Management Report and Financial Statements of MorphoSys AG as of December 31, 2021 MorphoSys AG, Planegg

2 Management Report MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021

Management Report 3 MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 Management Report Significant developments in financial year 2021 In 2021, MorphoSys continued its work to discover, develop and commercialize, innovative therapies for patients, with a focus on cancer and autoimmune diseases. In July 2021, we completed the acquisition of Constellation Pharmaceuticals, Inc. ("Constellation"). The addition of Constellation offers a transformational growth opportunity for MorphoSys, expanding our pipeline in a meaningful way with two clinical-stage cancer drug candidates. In addition to this major corporate event, we continued to make progress with our existing programs. At the time of the Constellation acquisition, we also entered into a funding agreement with Royalty Pharma plc. Our lead program, tafasitamab, is already on the market in the U.S. under the brand name Monjuvi (tafasitamab-cxix). Monjuvi (tafasitamab-cxix) has been approved under accelerated approval by the U.S. FDA in July 2020. Together with Incyte, we are co-promoting Monjuvi in the U.S. Incyte holds exclusive rights for development and commercialization outside the U.S. In August 2021, the European Commission (EC) granted conditional marketing authorization for Minjuvi® (tafasitamab) in Europe in combination with lenalidomide, followed by Minjuvi monotherapy, for the treatment of adult patients with relapsed or refractory (r/r) diffuse large B-cell lymphoma (DLBCL) who are not eligible for autologous stem cell transplant (ASCT). Also in August 2021, Health Canada granted Incyte a Notice of Compliance with conditions for Minjuvi (tafasitamab) in combination with lenalidomide for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low-grade lymphoma, who are not eligible for ASCT. In January 2021, a marketing authorization application for tafasitamab was accepted for review by regulatory authorities in Switzerland. To further broaden the tafasitamab opportunity, during 2021, MorphoSys initiated the frontMIND study, a pivotal phase 3 trial in patients with first-line DLBCL. Also, MorphoSys and Incyte announced the first patient dosed in inMIND, a phase 3 study in patients with r/r follicular lymphoma or r/r marginal zone lymphoma (MZL). In June 2021, MorphoSys and Incyte announced new three-year follow-up data from the phase 2 L- MIND study of tafasitamab in combination with lenalidomide in adult patients with r/r DLBCL. The new results built on previous findings showing durable responses and a consistent safety profile of tafasitamab in combination with lenalidomide followed by tafasitamab monotherapy. In December 2021, additional results from RE-MIND2 dataset comparing tafasitamab and lenalidomide outcomes to those observed in matched cohorts of 1) polatuzumab vedotin plus bendamustine and rituximab (pola-BR), 2) rituximab plus lenalidomide (R2); and 3) CAR-T therapies were presented. The findings suggested that tafasitamab plus lenalidomide may improve health outcomes compared to pola-BR and R2, with a prolonged survival benefit for r/r DLBCL patients. Comparable overall survival (OS) between tafasitamab and lenalidomide and CAR-T therapies was observed. Pelabresib is a late-stage proprietary program that MorphoSys acquired through the Constellation acquisition. We are currently conducting two clinical trials of pelabresib for the treatment of myelofibrosis (MF): MANIFEST, our ongoing, open-label phase 2 clinical trial evaluating pelabresib both as a monotherapy and in combination with ruxolitinib, and MANIFEST-2, our global, double-blinded, randomized pivotal phase 3 study evaluating pelabresib in combination with ruxolitinib versus placebo in JAK-inhibitor-naïve MF patients. Exploratory data from the MANIFEST trial were presented at the European Hematology Association (EHA) Annual Meeting in June 2021. Translational data across all three arms of the study illustrated the effect of pelabresib on key cytokines associated with MF and its impact on bone marrow fibrosis. Taken together,

4 Management Report MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 these data support our hypothesis that pelabresib may have a potential disease-modifying activity in MF. At the American Society of Hematology (ASH) Annual Meeting in December 2021, we presented updated interim clinical and translational data from the ongoing MANIFEST trial, which included 54 more patients and longer- term follow-up than previously reported data. We believe that the latest interim data from MANIFEST underscore the potential of pelabresib in the treatment of MF. With respect to MANIFEST-2, MorphoSys has optimized the study design and implemented measures to accelerate patient recruitment since the acquisition of Constellation. Progress was also made with programs in earlier stages of clinical development. Interim data from the phase 1/2 proof-of-concept M-PLACE trial that evaluates felzartamab in anti-PLA2R antibody positive membranous nephropathy (MN) were presented in November 2021. Early efficacy data were presented: of the 27 treated patients with evaluable results, 24 showed an initial rapid reduction of anti-PLA2R antibody levels one week after the first treatment. The safety profile was shown to be consistent with the proposed mechanism of action of felzartamab. The trial was fully enrolled in November 2021. Two additional trials with felzartamab were initiated during 2021 – New-PLACE, a phase 2 study evaluating different treatment schedules to identify the regimen for a pivotal study in patients with anti-PLA2R antibody positive MN, and the phase 2 IGNAZ trial evaluating felzartamab in patients with immunoglobulin A nephropathy (IgAN). CPI-0209 is another product candidate acquired through Constellation. CPI-0209 is a small molecule designed to promote anti-tumor activity by specifically inhibiting the enzymatic function of enhancer of zeste homolog 2 (EZH2) protein. We are currently conducting a phase 1/2 clinical trial of CPI-0209 in patients with solid tumors and hematological malignancies. Our partners responsible for clinical development of licensed programs also continued their activities during 2021. For example, in June I-Mab announced that the Center for Drug Evaluation (CDE) of the China National Medical Products Administration (NMPA) had approved the Investigational New Drug (IND) application to initiate a phase 1b study with felzartamab in patients with systemic lupus erythematosus (SLE), the most common form of lupus. In October, licensing partner Roche received Breakthrough Therapy Designation from the U.S. Food and Drug Administration (FDA) for gantenerumab for the treatment of people living with Alzheimer’s disease. Also in October 2021, licensing partner GSK announced that it had made the decision not to further explore otilimab as a potential treatment for severe pulmonary COVID-19- related disease in patients aged of 70 years and older. Clinical development of otilimab in rheumatoid arthritis remains ongoing. In 2021, MorphoSys continued to transform the Company with activities focused on advancing and positioning the Company for long-term success. We grew sales of Monjuvi, while also broadening our pipeline through a transformative acquisition.

Management Report 5 MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 Fundamentals of MorphoSys AG Organizational Structure and Business Model MorphoSys AG discovers and develops innovative therapies for patients suffering from cancer and autoimmune diseases. MorphoSys AG, as the ultimate parent company, is located in Planegg, near Munich. MorphoSys AG has one wholly owned subsidiary, MorphoSys US Inc. (Boston, Massachusetts, USA). MorphoSys US Inc. in turn has a wholly owned subsidiary - Constellation Pharmaceuticals, Inc. (Cambridge, Massachusetts, USA). Constellation Pharmaceuticals, Inc. also has a wholly owned subsidiary, Constellation Securities Corp. (Cambridge, Massachusetts, USA). Constellation Pharmaceuticals, Inc. and Constellation Securities Corp. are collectively referred to as “Constellation”, and all entities constitute the “MorphoSys Group” or “Group”. The Planegg site MorphoSys AG houses the central functions such as accounting, controlling, human resources, legal, patents, purchasing, corporate communications and investor relations, as well as the scientific research departments and laboratories. MorphoSys US Inc. is responsible for advancing tafasitamab’s commercialization. Constellation focuses its activities on the clinical development of drug candidates and the related administrative departments. Legal structure of the MorphoSys: Company Management and supervision The parent company of the MorphoSys Group is MorphoSys AG, a German stock corporation listed in the Prime Standard segment of the Frankfurt Stock Exchange and on the NASDAQ Global Market. In accordance with the German Stock Corporation Act, the Company has a dual management structure with the Management Board as the governing body. The four members of the Management Board are appointed and supervised by the Supervisory Board. Following the departure of Roland Wandeler, Ph.D., Chief Operating Officer, effective December 31, 2021, the Management Board consists of only three members. The Supervisory Board of MorphoSys AG is elected by the Annual General Meeting and currently consists of six members. Detailed information on the Company’s management and supervision and its corporate governance principles can be found in the Corporate Governance Report. Targets and Strategy MorphoSys mission is to discover, develop and commercialize innovative therapies for patients. MorphoSys is a fully integrated commercial biopharmaceutical company. Its activities in 2021 focused on hematology/oncology and autoimmune diseases. The Company aims to realize intermediate- and long-term growth through its focus on proprietary drug development and commercialization. Through the acquisition of Constellation, the Company has rapidly expanded its pipeline in the hematology/oncology area. Our priority is on the Company’s lead development candidates pelabresib and tafasitamab; continuing to make progress with the commercialization of Monjuvi and obtaining approvals in additional indications; bringing pelabresib to the market as well as continuing to develop other clinical candidates. MorphoSys is now primarily advancing the clinical development of its own compounds, with further antibody candidates being clinically developed by partners. During the clinical phases, decisions are made on a case-

6 Management Report MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 by-case basis as to whether and at what point a partnership for further development and commercialization should be pursued. Drug candidates can be either fully out-licensed, developed on a proprietary basis or with a partner (co-development). The development of drug candidates on behalf of other companies is no longer a focus of MorphoSys’ business activities. As such, the previous segment reporting for the Proprietary Development and Partnered Discovery segments was discontinued as of the first quarter of 2021. The development of drug candidates is broadly based on MorphoSys’ innovative technologies. These include our established antibody and technology platforms HuCAL®, Ylanthia® and Slonomics®, as well as the bispecific technology CyCAT®. Under the agreement signed with Cherry Biolabs in November 2020, MorphoSys was granted exclusive access to the Hemibody technology for several targets, which will be used to develop a novel multispecific antibody technology for effector cell recruitment (T-cell engager). We continue to leverage our resources and know-how to expand and develop these technologies. This may include the expansions of our portfolio not only through our own proprietary research and development activities but also through in-licensing and acquisitions. Company’s Management and Performance Indicators MorphoSys AG uses financial indicators to steer the Company. These indicators help to monitor the success of strategic decisions and give the Company the opportunity to take quick corrective action when necessary. The Company’s management also monitors and evaluates selected early indicators so that it can thoroughly assess a project’s progress and promptly take the appropriate actions should a problem occur. No most important non-financial performance indicators are used for steering the Company. Material non-financial aspects are taken into account in a separate “Non-Financial Group Report", which is available on our website. Financial Performance Indicators The development of the financial performance indicators in the reporting year is described in detail in the chapter “Analysis of Net Assets, Financial Position and Results of Operations”. The most important financial indicators used to measure the Company’s operating performance are revenues, operating expenses (total sum of cost of sales, research and development expenses, selling expenses and general administration expenses) and research and development expenses as percentage of total operating expenses. In future periods, research and development expenses as well as selling, general and administrative expenses will be used as most important financial performance indicators for steering the Company. MorphoSys’ business performance is additionally influenced by liquidity. This indicator is also routinely analyzed and evaluated. Liquidity position is not considered to be part of the key financial performance indicators The budget for the respective financial year is approved by the Management Board and Supervisory Board. Subsequent to the approval of the budget, a forecast is made two times within the year, to assess if the Company is on track to achieve its financial goals and progress towards financial guidance. The forecast informs decision making and enables management to take actions to achieve its goals. Non-Financial Aspects With its own marketed drug in the U.S., MorphoSys has completed its transformation from a technology provider to a fully integrated biopharmaceutical company. The Company’s core mission has not changed in

Management Report 7 MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 this process: We strive to develop new drugs for the well-being of patients with serious diseases. To ensure sustainable business success in this endeavor, we take selected non-financial aspects into account in addition to financial performance indicators. At MorphoSys, innovation in research and development remains a central aspect. Our research and development strategy focuses on indications with high unmet medical need, where patients’ lives depend on new treatment options. Our goal is to improve the lives of these patients by focusing on therapeutic areas that best fit our expertise while making optimal use of our resources. The acquisition of Constellation in July 2021 represents a significant investment in the development of new drugs for patients with limited treatment options in the field of hematology/oncology. Leading Indicators MorphoSys follows a variety of leading indicators to monitor the macroeconomic environment, the industry and the Company itself. At the Company level, economic data is gathered on the progress of individual programs. MorphoSys uses general market data and external financial reports to acquire information on leading macroeconomic indicators such as industry transactions, changes in the legal environment and the availability of research funding and reviews these data carefully. Market analyses that assess the medical need for innovative therapies for serious diseases focused not only on cancer and autoimmune diseases, but also generally with regard to new technologies in the market, serve as early indicators in the area of business development. By continuously monitoring the market, MorphoSys can respond to trends and requirements quickly and initiate its own activities and partnerships. For active collaborations, a joint steering committee meets regularly (usually two to four times per year) to update and monitor the programs’ progress. These ongoing reviews give the Company a chance to intervene at an early stage if there are any negative developments and provide it with information about expected interim goals and related milestone payments well in advance. Partners in non-active collaborations regularly provide (once per year) MorphoSys with written reports so that the Company can follow the progress of active therapeutic programs. Commercialization In July 2018, MorphoSys established a subsidiary in the United States – MorphoSys US Inc. – in preparation for the potential marketing approval of tafasitamab. The subsidiary’s registered office is located in Boston, Massachusetts, USA. At the end of 2021, MorphoSys US Inc. had 93 people employed as part of, or to support, its commercial structure. On July 31, 2020, Monjuvi (tafasitamab-cxix) in combination with lenalidomide was approved under accelerated approval by the U.S. FDA for the treatment of adult patients with relapsed or refractory (r/r) diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low-grade lymphoma, and who are not eligible for autologous stem cell transplant (ASCT). This was the first U.S. FDA approval of a second-line treatment for adult patients with r/r DLBCL in the U.S. The safety and tolerability profile supports a paradigm shift towards treating patients to progression, which could enable long-term disease control. Monjuvi is accessible to patients in both community care and academic settings as an off-the- shelf intravenous infusion that does not require hospitalization or heavy monitoring. Upon approval, MorphoSys and Incyte launched 'My Mission Support', a robust patient support program offering financial

8 Management Report MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 assistance, ongoing education and other resources to eligible patients who are prescribed Monjuvi in the U.S. The program was launched to support patients throughout their treatment journeys and to help lower patient access barriers. Monjuvi has been included in the National Comprehensive Cancer Network® Clinical Practice Guidelines (NCCN Guidelines®) in Oncology for B-cell Lymphomas since August 2020. The NCCN Guidelines in the United States were updated to include Monjuvi in combination with lenalidomide with a Category 2A designation as an option for the treatment of adult patients with relapsed or refractory (r/r) diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low-grade lymphoma, and who are not eligible for ASCT. Inclusion in these guidelines increases awareness of a product within the oncology community and also drives certain formulary decisions. As of April 1, 2021, Monjuvi was granted a J-code, further simplifying reimbursement for some treatment centers. Business Performance During 2021, MorphoSys focused on advancing product candidates at various stages of development. The acquisition of Constellation represents a transformation for MorphoSys, expanding its clinical development pipeline and positioning the Company for long-term sustainable growth. The key measures of value for MorphoSys’ research and development activities include: • Project launches and the advancement of individual development programs • Clinical and preclinical research results • Regulatory guidance of healthcare authorities for the approval of individual therapeutic programs • Collaborations, partnerships and M&A activities with other companies to expand the technology base and expand the drug pipeline, as well as to commercialize the therapeutic programs • Strong patent protection to secure MorphoSys’ market position MorphoSys announced on June 2, 2021, its plans to acquire Constellation Pharmaceuticals, Inc. for US$ 34.00 (equivalent to € 28.79) per share in cash, representing a total equity value of US$1,635.2 million (equivalent to €1,384.7 million). The transaction was unanimously approved by the Management Board and Supervisory Board of MorphoSys as well as by the Board of Directors of Constellation. The acquisition was completed on July 15, 2021. Constellation is a clinical-stage biopharmaceutical company that discovers and develops novel product candidates to address serious unmet medical needs in patients with cancers associated with abnormal gene expression or drug resistance. Constellation’s two lead product candidates, pelabresib (CPI- 0610), a BET inhibitor, and CPI-0209, a second-generation EZH2 inhibitor, are in mid- to late-stage clinical development. MorphoSys expects the following benefits from the acquisition: • Accelerates growth strategy with promising mid- to late-stage product candidates: The transaction accelerates MorphoSys’ strategy to grow through proprietary drug development and commercialization. Constellation’s lead product candidates, pelabresib and CPI-0209, are in phase 3 and phase 2, respectively, and may offer broad potential for a range of oncology indications. They fit well with MorphoSys’ proven clinical development, regulatory and commercial capabilities, and MorphoSys is well positioned to rapidly advance and unlock the potential of the Constellation portfolio. • Strengthens position in hematology/oncology and expands into solid tumors: Constellation adds an attractive, complementary pipeline of highly innovative mid- to late-stage cancer therapy candidates, augmenting MorphoSys’ existing pipeline in hematologic malignancies and expanding into potential therapies for solid tumors.

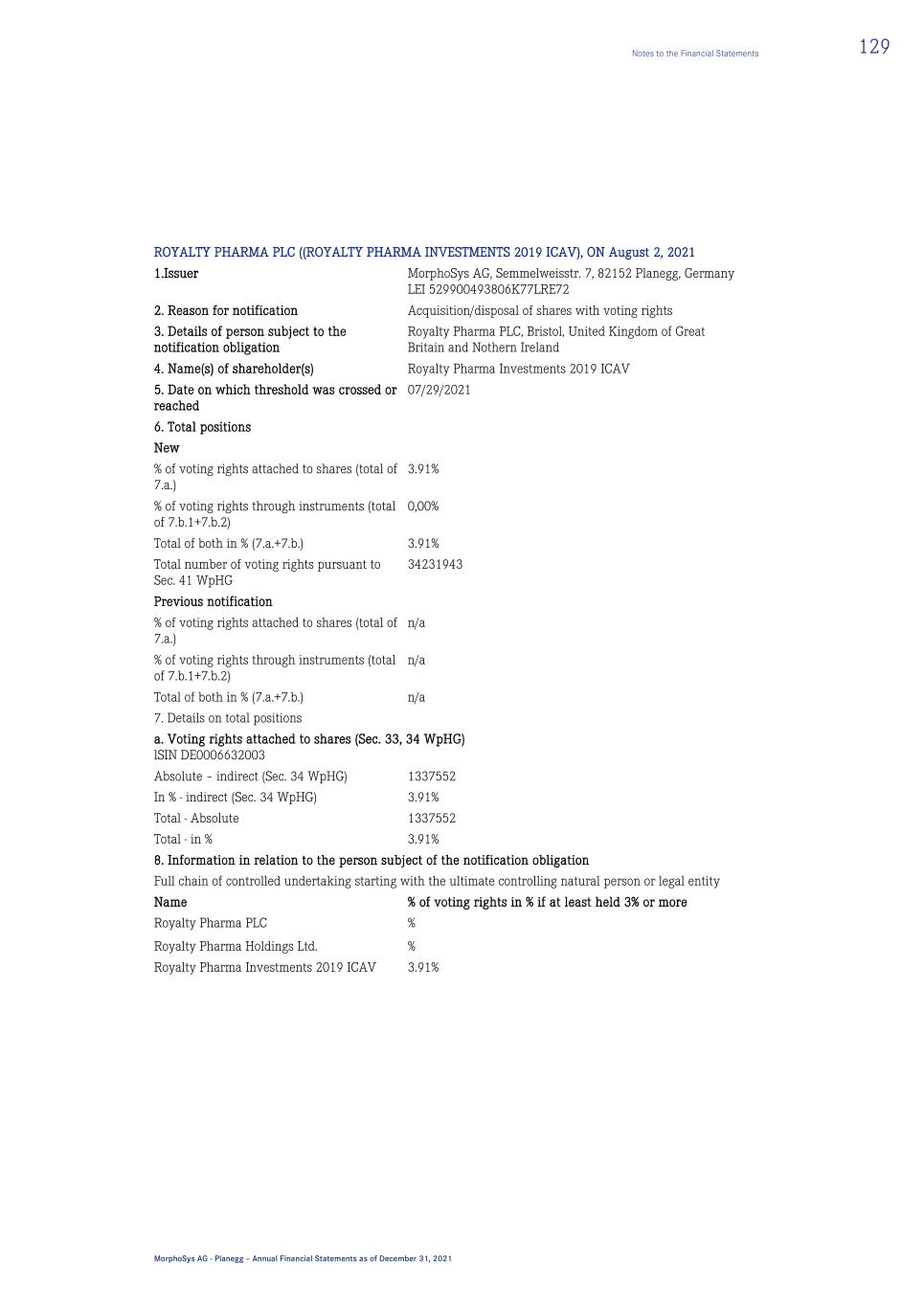

Management Report 9 MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 At the time of the Constellation acquisition, MorphoSys also entered into a funding agreement with Royalty Pharma plc (“Royalty Pharma”). Under the terms of this agreement, Royalty Pharma made a US$ 1,300.0 million (€1,100.9 million) upfront payment to MorphoSys and also provided the MorphoSys group access to up to US$ 350.0 million (€ 296.4 million) in development funding bonds with the flexibility to draw over a one-year period. Royalty Pharma also invested US$ 100.0 million (€ 84.7 million) in a cash capital increase of MorphoSys under an authorization to exclude subscription rights of existing shareholders and will make additional payments of up to US$ 100.0 million (€ 84.7 million) upon reaching clinical, regulatory and commercial milestones for otilimab and gantenerumab. Royalty Pharma gained rights to receive 100% of MorphoSys’ royalties on net sales of Tremfya, 80% of future royalties and 100% of future milestone payments on otilimab and 60% of future royalties on gantenerumab. Research and Development As of December 31, 2021, MorphoSys’ research and development activities are currently focused on the following clinical candidates: • Tafasitamab (MOR208, formerly XmAb5574) is a humanized Fc-modified monoclonal antibody directed against CD19. CD19 is selectively expressed on the surface of B-cells, which belong to a group of white blood cells. CD19 enhances B-cell receptor signaling, which is an important factor in B-cell survival and growth. CD19 is a potential target structure for the treatment of B-cell malignancies. • Pelabresib (CPI-0610) is an investigational selective small molecule BET inhibitor with an epigenetic mechanism of action that has been designed to promote anti-tumor activity by specifically inhibiting the function of BET proteins, which normally enhance target gene expression. The FDA and the EMA granted orphan drug designation to pelabresib for the treatment of myelofibrosis in November 2019 and February 2020 respectively. We believe there is an opportunity to address serious unmet medical needs in patients with myelofibrosis. As part of MorphoSys’ agreement with Royalty Pharma, Royalty Pharma is entitled to receive 3% of future net sales of pelabresib. • Felzartamab (MOR202/TJ202) is an investigational human monoclonal HuCAL-IgG1-antibody directed against a unique epitope of the target molecule CD38. CD38 is a surface antigen broadly expressed on malignant myeloma cells as well as on antibody-producing plasmablasts and plasma cells, the latter playing an important role in the pathogenesis of antibody-mediated autoimmune diseases. • CPI‑0209 is an investigational small molecule, second-generation EZH2 inhibitor with an epigenetic mechanism of action that has been designed to achieve comprehensive target coverage through increased on-target residence time. Data from in vitro preclinical models of multiple cancer types suggested that CPI- 0209 may bind to EZH2 more durably and with higher affinity than first-generation EZH2 inhibitors. CPI- 0209 was designed to eliminate auto-induction of metabolism, which has been an issue with other EZH2 inhibitors. Royalty Pharma is entitled to receive 3% of future net sales of CPI-0209. In addition to MorphoSys’ own pipeline, the following programs, among others, are being further developed by MorphoSys’ partners: • Felzartamab (see above) is also being further developed by I-Mab for mainland China, Taiwan, Hong Kong and Macao, where, if approved, it may also be commercialized. I-Mab is currently pursuing development in multiple myeloma (MM) and systemic lupus erythematosus (SLE).

10 Management Report MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 • Gantenerumab, a HuCAL antibody targeting amyloid beta, is being developed by Roche as a potential treatment for Alzheimer’s disease. As part of the agreement with Royalty Pharma, MorphoSys will retain 40% of future royalties on gantenerumab and will provide Royalty Pharma with 60% of future royalties. • Otilimab (formerly MOR103/GSK3196165) is a HuCAL antibody directed against granulocyte-monocyte colony-stimulating factor (GM-CSF). Due to its diverse functions in the immune system, GM-CSF can be considered a target for a broad range of anti-inflammatory therapies such as rheumatoid arthritis (RA). Otilimab was fully out-licensed to GlaxoSmithKline (GSK) in 2013. MorphoSys will retain 20% of future royalties on otilimab and, as part of the agreement with Royalty Pharma, will provide Royalty Pharma with 80% of future royalties and 100% of future milestone payments. • Tremfya® is a HuCAL antibody targeting the p19 subunit of IL-23 that is being developed and commercialized by Janssen. It is the first commercial product based on MorphoSys’ proprietary technology. Royalty Pharma is entitled to receive 100% of MorphoSys’ royalties on net sales of Tremfya, commencing with the second quarter of 2021. • MOR210/TJ210 is an antibody directed against C5aR, derived from MorphoSys’ HuCAL library. C5aR, the receptor of complement factor C5a, is being investigated as a potential new drug target in the fields of immuno-oncology, immune and chronic inflammatory diseases. In November 2018, MOR210/TJ210 was out-licensed to I-Mab for Greater China and South Korea. • In addition to the programs listed above, MorphoSys and its partners are pursuing several programs in various stages of research and clinical development. Proprietary Clinical Development Tafasitamab Overview Tafasitamab (MOR208, formerly XmAb5574) is a humanized Fc-modified monoclonal antibody directed against CD19. CD19 is selectively expressed on the surface of B-cells, which belong to a group of white blood cells. CD19 enhances B-cell receptor signaling, which is an important factor in B-cell survival and growth, making CD19 a potential target structure for the treatment of B-cell malignancies. The clinical development of tafasitamab is currently focused on B-cell non-Hodgkin’s lymphoma (NHL), particularly diffuse large B-cell lymphoma (DLBCL), follicular lymphoma (FL) and marginal zone lymphoma (MZL). In addition, we will initiate the MINDway study, in which we are investigating an optimized treatment regimen to reduce the frequency of drug administration and thereby reduce the burden on the patient. Lymphomas collectively represent approximately 5% of all cancers diagnosed in the United States. The group of NHL diseases is the most prevalent of all lymphoproliferative diseases. According to the National Cancer Institute, there were an estimated 81,560 new cases in the United States in 2021 and an estimated 20,720 deaths due to this disease (“Cancer Stat Facts 2021: Non-Hodgkin’s Lymphoma”). DLBCL is the most common type of NHL in adults and accounts for approximately one-third of all NHL cases globally. The current first- line treatment of B-cell lymphomas, including DLBCL, most commonly consists of a combination chemotherapy regimen plus the antibody rituximab, also referred to commonly as R-CHOP (R, rituximab; CHOP, cyclophosphamide, doxorubicin, vincristine and prednisone). Yet, despite the therapeutic success of frontline R-CHOP in DLBCL, up to 40% of patients either do not respond to the treatment (are refractory) or relapse after initial treatment with fast disease progression. The market research and consulting firm GlobalData expects the therapeutic market for non-Hodgkin’s lymphoma (NHL) to reach approximately € 8 billion (approximately US$ 9 billion) in 2024 (report “B-cell NHL: Opportunity Analysis 2017–2027”). We currently forecast an opportunity as a second- and later-line treatment in r/r DLBCL of approximately 10,000 eligible patients per year in the U.S. and approximately 14,000 eligible patients per year in Europe who are not eligible for high-dose chemotherapy (HDC) and ASCT. As a potential first-line treatment in

Management Report 11 MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 DLBCL, we believe there is currently a market opportunity of 30,000 patients in the U.S. and 40,000 patients in Europe. Operational Development Tafasitamab is being developed pursuant to a collaboration and license agreement entered into with Xencor, Inc. (Xencor) in June 2010. Under this agreement, Xencor granted MorphoSys an exclusive worldwide license to tafasitamab for all indications. MorphoSys also has a collaboration and license agreement for the global further development and commercialization of tafasitamab with Incyte, signed in January 2020. Under the terms of the agreement, MorphoSys and Incyte will develop tafasitamab broadly in relapsed or refractory (r/r) DLBCL and first-line DLBCL, as well as in additional indications beyond DLBCL, such as follicular lymphoma (FL), and marginal zone lymphoma (MZL). MorphoSys is responsible for conducting frontMIND, a pivotal phase 3 study in first-line DLBCL. Incyte is responsible for conducting inMIND, a pivotal phase 3 study in r/r FL/MZL. Incyte is also responsible for conducting a phase 1b combination study of its PI3K delta inhibitor parsaclisib with tafasitamab in various r/r B-cell malignancies. MorphoSys and Incyte share responsibility for initiating additional global clinical trials. MorphoSys and Incyte are co-commercializing Monjuvi in the United States. Monjuvi in combination with lenalidomide was approved in the U.S. in July 2020 for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low- grade lymphoma, and who are not eligible for autologous stem cell transplantation (ASCT). This was the first FDA approval of a second-line therapy for adult patients with r/r DLBCL in the United States. Monjuvi was approved by the FDA under an accelerated approval process based on overall response rate. Continued approval for this indication may be contingent upon verification and description of clinical benefit in a confirmatory trial(s). On August 26, 2021, MorphoSys and Incyte announced that the European Commission (EC) had granted conditional marketing authorization for tafasitamab (brand name Minjuvi) in combination with lenalidomide, followed by tafasitamab monotherapy, for the treatment of adult patients with relapsed or refractory (r/r) diffuse large B-cell lymphoma (DLBCL) who are not eligible for ASCT. In July 2021, the Committee for Orphan Medicinal Products (COMP) confirmed the orphan drug designation status of Minjuvi, agreeing that sufficient justification had been provided that Minjuvi may be of significant benefit to patients with this disease. On August 24, 2021, Health Canada granted conditional marketing authorization to Incyte for Minjuvi in combination with lenalidomide for the treatment of adults with relapsed or refractory (r/r) diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low-grade lymphoma, who are not eligible for ASCT. Related to these ex-U.S. regulatory approvals, in the third quarter 2021, MorphoSys received, for the first time, royalty revenue for Minjuvi sales outside of the U.S. pursuant to the agreement with Incyte. On January 5, 2021, MorphoSys and Incyte announced that the Swiss Agency for Therapeutic Products (Swissmedic) had accepted the marketing authorization application (MAA) for tafasitamab. The MAA seeks approval for tafasitamab, in combination with lenalidomide, followed by tafasitamab monotherapy, for the treatment of adult patients with r/r DLBCL, including DLBCL arising from low-grade lymphoma, who are not candidates for ASCT. The MAA is being reviewed as part of the U.S. Food and Drug Administration’s (FDA) modified Project Orbis, which provides a framework for concurrent submission and review of oncology drug applications among the FDA’s international collaborators. Collaboration among international regulators may allow patients with cancer to receive earlier access to products in other countries.

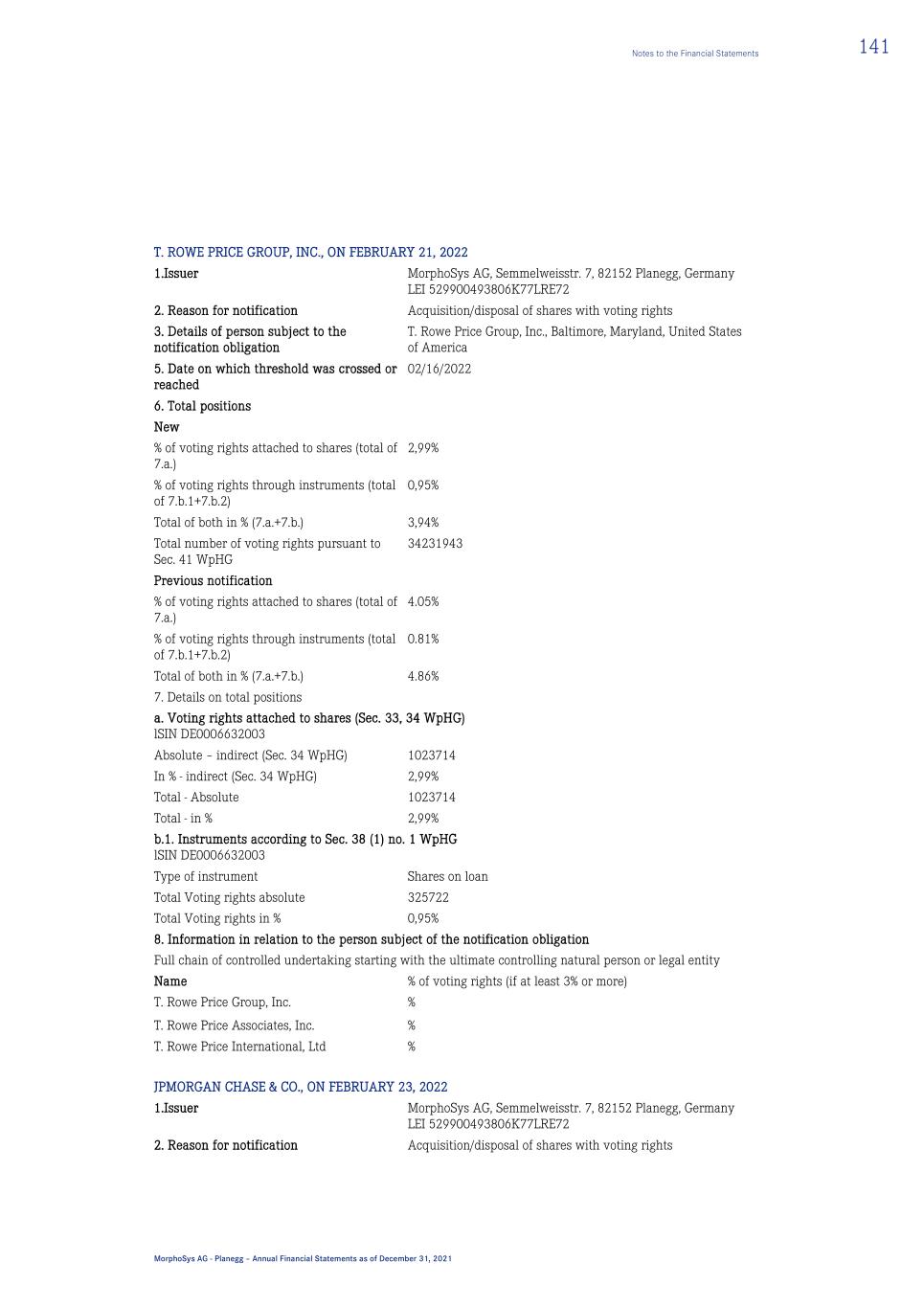

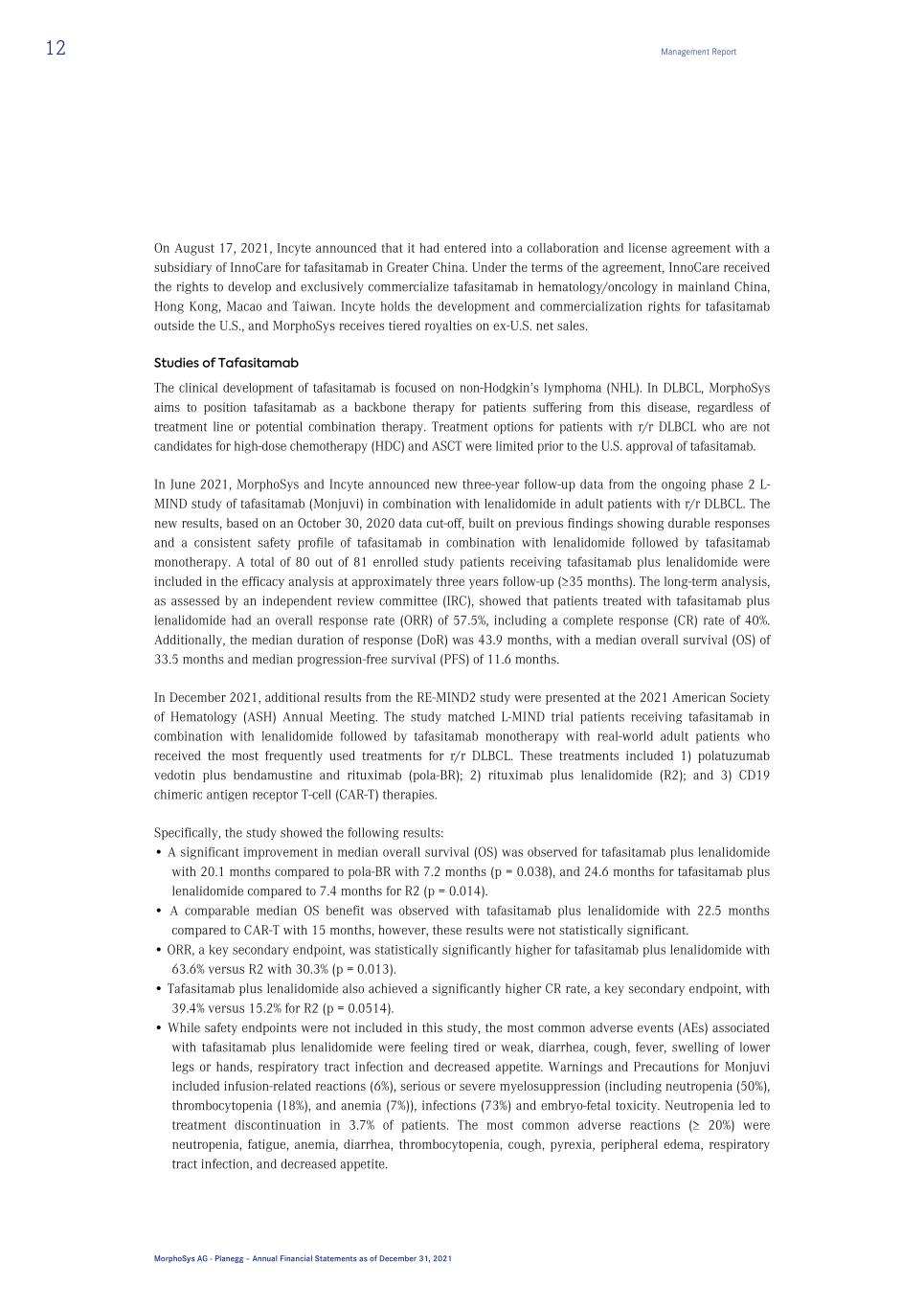

12 Management Report MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 On August 17, 2021, Incyte announced that it had entered into a collaboration and license agreement with a subsidiary of InnoCare for tafasitamab in Greater China. Under the terms of the agreement, InnoCare received the rights to develop and exclusively commercialize tafasitamab in hematology/oncology in mainland China, Hong Kong, Macao and Taiwan. Incyte holds the development and commercialization rights for tafasitamab outside the U.S., and MorphoSys receives tiered royalties on ex-U.S. net sales. Studies of Tafasitamab The clinical development of tafasitamab is focused on non-Hodgkin’s lymphoma (NHL). In DLBCL, MorphoSys aims to position tafasitamab as a backbone therapy for patients suffering from this disease, regardless of treatment line or potential combination therapy. Treatment options for patients with r/r DLBCL who are not candidates for high-dose chemotherapy (HDC) and ASCT were limited prior to the U.S. approval of tafasitamab. In June 2021, MorphoSys and Incyte announced new three-year follow-up data from the ongoing phase 2 L- MIND study of tafasitamab (Monjuvi) in combination with lenalidomide in adult patients with r/r DLBCL. The new results, based on an October 30, 2020 data cut-off, built on previous findings showing durable responses and a consistent safety profile of tafasitamab in combination with lenalidomide followed by tafasitamab monotherapy. A total of 80 out of 81 enrolled study patients receiving tafasitamab plus lenalidomide were included in the efficacy analysis at approximately three years follow-up (≥35 months). The long-term analysis, as assessed by an independent review committee (IRC), showed that patients treated with tafasitamab plus lenalidomide had an overall response rate (ORR) of 57.5%, including a complete response (CR) rate of 40%. Additionally, the median duration of response (DoR) was 43.9 months, with a median overall survival (OS) of 33.5 months and median progression-free survival (PFS) of 11.6 months. In December 2021, additional results from the RE-MIND2 study were presented at the 2021 American Society of Hematology (ASH) Annual Meeting. The study matched L-MIND trial patients receiving tafasitamab in combination with lenalidomide followed by tafasitamab monotherapy with real-world adult patients who received the most frequently used treatments for r/r DLBCL. These treatments included 1) polatuzumab vedotin plus bendamustine and rituximab (pola-BR); 2) rituximab plus lenalidomide (R2); and 3) CD19 chimeric antigen receptor T-cell (CAR-T) therapies. Specifically, the study showed the following results: • A significant improvement in median overall survival (OS) was observed for tafasitamab plus lenalidomide with 20.1 months compared to pola-BR with 7.2 months (p = 0.038), and 24.6 months for tafasitamab plus lenalidomide compared to 7.4 months for R2 (p = 0.014). • A comparable median OS benefit was observed with tafasitamab plus lenalidomide with 22.5 months compared to CAR-T with 15 months, however, these results were not statistically significant. • ORR, a key secondary endpoint, was statistically significantly higher for tafasitamab plus lenalidomide with 63.6% versus R2 with 30.3% (p = 0.013). • Tafasitamab plus lenalidomide also achieved a significantly higher CR rate, a key secondary endpoint, with 39.4% versus 15.2% for R2 (p = 0.0514). • While safety endpoints were not included in this study, the most common adverse events (AEs) associated with tafasitamab plus lenalidomide were feeling tired or weak, diarrhea, cough, fever, swelling of lower legs or hands, respiratory tract infection and decreased appetite. Warnings and Precautions for Monjuvi included infusion-related reactions (6%), serious or severe myelosuppression (including neutropenia (50%), thrombocytopenia (18%), and anemia (7%)), infections (73%) and embryo-fetal toxicity. Neutropenia led to treatment discontinuation in 3.7% of patients. The most common adverse reactions (≥ 20%) were neutropenia, fatigue, anemia, diarrhea, thrombocytopenia, cough, pyrexia, peripheral edema, respiratory tract infection, and decreased appetite.

Management Report 13 MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 The phase 2/3 study, B-MIND, is evaluating the safety and efficacy of tafasitamab in combination with the chemotherapeutic agent bendamustine in comparison to rituximab plus bendamustine in patients with r/r DLBCL who are not candidates for HDC and ASCT. The study has been fully recruited as of June 2021. The regulatory significance of the B-MIND study has decreased as both FDA and EMA have approved Monjuvi and Minjuvi, respectively, based on L-MIND data. Long-term safety data of B-MIND are required by the EMA as an obligation for the conditional marketing authorization. As such, the event-driven primary analysis has been removed from the planned analyses; all final analyses of primary and secondary endpoints will be performed in mid-2024. In addition to clinical development in r/r DLBCL, on May 11, 2021 MorphoSys announced that the first patient had been dosed in frontMIND, a pivotal phase 3 trial of tafasitamab in first-line DLBCL: frontMIND is evaluating tafasitamab and lenalidomide in combination with R-CHOP compared to R-CHOP alone as first-line treatment for high-intermediate and high-risk patients with untreated DLBCL. The study is planned to enroll up to 880 patients. Updated preliminary data presented at ASH 2021, from firstMIND, a phase 1b, open-label, randomized study on the safety and efficacy of R-CHOP plus either tafasitamab or tafasitamab plus lenalidomide for patients with newly diagnosed DLBCL, showed a preliminary overall response rate of 90.9% versus 93.9%, respectively, in a patient population that had an overall poor prognosis. The combination of tafasitamab, lenalidomide and R-CHOP had an acceptable and manageable safety profile. These results supported further investigation of the tafasitamab plus lenalidomide combination in the frontMIND study. On November 11, 2021, MorphoSys provided an update on the frontMIND study, indicating that enrollment was going well and that additional sites were being added in the United States to satisfy investigator and patient interests. Topline data from the trial are expected in the second half of 2025. On April 19, 2021, MorphoSys and Incyte announced that the first patient had been dosed in the phase 3 inMIND study. InMIND is a global, double-blind, placebo-controlled, randomized phase 3 study evaluating whether tafasitamab and lenalidomide as an add-on to rituximab provides improved clinical benefit compared with lenalidomide alone as an add-on to rituximab in patients with r/r FL Grade 1 to 3a or r/r nodal, splenic or extranodal MZL. The study is expected to enroll over 600 adult patients with r/r FL or r/r MZL. The primary endpoint of the study is PFS in the FL population, and the key secondary endpoints are PFS and OS in the overall population as well as positron emission tomography complete response (PET-CR) at the end of treatment (EOT) in the FL population. Topline data from the inMIND trial are expected in the second half of 2023. Initiated in late 2021 and sponsored by Incyte, the topMIND trial is a single-arm, open-label, phase 1b/2a, multicenter basket study to evaluate whether tafasitamab and parsaclisib can be safely combined at the recommended phase 2 dose and dosing regimen that was established for each of the two compounds as a treatment option for adult participants with r/r B-cell malignancies. Participants will be assigned to disease- specific cohorts based on the histology of their underlying disease: Cohort 1: r/r DLBCL, Cohort 2: r/r MCL, Cohort 3: r/r FL, Cohort 4: r/r MZL, and Cohort 5: r/r CLL/SLL. The primary outcomes of the phase 1b part of the trial will be the number of TEAEs and incidence of dose-limiting toxicities. Key secondary objectives include ORR for the phase 2a part and various PK measures. Pelabresib Overview Pelabresib, also known as CPI-0610, is a small molecule designed to promote anti-tumor activity by selectively inhibiting the function of BET proteins to decrease the expression of abnormally expressed genes in cancer. The clinical development of pelabresib is currently focused on myelofibrosis (MF). MF is a form of bone marrow cancer that disrupts the body's normal production of blood cells. It causes fibrosis (scarring) of

14 Management Report MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 the bone marrow, leading to severe anemia as well as thrombocytopenia. MF have enlarged spleens as well as many other physical symptoms, including abdominal discomfort, bone pain and extreme fatigue. Approximately 4–6 per 100,000 people in the U.S. are diagnosed with MF, most of whom are intermediate- or high-risk patients. There are limited treatment options for patients with MF. We believe there are approximately 30,000 to 35,000 intermediate- or high-risk MF patients in the United States and Europe that are eligible for systemic treatment, including ruxolitinib. Incyte, which markets ruxolitinib (Jakafi®), has estimated that about half of these eligible patients in the United States receive treatment with ruxolitinib. Ruxolitinib, a JAK1/2 inhibitor, is the current standard of care for intermediate- and high-risk MF patients. Many of these eligible patients do not initially receive treatment with ruxolitinib. For example, patients with low red blood cell or platelet counts are ineligible to receive ruxolitinib. Fedratinib is a second JAK1/2 inhibitor approved for use in treating MF. Patients who become refractory to, or discontinue therapy with, ruxolitinib and fedratinib generally have a poor survival prognosis. Currently approved drugs for the treatment of patients suffering from MF offer symptomatic improvement and are generally not considered to be disease-modifying. As part of MorphoSys’ agreement with Royalty Pharma, Royalty Pharma is entitled to receive 3% of future net sales of pelabresib. Studies of Pelabresib Pelabresib is currently in two clinical trials for the treatment of MF, the phase 2 MANIFEST trial and the phase 3 MANIFEST-2 trial. MANIFEST is a global, multicenter, open-label, phase 2 study that evaluates pelabresib as monotherapy or in combination with ruxolitinib, the current standard of care. In Arm 3 of this study, pelabresib is being evaluated in combination with ruxolitinib, in JAK-inhibitor-naïve MF patients, with a primary endpoint of the proportion of patients with a ≥35% spleen volume reduction from baseline (SVR35) after 24 weeks of treatment. Pelabresib is also being evaluated in a second-line setting (2L) either as a monotherapy in patients who are resistant to, intolerant of, or ineligible for ruxolitinib and no longer on the drug (Arm 1), or as add-on therapy to ruxolitinib in patients with a sub-optimal response to ruxolitinib or MF progression (Arm 2). Patients in Arms 1 and 2 are being stratified based on transfusion-dependent (TD) status. The primary endpoint for the patients in cohorts 1A and 2A, who were TD at baseline, is conversion to transfusion independence for 12 consecutive weeks. The primary endpoint for patients in cohorts 1B and 2B, who were not TD at baseline, is the proportion of patients with a SVR35 after 24 weeks of treatment. On June 11, 2021, Constellation announced that interim data from the MANIFEST trial were presented at the European Hematology Association (EHA) annual meeting. The data were based on a data cut-off of September 29, 2020. In Arm 3 of the study, an interim efficacy subgroup analysis in JAK-inhibitor-naïve patients was presented. Forty-two of 63 evaluable patients (67%) achieved a SVR35 at 24 weeks, achieving the primary endpoint for Arm 3. Thirty-four of 60 evaluable patients (57%) achieved a ≥50% reduction in Total Symptom Scores (TSS50) at 24 weeks. Strong response was observed with pelabresib, irrespective of baseline risk status or demographic and disease characteristics. Central pathology review of 27 1L patient bone marrow samples showed at least a one-grade improvement in bone marrow fibrosis in 9 out of 27 patients (33%); in all of these patients, improvement was observed within six months of starting treatment. Sixteen out of 27 patients (59%) showed stabilization of bone marrow fibrosis, while only one out of 27 patients (4%) showed worsening. An interim analysis of Arms 1 and 2 suggested that pelabresib monotherapy in JAK-inhibitor- experienced or -ineligible patients, and with pelabresib in combination with ruxolitinib in ruxolitinib- experienced patients, may result in improvements in anemia.

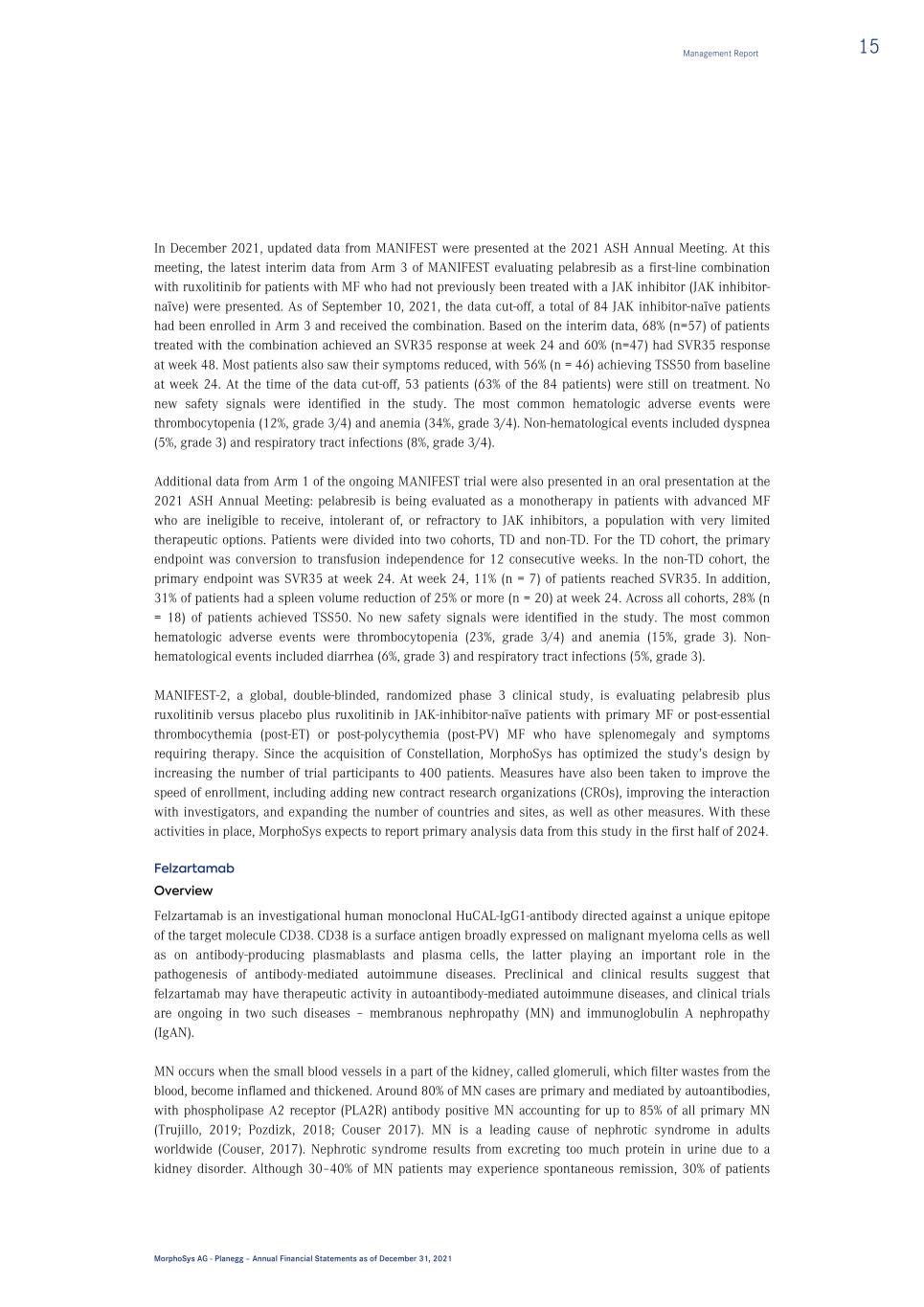

Management Report 15 MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 In December 2021, updated data from MANIFEST were presented at the 2021 ASH Annual Meeting. At this meeting, the latest interim data from Arm 3 of MANIFEST evaluating pelabresib as a first-line combination with ruxolitinib for patients with MF who had not previously been treated with a JAK inhibitor (JAK inhibitor- naïve) were presented. As of September 10, 2021, the data cut-off, a total of 84 JAK inhibitor-naïve patients had been enrolled in Arm 3 and received the combination. Based on the interim data, 68% (n=57) of patients treated with the combination achieved an SVR35 response at week 24 and 60% (n=47) had SVR35 response at week 48. Most patients also saw their symptoms reduced, with 56% (n = 46) achieving TSS50 from baseline at week 24. At the time of the data cut-off, 53 patients (63% of the 84 patients) were still on treatment. No new safety signals were identified in the study. The most common hematologic adverse events were thrombocytopenia (12%, grade 3/4) and anemia (34%, grade 3/4). Non-hematological events included dyspnea (5%, grade 3) and respiratory tract infections (8%, grade 3/4). Additional data from Arm 1 of the ongoing MANIFEST trial were also presented in an oral presentation at the 2021 ASH Annual Meeting: pelabresib is being evaluated as a monotherapy in patients with advanced MF who are ineligible to receive, intolerant of, or refractory to JAK inhibitors, a population with very limited therapeutic options. Patients were divided into two cohorts, TD and non-TD. For the TD cohort, the primary endpoint was conversion to transfusion independence for 12 consecutive weeks. In the non-TD cohort, the primary endpoint was SVR35 at week 24. At week 24, 11% (n = 7) of patients reached SVR35. In addition, 31% of patients had a spleen volume reduction of 25% or more (n = 20) at week 24. Across all cohorts, 28% (n = 18) of patients achieved TSS50. No new safety signals were identified in the study. The most common hematologic adverse events were thrombocytopenia (23%, grade 3/4) and anemia (15%, grade 3). Non- hematological events included diarrhea (6%, grade 3) and respiratory tract infections (5%, grade 3). MANIFEST‑2, a global, double-blinded, randomized phase 3 clinical study, is evaluating pelabresib plus ruxolitinib versus placebo plus ruxolitinib in JAK-inhibitor-naïve patients with primary MF or post-essential thrombocythemia (post-ET) or post-polycythemia (post-PV) MF who have splenomegaly and symptoms requiring therapy. Since the acquisition of Constellation, MorphoSys has optimized the study’s design by increasing the number of trial participants to 400 patients. Measures have also been taken to improve the speed of enrollment, including adding new contract research organizations (CROs), improving the interaction with investigators, and expanding the number of countries and sites, as well as other measures. With these activities in place, MorphoSys expects to report primary analysis data from this study in the first half of 2024. Felzartamab Overview Felzartamab is an investigational human monoclonal HuCAL-IgG1-antibody directed against a unique epitope of the target molecule CD38. CD38 is a surface antigen broadly expressed on malignant myeloma cells as well as on antibody-producing plasmablasts and plasma cells, the latter playing an important role in the pathogenesis of antibody-mediated autoimmune diseases. Preclinical and clinical results suggest that felzartamab may have therapeutic activity in autoantibody-mediated autoimmune diseases, and clinical trials are ongoing in two such diseases – membranous nephropathy (MN) and immunoglobulin A nephropathy (IgAN). MN occurs when the small blood vessels in a part of the kidney, called glomeruli, which filter wastes from the blood, become inflamed and thickened. Around 80% of MN cases are primary and mediated by autoantibodies, with phospholipase A2 receptor (PLA2R) antibody positive MN accounting for up to 85% of all primary MN (Trujillo, 2019; Pozdizk, 2018; Couser 2017). MN is a leading cause of nephrotic syndrome in adults worldwide (Couser, 2017). Nephrotic syndrome results from excreting too much protein in urine due to a kidney disorder. Although 30–40% of MN patients may experience spontaneous remission, 30% of patients

16 Management Report MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 experience persistent proteinuria with long-term preservation of renal function, and another 30–50% progress to renal failure within 10–15 years (Trujillo, 2019; Heaf, 1999; Troyanov, 2004). Even if patients do not progress to renal failure, they have an increased risk of life-threatening thromboembolic and cardiovascular events, and are subject to infections (Wagner, 1983; Heaf, 1999; Lee, 2016). In the U.S., the incidence of MN is estimated at 1.2 per 100,000; about 3,000 adults are newly diagnosed every year (McGrogan, 2011). There currently is no approved standard treatment for MN. IgAN is the most common form of glomerulonephritis, a group of renal disorders that causes damage to the glomeruli, hindering their ability to carry out their essential functions. In IgAN, a combination of genetic and environmental factors causes patients to produce galactose-deficient IgA (Gd-IgA), whereupon the patients’ immune system reacts by producing specific autoantibodies. The binding of these IgG autoantibodies to Gd- IgA leads to the formation of immune complexes in the circulation. The immune complexes then accumulate in the glomerular mesangium where they induce local inflammation, mesangial proliferation, glomerulosclerosis and loss of renal function. Patients with IgAN may experience different symptoms including blood and/or protein leaking into the urine, high blood pressure, interstitial lung disease, glomerulosclerosis (scarring of the kidneys’ blood vessels) and a slow progression to chronic kidney disease. About 40% of patients with IgAN progress to end-stage renal disease within 20 years of diagnosis. Worldwide IgAN incidence is estimated at 2.5 per 100,000. Currently there are no approved treatments that can specifically prevent the production of Gd-IgA nor its corresponding autoantibody. According to Data Bridge Market Research, the U.S. membranous nephropathy market is projected to grow at a CAGR of 5.0% between 2021 and 2028 and is expected to reach US$ 153.1 million (€ 135.2 million) by 2028. According to Research and Markets, the IgAN market in the seven major markets (United States, Germany, Spain, Italy, France, United Kingdom and Japan) was US$ 109.3 million (€ 96.5 million) in 2020 and the prevalence has been shown to increase over time. Studies of Felzartamab In October 2019, MorphoSys initiated a phase 1/2 trial in anti-PLA2R antibody positive MN. The proof-of- concept trial called M-PLACE is an open-label, multicenter trial primarily assessing the safety and tolerability of felzartamab. On November 4, 2021, MorphoSys presented interim results from M-PLACE at the 2021 Annual Meeting of the American Society of Nephrology (ASN). The study included 31 patients with primarily medium or high levels of anti-PLA2R antibody titers at baseline and/or patients who were refractory to previous treatments. Of the 27 treated patients with evaluable results, 24 showed an initial rapid reduction of anti-PLA2R antibody levels one week after the first treatment. After 12 weeks of treatment, most patients showed a substantial reduction in autoantibody titer. The observed titer reduction was independent of cohort and suggests successful depletion of CD38-positive plasma cells. The safety profile was consistent with the proposed mechanism of action of felzartamab. An early assessment of urine protein: creatinine ratio (UPCR) results at six months of treatment showed a decrease in six of ten patients, with four patients having a decrease of >=50% from baseline. The first patient who had already reached the 12-month time point showed a complete immunologic response and a partial clinical response. Also in November 2021, MorphoSys reported that the M-PLACE trial was fully enrolled. Additional data from the study are expected to be available in the second half of 2022.In February 2021, the first patient was dosed in the New-PLACE study, a phase 2 study evaluating different treatment schedules to identify the regimen for a pivotal study in patients with anti-PLA2R antibody positive MN. Enrollment in this study was completed at the end of 2021, and topline data are expected in the second half of 2022.

Management Report 17 MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 In October 2021, the first patient was dosed in the phase 2 IGNAZ trial evaluating felzartamab in patients with IgAN. This multicenter, randomized, double-blind, parallel-group, placebo-controlled trial is planned to enroll approximately 48 patients and is designed to assess the efficacy, safety and pharmacokinetics (PK)/pharmacodynamics (PD) of felzartamab in patients with IgAN. The primary objective of this study is to evaluate the efficacy of felzartamab compared to placebo. The primary endpoint is the relative change in UPCR and will be assessed for each patient nine months after treatment initiation. Study sites are located in Europe, North America and Asia-Pacific, excluding Greater China. Proof-of-concept data from the IGNAZ trial are expected in the fourth quarter of 2022. CPI-0209 Overview CPI-0209 is a small molecule designed to promote anti-tumor activity by specifically inhibiting EZH2, an enzyme that suppresses target gene expression. We believe that targeting EZH2 may have the potential for therapeutic application in various tumor types. Royalty Pharma is entitled to receive 3% of future net sales of CPI-0209. Studies of CPI-0209 Patient enrollment in a phase 1/2 clinical trial of CPI‑0209 is ongoing. The phase 1 portion of the trial evaluated CPI‑0209 as a monotherapy in patients with advanced solid tumors. After determining the recommended phase 2 dose of 350 mg (oral, once-daily), patients are currently being dosed in the phase 2 expansion cohorts in select tumor indications (urothelial carcinoma (ARID1A mutant), ovarian clear cell carcinoma (ARID1A mutant), endometrial carcinoma (ARID1A mutant), lymphoma, mesothelioma, metastatic castration resistant prostate cancer), and data from this part of the trial are expected in 2022. As of the data cut off of March 9, 2021, of the 4 BAP1 loss mesothelioma patients, one patient had a PR after four cycles of treatment and two had SD. The high levels of target engagement observed preclinically were corroborated clinically. All 40 patients were evaluated for safety. Across all dose cohorts, 43% of patients had at least one Grade 3 or greater treatment emergent adverse event (TEAE), 28% of patients had at least one serious adverse event (SAE). The most common TEAEs (≥15%) included thrombocytopenia (reversible and dose dependent), diarrhea, asthenic conditions, nausea, anemia, dysgeusia, abdominal pain and alopecia. 23% of patients reported a TEAE that led to dose reduction or interruption. Four patients discontinued treatment because of TEAEs. One patient in the highest dose cohort (375mg) experienced Grade 4 thrombocytopenia, and one patient experienced a Grade 5 adverse event due to progressive disease. Based on this preliminary data, CPI-0209 appeared to be generally well tolerated. We expect to report additional results from the trial in 2022. Clinical Development through Partners The most advanced programs being developed by partners are outlined below. Felzartamab Overview MorphoSys has an exclusive regional licensing agreement for felzartamab with I-Mab for Greater China, where development is currently focused on multiple myeloma (MM), a blood cancer that develops in mature plasma cells in the bone marrow. MM is the second most common form of blood cancer worldwide. According to GLOBOCAN 2020 statistics, there were an estimated 4.6 million cancer cases, more than 21,000 MM cases and more than 16,000 deaths in China in 2020. In China, the incidence of MM is projected to continue to increase at least through 2040. Current therapies are associated with serious side effects and limited efficacy.

18 Management Report MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 Regional Agreement with I-Mab MorphoSys has an exclusive regional licensing agreement for felzartamab with I-Mab. Under the terms of the agreement, signed in November 2017, I-Mab has the exclusive rights to develop and commercialize felzartamab in mainland China, Taiwan, Hong Kong and Macao. Upon signing the agreement, MorphoSys received an immediate upfront payment of US$ 20 million (€ 18 million). MorphoSys is also entitled to receive additional success-based clinical and commercial milestone payments from I-Mab of up to US$ 100 million (€ 88 million), as well as tiered double-digit royalties on net sales of felzartamab in the agreed regions. Studies of Felzartamab I-Mab is conducting a phase 3 clinical trial in Greater China to evaluate felzartamab in combination with lenalidomide plus dexamethasone in patients with r/r MM. This study is a randomized, open-label, parallel- controlled, multi-center study to evaluate the efficacy and safety of the combination of felzartamab, lenalidomide and dexamethasone versus the combination of lenalidomide and dexamethasone in patients with r/r MM who have received at least one prior line of treatment. The study was initiated in April 2019 at sites in Taiwan and started in mainland China in April 2020 as part of a coordinated effort to accelerate the study. In October 2021, I-Mab announced that patient enrollment in this pivotal phase 3 trial has been completed. I-Mab is also evaluating felzartamab as a third-line therapy in patients with r/r MM in a pivotal phase 2 trial that started in March 2019. At the end of August 2021, I-Mab announced that topline data met primary and secondary endpoints. On June 25, 2021, I-Mab announced that the Center for Drug Evaluation (CDE) of the China National Medical Products Administration (NMPA) had approved the Investigational New Drug (IND) application to initiate a phase 1b study with felzartamab in patients with systemic lupus erythematosus (SLE). SLE, the most common type of lupus, is an autoimmune disease in which the immune system attacks its own tissues, causing widespread inflammation and tissue damage in the affected organs. It can affect the joints, skin, brain, lungs, kidneys and blood vessels. There is no cure for SLE. The phase 1b multi-center trial is evaluating the safety, tolerability, pharmacokinetics (PK) and pharmacodynamics (PD) of felzartamab in patients with SLE in China. The SLE study start date is scheduled for Q1 2022. Gantenerumab Overview Gantenerumab is a HuCAL antibody targeting amyloid beta, and is being developed by licensing partner Roche as a potential treatment for Alzheimer’s disease (AD). Amyloid beta refers to a group of peptides that play an important role in Alzheimer’s disease as they are the main component of the amyloid plaques found in the brain of Alzheimer’s patients. Gantenerumab binds to the N-terminus and a section in the middle of the amyloid beta peptide. The antibody removes amyloid beta via microglia-mediated phagocytosis. It has been designed to promote clearance of amyloid plaques in the brain, a pathological hallmark of AD, and has shown downstream effects on multiple biomarkers of AD pathology and neurodegeneration in clinical trials. According to the market research and consulting company Decision Resources, the value of the global market for the treatment of Alzheimer’s disease is expected to reach approximately € 35 billion (approximately US$ 40 billion) in 2030 (report titled “Market Forecast Assumption Alzheimer’s Disease 2020–2030”). According to figures from the Alzheimer’s Association, more than six million people in the United States live with Alzheimer’s disease. Deaths from Alzheimer’s disease increased 16% during the COVID-19 pandemic (https://www.alz.org/alzheimers-dementia/facts-figures). In 2019, Alzheimer’s disease was the sixth-leading cause of death in the United States (https://www.cdc.gov/nchs/fastats/leading-causes-of-death.htm).

Management Report 19 MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 Operational Development Under the agreement announced in June 2021 between MorphoSys and Royalty Pharma, Royalty Pharma has the right to receive 60% of future royalties on gantenerumab. On October 11, 2021, MorphoSys announced that Roche had received Breakthrough Therapy Designation by the U.S. FDA for gantenerumab for the treatment of Alzheimer’s disease. This designation was based on data showing that gantenerumab significantly reduced brain amyloid plaque, a pathological hallmark of this disease, in the SCarlet RoAD and Marguerite RoAD open-label extension trials, as well as other studies. Studies of Gantenerumab In June 2018, Roche initiated a new phase 3 development program for patients with Alzheimer’s disease. The program consists of the GRADUATE 1 and GRADUATE 2 phase 3 trials. The two multicenter, randomized, double-blinded, placebo-controlled studies are investigating the efficacy and safety of gantenerumab in more than 2,000 patients with early (prodromal to mild) Alzheimer’s disease and follow them for over two years. The primary endpoint for both studies is the assessment of the signs and symptoms of dementia, measured as the clinical dementia rating sum of boxes (CDR-SOB) score. Learnings from the SCarlet RoAD and Marguerite RoAD studies were incorporated into the optimized design of the phase 3 GRADUATE trials, with patients receiving a significantly higher dose of gantenerumab as a subcutaneous injection than in Roche’s previous trials. The GRADUATE 1 and 2 trials are expected to be completed in Q4 2022. Otilimab Overview Otilimab (formerly MOR103/GSK3196165) is a HuCAL-IgG1-antibody directed against granulocyte- macrophage colony-stimulating factor (GM-CSF). Due to its diverse functions in the immune system, GM-CSF can be considered a target for a broad spectrum of anti-inflammatory therapies, such as those in rheumatoid arthritis (RA). RA is a chronic inflammatory disease that affects the synovial membrane of the joints and is accompanied by painful swelling that can lead to bone destruction and joint deformity. MorphoSys discovered and advanced otilimab to clinical development. In June 2013, MorphoSys announced that it had entered into a worldwide agreement with GSK for the development and commercialization of otilimab. Under the terms of the agreement, GSK assumes responsibility for all further development and commercialization of the compound. Under the terms of the agreement, MorphoSys received an upfront payment of € 22.5 million. Depending on the achievement of certain development, regulatory, commercial and revenue milestones, MorphoSys is eligible to receive further payments from GSK of up to € 423 million, as well as tiered double-digit royalties on net sales. Under the agreement between MorphoSys and Royalty Pharma, Royalty Pharma is entitled to 80% of future royalties and 100% of future milestone payments for otilimab. The total market for RA drugs is growing steadily. According to the market research and consulting firm Decision Resources, the market for RA drugs was projected to reach € 28 billion (US$ 32 billion) in 2022 in G7 countries (report titled “Market Forecast Assumptions Rheumatoid Arthritis 2020–2030”). Studies of Otilimab In July 2019, GSK launched a phase 3 program for RA called ContRAst. The treatment of the first patient in this program triggered a milestone payment of € 22 million to MorphoSys. Data from the ContRAst program studies are expected by the end of 2022.

20 Management Report MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 GSK also initiated a clinical trial (OSCAR) in 2020 to evaluate the efficacy and safety of otilimab in patients with severe pulmonary COVID-19-associated disease. The event of the first patient dosed in the expanded OSCAR study triggered milestone payments totaling € 16 million to MorphoSys in financial year 2021. In October 2021, GSK provided an update that it had made the decision not to further explore otilimab as a potential treatment for severe pulmonary COVID-19 related disease in patients aged of 70 years and older. Tremfya® (Guselkumab) Overview Tremfya is a human HuCAL antibody targeting the p19 subunit of IL-23 that is being developed and commercialized by Janssen. It is the first commercial product based on MorphoSys’ proprietary technology. It is approved for the treatment of patients with moderate to severe psoriasis (plaque psoriasis) in the United States, Canada, the European Union (EU), Japan, China and a number of other countries. In the U.S. and elsewhere, it is also approved for the treatment of adults with active psoriatic arthritis and in the EU for the treatment of adult patients with active psoriatic arthritis who have had an inadequate response or have not tolerated prior disease-modifying antirheumatic drug (DMARD) therapy. In Japan, Tremfya is approved for the treatment of patients with various forms of psoriasis, psoriatic arthritis and palmoplantar pustulosis. Under an agreement with Janssen, MorphoSys receives royalties on net sales of Tremfya and is also entitled to milestone payments on selected future development activities. Under the agreement between MorphoSys and Royalty Pharma, Royalty Pharma is entitled to 100% of future Tremfya royalties starting with royalties for the second quarter of 2021. MOR210/TJ210 Overview MOR210/TJ210 is a human antibody directed against C5aR, derived from MorphoSys' HuCAL technology. C5aR, the receptor of complement factor C5a, is being investigated as a potential new drug target in the fields of immuno-oncology and autoimmune diseases. Tumor cells generate high levels of C5a, which is believed to contribute to an immuno-suppressive and, consequently, tumor growth-promoting microenvironment by recruiting and activating myeloid suppressor cells (MDSCs). MOR210/TJ210 is engineered to neutralize the immuno-suppressive function of MDSCs by blocking the interaction between C5a and its receptor and enabling the immune system to fight the tumor. Regional Agreement with I-Mab In November 2018, MorphoSys announced that the Company had entered into an exclusive strategic collaboration and regional licensing agreement with I-Mab. Under the agreement, I-Mab has exclusive rights to develop and commercialize MOR210/TJ210 in mainland China, Hong Kong, Macao, Taiwan and South Korea, while MorphoSys retains rights in the rest of the world. The agreement deepened the existing partnership with I-Mab and built on the existing collaboration to develop MOR210/TJ210. Under the agreement, I-Mab has exclusive rights to develop and commercialize MOR210/TJ210 in the territories covered by the agreement. With MorphoSys’ support, I-Mab is to conduct and fund all worldwide development activities for MOR210/TJ210, including clinical trials in China and the U.S., up to proof-of-concept in oncology. Study of MOR210/TJ210 On January 25, 2021, MorphoSys and I-Mab announced the dosing of the first patient in the U.S. in a phase 1 dose-finding study evaluating the safety, tolerability, PK and PD of MOR210/TJ210 as monotherapy in

Management Report 21 MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 patients with r/r advanced solid tumors. The phase 1 clinical trial is an open-label, multiple-dose group, dose- finding study in various centers across the U.S. I-Mab has announced another phase 1 clinical trial to evaluate the dose-finding and safety for the treatment of patients with advanced solid tumors in 2022 in China. Other Business Activities Technologies MorphoSys has developed a number of technologies that provide direct access to human antibodies for the treatment of diseases. MorphoSys has historically used these technologies for proprietary and partnered programs but is now primarily focused on expanding its own pipeline with these and other technologies. MorphoSys’ most important technologies include HuCAL, a collection of several billion fully human antibodies, and a system for their optimization. Another important and, compared to HuCAL, further optimized platform is Ylanthia: a large antibody library representing the next generation of antibody technologies. Ylanthia is based on an innovative concept for generating highly specific and fully human antibodies. With Ylanthia, MorphoSys has set a new standard in therapeutic antibody development and will continue to preferentially use this technology to identify antibody candidates for its proprietary pipeline. With Slonomics, MorphoSys has a patent-protected, fully automated gene synthesis and modification technology to generate highly diverse gene libraries in a controlled process, for example to improve antibody properties. MorphoSys also has a licensing agreement with Cherry Biolabs, a spin-off of the University Hospital of Würzburg, Germany, granting MorphoSys the rights to apply Cherry Biolabs’ innovative, multispecific Hemibody technology to six exclusive targets. Combined with MorphoSys’ expertise in antibody technologies, the Hemibody technology offers the potential to generate novel T-cell-engaging medicines with higher precision and better safety profiles for the treatment of cancer patients. MorphoSys intends to further develop the Hemibody technology in the context of MorphoSys’ CyCAT dual-targeting platform to advance novel Hemibody-based treatment options for patients with hematological and solid cancers. Drug Development MorphoSys has a broad development pipeline and develops drugs using its own research and development and in collaboration with pharmaceutical and biotechnology partners as well as academic institutions. Our core business is the development of new therapies for patients suffering from serious diseases. Our first proprietary program to receive marketing approval is tafasitamab – brand name Monjuvi, which was first approved in the U.S. in July 2020 in combination with lenalidomide for the treatment of adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) not otherwise specified, including DLBCL arising from low-grade lymphoma, and who are not eligible for ASCT. Tafasitamab under the brand name Minjuvi has also been approved for marketing in the EU and Canada. We have become a fully integrated biopharmaceutical company developing and commercializing proprietary medicines. Our activities focus on cancer treatments, but we also conduct select programs in inflammatory diseases. The ability of monoclonal antibodies to bind to specific antigens on tumors or activate the immune system against cancer to unleash a therapeutic effect in patients has led to their dominant role in targeted cancer therapies. According to the report “2021 Global Oncology Trends” published by the IQVIA Institute, the surge

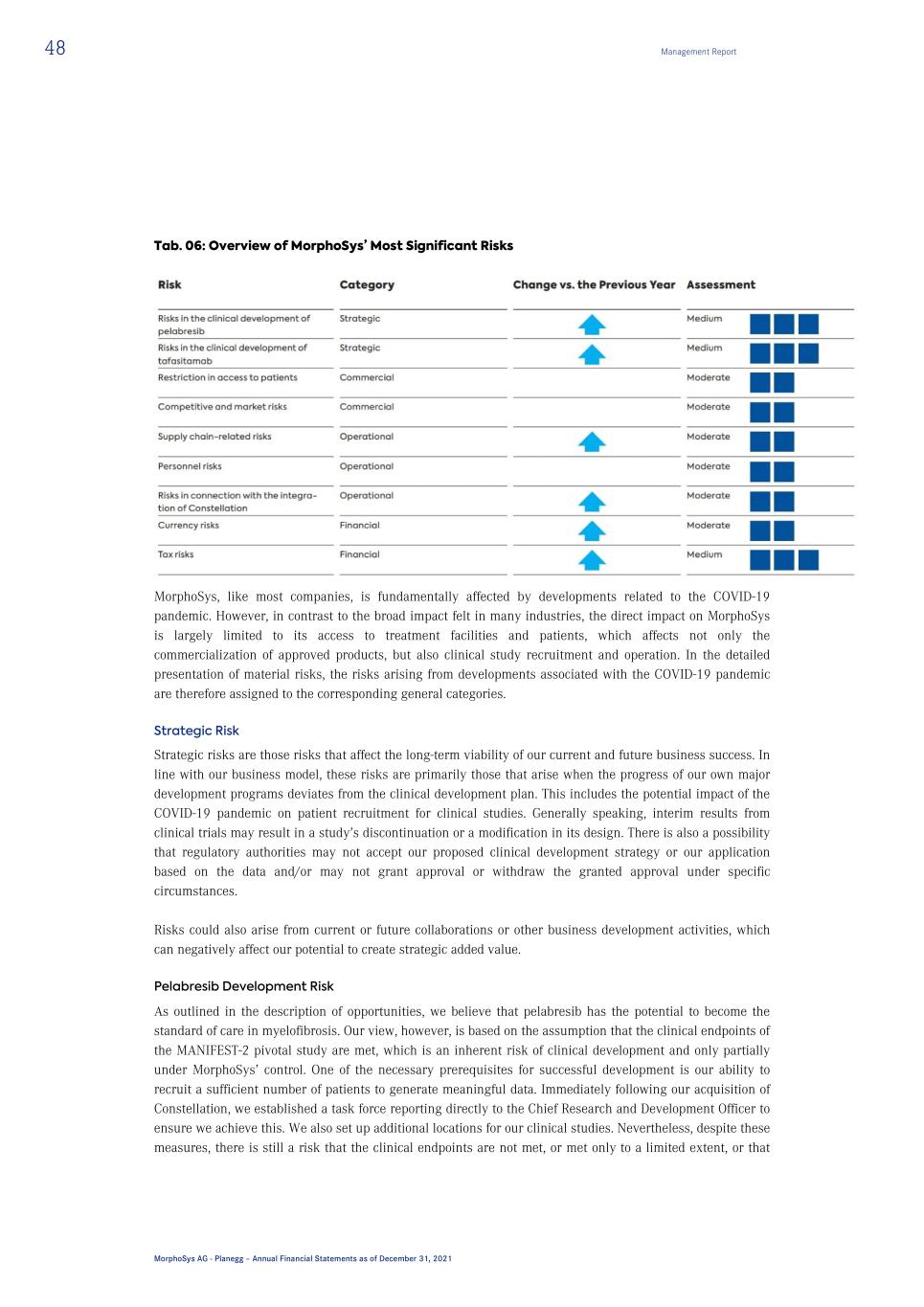

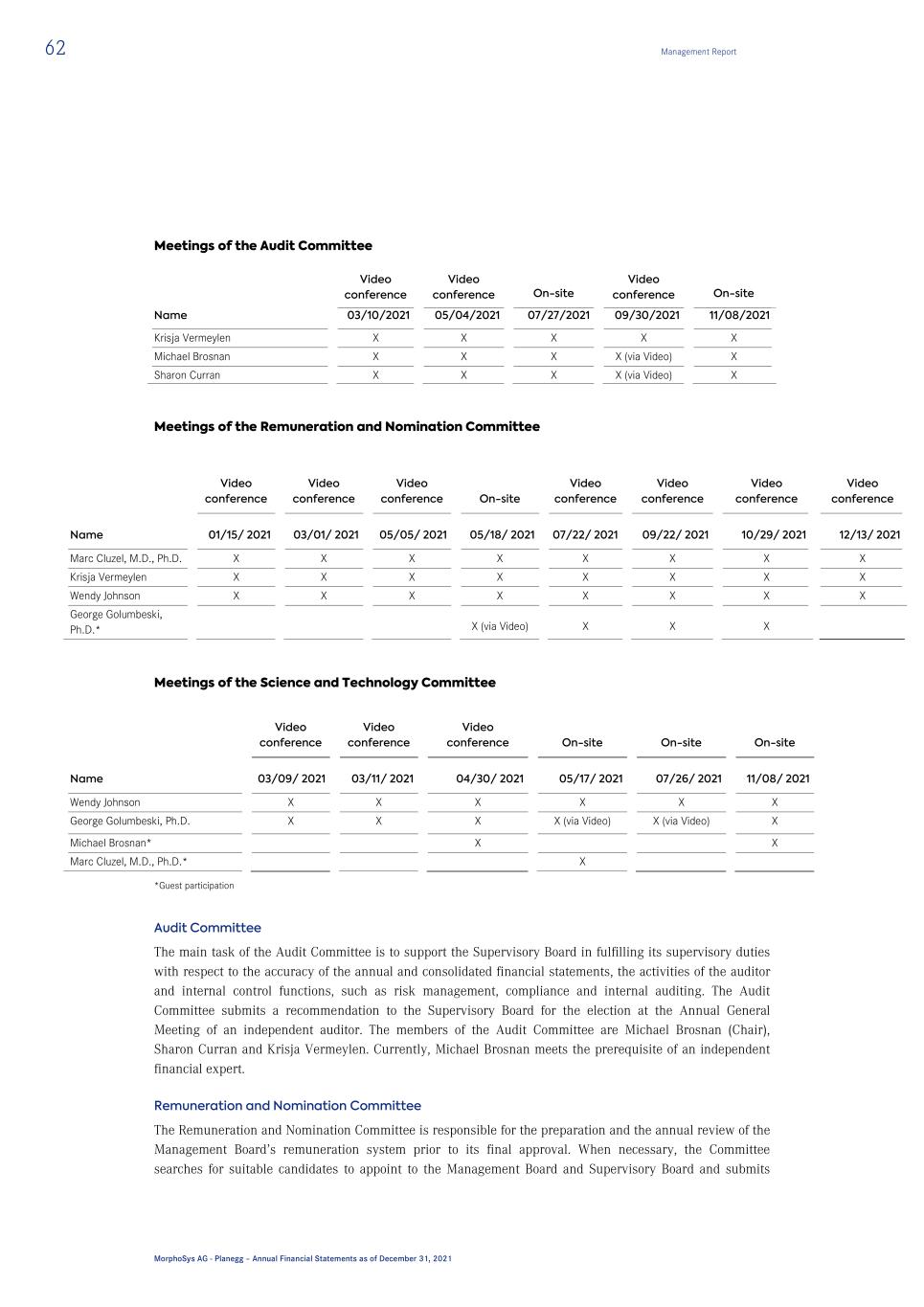

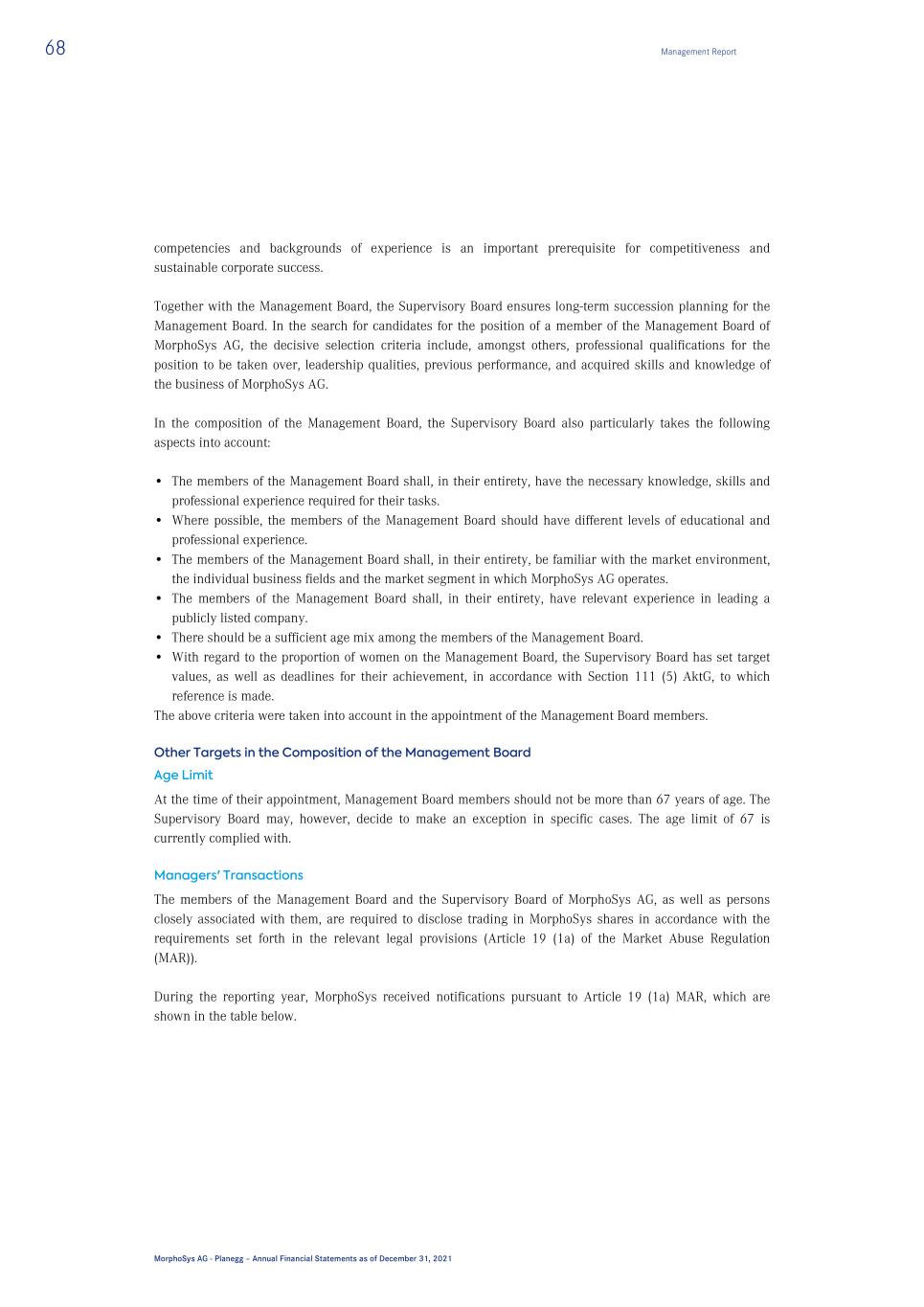

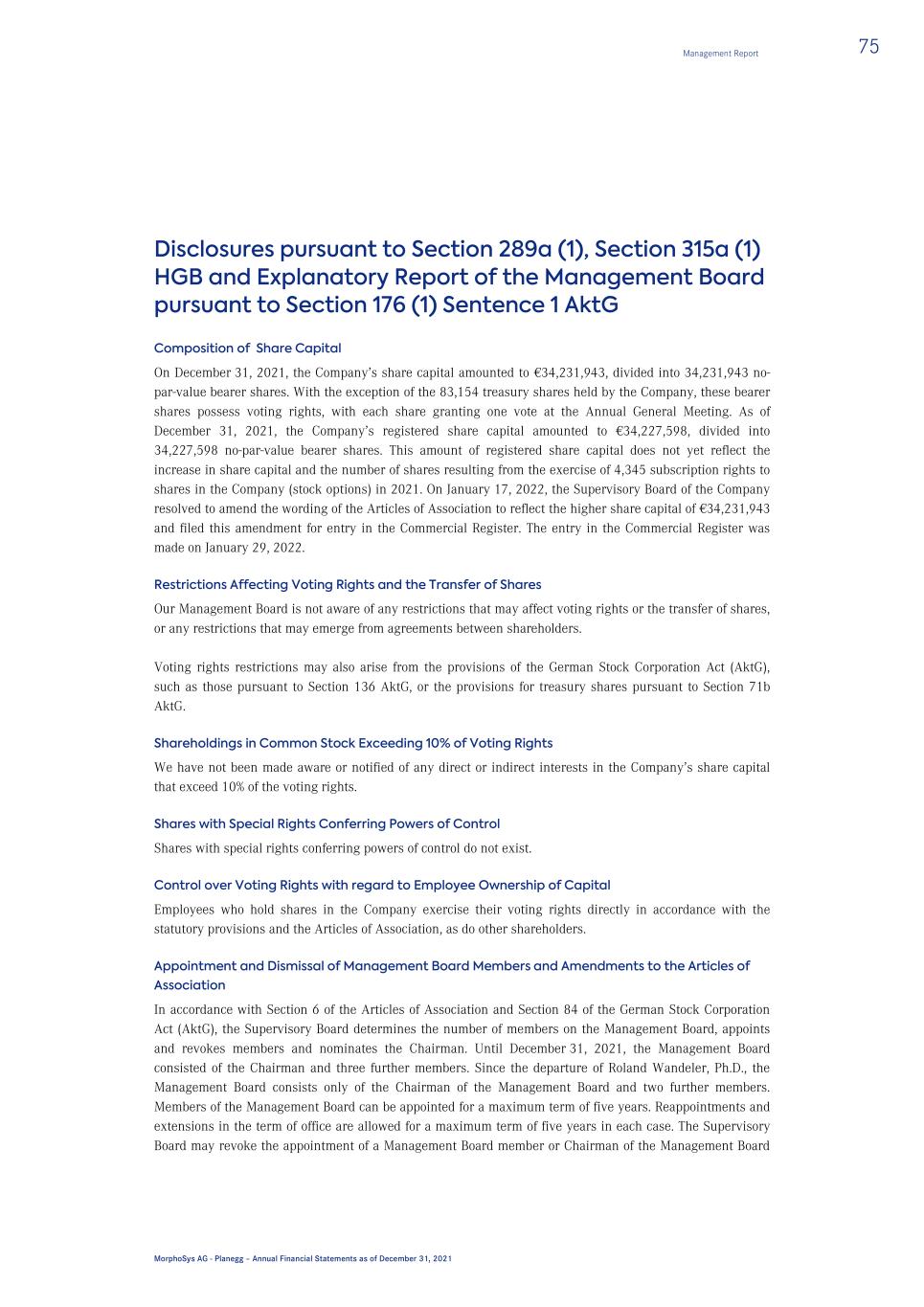

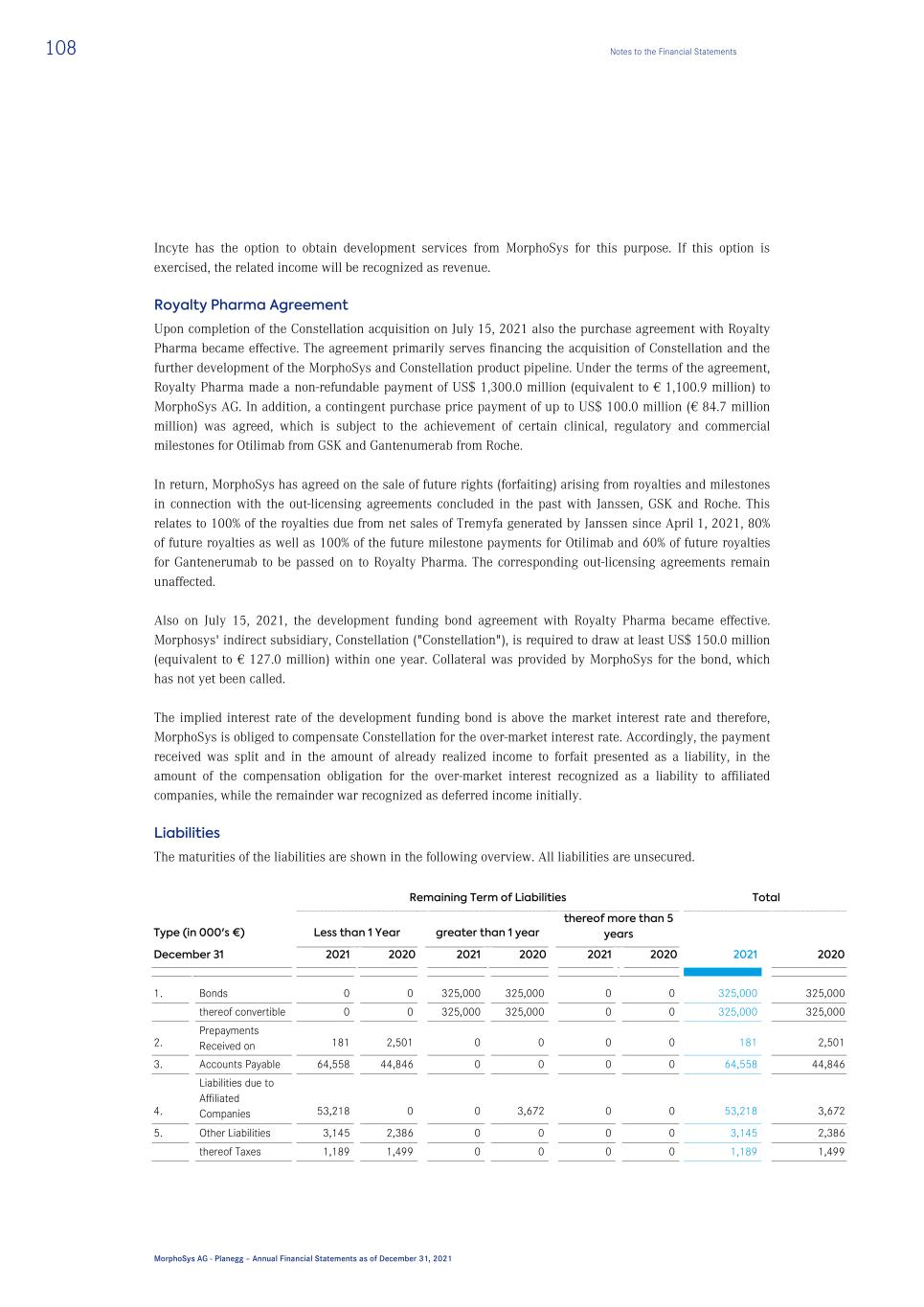

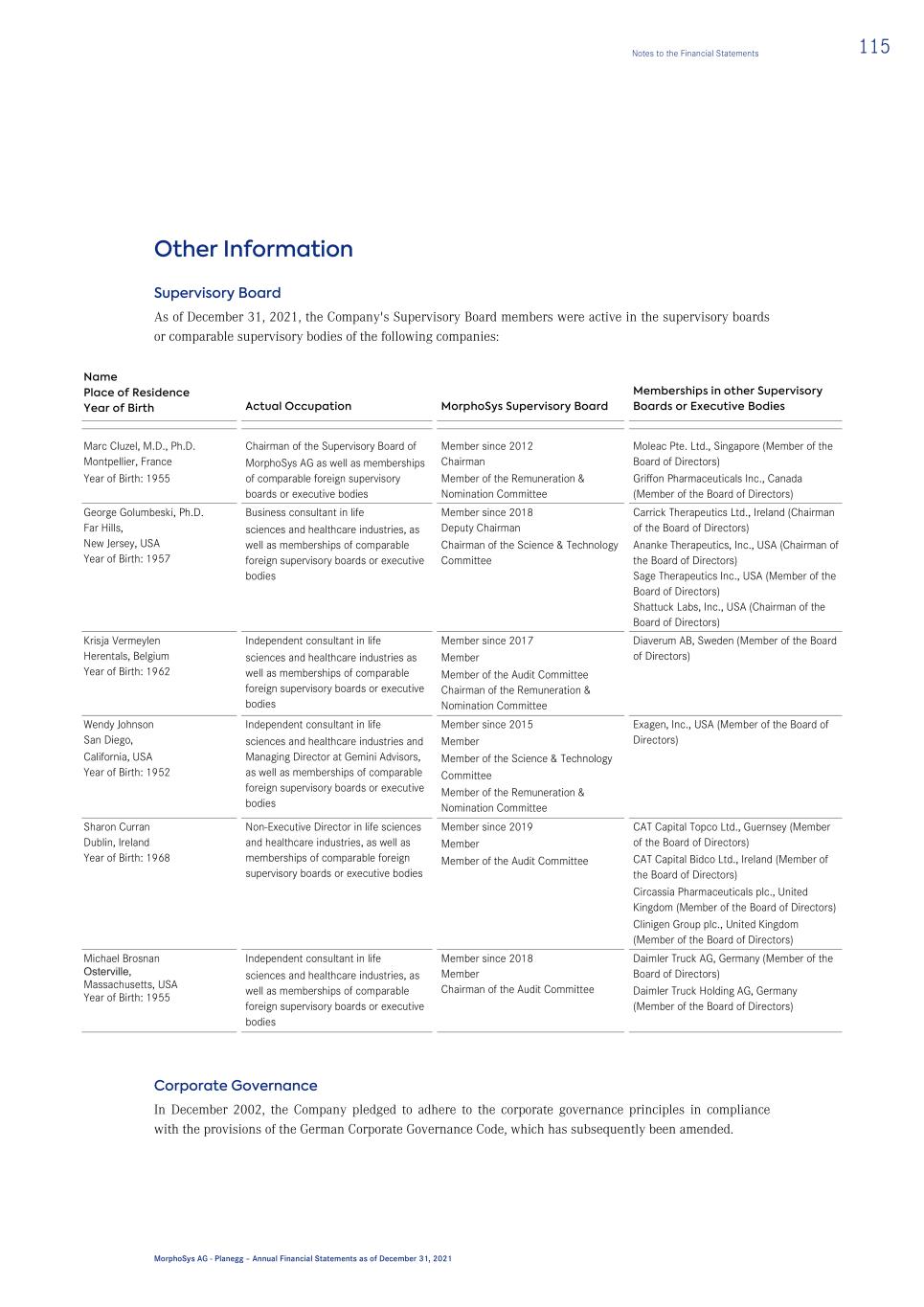

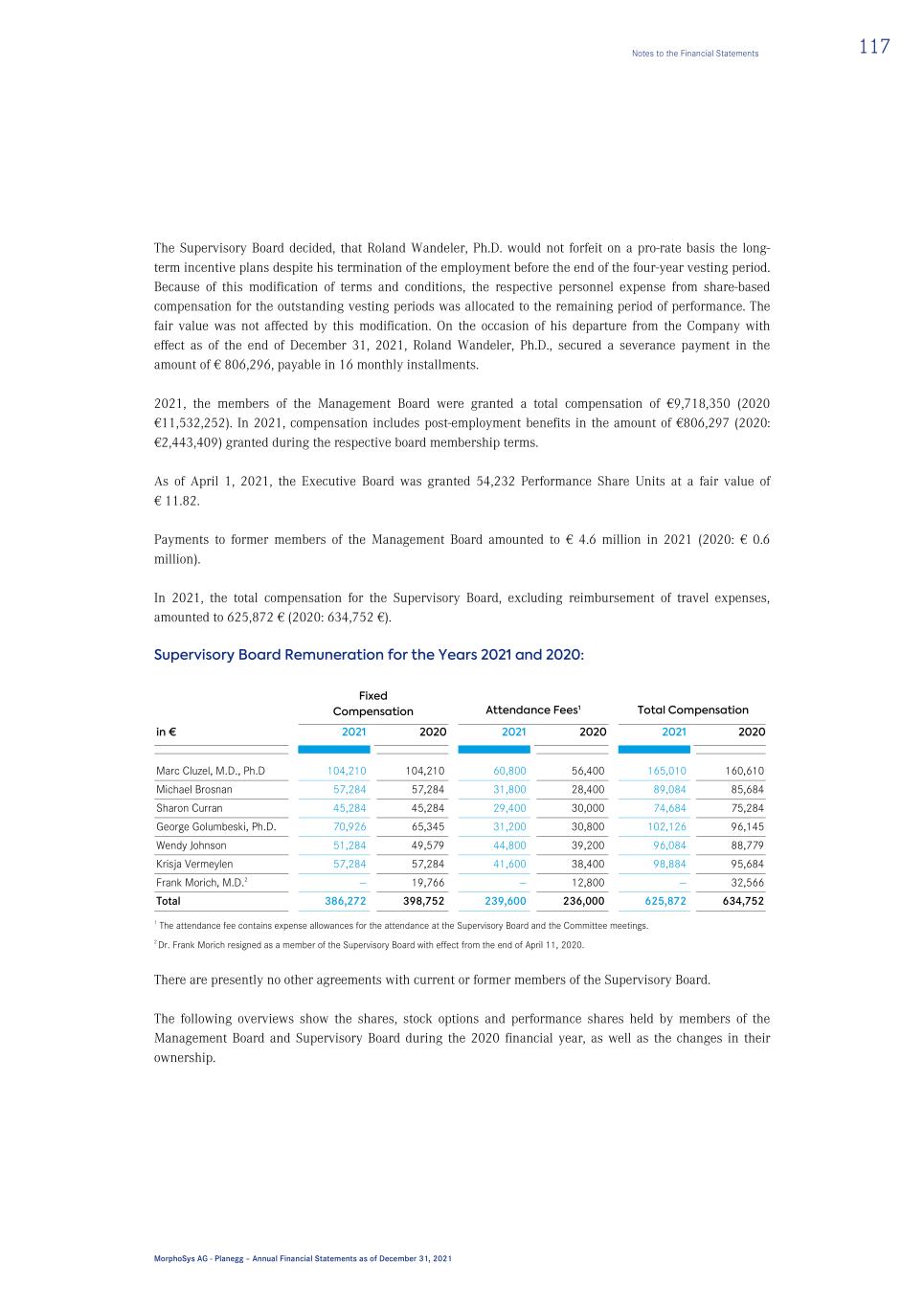

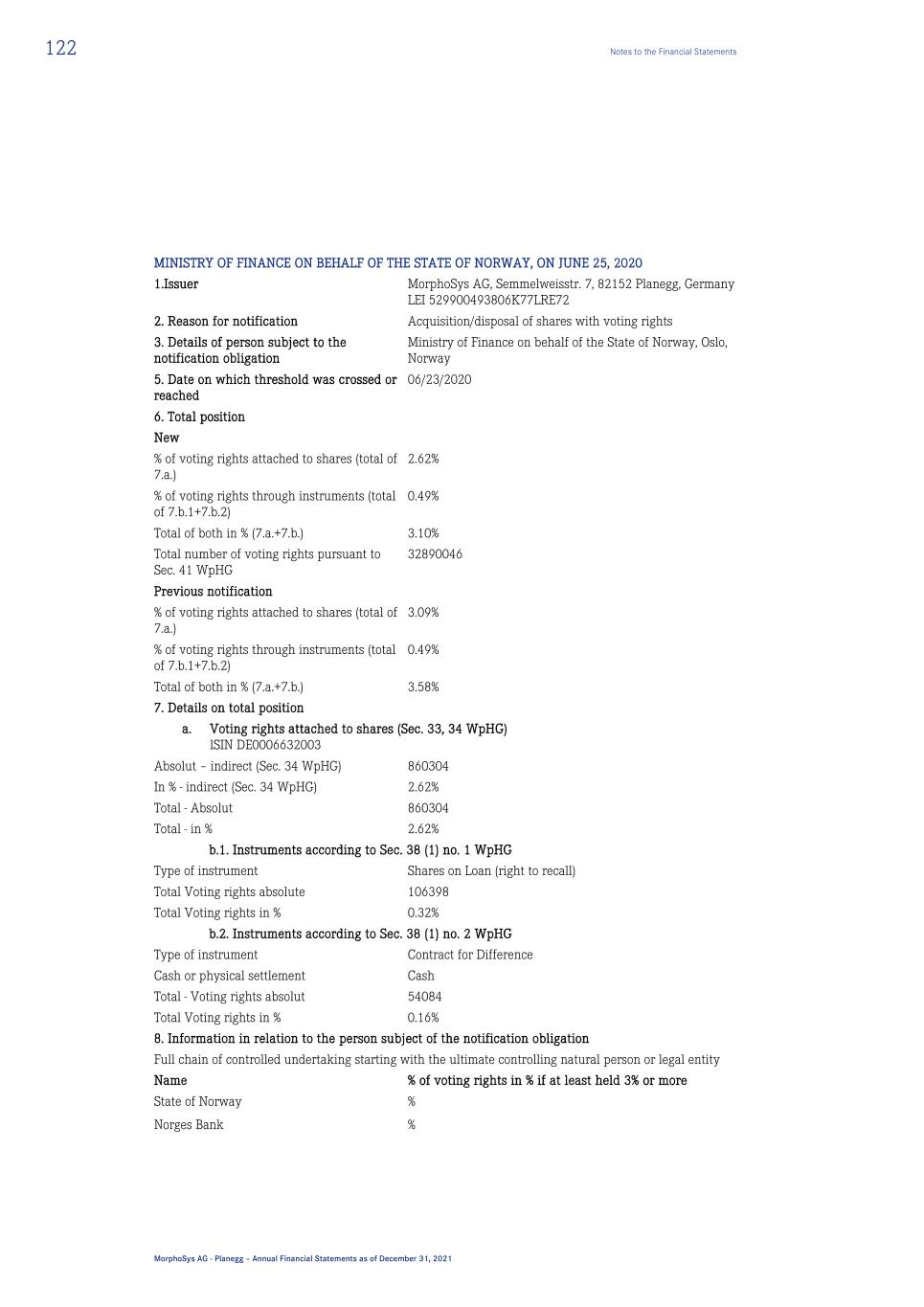

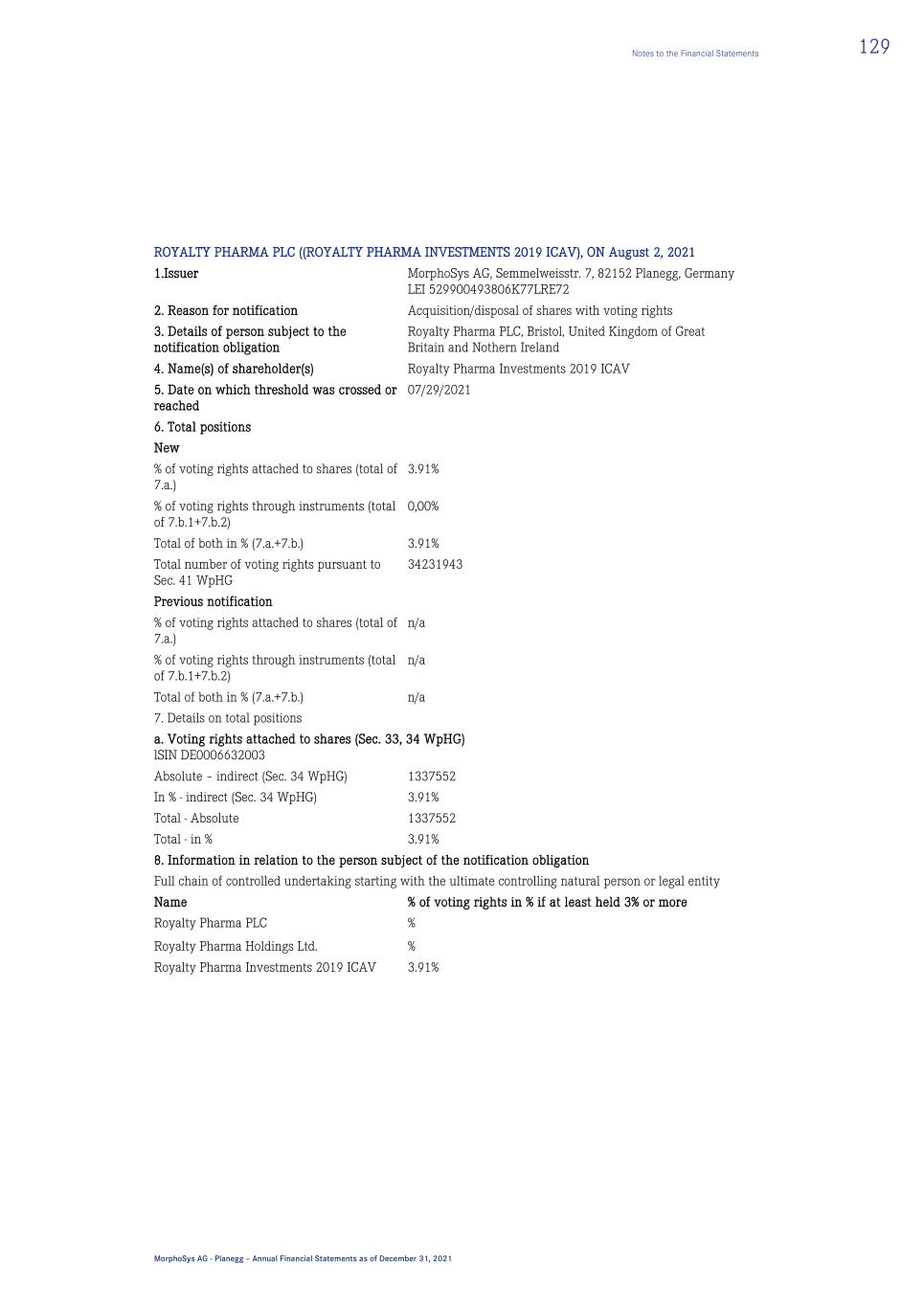

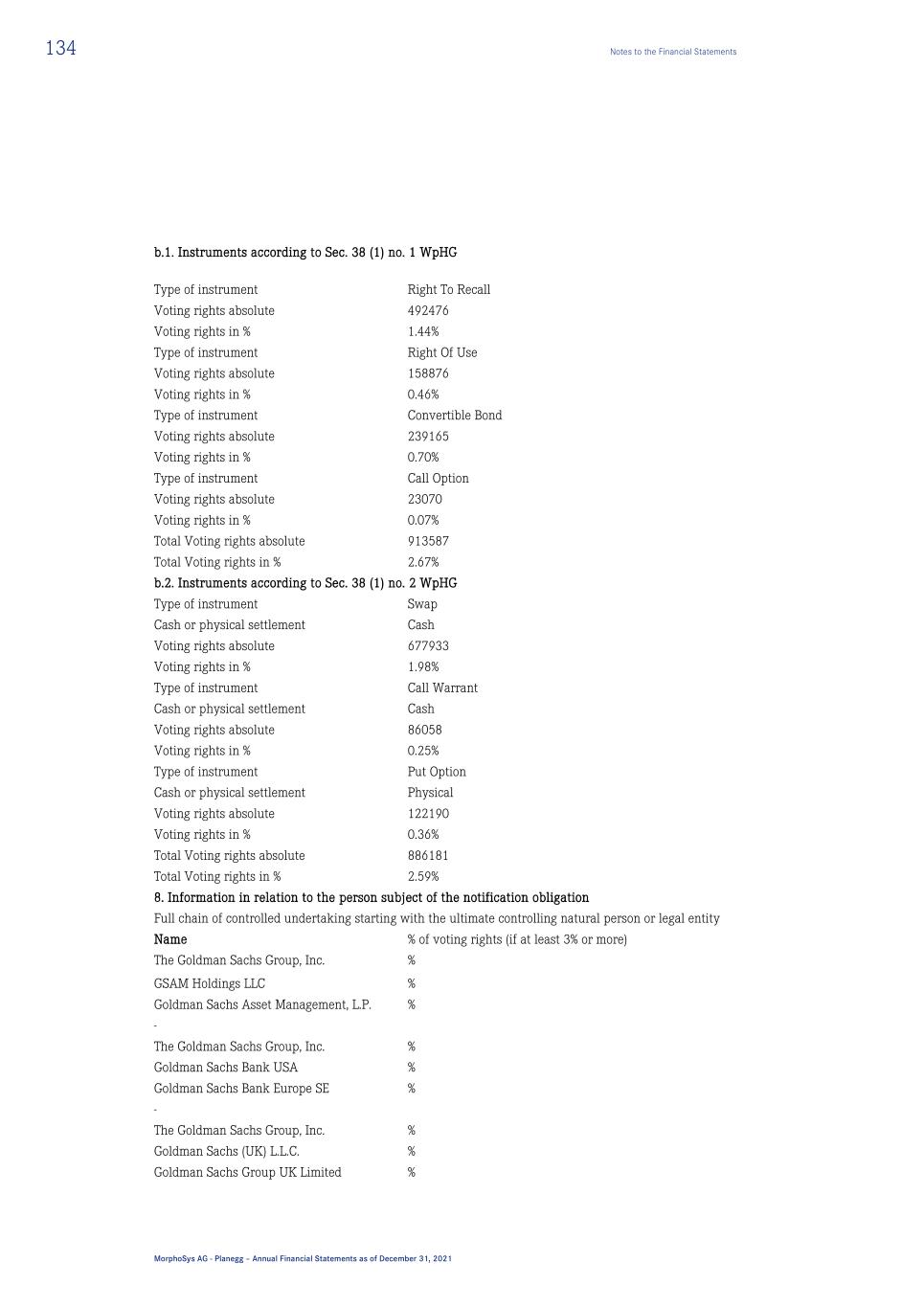

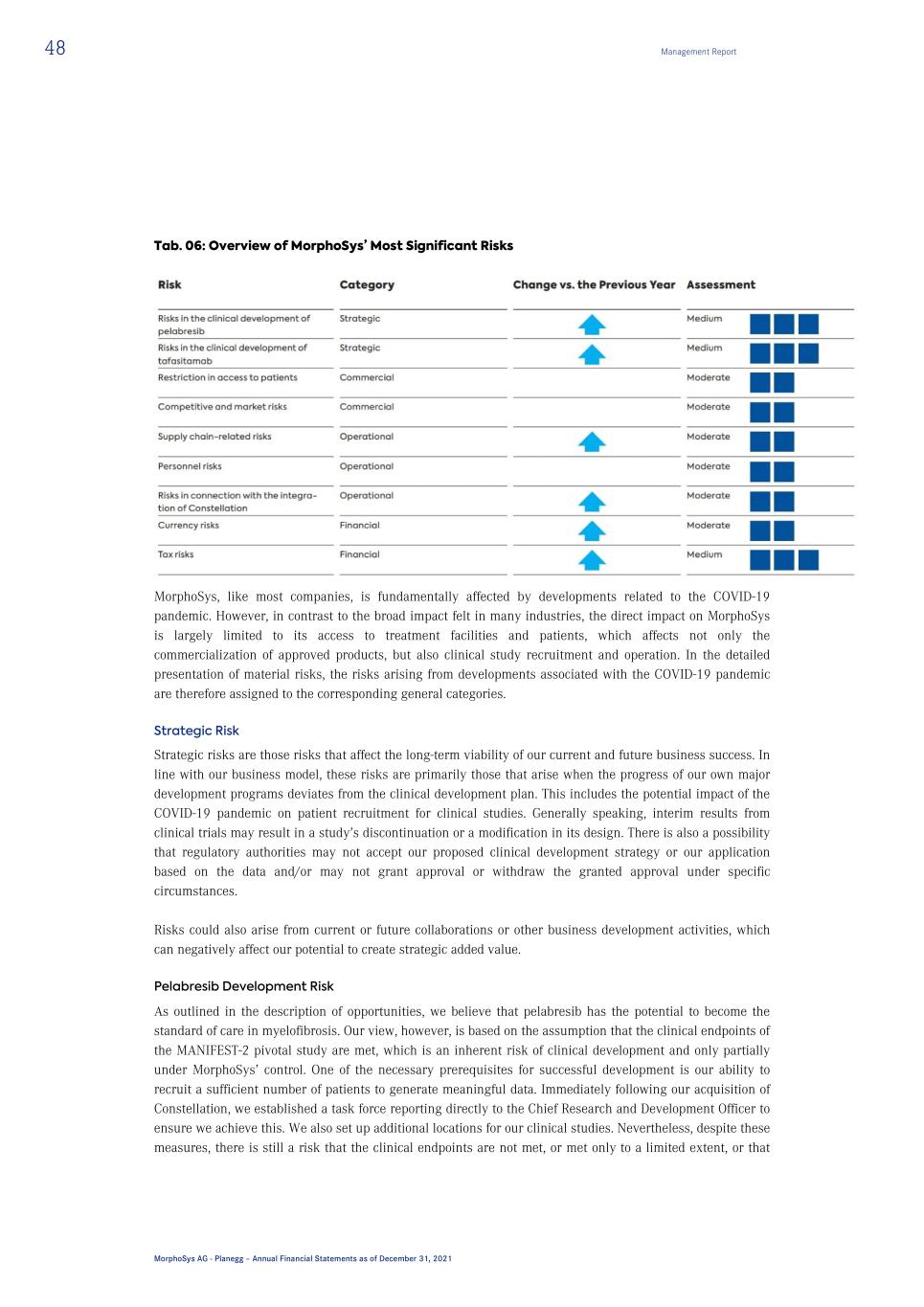

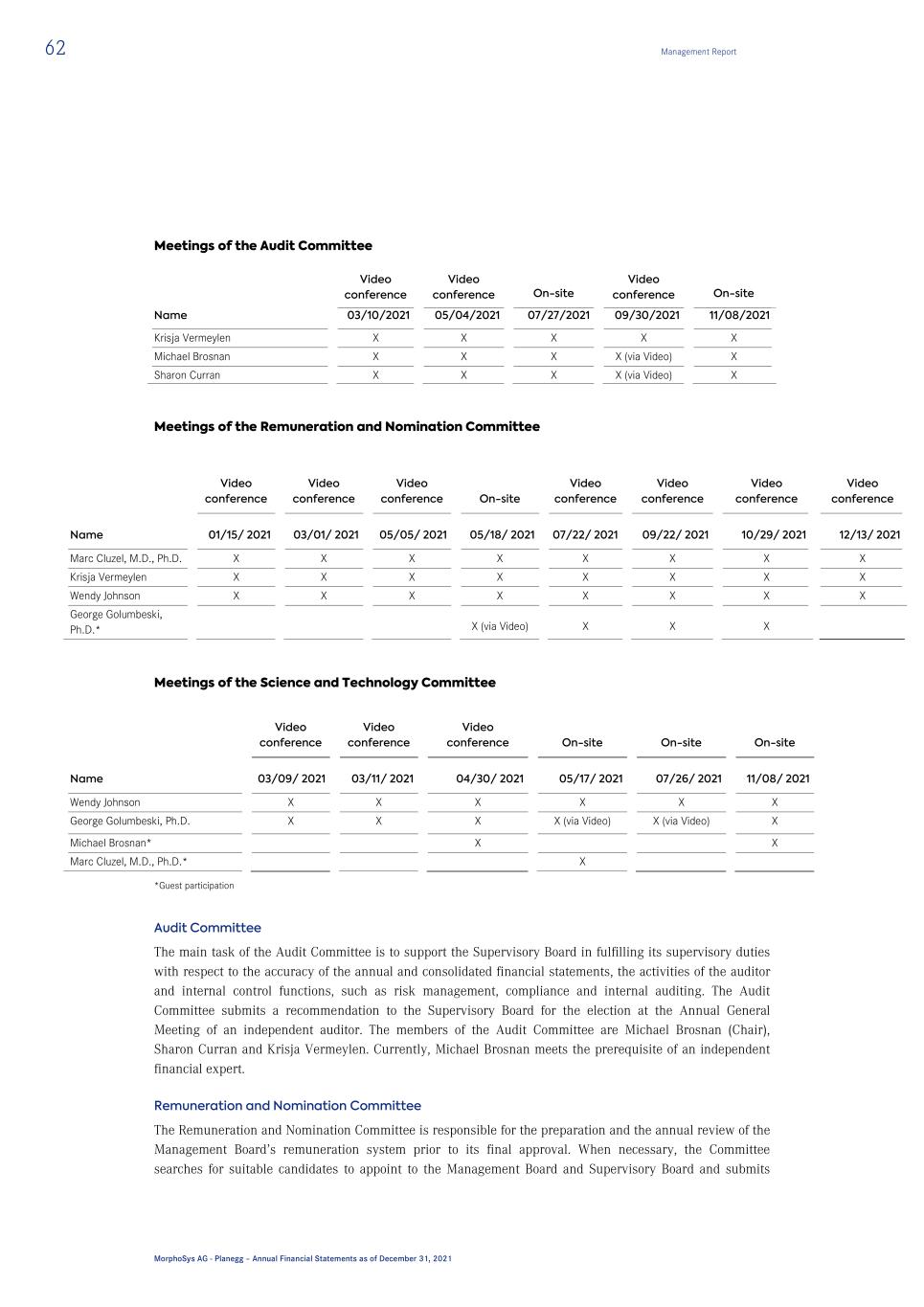

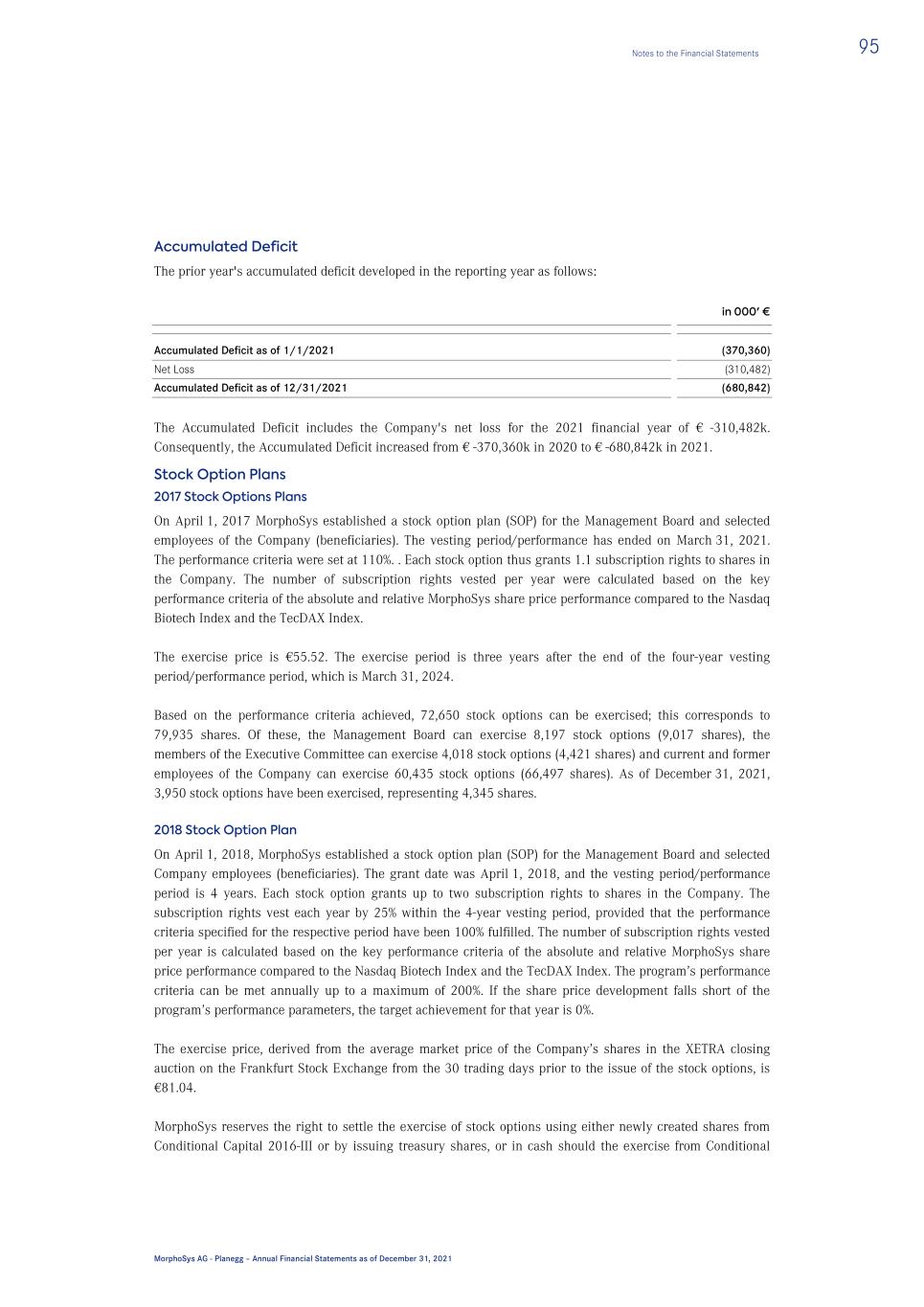

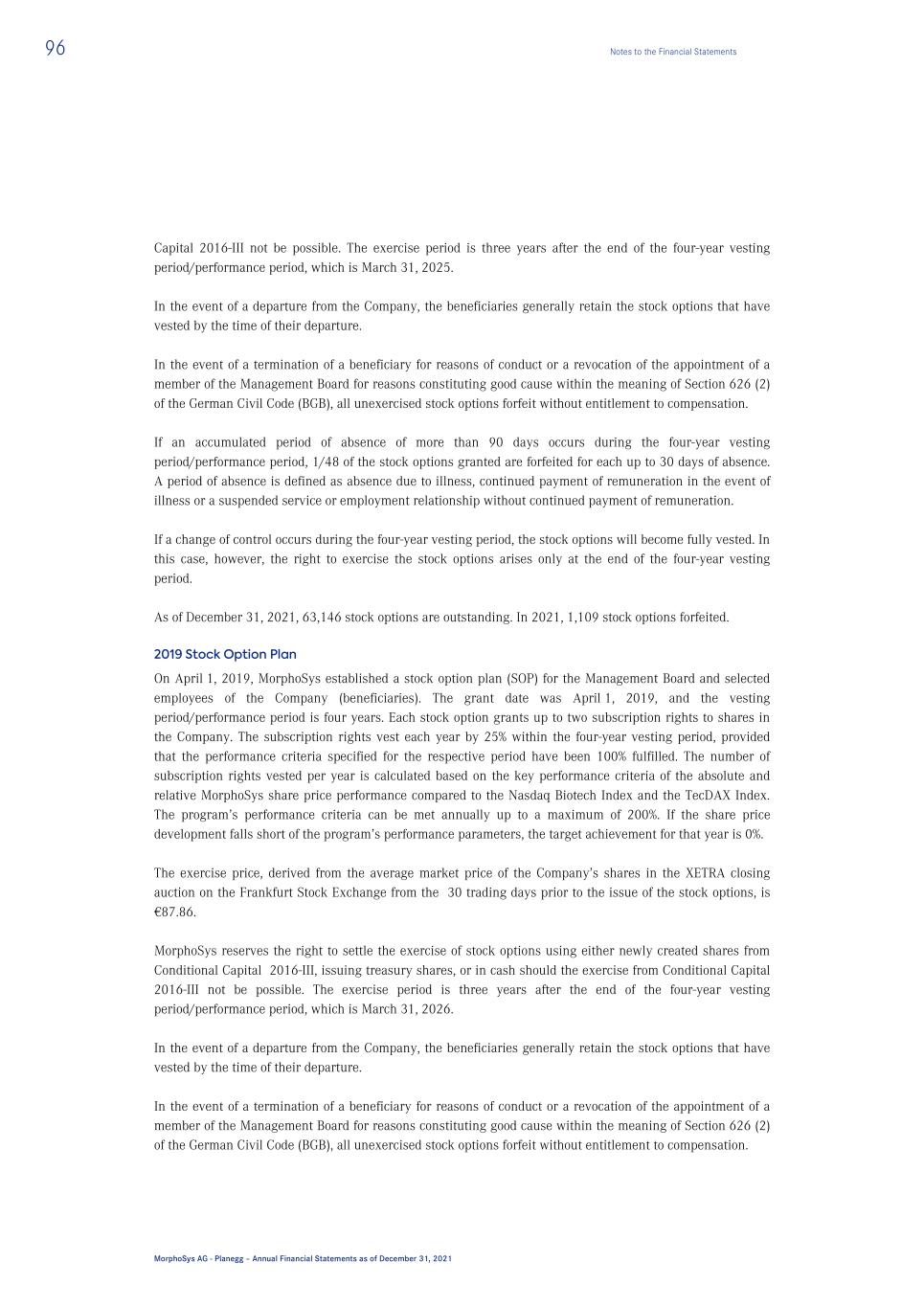

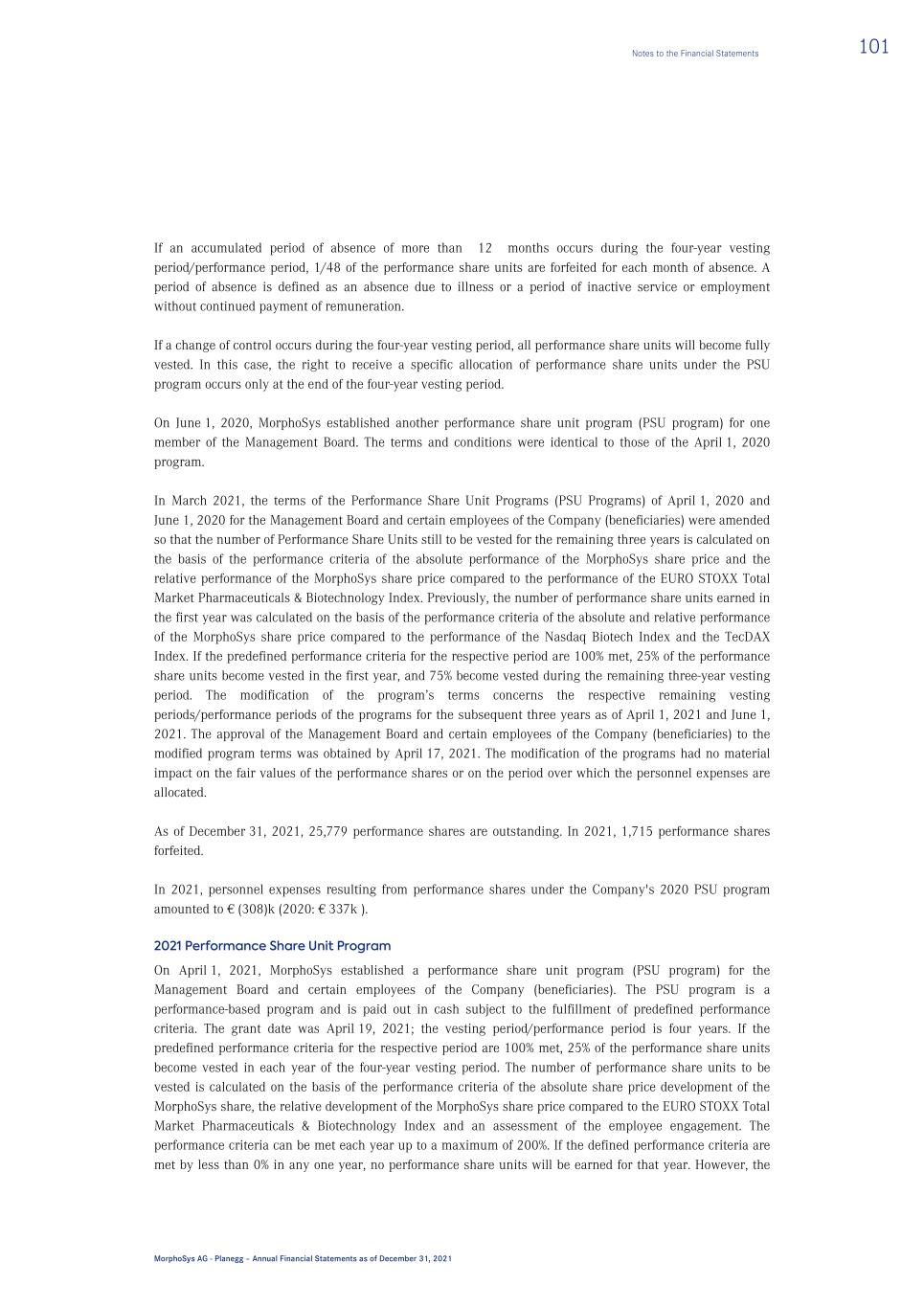

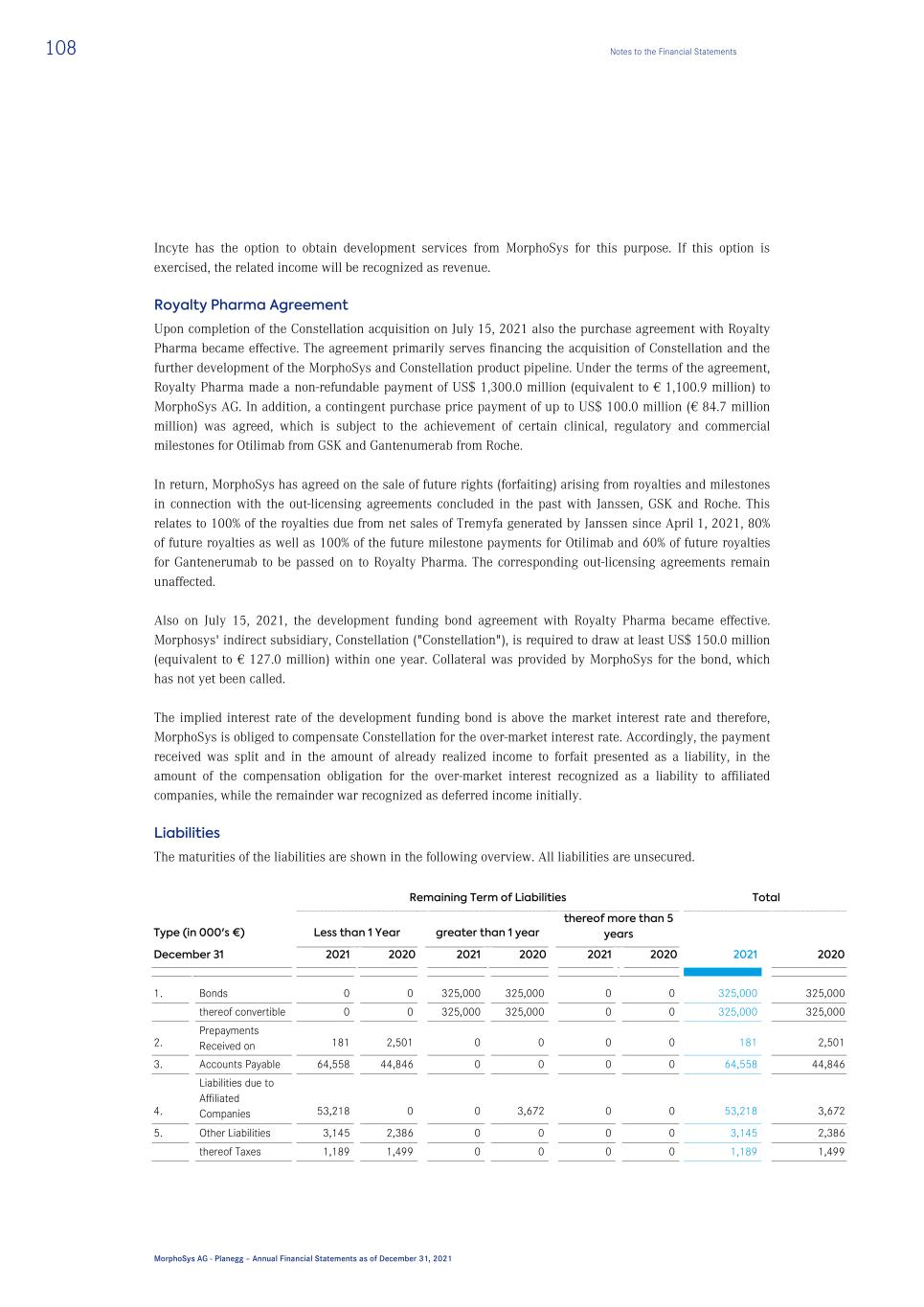

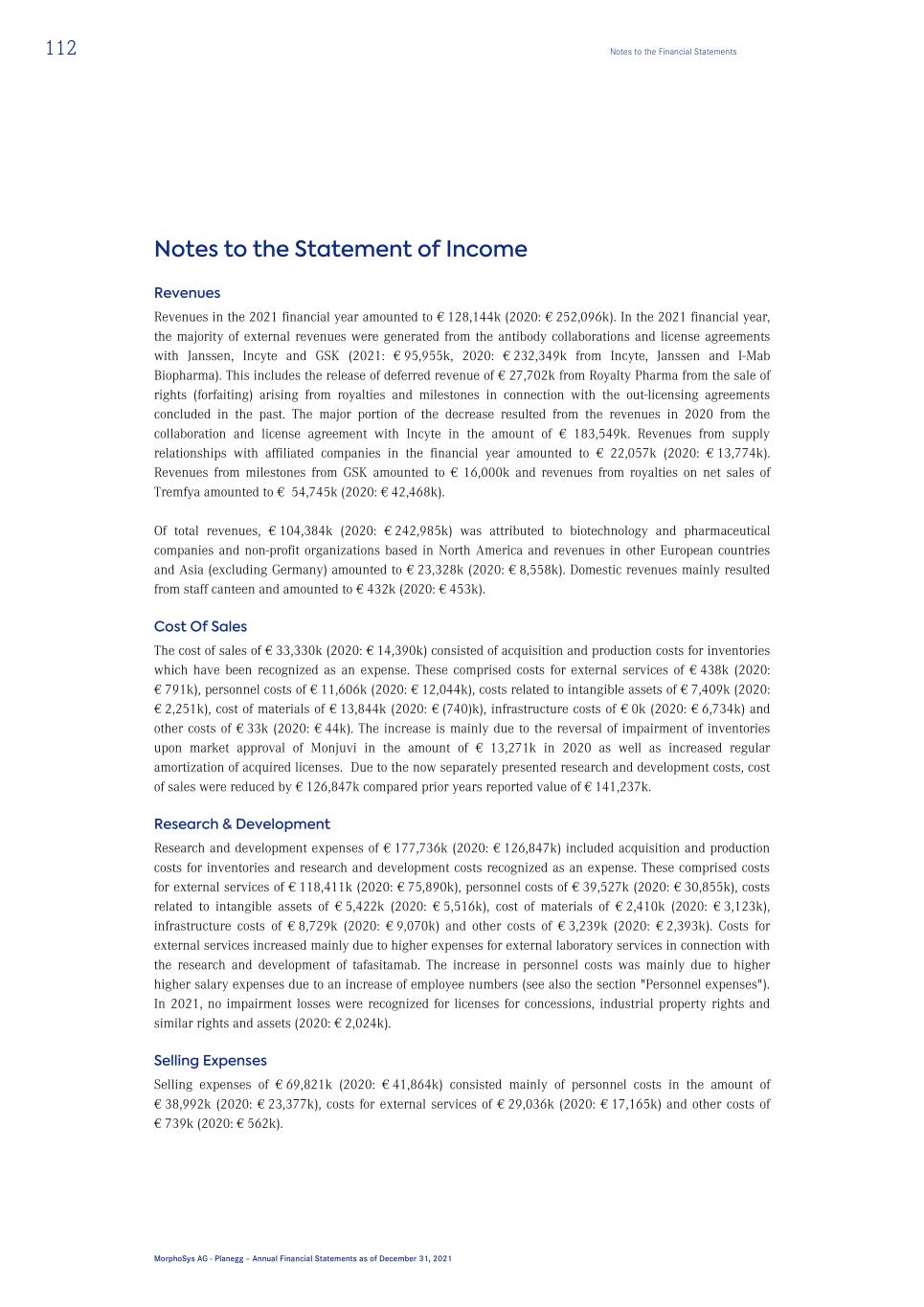

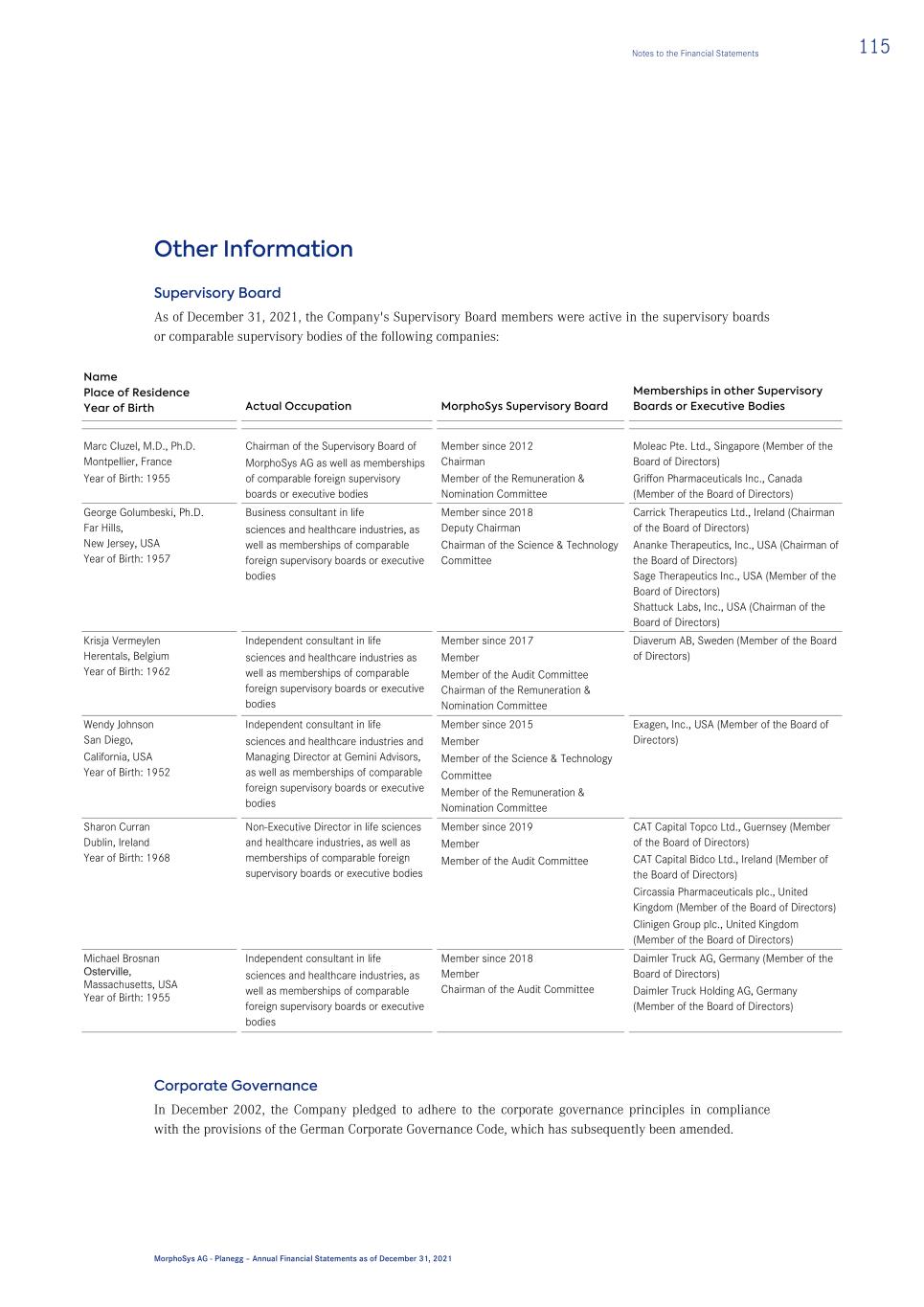

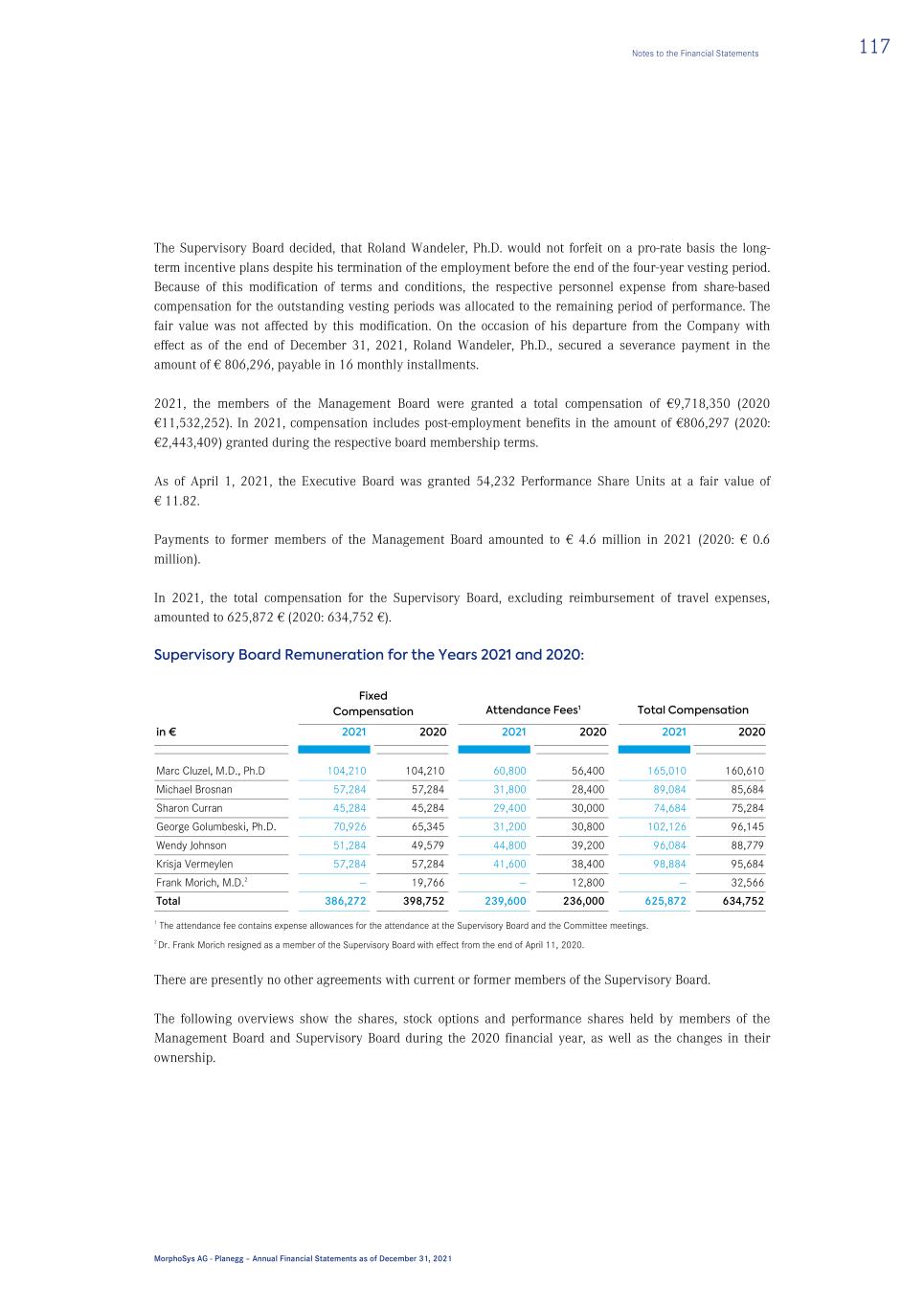

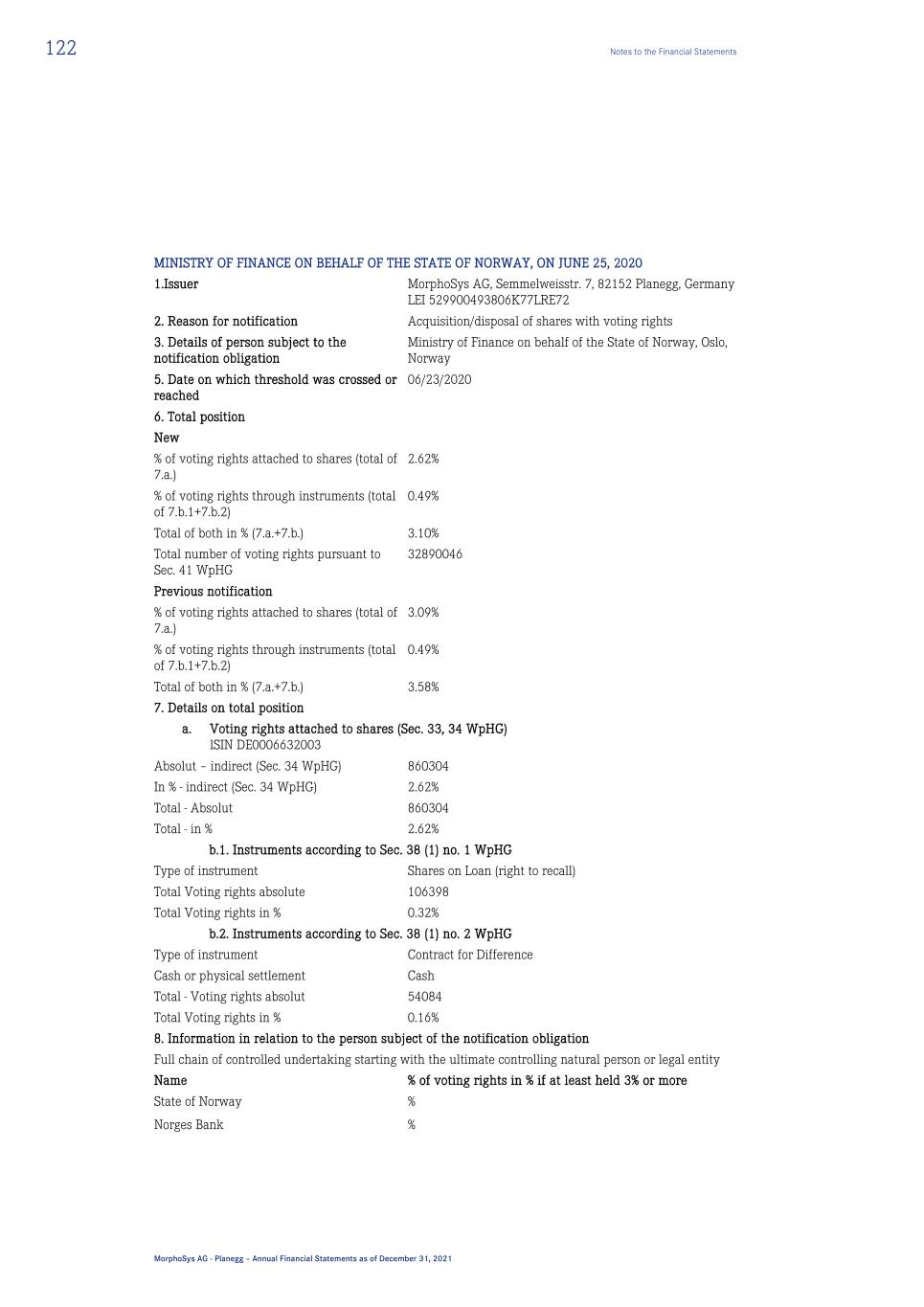

22 Management Report MorphoSys AG - Planegg – Annual Financial Statements as of December 31, 2021 in innovation treatments in recent years, accompanied by a strong focus across health systems to increase early diagnosis and expanded patient access to treatments, has resulted in global spending on oncology drugs reaching US$ 164 billion in 2020 and an estimated US$ 269 billion by 2025 even as annual growth rates ease to about 10%. Chronic inflammatory and autoimmune diseases affect millions of patients worldwide and impose an enormous social and economic burden. MorphoSys’ most advanced proprietary clinical programs are described in the Research and Development section. Clinical-stage programs developed through partners are entirely under the control of our partners. These programs include not only those in our core area of oncology but also in indications where we have not established proprietary expertise. Programs, which are the most advanced, are outlined in the Research and Development section. Influential Factors Good public medical care is a political goal in many countries. The need for new forms of therapy is growing as a result of demographic change. Certain cost containment measures in Europe and the U.S. risk limiting access to innovation for patients and could slow the industry’s investment in the development of new therapies. Regulatory approval processes in the U.S., Europe and elsewhere are lengthy, time-consuming and largely unpredictable. Approval-related laws, regulations and policies and the type and amount of information necessary to gain approval may change during the course of a product candidate’s clinical development and may vary among jurisdictions. MorphoSys recognized the impact of the global COVID‑19 pandemic on healthcare systems and society worldwide, as well as the resulting potential impact on preclinical and clinical programs, specifically clinical trials. In spring 2020, MorphoSys activated its existing business continuity plans to minimize any disruptions to ongoing operations caused by the COVID‑19 pandemic and to take the necessary actions to protect its employees. In addition, MorphoSys continuously monitors the situation as a whole as well as each clinical program individually and decides on the necessary course of action to ensure the safety of patients, personnel and other stakeholders, as well as on the collection of data. The Company makes adjustments where necessary to comply with regulatory, institutional and governmental requirements and guidelines related to COVID‑19. The top priority is the safety of all clinical program participants and ensuring that the studies in which they participate are conducted in accordance with the study protocol. Despite the rapid changes in conditions worldwide and the potential impact they may have on clinical trials, MorphoSys continues to work diligently to maintain its drug development plans. The continuation of the commercialization of Monjuvi had incorporated the use of digital channels. In addition, the sales and medical teams are using a combination of virtual and face-to-face communication to market Monjuvi, which enables them to take the right response to the uncertainty caused by the COVID‑19 pandemic in the U.S. MorphoSys continuously monitors the development of the global COVID-19 pandemic and the emergence of any new virus variants and decides on a case-by-case basis on the necessary course of action and measures to ensure the safety of employees and patients.