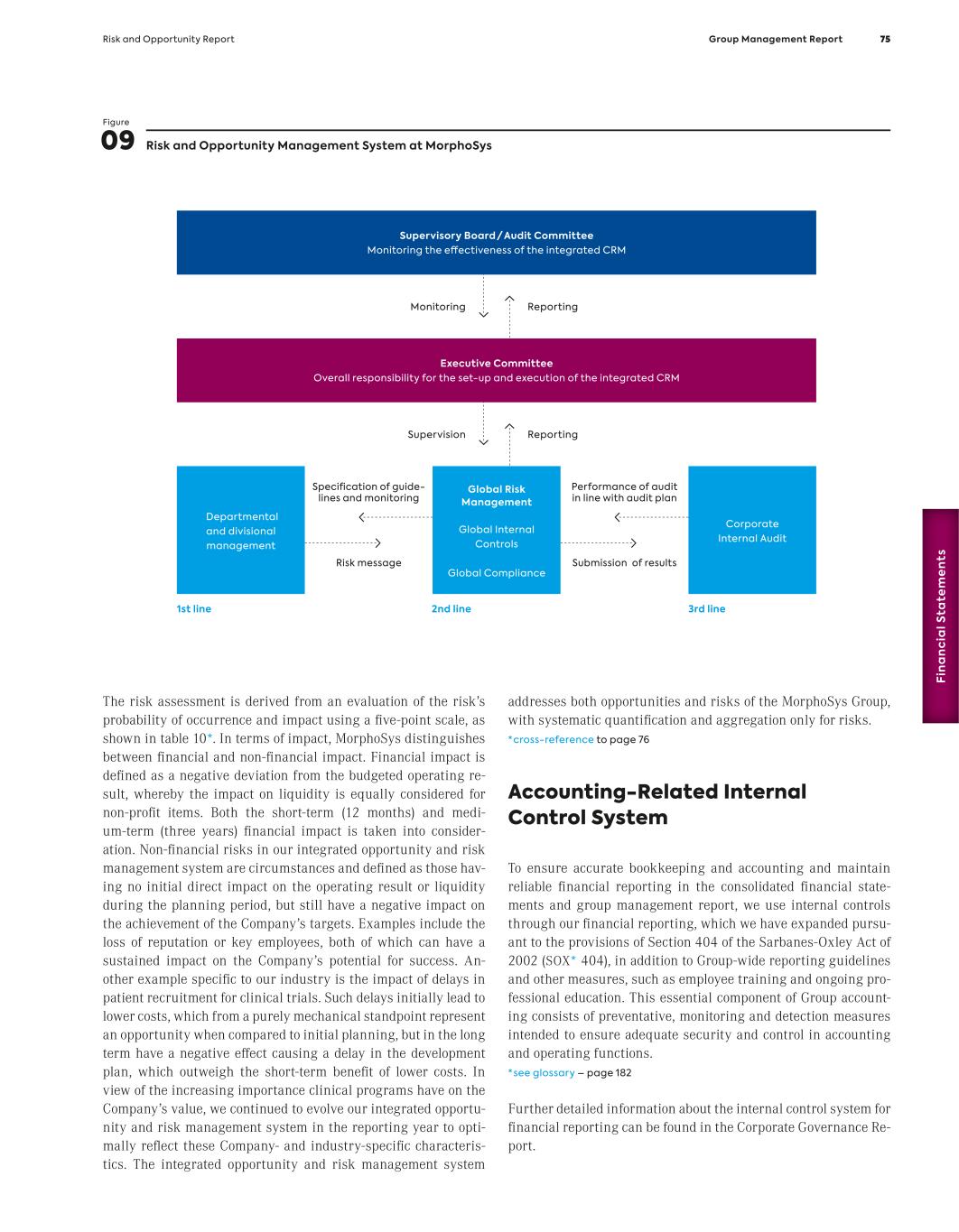

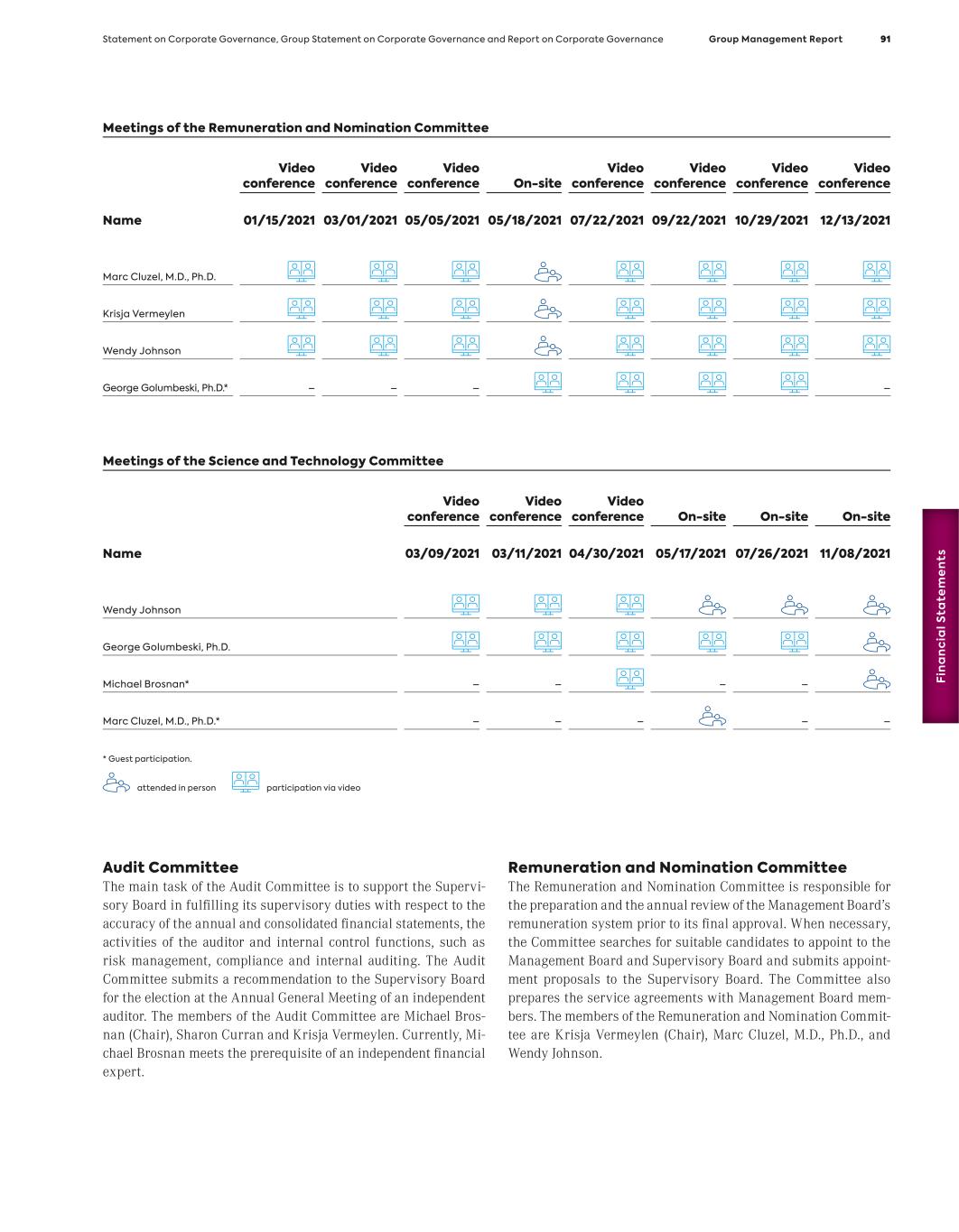

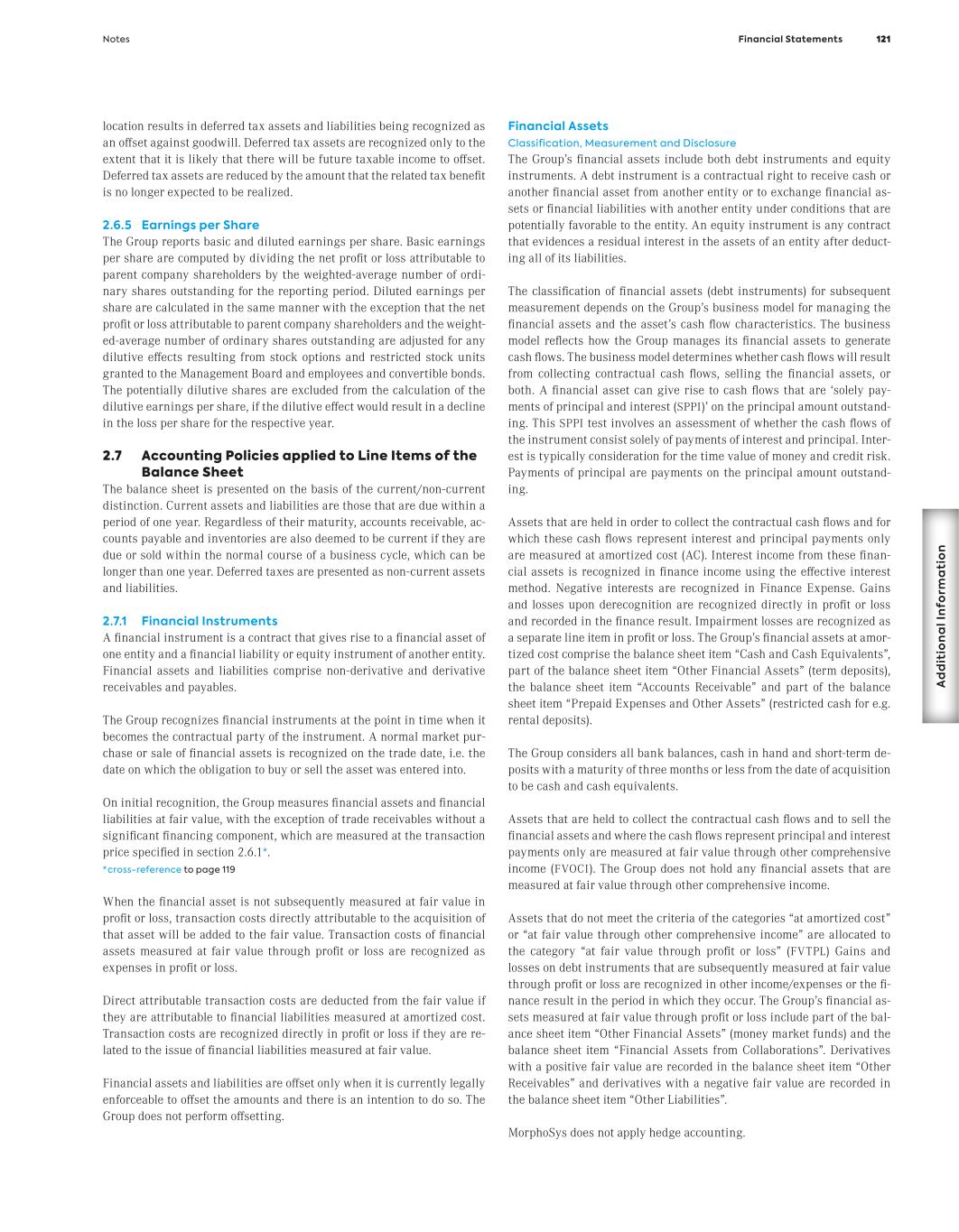

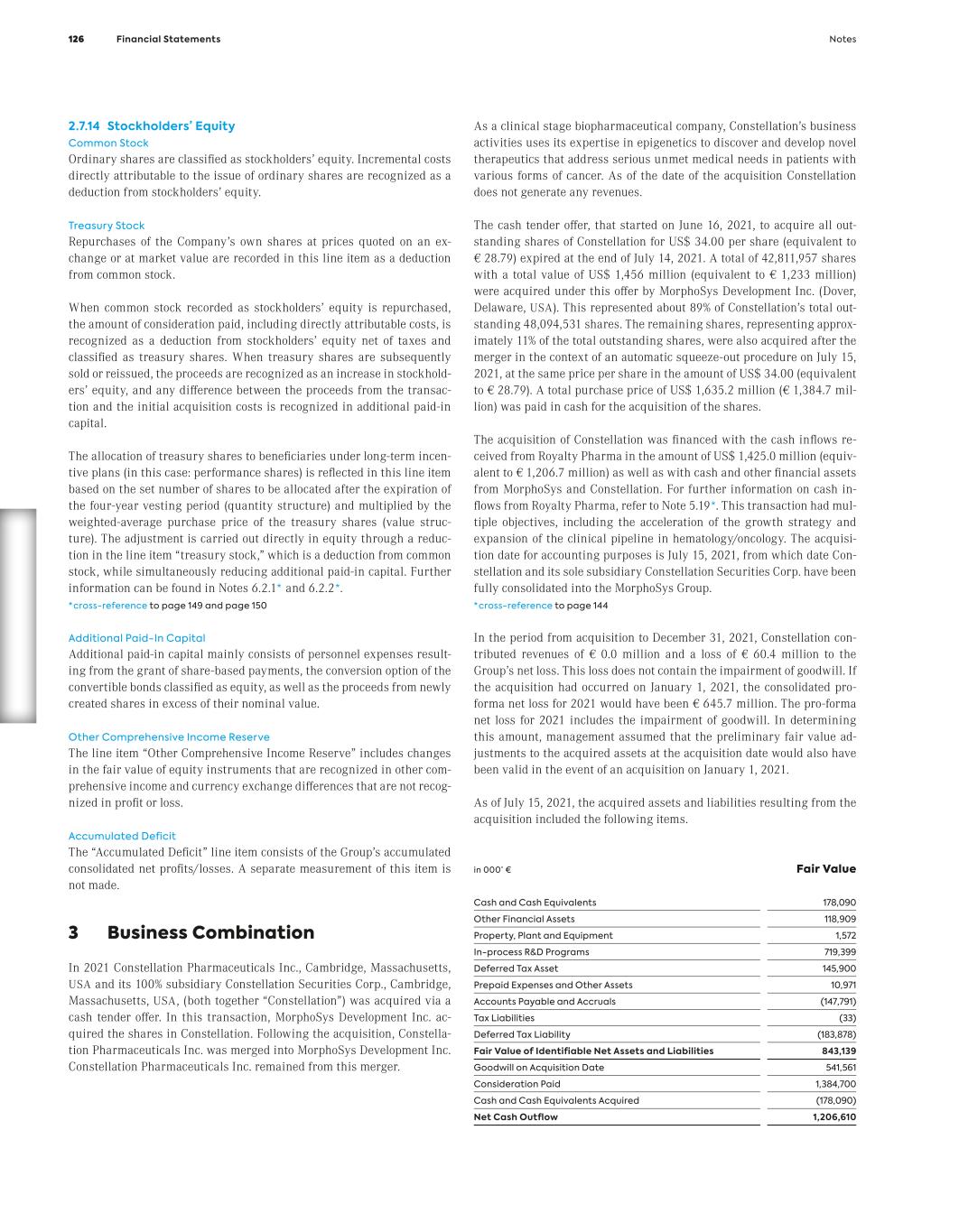

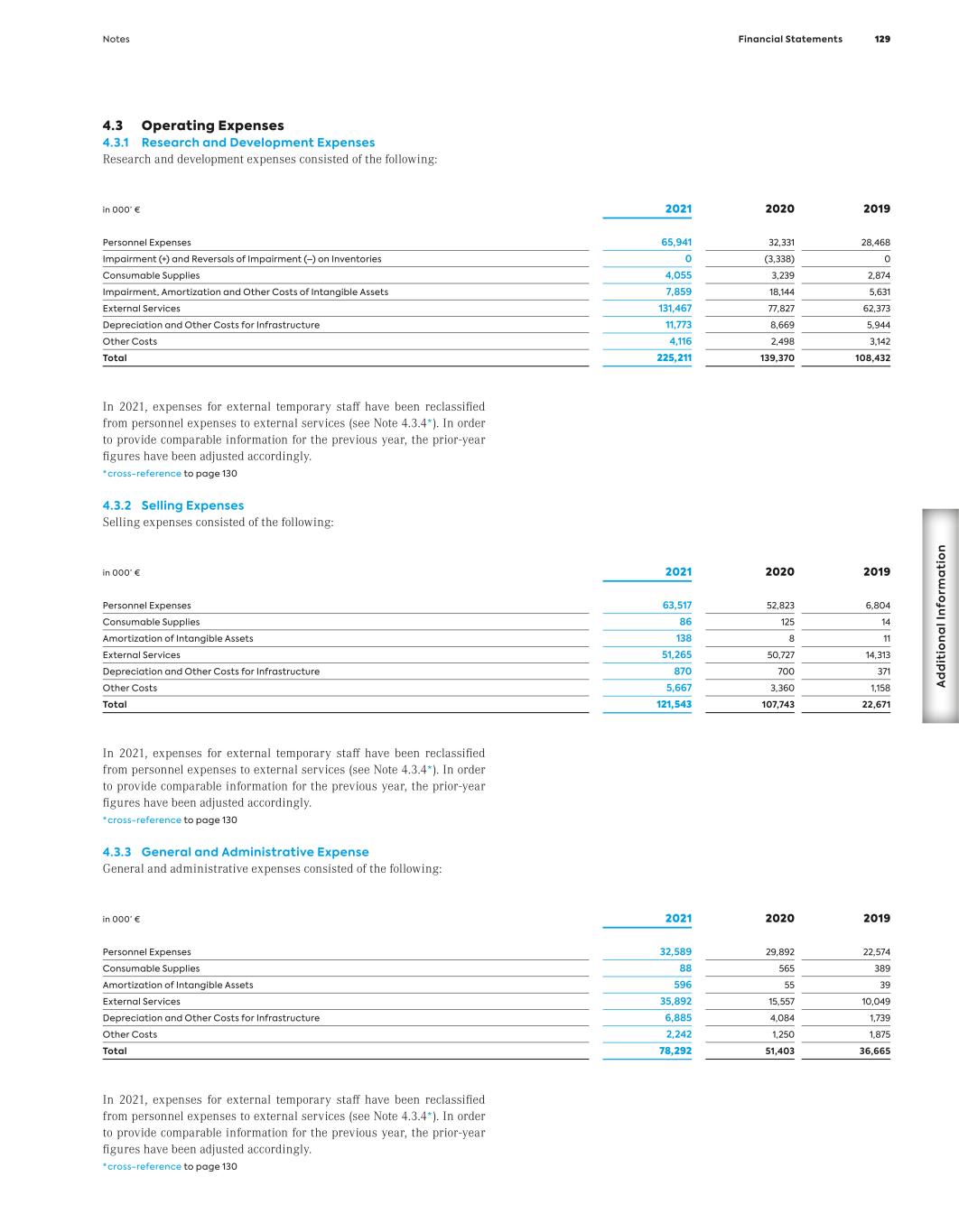

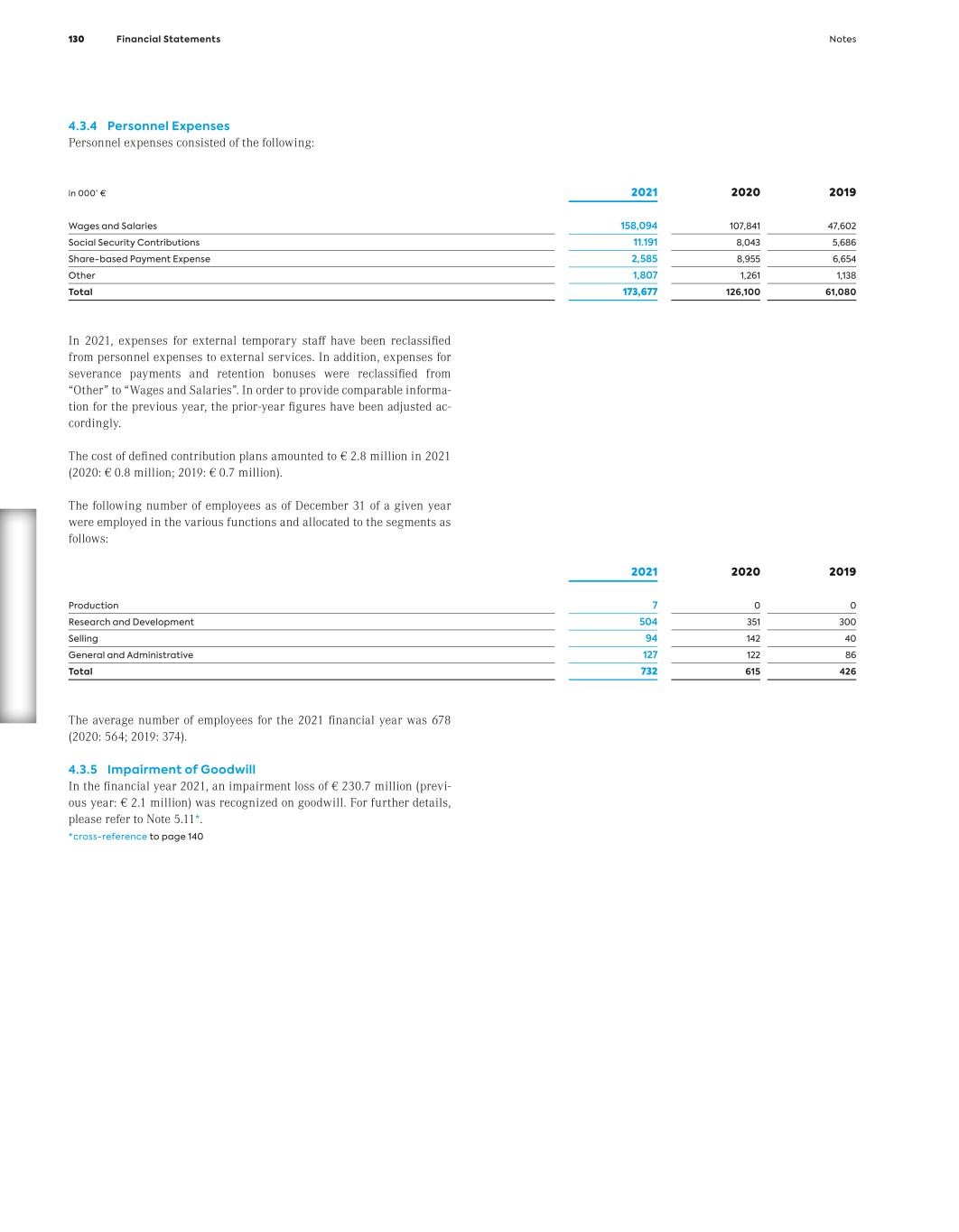

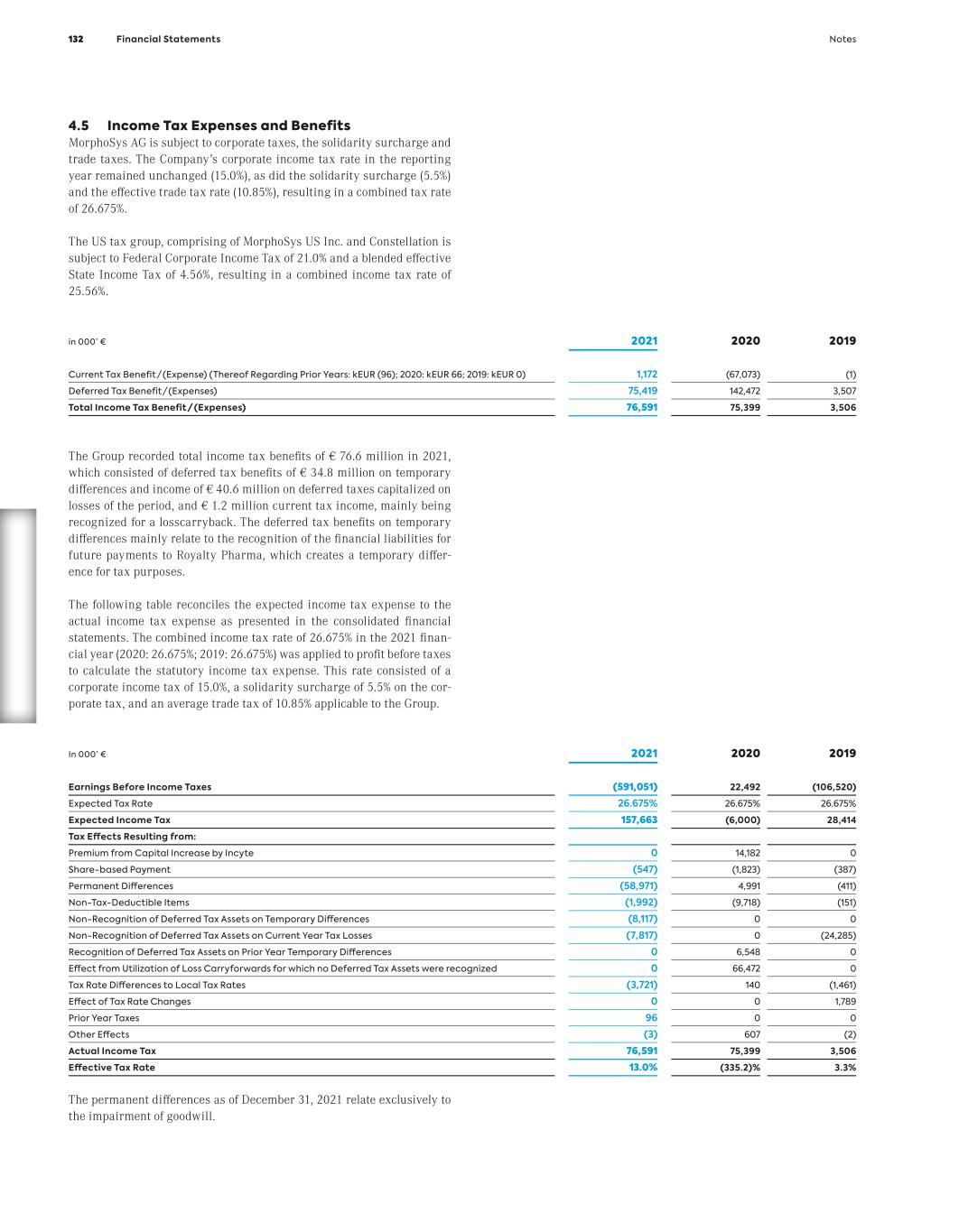

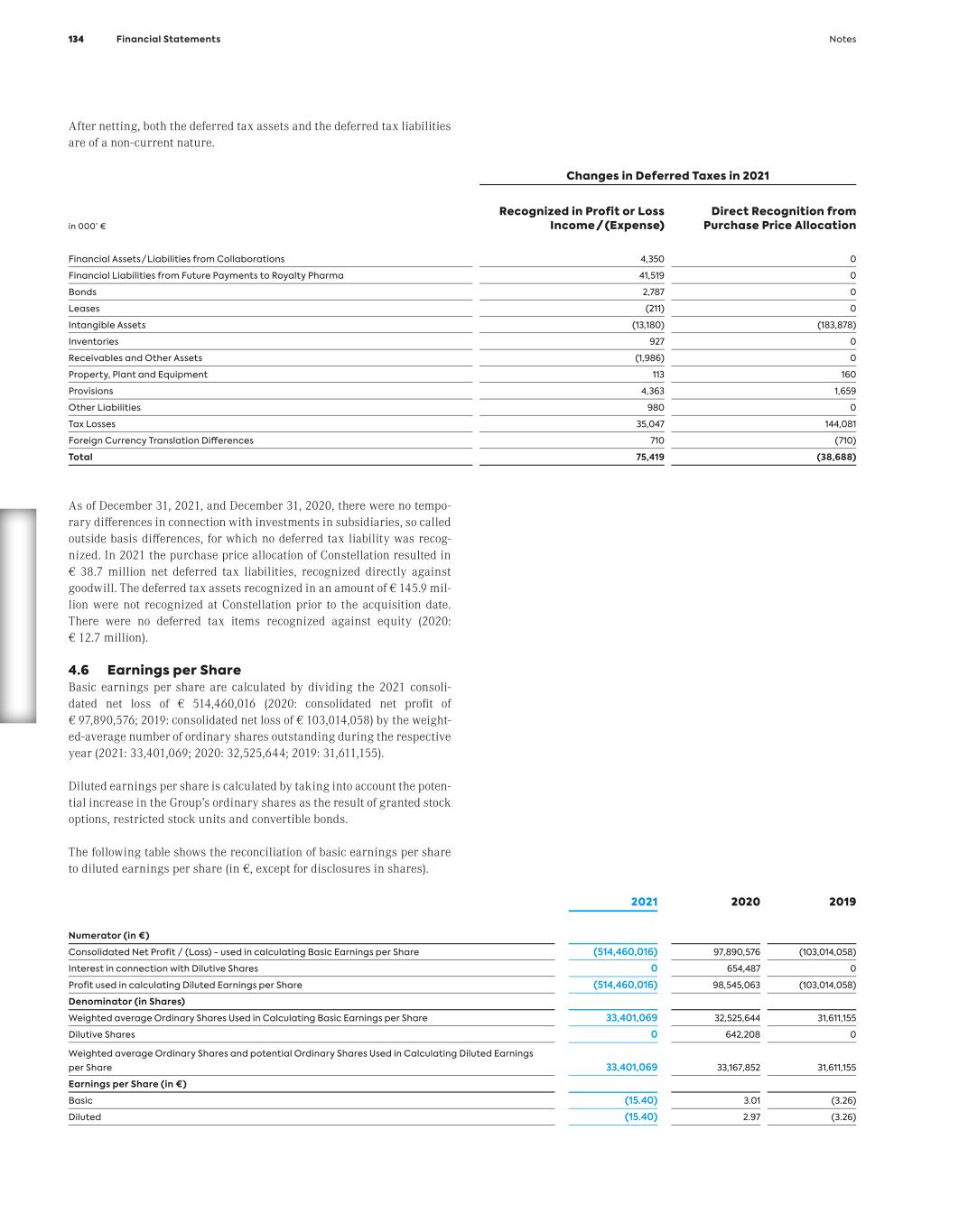

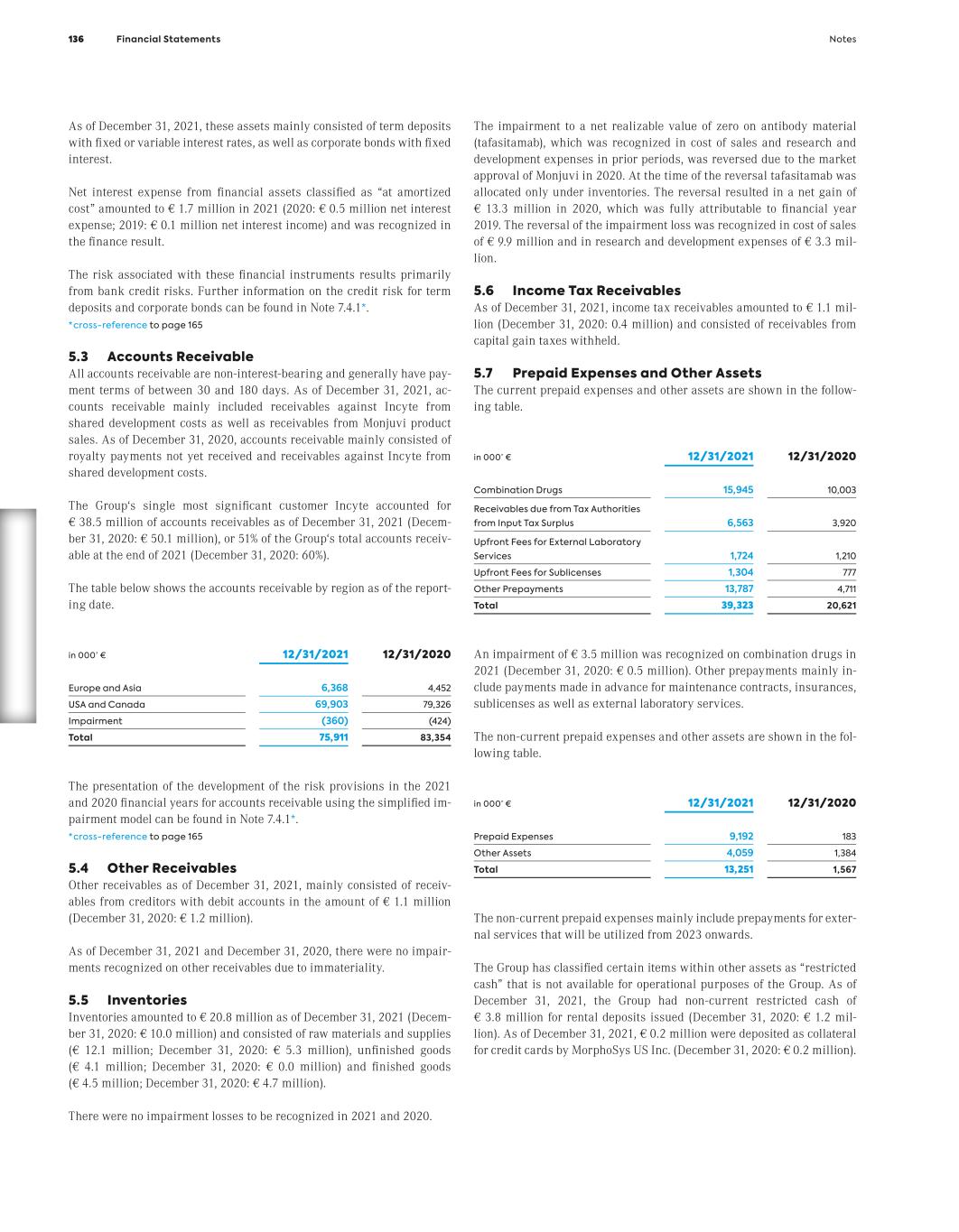

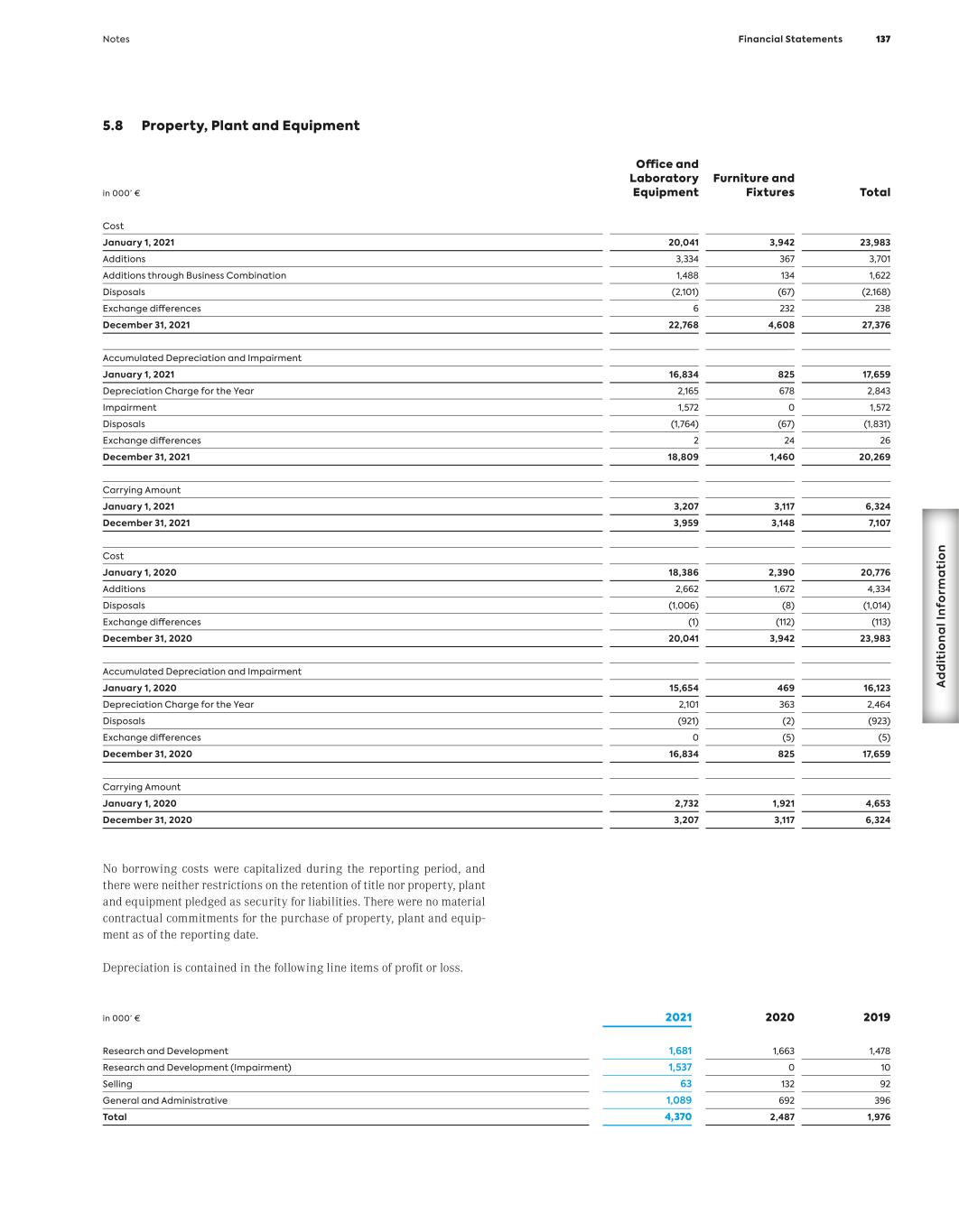

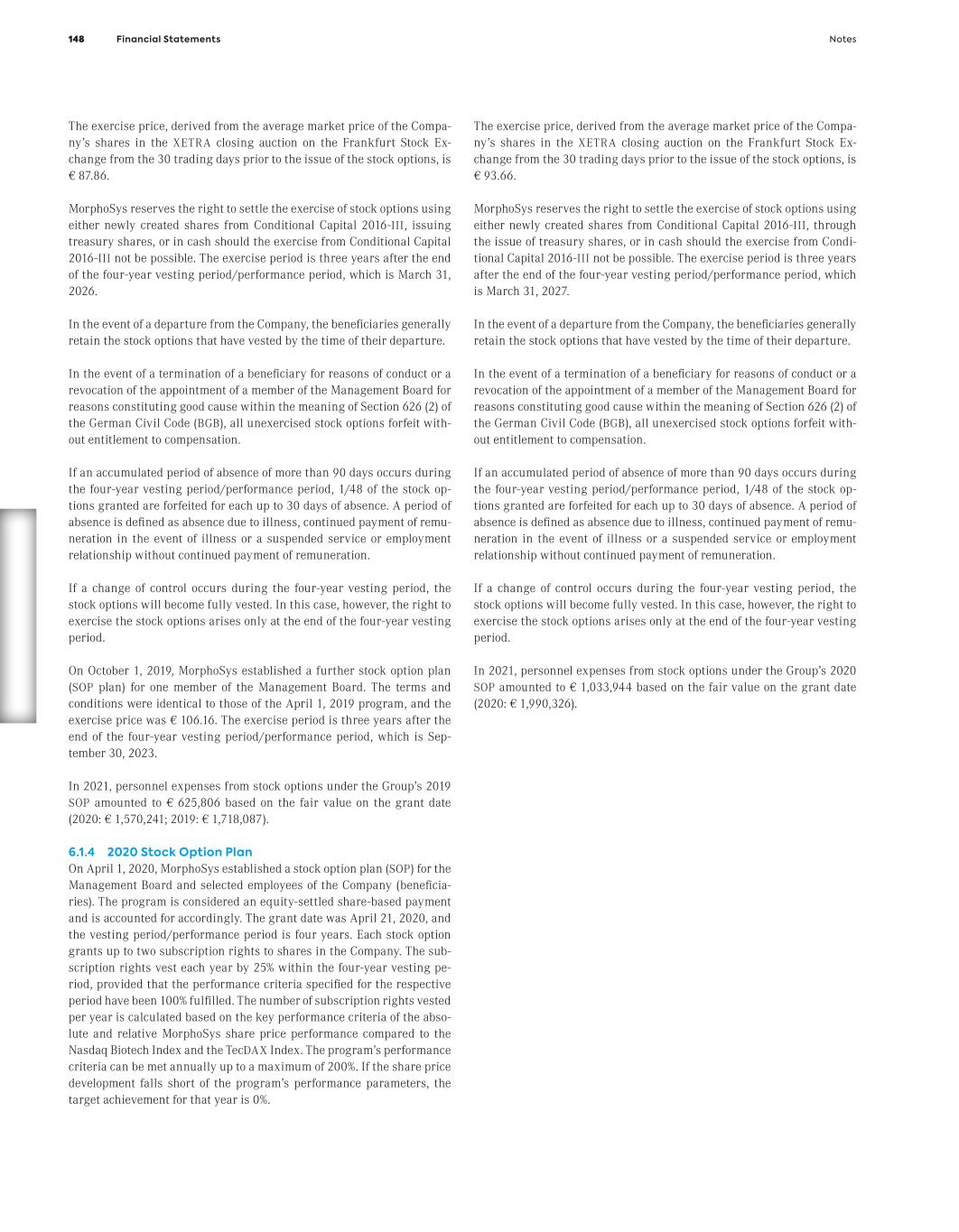

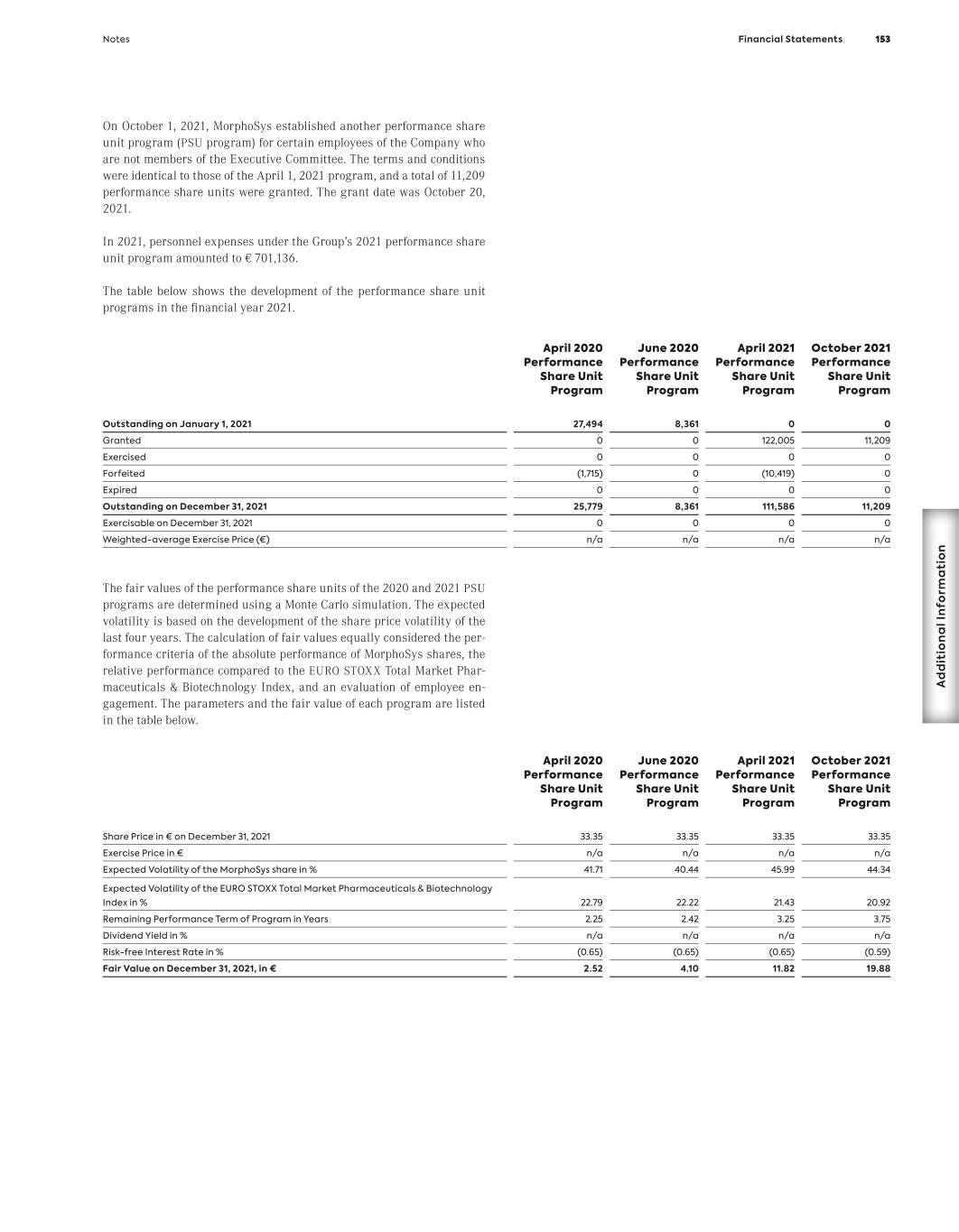

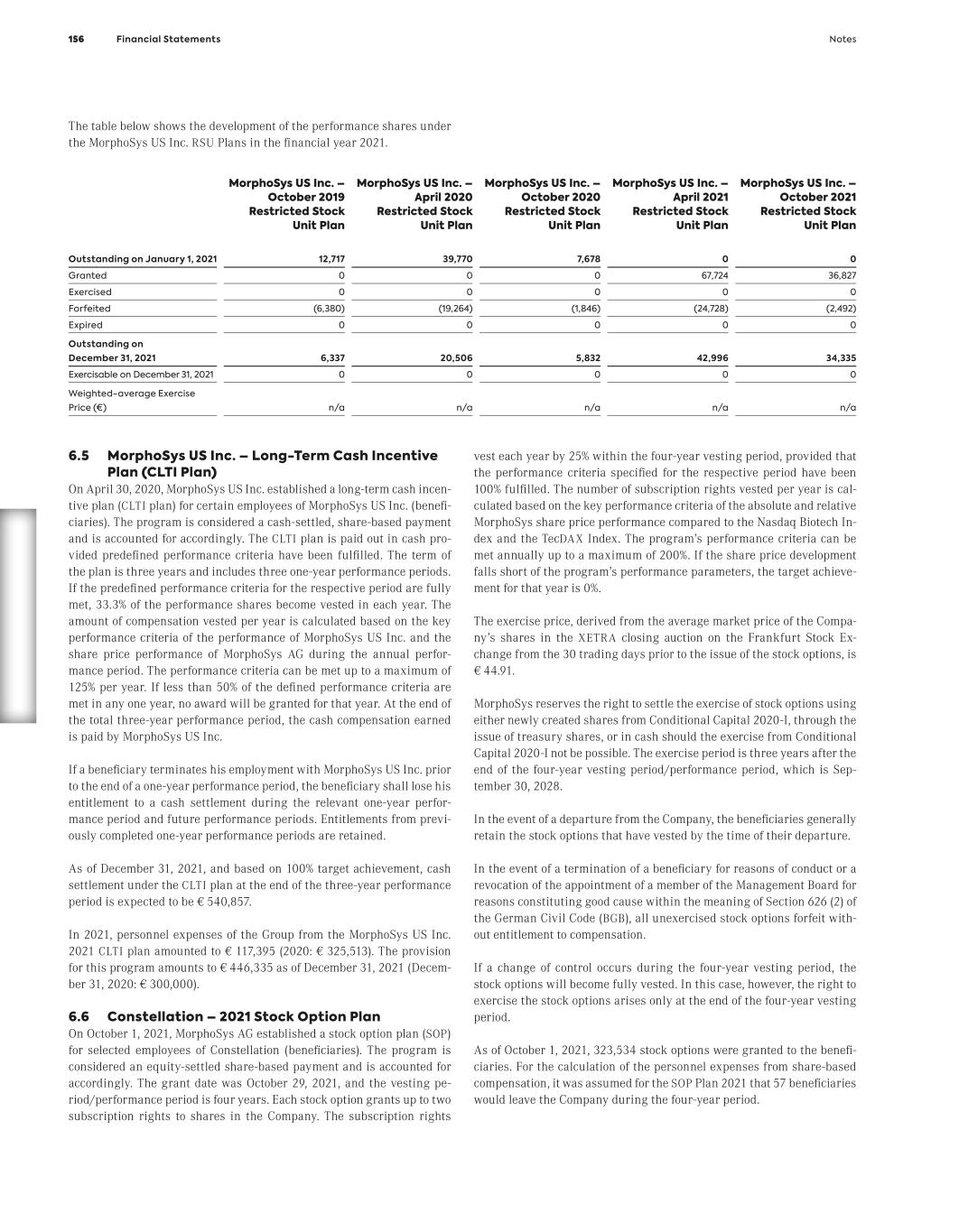

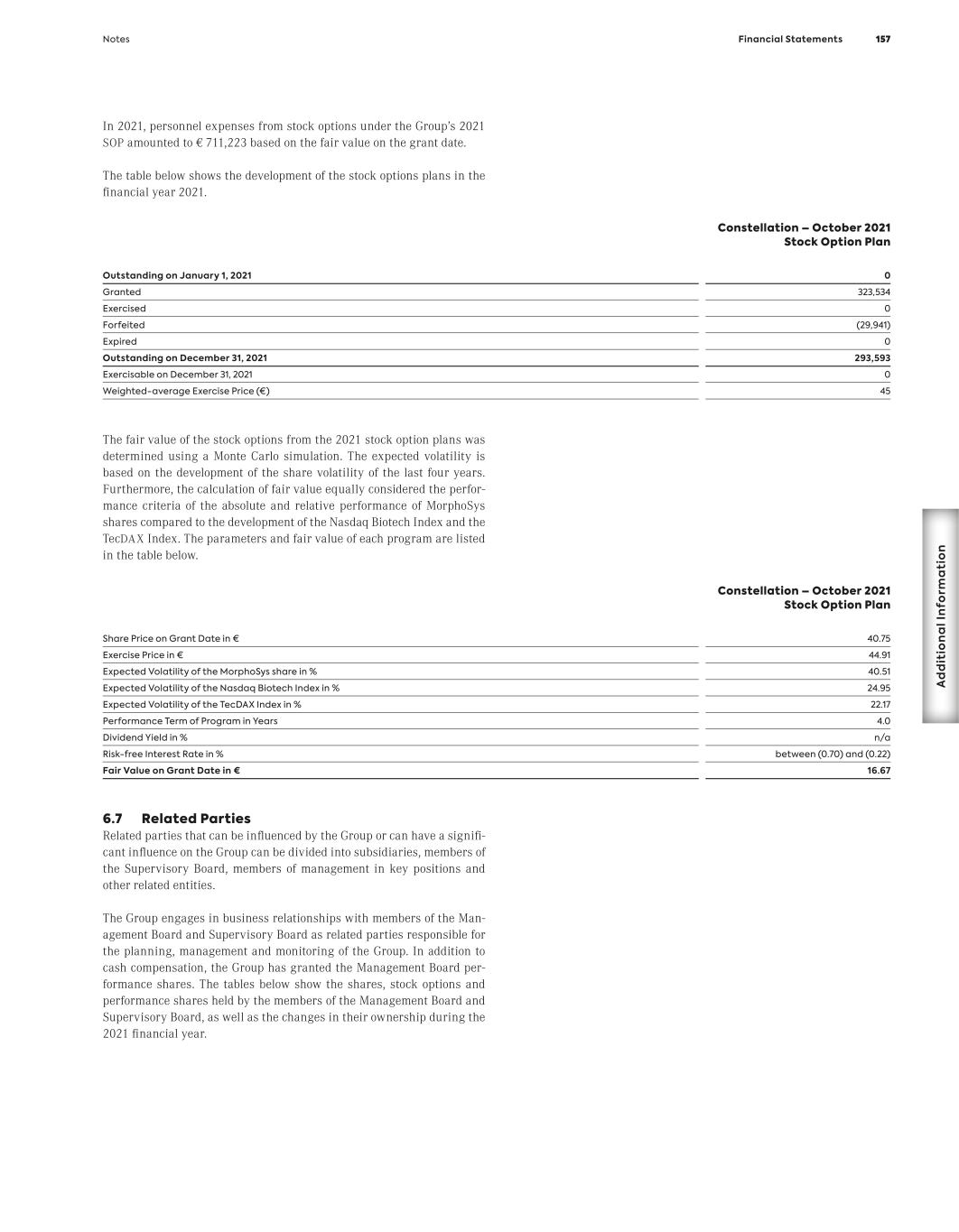

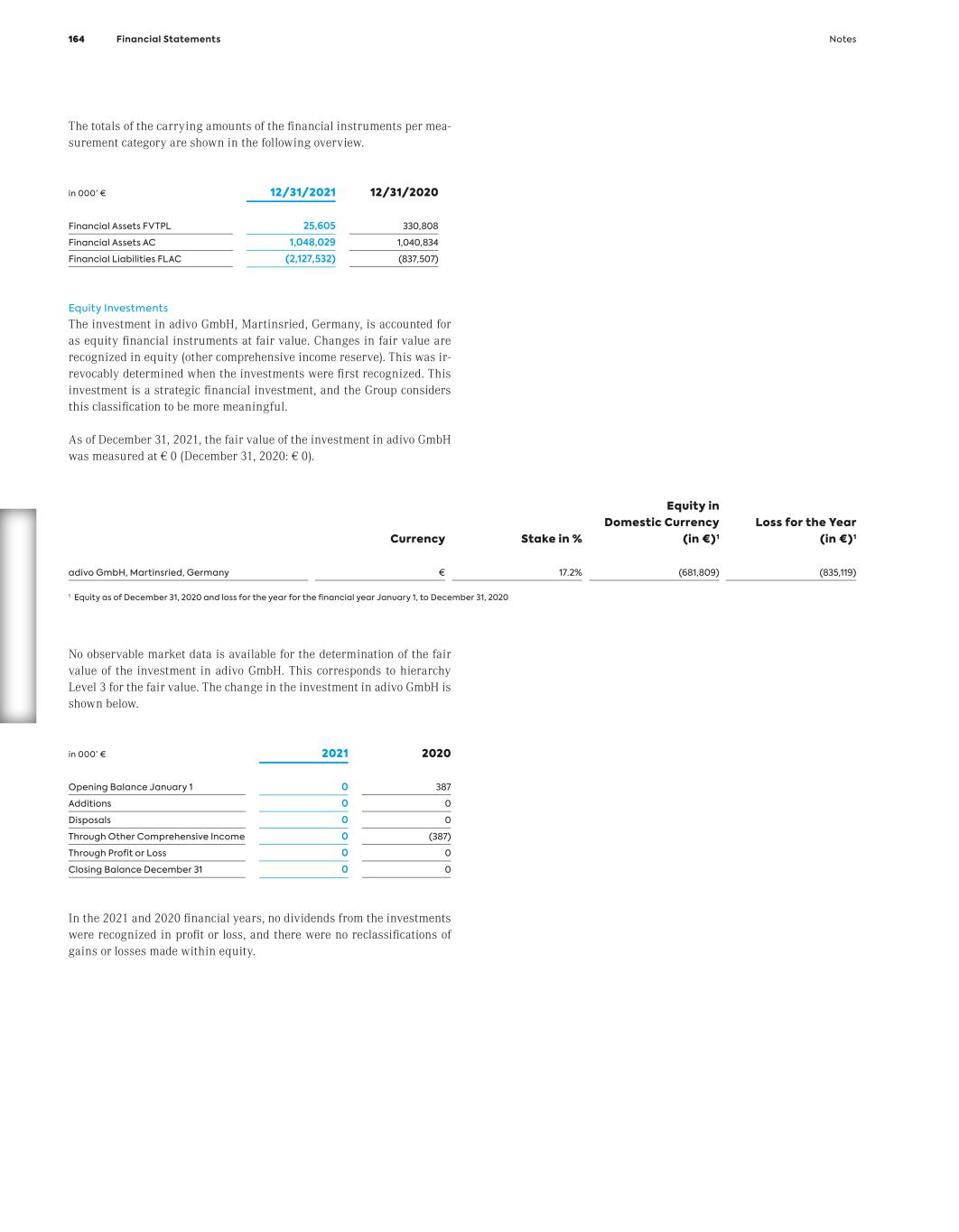

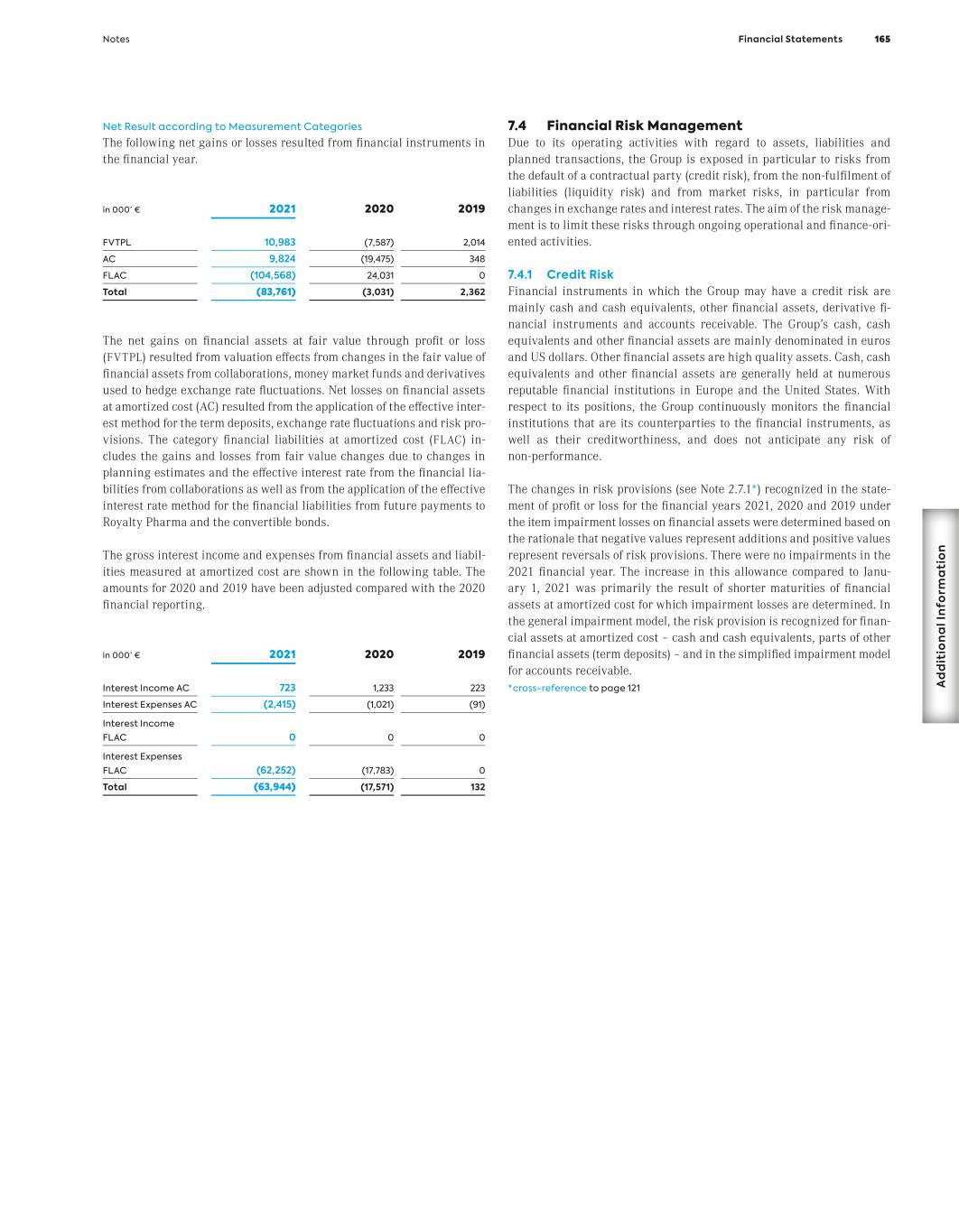

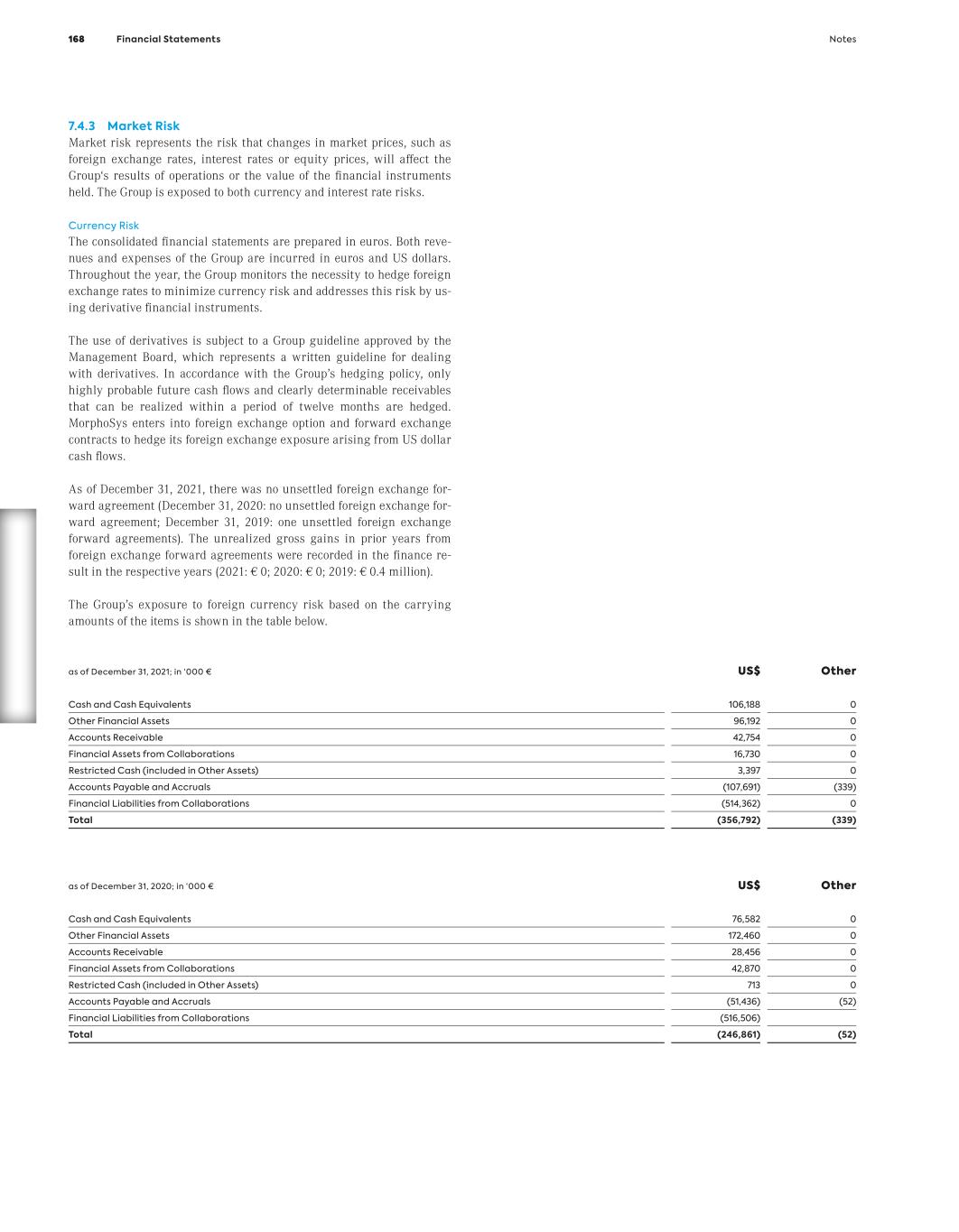

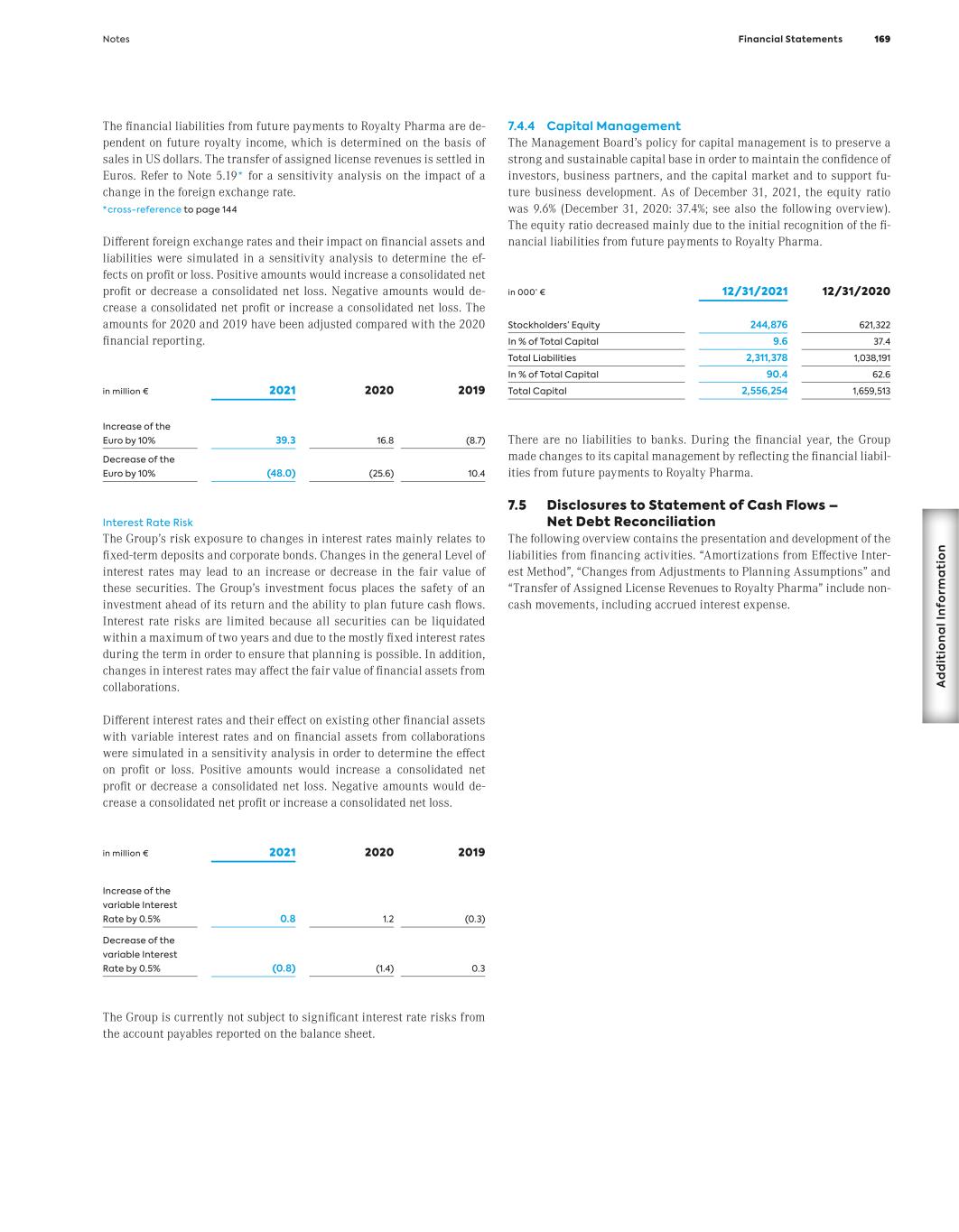

Fi na nc ia l S ta te m en ts Commercialization In July 2018, MorphoSys established a subsidiary in the United States – MorphoSys US Inc. – in preparation for the potential mar- keting approval of tafasitamab. The subsidiary’s registered office is located in Boston, Massachusetts, USA. At the end of 2021, MorphoSys US Inc. had 93 people employed as part of, or to sup- port, its commercial structure. MorphoSys’ commercial activities are currently focused on Monjuvi in the United States; the Com- pany is co-commercializing this product with Incyte. On July 31, 2020, Monjuvi (tafasitamab-cxix)* in combination with lenalidomide was approved under acceleratd approval by the U.S. FDA* for the treatment of adult patients with relapsed or re- fractory (r/r*) diffuse large B-cell lymphoma (DLBCL*) not other- wise specified, including DLBCL arising from low-grade lym- phoma, and who are not eligible for autologous stem cell transplant (ASCT*). This was the first U.S. FDA approval of a second-line treatment for adult patients with r/r DLBCL in the U.S. The safety and tolerability profile supports a paradigm shift towards treat- ing patients to progression, which could enable long-term disease control. Monjuvi is accessible to patients in both community care and academic settings as an off-the-shelf intravenous infusion that does not require hospitalization or heavy monitoring. Upon approval, MorphoSys and Incyte launched ‘My Mission Support’, a robust patient support program offering financial assistance, ongoing education and other resources to eligible patients who are prescribed Monjuvi in the U.S. The program was launched to support patients throughout their treatment journeys and to help lower patient access barriers. Monjuvi has been included in the National Comprehensive Can- cer Network® Clinical Practice Guidelines (NCCN Guidelines®) in Oncology for B-cell Lymphomas since August 2020. The NCCN Guidelines in the United States were updated to include Monjuvi in combination with lenalidomide with a Category 2A designation as an option for the treatment of adult patients with relapsed or refractory (r/r) diffuse large B-cell lymphoma (DLBCL) not other- wise specified, including DLBCL arising from low-grade lym- phoma, and who are not eligible for ASCT. Inclusion in these guidelines increases awareness of a product within the oncology community and also drives certain formulary decisions. As of April 1, 2021, Monjuvi was granted a J-code, further simplifying reimbursement for some treatment centers. In the first half of 2021, commercial performance was adversely impacted by the COVID-19 pandemic. As vaccination rates in- creased there was a gradual easing of restrictions at sites of care, which allowed sales teams to engage in more face-to-face meet- ings with physicians and contributed to the positive momentum we observed in the second half of 2021. Many larger facilities, however, opened at a slower pace than community health centers. In 2021, MorphoSys and Incyte continued to see high penetration in the community setting which drove approximately 70% of Mon- juvi prescriptions. Since launch, the Company, along with partner Incyte, has in aggregate received orders from more than 1,000 treatment sites. During the fourth quarter, more than 570 ac- counts placed orders, with over 70% of those accounts representing repeat accounts. The proportion of accounts that reordered has been consistent from the third quarter through the fourth quarter. The partnership has also made tremendous strides in educating our customers of the value of combination treatment of Monjuvi and lenalidomide for people with r/r DLBCL not otherwise speci- fied, and who are ineligible for ASCT. Approximately 2,000 pa- tients have been treated with Monjuvi in the U.S. since its launch. Operating Business Performance During 2021, MorphoSys focused on commercializing its marketed product and in advancing product candidates at various stages of development. The acquisition of Constellation represents a trans- formation for MorphoSys, expanding its clinical development pipe- line and positioning the Company for long-term sustainable growth. The key measures of value for MorphoSys’ research and develop- ment activities include: • Project launches and the advancement of individual develop- ment programs • Clinical and preclinical research results • Regulatory guidance of healthcare authorities for the approval of individual therapeutic programs • Collaborations, partnerships and M&A activities with other companies to expand the technology base and expand the drug pipeline, as well as to commercialize the therapeutic programs • Strong patent protection to secure MorphoSys’ market position MorphoSys announced on June 2, 2021, its plans to acquire Con- stellation Pharmaceuticals Inc. for US$ 34.00 (equivalent to € 28.79) per share in cash, representing a total equity value of US$1,635.2 million (equivalent to € 1,384.7 million). The transac- tion was unanimously approved by the Management Board and Supervisory Board of MorphoSys as well as by the Board of Direc- tors of Constellation. The acquisition was completed on July 15, 2021. Constellation is a clinical-stage biopharmaceutical com- pany that discovers and develops novel product candidates to ad- dress serious unmet medical needs in patients with cancers asso- ciated with abnormal gene expression or drug resistance. Constellation’s two lead product candidates, pelabresib (CPI- 0610*), a BET inhibitor, and CPI-0209, a second-generation EZH2* inhibitor, are in mid- to late-stage clinical development. MorphoSys expects the following benefits from the acquisition: • Accelerates growth strategy with promising mid- to late-stage product candidates: The transaction accelerates MorphoSys’ strategy to grow through proprietary drug development and commercialization. Constellation’s lead product candidates, pelabresib and CPI-0209, are in phase 3 and phase 2, respec- tively, and may offer broad potential for a range of oncology in- dications. They fit well with MorphoSys’ proven clinical devel- opment, regulatory and commercial capabilities, and MorphoSys is well positioned to rapidly advance and unlock the potential of the Constellation portfolio. * see glossary – page 182 Fundamentals of the MorphoSys Group Group Management Report 37