MORPHOSYS AG

STOCK OPTION PLAN 2021

– TERMS AND CONDITIONS –

TABLE OF CONTENT

DEFINITIONS

| | | | | | | | | | | | | | |

| Absolute Performance Target | 9 | | Good Leaver | 19 |

| Adjustment Event | 22 | | Grant | 7 |

| AktG | 8 | | Grant Date | 7 |

| Allocation Value | 6 | | Granting Period | 7 |

| Average Yearly Period Performance Target Achievement | 23 | | Group 1-Participant | 6 |

| Bad Leaver | 19 | | Group 2-Participant | 6 |

| Bank | 15 | | Group 3-Participant | 6 |

| Benchmark Index | 11 | | Group of Participants | 6 |

| Benchmark Indices | 11 | | Initial Number of Stock Options | 6 |

| BGB | 19 | | Insider Trading Rules | 26 |

| Black-Out Periods | 26 | | MAR | 19 |

| BörsG | 8 | | Maximum Limit | 13 |

| Breach of Duty | 16 | | Maximum Value Absolute Performance Target | 10 |

| Cash Settlement | 8 | | Maximum Value Performance Target | 10 |

| Cashless Exercise Option | 15 | | Maximum Value Relative Performance Target | 10 |

| Change of Control | 22 | | Minimum Value Absolute Performance Target | 10 |

| Code | 40 | | Minimum Value Relative Performance Target | 10 |

| Company | 5 | | MorphoSys | 5 |

| Complete Yearly Period | 23 | | NASDAQ Biotech Index | 9 |

| Complete Yearly Periods | 23 | | NASDAQ Trading Days | 11 |

| Conditional Capital 2020-I | 5 | | Notices | 27 |

| Data Subjects | 37 | | Option Agreement | 27 |

| Exercise Conditions | 8 | | Option Terms & Conditions | 5 |

| Exercise Notice | 15 | | Overall Absolute Performance Target Achievement | 13 |

| Exercise Period | 14 | | Overall Performance Target Achievement | 13 |

| Exercise Price | 8 | | Overall Relative Performance Target Achievement | 13 |

| Exercise Shares | 7 | | Participant | 6 |

| Expiry Date | 18 | | Performance Target | 9 |

| External Service Provider | 38 | | Performance Targets | 9 |

| Extraordinary Events or Developments | 16 | | Pre-Financing | 15 |

| Fair Market Value | 40 | | Relative Performance Target | 9 |

| Final Number of Stock Options | 13 | | Relevant Closing Price | 8 |

| GDPR | 37 | | Set Target Absolute Performance Target | 9 |

| | | | | | | | | | | | | | |

| Set Target Performance Target | 9 | | TecDAX Index | 9 |

| Set Target Performance Targets | 10 | | Termination Date | 19 |

| Set Target Relative Performance Target | 10 | | Trading Day | 8 |

| Share | 5 | | U.S. Taxpayer | 40 |

| Share Settlement | 7 | | Waiting Period | 14 |

| Shares | 5 | | Yearly Period | 10 |

| SOP 2021 | 5 | | Yearly Period Absolute Performance Target Achievement | 11 |

| SOP Resolution | 5 | | Yearly Period Relative Performance Target Achievement | 12 |

| Stock Option | 5 | | Yearly Period Relative Performance Target Benchmark | 11 |

| Stock Options | 5 | | | |

RECITALS

The participation of the management and employees in the economic risks and opportunities of the relevant business operation is an important component of an internationally competitive remuneration system.

For this purpose, MorphoSys AG (“MorphoSys” or the “Company”) intends to implement a stock option plan (the “SOP 2021”) under which stock options shall be granted to members of the Management Board (Vorstand) of MorphoSys (the “Management Board”), members of management bodies of affiliated companies in Germany and abroad and to selected employees of MorphoSys and affiliated companies in Germany and abroad, entitling each of them to acquire a specified number of no-par-value bearer shares (auf den Inhaber lautende Stückaktien) of the Company, each representing a pro rata amount of EUR 1.00 of the Company’s nominal share capital (each a “Share”, and together the “Shares”).

With resolution dated May 27, 2020 (the “SOP Resolution”), the Company’s general meeting (Hauptversammlung) has authorized (i) the Supervisory Board (Aufsichtsrat) to grant stock options that entitle to the subscription of up to 657,307 Shares to members of the Management Board; and (ii) the Management Board to grant, with the consent of the Supervisory Board, stock options that entitle to the subscription of up to 657,308 Shares to members of management bodies of affiliated companies in Germany and abroad and to selected employees of MorphoSys and affiliated companies in Germany and abroad (each a “Stock Option”, and together the “Stock Options”). The same general meeting also created a conditional capital (bedingtes Kapital) of up to EUR 1,314,615.00 (the “Conditional Capital 2020-I”) in order to fund the Stock Options. The general meeting has authorized the Supervisory Board, when members of the Management Board are concerned, and the Management Board, when members of management bodies of affiliated companies in Germany and abroad as well as selected employees of MorphoSys and affiliated companies in Germany and abroad are concerned, to determine the further details of the SOP 2021, in particular concerning the grant of Stock Options and the relevant terms and conditions in accordance with the parameters set forth in the SOP Resolution.

The present terms and conditions (the “Option Terms & Conditions”) establish the rules pursuant to which the Stock Options under the SOP 2021 can be granted and exercised.

§ 1

ELIGIBILITY

1.1Stock Options will be granted to the following participants (each a “Participant”), who are divided into three (3) groups of Participants (each a “Group of Participants”):

1.1.1Members of the Management Board of MorphoSys (“Group 1-Participants”);

1.1.2Members of management bodies of affiliated companies in Germany and abroad (“Group 2-Participants”);

1.1.3Selected employees of MorphoSys and of affiliated companies in Germany and abroad (“Group 3-Participants”).

1.2If a Participant belongs to more than one Group of Participants, the Participant will receive Stock Options based solely on his membership in one Group of Participants. Membership in a Group of Participants is determined by the Company’s Management Board, unless members of the Company’s Management Board are concerned, in which case the Company’s Supervisory Board determines the membership in a Group of Participants. The Participants of each Group of Participants and the number of Stock Options to be granted may vary over the term of the SOP 2021 and are determined by the Company’s Management Board, unless members of the Company’s Management Board are concerned, in which case they are determined by the Company’s Supervisory Board.

1.3For each Group 1-Participant, the Supervisory Board, for each Group 2-Participant and Group 3-Participant, the Management Board, will determine a target value in Euro (EUR) as allocation value (the “Allocation Value”; Zuteilungswert). The initial number of Stock Options for each Participant for each tranche is equivalent to the Allocation Value divided by the fair value of a stock option at the Grant Date (§ 2) as determined on the basis of an option-pricing-model, rounded up to the nearest whole number (the “Initial Number of Stock Options”).

§ 2

PLAN VOLUME AND GRANT OF STOCK OPTIONS

2.1The Group 1-Participants together receive no more than 50 % of the Stock Options to be issued in total. The Group 2-Participants together receive no more than 5 % of the Stock Options to be issued in total. The Group 3-Participants together receive no more than 45 % of the Stock Options to be issued in total.

2.2The number of Stock Options from one tranche allocated to each Group of Participants is determined by the Initial Number of Stock Options for each individual Participant of the respective Group of Participants.

2.3The Stock Options will be granted (the “Grant”) in accordance with legal requirements in each case within three (3) months after the end of the first or third quarter in the respective year (the “Granting Period”), subject to a continuing and non-terminated (ungekündigt) service relationship or employment of the relevant Participant at the relevant Grant Date (§ 2.4).

2.4The date on which the Grant becomes effective (the “Grant Date”) shall be the date on which the Participant receives the offer granting Stock Options, irrespective of the point in time the offer is accepted. The offer can specify another date as Grant Date.

2.5Subject to (i) a forfeiture or a reduction of the number of Stock Options pursuant to § 10 below; and (ii) the satisfaction of the terms and conditions set forth in these Option Terms & Conditions, each Stock Option entitles the Participant up to two (2) subscription rights to each acquire one (1) Share in the Company against payment of the Exercise Price (§ 3).

2.6In fulfilment of the Stock Options the Company may, at its sole discretion:

2.6.1deliver the number of Shares with respect to which the Stock Options are being exercised (the “Exercise Shares”) out of the Conditional Capital 2020-I or from treasury shares or from a combination of both (the “Share Settlement”); and/or

2.6.2instead of the delivery of all or some of the Exercise Shares make a cash payment in the amount of (i) the product of the Xetra closing price (Schlusskurs) of the Shares on the regulated market of the Frankfurt Stock Exchange on the day of receipt of the Exercise Notice (§ 7) or, in case of a previous delisting of the Company, the price which had to be offered as part of the compulsory public tender offer pursuant to Sec. 39 para. 2 sentence 3 no. 1, paras. 3 et seqq. of the German Stock Exchange Act (Börsengesetz - the ”BörsG”) (the “Relevant Closing Price”), multiplied by the aggregate number of Exercise Shares to be settled in cash, minus (ii) the Exercise Price (§ 3), multiplied by the aggregate number of Exercise Shares to be settled in cash or, in case the Participant has already paid to the Company the Exercise Price for all Exercise Shares to be settled in cash, EUR 0.00 (the “Cash Settlement”).

§ 3

EXERCISE PRICE

The price at which one (1) Share may be acquired upon exercise of one (1) subscription right equals the 30 (thirty) Trading Days average closing price of the Shares in Xetra trading (or a comparable successor system) on the Frankfurt Stock Exchange before the Grant Date (the “Exercise Price”). If a closing auction does not take place on the relevant Trading Days or a price is not determined in the auction, the applicable price will be the last price quoted in continuous trading, provided there was continuous trading on that Trading Day. “Trading Day” means a day other than a Saturday or Sunday or public holiday on which the Frankfurt Stock Exchange is open for trading. The minimum Exercise Price is equivalent to the minimum issue price as set forth in Sec. 9 para. 1 of the German Stock Corporation Act (Aktiengesetz - the “AktG”), i.e. currently EUR 1.00.

§ 4

EXERCISE CONDITIONS

Any exercise of the Stock Options requires satisfaction of all of the following conditions (the “Exercise Conditions”):

4.1a Minimum Value Performance Target (§ 5) has been exceeded;

4.2the Maximum Limit (5.8) has not been exceeded;

4.3the respective Stock Options have vested (§§ 10.2, 10.3 and 13.3);

4.4the applicable Waiting Period (§ 6.1) has expired;

4.5an Exercise Period (§ 6.2) has started and not yet ended;

4.6the exercise has not been temporarily suspended according to § 16.2; and

4.7the Expiry Date (§ 9.1) for the Stock Options to be exercised has not passed.

§ 5

PERFORMANCE TARGETS

5.1Stock Options may only be exercised if and to the extent the Performance Targets (as defined below) have been reached in accordance with the following provisions.

5.2The Performance Targets are linked to:

5.2.1the absolute market price performance of the Shares during the Waiting Period (§ 6.1) (the “Absolute Performance Target”); and

5.2.2the relative market price performance of the Shares in relation to the performance of the NASDAQ Biotechnology Index of the NASDAQ Stock Exchange (“NASDAQ Biotech Index”) as well as the TecDAX Index of the Frankfurt Stock Exchange (“TecDAX Index”) (the “Relative Performance Target”; the Absolute Performance Target and the Relative Performance Target each a “Performance Target” and together the “Performance Targets”).

5.3Each Performance Target is weighted with 50 % with respect to the Overall Performance Target Achievement (as defined below). Each Performance Target has a set target (Zielvorgabe) as well as a minimum target value (Minimalwert) and a maximum target value (Maximalwert). The set target determines the value at which the respective Performance Target is achieved by 100 % (the “Set Target Performance Target”, respectively the “Set Target Absolute Performance Target” or the “Set Target Relative Performance Target”,

together the “Set Target Performance Targets”). The minimum value defines the lower end of the target range (the “Minimum Value Performance Target, respectively the “Minimum Value Absolute Performance Target” or the “Minimum Value Relative Performance Target”). When achieving or falling below this level, the achievement level of the respective Performance Target is 0 %. The maximum value defines the value that, when reached or exceeded, amounts to an achievement level of the respective Performance Target of 200 % (the “Maximum Value Performance Target”, respectively the “Maximum Value Absolute Performance Target” or the “Maximum Value Relative Performance Target”).

5.4To determine the level of achievement of each Performance Target, the Waiting Period (§ 6.1) is divided into four (4) identical periods of one (1) year each (“Yearly Period”).

5.5To determine the level of achievement of the Absolute Performance Target, the following provisions apply:

5.5.1With respect to each Yearly Period, the market price of the Shares at the beginning of the respective Yearly Period is compared to the market price at the end of the respective Yearly Period (for the first Yearly Period, this is the period between the date after the Grant Date and until the date of the following year, that corresponds to the Grant Date, and correspondingly for the following three Yearly Periods). The relevant market price of the Shares is the average closing auction price in Xetra trading (or a comparable successor system) on the Frankfurt Stock Exchange thirty (30) Trading Days prior to the start of the respective Yearly Period, and prior to the end of the respective Yearly Period, including the last day of the Yearly Period. If a closing auction does not take place on the relevant Trading Days or a price is not determined in the auction, the applicable price will be the last price quoted in continuous trading, provided there was continuous trading on that Trading Day.

5.5.2If in the respective Yearly Period the market price of the Shares declines, the achievement level of the Absolute Performance Target is 0 % (Minimum Value Absolute Performance Target). If the market price performance of the Shares is 0 %, the Absolute Performance Target is achieved by 50 %. Subsequent increases in the achievement level of the

Absolute Performance Target are linear. An 8 % increase of the market price of the Shares therefore results in an achievement level of the Absolute Performance Target of 100 % (Set Target Absolute Performance Target), a 16 % increase of the market price therefore results in an achievement level of the Absolute Performance Target of 150 %, and a 24 % increase of the market price therefore results in an achievement level of the Absolute Performance Target of 200 % (Maximum Value Absolute Performance Target). Any further increase of the market price of the Shares does not result in a further increase of the achievement level of the Absolute Performance Target.

The level of achievement for each Yearly Period for the Absolute Performance Target is the “Yearly Period Absolute Performance Target Achievement”.

5.6To determine the level of achievement of the Relative Performance Target, the following provisions apply:

5.6.1With respect to each Yearly Period, the performance of the market price of the Shares is compared to the performance of the NASDAQ Biotech Index and the TecDAX Index (collectively the “Benchmark Indices”, and each a “Benchmark Index”), and the respective values are put into proportion (for the first Yearly Period, this is the respective performance during the period between the date after the Grant Date and until the date of the following year that corresponds to the Grant Date, and correspondingly for the following three Yearly Periods). Within the Benchmark Indices, the NASDAQ Biotech Index and the TecDAX Index are each weighted with 50 % in a way that the percentage performance per Benchmark Index and per Yearly Period is added and divided by two (2) (the “Yearly Period Relative Performance Target Benchmark”). The relevant market price of the Shares is the average closing auction price in Xetra trading (or a comparable successor system) on the Frankfurt Stock Exchange thirty (30) Trading Days prior to the start of the respective Yearly Period, and prior to the end of the respective Yearly Period, including the last day of the Yearly Period. The relevant price of the NASDAQ Biotech Index is the average closing price of the NASDAQ Biotech Index thirty (30) trading days pursuant to the applicable official trading day calendar (the “NASDAQ Trading Days”) prior to the start of the respective Yearly Period, and prior to the end of the respective Yearly

Period, including the last day of the Yearly Period. The relevant price of the TecDAX Index is the average closing price of the TecDAX on the Frankfurt Stock Exchange thirty (30) Trading Days prior to the start of the respective Yearly Period, and prior to the end of the respective Yearly Period, including the last day of the Yearly Period. If a closing auction does not take place on the relevant Trading Days, respectively on the relevant NASDAQ Trading Days, or a price is not determined in the auction, the applicable price will be the last price quoted in continuous trading, provided there was continuous trading on that Trading Day, respectively on that NASDAQ Trading Day.

5.6.2If in the respective Yearly Period the market price of the Shares declines compared to the Yearly Period Relative Performance Target Benchmark, the achievement level of the Relative Performance Target is 0 % (Minimum Value Relative Performance Target). If the market price performance of the Shares is 0 % compared to the Yearly Period Relative Performance Target Benchmark, the Relative Performance Target is achieved by 100 % (Set Target Relative Performance Target). Subsequent increases in the achievement level of the Relative Performance Target are linear. An 8 % increase of the market price of the Shares compared to the Yearly Period Relative Performance Target Benchmark therefore results in an achievement level of the Relative Performance Target of 150 %, and a 16 % increase of the market price of the Shares compared to the Yearly Period Relative Performance Target Benchmark therefore results in an achievement level of the Relative Performance Target of 200 % (Maximum Value Relative Performance Target). Any further increase of the market price of the Shares compared to the Yearly Period Relative Performance Target Benchmark does not result in a further increase of the achievement level of the Relative Performance Target.

The level of achievement for each Yearly Period for the Relative Performance Target is the “Yearly Period Relative Performance Target Achievement”.

5.7The overall target achievement for each Performance Target shall be calculated as the arithmetic mean of (i) the Yearly Period Absolute Performance Target Achievements, as well as of (ii) the Yearly Period Relative Performance Target Achievements, which determines the final percentage target achievement for

each Performance Target (respectively, the “Overall Absolute Performance Target Achievement” and the “Overall Relative Performance Target Achievement). At the end of the Waiting Period, the percentage Overall Absolute Performance Target Achievement and the percentage Overall Relative Performance Target Achievement are added up and divided by two, resulting in the overall achievement of the Performance Targets (“Overall Performance Target Achievement”).

5.8The Initial Number of Stock Options is multiplied by the decimal number, rounded to two decimal places, that represents the percentage Overall Performance Target Achievement (e.g. 143 % equals 1.43), and rounded up to the nearest whole number, resulting in the final number of Shares the respective Participant is entitled to subscribe for (the “Final Number of Stock Options”). Stock Options can only be exercised if either the Minimum Value Absolute Performance Target or the Minimum Value Relative Performance Target has been exceeded at least in one (1) Yearly Period. The Final Number of Stock Options is limited to 200 % of the Initial Number of Stock Options (Cap). Group 1-Participants may exercise Stock Options granted to them further only to the extent that the amount of (i) the Relevant Closing Price minus the Exercise Price, (ii) multiplied by the Final Number of Stock Options, does not exceed an amount of 250 % of the respective Allocation Value (the “Maximum Limit”). If the Maximum Limit would be exceeded when exercising Stock Options, Stock Options will forfeit without entitlement for compensation in accordance with the following calculation:

The number of Stock Options which will forfeit equals the amount (rounded down to the nearest whole number) of (i) the Final Number of Stock Options minus (ii) the Maximum Limit divided by the difference between the Relevant Closing Price and the Exercise Price.

The above shall apply accordingly in case of a Cash Settlement instead of a Share Settlement.

5.9One (1) Stock Option, as determined by the Final Number of Stock Options, entitles to the subscription right for one (1) Share.

5.10Stock Options for which neither the Minimum Value Absolute Performance Target nor the Minimum Value Relative Performance Target has been exceeded with respect to any Yearly Period shall forfeit completely without any further consideration.

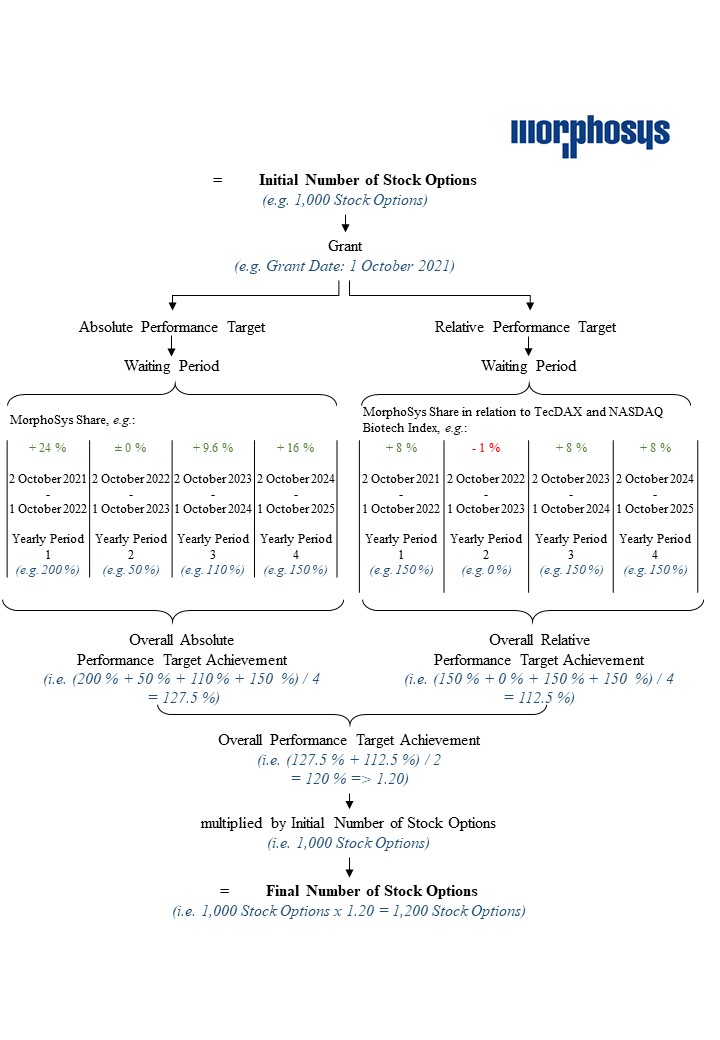

5.11Annex 1 to these Option Terms & Conditions comprises a calculation example of the determination of the Final Number of Stock Options. For the avoidance of doubt: The determination of the Final Number of Stock Options, including all intermediate steps in the determination process, is subject to these Option Terms & Conditions exclusively. Annex 1 does not form a part of these Option Terms & Conditions and is for convenience only. All figures in the calculation example in Annex 1 are fictitious and selected without prejudice to any rights under these Option Terms & Conditions. In case of any inconsistencies between these Option Terms & Conditions and Annex 1 these Terms & Conditions shall prevail.

§ 6

WAITING PERIOD AND EXERCISE PERIOD

6.1The waiting period until the date on which the Stock Options may initially be exercised is four (4) years commencing on the Grant Date (the “Waiting Period”).

6.2Subject to § 5, all Stock Options may be exercised only within a time period of three (3) years following the date on which both the Company’s consolidated financial statements for the financial year that precedes the financial year during which the Waiting Period has elapsed have been approved (Billigung des Konzernabschlusses der MorphoSys AG) and the Waiting Period has expired (the “Exercise Period”).

§ 7

EXERCISE NOTICE

7.1Subject to the fulfilment of the Exercise Conditions, each Participant may exercise all or part of his Stock Options in writing or by email by way of an exercise notice which includes the necessary subscription declarations regarding

the Exercise Shares (the “Exercise Notice”). The Exercise Notice has to be addressed to MorphoSys AG, Head of Human Resources, Semmelweisstraße 7, 82152 Planegg, Germany. The Exercise Notice has to state the number of Stock Options that are exercised and the number of Shares to be subscribed for, or acquired by (as the case may be), the exercise. With receipt of the Exercise Notice the subscription or purchase agreement takes effect for the number of Shares for which Stock Options are exercised. A form of the Exercise Notice is attached as Annex 2 to these Option Terms & Conditions.

7.2The Exercise Notice shall be backed by sufficient funds for the Exercise Price and further expenses payable in respect of the number of exercised Stock Options and by sufficient funds for the estimated payroll taxes and employee social security contributions (if any) or any similar taxes and duties. The Company reserves the right not to transfer the Shares to the Participant until full payment of the Exercise Price, including taxes and social security contributions, if and to the extent applicable.

7.3In order to facilitate the exercise of the Stock Options by the Participants and to further align the interests of the Participants and the shareholders, the Company may – in its sole discretion and subject always to applicable law – arrange for the benefit of the Participants with a financial institution (the “Bank”) a pre-financing of the payment of some or all of the aggregate Exercise Price (together with any taxes and social security contributions) (the “Pre-Financing”) and a sale on behalf of the relevant Participant of such a number of Exercise Shares on a stock exchange necessary to repay the Pre-Financing (the “Cashless Exercise Option”). Participants who wish to use the Cashless Exercise Option may be required inter alia: (i) to open a deposit account (Depot) with the Bank; (ii) to have all Exercise Shares for which the Cashless Exercise Option is used booked into such deposit account; and (iii) irrevocably instruct and authorize the Bank to sell the number of Exercise Shares necessary to repay the Pre-Financing. The Company bears all costs relating to the implementation of the Cashless Exercise Option (such as arrangement or administration fees). Any Participant who makes use of the Cashless Exercise Option has to bear all costs relating to the Pre-Financing and the sale of the Exercise Shares (in particular any interest and brokerage fees).

§ 8

EXTRAORDINARY DEVELOPMENTS; FURTHER ADJUSTMENTS; CLAW-BACK

8.1For purposes of this § 8, “Extraordinary Events or Developments” means – subject always to mandatory law – situations where the potential gain realized by the Participant upon the exercise of Stock Options (i) is caused by unusual external events and developments; and (ii) cannot be reasonably justified under any circumstances by the development or business perspective of the Company, also taking into account international remuneration and incentive standards. For the avoidance of doubt, the exercise of Stock Options by a Participant as such, that results in an economic benefit for the Participant, does not constitute an Extraordinary Event or Development.

8.2In case of Extraordinary Events or Developments, the Supervisory Board (with regard to Group 1-Participants) or the Management Board (with regard to Group 2-Participants and/or Group 3-Participants) is entitled to adjust upon receipt by the Company of an Exercise Notice in its discretion (pflichtgemäßes Ermessen) the payout, to the extent required to eliminate such extraordinary effects. For the avoidance of doubt, such adjustment shall not result in a reduction or withdrawal of the Participant's economic benefit achieved under the SOP 2021 prior to the occurrence of such Extraordinary Events or Developments. In any such case, Sec. 87 para. 1 AktG must be observed (in case of Group 2-Participants and/or Group 3-Participants mutatis mutandis).

8.3The Supervisory Board is further entitled to adjust in its discretion (pflichtgemäßes Ermessen) the payout to Group-1-Participants if so required to ensure the appropriateness of remuneration as defined in Section 87 para. (1) sentence 1 AktG.

8.4In the event that a Group 1-Participant willfully or grossly negligent breaches statutory duties or the code of conduct of the Company (each a “Breach of Duty”), the Supervisory Board is entitled to retain or reclaim in its discretion (pflichtgemäßes Ermessen) the payout in the form of a Cash Settlement or Share Settlement in whole or in part in accordance with the following provisions:

8.4.1In the event a Breach of Duty occurs, the Supervisory Board may decide in its discretion (pflichtgemäßes Ermessen) that Stock Options which were granted for the financial year in which the Breach of Duty has occurred and which have not been settled by the Company in accordance with § 2.6 above shall forfeit without entitlement to compensation (malus).

8.4.2In the event a Breach of Duty occurs and the Stock Options have already been settled by the Company in accordance with § 2.6 above, the Supervisory Board is further entitled to reclaim, in its discretion (pflichtgemäßes Ermessen) the payout in whole or in part for the financial year in which the Breach of Duty has occurred (clawback), whereby the following shall apply:

(i)If the Stock Options have been settled in cash in accordance with § 2.6.2 above, the Supervisory Board is entitled to reclaim in its discretion (pflichtgemäßes Ermessen) the payout in whole or in part, provided that no more than two years have passed since the settlement of the Stock Options.

(ii)If the Stock Options have been settled in shares in accordance with § 2.6.1 above, the Supervisory Board is entitled to claim a compensation payment for all or part of the Stock Options already settled, provided that not more than two years have passed since the settlement of the Stock Options. The compensation payment shall correspond to the amount of (i) the number of Stock Options, the Supervisory Board claims compensation for, multiplied by the Relevant Closing Price, and (ii) in case, the respective Participant has already paid the Exercise Price for Stock Options, minus the Exercise Price multiplied by the number of Stock Options the Supervisory Board claims compensation for.

8.4.3Proof of damage is not required.

8.4.4In case of a permanent or recurring Breach of Duty, § 8.4.1 and 8.4.2 above shall apply for all financial years in which the Breach of Duty occurs or is still continuing.

8.4.5The Supervisory Board shall decide in each individual case at its due discretion, taking into account the circumstances of the individual case, in particular the significance of the duty that has been breached, the weight of the causal contribution of the Participant and the damage incurred, and considering the interests of both the Participant and the Company.

8.4.6§ 818 para. (3) of the German Civil Code (Bürgerliches Gesetzbuch) shall not apply. Claims for damages of the Company shall remain unaffected.

8.4.7The above shall also apply in case the appointment of the Participant and/or the service agreement of the Participant has already ended.

8.5The Supervisory Board is further entitled to reclaim in its discretion (pflichtgemäßes Ermessen) the payout already made in case it turns out that the calculation on the basis of which the payout was made was incorrect and that no payment or a lower payment would have been made on the basis of the correct calculation, whereby the following shall apply:

8.5.1If the Stock Options have been settled in cash in accordance with § 2.6.2 above, the Supervisory Board is entitled to reclaim the difference between the cash payment made by the Company and the cash payment amount that would have been made on the basis of the correct calculation, provided that not more than two years have passed since the settlement of the Stock Options.

8.5.2If the Stock Options have been settled in shares in accordance with § 2.6.1 above, the Supervisory Board is entitled to claim a compensation payment for all Stock Options which have been settled in excess, provided that not more than two years have passed since the settlement of the Stock Options. The compensation payment shall correspond to the amount of (i) the number of Stock Options which have been transferred to the Participant in excess, multiplied by the Relevant Closing Price and (ii) in case, the respective Participant has already paid the Exercise Price for Exercise Shares, minus the Exercise Price multiplied by the number of Stock Options which have been settled in excess.

8.5.3§ 8.4.6 and § 8.4.7 shall apply accordingly.

§ 9

EXPIRY DATE OF STOCK OPTIONS

9.1Stock Options can only be exercised by the Participants until the date of expiry of the Exercise Period (the “Expiry Date”).

9.2Notwithstanding anything contained in these Option Terms & Conditions, in no case will a Stock Option be exercisable later than the Expiry Date, provided, however, that if the term of a Stock Option expires during a Black-Out Period (§ 16.2) or within ten (10) Trading Days after the date on which the Black-Out Period ends, the term of such Stock Option will be extended to the date on which the next Exercise Period after the expiry of the Black-out Period ends; this shall apply mutatis mutandis to closed periods pursuant to Art. 19 paras. 11, 12 of the European Market Abuse Regulation (“MAR”) (§ 16.2).

§ 10

CONSEQUENCES OF A TERMINATION OF OFFICE OR EMPLOYMENT

10.1In the event a Group 1-Participant's office as member of the Management Board ends before the expiry of the applicable Waiting Period due to a termination for Cause (as defined hereinafter)), all unexercised Stock Options granted to the Bad Leaver (whether held by him or any third party) will be forfeited without entitlement to compensation. An event of “Cause” exists if a Group 1- Participant: (i) materially violates any term of any agreement between the Group 1-Participant and MorphoSys or MorphoSys US Inc. (“MorphoSys US”), as applicable; (ii) repeatedly fails to follow reasonable instructions of MorphoSys or MorphoSys US, as applicable, is chronically absent from work, fails to perform any reasonably assigned duties after receiving written notice of same from MorphoSys or MorphoSys US, as applicable, or willfully violates any written policy of MorphoSys or MorphoSys US, as applicable, provided to the Group 1-Participant; (iii) engages in unprofessional conduct that results in, or reasonably could result in, unfavorable publicity for MorphoSys or MorphoSys US, as applicable, or engages in unprofessional conduct inconsistent with the Group 1-Participant’s position with MorphoSys or MorphoSys US, as applicable; or (iv) engages in any of the following forms of willful misconduct: (a) conviction of the commission of any felony, or any criminal act involving moral turpitude, or any misdemeanor where imprisonment is imposed; (b) misappropriation, theft or destruction of MorphoSys or MorphoSys US property; (c) securing or attempting to secure any personal profit in connection with any transaction entered into by or on behalf of MorphoSys or MorphoSys US, as applicable; (d) causing substantial material harm to MorphoSys or MorphoSys US as a result of Group 1-Participant’s malfeasance, gross negligence or reckless disregard of Group 1-Participant’s duties and responsibilities; (e) falsification of

any business record of MorphoSys or MorphoSys US; (f) any material act of fraud or dishonesty within the scope of, or relating to, Group 1-Participant’s employment by MorphoSys or MorphoSys US, as applicable; (g) commission of any crime relating to Group 1-Participant’s employment with MorphoSys or MorphoSys US, as applicable; or (h) violation of any law or regulation applicable to the business of MorphoSys or MorphoSys US. For the avoidance of doubt: If the office as member of the Management Board of a Bad Leaver ends after the expiry of the applicable Waiting Period, such Bad Leaver will retain all Stock Options that were not yet exercised on the date of his effective termination of office (the “Termination Date”). The terms and conditions set forth in these Option Terms & Conditions (Waiting Period, Performance Target, Exercise Conditions etc.) will continue to apply unchanged to the Stock Options retained pursuant to this § 10.1 (sentence 2).

10.2In the event a Group 1-Participant's office as member of the Management Board ends before the expiry of the applicable Waiting Period due to any reason other than for Cause (such Group 1-Participant a “Good Leaver”), such Good Leaver will retain all Stock Options that (i) have already vested (Stock Options for Group 1-Participants vest in forty-eight (48) monthly instalments over a four (4)-year vesting period commencing on the Grant Date, whereas one forty-eighth (1/48) of the Stock Options granted will vest on each of the forty-eight (48) monthly anniversaries following the Grant Date); and (ii) were not yet exercised on the date of his effective termination of office (the “Termination Date”). For the avoidance of doubt: If the office as member of the Management Board of a Good Leaver ends after the expiry of the applicable Waiting Period, such Good Leaver will retain all vested Stock Options that were not yet exercised on the Termination Date. The terms and conditions set forth in these Option Terms & Conditions (Waiting Period, Performance Target, Exercise Conditions etc.) will continue to apply unchanged to the Stock Options retained pursuant to this § 10.2 (sentences 1 or 2). All Stock Options which are not retained pursuant to this § 10.2 shall forfeit without entitlement to compensation.

10.3In the event a Group 2-Participant's office as member of a management body of an affiliated company of MorphoSys in Germany or abroad ends, or in the event a Group 2-Participant's or a Group 3-Participant's employment with the Company or with an affiliated company of MorphoSys in Germany or abroad ends before the expiry of the applicable Waiting Period, § 10.1 and § 10.2 shall apply accordingly to the unexercised Stock Options of the respective Group 2-Participant or Group 3-Participant, provided that the existence of grounds justifying a termination of employment for Cause shall also qualify as a Bad Leaver scenario pursuant to § 10.1 sentence 1.

10.4For the avoidance of doubt: Any Exercise Shares delivered and any cash settlement payments made by the Company pursuant to § 2.6.2 upon exercise of Stock Options prior to the Termination Date shall remain unaffected by the forfeiture of Stock Options pursuant to § 10.1 sentence 1 and § 10.2 last sentence, also in conjunction with § 10.3.

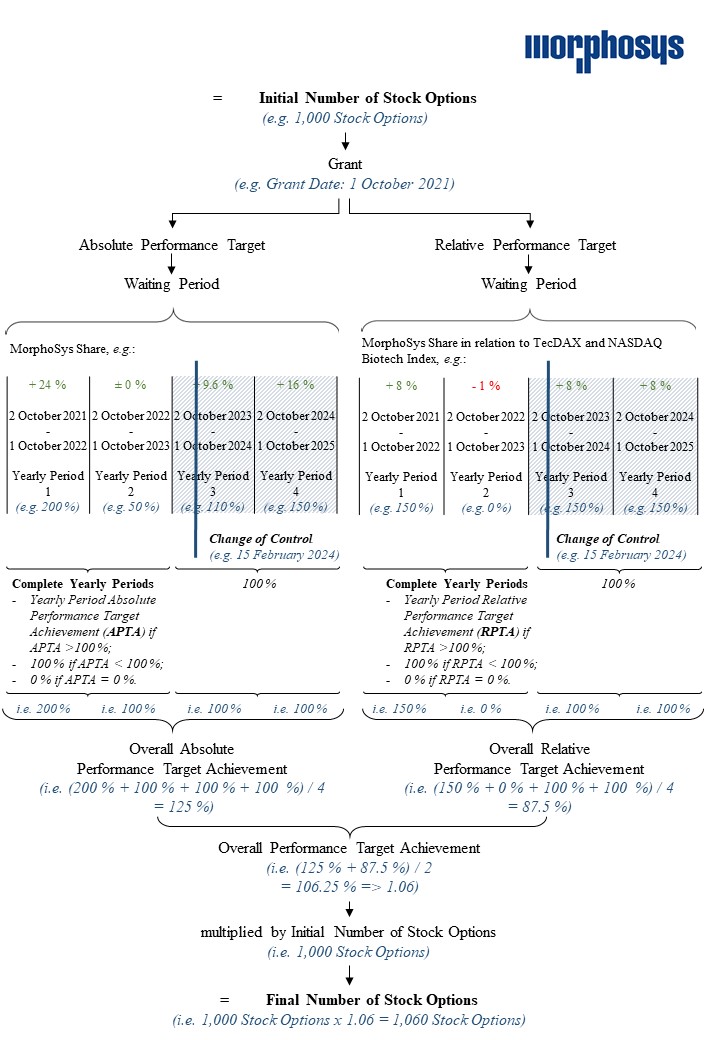

10.5Annex 3 to these Option Terms & Conditions supplements the calculation example pursuant to Annex 1 in a Good Leaver scenario pursuant to § 10.2 and 10.3, respectively. For the avoidance of doubt: Also with respect to the supplemental calculation example pursuant to Annex 3, the determination of the Final Number of Stock Options, including all intermediate steps in the determination process, is subject to these Option Terms & Conditions exclusively. Annex 3 does not form a part of these Option Terms & Conditions and is for convenience only. All figures in the calculation example in Annex 3 are fictitious and selected without prejudice to any rights under these Option Terms & Conditions. In case of any inconsistencies between these Option Terms & Conditions and Annex 3, these Terms & Conditions shall prevail. No sample calculation is provided for a Bad Leaver scenario within the meaning of § 10.1 sentence 1, as in such case, all unexercised Stock Options will be forfeited without compensation.

§ 11

TRANSFERABILlTY

11.1Neither the Stock Options nor the rights of any Participant under any Stock Option or under the SOP 2021 are assignable or otherwise transferable except as provided in this § 11.

11.2The Stock Options are transferable by will or applicable laws of descent upon the death of the relevant Participant.

§ 12

ADJUSTMENT IN CASE OF SPECIFIC CAPITAL AND OTHER

STRUCTURAL MEASURES

12.1In the event of:

12.1.1a capital increase from Company funds by the issue of new shares (Kapitalerhöhung aus Gesellschaftsmitteln);

12.1.2a reduction in the number of Shares by merging Shares without capital reduction (reverse share split) or an increase in the number of Shares without capital increase (share split);

12.1.3a capital reduction (Kapitalherabsetzung) with a change in the total number of Shares issued by the Company; or

12.1.4any other such event having an effect similar to any of the foregoing (each an “Adjustment Event”),

the Supervisory Board (with regard to Group 1-Participants) or the Management Board (with regard to Group 2-Participants and/or Group 3-Participants) may (or shall, to the extent required to avoid adverse accounting consequences under applicable accounting standards) – subject to mandatory law – establish financial equality for the Participants in order to prevent that such Adjustment Event results in a dilution or enlargement of the benefits or potential benefits intended to be made available under the outstanding Stock Options. In such an Adjustment Event the financial equality shall preferably be established by adjusting the number of Stock Options (subject to available funding with Shares).

12.2For the avoidance of doubt, no adjustment pursuant to § 12.1 shall occur in the event of:

12.2.1a capital increase from Company funds without the issue of new Shares (Kapitalerhöhung aus Gesellschaftsmitteln ohne Ausgabe neuer Aktien); or

12.2.2a capital reduction without a change in the total number of Shares issued by the Company.

12.3If an adjustment occurs in accordance with this § 12, fractions of shares will not be granted on the exercise of Stock Options nor will they be compensated by a payment in cash.

12.4For the avoidance of doubt, Sec. 9 para. 1 AktG applies mutatis mutandis to Stock Options which have been adjusted pursuant to this § 12.

§ 13

CHANGE OF CONTROL

13.1For purposes of this § 13, “Change of Control” means:

13.1.1a transaction or series of related transactions in which a person or entity (other than a wholly-owned direct or indirect subsidiary of the Company) alone or acting in concert with other persons or entities acquires (i) all or substantially all of the Company's assets; or (ii) directly or indirectly at least 30 % of the voting rights in the Company within in the meaning of the German Securities Acquisition and Takeover Act (Wertpapiererwerbs- und Übernahmegesetz – WpÜG);

13.1.2a merger or another similar business combination transaction of the Company with or into another entity which is not a wholly-owned direct or indirect subsidiary of the Company having an effect similar to the events described under § 13.1.1 above.

13.2In case a Change of Control occurs during the Waiting Period, the Final Number of Stock Options shall be calculated as follows:

13.2.1if the Average Yearly Period Performance Target Achievement (as defined below) exceeds 100 % in Yearly Periods preceding the Change of Control, i.e. Yearly Periods that are already complete at the date when the Change of Control occurs (“Complete Yearly Periods”, each a “Complete Yearly Period”), the

respective individual achievement of the Performance Targets shall be decisive for the respective Complete Yearly Period(s) in the determination of the Overall Performance Target Achievement. “Average Yearly Period Performance Target Achievement” refers to the average (arithmetic mean) of (i) the respective Yearly Period Absolute Performance Target Achievement; and (ii) the respective Yearly Period Relative Performance Target Achievement.

13.2.2if the Average Yearly Period Performance Target Achievement is below 100 % in Complete Yearly Periods the level of achievement of the Yearly Period Absolute Performance Target Achievement and the Yearly Period Relative Performance Target Achievement shall nevertheless be 100 % for the respective Complete Yearly Period(s) in the determination of the Overall Performance Target Achievement, provided, however, that at least either the Minimum Value Absolute Performance Target or the Minimum Value Relative Performance Target has been exceeded in the respective Complete Yearly Period.

13.2.3for the Yearly Period, during which the Change of Control occurred, as well as for subsequent Yearly Periods, a level of achievement of 100 % of the Yearly Period Absolute Performance Target Achievement and the Yearly Period Relative Performance Target Achievement shall be decisive for the respective Yearly Period(s) in the determination of the Overall Performance Target Achievement, irrespective of the individual achievement (if any) of the Performance Targets.

13.3In addition, the terms and conditions set forth in these Option Terms & Conditions (Waiting Period, Exercise Conditions etc.), in particular the vesting provisions in § 10.2, and § 10.3 respectively, will continue to apply unchanged to the Stock Options in case of a Change of Control during the Waiting Period. For clarification purposes: The “Amended and Restated Change of Control Severance Plan” dated July 18, 2018, of Constellation Pharmaceuticals Inc., as well as any subsequent amendment or renewal of such plan shall not apply to these Option Terms & Conditions or to the Stock Options granted hereunder.

13.4Annex 4 to these Option Terms & Conditions supplements the calculation example pursuant to Annex 1 in the event of a Change of Control. For the avoidance of doubt: Also with respect to the supplemental calculation example pursuant to Annex 4, the determination of the Final Number of Stock Options, including all intermediate steps in the determination process, is subject to these Option Terms & Conditions exclusively. Annex 4 does not form a part of these

Option Terms & Conditions and is for convenience only. All figures in the calculation example in Annex 4 are fictitious and selected without prejudice to any rights under these Option Terms & Conditions. In case of any inconsistencies between these Option Terms & Conditions and Annex 4 these Terms & Conditions shall prevail.

§ 14

LIMITATION OF LIABILITY

14.1The Company (or any of its directors, officers, employees, agents or advisors) does not:

14.1.1assume any responsibility or liability for the development of the value or market price of the Shares;

14.1.2warrant, assure or guarantee any increase in value of the Shares, in particular it is neither warranted, assured or guaranteed that a Participant will be able to sell his participation in the Company with a profit in the future, nor that no loss will be incurred; or

14.1.3warrant, assure or guarantee a profit of a Participant from the SOP 2021 or any Stock Option granted thereunder.

14.2Each Participant declares with his participation in the SOP 2021 that the participation is voluntary. Each Participant is aware of the fact that he alone bears the risk of a decrease in or total loss of value of his investments. Each Participant accepts the offer to participate in the SOP 2021 at his own risk and assumes any liability relating thereto.

14.3Each Participant is responsible for obtaining legal, tax and any other necessary advice before participating in the SOP 2021 and for evaluating the tax effects connected with the SOP 2021. Each Participant accepts and declares that he has not been advised by or on behalf of the Company with respect to his participation in the SOP 2021 (in particular, regarding legal and tax issues of such participation).

§ 15

TAXES, SOCIAL SECURITY AND COSTS

15.1All taxes (including payroll taxes), social security contributions, further duties and costs accrued by the Participant in connection with his participation in the SOP 2021 shall be borne by each Participant. Each Participant is obliged to pay taxes relating to the respective Stock Options granted/exercised under the SOP 2021, or relating to a transfer of such Stock Options by the Participant to a third party, to the competent tax authorities. Each Participant shall fully indemnify the Company in respect of all such liabilities and obligations against tax authorities.

15.2The employer of the Participant is entitled, if required by statutory law, to withhold payroll tax or any other taxes or duties or social security contributions to be paid by (or on behalf and account of) the Participant. This applies even after termination of the employment relationship of a Participant with the Company. The Company is entitled to demand the full cooperation of the Participant even after his leave with respect to the withholding of taxes, social security contributions, other duties and costs in connection with the SOP 2021. The Participant undertakes to fully co-operate with the Company.

15.3Withholdings mentioned above do not release the Participant from his responsibility and obligation to pay all taxes, social contributions, further duties and costs being due and accruing in connection with his participation in the SOP 2021 or the grant, exercise or transfer of any Stock Options.

§ 16

INSIDER TRADING AND BLACK-OUT PERIODS

16.1Any exercise of, or any other transaction in, the Stock Options (each a “Transaction”) must be conducted in compliance with (i) all applicable insider trading laws and regulations, including Art. 14, 7 et seqq. MAR, and (ii) all provisions of any insider trading rules established by the Company ((i) and (ii) together the “Insider Trading Rules”). Each Participant is personally responsible for informing himself about, and acting in full compliance with all applicable Insider Trading Rules. Any individual non-compliance with applicable Insider Trading Rules may lead to the imposition of civil and criminal penalties (as the case may be).

16.2In order to minimize the potential for prohibited insider trading, the Supervisory Board may establish in its sole discretion periods from time to time during which all or some of the Participants may not engage in transactions involving the Stock Options (the “Black-Out Periods”). Notwithstanding any other provisions in these Option Terms & Conditions, the Participants may not exercise any Stock Options during an applicable Black-Out Period. Art. 19 paras. 11, 12 MAR regarding closed periods and the permissibility of trading by persons discharging managerial responsibilities within the Company during closed periods, as well as the respective delegated regulation by the European Commission, as applicable from time to time, remain unaffected.

§ 17

FORM REQUIREMENTS

17.1Any legal statements and other notices in connection with the SOP 2021 (collectively the “Notices”) or any amendment of these Option Terms & Conditions (including an amendment of this § 17.1) shall be made in text form (Textform) pursuant to Sec. 126b BGB unless any other specific form is required by mandatory law or these Option Terms & Conditions.

17.2Any Notice to be delivered to the Company shall be addressed both by mail and email to MorphoSys AG, Head of Human Resources, Semmelweisstraße 7, 82152 Planegg, Germany, email address: maria.catresanajauregui@morphosys.com. The Company shall communicate changes in the address set forth in the previous sentence as soon as possible to the Participants. In the absence of such communication, the address stated above shall remain in place.

17.3Any Notice to be given to a Participant may be served by being handed to him personally or by being sent to him at his home or business address set forth in the option agreement relating to the Stock Options (“Option Agreement”). Each Participant shall communicate changes of address as soon as possible to the Company. In the absence of a notification of a change of address the address indicated in the Option Agreement shall remain in place.

§ 18

PROCESSING OF PERSONAL DATA

The Company processes personal data of the Participants in connection with the administration, implementation and settlement of the SOP 2021. Additional information regarding the processing of personal data in connection with the SOP 2021 is included in Annex 5 (Information on the Processing of Personal Data).

§ 19

GOVERNING LAW AND JURISDICTION

19.1The SOP 2021, any Stock Options granted thereunder and these Option Terms & Conditions shall be exclusively governed by, and be construed in accordance with, the laws of the Federal Republic of Germany, without regard to principles of conflicts of laws.

19.2Any dispute, controversy or claim arising from or in connection with the SOP 2021, any Stock Options granted thereunder or these Option Terms & Conditions or their validity shall be decided upon by the competent courts in Munich, Germany.

§ 20

FINAL PROVISIONS

20.1All provisions in these Option Terms & Conditions shall be subject to the terms and conditions established by the SOP Resolution.

20.2Unless otherwise explicitly provided for in these Option Terms & Conditions, no Participant shall be entitled to assign any rights or claims under the SOP 2021 and these Option Terms & Conditions without the written consent of the Company.

20.3In these Option Terms & Conditions, the headings are inserted for convenience only and shall not affect the interpretation of these Option Terms & Conditions; where a German term has been inserted in italics, it alone (and not the English term to which it relates) shall be authoritative for the purpose of the interpretation of the relevant English term in these Option Terms & Conditions. The terms “including” and “in particular” shall always mean “including, without limitation” and “in particular, without limitation”, respectively. Any reference made in these Option Terms & Conditions to any clauses without further indication of a law, an agreement or another document shall mean clauses of these Option Terms & Conditions.

20.4In the event that one or more provisions of these Option Terms & Conditions shall, or shall be deemed to, be invalid or unenforceable, the validity and enforceability of the other provisions of these Option Terms & Conditions shall not be affected thereby. In such case, the Company and each Participant agree to recognize and give effect to such valid and enforceable provision or provisions, which correspond as closely as possible with the commercial intent of the Parties. The same shall apply in the event that these Option Terms & Conditions contain any unintended gaps (unbeabsichtigte Lücken).

Planegg, October 2021

MorphoSys AG

* * * *

Annex 1

- Non-binding calculation example -

Example Calculation Maximum Limit

Example 1:

The Allocation Value of the Participant amounted to EUR 100,000. Thus, the Maximum Limit amounts to EUR 250,000 (i.e., 250% of EUR 100,000).

The Final Number of Stock Options amounts to 1,200. The Exercise Price amounts to EUR 55,00 and the Relevant Closing Price amounts to EUR 120,00.

The economical inflow of the Participant at the time of the exercise of the Stock Options would amount to EUR 78,000 (i.e., 1,200* (EUR 120,00 - EUR 55,00), which is below the Maximum Limit of EUR 250,000. Thus, no Stock Options will forfeit.

Example 2:

The Allocation Value of the Participant amounted to EUR 100,000. Thus, the Maximum Limit amounts to EUR 250,000 (i.e., 250% of EUR 100,000).

The Final Number of Stock Options amounts to 1,200. The Exercise Price amounts to EUR 55,00 and the Relevant Closing Price amounts to EUR 280,00.

The economical inflow of the Participant at the time of the exercise of the Stock Options would amount to EUR 270,000 (i.e., 1,200* (EUR 280,00 - EUR 55,00), which exceeds the Maximum Limit of EUR 250,000. Thus, Stock Options will forfeit in accordance with the following calculation:

1,200 – (250,000 / (280,00 – 55,00)) = 88,8888, i.e., 89 Stock Options will forfeit.

Annex 2

- Template Exercise Notice -

| | | | | |

AUSÜBUNGS- UND

BEZUGSERKLÄRUNG zum

Aktienoptionsprogramm 2021

gemäß § 198 Abs. 1 AktG (doppelt ausgestellt) | EXERCISE NOTICE AND

SUBSCRIPTION DECLARATION relating to the

Stock Option Plan 2021

pursuant to Sec. 198 para. 1 of the

German Stock Corporation Act (“AktG”) (issued twice) |

| |

Durch Beschluss der Hauptversammlung der MorphoSys AG vom 27. Mai 2020 wurde das Grundkapital der MorphoSys AG um EUR 1.314.615,00 durch Ausgabe von bis zu 1.314.615 auf den Inhaber lautenden Stückaktien mit einem rechnerischen Anteil am Grundkapital von EUR 1,00 je Aktie bedingt erhöht („Bedingtes Kapital 2020-I“). Das Bedingte Kapital 2020-I dient der Sicherung von Bezugsrechten aus Aktienoptionen, die im Rahmen des Aktienoptionsprogramms 2021 (Stock Option Plan 2021; „SOP 2021“) in der Zeit ab Eintragung des Bedingten Kapitals 2020-I bis zum 26. Mai 2025 ausgegeben werden. | By resolution of the general meeting of MorphoSys AG of May 27, 2020, the nominal share capital of MorphoSys AG was conditionally increased by EUR 1,314,615.00 through the issue of up to 1,314,615 no-par-value bearer shares with a pro rata amount of the nominal share capital of EUR 1.00 per share (“Conditional Capital 2020-I”). The Conditional Capital 2020-I serves to secure subscription rights from stock options issued under the stock option plan 2021 (“SOP 2021”) in the time period from the date of registration of the Conditional Capital 2020-I until May 26, 2025. |

| |

| | | | | |

| Der Vorstand wurde im Rahmen des SOP 2021 durch Beschluss der Hauptversammlung der MorphoSys AG vom 27. Mai 2020 ermächtigt, bis einschließlich zum 26. Mai 2025, mit Zustimmung des Aufsichtsrats, einmalig oder mehrmals Bezugsrechte („Stock Options“) auf insgesamt bis zu 657.308 auf den Inhaber lautende Stückaktien der Gesellschaft an Mitglieder von Geschäftsleitungsorganen verbundener Unternehmen im In- und Ausland sowie an ausgewählte Mitarbeiter der MorphoSys AG und verbundener Unternehmen im In- und Ausland zu gewähren. Der Aufsichtsrat wurde im Rahmen des SOP 2021 durch Beschluss der Hauptversammlung der MorphoSys AG vom 27. Mai 2020 ermächtigt, bis einschließlich zum 26. Mai 2025 einmalig oder mehrmals Bezugsrechte auf insgesamt bis zu 657.307 auf den Inhaber lautende Stückaktien der Gesellschaft an Mitglieder des Vorstands der Gesellschaft zu gewähren. | Under the SOP 2021, by resolution of the general meeting of MorphoSys AG of May 27, 2020, the Management Board was authorized to grant, with the consent of the Supervisory Board, on one or more occasions until and including the date of May 26, 2025, stock options to up to 657,308 no-par-value bearer shares of the company to members of management bodies of affiliated companies in Germany and abroad and to selected employees of MorphoSys AG and affiliated companies in Germany and abroad. The Supervisory Board was authorized under the SOP 2021 by resolution of the general meeting of MorphoSys AG of May 27, 2020 to grant, on one or more occasions until and including the date of May 26, 2025, stock options to up to 657,307 no-par-value bearer shares of the company to members of the Management Board of the company. |

| |

| Eine Aktienoption (Stock Option) gewährt Bezugsrechte auf bis zu zwei Aktien der Gesellschaft mit einem rechnerischen Anteil am Grundkapital der MorphoSys AG von EUR 1,00. | One stock option grants subscription rights to a maximum of two shares of the company with a pro rata amount of the nominal share capital of MorphoSys AG of EUR 1.00. |

| |

Ich, Frau/Herr [Vor- und Nachname, Geburtsdatum, Adresse], bin Inhaber/in von insgesamt [] Bezugsrechten aus [] Aktienoptionen mit dem Recht auf den Bezug von jeweils einer auf den Inhaber lautenden Stückaktie der MorphoSys AG mit einem rechnerischen Anteil am Grundkapital der MorphoSys AG von EUR 1,00 je Aktie aus dem SOP 2021. | I, Mrs./Mr. [first and last name, date of birth, address], am the holder of a total of [] subscription rights from [] stock options, each of them entitling me to the subscription of one no-par-value bearer share of MorphoSys AG with a pro rata amount of EUR 1.00 of the nominal share capital of MorphoSys AG under the SOP 2021. |

| |

| | | | | |

Ich erkläre hiermit gemäß § 198 Abs. 1 AktG nach Maßgabe der Optionsbedingungen die Ausübung von [] Bezugsrechten, und zeichne und übernehme aus dem von der Hauptversammlung der MorphoSys AG vom 27. Mai 2020 unter TOP 11 beschlossenen und in das Handelsregister eingetragenen Bedingten Kapital 2020-I insgesamt [] auf den Inhaber lautende Stückaktien der MorphoSys AG mit einem rechnerischen Anteil am Grundkapital der MorphoSys AG von EUR 1,00 je Aktie. | I herewith declare pursuant to Sec. 198 para. 1 AktG in accordance with the Option Terms & Conditions the exercise of [] subscription rights, and subscribe for a total of [] no-par-value bearer shares of MorphoSys AG with a pro rata amount of EUR 1.00 of the nominal share capital of MorphoSys AG out of the Conditional Capital 2020-I, resolved upon by the general meeting of MorphoSys AG as of May 27, 2020, under agenda item 11 and registered with the commercial register. |

| |

Der für diese Aktien zu leistende Ausübungspreis von EUR [] je Aktie, und damit EUR [] insgesamt, wurde auf das vom Aufsichtsrat oder vom Vorstand mit Zustimmung des Aufsichtsrats bezeichnete Konto der MorphoSys AG bei der | The exercise price for these shares in the amount of EUR [] per share and, thus, a total amount of EUR [], has been paid or transferred to the account of MorphoSys AG, as determined by the Supervisory Board or the Management Board with the consent of the Supervisory Board at |

1[[], 2IBAN: [], 3BIC: []], eingezahlt bzw. überwiesen. | 1[[], 2IBAN: [], 3BIC: []]. |

| |

| Die Aktien sollen in Form von Miteigentumsanteilen an einer Globalurkunde in mein Depot bei der | The shares shall be booked in my share deposit in the form of a co-ownership share (Miteigentumsanteil) of a global share certificate (Globalurkunde) with |

1[Bezeichnung des Kreditinstituts], 2IBAN: [], 3BIC: [], 4Depotinhaber: [], eingebucht werden. | 1[name of bank], 2IBAN: [], 3BIC: [], 4depositor: []. |

| |

| Eine Zweitausfertigung dieser Ausübungs- und Bezugserklärung ist beigefügt. Die deutsche Fassung dieser Ausübungs- und Bezugserklärung ist maßgeblich. | A duplicate of this exercise notice and subscription declaration is attached. The German version of this exercise notice and subscription declaration shall prevail. |

Ort/Place, Datum/Date: __________________________

Unterschrift/Signature: ___________________________

Annex 3

- Non-binding calculation example –

Annex 4

- Non-binding calculation example –

Annex 5

Information on the Processing of Personal Data

in connection with the Stock Option Plan 2021

(hereinafter referred to as “SOP 2021”)

of MorphoSys AG

(hereinafter referred to as the “Company”)

In connection with the administration, processing and execution of the SOP 2021, the Company processes personal data of the participants (hereinafter also referred to as “Data Subjects”) in accordance with the EU General Data Protection Regulation (“GDPR”). Pursuant to the GDPR, the Company is obliged to provide the following information on the processing of personal data. All defined terms used in this information have the meaning assigned to them in the option conditions.

I. Responsibilities and Contact Information

The controller of the personal data pursuant to Art. 4 para. 7 GDPR is the Company:

MorphoSys AG

Semmelweisstraße 7

82152 Planegg

Germany

Telephone: +49 (0)89 899 27-0

Facsimile: +49 (0)89 899 27-222

E-Mail: info@morphosys.com

Website: www.morphosys.com

The Data Protection Officer of the Company can be contacted through:

MorphoSys AG

Data Protection Officer

Semmelweisstraße 7

82152 Planegg

Germany

or

Email: datenschutz@morphosys.com

II. Use of Personal Data by the Company

The Company processes personal data of the Data Subjects such as names, contact data, tax numbers and all other information necessary for the participation of a Data Subject in the SOP 2021 as well as for the administration, processing and execution of the SOP 2021 (processing purpose). The legal basis for data processing is Art. 6 para. 1 (b) GDPR.

In addition, the Company processes personal data of the Data Subjects if and to the extent required by the law applicable to the Company (e.g., tax law). The legal basis for data processing in this respect is Art. 6 para. 1 (c) GDPR.

III. Transfer of Personal Data

The Company may disclose personal data to an external service provider (“External Service Provider”) commissioned or involved for the purposes of the administration, processing and/or execution of the SOP 2021 in order to support the processing of personal data for the processing purpose set out in Section II above. If and to the extent permitted by law, the Company may also commission other third parties to provide certain services, such as IT-services and legal services, for the processing purpose set out in Section II above and may disclose personal data to such third parties. These recipients provide their assistance or services to the Company under its control and direction and may have access to personal data to the extent necessary to provide their assistance or services.

In addition, the Company may, to the extent required and permitted by law, transfer personal data to domestic and foreign authorities or courts in order to fulfil legal obligations.

IV. Storage and Deletion of Personal Data

The Company processes the personal data within the framework of the participation of the Data Subjects in the SOP 2021. The Company deletes the personal data if it no longer needs it for the fulfilment of its contractual obligations under the SOP 2021 and if there are

no legal storage obligations. In the event of a legal obligation to retain personal data, the Company shall restrict the processing of such personal data.

V. Rights of the Data Subjects

The Data Subjects may, at any time and free of charge, contact the Company or its Data Protection Officer directly with an informal notification in order to exercise their rights under the GDPR. The Data Subjects have the right, subject to the legal requirements, the fulfilment of which is to be examined on a case-by-case basis, to request information on their personal data, any rectification or deletion of their personal data, information regarding restrictions on the processing of their personal data and they have the right to receive their personal data in a structured, generally used and machine-readable format.

The Data Subjects also have the right to object to the processing of their personal data, subject to the legal requirements, the fulfilment of which must be examined on a case-by-case basis.

In addition, Data Subjects have the right to lodge a complaint with a supervisory authority.

ANNEX 6 TO THE SOP 2021

FOR U.S. TAXPAYERS

1.SPECIAL PROVISIONS FOR U.S. TAXPAYERS

1.1The provisions of this Annex apply only to persons who are subject to U.S. federal income tax (any such person, a “U.S. Taxpayer”).

1.2This Annex is to be read as a continuation of the SOP 2021 and applies only with respect to Stock Options under the SOP 2021 granted to U.S. Taxpayers. The purpose of this Annex is to establish certain rules and limitations applicable to Stock Options that may be granted or issued under the SOP 2021 to U.S. Taxpayers from time to time, in compliance with applicable tax, securities and other applicable laws currently in force. For the avoidance of doubt, this Annex does not add to or modify the SOP 2021 in respect of any other category of Participants.

1.3The SOP 2021 and this Annex are complementary to each other and shall be deemed as one. Subject to Section 1.2 above, in any case of contradiction, whether explicit or implied, between any definitions and/or provisions of this Annex and the SOP 2021, the provisions set out in this Annex shall prevail.

2.DEFINITIONS

Capitalized terms not otherwise defined herein shall have the meaning assigned to them in the SOP 2021. The following additional definitions will apply to grants made pursuant to this Annex, provided, however, that to the extent that such definitions are provided for in the SOP 2021 and the Annex, the definitions in this Annex shall apply to Grants to U.S. Taxpayers:

2.1“Code” means the Internal Revenue Code of 1986, as it may be amended from time to time, including rules and regulations promulgated thereunder and successor provisions and rules and regulations thereto.

2.2“Fair Market Value” means the fair market value of the Shares on the Grant Date as determined by the Supervisory Board or the Management Board, as applicable under the SOP 2021, by the reasonable application of a reasonable valuation method, consistently applied, as the Supervisory Board or the Management Board, as applicable under the SOP 2021, deems appropriate; provided, however, that if the Shares are readily tradable on an established securities market, Fair Market Value on any Grant Date shall be the last sale price reported for the Shares on such market on such date or, if no sale is reported on such date, on the last date preceding such date on which a sale was reported. In each case, the Supervisory Board or the Management Board, as applicable under the SOP 2021, shall

determine Fair Market Value in a manner that satisfies the applicable requirements of Code Section 409A.

3.STOCK OPTIONS

3.1Stock Options granted to U.S. Taxpayers are not intended to meet the requirements of Section 422 of the Code.

3.2The Exercise Price applicable to a Stock Option shall be determined pursuant to Section 3 of the SOP 2021, provided that prior to the commencement of the thirty (30) Trading Day period referenced in such Section 3 of the SOP 2021 for purposes of determining the Exercise Price of a Grant of Stock Options on an applicable Grant Date, the Supervisory Board or the Management Board, as applicable under the SOP 2021, must irrevocably identify and approve (i) each Participant who is a U.S. Taxpayer who will receive a Grant of Stock Options on the applicable Grant Date and (ii) the number of Stock Options that will be subject to each such grant to a Participant who is a U.S. Taxpayer.

4.MISCELLANEOUS

4.1Neither the Supervisory Board nor the Management Board shall take any action that would cause a Grant that is otherwise exempt from Section 409A of the Code to become subject to Code Section 409A, and if any Grant would be considered deferred compensation as defined under Code Section 409A and would fail to meet the requirements of Code Section 409A, then such Grant shall be null and void.

4.2The Supervisory Board or the Management Board, as applicable under the SOP 2021, shall not extend the period to exercise a Stock Option to the extent that such extension would cause the Stock Option to become subject to Code Section 409A. An Option Agreement may provide that the period of time over which a Stock Option may be exercised shall be automatically extended if on the scheduled expiration date of such Stock Option the Participant’s exercise of such Stock Option would violate applicable securities laws; provided, however, that during such extended exercise period the Stock Option may only be exercised to the extent the Stock Option was exercisable in accordance with its terms immediately prior to such scheduled expiration date; provided further, however, that such extended exercise period shall end not later than thirty (30) days after the exercise of such Stock Option first would no longer violate such laws.

4.3Although the Company intends to administer the SOP 2021 so that Grants will be exempt from, or will comply with, the requirements of Code Section 409A, the Company does not warrant that any Grant under the SOP 2021 will qualify for favorable tax treatment under Code Section 409A or any other provision of federal, state, local, or non-United States law. The Company shall not be liable to any

Participant for any tax, interest, or penalties the Participant might owe as a result of the grant, holding, vesting, exercise, or payment of any Grant under the SOP 2021.